UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03980

Morgan Stanley Institutional Fund Trust

(Exact name of registrant as specified in charter)

| 522 Fifth Avenue, New York, New York | 10036 |

| (Address of principal executive offices) | (Zip code) |

John H. Gernon

522 Fifth Avenue, New York, New York 10036

(Name and address of agent for service)

Registrant's telephone number, including area code: 212-296-0289

Date of fiscal year end: September 30,

Date of reporting period: September 30, 2021

Item 1 - Report to Shareholders

Morgan Stanley Institutional Fund Trust

Core Plus Fixed Income Portfolio

Annual Report

September 30, 2021

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2021

Shareholders' Letter | | | 2 | | |

Expense Example | | | 3 | | |

Investment Overview | | | 4 | | |

Portfolio of Investments | | | 7 | | |

Statement of Assets and Liabilities | | | 21 | | |

Statement of Operations | | | 23 | | |

Statements of Changes in Net Assets | | | 24 | | |

Financial Highlights | | | 26 | | |

Notes to Financial Statements | | | 31 | | |

Report of Independent Registered Public Accounting Firm | | | 43 | | |

Investment Advisory Agreement Approval | | | 44 | | |

Liquidity Risk Management Program | | | 46 | | |

Federal Tax Notice | | | 47 | | |

U.S. Customer Privacy Notice | | | 48 | | |

Trustee and Officer Information | | | 51 | | |

This report is authorized for distribution only when preceded or accompanied by a prospectus or summary prospectus of the applicable Fund of the Morgan Stanley Institutional Fund Trust. To receive a prospectus and/or statement of additional information ("SAI"), which contains more complete information such as investment objectives, charges, expenses, policies for voting proxies, risk considerations and describes in detail each of the Fund's investment policies to the prospective investor, please call toll free 1 (800) 548-7786. Please read the prospectuses carefully before you invest or send money.

Additionally, you can access information about the Fund, including performance, characteristics and investment team commentary, through Morgan Stanley Investment Management's website: www.morganstanley.com/im/shareholderreports.

Market forecasts provided in this report may not necessarily come to pass. There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Fund in the future. There is no assurance that a fund will achieve its investment objective. Funds are subject to market risk, which is the possibility that market values of securities owned by the Fund will decline and, therefore, the value of the Fund's shares may be less than what you paid for them. Accordingly, you can lose money investing in this Fund. Please see the prospectus for more complete information on investment risks.

1

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2021

Shareholders' Letter (unaudited)

Dear Shareholders,

We are pleased to provide this Annual Report, in which you will learn how your investment in Core Plus Fixed Income Portfolio (the "Fund") performed during the latest twelve-month period.

Morgan Stanley Investment Management is a client-centric, investor-led organization. Our global presence, intellectual capital, and breadth of products and services enable us to partner with investors to meet the evolving challenges of today's financial markets. We aim to deliver superior investment service and to empower our clients to make the informed decisions that help them reach their investment goals.

As always, we thank you for selecting Morgan Stanley Investment Management, and look forward to working with you in the months and years ahead.

Sincerely,

John H. Gernon

President and Principal Executive Officer

October 2021

2

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2021

Expense Example (unaudited)

Core Plus Fixed Income Portfolio

As a shareholder of the Fund, you may incur two types of costs: (1) transactional costs, including sales charge (loads) on purchase payments; and (2) ongoing costs, which may include advisory fees, administration fees, distribution and shareholder services fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the six-month period ended September 30, 2021 and held for the entire six-month period.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled "Actual Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads, if applicable). Therefore, the information for each class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value

4/1/21 | | Actual Ending

Account

Value

9/30/21 | | Hypothetical

Ending Account

Value | | Actual

Expenses

Paid

During

Period* | | Hypothetical

Expenses Paid

During Period* | | Net

Expense

Ratio

During

Period** | |

Core Plus Fixed Income Portfolio Class I | | $ | 1,000.00 | | | $ | 1,024.90 | | | $ | 1,023.01 | | | $ | 2.08 | | | $ | 2.08 | | | | 0.41 | % | |

Core Plus Fixed Income Portfolio Class A | | | 1,000.00 | | | | 1,023.00 | | | | 1,021.21 | | | | 3.90 | | | | 3.90 | | | | 0.77 | | |

Core Plus Fixed Income Portfolio Class L | | | 1,000.00 | | | | 1,021.70 | | | | 1,020.00 | | | | 5.12 | | | | 5.11 | | | | 1.01 | | |

Core Plus Fixed Income Portfolio Class C | | | 1,000.00 | | | | 1,018.70 | | | | 1,017.75 | | | | 7.39 | | | | 7.38 | | | | 1.46 | | |

Core Plus Fixed Income Portfolio Class IS | | | 1,000.00 | | | | 1,025.20 | | | | 1,023.26 | | | | 1.83 | | | | 1.83 | | | | 0.36 | | |

* Expenses are calculated using each Fund Class' annualized net expense ratio (as disclosed), multiplied by the average account value over the period and multiplied by 183/365 (to reflect the most recent one-half year period).

** Annualized.

3

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2021

Investment Overview (unaudited)

Core Plus Fixed Income Portfolio

The Fund seeks above-average total return over a market cycle of three to five years.

Performance

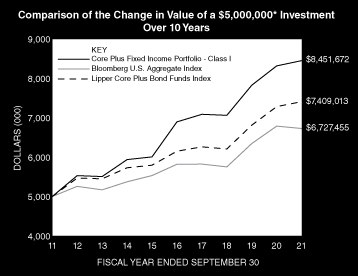

For the fiscal year ended September 30, 2021, the Fund's Class I shares had a total return based on net asset value and reinvestment of distributions per share of 1.61%, net of fees. The Fund's Class I shares outperformed against the Fund's benchmark, the Bloomberg U.S. Aggregate Index1 (the "Index"), which returned –0.90%.

Factors Affecting Performance

• Government bond yields rose significantly over the period, particularly in the first quarter of 2021, in the U.S. and throughout the world. This had a positive impact on performance as the Fund held a short duration position in the U.S. versus the Index. The portfolio's long duration position in emerging markets (EM) external debt also contributed positively, particularly in Mexico and Nigeria.

• Overall securitized sector positioning contributed positively to relative performance during the period as securitized spreads continued to recover amid an improved economic backdrop. The allocation to non-agency residential mortgage-backed securities (RMBS) was the largest contributor over the period, followed by the overweight positioning to the non-agency commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS) sectors.

• Over the period, the portfolio's overweight to investment grade corporate bonds and allocation to high yield corporate bonds contributed to relative performance as credit spreads continued to tighten over the period.

• This positive relative performance was partially offset by the portfolio's long Brazilian real position versus the U.S. dollar, which had a small negative impact on relative performance over the period.

Management Strategies

• Resurgent COVID-19 infections present a potential headwind to the U.S. and global economy getting

back to trend growth. We still view it as a potentially delaying, rather than derailing, risk. Even though some economies have recovered quicker than anticipated, they are still operating below their estimated capacity, especially in the services sector, and the pandemic has most likely led to, or accelerated, structural changes to the economy, which could cause disruption for some time. While we do not expect a dramatic sell-off in government bond markets, we think the risk is skewed to yields rising, as markets price in the path to monetary policy normalization.

• We expect inflation to remain high for some time, with year-over-year rates not declining until the second half of 2022. It is still our view that the surge is mainly transitory, due to technical factors, higher commodity prices and temporary bottlenecks in the economy. However, there is a risk that higher inflation proves to be more sustained, as wages and housing costs (which are usually more sticky than other prices) and inflation expectations (both market-based measures and consumer surveys) have also risen.

• The backdrop for the U.S. Treasury market remains positive in our view. Tapering of the Federal Reserve's (Fed) asset purchases is expected to be announced in November or December 2021. For now, we stick with our outlook for Treasury yields to drift higher.

• Looking forward, we see credit as fully valued but likely to consolidate at current levels supported by the four pillars of: (1) expectations financial conditions will remain easy, supporting low default rates; (2) economic activity that is expected to rebound as vaccinations allow economies to reopen; (3) strong corporate profitability with conservative balance sheet management as overall uncertainty remains high; and (4) demand for credit to stay strong as excess liquidity looks to be invested. We expect good ability to earn attractive incremental yield but see limited opportunities for capital gains from spread tightening.

1 "Bloomberg®" and the Bloomberg Index/Indices used are service marks of Bloomberg Finance L.P. and its affiliates, and have been licensed for use for certain purposes by Morgan Stanley Investment Management (MSIM). Bloomberg is not affiliated with MSIM, does not approve, endorse, review, or recommend any product, and. does not guarantee the timeliness, accurateness, or completeness of any data or information relating to any product.

4

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2021

Investment Overview (unaudited) (cont'd)

Core Plus Fixed Income Portfolio

• Within securitized assets, U.S. residential credit-related assets appear to offer more attractive opportunities, in our view, as the fundamentals of the housing market continue to be strong. U.S. home prices are up nearly 20% over the past year, driven by affordability from low mortgage rates, low housing supply, and increasing demand from both the millennial generation (largest U.S. demographic cohort ever) and the evolving work-from-home dynamics.ii We favor more stable, very high-quality (AAA through A rated securities) CMBS sectors such as multi-family and office over shopping centers. Within ABS, we have a mixed outlook, with traditional consumer ABS (credit cards and auto loans) looking relatively expensive while the more COVID-challenged ABS sectors continue to offer much greater recovery potential. We remain negative on agency mortgage-backed securities (MBS) given our concerns about the potential impact on agency MBS if the Fed begins to taper its MBS purchases. We believe the Fed's taper plans have been thoroughly communicated and priced into the market, as spreads have widened meaningfully in 2021 in anticipation of this taper.

• The near-term outlook for EM debt looks challenging, as the asset class faces multiple disruptive forces. The prospects of Fed tapering as early as November 2021 and its impact on real yields and the U.S. dollar may weigh on EM asset performance. A strengthening dollar is even more challenging in the current scenario where EM growth so far has failed to catch up with that of advanced economies and inflationary pressures remain at large (mainly due to supply-side disruptions), forcing a global tightening of monetary conditions. Moreover, recent negative headlines about China's real estate market, besides contributing to deteriorating market sentiment, imply a weakening Chinese economy in the quarters ahead, which could adversely impact commodity exporters in the EM universe (except oil, which seems to be well supported due to supply-side factors). Therefore, we remain cautious on risk in the near term, despite valuations being generally attractive. We are biased towards EM high yield credits with positive idiosyncratic stories and/or exposed to higher oil prices (and similarly, in EM currencies). In rates markets, we prefer the yield curves of countries that are already pricing in aggressive monetary policy tightening.

ii Source: S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index. Data as of September 30, 2021.

5

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2021

Investment Overview (unaudited) (cont'd)

Core Plus Fixed Income Portfolio

* Minimum Investment

In accordance with SEC regulations, the Fund's performance shown assumes that all recurring fees (including management fees) were deducted and all dividends and distributions were reinvested. The performance of Class A, Class L, Class C and Class IS shares will vary from the performance of Class I shares based upon their different inception dates and will be negatively impacted by additional fees assessed to those classes (where applicable).

