UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04015 |

|

Eaton Vance Mutual Funds Trust |

(Exact name of registrant as specified in charter) |

|

The Eaton Vance Building, 255 State Street, Boston, Massachusetts | | 02109 |

(Address of principal executive offices) | | (Zip code) |

|

Alan R. Dynner

The Eaton Vance Building, 255 State Street, Boston, Massachusetts 02109 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (617) 482-8260 | |

|

Date of fiscal year end: | April 30 | |

|

Date of reporting period: | April 30, 2005 | |

| | | | | | | | |

Item 1. Reports to Stockholders

Annual Report April 30, 2005

EATON VANCE

TAX-MANAGED

DIVIDEND

INCOME

FUND

IMPORTANT NOTICES REGARDING PRIVACY,

DELIVERY OF SHAREHOLDER DOCUMENTS,

PORTFOLIO HOLDINGS AND PROXY VOTING

Privacy. The Eaton Vance organization is committed to ensuring your financial privacy. Each of the financial institutions identified below has in effect the following policy ("Privacy Policy") with respect to nonpublic personal information about its customers:

• Only such information received from you, through application forms or otherwise, and information about your Eaton Vance fund transactions will be collected. This may include information such as name, address, social security number, tax status, account balances and transactions.

• None of such information about you (or former customers) will be disclosed to anyone, except as permitted by law (which includes disclosure to employees necessary to service your account). In the normal course of servicing a customer's account, Eaton Vance may share information with unaffiliated third parties that perform various required services such as transfer agents, custodians and broker/dealers.

• Policies and procedures (including physical, electronic and procedural safeguards) are in place that are designed to protect the confidentiality of such information.

• We reserve the right to change our Privacy Policy at any time upon proper notification to you. Customers may want to review our Policy periodically for changes by accessing the link on our homepage: www.eatonvance.com.

Our pledge of privacy applies to the following entities within the Eaton Vance organization: the Eaton Vance Family of Funds, Eaton Vance Management, Eaton Vance Investment Counsel, Boston Management and Research, and Eaton Vance Distributors, Inc.

In addition, our Privacy Policy only applies to those Eaton Vance customers who are individuals and who have a direct relationship with us. If a customer's account (i.e. fund shares) is held in the name of a third-party financial adviser/ broker-dealer, it is likely that only such adviser's privacy policies apply to the customer. This notice supersedes all previously issued privacy disclosures.

For more information about Eaton Vance's Privacy Policy, please call 1-800-262-1122.

Delivery of Shareholder Documents. The Securities and Exchange Commission permits funds to deliver only one copy of shareholder documents, including prospectuses, proxy statements and shareholder reports, to fund investors with multiple accounts at the same residential or post office box address. This practice is often called "householding" and it helps eliminate duplicate mailings to shareholders.

Eaton Vance, or your financial adviser, may household the mailing of your documents indefinitely unless you instruct Eaton Vance, or your financial adviser, otherwise.

If you would prefer that your Eaton Vance documents not be householded, please contact Eaton Vance at 1-800-262-1122, or contact your financial adviser.

Your instructions that householding not apply to delivery of your Eaton Vance documents will be effective within 30 days of receipt by Eaton Vance or your financial adviser.

Portfolio Holdings. Each Eaton Vance Fund and it's underlying Portfolio will file a schedule of its portfolio holdings on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Form N-Q will be available on the Eaton Vance website www.eatonvance.com, by calling Eaton Vance at 1-800-262-1122 or in the EDGAR database on the SEC's website at www.sec.gov. Form N-Q may also be reviewed and copied at the SEC's public reference room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the public reference room).

Proxy Voting. From time to time, funds are required to vote proxies related to the securities held by the funds. The Eaton Vance Funds or their underlying Portfolios (if applicable) vote proxies according to a set of policies and procedures approved by the Funds' and Portfolios' Boards. You may obtain a description of these policies and procedures and information on how the Funds or Portfolios voted proxies relating to Portfolio securities during the most recent 12 month period ended June 30, without charge, upon request, by calling 1-800-262-1122. This description is also available on the SEC's website at www.sec.gov.

Eaton Vance Tax-Managed Dividend Income Fund as of April 30, 2005

INVESTMENT UPDATE

Michael R. Mach, CFA

Co-Portfolio Manager

Judith A. Saryan, CFA

Co-Portfolio Manager

The Fund

Performance for the Past Year

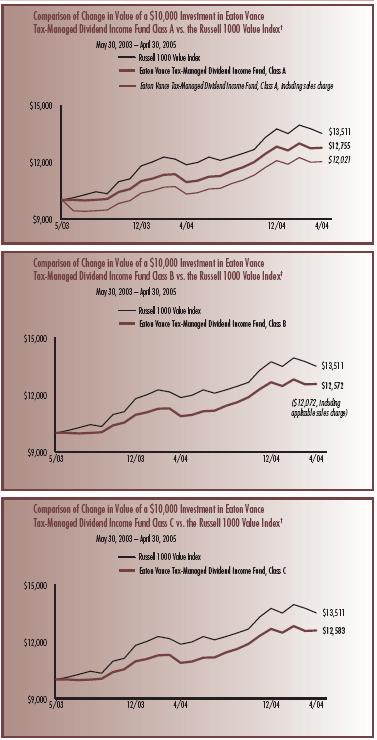

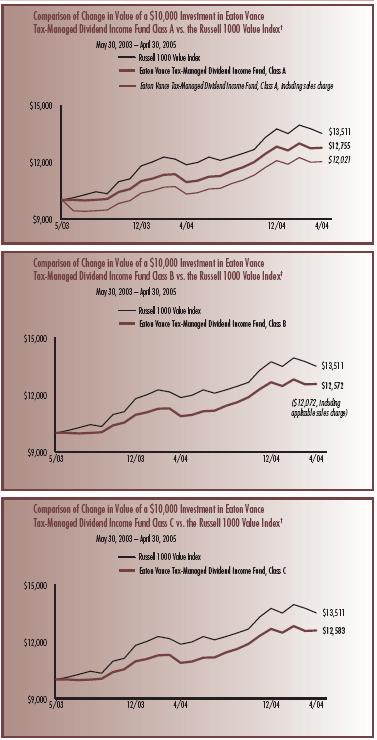

• For the year ended April 30, 2005, the Fund’s Class A shares had a total return of 16.54%. This return was the result of an increase in net asset value (NAV) per share to $11.82 on April 30, 2005, from $10.64 on April 30, 2004, and the reinvestment of $0.552 per share in dividend income.(1)

• The Fund’s Class B shares had a total return of 15.57% during the same period, the result of an increase in NAV per share to $11.79 from $10.63, and the reinvestment of $0.474 per share in dividend income.(1)

• The Fund’s Class C shares had a total return of 15.66% during the same period, the result of an increase in NAV per share to $11.80 from $10.63, and the reinvestment of $0.474 per share in dividend income.(1)

• For comparison, the Fund’s benchmark, the Russell 1000 value Index – a broad-based, unmanaged index of value stocks – had a total return of 13.92% during the period.(2)

See pages 4 and 5 for more performance information, including after-tax returns.

Management Discussion

• During the 12 months ended April 30, 2005, U.S. equity markets rose, as continued economic growth helped drive corporate earnings and stock prices higher. Recent growth in the U.S. economy has been facilitated by a combination of lower tax rates, which have kept more income in the hands of consumers, along with a more restrictive Federal Reserve Board policy that has successfully kept long-term interest rates at relatively low levels.

• Based on the Fund’s objective of achieving a high level of after-tax total return, the Fund was primarily invested in securities that generated a relatively high level of qualified dividend income (QDI) during the period. At the end of the period, the Fund had approximately 79% of total investments invested in common stocks and approximately 21% of total investments invested in preferred stocks. Within the common stock portfolio, the Fund had approximately 24% of total investments invested in utility and telecommunication stocks. The Fund also had approximately 55% of the Fund’s total investments invested in common stocks diversified across the consumer, industrial, energy and financial sectors.

• During the last 12 months, the utility sector generally outperformed the overall markets. During this same period, the Fund’s utility and telecommunication holdings outperformed their counterparts in the Russell 1000 Value Index.(2) In the utility and telecommunication sectors, the Fund’s strategy was to focus its investments in companies generating high levels of free cash flow. Over the last few months of the year ended April 30, 2005, the strong free cash flows generated by the Fund’s utility and telecommunication stocks allowed many of these holdings to increase their regular dividend payments and, in a number of cases, to reward shareholders with special one-time dividend payments.

