United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-4017

(Investment Company Act File Number)

Federated Equity Funds

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Investors Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

John W. McGonigle, Esquire

Federated Investors Tower

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 10/31/09

Date of Reporting Period: 10/31/09

Item 1. Reports to Stockholders

Federated Capital Appreciation FundEstablished 1977

A Portfolio of Federated Equity Funds

ANNUAL SHAREHOLDER REPORTOctober 31, 2009

Class A Shares

Class B Shares

Class C Shares

Class K Shares

FINANCIAL HIGHLIGHTS

SHAREHOLDER EXPENSE EXAMPLE

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

PORTFOLIO OF INVESTMENTS SUMMARY TABLE

PORTFOLIO OF INVESTMENTS

STATEMENT OF ASSETS AND LIABILITIES

STATEMENT OF OPERATIONS

STATEMENT OF CHANGES IN NET ASSETS

NOTES TO FINANCIAL STATEMENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

BOARD OF TRUSTEES AND TRUST OFFICERS

EVALUATION AND APPROVAL OF ADVISORY CONTRACT

VOTING PROXIES ON FUND PORTFOLIO SECURITIES

QUARTERLY PORTFOLIO SCHEDULE

Financial Highlights - Class A Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended October 31 | 2009 | 2008 | 2007 | 20061 | 2005 |

| Net Asset Value, Beginning of Period | $16.03 | $28.14 | $27.91 | $25.06 | $24.04 |

| Income From Investment Operations: | | | | | |

| Net investment income | 0.172 | 0.182 | 0.152 | 0.212 | 0.26 |

| Net realized and unrealized gain (loss) on investments and foreign currency transactions | 0.09 | (6.60) | 4.62 | 3.39 | 0.99 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.26 | (6.42) | 4.77 | 3.60 | 1.25 |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.16) | (0.15) | (0.18) | (0.19) | (0.21) |

| Distributions from net realized gain on investments and foreign currency transactions | — | (5.54) | (4.36) | (0.56) | (0.02) |

| TOTAL DISTRIBUTIONS | (0.16) | (5.69) | (4.54) | (0.75) | (0.23) |

| Net Asset Value, End of Period | $16.13 | $16.03 | $28.14 | $27.91 | $25.06 |

| Total Return3 | 1.71% | (27.70)% | 19.78% | 14.73% | 5.22% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 1.23%4 | 1.25%4 | 1.23%4 | 1.24%4 | 1.22%4 |

| Net investment income | 1.11% | 0.88% | 0.59% | 0.79% | 0.98% |

| Expense waiver/reimbursement5 | 0.08% | 0.01% | 0.01% | 0.01% | 0.02% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $943,922 | $939,280 | $1,433,917 | $1,600,635 | $2,225,781 |

| Portfolio turnover | 254% | 252% | 165% | 113% | 43% |

| 1 | Beginning with the year ended October 31, 2006, the Fund was audited by KPMG LLP. The previous year was audited by another independent registered public accounting firm. |

| 2 | Per share numbers have been calculated using the average shares method. |

| 3 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 4 | The net expense ratio is calculated without reduction for expense offset arrangements. The net expense ratios are 1.22%, 1.24%, 1.22%, 1.23% and 1.21% for the years ended October 31, 2009, 2008, 2007, 2006 and 2005, respectively, after taking into account these expense reductions. |

| 5 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

- See Notes which are an integral part of the Financial Statements

Annual Shareholder Report1

Financial Highlights - Class B Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended October 31 | 2009 | 2008 | 2007 | 20061 | 2005 |

| Net Asset Value, Beginning of Period | $15.24 | $27.07 | $27.03 | $24.30 | $23.34 |

| Income From Investment Operations: | | | | | |

| Net investment income (loss) | 0.042 | 0.022 | (0.05)2 | (0.01)2 | 0.02 |

| Net realized and unrealized gain (loss) on investments and foreign currency transactions | 0.08 | (6.31) | 4.45 | 3.30 | 1.00 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.12 | (6.29) | 4.40 | 3.29 | 1.02 |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.04) | — | — | — | (0.04) |

| Distributions from net realized gain on investments and foreign currency transactions | — | (5.54) | (4.36) | (0.56) | (0.02) |

| TOTAL DISTRIBUTIONS | (0.04) | (5.54) | (4.36) | (0.56) | (0.06) |

| Net Asset Value, End of Period | $15.32 | $15.24 | $27.07 | $27.03 | $24.30 |

| Total Return3 | 0.83% | (28.29)% | 18.82% | 13.83% | 4.37% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 2.10%4 | 2.05%4 | 2.03%4 | 2.04%4 | 2.01%4 |

| Net investment income (loss) | 0.31% | 0.10% | (0.22)% | (0.03)% | 0.19% |

| Expense waiver/reimbursement5 | 0.02% | 0.01% | 0.01% | 0.00%6 | 0.00%6 |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $163,827 | $221,131 | $423,377 | $448,037 | $507,271 |

| Portfolio turnover | 254% | 252% | 165% | 113% | 43% |

| 1 | Beginning with the year ended October 31, 2006, the Fund was audited by KPMG LLP. The previous year was audited by another independent registered public accounting firm. |

| 2 | Per share numbers have been calculated using the average shares method. |

| 3 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 4 | The net expense ratio is calculated without reduction for expense offset arrangements. The net expense ratios are 2.09%, 2.04%, 2.02%, 2.03% and 2.00% for the years ended October 31, 2009, 2008, 2007, 2006 and 2005, respectively, after taking into account these expense reductions. |

| 5 | This expense decrease is reflected in both the net expense and the net investment income (loss) ratios shown above. |

| 6 | Represents less than 0.01%. |

- See Notes which are an integral part of the Financial Statements

Annual Shareholder Report2

Financial Highlights - Class C Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended October 31 | 2009 | 2008 | 2007 | 20061 | 2005 |

| Net Asset Value, Beginning of Period | $15.23 | $27.05 | $27.00 | $24.28 | $23.32 |

| Income From Investment Operations: | | | | | |

| Net investment income (loss) | 0.042 | 0.022 | (0.05)2 | (0.00)2,3 | 0.02 |

| Net realized and unrealized gain (loss) on investments and foreign currency transactions | 0.09 | (6.30) | 4.46 | 3.28 | 0.99 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.13 | (6.28) | 4.41 | 3.28 | 1.01 |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.07) | — | — | — | (0.03) |

| Distributions from net realized gain on investments and foreign currency transactions | — | (5.54) | (4.36) | (0.56) | (0.02) |

| TOTAL DISTRIBUTIONS | (0.07) | (5.54) | (4.36) | (0.56) | (0.05) |

| Net Asset Value, End of Period | $15.29 | $15.23 | $27.05 | $27.00 | $24.28 |

| Total Return4 | 0.89% | (28.27)% | 18.89% | 13.80% | 4.35% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 2.06%5 | 2.03%5 | 2.01%5 | 2.03%5 | 2.02%5 |

| Net investment income (loss) | 0.30% | 0.11% | (0.20)% | (0.01)% | 0.18% |

| Expense waiver/reimbursement6 | 0.02% | 0.01% | 0.01% | 0.00%7 | 0.00%7 |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $83,060 | $88,572 | $144,473 | $145,655 | $185,175 |

| Portfolio turnover | 254% | 252% | 165% | 113% | 43% |

| 1 | Beginning with the year ended October 31, 2006, the Fund was audited by KPMG LLP. The previous year was audited by another independent registered public accounting firm. |

| 2 | Per share numbers have been calculated using the average shares method. |

| 3 | Represents less than $0.01. |

| 4 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 5 | The net expense ratio is calculated without reduction for expense offset arrangements. The net expense ratios are 2.05%, 2.02%, 2.00%, 2.02% and 2.01% for the years ended October 31, 2009, 2008, 2007, 2006 and 2005, respectively, after taking into account these expense reductions. |

| 6 | This expense decrease is reflected in both the net expense and the net investment income (loss) ratios shown above. |

| 7 | Represents less than 0.01%. |

- See Notes which are an integral part of the Financial Statements

Annual Shareholder Report3

Financial Highlights - Class K Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended October 31 | 2009 | 2008 | 2007 | 20061 | 2005 |

| Net Asset Value, Beginning of Period | $15.90 | $27.98 | $27.80 | $24.94 | $23.87 |

