UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04015 |

|

Eaton Vance Mutual Funds Trust |

(Exact name of registrant as specified in charter) |

|

The Eaton Vance Building, 255 State Street, Boston, Massachusetts | | 02109 |

(Address of principal executive offices) | | (Zip code) |

|

Alan R. Dynner The Eaton Vance Building, 255 State Street, Boston, Massachusetts 02109 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (617) 482-8260 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | October 31, 2005 | |

| | | | | | | | |

Item 1. Reports to Stockholders

Annual Report October 31, 2005

EATON VANCE

TAX-MANAGED

EQUITY ASSET

ALLOCATION

FUND

IMPORTANT NOTICES REGARDING PRIVACY,

DELIVERY OF SHAREHOLDER DOCUMENTS,

PORTFOLIO HOLDINGS AND PROXY VOTING

Privacy. The Eaton Vance organization is committed to ensuring your financial privacy. Each of the financial institutions identified below has in effect the following policy ("Privacy Policy") with respect to nonpublic personal information about its customers:

• Only such information received from you, through application forms or otherwise, and information about your Eaton Vance fund transactions will be collected. This may include information such as name, address, social security number, tax status, account balances and transactions.

• None of such information about you (or former customers) will be disclosed to anyone, except as permitted by law (which includes disclosure to employees necessary to service your account). In the normal course of servicing a customer's account, Eaton Vance may share information with unaffiliated third parties that perform various required services such as transfer agents, custodians and broker/dealers.

• Policies and procedures (including physical, electronic and procedural safeguards) are in place that are designed to protect the confidentiality of such information.

• We reserve the right to change our Privacy Policy at any time upon proper notification to you. Customers may want to review our Policy periodically for changes by accessing the link on our homepage: www.eatonvance.com.

Our pledge of privacy applies to the following entities within the Eaton Vance organization: the Eaton Vance Family of Funds, Eaton Vance Management, Eaton Vance Investment Counsel, Boston Management and Research, and Eaton Vance Distributors, Inc.

In addition, our Privacy Policy only applies to those Eaton Vance customers who are individuals and who have a direct relationship with us. If a customer's account (i.e., fund shares) is held in the name of a third-party financial adviser/ broker-dealer, it is likely that only such adviser's privacy policies apply to the customer. This notice supersedes all previously issued privacy disclosures.

For more information about Eaton Vance's Privacy Policy, please call 1-800-262-1122.

Delivery of Shareholder Documents. The Securities and Exchange Commission (the "SEC") permits funds to deliver only one copy of shareholder documents, including prospectuses, proxy statements and shareholder reports, to fund investors with multiple accounts at the same residential or post office box address. This practice is often called "householding" and it helps eliminate duplicate mailings to shareholders.

Eaton Vance, or your financial adviser, may household the mailing of your documents indefinitely unless you instruct Eaton Vance, or your financial adviser, otherwise.

If you would prefer that your Eaton Vance documents not be householded, please contact Eaton Vance at 1-800-262-1122, or contact your financial adviser.

Your instructions that householding not apply to delivery of your Eaton Vance documents will be effective within 30 days of receipt by Eaton Vance or your financial adviser.

Portfolio Holdings. The Fund and its underlying Portfolio (if applicable) will file a schedule of its portfolio holdings on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Form N-Q will be available on the Eaton Vance website www.eatonvance.com, by calling Eaton Vance at 1-800-262-1122 or in the EDGAR database on the SEC's website at www.sec.gov. Form N-Q may also be reviewed and copied at the SEC's public reference room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the public reference room).

Proxy Voting. From time to time, funds are required to vote proxies related to the securities held by the funds. The Eaton Vance Funds or their underlying Portfolios (if applicable) vote proxies according to a set of policies and procedures approved by the Funds' and Portfolios' Boards. You may obtain a description of these policies and procedures and information on how the Funds or Portfolios voted proxies relating to portfolio securities during the most recent 12 month period ended June 30, without charge, upon request, by calling 1-800-262-1122. This description is also available on the SEC's website at www.sec.gov.

Eaton Vance Tax-Managed Equity Asset Allocation Fund as of October 31, 2005

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

Duncan W. Richardson, CFA

Portfolio Manager

The Fund

Performance for the Past Year

• For the year ended October 31, 2005, the Fund’s Class A shares had a total return of 12.14%. This return was the result of an increase in net asset value (NAV) per share to $12.10 on October 31, 2005, from $10.79 on October 31, 2004.(1)

• The Fund’s Class B shares had a total return of 11.32% for the same period, the result of an increase in NAV per share to $11.80 from $10.60.(1)

• The Fund’s Class C shares had a total return of 11.34% for the same period, the result of an increase in NAV per share to $11.78 from $10.58.(1)

• For comparison, the Russell 3000 Index, a broadbased, unmanaged market index of 3000 U.S. stocks, had a total return of 10.60% during the same period.(2)

See pages 3 and 4 for more performance information, including after-tax returns.

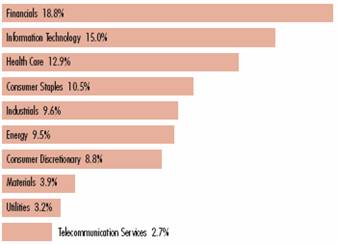

Management Discussion

• Although business spending and corporate earnings growth remained healthy during the year ended October 31, 2005, the spike in energy costs, exacerbated by two catastrophic Gulf Coast hurricanes, and higher short-term interest rates dampened activity. Equity market leadership during this period can be characterized as commodity-driven, defensive and interest rate sensitive. On average, higher-yielding investments outperformed more aggressive stocks, and small- and mid-cap stocks continued to lead large-cap holdings.

• In this environment, the Fund outperformed its benchmark, the Russell 3000 Index.(2) The Fund’s performance is a function of both the performance of the underlying Portfolios, and its asset allocation among the Portfolios. The Fund benefited from its continued emphasis of small- and mid-cap investments, as well as an overweight exposure to international securities, which on average outpaced domestic investments.

• In February of this year, management decided to gradually reallocate approximately 2.5% of the Fund’s assets from Tax-Managed Small-Cap Value Portfolio into Tax-Managed Multi-Cap Opportunity Portfolio. This shift added to the Fund’s performance, as mid-cap growth stocks (characterized by the Russell Mid-Cap Growth Index) on average outperformed small-cap value investments (Russell 2000 Value) in the ensuing period.(2) The Fund retains its emphasis of growth stocks over value. Although the value-style continued to dominate growth during the last year, the performance gap between the two is narrowing.

• Returns among investment classes and styles continue to be unpredictable, validating the benefits of a strategy that emphasizes broad diversification and continuous rebalancing. We believe that through careful asset allocation and the ongoing research supporting each Portfolio, the Fund can provide a solid investment vehicle for tax-sensitive investors seeking broad equity exposure with moderate volatility and high-tax efficiency.

The views expressed throughout this report are those of the portfolio manager and are current only through the end of the period of the report as stated on the cover. These views are subject to change at any time based upon market or other conditions, and the investment adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on many factors, may not be relied on as an indication of trading intent on behalf of any Eaton Vance fund.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

(1) These returns do not include the 5.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charge (CDSC) for Class B and Class C shares. If sales charges were deducted, the returns would be lower.

(2) It is not possible to invest directly in an Index. The Indexes’ total return does not reflect commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in an Index.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

