UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4008

Fidelity Investment Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | October 31 |

| |

Date of reporting period: | October 31, 2017 |

This report on Form N-CSR relates solely to the Registrant’s Fidelity Canada Fund, Fidelity China Region Fund, Fidelity Emerging Asia Fund, Fidelity Emerging Markets Fund, Fidelity Europe Fund, Fidelity Japan Fund, Fidelity Japan Smaller Companies Fund, Fidelity Latin America Fund, Fidelity Nordic Fund and Fidelity Pacific Basin Fund (each, a “Fund” and collectively, the “Funds”).

Item 1.

Reports to Stockholders

Fidelity Advisor® Canada Fund - Class A, Class M (formerly Class T), Class C and Class I

Annual Report October 31, 2017 Class A, Class M, Class C and Class I are classes of Fidelity® Canada Fund |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2017 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

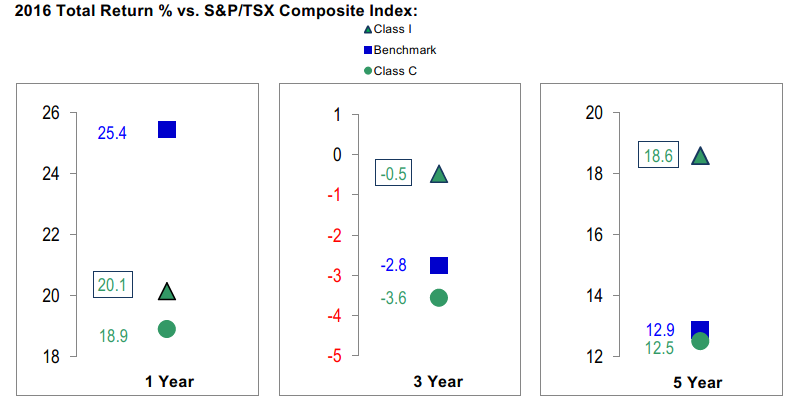

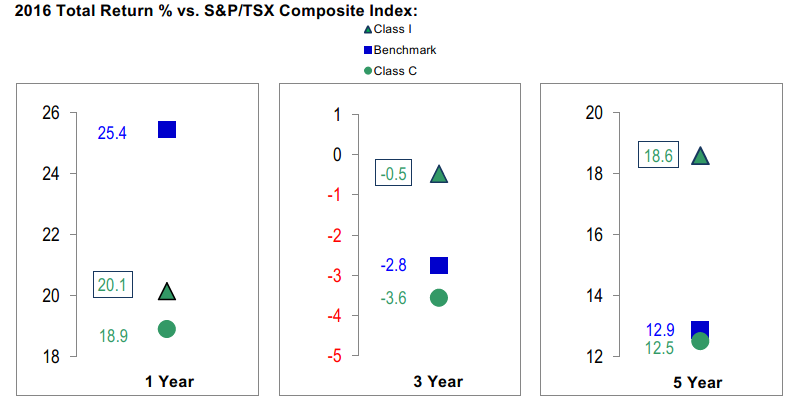

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended October 31, 2017 | Past 1 year | Past 5 years | Past 10 years |

| Class A (incl. 5.75% sales charge) | 7.42% | 2.57% | (0.46)% |

| Class M (incl. 3.50% sales charge) | 9.67% | 2.76% | (0.51)% |

| Class C (incl. contingent deferred sales charge) | 12.16% | 3.04% | (0.61)% |

| Class I | 14.38% | 4.13% | 0.44% |

Class C shares' contingent deferred sales charges included in the past one year, past five years and past ten years total return figures are 1%, 0% and 0%, respectively.