• In addition to the utility and telecommunication stocks mentioned above, the Fund has been invested in a broadly diversified basket of other dividend-paying common stocks. During recent months, consumer-related stocks have benefited from healthy consumer spending and solid new job creation. On average, the Fund’s consumer-related stock holdings performed better than their counterparts in the Russell 1000 Value Index.(2) Energy stocks also performed well during the period, as worldwide demand allowed oil and gas prices to move higher. That said, over the last 12 months, energy stocks held in the Fund’s portfolio modestly underperformed their counterparts in the Russel 1000 Value Index.(2)

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

(1) These returns do not include the 5.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charge (CDSC) for Class B and Class C shares. If sales charges were deducted, returns would be lower.

(2) It is not possible to invest directly in an Index. The Index’s total return does not reflect commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

2

• Over the past 12 months, the Fund’s preferred stocks generated mid single-digit returns. The preferred stock portion of the Fund’s portfolio performed well, as corporate credit quality continued to improve, which helped narrow yield spreads between preferreds and riskless rates. In addition, the preferreds produced solid, risk-adjusted performance because the Fund actively sought to invest in both high current yield and relatively low-interest-rate-risk opportunities.

• During the period, a significant portion of Fund assets were invested in non-U.S. common and preferred stocks. These investments provided the Fund with international diversification and dividend yields often more attractive than the yields available on stocks issued by similar domestic corporations. As of April 30, 2005, approximately 40% of the Fund’s total investments was invested in non-U.S. common stocks. In addition, approximately 9% of the Fund’s total investments was invested in “Yankee” preferreds. Yankee preferreds are preferred stocks generally issued by large, highly rated, European financial institutions but denominated in U.S. dollars.

• We are pleased to report that since inception, the Fund has increased its monthly dividend three times for all share classes. The amounts following are only for Class A shares. The first increase, announced in August 2004, was from $0.033 to $0.035 per share. The second dividend increase, announced in December 2004, was from $0.035 to $0.038 per share. Also, on December 17, 2004, the Fund announced a special dividend of $0.1236 per share. The third increase was in May 2005, from $0.038 to $0.042. Since its inception, all of the income generated by the Fund has come from dividends paid by the Fund’s common and preferred stock holdings. All of the dividends paid by the Fund in fiscal 2004 were qualified dividends subject to federal income tax at long-term capital gain rates (up to 15%, as long as certain holding period and other requirements have been met by receiving shareholders).

• The increases in the Fund’s monthly dividend and the Fund’s ability to pay a special dividend reflect both the effective implementation of the Fund’s dividend capture strategy and the significant number of dividend increases announced by companies represented in the Fund’s common stock portfolio.

• The Fund’s dividend capture strategy is a trading strategy designed to enhance the level of qualified, tax-advantaged dividend income earned by the Fund. By implementing its dividend capture strategy, the Fund has been able to collect a greater number of dividend payments than it would have collected by simply adhering to a buy-and-hold strategy. (There can be no assurance that the continued use of the dividend capture strategy will be successful in the future).

• The Fund continues to adhere to its strategy of owning a diversified portfolio of dividend-paying common and preferred stocks. Our strategy is to focus investments in companies characterized by strong business franchises and solid balance sheets. For common stocks, we generally focus on companies that offer the potential for growth of earnings and dividends, and for capital appreciation over time. For preferred stocks, we take into consideration the interest rate sensitivity of the investment and our interest rate expectations.

The views expressed throughout this report are those of the portfolio managers and are current only through the end of the period of the report as stated on the cover. These views are subject to change at any time based upon market or other conditions, and the investment adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on many factors, may not be relied on as an indication of trading intent on behalf of any Eaton Vance fund.

Top Ten Holdings*

By net assets

Altria Group, Inc. | | 2.36 | % |

ChevronTexaco Corp. | | 2.16 | % |

Citizens Communications, Co. | | 2.12 | % |

Bank of America Corp. | | 2.11 | % |

GlaxoSmithKline PLC ADR | | 2.10 | % |

BCE, Inc. | | 2.00 | % |

Dominion Resources, Inc. | | 1.96 | % |

Citigroup, Inc. | | 1.95 | % |

Marathon Oil Corp. | | 1.94 | % |

Wells Fargo & Co. | | 1.87 | % |

* Fund information may not be representative of the Fund’s current or future investments and may change due to active management.

3

Performance* | | Class A | | Class B | | Class C | |

Average Annual Total Returns (at net asset value) | | | | | | | |

One Year | | 16.54 | % | 15.57 | % | 15.66 | % |

Life of Fund† | | 13.51 | % | 12.66 | % | 12.71 | % |

| | | | | | | |

SEC Average Annual Total Returns (including sales charge or applicable CDSC) | | | | | | | |

One Year | | 9.83 | % | 10.57 | % | 14.66 | % |

Life of Fund† | | 10.06 | % | 10.31 | % | 12.71 | % |

† Inception Dates – Class A: 5/30/03; Class B: 5/30/03; Class C: 5/30/03

* Average Annual Total Returns do not include the 5.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charge (CDSC) for Class B and Class C shares. If sales charges were deducted, returns would be lower. SEC average annual total returns for Class A reflect the maximum 5.75% sales charge. SEC returns for Class B shares reflect the applicable CDSC based on the following schedule: 5% - 1st and 2nd years; 4% - 3rd year; 3%- 4th year; 2% - 5th year; 1% - 6th year. SEC 1-year return for Class C reflects a 1% CDSC.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

Asset Allocation**

By net assets

** Fund information may not be representative of the Fund’s current or future investments and may change due to active management.

† Source: Thomson Financial. Investment operations commenced 5/30/03.

The chart compares the Fund’s total return with that of the Russell 1000 Value Index, a broad-based, unmanaged market index of 1000 U.S. value stocks. Returns are calculated by determining the percentage change in net asset value with all distributions reinvested. The lines on the chart represent the total returns of a $10,000 hypothetical investment in the Fund and in the Russell 1000 Index. The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Index’s total returns do not reflect any commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. It is not possible to invest directly in an Index.

4

“Return Before Taxes” does not take into consideration shareholder taxes. It is most relevant to tax-free or tax-deferred shareholder accounts. “Return After Taxes on Distributions” reflects the impact of federal income taxes due on Fund distributions of dividends and capital gains. It is most relevant to taxpaying shareholders who continue to hold their shares. “Return After Taxes on Distributions and Sale of Fund Shares” also reflects the impact of taxes on capital gain or loss realized upon a sale of shares. It is most relevant to taxpaying shareholders who sell their shares.

Average Annual Total Returns

(For the periods ended April 30, 2005)

Returns at Net Asset Value (NAV) (Class A)

| | One year | | Life of Fund | |

Return Before Taxes | | 16.54 | % | 13.51 | % |

Return After Taxes on Distributions | | 15.70 | % | 12.84 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 11.78 | % | 11.52 | % |

Returns at Public Offering Price (POP) (Class A)

| | One Year | | Life of Fund | |

Return Before Taxes | | 9.83 | % | 10.06 | % |

Return After Taxes on Distributions | | 9.04 | % | 9.41 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 7.36 | % | 8.55 | % |

Average Annual Total Returns

(For the periods ended April 30, 2005)

Returns at Net Asset Value (NAV) (Class C)

| | One Year | | Life of Fund | |

Return Before Taxes | | 15.66 | % | 12.71 | % |

Return After Taxes on Distributions | | 14.95 | % | 12.15 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 11.07 | % | 10.84 | % |

Return at Public Offering Price (POP) (Class C)

| | One Year | | Life of Fund | |

Return Before Taxes | | 14.66 | % | 12.71 | % |

Return After Taxes on Distributions | | 13.95 | % | 12.15 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 10.42 | % | 10.84 | % |

Average Annual Total Returns

(For the periods ended April 30, 2005)

Returns at Net Asset Value (NAV) (Class B)

| | One year | | Life of Fund | |

Return Before Taxes | | 15.57 | % | 12.66 | % |

Return After Taxes on Distributions | | 14.86 | % | 12.10 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 11.00 | % | 10.80 | % |

Returns at Public Offering Price (POP) (Class B)

| | One Year | | Life of Fund | |

Return Before Taxes | | 10.57 | % | 10.31 | % |

Return After Taxes on Distributions | | 9.86 | % | 9.73 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 7.75 | % | 8.77 | % |

Class A, Class B, and Class C commenced operations on 5/30/03. Returns of Public Offering Price (POP) reflect the deduction of the maximum initial sales charge and applicable CDSC, while Returns at Net Asset Value (NAV) do not.

After-tax returns are calculated using the highest historical individual federal income tax rate and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and may differ from those shown. After-tax returns are not relevant for shareholders who hold shares in tax-deferred accounts or to shares held by non-taxable entities. Return After Taxes on Distributions for a period may be the same as Return Before Taxes for that period because no distributions were paid during that period, or because the taxable portion of distributions made during the period was insignificant. Also, Return After Taxes on Distributions and Sale of Fund Shares for a period may be greater than Return After Taxes on Distributions for the same period because of realized losses on the sale of Fund Shares.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to www.eatonvance.com.