2

Eaton Vance Tax-Managed Equity Asset Allocation Fund as of October 31, 2005

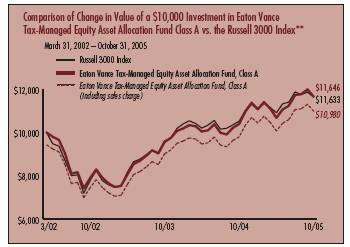

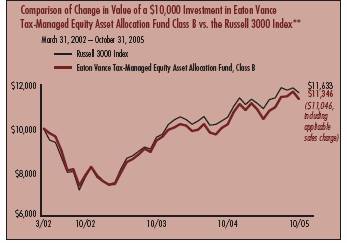

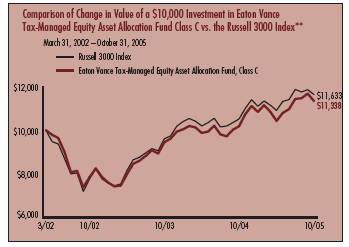

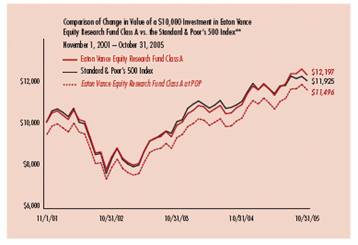

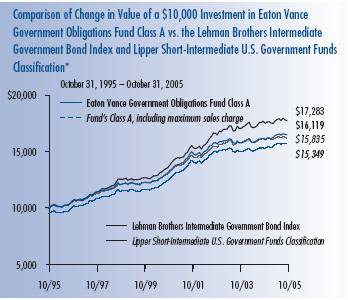

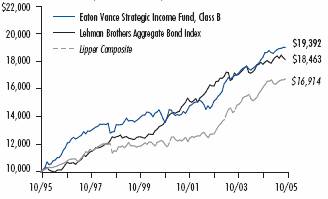

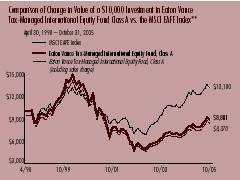

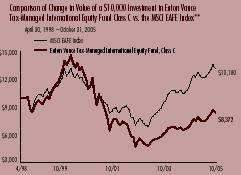

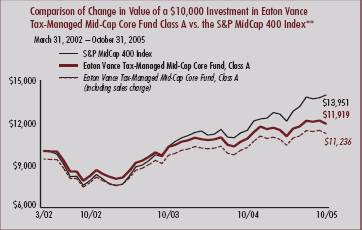

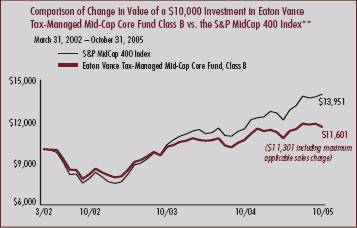

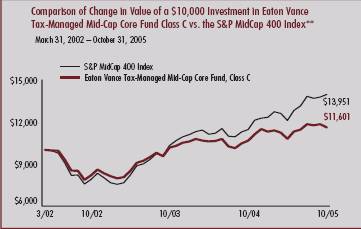

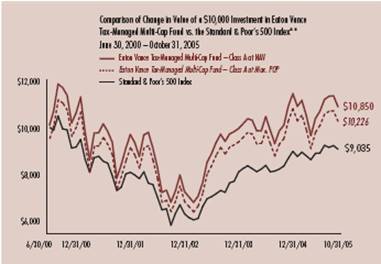

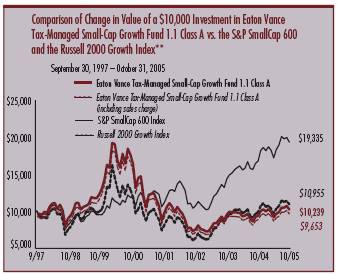

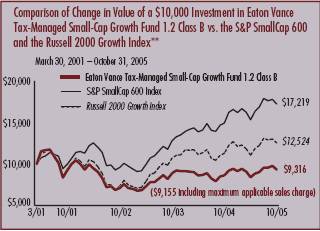

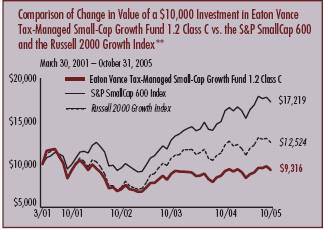

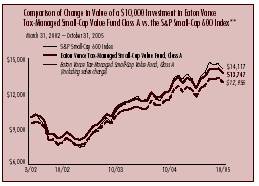

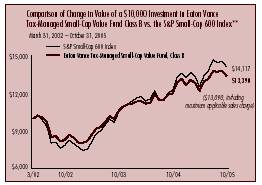

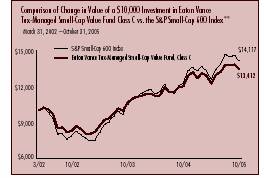

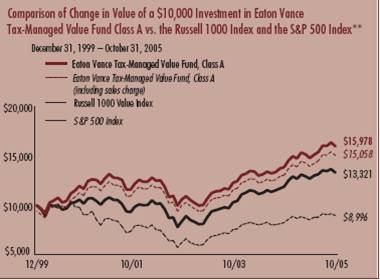

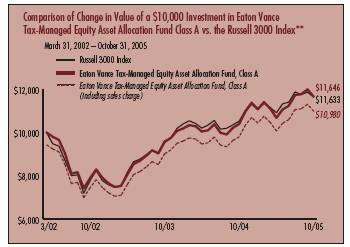

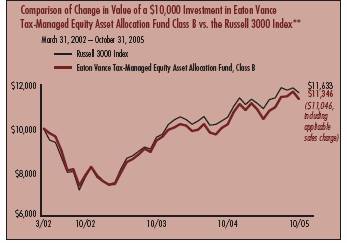

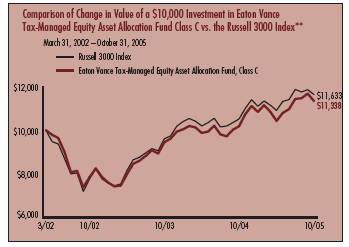

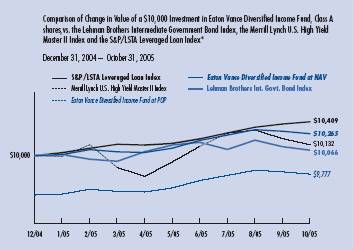

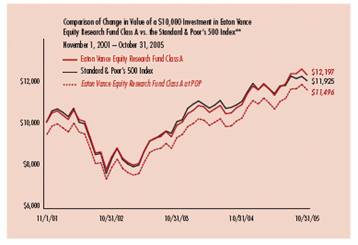

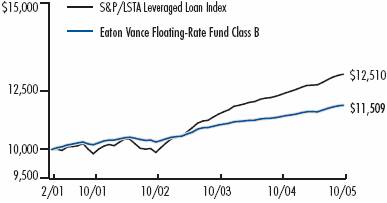

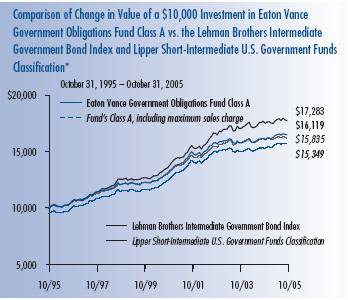

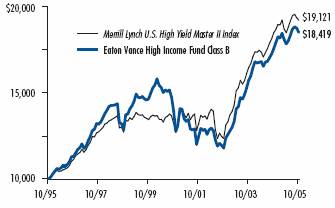

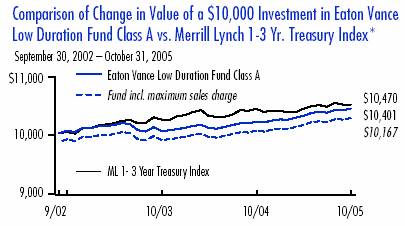

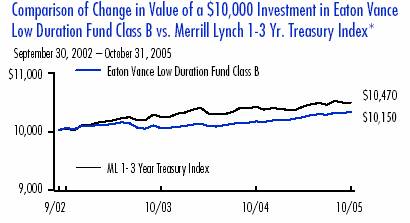

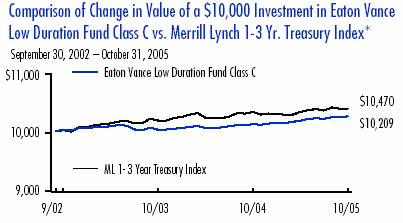

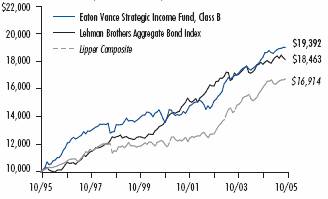

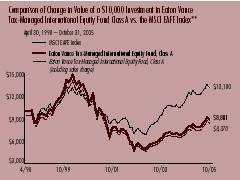

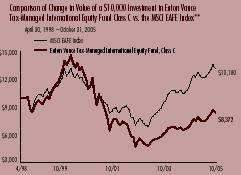

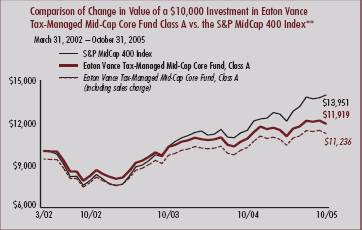

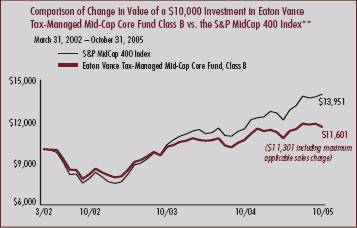

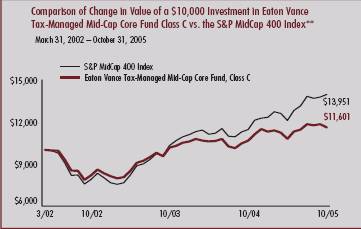

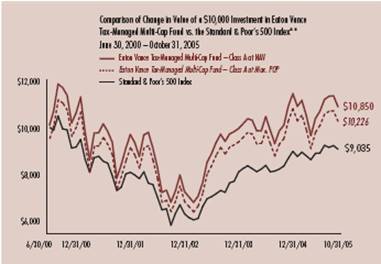

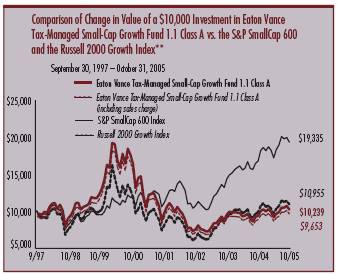

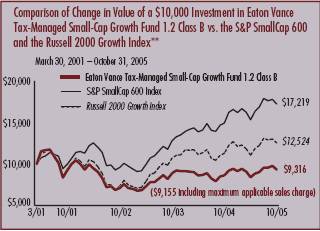

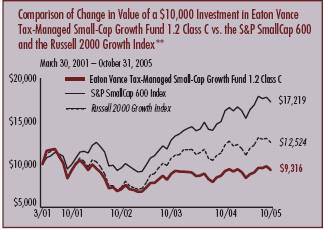

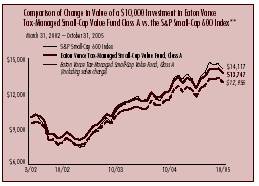

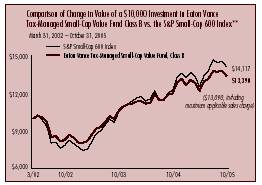

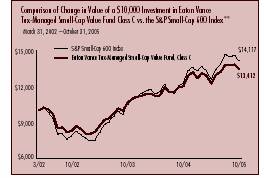

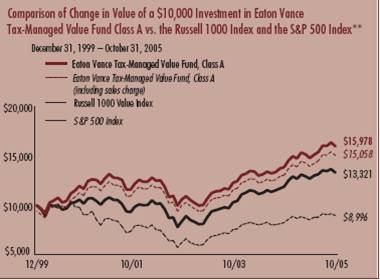

FUND PERFORMANCE

The line graphs and table set forth below provide information about the Fund’s performance. The line graphs compare the performance of Class A, Class B, and Class C of the Fund with that of the Russell 3000 Index, a broad-based, unmanaged market index of 3000 U.S. stocks. The lines on the graph represent the total returns of a hypothetical investment of $10,000 in each of Class A, Class B, and Class C of the Fund and the Russell 3000 Index. Class A total returns are presented at net asset value and maximum public offering price. The table includes the total returns of each Class of the Fund at net asset value and public offering price. The performance presented below does not reflect the deduction of taxes, if any, that a shareholder would pay on distributions or redemptions of Fund shares.