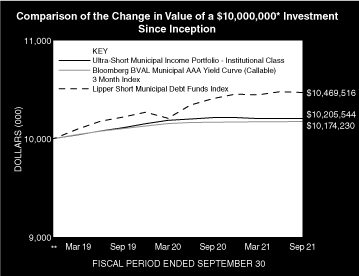

Performance Compared to the Bloomberg U.S. Aggregate Index(1) and the Lipper Core Plus Bond Funds Index(2)

| | | Period Ended September 30, 2021

Total Returns(3) | |

| | | | | Average Annual | |

| | | One

Year | | Five

Years | | Ten

Years | | Since

Inception(9) | |

Fund — Class I Shares

w/o sales charges(4) | | | 1.61 | % | | | 4.15 | % | | | 5.39 | % | | | 7.01 | % | |

Fund — Class A Shares

w/o sales charges(5) | | | 1.17 | | | | 3.78 | | | | 5.03 | | | | 4.80 | | |

Fund — Class A Shares with

maximum 3.25% sales charges(5) | | | –2.12 | | | | 3.10 | | | | 4.69 | | | | 4.66 | | |

Fund — Class L Shares

w/o sales charges(6) | | | 1.00 | | | | 3.52 | | | | — | | | | 4.51 | | |

Fund — Class C Shares

w/o sales charges(7) | | | 0.49 | | | | 3.03 | | | | — | | | | 4.06 | | |

Fund — Class C Shares with

maximum 1.00% deferred

sales charges(7) | | | –0.48 | | | | 3.03 | | | | — | | | | 4.06 | | |

Fund — Class IS Shares

w/o sales charges(8) | | | 1.66 | | | | — | | | | — | | | | 5.81 | | |

Bloomberg U.S. Aggregate Index | | | –0.90 | | | | 2.94 | | | | 3.01 | | | | 6.68 | | |

Lipper Core Plus Bond Funds Index | | | 1.72 | | | | 3.79 | | | | 4.01 | | | | — | | |

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. Performance assumes that all dividends and distributions, if any, were reinvested. For the most recent month-end performance figures, please visit www.morganstanley.com/im/shareholderreports. Investment returns and principal value will fluctuate so that Fund shares, when redeemed, may be worth more or less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance of share classes will vary due to differences in sales charges and expenses.

(1) The Bloomberg U.S. Aggregate Index tracks the performance of U.S. government agency and Treasury securities, investment-grade corporate debt securities, agency mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

(2) The Lipper Core Plus Bond Funds Index is an equally weighted performance index of the largest qualifying funds (based on net assets) in the Lipper Core Plus Bond Funds classification. The Index, which is adjusted for capital gains distributions and income dividends, is unmanaged and should not be considered an investment. There are currently 30 funds represented in this Index. As of the date of this report, the Fund was in the Lipper Core Plus Bond Funds classification.

(3) Total returns for the Fund reflect expenses waived and/or reimbursed, if applicable, by the Adviser. Without such waivers and/or reimbursements, total returns would have been lower.

(4) Commenced operations on November 14, 1984.

(5) Commenced offering on November 7, 1996.

(6) Commenced offering on April 27, 2012.

(7) Commenced offering on April 30, 2015.

(8) Commenced offering on June 15, 2018.

(9) For comparative purposes, average annual since inception returns listed for the Indexes refer to the inception date of Class I of the Fund, not the inception of the Indexes.

6

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2021

Portfolio of Investments

Core Plus Fixed Income Portfolio

| | | Face

Amount

(000) | | Value

(000) | |

Fixed Income Securities (99.1%) | |

Agency Adjustable Rate Mortgage (0.0%) (a) | |

Federal Home Loan Mortgage Corporation,

Conventional Pool:

12 Month USD LIBOR + 1.63%,

1.94%, 7/1/45 | | $ | 15 | | | $ | 16 | | |

Agency Fixed Rate Mortgages (18.1%) | |

Federal Home Loan Mortgage Corporation, | |

Conventional Pools: | |

2.50%, 11/1/49 | | | 905 | | | | 934 | | |

3.00%, 11/1/49 - 12/1/49 | | | 635 | | | | 652 | | |

3.50%, 8/1/49 | | | 275 | | | | 286 | | |

4.00%, 4/1/49 - 11/1/49 | | | 1,241 | | | | 1,311 | | |

4.50%, 2/1/49 | | | 580 | | | | 627 | | |

Gold Pools: | |

3.00%, 3/1/47 - 6/1/49 | | | 1,595 | | | | 1,686 | | |

3.50%, 1/1/44 - 4/1/49 | | | 985 | | | | 1,072 | | |

4.00%, 6/1/44 - 1/1/48 | | | 467 | | | | 508 | | |

5.41%, 7/1/37 - 8/1/37 | | | 11 | | | | 13 | | |

5.44%, 1/1/37 - 2/1/38 | | | 47 | | | | 53 | | |

5.46%, 5/1/37 - 1/1/38 | | | 41 | | | | 45 | | |

5.48%, 8/1/37 | | | 11 | | | | 12 | | |

5.50%, 8/1/37 - 4/1/38 | | | 56 | | | | 63 | | |

5.52%, 10/1/37 | | | 5 | | | | 6 | | |

5.62%, 12/1/36 - 8/1/37 | | | 47 | | | | 54 | | |

6.00%, 10/1/36 - 8/1/38 | | | 81 | | | | 92 | | |

6.50%, 12/1/25 - 8/1/33 | | | 58 | | | | 65 | | |

7.00%, 6/1/28 - 11/1/31 | | | 26 | | | | 27 | | |

Federal National Mortgage Association, | |

Conventional Pools: | |

2.50%, 10/1/49 - 2/1/50 | | | 1,536 | | | | 1,578 | | |

3.00%, 6/1/40 - 1/1/50 | | | 4,368 | | | | 4,546 | | |

3.50%, 8/1/45 - 1/1/51 | | | 26,290 | | | | 27,810 | | |

4.00%, 11/1/41 - 9/1/49 | | | 3,680 | | | | 3,988 | | |

4.50%, 3/1/41 - 8/1/49 | | | 1,609 | | | | 1,744 | | |

5.00%, 3/1/41 | | | 110 | | | | 123 | | |

5.50%, 6/1/35 - 1/1/37 | | | 38 | | | | 45 | | |

5.62%, 12/1/36 | | | 18 | | | | 20 | | |

6.50%, 4/1/24 - 1/1/34 | | | 537 | | | | 608 | | |

7.00%, 5/1/28 - 12/1/33 | | | 90 | | | | 95 | | |

9.50%, 4/1/30 | | | 32 | | | | 35 | | |

December TBA: | |

2.00%, 12/1/51 (b) | | | 9,900 | | | | 9,887 | | |

2.50%, 12/1/51 (b) | | | 76,850 | | | | 78,906 | | |

November TBA: | |

3.00%, 11/1/51 (b) | | | 23,150 | | | | 24,195 | | |

Government National Mortgage Association, | |

December TBA: | |

3.00%, 12/20/51 (b) | | | 9,475 | | | | 9,865 | | |

| | | Face

Amount

(000) | | Value

(000) | |

Various Pools: | |

3.50%, 11/20/40 - 7/20/49 | | $ | 1,091 | | | $ | 1,160 | | |

4.00%, 8/20/41 - 11/20/49 | | | 3,648 | | | | 3,901 | | |

4.50%, 4/20/49 - 7/20/49 | | | 512 | | | | 539 | | |

5.00%, 12/20/48 - 2/20/49 | | | 60 | | | | 63 | | |

6.50%, 5/15/40 | | | 318 | | | | 371 | | |

| | | | 176,985 | | |

Asset-Backed Securities (13.2%) | |

AASET 2018-2 US Ltd., | |

4.45%, 11/18/38 (c) | | | 3,124 | | | | 3,040 | | |

AIMCO CLO, | |

Series 2018-B | |

3 Month USD LIBOR + 1.10%,

1.23%, 1/15/32 (c)(d) | | | 3,600 | | | | 3,602 | | |

Ajax Mortgage Loan Trust, | |

1.70%, 5/25/59 (c) | | | 1,995 | | | | 2,016 | | |

2.24%, 6/25/66 (c) | | | 2,184 | | | | 2,182 | | |

American Homes 4 Rent Trust, | |

6.07%, 10/17/52 (c) | | | 601 | | | | 674 | | |

AMSR 2019-SFR1 Trust, | |

2.77%, 1/19/39 (c) | | | 3,100 | | | | 3,228 | | |

Aqua Finance Trust, | |

1.79%, 7/17/46 | | | 1,540 | | | | 1,540 | | |

3.47%, 7/16/40 (c) | | | 900 | | | | 931 | | |

BCMSC Trust, | |

7.51%, 1/15/29 (d) | | | 1,341 | | | | 1,303 | | |

Benefit Street Partners CLO XX Ltd., | |

3 Month USD LIBOR + 1.17%,

1.31%, 7/15/34 (c)(d) | | | 3,685 | | | | 3,687 | | |

Blackbird Capital Aircraft, | |

2.44%, 7/15/46 (c) | | | 1,554 | | | | 1,559 | | |

Blackbird Capital Aircraft Lease

Securitization Ltd., | |

5.68%, 12/16/41 (c) | | | 714 | | | | 701 | | |

Cascade MH Asset Trust, | |

4.00%, 11/25/44 (c)(d) | | | 1,354 | | | | 1,414 | | |

| CFMT 2020-HB4 LLC, | |

2.72%, 12/26/30 (c)(d) | | | 3,850 | | | | 3,855 | | |

Consumer Loan Underlying Bond Credit Trust, | |

4.41%, 10/15/26 (c) | | | 2,000 | | | | 2,042 | | |

4.66%, 7/15/26 (c) | | | 1,000 | | | | 1,019 | | |

5.21%, 7/15/25 (c) | | | 596 | | | | 604 | | |

ContiMortgage Home Equity Loan Trust, | |

8.10%, 8/15/25 | | | 19 | | | | 15 | | |

CWABS Asset-Backed Certificates Trust, | |

1 Month USD LIBOR + 1.58%,

1.66%, 12/25/34 (d) | | | 3,680 | | | | 3,687 | | |

Diamond Resorts Owner Trust, | |

4.02%, 2/20/32 (c) | | | 762 | | | | 783 | | |

Fair Square Issuance Trust, | |

2.90%, 9/20/24 (c) | | | 900 | | | | 906 | | |

Falcon Aerospace Ltd., | |

3.60%, 9/15/39 (c) | | | 803 | | | | 797 | | |

The accompanying notes are an integral part of the financial statements.

