UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4008

Fidelity Investment Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | October 31 |

| |

Date of reporting period: | October 31, 2004 |

Item 1. Reports to Stockholders

Fidelity Advisor

International Small Cap

Fund - Class A, Class T, Class B

and Class C

Annual Report

October 31, 2004

(2_fidelity_logos) (Registered_Trademark)

Class A, Class T, Class B, and Class C are classes of Fidelity®

International Small Cap Fund

Contents

Chairman's Message | 4 | Ned Johnson's message to shareholders. |

Performance | 5 | How the fund has done over time. |

Management's Discussion | 7 | The managers' review of fund performance, strategy and outlook. |

Shareholder Expense Example | 8 | An example of shareholder expenses. |

Investment Changes | 10 | A summary of major shifts in the fund's investments over the past six months. |

Investments | 12 | A complete list of the fund's investments with their market values. |

Financial Statements | 27 | Statements of assets and liabilities, operations, and changes in net assets,

as well as financial highlights. |

Notes | 27 | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | 46 | |

Trustees and Officers | 47 | |

Distributions | 59 | |

Proxy Voting Results | 60 | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

The fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. The fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of the fund's portfolio holdings, view the fund's most recent quarterly holdings report, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com/holdings.

NOT FDIC INSURED ·MAY LOSE VALUE ·NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Annual Report

Chairman's Message

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

During the past year or so, much has been reported about the mutual fund industry, and much of it has been more critical than I believe is warranted. Allegations that some companies have been less than forthright with their shareholders have cast a shadow on the entire industry. I continue to find these reports disturbing, and assert that they do not create an accurate picture of the industry overall. Therefore, I would like to remind everyone where Fidelity stands on these issues. I will say two things specifically regarding allegations that some mutual fund companies were in violation of the Securities and Exchange Commission's forward pricing rules or were involved in so-called "market timing" activities.

First, Fidelity has no agreements that permit customers who buy fund shares after 4 p.m. to obtain the 4 p.m. price. This is not a new policy. This is not to say that someone could not deceive the company through fraudulent acts. However, we are extremely diligent in preventing fraud from occurring in this manner - and in every other. But I underscore again that Fidelity has no so-called "agreements" that sanction illegal practices.

Second, Fidelity continues to stand on record, as we have for years, in opposition to predatory short-term trading that adversely affects shareholders in a mutual fund. Back in the 1980s, we initiated a fee - which is returned to the fund and, therefore, to investors - to discourage this activity. Further, we took the lead several years ago in developing a Fair Value Pricing Policy to prevent market timing on foreign securities in our funds. I am confident we will find other ways to make it more difficult for predatory traders to operate. However, this will only be achieved through close cooperation among regulators, legislators and the industry.

Yes, there have been unfortunate instances of unethical and illegal activity within the mutual fund industry from time to time. That is true of any industry. When this occurs, confessed or convicted offenders should be dealt with appropriately. But we are still concerned about the risk of over-regulation and the quick application of simplistic solutions to intricate problems. Every system can be improved, and we support and applaud well thought out improvements by regulators, legislators and industry representatives that achieve the common goal of building and protecting the value of investors' holdings.

For nearly 60 years, Fidelity has worked very hard to improve its products and service to justify your trust. When our family founded this company in 1946, we had only a few hundred customers. Today, we serve more than 18 million customers including individual investors and participants in retirement plans across America.

Let me close by saying that we do not take your trust in us for granted, and we realize that we must always work to improve all aspects of our service to you. In turn, we urge you to continue your active participation with your financial matters, so that your interests can be well served.

Best regards,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class' dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow. Returns may reflect the conversion of Class B shares to Class A shares after a maximum of seven years.

Average Annual Total Returns

Periods ending October 31, 2004 | | | Past 1

year | Life of

fundA |

Class A (incl. 5.75% sales charge)B | | | 15.32% | 40.08% |

Class T (incl. 3.50% sales charge)C | | | 17.80% | 41.45% |

Class B (incl. contingent deferred sales charge)D | | | 16.21% | 42.19% |

Class C (incl. contingent deferred sales charge)E | | | 20.43% | 43.34% |

AFrom September 18, 2002.

BClass A shares bear a 0.25% 12b-1 fee. The initial offering of Class A shares took place on May 27, 2003. Returns prior to May 27, 2003 are those of International Small Cap, the original class of the fund, which has no 12b-1 fee. Had Class A shares' 12b-1 fee been reflected, returns prior to May 27, 2003 would have been lower.

CClass T shares bear a 0.50% 12b-1 fee. The initial offering of Class T shares took place on May 27, 2003. Returns prior to May 27, 2003 are those of International Small Cap, the original class of the fund, which has no 12b-1 fee. Had Class T shares' 12b-1 fee been reflected, returns prior to May 27, 2003 would have been lower.

DClass B shares bear a 1.00% 12b-1 fee. The initial offering of Class B shares took place on May 27, 2003. Returns prior to May 27, 2003 are those of International Small Cap, the original class of the fund, which has no 12b-1 fee. Had Class B shares' 12b-1 fee been reflected, returns prior to May 27, 2003 would have been lower. Class B shares' contingent deferred sales charge included in the past one year and life of fund total return figure is 5% and 3%, respectively.

EClass C shares bear a 1.00% 12b-1 fee. The initial offering of Class C shares took place on May 27, 2003. Returns prior to May 27, 2003 are those of International Small Cap, the original class of the fund, which has no 12b-1 fee. Had Class C shares' 12b-1 fee been reflected, returns prior to May 27, 2003 would have been lower. Class C shares' contingent deferred sales charge included in the past one year and life of fund total return figure is 1% and 0%, respectively.