Performance * | | Class A | | Class B | | Class C | |

Average Annual Total Returns (at net asset value) | | | | | | | |

One Year | | 12.14 | % | 11.32 | % | 11.34 | % |

Life of Fund† | | 5.33 | % | 4.61 | % | 4.56 | % |

SEC Average Annual Total Returns (including sales charge or applicable CDSC) | | | | | |

One Year | | 5.68 | % | 6.32 | % | 10.34 | % |

Life of Fund† | | 3.65 | % | 3.88 | % | 4.56 | % |

†Inception Dates – Class A: 3/4/02; Class B: 3/4/02; Class C: 3/4/02

* Average annual total returns do not include the 5.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charge (CDSC) for Class B and Class C shares. If sales charges were deducted, the returns would be lower. SEC average annual total returns for Class A reflect the maximum 5.75% sales charge. SEC returns for Class B shares reflect the applicable CDSC based on the following schedule: 5% - 1st and 2nd years; 4% - 3rd year; 3% - 4th year; 2% - 5th year; 1% - 6th year. SEC 1-year return for Class C reflects a 1% CDSC.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to www.eatonvance.com.

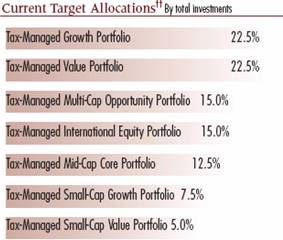

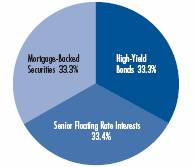

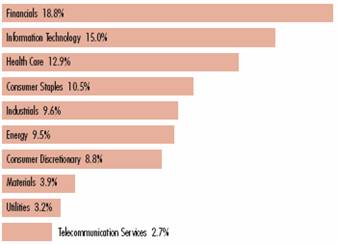

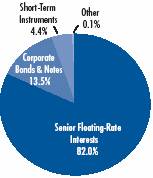

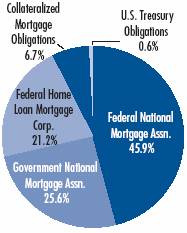

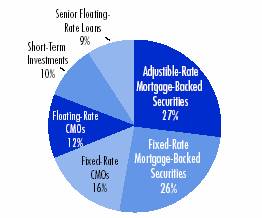

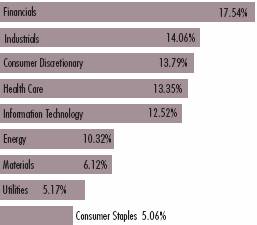

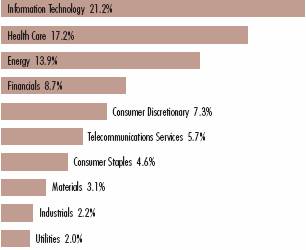

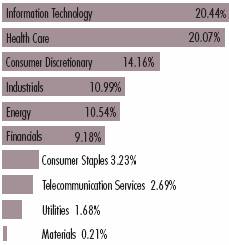

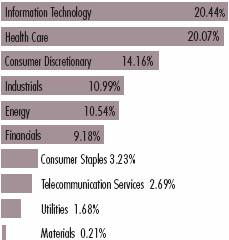

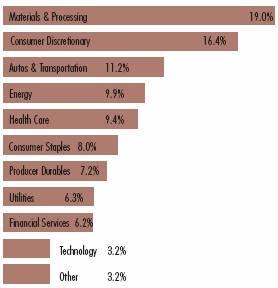

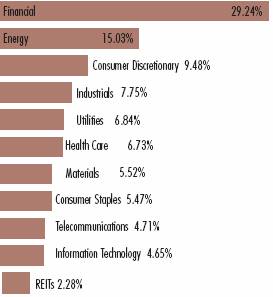

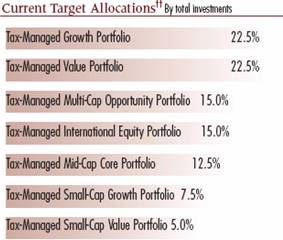

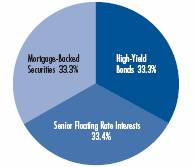

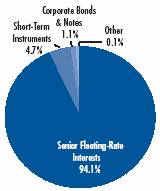

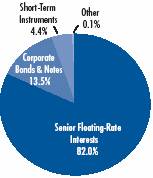

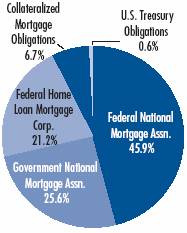

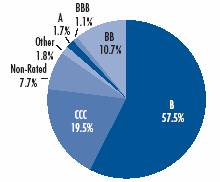

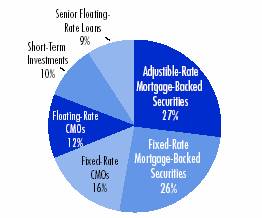

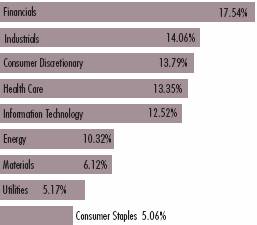

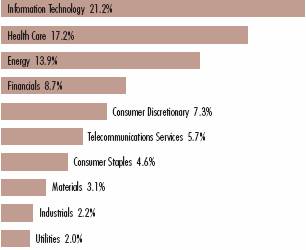

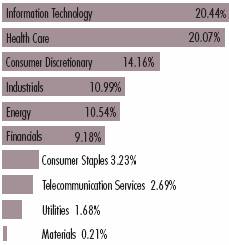

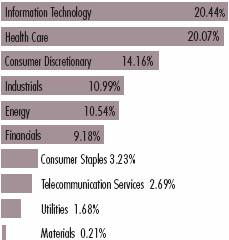

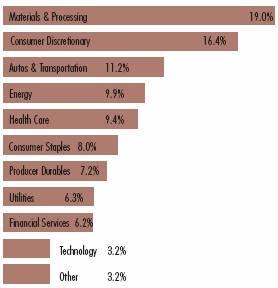

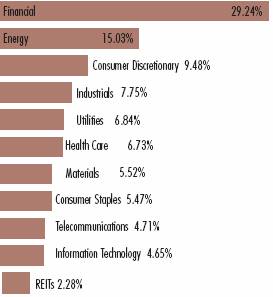

Current Target Allocations †† By total Investments

†† Fund information may not be representative of the Fund’s current or future investments and may change due to active management. You may obtain free copies of each of the Portfolios’ most recent financial statements by contacting Eaton Vance Distributors, Inc. at 1-800-225-6265 or from the EDGAR database on the Securities and Exchange Commission’s website (www.sec.gov).

**Source: Thomson Financial. Class A, Class B, and Class C of the Fund commenced investment operations on 3/4/02. It is not possible to invest directly in an Index. The Index’s total returns do not reflect commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

3

“Return Before Taxes” does not take into consideration shareholder taxes. It is most relevant to tax-free or tax-deferred shareholder accounts. “Return After Taxes on Distributions” reflects the impact of federal income taxes due on Fund distributions of dividends and capital gains. It is most relevant to taxpaying shareholders who continue to hold their shares. “Return After Taxes on Distributions and Sale of Fund Shares” also reflects the impact of taxes on capital gain or loss realized upon a sale of shares. It is most relevant to taxpaying shareholders who sell their shares.

Average Annual Total Returns

(For the periods ended October 31, 2005)

Returns at Net Asset Value (NAV) (Class A)

| | One Year | | Life of Fund | |

| | | | | |

Return Before Taxes | | 12.14 | % | 5.33 | % |

Return After Taxes on Distributions | | 12.14 | % | 5.33 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 7.89 | % | 4.58 | % |

Returns at Public Offering Price (POP) (Class A)

| | One Year | | Life of Fund | |

| | | | | |

Return Before Taxes | | 5.68 | % | 3.65 | % |

Return After Taxes on Distributions | | 5.68 | % | 3.65 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 3.69 | % | 3.12 | % |

Average Annual Total Returns

(For the periods ended October 31, 2005)

Returns at Net Asset Value (NAV) (Class C)

| | One Year | | Life of Fund | |

| | | | | |

Return Before Taxes | | 11.34 | % | 4.56 | % |

Return After Taxes on Distributions | | 11.34 | % | 4.56 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 7.37 | % | 3.91 | % |

Returns at Public Offering Price (POP) (Class C)

| | One Year | | Life of Fund | |

| | | | | |

Return Before Taxes | | 10.34 | % | 4.56 | % |

Return After Taxes on Distributions | | 10.34 | % | 4.56 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 6.72 | % | 3.91 | % |

Average Annual Total Returns

(For the periods ended October 31, 2005)

Returns at Net Asset Value (NAV) (Class B)

| | One Year | | Life of Fund | |

| | | | | |

Return Before Taxes | | 11.32 | % | 4.61 | % |

Return After Taxes on Distributions | | 11.32 | % | 4.61 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 7.36 | % | 3.96 | % |

Returns at Public Offering Price (POP) (Class B)

| | One Year | | Life of Fund | |

| | | | | |

Return Before Taxes | | 6.32 | % | 3.88 | % |

Return After Taxes on Distributions | | 6.32 | % | 3.88 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 4.11 | % | 3.32 | % |

Class A, Class B, and Class C of the Fund commenced investment operations on 3/4/02. Returns at Public Offering Price (POP) reflect the deduction of the maximum initial sales charge or applicable CDSC, while Returns at Net Asset Value (NAV) do not.

After-tax returns are calculated using the highest historical individual federal income tax rate and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and may differ from those shown. After-tax returns are not relevant for shareholders who hold shares in tax-deferred accounts or to shares held by non-taxable entities. Return After Taxes on Distributions for a period may be the same as Return Before Taxes for that period because no distributions were paid during that period, or because the taxable portion of distributions made during the period was insignificant. Also, Return After Taxes on Distributions and Sale of Fund Shares for a period may be greater than Return After Taxes on Distributions for the same period because of realized losses on the sale of Fund shares.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to www.eatonvance.com.

4

Eaton Vance Tax-Managed Equity Asset Allocation Fund as of October 31, 2005

FUND EXPENSES

Example: As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2005 – October 31, 2005).

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled ���Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual return of the Fund. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Eaton Vance Tax-Managed Equity Asset Allocation Fund

| | Beginning Account Value | | Ending Account Value | | Expenses Paid During Period* | |

| | (5/1/05) | | (10/31/05) | | (5/1/05 – 10/31/05) | |

| | | | | | | |

Actual | | | | | | | |

Class A | | $ | 1,000.00 | | $ | 1,091.10 | | $ | 7.48 | |

Class B | | $ | 1,000.00 | | $ | 1,087.60 | | $ | 11.42 | |

Class C | | $ | 1,000.00 | | $ | 1,087.70 | | $ | 11.42 | |

| | | | | | | |

Hypothetical | | | | | | | |

(5% return per year before expenses) | | | | | | | |

Class A | | $ | 1,000.00 | | $ | 1,018.00 | | $ | 7.22 | |

Class B | | $ | 1,000.00 | | $ | 1,014.30 | | $ | 11.02 | |

Class C | | $ | 1,000.00 | | $ | 1,014.30 | | $ | 11.02 | |

| | | | | | | | | | | | | | |

* Expenses are equal to the Fund’s annualized expense ratio of 1.42% for Class A shares, 2.17% for Class B shares, and 2.17% for Class C shares multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on April 30, 2005. The Example reflects the expenses of both the Fund and the Portfolios. |

5

Eaton Vance Tax-Managed Equity Asset Allocation Fund as of October 31, 2005

FINANCIAL STATEMENTS

Statement of Assets and Liabilities

As of October 31, 2005

| Assets | |

Investment in Tax-Managed Growth Portfolio, at value

(identified cost, $91,081,914) | | $ | 101,919,134 | | |

Investment in Tax-Managed Value Portfolio, at value

(identified cost, $72,430,704) | | | 96,061,658 | | |

Investment in Tax-Managed Multi-Cap Opportunity Portfolio, at value

(identified cost, $70,984,091) | | | 77,697,258 | | |

Investment in Tax-Managed International Equity Portfolio, at value

(identified cost, $56,249,210) | | | 75,197,189 | | |

Investment in Tax-Managed Mid-Cap Core Portfolio, at value

(identified cost, $39,488,864) | | | 49,686,529 | | |

Investment in Tax-Managed Small-Cap Growth Portfolio, at value

(identified cost, $25,844,982) | | | 29,555,291 | | |

Investment in Tax-Managed Small-Cap Value Portfolio, at value

(identified cost, $13,027,680) | | | 21,504,952 | | |

| Receivable for Fund shares sold | | | 630,028 | | |

| Total assets | | $ | 452,252,039 | | |

| Liabilities | |

| Payable for Fund shares redeemed | | $ | 456,881 | | |

| Payable to affiliate for distribution and service fees | | | 272,231 | | |

| Payable to affiliate for investment adviser fee | | | 44,991 | | |

| Payable to affiliate for Trustees' fees | | | 36 | | |

| Other accrued expenses | | | 204,293 | | |

| Total liabilities | | $ | 978,432 | | |

| Net Assets | | $ | 451,273,607 | | |

| Sources of Net Assets | |

| Paid-in capital | | $ | 358,175,587 | | |

Accumulated net realized gain from Portfolios (computed on the basis of

identified cost) | | | 9,820,936 | | |

| Accumulated undistributed net investment income | | | 762,518 | | |

Net unrealized appreciation from Portfolios (computed on the basis of

identified cost) | | | 82,514,566 | | |

| Total | | $ | 451,273,607 | | |

| Class A Shares | |

| Net Assets | | $ | 169,704,471 | | |

| Shares Outstanding | | | 14,024,039 | | |

Net Asset Value and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | | $ | 12.10 | | |

Maximum Offering Price Per Share

(100 ÷ 94.25 of $12.10) | | $ | 12.84 | | |

| Class B Shares | |

| Net Assets | | $ | 123,431,453 | | |

| Shares Outstanding | | | 10,460,587 | | |

Net Asset Value, Offering Price and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | | $ | 11.80 | | |

| Class C Shares | |

| Net Assets | | $ | 158,137,683 | | |

| Shares Outstanding | | | 13,425,957 | | |

Net Asset Value, Offering Price and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | | $ | 11.78 | | |

| On sales of $50,000 or more, the offering price of Class A shares is reduced. | |

Statement of Operations

For the Year Ended

October 31, 2005

| Investment Income | |

| Dividends allocated from Portfolios (net of foreign taxes, $226,503) | | $ | 6,505,210 | | |

| Interest allocated from Portfolios | | | 225,678 | | |

| Expenses allocated from Portfolios | | | (3,299,615 | ) | |

| Net investment income from Portfolios | | $ | 3,431,273 | | |

| Expenses | |

| Investment adviser fee | | $ | 458,984 | | |

| Administration fee | | | 635,803 | | |

| Trustees' fees and expenses | | | 2,944 | | |

Distribution and service fees

Class A | | | 391,568 | | |

| Class B | | | 1,208,275 | | |

| Class C | | | 1,464,140 | | |

| Transfer and dividend disbursing agent fees | | | 354,743 | | |

| Registration fees | | | 88,055 | | |

| Legal and accounting services | | | 74,357 | | |

| Printing and postage | | | 45,859 | | |

| Custodian fee | | | 41,939 | | |

| Miscellaneous | | | 18,309 | | |

| Total expenses | | $ | 4,784,976 | | |

| Net investment loss | | $ | (1,353,703 | ) | |

Realized and Unrealized

Gain (Loss) from Portfolios | |

Net realized gain (loss) —

Investment transactions (identified cost basis) | | $ | 14,145,652 | | |

| Securities sold short | | | (155,770 | ) | |

| Foreign currency transactions | | | (139,967 | ) | |

| Net realized gain | | $ | 13,849,915 | | |

Change in unrealized appreciation (depreciation) —

Investments (identified cost basis) | | $ | 31,874,780 | | |

| Securities sold short | | | 21,974 | | |

| Foreign currency | | | (8,518 | ) | |

| Net change in unrealized appreciation (depreciation) | | $ | 31,888,236 | | |

| Net realized and unrealized gain | | $ | 45,738,151 | | |

| Net increase in net assets from operations | | $ | 44,384,448 | | |

See notes to financial statements

6

Eaton Vance Tax-Managed Equity Asset Allocation Fund as of October 31, 2005

FINANCIAL STATEMENTS CONT'D

Statements of Changes in Net Assets

Increase (Decrease)

in Net Assets | | Year Ended

October 31, 2005 | | Year Ended

October 31, 2004 | |

From operations —

Net investment loss | | $ | (1,353,703 | ) | | $ | (1,524,011 | ) | |

Net realized gain from investments,

securities sold short, foreign

currency and payment by

affiliate transactions | | | 13,849,915 | | | | 4,855,983 | | |

Net change in unrealized appreciation

(depreciation) of investments,

securities sold short and foreign currency | | | 31,888,236 | | | | 19,560,424 | | |

| Net increase in net assets from operations | | $ | 44,384,448 | | | $ | 22,892,396 | | |

Transactions in shares of beneficial interest —

Proceeds from sale of shares | |

| Class A | | $ | 42,975,393 | | | $ | 60,067,487 | | |

| Class B | | | 20,001,051 | | | | 35,938,466 | | |

| Class C | | | 37,613,007 | | | | 46,557,647 | | |

| Cost of shares redeemed | |

| Class A | | | (26,271,557 | ) | | | (17,852,992 | ) | |

| Class B | | | (16,721,504 | ) | | | (12,602,084 | ) | |

| Class C | | | (19,027,014 | ) | | | (14,442,434 | ) | |

| Net asset value of shares exchanged | |

| Class A | | | 1,863,233 | | | | 589,553 | | |

| Class B | | | (1,863,233 | ) | | | (589,553 | ) | |

Net increase in net assets from Fund

share transactions | | $ | 38,569,376 | | | $ | 97,666,090 | | |

| Net increase in net assets | | $ | 82,953,824 | | | $ | 120,558,486 | | |

| Net Assets | |

| At beginning of year | | $ | 368,319,783 | | | $ | 247,761,297 | | |

| At end of year | | $ | 451,273,607 | | | $ | 368,319,783 | | |

Accumulated undistributed

net investment income

included in net assets | |

| At end of year | | $ | 762,518 | | | $ | 575,663 | | |

See notes to financial statements

7

Eaton Vance Tax-Managed Equity Asset Allocation Fund as of October 31, 2005

FINANCIAL STATEMENTS CONT'D

Financial Highlights

| | | Class A | |

| | | Year Ended October 31, | | Period Ended | |

| | | 2005 | | 2004 | | 2003 | | October 31, 2002(1) | |

| Net asset value — Beginning of year | | $ | 10.790 | | | $ | 9.930 | | | $ | 8.190 | | | $ | 10.000 | | |

| Income (loss) from operations | |

| Net investment income (loss)(2) | | $ | 0.018 | | | $ | 0.002 | | | $ | (0.012 | ) | | $ | (0.024 | ) | |

| Net realized and unrealized gain (loss) | | | 1.292 | | | | 0.858 | | | | 1.752 | | | | (1.786 | ) | |

| Total income (loss) from operations | | $ | 1.310 | | | $ | 0.860 | | | $ | 1.740 | | | $ | (1.810 | ) | |

| Net asset value — End of year | | $ | 12.100 | | | $ | 10.790 | | | $ | 9.930 | | | $ | 8.190 | | |

| Total Return(3) | | | 12.14 | % | | | 8.66 | %(4) | | | 21.25 | % | | | (18.10 | )% | |

| Ratios/Supplemental Data† | |

| Net assets, end of year (000's omitted) | | $ | 169,704 | | | $ | 134,070 | | | $ | 82,868 | | | $ | 38,528 | | |

| Ratios (As a percentage of average daily net assets): | |

| Net expenses(5) | | | 1.43 | % | | | 1.46 | % | | | 1.52 | % | | | 1.55 | %(6) | |

| Net investment income (loss) | | | 0.15 | % | | | 0.02 | % | | | (0.14 | )% | | | (0.43 | )%(6) | |

| Portfolio Turnover of the Tax-Managed Growth Portfolio | | | 1 | % | | | 4 | % | | | 19 | % | | | 21 | % | |

| Portfolio Turnover of the Tax-Managed Value Portfolio | | | 40 | % | | | 44 | % | | | 76 | % | | | 213 | % | |

| Portfolio Turnover of the Tax-Managed Multi-Cap Opportunity Portfolio | | | 217 | % | | | 239 | % | | | 224 | % | | | 225 | % | |

| Portfolio Turnover of the Tax-Managed International Equity Portfolio | | | 39 | % | | | 62 | % | | | 100 | % | | | 128 | % | |

| Portfolio Turnover of the Tax-Managed Mid-Cap Core Portfolio | | | 53 | % | | | 42 | % | | | 50 | % | | | 13 | % | |

| Portfolio Turnover of the Tax-Managed Small-Cap Growth Portfolio | | | 223 | % | | | 282 | % | | | 248 | % | | | 131 | % | |

| Portfolio Turnover of the Tax-Managed Small-Cap Value Portfolio | | | 24 | % | | | 12 | % | | | 21 | % | | | 5 | % | |

| † | | The operating expenses of the Portfolios may reflect a reduction of their investment adviser fee. The operating expenses of the Fund reflect an allocation of expenses to the Administrator for the period from the start of business, March 4, 2002, to October 31, 2002. Had such actions not been taken, the ratios and net investment income (loss) per share would have been as follows: | | | |

| Ratios (As a percentage of average daily net assets): | |

| Expenses(5) | | | 1.44 | % | | | 1.47 | % | | | | | | | 1.77 | %(6) | |

| Net investment income (loss) | | | 0.14 | % | | | 0.01 | % | | | | | | | (0.65 | )%(6) | |

| Net investment income (loss) per share(2) | | $ | 0.017 | | | $ | 0.001 | | | | | | | $ | (0.036 | ) | |

(1) For the period from the start of business, March 4, 2002, to October 31, 2002.