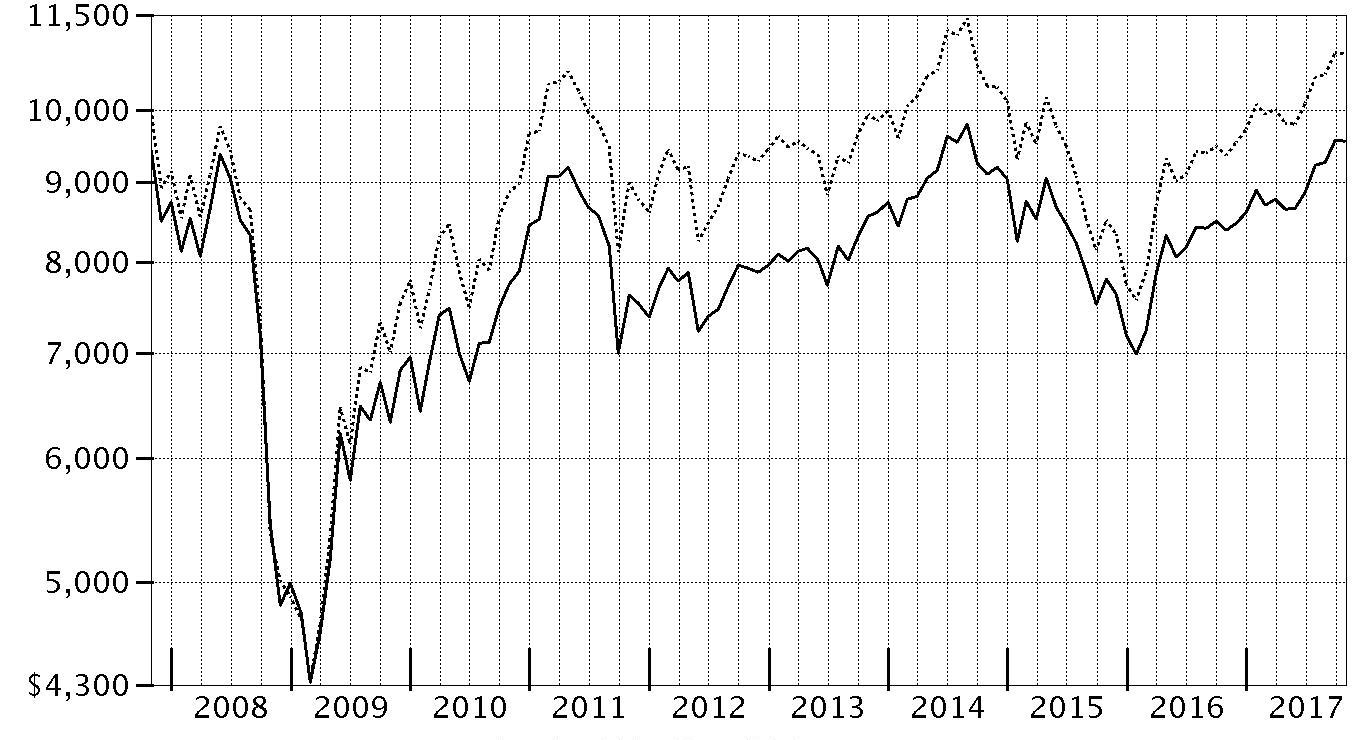

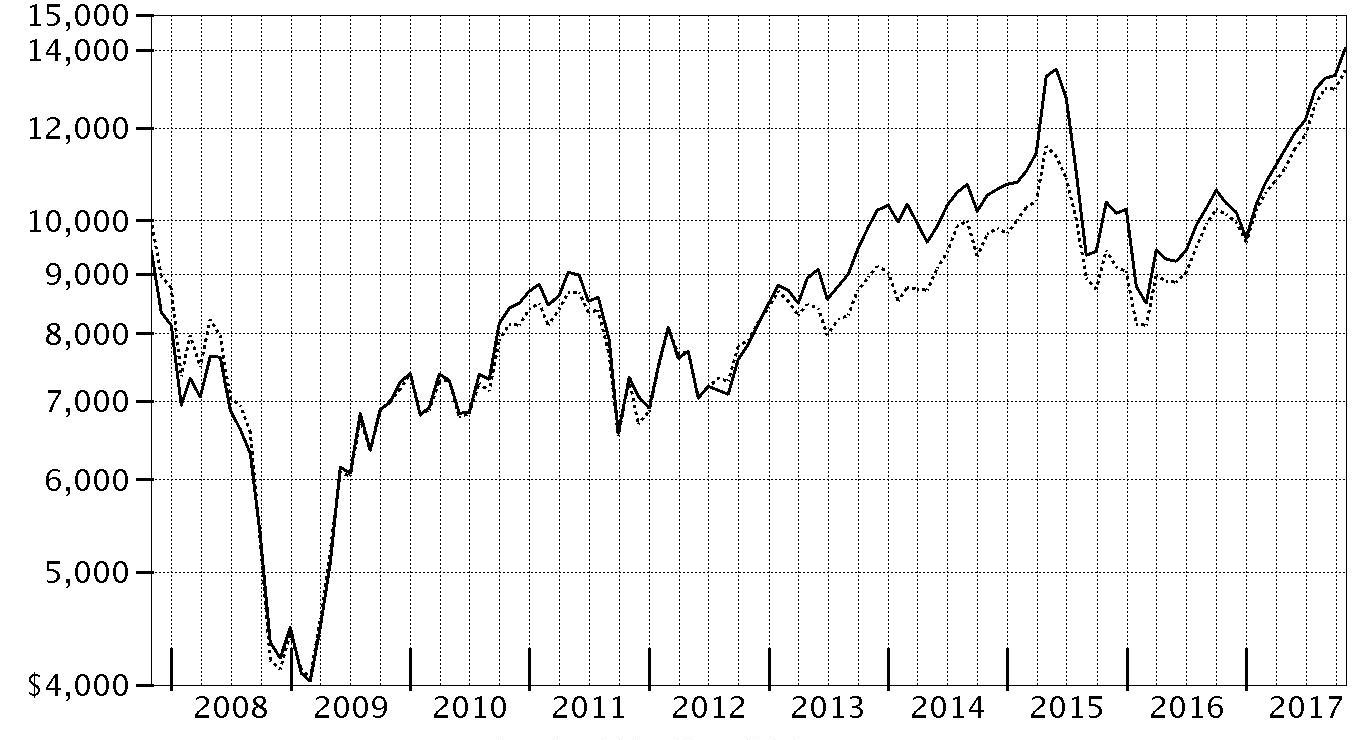

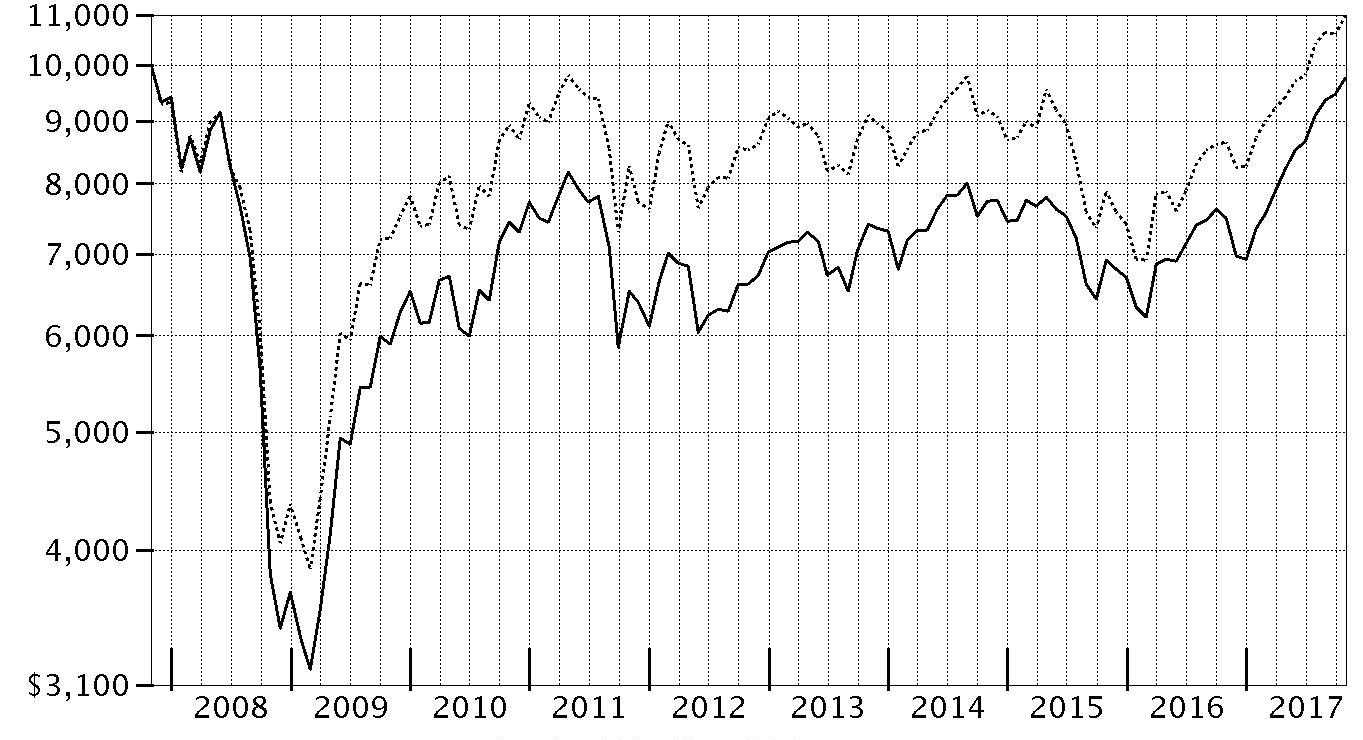

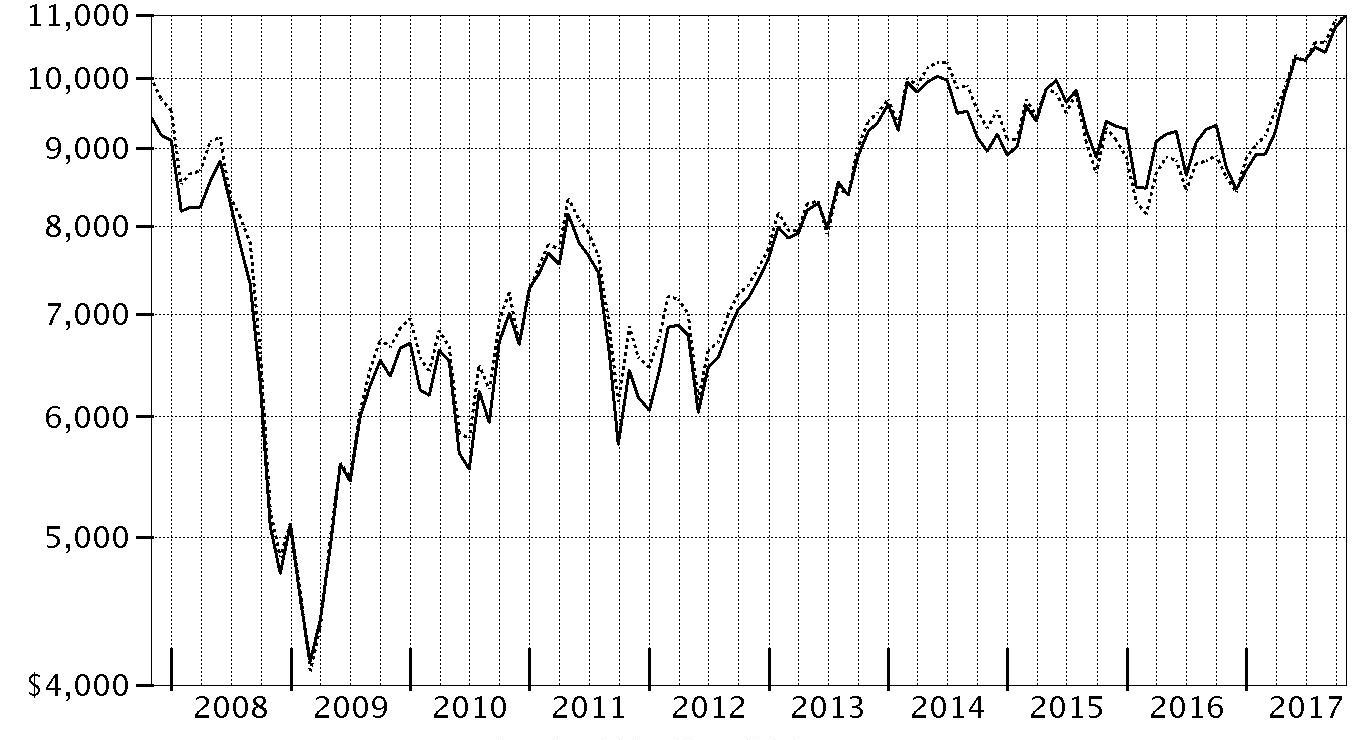

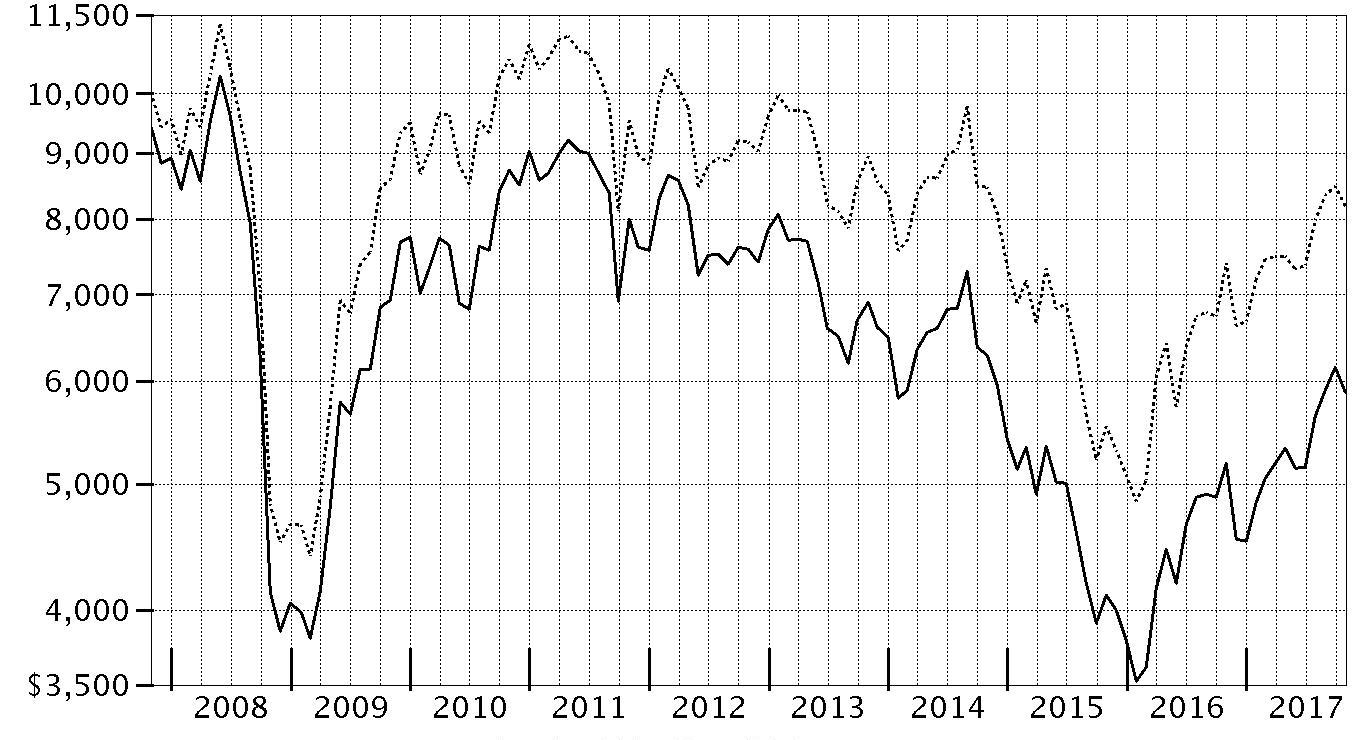

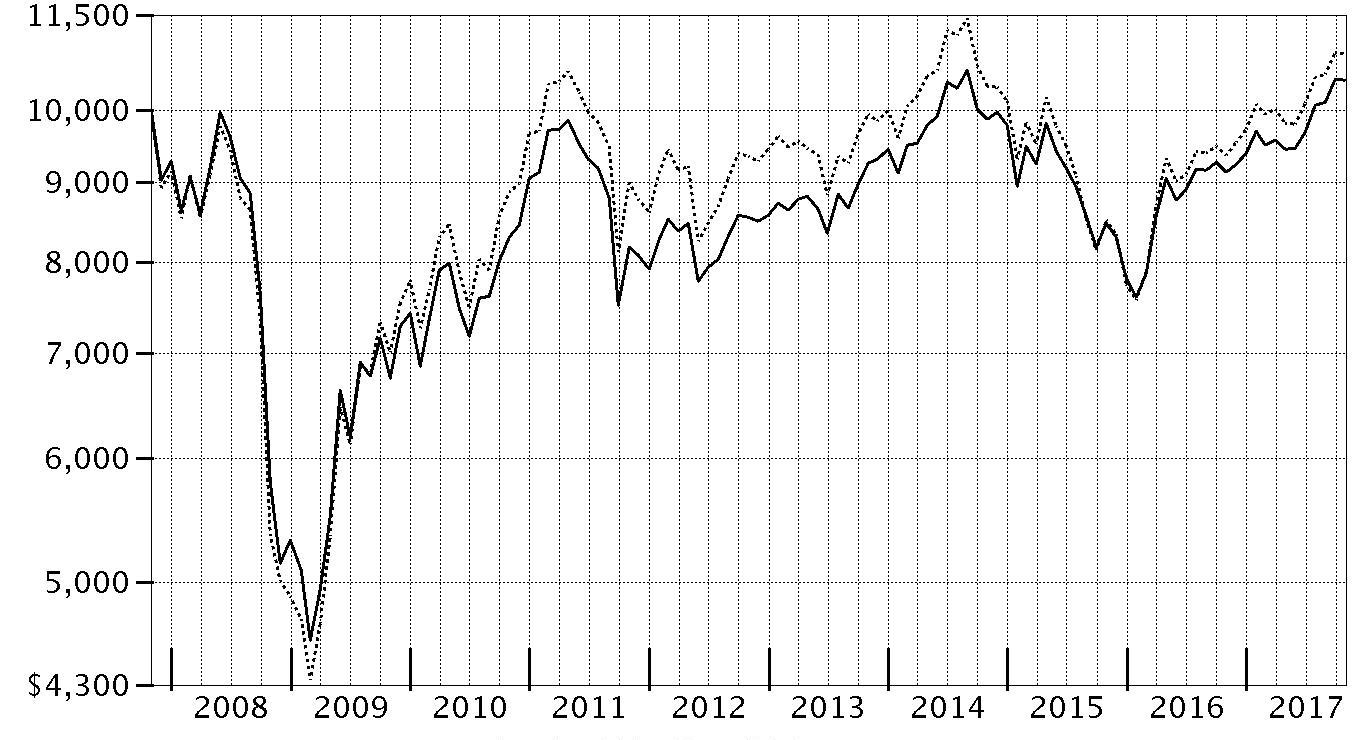

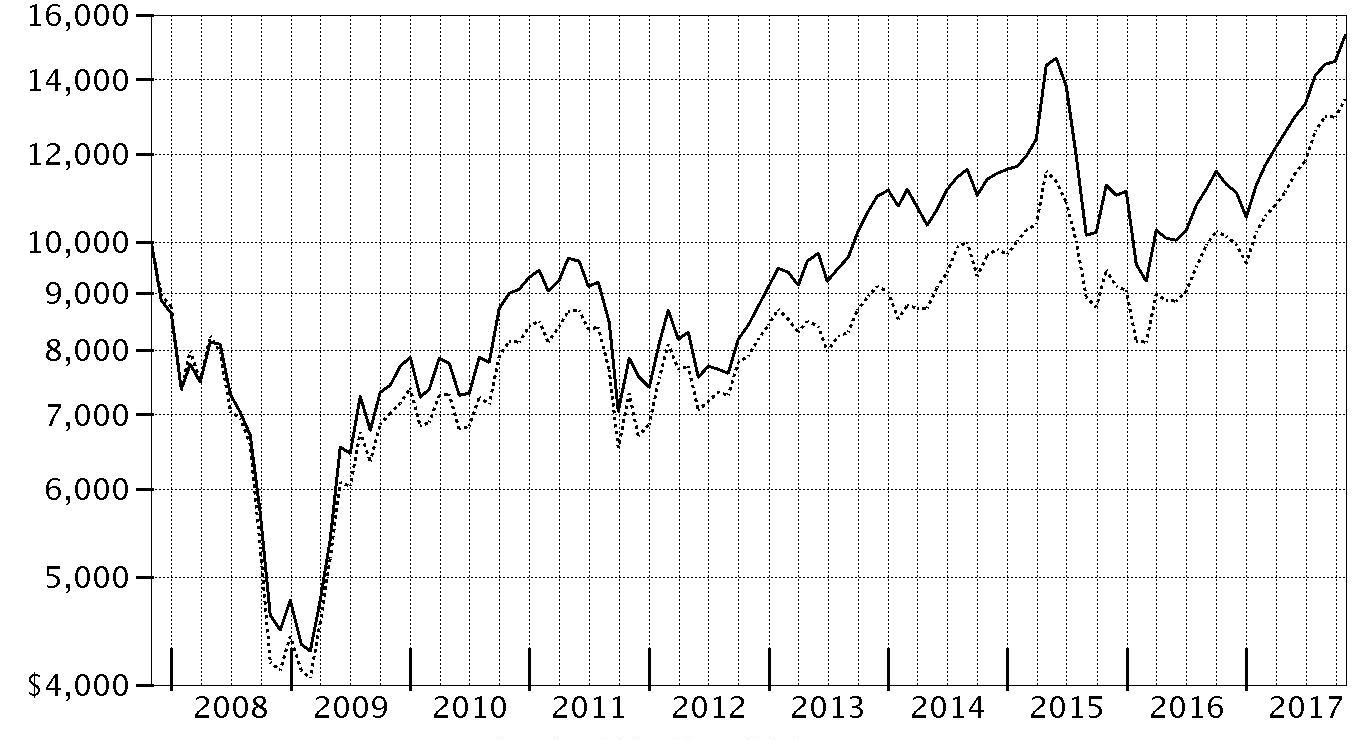

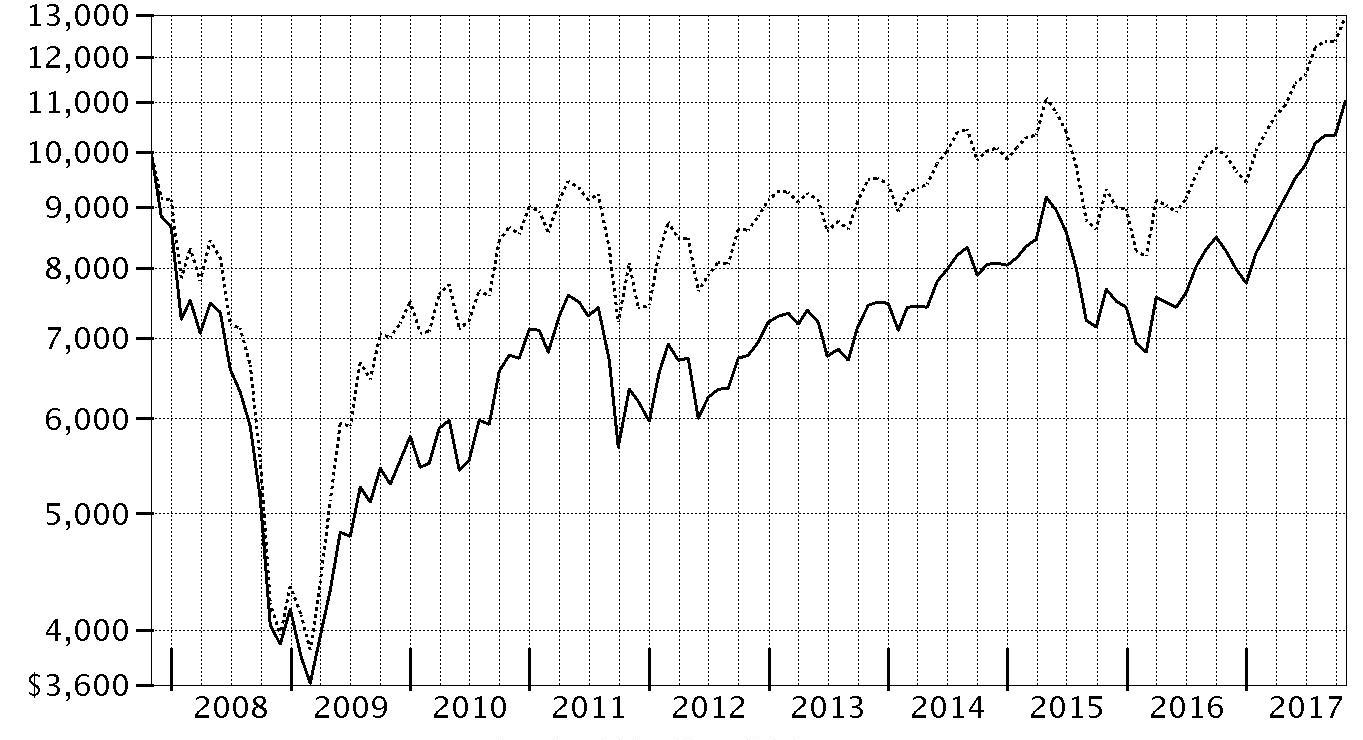

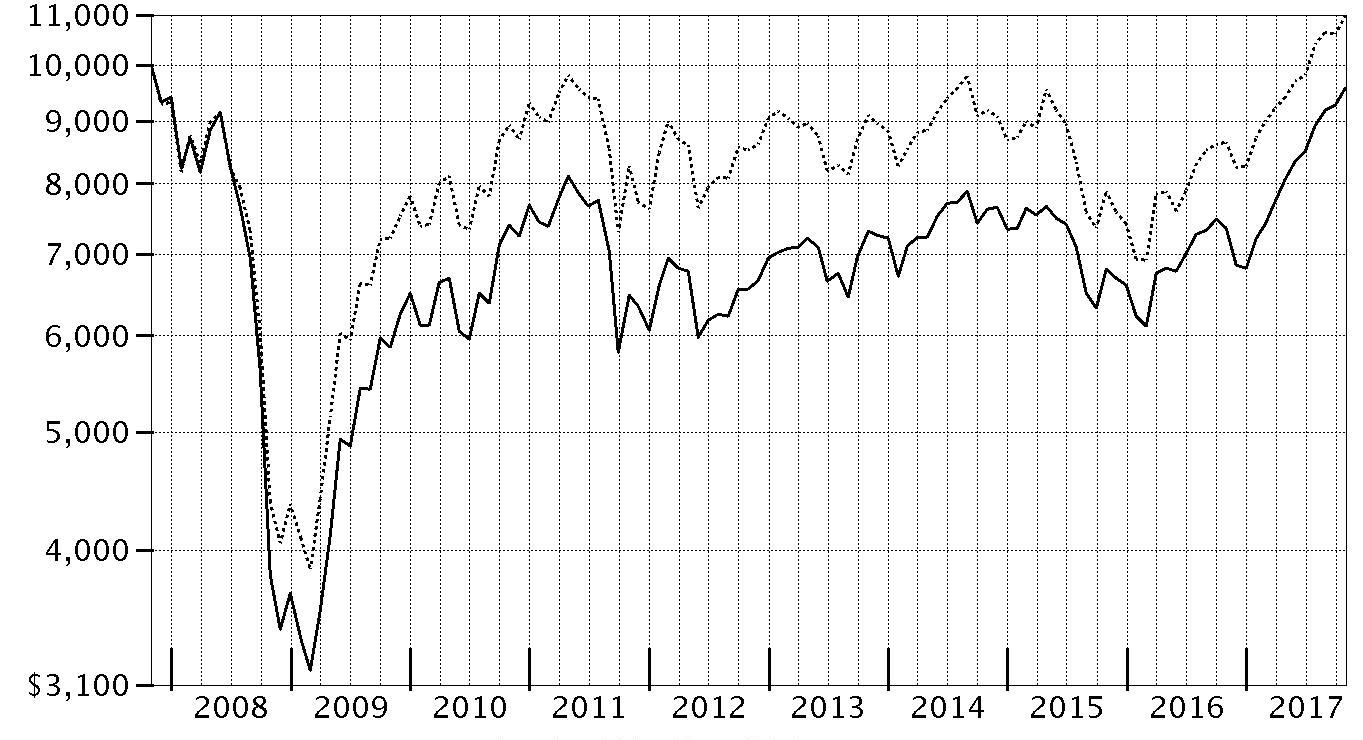