Annual Report

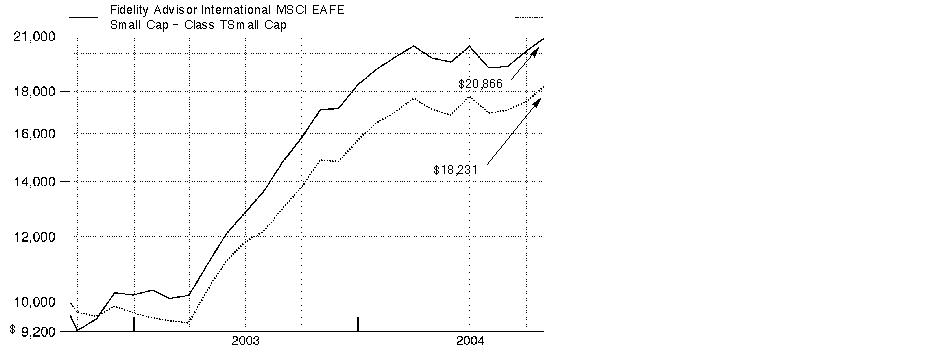

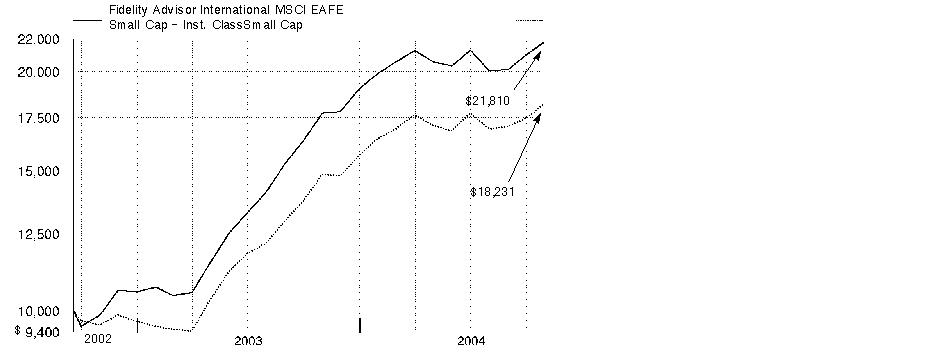

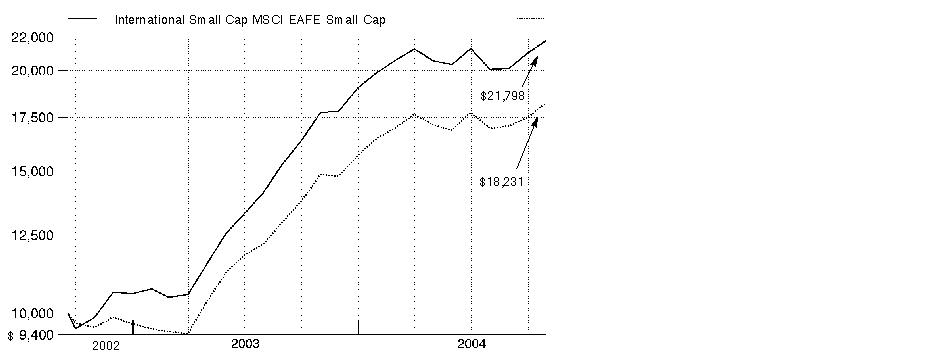

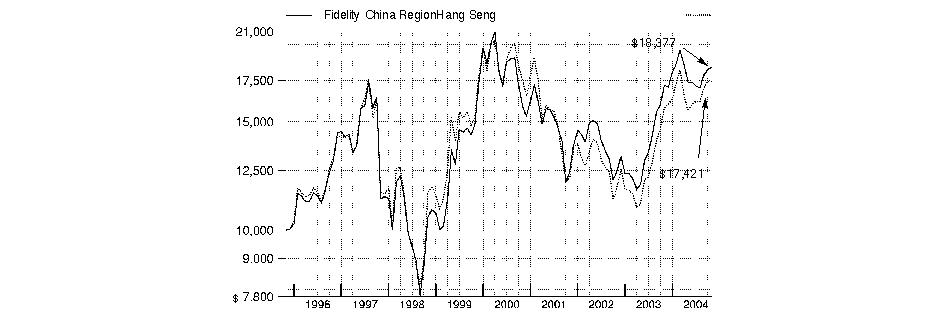

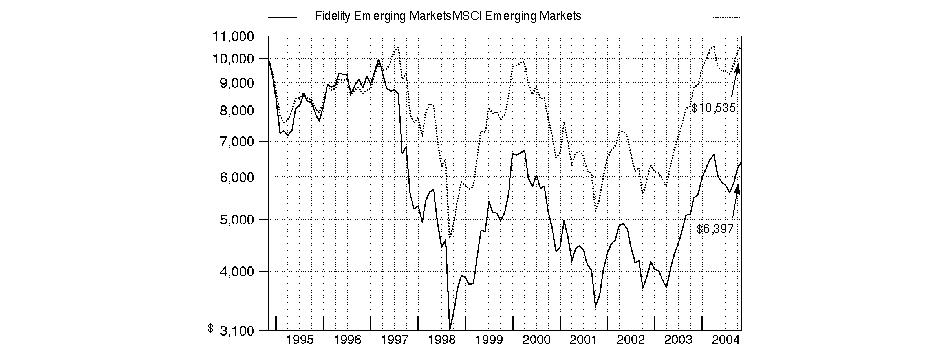

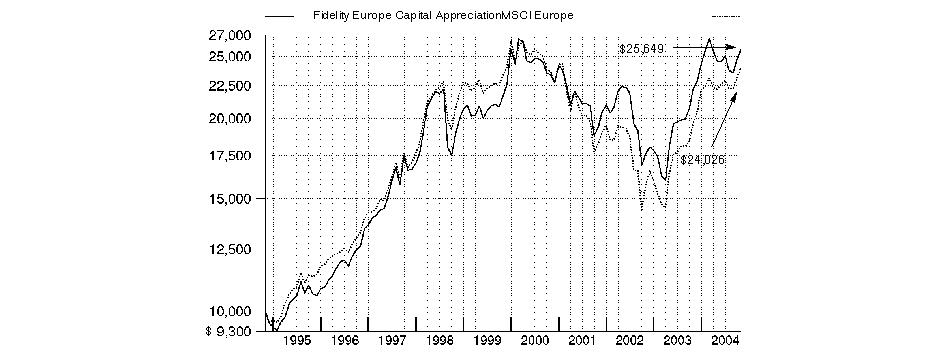

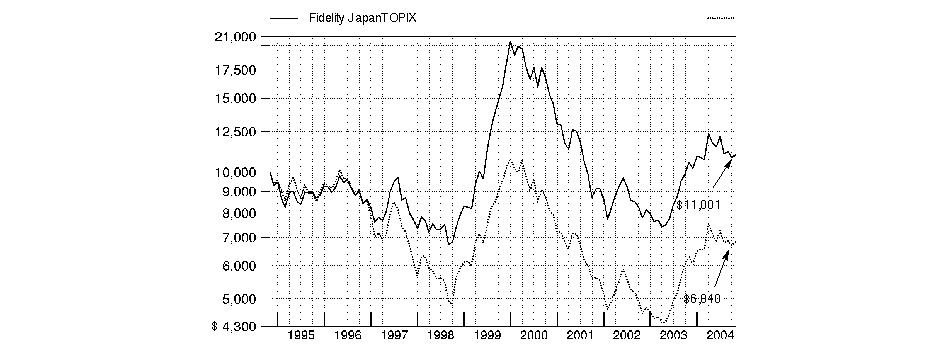

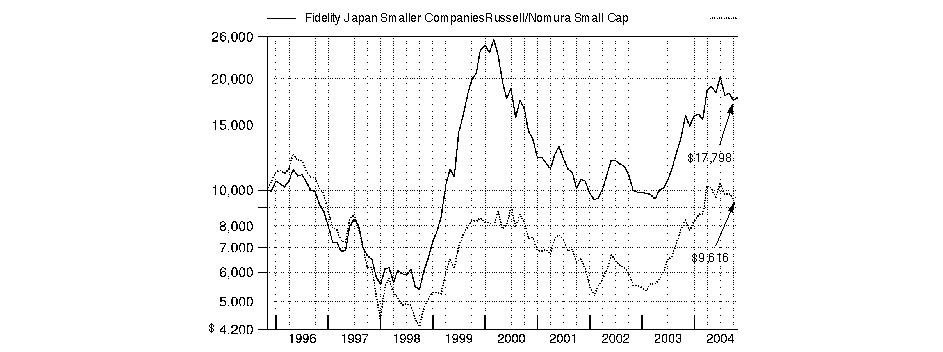

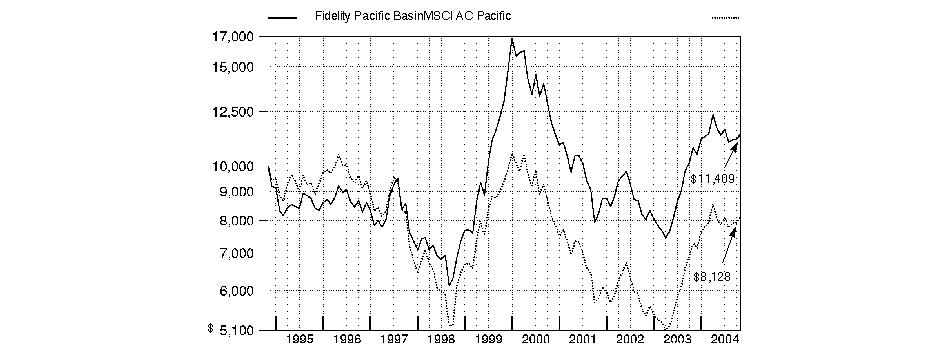

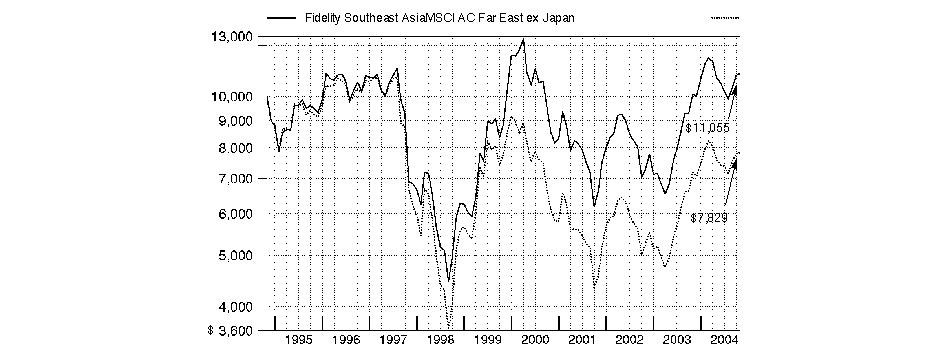

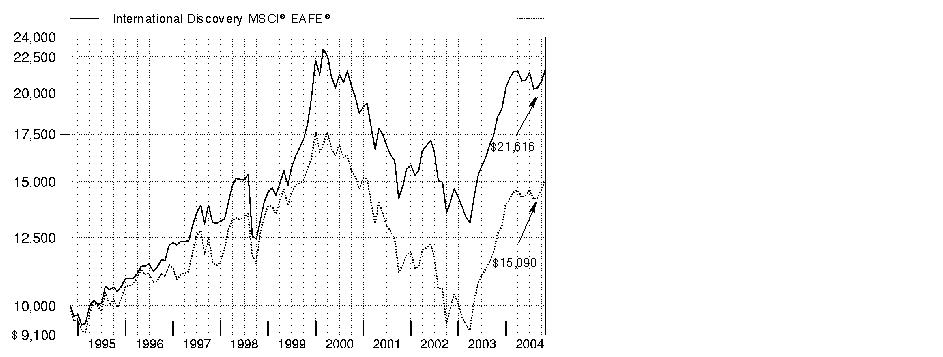

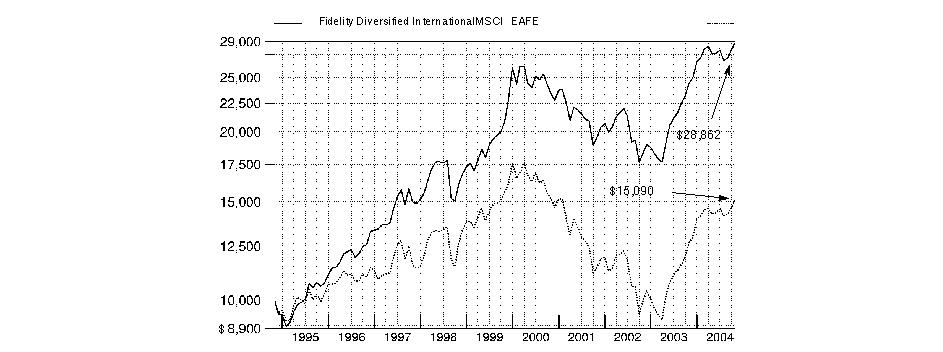

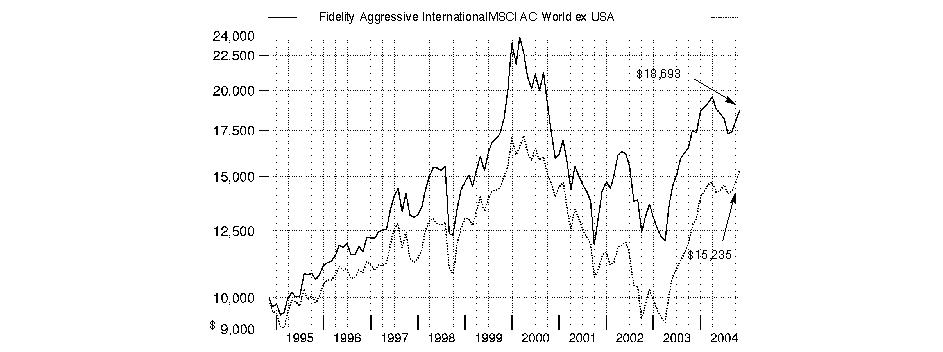

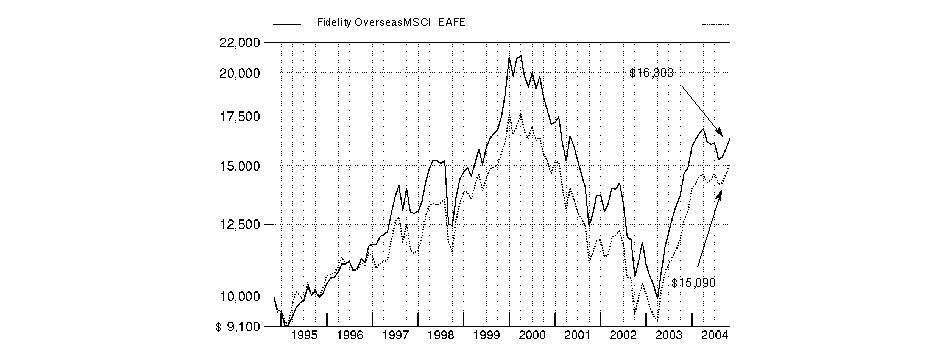

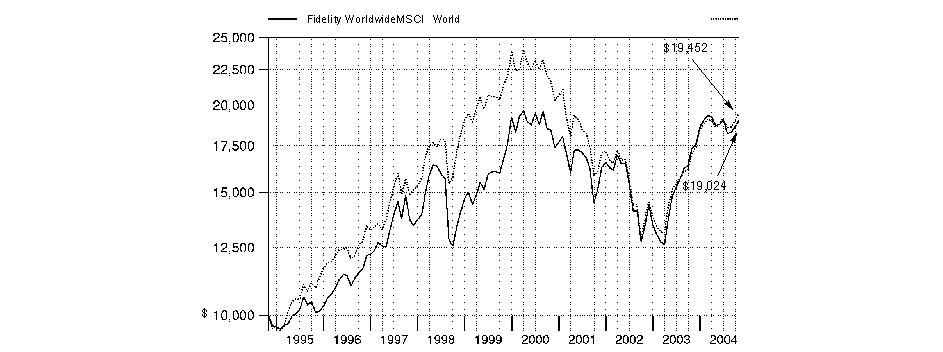

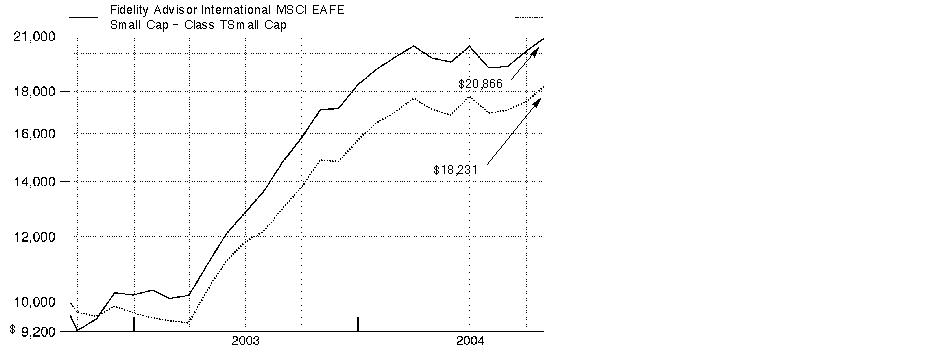

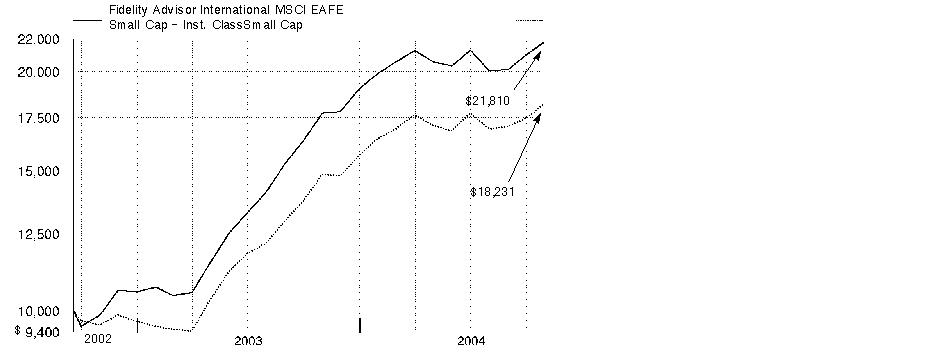

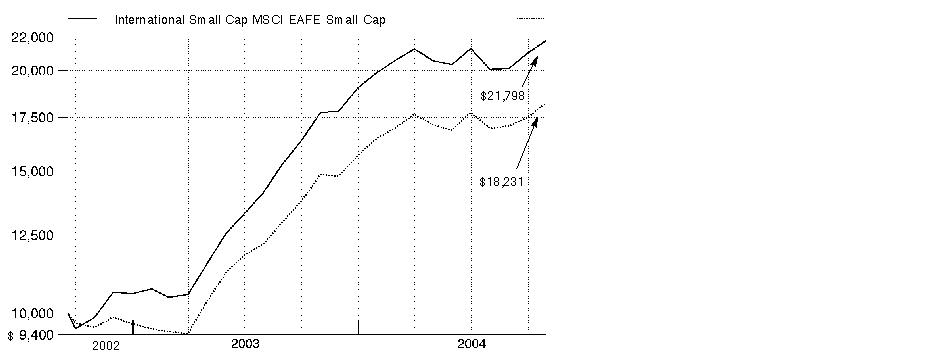

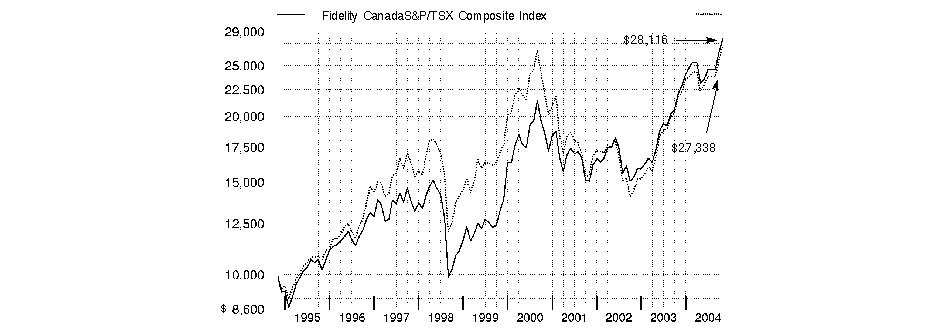

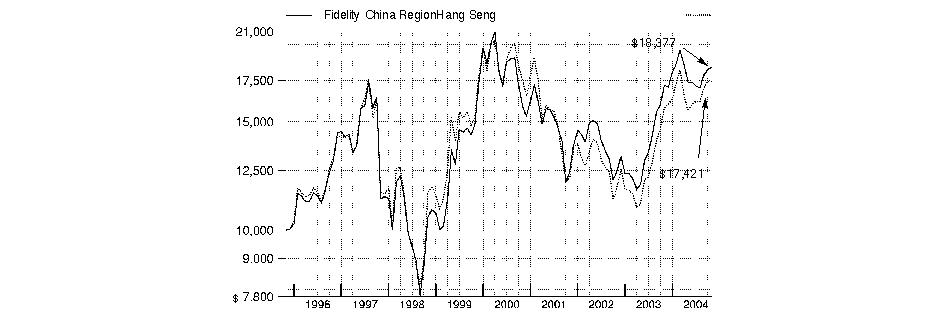

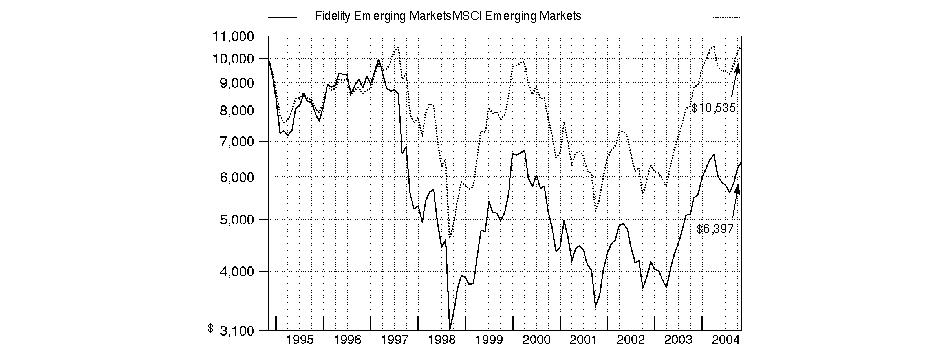

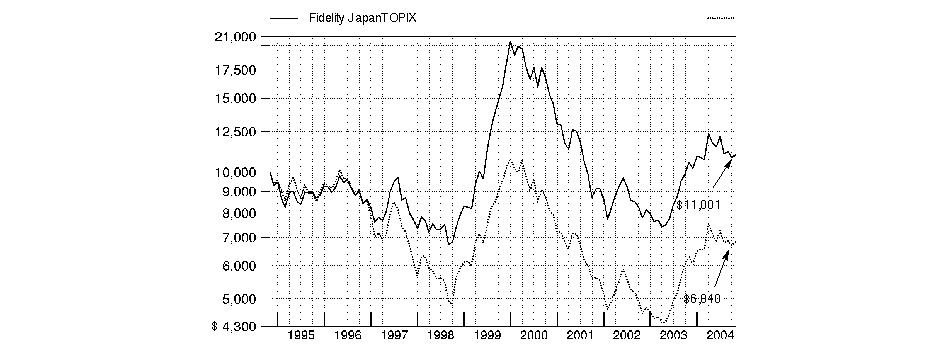

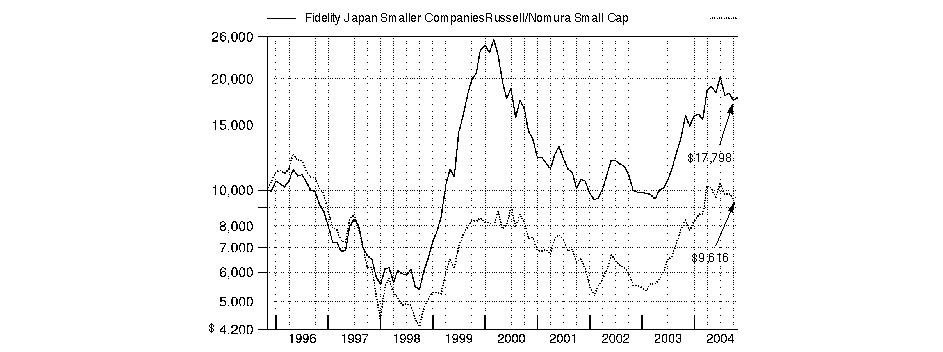

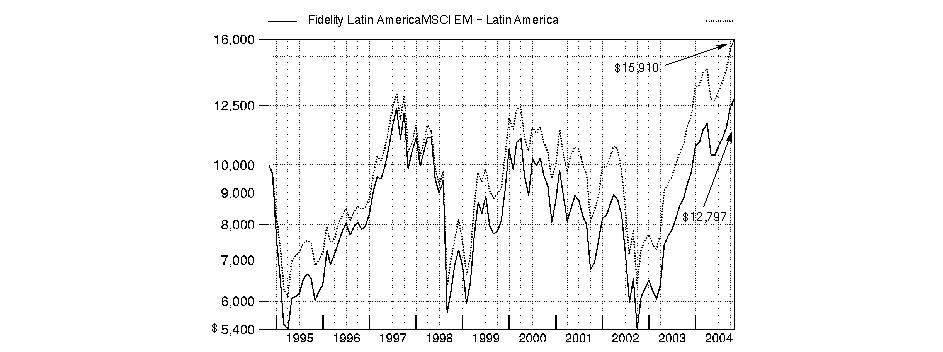

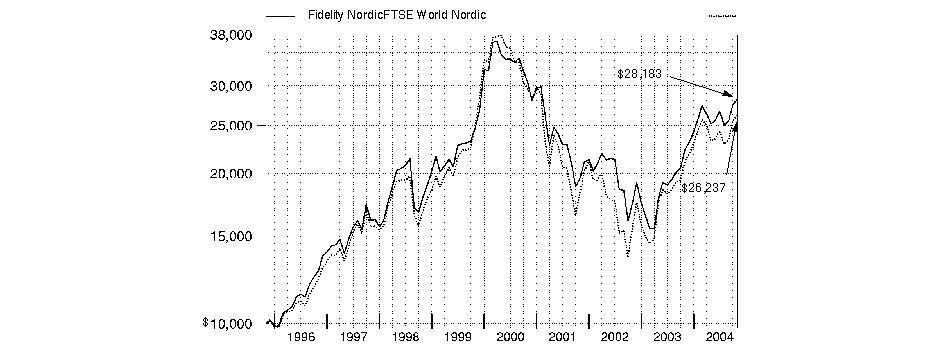

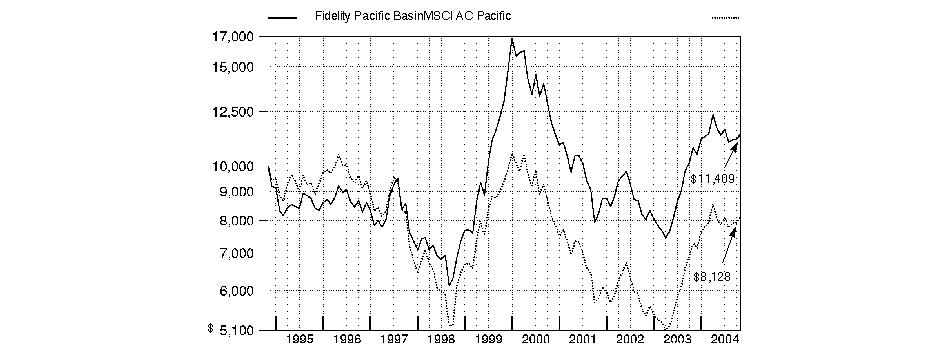

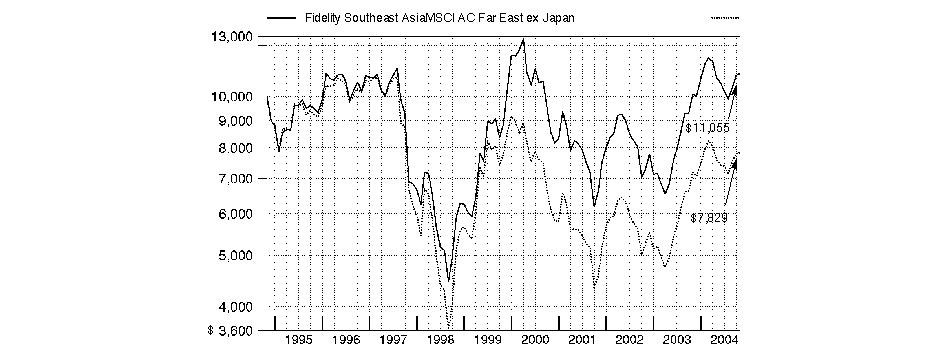

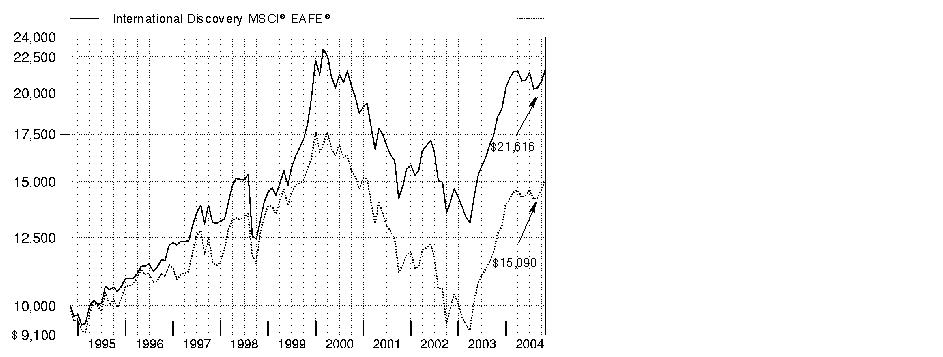

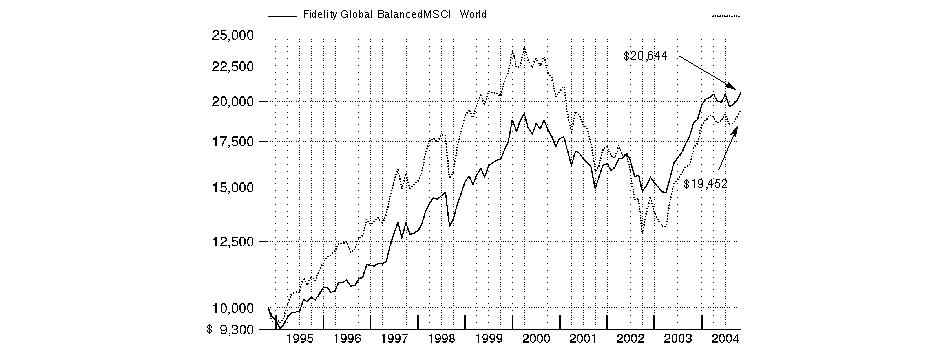

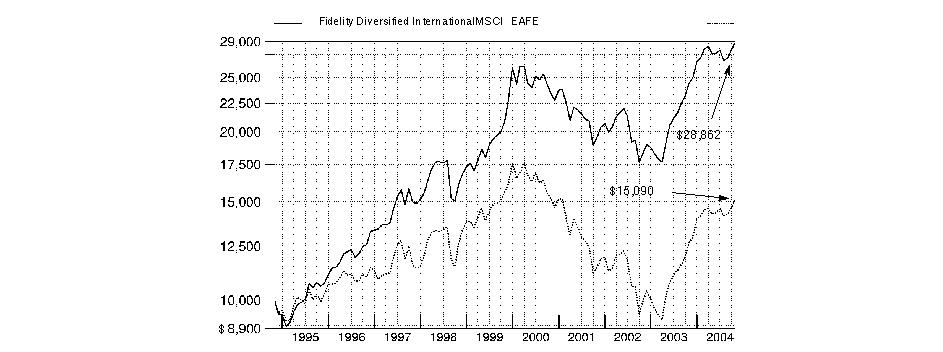

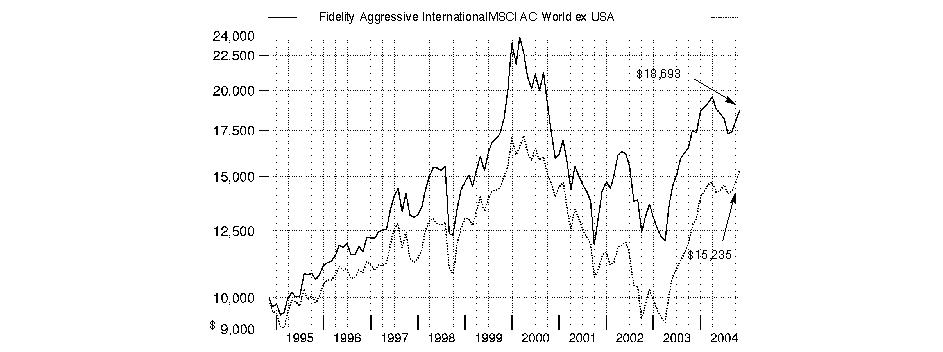

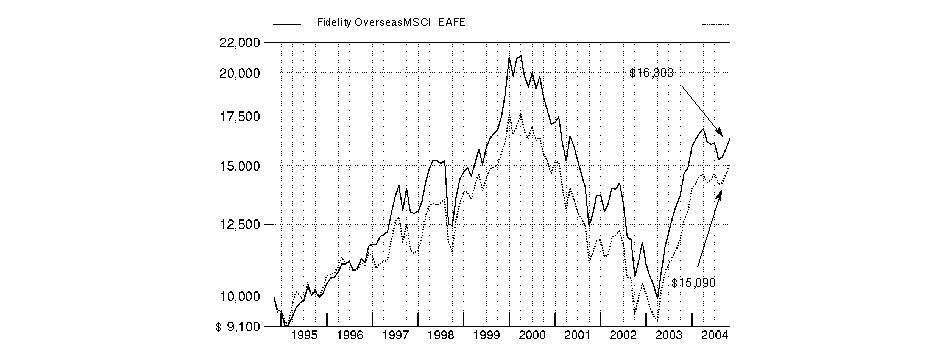

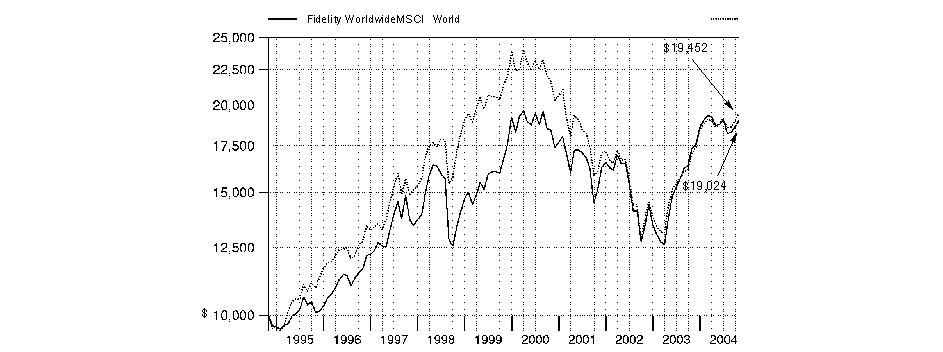

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in Fidelity Advisor International Small Cap Fund - Class T on September 18, 2002, when the fund started, and the current 3.50% sales charge was paid. The chart shows how the value of your investment would have grown, and also shows how the MSCI® EAFE® Small Cap Index did over the same period.

Annual Report

Management's Discussion of Fund Performance

Comments from Tokuya Sano and Ben Paton, Co-Portfolio Managers of Fidelity Advisor International Small Cap Fund

Most of the world's major stock markets posted solid gains for the year ending October 31, 2004. The Morgan Stanley Capital InternationalSM Europe, Australasia, Far East (MSCI® EAFE®) Index - designed to represent the performance of developed stock markets outside the United States and Canada - gained 19.00%, compared to 9.42% for the Standard & Poor's 