7

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2021

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

| | | Face

Amount

(000) | | Value

(000) | |

Asset-Backed Securities (cont'd) | |

FCI Funding 2019-1 LLC, | |

3.63%, 2/18/31 (c) | | $ | 132 | | | $ | 133 | | |

Foundation Finance Trust, | |

3.86%, 11/15/34 (c) | | | 383 | | | | 395 | | |

FREED ABS Trust, | |

3.19%, 11/18/26 (c) | | | 1,512 | | | | 1,519 | | |

3.87%, 6/18/26 (c) | | | 71 | | | | 72 | | |

4.61%, 10/20/25 (c) | | | 49 | | | | 49 | | |

GAIA Aviation Ltd., | |

7.00%, 12/15/44 (c) | | | 1,363 | | | | 1,124 | | |

GCI Funding I LLC, | |

2.82%, 10/18/45 (c) | | | 905 | | | | 918 | | |

Golub Capital Partners ABS Funding Ltd., | |

2.77%, 4/20/29 (c) | | | 875 | | | | 872 | | |

Class A2 | |

3.21%, 1/22/29 (c) | | | 3,290 | | | | 3,321 | | |

Goodgreen Trust, | |

5.53%, 4/15/55 (c) | | | 2,521 | | | | 2,604 | | |

5.74%, 10/15/56 (c) | | | 3,410 | | | | 3,489 | | |

Home Partners of America Trust, | |

1 Month USD LIBOR + 1.45%,

1.54%, 7/17/37 (c)(d) | | | 2,200 | | | | 2,204 | | |

JOL Air Ltd., | |

4.95%, 4/15/44 (c) | | | 241 | | | | 224 | | |

Lunar Aircraft Ltd., | |

3.38%, 2/15/45 (c) | | | 428 | | | | 425 | | |

MACH 1 Cayman Ltd., | |

3.47%, 10/15/39 (c) | | | 956 | | | | 956 | | |

MAPS Ltd., | |

4.21%, 5/15/43 (c) | | | 479 | | | | 484 | | |

METAL LLC, | |

4.58%, 10/15/42 (c) | | | 623 | | | | 573 | | |

Mosaic Solar Loan Trust, | |

2.10%, 4/20/46 (c) | | | 753 | | | | 764 | | |

Nationstar HECM Loan Trust, | |

2.82%, 9/25/30 (c)(d) | | | 775 | | | | 775 | | |

Navistar Financial Dealer Note Master Trust, | |

1 Month USD LIBOR + 2.90%,

2.99%, 7/25/25 (c)(d) | | | 1,300 | | | | 1,315 | | |

New Residential Mortgage LLC, | |

5.44%, 6/25/25 - 7/25/25 (c) | | | 4,327 | | | | 4,429 | | |

Newday Funding Master Issuer PLC, | |

SOFR + 1.10%, 1.15%, 3/15/29 (c)(d) | | | 4,150 | | | | 4,177 | | |

Newtek Small Business Loan Trust, | |

Daily U.S. Prime Rate - 0.55%,

2.70%, 2/25/44 (c)(d) | | | 451 | | | | 445 | | |

NRZ Excess Spread-Collateralized Notes, | |

4.69%, 5/25/23 (c) | | | 148 | | | | 148 | | |

NYCTL Trust, | |

2.19%, 11/10/32 (c) | | | 632 | | | | 636 | | |

Octagon Investment Partners 51 Ltd., | |

3 Month USD LIBOR + 1.15%,

1.26%, 7/20/34 (c)(d) | | | 5,225 | | | | 5,225 | | |

| | | Face

Amount

(000) | | Value

(000) | |

Oxford Finance Funding LLC, | |

3.10%, 2/15/28 (c) | | $ | 1,000 | | | $ | 1,026 | | |

5.44%, 2/15/27 (c) | | | 456 | | | | 469 | | |

PMT FMSR Issuer Trust, | |

1 Month USD LIBOR + 3.00%,

3.09%, 3/25/26 (c)(d) | | | 3,900 | | | | 3,907 | | |

PNMAC FMSR Issuer Trust, | |

1 Month USD LIBOR + 2.35%,

2.44%, 4/25/23 (c)(d) | | | 2,000 | | | | 2,005 | | |

PNMAC GMSR Issuer Trust, | |

1 Month USD LIBOR + 2.65%,

2.74%, 8/25/25 (c)(d) | | | 1,400 | | | | 1,400 | | |

1 Month USD LIBOR + 2.85%,

2.94%, 2/25/23 (c)(d) | | | 500 | | | | 502 | | |

Progress Residential Trust, | |

2.31%, 5/17/38 (c) | | | 650 | | | | 655 | | |

Prosper Marketplace Issuance Trust, | |

3.20%, 2/17/26 (c) | | | 783 | | | | 787 | | |

3.59%, 7/15/25 (c) | | | 104 | | | | 104 | | |

Raptor Aircraft Finance I LLC, | |

4.21%, 8/23/44 (c) | | | 2,238 | | | | 1,980 | | |

ReadyCap Lending Small Business

Loan Trust, | |

Daily U.S. Prime Rate - 0.50%,

2.75%, 12/27/44 (c)(d) | | | 649 | | | | 623 | | |

Republic FInance Issuance Trust, | |

3.43%, 11/22/27 (c) | | | 1,100 | | | | 1,110 | | |

3.54%, 11/20/30 (c) | | | 1,385 | | | | 1,429 | | |

3.93%, 11/22/27 (c) | | | 500 | | | | 509 | | |

S-Jets Ltd., | |

3.97%, 8/15/42 (c) | | | 3,285 | | | | 3,265 | | |

7.02%, 8/15/42 (c) | | | 1,081 | | | | 841 | | |

Sculptor CLO XXVI Ltd., | |

3 Month USD LIBOR + 1.27%,

1.42%, 7/20/34 (c)(d) | | | 4,900 | | | | 4,918 | | |

SFS Asset Securitization LLC, | |

4.24%, 6/10/25 (c) | | | 2,137 | | | | 2,141 | | |

SLM Student Loan Trust, | |

3 Month EURIBOR + 0.55%,

0.10%, 7/25/39 | | EUR | 1,872 | | | | 2,152 | | |

3 Month EURIBOR + 0.55%,

0.10%, 1/25/40 (d) | | | 1,900 | | | | 2,125 | | |

Small Business Origination Loan Trust, | |

3.85%, 12/15/27 | | GBP | 751 | | | | 1,010 | | |

Sofi Consumer Loan Program Trust, | |

3.79%, 4/26/27 (c) | | $ | 163 | | | | 164 | | |

4.02%, 8/25/27 (c) | | | 94 | | | | 95 | | |

Sprite Ltd., | |

4.25%, 12/15/37 (c) | | | 501 | | | | 499 | | |

START Ireland, | |

4.09%, 3/15/44 (c) | | | 333 | | | | 333 | | |

Start Ltd., | |

4.09%, 5/15/43 (c) | | | 3,280 | | | | 3,277 | | |

Sunbird Engine Finance LLC, | |

3.67%, 2/15/45 (c) | | | 973 | | | | 945 | | |

The accompanying notes are an integral part of the financial statements.

8

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2021

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

| | | Face

Amount

(000) | | Value

(000) | |

Asset-Backed Securities (cont'd) | |

Tricon American Homes Trust, | |

5.10%, 1/17/36 (c) | | $ | 3,500 | | | $ | 3,618 | | |

5.15%, 9/17/34 (c) | | | 1,200 | | | | 1,206 | | |

Upstart Securitization Trust, | |

3.73%, 9/20/29 (c) | | | 1,353 | | | | 1,365 | | |

Verizon Owner Trust, | |

0.41%, 4/21/25 | | | 6,620 | | | | 6,633 | | |

1.94%, 4/22/24 | | | 1,700 | | | | 1,717 | | |

| | | | 129,671 | | |

Collateralized Mortgage Obligations — Agency Collateral Series (1.5%) | |

Federal Home Loan Mortgage Corporation, | |

IO | |

2.83%, 8/25/48 (d) | | | 5,484 | | | | 1,101 | | |

Federal Home Loan Mortgage Corporation, | |

1 Month USD LIBOR + 4.35%,

4.43%, 12/25/26 (c)(d) | | | 90 | | | | 90 | | |

1 Month USD LIBOR + 5.05%,

5.13%, 7/25/23 (d) | | | 99 | | | | 101 | | |

1 Month USD LIBOR + 5.25%,

5.33%, 7/25/26 (c)(d) | | | 46 | | | | 47 | | |

IO | |

0.46%, 11/25/27 (d) | | | 23,623 | | | | 452 | | |

2.72%, 1/25/49 (d) | | | 4,091 | | | | 825 | | |

2.75%, 1/25/49 - 2/25/49(d) | | | 26,722 | | | | 5,559 | | |

2.82%, 9/25/48 (d) | | | 16,800 | | | | 3,507 | | |

3.20%, 4/25/39 (d) | | | 3,200 | | | | 1,062 | | |

3.57%, 10/25/38 (d) | | | 3,500 | | | | 1,261 | | |

IO REMIC | |

6.00% - 1 Month USD LIBOR,

5.92%, 11/15/43 (d) | | | 559 | | | | 96 | | |

IO STRIPS | |

7.50%, 12/15/29 | | | 16 | | | | 3 | | |

Federal National Mortgage Association, | |

IO PAC REMIC | |

8.00%, 9/18/27 | | | 44 | | | | 6 | | |

IO REMIC | |

6.00%, 7/25/33 | | | 39 | | | | 5 | | |

IO STRIPS | |

6.50%, 9/25/29 - 12/25/29 | | | 200 | | | | 23 | | |

8.00%, 4/25/24 | | | 10 | | | | — | @ | |

8.50%, 10/25/25 | | | 13 | | | | 1 | | |

9.00%, 11/25/26 | | | 14 | | | | 1 | | |

REMIC | |

7.00%, 9/25/32 | | | 125 | | | | 149 | | |

Government National Mortgage Association, | |

IO | |

5.00%, 2/16/41 | | | 107 | | | | 19 | | |

IO PAC | |

6.15% - 1 Month USD LIBOR,

6.06%, 10/20/41 (e) | | | 69 | | | | 1 | | |

| | | | 14,309 | | |

| | | Face

Amount

(000) | | Value

(000) | |

Commercial Mortgage-Backed Securities (5.7%) | |

Bancorp Commercial Mortgage Trust, | |

SOFR + 2.41%, 2.46%, 9/15/36 (c)(d) | | $ | 1,400 | | | $ | 1,401 | | |

BANK 2019-BNK21, | |

IO | |

0.99%, 10/17/52 (d) | | | 14,900 | | | | 875 | | |

BANK 2020-BNK30, | |

3.02%, 12/15/53 (d) | | | 4,200 | | | | 3,911 | | |

Benchmark Mortgage Trust, | |

3.76%, 7/15/53 (c) | | | 2,000 | | | | 2,042 | | |

IO | |

0.99%, 9/15/48 (c)(d) | | | 31,000 | | | | 1,303 | | |

BF 2019-NYT Mortgage Trust, | |

1 Month USD LIBOR + 1.70%,

1.78%, 12/15/35 (c)(d) | | | 2,500 | | | | 2,504 | | |

BXP Trust, | |

1 Month USD LIBOR + 3.00%,

3.08%, 11/15/34 (c)(d) | | | 1,150 | | | | 1,055 | | |

CG-CCRE Commercial Mortgage Trust, | |

1 Month USD LIBOR + 1.85%,

1.94%, 11/15/31 (c)(d) | | | 561 | | | | 552 | | |

Citigroup Commercial Mortgage Trust, | |

3.62%, 12/10/41 (c)(d) | | | 1,100 | | | | 883 | | |

IO | |

0.87%, 11/10/48 (d) | | | 2,380 | | | | 61 | | |

1.03%, 9/10/58 (d) | | | 4,466 | | | | 135 | | |

COMM Mortgage Trust, | |

3.51%, 8/15/57 (c)(d) | | | 1,400 | | | | 1,359 | | |

IO | |

0.08%, 7/10/45 (d) | | | 10,283 | | | | 7 | | |

0.88%, 10/10/47 (d) | | | 2,770 | | | | 49 | | |

1.16%, 7/15/47 (d) | | | 2,771 | | | | 64 | | |

CSMC 2020-TMIC, | |

Class A | |

1 Month USD LIBOR + 3.00%,

3.25%, 12/15/35 (c)(d) | | | 5,275 | | | | 5,381 | | |

CSWF Commercial Mortgage Trust, | |

1 Month USD LIBOR + 1.57%,

1.65%, 6/15/34 (c)(d) | | | 3,350 | | | | 3,344 | | |

DROP Mortgage Trust, | |

1 Month USD LIBOR + 1.15%,

1.23%, 4/15/26 (c)(d) | | | 3,525 | | | | 3,542 | | |

GS Mortgage Securities Trust, | |

4.90%, 8/10/46 (c)(d) | | | 500 | | | | 494 | | |

IO | |

0.85%, 9/10/47 (d) | | | 4,832 | | | | 88 | | |

1.38%, 10/10/48 (d) | | | 4,820 | | | | 197 | | |

InTown Hotel Portfolio Trust, | |

1 Month USD LIBOR + 2.30%,

2.38%, 1/15/33 (c)(d) | | | 579 | | | | 580 | | |

Jackson Park Trust LIC, | |

3.35%, 10/14/39 (c)(d) | | | 1,700 | | | | 1,577 | | |

The accompanying notes are an integral part of the financial statements.

