UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04033

Sit Mutual Funds II, Inc.

(Exact name of registrant as specified in charter)

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Address of principal executive offices)

Paul E. Rasmussen, VP Treasurer

Sit Mutual Funds, Inc.

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Copy to:

Mike Radmer, Esq.

Dorsey & Whitney

Suite 1500

50 South Sixth Street

Minneapolis, MN 55402-1498

Registrant’s telephone number, including area code:

(612) 332-3223

Date of fiscal year end: March 31, 2018

Date of reporting period: March 31, 2018

| Item 1: | Report to Stockholders |

|

Sit Mutual Funds BOND FUNDS ANNUAL REPORT TABLE OF CONTENTS |

This document must be preceded or accompanied by a Prospectus.

CHAIRMAN’S LETTER

May 4, 2018

Dear fellow shareholders:

The last year provided fixed income investors much to chew on.

Although it still remains accommodative at present, the U.S. Federal Reserve (Fed) moved towards a more neutral monetary policy stance as they balance their dual mandates of inflation and unemployment. Economic growth was strong with quarterly ranges of 2.9-3.2% for the last three quarters of calendar 2017 after a modest increase of 1.2% in the first quarter of last year. Inflation approached the Fed’s target of 2% during the past year, while the labor market remains strong but has yet to fuel much inflation.

In Washington, D.C., policy makers passed a signature piece of legislation with the Tax Cut and Jobs Act (TCJA), the first significant tax reform in over 30 years for the United States. Combining TCJA with overall economic activity and both current and projected monetary policy changes, resulted in a significantly flatter yield curve.

Federal Reserve

The Fed moved to normalize monetary policy by accelerating the pace of short-term interest rate increases and initiating the removal of multiple rounds of quantitative easing that ultimately increased the size of the Fed’s balance sheet from modestly less than $1 trillion early in 2008 to approximately $4.5 trillion by 2015. Furthermore, the Fed experienced a change in leadership as President Trump nominated Jerome “Jay” Powell to replace Janet Yellen at the end of her term in February 2018.

In terms of raising rates, the Fed increased the Target Federal Funds Rate a total of three times in 2017 at its meetings in March, June, and December and once so far in 2018 at its March meeting, a marked increase in pace after a single 0.25% increase in the Target Federal Funds Rate each in 2016 and 2015. The current Federal Funds Target Rate is a range of 1.50-1.75% as of March 2018 versus the near-zero range of 0-0.25% as recently as November 2015. Remember, the Federal Funds rate is the rate at which banks lend excess reserves held at the Federal Reserve to other banks on an overnight basis. The Fed sets the target rate, which in turn is highly correlated with other short-term interest rates in fixed income markets.

The Fed first announced that it may begin reducing its balance sheet at its June 2017 meeting. Soon thereafter, at its September 2017 meeting, the Fed announced it would initiate this balance sheet normalization program in October 2017 by decreasing the reinvestment of principal payments from securities. The pace began slowly with a $10 billion balance sheet reduction in October 2017 but is scheduled to progressively increase to $50 billion per month by October 2018. The normalization of its balance sheet will take years, not months, but it does mark a return towards a more neutral policy stance.

With respect to the change in leadership at the Fed, Powell had previously served as the Fed’s Vice Chairman under Yellen and as a member of the Fed’s Board of Governors since 2012. The market generally expects Chairman Powell to continue on the path initiated by Chair Yellen, at least for the time being. However, it should be noted that Chairman Powell is not a career economist but rather has spent a significant portion of his career in the investment banking industry and a few years at the Treasury in addition to his experience

at the Fed. As a result, some market participants expect him to be modestly more pro-business in his stance than was Chair Yellen.

Tax Reform

Much of the political discourse in 2017 centered around tax reform. After a failed attempt at health care reform in the first half of 2017, policy makers moved towards tax reform. As the year progressed, market participants possessed varying degrees of confidence that some form of tax reform would pass. When the House passed its tax reform bill in mid-November 2017, the market became increasingly confident tax reform may pass by year end. Ultimately, the final version of tax reform was signed into law by President Trump on December 22, 2017.

Significant provisions of corporate tax reform included a reduction in the tax rate to 21% from 35%, a repatriation tax on foreign earnings of 8% (15.5% for cash), full expensing of most tangible non-real property for a limited time, and a repeal of the corporate alternative minimum tax. Individuals saw less significant tax changes including numerous bracket changes and modest rate decreases combined with an increase in the standard deduction to partially offset the elimination or reduction of many deductions. Tax reform should stimulate economic growth, at least over the near term. However, it will also significantly increase the deficit before accounting for any potential offsets from increased economic growth on future tax collections.

The initial version of tax reform passed by the House contained many concerning provisions for the tax-exempt segment of fixed income markets. Specifically, the initial House version contained a provision to eliminate private activity bonds as well as advanced refunding transactions. By late December many issuers had rushed to market over fears their tax-exempt status could be lost, resulting in record monthly municipal supply in excess of $60 billion in December 2017, topping the previous record of nearly $55 billion established in December 1985, just before the last version of tax reform was implemented. The final version passed and signed into law in late December did eliminate tax-exempt advanced refunding transactions but maintained the tax-exempt status of private activity bonds.

Yield Curve

The yield curve flattened dramatically over the last year as the Fed’s actions to raise short-term interest rates combined with confidence that the economy, aided by the recent fiscal stimulus from the TCJA, would remain on a solid growth trajectory for the short-to-intermediate term. Moreover, the yield curve was likely impacted by the expectation that the Fed continue a gradual pace of short-term rate increases throughout 2018 and into 2019.

The Fed’s balance sheet reduction also impacted the yield curve. The Fed had total maturities of $156 billion in the six months since starting balance sheet reduction and the Funds’ fiscal year-end in March versus a scheduled balance sheet reduction of $54 billion over the same time period, for net remaining reinvestment of $102 billion. Over 80% of the Fed’s $102 billion purchases over this time

| | | | |

| | | | |

2 | | | SIT MUTUAL FUNDS ANNUAL REPORT | |

period were in new securities with maturities of 7 years or less. The balance sheet reduction over the last 6 months effectively increased the public supply of U.S. Treasury securities by $54 billion, 80% of which or approximately $43 billion was in maturities less than or equal to 7-years, contributing to shorter-term rates increasing relative to longer-term rates.

Specifically, the spread between 2-year and 30-year U.S. Treasury bonds decreased by over 1 percentage point over the last 12 months to 70 basis points at the end of March 2018 versus 175 basis points the previous March. This was achieved by a dramatic increase in short-term rates as the 2-year U.S. Treasury yield increased to 2.27% from 1.26% and a slight decrease in long-term rates as the 30-year U.S. Treasury yield decreased to 2.97% from 3.01%.

Strategy

We have positioned our funds to remain resilient in the face of continued increases in short-term interest rates and stable to modestly increasing longer-term interest rates. We believe that they are positioned to withstand rising interest rates while continuing to earn substantial levels of current income.

The U.S. Government Securities Fund remains focused on seasoned, high coupon agency-backed securities which should continue to provide long-term income stability and principal preservation as mortgage rates increase from near all-time lows. The Sit

Quality Income Fund continues to focus on shorter than benchmark duration using a combination of government securities, predominantly agency MBS, combined with attractive short-term asset-backed securities, corporate bonds, and taxable municipal securities, including select floating rate securities.

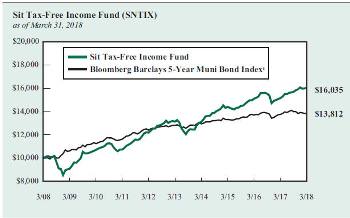

The tax-exempt fixed income strategy for both the Tax-Free Income Fund and the Minnesota Tax-Free Income Fund will continue to focus heavily on the use of high coupon bonds and bonds structured with put, call, sinking fund, and prepayment provisions that provide regular cash flow. Our investment strategy focuses on income, which is the primary source of return over longer periods of time. We believe that this will continue to deliver positive relative performance. We continue to focus on sectors and security structures that provide incremental yield, while using diversification to help manage credit risk.

We appreciate your continued interest in the Sit family of funds.

With best wishes,

Roger J. Sit

Chairman and President Sit Mutual Funds

|

|

| |

Sit U.S. Government Securities Fund |

OBJECTIVE & STRATEGY

The objective of the U.S. Government Securities Fund is to provide high current income and safety of principal, which it seeks to attain by investing solely in debt obligations issued, guaranteed or insured by the U.S. government or its agencies or its instrumentalities. Agency mortgage securities and U.S. Treasury securities are the principal holdings in the Fund. The mortgage securities that the Fund purchases consist of pass-through securities including those issued by Government National Mortgage Association (GNMA), Federal National Mortgage Association (FNMA), and Federal Home Loan Mortgage Corporation (FHLMC).

The Sit U.S. Government Securities Fund provided a return of +0.76% during the year ending March 31, 2018, compared to the return of the Bloomberg Barclays Intermediate Government Bond Index of -0.14%. The Fund’s 30-day SEC yield was 2.69% and its 12-month distribution rate was 1.67%.

During the 12-month period, the Fund benefited from the consistent relatively high level of income provided by its holdings in higher coupon government agency mortgages. The Fund uses Treasury options to reduce interest rate risk. The use of options was successful in providing stability to the Fund’s net asset value and contributed positively to the return. The Federal Reserve hiked the Fed Funds rate three times over the 12-month period as it continued to normalize monetary policy. In addition, the Federal Reserve began its plan to normalize its balance sheet. While the effects have been minimal, we believe the impact will be amplified in the upcoming year. We expect interest rates to move higher with short term rates outpacing long term rates. The new Federal Reserve Chairman, Jerome Powell, held his first press conference and was well received by investors. We expect the Federal Reserve to maintain a methodical approach for normalizing its balance sheet and gradually raising interest rates over time. The Fund’s high coupon mortgages should continue to produce an income advantage in this environment as prepayments are likely to remain stable or potentially slow.

We continue to position the Fund defensively against rising short-term interest rates while maintaining the Fund’s focus on seasoned, high coupon agency mortgage securities which provide a high level of income with relatively stable prices. This high level of income and stability of principal has been a fundamental focus of the Fund since its inception.

Michael C. Brilley Bryce A. Doty, CFA

Senior Portfolio Managers

Mark H. Book, CFA

Portfolio Manager

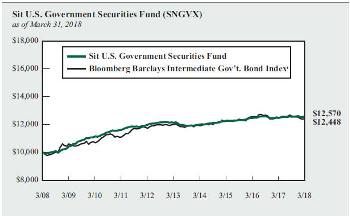

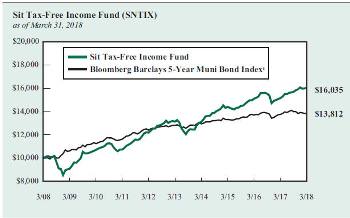

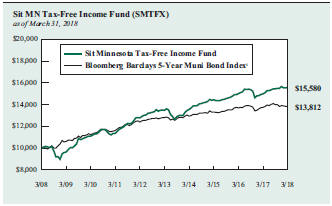

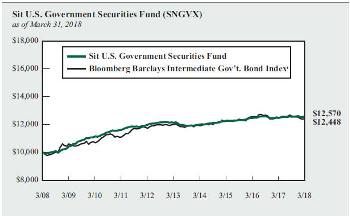

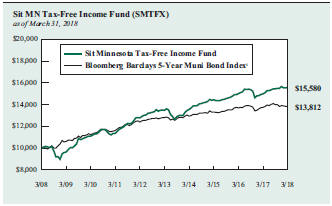

HYPOTHETICAL GROWTH OF $10,000

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter) as compared to the performance of the Bloomberg Barclays Intermediate Government Bond Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

1 The Bloomberg Barclays Intermediate Government Bond Index is a sub-index of the Bloomberg Barclays Government Bond Index covering issues with remaining maturities of between three and five years. The Bloomberg Barclays Government Bond Index is an index that measures the performance of all public U.S. government obligations with remaining maturities of one year or more. The returns include the reinvestment of income and do not include any transaction costs, management fees or other costs. It is not possible to invest directly in an index. This is the Fund’s primary index.

| | |

| Information on this page is unaudited. |

4 | | SIT MUTUAL FUNDS ANNUAL REPORT |

| | | | | | | | | | | | |

COMPARATIVE RATES OF RETURNS | |

as of March 31, 2018 | | | | | | | | | | | | |

| | | Sit U.S.

Government

Securities

Fund | | Bloomberg

Barclays

Inter. Gov’t

Bond Index1 | | Lipper

U.S.

Gov’t Fund

Index2 |

| | | |

One Year | | | 0.76 | % | | | -0.14 | % | | | 0.60 | % |

Five Years | | | 0.71 | | | | 0.75 | | | | 1.18 | |

Ten Years | | | 2.31 | | | | 2.21 | | | | 2.99 | |

Since Inception (6/2/87) | | | 5.26 | | | | 5.41 | | | | 5.30 | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains and all fee waivers. Without the fee waivers total return and yield figures would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for periods greater than one year are compounded average annual rates of return.

1 The Bloomberg Barclays Intermediate Government Bond Index is a sub-index of the Bloomberg Barclays Government Bond Index covering issues with remaining maturities of between three and five years. The Bloomberg Barclays Government Bond Index is an index that measures the performance of all public U.S. government obligations with remaining maturities of one year or more. The returns include the reinvestment of income and do not include any transaction costs, management fees or other costs. It is not possible to invest directly in an index.

2 The Lipper returns are obtained from Lipper Analytical Services, Inc., a large independent evaluator of mutual funds.

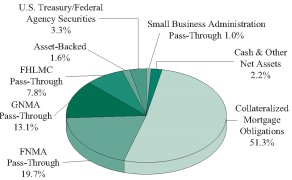

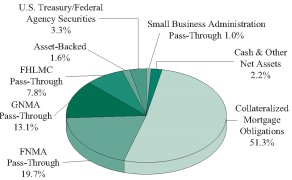

FUND DIVERSIFICATION

Based on total net assets as of March 31, 2018. Subject to change.

| | |

PORTFOLIO SUMMARY |

| |

Net Asset Value 3/31/18: | | $10.80 Per Share |

Net Asset Value 3/31/17: | | $10.90 Per Share |

Total Net Assets: | | $527.7 Million |

Effective Duration3: | | 0.8 Years |

3 Duration is a measure of estimated price sensitivity relative to changes in interest rates. Portfolios with longer durations are typically more sensitive to changes in interest rates. For example, if interest rates rise by 1%, the fair value of a security with an effective duration of 5 years would decrease by 5%, with all other factors being constant. The correlation between duration and price sensitivity is greater for securities rated investment-grade than it is for securities rated below investment-grade. Duration estimates are based on assumptions by the Adviser and are subject to a number of limitations. Effective duration is calculated based on historical price changes of securities held by the Fund, and therefore is a more accurate estimate of price sensitivity provided interest rates remain within their historical range.

| | | | |

ESTIMATED AVERAGE LIFE | |

| |

0-1 Year | | | 2.2 | % |

1-5 Years. | | | 96.4 | |

20+ Years | | | 1.4 | |

The table represents the Adviser’s estimates of the dollar weighted average life of the portfolio’s securities, which differ from their stated maturities. The Fund’s average stated maturity was 18.7 years as of March 31, 2018.

| | |

| Information on this page is unaudited. |

| MARCH 31, 2018 | | 5 |

SCHEDULE OF INVESTMENTS

March 31, 2018

Sit U.S. Government Securities Fund

| | | | | | | | | | |

Principal Amount ($) | | Coupon Rate (%) | | Maturity

Date | | | Fair Value ($) | |

| |

Mortgage Pass-Through Securities - 41.6% | | | | | |

Federal Home Loan Mortgage Corporation - 7.8% | | | | | |

240,924 | | 4.00 | | | 7/1/25 | | | | 248,395 | |

1,383,805 | | 5.00 | | | 5/1/42 | | | | 1,503,309 | |

1,340,108 | | 5.00 | | | 9/1/43 | | | | 1,467,768 | |

55,795 | | 5.82 | | | 10/1/37 | | | | 61,396 | |

814,816 | | 6.50 | | | 11/1/27 | | | | 917,628 | |

573,193 | | 6.50 | | | 12/1/34 | | | | 640,033 | |

2,396,592 | | 6.50 | | | 11/1/35 | | | | 2,698,991 | |

929,502 | | 6.50 | | | 11/1/37 | | | | 1,046,786 | |

1,097,512 | | 6.50 | | | 11/1/38 | | | | 1,235,995 | |

267,889 | | 6.88 | | | 2/17/31 | | | | 297,411 | |

73,192 | | 7.00 | | | 8/1/27 | | | | 75,717 | |

27,508 | | 7.00 | | | 10/1/27 | | | | 27,637 | |

1,210,984 | | 7.00 | | | 4/1/28 | | | | 1,317,069 | |

9,236,205 | | 7.00 | | | 12/1/31 | | | | 10,178,139 | |

1,100,756 | | 7.00 | | | 2/1/37 | | | | 1,250,355 | |

7,470,607 | | 7.00 | | | 10/1/37 | | | | 8,553,013 | |

646,622 | | 7.00 | | | 7/1/38 | | | | 722,153 | |

651,031 | | 7.00 | | | 8/1/38 | | | | 733,871 | |

3,626,318 | | 7.00 | | | 10/1/38 | | | | 4,110,361 | |

856,726 | | 7.00 | | | 1/1/39 | | | | 958,355 | |

97,677 | | 7.38 | | | 12/17/24 | | | | 103,611 | |

120,092 | | 7.50 | | | 1/1/31 | | | | 124,683 | |

456,538 | | 7.50 | | | 1/1/32 | | | | 513,019 | |

406,940 | | 7.50 | | | 8/1/32 | | | | 436,374 | |

62,003 | | 7.50 | | | 10/1/38 | | | | 66,201 | |

14,298 | | 7.95 | | | 10/1/25 | | | | 14,334 | |

18,514 | | 7.95 | | | 11/1/25 | | | | 18,561 | |

84,044 | | 8.00 | | | 5/1/31 | | | | 90,364 | |

78,844 | | 8.00 | | | 11/1/36 | | | | 89,697 | |

185,965 | | 8.00 | | | 1/1/37 | | | | 214,511 | |

286,984 | | 8.50 | | | 12/1/21 | | | | 303,592 | |

220,243 | | 8.50 | | | 6/20/27 | | | | 252,105 | |

51,504 | | 8.50 | | | 12/1/29 | | | | 55,945 | |

128,615 | | 8.50 | | | 3/1/31 | | | | 146,937 | |

18,047 | | 9.00 | | | 11/1/25 | | | | 18,486 | |

59,963 | | 9.00 | | | 3/20/27 | | | | 60,277 | |

188,702 | | 9.00 | | | 2/17/31 | | | | 189,075 | |

157,821 | | 9.00 | | | 5/1/31 | | | | 174,881 | |

52,681 | | 9.50 | | | 12/17/21 | | | | 52,591 | |

9,069 | | 10.00 | | | 9/1/20 | | | | 9,128 | |

25,672 | | 10.00 | | | 3/1/21 | | | | 25,890 | |

87,058 | | 10.00 | | | 3/17/25 | | | | 86,072 | |

20,228 | | 10.00 | | | 3/25/25 | | | | 20,101 | |

57,024 | | 10.00 | | | 7/1/30 | | | | 60,036 | |

10,927 | | 10.50 | | | 6/1/19 | | | | 11,011 | |

5,336 | | 11.00 | | | 8/25/20 | | | | 5,376 | |

| | | | | | | | | | |

| | | |

| | | | | | | | | 41,187,240 | |

| | | | | | | | | | |

| | | | | | | | | | |

Principal Amount ($) | | Coupon Rate (%) | | Maturity

Date | | | Fair Value ($) | |

| |

Federal National Mortgage Association - 19.7% | | | | | |

285 | | 3.21 | | | 3/1/19 | 1 | | | 278 | |

880,029 | | 5.50 | | | 12/1/32 | | | | 935,467 | |

428,171 | | 5.50 | | | 6/1/33 | | | | 453,918 | |

448,989 | | 5.61 | | | 11/1/22 | | | | 448,782 | |

3,442,063 | | 5.65 | | | 10/1/48 | | | | 3,715,764 | |

969,226 | | 5.93 | | | 5/1/35 | | | | 1,021,090 | |

2,863,342 | | 5.96 | | | 6/1/28 | | | | 3,275,847 | |

864,299 | | 6.00 | | | 11/1/34 | | | | 970,697 | |

313,056 | | 6.00 | | | 5/1/37 | | | | 349,850 | |

129,383 | | 6.00 | | | 9/1/37 | | | | 139,462 | |

265,267 | | 6.00 | | | 11/1/37 | | | | 276,715 | |

2,761,719 | | 6.00 | | | 4/1/38 | | | | 3,100,320 | |

2,943,657 | | 6.00 | | | 3/1/41 | | | | 3,310,538 | |

8,971,007 | | 6.00 | | | 5/1/41 | | | | 10,083,243 | |

2,799,380 | | 6.10 | | | 11/1/43 | | | | 3,077,165 | |

20,307 | | 6.50 | | | 1/1/22 | | | | 20,876 | |

2,452,252 | | 6.50 | | | 2/1/29 | | | | 2,736,660 | |

443,765 | | 6.50 | | | 3/1/29 | | | | 475,974 | |

5,917,526 | | 6.50 | | | 12/1/30 | | | | 6,603,831 | |

449,644 | | 6.50 | | | 6/1/31 | | | | 494,793 | |

67,708 | | 6.50 | | | 8/1/34 | | | | 73,073 | |

1,177,339 | | 6.50 | | | 10/1/36 | | | | 1,353,548 | |

1,317,645 | | 6.50 | | | 12/1/36 | | | | 1,476,016 | |

490,687 | | 6.50 | | | 1/1/39 | | | | 529,916 | |

6,349,168 | | 6.50 | | | 4/1/39 | | | | 7,138,867 | |

4,520,358 | | 6.50 | | | 6/1/40 | | | | 5,088,049 | |

2,156,179 | | 6.50 | | | 9/1/40 | | | | 2,537,771 | |

1,464,690 | | 6.75 | | | 6/1/32 | | | | 1,657,160 | |

1,519,181 | | 6.92 | | | 6/1/40 | | | | 1,671,022 | |

41,954 | | 1 Mo. Libor + 2.28, 6.95% | | | 8/1/21 | 1 | | | 41,044 | |

79,914 | | 7.00 | | | 9/1/21 | | | | 82,153 | |

142,555 | | 7.00 | | | 3/1/22 | | | | 148,808 | |

201,118 | | 7.00 | | | 6/1/22 | | | | 210,330 | |

67,337 | | 7.00 | | | 1/1/24 | | | | 70,771 | |

43,110 | | 7.00 | | | 2/1/26 | | | | 45,338 | |

112,491 | | 7.00 | | | 9/1/27 | | | | 119,622 | |

48,906 | | 7.00 | | | 10/1/27 | | | | 52,020 | |

236,410 | | 7.00 | | | 11/1/27 | | | | 258,178 | |

43,643 | | 7.00 | | | 1/1/28 | | | | 46,576 | |

49,562 | | 7.00 | | | 10/1/32 | | | | 53,696 | |

5,887,326 | | 7.00 | | | 12/1/32 | | | | 6,687,285 | |

108,191 | | 7.00 | | | 7/1/33 | | | | 118,083 | |

3,491,150 | | 7.00 | | | 12/1/33 | | | | 3,947,162 | |

142,588 | | 7.00 | | | 7/1/34 | | | | 160,452 | |

758,889 | | 7.00 | | | 3/1/37 | | | | 861,935 | |

1,202,573 | | 7.00 | | | 10/1/37 | | | | 1,385,105 | |

40,507 | | 7.00 | | | 12/1/37 | | | | 43,464 | |

788,740 | | 7.00 | | | 11/1/38 | | | | 920,675 | |

9,214,725 | | 7.00 | | | 3/1/39 | | | | 10,700,063 | |

1,055,794 | | 7.00 | | | 5/1/39 | | | | 1,199,923 | |

2,183,210 | | 7.00 | | | 1/1/40 | | | | 2,476,564 | |

829,233 | | 7.00 | | | 9/1/47 | | | | 904,728 | |

| | | | |

See accompanying notes to financial statements. | | | | |

6 | | | SIT MUTUAL FUNDS ANNUAL REPORT | |

| | | | | | | | | | |

Principal Amount ($) | | Coupon Rate (%) | | Maturity

Date | | | Fair Value ($) | |

46,442 | | 7.50 | | | 6/1/22 | | | | 48,339 | |

30,414 | | 7.50 | | | 8/1/22 | | | | 31,169 | |

40,914 | | 7.50 | | | 12/1/22 | | | | 42,346 | |

43,509 | | 7.50 | | | 3/1/23 | | | | 44,205 | |

266,744 | | 7.50 | | | 4/1/32 | | | | 298,563 | |

21,525 | | 7.50 | | | 8/1/32 | | | | 22,684 | |

134,035 | | 7.50 | | | 1/1/34 | | | | 145,050 | |

1,256,642 | | 7.50 | | | 10/1/37 | | | | 1,461,876 | |

2,318,478 | | 7.50 | | | 11/1/38 | | | | 2,637,740 | |

27,771 | | 7.61 | | | 7/20/30 | | | | 28,061 | |

84,916 | | 8.00 | | | 10/1/23 | | | | 88,316 | |

313,373 | | 8.00 | | | 6/1/25 | | | | 336,104 | |

9,591 | | 8.00 | | | 7/20/28 | | | | 9,683 | |

125,470 | | 8.00 | | | 2/1/31 | | | | 142,968 | |

104,107 | | 8.00 | | | 1/1/32 | | | | 115,151 | |

515,361 | | 8.00 | | | 11/1/37 | | | | 594,214 | |

374,543 | | 8.00 | | | 3/1/38 | | | | 439,931 | |

138,763 | | 8.09 | | | 11/15/31 | | | | 154,436 | |

15,871 | | 8.33 | | | 7/15/20 | | | | 16,313 | |

118,211 | | 8.50 | | | 11/1/26 | | | | 130,059 | |

121,111 | | 8.50 | | | 3/1/28 | | | | 134,175 | |

85,837 | | 8.50 | | | 10/1/28 | | | | 98,483 | |

43,384 | | 8.50 | | | 11/1/28 | | | | 48,471 | |

244,616 | | 8.50 | | | 4/1/29 | | | | 273,102 | |

52,644 | | 8.50 | | | 10/1/29 | | | | 53,197 | |

155,669 | | 8.50 | | | 7/1/30 | | | | 177,620 | |

84,005 | | 8.50 | | | 8/1/30 | | | | 100,554 | |

305,835 | | 8.50 | | | 4/1/32 | | | | 367,738 | |

455,198 | | 8.50 | | | 1/1/37 | | | | 547,636 | |

29,997 | | 9.00 | | | 9/1/24 | | | | 30,333 | |

17,425 | | 9.00 | | | 6/15/25 | | | | 17,772 | |

60,051 | | 9.00 | | | 6/1/30 | | | | 65,985 | |

53,529 | | 9.00 | | | 7/1/30 | | | | 55,826 | |

40,255 | | 9.00 | | | 10/1/30 | | | | 44,344 | |

183,042 | | 9.00 | | | 2/1/31 | | | | 209,312 | |

22,866 | | 9.00 | | | 7/1/31 | | | | 22,931 | |

73,906 | | 9.00 | | | 10/1/31 | | | | 85,781 | |

84,277 | | 9.00 | | | 8/1/37 | | | | 93,529 | |

24,382 | | 9.00 | | | 1/1/38 | | | | 24,611 | |

190,350 | | 9.00 | | | 2/1/38 | | | | 210,722 | |

32,688 | | 9.02 | | | 5/15/28 | | | | 33,419 | |

12,053 | | 9.24 | | | 3/15/22 | | | | 12,215 | |

40,517 | | 9.34 | | | 8/20/25 | | | | 43,274 | |

27,127 | | 9.50 | | | 3/1/20 | | | | 27,902 | |

34,028 | | 9.50 | | | 7/1/20 | | | | 35,386 | |

938 | | 9.50 | | | 12/15/20 | | | | 949 | |

2,095 | | 9.50 | | | 4/15/21 | | | | 2,188 | |

27,066 | | 9.50 | | | 8/1/24 | | | | 27,418 | |

23,422 | | 9.50 | | | 5/1/27 | | | | 24,415 | |

183,783 | | 9.50 | | | 5/1/29 | | | | 211,767 | |

51,499 | | 9.50 | | | 4/1/30 | | | | 58,570 | |

212,964 | | 9.50 | | | 8/1/31 | | | | 243,510 | |

2,640 | | 10.00 | | | 8/15/20 | | | | 2,675 | |

| | | | | | | | | | |

Principal Amount ($) | | Coupon Rate (%) | | Maturity

Date | | | Fair Value ($) | |

| | | |

56,520 | | 10.00 | | | 2/1/28 | | | | 63,020 | |

174,872 | | 10.00 | | | 6/1/30 | | | | 200,104 | |

7,909 | | 10.50 | | | 6/1/28 | | | | 7,996 | |

1,278 | | 10.91 | | | 7/15/20 | | | | 1,295 | |

| | | | | | | | | | |

| | | |

| | | | | | | | | 103,996,100 | |

| | | | | | | | | | |

Government National Mortgage Association - 13.1% | | | | | |

347,336 | | 4.00 | | | 12/15/24 | | | | 357,963 | |

775,592 | | 4.00 | | | 10/20/30 | | | | 804,087 | |

12,113,687 | | 4.00 | | | 8/20/31 | | | | 12,559,074 | |

1,032,618 | | 4.00 | | | 12/20/31 | | | | 1,070,607 | |

1,074,604 | | 4.25 | | | 10/20/31 | | | | 1,123,348 | |

545,011 | | 4.25 | | | 3/20/37 | | | | 569,763 | |

2,627,032 | | 4.75 | | | 9/20/31 | | | | 2,796,676 | |

103,380 | | 5.50 | | | 9/15/25 | | | | 113,162 | |

1,423,585 | | 5.50 | | | 5/15/29 | | | | 1,558,724 | |

3,288,653 | | 5.75 | | | 2/15/29 | | | | 3,613,338 | |

1,031,176 | | 5.75 | | | 10/20/31 | | | | 1,137,918 | |

695,630 | | 6.00 | | | 9/15/33 | | | | 772,648 | |

2,401,010 | | 6.00 | | | 12/15/40 | | | | 2,671,928 | |

662,983 | | 6.00 | | | 2/20/47 | | | | 729,845 | |

7,026,858 | | 6.00 | | | 7/20/47 | | | | 7,720,712 | |

97,601 | | 6.25 | | | 12/15/23 | | | | 109,149 | |

1,011,244 | | 6.25 | | | 4/15/29 | | | | 1,131,559 | |

224,431 | | 6.50 | | | 11/15/23 | | | | 237,267 | |

393,686 | | 6.50 | | | 4/15/24 | | | | 415,315 | |

1,245,901 | | 6.50 | | | 2/20/28 | | | | 1,399,218 | |

687,642 | | 6.50 | | | 2/20/29 | | | | 742,586 | |

1,396,461 | | 6.50 | | | 11/20/29 | | | | 1,569,681 | |

4,442,720 | | 6.50 | | | 2/15/35 | | | | 4,994,540 | |

54,243 | | 6.50 | | | 12/20/38 | | | | 56,272 | |

401,573 | | 6.50 | | | 1/20/39 | | | | 446,057 | |

309,868 | | 6.50 | | | 2/20/39 | | | | 348,905 | |

559,689 | | 6.50 | | | 4/20/39 | | | | 617,750 | |

823,988 | | 6.50 | | | 6/20/39 | | | | 923,295 | |

1,002,547 | | 6.50 | | | 8/20/39 | | | | 1,109,619 | |

659,159 | | 6.50 | | | 4/20/43 | | | | 731,590 | |

7,240,981 | | 7.00 | | | 8/15/29 | | | | 8,154,373 | |

7,458,459 | | 7.00 | | | 10/15/29 | | | | 8,428,688 | |

| | | | | | | | | | |

| | | |

| | | | | | | | | 69,015,657 | |

| | | | | | | | | | |

Small Business Administration - 1.0% | | | | | |

1,534,989 | | 5.33 | | | 8/25/36 | | | | 1,611,471 | |

3,663,164 | | 5.33 | | | 9/25/36 | | | | 3,837,228 | |

| | | | | | | | | | |

| | | |

| | | | | | | | | 5,448,699 | |

| | | | | | | | | | |

Total Mortgage Pass-Through Securities

(cost: $221,702,960) | | | | | | | 219,647,696 | |

| | | | | | | | | | |

| | | | |

See accompanying notes to financial statements. | | | | |

MARCH 31, 2018 | | | 7 | |

SCHEDULE OF INVESTMENTS

March 31, 2018

Sit U.S. Government Securities Fund (Continued)

| | | | | | | | | | |

Principal Amount ($) | | Coupon Rate (%) | | Maturity

Date | | | Fair Value ($) | |

U.S. Treasury / Federal Agency Securities - 3.3% | | | | | |

U.S. Treasury Bill: | | | | | | | | |

10,000,000 | | 1.50 | | | 4/5/18 | 6 | | | 9,998,333 | |

U.S. Treasury Strips: | | | | | | | | |

16,600,000 | | 2.92 | | | 5/15/44 | 6 | | | 7,626,314 | |

| | | | | | | | | | |

| | |

Total U.S. Treasury / Federal Agency Securities

(cost: $17,935,628) | | | | | | | 17,624,647 | |

| | | | | | | | | | |

| |

Collateralized Mortgage Obligations - 51.3% | | | | | |

Federal Home Loan Mortgage Corporation - 13.4% | | | | | |

2,158,584 | | 4.32 | | | 7/25/32 | 1 | | | 2,253,691 | |

755,993 | | 5.00 | | | 2/15/23 | | | | 792,167 | |

778,274 | | 5.55 | | | 5/15/38 | 1 | | | 832,410 | |

9,813 | | 6.00 | | | 9/15/21 | | | | 10,152 | |

1,633,461 | | 6.00 | | | 1/15/33 | | | | 1,863,600 | |

3,418,811 | | 6.00 | | | 9/15/42 | | | | 3,828,599 | |

48,419 | | 6.25 | | | 5/15/29 | | | | 52,094 | |

43,067 | | 6.50 | | | 12/15/21 | | | | 43,524 | |

225,916 | | 6.50 | | | 9/15/23 | | | | 241,063 | |

82,901 | | 6.50 | | | 3/15/24 | | | | 88,932 | |

25,934 | | 6.50 | | | 2/15/30 | | | | 29,228 | |

517,334 | | 6.50 | | | 8/15/31 | | | | 586,291 | |

432,813 | | 6.50 | | | 1/15/32 | | | | 489,598 | |

114,145 | | 6.50 | | | 3/15/32 | | | | 128,278 | |

540,517 | | 6.50 | | | 6/25/32 | | | | 593,652 | |

26,373 | | 6.50 | | | 7/15/32 | | | | 28,961 | |

7,685,023 | | 6.50 | | | 5/15/33 | | | | 8,579,702 | |

1,335,323 | | 6.50 | | | 5/15/35 | | | | 1,501,764 | |

735,089 | | 6.50 | | | 8/15/39 | | | | 822,282 | |

750,188 | | 6.50 | | | 2/25/43 | | | | 855,298 | |

718,986 | | 6.50 | | | 3/25/43 | | | | 796,905 | |

890,300 | | 6.50 | | | 7/25/43 | | | | 1,009,421 | |

670,254 | | 6.50 | | | 9/25/43 | 1 | | | 756,124 | |

771,245 | | 6.50 | | | 10/25/43 | | | | 869,126 | |

6,375,775 | | 6.50 | | | 8/15/45 | | | | 7,447,756 | |

30,668 | | 6.70 | | | 9/15/23 | | | | 33,002 | |

226,901 | | 6.95 | | | 3/15/28 | | | | 248,086 | |

516 | | 7.00 | | | 12/15/20 | | | | 521 | |

7,023 | | 7.00 | | | 3/15/21 | | | | 7,175 | |

4,657 | | 7.00 | | | 9/15/21 | | | | 4,657 | |

44,616 | | 7.00 | | | 10/15/22 | | | | 47,425 | |

14,519 | | 7.00 | | | 11/15/22 | | | | 15,356 | |

482,649 | | 7.00 | | | 3/25/23 | | | | 509,574 | |

19,774 | | 7.00 | | | 4/15/23 | | | | 21,125 | |

84,499 | | 7.00 | | | 7/15/23 | | | | 90,242 | |

130,301 | | 7.00 | | | 1/15/24 | | | | 139,450 | |

103,816 | | 7.00 | | | 3/15/24 | | | | 111,401 | |

130,297 | | 7.00 | | | 8/15/25 | | | | 141,844 | |

133,057 | | 7.00 | | | 9/15/26 | | | | 145,593 | |

189,418 | | 7.00 | | | 6/15/29 | | | | 210,286 | |

1,702,106 | | 7.00 | | | 8/15/29 | | | | 1,807,977 | |

564,157 | | 7.00 | | | 10/20/29 | | | | 638,324 | |

1,367,081 | | 7.00 | | | 11/15/29 | | | | 1,432,469 | |

| | | | | | | | | | |

Principal Amount ($) | | Coupon Rate (%) | | Maturity

Date | | | Fair Value ($) | |

| | | |

3,164,205 | | 7.00 | | | 12/15/29 | | | | 3,283,028 | |

189,852 | | 7.00 | | | 1/15/30 | | | | 213,366 | |

352,244 | | 7.00 | | | 10/15/30 | | | | 399,504 | |

199,166 | | 7.00 | | | 7/15/31 | | | | 222,935 | |

157,764 | | 7.00 | | | 4/15/32 | | | | 174,469 | |

848,951 | | 7.00 | | | 5/15/32 | | | | 957,809 | |

4,667,819 | | 7.00 | | | 8/15/41 | | | | 5,099,987 | |

2,673,985 | | 7.00 | | | 2/25/43 | | | | 3,048,318 | |

506,231 | | 7.00 | | | 3/25/43 | | | | 567,494 | |

1,083,954 | | 7.00 | | | 7/25/43 | | | | 1,253,781 | |

2,204,935 | | 7.00 | | | 9/25/43 | | | | 2,548,837 | |

45,510 | | 7.50 | | | 10/15/21 | | | | 47,817 | |

153,845 | | 7.50 | | | 7/15/22 | | | | 162,879 | |

221,306 | | 7.50 | | | 3/15/23 | | | | 237,419 | |

752,723 | | 7.50 | | | 4/15/23 | | | | 810,571 | |

87,888 | | 7.50 | | | 9/20/26 | | | | 98,428 | |

419,478 | | 7.50 | | | 3/15/28 | | | | 472,279 | |

498,780 | | 7.50 | | | 9/15/29 | | | | 567,804 | |

209,823 | | 7.50 | | | 12/15/29 | | | | 234,791 | |

301,748 | | 7.50 | | | 6/15/30 | | | | 345,016 | |

314,717 | | 7.50 | | | 8/15/30 | | | | 351,959 | |

501,962 | | 7.50 | | | 9/15/30 | | | | 571,776 | |

167,883 | | 7.50 | | | 11/15/30 | | | | 190,259 | |

3,843,433 | | 7.50 | | | 6/15/34 | | | | 4,454,062 | |

1,379,005 | | 7.50 | | | 8/25/42 | 1 | | | 1,618,080 | |

555,549 | | 7.50 | | | 9/25/43 | | | | 643,590 | |

69,465 | | 8.00 | | | 7/15/21 | | | | 71,087 | |

858,276 | | 8.00 | | | 2/15/23 | | | | 922,844 | |

65,791 | | 8.00 | | | 4/25/24 | | | | 71,145 | |

186,279 | | 8.00 | | | 2/15/27 | | | | 211,592 | |

201,048 | | 8.00 | | | 11/20/29 | | | | 230,566 | |

287,235 | | 8.00 | | | 1/15/30 | | | | 332,069 | |

15,354 | | 8.25 | | | 6/15/22 | | | | 16,597 | |

45,493 | | 8.30 | | | 11/15/20 | | | | 47,813 | |

22,231 | | 8.50 | | | 10/15/22 | | | | 23,128 | |

161,738 | | 8.50 | | | 3/15/25 | | | | 182,281 | |

41,674 | | 8.50 | | | 3/15/32 | | | | 46,911 | |

3,340 | | 9.00 | | | 12/15/19 | | | | 3,362 | |

837 | | 9.15 | | | 10/15/20 | | | | 870 | |

15,517 | | 9.50 | | | 2/15/20 | | | | 15,769 | |

| | | | | | | | | | |

| | | | | | | | | 70,857,417 | |

| | | | | | | | | | |

Federal National Mortgage Association - 23.8% | | | | | | | | |

394,787 | | 4.55 | | | 6/25/43 | | | | 411,642 | |

1,078,214 | | 5.00 | | | 6/25/43 | | | | 1,127,731 | |

885,344 | | 5.36 | | | 6/25/42 | | | | 954,515 | |

610,467 | | 5.50 | | | 9/25/33 | | | | 653,085 | |

4,258,131 | | 5.50 | | | 6/25/40 | | | | 4,403,745 | |

1,769,857 | | 5.60 | | | 12/25/53 | 1 | | | 1,959,026 | |

1,141,017 | | 5.81 | | | 8/25/43 | | | | 1,221,183 | |

2,653,229 | | 6.00 | | | 5/25/30 | | | | 2,929,613 | |

3,551,894 | | 6.00 | | | 5/25/36 | | | | 3,968,573 | |

3,076,322 | | 6.00 | | | 11/25/43 | | | | 3,381,624 | |

2,737,569 | | 6.00 | | | 2/25/48 | | | | 3,120,124 | |

| | | | |

See accompanying notes to financial statements. | | | | |

8 | | | SIT MUTUAL FUNDS ANNUAL REPORT | |

| | | | | | | | | | |

Principal

Amount ($) | | Coupon Rate (%) | | Maturity

Date | | | Fair Value ($) | |

397,468 | | 6.03 | | | 12/25/42 | 1 | | | 438,379 | |

2,081,882 | | 6.05 | | | 2/25/44 | | | | 2,273,967 | |

1,456,428 | | 6.34 | | | 8/25/47 | 1 | | | 1,568,450 | |

376,756 | | 6.50 | | | 8/20/28 | | | | 404,931 | |

197,027 | | 6.50 | | | 3/25/32 | | | | 211,435 | |

310,193 | | 6.50 | | | 6/25/32 | | | | 349,848 | |

463,019 | | 6.50 | | | 7/25/34 | | | | 463,548 | |

415,565 | | 6.50 | | | 7/25/36 | | | | 472,148 | |

179,516 | | 6.50 | | | 9/25/36 | | | | 195,360 | |

352,485 | | 6.50 | | | 3/25/42 | | | | 390,163 | |

2,324,195 | | 6.50 | | | 5/25/42 | | | | 2,567,857 | |

6,677,208 | | 6.50 | | | 7/25/42 | | | | 7,513,212 | |

277,293 | | 6.50 | | | 9/25/42 | | | | 308,839 | |

198,577 | | 6.50 | | | 11/25/42 | | | | 219,174 | |

5,564,351 | | 6.50 | | | 7/25/44 | | | | 6,155,616 | |

620,053 | | 6.55 | | | 9/25/37 | 1 | | | 666,333 | |

447,875 | | 6.70 | | | 2/25/45 | 1 | | | 507,839 | |

4,943,791 | | 6.75 | | | 6/25/32 | | | | 5,589,591 | |

785,748 | | 6.75 | | | 4/25/37 | | | | 864,447 | |

123,229 | | 6.85 | | | 12/18/27 | | | | 135,949 | |

616,496 | | 6.99 | | | 8/25/37 | 1 | | | 646,213 | |

3,780 | | 7.00 | | | 1/25/21 | | | | 3,905 | |

14,318 | | 7.00 | | | 7/25/22 | | | | 15,079 | |

29,873 | | 7.00 | | | 11/25/22 | | | | 31,696 | |

51,904 | | 7.00 | | | 12/25/22 | | | | 55,791 | |

6,626 | | 7.00 | | | 6/25/23 | | | | 7,018 | |

977,670 | | 7.00 | | | 4/25/24 | | | | 1,042,674 | |

298,536 | | 7.00 | | | 9/18/27 | | | | 328,899 | |

5,479,184 | | 7.00 | | | 5/25/31 | | | | 6,204,623 | |

414,876 | | 7.00 | | | 9/25/40 | | | | 464,387 | |

670,052 | | 7.00 | | | 10/25/41 | | | | 747,237 | |

415,044 | | 7.00 | | | 11/25/41 | | | | 474,119 | |

2,367,838 | | 7.00 | | | 12/25/41 | | | | 2,699,163 | |

857,652 | | 7.00 | | | 1/25/42 | | | | 968,442 | |

1,203,664 | | 7.00 | | | 7/25/42 | | | | 1,392,024 | |

2,184,271 | | 7.00 | | | 10/25/42 | 1 | | | 2,441,730 | |

2,516,998 | | 7.00 | | | 2/25/44 | | | | 2,833,313 | |

163,913 | | 7.00 | | | 8/25/44 | | | | 186,607 | |

1,423,028 | | 7.00 | | | 3/25/45 | | | | 1,606,102 | |

52,043 | | 7.50 | | | 8/20/27 | | | | 58,094 | |

331,826 | | 7.50 | | | 10/25/40 | | | | 371,101 | |

938,347 | | 7.50 | | | 11/25/40 | | | | 1,046,420 | |

354,482 | | 7.50 | | | 2/25/41 | | | | 403,937 | |

974,388 | | 7.50 | | | 6/19/41 | 1 | | | 1,095,561 | |

2,114,126 | | 7.50 | | | 7/25/41 | | | | 2,422,285 | |

1,436,566 | | 7.50 | | | 8/25/41 | | | | 1,647,520 | |

4,260,352 | | 7.50 | | | 10/25/41 | | | | 5,005,415 | |

355,198 | | 7.50 | | | 11/25/41 | | | | 408,237 | |

700,772 | | 7.50 | | | 1/25/42 | | | | 803,058 | |

2,582,183 | | 7.50 | | | 2/25/42 | 1 | | | 2,831,233 | |

4,392,838 | | 7.50 | | | 5/25/42 | | | | 5,101,529 | |

536,847 | | 7.50 | | | 6/25/42 | | | | 625,074 | |

| | | | | | | | | | |

Principal

Amount ($) | | Coupon Rate (%) | | Maturity

Date | | | Fair Value ($) | |

4,135,579 | | 7.50 | | | 8/25/42 | 1 | | | 4,819,681 | |

1,524,718 | | 7.50 | | | 2/25/44 | | | | 1,762,187 | |

1,026,321 | | 7.50 | | | 3/25/44 | | | | 1,140,207 | |

1,085,959 | | 7.50 | | | 5/25/44 | | | | 1,261,483 | |

74,036 | | 7.50 | | | 10/25/44 | | | | 84,224 | |

6,789,102 | | 7.50 | | | 1/25/48 | | | | 7,846,925 | |

76,028 | | 8.00 | | | 7/25/22 | | | | 81,502 | |

40,281 | | 8.00 | | | 7/18/27 | | | | 45,292 | |

659,447 | | 8.00 | | | 7/25/44 | | | | 750,309 | |

975,999 | | 8.04 | | | 11/25/37 | 1 | | | 1,125,225 | |

1,181,048 | | 8.13 | | | 7/25/37 | 1 | | | 1,115,202 | |

337,554 | | 8.17 | | | 11/25/37 | 1 | | | 389,956 | |

69,281 | | 8.32 | | | 10/25/42 | 1 | | | 84,076 | |

23,690 | | 8.50 | | | 1/25/21 | | | | 24,197 | |

16,138 | | 8.50 | | | 9/25/21 | | | | 16,979 | |

21,139 | | 8.50 | | | 1/25/25 | | | | 21,980 | |

787,016 | | 8.50 | | | 6/25/30 | | | | 914,214 | |

8,015 | | 8.70 | | | 12/25/19 | | | | 8,290 | |

1,237 | | 8.75 | | | 9/25/20 | | | | 1,300 | |

12,640 | | 8.95 | | | 10/25/20 | | | | 13,307 | |

4,552 | | 9.00 | | | 7/25/19 | | | | 4,618 | |

6,052 | | 9.00 | | | 12/25/19 | | | | 6,259 | |

856 | | 9.00 | | | 3/25/20 | | | | 892 | |

26,702 | | 9.00 | | | 5/25/20 | | | | 27,993 | |

2,238 | | 9.00 | | | 6/25/20 | | | | 2,341 | |

1,822 | | 9.00 | | | 7/25/20 | | | | 1,907 | |

5,901 | | 9.00 | | | 9/25/20 | | | | 6,224 | |

6,693 | | 9.00 | | | 10/25/20 | | | | 7,055 | |

91,361 | | 9.00 | | | 1/25/21 | | | | 96,762 | |

14,841 | | 9.00 | | | 8/25/22 | | | | 16,324 | |

73,171 | | 9.00 | | | 11/25/28 | | | | 82,386 | |

579,393 | | 9.00 | | | 6/25/30 | | | | 695,657 | |

131,712 | | 9.00 | | | 10/25/30 | | | | 157,544 | |

4,034 | | 9.25 | | | 1/25/20 | | | | 4,152 | |

235,954 | | 9.32 | | | 6/25/32 | 1 | | | 265,272 | |

896 | | 9.50 | | | 12/25/18 | | | | 904 | |

10,624 | | 9.50 | | | 3/25/20 | | | | 11,130 | |

1,513 | | 9.50 | | | 4/25/20 | | | | 1,579 | |

11,191 | | 9.50 | | | 11/25/20 | | | | 11,835 | |

118,922 | | 9.50 | | | 11/25/31 | | | | 137,686 | |

328,126 | | 9.50 | | | 12/25/41 | | | | 388,872 | |

20,869 | | 9.60 | | | 3/25/20 | | | | 21,784 | |

1,605,486 | | 10.58 | | | 9/25/42 | 1 | | | 2,026,913 | |

533,941 | | 11.05 | | | 6/25/44 | 1 | | | 603,994 | |

29,077 | | 21.15 | | | 3/25/39 | 1 | | | 39,285 | |

| | | | | | | | | | |

| | | |

| | | | | | | | | 125,522,337 | |

| | | | | | | | | | |

Government National Mortgage Association - 11.7% | | | | | |

500,000 | | 5.50 | | | 9/20/39 | | | | 577,982 | |

3,307,698 | | 5.52 | | | 11/20/45 | 1 | | | 3,612,712 | |

8,880,320 | | 5.64 | | | 4/20/40 | 1 | | | 9,867,255 | |

1,295,189 | | 5.99 | | | 11/20/43 | 1 | | | 1,413,577 | |

3,089,488 | | 6.00 | | | 11/20/33 | | | | 3,382,821 | |

| | | | |

See accompanying notes to financial statements. | | | | |

MARCH 31, 2018 | | | 9 | |

SCHEDULE OF INVESTMENTS

March 31, 2018

Sit U.S. Government Securities Fund (Continued)

| | | | | | | | | | |

Principal

Amount ($) | | Coupon Rate (%) | | Maturity

Date | | | Fair Value ($) | |

1,198,224 | | 6.00 | | | 6/20/43 | | | | 1,306,697 | |

1,648,995 | | 6.00 | | | 2/20/46 | | | | 1,848,660 | |

3,183,821 | | 6.14 | | | 1/20/39 | 1 | | | 3,596,783 | |

1,518,677 | | 6.17 | | | 10/20/40 | 1 | | | 1,691,239 | |

4,070,701 | | 6.27 | | | 12/20/42 | 1 | | | 4,643,241 | |

2,935,745 | | 6.29 | | | 12/20/40 | 1 | | | 3,266,358 | |

3,724,337 | | 6.37 | | | 5/20/43 | 1 | | | 4,196,875 | |

1,690,294 | | 6.50 | | | 7/20/32 | | | | 1,854,964 | |

3,857,491 | | 6.51 | | | 6/20/41 | 1 | | | 4,339,806 | |

1,273,835 | | 6.58 | | | 7/20/39 | 1 | | | 1,442,879 | |

553,600 | | 6.65 | | | 4/20/39 | 1 | | | 631,295 | |

911,295 | | 6.66 | | | 9/20/44 | 1 | | | 1,035,245 | |

171,555 | | 6.86 | | | 3/16/41 | 1 | | | 183,417 | |

1,890,494 | | 6.92 | | | 8/20/40 | 1 | | | 2,172,158 | |

1,259,340 | | 6.98 | | | 6/20/45 | 1 | | | 1,427,653 | |

274,862 | | 7.00 | | | 6/20/26 | | | | 275,350 | |

65,932 | | 7.00 | | | 5/20/38 | | | | 65,882 | |

714,690 | | 7.00 | | | 5/20/42 | | | | 816,103 | |

475,979 | | 7.15 | | | 12/20/33 | 1 | | | 540,931 | |

2,540,347 | | 7.29 | | | 8/20/38 | 1 | | | 2,920,615 | |

70,860 | | 7.50 | | | 5/16/27 | | | | 70,797 | |

3,286,790 | | 7.51 | | | 7/20/44 | 1 | | | 3,722,992 | |

23,607 | | 8.50 | | | 2/20/32 | | | | 27,938 | |

996,039 | | 9.00 | | | 3/16/30 | | | | 1,007,669 | |

| | | | | | | | | | |

| | | |

| | | | | | | | | 61,939,894 | |

| | | | | | | | | | |

Vendee Mortgage Trust - 2.4% | | | | | | | | |

3,005,588 | | 6.50 | | | 8/15/31 | | | | 3,381,736 | |

1,444,650 | | 6.50 | | | 10/15/31 | | | | 1,622,203 | |

1,258,982 | | 6.75 | | | 2/15/26 | | | | 1,375,322 | |

2,033,962 | | 6.99 | | | 3/15/25 | 1 | | | 2,285,745 | |

1,301,336 | | 7.00 | | | 3/15/28 | | | | 1,455,138 | |

258,617 | | 7.25 | | | 9/15/22 | | | | 266,722 | |

474,253 | | 7.25 | | | 9/15/25 | | | | 522,833 | |

395,610 | | 7.75 | | | 5/15/22 | | | | 422,025 | |

642,523 | | 7.75 | | | 9/15/24 | | | | 701,870 | |

226,912 | | 8.00 | | | 2/15/25 | | | | 255,344 | |

126,012 | | 8.29 | | | 12/15/26 | | | | 142,120 | |

| | | | | | | | | | |

| | | |

| | | | | | | | | 12,431,058 | |

| | | | | | | | | | |

Total Collateralized Mortgage Obligations

(cost: $272,929,986) | | | | | | | 270,750,706 | |

| | | | | | | | | | |

| | |

Asset-Backed Securities - 1.6% | | | | | | | | |

Federal Home Loan Mortgage Corporation - 0.3% | | | | | |

924 | | 6.09 | | | 9/25/29 | 1 | | | 906 | |

162,385 | | 6.28 | | | 10/27/31 | 14 | | | 185,476 | |

1,531,612 | | 7.16 | | | 7/25/29 | | | | 1,665,436 | |

| | | | | | | | | | |

| | | |

| | | | | | | | | 1,851,818 | |

| | | | | | | | | | |

Federal National Mortgage Association - 0.5% | | | | | | | | |

18,769 | | 1 Mo. Libor + 0.34, 2.21% | | | 11/25/32 | 1 | | | 18,369 | |

613,308 | | 4.70 | | | 9/26/33 | 14 | | | 660,948 | |

194,981 | | 5.00 | | | 10/25/33 | 14 | | | 199,344 | |

| | | | | | | | | | |

Principal

Amount ($) | | Coupon Rate (%) | | Maturity

Date | | | Fair Value ($) | |

1,323,058 | | 5.75 | | | 2/25/33 | 14 | | | 1,374,616 | |

5,402 | | 6.47 | | | 10/25/31 | 14 | | | 5,363 | |

33,404 | | 6.50 | | | 5/25/32 | 14 | | | 34,020 | |

316,883 | | 6.59 | | | 10/25/31 | 14 | | | 335,403 | |

1,830 | | 6.83 | | | 7/25/31 | 14 | | | 1,820 | |

9,968 | | 7.80 | | | 6/25/26 | 1 | | | 11,153 | |

| | | | | | | | | | |

| | | |

| | | | | | | | | 2,641,036 | |

| | | | | | | | | | |

Small Business Administration - 0.8% | | | | | | | | |

2,656,448 | | 5.87 | | | 7/1/28 | | | | 2,852,505 | |

454,631 | | 7.13 | | | 10/1/20 | | | | 464,784 | |

373,812 | | 7.33 | | | 8/1/20 | | | | 383,382 | |

313,032 | | 8.03 | | | 5/1/20 | | | | 322,394 | |

| | | | | | | | | | |

| | | |

| | | | | | | | | 4,023,065 | |

| | | | | | | | | | |

Total Asset-Backed Securities

(cost: $8,494,904) | | | | | | | 8,515,919 | |

| | | | | | | | | | |

| | |

Put Options Purchased 10, 19 -0.1% | | | | | | | | |

(cost: $635,156) | | | | | | | 314,531 | |

| | | | | | | | | | |

| | | | |

| Quantity Name of Issuer | | Fair Value ($) | |

Short-Term Securities - 0.7% | | | | |

3,788,592 Fidelity Inst. Money Mkt. Gvt. Fund, 1.49% | | | 3,788,592 | |

| | | | |

(cost: $3,788,592) | | | | |

Total Investments in Securities - 98.6%

(cost: $525,487,226) | | | 520,642,091 | |

| | | | |

| |

Call Options Written 10, 19 - (0.2%) | | | | |

(premiums received: $941,373) | | | (1,243,047 | ) |

| |

Other Assets and Liabilities, net - 1.6% | | | 8,349,403 | |

| | | | |

| |

Total Net Assets - 100.0% | | $ | 527,748,447 | |

| | | | |

| 1 | Variable rate security. Rate disclosed is as of March 31, 2018. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions, or, for mortgage-backed securities, are impacted by the individual mortgages which are paying off over time. These securities do not indicate a reference rate and spread in their descriptions. |

| 6 | Zero coupon or convertible capital appreciation bond, for which the rate disclosed is either the effective yield on purchase date or the coupon rate to be paid upon conversion to coupon paying, respectively. |

| 10 | The amount of $7,000,000 in cash was segregated with the broker to cover margin requirements for derivative transactions as of March 31, 2018. |

| 14 | Step Coupon: A bond that pays an initial coupon rate for the first period and then a higher coupon rate for the following periods. Rate disclosed is as of March 31, 2018. |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

| | | | |

See accompanying notes to financial statements. | | | | |

10 | | | SIT MUTUAL FUNDS ANNUAL REPORT | |

| (19) | Options outstanding as of March 31, 2018 were as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Exercise | | | Expiration | | | | | | Notional | | | Cost/ | | | | |

| Description | | Contracts | | Price ($) | | | Date | | | Counterparty | | | Amount ($) | | | Premiums ($) | | | Value ($) | |

| | |

Put Options Purchased - U.S. Treasury Futures: | | | | | | | | | |

| 5-Year | | | 1,830 | | | | 113.75 | | | | June 2018 | | | | Societe Generale | | | | 208,162,500 | | | | 635,156 | | | | 314,531 | |

Call Options Written - U.S. Treasury Futures: | | | | | | | | | |

| 2-Year | | | (425 | ) | | | 106.13 | | | | May 2018 | | | | Societe Generale | | | | 90,206,250 | | | | (171,241 | ) | | | (179,297 | ) |

| 5-Year | | | (1,840 | ) | | | 114.00 | | | | May 2018 | | | | Societe Generale | | | | 209,760,000 | | | | (770,132 | ) | | | (1,063,750 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | (941,373 | ) | | | (1,243,047 | ) |

A summary of the levels for the Fund’s investments as of March 31, 2018 is as follows (see Note 2 - significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | |

| | | Investment in Securities | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | |

| | | Quoted | | | Other significant | | | Significant | | | |

| | | Price ($) | | | observable inputs ($) | | | unobservable inputs ($) | | Total ($) | |

Assets | | | | | | | | | | | | | | |

Mortgage Pass-Through Securities | | | — | | | | 219,647,696 | | | — | | | 219,647,696 | |

U.S. Treasury / Federal Agency Securities | | | — | | | | 17,624,647 | | | — | | | 17,624,647 | |

Collateralized Mortgage Obligations | | | — | | | | 270,750,706 | | | — | | | 270,750,706 | |

Asset-Backed Securities | | | — | | | | 8,515,919 | | | — | | | 8,515,919 | |

Put Options Purchased | | | 314,531 | | | | — | | | — | | | 314,531 | |

Short-Term Securities | | | 3,788,592 | | | | — | | | — | | | 3,788,592 | |

| | | | |

| | | 4,103,123 | | | | 516,538,968 | | | — | | | 520,642,091 | |

Liabilities | | | | | | | | | | | | | | |

Call Options Written | | | (1,243,047 | ) | | | — | | | — | | | (1,243,047 | ) |

For the reporting period, there were no transfers between levels 1, 2 and 3.

| | | | |

See accompanying notes to financial statements. | | | | |

MARCH 31, 2018 | | | 11 | |

OBJECTIVE & STRATEGY

The objective of the Quality Income Fund is to provide high current income and safety of principal, which it seeks to attain by investing at least 80% of its assets in debt securities issued by the U.S. government and its agencies, debt securities issued by corporations and, mortgage and other asset-backed securities. The Fund invests at least 50% of its assets in U.S. government debt securities, which are securities issued, guaranteed or insured by the U.S. government, its agencies or instrumentalities.

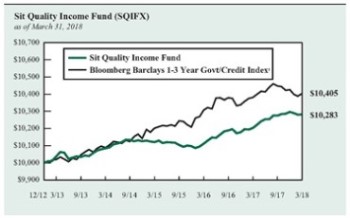

The Sit Quality Income Fund provided a return of +0.79% during the 12-month period ending March 31, 2018, compared to the return of the Bloomberg Barclays 1-3 Year Government/Credit Bond Index of +0.24%. The Fund’s 30-day SEC yield was 2.08% and its 12-month distribution rate was 1.30%.

The primary goal of the Fund is to maintain a high credit quality portfolio with stable principal values, while generating a relatively high level of income. During the year, the Fund benefitted from the income advantage produced by its holdings in non-agency residential mortgage, corporate, and taxable municipal securities. Nonagency residential mortgages outperformed as higher home prices increased demand for these securities. Taxable municipal securities also outperformed as their higher yields were attractive for investors. Corporate securities outperformed as future growth prospects continue to increase demand, causing yields to decrease relative to treasuries. The Fund uses Treasury futures and options to reduce interest rate risk. The use of futures and options was successful in providing stability to the Fund’s net asset value and contributed positively to the return. The Federal Reserve hiked the Fed Funds rate three times over the 12-month period as it continued to normalize monetary policy. In addition, the Federal Reserve began its plan to normalize its balance sheet. While the effects have been minimal, we believe the impact will be amplified in the upcoming year. We expect interest rates to move higher with short term rates outpacing long term rates. The new Federal Reserve Chairman, Jerome Powell, held his first press conference and was well received by investors. We expect the Federal Reserve to maintain a methodical approach for normalizing its balance sheet and gradually raising interest rates over time.

We have positioned the Fund defensively, in both credit quality and interest rate sensitivity to maximize return potential while preserving principal. We focus on a mix of Treasury, agency and credit sectors that provide relatively high levels of income and stable prices.

| | |

| Michael C. Brilley | | Mark H. Book, CFA |

| Bryce A. Doty, CFA | | Chris M. Rasmussen, CFA |

| Senior Portfolio Managers | | Portfolio Managers |

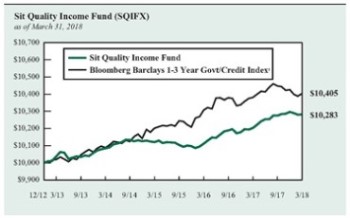

HYPOTHETICAL GROWTH OF $10,000

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter) as compared to the performance of the Bloomberg Barclays 1-3 Year Government/Credit Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

1 The Bloomberg Barclays 1-3 Year Government/Credit Index is an unmanaged index of Treasury or government agency securities and investment grade corporate debt securities with maturities of one to three years. The returns include the reinvestment of income and do not include any transaction costs, management fees or other costs. It is not possible to invest directly in an index. This is the Fund’s primary index.

| | |

| Information on this page is unaudited. |

12 | | SIT MUTUAL FUNDS ANNUAL REPORT |

COMPARATIVE RATES OF RETURNS

| | | | | | | | | | | | |

as of March 31, 2018 | | | |

| | | | | Bloomberg | | Lipper |

| | | | | Barclays | | Short |

| | | Sit | | 1-3 Year | | Investment |

| | | Quality | | Government/Credit | | Grade Bond |

| | | Income Fund | | Index1 | | Index2 |

| | | |

One Year | | | 0.79 | % | | | 0.24 | % | | | 0.94 | % |

Five Years | �� | | 0.48 | | | | 0.76 | | | | 1.07 | |

Since Inception

(12/31/12) | | | 0.53 | | | | 0.76 | | | | 1.10 | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains and all fee waivers. Without the fee waivers total return and yield figures would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for the periods greater than one year are compounded average annual rates of return.

1 The Bloomberg Barclays 1-3 Year Government/Credit Index is an unmanaged index of Treasury or government agency securities and investment grade corporate debt securities with maturities of one to three years. The returns include the reinvestment of income and do not include any transaction costs, management fees or other costs. It is not possible to invest directly in an index.

2 The Lipper returns are obtained from Lipper Analytical Services, Inc., a large independent evaluator of mutual funds.

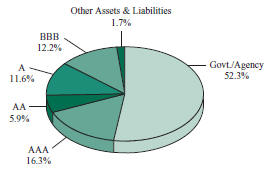

FUND DIVERSIFICATION

| | | | |

| |

U.S. Treasury/Federal Agency Securities | | | 29.8 | % |

Mortgage Pass-Through (Agency) | | | 19.6 | |

Corporate Bonds | | | 17.0 | |

Asset-Backed (Non-Agency) | | | 13.8 | |

Collateralized Mortgage Obligations (Non-Agency) | | | 10.0 | |

Taxable Municipal Bonds | | | 8.1 | |

Other Net Assets | | | 1.7 | |

Based on total net assets as of March 31, 2018. Subject to change.

PORTFOLIO SUMMARY

| | |

Net Asset Value 3/31/18: | | $9.78 Per Share |

Net Asset Value 3/31/17: | | $9.83 Per Share |

Total Net Assets: | | $74.5 Million |

Average Maturity: | | 9.3 Years |

Effective Duration3: | | 0.9 Years |

3 Duration is a measure of estimated price sensitivity relative to changes in interest rates. Portfolios with longer durations are typically more sensitive to changes in interest rates. For example, if interest rates rise by 1%, the fair value of a security with an effective duration of 5 years would decrease by 5%, with all other factors being constant. The correlation between duration and price sensitivity is greater for securities rated investment-grade than it is for securities rated below investment-grade. Duration estimates are based on assumptions by the Adviser and are subject to a number of limitations. Effective duration is calculated based on historical price changes of securities held by the Fund, and therefore is a more accurate estimate of price sensitivity provided interest rates remain within their historical range.

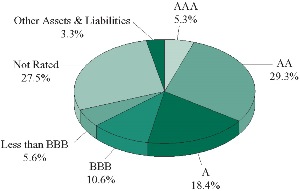

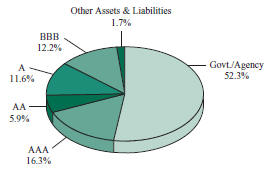

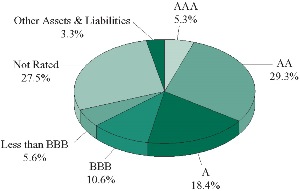

QUALITY RATINGS (% of Total Net Assets)

Lower of Moody’s, S&P, Fitch or Duff & Phelps ratings used.

| | |

| Information on this page is unaudited. |

| MARCH 31, 2018 | | 13 |

SCHEDULE OF INVESTMENTS

March 31, 2018

Sit Quality Income Fund

| | | | | | | | | | | | | | |

| | | | | |

| Name of Issuer | | Principal

Amount ($) | | Coupon Rate (%) | | Maturity Date | | | Fair Value ($) | |

| | | | |

Asset-Backed Securities - 16.1% | | | | | | | | | | | | | | |

Agency - 2.3% | | | | | | | | | | | | | | |

FNMA Grantor Trust, Series 2004-T5, Class A11 1 | | | 794,273 | | | 2.05 | | | 5/28/35 | | | | 773,922 | |

FNMA REMICS, Series 2001-W2, Class AS5 14 | | | 6,691 | | | 6.47 | | | 10/25/31 | | | | 6,642 | |

Small Business Administration, Series 2000-20D | | | 76,622 | | | 7.47 | | | 4/1/20 | | | | 78,492 | |

Small Business Administration, Series 2006-20D, Class 1 | | | 372,268 | | | 5.64 | | | 4/1/26 | | | | 390,188 | |

Small Business Administration, Series 2007-20B, Class 1 | | | 205,410 | | | 5.49 | | | 2/1/27 | | | | 215,333 | |

Small Business Administration, Series 2007-20J, Class 1 | | | 253,320 | | | 5.57 | | | 10/1/27 | | | | 265,593 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 1,730,170 | |

| | | | | | | | | | | | | | |

Non-Agency - 13.8% | | | | | | | | | | | | | | |

Bayview Financial Mortgage Pass-Through Trust, Series 2006-B, Class 1A5 14 | | | 497 | | | 6.04 | | | 4/28/36 | | | | 495 | |

Bayview Opportunity Master Fund, Series 2017-SPL5, Class A 1, 4 | | | 540,601 | | | 3.50 | | | 6/28/57 | | | | 543,006 | |

Bear Stearns Asset Backed Securities I Trust, Series 2005-AQ2, Class A3, 1 Mo. Libor + 0.36%1 | | | 281,968 | | | 2.23 | | | 9/25/35 | | | | 282,064 | |

Bear Stearns Asset Backed Securities Trust, Series 2005-SD2, Class 1A2, 1 Mo. Libor + 0.47%1 | | | 69,528 | | | 2.34 | | | 3/25/35 | | | | 69,536 | |

Centex Home Equity Loan Trust, Series 2004-A, Class AF4 14 | | | 102,684 | | | 5.01 | | | 8/25/32 | | | | 104,151 | |

Centex Home Equity Loan Trust, Series 2004-A, Class AF5 14 | | | 310,000 | | | 5.43 | | | 1/25/34 | | | | 315,914 | |

Centex Home Equity Loan Trust, Series 2004-D, Class AF6 14 | | | 27,199 | | | 5.17 | | | 9/25/34 | | | | 27,590 | |

CIT Home Equity Loan Trust, Series 2003-1, Class A6 14 | | | 20,613 | | | 4.56 | | | 10/20/32 | | | | 20,941 | |

Conseco Finance Home Equity Loan Trust, Series 2002-B, Class M1, 1 Mo. Libor + 1.75%1 | | | 30,343 | | | 3.53 | | | 5/15/33 | | | | 30,364 | |

Countrywide Asset-Backed Certificates, Series 2004-S1, Class A3 14 | | | 218,257 | | | 5.12 | | | 2/25/35 | | | | 219,965 | |

Credit Suisse First Boston Mortgage Securities Corp. Series 2005-AGE1, Class M3, 1 Mo. Libor + 0.65%1 | | | 257,774 | | | 2.52 | | | 2/25/32 | | | | 256,179 | |

Fairway Outdoor Funding, LLC, Series 2012-1A, Class A2 4 | | | 507,470 | | | 4.21 | | | 10/15/42 | | | | 509,150 | |

First Alliance Mortgage Loan Trust, Series 1997-4, Class A2 14 | | | 311,428 | | | 7.63 | | | 4/20/29 | | | | 314,508 | |

GSAMP Trust, Series 2004-FM1, Class M1, 1 Mo. Libor + 0.98%1 | | | 226,561 | | | 2.85 | | | 11/25/33 | | | | 223,914 | |

Hertz Vehicle Financing II LP, Series 2018-1A, Class A 4 | | | 750,000 | | | 3.29 | | | 2/25/24 | | | | 741,958 | |

Irwin Whole Loan Home Equity Trust, Series 2003-B, Class M, 1 Mo. Libor + 2.00%1 | | | 73,840 | | | 3.87 | | | 11/25/32 | | | | 73,956 | |

Irwin Whole Loan Home Equity Trust, Series 2005-A, Class M1, 1 Mo. Libor + 0.86%1 | | | 768,563 | | | 2.73 | | | 6/25/34 | | | | 764,704 | |

Mill City Mortgage Loan Trust 2017-3, Class A1 1, 4 | | | 455,133 | | | 2.75 | | | 1/25/61 | | | | 449,809 | |

New Century Home Equity Loan Trust, Series 2003-5, Class AI7 1 | | | 8,446 | | | 5.11 | | | 11/25/33 | | | | 8,623 | |

New Residential Mortgage Loan Trust, Series 2017-6A, Class A1 1, 4 | | | 270,611 | | | 4.00 | | | 8/27/57 | | | | 274,709 | |

New Residential Mortgage Trust, 2018-1A, Class A1A 1, 4 | | | 388,198 | | | 4.00 | | | 12/25/57 | | | | 396,886 | |

NovaStar Mortgage Funding Trust, Series 2004-2, Class M2, 1 Mo. Libor + 1.02%1 | | | 44,812 | | | 2.89 | | | 9/25/34 | | | | 44,858 | |

OSCAR US Funding Trust VI, LLC, Series 2017-1A, Class A3 4 | | | 1,000,000 | | | 2.82 | | | 6/10/21 | | | | 991,634 | |

OSCAR US Funding Trust VI, LLC, Series 2017-1A, Class A4 4 | | | 560,000 | | | 3.30 | | | 5/10/24 | | | | 554,371 | |

OSCAR US Funding Trust VII, LLC, Series 2017-2A, Class A3 4 | | | 500,000 | | | 2.45 | | | 12/10/21 | | | | 491,462 | |

OSCAR US Funding Trust VIII, LLC, Series 2018-1A, Class A2B, 1 Mo. Libor + 0.49%1, 4 | | | 1,000,000 | | | 2.42 | | | 4/12/21 | | | | 1,000,044 | |

OSCAR US Funding Trust, Series 2014-1A, Class A4 4 | | | 193,272 | | | 2.55 | | | 12/15/21 | | | | 192,666 | |

RAAC Trust, Series 2006-RP2, Class A, 1 Mo. Libor + 0.25%1, 4 | | | 48,275 | | | 2.12 | | | 2/25/37 | | | | 48,195 | |

Residential Asset Mortgage Products Trust, Series 2004-RS12, Class AI6 | | | 111 | | | 4.55 | | | 12/25/34 | | | | 111 | |

Residential Funding Mortgage Securities, Series 2006-HI1, Class M2 14 | | | 96,545 | | | 6.56 | | | 2/25/36 | | | | 100,243 | |

Santander Drive Auto Receivables Trust, Series 2016-2, Class B | | | 700,000 | | | 2.08 | | | 2/16/21 | | | | 698,339 | |

World Omni Auto Receivables Trust | | | 500,000 | | | 2.89 | | | 4/15/25 | | | | 497,602 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 10,247,947 | |

| | | | | | | | | | | | | | |

| | | | |

Total Asset-Backed Securities

(cost: $12,047,778) | | | | | | | | | | | | | 11,978,117 | |

| | | | | | | | | | | | | | |

| | | | |

Collateralized Mortgage Obligations - 31.5% | | | | | | | | | | | | | | |

| | | | |

Agency - 21.5% | | | | | | | | | | | | | | |

FHLMC Multifamily Structured Pass Through Certificates, Series K007, Class A2 | | | 99,750 | | | 4.22 | | | 3/25/20 | | | | 102,309 | |

FHLMC Multifamily Structured Pass Through Certificates, Series K012, Class A2 1 | | | 420,000 | | | 4.19 | | | 12/25/20 | | | | 434,627 | |

FHLMC Multifamily Structured Pass Through Certificates, Series K013, Class A2 1 | | | 2,040,000 | | | 3.97 | | | 1/25/21 | | | | 2,098,610 | |

| | | | |

See accompanying notes to financial statements. | | | | |

14 | | | SIT MUTUAL FUNDS ANNUAL REPORT | |

| | | | | | | | | | | | | | | | |

| | | | | |

| Name of Issuer | | Principal

Amount ($) | | Coupon Rate (%) | | Maturity Date | | Fair Value ($) | |

FHLMC Multifamily Structured Pass Through Certificates, Series K017, Class A2 | | | 500,000 | | | | 2.87 | | | | 12/25/21 | | | | 499,721 | |

FHLMC Multifamily Structured Pass Through Certificates, Series K020, Class A2 | | | 400,000 | | | | 2.37 | | | | 5/25/22 | | | | 392,582 | |

FHLMC Multifamily Structured Pass Through Certificates, Series K026, Class A2 | | | 1,345,000 | | | | 2.51 | | | | 11/25/22 | | | | 1,323,813 | |

FHLMC Multifamily Structured Pass Through Certificates, Series K715, Class A2 | | | 500,000 | | | | 2.86 | | | | 1/25/21 | | | | 500,256 | |

FHLMC Multifamily Structured Pass Through Certificates, Series K716, Class A2 | | | 2,000,000 | | | | 3.13 | | | | 6/25/21 | | | | 2,015,910 | |

FHLMC REMICS, Series 2528, Class KM | | | 58,335 | | | | 5.50 | | | | 11/15/22 | | | | 61,334 | |

FHLMC REMICS, Series 3104, Class BY | | | 182,367 | | | | 5.50 | | | | 1/15/26 | | | | 196,330 | |

FHLMC REMICS, Series 3614, Class QA | | | 287,702 | | | | 4.00 | | | | 5/15/24 | | | | 289,567 | |

FHLMC REMICS, Series 3795, Class CA | | | 138,588 | | | | 4.50 | | | | 5/15/39 | | | | 138,986 | |

FHLMC REMICS, Series 3806, Class JA | | | 484,575 | | | | 3.50 | | | | 2/15/26 | | | | 491,171 | |

FHLMC REMICS, Series 3817, Class GA | | | 111,158 | | | | 3.50 | | | | 6/15/24 | | | | 111,297 | |

FNMA ACES, Series 2009-M1, Class A2 | | | 346,046 | | | | 4.29 | | | | 7/25/19 | | | | 349,322 | |

FNMA ACES, Series 2013-M14, Class A2 1 | | | 340,000 | | | | 3.33 | | | | 10/25/23 | | | | 346,039 | |

FNMA ACES, Series 2013-M9, Class A2 1 | | | 1,264,515 | | | | 2.39 | | | | 1/25/23 | | | | 1,238,176 | |

FNMA REMICS, Series 2003-52, Class NA | | | 75,652 | | | | 4.00 | | | | 6/25/23 | | | | 77,220 | |

FNMA REMICS, Series 2005-19, Class PA | | | 76,621 | | | | 5.50 | | | | 7/25/34 | | | | 78,668 | |

FNMA REMICS, Series 2005-68, Class PC | | | 17,207 | | | | 5.50 | | | | 7/25/35 | | | | 17,629 | |

FNMA REMICS, Series 2008-65, Class CD | | | 57,682 | | | | 4.50 | | | | 8/25/23 | | | | 58,400 | |

FNMA REMICS, Series 2009-13, Class NX | | | 252,337 | | | | 4.50 | | | | 3/25/24 | | | | 255,722 | |

FNMA REMICS, Series 2009-71, Class MB | | | 70,457 | | | | 4.50 | | | | 9/25/24 | | | | 73,613 | |

FNMA REMICS, Series 2009-88, Class DA | | | 22,404 | | | | 4.50 | | | | 10/25/20 | | | | 22,573 | |

FNMA REMICS, Series 2010-28, Class DA | | | 2,773 | | | | 5.00 | | | | 9/25/28 | | | | 2,771 | |

FNMA REMICS, Series 2011-16, Class GE | | | 15,562 | | | | 2.75 | | | | 3/25/26 | | | | 15,541 | |

FNMA REMICS, Series 2011-42, Class BJ | | | 24,115 | | | | 3.00 | | | | 8/25/25 | | | | 24,087 | |

FNMA REMICS, Series 2011-46, Class A | | | 25,038 | | | | 3.00 | | | | 5/25/24 | | | | 25,078 | |

FNMA REMICS, Series 2012-19, Class GH | | | 46,482 | | | | 3.00 | | | | 11/25/30 | | | | 46,891 | |

FNMA REMICS, Series 2013-74, Class AD | | | 283,989 | | | | 2.00 | | | | 7/25/23 | | | | 280,522 | |

FREMF Multifamily Aggregation Risk Transfer Trust, Series 2017-KT01, Class A, 1 Mo. Libor + 0.32%1 | | | 1,000,000 | | | | 2.18 | | | | 2/25/20 | | | | 1,003,217 | |

FRESB Mortgage Trust, Series 2018-SB45, Class A5H, 1 Mo. Libor + 2.96%1 | | | 998,834 | | | | 2.96 | | | | 11/25/37 | | | | 996,650 | |

FRESB Mortgage Trust, Series 2018-SB46, Class A5H, 1 Mo. Libor + 2.89%1 | | | 899,241 | | | | 2.89 | | | | 12/25/37 | | | | 894,802 | |

GNMA, Series 2011-29, Class JA | | | 42,414 | | | | 4.50 | | | | 4/20/40 | | | | 42,713 | |

NCUA Guaranteed Notes Trust, Series 2010-R1, Class 1A, 1 Mo. Libor + 0.45%1 | | | 258,109 | | | | 2.16 | | | | 10/7/20 | | | | 259,051 | |

NCUA Guaranteed Notes Trust, Series 2010-R3, Class 2A, 1 Mo. Libor + 0.56%1 | | | 1,117,172 | | | | 2.18 | | | | 12/8/20 | | | | 1,123,840 | |

Vendee Mortgage Trust, Series 1993-1, Class ZB | | | 113,003 | | | | 7.25 | | | | 2/15/23 | | | | 121,322 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 16,010,360 | |

| | | | | | | | | | | | | | | | |

Non-Agency - 10.0% | | | | | | | | | | | | | | | | |

CHL Mortgage Pass-Through Trust, Series 2003-56, Class 6A1 1 | | | 834,283 | | | | 3.71 | | | | 12/25/33 | | | | 851,027 | |

COLT Mortgage Loan Trust, Series 2017-1, Class A1 1, 4 | | | 288,374 | | | | 2.61 | | | | 5/27/47 | | | | 286,028 | |

COLT Mortgage Loan Trust, Series 2017-2, Class A2A 1, 4 | | | 391,749 | | | | 2.57 | | | | 10/25/47 | | | | 392,185 | |

COMM Mortgage Trust, Series 2014-CR21, Class A1 | | | 259,621 | | | | 1.49 | | | | 12/10/47 | | | | 257,715 | |

Deutsche Mortgage Securities, Inc. Mortgage Loan Trust, Series 2004-1, Class 2A1 | | | 5,473 | | | | 4.75 | | | | 10/25/18 | | | | 5,477 | |

Deutsche Mortgage Securities, Inc. Mortgage Loan Trust, Series 2004-1, Class 2A3 | | | 20,280 | | | | 4.75 | | | | 10/25/18 | | | | 20,281 | |

GSR Mortgage Loan Trust, Series 2005-5F, Class 8A1, 1 Mo. Libor + 0.50%1 | | | 54,068 | | | | 2.37 | | | | 6/25/35 | | | | 51,562 | |

MASTR Adjustable Rate Mortgages Trust, Series 2004-13, Class 3A1 1 | | | 304,663 | | | | 3.47 | | | | 11/21/34 | | | | 312,950 | |

MASTR Alternative Loan Trust, Series 2003-4, Class 2A1 | | | 77,423 | | | | 6.25 | | | | 6/25/33 | | | | 80,507 | |

MASTR Alternative Loan Trust, Series 2003-5, Class 4A1 | | | 126,932 | | | | 5.50 | | | | 7/25/33 | | | | 132,588 | |

MASTR Alternative Loan Trust, Series 2003-8, Class 3A1 | | | 139,349 | | | | 5.50 | | | | 12/25/33 | | | | 143,814 | |

MASTR Asset Securitization Trust, Series 2005-2, Class 1A3 | | | 53,000 | | | | 5.35 | | | | 11/25/35 | | | | 55,250 | |

New Residential Mortgage Loan Trust, Series 2017-2A, Class A4 1, 4 | | | 765,609 | | | | 4.00 | | | | 3/25/57 | | | | 774,719 | |

New Residential Mortgage Loan Trust, Series 2017-3A, Class A1 1, 4 | | | 825,558 | | | | 4.00 | | | | 4/25/57 | | | | 839,129 | |

New Residential Mortgage Loan Trust, Series 2017-5A, Class A1, 1 Mo. Libor + 1.50%1, 4 | | | 420,145 | | | | 3.37 | | | | 6/25/57 | | | | 432,352 | |

| | | | |

See accompanying notes to financial statements. | | | | |

MARCH 31, 2018 | | | 15 | |

SCHEDULE OF INVESTMENTS

March 31, 2018

Sit Quality Income Fund (Continued)

| | | | | | | | | | | | | | | | |

| | | | | |

| Name of Issuer | | Principal

Amount ($) | | Coupon Rate (%) | | Maturity Date | | Fair Value ($) | |

| | | | |

Prime Mortgage Trust, Series 2004-CL1, Class 1A1 | | | 95,721 | | | | 6.00 | | | | 2/25/34 | | | | 101,090 | |

RAAC Trust, Series 2004-SP3, Class AI5 1 | | | 1,939 | | | | 4.89 | | | | 12/25/32 | | | | 1,963 | |

Sequoia Mortgage Trust, Series 2012-1, Class 2A1 1 | | | 52,077 | | | | 3.47 | | | | 1/25/42 | | | | 51,766 | |

Sequoia Mortgage Trust, Series 2012-1, Class B1 1 | | | 497,059 | | | | 4.26 | | | | 1/25/42 | | | | 502,904 | |

Sequoia Mortgage Trust, Series 2012-2, Class B1 1 | | | 729,770 | | | | 4.25 | | | | 4/25/42 | | | | 745,950 | |

Sequoia Mortgage Trust, Series 2017-4, Class A4 1, 4 | | | 426,610 | | | | 3.50 | | | | 7/25/47 | | | | 427,610 | |

Sequoia Mortgage Trust, Series 2018-3, Class A4 1, 4 | | | 744,478 | | | | 3.50 | | | | 3/25/48 | | | | 746,363 | |

Structured Asset Securities, Corp. Mtg Loan Trust, Series 2005-GEL3, Class M3, 1 Mo. Libor + 1.20%1 | | | 13,268 | | | | 3.07 | | | | 6/25/35 | | | | 13,255 | |

Structured Asset Securities, Corp. Mtg Pass-Through Certificates, Series 2003-22A, Class 3A 1 | | | 127,592 | | | | 3.63 | | | | 6/25/33 | | | | 129,415 | |

WaMu Mortgage Pass Through Certificates, Series 2002-AR2 Class A, US FED + 1.25%1 | | | 72,179 | | | | 2.03 | | | | 2/27/34 | | | | 71,240 | |

WaMu Mortgage Pass Through Certificates, Series 2004-CB2, Class 7A | | | 15,126 | | | | 5.50 | | | | 8/25/19 | | | | 15,200 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 7,442,340 | |

| | | | | | | | | | | | | | | | |

Total Collateralized Mortgage Obligations

(cost: $23,679,549) | | | | | | | | | | | | | | | 23,452,700 | |

| | | | | | | | | | | | | | | | |

Corporate Bonds - 17.0% | | | | | | | | | | | | | | | | |

AbbVie, Inc. | | | 350,000 | | | | 2.90 | | | | 11/6/22 | | | | 341,887 | |

Anheuser-Busch InBev Finance, Inc. | | | 675,000 | | | | 3.30 | | | | 2/1/23 | | | | 675,496 | |

Bank of America Corp., 3 Mo. Libor + 0.79%1 | | | 750,000 | | | | 2.81 | | | | 3/5/24 | | | | 746,263 | |

Campbell Soup Co., 3 Mo. Libor + 0.63%1 | | | 400,000 | | | | 2.78 | | | | 3/15/21 | | | | 400,451 | |

Capital One Bank USA NA (Subordinated) | | | 750,000 | | | | 3.38 | | | | 2/15/23 | | | | 730,875 | |

Citigroup, Inc., 3 Mo. Libor + 1.43%1 | | | 800,000 | | | | 3.44 | | | | 9/1/23 | | | | 819,500 | |

Continental Airlines 2000-2 Class A-1 Pass Through Trust | | | 75,843 | | | | 7.71 | | | | 4/2/21 | | | | 81,380 | |

Dominion Energy, Inc. | | | 350,000 | | | | 2.75 | | | | 9/15/22 | | | | 338,525 | |

Doric Nimrod Air Finance Alpha 2012-1 Trust 4 | | | 361,072 | | | | 5.13 | | | | 11/30/22 | | | | 370,772 | |

HSBC Holdings, PLC, 3 Mo. Libor + 1.50%1 | | | 750,000 | | | | 3.20 | | | | 1/5/22 | | | | 772,365 | |

KeyBank NA | | | 250,000 | | | | 3.38 | | | | 3/7/23 | | | | 250,987 | |

Leggett & Platt, Inc. | | | 400,000 | | | | 3.40 | | | | 8/15/22 | | | | 395,487 | |

Manufacturers & Traders Trust Co. (Subordinated), 3 Mo. Libor + 0.64%1 | | | 750,000 | | | | 2.65 | | | | 12/1/21 | | | | 747,146 | |

Massachusetts Mutual Life Insurance Co. (Subordinated) 4 | | | 700,000 | | | | 7.50 | | | | 3/1/24 | | | | 818,370 | |

Mosaic Co. | | | 300,000 | | | | 4.25 | | | | 11/15/23 | | | | 305,888 | |

Nationwide Mutual Insurance Co. (Subordinated), 3 Mo. Libor + 2.29%1, 4 | | | 500,000 | | | | 4.41 | | | | 12/15/24 | | | | 499,992 | |

Newell Brands, Inc. | | | 368,000 | | | | 5.00 | | | | 11/15/23 | | | | 377,713 | |

Prudential Financial, Inc., CPI YOY + 2.75%1 | | | 800,000 | | | | 4.86 | | | | 8/10/18 | | | | 802,000 | |

Statoil ASA | | | 534,000 | | | | 7.75 | | | | 6/15/23 | | | | 643,906 | |

United Airlines 2013-1 Class A Pass Through Trust | | | 496,443 | | | | 4.30 | | | | 2/15/27 | | | | 511,629 | |

United Community Bank (Subordinated), 3 Mo. Libor + 2.12%1 | | | 500,000 | | | | 4.50 | | | | 1/30/28 | | | | 503,163 | |

Visa, Inc. | | | 350,000 | | | | 2.80 | | | | 12/14/22 | | | | 345,539 | |

Wells Fargo & Co. (Subordinated) | | | 800,000 | | | | 6.65 | | | | 10/15/23 | | | | 896,474 | |

WGL Holdings, Inc., 3 Mo. Libor + 0.40%1 | | | 300,000 | | | | 2.38 | | | | 11/29/19 | | | | 299,416 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Corporate Bonds

(cost: $12,910,819) | | | | | | | | | | | | | | | 12,675,224 | |

| | | | | | | | | | | | | | | | |

Mortgage Pass-Through Securities - 19.6% | | | | | | | | | | | | | | | | |

Federal Home Loan Mortgage Corporation - 1.6% | | | | | | | | | | | | | | | | |

Freddie Mac | | | 198,076 | | | | 3.00 | | | | 9/1/27 | | | | 199,187 | |

Freddie Mac | | | 43,687 | | | | 3.50 | | | | 7/1/26 | | | | 44,614 | |

Freddie Mac | | | 288,234 | | | | 4.00 | | | | 7/1/26 | | | | 301,110 | |

Freddie Mac | | | 295,303 | | | | 4.00 | | | | 1/1/27 | | | | 308,589 | |

Freddie Mac | | | 8,629 | | | | 4.50 | | | | 5/1/19 | | | | 8,686 | |

Freddie Mac | | | 19,612 | | | | 4.50 | | | | 6/1/19 | | | | 19,745 | |

Freddie Mac | | | 13,419 | | | | 4.50 | | | | 6/1/19 | | | | 13,562 | |

| | | | |

See accompanying notes to financial statements. | | | | |

16 | | | SIT MUTUAL FUNDS ANNUAL REPORT | |

| | | | | | | | | | | | | | | | |

| | | | | |

| Name of Issuer | | Principal

Amount ($) | | Coupon Rate (%) | | Maturity Date | | Fair Value ($) | |

| | | | |

Freddie Mac | | | 73,033 | | | | 4.50 | | | | 12/1/21 | | | | 73,648 | |

Freddie Mac | | | 25,849 | | | | 4.50 | | | | 7/1/26 | | | | 26,128 | |

Freddie Mac | | | 20,110 | | | | 5.00 | | | | 7/1/19 | | | | 20,448 | |

Freddie Mac | | | 19,873 | | | | 5.00 | | | | 10/1/25 | | | | 21,230 | |

Freddie Mac | | | 6,268 | | | | 5.50 | | | | 10/1/19 | | | | 6,317 | |

Freddie Mac | | | 56,512 | | | | 5.50 | | | | 5/1/20 | | | | 57,393 | |

Freddie Mac | | | 13,850 | | | | 5.50 | | | | 7/1/20 | | | | 14,046 | |

Freddie Mac | | | 13,068 | | | | 5.50 | | | | 12/1/20 | | | | 13,191 | |

Freddie Mac | | | 49,669 | | | | 5.50 | | | | 3/1/21 | | | | 50,838 | |

Freddie Mac | | | 29,345 | | | | 5.50 | | | | 3/1/21 | | | | 30,114 | |