5

Example: As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2004 – April 30, 2005).

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual return of the Fund. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Eaton Vance Tax-Managed Dividend Income Fund

| | Beginning Account Value

(11/1/04) | | Ending Account Value

(4/30/05) | | Expenses Paid During Period*

(11/1/04 – 4/30/05) | |

| | | | | | | |

Actual | | | | | | | |

Class A | | $ | 1,000.00 | | $ | 1,062.90 | | $ | 6.34 | |

Class B | | $ | 1,000.00 | | $ | 1,058.40 | | $ | 10.21 | |

Class C | | $ | 1,000.00 | | $ | 1,059.30 | | $ | 10.16 | |

| | | | | | | |

Hypothetical | | | | | | | |

(5% return per year before expenses) | | | | | | | |

Class A | | $ | 1,000.00 | | $ | 1,018.60 | | $ | 6.21 | |

Class B | | $ | 1,000.00 | | $ | 1,014.90 | | $ | 9.99 | |

Class C | | $ | 1,000.00 | | $ | 1,014.90 | | $ | 9.94 | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.25% for Class A shares, 2.00% for Class B shares, and 2.00% for Class C shares, multiplied by the average account value over the period, multiplied by 181/365 ( to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on October 31, 2004.

6

Eaton Vance Tax-Managed Dividend Income Fund as of April 30, 2005

PORTFOLIO OF INVESTMENTS

| Common Stocks - 78.9% | | | | | | | | | |

| Security | | Shares | | Value | |

| Building Materials - 0.3% | | | | | | | | | |

| Stanley Works (The) | | | 35,000 | | | $ | 1,506,050 | | |

| | | | | | | $ | 1,506,050 | | |

| Chemicals - 1.4% | | | |

| Akzo Nobel NV(1) | | | 75,000 | | | $ | 3,085,104 | | |

| Lyondell Chemical Co. | | | 150,000 | | | | 3,763,500 | | |

| | | | | | | $ | 6,848,604 | | |

| Commercial Banks - 10.5% | | | |

| Associated Banc-Corp. | | | 125,000 | | | $ | 3,865,000 | | |

| Banco Latinoamericano de Exportaciones SA(1) | | | 80,000 | | | | 1,511,200 | | |

| Bank of America Corp. | | | 225,000 | | | | 10,134,000 | | |

| HBOS PLC(1) | | | 175,000 | | | | 2,598,129 | | |

| Lloyds TSB Group PLC(1) | | | 220,000 | | | | 1,892,307 | | |

| Royal Bank of Scotland Group PLC(1) | | | 100,000 | | | | 3,022,973 | | |

| SunTrust Banks, Inc. | | | 50,000 | | | | 3,641,500 | | |

| Svenska Handelsbanken AB(1) | | | 150,000 | | | | 3,386,762 | | |

| TCF Financial Corp. | | | 150,000 | | | | 3,793,500 | | |

| Wachovia Corp. | | | 150,000 | | | | 7,677,000 | | |

| Wells Fargo & Co. | | | 150,000 | | | | 8,991,000 | | |

| | | | | | | $ | 50,513,371 | | |

| Commercial Services and Supplies - 1.4% | | | |

| Donnelley (R.R.) & Sons Co. | | | 200,000 | | | $ | 6,582,000 | | |

| | | | | | | $ | 6,582,000 | | |

| Containers-Paper / Plastic - 0.2% | | | |

| Packaging Corp. of America | | | 35,000 | | | $ | 783,650 | | |

| | | | | | | $ | 783,650 | | |

| Distributors - 0.4% | | | |

| Genuine Parts Co. | | | 50,000 | | | $ | 2,145,000 | | |

| | | | | | | $ | 2,145,000 | | |

| Diversified Financial Services - 2.6% | | | |

| Citigroup, Inc. | | | 200,000 | | | $ | 9,392,000 | | |

| Credit Suisse Group ADR | | | 75,000 | | | | 3,159,000 | | |

| | | | | | | $ | 12,551,000 | | |

| Security | | Shares | | Value | |

| Diversified Telecommunication Services - 9.4% | | | | | | | | | |

| Alltel Corp. | | | 75,000 | | | $ | 4,272,000 | | |

| BCE, Inc.(1) | | | 400,000 | | | | 9,624,000 | | |

| Belgacom SA(1) | | | 50,000 | | | | 1,920,881 | | |

| Citizens Communications Co. | | | 800,000 | | | | 10,200,000 | | |

| Koninklijke (Royal) KPN NV(1) | | | 300,000 | | | | 2,510,719 | | |

| Telecom Corporation of New Zealand, Ltd.(1) | | | 1,740,000 | | | | 7,748,706 | | |