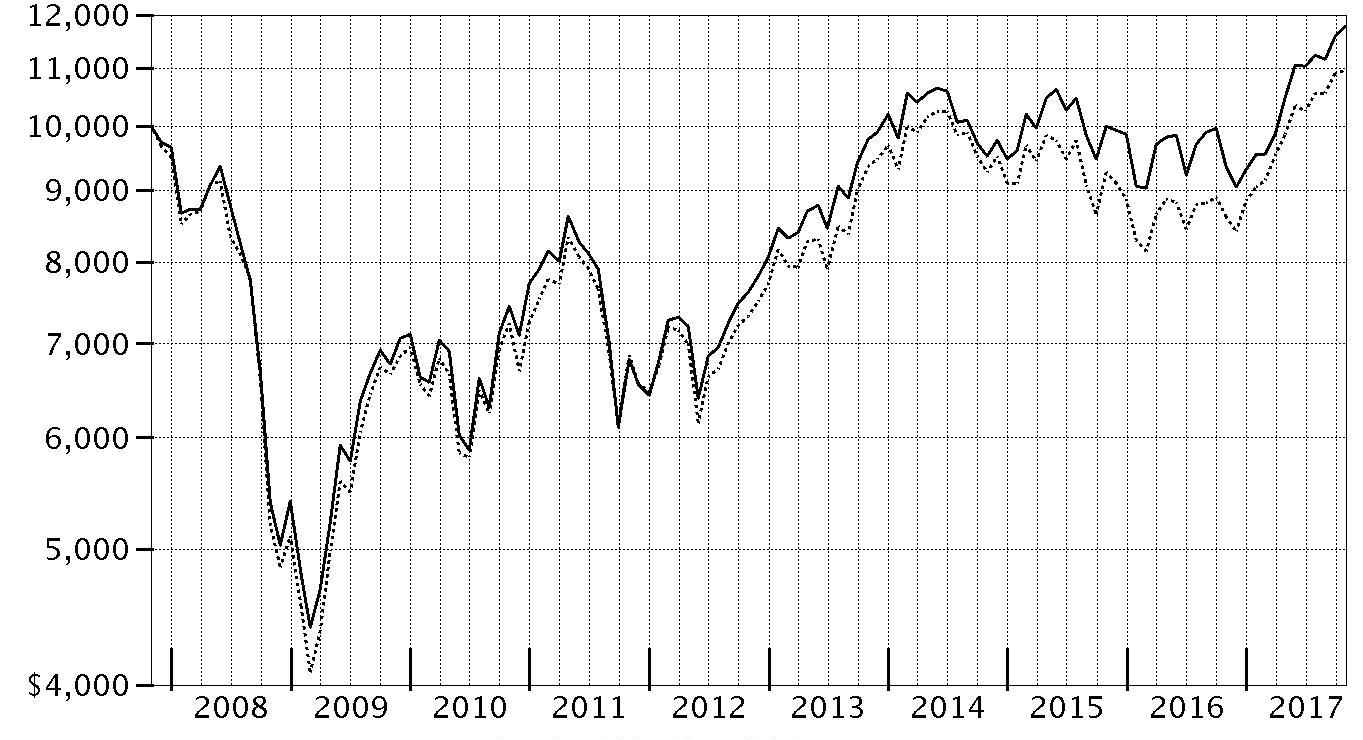

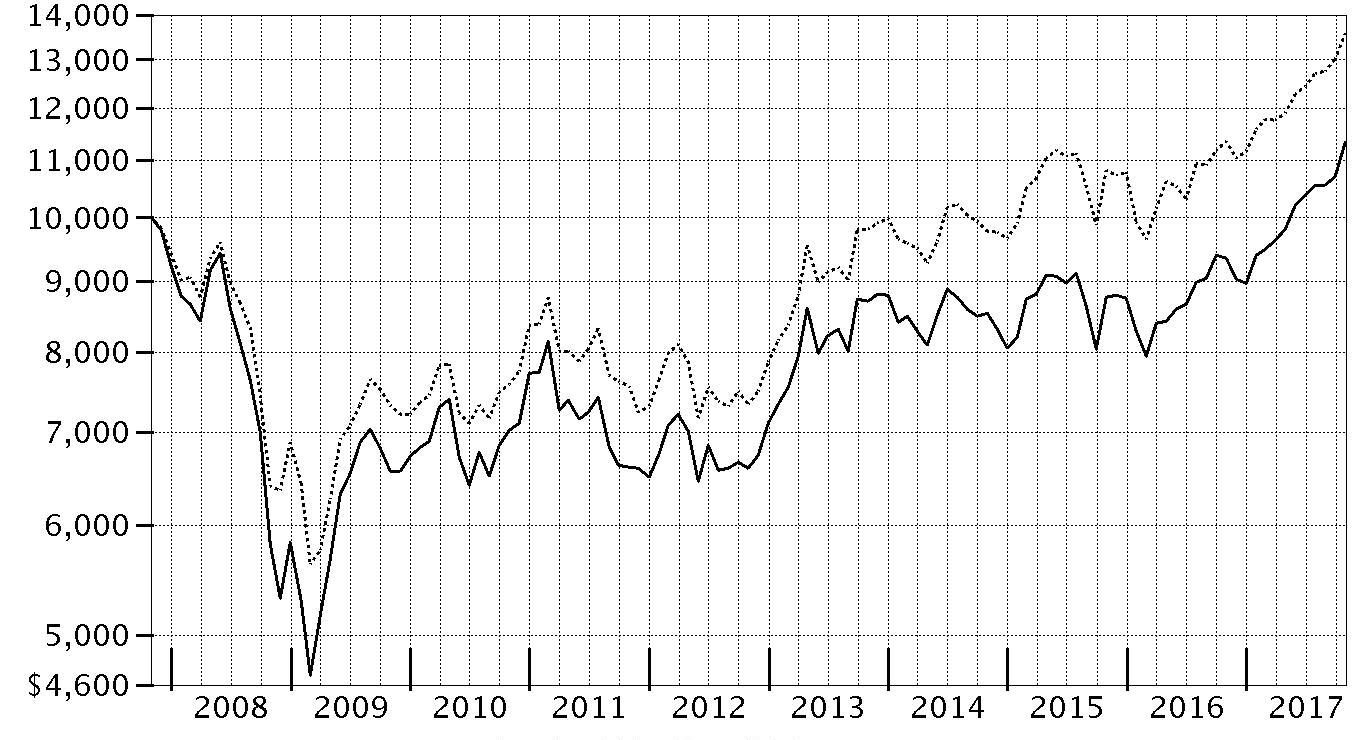

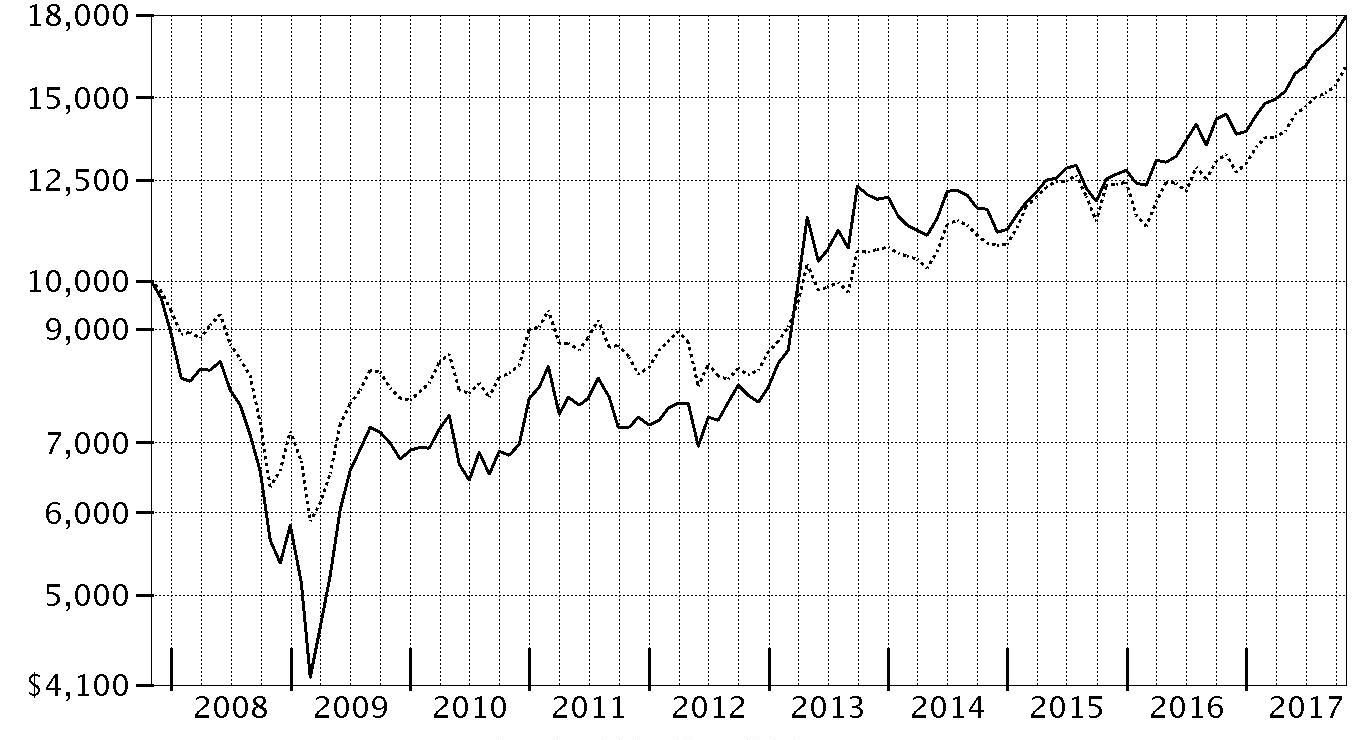

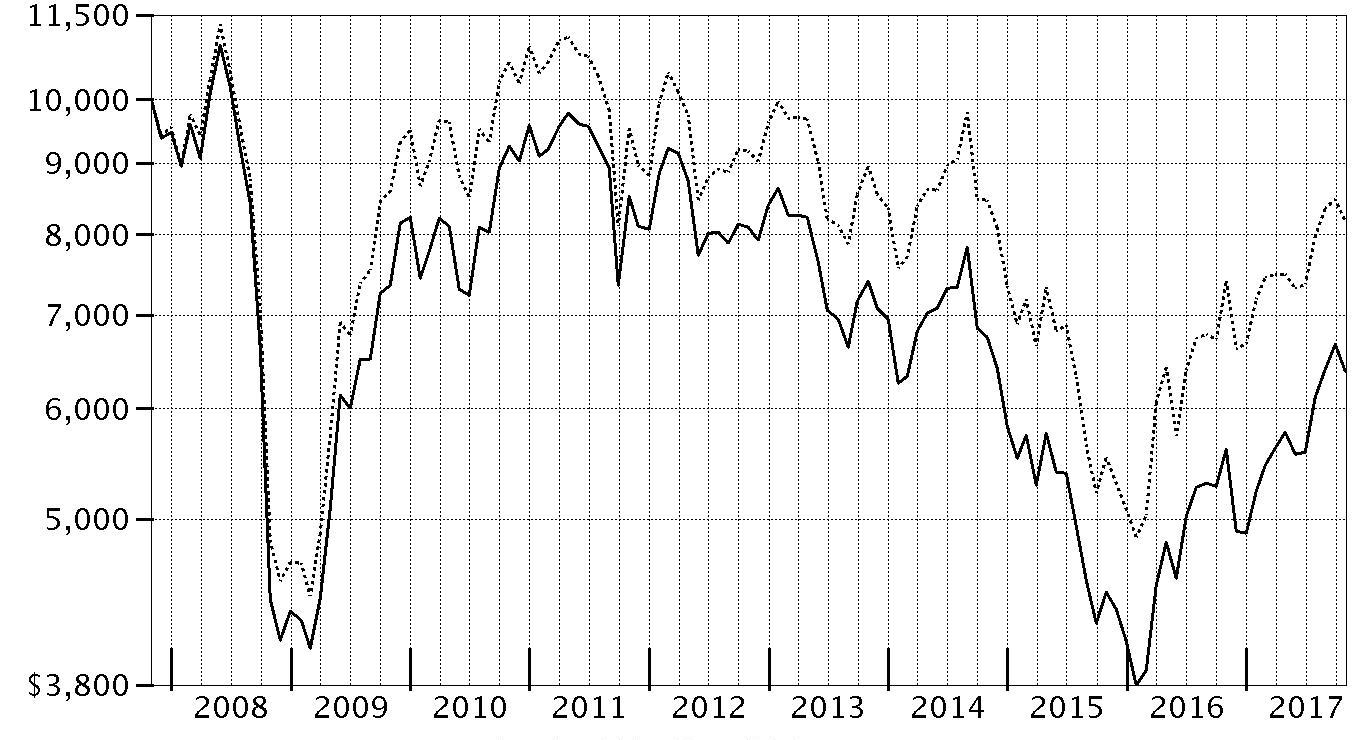

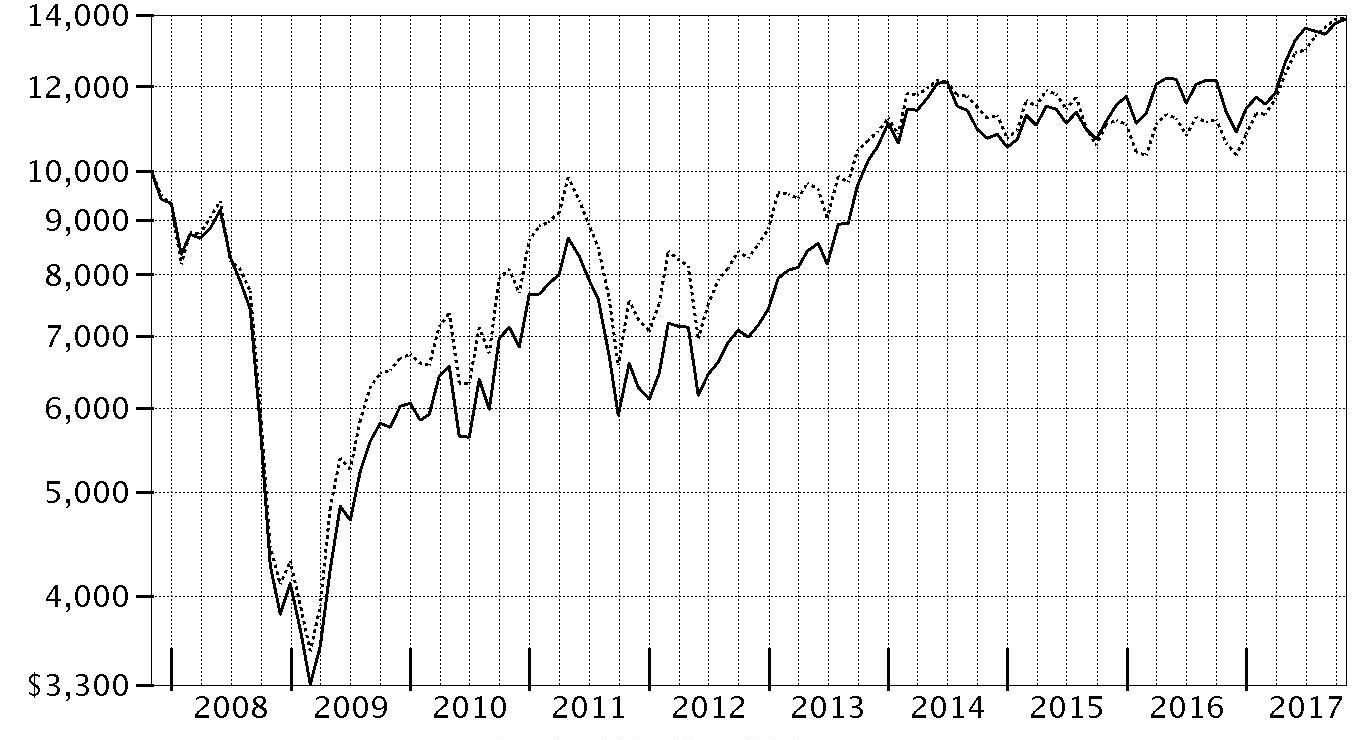

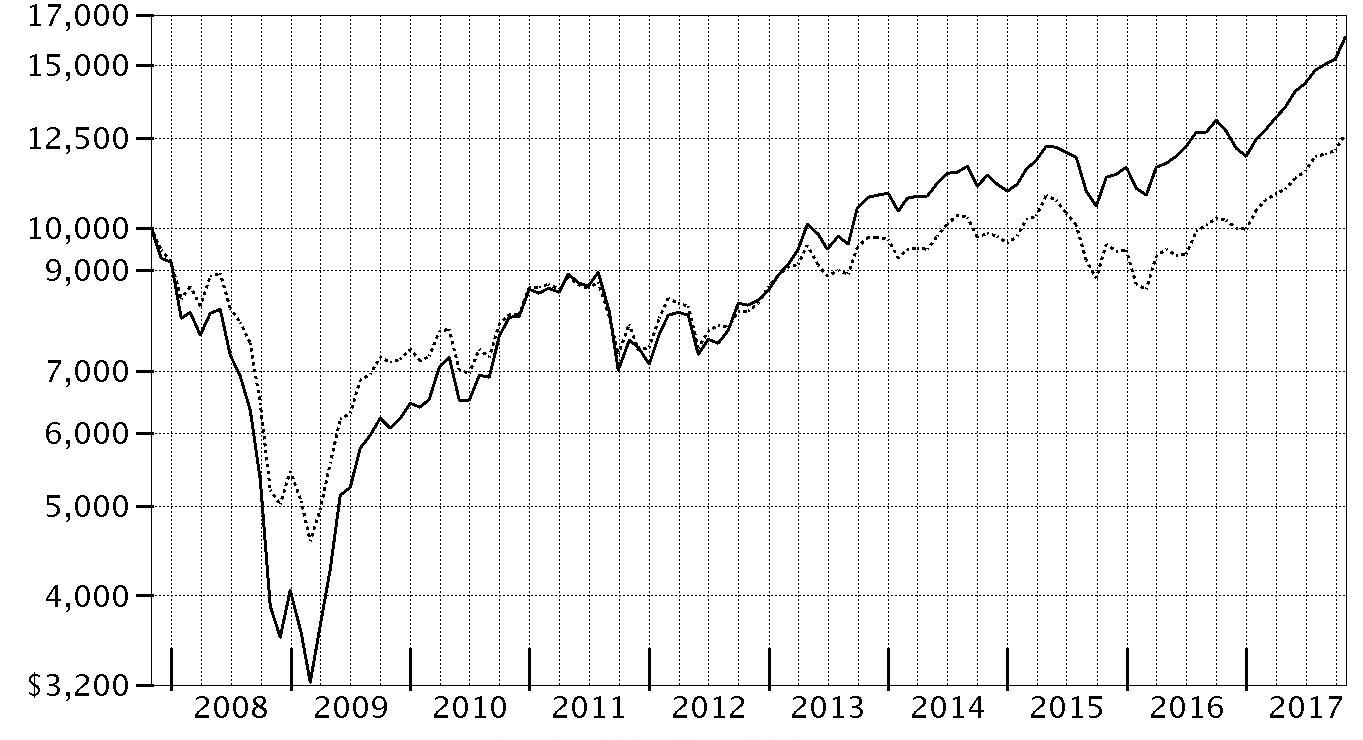

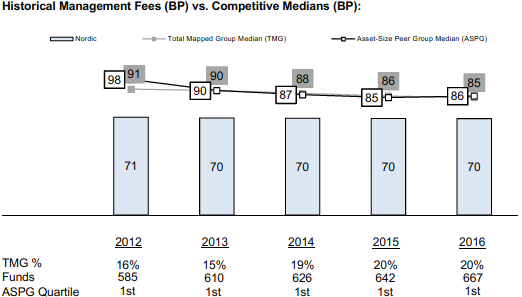

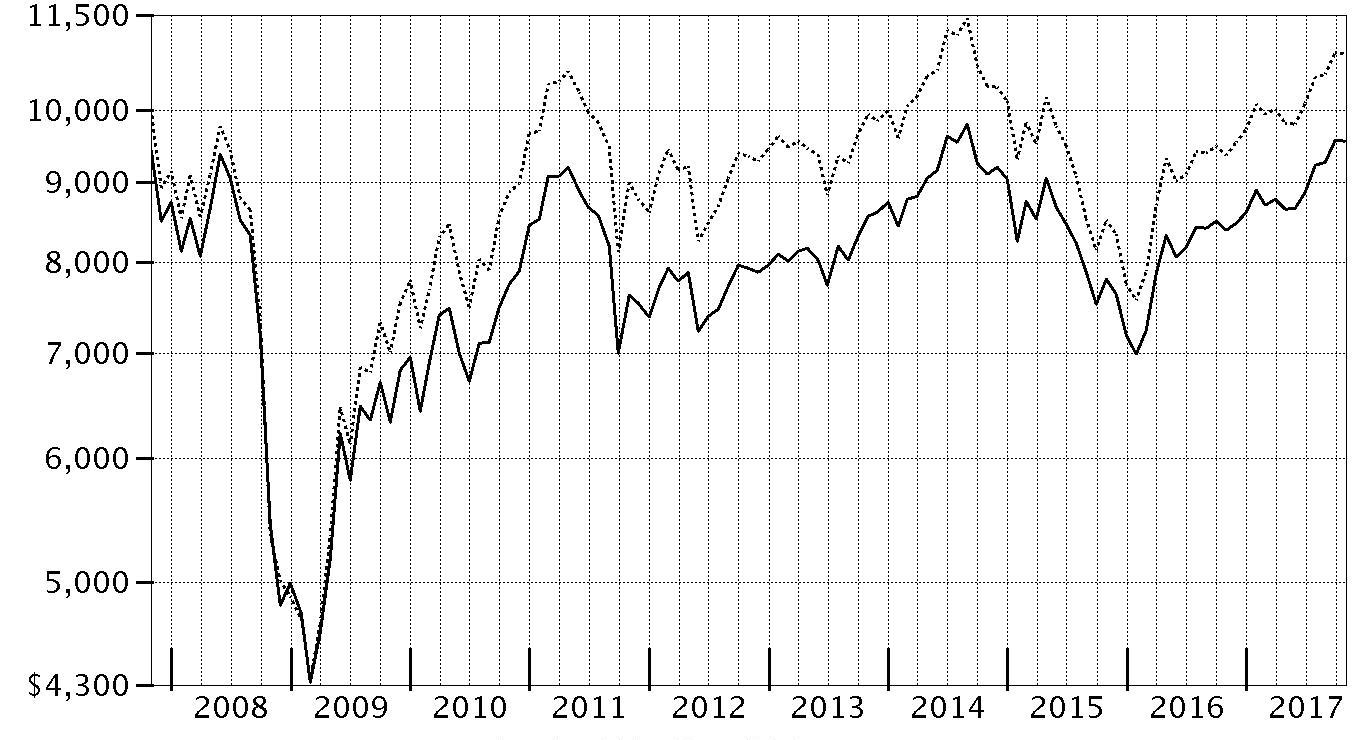

