UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04087

Manning & Napier Fund, Inc.

(Exact name of registrant as specified in charter)

290 Woodcliff Drive, Fairport, NY 14450

(Address of principal executive offices)(Zip Code)

B. Reuben Auspitz 290 Woodcliff Drive, Fairport, NY 14450

(Name and address of agent for service)

Registrant’s telephone number, including area code: 585-325-6880

Date of fiscal year end: December 31

Date of reporting period: January 1, 2014 through December 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1: REPORTS TO STOCKHOLDERS.

Real Estate Series

Management Discussion and Analysis

(unaudited)

Dear Shareholders:

The global economy remained on a slow growth path during the past year. Developed economies continued to support economic growth through accommodative monetary policy, and as the year progressed, central banks in areas such as Europe and Japan loosened policy further to combat persistent growth headwinds. Meanwhile, the U.S. economy slowed as it meandered through a very harsh winter, but recovered quickly during the spring and summer months. The Federal Reserve completed its third quantitative easing program, and market expectations for subsequent adjustment to domestic monetary policy during 2015 helped fuel a meaningful increase in the value of the dollar relative to other global currencies during the period. With the U.S. economy making positive strides, its equity markets generally performed strongly as well. Global markets were broadly weaker, although pockets of strength existed in certain emerging market countries where encouraging political developments and reform momentum helped lift investor sentiment. Looking ahead, we expect the slow global growth environment to remain in place for the foreseeable future.

As always, we appreciate your business.

Sincerely,

Manning & Napier Advisors, LLC

1

Real Estate Series

Fund Commentary

(unaudited)

Investment Objective

To provide high current income and long-term capital appreciation by investing principally in companies in the real estate industry. Under normal circumstances, at least 80% of the Series’ assets will be invested in securities of companies that are principally engaged in the U.S. real estate industry. These companies include those directly engaged in the real estate industry as well as in industries serving and/or related to the real estate industry.

Performance Commentary

Regarding U.S. real estate, the progress the housing market has been making toward recovery stalled to a degree over the last year, but improving economic conditions point more toward a renewed recovery than another downturn. We believe steady improvement in job growth should spur demand for housing and homeownership. Increasing consumer activity should also translate into a greater need for commercial real estate as businesses seek to expand. Some categories of real estate investments might face volatility in the near term as investors carefully weigh the Federal Reserve’s intentions concerning interest rates, which could create attractive buying opportunities.

As longer-term Treasury yields and interest rates generally declined during 2014 spurring investor interest in the real estate sector, the MSCI U.S. Real Estate Investment Trust (REIT) Index experienced robust absolute returns of 28.82%. The Real Estate Series Class S also performed strongly, returning 28.14%, in line with the benchmark.

While stock selection in sub-industries such as Homebuilders, Timber REITs, Data Storage REITs, and Hospitality challenged relative returns, in aggregate, sub-industry allocations contributed positively to relative returns. Relative to the benchmark, underweight allocations to Diversified REITs and Industrial REITs, as well as an overweight to Data Storage REITs, aided relative returns. Stock selection in Healthcare REITs also contributed positively to relative returns.

Heading into 2015, we maintain our slow growth outlook for the U.S. economy. We anticipate the Federal Reserve will embark on a path of policy tightening amid incrementally better growth and healthier labor market activity this year. Geopolitical risks such as ongoing regional conflicts and European politics may reverberate through U.S. financial markets, leading to bouts of volatility; however, the economic, valuation, and sentiment indicators we monitor do not suggest capital risk is a significant near-term concern, so we would view the resurgence of volatility as a buying opportunity. Importantly, valuations in the U.S. are elevated but not excessive, and are now at levels consistent with more moderate growth as compared to recent periods. In light of the current environment, it is important that investors remain flexible and selective in their approach in an attempt to avoid overvalued areas of the market, something that Manning & Napier has done for over 40 years as an active investment manager.

Please see the next page for additional performance information as of December 31, 2014.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than that quoted; investors can obtain the most recent month-end performance at www.manning-napier.com or by calling (800) 466-3863.

All investments involve risks, including potential loss of principal. Funds whose investments are concentrated in a specific industry or sector may be subject to a higher degree of market risk than funds whose investments are diversified among a variety of sectors. The Real Estate Series is subject to risks associated with the direct ownership of real estate, including the potential for falling real estate prices and the possibility of being highly leveraged; an investment in the Series will be closely aligned with the performance of the real estate markets. Additionally, like all derivatives, investments in options can be highly volatile and involve risks in addition to the risks of the underlying instrument on which the derivative is based, such as counterparty, correlation and liquidity risk.

2

Real Estate Series

Performance Update as of December 31, 2014

(unaudited)

| | | | | | | | | | | | |

| | | AVERAGE ANNUAL TOTAL RETURNS

AS OF DECEMBER 31, 2014 | |

| | | ONE YEAR1 | | | FIVE YEAR | | | SINCE

INCEPTION2 | |

Manning & Napier Fund, Inc. - Real Estate Series - Class S3 | | | 28.14 | % | | | 16.01 | % | | | 16.94 | % |

Manning & Napier Fund, Inc. - Real Estate Series - Class I3,4 | | | 28.44 | % | | | 16.14 | % | | | 17.07 | % |

S&P 500 Total Return Index5 | | | 13.67 | % | | | 15.45 | % | | | 15.50 | % |

MSCI U.S. Real Estate Investment Trust (REIT) Index5,6 | | | 28.82 | % | | | 15.70 | % | | | 17.31 | % |

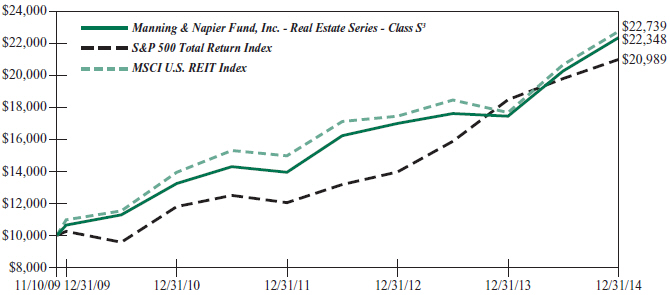

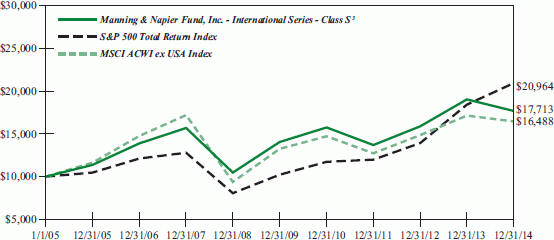

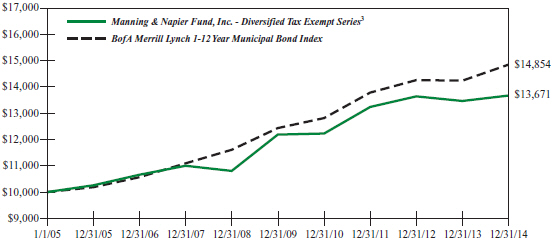

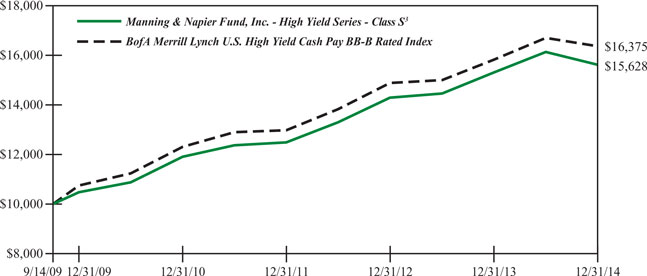

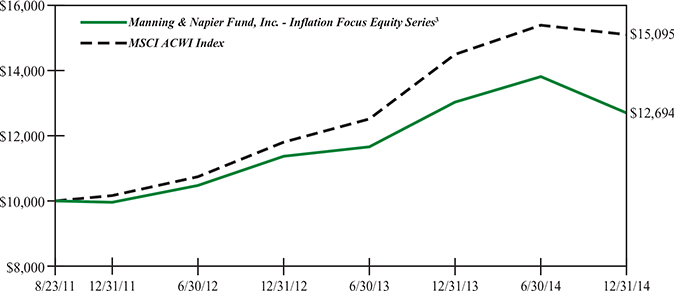

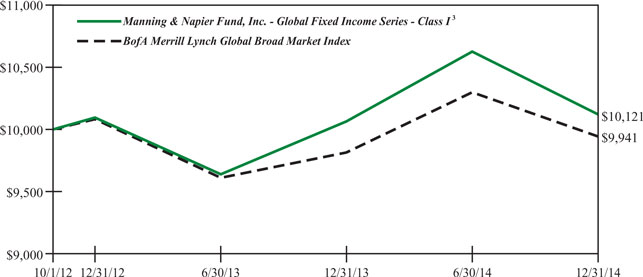

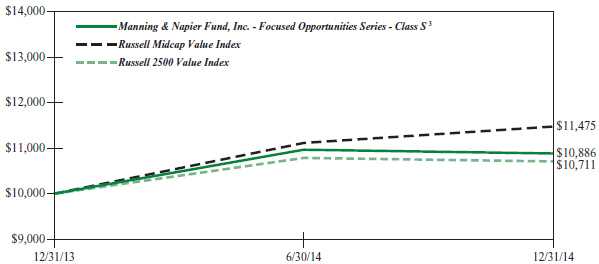

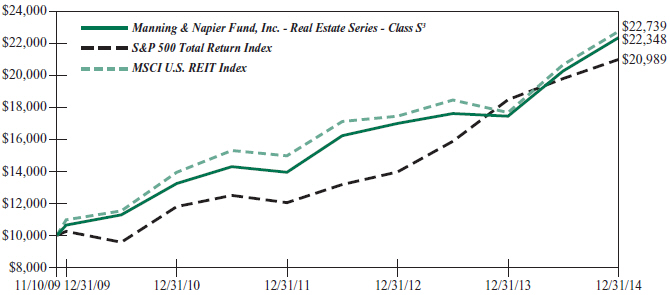

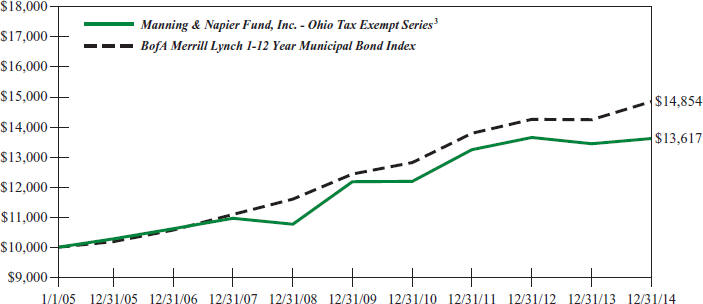

The following graph compares the value of a $10,000 investment in the Manning & Napier Fund, Inc. - Real Estate Series - Class S from its inception1 (November 10, 2009) to present (December 31, 2014) to the S&P 500 Total Return Index and the MSCI U.S. REIT Index.

1The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

2Performance numbers for the Series and Index are calculated from November 10, 2009, the Class S inception date.

3The Series’ performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. The Series’ performance is historical and may not be indicative of future results. The performance returns shown are inclusive of the net expense ratio of the Series. For the year ended December 31, 2014, this net expense ratio was 1.11% for Class S and 0.86% for Class I. The gross expense ratio, which does not account for any voluntary or contractual waivers currently in effect, was 1.11% for Class S and 0.86% for Class I for the year ended December 31, 2014.

4 For periods prior to the inception of Class I on August 1, 2012, the performance figures are hypothetical and reflect the performance of the Manning & Napier Fund, Inc. - Real Estate Series - Class S.

5The S&P 500 Total Return Index is an unmanaged, capitalization-weighted measure of 500 widely held common stocks listed on the New York Stock Exchange, American Stock Exchange, and the Over-the-Counter market. The Index returns assume daily reinvestment of dividends and do not reflect any fees or expenses. Index returns provided by Bloomberg.

6The MSCI U.S. Real Estate Investment Trust (REIT) Index is a free float-adjusted, market capitalization-weighted index that is comprised of equity REITs that are included in the MSCI U.S. Investment Market 2500 Index, with the exception of specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. The Index represents approximately 85% of the U.S. REIT universe. The Index returns do not reflect any fees or expenses. The Index returns are net of withholding taxes. They assume daily reinvestment of net dividends thus accounting for any applicable dividend taxation. Index returns provided by Bloomberg.

3

Real Estate Series

Shareholder Expense Example

(unaudited)

As a shareholder of the Series, you may incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested in each class at the beginning of the period and held for the entire period (July 1, 2014 to December 31, 2014).

Actual Expenses

The Actual lines of the table below provide information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the Actual line for the Class in which you have invested under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The Hypothetical lines of each Class in the table below provide information about hypothetical account values and hypothetical expenses based on the Class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. You may use this information to compare the ongoing costs of investing in a class of the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the Hypothetical lines for each Class in the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | |

| | | BEGINNING ACCOUNT VALUE 7/1/14 | | ENDING ACCOUNT VALUE 12/31/14 | | EXPENSES PAID

DURING PERIOD* 7/1/14-12/31/14 | | ANNUALIZED EXPENSE RATIO |

Class S | | | | | | | | |

Actual | | $1,000.00 | | $1,103.40 | | $5.88 | | 1.11% |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,019.61 | | $5.65 | | 1.11% |

Class I | | | | | | | | |

Actual | | $1,000.00 | | $1,104.80 | | $4.56 | | 0.86% |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,020.87 | | $4.38 | | 0.86% |

*Expenses are equal to each Class’ annualized expense ratio (for the six-month period), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses are based on the most recent fiscal half year; therefore, the expense ratio stated above may differ from the expense ratio stated in the financial highlights, which is based on one-year data.

4

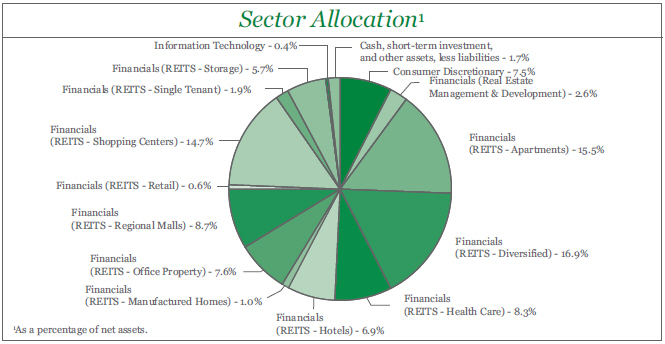

Real Estate Series

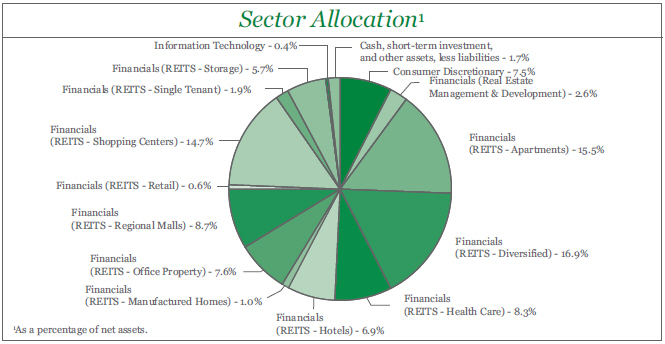

Portfolio Composition as of December 31, 2014

(unaudited)

| | | | | | | | | | | | |

Top Ten Stock Holdings2 | | |

Simon Property Group, Inc. | | | 5.2 | % | | | | Kite Realty Group Trust | | 2.0% | | |

Weyerhaeuser Co. | | | 3.0 | % | | | | LaSalle Hotel Properties | | 2.0% | | |

Plum Creek Timber Co., Inc. | | | 2.8 | % | | | | Sovran Self Storage, Inc. | | 2.0% | | |

Westfield Corp. (Australia) | | | 2.6 | % | | | | DDR Corp. | | 2.0% | | |

Chesapeake Lodging Trust | | | 2.1 | % | | | | Kimco Realty Corp. | | 1.9% | | |

| | | |

| 2As a percentage of total investments. | | | | |

5

Real Estate Series

Investment Portfolio - December 31, 2014

| | | | | | | | |

| | | SHARES | | | VALUE (NOTE 2) | |

| | |

COMMON STOCKS - 98.3% | | | | | | | | |

| | |

Consumer Discretionary - 7.5% | | | | | | | | |

Hotels, Restaurants & Leisure - 3.0% | | | | | | | | |

Accor S.A. (France)1 | | | 91,900 | | | $ | 4,131,006 | |

Hyatt Hotels Corp. - Class A* | | | 73,090 | | | | 4,400,749 | |

| | | | | | | | |

| | |

| | | | | | | 8,531,755 | |

| | | | | | | | |

Household Durables - 4.5% | | | | | | | | |

DR Horton, Inc. | | | 126,030 | | | | 3,187,299 | |

Lennar Corp. - Class A | | | 69,676 | | | | 3,122,181 | |

Toll Brothers, Inc.* | | | 74,932 | | | | 2,567,920 | |

TRI Pointe Homes, Inc.* | | | 161,970 | | | | 2,470,043 | |

WCI Communities, Inc.* | | | 59,510 | | | | 1,165,206 | |

| | | | | | | | |

| | |

| | | | | | | 12,512,649 | |

| | | | | | | | |

| | |

Total Consumer Discretionary | | | | | | | 21,044,404 | |

| | | | | | | | |

| | |

Financials - 90.4% | | | | | | | | |

Real Estate Management & Development - 2.6% | | | | | | | | |

Forest City Enterprises, Inc. - Class A* | | | 178,070 | | | | 3,792,891 | |

Forestar Group, Inc.* | | | 175,240 | | | | 2,698,696 | |

General Shopping Brasil S.A. (Brazil)* | | | 288,710 | | | | 790,689 | |

| | | | | | | | |

| | |

| | | | | | | 7,282,276 | |

| | | | | | | | |

REITS - Apartments - 15.5% | | | | | | | | |

American Campus Communities, Inc. | | | 61,810 | | | | 2,556,462 | |

Apartment Investment & Management Co. - Class A | | | 124,570 | | | | 4,627,775 | |

Associated Estates Realty Corp. | | | 192,248 | | | | 4,462,076 | |

AvalonBay Communities, Inc. | | | 25,070 | | | | 4,096,187 | |

Camden Property Trust | | | 49,590 | | | | 3,661,726 | |

Education Realty Trust, Inc. | | | 112,810 | | | | 4,127,718 | |

Equity Residential | | | 60,150 | | | | 4,321,176 | |

Essex Property Trust, Inc. | | | 21,080 | | | | 4,355,128 | |

Home Properties, Inc. | | | 41,220 | | | | 2,704,032 | |

Mid-America Apartment Communities, Inc. | | | 61,860 | | | | 4,619,705 | |

UDR, Inc. | | | 135,060 | | | | 4,162,549 | |

| | | | | | | | |

| | |

| | | | | | | 43,694,534 | |

| | | | | | | | |

REITS - Diversified - 16.9% | | | | | | | | |

CatchMark Timber Trust, Inc. - Class A | | | 225,920 | | | | 2,557,414 | |

CoreSite Realty Corp. | | | 94,730 | | | | 3,699,207 | |

Crown Castle International Corp. | | | 30,720 | | | | 2,417,664 | |

Digital Realty Trust, Inc. | | | 73,370 | | | | 4,864,431 | |

Duke Realty Corp. | | | 207,910 | | | | 4,199,782 | |

DuPont Fabros Technology, Inc. | | | 112,620 | | | | 3,743,489 | |

Lamar Advertising Co. - Class A | | | 73,050 | | | | 3,918,402 | |

Outfront Media, Inc. | | | 127,026 | | | | 3,409,365 | |

Plum Creek Timber Co., Inc. | | | 184,560 | | | | 7,897,322 | |

The accompanying notes are an integral part of the financial statements.

6

Real Estate Series

Investment Portfolio - December 31, 2014

| | | | | | | | |

| | | | | | VALUE | |

| | | SHARES | | | (NOTE 2) | |

| | |

COMMON STOCKS (continued) | | | | | | | | |

| | |

Financials (continued) | | | | | | | | |

REITS - Diversified (continued) | | | | | | | | |

Washington Real Estate Investment Trust | | | 92,260 | | | $ | 2,551,912 | |

Weyerhaeuser Co. | | | 236,670 | | | | 8,494,086 | |

| | | | | | | | |

| | |

| | | | | | | 47,753,074 | |

| | | | | | | | |

REITS - Health Care - 8.3% | | | | | | | | |

HCP, Inc. | | | 90,820 | | | | 3,998,804 | |

Health Care REIT, Inc. | | | 54,010 | | | | 4,086,937 | |

Healthcare Trust of America, Inc. - Class A | | | 110,025 | | | | 2,964,073 | |

Physicians Realty Trust | | | 322,470 | | | | 5,353,002 | |

Sabra Health Care REIT, Inc. | | | 94,540 | | | | 2,871,180 | |

Ventas, Inc. | | | 55,810 | | | | 4,001,577 | |

| | | | | | | | |

| | |

| | | | | | | 23,275,573 | |

| | | | | | | | |

REITS - Hotels - 6.9% | | | | | | | | |

Chesapeake Lodging Trust | | | 158,160 | | | | 5,885,134 | |

Host Hotels & Resorts, Inc. | | | 219,170 | | | | 5,209,671 | |

LaSalle Hotel Properties | | | 138,160 | | | | 5,591,335 | |

Pebblebrook Hotel Trust | | | 62,774 | | | | 2,864,378 | |

| | | | | | | | |

| | |

| | | | | | | 19,550,518 | |

| | | | | | | | |

REITS - Manufactured Homes - 1.0% | | | | | | | | |

Equity LifeStyle Properties, Inc. | | | 55,840 | | | | 2,878,552 | |

| | | | | | | | |

REITS - Office Property - 7.6% | | | | | | | | |

Alexandria Real Estate Equities, Inc. | | | 55,220 | | | | 4,900,223 | |

BioMed Realty Trust, Inc. | | | 200,017 | | | | 4,308,366 | |

Boston Properties, Inc. | | | 23,690 | | | | 3,048,666 | |

Corporate Office Properties Trust | | | 87,500 | | | | 2,482,375 | |

Mack-Cali Realty Corp. | | | 174,860 | | | | 3,332,832 | |

Paramount Group, Inc.* | | | 182,970 | | | | 3,401,412 | |

| | | | | | | | |

| | |

| | | | | | | 21,473,874 | |

| | | | | | | | |

REITS - Regional Malls - 8.7% | | | | | | | | |

Fibra Shop Portafolios Inmobiliarios SAPI de CV (Mexico)* | | | 1,324,200 | | | | 1,751,987 | |

General Growth Properties, Inc. | | | 154,460 | | | | 4,344,960 | |

Pennsylvania Real Estate Investment Trust | | | 57,480 | | | | 1,348,481 | |

Rouse Properties, Inc. | | | 131,080 | | | | 2,427,602 | |

Simon Property Group, Inc. | | | 80,270 | | | | 14,617,970 | |

| | | | | | | | |

| | |

| | | | | | | 24,491,000 | |

| | | | | | | | |

REITS - Retail - 0.6% | | | | | | | | |

Scentre Group (Australia)*1 | | | 593,137 | | | | 1,680,460 | |

| | | | | | | | |

REITS - Shopping Centers - 14.7% | | | | | | | | |

Brixmor Property Group, Inc. | | | 111,920 | | | | 2,780,093 | |

DDR Corp. | | | 300,820 | | | | 5,523,055 | |

The accompanying notes are an integral part of the financial statements.

7

Real Estate Series

Investment Portfolio - December 31, 2014

| | | | | | | | |

| | | | | | VALUE | |

| | | SHARES | | | (NOTE 2) | |

| | |

COMMON STOCKS (continued) | | | | | | | | |

| | |

Financials (continued) | | | | | | | | |

REITS - Shopping Centers (continued) | | | | | | | | |

Equity One, Inc. | | | 169,000 | | | $ | 4,285,840 | |

Excel Trust, Inc. | | | 262,370 | | | | 3,513,134 | |

Inland Real Estate Corp. | | | 244,480 | | | | 2,677,056 | |

Kimco Realty Corp. | | | 216,170 | | | | 5,434,514 | |

Kite Realty Group Trust | | | 196,327 | | | | 5,642,438 | |

Saul Centers, Inc. | | | 25,200 | | | | 1,441,188 | |

Washington Prime Group, Inc. | | | 165,520 | | | | 2,850,254 | |

Westfield Corp. (Australia)1 | | | 996,070 | | | | 7,301,558 | |

| | | | | | | | |

| | |

| | | | | | | 41,449,130 | |

| | | | | | | | |

REITS - Single Tenant - 1.9% | | | | | | | | |

Agree Realty Corp. | | | 167,960 | | | | 5,221,876 | |

| | | | | | | | |

REITS - Storage - 5.7% | | | | | | | | |

CubeSmart | | | 134,090 | | | | 2,959,366 | |

Extra Space Storage, Inc. | | | 41,150 | | | | 2,413,036 | |

Public Storage | | | 26,980 | | | | 4,987,253 | |

Sovran Self Storage, Inc. | | | 63,901 | | | | 5,573,445 | |

| | | | | | | | |

| | |

| | | | | | | 15,933,100 | |

| | | | | | | | |

| | |

Total Financials | | | | | | | 254,683,967 | |

| | | | | | | | |

Information Technology - 0.4% | | | | | | | | |

IT Services - 0.4% | | | | | | | | |

InterXion Holding N.V. - ADR (Netherlands)* | | | 45,440 | | | | 1,242,330 | |

| | | | | | | | |

Utilities - 0.0% | | | | | | | | |

Electric Utilities - 0.0% | | | | | | | | |

Prime AET&D Holdings No.1 Ltd. (Australia)*2 | | | 125,000 | | | | — | |

| | | | | | | | |

TOTAL COMMON STOCKS | | | | | | | | |

(Identified Cost $218,016,107) | | | | | | | 276,970,701 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

8

Real Estate Series

Investment Portfolio - December 31, 2014

| | | | | | | | |

| | | | | | VALUE | |

| | | SHARES | | | (NOTE 2) | |

| | |

SHORT-TERM INVESTMENT - 1.4% | | | | | | | | |

Dreyfus Cash Management, Inc. - Institutional Shares3, 0.03% | | | | | | | | |

(Identified Cost $ 3,790,534) | | | 3,790,534 | | | $ | 3,790,534 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS - 99.7% | | | | | | | | |

(Identified Cost $ 221,806,641) | | | | | | | 280,761,235 | |

OTHER ASSETS, LESS LIABILITIES - 0.3% | | | | | | | 939,735 | |

| | | | | | | | |

| | |

NET ASSETS - 100% | | | | | | $ | 281,700,970 | |

| | | | | | | | |

No. - Number

ADR - American Depositary Receipt

REITS - Real Estate Investment Trusts

*Non-income producing security.

1A factor from a third party vendor was applied to determine the security’s fair value following the close of local trading.

2Security has been valued at fair value as determined in good faith by the Advisor.

3Rate shown is the current yield as of December 31, 2014.

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of MSCI Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P), and is licensed for use by Manning & Napier when referencing GICS sectors. Neither MSCI, S&P, nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification, nor shall any such party have any liability therefrom.

The accompanying notes are an integral part of the financial statements.

9

Real Estate Series

Statement of Assets and Liabilities

December 31, 2014

| | | | |

ASSETS: | | | | |

| |

Investments, at value (identified cost $221,806,641) (Note 2) | | $ | 280,761,235 | |

Dividends receivable | | | 1,046,742 | |

Receivable for fund shares sold | | | 532,694 | |

Foreign tax reclaims receivable | | | 14,416 | |

| | | | |

| |

TOTAL ASSETS | | | 282,355,087 | |

| | | | |

| |

LIABILITIES: | | | | |

| |

Accrued management fees (Note 3) | | | 188,055 | |

Accrued shareholder services fees (Class S)(Note 3) | | | 51,553 | |

Accrued fund accounting and administration fees (Note 3) | | | 15,126 | |

Accrued transfer agent fees (Note 3) | | | 6,187 | |

Accrued Chief Compliance Officer service fees (Note 3) | | | 407 | |

Accrued Directors’ fees (Note 3) | | | 2 | |

Payable for fund shares repurchased | | | 328,512 | |

Other payables and accrued expenses | | | 64,275 | |

| | | | |

| |

TOTAL LIABILITIES | | | 654,117 | |

| | | | |

| |

TOTAL NET ASSETS | | $ | 281,700,970 | |

| | | | |

| |

NET ASSETS CONSIST OF: | | | | |

| |

Capital stock | | $ | 206,537 | |

Additional paid-in-capital | | | 221,100,532 | |

Distributions in excess of net investment income | | | (1,703,240 | ) |

Accumulated net realized gain on investments, foreign currency and translation of other assets and liabilities | | | 3,144,520 | |

Net unrealized appreciation on investments, foreign currency and translation of other assets and liabilities | | | 58,952,621 | |

| | | | |

| |

TOTAL NET ASSETS | | $ | 281,700,970 | |

| | | | |

| |

NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - Class S

($231,187,853/14,953,383 shares) | | $ | 15.46 | |

| | | | |

| |

NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - Class I

($50,513,117/5,700,326 shares) | | $ | 8.86 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

10

Real Estate Series

Statement of Operations

For the Year Ended December 31, 2014

| | | | |

INVESTMENT INCOME: | | | | |

| |

Dividends (net of foreign taxes withheld, $25,404) | | $ | 9,736,477 | |

| | | | |

| |

EXPENSES: | | | | |

| |

Management fees (Note 3) | | | 1,827,867 | |

Shareholder services fees (Class S) (Note 3) | | | 500,609 | |

Fund accounting and administration fees (Note 3) | | | 59,268 | |

Transfer agent fees (Note 3) | | | 24,053 | |

Directors’ fees (Note 3) | | | 5,335 | |

Chief Compliance Officer service fees (Note 3) | | | 3,160 | |

Custodian fees | | | 17,642 | |

Miscellaneous | | | 152,856 | |

| | | | |

| |

Total Expenses | | | 2,590,790 | |

| | | | |

| |

NET INVESTMENT INCOME | | | 7,145,687 | |

| | | | |

| |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | | | | |

| |

Net realized gain (loss) on- | | | | |

Investments | | | 19,281,677 | |

Foreign currency and translation of other assets and liabilities | | | (2,885 | ) |

| | | | |

| |

| | | 19,278,792 | |

| | | | |

| |

Net change in unrealized appreciation (depreciation) on- | | | | |

Investments | | | 33,941,634 | |

Foreign currency and translation of other assets and liabilities | | | (1,973 | ) |

| | | | |

| |

| | | 33,939,661 | |

| | | | |

| |

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY | | | 53,218,453 | |

| | | | |

| |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 60,364,140 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

11

Real Estate Series

Statements of Changes in Net Assets

| | | | | | | | |

| | | FOR THE YEAR ENDED 12/31/14 | | | FOR THE YEAR ENDED 12/31/13 | |

INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | |

| | |

OPERATIONS: | | | | | | | | |

| | |

Net investment income | | $ | 7,145,687 | | | $ | 3,397,937 | |

Net realized gain (loss) on investments and foreign currency | | | 19,278,792 | | | | 22,424,324 | |

Net change in unrealized appreciation (depreciation) on investments and foreign currency | | | 33,939,661 | | | | (20,666,794 | ) |

| | | | | | | | |

| | |

Net increase from operations | | | 60,364,140 | | | | 5,155,467 | |

| | | | | | | | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS (Note 9): | | | | | | | | |

| | |

From net investment income (Class S) | | | (6,031,527 | ) | | | (2,389,572 | ) |

From net investment income (Class I) | | | (2,316,228 | ) | | | (861,626 | ) |

From net realized gain on investments (Class S) | | | (14,939,980 | ) | | | (15,654,458 | ) |

From net realized gain on investments (Class I) | | | (5,249,295 | ) | | | (5,342,785 | ) |

| | | | | | | | |

| | |

Total distributions to shareholders | | | (28,537,030 | ) | | | (24,248,441 | ) |

| | | | | | | | |

| | |

CAPITAL STOCK ISSUED AND REPURCHASED: | | | | | | | | |

| | |

Net increase from capital share transactions (Note 5) | | | 44,396,863 | | | | 27,275,985 | |

| | | | | | | | |

| | |

Net increase in net assets | | | 76,223,973 | | | | 8,183,011 | |

| | |

NET ASSETS: | | | | | | | | |

| | |

Beginning of year | | | 205,476,997 | | | | 197,293,986 | |

| | | | | | | | |

| | |

End of year (including distributions in excess of net investment income of $1,703,240 and undistributed net investment income of $182,326, respectively) | | $ | 281,700,970 | | | $ | 205,476,997 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

12

Real Estate Series

Financial Highlights - Class S*

| | | | | | | | | | | | | | | | | | | | |

| | | FOR THE YEARS ENDED | |

| | | 12/31/14 | | | 12/31/13 | | | 12/31/12 | | | 12/31/11 | | | 12/31/10 | |

Per share data (for a share outstanding throughout each year): | | | | | | | | | | | | | | | | | | | | |

Net asset value - Beginning of year | | $ | 13.32 | | | $ | 14.57 | | | $ | 12.65 | | | $ | 12.58 | | | $ | 10.61 | |

| | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income1 | | | 0.44 | 2 | | | 0.24 | | | | 0.21 | | | | 0.15 | | | | 0.12 | |

Net realized and unrealized gain on investments | | | 3.24 | | | | 0.10 | | | | 2.54 | | | | 0.49 | | | | 2.44 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total from investment operations | | | 3.68 | | | | 0.34 | | | | 2.75 | | | | 0.64 | | | | 2.56 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.44 | ) | | | (0.21 | ) | | | (0.29 | ) | | | (0.15 | ) | | | (0.12 | ) |

From net realized gain on investments | | | (1.10 | ) | | | (1.38 | ) | | | (0.54 | ) | | | (0.42 | ) | | | (0.47 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total distributions to shareholders | | | (1.54 | ) | | | (1.59 | ) | | | (0.83 | ) | | | (0.57 | ) | | | (0.59 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value - End of year | | $ | 15.46 | | | $ | 13.32 | | | $ | 14.57 | | | $ | 12.65 | | | $ | 12.58 | |

| | | | | | | | | | | | | | | | | | | | |

Net assets - End of year | | | | | | | | | | | | | | | | | | | | |

(000’s omitted) | | $ | 231,188 | | | $ | 168,167 | | | $ | 170,898 | | | $ | 167,153 | | | $ | 89,136 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total return3 | | | 28.14 | % | | | 2.67 | % | | | 21.93 | % | | | 5.29 | % | | | 24.40 | % |

Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Expenses** | | | 1.11 | % | | | 1.12 | % | | | 1.10 | % | | | 1.18 | % | | | 1.20 | % |

Net investment income | | | 2.89 | %2 | | | 1.57 | % | | | 1.49 | % | | | 1.21 | % | | | 1.02 | % |

Portfolio turnover | | | 44 | % | | | 40 | % | | | 14 | % | | | 34 | % | | | 34 | % |

|

*Effective August 1, 2012, the shares of the Series have been designated as Class S. **For certain years presented, the investment advisor did not impose all or a portion of its management and/or other fees, and in some years may have paid a portion of the Series’ expenses. If these expenses had been incurred by the Series, the expense ratio (to average net assets) would have increased by the following amounts: | |

| | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 0.01 | % |

1Calculated based on average shares outstanding during the years.

2Reflects a special dividend paid out during the period by two of the Series’ holdings. Had the Series not received the special dividends, the net investment income per share would have been $0.22 and the net investment income ratio would have been 1.49%.

3Represents aggregate total return for the years indicated, and assumes reinvestment of all distributions. Total return would have been lower had certain expenses not been waived or reimbursed during certain years.

The accompanying notes are an integral part of the financial statements.

13

Real Estate Series

Financial Highlights - Class I

| | | | | | | | | | | | |

| | | FOR THE YEARS ENDED | | | FOR THE PERIOD | |

| | 12/31/14 | | | 12/31/13 | | | 8/1/121 TO 12/31/12 | |

Per share data (for a share outstanding throughout each period): | | | | | | | | | | | | |

Net asset value - Beginning of period | | $ | 8.18 | | | $ | 9.55 | | | $ | 10.00 | |

| | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | |

Net investment income2 | | | 0.29 | 3 | | | 0.19 | | | | 0.08 | |

Net realized and unrealized gain (loss) on investments | | | 1.97 | | | | 0.04 | | | | 0.32 | |

| | | | | | | | | | | | |

| | | |

Total from investment operations | | | 2.26 | | | | 0.23 | | | | 0.40 | |

| | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | |

| | | |

From net investment income | | | (0.48 | ) | | | (0.22 | ) | | | (0.31 | ) |

From net realized gain on investments | | | (1.10 | ) | | | (1.38 | ) | | | (0.54 | ) |

| | | | | | | | | | | | |

| | | |

Total distributions to shareholders | | | (1.58 | ) | | | (1.60 | ) | | | (0.85 | ) |

| | | | | | | | | | | | |

| | | |

Net asset value - End of period | | $ | 8.86 | | | $ | 8.18 | | | $ | 9.55 | |

| | | | | | | | | | | | |

| | | |

Net assets - End of period (000’s omitted) | | $ | 50,513 | | | $ | 37,310 | | | $ | 26,396 | |

| | | | | | | | | | | | |

| | | |

Total return4 | | | 28.44 | % | | | 2.94 | % | | | 4.16 | % |

Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | |

Expenses | | | 0.86 | % | | | 0.87 | % | | | 0.87 | %5 |

Net investment income | | | 3.14 | %3 | | | 1.88 | % | | | 1.95 | %5 |

Portfolio turnover | | | 44 | % | | | 40 | % | | | 14 | % |

1Commencement of operations.

2Calculated based on average shares outstanding during the periods.

3Reflects a special dividend paid out during the period by two of the Series’ holdings. Had the Series not received the special dividends, the net investment income per share would have been $0.16 and the net investment income ratio would have been 1.74%.

4Represents aggregate total return for the periods indicated, and assumes reinvestment of all distributions. Periods less than one year are not annualized.

5Annualized.

The accompanying notes are an integral part of the financial statements.

14

Real Estate Series

Notes to Financial Statements

Real Estate Series (the “Series”) is a no-load diversified series of Manning & Napier Fund, Inc. (the “Fund”). The Fund is organized in Maryland and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

The Series’ investment objective is to provide high current income and long-term capital appreciation by investing principally in companies in the real estate industry.

The Fund’s advisor is Manning & Napier Advisors, LLC (the “Advisor”). Shares of the Series are offered to investors, clients and employees of the Advisor and its affiliates. The Series is authorized to issue two classes of shares (Class S and Class I). Each class of shares is substantially the same, except that Class S shares bear shareholder services fees. The total authorized capital stock of the Fund consists of 15 billion shares of common stock each having a par value of $0.01. As of December 31, 2014, 10.6 billion shares have been designated in total among 42 series, of which 100 million have been designated as Real Estate Series Class S common stock and 100 million have been designated as Real Estate Series Class I common stock.

| 2. | Significant Accounting Policies |

The following is a summary of significant accounting policies followed by the Series. The Series is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 - Investment Companies, which is part of accounting principles generally accepted in the United States of America (“GAAP”).

Security Valuation

Portfolio securities, including domestic equities, foreign equities, warrants and options, listed on an exchange other than the NASDAQ Stock Market are valued at the latest quoted sales price of the exchange on which the security is primarily traded. Securities not traded on valuation date or securities not listed on an exchange are valued at the latest quoted bid price provided by the Fund’s pricing service. Securities listed on the NASDAQ Stock Market are valued in accordance with the NASDAQ Official Closing Price.

Short-term investments that mature in sixty days or less are valued at amortized cost, which approximates fair value. Investments in open-end investment companies are valued at their net asset value per share on valuation date.

Volume and level of activity in established markets for an asset or liability are evaluated to determine whether recent transactions and quoted prices are determinative of fair value. Where there have been significant decreases in volume and level of activity, further analysis and adjustment may be necessary to estimate fair value. The Series measures fair value in these instances by the use of inputs and valuation techniques which may be based upon current market prices of securities that are comparable in coupon, rating, maturity and industry and/or expectation of future cash flows. As a result of trading in relatively thin markets and/or markets that experience significant volatility, the prices used by the Series to value these securities may differ from the value that would be realized if these securities were sold, and the differences could be material.

Securities for which representative valuations or prices are not available from the Series’ pricing service may be valued at fair value as determined in good faith by the Advisor under procedures approved by and under the general supervision and responsibility of the Fund’s Board of Directors (the “Board”). Due to the inherent uncertainty of valuations of such securities, the fair value may differ significantly from the values that would have been used had a ready market for such securities existed. If trading or events occurring after the close of the principal market in which securities are traded are expected to materially affect the value of those securities, then they may be valued at their fair value, taking this trading or these events into account. In accordance with the procedures approved by the Board, the values of certain securities trading outside the U.S. were adjusted following the close of local trading using a factor from a third party vendor. The third party vendor uses statistical analyses and quantitative models, which consider among other things subsequent movement and changes in the prices of indices, securities and exchange rates in other markets, to determine the factors which are used to adjust local market prices. The value of

15

Real Estate Series

Notes to Financial Statements (continued)

| 2. | Significant Accounting Policies (continued) |

Security Valuation (continued)

securities used for net asset value calculation under these procedures may differ from published prices for the same securities. It is the Fund’s policy to classify each foreign equity security where a factor from a third party vendor is provided as a Level 2 security.

Various inputs are used in determining the value of the Series’ assets or liabilities carried at fair value. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical assets and liabilities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Level 3 includes significant unobservable inputs (including the Series’ own assumptions in determining the fair value of investments). A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input both individually and in aggregate that is significant to the fair value measurement. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the valuation levels used for major security types as of December 31, 2014 in valuing the Series’ assets or liabilities carried at fair value:

| | | | | | | | | | | | | | | | |

| DESCRIPTION | | TOTAL | | | LEVEL 1 | | | LEVEL 2 | | | LEVEL 3 | |

Assets: | | | | | | | | | | | | | | | | |

Equity securities: | | | | | | | | | | | | | | | | |

Consumer Discretionary | | $ | 21,044,404 | | | $ | 16,913,398 | | | $ | 4,131,006 | | | $ | — | |

Financials | | | 254,683,967 | | | | 245,701,949 | | | | 8,982,018 | | | | — | |

Information Technology | | | 1,242,330 | | | | 1,242,330 | | | | — | | | | — | |

Utilities | | | — | | | | — | | | | — | | | | — | * |

Mutual fund | | | 3,790,534 | | | | 3,790,534 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total assets | | $ | 280,761,235 | | | $ | 267,648,211 | | | $ | 13,113,024 | | | $ | — | |

| | | | | | | | | | | | | | | | |

*Prime AET&D Holdings No.1 Ltd. is a Level 3 security as of December 31, 2014. However, there is no value for this security reported in the financial statements. There was no activity in this security for the year ended December 31, 2014.

Please see the Investment Portfolio for foreign securities where a factor from a third party vendor was applied to determine the securities’ fair value following the close of local trading. Such securities are included in Level 2 in the table above.

The Fund’s policy is to recognize transfers in and transfers out of the valuation levels as of the beginning of the reporting period. There were no transfers between fair value levels during the year ended December 31, 2014.

Security Transactions, Investment Income and Expenses

Security transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date, except that if the ex-dividend date has passed, certain dividends from foreign securities are recorded as soon as the Series is informed of the ex-dividend date. Non-cash dividends, if any, are recorded at the fair value of the securities received. Interest income, including amortization of premium and accretion of discounts using the effective interest method, is earned from settlement date and accrued daily.

Expenses are recorded on an accrual basis. Most expenses of the Fund can be attributed to a specific series. Expenses which cannot be directly attributed are apportioned among the series in the Fund in such a manner as deemed equitable by the Fund’s Board, taking into consideration, among other things, the nature and type of expense. Income, expenses (other than shareholder services fees), and realized and unrealized gains and losses are prorated among the classes based on the relative net assets of each class. Class specific expenses are directly charged to that class.

The Fund records distributions received in excess of income from underlying investments as a reduction of cost of investments and/or realized gain. Such amounts are based on estimates if actual amounts are not available and actual amounts of income, realized gain and return of capital may differ from the estimated amounts. The Fund adjusts the estimated amounts of

16

Real Estate Series

Notes to Financial Statements (continued)

| 2. | Significant Accounting Policies (continued) |

Security Transactions, Investment Income and Expenses (continued)

components of distributions (and consequently its net investment income) as necessary once the issuers provide information about the actual composition of the distributions.

The Series uses the identified cost method for determining realized gain or loss on investments for both financial statement and federal income tax reporting purposes.

Foreign Currency Translation

The books and records of the Series are maintained in U.S. dollars. Foreign currencies, investments and other assets and liabilities are translated into U.S. dollars at the current exchange rates. Purchases and sales of investment securities and income and expenses are translated on the respective dates of such transactions. The Series does not isolate realized and unrealized gains and losses attributable to changes in the exchange rates from gains and losses that arise from changes in the market value of investments. Such fluctuations are included with net realized and unrealized gain or loss on investments. Net realized foreign currency gains and losses represent foreign currency gains and losses between trade date and settlement date on securities transactions, gains and losses on disposition of foreign currencies and the difference between the amount of income and foreign withholding taxes recorded on the books of the Series and the amounts actually received or paid.

Federal Taxes

The Series’ policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. The Series is not subject to federal income tax or excise tax to the extent that the Series distributes to shareholders each year its taxable income, including any net realized gains on investments, in accordance with requirements of the Internal Revenue Code. Accordingly, no provision for federal income tax or excise tax has been made in the financial statements.

Management evaluates its tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. At December 31, 2014, the Series has recorded no liability for net unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken in future tax returns.

The Series files income tax returns in the U.S. federal jurisdiction, various states and foreign jurisdictions, as required. No income tax returns are currently under investigation. The statute of limitations on the Series’ tax returns remains open for the years ended December 31, 2011 through December 31, 2014. The Series is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Foreign Taxes

Based on the Series’ understanding of the tax rules and rates related to income, gains and currency purchase/repatriation transactions for foreign jurisdictions in which it invests, the Series will provide for foreign taxes, and where appropriate, deferred foreign tax.

Distributions of Income and Gains

Distributions to shareholders of net investment income and net realized gains are made annually. An additional distribution may be necessary to avoid taxation of the Series. Distributions are recorded on the ex-dividend date.

Indemnifications

The Fund’s organizational documents provide former and current directors and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

17

Real Estate Series

Notes to Financial Statements (continued)

| 2. | Significant Accounting Policies (continued) |

Other

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

| 3. | Transactions with Affiliates |

The Fund has an Investment Advisory Agreement (the “Agreement”) with the Advisor, for which the Series pays a fee, computed daily and payable monthly, at an annual rate of 0.75% of the Series’ average daily net assets.

Under the Agreement, personnel of the Advisor provide the Series with advice and assistance in the choice of investments and the execution of securities transactions, and otherwise maintain the Series’ organization. The Advisor also provides the Fund with necessary office space and fund administration and support services. The salaries of all officers of the Fund (except a percentage of the Fund’s Chief Compliance Officer’s salary, which is paid by the Fund), and of all Directors who are “affiliated persons” of the Fund, or of the Advisor, and all personnel of the Fund, or of the Advisor, performing services relating to research, statistical and investment activities, are paid by the Advisor. Each “non-affiliated” Director receives an annual stipend, which is allocated among all the active series of the Fund. In addition, these Directors also receive a fee per Board meeting attended plus a fee for each committee meeting attended and are reimbursed for travel and other out-of-pocket expenses incurred by them in connection with attending such meetings. The Fund also has an Audit Committee Chair, who receives an additional annual stipend for this role.

The Class S shares of the Series are subject to a shareholder services fee in accordance with a shareholder services plan adopted by the Board. The shareholder services fee is intended to compensate financial intermediaries, including affiliates of the Fund, in connection with the provision of direct client service, personal services, maintenance of shareholder accounts and reporting services. For these services, Class S of the Series pays a fee, computed daily and payable monthly, at an annual rate of 0.25% of the average daily net assets of Class S. The Fund has a Shareholder Services Agreement with the Advisor, for which the Advisor receives the shareholder services fee as stated above.

The Advisor has contractually agreed, until at least April 30, 2016, to waive its management fee and, if necessary, pay other operating expenses of the Series in order to maintain total direct annual fund operating expenses for the Series, exclusive of each share class’ shareholder services fee, at no more than 0.95% of average daily net assets. The Advisor did not waive any fees for the year ended December 31, 2014. The Advisor is not eligible to recoup any expenses that have been waived or reimbursed in prior years.

Manning & Napier Investor Services, Inc., a registered broker-dealer affiliate of the Advisor, acts as distributor for the Fund’s shares. The services of Manning & Napier Investor Services, Inc. are provided at no additional cost to the Series.

Pursuant to a master services agreement effective through October 31, 2014, the Fund paid the Advisor an annual fee related to fund accounting and administration of 0.0175% on the first $3 billion of average daily net assets (excluding Target Series and Strategic Income Series); 0.015% on the next $3 billion of average daily net assets (excluding Target Series and Strategic Income Series); and 0.01% of the average daily net assets in excess of $6 billion (excluding Target Series and Strategic Income Series); plus a base fee of $25,500 per series. The aforementioned agreement was modified to reduce the annual fee related to fund accounting and administration, as well as transfer agent fees, by 10%, excluding out-of-pocket expenses. Pursuant to a master services agreement dated November 1, 2014, the Fund pays the Advisor an annual fee related to fund accounting and administration of 0.0085% on the first $25 billion of average daily net assets (excluding Target Series and Strategic Income Series); 0.0075% on the next $15 billion of average daily net assets (excluding Target Series and Strategic Income Series); and 0.0065% of the average daily net assets in excess of $40 billion (excluding Target Series and Strategic Income Series); plus a base fee of $30,400 per series. Transfer agent fees are charged to the Fund on a per account basis. Additionally, certain transaction and out-of-pocket expenses, including charges for reporting relating to the Fund’s compliance program, are charged.

18

Real Estate Series

Notes to Financial Statements (continued)

| 3. | Transactions with Affiliates (continued) |

The Advisor has agreements with BNY Mellon Investment Servicing (U.S.) Inc. (“BNY”) under which BNY serves as sub-accountant services agent and sub-transfer agent.

Expenses not directly attributable to a Series are allocated based on each Series’ relative net assets or number of accounts, depending on the expense.

| 4. | Purchases and Sales of Securities |

For the year ended December 31, 2014, purchases and sales of securities, other than U.S. Government securities and short-term securities, were $130,955,945 and $107,032,694, respectively. There were no purchases or sales of U.S. Government securities.

| 5. | Capital Stock Transactions |

Transactions in shares of Class S and I shares of Real Estate Series were:

| | | | | | | | | | | | | | | | |

| CLASS S | | FOR THE YEAR ENDED 12/31/2014 | | | FOR THE YEAR ENDED 12/31/2013 | |

| | SHARES | | | AMOUNT | | | SHARES | | | AMOUNT | |

Sold | | | 2,877,508 | | | $ | 43,298,509 | | | | 1,431,034 | | | $ | 21,346,726 | |

Reinvested | | | 1,371,635 | | | | 20,505,790 | | | | 1,348,479 | | | | 17,696,259 | |

Repurchased | | | (1,925,594 | ) | | | (29,217,124 | ) | | | (1,881,551 | ) | | | (28,467,869 | ) |

| | | | | | | | | | | | | | | | |

Total | | | 2,323,549 | | | $ | 34,587,175 | | | | 897,962 | | | $ | 10,575,116 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| CLASS I | | FOR THE YEAR ENDED 12/31/14 | | | FOR THE YEAR ENDED 12/31/13 | |

| | SHARES | | | AMOUNT | | | SHARES | | | AMOUNT | |

Sold | | | 1,529,781 | | | $ | 13,799,732 | | | | 1,281,689 | | | $ | 12,800,012 | |

Reinvested | | | 828,373 | | | | 7,151,070 | | | | 724,906 | | | | 5,877,560 | |

Repurchased | | | (1,221,118 | ) | | | (11,141,114 | ) | | | (207,583 | ) | | | (1,976,703 | ) |

| | | | | | | | | | | | | | | | |

Total | | | 1,137,036 | | | $ | 9,809,688 | | | | 1,799,012 | | | $ | 16,700,869 | |

| | | | | | | | | | | | | | | | |

Substantially all of the Series’ shares represent investments by fiduciary accounts over which the Advisor has sole investment discretion.

The Series may trade in instruments including written and purchased options, forward foreign currency exchange contracts and futures contracts and other derivatives in the normal course of investing activities to assist in managing exposure to various market risks. The Series may be subject to various elements of risk, which may involve, to a varying degree, elements of risk in excess of the amounts recognized for financial statement purposes. These risks include: the risk that changes in the value of a derivative may not correlate perfectly with the underlying asset, rate or index; counterparty credit risk related to over the counter derivative counterparties’ failure to perform under contract terms; liquidity risk related to the lack of a liquid market for these contracts allowing the fund to close out its position(s); and documentation risk relating to disagreement over contract terms. No such investments were held by the Series as of December 31, 2014.

Investing in securities of foreign companies and foreign governments involves special risks and considerations not typically associated with investing in securities of domestic companies and the U.S. Government. These risks include revaluation of currencies and future adverse political and economic developments. Moreover, securities of foreign companies and foreign

19

Real Estate Series

Notes to Financial Statements (continued)

| 7. | Foreign Securities (continued) |

governments and their markets may be less liquid and their prices more volatile than those of comparable domestic companies and the U.S. Government.

The Series may focus its investments in certain real estate related industries; hence, the Series may subject itself to a greater degree of risk than a series that is more diversified.

| 9. | Federal Income Tax Information |

The amount and characterization of certain income and capital gains to be distributed are determined in accordance with federal income tax regulations, which may differ from GAAP. These differences are primarily due to differing book and tax treatments in the timing and/or treatment of the recognition of net investment income or gains and losses, including redesignation of distributions paid, investments in passive foreign investment companies (PFICs) and qualified late-year losses. The Series may periodically make reclassifications among its capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations without impacting the Series’ net asset value. For the year ended December 31, 2014, $683,498 was reclassified within the capital accounts to decrease Distributions in Excess of Net Investment Income and increase Accumulated Net Realized Gain on Investments. Any such reclassifications are not reflected in the financial highlights.

The tax character of distributions paid were as follows:

| | | | | | | | |

| | | FOR THE YEAR

ENDED 12/31/14 | | | FOR THE YEAR

ENDED 12/31/13 | |

Ordinary income | | $ | 10,317,395 | | | $ | 4,362,646 | |

Long-term capital gains | | | 18,219,635 | | | | 19,885,795 | |

At December 31, 2014, the tax basis of components of distributable earnings and the net unrealized depreciation based on identified cost for federal income tax purposes were as follows:

| | | | |

Cost for federal income tax purposes | | $ | 223,509,880 | |

Unrealized appreciation | | | 62,430,429 | |

Unrealized depreciation | | | (5,179,074 | ) |

| | | | |

Net unrealized appreciation | | $ | 57,251,355 | |

| | | | |

Undistributed long-term gains | | $ | 5,260,937 | |

Qualified late-year losses1 | | $ | 2,116,417 | |

1Late-year ordinary losses and net capital losses incurred after October 31 and within the taxable year are deemed to arise on the first business day of the Series’ next taxable year. For the year ended December 31, 2014, the Series deferred to January 1, 2015 late year short-term ordinary losses of $2,116,417.

20

Real Estate Series

Report of Independent Registered Public Accounting Firm

To the Board of Directors of Manning & Napier Fund, Inc. and Shareholders of

Real Estate Series:

In our opinion, the accompanying statement of assets and liabilities, including the investment portfolio, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the Real Estate Series (a series of Manning & Napier Fund, Inc., hereafter referred to as the “Series”) at December 31, 2014, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Series’ management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2014 by correspondence with the custodian, provide a reasonable basis for our opinion.

New York, New York

February 19, 2015

21

Real Estate Series

Supplemental Tax Information

(unaudited)

All reportings are based on financial information available as of the date of this annual report and, accordingly, are subject to change.

For federal income tax purposes, the Series reports for the current fiscal year $309,681 or, if different, the maximum amount allowable under the tax law as qualified dividend income.

For corporate shareholders, the percentage of investment income (dividend income plus short-term gains, if any) that qualifies for the dividends received deduction for the current fiscal year is 1.54%, or if different, the maximum allowable under tax law.

The Series designates $20,707,314 as Long-Term Capital Gain dividends pursuant to Section 852(b) of the Internal Revenue Code for the fiscal year ended December 31, 2014.

22

Real Estate Series

Renewal of Investment Advisory Agreement

(unaudited)

At the Manning & Napier Fund, Inc. (the “Fund”) Board of Directors’ (the “Board”) meeting, held on November 18, 2014, the Investment Advisory Agreement (the “Agreement”) between the Fund and Manning & Napier Advisors, LLC (the “Advisor”) was considered by the Board for renewal. In connection with the decision whether to renew the Agreement, a variety of material was prepared for and considered by the Board.

Representatives of the Advisor attended the meeting and presented additional oral and written information to the Board to assist the Board in its considerations. The discussion immediately below outlines the materials and information presented to the Board in connection with the Board’s 2014 Annual consideration of the Agreement and the conclusions made by the Directors when determining to continue the Agreement.

| | • | | The Board considered the services provided by the Advisor under the Agreement including, among others: deciding what securities to purchase and sell for each Series; arranging for the purchase and sale of such securities by placing orders with broker-dealers; administering the affairs of the Fund (including the books and records of the Fund not maintained by third party service providers such as the custodian or sub-transfer agent); arranging for the insurance coverage for the Fund; and supervising the preparation of tax returns, SEC filings (including registration statements) and reports to shareholders for the Fund. The Board also considered the nature and quality of such services provided under the Agreement in light of the Advisor’s services provided to the Fund for 28 years. The Board discussed the quality of these services with representatives from the Advisor and concluded that the Advisor was performing its services to the Fund required under the Agreement in a reasonable manner. |

| | • | | The Board considered the performance of each Series since its inception, as well as performance over multiple time periods. Performance for one or more of the following time periods was considered as applicable to the Series’ inception date: inception, three year, five year, ten year, and current market cycle. A market cycle includes periods of both rising and falling markets. Returns for established benchmark indices for each Series were provided. In addition, the Board considered at the meeting (and considers on a quarterly basis) a peer group performance analysis consisting of Morningstar universes of mutual funds with similar investment objectives. The Board discussed the performance with representatives from the Advisor and concluded that the investment performance of each of the Fund’s Series was reasonable based on the Series’ actual performance and comparative performance, especially for those series with performance over the current market cycle. |

| | • | | The Board considered the costs of the Advisor’s services and the profits of the Advisor as they relate to the Advisor’s services to the Fund under the Agreement. In reviewing the Advisor’s costs and profits, the Board discussed the Advisor’s revenues generated from the Fund (on both an actual and adjusted basis) and its expenses associated with providing the services under the Agreement. In addition, the Board reviewed the Advisor’s expenses associated with Fund activities outside of the Agreement (such as expense reimbursements pursuant to expense caps and payments made by the Advisor to third party platforms on which shares of the Fund are available for purchase). It was noted by representatives of the Advisor that 20 of the 36 active Series of the Fund are currently experiencing expenses above the capped expense ratios and thus the advisor in incurring those expenses over the caps. After discussing the above costs and profits, the Board concluded that the Advisor’s profitability relating to its services provided under the Agreement was reasonable. |

| | • | | The Board considered the fees and expenses of the various Series of the Fund. The Advisor presented the advisory fees and total expenses for each Series, including the advisory fee adjusted for any expense waivers or reimbursements (either contractual or voluntary) paid by the Advisor. The advisory fees and expense ratios of each Series were compared to an average (on both a mean and median basis) of similar funds as disclosed on the Morningstar database. Representatives of the Advisor discussed with the Board the levels of its advisory fee for each Series of the Fund and as compared to the median and mean advisory fees for similar funds as listed on Morningstar. Expense ratios for every Series, except the Tax Managed Series, Pro-Blend Series Class C, and Target Series’ Class R and Class C, are lower than, or substantially similar to the Morningstar mean and median reported total expense ratio. The higher than mean and median total expense ratios for Classes C and R reflect higher distribution, marketing and shareholder service fees payable to broker-dealers through a 100bp 12b-1 fee for Class C and a 50bp 12b-1 fee for Class R. Based on their review of the information provided, the Board concluded that the fees and expenses of each Series of the Fund were reasonable on a comparative basis. |

23

Real Estate Series

Renewal of Investment Advisory Agreement

(unaudited)

| | • | | The Board also considered the other benefits the Advisor derives from its relationship with the Fund. Such other benefits include certain research services provided by soft dollars. The Board reviewed the broker-dealers who provided research to the Advisor and the products and services paid for, in whole or in part, using soft dollar commissions. Given the level of soft dollar transactions involving the Fund, the Board concluded that these additional benefits to the Advisor were reasonable. |

| | • | | In addition to the factors described above, the Board considered the Advisor’s personnel, investment strategies, policies and procedures relating to compliance with personal securities transactions, reputation, expertise and resources in domestic and foreign financial markets. The Board concluded that these factors support the conclusion that the Advisor performs its services in a reasonable manner. |

| | • | | The Board then considered economies of scale and concluded that the current fee schedule to the advisory agreement remained reasonable given the multiple uses of the Fund (for the Advisor’s discretionary investment account clients in addition to direct investors), the current profitability of the Advisor’s services to the Fund under the Agreement, the number of newly established series of the Fund and the overall size of the Fund complex. |

Based on the Board’s deliberations and their evaluation of the information described above, the Board, including a majority of Directors that are not “interested persons” as defined in the Investment Company Act of 1940, concluded that the compensation under the Agreement was fair and reasonable in light of the services and expenses and such other matters as the Directors considered to be relevant in the exercise of their reasonable judgment. Accordingly, the Board approved the renewal of the Agreement. In the course of their deliberations, the Directors did not identify any particular information that was all important or controlling.

24

Real Estate Series

Directors’ and Officers’ Information

(unaudited)

The Statement of Additional Information provides additional information about the Fund’s directors and officers and can be obtained without charge by calling 1-800-466-3863, at www.manningnapieradvisors.com, or on the EDGAR Database on the SEC Internet web site (http:// www.sec.gov). The following chart shows certain information about the Fund’s officers and directors, including their principal occupations during the last five years. Unless specific dates are provided, the individuals have held the listed positions for longer than five years.

Interested Director/Officer

| | |

| Name: | | B. Reuben Auspitz* |

| Address: | | 290 Woodcliff Drive Fairport, NY 14450 |

| Age: | | 67 |

| Current Position(s) Held with Fund: | | Principal Executive Officer, President, Chairman & Director |

| Term of Office1 & Length of Time Served: | | Indefinite - Director since 1984; Principal Executive Officer since 2002; President since 2004; Vice President 1984-2003. |

| Principal Occupation(s) During Past 5 Years: | | Executive Vice President since 1993; Chief Compliance Officer since 2004; Vice Chairman since June 2010; Co-Executive Director from 2002-2010 - Manning & Napier Advisors, LLC; President, Director - Manning & Napier Investor Services, Inc. Holds or has held one or more of the following titles for various subsidiaries and affiliates: President, Vice President, Director, Chairman, Treasurer, Chief Compliance Officer or Member. |

| Number of Portfolios Overseen within Fund Complex: | | 42 |

| Other Directorships Held Outside Fund Complex: | | N/A |

Independent Directors | | |

| Name: | | Stephen B. Ashley |

| Address: | | 290 Woodcliff Drive Fairport, NY 14450 |

| Age: | | 74 |

| Current Position(s) Held with Fund: | | Director, Audit Committee Member, Governance & Nominating Committee Member |

| Term of Office & Length of Time Served: | | Indefinite - Since 1996 |

| Principal Occupation(s) During Past 5 Years: | | Chairman, Director, President & Chief Executive Officer, The Ashley Group (property management and investment). Director 1995-2008 and Chairman (non-executive) 2004-2008 - Fannie Mae (mortgage) |

| Number of Portfolios Overseen within Fund Complex: | | 42 |

| Other Directorships Held Outside Fund Complex: | | Fannie Mae (1995-2008) The Ashley Group (1995-2008) Genesee Corporation (1987-2007) |

Name: Address: | | Paul A. Brooke 290 Woodcliff Drive Fairport, NY 14450 |

| Age: | | 69 |

| Current Position(s) Held with Fund: | | Director, Audit Committee Member, Governance & Nominating Committee Member |

| Term of Office & Length of Time Served: | | Indefinite - Since 2007 |

| Principal Occupation(s) During Past 5 Years: | | Chairman & CEO (2005-2009) - Alsius Corporation (investments); Managing Member, PMSV Holdings LLC (investments) since 1991; Managing Member, Venbio (investments) since 2010. |

| Number of Portfolios Overseen within Fund Complex: | | 42 |

| Other Directorships Held Outside Fund Complex: | | Incyte Corp. (2000-present) ViroPharma, Inc. (2000-2014) HLTH Corp (WebMD) (2000-2010) Cheyne Capital International (2000-present) GMP Companies (2000-2011) Cytos Biotechnology Ltd. (2012-2014) |

25

Real Estate Series

Directors’ and Officers’ Information

(unaudited)

Independent Directors (continued)

| | |

| Name: | | Peter L. Faber |

| Address: | | 290 Woodcliff Drive Fairport, NY 14450 |

| Age: | | 76 |

| Current Position(s) Held with Fund: | | Director, Governance & Nominating Committee Member |

| Term of Office & Length of Time Served: | | Indefinite - Since 1987 |

| Principal Occupation(s) During Past 5 Years: | | Senior Counsel (2006-2012), Partner (1995-2006 & 2013-present) - McDermott, Will & Emery LLP (law firm) |

| Number of Portfolios Overseen within Fund Complex: | | 42 |

| Other Directorships Held Outside Fund Complex: | | Partnership for New York City, Inc. (non-profit) (1989-2010) New York Collegium (non-profit) (2004-2011) Boston Early Music Festival (non-profit) |

| Name: | | Harris H. Rusitzky |

| Address: | | 290 Woodcliff Drive Fairport, NY 14450 |

| Age: | | 80 |

| Current Position(s) Held with Fund: | | Director, Audit Committee Member, Governance & Nominating Committee Member |

| Term of Office & Length of Time Served: | | Indefinite - Since 1985 |

| Principal Occupation(s) During Past 5 Years: | | President, The Greening Group (business consultants) since 1994; Partner, The Restaurant Group (restaurants) since 2006 |

| Number of Portfolios Overseen within Fund Complex: | | 42 |

| Other Directorships Held Outside Fund Complex: | | N/A |

| Name: | | Chester N. Watson |

| Address: | | 290 Woodcliff Drive Fairport, NY 14450 |

| Age: | | 64 |

| Current Position(s) Held with Fund: | | Director, Audit Committee Chairman, Governance & Nominating Committee Member |

| Term of Office & Length of Time Served: | | Indefinite - Since 2012 |

| Principal Occupation(s) During Past 5 Years: | | General Auditor (2003-2011) - General Motors Company (auto manufacturer) |

| Number of Portfolios Overseen within Fund Complex: | | 42 |

| Other Directorships Held Outside Fund Complex: | | N/A |

Officers | | |

| Name: | | Jeffrey S. Coons, Ph.D., CFA |

| Address: | | 290 Woodcliff Drive Fairport, NY 14450 |

| Age: | | 51 |

| Current Position(s) Held with Fund: | | Vice President |

| Term of Office1 & Length of Time Served: | | Since 2004 |

| Principal Occupation(s) During Past 5 Years: | | President since 2010, Co-Director of Research since 2002 - Manning & Napier Advisors, LLC Holds one or more of the following titles for various subsidiaries and affiliates: President, Director, Treasurer or Senior Trust Officer. |

| Number of Portfolios Overseen within Fund Complex: | | 42 |

| Other Directorships Held Outside Fund Complex: | | N/A |

| Name: | | Elizabeth Craig |

| Address: | | 290 Woodcliff Drive Fairport, NY 14450 |

| Age: | | 28 |

| Current Position(s) Held with Fund: | | Assistant Corporate Secretary |

| Term of Office1 & Length of Time Served: | | Since 2011 |

| Principal Occupation(s) During Past 5 Years: | | Mutual Fund Compliance Specialist since 2009 - Manning & Napier Advisors, LLC |

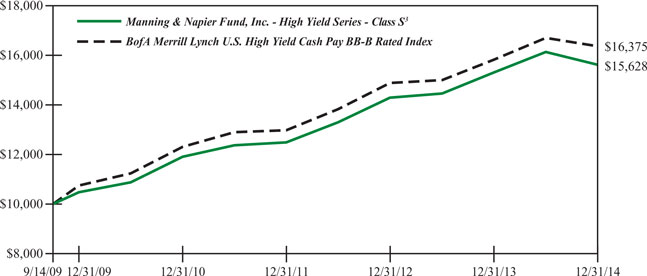

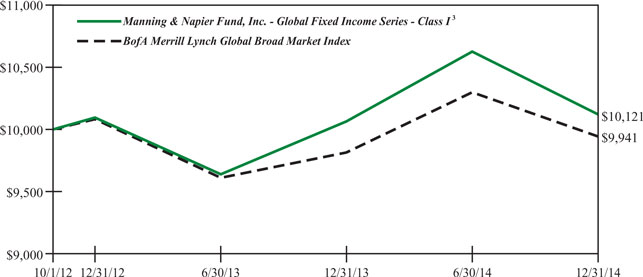

| Number of Portfolios Overseen within Fund Complex: | | 42 |