UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04015 |

|

Eaton Vance Mutual Funds Trust |

(Exact name of registrant as specified in charter) |

|

The Eaton Vance Building, 255 State Street, Boston, Massachusetts | | 02109 |

(Address of principal executive offices) | | (Zip code) |

|

Maureen A. Gemma The Eaton Vance Building, 255 State Street, Boston, Massachusetts 02109 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (617) 482-8260 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | October 31, 2007 | |

| | | | | | | | |

Item 1. Reports to Stockholders

Annual Report October 31, 2007

EATON VANCE

COMBINED

MONEY

MARKET

FUNDS

Cash Management Fund

Money Market Fund

IMPORTANT NOTICES REGARDING PRIVACY,

DELIVERY OF SHAREHOLDER DOCUMENTS,

PORTFOLIO HOLDINGS, AND PROXY VOTING

Privacy. The Eaton Vance organization is committed to ensuring your financial privacy. Each of the financial institutions identified below has in effect the following policy ("Privacy Policy") with respect to nonpublic personal information about its customers:

• Only such information received from you, through application forms or otherwise, and information about your Eaton Vance fund transactions will be collected. This may include information such as name, address, social security number, tax status, account balances and transactions.

• None of such information about you (or former customers) will be disclosed to anyone, except as permitted by law (which includes disclosure to employees necessary to service your account). In the normal course of servicing a customer's account, Eaton Vance may share information with unaffiliated third parties that perform various required services such as transfer agents, custodians and broker/dealers.

• Policies and procedures (including physical, electronic and procedural safeguards) are in place that are designed to protect the confidentiality of such information.

• We reserve the right to change our Privacy Policy at any time upon proper notification to you. Customers may want to review our Policy periodically for changes by accessing the link on our homepage: www.eatonvance.com.

Our pledge of privacy applies to the following entities within the Eaton Vance organization: the Eaton Vance Family of Funds, Eaton Vance Management, Eaton Vance Investment Counsel, Boston Management and Research, and Eaton Vance Distributors, Inc.

In addition, our Privacy Policy only applies to those Eaton Vance customers who are individuals and who have a direct relationship with us. If a customer's account (i.e., fund shares) is held in the name of a third-party financial adviser/broker-dealer, it is likely that only such adviser's privacy policies apply to the customer. This notice supersedes all previously issued privacy disclosures.

For more information about Eaton Vance's Privacy Policy, please call 1-800-262-1122.

Delivery of Shareholder Documents. The Securities and Exchange Commission (the "SEC") permits funds to deliver only one copy of shareholder documents, including prospectuses, proxy statements and shareholder reports, to fund investors with multiple accounts at the same residential or post office box address. This practice is often called "householding" and it helps eliminate duplicate mailings to shareholders.

Eaton Vance, or your financial adviser, may household the mailing of your documents indefinitely unless you instruct Eaton Vance, or your financial adviser, otherwise.

If you would prefer that your Eaton Vance documents not be householded, please contact Eaton Vance at 1-800-262-1122, or contact your financial adviser.

Your instructions that householding not apply to delivery of your Eaton Vance documents will be effective within 30 days of receipt by Eaton Vance or your financial adviser.

Portfolio Holdings. Each Eaton Vance Fund and its underlying Portfolio (if applicable) will file a schedule of its portfolio holdings on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Form N-Q will be available on the Eaton Vance website www.eatonvance.com, by calling Eaton Vance at 1-800-262-1122 or in the EDGAR database on the SEC's website at www.sec.gov. Form N-Q may also be reviewed and copied at the SEC's public reference room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the public reference room).

Proxy Voting. From time to time, funds are required to vote proxies related to the securities held by the funds. The Eaton Vance Funds or their underlying Portfolios (if applicable) vote proxies according to a set of policies and procedures approved by the Funds' and Portfolios' Boards. You may obtain a description of these policies and procedures and information on how the Funds or Portfolios voted proxies relating to portfolio securities during the most recent 12 month period ended June 30, without charge, upon request, by calling 1-800-262-1122. This description is also available on the SEC's website at www.sec.gov.

Eaton Vance Money Market Funds as of October 31, 2007

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

Elizabeth S. Kenyon, CFA

Portfolio Manager

Investment Environment

· The fiscal year end for Cash Management Portfolio, Eaton Vance Cash Management Fund and Eaton Vance Money Market Fund has changed from December 31 to October 31. As a result, this is the first annual report for the Funds’ new fiscal year.

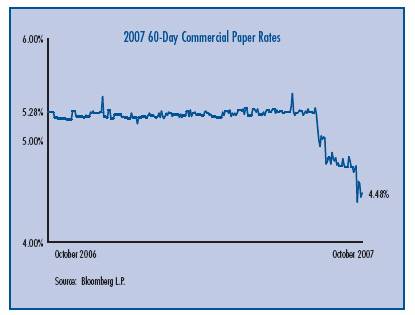

· During the year ended October 31, 2007, the U.S. economy began to show signs of slowing but generally remained on solid footing. Third quarter economic growth rose 3.9%, according to preliminary Commerce Department data. The economy grew at annualized rates of 3.8% and 1.3% in the second and first quarters of 2007, respectively, following a 2.5% growth rate achieved in the fourth quarter of 2006. Despite this solid performance, the economy’s resilience was increasingly tested during 2007 by the sluggish housing and financial sectors and a sharp rise in the price of oil.

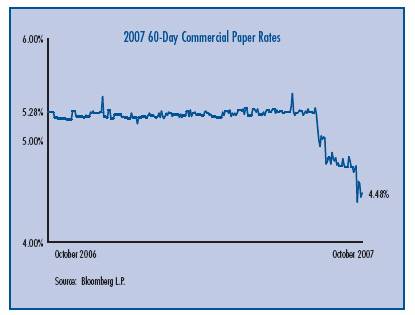

· In an unscheduled August 17, 2007 meeting, the U.S. Federal Reserve Board (the “Fed”) lowered its Discount Rate – the rate charged to banks borrowing directly from the Fed – to 5.75% from 6.25%. The move was aimed at providing liquidity during a period of increased uncertainty and tighter credit conditions that surfaced rapidly in mid-August 2007. On September 18, 2007, the Fed lowered its Federal Funds Rate to 4.75% from 5.25% – its first rate cut since the Fed stopped raising rates in June 2006 – and lowered the Discount Rate again to 5.25% from 5.75%. The Federal Funds Rate was again lowered on October 31, 2007, to 4.50%.