| Telecom Italia SPA(1) | | | 2,500,000 | | | | 7,074,209 | | |

| Telstra Corp. Ltd.(1) | | | 500,000 | | | | 1,892,429 | | |

| | | | | | | $ | 45,242,944 | | |

| Electrical / Electronic Manufacturer - 1.6% | | | |

| Emerson Electric Co. | | | 75,000 | | | $ | 4,700,250 | | |

| Nokia Oyj ADR | | | 200,000 | | | | 3,196,000 | | |

| | | | | | | $ | 7,896,250 | | |

| Entertainment - 1.3% | | | |

| Lottomatica SPA(1) | | | 25,000 | | | $ | 853,758 | | |

| Regal Entertainment Group | | | 275,000 | | | | 5,579,750 | | |

| | | | | | | $ | 6,433,508 | | |

| Industrial Conglomerates - 1.3% | | | |

| General Electric Co. | | | 75,000 | | | $ | 2,715,000 | | |

| Tomkins PLC(1) | | | 750,000 | | | | 3,527,614 | | |

| | | | | | | $ | 6,242,614 | | |

| Insurance - 1.2% | | | |

| Fidelity National Financial, Inc. | | | 60,000 | | | $ | 1,926,600 | | |

| Milano Assicurazioni SPA(1) | | | 600,000 | | | | 3,677,830 | | |

| | | | | | | $ | 5,604,430 | | |

| Machinery - 0.8% | | | |

| Sandvik AB(1) | | | 100,000 | | | $ | 3,922,593 | | |

| | | | | | | $ | 3,922,593 | | |

| Metals and Mining - 1.0% | | | |

| Fording Canadian Coal Trust(1) | | | 25,000 | | | $ | 2,221,000 | | |

| Southern Peru Copper Corp.(1) | | | 50,000 | | | | 2,557,000 | | |

| | | | | | | $ | 4,778,000 | | |

See notes to financial statements

7

Eaton Vance Tax-Managed Dividend Income Fund as of April 30, 2005

PORTFOLIO OF INVESTMENTS CONT'D

| Security | | Shares | | Value | |

| Oil and Gas - 10.6% | | | | | | | | | |

| BP PLC ADR | | | 75,000 | | | $ | 4,567,500 | | |

| ChevronTexaco Corp. | | | 200,000 | | | | 10,400,000 | | |

| Enbridge, Inc.(1) | | | 50,000 | | | | 2,523,000 | | |

| ENI SPA(1) | | | 200,000 | | | | 5,045,311 | | |

| Kerr-McGee Corp. | | | 100,000 | | | | 7,760,000 | | |

| Marathon Oil Corp. | | | 200,000 | | | | 9,314,000 | | |

| Statoil ASA ADR | | | 400,000 | | | | 6,996,000 | | |

| Total SA ADR | | | 40,000 | | | | 4,436,400 | | |

| | | | | | | $ | 51,042,211 | | |

| Paper and Forest Products - 1.8% | | | |

| Kimberly-Clark de Mexico SA de CV(1) | | | 1,000,000 | | | $ | 2,840,653 | | |

| MeadWestvaco Corp. | | | 75,000 | | | | 2,208,750 | | |

| Weyerhaeuser Co. | | | 50,000 | | | | 3,430,500 | | |

| | | | | | | $ | 8,479,903 | | |

| Pharmaceuticals - 3.8% | | | |

| Bristol-Myers Squibb Co. | | | 150,000 | | | $ | 3,900,000 | | |

| GlaxoSmithKline PLC ADR | | | 200,000 | | | | 10,110,000 | | |

| Pfizer, Inc. | | | 150,000 | | | | 4,075,500 | | |

| | | | | | | $ | 18,085,500 | | |

| REITS - 8.1% | | | |

| Boston Properties, Inc. | | | 75,000 | | | $ | 4,985,250 | | |

| Colonial Properties Trust | | | 100,000 | | | | 3,865,000 | | |

| Developers Diversified Realty Corp. | | | 75,000 | | | | 3,183,000 | | |

| Duke Realty Corp. | | | 125,000 | | | | 3,825,000 | | |

| Health Care Property Investors, Inc. | | | 150,000 | | | | 3,846,000 | | |

| Home Properties, Inc. | | | 75,000 | | | | 3,138,750 | | |

| Plum Creek Timber Co., Inc. | | | 75,000 | | | | 2,590,500 | | |

| Public Storage, Inc. | | | 50,000 | | | | 2,935,000 | | |

| Simon Property Group, Inc. | | | 100,000 | | | | 6,607,000 | | |

| Vornado Realty Trust | | | 50,000 | | | | 3,822,500 | | |

| | | | | | | $ | 38,798,000 | | |

| Retail-General - 0.9% | | | |

| May Department Stores Co. (The) | | | 125,000 | | | $ | 4,385,000 | | |

| | | | | | | $ | 4,385,000 | | |

| Retail-Specialty - 0.4% | | | |

| Limited, Inc. (The) | | | 100,000 | | | $ | 2,169,000 | | |

| | | | | | | $ | 2,169,000 | | |

| Security | | Shares | | Value | |

| Thrifts & Mortgage Finance - 2.8% | | | |

| IndyMac Bancorp, Inc. | | | 100,000 | | | $ | 3,848,000 | | |

| New York Community Bancorp, Inc. | | | 200,000 | | | | 3,540,000 | | |

| Washington Mutual, Inc. | | | 150,000 | | | | 6,198,000 | | |

| | | | | | | $ | 13,586,000 | | |

| Tobacco - 2.4% | | | |

| Altria Group, Inc. | | | 175,000 | | | $ | 11,373,250 | | |

| | | | | | | $ | 11,373,250 | | |

| Utilities-Electric - 5.0% | | | |

| Edison International | | | 200,000 | | | $ | 7,260,000 | | |

| Enel SPA(1) | | | 750,000 | | | | 7,137,358 | | |

| Fortum Oyj(1) | | | 300,000 | | | | 4,558,344 | | |

| Scottish Power PLC ADR | | | 150,000 | | | | 4,867,500 | | |

| | | | | | | $ | 23,823,202 | | |

| Utilities-Electric and Gas - 6.6% | | | |

| Dominion Resources, Inc. | | | 125,000 | | | $ | 9,425,000 | | |

| E.ON AG(1) | | | 75,000 | | | | 6,377,096 | | |

| Electrabel(1) | | | 5,000 | | | | 2,332,251 | | |

| RWE AG(1) | | | 150,000 | | | | 8,985,277 | | |

| Scottish and Southern Energy PLC(1) | | | 250,000 | | | | 4,497,448 | | |

| | | | | | | $ | 31,617,072 | | |

| Utilities-Gas - 0.6% | | | |

| Snam Rete Gas SPA(1) | | | 500,000 | | | $ | 2,817,085 | | |

| | | | | | | $ | 2,817,085 | | |

| Utilities-Water - 2.5% | | | |

| Severn Trent PLC(1) | | | 325,000 | | | $ | 6,042,700 | | |

| United Utilities PLC(1) | | | 500,000 | | | | 6,082,481 | | |

| | | | | | | $ | 12,125,181 | | |

Total Common Stocks

(identified cost $349,917,170) | | | | | | $ | 379,351,418 | | |

| Preferred Stocks - 20.8% | | | |

| Security | | Shares | | Value | |

| Commercial Banks - 5.6% | | | |

| Abbey National PLC, 7.375%(1) | | | 112,000 | | | $ | 2,980,320 | | |

| ABN AMRO Capital Funding Trust VII, 6.08%(1) | | | 80,000 | | | | 1,990,400 | | |

See notes to financial statements

8

Eaton Vance Tax-Managed Dividend Income Fund as of April 30, 2005

PORTFOLIO OF INVESTMENTS CONT'D

| Security | | Shares | | Value | |

| Commercial Banks (continued) | | | | | | | | | |

ABN AMRO North America Capital

Funding Trust, 6.968%(1)(2) | | | 500 | | | $ | 548,281 | | |

| Banco Santander, 6.41%(1) | | | 125,000 | | | | 3,187,500 | | |

| Barclays Bank PLC, 8.55%(1)(2)(3) | | | 18,900 | | | | 2,310,827 | | |

| CA Preferred Fund Trust, 7.00%(3) | | | 11,500 | | | | 1,208,625 | | |

| First Republic Bank, 6.70% | | | 162,000 | | | | 4,212,000 | | |

| First Tennessee Bank, 3.90%(2) | | | 3,000 | | | | 2,993,250 | | |

| HSBC USA, Inc., Series F, 3.87%(1) | | | 150,000 | | | | 3,742,500 | | |

| Royal Bank of Scotland Group PLC, 6.40%(1) | | | 145,000 | | | | 3,733,750 | | |

| | | | | | | $ | 26,907,453 | | |

| Financial Services - 3.3% | | | |

| BBVA Preferred Capital Ltd., 7.75%(1) | | | 155,900 | | | $ | 4,053,400 | | |

Federal National Mortgage Association,

Variable Rate, 7.00% | | | 65,000 | | | | 3,625,785 | | |

| Goldman Sachs Group, Inc., Series A, 3.911% | | | 60,000 | | | | 1,498,800 | | |

| Lehman Brothers Holdings, 6.50% | | | 107,000 | | | | 2,846,200 | | |

| Merrill Lynch & Co., Inc., 3.64% | | | 150,000 | | | | 3,744,000 | | |

| | | | | | | $ | 15,768,185 | | |

| Food Products - 0.1% | | | |

| Ocean Spray Cranberries, Inc., 6.25%(2) | | | 5,750 | | | $ | 491,805 | | |

| | | | | | | $ | 491,805 | | |

| Insurance - 3.9% | | | |

| Ace Ltd., 7.80%(1) | | | 163,800 | | | $ | 4,321,044 | | |

| ING Groep NV, 7.05%(1) | | | 140,300 | | | | 3,664,636 | | |

| PartnerRe Ltd., 6.50%(1) | | | 80,000 | | | | 1,988,000 | | |

| PartnerRe Ltd., 6.75%(1) | | | 64,700 | | | | 1,644,027 | | |

| RenaissanceRe Holdings Ltd., 6.08%(1) | | | 70,000 | | | | 1,603,000 | | |

| RenaissanceRe Holdings Ltd., 8.10%(1) | | | 46,700 | | | | 1,221,672 | | |

| XL Capital Ltd., 7.625%(1) | | | 65,000 | | | | 1,706,900 | | |

| XL Capital Ltd., Series A, 8.00%(1) | | | 100,000 | | | | 2,745,000 | | |

| | | | | | | $ | 18,894,279 | | |

| REITS - 6.8% | | | |

| AMB Property Corp., 6.75% | | | 79,900 | | | $ | 2,027,063 | | |

| BRE Properties, Series C, 6.75% | | | 95,000 | | | | 2,375,000 | | |

| BRE Properties, Series D, 6.75% | | | 40,000 | | | | 1,002,800 | | |

| Colonial Properties Trust, 8.125% | | | 169,000 | | | | 4,326,400 | | |

| Developers Diversified Realty Corp., 7.375% | | | 85,500 | | | | 2,162,295 | | |

| Duke Realty Corp., 6.60% | | | 160,000 | | | | 3,993,600 | | |

| Security | | Shares | | Value | |

| REITS (continued) | | | | | | | | | |

| Health Care Property, 7.10% | | | 150,000 | | | $ | 3,823,500 | | |

| Health Care REIT, Inc., 7.875% | | | 110,000 | | | | 2,808,300 | | |

| Prologis Trust, 6.75% | | | 65,000 | | | | 1,657,500 | | |

| PS Business Parks, Inc., 7.00% | | | 50,000 | | | | 1,230,000 | | |

| PS Business Parks, Inc., 7.95% | | | 110,000 | | | | 2,893,000 | | |

| Simon Property Group, Inc., 7.89% | | | 9,500 | | | | 505,400 | | |

| Vornado Realty Trust, 6.75% | | | 155,000 | | | | 3,844,000 | | |

| | | | | | | $ | 32,648,858 | | |

| Utilities-Electric - 0.4% | | | |

| Alabama Power Co., 5.30% | | | 80,000 | | | $ | 2,112,000 | | |

| | | | | | | $ | 2,112,000 | | |

| Utilities-Gas - 0.7% | | | |

| Southern Union Co., 7.55% | | | 118,300 | | | $ | 3,164,525 | | |

| | | | | | | $ | 3,164,525 | | |

Total Preferred Stocks

(identified cost $100,140,089) | | | | | | $ | 99,987,105 | | |

Total Investments - 99.7%

(identified cost $450,057,259) | | | | | | $ | 479,338,523 | | |

| Other Assets, Less Liabilities - 0.3% | | | | | | $ | 1,594,787 | | |

| Net Assets - 100.0% | | | | | | $ | 480,933,310 | | |

ADR - American Depository Receipt

REIT - Real Estate Investment Trust

(1) Foreign security.