500SM Index. A weak U.S. dollar relative to most foreign currencies was partly responsible for the performance disparity. On a regional basis, Europe was one of the top performers. Many investors felt European stocks offered better valuations and brighter earnings prospects than U.S. equities. Latin American countries, many of which are exporters of oil and materials that received strong support from high commodity prices, also did well. Conversely, Japan significantly underperformed, as early optimism was eroded by disappointing economic indicators and concerns about the impact of China's economic slowdown on exports. Meanwhile, technology-focused Asian emerging markets suffered due to a deceleration in corporate capital spending.

For the 12 months ending October 31, 2004, the fund's Class A, Class T, Class B and Class C shares returned 22.36%, 22.07%, 21.21% and 21.43%, respectively, slightly trailing the 22.72% mark posted by the Morgan Stanley Capital International Europe, Australasia, Far East Small Cap Index. However, the fund finished ahead of the LipperSM International Small Cap Funds Average, which returned 18.46%. Strong stock selection in telecommunication services, semiconductors and capital goods aided performance compared with the index. Looking at geographical categories, Germany and Australia were two of the fund's stronger countries, while Japan struggled. German wireless services reseller MobilCom was the fund's top contributor both in absolute terms and compared with the MSCI EAFE Small Cap Index. Believing its valuation to be stretched, I liquidated the position - a timely decision. Performance was also helped by United Group Ltd., an Australian conglomerate. On the negative side, our picks in automobiles and components hurt the fund's results, as did an underweighting in real estate and an overweighting in software and services. Russian oil giant Yukos was the largest detractor in absolute terms and the second-largest relative to the index. The biggest detractor compared to the index was Japanese holding NOK, a maker of flexible printed circuit boards.

The views expressed in this statement reflect those of the portfolio managers only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2004 to October 31, 2004).