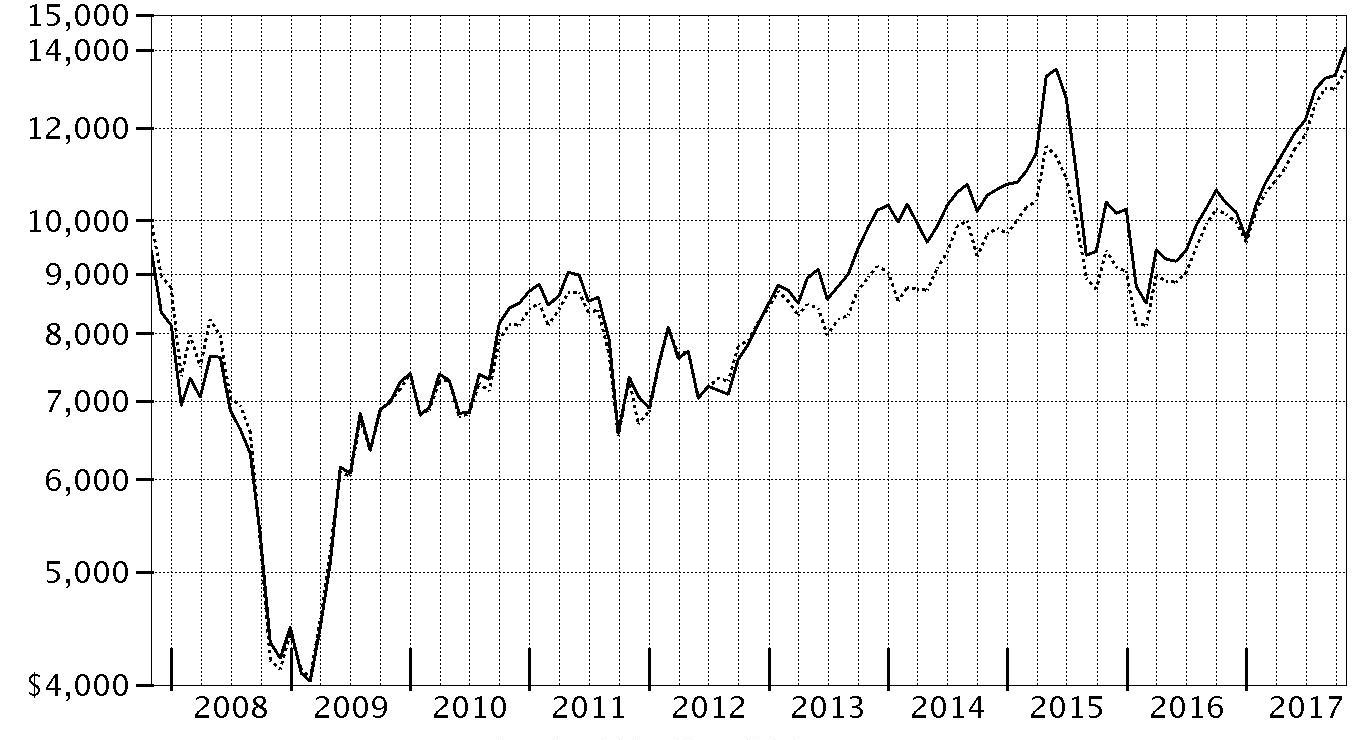

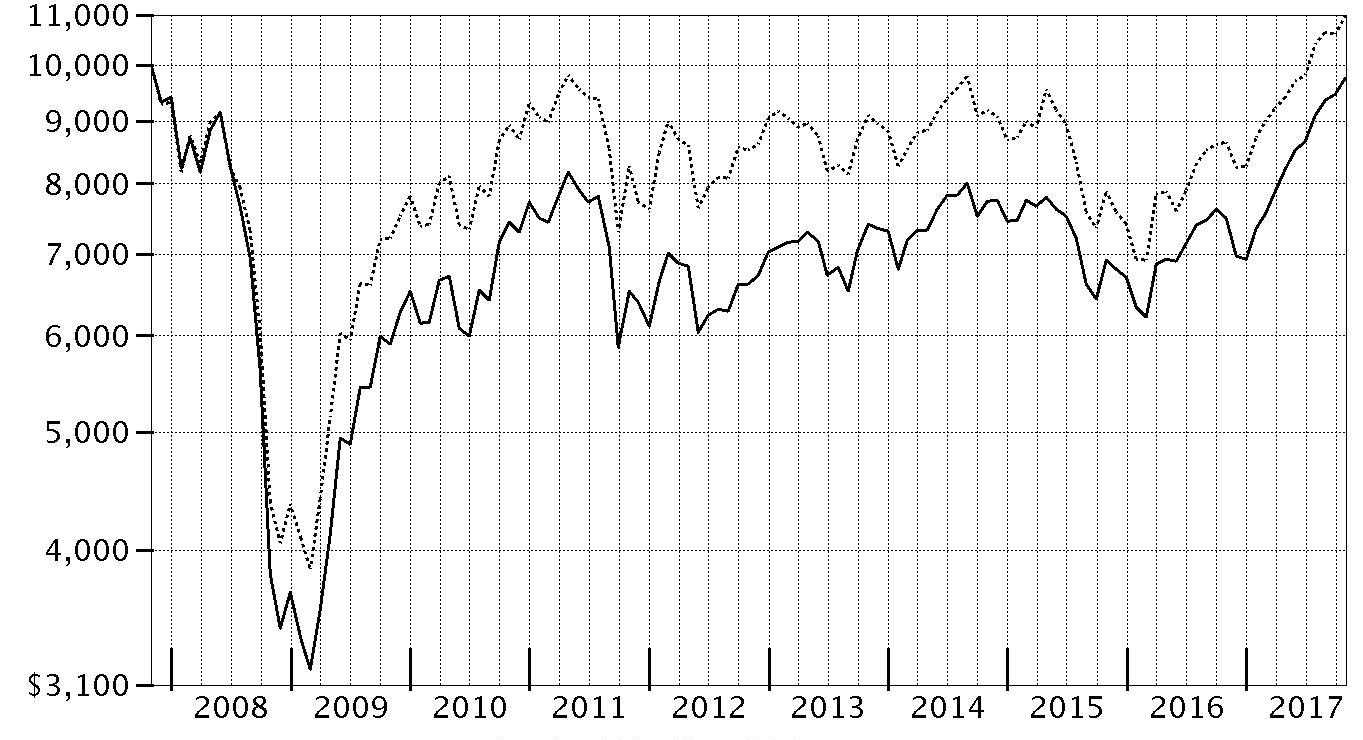

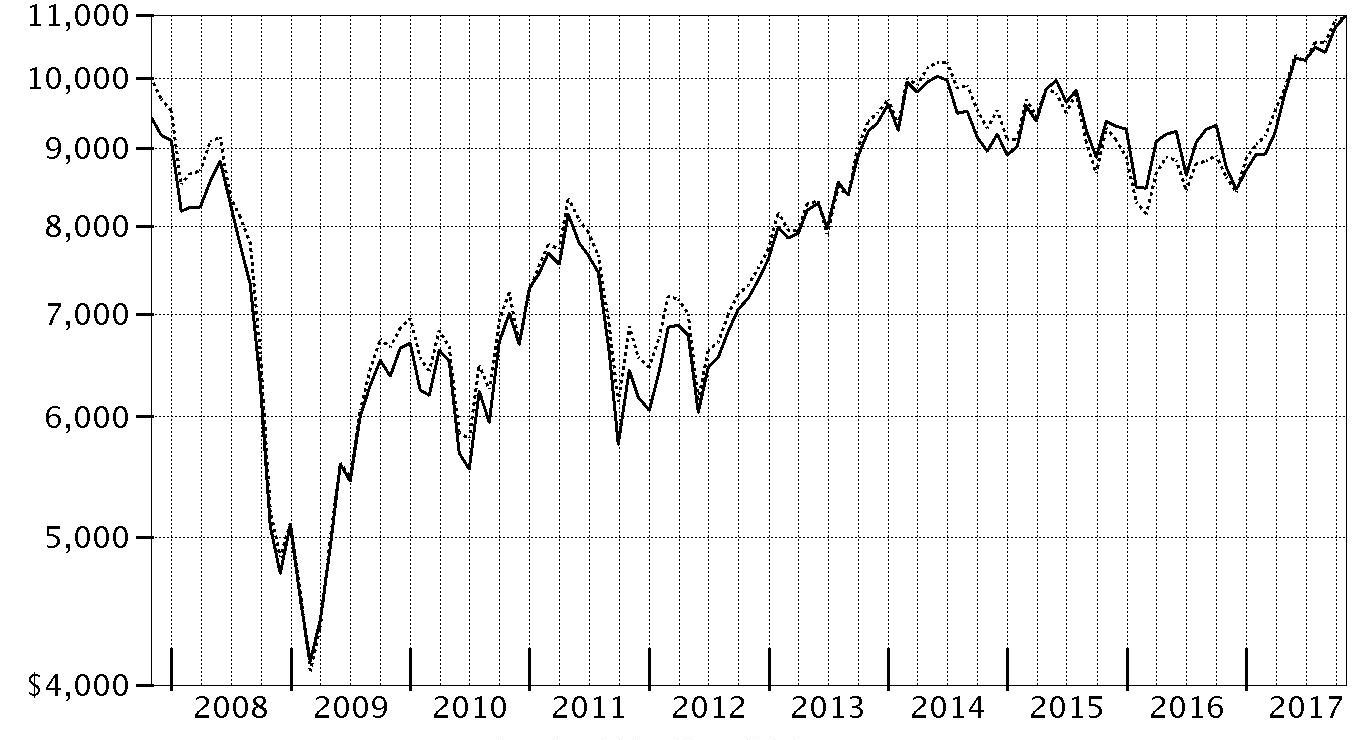

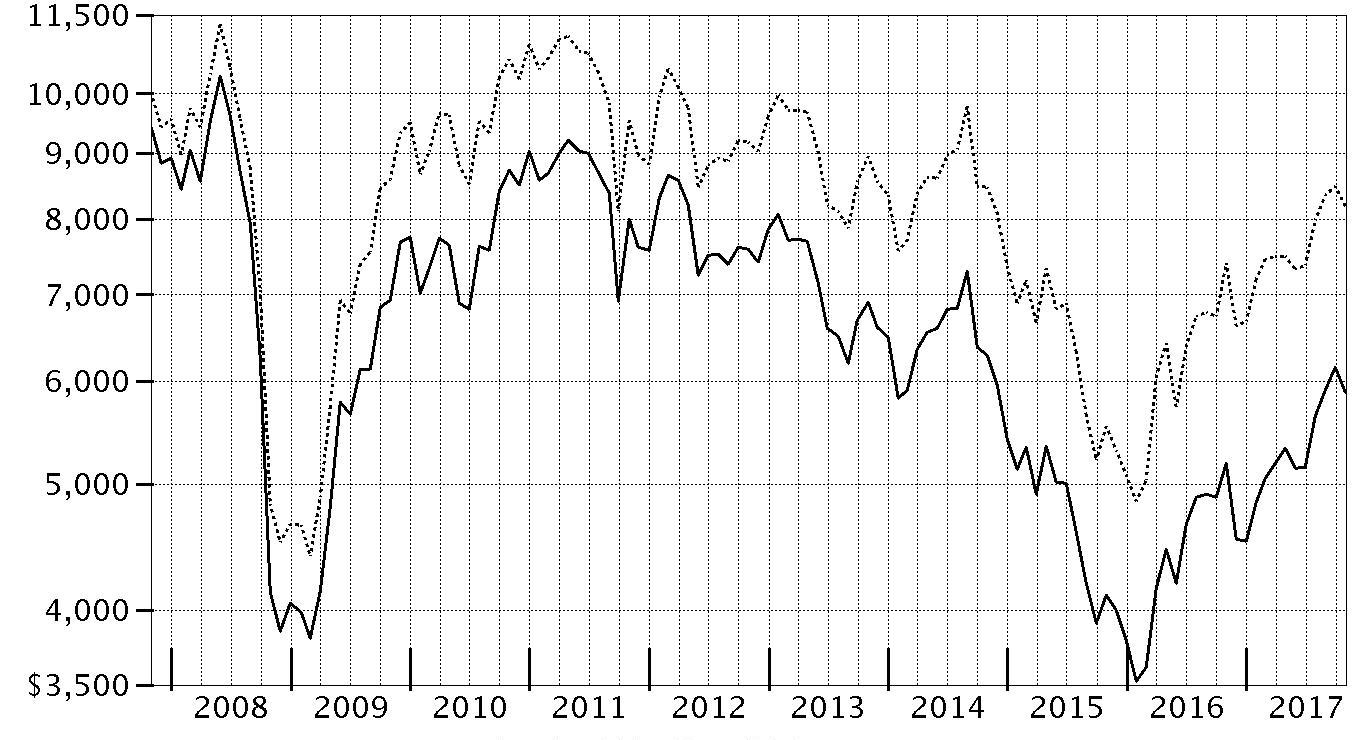

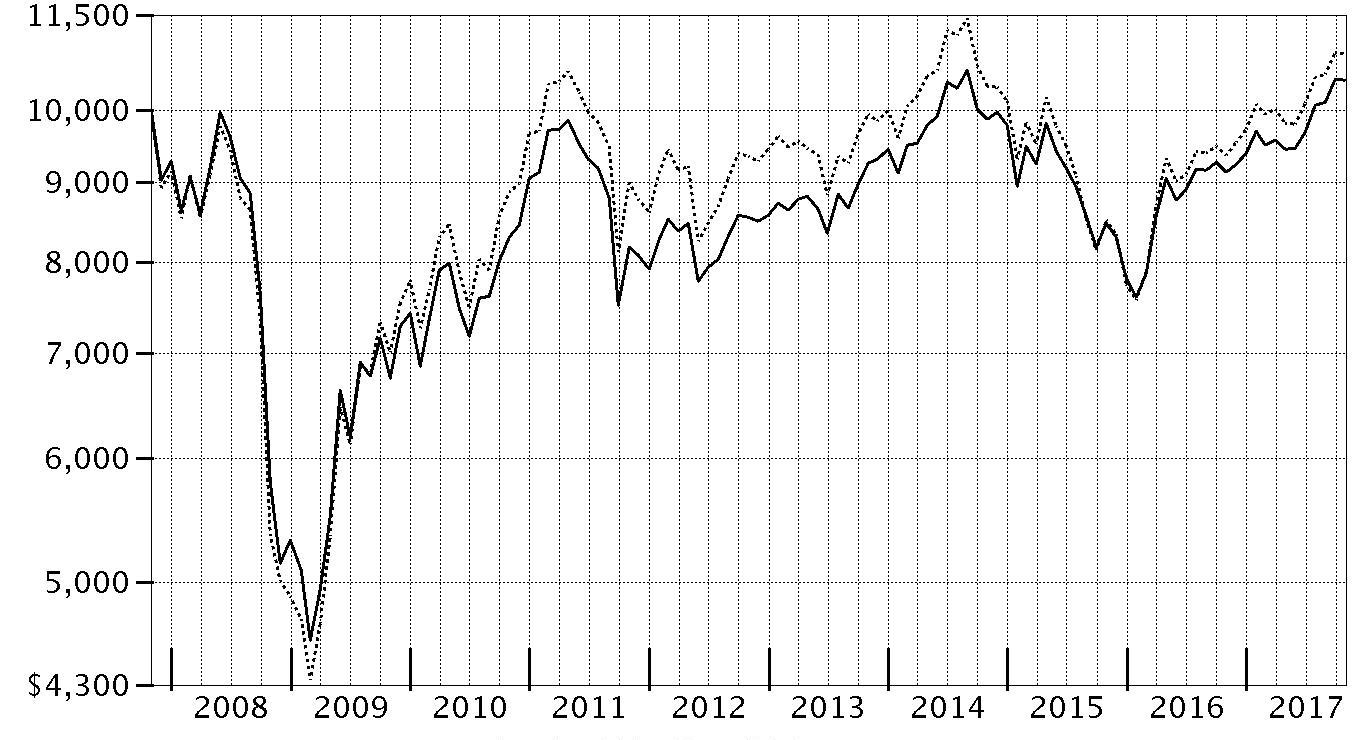

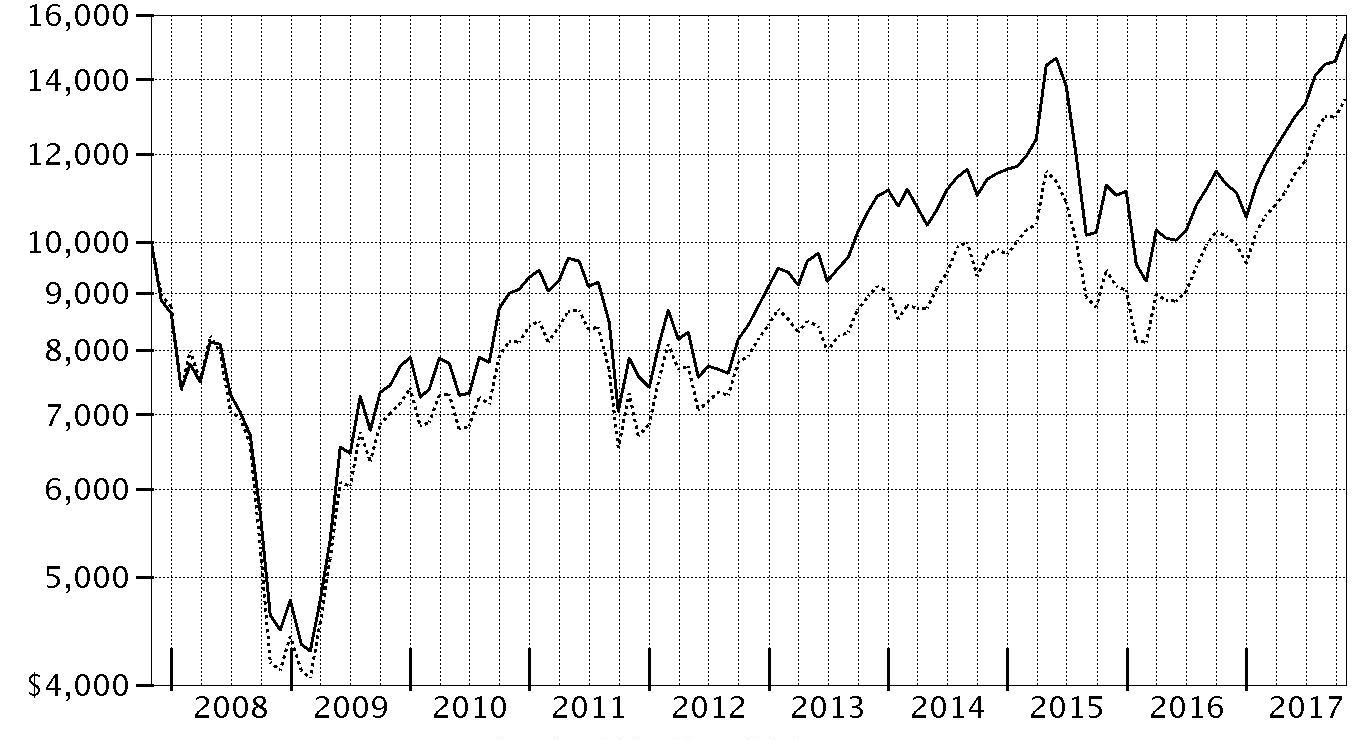

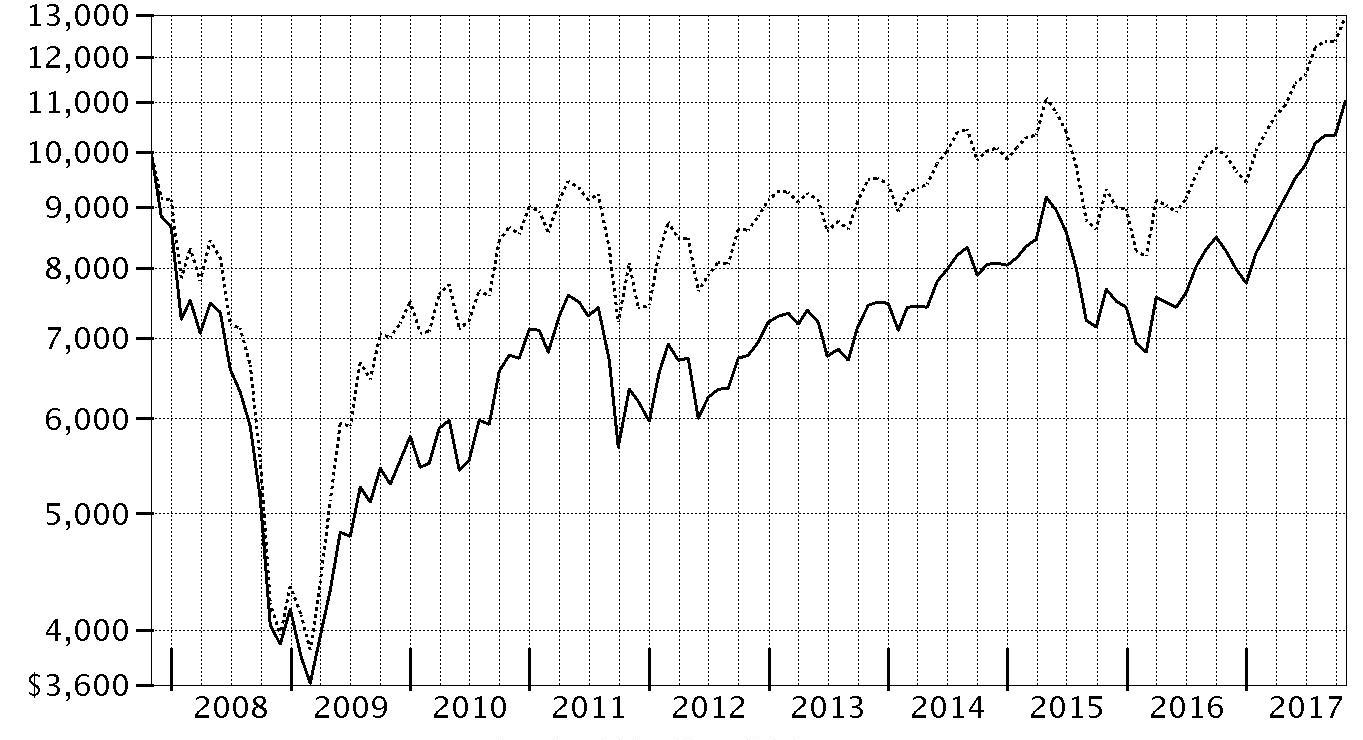

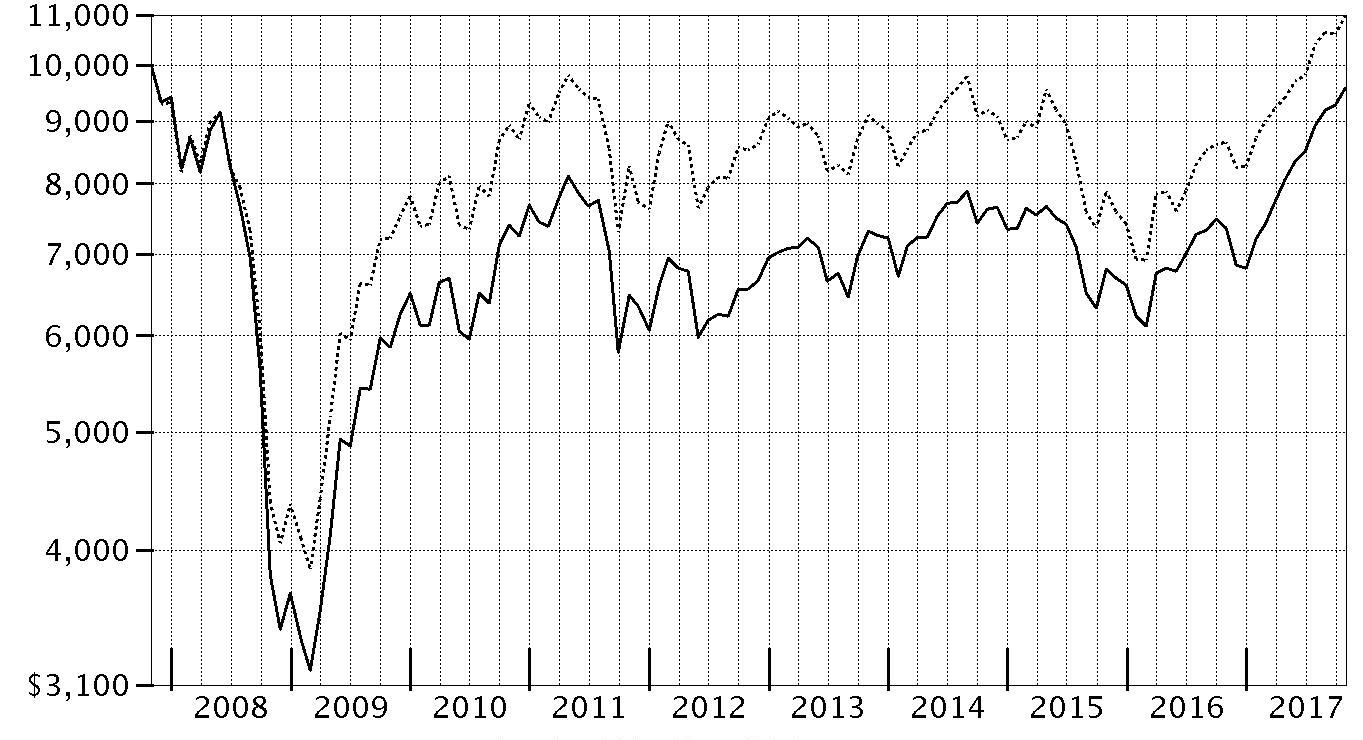

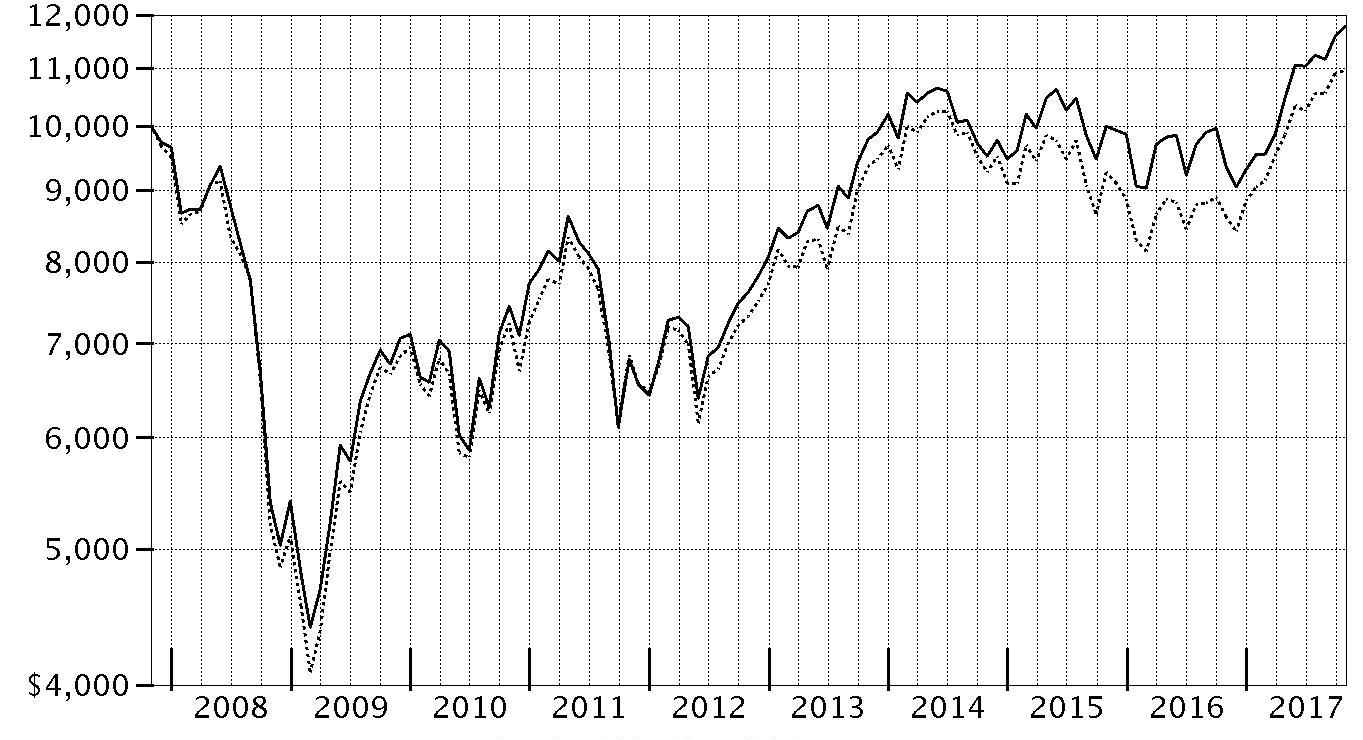

