United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-4017

(Investment Company Act File Number)

Federated Hermes Equity Funds

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

Peter J. Germain, Esquire

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 10/31/20

Date of Reporting Period: 10/31/20

| Item 1. | Reports to Stockholders |

Annual Shareholder Report

October 31, 2020

Federated Hermes Global Strategic Value Dividend Fund(formerly, Federated Global Strategic Value Dividend Fund)

Fund Established 2017

A Portfolio of Federated Hermes Equity Funds(formerly, Federated Equity Funds)

IMPORTANT NOTICE REGARDING REPORT DELIVERY

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically by contacting your financial intermediary (such as a broker-dealer or bank); other shareholders may call the Fund at 1-800-341-7400, Option 4.

You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by contacting your financial intermediary (such as a broker-dealer or bank); other shareholders may call the Fund at 1-800-341-7400, Option 4. Your election to receive reports in paper will apply to all funds held with the Fund complex or your financial intermediary.

Not FDIC Insured ▪ May Lose Value ▪ No Bank Guarantee

J. Christopher

Donahue

President

Federated Hermes Global Strategic Value Dividend Fund

Letter from the President

Dear Valued Shareholder,

I am pleased to present the Annual Shareholder Report for your fund covering the period from November 1, 2019 through October 31, 2020.

As we all confront the unprecedented effects of the coronavirus and the challenges it presents to our families, communities, businesses and the financial markets, I want you to know that everyone at Federated Hermes is dedicated to helping you successfully navigate the markets ahead. You can count on us for the insights, investment management knowledge and client service that you have come to expect. Please refer to our website, FederatedInvestors.com, for timely updates on this and other economic and market matters.

Thank you for investing with us. I hope you find this information useful and look forward to keeping you informed.

Sincerely,

J. Christopher Donahue, President

Management’s Discussion of Fund Performance (unaudited)

The total return of Federated Hermes Global Strategic Value Dividend Fund (the “Fund”), based on net asset value, for the 12-month reporting period ended October 31, 2020, was -13.58% for the Class A Shares, -14.24% for the Class C Shares, -13.37% for the Institutional Shares and -13.35% for the Class R6 Shares. The -13.35% total return of the Class R6 Shares consisted of 3.32% in dividend income and -16.67% change in net asset value of the shares. The total return of the MSCI World High Dividend Yield Index1 (MWHDYI), a broad-based securities market index that represents the global dividend-paying universe, was -9.35% for the reporting period. The MSCI World Index2 (MWI), which is representative of the broader global stock market,3 had a total return of 4.36% for the same period. The Fund’s total return for the most recently completed fiscal year reflected actual cash flows, transaction costs and other expenses which are not reflected in the total return of the MWHDYI or the MWI.

The following discussion will focus on the performance of the Fund’s Class R6 Shares relative to the MWHDYI.

MARKET OVERVIEW

The fiscal year began with global equites rallying strongly on signs that a manufacturing slump was bottoming, a trade truce was imminent and fiscal and monetary support would remain in full force. In the U.S., all three major indexes hit record highs during November 2019, while overseas, both developed and emerging equity markets posted gains. Equities continued to rally through the end of the calendar year as hopes for improving growth and earnings in 2020 drove the major U.S. indexes to a series of record highs over the course of 2019’s final month. The S&P 500 Index (S&P 500)4 closed calendar year 2019 up 29%, its best showing since 2013, while the Dow Jones Industrial Average (the “Dow”)5 added 22% and the NASDAQ Composite Index (NASDAQ)6 advanced 25%. The story was much the same overseas as the Stoxx Europe 6007 rose 23% for its biggest gain in 10 years, the Shanghai Composite Index8 climbed 22%, the MWI rose 25% and the MSCI All Country World Index Ex US9 increased 18% (returns for calendar year 2019).

In the first months of the new calendar year, U.S. stocks started selling off sharply, causing the Dow to fall 1% and the S&P 500 to slip 0.2% for January, while the NASDAQ still ended up 2%. Fears that the novel coronavirus (“Covid-19”) that started in the commercial hub of Wuhan might spread from China to the rest of the world drove the unsteady finish, as it brought economic activity to a halt in the world’s second-largest economy, disrupted global supply chains and created a new headwind for already struggling manufacturing.

Annual Shareholder Report

Heading into the end of March, fears of a global pandemic grew as Covid-19 spread far beyond China, causing a worldwide rout in risk assets, with the S&P, Dow and NASDAQ all cratering into correction territory. Oil prices plunged, and even gold was unable to hold onto earlier gains. Global risk markets collapsed in March as fears of a global pandemic became a reality, with Covid-19 sweeping across continents and deeply affecting the United States, which by quarter-end had the most confirmed cases of any country in the world.

The second quarter of the calendar year ended with a recovery in the markets. Just a month after falling into a bear market at their fastest rate in history, stocks bounced back dramatically in April, posting their best month in decades even as Covid-19 cases continued to spread. The rally came on unprecedented stimulus–$2.4 trillion from Congress and the Trump administration and commitments up to $6 trillion or more from the Federal Reserve–and on signs the pandemic may have been peaking even as its economic damage–and fatalities–kept piling up.

Mid-year, stocks continued to rebound off March’s bear-market lows as the economy began to reopen gradually and the worst of Covid-19 and its economic damage appeared to be in the rearview mirror. The rebound slowed in June, however, as a late-month surge in Sunbelt states pushed new daily Covid-19 cases to new highs, raising fears the economic recovery may drag out and behave more like a “U” than a “V” curve. The rally continued through the summer on the back of big tech stocks despite sobering reports on the economy and record Covid-19 caseloads in many Sunbelt and coastal states. The rally fed off a trifecta of continued unprecedented central bank and government stimulus, an ugly earnings season that nonetheless was better than expected and encouraging signs of renewed manufacturing activity at home and abroad.

Heading into the final months of the Fund’s fiscal year, U.S equities continued their post-bear market run, as the S&P 500 and NASDAQ set new highs and the Dow inched closer to positive territory for the year. Improving economic data, particularly in housing and manufacturing, and declining Covid-19 death rates were factors. There was a shift in September as stocks pulled back on the failure of Congress and the White House to come up with more stimulus as the number of Covid-19 cases began to climb again and previous aid began to run out. September’s sell-off carried over into October, as a renewed surge in Covid-19 cases, the collapse of stimulus talks and election uncertainties weighed on stocks. The damage extended to Europe, as countries there began a new wave of pandemic-driven shutdowns, although the restrictions were less draconian than last spring.

Annual Shareholder Report

DIVIDEND-BASED10 PERFORMANCE

The Fund ended the reporting period with a 30-day SEC yield of 4.23%11 and a gross weighted-average dividend yield of 4.84%. The Fund’s gross yield was greater than the yield of the 10-year U.S. Treasury Note (0.87%), the yield of the broad-market MWI (2.04%) and that of the Fund’s benchmark, the MWHDYI (4.27%).

In addition to its higher-than-market yield, the Fund seeks to own high-quality companies with the ability and willingness to raise their dividends over time. During the reporting period, 34 companies within the Fund raised their dividend, accounting for 34 separate increases, three dividend reductions and one company having suspended their dividend. Some of the most generous increases in the reporting period came from holdings such as Enel (+17.1%), Iberdrola (+14.0%), Amgen (+10.3%) and AbbVie (+10.2%), Enbridge (+9.8%), Chevron (+8.4%), TC Energy (+8.0%), Gilead (+7.9%), Pepsi (+7.1%), Munich Re (+5.9%), Fortis (+5.8%), and Zurich Insurance (+5.3%).

While stock prices can be highly impacted in the short term by rapidly changing market conditions–including a shifting political landscape, oil price fluctuations and changing interest rate expectations–the Fund’s management remained steadfastly focused on its objectives of providing a higher-than-market yield and long-term dividend growth. Irrespective of short-term market trends, the Fund pursued these income-based goals by taking a long-term approach to its investments and by owning primarily high-yielding, mature companies with defensive cash flow profiles. With the Fund’s investments in the dividend income-producing segment of the worldwide equity markets, which tend to have a lower beta12 versus the MWI, the Fund’s short-term returns are not expected to move in line with the broad market. The Fund posted a total return of -13.35% despite recovering many of the losses experienced during the height of the pandemic, after a shift occurred in September and continued into October as stocks pulled back from uncertainty surrounding the U.S. election, a resurgence of Covid-19 infection rates and the stalled U.S. stimulus package. These all hampered investor sentiment as the fiscal period closed.

Consistent with its dividend-focused strategy, the Fund’s holdings remained concentrated in mature markets that consistently offer a broad selection of high-dividend-paying stocks. In addition to the U.S., the Fund also has significant exposure to the UK, Canada, and select European countries including France, Germany and Switzerland. During the reporting period, the Fund received positive contributions from its core holdings in Japan (the Fund has since exited those positions), Australia (2.38% of ending Fund assets) and Italy (3.15% of ending Fund assets) where its investments posted weighted

Annual Shareholder Report

average returns of 37.27%, 64.16%, and 8.00%, respectively. Fund holdings in the United States (52.30% of ending Fund assets), United Kingdom (11.21% of ending Fund assets), and France (7.50% of ending Fund assets) declined in the period with weighted average returns of -11.91%, -21.86% and -27.42%, respectively.

Within the MWI, returns across economic sectors were mixed in the reporting period with Information Technology, Consumer Discretionary and Communication Services leading the market, while Energy, Financials and Real Estate posted the reporting period’s weakest returns. Through most of the fiscal period, investors tended to favor lower-yielding stocks despite low beta outperforming high beta equities. But while investor preferences for certain sectors and risk profiles will vary from year to year, the Fund’s management remained focused on the key long-term drivers of total return–dividend yield and dividend growth. In order to pursue these income-based goals, the portfolio seeks to invest in high quality companies with attractive, sustainable dividends and stable cash flow profiles–conditions which are most commonly met in sectors that exhibit low levels of cyclicality. Given its persistent preference for stable income generation, the Fund’s largest sector concentrations at period-end were in Health Care, Utilities and Financials, representing 22.92%, 21.48% and 15.88%, respectively.

From a sector perspective, the Fund’s holdings in Industrials were the most significant contributors to performance, posting a return of 24.18%. Outperformance was driven mainly by United Parcel Service which returned 55.27% after reporting very strong Q2 earnings due to continued momentum in e-commerce. Health Care was also a solid contributor to overall Fund performance, delivering a return of 5.21%, led by Sonic Healthcare, Amgen and AbbVie which returned 64.16%, 18.66% and 12.80%, respectively. Utilities added further to Fund performance as Iberdrola, E.ON, and American Electric Power returned 18.04%, 13.48% and 10.03%, respectively for the reporting period.

By contrast, the Fund’s weakest contribution was noted in the Energy sector, which delivered a weighted average return of -37.62% driven by declining oil prices and worse-than-expected earnings from Royal Dutch Shell, ExxonMobil, BP and Chevron which returned -59.65%, -48.45%, -39.37% and -37.10%, respectively. Contributions from Real Estate also lagged–returning -42.75% for the reporting period. Detractors in this sector included Ventas, Omega Healthcare, and Welltower which returned -66.40%, -34.94% and -9.15%, respectively. Healthcare REITS were particularly hit hard by Covid-19 during the period. In addition, the Financials sector was a drag on performance during the reporting period returning -19.19% due to Scor SE, BNP Paribas and Regions Financial which returned -42.35%, -45.23% and -13.53%, respectively.

Annual Shareholder Report

Due to its focus on high dividend income and growth in that income stream over time, the Fund tends to perform best when investors prefer high-yield, high-quality, low-beta, large-cap stocks. Often times, the strategy outperforms in flat markets or periods of market distress. Conversely, the strategy may lag the broad market when investors prefer low-yield, low-quality, high-risk, small-cap stocks. Over the reporting period, the Fund underperformed the broad global market as investor’s tended to favor low-yielding equities and growth over value.

1

Please see the footnotes to the line graphs below for definitions of, and further information about, the MWHDYI.

2

Please see the footnotes to the line graphs below for definitions of, and further information about, the MWI.

3

International investing involves special risks including currency risk, increased volatility of foreign securities, political risks and differences in auditing and other financial standards. Prices of emerging markets securities can be significantly more volatile than the prices of securities in developed countries and currency risk and political risks are accentuated in emerging markets.

4

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.*

5

The Dow Jones Industrial Average is a price weighted index comprised of 30 of the largest and most widely held public companies in the United States.*

6

The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. Today the NASDAQ Composite includes over 3,000 companies.*

7

The Stoxx Europe 600 represents large, mid and small capitalization companies across 17 countries of the European region.*

8

The Shanghai Composite Index is a capitalization-weighted index. The index tracks the daily price performance of all A-shares and B-shares listed on the Shanghai Stock Exchange.*

9

The MSCI All Country World ex US Index captures large- and mid-cap representation across 22 of 23 developed markets countries (excluding the U.S.) and 23 emerging markets countries. The index covers approximately 85% of the global equity opportunity set outside the U.S.*

10

There are no guarantees that dividend-paying stocks will continue to pay dividends. In addition, dividend-paying stocks may not experience the same capital appreciation potential as non-dividend-paying stocks.

11

Represents the 30-day SEC yield for the Fund’s R6 Shares. In the absence of temporary expense waivers or reimbursements the 30-day SEC yield would have been 2.88% for the Fund’s R6 Shares. The dividend yield represents the average yield of the underlying securities within the portfolio.

12

Beta measures a security/fund’s volatility relative to the market. A beta greater than 1.00 suggests the security/fund has historically had less volatility relative to the market.

*

The index is unmanaged, and it is not possible to invest directly in an index.

Annual Shareholder Report

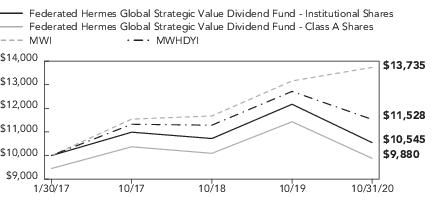

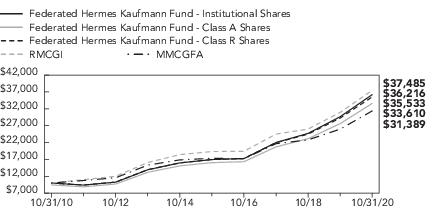

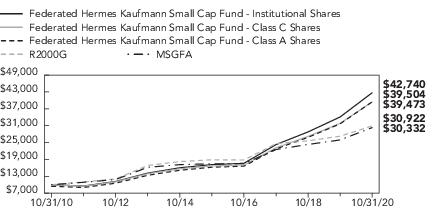

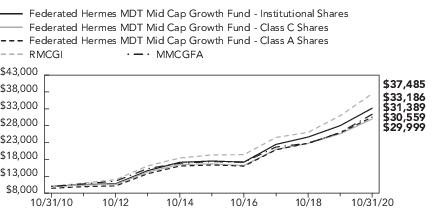

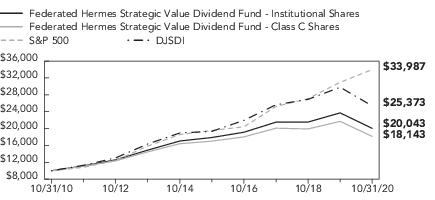

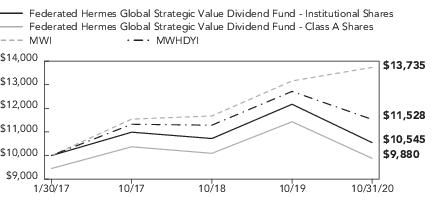

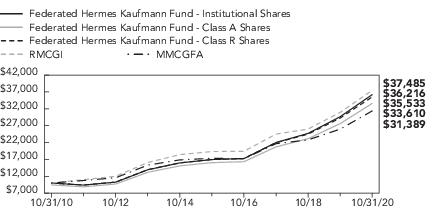

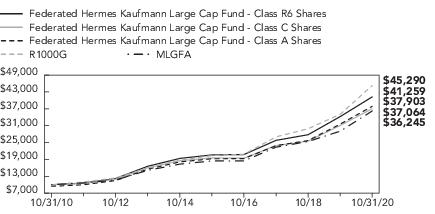

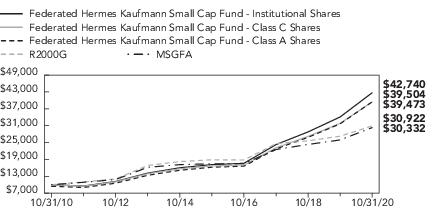

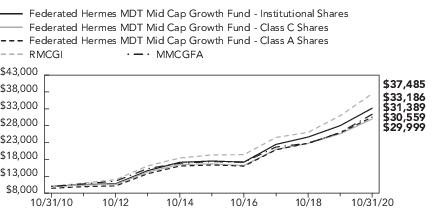

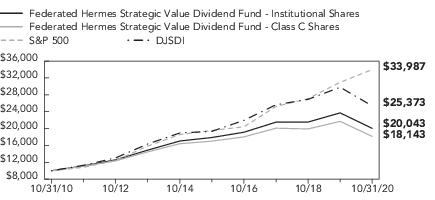

FUND PERFORMANCE AND GROWTH OF A $10,000 INVESTMENT

The graph below illustrates the hypothetical investment of $10,0001 in the Federated Hermes Global Strategic Value Dividend Fund from January 30, 2017 to October 31, 2020, compared to the MSCI World Index (MWI)2 and the MSCI World High Dividend Yield Index (MWHDYI).3 The Average Annual Total Return table below shows returns for each class averaged over the stated periods.

Growth of a $10,000 InvestmenT

Growth of $10,000 as of October 31, 2020

■ Total returns shown for Class A Shares include the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450).

The Fund offers multiple share classes whose performance may be greater than or less than its other share class(es) due to differences in sales charges and expenses. See the Average Annual Return table below for the returns of additional classes not shown in the line graph above.

Annual Shareholder Report

Average Annual Total Returns for the Period Ended 10/31/2020

(returns reflect all applicable sales charges and contingent sales charges as specified below in footnote #1)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

1

Represents a hypothetical investment of $10,000 in the Fund after deducting applicable sales charges: For Class A Shares, the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450). For Class C Shares, a 1.00% contingent deferred sales charge would be applied on any redemption less than one year from the purchase date. The Fund’s performance assumes the reinvestment of all dividends and distributions. The MWI and MWHDYI have been adjusted to reflect reinvestment of dividends on securities in the indexes.

2

The MWI captures large- and mid-cap representation across 23 developed market countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. The MWI is not adjusted to reflect taxes, expenses or other fees that the Securities and Exchange Commission (SEC) requires to be reflected in the Fund’s performance. The MWI is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index.

3

The MSCI World High Dividend Yield Index is based on the MSCI World Index, its parent index, and includes large- and mid-cap stocks across 23 developed market countries. The index is designed to reflect the performance of equities in the parent index (excluding REITs) with higher dividend income and quality characteristics than average dividend yields that are both sustainable and persistent. The index also applies quality screens and reviews 12-month past performance to omit stocks with potentially deteriorating fundamentals that could force them to cut or reduce dividends. The MWHDYI is not adjusted to reflect taxes, expenses or other fees that the SEC requires to be reflected in the Fund’s performance. The MWHDYI is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index.

4

The Fund commenced operations on January 30, 2017.

Annual Shareholder Report

Portfolio of Investments Summary Table (unaudited)

At October 31, 2020, the Fund’s sector composition1 was as follows:

| Percentage of

Total Net Assets |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Other Assets and Liabilities—Net3 | |

| |

1

Except for Cash Equivalents and Other Assets and Liabilities, sector classifications are based upon, and individual portfolio securities are assigned to, the classifications of the Global Industry Classification Standard (GICS) except that the Adviser assigns a classification to securities not classified by the GICS and to securities for which the Adviser does not have access to the classification made by the GICS.

2

Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements.

3

Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities.

Annual Shareholder Report

Portfolio of Investments

October 31, 2020

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Canadian Imperial Bank of Commerce | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Muenchener Rueckversicherungs-Gesellschaft AG | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Zurich Insurance Group AG | |

| | | |

| | | |

| | British American Tobacco PLC | |

| | | |

Annual Shareholder Report

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | American Electric Power Co., Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Philip Morris International, Inc. | |

| | PNC Financial Services Group | |

| | | |

| | | |

| | | |

| | | |

| | Verizon Communications, Inc. | |

| | | |

| | TOTAL COMMON STOCKS

(IDENTIFIED COST $2,130,157) | |

Annual Shareholder Report

| | | |

| | | |

| | Federated Hermes Institutional Prime Value Obligations Fund, Institutional Shares, 0.10%2

(IDENTIFIED COST $20,433) | |

| | TOTAL INVESTMENT IN SECURITIES—107.8%

(IDENTIFIED COST $2,150,590)3 | |

| | OTHER ASSETS AND LIABILITIES - NET—(7.8)%4 | |

| | | |

Affiliated fund holdings are investment companies which are managed by the Adviser or an affiliate of the Adviser. Transactions with affiliated fund holdings during the period ended October 31, 2020, were as follows:

| Federated Hermes

Institutional

Prime Value

Obligations Fund,

Institutional Shares |

| |

| |

| |

Change in Unrealized Appreciation/Depreciation | |

| |

| |

Shares Held as of 10/31/2020 | |

| |

1

Non-income-producing security.

3

The cost of investments for federal tax purposes amounts to $2,150,971.

4

Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities.

Note: The categories of investments are shown as a percentage of total net assets at October 31, 2020.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1—quoted prices in active markets for identical securities.

Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Also includes securities valued at amortized cost.

Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

Annual Shareholder Report

The following is a summary of the inputs used, as of October 31, 2020, in valuing the Fund’s assets carried at fair value:

| | | | |

| | Level 2—

Other

Significant

Observable

Inputs | Level 3—

Significant

Unobservable

Inputs | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class A Shares

(For a Share Outstanding Throughout Each Period)

| | |

| | |

Net Asset Value, Beginning of Period | | | | |

Income From Investment Operations: | | | | |

| | | | |

Net realized and unrealized gain (loss) | | | | |

TOTAL FROM INVESTMENT OPERATIONS | | | | |

| | | | |

Distributions from net investment income | | | | |

Distributions from net realized gain | | | | |

| | | | |

Net Asset Value, End of Period | | | | |

| | | | |

Ratios to Average Net Assets: | | | | |

| | | | |

| | | | |

Expense waiver/reimbursement6 | | | | |

| | | | |

Net assets, end of period (000 omitted) | | | | |

| | | | |

1

Reflects operations for the period from January 30, 2017 (date of initial investment) to October 31, 2017. Certain ratios included above in Ratios to Average Net Assets and per share amounts may be inflated or deflated as compared to the fee structure for each respective share class as a result of daily systematic allocations being rounded to the nearest penny for fund level income, expense and realized/unrealized gain/loss amounts. Such differences are immaterial.

2

Per share number has been calculated using the average shares method.

3

Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. Total returns for periods of less than one year are not annualized.

4

Amount does not reflect net expenses incurred by investment companies in which the Fund may invest.

5

Computed on an annualized basis.

6

This expense decrease is reflected in both the net expense and the net investment income ratios shown above. Amount does not reflect expense waiver/reimbursement recorded by investment companies in which the Fund may invest.

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class C Shares

(For a Share Outstanding Throughout Each Period)

| | |

| | |

Net Asset Value, Beginning of Period | | | | |

Income From Investment Operations: | | | | |

| | | | |

Net realized and unrealized gain (loss) | | | | |

TOTAL FROM INVESTMENT OPERATIONS | | | | |

| | | | |

Distributions from net investment income | | | | |

Distributions from net realized gain | | | | |

| | | | |

Net Asset Value, End of Period | | | | |

| | | | |

Ratios to Average Net Assets: | | | | |

| | | | |

| | | | |

Expense waiver/reimbursement6 | | | | |

| | | | |

Net assets, end of period (000 omitted) | | | | |

| | | | |

1

Reflects operations for the period from January 30, 2017 (date of initial investment) to October 31, 2017. Certain ratios included above in Ratios to Average Net Assets and per share amounts may be inflated or deflated as compared to the fee structure for each respective share class as a result of daily systematic allocations being rounded to the nearest penny for fund level income, expense and realized/unrealized gain/loss amounts. Such differences are immaterial.

2

Per share number has been calculated using the average shares method.

3

Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. Total returns for periods of less than one year are not annualized.

4

Amount does not reflect net expenses incurred by investment companies in which the Fund may invest.

5

Computed on an annualized basis.

6

This expense decrease is reflected in both the net expense and the net investment income ratios shown above. Amount does not reflect expense waiver/reimbursement recorded by investment companies in which the Fund may invest.

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Institutional Shares

(For a Share Outstanding Throughout Each Period)

| | |

| | |

Net Asset Value, Beginning of Period | | | | |

Income From Investment Operations: | | | | |

| | | | |

Net realized and unrealized gain (loss) | | | | |

TOTAL FROM INVESTMENT OPERATIONS | | | | |

| | | | |

Distributions from net investment income | | | | |

Distributions from net realized gain | | | | |

| | | | |

Net Asset Value, End of Period | | | | |

| | | | |

Ratios to Average Net Assets: | | | | |

| | | | |

| | | | |

Expense waiver/reimbursement6 | | | | |

| | | | |

Net assets, end of period (000 omitted) | | | | |

| | | | |

1

Reflects operations for the period from January 30, 2017 (date of initial investment) to October 31, 2017. Certain ratios included above in Ratios to Average Net Assets and per share amounts may be inflated or deflated as compared to the fee structure for each respective share class as a result of daily systematic allocations being rounded to the nearest penny for fund level income, expense and realized/unrealized gain/loss amounts. Such differences are immaterial.

2

Per share number has been calculated using the average shares method.

3

Based on net asset value. Total returns for periods of less than one year are not annualized.

4

Amount does not reflect net expenses incurred by investment companies in which the Fund may invest.

5

Computed on an annualized basis.

6

This expense decrease is reflected in both the net expense and the net investment income ratios shown above. Amount does not reflect expense waiver/reimbursement recorded by investment companies in which the Fund may invest.

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class R6 Shares

(For a Share Outstanding Throughout Each Period)

| | |

| | |

Net Asset Value, Beginning of Period | | | | |

Income From Investment Operations: | | | | |

| | | | |

Net realized and unrealized gain (loss) | | | | |

TOTAL FROM INVESTMENT OPERATIONS | | | | |

| | | | |

Distributions from net investment income | | | | |

Distributions from net realized gain | | | | |

| | | | |

Net Asset Value, End of Period | | | | |

| | | | |

Ratios to Average Net Assets: | | | | |

| | | | |

| | | | |

Expense waiver/reimbursement6 | | | | |

| | | | |

Net assets, end of period (000 omitted) | | | | |

| | | | |

1

Reflects operations for the period from January 30, 2017 (date of initial investment) to October 31, 2017. Certain ratios included above in Ratios to Average Net Assets and per share amounts may be inflated or deflated as compared to the fee structure for each respective share class as a result of daily systematic allocations being rounded to the nearest penny for fund level income, expense and realized/unrealized gain/loss amounts. Such differences are immaterial.

2

Per share number has been calculated using the average shares method.

3

Based on net asset value. Total returns for periods of less than one year are not annualized.

4

Amount does not reflect net expenses incurred by investment companies in which the Fund may invest.

5

Computed on an annualized basis.

6

This expense decrease is reflected in both the net expense and the net investment income ratios shown above. Amount does not reflect expense waiver/reimbursement recorded by investment companies in which the Fund may invest.

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Assets and LiabilitiesOctober 31, 2020

| | |

Investment in securities, at value including $20,450 of investment in an affiliated holding* (identified cost $2,150,590) | | |

| | |

| | |

| | |

| | |

Payable for portfolio accounting fees | | |

Payable for auditing fees | | |

Payable to adviser (Note 5) | | |

Payable for share registration costs | | |

Payable for custodian fees | | |

Payable for insurance premiums | | |

Payable for administrative fee (Note 5) | | |

Payable for other service fees (Notes 2 and 5) | | |

Accrued expenses (Note 5) | | |

| | |

Net assets for 423,891 shares outstanding | | |

| | |

| | |

Total distributable earnings (loss) | | |

| | |

Annual Shareholder Report

Statement of Assets and Liabilities–continued

Net Asset Value, Offering Price and Redemption Proceeds Per Share: | | |

| | |

Net asset value per share ($486,813 ÷ 109,477 shares outstanding) no par value, unlimited shares authorized | | |

Offering price per share (100/94.50 of $4.45) | | |

Redemption proceeds per share | | |

| | |

Net asset value per share ($40,093 ÷ 9,008 shares outstanding) no par value, unlimited shares authorized | | |

| | |

Redemption proceeds per share (99.00/100 of $4.45) | | |

| | |

Net asset value per share ($303,239 ÷ 68,085 shares outstanding) no par value, unlimited shares authorized | | |

| | |

Redemption proceeds per share | | |

| | |

Net asset value per share ($1,055,374 ÷ 237,321 shares outstanding) no par value, unlimited shares authorized | | |

| | |

Redemption proceeds per share | | |

*

See information listed after the Fund’s Portfolio of Investments

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of OperationsYear Ended October 31, 2020

| | | |

Dividends (including $254 received from an affiliated holding* and net of foreign taxes withheld of $5,964) | | | |

| | | |

Investment adviser fee (Note 5) | | | |

Administrative fee (Note 5) | | | |

| | | |

Transfer agent fees (Note 2) | | | |

Directors’/Trustees’ fees (Note 5) | | | |

| | | |

| | | |

Distribution services fee (Note 5) | | | |

Other service fees (Notes 2 and 5) | | | |

Portfolio accounting fees | | | |

| | | |

| | | |

| | | |

| | | |

Waiver and Reimbursements: | | | |

Waiver/reimbursement of investment adviser fee (Note 5) | | | |

Reimbursements of other operating expenses (Notes 2 and 5) | | | |

TOTAL WAIVER AND REIMBURSEMENTS | | | |

| | | |

| | | |

Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Transactions: | | | |

Net realized loss on investments (including net realized loss of ($40) on sales of investments in an affiliated holding*) and foreign currency transactions | | | |

Net change in unrealized appreciation of investments and translation of assets and liabilities in foreign currency (including net change in unrealized appreciation of $16 of investments in an affiliated holding*) | | | |

Net realized and unrealized gain (loss) on investments and foreign currency transactions | | | |

Change in net assets resulting from operations | | | |

*

See information listed after the Fund’s Portfolio of Investments

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Changes in Net Assets

| | |

Increase (Decrease) in Net Assets | | |

| | |

| | |

| | |

Net change in unrealized appreciation/depreciation | | |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | | |

Distributions to Shareholders: | | |

| | |

| | |

| | |

| | |

CHANGE IN NET ASSETS RESULTING FROM DISTRIBUTIONS TO SHAREHOLDERS | | |

| | |

Proceeds from sale of shares | | |

Net asset value of shares issued to shareholders in payment of distributions declared | | |

| | |

CHANGE IN NET ASSETS RESULTING FROM SHARE TRANSACTIONS | | |

| | |

| | |

| | |

| | |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Notes to Financial Statements

October 31, 2020

1. ORGANIZATION

Federated Hermes Equity Funds (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The Trust consists of nine portfolios. The financial statements included herein are only those of Federated Hermes Global Strategic Value Dividend Fund (the “Fund”), a diversified portfolio. The financial statements of the other portfolios are presented separately. The assets of each portfolio are segregated and a shareholder’s interest is limited to the portfolio in which shares are held. Each portfolio pays its own expenses. The Fund offers four classes of shares: Class A Shares, Class C Shares, Institutional Shares and Class R6 Shares. All shares of the Fund have equal rights with respect to voting, except on class-specific matters. The investment objective of the Fund is to provide income and long-term capital appreciation.

Prior to June 29, 2020, the names of the Trust and Fund were Federated Equity Funds and Federated Global Strategic Value Dividend Fund, respectively.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles (GAAP).

Investment Valuation

In calculating its net asset value (NAV), the Fund generally values investments as follows:

■ Equity securities listed on an exchange or traded through a regulated market system are valued at their last reported sale price or official closing price in their principal exchange or market.

■ Shares of other mutual funds or non-exchange-traded investment companies are valued based upon their reported NAVs.

■ Derivative contracts listed on exchanges are valued at their reported settlement or closing price, except that options are valued at the mean of closing bid and asked quotations.

■ Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Fund’s Board of Trustees (the “Trustees”).

■ Fixed-income securities are fair valued using price evaluations provided by a pricing service approved by the Fund’s Trustees.

■ For securities that are fair valued in accordance with procedures established by and under the general supervision of the Trustees, certain factors may be considered such as: the last traded or purchase price of the security, information obtained by contacting the issuer or dealers, analysis of the issuer’s financial statements or other available documents, fundamental analytical data, the nature and duration of restrictions on disposition, the movement of the market in which the security is normally traded, public trading in similar securities or derivative contracts of the issuer or comparable issuers, movement of a relevant index, or other factors including but not limited to industry changes and relevant government actions.

Annual Shareholder Report

If any price, quotation, price evaluation or other pricing source is not readily available when the NAV is calculated, if the Fund cannot obtain price evaluations from a pricing service or from more than one dealer for an investment within a reasonable period of time as set forth in the Fund’s valuation policies and procedures, or if information furnished by a pricing service, in the opinion of the valuation committee (“Valuation Committee”), is deemed not representative of the fair value of such security, the Fund uses the fair value of the investment determined in accordance with the procedures described below. There can be no assurance that the Fund could obtain the fair value assigned to an investment if it sold the investment at approximately the time at which the Fund determines its NAV per share, and the actual value obtained could be materially different.

Fair Valuation and Significant Events Procedures

The Trustees have ultimate responsibility for determining the fair value of investments for which market quotations are not readily available. The Trustees have appointed a Valuation Committee comprised of officers of the Fund, Federated Equity Management Company of Pennsylvania (the “Adviser”) and certain of the Adviser’s affiliated companies to assist in determining fair value and in overseeing the calculation of the NAV. The Trustees have also authorized the use of pricing services recommended by the Valuation Committee to provide fair value evaluations of the current value of certain investments for purposes of calculating the NAV. The Valuation Committee employs various methods for reviewing third-party pricing-service evaluations including periodic reviews of third-party pricing services’ policies, procedures and valuation methods (including key inputs, methods, models and assumptions), transactional back-testing, comparisons of evaluations of different pricing services, and review of price challenges by the Adviser based on recent market activity. In the event that market quotations and price evaluations are not available for an investment, the Valuation Committee determines the fair value of the investment in accordance with procedures adopted by the Trustees. The Trustees periodically review and approve the fair valuations made by the Valuation Committee and any changes made to the procedures.

Factors considered by pricing services in evaluating an investment include the yields or prices of investments of comparable quality, coupon, maturity, call rights and other potential prepayments, terms and type, reported transactions, indications as to values from dealers and general market conditions. Some pricing services provide a single price evaluation reflecting the bid-side of the market for an investment (a “bid” evaluation). Other pricing services offer both bid evaluations and price evaluations indicative of a price between the prices bid and asked for the investment (a “mid” evaluation). The Fund normally uses bid evaluations for any U.S. Treasury and Agency securities, mortgage-backed securities and municipal securities. The Fund normally uses mid evaluations for any other types of fixed-income securities and any OTC derivative contracts. In the event that market quotations and price evaluations are not available for an investment, the fair value of the investment is determined in accordance with procedures adopted by the Trustees.

The Trustees also have adopted procedures requiring an investment to be priced at its fair value whenever the Adviser determines that a significant event affecting the value of the investment has occurred between the time as of which the price of the investment would otherwise be determined and the time as of which the NAV is computed. An event is considered significant if there is both an affirmative expectation

Annual Shareholder Report

that the investment’s value will change in response to the event and a reasonable basis for quantifying the resulting change in value. Examples of significant events that may occur after the close of the principal market on which a security is traded, or after the time of a price evaluation provided by a pricing service or a dealer, include:

■ With respect to securities traded principally in foreign markets, significant trends in U.S. equity markets or in the trading of foreign securities index futures contracts;

■ Political or other developments affecting the economy or markets in which an issuer conducts its operations or its securities are traded;

■ Announcements concerning matters such as acquisitions, recapitalizations, litigation developments, or a natural disaster affecting the issuer’s operations or regulatory changes or market developments affecting the issuer's industry.

The Trustees have adopted procedures whereby the Valuation Committee uses a pricing service to provide factors to update the fair value of equity securities traded principally in foreign markets from the time of the close of their respective foreign stock exchanges to the pricing time of the Fund. For other significant events, the Fund may seek to obtain more current quotations or price evaluations from alternative pricing sources. If a reliable alternative pricing source is not available, the Fund will determine the fair value of the investment in accordance with the fair valuation procedures approved by the Trustees. The Trustees have ultimate responsibility for any fair valuations made in response to a significant event.

Repurchase Agreements

The Fund may invest in repurchase agreements for short-term liquidity purposes. It is the policy of the Fund to require the other party to a repurchase agreement to transfer to the Fund’s custodian or sub-custodian eligible securities or cash with a market value (after transaction costs) at least equal to the repurchase price to be paid under the repurchase agreement. The eligible securities are transferred to accounts with the custodian or sub-custodian in which the Fund holds a “securities entitlement” and exercises “control” as those terms are defined in the Uniform Commercial Code. The Fund has established procedures for monitoring the market value of the transferred securities and requiring the transfer of additional eligible securities if necessary to equal at least the repurchase price. These procedures also allow the other party to require securities to be transferred from the account to the extent that their market value exceeds the repurchase price or in exchange for other eligible securities of equivalent market value.

The insolvency of the other party or other failure to repurchase the securities may delay the disposition of the underlying securities or cause the Fund to receive less than the full repurchase price. Under the terms of the repurchase agreement, any amounts received by the Fund in excess of the repurchase price and related transaction costs must be remitted to the other party.

The Fund may enter into repurchase agreements in which eligible securities are transferred into joint trading accounts maintained by the custodian or sub-custodian for investment companies and other clients advised by the Adviser and its affiliates. The Fund will participate on a pro rata basis with the other investment companies and clients in its share of the securities transferred under such repurchase agreements and in its share of proceeds from any repurchase or other disposition of such securities.

Annual Shareholder Report

Investment Income, Gains and Losses, Expenses and Distributions

Investment transactions are accounted for on a trade-date basis. Realized gains and losses from investment transactions are recorded on an identified-cost basis. Interest income and expenses are accrued daily. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Foreign dividends are recorded on the ex-dividend date or when the Fund is informed of the ex-dividend date. Distributions of net investment income, if any, are declared and paid monthly. Non-cash dividends included in dividend income, if any, are recorded at fair value. Amortization/accretion of premium and discount is included in investment income. Investment income, realized and unrealized gains and losses, and certain fund-level expenses are allocated to each class based on relative average daily net assets, except that select classes will bear certain expenses unique to those classes. The detail of the total fund expense waiver and reimbursements of $304,884 is disclosed in various locations in this Note 2 and Note 5. For the year ended October 31, 2020, transfer agent fees for the Fund were as follows:

| Transfer Agent

Fees Incurred | Transfer Agent

Fees Reimbursed |

| | |

| | |

| | |

| | |

| | |

Dividends are declared separately for each class. No class has preferential dividend rights; differences in per share dividend rates are generally due to differences in separate class expenses.

Other Service Fees

The Fund may pay other service fees up to 0.25% of the average daily net assets of the Fund’s Class A Shares and Class C Shares to unaffiliated financial intermediaries or to Federated Shareholder Services Company (FSSC) for providing services to shareholders and maintaining shareholder accounts. Subject to the terms described in the Expense Limitation note, FSSC may voluntarily reimburse the Fund for other service fees. For the year ended October 31, 2020, other service fees for the Fund were as follows:

| Other

Service Fees

Incurred |

| |

| |

| |

Federal Taxes

It is the Fund’s policy to comply with the Subchapter M provision of the Internal Revenue Code (the “Code”) and to distribute to shareholders each year substantially all of its income. Accordingly, no provision for federal income tax is necessary. As of and during the year ended October 31, 2020, the Fund did not have a liability for any

Annual Shareholder Report

uncertain tax positions. The Fund recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of Operations. As of October 31, 2020, tax years 2017 through 2020 remain subject to examination by the Fund’s major tax jurisdictions which include the United States of America and the Commonwealth of Massachusetts.

The Fund may be subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or gains are earned.

When-Issued and Delayed-Delivery Transactions

The Fund may engage in when-issued or delayed-delivery transactions. The Fund records when-issued securities on the trade date and maintains security positions such that sufficient liquid assets will be available to make payment for the securities purchased. Securities purchased on a when-issued or delayed-delivery basis are marked to market daily and begin earning interest on the settlement date. Losses may occur on these transactions due to changes in market conditions or the failure of counterparties to perform under the contract.

Foreign Exchange Contracts

The Fund may enter into foreign exchange contracts to manage currency risk. Purchased contracts are used to acquire exposure to foreign currencies, whereas, contracts to sell are used to hedge the Fund’s securities against currency fluctuations. Risks may arise upon entering into these transactions from the potential inability of counterparties to meet the terms of their commitments and from unanticipated movements in security prices or foreign exchange rates. The foreign exchange contracts are adjusted by the daily exchange rate of the underlying currency and any gains or losses are recorded for financial statement purposes as unrealized until the settlement date.

At October 31, 2020, the Fund had no outstanding foreign exchange contracts.

Foreign Currency Translation

The accounting records of the Fund are maintained in U.S. dollars. All assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the rates of exchange of such currencies against U.S. dollars on the date of valuation. Purchases and sales of securities, income and expenses are translated at the rate of exchange quoted on the respective date that such transactions are recorded. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities at period end, resulting from changes in the exchange rate.

Annual Shareholder Report

Other

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets, liabilities, expenses and revenues reported in the financial statements. Actual results could differ materially from those estimated. The Fund applies investment company accounting and reporting guidance.

3. SHARES OF BENEFICIAL INTEREST

The following tables summarize share activity:

| | |

| | | | |

| | | | |

Shares issued to shareholders in payment of distributions declared | | | | |

| | | | |

NET CHANGE RESULTING FROM CLASS A SHARE TRANSACTIONS | | | | |

| | |

| | | | |

| | | | |

Shares issued to shareholders in payment of distributions declared | | | | |

| | | | |

NET CHANGE RESULTING FROM CLASS C SHARE TRANSACTIONS | | | | |

| | |

| | | | |

| | | | |

Shares issued to shareholders in payment of distributions declared | | | | |

| | | | |

NET CHANGE RESULTING FROM INSTITUTIONAL SHARE TRANSACTIONS | | | | |

Annual Shareholder Report

| | |

| | | | |

| | | | |

Shares issued to shareholders in payment of distributions declared | | | | |

| | | | |

NET CHANGE RESULTING FROM

CLASS R6 SHARE TRANSACTIONS | | | | |

NET CHANGE RESULTING FROM

TOTAL FUND SHARE TRANSACTIONS | | | | |

4. FEDERAL TAX INFORMATION

The tax character of distributions as reported on the Statement of Changes in Net Assets for the years ended October 31, 2020 and 2019, was as follows:

As of October 31, 2020, the components of distributable earnings on a tax-basis were as follows:

Undistributed ordinary income | |

Net unrealized depreciation | |

Capital loss carryforwards | |

The difference between book-basis and tax-basis net unrealized depreciation is attributable to differing treatments for the deferral of losses on wash sales.

At October 31, 2020, the cost of investments for federal tax purposes was $2,150,971. The net unrealized depreciation of investments for federal tax purposes was $118,471. This consists of net unrealized appreciation from investments for those securities having an excess of value over cost of $95,198 and net unrealized depreciation from investments for those securities having an excess of cost over value of $213,669.

As of October 31, 2020, the Fund had a capital loss carryforward of $207,413 which will reduce the Fund’s taxable income arising from future net realized gains on investments, if any, to the extent permitted by the Code, thereby reducing the amount of distributions to shareholders which would otherwise be necessary to relieve the Fund of any liability for federal income tax. Pursuant to the Code, these net capital losses retain their character as either short-term or long-term and do not expire.

The following schedule summarizes the Fund’s capital loss carryforwards:

Annual Shareholder Report

5. INVESTMENT ADVISER FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Investment Adviser Fee

The advisory agreement between the Fund and the Adviser provides for an annual fee equal to 0.75% of the Fund’s average daily net assets. Subject to the terms described in the Expense Limitation note, the Adviser may voluntarily choose to waive any portion of its fee and/or reimburse certain operating expenses of the Fund. For the year ended October 31, 2020, the Adviser voluntarily waived $14,400 of its fee and voluntarily reimbursed $356 of transfer agent fees and $290,110 of other operating expenses.

The Adviser has agreed to reimburse the Fund for certain investment adviser fees as a result of transactions in other affiliated investment companies. For the year ended October 31, 2020, the Adviser reimbursed $18.

Administrative Fee

Federated Administrative Services (FAS), under the Administrative Services Agreement, provides the Fund with administrative personnel and services. For purposes of determining the appropriate rate breakpoint, “Investment Complex” is defined as all of the Federated Hermes Funds subject to a fee under the Administrative Services Agreement. The fee paid to FAS is based on the average daily net assets of the Investment Complex as specified below:

| Average Daily Net Assets

of the Investment Complex |

| on assets up to $50 billion |

| on assets over $50 billion |

Subject to the terms described in the Expense Limitation note, FAS may voluntarily choose to waive any portion of its fee. For the year ended October 31, 2020, the annualized fee paid to FAS was 0.103% of average daily net assets of the Fund.

In addition, FAS may charge certain out-of-pocket expenses to the Fund.

Distribution Services Fee

The Fund has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the Act. Under the terms of the Plan, the Fund will compensate Federated Securities Corp. (FSC), the principal distributor, from the daily net assets of the Fund’s Class A Shares and Class C Shares to finance activities intended to result in the sale of these shares. The Plan provides that the Fund may incur distribution expenses at the following percentages of average daily net assets annually to compensate FSC:

| Percentage of Average Daily

Net Assets of Class |

| |

| |

Annual Shareholder Report

Subject to the terms described in the Expense Limitation note, FSC may voluntarily choose to waive any portion of its fee. For the year ended October 31, 2020, distribution services fees for the Fund were as follows:

| Distribution

Services Fees

Incurred |

| |

When FSC receives fees, it may pay some or all of them to financial intermediaries whose customers purchase shares. For the year ended October 31, 2020, FSC retained $61 of fees paid by the Fund. For the year ended October 31, 2020, the Fund’s Class A Shares did not incur a distribution services fee; however, it may begin to incur this fee upon approval of the Trustees.

Sales Charges

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. They are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. For the year ended October 31, 2020, FSC retained $45 in sales charges from the sale of Class A Shares.

Other Service Fees

For the year ended October 31, 2020, FSSC received $306 of other service fees disclosed in Note 2.

Expense Limitation

The Adviser and certain of its affiliates (which may include FSC, FAS and FSSC) on their own initiative have agreed to waive certain amounts of their respective fees and/or reimburse expenses. Total annual fund operating expenses (as shown in the financial highlights, excluding tax reclaim recovery expenses, interest expense, extraordinary expenses and proxy-related expenses paid by the Fund, if any) paid by the Fund’s Class A Shares, Class C Shares, Institutional Shares and Class R6 Shares (after the voluntary waivers and/or reimbursements) will not exceed 1.10%, 1.89%, 0.85% and 0.84% (the “Fee Limit”), respectively, up to but not including the later of (the “Termination Date”): (a) January 1, 2021; or (b) the date of the Fund’s next effective Prospectus. While the Adviser and its applicable affiliates currently do not anticipate terminating or increasing these arrangements prior to the Termination Date, these arrangements may only be terminated or the Fee Limit increased prior to the Termination Date with the agreement of the Trustees.

Directors’/Trustees’ and Miscellaneous Fees

Certain Officers and Trustees of the Fund are Officers and Directors or Trustees of certain of the above companies. To efficiently facilitate payment, Independent Directors’/Trustees’ fees and certain expenses related to conducting meetings of the Directors/Trustees and other miscellaneous expenses are paid by an affiliate of the Adviser which in due course are reimbursed by the Fund. These expenses related to conducting meetings of the Directors/Trustees and other miscellaneous expenses may be included in Accrued and Miscellaneous Expenses on the Statement of Assets and Liabilities and Statement of Operations, respectively.

Annual Shareholder Report

Affiliated Shares of Beneficial Interest

As of October 31, 2020, a majority of the shares of beneficial interest outstanding are owned by an affiliate of the Adviser.

6. Investment TRANSACTIONS

Purchases and sales of investments, excluding long-term U.S. government securities and short-term obligations, for the year ended October 31, 2020, were as follows:

7. CONCENTRATION OF RISK

The Fund invests in securities of non-U.S. issuers. Political or economic developments may have an effect on the liquidity and volatility of portfolio securities and currency holdings. The Fund may invest a portion of its assets in securities of companies that are deemed by the Fund’s management to be classified in similar business sectors. Economic developments may have an effect on the liquidity and volatility of the portfolio securities.

8. Line of cREDIT

The Fund participates with certain other Federated Hermes Funds, on a several basis, in an up to $500,000,000 unsecured, 364-day, committed, revolving line of credit (LOC) agreement dated June 24, 2020. The LOC was made available to temporarily finance the repurchase or redemption of shares of the Fund, failed trades, payment of dividends, settlement of trades and for other short-term, temporary or emergency general business purposes. The Fund cannot borrow under the LOC if an inter-fund loan is outstanding. The Fund’s ability to borrow under the LOC also is subject to the limitations of the Act and various conditions precedent that must be satisfied before the Fund can borrow. Loans under the LOC are charged interest at a fluctuating rate per annum equal to the highest, on any day, of (a) (i) the federal funds effective rate, (ii) the one month London Interbank Offered Rate (LIBOR), or a replacement rate as appropriate, and (iii) 0.0%, plus (b) a margin. Any fund eligible to borrow under the LOC pays its pro rata share of an upfront fee, and its pro rata share of a commitment fee based on the amount of the lenders’ commitment that has not been utilized, quarterly in arrears and at maturity. As of October 31, 2020, the Fund had no outstanding loans. During the year ended October 31, 2020, the Fund did not utilize the LOC.

9. INTERFUND LENDING

Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the Fund, along with other funds advised by subsidiaries of Federated Hermes, Inc., may participate in an interfund lending program. This program provides an alternative credit facility allowing the Fund to borrow from other participating affiliated funds. As of October 31, 2020, there were no outstanding loans. During the year ended October 31, 2020, the program was not utilized.

Annual Shareholder Report

10. OTHER MATTERS

An outbreak of respiratory disease caused by a novel coronavirus was first detected in China in late 2019 and subsequently spread globally. As of the date of the issuance of these financial statements, this coronavirus has resulted in closing borders, enhanced health screenings, healthcare service preparation and delivery, quarantines, cancellations, and disruptions to supply chains, workflow operations and consumer activity, as well as general concern and uncertainty. The impact of this coronavirus may be short-term or may last for an extended period of time and has resulted in a substantial economic downturn. Health crises caused by outbreaks, such as the coronavirus outbreak, may exacerbate other pre-existing political, social and economic risks. The impact of this outbreak, and other epidemics and pandemics that may arise in the future, could continue to negatively affect the worldwide economy, as well as the economies of individual countries, individual companies (including certain Fund service providers and issuers of the Fund’s investments) and the markets in general in significant and unforeseen ways. Any such impact could adversely affect the Fund’s performance.

11. SUBSEQUENT EVENT

On November 11, 2020, the Trustees of the Trust approved a Plan of Liquidation for the Fund pursuant to which the Fund will be liquidated on or about the close of business on January 22, 2021.

12. FEDERAL TAX INFORMATION (UNAUDITED)

For the fiscal year ended October 31, 2020, 100.0% of total ordinary income distributions made by the Fund are qualifying dividends which may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Act of 2003. Complete information is reported in conjunction with the reporting of your distributions on Form 1099-DIV.

Of the ordinary income distributions made by the Fund during the year ended October 31, 2020, 56.82% qualify for the dividend received deduction available to corporate shareholders.

If the Fund meets the requirements of Section 853 of the Code, the Fund will pass through to its shareholders credits for foreign taxes paid. For the fiscal year ended October 31, 2020, the Fund derived $52,354 of gross income from foreign sources and paid foreign taxes of $5,964.

Annual Shareholder Report

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Federated Hermes Equity Funds and Shareholders of Federated HERMES Global Strategic Value Dividend Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of the Federated Hermes Global Strategic Value Dividend Fund (formerly, Federated Global Strategic Value Dividend Fund) (the “Fund”), a portfolio of Federated Hermes Equity Funds (formerly Federated Equity Funds), as of October 31, 2020, the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the related notes (collectively, the “financial statements”) and the financial highlights for each of the years or periods ended in the four-year period ended October 31, 2020. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of October 31, 2020, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years or periods in the four-year period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

Annual Shareholder Report

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of October 31, 2020, by correspondence with the custodians. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more of Federated Hermes’ investment companies since 2006.

Boston, Massachusetts

December 22, 2020

Annual Shareholder Report

Shareholder Expense Example (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (“loads”) on purchase or redemption payments; and (2) ongoing costs, including management fees and to the extent applicable, distribution (12b-1) fees and/or other service fees and other Fund expenses. This Example is intended to help you to understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2020 to October 31, 2020.

ACTUAL EXPENSES

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are required to be provided to enable you to compare the ongoing costs of investing in the Fund with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Annual Shareholder Report

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges on purchase or redemption payments. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| Beginning

Account Value

5/1/2020 | Ending

Account Value

10/31/2020 | Expenses Paid

During Period1 |

| | | |

| | | |

| | | |

| | | |

| | | |

Hypothetical (assuming a 5% return

before expenses): | | | |

| | | |

| | | |

| | | |

| | | |

1

Expenses are equal to the Fund’s annualized net expense ratios, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half-year period). The annualized net expense ratios are as follows:

Annual Shareholder Report

Board of Trustees and Trust Officers

The Board of Trustees is responsible for managing the Trust’s business affairs and for exercising all the Trust’s powers except those reserved for the shareholders. The following tables give information about each Trustee and the senior officers of the Fund. Where required, the tables separately list Trustees who are “interested persons” of the Fund (i.e., “Interested” Trustees) and those who are not (i.e., “Independent” Trustees). Unless otherwise noted, the address of each person listed is 1001 Liberty Avenue, Pittsburgh, PA 15222. The address of all Independent Trustees listed is 4000 Ericsson Drive, Warrendale, PA 15086-7561; Attention: Mutual Fund Board. As of December 31, 2019, the Trust comprised 9 portfolio(s), and the Federated Hermes Fund Family consisted of 41 investment companies (comprising 135 portfolios). Unless otherwise noted, each Officer is elected annually. Unless otherwise noted, each Trustee oversees all portfolios in the Federated Hermes Fund Family and serves for an indefinite term. The Fund’s Statement of Additional Information includes additional information about Trust Trustees and is available, without charge and upon request, by calling 1-800-341-7400.

Interested TRUSTEES Background

Name

Birth Date

Positions Held with Trust

Date Service Began | Principal Occupation(s) for Past Five Years,

Other Directorships Held and Previous Position(s) |

J. Christopher Donahue*

Birth Date: April 11, 1949

President and Trustee

Indefinite Term

Began serving:

September 1999 | Principal Occupations: Principal Executive Officer and President of certain of the Funds in the Federated Hermes Fund Family; Director or Trustee of the Funds in the Federated Hermes Fund Family; President, Chief Executive Officer and Director, Federated Hermes, Inc.; Chairman and Trustee, Federated Investment Management Company; Trustee, Federated Investment Counseling; Chairman and Director, Federated Global Investment Management Corp.; Chairman and Trustee, Federated Equity Management Company of Pennsylvania; Trustee, Federated Shareholder Services Company; Director, Federated Services Company.

Previous Positions: President, Federated Investment Counseling; President and Chief Executive Officer, Federated Investment Management Company, Federated Global Investment Management Corp. and Passport Research, Ltd; Chairman, Passport Research, Ltd. |

Annual Shareholder Report

Name Birth Date Positions Held with Trust Date Service Began | Principal Occupation(s) for Past Five Years, Other Directorships Held and Previous Position(s) |

John B. Fisher*

Birth Date: May 16, 1956

Trustee

Indefinite Term

Began serving: May 2016 | Principal Occupations: Principal Executive Officer and President of certain of the Funds in the Federated Hermes Fund Family; Director or Trustee of certain of the Funds in the Federated Hermes Fund Family; Vice President, Federated Hermes, Inc.; President, Director/Trustee and CEO, Federated Advisory Services Company, Federated Equity Management Company of Pennsylvania, Federated Global Investment Management Corp., Federated Investment Counseling, Federated Investment Management Company; President of some of the Funds in the Federated Hermes Fund Family and Director, Federated Investors Trust Company.