Actual Expenses

The first line of the table below for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

The second line of the table below for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Annual Report

| Beginning

Account Value

May 1, 2004 | Ending

Account Value

October 31, 2004 | Expenses Paid

During Period *

May 1, 2004

to October 31, 2004 |

Class A | | | |

Actual | $1,000.00 | $1,057.20 | $8.95 |

HypotheticalA | $1,000.00 | $1,016.19 | $8.81 |

Class T | | | |

Actual | $1,000.00 | $1,056.30 | $10.23 |

HypotheticalA | $1,000.00 | $1,014.92 | $10.08 |

Class B | | | |

Actual | $1,000.00 | $1,052.70 | $13.83** |

HypotheticalA | $1,000.00 | $1,011.36 | $13.64** |

Class C | | | |

Actual | $1,000.00 | $1,053.60 | $12.70 |

HypotheticalA | $1,000.00 | $1,012.48 | $12.52 |

Institutional Class | | | |

Actual | $1,000.00 | $1,059.50 | $6.94 |

HypotheticalA | $1,000.00 | $1,018.18 | $6.82 |

International Small Cap | | | |

Actual | $1,000.00 | $1,059.50 | $6.78 |

HypotheticalA | $1,000.00 | $1,018.33 | $6.67 |

A5% return per year before expenses

*Expenses are equal to each Class' annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

| Annualized

Expense Ratio |

Class A | 1.73% |

Class T | 1.98% |

Class B | 2.68% |

Class C | 2.46% |

Institutional Class | 1.34% |

International Small Cap | 1.31% |

**If fees effective January 1, 2005 had been in effect during the period, the annualized expense ratio and the expenses paid in the actual and hypothetical examples above would have been as follows:

| Annualized

Expense Ratio | Expenses Paid |

Class B | | |

Actual | 2.52% | $13.00 |

HypotheticalA | | $12.83 |

A5% return per year before expenses

Annual Report

Investment Changes

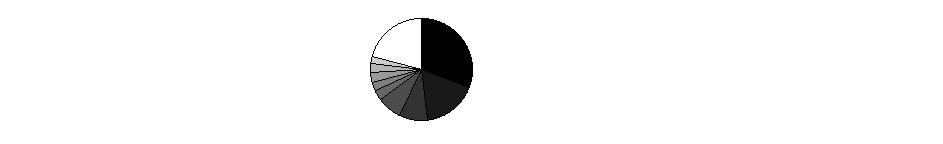

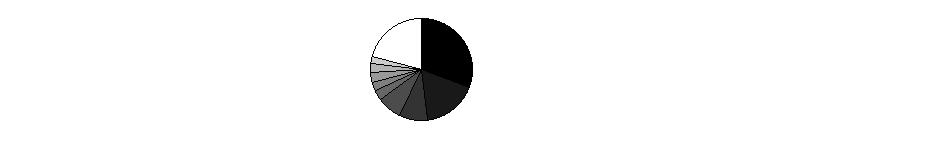

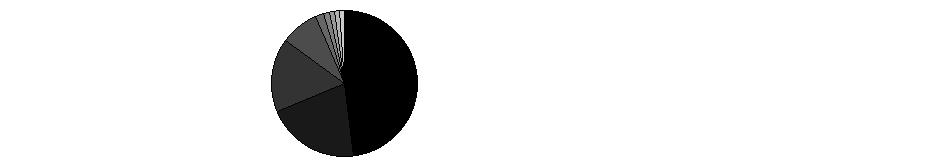

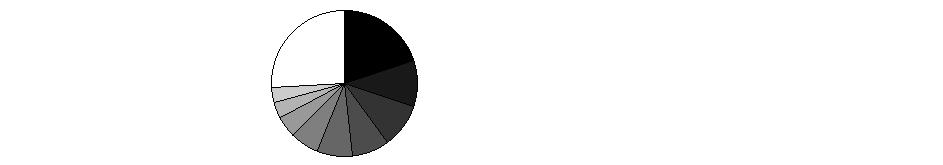

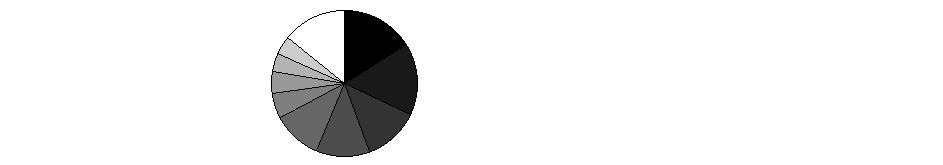

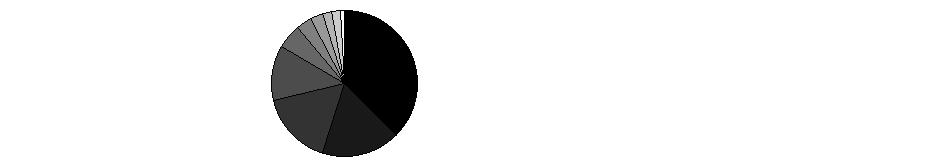

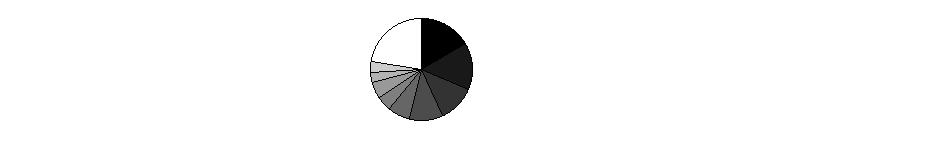

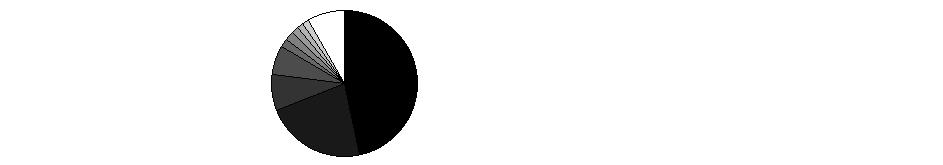

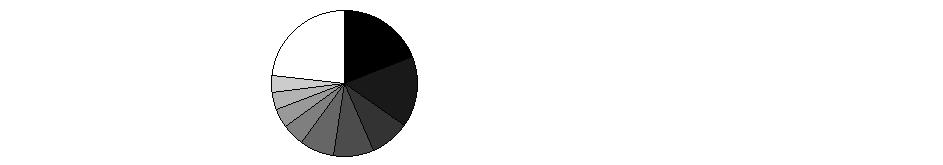

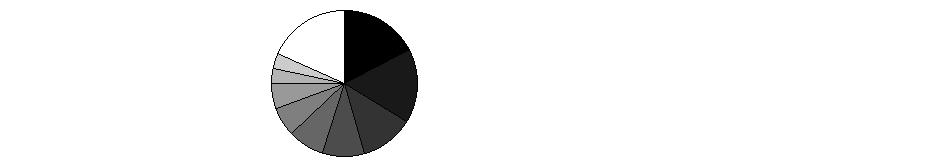

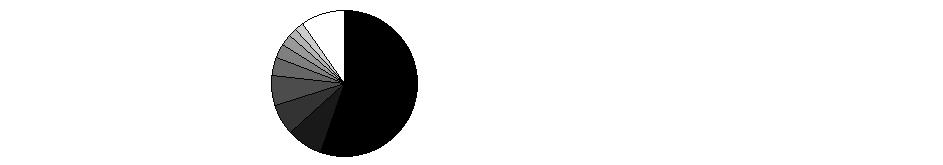

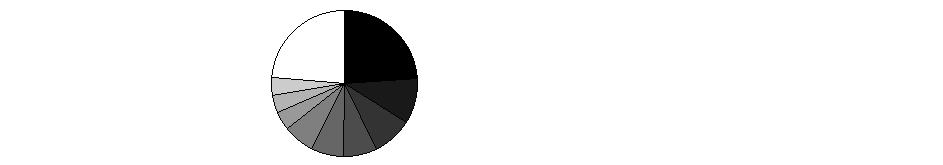

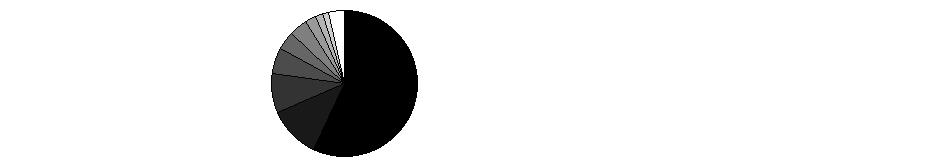

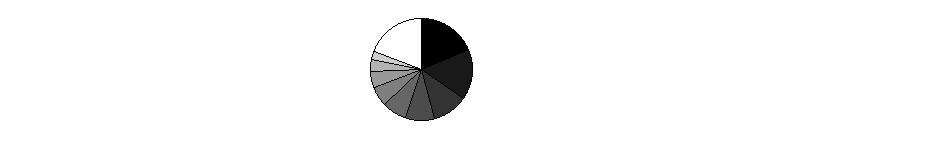

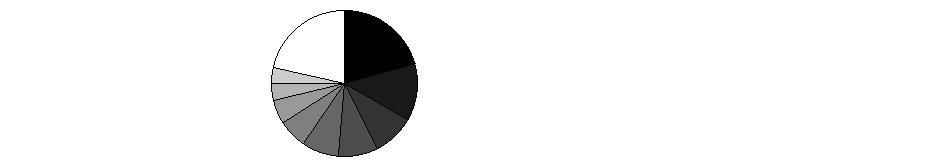

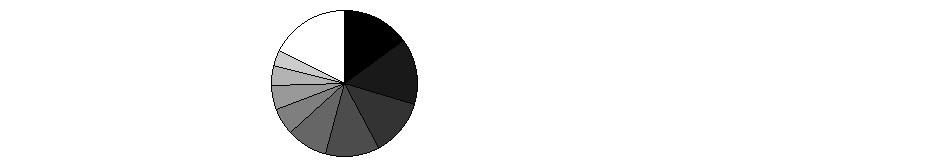

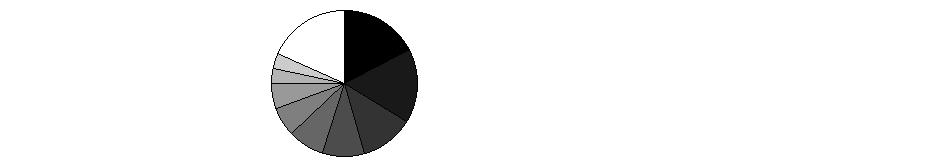

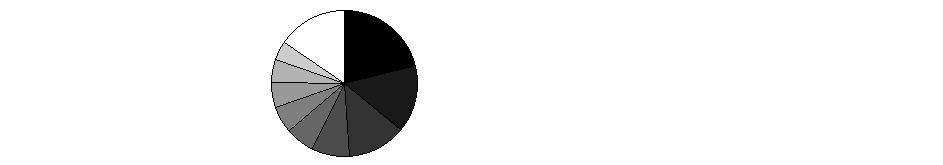

Geographic Diversification (% of fund's net assets) |

As of October 31, 2004 |

| Japan27.7% | |

| United Kingdom16.1% | |

| Australia9.2% | |

| Germany7.7% | |

| United States of America5.2% | |

| South Africa3.0% | |

| Norway2.9% | |

| Greece2.6% | |

| Italy2.4% | |

| Other23.2% | |

Percentages are adjusted for the effect of futures contracts, if applicable. |

|

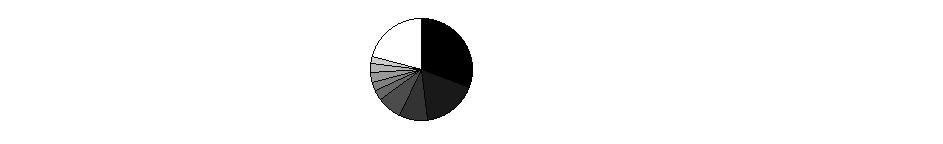

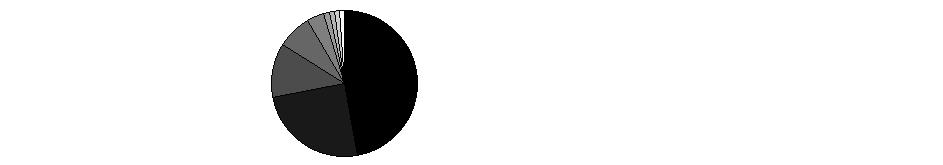

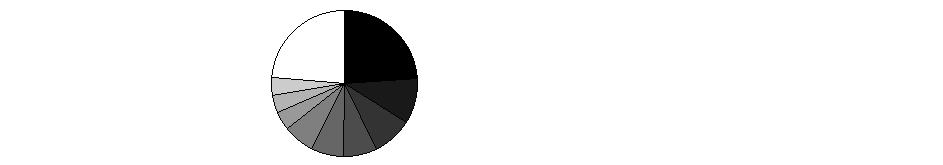

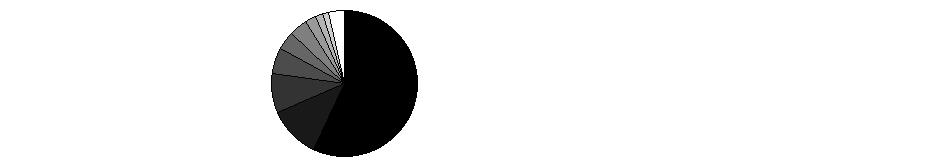

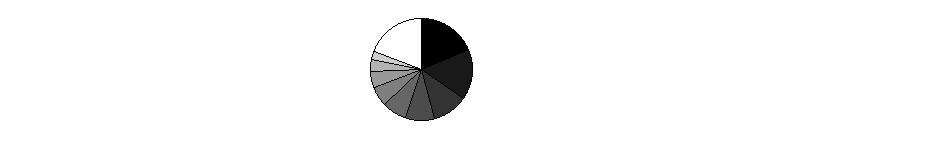

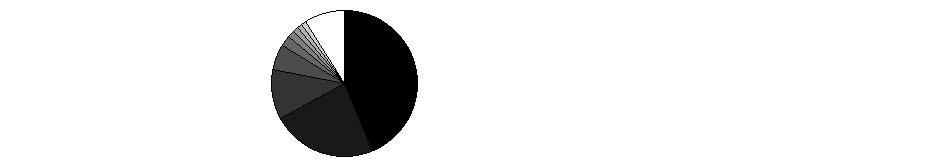

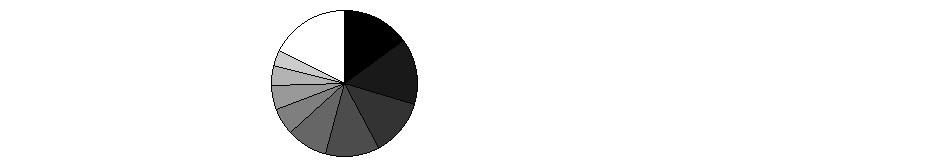

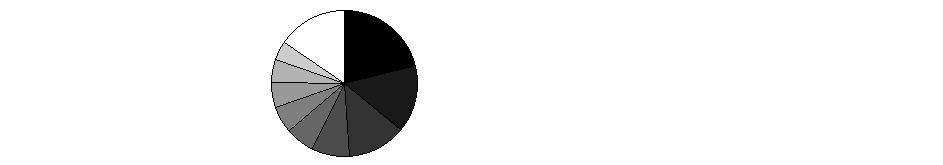

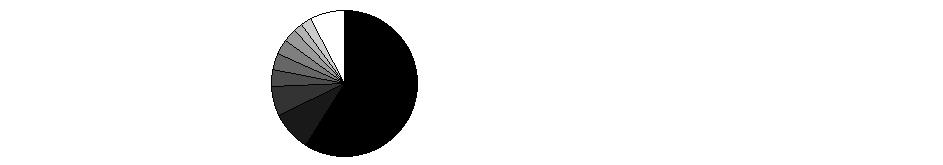

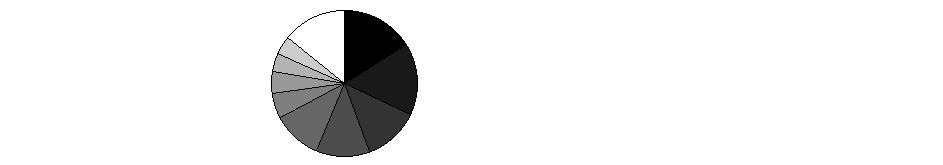

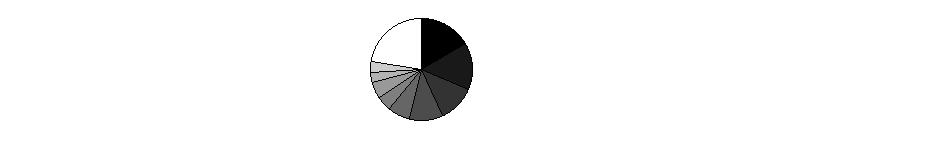

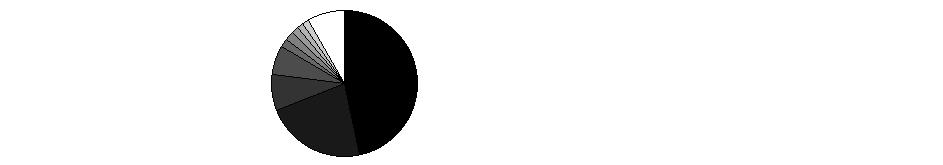

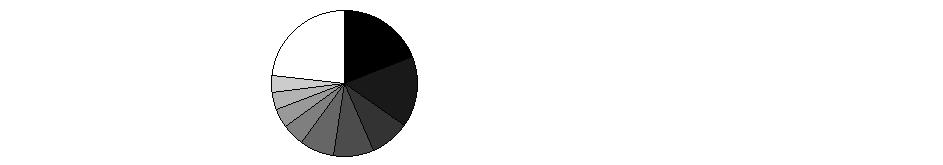

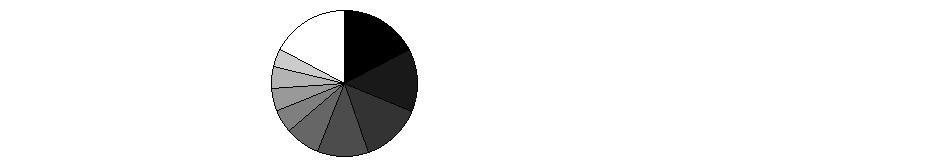

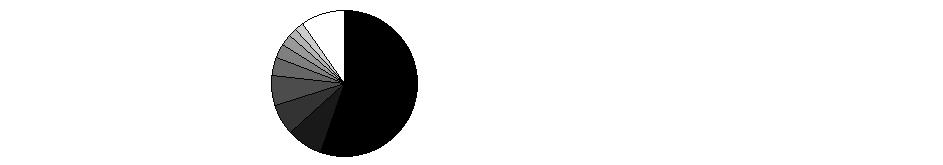

As of April 30, 2004 |

| Japan31.0% | |

| United Kingdom17.4% | |

| Germany8.8% | |

| Australia7.8% | |

| Greece3.0% | |

| Sweden2.9% | |

| Norway2.9% | |

| France2.8% | |

| Hong Kong2.3% | |

| Other21.1% | |

Percentages are adjusted for the effect of futures contracts, if applicable. |

Asset Allocation |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Stocks | 96.6 | 98.6 |

Short-Term Investments and Net Other Assets | 3.4 | 1.4 |

Top Ten Stocks as of October 31, 2004 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Steinhoff International Holdings Ltd. (South Africa, Household Durables) | 1.8 | 1.4 |

K&S AG (Germany, Chemicals) | 1.5 | 0.0 |

United Group Ltd. (Australia, Construction & Engineering) | 1.5 | 0.9 |

Hikari Tsushin, Inc. (Japan, Specialty Retail) | 1.5 | 0.0 |

Orascom Telecom SAE unit (Egypt, Wireless Telecommunication Services) | 1.4 | 0.3 |

Freenet.de AG (Germany, Internet Software & Services) | 1.4 | 2.5 |

Pfleiderer AG (Germany, Building Products) | 1.3 | 0.6 |

BlueScope Steel Ltd. (Australia, Metals & Mining) | 1.3 | 1.0 |

Centennial Coal Co. Ltd. (Australia, Metals & Mining) | 1.2 | 0.7 |

QBE Insurance Group Ltd. (Australia, Insurance) | 1.1 | 1.0 |

| 14.0 | |

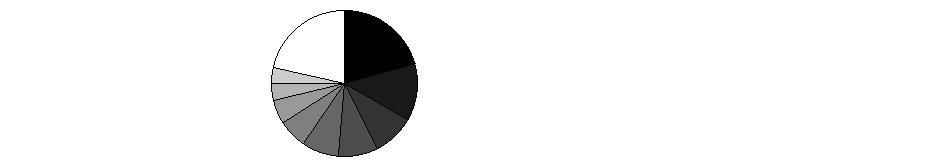

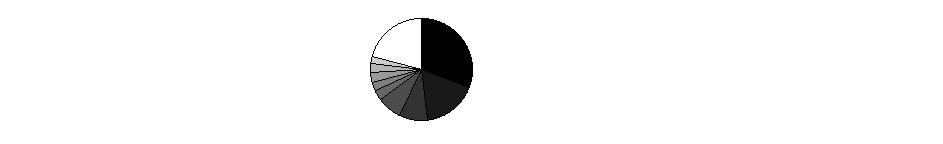

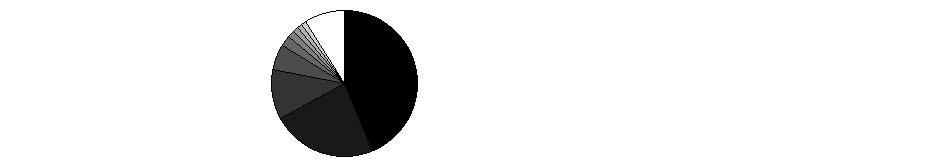

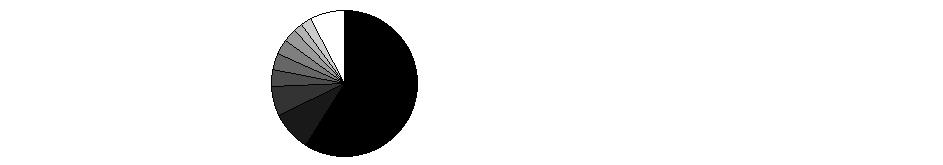

Market Sectors as of October 31, 2004 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Consumer Discretionary | 22.7 | 21.2 |

Materials | 14.5 | 10.8 |

Industrials | 13.9 | 15.4 |

Information Technology | 13.3 | 19.9 |

Financials | 10.8 | 12.7 |

Health Care | 7.7 | 6.6 |

Energy | 6.6 | 4.8 |

Telecommunication Services | 3.9 | 4.2 |

Consumer Staples | 2.8 | 2.6 |

Utilities | 0.4 | 0.4 |

Annual Report

Investments October 31, 2004

Showing Percentage of Net Assets

Common Stocks - 95.5% |

| Shares | | Value (Note 1) |

Australia - 9.2% |

Australian Stock Exchange Ltd. | 603,839 | | $8,368,824 |

BlueScope Steel Ltd. | 2,519,309 | | 14,581,351 |

Boral Ltd. | 1,902,417 | | 9,458,247 |

Bradken Ltd. | 63,288 | | 145,952 |

Centamin Egypt Ltd. (a) | 5,509,616 | | 1,126,378 |

Centennial Coal Co. Ltd. | 4,089,388 | | 13,166,296 |

Corporate Express Australia Ltd. (d) | 1,697,169 | | 7,294,135 |

Dwyka Diamonds Ltd. (a) | 4,010,385 | | 2,358,299 |

Elkedra Diamonds NL | 3,000,000 | | 689,119 |

Fox Resources Ltd. (a) | 1,000,000 | | 486,688 |

Hardman Resources Ltd. (a) | 915,681 | | 1,474,075 |

Hardman Resources Ltd. (UK) (a) | 217,653 | | 351,974 |

JB Hi-Fi Ltd. | 1,483,593 | | 3,976,808 |

Patrick Corp. Ltd. | 914,738 | | 3,808,100 |

Promina Group Ltd. | 914,490 | | 3,108,649 |

QBE Insurance Group Ltd. | 1,235,719 | | 12,703,608 |

Stockland New (a) | 12,301 | | 54,065 |

United Group Ltd. | 3,412,640 | | 17,324,352 |

Virotec International Ltd. (a) | 1,852,832 | | 638,162 |

Virotec International Ltd. (a) | 1,084,000 | | 373,502 |

Westpac Banking Corp. | 212,356 | | 3,001,949 |

TOTAL AUSTRALIA | | 104,490,533 |

Belgium - 1.3% |

EVS Broadcast Equipment SA | 28,000 | | 2,239,475 |

Exmar NV | 17,400 | | 1,046,539 |

Melexis NV | 93,199 | | 1,115,144 |

Omega Pharma SA | 60,100 | | 3,299,438 |

Recticel SA | 67,444 | | 724,125 |

Roularta Media Group NV | 22,376 | | 1,438,887 |

Telindus Group NV | 582,193 | | 5,371,683 |

TOTAL BELGIUM | | 15,235,291 |

Bermuda - 0.4% |

Frontline Ltd. | 54,700 | | 2,701,043 |

Ship Finance International Ltd. | 2,895 | | 58,190 |

Tanzanite One Ltd. (a) | 1,166,001 | | 1,521,318 |

TOTAL BERMUDA | | 4,280,551 |

Brazil - 0.3% |

Petroleo Brasileiro SA Petrobras sponsored ADR | 108,000 | | 3,835,080 |

Canada - 0.8% |

Adastra Minerals, Inc. (a) | 10,000 | | 11,302 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

Canada - continued |

La Mancha Resources, Inc. (a) | 334,000 | | $246,828 |

Oilexco, Inc. (a) | 1,388,800 | | 3,295,670 |

Ontzinc Corp. (a)(e) | 16,612,000 | | 1,841,458 |

Uruguay Mineral Exploration, Inc. (a) | 515,300 | | 2,200,238 |

Western Canadian Coal Corp. (f) | 385,886 | | 1,024,682 |

TOTAL CANADA | | 8,620,178 |

Cayman Islands - 0.0% |

Kingboard Chemical Holdings Ltd. warrants 12/31/06 (a) | 362,380 | | 167,603 |

China - 0.8% |

Aluminum Corp. of China Ltd. (H Shares) | 5,744,000 | | 3,283,888 |

Global Bio-Chem Technology Group Co. Ltd. | 2,632,000 | | 2,062,669 |

Global Bio-Chem Technology Group Co. Ltd. warrants 5/31/07 (a) | 376,000 | | 26,085 |

PICC Property & Casualty Co. Ltd. (H Shares) | 9,086,000 | | 3,268,471 |

TOTAL CHINA | | 8,641,113 |

Czech Republic - 0.3% |

Komercni Banka AS unit | 84,634 | | 3,512,311 |

Denmark - 0.2% |

Coloplast AS Series B | 5,950 | | 592,183 |

SimCorp AS | 33,539 | | 1,498,643 |

TOTAL DENMARK | | 2,090,826 |

Egypt - 1.4% |

Orascom Telecom SAE unit (a) | 928,725 | | 15,881,198 |

Estonia - 0.4% |

Hansabank SA | 422,628 | | 4,272,613 |

Finland - 0.8% |

Aldata Solutions Oyj (a) | 1,617,346 | | 2,255,992 |

Alma Media Corp. (d) | 133,020 | | 1,463,941 |

Capman Oyj (A Shares) | 496,937 | | 1,163,752 |

Nokian Tyres Ltd. | 25,678 | | 2,791,140 |

Vacon Oyj | 73,381 | | 1,031,084 |

TOTAL FINLAND | | 8,705,909 |

France - 2.1% |

Areva (investment certificates) | 7,600 | | 2,809,760 |

Bacou Dalloz | 20,330 | | 1,567,482 |

Galeries Lafayette SA | 5,900 | | 1,155,940 |

Generale de Sante | 200,152 | | 3,439,887 |

Groupe Bourbon SA | 40,038 | | 1,972,610 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

France - continued |

Groupe Open SA | 52,500 | | $560,317 |

Groupe Open SA warrants 10/21/06 (a) | 14,809 | | 6,064 |

Inter Parfums SA | 17,290 | | 604,040 |

Ipsos SA | 16,003 | | 1,501,114 |

Maisons France Confort | 10,498 | | 836,956 |

Medidep SA (a) | 46,000 | | 1,280,340 |

Nexity | 40,000 | | 956,704 |

Oeneo Group (a) | 86,962 | | 144,671 |

Orpea (a) | 25,207 | | 746,759 |

Stedim SA | 27,038 | | 2,524,109 |

Toupargel-Agrigel | 43,520 | | 1,732,038 |

U10 SA (d) | 12,679 | | 700,934 |

Vivendi Universal SA (a) | 66,932 | | 1,835,945 |

TOTAL FRANCE | | 24,375,670 |

Germany - 7.0% |

Advanced Photonics Technologies AG (a) | 48,552 | | 80,772 |

Articon-Integralis AG (Reg.) (a) | 495,185 | | 1,191,334 |

Bijou Brigitte Modische Accessoires AG | 21,486 | | 2,532,348 |

Deutsche Boerse AG | 42,300 | | 2,119,241 |

ElringKlinger AG | 9,142 | | 583,781 |

Fielmann AG | 19,100 | | 1,201,093 |

Freenet.de AG (a)(d) | 773,219 | | 15,633,916 |

Fresenius AG | 43,586 | | 4,049,410 |

Fresenius Medical Care AG | 65,113 | | 4,999,506 |

Gpc Biotech AG (a) | 49,345 | | 628,311 |

Grenkeleasing AG | 100,818 | | 3,825,348 |

Hyrican Informationssysteme AG | 17,925 | | 155,294 |

K&S AG | 420,200 | | 17,562,260 |

Kontron AG (a) | 154,264 | | 1,411,493 |

Merck KGaA | 48,441 | | 2,707,101 |

Parsytec AG (a) | 188,871 | | 693,674 |

PC-Spezialist Franchise AG (d) | 150,000 | | 1,516,445 |

Pfleiderer AG (a) | 1,644,359 | | 14,582,703 |

PSI AG (a) | 228,043 | | 992,211 |

Pulsion Medical Systems AG (a) | 156,865 | | 682,516 |

Rational AG | 17,800 | | 1,404,532 |

United Internet AG | 40,352 | | 984,745 |

TOTAL GERMANY | | 79,538,034 |

Greece - 2.6% |

Alfa-Beta Vassilopoulos SA (Reg.) | 31,800 | | 516,820 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

Greece - continued |

Cosmote Mobile Telecommunications SA | 148,300 | | $2,687,278 |

Folli Follie SA | 268,648 | | 8,250,932 |

Greek Organization of Football Prognostics SA | 266,442 | | 5,448,634 |

Hellenic Exchanges Holding SA (a) | 166,195 | | 1,510,026 |

Hyatt Regency SA (Reg.) | 213,182 | | 2,367,982 |

Public Power Corp. of Greece | 54,000 | | 1,344,760 |

Sarantis SA (Reg.) | 1,046,648 | | 5,705,825 |

Technical Olympic SA (Reg.) | 426,896 | | 2,054,084 |

TOTAL GREECE | | 29,886,341 |

Hong Kong - 2.2% |

ASM Pacific Technology Ltd. | 528,500 | | 1,714,432 |

China Insurance International Holdings Co. Ltd. | 13,106,000 | | 6,019,496 |

China Merchants Holdings International Co. Ltd. | 5,166,000 | | 7,632,488 |

China Pharmaceutical Enterprise and Investment Corp. Ltd. (a) | 9,820,000 | | 2,409,677 |

Kingboard Chemical Holdings Ltd. | 3,623,800 | | 7,588,671 |

TOTAL HONG KONG | | 25,364,764 |

Hungary - 0.6% |

MOL Magyar Olay-es Gazipari RT Series A (For. Reg.) | 44,200 | | 2,481,194 |

OTP Bank Rt. | 152,073 | | 3,856,565 |

TOTAL HUNGARY | | 6,337,759 |

India - 0.0% |

Kotak Mahindra Bank Ltd. | 100,669 | | 398,590 |

State Bank of India | 6,592 | | 68,958 |

TOTAL INDIA | | 467,548 |

Ireland - 1.4% |

DEPFA BANK PLC | 187,900 | | 2,885,468 |

Glanbia PLC | 543,500 | | 1,704,017 |

IAWS Group PLC (Ireland) | 38,059 | | 507,010 |

Independent News & Media PLC (Ireland) | 846,964 | | 2,471,200 |

Kenmare Resources PLC (a) | 6,850,000 | | 2,045,534 |

Kenmare Resources PLC warrants 7/23/09 (a) | 1,712,500 | | 178,748 |

Paddy Power PLC | 137,311 | | 1,825,698 |

Petroceltic International PLC (a) | 12,421,734 | | 3,937,623 |

TOTAL IRELAND | | 15,555,298 |

Italy - 2.0% |

Amplifon Spa | 38,350 | | 1,713,751 |

Cassa Di Risparmio Di Firenze | 2,942,982 | | 5,758,419 |

Lottomatica Spa New (d) | 383,300 | | 11,571,108 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

Italy - continued |

Saipem Spa | 79,800 | | $922,553 |

Teleunit Spa (a) | 7,365,800 | | 2,571,795 |

TOTAL ITALY | | 22,537,626 |

Japan - 27.7% |

Able, Inc. | 272,700 | | 7,678,424 |

Adtec Plasma Technology Co. Ltd. (a) | 32 | | 323,522 |

Ahresty Corp. | 53,300 | | 694,987 |

Amiyaki Tei Co. Ltd. (d) | 185 | | 592,573 |

Apple International Co. Ltd. | 384 | | 885,303 |

ARRK Corp. | 140,600 | | 5,234,223 |

Asahi Broadcasting Corp. | 14,940 | | 961,321 |

Asahi Denka Co. Ltd. | 108,000 | | 953,106 |

Asahi Glass Co. Ltd. | 102,000 | | 938,706 |

Asahi Intecc Co. Ltd. | 49,300 | | 1,784,088 |

Axell Corp. | 282 | | 1,718,619 |

Benefit One, Inc. (a) | 1 | | 12,378 |

Casio Computer Co. Ltd. | 170,700 | | 2,030,626 |

Chiyoda Integre Co. Ltd. | 78,960 | | 1,437,671 |

Citizen Electronics Co. Ltd. (d) | 19,200 | | 865,347 |

CMK Corp. (d) | 55,000 | | 727,028 |

Culture Convenience Club Co. Ltd. (d) | 63,400 | | 790,740 |

Cyber Agent Ltd. (a)(d) | 867 | | 2,523,135 |

Cyber Agent Ltd. New (a)(d) | 867 | | 2,523,135 |

Daikin Industries Ltd. | 24,000 | | 585,062 |

Dream Technologies Corp. (a)(d) | 718 | | 511,525 |

Dwango Co. Ltd. New (a) | 168 | | 888,931 |

Dynic Corp. (a) | 45,000 | | 191,336 |

Eizo Nanao Corp. | 119,000 | | 3,339,443 |

Faith, Inc. (d) | 3,374 | | 9,245,146 |

Fancl Corp. | 26,500 | | 976,520 |

Fuji Seal International, Inc. | 81,300 | | 3,495,205 |

Fuji Spinning Co. Ltd. (a) | 2,524,000 | | 3,195,691 |

Fujikura Ltd. | 1,740,000 | | 7,661,360 |

Fujitsu Business Systems Ltd. | 29,800 | | 380,683 |

Globaly Corp. | 23,100 | | 757,377 |

Heian Ceremony Service Co. Ltd. (d) | 151,000 | | 984,457 |

Hikari Tsushin, Inc. (d) | 277,300 | | 16,611,537 |

Hogy Medical Co. | 21,400 | | 877,555 |

Hokuto Corp. | 35,100 | | 644,061 |

Human Holdings Co. Ltd. (a) | 4 | | 15,496 |

HUNET, Inc. (d) | 520,000 | | 967,922 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

Japan - continued |

Ibiden Co. Ltd. (d) | 83,400 | | $1,286,835 |

Information Planning Co. Ltd. (d) | 111 | | 326,178 |

Intelligent Wave, Inc. (d) | 901 | | 1,489,819 |

Intertrade Co. Ltd. | 8 | | 48,831 |

Ishihara Chemical Co. Ltd. (d) | 53,000 | | 901,403 |

Ishihara Sangyo Kaisha Ltd. | 269,000 | | 564,256 |

Iwatani International Corp. | 945,000 | | 2,294,751 |

JACCS Co. Ltd. (d) | 226,000 | | 1,136,032 |

Japan Medical Dynamic Marketing, Inc. | 82,600 | | 850,702 |

Jastec Co. Ltd. | 54,500 | | 933,094 |

JFE Shoji Holdings, Inc. (a)(d) | 922,000 | | 4,486,512 |

KAGA ELECTRONICS Co. Ltd. (d) | 160,500 | | 2,714,556 |

Kibun Food Chemifa Co. Ltd. (d) | 49,400 | | 963,868 |

Kobe Steel Ltd. | 7,068,000 | | 9,883,914 |

Kubota Corp. | 197,000 | | 899,050 |

Kura Corp. Ltd. | 1,054 | | 2,688,902 |

Lawson, Inc. (d) | 53,300 | | 1,782,794 |

Leopalace21 Corp. | 82,000 | | 1,499,995 |

livedoor Co. Ltd. (a)(d) | 301,100 | | 1,007,128 |

Marktec Corp. | 1,000 | | 7,644 |

Maruha Group, Inc. (a) | 303,000 | | 658,478 |

Matsui Securities Co. Ltd. (d) | 43,700 | | 1,160,268 |

Meganesuper Co. Ltd. | 47,520 | | 830,651 |

Meitec Corp. | 15,075 | | 568,330 |

Melco Holdings, Inc. (d) | 70,200 | | 1,086,480 |

Mitsubishi Materials Corp. (d) | 1,179,000 | | 2,372,816 |

Mitsubishi Plastics, Inc. | 317,000 | | 805,716 |

Mitsui & Associates Telepark Corp. | 484 | | 1,495,422 |

Mitsui Fudosan Co. Ltd. | 246,000 | | 2,614,919 |

Mitsui O.S.K. Lines Ltd. | 296,000 | | 1,756,394 |

Mitsui Trust Holdings, Inc. | 768,000 | | 5,290,046 |

Mobilephone Telecommunications International Ltd. | 364 | | 567,487 |

Neturen Co. Ltd. (d) | 195,000 | | 1,227,099 |

NHK Spring Co. Ltd. | 148,000 | | 1,023,631 |

Nidec Corp. | 46,700 | | 5,065,583 |

Nihon Chouzai Co. Ltd. (a) | 39,700 | | 1,575,471 |

Nihon Dempa Kogyo Co. Ltd. (d) | 510,100 | | 10,820,376 |

Nihon Falcom Corp. | 330 | | 926,064 |

Nihon Micro Coating Co. Ltd. (a) | 10,300 | | 111,920 |

Nihon Trim Co. Ltd. (d) | 72,050 | | 4,976,478 |

Nihon Unicom Corp. | 5,300 | | 78,122 |

Ninety-Nine Plus, Inc. | 1 | | 17,669 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

Japan - continued |

Nippon Chemi-con Corp. (d) | 1,046,000 | | $5,119,554 |

Nippon Chemical Industrial Co. Ltd. | 222,000 | | 788,699 |

Nippon Electric Glass Co. Ltd. | 56,000 | | 1,251,382 |

Nippon Mining Holdings, Inc. | 542,500 | | 2,583,455 |

Nippon Oil Corp. | 329,000 | | 2,092,096 |

Nippon Shinpan Co. Ltd. | 195,000 | | 591,440 |

Nippon Suisan Kaisha Co. Ltd. | 319,000 | | 1,015,760 |

Nishi-Nippon City Bank Ltd. | 199,000 | | 885,614 |

Nissin Co. Ltd. (d) | 221,300 | | 460,018 |

Nissin Co. Ltd. New (a)(d) | 221,300 | | 460,018 |

Nissin Kogyo Co. Ltd. | 378,400 | | 11,155,175 |

Nitta Corp. | 172,800 | | 2,504,608 |

Nittoku Engineering Co. Ltd. | 87,500 | | 632,470 |

NOK Corp. | 372,600 | | 11,336,250 |

Opt, Inc. | 70 | | 380,309 |

Organo Corp. | 274,000 | | 1,444,626 |

Osaki Electric Co. Ltd. (d) | 60,000 | | 239,240 |

Pacific Metals Co. Ltd. (a)(d) | 846,000 | | 3,453,224 |

Park24 Co. Ltd. (d) | 78,900 | | 1,340,409 |

Park24 Co. Ltd. New (a) | 78,900 | | 1,326,990 |

Pigeon Corp. | 217,400 | | 3,298,950 |

Pixela Corp. (d) | 25,700 | | 396,300 |

Rakuten, Inc. (d) | 323 | | 2,426,277 |

Reins International, Inc. (d) | 1,271 | | 4,983,843 |

Rohto Pharmaceutical Co. Ltd. | 611,000 | | 6,633,335 |

Sammy NetWorks Co. Ltd. (a) | 240 | | 8,934,662 |

Sega Sammy Holdings, Inc. (a) | 95,540 | | 4,441,412 |

Sekisui Chemical Co. Ltd. | 136,000 | | 866,103 |

Shicoh Engineering Co. Ltd. (a) | 28 | | 886,285 |

Shin Nippon Biomedical Laboratories Ltd. | 25,900 | | 502,901 |

Shinko Electric Industries Co.Ltd. | 41,500 | | 1,199,887 |

Showa Denko KK (d) | 1,726,000 | | 4,174,952 |

SMBC Friend Securities Co. Ltd. | 379,000 | | 2,402,882 |

So-net M3, Inc. | 3 | | 21,826 |

Soken Chemical & Engineer Co. Ltd. | 66,200 | | 1,057,098 |

Square Enix Co. Ltd. | 24,000 | | 667,832 |

Stanley Electric Co. Ltd. (d) | 195,700 | | 3,023,286 |

Sumitomo Corp. | 236,000 | | 1,759,380 |

Sumitomo Light Metal Industries Ltd. (d) | 1,819,000 | | 2,870,251 |

Sumitomo Metal Mining Co. Ltd. | 528,000 | | 3,567,062 |

Sumitomo Rubber Industries Ltd. | 132,000 | | 1,126,244 |

Sumitomo Titanium Corp. | 29,500 | | 1,410,403 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

Japan - continued |

Suncall Corp. | 206,000 | | $1,080,266 |

Sunx Ltd. | 92,000 | | 1,607,294 |

Takara Co. Ltd. (d) | 228,600 | | 987,104 |

Techno Medica Co. Ltd. | 139 | | 577,881 |

Telewave, Inc. (d) | 230 | | 1,679,879 |

Teraoka Seisakusho Co. Ltd. | 58,000 | | 442,803 |

Toho Titanium Co. Ltd. | 65,000 | | 1,461,709 |

Tokyo Seimitsu Co. Ltd. (d) | 101,500 | | 3,155,242 |

Tokyo Steel Manufacturing Co. Ltd. (d) | 370,200 | | 5,848,485 |

Toppan Printing Co. Ltd. | 98,000 | | 948,193 |

Toray Industries, Inc. | 589,000 | | 2,754,807 |

Toyo Ink Manufacturing Co. Ltd. (d) | 2,749,000 | | 9,480,654 |

Toyo Machinery & Metal Co. Ltd. | 220,000 | | 1,184,863 |

Toyo Radiator Co. Ltd. (d) | 202,000 | | 988,671 |

Toyo Suisan Kaisha Ltd. | 65,000 | | 762,177 |

Trancom Co. Ltd. | 65,400 | | 1,328,577 |

Trend Micro, Inc. | 29,500 | | 1,415,978 |

Ulvac, Inc. | 2,900 | | 66,585 |

Unicharm Petcare Corp. | 200 | | 7,559 |

USS Co. Ltd. | 68,480 | | 5,545,175 |

Wintest Corp. | 70 | | 261,256 |

Works Applications Co. Ltd. (a) | 389 | | 1,201,899 |

Zakkaya Bulldog Co. Ltd. (a) | 31,400 | | 1,014,674 |

Zwei Co. Ltd. (a) | 500 | | 10,960 |

TOTAL JAPAN | | 314,325,122 |

Korea (South) - 0.2% |

SKC Co. Ltd. (a) | 353,470 | | 2,525,914 |

Luxembourg - 1.5% |

Millicom International Cellular SA unit (a) | 183,000 | | 3,711,889 |

Orco Property Group | 37,100 | | 1,401,042 |

Stolt-Nielsen SA (a)(d) | 572,390 | | 12,016,774 |

TOTAL LUXEMBOURG | | 17,129,705 |

Netherlands - 0.7% |

Completel Europe NV (a) | 76,809 | | 2,531,031 |

Efes Breweries International NV unit | 32,700 | | 907,425 |

Fugro NV (Certificaten Van Aandelen) | 24,365 | | 1,898,855 |

PinkRoccade NV | 137,626 | | 1,805,230 |

Wolters Kluwer NV (Certificaten Van Aandelen) | 46,025 | | 841,655 |

TOTAL NETHERLANDS | | 7,984,196 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

New Zealand - 0.1% |

The Warehouse Group Ltd. | 344,626 | | $962,598 |

Norway - 2.9% |

ABG Sundal Collier ASA | 3,358,000 | | 2,640,373 |

Bolig-og Naeringsbanken ASA | 29,040 | | 1,214,767 |

Catch Communications ASA | 633,000 | | 1,592,716 |

Mamut ASA | 1,851,000 | | 2,605,218 |

Nordic VLSI ASA (a) | 591,000 | | 4,042,884 |

Norman ASA (a) | 65,300 | | 549,391 |

Norsk Hydro ASA | 101,680 | | 7,499,339 |

Orkla ASA (A Shares) | 47,772 | | 1,363,530 |

P4 Radio Hele Norge ASA (a)(d) | 141,400 | | 378,018 |

Petroleum Geo-Services ASA (a) | 38,750 | | 1,788,522 |

Statoil ASA | 215,500 | | 3,126,283 |

Tandberg ASA | 339,500 | | 3,203,359 |

TANDBERG Television ASA (a) | 388,829 | | 2,824,979 |

TOTAL NORWAY | | 32,829,379 |

Poland - 0.9% |

Polski Koncern Naftowy Orlen SA unit | 455,400 | | 9,791,100 |

Portugal - 0.8% |

Impresa SGPS (a) | 596,953 | | 3,483,479 |

Media Capital SGPS SA | 880,576 | | 5,983,696 |

TOTAL PORTUGAL | | 9,467,175 |

Russia - 0.4% |

Mobile TeleSystems OJSC sponsored ADR | 17,100 | | 2,481,552 |

Surgutneftegaz JSC sponsored ADR | 36,600 | | 1,916,925 |

TOTAL RUSSIA | | 4,398,477 |

Singapore - 1.2% |

Accord Customer Care Solutions Ltd. (a) | 13,435,000 | | 6,220,842 |

Singapore Exchange Ltd. | 2,698,000 | | 2,855,456 |

Singapore Petroleum Co. Ltd. | 1,501,000 | | 3,375,772 |

Venture Corp. Ltd. | 124,000 | | 1,178,147 |

TOTAL SINGAPORE | | 13,630,217 |

South Africa - 3.0% |

African Bank Investments Ltd. | 1,208,151 | | 2,831,983 |

Discovery Holdings Ltd. (a) | 2,442,719 | | 6,651,488 |

MTN Group Ltd. | 594,602 | | 3,247,939 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

