UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04014

Meridian Fund, Inc.®

(Exact name of registrant as specified in charter)

100 Fillmore St., Suite 325

Denver, CO 80206

(Address of principal executive offices) (Zip code)

David J. Corkins

100 Fillmore St., Suite 325

Denver, CO 80206

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-398-2929

Date of fiscal year end: June 30

Date of reporting period: June 30, 2021

| Item 1. | Reports to Stockholders. |

| | (a) | Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

The Report to Shareholders is attached herewith.

Annual Report

June 30, 2021

Meridian Fund, Inc.

Meridian Growth Fund

Meridian Contrarian Fund

Meridian Enhanced Equity Fund

Meridian Small Cap Growth Fund

MERIDIAN FUND, INC.

Table of Contents

| 4 |

| 23 |

| 28 |

| 29 |

| 47 |

| 49 |

| 50 |

| 52 |

| 70 |

| 90 |

| 91 |

| 92 |

| 93 |

| 95 |

| Meridian Funds | 3 | www.meridianfund.com |

Meridian Growth Fund

Portfolio Performance and Composition (Unaudited)

Market Overview

At the start of the 12-month period, rising COVID-19 infection rates, shuttered economies and U.S. presidential election-related anxiety made it difficult for the world to look to the future with optimism. Uncertainty caused a number of companies to retract or refrain from providing earnings guidance and led to economic forecasts that projected as much as a 3.8% contraction in global GDP growth for 2020. However, ongoing accommodative measures by central banks around the world helped stabilize markets and economies, and the approval and subsequent rollout of coronavirus vaccines brightened investors’ outlook heading into 2021.

In the second half of the period, growing optimism about a return to normalcy, the passage of an additional $1.9 trillion U.S. relief package, and President Biden’s proposed $2.25 trillion infrastructure spending plan propelled U.S. equity markets to new highs. Key economic data also contributed to investor optimism, including a significant increase in U.S. manufacturing activity. Commodity prices also increased, leading to inflation fears. While Federal Reserve policymakers viewed inflation as “transitory” and kept short-term interest rates near zero, they indicated that higher inflation readings could accelerate the timeframe for interest rate hikes and projected at least one rate increase by the end of 2023.

Against this backdrop, small-capitalization stocks outperformed large- and mid-caps, according to the Russell family of U.S. indices. Additionally, value stocks outpaced growth stocks across the capitalization spectrum.

Fund Performance

The Meridian Growth Fund (the "Fund") Legacy Class Shares returned 56.11% (net) for the 12 months ended June 30, 2021, outperforming its benchmark, the Russell 2500® Growth Index, which returned 49.63%.

Our investment process prioritizes the management of risk over the opportunity for return. We look to build an enduring fund that can mitigate capital losses during turbulent bear market environments and, secondarily, participate on the upside during strong market environments. During the period, volatility was slightly below average. In fact, there were 17 days in which the index dropped 2% or more. Notably, the Fund’s strategy outperformed the index on 15 of these 17 down days.

At the sector level, the Fund benefitted from positive stock selection in the communication services and information technology sectors. In addition, an overweight position in the industrials sector aided performance, as industrials was one of the top performing sectors in the index during the period. The Fund maintained its overweight to industrials given the Fund’s focus on commercial and professional service companies, which tend to exhibit strong competitive advantages and generally less macro sensitivity than the broader sector. The Fund remains underweight the information technology sector as we continue to be unable to justify current valuations and worry that a bubble is forming in the software industry, where many companies are operating under a grow at all costs model with little to no focus on profits. Conversely, select consumer discretionary holdings detracted from relative performance during the period, as names including Vroom, Inc. and Carter’s, Inc., appreciated but couldn’t keep pace with the broader market. Market factors were mixed during the trailing one-year period, a welcome relief from the previous year in which larger-cap, momentum-driven, and more aggressive growth companies outperformed.

The three largest contributors to the Fund’s performance during the period were Pinterest, Inc., J2 Global, Inc., and Generac Holdings, Inc.

| • | Pinterest, Inc. is a social media platform where users create, manage, and share theme-based image collections online. The company generates revenue through a targeted advertising model. We purchased the stock at what we felt was an attractive price based on our belief that Pinterest’s user base was drastically under-monetized and that revenue growth could accelerate. The stock rallied after management reported strong revenue trends in July driven by stay-at-home mandates. During pandemic-related quarantines, social media platforms like Pinterest have become a more important way for retailers and brands to reach consumers. Pinterest’s average revenue per user in the US remains well below its most comparable peers. We believe the company has a very clear opportunity to close this gap which will drive long duration revenue growth and expanding margins. Despite the attractive long-term outlook, we sold our position in the stock during the period based on our market cap and valuation discipline. |

| • | J2 Global, Inc. is a leading internet and software services company, operating through two segments: business cloud services and digital media. The combined company has grown revenues for 24 consecutive years with high |

| Meridian Funds | 4 | www.meridianfund.com |

Meridian Growth Fund

Portfolio Performance and Composition (Unaudited) (continued)

| | margins and attractive returns on invested capital. The cloud services business which provides niche products to small and mid-sized businesses enjoys a high percentage of recurring revenues, low churn, and high margins. J2’s digital media business generates revenue through subscriptions to websites it owns, including tech, entertainment, and culture site Mashable, and through advertising on those sites. J2’s advertising business model is unique in that it is almost entirely performance-based, as opposed to other sites that rely heavily on banner advertisements. Part of our initial attraction to J2 was its successful track record of acquiring undermanaged companies and restructuring them to significantly increase profitability. In April, J2 announced plans to spin off its Cloud Fax business which we believe will create value for shareholders. Our continued confidence in J2 prompted us to cause the Fund to maintain a large position in the stock which we believe is significantly undervalued by the market.

|

| • | Generac Holdings, Inc. is a manufacturer of power generation equipment with a leading position in home standby generators. Generac also offers consumers a home energy management system that harnesses and stores power from the sun to be used for backup during utility power outages. Severe weather events that strained already-overburdened power grids in California and other key markets have created significant opportunity for home power generation equipment manufacturers. Moreover, with the future potential to aggregate these distributed energy resources through the company’s grid services business, homeowners have the potential to monetize these assets. With the total U.S. household penetration rate at less than 10%, we are excited about the future market opportunity. In February, the winter storm that left more than five million homes in Texas without power resulted in soaring demand for Generac’s home generators and drove gains in the company’s stock. More recently, record-high temperatures and droughts, rolling blackouts in the Pacific Northwest, and an increase in attach rates on new homes have driven demand. We trimmed the Fund’s position in the stock during the quarter based on valuation but remain confident in the long-term growth potential of Generac. |

The three largest detractors from the Fund’s performance during the period were Quidel Corp., Deciphera Pharmaceuticals, Inc., and Vroom, Inc.

| • | Quidel Corp. is a leader in developing point-of-care (POC) rapid diagnostic testing systems. It generates a significant portion of its revenue from point-of-care flu tests. In March of 2020, the company became one of the first in the industry to receive FDA Emergency Use Authorization for its COVID-19 detection test. As testing ramped up in the following months, the stock rallied. More recently, however, the stock has pulled back amid rising COVID-19 vaccination rates and declining COVID-19 testing volumes. Our investment thesis for Quidel remains intact as the company has a solid business in other diagnostic areas with a robust product pipeline. Pipeline developments include the company’s Savanna platform, its POC molecular diagnostic system that is accurate, fast and cost effective. We trimmed the Fund’s position in the stock during the period.

|

| • | Deciphera Pharmaceuticals, Inc. is a commercial-stage biopharmaceutical firm focused on developing therapies for cancer through its switch-control kinase inhibitor platform. We were drawn to this company for the commercial launch of Qinlock, its recently approved drug for gastrointestinal stromal tumors (GIST) and its promising pipeline of developmental drugs. The disappointing commercial launch of Qinlock caused the stock to slide during the period. While sales of the drug initially were strong, they’ve recently stalled as the therapy is only approved as a fourth-line treatment option. However, the company is currently conducting trials in second-line GIST patients which could significantly expand usage for Qinlock. If approved, we believe the upside for Deciphera could be considerable. During the period, we trimmed the Fund’s position in the stock. |

| • | Vroom, Inc. operates an end-to-end e-commerce platform for the used car industry. We believe Vroom is well positioned to benefit from a growing trend in which used car buyers are choosing the online shopping experience over the traditional car lot experience. We believe only a few e-commerce platforms will be able to take significant market share from traditional used car dealers due to inventory, sourcing, and operational challenges that most online sellers are unable to overcome. We are confident Vroom, which is currently the second-largest player in this space, will be among them. During the period, Vroom saw more demand for used cars than it was able to fulfill. Its call center, which fields inquiries from prospective buyers, was not able to keep up with call volumes which negatively impacted top-line results. We believe this is only a speed bump for Vroom, which is already in the process of improving its infrastructure. Revenue growth is likely to accelerate meaningfully through ’21 and we expect macro trends to remain supportive of online used car shopping. We added to the Fund’s position during periods of share price weakness. |

| Meridian Funds | 5 | www.meridianfund.com |

Meridian Growth Fund

Portfolio Performance and Composition (Unaudited) (continued)

Outlook

As we look ahead, we are encouraged by the prospect that COVID-19 infection rates will continue to taper and that economies will fully reopen. However, the speed and breadth of a global recovery remains to be seen and depends largely on the rate of vaccine deployment and the potential spread of COVID-19 variants. With increased stimulus, declining unemployment, and a more robust economy it is very possible that increasing inflation will lead to higher interest rates. We believe this dynamic could introduce even more volatility into the markets, potentially pressuring some of the extreme valuations we see in the information technology and healthcare sectors – a development that we would welcome.

Now more than ever, we maintain strong conviction in the companies we own. Our focus remains on companies that can not only weather the market volatility but also emerge even stronger once the pandemic clouds clear. We believe the market’s correction and subsequent rebound has presented us with opportunities to continue to upgrade the quality of the portfolio while maintaining our strict valuation discipline. Although recent economic events are unprecedented, we remain confident that staying disciplined to our investment process is the best approach to achieve the strategy’s long-term investment objectives.

Thank you for your continued partnership with ArrowMark.

Brian Schaub & Chad Meade

Co-Portfolio Managers

| Meridian Funds | 6 | www.meridianfund.com |

Meridian Growth Fund

Portfolio Performance and Composition (Unaudited) (continued)

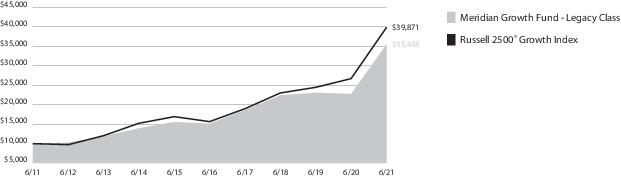

Total Return Based on a $10,000 investment for the Period Ended June 30, 2021

This graph shows the change in value of a hypothetical investment of $10,000 in Legacy Class Shares of the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. For comparison, the same investment is shown in the indicated index.

Average Annual Total Return as of 6.30.21

| | Inception | 1 Year | 5 Year | 10 Year | Since

Inception |

| Legacy Class (MERDX) | 8/1/84 | 56.11% | 18.65% | 13.49% | 13.08% |

| Institutional Class (MRRGX) | 12/24/14 | 56.13% | 18.67% | — | 14.15% |

| Class A (MRAGX) w/o sales charge | 11/15/13 | 55.62% | 18.28% | — | 13.50% |

| Class A (MRAGX) with sales charge1 | 11/15/13 | 46.68% | 16.89% | — | 12.62% |

| Class C (MRCGX) | 7/1/15 | 54.49% | 17.44% | — | 13.57% |

| Investor Class (MRIGX) | 11/15/13 | 56.01% | 18.59% | — | 13.85% |

| Russell 2500® Growth Index | 8/1/84 2 | 49.63% | 20.68% | 14.83% | N/A 3 |

| 1 | Assuming maximum sales charge, if any. Class A Shares are subject to a maximum initial sales charge of 5.75%. |

| 2 | Inception date of Legacy Class Shares. |

| 3 | Inception date of Legacy Class precedes the inception date of Russell 2500® Growth Index. |

See “Disclosures Regarding Fund Performance” on page 28 for important information regarding reported performance.

The views of the author and information discussed in this commentary are as of June 30, 2021, are subject to change, and may not reflect the writer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund or any securities or any sectors mentioned in this letter. The subject matter contained in this letter had been derived from several sources believed to be reliable and accurate at the time of compilation. To the extent permitted by federal securities laws, ArrowMark Colorado Holdings, LLC, Meridian Fund, Inc., nor the Fund accept any liability for losses either direct or consequential caused by the use of this third party information. Diversification cannot guarantee gain or prevent losses.

Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares and do not reflect the imposition of a 2% redemption fee on shares held 60 days or less to deter market timers. If reflected, the taxes and fees would reduce the performance quoted. Net asset value, investment return and principal value will fluctuate, so shares, when redeemed, may be worth more or less than their original cost.

| Meridian Funds | 7 | www.meridianfund.com |

Meridian Growth Fund

Portfolio Composition (Unaudited)

Top 10 Holdings as of 6.30.21

| j2 Global, Inc. | 3.19% |

| Skechers U.S.A., Inc. Class A | 2.94% |

| STERIS Plc | 2.89% |

| Sally Beauty Holdings, Inc. | 2.65% |

| ON Semiconductor Corp. | 2.49% |

| 2U, Inc. | 2.39% |

| Sensata Technologies Holding Plc | 2.14% |

| Matson, Inc. | 2.14% |

| Generac Holdings, Inc. | 2.04% |

| Hanesbrands, Inc. | 2.03% |

Portfolio holdings are subject to change and may not reflect the current or future position of the portfolio. Top ten holdings excluding short-term investments are reported as a percentage of net assets.

Sector Allocation as of 6.30.21

Sector allocations are subject to change and may not reflect the current or future position of the portfolio. Sector allocations are reported as a percentage of equity investments excluding cash or cash equivalents. As of period end, the Fund invested a significant portion of their assets in securities in the Health Care, Information Technology and Industrials. Changes in economic conditions affecting such sectors would have a greater impact on the Fund and could affect the value, income and/or liquidity of positions in such securities.

For compliance purposes, the Fund’s industry classifications may refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease.

| Meridian Funds | 8 | www.meridianfund.com |

Meridian Contrarian Fund

Portfolio Performance and Composition (Unaudited)

Market Overview

At the start of the 12-month period, rising COVID-19 infection rates, shuttered economies and U.S. presidential election-related anxiety made it difficult for the world to look to the future with optimism. Uncertainty caused a number of companies to retract or refrain from providing earnings guidance and led to economic forecasts that projected as much as a 3.8% contraction in global GDP growth for 2020. However, ongoing accommodative measures by central banks around the world helped stabilize markets and economies, and the approval and subsequent rollout of coronavirus vaccines brightened investors’ outlook heading into 2021.

In the second half of the period, growing optimism about a return to normalcy, the passage of an additional $1.9 trillion U.S. relief package, and President Biden’s proposed $2.25 trillion infrastructure spending plan propelled U.S. equity markets to new highs. Key economic data also contributed to investor optimism, including a significant increase in U.S. manufacturing activity. Commodity prices also increased, leading to inflation fears. While Federal Reserve policymakers viewed inflation as “transitory” and kept short-term interest rates near zero, they indicated that higher inflation readings could accelerate the timeframe on interest rate hikes and projected at least one rate increase by the end of 2023.

Against this backdrop, small-capitalization stocks outperformed large- and mid-caps, according to the Russell family of U.S. indices. Additionally, value stocks outpaced growth stocks across the capitalization spectrum.

Fund Performance

The Meridian Contrarian Fund (the “Fund”) Legacy Class Shares returned 66.77% (net) for the 12 months ending June 30, 2021, outperforming its benchmark, the Russell 2500® Index, which returned 57.79%. The Fund also outperformed its secondary benchmark, the Russell 2500® Value Index, which returned 63.23%.

Our investment process seeks to identify out-of-favor companies that we believe have depressed valuations and visible catalysts for sustainable improvement. Our experience has taught us that businesses with the potential for earnings growth and multiple expansion can be a powerful source of outperformance. As such, we employ a fundamental research-driven process that includes screening for companies that have multiple quarters of year-over-year earnings declines, understanding the reason for the declines, then singling out the companies we believe are poised for an earnings rebound via a cohesive turnaround plan, a new management team, or through improvements or changes to the business. The outcome of this process is a concentrated portfolio of 50-75 of our best ideas.

With a process that prioritizes the management of risk over the opportunity for return, we scrutinize the quality of each prospective investment’s business model and its valuation. Our high standards for quality require that a company have a durable competitive advantage, improving return on invested capital and free cash flow, as well as sustainable future earnings growth.

While we manage the Fund from the bottom up based on individual company fundamentals, we augment this by monitoring overall portfolio characteristics as part of our risk-management process. Two of our primary risk measures are beta-adjusted weight and downside capture, both of which we measure on portfolio, sector, and individual company levels. We analyze the beta-adjusted weights of portfolio holdings against the Russell 2500® Index to determine how sensitive each holding is to movement in the broader market and identify where the Fund’s risk exposure lies within the portfolio. Depending on the degree to which a stock correlates closely with market movement (high beta) or inversely to the market (low beta) we may increase or decrease the Fund’s weighting to align with the Fund’s risk parameters, as we prioritize risk before reward. Downside capture measures how much a stock goes down relative to an overall market decline, with lower capture representing lower risk. For both these measures we focus on absolute levels and changes over time. This is part of our ongoing process of recycling capital, and we are comfortable with the Fund’s current lower-risk profile.

Key drivers of the Fund’s performance included select industrials and information technology holdings. Conversely, the relative underperformance of several consumer staples and financials holdings hindered results.

The three largest contributors to the Fund’s performance were Welbilt, Inc., Acadia Healthcare Co., Inc., and DigitalBridge Group, Inc.

| • | Welbilt, Inc. manufactures commercial foodservice equipment for restaurants and food service organizations globally. Customers include quick-service and full-service restaurant chains, hotels, resorts and supermarkets. |

| Meridian Funds | 9 | www.meridianfund.com |

Meridian Contrarian Fund

Portfolio Performance and Composition (Unaudited) (continued)

| | After spinning off from a large industrial conglomerate several years ago, the company struggled from low profit margins relative to competitors. A new CEO with a strong track record of successful business transformations was appointed in 2018 and outlined a process for improvement. Despite the company’s problems appearing fixable, our research suggested Welbilt’s stock traded at a significant discount. However, the Fund did not invest in the company until early 2020, when pandemic-related uncertainty for restaurants caused the stock to pull back to what we viewed as a deeply discounted value. The majority of Welbilt’s customers were considered essential businesses during the pandemic lockdowns. In our opinion, management executed well during the depth of the pandemic–cutting costs and enabling the company to remain cash-flow positive. This sent Welbilt’s stock higher during the second quarter. The stock rallied further when, in May, management announced a key competitor had reached a deal to acquire Welbilt. Another competitor later announced they would also consider a bid for the company. In July, Welbilt agreed to be acquired for cash by a private competitor, and the public competitor decided not to further bid up the value of Welbilt. We believe the $24 per share deal price is a fair take private price for Welbilt – a stock the Fund began accumulating under $5 per share. The announced deal will close out the Fund's position.

|

| • | Acadia Healthcare Co., Inc. is a provider of behavioral healthcare services in the U.S. and U.K. Through its network of healthcare facilities, it offers care expertise in acute rehabilitation, long-term addiction therapy, child behavior, and other behavioral health issues. While Acadia’s U.S. business historically has grown mid-single digits and is profitable, its U.K. operations have struggled. In 2018-19, labor inefficiencies and frequent national health system regulation changes in the U.K. led to negative earnings growth and prompted the board of directors to replace the company’s CEO. In early 2020, Acadia’s new management announced they would begin the process of selling its unprofitable U.K. segment—a catalyst we felt could lead to an earnings rebound. While COVID-related market disruption delayed the sale and depressed the stock, it provided the Fund with an opportunity to build a position in Acadia. The Fund was rewarded for our insight, as the stock gained significantly over the period. Positive developments included profitability improvements in Acadia’s core U.S. behavioral health business and news of a buyer for its U.K. operations. The company continues to execute on its U.S. businesses, increasing partnerships in new states. It also enjoys strong organic growth, which has been a key driver of earnings growth. The stock’s exceptional performance during the period brought it closer to our assessment of the company’s intrinsic value and we subsequently trimmed the Fund's position. However, our outlook for future earnings growth remains positive. |

| • | DigitalBridge Group, Inc. (formerly Colony Capital, Inc.) is a real estate investment trust (REIT) focused on digital infrastructure such as data centers, wireless towers, and similar assets. The company both owns and operates properties and has a fee-based asset management division. DigitalBridge suffered an extended decline in its business when previous management strayed from the company’s traditionally strong property investment business by completing a merger that added a collection of diverse yet undifferentiated and subscale properties to its portfolio and burdened it with debt. The catalyst for the Fund's investment was a new management team in 2019 that brought significant experience in digital assets to the company and began to transform the business by selling its hospitality, healthcare, and industrial properties, and reinvesting the proceeds into digital infrastructure properties. DigitalBridge continued to make progress with this transformation in the period, with digital assets now accounting for 80% of total assets. We maintained the Fund's position in the stock. |

The three largest detractors from the Fund’s performance during the period were Perrigo Co., Deciphera Pharmaceuticals, Inc., and Teva Pharmaceutical Industries Ltd.

| • | Perrigo Co. is the leader in store brand consumer wellness and self-care products and also operates a smaller prescription drug business. The company has endured five years of declining earnings due to what we believe was poor capital allocation by its previous management team, which chased growth through acquisitions outside of Perrigo’s core business. Our investment in Perrigo was inspired by a new management team that has committed to pursuing realistic, steady growth rates within the core business, and delivering improved profitability and returns on capital. We also liked the stock’s valuation, which was less than 11x price to earnings at the time of our investment. Perrigo’s stock declined following an adverse tax ruling related to its domicile in Ireland, which is a hangover from previous management, and a product recall of generic Albuterol due to a packaging issue. We believe these headwinds may persist for some time and therefore liquidated the Fund's position in Perrigo’s stock. |

| • | Deciphera Pharmaceuticals, Inc. is a biotech company focused on cancer therapies based on its proprietary kinase switch control inhibitor platform. When we initially became interested in Deciphera, the stock was out of |

| Meridian Funds | 10 | www.meridianfund.com |

Meridian Contrarian Fund

Portfolio Performance and Composition (Unaudited) (continued)

| | favor with investors as a result of confusing clinical trial results reported in 2018 for one of its therapies. However, our team’s analysis detected several positive underlying signs in the data. We felt that, given the large market opportunity for cancer therapies and our positive outlook for Deciphera’s pipeline of drug candidates, Deciphera represented a favorable risk/reward opportunity. As such, we purchased the stock in the second quarter of 2019. Our thesis has since begun to play out and Decipher has been a profitable investment for the Fund. However, despite reporting relatively solid earnings results and indications that additional data on its therapies will be coming out in the second half of 2021, the stock declined. We believe the company’s risk/reward dynamics remain favorable and maintained the Fund's position in the stock. |

| • | Teva Pharmaceutical Industries Ltd. develops, manufactures, and markets generic and branded drugs. The stock fell roughly 80% following the loss of patent protection for its top-selling multiple sclerosis drug Copaxone in 2015. The setback led to a decline in sales and margins. Teva’s generic drug business also fell on hard times when, in 2018, it suffered from pricing pressure and the company worked towards a multi- billion-dollar litigation settlement for its role in the nationwide Opioid crisis. Our research of the company suggested liquidity risk from large settlements was limited and that generic pricing pressure was normalizing as the FDA completed its accelerated approval program. We also had confidence that management, which was executing a restructuring program to improve margins and free cash flow, could reignite earnings growth. We were particularly excited about Teva’s decision to divest its generic manufacturing assets and launch two new branded drugs, which we believed could offset the sales decline resulting from Copaxone's patent loss. During the period, Teva’s stock declined amid accusations it violated anti-kickback rules by donating $300 million to charities that helped patients pay for Capaxone, which supported a price increase for the drug. We exited the Fund's position in the stock as our outlook for the company dimmed. |

Outlook

With the future of inflation, interest rates, and variants of the coronavirus hanging in the balance, we believe it’s likely market “noise” levels will grow. Our approach to cutting through the noise is to focus on individual company fundamentals. Through detailed, bottom-up fundamental analysis, we will continue to search for and invest in out-of-favor companies that we believe are primed to demonstrate improved results. We believe this approach will enable the Fund to deliver on its performance objectives.

Thank you for your continued partnership with ArrowMark.

Jamie England

Portfolio Manager

| Meridian Funds | 11 | www.meridianfund.com |

Meridian Contrarian Fund

Portfolio Performance and Composition (Unaudited) (continued)

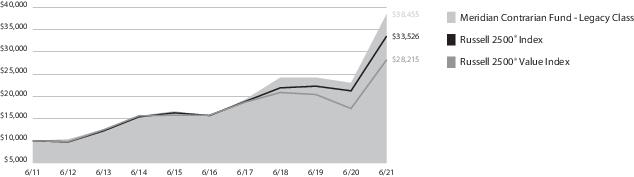

Total Return Based on a $10,000 investment for the Period Ended June 30, 2021

This graph shows the change in value of a hypothetical investment of $10,000 in Legacy Class Shares of the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. For comparison, the same investment is shown in the indicated index.

Average Annual Total Return as of 6.30.21

| | Inception | 1 Year | 5 Year | 10 Year | Since

Inception |

| Legacy Class (MVALX) | 2/10/94 | 66.77% | 19.71% | 14.42% | 13.59% |

| Class A (MFCAX) w/o sales charge | 11/15/13 | 66.22% | 19.24% | — | 13.11% |

| Class A (MFCAX) with sales charge1 | 11/15/13 | 56.67% | 17.83% | — | 12.23% |

| Class C (MFCCX) | 7/1/15 | 65.03% | 18.50% | — | 13.70% |

| Investor Class (MFCIX) | 11/15/13 | 66.65% | 19.55% | — | 13.40% |

| Russell 2500® Index | 2/10/94 2 | 57.79% | 16.35% | 12.86% | 11.00% |

| Russell 2500® Value Index | 2/10/94 2 | 63.23% | 12.29% | 10.93% | 10.77% |

| 1 | Assuming maximum sales charge, if any. Class A Shares are subject to a maximum initial sales charge of 5.75%. |

| 2 | Inception date of Legacy Class Shares. |

See “Disclosures Regarding Fund Performance” on page 28 for important information regarding reported performance.

The views of the author and information discussed in this commentary are as of June 30, 2021, are subject to change, and may not reflect the writer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund or any securities or any sectors mentioned in this letter. The subject matter contained in this letter had been derived from several sources believed to be reliable and accurate at the time of compilation. To the extent permitted by federal securities laws, ArrowMark Colorado Holdings, LLC, Meridian Fund, Inc., nor the Fund accept any liability for losses either direct or consequential caused by the use of this third party information. Diversification cannot guarantee gain or prevent losses.

Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares and do not reflect the imposition of a 2% redemption fee on shares held 60 days or less to deter market timers. If reflected, the taxes and fees would reduce the performance quoted. Net asset value, investment return and principal value will fluctuate, so shares, when redeemed, may be worth more or less than their original cost.

| Meridian Funds | 12 | www.meridianfund.com |

Meridian Contrarian Fund

Portfolio Composition (Unaudited)

Top 10 Holdings as of 6.30.21

| DigitalBridge Group, Inc. | 3.33% |

| Acadia Healthcare Co., Inc. | 3.10% |

| Newell Brands, Inc. | 2.30% |

| VICI Properties, Inc. | 2.30% |

| SMART Global Holdings, Inc. | 2.29% |

| Covanta Holding Corp. | 2.28% |

| TreeHouse Foods, Inc. | 2.27% |

| CNH Industrial, N.V. (United Kingdom) | 2.20% |

| First Horizon Corp. | 2.18% |

| Telephone and Data Systems, Inc. | 2.14% |

Portfolio holdings are subject to change and may not reflect the current or future position of the portfolio. Top ten holdings excluding short-term and options written investments are reported as a percentage of net assets.

Sector Allocation as of 6.30.21

Sector allocations are subject to change and may not reflect the current or future position of the portfolio. Sector allocations are reported as a percentage of equity investments excluding cash or cash equivalents. As of period end, the Fund invested a significant portion of their assets in securities in the Information Technology and Industrials sectors. Changes in economic conditions affecting such sectors would have a greater impact on the Fund and could affect the value, income and/or liquidity of positions in such securities.

For compliance purposes, the Fund’s industry classifications may refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease.

| Meridian Funds | 13 | www.meridianfund.com |

Meridian Enhanced Equity Fund

Portfolio Performance and Composition (Unaudited)

Market Overview

At the start of the 12-month period, rising COVID-19 infection rates, shuttered economies and U.S. presidential election-related anxiety made it difficult for the world to look to the future with optimism. Uncertainty caused a number of companies to retract or refrain from providing earnings guidance and led to economic forecasts that projected as much as a 3.8% contraction in global GDP growth for 2020. However, ongoing accommodative measures by central banks around the world helped stabilize markets and economies, and the approval and subsequent rollout of coronavirus vaccines brightened investors’ outlook heading into 2021.

In the second half of the period, growing optimism about a return to normalcy, the passage of an additional $1.9 trillion U.S. relief package, and President Biden’s proposed $2.25 trillion infrastructure spending plan propelled U.S. equity markets to new highs. Key economic data also contributed to investor optimism, including a significant increase in U.S. manufacturing activity. Commodity prices also increased, leading to inflation fears. While Federal Reserve policymakers viewed inflation as “transitory” and kept short-term interest rates near zero, they indicated that higher inflation readings could accelerate the timeframe for interest rate hikes and projected at least one rate increase by the end of 2023.

Against this backdrop, small-capitalization stocks outperformed large- and mid-caps, according to the Russell family of U.S. indices. Additionally, value stocks outpaced growth stocks across the capitalization spectrum.

Fund Performance

The Meridian Enhanced Equity Fund (the “Fund”) Legacy Class Shares advanced 33.17% (net) for the 12-month period ended June 30, 2021, underperforming its benchmark, the S&P 500® Index, which gained 40.79%.

Our investment process prioritizes the management of risk over the opportunity for return. We look to build an enduring portfolio that can mitigate capital losses during turbulent bear market environments and offer upside participation during strong bull market environments as well. To achieve that, we seek out quality businesses maintaining considerable competitive advantages and healthy balance sheets that offer robust cash flow characteristics and muted volatility traits.

At any given time, roughly half of the Fund is invested in what we view as high quality, larger capitalization companies with promising growth prospects. The balance of the portfolio is invested in equities hedged in a risk-managed approach where more predictable stocks are married with options in an effort to reduce downside risks. Accordingly, during periods of excessive market returns, this strategy results in a willingness to trade some upside while preserving potential downside protection. Underlying this approach is our commitment to deep fundamental research.

Against this backdrop, leading detractors during the period included Match Group, Inc., Talis Biomedical Corp., and Vroom, Inc.

| • | Match Group, Inc. is the global leader in online dating services, led by Tinder, the highest grossing non-gaming app in the world. The company was spun off from core holding Interactive Corp. early in the period, and as we assessed its value in the Fund, we exited the position due to what we believed was a stretched valuation. The Fund continues to hold Interactive Corp., which we believe has built a diverse portfolio of digital assets that frequently contends with a disconnect between the intrinsic value of its holdings and the price the market is willing to pay for the collection of platforms. |

| • | Talis Biomedical Corp. develops diagnostic testing technologies for infectious diseases. We added it to the Fund's portfolio after its IPO in early 2021. The company’s Talis One platform addresses a wide range of potential infections, from those that afflict the respiratory system to those related to women’s health. Admittedly, we underestimated the pandemic-stoked competitive pressures for point-of-care diagnostic tests, while moderating COVID-19 infection levels limited near-term growth prospects. We continue to believe there is an unmet market need for highly accurate and low-cost molecular testing, but we’re monitoring developments at Talis closely.

|

| • | Vroom, Inc. operates an end-to-end e-commerce platform for the highly fragmented $840 billion used auto market. We believe the company is well positioned to benefit from a growing trend in which used car customers opt for an online shopping experience instead of a traditional car lot. Although we believe few e-commerce |

| Meridian Funds | 14 | www.meridianfund.com |

Meridian Enhanced Equity Fund

Portfolio Performance and Composition (Unaudited) (continued)

| | companies can overcome inventory, sourcing, and operational issues that are common to challengers in the used car market, we believe Vroom has the strategy and capacity to dominate as sales increasingly migrate from physical to digital outlets. Despite the stock’s underperformance in the period, the Fund continues to hold Vroom. |

Top individual contributors during the period included salesforce.com, Inc., Apple, Inc., and NVIDIA Corp.

| • | salesforce.com, Inc. develops cloud-based technology that helps clients manage customer service, sales, and operational data and processes. The company’s attractive business model, which is rooted in contracts with enterprise clients, provides considerable revenue visibility and enhances the breadth and scale of its product and service offerings. The pandemic-forced rethinking of the concept of the office underscored Salesforce’s essential nature and it reported a strong start to 2021 with high net new customer figures. It also anticipates increased cross-selling opportunities once it closes on its acquisition of leading-edge collaboration provider Slack, which could close as early as the third quarter. Ultimately, we believe that salesforce.com fits squarely within the Fund's focus of owning companies that allow their customers to better provision mission-critical data and services. |

| • | Apple, Inc. a leading consumer hardware, software, and services company, endured the market’s broad rotation into value stocks and surging preference for small cap companies to rank among our top contributors. Over the past 12 months, homebound consumers contributed to strong iPad and Mac desktop sales, as well as stellar growth in wearables technology, especially the Apple Watch and AirPods. In addition, with the fall 2020 launch of the iPhone 12, its first 5G-compatible device, Apple reversed downward momentum in its critical smartphone business. Additionally, signs of new products within the automotive and home entertainment industries in early 2021 were encouraging. Given the numerous potential drivers for growth, Apple remains a high conviction name for the Fund. |

| • | Despite a global semiconductor chip shortage, NVIDIA Corp. also rallied as it reported consistently strong fundamental growth and a promising outlook. The company develops graphics and video processing chips for desktop and notebook gaming personal computers, workstations, consoles, servers, and supercomputers. Amid the pandemic, it benefited from stay-at-home orders as many consumers sought computer upgrades to fulfill work-from-home responsibilities, improved gaming systems for entertainment purposes, or both. Furthermore, the company announced it was acquiring Arm Limited, a leading semiconductor chip designer, which would further expand NVIDIA's market footprint, although the deal faces numerous regulatory hurdles. |

Outlook

Looking ahead, we are encouraged by the prospect of falling COVID-19 infection rates and the full reopening of economies worldwide. The speed and breadth, however, of improvements on both fronts remains to be seen, and depends largely on the rate of vaccine deployment and the spread of coronavirus variants. Meanwhile, sustained inflation remains a threat, given the robust U.S. growth outlook and the steadily improving employment picture. Such conditions historically lead to higher interest rates, which could spark market volatility, as might an increase in the corporate tax rate and renewed scrutiny of alleged anti-competitive practices among technology industry leaders.

Should volatility emerge, we will look to capitalize on it by buying high-quality businesses that we believe will compound value over the long-term. We will stick to our playbook, working prudently to manage risk and using deep fundamental company-level research rather than macroeconomic assessments. Meanwhile, our charge remains to prioritize risk over return, even if that means trading some incremental market upside for downside protection. Through the combination of stock selection and our covered call strategy, we believe our disciplined and conservative approach to deploying capital is ideal for a market that still appears to have gotten ahead of economic realities.

Thank you for your continued partnership with ArrowMark.

Clay Freeman

Portfolio Manager

| Meridian Funds | 15 | www.meridianfund.com |

Meridian Enhanced Equity Fund

Portfolio Performance and Composition (Unaudited) (continued)

Total Return Based on a $10,000 investment for the Period Ended June 30, 2021

This graph shows the change in value of a hypothetical investment of $10,000 in Legacy Class Shares of the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. For comparison, the same investment is shown in the indicated index.

Average Annual Total Return as of 6.30.21

| | Inception | 1 Year | 5 Year | 10 Year | Since

Inception |

| Legacy Class (MEIFX) | 1/31/05 | 33.17% | 22.96% | 15.30% | 11.08% |

| Class A (MRAEX) w/o sales charge | 11/15/13 | 32.78% | 22.55% | — | 15.29% |

| Class A (MRAEX) with sales charge1 | 11/15/13 | 25.17% | 21.11% | — | 14.40% |

| Class C (MRCEX) | 7/1/15 | 32.27% | 22.06% | — | 17.16% |

| Investor Class (MRIEX) | 11/15/13 | 33.37% | 22.86% | — | 15.58% |

| S&P 500® Index | 1/31/05 2 | 40.79% | 17.65% | 14.84% | 10.43% |

| 1 | Assuming maximum sales charge, if any. Class A Shares are subject to a maximum initial sales charge of 5.75%. |

| 2 | Inception date of Legacy Class Shares. |

See “Disclosures Regarding Fund Performance” on page 28 for important information regarding reported performance.

The views of the author and information discussed in this commentary are as of June 30, 2021, are subject to change, and may not reflect the writer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund or any securities or any sectors mentioned in this letter. The subject matter contained in this letter had been derived from several sources believed to be reliable and accurate at the time of compilation. To the extent permitted by federal securities laws, ArrowMark Colorado Holdings, LLC, Meridian Fund, Inc., nor the Fund accept any liability for losses either direct or consequential caused by the use of this third party information. Diversification cannot guarantee gain or prevent losses.

Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares and do not reflect the imposition of a 2% redemption fee on shares held 60 days or less to deter market timers. If reflected, the taxes and fees would reduce the performance quoted. Net asset value, investment return and principal value will fluctuate, so shares, when redeemed, may be worth more or less than their original cost.

| Meridian Funds | 16 | www.meridianfund.com |

Meridian Enhanced Equity Fund

Portfolio Composition (Unaudited)

Top 10 Holdings as of 6.30.21

| Wells Fargo & Co. | 5.84% |

| Skechers U.S.A., Inc. Class A | 5.35% |

| WW Grainger, Inc. | 5.08% |

| ON Semiconductor Corp. | 3.81% |

| Domtar Corp. | 3.53% |

| Vistra Corp. | 3.50% |

| ViacomCBS, Inc. Class B | 3.45% |

| Live Nation Entertainment, Inc. | 3.32% |

| Mimecast Ltd. | 3.22% |

| Zuora, Inc. Class A | 3.22% |

Portfolio holdings are subject to change and may not reflect the current or future position of the portfolio. Top ten holdings excluding short-term investments are reported as a percentage of net assets.

Sector Allocation as of 6.30.21

Sector allocations are subject to change and may not reflect the current or future position of the portfolio. Sector allocations are reported as a percentage of equity investments excluding cash or cash equivalents. As of period end, the Fund invested a significant portion of their assets in securities in the Information Technology sector. Changes in economic conditions affecting such sector would have a greater impact on the Fund and could affect the value, income and/or liquidity of positions in such securities.

For compliance purposes, the Fund’s industry classifications may refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease.

| Meridian Funds | 17 | www.meridianfund.com |

Meridian Small Cap Growth Fund

Portfolio Performance and Composition (Unaudited)

Market Overview

At the start of the 12-month period, rising COVID-19 infection rates, shuttered economies and U.S. presidential election-related anxiety made it difficult for the world to look to the future with optimism. Uncertainty caused a number of companies to retract or refrain from providing earnings guidance and led to economic forecasts that projected as much as a 3.8% contraction in global GDP growth for 2020. However, ongoing accommodative measures by central banks around the world helped stabilize markets and economies, and the approval and subsequent rollout of coronavirus vaccines brightened investors’ outlook heading into 2021.

In the second half of the period, growing optimism about a return to normalcy, the passage of an additional $1.9 trillion U.S. relief package, and President Biden’s proposed $2.25 trillion infrastructure spending plan propelled U.S. equity markets to new highs. Key economic data also contributed to investor optimism, including a significant increase in U.S. manufacturing activity. Commodity prices also increased, leading to inflation fears. While Federal Reserve policymakers viewed inflation as “transitory” and kept short-term interest rates near zero, they indicated that higher inflation readings could accelerate the timeframe for interest rate hikes and projected at least one rate increase by the end of 2023.

Against this backdrop, small-capitalization stocks outperformed large- and mid-caps, according to the Russell family of U.S. indices. Additionally, value stocks outpaced growth stocks across the capitalization spectrum.

Fund Performance

The Meridian Small Cap Growth Fund (the “Fund”) Legacy Class Shares returned 61.51% (net) during the 12 months ended June 30, 2021, outperforming its benchmark, the Russell 2000® Growth Index, which returned 51.36%.

Our investment process prioritizes the management of risk over the opportunity for return. We look to build an enduring fund that can mitigate capital losses during turbulent bear market environments and, secondarily, participate on the upside during strong market environments. During the period, volatility was slightly below average. In fact, there were 20 days in which the index dropped 2% or more. Notably, the Fund's strategy outperformed the index on 17 of these 20 down days.

At the sector level, the Fund benefitted from positive stock selection in the communication services and materials sectors. In addition, an overweight position in the industrials sector aided performance, as industrials was one of the top performing sectors in the index during the period. The Fund maintained its overweight to industrials given the Fund's focus on commercial and professional service companies, which tend to exhibit strong competitive advantages and generally less macro sensitivity than the broader sector. Conversely, select information technology holdings detracted from relative performance during the period, as several names appreciated but couldn’t keep pace with the broader market. The Fund remains underweight the information technology sector as we continue to be unable to justify current valuations and worry that a bubble is forming in the software industry, where, in our opinion, many companies are operating under a grow at all costs model with little to no focus on profits. Market factors were mixed during the trailing one-year period, a welcome relief from the previous year in which larger-cap, momentum-driven, and more aggressive growth companies outperformed.

The three largest contributors to the Fund's performance during the period were Ranpak Holdings Corp., Forte Biosciences, Inc., and Heritage-Crystal Clean, Inc.

| • | Ranpak Holdings Corp. is a manufacturer of paper based protective packaging solutions. Among the many things we like about Ranpak is the sustainability of its product which is environmentally friendly compared to plastic, foam, and other packaging materials. We also like its consumable business model and attractive unit economics. The Fund first invested in the company as a special purpose acquisitions company (SPAC). Operational challenges in the U.S. segment and higher than expected leverage impacted the share price when the company initially entered the public markets. The stock recovered nicely due to more consistent execution and strong fourth quarter and full-year 2020 financial results. Quarterly revenues grew 13.9% in constant currency, driven by 30% growth in Asia and Europe where customers are increasingly shifting away from plastic packaging toward paper. Although the Fund continues to hold a position in Ranpak due to our belief that sustainable packaging solutions will continue to gain market share, we reduced the Fund's exposure following the stock’s strong price appreciation. |

| • | Forte Biosciences, Inc. is a clinical-stage biopharmaceutical firm focused on the treatment of inflammatory skin diseases, particularly atopic dermatitis (eczema). Our research indicates there is a large unmet need for Forte’s lead |

| Meridian Funds | 18 | www.meridianfund.com |

Meridian Small Cap Growth Fund

Portfolio Performance and Composition (Unaudited) (continued)

| | drug candidate FB-401, a live biotherapeutic being developed as a topical therapy for inflammatory skin disease. Currently, there are few treatment options for pediatric patients with eczema and many of them include steroids which are often a non-starter for parents. However, FB-401 has shown a significant reduction in the disease among both adult and pediatric patients while tapering steroid use in a Phase 2a trial. The stock rallied during the quarter on increased awareness of the company following its reverse merger with Tocagen and excitement about a new placebo-controlled trial for FB-401 that dosed its first patient in September. We maintained the Fund's position in Forte, which is now fully funded through the readout of the placebo-controlled trial results in mid-2021. |

| • | Heritage-Crystal Clean, Inc. is an environmental services company focused on machine parts cleaning, used oil collection, oil re-refining, and hazardous and non-hazardous waste services. Our rationale for investing in this company includes the strong recurring revenue stream it generates and substantial growth opportunities in the re-refinery and used oil collection segments. The development and rollout of COVID-19 vaccinations and subsequent re-opening of economies have led to a rebound in miles traveled. Consequently, car maintenance shops saw increased demand for their services which benefited Heritage-Crystal Clean’s environmental services segment. Higher crude oil prices also contributed to strength in the oil segment, leading to record first-quarter 2021 revenue. Although we scaled back the Fund's exposure to Heritage-Crystal Clean as its share price appreciated, we remain confident in the long-term growth prospects for the company. |

The three largest detractors from the Fund's performance during the period were Liquidia Corp., Quidel Corp, and Kiniksa Pharmaceuticals Ltd.

| • | Liquidia Corp. is a late-stage clinical biopharmaceutical company that utilizes its proprietary PRINT technology to help address drug delivery challenges. The Fund initially invested in this company due to our enthusiasm for the use of its PRINT technology in the delivery of Treprostinil for the treatment of pulmonary arterial hypertension (PAH). Liquidia’s technology combines a simple, easy to use form factor with a unique drug formulation that is in a dry powder form. As a result, the company’s drug is much easier to administer and offers significant advantages over competing delivery mechanisms that require the use of a nebulizer. However, Liquidia’s stock declined following an unfavorable patent ruling that pushed out the commercialization of the company’s PAH drug from late 2021 to late 2022. As we currently see no near-term catalyst for the stock, we liquidated the Fund's position. |

| • | Quidel Corp is a leader in developing point-of-care (POC) rapid diagnostic testing systems. It generates a significant portion of its revenue from point-of-care flu tests. In March of 2020, the company became one of the first in the industry to receive FDA Emergency Use Authorization for its COVID-19 detection test. As testing ramped up in the following months, the stock rallied. More recently, however, the stock has pulled back amid rising COVID-19 vaccination rates and declining COVID-19 testing volumes. Our investment thesis for Quidel remains intact as the company has a solid business in other diagnostic areas with a robust product pipeline. Pipeline developments include the company’s Savanna platform, its POC molecular diagnostic system that is accurate, fast, and cost effective. We trimmed the Fund's position in the stock during the period. |

| • | Kiniksa Pharmaceuticals Ltd. is a clinical-stage biopharmaceutical firm focused on developing and commercializing therapeutic medicines for patients with unmet medical needs. Key to our investment thesis is the company’s drug Rilonacept, an FDA-approved treatment for inflammatory diseases that, in recent clinical trials, proved effective in also treating recurring pericarditis. The stock traded lower following the approval of COVID-19 vaccines, which dimmed investors’ outlook for Kiniksa’s experimental COVID-19 antibody treatment for patients with severe coronavirus pneumonia. A secondary stock offering also negatively impacted the company’s share price. We maintained the Fund's position in the stock, as we believe these are merely short-term headwinds and are optimistic about potential new indications for Rilonacept and the company’s attractive pipeline of clinical-stage products. |

Outlook

As we look ahead, we are encouraged by the prospect that COVID-19 infection rates will continue to taper and that economies will fully reopen. However, the speed and breadth of a global recovery remains to be seen and depends largely on the rate of vaccine deployment and the potential spread of COVID-19 variants. With increased stimulus, declining unemployment, and a more robust economy it is very possible that increasing inflation will lead to higher interest rates. We

| Meridian Funds | 19 | www.meridianfund.com |

Meridian Small Cap Growth Fund

Portfolio Performance and Composition (Unaudited) (continued)

believe this dynamic could introduce even more volatility into the markets, potentially pressuring some of the extreme valuations we see in the information technology and healthcare sectors – a development that we would welcome.

Now more than ever, we maintain strong conviction in the companies we own. Our focus remains on companies that can not only weather the market volatility but also emerge even stronger once the pandemic clouds clear. We believe the market’s correction and subsequent rebound has presented us with opportunities to continue to upgrade the quality of the portfolio while maintaining our strict valuation discipline. Although recent economic events are unprecedented, we remain confident that staying disciplined to our investment process is the best approach to achieve the strategy’s long-term investment objectives.

Thank you for your continued partnership with ArrowMark.

Brian Schaub & Chad Meade

Co-Portfolio Managers

| Meridian Funds | 20 | www.meridianfund.com |

Meridian Small Cap Growth Fund

Portfolio Performance and Composition (Unaudited) (continued)

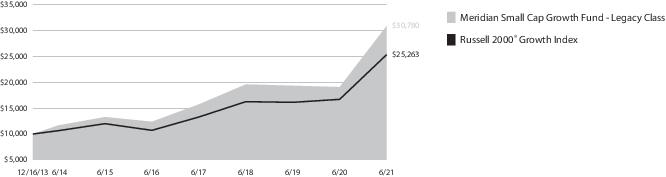

Total Return Based on a $10,000 investment for the Period Ended June 30, 2021

This graph shows the change in value of a hypothetical investment of $10,000 in Legacy Class Shares of the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. For comparison, the same investment is shown in the indicated index.

Average Annual Total Return as of 6.30.21

| | Inception | 1 Year | 5 Year | Since

Inception |

| Legacy Class (MSGGX) | 12/16/13 | 61.51% | 20.00% | 16.09% |

| Institutional Class (MSGRX) | 12/24/14 | 61.59% | 20.11% | 14.87% |

| Class A (MSGAX) w/o sales charge | 12/16/13 | 61.05% | 19.63% | 15.71% |

| Class A (MSGAX) with sales charge1 | 12/16/13 | 51.83% | 18.21% | 14.80% |

| Class C (MSGCX) | 7/1/15 | 59.94% | 18.79% | 13.84% |

| Investor Class (MISGX) | 12/16/13 | 61.51% | 19.93% | 16.01% |

| Russell 2000® Growth Index | 12/16/13 2 | 51.36% | 18.76% | 13.08% |

| 1 | Assuming maximum sales charge, if any. Class A Shares are subject to a maximum initial sales charge of 5.75%. |

| 2 | Inception date of Legacy Class Shares. |

See “Disclosures Regarding Fund Performance” on page 28 for important information regarding reported performance.

The views of the author and information discussed in this commentary are as of June 30, 2021, are subject to change, and may not reflect the writer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund or any securities or any sectors mentioned in this letter. The subject matter contained in this letter had been derived from several sources believed to be reliable and accurate at the time of compilation. To the extent permitted by federal securities laws, ArrowMark Colorado Holdings, LLC, Meridian Fund, Inc., nor the Fund accept any liability for losses either direct or consequential caused by the use of this third party information. Diversification cannot guarantee gain or prevent losses.

Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares and do not reflect the imposition of a 2% redemption fee on shares held 60 days or less to deter market timers. If reflected, the taxes and fees would reduce the performance quoted. Net asset value, investment return and principal value will fluctuate, so shares, when redeemed, may be worth more or less than their original cost.

| Meridian Funds | 21 | www.meridianfund.com |

Meridian Small Cap Growth Fund

Portfolio Composition (Unaudited)

Top 10 Holdings as of 6.30.21

| Heritage-Crystal Clean, Inc. | 2.95% |

| Skechers U.S.A., Inc. Class A | 2.87% |

| 2U, Inc. | 2.47% |

| Sally Beauty Holdings, Inc. | 2.42% |

| Mimecast Ltd. | 2.31% |

| Matson, Inc. | 2.06% |

| Ritchie Bros. Auctioneers, Inc. (Canada) | 1.92% |

| TriNet Group, Inc. | 1.92% |

| Momentive Global, Inc. | 1.81% |

| Merit Medical Systems, Inc. | 1.75% |

Portfolio holdings are subject to change and may not reflect the current or future position of the portfolio. Top ten holdings excluding short-term investments are reported as a percentage of net assets.

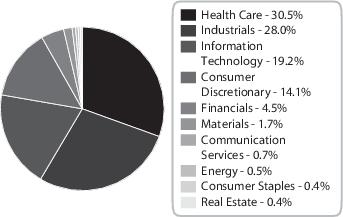

Sector Allocation as of 6.30.21

Sector allocations are subject to change and may not reflect the current or future position of the portfolio. Sector allocations are reported as a percentage of long-term investments excluding cash or cash equivalents. As of period end, the Fund invested a significant portion of their assets in securities in the Health Care and Industrials sectors. Changes in economic conditions affecting such sectors would have a greater impact on the Fund and could affect the value, income and/or liquidity of positions in such securities.

For compliance purposes, the Fund’s industry classifications may refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease.

| Meridian Funds | 22 | www.meridianfund.com |

Meridian Fund, Inc.

Expense Disclosure

June 30, 2021 (Unaudited)

Disclosures Regarding Fund Expenses

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and (2) ongoing costs, including management fees; service and distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period of January 1, 2021 through June 30, 2021.

Actual Expenses

The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (e.g., an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number reported under “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Meridian Funds | 23 | www.meridianfund.com |

Meridian Growth Fund

Fund Expenses

June 30, 2021 (Unaudited)

Expense Example

| Actual | Annualized

Expense Ratio | Beginning Account

Value January 1, 2021 | Ending Account Value

June 30, 2021 | Expenses Paid During

the Period 1 |

| Legacy Class (MERDX) | 0.84% | $1,000.00 | $1,155.60 | $4.49 |

| Institutional Class (MRRGX) | 0.82% | $1,000.00 | $1,155.60 | $4.38 |

| Class A (MRAGX) | 1.16% | $1,000.00 | $1,153.80 | $6.19 |

| Class C (MRCGX) | 1.87% | $1,000.00 | $1,149.60 | $9.97 |

| Investor Class (MRIGX) | 0.87% | $1,000.00 | $1,154.80 | $4.65 |

| Hypothetical 2 | Annualized

Expense Ratio | Beginning Account

Value January 1, 2021 | Ending Account Value

June 30, 2021 | Expenses Paid During

the Period 1 |

| Legacy Class (MERDX) | 0.84% | $1,000.00 | $1,020.63 | $4.21 |

| Institutional Class (MRRGX) | 0.82% | $1,000.00 | $1,020.73 | $4.11 |

| Class A (MRAGX) | 1.16% | $1,000.00 | $1,019.04 | $5.81 |

| Class C (MRCGX) | 1.87% | $1,000.00 | $1,015.52 | $9.35 |

| Investor Class (MRIGX) | 0.87% | $1,000.00 | $1,020.48 | $4.36 |

| 1 | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 181 days, the number of days in the most recent fiscal half-year, then divided by 365. |

| 2 | Hypothetical 5% return before expenses. |

The above “Annualized Expense Ratios” reflect waivers and/or reimbursements of expenses by the Fund’s Adviser. Such waivers and/or reimbursements may not be withdrawn earlier than one year after the date of the current prospectus. The “Financial Highlights” included within the Fund’s financial statements shows the gross expense ratios for each share class.

See “Disclosure Regarding Fund Expenses” on page 23 for further information on how the above examples were calculated.

| Meridian Funds | 24 | www.meridianfund.com |

Meridian Contrarian Fund

Fund Expenses

June 30, 2021 (Unaudited)

Expense Example

| Actual | Annualized

Expense Ratio | Beginning Account

Value January 1, 2021 | Ending Account Value

June 30, 2021 | Expenses Paid During

the Period 1 |

| Legacy Class (MVALX) | 1.11% | $1,000.00 | $1,204.40 | $ 6.07 |

| Class A (MFCAX) | 1.42% | $1,000.00 | $1,202.30 | $ 7.75 |

| Class C (MFCCX) | 2.16% | $1,000.00 | $1,198.00 | $11.77 |

| Investor Class (MFCIX) | 1.19% | $1,000.00 | $1,203.90 | $ 6.50 |

| Hypothetical 2 | Annualized

Expense Ratio | Beginning Account

Value January 1, 2021 | Ending Account Value

June 30, 2021 | Expenses Paid During

the Period 1 |

| Legacy Class (MVALX) | 1.11% | $1,000.00 | $1,019.29 | $ 5.56 |

| Class A (MFCAX) | 1.42% | $1,000.00 | $1,017.75 | $ 7.10 |

| Class C (MFCCX) | 2.16% | $1,000.00 | $1,014.08 | $10.79 |

| Investor Class (MFCIX) | 1.19% | $1,000.00 | $1,018.89 | $ 5.96 |

| 1 | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 181 days, the number of days in the most recent fiscal half-year, then divided by 365. |

| 2 | Hypothetical 5% return before expenses. |

The above “Annualized Expense Ratios” reflect waivers and/or reimbursements of expenses by the Fund’s Adviser. Such waivers and/or reimbursements may not be withdrawn earlier than one year after the date of the current prospectus. The “Financial Highlights” included within the Fund’s financial statements shows the gross expense ratios for each share class.

See “Disclosure Regarding Fund Expenses” on page 23 for further information on how the above examples were calculated.

| Meridian Funds | 25 | www.meridianfund.com |

Meridian Enhanced Equity Fund

Fund Expenses

June 30, 2021 (Unaudited)

Expense Example

| Actual | Annualized

Expense Ratio | Beginning Account

Value January 1, 2021 | Ending Account Value

June 30, 2021 | Expenses Paid During

the Period 1 |

| Legacy Class (MEIFX) | 1.24% | $1,000.00 | $1,101.50 | $ 6.46 |

| Class A (MRAEX) | 1.60% | $1,000.00 | $1,100.10 | $ 8.33 |

| Class C (MRCEX) | 2.00% | $1,000.00 | $1,098.10 | $10.40 |

| Investor Class (MRIEX) | 1.11% | $1,000.00 | $1,103.10 | $ 5.79 |

| Hypothetical 2 | Annualized

Expense Ratio | Beginning Account

Value January 1, 2021 | Ending Account Value

June 30, 2021 | Expenses Paid During

the Period 1 |

| Legacy Class (MEIFX) | 1.24% | $1,000.00 | $1,018.65 | $6.21 |

| Class A (MRAEX) | 1.60% | $1,000.00 | $1,016.86 | $8.00 |

| Class C (MRCEX) | 2.00% | $1,000.00 | $1,014.88 | $9.99 |

| Investor Class (MRIEX) | 1.11% | $1,000.00 | $1,019.29 | $5.56 |

| 1 | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 181 days, the number of days in the most recent fiscal half-year, then divided by 365. |

| 2 | Hypothetical 5% return before expenses. |

The above “Annualized Expense Ratios” reflect waivers and/or reimbursements of expenses by the Fund’s Adviser. Such waivers and/or reimbursements may not be withdrawn earlier than one year after the date of the current prospectus. The “Financial Highlights” included within the Fund’s financial statements shows the gross expense ratios for each share class.

See “Disclosure Regarding Fund Expenses” on page 23 for further information on how the above examples were calculated.

| Meridian Funds | 26 | www.meridianfund.com |

Meridian Small Cap Growth Fund

Fund Expenses

June 30, 2021 (Unaudited)

Expense Example

| Actual | Annualized

Expense Ratio | Beginning Account

Value January 1, 2021 | Ending Account Value

June 30, 2021 | Expenses Paid During

the Period 1 |

| Legacy Class (MSGGX) | 1.11% | $1,000.00 | $1,155.20 | $ 5.93 |

| Institutional Class (MSGRX) | 1.10% | $1,000.00 | $1,155.20 | $ 5.88 |

| Class A (MSGAX) | 1.46% | $1,000.00 | $1,153.50 | $ 7.80 |

| Class C (MSGCX) | 2.15% | $1,000.00 | $1,149.50 | $11.46 |

| Investor Class (MISGX) | 1.14% | $1,000.00 | $1,155.00 | $ 6.09 |

| Hypothetical 2 | Annualized

Expense Ratio | Beginning Account

Value January 1, 2021 | Ending Account Value

June 30, 2021 | Expenses Paid During

the Period 1 |

| Legacy Class (MSGGX) | 1.11% | $1,000.00 | $1,019.29 | $ 5.56 |

| Institutional Class (MSGRX) | 1.10% | $1,000.00 | $1,019.34 | $ 5.51 |

| Class A (MSGAX) | 1.46% | $1,000.00 | $1,017.55 | $ 7.30 |

| Class C (MSGCX) | 2.15% | $1,000.00 | $1,014.13 | $10.74 |

| Investor Class (MISGX) | 1.14% | $1,000.00 | $1,019.14 | $ 5.71 |

| 1 | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 181 days, the number of days in the most recent fiscal half-year, then divided by 365. |

| 2 | Hypothetical 5% return before expenses. |

The above “Annualized Expense Ratios” reflect waivers and/or reimbursements of expenses by the Fund’s Adviser. Such waivers and/or reimbursements may not be withdrawn earlier than one year after the date of the current prospectus. The “Financial Highlights” included within the Fund’s financial statements shows the gross expense ratios for each share class.

See “Disclosure Regarding Fund Expenses” on page 23 for further information on how the above examples were calculated.

| Meridian Funds | 27 | www.meridianfund.com |

Meridian Fund, Inc.

Performance Disclosure

June 30, 2021 (Unaudited)

Disclosures Regarding Fund Performance

Past performance is not predictive of future performance. Current performance may be lower or higher than the quoted past performance. Reported performance assumes reinvestment of Fund distributions. Reported performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares, nor does it reflect the 2% redemption fee on shares sold within 60 days of original purchase date. If reflected, the taxes and fees would reduce the performance quoted. Net asset value, investment return and principal value will fluctuate, so shares, when redeemed, may be worth more or less than their original cost. You can obtain the most current month-end performance at www.meridianfund.com.

Performance prior to September 5, 2013 reflects the Fund’s performance under the management of Aster Investment Management Co.

Legacy class shares are no longer offered to the public effective March 1, 2014, except under certain limited circumstances.

Investor Class, Class A, and Class C Shares of the Meridian Growth Fund are closed to new investors effective June 15, 2017. Existing investors may continue to purchase shares.

Investor Class, Class A, and Class C Shares of the Meridian Small Cap Growth Fund are closed to new investors effective June 29, 2018. Existing investors may continue to purchase shares.

Indices are typically unmanaged, and do not reflect deductions for fees or expenses. You cannot invest directly in an index.