UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04041

GE INVESTMENTS FUNDS, INC.

(Exact name of registrant as specified in charter)

1600 SUMMER STREET, STAMFORD, CONNECTICUT 06905

(Address of principal executive offices) (Zip code)

GE ASSET MANAGEMENT, INC.

1600 SUMMER STREET, STAMFORD, CONNECTICUT 06905

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-242-0134

Date of fiscal year end: 12/31

Date of reporting period: 12/31/11

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

GE Investments Funds, Inc.

U.S. Equity Fund

Annual Report

December 31, 2011

GE Investments Funds, Inc.

| | |

| |

| U.S. Equity Fund | | Contents |

This report is prepared for Policyholders of certain variable contracts and may be distributed to others only if preceded or accompanied by the variable contract’s current prospectus and the current summary prospectus of the Fund available for investments thereunder.

| | |

| Notes to Performance | | December 31, 2011 (unaudited) |

The information provided on the performance pages relates to the GE Investments U.S. Equity Fund (the “Fund”).

Total returns take into account changes in share price and assume reinvestment of dividends and capital gains distributions, if any. Total returns shown are net of Fund fees and expenses but do not reflect fees and charges associated with the variable contracts such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the Fund’s total returns for all periods shown.

The performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Periods less than one year are not annualized. Please call 800-493-3042 or visit the Fund’s website at http://www.geam.com for the most recent month-end performance data.

An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. An investment in the Fund is subject to risk, including possible loss of principal invested.

The S&P 500® Index is an unmanaged market capitalization-weighted index of stocks of 500 large U.S. companies, which is widely used as a measure of large-cap U.S. stock market performance. The results shown for the foregoing index assume the reinvestment of net dividends or interest and do not reflect fees, expenses or taxes. They do not reflect the actual cost of investing in the instruments that comprise the index.

The peer universe of the underlying annuity funds used for the peer group average annual total return calculation is based on a blend of Morningstar peer categories, as shown. Morningstar is an independent mutual fund rating service. A Fund’s performance may be compared to or ranked within a universe of mutual funds with investment objectives and policies similar but not necessarily identical to that of the Fund.

©2012 Morningstar, Inc. All Rights Reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damage or losses relating from any use of this information. Past performance is no guarantee of future results.

GE Investment Distributors, Inc., Member of FINRA & SIPC, is the principal underwriter and distributor of the GE Investments Funds, Inc. and a wholly owned subsidiary of GE Asset Management Incorporated, the investment adviser of the Fund.

1

| | |

| U.S. Equity Fund | | (unaudited) |

David B. Carlson

Chief Investment Officer — U.S. Equities

Stephen V. Gelhaus

Senior Vice President

Thomas R. Lincoln

Senior Vice President

Paul C. Reinhardt

Senior Vice President

The U.S. Equity Fund is managed by a team of portfolio managers that includes David B. Carlson, Stephen V. Gelhaus, Thomas R. Lincoln and Paul C. Reinhardt. Each of the foregoing portfolio managers manages (or co-manages) one of three sub-portfolios, which comprise the Fund. A sub-portfolio refers to the portion of the Fund’s assets that are allocated to, and managed by, a particular portfolio managers on the Fund’s portfolio management team. The three sub-portfolios are managed independently of each other and the portfolio managers have full discretion over their sub-portfolio. The weightings to each sub-portfolio in the Fund, can be changed at any time but generally remain stable for 18 to 24 months.

David B. Carlson is Chief Investment Officer — U.S. Equities at GE Asset Management. He manages the overall U.S. equity investments for GE Asset Management. Mr. Carlson began serving as a portfolio manager for the U.S. Equity Fund effective May 2011. Mr. Carlson joined GE Asset Management in 1982 as a securities analyst for investment operations. He became a Vice President for Mutual Fund Portfolios in 1987, a Senior Vice President in 1989 and an Executive Vice President in 2003.

Stephen V. Gelhaus is a Senior Vice President of GE Asset Management. He has been a member of the portfolio management team for the Fund since January 2002. Mr. Gelhaus joined GE Asset Management in June 1991 and was a research analyst in the U.S. Equities group from 1995 through 2001.

Thomas R. Lincoln is a Senior Vice President of GE Asset Management. He has been a member of the portfolio management team for the Fund since May 2007. Mr. Lincoln joined GE Asset Management in 1994 as a financial analyst in U.S. Equities. Mr. Lincoln became part of the investment management team for U.S. Equities at GE Asset Management in 1997 and a portfolio manager for U.S. Equities in 2003.

Paul C. Reinhardt is a Senior Vice President of GE Asset Management. He has been a portfolio manager for the Fund since January 2001. Mr. Reinhardt joined GE Asset Management in 1982 as an equity analyst and has been a portfolio manager since 1987.

| Q. | How did the GE Investments U.S. Equity Fund perform compared to its benchmark and Morningstar peer group for the twelve-month period ended December 31, 2011? |

| A. | For the twelve-month period ended December 31, 2011, the GE Investments U.S. Equity Fund returned -2.91% for Class 1 shares. The S&P 500® Index (S&P 500), the Fund’s benchmark, returned 2.11% and the Fund’s Morningstar peer group of 350 U.S. Insurance Large Blend Funds returned an average of -1.46% over the same period. |

| Q. | What market factors affected the Fund’s performance? |

| A. | Macro events created an extremely volatile market environment for U.S. equities. Macro concerns which whipsawed stocks ranged from European sovereign debt woes, to political unrest in the Mid-East, to Japan’s earthquake and near-nuclear disaster to China’s slowing economy. Meanwhile, Washington’s contentious debt ceiling debate culminated with S&P’s U.S. debt rating downgrade, causing a severe market pull-back in August, erasing the year’s early gains. Debate around the possibility of a double-dip recession intensified in the third quarter, as economic indicators weakened and emerging markets growth slowed. Investors seemed to embrace risk again in the last quarter of the year, as glimmers of hope emerged in Europe in the form of central bank loans to ailing European financial institutions. The Chinese central bank took measures to stimulate growth and positive economic news suggested that the U.S. was withstanding the pressures from the European crisis better than expected. |

Amid the macro uncertainties, correlations (i.e., the degree to which individual securities traded in relation to the overall market) spiked, and investors seemed to ignore fundamentals — creating a very difficult stock-picking environment for active managers. In the persistently low interest rate environment, and due to solvency fears in Europe, the S&P 500 financial sector

2

declined 17% in 2011. The most cyclical sectors lagged amid slowing growth fears with the materials (-10%) and industrials (-1%) sectors losing ground. Many investors attempted to shed risk and seek the relative safety of higher-yielding areas of the equity market, including utilities (+20% and the best performing S&P 500 sector), consumer staples (+14%) and health care (+13%). The telecom, consumer discretionary and energy sectors also outperformed within the S&P 500. Technology outperformed, but performance was mixed.

| Q. | What were the primary drivers of Fund performance? |

| A. | The Fund was not positioned for the flight to safety that characterized the year, as the Fund was underweighted in utilities and consumer staples, which cost relative performance. Our valuation discipline kept us light in consumer staples, for example, and we saw greater long-term appreciation potential in other sectors, including technology which was the Fund’s largest overweight versus the S&P 500 at year-end. Key negative performance drivers included stock selection in health care (e.g., Express Scripts (-17%), Hospira (-47%) and underweighting defensive pharmaceuticals like Pfizer (+29%)). Express Scripts’ relationship with Walgreen’s faltered, and the company announced an acquisition, but we continued to believe in the pharmacy benefit manager’s ability to play a powerful role in reducing health care costs. We did not maintain conviction in Hospira, eliminating the position as the leader in generic injectable drugs fell under manufacturing-related FDA scrutiny. Nextel International (-52%) languished amid unfavorable foreign exchange moves and increased competition in the Latin American telecom markets. Due to the increased uncertainties, we reduced the Nextel International position. Goldman Sachs (-46%), CME (-23%) and JP Morgan Chase (-20%) each came under pressure in the difficult environment for financials. Two energy stocks also weighed on returns as cyclicals lagged, including global energy services leader Schlumberger (-17%) and Canadian oil sands producer Suncor (-24%), more than offsetting a positive contribution from the Fund’s small position in takeover target, El Paso Corp. (+93%). |

On the other hand, strength in the Fund’s information technology, industrials and materials holdings helped

reduce Fund underperformance. Within technology, ADR Baidu (+21%) and Qualcomm (+12%) contributed the most, demonstrating strong earnings growth throughout the year. In materials, strength in industrial gas producer, Praxair (+14%) offset the weakness in Allegheny (-12%) which fell along with steel commodity prices. In industrials, the Fund participated in the IPO of Nielsen Holdings (+17%) and it rose in part due to improving fundamentals in media, as well as a market-leading position in media information and analytics. The Fund continued to hold Nielsen at the end of the period. We also avoided some of the sluggishness in the deep cyclical machinery companies. A timely elimination of Citigroup shielded the Fund from the worst of the beleaguered bank’s declines. Amgen (+18%), Visa (+45%), Gilead (+13%) and American Tower (+17%) were four final key single-stock contributors.

| Q. | Were there any significant changes in the Fund during the period? |

| A. | We continued to focus on bottom-up fundamentals, searching for opportunities in the ups and downs of the market. At year-end, the Fund’s largest overweights were in technology, health care and materials and the largest underweights were in consumer staples, industrials and utilities although we construct the Fund on a bottom-up, stock-by-stock basis. We are staying very close to our portfolio companies, monitoring changes in strategic direction and how management teams utilize excess capital. In our view, the U.S. economy remains in a prolonged period of deleveraging, as are many economies around the globe. We continue to emphasize the Fund’s positioning in large cap, high quality companies that we believe have the potential to grow market share and take actions that benefit shareholders. |

We continue to expect volatility, especially in light of U.S. budget and debt debates as well as accelerating geopolitical events. In light of recent challenges, in our opinion, S&P 500 earnings revisions have not fallen in a way that would be indicative of a double-dip. We believe a future market rally could be dominated by outperformance by global market share winners that have the ability to meet or beat earnings expectations. Amid rapidly changing market conditions, we will maintain our bottom-up stock selection approach with a focus on the long-term investment horizon.

3

| | |

| U.S. Equity Fund | | (unaudited) |

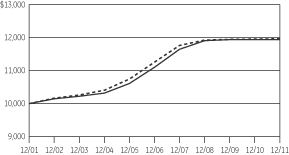

Understanding Your Fund’s Expenses

As a shareholder of the Fund you incur ongoing costs. Ongoing costs include portfolio management fees, professional fees, administrative fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in the Fund during the period. The information in the following table is based on an investment of $1,000, which is invested at the beginning of the period and held for the entire six-month period ended December 31, 2011.

Actual Expenses

The first section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your class under the heading “Expenses Paid During Period.”

Hypothetical Example for Comparison Purposes

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholders reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs, such as sales charges or redemption fees, if any. Additionally, the expenses shown do not reflect the fees or charges associated with variable contracts through which shares of the Fund are offered.

July 1, 2011 - December 31, 2011

| | | | | | | | | | | | |

| | | Account value at the

beginning of the period ($) | | | Account value at the

end of the period ($) | | | Expenses paid

during the period ($)* | |

Actual Fund Return** | | | 1,000.00 | | | | 932.30 | | | | 4.33 | |

Hypothetical 5% Return (2.5% for the period) | | | 1,000.00 | | | | 1,020.72 | | | | 4.53 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.89% (for the period July 1, 2011 - December 31, 2011), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| ** | | Actual Fund Return for the six-month period ended December 31, 2011 was: -6.77%. Past performance does not guarantee future results. |

4

| | |

| U.S. Equity Fund | | (unaudited) |

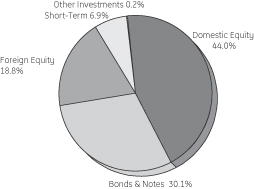

Investment Profile

A mutual fund designed for investors who seek long-term growth of capital. The Fund seeks its objective by investing at least 80% of its net assets under normal circumstances in equity securities of U.S. companies, such as common and preferred stocks.

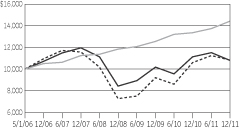

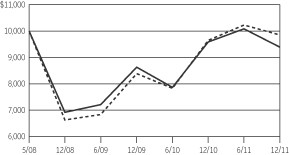

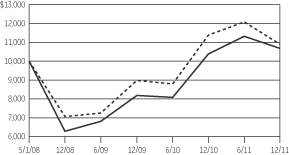

Morningstar Performance Comparison

Based on average annual returns for periods ended 12/31/11

| | | | | | | | | | | | | | |

| | | | | One

Year | | | Five

Year | | | Ten

Year | |

Number of funds in peer group | | | | | 350 | | | | 294 | | | | 192 | |

Peer group average annual total return | | | | | -1.46% | | | | -1.06% | | | | 2.39% | |

Morningstar category in peer group: U.S. Insurance Large Blend | | | | | | | | | | | | | | |

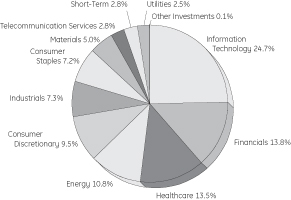

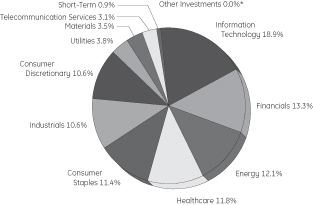

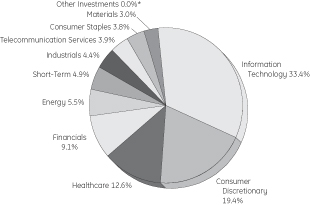

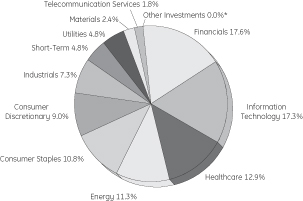

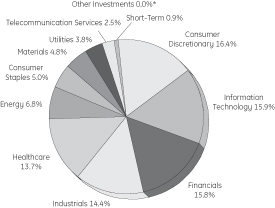

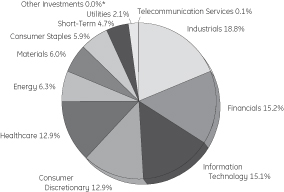

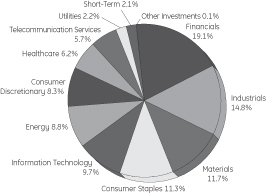

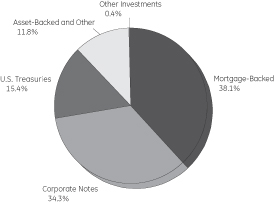

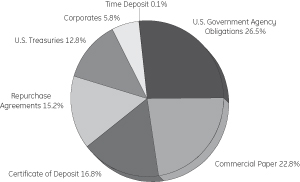

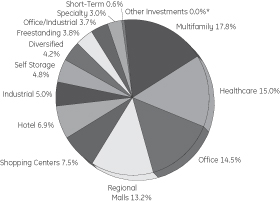

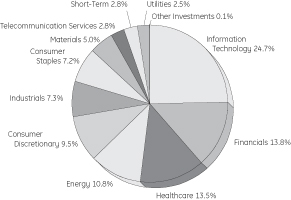

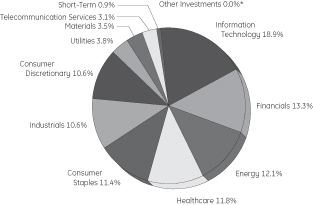

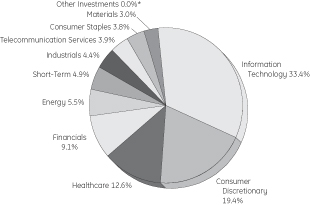

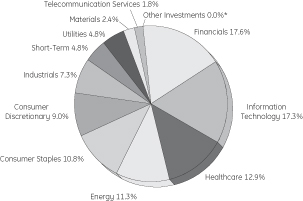

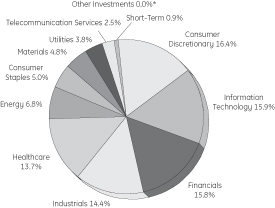

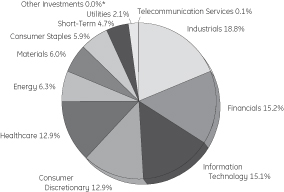

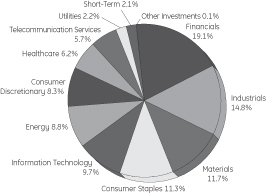

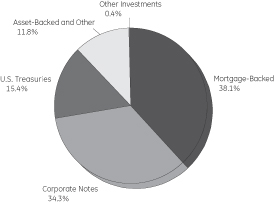

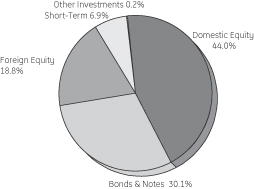

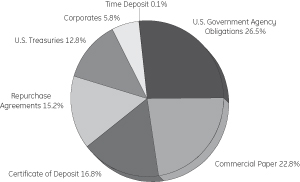

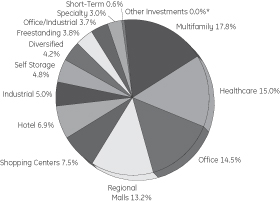

Sector Allocation

as a % of Fair Value(c) of $31,007 (in thousands) on December 31, 2011(b)(c)

Top Ten Largest Holdings

as of December 31, 2011 as a % of Fair Value(b)(c)

| | | | |

Apple Inc. | | | 5.01% | |

Qualcomm Inc. | | | 2.59% | |

Schlumberger Ltd. | | | 2.55% | |

Cisco Systems Inc. | | | 2.46% | |

PepsiCo Inc. | | | 2.26% | |

Google Inc. | | | 2.22% | |

Microsoft Corp. | | | 2.20% | |

Express Scripts Inc. | | | 2.18% | |

Visa Inc. | | | 1.90% | |

Covidien PLC | | | 1.87% | |

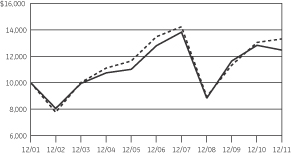

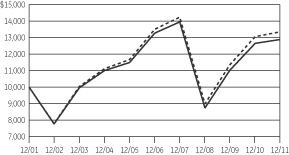

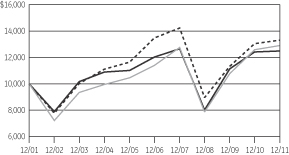

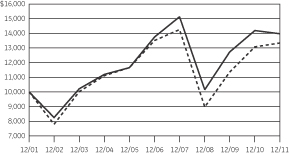

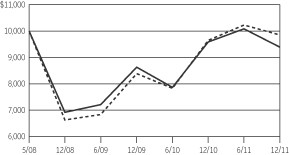

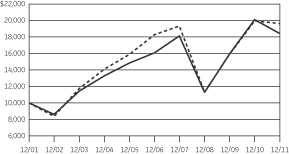

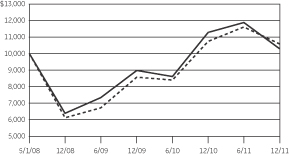

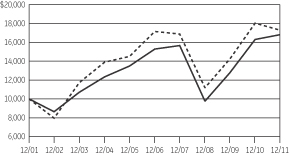

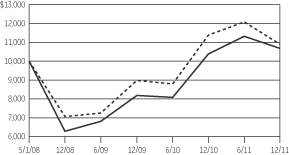

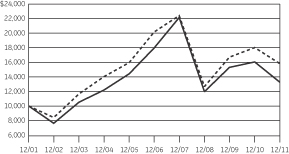

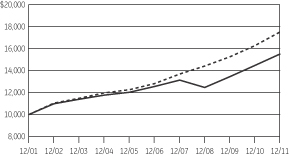

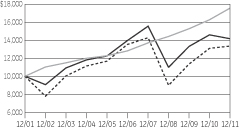

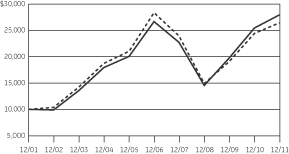

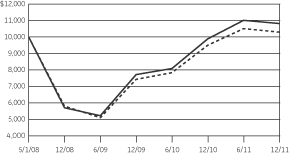

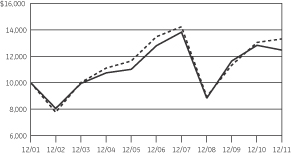

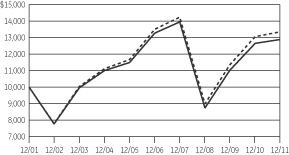

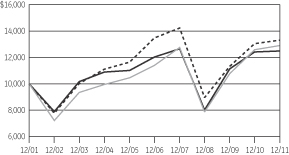

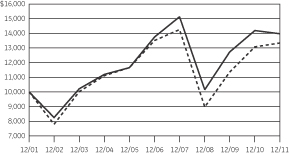

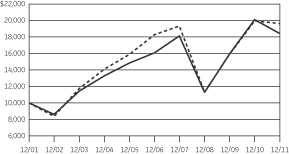

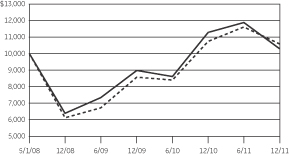

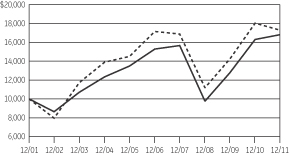

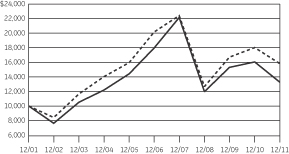

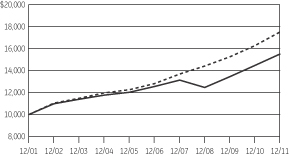

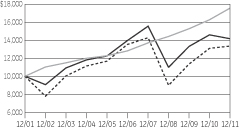

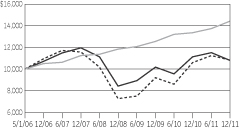

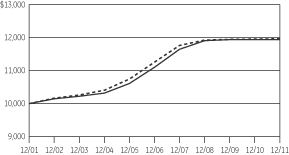

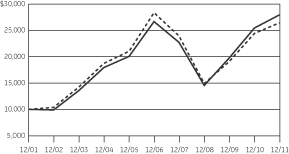

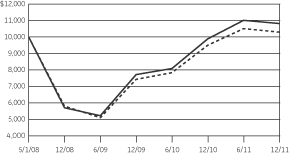

Change in Value of a $10,000 Investment(a)

Class 1 Shares

Average Annual Total Return

for the Periods Ended December 31, 2011

Class 1 Shares (Inception date: 1/3/95)

| | | | | | | | | | | | | | | | |

| | | One

Year | | | Five

Year | | | Ten

Year | | | Ending value of a

$10,000 investment(a) | |

U.S. Equity Fund | | | -2.91% | | | | -0.54% | | | | 2.23% | | | $ | 12,472 | |

S&P 500 Index | | | 2.11% | | | | -0.25% | | | | 2.92% | | | $ | 13,340 | |

| (a) | Ending value of a $10,000 investment for the ten-year period or since inception, whichever is less. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| (c) | Fair Value basis is inclusive of short-term investment in GE Institutional Money Market Fund Investment Class. |

See Notes to Performance on page 1 for further information, including an explanation of Morningstar peer categories.

Past performance does not predict future performance. The performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares and does not reflect the fees or charges that would be associated with variable contracts through which shares of the Fund are offered.

5

U.S. Equity Fund

| | |

| Schedule of Investments | | December 31, 2011 |

U.S. Equity Fund

| | | | | | | | | | | | |

| | | |

| | | Number

of Shares | | | Fair Value | | | | |

Common Stock — 95.8%† | |

| |

Advertising — 1.4% | | | | | |

| | | |

Omnicom Group Inc. | | | 9,943 | | | $ | 443,259 | | | | | |

| |

Aerospace & Defense — 3.2% | | | | | |

| | | |

CAE Inc. | | | 11,005 | | | | 106,889 | | | | | |

Hexcel Corp. | | | 3,609 | | | | 87,374 | | | | (a | ) |

Honeywell International Inc. | | | 9,784 | | | | 531,760 | | | | | |

Rockwell Collins Inc. | | | 3,422 | | | | 189,476 | | | | | |

United Technologies Corp. | | | 867 | | | | 63,369 | | | | | |

| | | | | | | 978,868 | | | | | |

| |

Agricultural Products — 0.7% | | | | | |

| | | |

Archer-Daniels-Midland Co. | | | 7,675 | | | | 219,505 | | | | | |

| |

Air Freight & Logistics — 1.4% | | | | | |

| | | |

FedEx Corp. | | | 2,441 | | | | 203,848 | | | | | |

United Parcel Service Inc. | | | 3,069 | | | | 224,620 | | | | | |

| | | | | | | 428,468 | | | | | |

| |

Asset Management & Custody Banks — 3.0% | | | | | |

| | | |

Ameriprise Financial Inc. | | | 3,936 | | | | 195,383 | | | | | |

Invesco Ltd. | | | 11,807 | | | | 237,203 | | | | | |

State Street Corp. | | | 12,283 | | | | 495,128 | | | | (c | ) |

| | | | | | | 927,714 | | | | | |

| |

Auto Parts & Equipment — 0.2% | | | | | |

| | | |

Johnson Controls Inc. | | | 2,085 | | | | 65,177 | | | | | |

| |

Automotive Retail — 0.2% | | | | | |

| | | |

O’Reilly Automotive Inc. | | | 715 | | | | 57,164 | | | | (a | ) |

| |

Biotechnology — 3.6% | | | | | |

| | | |

Amgen Inc. | | | 8,425 | | | | 540,969 | | | | | |

Gilead Sciences Inc. | | | 14,088 | | | | 576,622 | | | | (a | ) |

| | | | | | | 1,117,591 | | | | | |

| |

Brewers — 0.3% | | | | | |

| | | |

Molson Coors Brewing Co. | | | 1,771 | | | | 77,109 | | | | | |

| |

Cable & Satellite — 1.0% | | | | | |

| | | |

DIRECTV | | | 5,437 | | | | 232,486 | | | | (a | ) |

Liberty Global Inc. | | | 1,607 | | | | 63,509 | | | | (a | ) |

Sirius XM Radio Inc. | | | 7,262 | | | | 13,217 | | | | (a | ) |

| | | | | | | 309,212 | | | | | |

| |

Casinos & Gaming — 0.7% | | | | | |

| | | |

Las Vegas Sands Corp. | | | 4,855 | | | | 207,454 | | | | (a | ) |

| | | | | | | | | | | | |

| | | |

| | | Number

of Shares | | | Fair Value | | | | |

| |

Coal & Consumable Fuels — 0.0%* | | | | | |

| | | |

Peabody Energy Corp. | | | 183 | | | $ | 6,059 | | | | | |

| |

Communications Equipment — 5.1% | | | | | |

| | | |

Cisco Systems Inc. | | | 42,263 | | | | 764,115 | | | | | |

Qualcomm Inc. | | | 14,710 | | | | 804,637 | | | | | |

| | | | | | | 1,568,752 | | | | | |

| |

Computer Hardware — 5.2% | | | | | |

| | | |

Apple Inc. | | | 3,839 | | | | 1,554,795 | | | | (a | ) |

Hewlett-Packard Co. | | | 2,361 | | | | 60,819 | | | | | |

| | | | | | | 1,615,614 | | | | | |

| |

Construction & Farm Machinery & Heavy Trucks — 0.1% | | | | | |

| | | |

Deere & Co. | | | 393 | | | | 30,399 | | | | | |

| |

Consumer Finance — 1.1% | | | | | |

| | | |

American Express Co. | | | 6,201 | | | | 292,501 | | | | | |

Discover Financial Services | | | 1,815 | | | | 43,560 | | | | | |

| | | | | | | 336,061 | | | | | |

|

Data Processing & Outsourced Services — 2.6% | |

| | | |

The Western Union Co. | | | 12,318 | | | | 224,927 | | | | | |

Visa Inc. | | | 5,803 | | | | 589,179 | | | | | |

| | | | | | | 814,106 | | | | | |

| |

Department Stores — 0.3% | | | | | |

| | | |

Macy’s Inc. | | | 3,304 | | | | 106,323 | | | | | |

| |

Diversified Financial Services — 2.8% | | | | | |

| | | |

Bank of America Corp. | | | 26,845 | | | | 149,258 | | | | | |

Comerica Inc. | | | 2,480 | | | | 63,984 | | | | | |

JPMorgan Chase & Co. | | | 14,831 | | | | 493,131 | | | | | |

Wells Fargo & Co. | | | 6,298 | | | | 173,573 | | | | | |

| | | | | | | 879,946 | | | | | |

| |

Diversified Metals & Mining — 0.4% | | | | | |

| | | |

Freeport-McMoRan Copper & Gold Inc. | | | 3,227 | | | | 118,721 | | | | | |

| |

Drug Retail — 0.6% | | | | | |

| | | |

CVS Caremark Corp. | | | 4,250 | | | | 173,315 | | | | | |

| |

Electric Utilities — 1.0% | | | | | |

| | | |

FirstEnergy Corp. | | | 2,220 | | | | 98,346 | | | | | |

ITC Holdings Corp. | | | 821 | | | | 62,297 | | | | | |

NextEra Energy Inc. | | | 2,440 | | | | 148,547 | | | | | |

| | | | | | | 309,190 | | | | | |

| |

Electrical Components & Equipment — 0.5% | | | | | |

| | | |

Cooper Industries PLC | | | 3,031 | | | | 164,129 | | | | | |

See Notes to Schedule of Investments and Notes to Financial Statements.

6

U.S. Equity Fund

| | |

| Schedule of Investments | | December 31, 2011 |

| | | | | | | | | | | | |

| | | |

| | | Number

of Shares | | | Fair Value | | | | |

| |

Fertilizers & Agricultural Chemicals — 1.5% | | | | | |

| | | |

Monsanto Co. | | | 5,467 | | | $ | 383,073 | | | | | |

Potash Corporation of Saskatchewan Inc. | | | 2,165 | | | | 89,371 | | | | | |

| | | | | | | 472,444 | | | | | |

| |

General Merchandise Stores — 1.7% | | | | | |

| | | |

Target Corp. | | | 10,250 | | | | 525,005 | | | | | |

| |

Healthcare Equipment — 2.5% | | | | | |

| | | |

Baxter International Inc. | | | 1,452 | | | | 71,845 | | | | | |

Covidien PLC | | | 12,850 | | | | 578,378 | | | | | |

ResMed Inc. | | | 4,644 | | | | 117,958 | | | | (a | ) |

| | | | | | | 768,181 | | | | | |

| |

Healthcare Facilities — 0.2% | | | | | |

| | | |

HCA Holdings Inc. | | | 3,346 | | | | 73,712 | | | | (a | ) |

| |

Healthcare Services — 2.4% | | | | | |

| | | |

DaVita Inc. | | | 433 | | | | 32,826 | | | | (a | ) |

Express Scripts Inc. | | | 15,134 | | | | 676,338 | | | | (a | ) |

Omnicare Inc. | | | 1,181 | | | | 40,685 | | | | | |

| | | | | | | 749,849 | | | | | |

| |

Heavy Electrical Equipment — 0.1% | | | | | |

| | | |

ABB Ltd. ADR | | | 2,362 | | | | 44,476 | | | | | |

| |

Home Improvement Retail — 0.8% | | | | | |

| | | |

Lowe’s Companies Inc. | | | 2,239 | | | | 56,826 | | | | | |

The Home Depot Inc. | | | 4,357 | | | | 183,168 | | | | | |

| | | | | | | 239,994 | | | | | |

| |

Hotels, Resorts & Cruise Lines — 0.3% | | | | | |

| | | |

Carnival Corp. | | | 2,966 | | | | 96,810 | | | | | |

| |

Household Products — 1.0% | | | | | |

| | | |

The Procter & Gamble Co. | | | 4,538 | | | | 302,730 | | | | | |

| |

Independent Power Producers & Energy Traders — 1.1% | | | | | |

| | | |

Calpine Corp. | | | 6,297 | | | | 102,830 | | | | (a | ) |

The AES Corp. | | | 21,096 | | | | 249,777 | | | | (a | ) |

| | | | | | | 352,607 | | | | | |

| |

Industrial Conglomerates — 0.2% | | | | | |

| | | |

Siemens AG ADR | | | 630 | | | | 60,234 | | | | | |

| |

Industrial Gases—1.4% | | | | | |

Praxair Inc. | | | 3,935 | | | | 420,652 | | | | | |

| |

Industrial Machinery — 0.0%* | | | | | |

| | | |

Eaton Corp. | | | 315 | | | | 13,712 | | | | | |

| |

Insurance Brokers — 0.4% | | | | | |

| | | |

Marsh & McLennan Companies Inc. | | | 3,701 | | | | 117,026 | | | | | |

| | | | | | | | | | | | |

| | | |

| | | Number

of Shares | | | Fair Value | | | | |

| |

Integrated Oil & Gas — 4.8% | | | | | |

| | | |

Chevron Corp. | | | 4,869 | | | $ | 518,062 | | | | | |

Exxon Mobil Corp. | | | 4,952 | | | | 419,731 | | | | (d | ) |

Hess Corp. | | | 3,186 | | | | 180,965 | | | | | |

Occidental Petroleum Corp. | | | 2,087 | | | | 195,552 | | | | | |

Suncor Energy Inc. | | | 5,808 | | | | 167,445 | | | | | |

| | | | | | | 1,481,755 | | | | | |

|

Integrated Telecommunication Services — 0.8% | |

| | | |

AT&T Inc. | | | 4,920 | | | | 148,781 | | | | | |

Verizon Communications Inc. | | | 2,283 | | | | 91,594 | | | | | |

| | | | | | | 240,375 | | | | | |

| |

Internet Retail — 0.3% | | | | | |

| | | |

Amazon.com Inc. | | | 556 | | | | 96,244 | | | | (a | ) |

| |

Internet Software & Services — 4.6% | | | | | |

| | | |

Baidu Inc. ADR | | | 4,180 | | | | 486,845 | | | | (a | ) |

Equinix Inc. | | | 2,536 | | | | 257,150 | | | | (a | ) |

Google Inc. | | | 1,067 | | | | 689,175 | | | | (a | ) |

| | | | | | | 1,433,170 | | | | | |

| |

Investment Banking & Brokerage — 1.1% | | | | | |

| | | |

The Goldman Sachs Group Inc. | | | 3,849 | | | | 348,065 | | | | | |

| |

IT Consulting & Other Services — 2.2% | | | | | |

| | | |

Cognizant Technology Solutions Corp. | | | 3,740 | | | | 240,519 | | | | (a | ) |

International Business Machines Corp. | | | 2,342 | | | | 430,647 | | | | | |

| | | | | | | 671,166 | | | | | |

| |

Life & Health Insurance — 1.1% | | | | | |

MetLife Inc. | | | 3,345 | | | | 104,297 | | | | | |

Prudential Financial Inc. | | | 4,450 | | | | 223,034 | | | | | |

| | | | | | | 327,331 | | | | | |

| |

Life Sciences Tools & Services — 0.9% | | | | | |

| | | |

PerkinElmer Inc. | | | 9,794 | | | | 195,880 | | | | | |

Thermo Fisher Scientific Inc. | | | 1,496 | | | | 67,275 | | | | (a | ) |

| | | | | | | 263,155 | | | | | |

| |

Managed Healthcare — 0.1% | | | | | |

| | | |

UnitedHealth Group Inc. | | | 650 | | | | 32,942 | | | | | |

| |

Movies & Entertainment — 2.2% | | | | | |

| | | |

The Walt Disney Co. | | | 9,248 | | | | 346,800 | | | | | |

Time Warner Inc. | | | 9,359 | | | | 338,234 | | | | | |

| | | | | | | 685,034 | | | | | |

| |

Multi-Line Insurance — 0.3% | | | | | |

| | | |

Hartford Financial Services Group Inc. | | | 4,723 | | | | 76,749 | | | | | |

See Notes to Schedule of Investments and Notes to Financial Statements.

7

U.S. Equity Fund

| | |

| Schedule of Investments | | December 31, 2011 |

| | | | | | | | | | | | |

| | | |

| | | Number

of Shares | | | Fair Value | | | | |

| |

Multi-Utilities — 0.4% | | | | | |

| | | |

Dominion Resources Inc. | | | 1,573 | | | $ | 83,495 | | | | | |

Public Service Enterprise Group Inc. | | | 1,017 | | | | 33,571 | | | | | |

| | | | | | | 117,066 | | | | | |

| |

Oil & Gas Equipment & Services — 2.8% | | | | | |

| | | |

National Oilwell Varco Inc. | | | 1,243 | | | | 84,512 | | | | | |

Schlumberger Ltd. | | | 11,565 | | | | 790,005 | | | | | |

| | | | | | | 874,517 | | | | | |

| |

Oil & Gas Exploration & Production — 2.4% | | | | | |

| | | |

Anadarko Petroleum Corp. | | | 6,387 | | | | 487,520 | | | | | |

Apache Corp. | | | 1,162 | | | | 105,254 | | | | | |

Southwestern Energy Co. | | | 4,235 | | | | 135,266 | | | | (a | ) |

| | | | | | | 728,040 | | | | | |

| |

Oil & Gas Refining & Marketing — 0.2% | | | | | |

| | | |

Marathon Petroleum Corp. | | | 1,888 | | | | 62,852 | | | | | |

| |

Oil & Gas Storage & Transportation — 0.7% | | | | | |

| | | |

El Paso Corp. | | | 3,149 | | | | 83,669 | | | | | |

Spectra Energy Corp. | | | 1,968 | | | | 60,516 | | | | | |

The Williams Companies Inc. | | | 1,968 | | | | 64,983 | | | | | |

| | | | | | | 209,168 | | | | | |

| |

Packaged Foods & Meats — 2.1% | | | | | |

| | | |

ConAgra Foods Inc. | | | 5,916 | | | | 156,182 | | | | | |

Kraft Foods Inc. | | | 12,016 | | | | 448,918 | | | | | |

Nestle S.A. ADR | | | 984 | | | | 56,787 | | | | | |

| | | | | | | 661,887 | | | | | |

| |

Pharmaceuticals — 3.8% | | | | | |

| | | |

Bristol-Myers Squibb Co. | | | 4,721 | | | | 166,368 | | | | | |

Johnson & Johnson | | | 5,170 | | | | 339,049 | | | | | |

Novartis AG ADR | | | 2,432 | | | | 139,037 | | | | | |

Pfizer Inc. | | | 18,152 | | | | 392,809 | | | | | |

Teva Pharmaceutical Industries Ltd. ADR | | | 3,450 | | | | 139,242 | | | | | |

| | | | | | | 1,176,505 | | | | | |

| |

Property & Casualty Insurance — 1.9% | | | | | |

| | | |

ACE Ltd. | | | 6,440 | | | | 451,573 | | | | | |

The Chubb Corp. | | | 2,058 | | | | 142,455 | | | | | |

| | | | | | | 594,028 | | | | | |

| |

Reinsurance — 0.6% | | | | | |

| | | |

PartnerRe Ltd. | | | 1,634 | | | | 104,919 | | | | | |

RenaissanceRe Holdings Ltd. | | | 1,062 | | | | 78,981 | | | | | |

| | | | | | | 183,900 | | | | | |

| |

Research & Consulting Services — 0.2% | | | | | |

| | | |

Nielsen Holdings N.V. | | | 2,178 | | | | 64,665 | | | | (a | ) |

| |

Security & Alarm Services — 0.3% | | | | | |

| | | |

Corrections Corporation of America | | | 4,066 | | | | 82,824 | | | | (a | ) |

| | | | | | | | | | | | |

| | | |

| | | Number

of Shares | | | Fair Value | | | | |

| |

Semiconductors — 1.2% | | | | | |

| | | |

Altera Corp. | | | 1,889 | | | $ | 70,082 | | | | | |

Intel Corp. | | | 3,935 | | | | 95,424 | | | | | |

Microchip Technology Inc. | | | 1,417 | | | | 51,905 | | | | | |

Texas Instruments Inc. | | | 5,636 | | | | 164,064 | | | | | |

| | | | | | | 381,475 | | | | | |

| |

Soft Drinks — 2.6% | | | | | |

| | | |

Coca-Cola Enterprises Inc. | | | 4,329 | | | | 111,602 | | | | | |

PepsiCo Inc. | | | 10,561 | | | | 700,722 | | | | | |

| | | | | | | 812,324 | | | | | |

| |

Specialized Finance — 1.1% | | | | | |

| | | |

CME Group Inc. | | | 1,416 | | | | 345,037 | | | | | |

| |

Specialty Chemicals — 0.0%* | | | | | |

| | | |

Celanese Corp. | | | 237 | | | | 10,492 | | | | | |

| |

Specialty Stores — 0.4% | | | | | |

| | | |

Dick’s Sporting Goods Inc. | | | 2,905 | | | | 107,136 | | | | | |

| |

Steel — 1.7% | | | | | |

| | | |

Allegheny Technologies Inc. | | | 10,769 | | | | 514,758 | | | | | |

| |

Systems Software — 3.8% | | | | | |

| | | |

Microsoft Corp. | | | 26,327 | | | | 683,449 | | | | | |

Oracle Corp. | | | 19,293 | | | | 494,865 | | | | | |

| | | | | | | 1,178,314 | | | | | |

| |

Thrifts & Mortgage Finance — 0.1% | | | | | |

| | | |

People’s United Financial Inc. | | | 3,148 | | | | 40,452 | | | | | |

|

Wireless Telecommunication Services — 2.1% | |

| | | |

American Tower Corp. | | | 6,547 | | | | 392,885 | | | | (a | ) |

NII Holdings Inc. | | | 11,722 | | | | 249,679 | | | | (a | ) |

| | | | | | | 642,564 | | | | | |

| | | |

Total Common Stock

(Cost $27,521,588) | | | | | | | 29,635,558 | | | | | |

Exchange Traded Funds — 1.6% | | | | | |

Financial Select Sector SPDR Fund | | | 7,609 | | | | 98,917 | | | | (f | ) |

Industrial Select Sector SPDR Fund | | | 11,883 | | | | 401,051 | | | | (f | ) |

| | | |

Total Exchange Traded Funds

(Cost $511,787) | | | | | | | 499,968 | | | | | |

Other Investments — 0.0%* | |

GEI Investment Fund

(Cost $7,293) | | | | | | | 7,002 | | | | (e | ) |

| | | |

Total Investments in Securities

(Cost $28,040,668) | | | | | | | 30,142,528 | | | | | |

See Notes to Schedule of Investments and Notes to Financial Statements.

8

U.S. Equity Fund

| | |

| Schedule of Investments | | December 31, 2011 |

| | | | | | | | | | |

| | | |

| | | | | Fair Value | | | | |

Short-Term Investments — 2.8% | |

GE Institutional Money Market Fund Investment Class 0.06%

(Cost $864,814) | | | | $ | 864,814 | | | | (b,e | ) |

| | | |

Total Investments

(Cost $28,905,482) | | | | | 31,007,342 | | | | | |

| | | |

Liabilities in Excess of Other Assets, net — (0.2)% | | | | | (67,444 | ) | | | | |

| | | | | | | | | | |

| | | |

NET ASSETS — 100.0% | | | | $ | 30,939,898 | | | | | |

| | | | | | | | | | |

Other Information | |

The Fund had the following long futures contracts open at December 31, 2011:

| | | | | | | | | | | | | | | | |

| Description | | Expiration

date | | | Number of Contracts | | | Current Notional Value | | | Unrealized Appreciation | |

S&P 500 Emini Index Futures | | | March 2012 | | | | 6 | | | $ | 375,780 | | | $ | 9,777 | |

See Notes to Schedule of Investments and Notes to Financial Statements.

9

| | |

| Notes to Schedule of Investments | | December 31, 2011 |

The views expressed in this document reflect our judgment as of the publication date and are subject to change at any time without notice. The securities information regarding holdings, allocations and other characteristics are presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. See the Fund’s summary prospectus and statutory prospectus for complete descriptions of investment objectives, policies, risks and permissible investments.

| (a) | Non-income producing security. |

| (b) | Coupon amount represents effective yield. |

| (c) | State Street Corp. is the parent company of State Street Bank & Trust Co., the Fund’s custodian and accounting agent. |

| (d) | At December 31, 2011 , all or a portion of this security was reserved and/or pledged to cover collateral requirements for futures, options, forward foreign currency contracts and/or TBA’s. |

| (e) | GE Asset Management, the investment adviser of the Fund, also serves as investment adviser of the GEI Investment Fund and the GE Institutional Money Market Fund. |

| (f) | Sponsored by SSgA Funds Management, Inc., an affiliate of State Street Bank & Trust Co., the Fund’s custodian and accounting agent. |

| † | Percentages are based on net assets as of December 31, 2011. |

Abbreviations:

| | |

ADR | | American Depository Receipt |

REIT | | Real Estate Investment Trust |

SPDR | | Standard & Poors Depository Receipts |

10

Financial Highlights

Selected data based on a share outstanding throughout the fiscal years indicated

| | | | | | | | | | | | | | | | | | | | |

| | | CLASS 1 | |

| | | 12/31/11 | | | 12/31/10 | | | 12/31/09 | | | 12/31/08 | | | 12/31/07 | |

| Inception date | | | — | | | | — | | | | — | | | | — | | | | 1/3/95 | |

Net asset value,

beginning of period | | $ | 31.92 | | | $ | 29.23 | | | $ | 22.44 | | | $ | 36.41 | | | $ | 39.02 | |

Income/(loss)

from

investment

operations: | | | | | | | | | | | | | | | | | | | | |

Net investment

income (loss) | | | 0.24 | | | | 0.28 | ** | | | 0.30 | | | | 0.37 | | | | 0.45 | |

Net realized and unrealized

gains/(losses) on invest

ments | | | (1.17 | ) | | | 2.72 | | | | 6.80 | | | | (13.52 | ) | | | 2.70 | |

Total income/(loss)

from

investment

operations | | | (0.93 | ) | | | 3.00 | | | | 7.10 | | | | (13.15 | ) | | | 3.15 | |

Less distributions

from: | | | | | | | | | | | | | | | | | | | | |

Net investment

income | | | 0.25 | | | | 0.31 | | | | 0.31 | | | | 0.36 | | | | 0.44 | |

Net realized

gains | | | — | | | | — | | | | — | | | | 0.46 | | | | 5.32 | |

Total distributions | | | 0.25 | | | | 0.31 | | | | 0.31 | | | | 0.82 | | | | 5.76 | |

Net asset value,

end of period | | $ | 30.74 | | | $ | 31.92 | | | $ | 29.23 | | | $ | 22.44 | | | $ | 36.41 | |

TOTAL RETURN(a) | | | (2.91 | )% | | | 10.26 | % | | | 31.63 | % | | | (36.05 | )% | | | 8.01 | % |

| | | | | |

RATIOS/

SUPPLE

MENTAL

DATA: | | | | | | | | | | | | | | | | | | | | |

Net assets,

end of period

(in thousands) | | $ | 30,940 | | | $ | 38,305 | | | $ | 41,792 | | | $ | 37,917 | | | $ | 77,777 | |

Ratios to

average

net assets: | | | | | | | | | | | | | | | | | | | | |

Net invest

ment

income | | | 0.70 | % | | | 0.96 | % | | | 1.11 | % | | | 1.03 | % | | | 0.94 | % |

Net Expenses | | | 0.89 | %(b) | | | 0.69 | %(b) | | | 0.86 | %(b) | | | 0.72 | %(b) | | | 0.66 | % |

Gross expenses | | | 0.90 | % | | | 0.69 | % | | | 0.86 | % | | | 0.72 | % | | | 0.66 | % |

Portfolio turnover rate | | | 39 | % | | | 42 | % | | | 46 | % | | | 56 | % | | | 55 | % |

Notes to Financial Highlights

| (a) | Total returns are historical and assume changes in share price, reinvestment of dividends and capital gains distributions and do not include the effect of insurance contract charges. Past performance does not guarantee future results. |

| (b) | Reflects GE Asset Management’s waiver of a portion of the Fund’s management fee in an amount equal to the management fee earned by GEAM with respect to the Fund’s investment in the GE Institutional Money Market Fund or, prior to 2011, in another affiliated Money Market Fund formerly managed by GEAM. |

| ** | Per share values have been calculated using the average share method. |

The accompanying Notes are an integral part of these financial statements.

11

| | | | |

Statement of Assets and Liabilities December 31, 2011 | | | |

| |

ASSETS | | | | |

Investments in securities, at Fair Value (cost $28,033,375) | | | $30,135,526 | |

Investments in affiliated securities, at Fair Value (cost $7,293) | | | 7,002 | |

Short-term affiliated investments (at amortized cost) | | | 864,814 | |

Foreign cash (cost $372) | | | 373 | |

Income receivables | | | 27,457 | |

Receivable for fund shares sold | | | 15 | |

Other assets | | | 331 | |

Total Assets | | | 31,035,518 | |

| |

LIABILITIES | | | | |

Payable for fund shares redeemed | | | 13,379 | |

Payable to GEAM | | | 14,316 | |

Accrued custody and accounting expenses | | | 35,849 | |

Accrued other expenses | | | 30,636 | |

Variation margin payable | | | 1,440 | |

Total Liabilities | | | 95,620 | |

NET ASSETS | | | $30,939,898 | |

| |

NET ASSETS CONSIST OF: | | | | |

Capital paid in | | | 37,094,728 | |

Undistributed (distribution in excess of)

net investment income | | | (960 | ) |

Accumulated net realized gain (loss) | | | (8,265,508 | ) |

Net unrealized appreciation/ (depreciation) on: | | | | |

Investments | | | 2,101,860 | |

Futures | | | 9,777 | |

Foreign currency related transactions | | | 1 | |

NET ASSETS | | | $30,939,898 | |

| |

Class 1 | | | | |

| |

Net Assets | | | 30,939,898 | |

Shares outstanding( $.001 par value; unlimited shares authorized) | | | 1,006,620 | |

Net asset value per share | | | 30.74 | |

The accompanying Notes are an integral part of these financial statements.

12

| | | | |

Statement of Operations For the period ending December 31, 2011 | | | |

| |

INVESTMENT INCOME | | | | |

Income: | | | | |

Dividend | | | $537,443 | |

Interest | | | 18,790 | |

Interest from affiliated investments | | | 1,041 | |

Less: Foreign taxes withheld | | | (982 | ) |

Total Income | | | 556,292 | |

| |

Expenses: | | | | |

Advisory and administration fees | | | 192,880 | |

Distribution fees

Class 4* | | | 14 | |

Transfer agent fees | | | 3,021 | |

Director’s fees | | | 1,419 | |

Custody and accounting expenses | | | 61,690 | |

Professional fees | | | 18,871 | |

Printing costs | | | 24,643 | |

Other expenses | | | 10,989 | |

Total expenses before waiver and reimbursement | | | 313,527 | |

Less: Expenses waived or borne by the adviser | | | (1,200 | ) |

Net expenses | | | 312,327 | |

Net investment income | | | 243,965 | |

| |

NET REALIZED AND UNREALIZED GAIN (LOSS)

ON INVESTMENTS | | | | |

| |

Realized gain (loss) on: | | | | |

Investments | | | 2,668,620 | |

Futures | | | (129,682 | ) |

Foreign currency related transactions | | | (107 | ) |

| |

Increase (decrease) in unrealized appreciation/(depreciation) on: | | | | |

Investments | | | (3,709,606 | ) |

Futures | | | 4,961 | |

Foreign currency related transactions | | | 1 | |

Net realized and unrealized gain (loss) on investments | | | (1,165,813 | ) |

Net decrease in net assets resulting from operations | | $ | (921,848 | ) |

| * | Share Class 4 was closed effective April 30, 2011. |

The accompanying Notes are an integral part of these financial statements.

13

| | | | | | | | |

| Statements of Changes in Net Assets | | | |

| | | Year Ended

December 31,

2011 | | | Year Ended

December 31,

2010 | |

| | |

INCREASE (DECREASE) IN NET ASSETS | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | | $ 243,965 | | | | $ 366,984 | |

Net realized gain on investments, futures and foreign currency transactions | | | 2,538,831 | | | | 498,105 | |

Net increase (decrease) in unrealized appreciation / (depreciation) on investments, futures and foreign currency transaction | | | (3,704,644 | ) | | | 2,781,391 | |

Net increase (decrease) from operations | | | (921,848 | ) | | | 3,646,480 | |

Distributions to shareholders from : | | | | | | | | |

Net investment income | | | | | | | | |

Class 1 | | | (249,303 | ) | | | (369,247 | ) |

Class 4 | | | — | | | | (53 | ) |

Total distributions | | | (249,303 | ) | | | (369,300 | ) |

Increase (decrease) in net assets from operations and distributions | | | (1,171,151 | ) | | | 3,277,180 | |

Share transactions : | | | | | | | | |

Proceeds from sale of shares | | | | | | | | |

Class 1 | | | 509,995 | | | | 353,286 | |

Class 4* | | | — | | | | — | |

Value of distributions reinvested | | | | | | | | |

Class 1 | | | 249,303 | | | | 369,247 | |

Class 4* | | | — | | | | 53 | |

Cost of shares redeemed | | | | | | | | |

Class 1 | | | (6,952,804 | ) | | | (7,485,265 | ) |

Class 4* | | | (10,163 | ) | | | — | |

Net decrease from share transactions | | | (6,203,669 | ) | | | (6,762,679 | ) |

Total decrease in net assets | | | (7,374,820 | ) | | | (3,485,499 | ) |

| | |

NET ASSETS | | | | | | | | |

Beginning of period | | | 38,314,718 | | | | 41,800,217 | |

End of period | | | $30,939,898 | | | | $38,314,718 | |

Undistributed (distribution in excess of)

net investment income, end of period | | | $ (960) | | | | $ 902 | |

| | |

CHANGES IN FUND SHARES | | | | | | | | |

| | |

Class 1 | | | | | | | | |

Shares sold | | | 15,638 | | | | 11,976 | |

Issued for distributions reinvested | | | 8,171 | | | | 11,546 | |

Shares redeemed | | | (217,371 | ) | | | (253,018 | ) |

Net increase (decrease) in fund shares | | | (193,562 | ) | | | (229,496 | ) |

| | |

Class 4** | | | | | | | | |

Shares sold | | | — | | | | — | |

Issued for distributions reinvested | | | — | | | | 2 | |

Shares redeemed | | | (296 | ) | | | — | |

Net increase (decrease) in fund shares | | | (296 | ) | | | 2 | |

| * | Share Class 4 was closed effective April 30, 2011. |

The accompanying Notes are an integral part of these financial statements.

14

| | |

| Notes to Financial Statements | | December 31, 2011 |

| 1. | Organization of the Company |

GE Investments Funds, Inc. (the “Company”) was incorporated under the laws of the Commonwealth of Virginia on May 14, 1984 and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Company is composed of fourteen investment portfolios (collectively the “Funds”), although only the following eleven are currently being offered: U.S. Equity Fund, (the “Fund”) S&P 500 Index Fund, Premier Growth Equity Fund, Core Value Equity Fund, Mid-Cap Equity Fund, Small-Cap Equity Fund, International Equity Fund, Total Return Fund, Income Fund, Money Market Fund and Real Estate Securities Fund.

Shares of the Funds of the Company are offered only to insurance company separate accounts that fund certain variable life insurance contracts and variable annuity contracts. GE Asset Management Incorporated (“GEAM”) is the investment adviser and administrator of each of the Funds.

The Company currently offers one share class (Class 1) as an investment option for variable life insurance contracts and variable annuity contracts. Class 4 shares were first offered on May 1, 2008, and Fund shares outstanding prior to May 1, 2008 were designated as Class 1 shares. Effective April 30, 2011, Class 4 shares were closed and are no longer offered.

| 2. | Summary of Significant Accounting Policies |

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results may differ from those estimates.

Subsequent events after the balance sheet date through the date the financial statements were issued, have been evaluated in the preparation of the financial statements.

There are no items to report.

The following summarizes the significant accounting policies of the Company:

Securities Valuation and Transactions. All investments in securities are recorded at their estimated fair value, as described in Note 3.

Securities transactions are accounted for as of the trade date. Realized gains and losses on investments sold are recorded on the basis of identified cost for both financial statement and federal tax purposes.

The Fund’s income, expenses (other than distribution fees) and realized and unrealized gains and losses are allocated proportionally each day among the share classes based upon the relative net assets of each class.

Derivatives The Fund is subject to equity price risk, interest rate risk, credit risk, and foreign currency exchange rate risk in the normal course of pursuing its investment objective. The Fund may enter into derivative transactions to gain market exposure for residual and accumulating cash positions and for managing the duration of fixed-income investments.

Futures Contracts A futures contract represents a commitment for the future purchase or sale of an asset at a specified price on a specified date. The Fund invested in futures for a variety of portfolio management purposes such as hedging against the effects of changes in the value of portfolio securities due to anticipated changes in market conditions, gaining market exposure for accumulating and residual cash positions, or when the transactions are economically appropriate to the reduction of risks inherent in the management of the Fund. Buying futures tends to increase a Fund’s exposure to the underlying instrument while selling futures tends to decrease a Fund’s exposure to the underlying instrument or to hedge other Fund investments. The Fund will not enter into a transaction involving futures for speculative purposes. With futures contracts, there is minimal counterparty credit risk to the Fund since futures contracts are exchange traded and the exchange’s clearinghouse, as counterparty to all traded futures, guarantees the futures against default. A Fund’s risks in using these contracts include changes in the value of the underlying instruments, non- performance of the counterparties under the contracts’ terms and changes in the liquidity of the secondary market for the contracts. Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they principally trade.

Upon entering into a financial futures contract, the Fund is required to pledge to the broker an amount of cash and/or other assets equal to a certain percentage of the contract amount, known as initial margin deposit. Subsequent payments, known as variation margin, are made or received by the Fund each day, depending on the daily fluctuation in the fair value of the underlying security. The Fund records an unrealized gain or loss equal to the daily

15

| | |

| Notes to Financial Statements | | December 31, 2011 |

variation margin. Should market conditions move unexpectedly, the Fund may not achieve the anticipated benefits of the futures contracts and may incur a loss. The Fund recognizes a realized gain or loss upon the expiration or closing of a futures contract.

Investment Income Corporate actions (including cash dividends) are recorded on the ex-dividend date, net of applicable withholding taxes except for certain foreign corporate actions which are recorded as soon after ex-dividend date as such information becomes available. Interest income is recorded on the accrual basis.

Expenses Fund specific expenses are allocated to the Fund that incurs such expenses. Such expenses may include custodial fees, legal and accounting fees, printing costs and registration fees. Expenses that are not fund specific are allocated pro rata across the Funds. Certain class specific expenses (such as distribution fees) are allocated to the class that incurs such expense. Expenses of the Fund are generally paid directly by the Fund however, expenses may be paid by GEAM and reimbursed by the Fund.

Federal Income Taxes The Fund intends to comply with all sections of the Internal Revenue Code applicable to regulated investment companies including the distribution of substantially all of its taxable net investment income and net realized capital gains to its shareholders. Therefore, no provision for federal income tax has been made. The Fund is treated as a separate taxpayer for federal income tax purposes.

The Fund utilizes various methods to measure the fair value of most of its investments on a recurring basis. GAAP establishes a framework for measuring fair value and providing related disclosures. Broadly, the framework requires fair value to be determined based on the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants at the measurement date. In the absence of active markets for the identical assets or liabilities, such measurements involve developing assumptions based on market observable data and, in the absence of such data, internal information that is consistent with what market participants would use in a hypothetical transaction that occurs at the measurement date. It also establishes a three-level valuation hierarchy based upon observable and non-observable inputs.

Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect our market assumptions. Preference is given to observable inputs. These two types of inputs create the following fair value hierarchy:

Level 1 — Quoted prices for identical investments in active markets.

Level 2 — Quoted prices for similar investments in active markets; quoted prices for identical or similar investments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3 — Significant inputs to the valuation model are unobservable.

Policies and procedures are maintained to value investments using the best and most relevant data available. In addition, pricing vendors are utilized to assist in valuing investments. GEAM performs periodic reviews of the methodologies used by independent pricing services including price validation of individual securities.

Fair Value Measurement The following section describes the valuation methodologies the Fund uses to measure different financial investments at fair value.

The Fund’s portfolio securities are valued generally on the basis of market quotations. Equity securities generally are valued at the last reported sale price on the primary market in which they are traded. Portfolio securities listed on NASDAQ are valued using the NASDAQ Official Closing Price, Level 1 securities primarily include publicly-traded equity securities. If no sales occurred on the exchange or NASDAQ that day, the portfolio security generally is valued using the last reported bid price. In those circumstances the Fund classifies the investment securities in Level 2.

Short-term investments of sufficient credit quality with remaining maturities of sixty days or less at the time of purchase are typically valued on the basis of amortized cost which approximates fair value and these are included in Level 2.

If it is determined that amortized cost does not approximate fair value, securities may be valued based on dealer supplied valuations or quotations. In these infrequent circumstances, pricing services may provide the Fund with valuations that are based on significant unobservable inputs, and in those circumstances the investment securities are classified in Level 3.

16

| | |

| Notes to Financial Statements | | December 31, 2011 |

The Fund uses the net asset value per unit for collective funds (i.e., GEI Investment Fund). The Fund classifies the investment security in Level 2.

If prices are not readily available for a portfolio security, or if it is believed that a price for a portfolio security does not represent its fair value, the security may be valued using procedures approved by the Fund’s Board of Directors that are designed to establish its “fair” value. These securities are typically classified in Level 3. Those procedures require that the fair value of a security be established by a valuation committee of GEAM. The valuation committee follows different protocols for different types of investments and circumstances. The fair value procedures may be used to value any investment of the Fund in the appropriate circumstances.

Fair value determinations generally are used for securities whose value is affected by a significant event that will materially affect the value of a security and which occurs subsequent to the time of the close of the principal market on which such security trades but prior to the calculation of the Fund’s NAV.

The value established for such a portfolio security may be different than what would be produced through the use of market quotations or another methodology. Portfolio securities that are valued using techniques other than

market quotations, including “fair valued” securities, may be subject to greater fluctuation in their value from one day to the next than would be the case if market quotations were used. In addition, there is no assurance that the Fund could sell a portfolio security for the value established for it at any time and it is possible that the Fund would incur a loss because a portfolio security is sold at a discount to its established value.

Other financial investments are derivative instruments that are not reflected in total investments, such as futures, forwards, swaps, and written options contracts, which are valued based on fair value as discussed above.

The Fund uses closing prices for derivatives included in Level 1, which are traded either on exchanges or liquid over-the counter markets. Derivative assets and liabilities included in Level 2 primarily represent interest rate swaps, cross-currency swaps and foreign currency and commodity forward and option contracts. Derivative assets and liabilities included in Level 3 primarily represent interest rate products that contain embedded optionality or prepayment features.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following table presents the Fund’s investments measured at fair value on a recurring basis at December 31, 2011:

| | | | | | | | | | | | | | | | |

| Investments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments in Securities† | | | | | | | | | | | | | | | | |

Common Stock | | $ | 29,635,558 | | | $ | — | | | $ | — | | | $ | 29,635,558 | |

Exchange Traded Funds | | | 499,968 | | | | — | | | | — | | | | 499,968 | |

Other Investments | | | — | | | | 7,002 | | | | — | | | | 7,002 | |

Short-Term Investments | | | 864,814 | | | | — | | | | — | | | | 864,814 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 31,000,340 | | | $ | 7,002 | | | | — | | | $ | 31,007,342 | |

| | | | | | | | | | | | | | | | |

Other Financial Instruments* | | | | | | | | | | | | | | | | |

Futures Contracts — Unrealized Appreciation | | $ | 9,777 | | | $ | — | | | $ | — | | | $ | 9,777 | |

|

† See Schedule of Investments for Industry Classification * Other financial instruments include derivative instruments such as futures contracts. Amounts shown represent unrealized appreciation (depreciation), at period end. | |

There were no significant transfers between Level 1 and Level 2. Transfers between fair value levels are considered to occur at the beginning of the period.

17

| | |

| Notes to Financial Statements | | December 31, 2011 |

| 4. | Derivatives Transactions |

Shown below are the derivative contracts entered into by the Fund, summarized by primary risk exposure as they appear on the Statement of Assets and Liabilities, all of which are not accounted for as hedging instruments under FASB Accounting Standards Codification (“ASC”) No. 815 Derivatives and Hedging as of December 31, 2011.

| | | | | | | | | | | | |

| | | Asset Derivatives December 31, 2011 | | | Liability Derivatives December 31, 2011 | |

Derivatives not accounted for as hedging

instruments under ASC 815 | | Location in the Statement

of Assets and Liabilities | | Fair

Value ($) | | | Location in the Statements

of Assets and Liabilities | | Fair

Value ($) | |

| Equity Contracts | | Assets, Net Assets — Net Unrealized Appreciation/ (Depreciation) on Futures | | | 9,777 | * | | Liabilities, Net Assets — Net Unrealized Appreciation/ (Depreciation) on Futures | | | — | |

| * | Includes cumulative unrealized appreciation/(depreciation) of futures contracts as reported in the Schedule of Investments and within the components of the net assets section of the Statement of Assets and Liabilities. Only the current day’s variation margin is reported within the Assets and/or Liabilities section on the Statement of Assets and Liabilities. |

Shown below are the effects of derivative instruments on the Fund’s Statement of Operations, summarized by primary risk exposure all of which are not accounted for as hedging instruments under ASC 815.

| | | | | | | | | | | | | | |

Derivatives not accounted for

as hedging instruments under

ASC 815 | | Location in the Statement of

Operations | | Total Notional Amount of

Futures Contracts

Purchased/(Sold) ($) | | | Realized Gain or

(Loss) on

Derivatives

Recognized in

Income ($) | | | Change in Unrealized

Appreciation/(Depreciation)

on Derivatives Recognized

in Income ($) | |

Equity Contracts | | Realized gain/(loss) on Futures, Increase/(decrease) in unrealized appreciation/ (depreciation) on Futures | | | 8,513,088/(8,220,088) | | | | (129,682 | ) | | | 4,961 | |

The Company shares a revolving credit facility of up to $150 million with a number of its affiliates. The credit facility is with its custodian bank, State Street Bank and Trust Company (“State Street”). The revolving credit facility requires the payment of a commitment fee equal to 0.100% (prior to November 2, 2011, the rate was 0.125%) per annum on the daily unused portion of the credit facility, payable quarterly. The portion borne by the Funds generally is borne proportionally based upon net assets. In addition, the Company has a $100 million uncommitted, unsecured line of credit with State Street. Generally, borrowings under the credit facilities would accrue interest at the Federal Funds Rate plus 50 basis points and would be borne by the borrowing Fund. The maximum amount allowed to be borrowed by any one Fund is the lesser of (i) 33.33% of its total assets or (ii) 20% of its net assets. The credit facilities were not utilized by the Fund during the fiscal year ended December 31, 2011.

| 6. | Compensation and Fees Paid to Affiliates |

GEAM, a registered investment adviser, was retained by the Company’s Board of Directors effective November 17, 1997

to act as investment adviser and administrator of the Fund. GEAM’s compensation for investment advisory and administrative services is paid monthly based on the average daily net assets of the Fund at an annualized rate of 0.55%.

GEAM has a contractual agreement with the Fund to waive a portion of the Fund’s management fee in the amount equal to the management fee earned by GEAM with respect to the Fund’s investment in the GE Institutional Money Market Fund.

Distribution and Service (12b-1) Fees Prior to the closure of Class 4 shares on April 30, 2011 the Company had adopted a Distribution and Service (12b-1) Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act with respect to Class 4 shares of the Fund. Under the Plan, the Fund could compensate GE Investment Distributors, Inc. (“GEID”), a wholly-owned subsidiary of GEAM and the Fund’s principal distributor, for certain sales services provided by GEID or other broker dealers and investor services provided by GEID or other service providers relating to the Fund’s Class 4 shares, including services to owners or prospective owners of variable contracts issued by insurance companies that offered such share class as an investment option. The

18

| | |

| Notes to Financial Statements | | December 31, 2011 |

amount of compensation paid under the Plan by the Fund’s Class 4 shares was not to exceed 0.45% of the average daily net assets of the Fund attributable to such share class.

Directors’ Compensation The Fund pays no compensation to its directors who are officers or employees of GEAM or its affiliates. Directors who are not such officers or employees also serve in a similar capacity for other funds advised by GEAM. Compensation paid to non-interested Directors are reflected on the Statement of Operations. These fees are allocated pro rata across all of the mutual fund platforms served by the Directors,

including the Fund, and are based upon the relative net assets of each Fund within such platforms.

| 7. | Investment Transactions |

Purchases and Sales of Securities The cost of purchases and the proceeds from sales of investments, other than short-term securities, for the year ended December 31, 2011 were as follows:

| | |

| Non U.S. Government Securities |

| Purchases | | Sales |

| $13,221,703 | | $19,608,529 |

The Fund is subject to ASC 740, Income Taxes. ASC 740 provides guidance for financial accounting and reporting for the effects of income taxes that result from an entity’s activities during the year. ASC 740 also provides guidance regarding how certain uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. ASC 740 requires evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more likely than not” of being sustained by the applicable tax authority. There are no adjustments to the Fund’s net assets required under ASC 740. The Fund’s 2008, 2009, 2010 and 2011 fiscal years tax returns are still open to examination by the Federal and applicable state tax authorities.

At December 31, 2011, information on the tax components of capital was as follows:

| | | | | | | | | | | | | | |

| | | Gross Unrealized Tax | | Net Tax

Appreciation/(Depreciation) | | Undistributed | | |

Cost of

Investments For

Tax Purposes | | Appreciation | | Depreciation | | Investments | | Derivatives/

Currency | | Income | | Accumulated

Capital Loss | | Late-Year

Losses |

| $29,873,322 | | $3,587,596 | | $(2,453,576) | | $1,134,020 | | $1 | | $— | | $(7,278,866) | | $(9,985) |

As of December 31, 2011, the Fund has capital loss carryovers as indicated below. Capital loss carryovers are available to offset future realized capital gains to the extent provided in the Internal Revenue Code and regulations thereunder. To the extent that these carryover losses are used to offset future capital gains, it is probable that the gains so offset will not be distributed to shareholders because they would be taxable as ordinary income.

| | | | |

| Amount | | |

| Short-Term | | Long-Term | | Expires |

| $6,866,202 | | $— | | 12/31/2017 |

| 412,664 | | — | | 12/31/2018 |

These amounts will be available to offset future taxable capital gains. Under the recently enacted Regulated Investment Company Modernization Act of 2010, the Fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. However, any losses incurred during those future years will be required to be utilized prior to the losses incurred in pre-enactment tax years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

19

| | |

| Notes to Financial Statements | | December 31, 2011 |

During the year ended December 31, 2011, the Fund utilized $1,864,022 of prior year capital loss carryovers.

Any qualified late-year loss is deemed to arise on the first day of the Fund’s next tax year (if the Fund elects to defer such loss). Under this regime, generally, the Fund can elect to defer any post-October capital loss and/or any late-year ordinary loss as defined by the Internal Revenue Code.

The Fund elected to defer qualified late-year losses for the year ended December 31, 2011 as follows:

| | |

| Capital | | Ordinary |

| $9,968 | | $17 |

The tax composition of distributions paid during the years ended December 31, 2011 and December 31, 2010 were as follows:

| | | | | | | | | | | | |

| | | Ordinary

Income | | | Long-Term

Capital Gains | | | Total | |

2011 | | $ | 249,303 | | | $ | — | | | $ | 249,303 | |

2010 | | | 369,300 | | | | — | | | | 369,300 | |

Distributions to Shareholders The Fund declares and pays any dividends from net investment income annually. The Fund declares and pays any net realized capital gains in excess of capital loss carryforwards distributions annually. The character of income and gains to be distributed is determined in accordance with income tax regulations which may differ from generally accepted accounting principles. These differences include (but are not limited to) futures investments organized as partnerships for tax purposes and losses deferred due to wash sale transactions. Reclassifications due to permanent book/tax differences are made to the Fund’s capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations. These reclassifications have no impact on net

investment income, realized gains or losses, or the net asset value of the Fund. The calculation of net investment income per share in the Financial Highlights table excludes these adjustments.

The reclassifications for the year ended December 31, 2011 were as follows:

| | | | |

Undistributed

Net Investment Income | | Accumulated

Net Realized

Gain (Loss) | | Capital

Paid In |

| $3,476 | | $106 | | $(3,582) |

| 9. | Recent Accounting Pronouncements |

In May 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2011-04, Fair Value Measurement: Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs. ASU 2011-04 amended wording resulting in common fair value measurement and disclosure requirements in U.S. GAAP and International Financial Reporting Standards (IFRS). In particular, the amendments clarify how to apply existing fair value measurement and disclosure requirements as well as expand disclosure about valuation techniques and unobservable inputs used in Level 3 fair value measurements. In addition, the amendments require a narrative description of Level 3 measurements’ sensitivity to changes in unobservable inputs if such changes significantly alter the fair value measurement. The amendments are applied prospectively and are effective for an annual period beginning after December 15, 2011.

Management of the Fund does not believe the adoption of ASU 2011-04 will materially impact the financial statement amounts, however, additional disclosures will be required about valuation techniques and inputs.

20

Report of Independent Registered Public Accounting Firm

The Shareholders and Board of Directors

GE Investments Funds, Inc.

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of the U.S. Equity Fund, a series of GE Investments Funds, Inc., as of December 31, 2011, and the related statement of operations for the year then ended, statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years or periods in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2011 by correspondence with the custodian and brokers, or by other appropriate auditing procedures where replies from brokers were not received. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the U.S. Equity Fund as of December 31, 2011, the results of its operations, changes in its net assets and financial highlights for each of the years or periods described above, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

February 27, 2012

21

| | |

| Advisory and Administrative Agreement Renewal | | (unaudited) |

The Board of Directors of the GE Investments Funds, Inc. (the “Board”), including the independent Board members, considered and unanimously approved the continuance of the Fund’s Investment Advisory and Administration Agreement with GE Asset Management Incorporated (“GEAM”) at meetings held on December 6 and December 9, 2011.

In considering whether to approve the Fund’s investment advisory agreement, the Board members considered and discussed a substantial amount of information and analysis provided, at the Board’s request, by GEAM. The Board members also considered detailed information regarding performance and expenses of other investment companies, including those with similar investment strategies and sizes, which was prepared by independent third party provider Morningstar, Inc. (“Morningstar”). The Board members reviewed the fees charged by GEAM for other mutual funds and investment products other than mutual funds that employ the same investment strategy as the Fund. The Board had the opportunity to ask questions and request additional information in connection with its considerations.

Before approving the Fund’s investment advisory agreement, the Board members reviewed the information provided with management of GEAM and with independent legal counsel. The Board members also reviewed a memorandum prepared by independent legal counsel discussing the legal standards for the consideration of the proposed continuance. The independent Board members discussed the proposed continuance in detail during a private session with their independent legal counsel at which no representatives of GEAM were present. The independent Board members and their independent legal counsel requested, and received and considered, additional information from GEAM following these sessions.

In advance of the meetings, and in response to their request, the Board members received from GEAM written responses to their inquiries, which included substantial exhibits and other materials related to GEAM’s business and the services it provides to the Fund. The Board members took into account their multi-year experience as Board members and particularly their consideration of these types of agreements in recent years. The information was presented in a manner to facilitate comparison to prior periods and to reflect certain enhancements. To focus their review, the Board members asked GEAM management, in its oral presentation, to highlight material differences from the information presented in recent years.