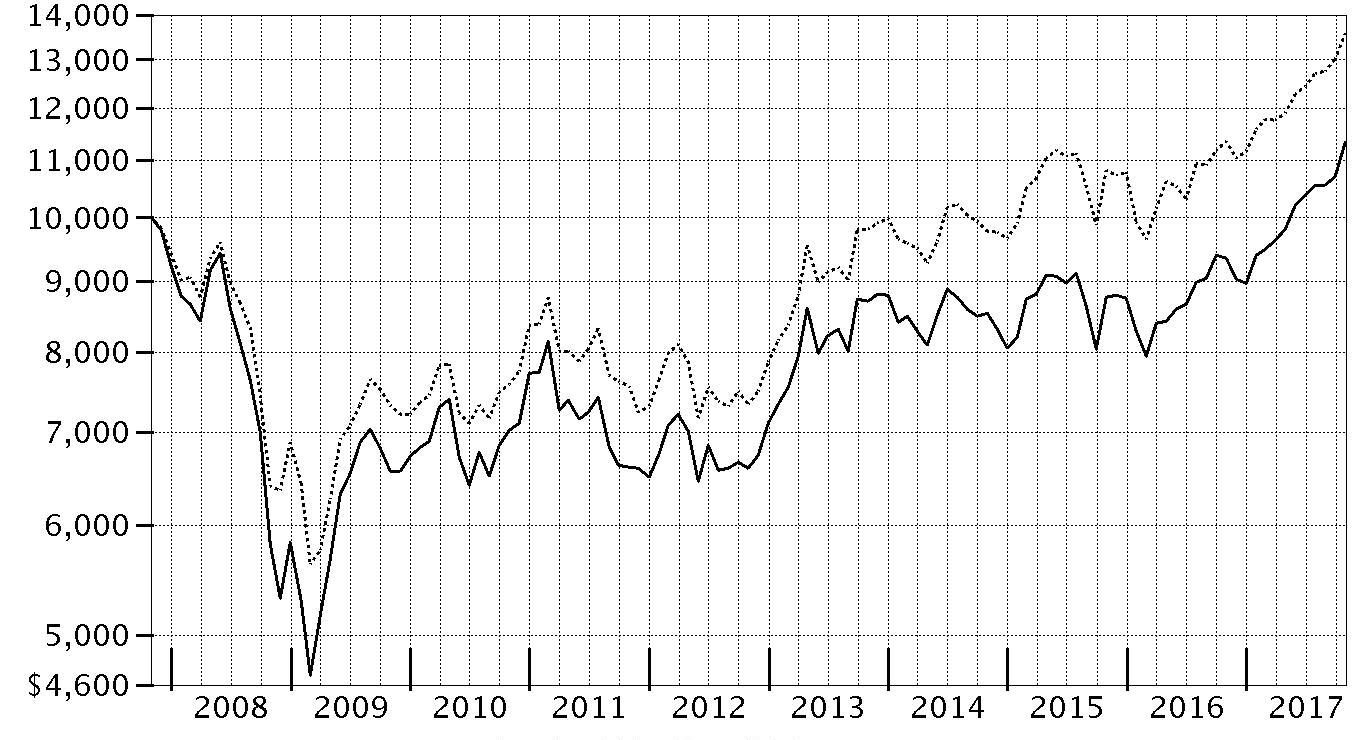

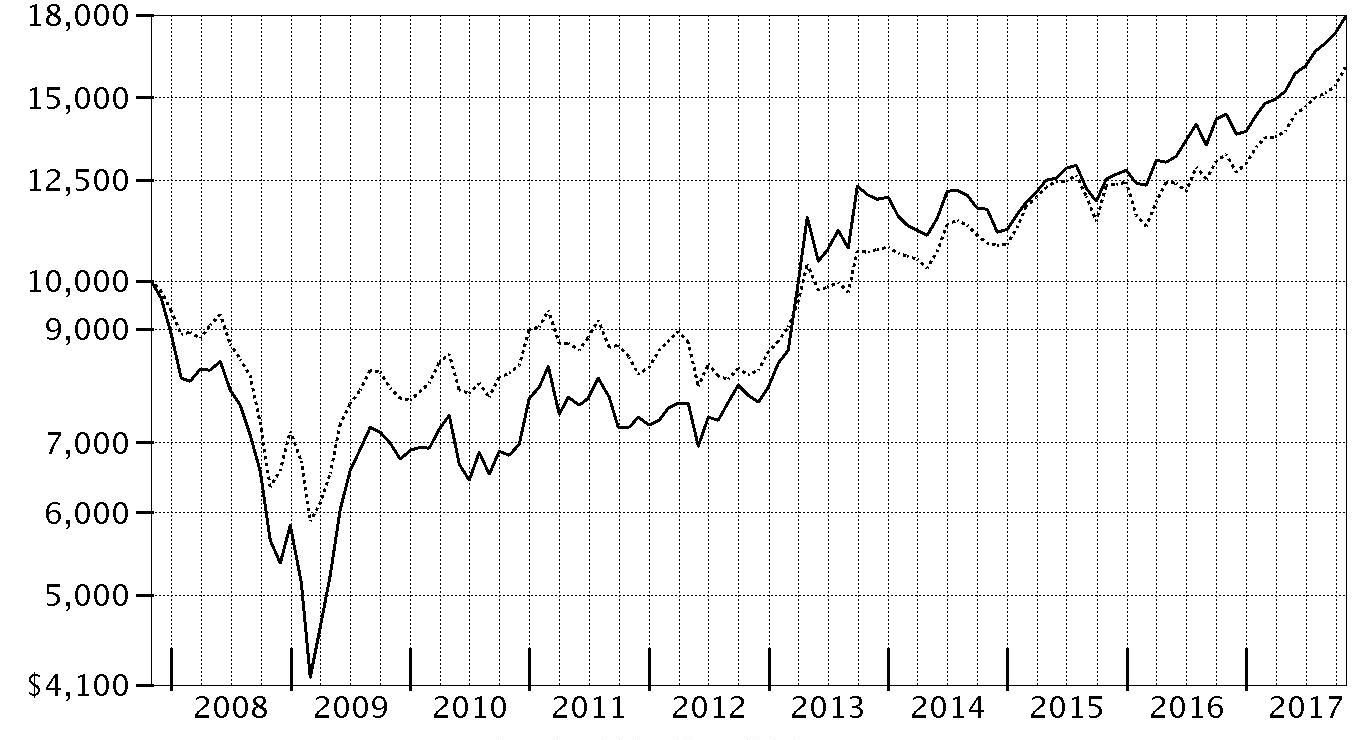

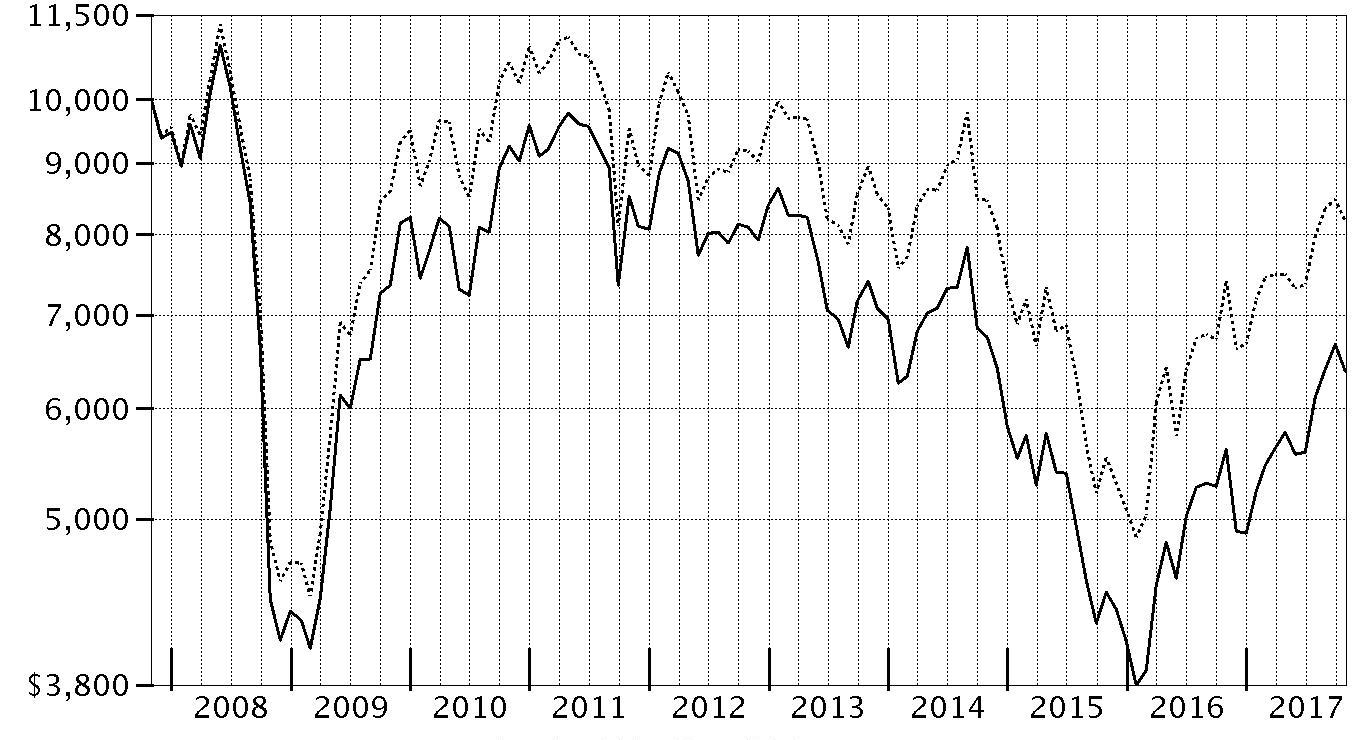

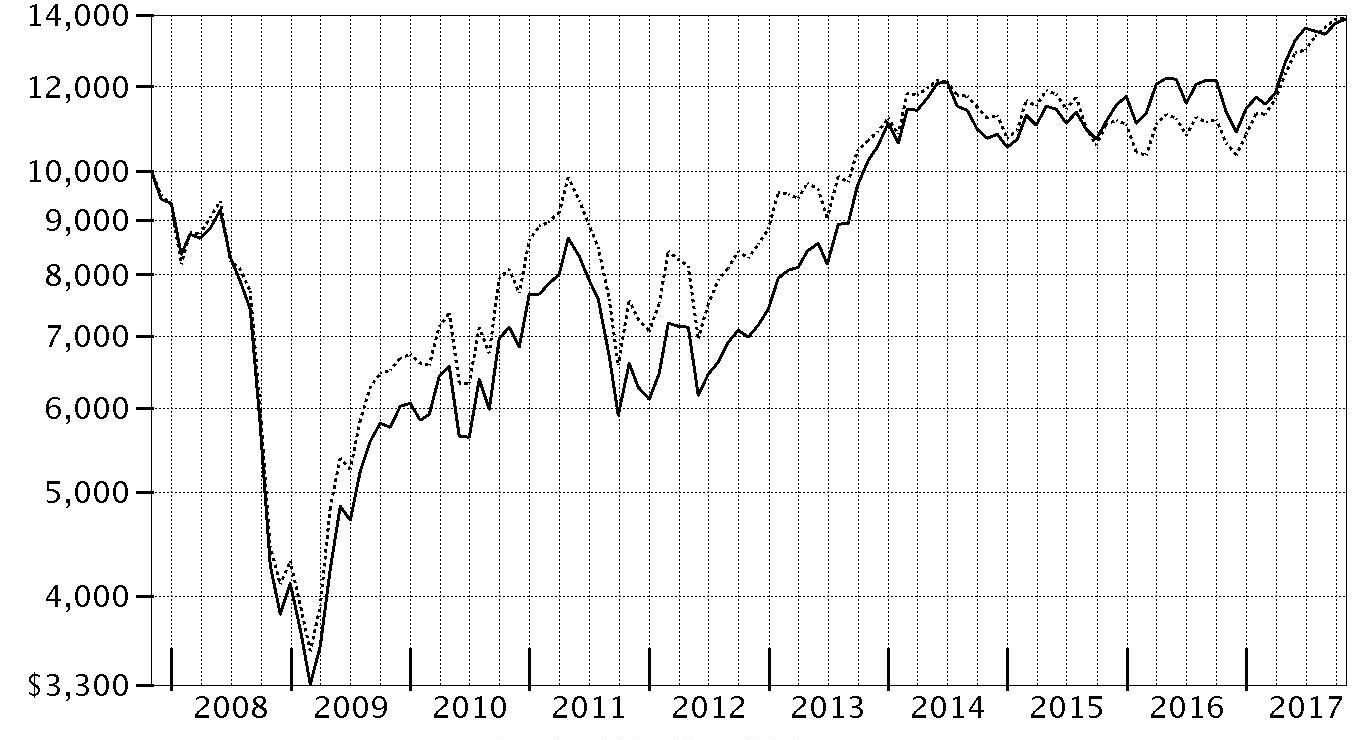

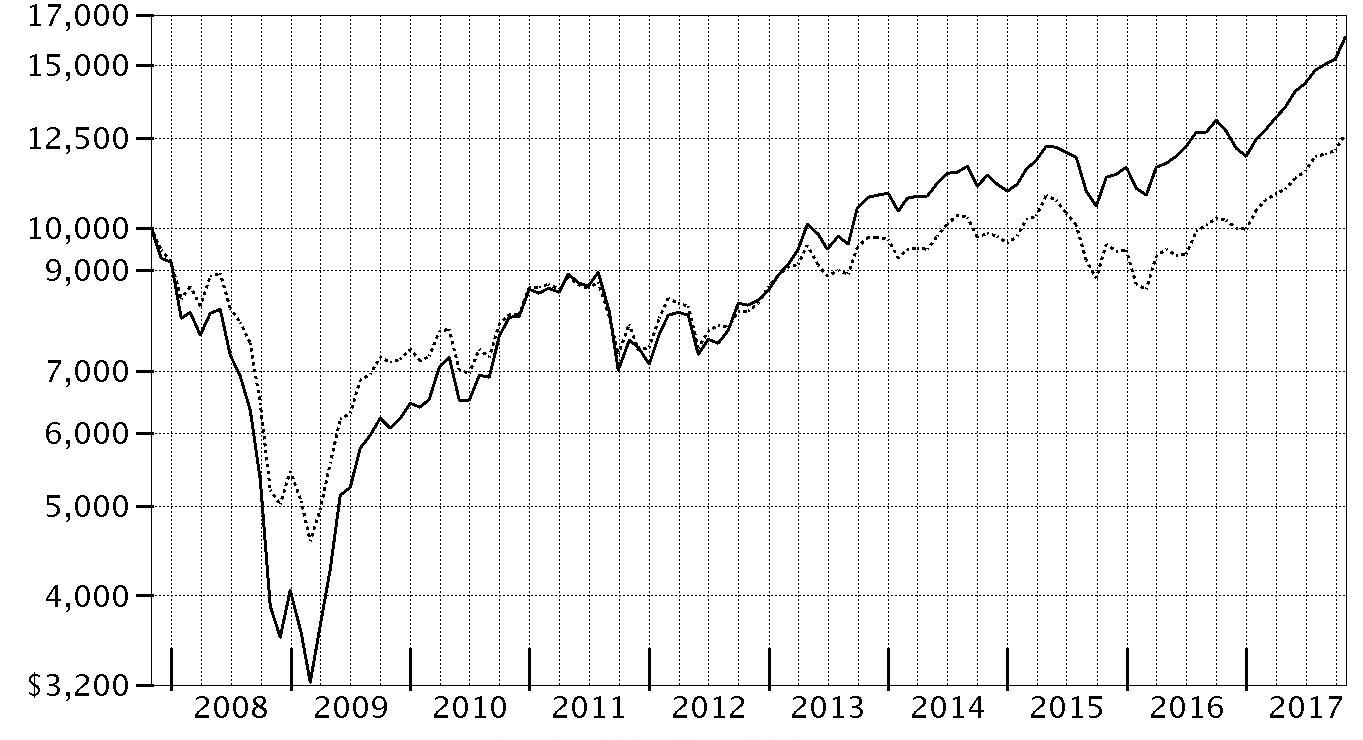

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® Canada Fund - Class A on October 31, 2007, and the current 5.75% sales charge was paid.