| Income From Investment Operations: | | | | | |

| Net investment income | 0.112 | 0.072 | 0.032 | 0.072 | 0.09 |

| Net realized and unrealized gain (loss) on investments and foreign currency transactions | 0.08 | (6.55) | 4.61 | 3.40 | 1.04 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.19 | (6.48) | 4.64 | 3.47 | 1.13 |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.15) | (0.06) | (0.10) | (0.05) | (0.04) |

| Distributions from net realized gain on investments and foreign currency transactions | — | (5.54) | (4.36) | (0.56) | (0.02) |

| TOTAL DISTRIBUTIONS | (0.15) | (5.60) | (4.46) | (0.61) | (0.06) |

| Net Asset Value, End of Period | $15.94 | $15.90 | $27.98 | $27.80 | $24.94 |

| Total Return3 | 1.30% | (28.05)% | 19.26% | 14.22% | 4.73% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 1.71%4 | 1.70%4 | 1.68%4 | 1.69%4 | 1.67%4 |

| Net investment income | 0.78% | 0.33% | 0.11% | 0.28% | 0.46% |

| Expense waiver/reimbursement5 | 0.02% | 0.01% | 0.01% | 0.00%6 | 0.00%6 |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $21,994 | $39,155 | $19,768 | $13,669 | $7,389 |

| Portfolio turnover | 254% | 252% | 165% | 113% | 43% |

| 1 | Beginning with the year ended October 31, 2006, the Fund was audited by KPMG LLP. The previous year was audited by another independent registered public accounting firm. |

| 2 | Per share numbers have been calculated using the average shares method. |

| 3 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 4 | The net expense ratio is calculated without reduction for expense offset arrangements. The net expense ratios are 1.70%, 1.69%, 1.67%, 1.68% and 1.66% for the years ended October 31, 2009, 2008, 2007, 2006 and 2005, respectively, after taking into account these expense reductions. |

| 5 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

| 6 | Represents less than 0.01%. |

- See Notes which are an integral part of the Financial Statements

Annual Shareholder Report4

Shareholder Expense Example (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase or redemption payments; and (2) ongoing costs, including management fees and to the extent applicable, distribution (12b-1) fees and/or shareholder services fees and other Fund expenses. This Example is intended to help you to understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2009 to October 31, 2009.

ACTUAL EXPENSES

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are required to be provided to enable you to compare the ongoing costs of investing in the Fund with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Annual Shareholder Report5

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) on purchase or redemption payments. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher. | Beginning

Account Value

5/1/2009 | Ending

Account Value

10/31/2009 | Expenses Paid

During Period1 |

| Actual: | | | |

| Class A Shares | $1,000 | $1,129.60 | $6.60 |

| Class B Shares | $1,000 | $1,124.80 | $10.93 |

| Class C Shares | $1,000 | $1,125.10 | $10.87 |

| Class K Shares | $1,000 | $1,127.30 | $9.06 |

Hypothetical (assuming a 5% return

before expenses): | | | |

| Class A Shares | $1,000 | $1,019.00 | $6.26 |

| Class B Shares | $1,000 | $1,014.92 | $10.36 |

| Class C Shares | $1,000 | $1,014.97 | $10.31 |

| Class K Shares | $1,000 | $1,016.69 | $8.59 |

| 1 | Expenses are equal to the Fund's annualized net expense ratios, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half-year period). The annualized net expense ratios are as follows: |

| Class A Shares | 1.23% |

| Class B Shares | 2.04% |

| Class C Shares | 2.03% |

| Class K Shares | 1.69% |

Annual Shareholder Report6

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400.

Management's Discussion of Fund Performance (Unaudited)

PERFORMANCE OVERVIEW

During the 12-month reporting period ended October 31, 2009, the Fund produced total returns of 1.71%, 0.83%, 0.89% and 1.30% for Class A Shares, Class B Shares, Class C Shares and Class K Shares, respectively, based on net asset value. The following discussion will focus on the performance of the Fund's Class A Shares.

Stocks as measured by the Standard & Poor 500 Index1 (S&P 500) rose 9.80% during the reporting period. Information Technology and Consumer Discretionary were the strongest performing sectors within the Index rising 31.5% and 20.8%, respectively. Materials (up 16.4%), and Consumer Staples (up 8.5%) were also strong performers within the Index. Only one sector, Financials, had negative returns for the reporting period, down 7.2%.

The Fund underperformed its benchmark, with Class A Shares ranking in the 95th percentile out of 1,999 funds in the Large Cap Core Peer Group of Morningstar2 and the 98th percentile out of 908 funds in the Lipper Large Cap Core Peer Group3 for the 1-year time period ending October 31, 2009. Nearly 80% of the relative underperformance was driven by stock selection, with the remaining coming from sector allocation. The Fund's relative performance was constrained by conservative stock selection within all sectors relative to the S&P 500, particularly in the Industrial and Technology sectors. Some conservative positions that aided performance in the downturn but did not rally in the recent upturn, and are still favored, include Kroger and Wal-Mart. Poor stock selection within the Health Care sector was also detrimental to performance.

| 1 | The S&P 500 Index is an unmanaged, capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Investment cannot be made directly in an index. |

| 2 | Morningstar rankings are based on total return and do not take sales charges into account. For the 5- and 10-year time periods ending October 31, 2009, the fund ranked in the 32nd percentile out of 1,352 funds and the 25th percentile out of 681 funds, respectively. Rankings are for Class A Shares and rankings for other share classes will vary. 2009 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. |

| 3 | Past performance is no guarantee of future results. Lipper rankings are based on total return and do not take sales charges into account. For the 5- and 10-year time periods ending October 31, 2009, the fund ranked in the 33rd percentile out of 628 funds and 21st percentile out of 368 funds, respectively. Rankings are for Class A Shares and rankings for other share classes will vary. |

Annual Shareholder Report7

The Fund outperformed the market in the downturn and was close to the market's performance at the start of the upturn. However, during the summer we became more conservative due to the rise in stock prices and our long-term concerns regarding consumer spending growth. The market continued to march upward, reflecting primarily excellent cost controls implemented by corporate management.The newly developed markets around the world have led worldwide economic growth in 2009 and, as such, have caused the economic recovery to be more industrial-based than consumer-oriented. At the Fund's fiscal year end, the Fund was overweight in the Industrial and Material sectors and underweight in the Financials sector. The Fund was tilted more toward growth stocks during the year, in line with the idea of looking for stable earnings growth with favorable valuation. The Fund's exposure to foreign stocks4 at the end of the fiscal year, through ADRs and stocks of listed ADRs, was approximately 15.14%.

The portfolio is constructed on a bottom up basis and is confirmed by top down factors when these factors are viewed as helpful. We analyze fundamentals, with emphasis on our forward growth rate, and weigh that against valuation parameters.

Top five positive contributors were Goldman Sachs, EMC Corp, Darden Restaurants, Tyco International and Petro Brasileiro. Largest negative contributors were: PNC Financial, General Electric, Google Inc., Jetblue Airways and Medtronic.

| 4 | International investing involves special risks including currency risk, increased volatility of foreign securities, political risks and differences in auditing and other financial standards. Prices of emerging markets securities can be significantly more volatile than the prices of securities in developed countries, and currency risks and political risks are accentuated in emerging markets. |

Annual Shareholder Report8

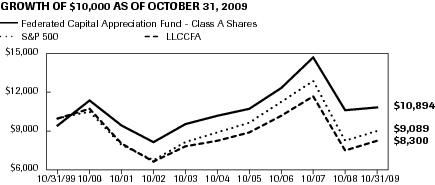

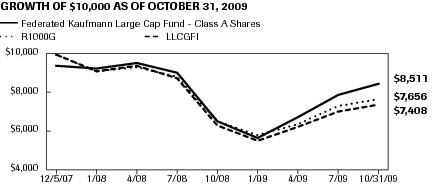

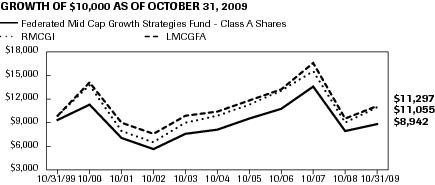

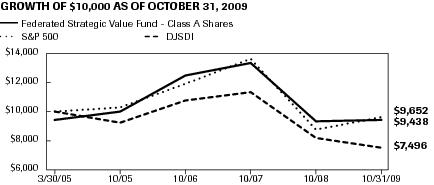

GROWTH OF A $10,000 INVESTMENT - CLASS A SHARES

The graph below illustrates the hypothetical investment of $10,0001 in Federated Capital Appreciation Fund (Class A Shares) (the “Fund”) from October 31, 1999 to October 31, 2009, compared to the S&P 500 Index (S&P 500)2 and the Lipper Large-Cap Core Funds Average (LLCCFA).2

| Average Annual Total Returns3 for the Period Ended 10/31/2009 | |

| 1 Year | -3.87% |

| 5 Years | 0.10% |

| 10 Years | 0.86% |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns shown include the maximum sales charge of 5.50%.

| 1 | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge=$9,450). The Fund's performance assumes the reinvestment of all dividends and distributions. The S&P 500 and LLCCFA have been adjusted to reflect reinvestment of dividends on securities in the index and average. |

| 2 | The S&P 500 is not adjusted to reflect sales loads, expenses or other fees that the Securities and Exchange Commission (SEC) requires to be reflected in the Fund's performance. The LLCCFA represents the average of the total returns reported by all of the mutual funds designated by Lipper, Inc. as falling into the category indicated, and is not adjusted to reflect any sales charges. However, these total returns are reported net of expenses or other fees that the SEC requires to be reflected in a fund's performance. The S&P 500 is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest in an index or average. |

| 3 | Total returns quoted reflect all applicable sales charges. |

Annual Shareholder Report9

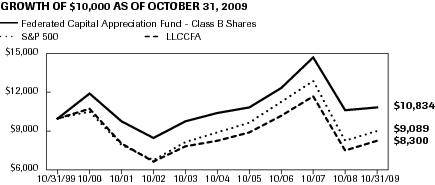

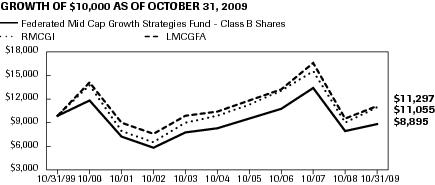

GROWTH OF A $10,000 INVESTMENT - CLASS B SHARES

The graph below illustrates the hypothetical investment of $10,0001 in Federated Capital Appreciation Fund (Class B Shares) (the “Fund”) from October 31, 1999 to October 31, 2009, compared to the S&P 500 Index (S&P 500)2 and the Lipper Large-Cap Core Funds Average (LLCCFA).2

| Average Annual Total Returns3 for the Period Ended 10/31/2009 | |

| 1 Year | -4.67% |

| 5 Years | 0.15% |

| 10 Years | 0.80% |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns shown include the maximum contingent deferred sales charge of 5.50%, as applicable.

| 1 | Represents a hypothetical investment of $10,000 in the Fund. The ending value of the Fund does not reflect a contingent deferred sales charge on any redemption over eight years from the purchase date. The maximum contingent deferred sales charge is 5.50% on any redemption less than one year from the purchase date. The Fund's performance assumes the reinvestment of all dividends and distributions. The S&P 500 and LLCCFA have been adjusted to reflect reinvestment of dividends on securities in the index and average. |

| 2 | The S&P 500 is not adjusted to reflect sales loads, expenses or other fees that the SEC requires to be reflected in the Fund's performance. The LLCCFA represents the average of the total returns reported by all of the mutual funds designated by Lipper, Inc. as falling into the category indicated, and is not adjusted to reflect any sales charges. However, these total returns are reported net of expenses or other fees that the SEC requires to be reflected in a fund's performance. The S&P 500 is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest in an index or average. |

| 3 | Total returns quoted reflect all applicable contingent deferred sales charges. |

Annual Shareholder Report10

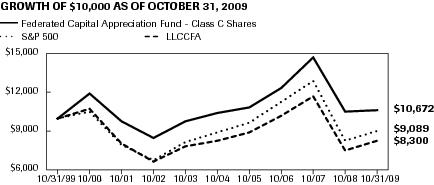

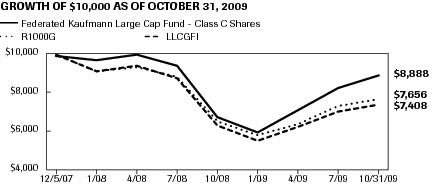

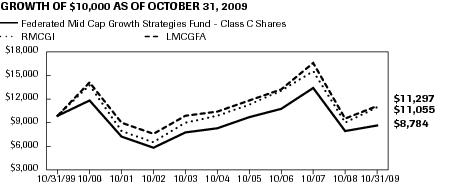

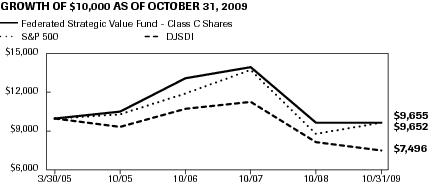

GROWTH OF A $10,000 INVESTMENT - CLASS C SHARES

The graph below illustrates the hypothetical investment of $10,0001 in Federated Capital Appreciation Fund (Class C Shares) (the “Fund”) from October 31, 1999 to October 31, 2009, compared to the S&P 500 Index (S&P 500)2 and the Lipper Large-Cap Core Funds Average (LLCCFA).2

| Average Annual Total Returns3 for the Period Ended 10/31/2009 | |

| 1 Year | -0.11% |

| 5 Years | 0.43% |

| 10 Years | 0.65% |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns shown include the maximum contingent deferred sales charge of 1.00%, as applicable.

| 1 | Represents a hypothetical investment of $10,000 in the Fund. A 1.00% contingent deferred sales charge would be imposed on any redemption less than one year from the purchase date. The Fund's performance assumes the reinvestment of all dividends and distributions. The S&P 500 and LLCCFA have been adjusted to reflect reinvestment of dividends on securities in the index and average. |

| 2 | The S&P 500 is not adjusted to reflect sales loads, expenses or other fees that the SEC requires to be reflected in the Fund's performance. The LLCCFA represents the average of the total returns reported by all of the mutual funds designated by Lipper, Inc. as falling into the category indicated, and is not adjusted to reflect any sales charges. However, these total returns are reported net of expenses or other fees that the SEC requires to be reflected in a fund's performance. The S&P 500 is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest in an index or average. |

| 3 | Total returns quoted reflect all applicable contingent deferred sales charges. |

Annual Shareholder Report11

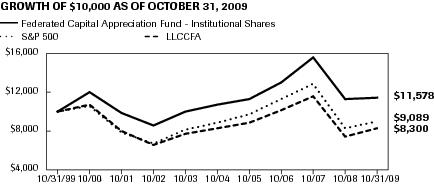

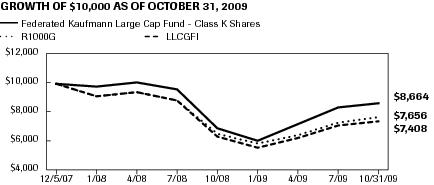

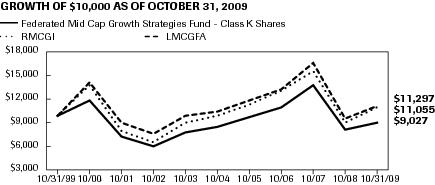

GROWTH OF A $10,000 INVESTMENT - CLASS K SHARES

The Fund's Class K Shares commenced operations on April 8, 2003. The Fund offers four other classes of shares: Class A Shares, Class B Shares, Class C Shares and Institutional Shares. For the period prior to the commencement of operations of the Class K Shares, the performance information shown is for the Fund's Class A Shares, adjusted to reflect the expenses of Class K Shares. The graph below illustrates the hypothetical investment of $10,0001 in Federated Capital Appreciation Fund (Class K Shares) (the “Fund”) from October 31, 1999 to October 31, 2009, compared to the S&P 500 Index (S&P 500)2 and the Lipper Large-Cap Core Funds Average (LLCCFA).2

| Average Annual Total Returns for the Period Ended 10/31/2009 | |

| 1 Year | 1.30% |

| 5 Years | 0.78% |

| 10 Years | 0.98% |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

| 1 | Represents a hypothetical investment of $10,000 in the Fund. The Fund's performance assumes the reinvestment of all dividends and distributions. The S&P 500 and LLCCFA have been adjusted to reflect reinvestment of dividends on securities in the index and average. |

| 2 | The S&P 500 is not adjusted to reflect sales loads, expenses or other fees that the SEC requires to be reflected in the Fund's performance. The LLCCFA represents the average of the total returns reported by all of the mutual funds designated by Lipper, Inc. as falling into the category indicated, and is not adjusted to reflect any sales charges. However, these total returns are reported net of expenses or other fees that the SEC requires to be reflected in a fund's performance. The S&P 500 is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest in an index or average. |

Annual Shareholder Report12

Portfolio of Investments Summary Table (unaudited)

At October 31, 2009, the Fund's sector composition1 was as follows:

| Sector Composition | Percentage of

Total Net Assets |

| Information Technology | 19.0% |

| Industrials | 12.5% |

| Consumer Staples | 12.3% |

| Energy | 11.9% |

| Financials | 11.9% |

| Health Care | 10.2% |

| Consumer Discretionary | 9.7% |

| Materials | 7.2% |

| Utilities | 2.4% |

| Cash Equivalents2 | 0.1% |

| Other Assets and Liabilities — Net3 | 2.8% |

| TOTAL | 100.0% |

| 1 | Except for Cash Equivalents and Other Assets and Liabilities, sector classifications are based upon, and individual portfolio securities are assigned to, the classifications of the Global Industry Classification Standard (GICS) except that the Adviser assigns a classification to securities not classified by the GICS and to securities for which the Adviser does not have access to the classification made by the GICS. |

| 2 | Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements. |

| 3 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

Annual Shareholder Report13

Portfolio of Investments

October 31, 2009

|

| Shares | | | Value |

| | Common Stocks – 97.1% | |

| | Consumer Discretionary – 9.7% | |

| 399,600 | | Advance Auto Parts, Inc. | 14,889,096 |

| 645,900 | 1 | Coach, Inc. | 21,295,323 |

| 502,900 | 1 | Gymboree Corp. | 21,408,453 |

| 818,600 | | Home Depot, Inc. | 20,538,674 |

| 743,700 | | Macy's, Inc. | 13,066,809 |

| 242,990 | | McDonald's Corp. | 14,241,644 |

| 659,500 | | Target Corp. | 31,939,585 |

| | TOTAL | 137,379,584 |

| | Consumer Staples – 12.3% | |

| 861,000 | | Avon Products, Inc. | 27,595,050 |

| 432,400 | | General Mills, Inc. | 28,503,808 |

| 589,400 | | Kellogg Co. | 30,377,676 |

| 1,854,700 | | Kroger Co. | 42,899,211 |

| 623,659 | | Nestle S.A. | 28,990,795 |

| 331,600 | | Wal-Mart Stores, Inc. | 16,473,888 |

| | TOTAL | 174,840,428 |

| | Energy – 11.9% | |

| 179,700 | | Apache Corp. | 16,913,364 |

| 292,900 | | CONSOL Energy, Inc. | 12,539,049 |

| 570,500 | | Chevron Corp. | 43,666,070 |

| 396,297 | | Exxon Mobil Corp. | 28,402,606 |

| 642,700 | | Schlumberger Ltd. | 39,975,940 |

| 168,200 | 1 | Transocean Ltd. | 14,113,662 |

| 347,650 | | XTO Energy, Inc. | 14,448,334 |

| | TOTAL | 170,059,025 |

| | Financials – 11.9% | |

| 371,400 | | Ace Ltd. | 19,075,104 |

| 163,600 | | Goldman Sachs Group, Inc. | 27,839,812 |

| 1,122,500 | | J.P. Morgan Chase & Co. | 46,886,825 |

| 235,500 | | Morgan Stanley | 7,564,260 |

| 428,900 | | T. Rowe Price Group, Inc. | 20,900,297 |

| 536,800 | | The Travelers Cos., Inc. | 26,727,272 |

| 909,400 | | U.S. Bancorp | 21,116,268 |

| | TOTAL | 170,109,838 |

Annual Shareholder Report14

|

| | Health Care – 10.2% | |

| 726,700 | | Abbott Laboratories | 36,749,219 |

| 492,000 | | Baxter International, Inc. | 26,597,520 |

| 481,500 | | Johnson & Johnson | 28,432,575 |

| 183,600 | | Merck & Co., Inc. | 5,678,748 |

| 1,286,800 | | Pfizer, Inc. | 21,914,204 |

| 373,000 | | Teva Pharmaceutical Industries Ltd., ADR | 18,829,040 |

| 276,900 | | UnitedHealth Group, Inc. | 7,185,555 |

| | TOTAL | 145,386,861 |

| | Industrials – 12.5% | |

| 196,400 | | 3M Co. | 14,449,148 |

| 193,600 | | FedEx Corp. | 14,072,784 |

| 72,500 | | Flowserve Corp. | 7,120,225 |

| 293,200 | | Fluor Corp. | 13,023,944 |

| 852,500 | | Norfolk Southern Corp. | 39,743,550 |

| 684,400 | | Raytheon Co. | 30,989,632 |

| 862,300 | | Tyco International Ltd. | 28,930,165 |

| 479,900 | | United Technologies Corp. | 29,489,855 |

| | TOTAL | 177,819,303 |

| | Information Technology – 19.0% | |

| 77,900 | 1 | Apple, Inc. | 14,684,150 |

| 1,470,000 | 1 | Broadcom Corp. | 39,116,700 |

| 1,106,900 | 1 | Cisco Systems, Inc. | 25,292,665 |

| 427,200 | 1 | EMC Corp. | 7,035,984 |

| 34,000 | 1 | Google Inc. | 18,228,080 |

| 783,100 | | Hewlett-Packard Co. | 37,165,926 |

| 299,000 | | IBM Corp. | 36,062,390 |

| 1,023,500 | | Intel Corp. | 19,559,085 |

| 492,900 | 1 | McAfee, Inc. | 20,642,652 |

| 1,025,600 | | Microsoft Corp. | 28,439,888 |

| 588,200 | | Qualcomm, Inc. | 24,357,362 |

| | TOTAL | 270,584,882 |

| | Materials – 7.2% | |

| 317,000 | | BHP Billiton Ltd., ADR | 20,788,860 |

| 743,900 | | Barrick Gold Corp. | 26,728,327 |

| 97,900 | | Freeport-McMoRan Copper & Gold, Inc. | 7,181,944 |

| 198,000 | | Potash Corp. of Saskatchewan, Inc. | 18,370,440 |

Annual Shareholder Report15

|

| 361,100 | | Praxair, Inc. | 28,685,784 |

| | TOTAL | 101,755,355 |

| | Utilities – 2.4% | |

| 388,100 | | Progress Energy, Inc. | 14,565,393 |

| 644,700 | | Southern Co. | 20,108,193 |

| | TOTAL | 34,673,586 |

| | TOTAL COMMON STOCKS

(IDENTIFIED COST $1,215,867,519) | 1,382,608,862 |

| | Mutual Fund – 0.1% | |

| 2,398,801 | 2,3 | Prime Value Obligations Fund, Institutional Shares, 0.22%

(AT NET ASSET VALUE) | 2,398,801 |

| | TOTAL INVESTMENTS — 97.2%

(IDENTIFIED COST $1,218,266,320)4 | 1,385,007,663 |

| | OTHER ASSETS AND LIABILITIES - NET — 2.8%5 | 39,265,568 |

| | TOTAL NET ASSETS — 100% | $1,424,273,231 |

- At October 31, 2009, the Fund had an outstanding foreign exchange contract as follows:

| Settlement Date | Foreign

Currency

Units to

Deliver | In

Exchange

For | Unrealized

Appreciation |

| Contract Sold: | | | |

| 11/2/2009 | 358,966 Swiss Francs | $ 352,792 | $ 2,889 |

- Unrealized Appreciation on the Foreign Exchange Contract is included in “Other Assets and Liabilities — Net.”

- Note: The categories of investments are shown as a percentage of total net assets at October 31, 2009.

- Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

- Level 1 — quoted prices in active markets for identical securities

- Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

- Level 3 — significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

Annual Shareholder Report16

- The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

- The following is a summary of the inputs used, as of October 31, 2009, in valuing the Fund's assets carried at fair value:

| Valuation Inputs | | | | |

| Level 1 -

Quoted

Prices and

Investments in

Mutual Funds | Level 2 -

Other

Significant

Observable

Inputs | Level 3 -

Significant

Unobservable

Inputs | Total |

| Equity Securities: | | | | |

| Domestic | $1,166,806,529 | $ — | $ — | $1,166,806,529 |

| International | 186,811,538 | 28,990,795 | — | 215,802,333 |

| Mutual Fund | 2,398,801 | — | — | 2,398,801 |

| TOTAL SECURITIES | $1,356,016,868 | $28,990,795 | $ — | $1,385,007,663 |

| OTHER FINANCIAL INSTRUMENTS* | $2,889 | $ — | $ — | $2,889 |

| * | Other financial instruments include a foreign exchange contract. |

- The following acronym is used throughout this portfolio:

- ADR — American Depositary Receipt

- See Notes which are an integral part of the Financial Statements

Annual Shareholder Report17

Statement of Assets and Liabilities

October 31, 2009

| Assets: | | |

| Total investments in securities, at value including $2,398,801 of investments in an affiliated issuer (Note 5) (identified cost $1,218,266,320) | | $1,385,007,663 |

| Cash | | 176,317 |

| Income receivable | | 2,174,414 |

| Receivable for investments sold | | 50,461,302 |

| Receivable for shares sold | | 1,217,706 |

| Receivable for foreign exchange contracts | | 2,889 |

| TOTAL ASSETS | | 1,439,040,291 |

| Liabilities: | | |

| Payable for investments purchased | $10,908,027 | |

| Payable for shares redeemed | 2,516,114 | |

| Payable for Directors'/Trustees' fees | 4,209 | |

| Payable for distribution services fee (Note 5) | 173,083 | |

| Payable for shareholder services fee (Note 5) | 590,864 | |

| Accrued expenses | 574,763 | |

| TOTAL LIABILITIES | | 14,767,060 |

| Net assets for 89,119,695 shares outstanding | | $1,424,273,231 |

| Net Assets Consist of: | | |

| Paid-in capital | | $1,639,806,688 |

| Net unrealized appreciation of investments and translation of assets and liabilities in foreign currency | | 166,758,636 |

| Accumulated net realized loss on investments, foreign currency transactions, futures contracts and written option contracts | | (391,508,562) |

| Undistributed net investment income | | 9,216,469 |

| TOTAL NET ASSETS | | $1,424,273,231 |

Annual Shareholder Report18

Statement of Assets and Liabilities — continued| Net Asset Value, Offering Price and Redemption Proceeds Per Share | | |

| Class A Shares: | | |

| Net asset value per share ($943,921,582 ÷ 58,516,596 shares outstanding), no par value, unlimited shares authorized | | $16.13 |

| Offering price per share (100/94.50 of $16.13) | | $17.07 |

| Redemption proceeds per share | | $16.13 |

| Class B Shares: | | |

| Net asset value per share ($163,826,985 ÷ 10,690,921 shares outstanding), no par value, unlimited shares authorized | | $15.32 |

| Offering price per share | | $15.32 |

| Redemption proceeds per share (94.50/100 of $15.32) | | $14.48 |

| Class C Shares: | | |

| Net asset value per share ($83,059,745 ÷ 5,432,515 shares outstanding), no par value, unlimited shares authorized | | $15.29 |

| Offering price per share | | $15.29 |

| Redemption proceeds per share (99.00/100 of $15.29) | | $15.14 |

| Class K Shares: | | |

| Net asset value per share ($21,994,497 ÷ 1,380,218 shares outstanding), no par value, unlimited shares authorized | | $15.94 |

| Offering price per share | | $15.94 |

| Redemption proceeds per share | | $15.94 |

| Institutional Shares: | | |

| Net asset value per share ($211,470,422 ÷ 13,099,445 shares outstanding), no par value, unlimited shares authorized | | $16.14 |

| Offering price per share | | $16.14 |

| Redemption proceeds per share | | $16.14 |

- See Notes which are an integral part of the Financial Statements

Annual Shareholder Report19

Statement of Operations

Year Ended October 31, 2009

| Investment Income: | | | |

| Dividends (including $764,043 received from an affiliated issuer (Note 5) and net of foreign taxes withheld of $474,464) | | | $30,400,069 |

| Interest | | | 910,450 |

| TOTAL INCOME | | | 31,310,519 |

| Expenses: | | | |

| Investment adviser fee (Note 5) | | $10,087,429 | |

| Administrative personnel and services fee (Note 5) | | 1,044,126 | |

| Custodian fees | | 67,047 | |

| Transfer and dividend disbursing agent fees and expenses — Class A Shares | | 1,652,754 | |

| Transfer and dividend disbursing agent fees and expenses — Class B Shares | | 413,273 | |

| Transfer and dividend disbursing agent fees and expenses — Class C Shares | | 163,120 | |

| Transfer and dividend disbursing agent fees and expenses — Class K Shares | | 94,414 | |

| Transfer and dividend disbursing agent fees and expenses — Institutional Shares | | 169,278 | |

| Directors'/Trustees' fees | | 12,499 | |

| Auditing fees | | 27,999 | |

| Legal fees | | 6,226 | |

| Portfolio accounting fees | | 189,198 | |

| Distribution services fee — Class B Shares (Note 5) | | 1,323,254 | |

| Distribution services fee — Class C Shares (Note 5) | | 604,587 | |

| Distribution services fee — Class K Shares (Note 5) | | 136,011 | |

| Shareholder services fee — Class A Shares (Note 5) | | 2,157,055 | |

| Shareholder services fee — Class B Shares (Note 5) | | 441,085 | |

| Shareholder services fee — Class C Shares (Note 5) | | 197,129 | |

| Account administration fee — Class A Shares | | 48,670 | |

| Account administration fee — Class C Shares | | 2,297 | |

| Share registration costs | | 90,940 | |

| Printing and postage | | 144,052 | |

| Insurance premiums | | 8,165 | |

| Miscellaneous | | 10,306 | |

| TOTAL EXPENSES | | 19,090,914 | |

Annual Shareholder Report20

Statement of Operations — continued| Waiver, Reimbursements and Expense Reduction: | | | |

| Reimbursement of investment adviser fee (Note 5) | $(69,879) | | |

| Waiver of administrative personnel and services fee (Note 5) | (20,588) | | |

| Reimbursement of shareholder services fee — Class A Shares (Note 5) | (464,794) | | |

| Reimbursement of transfer and dividend disbursing agent fees and expenses — Class A Shares (Note 5) | (59,838) | | |

| Reimbursement of transfer and dividend disbursing agent fees and expenses — Institutional Shares (Note 5) | (14,731) | | |

| Fees paid indirectly from directed brokerage arrangements (Note 6) | (154,693) | | |

| TOTAL WAIVER, REIMBURSEMENTS AND EXPENSE REDUCTION | | $(784,523) | |

| Net expenses | | | $18,306,391 |

| Net investment income | | | 13,004,128 |

| Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Transactions: | | | |

| Net realized loss on investments and foreign currency transactions | | | (208,647,386) |

| Net change in unrealized depreciation of investments and translation of assets and liabilities in foreign currency | | | 228,599,747 |

| Net realized and unrealized gain on investments and foreign currency transactions | | | 19,952,361 |

| Change in net assets resulting from operations | | | $32,956,489 |

- See Notes which are an integral part of the Financial Statements

Annual Shareholder Report21

Statement of Changes in Net Assets

| Year Ended October 31 | 2009 | 2008 |

| Increase (Decrease) in Net Assets | | |

| Operations: | | |

| Net investment income | $13,004,128 | $11,654,580 |

| Net realized loss on investments and foreign currency transactions | (208,647,386) | (165,689,372) |

| Net change in unrealized appreciation/depreciation of investments and translation of assets and liabilities in foreign currency | 228,599,747 | (384,676,782) |

| CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | 32,956,489 | (538,711,574) |

| Distributions to Shareholders: | | |

| Distributions from net investment income | | |

| Class A Shares | (9,327,315) | (9,287,303) |

| Class B Shares | (582,124) | — |

| Class C Shares | (406,255) | — |

| Class K Shares | (388,347) | (56,795) |

| Institutional Shares | (1,568,758) | — |

| Distributions from net realized gain on investments and foreign currency transactions | | |

| Class A Shares | — | (280,652,380) |

| Class B Shares | — | (85,611,210) |

| Class C Shares | — | (29,312,332) |

| Class K Shares | — | (3,928,786) |

| CHANGE IN NET ASSETS RESULTING FROM DISTRIBUTIONS TO SHAREHOLDERS | (12,272,799) | (408,848,806) |

| Share Transactions: | | |

| Proceeds from sale of shares | 528,867,667 | 481,922,779 |

| Proceeds from shares issued in connection with the tax-free transfer of assets from Suburban Common Trust Fund | 4,843,111 | — |

| Proceeds from shares issued in connection with the tax-free transfer of assets from Clearfield Bank Common Trust Fund | 2,596,634 | — |

| Proceeds from shares issued in connection with the tax-free transfer of assets from Central Bank Core Equity Fund | — | 42,103,041 |

| Net asset value of shares issued to shareholders in payment of distributions declared | 9,337,834 | 359,161,924 |

| Cost of shares redeemed | (505,968,842) | (593,249,539) |

| CHANGE IN NET ASSETS RESULTING FROM SHARE TRANSACTIONS | 39,676,404 | 289,938,205 |

| Change in net assets | 60,360,094 | (657,622,175) |

| Net Assets: | | |

| Beginning of period | 1,363,913,137 | 2,021,535,312 |

| End of period (including undistributed net investment income of $9,216,469 and $8,601,294, respectively) | $1,424,273,231 | $1,363,913,137 |

- See Notes which are an integral part of the Financial Statements

Annual Shareholder Report22

Notes to Financial Statements

October 31, 2009

1. ORGANIZATION

Federated Equity Funds (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The Trust consists of 13 portfolios. The financial statements included herein are only those of Federated Capital Appreciation Fund (the “Fund”), a diversified portfolio. The financial statements of the other portfolios are presented separately. The assets of each portfolio are segregated and a shareholder's interest is limited to the portfolio in which shares are held. Each portfolio pays its own expenses. The Fund offers five classes of shares: Class A Shares, Class B Shares, Class C Shares, Class K Shares and Institutional Shares. All shares of the Fund have equal rights with respect to voting, except on class-specific matters. The financial highlights of the Institutional Shares are presented separately. The investment objective of the Fund is to provide capital appreciation.

Effective December 31, 2007, the Fund began offering Institutional Shares.

On December 19, 2008, the Fund received assets from Suburban Common Trust Fund as a result of a tax-free reorganization, as follows:

Shares of the

Fund Issued | Suburban

Common

Trust Fund

Net Assets

Received | Unrealized

Depreciation1 | Net Assets

of the Fund

Immediately

Prior to

Combination | Net Assets

of the Fund

Immediately

After

Combination |

| 324,388 | $4,843,111 | $(2,305,234) | $1,294,808,821 | $1,299,651,932 |

| 1 | Unrealized Depreciation is included in the Suburban Common Trust Fund Net Assets Received amount shown above. |

On November 14, 2008, the Fund received assets from Clearfield Bank Common Trust Fund as a result of a tax-free reorganization, as follows:

Shares of the

Fund Issued | Clearfield

Bank

Common

Trust Fund

Net Assets

Received | Unrealized

Appreciation1 | Net Assets

of the Fund

Immediately

Prior to

Combination | Net Assets

of the Fund

Immediately

After

Combination |

| 175,330 | $2,596,634 | $206,477 | $1,262,255,683 | $1,264,852,317 |

| 1 | Unrealized Appreciation is included in the Clearfield Bank Common Trust Fund Net Assets Received amount shown above. |

Annual Shareholder Report23

On May 9, 2008, the Fund received assets from Central Bank Core Equity Fund as a result of a tax-free reorganization, as follows:

Shares of the

Fund Issued | Central Bank

Core Equity

Fund Net

Assets

Received | Unrealized

Appreciation1 | Net Assets

of the Fund

Immediately

Prior to

Combination | Net Assets

of the Fund

Immediately

After

Combination |

| 2,017,395 | $42,103,041 | $8,921,086 | $1,762,228,108 | $1,804,331,149 |

| 1 | Unrealized Appreciation is included in the Central Bank Core Equity Fund Net Assets Received amount shown above. |

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles (GAAP).

Investment Valuation

In calculating its net asset value (NAV), the Fund generally values investments as follows:

- Equity securities listed on an exchange or traded through a regulated market system are valued at their last reported sale price or official closing price in their principal exchange or market.

- Shares of other mutual funds are valued based upon their reported NAVs.

- Derivative contracts listed on exchanges are valued at their reported settlement or closing price.

- Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Board of Trustees (the “Trustees”).

- Fixed-income securities acquired with remaining maturities greater than 60 days are fair valued using price evaluations provided by a pricing service approved by the Trustees.

- Fixed-income securities acquired with remaining maturities of 60 days or less are valued at their cost (adjusted for the accretion of any discount or amortization of any premium).

If the Fund cannot obtain a price or price evaluation from a pricing service for an investment, the Fund may attempt to value the investment based upon the mean of bid and asked quotations or fair value the investment based on price evaluations, from one or more dealers. If any price, quotation, price evaluation or other pricing source is not readily available when the NAV is calculated, the Fund uses the fair value of the investment determined in accordance with the procedures described below. There can be no assurance that the Fund could purchase or sell an investment at the price used to calculate the Fund's NAV.

Fair Valuation and Significant Events Procedures

The Trustees have authorized the use of pricing services to provide evaluations of the current fair value of certain investments for purposes of calculating the NAV. Factors considered by pricing services in evaluating an investment include the yields or prices of investments of comparable quality, coupon, maturity, call rights and other potential prepayments, terms and type, reported transactions, indications as to values from dealers and general market conditions. Some pricing services provide a single price evaluation reflecting the bid-side of the market for an investment (a “bid” evaluation). Other pricing services offer both bid evaluations and price evaluations indicative of a price between the prices bid and asked for the investment (a “mid” evaluation). The Fund normally uses bid evaluations for U.S. Treasury Annual Shareholder Report24

and Agency securities and mortgage-backed securities. The Fund normally uses mid evaluations for other types of fixed-income securities and OTC derivative contracts. In the event that market quotations and price evaluations are not available for an investment, the fair value of the investment is determined in accordance with procedures adopted by the Trustees.The Trustees also have adopted procedures requiring an investment to be priced at its fair value whenever the Adviser determines that a significant event affecting the value of the investment has occurred between the time as of which the price of the investment would otherwise be determined and the time as of which the NAV is computed. An event is considered significant if there is both an affirmative expectation that the investment's value will change in response to the event and a reasonable basis for quantifying the resulting change in value. Examples of significant events that may occur after the close of the principal market on which a security is traded, or after the time of a price evaluation provided by a pricing service or a dealer, include:

- With respect to securities traded in foreign markets, significant trends in U.S. equity markets or in the trading of foreign securities index futures or options contracts;

- With respect to price evaluations of fixed-income securities determined before the close of regular trading on the NYSE, actions by the Federal Reserve Open Market Committee and other significant trends in U.S. fixed-income markets;

- Political or other developments affecting the economy or markets in which an issuer conducts its operations or its securities are traded; and

- Announcements concerning matters such as acquisitions, recapitalizations, litigation developments, a natural disaster affecting the issuer's operations or regulatory changes or market developments affecting the issuer's industry.

The Trustees have approved the use of a pricing service to determine the fair value of equity securities traded principally in foreign markets when the Adviser determines that there has been a significant trend in the U.S. equity markets or in index futures trading. For other significant events, the Fund may seek to obtain more current quotations or price evaluations from alternative pricing sources. If a reliable alternative pricing source is not available, the Fund will determine the fair value of the investment using another method approved by the Trustees.

Repurchase Agreements

It is the policy of the Fund to require the other party to a repurchase agreement to transfer to the Fund's custodian or sub-custodian eligible securities or cash with a market value (after transaction costs) at least equal to the repurchase price to be paid under the repurchase agreement. The eligible securities are transferred to accounts with the custodian or sub-custodian in which the Fund holds a “securities entitlement” and exercises “control” as those terms are defined in the Uniform Commercial Code. The Fund has established procedures for monitoring the market value of the transferred securities and requiring the transfer of additional eligible securities if necessary to equal at least the repurchase price. These procedures also allow the other party to require securities to be transferred from the account to the extent that their market value exceeds the repurchase price or in exchange for other eligible securities of equivalent market value.

With respect to agreements to repurchase U.S. government securities and cash items, the Fund treats the repurchase agreement as an investment in the underlying securities and not as an obligation of the other party to the repurchase agreement. Other repurchase agreements are treated as obligations of the other party secured by the underlying securities. Nevertheless, the insolvency of the other party or other failure to repurchase the securities Annual Shareholder Report25

may delay the disposition of the underlying securities or cause the Fund to receive less than the full repurchase price. Under the terms of the repurchase agreement, any amounts received by the Fund in excess of the repurchase price and related transaction costs must be remitted to the other party.The Fund may enter into repurchase agreements in which eligible securities are transferred into joint trading accounts maintained by the custodian or sub-custodian for investment companies and other clients advised by the Fund's Adviser and its affiliates. The Fund will participate on a pro rata basis with the other investment companies and clients in its share of the securities transferred under such repurchase agreements and in its share of proceeds from any repurchase or other disposition of such securities.

Investment Income, Gains and Losses, Expenses and Distributions

Investment transactions are accounted for on a trade-date basis. Realized gains and losses from investment transactions are recorded on an identified-cost basis. Interest income and expenses are accrued daily. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Foreign dividends are recorded on the ex-dividend date or when the Fund is informed of the ex-dividend date. Distributions of net investment income are declared and paid annually. Non-cash dividends included in dividend income, if any, are recorded at fair value. Investment income, realized and unrealized gains and losses and certain fund-level expenses are allocated to each class based on relative average daily net assets, except that Institutional Shares, Class A Shares, Class B Shares, Class C Shares and Class K Shares may bear distribution services fees, shareholder services fees, account administration fees and certain transfer and dividend disbursing agent fees unique to those classes. Dividends are declared separately for each class. No class has preferential dividend rights; differences in per share dividend rates are generally due to differences in separate class expenses.

Premium and Discount Amortization

All premiums and discounts on fixed-income securities are amortized/accreted for financial statement purposes.

Federal Taxes

It is the Fund's policy to comply with the Subchapter M provision of the Internal Revenue Code (the “Code”) and to distribute to shareholders each year substantially all of its income. Accordingly, no provision for federal income tax is necessary. As of and during the year ended October 31, 2009, the Fund did not have a liability for any uncertain tax positions. The Fund recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of Operations. As of October 31, 2009, tax years 2006 through 2009 remain subject to examination by the Fund's major tax jurisdictions, which include the United States of America and the Commonwealth of Massachusetts.

The Fund may be subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or gains are earned.

Annual Shareholder Report26

When-Issued and Delayed Delivery TransactionsThe Fund may engage in when-issued or delayed delivery transactions. The Fund records when-issued securities on the trade date and maintains security positions such that sufficient liquid assets will be available to make payment for the securities purchased. Securities purchased on a when-issued or delayed delivery basis are marked to market daily and begin earning interest on the settlement date. Losses may occur on these transactions due to changes in market conditions or the failure of counterparties to perform under the contract.

Foreign Exchange Contracts

The Fund may enter into foreign exchange contracts for the delayed delivery of securities or foreign currency exchange transactions. The Fund may enter into foreign exchange contracts to protect assets against adverse changes in foreign currency exchange rates or exchange control regulations. Purchased contracts are used to acquire exposure to foreign currencies, whereas, contracts to sell are used to hedge the Fund's securities against currency fluctuations. Risks may arise upon entering into these transactions from the potential inability of counterparties to meet the terms of their commitments and from unanticipated movements in security prices or foreign exchange rates. The foreign exchange contracts are adjusted by the daily exchange rate of the underlying currency and any gains or losses are recorded for financial statement purposes as unrealized until the settlement date.

Foreign exchange contracts outstanding at period end are listed after the Fund's Portfolio of Investments.

Foreign Currency Translation

The accounting records of the Fund are maintained in U.S. dollars. All assets and liabilities denominated in foreign currencies (FCs) are translated into U.S. dollars based on the rates of exchange of such currencies against U.S. dollars on the date of valuation. Purchases and sales of securities, income and expenses are translated at the rate of exchange quoted on the respective date that such transactions are recorded. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Reported net realized foreign exchange gains or losses arise from sales of portfolio securities, sales and maturities of short-term securities, sales of FCs, currency gains or losses realized between the trade and settlement dates on securities transactions, the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund's books, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities at fiscal year end, resulting from changes in the exchange rate.

Annual Shareholder Report27

Additional Disclosure Related to Derivative Instruments| Fair Value of Derivative Instruments |

| Asset | Liability |

| Statement of

Assets and

Liabilities

Location | Fair

Value | Statement of

Assets and

Liabilities

Location | Fair

Value |

| Derivatives not accounted for as hedging instruments under ASC Topic 815 | | | | |

| Foreign exchange contracts | Receivable for foreign exchange contracts | $2,889 | — | — |

The Effect of Derivative Instruments on the Statement of Operations for the Year Ended October 31, 2009

| Amount of Realized Gain or (Loss) on Derivatives Recognized in Income |

| Forward

Currency

Contracts |

| Foreign exchange contracts | $1,424 |

| Change in Unrealized Appreciation or (Depreciation) on Derivatives Recognized in Income |

| Forward

Currency

Contracts |

| Foreign exchange contracts | $43,221 |

Other

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets, liabilities, expenses and revenues reported in the financial statements. Actual results could differ from those estimated.

3. SHARES OF BENEFICIAL INTEREST

The following tables summarize share activity:

| Year Ended October 31 | 2009 | 2008 |

| Class A Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 20,847,863 | $307,583,080 | 16,853,104 | $336,236,946 |

| Shares issued to shareholders in payment of distributions declared | 535,205 | 7,781,880 | 11,739,668 | 249,902,539 |

| Shares redeemed | (21,476,847) | (317,973,196) | (20,931,618) | (419,767,400) |

NET CHANGE RESULTING

FROM CLASS A SHARE TRANSACTIONS | (93,779) | $(2,608,236) | 7,661,154 | $166,372,085 |

Annual Shareholder Report28

| Year Ended October 31 | 2009 | 2008 |

| Class B Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 857,656 | $12,075,453 | 791,872 | $15,361,782 |

| Shares issued to shareholders in payment of distributions declared | 39,608 | 551,341 | 3,969,781 | 80,388,061 |

| Shares redeemed | (4,715,500) | (66,134,508) | (5,889,752) | (112,993,395) |

NET CHANGE RESULTING

FROM CLASS B SHARE TRANSACTIONS | (3,818,236) | $(53,507,714) | (1,128,099) | $(17,243,552) |

| Year Ended October 31 | 2009 | 2008 |

| Class C Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 1,503,629 | $21,060,246 | 1,340,717 | $25,824,322 |

| Shares issued to shareholders in payment of distributions declared | 24,411 | 338,825 | 1,234,167 | 24,967,189 |

| Shares redeemed | (1,911,514) | (26,567,911) | (2,099,452) | (40,351,015) |

NET CHANGE RESULTING

FROM CLASS C SHARE TRANSACTIONS | (383,474) | $(5,168,840) | 475,432 | $10,440,496 |

| Year Ended October 31 | 2009 | 2008 |

| Class K Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 949,009 | $13,781,255 | 2,119,876 | $43,230,665 |

| Shares issued to shareholders in payment of distributions declared | 26,460 | 381,815 | 184,818 | 3,904,135 |

| Shares redeemed | (2,057,137) | (29,288,403) | (549,210) | (10,724,702) |

NET CHANGE RESULTING

FROM CLASS K SHARE TRANSACTIONS | (1,081,668) | $(15,125,333) | 1,755,484 | $36,410,098 |

Annual Shareholder Report29

| Year Ended

10/31/2009 | Period Ended

10/31/20081 |

| Institutional Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 12,046,730 | $174,367,633 | 3,186,759 | $61,269,064 |

| Proceeds from shares issued in connection with the tax-free transfer of assets from Suburban Common Trust Fund | 324,388 | 4,843,111 | — | — |

| Proceeds from shares issued in connection with the tax-free transfer of assets from Clearfield Bank Common Trust Fund | 175,330 | 2,596,634 | — | — |

| Proceeds from shares issued in connection with the tax-free transfer of assets from Central Bank Core Equity Fund | — | — | 2,017,395 | 42,103,041 |

| Shares issued to shareholders in payment of distributions declared | 19,543 | 283,973 | — | — |

| Shares redeemed | (4,184,146) | (66,004,824) | (486,554) | (9,413,027) |

NET CHANGE RESULTING

FROM INSTITUTIONAL SHARE TRANSACTIONS | 8,381,845 | $ 116,086,527 | 4,717,600 | $93,959,078 |

NET CHANGE RESULTING

FROM FUND SHARE TRANSACTIONS | 3,004,688 | $ 39,676,404 | 13,481,571 | $289,938,205 |

| 1 | Reflects operations for the period from December 31, 2007 (date of initial investment) to October 31, 2008. |

4. FEDERAL TAX INFORMATION

The timing and character of income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. These differences are attributable in part to reclass of gain (loss) on foreign exchange contracts, expiration of capital loss carryforwards and reclassification for regulatory settlement proceeds.

For the year ended October 31, 2009, permanent differences identified and reclassified among the components of net assets were as follows:

| Increase (Decrease) |

| Paid-In Capital | Undistributed

Net Investment

Income (Loss) | Accumulated

Net Realized

Gain (Loss) |

| $(4,147,107) | $(116,154) | $4,263,261 |

Net investment income (loss), net realized gains (losses), and net assets were not affected by this reclassification.

Annual Shareholder Report30

The tax character of distributions as reported on the Statement of Changes in Net Assets for the years ended October 31, 2009 and 2008, was as follows: | 2009 | 2008 |

| Ordinary income1 | $12,272,799 | $166,975,138 |

| Long-term capital gains | $ — | $241,873,668 |

| 1 | For tax purposes, short-term capital gain distributions are considered ordinary income distributions. |

As of October 31, 2009, the components of distributable earnings on a tax basis were as follows:

| Undistributed ordinary income | $9,216,469 |

| Net unrealized appreciation | $144,907,395 |

| Capital loss carryforwards | $(369,657,321) |

The difference between book-basis and tax-basis net unrealized appreciation/depreciation is attributable to differing treatments for the deferral of losses on wash sales.

At October 31, 2009, the cost of investments for federal tax purposes was $1,240,117,561. The net unrealized appreciation of investments for federal tax purposes excluding any unrealized appreciation resulting from changes in foreign currency exchange rates and outstanding foreign currency commitments was $144,890,102. This consists of net unrealized appreciation from investments for those securities having an excess of value over cost of $162,102,044 and net unrealized depreciation from investments for those securities having an excess of cost over value of $17,211,942.

At October 31, 2009, the Fund had a capital loss carryforward of $369,657,321 which will reduce the Fund's taxable income arising from future net realized gains on investments, if any, to the extent permitted by the Code and thus will reduce the amount of distributions to shareholders which would otherwise be necessary to relieve the Fund of any liability for federal income tax. Pursuant to the Code, such capital loss carryforward will expire as follows:

| Expiration Year | Expiration Amount |

| 2010 | $2,978,206 |

| 2011 | $978,641 |

| 2012 | $1,306,623 |

| 2016 | $110,598,251 |

| 2017 | $253,795,600 |

As a result of the tax-free transfer of assets from Vintage Growth Fund certain capital loss carryforwards listed above may be limited.

Capital loss carryforwards of $5,129,844 expired during the year ended October 31, 2009.

Annual Shareholder Report31

5. INVESTMENT ADVISER FEE AND OTHER TRANSACTIONS WITH AFFILIATESInvestment Adviser Fee

Federated Equity Management Company of Pennsylvania is the Fund's investment adviser (the “Adviser”). The advisory agreement between the Fund and the Adviser provides for an annual fee equal to 0.75% of the Fund's average daily net assets. Subject to the terms described in the Expense Limitation note, the Adviser may voluntarily choose to waive any portion of its fee. The Adviser can modify or terminate this voluntary waiver at any time at its sole discretion. For the year ended October 31, 2009, an affiliate of the adviser reimbursed $74,569 of transfer and dividend disbursing agent fees and expenses.

Administrative Fee

Federated Administrative Services (FAS), under the Administrative Services Agreement, provides the Fund with administrative personnel and services. The fee paid to FAS is based on the average aggregate daily net assets of certain Federated funds as specified below:

| Administrative Fee | Average Aggregate Daily Net Assets

of the Federated Funds |

| 0.150% | on the first $5 billion |

| 0.125% | on the next $5 billion |

| 0.100% | on the next $10 billion |

| 0.075% | on assets in excess of $20 billion |

The administrative fee received during any fiscal year shall be at least $150,000 per portfolio and $40,000 per each additional class of Shares. Subject to the terms described in the Expense Limitation note, FAS may voluntarily choose to waive any portion of its fee. FAS can modify or terminate this voluntary waiver at any time at its sole discretion. For the year ended

October 31, 2009, the net fee paid to FAS was 0.076% of average daily net assets of the Fund. FAS waived $20,588 of its fee.

Distribution Services Fee

The Fund has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the Act. Under the terms of the Plan, the Fund will compensate Federated Securities Corp. (FSC), the principal distributor, from the daily net assets of the Fund's Class A Shares, Class B Shares, Class C Shares and Class K Shares to finance activities intended to result in the sale of these shares. The Plan provides that the Fund may incur distribution expenses at the following percentages of average daily net assets annually, to compensate FSC:

| Share Class Name | Percentage of Average Daily

Net Assets of Class |

| Class A Shares | 0.05% |

| Class B Shares | 0.75% |

| Class C Shares | 0.75% |

| Class K Shares | 0.50% |

Annual Shareholder Report32

Subject to the terms described in the Expense Limitation note, FSC may voluntarily choose to waive any portion of its fee. FSC can modify or terminate this voluntary waiver at any time at its sole discretion. When FSC receives fees, it may pay some or all of them to financial intermediaries whose customers purchase shares. For the year ended October 31, 2009, FSC retained $57,554 of fees paid by the Fund. For the year ended October 31, 2009, the Fund's Class A Shares did not incur a distribution services fee; however it may begin to incur this fee upon approval of the Trustees.

Sales Charges

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. They are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. For the year ended October 31, 2009, FSC retained $86,541 in sales charges from the sale of Class A Shares. FSC also retained $2,571 of CDSC relating to redemptions of Class A Shares and $3,420 relating to redemptions of Class C Shares.

Shareholder Services Fee

The Fund may pay fees (Service Fees) up to 0.25% of the average daily net assets of the Fund's Class A Shares, Class B Shares and Class C Shares to financial intermediaries or to Federated Shareholder Services Company (FSSC) for providing services to shareholders and maintaining shareholder accounts. Financial intermediaries may include a company affiliated with management of Federated Investors, Inc. A financial intermediary affiliated with management of Federated Investors, Inc. received $10,438 of Service Fees for the year ended October 31, 2009. Subject to the terms described in the Expense Limitation note, FSSC may voluntarily reimburse the Fund for shareholder services fees. This voluntary reimbursement can be modified or terminated at any time. For the year ended October 31, 2009, FSSC voluntarily reimbursed $464,794 of shareholder services fees. For the year ended October 31, 2009, FSSC did not receive any fees paid by the Fund.

Interfund Transactions

During the year ended October 31, 2009, the Fund engaged in purchase and sale transactions with funds that have a common investment adviser (or affiliated investment advisers), common Directors/Trustees, and/or common Officers. These purchase and sale transactions complied with Rule 17a-7 under the Act and amounted to $1,572,922 and $1,236,733, respectively.

Expense Limitation

The Adviser and its affiliates (which may include FSC, FAS and FSSC) have voluntarily agreed to waive their fees and/or reimburse expenses so that the total operating expenses (as shown in the financial highlights) paid by the Fund's Class A Shares, Class B Shares, Class C Shares, Class K Shares and Institutional Shares (after the voluntary waivers and reimbursements) will not exceed 1.24%, 2.10%, 2.06%, 1.71% and 0.96%, respectively, through the later of (the “Termination Date”): (a) December 31, 2010; or (b) the date of the Fund's next effective Prospectus. While the Adviser and its affiliates currently do not anticipate terminating these arrangements prior to the Termination Date, these arrangements may only be terminated prior to the Termination Date with the agreement of the Fund's Board of Trustees.

General

Certain Officers and Trustees of the Fund are Officers and Directors or Trustees of the above companies.

Annual Shareholder Report33

Transactions with Affiliated CompaniesAffiliated holdings are mutual funds which are managed by the Adviser or an affiliate of the Adviser. The Adviser has agreed to reimburse the Fund for certain investment adviser fees as a result of transactions in other affiliated mutual funds. For the year ended October 31, 2009, the Adviser reimbursed $69,879. Transactions with the affiliated company during the year ended October 31, 2009 were as follows:

| Affiliate | Balance of

Shares Held

10/31/2008 | Purchases/

Additions | Sales/

Reductions | Balance of

Shares Held

10/31/2009 | Value | Dividend

Income |

| Prime Value Obligations Fund, Institutional Shares | 162,690,105 | 1,275,486,604 | 1,435,777,908 | 2,398,801 | $2,398,801 | $764,043 |

6. EXPENSE Reduction