UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-02258

Eaton Vance Series Trust II

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

June 30

Date of Fiscal Year End

June 30, 2015

Date of Reporting Period

Item 1. Reports to Stockholders

Parametric Tax-Managed Emerging Markets Fund

Annual Report

June 30, 2015

Commodity Futures Trading Commission Registration. Effective December 31, 2012, the Commodity Futures Trading Commission (“CFTC”) adopted certain regulatory changes that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The Fund has claimed an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act. Accordingly, neither the Fund nor the adviser with respect to the operation of the Fund is subject to CFTC regulation. Because of its management of other strategies, the Fund’s adviser is registered with the CFTC as a commodity pool operator and a commodity trading advisor.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial advisor. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-260-0761.

Annual Report June 30, 2015

Parametric Tax-Managed Emerging Markets Fund

Table of Contents

| | | | |

| |

Management’s Discussion of Fund Performance | | | 2 | |

| |

Performance | | | 3 | |

| |

Fund Profile | | | 4 | |

| |

Endnotes and Additional Disclosures | | | 5 | |

| |

Fund Expenses | | | 6 | |

| |

Financial Statements | | | 7 | |

| |

Report of Independent Registered Public Accounting Firm | | | 38 | |

| |

Federal Tax Information | | | 39 | |

| |

Board of Trustees’ Contract Approval | | | 40 | |

| |

Management and Organization | | | 43 | |

| |

Important Notices | | | 46 | |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2015

Management’s Discussion of Fund Performance1

Economic and Market Conditions

For the 12-month period ended June 30, 2015, emerging-market equities were characterized by dramatic price swings and volatility, along with country-specific themes such as political unrest, inflationary pressures and fiscal challenges.

The 12-month period began with many investors pessimistic toward the emerging-market asset class as a whole. This was partially a side effect of emerging-market returns generally trailing those of the developed markets, as well as a growing impression that rising U.S. interest rates would be detrimental to emerging-market economies. By the end of 2014, the collapse in crude oil prices, combined with political challenges in Greece, Brazil and Russia, had caused a steep decline in emerging-market returns. One positive event heading into 2015 was a sharp rally in Chinese stocks, which was helped by a renewed use of margin accounts by Chinese retail investors.

This rally continued to support emerging-market returns in the first half of 2015 and was aided by a bounce back in Russia: The ruble staged a powerful rally, making Russian stocks among the highest returning within the MSCI Emerging Markets Index2 for the first six months of 2015. However, in the last three months of the 12-month period, results again turned mixed, with Brazil’s equity market experiencing a rebound and China’s rally sharply reversing in the final weeks of the period. Meanwhile, Greece’s debt crisis increasingly became a source of investor concern.

Frontier markets (as measured by the MSCI Frontier Markets Index) presented an even more challenging situation than the broader emerging-market category (as measured by the MSCI Emerging Markets Index). A large representation of oil exporters created a stiff headwind for frontier markets in the second half of 2014 and early 2015. In addition, the mounting Greek crisis had negative ramifications for frontier-market countries in eastern Europe.

Fund Performance

For the 12-month period ended June 30, 2015, Parametric Tax-Managed Emerging Markets Fund (the Fund) Institutional Class shares had a total return of -9.93% at net asset value, underperforming the Fund’s benchmark, the MSCI Emerging Markets Index (the Index), which had a total return of -5.12% for the same period.

The largest detractor from the Fund’s performance versus the Index was its underweight position in China. China’s equity market rose strongly over the last three quarters of the 12-month period. This advance was largely fueled by the Chinese government’s economic stimulus programs, as well as by Chinese investors’ growing use of margin accounts. The Fund’s overweight position in Greece also hurt relative performance versus the Index, as Greek shares declined amid the increasingly contentious negotiations between Greece, the European central authorities and the International Monetary Fund (IMF). Finally, the Fund’s underweight position in Taiwan also hurt relative performance versus the Index.

The largest contributors to the Fund’s performance versus the Index were its underweight positions in Brazil and Korea, whose equity markets fell over the 12-month period. Brazil’s economy continued to be challenged by growing inflation, political scandals and the falling value of its commodity exports. Korea faced growing competition to its export-focused economy from both Japan and Taiwan. In addition, the Fund’s overweight position in Malaysia further benefited relative performance versus the Index.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recent month-end, please refer to eatonvance.com.

Parametric Tax-Managed Emerging Markets Fund

June 30, 2015

Performance2,3

Portfolio Managers Thomas C. Seto and Timothy W. Atwill, Ph.D., CFA, each of Parametric Portfolio Associates LLC

| | | | | | | | | | | | | | | | | | | | |

% Average Annual Total Returns | | Class

Inception Date | | | Performance

Inception Date | | | One Year | | | Five Years | | | Ten Years | |

Institutional Class at NAV | | | 06/30/1998 | | | | 06/30/1998 | | | | –9.93 | % | | | 4.41 | % | | | 9.01 | % |

Institutional Class at NAV with redemption fee | | | — | | | | — | | | | –11.70 | | | | 4.02 | | | | 8.83 | |

MSCI Emerging Markets Index | | | — | | | | — | | | | –5.12 | % | | | 3.68 | % | | | 8.11 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % After-Tax Returns with Redemption Fee | | Class

Inception Date | | | Performance

Inception Date | | | One Year | | | Five Years | | | Ten Years | |

Institutional Class After Taxes on Distribution | | | 06/30/1998 | | | | 06/30/1998 | | | | –12.05 | % | | | 3.81 | % | | | 8.61 | % |

Institutional Class After Taxes on Distribution and Sale of Fund Shares | | | — | | | | — | | | | –6.16 | | | | 3.36 | | | | 7.50 | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % Total Annual Operating Expense Ratio4 | | | | | | | | | | | | | | Institutional

Class | |

| | | | | | | | | | | | | | | | | | | 0.95 | % |

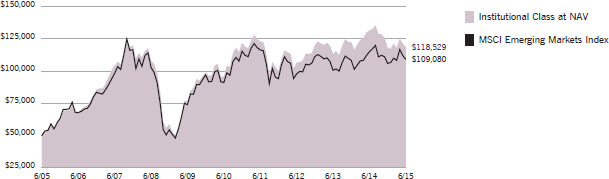

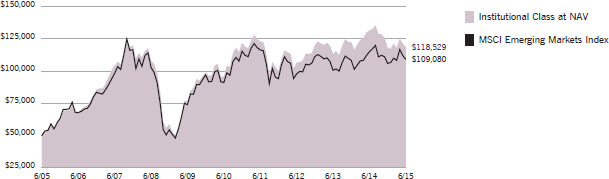

Growth of $50,000

This graph shows the change in value of a hypothetical investment of $50,000 in Institutional Class of the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recent month-end, please refer to eatonvance.com.

Parametric Tax-Managed Emerging Markets Fund

June 30, 2015

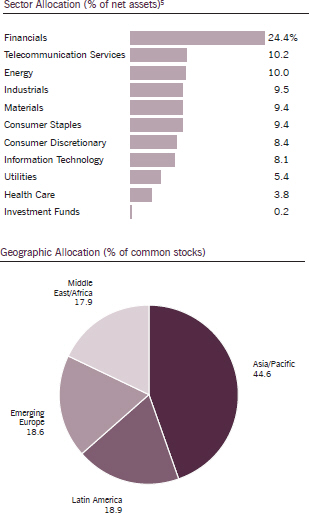

Fund Profile

| | | | |

| Top 10 Holdings (% of net assets)5 | | | | |

| |

America Movil SAB de CV, Series L | | | 1.2 | % |

MTN Group, Ltd. | | | 1.1 | |

China Mobile, Ltd. | | | 1.0 | |

Samsung Electronics Co., Ltd. | | | 0.9 | |

Tencent Holdings, Ltd. | | | 0.9 | |

OAO Gazprom ADR | | | 0.8 | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | | 0.8 | |

Grupo Televisa SAB, Series CPO | | | 0.7 | |

Sberbank of Russia | | | 0.7 | |

Naspers, Ltd., Class N | | | 0.6 | |

Total | | | 8.7 | % |

See Endnotes and Additional Disclosures in this report.

Parametric Tax-Managed Emerging Markets Fund

June 30, 2015

Endnotes and Additional Disclosures

| 1 | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward looking statements”. The Fund’s actual future results may differ significantly from those stated in any forward looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| 2 | MSCI Emerging Markets Index is an unmanaged index of emerging-markets common stocks. MSCI Frontier Markets Index is an unmanaged index that measures the performance of stock markets with less-developed economies and financial markets than emerging markets, and that typically have more restrictions on foreign stock ownership. MSCI indexes are net of foreign withholding taxes. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 3 | Institutional Class shares are offered at NAV. Institutional Class shares are subject to a 2% redemption fee at the time of exchange or redemption. Returns are historical and are calculated by determining the percentage change in NAV with all distributions reinvested. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares. Performance since inception for an index, if presented, is the performance since the Fund’s or oldest share class’ inception, as applicable. After-tax returns are calculated using certain assumptions, including using the highest historical individual federal income tax rates, and do not reflect the impact of state/ local taxes. Actual after-tax returns depend on a shareholder’s tax situation and the actual characterization of distributions and may differ from those shown. After-tax returns are not relevant to shareholders who hold shares in tax-deferred accounts or shares held by nontaxable entities. Return After Taxes on Distributions may be the same as Return Before Taxes for the same period because no taxable distributions were made during that period. Return After Taxes on Distributions and Sale of Fund Shares may be greater than or equal to Return After Taxes on Distributions for the same period because of losses realized on the sale of Fund shares. The Fund’s after-tax returns also may reflect foreign tax credits passed by the Fund to its shareholders. |

| 4 | Source: Fund prospectus. |

| 5 | Excludes cash and cash equivalents. |

| | Fund profile subject to change due to active management. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2015

Fund Expenses

Example: As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2015 – June 30, 2015).

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(1/1/15) | | | Ending

Account Value

(6/30/15) | | | Expenses Paid

During Period*

(1/1/15 – 6/30/15) | | | Annualized Expense

Ratio | |

| | | | |

| | | | | | | | | | | | | | | | |

Actual | | | | | | | | | | | | | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,003.90 | | | $ | 4.72 | | | | 0.95 | % |

| | | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

Hypothetical | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,020.10 | | | $ | 4.76 | | | | 0.95 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on December 31, 2014. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2015

Portfolio of Investments

| | | | | | | | |

| Common Stocks — 97.9% | |

| | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Argentina — 0.7% | |

Adecoagro SA(1) | | | 191,900 | | | $ | 1,769,318 | |

Arcos Dorados Holdings, Inc., Class A | | | 500,800 | | | | 2,634,208 | |

Banco Macro SA, Class B | | | 130,676 | | | | 857,123 | |

Banco Macro SA, Class B ADR | | | 6,100 | | | | 278,160 | |

BBVA Banco Frances SA | | | 76,594 | | | | 586,685 | |

BBVA Banco Frances SA ADR | | | 6,799 | | | | 107,968 | |

Cresud SA ADR(1) | | | 47,360 | | | | 616,627 | |

Grupo Financiero Galicia SA, Class B ADR | | | 67,900 | | | | 1,275,841 | |

IRSA Inversiones y Representaciones SA | | | 119,544 | | | | 305,880 | |

IRSA Inversiones y Representaciones SA ADR | | | 9,600 | | | | 172,320 | |

Ledesma SAAI | | | 259,501 | | | | 209,907 | |

MercadoLibre, Inc. | | | 35,600 | | | | 5,044,520 | |

Molinos Rio de la Plata SA, Class B | | | 93,310 | | | | 374,819 | |

Pampa Energia SA ADR(1) | | | 179,000 | | | | 2,471,990 | |

Petrobras Argentina SA ADR | | | 167,793 | | | | 1,119,179 | |

Siderar SAIC | | | 2,005,200 | | | | 1,368,203 | |

Telecom Argentina SA ADR | | | 142,000 | | | | 2,554,580 | |

Telecom Argentina SA, Class B | | | 229,824 | | | | 1,183,702 | |

Transportadora de Gas del Sur SA | | | 252,923 | | | | 317,318 | |

Transportadora de Gas del Sur SA ADR | | | 73,736 | | | | 333,287 | |

YPF SA ADR | | | 101,600 | | | | 2,786,888 | |

| | |

| | | | | | $ | 26,368,523 | |

| | |

|

Bahrain — 0.6% | |

Ahli United Bank BSC | | | 16,020,488 | | | $ | 11,433,352 | |

Al Salam Bank-Bahrain BSC | | | 21,545,754 | | | | 7,627,522 | |

Gulf Finance House EC(1) | | | 10,441,939 | | | | 2,021,189 | |

Ithmaar Bank BSC(1) | | | 16,428,969 | | | | 2,328,306 | |

| | |

| | | | | | $ | 23,410,369 | |

| | |

|

Bangladesh — 0.8% | |

Aftab Automobiles, Ltd. | | | 378,354 | | | $ | 275,838 | |

Al-Arafah Islami Bank, Ltd. | | | 3,219,220 | | | | 517,245 | |

Bangladesh Building Systems, Ltd. | | | 526,800 | | | | 323,009 | |

Bangladesh Export Import Co., Ltd.(1) | | | 5,371,333 | | | | 2,241,823 | |

Beximco Pharmaceuticals, Ltd. | | | 1,141,583 | | | | 912,740 | |

British American Tobacco Bangladesh Co., Ltd. | | | 27,950 | | | | 1,093,743 | |

BSRM Steels, Ltd. | | | 1,250,000 | | | | 1,185,071 | |

City Bank, Ltd. (The) | | | 3,640,644 | | | | 810,168 | |

Grameenphone, Ltd. | | | 943,200 | | | | 4,024,964 | |

Heidelberger Cement Bangladesh, Ltd. | | | 103,700 | | | | 764,021 | |

Islami Bank Bangladesh, Ltd. | | | 2,422,550 | | | | 529,527 | |

Jamuna Oil Co., Ltd. | | | 212,850 | | | | 540,268 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Bangladesh (continued) | |

Khulna Power Co., Ltd. | | | 1,208,340 | | | $ | 1,094,759 | |

Lankabangla Finance, Ltd. | | | 1,809,885 | | | | 643,929 | |

Malek Spinning Mills, Ltd. | | | 1,020,000 | | | | 252,949 | |

Meghna Petroleum, Ltd. | | | 210,100 | | | | 526,634 | |

National Bank, Ltd.(1) | | | 7,923,850 | | | | 1,161,178 | |

Olympic Industries, Ltd. | | | 278,775 | | | | 839,935 | |

Padma Oil Co., Ltd. | | | 175,100 | | | | 550,667 | |

People’s Leasing and Financial Services, Ltd.(1) | | | 665,379 | | | | 126,511 | |

Pubali Bank, Ltd. | | | 1,779,933 | | | | 423,414 | |

Social Islami Bank, Ltd. | | | 2,453,500 | | | | 426,063 | |

Southeast Bank, Ltd. | | | 1,909,500 | | | | 412,493 | |

Square Pharmaceuticals, Ltd. | | | 1,280,553 | | | | 4,318,476 | |

Summit Power, Ltd. | | | 1,381,500 | | | | 725,735 | |

Titas Gas Transmission & Distribution Co., Ltd. | | | 1,857,500 | | | | 1,672,131 | |

United Airways Bangladesh, Ltd.(1) | | | 8,470,123 | | | | 1,122,378 | |

United Commercial Bank, Ltd. | | | 6,014,400 | | | | 1,516,115 | |

| | |

| | | | | | $ | 29,031,784 | |

| | |

|

Botswana — 0.4% | |

Barclays Bank of Botswana, Ltd. | | | 1,308,506 | | | $ | 565,504 | |

Botswana Insurance Holdings, Ltd. | | | 801,726 | | | | 1,122,548 | |

First National Bank of Botswana, Ltd. | | | 7,511,600 | | | | 2,993,537 | |

Letshego Holdings, Ltd. | | | 16,310,999 | | | | 5,290,782 | |

Sechaba Breweries, Ltd. | | | 1,086,400 | | | | 3,138,950 | |

Sefalana Holding Co. | | | 991,000 | | | | 1,200,934 | |

Standard Chartered Bank Botswana, Ltd. | | | 850,790 | | | | 1,093,421 | |

| | |

| | | | | | $ | 15,405,676 | |

| | |

|

Brazil — 5.7% | |

AMBEV SA | | | 1,736,625 | | | $ | 10,668,533 | |

B2W Cia Digital(1) | | | 263,000 | | | | 1,724,798 | |

Banco Bradesco SA ADR, PFC Shares | | | 178,013 | | | | 1,630,599 | |

Banco Bradesco SA, PFC Shares | | | 1,004,795 | | | | 9,210,594 | |

Banco do Brasil SA | | | 312,199 | | | | 2,438,066 | |

Bombril SA, PFC Shares | | | 39,000 | | | | 29,792 | |

Braskem SA, PFC Shares | | | 301,200 | | | | 1,319,464 | |

BRF SA | | | 289,766 | | | | 6,121,331 | |

BRF SA ADR | | | 25,600 | | | | 535,296 | |

CCR SA | | | 887,700 | | | | 4,257,054 | |

Centrais Eletricas Brasileiras SA, PFC Shares | | | 468,682 | | | | 1,276,812 | |

CETIP SA - Mercados Organizados | | | 155,700 | | | | 1,706,686 | |

Cia Brasileira de Distribuicao ADR, PFC Shares | | | 14,300 | | | | 338,481 | |

Cia Brasileira de Distribuicao, PFC Shares | | | 43,256 | | | | 1,019,801 | |

Cia de Saneamento Basico do Estado de Sao Paulo | | | 125,400 | | | | 665,498 | |

Cia de Saneamento Basico do Estado de Sao Paulo ADR | | | 127,400 | | | | 659,932 | |

| | | | |

| | 7 | | See Notes to Financial Statements. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2015

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Brazil (continued) | |

Cia de Transmissao de Energia Eletrica Paulista, PFC Shares | | | 65,463 | | | $ | 824,104 | |

Cia Energetica de Minas Gerais SA, PFC Shares | | | 662,453 | | | | 2,526,999 | |

Cia Energetica de Sao Paulo, Class B, PFC Shares | | | 91,500 | | | | 577,117 | |

Cia Hering | | | 155,800 | | | | 608,848 | |

Cia Paranaense de Energia-Copel, PFC Shares | | | 134,100 | | | | 1,507,444 | |

Cia Siderurgica Nacional SA | | | 147,100 | | | | 244,607 | |

Cia Siderurgica Nacional SA ADR | | | 62,200 | | | | 102,630 | |

Cielo SA | | | 1,520,860 | | | | 21,435,169 | |

Contax Participacoes SA, PFC Shares | | | 151,000 | | | | 46,624 | |

Cosan SA Industria e Comercio | | | 137,900 | | | | 1,115,495 | |

CPFL Energia SA | | | 643,066 | | | | 3,981,545 | |

Cyrela Brazil Realty SA Empreendimentos e Participacoes | | | 115,024 | | | | 366,260 | |

Duratex SA | | | 335,583 | | | | 783,613 | |

EcoRodovias Infraestrutura e Logistica SA | | | 146,900 | | | | 366,175 | |

EDP-Energias do Brasil SA | | | 418,300 | | | | 1,548,562 | |

Eletropaulo Metropolitana SA, Class B, PFC Shares | | | 205,868 | | | | 1,177,959 | |

Embraer SA | | | 974,432 | | | | 7,415,349 | |

Embraer SA ADR | | | 26,152 | | | | 792,144 | |

Equatorial Energia SA | | | 260,300 | | | | 2,944,502 | |

Estacio Participacoes SA | | | 275,300 | | | | 1,593,837 | |

Even Construtora e Incorporadora SA | | | 652,400 | | | | 692,458 | |

Ez Tec Empreendimentos e Participacoes SA | | | 136,587 | | | | 636,126 | |

Fibria Celulose SA | | | 24,585 | | | | 335,433 | |

Fibria Celulose SA ADR | | | 54,900 | | | | 747,189 | |

Gafisa SA(1) | | | 845,200 | | | | 649,715 | |

Gerdau SA ADR | | | 170,900 | | | | 411,869 | |

Gerdau SA, PFC Shares | | | 227,900 | | | | 549,024 | |

Gol Linhas Aereas Inteligentes SA, PFC Shares | | | 242,400 | | | | 574,600 | |

Hypermarcas SA(1) | | | 88,100 | | | | 641,248 | |

Itau Unibanco Holding SA ADR, PFC Shares | | | 136,342 | | | | 1,492,945 | |

Itau Unibanco Holding SA, PFC Shares | | | 875,732 | | | | 9,638,657 | |

Itausa-Investimentos Itau SA, PFC Shares | | | 2,247,293 | | | | 6,440,250 | |

JBS SA | | | 444,227 | | | | 2,337,510 | |

Klabin SA | | | 255,400 | | | | 1,568,166 | |

Klabin SA, PFC Shares | | | 981,500 | | | | 1,196,451 | |

Kroton Educacional SA | | | 1,111,932 | | | | 4,252,315 | |

Light SA | | | 123,900 | | | | 674,673 | |

Localiza Rent a Car SA | | | 295,025 | | | | 2,912,199 | |

Lojas Americanas SA, PFC Shares | | | 804,242 | | | | 4,485,400 | |

Lojas Renner SA | | | 115,100 | | | | 4,183,301 | |

Marcopolo SA, PFC Shares | | | 786,900 | | | | 587,182 | |

MRV Engenharia e Participacoes SA | | | 553,800 | | | | 1,391,135 | |

Multiplus SA | | | 91,200 | | | | 1,099,997 | |

Natura Cosmeticos SA | | | 82,900 | | | | 734,317 | |

Odontoprev SA | | | 579,500 | | | | 2,009,266 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Brazil (continued) | |

Oi SA ADR(1) | | | 315,800 | | | $ | 603,178 | |

Oi SA, PFC Shares(1) | | | 888,684 | | | | 1,672,125 | |

PDG Realty SA Empreendimentos e Participacoes(1) | | | 1,321,600 | | | | 153,027 | |

Petroleo Brasileiro SA(1) | | | 275,200 | | | | 1,241,856 | |

Petroleo Brasileiro SA ADR(1) | | | 187,400 | | | | 1,529,184 | |

Petroleo Brasileiro SA, PFC Shares | | | 2,589,800 | | | | 10,587,102 | |

Prumo Logistica SA(1) | | | 828,800 | | | | 210,592 | |

Qualicorp SA | | | 577,500 | | | | 3,661,035 | |

Randon Participacoes SA, PFC Shares | | | 198,512 | | | | 205,593 | |

Rumo Logistica Operadora Multimodal SA(1) | | | 61,607 | | | | 25,165 | |

Souza Cruz SA | | | 198,800 | | | | 1,562,087 | |

Suzano Papel e Celulose SA, PFC Shares | | | 371,100 | | | | 1,974,203 | |

Telefonica Brasil SA ADR | | | 298,900 | | | | 4,163,677 | |

Telefonica Brasil SA, PFC Shares | | | 214,905 | | | | 3,010,923 | |

Tim Participacoes SA | | | 1,725,444 | | | | 5,682,849 | |

Totvs SA | | | 238,900 | | | | 2,996,719 | |

Tractebel Energia SA | | | 222,400 | | | | 2,445,678 | |

Transmissora Alianca de Energia Electrica SA | | | 166,500 | | | | 1,102,110 | |

Ultrapar Participacoes SA | | | 333,048 | | | | 7,037,810 | |

Usinas Siderurgicas de Minas Gerais SA, Class A, PFC Shares | | | 226,900 | | | | 300,675 | |

Vale SA ADR, PFC Shares | | | 337,600 | | | | 1,704,880 | |

Vale SA, PFC Shares | | | 1,863,092 | | | | 9,336,134 | |

Weg SA | | | 903,920 | | | | 5,538,476 | |

| | | | | | | | | |

| | | | | | $ | 210,548,224 | |

| | | | | | | | | |

|

Bulgaria — 0.1% | |

Albena Invest Holding PLC | | | 19,550 | | | $ | 66,478 | |

Bulgartabak Holding(1) | | | 3,450 | | | | 86,801 | |

CB First Investment Bank AD(1) | | | 54,000 | | | | 76,190 | |

Chimimport AD(1) | | | 825,588 | | | | 731,243 | |

Corporate Commercial Bank AD(1) | | | 19,900 | | | | 10,604 | |

Industrial Holding Bulgaria PLC(1) | | | 576,865 | | | | 326,075 | |

Olovno Tzinkov Komplex AD(1)(2) | | | 33,800 | | | | 0 | |

Petrol AD(1) | | | 76,205 | | | | 27,296 | |

Sopharma AD | | | 303,500 | | | | 534,595 | |

| | | | | | | | | |

| | | | | | $ | 1,859,282 | |

| | | | | | | | | |

|

Chile — 3.0% | |

AES Gener SA | | | 2,989,659 | | | $ | 1,697,620 | |

Aguas Andinas SA, Series A | | | 3,986,694 | | | | 2,276,240 | |

Almendral SA | | | 7,092,000 | | | | 568,558 | |

Antarchile SA, Series A | | | 114,800 | | | | 1,275,905 | |

Banco de Chile | | | 47,499,753 | | | | 5,221,982 | |

Banco de Chile ADR | | | 20,591 | | | | 1,356,535 | |

| | | | |

| | 8 | | See Notes to Financial Statements. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2015

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Chile (continued) | |

Banco de Credito e Inversiones | | | 78,597 | | | $ | 3,454,690 | |

Banco Santander Chile SA ADR | | | 269,549 | | | | 5,458,367 | |

Banmedica SA | | | 286,194 | | | | 537,222 | |

Besalco SA | | | 823,600 | | | | 371,040 | |

Bupa Chile SA, PFC Shares | | | 544,215 | | | | 447,784 | |

Cap SA | | | 186,746 | | | | 639,746 | |

Cencosud SA | | | 2,695,001 | | | | 6,513,279 | |

Cia Cervecerias Unidas SA ADR | | | 142,500 | | | | 3,018,150 | |

Cia Sud Americana de Vapores SA(1) | | | 10,829,733 | | | | 347,114 | |

Colbun SA | | | 9,437,809 | | | | 2,679,096 | |

Corpbanca SA | | | 222,749,200 | | | | 2,459,989 | |

Corpbanca SA ADR | | | 56,666 | | | | 935,556 | |

E.CL SA | | | 253,400 | | | | 344,064 | |

Embotelladora Andina SA, Series A ADR | | | 25,100 | | | | 381,771 | |

Embotelladora Andina SA, Series A, PFC Shares | | | 202,478 | | | | 485,263 | |

Embotelladora Andina SA, Series B ADR | | | 49,672 | | | | 990,460 | |

Empresa Nacional de Electricidad SA ADR | | | 134,059 | | | | 5,556,746 | |

Empresa Nacional de Telecomunicaciones SA | | | 323,187 | | | | 3,574,255 | |

Empresas CMPC SA | | | 2,309,849 | | | | 6,276,184 | |

Empresas Copec SA | | | 1,098,567 | | | | 11,685,340 | |

Enersis SA | | | 9,328,000 | | | | 2,962,081 | |

Enersis SA ADR | | | 266,371 | | | | 4,216,653 | |

Forus SA | | | 64,662 | | | | 232,643 | |

Inversiones Aguas Metropolitanas SA | | | 687,000 | | | | 1,043,490 | |

Latam Airlines Group SA(1) | | | 181,573 | | | | 1,298,583 | |

Latam Airlines Group SA ADR(1) | | | 300,348 | | | | 2,114,450 | |

Latam Airlines Group SA BDR(1) | | | 29,520 | | | | 212,207 | |

Masisa SA | | | 5,792,050 | | | | 176,677 | |

Parque Arauco SA | | | 1,452,200 | | | | 2,789,569 | |

Quinenco SA | | | 490,001 | | | | 1,023,271 | |

Ripley Corp. SA | | | 1,626,000 | | | | 674,029 | |

S.A.C.I. Falabella | | | 1,591,442 | | | | 11,115,386 | |

Salfacorp SA | | | 1,303,900 | | | | 877,051 | |

Sigdo Koppers SA | | | 879,641 | | | | 1,300,318 | |

Sociedad Matriz SAAM SA | | | 6,677,681 | | | | 532,940 | |

Sociedad Quimica y Minera de Chile SA, Series A | | | 20,950 | | | | 421,933 | |

Sociedad Quimica y Minera de Chile SA, Series B ADR | | | 196,100 | | | | 3,141,522 | |

Sonda SA | | | 2,937,360 | | | | 6,152,478 | |

Vina Concha y Toro SA | | | 146,373 | | | | 255,298 | |

Vina Concha y Toro SA ADR | | | 26,701 | | | | 939,875 | |

| | | | | | | | | |

| | | | | | $ | 110,033,410 | |

| | | | | | | | | |

|

China — 9.9% | |

Agile Property Holdings, Ltd. | | | 486,000 | | | $ | 326,550 | |

Agricultural Bank of China, Ltd., Class H | | | 7,024,000 | | | | 3,791,488 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

China (continued) | |

Air China, Ltd., Class H(1)(2) | | | 1,770,000 | | | $ | 2,000,271 | |

Aluminum Corp. of China, Ltd., Class H(1) | | | 2,306,000 | | | | 1,156,269 | |

Angang Steel Co., Ltd., Class H | | | 1,148,000 | | | | 790,447 | |

Anhui Conch Cement Co., Ltd., Class H | | | 1,014,000 | | | | 3,552,789 | |

ANTA Sports Products, Ltd. | | | 887,000 | | | | 2,161,786 | |

Baidu, Inc. ADR(1) | | | 39,900 | | | | 7,943,292 | |

Bank of China, Ltd., Class H | | | 10,281,000 | | | | 6,685,413 | |

Bank of Communications, Ltd., Class H | | | 2,201,300 | | | | 2,291,286 | |

BBMG Corp., Class H | | | 1,134,500 | | | | 1,138,408 | |

Beijing Capital International Airport Co., Ltd., Class H | | | 596,000 | | | | 686,245 | |

Beijing Enterprises Holdings, Ltd. | | | 223,500 | | | | 1,676,600 | |

Beijing Enterprises Water Group, Ltd.(1) | | | 916,000 | | | | 751,445 | |

BOE Technology Group Co., Ltd., Class B(1) | | | 1,686,360 | | | | 826,825 | |

BYD Co., Ltd., Class H | | | 575,000 | | | | 3,441,415 | |

China Agri-Industries Holdings, Ltd.(1) | | | 2,380,000 | | | | 1,351,459 | |

China Bluechemical, Ltd., Class H | | | 1,348,000 | | | | 493,462 | |

China Cinda Asset Management, Co., Ltd., Class H(1) | | | 3,202,000 | | | | 1,780,827 | |

China CITIC Bank Corp., Ltd., Class H(1) | | | 2,727,000 | | | | 2,171,243 | |

China Coal Energy Co., Ltd., Class H | | | 2,861,000 | | | | 1,706,106 | |

China Communications Construction Co., Ltd., Class H | | | 1,677,000 | | | | 2,495,407 | |

China Communications Services Corp., Ltd., Class H | | | 2,166,000 | | | | 1,085,472 | |

China Construction Bank Corp., Class H | | | 10,778,580 | | | | 9,845,627 | |

China COSCO Holdings Co., Ltd., Class H(1) | | | 2,729,150 | | | | 1,763,228 | |

China Dongxiang (Group) Co., Ltd. | | | 3,981,000 | | | | 1,051,389 | |

China Eastern Airlines Corp., Ltd., Class H(1) | | | 1,436,000 | | | | 1,199,705 | |

China Everbright International, Ltd. | | | 1,156,000 | | | | 2,082,308 | |

China Everbright, Ltd. | | | 456,000 | | | | 1,573,174 | |

China Gas Holdings, Ltd. | | | 546,000 | | | | 870,811 | |

China High Speed Transmission Equipment Group Co., Ltd.(1) | | | 672,000 | | | | 578,714 | |

China International Marine Containers Co., Ltd., Class B | | | 413,812 | | | | 1,059,148 | |

China Life Insurance Co., Ltd., Class H | | | 654,000 | | | | 2,825,901 | |

China Longyuan Power Group Corp., Ltd., Class H | | | 2,413,000 | | | | 2,678,311 | |

China Mengniu Dairy Co., Ltd. | | | 800,000 | | | | 3,981,122 | |

China Merchants Bank Co., Ltd., Class H | | | 1,204,500 | | | | 3,514,143 | |

China Merchants Holdings (International) Co., Ltd. | | | 790,000 | | | | 3,389,330 | |

China Merchants Property Development Co., Ltd., Class B(2) | | | 882,981 | | | | 2,077,723 | |

China Minsheng Banking Corp., Ltd., Class H | | | 2,229,600 | | | | 2,917,516 | |

China Mobile, Ltd. | | | 3,018,900 | | | | 38,681,889 | |

China National Building Material Co., Ltd., Class H | | | 2,156,000 | | | | 2,032,873 | |

China Oilfield Services, Ltd., Class H | | | 756,000 | | | | 1,198,357 | |

China Overseas Land & Investment, Ltd. | | | 1,148,360 | | | | 4,057,141 | |

China Pacific Insurance (Group) Co., Ltd., Class H | | | 532,000 | | | | 2,555,491 | |

China Petroleum & Chemical Corp., Class H | | | 12,211,800 | | | | 10,462,809 | |

China Pharmaceutical Group, Ltd. | | | 2,036,000 | | | | 2,015,579 | |

| | | | |

| | 9 | | See Notes to Financial Statements. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2015

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

China (continued) | |

China Railway Construction Corp., Ltd., Class H | | | 947,500 | | | $ | 1,455,509 | |

China Railway Group, Ltd., Class H | | | 2,265,000 | | | | 2,453,499 | |

China Resources Enterprise, Ltd. | | | 688,000 | | | | 2,220,405 | |

China Resources Land, Ltd. | | | 655,111 | | | | 2,120,168 | |

China Resources Power Holdings Co., Ltd. | | | 1,443,000 | | | | 3,993,836 | |

China Shenhua Energy Co., Ltd., Class H | | | 1,654,500 | | | | 3,768,006 | |

China Shipping Container Lines Co., Ltd., Class H(1) | | | 3,803,000 | | | | 1,483,444 | |

China Shipping Development Co., Ltd., Class H | | | 1,778,000 | | | | 1,343,977 | |

China Southern Airlines Co., Ltd., Class H | | | 2,064,500 | | | | 2,418,400 | |

China Taiping Insurance Holdings Co., Ltd.(1) | | | 277,000 | | | | 991,708 | |

China Telecom Corp., Ltd., Class H | | | 8,226,000 | | | | 4,817,966 | |

China Travel International Investment Hong Kong, Ltd. | | | 1,660,000 | | | | 728,713 | |

China Unicom (Hong Kong), Ltd. | | | 2,590,290 | | | | 4,042,983 | |

China Vanke Co., Ltd., Class H | | | 1,106,117 | | | | 2,715,786 | |

China Yurun Food Group, Ltd.(1) | | | 926,000 | | | | 352,354 | |

Chongqing Changan Automobile Co., Ltd., Class B | | | 1,301,443 | | | | 3,323,569 | |

CITIC, Ltd. | | | 628,000 | | | | 1,129,458 | |

CNOOC, Ltd. | | | 7,777,500 | | | | 11,052,258 | |

Cosco Pacific, Ltd. | | | 1,128,000 | | | | 1,526,311 | |

Country Garden Holdings Co., Ltd. | | | 1,582,000 | | | | 692,494 | |

Ctrip.com International, Ltd. ADR(1) | | | 81,800 | | | | 5,940,316 | |

Datang International Power Generation Co., Ltd., Class H | | | 3,276,000 | | | | 1,673,821 | |

Dazhong Transportation Group Co., Ltd., Class B | | | 633,875 | | | | 830,913 | |

Dongfeng Motor Group Co., Ltd., Class H | | | 1,748,000 | | | | 2,337,264 | |

Golden Eagle Retail Group, Ltd. | | | 516,000 | | | | 690,612 | |

Great Wall Motor Co., Ltd., Class H(1)(2) | | | 836,750 | | | | 4,101,954 | |

Guangdong Investment, Ltd. | | | 2,088,000 | | | | 2,916,447 | |

Guangzhou Automobile Group Co., Ltd., Class H | | | 1,750,857 | | | | 1,619,371 | |

Guangzhou R&F Properties Co., Ltd.,

Class H(1) | | | 670,400 | | | | 819,825 | |

Hangzhou Steam Turbine Co., Ltd., Class B(2) | | | 426,359 | | | | 703,599 | |

Hengan International Group Co., Ltd. | | | 248,000 | | | | 2,942,184 | |

Huaneng Power International, Inc., Class H | | | 3,084,000 | | | | 4,284,216 | |

Industrial & Commercial Bank of China, Ltd., Class H | | | 11,288,000 | | | | 8,942,779 | |

Inner Mongolia Eerduosi Resources Co., Ltd., Class B | | | 392,000 | | | | 419,322 | |

Inner Mongolia Yitai Coal Co., Ltd., Class B | | | 424,000 | | | | 605,641 | |

Jiangsu Expressway Co., Ltd., Class H | | | 796,000 | | | | 1,046,340 | |

Jiangxi Copper Co., Ltd., Class H | | | 1,055,000 | | | | 1,765,999 | |

Kingboard Chemical Holdings, Ltd. | | | 421,200 | | | | 728,604 | |

Kunlun Energy Co., Ltd. | | | 1,678,000 | | | | 1,705,345 | |

Lee & Man Paper Manufacturing, Ltd. | | | 876,000 | | | | 558,238 | |

Lenovo Group, Ltd. | | | 2,596,000 | | | | 3,589,137 | |

Li Ning Co., Ltd.(1) | | | 1,892,312 | | | | 863,609 | |

Lonking Holdings, Ltd. | | | 2,438,000 | | | | 477,193 | |

Maanshan Iron & Steel Co., Ltd., Class H(1) | | | 1,389,000 | | | | 476,627 | |

Mindray Medical International, Ltd. ADR | | | 83,200 | | | | 2,371,200 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

China (continued) | |

NetEase.com, Inc. ADR | | | 22,000 | | | $ | 3,187,030 | |

New Oriental Education & Technology Group, Inc. ADR(1) | | | 181,200 | | | | 4,443,024 | |

Nine Dragons Paper Holdings, Ltd. | | | 1,412,000 | | | | 1,228,072 | |

Parkson Retail Group, Ltd. | | | 1,024,000 | | | | 211,143 | |

PetroChina Co., Ltd., Class H | | | 10,100,300 | | | | 11,222,658 | |

PICC Property & Casualty Co., Ltd., Class H | | | 1,168,000 | | | | 2,655,821 | |

Ping An Insurance (Group) Co. of China, Ltd., Class H | | | 317,000 | | | | 4,265,822 | |

Poly Property Group Co., Ltd. | | | 970,000 | | | | 465,781 | |

Qingling Motors Co., Ltd., Class H | | | 1,448,966 | | | | 489,409 | |

Semiconductor Manufacturing International Corp.(1) | | | 12,412,000 | | | | 1,352,982 | |

Shandong Weigao Group Medical Polymer Co., Ltd., Class H | | | 1,712,000 | | | | 1,264,225 | |

Shanghai Diesel Engine Co., Ltd., Class B | | | 854,400 | | | | 883,738 | |

Shanghai Electric Group Co., Ltd., Class H | | | 1,644,000 | | | | 1,333,708 | |

Shanghai Haixin Group Co., Ltd., Class B(1) | | | 545,000 | | | | 474,259 | |

Shanghai Industrial Holdings, Ltd. | | | 291,000 | | | | 985,270 | |

Shanghai Jin Jiang International Hotels Development Co., Ltd., Class B | | | 574,800 | | | | 1,632,979 | |

Shanghai Zhenhua Heavy Industry Co., Ltd., Class B(1) | | | 863,200 | | | | 681,664 | |

Shimao Property Holdings, Ltd. | | | 532,000 | | | | 1,049,977 | |

Sihuan Pharmaceutical Holdings Group,

Ltd.(1)(2) | | | 5,255,000 | | | | 1,494,833 | |

SINA Corp.(1) | | | 25,700 | | | | 1,376,621 | |

Sino Biopharmaceutical, Ltd. | | | 2,360,000 | | | | 2,742,196 | |

Sino-Ocean Land Holdings, Ltd. | | | 1,370,500 | | | | 1,038,767 | |

Sinopec Oilfield Service Corp., Class H(1) | | | 4,801,500 | | | | 2,328,287 | |

Sinopec Shanghai Petrochemical Co., Ltd., Class H(1) | | | 3,136,000 | | | | 1,696,043 | |

Sinopharm Group Co., Ltd., Class H | | | 975,600 | | | | 4,326,041 | |

Sohu.com, Inc.(1) | | | 8,700 | | | | 514,083 | |

Tencent Holdings, Ltd. | | | 1,571,000 | | | | 31,434,832 | |

Tingyi (Cayman Islands) Holding Corp. | | | 1,184,000 | | | | 2,424,787 | |

Travelsky Technology, Ltd., Class H | | | 1,218,000 | | | | 1,788,561 | |

Tsingtao Brewery Co., Ltd., Class H | | | 874,000 | | | | 5,298,970 | |

Want Want China Holdings, Ltd. | | | 3,531,000 | | | | 3,728,137 | |

Weichai Power Co., Ltd., Class H | | | 226,800 | | | | 757,860 | |

Wumart Stores, Inc., Class H | | | 832,000 | | | | 582,539 | |

Yangzijiang Shipbuilding Holdings, Ltd. | | | 1,652,000 | | | | 1,735,121 | |

Yantai Changyu Pioneer Wine Co., Ltd., Class B | | | 135,132 | | | | 556,185 | |

Yanzhou Coal Mining Co., Ltd., Class H | | | 1,488,000 | | | | 1,163,007 | |

Zhejiang Expressway Co., Ltd., Class H | | | 870,000 | | | | 1,206,554 | |

Zhuzhou CSR Times Electric Co., Ltd., Class H | | | 288,000 | | | | 2,163,927 | |

Zijin Mining Group Co., Ltd., Class H | | | 3,148,000 | | | | 1,108,102 | |

ZTE Corp., Class H | | | 708,739 | | | | 1,795,957 | |

| | | | | | | | | |

| | | | | | $ | 366,847,166 | |

| | | | | | | | | |

|

Colombia — 1.5% | |

Almacenes Exito SA | | | 569,955 | | | $ | 4,970,560 | |

| | | | |

| | 10 | | See Notes to Financial Statements. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2015

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Colombia (continued) | |

Avianca Holdings SA, PFC Shares | | | 614,449 | | | $ | 790,109 | |

Banco Davivienda SA, PFC Shares | | | 190,600 | | | | 1,956,324 | |

Banco de Bogota SA | | | 69,328 | | | | 1,596,674 | |

Bancolombia SA | | | 86,292 | | | | 884,379 | |

Bancolombia SA ADR, PFC Shares | | | 127,200 | | | | 5,469,600 | |

Bolsa de Valores de Colombia | | | 85,691,900 | | | | 575,618 | |

Celsia SA ESP | | | 833,260 | | | | 1,354,535 | |

Cementos Argos SA | | | 509,458 | | | | 1,808,867 | |

Cementos Argos SA, PFC Shares | | | 190,626 | | | | 649,026 | |

Cemex Latam Holdings SA(1) | | | 266,452 | | | | 1,305,047 | |

Corporacion Financiera Colombiana SA | | | 154,506 | | | | 2,164,685 | |

Ecopetrol SA | | | 4,549,600 | | | | 3,021,174 | |

Ecopetrol SA ADR | | | 425,800 | | | | 5,646,108 | |

Empresa de Energia de Bogota SA | | | 2,602,208 | | | | 1,588,165 | |

Empresa de Telecommunicaciones de Bogota SA | | | 2,267,738 | | | | 451,769 | |

Fabricato SA(1) | | | 34,115,900 | | | | 183,333 | |

Grupo Argos SA | | | 466,160 | | | | 3,041,868 | |

Grupo Argos SA, PFC Shares | | | 147,122 | | | | 927,272 | |

Grupo Aval Acciones y Valores SA | | | 1,723,100 | | | | 839,983 | |

Grupo Aval Acciones y Valores SA, PFC Shares | | | 3,247,601 | | | | 1,589,386 | |

Grupo de Inversiones Suramericana SA | | | 365,800 | | | | 5,198,003 | |

Grupo Nutresa SA | | | 414,015 | | | | 3,639,217 | |

Grupo Odinsa SA(1) | | | 53,817 | | | | 185,504 | |

Interconexion Electrica SA | | | 945,400 | | | | 2,667,223 | |

ISAGEN SA ESP | | | 2,021,151 | | | | 2,156,751 | |

Organizacion Terpel SA | | | 13,768 | | | | 80,857 | |

| | | | | | | | | |

| | | | | | $ | 54,742,037 | |

| | | | | | | | | |

|

Croatia — 0.7% | |

AD Plastik DD | | | 51,587 | | | $ | 787,905 | |

Adris Grupa DD, PFC Shares | | | 45,976 | | | | 2,499,511 | |

Atlantic Grupa DD | | | 17,357 | | | | 2,269,559 | |

Atlantska Plovidba DD(1) | | | 15,437 | | | | 458,388 | |

Dalekovod DD(1) | | | 55,123 | | | | 141,322 | |

Ericsson Nikola Tesla | | | 5,610 | | | | 950,753 | |

Hrvatski Telekom DD | | | 421,671 | | | | 9,548,474 | |

Koncar-Elektroindustrija DD | | | 7,227 | | | | 719,246 | |

Kras DD(1) | | | 4,595 | | | | 307,961 | |

Ledo DD | | | 1,903 | | | | 2,263,236 | |

Petrokemija DD(1) | | | 17,450 | | | | 40,678 | |

Podravka Prehrambena Industrija DD(1) | | | 72,212 | | | | 3,285,416 | |

Privredna Banka Zagreb DD | | | 3,310 | | | | 292,079 | |

Valamar Riviera DD | | | 685,752 | | | | 2,075,331 | |

Zagrebacka Banka DD | | | 30,550 | | | | 189,798 | |

| | | | | | | | | |

| | | | | | $ | 25,829,657 | |

| | | | | | | | | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Czech Republic — 1.2% | |

CEZ AS | | | 716,870 | | | $ | 16,642,015 | |

Komercni Banka AS | | | 84,191 | | | | 18,657,571 | |

New World Resources PLC, Class A(1) | | | 860,500 | | | | 7,030 | |

Pegas Nonwovens SA | | | 48,000 | | | | 1,620,389 | |

Philip Morris CR AS | | | 6,810 | | | | 2,929,712 | |

Unipetrol AS(1) | | | 500,500 | | | | 3,252,197 | |

| | | | | | | | | |

| | | | | | $ | 43,108,914 | |

| | | | | | | | | |

|

Egypt — 1.4% | |

Alexandria Mineral Oils Co. | | | 121,900 | | | $ | 673,504 | |

Arab Cotton Ginning | | | 1,880,400 | | | | 759,183 | |

Commercial International Bank Egypt SAE | | | 1,828,235 | | | | 13,460,759 | |

Eastern Tobacco | | | 97,097 | | | | 2,728,508 | |

Egypt Kuwait Holding Co. SAE | | | 1,277,058 | | | | 789,238 | |

Egyptian Financial & Industrial Co. | | | 137,064 | | | | 116,928 | |

Egyptian Financial Group-Hermes Holding

Co.(1) | | | 1,590,030 | | | | 2,842,511 | |

Egyptian International Pharmaceutical Industrial Co. | | | 153,932 | | | | 1,707,656 | |

Egyptian Resorts Co.(1) | | | 4,213,900 | | | | 543,540 | |

El Ezz Aldekhela Steel Alexandria | | | 4,750 | | | | 266,480 | |

El Sewedy Electric Co.(1) | | | 384,121 | | | | 2,394,436 | |

Ezz Steel(1) | | | 1,677,500 | | | | 1,841,013 | |

Ghabbour Auto(1) | | | 345,862 | | | | 191,419 | |

Global Telecom Holding SAE(1) | | | 9,908,210 | | | | 3,260,806 | |

Juhayna Food Industries | | | 2,665,536 | | | | 2,951,370 | |

Maridive & Oil Services SAE(1) | | | 787,652 | | | | 344,731 | |

Medinet Nasr for Housing and Development SAE(1) | | | 460,182 | | | | 1,667,345 | |

Misr Cement (Qena) | | | 18,251 | | | | 198,782 | |

Nile Cotton Ginning Co.(1)(2) | | | 125,000 | | | | 0 | |

Orascom Telecom Media and Technology Holding SAE(1) | | | 13,585,310 | | | | 1,541,431 | |

Oriental Weavers Co. | | | 1,278,405 | | | | 1,706,342 | |

Pioneers Holding(1) | | | 734,900 | | | | 801,209 | |

Qalaa Holdings(1) | | | 1,600,000 | | | | 412,379 | |

Sidi Kerir Petrochemicals Co. | | | 957,400 | | | | 1,579,774 | |

Six of October Development & Investment

Co.(1) | | | 275,153 | | | | 386,402 | |

South Valley Cement | | | 485,000 | | | | 304,957 | |

Suez Cement Co. | | | 138,000 | | | | 654,534 | |

Talaat Moustafa Group | | | 3,963,160 | | | | 4,556,054 | |

Telecom Egypt | | | 1,449,600 | | | | 1,538,484 | |

| | | | | | | | | |

| | | | | | $ | 50,219,775 | |

| | | | | | | | | |

|

Estonia — 0.2% | |

AS Baltika(1) | | | 226,000 | | | $ | 93,160 | |

AS Merko Ehitus | | | 75,000 | | | | 702,224 | |

AS Nordecon International | | | 223,282 | | | | 261,221 | |

AS Olympic Entertainment Group | | | 803,899 | | | | 1,656,085 | |

| | | | |

| | 11 | | See Notes to Financial Statements. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2015

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Estonia (continued) | |

AS Tallink Grupp | | | 5,354,470 | | | $ | 4,345,445 | |

AS Tallinna Kaubamaja Grupp | | | 202,800 | | | | 1,363,129 | |

AS Tallinna Vesi | | | 35,235 | | | | 514,400 | |

| | | | | | | | | |

| | | | | | $ | 8,935,664 | |

| | | | | | | | | |

|

Ghana — 0.1% | |

Aluworks Ghana, Ltd.(1) | | | 5,176,100 | | | $ | 71,231 | |

CAL Bank, Ltd. | | | 4,406,554 | | | | 1,114,298 | |

Ghana Commercial Bank, Ltd. | | | 1,384,370 | | | | 1,549,893 | |

Produce Buying Co., Ltd.(1) | | | 650,000 | | | | 16,392 | |

Societe Generale Ghana, Ltd.(1) | | | 814,000 | | | | 169,911 | |

Standard Chartered Bank of Ghana, Ltd. | | | 242,700 | | | | 1,109,651 | |

Total Petroleum Ghana, Ltd. | | | 20,964 | | | | 25,483 | |

Unilever Ghana, Ltd.(1) | | | 249,000 | | | | 430,039 | |

| | | | | | | | | |

| | | | | | $ | 4,486,898 | |

| | | | | | | | | |

|

Greece(3) — 1.2% | |

Aegean Airlines SA | | | 64,124 | | | $ | 377,292 | |

Aegean Marine Petroleum Network, Inc. | | | 90,611 | | | | 1,119,952 | |

Alpha Bank AE(1) | | | 5,433,694 | | | | 1,665,791 | |

Athens Water Supply & Sewage Co. SA (The) | | | 227,849 | | | | 1,266,861 | |

Costamare, Inc. | | | 108,479 | | | | 1,992,759 | |

Diana Shipping, Inc.(1) | | | 190,420 | | | | 1,342,461 | |

DryShips, Inc.(1) | | | 1,438,000 | | | | 864,526 | |

Ellaktor SA(1) | | | 292,801 | | | | 521,294 | |

Eurobank Ergasias SA(1) | | | 11,975,587 | | | | 1,641,836 | |

FF Group(1) | | | 63,075 | | | | 1,453,254 | |

GasLog, Ltd. | | | 111,416 | | | | 2,222,749 | |

GEK Terna Holding Real Estate Construction

SA(1) | | | 120,661 | | | | 205,631 | |

Hellenic Exchanges - Athens Stock Exchange

SA(1) | | | 114,224 | | | | 504,597 | |

Hellenic Petroleum SA | | | 132,875 | | | | 592,050 | |

Hellenic Telecommunications Organization SA | | | 777,120 | | | | 6,066,956 | |

Intralot SA(1) | | | 260,400 | | | | 421,462 | |

JUMBO SA | | | 198,150 | | | | 1,399,803 | |

Marfin Investment Group Holdings SA(1) | | | 485,263 | | | | 62,833 | |

Metka SA | | | 43,400 | | | | 321,882 | |

Motor Oil (Hellas) Corinth Refineries SA | | | 170,500 | | | | 1,379,788 | |

Mytilineos Holdings SA(1) | | | 452,870 | | | | 2,496,440 | |

National Bank of Greece SA(1) | | | 1,894,449 | | | | 2,164,379 | |

Navios Maritime Acquisition Corp. | | | 191,284 | | | | 686,710 | |

Navios Maritime Holdings, Inc. | | | 87,850 | | | | 326,802 | |

OPAP SA | | | 402,600 | | | | 2,993,600 | |

Public Power Corp. SA(1) | | | 914,808 | | | | 4,102,228 | |

StealthGas, Inc.(1) | | | 81,587 | | | | 550,712 | |

Terna Energy SA(1) | | | 126,318 | | | | 369,209 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Greece (continued) | |

Titan Cement Co. SA | | | 220,407 | | | $ | 4,490,639 | |

Tsakos Energy Navigation, Ltd. | | | 201,900 | | | | 1,924,107 | |

Viohalco SA(1) | | | 184,517 | | | | 488,371 | |

| | | | | | | | | |

| | | | | | $ | 46,016,974 | |

| | | | | | | | | |

|

Hungary — 1.3% | |

Magyar Telekom Telecommunications PLC(1) | | | 4,030,434 | | | $ | 5,630,067 | |

Magyar Telekom Telecommunications PLC

ADR(1) | | | 37,300 | | | | 255,878 | |

MOL Hungarian Oil & Gas Rt. | | | 221,545 | | | | 11,335,673 | |

OTP Bank Rt. | | | 916,700 | | | | 18,117,683 | |

Richter Gedeon Nyrt. | | | 813,720 | | | | 12,223,446 | |

| | | | | | | | | |

| | | | | | $ | 47,562,747 | |

| | | | | | | | | |

|

India — 6.1% | |

ABB India, Ltd. | | | 33,400 | | | $ | 693,449 | |

ACC, Ltd. | | | 54,200 | | | | 1,231,673 | |

Adani Enterprises, Ltd. | | | 119,200 | | | | 169,721 | |

Adani Ports and Special Economic Zone, Ltd. | | | 719,546 | | | | 3,472,236 | |

Adani Power, Ltd.(1) | | | 518,864 | | | | 236,975 | |

Adani Transmissions, Ltd.(1)(2) | | | 119,200 | | | | 0 | |

Aditya Birla Nuvo, Ltd. | | | 26,506 | | | | 744,066 | |

Ambuja Cements, Ltd. | | | 566,900 | | | | 2,043,671 | |

Andhra Bank | | | 55,000 | | | | 58,686 | |

Apollo Hospitals Enterprise, Ltd. | | | 61,400 | | | | 1,270,166 | |

Ashok Leyland, Ltd. | | | 820,626 | | | | 933,924 | |

Asian Paints, Ltd. | | | 243,000 | | | | 2,890,133 | |

Axis Bank, Ltd. | | | 585,600 | | | | 5,124,789 | |

Bajaj Auto, Ltd. | | | 42,600 | | | | 1,694,524 | |

Bajaj Holdings & Investment, Ltd. | | | 11,100 | | | | 253,780 | |

Balrampur Chini Mills, Ltd.(1) | | | 262,700 | | | | 166,956 | |

Bharat Forge, Ltd. | | | 43,136 | | | | 715,341 | |

Bharat Heavy Electricals, Ltd. | | | 370,300 | | | | 1,432,792 | |

Bharat Petroleum Corp., Ltd. | | | 134,400 | | | | 1,852,053 | |

Bharti Airtel, Ltd. | | | 1,940,801 | | | | 12,787,615 | |

Biocon, Ltd. | | | 78,400 | | | | 565,994 | |

Bosch, Ltd. | | | 3,900 | | | | 1,334,317 | |

Cairn India, Ltd. | | | 157,100 | | | | 446,328 | |

Century Textiles & Industries, Ltd. | | | 50,000 | | | | 555,185 | |

Cipla, Ltd. | | | 207,400 | | | | 2,010,963 | |

Coal India, Ltd. | | | 372,500 | | | | 2,457,595 | |

Colgate-Palmolive (India), Ltd. | | | 23,100 | | | | 739,568 | |

Container Corp. of India, Ltd. | | | 69,900 | | | | 1,840,739 | |

Cummins India, Ltd. | | | 79,700 | | | | 1,113,270 | |

Dabur India, Ltd. | | | 278,000 | | | | 1,225,727 | |

Divi’s Laboratories, Ltd. | | | 24,900 | | | | 738,023 | |

| | | | |

| | 12 | | See Notes to Financial Statements. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2015

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

India (continued) | |

Dr. Reddy’s Laboratories, Ltd. | | | 24,300 | | | $ | 1,351,315 | |

Dr. Reddy’s Laboratories, Ltd. ADR | | | 26,800 | | | | 1,482,576 | |

Essar Oil, Ltd.(1) | | | 318,500 | | | | 691,488 | |

GAIL (India), Ltd. | | | 418,540 | | | | 2,579,646 | |

GAIL (India), Ltd. GDR(4) | | | 25,050 | | | | 933,185 | |

GlaxoSmithKline Pharmaceuticals, Ltd.(1) | | | 8,000 | | | | 422,235 | |

Glenmark Pharmaceuticals, Ltd. | | | 114,000 | | | | 1,786,242 | |

Grasim Industries, Ltd. GDR(4) | | | 13,300 | | | | 701,267 | |

Great Eastern Shipping Co., Ltd. (The) | | | 56,700 | | | | 296,823 | |

HCL Technologies, Ltd. | | | 221,600 | | | | 3,200,014 | |

HDFC Bank, Ltd. | | | 568,700 | | | | 10,906,009 | |

Hero MotoCorp, Ltd. | | | 51,542 | | | | 2,036,160 | |

Hindalco Industries, Ltd. | | | 436,910 | | | | 765,908 | |

Hindustan Petroleum Corp., Ltd. | | | 98,600 | | | | 1,123,682 | |

Hindustan Unilever, Ltd. | | | 588,309 | | | | 8,451,378 | |

Hindustan Zinc, Ltd. | | | 244,148 | | | | 639,505 | |

Housing Development Finance Corp., Ltd. | | | 390,318 | | | | 7,948,931 | |

ICICI Bank, Ltd. | | | 532,035 | | | | 2,581,838 | |

Idea Cellular, Ltd. | | | 1,449,679 | | | | 4,004,582 | |

IDFC, Ltd. | | | 179,200 | | | | 413,782 | |

Indian Hotels Co., Ltd.(1) | | | 173,820 | | | | 249,705 | |

Indian Oil Corp., Ltd. | | | 221,900 | | | | 1,336,539 | |

Infosys, Ltd. | | | 900,432 | | | | 14,037,610 | |

ITC, Ltd. | | | 1,223,800 | | | | 6,064,411 | |

Jaiprakash Associates, Ltd.(1) | | | 50 | | | | 9 | |

Jindal Steel & Power, Ltd. | | | 90,000 | | | | 121,145 | |

JSW Energy, Ltd. | | | 1,158,270 | | | | 1,783,197 | |

JSW Steel, Ltd. | | | 60,200 | | | | 825,308 | |

Kotak Mahindra Bank, Ltd. | | | 160,700 | | | | 3,467,592 | |

Larsen & Toubro, Ltd. | | | 112,578 | | | | 3,147,322 | |

Larsen & Toubro, Ltd. GDR(4) | | | 72,000 | | | | 2,006,142 | |

LIC Housing Finance, Ltd. | | | 62,800 | | | | 444,266 | |

Lupin, Ltd. | | | 97,200 | | | | 2,865,682 | |

Mahindra & Mahindra, Ltd. | | | 167,400 | | | | 3,379,379 | |

Maruti Suzuki India, Ltd. | | | 50,500 | | | | 3,367,846 | |

Mphasis, Ltd. | | | 37,500 | | | | 242,010 | |

Nestle India, Ltd. | | | 12,100 | | | | 1,207,499 | |

NHPC, Ltd. | | | 1,887,800 | | | | 579,045 | |

NTPC, Ltd. | | | 2,100,300 | | | | 4,533,198 | |

Oil & Natural Gas Corp., Ltd. | | | 1,236,700 | | | | 6,008,284 | |

Oracle Financial Service Software, Ltd. | | | 4,000 | | | | 239,916 | |

Petronet LNG, Ltd. | | | 216,300 | | | | 633,845 | |

Piramal Enterprises, Ltd. | | | 41,782 | | | | 606,738 | |

Power Grid Corporation of India, Ltd. | | | 1,419,700 | | | | 3,116,602 | |

Punjab National Bank | | | 65,000 | | | | 142,034 | |

Reliance Capital, Ltd. | | | 22,030 | | | | 125,238 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

India (continued) | |

Reliance Communications, Ltd.(1) | | | 1,408,559 | | | $ | 1,368,517 | |

Reliance Industries, Ltd. | | | 769,312 | | | | 12,057,744 | |

Reliance Industries, Ltd. GDR(5) | | | 42,816 | | | | 1,325,158 | |

Reliance Infrastructure, Ltd. | | | 171,400 | | | | 1,040,548 | |

Reliance Power, Ltd.(1) | | | 546,400 | | | | 384,512 | |

Siemens, Ltd. | | | 72,300 | | | | 1,528,008 | |

State Bank of India GDR(4) | | | 49,600 | | | | 2,049,475 | |

Steel Authority of India, Ltd. | | | 60,000 | | | | 58,727 | |

Sun Pharmaceutical Industries, Ltd. | | | 516,800 | | | | 7,101,436 | |

Tata Chemicals, Ltd. | | | 58,600 | | | | 386,445 | |

Tata Communications, Ltd. | | | 47,000 | | | | 326,995 | |

Tata Consultancy Services, Ltd. | | | 256,667 | | | | 10,291,559 | |

Tata Global Beverages, Ltd. | | | 156,000 | | | | 322,880 | |

Tata Motors, Ltd. | | | 542,926 | | | | 3,674,979 | |

Tata Motors, Ltd. ADR | | | 19,800 | | | | 682,506 | |

Tata Power Co., Ltd. | | | 1,002,648 | | | | 1,166,546 | |

Tata Steel, Ltd. | | | 149,900 | | | | 719,271 | |

Tech Mahindra, Ltd. | | | 143,648 | | | | 1,070,594 | |

Titan Co., Ltd. | | | 248,000 | | | | 1,476,121 | |

UltraTech Cement, Ltd. | | | 58,091 | | | | 2,730,814 | |

United Spirits, Ltd.(1) | | | 21,533 | | | | 1,142,064 | |

UPL, Ltd. | | | 237,900 | | | | 1,995,346 | |

Vedanta, Ltd. | | | 499,740 | | | | 1,357,913 | |

Voltas, Ltd. | | | 224,100 | | | | 1,105,911 | |

Wipro, Ltd. | | | 291,229 | | | | 2,492,884 | |

Zee Entertainment Enterprises, Ltd. | | | 413,300 | | | | 2,395,171 | |

| | | | | | | | | |

| | | $ | 223,899,511 | |

| | | | | | | | | |

|

Indonesia — 2.8% | |

Adaro Energy Tbk PT | | | 28,006,600 | | | $ | 1,591,592 | |

AKR Corporindo Tbk PT | | | 4,660,500 | | | | 2,067,790 | |

Aneka Tambang Persero Tbk PT(1) | | | 8,587,500 | | | | 437,082 | |

Astra Argo Lestari Tbk PT | | | 654,000 | | | | 1,123,361 | |

Astra International Tbk PT | | | 16,668,000 | | | | 8,822,606 | |

Bank Central Asia Tbk PT | | | 10,623,000 | | | | 10,727,923 | |

Bank Danamon Indonesia Tbk PT | | | 3,237,181 | | | | 1,042,934 | |

Bank Mandiri Tbk PT | | | 7,808,000 | | | | 5,869,509 | |

Bank Negara Indonesia Persero Tbk PT | | | 7,849,000 | | | | 3,111,832 | |

Bank Pan Indonesia Tbk PT(1) | | | 6,253,772 | | | | 515,408 | |

Bank Pembangunan Daerah Jawa Barat Dan Banten Tbk PT | | | 1,872,000 | | | | 114,984 | |

Bank Rakyat Indonesia Tbk PT | | | 9,392,000 | | | | 7,269,101 | |

Charoen Pokphand Indonesia Tbk PT | | | 4,000,700 | | | | 823,173 | |

Gudang Garam Tbk PT | | | 498,500 | | | | 1,682,636 | |

Hanson International Tbk PT(1) | | | 17,636,400 | | | | 978,140 | |

Indah Kiat Pulp & Paper Corp. Tbk PT | | | 3,326,500 | | | | 223,230 | |

| | | | |

| | 13 | | See Notes to Financial Statements. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2015

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Indonesia (continued) | |

Indo Tambangraya Megah Tbk PT | | | 1,269,200 | | | $ | 1,219,804 | |

Indocement Tunggal Prakarsa Tbk PT | | | 2,045,500 | | | | 3,197,088 | |

Indofood CBP Sukses Makmur Tbk PT | | | 1,273,000 | | | | 1,188,227 | |

Indofood Sukses Makmur Tbk PT | | | 4,544,500 | | | | 2,236,234 | |

Indosat Tbk PT(1) | | | 1,322,500 | | | | 396,356 | |

Jasa Marga (Persero) Tbk PT | | | 3,247,500 | | | | 1,329,921 | |

Kalbe Farma Tbk PT | | | 45,305,200 | | | | 5,683,358 | |

Lippo Karawaci Tbk PT | | | 26,506,000 | | | | 2,343,328 | |

Matahari Putra Prima Tbk PT | | | 5,148,000 | | | | 1,137,648 | |

Medco Energi Internasional Tbk PT | | | 698,500 | | | | 142,885 | |

Pembangunan Perumahan Persero Tbk PT | | | 4,793,000 | | | | 1,243,820 | |

Perusahaan Gas Negara Tbk PT | | | 19,152,100 | | | | 6,186,268 | |

Perusahaan Perkebunan London Sumatra Indonesia Tbk PT | | | 7,099,000 | | | | 826,252 | |

Semen Indonesia Persero Tbk PT | | | 4,703,500 | | | | 4,225,176 | |

Sigmagold Inti Perkasa Tbk PT(1) | | | 27,503,000 | | | | 926,100 | |

Surya Semesta Internusa Tbk PT | | | 3,178,000 | | | | 229,344 | |

Tambang Batubara Bukit Asam Tbk PT | | | 2,159,900 | | | | 1,356,534 | |

Telekomunikasi Indonesia Tbk PT | | | 58,725,800 | | | | 12,872,349 | |

Unilever Indonesia Tbk PT | | | 1,100,700 | | | | 3,254,020 | |

United Tractors Tbk PT | | | 3,148,000 | | | | 4,801,087 | |

Vale Indonesia Tbk PT | | | 4,748,000 | | | | 962,734 | |

Wijaya Karya Persero Tbk PT | | | 6,352,000 | | | | 1,190,308 | |

| | | | | | | | | |

| | | | | | $ | 103,350,142 | |

| | | | | | | | | |

|

Jordan — 0.8% | |

Al Eqbal Co. for Investment PLC | | | 23,341 | | | $ | 454,491 | |

Alia The Royal Jordanian Airlines PLC(1)(2) | | | 209,700 | | | | 137,266 | |

Arab Bank PLC | | | 1,524,456 | | | | 13,219,669 | |

Arab Potash Co. PLC | | | 71,074 | | | | 2,164,435 | |

Bank of Jordan | | | 262,189 | | | | 943,349 | |

Cairo Amman Bank | | | 86,860 | | | | 296,501 | |

Capital Bank of Jordan | | | 605,501 | | | | 1,184,736 | |

Jordan Ahli Bank | | | 517,414 | | | | 853,065 | |

Jordan Islamic Bank | | | 225,901 | | | | 1,060,695 | |

Jordan Petroleum Refinery | | | 427,730 | | | | 3,459,021 | |

Jordan Phosphate Mines(1) | | | 84,500 | | | | 703,107 | |

Jordan Steel(1) | | | 269,400 | | | | 204,890 | |

Jordan Telecommunications Co. | | | 278,100 | | | | 1,178,307 | |

Jordanian Electric Power Co. | | | 538,376 | | | | 1,967,855 | |

Union Land Development(1) | | | 360,100 | | | | 1,138,092 | |

| | | | | | | | | |

| | | | | | $ | 28,965,479 | |

| | | | | | | | | |

|

Kazakhstan — 0.7% | |

Halyk Savings Bank of Kazakhstan JSC GDR(4) | | | 716,100 | | | $ | 6,093,034 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Kazakhstan (continued) | |

KAZ Minerals PLC(1) | | | 2,233,589 | | | $ | 7,130,445 | |

Kazkommertsbank JSC GDR(1) | | | 284,200 | | | | 907,058 | |

KazMunaiGas Exploration Production GDR(4) | | | 632,226 | | | | 6,267,769 | |

Kcell JSC GDR(4) | | | 544,503 | | | | 4,725,398 | |

Nostrum Oil & Gas PLC | | | 178,200 | | | | 1,655,221 | |

| | | | | | | | | |

| | | | | | $ | 26,778,925 | |

| | | | | | | | | |

|

Kenya — 0.7% | |

ARM Cement, Ltd. | | | 1,677,000 | | | $ | 1,265,540 | |

Bamburi Cement Co., Ltd. | | | 460,041 | | | | 718,821 | |

Barclays Bank of Kenya, Ltd. | | | 5,636,820 | | | | 876,171 | |

Centum Investment Co., Ltd.(1) | | | 977,680 | | | | 645,809 | |

Co-operative Bank of Kenya, Ltd. (The) | | | 5,758,660 | | | | 1,247,541 | |

East African Breweries, Ltd. | | | 1,528,640 | | | | 4,691,530 | |

Equity Group Holdings, Ltd. | | | 5,413,000 | | | | 2,534,333 | |

KenolKobil, Ltd. | | | 3,831,500 | | | | 326,488 | |

Kenya Airways, Ltd.(1) | | | 2,398,400 | | | | 178,867 | |

Kenya Commercial Bank, Ltd. | | | 4,792,860 | | | | 2,604,991 | |

Kenya Electricity Generating Co., Ltd. | | | 1,875,100 | | | | 173,566 | |

Kenya Power & Lighting, Ltd. | | | 8,246,893 | | | | 1,520,038 | |

Nation Media Group, Ltd. | | | 442,376 | | | | 915,652 | |

NIC Bank, Ltd. | | | 852,975 | | | | 463,455 | |

Safaricom, Ltd. | | | 35,682,800 | | | | 5,936,411 | |

Standard Chartered Bank Kenya, Ltd. | | | 250,721 | | | | 752,161 | |

| | | | | | | | | |

| | | | | | $ | 24,851,374 | |

| | | | | | | | | |

|

Kuwait — 1.3% | |

Abyaar Real Estate Development(1) | | | 1,440,000 | | | $ | 149,557 | |

Agility Public Warehousing Co. KSC | | | 1,721,475 | | | | 4,091,241 | |

Ahli United Bank | | | 278,810 | | | | 525,629 | |

Al Ahli Bank of Kuwait KSCP | | | 122,180 | | | | 149,127 | |

Al-Mazaya Holding Co. | | | 551,200 | | | | 210,686 | |

Boubyan Petrochemicals Co. | | | 1,968,750 | | | | 4,107,813 | |

Burgan Bank SAK | | | 921,028 | | | | 1,294,145 | |

Combined Group Contracting Co. KSC | | | 137,658 | | | | 368,359 | |

Commercial Bank of Kuwait KSCP | | | 937,950 | | | | 1,948,287 | |

Commercial Real Estate Co. KSCC | | | 2,487,729 | | | | 697,987 | |

Gulf Bank(1) | | | 1,477,708 | | | | 1,316,318 | |

Gulf Cable and Electrical Industries Co. KSC | | | 165,000 | | | | 321,802 | |

Kuwait Finance House KSCP | | | 2,643,406 | | | | 5,575,725 | |

Kuwait Food Co. (Americana) SAK | | | 512,500 | | | | 4,569,156 | |

Kuwait International Bank | | | 818,000 | | | | 653,475 | |

Kuwait Pipes Industries & Oil Services Co.(1)(2) | | | 800,000 | | | | 0 | |

Kuwait Portland Cement Co. KSC | | | 202,125 | | | | 773,842 | |

Kuwait Projects Co. Holdings KSC | | | 964,872 | | | | 2,007,834 | |

| | | | |

| | 14 | | See Notes to Financial Statements. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2015

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Kuwait (continued) | |

Kuwait Real Estate Co. KSC | | | 1,720,000 | | | $ | 396,999 | |

Mabanee Co. SAK | | | 961,253 | | | | 3,140,468 | |

Mobile Telecommunications Co. | | | 4,387,600 | | | | 6,020,066 | |

National Bank of Kuwait SAK | | | 2,557,243 | | | | 7,255,255 | |

National Industries Group Holding SAK | | | 3,619,875 | | | | 1,936,956 | |

National Investment Co. | | | 645,000 | | | | 268,268 | |

National Real Estate Co.(1) | | | 628,204 | | | | 196,841 | |

Qurain Petrochemical Industries Co. KSC | | | 1,460,000 | | | | 927,795 | |

Sultan Center Food Products Co.(1) | | | 2,160,000 | | | | 620,322 | |

| | | | | | | | | |

| | | | | | $ | 49,523,953 | |

| | | | | | | | | |

|

Latvia — 0.0%(6) | |

Grindeks | | | 12,000 | | | $ | 75,583 | |

Latvian Shipping Co.(1) | | | 96,000 | | | | 40,777 | |

| | | | | | | | | |

| | | | | | $ | 116,360 | |

| | | | | | | | | |

|

Lebanon — 0.2% | |

Banque Audi sal-Audi Saradar Group | | | 246,610 | | | $ | 1,531,242 | |

Byblos Bank | | | 838,110 | | | | 1,350,519 | |

Solidere, Class A(1) | | | 275,848 | | | | 3,172,652 | |

Solidere, Class B(1) | | | 5,516 | | | | 62,904 | |

| | | | | | | | | |

| | | | | | $ | 6,117,317 | |

| | | | | | | | | |

|

Lithuania — 0.1% | |

Apranga PVA | | | 363,680 | | | $ | 1,099,614 | |

Invalda Privatus Kapitalas AB(1)(2) | | | 32,177 | | | | 0 | |

Klaipedos Nafta AB | | | 1,576,663 | | | | 667,724 | |

Lesto AB | | | 338,936 | | | | 359,481 | |

Panevezio Statybos Trestas | | | 323,592 | | | | 354,780 | |

Pieno Zvaigzdes | | | 94,000 | | | | 161,065 | |

Rokiskio Suris(1) | | | 177,000 | | | | 284,007 | |

Siauliu Bankas | | | 1,032,958 | | | | 333,240 | |

| | | | | | | | | |

| | | | | | $ | 3,259,911 | |

| | | | | | | | | |

|

Malaysia — 2.6% | |

Aeon Co. (M) Bhd | | | 736,800 | | | $ | 604,874 | |

Affin Holdings Bhd | | | 236,000 | | | | 168,726 | |

Airasia Bhd | | | 1,089,900 | | | | 444,683 | |

Alliance Financial Group Bhd | | | 330,800 | | | | 384,539 | |

AMMB Holdings Bhd | | | 615,900 | | | | 983,314 | |

Axiata Group Bhd | | | 1,791,575 | | | | 3,037,785 | |

Batu Kawan Bhd | | | 100,300 | | | | 484,648 | |

Berjaya Corp. Bhd | | | 2,498,100 | | | | 271,194 | |

Berjaya Sports Toto Bhd | | | 465,569 | | | | 404,610 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Malaysia (continued) | |

Boustead Holdings Bhd | | | 412,500 | | | $ | 453,653 | |

British American Tobacco Malaysia Bhd | | | 89,100 | | | | 1,462,761 | |

Bumi Armada Bhd(1) | | | 1,902,900 | | | | 574,233 | |

Bursa Malaysia Bhd | | | 224,600 | | | | 484,401 | |

CIMB Group Holdings Bhd | | | 1,425,966 | | | | 2,066,029 | |

Datasonic Group Bhd | | | 1,594,400 | | | | 451,491 | |

Dialog Group Bhd | | | 4,501,050 | | | | 1,894,848 | |

Digi.com Bhd | | | 1,538,000 | | | | 2,182,906 | |

Felda Global Ventures Holdings Bhd | | | 1,136,300 | | | | 490,177 | |

Gamuda Bhd | | | 1,983,700 | | | | 2,453,496 | |

Genting Bhd | | | 1,303,300 | | | | 2,783,490 | |

Genting Malaysia Bhd | | | 1,977,000 | | | | 2,199,206 | |

Genting Plantations Bhd | | | 261,000 | | | | 685,548 | |

Hartalega Holdings Bhd | | | 121,700 | | | | 274,327 | |

Hong Leong Bank Bhd | | | 256,700 | | | | 910,772 | |

Hong Leong Financial Group Bhd | | | 136,200 | | | | 546,885 | |

IHH Healthcare Bhd | | | 4,476,700 | | | | 6,711,110 | |

IJM Corp. Bhd | | | 1,328,220 | | | | 2,295,640 | |

IOI Corp. Bhd | | | 1,684,968 | | | | 1,812,255 | |

IOI Properties Group Bhd | | | 842,484 | | | | 412,611 | |

KLCCP Stapled Group | | | 250,000 | | | | 460,919 | |

KNM Group Bhd(1) | | | 3,198,075 | | | | 524,338 | |

Kossan Rubber Industries | | | 458,100 | | | | 789,359 | |

KPJ Healthcare Bhd | | | 403,200 | | | | 450,949 | |

Kuala Lumpur Kepong Bhd | | | 293,050 | | | | 1,659,679 | |

Kulim (Malaysia) Bhd | | | 792,800 | | | | 525,050 | |

Lafarge Malaysia Bhd | | | 789,960 | | | | 1,770,497 | |

Landmarks Bhd(1) | | | 576,800 | | | | 175,588 | |

Magnum Bhd | | | 617,940 | | | | 433,889 | |

Malayan Banking Bhd | | | 1,462,286 | | | | 3,540,782 | |

Malaysia Airports Holdings Bhd | | | 200,000 | | | | 328,846 | |

Malaysian Resources Corp. Bhd | | | 1,861,700 | | | | 581,529 | |

Maxis Bhd | | | 1,255,300 | | | | 2,116,586 | |

Media Prima Bhd | | | 567,300 | | | | 219,578 | |

MISC Bhd | | | 638,440 | | | | 1,306,033 | |

MMC Corp. Bhd | | | 662,000 | | | | 440,186 | |

Muhibbah Engineering (M) Bhd | | | 1,581,000 | | | | 949,689 | |

My EG Services Bhd | | | 1,724,000 | | | | 1,269,621 | |

Parkson Holdings Bhd(1) | | | 713,599 | | | | 292,841 | |

Petronas Chemicals Group Bhd | | | 2,816,700 | | | | 4,711,643 | |

Petronas Dagangan Bhd | | | 422,400 | | | | 2,302,841 | |

Petronas Gas Bhd | | | 268,500 | | | | 1,512,416 | |

PPB Group Bhd | | | 300,400 | | | | 1,202,421 | |

Press Metal Bhd | | | 930,000 | | | | 639,777 | |

Public Bank Bhd | | | 706,298 | | | | 3,503,453 | |

RHB Capital Bhd | | | 497,700 | | | | 971,974 | |

| | | | |

| | 15 | | See Notes to Financial Statements. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2015

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Malaysia (continued) | |

Sapurakencana Petroleum Bhd | | | 4,032,352 | | | $ | 2,518,632 | |

Silverlake Axis, Ltd. | | | 472,800 | | | | 343,264 | |

Sime Darby Bhd | | | 3,012,009 | | | | 6,800,323 | |

Sunway Bhd | | | 378,040 | | | | 344,448 | |

Sunway Construction Group Bhd(1)(2) | | | 37,804 | | | | 0 | |

Sunway Real Estate Investment Trust | | | 1,028,200 | | | | 419,553 | |

Supermax Corp. Bhd | | | 1,466,700 | | | | 804,365 | |

Ta Ann Holdings Bhd | | | 355,899 | | | | 358,849 | |

Tan Chong Motor Holdings Bhd | | | 219,000 | | | | 171,287 | |

Telekom Malaysia Bhd | | | 1,020,100 | | | | 1,764,837 | |

Tenaga Nasional Bhd | | | 1,450,631 | | | | 4,859,447 | |

Top Glove Corp. Bhd | | | 210,000 | | | | 370,101 | |

UEM Sunrise Bhd | | | 1,112,200 | | | | 287,251 | |

UMW Holdings Bhd | | | 391,900 | | | | 1,052,409 | |

UMW Oil & Gas Corp. Bhd | | | 1,133,700 | | | | 513,541 | |

Unisem (M) Bhd | | | 3,101,700 | | | | 1,913,591 | |

Wah Seong Corp. Bhd | | | 697,402 | | | | 254,912 | |

WCT Holdings Bhd | | | 820,593 | | | | 308,497 | |

YTL Corp. Bhd | | | 2,626,518 | | | | 1,078,521 | |

YTL Power International Bhd | | | 1,597,363 | | | | 676,972 | |

| | | | | | | | | |

| | | | | | $ | 95,451,496 | |

| | | | | | | | | |

|

Mauritius — 0.7% | |

Alteo, Ltd. | | | 352,391 | | | $ | 298,380 | |

CIEL, Ltd. | | | 2,019,231 | | | | 415,845 | |

CIM Financial Services, Ltd. | | | 1,742,485 | | | | 476,449 | |

ENL Land, Ltd. | | | 484,800 | | | | 630,932 | |

Ireland Blyth, Ltd. | | | 64,209 | | | | 211,274 | |

LUX Island Resorts, Ltd. | | | 931,480 | | | | 1,685,046 | |

MCB Group, Ltd. | | | 2,019,106 | | | | 12,534,047 | |

New Mauritius Hotels, Ltd.(1) | | | 4,357,728 | | | | 2,554,780 | |

Rogers & Co., Ltd. | | | 608,300 | | | | 527,357 | |

SBM Holdings, Ltd. | | | 174,116,462 | | | | 4,532,443 | |

Terra Mauricia, Ltd. | | | 1,146,500 | | | | 1,067,661 | |

United Basalt Products, Ltd. | | | 187,150 | | | | 455,424 | |

| | | | | | | | | |

| | | | | | $ | 25,389,638 | |

| | | | | | | | | |

|

Mexico — 6.0% | |

Alfa SAB de CV, Series A | | | 6,780,920 | | | $ | 12,994,516 | |

Alsea SAB de CV | | | 1,445,200 | | | | 4,361,116 | |

America Movil SAB de CV, Series L | | | 40,181,290 | | | | 42,948,667 | |

Arca Continental SAB de CV | | | 559,300 | | | | 3,176,276 | |

Bolsa Mexicana de Valores SAB de CV | | | 915,200 | | | | 1,583,804 | |

Cemex SAB de CV, Series CPO(1) | | | 13,509,355 | | | | 12,394,140 | |

Coca-Cola Femsa SAB de CV, Series L | | | 286,300 | | | | 2,275,099 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Mexico (continued) | |

El Puerto de Liverpool SAB de CV | | | 175,681 | | | $ | 2,028,812 | |

Empresas ICA SAB de CV(1) | | | 2,075,736 | | | | 1,609,876 | |

Fibra Uno Administracion SA de CV | | | 1,366,700 | | | | 3,250,342 | |

Fomento Economico Mexicano SAB de CV ADR | | | 19,900 | | | | 1,772,891 | |

Fomento Economico Mexicano SAB de CV, Series UBD | | | 1,424,800 | | | | 12,694,703 | |

Genomma Lab Internacional SAB de CV(1) | | | 2,065,500 | | | | 2,055,315 | |

Gentera SAB de CV | | | 3,190,800 | | | | 5,674,112 | |

Gruma SAB, Class B | | | 98,200 | | | | 1,266,744 | |

Grupo Aeroportuario del Pacifico SAB de CV, Class B(1) | | | 347,800 | | | | 2,380,995 | |

Grupo Aeroportuario del Sureste SAB de CV, Class B | | | 254,009 | | | | 3,608,730 | |

Grupo Bimbo SAB de CV, Series A(1) | | | 2,045,208 | | | | 5,284,294 | |

Grupo Carso SAB de CV, Series A1 | | | 1,023,400 | | | | 4,264,845 | |

Grupo Comercial Chedraui SA de CV | | | 208,900 | | | | 593,705 | |

Grupo Elektra SAB de CV | | | 140,026 | | | | 3,073,757 | |