The chart shows how the value of your investment would have changed, and also shows how the S&P/TSX Composite Index performed over the same period.

| Period Ending Values |

| $9,554 | Fidelity Advisor® Canada Fund - Class A |

| $10,849 | S&P/TSX Composite Index |

Management's Discussion of Fund Performance

Market Recap: The MSCI ACWI (All Country World Index) ex USA Index returned 23.85% for the 12 months ending October 31, 2017, helped partly by a generally weak U.S. dollar. Some favorable election results in continental Europe (+30%) suggested ebbing political uncertainty and near-term risk there, but the U.K. (+20%) faced more-mixed conditions ahead of its expected exit from the European Union. Despite central-bank easing – and pressured recently by yen strength – Japan (+18%) lagged the rest of the Asia-Pacific group (+22%). Commodity-price volatility slowed Canada (+17%), but the emerging-markets group (+26%) sped ahead. Sector-wise, information technology (+47%) was driven by a surge among several Chinese internet-related names. Financials (+27%) rode rising interest rates that, at the same time, weighed on real estate (+17%), utilities (+16%), consumer staples (+14%) and telecommunication services (+9%) – so-called “bond proxy” sectors. Materials (+28%) and industrials (+27%) responded to demand from China and price gains for certain commodities. In the energy sector (+20%), oil prices lost ground in the spring before rebounding through October 31 to end well above where they started 12 months ago. Lastly, health care (+14%) was hurt by early-period turmoil around drug pricing and health care legislation.

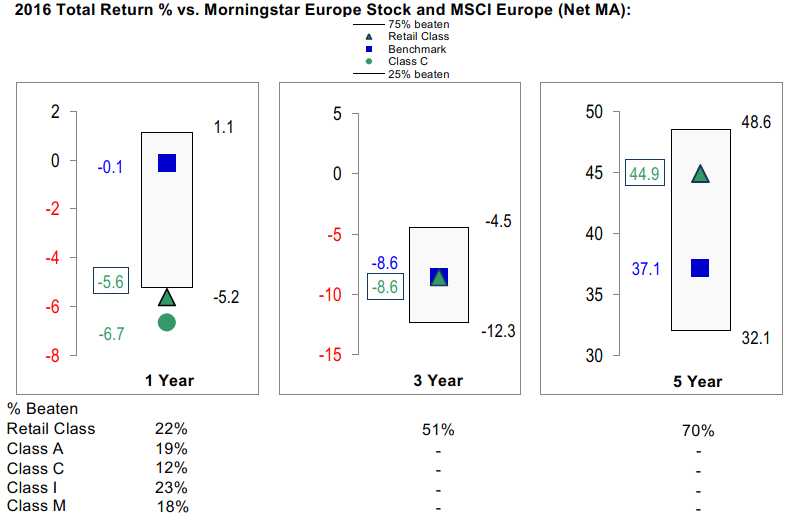

Comments from Portfolio Manager Risteard Hogan: For the fiscal year ending October 31, 2017, the fund’s share classes (excluding sales charges, if applicable) gained about 13% to 14%, lagging the 15.90% return of the benchmark S&P/TSX Composite Index. My more conservative investment approach, which emphasizes companies with what I consider solid fundamentals and long-term growth prospects, held back the fund’s performance versus the benchmark. An overweighting in consumer staples, most notably a position in convenience-store operator Alimentation Couche-Tard, detracted most. Investors became increasingly concerned about Couche-Tard’s June 2016 acquisition of U.S.-based CST Brands and any potential synergies from that purchase. The fund’s most significant relative detractor, though, was untimely positioning in insurer Manulife Financial. I had chosen to emphasize competitor Sun Life Financial earlier in the period, which rose in valuation, but not as much as Manulife. I sold Sun Life in February to take profits and redeployed assets to build an overweighting in Manulife, believing in the firm's further potential upside. It turned out, though, that Manulife already delivered its strongest results for the period, and the fund had missed out. Conversely, stock picking in materials benefited our relative results, led by the fund’s top individual relative contributor: copper, nickel and zinc miner Lundin Mining, which was aided by strength in base-metal prices, especially copper.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Investment Summary (Unaudited)

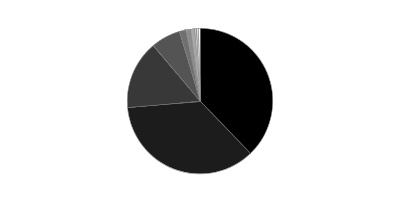

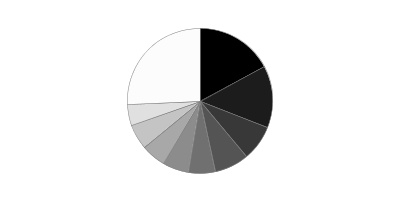

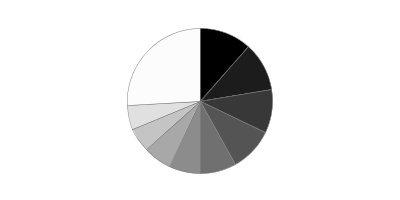

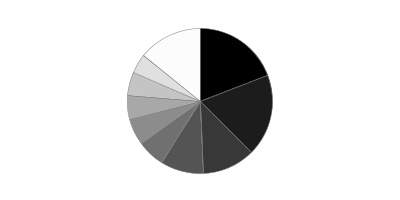

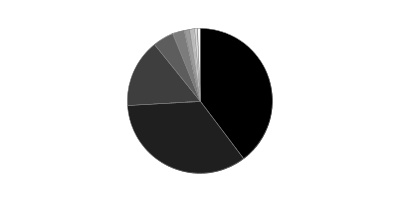

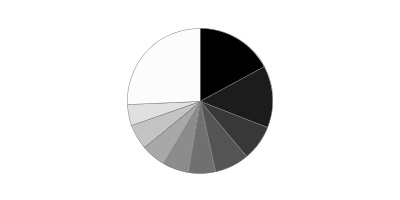

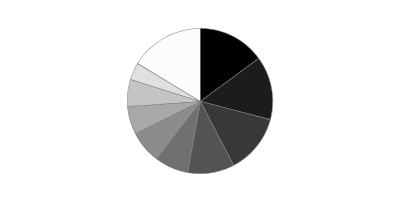

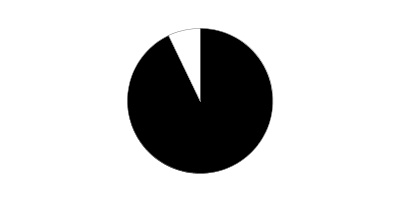

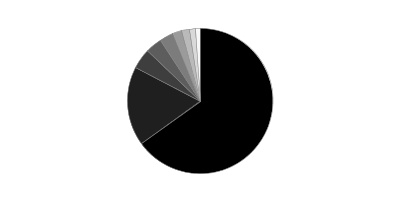

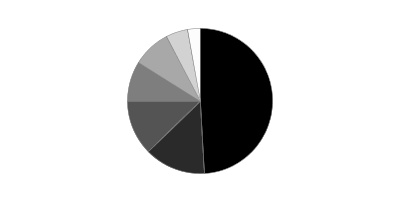

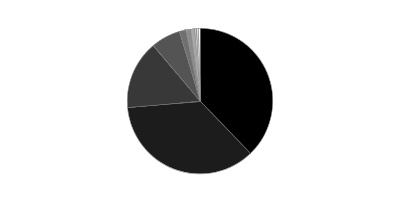

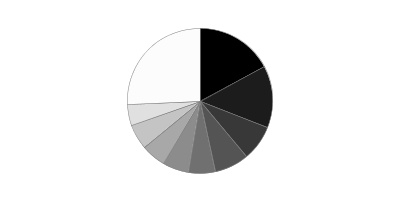

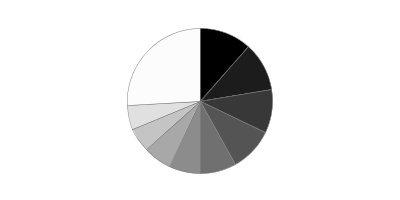

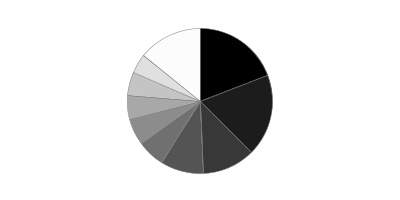

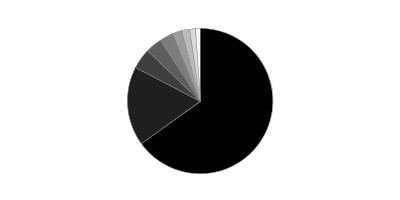

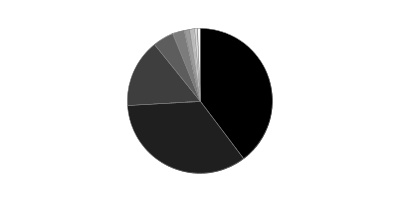

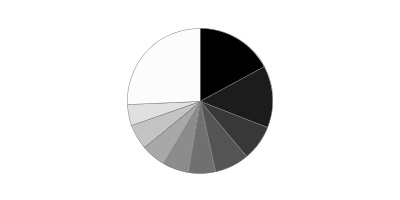

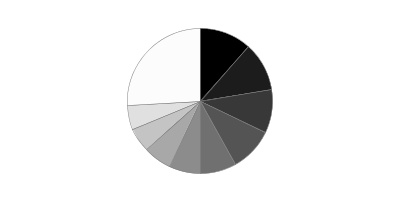

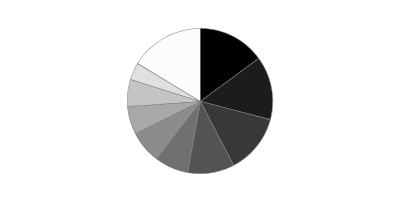

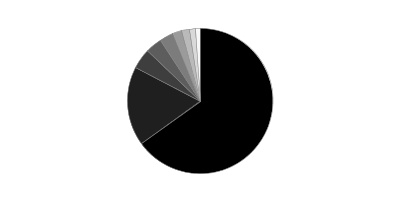

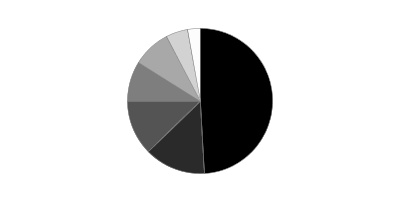

Geographic Diversification (% of fund's net assets)

| As of October 31, 2017 |

| | Canada | 95.3% |

| | United States of America* | 3.0% |

| | Bailiwick of Jersey | 0.7% |

| | Ireland | 0.5% |

| | United Kingdom | 0.5% |

* Includes Short-Term investments and Net Other Assets (Liabilities).

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable.

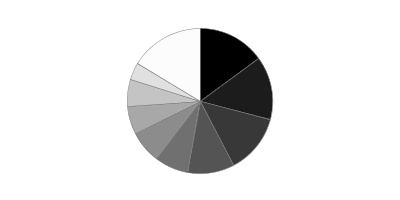

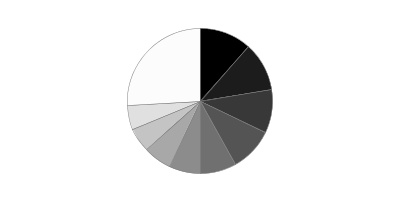

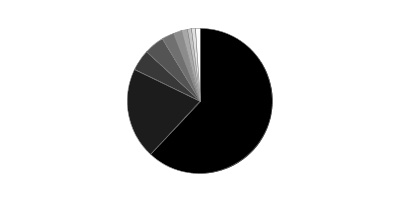

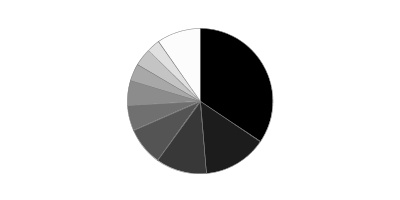

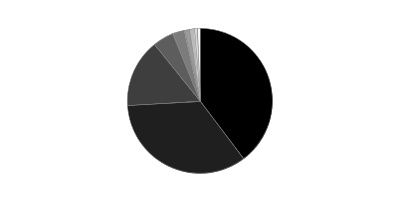

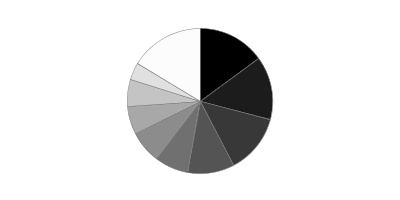

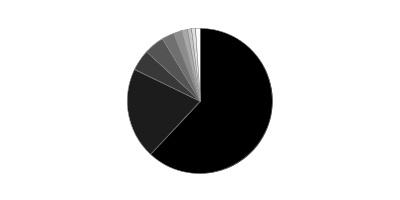

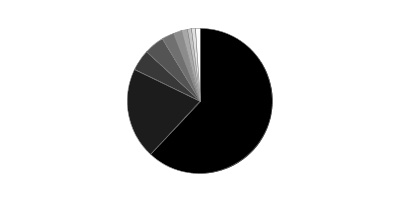

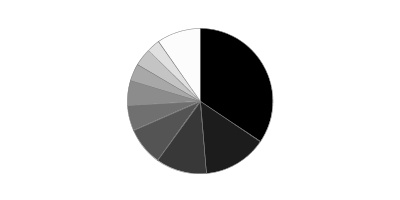

| As of April 30, 2017 |

| | Canada | 93.4% |

| | United States of America* | 3.3% |

| | Bailiwick of Jersey | 0.8% |

| | United Kingdom | 0.7% |

| | Germany | 0.6% |

| | France | 0.6% |

| | Ireland | 0.6% |

* Includes Short-Term investments and Net Other Assets (Liabilities).

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable.

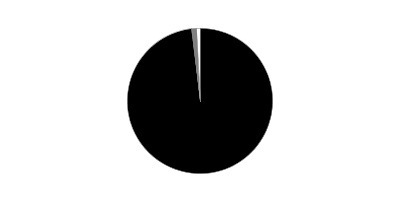

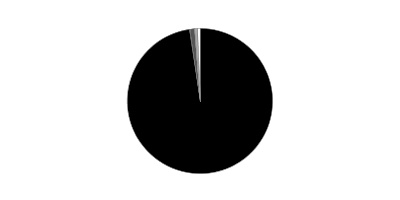

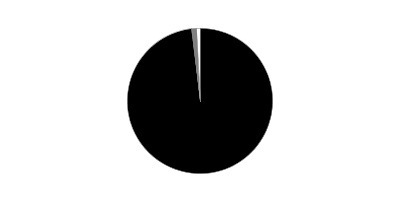

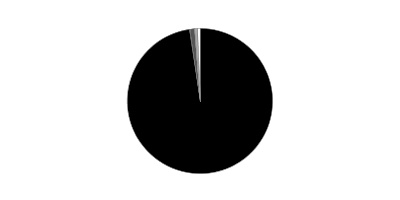

Asset Allocation as of October 31, 2017

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Stocks | 97.4 | 97.1 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.6 | 2.9 |

Top Ten Stocks as of October 31, 2017

| | % of fund's net assets | % of fund's net assets 6 months ago |

| The Toronto-Dominion Bank (Banks) | 9.7 | 8.9 |

| Royal Bank of Canada (Banks) | 9.7 | 9.9 |

| Suncor Energy, Inc. (Oil, Gas & Consumable Fuels) | 6.2 | 5.9 |

| Manulife Financial Corp. (Insurance) | 4.1 | 3.6 |

| Canadian Pacific Railway Ltd. (Road & Rail) | 3.6 | 3.1 |

| Rogers Communications, Inc. Class B (non-vtg.) (Wireless Telecommunication Services) | 3.3 | 3.7 |

| Canadian National Railway Co. (Road & Rail) | 3.3 | 3.1 |

| Agrium, Inc. (Chemicals) | 3.1 | 2.5 |

| TELUS Corp. (Diversified Telecommunication Services) | 3.1 | 2.8 |

| Enbridge, Inc. (Oil, Gas & Consumable Fuels) | 3.0 | 4.3 |

| | 49.1 | |

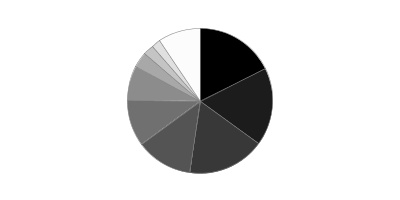

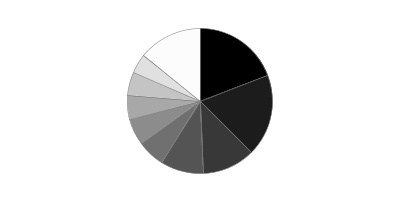

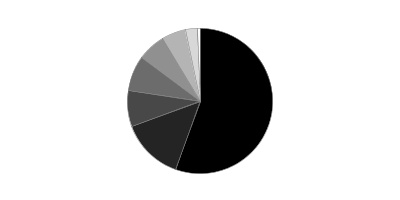

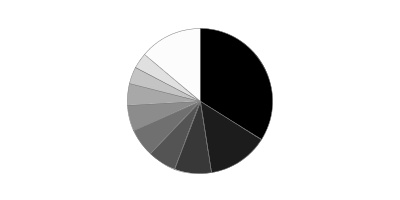

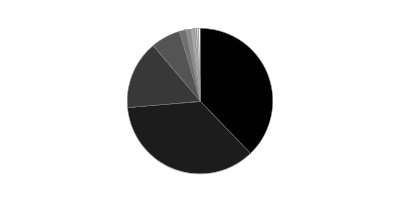

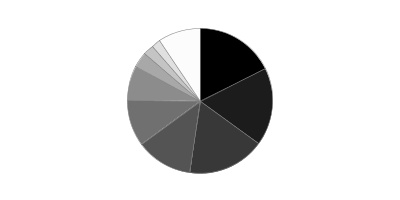

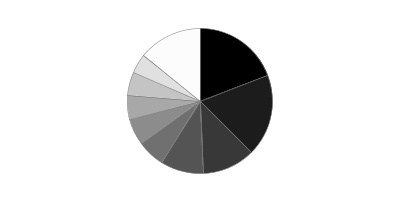

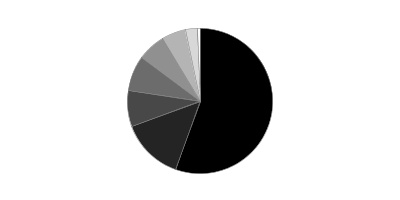

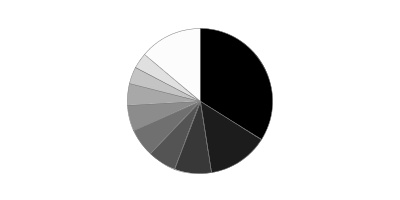

Top Market Sectors as of October 31, 2017

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Financials | 32.9 | 31.0 |

| Energy | 18.7 | 19.6 |

| Materials | 12.7 | 13.0 |

| Industrials | 9.1 | 8.5 |

| Consumer Staples | 7.5 | 8.1 |

| Telecommunication Services | 6.4 | 6.5 |

| Information Technology | 4.7 | 4.6 |

| Consumer Discretionary | 3.5 | 3.6 |

| Real Estate | 0.8 | 0.9 |

| Utilities | 0.7 | 0.7 |

Market Sectors may include more than one industry category.

The Fund may invest up to 35% of its total assets in any industry that represents more than 20% of the Canadian market. As of October 31, 2017, the Fund did not have more than 25% of its total assets invested in any one industry.