(2) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At April 30, 2005, the aggregate value of the securities is $6,344,163 or 1.3% of the Fund's net assets.

(3) Security valued at fair value using methods determined in good faith by or at the direction of the Trustees.

See notes to financial statements

9

Eaton Vance Tax-Managed Dividend Income Fund as of April 30, 2005

PORTFOLIO OF INVESTMENTS CONT'D

Country Concentration of Portfolio

| Country | | Percentage of

Total Investments | | Value | |

| United States | | | 59.7 | % | | $ | 286,248,304 | | |

| United Kingdom | | | 10.7 | % | | | 51,366,050 | | |

| Italy | | | 5.6 | % | | | 26,605,550 | | |

| Germany | | | 3.2 | % | | | 15,362,374 | | |

| Canada | | | 3.0 | % | | | 14,368,000 | | |

| Bermuda | | | 2.8 | % | | | 13,522,743 | | |

| Netherlands | | | 2.3 | % | | | 11,250,859 | | |

| Finland | | | 1.6 | % | | | 7,754,344 | | |

| New Zealand | | | 1.6 | % | | | 7,748,706 | | |

| Sweden | | | 1.5 | % | | | 7,309,355 | | |

| Spain | | | 1.5 | % | | | 7,240,900 | | |

| Norway | | | 1.5 | % | | | 6,996,000 | | |

| France | | | 1.2 | % | | | 5,645,025 | | |

| Mexico | | | 1.1 | % | | | 5,397,653 | | |

| Belgium | | | 0.9 | % | | | 4,253,132 | | |

| Switzerland | | | 0.7 | % | | | 3,159,000 | | |

| Australia | | | 0.4 | % | | | 1,892,428 | | |

| Cayman Islands | | | 0.4 | % | | | 1,706,900 | | |

| Panama | | | 0.3 | % | | | 1,511,200 | | |

| Total | | | 100.0 | % | | $ | 479,338,523 | | |

See notes to financial statements

10

Eaton Vance Tax-Managed Dividend Income Fund as of April 30, 2005

FINANCIAL STATEMENTS

Statement of Assets and Liabilities

As of April 30, 2005

| Assets | | | |

| Investments, at value (identified cost, $450,057,259) | | $ | 479,338,523 | | |

| Cash | | | 1,293,854 | | |

| Foreign currency, at value (cost $993,570) | | | 987,490 | | |

| Receivable for investments sold | | | 20,407,903 | | |

| Receivable for Fund shares sold | | | 2,508,728 | | |

| Dividends receivable | | | 2,055,414 | | |

| Tax reclaim receivable | | | 292,503 | | |

| Total assets | | $ | 506,884,415 | | |

| Liabilities | | | |

| Payable for investments purchased | | $ | 24,935,212 | | |

| Payable for Fund shares redeemed | | | 759,626 | | |

| Payable to affiliate for distribution and service fees | | | 79,467 | | |

| Payable to affiliate for Trustees' fees | | | 1,039 | | |

| Accrued expenses | | | 175,761 | | |

| Total liabilities | | $ | 25,951,105 | | |

| Net Assets | | $ | 480,933,310 | | |

| Sources of Net Assets | | | |

| Paid-in capital | | $ | 448,971,855 | | |

| Accumulated net realized loss (computed on the basis of identified cost) | | | (2,611,204 | ) | |

| Accumulated undistributed net investment income | | | 5,284,430 | | |

| Net unrealized appreciation (computed on the basis of identified cost) | | | 29,288,229 | | |

| Total | | $ | 480,933,310 | | |

| Class A Shares | | | |

| Net Assets | | $ | 215,759,205 | | |

| Shares Outstanding | | | 18,260,201 | | |

Net Asset Value and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | | $ | 11.82 | | |

Maximum Offering Price Per Share

(100 ÷ 94.25 of $11.82) | | $ | 12.54 | | |

| Class B Shares | | | |

| Net Assets | | $ | 79,871,062 | | |

| Shares Outstanding | | | 6,772,940 | | |

Net Asset Value, Offering Price and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | | $ | 11.79 | | |

| Class C Shares | | | |

| Net Assets | | $ | 185,303,043 | | |

| Shares Outstanding | | | 15,709,720 | | |

Net Asset Value, Offering Price and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | | $ | 11.80 | | |

| On sales of $50,000 or more, the offering price of Class A shares is reduced. | | | | | |

Statement of Operations

For the Year Ended

April 30, 2005

| Investment Income | | | |

| Dividends (net of foreign taxes, $768,889) | | $ | 26,141,208 | | |

| Interest | | | 242,796 | | |

| Total investment income | | $ | 26,384,004 | | |

| Expenses | | | |

| Investment adviser fee | | $ | 2,225,319 | | |

| Administration fee | | | 513,535 | | |

| Trustees' fees and expenses | | | 12,658 | | |

| Distribution and service fees | | | | | |

| Class A | | | 373,188 | | |

| Class B | | | 594,921 | | |

| Class C | | | 1,322,679 | | |

| Transfer and dividend disbursing agent fees | | | 272,625 | | |

| Custodian fee | | | 228,211 | | |

| Registration fees | | | 110,929 | | |

| Legal and accounting services | | | 64,630 | | |

| Printing and postage | | | 28,736 | | |

| Miscellaneous | | | 17,338 | | |

| Total expenses | | $ | 5,764,769 | | |

Deduct -

Reduction of custodian fee | | $ | 811 | | |

| Reduction of investment adviser fee | | | 33,151 | | |

| Total expense reductions | | $ | 33,962 | | |

| Net expenses | | $ | 5,730,807 | | |

| Net investment income | | $ | 20,653,197 | | |

| Realized and Unrealized Gain (Loss) | | | |

Net realized gain (loss) -

Investment transactions (identified cost basis) | | $ | (2,100,718 | ) | |

| Foreign currency transactions | | | (28,479 | ) | |

| Net realized loss | | $ | (2,129,197 | ) | |

Change in unrealized appreciation (depreciation) -

Investments (identified cost basis) | | $ | 27,120,117 | | |

| Foreign currency | | | 14,577 | | |

| Net change in unrealized appreciation (depreciation) | | $ | 27,134,694 | | |

| Net realized and unrealized gain | | $ | 25,005,497 | | |

| Net increase in net assets from operations | | $ | 45,658,694 | | |

See notes to financial statements

11

Eaton Vance Tax-Managed Dividend Income Fund as of April 30, 2005

FINANCIAL STATEMENTS CONT'D

| Statements of Changes in Net Assets | |

Increase (Decrease)

in Net Assets | | Year Ended

April 30, 2005 | | Period Ended

April 30, 2004(1) | |

From operations -

Net investment income | | $ | 20,653,197 | | | $ | 4,217,413 | | |

Net realized loss from investment transactions

and foreign currency transactions | | | (2,129,197 | ) | | | (1,407,408 | ) | |

Net change in unrealized appreciation

(depreciation) of investments

and foreign currency | | | 27,134,694 | | | | 2,153,535 | | |

| Net increase in net assets from operations | | $ | 45,658,694 | | | $ | 4,963,540 | | |

Distributions to shareholders -

From net investment income

Class A | | $ | (7,435,167 | ) | | $ | (1,558,015 | ) | |

| Class B | | | (2,537,028 | ) | | | (493,336 | ) | |

| Class C | | | (5,638,474 | ) | | | (998,759 | ) | |

| Total distributions to shareholders | | $ | (15,610,669 | ) | | $ | (3,050,110 | ) | |

Transactions in shares of beneficial interest -

Proceeds from sale of shares

Class A | | $ | 125,098,185 | | | $ | 109,885,414 | | |

| Class B | | | 38,656,600 | | | | 42,905,137 | | |

| Class C | | | 89,783,302 | | | | 93,048,164 | | |

Net asset value of shares issued to

shareholders in payment of

distributions declared

Class A | | | 4,995,133 | | | | 1,090,243 | | |

| Class B | | | 1,573,826 | | | | 275,740 | | |

| Class C | | | 2,801,624 | | | | 446,474 | | |

Cost of shares redeemed

Class A | | | (31,957,287 | ) | | | (9,432,933 | ) | |

| Class B | | | (6,044,426 | ) | | | (2,487,041 | ) | |

| Class C | | | (11,250,437 | ) | | | (1,415,863 | ) | |

Net asset value of shares exchanged

Class A | | | 412,800 | | | | 468,040 | | |

| Class B | | | (412,800 | ) | | | (468,040 | ) | |

Net increase in net assets from

Fund share transactions | | $ | 213,656,520 | | | $ | 234,315,335 | | |

| Net increase in net assets | | $ | 243,704,545 | | | $ | 236,228,765 | | |

| Net Assets | | | | | | | | | |

| At beginning of year | | $ | 237,228,765 | | | $ | 1,000,000 | | |

| At end of year | | $ | 480,933,310 | | | $ | 237,228,765 | | |

Accumulated undistributed

net investment income

included in net assets | | | | | | | | | |

| At end of year | | $ | 5,284,430 | | | $ | 1,045,038 | | |

(1) For the period from the start of business, May 30, 2003, to April 30, 2004.

See notes to financial statements

12

Eaton Vance Tax-Managed Dividend Income Fund as of April 30, 2005

FINANCIAL STATEMENTS CONT'D

Financial Highlights

| | | Class A | |

| | | Year Ended

April 30, 2005 | | Period Ended

April 30, 2004(1) | |

| Net asset value - Beginning of year | | $ | 10.640 | | | $ | 10.000 | | |

| Income (loss) from operations | | | |

| Net investment income(2) | | $ | 0.743 | | | $ | 0.500 | | |

| Net realized and unrealized gain | | | 0.989 | | | | 0.437 | | |

| Total income from operations | | $ | 1.732 | | | $ | 0.937 | | |

| Less distributions | | | |

| From net investment income | | $ | (0.552 | ) | | $ | (0.297 | ) | |

| Total distributions | | $ | (0.552 | ) | | $ | (0.297 | ) | |

| Net asset value - End of year | | $ | 11.820 | | | $ | 10.640 | | |

| Total Return(3) | | | 16.54 | % | | | 9.44 | % | |

| Ratios/Supplemental Data† | | | |

| Net assets, end of year (000's omitted) | | $ | 215,759 | | | $ | 104,169 | | |

| Ratios (As a percentage of average daily net assets): | | | | | | | | | |

| Net expenses | | | 1.25 | % | | | 1.40 | %(4) | |

| Net expenses after custodian fee reduction | | | 1.25 | % | | | 1.40 | %(4) | |

| Net investment income | | | 6.46 | % | | | 5.05 | %(4) | |

| Portfolio Turnover | | | 162 | % | | | 117 | % | |

† The operating expenses of the Fund reflect an allocation of expenses to the Administrator or a reduction of the investment adviser fee. Had such actions not been taken, the ratios and net investment income per share would have been as follows:

| Ratios (As a percentage of average daily net assets): | | | | | | | | | |

| Expenses | | | 1.26 | % | | | 1.47 | %(4) | |

| Expenses after custodian fee reduction | | | 1.26 | % | | | 1.47 | %(4) | |

| Net investment income | | | 6.45 | % | | | 4.98 | %(4) | |

| Net investment income per share(2) | | $ | 0.742 | | | $ | 0.493 | | |

(1) For the period from the start of business, May 30, 2003, to April 30, 2004.

(2) Net investment income per share was computed using average shares outstanding.

(3) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. Total return is not computed on an annualized basis.

(4) Annualized.

See notes to financial statements

13

Eaton Vance Tax-Managed Dividend Income Fund as of April 30, 2005

FINANCIAL STATEMENTS CONT'D

Financial Highlights

| | | Class B | |

| | | Year Ended

April 30, 2005 | | Period Ended

April 30, 2004(1) | |

| Net asset value - Beginning of year | | $ | 10.630 | | | $ | 10.000 | | |

| Income (loss) from operations | | | |

| Net investment income(2) | | $ | 0.648 | | | $ | 0.427 | | |

| Net realized and unrealized gain | | | 0.986 | | | | 0.446 | | |

| Total income from operations | | $ | 1.634 | | | $ | 0.873 | | |

| Less distributions | | | |

| From net investment income | | $ | (0.474 | ) | | $ | (0.243 | ) | |

| Total distributions | | $ | (0.474 | ) | | $ | (0.243 | ) | |

| Net asset value - End of year | | $ | 11.790 | | | $ | 10.630 | | |

| Total Return(3) | | | 15.57 | % | | | 8.79 | % | |

| Ratios/Supplemental Data† | | | |

| Net assets, end of year (000's omitted) | | $ | 79,871 | | | $ | 40,731 | | |

| Ratios (As a percentage of average daily net assets): | | | | | | | | | |

| Net expenses | | | 2.00 | % | | | 2.15 | %(4) | |

| Net expenses after custodian fee reduction | | | 2.00 | % | | | 2.15 | %(4) | |

| Net investment income | | | 5.65 | % | | | 4.31 | %(4) | |

| Portfolio Turnover | | | 162 | % | | | 117 | % | |

† The operating expenses of the Fund reflect an allocation of expenses to the Administrator or a reduction of the investment adviser fee. Had such actions not been taken, the ratios and net investment income per share would have been as follows:

| Ratios (As a percentage of average daily net assets): | | | | | | | | | |

| Expenses | | | 2.01 | % | | | 2.22 | %(4) | |

| Expenses after custodian fee reduction | | | 2.01 | % | | | 2.22 | %(4) | |

| Net investment income | | | 5.64 | % | | | 4.24 | %(4) | |

| Net investment income per share(2) | | $ | 0.647 | | | $ | 0.420 | | |

(1) For the period from the start of business, May 30, 2003, to April 30, 2004.

(2) Net investment income per share was computed using average shares outstanding.

(3) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. Total Return is not computed on an annualized basis.

(4) Annualized.

See notes to financial statements

14

Eaton Vance Tax-Managed Dividend Income Fund as of April 30, 2005

FINANCIAL STATEMENTS CONT'D

Financial Highlights

| | | Class C | |

| | | Year Ended

April 30, 2005 | | Period Ended

April 30, 2004(1) | |

| Net asset value - Beginning of year | | $ | 10.630 | | | $ | 10.000 | | |

| Income (loss) from operations | | | |

| Net investment income(2) | | $ | 0.653 | | | $ | 0.432 | | |

| Net realized and unrealized gain | | | 0.991 | | | | 0.441 | | |

| Total income from operations | | $ | 1.644 | | | $ | 0.873 | | |

| Less distributions | | | |

| From net investment income | | $ | (0.474 | ) | | $ | (0.243 | ) | |

| Total distributions | | $ | (0.474 | ) | | $ | (0.243 | ) | |

| Net asset value - End of year | | $ | 11.800 | | | $ | 10.630 | | |

| Total Return(3) | | | 15.66 | % | | | 8.79 | % | |

| Ratios/Supplemental Data† | | | |

| Net assets, end of year (000's omitted) | | $ | 185,303 | | | $ | 92,329 | | |

| Ratios (As a percentage of average daily net assets): | | | | | | | | | |

| Net expenses | | | 2.00 | % | | | 2.15 | %(4) | |

| Net expenses after custodian fee reduction | | | 2.00 | % | | | 2.15 | %(4) | |

| Net investment income | | | 5.69 | % | | | 4.34 | %(4) | |

| Portfolio Turnover | | | 162 | % | | | 117 | % | |

† The operating expenses of the Fund reflect an allocation of expenses to the Administrator or a reduction of the investment adviser fee. Had such actions not been taken, the ratios and net investment income per share would have been as follows:

| Ratios (As a percentage of average daily net assets): | | | | | | | | | |

| Expenses | | | 2.01 | % | | | 2.22 | %(4) | |

| Expenses after custodian fee reduction | | | 2.01 | % | | | 2.22 | %(4) | |

| Net investment income | | | 5.68 | % | | | 4.27 | %(4) | |

| Net investment income per share(2) | | $ | 0.652 | | | $ | 0.425 | | |

(1) For the period from the start of business, May 30, 2003, to April 30, 2004.

(2) Net investment income per share was computed using average shares outstanding.

(3) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. Total return is not computed on an annualized basis.

(4) Annualized.

See notes to financial statements

15

Eaton Vance Tax-Managed Dividend Income Fund as of April 30, 2005

NOTES TO FINANCIAL STATEMENTS

1 Significant Accounting Policies

Eaton Vance Tax-Managed Dividend Income Fund (the Fund) is a diversified series of Eaton Vance Mutual Funds Trust (the Trust). The Trust is an entity of the type commonly known as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Fund seeks to achieve after-tax total return by investing primarily in a diversified portfolio of common and preferred stocks that pay dividends that qualify for federal income taxation at long-term capital gains rates ("tax-favored dividends"). The Fund offers three classes of shares. Class A shares are generally sold subject to a sales charge imposed at time of purchase. Class B and Class C shares are sold at net asset value and are subject to a contingent deferred sales charge (see Note 6). Class B shares held for eight years will automatically c onvert to Class A shares. Each class represents a pro rata interest in the Fund, but votes separately on class-specific matters and (as noted below) is subject to different expenses. Realized and unrealized gains and losses and net investment income and losses, other than class specific expenses, are allocated daily to each class of shares based on the relative net assets of each class to the total net assets of the Fund. Each class of shares differs in its distribution plan and certain other class specific expenses.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America.

A Investment Valuation - Securities listed on a U.S. securities exchange generally are valued at the last sale price on the day of valuation or, if no sales took place on such date, at the mean between the closing bid and asked prices therefore on the exchange where such securities are principally traded. Equity securities listed on the NASDAQ National Market System generally are valued at the official NASDAQ closing price. Unlisted or listed securities for which closing sales prices or closing quotations are not available are valued at the mean between the lat est available bid and asked prices or, in the case of preferred equity securities that are not listed or traded in the over-the-counter market, by an independent pricing service. The value of preferred equity securities that are valued by a pricing service on a bond basis will be adjusted by an income factor, to be determined by the investment adviser, to reflect the next anticipated regular dividend. Exchange-traded options are valued at the last sale price for the day of valuation as quoted on the principal exchange or board of trade on which the options are traded or, in the absence of sales on such date, at the mean between the latest bid and asked prices therefore. Futures positions on securities and currencies generally are valued at closing settlement prices. Short-term debt securities with a remaining maturity of 60 days or less are valued at amortized cost. If short-term debt securities wer e acquired with a remaining maturity of more than 60 days, their amortized cost value will be based on their value on the sixty-first day prior to maturity. Other fixed income and debt securities, including listed securities and securities for which price quotations are available, will normally be valued on the basis of valuations furnished by a pricing service. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rate quotations supplied by an independent quotation service. The daily valuation of exchange-traded foreign securities generally is determined as of the close of trading on the principal exchange on which such securities trade. Events occurring after the close of trading on foreign exchanges may result in adjustments to the valuation of foreign securities to more accurately reflect their fair value as of the close of regular trading on the New York Stock Exchange. When valuing foreign equity securities that meet certain criteria, the Trustees have approv ed the use of a fair value service that values such securities to reflect market trading that occurs after the close of the applicable foreign markets of comparable securities or other instruments that have a strong correlation to the fair-valued securities. Investments held by the Fund for which valuations or market quotations are unavailable are valued at fair value using methods determined in good faith by or at the direction of the Trustees of the Fund considering relevant factors, data and information including the market value of freely tradable securities of the same class in the principal market on which such securities are normally traded.

B Income - Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities. However, if the ex-dividend date has passed, certain dividends from foreign securities are recorded as the Fund is informed of the ex-dividend date. Interest income is recorded on the accrual basis.

C Expenses - The majority of expenses of the Trust are directly identifiable to an individual fund. Expenses which are not readily identifiable to a specific fund are allocated taking into consideration, among other things, the nature and type of expense and the relative size of the fund.

D Federal Taxes - The Fund's policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders each year all of its taxable

16

Eaton Vance Tax-Managed Dividend Income Fund as of April 30, 2005

NOTES TO FINANCIAL STATEMENTS CONT'D

income, including any net realized capital gain on investments. Accordingly, no provision for federal income or excise tax is necessary. At April 30, 2005, the Fund, for federal income tax purposes, had a capital loss carryover of $2,291,925 which will reduce the taxable income arising from future net realized gain in investments, if any, to the extent permitted by the Internal Revenue Code and thus will reduce the amount of distributions to shareholders which would otherwise be necessary to relieve the Fund of any liability for federal income or excise tax. Such capital loss carryover will expire on: April 30, 2012 ($252,492) and April 30, 2013 ($2,039,433).

At April 30, 2005, undistributed ordinary income on a tax basis was $5,228,164. The difference between book basis and tax basis undistributed ordinary income is attributable primarily to differing treatment of certain dividends received from the Fund's investment in Real Estate Investment Trusts (REITs). The tax character of the dividends paid during the fiscal year ended April 30, 2005 was $15,610,669 of ordinary income.

E Expense Reduction - Investors Bank & Trust Company (IBT) serves as custodian of the Fund. Pursuant to the custodian agreement, IBT receives a fee reduced by credits which are determined based on the average daily cash balance the Fund maintains with IBT. All credit balances used to reduce the Fund's custodian fees are reported as a reduction of total expenses in the Statement of Operations.

F Financial Futures Contracts - Upon entering a financial futures contract, the Fund is required to deposit (initial margin) either in cash or securities an amount equal to a certain percentage of the purchase price indicated in the financial futures contract. Subsequent payments are made or received by the Fund (margin maintenance) each day, dependent on the daily fluctuations in the value of the underlying security, and are recorded for book purposes as unrealized gains or losses by the Fund. The Fund's investment in financial futures contracts is designed to hedge against anticipated future changes in price of current or anticipated Fund positions. Should prices move unexpectedly, the Fund may not achieve the anticipated benefits of the financial futures contracts and may realize a loss.

G Foreign Currency Translation - Investment valuations, other assets, and liabilities initially expressed in foreign currencies are converted each business day into U.S. dollars based upon current exchange rates. Purchases and sales of foreign investment securities and income and expenses are converted into U.S. dollars based upon currency exchange rates prevailing on the respective dates of such transactions. Recognized gains or losses on investment transaction s attributable to foreign currency exchange rates are recorded for financial statement purposes as net realized gains and losses on investments. That portion of unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

H Put Options - Upon the purchase of a put option by the Fund, the premium paid is recorded as an investment, the value of which is marked-to-market daily. When a purchased option expires, the Fund will realize a loss in the amount of the cost of the option. When the Fund enters into a closing sale transaction, the Fund will realize a gain or loss depending on whether the sales proceeds from the closing sale transaction are greater or less than the cost of the option. When the Fund exercises a put option, settlement is made in cash. The risk associated with purchasi ng options is limited to the premium originally paid.

I Securities Sold Short - The Fund may sell a security short if it owns at least an equal amount of the security sold short or another security convertible or exchangeable for an equal amount of the security sold short. Such transactions are done in anticipation of a decline in the market price of the securities or in order to hedge Fund positions. The Fund will generally borrow the security sold in order to make delivery to the buyer. Upon executing the transaction, the Fund records the proceeds as deposits with brokers in the Statement of Assets and Liabilities an d establishes an offsetting payable for securities sold short for the securities due on settlement. The proceeds are retained by the broker as collateral for the short position. The liability is marked-to-market and the Fund is required to pay the lending broker any dividend or interest income earned while the short position is open. A gain or loss is recorded when the security is delivered to the broker. The Fund may recognize a loss on the transaction if the market value of the securities sold increases before the securities are delivered.

J Use of Estimates - The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

17

Eaton Vance Tax-Managed Dividend Income Fund as of April 30, 2005

NOTES TO FINANCIAL STATEMENTS CONT'D

K Indemnifications - Under the Trust's organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund and shareholders are indemnified against personal liability for obligations of the Trust. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made agai nst the Fund that have not yet occurred.

L Other - Investment transactions are accounted for on a trade-date basis. Realized gains and losses are computed on the specific identification of the securities sold.

2 Distribution to Shareholders

It is the present policy of the Fund to make monthly distributions of all or substantially all of its net investment income, if any, and at least one distribution annually of all or substantially all of its net realized capital gains, if any (reduced by available capital loss carryforwards from prior years, if any). Distributions are declared separately for each class of shares. Distributions are paid in the form of additional shares of the same class of the Fund or, at the election of the shareholder, in cash. Shareholders may reinvest all distributions in additional shares of the same class of the Fund at the net asset value as of the close of business on the ex-dividend date. The Fund distinguishes between distributions on a tax basis and a financial reporting basis. Accounting principles generally accepted in the United States of America require that only distributions in excess of tax basis earnings and profits be reported in the financial statements as a return of capital. Permanent differences between book and tax accounting relating to distributions are reclassified to paid-in capital.

The tax character of distributions paid for the years ended April 30, 2005 and April 30, 2004 was as follows:

| | | Year Ended April 30, | |

| | | 2005 | | 2004 | |

| Distributions declared from: | | | | | | | | | |

| Ordinary Income | | $ | 15,610,669 | | | $ | 3,050,110 | | |

During the year ended April 30, 2005, accumulated undistributed net investment income was decreased by $803,136, and accumulated net realized loss was decreased by $803,136 primarily due to differences between book and tax accounting for investment transactions. This change had no effect on the net assets or the net asset value per share.