9

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2021

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

| | | Face

Amount

(000) | | Value

(000) | |

Commercial Mortgage-Backed Securities (cont'd) | |

JP Morgan Chase Commercial Mortgage

Securities Corp., | |

1 Month USD LIBOR + 2.45%,

2.53%, 4/15/38 (c)(d) | | $ | 2,400 | | | $ | 2,409 | | |

JP Morgan Chase Commercial Mortgage

Securities Trust, | |

IO | |

0.65%, 4/15/46 (d) | | | 6,956 | | | | 53 | | |

0.81%, 12/15/49 (d) | | | 4,075 | | | | 90 | | |

1.01%, 7/15/47 (d) | | | 5,573 | | | | 85 | | |

JPMBB Commercial Mortgage Securities Trust, | |

4.81%, 4/15/47 (c)(d) | | | 775 | | | | 790 | | |

IO | |

1.12%, 8/15/47 (d) | | | 3,454 | | | | 81 | | |

Last Mile Logistics Pan Euro Finance DAC, | |

1.90%, 8/17/33 | | EUR | 750 | | | | 869 | | |

Manhattan West Mortgage Trust, | |

2.41%, 9/10/39 (c)(d) | | $ | 1,500 | | | | 1,488 | | |

MFT Mortgage Trust, | |

3.39%, 8/10/40 (c)(d) | | | 1,000 | | | | 1,011 | | |

MFT Trust, | |

3.59%, 2/10/42 (c)(d) | | | 800 | | | | 765 | | |

MKT 2020-525M Mortgage Trust, | |

3.04%, 2/12/40 (c)(d) | | | 1,000 | | | | 935 | | |

Multifamily Connecticut Avenue Securities Trust, | |

1 Month USD LIBOR + 1.70%,

1.79%, 10/15/49 (c)(d) | | | 351 | | | | 352 | | |

1 Month USD LIBOR + 1.95%,

2.04%, 3/25/50 (c)(d) | | | 2,259 | | | | 2,265 | | |

Natixis Commercial Mortgage Securities Trust, | |

1 Month USD LIBOR + 2.20%,

2.28%, 7/15/36 (c)(d) | | | 2,300 | | | | 2,303 | | |

4.27%, 5/15/39 (c)(d) | | | 2,300 | | | | 2,286 | | |

4.46%, 1/15/43 (c)(d) | | | 800 | | | | 823 | | |

Olympic Tower 2017-OT Mortgage Trust, | |

3.57%, 5/10/39 (c) | | | 2,900 | | | | 3,105 | | |

SG Commercial Mortgage Securities Trust, | |

3.85%, 3/15/37 (c)(d) | | | 1,900 | | | | 1,916 | | |

4.66%, 2/15/41 (c)(d) | | | 1,250 | | | | 1,240 | | |

SLG Office Trust, | |

IO | |

0.26%, 7/15/41 (c)(d) | | | 34,800 | | | | 728 | | |

Wells Fargo Commercial Mortgage Trust, | |

1 Month USD LIBOR + 1.74%,

1.82%, 2/15/37 (c)(d) | | | 900 | | | | 898 | | |

WFRBS Commercial Mortgage Trust, | |

4.28%, 5/15/45 (c)(d) | | | 425 | | | | 420 | | |

| | | | 56,316 | | |

Corporate Bonds (33.9%) | |

Finance (11.5%) | |

AerCap Ireland Capital DAC/AerCap Global

Aviation Trust, | |

4.13%, 7/3/23 | | | 1,150 | | | | 1,210 | | |

| | | Face

Amount

(000) | | Value

(000) | |

Aflac, Inc., | |

4.75%, 1/15/49 | | $ | 500 | | | $ | 655 | | |

Air Lease Corp., | |

2.30%, 2/1/25 | | | 1,325 | | | | 1,361 | | |

American International Group, Inc., | |

4.50%, 7/16/44 | | | 1,075 | | | | 1,314 | | |

Anthem, Inc., | |

2.25%, 5/15/30 | | | 1,325 | | | | 1,330 | | |

Aon Corp., | |

2.80%, 5/15/30 | | | 1,750 | | | | 1,830 | | |

Australia & New Zealand Banking Group Ltd., | |

2.57%, 11/25/35 (c) | | | 875 | | | | 850 | | |

AvalonBay Communities, Inc., | |

2.95%, 5/11/26 | | | 375 | | | | 402 | | |

Avolon Holdings Funding Ltd., | |

2.88%, 2/15/25 (c) | | | 2,650 | | | | 2,728 | | |

Banco Santander Chile, | |

2.70%, 1/10/25 (c) | | | 1,125 | | | | 1,171 | | |

Banco Santander SA, | |

5.18%, 11/19/25 | | | 600 | | | | 682 | | |

Bank of America Corp., | |

1.73%, 7/22/27 | | | 2,525 | | | | 2,537 | | |

2.69%, 4/22/32 | | | 7,200 | | | | 7,336 | | |

3.31%, 4/22/42 | | | 600 | | | | 630 | | |

MTN | |

4.00%, 1/22/25 | | | 1,055 | | | | 1,147 | | |

Bank of Ireland Group PLC, | |

2.03%, 9/30/27 (c) | | | 2,500 | | | | 2,501 | | |

Bank of Montreal, | |

3.80%, 12/15/32 | | | 2,700 | | | | 2,960 | | |

Belrose Funding Trust, | |

2.33%, 8/15/30 (c) | | | 1,225 | | | | 1,210 | | |

BNP Paribas SA, | |

2.82%, 11/19/25 (c) | | | 700 | | | | 733 | | |

2.82%, 1/26/41 (c)(f) | | | 750 | | | | 713 | | |

4.40%, 8/14/28 (c) | | | 1,050 | | | | 1,198 | | |

| BPCE SA, | |

5.15%, 7/21/24 (c) | | | 2,750 | | | | 3,040 | | |

Brookfield Finance LLC, | |

3.45%, 4/15/50 | | | 1,350 | | | | 1,396 | | |

Brown & Brown, Inc., | |

2.38%, 3/15/31 | | | 900 | | | | 898 | | |

4.20%, 9/15/24 | | | 1,150 | | | | 1,251 | | |

Chubb INA Holdings, Inc., | |

1.38%, 9/15/30 | | | 2,275 | | | | 2,156 | | |

Citigroup, Inc., | |

2.56%, 5/1/32 | | | 2,150 | | | | 2,173 | | |

CNO Financial Group, Inc., | |

5.25%, 5/30/29 | | | 885 | | | | 1,038 | | |

Coinbase Global, Inc., | |

3.38%, 10/1/28 (c)(f) | | | 730 | | | | 702 | | |

Credit Agricole SA, | |

3.25%, 10/4/24 (c) | | | 725 | | | | 774 | | |

The accompanying notes are an integral part of the financial statements.