Investments October 31, 2017

Showing Percentage of Net Assets

| Common Stocks - 97.4% | | | |

| | | Shares | Value |

| CONSUMER DISCRETIONARY - 3.5% | | | |

| Diversified Consumer Services - 0.1% | | | |

| Park Lawn Corp. | | 44,000 | $678,707 |

| Hotels, Restaurants & Leisure - 0.4% | | | |

| Cara Operations Ltd. | | 222,000 | 4,544,624 |

| Leisure Products - 0.4% | | | |

| BRP, Inc. | | 157,000 | 5,276,738 |

| Media - 1.9% | | | |

| Cogeco Communications, Inc. | | 120,300 | 8,648,806 |

| Corus Entertainment, Inc. Class B (non-vtg.) | | 351,400 | 3,260,412 |

| Quebecor, Inc. Class B (sub. vtg.) | | 294,900 | 11,127,612 |

| | | | 23,036,830 |

| Specialty Retail - 0.5% | | | |

| AutoCanada, Inc. (a) | | 81,500 | 1,472,572 |

| Sleep Country Canada Holdings, Inc. | | 155,600 | 4,615,776 |

| | | | 6,088,348 |

| Textiles, Apparel & Luxury Goods - 0.2% | | | |

| ERO Copper Corp. | | 779,000 | 3,091,605 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 42,716,852 |

|

| CONSUMER STAPLES - 7.5% | | | |

| Food & Staples Retailing - 7.0% | | | |

| Alimentation Couche-Tard, Inc. Class B (sub. vtg.) | | 715,700 | 33,557,626 |

| George Weston Ltd. | | 270,700 | 22,728,644 |

| Jean Coutu Group, Inc. Class A (sub. vtg.) | | 395,700 | 7,508,516 |

| Metro, Inc. Class A (sub. vtg.) | | 375,295 | 11,813,604 |

| North West Co., Inc. | | 405,300 | 9,889,810 |

| | | | 85,498,200 |

| Tobacco - 0.5% | | | |

| Imperial Tobacco Group PLC | | 149,313 | 6,089,110 |

|

| TOTAL CONSUMER STAPLES | | | 91,587,310 |

|

| ENERGY - 18.7% | | | |

| Energy Equipment & Services - 1.3% | | | |

| Canadian Energy Services & Technology Corp. | | 1,643,800 | 8,855,445 |

| ShawCor Ltd. Class A | | 308,900 | 6,694,709 |

| | | | 15,550,154 |

| Oil, Gas & Consumable Fuels - 17.4% | | | |

| ARC Resources Ltd. | | 662,400 | 8,076,546 |

| Canadian Natural Resources Ltd. | | 788,398 | 27,512,346 |

| Cenovus Energy, Inc. | | 1,497,400 | 14,531,779 |

| Enbridge, Inc. | | 957,000 | 36,778,591 |

| Imperial Oil Ltd. | | 242,800 | 7,872,509 |

| NuVista Energy Ltd. (b) | | 1,036,200 | 6,441,612 |

| Peyto Exploration & Development Corp. (a) | | 397,800 | 5,426,928 |

| PrairieSky Royalty Ltd. (a) | | 940,118 | 25,024,147 |

| Raging River Exploration, Inc. (b) | | 932,200 | 5,498,831 |

| Suncor Energy, Inc. | | 2,252,300 | 76,467,514 |

| | | | 213,630,803 |

|

| TOTAL ENERGY | | | 229,180,957 |

|

| FINANCIALS - 32.9% | | | |

| Banks - 21.6% | | | |

| Bank of Nova Scotia | | 422,900 | 27,299,521 |

| Royal Bank of Canada | | 1,514,700 | 118,430,966 |

| The Toronto-Dominion Bank | | 2,096,700 | 119,193,848 |

| | | | 264,924,335 |

| Capital Markets - 3.3% | | | |

| Brookfield Asset Management, Inc. Class A | | 330,900 | 13,881,333 |

| CI Financial Corp. | | 555,000 | 12,338,113 |

| Fairfax India Holdings Corp. (b) | | 102,000 | 1,731,960 |

| Gluskin Sheff + Associates, Inc. | | 104,900 | 1,312,368 |

| TMX Group Ltd. | | 208,000 | 11,364,948 |

| | | | 40,628,722 |

| Insurance - 8.0% | | | |

| Intact Financial Corp. | | 196,425 | 16,055,357 |

| Manulife Financial Corp. | | 2,499,400 | 50,255,357 |

| Power Corp. of Canada (sub. vtg.) | | 1,230,200 | 31,544,079 |

| | | | 97,854,793 |

|

| TOTAL FINANCIALS | | | 403,407,850 |

|

| HEALTH CARE - 0.4% | | | |

| Biotechnology - 0.4% | | | |

| Amgen, Inc. | | 31,500 | 5,519,430 |

| INDUSTRIALS - 9.1% | | | |

| Professional Services - 0.8% | | | |

| Stantec, Inc. | | 339,000 | 9,685,714 |

| Road & Rail - 7.5% | | | |

| Canadian National Railway Co. | | 507,400 | 40,828,768 |

| Canadian Pacific Railway Ltd. | | 250,500 | 43,432,168 |

| TransForce, Inc. | | 320,600 | 7,738,535 |

| | | | 91,999,471 |

| Trading Companies & Distributors - 0.8% | | | |

| Toromont Industries Ltd. | | 216,700 | 9,552,538 |

|

| TOTAL INDUSTRIALS | | | 111,237,723 |

|

| INFORMATION TECHNOLOGY - 4.7% | | | |

| IT Services - 2.0% | | | |

| CGI Group, Inc. Class A (sub. vtg.) (b) | | 468,000 | 24,867,375 |

| Software - 2.7% | | | |

| Constellation Software, Inc. | | 30,300 | 17,238,659 |

| Open Text Corp. | | 457,528 | 15,998,053 |

| | | | 33,236,712 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 58,104,087 |

|

| MATERIALS - 12.7% | | | |

| Chemicals - 3.4% | | | |

| Agrium, Inc. | | 344,700 | 37,526,637 |

| Methanex Corp. | | 73,300 | 3,572,104 |

| | | | 41,098,741 |

| Construction Materials - 0.5% | | | |

| CRH PLC | | 169,400 | 6,374,854 |

| Containers & Packaging - 1.0% | | | |

| CCL Industries, Inc. Class B | | 265,900 | 12,815,799 |

| Metals & Mining - 7.0% | | | |

| Agnico Eagle Mines Ltd. (Canada) | | 305,500 | 13,639,873 |

| Barrick Gold Corp. | | 454,700 | 6,569,729 |

| Detour Gold Corp. (b) | | 45,300 | 482,811 |

| Franco-Nevada Corp. | | 274,500 | 21,813,611 |

| Lundin Mining Corp. | | 1,739,600 | 13,268,478 |

| Premier Gold Mines Ltd. (b) | | 1,631,800 | 4,338,481 |

| Randgold Resources Ltd. | | 92,064 | 9,046,925 |

| Torex Gold Resources, Inc. (b) | | 276,270 | 3,809,661 |

| Wheaton Precious Metals Corp. | | 601,900 | 12,489,623 |

| | | | 85,459,192 |

| Paper & Forest Products - 0.8% | | | |

| Western Forest Products, Inc. | | 4,756,900 | 9,660,552 |

|

| TOTAL MATERIALS | | | 155,409,138 |

|

| REAL ESTATE - 0.8% | | | |

| Equity Real Estate Investment Trusts (REITs) - 0.8% | | | |

| Allied Properties (REIT) | | 308,500 | 9,885,583 |

| TELECOMMUNICATION SERVICES - 6.4% | | | |

| Diversified Telecommunication Services - 3.1% | | | |

| TELUS Corp. | | 1,034,300 | 37,456,396 |

| Wireless Telecommunication Services - 3.3% | | | |

| Rogers Communications, Inc. Class B (non-vtg.) | | 788,800 | 40,928,821 |

|

| TOTAL TELECOMMUNICATION SERVICES | | | 78,385,217 |

|

| UTILITIES - 0.7% | | | |

| Electric Utilities - 0.7% | | | |

| Hydro One Ltd. | | 495,600 | 8,762,604 |

| TOTAL COMMON STOCKS | | | |

| (Cost $840,299,904) | | | 1,194,196,751 |

|

| Money Market Funds - 4.1% | | | |

| Fidelity Cash Central Fund, 1.10% (c) | | 28,350,091 | 28,355,761 |

| Fidelity Securities Lending Cash Central Fund 1.11% (c)(d) | | 21,558,076 | 21,560,232 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $49,915,993) | | | 49,915,993 |

| TOTAL INVESTMENT IN SECURITIES - 101.5% | | | |

| (Cost $890,215,897) | | | 1,244,112,744 |

| NET OTHER ASSETS (LIABILITIES) - (1.5)% | | | (18,879,072) |

| NET ASSETS - 100% | | | $1,225,233,672 |

Legend

(a) Security or a portion of the security is on loan at period end.

(b) Non-income producing

(c) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(d) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $246,412 |

| Fidelity Securities Lending Cash Central Fund | 641,086 |

| Total | $887,498 |

Investment Valuation

The following is a summary of the inputs used, as of October 31, 2017, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Consumer Discretionary | $42,716,852 | $42,716,852 | $-- | $-- |

| Consumer Staples | 91,587,310 | 91,587,310 | -- | -- |

| Energy | 229,180,957 | 229,180,957 | -- | -- |

| Financials | 403,407,850 | 403,407,850 | -- | -- |

| Health Care | 5,519,430 | 5,519,430 | -- | -- |

| Industrials | 111,237,723 | 111,237,723 | -- | -- |

| Information Technology | 58,104,087 | 58,104,087 | -- | -- |

| Materials | 155,409,138 | 139,987,359 | 15,421,779 | -- |

| Real Estate | 9,885,583 | 9,885,583 | -- | -- |

| Telecommunication Services | 78,385,217 | 78,385,217 | -- | -- |

| Utilities | 8,762,604 | 8,762,604 | -- | -- |

| Money Market Funds | 49,915,993 | 49,915,993 | -- | -- |

| Total Investments in Securities: | $1,244,112,744 | $1,228,690,965 | $15,421,779 | $-- |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | October 31, 2017 |

| Assets | | |

Investment in securities, at value (including securities loaned of $20,327,440) — See accompanying schedule:

Unaffiliated issuers (cost $840,299,904) | $1,194,196,751 | |

| Fidelity Central Funds (cost $49,915,993) | 49,915,993 | |

| Total Investment in Securities (cost $890,215,897) | | $1,244,112,744 |

| Foreign currency held at value (cost $848,874) | | 848,874 |

| Receivable for investments sold | | 3,078,869 |

| Receivable for fund shares sold | | 1,453,857 |

| Dividends receivable | | 1,432,929 |

| Distributions receivable from Fidelity Central Funds | | 34,125 |

| Prepaid expenses | | 2,971 |

| Other receivables | | 18,556 |

| Total assets | | 1,250,982,925 |

| Liabilities | | |

| Payable for investments purchased | $602,941 | |

| Payable for fund shares redeemed | 2,474,545 | |

| Accrued management fee | 750,639 | |

| Distribution and service plan fees payable | 25,849 | |

| Other affiliated payables | 270,258 | |

| Other payables and accrued expenses | 67,249 | |

| Collateral on securities loaned | 21,557,772 | |

| Total liabilities | | 25,749,253 |

| Net Assets | | $1,225,233,672 |

| Net Assets consist of: | | |

| Paid in capital | | $855,795,706 |

| Undistributed net investment income | | 13,463,474 |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | 2,087,258 |

| Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 353,887,234 |

| Net Assets | | $1,225,233,672 |

| Calculation of Maximum Offering Price | | |

| Class A: | | |

| Net Asset Value and redemption price per share ($37,556,754 ÷ 694,094 shares) | | $54.11 |

| Maximum offering price per share (100/94.25 of $54.11) | | $57.41 |

| Class M: | | |

| Net Asset Value and redemption price per share ($10,355,815 ÷ 192,605 shares) | | $53.77 |

| Maximum offering price per share (100/96.50 of $53.77) | | $55.72 |

| Class C: | | |

| Net Asset Value and offering price per share ($15,937,951 ÷ 302,330 shares)(a) | | $52.72 |

| Canada: | | |

| Net Asset Value, offering price and redemption price per share ($1,130,802,507 ÷ 20,783,469 shares) | | $54.41 |

| Class I: | | |

| Net Asset Value, offering price and redemption price per share ($30,580,645 ÷ 563,294 shares) | | $54.29 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Year ended October 31, 2017 |

| Investment Income | | |

| Dividends | | $34,811,602 |

| Income from Fidelity Central Funds | | 887,498 |

| Income before foreign taxes withheld | | 35,699,100 |

| Less foreign taxes withheld | | (5,108,976) |

| Total income | | 30,590,124 |

| Expenses | | |

| Management fee | | |

| Basic fee | $9,178,955 | |

| Performance adjustment | 698,108 | |

| Transfer agent fees | 2,811,788 | |

| Distribution and service plan fees | 328,967 | |

| Accounting and security lending fees | 606,213 | |

| Custodian fees and expenses | 21,527 | |

| Independent trustees' fees and expenses | 5,317 | |

| Registration fees | 78,523 | |

| Audit | 77,648 | |

| Legal | 4,549 | |

| Miscellaneous | 11,407 | |

| Total expenses before reductions | 13,823,002 | |

| Expense reductions | (52,679) | 13,770,323 |

| Net investment income (loss) | | 16,819,801 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 52,759,350 | |

| Fidelity Central Funds | 6,750 | |

| Foreign currency transactions | 172,359 | |

| Total net realized gain (loss) | | 52,938,459 |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 106,010,225 | |

| Fidelity Central Funds | (8,858) | |

| Assets and liabilities in foreign currencies | (5,883) | |

| Total change in net unrealized appreciation (depreciation) | | 105,995,484 |

| Net gain (loss) | | 158,933,943 |

| Net increase (decrease) in net assets resulting from operations | | $175,753,744 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Year ended October 31, 2017 | Year ended October 31, 2016 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $16,819,801 | $17,076,194 |

| Net realized gain (loss) | 52,938,459 | (32,588,329) |

| Change in net unrealized appreciation (depreciation) | 105,995,484 | 98,530,458 |

| Net increase (decrease) in net assets resulting from operations | 175,753,744 | 83,018,323 |

| Distributions to shareholders from net investment income | (16,443,381) | (17,462,078) |

| Distributions to shareholders from net realized gain | (5,168,976) | (1,771,774) |

| Total distributions | (21,612,357) | (19,233,852) |

| Share transactions - net increase (decrease) | (276,985,730) | (105,554,211) |

| Redemption fees | 38,887 | 81,286 |

| Total increase (decrease) in net assets | (122,805,456) | (41,688,454) |

| Net Assets | | |

| Beginning of period | 1,348,039,128 | 1,389,727,582 |

| End of period | $1,225,233,672 | $1,348,039,128 |

| Other Information | | |

| Undistributed net investment income end of period | $13,463,474 | $13,430,443 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Canada Fund Class A

| Years ended October 31, | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $48.09 | $45.25 | $60.56 | $57.31 | $53.65 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .50 | .48 | .45 | .47 | .60 |

| Net realized and unrealized gain (loss) | 6.16 | 2.84 | (8.04) | 3.13 | 3.63 |

| Total from investment operations | 6.66 | 3.32 | (7.59) | 3.60 | 4.23 |

| Distributions from net investment income | (.45) | (.42) | (.50) | (.03) | (.57) |

| Distributions from net realized gain | (.19) | (.06) | (7.22) | (.32) | – |

| Total distributions | (.64) | (.48) | (7.72) | (.35) | (.57) |

| Redemption fees added to paid in capitalA,B | – | – | – | – | – |

| Net asset value, end of period | $54.11 | $48.09 | $45.25 | $60.56 | $57.31 |

| Total ReturnC,D | 13.98% | 7.45% | (14.32)% | 6.32% | 7.98% |

| Ratios to Average Net AssetsE,F | | | | | |

| Expenses before reductions | 1.34% | 1.48% | 1.43% | 1.29% | 1.19% |

| Expenses net of fee waivers, if any | 1.34% | 1.48% | 1.43% | 1.29% | 1.19% |

| Expenses net of all reductions | 1.34% | 1.48% | 1.43% | 1.29% | 1.18% |

| Net investment income (loss) | .98% | 1.06% | .90% | .79% | 1.11% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $37,557 | $44,144 | $58,286 | $95,004 | $116,661 |

| Portfolio turnover rateG | 26% | 44% | 24% | 85% | 64% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the sales charges.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity Canada Fund Class M

| Years ended October 31, | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $47.82 | $44.99 | $60.22 | $57.14 | $53.48 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .35 | .35 | .29 | .29 | .45 |

| Net realized and unrealized gain (loss) | 6.13 | 2.83 | (8.00) | 3.11 | 3.63 |

| Total from investment operations | 6.48 | 3.18 | (7.71) | 3.40 | 4.08 |

| Distributions from net investment income | (.34) | (.29) | (.30) | – | (.42) |

| Distributions from net realized gain | (.19) | (.06) | (7.22) | (.32) | – |

| Total distributions | (.53) | (.35) | (7.52) | (.32) | (.42) |

| Redemption fees added to paid in capitalA,B | – | – | – | – | – |

| Net asset value, end of period | $53.77 | $47.82 | $44.99 | $60.22 | $57.14 |

| Total ReturnC,D | 13.64% | 7.14% | (14.58)% | 5.99% | 7.69% |

| Ratios to Average Net AssetsE,F | | | | | |

| Expenses before reductions | 1.63% | 1.77% | 1.75% | 1.59% | 1.47% |

| Expenses net of fee waivers, if any | 1.63% | 1.77% | 1.75% | 1.59% | 1.47% |

| Expenses net of all reductions | 1.63% | 1.77% | 1.75% | 1.59% | 1.46% |

| Net investment income (loss) | .69% | .78% | .58% | .48% | .83% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $10,356 | $11,140 | $12,820 | $21,989 | $23,751 |

| Portfolio turnover rateG | 26% | 44% | 24% | 85% | 64% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the sales charges.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity Canada Fund Class C

| Years ended October 31, | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $46.87 | $44.02 | $59.04 | $56.27 | $52.61 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .13 | .15 | .07 | .02 | .20 |

| Net realized and unrealized gain (loss) | 6.01 | 2.78 | (7.85) | 3.07 | 3.58 |

| Total from investment operations | 6.14 | 2.93 | (7.78) | 3.09 | 3.78 |

| Distributions from net investment income | (.11) | (.02) | (.02) | – | (.12) |

| Distributions from net realized gain | (.19) | (.06) | (7.22) | (.32) | – |

| Total distributions | (.29)B | (.08) | (7.24) | (.32) | (.12) |

| Redemption fees added to paid in capitalA,C | – | – | – | – | – |

| Net asset value, end of period | $52.72 | $46.87 | $44.02 | $59.04 | $56.27 |

| Total ReturnD,E | 13.16% | 6.67% | (14.96)% | 5.53% | 7.21% |

| Ratios to Average Net AssetsF,G | | | | | |

| Expenses before reductions | 2.06% | 2.21% | 2.19% | 2.03% | 1.93% |

| Expenses net of fee waivers, if any | 2.06% | 2.21% | 2.19% | 2.03% | 1.92% |

| Expenses net of all reductions | 2.06% | 2.21% | 2.18% | 2.03% | 1.92% |

| Net investment income (loss) | .26% | .33% | .14% | .04% | .37% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $15,938 | $18,489 | $21,610 | $38,749 | $46,040 |

| Portfolio turnover rateH | 26% | 44% | 24% | 85% | 64% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $.29 per share is comprised of distributions from net investment income of $.105 and distributions from net realized gain of $.188 per share.

C Amount represents less than $.005 per share.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the contingent deferred sales charge.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity Canada Fund

| Years ended October 31, | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $48.35 | $45.55 | $60.95 | $57.72 | $54.05 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .66 | .62 | .60 | .66 | .77 |

| Net realized and unrealized gain (loss) | 6.20 | 2.85 | (8.09) | 3.13 | 3.66 |

| Total from investment operations | 6.86 | 3.47 | (7.49) | 3.79 | 4.43 |

| Distributions from net investment income | (.61) | (.61) | (.69) | (.24) | (.76) |

| Distributions from net realized gain | (.19) | (.06) | (7.22) | (.32) | – |

| Total distributions | (.80) | (.67) | (7.91) | (.56) | (.76) |

| Redemption fees added to paid in capitalA,B | – | – | – | – | – |

| Net asset value, end of period | $54.41 | $48.35 | $45.55 | $60.95 | $57.72 |

| Total ReturnC | 14.35% | 7.79% | (14.08)% | 6.64% | 8.32% |

| Ratios to Average Net AssetsD,E | | | | | |

| Expenses before reductions | 1.02% | 1.17% | 1.15% | .98% | .87% |

| Expenses net of fee waivers, if any | 1.02% | 1.17% | 1.15% | .98% | .87% |

| Expenses net of all reductions | 1.02% | 1.17% | 1.14% | .98% | .86% |

| Net investment income (loss) | 1.30% | 1.37% | 1.18% | 1.09% | 1.42% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $1,130,803 | $1,233,050 | $1,279,488 | $2,057,843 | $2,262,380 |

| Portfolio turnover rateF | 26% | 44% | 24% | 85% | 64% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Fidelity Canada Fund Class I

| Years ended October 31, | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $48.28 | $45.44 | $60.80 | $57.57 | $53.91 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .67 | .66 | .61 | .65 | .78 |

| Net realized and unrealized gain (loss) | 6.19 | 2.83 | (8.07) | 3.12 | 3.64 |

| Total from investment operations | 6.86 | 3.49 | (7.46) | 3.77 | 4.42 |

| Distributions from net investment income | (.66) | (.59) | (.68) | (.22) | (.76) |

| Distributions from net realized gain | (.19) | (.06) | (7.22) | (.32) | – |

| Total distributions | (.85) | (.65) | (7.90) | (.54) | (.76) |

| Redemption fees added to paid in capitalA,B | – | – | – | – | – |

| Net asset value, end of period | $54.29 | $48.28 | $45.44 | $60.80 | $57.57 |

| Total ReturnC | 14.38% | 7.83% | (14.05)% | 6.62% | 8.34% |

| Ratios to Average Net AssetsD,E | | | | | |

| Expenses before reductions | 1.00% | 1.14% | 1.13% | 1.00% | .86% |

| Expenses net of fee waivers, if any | .99% | 1.13% | 1.12% | 1.00% | .86% |

| Expenses net of all reductions | .99% | 1.13% | 1.12% | 1.00% | .85% |

| Net investment income (loss) | 1.33% | 1.41% | 1.21% | 1.08% | 1.43% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $30,581 | $41,217 | $14,846 | $30,165 | $30,831 |

| Portfolio turnover rateF | 26% | 44% | 24% | 85% | 64% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended October 31, 2017

1. Organization.

Fidelity Canada Fund (the Fund) is a fund of Fidelity Investment Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class M (formerly Class T), Class C, Canada and Class I shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class.