(2) Net investment income (loss) per share was computed using average shares outstanding.

(3) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. Total return is not computed on an annualized basis.

(4) The effect of the net increase from payments by affiliate and net gains (losses), realized through the Fund's investment in Tax-Managed Small-Cap Growth Portfolio (the Portfolio) on the disposal of investments purchased which did not meet the Portfolio's investment guidelines amounted to less than $0.01 per share and had no effect on total return for the year ended October 31, 2004.

(5) Includes the Fund's share of the Portfolios' allocated expenses.

(6) Annualized.

See notes to financial statements

8

Eaton Vance Tax-Managed Equity Asset Allocation Fund as of October 31, 2005

FINANCIAL STATEMENTS CONT'D

Financial Highlights

| | | Class B | |

| | | Year Ended October 31, | | Period Ended | |

| | | 2005 | | 2004 | | 2003 | | October 31, 2002(1) | |

| Net asset value — Beginning of year | | $ | 10.600 | | | $ | 9.830 | | | $ | 8.170 | | | $ | 10.000 | | |

| Income (loss) from operations | |

| Net investment loss(2) | | $ | (0.068 | ) | | $ | (0.076 | ) | | $ | (0.077 | ) | | $ | (0.065 | ) | |

| Net realized and unrealized gain (loss) | | | 1.268 | | | | 0.846 | | | | 1.737 | | | | (1.765 | ) | |

| Total income (loss) from operations | | $ | 1.200 | | | $ | 0.770 | | | $ | 1.660 | | | $ | (1.830 | ) | |

| Net asset value — End of year | | $ | 11.800 | | | $ | 10.600 | | | $ | 9.830 | | | $ | 8.170 | | |

| Total Return(3) | | | 11.32 | % | | | 7.83 | %(4) | | | 20.32 | % | | | (18.30 | )% | |

| Ratios/Supplemental Data† | |

| Net assets, end of year (000's omitted) | | $ | 123,431 | | | $ | 109,471 | | | $ | 79,854 | | | $ | 31,101 | | |

| Ratios (As a percentage of average daily net assets): | |

| Net expenses(5) | | | 2.18 | % | | | 2.21 | % | | | 2.27 | % | | | 2.30 | %(6) | |

| Net investment loss | | | (0.59 | )% | | | (0.73 | )% | | | (0.88 | )% | | | (1.17 | )%(6) | |

| Portfolio Turnover of the Tax-Managed Growth Portfolio | | | 1 | % | | | 4 | % | | | 19 | % | | | 21 | % | |

| Portfolio Turnover of the Tax-Managed Value Portfolio | | | 40 | % | | | 44 | % | | | 76 | % | | | 213 | % | |

| Portfolio Turnover of the Tax-Managed Multi-Cap Opportunity Portfolio | | | 217 | % | | | 239 | % | | | 224 | % | | | 225 | % | |

| Portfolio Turnover of the Tax-Managed International Equity Portfolio | | | 39 | % | | | 62 | % | | | 100 | % | | | 128 | % | |

| Portfolio Turnover of the Tax-Managed Mid-Cap Core Portfolio | | | 53 | % | | | 42 | % | | | 50 | % | | | 13 | % | |

| Portfolio Turnover of the Tax-Managed Small-Cap Growth Portfolio | | | 223 | % | | | 282 | % | | | 248 | % | | | 131 | % | |

| Portfolio Turnover of the Tax-Managed Small-Cap Value Portfolio | | | 24 | % | | | 12 | % | | | 21 | % | | | 5 | % | |

| † | | The operating expenses of the Portfolios may reflect a reduction of their investment adviser fee. The operating expenses of the Fund reflect an allocation of expenses to the Administrator for the period from the start of business, March 4, 2002, to October 31, 2002. Had such actions not been taken, the ratios and net investment loss per share would have been as follows: | | | |

| Ratios (As a percentage of average daily net assets): | |

| Expenses(5) | | | 2.19 | % | | | 2.22 | % | | | | | | | 2.52 | %(6) | |

| Net investment loss | | | (0.60 | )% | | | (0.74 | )% | | | | | | | (1.39 | )%(6) | |

| Net investment loss per share(2) | | $ | (0.069 | ) | | $ | (0.077 | ) | | | | | | $ | (0.077 | ) | |

(1) For the period from the start of business, March 4, 2002, to October 31, 2002.

(2) Net investment loss per share was computed using average shares outstanding.

(3) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. Total return is not computed on an annualized basis.

(4) The effect of the net increase from payments by affiliate and net gains (losses), realized through the Fund's investment in Tax-Managed Small-Cap Growth Portfolio (the Portfolio) on the disposal of investments purchased which did not meet the Portfolio's investment guidelines amounted to less than $0.01 per share and had no effect on total return for the year ended October 31, 2004.

(5) Includes the Fund's share of the Portfolios' allocated expenses.

(6) Annualized.

See notes to financial statements

9

Eaton Vance Tax-Managed Equity Asset Allocation Fund as of October 31, 2005

FINANCIAL STATEMENTS CONT'D

Financial Highlights

| | | Class C | |

| | | Year Ended October 31, | | Period Ended | |

| | | 2005 | | 2004 | | 2003 | | October 31, 2002(1) | |

| Net asset value — Beginning of year | | $ | 10.580 | | | $ | 9.810 | | | $ | 8.150 | | | $ | 10.000 | | |

| Income (loss) from operations | |

| Net investment loss(2) | | $ | (0.068 | ) | | $ | (0.076 | ) | | $ | (0.076 | ) | | $ | (0.065 | ) | |

| Net realized and unrealized gain (loss) | | | 1.268 | | | | 0.846 | | | | 1.736 | | | | (1.785 | ) | |

| Total income (loss) from operations | | $ | 1.200 | | | $ | 0.770 | | | $ | 1.660 | | | $ | (1.850 | ) | |

| Net asset value — End of year | | $ | 11.780 | | | $ | 10.580 | | | $ | 9.810 | | | $ | 8.150 | | |

| Total Return(3) | | | 11.34 | % | | | 7.85 | %(4) | | | 20.37 | % | | | (18.50 | )% | |

| Ratios/Supplemental Data† | |

| Net assets, end of year (000's omitted) | | $ | 158,138 | | | $ | 124,779 | | | $ | 85,040 | | | $ | 31,903 | | |

| Ratios (As a percentage of average daily net assets): | |

| Net expenses(5) | | | 2.18 | % | | | 2.21 | % | | | 2.27 | % | | | 2.30 | %(6) | |

| Net investment loss | | | (0.59 | )% | | | (0.73 | )% | | | (0.88 | )% | | | (1.17 | )%(6) | |

| Portfolio Turnover of the Tax-Managed Growth Portfolio | | | 1 | % | | | 4 | % | | | 19 | % | | | 21 | % | |

| Portfolio Turnover of the Tax-Managed Value Portfolio | | | 40 | % | | | 44 | % | | | 76 | % | | | 213 | % | |

| Portfolio Turnover of the Tax-Managed Multi-Cap Opportunity Portfolio | | | 217 | % | | | 239 | % | | | 224 | % | | | 225 | % | |

| Portfolio Turnover of the Tax-Managed International Equity Portfolio | | | 39 | % | | | 62 | % | | | 100 | % | | | 128 | % | |

| Portfolio Turnover of the Tax-Managed Mid-Cap Core Portfolio | | | 53 | % | | | 42 | % | | | 50 | % | | | 13 | % | |

| Portfolio Turnover of the Tax-Managed Small-Cap Growth Portfolio | | | 223 | % | | | 282 | % | | | 248 | % | | | 131 | % | |

| Portfolio Turnover of the Tax-Managed Small-Cap Value Portfolio | | | 24 | % | | | 12 | % | | | 21 | % | | | 5 | % | |

| † | | The operating expenses of the Portfolios may reflect a reduction of their investment adviser fee. The operating expenses of the Fund reflect an allocation of expenses to the Administrator for the period from the start of business, March 4, 2002, to October 31, 2002. Had such actions not been taken, the ratios and net investment loss per share would have been as follows: | | | |

| Ratios (As a percentage of average daily net assets): | |

| Expenses(5) | | | 2.19 | % | | | 2.22 | % | | | | | | | 2.52 | %(6) | |

| Net investment loss | | | (0.60 | )% | | | (0.74 | )% | | | | | | | (1.39 | )%(6) | |

| Net investment loss per share(2) | | $ | (0.069 | ) | | $ | (0.077 | ) | | | | | | $ | (0.077 | ) | |

(1) For the period from the start of business, March 4, 2002, to October 31, 2002.

(2) Net investment loss per share was computed using average shares outstanding.

(3) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. Total return is not computed on an annualized basis.

(4) The effect of the net increase from payments by affiliate and net gains (losses), realized through the Fund's investment in Tax-Managed Small-Cap Growth Portfolio (the Portfolio) on the disposal of investments purchased which did not meet the Portfolio's investment guidelines amounted to less than $ 0.01 per share and had no effect on total return for the year ended October 31, 2004.

(5) Includes the Fund's share of the Portfolios' allocated expenses.

(6) Annualized.

See notes to financial statements

10

Eaton Vance Tax-Managed Equity Asset Allocation Fund as of October 31, 2005

NOTES TO FINANCIAL STATEMENTS

1 Significant Accounting Policies

Eaton Vance Tax-Managed Equity Asset Allocation Fund (the Fund) is a diversified series of Eaton Vance Mutual Funds Trust (the Trust). The Trust is an entity of the type commonly known as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Fund offers three classes of shares. Class A shares are generally sold subject to a sales charge imposed at time of purchase. Class B and Class C shares are sold at net asset value and are generally subject to a contingent deferred sales charge (see Note 6). Class B shares held for eight years will automatically convert to Class A shares. Each class represents a pro-rata interest in the Fund, but votes separately on class-specific matters and (as noted below) is subject to different expenses. Realized and unrealized gains and losses and net investment income and losses, other than class-specifi c expenses, are allocated daily to each class of shares based on the relative net assets of each class to the total net assets of the Fund. Each class of shares differs in its distribution plan and certain other class-specific expenses. The Fund currently invests all of its investable assets in the following seven tax-managed equity portfolios managed by Eaton Vance or its affiliates: Tax-Managed Growth Portfolio, Tax-Managed Value Portfolio, Tax-Managed Multi-Cap Opportunity Portfolio, Tax-Managed International Equity Portfolio, Tax-Managed Mid-Cap Core Portfolio, Tax-Managed Small-Cap Growth Portfolio and Tax-Managed Small-Cap Value Portfolio (the Portfolios). Each Portfolio is organized as a New York Trust. The investment objectives and policies of the Portfolios together are the same as those of the Fund. The value of the Fund's investment in each Portfolio reflects the Fund's proportionate interest in the net assets of the Tax-Managed Growth Portfolio, Tax-Managed Value Portfolio, Tax-Managed Multi-Cap Opportunity Portfolio, Tax-Managed International Equity Portfolio, Tax-Managed Mid-Cap Core Portfolio, Tax-Managed Small-Cap Growth Portfolio and Tax-Managed Small-Cap Value Portfolio (0.6%, 10.2%, 57.2%, 49.6%, 65.3%, 19.3%, and 42.3%, respectively, at October 31, 2005). The performance of the Fund is directly affected by the performance of the Portfolios. A copy of each Portfolio's financial statements is available on the EDGAR Database on the Securities and Exchange Commission's website (www.sec.gov), at the Commission's public reference room in Washington, DC or upon request from the Fund's principal underwriter, Eaton Vance Distributors Inc. (EVD), by calling 1-800-225-6265.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America.

A Investment Valuation — The valuation policy of each Portfolio is as follows: Securities listed on a U.S. securities exchange generally are valued at the last sale price on the day of valuation or, if no sales took place on such date, at the mean between the closing bid and asked prices therefore on the exchange where such securities are principally traded. Equity securities listed on the NASDAQ National Market System generally are valued at the official NASDAQ closing price. Unlisted or listed securities for which closing sales prices or closing quotations are not available are valued at the mean between the latest available bid and asked prices or, in the case of preferred equity securities that are not listed or traded in the over-the-counter market, by an independent pricing service. Exchange-traded options are valued at the last sale price for the day of valuation as quoted on the principal exchange or board of trade on which the options are traded or, in the absence of sales on such date, at the mean between the latest bid and asked prices therefore. Futures positions on securities and currencies generally are valued at closing settlement prices. Short-term debt securities with a remaining maturity of 60 days or less are valued at amortized cost. If short-term debt securities were acquired with a remaining maturity of more than 60 days, their amortized cost value will be based on their value on the sixty-first day prior to maturity. Other fixed income and debt securities, including listed securities and securities for which price quotations are available, will normally be valued on the basis of valuations furnished by a pricing service. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rate quotations and supplied by an i ndependent quotation service. The daily valuation of exchange-traded foreign securities generally is determined as of the close of trading on the principal exchange on which such securities trade. Events occurring after the close of trading on foreign exchanges may result in adjustments to the valuation of foreign securities to more accurately reflect their fair value as of the close of regular trading on the New York Stock Exchange. When valuing foreign equity securities that meet certain criteria, the Trustees have approved the use of a fair value service that values such securities to reflect market trading that occurs after the close of the applicable foreign markets of comparable securities or other instruments that have a strong correlation to the fair-valued securities. Investments held by the Portfolios for which valuations or market quotations are unavailable are valued at fair value using

11

Eaton Vance Tax-Managed Equity Asset Allocation Fund as of October 31, 2005

NOTES TO FINANCIAL STATEMENTS CONT'D

methods determined in good faith by or at the direction of the Trustees of the Portfolios considering relevant factors, data and information including the market value of freely tradable securities of the same class in the principal market on which such securities are normally traded.

B Income — The Fund's net investment income or loss consists of the Fund's pro-rata share of the net investment income or loss of the Portfolios, less all actual and accrued expenses of the Fund, determined in accordance with accounting principles generally accepted in the United States of America.

C Expenses — The majority of expenses of the Trust are directly identifiable to an individual fund. Expenses which are not readily identifiable to a specific fund are allocated taking into consideration, among other things, the nature and type of expense and the relative size of the fund.

D Federal Taxes — The Fund's policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders each year all of its taxable income, including any net realized gain on investments. Accordingly, no provision for federal income or excise tax is necessary.

E Expense Reduction — Investors Bank & Trust Company (IBT) serves as custodian to the Fund. Pursuant to the custodian agreement, IBT receives a fee reduced by credits which are determined based on the average daily cash balance the Fund maintains with IBT. All credit balances used to reduce the Fund's custodian fees are reported as a reduction of total expenses in the Statement of Operations.

F Other — Investment transactions are accounted for on a trade-date basis. Dividends to shareholders are recorded on the ex-dividend date.

G Indemnifications — Under the Trust's organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund, and shareholders are indemnified against personal liability for obligations of the Trust. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

H Use of Estimates — The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

2 Distributions to Shareholders

It is the present policy of the Fund to make at least one distribution annually (normally in December) of all or substantially all of its net investment income, if any, and at least one distribution annually of all or substantially all of its net realized capital gains, if any (reduced by available capital loss carryforwards from prior year, if any). Shareholders may reinvest all distributions in shares of the same class of the Fund at the net asset value as of the close of business on the ex-dividend date. Distributions are paid in the form of additional shares of the same class of the Fund or, at the election of the shareholder, in cash. The Fund distinguishes between distributions on a tax basis and a financial reporting basis. Accounting principles generally accepted in the United States of America require that only distributions in excess of tax basis earnings and profits be reported in the financial statements as a return of capital. Permanent differences between book and tax accounting relating to distributions are reclassified to paid-in capital.

During the year ended October 31, 2005, accumulated paid-in capital was decreased by $1,034,482, net investment loss was decreased by $1,540,558, and accumulated net realized gain was decreased by $506,076 primarily due to differences between book and tax accounting treatment of net operating losses, foreign currency gains and losses, passive foreign investment companies and real estate investment trusts. This change had no effect on net assets or the net asset value per share.

As of October 31, 2005, the components of distributable earnings on a tax basis were as follows:

| Undistributed capital gains | | $ | 11,906,848 | | |

| Unrealized appreciation | | $ | 80,144,283 | | |

| Other temporary differences | | $ | 1,046,889 | | |

3 Shares of Beneficial Interest

The Fund's Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest (without par value). Such shares may be

12

Eaton Vance Tax-Managed Equity Asset Allocation Fund as of October 31, 2005

NOTES TO FINANCIAL STATEMENTS CONT'D

issued in a number of different series (such as the Fund) and classes. Transactions in Fund shares were as follows:

| | | Year Ended October 31, | |

| Class A | | 2005 | | 2004 | |

| Sales | | | 3,682,231 | | | | 5,725,932 | | |

| Redemptions | | | (2,239,692 | ) | | | (1,703,864 | ) | |

| Exchange from Class B shares | | | 157,175 | | | | 56,477 | | |

| Net increase | | | 1,599,714 | | | | 4,078,545 | | |

| | | Year Ended October 31, | |

| Class B | | 2005 | | 2004 | |

| Sales | | | 1,754,278 | | | | 3,476,531 | | |

| Redemptions | | | (1,458,508 | ) | | | (1,219,817 | ) | |

| Exchange to Class A shares | | | (160,784 | ) | | | (57,280 | ) | |

| Net increase | | | 134,986 | | | | 2,199,434 | | |

| | | Year Ended October 31, | |

| Class C | | 2005 | | 2004 | |

| Sales | | | 3,298,523 | | | | 4,526,216 | | |

| Redemptions | | | (1,663,691 | ) | | | (1,404,403 | ) | |

| Net increase | | | 1,634,832 | | | | 3,121,813 | | |

4 Transactions with Affiliates

The investment adviser fee is earned by Eaton Vance Management (EVM), as compensation for management and investment advisory services rendered to the Fund. Under the advisory agreement, EVM receives a monthly advisory fee in the amount of 0.80% (annually) of average daily net assets of the Fund up to $500 million and at reduced rates as daily net assets exceed that level. The advisory fee payable by the Fund is reduced by the Fund's allocable portion of the advisory fees paid by the Portfolios in which it invests. The Fund's allocated portion of the advisory fees paid by the Portfolios totaled $2,940,052 for the year ended October 31, 2005. For the year ended October 31, 2005, the advisory fee paid directly by the Fund amounted to $458,984.

An administrative fee is earned by EVM for managing and administering the business affairs of the Fund. Under the administration agreement, EVM earns a fee in the amount of 0.15% per annum of the average daily net assets of the Fund. For the year ended October 31, 2005, the administration fee amounted to $635,803.

Except for Trustees of the Fund and the Portfolios who are not members of EVM's organization, officers and Trustees of the Fund and Portfolios receive remuneration for their services to the Fund out of the investment adviser and sub-advisory fees. Trustees of the Fund who are not affiliated with EVM may elect to defer receipt of all or a percentage of their annual fees in accordance with the terms of the Trustees Deferred Compensation Plan. For the year ended October 31, 2005, no significant amounts have been deferred. Certain officers and Trustees of the Fund and Portfolios are officers of the above organization.