10

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2021

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

| | | Face

Amount

(000) | | Value

(000) | |

Finance (cont'd) | |

Credit Suisse Group AG, | |

2.59%, 9/11/25 (c) | | $ | 4,800 | | | $ | 4,977 | | |

Danske Bank A/S, | |

5.00%, 1/12/23 (c) | | | 350 | | | | 354 | | |

Deutsche Bank AG, | |

3.95%, 2/27/23 | | | 850 | | | | 889 | | |

GA Global Funding Trust, | |

1.00%, 4/8/24 (c) | | | 1,875 | | | | 1,884 | | |

GE Capital International Funding Co., Unlimited Co., | |

4.42%, 11/15/35 | | | 1,965 | | | | 2,360 | | |

Global Atlantic Fin Co., | |

4.70%, 10/15/51 (c) | | | 2,220 | | | | 2,297 | | |

Goldman Sachs Group, Inc. (The), | |

2.38%, 7/21/32 | | | 975 | | | | 966 | | |

2.62%, 4/22/32 | | | 2,175 | | | | 2,203 | | |

MTN | |

4.80%, 7/8/44 | | | 625 | | | | 800 | | |

Grupo Aval Ltd., | |

4.38%, 2/4/30 (c) | | | 770 | | | | 762 | | |

Howard Hughes Corp. (The), | |

4.38%, 2/1/31 (c) | | | 1,480 | | | | 1,491 | | |

HSBC Holdings PLC, | |

4.25%, 3/14/24 | | | 2,325 | | | | 2,499 | | |

Intercontinental Exchange, Inc., | |

1.85%, 9/15/32 | | | 2,675 | | | | 2,530 | | |

Intesa Sanpaolo SpA, | |

5.25%, 1/12/24 | | | 610 | | | | 667 | | |

Jefferies Finance LLC/JFIN Co-Issuer Corp., | |

5.00%, 8/15/28 (c) | | | 1,490 | | | | 1,512 | | |

JPMorgan Chase & Co., | |

1.95%, 2/4/32 | | | 3,775 | | | | 3,644 | | |

4.13%, 12/15/26 | | | 3,225 | | | | 3,628 | | |

JPMorgan Chase Bank NA, | |

0.13%, 1/1/23 (c)(f) | | | 1,140 | | | | 1,169 | | |

Kimco Realty Corp., | |

3.70%, 10/1/49 | | | 1,050 | | | | 1,139 | | |

Lloyds Banking Group PLC, | |

3.57%, 11/7/28 | | | 250 | | | | 272 | | |

4.38%, 3/22/28 | | | 1,525 | | | | 1,736 | | |

Macquarie Bank Ltd., | |

2.30%, 1/22/25 (c)(f) | | | 1,700 | | | | 1,769 | | |

Marsh & McLennan Cos., Inc., | |

5.88%, 8/1/33 | | | 1,554 | | | | 2,088 | | |

MassMutual Global Funding II, | |

3.40%, 3/8/26 (c) | | | 1,040 | | | | 1,135 | | |

Metropolitan Life Global Funding I, | |

2.95%, 4/9/30 (c) | | | 1,300 | | | | 1,391 | | |

Nationwide Building Society, | |

3.96%, 7/18/30 (c) | | | 1,200 | | | | 1,335 | | |

4.30%, 3/8/29 (c) | | | 1,550 | | | | 1,746 | | |

4.36%, 8/1/24 (c) | | | 500 | | | | 532 | | |

| | | Face

Amount

(000) | | Value

(000) | |

Natwest Group PLC, | |

3.88%, 9/12/23 | | $ | 875 | | | $ | 928 | | |

Oversea-Chinese Banking Corp. Ltd., | |

1.83%, 9/10/30 (c) | | | 970 | | | | 968 | | |

Pine Street Trust I, | |

4.57%, 2/15/29 (c) | | | 575 | | | | 654 | | |

Progressive Corp. (The), | |

3.20%, 3/26/30 | | | 175 | | | | 191 | | |

4.00%, 3/1/29 | | | 575 | | | | 657 | | |

Realty Income Corp., | |

0.75%, 3/15/26 | | | 1,602 | | | | 1,565 | | |

Rocket Mortgage LLC/Rocket Mortgage

Co-Issuer, Inc., | |

3.88%, 3/1/31 (c) | | | 1,350 | | | | 1,364 | | |

Santander UK Group Holdings PLC, | |

3.57%, 1/10/23 | | | 2,400 | | | | 2,421 | | |

Societe Generale SA, | |

2.63%, 1/22/25 (c) | | | 1,625 | | | | 1,688 | | |

Standard Chartered PLC, | |

2.68%, 6/29/32 (c) | | | 475 | | | | 473 | | |

SVB Financial Group, | |

1.80%, 2/2/31 (f) | | | 2,900 | | | | 2,786 | | |

Travelers Cos., Inc. (The), | |

3.75%, 5/15/46 | | | 800 | | | | 924 | | |

USAA Capital Corp., | |

2.13%, 5/1/30 (c) | | | 350 | | | | 353 | | |

Wells Fargo & Co., | |

2.88%, 10/30/30 | | | 1,150 | | | | 1,202 | | |

Westpac Banking Corp., | |

2.67%, 11/15/35 | | | 775 | | | | 759 | | |

| | | | 112,634 | | |

Industrials (20.9%) | |

7-Eleven, Inc., | |

1.80%, 2/10/31 (c) | | | 2,500 | | | | 2,382 | | |

AbbVie, Inc., | |

4.25%, 11/21/49 | | | 850 | | | | 1,008 | | |

Adobe, Inc., | |

2.30%, 2/1/30 | | | 1,975 | | | | 2,044 | | |

Airbnb, Inc., | |

0.00%, 3/15/26 (c) | | | 1,015 | | | | 1,000 | | |

Alibaba Group Holding Ltd., | |

2.13%, 2/9/31 (f) | | | 825 | | | | 793 | | |

Altria Group, Inc., | |

3.40%, 2/4/41 | | | 2,225 | | | | 2,110 | | |

Amazon.com, Inc., | |

2.70%, 6/3/60 | | | 1,075 | | | | 1,011 | | |

American Airlines Inc/AAdvantage Loyalty IP Ltd., | |

5.75%, 4/20/29 (c) | | | 1,590 | | | | 1,715 | | |

Amgen, Inc., | |

2.80%, 8/15/41 | | | 1,075 | | | | 1,040 | | |

Anheuser-Busch InBev Worldwide, Inc., | |

3.50%, 6/1/30 | | | 650 | | | | 712 | | |

4.60%, 4/15/48 | | | 2,683 | | | | 3,209 | | |

The accompanying notes are an integral part of the financial statements.

11

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2021

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

| | | Face

Amount

(000) | | Value

(000) | |

Industrials (cont'd) | |

Apple, Inc., | |

2.65%, 5/11/50 | | $ | 2,050 | | | $ | 1,974 | | |

2.70%, 8/5/51 | | | 975 | | | | 942 | | |

Arches Buyer, Inc., | |

4.25%, 6/1/28 (c) | | | 1,550 | | | | 1,573 | | |

AT&T, Inc., | |

2.55%, 12/1/33 | | | 1,725 | | | | 1,699 | | |

3.55%, 9/15/55 | | | 3,375 | | | | 3,335 | | |

Baidu, Inc., | |

1.72%, 4/9/26 | | | 1,450 | | | | 1,455 | | |

BAT Capital Corp., | |

3.56%, 8/15/27 | | | 2,100 | | | | 2,264 | | |

Boeing Co. (The), | |

2.95%, 2/1/30 | | | 650 | | | | 663 | | |

3.25%, 2/1/35 | | | 225 | | | | 225 | | |

3.95%, 8/1/59 | | | 350 | | | | 360 | | |

BP Capital Markets PLC, | |

4.38%, 6/22/25 (g) | | | 700 | | | | 748 | | |

4.88%, 3/22/30 (g) | | | 700 | | | | 771 | | |

Burlington Northern Santa Fe LLC, | |

3.30%, 9/15/51 | | | 850 | | | | 918 | | |

Charter Communications Operating LLC/

Charter Communications Operating Capital, | |

2.30%, 2/1/32 | | | 1,200 | | | | 1,144 | | |

3.50%, 3/1/42 (h) | | | 900 | | | | 882 | | |

3.85%, 4/1/61 | | | 1,325 | | | | 1,267 | | |

3.95%, 6/30/62 (h) | | | 750 | | | | 725 | | |

Chemours Co. (The), | |

4.63%, 11/15/29 (c) | | | 2,550 | | | | 2,493 | | |

Children's Health System of Texas, | |

2.51%, 8/15/50 | | | 800 | | | | 746 | | |

Cigna Corp., | |

2.38%, 3/15/31 | | | 1,975 | | | | 1,995 | | |

3.40%, 3/15/51 | | | 625 | | | | 643 | | |

CNOOC Finance 2013 Ltd., | |

3.00%, 5/9/23 | | | 540 | | | | 558 | | |

Comcast Corp., | |

1.95%, 1/15/31 | | | 3,725 | | | | 3,659 | | |

2.89%, 11/1/51 (c) | | | 200 | | | | 192 | | |

2.94%, 11/1/56 (c) | | | 1,100 | | | | 1,041 | | |

CVS Health Corp., | |

1.88%, 2/28/31 | | | 2,555 | | | | 2,470 | | |

5.13%, 7/20/45 | | | 425 | | | | 548 | | |

Dell International LLC/EMC Corp., | |

5.85%, 7/15/25 | | | 400 | | | | 466 | | |

6.02%, 6/15/26 | | | 1,475 | | | | 1,756 | | |

Delta Air Lines Pass Through Trust, | |

Series AA | |

3.20%, 10/25/25 | | | 1,050 | | | | 1,110 | | |

Dexcom, Inc., | |

0.25%, 11/15/25 | | | 1,175 | | | | 1,398 | | |

| | | Face

Amount

(000) | | Value

(000) | |

Diamond Sports Group LLC/Diamond

Sports Finance Co., | |

6.63%, 8/15/27 (c) | | $ | 700 | | | $ | 307 | | |

Diamondback Energy, Inc., | |

3.25%, 12/1/26 | | | 1,750 | | | | 1,875 | | |

Duke University, | |

Series 2020 | |

2.83%, 10/1/55 | | | 1,600 | | | | 1,642 | | |

DXC Technology Co., | |

1.80%, 9/15/26 | | | 3,450 | | | | 3,447 | | |

eBay, Inc., | |

3.65%, 5/10/51 | | | 1,550 | | | | 1,664 | | |

Enbridge, Inc., | |

2.50%, 1/15/25 (f) | | | 925 | | | | 964 | | |

2.50%, 8/1/33 | | | 3,025 | | | | 3,039 | | |

Energy Transfer LP, | |

2.90%, 5/15/25 | | | 1,575 | | | | 1,652 | | |

3.90%, 7/15/26 | | | 750 | | | | 819 | | |

Enterprise Products Operating LLC, | |

3.30%, 2/15/53 | | | 825 | | | | 806 | | |

Equinix, Inc., | |

1.00%, 9/15/25 | | | 2,500 | | | | 2,467 | | |

Expedia Group, Inc., | |

0.00%, 2/15/26 (c)(f) | | | 950 | | | | 1,030 | | |

Exxon Mobil Corp., | |

3.45%, 4/15/51 | | | 1,375 | | | | 1,465 | | |

Fiserv, Inc., | |

2.65%, 6/1/30 | | | 500 | | | | 512 | | |

Ford Motor Credit Co. LLC, | |

4.00%, 11/13/30 | | | 490 | | | | 510 | | |

Ford Motor Credit Co., LLC, | |

3.10%, 5/4/23 | | | 200 | | | | 203 | | |

4.39%, 1/8/26 | | | 800 | | | | 854 | | |

Fox Corp., | |

5.48%, 1/25/39 | | | 1,300 | | | | 1,662 | | |

Galaxy Pipeline Assets Bidco Ltd., | |

1.75%, 9/30/27 (c) | | | 2,985 | | | | 3,021 | | |

General Motors Co., | |

6.60%, 4/1/36 | | | 200 | | | | 269 | | |

General Motors Financial Co., Inc., | |

3.85%, 1/5/28 | | | 800 | | | | 871 | | |

4.35%, 1/17/27 | | | 1,825 | | | | 2,047 | | |

Georgia-Pacific LLC, | |

2.30%, 4/30/30 (c)(f) | | | 1,525 | | | | 1,554 | | |

Gilead Sciences, Inc., | |

2.80%, 10/1/50 | | | 700 | | | | 661 | | |

Glencore Funding LLC, | |

4.13%, 3/12/24 (c) | | | 2,375 | | | | 2,545 | | |

Global Payments, Inc., | |

1.20%, 3/1/26 | | | 1,075 | | | | 1,065 | | |

GLP Capital LP/GLP Financing II, Inc., | |

5.38%, 4/15/26 | | | 1,250 | | | | 1,423 | | |

GSK Finance No 3 PLC, | |

0.00%, 6/22/23 (c) | | | 1,500 | | | | 1,487 | | |

The accompanying notes are an integral part of the financial statements.

12

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2021

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

| | | Face

Amount

(000) | | Value

(000) | |

Industrials (cont'd) | |

HCA, Inc., | |

5.25%, 6/15/49 | | $ | 1,900 | | | $ | 2,429 | | |

Hyatt Hotels Corp., | |

1.80%, 10/1/24 (h) | | | 1,600 | | | | 1,604 | | |

Hyundai Capital America, | |

1.80%, 1/10/28 (c) | | | 2,650 | | | | 2,595 | | |

Imperial Brands Finance PLC, | |

3.13%, 7/26/24 (c) | | | 1,000 | | | | 1,052 | | |

J2 Global, Inc., | |

1.75%, 11/1/26 (c) | | | 825 | | | | 1,037 | | |

Johns Hopkins University, | |

Series A | |

2.81%, 1/1/60 | | | 1,170 | | | | 1,195 | | |

Kimberly-Clark de Mexico SAB de CV, | |

2.43%, 7/1/31 (c) | | | 1,375 | | | | 1,372 | | |

Las Vegas Sands Corp., | |

3.20%, 8/8/24 | | | 850 | | | | 873 | | |

Level 3 Financing, Inc., | |

3.40%, 3/1/27 (c) | | | 1,275 | | | | 1,345 | | |

Lions Gate Capital Holdings LLC, | |

5.50%, 4/15/29 (c) | | | 1,570 | | | | 1,625 | | |

LYB International Finance III LLC, | |

4.20%, 5/1/50 | | | 550 | | | | 628 | | |

MARB BondCo PLC, | |

3.95%, 1/29/31 (c) | | | 2,720 | | | | 2,602 | | |

Marriott Vacations Worldwide Corp., | |

1.50%, 9/15/22 | | | 915 | | | | 1,086 | | |

Masco Corp., | |

2.00%, 2/15/31 | | | 492 | | | | 476 | | |

McDonald's Corp., | |

4.45%, 9/1/48 | | | 450 | | | | 553 | | |

McLaren Health Care Corp., | |

Series A | |

4.39%, 5/15/48 | | | 1,175 | | | | 1,483 | | |

Microsoft Corp., | |

2.53%, 6/1/50 | | | 750 | | | | 723 | | |

Midwest Connector Capital Co. LLC, | |

3.63%, 4/1/22 (c)(f) | | | 400 | | | | 405 | | |

NBN Co. Ltd., | |

2.63%, 5/5/31 (c) | | | 2,400 | | | | 2,437 | | |

Newcastle Coal Infrastructure Group Pty Ltd., | |

4.40%, 9/29/27 (c) | | | 2,550 | | | | 2,614 | | |

Newmont Corp., | |

2.25%, 10/1/30 | | | 1,150 | | | | 1,145 | | |

NIKE, Inc., | |

2.85%, 3/27/30 | | | 1,225 | | | | 1,318 | | |

Nissan Motor Co. Ltd., | |

3.04%, 9/15/23 (c) | | | 2,400 | | | | 2,497 | | |

NOVA Chemicals Corp., | |

4.25%, 5/15/29 (c) | | | 2,075 | | | | 2,078 | | |

NTT Finance Corp., | |

1.59%, 4/3/28 (c) | | | 3,900 | | | | 3,863 | | |

| | | Face

Amount

(000) | | Value

(000) | |

NuStar Logistics LP, | |

6.38%, 10/1/30 | | $ | 2,350 | | | $ | 2,588 | | |

NVIDIA Corp., | |

2.85%, 4/1/30 | | | 1,250 | | | | 1,340 | | |

Occidental Petroleum Corp., | |

3.20%, 8/15/26 | | | 10 | | | | 10 | | |

3.50%, 8/15/29 | | | 2,600 | | | | 2,648 | | |

ONEOK, Inc., | |

3.10%, 3/15/30 | | | 1,625 | | | | 1,697 | | |

Ooredoo International Finance Ltd., | |

2.63%, 4/8/31 (c) | | | 1,470 | | | | 1,501 | | |

Oracle Corp., | |

2.50%, 4/1/25 | | | 1,900 | | | | 1,989 | | |

Peloton Interactive, Inc., | |

0.00%, 2/15/26 (c) | | | 975 | | | | 863 | | |

Resorts World Las Vegas LLC/RWLV Capital, Inc., | |

4.63%, 4/16/29 (c)(f) | | | 2,800 | | | | 2,860 | | |

RingCentral, Inc., | |

0.00%, 3/15/26 | | | 895 | | | | 842 | | |

Rockies Express Pipeline LLC, | |

3.60%, 5/15/25 (c) | | | 2,125 | | | | 2,197 | | |

Ross Stores, Inc., | |

0.88%, 4/15/26 | | | 2,100 | | | | 2,067 | | |

Royalty Pharma PLC, | |

3.55%, 9/2/50 | | | 925 | | | | 910 | | |

Saudi Arabian Oil Co., | |

3.25%, 11/24/50 (c) | | | 960 | | | | 918 | | |

SBA Communications Corp., | |

3.13%, 2/1/29 (c) | | | 1,610 | | | | 1,558 | | |

Seattle Children's Hospital, | |

Series 2021 | |

2.72%, 10/1/50 | | | 2,750 | | | | 2,682 | | |

Sherwin-Williams Co. (The), | |

2.30%, 5/15/30 | | | 925 | | | | 935 | | |

2.95%, 8/15/29 | | | 625 | | | | 664 | | |

Siemens Financieringsmaatschappij N.V., | |

2.35%, 10/15/26 (c) | | | 2,050 | | | | 2,142 | | |

Silgan Holdings, Inc., | |

1.40%, 4/1/26 (c) | | | 2,150 | | | | 2,118 | | |

Splunk, Inc., | |

1.13%, 6/15/27 | | | 1,200 | | | | 1,183 | | |

Spotify USA, Inc., | |

0.00%, 3/15/26 (c) | | | 1,190 | | | | 1,075 | | |

Standard Industries, Inc., | |

2.25%, 11/21/26 (c) | | EUR | 575 | | | | 659 | | |

Syngenta Finance N.V., | |

4.89%, 4/24/25 (c) | | $ | 975 | | | | 1,067 | | |

T-Mobile USA, Inc., | |

2.25%, 11/15/31 | | | 1,700 | | | | 1,668 | | |

3.60%, 11/15/60 | | | 650 | | | | 640 | | |

Targa Resources Partners LP/Targa

Resources Partners Finance Corp., | |

4.00%, 1/15/32 (c) | | | 2,695 | | | | 2,789 | | |

The accompanying notes are an integral part of the financial statements.

13

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2021

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

| | | Face

Amount

(000) | | Value

(000) | |

Industrials (cont'd) | |

Telefonica Emisiones SA, | |

4.10%, 3/8/27 | | $ | 1,800 | | | $ | 2,024 | | |

TotalEnergies SE, | |

Series FP | |

0.50%, 12/2/22 | | | 1,200 | | | | 1,220 | | |

Trimble, Inc., | |

4.15%, 6/15/23 | | | 1,150 | | | | 1,213 | | |

TSMC Global Ltd., | |

0.75%, 9/28/25 (c) | | | 1,325 | | | | 1,293 | | |

Uber Technologies, Inc., | |

0.01%, 12/15/25 (c) | | | 1,560 | | | | 1,525 | | |

Univision Communications, Inc., | |

4.50%, 5/1/29 (c) | | | 1,470 | | | | 1,496 | | |

US Foods, Inc., | |

4.75%, 2/15/29 (c) | | | 2,350 | | | | 2,415 | | |

Verizon Communications, Inc., | |

2.36%, 3/15/32 (c) | | | 300 | | | | 297 | | |

2.65%, 11/20/40 | | | 2,050 | | | | 1,929 | | |

2.99%, 10/30/56 | | | 3,025 | | | | 2,800 | | |

3.40%, 3/22/41 | | | 275 | | | | 287 | | |

Volkswagen Group of America Finance LLC, | |

4.75%, 11/13/28 (c) | | | 1,025 | | | | 1,200 | | |

Vontier Corp., | |

2.40%, 4/1/28 (c) | | | 2,700 | | | | 2,666 | | |

VTR Finance N.V., | |

6.38%, 7/15/28 (c) | | | 1,050 | | | | 1,133 | | |

Walmart, Inc., | |

2.65%, 9/22/51 | | | 225 | | | | 224 | | |

Walt Disney Co. (The), | |

2.75%, 9/1/49 | | | 2,491 | | | | 2,395 | | |

3.50%, 5/13/40 | | | 375 | | | | 414 | | |

Western Digital Corp., | |

1.50%, 2/1/24 | | | 1,055 | | | | 1,069 | | |

Williams Cos., Inc. (The), | |

4.85%, 3/1/48 | | | 475 | | | | 582 | | |

Zynga, Inc., | |

0.00%, 12/15/26 (c) | | | 1,150 | | | | 1,116 | | |

| | | | 204,848 | | |

Utilities (1.5%) | |

DTE Electric Co., | |

2.95%, 3/1/50 | | | 350 | | | | 352 | | |

Duke Energy Indiana LLC, | |

2.75%, 4/1/50 | | | 460 | | | | 441 | | |

Enel Finance International N.V., | |

3.63%, 5/25/27 (c) | | | 1,800 | | | | 1,994 | | |

Jersey Central Power & Light Co., | |

2.75%, 3/1/32 (c) | | | 1,400 | | | | 1,436 | | |

Korea Hydro & Nuclear Power Co., Ltd., | |

3.75%, 7/25/23 (c) | | | 1,380 | | | | 1,460 | | |

Mississippi Power Co., | |

3.95%, 3/30/28 | | | 2,325 | | | | 2,593 | | |

| | | Face

Amount

(000) | | Value

(000) | |

Northern States Power Co., | |

2.90%, 3/1/50 | | $ | 1,400 | | | $ | 1,410 | | |

NRG Energy, Inc., | |

3.63%, 2/15/31 (c) | | | 1,530 | | | | 1,505 | | |

Pacific Gas and Electric Co., | |

3.30%, 8/1/40 | | | 1,025 | | | | 947 | | |

Piedmont Natural Gas Co., Inc., | |

2.50%, 3/15/31 | | | 975 | | | | 981 | | |

Xcel Energy, Inc., | |

2.60%, 12/1/29 | | | 1,850 | | | | 1,915 | | |

| | | | 15,034 | | |

| | | | 332,516 | | |

Mortgages — Other (17.3%) | |

Adjustable Rate Mortgage Trust, | |

3.29%, 6/25/35 (d) | | | 106 | | | | 107 | | |

Ajax Mortgage Loan Trust, | |

2.35%, 9/25/65 (c)(d) | | | 725 | | | | 731 | | |

Alternative Loan Trust, | |

1 Month USD LIBOR + 0.18%,

0.27%, 5/25/47 (d) | | | 91 | | | | 88 | | |

Asset Backed Trust, | |

2.24%, 6/25/61 (c) | | | 2,642 | | | | 2,644 | | |

Banc of America Alternative Loan Trust, | |

1 Month USD LIBOR + 0.65%,

0.74%, 7/25/46 (d) | | | 127 | | | | 97 | | |

6.36%, 10/25/36 | | | 437 | | | | 187 | | |

Banc of America Funding Trust, | |

5.25%, 7/25/37 | | | 24 | | | | 25 | | |

Bear Stearns ARM Trust, | |

2.66%, 2/25/34 (d) | | | 573 | | | | 591 | | |

BRAVO Residential Funding Trust, | |

2.00%, 5/25/59 (c)(d) | | | 2,142 | | | | 2,179 | | |

Brean Asset Backed Securities Trust, | |

1.40%, 10/25/63 (c)(d) | | | 1,831 | | | | 1,761 | | |

1.75%, 10/25/61 (c)(d) | | | 2,550 | | | | 2,494 | | |

Bunker Hill Loan Depositary Trust, | |

1.72%, 2/25/55 (c)(d) | | | 1,515 | | | | 1,531 | | |

Cascade Funding Mortgage Trust, | |

1.94%, 9/25/50 (c)(d) | | | 4,322 | | | | 4,294 | | |

3.73%, 6/25/36 (c)(d) | | | 3,825 | | | | 3,815 | | |

4.00%, 10/25/68 (c)(d) | | | 1,902 | | | | 1,942 | | |

| CFMT 2021-HB5 LLC, | |

2.91%, 2/25/31 (c)(d) | | | 3,800 | | | | 3,808 | | |

ChaseFlex Trust, | |

6.00%, 2/25/37 | | | 617 | | | | 359 | | |

CIM Trust, | |

2.50%, 7/1/51 (c)(d) | | | 4,019 | | | | 4,087 | | |

Citigroup Mortgage Loan Trust, | |

2.50%, 9/25/51 (c)(d) | | | 4,900 | | | | 4,963 | | |

Classic RMBS Trust, | |

3.06%, 8/16/49 (c) | | CAD | 59 | | | | 48 | | |

Credit Suisse Mortgage Trust, | |

1 Month USD LIBOR + 3.97%,

4.05%, 4/15/23 (c)(d) | | $ | 3,350 | | | | 3,368 | | |

The accompanying notes are an integral part of the financial statements.

14

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2021

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

| | | Face

Amount

(000) | | Value

(000) | |

Mortgages — Other (cont'd) | |

CSMC Trust, | |

3.89%, 12/15/23 | | $ | 3,300 | | | $ | 3,317 | | |

E-MAC NL 2004-I BV, | |

3 Month EURIBOR + 0.18%,

1.71%, 7/25/36 (d) | | EUR | 419 | | | | 481 | | |

Eurosail BV, | |

3 Month EURIBOR + 1.80%,

1.25%, 10/17/40 (d) | | | 700 | | | | 814 | | |

Eurosail PLC, | |

3 Month GBP LIBOR + 0.95%,

1.02%, 6/13/45 (d) | | GBP | 601 | | | | 803 | | |

Farringdon Mortgages No. 2 PLC, | |

3 Month GBP LIBOR + 1.50%,

1.58%, 7/15/47 (d) | | | 209 | | | | 284 | | |

Federal Home Loan Mortgage Corporation, | |

3.00%, 7/25/46 - 5/25/47 | | $ | 1,376 | | | | 1,389 | | |

3.50%, 5/25/45 - 5/25/47 | | | 581 | | | | 598 | | |

3.86%, 5/25/45 (c)(d) | | | 7 | | | | 7 | | |

4.00%, 5/25/45 | | | 13 | | | | 13 | | |

1 Month USD LIBOR + 5.15%,

5.24%, 10/25/29 (d) | | | 300 | | | | 328 | | |

Flagstar Mortgage Trust, | |

2.50%, 9/25/51 (c)(d) | | | 3,873 | | | | 3,923 | | |

FMC GMSR Issuer Trust, | |

4.23%, 9/25/24 (c)(d) | | | 1,900 | | | | 1,899 | | |

4.45%, 1/25/26 (c)(d) | | | 3,500 | | | | 3,485 | | |

Glenbeigh 2 Issuer 2021-2 DAC, | |

3 Month EURIBOR + 0.75%,

0.00%, 6/24/50 (c) | | EUR | 4,400 | | | | 5,129 | | |

Grifonas Finance No. 1 PLC, | |

6 Month EURIBOR + 0.28%,

0.00%, 8/28/39 (d) | | | 309 | | | | 353 | | |

HarborView Mortgage Loan Trust, | |

1 Month USD LIBOR + 0.19%,

0.28%, 1/19/38 (d) | | $ | 337 | | | | 327 | | |

Headlands Residential LLC, | |

2.49%, 9/25/26 (c)(d) | | | 3,320 | | | | 3,320 | | |

3.97%, 6/25/24 (c) | | | 8 | | | | 8 | | |

Hundred Acre Wood Trust, | |

2.50%, 10/25/51 (c)(d) | | | 4,425 | | | | 4,513 | | |

IM Pastor 3 FTH, | |

3 Month EURIBOR + 0.14%,

0.00%, 3/22/43 (d) | | EUR | 399 | | | | 432 | | |

JP Morgan Mortgage Trust, | |

3.05%, 6/25/37 (d) | | $ | 76 | | | | 68 | | |

6.00%, 6/25/37 | | | 40 | | | | 45 | | |

Landmark Mortgage Securities No. 1 PLC, | |

3 Month EURIBOR + 0.60%,

0.06%, 6/17/38 (d) | | EUR | 756 | | | | 867 | | |

Legacy Mortgage Asset Trust, | |

3.25%, 2/25/60 (c) | | $ | 3,085 | | | | 3,107 | | |

Lehman Mortgage Trust, | |

6.50%, 9/25/37 | | | 626 | | | | 314 | | |

| | | Face

Amount

(000) | | Value

(000) | |

LHOME Mortgage Trust, | |

3.23%, 10/25/24 (c) | | $ | 675 | | | $ | 680 | | |

Mello Mortgage Capital Acceptance, | |

2.50%, 8/25/51 (c) | | | 4,719 | | | | 4,796 | | |

Mello Warehouse Securitization Trust, | |

1 Month USD LIBOR + 0.70%,

0.78%, 2/25/55 (c)(d) | | | 2,215 | | | | 2,222 | | |

1 Month USD LIBOR + 1.30%,

1.39%, 11/25/53 (c)(d) | | | 2,000 | | | | 1,996 | | |

Natixis Commercial Mortgage Securities Trust, | |

1.80%, 8/15/38 | | | 3,250 | | | | 3,250 | | |

New Residential Mortgage Loan Trust, | |

4.00%, 9/25/57 (c)(d) | | | 573 | | | | 605 | | |

Newgate Funding PLC, | |

3 Month GBP LIBOR + 0.16%,

0.23%, 12/15/50 (d) | | GBP | 1,293 | | | | 1,686 | | |

NRPL Trust, | |

4.25%, 7/25/67 (c) | | $ | 769 | | | | 769 | | |

NYMT Loan Trust, | |

2.94%, 10/25/60 (c)(d) | | | 1,660 | | | | 1,676 | | |

OBX Trust, | |

3.50%, 10/25/59 - 2/25/60 (c)(d) | | | 1,025 | | | | 1,049 | | |

Pepper Residential Securities Trust, | |

1 Month USD LIBOR + 0.93%,

1.01%, 3/12/61 (c)(d) | | | 702 | | | | 703 | | |

Preston Ridge Partners LLC, | |

2.86%, 9/25/25 (c) | | | 2,363 | | | | 2,370 | | |

PRMI Securitization Trust, | |

2.50%, 4/25/51 (c)(d) | | | 5,045 | | | | 5,113 | | |

PRPM LLC, | |

1.74%, 9/25/26 (c)(d) | | | 2,800 | | | | 2,801 | | |

3.50%, 10/25/24 (c)(d) | | | 1,490 | | | | 1,496 | | |

RMF Buyout Issuance Trust, | |

1.71%, 6/25/30 (c)(d) | | | 1,373 | | | | 1,377 | | |

2.15%, 6/25/30 (c)(d) | | | 750 | | | | 754 | | |

Seasoned Credit Risk Transfer Trust, | |

3.00%, 9/25/55 - 5/25/60 | | | 14,873 | | | | 15,693 | | |

4.00%, 7/25/56 (d) | | | 450 | | | | 455 | | |

4.00%, 8/25/56 (c)(d) | | | 1,000 | | | | 1,032 | | |

4.00%, 8/25/58 - 2/25/59 | | | 1,641 | | | | 1,788 | | |

4.25%, 8/25/59 - 11/25/60(c)(d) | | | 6,550 | | | | 6,887 | | |

4.50%, 6/25/57 | | | 1,542 | | | | 1,709 | | |

4.75%, 7/25/56 - 6/25/57(c)(d) | | | 1,408 | | | | 1,464 | | |

4.75%, 10/25/58 (d) | | | 1,300 | | | | 1,384 | | |

Stratton Mortgage Funding PLC, | |

2.15%, 5/25/51 | | GBP | 2,500 | | | | 3,384 | | |

Structured Asset Securities Corp.

Reverse Mortgage Loan Trust, | |

1 Month USD LIBOR + 1.85%,

1.94%, 5/25/47 (c)(d) | | $ | 1,495 | | | | 1,340 | | |

TDA 27 FTA, | |

3 Month EURIBOR + 0.19%,

0.00%, 12/28/50 (d) | | EUR | 1,548 | | | | 1,602 | | |

Toorak Mortgage Corp. Ltd., | |

3.72%, 9/25/22 | | $ | 2,000 | | | | 2,012 | | |

The accompanying notes are an integral part of the financial statements.

15

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2021

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

| | | Face

Amount

(000) | | Value

(000) | |

Mortgages — Other (cont'd) | |

Towd Point HE Trust, | |

0.92%, 2/25/63 (c)(d) | | $ | 4,338 | | | $ | 4,341 | | |

Towd Point Mortgage Funding PLC, | |

3 Month GBP SONIA LIBOR + 1.80%,

1.85%, 7/20/44 (d) | | | 1,800 | | | | 2,415 | | |

2.40%, 2/20/54 | | | 2,400 | | | | 3,247 | | |

TVC Mortgage Trust, | |

3.47%, 9/25/24 (c) | | | 850 | | | | 856 | | |

United Wholesale Mortgage Trust, | |

2.50%, 8/25/51 (c)(d) | | | 4,944 | | | | 5,021 | | |

Vista Point Securitization Trust, | |

1.76%, 3/25/65 (c)(d) | | | 1,407 | | | | 1,415 | | |

VOLT XCIII LLC, | |

1.89%, 2/27/51 (c) | | | 2,279 | | | | 2,288 | | |

VOLT XCIV LLC, | |

2.24%, 2/27/51 (c) | | | 2,800 | | | | 2,805 | | |

| | | | 169,424 | | |

Municipal Bonds (0.5%) | |

Chicago O'Hare International Airport, IL, | |

O'Hare International Airport Revenue

Series 2010B | |

6.40%, 1/1/40 | | | 255 | | | | 383 | | |

City of New York, NY, | |

Series G-1 | |

5.97%, 3/1/36 | | | 270 | | | | 372 | | |

Illinois State Toll Highway Authority, IL, | |

Highway Revenue, Build America Bonds

Series A | |

6.18%, 1/1/34 | | | 477 | | | | 663 | | |

New York City, NY, Transitional Finance

Authority Future Tax Secured Revenue

Series A | |

5.27%, 5/1/27 | | | 320 | | | | 382 | | |

Onondaga Civic Development Corp., NY, | |

3.07%, 12/1/55 | | | 2,925 | | | | 2,860 | | |

| | | | 4,660 | | |

Sovereign (5.7%) | |

Australia Government Bond, | |

3.25%, 4/21/25 | | AUD | 10,500 | | | | 8,344 | | |

Brazil Notas do Tesouro Nacional, Series F, | |

10.00%, 1/1/25 | | BRL | 12,400 | | | | 2,268 | | |

Croatia Government International Bond, | |

1.50%, 6/17/31 | | EUR | 1,307 | | | | 1,587 | | |

Dominican Republic International Bond, | |

4.88%, 9/23/32 (c) | | $ | 410 | | | | 419 | | |

5.88%, 1/30/60 (c) | | | 2,310 | | | | 2,266 | | |

Ecuador Government International Bond, | |

0.50%, 7/31/40 (c)(i) | | | 261 | | | | 153 | | |

Egypt Government Bond, | |

13.77%, 1/5/24 | | EGP | 16,300 | | | | 1,031 | | |

Egypt Government International Bond, | |

6.38%, 4/11/31 (c) | | EUR | 2,025 | | | | 2,307 | | |

| | | Face

Amount

(000) | | Value

(000) | |

7.50%, 2/16/61 (c) | | $ | 290 | | | $ | 255 | | |

8.15%, 11/20/59 (c) | | | 210 | | | | 194 | | |

8.88%, 5/29/50 (c) | | | 410 | | | | 407 | | |

Export-Import Bank of India, | |

3.25%, 1/15/30 (c) | | | 670 | | | | 681 | | |

3.88%, 2/1/28 (c) | | | 505 | | | | 543 | | |

Honduras Government International Bond, | |

5.63%, 6/24/30 (c) | | | 350 | | | | 366 | | |

Italy Buoni Poliennali Del Tesoro, | |

0.65%, 10/28/27 (c) | | EUR | 6,196 | | | | 7,766 | | |

Ivory Coast Government International Bond, | |

4.88%, 1/30/32 (c) | | | 1,360 | | | | 1,539 | | |

Mexican Bonos, | |

Series M | |

7.75%, 5/29/31 | | MXN | 74,500 | | | | 3,703 | | |

Mexico Government International Bond, | |

3.25%, 4/16/30 (f) | | $ | 750 | | | | 770 | | |

3.75%, 4/19/71 | | | 850 | | | | 737 | | |

Morocco Government International Bond, | |

4.00%, 12/15/50 (c) | | | 790 | | | | 723 | | |

Nigeria Government International Bond, | |

9.25%, 1/21/49 (c) | | | 2,270 | | | | 2,477 | | |

North Macedonia Government

International Bond, | |

1.63%, 3/10/28 (c) | | EUR | 940 | | | | 1,066 | | |

Pertamina Persero PT, | |

6.50%, 11/7/48 (c) | | $ | 1,325 | | | | 1,762 | | |

Petroleos Mexicanos, | |

6.50%, 1/23/29 | | | 525 | | | | 540 | | |

6.84%, 1/23/30 | | | 570 | | | | 590 | | |

6.88%, 10/16/25 (c) | | | 840 | | | | 921 | | |

6.95%, 1/28/60 | | | 350 | | | | 306 | | |

7.69%, 1/23/50 | | | 536 | | | | 508 | | |

Qatar Government International Bond, | |

5.10%, 4/23/48 (c) | | | 1,480 | | | | 1,967 | | |

Republic of Italy Government International Bond, | |

0.88%, 5/6/24 | | | 2,330 | | | | 2,325 | | |

Republic of South Africa Government Bond, | |

8.00%, 1/31/30 | | ZAR | 22,750 | | | | 1,405 | | |

8.25%, 3/31/32 | | | 59,630 | | | | 3,544 | | |

Republic of Uzbekistan International Bond, | |

3.70%, 11/25/30 (c) | | $ | 840 | | | | 815 | | |

Senegal Government International Bond, | |

6.25%, 5/23/33 (c) | | | 705 | | | | 737 | | |

Serbia International Bond, | |

1.65%, 3/3/33 (c) | | EUR | 800 | | | | 883 | | |

| | | | 55,905 | | |

Supranational (0.2%) | |

Banque Ouest Africaine de Developpement, | |

2.75%, 1/22/33 (c) | | | 590 | | | | 733 | | |

4.70%, 10/22/31 (c) | | $ | 1,240 | | | | 1,365 | | |

| | | | 2,098 | | |

The accompanying notes are an integral part of the financial statements.

16

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2021

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

| | | Face

Amount

(000) | | Value

(000) | |

U.S. Treasury Security (0.6%) | |

U.S. Treasury Bond,

2.25%, 8/15/46 | | $ | 6,050 | | | $ | 6,250 | | |

Variable Rate Senior Loan Interests (2.4%) | |

American Airlines, Inc., | |

| 2018 Term Loan B | | | | | |

1 Month USD LIBOR + 1.75%,

1.84%, 6/27/25 (d) | | | 980 | | | | 940 | | |

American Builders & Contractors Supply Co., Inc., | |

| 2019 Term Loan | | | | | |

1 Month USD LIBOR + 2.00%,

2.08%, 1/15/27 (d) | | | 992 | | | | 987 | | |

Asurion LLC, | |

| 2020 Term Loan B8 | | | | | |

1 Month USD LIBOR + 3.25%,

3.33%, 12/23/26 (d) | | | 993 | | | | 979 | | |

Bausch Health Companies Inc., | |

| 2018 Term Loan B | | | | | |

1 Month USD LIBOR + 3.00%,

3.08%, 6/2/25 (d) | | | 807 | | | | 807 | | |

BWAY Holding Co., | |

| 2017 Term Loan B | | | | | |

1 Month USD LIBOR + 3.25%,

3.33%, 4/3/24 (d) | | | 980 | | | | 961 | | |

Carrols Restaurant Group, Inc., | |

Term Loan B | | | | | |

1 Month USD LIBOR + 3.25%,

3.34%, 4/30/26 (d) | | | 408 | | | | 402 | | |

CenturyLink, Inc., | |

| 2020 Term Loan B | | | | | |

1 Month USD LIBOR + 2.25%,

2.33%, 3/15/27 (d) | | | 990 | | | | 981 | | |

Chemours Co. (The), | |

| 2018 USD Term Loan B | | | | | |

1 Month USD LIBOR + 1.75%,

1.84%, 4/3/25 (d) | | | 982 | | | | 963 | | |

Core & Main LP, | |

| 2017 Term Loan B | | | | | |

1 Month USD LIBOR + 2.50%,

2.59%, 8/1/24 (d) | | | 985 | | | | 982 | | |

CPG International, Inc., | |

| 2017 Term Loan | | | | | |

3 Month USD LIBOR + 2.50%,

3.25%, 5/5/24 (d) | | | 218 | | | | 218 | | |

Creative Artists Agency, LLC, | |

| 2019 Term Loan B | | | | | |

1 Month USD LIBOR + 3.75%,

3.83%, 11/26/26 (d) | | | 943 | | | | 939 | | |

DaVita, Inc., | |

| 2020 Term Loan B | | | | | |

1 Month USD LIBOR + 1.75%,

1.83%, 8/12/26 (d) | | | 983 | | | | 978 | | |

Froneri International Ltd., | |

| 2020 USD Term Loan | | | | | |

1 Month USD LIBOR + 2.25%,

2.33%, 1/29/27 (d) | | | 990 | | | | 980 | | |

| | | Face

Amount

(000) | | Value

(000) | |

Grifols Worldwide Operations USA, Inc., | |

| USD 2019 Term Loan B | | | | | |

1 Week USD LIBOR + 2.00%,

2.07%, 11/15/27 (d) | | $ | 983 | | | $ | 968 | | |

Level 3 Financing, Inc., | |

| 2019 Term Loan B | | | | | |

1 Month USD LIBOR + 1.75%,

1.83%, 3/1/27 (d) | | | 1,000 | | | | 989 | | |

Lions Gate Capital Holdings LLC, | |

| 2018 Term Loan B | | | | | |

1 Month USD LIBOR + 2.25%,

2.33%, 3/24/25 (d) | | | 977 | | | | 971 | | |

Medallion Midland Acquisition, LLC, | |

| 1st Lien Term Loan | | | | | |

1 Month USD LIBOR + 3.25%,

4.25%, 10/30/24 (d) | | | 786 | | | | 782 | | |

Scientific Games International, Inc., | |

| 2018 Term Loan B5 | | | | | |

1 Month USD LIBOR + 2.75%,

2.83%, 8/14/24 (d) | | | 992 | | | | 989 | | |

Surf Holdings LLC, | |

| USD Term Loan | | | | | |

3 Month USD LIBOR + 3.50%,

3.62%, 3/5/27 (d) | | | 741 | | | | 738 | | |

Surgery Center Holdings, Inc., | |

| 2021 Term Loan | | | | | |

1 Month USD LIBOR + 3.75%,

4.50%, 8/31/26 (d) | | | 982 | | | | 985 | | |

TransDigm, Inc., | |

| 2020 Term Loan F | | | | | |

1 Month USD LIBOR + 2.25%,

2.33%, 12/9/25 (d) | | | 992 | | | | 982 | | |

Univision Communications, Inc., | |

2020 Replacement Term Loan | | | | | |

1 Month USD LIBOR + 3.75%,

4.75%, 3/15/26 (d) | | | 904 | | | | 905 | | |

US Foods, Inc., | |

| 2019 Term Loan B | | | | | |

1 Month USD LIBOR + 2.00%,

2.08%, 9/13/26 (d) | | | 992 | | | | 981 | | |

Verifone Systems, Inc., | |

| 2018 1st Lien Term Loan | | | | | |

3 Month USD LIBOR + 4.00%,

4.13%, 8/20/25 (d) | | | 982 | | | | 964 | | |

Virgin Media Bristol LLC, | |

| USD Term Loan N | | | | | |

1 Month USD LIBOR + 2.50%,

2.58%, 1/31/28 (d) | | | 1,000 | | | | 995 | | |

Ziggo Financing Partnership, | |

| USD Term Loan I | | | | | |

1 Month USD LIBOR + 2.50%,

2.58%, 4/30/28 (d) | | | 1,500 | | | | 1,490 | | |

| | | | 23,856 | | |

Total Fixed Income Securities (Cost $964,337) | | | 972,006 | | |

The accompanying notes are an integral part of the financial statements.

17

Morgan Stanley Institutional Fund Trust

Annual Report — September 30, 2021

Portfolio of Investments (cont'd)

Core Plus Fixed Income Portfolio

| | | Shares | | Value

(000) | |

Short-Term Investments (13.5%) | |

Investment Company (12.4%) | |

Morgan Stanley Institutional Liquidity

Funds — Government Portfolio —

Institutional Class (See Note G)

(Cost $121,689) | | | 121,689,168 | | | $ | 121,689 | | |

Security held as Collateral on Loaned Securities (0.6%) | |

Investment Company (0.6%) | |

Morgan Stanley Institutional Liquidity

Funds — Government Portfolio —

Institutional Class (See Note G)

(Cost $5,945) | | | 5,945,133 | | | | 5,945 | | |

| | | Face

Amount

(000) | | | |

U.S. Treasury Security (0.5%) | |

U.S. Treasury Bill | |

0.06%, 7/14/22 (j)

(Cost $4,516) | | $ | 4,518 | | | | 4,516 | | |

Total Short-Term Investments

(Cost $132,150) | | | 132,150 | | |

Total Investments (112.6%) (Cost $1,096,487)

Including $6,278 of Securities Loaned (k)(l) | | | 1,104,156 | | |

Liabilities in Excess of Other Assets (–12.6%) | | | (123,827 | ) | |

Net Assets (100.0%) | | $ | 980,329 | | |

(a) Amount is less than 0.05%.

(b) Security is subject to delayed delivery.

(c) 144A security — Certain conditions for public sale may exist. Unless otherwise noted, these securities are deemed to be liquid.

(d) Floating or variable rate securities: The rates disclosed are as of September 30, 2021. For securities based on a published reference rate and spread, the reference rate and spread are indicated in the description in the Portfolio of Investments. Certain variable rate securities may not be based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description in the Portfolio of Investments.

(e) Inverse Floating Rate Security — Interest rate fluctuates with an inverse relationship to an associated interest rate. Indicated rate is the effective rate at September 30, 2021.

(f) All or a portion of this security was on loan at September 30, 2021.

(g) Perpetual — One or more securities do not have a predetermined maturity date. Rates for these securities are fixed for a period of time, after which they revert to a floating rate. Interest rates in effect are as of September 30, 2021.

(h) When-issued security.

(i) Multi-step — Coupon rate changes in predetermined increments to maturity. Rate disclosed is as of September 30, 2021. Maturity date disclosed is the ultimate maturity date.

(j) Rate shown is the yield to maturity at September 30, 2021.

(k) Securities are available for collateral in connection with purchase of when-issued securities, securities purchased on a forward commitment basis, open foreign currency exchange contracts and futures contracts.

(l) At September 30, 2021, the aggregate cost for federal income tax purposes is approximately $1,095,996,000. The aggregate gross unrealized appreciation is approximately $22,301,000 and the aggregate gross unrealized depreciation is approximately $14,639,000, resulting in net unrealized appreciation of approximately $7,662,000.

CLO Collateralized Loan Obligation.

EURIBOR Euro Interbank Offered Rate.

IO Interest Only.

LIBOR London Interbank Offered Rate.

MTN Medium Term Note.

PAC Planned Amortization Class.

REMIC Real Estate Mortgage Investment Conduit.