South Africa - continued |

Steinhoff International Holdings Ltd. | 11,751,132 | | $20,567,495 |

Wilson Bayly Holmes-Ovcon Ltd. | 333,456 | | 1,364,729 |

TOTAL SOUTH AFRICA | | 34,663,634 |

Spain - 0.2% |

Antena 3 Television SA (a) | 36,758 | | 2,368,424 |

Sweden - 1.7% |

Eniro AB | 153,028 | | 1,297,819 |

Finnveden Invest AB Series B (a) | 368,884 | | 2,854,736 |

Gambro AB (A Shares) | 269,000 | | 3,146,388 |

Hexagon AB (B Shares) | 80,143 | | 2,956,637 |

Lindex AB | 31,898 | | 885,968 |

Mekonomen AB | 68,000 | | 1,807,002 |

Modern Times Group AB (MTG) (B Shares) (a) | 105,200 | | 2,342,007 |

Observer AB | 297,314 | | 1,176,699 |

OMX AB (a) | 162,285 | | 1,921,123 |

VBG AB Class B | 6,710 | | 100,536 |

Wedins Norden AB Series B (a) | 3,202,790 | | 307,843 |

TOTAL SWEDEN | | 18,796,758 |

Switzerland - 1.6% |

A Hiestand Holding AG | 1,812 | | 1,265,880 |

Actelion Ltd. (Reg.) (a) | 18,108 | | 2,078,067 |

Amazys Holding AG | 54,100 | | 2,628,413 |

Barry Callebaut AG | 5,721 | | 1,102,220 |

Escor Casino & Entertainment SA | 19,770 | | 514,205 |

Geberit AG (Reg.) | 1,663 | | 1,086,564 |

Micronas Semiconductor Holding AG (a) | 15,752 | | 620,157 |

Mobilezone Holding AG | 462,199 | | 1,579,638 |

Roche Holding AG (participation certificate) | 30,328 | | 3,109,522 |

Sika AG (Bearer) | 1,436 | | 886,524 |

Sulzer AG (Reg.) | 4,024 | | 1,361,783 |

Swissquote Group Holding SA (a) | 18,811 | | 1,402,395 |

Temenos Group AG (a) | 63,126 | | 449,465 |

TOTAL SWITZERLAND | | 18,084,833 |

Taiwan - 0.1% |

Merry Electronics Co. Ltd. | 584,568 | | 1,319,626 |

Turkey - 0.8% |

Beko Elektronik AS (a) | 887,743,640 | | 3,726,215 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

Turkey - continued |

Dogan Gazetecilik AS (a) | 2,269,570,200 | | $4,363,657 |

Dogan Yayin Holding AS (a) | 359,364,500 | | 1,277,271 |

TOTAL TURKEY | | 9,367,143 |

United Kingdom - 16.1% |

Advanced Technology (UK) PLC (a)(e) | 7,355,000 | | 558,207 |

AeroBox PLC (a) | 3,640,000 | | 986,634 |

Air Partner PLC | 45,000 | | 361,787 |

Alba PLC | 402,700 | | 5,498,361 |

Alliance Pharma PLC (a)(e) | 6,259,500 | | 1,811,686 |

Amlin PLC | 157,014 | | 419,821 |

Asia Energy PLC | 694,600 | | 4,607,918 |

Atrium Underwriting PLC | 257,060 | | 862,105 |

Axis Shield PLC (a) | 89,600 | | 330,953 |

BETonSPORTS PLC | 2,407,121 | | 6,922,693 |

BG Group PLC | 441,600 | | 2,880,847 |

BHP Billiton PLC | 193,400 | | 1,967,147 |

Biocompatibles International PLC | 79,010 | | 330,313 |

Blacks Leisure Group PLC | 45,443 | | 367,437 |

Caffe Nero Group PLC (a) | 282,978 | | 520,015 |

Carphone Warehouse Group PLC | 542,849 | | 1,660,948 |

Chaucer Holdings PLC | 1,612,100 | | 1,303,489 |

Cobra Biomanufacturing PLC (a) | 818,400 | | 515,097 |

Corac Group PLC (a)(e) | 4,698,004 | | 2,460,487 |

Corin Group PLC | 1,122,914 | | 7,067,566 |

CSS Stellar PLC (a) | 623,908 | | 418,481 |

CustomVis PLC (a) | 375,215 | | 131,008 |

Domino's Pizza UK & IRL PLC | 344,636 | | 1,304,640 |

Edinburgh Oil & Gas PLC (a) | 713,381 | | 2,484,240 |

Entertainment Rights PLC (a) | 4,002,089 | | 965,638 |

Flomerics Group PLC | 449,658 | | 458,604 |

Future Network PLC | 1,717,169 | | 1,830,222 |

GMA Resources PLC (a) | 6,547,930 | | 1,955,331 |

Goldshield Group PLC | 575,700 | | 2,248,112 |

GTL Resources PLC (a) | 13,669,072 | | 1,318,746 |

Gyrus Group PLC (a) | 220,640 | | 950,802 |

Hardide Ltd. | 125,000 | | 918,825 |

Healthcare Enterprise Group PLC (a) | 30,417,845 | | 1,062,050 |

Hereward Ventures PLC (a) | 1,818,182 | | 167,059 |

Highbury House Communications PLC | 713,914 | | 131,192 |

Holidaybreak PLC | 72,426 | | 714,047 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

United Kingdom - continued |

Hornby PLC | 471,440 | | $2,391,103 |

Hunting PLC | 530,400 | | 1,832,416 |

Icap PLC | 298,550 | | 1,283,795 |

Ideal Shopping Direct PLC (a) | 273,686 | | 749,379 |

Inchcape PLC | 30,122 | | 818,128 |

International Energy Group Ltd. | 1,148,800 | | 3,937,187 |

Intertek Group PLC | 116,310 | | 1,470,511 |

ITE Group PLC | 3,133,116 | | 4,505,299 |

ITM Power PLC | 2,700,000 | | 3,845,283 |

Jubilee Platinum PLC (a)(e) | 3,852,022 | | 1,822,757 |

Kesa Electricals PLC | 556,201 | | 2,780,120 |

Lambert Howarth Group PLC (e) | 1,320,284 | | 6,550,794 |

Landround PLC | 74,400 | | 345,221 |

Lastminute.com PLC (a) | 1,749,526 | | 3,584,743 |

Lawrence PLC | 1,073,124 | | 7,424,679 |

London Clubs International PLC (a) | 1,172,500 | | 2,510,161 |

LTG Technologies PLC (a) | 6,914,968 | | 1,207,193 |

Man Group PLC | 36,969 | | 887,925 |

Manganese Bronze Holdings PLC | 239,797 | | 846,073 |

Manpower Software PLC (a) | 258,824 | | 160,524 |

Marlborough Stirling PLC | 793,069 | | 648,536 |

Matchnet PLC unit (a) | 823,933 | | 5,271,935 |

Meridian Petroleum PLC | 2,747,000 | | 1,438,687 |

Microgen PLC (a) | 289,948 | | 303,709 |

N Brown Group PLC | 439,410 | | 1,037,614 |

NDS Group PLC sponsored ADR (a) | 105,154 | | 2,751,880 |

Ocean Wilsons Holdings Ltd. | 170,311 | | 604,036 |

Oystertec PLC (a) | 7,009,687 | | 3,155,931 |

P&MM Group PLC (e) | 2,035,000 | | 2,299,865 |

Peacock Group PLC | 835,318 | | 3,968,032 |

Phytopharm PLC (a) | 528,100 | | 1,455,694 |

Pilat Media Global PLC (a)(e) | 2,880,000 | | 2,196,359 |

PlusNet Technologies Ltd. | 912,355 | | 2,347,225 |

Premier Oil PLC (a) | 159,291 | | 1,832,434 |

Proteome Sciences PLC (a) | 645,184 | | 889,217 |

Provident Financial PLC | 434,894 | | 4,671,224 |

Psion PLC | 2,900,000 | | 3,130,896 |

QA PLC (a) | 13,554,656 | | 592,827 |

Regal Petroleum PLC (a) | 137,516 | | 865,519 |

Royalblue Group PLC | 210,803 | | 1,646,374 |

Sanctuary Group PLC | 3,046,215 | | 2,337,114 |

SCI Entertainment Group PLC (a) | 401,531 | | 1,014,576 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

United Kingdom - continued |

SDL PLC (a) | 227,897 | | $487,896 |

Sibir Energy PLC (a) | 1,162,800 | | 299,155 |

Sinclair Pharma PLC | 734,198 | | 1,517,849 |

SkyePharma PLC (a) | 124,100 | | 121,438 |

Sondex PLC | 354,900 | | 1,317,408 |

Spice Holdings PLC | 1,362,100 | | 3,566,865 |

Sportingbet PLC | 345,100 | | 697,590 |

Sterling Energy PLC (a) | 4,035,800 | | 1,409,114 |

SubSea Resources PLC (a) | 7,222,500 | | 2,654,485 |

SubSea Resources PLC warrants 11/4/09 (a) | 1,805,625 | | 33 |

Taghmen Energy Ltd. | 2,279,573 | | 1,481,722 |

Teesland PLC | 1,380,000 | | 1,711,771 |

Tikit Group PLC (e) | 822,761 | | 2,154,524 |

ukbetting PLC (a) | 2,517,419 | | 1,954,542 |

Unibet Group PLC unit | 55,964 | | 1,589,999 |

Urbium PLC | 141,255 | | 1,265,439 |

William Hill PLC | 333,186 | | 2,994,046 |

William Ransom & Son PLC (e) | 2,684,500 | | 2,392,588 |

Windsor PLC | 700,000 | | 546,701 |

Wolfson Microelectronics PLC | 685,250 | | 1,240,361 |

Xstrata PLC | 133,500 | | 2,073,007 |

TOTAL UNITED KINGDOM | | 183,382,016 |

United States of America - 1.8% |

Frontier Mining Ltd. (e) | 4,487,533 | | 1,443,140 |

Golden Telecom, Inc. (d) | 88,900 | | 2,532,761 |

Marathon Oil Corp. | 39,900 | | 1,520,589 |

NTL, Inc. (a) | 69,000 | | 4,589,190 |

Private Media Group, Inc. (a)(d) | 202,400 | | 514,096 |

ResMed, Inc. CHESS Depositary Interests (a) | 642,463 | | 3,054,630 |

Solar Integrated Technologies, Inc. | 876,373 | | 2,214,392 |

Valero Energy Corp. | 41,400 | | 1,778,958 |

XL TechGroup, Inc. | 736,700 | | 2,707,594 |

TOTAL UNITED STATES OF AMERICA | | 20,355,350 |

TOTAL COMMON STOCKS (Cost $910,182,332) | 1,085,177,913 |

Nonconvertible Preferred Stocks - 1.1% |

| Shares | | Value (Note 1) |

Germany - 0.7% |

Fresenius AG | 49,105 | | $4,166,270 |

Fresenius Medical Care AG | 68,266 | | 3,736,387 |

TOTAL GERMANY | | 7,902,657 |

Italy - 0.4% |

Buzzi Unicem Spa (Risp) | 483,900 | | 4,415,230 |

TOTAL NONCONVERTIBLE PREFERRED STOCKS (Cost $9,850,251) | 12,317,887 |

Money Market Funds - 8.3% |

| | | |

Fidelity Cash Central Fund, 1.79% (b) | 31,425,450 | | 31,425,450 |

Fidelity Securities Lending Cash Central Fund, 1.77% (b)(c) | 62,835,268 | | 62,835,268 |

TOTAL MONEY MARKET FUNDS (Cost $94,260,718) | 94,260,718 |

TOTAL INVESTMENT PORTFOLIO - 104.9% (Cost $1,014,293,301) | | 1,191,756,518 |

NET OTHER ASSETS - (4.9)% | | (55,719,257) |

NET ASSETS - 100% | $1,136,037,261 |

Legend |

(a)Non-income producing |

(b)Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent fiscal year end is available upon request. |

(c)Includes investment made with cash collateral received from securities on loan. |

(d)Security or a portion of the security is on loan at period end. |

(e)Affiliated company |

(f)Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $1,024,682 or 0.1% of net assets. |

Additional information on each holding is as follows: |

Security | Acquisition Date | Acquisition Cost |

Western Canadian Coal Corp. | 9/29/04 | $0 |

Other Information |

An affiliated company is a company in which the fund has ownership of at least 5% of the voting securities. Companies which are affiliates of the fund at period-end are noted in the fund's Schedule of Investments. Transactions during the period with companies which are or were affiliates are as follows: |

Affiliates | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Value,

end of

period |

Advanced Technology (UK) PLC | $- | $677,635 | $- | $- | $558,207 |

Alliance Pharma PLC | - | 1,378,455 | - | - | 1,811,686 |

Articon-Integralis AG (Reg.) | - | 3,216,353 | 382,484 | - | - |

Corac Group PLC | - | 2,448,084 | - | - | 2,460,487 |

Frontier Mining Ltd. | - | 1,213,216 | - | - | 1,443,140 |

Jubilee Platinum PLC | - | 1,879,542 | 562,643 | - | 1,822,757 |

Lambert Howarth Group PLC | 4,376,721 | 1,140,404 | - | 228,933 | 6,550,794 |

Online Travel Corp. PLC | 2,164,843 | - | - | - | - |

Ontzinc Corp. | - | 1,719,571 | - | - | 1,841,458 |

P&MM Group PLC | - | 1,986,262 | - | - | 2,299,865 |

Pilat Media Global PLC | - | 2,810,095 | - | - | 2,196,359 |

Tikit Group PLC | - | 2,069,038 | - | 24,172 | 2,154,524 |

Wedins Norden AB Series B | 956,215 | 2,235,131 | 1,034,922 | - | - |

William Ransom & Son PLC | - | 2,458,423 | - | 48,384 | 2,392,588 |

Totals | $7,497,779 | $25,232,209 | $1,980,049 | $301,489 | $25,531,865 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements

Statement of Assets and Liabilities

October 31, 2004 |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $58,511,696) (cost $1,014,293,301) - See accompanying schedule | | $1,191,756,518 |