EVM serves as the sub-transfer agent of the Fund and receives from the transfer agent an aggregate fee based upon the actual expenses incurred by EVM in the performance of those activities. During the year ended October 31, 2005, EVM earned $28,899 in sub-transfer agent fees.

The Fund was informed that EVD, a subsidiary of EVM and the Fund's principal underwriter, received $184,348, as its portion of the sales charge on sales of Class A for the year ended October 31, 2005.

5 Distribution and Service Plans

The Fund has in effect distribution plans for Class B shares (Class B Plan) and Class C shares (Class C Plan), pursuant to Rule 12b-1 under the Investment Company Act of 1940 and a service plan for Class A shares (Class A Plan) (collectively, the Plans). The Class B and Class C Plans require the Fund to pay EVD amounts equal to 1/365 of 0.75% of the Fund's average daily net assets attributable to Class B and Class C shares for providing ongoing distribution services and facilities to the Fund. The Fund will automatically discontinue payments to EVD during any period in which there are no outstanding Uncovered Distribution Charges, which are equivalent to the sum of (i) 6.25% of the aggregate amount received by the Fund for the Class B and Class C shares sold, plus (ii) interest calculated by applying the rate of 1% over the prevailing prime rate to the outstanding balance of Uncovered Distribution Charges of EVD of each respecti ve class, reduced by the aggregate amount of contingent deferred sales charges (see Note 6) and daily amounts theretofore paid to EVD by each respective class. The Fund paid or accrued $906,206, and $1,098,105 for Class B and Class C shares, respectively, to or payable to EVD for the year ended October 31, 2005, representing 0.75% of the average daily net assets for Class B and Class C shares, respectively. At October 31, 2005, the amount of Uncovered Distribution Charges of EVD calculated under the Plans was

13

Eaton Vance Tax-Managed Equity Asset Allocation Fund as of October 31, 2005

NOTES TO FINANCIAL STATEMENTS CONT'D

approximately $3,635,000, and $5,683,000 for Class B and Class C shares, respectively.

The Plans authorize the Fund to make payments of service fees to EVD, investment dealers and other persons in amounts equal to 0.25% of the Fund's average daily net assets attributable to Class A, Class B and Class C shares for each fiscal year. Service fee payments are made for personal services and/or the maintenance of shareholder accounts. Service fees are separate and distinct from the sales commissions and distribution fees payable by the Fund to EVD and, as such, are not subject to automatic discontinuance when there are no outstanding Uncovered Distribution Charges of EVD. Service fees paid or accrued for the year ended October 31, 2005 amounted to $391,568, $302,069 and $366,035 for Class A, Class B, and Class C shares, respectively.

6 Contingent Deferred Sales Charge

A contingent deferred sales charge (CDSC) generally is imposed on redemptions of Class B shares made within six years of purchase and on redemptions of Class C shares made within one year of purchase. Generally, the CDSC is based upon the lower of the net asset value at date of redemption or date of purchase. No charge is levied on shares acquired by reinvestment of dividends or capital gain distributions. Class A shares may be subject to a 1% CDSC if redeemed within one year of purchase (depending upon the circumstances of purchase). The Class B CDSC is imposed at declining rates that begin at 5% in the case of redemptions in the first and second year after purchase, declining one percentage point each subsequent year. Class C shares will be subject to a 1% CDSC if redeemed within one year of purchase.

No CDSC is levied on shares which have been sold to EVM or its affiliates or to their respective employees or clients and may be waived under certain other limited conditions. CDSC on Class B and Class C redemptions are paid to EVD to reduce the amount of Uncovered Distribution Charges calculated under the Class B and Class C Plans, respectively (see Note 5). CDSC assessed on Class B and Class C shares when no Uncovered Distribution Charges exist for the respective classes will be credited to the Fund. EVD received approximately $288,000 and $21,000 of CDSC paid by shareholders for Class B and Class C shares, respectively, for the year ended October 31, 2005. EVD did not receive any CDSC for Class A shares for the year ended October 31, 2005.

7 Investment Transactions

For the year ended October 31, 2005, increases and decreases in the Fund's investment in the Portfolios were as follows:

| Portfolio | | Contributions | | Withdrawals | |

| Tax-Managed Growth Portfolio | | $ | 16,485,063 | | | $ | — | | |

| Tax-Managed Value Portfolio | | | 1,438,853 | | | | — | | |

| Tax-Managed Multi-Cap Opportunity Portfolio | | | 27,437,227 | | | | — | | |

| Tax-Managed International Equity Portfolio | | | — | | | | 563,288 | | |

| Tax-Managed Mid-Cap Core Portfolio | | | 419,840 | | | | — | | |

| Tax-Managed Small-Cap Growth Portfolio | | | — | | | | — | | |

| Tax-Managed Small-Cap Value Portfolio | | | — | | | | 11,582,095 | | |

14

Eaton Vance Tax-Managed Equity Asset Allocation Fund as of October 31, 2005

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Trustees of Eaton Vance Mutual Funds Trust and Shareholders of Eaton Vance Tax-Managed Equity Asset Allocation Fund:

We have audited the accompanying statement of assets and liabilities of Eaton Vance Tax-Managed Equity Asset Allocation Fund (the Fund) (one of the series of Eaton Vance Mutual Funds Trust) as of October 31, 2005, the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the three years in the period then ended, and for the period from the start of business, March 4, 2002 to October 31, 2002. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. An audit includes consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Eaton Vance Tax-Managed Equity Asset Allocation Fund as of October 31, 2005, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the three years in the period then ended, and for the period from the start of business, March 4, 2002 to October 31, 2002, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Boston, Massachusetts

December 19, 2005

15

Eaton Vance Tax-Managed Equity Asset Allocation Fund

BOARD OF TRUSTEES' ANNUAL APPROVAL OF THE INVESTMENT ADVISORY AGREEMENT

The investment advisory agreement between Tax-Managed Equity Asset Allocation Fund (the "Fund") and its investment adviser, Eaton Vance Management ("Eaton Vance"), provides that the advisory agreement will continue in effect from year to year so long as its continuance is approved at least annually (i) by a vote of a majority of the noninterested Trustees of the Fund cast in person at a meeting called for the purpose of voting on such approval and (ii) by the Trustees of the Fund or by vote of a majority of the outstanding interests of the Fund.

In considering the annual approval of the investment advisory agreement between the Fund and its investment adviser, the Special Committee of the Board of Trustees considered information that had been provided throughout the year at regular Board meetings, as well as information furnished for a series of meetings held in February and March in preparation for a Board meeting held on March 21, 2005 to specifically consider the renewal of the investment advisory agreement. Such information included, among other things, the following:

• An independent report comparing the advisory fees of the Fund with those of comparable funds;

• An independent report comparing the expense ratio of the Fund to those of comparable funds;

• Information regarding Fund investment performance in comparison to relevant peer groups of funds and appropriate indices;

• The economic outlook and the general investment outlook in relevant investment markets;

• Eaton Vance's results and financial condition and the overall organization of the investment adviser;

• The procedures and processes used to determine the fair value of Fund assets and actions taken to monitor and test the effectiveness of such procedures and processes;

• The allocation of brokerage and the benefits received by the investment adviser as the result of brokerage allocation;

• Eaton Vance's management of the relationship with the custodian, subcustodians and fund accountants;

• The resources devoted to compliance efforts undertaken by Eaton Vance on behalf of the funds they manage and the record of compliance with the investment policies and restrictions and with policies on personal securities transactions;

• The quality, nature, cost and character of the administrative and other non-investment management services provided by Eaton Vance and its affiliates; and

• The terms of the advisory agreement and the reasonableness and appropriateness of the particular fee paid by the Fund for the services described therein.

The Special Committee also considered the nature, extent and quality of the management services provided by the investment adviser. In so doing, the Special Committee considered their management capabilities with respect to the types of investments held by the Fund, including information relating to the education, experience and number of investment professionals and other personnel who provide services under the investment advisory agreement. The Special Committee specifically noted the investment adviser's in-house equity research capabilities and experience in managing funds that seek to maximize after-tax returns. The Special Committee evaluated the level of skill required to manage the Fund and concluded that the human resources available at the investment adviser were appropriate to fulfill effectively its duties on behalf of the Fund.

16

Eaton Vance Tax-Managed Equity Asset Allocation Fund

BOARD OF TRUSTEES' ANNUAL APPROVAL OF THE INVESTMENT ADVISORY AGREEMENT CONT'D

In its review of comparative information with respect to investment performance, the Special Committee concluded that the Fund has performed within a range that the Special Committee deemed competitive. With respect to its review of investment advisory fees, the Special Committee concluded that the fees paid by the Fund are within the range of those paid by comparable funds within the mutual fund industry. In reviewing the information regarding the expense ratio of the Fund, the Special Committee concluded that, in light of the asset size of the Fund, the Fund's expense ratio is reasonable.

In addition to the factors mentioned above, the Special Committee reviewed the level of profits of the investment adviser in providing investment management services for the Fund and for all Eaton Vance funds as a group. The Special Committee also reviewed the implementation of a soft dollar reimbursement program pursuant to which the Fund may receive reimbursement payments in respect of third party research services obtained by the investment adviser as a result of soft dollar credits generated through trading on behalf of the Fund. The Special Committee also reviewed the benefits to Eaton Vance and its affiliates in providing administration services for the Fund and for all Eaton Vance funds as a group. In addition, the Special Committee considered the fiduciary duty assumed by the investment adviser in connection with the services rendered to the Fund and the business reputation of the investment adviser and its financial res ources. The Trustees concluded that in light of the services rendered, the profits realized by the investment adviser are not unreasonable. The Special Committee also considered the extent to which the investment adviser appears to be realizing benefits from economies of scale in managing the Fund, and concluded that the fee breakpoints which are in place will allow for an equitable sharing of such benefits, when realized, with the Fund and its shareholders.

The Special Committee did not consider any single factor as controlling in determining whether or not to renew the investment advisory agreement. Nor are the items described herein all the matters considered by the Special Committee. In assessing the information provided by Eaton Vance and its affiliates, the Special Committee also took into consideration the benefits to shareholders of investing in a fund that is a part of a large family of funds which provides a large variety of shareholder services.

Based on its consideration of the foregoing factors and conclusions, and such other factors and conclusions as it deemed relevant, and assisted by independent counsel, the Special Committee concluded that the renewal of the investment advisory agreement, including the fee structure, is in the interests of shareholders.

17

Eaton Vance Tax-Managed Equity Asset Allocation Fund

MANAGEMENT AND ORGANIZATION

Fund Management. The Trustees of Eaton Vance Mutual Funds Trust (the Trust) are responsible for the overall management and supervision of the Trust's affairs. The Trustees and officers of the Trust are listed below. Except as indicated, each individual has held the office shown or other offices in the same company for the last five years. Trustees and officers of the Trust hold indefinite terms of office. The "noninterested Trustees" consist of those Trustees who are not "interested persons" of the Trust, as that term is defined under the 1940 Act. The business address of each Trustee and officer is The Eaton Vance Building, 255 State Street, Boston, Massachusetts 02109. As used below, "EVC" refers to Eaton Vance Corp., "EV" refers to Eaton Vance, Inc., "EVM" refers to Eaton Vance Management, "BMR" refers to Boston Management and Research and "EVD" refers to Eaton Vance Distributors, Inc. EVC and EV are the corporate parent and trustee, respectively, of EVM and BMR. EVD is the Fund's principal underwriter a wholly-owned subsidiary of EVM. Each officer affiliated with Eaton Vance may hold a position with other Eaton Vance affiliates that is comparable to its position with EVM listed below.

Name and

Date of Birth | | Position

with the

Trust | | Term of

Office and

Length of

Service | | Principal Occupation(s)

During Past Five Years | | Number of Portfolios

in Fund Complex

Overseen By

Trustee(1) | | Other Directorships Held | |

| Interested Trustee | |

|

James B. Hawkes

11/9/41 | | Trustee | | Since 1991 | | Chairman, President and Chief Executive Officer of BMR, EVC, EVM and EV; Director of EV; Vice President and Director of EVD. Trustee and/or officer of 161 registered investment companies in the Eaton Vance Fund Complex. Mr. Hawkes is an interested person because of his positions with BMR, EVM, EVC and EV, which are affiliates of the Trust. | | | 161 | | | Director of EVC | |

|

| Noninterested Trustee(s) | |

|

Benjamin C. Esty

1/2/63 | | Trustee | | Since 2005 | | Professor, Harvard University Graduate School of Business Administration (since 2003). Formerly, Associate Professor, Harvard University Graduate School of Business Administration (2000-2003). | | | 152 | | | None | |

|

Samuel L. Hayes, III

2/23/35 | | Trustee | | Trustee since 1986 and Chairman of the Board since 2005 | | Jacob H. Schiff Professor of Investment Banking Emeritus, Harvard University Graduate School of Business Administration. | | | 161 | | | Director of Tiffany & Co. (specialty retailer) and Telect, Inc. (telecommunication services company) | |

|

William H. Park

9/19/47 | | Trustee | | Since 2003 | | President and Chief Executive Officer, Prizm Capital Management, LLC (investment management firm) (since 2002). Executive Vice President and Chief Financial Officer, United Asset Management Corporation (a holding company owning institutional investment management firms) (1982-2001). | | | 161 | | | None | |

|

Ronald A. Pearlman

7/10/40 | | Trustee | | Since 2003 | | Professor of Law, Georgetown University Law Center (since 1999). Tax Partner Covington & Burling, Washington, DC (1991-2000). | | | 161 | | | None | |

|

Norton H. Reamer

9/21/35 | | Trustee | | Since 1986 | | President, Chief Executive Officer and a Director of Asset Management Finance Corp. (a specialty finance company serving the investment management industry) (since October 2003). President, Unicorn Corporation (an investment and financial advisory services company) (since September 2000). Formerly, Chairman, Hellman, Jordan Management Co., Inc. (an investment management company) (2000-2003). Formerly, Advisory Director of Berkshire Capital Corporation (investment banking firm) (2002-2003). Formerly Chairman of the Board, United Asset Management Corporation (a holding company owning institutional investment management firms) and Chairman, President and Director, UAM Funds (mutual funds) (1980-2000). | | | 161 | | | None | |

|

18

Eaton Vance Tax-Managed Equity Asset Allocation Fund

MANAGEMENT AND ORGANIZATION CONT'D

Name and

Date of Birth | | Position

with the

Trust | | Term of

Office and

Length of

Service | | Principal Occupation(s)

During Past Five Years | | Number of Portfolios

in Fund Complex

Overseen By

Trustee(1) | | Other Directorships Held | |

| Noninterested Trustee(s) (continued) | |

|

Lynn A. Stout

9/14/57 | | Trustee | | Since 1998 | | Professor of Law, University of California at Los Angeles School of Law (since July 2001). Formerly, Professor of Law, Georgetown University Law Center. | | | 161 | | | None | |

|

Ralph F. Verni

1/26/43 | | Trustee | | Since 2005 | | Consultant and private investor (since 2000). Formerly, President and Chief Executive Officer, Redwood Investment Systems, Inc. (software developer) (2000). Formerly, President and Chief Executive Officer, State Street Research & Management (investment advisor), SSRM Holdings (parent of State Street Research & management), and SSR Realty (institutional realty manager) (1992-2000). | | | 152 | | | Director of W.P. Carey & Company LLC (manager of real estate investment trusts) | |

|

| Principal Officers who are not Trustees | |

|

Name and

Date of Birth | | Position

with the

Trust | | Term of

Office and

Length of

Service | | Principal Occupation(s)

During Past Five Years | |

Thomas E. Faust Jr.

5/31/58 | | President | | Since 2002 | | Executive Vice President of EVM, BMR, EVC and EV; Chief Investment Officer of EVM and BMR and Director of EVC. Chief Executive Officer of Belair Capital Fund LLC, Belcrest Capital Fund LLC, Belmar Capital Fund LLC, Belport Capital Fund LLC and Belrose Capital Fund LLC (private investment companies sponsored by EVM). Officer of 65 registered investment companies managed by EVM or BMR. | |

|

William H. Ahern, Jr.

7/28/59 | | Vice President | | Since 1995 | | Vice President of EVM and BMR. Officer of 70 registered investment companies managed by EVM or BMR. | |

|

Cynthia J. Clemson

3/2/63 | | Vice President | | Since 2004 | | Vice President of EVM and BMR. Officer of 85 registered investment companies managed by EVM or BMR. | |

|

Kevin S. Dyer

2/21/75 | | Vice President | | Since 2005 | | Assistant Vice President of EVM and BMR. Officer of 24 registered investment companies managed by EVM or BMR. | |

|

Aamer Khan

6/7/60 | | Vice President | | Since 2005 | | Vice President of EVM and BMR. Officer of 27 registered investment companies managed by EVM or BMR. | |

|

Michael R. Mach

7/15/47 | | Vice President | | Since 1999 | | Vice President of EVM and BMR. Officer of 32 registered investment companies managed by EVM or BMR. | |

|

Robert B. MacIntosh

1/22/57 | | Vice President | | Since 1998 | | Vice President of EVM and BMR. Officer of 85 registered investment companies managed by EVM or BMR. | |

|

Duncan W. Richardson

10/26/57 | | Vice President | | Since 2001 | | Senior Vice President and Chief Equity Investment Officer of EVM and BMR. Officer of 51 registered investment companies managed by EVM or BMR. | |

|

Walter A. Row, III

7/20/57 | | Vice President | | Since 2001 | | Director of Equity Research and a Vice President of EVM and BMR. Officer of 31 registered investment companies managed by EVM or BMR. | |

|

Judith A. Saryan

8/21/54 | | Vice President | | Since 2003 | | Vice President of EVM and BMR. Officer of 33 registered investment companies managed by EVM or BMR. | |

|

Susan Schiff

3/13/61 | | Vice President | | Since 2002 | | Vice President of EVM and BMR. Officer of 29 registered investment companies managed by EVM or BMR. | |

|

Barbara E. Campbell

6/19/57 | | Treasurer | | Since 2005(2) | | Vice President of EVM and BMR. Officer of 161 registered investment companies managed by EVM or BMR. | |

|

19

Eaton Vance Tax-Managed Equity Asset Allocation Fund

MANAGEMENT AND ORGANIZATION CONT'D

Name and

Date of Birth | | Position

with the

Trust | | Term of

Office and

Length of

Service | | Principal Occupation(s)

During Past Five Years | |

| Principal Officers who are not Trustees (continued) | |

|

Alan R. Dynner

10/10/40 | | Secretary | | Since 1997 | | Vice President, Secretary and Chief Legal Officer of BMR, EVM, EVD, EV and EVC. Officer of 161 registered investment companies managed by EVM or BMR. | |

|

Paul M. O'Neil

7/11/53 | | Chief Compliance Officer | | Since 2004 | | Vice President of EVM and BMR. Officer of 161 registered investment companies managed by EVM or BMR. | |

|

(1) Includes both master and feeder funds in a master-feeder structure.

(2) Prior to 2005, Ms. Campbell served as Assistant Treasurer of the Trust since 1995.

The SAI for the Fund includes additional information about the Trustees and officers of the Fund and can be obtained without charge by calling 1-800-225-6265.

20

This Page Intentionally Left Blank

Investment Adviser of Eaton Vance Tax-Managed Equity Asset Allocation Fund

Eaton Vance Management

The Eaton Vance Building

255 State Street

Boston, MA 02109

Administrator of Eaton Vance Tax-Managed Equity Asset Allocation Fund

Eaton Vance Management

The Eaton Vance Building

255 State Street

Boston, MA 02109

Principal Underwriter

Eaton Vance Distributors, Inc.

The Eaton Vance Building

255 State Street

Boston, MA 02109

(617) 482-8260

Custodian

Investors Bank & Trust Company

200 Clarendon Street

Boston, MA 02116

Transfer Agent

PFPC Inc.

Attn: Eaton Vance Funds

P.O. Box 9653

Providence, RI 02940-9653

(800) 262-1122

Independent Registered Public Accounting Firm

Deloitte & Touche LLP