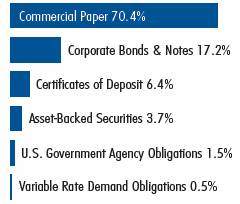

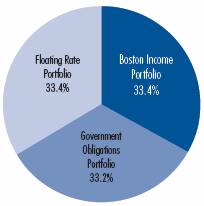

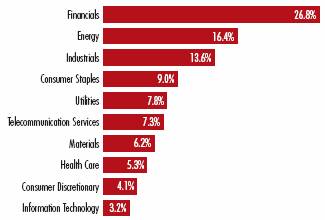

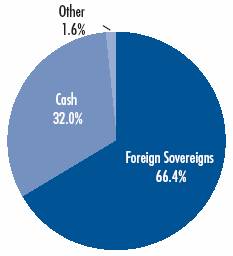

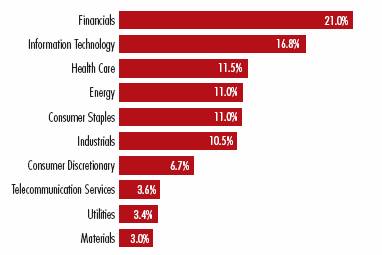

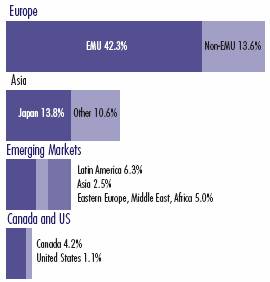

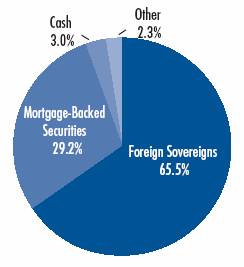

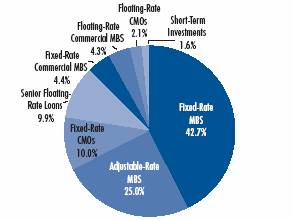

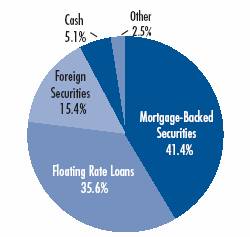

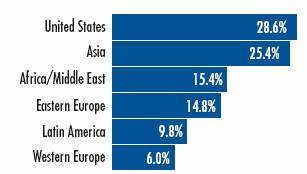

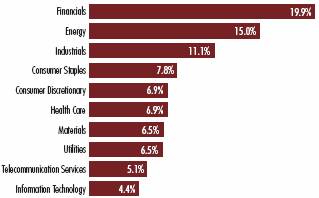

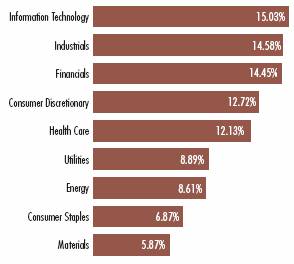

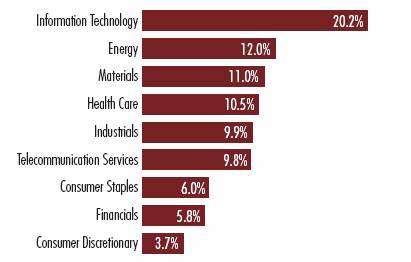

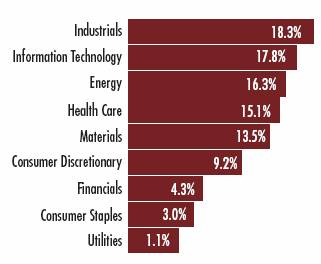

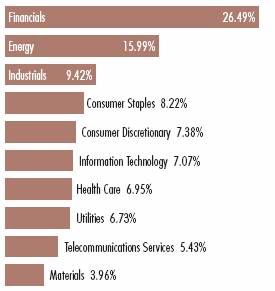

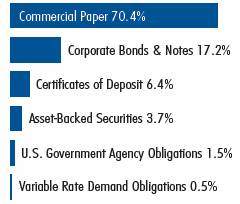

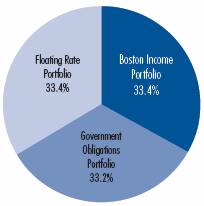

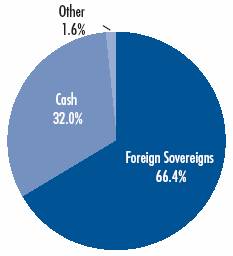

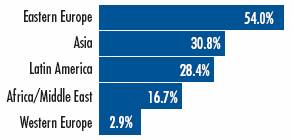

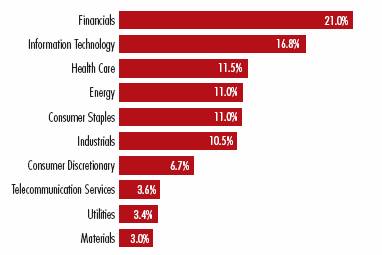

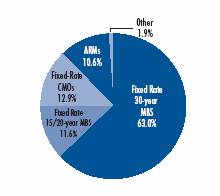

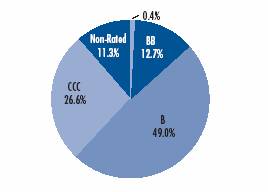

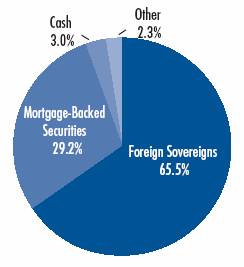

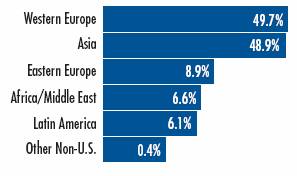

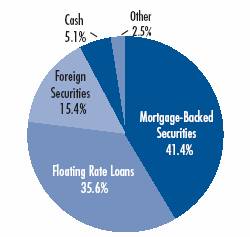

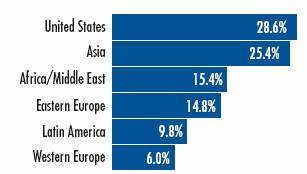

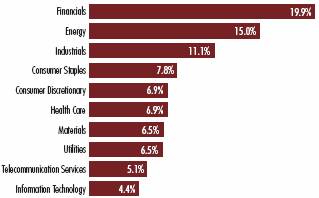

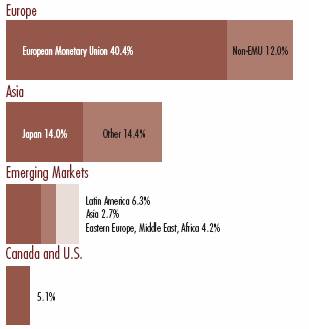

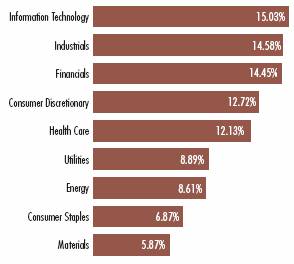

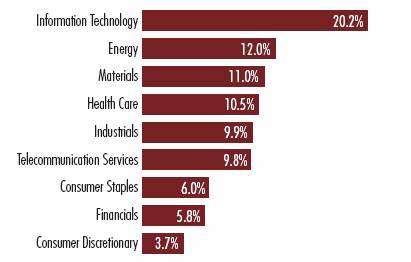

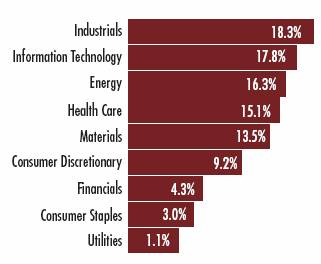

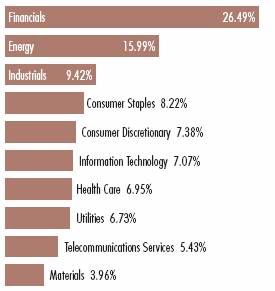

Asset Allocation*

By net assets

* Asset Allocation information may not be representative of the Portfolio’s current or future investments and may change due to active management.

· At October 31, 2007, Cash Management Portfolio — in which the Funds invest their assets — had 70.4% of its net assets invested in high-quality commercial paper, a highly liquid type of security in which money market funds commonly invest. The Portfolio also invests in high-quality U.S. Government agency securities and other short-term investments.

· During the ten months ended October 31, 2007, shareholders of Eaton Vance Cash Management Fund and Eaton Vance Money Market Fund received $0.040 and $0.031 per share, respectively, in income dividends. Eaton Vance Cash Management Fund and Eaton Vance Money Market Fund had total returns of 4.04% and 3.16%, respectively, during the same period.(1) An investment in one of the money market funds is neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Funds seek to maintain a stable net asset value of $1.00 per share, it is possible to lose money by investing in a Fund.

· During the period, management maintained a relatively short weighted average maturity in the Portfolio to allow for more frequent reinvestments and help maintain each Fund’s income stream. Toward the end of the period, management extended the average maturity in the Funds, seeking to lock in more attractive rates in anticipation of Fed rate cuts The Funds have never owned asset-backed commercial paper issued by structured investment vehicles or collateralized debt obligations and do not intend to in the future.

(1) Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. There is no sales charge.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

The views expressed in this report are those of the portfolio manager and are current only through the end of the period of the report as stated on the cover. These views are subject to change at any time based upon market or other conditions, and the investment adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on many factors, may not be relied on as an indication of trading intent on behalf of any Eaton Vance fund.

1

Eaton Vance Money Market Funds as of October 31, 2007

FUND EXPENSES

Example: As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2007 – October 31, 2007).

Actual Expenses: The first section of each table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of each table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual return of a Fund. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Eaton Vance Cash Management Fund

| | | Beginning Account Value

(5/1/07) | | Ending Account Value

(10/31/07) | | Expenses Paid During Period*

(5/1/07 – 10/31/07) | |

| Actual | | $ | 1,000.00 | | | $ | 1,024.40 | | | $ | 3.11 | | |

| Hypothetical | |

| (5% return per year before expenses) | | $ | 1,000.00 | | | $ | 1,022.10 | | | $ | 3.11 | | |

* Expenses are equal to the Fund's annualized expense ratio of 0.61% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on April 30, 2007. The Example reflects the expenses of both the Fund and the Portfolio.

Eaton Vance Money Market Fund

| | | Beginning Account Value

(5/1/07) | | Ending Account Value

(10/31/07) | | Expenses Paid During Period*

(5/1/07 – 10/31/07) | |

| Actual | | $ | 1,000.00 | | | $ | 1,019.20 | | | $ | 8.40 | | |

| Hypothetical | |

| (5% return per year before expenses) | | $ | 1,000.00 | | | $ | 1,016.90 | | | $ | 8.39 | | |

* Expenses are equal to the Fund's annualized expense ratio of 1.65% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on April 30, 2007. The Example reflects the expenses of both the Fund and the Portfolio.

2

Eaton Vance Money Market Funds as of October 31, 2007

FINANCIAL STATEMENTS

Statements of Assets and Liabilities

As of October 31, 2007

| | | Cash

Management Fund | | Money

Market Fund | |

| Assets | |

| Investment in Cash Management Portfolio, at value | | $ | 178,745,667 | | | $ | 67,514,687 | | |

| Receivable for Fund shares sold | | | 1,646,601 | | | | 176,875 | | |

| Total assets | | $ | 180,392,268 | | | $ | 67,691,562 | | |

| Liabilities | |

| Payable for Fund shares redeemed | | $ | 5,241,960 | | | $ | 1,039,091 | | |

| Dividends payable | | | 990,863 | | | | 33,397 | | |

| Payable to affiliate for Trustees' fees | | | 156 | | | | 7 | | |

| Payable to affiliate for distribution and service fees | | | — | | | | 74,344 | | |

| Accrued expenses | | | 36,909 | | | | 37,771 | | |

| Total liabilities | | $ | 6,269,888 | | | $ | 1,184,610 | | |

| Net Assets | | $ | 174,122,380 | | | $ | 66,506,952 | | |

| Sources of Net Assets | |

| Paid-in capital | | $ | 174,117,923 | | | $ | 66,507,059 | | |

| Accumulated net realized loss (computed on the basis of identified cost) | | | (362 | ) | | | (190 | ) | |

| Accumulated undistributed net investment income | | | 4,819 | | | | 83 | | |

| Total | | $ | 174,122,380 | | | $ | 66,506,952 | | |

| Shares of Beneficial Interest Outstanding | |

| | | | 174,122,579 | | | | 66,507,045 | | |

Net Asset Value, Offering Price and

Redemption Price Per Share | |

| (Net assets ÷ shares of beneficial interest outstanding) | | $ | 1.00 | | | $ | 1.00 | | |

See notes to financial statements

3

Eaton Vance Money Market Funds as of October 31, 2007

FINANCIAL STATEMENTS CONT'D

Statements of Operations

For the Period Ended October 31, 2007(1)

| | | Cash

Management Fund | | Money

Market Fund | |

| Investment Income | |

| Interest allocated from Portfolio | | $ | 6,381,185 | | | $ | 2,313,978 | | |

| Expenses allocated from Portfolio | | | (596,738 | ) | | | (217,293 | ) | |

| Total investment income from Portfolio | | $ | 5,784,447 | | | $ | 2,096,685 | | |

| Expenses | |

| Trustees' fees and expenses | | $ | 1,563 | | | $ | 149 | | |

| Distribution and service fees | | | — | | | | 374,558 | | |

| Legal and accounting services | | | 22,571 | | | | 21,622 | | |

| Printing and postage | | | 10,650 | | | | 8,673 | | |

| Custodian fee | | | 12,036 | | | | 8,581 | | |

| Transfer and dividend disbursing agent fees | | | 57,355 | | | | 52,947 | | |

| Registration fees | | | 20,650 | | | | 18,359 | | |

| Miscellaneous | | | 4,822 | | | | 4,514 | | |

| Total expenses | | $ | 129,647 | | | $ | 489,403 | | |

| Net investment income | | $ | 5,654,800 | | | $ | 1,607,282 | | |

| Realized and Unrealized Loss from Portfolio | |

| Net realized loss — | |

| Investment transactions (identified cost basis) | | $ | (55 | ) | | $ | (9 | ) | |

| Net realized loss | | $ | (55 | ) | | $ | (9 | ) | |

| Net increase in net assets from operations | | $ | 5,654,745 | | | $ | 1,607,273 | | |

(1) For the ten months ended October 31, 2007.

See notes to financial statements

4

Eaton Vance Money Market Funds as of October 31, 2007

FINANCIAL STATEMENTS CONT'D

Statements of Operations

For the Year Ended December 31, 2006

| | | Cash

Management Fund | | Money

Market Fund | |

| Investment Income | |

| Interest allocated from Portfolio | | $ | 4,370,009 | | | $ | 2,342,947 | | |

| Expenses allocated from Portfolio | | | (508,896 | ) | | | (272,196 | ) | |

| Total investment income from Portfolio | | $ | 3,861,113 | | | $ | 2,070,751 | | |

| Expenses | |

| Trustees' fees and expenses | | $ | 1,698 | | | $ | 539 | | |

| Distribution and service fees | | | — | | | | 404,131 | | |

| Legal and accounting services | | | 20,402 | | | | 20,076 | | |

| Printing and postage | | | 9,448 | | | | 9,854 | | |

| Custodian fee | | | 16,397 | | | | 11,154 | | |

| Transfer and dividend disbursing agent fees | | | 55,829 | | | | 66,893 | | |

| Registration fees | | | 30,736 | | | | 37,632 | | |

| Miscellaneous | | | 1,846 | | | | 3,135 | | |

| Total expenses | | $ | 136,356 | | | $ | 553,414 | | |

| Net investment income | | $ | 3,724,757 | | | $ | 1,517,337 | | |

| Realized and Unrealized Gain (Loss) from Portfolio | |

| Net realized gain (loss) — | |

| Investment transactions (identified cost basis) | | $ | (197 | ) | | $ | (113 | ) | |

| Increase from payments by affiliate | | | 35 | | | | 18 | | |

| Net loss realized on the disposal of investments which did not meet the Portfolio's investment guidelines | | | (35 | ) | | | (18 | ) | |

| Net realized loss | | $ | (197 | ) | | $ | (113 | ) | |

| Net increase in net assets from operations | | $ | 3,724,560 | | | $ | 1,517,224 | | |

See notes to financial statements

5

Eaton Vance Money Market Funds as of October 31, 2007

FINANCIAL STATEMENTS CONT'D

Statements of Changes in Net Assets

For the Period Ended October 31, 2007(1)

| Increase (Decrease) in Net Assets | | Cash

Management Fund | | Money

Market Fund | |

| From operations — | |

| Net investment income | | $ | 5,654,800 | | | $ | 1,607,282 | | |

| Net realized loss from investment transactions | | | (55 | ) | | | (9 | ) | |

| Net increase in net assets from operations | | $ | 5,654,745 | | | $ | 1,607,273 | | |

| Distributions to shareholders — | |

| From net investment income | | $ | (5,654,800 | ) | | $ | (1,607,282 | ) | |

| Total distributions to shareholders | | $ | (5,654,800 | ) | | $ | (1,607,282 | ) | |

| Transactions in shares of beneficial interest at Net Asset Value of $1.00 per share — | |

| Proceeds from sale of shares | | $ | 626,885,761 | | | $ | 82,204,969 | | |

| Net asset value of shares issued to shareholders in payment of distributions declared | | | 3,184,751 | | | | 1,269,302 | | |

| Cost of shares redeemed | | | (575,931,031 | ) | | | (59,064,924 | ) | |

| Net increase in net assets from Fund share transactions | | $ | 54,139,481 | | | $ | 24,409,347 | | |

| Net increase in net assets | | $ | 54,139,426 | | | $ | 24,409,338 | | |

| Net Assets | |

| At beginning of period | | $ | 119,982,954 | | | $ | 42,097,614 | | |

| At end of period | | $ | 174,122,380 | | | $ | 66,506,952 | | |

Accumulated undistributed

net investment income

included in net assets | |

| At end of year | | $ | 4,819 | | | $ | 83 | | |

(1) For the ten months ended October 31, 2007.

See notes to financial statements

6

Eaton Vance Money Market Funds as of October 31, 2007

FINANCIAL STATEMENTS CONT'D

Statements of Changes in Net Assets

For the Year Ended December 31, 2006

| Increase (Decrease) in Net Assets | | Cash

Management Fund | | Money

Market Fund | |

| From operations — | |

| Net investment income | | $ | 3,724,757 | | | $ | 1,517,337 | | |

Net realized loss from investment transactions, payments by affiliate and

the disposal of investments which did not meet the Portfolio's investment guidelines | | | (197 | ) | | | (113 | ) | |

| Net increase in net assets from operations | | $ | 3,724,560 | | | $ | 1,517,224 | | |

| Distributions to shareholders — | |

| From net investment income | | $ | (3,724,704 | ) | | $ | (1,517,308 | ) | |

| Total distributions to shareholders | | $ | (3,724,704 | ) | | $ | (1,517,308 | ) | |

| Transactions in shares of beneficial interest at Net Asset Value of $1.00 per share — | |

| Proceeds from sale of shares | | $ | 164,749,685 | | | $ | 41,881,817 | | |

| Net asset value of shares issued to shareholders in payment of distributions declared | | | 2,345,894 | | | | 1,198,865 | | |

| Cost of shares redeemed | | | (142,081,892 | ) | | | (49,322,436 | ) | |

| Net increase (decrease) in net assets from Fund share transactions | | $ | 25,013,687 | | | $ | (6,241,754 | ) | |

| Net increase (decrease) in net assets | | $ | 25,013,543 | | | $ | (6,241,838 | ) | |

| Net Assets | |

| At beginning of year | | $ | 94,969,411 | | | $ | 48,339,452 | | |

| At end of year | | $ | 119,982,954 | | | $ | 42,097,614 | | |

Accumulated undistributed

net investment income

included in net assets | |

| At end of year | | $ | 4,819 | | | $ | 83 | | |

See notes to financial statements

7

Eaton Vance Money Market Funds as of October 31, 2007

FINANCIAL STATEMENTS CONT'D

Statements of Changes in Net Assets

For the Year Ended December 31, 2005

| Increase (Decrease) in Net Assets | | Cash

Management Fund | | Money

Market Fund | |

| From operations — | |

| Net investment income | | $ | 2,239,721 | | | $ | 788,564 | | |

Net realized loss from investment transactions, payments by affiliate and

the disposal of investments which did not meet the Portfolio's investment guidelines | | | (86 | ) | | | (54 | ) | |

| Net increase in net assets from operations | | $ | 2,239,635 | | | $ | 788,510 | | |

| Distributions to shareholders — | |

| From net investment income | | $ | (2,239,635 | ) | | $ | (788,510 | ) | |

| Total distributions to shareholders | | $ | (2,239,635 | ) | | $ | (788,510 | ) | |

| Transactions in shares of beneficial interest at Net Asset Value of $1.00 per share — | |

| Proceeds from sale of shares | | $ | 138,809,354 | | | $ | 43,940,101 | | |

| Net asset value of shares issued to shareholders in payment of distributions declared | | | 1,366,207 | | | | 637,780 | | |

| Cost of shares redeemed | | | (143,371,207 | ) | | | (64,123,257 | ) | |

| Net decrease in net assets from Fund share transactions | | $ | (3,195,646 | ) | | $ | (19,545,376 | ) | |

| Net decrease in net assets | | $ | (3,195,646 | ) | | $ | (19,545,376 | ) | |

| Net Assets | |

| At beginning of year | | $ | 98,165,057 | | | $ | 67,884,828 | | |

| At end of year | | $ | 94,969,411 | | | $ | 48,339,452 | | |

See notes to financial statements

8

Eaton Vance Money Market Funds as of October 31, 2007

FINANCIAL STATEMENTS CONT'D

Financial Highlights

| | | Cash Management Fund | |

| | | Period Ended | | Year Ended December 31, | |

| | | October 31, 2007(1) | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| Net asset value — Beginning of period | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | |

| Income (loss) from operations | |

| Net investment income | | $ | 0.040 | | | $ | 0.043 | | | $ | 0.024 | | | $ | 0.006 | | | $ | 0.005 | | | $ | 0.010 | | |

| Less distributions | |

| From net investment income | | $ | (0.040 | ) | | $ | (0.043 | ) | | $ | (0.024 | ) | | $ | (0.006 | ) | | $ | (0.005 | ) | | $ | (0.010 | ) | |

| Total distributions | | $ | (0.040 | ) | | $ | (0.043 | ) | | $ | (0.024 | ) | | $ | (0.006 | ) | | $ | (0.005 | ) | | $ | (0.010 | ) | |

| Net asset value — End of period | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | |

| Total Return(2) | | | 4.04 | %(6) | | | 4.40 | %(3) | | | 2.48 | %(3) | | | 0.60 | % | | | 0.48 | % | | | 1.02 | % | |

| Ratios/Supplemental Data | |

| Net assets, end of period (000's omitted) | | $ | 174,122 | | | $ | 119,983 | | | $ | 94,969 | | | $ | 98,165 | | | $ | 101,364 | | | $ | 111,741 | | |

| Ratios (As a percentage of average daily net assets): | |

| Expenses before custodian fee reduction(4) | | | 0.62 | %(5) | | | 0.75 | % | | | 0.80 | % | | | 0.79 | % | | | 0.68 | % | | | 0.79 | % | |

| Expenses after custodian fee reduction(4) | | | 0.62 | %(5) | | | 0.75 | % | | | 0.80 | % | | | 0.79 | % | | | 0.68 | % | | | 0.79 | % | |

| Net investment income | | | 4.82 | %(5) | | | 4.32 | % | | | 2.46 | % | | | 0.60 | % | | | 0.47 | % | | | 1.02 | % | |

(1) For the ten months ended October 31, 2007. The Fund changed its fiscal year-end from December 31 to October 31.

(2) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested.

(3) During the years ended December 31, 2006 and December 31, 2005, the investment adviser reimbursed the Fund, through its investment in the Portfolio, for net losses realized on the disposal of investments which did not meet the Portfolio's investment guidelines. The reimbursement was less than $0.01 per share and had no effect on total return for the years ended December 31, 2006 and December 31, 2005.

(4) Includes the Fund's share of the Portfolio's allocated expenses.

(5) Annualized.

(6) Not annualized.

See notes to financial statements

9

Eaton Vance Money Market Funds as of October 31, 2007

FINANCIAL STATEMENTS CONT'D

Financial Highlights

| | | Money Market Fund | |

| | | Period Ended | | Year Ended December 31, | |

| | | October 31, 2007(1) | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| Net asset value — Beginning of period | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | |

| Income (loss) from operations | |

| Net investment income | | $ | 0.031 | | | $ | 0.033 | | | $ | 0.014 | | | $ | 0.001 | | | $ | — | | | $ | 0.002 | | |

| Less distributions | |

| From net investment income | | $ | (0.031 | ) | | $ | (0.033 | ) | | $ | (0.014 | ) | | $ | (0.001 | ) | | $ | — | | | $ | (0.002 | ) | |

| Total distributions | | $ | (0.031 | ) | | $ | (0.033 | ) | | $ | (0.014 | ) | | $ | (0.001 | ) | | $ | — | | | $ | (0.002 | ) | |

| Net asset value — End of period | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | |

| Total Return(2) | | | 3.16 | %(7) | | | 3.32 | %(3) | | | 1.45 | %(3) | | | 0.05 | % | | | 0.00 | % | | | 0.19 | % | |

| Ratios/Supplemental Data | |

| Net assets, end of period (000's omitted) | | $ | 66,507 | | | $ | 42,098 | | | $ | 48,339 | | | $ | 67,885 | | | $ | 100,241 | | | $ | 158,719 | | |

| Ratios (As a percentage of average daily net assets): | |

| Expenses before custodian fee reduction(4) | | | 1.66 | %(5) | | | 1.80 | % | | | 1.82 | % | | | 1.31 | %(6) | | | 1.17 | %(6) | | | 1.61 | %(6) | |

| Expenses after custodian fee reduction(4) | | | 1.66 | %(5) | | | 1.80 | % | | | 1.82 | % | | | 1.31 | %(6) | | | 1.17 | %(6) | | | 1.61 | %(6) | |

| Net investment income | | | 3.78 | %(5) | | | 3.30 | % | | | 1.40 | % | | | 0.04 | % | | | 0.00 | % | | | 0.20 | % | |

(1) For the ten months ended October 31, 2007. The Fund changed its fiscal year-end from December 31 to October 31.

(2) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested.

(3) During the years ended December 31, 2006 and December 31, 2005, the investment adviser reimbursed the Fund, through its investment in the Portfolio, for net losses realized on the disposal of investments which did not meet the Portfolio's investment guidelines. The reimbursement was less than $0.01 per share and had no effect on total return for the years ended December 31, 2006 and December 31, 2005.

(4) Includes the Fund's share of the Portfolio's allocated expenses.

(5) Annualized.

(6) The principal underwriter voluntarily waived a portion of its distribution fee and the administrator subsidized certain operating expenses (equal to 0.40%, 0.49% and less than 0.01% of average daily net assets for the years ended December 31, 2004, 2003 and 2002, respectively). Absent this waiver and allocation, total return would have been lower.

(7) Not annualized.

See notes to financial statements

10

Eaton Vance Money Market Funds as of October 31, 2007

NOTES TO FINANCIAL STATEMENTS

1 Significant Accounting Policies

Eaton Vance Cash Management Fund (Cash Management Fund) and Eaton Vance Money Market Fund (Money Market Fund) (individually, the Fund and collectively, the Funds) are each a diversified series of Eaton Vance Mutual Funds Trust (the Trust). The Trust is a Massachusetts business trust registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company. The Funds invest all of their investable assets in interests in the Cash Management Portfolio (the Portfolio), a New York trust, having the same investment objective and policies as the Funds. The value of each Fund's investment in the Portfolio reflects each Fund's proportionate interest in the net assets of the Portfolio (10.5% for Cash Management Fund and 4.0% for Money Market Fund at October 31, 2007). The performance of each Fund is directly affected by the performance of the Portfolio. The financial statements of the Por tfolio, including the portfolio of investments, are included elsewhere in this report and should be read in conjunction with each Fund's financial statements.

The following is a summary of significant accounting policies of the Funds. The policies are in conformity with accounting principles generally accepted in the United States of America.

A Investment Valuation — Valuation of securities by the Portfolio is discussed in Note 1A of the Portfolio's Notes to Financial Statements, which are included elsewhere in this report.

B Income — The Fund's net investment income or loss consists of the Fund's pro-rata share of the net investment income or loss of the Portfolio, less all actual and accrued expenses of the Fund.

C Federal Taxes — Each Fund's policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders each year substantially all of its net investment income, and all or substantially all of its net realized capital gains. Accordingly, no provision for federal income or excise tax is necessary. At October 31, 2007, the Funds, for federal income tax purposes, had capital loss carryforwards which will reduce each Fund's taxable income arising from future net realized gains on investment transactions, if any, to the extent permitted by the Internal Revenue Code, and thus will reduce the amount of distributions to shareholders which would otherwise be necessary to relieve the Funds of any liability f or federal income or excise tax. The amounts and expiration dates of the capital loss carryforwards are as follows:

| Fund | | Amount | | Expiration Date | |

| Cash Management | | $ | 5 | | | October 31, 2010 | |

|

| | | 20 | | | October 31, 2011 | |

|

| | | 85 | | | October 31, 2013 | |

|

| | | | 197 | | | October 31, 2014 | |

|

| | | 55 | | | October 31, 2015 | |

|

| Money Market | | | 10 | | | October 31, 2010 | |

|

| | | 5 | | | October 31, 2011 | |

|

| | | 53 | | | October 31, 2013 | |

|

| | | | 113 | | | October 31, 2014 | |

|

| | | 9 | | | October 31, 2015 | |

|

D Expenses — The majority of expenses of the Trust are directly identifiable to an individual fund. Expenses which are not readily identifiable to a specific fund are allocated taking into consideration, among other things, the nature and type of expense and the relative size of the funds.

E Expense Reduction — State Street Bank and Trust Company (SSBT) serves as custodian of the Funds. Pursuant to the respective custodian agreements, SSBT receives a fee reduced by credits, which are determined based on the average daily cash balance each Fund maintains with SSBT. All credit balances, if any, used to reduce each Fund's custodian fees are reported as a reduction of expenses in the Statements of Operations.

F Use of Estimates — The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

G Indemnifications — Under the Trust's organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Funds, and shareholders are indemnified against personal liability for obligations of the Trust. Additionally, in the normal course of business, each Fund enters into agreements with service providers that may contain indemnification clauses. Each Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against each Fund that have not yet occurred.

11

Eaton Vance Money Market Funds as of October 31, 2007

NOTES TO FINANCIAL STATEMENTS CONT'D

H Other — Investment transactions are accounted for on a trade date basis.

2 Distributions to Shareholders

The net investment income of each Fund is determined daily, and substantially all of the net investment income so determined is declared daily as a dividend to shareholders of record at the time of declaration. Distributions are paid monthly. Distributions are paid in the form of additional shares or, at the election of the shareholder, in cash.

The Funds distinguish between distributions on a tax basis and a financial reporting basis. Accounting principles generally accepted in the United States of America require that only distributions in excess of tax basis earnings and profits be reported in the financial statements as a return of capital. Permanent differences between book and tax accounting relating to distributions are reclassified to paid-in capital.

The tax character of the distributions declared for the period ended October 31, 2007 and years ended December 31, 2006 and December 31, 2005 was as follows:

| Period Ended October 31, 2007 | | Cash

Management Fund | | Money

Market Fund | |

| Distributions declared from: | |

| Ordinary income | | $ | 5,654,800 | | | $ | 1,607,282 | | |

| Year Ended December 31, 2006 | | Cash

Management Fund | | Money

Market Fund | |

| Distributions declared from: | |

| Ordinary income | | $ | 3,724,704 | | | $ | 1,517,308 | | |

| Year Ended December 31, 2005 | | Cash

Management Fund | | Money

Market Fund | |

| Distributions declared from: | |

| Ordinary income | | $ | 2,239,635 | | | $ | 788,510 | | |

At October 31, 2007, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

| | | Cash

Management Fund | | Money

Market Fund | |

| Undistributed ordinary income | | $ | 995,682 | | | $ | 33,480 | | |

| Capital loss carryforward | | $ | (362 | ) | | $ | (190 | ) | |

| Other temporary differences | | $ | (990,863 | ) | | $ | (33,397 | ) | |

The differences between components of distributable earnings (accumulated loss) on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to the timing of recognizing distributions to shareholders.

3 Shares of Beneficial Interest

The Funds' Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest (without par value).

4 Transactions with Affiliates

Eaton Vance Management (EVM) serves as the administrator of the Funds, but receives no compensation. The Portfolio has engaged Boston Management and Research (BMR), a subsidiary of EVM, to render investment advisory services. See Note 2 of the Portfolio's Notes to Financial Statements which are included elsewhere in this report. EVM serves as the sub-transfer agent of the Funds and receives from the transfer agent an aggregate fee based upon the actual expenses incurred by EVM in the performance of these services. For the period ended October 31, 2007, EVM earned $4,720 and $4,252 from Cash Management Fund and Money Market Fund, respectively, in sub-transfer agent fees. For the year ended December 31, 2006, EVM earned $4,896 and $4,763 from Cash Management Fund and Money Market Fund, respectively, in sub-transfer agent fees. Eaton Vance Distributors, Inc. (EVD), a subsidiary of EVM and the Fund's principal underwriter, also rece ived distribution and service fees from the Money Market Fund (see Note 5) and contingent deferred sales charges (see Note 6) from the Funds.

Except for Trustees of the Funds and the Portfolio who are not members of EVM's or BMR's organizations, officers and Trustees receive remuneration for their services to each Fund out of the investment advisory fee. Certain officers and Trustees of the Funds and the Portfolio are officers of the above organizations.

5 Distribution Plans

The Money Market Fund (the Fund) has in effect a distribution plan (the Plan) pursuant to Rule 12b-1 under the 1940 Act. The Plan requires the Fund to pay EVD 0.75% per annum of its average daily net assets for providing ongoing distribution services and facilities to the Fund. The Fund will automatically discontinue payments to EVD during any period in which there are no outstanding Uncovered Distribution Charges, which are equivalent to the sum of (i) 6.25% of the aggregate amount received by the Fund for shares sold plus (ii) interest calculated by applying the rate of 1% over the prevailing prime rate to the outstanding balance of

12

Eaton Vance Money Market Funds as of October 31, 2007

NOTES TO FINANCIAL STATEMENTS CONT'D

Uncovered Distribution Charges of EVD, reduced by the aggregate amount of contingent deferred sales charges (Note 6) and amounts theretofore paid or payable to EVD. For the period ended October 31, 2007 and for the year ended December 31, 2006, the Fund paid or accrued to EVD $318,785 and $344,564, respectively, representing 0.75% of its average daily net assets. At October 31, 2007, the amount of Uncovered Distribution Charges of EVD calculated under the Plan was approximately $13,055,000. The Plan also authorizes the Fund to make payments of service fees to EVD, investment dealers and other persons in amounts not exceeding 0.25% per annum of its average daily net assets. The Trustees approved service fee payments equal to 0.15% per annum of its average daily net assets of shares outstanding for one year or more. Service fees paid or accrued are for personal services and/or the maintenance of shareholder accounts. They are sepa rate and distinct from the sales commissions and distribution fees payable to EVD and, as such, are not subject to automatic discontinuance when there are no outstanding Uncovered Distribution Charges of EVD. Service fees paid or accrued for the period ended October 31, 2007 and for the year ended December 31, 2006 amounted to $55,773 and $59,567, respectively.

6 Contingent Deferred Sales Charges

A contingent deferred sales charge (CDSC) generally is imposed on shares of the Money Market Fund (other than those acquired as the result of an exchange from another Eaton Vance fund) on redemptions of shares made within six years of purchase. The CDSC is imposed at declining rates that begin at 5% in the case of redemptions in the first and second year after purchase, declining one percentage point each subsequent year. Shares of Money Market Fund and Cash Management Fund acquired as a result of an exchange from shares of another Eaton Vance Fund are subject to the original CDSC rate, if any, from the date of original purchase. Generally, the CDSC is based upon the lower of the net asset value at date of redemption or date of purchase. No charge is levied on shares acquired by reinvestment of dividends or capital gains distributions. No CDSC is levied on shares which have been sold to EVM or its affiliates or to their respecti ve employees or clients and may be waived under certain other limited conditions. CDSCs received on redemptions of Money Market Fund shares are paid to EVD to reduce the amount of Uncovered Distribution Charges calculated under the Fund's Distribution Plan. CDSCs received on redemptions of Money Market Fund shares when no Uncovered Distribution Charges exist are credited to the Fund. For the period ended October 31, 2007, the Fund was informed that EVD received approximately $27,000 and $114,000 of CDSCs paid by shareholders of the Cash Management Fund and Money Market Fund, respectively.

7 Investment Transactions

Increases and decreases in each Fund's investment in the Portfolio for the period ended October 31, 2007 were as follows:

| Cash Management Fund | | | |

| Increases | | $ | 625,532,672 | | |

| Decreases | | | 572,988,483 | | |

| Money Market Fund | | | |

| Increases | | $ | 82,076,645 | | |

| Decreases | | | 59,098,620 | | |

8 Recently Issued Accounting Pronouncements

In June 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48 (FIN 48), "Accounting for Uncertainty in Income Taxes – an interpretation of FASB Statement No. 109". FIN 48 clarifies the accounting for uncertainty in income taxes recognized in accordance with FASB Statement No. 109, "Accounting for Income Taxes". This interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. It also provides guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. FIN 48 is effective on the last business day of the first required financial reporting period for fiscal years beginning after December 15, 2006. Management has concluded that as of October 31, 2007, there are no uncertain tax positions that wou ld require financial statement recognition, derecognition, or disclosure.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157 (FAS 157), "Fair Value Measurements". FAS 157 defines fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting principles and expands disclosure about fair value measurements. FAS 157 is effective for fiscal years beginning after November 15, 2007. Management is currently evaluating the impact the adoption of FAS 157 will have on the Funds' financial statement disclosures.

9 Fiscal Year-End Change

Effective March 12, 2007, Cash Management Fund and Money Market Fund each changed its fiscal year-end from December 31 to October 31.

13

Eaton Vance Money Market Funds as of October 31, 2007

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Trustees of Eaton Vance Mutual

Funds Trust and Shareholders of the

Eaton Vance Cash Management Fund

and Eaton Vance Money Market Fund:

We have audited the accompanying statements of assets and liabilities of Eaton Vance Cash Management Fund and Eaton Vance Money Market Fund (the "Funds") (each a series of Eaton Vance Mutual Funds Trust) as of October 31, 2007, and the related statements of operations, the statements of changes in net assets, and the financial highlights for the ten month period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The statements of operations and the statements of changes in net assets for the years ended December 31, 2006 and 2005, and the financial highlights for the five years in the period ended December 31, 2006 were audited by other auditors. Those auditors expressed an unqualified opinion on those financial statements and financial highlights in their report dated February 21, 2007.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Funds are not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds' internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used an d significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial positions of Eaton Vance Cash Management Fund and Eaton Vance Money Market Fund as of October 31, 2007, the results of their operations, the changes in their net assets, and the financial highlights for the ten month period then ended, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Boston, Massachusetts

December 17, 2007

14

Eaton Vance Money Market Funds as of October 31, 2007

FEDERAL TAX INFORMATION (Unaudited)

The Form 1099-DIV you receive in January 2008 will show the tax status of all distributions paid to your account in calendar 2007. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Funds.

15

Cash Management Portfolio as of October 31, 2007

PORTFOLIO OF INVESTMENTS

Asset Backed Securities — 3.7% | | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| $ | 1,044 | | | AMCAR, Series 2007-BF, Class A1, 5.319%, 5/6/08 | | $ | 1,043,620 | | |

| | 6,792 | | | CARAT, Series 2007-1, Class A1, 5.325%, 5/15/08(1) | | | 6,791,576 | | |

| | 15,787 | | | CARAT, Series 2007-2, Class A1A, 5.605%, 8/15/08(1) | | | 15,787,405 | | |

| | 9,868 | | | CARAT, Series 2007-3, Class A1, 5.264%, 9/15/08(1) | | | 9,868,167 | | |

| | 3,196 | | | CARMX, Series 2007-2, Class A1, 5.328%, 6/16/08 | | | 3,196,000 | | |

| | 4,928 | | | DTAOT, Series 2007-A, Class A1, 5.343%, 5/15/08(1) | | | 4,928,171 | | |

| | 10,702 | | | FORDO, Series 2007-A, Class A1, 5.349%, 7/15/08(1) | | | 10,701,858 | | |

| | 10,000 | | | FORDO, Series 2007-B, Class A1, 5.292%, 10/15/08(1) | | | 10,000,000 | | |

| | 1,705 | | | TAROT, Series 2007-A, Class A1, 5.303%, 6/12/08 | | | 1,705,010 | | |

Total Asset Backed Securities

(amortized cost $64,021,807) | | $ | 64,021,807 | | |

| Certificates of Deposit — 6.4% | | | |

Principal Amount

(000's omitted) | | Security | | Value | |

| $ | 21,000 | | | Deutsche Bank, NY, 4.65%, 4/24/08(2) | | $ | 21,000,000 | | |

| | 38,000 | | | Royal Bank of Scotland, NY, 5.294%, 7/11/08(2) | | | 38,000,000 | | |

| | 50,000 | | | Societe Generale, NY, 5.76%, 7/7/08(2) | | | 50,000,000 | | |

Total Certificates of Deposit

(amortized cost $109,000,000) | | $ | 109,000,000 | | |

| Commercial Paper — 70.4% | | | |

Principal Amount

(000's omitted) | | Security | | Value | |

| Banks and Money Services — 62.6% | | | |

| $ | 8,050 | | | Abbey National, LLC, 4.75%, 11/1/07 | | $ | 8,050,000 | | |

| | 25,000 | | | American Express Credit Corp., 5.50%, 12/7/07 | | | 24,862,500 | | |

| | 35,000 | | | American General Corp., 5.39%, 11/9/07(3) | | | 34,958,078 | | |

| | 10,000 | | | BankAmerica Corp., 5.50%, 11/20/07 | | | 9,970,972 | | |

| | 9,500 | | | Barclays U.S. Funding, LLC, 4.95%, 1/9/08 | | | 9,409,869 | | |

| | 38,000 | | | Barclays U.S. Funding, LLC, 5.135%, 12/10/07 | | | 37,788,609 | | |

| | 8,381 | | | Barton Capital Corp., LLC, 4.83%, 11/1/07(3) | | | 8,381,000 | | |

| | 11,000 | | | Barton Capital Corp., LLC, 4.84%, 12/7/07(3) | | | 10,946,760 | | |

| | 24,900 | | | Barton Capital Corp., LLC, 5.00%, 1/11/08(3) | | | 24,654,458 | | |

| | 11,000 | | | Barton Capital Corp., LLC, 5.15%, 11/9/07(3) | | | 10,987,411 | | |

| | 15,000 | | | Barton Capital Corp., LLC, 5.95%, 11/19/07 | | | 14,955,375 | | |

| | 20,000 | | | CAFCO, LLC, 5.13%, 1/10/08(3) | | | 19,800,500 | | |

| | 10,000 | | | CAFCO, LLC, 5.95%, 1/15/08(3) | | | 9,876,042 | | |

| | 11,425 | | | CAFCO, LLC, 6.20%, 11/15/07(3) | | | 11,397,453 | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Banks and Money Services (continued) | | | |

| $ | 11,500 | | | CIESCO, LLC, 5.10%, 11/5/07(3) | | $ | 11,493,483 | | |

| | 16,500 | | | CIESCO, LLC, 5.50%, 11/2/07(3) | | | 16,497,479 | | |

| | 11,000 | | | CIESCO, LLC, 5.50%, 2/15/08(3) | | | 10,821,861 | | |

| | 12,500 | | | CIT Group, Inc., 5.16%, 2/15/08(3) | | | 12,310,083 | | |

| | 10,000 | | | CIT Group, Inc., 5.25%, 12/19/07(3) | | | 9,930,000 | | |

| | 10,500 | | | CIT Group, Inc., 5.32%, 2/1/08(3) | | | 10,357,247 | | |

| | 10,000 | | | CIT Group, Inc., 5.37%, 2/7/08(3) | | | 9,853,817 | | |

| | 11,000 | | | CIT Group, Inc., 5.48%, 2/8/08(3) | | | 10,834,230 | | |

| | 18,500 | | | CIT Group, Inc., 5.53%, 11/13/07(3) | | | 18,465,898 | | |

| | 15,500 | | | CIT Group, Inc., 5.63%, 11/20/07(3) | | | 15,453,944 | | |

| | 10,000 | | | CRC Funding, LLC, 5.05%, 12/14/07(3) | | | 9,939,681 | | |

| | 11,500 | | | CRC Funding, LLC, 5.85%, 3/5/08(3) | | | 11,266,406 | | |

| | 7,500 | | | CRC Funding, LLC, 5.88%, 2/8/08(3) | | | 7,378,725 | | |

| | 25,000 | | | CRC Funding, LLC, 6.05%, 11/14/07(3) | | | 24,945,382 | | |

| | 12,000 | | | Fortis Funding, LLC, 5.64%, 11/5/07(3) | | | 11,992,474 | | |

| | 35,000 | | | HSBC Finance Corp., 5.42%, 12/6/07 | | | 34,815,569 | | |

| | 25,000 | | | ING (US) Funding, LLC, 4.89%, 1/22/08 | | | 24,721,542 | | |

| | 8,075 | | | Kitty Hawk Funding Corp., 4.80%, 1/17/08(3) | | | 7,992,097 | | |

| | 13,356 | | | Kitty Hawk Funding Corp., 4.80%, 1/29/08(3) | | | 13,197,509 | | |

| | 8,500 | | | Kitty Hawk Funding Corp., 4.90%, 12/14/07(3) | | | 8,450,251 | | |

| | 15,000 | | | Kitty Hawk Funding Corp., 4.95%, 11/19/07(3) | | | 14,962,875 | | |

| | 11,000 | | | Kitty Hawk Funding Corp., 5.11%, 1/11/08(3) | | | 10,889,141 | | |

| | 7,500 | | | Kitty Hawk Funding Corp., 5.50%, 12/18/07(3) | | | 7,446,146 | | |

| | 25,000 | | | Merrill Lynch & Co., 4.77%, 12/12/07 | | | 24,864,187 | | |

| | 8,000 | | | Morgan Stanley, 5.39%, 2/8/08 | | | 7,881,420 | | |

| | 26,400 | | | Morgan Stanley, 5.48%, 11/20/07 | | | 26,323,646 | | |

| | 25,000 | | | Morgan Stanley, 5.50%, 11/28/07 | | | 24,896,875 | | |

| | 20,000 | | | Nestle Capital Corp., 5.30%, 11/15/07(3) | | | 19,958,777 | | |

| | 9,500 | | | Old Line Funding Corp., LLC, 4.93%, 11/19/07(3) | | | 9,476,582 | | |

| | 6,150 | | | Old Line Funding Corp., LLC, 4.95%, 1/22/08(3) | | | 6,080,659 | | |

| | 16,378 | | | Old Line Funding Corp., LLC, 5.12%, 1/17/08(3) | | | 16,197,592 | | |

| | 10,000 | | | Old Line Funding Corp., LLC, 5.20%, 11/9/07(3) | | | 9,988,444 | | |

| | 26,178 | | | Old Line Funding Corp., LLC, 5.70%, 12/13/07(3) | | | 26,003,916 | | |

| | 8,500 | | | Old Line Funding Corp., LLC, 5.95%, 11/14/07(3) | | | 8,481,737 | | |

| | 6,000 | | | Old Line Funding Corp., LLC, 6.15%, 12/7/07(3) | | | 5,963,100 | | |

| | 6,500 | | | Ranger Funding Co., LLC, 4.90%, 11/21/07(3) | | | 6,482,306 | | |

| | 10,000 | | | Ranger Funding Co., LLC, 4.91%, 1/14/08(3) | | | 9,899,072 | | |

| | 11,000 | | | Ranger Funding Co., LLC, 5.10%, 11/26/07(3) | | | 10,961,042 | | |

| | 11,000 | | | Ranger Funding Co., LLC, 5.13%, 1/10/08(3) | | | 10,890,275 | | |

| | 25,000 | | | Royal Bank of Canada, 5.44%, 11/8/07 | | | 24,973,556 | | |

| | 10,000 | | | Royal Bank of Scotland, 5.06%, 12/11/07 | | | 9,943,778 | | |

| | 7,000 | | | Sheffield Receivables Corp., 4.90%, 11/15/07(3) | | | 6,986,661 | | |

| | 8,750 | | | Sheffield Receivables Corp., 4.95%, 11/7/07(3) | | | 8,742,781 | | |

| | 15,000 | | | Sheffield Receivables Corp., 4.96%, 11/13/07(3) | | | 14,975,200 | | |

See notes to financial statements

16

Cash Management Portfolio as of October 31, 2007

PORTFOLIO OF INVESTMENTS CONT'D

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Banks and Money Services (continued) | | | |

| $ | 24,750 | | | Sheffield Receivables Corp., 5.08%, 1/18/08(3) | | $ | 24,477,585 | | |

| | 10,000 | | | Sheffield Receivables Corp., 5.17%, 11/9/07(3) | | | 9,988,511 | | |

| | 10,053 | | | Societe Generale North America, Inc., 4.89%, 1/24/08 | | | 9,938,295 | | |

| | 18,500 | | | Societe Generale North America, Inc., 5.15%, 1/7/08 | | | 18,322,683 | | |

| | 15,150 | | | Societe Generale North America, Inc., 5.46%, 11/6/07 | | | 15,138,511 | | |

| | 20,000 | | | UBS Finance Delaware, LLC, 4.785%, 12/27/07 | | | 19,851,133 | | |

| | 23,000 | | | UBS Finance Delaware, LLC, 4.79%, 12/21/07 | | | 22,846,986 | | |

| | 39,719 | | | UBS Finance Delaware, LLC, 5.40%, 11/7/07 | | | 39,683,253 | | |

| | 18,000 | | | Yorktown Capital, LLC, 4.85%, 11/1/07(3) | | | 18,000,000 | | |

| | 10,000 | | | Yorktown Capital, LLC, 4.88%, 1/25/08(3) | | | 9,884,778 | | |

| | 5,741 | | | Yorktown Capital, LLC, 5.00%, 1/14/08(3) | | | 5,681,995 | | |

| | 6,250 | | | Yorktown Capital, LLC, 5.15%, 12/20/07(3) | | | 6,206,189 | | |

| | 14,800 | | | Yorktown Capital, LLC, 5.18%, 11/13/07(3) | | | 14,774,445 | | |

| | 10,000 | | | Yorktown Capital, LLC, 5.75%, 11/27/07(3) | | | 9,958,472 | | |

| | | | | | | $ | 1,064,779,309 | | |

| Foods — 1.1% | | | |

| $ | 8,000 | | | General Mills, Inc., 5.04%, 1/29/08(3) | | $ | 7,900,320 | | |

| | 11,000 | | | General Mills, Inc., 5.13%, 11/8/07(3) | | | 10,989,028 | | |

| | | | | | | $ | 18,889,348 | | |

| Household Products — 0.3% | | | |

| $ | 5,253 | | | Fortune Brands, Inc., 5.25%, 11/14/07(3) | | $ | 5,243,041 | | |

| | | | | | | $ | 5,243,041 | | |

| Insurance — 4.3% | | | |

| $ | 25,000 | | | Prudential Financial, Inc., 5.05%, 1/25/08(3) | | $ | 24,701,910 | | |

| | 16,500 | | | Prudential Financial, Inc., 5.67%, 11/15/07(3) | | | 16,463,618 | | |

| | 16,500 | | | Prudential Financial, Inc., 5.67%, 12/17/07(3) | | | 16,380,458 | | |

| | 15,000 | | | Prudential Financial, Inc., 5.75%, 11/21/07(3) | | | 14,952,083 | | |

| | | | | | | $ | 72,498,069 | | |

| Machinery — 0.6% | | | |

| $ | 10,000 | | | Ingersoll-Rand Co., Ltd., 5.07%, 12/7/07(3) | | $ | 9,949,300 | | |

| | | | | | | $ | 9,949,300 | | |

| Oil and Gas-Equipment and Services — 0.9% | | | |

| $ | 8,600 | | | XTO Energy, Inc., 5.38%, 1/22/08(3) | | $ | 8,494,612 | | |

| | 6,765 | | | XTO Energy, Inc., 5.38%, 1/29/08(3) | | | 6,675,022 | | |

| | | | | | | $ | 15,169,634 | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Retail-Food and Drug — 0.6% | | | |

| $ | 11,000 | | | CVS Corp., 5.42%, 1/9/08(3) | | $ | 10,885,728 | | |

| | | | | | | $ | 10,885,728 | | |

Total Commercial Paper

(amortized cost $1,197,414,429) | | $ | 1,197,414,429 | | |

| Corporate Bonds & Notes — 17.2% | | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Banks and Money Services — 15.1% | | | |

| $ | 14,000 | | | Countrywide Financial Corp., MTN,

5.768%, 12/19/07(2) | | $ | 14,000,321 | | |

| | 10,000 | | | Countrywide Home Loan, MTN, 3.25%, 5/21/08 | | | 9,876,516 | | |

| | 20,000 | | | Credit Agricole SA/London, 5.18%, 10/21/08(1)(2) | | | 20,000,000 | | |

| | 16,000 | | | Diageo Capital PLC, 3.50%, 11/19/07 | | | 15,985,205 | | |

| | 23,000 | | | Fortis Bank, NY, 5.169%, 11/19/08(1)(2) | | | 23,000,000 | | |

| | 21,500 | | | General Electric Capital Corp., 5.696%, 1/15/08(2) | | | 21,495,069 | | |

| | 13,500 | | | John Deere Capital Corp., 5.383%, 9/25/08(2) | | | 13,500,000 | | |

| | 11,000 | | | Merrill Lynch & Co., 3.70%, 4/21/08 | | | 10,891,125 | | |

| | 25,000 | | | Merrill Lynch & Co., 5.175%, 11/17/08(2) | | | 25,000,000 | | |

| | 9,500 | | | Merrill Lynch & Co., MTN, 3.125%, 7/15/08 | | | 9,345,233 | | |

| | 20,000 | | | Morgan Stanley, MTN, 5.118%, 1/11/08(2) | | | 20,004,348 | | |

| | 25,000 | | | Rabobank Nederland, MTN, 4.53%, 3/12/08(2) | | | 25,000,000 | | |

| | 20,000 | | | Totta Ireland PLC, 5.122%, 11/6/08(1)(2) | | | 20,000,000 | | |

| | 14,800 | | | Unilever Capital Corp., 5.10%, 11/11/08(1)(2) | | | 14,800,000 | | |

| | 14,730 | | | Washington Mutual, 4.375%, 1/15/08 | | | 14,694,490 | | |

| | | | | | | $ | 257,592,307 | | |

| Insurance — 1.2% | | | |

| $ | 20,000 | | | Prudential Financial, Inc., 5.791%, 9/4/08(2) | | $ | 20,000,000 | | |

| | | | | | | $ | 20,000,000 | | |

| Telecommunications — 0.9% | | | |

| $ | 16,000 | | | Vodafone Group PLC, 3.95%, 1/30/08 | | $ | 15,944,447 | | |

| | | | | | | $ | 15,944,447 | | |

Total Corporate Bonds & Notes

(amortized cost $293,536,754) | | $ | 293,536,754 | | |

See notes to financial statements

17

Cash Management Portfolio as of October 31, 2007

PORTFOLIO OF INVESTMENTS CONT'D

U.S. Government Agency Obligations — 1.5% | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| $ | 25,000 | | | FHLB, 5.375%, 2/28/08 | | $ | 25,000,000 | | |

Total U.S. Government Agency Obligations

(amortized cost $25,000,000) | | $ | 25,000,000 | | |

| Variable Rate Demand Obligations — 0.5% | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| $ | 8,000 | | | Miami, FL, (MBIA), (SPA - Wachovia Bank N.A.),

4.75%, 12/1/25(2) | | $ | 8,000,000 | | |

Total Variable Rate Demand Obligations

(amortized cost $8,000,000) | | $ | 8,000,000 | | |

Total Investments — 99.7%

(amortized cost $1,696,972,990)(4) | | $ | 1,696,972,990 | | |

| Other Assets, Less Liabilities — 0.3% | | $ | 4,621,269 | | |

| Net Assets — 100.0% | | $ | 1,701,594,259 | | |

AMCAR - AmeriCredit Automobile Receivables Trust

CARAT - Capital Auto Receivables Asset Trust

CARMX - Carmax Auto Owner Trust

DTAOT - DT Auto Owner Trust

FHLB - Federal Home Loan Bank

FORDO - Ford Credit Auto Owner Trust

MTN - Medium-Term Note

TAROT - Triad Auto Receivables Owner Trust

(1) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2007, the aggregate value of the securities is $135,877,177 or 8.0% of the Portfolio's net assets.

(2) Variable rate obligation. The stated interest rate represents the rate in effect at October 31, 2007.

(3) A security which has been issued under section 4(2) of the Securities Act of 1933 and is generally regarded as restricted and illiquid. This security may be resold in transactions exempt from registration or to the public if the security is registered. All such securities held are deemed liquid based on criteria and procedures authorized by the Trustees.

(4) Cost for federal income taxes is the same.

See notes to financial statements

18

Cash Management Portfolio as of October 31, 2007

FINANCIAL STATEMENTS

Statement of Assets and Liabilities

As of October 31, 2007

| Assets | |

| Investments, at amortized cost | | $ | 1,696,972,990 | | |

| Cash | | | 426 | | |

| Interest receivable | | | 5,553,299 | | |

| Total assets | | $ | 1,702,526,715 | | |

| Liabilities | |

| Payable to affiliate for investment advisory fee | | $ | 833,520 | | |

| Payable to affiliate for Trustees' fee | | | 2,773 | | |

| Accrued expenses | | | 96,163 | | |

| Total liabilities | | $ | 932,456 | | |

| Net Assets applicable to investors' interest in Portfolio | | $ | 1,701,594,259 | | |

| Sources of Net Assets | |

| Net proceeds from capital contributions and withdrawals | | $ | 1,701,594,259 | | |

| Total | | $ | 1,701,594,259 | | |

Statements of Operations

For the Period Ended

October 31, 2007(1)

| Investment Income | | Period Ended(1)

October 31, 2007 | | Year Ended

December 31, 2006 | |

| Interest | | $ | 96,036,530 | | | $ | 14,388,824 | | |

| Total investment income | | $ | 96,036,530 | | | $ | 14,388,824 | | |

| Expenses | |

| Investment adviser fee | | $ | 8,714,325 | | | $ | 1,360,454 | | |

| Trustees' fees and expenses | | | 22,782 | | | | 8,016 | | |

| Custodian fee | | | 182,662 | | | | 85,116 | | |

| Legal and accounting services | | | 113,357 | | | | 44,598 | | |

| Miscellaneous | | | 12,978 | | | | 368 | | |

| Total expenses | | $ | 9,046,104 | | | $ | 1,498,552 | | |

Deduct —

Reduction of custodian fee | | $ | 293 | | | $ | 18 | | |

| Total expense reductions | | $ | 293 | | | $ | 18 | | |

| Net expenses | | $ | 9,045,811 | | | $ | 1,498,534 | | |

| Net investment income | | $ | 86,990,719 | | | $ | 12,890,290 | | |

| Realized Gain (Loss) | |

Net realized gain (loss) —

Investment transactions (identified

cost basis) | | $ | (196 | ) | | $ | (2,730 | ) | |

| Increase from payments by affiliate | | | — | | | | 53 | | |

Net loss realized on the disposal of

investments which did not meet

the Portfolio's investment guidelines | | | — | | | | (53 | ) | |

| Net realized loss | | $ | (196 | ) | | $ | (2,730 | ) | |

| Net increase in net assets from operations | | $ | 86,990,523 | | | $ | 12,887,560 | | |

(1) For the ten months ended October 31, 2007.

See notes to financial statements

19

Cash Management Portfolio as of October 31, 2007

FINANCIAL STATEMENTS CONT'D

Statements of Changes in Net Assets

| Increase (Decrease) in Net Assets | | Period Ended

October 31, 2007(1) | | Year Ended

December 31, 2006 | | Year Ended

December 31, 2005 | |

From operations —

Net investment income | | $ | 86,990,719 | | | $ | 12,890,290 | | | $ | 3,954,413 | | |

Net realized loss from investment transactions, payments by affiliate and the disposal of investments

which did not meet the Portfolio's investment guidelines | | | (196 | ) | | | (2,730 | ) | | | (141 | ) | |

| Net increase in net assets from operations | | $ | 86,990,523 | | | $ | 12,887,560 | | | $ | 3,954,272 | | |

Capital transactions —

Contributions | | $ | 24,122,874,395 | | | $ | 3,903,906,779 | | | $ | 184,089,048 | | |

| Withdrawals | | | (23,798,494,086 | ) | | | (2,773,384,656 | ) | | | (210,117,271 | ) | |

| Net increase (decrease) in net assets from capital transactions | | $ | 324,380,309 | | | $ | 1,130,522,123 | | | $ | (26,028,223 | ) | |

| Net increase (decrease) in net assets | | $ | 411,370,832 | | | $ | 1,143,409,683 | | | $ | (22,073,951 | ) | |

| Net Assets | |

| At beginning of period | | $ | 1,290,223,427 | | | $ | 146,813,744 | | | $ | 168,887,695 | | |

| At end of period | | $ | 1,701,594,259 | | | $ | 1,290,223,427 | | | $ | 146,813,744 | | |

(1) For the ten months ended October 31, 2007.