After the close of business on June 24, 2016, all outstanding Class B shares were converted to Class A shares. All prior fiscal period dollar and share amounts for Class B presented in the Notes to Financial Statements are for the period November 1, 2015 through June 24, 2016.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of October 31, 2017 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and includes proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of October 31, 2017, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. In addition, the Fund claimed a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, passive foreign investment companies (PFIC), capital loss carryforwards, deferred trustees compensation and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $367,425,210 |

| Gross unrealized depreciation | (22,192,086) |

| Net unrealized appreciation (depreciation) | $345,233,124 |

| Tax Cost | $898,879,620 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed ordinary income | $19,133,560 |

| Undistributed long-term capital gain | $5,081,189 |

| Net unrealized appreciation (depreciation) on securities and other investments | $345,223,511 |

The tax character of distributions paid was as follows:

| | October 31, 2017 | October 31, 2016 |

| Ordinary Income | $21,612,357 | $ 17,462,078 |

| Long-term Capital Gains | – | 1,771,775 |

| Total | $21,612,357 | $ 19,233,853 |

Short-Term Trading (Redemption) Fees. Shares held by investors in the Fund less than 90 days may have been subject to a redemption fee equal to 1.50% of the NAV of shares redeemed. All redemption fees, which reduce the proceeds of the shareholder redemption, are retained by the Fund and accounted for as an addition to paid in capital. In November 2017, the Board of Trustees approved the elimination of these redemption fees effective December 18, 2017.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $338,726,398 and $612,426,009, respectively.

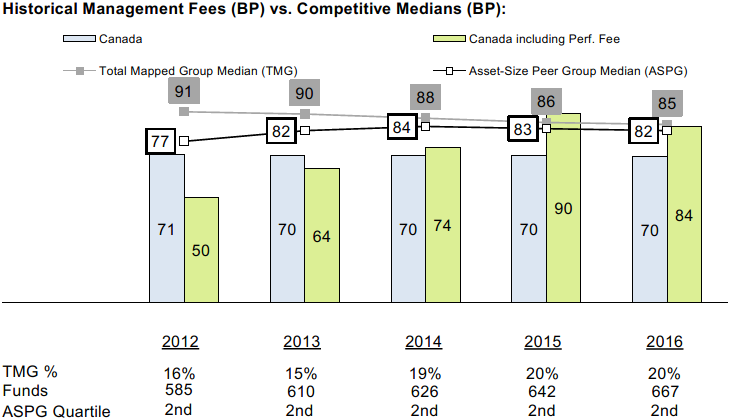

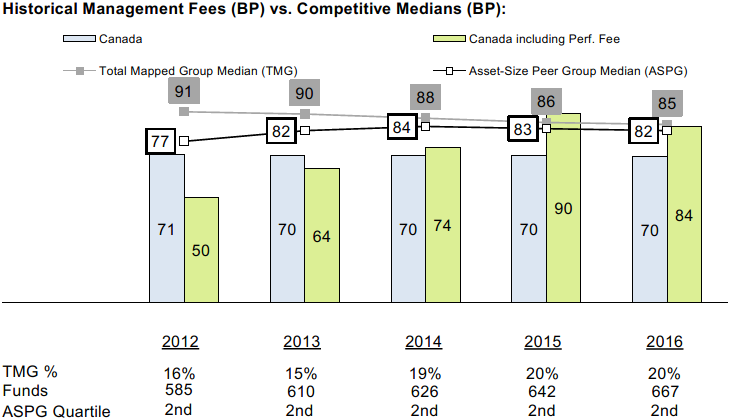

5. Fees and Other Transactions with Affiliates.

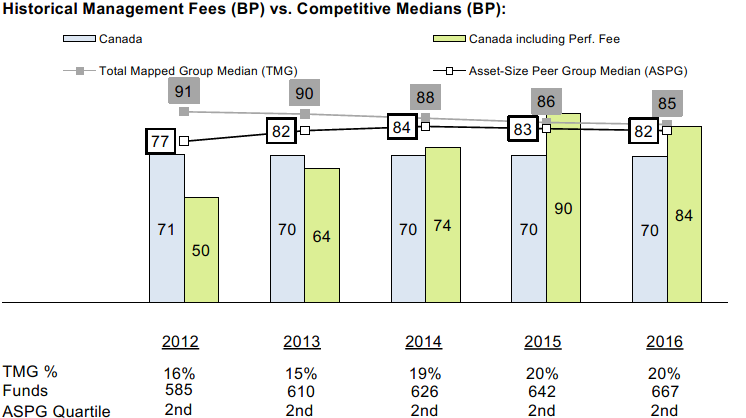

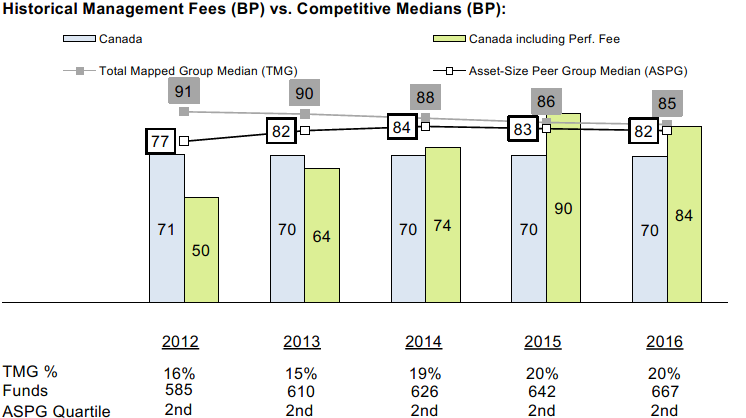

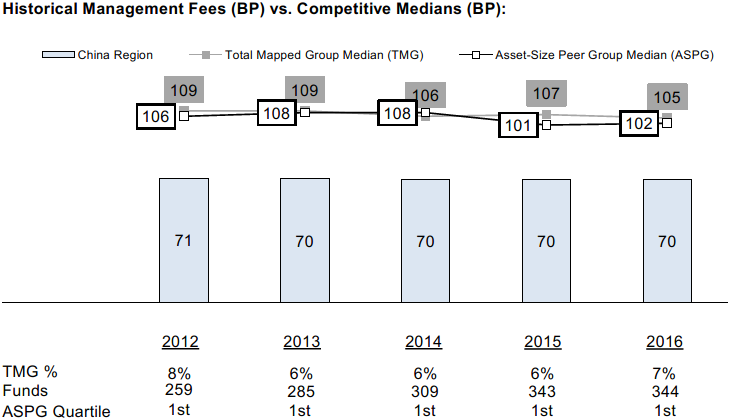

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .45% of the Fund's average net assets and an annualized group fee rate that averaged .25% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by the investment adviser, including any mutual funds previously advised by the investment adviser that are currently advised by Fidelity SelectCo, LLC, an affiliate of the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is subject to a performance adjustment (up to a maximum of +/- .20% of the Fund's average net assets over a 36 month performance period). The upward or downward adjustment to the management fee is based on the relative investment performance of Canada as compared to its benchmark index, the S&P/TSX Composite Index, over the same 36 month performance period. For the reporting period, the total annual management fee rate, including the performance adjustment, was .75% of the Fund's average net assets. The performance adjustment included in the management fee rate may be higher or lower than the maximum performance adjustment rate due to the difference between the average net assets for the reporting and performance periods.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of the investment adviser, separate Distribution and Service Fees, each of which is based on an annual percentage of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services. For the period, the Distribution and Service Fee rates, total fees and amounts retained by FDC were as follows:

| | Distribution

Fee | Service

Fee | Total Fees | Retained

by FDC |

| Class A | -% | .25% | $100,799 | $100 |

| Class M | .25% | .25% | 56,703 | – |

| Class C | .75% | .25% | 171,465 | 4,926 |

| | | | $328,967 | $5,026 |

Sales Load. FDC may receive a front-end sales charge of up to 5.75% for selling Class A shares and 3.50% for selling Class M shares, some of which is paid to financial intermediaries for selling shares of the Fund. Depending on the holding period, FDC may receive contingent deferred sales charges levied on Class A, Class M and Class C redemptions. The deferred sales charges are 1.00% for Class C shares, 1.00% for certain purchases of Class A shares and .25% for certain purchases of Class M shares.

For the period, sales charge amounts retained by FDC were as follows:

| | Retained

by FDC |

| Class A | $3,994 |

| Class M | 1,681 |

| Class C(a) | 1,426 |

| | $7,101 |

(a) When Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the Fund. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each class were as follows:

| | Amount | % of

Class-Level Average

Net Assets |

| Class A | $112,117 | .28 |

| Class M | 36,358 | .32 |

| Class C | 43,158 | .25 |

| Canada | 2,538,563 | .21 |

| Class I | 81,592 | .19 |

| | $2,811,788 | |

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $135 for the period.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

6. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $4,281 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

7. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. For equity securities, a lending agent is used and may loan securities to certain qualified borrowers, including Fidelity Capital Markets (FCM), a broker-dealer affiliated with the Fund. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. The Fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. At period end, there were no security loans outstanding with FCM. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Total security lending income during the period amounted to $641,086, including $5,377 from securities loaned to FCM.

8. Expense Reductions.

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $40,399 for the period. In addition, through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, these credits reduced the Fund's custody expenses by $4.

In addition, during the period the investment adviser reimbursed and/or waived a portion of fund-level operating expenses in the amount of $12,276.

9. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Year ended October 31, 2017 | Year ended October 31, 2016 |

| From net investment income | | |

| Class A | $406,836 | $482,934 |

| Class M | 78,661 | 79,315 |

| Class C | 39,905 | 8,502 |

| Canada | 15,352,959 | 16,735,044 |

| Class I | 565,020 | 156,283 |

| Total | $16,443,381 | $17,462,078 |

| From net realized gain | | |

| Class A | $168,842 | $69,321 |

| Class M | 43,752 | 16,639 |

| Class B | – | 3,460 |

| Class C | 71,450 | 28,339 |

| Canada | 4,723,987 | 1,638,014 |

| Class I | 160,945 | 16,001 |

| Total | $5,168,976 | $1,771,774 |

10. Share Transactions.

Share transactions for each class were as follows and may contain automatic conversions between classes or exchanges between affiliated funds:

| | Shares | Shares | Dollars | Dollars |

| | Year ended October 31, 2017 | Year ended October 31, 2016 | Year ended October 31, 2017 | Year ended October 31, 2016 |

| Class A | | | | |

| Shares sold | 63,470 | 134,113 | $3,161,163 | $6,147,050 |

| Reinvestment of distributions | 10,631 | 11,425 | 525,595 | 496,287 |

| Shares redeemed | (297,916) | (515,795) | (14,925,894) | (23,017,589) |

| Net increase (decrease) | (223,815) | (370,257) | $(11,239,136) | $(16,374,252) |

| Class M | | | | |

| Shares sold | 24,195 | 23,059 | $1,198,423 | $1,036,279 |

| Reinvestment of distributions | 2,464 | 2,169 | 121,397 | 93,951 |

| Shares redeemed | (67,009) | (77,250) | (3,403,775) | (3,322,138) |

| Net increase (decrease) | (40,350) | (52,022) | $(2,083,955) | $(2,191,908) |

| Class B | | | | |

| Shares sold | – | 499 | $– | $21,798 |

| Reinvestment of distributions | – | 68 | – | 2,895 |

| Shares redeemed | – | (61,115) | – | (2,725,253) |

| Net increase (decrease) | – | (60,548) | $– | $(2,700,560) |

| Class C | | | | |

| Shares sold | 25,680 | 41,578 | $1,254,827 | $1,834,681 |

| Reinvestment of distributions | 1,995 | 731 | 96,717 | 31,141 |

| Shares redeemed | (119,795) | (138,754) | (5,862,219) | (5,980,751) |

| Net increase (decrease) | (92,120) | (96,445) | $(4,510,675) | $(4,114,929) |

| Canada | | | | |

| Shares sold | 1,830,107 | 3,590,664 | $91,494,332 | $166,771,731 |

| Reinvestment of distributions | 381,896 | 388,588 | 18,930,598 | 16,926,879 |

| Shares redeemed | (6,928,660) | (6,566,019) | (353,430,502) | (289,731,847) |

| Net increase (decrease) | (4,716,657) | (2,586,767) | $(243,005,572) | $(106,033,237) |

| Class I | | | | |

| Shares sold | 249,628 | 807,708 | $12,551,193 | $37,813,282 |

| Reinvestment of distributions | 14,338 | 2,849 | 709,005 | 123,890 |

| Shares redeemed | (554,299) | (283,652) | (29,406,590) | (12,076,497) |

| Net increase (decrease) | (290,333) | 526,905 | $(16,146,392) | $25,860,675 |

11. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Report of Independent Registered Public Accounting Firm

To the Trustees of Fidelity Investment Trust and Shareholders of Fidelity Canada Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Fidelity Canada Fund (a fund of Fidelity Investment Trust) as of October 31, 2017, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fidelity Canada Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2017 by correspondence with the custodians and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

December 18, 2017

Trustees and Officers

The Trustees, Members of the Advisory Board (if any), and officers of the trusts and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund's activities, review contractual arrangements with companies that provide services to the fund, oversee management of the risks associated with such activities and contractual arrangements, and review the fund's performance. Except for Jonathan Chiel, each of the Trustees oversees 190 funds. Mr. Chiel oversees 143 funds.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. Each Trustee who is not an interested person (as defined in the 1940 Act) of the trust and the fund is referred to herein as an Independent Trustee. Each Independent Trustee shall retire not later than the last day of the calendar year in which his or her 75th birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. Officers and Advisory Board Members hold office without limit in time, except that any officer or Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

The fund’s Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-877-208-0098.

Experience, Skills, Attributes, and Qualifications of the Trustees. The Governance and Nominating Committee has adopted a statement of policy that describes the experience, qualifications, attributes, and skills that are necessary and desirable for potential Independent Trustee candidates (Statement of Policy). The Board believes that each Trustee satisfied at the time he or she was initially elected or appointed a Trustee, and continues to satisfy, the standards contemplated by the Statement of Policy. The Governance and Nominating Committee also engages professional search firms to help identify potential Independent Trustee candidates who have the experience, qualifications, attributes, and skills consistent with the Statement of Policy. From time to time, additional criteria based on the composition and skills of the current Independent Trustees, as well as experience or skills that may be appropriate in light of future changes to board composition, business conditions, and regulatory or other developments, have also been considered by the professional search firms and the Governance and Nominating Committee. In addition, the Board takes into account the Trustees' commitment and participation in Board and committee meetings, as well as their leadership of standing and ad hoc committees throughout their tenure.

In determining that a particular Trustee was and continues to be qualified to serve as a Trustee, the Board has considered a variety of criteria, none of which, in isolation, was controlling. The Board believes that, collectively, the Trustees have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing the fund and protecting the interests of shareholders. Information about the specific experience, skills, attributes, and qualifications of each Trustee, which in each case led to the Board's conclusion that the Trustee should serve (or continue to serve) as a trustee of the fund, is provided below.

Board Structure and Oversight Function. James C. Curvey is an interested person and currently serves as Chairman. The Trustees have determined that an interested Chairman is appropriate and benefits shareholders because an interested Chairman has a personal and professional stake in the quality and continuity of services provided to the fund. Independent Trustees exercise their informed business judgment to appoint an individual of their choosing to serve as Chairman, regardless of whether the Trustee happens to be independent or a member of management. The Independent Trustees have determined that they can act independently and effectively without having an Independent Trustee serve as Chairman and that a key structural component for assuring that they are in a position to do so is for the Independent Trustees to constitute a substantial majority for the Board. The Independent Trustees also regularly meet in executive session. Ned C. Lautenbach serves as Chairman of the Independent Trustees and as such (i) acts as a liaison between the Independent Trustees and management with respect to matters important to the Independent Trustees and (ii) with management prepares agendas for Board meetings.

Fidelity® funds are overseen by different Boards of Trustees. The fund's Board oversees Fidelity's high income and certain equity funds, and other Boards oversee Fidelity's investment-grade bond, money market, asset allocation, and sector funds. The asset allocation funds may invest in Fidelity® funds overseen by the fund's Board. The use of separate Boards, each with its own committee structure, allows the Trustees of each group of Fidelity® funds to focus on the unique issues of the funds they oversee, including common research, investment, and operational issues. On occasion, the separate Boards establish joint committees to address issues of overlapping consequences for the Fidelity® funds overseen by each Board.

The Trustees operate using a system of committees to facilitate the timely and efficient consideration of all matters of importance to the Trustees, the fund, and fund shareholders and to facilitate compliance with legal and regulatory requirements and oversight of the fund's activities and associated risks. The Board, acting through its committees, has charged FMR and its affiliates with (i) identifying events or circumstances the occurrence of which could have demonstrably adverse effects on the fund's business and/or reputation; (ii) implementing processes and controls to lessen the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously business and market conditions in order to facilitate the identification and implementation processes described in (i) and (ii) above. Because the day-to-day operations and activities of the fund are carried out by or through FMR, its affiliates, and other service providers, the fund's exposure to risks is mitigated but not eliminated by the processes overseen by the Trustees. While each of the Board's committees has responsibility for overseeing different aspects of the fund's activities, oversight is exercised primarily through the Operations, Audit, and Compliance Committees. In addition, the Independent Trustees have worked with FMR to enhance the Board's oversight of investment and financial risks, legal and regulatory risks, technology risks, and operational risks, including the development of additional risk reporting to the Board. For example, a working group comprised of Independent Trustees and FMR has worked and continues to work to review the Fidelity® funds' valuation-related activities, reporting and risk management. Appropriate personnel, including but not limited to the fund's Chief Compliance Officer (CCO), FMR's internal auditor, the independent accountants, the fund's Treasurer and portfolio management personnel, make periodic reports to the Board's committees, as appropriate, including an annual review of Fidelity's risk management program for the Fidelity® funds. The responsibilities of each standing committee, including their oversight responsibilities, are described further under "Standing Committees of the Trustees."

Interested Trustees*:

Correspondence intended for a Trustee who is an interested person may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Jonathan Chiel (1957)

Year of Election or Appointment: 2016

Trustee

Mr. Chiel also serves as Trustee of other Fidelity® funds. Mr. Chiel is Executive Vice President and General Counsel for FMR LLC (diversified financial services company, 2012-present). Previously, Mr. Chiel served as general counsel (2004-2012) and senior vice president and deputy general counsel (2000-2004) for John Hancock Financial Services; a partner with Choate, Hall & Stewart (1996-2000) (law firm); and an Assistant United States Attorney for the United States Attorney’s Office of the District of Massachusetts (1986-95), including Chief of the Criminal Division (1993-1995). Mr. Chiel is a director on the boards of the Boston Bar Foundation and the Maimonides School.

James C. Curvey (1935)

Year of Election or Appointment: 2007

Trustee

Chairman of the Board of Trustees