As of April 30, 2005, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

| Undistributed income | | $ | 5,228,164 | | |

| Capital loss carryforward | | $ | (2,291,925 | ) | |

| Unrealized gain | | $ | 29,025,216 | | |

3 Shares of Beneficial Interest

The Fund's Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest (without par value). Transactions in Fund shares were as follows:

| Class A | | Year Ended

April 30, 2005 | | Period Ended

April 30, 2004(1) | |

| Sales | | | 10,852,656 | | | | 10,414,630 | | |

Issued to shareholders electing to

receive payments of distributions

in Fund shares | | | 431,760 | | | | 101,947 | | |

| Redemptions | | | (2,847,599 | ) | | | (870,532 | ) | |

| Exchanges from Class B shares | | | 35,461 | | | | 43,878 | | |

| Net increase | | | 8,472,278 | | | | 9,689,923 | | |

| Class B | | Year Ended

April 30, 2005 | | Period Ended

April 30, 2004(1) | |

| Sales | | | 3,368,539 | | | | 4,081,954 | | |

Issued to shareholders electing to

receive payments of distributions

in Fund shares | | | 136,088 | | | | 25,734 | | |

| Redemptions | | | (528,003 | ) | | | (232,925 | ) | |

| Exchanges to Class A shares | | | (35,527 | ) | | | (43,920 | ) | |

| Net increase | | | 2,941,097 | | | | 3,830,843 | | |

| Class C | | Year Ended

April 30, 2005 | | Period Ended

April 30, 2004(1) | |

| Sales | | | 7,760,896 | | | | 8,773,081 | | |

Issued to shareholders electing to

receive payments of distributions

in Fund shares | | | 242,047 | | | | 41,529 | | |

| Redemptions | | | (978,209 | ) | | | (130,624 | ) | |

| Net increase | | | 7,024,734 | | | | 8,683,986 | | |

(1) For the period from the start of business, May 30, 2003, to April 30, 2004.

18

Eaton Vance Tax-Managed Dividend Income Fund as of April 30, 2005

NOTES TO FINANCIAL STATEMENTS CONT'D

4 Investment Adviser Fee and Other Transactions with Affiliates

The investment adviser fee is earned by Eaton Vance Management (EVM), as compensation for management and investment advisory services rendered to the Fund. Under the advisory agreement, EVM receives a monthly advisory fee equal to 0.650% annually of average daily net assets of the Fund up to $500 million, and at reduced rates as daily net assets exceed that level. For the year ended April 30, 2005, the advisory fee amounted to $2,225,319. EVM has agreed to reduce the investment adviser fee by an amount equal to that portion of commissions paid to broker dealers in execution of Fund portfolio transactions that is consideration for third-party research services. For the year ended April 30, 2005, EVM waived $33,151 of its advisory fee. An administration fee is earned by EVM for managing and administering the business affairs of the Fund. Under the administration agreement, EVM earns a fe e in the amount of 0.15% per annum of the average daily net assets of the Fund. For the year ended April 30, 2005, the administration fee amounted to $513,535.

Except for Trustees of the Fund who are not members of EVM's organization, officers and Trustees receive remuneration for their services to the Fund out of the investment adviser fee earned by EVM. Trustees of the Fund who are not affiliated with EVM may elect to defer receipt of all or a percentage of their annual fees in accordance with the terms of the Trustees Deferred Compensation Plan. For the year ended April 30, 2005, no significant amounts have been deferred.

EVM serves as the sub-transfer agent of the Fund and receives from the transfer agent an aggregate fee based upon the actual expenses incurred by EVM in the performance of those activities. For the year ended April 30, 2005, EVM earned $23,811 in sub-transfer agent fees.

Eaton Vance Distributors, Inc. (EVD), a subsidiary of EVM and the Fund's principal underwriter, received $307,713 as its portion of the sales charge on sales of Class A shares for the year ended April 30, 2005.

Certain officers and Trustees of the Fund are officers of the above organizations.

5 Distribution and Service Plans

The Fund has in effect distribution plans for Class B shares (Class B Plan) and Class C shares (Class C Plan), pursuant to Rule 12b-1 under the Investment Company Act of 1940 and a service plan for Class A shares (Class A Plan) (collectively, the Plans). The Class B and Class C Plans require the Fund to pay EVD amounts equal to 1/365 of 0.75% of the Fund's average daily net assets attributable to Class B and Class C shares, for providing ongoing distribution services and facilities to the Fund. The Fund will automatically discontinue payments to EVD during any period in which there are no outstanding Uncovered Distribution Charges, which are equivalent to the sum of (i) 6.25% of the aggregate amount received by the Fund for the Clas s B and Class C shares sold, plus (ii) interest calculated by applying the rate of 1% over the prevailing prime rate to the outstanding balance of Uncovered Distribution Charges of EVD, of each respective class, reduced by the aggregate amount of contingent deferred sales charges (see Note 6) and daily amounts theretofore paid to EVD by each respective class. The Fund paid or accrued $446,191 and $992,855 for Class B and Class C shares, respectively, to or payable to EVD for the year ended April 30, 2005, representing 0.75% of the average daily net assets for Class B and Class C shares, respectively. At April 30, 2005, the amount of Uncovered Distribution Charges of EVD calculated under the Plans was approximately $2,979,000 and $8,563,000 for Class B and Class C shares, respectively.

The Plans authorize the Fund to make payments of service fees to EVD, investment dealers and other persons in amounts equal to 0.25% of the Fund's average daily net assets attributable to Class A, Class B and Class C shares for each fiscal year. Service fee payments are made for personal services and/or the maintenance of shareholder accounts. Service fees are separate and distinct from the sales commissions and distribution fees payable by the Fund to EVD and, as such, are not subject to automatic discontinuance when there are no outstanding Uncovered Distribution Charges of EVD. Service fees paid or accrued for the year ended April 30, 2005 amounted to $373,188, $148,730, and $329,824 for Class A, Class B and Class C shares, respectively.

6 Contingent Deferred Sales Charge

A contingent deferred sales charge (CDSC) generally is imposed on redemptions of Class B shares made within six years of purchase and on redemptions of Class C shares made within one year of purchase. Generally, the CDSC is based upon the lower of the net asset value at date of redemption or date of purchase. No charge is levied on shares acquired by reinvestment of dividends or capital gain distributions. Class A shares may be subject to a 1% CDSC if redeemed within one year of purchase (depending upon the circumstances of purchase). The Class B CDSC is imposed at declining rates that begin at 5% in the case of

19

Eaton Vance Tax-Managed Dividend Income Fund as of April 30, 2005

NOTES TO FINANCIAL STATEMENTS CONT'D

redemptions in the first and second year after purchase, declining one percentage point each subsequent year. Class C shares will be subject to a 1% CDSC if redeemed within one year of purchase.

No CDSC is levied on shares which have been sold to EVM or its affiliates or to their respective employees or clients and may be waived under certain other limited conditions. CDSC pertaining to Class B and Class C redemptions are paid to EVD to reduce the amount of Uncovered Distribution Charges calculated under the Class B and Class C Plans, respectively (see Note 5). CDSC assessed on Class B and Class C shares when no Uncovered Distribution Charges exist for the respective classes will be credited to the Fund. EVD received approximately $3,000, $106,000 and $30,000 of CDSC paid by shareholders for Class A, Class B shares and Class C shares, respectively, for the year ended April 30, 2005.

7 Investments Transactions

Purchases and sales of investments, other than short-term obligations, aggregated $766,784,993 and $537,332,181 respectively, for the year ended April 30, 2005.

8 Federal Income Tax Basis of Unrealized Appreciation (Depreciation)

The cost and unrealized appreciation (depreciation) of investments of the Fund at April 30, 2005, as computed on a federal income tax basis, were as follows:

| Aggregate Cost | | $ | 450,320,272 | | |

| Gross unrealized appreciation | | $ | 34,551,065 | | |

| Gross unrealized depreciation | | | (5,532,814 | ) | |

| Net unrealized appreciation | | $ | 29,018,251 | | |

Unrealized appreciation on foreign currency as of April 30, 2005 is $6,965.

9 Financial Instruments

The Fund may trade in financial instruments with off-balance sheet risk in the normal course of its investing activities to assist in managing exposure to various market risks. These financial instruments include written options, and financial futures contracts and may involve, to a varying degree, elements of risk in excess of the amounts recognized for financial statement purposes.

The notional or contractual amounts of these instruments represent the investment the Fund has in particular classes of financial instruments and does not necessarily represent the amounts potentially subject to risk. The measurement of the risks associated with these instruments is meaningful only when all related and offsetting transactions are considered. The Fund did not have any open obligations under these financial instruments at April 30, 2005.

10 Line of Credit

The Fund participates with other portfolios and funds managed by EVM and its affiliates in a $150 million unsecured line of credit agreement with a group of banks. Borrowings will be made by the Fund solely to facilitate the handling of unusual and/or unanticipated short term cash requirements. Interest is charged to each participating portfolio or fund based on its borrowings at an amount above either the Eurodollar rate or Federal Funds rate. In addition, a fee computed at an annual rate of 0.10% on the daily unused portion of the line of credit is allocated among the participating portfolios and funds at the end of each quarter. The Fund did not have any significant borrowings or allocated fees during the year ended April 30, 2005.

20

Eaton Vance Tax-Managed Dividend Income Fund as of April 30, 2005

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Trustees of Eaton Vance Mutual Funds Trust and Shareholders of Eaton Vance Tax-Managed Dividend Income Fund: