UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04015

Eaton Vance Mutual Funds Trust

(Exact Name of registrant as Specified in Charter)

The Eaton Vance Building, 255 State Street, Boston, Massachusetts 02109

(Address of Principal Executive Offices)

Alan R. Dynner

The Eaton Vance Building, 255 State Street, Boston, Massachusetts 02109

(Name and Address of Agent for Services)

(617) 482-8260

(registrant’s Telephone Number)

December 31

Date of Fiscal Year End

December 31, 2006

Date of Reporting Period

Item 1. Reports to Stockholders

Annual Report December 31, 2006

EATON VANCE

COMBINED

MONEY

MARKET

FUNDS

Cash Management Fund

Money Market Fund

IMPORTANT NOTICES REGARDING PRIVACY,

DELIVERY OF SHAREHOLDER DOCUMENTS,

PORTFOLIO HOLDINGS, AND PROXY VOTING

Privacy. The Eaton Vance organization is committed to ensuring your financial privacy. Each of the financial institutions identified below has in effect the following policy ("Privacy Policy") with respect to nonpublic personal information about its customers:

• Only such information received from you, through application forms or otherwise, and information about your Eaton Vance fund transactions will be collected. This may include information such as name, address, social security number, tax status, account balances and transactions.

• None of such information about you (or former customers) will be disclosed to anyone, except as permitted by law (which includes disclosure to employees necessary to service your account). In the normal course of servicing a customer's account, Eaton Vance may share information with unaffiliated third parties that perform various required services such as transfer agents, custodians and broker/dealers.

• Policies and procedures (including physical, electronic and procedural safeguards) are in place that are designed to protect the confidentiality of such information.

• We reserve the right to change our Privacy Policy at any time upon proper notification to you. Customers may want to review our Policy periodically for changes by accessing the link on our homepage: www.eatonvance.com.

Our pledge of privacy applies to the following entities within the Eaton Vance organization: the Eaton Vance Family of Funds, Eaton Vance Management, Eaton Vance Investment Counsel, Boston Management and Research, and Eaton Vance Distributors, Inc.

In addition, our Privacy Policy only applies to those Eaton Vance customers who are individuals and who have a direct relationship with us. If a customer's account (i.e., fund shares) is held in the name of a third-party financial adviser/broker-dealer, it is likely that only such adviser's privacy policies apply to the customer. This notice supersedes all previously issued privacy disclosures.

For more information about Eaton Vance's Privacy Policy, please call 1-800-262-1122.

Delivery of Shareholder Documents. The Securities and Exchange Commission (the "SEC") permits funds to deliver only one copy of shareholder documents, including prospectuses, proxy statements and shareholder reports, to fund investors with multiple accounts at the same residential or post office box address. This practice is often called "householding" and it helps eliminate duplicate mailings to shareholders.

Eaton Vance, or your financial adviser, may household the mailing of your documents indefinitely unless you instruct Eaton Vance, or your financial adviser, otherwise.

If you would prefer that your Eaton Vance documents not be householded, please contact Eaton Vance at 1-800-262-1122, or contact your financial adviser.

Your instructions that householding not apply to delivery of your Eaton Vance documents will be effective within 30 days of receipt by Eaton Vance or your financial adviser.

Portfolio Holdings. Each Eaton Vance Fund and its underlying Portfolio (if applicable) will file a schedule of its portfolio holdings on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Form N-Q will be available on the Eaton Vance website www.eatonvance.com, by calling Eaton Vance at 1-800-262-1122 or in the EDGAR database on the SEC's website at www.sec.gov. Form N-Q may also be reviewed and copied at the SEC's public reference room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the public reference room).

Proxy Voting. From time to time, funds are required to vote proxies related to the securities held by the funds. The Eaton Vance Funds or their underlying Portfolios (if applicable) vote proxies according to a set of policies and procedures approved by the Funds' and Portfolios' Boards. You may obtain a description of these policies and procedures and information on how the Funds or Portfolios voted proxies relating to portfolio securities during the most recent 12 month period ended June 30, without charge, upon request, by calling 1-800-262-1122. This description is also available on the SEC's website at www.sec.gov.

Eaton Vance Money Market Funds as of December 31, 2006

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

|

Elizabeth S. Kenyon, CFA |

Portfolio Manager |

Investment Environment

· During 2006, the U.S. economy grew at a solid pace, with low to moderate inflation. U.S. Gross Domestic Product (GDP), the primary indicator of growth, expanded at a robust 5.6% annualized rate in the first quarter of 2006, 2.6% in the second quarter, 2.0% in the third quarter and an estimated 3.5% in the fourth quarter. Unemployment moved lower to 4.5% in December 2006 from 4.9% a year earlier.

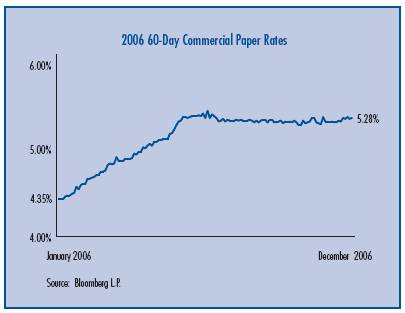

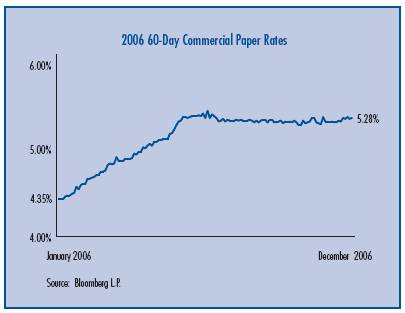

· At its June 2006 meeting, the Federal Reserve Board (the Fed) increased the Fed Funds target rate, a key short-term interest rate benchmark, by 25 basis points (0.25%). This was the Fed’s 17th consecutive increase since June 2004, and it brought the Fed Funds target rate to 5.25%. Since June 2006, the Fed has held short rates steady, awaiting further economic inputs to determine the future direction of interest rate moves.

· In past cycles, as the Fed has moved short-term interest rates higher, market forces have pushed intermediate and long-term bond yields higher as well. During the past year, however, yields on longer-term bonds did not rise as much as those on short-term bonds, creating an “inverted” yield curve, in which longer-term bond yields were lower than short-term bond yields at December 31, 2006 (the yield curve is a graphical depiction of bond yields across all maturities). This situation was beneficial for investors in shorter-maturity bonds.

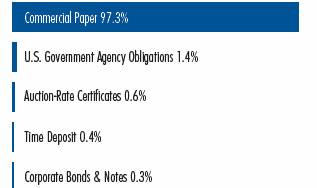

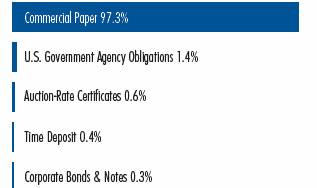

The Cash Management Portfolio

· At December 31, 2006, Cash Management Portfolio — in which the Funds invest their assets — had 97.3% of its net assets invested in high-quality commercial paper, a highly liquid type of security in which money market funds commonly invest.(1) The Portfolio also invests in high-quality U.S. Government agency securities and other short-term investments such as bank time deposits.

· During the year ended December 31, 2006, shareholders of Eaton Vance Cash Management Fund and Eaton Vance Money Market Fund received $0.043 and $0.033 per share, respectively, in income dividends. Eaton Vance Cash Management Fund and Eaton Vance Money Market Fund had total returns of 4.40% and 3.32%, respectively, during the same period.(2)

· During the year, management maintained a relatively short weighted average maturity in the Portfolio to provide flexibility for interest rate increases, enabling it to reinvest more quickly and helping to increase each Fund’s income stream.

(1) An investment in one of the money market funds is neither insured nor guaranteed by the U.S. Government. Although the Funds seek to maintain a stable net asset value of $1.00 per share, it is possible to lose money by investing in a Fund.

(2) Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. There is no sales charge.

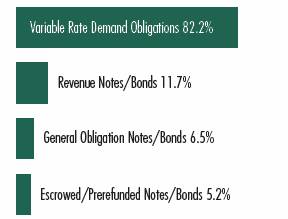

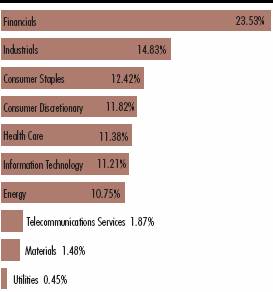

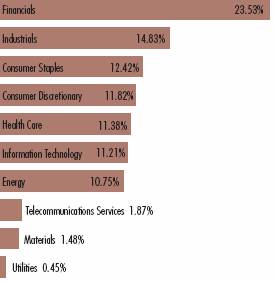

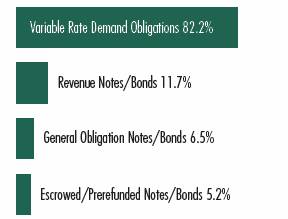

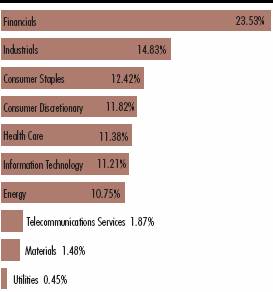

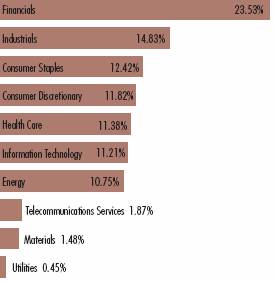

Asset Allocation*

By net assets

* Asset Allocation information may not be representative of the current or future investments and may change due to active management.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

The views expressed in this report are those of the portfolio manager and are current only through the end of the period of the report as stated on the cover. These views are subject to change at any time based upon market or other conditions, and the investment adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on many factors, may not be relied on as an indication of trading intent on behalf of any Eaton Vance fund.

1

Eaton Vance Money Market Funds as of December 31, 2006

FUND EXPENSES

Example: As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2006 – December 31, 2006).

Actual Expenses: The first section of each table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of each table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual return of the Fund. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Eaton Vance Cash Management Fund

| | | Beginning Account Value

(7/1/06) | | Ending Account Value

(12/31/06) | | Expenses Paid During Period*

(7/1/06 – 12/31/06) | |

| Actual | | $ | 1,000.00 | | | $ | 1,023.60 | | | $ | 3.72 | | |

| Hypothetical | |

| (5% return per year before expenses) | | $ | 1,000.00 | | | $ | 1,021.50 | | | $ | 3.72 | | |

* Expenses are equal to the Fund's annualized expense ratio of 0.73% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2006. The example reflects the expenses of both the Fund and the Portfolio.

Eaton Vance Money Market Fund

| | | Beginning Account Value

(7/1/06) | | Ending Account Value

(12/31/06) | | Expenses Paid During Period*

(7/1/06 – 12/31/06) | |

| Actual | | $ | 1,000.00 | | | $ | 1,018.40 | | | $ | 8.90 | | |

| Hypothetical | |

| (5% return per year before expenses) | | $ | 1,000.00 | | | $ | 1,016.40 | | | $ | 8.89 | | |

* Expenses are equal to the Fund's annualized expense ratio of 1.75% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2006. The example reflects the expenses of both the Fund and the Portfolio.

2

Eaton Vance Money Market Funds as of December 31, 2006

FINANCIAL STATEMENTS

Statements of Assets and Liabilities

As of December 31, 2006

| | | Cash

Management Fund | | Money

Market Fund | |

| Assets | |

| Investments in Cash Management Portfolio, at value | | $ | 120,417,086 | | | $ | 42,439,987 | | |

| Receivable for Fund shares sold | | | 293,512 | | | | 48,549 | | |

| Total assets | | $ | 120,710,598 | | | $ | 42,488,536 | | |

| Liabilities | |

| Payable for Fund shares redeemed | | $ | 586,301 | | | $ | 275,944 | | |

| Dividends payable | | | 103,556 | | | | 26,490 | | |

| Payable to affiliate for Trustees' fees | | | 439 | | | | 42 | | |

| Payable to affiliate for distribution and service fees | | | — | | | | 42,058 | | |

| Accrued expenses | | | 37,348 | | | | 46,388 | | |

| Total liabilities | | $ | 727,644 | | | $ | 390,922 | | |

| Net Assets | | $ | 119,982,954 | | | $ | 42,097,614 | | |

| Sources of Net Assets | |

| Paid-in capital | | $ | 119,978,442 | | | $ | 42,097,712 | | |

| Accumulated net realized loss (computed on the basis of identified cost) | | | (307 | ) | | | (181 | ) | |

| Accumulated undistributed net investment income | | | 4,819 | | | | 83 | | |

| Total | | $ | 119,982,954 | | | $ | 42,097,614 | | |

| Shares of Beneficial Interest Outstanding | |

| | | | 119,983,098 | | | | 42,097,698 | | |

Net Asset Value, Offering Price and

Redemption Price Per Share | |

| (net assets ÷ shares of beneficial interest outstanding) | | $ | 1.00 | | | $ | 1.00 | | |

See notes to financial statements

3

Eaton Vance Money Market Funds as of December 31, 2006

FINANCIAL STATEMENTS CONT'D

Statements of Operations

For the Year Ended December 31, 2006

| | | Cash

Management Fund | | Money

Market Fund | |

| Investment Income | |

| Interest allocated from Portfolio | | $ | 4,370,009 | | | $ | 2,342,947 | | |

| Expenses allocated from Portfolio | | | (508,896 | ) | | | (272,196 | ) | |

| Total investment income from Portfolio | | $ | 3,861,113 | | | $ | 2,070,751 | | |

| Expenses | |

| Trustees' fees and expenses | | $ | 1,698 | | | $ | 539 | | |

| Distribution and service fees | | | — | | | | 404,131 | | |

| Legal and accounting services | | | 20,402 | | | | 20,076 | | |

| Printing and postage | | | 9,448 | | | | 9,854 | | |

| Custodian fee | | | 16,397 | | | | 11,154 | | |

| Transfer and dividend disbursing agent fees | | | 55,829 | | | | 66,893 | | |

| Registration fees | | | 30,736 | | | | 37,632 | | |

| Miscellaneous | | | 1,846 | | | | 3,135 | | |

| Total expenses | | $ | 136,356 | | | $ | 553,414 | | |

| Net investment income | | $ | 3,724,757 | | | $ | 1,517,337 | | |

| Realized and Unrealized Gain (Loss) from Portfolio | |

| Net realized gain (loss) — | |

| Investment transactions (identified cost basis) | | $ | (197 | ) | | $ | (113 | ) | |

| Increase from payments by affiliate | | | 35 | | | | 18 | | |

| Net loss realized on the disposal of investments which did not meet the Portfolio's investment guidelines | | | (35 | ) | | | (18 | ) | |

| Net realized loss | | $ | (197 | ) | | $ | (113 | ) | |

| Net increase in net assets from operations | | $ | 3,724,560 | | | $ | 1,517,224 | | |

See notes to financial statements

4

Eaton Vance Money Market Funds as of December 31, 2006

FINANCIAL STATEMENTS CONT'D

Statements of Changes in Net Assets

For the Year Ended December 31, 2006

| Increase (Decrease) in Net Assets | | Cash

Management Fund | | Money

Market Fund | |

| From operations — | |

| Net investment income | | $ | 3,724,757 | | | $ | 1,517,337 | | |

Net realized loss from investment transactions, payments by

affiliate and the disposal of investments which did not meet the

Portfolio's investment guidelines | | | (197 | ) | | | (113 | ) | |

| Net increase in net assets from operations | | $ | 3,724,560 | | | $ | 1,517,224 | | |

| Distributions to shareholders — | |

| From net investment income | | $ | (3,724,704 | ) | | $ | (1,517,308 | ) | |

| Total distributions to shareholders | | $ | (3,724,704 | ) | | $ | (1,517,308 | ) | |

| Transactions in shares of beneficial interest at Net Asset Value of $1.00 per share — | |

| Proceeds from sale of shares | | $ | 164,749,685 | | | $ | 41,881,817 | | |

| Net asset value of shares issued to shareholders in payment of distributions declared | | | 2,345,894 | | | | 1,198,865 | | |

| Cost of shares redeemed | | | (142,081,892 | ) | | | (49,322,436 | ) | |

| Net increase (decrease) in net assets from Fund share transactions | | $ | 25,013,687 | | | $ | (6,241,754 | ) | |

| Net increase (decrease) in net assets | | $ | 25,013,543 | | | $ | (6,241,838 | ) | |

| Net Assets | |

| At beginning of year | | $ | 94,969,411 | | | $ | 48,339,452 | | |

| At end of year | | $ | 119,982,954 | | | $ | 42,097,614 | | |

See notes to financial statements

5

Eaton Vance Money Market Funds as of December 31, 2006

FINANCIAL STATEMENTS CONT'D

Statements of Changes in Net Assets

For the Year Ended December 31, 2005

| Increase (Decrease) in Net Assets | | Cash

Management Fund | | Money

Market Fund | |

| From operations — | |

| Net investment income | | $ | 2,239,721 | | | $ | 788,564 | | |

Net realized loss from investment transactions, payment by

affiliate and the disposal of an investment which did not meet the

Portfolio's investment guidelines | | | (86 | ) | | | (54 | ) | |

| Net increase in net assets from operations | | $ | 2,239,635 | | | $ | 788,510 | | |

| Distributions to shareholders — | |

| From net investment income | | $ | (2,239,635 | ) | | $ | (788,510 | ) | |

| Total distributions to shareholders | | $ | (2,239,635 | ) | | $ | (788,510 | ) | |

| Transactions in shares of beneficial interest at Net Asset Value of $1.00 per share — | |

| Proceeds from sale of shares | | $ | 138,809,354 | | | $ | 43,940,101 | | |

| Net asset value of shares issued to shareholders in payment of distributions declared | | | 1,366,207 | | | | 637,780 | | |

| Cost of shares redeemed | | | (143,371,207 | ) | | | (64,123,257 | ) | |

| Net decrease in net assets from Fund share transactions | | $ | (3,195,646 | ) | | $ | (19,545,376 | ) | |

| Net decrease in net assets | | $ | (3,195,646 | ) | | $ | (19,545,376 | ) | |

| Net Assets | |

| At beginning of year | | $ | 98,165,057 | | | $ | 67,884,828 | | |

| At end of year | | $ | 94,969,411 | | | $ | 48,339,452 | | |

See notes to financial statements

6

Eaton Vance Money Market Funds as of December 31, 2006

FINANCIAL STATEMENTS CONT'D

Financial Highlights

| | | Cash Management Fund | |

| | | Year Ended December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| Net asset value — Beginning of year | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | |

| Income (loss) from operations | |

| Net investment income | | $ | 0.043 | | | $ | 0.024 | | | $ | 0.006 | | | $ | 0.005 | | | $ | 0.010 | | |

| Less distributions | |

| From net investment income | | $ | (0.043 | ) | | $ | (0.024 | ) | | $ | (0.006 | ) | | $ | (0.005 | ) | | $ | (0.010 | ) | |

| Total distributions | | $ | (0.043 | ) | | $ | (0.024 | ) | | $ | (0.006 | ) | | $ | (0.005 | ) | | $ | (0.010 | ) | |

| Net asset value — End of year | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | |

| Total Return(1) | | | 4.40 | %(2) | | | 2.48 | %(2) | | | 0.60 | % | | | 0.48 | % | | | 1.02 | % | |

| Ratios/Supplemental Data | |

| Net assets, end of year (000's omitted) | | $ | 119,983 | | | $ | 94,969 | | | $ | 98,165 | | | $ | 101,364 | | | $ | 111,741 | | |

| Ratios (As a percentage of average daily net assets): | |

| Expenses before custodian fee reduction(3) | | | 0.75 | % | | | 0.80 | % | | | 0.79 | % | | | 0.68 | % | | | 0.79 | % | |

| Expenses after custodian fee reduction(3) | | | 0.75 | % | | | 0.80 | % | | | 0.79 | % | | | 0.68 | % | | | 0.79 | % | |

| Net investment income | | | 4.32 | % | | | 2.46 | % | | | 0.60 | % | | | 0.47 | % | | | 1.02 | % | |

(1) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. Total return is not computed on an annualized basis.

(2) During the years ended December 31, 2006 and December 31, 2005, the investment adviser reimbursed the Fund, through its investment in the Portfolio, for net losses realized on the disposal of investments which did not meet the Portfolio's investment guidelines. The reimbursement was less than $0.01 per share and had no effect on total return for the years ended December 31, 2006 and December 31, 2005.

(3) Includes the Fund's share of the Portfolio's allocated expenses.

See notes to financial statements

7

Eaton Vance Money Market Funds as of December 31, 2006

FINANCIAL STATEMENTS CONT'D

Financial Highlights

| | | Money Market Fund | |

| | | Year Ended December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| Net asset value — Beginning of year | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | |

| Income (loss) from operations | |

| Net investment income | | $ | 0.033 | | | $ | 0.014 | | | $ | 0.001 | | | $ | — | | | $ | 0.002 | | |

| Less distributions | |

| From net investment income | | $ | (0.033 | ) | | $ | (0.014 | ) | | $ | (0.001 | ) | | $ | — | | | $ | (0.002 | ) | |

| Total distributions | | $ | (0.033 | ) | | $ | (0.014 | ) | | $ | (0.001 | ) | | $ | — | | | $ | (0.002 | ) | |

| Net asset value — End of year | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | |

| Total Return(1) | | | 3.32 | %(2) | | | 1.45 | %(2) | | | 0.05 | % | | | 0.00 | % | | | 0.19 | % | |

| Ratios/Supplemental Data | |

| Net assets, end of year (000's omitted) | | $ | 42,098 | | | $ | 48,339 | | | $ | 67,885 | | | $ | 100,241 | | | $ | 158,719 | | |

| Ratios (As a percentage of average daily net assets): | |

| Expenses before custodian fee reduction(3) | | | 1.80 | % | | | 1.82 | % | | | 1.31 | %(4) | | | 1.17 | %(4) | | | 1.61 | %(4) | |

| Expenses after custodian fee reduction(3) | | | 1.80 | % | | | 1.82 | % | | | 1.31 | %(4) | | | 1.17 | %(4) | | | 1.61 | %(4) | |

| Net investment income | | | 3.30 | % | | | 1.40 | % | | | 0.04 | % | | | 0.00 | % | | | 0.20 | % | |

(1) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. Total return is not computed on an annualized basis. Total return would have been lower had certain expenses not been reduced during the periods shown.

(2) During the years ended December 31, 2006 and December 31, 2005, the investment adviser reimbursed the Fund, through its investment in the Portfolio, for net losses realized on the disposal of investments which did not meet the Portfolio's investment guidelines. The reimbursement was less than $0.01 per share and had no effect on total return for the years ended December 31, 2006 and December 31, 2005.

(3) Includes the Fund's share of the Portfolio's allocated expenses.

(4) The principal underwriter voluntarily waived a portion of its distribution fee and the administrator subsidized certain operating expenses (equal to 0.40%, 0.49% and less than 0.01% of average daily net assets for 2004, 2003 and 2002, respectively).

See notes to financial statements

8

Eaton Vance Money Market Funds as of December 31, 2006

NOTES TO FINANCIAL STATEMENTS

1 Significant Accounting Policies

Eaton Vance Cash Management Fund (Cash Management Fund) and Eaton Vance Money Market Fund (Money Market Fund) (individually, the Fund, collectively the Funds) are each diversified series of Eaton Vance Mutual Funds Trust (the Trust). The Trust is an entity of the type commonly known as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Funds invest all of their investable assets in interests in the Cash Management Portfolio (the Portfolio), a New York Trust, having the same investment objective as the Funds. The value of each Fund's investment in the Portfolio reflects each Fund's proportionate interest in the net assets of the Portfolio (9.3% for Cash Management Fund and 3.3% for Money Market Fund at December 31, 2006). The performance of each Fund is directly affected by the performance of the Portfolio. The financial statemen ts of the Portfolio, including the portfolio of investments, are included elsewhere in this report and should be read in conjunction with each of the Fund's financial statements. The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of their financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America.

A Investment Valuation — Valuation of securities by the Portfolio is discussed in Note 1A of the Portfolio's Notes to Financial Statements, which are included elsewhere in this report.

B Income — The Fund's net investment income consists of the Fund's pro rata share of the net investment income of the Portfolio, less all actual and accrued expenses of each Fund.

C Federal Taxes — Each Fund's policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders, each year, substantially all of its net investment income and all or substantially all of its net realized capital gains. Accordingly, no provision for federal income or excise tax is necessary. At December 31, 2006, the Funds, for federal income tax purposes, had capital loss carryovers which will reduce taxable income arising from future net realized gain on investments, if any, to the extent permitted by the Internal Revenue Code, and thus will reduce the amount of distributions to shareholders which would otherwise be necessary to relieve the Funds of any liability for federal income or excis e tax. The amounts and expiration dates of the capital loss carryovers are as follows:

| Fund | | Amount | | Expires | |

| Cash Management | | $ | 5 | | | December 31, 2010 | |

|

| | | | 20 | | | December 31, 2011 | |

|

| | | | 85 | | | December 31, 2013 | |

|

| | | | 197 | | | December 31, 2014 | |

|

| Money Market | | | 10 | | | December 31, 2010 | |

|

| | | | 5 | | | December 31, 2011 | |

|

| | | | 53 | | | December 31, 2013 | |

|

| | | | 113 | | | December 31, 2014 | |

|

D Expenses — The majority of expenses of the Trust are directly identifiable to an individual fund. Expenses which are not readily identifiable to a specific fund are allocated taking into consideration, among other things, the nature and type of expense and the relative size of the funds.

E Expense Reduction — Investors Bank & Trust Company (IBT) serves as custodian to the Funds. Pursuant to the respective custodian agreements, IBT receives a fee reduced by credits which are determined based on the average daily cash balance each respective Fund maintains with IBT. All credit balances used to reduce the Funds' custodian fees are reported as a reduction of expenses in the Statement of Operations.

F Use of Estimates — The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

G Indemnifications — Under the Trust's organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Funds, and shareholders are indemnified against personal liability for obligations of the Trust. Additionally, in the normal course of business, the Funds enter into agreements with service providers that may contain indemnification clauses. The Funds' maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Funds that have not yet occurred.

Eaton Vance Money Market Funds as of December 31, 2006

NOTES TO FINANCIAL STATEMENTS CONT'D

H Other — Investment transactions are accounted for on a trade-date basis.

2 Distributions to Shareholders

The net investment income of each Fund is determined daily, and substantially all of the net investment income so determined is declared daily as a dividend to shareholders of record at the time of declaration. Distributions are paid monthly. Distributions are paid in the form of additional shares or, at the election of the shareholder, in cash.

The Funds distinguish between distributions on a tax basis and a financial reporting basis. Accounting principles generally accepted in the United States of America require that only distributions in excess of tax basis earnings and profits be reported in the financial statements as a return of capital. Permanent differences between book and tax accounting relating to distributions are reclassified to paid-in capital.

The tax character of distributions declared for the years ended December 31, 2006 and December 31, 2005 was as follows:

| Year Ended December 31, 2006 | | Cash

Management Fund | | Money

Market Fund | |

| Distributions declared from: | |

| Ordinary Income | | $ | 3,724,704 | | | $ | 1,517,308 | | |

| Year Ended December 31, 2005 | |

| Distributions declared from: | |

| Ordinary Income | | $ | 2,239,635 | | | $ | 788,510 | | |

As of December 31, 2006, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

| | | Cash

Management Fund | | Money

Market Fund | |

| Undistributed income | | $ | 4,819 | | | $ | 83 | | |

| Capital loss carryforward | | | (307 | ) | | | (181 | ) | |

3 Shares of Beneficial Interest

The Funds' Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest (without par value).

4 Transactions with Affiliates

EVM serves as the administrator of the Funds, but receives no compensation. The Portfolio has engaged Boston Management and Research (BMR), a subsidiary of EVM, to render investment advisory services. See Note 2 of the Portfolio's Notes to Financial Statements which are included elsewhere in this report. EVM serves as the sub-transfer agent of the Funds and receives from the transfer agent an aggregate fee based upon the actual expenses incurred by EVM in the performance of those services. For the year ended December 31, 2006, EVM received $4,896 and $4,763 from Cash Management Fund and Money Market Fund, respectively, in sub-transfer agent fees. Except as to Trustees of the Funds and the Portfolio who are not members of EVM's or BMR's organization, officers and Trustees receive remuneration for their services to each Fund out of such investment adviser fee. Certain officers and Trustees of the Funds and of the Portfolio are off icers of the above organizations.

5 Distribution and Service Plans

The Money Market Fund (the Fund) has in effect a distribution plan (the Plan) pursuant to Rule 12b-1 under the Investment Company Act of 1940. The Plan requires the Fund to pay the Principal Underwriter, Eaton Vance Distributors, Inc. (EVD), daily amounts equal to 1/365 of 0.75% of the Fund's average daily net assets, for providing ongoing distribution services and facilities to the Fund. The Fund will automatically discontinue payments to EVD during any period in which there are no outstanding Uncovered Distribution Charges, which are equivalent to the sum of (i) 6.25% of the aggregate amount received by the Fund for shares sold plus (ii) interest calculated by applying the rate of 1% over the prevailing prime rate to the outstanding balance of Uncovered Distribution Charges of EVD reduced by the aggregate amount of contingent deferred sales charges (Note 6) and amounts theretofore paid to EVD. The Fund paid or accrued $344,564 to or payable to EVD for the year ended December 31, 2006, representing 0.75% of the Fund's average daily net assets. At December 31, 2006, the amount of Uncovered Distribution Charges of EVD calculated under the Plan was approximately $11,913,000. The Plan also authorizes the Fund to make payments of service fees to EVD, investment dealers and other persons in amounts not exceeding 0.25% annually of the Fund's average daily net assets. The Trustees approved service fee payments equal to 0.15% annually of the Fund's average daily net assets of shares outstanding for one year or more. Service fees are paid for personal services and/or the maintenance of shareholder accounts. They are separate and distinct from the sales commissions and

Eaton Vance Money Market Funds as of December 31, 2006

NOTES TO FINANCIAL STATEMENTS CONT'D

distribution fees and, as such, are not subject to automatic discontinuance when there are no outstanding Uncovered Distribution Charges of EVD. Service fees paid or accrued for the year ended December 31, 2006 amounted to $59,567.

Certain officers and Trustees of the Funds are officers of EVD.

6 Contingent Deferred Sales Charge (CDSC)

Shares of the Money Market Fund (other than those acquired as the result of an exchange from another Eaton Vance fund) generally are subject to a CDSC on redemptions of shares made within six years of purchase, at rates that begin at 5% in the case of redemptions in the first and second year after purchase, declining one percentage point each subsequent year. Shares of Money Market Fund and Cash Management Fund acquired as a result of an exchange from shares of another Eaton Vance Fund are subject to the original CDSC rate, if any, from the date of original purchase. Generally, the CDSC is based upon the lower of the net asset value at date of redemption or date of purchase. No charge is levied on shares acquired by reinvestment of dividends or capital gains distributions. No CDSC is levied on shares which have been sold to EVM or its affiliates or to their respective employees or clients and may be waived under certain other li mited conditions. CDSC assessed on Money Market Fund shares are paid to EVD to reduce the amount of Uncovered Distribution Charges calculated under the Fund's Distribution Plan. CDSC received from Money Market Fund shares when no Uncovered Distribution Charges exist will be credited to the Fund. EVD received approximately $10,000 and $222,000 of CDSC paid by shareholders of the Cash Management Fund and Money Market Fund, respectively, for the year ended December 31, 2006.

7 Investment Transactions

Increases and decreases in the Funds' investment in the Portfolio for the year ended December 31, 2006 were as follows:

| Cash Management Fund | |

| Increases | | $ | 164,626,975 | | |

| Decreases | | | 143,584,043 | | |

| Money Market Fund | |

| Increases | | $ | 41,933,279 | | |

| Decreases | | | 50,135,548 | | |

8 Recently Issued Accounting Pronouncements

In June 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48, (FIN 48) "Accounting for Uncertainty in Income Taxes – an interpretation of FASB Statement No. 109". FIN 48 clarifies the accounting for uncertainty in income taxes recognized in accordance with FASB Statement No. 109, "Accounting for Income Taxes." This interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. It also provides guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. FIN 48 is effective during the first required financial reporting period for fiscal years beginning after December 15, 2006. Management is currently evaluating the impact of applying the various provisions of FIN 48.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157, (FAS 157) "Fair Value Measurements". FAS 157 defines fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting principles and expands disclosure about fair value measurements. FAS 157 is effective for fiscal years beginning after November 15, 2007. Management is currently evaluating the impact the adoption of FAS 157 will have on the Funds' financial statement disclosures.

Eaton Vance Money Market Funds as of December 31, 2006

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Trustees of Eaton Vance Mutual Funds Trust and Shareholders of Eaton Vance Cash Management Fund and Eaton Vance Money Market Fund:

In our opinion, the accompanying statements of assets and liabilities, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Eaton Vance Cash Management Fund and Eaton Vance Money Market Fund, each a series of Eaton Vance Mutual Funds Trust (the "Funds") at December 31, 2006, and the results of each of their operations, the changes in each of their net assets and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Funds' management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accorda nce with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

February 21, 2007

12

Eaton Vance Money Market Funds as of December 31, 2006

FEDERAL TAX INFORMATION (Unaudited)

The Form 1099-DIV you received in January 2007 showed the tax status of all distributions paid to your account in calendar 2006. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Funds.

13

Cash Management Portfolio as of December 31, 2006

PORTFOLIO OF INVESTMENTS

| Commercial Paper — 97.3% | | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Automotive — 5.1% | | | |

| $ | 20,000 | | | American Honda Motor Corp., 5.26%, 1/25/07 | | $ | 19,929,867 | | |

| | 15,800 | | | American Honda Motor Corp., 5.26%, 3/19/07 | | | 15,622,241 | | |

| | 10,220 | | | American Honda Motor Corp., 5.31%, 1/26/07 | | | 10,182,314 | | |

| | 20,000 | | | Toyota Motor Credit Co., 5.26%, 1/4/07 | | | 19,991,233 | | |

| | | | | | | $ | 65,725,655 | | |

| Banks and Money Services — 64.0% | | | |

| $ | 15,000 | | | Abbey National North America, LLC, 5.27%, 1/8/07 | | $ | 14,984,629 | | |

| | 40,000 | | | Abbey National North America, LLC, 5.33%, 1/2/07 | | | 39,994,078 | | |

| | 2,650 | | | Barclays U.S. Funding, LLC, 5.25%, 1/12/07 | | | 2,645,749 | | |

| | 25,600 | | | Barclays U.S. Funding, LLC, 5.25%, 3/20/07 | | | 25,308,800 | | |

| | 17,660 | | | Barclays U.S. Funding, LLC, 5.27%, 3/14/07 | | | 17,473,864 | | |

| | 4,760 | | | Barton Capital Corp., LLC, 5.26%, 1/12/07(1) | | | 4,752,350 | | |

| | 50,000 | | | Barton Capital Corp., LLC, 5.26%, 1/16/07(1) | | | 49,890,417 | | |

| | 25,000 | | | BNP Paribas Finance, Inc., 5.25%, 2/14/07 | | | 24,839,583 | | |

| | 3,475 | | | CAFCO, LLC, 5.26%, 1/9/07(1) | | | 3,470,938 | | |

| | 40,000 | | | CAFCO, LLC, 5.27%, 1/5/07(1) | | | 39,976,578 | | |

| | 13,000 | | | CAFCO, LLC, 5.27%, 1/8/07(1) | | | 12,986,679 | | |

| | 50,000 | | | CIESCO, LLC, 5.26%, 1/16/07(1) | | | 49,890,417 | | |

| | 45,000 | | | Countrywide Financial Corp., 5.40%, 1/2/07 | | | 44,993,250 | | |

| | 20,000 | | | CRC Funding, LLC, 5.26%, 1/5/07(1) | | | 19,988,311 | | |

| | 25,000 | | | CRC Funding, LLC, 5.28%, 2/12/07(1) | | | 24,846,000 | | |

| | 46,360 | | | Fortis Funding, LLC, 5.28%, 1/2/07(1) | | | 46,353,201 | | |

| | 3,141 | | | ING (U.S.) Funding, LLC, 5.25%, 1/18/07 | | | 3,133,213 | | |

| | 9,800 | | | ING (U.S.) Funding, LLC, 5.26%, 2/8/07 | | | 9,745,588 | | |

| | 35,050 | | | ING (U.S.) Funding, LLC, 5.27%, 3/21/07 | | | 34,644,656 | | |

| | 12,986 | | | Kittyhawk Funding Corp., 5.33%, 1/3/07(1) | | | 12,982,155 | | |

| | 15,306 | | | Kittyhawk Funding Corp., 5.33%, 1/25/07(1) | | | 15,251,613 | | |

| | 6,308 | | | Kittyhawk Funding Corp., 5.34%, 1/3/07(1) | | | 6,306,129 | | |

| | 35,000 | | | Nestle Capital Corp., 5.25%, 1/9/07 | | | 34,959,167 | | |

| | 8,000 | | | Old Line Funding Corp., LLC, 5.27%, 1/10/07(1) | | | 7,989,460 | | |

| | 15,000 | | | Old Line Funding Corp., LLC, 5.28%, 1/4/07(1) | | | 14,993,400 | | |

| | 19,000 | | | Old Line Funding Corp., LLC, 5.33%, 1/11/07(1) | | | 18,971,869 | | |

| | 9,077 | | | Old Line Funding Corp., LLC, 5.35%, 1/5/07(1) | | | 9,071,604 | | |

| | 25,000 | | | Ranger Funding Co., LLC, 5.28%, 2/14/07(1) | | | 24,838,667 | | |

| | 23,963 | | | Ranger Funding Co., LLC, 5.29%, 1/3/07(1) | | | 23,955,958 | | |

| | 25,000 | | | Sheffield Receivables Corp., 5.29%, 1/12/07(1) | | | 24,959,590 | | |

| | 14,015 | | | Sheffield Receivables Corp., 5.30%, 1/24/07(1) | | | 13,967,544 | | |

| | 13,500 | | | Sheffield Receivables Corp., 5.33%, 1/10/07(1) | | | 13,482,011 | | |

| | 7,165 | | | Sheffield Receivables Corp., 5.35%, 1/2/07(1) | | | 7,163,935 | | |

| | 1,827 | | | Societe Generale N.A., 5.25%, 1/8/07 | | | 1,825,135 | | |

| | 1,000 | | | Societe Generale N.A., 5.25%, 2/16/07 | | | 993,291 | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Banks and Money Services (continued) | | | |

| $ | 22,000 | | | U.S. Central Federal Credit Union, 5.27%, 1/25/07 | | $ | 21,922,707 | | |

| | 3,600 | | | UBS Finance Delaware, LLC, 5.25%, 1/8/07 | | | 3,596,325 | | |

| | 25,000 | | | UBS Finance Delaware, LLC, 5.255%, 1/2/07 | | | 24,996,351 | | |

| | 9,500 | | | UBS Finance Delaware, LLC, 5.27%, 1/8/07 | | | 9,490,265 | | |

| | 13,200 | | | UBS Finance Delaware, LLC, 5.37%, 1/5/07 | | | 13,192,124 | | |

| | 8,000 | | | Yorktown Capital, LLC, 5.27%, 3/7/07(1) | | | 7,923,878 | | |

| | 3,679 | | | Yorktown Capital, LLC, 5.28%, 1/12/07(1) | | | 3,673,065 | | |

| | 13,900 | | | Yorktown Capital, LLC, 5.30%, 1/23/07(1) | | | 13,854,979 | | |

| | 26,232 | | | Yorktown Capital, LLC, 5.305%, 1/22/07(1) | | | 26,150,823 | | |

| | | | | | | $ | 826,430,346 | | |

| Electric Utilities — 6.3% | | | |

| $ | 12,450 | | | General Electric Capital Corp., 5.25%, 2/9/07 | | $ | 12,379,191 | | |

| | 45,000 | | | General Electric Capital Corp., 5.27%, 1/2/07 | | | 44,993,413 | | |

| | 13,150 | | | Southern Co., 5.30%, 1/30/07(1) | | | 13,093,857 | | |

| | 10,684 | | | Southern Co., 5.32%, 1/5/07(1) | | | 10,677,685 | | |

| | | | | | | $ | 81,144,146 | | |

| Household Products — 4.0% | | | |

| $ | 8,100 | | | Fortune Brands, Inc., 5.35%, 1/26/07(1) | | $ | 8,069,906 | | |

| | 2,460 | | | Fortune Brands, Inc., 5.35%, 2/7/07(1) | | | 2,446,473 | | |

| | 30,000 | | | Proctor & Gamble Co., 5.26%, 2/14/07 | | | 29,807,133 | | |

| | 11,000 | | | Proctor & Gamble Co., 5.27%, 2/14/07 | | | 10,929,148 | | |

| | | | | | | $ | 51,252,660 | | |

| Industrial Equipment — 0.8% | | | |

| $ | 10,000 | | | Ingersoll-Rand Co. Ltd., 5.37%, 1/10/07(1) | | $ | 9,986,575 | | |

| | | | | | | $ | 9,986,575 | | |

| Insurance — 9.7% | | | |

| $ | 41,000 | | | American General Finance Corp., 5.30%, 1/16/07(1) | | $ | 40,909,458 | | |

| | 18,000 | | | Metropolitan-Life Funding, Inc., 5.23%, 1/16/07 | | | 17,960,775 | | |

| | 25,000 | | | Metropolitan-Life Funding, Inc., 5.25%, 1/16/07 | | | 24,945,312 | | |

| | 17,234 | | | New York Life Capital Corp., 5.26%, 1/29/07(1) | | | 17,163,494 | | |

| | 25,000 | | | New York Life Capital Corp., 5.26%, 2/5/07(1) | | | 24,872,153 | | |

| | | | | | | $ | 125,851,192 | | |

| Metals-Industrial — 4.0% | | | |

| $ | 18,760 | | | Alcoa, Inc., 5.29%, 1/8/07 | | $ | 18,740,703 | | |

| | 12,800 | | | Alcoa, Inc., 5.31%, 1/4/07 | | | 12,794,336 | | |

| | 20,000 | | | Alcoa, Inc., 5.35%, 1/5/07 | | | 19,988,111 | | |

| | | | | | | $ | 51,523,150 | | |

See notes to financial statements

14

Cash Management Portfolio as of December 31, 2006

PORTFOLIO OF INVESTMENTS CONT'D

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Retail-Food and Drug — 0.7% | | | |

| $ | 8,700 | | | CVS Corp., 5.35%, 1/2/07(1) | | $ | 8,698,707 | | |

| | | | | | | $ | 8,698,707 | | |

| Telecommunications — 2.7% | | | |

| $ | 25,000 | | | Motorola, Inc., 5.29%, 1/16/07 | | $ | 24,944,896 | | |

| | 10,335 | | | Motorola, Inc., 5.30%, 1/12/07 | | | 10,318,263 | | |

| | | | | | | $ | 35,263,159 | | |

| | Total Commercial Paper

(amortized cost $1,255,875,590) | | | | | $ | 1,255,875,590 | | |

| Corporate Bonds & Notes — 0.3% | | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Chemicals — 0.1% | | | |

| $ | 1,700 | | | Praxair, Inc., 6.625%, 10/15/07 | | $ | 1,740,089 | | |

| | | | | | | $ | 1,740,089 | | |

| Insurance — 0.2% | | | |

| $ | 2,550 | | | Ace Ltd., 6.00%, 4/1/07 | | $ | 2,591,034 | | |

| | | | | | | $ | 2,591,034 | | |

| | Total Corporate Bonds & Notes

(amortized cost $4,331,123) | | | | | $ | 4,331,123 | | |

| Auction-Rate Certificates — 0.6% | | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| General Obligations — 0.6% | | | |

| $ | 8,000 | | | Miami, FL (MBIA), (Liq: Wachovia Bank),

5.28%, 12/1/25 | | $ | 8,000,000 | | |

| | | | | | | $ | 8,000,000 | | |

| | Total Auction-Rate Certificates

(amortized cost $8,000,000) | | | | | $ | 8,000,000 | | |

| U.S. Government Agency Obligations — 1.4% | | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| $ | 2,000 | | | FHLB, 5.30%, 11/1/07 | | $ | 2,000,000 | | |

| | 16,000 | | | FHLMC, 5.35%, 11/21/07 | | | 16,000,000 | | |

| | Total U.S. Government Agency Obligations

(amortized cost, $18,000,000) | | | | | $ | 18,000,000 | | |

| Time Deposit — 0.4% | | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| $ | 4,399 | | | Investors Bank and Trust Company Time Deposit,

5.31%, 1/2/07 | | $ | 4,399,000 | | |

| | Total Time Deposit

(amortized cost, $4,399,000) | | | | | $ | 4,399,000 | | |

| | Total Investments — 100.0%

(amortized cost $1,290,605,713)(2) | | | | | $ | 1,290,605,713 | | |

| | Other Assets, Less Liabilities — (0.0)% | | | | | $ | (382,286 | ) | |

| | Net Assets — 100.0% | | | | | $ | 1,290,223,427 | | |

FHLB - Federal Home Loan Bank

FHLMC - Federal Home Loan Mortgage Corporation (Freddie Mac)

Liq - Liquidity Provider

MBIA - Municipal Bond Insurance Association

Securities issued by Freddie Mac are not issued or insured by the U.S. Government.

(1) A security which has been issued under section 4(2) of the Securities Act of 1933 and is generally regarded as restricted and illiquid. This security may be resold in transactions exempt from registration or to the public if the security is registered. All such securities held have been deemed by the Portfolio's Trustees to be liquid and were purchased with the expectation that resale would not be necessary.

(2) Cost for federal income taxes is the same.

See notes to financial statements

15

Cash Management Portfolio as of December 31, 2006

FINANCIAL STATEMENTS

Statement of Assets and Liabilities

As of December 31, 2006

| Assets | |

| Investments, at amortized cost | | $ | 1,290,605,713 | | |

| Cash | | | 990 | | |

| Interest receivable | | | 152,400 | | |

| Total assets | | $ | 1,290,759,103 | | |

| Liabilities | |

| Payable to affiliate for investment advisory fees | | $ | 473,987 | | |

| Payable to affiliate for Trustees' fees | | | 2,180 | | |

| Accrued expenses | | | 59,509 | | |

| Total liabilities | | $ | 535,676 | | |

| Net Assets applicable to investors' interest in Portfolio | | $ | 1,290,223,427 | | |

| Sources of Net Assets | |

| Net proceeds from capital contributions and withdrawals | | $ | 1,290,223,427 | | |

| Total | | $ | 1,290,223,427 | | |

Statement of Operations

For the Year Ended

December 31, 2006

| Investment Income | |

| Interest | | $ | 14,388,824 | | |

| Total investment income | | $ | 14,388,824 | | |

| Expenses | |

| Investment adviser fee | | $ | 1,360,454 | | |

| Trustees' fees and expenses | | | 8,016 | | |

| Custodian fee | | | 85,116 | | |

| Legal and accounting services | | | 44,598 | | |

| Miscellaneous | | | 368 | | |

| Total expenses | | $ | 1,498,552 | | |

Deduct —

Reduction of custodian fee | | $ | 18 | | |

| Total expense reductions | | $ | 18 | | |

| Net expenses | | $ | 1,498,534 | | |

| Net investment income | | $ | 12,890,290 | | |

| Realized Gain (Loss) | |

Net realized gain (loss) —

Investment transactions (identified cost basis) | | $ | (2,730 | ) | |

| Increase from payments by affiliate | | | 53 | | |

Net loss realized on the disposal of investments which did not

meet the Portfolio's investment guidelines | | | (53 | ) | |

| Net realized loss | | $ | (2,730 | ) | |

| Net increase in net assets from operations | | $ | 12,887,560 | | |

See notes to financial statements

16

Cash Management Portfolio as of December 31, 2006

FINANCIAL STATEMENTS CONT'D

Statements of Changes in Net Assets

Increase (Decrease)

in Net Assets | | Year Ended

December 31, 2006 | | Year Ended

December 31, 2005 | |

| From operations — | |

| Net investment income | | $ | 12,890,290 | | | $ | 3,954,413 | | |

Net realized loss from investment

transactions, payments by affiliate

and the disposal of investments

which did not meet the Portfolio's

investment guidelines | | | (2,730 | ) | | | (141 | ) | |

| Net increase in net assets from operations | | $ | 12,887,560 | | | $ | 3,954,272 | | |

Capital transactions —

Contributions | | $ | 3,903,906,779 | | | $ | 184,089,048 | | |

| Withdrawals | | | (2,773,384,656 | ) | | | (210,117,271 | ) | |

Net increase (decrease) in net assets

from capital transactions | | $ | 1,130,522,123 | | | $ | (26,028,223 | ) | |

| Net increase (decrease) in net assets | | $ | 1,143,409,683 | | | $ | (22,073,951 | ) | |

| Net Assets | |

| At beginning of year | | $ | 146,813,744 | | | $ | 168,887,695 | | |

| At end of year | | $ | 1,290,223,427 | | | $ | 146,813,744 | | |

See notes to financial statements

17

Cash Management Portfolio as of December 31, 2006

FINANCIAL STATEMENTS CONT'D

Supplementary Data

| | | Year Ended December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| Ratios/Supplemental Data | |

| Ratios (As a percentage of average daily net assets): | |

| Expenses before custodian fee reduction | | | 0.54 | % | | | 0.60 | % | | | 0.59 | % | | | 0.57 | % | | | 0.58 | % | |

| Expenses after custodian fee reduction | | | 0.54 | % | | | 0.60 | % | | | 0.59 | % | | | 0.57 | % | | | 0.58 | % | |

| Net investment income | | | 4.67 | % | | | 2.63 | % | | | 0.78 | % | | | 0.59 | % | | | 1.22 | % | |

| Total Return | | | 4.60 | %(1) | | | 2.67 | %(1) | | | 0.78 | % | | | 0.60 | % | | | 1.22 | % | |

(1) During the years ended December 31, 2006 and December 31, 2005, the investment adviser reimbursed the Portfolio for net losses realized on the disposal of investments which did not meet the Portfolio's investment guidelines. The reimbursement had no effect on total return for the years ended December 31, 2006 and December 31, 2005.

See notes to financial statements

18

Cash Management Portfolio as of December 31, 2006

NOTES TO FINANCIAL STATEMENTS

1 Significant Accounting Policies

Cash Management Portfolio (the Portfolio) is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company. The Portfolio was organized as a trust under the laws of the State of New York on May 1, 1992. The Portfolio's objective is to provide as high a rate of income as may be consistent with preservation of capital and maintenance of liquidity. The Declaration of Trust permits the Trustees to issue interests in the Portfolio. At December 31, 2006, the Eaton Vance Cash Management Fund and the Eaton Vance Money Market Fund held interests of approximately 9.3% and 3.3%, respectively, in the Portfolio. In November 2006, the Portfolio was made available to other portfolios and funds managed by Boston Management and Research (BMR) and Eaton Vance Management (EVM) and its affiliates for short-term investment purposes. At December 31, 2006, other portfolios and funds managed b y BMR and EVM and its affiliates held interests totaling 87.4% of the Portfolio's net assets. At December 31, 2006, Large Cap Value Portfolio and Floating Rate Portfolio each held a greater than 10% interest in the Portfolio (10.9% and 10.7%, respectively). The following is a summary of significant accounting policies of the Portfolio. The policies are in conformity with accounting principles generally accepted in the United States of America.

A Security Valuation — The Portfolio values investment securities utilizing the amortized cost valuation technique permitted by Rule 2a-7 of the Investment Company Act of 1940, pursuant to which the Portfolio must comply with certain conditions. This technique involves initially valuing a portfolio security at its cost and thereafter assuming a constant amortization to maturity of any discount or premium.

B Income — Interest income is recorded on the basis of interest accrued, adjusted for amortization of premium or accretion of discount.

C Federal Taxes — The Portfolio has elected to be treated as a partnership for federal tax purposes. No provision is made by the Portfolio for federal or state taxes on any taxable income of the Portfolio because each investor in the Portfolio is ultimately responsible for the payment of any taxes on its share of taxable income. Since at least one of the Portfolio's investors is a regulated investment company that invests all or substantially all of its assets in the Portfolio, the Portfolio normally must satisfy the applicable source of income and diversification requirements (under the Internal Revenue Code) in order for its investors to satisfy them. The Portfolio will allocate, at least annually a mong its investors, each investor's distributive share of the Portfolio's net investment income, net realized capital gains, and any other items of income, gain, loss, deduction or credit.

D Expense Reduction — Investors Bank & Trust Company (IBT) serves as custodian to the Portfolio. Pursuant to the custodian agreement, IBT receives a fee reduced by credits which are determined based on the average daily cash balance the Portfolio maintains with IBT. All credit balances, if any, used to reduce the Portfolio's custodian fees are reported as a reduction of expenses in the Statement of Operations.

E Use of Estimates — The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

F Indemnifications — Under the Portfolio's organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Portfolio. Interestholders in the Portfolio are jointly and severally liable for the liabilities and obligations of the Portfolio in the event that the Portfolio fails to satisfy such liabilities and obligations; provided, however, that, to the extent assets are available in the Portfolio, the Portfolio may, under certain circumstances, indemnify interestholders from and against any claim or liability to which such holder may become subject by reason of being or having been an interestholder in the Portfolio. Additionally, in the normal course of business, the Portfo lio enters into agreements with service providers that may contain indemnification clauses. The Portfolio's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Portfolio that have not yet occurred.

G Other — Investment transactions are accounted for on the date the securities are purchased or sold. Realized gains and losses on securities sold are determined on the basis of identified cost.

19

Cash Management Portfolio as of December 31, 2006

NOTES TO FINANCIAL STATEMENTS CONT'D

2 Investment Adviser Fee and Other Transactions with Affiliates

The investment adviser fee is earned by Boston Management and Research (BMR), a wholly-owned subsidiary of Eaton Vance Management (EVM), as compensation for management and investment advisory services rendered to the Portfolio. The fee is computed at the rate of 1/2 of 1% per annum of the Portfolio's average daily net assets and amounted to $1,360,454 for the year ended December 31, 2006. Except as to Trustees of the Portfolio who are not members of EVM's or BMR's organization, officers and Trustees receive remuneration for their services to the Portfolio out of such investment adviser fee.

BMR made voluntary reimbursements to the Portfolio totaling $53 to compensate the Portfolio for realized losses incurred from the sale of investment securities which did not meet the Portfolio's investment guidelines.

Certain officers and Trustees of the Portfolio are officers of the above organizations.

3 Line of Credit

The Portfolio participates with other portfolios and funds managed by BMR or EVM and its affiliates in a $150 million unsecured line of credit agreement with a group of banks. Borrowings will be made by the Portfolio solely to facilitate the handling of unusual and/or unanticipated short-term cash requirements. Interest is charged to each participating portfolio or fund based on its borrowings at an amount above either the Eurodollar rate or federal funds rate. In addition, a fee computed at an annual rate of 0.10% on the daily unused portion of the line of credit is allocated among the participating portfolios and funds at the end of each quarter. The Portfolio did not have any significant borrowings or allocated fees during the year ended December 31, 2006.

4 Investments

Purchases and sales (including maturities) of investments during the year ended December 31, 2006, exclusive of U.S. Government and agency securities, aggregated $8,539,997,844 and $7,426,455,552 respectively. Purchases and sales (including maturities) of U.S. Government and agency securities aggregated $18,000,000 and $1,521,075, respectively.

5 Recently Issued Accounting Pronouncements

In June 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48, (FIN 48) "Accounting for Uncertainty in Income Taxes – an interpretation of FASB Statement No. 109". FIN 48 clarifies the accounting for uncertainty in income taxes recognized in accordance with FASB Statement No. 109, "Accounting for Income Taxes." This interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. It also provides guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. FIN 48 is effective during the first required financial reporting period for fiscal years beginning after December 15, 2006. Management is currently evaluating the impact of applying the various provisions of FIN 48.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157, (FAS 157) "Fair Value Measurements". FAS 157 defines fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting principles and expands disclosure about fair value measurements. FAS 157 is effective for fiscal years beginning after November 15, 2007. Management is currently evaluating the impact the adoption of FAS 157 will have on the Portfolio's financial statement disclosures.

20

Cash Management Portfolio as of December 31, 2006

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Trustees and Investors

of Cash Management Portfolio:

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the supplementary data present fairly, in all material respects, the financial position of Cash Management Portfolio (the "Portfolio") at December 31, 2006, and the results of its operations, the changes in its net assets and the supplementary data for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and supplementary data (hereafter referred to as "financial statements") are the responsibility of the Portfolio's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Bo ard (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2006 by correspondence with the custodian, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

February 21, 2007

21

Eaton Vance Money Market Funds

BOARD OF TRUSTEES' ANNUAL APPROVAL OF THE INVESTMENT ADVISORY AGREEMENT

Overview of the Contract Review Process

The Investment Company Act of 1940, as amended (the "1940 Act"), provides, in substance, that each investment advisory agreement between a fund and its investment adviser will continue in effect from year to year only if its continuance is approved at least annually by the fund's board of trustees, including by a vote of a majority of the trustees who are not "interested persons" of the fund ("Independent Trustees") cast in person at a meeting called for the purpose of considering such approval.

At a meeting of the Boards of Trustees (each a "Board") of the Eaton Vance group of mutual funds (the "Eaton Vance Funds") held on March 27, 2006, the Board, including a majority of the Independent Trustees, voted to approve continuation of existing advisory and sub-advisory agreements for the Eaton Vance Funds for an additional one-year period. In voting its approval, the Board relied upon the affirmative recommendation of the Special Committee of the Board, which is a committee comprised exclusively of Independent Trustees. Prior to making its recommendation, the Special Committee reviewed information furnished for a series of meetings of the Special Committee held in February and March 2006. Such information included, among other things, the following:

Information about Fees, Performance and Expenses

• An independent report comparing the advisory and related fees paid by each fund with fees paid by comparable funds;

• An independent report comparing each fund's total expense ratio and its components to comparable funds;

• An independent report comparing the investment performance of each fund to the investment performance of comparable funds over various time periods;

• Data regarding investment performance in comparison to relevant peer groups of funds and appropriate indices;

• Comparative information concerning fees charged by each adviser for managing other mutual funds and institutional accounts using investment strategies and techniques similar to those used in managing the fund;

• Profitability analyses for each adviser with respect to each fund managed by it;

Information about Portfolio Management

• Descriptions of the investment management services provided to each fund, including the investment strategies and processes employed;

• Information concerning the allocation of brokerage and the benefits received by each adviser as a result of brokerage allocation, including information concerning the acquisition of research through "soft dollar" benefits received in connection with the funds' brokerage, and the implementation of a soft dollar reimbursement program established with respect to the funds;

• Data relating to portfolio turnover rates of each fund;

• The procedures and processes used to determine the fair value of fund assets and actions taken to monitor and test the effectiveness of such procedures and processes;

Information about each Adviser

• Reports detailing the financial results and condition of each adviser;

• Descriptions of the qualifications, education and experience of the individual investment professionals whose responsibilities include portfolio management and investment research for the funds, and information relating to their compensation and responsibilities with respect to managing other mutual funds and investment accounts;

• Copies of the Codes of Ethics of each adviser and its affiliates, together with information relating to compliance with and the administration of such codes;

• Information concerning the resources devoted to compliance efforts undertaken by each adviser and its affiliates on behalf of the funds (including descriptions of various compliance programs) and their record of compliance with investment policies and restrictions, including policies with respect to market-timing, late trading and selective portfolio disclosure, and with policies on personal securities transactions;

• Descriptions of the business continuity and disaster recovery plans of each adviser and its affiliates;

Other Relevant Information

• Information concerning the nature, cost and character of the administrative and other non-investment management services provided by Eaton Vance Management and its affiliates;

• Information concerning management of the relationship with the custodian, subcustodians and fund accountants by each adviser or the funds' administrator; and

• The terms of each advisory agreement.

In addition to the information identified above, the Special Committee considered information provided from time to time by each adviser throughout the year at meetings of the Board and its committees. Over the course of the twelve month period ended March 31,

22

Eaton Vance Money Market Funds

BOARD OF TRUSTEES' ANNUAL APPROVAL OF THE INVESTMENT ADVISORY AGREEMENT CONT'D

2006, the Board met nine times and the Special Committee, the Audit Committee and the Governance Committee, each of which is a Committee comprised solely of Independent Trustees, met eight, twelve and five times, respectively. At such meetings, the Trustees received, among other things, presentations by the portfolio managers and other investment professionals of each adviser relating to the investment performance of each fund and the investment strategies used in pursuing the fund's investment objective.

For funds that invest through one or more underlying portfolios, the Board considered similar information about the portfolio(s) when considering the approval of advisory agreements. In addition, in cases where the fund's investment adviser has engaged a sub-adviser, the Board considered similar information about the sub-adviser when considering the approval of any sub-advisory agreement.

The Special Committee was assisted throughout the contract review process by Goodwin Procter LLP, legal counsel for the Independent Trustees. The members of the Special Committee relied upon the advice of such counsel and their own business judgment in determining the material factors to be considered in evaluating each advisory and sub-advisory agreement and the weight to be given to each such factor. The conclusions reached with respect to each advisory and sub-advisory agreement were based on a comprehensive evaluation of all the information provided and not any single factor. Moreover, each member of the Special Committee may have placed varying emphasis on particular factors in reaching conclusions with respect to each advisory and sub-advisory agreement.

Results of the Process

Based on its consideration of the foregoing, and such other information as it deemed relevant, including the factors and conclusions described below, the Special Committee concluded that the continuance of the investment advisory agreement of the Cash Management Portfolio (the "Portfolio"), the portfolio in which the Eaton Vance Cash Management Fund and the Eaton Vance Money Market Fund (the "Funds") invest, with Boston Management and Research (the "Adviser"), including its fee structure, is in the interests of shareholders and, therefore, the Special Committee recommended to the Board approval of the agreement. The Board accepted the recommendation of the Special Committee as well as the factors considered and conclusions reached by the Special Committee with respect to the agreement. Accordingly, the Board, including a majority of the Independent Trustees, voted to approve continuation of the investment advisory agreement for the Portfolio.

Nature, Extent and Quality of Services

In considering whether to approve the investment advisory agreement of the Portfolio, the Board evaluated the nature, extent and quality of services provided to the Portfolio by the Adviser.

The Board considered the Adviser's management capabilities and investment process with respect to the types of investments held by the Portfolio, including the education, experience and number of its investment professionals and other personnel who provide portfolio management, investment research, and similar services to the Portfolio. The Board specifically noted the Adviser's experience in managing portfolios consisting of high quality money market instruments and short-term obligations. The Board also took into account the resources dedicated to portfolio management and other services, including the compensation paid to recruit and retain investment personnel, and the time and attention devoted to the Portfolio by senior management.

The Board reviewed the compliance programs of the Adviser and relevant affiliates thereof. Among other matters, the Board considered compliance and reporting matters relating to personal trading by investment personnel, selective disclosure of portfolio holdings, late trading, frequent trading, portfolio valuation, business continuity and the allocation of investment opportunities. The Board also evaluated the responses of the Adviser and its affiliates to requests from regulatory authorities such as the Securities and Exchange Commission and the National Association of Securities Dealers.

The Board considered shareholder and other administrative services provided or managed by Eaton Vance Management and its affiliates, including transfer agency and accounting services. The Board evaluated the benefits to shareholders of investing in a fund that is a part of a large family of funds, including the ability, in many cases, to exchange an investment among different funds without incurring additional sales charges. The Fund is maintained by the Adviser primarily as an administrative convenience for shareholders of other Eaton Vance Funds and is not actively marketed to the public as a stand-alone investment product.

After consideration of the foregoing factors, among others, the Board concluded that the nature, extent and quality of services provided by the Adviser, taken as a whole, are appropriate and consistent with the terms of the investment advisory agreement.

Fund Performance

The Board compared each Fund's investment performance to a relevant universe of similarly managed funds identified by an independent data provider and appropriate benchmark indices. The Board reviewed comparative performance data for the one-, three-, five- and ten-year periods ended September 30, 2005 for each Fund. The Board concluded that the performance of each Fund was satisfactory.

23

Eaton Vance Money Market Funds

BOARD OF TRUSTEES' ANNUAL APPROVAL OF THE INVESTMENT ADVISORY AGREEMENT CONT'D

Management Fees and Expenses

The Board reviewed contractual investment advisory fee rates payable by the Portfolio and the Fund (referred to as "management fees"). As part of its review, the Board considered the management fees and each Fund's total expense ratio for the year ended September 30, 2005, as compared to a group of similarly managed funds selected by an independent data provider.

After reviewing the foregoing information, and in light of the nature, extent and quality of the services provided by the Adviser, the Board concluded that the management fees charged for advisory and related services and each Fund's total expense ratio are reasonable.

Profitability

The Board reviewed the level of profits realized by the Adviser and relevant affiliates thereof in providing investment advisory and administrative services to the Portfolio, each Fund and to all Eaton Vance Funds as a group. The Board considered the level of profits realized without regard to revenue sharing or other payments by the Adviser and its affiliates to third parties in respect of distribution services. The Board also considered other direct or indirect benefits received by the Adviser and its affiliates in connection with its relationship with the Portfolio and the Fund, including the benefits of research services that may be available to the Adviser as a result of securities transactions effected for the Portfolio and other advisory clients.

The Board concluded that, in light of the foregoing factors and the nature, extent and quality of the services rendered, the profits realized by the Adviser and its affiliates are reasonable.

Economies of Scale