UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04041

GE INVESTMENTS FUNDS, INC.

(Exact name of registrant as specified in charter)

3001 SUMMER STREET, STAMFORD, CONNECTICUT 06905

(Address of principal executive offices) (Zip code)

GE ASSET MANAGEMENT, INC.

3001 SUMMER STREET, STAMFORD, CONNECTICUT 06905

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-242-0134

Date of fiscal year end: 12/31

Date of reporting period: 12/31/10

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

GE Investments Funds, Inc.

U.S. Equity Fund

Annual Report

December 31, 2010

GE Investments Funds, Inc.

| | |

| |

| U.S. Equity Fund | | Contents |

This report is prepared for Policyholders of certain variable contracts and may be distributed to others only if preceded or accompanied by the variable contract’s current prospectus and the current prospectus of the Fund available for investments thereunder.

| | |

| Notes to Performance | | December 31, 2010 (unaudited) |

The information on the following performance pages relates to the GE Investments U.S. Equity Fund (the “Fund”).

Total returns take into account changes in share price and assume reinvestment of dividends and capital gains distributions, if any. Total returns shown are net of Fund fees and expenses but do not reflect fees and charges associated with the variable contracts such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the Fund’s total returns for all periods shown.

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Periods less than one year are not annualized. Please call 800-493-3042 or visit the Fund’s website at http://www.geam.com for the most recent month-end performance data.

An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. An investment in the Fund is subject to risk, including possible loss of principal invested.

The S&P 500® Index is an unmanaged market capitalization-weighted index of stocks of 500 large U.S. companies, which is widely used as a measure of large-cap stock market performance. The results shown for the foregoing index assume the reinvestment of net dividends or interest. They do not reflect the actual cost of investing in the instruments that comprise the index.

The peer universe of the underlying annuity funds used for the peer group average annual total return calculation is based on a blend of Morningstar peer categories, as shown. Morningstar is an independent mutual fund rating service. A Fund’s performance may be compared to or ranked within a universe of mutual funds with investment objectives and policies similar but not necessarily identical to that of the Fund.

©2010 Morningstar, Inc. All Rights Reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is no warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damage or losses relating from any use of this information. Past performance is no guarantee or future results.

GE Investment Distributors, Inc., Member of FINRA & SIPC, is the principal underwriter and distributor of the GE Investments Funds, Inc. and a wholly owned subsidiary of GE Asset Management Incorporated, the investment adviser of the Fund.

1

| | |

| U.S. Equity Fund | | (unaudited) |

George A. Bicher

Stephen V. Gelhaus

Thomas R. Lincoln

Paul C. Reinhardt

The U.S. Equity Fund is managed by a team of portfolio managers that includes George A. Bicher, Paul C. Reinhardt, Stephen V. Gelhaus and Thomas R. Lincoln. Each of the foregoing portfolio managers manages (or co-manages) one of three sub-portfolios, which comprise the Fund. A sub-portfolio refers to the portion of the Fund’s assets that are allocated to, and managed by, a particular portfolio manager on the Fund’s portfolio management team. The three sub-portfolios are managed independently of each other and the portfolio managers have full discretion over their sub-portfolio. The weightings to each sub-portfolio in the Fund, can be changed at any time but generally remain stable for 18 to 24 months.

George A. Bicher is a Senior Vice President of GE Asset Management. Mr. Bicher is Director of the U.S. Equity Research Team and a portfolio manager for the Fund. Mr. Bicher has held the position of equity research analyst since joining GE Asset Management in June 2002. Prior to joining GE Asset Management, he served in a number of positions at Deutsche Banc Alex Brown since 1994.

Stephen V. Gelhaus is a Senior Vice President of GE Asset Management. He has been a member of the portfolio management team for the Fund since January 2002. Mr. Gelhaus joined GE Asset Management in June 1991 and was a research analyst in the U.S. Equities group from 1995 through 2001.

Thomas R. Lincoln is a Senior Vice President of GE Asset Management. He has been a member of the portfolio management team for the Fund since May 2007. Mr. Lincoln joined GE Asset Management in 1994 as a financial analyst in U.S. Equities. Mr. Lincoln became part of the investment management team for U.S. Equities at GE Asset Management in 1997 and a portfolio manager for U.S. Equities in 2003.

Paul C. Reinhardt is a Senior Vice President of GE Asset Management. He has been a portfolio manager for the Fund since January 2001. Mr. Reinhardt joined GE Asset Management in 1982 as an equity analyst and has been a portfolio manager since 1987.

| Q. | How did the U.S. Equity Fund perform compared to its benchmarks and Morningstar peer group for the twelve-month period ended December 31, 2010? |

| A. | For the twelve-month period ended December 31, 2010, the U.S. Equity Fund returned 10.26% for Class 1 shares and 9.81% for Class 4 shares. The S&P 500 Index, the Fund’s benchmark, returned 15.06% and the Fund’s Morningstar peer group of 454 US Insurance Large Blend funds returned on average of 14.31% for the same period. |

| Q. | What market conditions impacted the Fund performance? |

| A. | 2010’s 15% advance did not feel like an easy climb for the S&P 500, amid ongoing debate around the durability of the economic expansion. Indeed, all U.S. equity indices were in negative territory at mid-year and over much of the summer, beset by concerns about the European debt crisis, persistently high unemployment levels and skyrocketing government debt. However, reassurances that the Fed would purchase additional treasury bonds in a $600B “quantitative easing-2” program ignited a mighty second-half rally. In this environment, cyclical sectors generally outperformed, while defensive sectors lagged. For the year, the S&P 500 consumer discretionary, industrials, materials and energy sectors each advanced over 20%, while health care, utilities and IT lagged. |

2010 was a challenging investment environment for large-cap, high quality investors. Small and mid-cap companies led — typical in the early innings of economic recovery. Smaller companies also benefitted from increased M&A activity as larger companies looked to spend excess balance sheet cash on strategic acquisitions. Low quality also outperformed high quality, with an approximately 22% increase in S&P 500 C-rated companies, while the high-quality A-rated companies rose only 15%. We generally prefer to invest in high quality companies, and acknowledge that relative performance may be challenged in the early stages of an economic recovery, when higher-risk (i.e., lower quality) companies get re-rated. We continue to believe that higher quality companies can make the best long-term investments, and a diversified portfolio of high quality large caps has the potential to outperform over a full market cycle.

2

Amid the year’s uncertainties, correlations of performance among S&P 500 stocks reached levels unseen since the Great Depression. It was difficult for the active manager to differentiate as top-down factors moved the markets, with fundamentals largely ignored. For example, Microsoft achieved and raised earnings estimates throughout the year, yet the stock lagged. This seeming disconnect between fundamentals, valuations and performance created a source of frustration for many large-cap active managers.

| Q. | What were the primary drivers of Fund performance? |

| A. | After last year’s strong outperformance, the Fund struggled to keep pace in the investing environment generally favoring smaller-cap, low quality companies this year. The key contributions came from strong stock selection among telecommunications, utilities and industrials stocks, while stock selection within technology and health care weighed most on returns. The Fund benefited from strength in its wireless communications holdings, driven by rallies in NII Holdings (+33%) and American Tower (+20%). Nextel International rallied after successful spectrum auctions, and enjoyed a general relief rally from as pressures from the failed Televisa deal subsided. American Tower benefited from strong secular growth in wireless data transmission and communications. Northeast Utilities (+28%) and Dominion (+15%) were top contributors within the utilities sector. As the recovery strengthened, several of our industrials holdings performed well, as illustrated by Honeywell (+39%) which generated strong free cash flow and earnings growth as the aerospace and material segments built momentum. The top-performer in the Fund was Baidu (+135%) as the dominant Chinese Internet search engine took share from Google as it left China. One of our holdings was the target of one of the year’s largest announced M&A transactions: Potash Corp. of Saskatchewan (+43%). We trimmed our position in this leading maker of potash fertilizer upon the announcement. |

In terms of portfolio detractors, the technology sector saw a divergence in performance between the larger- cap, less cyclical companies and smaller, more economically-sensitive firms. For example, Cisco (-16%) experienced demand disappointments from the public sector and Europe. At the same time, Cisco’s smaller competitor Juniper (+38% and not held in the Fund) detracted from performance. The Fed’s move to cut debit fees hurt Visa (-19%) within technology services, although we believe that the selling was overdone in the stock. Research in Motion (-14%) declined amid U.S. share losses for BlackBerry. While we trimmed RIMM to

reflect the shift in fundamentals, on the whole we continued to believe that there was ample growth in the smart phone market to support multiple competitors, especially outside of North America.

The Fund’s financials holdings also lagged, with Goldman Sachs (+1%) and CME (-3%) weighing most. Goldman Sachs plunged on news of the SEC fraud allegations that emerged in April. We continued to hold Goldman at a lighter weighting at the end of the year, as we believed that its fundamentals and market leadership were not broken. CME was hurt by decreased derivatives transaction volumes during the year. Within health care, Gilead (-16%) and Amgen (-3%) both underperformed smaller biotech companies that enjoyed takeout premiums. We maintained our conviction in both stocks. The Fund’s modest overweight in health care stocks amplified the performance drag from these holdings.

| Q. | Were there any significant changes to the Fund during the period? |

| A. | No. Our process remained consistent as we continued to seek large-cap, high quality companies that we felt had the potential to grow market share during a slow, gradual recovery. We continued to emphasize companies with strong balance sheets and earnings stability, over more cyclical or leveraged opportunities. We became underweight in energy, due to our Transocean elimination and trims of Marathon Oil, Occidental Petroleum, Chevron and Halliburton. We took advantage of volatility around regulatory changes to increase our exposure to financials — ending the year with an overweight position. We initiated positions in Invesco, American Express and Wells Fargo, and increased our weightings in JPMorgan Chase, Bank of America and CME Group. We bolstered our materials holdings by adding to Allegheny Technologies and Monsanto. At December 31, 2010, the Fund’s largest overweights were in technology and materials, and the largest underweights were in consumer staples, industrials, consumer discretionary. |

Valuations for many companies remain attractive, in our view. If the slow growth recovery continues as we believe it will, we believe that market share winners with strong balance sheets and management teams can survive, and have the potential to outperform. Amid changing market conditions in the past year, we have maintained our time-tested bottom-up stock selection approach with focus on a long-term investment horizon.

3

| | |

| U.S. Equity Fund | | (unaudited) |

Understanding Your Fund’s Expenses

As a shareholder of the Fund you incur transaction and ongoing expenses. Transaction expenses including sales charges on purchases payments, reinvested dividends (or other distributions), and redemption fees directly reduce the investment return of the Fund. Ongoing costs include portfolio management fees, distribution and services fees, professional fees, administrative fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors during the period. The information in the following table is based on an investment of $1,000, which is invested at the beginning of the period and held for the entire six-month period ended December 31, 2010.

Actual Expenses

The first section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid

over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your class under the heading “Expenses Paid During Period.”

Hypothetical Example for Comparison Purposes

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholders reports of other funds.

Please note that the expenses shown in the table for both “Actual” and “Hypothetical” do not reflect any transaction costs, such as sales charges or redemption fees. Additionally, the expenses shown do not reflect the fees or charges associated with variable contracts through which shares of the Fund are offered.

July 1, 2010 - December 31, 2010

| | | | | | | | | | | | |

| | | Account value at the

beginning of the period ($) | | | Account value at the

end of the period ($) | | | Expenses paid

during the period ($)* | |

Actual Fund Return** | | | | | | | | | | | | |

Class 1 | | | 1,000.00 | | | | 1,219.44 | | | | 3.86 | |

Class 4 | | | 1,000.00 | | | | 1,216.65 | | | | 6.09 | |

Hypothetical 5% Return (2.5% for the period) | | | | | | | | | |

Class 1 | | | 1,000.00 | | | | 1,021.50 | | | | 3.52 | |

Class 4 | | | 1,000.00 | | | | 1,019.52 | | | | 5.55 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.69% for Class 1 shares and 1.09% for Class 4 shares (for the period July 1, 2010 - December 31, 2010), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| ** | | Actual Fund Returns for the six-month period ended December 31, 2010 were as follows: 21.94% for Class 1 shares, and 21.66% for Class 4 shares. Past performance does not guarantee future results. |

4

| | |

| U.S. Equity Fund | | (unaudited) |

Investment Profile

A mutual fund designed for investors who seek long-term growth of capital by investing at least 80% of its net assets in equity securities of U.S. companies, such as common and preferred stocks.

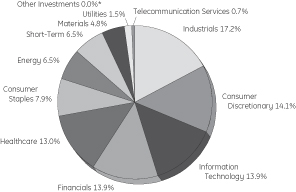

Morningstar Performance Comparison

Based on average annual returns for periods ended 12/31/10

| | | | | | | | | | | | | | | | |

| | | | | | One

Year | | | Five

Year | | | Ten

Year | |

Number of Funds in peer group: | | | | | | | 454 | | | | 397 | | | | 302 | |

Peer group average annual total return: | | | | | | | 14.31% | | | | 1.86% | | | | 1.14% | |

Morningstar category in peer group: U.S. Insurance Large Blend | | | | | | | | | | | | | | | | |

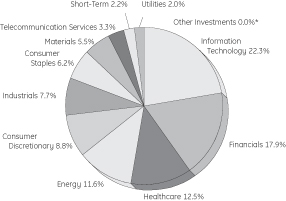

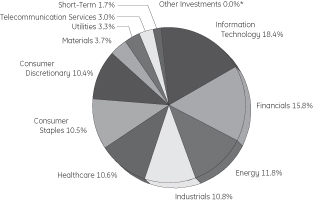

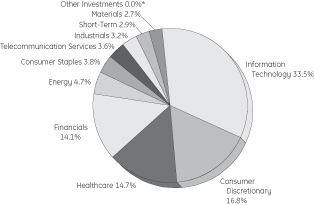

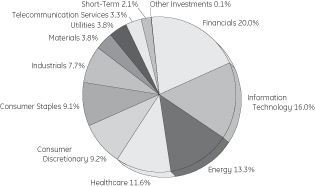

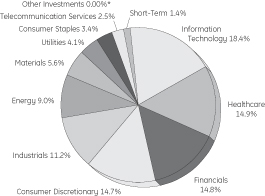

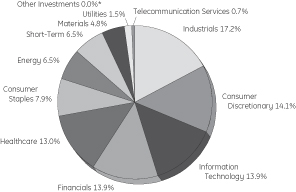

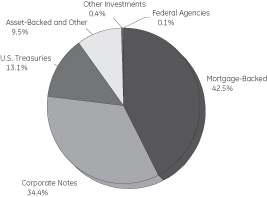

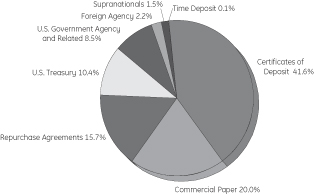

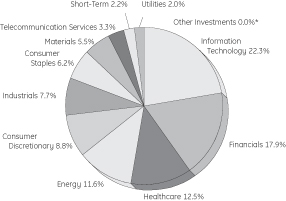

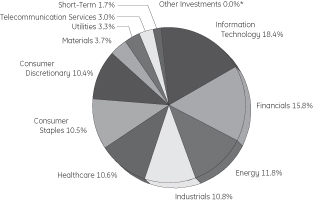

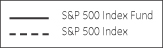

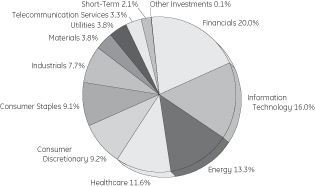

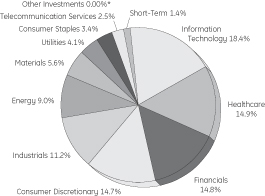

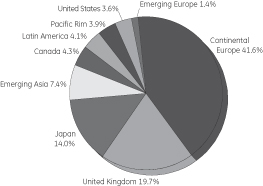

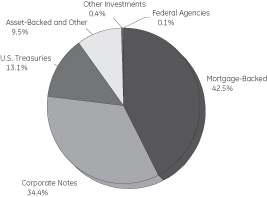

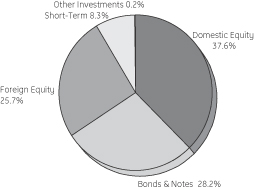

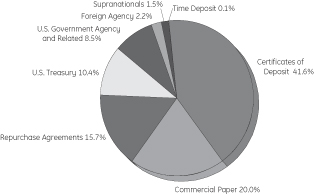

Sector Allocation

as a % of Fair Value(c) of $38,425 (in thousands) on December 31, 2010(b)(c)

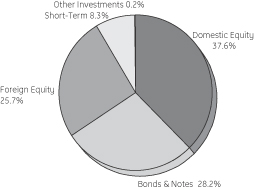

Top Ten Largest Holdings

as of December 31, 2010 (as a % of Fair Value)(b)(c)

| | | | |

Microsoft Corp. | | | 3.31% | |

Schlumberger Ltd. | | | 2.80% | |

PepsiCo Inc. | | | 2.49% | |

QUALCOMM Inc. | | | 2.47% | |

Apple Inc. | | | 2.39% | |

Exxon Mobil Corp. | | | 2.03% | |

JPMorgan Chase & Co. | | | 2.03% | |

The Goldman Sachs Group Inc. | | | 2.02% | |

State Street Corp. | | | 2.01% | |

Amgen Inc. | | | 2.00% | |

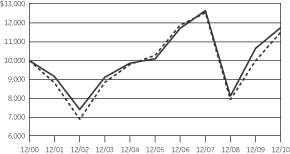

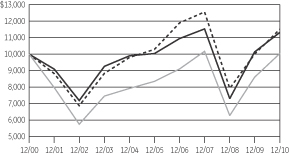

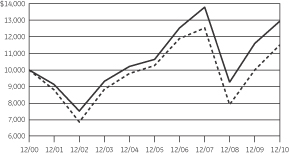

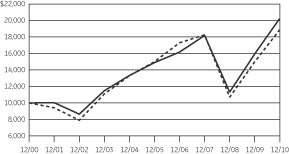

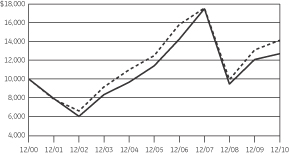

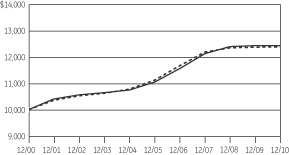

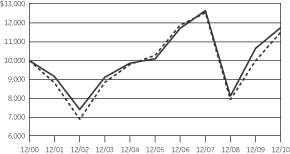

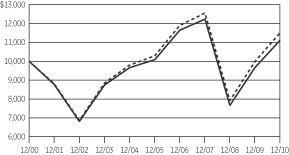

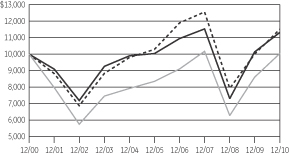

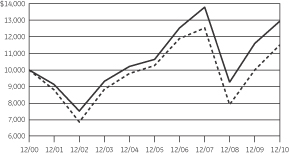

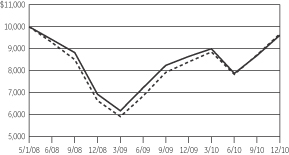

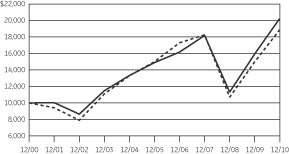

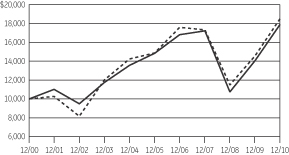

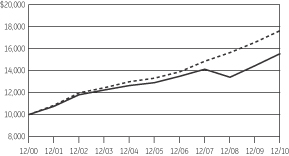

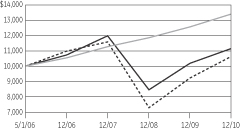

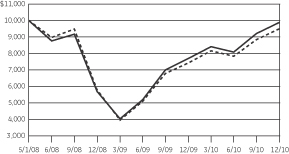

Change in Value of a $10,000 Investment

Class 1 Shares

Average Annual Total Return

for the Periods Ended December 31, 2010

Class 1 Shares (Inception date: 1/3/95)

| | | | | | | | | | | | | | | | |

| | | One

Year | | | Five

Year | | | Ten

Year | | | Ending value of a

$10,000

investment(a) | |

U.S. Equity Fund | | | 10.26% | | | | 3.08% | | | | 1.63% | | | | 11,757 | |

S&P 500 Index | | | 15.06% | | | | 2.29% | | | | 1.41% | | | | 11,508 | |

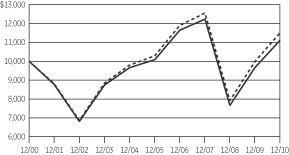

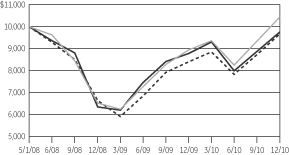

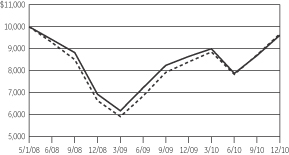

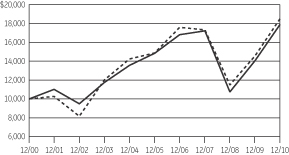

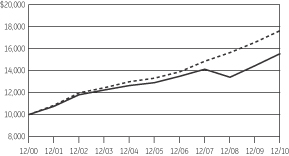

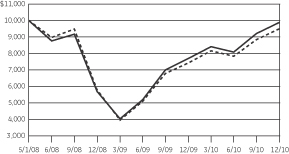

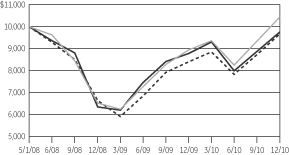

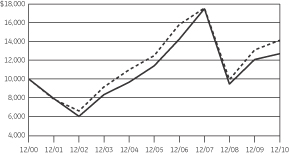

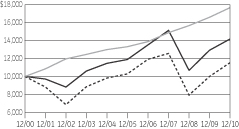

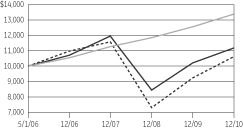

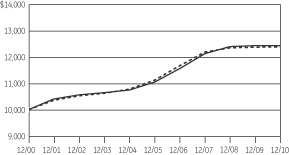

Change in Value of a $10,000 Investment

Class 4 Shares

Average Annual Total Returns

for the Periods Ended December 31, 2010

Class 4 Shares (Inception date: 5/1/08)

| | | | | | | | | | | | | | | | |

| | | | | | One

Year | | | Since

Inception | | | Ending value of a

$10,000

investment(a) | |

U.S. Equity Fund | | | | | | | 9.81% | | | | -2.05% | | | | 9,461 | |

S&P 500 Index | | | | | | | 15.06% | | | | -1.31% | | | | 9,654 | |

| (a) | Ending value of a $10,000 investment for the ten-year period or since inception, whichever is less. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| (c) | Fair value basis is inclusive of Short Term Investment in GE Money Market Fund. |

See Notes to Performance on page 1 for further information, including an explanation of Morningstar peer categories.

Past performance does not predict future performance. The performance shown in the graphs and tables does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares and do not reflect the fees or charges that would be associated with variable contracts through which shares of the Fund are offered.

5

U.S. Equity Fund

| | |

| Schedule of Investments | | December 31, 2010 |

U.S. Equity Fund

| | | | | | | | | | | | |

| | | |

| | | Number

of Shares | | | Fair Value | | | | |

Common Stock — 96.5%† | | | | | |

| |

Advertising — 1.5% | | | | | |

| | | |

Omnicom Group Inc. | | | 12,775 | | | $ | 585,095 | | | | | |

| |

Aerospace & Defense — 3.2% | | | | | |

| | | |

CAE Inc. | | | 17,386 | | | | 201,392 | | | | | |

Hexcel Corp. | | | 5,705 | | | | 103,203 | | | | (a | ) |

Honeywell International Inc. | | | 11,090 | | | | 589,544 | | | | | |

Rockwell Collins Inc. | | | 2,447 | | | | 142,562 | | | | | |

United Technologies Corp. | | | 2,366 | | | | 186,252 | | | | | |

| | | | | | | 1,222,953 | | | | | |

| |

Agricultural Products — 0.5% | | | | | |

| | | |

Archer-Daniels-Midland Co. | | | 5,879 | | | | 176,840 | | | | | |

| |

Air Freight & Logistics — 0.3% | | | | | |

| | | |

FedEx Corp. | | | 1,323 | | | | 123,052 | | | | | |

| |

Asset Management & Custody Banks — 4.3% | | | | | |

| | | |

Ameriprise Financial Inc. | | | 4,849 | | | | 279,060 | | | | | |

Invesco Ltd. | | | 16,259 | | | | 391,192 | | | | | |

State Street Corp. | | | 16,702 | | | | 773,971 | | | | (c | ) |

The Bank of New York Mellon Corp. | | | 7,187 | | | | 217,047 | | | | | |

| | | | | | | 1,661,270 | | | | | |

| |

Automobile Manufacturers — 0.1% | | | | | |

| | | |

O’Reilly Automotive Inc. | | | 785 | | | | 47,430 | | | | | |

| |

Biotechnology — 3.9% | | | | | |

| | | |

Amgen Inc. | | | 13,995 | | | | 768,325 | | | | (a | ) |

Gilead Sciences Inc. | | | 20,299 | | | | 735,636 | | | | (a | ) |

| | | | | | | 1,503,961 | | | | | |

| |

Cable & Satellite — 1.0% | | | | | |

| | | |

DIRECTV | | | 6,160 | | | | 245,969 | | | | (a | ) |

Liberty Global Inc. | | | 4,449 | | | | 150,777 | | | | (a | ) |

| | | | | | | 396,746 | | | | | |

| |

Coal & Consumable Fuels — 0.2% | | | | | |

| | | |

Peabody Energy Corp. | | | 1,216 | | | | 77,800 | | | | | |

| |

Communications Equipment — 4.6% | | | | | |

| | | |

Cisco Systems Inc. | | | 33,423 | | | | 676,147 | | | | (a | ) |

QUALCOMM Inc. | | | 19,180 | | | | 949,218 | | | | | |

Research In Motion Ltd. | | | 2,092 | | | | 121,608 | | | | (a | ) |

| | | | | | | 1,746,973 | | | | | |

| |

Computer Hardware — 2.7% | | | | | |

| | | |

Apple Inc. | | | 2,849 | | | | 918,973 | | | | (a | ) |

| | | | | | | | | | | | |

| | | |

| | | Number

of Shares | | | Fair Value | | | | |

| | | |

Hewlett-Packard Co. | | | 2,994 | | | $ | 126,047 | | | | | |

| | | | | | | 1,045,020 | | | | | |

| |

Construction & Farm Machinery & Heavy Trucks — 1.0% | | | | | |

| | | |

Cummins Inc. | | | 1,131 | | | | 124,421 | | | | | |

Deere & Co. | | | 2,524 | | | | 209,618 | | | | | |

Navistar International Corp. | | | 973 | | | | 56,346 | | | | (a | ) |

| | | | | | | 390,385 | | | | | |

| |

Consumer Finance — 0.6% | | | | | |

| | | |

American Express Co. | | | 2,645 | | | | 113,523 | | | | | |

Capital One Financial Corp. | | | 2,348 | | | | 99,931 | | | | | |

| | | | | | | 213,454 | | | | | |

| |

Data Processing & Outsourced Services — 3.0% | | | | | |

| | | |

The Western Union Co. | | | 31,950 | | | | 593,312 | | | | | |

Visa Inc. | | | 7,841 | | | | 551,850 | | | | | |

| | | | | | | 1,145,162 | | | | | |

| |

Department Stores — 0.2% | | | | | |

| | | |

Macy’s Inc. | | | 3,294 | | | | 83,338 | | | | | |

| |

Diversified Financial Services — 4.8% | | | | | |

| | | |

Bank of America Corp. | | | 29,287 | | | | 390,689 | | | | | |

Citigroup Inc. | | | 34,948 | | | | 165,304 | | | | (a | ) |

JPMorgan Chase & Co. | | | 18,354 | | | | 778,577 | | | | | |

US BanCorp | | | 2,567 | | | | 69,232 | | | | | |

Wells Fargo & Co. | | | 13,802 | | | | 427,724 | | | | | |

| | | | | | | 1,831,526 | | | | | |

| |

Diversified Metals & Mining — 0.5% | | | | | |

| | | |

Freeport-McMoRan Copper & Gold Inc. | | | 1,735 | | | | 208,356 | | | | | |

| |

Diversified Support Services — 0.2% | | | | | |

| | | |

Iron Mountain Inc. | | | 3,536 | | | | 88,435 | | | | | |

| |

Drug Retail — 0.2% | | | | | |

| | | |

CVS Caremark Corp. | | | 1,984 | | | | 68,984 | | | | | |

| |

Electric Utilities — 1.2% | | | | | |

| | | |

Edison International | | | 1,675 | | | | 64,655 | | | | | |

Entergy Corp. | | | 1,102 | | | | 78,055 | | | | | |

ITC Holdings Corp. | | | 997 | | | | 61,794 | | | | | |

NextEra Energy Inc. | | | 2,054 | | | | 106,787 | | | | | |

Northeast Utilities | | | 4,710 | | | | 150,155 | | | | | |

| | | | | | | 461,446 | | | | | |

| |

Electrical Components & Equipment — 0.5% | | | | | |

| | | |

Cooper Industries PLC | | | 2,976 | | | | 173,471 | | | | | |

| |

Electronic Components — 0.3% | | | | | |

| | | |

Corning Inc. | | | 5,561 | | | | 107,439 | | | | | |

See Notes to Schedule of Investments and Notes to Financial Statements.

6

U.S. Equity Fund

| | |

| Schedule of Investments | | December 31, 2010 |

| | | | | | | | | | | | |

| | | |

| | | Number

of Shares | | | Fair Value | | | | |

| |

Fertilizers & Agricultural Chemicals — 1.8% | | | | | |

| | | |

Monsanto Co. | | | 6,598 | | | $ | 459,485 | | | | | |

Potash Corporation of Saskatchewan Inc. | | | 1,116 | | | | 172,790 | | | | | |

The Mosaic Co. | | | 559 | | | | 42,685 | | | | | |

| | | | | | | 674,960 | | | | | |

| |

General Merchandise Stores — 1.5% | | | | | |

| | | |

Target Corp. | | | 9,464 | | | | 569,070 | | | | | |

| |

Gold — 0.2% | | | | | |

| | | |

Barrick Gold Corp. | | | 1,763 | | | | 93,756 | | | | | |

| |

Healthcare Distributors — 0.2% | | | | | |

| | | |

Cardinal Health Inc. | | | 1,984 | | | | 76,007 | | | | | |

| |

Healthcare Equipment — 2.6% | | | | | |

| | | |

Becton Dickinson and Co. | | | 573 | | | | 48,430 | | | | | |

Covidien PLC | | | 15,049 | | | | 687,137 | | | | | |

ResMed Inc. | | | 7,842 | | | | 271,647 | | | | (a | ) |

| | | | | | | 1,007,214 | | | | | |

| |

Healthcare Services — 2.0% | | | | | |

| | | |

Express Scripts Inc. | | | 10,164 | | | | 549,364 | | | | (a | ) |

Medco Health Solutions Inc. | | | 1,014 | | | | 62,128 | | | | (a | ) |

Omnicare Inc. | | | 5,775 | | | | 146,627 | | | | | |

| | | | | | | 758,119 | | | | | |

| |

Home Improvement Retail — 1.4% | | | | | |

| | | |

Lowe’s companies Inc. | | | 21,251 | | | | 532,975 | | | | | |

| |

Homebuilding — 0.1% | | | | | |

| | | |

MDC Holdings Inc. | | | 929 | | | | 26,727 | | | | | |

| |

Homefurnishing Retail — 0.2% | | | | | |

| | | |

Bed Bath & Beyond Inc. | | | 1,680 | | | | 82,572 | | | | (a | ) |

| |

Hotels, Resorts & Cruise Lines — 0.6% | | | | | |

| | | |

Carnival Corp. | | | 4,684 | | | | 215,979 | | | | | |

| |

Household Products — 1.9% | | | | | |

| | | |

Clorox Co. | | | 3,080 | | | | 194,902 | | | | | |

The Procter & Gamble Co. | | | 8,246 | | | | 530,465 | | | | | |

| | | | | | | 725,367 | | | | | |

| |

Independent Power Producers & Energy Traders — 0.3% | | | | | |

| | | |

Calpine Corp. | | | 3,593 | | | | 47,931 | | | | (a | ) |

The AES Corp. | | | 6,770 | | | | 82,459 | | | | (a | ) |

| | | | | | | 130,390 | | | | | |

| |

Industrial Gases — 1.1% | | | | | |

| | | |

Praxair Inc. | | | 4,570 | | | | 436,298 | | | | | |

| | | | | | | | | | | | |

| | | |

| | | Number

of Shares | | | Fair Value | | | | |

| |

Industrial Machinery — 0.1% | | | | | |

| | | |

Eaton Corp. | | | 299 | | | $ | 30,351 | | | | | |

| |

Integrated Oil & Gas — 5.8% | | | | | |

| | | |

Chevron Corp. | | | 4,849 | | | | 442,471 | | | | | |

Exxon Mobil Corp. | | | 10,657 | | | | 779,240 | | | | (d | ) |

Hess Corp. | | | 1,732 | | | | 132,567 | | | | | |

Marathon Oil Corp. | | | 3,086 | | | | 114,275 | | | | | |

Occidental Petroleum Corp. | | | 1,422 | | | | 139,498 | | | | | |

Suncor Energy Inc. | | | 15,828 | | | | 606,054 | | | | | |

| | | | | | | 2,214,105 | | | | | |

| |

Integrated Telecommunication Services — 1.3% | | | | | |

| | | |

AT&T Inc. | | | 9,540 | | | | 280,285 | | | | | |

Verizon Communications Inc. | | | 5,561 | | | | 198,973 | | | | | |

| | | | | | | 479,258 | | | | | |

| |

Internet Retail — 0.1% | | | | | |

| | | |

Amazon.com Inc. | | | 214 | | | | 38,520 | | | | (a | ) |

| |

Internet Software & Services — 2.6% | | | | | |

| | | |

Baidu Inc. ADR | | | 4,771 | | | | 460,545 | | | | (a | ) |

Equinix Inc. | | | 2,256 | | | | 183,323 | | | | (a | ) |

Google Inc. | | | 628 | | | | 373,013 | | | | (a | ) |

| | | | | | | 1,016,881 | | | | | |

| |

Investment Banking & Brokerage — 2.4% | | | | | |

| | | |

Morgan Stanley | | | 4,706 | | | | 128,050 | | | | | |

The Goldman Sachs Group Inc. | | | 4,622 | | | | 777,236 | | | | | |

| | | | | | | 905,286 | | | | | |

| |

IT Consulting & Other Services — 1.6% | | | | | |

| | | |

International Business Machines Corp. | | | 4,212 | | | | 618,153 | | | | | |

| |

Life & Health Insurance — 2.3% | | | | | |

| | | |

Aflac Inc. | | | 3,580 | | | | 202,019 | | | | | |

MetLife Inc. | | | 3,037 | | | | 134,964 | | | | | |

Principal Financial Group Inc. | | | 5,133 | | | | 167,130 | | | | | |

Prudential Financial Inc. | | | 6,156 | | | | 361,419 | | | | | |

| | | | | | | 865,532 | | | | | |

| |

Life Sciences Tools & Services — 1.1% | | | | | |

| | | |

Life Technologies Corp. | | | 2,360 | | | | 130,980 | | | | (a | ) |

PerkinElmer Inc. | | | 1,672 | | | | 43,171 | | | | | |

Thermo Fisher Scientific Inc. | | | 4,789 | | | | 265,119 | | | | (a | ) |

| | | | | | | 439,270 | | | | | |

| |

Movies & Entertainment — 2.1% | | | | | |

| | | |

News Corp. | | | 13,176 | | | | 191,843 | | | | | |

The Walt Disney Co. | | | 4,919 | | | | 184,512 | | | | | |

Time Warner Inc. | | | 13,262 | | | | 426,639 | | | | | |

| | | | | | | 802,994 | | | | | |

See Notes to Schedule of Investments and Notes to Financial Statements.

7

U.S. Equity Fund

| | |

| Schedule of Investments | | December 31, 2010 |

| | | | | | | | | | | | |

| | | |

| | | Number

of Shares | | | Fair Value | | | | |

| |

Multi-Line Insurance — 0.1% | | | | | |

| | | |

Hartford Financial Services Group Inc. | | | 822 | | | $ | 21,775 | | | | | |

| |

Multi-Utilities — 0.5% | | | | | |

| | | |

Dominion Resources Inc. | | | 4,278 | | | | 182,756 | | | | | |

| |

Oil & Gas Equipment & Services — 3.3% | | | | | |

| | | |

Halliburton Co. | | | 1,283 | | | | 52,385 | | | | | |

National Oilwell Varco Inc. | | | 1,102 | | | | 74,110 | | | | | |

Schlumberger Ltd. | | | 12,866 | | | | 1,074,311 | | | | | |

Weatherford International Ltd. | | | 3,129 | | | | 71,341 | | | | (a | ) |

| | | | | | | 1,272,147 | | | | | |

| |

Oil & Gas Exploration & Production — 1.6% | | | | | |

| | | |

Apache Corp. | | | 3,805 | | | | 453,670 | | | | | |

Devon Energy Corp. | | | 1,198 | | | | 94,055 | | | | | |

Southwestern Energy Co. | | | 1,518 | | | | 56,819 | | | | (a | ) |

| | | | | | | 604,544 | | | | | |

| |

Oil & Gas Storage & Transportation — 0.7% | | | | | |

| | | |

El Paso Corp. | | | 14,858 | | | | 204,446 | | | | | |

Spectra Energy Corp. | | | 2,781 | | | | 69,497 | | | | | |

| | | | | | | 273,943 | | | | | |

| |

Packaged Foods & Meats — 1.2% | | | | | |

| | | |

Kraft Foods Inc. | | | 11,131 | | | | 350,738 | | | | | |

McCormick & Company Inc. | | | 925 | | | | 43,040 | | | | | |

Nestle S.A. ADR | | | 881 | | | | 51,820 | | | | | |

| | | | | | | 445,598 | | | | | |

| |

Pharmaceuticals — 2.6% | | | | | |

| | | |

Bristol-Myers Squibb Co. | | | 8,002 | | | | 211,893 | | | | | |

Hospira Inc. | | | 3,421 | | | | 190,516 | | | | (a | ) |

Johnson & Johnson | | | 5,561 | | | | 343,948 | | | | | |

Novartis AG ADR | | | 1,843 | | | | 108,645 | | | | | |

Pfizer Inc. | | | 8,952 | | | | 156,750 | | | | | |

| | | | | | | 1,011,752 | | | | | |

| |

Property & Casualty Insurance — 0.5% | | | | | |

| | | |

ACE Ltd. | | | 2,822 | | | | 175,670 | | | | | |

| |

Railroads — 0.9% | | | | | |

| | | |

Union Pacific Corp. | | | 3,795 | | | | 351,645 | | | | | |

| |

Real Estate Services — 0.4% | | | | | |

| | | |

CB Richard Ellis Group Inc. (REIT) | | | 6,935 | | | | 142,029 | | | | (a | ) |

| |

Regional Banks — 0.1% | | | | | |

| | | |

Regions Financial Corp. | | | 4,909 | | | | 34,363 | | | | | |

| |

Reinsurance — 0.4% | | | | | |

| | | |

PartnerRe Ltd. | | | 1,713 | | | | 137,640 | | | | | |

| | | | | | | | | | | | |

| | | |

| | | Number

of Shares | | | Fair Value | | | | |

| |

Security & Alarm Services — 0.4% | | | | | |

| | | |

Corrections Corporation of America | | | 6,545 | | | $ | 164,018 | | | | (a | ) |

| |

Semiconductor Equipment — 0.3% | | | | | |

| | | |

KLA-Tencor Corp. | | | 2,792 | | | | 107,883 | | | | | |

| |

Semiconductors — 2.5% | | | | | |

| | | |

Intel Corp. | | | 27,211 | | | | 572,247 | | | | | |

Microchip Technology Inc. | | | 1,969 | | | | 67,359 | | | | | |

Texas Instruments Inc. | | | 9,303 | | | | 302,347 | | | | | |

| | | | | | | 941,953 | | | | | |

| |

Soft Drinks — 2.5% | | | | | |

| | | |

PepsiCo Inc. | | | 14,620 | | | | 955,125 | | | | | |

| |

Specialized Finance — 1.9% | | | | | |

| | | |

CME Group Inc. | | | 2,328 | | | | 749,034 | | | | | |

| |

Steel — 1.8% | | | | | |

| | | |

Allegheny Technologies Inc. | | | 12,804 | | | | 706,525 | | | | | |

| |

Systems Software — 4.6% | | | | | |

| | | |

Microsoft Corp. | | | 45,498 | | | | 1,270,304 | | | | (d | ) |

Oracle Corp. | | | 15,907 | | | | 497,889 | | | | | |

| | | | | | | 1,768,193 | | | | | |

| |

Wireless Telecommunication Services — 2.1% | | | | | |

| | | |

American Tower Corp. | | | 3,079 | | | | 159,000 | | | | (a | ) |

NII Holdings Inc. | | | 14,543 | | | | 649,490 | | | | (a | ) |

| | | | | | | 808,490 | | | | | |

| | | |

Total Common Stock

(Cost $31,153,082) | | | | | | | 36,954,003 | | | | | |

Exchange Traded Funds — 1.6% | | | | | |

Financial Select Sector SPDR Fund | | | 7,758 | | | | 123,740 | | | | (f | ) |

Industrial Select Sector SPDR Fund | | | 13,918 | | | | 485,738 | | | | (f | ) |

| | | |

Total Exchange Traded Funds

(Cost $598,484) | | | | | | | 609,478 | | | | | |

Other Investments — 0.0%* | | | | | | | | | |

GEI Investment Fund

(Cost $8,988) | | | | | | | 8,539 | | | | (e | ) |

| | | |

Total Investments in Securities

(Cost $31,760,554) | | | | | | | 37,572,020 | | | | | |

See Notes to Schedule of Investments and Notes to Financial Statements.

8

U.S. Equity Fund

| | |

| Schedule of Investments | | December 31, 2010 |

| | | | | | | | | | | | |

| | | |

| | | | | | Fair Value | | | | |

Short-Term Investments — 2.2% | | | | | |

GE Money Market Fund Institutional

Class 0.00%

(Cost $852,619) | | | | | | $ | 852,619 | | | | (b,e | ) |

| | | |

Total Investments

(Cost $32,613,173) | | | | | | | 38,424,639 | | | | | |

| | | |

Liabilities in Excess Of Other Assets,

net — (0.3)% | | | | | | | (109,921 | ) | | | | |

| | | | | | | | | | | | |

| | | |

NET ASSETS — 100.0% | | | | | | $ | 38,314,718 | | | | | |

| | | | | | | | | | | | |

| | | |

| | | | | | | | | | | | |

Other Information | |

The GEI U.S. Equity Fund had the following long futures contracts open at December 31, 2010

| | | | | | | | | | | | | | | | |

| Description | | Expiration

date | | | Number

of

Contracts | | | Current

Notional

Value | | | Unrealized

Appreciation | |

S&P 500 EMini Index

Futures | | | March 2011 | | | | 6 | | | $ | 375,900 | | | $ | 4,812 | |

See Notes to Schedule of Investments and Notes to Financial Statements.

9

| | |

| Notes to Schedule of Investments | | December 31, 2010 |

The views expressed in this document reflect our judgment as of the publication date and are subject to change at any time without notice. The securities information regarding holdings, allocations and other characteristics are presented as of a particular date to illustrate examples of securities that the Fund bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. See the prospectus for complete descriptions of investment objective, policies, risks and permissible investments.

| (a) | Non-income producing security. |

| (b) | Coupon amount represents effective yield. |

| (c) | State Street Corp. is the parent company of State Street Bank & Trust Co., the Fund’s custodian and accounting agent. |

| (d) | At December 31, 2010 , all or a portion of this security was pledged to cover collateral requirements for futures, options, forward foreign currency contracts and/or TBA’s. |

| (e) | GE Asset Management, the investment adviser of the Fund, also serves as investment adviser of the GEI Investment Fund and the GE Funds-GE Money Market Fund. |

| (f) | Sponsored by SSgA Funds Management, Inc., an affiliate of State Street Bank & Trust Co., the Fund’s custodian and accounting agent. |

| † | Percentages are based on net assets as of December 31, 2010 . |

Abbreviations:

| | |

ADR | | American Depository Receipt |

SPDR | | Standard & Poors Depository Receipts |

10

Financial Highlights

Selected data based on a share outstanding throughout the fiscal years indicated

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | CLASS 1 | | | | | | CLASS 4 | |

| | | 12/31/10 | | | 12/31/09 | | | 12/31/08 | | | 12/31/07 | | | 12/31/06 | | | | | | 12/31/10 | | | 12/31/09 | | | 12/31/08 | |

| Inception date | | | — | | | | — | | | | — | | | | — | | | | 1/3/95 | | | | | | | | | | | | — | | | | 5/1/08 | |

Net asset value,

beginning of period | | $ | 29.23 | | | $ | 22.44 | | | $ | 36.41 | | | $ | 39.02 | | | $ | 34.06 | | | | | | | $ | 29.25 | | | $ | 22.47 | | | $ | 35.32 | |

Income/(loss)

from

investment

operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment

income (loss) | | | 0.28 | ** | | | 0.30 | | | | 0.37 | | | | 0.45 | | | | 0.53 | | | | | | | | 0.16 | ** | | | 0.03 | | | | 0.15 | ** |

Net realized and unrealized

gains/(losses) on invest

ments | | | 2.72 | | | | 6.80 | | | | (13.52 | ) | | | 2.70 | | | | 4.96 | | | | | | | | 2.71 | | | | 6.95 | | | | (12.26 | ) |

Total income/(loss)

from

investment

operations | | | 3.00 | | | | 7.10 | | | | (13.15 | ) | | | 3.15 | | | | 5.49 | | | | | | | | 2.87 | | | | 6.98 | | | | (12.11 | ) |

Less distributions

from: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment

income | | | 0.31 | | | | 0.31 | | | | 0.36 | | | | 0.44 | | | | 0.53 | | | | | | | | 0.18 | | | | 0.20 | | | | 0.28 | |

Net realized

gains | | | — | | | | — | | | | 0.46 | | | | 5.32 | | | | — | | | | | | | | — | | | | — | | | | 0.46 | |

Total distributions | | | 0.31 | | | | 0.31 | | | | 0.82 | | | | 5.76 | | | | 0.53 | | | | | | | | 0.18 | | | | 0.20 | | | | 0.74 | |

Net asset value,

end of period | | $ | 31.92 | | | $ | 29.23 | | | $ | 22.44 | | | $ | 36.41 | | | $ | 39.02 | | | | | | | $ | 31.94 | | | | $29.25 | | | | $22.47 | |

TOTAL RETURN(a) | | | 10.26 | % | | | 31.63 | % | | | (36.05 | )% | | | 8.01 | % | | | 16.12 | % | | | | | | | 9.81 | % | | | 31.05 | % | | | (34.25 | )% |

| | | | | | | | | |

RATIOS/

SUPPLE

MENTAL

DATA: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets,

end of period

(in thousands) | | $ | 38,305 | | | $ | 41,792 | | | $ | 37,917 | | | $ | 77,777 | | | $ | 101,885 | | | | | | | $ | 9 | | | $ | 9 | | | $ | 7 | |

Ratios to

average

net assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net invest

ment

income | | | 0.96 | % | | | 1.11 | % | | | 1.03 | % | | | 0.94 | % | | | 1.43 | % | | | | | | | 0.56 | % | | | 0.68 | % | | | 0.74 | %* |

Net Expenses | | | 0.69 | %(b) | | | 0.86 | %(b) | | | 0.72 | %(b) | | | 0.66 | % | | | 0.63 | % | | | | | | | 1.09 | %(b) | | | 1.31 | %(b) | | | 1.17 | %(b)* |

Gross expenses | | | 0.69 | % | | | 0.86 | % | | | 0.72 | % | | | 0.66 | % | | | 0.63 | % | | | | | | | 1.09 | % | | | 1.31 | % | | | 1.17 | % |

Portfolio turnover rate | | | 42 | % | | | 46 | % | | | 56 | % | | | 55 | % | | | 45 | % | | | | | | | 42 | % | | | 46 | % | | | 56 | % |

Notes to Financial Highlights

| (a) | Total returns are historical and assume changes in share price, reinvestment of dividends and capital gains distributions and do not include the effect of insurance contract charges. Past performance does not guarantee future results. |

| (b) | Reflects GE Asset Management’s waiver of a portion of the Fund’s management fee in an amount equal to the management fee earned by GEAM with respect to the Fund’s investment in the GE Funds – GE Money Market Fund. Excluding waiver, the expense ratios would be unchanged. |

| * | Annualized for periods less than one year. |

| ** | Per share values have been calculated using the average share method. |

The accompanying Notes are an integral part of these financial statements.

11

| | | | |

Statement of Assets and Liabilities December 31, 2010 | | | |

| |

ASSETS | | | | |

Investments in securities, at Fair Value (cost $31,751,566) | | | $37,563,481 | |

Investments in affiliated securities, at Fair Value (cost $8,988) | | | 8,539 | |

Short-term affiliated investments (at amortized cost) | | | 852,619 | |

Foreign cash (cost $591) | | | 595 | |

Receivable for investments sold | | | 435 | |

Income receivables | | | 24,938 | |

Receivable for fund shares sold | | | 2,644 | |

Total Assets | | | 38,453,251 | |

| |

LIABILITIES | | | | |

Payable for Fund shares redeemed | | | 4,220 | |

Payable to GEAM | | | 17,728 | |

Accrued other expenses | | | 116,135 | |

Variation margin payable | | | 450 | |

Total Liabilities | | | 138,533 | |

NET ASSETS | | | $38,314,718 | |

| |

NET ASSETS CONSIST OF : | | | | |

Capital paid in | | | 43,301,979 | |

Undistributed (distribution in excess of)

net investment income | | | 902 | |

Accumulated net realized gain (loss) | | | (10,804,445 | ) |

Net unrealized appreciation/(depreciation) on: | | | | |

Investments | | | 5,811,466 | |

Futures and other | | | 4,816 | |

NET ASSETS | | | $38,314,718 | |

| |

Class 1: | | | | |

| |

NET ASSETS | | | 38,305,258 | |

Shares outstanding ($0.01 par value; unlimited shares authorized) | | | 1,200,182 | |

Net asset value per share | | | 31.92 | |

| |

Class 4: | | | | |

| |

NET ASSETS | | | 9,460 | |

Shares outstanding ($0.01 par value; unlimited shares authorized) | | | 296 | |

Net asset value per share | | | 31.94 | |

The accompanying Notes are an integral part of these financial statements.

12

| | | | |

Statement of Operations For the year ending December 31, 2010 | | | |

| |

INVESTMENT INCOME | | | | |

Income: | | | | |

Dividends | | | $609,314 | |

Interest | | | 23,374 | |

Interest from affiliated investments | | | 225 | |

Less: Foreign taxes withheld | | | (2,916 | ) |

Total Income | | | 629,997 | |

| |

Expenses: | | | | |

Advisory and administrative fees | | | 211,600 | |

Transfer agent fees | | | 13,037 | |

Directors’ fees | | | 1,395 | |

Custody and accounting expenses | | | 14,805 | |

Professional fees | | | 15,371 | |

Other expenses | | | 9,005 | |

Total expenses before waiver and reimbursement | | | 265,213 | |

Less: Expenses reimbursed by the adviser | | | (2,200 | ) |

Net expenses | | | 263,013 | |

Net investment income (loss) | | | 366,984 | |

| |

NET REALIZED AND UNREALIZED GAIN (LOSS)

ON INVESTMENTS | | | | |

| |

Realized gain (loss) on: | | | | |

Investments | | | 354,541 | |

Futures and other | | | 143,564 | |

| |

Increase (decrease) in unrealized appreciation/(depreciation) on: | | | | |

Investments | | | 2,777,037 | |

Futures and other | | | 4,354 | |

Net realized and unrealized gain (loss) on investments | | | 3,279,496 | |

Net increase (decrease) in net assets resulting from operations | | | $3,646,480 | |

The accompanying Notes are an integral part of these financial statements.

13

| | | | | | | | |

Statements of Changes in Net Assets | | | |

| | | Year Ended

December

31, 2010 | | | Year Ended

December

31, 2009 | |

| | |

INCREASE (DECREASE) IN NET ASSETS | | | | | | | | |

Operations: | | | | | | | | |

Net investments income | | | $ 366,984 | | | | $ 423,730 | |

Net realized gain (loss) on investments, futures and foreign currency transactions | | | 498,105 | | | | (6,358,263 | ) |

Net increase (decrease) in unrealized appreciation/(depreciation) on investments,

futures and foreign currency transaction | | | 2,781,391 | | | | 16,408,296 | |

Net increase (decrease) from operations | | | 3,646,480 | | | | 10,473,763 | |

Distributions to shareholders from : | | | | | | | | |

Net investment income | | | | | | | | |

Class 1 | | | (369,247 | ) | | | (439,224 | ) |

Class 4 | | | (53 | ) | | | (58 | ) |

Total distributions | | | (369,300 | ) | | | (439,282 | ) |

Increase (decrease) in net assets from operations and distributions | | | 3,277,180 | | | | 10,034,481 | |

Share transactions : | | | | | | | | |

Proceeds from sale of shares | | | | | | | | |

Class 1 | | | 353,286 | | | | 798,549 | |

Class 4 | | | — | | | | — | |

Value of distributions reinvested | | | | | | | | |

Class 1 | | | 369,247 | | | | 439,224 | |

Class 4 | | | 53 | | | | 58 | |

Cost of shares redeemed | | | | | | | | |

Class 1 | | | (7,485,265 | ) | | | (7,396,085 | ) |

Class 4 | | | — | | | | — | |

Net increase (decrease) from share transactions | | | (6,762,679 | ) | | | (6,158,254 | ) |

Total increase (decrease) in net assets | | | (3,485,499 | ) | | | 3,876,227 | |

| | |

NET ASSETS | | | | | | | | |

Beginning of period | | | 41,800,217 | | | | 37,923,990 | |

End of period | | | $38,314,718 | | | | $41,800,217 | |

Undistributed (distribution in excess of)

net investment income, end of period | | | $ 902 | | | | $ 3,181 | |

| | |

CHANGES IN FUND SHARES | | | | | | | | |

| | |

Class 1 | | | | | | | | |

Shares sold | | | 11,976 | | | | 30,844 | |

Issued for distributions reinvested | | | 11,546 | | | | 14,889 | |

Shares redeemed | | | (253,018 | ) | | | (305,851 | ) |

Net increase (decrease) in fund shares | | | (229,496 | ) | | | (260,118 | ) |

| | |

Class 4 | | | | | | | | |

Shares sold | | | — | | | | — | |

Issued for distributions reinvested | | | 2 | | | | 2 | |

Shares redeemed | | | — | | | | — | |

Net increase (decrease) in fund shares | | | 2 | | | | 2 | |

The accompanying Notes are an integral part of these financial statements.

14

| | |

| Notes to Financial Statements | | December 31, 2010 |

| 1. | Organization of the Company |

GE Investments Funds, Inc. (the “Company”) was incorporated under the laws of the Commonwealth of Virginia on May 14, 1984 and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Company is composed of fourteen investment portfolios (collectively the “Funds”), although only the following eleven are currently being offered: U.S. Equity Fund, (the “Fund”) S&P 500 Index Fund, Premier Growth Equity Fund, Core Value Equity Fund, Mid-Cap Equity Fund, Small-Cap Equity Fund, International Equity Fund, Total Return Fund, Income Fund, Money Market Fund and Real Estate Securities Fund.

Shares of the Funds of the Company are offered only to insurance company separate accounts that fund certain variable life insurance contracts and variable annuity contracts. GE Asset Management Incorporated (“GEAM”) is the investment adviser and administrator of each of the Funds.

The Company offers two share classes (Class 1 and Class 4) of the Fund. Class 4 shares were first offered on May 1, 2008, and Fund shares outstanding prior to May 1, 2008 were designated as Class 1 shares. Each share class has different fees and expenses, and as a result, each share class will have different share price and performance. Not all variable contracts offer both share classes of the Fund.

| 2. | Summary of Significant Accounting Policies |

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results may differ from those estimates.

Subsequent events after the balance sheet date through the date the financial statements were issued, have been evaluated in the preparation of the financial statements.

There are no items to report.

The following summarizes the significant accounting policies of the Company:

Securities Valuation and Transactions. All investments in securities are recorded at their estimated fair value, as described in Note 3.

Securities transactions are accounted for as of the trade date. Realized gains and losses on investments sold are recorded on the basis of identified cost for both financial statement and federal tax purposes.

The Fund’s income, expenses (other than distribution fees) and realized and unrealized gains and losses are allocated proportionally each day among the share classes based upon the relative net assets of each class.

Futures Contracts A futures contract represents a commitment for the future purchase or sale of an asset at a specified price on a specified date. The Fund invests in stock index futures contracts subject to certain limitations to manage its exposure to the stock markets. Buying futures tends to increase a Fund’s exposure to the underlying instrument while selling futures tends to decrease a Fund’s exposure to the underlying instrument or to hedge other Fund investments. With futures contracts, there is minimal counterparty credit risk to the Fund since futures contracts are exchange traded and the exchange’s clearinghouse, as counterparty to all traded futures, guarantees the futures against default. A Fund’s risks in using these contracts include changes in the value of the underlying instruments, non- performance of the counterparties under the contracts’ terms and changes in the liquidity of the secondary market for the contracts. Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they principally trade.

Upon entering into a financial futures contract, the Fund is required to pledge to the broker an amount of cash and/or other assets equal to a certain percentage of the contract amount, known as initial margin deposit. Subsequent payments, known as variation margin, are made or received by the Fund each day, depending on the daily fluctuation in the fair value of the underlying security. The Fund records an unrealized gain or loss equal to the daily variation margin. Should market conditions move unexpectedly, the Fund may not achieve the anticipated benefits of the futures contracts and may incur a loss. The Fund recognizes a realized gain or loss upon the expiration or closing of a futures contract.

Investment Income Corporate actions (including cash dividends) are recorded on the ex-dividend date, net of applicable withholding taxes. Interest income is recorded on the accrual basis.

15

| | |

| Notes to Financial Statements | | December 31, 2010 |

Expenses Fund specific expenses are allocated to the Fund that incurs such expenses and pro rata across share classes. Expenses, other than those incurred by a specific Fund, are allocated pro rata among Fund’s share classes. Such expenses may include custodial fees, legal and accounting fees, printing costs and registration fees. All expenses of the Fund are paid by GEAM and reimbursed by the Fund. Certain class specific expenses (such as transfer agency fees or distribution fees) are allocated to the class that incurs such expense.

Federal Income Taxes The Fund intends to comply with all sections of the Internal Revenue Code applicable to regulated investment companies including the distribution of substantially all of its taxable net investment income and net realized capital gains to its shareholders. Therefore, no provision for federal income tax has been made. The Fund is treated as a separate taxpayer for federal income tax purposes.

The Fund utilizes various methods to measure the fair value of most of its investments on a recurring basis. GAAP establishes a framework for measuring fair value and providing related disclosures. Broadly, the framework requires fair value to be determined based on the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants at the measurement date. In the absence of active markets for the identical assets or liabilities, such measurements involve developing assumptions based on market observable data and, in the absence of such data, internal information that is consistent with what market participants would use in a hypothetical transaction that occurs at the measurement date. It also establishes a three-level valuation hierarchy based upon observable and non-observable inputs.

Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect our market assumptions. Preference is given to observable inputs. These two types of inputs create the following fair value hierarchy:

Level 1 — Quoted prices for identical investments in active markets.

Level 2 — Quoted prices for similar investments in active markets; quoted prices for identical or similar

investments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3 — Significant inputs to the valuation model are unobservable.

Policies and procedures are maintained to value investments using the best and most relevant data available. In addition, pricing vendors are utilized to assist in valuing investments. GEAM performs periodic reviews of the methodologies used by independent pricing services including price validation of individual securities.

Fair Value Measurement The following section describes the valuation methodologies the Fund use to measure different financial investments at fair value.

The Fund’s portfolio securities are valued generally on the basis of market quotations. Equity securities generally are valued at the last reported sale price on the primary market in which they are traded. Portfolio securities listed on NASDAQ are valued using the NASDAQ Official Closing Price. Level 1 securities primarily include publicly-traded equity securities which may not necessarily represent the last sale price. If no sales occurred on the exchange or NASDAQ that day, the portfolio security generally is valued using the last reported bid price. In those circumstances the Fund classifies the investment securities in Level 2.

The Fund uses non-binding broker quotes as the primary basis for valuation when there is limited, or no, relevant market activity for a specific investment or for other investments that share similar characteristics. The Funds have not adjusted the prices obtained. Investment securities priced using non-binding broker quotes are included in Level 3. As is the case with the primary pricing vendor, third-party brokers do not provide access to their proprietary valuation models, inputs and assumptions. Accordingly, GEAM conducts internal reviews of pricing for all such investment securities periodically to ensure reasonableness of valuations used in the Fund‘s financial statements. These reviews are designed to identify prices that appear stale, those that have changed significantly from prior valuations, and other anomalies that may indicate that a price may not be accurate. Based on the information available, GEAM believes that the fair values provided by the brokers are representative of prices that would be received to sell the assets at the measurement date (exit prices).

16

| | |

| Notes to Financial Statements | | December 31, 2010 |

A Fund’s written or purchased options are valued at the last sales price, or if no sales occurred that day, at the last reported bid price and those are also included in Level 2.

If prices are not readily available for a portfolio security, or if it is believed that a price for a portfolio security does not represent its fair value, the security may be valued using procedures approved by the Fund’s Board of Directors that are designed to establish its “fair” value. These securities would be classified in Level 3. Those procedures require

that the fair value of a security be established by the valuation committee. The valuation committee follows different protocols for different types of investments and circumstances. The fair value procedures may be used to value any investment of the Fund in the appropriate circumstances.

The following table presents the Fund’s investments measured at fair value on a recurring basis at December 31, 2010:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments in Securities† | | | | | | | | | | | | | | | | |

Common Stock | | $ | 36,954,003 | | | $ | — | | | $ | — | | | $ | 36,954,003 | |

Exchanged Traded Funds | | | 609,478 | | | | — | | | | — | | | | 609,478 | |

Other Investments | | | — | | | | 8,539 | | | | — | | | | 8,539 | |

Short-Term Investments | | | 852,619 | | | | — | | | | — | | | | 852,619 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 38,416,100 | | | $ | 8,539 | | | | — | | | $ | 38,424,639 | |

| | | | | | | | | | | | | | | | |

Other Financial Instruments* | | | | | | | | | | | | | | | | |

Futures Contracts — Unrealized Appreciation | | $ | 4,812 | | | $ | — | | | $ | — | | | $ | 4,812 | |

|

† See Schedule of Investments for Industry Classification. * Other financial instruments include derivative instruments such as futures, forward foreign currency exchange contracts, swap contacts and option contacts. Amounts shown represent unrealized appreciation (depreciation), or in the case of options, market value at period end. | |

| 4. | Derivatives Transactions |

Shown below are the derivative contracts entered into by the Fund, summarized by primary risk exposure as they appear on the Statement of Assets and Liabilities, all of which are not accounted for as hedging instruments under FASB Accounting Standards Codification (“ASC”) No. 815 Derivatives and Hedging as of December 31, 2010.

| | | | | | | | | | | | |

| | | Asset Derivatives | | | Liability Derivatives | |

| | | Location | | Fair Value($) | | | Location | | Fair Value($) | |

| Equity Futures | | Assets, Net Assets — Unrealized Appreciation/ (Depreciation) on Futures | | | 4,812 | * | | | | | | |

Shown below are the effects of derivative instruments on the Fund’s Statement of Operations, summarized by primary risk exposure all of which are not accounted for as hedging instruments under ASC 815.

| | | | | | | | | | | | | | |

| | | Location | | Notional Amount of

Futures Contracts

Purchased/(Sold)($) | | | Realized Gain

or (Loss)($) | | | Change in Unrealized

Appreciation/(Depreciation)($) | |

Equity Futures | | Net realized gain/(loss) on futures, Increase/(decrease) in unrealized appreciation/ (depreciation) on futures | | | 8,598,685/(8,315,245) | | | | 143,646 | | | | 4,350 | |

| * | Includes cumulative appreciation/depreciation of futures contracts as reported in the Schedule of Investments and within the components of Net Assets section of the Statements of Assets and Liabilities. Only the current day’s variation margin is reported within the receivables and/or payables of the Statement of Assets and Liabilities. |

17

| | |

| Notes to Financial Statements | | December 31, 2010 |

The Company shares a revolving credit facility of up to $150 million with a number of its affiliates. The credit facility is with its custodian bank, State Street Bank and Trust Company (“State Street”). The revolving credit facility requires the payment of a commitment fee equal to 0.125% per annum on the daily unused portion of the credit facility, payable quarterly. The portion borne by the Funds generally is borne proportionally based upon net assets. In addition, the Company has a $100 million uncommitted, unsecured line of credit with State Street. Generally, borrowings under the credit facilities would accrue interest at the Federal Funds Rate plus 50 basis points and would be borne by the borrowing Fund. The maximum amount allowed to be borrowed by any one Fund is the lesser of (i) 33.33% of its total assets or (ii) 20% of its net assets. The credit facilities were not utilized by the Fund during the fiscal year ended December 31, 2010.

| 6. | Fees and Compensation Paid to Affiliates |

GEAM, a registered investment adviser, was retained by the Company’s Board of Directors effective November 17, 1997 to act as investment adviser and administrator of the Fund. GEAM’s compensation for investment advisory and administrative services is paid monthly based on the average daily net assets of the Fund at an annualized rate of 0.55%.

GEAM waives a portion of the Fund’s management fee in the amount equal to the management fee earned by GEAM with respect to the Fund’s investment in the GE Funds—GE Money Market Fund.

Distribution and Service (12b-1) Fees The Company has adopted a Distribution and Service (12b-1) Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act with respect to Class 4 shares of the Fund. Under the Plan, the Fund may compensate GE Investment Distributors, Inc. (“GEID”), a wholly-owned subsidiary of GEAM and the Fund’s principal distributor, for certain sales services provided by GEID or other broker dealers and investor services provided by GEID or other service providers relating to the Fund’s Class 4 shares, including services to owners or prospective owners of variable contracts issued by insurance companies that offer such share class as an investment option. The amount of compensation paid under the Plan by the Fund’s Class 4 shares may not exceed 0.45% of the average daily net assets of the Fund attributable to such share class. The Plan continues in effect from year to year for so long as such

continuance is approved annually by the Board of Directors, including by those directors who are not interested persons of the Company and who have no direct or indirect financial interest in the operation of the Plan or in any agreement related to it.

Directors’ Compensation The Fund pays no compensation to its directors who are officers or employees of GEAM or its affiliates. Directors who are not such officers or employees also serve in a similar capacity for other funds advised by GEAM. Compensation paid to unaffiliated directors are reflected on the Statement of Operations. These fees are allocated pro rata across all of the mutual fund platforms and share classes served by the directors, including the Fund, and are based upon the relative net assets of each Fund within such platforms.

| 7. | Investment Transactions |

Purchases and Sales of Securities The cost of purchases and the proceeds from sales of investments, other than short-term securities and options, for the year ended December 31, 2010 were as follows:

| | |

| Non U.S. Government Securities |

| Purchases | | Sales |

$15,762,135 | | $22,469,061 |

The Fund is subject to ASC 740, Income Taxes. ASC 740 provides guidance for financial accounting and reporting for the effects of income taxes that result from an entity’s activities during the year. ASC 740 also provides guidance regarding how certain uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. ASC 740 requires evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more likely than not” of being sustained by the applicable tax authority. There are no adjustments to the Fund’s net assets required under ASC 740. The Fund’s 2007, 2008, 2009 and 2010 fiscal years tax returns are still open to examination by the Federal and applicable state tax authorities.

18

| | |

| Notes to Financial Statements | | December 31, 2010 |

At December 31, 2010, information on the tax components of capital is as follows:

| | | | | | | | | | | | | | |

Cost on

Tax Basis | | Gross Unrealized Tax | | Net Tax Appreciation/(Depreciation) | | | | | | |

| | Appreciation | | Depreciation | | Investments | | Derivatives/

Currency | | Undistributed

Income | | Undistributed

Accumulated

Capital Loss | | Post

October

Losses |

| $35,461,993 | | $6,399,030 | | $(3,436,384) | | $2,962,646 | | $— | | $1,579 | | $(7,951,481) | | $(5) |

As of December 31, 2010, the Fund has capital loss carryovers as indicated below. Capital loss carryovers are available to offset future realized capital gains to the extent provided in the Internal Revenue Code and regulations thereunder. To the extent that these carryover losses are used to offset future capital gains, it is probable that the gains so offset will not be distributed to shareholders because they would be taxable as ordinary income.

| | |

| Amount | | Expires |

$ 26,864 | | 12/31/2016 |

7,924,617 | | 12/31/2017 |

These amounts will be available to offset future taxable capital gains. Under the recently enacted Regulated Investment Company Modernization Act of 2010, the Fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. However, any losses incurred during those future years will be required to be utilized prior to the losses incurred in pre-enactment tax years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

During the year ended December 31, 2010, the Fund utilized $778,743 of prior year capital loss carryovers.

Any net capital and currency losses incurred after October 31, within the Fund’s tax year, are deemed to arise on the first day of the Fund’s next tax year if the Fund so elects to defer such losses.

The Fund elected to defer losses incurred after October 31, 2010 as follows:

The tax composition of distributions paid during the years ended December 31, 2010 and December 31, 2009 were as follows:

| | | | | | | | | | | | |

| | | Ordinary

Income | | | Long-Term

Capital Gains | | | Total | |

2010 | | $ | 369,300 | | | $ | — | | | $ | 369,300 | |

2009 | | | 439,282 | | | | — | | | | 439,282 | |

Distributions to Shareholders The Fund declares and pays any dividends from net investment income annually. The Fund declares and pays any net realized capital gains in excess of capital loss carryforwards distributions annually. The character of income and gains to be distributed is determined in accordance with income tax regulations which may differ from generally accepted accounting principles. These differences include (but are not limited to) futures investments organized as partnerships for tax purposes and losses deferred due to wash sale transactions. Reclassifications due to permanent book/tax differences are made to the Fund’s capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations. These reclassifications have no impact on net investment income, realized gains or losses, or the net asset value of the Fund. The calculation of net investment income per share in the Financial Highlights table excludes these adjustments.

The reclassifications for the year ended December 31, 2010 were as follows:

| | |

Undistributed Net Investment Income | | Accumulated Net Realized (Loss) |

$37 | | $(37) |

19

Report of Independent Registered Public Accounting Firm

The Shareholders and Board of Directors

GE Investments Funds, Inc.

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of the U.S. Equity Fund, a series of GE Investments Funds, Inc., as of December 31, 2010, and the related statement of operations for the year then ended, statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2010 by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the U.S. Equity Fund as of December 31, 2010, the results of its operations, changes in its net assets and financial highlights for each of the years or periods described above, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

February 25, 2011

20

| | |

| Advisory and Administrative Agreement Renewal | | (unaudited) |

The Board of Directors of the GE Investments Funds, Inc. (the “Board”), including the independent Board members, considered and all those that were present unanimously approved the continuance of the Fund’s Investment Advisory and Administration Agreement with GE Asset Management Incorporated (“GEAM”) at meetings held on December 3 and December 10, 2010.

In considering whether to approve the Fund’s investment advisory agreement, the Board members considered and discussed a substantial amount of information and analysis provided, at the Board’s request, by GEAM. The Board members also considered detailed information regarding performance and expenses of other investment companies, including those with similar investment strategies and sizes, which was prepared by independent third party provider Morningstar, Inc. (“Morningstar”). The Board members reviewed the fees charged by GEAM for other mutual funds and investment products other than mutual funds that employ the same investment strategy as the Fund. The Board had the opportunity to ask questions and request additional information in connection with its considerations.

Before approving the Fund’s advisory agreement, the Board members reviewed the information provided with management of GEAM and with independent legal counsel. The Board members also reviewed a memorandum prepared by independent legal counsel discussing the legal standards for the consideration of the proposed continuance. The independent Board members discussed the proposed continuance in detail during a private session with their independent legal counsel at which no representatives of GEAM were present. The independent Board members and their independent legal counsel requested, and received and considered, additional information from GEAM following these sessions.

In advance of the meetings, and in response to their request, the Board members received from GEAM written responses to their inquiries, which included substantial exhibits and other materials related to GEAM’s business and the services it provides to the Fund. The Board members took into account their multi-year experience as Board members and particularly their consideration of these types of agreements in recent years. The information was presented in a manner to facilitate comparison to prior periods and to reflect certain enhancements. To focus their review, the Board members asked GEAM management, in its oral presentation, to highlight material differences from the information presented in recent years.

During the meetings, the Board members had an opportunity to discuss this information with GEAM managers, including senior executives, representatives from the legal, compliance and finance departments, and investment personnel. The Board members posed questions to these representatives and engaged in substantive discussions with them concerning GEAM’s investment process.

In reaching their determination relating to continuance of the Fund’s investment advisory agreement, the Board members considered all factors that they deemed relevant, including the factors discussed below. In their deliberations, the Board members did not identify any particular information that was all-important or controlling, and each Board member may have attributed different weights to the various factors. In particular, the Board members focused on the following:

The Nature, Extent And Quality Of Services Provided.

The Board members reviewed the services provided by GEAM, taking into account their extensive past experiences with GEAM. They focused on the favorable attributes of GEAM, including (i) an investment philosophy oriented toward long-term performance; (ii) effective processes used for selecting investments and brokers; (iii) effective processes used for providing Fund administration, including controllership and compliance functions and oversight of the performance of other companies that provide services to the Fund; (iv) highly skilled professionals including analysts, research professionals, traders and portfolio managers with a depth of experience relevant to the Fund; (v) access to significant technological resources from which the Fund may benefit; and (vi) a favorable history and reputation. The Board members noted that the Fund represents only a small portion of the assets managed by GEAM, but benefits from a full array of services and resources provided by GEAM.

In light of these discussions, the Board, including the independent Board members, concluded that GEAM’s services continue to be satisfactory.

Investment Performance Of The Fund.

The Board members considered the investment performance of the Fund for various periods. The Board members reviewed detailed comparisons of the performance of the Fund with the relevant securities index and peer groupings of mutual funds prepared by