UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-04087

Manning & Napier Fund, Inc.

(Exact name of registrant as specified in charter)

290 Woodcliff Drive, Fairport, NY 14450

(Address of principal executive offices)(Zip Code)

B. Reuben Auspitz 290 Woodcliff Drive, Fairport, NY 14450

(Name and address of agent for service)

Registrant’s telephone number, including area code: 585-325-6880

Date of fiscal year end: October 31, 2010

Date of reporting period: November 1, 2009 through April 30, 2010

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1: REPORTS TO STOCKHOLDERS.

Shareholder Expense Example (unaudited)

As a shareholder of the Series, you may incur two types of costs: (1) transaction costs, including potential wire charges on redemptions and (2) ongoing costs, including management fees and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2009 to April 30, 2010).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Series’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | |

| | | Beginning

Account Value

11/1/09 | | Ending

Account Value

4/30/10 | | Expenses Paid

During Period*

11/1/09-4/30/10 |

Actual | | $1,000.00 | | $1,172.80 | | $5.66 |

Hypothetical | | | | | | |

(5% return before expenses) | | $1,000.00 | | $1,019.59 | | $5.26 |

*Expenses are equal to the Series’ annualized expense ratio (for the six-month period) of 1.05%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Expenses are based on the most recent fiscal half year. The Series’ total return would have been lower had certain expenses not been waived during the period.

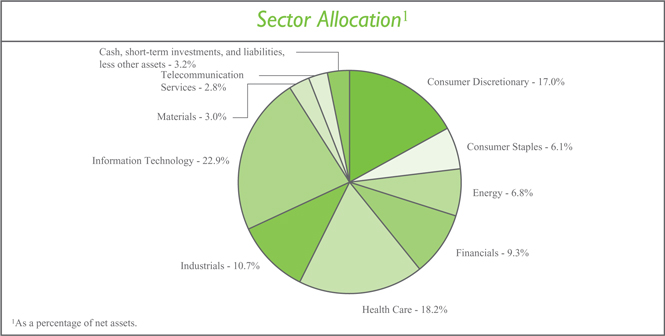

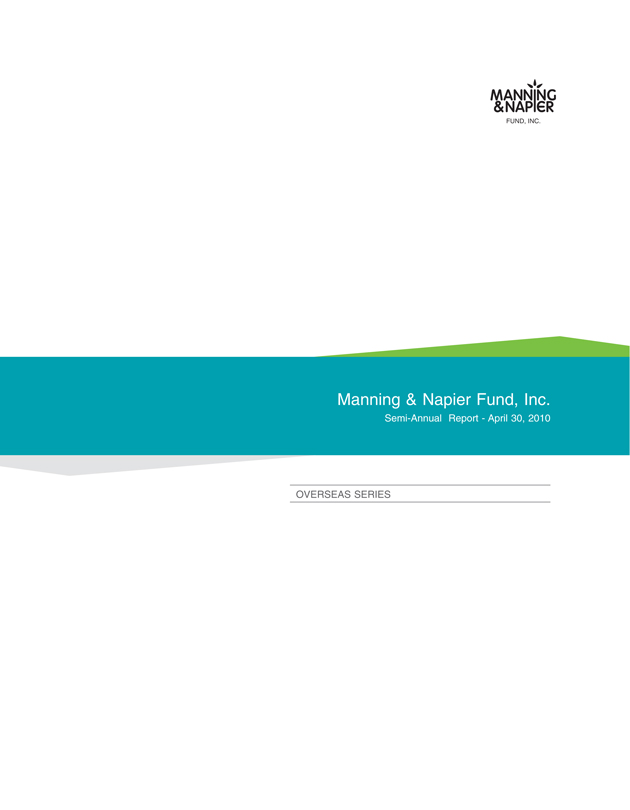

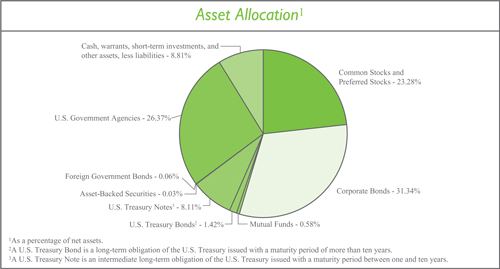

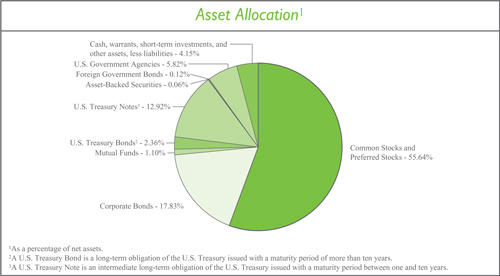

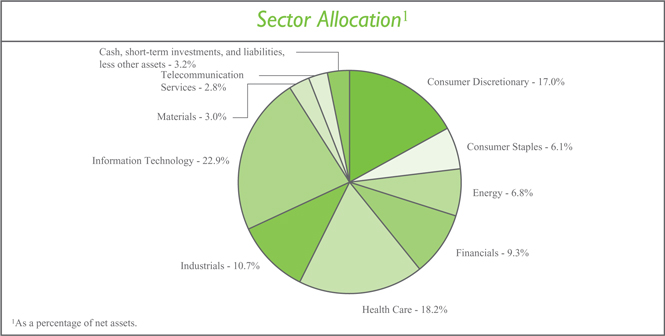

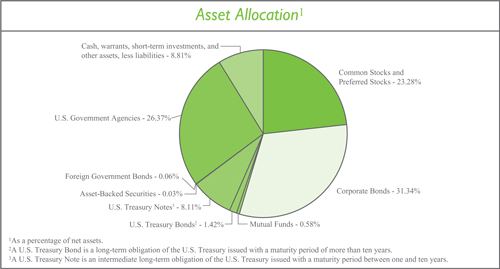

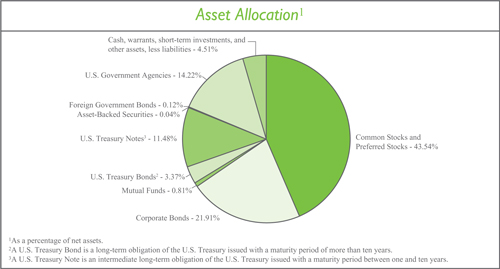

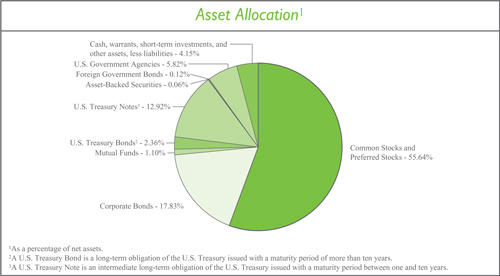

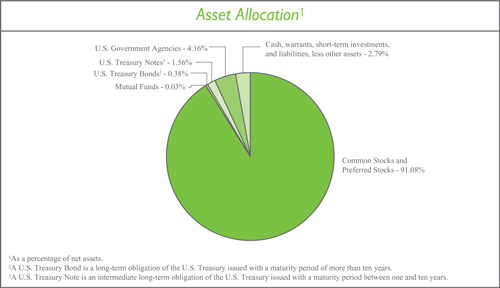

Portfolio Composition as of April 30, 2010 (unaudited)

Investment Portfolio - April 30, 2010 (unaudited)

| | | | | |

| | |

| | | Shares | | Value (Note 2) |

| | |

COMMON STOCKS - 96.8% | | | | | |

| | |

Consumer Discretionary - 17.0% | | | | | |

Hotels, Restaurants & Leisure - 2.6% | | | | | |

Carnival Corp. | | 541,870 | | $ | 22,595,979 |

International Game Technology | | 584,980 | | | 12,331,378 |

| | | | | |

| | | | | 34,927,357 |

| | | | | |

Media - 7.7% | | | | | |

Discovery Communications, Inc. - Class A* | | 503,520 | | | 19,486,224 |

Time Warner, Inc. | | 656,070 | | | 21,702,796 |

The Walt Disney Co. | | 1,237,350 | | | 45,583,974 |

The Washington Post Co. - Class B | | 37,550 | | | 19,043,858 |

| | | | | |

| | | | | 105,816,852 |

| | | | | |

Multiline Retail - 2.3% | | | | | |

Kohl’s Corp.* | | 278,650 | | | 15,322,964 |

Nordstrom, Inc. | | 397,810 | | | 16,441,487 |

| | | | | |

| | | | | 31,764,451 |

| | | | | |

Specialty Retail - 4.4% | | | | | |

Dick’s Sporting Goods, Inc.* | | 659,510 | | | 19,198,336 |

The Home Depot, Inc. | | 320,210 | | | 11,287,403 |

Lowe’s Companies, Inc. | | 416,510 | | | 11,295,751 |

The Sherwin-Williams Co. | | 243,200 | | | 18,986,624 |

| | | | | |

| | | | | 60,768,114 |

| | | | | |

Total Consumer Discretionary | | | | | 233,276,774 |

| | | | | |

Consumer Staples - 6.1% | | | | | |

Food & Staples Retailing - 2.2% | | | | | |

The Kroger Co. | | 763,200 | | | 16,965,936 |

Safeway, Inc. | | 593,090 | | | 13,996,924 |

| | | | | |

| | | | | 30,962,860 |

| | | | | |

Food Products - 3.9% | | | | | |

Dean Foods Co.* | | 1,169,590 | | | 18,362,563 |

General Mills, Inc. | | 153,160 | | | 10,901,929 |

H.J. Heinz Co. | | 297,460 | | | 13,941,950 |

Kellogg Co. | | 183,600 | | | 10,086,984 |

| | | | | |

| | | | | 53,293,426 |

| | | | | |

Total Consumer Staples | | | | | 84,256,286 |

| | | | | |

Energy - 6.8% | | | | | |

Energy Equipment & Services - 4.3% | | | | | |

Baker Hughes, Inc. | | 554,640 | | | 27,598,886 |

Weatherford International Ltd. (Switzerland)* | | 1,710,960 | | | 30,985,486 |

| | | | | |

| | | | | 58,584,372 |

| | | | | |

| | | | |

3 | | The accompanying notes are an integral part of the financial statements. | | |

Investment Portfolio - April 30, 2010 (unaudited)

| | | | | |

| | |

| | | Shares | | Value (Note 2) |

| | |

COMMON STOCKS (continued) | | | | | |

| | |

Energy (continued) | | | | | |

Oil, Gas & Consumable Fuels - 2.5% | | | | | |

Hess Corp. | | 543,220 | | $ | 34,521,631 |

| | | | | |

Total Energy | | | | | 93,106,003 |

| | | | | |

Financials - 9.3% | | | | | |

Capital Markets - 5.5% | | | | | |

The Bank of New York Mellon Corp.1 | | 1,099,300 | | | 34,221,209 |

Federated Investors, Inc. - Class B | | 1,035,840 | | | 24,984,461 |

Northern Trust Corp. | | 304,130 | | | 16,721,067 |

| | | | | |

| | | | | 75,926,737 |

| | | | | |

Consumer Finance - 1.8% | | | | | |

American Express Co. | | 526,930 | | | 24,302,012 |

| | | | | |

Insurance - 2.0% | | | | | |

The Progressive Corp. | | 1,399,770 | | | 28,121,379 |

| | | | | |

Total Financials | | | | | 128,350,128 |

| | | | | |

Health Care - 18.2% | | | | | |

Biotechnology - 2.0% | | | | | |

Genzyme Corp.* | | 520,800 | | | 27,727,392 |

| | | | | |

Health Care Equipment & Supplies - 7.8% | | | | | |

Becton, Dickinson and Co. | | 421,599 | | | 32,197,516 |

Boston Scientific Corp.* | | 3,077,180 | | | 21,170,998 |

Gen-Probe, Inc.* | | 516,970 | | | 24,499,208 |

Inverness Medical Innovations, Inc.* | | 738,410 | | | 29,373,950 |

| | | | | |

| | | | | 107,241,672 |

| | | | | |

Health Care Providers & Services - 1.1% | | | | | |

Quest Diagnostics, Inc. | | 272,910 | | | 15,599,535 |

| | | | | |

Health Care Technology - 2.5% | | | | | |

Cerner Corp.* | | 179,190 | | | 15,215,023 |

Eclipsys Corp.* | | 944,650 | | | 19,535,362 |

| | | | | |

| | | | | 34,750,385 |

| | | | | |

Life Sciences Tools & Services - 2.4% | | | | | |

PerkinElmer, Inc. | | 431,820 | | | 10,817,091 |

Thermo Fisher Scientific, Inc.* | | 396,210 | | | 21,902,489 |

| | | | | |

| | | | | 32,719,580 |

| | | | | |

Pharmaceuticals - 2.4% | | | | | |

Johnson & Johnson | | 502,680 | | | 32,322,324 |

| | | | | |

Total Health Care | | | | | 250,360,888 |

| | | | | |

Industrials - 10.7% | | | | | |

Aerospace & Defense - 1.4% | | | | | |

The Boeing Co. | | 266,030 | | | 19,268,553 |

| | | | | |

| | | | |

| | The accompanying notes are an integral part of the financial statements. | | 4 |

Investment Portfolio - April 30, 2010 (unaudited)

| | | | | |

| | |

| | | Shares | | Value (Note 2) |

| | |

COMMON STOCKS (continued) | | | | | |

| | |

Industrials (continued) | | | | | |

Air Freight & Logistics - 3.6% | | | | | |

FedEx Corp. | | 187,020 | | $ | 16,833,670 |

United Parcel Service, Inc. - Class B | | 474,430 | | | 32,802,090 |

| | | | | |

| | | | | 49,635,760 |

| | | | | |

Airlines - 2.2% | | | | | |

Southwest Airlines Co. | | 2,285,640 | | | 30,124,735 |

| | | | | |

Commercial Services & Supplies - 1.2% | | | | | |

Waste Management, Inc. | | 477,030 | | | 16,543,401 |

| | | | | |

Machinery - 1.1% | | | | | |

Pall Corp. | | 405,040 | | | 15,792,510 |

| | | | | |

Road & Rail - 1.2% | | | | | |

Heartland Express, Inc. | | 362,670 | | | 5,998,562 |

J.B. Hunt Transport Services, Inc. | | 271,870 | | | 10,021,128 |

| | | | | |

| | | | | 16,019,690 |

| | | | | |

Total Industrials | | | | | 147,384,649 |

| | | | | |

Information Technology - 22.9% | | | | | |

Communications Equipment - 4.5% | | | | | |

Cisco Systems, Inc.* | | 1,558,130 | | | 41,944,860 |

Juniper Networks, Inc.* | | 343,760 | | | 9,766,222 |

QUALCOMM, Inc. | | 245,490 | | | 9,510,282 |

| | | | | |

| | | | | 61,221,364 |

| | | | | |

Computers & Peripherals - 2.5% | | | | | |

EMC Corp.* | | 1,818,400 | | | 34,567,784 |

| | | | | |

Internet Software & Services - 3.7% | | | | | |

Google, Inc. - Class A* | | 96,590 | | | 50,752,249 |

| | | | | |

IT Services - 4.8% | | | | | |

Automatic Data Processing, Inc. | | 462,370 | | | 20,048,363 |

Paychex, Inc. | | 583,400 | | | 17,852,040 |

The Western Union Co. | | 1,516,410 | | | 27,674,483 |

| | | | | |

| | | | | 65,574,886 |

| | | | | |

Semiconductors & Semiconductor Equipment - 0.6% | | | | | |

KLA-Tencor Corp. | | 247,460 | | | 8,428,487 |

| | | | | |

Software - 6.8% | | | | | |

Autodesk, Inc.* | | 1,119,160 | | | 38,062,632 |

Electronic Arts, Inc.* | | 1,427,470 | | | 27,650,094 |

Microsoft Corp. | | 915,430 | | | 27,957,232 |

| | | | | |

| | | | | 93,669,958 |

| | | | | |

Total Information Technology | | | | | 314,214,728 |

| | | | | |

| | | | |

5 | | The accompanying notes are an integral part of the financial statements. | | |

Investment Portfolio - April 30, 2010 (unaudited)

| | | | | | |

| | |

| | | Shares | | Value (Note 2) | |

| | |

COMMON STOCKS (continued) | | | | | | |

| | |

Materials - 3.0% | | | | | | |

Chemicals - 2.1% | | | | | | |

Monsanto Co. | | 456,060 | | $ | 28,759,143 | |

| | | | | | |

Construction Materials - 0.9% | | | | | | |

Martin Marietta Materials, Inc. | | 122,460 | | | 11,741,465 | |

| | | | | | |

Total Materials | | | | | 40,500,608 | |

| | | | | | |

Telecommunication Services - 2.8% | | | | | | |

Wireless Telecommunication Services - 2.8% | | | | | | |

American Tower Corp. - Class A* | | 318,750 | | | 13,008,188 | |

Crown Castle International Corp.* | | 655,620 | | | 24,815,217 | |

| | | | | | |

Total Telecommunication Services | | | | | 37,823,405 | |

| | | | | | |

TOTAL COMMON STOCKS | | | | | | |

(Identified Cost $1,106,502,679) | | | | | 1,329,273,469 | |

| | | | | | |

| | |

SHORT-TERM INVESTMENTS - 4.7% | | | | | | |

| | |

Dreyfus Cash Management, Inc. - Institutional Shares2 , 0.09% | | | | | | |

(Identified Cost $63,965,683) | | 63,965,683 | | | 63,965,683 | |

| | | | | | |

TOTAL INVESTMENTS - 101.5% | | | | | | |

(Identified Cost $1,170,468,362) | | | | | 1,393,239,152 | |

LIABILITIES, LESS OTHER ASSETS - (1.5%) | | | | | (20,288,249 | ) |

| | | | | | |

NET ASSETS - 100% | | | | $ | 1,372,950,903 | |

| | | | | | |

*Non-income producing security

1The Bank of New York Mellon Corp. is the Series’ custodian.

2Rate shown is the current yield as of April 30, 2010.

| | | | |

| | The accompanying notes are an integral part of the financial statements. | | 6 |

Statement of Assets and Liabilities (unaudited)

April 30, 2010

| | | | |

ASSETS: | | | | |

| |

Investments, at value (identified cost $1,170,468,362) (Note 2) | | $ | 1,393,239,152 | |

Receivable for fund shares sold | | | 3,120,814 | |

Dividends receivable | | | 595,821 | |

| | | | |

| |

TOTAL ASSETS | | | 1,396,955,787 | |

| | | | |

| |

LIABILITIES: | | | | |

| |

Accrued management fees (Note 3) | | | 1,092,388 | |

Accrued transfer agent fees (Note 3) | | | 60,507 | |

Accrued fund accounting and administration fees (Note 3) | | | 17,370 | |

Accrued Chief Compliance Officer service fees (Note 3) | | | 667 | |

Payable for securities purchased | | | 21,578,248 | |

Payable for fund shares repurchased | | | 1,236,430 | |

Other payables and accrued expenses | | | 19,274 | |

| | | | |

| |

TOTAL LIABILITIES | | | 24,004,884 | |

| | | | |

| |

TOTAL NET ASSETS | | $ | 1,372,950,903 | |

| | | | |

| |

NET ASSETS CONSIST OF: | | | | |

| |

Capital stock | | $ | 753,465 | |

Additional paid-in-capital | | | 1,221,139,205 | |

Undistributed net investment income | | | 993,659 | |

Accumulated net realized loss on investments | | | (72,706,216 | ) |

Net unrealized appreciation on investments | | | 222,770,790 | |

| | | | |

| |

TOTAL NET ASSETS | | $ | 1,372,950,903 | |

| | | | |

| |

NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - Class A | | | | |

($1,372,950,903/75,346,464 shares) | | $ | 18.22 | |

| | | | |

| | | | |

7 | | The accompanying notes are an integral part of the financial statements. | | |

Statement of Operations (unaudited)

For the Six Months Ended April 30, 2010

| | | | |

INVESTMENT INCOME: | | | | |

| |

Dividends | | $ | 7,435,488 | |

Interest | | | 4,961 | |

| | | | |

| |

Total Investment Income | | | 7,440,449 | |

| | | | |

| |

EXPENSES: | | | | |

| |

Management fees (Note 3) | | | 5,885,046 | |

Transfer agent fees (Note 3) | | | 206,115 | |

Fund accounting and administration fees (Note 3) | | | 99,658 | |

Directors’ fees (Note 3) | | | 6,373 | |

Chief Compliance Officer service fees (Note 3) | | | 1,700 | |

Custodian fees | | | 24,974 | |

Miscellaneous | | | 80,034 | |

| | | | |

| |

Total Expenses | | | 6,303,900 | |

Less reduction of expenses (Note 3) | | | (124,602 | ) |

| | | | |

| |

Net Expenses | | | 6,179,298 | |

| | | | |

| |

NET INVESTMENT INCOME | | | 1,261,151 | |

| | | | |

| |

REALIZED AND UNREALIZED GAIN ON INVESTMENTS: | | | | |

| |

Net realized gain on investments | | | 24,844,665 | |

Net change in unrealized appreciation on investments | | | 158,205,645 | |

| | | | |

| |

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 183,050,310 | |

| | | | |

| |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 184,311,461 | |

| | | | |

| | | | |

| | The accompanying notes are an integral part of the financial statements. | | 8 |

Statements of Changes in Net Assets

| | | | | | | | |

| | | For the Six Months Ended

4/30/10

(unaudited) | | | For the Year Ended

10/31/09 | |

INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | |

| | |

OPERATIONS: | | | | | | | | |

| | |

Net investment income | | $ | 1,261,151 | | | $ | 1,741,459 | |

Net realized gain (loss) on investments | | | 24,844,665 | | | | (59,388,937 | ) |

Net change in unrealized appreciation on investments | | | 158,205,645 | | | | 195,678,137 | |

| | | | | | | | |

| | |

Net increase from operations | | | 184,311,461 | | | | 138,030,659 | |

| | | | | | | | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS (Note 8): | | | | | | | | |

| | |

From net investment income | | | (1,082,233 | ) | | | (2,526,440 | ) |

| | | | | | | | |

| | |

CAPITAL STOCK ISSUED AND REPURCHASED: | | | | | | | | |

| | |

Net increase from capital share transactions (Note 5) | | | 186,678,589 | | | | 365,955,855 | |

| | | | | | | | |

| | |

Net increase in net assets | | | 369,907,817 | | | | 501,460,074 | |

| | |

NET ASSETS: | | | | | | | | |

| | |

Beginning of period | | | 1,003,043,086 | | | | 501,583,012 | |

| | | | | | | | |

| | |

End of period (including undistributed net investment income of $993,659 and $814,741, respectively) | | $ | 1,372,950,903 | | | $ | 1,003,043,086 | |

| | | | | | | | |

| | | | |

9 | | The accompanying notes are an integral part of the financial statements. | | |

Financial Highlights

| | | | | | | | | | | | | | | |

| | | | |

| | | For the Six

Months Ended 4/30/10 | | | | | For the Years Ended | | |

| | | (unaudited) | | 10/31/09 | | | 10/31/08 | | | 10/31/07 | | | 10/31/06 | | 10/31/05 |

Per share data (for a share outstanding throughout each period): | | | | | | | | | | | | | | | |

Net asset value - Beginning of period | | $15.55 | | $13.34 | | | $21.43 | | | $19.19 | | | $17.24 | | $15.63 |

| | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | |

Net investment income (loss) | | 0.021 | | 0.04 | 1 | | 0.07 | | | 0.06 | | | 0.04 | | (0.01) |

Net realized and unrealized gain (loss) on investments | | 2.67 | | 2.24 | | | (7.35 | ) | | 2.65 | | | 3.25 | | 2.45 |

| | | | | | | | | | | | | | | |

Total from investment operations | | 2.69 | | 2.28 | | | (7.28 | ) | | 2.71 | | | 3.29 | | 2.44 |

| | | | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | |

From net investment income | | (0.02) | | (0.07 | ) | | (0.07 | ) | | (0.05 | ) | | — | | — |

From net realized gain on investments | | — | | — | | | (0.74 | ) | | (0.42 | ) | | (1.34) | | (0.83) |

| | | | | | | | | | | | | | | |

Total distributions to shareholders | | (0.02) | | (0.07 | ) | | (0.81 | ) | | (0.47 | ) | | (1.34) | | (0.83) |

| | | | | | | | | | | | | | | |

Net asset value - End of period | | $18.22 | | $15.55 | | | $13.34 | | | $21.43 | | | $19.19 | | $17.24 |

| | | | | | | | | | | | | | | |

| | | | | | |

Net assets - End of period | | | | | | | | | | | | | | | |

(000’s omitted) | | $1,372,951 | | $1,003,043 | | | $501,583 | | | $191,026 | | | $8,310 | | $2,714 |

| | | | | | | | | | | | | | | |

| | | | | | |

Total return2 | | 17.28% | | 17.23% | | | (35.09% | ) | | 14.37% | | | 20.36% | | 16.05% |

Ratios (to average net assets)/ | | | | | | | | | | | | | | | |

Supplemental Data: | | | | | | | | | | | | | | | |

Expenses* | | 1.05%3 | | 1.05% | | | 1.05% | | | 1.05% | | | 1.05% | | 1.05% |

Net investment income (loss) | | 0.21%3 | | 0.26% | | | 0.56% | | | 0.45% | | | 0.35% | | (0.04%) |

Portfolio turnover | | 20% | | 50% | | | 63% | | | 44% | | | 55% | | 57% |

|

*The investment advisor did not impose all or a portion of its management fees, CCO fees, fund accounting and transfer agent fees, and other fees in some periods and in some periods paid a portion of the Series’ expenses. If these expenses had been incurred by the Series, the expense ratio (to average net assets) would have been increased by the following amount: |

| | | | | | |

| | 0.02%3 | | 0.06% | | | 0.06% | | | 0.11% | | | 1.24% | | 2.33% |

1Calculated based on average shares outstanding during the periods.

2Represents aggregate total return for the periods indicated, and assumes reinvestment of all distributions. Total return would have been lower had certain expenses not been waived or reimbursed during the periods. Periods less than one year are not annualized.

3Annualized.

| | | | |

| | The accompanying notes are an integral part of the financial statements. | | 10 |

Notes to Financial Statements (unaudited)

Equity Series (the “Series”) is a no-load diversified series of Manning & Napier Fund, Inc. (the “Fund”). The Fund is organized in Maryland and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

The Series’ investment objective is to provide long-term growth of capital, primarily through investments in U.S. common stocks.

The Fund’s Advisor is Manning & Napier Advisors, Inc. (the “Advisor”). Shares of the Series are offered to investors and employees of the Advisor and its affiliates. The total authorized capital stock of the Fund consists of 10.0 billion shares of common stock each having a par value of $0.01. As of April 30, 2010, 6.2 billion shares have been designated in total among 29 series, of which 200 million have been designated as Equity Series Class A common stock.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

Security Valuation

Portfolio securities, including domestic equities, listed on an exchange other than the NASDAQ National Market System are valued at the latest quoted sales price of the exchange on which the security is primarily traded. Securities not traded on valuation date or securities not listed on an exchange are valued at the latest quoted bid price provided by the Fund’s pricing service. Securities listed on the NASDAQ National Market System are valued in accordance with the NASDAQ Official Closing Price.

Short-term investments that mature in sixty days or less are valued at amortized cost, which approximates market value. Investments in open-end investment companies are valued at their net asset value per share on valuation date.

Volume and level of activity in established markets for an asset or liability are evaluated to determine whether recent transactions and quoted prices are determinative of fair value. Where there have been significant decreases in volume and level of activity, further analysis and adjustment may be necessary to estimate fair value. The Series measures fair value in these instances by the use of inputs and valuation techniques which may be based upon current market prices of securities that are comparable in coupon, rating, maturity and industry and/or expectation of future cash flows. As a result of trading in relatively thin markets and/or markets that experience significant volatility, the prices used by the Series to value these securities may differ from the value that would be realized if these securities were sold, and the differences could be material.

Securities for which representative valuations or prices are not available from the Fund’s pricing service may be valued at fair value. Due to the inherent uncertainty of valuations of such securities, the fair value may differ significantly from the values that would have been used had a ready market for such securities existed. If trading or events occurring after the close of the principal market in which securities are traded are expected to materially affect the value of those securities, then they may be valued at their fair value, taking this trading or these events into account. Fair value is determined in good faith by the Advisor under procedures approved by and under the general supervision and responsibility of the Fund’s Board of Directors (the “Board”).

Various inputs are used in determining the value of the Series’ assets or liabilities carried at market value. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical assets and liabilities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Level 3 includes significant unobservable inputs (including the Series’ own assumptions in determining the fair value of investments). The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Notes to Financial Statements (unaudited)

| 2. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

Security Valuation (continued)

The following is a summary of the valuation levels used for major security types as of April 30, 2010 in valuing the Series’ assets or liabilities carried at market value:

| | | | | | | | | | | | |

Description | | | 4/30/10 | | | Level 1 | | | Level 2 | | | Level 3 |

Equity securities* | | $ | 1,329,273,469 | | $ | 1,329,273,469 | | $ | — | | $ | — |

Preferred securities | | | — | | | — | | | — | | | — |

Debt securities | | | — | | | — | | | — | | | — |

Mutual funds | | | 63,965,683 | | | 63,965,683 | | | — | | | — |

Other financial instruments** | | | — | | | — | | | — | | | — |

| | | | | | | | | | | | |

Total | | $ | 1,393,239,152 | | $ | 1,393,239,152 | | $ | — | | $ | — |

| | | | | | | | | | | | |

*Includes common stock, warrants and rights. Please see the Investment Portfolio for industry classification.

**Other financial instruments are derivative instruments not reflected in the Investment Portfolio, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation/ depreciation on the instrument. As of April 30, 2010, the Series did not hold any derivative instruments.

There were no Level 3 securities held by the Series as of October 31, 2009 or April 30, 2010.

The Fund’s policy is to recognize transfers in and transfers out of the valuation levels as of the end of the reporting period. There were no significant transfers between Level 1 and Level 2 as of April 30, 2010.

Additional disclosure surrounding the activity in Level 3 fair value measurement will also be effective for fiscal years beginning after December 15, 2010. Management has concluded that this will not have a material impact on the Series’ financial statements.

Security Transactions, Investment Income and Expenses

Security transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date, except that if the ex-dividend date has passed, certain dividends from foreign securities are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Interest income, including amortization of premium and accretion of discounts using the effective interest method, is earned from settlement date and accrued daily.

Expenses are recorded on an accrual basis. Most expenses of the Fund can be attributed to a specific series. Expenses which cannot be directly attributed are apportioned among the series in the Fund in such a manner as deemed equitable by the Fund’s Board, taking into consideration, among other things, the nature and type of expense.

The Series uses the identified cost method for determining realized gain or loss on investments for both financial statement and federal income tax reporting purposes.

Federal Taxes

The Series’ policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. The Series is not subject to federal income tax or excise tax to the extent that the Series distributes to shareholders each year its taxable income, including any net realized gains on investments, in accordance with requirements of the Internal Revenue Code. Accordingly, no provision for federal income tax or excise tax has been made in the financial statements.

Notes to Financial Statements (unaudited)

| 2. | SIGNIFICANT ACCOUNTING POLICIES (continued) |

Federal Taxes (continued)

Management evaluates its tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. At April 30, 2010, the Series has recorded no liability for net unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken in future tax returns.

The Series files income tax returns in the U.S. federal jurisdiction, various states and foreign jurisdictions, as required. No income tax returns are currently under investigation. The statute of limitations on the Series’ tax returns remains open for the years ended October 31, 2006 through October 31, 2009. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Additionally, based on the Fund’s understanding of the tax rules and rates related to income, gains and transactions for foreign jurisdictions in which it invests, the Series will provide for foreign taxes, and where appropriate, deferred foreign tax.

Distributions of Income and Gains

Distributions to shareholders of net investment income and net realized gains are made annually. An additional distribution may be necessary to avoid taxation of the Series. Distributions are recorded on the ex-dividend date.

Indemnifications

The Fund’s organizational documents provide former and current directors and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Other

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

| 3. | TRANSACTIONS WITH AFFILIATES |

The Fund has an Investment Advisory Agreement (the “Agreement”) with the Advisor, for which the Series pays a fee, computed daily and payable monthly, at an annual rate of 1.00% of the Series’ average daily net assets.

Under the Agreement, personnel of the Advisor provide the Series with advice and assistance in the choice of investments and the execution of securities transactions, and otherwise maintain the Series’ organization. The Advisor also provides the Fund with necessary office space and fund administration and support services. The salaries of all officers of the Fund (except a percentage of the Fund’s Chief Compliance Officer’s salary, which is paid by the Fund), and of all Directors who are “affiliated persons” of the Fund, or of the Advisor, and all personnel of the Fund, or of the Advisor, performing services relating to research, statistical and investment activities, are paid by the Advisor. Each “non-affiliated” Director receives an annual stipend, which is allocated among all the active series of the Fund. In addition, these Directors also receive a fee per Board meeting attended for each active series of the Fund plus a fee for each committee meeting attended.

Notes to Financial Statements (unaudited)

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

The Advisor has contractually agreed, until at least February 28, 2011, to waive its fee and, if necessary, pay other operating expenses of the Series in order to maintain total direct annual fund operating expenses for the Series at no more than 1.05% of average daily net assets each year. Accordingly, the Advisor waived fees of $123,843 for the six months ended April 30, 2010, which is included as a reduction of expenses on the Statement of Operations. The Advisor voluntarily waived additional fees of $759 for the six months ended April 30, 2010, which is also included as a reduction of expenses on the Statement of Operations. The Advisor is not eligible to recoup any expenses that have been waived or reimbursed in prior years.

Manning & Napier Investor Services, Inc., a registered broker-dealer affiliate of the Advisor, acts as distributor for the Fund’s shares. The services of Manning & Napier Investor Services, Inc. are provided at no additional cost to the Series.

For fund accounting and transfer agent services through November 7, 2009, the Fund paid the Advisor an annual fee of 0.055% of the Fund’s average daily net assets up to $4.5 billion, 0.03% of the Fund’s average daily net assets between $4.5 billion and $7.5 billion, and 0.02% of the Fund’s average daily net assets over $7.5 billion. Additionally, certain transaction and account-based fees and out-of-pocket expenses, including charges for reporting relating to the Fund’s compliance program, were charged. Expenses not directly attributable to a Series are allocated based on each Series’ relative net assets or number of accounts, depending on the expense. Prior to October 12, 2009 (for sub-accountant) and November 9, 2009 (for sub-transfer agent), the Advisor had and agreement with Citi Fund Services Ohio, Inc. (“Citi”) under which Citi served as sub-accountant and sub-transfer agent.

The Advisor has entered into agreements dated October 12, 2009 and November 9, 2009 with PNC Global Investment Servicing (“PNCGIS”) under which PNCGIS serves as sub-accountant services agent and sub-transfer agent, respectively. Effective November 7, 2009 under the amended master services agreement, the Fund pays the Advisor an annual fee of 0.0175% on the first $3 billion of average daily net assets (excluding Target Series); 0.015% on the next $3 billion of average daily net assets (excluding Target Series); and 0.01% of the average daily net assets in excess of $6 billion (excluding Target Series); plus a base fee of $25,500 per Series. Additionally, certain transaction-, account-, and cusip-based fees and out-of-pocket expenses, including charges for reporting relating to the Fund’s compliance program, are charged.

On February 2, 2010, The PNC Financial Services Group, Inc. (“PNC”), which serves as the Series’ sub-accountant services agent and sub-transfer agent, entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with The Bank of New York Mellon Corporation (“BNY Mellon”), the Series’ custodian. Upon the terms and subject to the conditions set forth in the Stock Purchase Agreement, which has been approved by the board of directors of each company, PNC will sell to BNY Mellon (the “Stock Sale”) 100% of the issued and outstanding shares of PNC Global Investment Servicing Inc., an indirect, wholly-owned subsidiary of PNC. The Stock Sale is expected to close in the third quarter of 2010. Management has concluded that this will not have a material impact on the Series’ financial statements.

| 4. | PURCHASES AND SALES OF SECURITIES |

For the six months ended April 30, 2010, purchases and sales of securities, other than U.S. Government securities and short-term securities, were $417,336,551 and $227,707,632, respectively. There were no purchases or sales of U. S. Government securities.

Notes to Financial Statements (unaudited)

| 5. | CAPITAL STOCK TRANSACTIONS |

Transactions in shares of Equity Series were:

| | | | | | | | | | | | | | |

| | | For the Six Months | | | For the Year | |

| | | Ended 4/30/10 | | | Ended 10/31/09 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

Sold | | 18,697,959 | | | $ | 320,637,949 | | | 45,553,334 | | | $ | 605,942,070 | |

Reinvested | | 26,609 | | | | 443,305 | | | 81,554 | | | | 954,994 | |

Repurchased | | (7,863,278 | ) | | | (134,402,665 | ) | | (18,762,919 | ) | | | (240,941,209 | ) |

| | | | | | | | | | | | | | |

Total | | 10,861,290 | | | $ | 186,678,589 | | | 26,871,969 | | | $ | 365,955,855 | |

| | | | | | | | | | | | | | |

At April 30, 2010, the retirement plan of the Advisor and its affiliates owned 184,525 shares of the Series (0.2% of shares outstanding) valued at $3,362,041.

The Series may trade in instruments including written and purchased options, forward foreign currency exchange contracts and futures contracts and other derivatives in the normal course of investing activities to assist in managing exposure to various market risks. The Series may be subject to various elements of risk and may involve, to a varying degree, elements of risk in excess of the amounts recognized for financial statement purposes. These risks include: the risk that changes in the value of a derivative may not correlate perfectly with the underlying asset, rate or index, counterparty credit risk related to over the counter derivatives counterparties failure to perform under contract terms, liquidity risk related to the lack of a liquid market for these contracts allowing the fund to close out its position(s) and documentation risk relating to disagreement over contract terms. No such investments were held by the Series on April 30, 2010.

Investing in securities of foreign companies and foreign governments involves special risks and considerations not typically associated with investing in securities of domestic companies and the U.S. Government. These risks include revaluation of currencies and future adverse political and economic developments. Moreover, securities of foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of comparable domestic companies and the U.S. Government.

| 8. | FEDERAL INCOME TAX INFORMATION |

The amount and characterization of certain income and capital gains to be distributed are determined in accordance with federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America. These differences are primarily due to differing book and tax treatments in the timing of recognition of net investment income or gains and losses, including losses deferred due to wash sales. The Series may periodically make reclassifications among its capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations, without impacting the Series’ net asset value.Any such reclassifications are not reflected in the financial highlights.

The final determination of the tax character of current year distributions will be made at the conclusion of the fiscal year. The tax character of distributions paid for the year ended October 31, 2009 were as follows:

| | | | |

Ordinary income | | $2,526,440 | | |

Notes to Financial Statements (unaudited)

| 8. | FEDERAL INCOME TAX INFORMATION (continued) |

At October 31, 2009, the Series had a capital loss carryover of $79,507,620, available to the extent allowed by tax law to offset future net capital gain, if any, which will expire as follows:

| | | | | | |

| | Loss Carryover | | Expiration Date | | |

| | $36,496,456 | | October 31, 2016 | | |

| | $43,011,164 | | October 31, 2017 | | |

At April 30, 2010, the identified cost of investments for federal income tax purposes, the resulting gross unrealized appreciation and depreciation, and the net unrealized appreciation were as follows:

| | | | | | | |

Cost for federal income tax purposes | | | | $1,186,234,338 | | | |

Unrealized appreciation | | | | $ 237,909,376 | | | |

Unrealized depreciation | | | | (30,904,562 | ) | | |

| | | | | | | |

Net unrealized appreciation | | | | $ 207,004,814 | | | |

| | | | | | | |

There were no subsequent events that require recognition or disclosure. In preparing these financial statements, management of the Fund has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued.

Renewal of Investment Advisory Agreement (unaudited)

At the Manning & Napier Fund, Inc. (the “Fund”) Board of Directors’ (the “Board”) meeting, held on December 7, 2009, the Investment Advisory Agreement (the “Agreement”) between the Fund and Manning & Napier Advisors, Inc. (the “Advisor”) was reviewed by the Board for renewal. In connection with the decision whether to renew the Agreement, a variety of material was prepared for and reviewed by the Board.

Representatives of the Advisor attended the meeting and presented additional oral and written information to the Board to assist the Board in its considerations. The discussion immediately below outlines the materials and information presented to the Board in connection with the Board’s 2009 Annual Review of the Agreement and the conclusions made by the Directors when determining to continue the Agreement.

| | • | | The Board considered the services provided by the Advisor under the Agreement including, among others: deciding what securities to purchase and sell for each Series; arranging for the purchase and sale of such securities by placing orders with broker-dealers; administering the affairs of the Fund (including the books and records of the Fund not maintained by third party service providers such as the custodian or sub-transfer agent); arranging for the insurance coverage for the Fund; and supervising the preparation of tax returns, SEC filings (including registration statements) and reports to shareholders for the Fund. The Board also considered the nature and quality of such services provided under the Agreement in light of the Advisor’s services provided to the Fund for 23 years. The Board discussed the quality of these services with representatives from the Advisor and concluded that the Advisor was performing its services to the Fund required under the Agreement in a reasonable manner. |

| | • | | The Board considered the investment performance of the various Series of the Fund. The investment performance for each Series was reviewed on a cumulative basis since inception and on a one year basis. In addition, annualized performance for the following time periods was considered: inception, three year, five year, ten year, and current market cycle. A market cycle includes periods of both rising and falling markets. Returns for established benchmark indices for each Series were provided for each time period. The Board noted that the various Series were competitive against their respective benchmarks and/or peer groups over various time periods, but in particular over the full market cycle periods relevant for the Series. In addition, the Board considered at the meeting (and considers on a quarterly basis) a peer group performance analysis consisting of Morningstar universes of mutual funds with similar investment objectives. The Board discussed the performance with representatives from the Advisor and concluded that the investment performance of each of the Fund’s Series was reasonable based on the Fund’s actual performance and comparative performance, especially performance over the current market cycle. |

| | • | | The Board considered the costs of the Advisor’s services and the profits of the Advisor as they relate to the Advisor’s services to the Fund under the Agreement. In reviewing the Advisor’s costs and profits, the Board discussed the Advisor’s revenues generated from the Fund (on both an actual and adjusted basis) and its expenses associated with providing the services under the Agreement. In addition, the Board reviewed the Advisor’s expenses associated with Fund activities outside of the Agreement (such as expense reimbursements pursuant to expense caps and payments made by the Advisor to third party platforms on which shares of the Fund are available for purchase). It was noted by representatives of the Advisor that 13 of the 26 active Series of the Fund are currently experiencing expenses above the capped expense ratios. After discussing the above costs and profits, the Board concluded that the Advisor’s profitability relating to its services provided under the Agreement was reasonable. |

| | • | | The Board considered the fees and expenses of the various Series of the Fund. The Advisor presented the advisory fees and total expenses for each Series, including the advisory fee adjusted for any expense waivers or reimbursements (either contractual or voluntary) paid by the Advisor. The advisory fees and expense ratios of each Series were compared to an average (on both a mean and median basis) of similar funds as disclosed on the Morningstar database. Representatives of the Advisor discussed with the Board the levels of its advisory |

Renewal of Investment Advisory Agreement (unaudited)

| | fee for each Series of the Fund and as compared to the median and mean advisory fees for similar funds as listed on Morningstar. Expense ratios for every Series, except the Global Fixed Income Series and the Target Series Class R and Class C, are currently below the median and mean for similar funds as listed on Morningstar. Based on their review of the information provided, the Board concluded that the fees and expenses of each Series of the Fund were reasonable on a comparative basis. |

| | • | | The Board also considered the other benefits the Advisor derives from its relationship with the Fund. Such other benefits include certain research products provided by soft dollars. Given the level of soft dollar transactions involving the Fund, the Board concluded that these additional benefits to the Advisor were reasonable. |

| | • | | In addition to the factors described above, the Board considered the Advisor’s personnel, investment strategies, policies and procedures relating to compliance with personal securities transactions, and reputation, expertise and resources in domestic and foreign financial markets. The Board concluded that these factors support the conclusion that the Advisor performs its services in a reasonable manner. |

| | • | | The Board did not consider economies of scale at this time because of the multiple uses of the Fund (for the Advisor’s discretionary investment account clients in addition to direct investors), the current profitability of the Advisor’s services to the Fund under the Agreement, and the overall size of the Fund complex. |

Based on the Board’s deliberations and their evaluation of the information described above, the Board, including a majority of Directors that are not “interested persons” as defined in the Investment Company Act of 1940, concluded that the compensation under the Agreement was fair and reasonable in light of the services and expenses and such other matters as the Directors considered to be relevant in the exercise of their reasonable judgment. Accordingly, the Board approved the renewal of the Agreement. In the course of their deliberations, the Directors did not identify any particular information that was all important or controlling.

Literature Requests (unaudited)

Proxy Voting Policies and Procedures

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available, without charge, upon request:

| | | | |

By phone | | 1-800-466-3863 | | |

On the Securities and Exchange | | | | |

Commission’s (SEC) web site | | http://www.sec.gov | | |

Proxy Voting Record

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available, without charge, upon request:

| | | | |

By phone | | 1-800-466-3863 | | |

On the SEC’s web site | | http://www.sec.gov | | |

Quarterly Portfolio Holdings

The Series’ complete schedule of portfolio holdings for the 1st and 3rd quarters of each fiscal year are provided on Form N-Q, and are available, without charge, upon request:

| | | | |

By phone | | 1-800-466-3863 | | |

On the SEC’s web site | | http://www.sec.gov | | |

The Series’ Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Prospectus and Statement of Additional Information (SAI)

The prospectus and SAI provide additional information about each Series, including charges, expenses and risks. These documents are available, without charge, upon request:

| | | | |

By phone | | 1-800-466-3863 | | |

On the SEC’s web site | | http://www.sec.gov | | |

On the Advisor’s web site | | http://www.manningnapieradvisors.com | | |

Additional information available at www.manningnapieradvisors.com

| 1. | Fund Holdings - Month-End |

| 2. | Fund Holdings - Quarter-End |

| 3. | Shareholder Report - Annual |

| 4. | Shareholder Report - Semi-Annual |

Shareholder Expense Example (unaudited)

As a shareholder of the Series, you may incur two types of costs: (1) transaction costs, including potential wire charges on redemptions and (2) ongoing costs, including management fees and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2009 to April 30, 2010).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Series’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | |

| | | Beginning

Account Value

11/1/09 | | Ending

Account Value

4/30/10 | | Expenses Paid

During Period*

11/1/09-4/30/10 |

Actual | | $1,000.00 | | $1,159.50 | | $6.43 |

Hypothetical

(5% return before expenses) | | $1,000.00 | | $1,018.84 | | $6.01 |

*Expenses are equal to the Series’ annualized expense ratio (for the six-month period) of 1.20%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Expenses are based on the most recent fiscal half year. The Series’ total return would have been lower had certain expenses not been waived during the period.

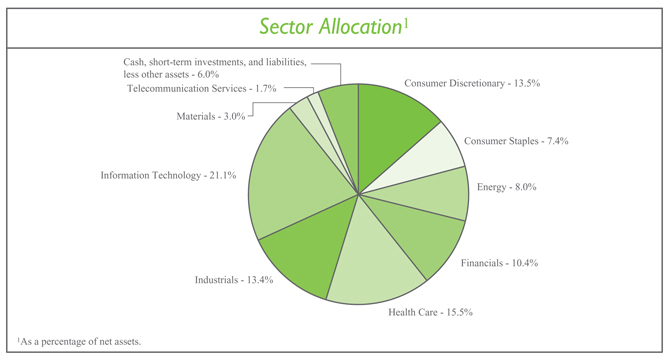

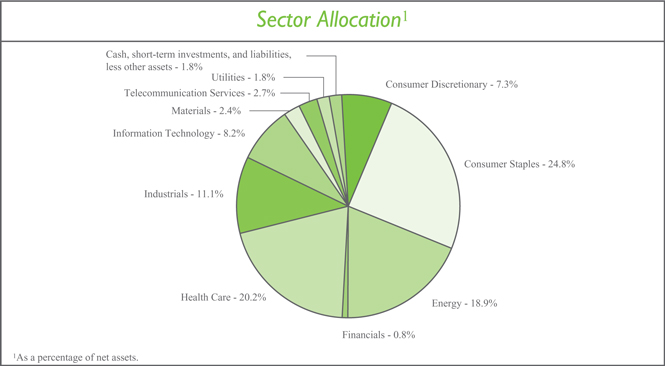

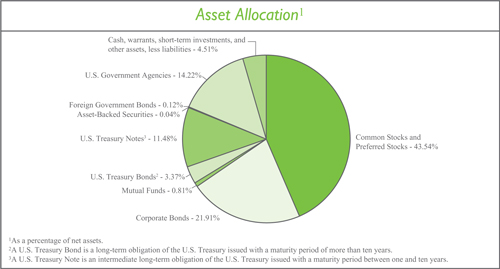

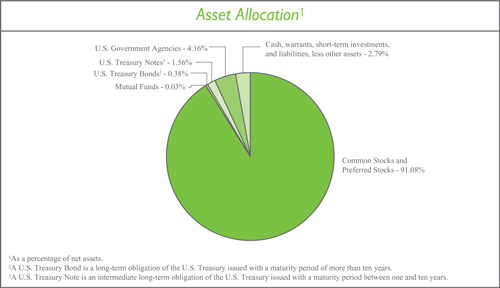

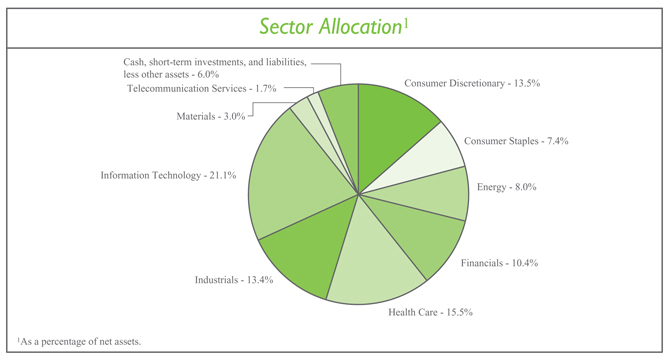

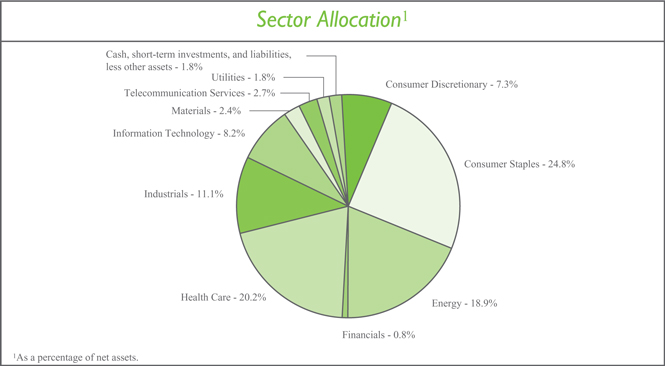

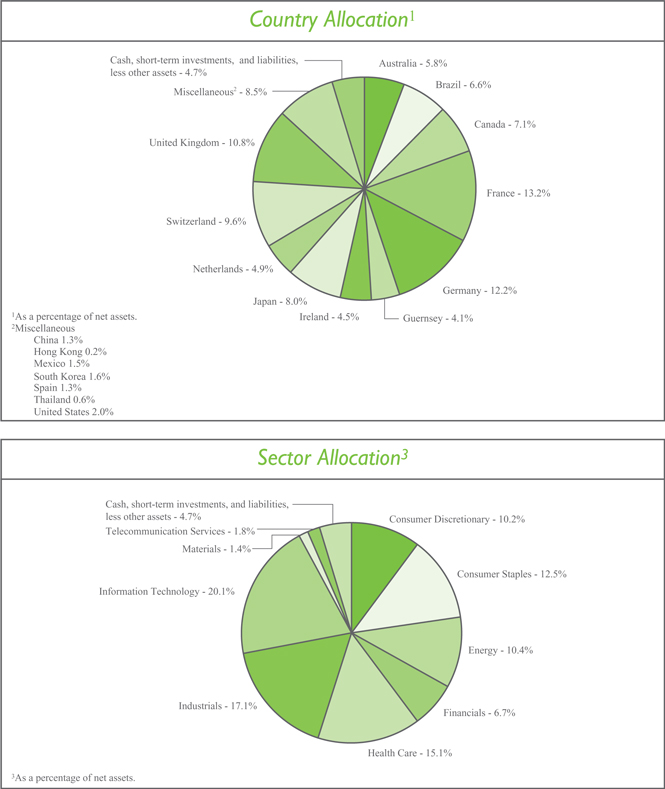

Portfolio Composition as of April 30, 2010 (unaudited)

Investment Portfolio - April 30, 2010 (unaudited)

| | | | | | | |

| | | Shares | | Value (Note 2) | | |

| | | |

COMMON STOCKS - 94.0% | | | | | | | |

| | | |

Consumer Discretionary - 13.5% | | | | | | | |

Automobiles - 0.8% | | | | | | | |

Bayerische Motoren Werke AG (BMW) (Germany) | | 6,760 | | $ | 334,193 | | |

| | | | | | | |

Hotels, Restaurants & Leisure - 2.0% | | | | | | | |

Carnival Corp. | | 12,560 | | | 523,752 | | |

International Game Technology | | 13,560 | | | 285,845 | | |

| | | | | | | |

| | | | | 809,597 | | |

| | | | | | | |

Media - 7.6% | | | | | | | |

Discovery Communications, Inc. - Class A* | | 13,240 | | | 512,388 | | |

Reed Elsevier plc (United Kingdom) | | 52,560 | | | 413,760 | | |

Time Warner, Inc. | | 17,530 | | | 579,892 | | |

The Walt Disney Co. | | 29,030 | | | 1,069,465 | | |

The Washington Post Co. - Class B | | 1,010 | | | 512,232 | | |

| | | | | | | |

| | | | | 3,087,737 | | |

| | | | | | | |

Specialty Retail - 3.1% | | | | | | | |

Dick’s Sporting Goods, Inc.* | | 17,310 | | | 503,894 | | |

The Home Depot, Inc. | | 3,520 | | | 124,080 | | |

Lowe’s Companies, Inc. | | 5,430 | | | 147,262 | | |

The Sherwin-Williams Co. | | 6,150 | | | 480,130 | | |

| | | | | | | |

| | | | | 1,255,366 | | |

| | | | | | | |

Total Consumer Discretionary | | | | | 5,486,893 | | |

| | | | | | | |

Consumer Staples - 7.4% | | | | | | | |

Food & Staples Retailing - 1.9% | | | | | | | |

The Kroger Co. | | 19,240 | | | 427,705 | | |

Safeway, Inc. | | 15,300 | | | 361,080 | | |

| | | | | | | |

| | | | | 788,785 | | |

| | | | | | | |

Food Products - 5.5% | | | | | | | |

General Mills, Inc. | | 6,090 | | | 433,486 | | |

Kellogg Co. | | 8,150 | | | 447,761 | | |

Nestle S.A. (Switzerland) | | 15,860 | | | 778,889 | | |

Unilever plc - ADR (United Kingdom) | | 19,000 | | | 571,900 | | |

| | | | | | | |

| | | | | 2,232,036 | | |

| | | | | | | |

Total Consumer Staples | | | | | 3,020,821 | | |

| | | | | | | |

Energy - 8.0% | | | | | | | |

Energy Equipment & Services - 4.7% | | | | | | | |

Baker Hughes, Inc. | | 10,490 | | | 521,982 | | |

National Oilwell Varco, Inc. | | 2,752 | | | 121,171 | | |

Schlumberger Ltd. | | 9,060 | | | 647,065 | | |

Weatherford International Ltd. (Switzerland)* | | 34,540 | | | 625,519 | | |

| | | | | | | |

| | | | | 1,915,737 | | |

| | | | | | | |

| | | | |

| | The accompanying notes are an integral part of the financial statements. | | 3 |

Investment Portfolio - April 30, 2010 (unaudited)

| | | | | | | |

| | | Shares | | Value (Note 2) | | |

| | | |

COMMON STOCKS (continued) | | | | | | | |

| | | |

Energy (continued) | | | | | | | |

Oil, Gas & Consumable Fuels - 3.3% | | | | | | | |

Cameco Corp. (Canada) | | 12,760 | | $ | 314,024 | | |

Hess Corp. | | 14,680 | | | 932,914 | | |

Uranium One, Inc. (Canada)* | | 29,880 | | | 75,597 | | |

| | | | | | | |

| | | | | 1,322,535 | | |

| | | | | | | |

Total Energy | | | | | 3,238,272 | | |

| | | | | | | |

Financials - 10.4% | | | | | | | |

Capital Markets - 4.5% | | | | | | | |

The Bank of New York Mellon Corp.1 | | 29,770 | | | 926,740 | | |

Federated Investors, Inc. - Class B | | 17,430 | | | 420,411 | | |

Northern Trust Corp. | | 8,360 | | | 459,633 | | |

| | | | | | | |

| | | | | 1,806,784 | | |

| | | | | | | |

Commercial Banks - 1.1% | | | | | | | |

HSBC Holdings plc (United Kingdom) | | 44,630 | | | 456,154 | | |

| | | | | | | |

Consumer Finance - 2.1% | | | | | | | |

American Express Co. | | 18,390 | | | 848,147 | | |

| | | | | | | |

Diversified Financial Services - 1.1% | | | | | | | |

Deutsche Boerse AG (Germany) | | 5,620 | | | 438,041 | | |

| | | | | | | |

Insurance - 1.6% | | | | | | | |

The Progressive Corp. | | 33,300 | | | 668,997 | | |

| | | | | | | |

Total Financials | | | | | 4,218,123 | | |

| | | | | | | |

Health Care - 15.5% | | | | | | | |

Biotechnology - 1.8% | | | | | | | |

Genzyme Corp.* | | 10,520 | | | 560,085 | | |

Grifols S.A. (Spain) | | 15,090 | | | 191,875 | | |

| | | | | | | |

| | | | | 751,960 | | |

| | | | | | | |

Health Care Equipment & Supplies - 6.3% | | | | | | | |

Becton, Dickinson and Co. | | 11,020 | | | 841,597 | | |

Boston Scientific Corp.* | | 80,800 | | | 555,904 | | |

Gen-Probe, Inc.* | | 8,600 | | | 407,554 | | |

Inverness Medical Innovations, Inc.* | | 19,350 | | | 769,743 | | |

| | | | | | | |

| | | | | 2,574,798 | | |

| | | | | | | |

Health Care Providers & Services - 1.0% | | | | | | | |

Quest Diagnostics, Inc. | | 7,170 | | | 409,837 | | |

| | | | | | | |

Health Care Technology - 1.2% | | | | | | | |

Cerner Corp.* | | 5,570 | | | 472,949 | | |

| | | | | | | |

Life Sciences Tools & Services - 2.6% | | | | | | | |

Lonza Group AG (Switzerland) | | 2,430 | | | 190,805 | | |

PerkinElmer, Inc. | | 11,080 | | | 277,554 | | |

| | | | |

| 4 | | The accompanying notes are an integral part of the financial statements. | | |

Investment Portfolio - April 30, 2010 (unaudited)

| | | | | | | |

| | | Shares | | Value (Note 2) | | |

| | | |

COMMON STOCKS (continued) | | | | | | | |

| | | |

Health Care (continued) | | | | | | | |

Life Sciences Tools & Services (continued) | | | | | | | |

Thermo Fisher Scientific, Inc.* | | 10,570 | | $ | 584,310 | | |

| | | | | | | |

| | | | | 1,052,669 | | |

| | | | | | | |

Pharmaceuticals - 2.6% | | | | | | | |

Johnson & Johnson | | 12,700 | | | 816,610 | | |

Novartis AG - ADR (Switzerland) | | 4,430 | | | 225,265 | | |

| | | | | | | |

| | | | | 1,041,875 | | |

| | | | | | | |

Total Health Care | | | | | 6,304,088 | | |

| | | | | | | |

Industrials - 13.4% | | | | | | | |

Aerospace & Defense - 1.1% | | | | | | | |

The Boeing Co. | | 6,410 | | | 464,276 | | |

| | | | | | | |

Air Freight & Logistics - 2.9% | | | | | | | |

FedEx Corp. | | 4,690 | | | 422,147 | | |

United Parcel Service, Inc. - Class B | | 10,700 | | | 739,798 | | |

| | | | | | | |

| | | | | 1,161,945 | | |

| | | | | | | |

Airlines - 4.2% | | | | | | | |

Ryanair Holdings plc - ADR (Ireland)* | | 16,750 | | | 471,680 | | |

Southwest Airlines Co. | | 94,640 | | | 1,247,355 | | |

| | | | | | | |

| | | | | 1,719,035 | | |

| | | | | | | |

Commercial Services & Supplies - 1.1% | | | | | | | |

Waste Management, Inc. | | 12,640 | | | 438,355 | | |

| | | | | | | |

Machinery - 1.3% | | | | | | | |

Pall Corp. | | 13,630 | | | 531,434 | | |

| | | | | | | |

Professional Services - 1.8% | | | | | | | |

Adecco S.A. (Switzerland) | | 12,320 | | | 726,962 | | |

| | | | | | | |

Road & Rail - 1.0% | | | | | | | |

Heartland Express, Inc. | | 8,360 | | | 138,274 | | |

J.B. Hunt Transport Services, Inc. | | 3,030 | | | 111,686 | | |

Knight Transportation, Inc. | | 6,460 | | | 137,534 | | |

| | | | | | | |

| | | | | 387,494 | | |

| | | | | | | |

Total Industrials | | | | | 5,429,501 | | |

| | | | | | | |

Information Technology - 21.1% | | | | | | | |

Communications Equipment - 3.3% | | | | | | | |

Cisco Systems, Inc.* | | 31,750 | | | 854,710 | | |

Juniper Networks, Inc.* | | 8,360 | | | 237,507 | | |

QUALCOMM, Inc. | | 6,570 | | | 254,522 | | |

| | | | | | | |

| | | | | 1,346,739 | | |

| | | | | | | |

| | | | |

| | The accompanying notes are an integral part of the financial statements. | | 5 |

Investment Portfolio - April 30, 2010 (unaudited)

| | | | | | | |

| | | Shares | | Value (Note 2) | | |

| | | |

COMMON STOCKS (continued) | | | | | | | |

| | | |

Information Technology (continued) | | | | | | | |

Computers & Peripherals - 2.1% | | | | | | | |

EMC Corp.* | | 45,920 | | $ | 872,939 | | |

| | | | | | | |

Internet Software & Services - 3.2% | | | | | | | |

Google, Inc. - Class A* | | 2,440 | | | 1,282,074 | | |

| | | | | | | |

IT Services - 5.8% | | | | | | | |

Accenture plc - Class A (Ireland) | | 10,850 | | | 473,494 | | |

Automatic Data Processing, Inc. | | 12,350 | | | 535,496 | | |

Paychex, Inc. | | 19,500 | | | 596,700 | | |

The Western Union Co. | | 40,430 | | | 737,848 | | |

| | | | | | | |

| | | | | 2,343,538 | | |

| | | | | | | |

Semiconductors & Semiconductor Equipment - 1.9% | | | | | | | |

Advantest Corp. (Japan) | | 7,500 | | | 195,694 | | |

KLA-Tencor Corp. | | 6,690 | | | 227,861 | | |

Lam Research Corp.* | | 4,130 | | | 167,472 | | |

Tokyo Electron Ltd. (Japan) | | 2,800 | | | 185,107 | | |

| | | | | | | |

| | | | | 776,134 | | |

| | | | | | | |

Software - 4.8% | | | | | | | |

Autodesk, Inc.* | | 18,200 | | | 618,982 | | |

Microsoft Corp. | | 12,820 | | | 391,523 | | |

Salesforce.com, Inc.* | | 4,510 | | | 386,056 | | |

SAP AG - ADR (Germany) | | 11,510 | | | 546,149 | | |

| | | | | | | |

| | | | | 1,942,710 | | |

| | | | | | | |

Total Information Technology | | | | | 8,564,134 | | |

| | | | | | | |

Materials - 3.0% | | | | | | | |

Chemicals - 2.2% | | | | | | | |

Monsanto Co. | | 14,500 | | | 914,370 | | |

| | | | | | | |

Construction Materials - 0.8% | | | | | | | |

Martin Marietta Materials, Inc. | | 3,200 | | | 306,816 | | |

| | | | | | | |

Total Materials | | | | | 1,221,186 | | |

| | | | | | | |

Telecommunication Services - 1.7% | | | | | | | |

Wireless Telecommunication Services - 1.7% | | | | | | | |

American Tower Corp. - Class A* | | 5,120 | | | 208,947 | | |

Crown Castle International Corp.* | | 12,340 | | | 467,069 | | |

| | | | | | | |

Total Telecommunication Services | | | | | 676,016 | | |

| | | | | | | |

TOTAL COMMON STOCKS | | | | | | | |

(Identified Cost $31,199,939) | | | | | 38,159,034 | | |

| | | | | | | |

| | | | |

| 6 | | The accompanying notes are an integral part of the financial statements. | | |

Investment Portfolio - April 30, 2010 (unaudited)

| | | | | | | | |

| | | Shares | | Value (Note 2) | | | |

| | | |

SHORT-TERM INVESTMENTS - 6.5% | | | | | | | | |

| | | |

Dreyfus Cash Management, Inc. - Institutional Shares2, 0.09% | | | | | | | | |

(Identified Cost $2,639,452) | | 2,639,452 | | $ | 2,639,452 | | | |

| | | | | | | | |

TOTAL INVESTMENTS - 100.5% | | | | | | | | |

(Identified Cost $33,839,391) | | | | | 40,798,486 | | | |

LIABILITIES, LESS OTHER ASSETS - (0.5%) | | | | | (193,404 | ) | | |

| | | | | | | | |

NET ASSETS - 100% | | | | $ | 40,605,082 | | | |

| | | | | | | | |

ADR - American Depository Receipt

*Non-income producing security

1The Bank of New York Mellon Corp. is the Series’ custodian.

2Rate shown is the current yield as of April 30, 2010.

| | | | |

| | The accompanying notes are an integral part of the financial statements. | | 7 |

Statement of Assets and Liabilities (unaudited)

April 30, 2010

| | | | |

ASSETS: | | | | |

| |

Investments, at value (identified cost $33,839,391) (Note 2) | | $ | 40,798,486 | |

Cash | | | 120 | |

Receivable for fund shares sold | | | 394,104 | |

Receivable for securities sold | | | 246,334 | |

Dividends receivable | | | 35,649 | |

Foreign tax reclaims receivable | | | 16,495 | |

| | | | |

| |

TOTAL ASSETS | | | 41,491,188 | |

| | | | |

| |

LIABILITIES: | | | | |

| |

Accrued management fees (Note 3) | | | 26,733 | |

Accrued fund accounting and administration fees (Note 3) | | | 2,093 | |

Accrued Chief Compliance Officer service fees (Note 3) | | | 667 | |

Accrued transfer agent fees (Note 3) | | | 594 | |

Payable for securities purchased | | | 804,931 | |

Payable for fund shares repurchased | | | 35,807 | |

Other payables and accrued expenses | | | 15,281 | |

| | | | |

| |

TOTAL LIABILITIES | | | 886,106 | |

| | | | |

| |

TOTAL NET ASSETS | | $ | 40,605,082 | |

| | | | |

| |

NET ASSETS CONSIST OF: | | | | |

| |

Capital stock | | $ | 16,455 | |

Additional paid-in-capital | | | 37,588,646 | |

Undistributed net investment income | | | 44,223 | |

Accumulated net realized loss on investments, foreign currency and translation of other assets and liabilities | | | (4,003,674 | ) |

Net unrealized appreciation on investments, foreign currency and translation of other assets and liabilities | | | 6,959,432 | |

| | | | |

| |

TOTAL NET ASSETS | | $ | 40,605,082 | |

| | | | |

| |

NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - CLASS A ($40,605,082/1,645,542 shares) | | $ | 24.68 | |

| | | | |

| | | | |

| 8 | | The accompanying notes are an integral part of the financial statements. | | |

Statement of Operations (unaudited)

For the Six Months Ended April 30, 2010

| | | | |

INVESTMENT INCOME: | | | | |

| |

Dividends (net of foreign taxes withheld, $7,488) | | $ | 245,971 | |

Interest | | | 25 | |

| | | | |

| |

Total Investment Income | | | 245,996 | |

| | | | |

| |

EXPENSES: | | | | |

| |

Management fees (Note 3) | | | 163,732 | |

Fund accounting and administration fees (Note 3) | | | 16,354 | |

Directors’ fees (Note 3) | | | 6,373 | |

Transfer agent fees (Note 3) | | | 3,878 | |

Chief Compliance Officer service fees (Note 3) | | | 1,700 | |

Audit fees | | | 15,359 | |

Registration and filing fees | | | 10,201 | |

Custodian fees | | | 1,861 | |

Miscellaneous | | | 4,058 | |

| | | | |

| |

Total Expenses | | | 223,516 | |

Less reduction of expenses (Note 3) | | | (27,038 | ) |

| | | | |

| |

Net Expenses | | | 196,478 | |

| | | | |

| |

NET INVESTMENT INCOME | | | 49,518 | |

| | | | |

| |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | | | | |

| |

Net realized gain (loss) on- | | | | |

Investments | | | 674,595 | |

Foreign currency and translation of other assets and liabilities | | | (201 | ) |

| | | | |

| |

| | | 674,394 | |

| | | | |

Net change in unrealized appreciation (depreciation) on- | | | | |

Investments | | | 4,002,538 | |

Foreign currency and translation of other assets and liabilities | | | (566 | ) |

| | | | |

| |

| | | 4,001,972 | |

| | | | |

| |

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY | | | 4,676,366 | |

| | | | |

| |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 4,725,884 | |

| | | | |

| | | | |

| | The accompanying notes are an integral part of the financial statements. | | 9 |

Statements of Changes in Net Assets

| | | | | | | | |

| | | For the Six Months Ended

4/30/10

(unaudited) | | | For the Year Ended 10/31/09 | |

INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | |

| | |

OPERATIONS: | | | | | | | | |

| | |

Net investment income | | $ | 49,518 | | | $ | 65,162 | |

Net realized gain (loss) on investments and foreign currency | | | 674,394 | | | | (1,837,316 | ) |

Net change in unrealized appreciation (depreciation) on investments and foreign currency | | | 4,001,972 | | | | 6,428,424 | |

| | | | | | | | |

| | |

Net increase from operations | | | 4,725,884 | | | | 4,656,270 | |

| | | | | | | | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS (Note 8): | | | | | | | | |

| | |

From net investment income | | | (50,092 | ) | | | (99,078 | ) |

| | | | | | | | |

| | |

CAPITAL STOCK ISSUED AND REPURCHASED: | | | | | | | | |

| | |

Net increase from capital share transactions (Note 5) | | | 6,670,415 | | | | 9,171,810 | |

| | | | | | | | |

| | |

Net increase in net assets | | | 11,346,207 | | | | 13,729,002 | |

| | |

NET ASSETS: | | | | | | | | |

| | |

Beginning of period | | | 29,258,875 | | | | 15,529,873 | |

| | | | | | | | |

| | |

End of period (including undistributed net investment income of $44,223 and $44,797, respectively) | | $ | 40,605,082 | | | $ | 29,258,875 | |

| | | | | | | | |

| | | | |

| 10 | | The accompanying notes are an integral part of the financial statements. | | |

Financial Highlights

| | | | | | | | | | | | | |

| | | | | | |

| | | For the Six | | | | | | | | | | | |

| | | Months Ended | | | | | | | | | | | |

| | | 4/30/10 | | | | | For the Years Ended | | |

| | | (unaudited) | | 10/31/09 | | | 10/31/08 | | 10/31/07 | | 10/31/06 | | 10/31/05 |

Per share data (for a share outstanding throughout each period): | | | | | | | | | | | | | |

Net asset value - Beginning of period | | $21.32 | | $18.26 | | | $28.44 | | $27.01 | | $25.60 | | $23.51 |

| | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | |

Net investment income | | 0.041 | | 0.06 | 1 | | 0.12 | | 0.08 | | 0.13 | | 0.06 |

Net realized and unrealized gain (loss) on investments | | 3.36 | | 3.11 | | | (9.42) | | 3.44 | | 4.41 | | 3.36 |

| | | | | | | | | | | | | |

Total from investment operations | | 3.40 | | 3.17 | | | (9.30) | | 3.52 | | 4.54 | | 3.42 |

| | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | |

From net investment income | | (0.04) | | (0.11) | | | (0.09) | | (0.14) | | (0.06) | | (0.02) |

From net realized gain on investments | | — | | — | | | (0.79) | | (1.95) | | (3.07) | | (1.31) |

| | | | | | | | | | | | | |

Total distributions to shareholders | | (0.04) | | (0.11) | | | (0.88) | | (2.09) | | (3.13) | | (1.33) |

| | | | | | | | | | | | | |

Net asset value - End of period | | $24.68 | | $21.32 | | | $18.26 | | $28.44 | | $27.01 | | $25.60 |

| | | | | | | | | | | | | |

Net assets - End of period | | | | | | | | | | | | | |

(000’s omitted) | | $40,605 | | $29,259 | | | $15,530 | | $25,695 | | $7,585 | | $6,886 |

| | | | | | | | | | | | | |

Total return2 | | 15.95% | | 17.57% | | | (33.62%) | | 13.65% | | 20.01% | | 14.96% |

Ratios (to average net assets)/ | | | | | | | | | | | | | |

Supplemental Data: | | | | | | | | | | | | | |

Expenses* | | 1.20%3 | | 1.20% | | | 1.20% | | 1.20% | | 1.20% | | 1.20% |

Net investment income | | 0.30%3 | | 0.31% | | | 0.44% | | 0.38% | | 0.54% | | 0.23% |

Portfolio turnover | | 22% | | 48% | | | 96% | | 65% | | 61% | | 68% |

|

* The investment advisor did not impose all of its management fees, CCO fees, fund accounting and transfer agent fees, and other fees in some periods and in some periods paid a portion of the Series’ expenses. If these expenses had been incurred by the Series, the expense ratio (to average net assets) would have been increased by the following amounts: |

| | | | | | |

| | 0.17%3 | | 0.24% | | | 0.20% | | 0.25% | | 0.78% | | 0.82% |

1Calculated based on average shares outstanding during the periods.

2Represents aggregate total return for the periods indicated, and assumes reinvestment of all distributions. Total return would have been lower had certain expenses not been waived or reimbursed during the periods. Periods less than one year are not annualized.

3Annualized.

| | | | |

| | The accompanying notes are an integral part of the financial statements. | | 11 |

Notes to Financial Statements (unaudited)

Tax Managed Series (the “Series”) is a no-load diversified series of Manning & Napier Fund, Inc. (the “Fund”). The Fund is organized in Maryland and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

The Series’ investment objective is to maximize long-term growth while attempting to minimize the impact of taxes on the total return earned by shareholders.

The Series is authorized to issue five classes of shares (Class A, B, D, E and Z). Currently, only Class A shares have been issued. Each class of shares is substantially the same, except that class specific distribution and shareholder servicing expenses are borne by the specific class of shares to which they relate.

The Fund’s Advisor is Manning & Napier Advisors, Inc. (the “Advisor”). Shares of the Series are offered to investors and employees of the Advisor and its affiliates. The total authorized capital stock of the Fund consists of 10.0 billion shares of common stock each having a par value of $0.01. As of April 30, 2010, 6.2 billion shares have been designated in total among 29 series, of which 87.5 million have been designated as Tax Managed Series Class A common stock.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

Security Valuation

Portfolio securities, including domestic equities, foreign equities, warrants and options, listed on an exchange other than the NASDAQ National Market System are valued at the latest quoted sales price of the exchange on which the security is primarily traded. Securities not traded on valuation date or securities not listed on an exchange are valued at the latest quoted bid price provided by the Fund’s pricing service. Securities listed on the NASDAQ National Market System are valued in accordance with the NASDAQ Official Closing Price.

Short-term investments that mature in sixty days or less are valued at amortized cost, which approximates market value. Investments in open-end investment companies are valued at their net asset value per share on valuation date.

Volume and level of activity in established markets for an asset or liability are evaluated to determine whether recent transactions and quoted prices are determinative of fair value. Where there have been significant decreases in volume and level of activity, further analysis and adjustment may be necessary to estimate fair value. The Series measures fair value in these instances by the use of inputs and valuation techniques which may be based upon current market prices of securities that are comparable in coupon, rating, maturity and industry and/or expectation of future cash flows. As a result of trading in relatively thin markets and/or markets that experience significant volatility, the prices used by the Series to value these securities may differ from the value that would be realized if these securities were sold, and the differences could be material.