See notes to financial statements

20

Cash Management Portfolio as of October 31, 2007

FINANCIAL STATEMENTS CONT'D

Supplementary Data

| | | Period Ended | | Year Ended December 31, | |

| | | October 31, 2007(1) | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| Ratios/Supplemental Data | |

| Ratios (As a percentage of average daily net assets): | |

| Expenses before custodian fee reduction | | | 0.51 | %(2) | | | 0.54 | % | | | 0.60 | % | | | 0.59 | % | | | 0.57 | % | | | 0.58 | % | |

| Expenses after custodian fee reduction | | | 0.51 | %(2) | | | 0.54 | % | | | 0.60 | % | | | 0.59 | % | | | 0.57 | % | | | 0.58 | % | |

| Net investment income | | | 4.88 | %(2) | | | 4.67 | % | | | 2.63 | % | | | 0.78 | % | | | 0.59 | % | | | 1.22 | % | |

| Total Return | | | 4.14 | %(4) | | | 4.60 | %(3) | | | 2.67 | %(3) | | | 0.78 | % | | | 0.60 | % | | | 1.22 | % | |

(1) For the ten months ended October 31, 2007. The Portfolio changed its fiscal year end from December 31 to October 31.

(2) Annualized.

(3) During the years ended December 31, 2006 and December 31, 2005, the investment adviser reimbursed the Portfolio for net losses realized on the disposal of investments which did not meet the Portfolio's investment guidelines. The reimbursement had no effect on total return for the years ended December 31, 2006 and December 31, 2005.

(4) Not annualized.

See notes to financial statements

21

Cash Management Portfolio as of October 31, 2007

NOTES TO FINANCIAL STATEMENTS

1 Significant Accounting Policies

Cash Management Portfolio (the Portfolio) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as a diversified, open-end management investment company. The Portfolio's objective is to provide as high a rate of income as may be consistent with preservation of capital and maintenance of liquidity. The Declaration of Trust permits the Trustees to issue interests in the Portfolio. At October 31, 2007, Eaton Vance Cash Management Fund and Eaton Vance Money Market Fund held an approximate 10.5% and 4.0% interest, respectively, in the Portfolio. The Portfolio is also available to other portfolios and funds managed by Boston Management and Research (BMR) and Eaton Vance Management (EVM) and its affiliates for short-term investment purposes. At October 31, 2007, other portfolios and funds managed by BMR and EVM and its affiliates held interests totaling 85.3% of the Portfolio's net assets. At October 31, 20 07, Eaton Vance Tax-Managed Global Diversified Equity Income Fund and Large-Cap Value Portfolio each held a greater than 10% interest in the Portfolio (16.9% and 12.6%, respectively).

The following is a summary of significant accounting policies of the Portfolio. The policies are in conformity with accounting principles generally accepted in the United States of America.

A Investment Valuation — The Portfolio values its investment securities utilizing the amortized cost valuation technique permitted by Rule 2a-7 of the 1940 Act, pursuant to which the Portfolio must comply with certain conditions. This technique involves initially valuing a portfolio security at its cost and thereafter assuming a constant amortization to maturity of any discount or premium.

B Investment Transactions — Investment transactions for financial statement purposes are accounted for on a trade date basis. Realized gains and losses on investments sold are determined on the basis of identified cost.

C Income — Interest income is recorded on the basis of interest accrued, adjusted for amortization of premium or accretion of discount.

D Federal Taxes — The Portfolio has elected to be treated as a partnership for federal tax purposes. No provision is made by the Portfolio for federal or state taxes on any taxable income of the Portfolio because each investor in the Portfolio is ultimately responsible for the payment of any taxes on its share of taxable income. Since at least one of the Portfolio's investors is a regulated investment company that invests all or substantially all of its assets in the Portfolio, the Portfolio normally must satisfy the applicable source of income and diversification requirements (under the Internal Revenue Code) in order for its investors to satisfy them. The Portfolio will allocate, at least annually a mong its investors, each investor's distributive share of the Portfolio's net investment income, net realized capital gains and any other items of income, gain, loss, deduction or credit.

E Expense Reduction — State Street Bank and Trust Company (SSBT) serves as custodian of the Portfolio. Pursuant to the custodian agreement, SSBT receives a fee reduced by credits, which are determined based on the average daily cash balance the Portfolio maintains with SSBT. All credit balances, if any, used to reduce the Portfolio's custodian fees are reported as a reduction of expenses in the Statement of Operations.

F Use of Estimates — The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

G Indemnifications — Under the Portfolio's organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Portfolio. Interestholders in the Portfolio are jointly and severally liable for the liabilities and obligations of the Portfolio in the event that the Portfolio fails to satisfy such liabilities and obligations; provided, however, that, to the extent assets are available in the Portfolio, the Portfolio may, under certain circumstances, indemnify interestholders from and against any claim or liability to which such holder may become subject by reason of being or having been an interestholder in the Portfolio. Additionally, in the normal course of business, the Portfo lio enters into agreements with service providers that may contain indemnification clauses. The Portfolio's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Portfolio that have not yet occurred.

22

Cash Management Portfolio as of October 31, 2007

NOTES TO FINANCIAL STATEMENTS CONT'D

2 Investment Adviser Fee and Other Transactions with Affiliates

The investment adviser fee is earned by BMR, a subsidiary of EVM, as compensation for management and investment advisory services rendered to the Portfolio. Pursuant to the advisory agreement, BMR receives a monthly advisory fee at the annual rate of 1/2 of 1% of the Portfolio's average daily net assets. However, BMR has contractually agreed to reduce its advisory fee to 0.50% annually of the Portfolio's average daily net assets up to $1 billion, 0.475% annually of average daily net assets of $1 billion but less than $2 billion, 0.450% annually of average daily net assets of $2 billion but less than $5 billion and at reduced rates as daily net as sets exceed that level. This contractual reduction, which cannot be terminated or amended without Trustee consent and decreased without shareholder consent, was accepted by a vote of the Trustees on April 23, 2007. For the period ended October 31, 2007, the fee was equivalent to 0.49% (annualized) of the Portfolio's average daily net assets and amounted to $8,714,325. For the year ended December 31, 2006, the fee was equivalent to 0.50% and amounted to $1,360,454.

Except for Trustees of the Portfolio who are not members of EVM's or BMR's organizations, officers and Trustees receive remuneration for their services to the Portfolio out of such investment adviser fee. Certain officers and Trustees of the Portfolio are officers of the above organizations.

3 Purchases and Sales of Investments

Purchases and sales (including maturities and paydowns) of investments during the period ended October 31, 2007, exclusive of U.S. Government and agency securities, aggregated $46,643,261,683 and $46,321,821,035 respectively. Purchases and sales (including maturities) of U.S. Government and agency securities aggregated $25,000,000 and $18,000,000, respectively.

4 Line of Credit

The Portfolio participates with other portfolios and funds managed by EVM and its affiliates in a $200 million unsecured line of credit agreement with a group of banks. Borrowings are made by the Portfolio solely to facilitate the handling of unusual and/or unanticipated short-term cash requirements. Interest is charged to the Portfolio based on its borrowings at an amount above either the Eurodollar rate or Federal Funds rate. In addition, a fee computed at an annual rate of 0.07% on the daily unused portion of the line of credit is allocated among the participating portfolios and funds at the end of each quarter. The Portfolio did not have any significant borrowings or allocated fees during the period ended October 31, 2007.

5 Recently Issued Accounting Pronouncements

In June 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48 (FIN 48), "Accounting for Uncertainty in Income Taxes – an interpretation of FASB Statement No. 109". FIN 48 clarifies the accounting for uncertainty in income taxes recognized in accordance with FASB Statement No. 109, "Accounting for Income Taxes". This interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. It also provides guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. FIN 48 is effective on the last business day of the first required financial reporting period for fiscal years beginning after December 15, 2006. Management has concluded that as of October 31, 2007, there are no uncertain tax positions that wou ld require financial statement recognition, derecognition, or disclosure.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157 (FAS 157), "Fair Value Measurements". FAS 157 defines fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting principles and expands disclosure about fair value measurements. FAS 157 is effective for fiscal years beginning after November 15, 2007. Management is currently evaluating the impact the adoption of FAS 157 will have on the Portfolio's financial statement disclosures.

6 Fiscal Year-End Change

Effective January 1, 2007, the Portfolio changed its fiscal year-end from December 31 to October 31.

23

Cash Management Portfolio as of October 31, 2007

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Trustees and Investors of

Cash Management Portfolio:

We have audited the accompanying statement of assets and liabilities of Cash Management Portfolio (the "Portfolio"), including the portfolio of investments, as of October 31, 2007, and the related statement of operations, the statement of changes in net assets, and the supplementary data for the ten month period then ended. These financial statements and supplementary data are the responsibility of the Portfolio's management. Our responsibility is to express an opinion on these financial statements and supplementary data based on our audit. The statement of operations for the year ended December 31, 2006, the statements of changes in net assets for the years ended December 31, 2006 and 2005, and the supplementary data for the five years in the period ended December 31, 2006 were audited by other auditors. Those auditors expressed an unqualified opinion on those financial statements and supplementary data in their report dated Fe bruary 21, 2007.