Cash | | 153,592 |

Foreign currency held at value (cost $5,447,045) | | 5,423,146 |

Receivable for investments sold | | 9,813,009 |

Receivable for fund shares sold | | 2,888,611 |

Dividends receivable | | 1,251,600 |

Interest receivable | | 38,100 |

Other affiliated receivables | | 3,355 |

Other receivables | | 129,888 |

Total assets | | 1,211,457,819 |

| | |

Liabilities | | |

Payable for investments purchased | $9,970,193 | |

Payable for fund shares redeemed | 1,253,833 | |

Accrued management fee | 896,565 | |

Distribution fees payable | 19,420 | |

Other affiliated payables | 246,714 | |

Other payables and accrued expenses | 198,565 | |

Collateral on securities loaned, at value | 62,835,268 | |

Total liabilities | | 75,420,558 |

| | |

Net Assets | | $1,136,037,261 |

Net Assets consist of: | | |

Paid in capital | | $898,686,393 |

Undistributed net investment income | | 5,017,937 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | 54,860,187 |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 177,472,744 |

Net Assets | | $1,136,037,261 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Assets and Liabilities - continued

October 31, 2004 |

| | |

Calculation of Maximum Offering Price

Class A:

Net Asset Value and redemption price per share

($13,277,823 ÷ 624,767 shares) | | $21.25 |

| | |

Maximum offering price per share (100/94.25 of $21.25) | | $22.55 |

Class T:

Net Asset Value and redemption price per share ($15,131,252 ÷ 713,891 shares) | | $21.20 |

| | |

Maximum offering price per share (100/96.50 of $21.20) | | $21.97 |

Class B:

Net Asset Value and offering price per share ($5,060,793 ÷ 241,137 shares) A | | $20.99 |

| | |

Class C:

Net Asset Value and offering price per share ($8,664,337 ÷ 411,711 shares) A | | $21.04 |

| | |

| | |

International Small Cap:

Net Asset Value, offering price and redemption price per share ($1,091,335,065 ÷ 51,091,331 shares) | | $21.36 |

| | |

Institutional Class:

Net Asset Value, offering price and redemption price per share ($2,567,991 ÷ 120,234 shares) | | $21.36 |

ARedemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Operations

Year ended October 31, 2004 |

| | |

Investment Income | | |

Dividends (including $301,489 received from

affiliated issuers) | | $17,760,750 |

Interest | | 500,442 |

Security lending | | 1,159,171 |

| | 19,420,363 |

Less foreign taxes withheld | | (1,435,129) |

Total income | | 17,985,234 |

| | |

Expenses | | |

Management fee

Basic fee | $8,826,255 | |

Performance adjustment | 713,427 | |

Transfer agent fees | 2,181,571 | |

Distribution fees | 153,758 | |

Accounting and security lending fees | 516,934 | |

Non-interested trustees' compensation | 4,963 | |

Custodian fees and expenses | 574,790 | |

Registration fees | 266,493 | |

Audit | 41,794 | |

Legal | 19,756 | |

Interest | 2,571 | |

Miscellaneous | 54,905 | |

Total expenses before reductions | 13,357,217 | |

Expense reductions | (235,589) | 13,121,628 |

Net investment income (loss) | | 4,863,606 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities (Including realized gain (loss) of $(1,489,101) from affiliated issuers) | 55,896,770 | |

Foreign currency transactions | (196,336) | |

Total net realized gain (loss) | | 55,700,434 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 104,967,642 | |

Assets and liabilities in foreign currencies | 20,845 | |

Total change in net unrealized appreciation (depreciation) | | 104,988,487 |

Net gain (loss) | | 160,688,921 |

Net increase (decrease) in net assets resulting from operations | | $165,552,527 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended

October 31,

2004 | Year ended

October 31,

2003 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $4,863,606 | $516,714 |

Net realized gain (loss) | 55,700,434 | 11,443,482 |

Change in net unrealized appreciation (depreciation) | 104,988,487 | 72,481,971 |

Net increase (decrease) in net assets resulting

from operations | 165,552,527 | 84,442,167 |

Distributions to shareholders from net investment income | (740,885) | - |

Distributions to shareholders from net realized gain | (11,573,205) | (27,060) |

Total distributions | (12,314,090) | (27,060) |

Share transactions - net increase (decrease) | 422,159,706 | 470,607,516 |

Redemption fees | 1,900,450 | 290,434 |

Total increase (decrease) in net assets | 577,298,593 | 555,313,057 |

| | |

Net Assets | | |

Beginning of period | 558,738,668 | 3,425,611 |

End of period (including undistributed net investment income of $5,017,937 and undistributed net investment income of $614,412, respectively) | $1,136,037,261 | $558,738,668 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class A

Years ended October 31, | 2004 | 2003 G |

Selected Per-Share Data | | |

Net asset value, beginning of period | $17.69 | $12.35 |

Income from Investment Operations | | |

Net investment income (loss) E | .02 | .02 F |

Net realized and unrealized gain (loss) | 3.83 | 5.30 |

Total from investment operations | 3.85 | 5.32 |

Distributions from net investment income | (.02) | - |

Distributions from net realized gain | (.31) | - |

Total distributions | (.33) | - |

Redemption fees added to paid in capital E | .04 | .02 |

Net asset value, end of period | $21.25 | $17.69 |

Total Return B, C, D | 22.36% | 43.24% |

Ratios to Average Net Assets H | | |

Expenses before expense reductions | 1.71% | 1.77% A |

Expenses net of voluntary waivers, if any | 1.71% | 1.77% A |

Expenses net of all reductions | 1.69% | 1.74% A |

Net investment income (loss) | .09% | .28% A |

Supplemental Data | | |

Net assets, end of period (000 omitted) | $13,278 | $4,960 |

Portfolio turnover rate | 77% | 84% A |

AAnnualized

BTotal returns for periods of less than one year are not annualized.

CTotal returns would have been lower had certain expenses not been reduced during the periods shown.

DTotal returns do not include the effect of the sales charges.

ECalculated based on average shares outstanding during the period.

FInvestment income per share reflects a special dividend which amounted to $.01 per share.

GFor the period May 27, 2003 (commencement of sale of shares) to October 31, 2003.

HExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class T

Years ended October 31, | 2004 | 2003 G |

Selected Per-Share Data | | |

Net asset value, beginning of period | $17.68 | $12.35 |

Income from Investment Operations | | |

Net investment income (loss) E | (.03) | -F,I |

Net realized and unrealized gain (loss) | 3.83 | 5.31 |

Total from investment operations | 3.80 | 5.31 |

Distributions from net investment income | (.01) | - |

Distributions from net realized gain | (.31) | - |

Total distributions | (.32) | - |

Redemption fees added to paid in capital E | .04 | .02 |

Net asset value, end of period | $21.20 | $17.68 |

Total Return B,C,D | 22.07% | 43.16% |

Ratios to Average Net AssetsH | | |

Expenses before expense reductions | 1.94% | 2.12% A |

Expenses net of voluntary waivers, if any | 1.94% | 2.12% A |

Expenses net of all reductions | 1.92% | 2.09% A |

Net investment income (loss) | (.14)% | (.07)%A |

Supplemental Data | | |

Net assets, end of period (000 omitted) | $15,131 | $3,990 |

Portfolio turnover rate | 77% | 84% A |

AAnnualized

BTotal returns for periods of less than one year are not annualized.

CTotal returns would have been lower had certain expenses not been reduced during the periods shown.

DTotal returns do not include the effect of the sales charges.

ECalculated based on average shares outstanding during the period.

FInvestment income per share reflects a special dividend which amounted to $.01 per share.

GFor the period May 27, 2003 (commencement of sale of shares) to October 31, 2003.

HExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

IAmount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class B

Years ended October 31, | 2004 | 2003 G |

Selected Per-Share Data | | |

Net asset value, beginning of period | $17.62 | $12.35 |

Income from Investment Operations | | |

Net investment income (loss) E | (.16) | (.05) F |

Net realized and unrealized gain (loss) | 3.80 | 5.30 |

Total from investment operations | 3.64 | 5.25 |

Distributions from net realized gain | (.31) | - |

Redemption fees added to paid in capital E | .04 | .02 |

Net asset value, end of period | $20.99 | $17.62 |

Total Return B, C, D | 21.21% | 42.67% |

Ratios to Average Net Assets H | | |

Expenses before expense reductions | 2.63% | 2.76% A |

Expenses net of voluntary waivers, if any | 2.63% | 2.76%A |

Expenses net of all reductions | 2.60% | 2.73%A |

Net investment income (loss) | (.83)% | (.71)%A |

Supplemental Data | | |

Net assets, end of period (000 omitted) | $5,061 | $1,016 |

Portfolio turnover rate | 77% | 84%A |

AAnnualized

BTotal returns for periods of less than one year are not annualized.

CTotal returns would have been lower had certain expenses not been reduced during the periods shown.

DTotal returns do not include the effect of the contingent deferred sales charge.

ECalculated based on average shares outstanding during the period.

FInvestment income per share reflects a special dividend which amounted to $.01 per share.

GFor the period May 27, 2003 (commencement of sale of shares) to October 31, 2003.

HExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class C

Years ended October 31, | 2004 | 2003 G |

Selected Per-Share Data | | |

Net asset value, beginning of period | $17.64 | $12.35 |

Income from Investment Operations | | |

Net investment income (loss) E | (.12) | (.04) F |

Net realized and unrealized gain (loss) | 3.80 | 5.31 |

Total from investment operations | 3.68 | 5.27 |

Distributions from net investment income | (.01) | - |

Distributions from net realized gain | (.31) | - |

Total distributions | (.32) | - |

Redemption fees added to paid in capital E | .04 | .02 |

Net asset value, end of period | $21.04 | $17.64 |

Total Return B, C, D | 21.43% | 42.83% |

Ratios to Average Net Assets H | | |

Expenses before expense reductions | 2.43% | 2.57% A |

Expenses net of voluntary waivers, if any | 2.43% | 2.57% A |

Expenses net of all reductions | 2.40% | 2.55% A |

Net investment income (loss) | (.62)% | (.52)%A |

Supplemental Data | | |

Net assets, end of period (000 omitted) | $8,664 | $1,383 |

Portfolio turnover rate | 77% | 84% A |

AAnnualized

BTotal returns for periods of less than one year are not annualized.

CTotal returns would have been lower had certain expenses not been reduced during the periods shown.

DTotal returns do not include the effect of the contingent deferred sales charge.

ECalculated based on average shares outstanding during the period.

FInvestment income per share reflects a special dividend which amounted to $.01 per share.

GFor the period May 27, 2003 (commencement of sale of shares) to October 31, 2003.

HExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - International Small Cap

Years ended October 31, | 2004 | 2003 | 2002 F |

Selected Per-Share Data | | | |

Net asset value, beginning of period | $17.71 | $9.87 | $10.00 |

Income from Investment Operations | | | |

Net investment income (loss) D | .10 | .07 E | (.01) |

Net realized and unrealized gain (loss) | 3.84 | 7.75 | (.12) |

Total from investment operations | 3.94 | 7.82 | (.13) |

Distributions from net investment income | (.02) | - | - |

Distributions from net realized gain | (.31) | (.02) | - |

Total distributions | (.33) | (.02) | - |

Redemption fees added to paid in capital D | .04 | .04 | - H |

Net asset value, end of period | $21.36 | $17.71 | $9.87 |

Total Return B, C | 22.84% | 79.78% | (1.30)% |

Ratios to Average Net Assets G | | | |

Expenses before expense reductions | 1.30% | 1.54% | 13.70% A |

Expenses net of voluntary waivers, if any | 1.30% | 1.54% | 1.80% A |

Expenses net of all reductions | 1.28% | 1.51% | 1.80% A |

Net investment income (loss) | .50% | .46% | (.56)% A |

Supplemental Data | | | |

Net assets, end of period (000 omitted) | $1,091,335 | $546,989 | $3,426 |

Portfolio turnover rate | 77% | 84% | 85% A |

AAnnualized

BTotal returns for periods of less than one year are not annualized.

CTotal returns would have been lower had certain expenses not been reduced during the periods shown.

DCalculated based on average shares outstanding during the period.

EInvestment income per share reflects a special dividend which amounted to $.03 per share.

FFor the period September 18, 2002 (commencement of operations) to October 31, 2002.

GExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

HAmount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Institutional Class

Years ended October 31, | 2004 | 2003 F |

Selected Per-Share Data | | |

Net asset value, beginning of period | $17.72 | $12.35 |

Income from Investment Operations | | |

Net investment income (loss) D | .10 | .04 E |

Net realized and unrealized gain (loss) | 3.84 | 5.31 |

Total from investment operations | 3.94 | 5.35 |

Distributions from net investment income | (.03) | - |

Distributions from net realized gain | (.31) | - |

Total distributions | (.34) | - |

Redemption fees added to paid in capital D | .04 | .02 |

Net asset value, end of period | $21.36 | $17.72 |

Total Return B, C | 22.84% | 43.48% |

Ratios to Average Net Assets G | | |

Expenses before expense reductions | 1.32% | 1.51% A |

Expenses net of voluntary waivers, if any | 1.32% | 1.51% A |

Expenses net of all reductions | 1.29% | 1.48% A |

Net investment income (loss) | .49% | .54% A |

Supplemental Data | | |

Net assets, end of period (000 omitted) | $2,568 | $401 |

Portfolio turnover rate | 77% | 84% A |

AAnnualized

BTotal returns for periods of less than one year are not annualized.

CTotal returns would have been lower had certain expenses not been reduced during the periods shown.

DCalculated based on average shares outstanding during the period.

EInvestment income per share reflects a special dividend which amounted to $.01 per share.

FFor the period May 27, 2003 (commencement of sale of shares) to October 31, 2003.

GExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended October 31, 2004

1. Significant Accounting Policies.

Fidelity International Small Cap Fund (the fund) is a fund of Fidelity Investment Trust (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

The fund offers Class A, Class T, Class B, Class C, International Small Cap (the original class), and Institutional Class shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase. Investment income, realized and unrealized capital gains and losses, the common expenses of the fund, and certain fund-level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions also differ by class.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Net asset value per share (NAV calculation) is calculated as of the close of business of the New York Stock Exchange, normally 4:00 p.m. Eastern time. Equity securities, including restricted securities, for which market quotations are available are valued at the last sale price or official closing price (closing bid price or last evaluated quote if no sale has occurred) on the primary market or exchange on which they trade. Debt securities, including restricted securities, for which quotations are readily available are valued at their most recent bid prices (sales prices if the principal market is an exchange) in the principal market in which such securities are normally traded, as determined by recognized dealers in such securities, or securities are valued on the basis of information provided by a pricing service. Pricing services use valuation matrices that incorporate both dealer-supplied valuations and valuation models. If prices are not readily available or do not accurately reflect fair value for a security, or if a security's value has been materially affected by events occurring after the close of the exchange or market on which the security is principally traded, that security may be valued by another method that the Board of Trustees believes accurately reflects fair value. A security's valuation may differ depending on the method used for determining value. Price movements in futures contracts and ADRs, market and trading trends, the bid/ask quotes of brokers and off-exchange institutional trading may be reviewed in the course of making a good faith determination of a security's fair value. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily

Annual Report

Notes to Financial Statements - continued

1. Significant Accounting Policies - continued

Security Valuation - continued

available are valued on the basis of amortized cost. Investments in open-end investment companies are valued at their net asset value each business day.

Foreign Currency. The fund uses foreign currency contracts to facilitate transactions in foreign-denominated securities. Losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rate at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income is accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among the funds in the trust.

Income Tax Information and Distributions to Shareholders. Each year, the fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements. Foreign taxes are provided for based on the fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Annual Report

1. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued