UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04041

STATE STREET VARIABLE INSURANCE SERIES FUNDS, INC.

(Exact name of registrant as specified in charter)

One Iron Street

Boston, Massachusetts 02210

(Address of principal executive offices)(Zip code)

| | |

| (Name and Address of Agent for Service) | | Copy to: |

| |

Sean O’Malley, Esq. Senior Vice President and Deputy General Counsel c/o SSGA Funds Management, Inc. One Iron Street Boston, Massachusetts 02210 | | Timothy W. Diggins, Esq. Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, Massachusetts 02199-3600 |

Registrant’s telephone number, including area code: 800-242-0134

Date of fiscal year end: December 31

Date of reporting period: June 30, 2021

Item 1. Shareholder Reports.

(a) The Report to Shareholders is attached herewith.

Semi-Annual Report

June 30, 2021

| State Street S&P 500 Index V.I.S. Fund |

State Street S&P 500 Index V.I.S. Fund

Semi-Annual Report

June 30, 2021 (Unaudited)

| | Page |

| 1 |

| 4 |

| Financial Statements | |

| 15 |

| 16 |

| 17 |

| 18 |

| 19 |

| 25 |

This report is prepared for Policyholders of certain variable contracts and may be distributed to others only if preceded or accompanied by the variable contract’s current prospectus and the current summary prospectus of the Fund available for investments thereunder.

[This page intentionally left blank]

State Street S&P 500 Index V.I.S. Fund

Fund Information — June 30, 2021 (Unaudited)

Total return performance shown in this report for the Fund takes into account changes in share price and assumes reinvestment of dividends and capital gains distributions, if any. Total returns shown are net of Fund fees and expenses but do not reflect fees and charges associated with the variable contracts such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the Fund’s total returns for all periods shown.

The performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Periods less than one year are not annualized. Please call toll-free (800) 242-0134 or visit the Fund’s website at www.ssga.com for the most recent month-end performance data.

An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other government agency. An investment in the Fund is subject to risk, including possible loss of principal invested.

State Street Global Advisors Funds Distributors, LLC, member of FINRA & SIPC is the principal underwriter and distributor of the State Street V.I.S. Funds and an indirect wholly-owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. The Funds pay State Street Bank and Trust Company for its services as custodian and Fund Accounting agent, and pay SSGA Funds Management, Inc. for investment advisory and administrative services.

| State Street S&P 500 Index V.I.S. Fund | 1 |

State Street S&P 500 Index V.I.S. Fund

Fund Information, continued — June 30, 2021 (Unaudited)

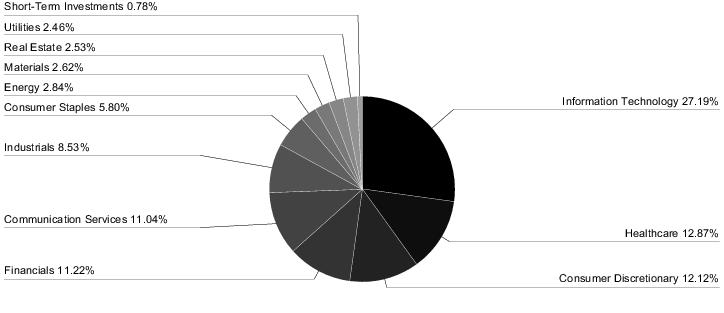

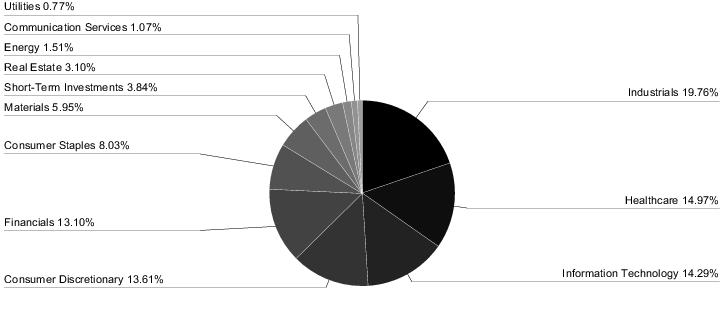

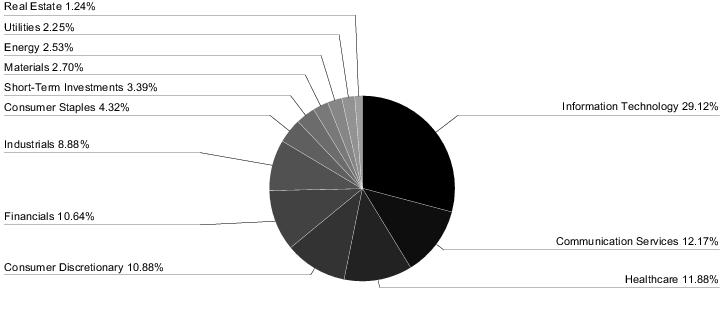

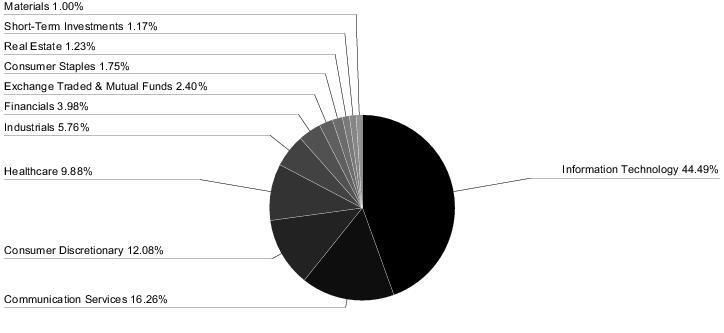

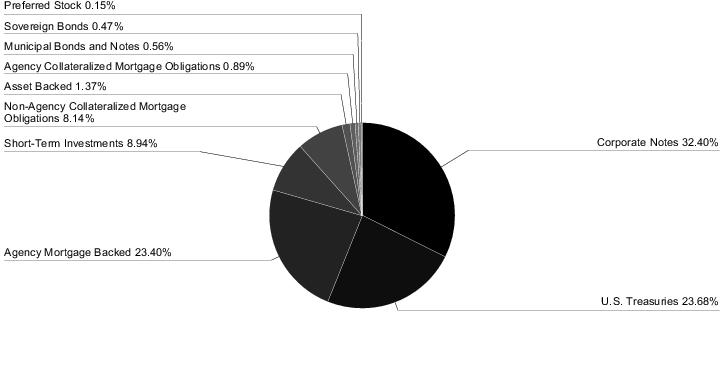

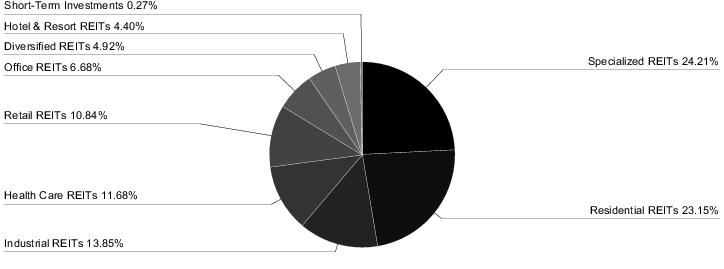

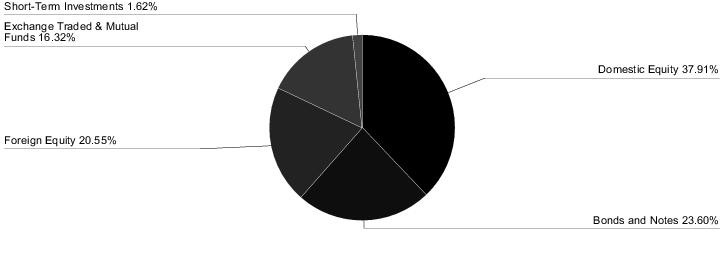

| Sector Allocation |

| Portfolio Composition as a % of Fair Value of $200,481 (in thousands) as of June 30, 2021 (a)(b) |

| Top Ten Largest Holdings |

| as of June 30, 2021 (as a % of Fair Value) (a)(b) |

| Apple Inc. | 5.87% |

| Microsoft Corp. | 5.58% |

| Amazon.com Inc. | 4.03% |

| Facebook Inc., Class A | 2.27% |

| Alphabet Inc., Class A | 2.01% |

| Alphabet Inc., Class C | 1.95% |

| Berkshire Hathaway Inc., Class B | 1.44% |

| Tesla Inc. | 1.43% |

| NVIDIA Corp. | 1.36% |

| JPMorgan Chase & Co. | 1.28% |

|

| (a) | Fair Value basis is inclusive of short-term investment in State Street Institutional Liquid Reserves Fund — Premier Class. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| 2 | State Street S&P 500 Index V.I.S. Fund |

State Street S&P 500 Index V.I.S. Fund

Understanding Your Fund’s Expenses — June 30, 2021 (Unaudited)

As a shareholder of the Fund you incur ongoing costs. Ongoing costs include portfolio management fees, professional fees, administrative fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in the Fund during the period. The information in the following table is based on an investment of $1,000, which is invested at the beginning of the period and held for the entire six-month period ended June 30, 2021.

Actual Expenses

The first section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your class under the heading “Expenses paid during the period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs, such as sales charges or redemption fees, if any. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. Additionally, the expenses shown do not reflect the fees or charges associated with variable contracts through which shares of the Fund are offered.

| | Actual

Fund Return | | Hypothetical

5% Return

(2.5% for

the period) |

| Account value at the | | | |

beginning of the period

January 1, 2021 | $1,000.00 | | $1,000.00 |

Account value at the end of the period

June 30, 2021 | $1,150.90 | | $1,023.30 |

| Expenses Paid During Period* | $ 1.65 | | $ 1.56 |

| * | Expenses are equal to the Fund's annualized expense ratio of 0.31%** (for the period January 1, 2021 - June 30, 2021), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| State Street S&P 500 Index V.I.S. Fund | 3 |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments — June 30, 2021 (Unaudited)

| | Number

of Shares | Fair

Value |

| Common Stock - 99.0% † |

| Advertising - 0.1% |

| Omnicom Group Inc. | 1,023 | $ 81,830 |

| The Interpublic Group of Companies Inc. | 2,061 | 66,962 |

| | | 148,792 |

| Aerospace & Defense - 1.6% |

| General Dynamics Corp. | 1,286 | 242,102 |

| Howmet Aerospace Inc. (a) | 2,272 | 78,316 |

| Huntington Ingalls Industries Inc. | 200 | 42,150 |

| L3Harris Technologies Inc. | 1,168 | 252,463 |

| Lockheed Martin Corp. | 1,352 | 511,529 |

| Northrop Grumman Corp. | 795 | 288,927 |

| Raytheon Technologies Corp. | 8,377 | 714,642 |

| Teledyne Technologies Inc. (a) | 252 | 105,545 |

| Textron Inc. | 1,311 | 90,158 |

| The Boeing Co. (a) | 3,033 | 726,586 |

| TransDigm Group Inc. (a) | 301 | 194,834 |

| | | 3,247,252 |

| Agricultural & Farm Machinery - 0.3% |

| Deere & Co. | 1,670 | 589,026 |

| Agricultural Products - 0.1% |

| Archer-Daniels-Midland Co. | 3,171 | 192,163 |

| Air Freight & Logistics - 0.7% |

| CH Robinson Worldwide Inc. | 787 | 73,718 |

| Expeditors International of Washington Inc. | 832 | 105,331 |

| FedEx Corp. | 1,308 | 390,216 |

| United Parcel Service Inc., Class B | 3,969 | 825,433 |

| | | 1,394,698 |

| Airlines - 0.3% |

| Alaska Air Group Inc. (a) | 700 | 42,217 |

| American Airlines Group Inc. (a) | 3,511 | 74,468 |

| Delta Air Lines Inc. (a) | 3,506 | 151,670 |

| Southwest Airlines Co. (a) | 3,202 | 169,994 |

| United Airlines Holdings Inc. (a) | 1,450 | 75,821 |

| | | 514,170 |

| Alternative Carriers - 0.0% * |

| Lumen Technologies Inc. | 5,933 | 80,629 |

| | Number

of Shares | Fair

Value |

| Apparel Retail - 0.4% |

| L Brands Inc. (a) | 1,225 | $ 88,273 |

| Ross Stores Inc. | 2,026 | 251,224 |

| The Gap Inc. | 1,215 | 40,885 |

| The TJX Companies Inc. | 6,449 | 434,792 |

| | | 815,174 |

| Apparel, Accessories & Luxury Goods - 0.2% |

| Hanesbrands Inc. | 1,711 | 31,944 |

| PVH Corp. (a) | 407 | 43,789 |

| Ralph Lauren Corp. | 270 | 31,809 |

| Tapestry Inc. (a) | 1,589 | 69,090 |

| Under Armour Inc., Class A (a) | 500 | 10,575 |

| Under Armour Inc., Class C (a) | 1,012 | 18,793 |

| VF Corp. | 1,741 | 142,831 |

| | | 348,831 |

| Application Software - 2.4% |

| Adobe Inc. (a)(b) | 2,615 | 1,531,449 |

| ANSYS Inc. (a) | 471 | 163,465 |

| Autodesk Inc. (a) | 1,173 | 342,399 |

| Cadence Design Systems Inc. (a) | 1,543 | 211,113 |

| Citrix Systems Inc. | 707 | 82,910 |

| Intuit Inc. | 1,474 | 722,511 |

| Paycom Software Inc. (a) | 250 | 90,867 |

| PTC Inc. (a) | 600 | 84,756 |

| salesforce.com Inc. (a) | 5,081 | 1,241,136 |

| Synopsys Inc. (a) | 843 | 232,491 |

| Tyler Technologies Inc. (a) | 200 | 90,474 |

| | | 4,793,571 |

| Asset Management & Custody Banks - 0.9% |

| Ameriprise Financial Inc. | 676 | 168,243 |

| BlackRock Inc. | 782 | 684,227 |

| Franklin Resources Inc. | 1,491 | 47,697 |

| Invesco Ltd. | 2,050 | 54,796 |

| Northern Trust Corp. | 1,192 | 137,819 |

| State Street Corp. (c) | 1,906 | 156,826 |

| T Rowe Price Group Inc. | 1,203 | 238,158 |

| The Bank of New York Mellon Corp. | 4,519 | 231,508 |

| | | 1,719,274 |

| Auto Parts & Equipment - 0.2% |

| Aptiv PLC (a) | 1,487 | 233,950 |

See Notes to Schedule of Investments and Notes to Financial Statements.

| 4 | State Street S&P 500 Index V.I.S. Fund |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments, continued — June 30, 2021 (Unaudited)

| | Number

of Shares | Fair

Value |

| BorgWarner Inc. | 1,447 | $ 70,237 |

| | | 304,187 |

| Automobile Manufacturers - 1.8% |

| Ford Motor Co. (a) | 22,137 | 328,956 |

| General Motors Co. (a) | 6,931 | 410,107 |

| Tesla Inc. (a) | 4,204 | 2,857,459 |

| | | 3,596,522 |

| Automotive Retail - 0.3% |

| Advance Auto Parts Inc. | 401 | 82,261 |

| AutoZone Inc. (a) | 112 | 167,129 |

| CarMax Inc. (a) | 834 | 107,711 |

| O'Reilly Automotive Inc. (a) | 374 | 211,762 |

| | | 568,863 |

| Biotechnology - 1.8% |

| AbbVie Inc. (b) | 9,755 | 1,098,803 |

| Alexion Pharmaceuticals Inc. (a) | 1,204 | 221,187 |

| Amgen Inc. | 3,111 | 758,306 |

| Biogen Inc. (a) | 800 | 277,016 |

| Gilead Sciences Inc. | 6,808 | 468,799 |

| Incyte Corp. (a) | 1,122 | 94,394 |

| Regeneron Pharmaceuticals Inc. (a) | 561 | 313,341 |

| Vertex Pharmaceuticals Inc. (a) | 1,392 | 280,669 |

| | | 3,512,515 |

| Brewers - 0.0% * |

| Molson Coors Beverage Co., Class B (a) | 1,078 | 57,878 |

| Broadcasting - 0.2% |

| Discovery Inc., Class A (a) | 806 | 24,728 |

| Discovery Inc., Class C (a) | 1,640 | 47,527 |

| Fox Corp., Class A | 1,530 | 56,809 |

| Fox Corp., Class B | 740 | 26,048 |

| ViacomCBS Inc., Class B | 3,236 | 146,267 |

| | | 301,379 |

| Building Products - 0.5% |

| Allegion PLC | 533 | 74,247 |

| AO Smith Corp. | 798 | 57,504 |

| Carrier Global Corp. | 4,670 | 226,962 |

| Fortune Brands Home & Security Inc. | 799 | 79,588 |

| | Number

of Shares | Fair

Value |

| Johnson Controls International PLC | 3,783 | $ 259,627 |

| Masco Corp. | 1,282 | 75,523 |

| Trane Technologies PLC | 1,257 | 231,464 |

| | | 1,004,915 |

| Cable & Satellite - 1.0% |

| Charter Communications Inc., Class A (a) | 741 | 534,594 |

| Comcast Corp., Class A | 24,947 | 1,422,478 |

| DISH Network Corp., Class A (a) | 1,581 | 66,086 |

| | | 2,023,158 |

| Casinos & Gaming - 0.2% |

| Caesars Entertainment Inc. (a) | 1,071 | 111,116 |

| Las Vegas Sands Corp. (a) | 1,739 | 91,628 |

| MGM Resorts International | 1,997 | 85,172 |

| Penn National Gaming Inc. (a) | 755 | 57,750 |

| Wynn Resorts Ltd. (a) | 481 | 58,826 |

| | | 404,492 |

| Commodity Chemicals - 0.2% |

| Dow Inc. | 4,148 | 262,485 |

| LyondellBasell Industries N.V., Class A | 1,338 | 137,640 |

| | | 400,125 |

| Communications Equipment - 0.8% |

| Arista Networks Inc. (a) | 282 | 102,172 |

| Cisco Systems Inc. | 23,019 | 1,220,007 |

| F5 Networks Inc. (a) | 353 | 65,891 |

| Juniper Networks Inc. | 1,889 | 51,664 |

| Motorola Solutions Inc. | 925 | 200,586 |

| | | 1,640,320 |

| Computer & Electronics Retail - 0.1% |

| Best Buy Company Inc. | 1,317 | 151,429 |

| Construction & Engineering - 0.0% * |

| Quanta Services Inc. | 784 | 71,007 |

| Construction Machinery & Heavy Trucks - 0.6% |

| Caterpillar Inc. | 2,987 | 650,061 |

| Cummins Inc. | 815 | 198,705 |

| PACCAR Inc. | 1,990 | 177,607 |

| Westinghouse Air Brake Technologies Corp. | 1,025 | 84,358 |

| | | 1,110,731 |

See Notes to Schedule of Investments and Notes to Financial Statements.

| State Street S&P 500 Index V.I.S. Fund | 5 |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments, continued — June 30, 2021 (Unaudited)

| | Number

of Shares | Fair

Value |

| Construction Materials - 0.1% |

| Martin Marietta Materials Inc. | 327 | $ 115,042 |

| Vulcan Materials Co. | 695 | 120,978 |

| | | 236,020 |

| Consumer Electronics - 0.1% |

| Garmin Ltd. | 800 | 115,712 |

| Consumer Finance - 0.7% |

| American Express Co. | 3,619 | 597,968 |

| Capital One Financial Corp. | 2,496 | 386,106 |

| Discover Financial Services | 1,677 | 198,372 |

| Synchrony Financial | 2,866 | 139,058 |

| | | 1,321,504 |

| Copper - 0.1% |

| Freeport-McMoRan Inc. | 8,021 | 297,659 |

| Data Processing & Outsourced Services - 3.9% |

| Automatic Data Processing Inc. | 2,326 | 461,990 |

| Broadridge Financial Solutions Inc. | 662 | 106,933 |

| Fidelity National Information Services Inc. | 3,434 | 486,495 |

| Fiserv Inc. (a) | 3,225 | 344,720 |

| FleetCor Technologies Inc. (a) | 439 | 112,410 |

| Global Payments Inc. | 1,596 | 299,314 |

| Jack Henry & Associates Inc. | 437 | 71,454 |

| Mastercard Inc., Class A | 4,818 | 1,759,004 |

| Paychex Inc. | 1,829 | 196,252 |

| PayPal Holdings Inc. (a) | 6,399 | 1,865,180 |

| The Western Union Co. | 2,524 | 57,976 |

| Visa Inc., Class A | 9,279 | 2,169,616 |

| | | 7,931,344 |

| Distillers & Vintners - 0.1% |

| Brown-Forman Corp., Class B | 994 | 74,490 |

| Constellation Brands Inc., Class A | 951 | 222,430 |

| | | 296,920 |

| Distributors - 0.1% |

| Genuine Parts Co. | 797 | 100,796 |

| LKQ Corp. (a) | 1,180 | 58,080 |

| Pool Corp. | 200 | 91,732 |

| | | 250,608 |

| | Number

of Shares | Fair

Value |

| Diversified Banks - 3.2% |

| Bank of America Corp. | 41,522 | $ 1,711,952 |

| Citigroup Inc. | 11,196 | 792,117 |

| JPMorgan Chase & Co. | 16,539 | 2,572,476 |

| U.S. Bancorp | 7,476 | 425,908 |

| Wells Fargo & Co. | 22,508 | 1,019,387 |

| | | 6,521,840 |

| Diversified Chemicals - 0.0% * |

| Eastman Chemical Co. | 817 | 95,385 |

| Diversified Support Services - 0.2% |

| Cintas Corp. | 508 | 194,056 |

| Copart Inc. (a) | 1,178 | 155,296 |

| | | 349,352 |

| Drug Retail - 0.1% |

| Walgreens Boots Alliance Inc. | 4,099 | 215,648 |

| Electric Utilities - 1.5% |

| Alliant Energy Corp. | 1,400 | 78,064 |

| American Electric Power Company Inc. | 2,666 | 225,517 |

| Duke Energy Corp. | 4,215 | 416,105 |

| Edison International | 2,230 | 128,939 |

| Entergy Corp. | 1,147 | 114,356 |

| Evergy Inc. | 1,388 | 83,877 |

| Eversource Energy | 1,971 | 158,153 |

| Exelon Corp. | 5,234 | 231,919 |

| FirstEnergy Corp. | 3,108 | 115,649 |

| NextEra Energy Inc. | 10,839 | 794,282 |

| NRG Energy Inc. | 1,518 | 61,175 |

| Pinnacle West Capital Corp. | 700 | 57,379 |

| PPL Corp. | 3,931 | 109,950 |

| The Southern Co. | 5,652 | 342,002 |

| Xcel Energy Inc. | 2,897 | 190,854 |

| | | 3,108,221 |

| Electrical Components & Equipment - 0.6% |

| AMETEK Inc. | 1,249 | 166,741 |

| Eaton Corporation PLC | 2,225 | 329,700 |

| Emerson Electric Co. | 3,266 | 314,320 |

| Generac Holdings Inc. (a) | 324 | 134,509 |

| Rockwell Automation Inc. | 635 | 181,623 |

| | | 1,126,893 |

| Electronic Components - 0.2% |

| Amphenol Corp., Class A | 3,304 | 226,027 |

See Notes to Schedule of Investments and Notes to Financial Statements.

| 6 | State Street S&P 500 Index V.I.S. Fund |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments, continued — June 30, 2021 (Unaudited)

| | Number

of Shares | Fair

Value |

| Corning Inc. | 4,347 | $ 177,792 |

| | | 403,819 |

| Electronic Equipment & Instruments - 0.2% |

| Keysight Technologies Inc. (a) | 1,000 | 154,410 |

| Trimble Inc. (a) | 1,400 | 114,562 |

| Zebra Technologies Corp., Class A (a) | 300 | 158,847 |

| | | 427,819 |

| Electronic Manufacturing Services - 0.1% |

| IPG Photonics Corp. (a) | 179 | 37,728 |

| TE Connectivity Ltd. | 1,854 | 250,679 |

| | | 288,407 |

| Environmental & Facilities Services - 0.2% |

| Republic Services Inc. | 1,215 | 133,662 |

| Rollins Inc. | 1,200 | 41,040 |

| Waste Management Inc. | 2,203 | 308,662 |

| | | 483,364 |

| Fertilizers & Agricultural Chemicals - 0.2% |

| CF Industries Holdings Inc. | 1,250 | 64,312 |

| Corteva Inc. | 4,217 | 187,024 |

| FMC Corp. | 758 | 82,016 |

| The Mosaic Co. | 2,054 | 65,543 |

| | | 398,895 |

| Financial Exchanges & Data - 1.1% |

| Cboe Global Markets Inc. | 663 | 78,930 |

| CME Group Inc. | 2,015 | 428,550 |

| Intercontinental Exchange Inc. | 3,001 | 356,219 |

| MarketAxess Holdings Inc. | 228 | 105,698 |

| Moody's Corp. | 903 | 327,220 |

| MSCI Inc. | 433 | 230,824 |

| Nasdaq Inc. | 576 | 101,261 |

| S&P Global Inc. | 1,311 | 538,100 |

| | | 2,166,802 |

| Food Distributors - 0.1% |

| Sysco Corp. | 2,842 | 220,965 |

| Food Retail - 0.1% |

| The Kroger Co. | 4,256 | 163,047 |

| Footwear - 0.5% |

| NIKE Inc., Class B | 6,914 | 1,068,144 |

| | Number

of Shares | Fair

Value |

| Gas Utilities - 0.0% * |

| Atmos Energy Corp. | 700 | $ 67,277 |

| General Merchandise Stores - 0.5% |

| Dollar General Corp. | 1,250 | 270,487 |

| Dollar Tree Inc. (a) | 1,351 | 134,425 |

| Target Corp. | 2,740 | 662,368 |

| | | 1,067,280 |

| Gold - 0.1% |

| Newmont Corp. | 4,507 | 285,654 |

| Health Care REITs - 0.2% |

| Healthpeak Properties Inc. | 2,669 | 88,851 |

| Ventas Inc. | 2,129 | 121,566 |

| Welltower Inc. | 2,320 | 192,792 |

| | | 403,209 |

| Healthcare Distributors - 0.2% |

| AmerisourceBergen Corp. | 813 | 93,080 |

| Cardinal Health Inc. | 1,681 | 95,968 |

| Henry Schein Inc. (a) | 863 | 64,026 |

| McKesson Corp. | 816 | 156,052 |

| | | 409,126 |

| Healthcare Equipment - 3.3% |

| Abbott Laboratories (b) | 9,830 | 1,139,592 |

| ABIOMED Inc. (a) | 272 | 84,894 |

| Baxter International Inc. | 2,723 | 219,202 |

| Becton Dickinson & Co. | 1,627 | 395,670 |

| Boston Scientific Corp. (a) | 7,745 | 331,176 |

| Danaher Corp. | 3,504 | 940,334 |

| DexCom Inc. (a) | 512 | 218,624 |

| Edwards Lifesciences Corp. (a) | 3,464 | 358,767 |

| Hologic Inc. (a) | 1,500 | 100,080 |

| IDEXX Laboratories Inc. (a) | 452 | 285,461 |

| Intuitive Surgical Inc. (a) | 638 | 586,730 |

| Medtronic PLC | 7,462 | 926,258 |

| ResMed Inc. | 795 | 195,983 |

| STERIS PLC | 500 | 103,150 |

| Stryker Corp. | 1,837 | 477,124 |

| Teleflex Inc. | 260 | 104,465 |

| Zimmer Biomet Holdings Inc. | 1,187 | 190,893 |

| | | 6,658,403 |

| Healthcare Facilities - 0.2% |

| HCA Healthcare Inc. | 1,427 | 295,018 |

See Notes to Schedule of Investments and Notes to Financial Statements.

| State Street S&P 500 Index V.I.S. Fund | 7 |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments, continued — June 30, 2021 (Unaudited)

| | Number

of Shares | Fair

Value |

| Universal Health Services Inc., Class B | 483 | $ 70,726 |

| | | 365,744 |

| Healthcare Services - 0.7% |

| Cigna Corp. | 1,841 | 436,446 |

| CVS Health Corp. | 7,208 | 601,435 |

| DaVita Inc. (a) | 358 | 43,114 |

| Laboratory Corporation of America Holdings (a) | 529 | 145,925 |

| Quest Diagnostics Inc. | 800 | 105,576 |

| | | 1,332,496 |

| Healthcare Supplies - 0.3% |

| Align Technology Inc. (a) | 394 | 240,734 |

| DENTSPLY SIRONA Inc. | 1,277 | 80,783 |

| The Cooper Companies Inc. | 257 | 101,841 |

| West Pharmaceutical Services Inc. | 350 | 125,685 |

| | | 549,043 |

| Healthcare Technology - 0.1% |

| Cerner Corp. | 1,756 | 137,249 |

| Home Building - 0.2% |

| D.R. Horton Inc. | 1,899 | 171,613 |

| Lennar Corp., Class A | 1,444 | 143,461 |

| NVR Inc. (a) | 20 | 99,466 |

| PulteGroup Inc. | 1,535 | 83,765 |

| | | 498,305 |

| Home Furnishings - 0.1% |

| Leggett & Platt Inc. | 775 | 40,153 |

| Mohawk Industries Inc. (a) | 331 | 63,615 |

| | | 103,768 |

| Home Improvement Retail - 1.3% |

| Lowe's Companies Inc. | 3,825 | 741,935 |

| The Home Depot Inc. | 5,800 | 1,849,562 |

| | | 2,591,497 |

| Hotel & Resort REITs - 0.0% * |

| Host Hotels & Resorts Inc. (a) | 3,617 | 61,815 |

| Hotels, Resorts & Cruise Lines - 0.6% |

| Booking Holdings Inc. (a) | 223 | 487,944 |

| Carnival Corp. (a) | 4,167 | 109,842 |

| Expedia Group Inc. (a) | 764 | 125,074 |

| | Number

of Shares | Fair

Value |

| Hilton Worldwide Holdings Inc. (a) | 1,515 | $ 182,739 |

| Marriott International Inc., Class A (a) | 1,497 | 204,371 |

| Norwegian Cruise Line Holdings Ltd. (a) | 1,500 | 44,115 |

| Royal Caribbean Cruises Ltd. (a) | 1,063 | 90,653 |

| | | 1,244,738 |

| Household Appliances - 0.0% * |

| Whirlpool Corp. | 359 | 78,269 |

| Household Products - 1.3% |

| Church & Dwight Company Inc. | 1,423 | 121,268 |

| Colgate-Palmolive Co. | 4,626 | 376,325 |

| Kimberly-Clark Corp. | 1,887 | 252,443 |

| The Clorox Co. | 684 | 123,059 |

| The Procter & Gamble Co. | 13,355 | 1,801,990 |

| | | 2,675,085 |

| Housewares & Specialties - 0.0% * |

| Newell Brands Inc. | 2,334 | 64,115 |

| Human Resource & Employment Services - 0.0% * |

| Robert Half International Inc. | 575 | 51,158 |

| Hypermarkets & Super Centers - 1.0% |

| Costco Wholesale Corp. | 2,383 | 942,882 |

| Walmart Inc. | 7,460 | 1,052,009 |

| | | 1,994,891 |

| Independent Power Producers & Energy Traders - 0.1% |

| The AES Corp. | 3,956 | 103,133 |

| Industrial Conglomerates - 1.2% |

| 3M Co. | 3,190 | 633,630 |

| General Electric Co. | 48,354 | 650,845 |

| Honeywell International Inc. | 3,779 | 828,923 |

| Roper Technologies Inc. | 601 | 282,590 |

| | | 2,395,988 |

| Industrial Gases - 0.6% |

| Air Products & Chemicals Inc. | 1,232 | 354,422 |

| Linde PLC | 2,840 | 821,044 |

| | | 1,175,466 |

| Industrial Machinery - 0.8% |

| Dover Corp. | 806 | 121,384 |

See Notes to Schedule of Investments and Notes to Financial Statements.

| 8 | State Street S&P 500 Index V.I.S. Fund |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments, continued — June 30, 2021 (Unaudited)

| | Number

of Shares | Fair

Value |

| Fortive Corp. | 1,849 | $ 128,949 |

| IDEX Corp. | 455 | 100,123 |

| Illinois Tool Works Inc. | 1,607 | 359,261 |

| Ingersoll Rand Inc. (a) | 2,211 | 107,919 |

| Otis Worldwide Corp. | 2,285 | 186,844 |

| Parker-Hannifin Corp. | 738 | 226,647 |

| Pentair PLC | 953 | 64,318 |

| Snap-on Inc. | 282 | 63,007 |

| Stanley Black & Decker Inc. | 929 | 190,436 |

| Xylem Inc. | 895 | 107,364 |

| | | 1,656,252 |

| Industrial REITs - 0.3% |

| Duke Realty Corp. | 1,853 | 87,740 |

| Prologis Inc. | 4,012 | 479,554 |

| | | 567,294 |

| Insurance Brokers - 0.5% |

| Aon PLC, Class A | 989 | 236,134 |

| Arthur J Gallagher & Co. | 1,027 | 143,862 |

| Marsh & McLennan Companies Inc. | 2,696 | 379,273 |

| Willis Towers Watson PLC | 1,054 | 242,441 |

| | | 1,001,710 |

| Integrated Oil & Gas - 1.4% |

| Chevron Corp. | 10,685 | 1,119,147 |

| Exxon Mobil Corp. | 23,107 | 1,457,590 |

| Occidental Petroleum Corp. | 4,649 | 145,374 |

| | | 2,722,111 |

| Integrated Telecommunication Services - 1.2% |

| AT&T Inc. | 38,854 | 1,118,218 |

| Verizon Communications Inc. | 22,569 | 1,264,541 |

| | | 2,382,759 |

| Interactive Home Entertainment - 0.4% |

| Activision Blizzard Inc. (b) | 4,228 | 403,520 |

| Electronic Arts Inc. | 1,598 | 229,840 |

| Take-Two Interactive Software Inc. (a) | 691 | 122,321 |

| | | 755,681 |

| Interactive Media & Services - 6.4% |

| Alphabet Inc., Class C (a) | 1,558 | 3,904,847 |

| Alphabet Inc., Class A (a) | 1,649 | 4,026,512 |

| Facebook Inc., Class A (a) | 13,113 | 4,559,521 |

| | Number

of Shares | Fair

Value |

| Twitter Inc. (a) | 4,551 | $ 313,154 |

| | | 12,804,034 |

| Internet & Direct Marketing Retail - 4.2% |

| Amazon.com Inc. (a) | 2,349 | 8,080,936 |

| eBay Inc. | 3,486 | 244,752 |

| Etsy Inc. (a) | 700 | 144,088 |

| | | 8,469,776 |

| Internet Services & Infrastructure - 0.1% |

| Akamai Technologies Inc. (a) | 794 | 92,580 |

| VeriSign Inc. (a) | 543 | 123,636 |

| | | 216,216 |

| Investment Banking & Brokerage - 1.1% |

| Morgan Stanley | 8,186 | 750,574 |

| Raymond James Financial Inc. | 680 | 88,332 |

| The Charles Schwab Corp. | 8,370 | 609,420 |

| The Goldman Sachs Group Inc. | 1,852 | 702,890 |

| | | 2,151,216 |

| IT Consulting & Other Services - 1.1% |

| Accenture PLC, Class A (b) | 3,469 | 1,022,627 |

| Cognizant Technology Solutions Corp., Class A | 2,986 | 206,810 |

| DXC Technology Co. (a) | 1,457 | 56,736 |

| Gartner Inc. (a) | 437 | 105,841 |

| International Business Machines Corp. | 4,956 | 726,500 |

| | | 2,118,514 |

| Leisure Products - 0.0% * |

| Hasbro Inc. | 796 | 75,238 |

| Life & Health Insurance - 0.4% |

| Aflac Inc. | 3,566 | 191,352 |

| Globe Life Inc. | 457 | 43,529 |

| Lincoln National Corp. | 863 | 54,231 |

| MetLife Inc. | 4,087 | 244,607 |

| Principal Financial Group Inc. | 1,311 | 82,842 |

| Prudential Financial Inc. | 2,205 | 225,946 |

| Unum Group | 1,164 | 33,058 |

| | | 875,565 |

| Life Sciences Tools & Services - 1.2% |

| Agilent Technologies Inc. | 1,722 | 254,529 |

See Notes to Schedule of Investments and Notes to Financial Statements.

| State Street S&P 500 Index V.I.S. Fund | 9 |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments, continued — June 30, 2021 (Unaudited)

| | Number

of Shares | Fair

Value |

| Bio-Rad Laboratories Inc., Class A (a) | 100 | $ 64,429 |

| Charles River Laboratories International Inc. (a) | 300 | 110,976 |

| Illumina Inc. (a) | 803 | 379,987 |

| IQVIA Holdings Inc. (a) | 1,003 | 243,047 |

| Mettler-Toledo International Inc. (a) | 120 | 166,241 |

| PerkinElmer Inc. | 641 | 98,977 |

| Thermo Fisher Scientific Inc. | 2,136 | 1,077,548 |

| Waters Corp. (a) | 315 | 108,867 |

| | | 2,504,601 |

| Managed Healthcare - 1.6% |

| Anthem Inc. | 1,343 | 512,757 |

| Centene Corp. (a) | 3,195 | 233,011 |

| Humana Inc. | 704 | 311,675 |

| UnitedHealth Group Inc. | 5,152 | 2,063,067 |

| | | 3,120,510 |

| Metal & Glass Containers - 0.1% |

| Ball Corp. | 1,882 | 152,480 |

| Movies & Entertainment - 1.5% |

| Live Nation Entertainment Inc. (a) | 800 | 70,072 |

| Netflix Inc. (a) | 2,414 | 1,275,099 |

| The Walt Disney Co. (a) | 10,004 | 1,758,403 |

| | | 3,103,574 |

| Multi-Line Insurance - 0.2% |

| American International Group Inc. | 4,776 | 227,338 |

| Assurant Inc. | 339 | 52,945 |

| The Hartford Financial Services Group Inc. | 1,931 | 119,664 |

| | | 399,947 |

| Multi-Sector Holdings - 1.4% |

| Berkshire Hathaway Inc., Class B (a) | 10,361 | 2,879,529 |

| Multi-Utilities - 0.8% |

| Ameren Corp. | 1,442 | 115,418 |

| CenterPoint Energy Inc. | 2,964 | 72,677 |

| CMS Energy Corp. | 1,749 | 103,331 |

| Consolidated Edison Inc. | 1,879 | 134,762 |

| Dominion Energy Inc. | 4,307 | 316,866 |

| DTE Energy Co. | 1,080 | 139,968 |

| NiSource Inc. | 2,515 | 61,617 |

| | Number

of Shares | Fair

Value |

| Public Service Enterprise Group Inc. | 2,905 | $ 173,545 |

| Sempra Energy | 1,700 | 225,216 |

| WEC Energy Group Inc. | 1,835 | 163,223 |

| | | 1,506,623 |

| Office REITs - 0.1% |

| Alexandria Real Estate Equities Inc. | 700 | 127,358 |

| Boston Properties Inc. | 798 | 91,443 |

| Vornado Realty Trust | 811 | 37,849 |

| | | 256,650 |

| Oil & Gas Equipment & Services - 0.2% |

| Baker Hughes Co. | 3,481 | 79,610 |

| Halliburton Co. | 4,615 | 106,699 |

| NOV Inc. (a) | 2,046 | 31,345 |

| Schlumberger N.V. | 7,704 | 246,605 |

| | | 464,259 |

| Oil & Gas Exploration & Production - 0.7% |

| APA Corp. | 2,348 | 50,787 |

| Cabot Oil & Gas Corp. | 2,380 | 41,555 |

| ConocoPhillips | 7,458 | 454,192 |

| Devon Energy Corp. | 2,912 | 85,001 |

| Diamondback Energy Inc. | 905 | 84,971 |

| EOG Resources Inc. | 3,304 | 275,686 |

| Hess Corp. | 1,531 | 133,687 |

| Marathon Oil Corp. | 4,302 | 58,593 |

| Pioneer Natural Resources Co. | 1,209 | 196,487 |

| | | 1,380,959 |

| Oil & Gas Refining & Marketing - 0.3% |

| Marathon Petroleum Corp. | 3,727 | 225,185 |

| Phillips 66 | 2,502 | 214,722 |

| Valero Energy Corp. | 2,188 | 170,839 |

| | | 610,746 |

| Oil & Gas Storage & Transportation - 0.3% |

| Kinder Morgan Inc. | 11,109 | 202,517 |

| ONEOK Inc. | 2,408 | 133,981 |

| The Williams Companies Inc. | 6,951 | 184,549 |

| | | 521,047 |

| Packaged Foods & Meats - 0.8% |

| Campbell Soup Co. | 1,076 | 49,055 |

| Conagra Brands Inc. | 2,363 | 85,966 |

| General Mills Inc. | 3,499 | 213,194 |

See Notes to Schedule of Investments and Notes to Financial Statements.

| 10 | State Street S&P 500 Index V.I.S. Fund |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments, continued — June 30, 2021 (Unaudited)

| | Number

of Shares | Fair

Value |

| Hormel Foods Corp. | 1,608 | $ 76,782 |

| Kellogg Co. | 1,286 | 82,728 |

| Lamb Weston Holdings Inc. | 868 | 70,013 |

| McCormick & Company Inc. | 1,310 | 115,699 |

| Mondelez International Inc., Class A | 7,736 | 483,036 |

| The Hershey Co. | 789 | 137,428 |

| The JM Smucker Co. | 653 | 84,609 |

| The Kraft Heinz Co. | 3,328 | 135,716 |

| Tyson Foods Inc., Class A | 1,466 | 108,132 |

| | | 1,642,358 |

| Paper Packaging - 0.3% |

| Amcor PLC | 8,803 | 100,882 |

| Avery Dennison Corp. | 492 | 103,438 |

| International Paper Co. | 2,215 | 135,802 |

| Packaging Corporation of America | 498 | 67,439 |

| Sealed Air Corp. | 931 | 55,162 |

| Westrock Co. | 1,358 | 72,273 |

| | | 534,996 |

| Personal Products - 0.2% |

| The Estee Lauder Companies Inc., Class A | 1,206 | 383,604 |

| Pharmaceuticals - 3.6% |

| Bristol-Myers Squibb Co. | 12,106 | 808,923 |

| Catalent Inc. (a) | 1,000 | 108,120 |

| Eli Lilly & Co. | 4,374 | 1,003,920 |

| Johnson & Johnson | 14,386 | 2,369,950 |

| Merck & Company Inc. | 13,761 | 1,070,193 |

| Organon & Co. (a) | 1,403 | 42,455 |

| Perrigo Company PLC | 807 | 37,001 |

| Pfizer Inc. | 30,855 | 1,208,282 |

| Viatris Inc. | 7,112 | 101,630 |

| Zoetis Inc. | 2,589 | 482,486 |

| | | 7,232,960 |

| Property & Casualty Insurance - 0.7% |

| Chubb Ltd. | 2,456 | 390,357 |

| Cincinnati Financial Corp. | 723 | 84,316 |

| Loews Corp. | 1,324 | 72,357 |

| The Allstate Corp. | 1,612 | 210,269 |

| The Progressive Corp. | 3,177 | 312,013 |

| The Travelers Companies Inc. | 1,324 | 198,216 |

| WR Berkley Corp. | 878 | 65,350 |

| | | 1,332,878 |

| | Number

of Shares | Fair

Value |

| Publishing - 0.0% * |

| News Corp., Class A | 2,096 | $ 54,014 |

| Railroads - 0.8% |

| CSX Corp. | 12,456 | 399,589 |

| Kansas City Southern | 528 | 149,619 |

| Norfolk Southern Corp. | 1,336 | 354,588 |

| Union Pacific Corp. | 3,637 | 799,885 |

| | | 1,703,681 |

| Real Estate Services - 0.1% |

| CBRE Group Inc., Class A (a) | 1,921 | 164,687 |

| Regional Banks - 1.0% |

| Citizens Financial Group Inc. | 2,500 | 114,675 |

| Comerica Inc. | 848 | 60,496 |

| Fifth Third Bancorp | 3,893 | 148,830 |

| First Republic Bank | 936 | 175,191 |

| Huntington Bancshares Inc. | 8,076 | 115,245 |

| KeyCorp | 5,765 | 119,047 |

| M&T Bank Corp. | 690 | 100,264 |

| People's United Financial Inc. | 2,459 | 42,147 |

| Regions Financial Corp. | 5,743 | 115,894 |

| SVB Financial Group (a) | 300 | 166,929 |

| The PNC Financial Services Group Inc. | 2,311 | 440,846 |

| Truist Financial Corp. | 7,568 | 420,024 |

| Zions Bancorp NA | 1,000 | 52,860 |

| | | 2,072,448 |

| Reinsurance - 0.0% * |

| Everest Re Group Ltd. | 200 | 50,402 |

| Research & Consulting Services - 0.4% |

| Equifax Inc. | 644 | 154,244 |

| IHS Markit Ltd. | 2,131 | 240,079 |

| Jacobs Engineering Group Inc. | 664 | 88,591 |

| Leidos Holdings Inc. | 800 | 80,880 |

| Nielsen Holdings PLC | 2,328 | 57,432 |

| Verisk Analytics Inc. | 895 | 156,374 |

| | | 777,600 |

| Residential REITs - 0.3% |

| AvalonBay Communities Inc. | 800 | 166,952 |

| Equity Residential | 1,930 | 148,610 |

| Essex Property Trust Inc. | 337 | 101,104 |

| Mid-America Apartment Communities Inc. | 600 | 101,052 |

See Notes to Schedule of Investments and Notes to Financial Statements.

| State Street S&P 500 Index V.I.S. Fund | 11 |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments, continued — June 30, 2021 (Unaudited)

| | Number

of Shares | Fair

Value |

| UDR Inc. | 1,639 | $ 80,278 |

| | | 597,996 |

| Restaurants - 1.1% |

| Chipotle Mexican Grill Inc. (a) | 160 | 248,054 |

| Darden Restaurants Inc. | 782 | 114,164 |

| Domino's Pizza Inc. | 200 | 93,298 |

| McDonald's Corp. | 4,097 | 946,366 |

| Starbucks Corp. | 6,500 | 726,765 |

| Yum! Brands Inc. | 1,550 | 178,297 |

| | | 2,306,944 |

| Retail REITs - 0.3% |

| Federal Realty Investment Trust | 394 | 46,165 |

| Kimco Realty Corp. | 2,477 | 51,645 |

| Realty Income Corp. | 2,000 | 133,480 |

| Regency Centers Corp. | 999 | 64,006 |

| Simon Property Group Inc. | 1,862 | 242,954 |

| | | 538,250 |

| Semiconductor Equipment - 0.9% |

| Applied Materials Inc. | 4,970 | 707,728 |

| Enphase Energy Inc. (a) | 700 | 128,541 |

| KLA Corp. | 785 | 254,505 |

| Lam Research Corp. | 785 | 510,799 |

| Teradyne Inc. | 836 | 111,991 |

| | | 1,713,564 |

| Semiconductors - 4.8% |

| Advanced Micro Devices Inc. (a) | 5,383 | 505,625 |

| Analog Devices Inc. | 1,529 | 263,232 |

| Broadcom Inc. | 2,219 | 1,058,108 |

| Intel Corp. | 22,259 | 1,249,620 |

| Maxim Integrated Products Inc. | 2,425 | 255,498 |

| Microchip Technology Inc. | 1,451 | 217,273 |

| Micron Technology Inc. (a) | 6,156 | 523,137 |

| Monolithic Power Systems Inc. | 200 | 74,690 |

| NVIDIA Corp. | 3,401 | 2,721,140 |

| NXP Semiconductors N.V. | 1,515 | 311,666 |

| Qorvo Inc. (a) | 600 | 117,390 |

| QUALCOMM Inc. | 6,115 | 874,017 |

| Skyworks Solutions Inc. | 904 | 173,342 |

| Texas Instruments Inc. | 5,069 | 974,769 |

| Xilinx Inc. | 2,205 | 318,931 |

| | | 9,638,438 |

| | Number

of Shares | Fair

Value |

| Soft Drinks - 1.2% |

| Monster Beverage Corp. (a) | 2,033 | $ 185,714 |

| PepsiCo Inc. | 7,651 | 1,133,649 |

| The Coca-Cola Co. | 21,106 | 1,142,046 |

| | | 2,461,409 |

| Specialized REITs - 1.2% |

| American Tower Corp. | 2,424 | 654,819 |

| Crown Castle International Corp. | 2,352 | 458,875 |

| Digital Realty Trust Inc. | 1,555 | 233,965 |

| Equinix Inc. | 496 | 398,090 |

| Extra Space Storage Inc. | 664 | 108,777 |

| Iron Mountain Inc. | 1,483 | 62,761 |

| Public Storage | 802 | 241,153 |

| SBA Communications Corp. | 609 | 194,088 |

| Weyerhaeuser Co. | 3,967 | 136,544 |

| | | 2,489,072 |

| Specialty Chemicals - 0.7% |

| Albemarle Corp. | 610 | 102,761 |

| Celanese Corp. | 626 | 94,902 |

| DuPont de Nemours Inc. | 2,938 | 227,430 |

| Ecolab Inc. | 1,347 | 277,441 |

| International Flavors & Fragrances Inc. | 1,299 | 194,071 |

| PPG Industries Inc. | 1,278 | 216,966 |

| The Sherwin-Williams Co. | 1,323 | 360,451 |

| | | 1,474,022 |

| Specialty Stores - 0.1% |

| Tractor Supply Co. | 637 | 118,520 |

| Ulta Beauty Inc. (a) | 292 | 100,965 |

| | | 219,485 |

| Steel - 0.1% |

| Nucor Corp. | 1,591 | 152,625 |

| Systems Software - 6.4% |

| Fortinet Inc. (a) | 700 | 166,733 |

| Microsoft Corp. | 41,273 | 11,180,855 |

| NortonLifeLock Inc. | 3,572 | 97,230 |

| Oracle Corp. | 9,838 | 765,790 |

| ServiceNow Inc. (a) | 1,078 | 592,415 |

| | | 12,803,023 |

| Technology Distributors - 0.1% |

| CDW Corp. | 805 | 140,593 |

See Notes to Schedule of Investments and Notes to Financial Statements.

| 12 | State Street S&P 500 Index V.I.S. Fund |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments, continued — June 30, 2021 (Unaudited)

| | Number

of Shares | Fair

Value |

| Technology Hardware, Storage & Peripherals - 6.2% |

| Apple Inc. | 85,965 | $ 11,773,766 |

| Hewlett Packard Enterprise Co. | 6,633 | 96,709 |

| HP Inc. | 6,753 | 203,873 |

| NetApp Inc. | 1,158 | 94,748 |

| Seagate Technology Holdings PLC | 1,002 | 88,106 |

| Western Digital Corp. (a) | 1,815 | 129,174 |

| | | 12,386,376 |

| Tobacco - 0.7% |

| Altria Group Inc. | 10,205 | 486,575 |

| Philip Morris International Inc. | 8,456 | 838,074 |

| | | 1,324,649 |

| Trading Companies & Distributors - 0.2% |

| Fastenal Co. | 3,100 | 161,200 |

| United Rentals Inc. (a) | 391 | 124,733 |

| WW Grainger Inc. | 242 | 105,996 |

| | | 391,929 |

| Trucking - 0.1% |

| JB Hunt Transport Services Inc. | 520 | 84,734 |

| | Number

of Shares | Fair

Value |

| Old Dominion Freight Line Inc. | 551 | $ 139,844 |

| | | 224,578 |

| Water Utilities - 0.1% |

| American Water Works Company Inc. | 1,038 | 159,987 |

| Wireless Telecommunication Services - 0.2% |

| T-Mobile US Inc. (a) | 3,142 | 455,056 |

Total Common Stock

(Cost $54,586,636) | | 198,918,093 |

| Short-Term Investments - 0.8% |

State Street Institutional Liquid Reserves Fund - Premier Class 0.05% (d)(e)

(Cost $1,562,792) | 1,562,378 | 1,562,847 |

Total Investments

(Cost $56,149,428) | | 200,480,940 |

| Other Assets and Liabilities, net - 0.2% | | 389,169 |

| NET ASSETS - 100.0% | | $ 200,870,109 |

Other Information:

| The Fund had the following long futures contracts open at June 30, 2021: |

| Description | Expiration

Date | Number of

Contracts | Notional

Amount | Value | Unrealized

Appreciation

(Depreciation) |

| S&P 500 Emini Index Futures | September 2021 | 8 | $ 1,693,533 | $ 1,715,422 | $ 21,889 |

During the period ended June 30, 2021, average notional values related to long futures contracts was $1,752,739.

Notes to Schedule of Investments

The views expressed in this document reflect our judgment as of the publication date and are subject to change at any time without notice. The securities cited may not be representative of the Fund’s future investments and should not be construed as a recommendation to purchase or sell a particular security. See the Fund’s summary prospectus and statutory prospectus for complete descriptions of investment objectives, policies, risks and permissible investments.

| (a) | Non-income producing security. |

| (b) | At June 30, 2021, all or a portion of this security was pledged to cover collateral requirements for futures. |

| (c) | State Street Corporation is the parent company of SSGA Funds Management, Inc., the Fund's investment adviser and administrator, and State Street Bank & Trust Co., the Fund’s sub-administrator, custodian and accounting agent. |

| (d) | Sponsored by SSGA Funds Management, Inc., the Fund’s investment adviser and administrator, and an affiliate of State Street Bank & Trust Co., the Fund’s sub-administrator, custodian and accounting agent. |

See Notes to Schedule of Investments and Notes to Financial Statements.

| State Street S&P 500 Index V.I.S. Fund | 13 |

State Street S&P 500 Index V.I.S. Fund

Schedule of Investments, continued — June 30, 2021 (Unaudited)

| (e) | Coupon amount represents effective yield. |

| † | Percentages are based on net assets as of June 30, 2021. |

| * | Less than 0.05%. |

| Abbreviations: |

| REIT - Real Estate Investment Trust |

The following table presents the Fund’s investments measured at fair value on a recurring basis at June 30, 2021:

| Investments | Level 1 | | Level 2 | | Level 3 | | Total |

| Investments in Securities | | | | | | | |

| Common Stock | $ 198,918,093 | | $ — | | $ — | | $ 198,918,093 |

| Short-Term Investments | 1,562,847 | | — | | — | | 1,562,847 |

| Total Investments in Securities | $ 200,480,940 | | $ — | | $ — | | $ 200,480,940 |

| Other Financial Instruments | | | | | | | |

| Long Futures Contracts - Unrealized Appreciation | $ 21,889 | | $ — | | $ — | | $ 21,889 |

| | Number

of Shares

Held at

12/31/20 | Value at

12/31/20 | | Cost of

Purchases | | Proceeds

from

Shares

Sold | | Realized

Gain

(Loss) | | Change in

Unrealized

Appreciation

(Depreciation) | Number of

Shares

Held at

6/30/21 | Value at

6/30/21 | | Dividend

Income |

| State Street Corp. | 1,906 | $ 138,719 | | $ — | | $ — | | $ — | | $18,107 | 1,906 | $ 156,826 | | $1,982 |

| State Street Institutional Liquid Reserves Fund, Premier Class | 1,280,065 | 1,280,321 | | 11,615,943 | | 11,332,479 | | (993) | | 55 | 1,562,378 | 1,562,847 | | 510 |

| TOTAL | | $1,419,040 | | $11,615,943 | | $11,332,479 | | $(993) | | $18,162 | | $1,719,673 | | $2,492 |

See Notes to Schedule of Investments and Notes to Financial Statements.

| 14 | State Street S&P 500 Index V.I.S. Fund |

State Street S&P 500 Index V.I.S. Fund

Financial Highlights

Selected data based on a share outstanding throughout the periods indicated

| | 6/30/21 (a) | | 12/31/20 | | 12/31/19 | | 12/31/18 | | 12/31/17 | | 12/31/16 |

| Inception date | | | 4/15/85 |

| Net asset value, beginning of period | $ 49.96 | | $ 46.61 | | $ 38.13 | | $ 44.09 | | $ 38.22 | | $ 36.16 |

| Income/(loss) from investment operations: | | | | | | | | | | | |

| Net investment income | 0.30 (b) | | 0.72 (b) | | 0.75 (b) | | 0.74 (b) | | 0.71 (b) | | 0.72 |

| Net realized and unrealized gains/(losses) on investments | 7.24 | | 7.61 | | 11.09 | | (2.86) | | 7.52 | | 3.49 |

| Total income/(loss) from investment operations | 7.54 | | 8.33 | | 11.84 | | (2.12) | | 8.23 | | 4.21 |

| Less distributions from: | | | | | | | | | | | |

| Net investment income | — | | 0.88 | | 0.62 | | 0.80 | | 0.79 | | 0.73 |

| Net realized gains | — | | 4.10 | | 2.74 | | 3.04 | | 1.57 | | 1.42 |

| Total distributions | — | | 4.98 | | 3.36 | | 3.84 | | 2.36 | | 2.15 |

| Net asset value, end of period | $ 57.50 | | $ 49.96 | | $ 46.61 | | $ 38.13 | | $ 44.09 | | $ 38.22 |

| Total Return(c) | 15.09% | | 17.92% | | 31.05% | | (4.73)% | | 21.50% | | 11.61% |

| Ratios/Supplemental Data: | | | | | | | | | | | |

| Net assets, end of period (in thousands) | $200,870 | | $184,164 | | $186,771 | | $160,902 | | $194,117 | | $180,761 |

| Ratios to average net assets: | | | | | | | | | | | |

| Net expenses | 0.31% (d) | | 0.31% | | 0.34% | | 0.33% | | 0.32% | | 0.34% (e) |

| Gross expenses | 0.31% (d) | | 0.31% | | 0.34% | | 0.33% | | 0.32% | | 0.37% |

| Net investment income | 1.15% (d) | | 1.54% | | 1.67% | | 1.62% | | 1.69% | | 1.86% |

| Portfolio turnover rate | 1% | | 3% | | 2% | | 2% | | 2% | | 2% |

| Notes to Financial Highlights |

| (a) | Unaudited. |

| (b) | Per share values have been calculated using the average shares method. |

| (c) | Total returns are historical and assume changes in share price, reinvestment of dividends and capital gains distributions and do not include the effect of insurance contract charges. Past performance does not guarantee future results. |

| (d) | Annualized for periods less than one year. |

| (e) | Reflects a contractual arrangement with GE Asset Management Incorporated, the Fund's investment adviser and administrator prior to July 1, 2016, to limit the advisory and administrative fee charged to the Fund to 0.30% of the average daily net assets of the Fund. |

The accompanying Notes are an integral part of these financial statements.

State Street S&P 500 Index V.I.S. Fund

Statement of Assets and Liabilities — June 30, 2021 (Unaudited)

| Assets | |

| Investments in securities, at fair value (cost $54,488,876) | $ 198,761,267 |

| Investments in affiliated securities, at fair value (cost $1,660,552) | 1,719,673 |

| Cash | 1,003 |

| Net cash collateral on deposit with broker for future contracts | 77,533 |

| Income receivables | 114,625 |

| Receivable for fund shares sold | 281,219 |

| Income receivable from affiliated investments | 1,046 |

| Receivable for accumulated variation margin on futures contracts | 21,908 |

| Total assets | 200,978,274 |

| Liabilities | |

| Payable for fund shares redeemed | 8,348 |

| Payable to the Adviser | 40,813 |

| Payable for custody, fund accounting and sub-administration fees | 11,257 |

| Accrued other expenses | 47,747 |

| Total liabilities | 108,165 |

|

| Net Assets | $ 200,870,109 |

| Net Assets Consist of: | |

| Capital paid in | $ 46,940,033 |

| Total distributable earnings (loss) | 153,930,076 |

| Net Assets | $ 200,870,109 |

| Shares outstanding ($0.01 par value; unlimited shares authorized) | 3,493,573 |

| Net asset value per share | $ 57.50 |

The accompanying Notes are an integral part of these financial statements.

| 16 | Statement of Assets and Liabilities |

State Street S&P 500 Index V.I.S. Fund

Statement of Operations — For the period ended June 30, 2021 (Unaudited)

| Investment Income | |

| Income | |

| Dividend | $ 1,394,408 |

| Income from affiliated investments | 2,492 |

| Less: Foreign taxes withheld | (128) |

| Total income | 1,396,772 |

| Expenses | |

| Advisory and administration fees | 238,988 |

| Directors' fees | 10,096 |

| Custody, fund accounting and sub-administration fees | 20,202 |

| Professional fees | 14,876 |

| Printing and shareholder reports | 9,309 |

| Other expenses | 7,168 |

| Total expenses | 300,639 |

| Net investment income | $ 1,096,133 |

| Net Realized and Unrealized Gain (Loss) on Investments | |

| Realized gain (loss) on: | |

| Unaffiliated investments | $ 6,742,800 |

| Affiliated investments | (993) |

| Futures | 291,582 |

| Increase (decrease) in unrealized appreciation/depreciation on: | |

| Unaffiliated investments | 19,008,777 |

| Affiliated investments | 18,162 |

| Futures | (25,493) |

| Net realized and unrealized gain (loss) on investments | 26,034,835 |

| Net Increase in Net Assets Resulting from Operations | $ 27,130,968 |

The accompanying Notes are an integral part of these financial statements.

| Statement of Operations | 17 |

State Street S&P 500 Index V.I.S. Fund

Statements of Changes in Net Assets

| | Six Months

Ended

June 30,

2021(a) | | Year Ended

December 31,

2020 |

| Increase (Decrease) in Net Assets | | | |

| Operations: | | | |

| Net investment income | $ 1,096,133 | | $ 2,627,581 |

| Net realized gain (loss) on investments and futures | 7,033,389 | | 18,145,054 |

| Net increase (decrease) in unrealized appreciation/depreciation on investments and futures | 19,001,446 | | 6,136,361 |

| Net increase (decrease) from operations | 27,130,968 | | 26,908,996 |

| Distributions to shareholders: | | | |

| Total distributions | — | | (16,701,378) |

| Increase (decrease) in assets from operations and distributions | 27,130,968 | | 10,207,618 |

| Share transactions: | | | |

| Proceeds from sale of shares | 2,872,998 | | 3,703,237 |

| Value of distributions reinvested | — | | 16,701,377 |

| Cost of shares redeemed | (13,297,922) | | (33,218,777) |

| Net increase (decrease) from share transactions | (10,424,924) | | (12,814,163) |

| Total increase (decrease) in net assets | 16,706,044 | | (2,606,545) |

| Net Assets | | | |

| Beginning of period | 184,164,065 | | 186,770,610 |

| End of period | $ 200,870,109 | | $ 184,164,065 |

| Changes in Fund Shares | | | |

| Shares sold | 53,797 | | 82,249 |

| Issued for distributions reinvested | — | | 336,247 |

| Shares redeemed | (246,629) | | (739,201) |

| Net decrease in fund shares | (192,832) | | (320,705) |

The accompanying Notes are an integral part of these financial statements.

| 18 | Statements of Changes in Net Assets |

State Street S&P 500 Index V.I.S. Fund

Notes to Financial Statements — June 30, 2021 (Unaudited)

1. Organization of the Company

State Street Variable Insurance Series Funds, Inc. (the “Company”) was incorporated under the laws of the Commonwealth of Virginia on May 14, 1984 and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Company is currently composed of the following seven investment portfolios (collectively, the “Funds”): State Street U.S. Equity V.I.S. Fund, State Street S&P 500 Index V.I.S. Fund (the “Fund”), State Street Premier Growth Equity V.I.S. Fund, State Street Small-Cap Equity V.I.S. Fund, State Street Total Return V.I.S. Fund, State Street Income V.I.S. Fund and State Street Real Estate Securities V.I.S. Fund. Each Fund is a diversified investment company within the meaning of the 1940 Act.

Shares of the Funds of the Company are offered only to insurance company separate accounts that fund certain variable life insurance contracts and variable annuity contracts.

The Company currently offers one share class (Class 1) of the Fund as an investment option for variable life insurance and variable annuity contracts.

Under the Company’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Company. Additionally, in the normal course of business, the Company enters into contracts with service providers that contain general indemnification clauses. The Company’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Company that have not yet occurred.

2.Summary of Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Company in the preparation of its financial statements:

The preparation of financial statements in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates. The Fund is an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies.

Security Valuation The Fund’s investments are valued at fair value each day that the New York Stock Exchange (“NYSE”) is open and, for financial reporting purposes, as of the report date should the reporting period end on a day that the NYSE is not open. Fair value is generally defined as the price a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. By its nature, a fair value price is a good faith estimate of the valuation in a current sale and may not reflect an actual market price. The investments of the Fund are valued pursuant to the policy and procedures developed by the Oversight Committee (the “Committee”) and approved by the Company's Board of Directors (the “Board”). The Committee provides oversight of the valuation of investments for the Fund. The Board has responsibility for overseeing the determination of the fair value of investments.

Valuation techniques used to value the Fund’s investments by major category are as follows:

| • | Equity investments traded on a recognized securities exchange for which market quotations are readily available are valued at the last sale price or official closing price, as applicable, on the primary market or exchange on which they trade. Equity investments traded on a recognized exchange for which there were no sales on that day are valued at the last published sale price or at fair value. |

| • | Investments in registered investment companies (including money market funds) or other unitized pooled investment vehicles that are not traded on an exchange are valued at that day’s published net asset value (“NAV”) per share or unit. |

| Notes to Financial Statements | 19 |

State Street S&P 500 Index V.I.S. Fund

Notes to Financial Statements, continued — June 30, 2021 (Unaudited)

| • | Exchange-traded futures contracts are valued at the closing settlement price on the primary market on which they are traded most extensively. Exchange-traded futures contracts traded on a recognized exchange for which there were no sales on that day are valued at the last reported sale price obtained from independent pricing services or brokers or at fair value. |

In the event prices or quotations are not readily available or that the application of these valuation methods results in a price for an investment that is deemed to be not representative of the fair value of such investment, fair value will be determined in good faith by the Committee, in accordance with the valuation policy and procedures approved by the Board.

The Fund values its assets and liabilities at fair value using a fair value hierarchy consisting of three broad levels that prioritize the inputs to valuation techniques giving the highest priority to readily available unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements) when market prices are not readily available or reliable. The categorization of a value determined for an investment within the hierarchy is based upon the pricing transparency of the investment and is not necessarily an indication of the risk associated with investing in it.

The three levels of the fair value hierarchy are as follows:

| • | Level 1 — Unadjusted quoted prices in active markets for an identical asset or liability; |

| • | Level 2 — Inputs other than quoted prices included within Level 1 that are observable for the asset or liability either directly or indirectly, including quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not considered to be active, inputs other than quoted prices that are observable for the asset or liability (such as exchange rates, financing terms, interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs; and |

| • | Level 3 — Unobservable inputs for the asset or liability, including the Committee’s assumptions used in determining the fair value of investments. |

The value of the Fund’s investments according to the fair value hierarchy as of June 30, 2021 is disclosed in the Fund’s Schedule of Investments.

Investment Transactions and Income Recognition Investment transactions are accounted for on trade date for financial reporting purposes. Realized gains and losses from the sale or disposition of investments and foreign exchange transactions, if any, are determined using the identified cost method.

Dividend income and capital gain distributions, if any, are recognized on the ex-dividend date, net of any foreign taxes withheld at source, if any.

Interest income is recorded daily on an accrual basis. All premiums and discounts are amortized/accreted for financial reporting purposes.

Non-cash dividends received in the form of stock are recorded as dividend income at fair value.

The Fund invests in real estate investment trusts (“REITs”). REITs determine the tax character of their distributions annually and may characterize a portion of their distributions as a return of capital or capital gain. The Fund’s policy is to record all REIT distributions initially as dividend income and re-designate a portion to return of capital or capital gain distributions at year end based on information provided by the REIT and/or SSGA Funds Management, Inc.’s (the “Adviser” or “SSGA FM”) estimates of such re-designations for which actual information has not yet been reported. Non-cash dividends received in the form of stock are recorded as dividend income at fair value.

Expenses Certain expenses, which are directly identifiable to a specific Fund, are applied to the Fund within the Company. Other expenses which cannot be attributed to a specific Fund are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative net assets of the Fund within the Company.

| 20 | Notes to Financial Statements |

State Street S&P 500 Index V.I.S. Fund

Notes to Financial Statements, continued — June 30, 2021 (Unaudited)

Distributions The Fund declares and pays any dividends from net investment income annually.

Net realized capital gains, if any, are distributed annually, unless additional distributions are required for compliance with applicable tax regulations. The amount and character of income and capital gains to be distributed are determined in accordance with applicable tax regulations which may differ from net investment income and realized gains recognized for U.S. GAAP purposes.

3.Derivative Financial Instruments

Futures Contracts The Fund may enter into futures contracts to meet the Fund’s objectives. A futures contract is a standardized, exchange-traded agreement to buy or sell a financial instrument at a set price on a future date. Upon entering into a futures contract, the Fund is required to deposit with the broker, cash or securities in an amount equal to the minimum initial margin requirements of the clearing house. Securities deposited, if any, are designated on the Schedule of Investments and cash deposited, if any, is included in Net cash collateral on deposit with broker for future contracts on the Statement of Assets and Liabilities. Subsequent payments are made or received by the Fund equal to the daily change in the contract value, accumulated, exchange rates, and/or other transactional fees. The accumulation of those payments are recorded as variation margin receivable or payable with a corresponding offset to unrealized gains or losses. The Fund recognizes a realized gain or loss when the contract is closed.

Losses may arise if the value of a futures contract decreases due to unfavorable changes in the market rates or values of the underlying instrument during the term of the contract or if the counterparty does not perform under the contract. The use of futures contracts also involves the risk that the movements in the price of the futures contracts do not correlate with the movement of the assets underlying such contracts.

For the period ended June 30, 2021, the Fund entered into futures contracts for cash equitization.

The following tables summarize the value of the Fund’s derivative instruments as of June 30, 2021 and the related location in the accompanying Statement of Assets and Liabilities and Statement of Operations, presented by primary underlying risk exposure:

| Asset Derivatives |

| | Interest

Rate

Contracts

Risk | Foreign

Exchange

Contracts

Risk | Credit

Contracts

Risks | Equity

Contracts

Risks | Commodity

Contracts

Risks | Total |

| State Street S&P 500 Index V.I.S. Fund | | | | | | |

| Futures Contracts | $ — | $ — | $ — | $ 21,908 | $ — | $ 21,908 |

| Realized Gain/Loss |

| | Interest

Rate

Contracts

Risk | Foreign

Exchange

Contracts

Risk | Credit

Contracts

Risks | Equity

Contracts

Risks | Commodity

Contracts

Risks | Total |

| State Street S&P 500 Index V.I.S. Fund | | | | | | |

| Futures Contracts | $ — | $ — | $ — | $ 291,582 | $ — | $ 291,582 |

| Notes to Financial Statements | 21 |

State Street S&P 500 Index V.I.S. Fund

Notes to Financial Statements, continued — June 30, 2021 (Unaudited)

| Net Change in Unrealized Appreciation (Depreciation) |

| | Interest

Rate

Contracts

Risk | Foreign

Exchange

Contracts

Risk | Credit

Contracts

Risks | Equity

Contracts

Risks | Commodity

Contracts

Risks | Total |

| State Street S&P 500 Index V.I.S. Fund | | | | | | |

| Futures Contracts | $ — | $ — | $ — | $ (25,493) | $ — | $ (25,493) |

4.Fees and Transactions with Affiliates

Advisory Fee SSGA FM, a registered investment adviser, was retained by the Board to act as investment adviser and administrator of the Fund. SSGA FM’s compensation for investment advisory and administrative services (“Management Fee”) is paid monthly based on the average daily net assets of the Fund at an annualized rate of 0.25%.

Custody, Fund Accounting and Sub-Administration Fees State Street Bank and Trust Company (“State Street”) serves as the custodian, fund accountant and sub-administrator to the Fund. Amounts paid by the Fund to State Street for performing such services are included as custody, fund accounting and sub-administration fees in the Statement of Operations.

Other Transactions with Affiliates The Fund may invest in affiliated entities, including securities issued by State Street Corporation, affiliated funds, or entities deemed to be affiliates as a result of the Fund owning more than five percent of the entity’s voting securities or outstanding shares. Amounts relating to these transactions during the period ended June 30, 2021 are disclosed in the Schedule of Investments.

5.Directors’ Fees

The fees and expenses of the Company’s directors who are not “interested persons” of the Company, as defined in the 1940 Act (“Independent Directors”), are paid directly by the Fund. The Independent Directors are reimbursed for travel and other out-of-pocket expenses in connection with meeting attendance and industry seminars.

6.Investment Transactions

Purchases and sales of investments (excluding in-kind transactions, short term investments and derivative contracts) for the period ended June 30, 2021 were as follows:

| Non-U.S. Government Securities |

| Purchases | Sales |

| $ 1,399,202 | $ 10,366,118 |

7.Income Taxes

The Fund has qualified and intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended. The Fund will not be subject to federal income taxes to the extent it distributes its taxable income, including any net realized capital gains, for each fiscal year. Therefore, no provision for federal income tax is required.

The Fund files federal and various state and local tax returns as required. No income tax returns are currently under examination. Generally, the federal returns are subject to examination by the Internal Revenue Service for a period of three years from date of filing, while the state returns may remain open for an additional year depending upon jurisdiction. SSGA FM has analyzed the Fund's tax positions taken on tax returns for all open years and does not believe there are any uncertain tax positions that would require recognition of a tax liability.

Distributions to shareholders are recorded on ex-dividend date. Income dividends and gain distributions are determined in accordance with income tax rules and regulations, which may differ from generally accepted accounting principles.

| 22 | Notes to Financial Statements |

State Street S&P 500 Index V.I.S. Fund

Notes to Financial Statements, continued — June 30, 2021 (Unaudited)

As of June 30, 2021, gross unrealized appreciation and gross unrealized depreciation of investments and other financial instruments based on cost for federal income tax purposes were as follows:

Tax

Cost | Gross

Unrealized

Appreciation | Gross

Unrealized

Depreciation | Net

Unrealized

Appreciation

(Depreciation) |

| $ 62,205,322 | $ 140,071,678 | $ 1,774,171 | $ 138,297,507 |

8.Line of Credit

The Fund and other affiliated funds (each, a “Participant” and collectively, the “Participants”) have access to $200 million of a $500 million revolving credit facility provided by a syndication of banks under which the Participants may borrow to fund shareholder redemptions. This agreement expires in October 2021 unless extended or renewed.

The Participants are charged an annual commitment fee which is calculated based on the unused portion of the shared credit line. Commitment fees are allocated among each of the Participants based on relative net assets. Commitment fees are ordinary fund operating expenses. A Participant incurs and pays the interest expense related to its borrowing. Interest is calculated at a rate per annum equal to the sum of 1.25% plus the New York Fed Bank Rate.

The Fund had no outstanding loans as of June 30, 2021.

9.Risks

Concentration Risk As a result of the Fund's ability to invest a large percentage of its assets in obligations of issuers within the same country, state, region, currency or economic sector, an adverse economic, business or political development may affect the value of the Fund's investments more than if the Fund was more broadly diversified.

Credit Risk The Fund may be exposed to credit risk in the event that an issuer or guarantor fails to perform or that an institution or entity with which the Fund has unsettled or open transactions defaults.

Market Risk The Fund’s investments are subject to changes in general economic conditions, and general market fluctuations and the risks inherent in investment in securities markets. Investment markets can be volatile and prices of investments can change substantially due to various factors including, but not limited to, economic growth or recession, changes in interest rates, changes in the actual or perceived creditworthiness of issuers, and general market liquidity. The Fund is subject to the risk that geopolitical events will disrupt securities markets and adversely affect global economies and markets. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, or other events could have a significant impact on the Fund and its investments.

An outbreak of a respiratory disease caused by a novel coronavirus (known as COVID-19) first detected in China in December 2019 has resulted in a global pandemic and major disruptions to economies and markets around the world, including the United States. Financial markets experienced and may continue to experience extreme volatility and severe losses, and trading in many instruments was and may continue to be disrupted as a result. Liquidity for many instruments was and may continue to be greatly reduced for periods of time. Some interest rates are very low and in some cases yields are negative. Governments and central banks, including the Federal Reserve in the United States, have taken extraordinary and unprecedented actions to support local and global economies and the financial markets. The impact of these measures, and whether they will be effective to mitigate the economic and market disruption, will not be known for some time. In addition, the outbreak of COVID-19, and measures taken to mitigate its effects, could result in disruptions to the services provided to the Fund by its service providers.

| Notes to Financial Statements | 23 |

State Street S&P 500 Index V.I.S. Fund

Notes to Financial Statements, continued — June 30, 2021 (Unaudited)

10.Subsequent Events

Management has evaluated the impact of all subsequent events on the Fund through the date on which the financial statements were available to be issued and has determined that there were no subsequent events requiring adjustment or disclosure in the financial statements.

| 24 | Notes to Financial Statements |

State Street S&P 500 Index V.I.S. Fund

Other Information — June 30, 2021 (Unaudited)

Proxy Voting Policies and Procedures and Record

The Fund has adopted the proxy voting policies of the Adviser. A description of the Fund's proxy voting policies and procedures that are used by the Adviser to vote proxies relating to the Fund’s portfolios of securities are available (i) without charge, upon request by calling 1-800-242-0134 (toll free) or (ii) on the SEC's website, at www.sec.gov. Information regarding how the investment adviser voted for the prior 12-months period ended June 30 is available by August 31 of each year by calling the same number, on the SEC’s website at www.sec.gov, and on the Fund's website at www.ssga.com.

Quarterly Portfolio Schedule

Following the Fund's first and third fiscal quarter-ends, a complete schedule of investments is filed with the SEC as an exhibit to its reports on Form N-PORT, which can be found on the SEC’s website at www.sec.gov, and on the Fund's website at www.ssga.com. The Fund's schedules of investments are available upon request, without charge, by calling 1-800-242-0134.

State Street S&P 500 Index V.I.S. Fund

Other Information, continued — June 30, 2021 (Unaudited)

Director Considerations in Approving Continuation of the Investment Advisory Agreement1

Overview of the Contract Review Process

Under the Investment Company Act of 1940, as amended (the “1940 Act”), an investment advisory agreement between a mutual fund and its investment adviser may continue in effect from year to year only if its continuance is approved at least annually by the fund’s board of directors or its shareholders, and by a vote of a majority of those directors who are not “interested persons” of the fund (commonly referred to as, the “Independent Directors”) cast in person at a meeting called for the purpose of considering such approval.2

Consistent with these requirements, the Board of Directors (the “Board”) of the State Street Variable Insurance Series Funds, Inc. (the “Company”) met telephonically or by videoconference on April 7, 2021 and May 24-25, 2021 (in reliance on the Orders), including in executive sessions attended by the Independent Directors, to consider a proposal to approve, with respect to the State Street S&P 500 Index V.I.S. Fund (the “Fund”), the continuation of the investment advisory agreement (the “Advisory Agreement”) with SSGA Funds Management, Inc. (“SSGA FM” or the “Adviser”). Prior to voting on the proposal, the Independent Directors, as well as the Directors who are “interested persons” of the Adviser, reviewed information furnished by the Adviser and others reasonably necessary to permit the Board to evaluate the proposal fully. The Independent Directors were separately represented by counsel who are independent of the Adviser in connection with their consideration of approval of the Advisory Agreement. Following the April 7, 2021 meeting, the Independent Directors submitted questions and requests for additional information to management, and considered management’s responses thereto prior to and at the May 24-25, 2021 meeting. The Independent Directors considered, among other things, the following:

___________________________________________