UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-04087

Manning & Napier Fund, Inc.

(Exact name of registrant as specified in charter)

290 Woodcliff Drive, Fairport, NY 14450

(Address of principal executive offices)(Zip Code)

James Mikolaichik 290 Woodcliff Drive, Fairport, NY 14450

(Name and address of agent for service)

Registrant’s telephone number, including area code: 585-325-6880

Date of fiscal year end: October 31

Date of reporting period: November 1, 2015 through April 30, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1: REPORTS TO STOCKHOLDERS.

Equity Series

Shareholder Expense Example

(unaudited)

As a shareholder of the Series, you incur ongoing costs, including management fees, shareholder service fees and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2015 to April 30, 2016).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Series’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads), redemptions fees, or exchange fees that you may incur in other mutual funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | |

| | | BEGINNING

ACCOUNT VALUE

11/1/15 | | ENDING

ACCOUNT VALUE

4/30/16 | | EXPENSES PAID

DURING PERIOD*

11/1/15-4/30/16 |

Actual | | $1,000.00 | | $1,029.50 | | $5.30 |

Hypothetical | | | | | | |

(5% return before expenses) | | $1,000.00 | | $1,019.64 | | $5.27 |

*Expenses are equal to the Series’ annualized expense ratio (for the six-month period) of 1.05%, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). The Series’ total return would have been lower had certain expenses not been waived during the period.

1

Equity Series

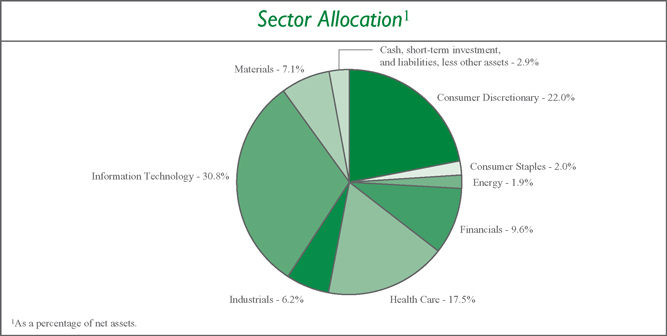

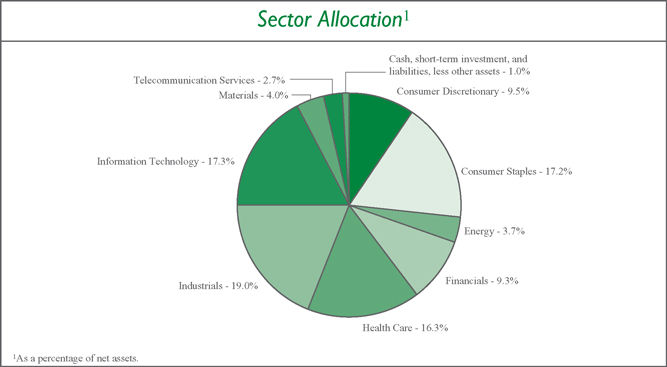

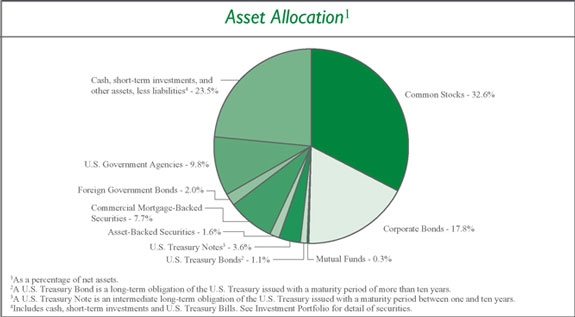

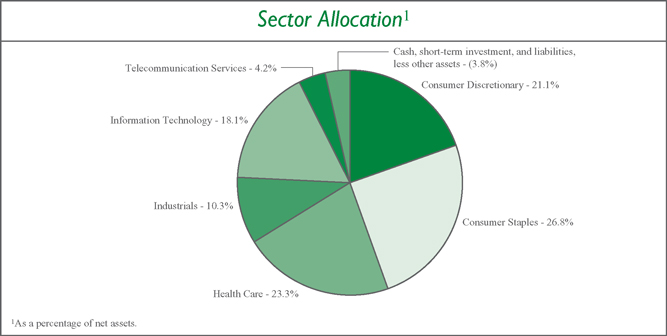

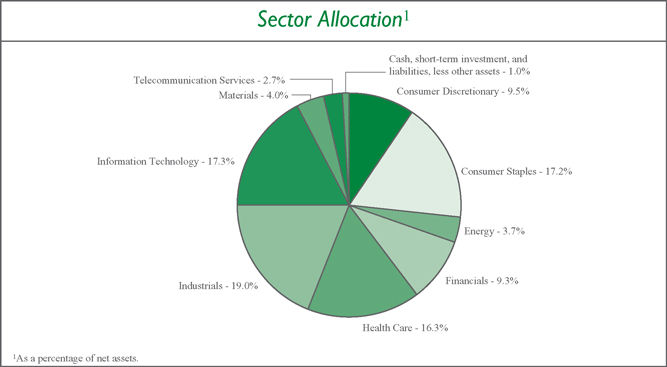

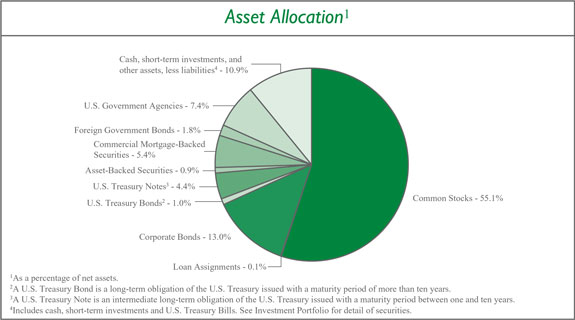

Portfolio Composition as of April 30, 2016

(unaudited)

2

Equity Series

Investment Portfolio - April 30, 2016

(unaudited)

| | | | | | | | |

| | | SHARES | | | VALUE (NOTE 2) | |

| | |

COMMON STOCKS - 97.1% | | | | | | | | |

| | |

Consumer Discretionary - 22.0% | | | | | | | | |

Diversified Consumer Services - 1.5% | | | | | | | | |

Houghton Mifflin Harcourt Co.* | | | 82,760 | | | $ | 1,697,408 | |

| | | | | | | | |

Hotels, Restaurants & Leisure - 2.8% | | | | | | | | |

Jack in the Box, Inc. | | | 8,560 | | | | 578,228 | |

Yum! Brands, Inc. | | | 32,220 | | | | 2,563,423 | |

| | | | | | | | |

| | |

| | | | | | | 3,141,651 | |

| | | | | | | | |

Internet & Catalog Retail - 7.8% | | | | | | | | |

Amazon.com, Inc.* | | | 4,680 | | | | 3,086,881 | |

The Priceline Group, Inc.* | | | 2,550 | | | | 3,426,333 | |

TripAdvisor, Inc.* | | | 35,070 | | | | 2,265,171 | |

| | | | | | | | |

| | |

| | | | | | | 8,778,385 | |

| | | | | | | | |

Media - 9.9% | | | | | | | | |

AMC Networks, Inc. - Class A* | | | 28,520 | | | | 1,860,360 | |

Sinclair Broadcast Group, Inc. - Class A | | | 38,700 | | | | 1,241,109 | |

TEGNA, Inc. | | | 19,120 | | | | 446,643 | |

Time Warner, Inc. | | | 38,520 | | | | 2,894,393 | |

Tribune Media Co. - Class A | | | 59,290 | | | | 2,285,630 | |

Twenty-First Century Fox, Inc. - Class A | | | 80,520 | | | | 2,436,535 | |

| | | | | | | | |

| | |

| | | | | | | 11,164,670 | |

| | | | | | | | |

| | |

Total Consumer Discretionary | | | | | | | 24,782,114 | |

| | | | | | | | |

| | |

Consumer Staples - 2.0% | | | | | | | | |

Beverages - 2.0% | | | | | | | | |

The Coca-Cola Co. | | | 50,430 | | | | 2,259,264 | |

| | | | | | | | |

| | |

Energy - 1.9% | | | | | | | | |

Oil, Gas & Consumable Fuels - 1.9% | | | | | | | | |

Range Resources Corp. | | | 47,220 | | | | 2,082,874 | |

| | | | | | | | |

Financials - 9.6% | | | | | | | | |

Capital Markets - 2.5% | | | | | | | | |

BlackRock, Inc. | | | 7,890 | | | | 2,811,444 | |

| | | | | | | | |

Consumer Finance - 3.6% | | | | | | | | |

SLM Corp.* | | | 255,490 | | | | 1,729,667 | |

Synchrony Financial* | | | 75,780 | | | | 2,316,595 | |

| | | | | | | | |

| | |

| | | | | | | 4,046,262 | |

| | | | | | | | |

Real Estate Investment Trusts (REITS) - 2.0% | | | | | | | | |

Weyerhaeuser Co. | | | 72,200 | | | | 2,319,064 | |

| | | | | | | | |

Real Estate Management & Development - 1.5% | | | | | | | | |

Realogy Holdings Corp.* | | | 46,950 | | | | 1,677,993 | |

| | | | | | | | |

Total Financials | | | | | | | 10,854,763 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

3

Equity Series

Investment Portfolio - April 30, 2016

(unaudited)

| | | | | | | | |

| | | | | | VALUE | |

| | | SHARES | | | (NOTE 2) | |

| | |

COMMON STOCKS (continued) | | | | | | | | |

| | |

Health Care - 17.5% | | | | | | | | |

Health Care Equipment & Supplies - 4.6% | | | | | | | | |

The Cooper Companies, Inc. | | | 14,880 | | | $ | 2,277,830 | |

Intuitive Surgical, Inc.* | | | 4,590 | | | | 2,874,992 | |

| | | | | | | | |

| | |

| | | | | | | 5,152,822 | |

| | | | | | | | |

Health Care Providers & Services - 5.7% | | | | | | | | |

DaVita HealthCare Partners, Inc.* | | | 46,930 | | | | 3,468,127 | |

Express Scripts Holding Co.* | | | 40,340 | | | | 2,974,268 | |

| | | | | | | | |

| | |

| | | | | | | 6,442,395 | |

| | | | | | | | |

Health Care Technology - 3.2% | | | | | | | | |

Cerner Corp.* | | | 63,420 | | | | 3,560,399 | |

| | | | | | | | |

Life Sciences Tools & Services - 2.0% | | | | | | | | |

Thermo Fisher Scientific, Inc. | | | 15,930 | | | | 2,297,902 | |

| | | | | | | | |

Pharmaceuticals - 2.0% | | | | | | | | |

Johnson & Johnson | | | 20,360 | | | | 2,281,949 | |

| | | | | | | | |

| | |

Total Health Care | | | | | | | 19,735,467 | |

| | | | | | | | |

Industrials - 6.2% | | | | | | | | |

Building Products - 1.0% | | | | | | | | |

Masco Corp. | | | 36,040 | | | | 1,106,788 | |

| | | | | | | | |

Industrial Conglomerates - 3.1% | | | | | | | | |

Danaher Corp. | | | 36,380 | | | | 3,519,765 | |

| | | | | | | | |

Machinery - 2.1% | | | | | | | | |

Flowserve Corp. | | | 49,540 | | | | 2,418,047 | |

| | | | | | | | |

| | |

Total Industrials | | | | | | | 7,044,600 | |

| | | | | | | | |

Information Technology - 30.8% | | | | | | | | |

Electronic Equipment, Instruments & Components - 3.8% | | | | | | | | |

FLIR Systems, Inc. | | | 77,710 | | | | 2,347,619 | |

VeriFone Systems, Inc.* | | | 68,550 | | | | 1,950,933 | |

| | | | | | | | |

| | |

| | | | | | | 4,298,552 | |

| | | | | | | | |

Internet Software & Services - 6.1% | | | | | | | | |

Alphabet, Inc. - Class A* | | | 2,290 | | | | 1,621,045 | |

Alphabet, Inc. - Class C* | | | 2,310 | | | | 1,600,853 | |

Facebook, Inc. - Class A* | | | 30,860 | | | | 3,628,519 | |

| | | | | | | | |

| | |

| | | | | | | 6,850,417 | |

| | | | | | | | |

IT Services - 9.6% | | | | | | | | |

EVERTEC, Inc. | | | 125,800 | | | | 1,694,526 | |

MasterCard, Inc. - Class A | | | 33,050 | | | | 3,205,520 | |

PayPal Holdings, Inc.* | | | 73,560 | | | | 2,882,081 | |

Visa, Inc. - Class A | | | 39,800 | | | | 3,074,152 | |

| | | | | | | | |

| | |

| | | | | | | 10,856,279 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

4

Equity Series

Investment Portfolio - April 30, 2016

(unaudited)

| | | | | | | | |

| | | | | | VALUE | |

| | | SHARES | | | (NOTE 2) | |

| | |

COMMON STOCKS (continued) | | | | | | | | |

| | |

Information Technology (continued) | | | | | | | | |

Semiconductors & Semiconductor Equipment - 2.4% | | | | | | | | |

QUALCOMM, Inc. | | | 54,780 | | | $ | 2,767,486 | |

| | | | | | | | |

Software - 6.3% | | | | | | | | |

Aspen Technology, Inc.* | | | 62,580 | | | | 2,379,917 | |

Electronic Arts, Inc.* | | | 34,810 | | | | 2,152,999 | |

ServiceNow, Inc.* | | | 36,550 | | | | 2,612,594 | |

| | | | | | | | |

| | |

| | | | | | | 7,145,510 | |

| | | | | | | | |

Technology Hardware, Storage & Peripherals - 2.6% | | | | | | | | |

Apple, Inc. | | | 30,770 | | | | 2,884,380 | |

| | | | | | | | |

| | |

Total Information Technology | | | | | | | 34,802,624 | |

| | | | | | | | |

Materials - 7.1% | | | | | | | | |

Chemicals - 3.9% | | | | | | | | |

Ashland, Inc. | | | 15,150 | | | | 1,690,740 | |

Monsanto Co. | | | 28,750 | | | | 2,693,300 | |

| | | | | | | | |

| | |

| | | | | | | 4,384,040 | |

| | | | | | | | |

Metals & Mining - 3.2% | | | | | | | | |

Alcoa, Inc. | | | 325,140 | | | | 3,631,814 | |

| | | | | | | | |

| | |

Total Materials | | | | | | | 8,015,854 | |

| | | | | | | | |

TOTAL COMMON STOCKS | | | | | | | | |

(Identified Cost $107,439,806) | | | | | | | 109,577,560 | |

| | | | | | | | |

| | |

SHORT-TERM INVESTMENT - 3.3% | | | | | | | | |

Dreyfus Cash Management, Inc. - Institutional Shares1, 0.29% | | | | | | | | |

(Identified Cost $3,757,862) | | | 3,757,862 | | | | 3,757,862 | |

| | | | | | | | |

TOTAL INVESTMENTS - 100.4% | | | | | | | | |

(Identified Cost $111,197,668) | | | | | | | 113,335,422 | |

LIABILITIES, LESS OTHER ASSETS - (0.4%) | | | | | | | (421,080 | ) |

| | | | | | | | |

| | |

NET ASSETS - 100% | | | | | | $ | 112,914,342 | |

| | | | | | | | |

ADR - American Depositary Receipt

*Non-income producing security.

1Rate shown is the current yield as of April 30, 2016.

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of MSCI Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P), and is licensed for use by Manning & Napier when referencing GICS sectors. Neither MSCI, S&P, nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification, nor shall any such party have any liability therefrom.

The accompanying notes are an integral part of the financial statements.

5

Equity Series

Statement of Assets and Liabilities

April 30, 2016 (unaudited)

| | | | |

ASSETS: | | | | |

| |

Investments, at value (identified cost $111,197,668) (Note 2) | | $ | 113,335,422 | |

Receivable for fund shares sold | | | 72,057 | |

Dividends receivable | | | 24,606 | |

Prepaid expenses | | | 3,607 | |

| | | | |

| |

TOTAL ASSETS | | | 113,435,692 | |

| | | | |

| |

LIABILITIES: | | | | |

| |

Accrued transfer agent fees (Note 3) | | | 70,618 | |

Accrued management fees (Note 3) | | | 49,914 | |

Accrued fund accounting and administration fees (Note 3) | | | 26,756 | |

Accrued Directors’ fees (Note 3) | | | 6,007 | |

Accrued Chief Compliance Officer service fees (Note 3) | | | 381 | |

Accrued printing and postage | | | 143,505 | |

Payable for fund shares repurchased | | | 133,775 | |

Accrued custodian fees | | | 48,493 | |

Other payables and accrued expenses | | | 41,901 | |

| | | | |

| |

TOTAL LIABILITIES | | | 521,350 | |

| | | | |

| |

TOTAL NET ASSETS | | $ | 112,914,342 | |

| | | | |

| |

NET ASSETS CONSIST OF: | | | | |

| |

Capital stock | | $ | 95,439 | |

Additional paid-in-capital | | | 103,487,737 | |

Undistributed net investment loss | | | (787,357 | ) |

Accumulated net realized gain on investments | | | 7,980,769 | |

Net unrealized appreciation (depreciation) on investments | | | 2,137,754 | |

| | | | |

| |

TOTAL NET ASSETS | | $ | 112,914,342 | |

| | | | |

NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - Class A

($112,914,342/9,543,894 shares) | | $ | 11.83 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

6

Equity Series

Statement of Operations

For the Six Months Ended April 30, 2016 (unaudited)

| | | | |

INVESTMENT INCOME: | | | | |

| |

Dividends | | $ | 170,210 | |

| | | | |

| |

EXPENSES: | | | | |

| |

Management fees (Note 3) | | | 892,585 | |

Transfer agent fees (Note 3) | | | 72,896 | |

Fund accounting and administration fees (Note 3) | | | 37,093 | |

Directors’ fees (Note 3) | | | 14,211 | |

Chief Compliance Officer service fees (Note 3) | | | 1,257 | |

Printing and postage fees | | | 82,502 | |

Custodian fees | | | 28,113 | |

Miscellaneous | | | 58,710 | |

| | | | |

| |

Total Expenses | | | 1,187,367 | |

Less reduction of expenses (Note 3) | | | (250,153 | ) |

| | | | |

| |

Net Expenses | | | 937,214 | |

| | | | |

| |

NET INVESTMENT LOSS | | | (767,004 | ) |

| | | | |

| |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | |

| |

Net realized gain on investments | | | 12,305,208 | |

Net change in unrealized appreciation (depreciation) on investments | | | (17,667,545 | ) |

| | | | |

| |

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | (5,362,337 | ) |

| | | | |

| |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (6,129,341 | ) |

| | | | |

The accompanying notes are an integral part of the financial statements.

7

Equity Series

Statements of Changes in Net Assets

| | | | | | | | |

| | | FOR THE SIX MONTHS ENDED 4/30/16 (UNAUDITED) | | | FOR THE YEAR ENDED 10/31/15 | |

INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | |

| | |

OPERATIONS: | | | | | | | | |

Net investment income (loss) | | $ | (767,004 | ) | | $ | 343,865 | |

Net realized gain on investments | | | 12,305,208 | | | | 108,788,624 | |

Net change in unrealized appreciation (depreciation) on investments | | | (17,667,545 | ) | | | (104,920,453 | ) |

| | | | | | | | |

| | |

Net increase (decrease) from operations | | | (6,129,341 | ) | | | 4,212,036 | |

| | | | | | | | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS (Note 8): | | | | | | | | |

| | |

From net investment income | | | (42,667 | ) | | | (246,854 | ) |

From net realized gain on investments | | | (57,461,992 | ) | | | (202,981,217 | ) |

| | | | | | | | |

| | |

Total distributions to shareholders | | | (57,504,659 | ) | | | (203,228,071 | ) |

| | | | | | | | |

| | |

CAPITAL STOCK ISSUED AND REPURCHASED: | | | | | | | | |

| | |

Net decrease from capital share transactions (Note 5) | | | (324,397,877 | ) | | | (590,372,793 | ) |

| | | | | | | | |

| | |

Net decrease in net assets | | | (388,031,877 | ) | | | (789,388,828 | ) |

| | |

NET ASSETS: | | | | | | | | |

| | |

Beginning of period | | | 500,946,219 | | | | 1,290,335,047 | |

| | | | | | | | |

| | |

End of period (including undistributed net investment loss of $787,357 and $22,314, respectively) | | $ | 112,914,342 | | | $ | 500,946,219 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

8

Equity Series

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | FOR THE SIX

MONTHS ENDED 4/30/15 | | | FOR THE YEARS ENDED | |

| | | (UNAUDITED) | | | 10/31/15 | | | 10/31/14 | | | 10/31/13 | | | 10/31/12 | | | 10/31/11 | |

Per share data (for a share outstanding throughout each period): | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value - Beginning of period | | $ | 16.62 | | | $ | 21.15 | | | $ | 21.60 | | | $ | 19.03 | | | $ | 18.45 | | | $ | 17.91 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)1 | | | (0.06 | ) | | | 0.01 | | | | (0.00 | )2 | | | 0.01 | | | | 0.01 | | | | 0.04 | |

Net realized and unrealized gain (loss) on investments | | | 0.26 | | | | (0.42 | ) | | | 2.51 | | | | 5.14 | | | | 1.26 | | | | 0.55 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total from investment operations | | | 0.20 | | | | (0.41 | ) | | | 2.51 | | | | 5.15 | | | | 1.27 | | | | 0.59 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.00 | )2 | | | (0.00 | )2 | | | (0.01 | ) | | | (0.03 | ) | | | (0.04 | ) | | | (0.05 | ) |

From net realized gain on investments | | | (4.99 | ) | | | (4.12 | ) | | | (2.95 | ) | | | (2.55 | ) | | | (0.65 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (4.99 | ) | | | (4.12 | ) | | | (2.96 | ) | | | (2.58 | ) | | | (0.69 | ) | | | (0.05 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value - End of period | | $ | 11.83 | | | $ | 16.62 | | | $ | 21.15 | | | $ | 21.60 | | | $ | 19.03 | | | $ | 18.45 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets - End of period (000’s omitted) | | $ | 112,914 | | | $ | 500,946 | | | $ | 1,290,335 | | | $ | 1,237,520 | | | $ | 1,418,468 | | | $ | 1,925,038 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return3 | | | 2.95 | % | | | (1.46 | %) | | | 13.23 | % | | | 30.61 | % | | | 7.37 | % | | | 3.30 | % |

Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses* | | | 1.05 | %4 | | | 1.05 | % | | | 1.05 | % | | | 1.05 | % | | | 1.05 | % | | | 1.05 | % |

Net investment income (loss) | | | (0.86 | %)4 | | | 0.04 | % | | | (0.01 | %) | | | 0.06 | % | | | 0.06 | % | | | 0.24 | % |

Portfolio turnover | | | 21 | % | | | 62 | % | | | 61 | % | | | 52 | % | | | 63 | % | | | 54 | % |

|

| *The investment advisor did not impose all or a portion of its management and/or other fees, and in some years may have paid a portion of the Series’ expenses. If these expenses had been incurred by the Series, the expense ratio (to average net assets) would have increased by the following amounts: | |

| | | 0.28 | %4 | | | 0.03 | % | | | 0.02 | % | | | 0.06 | % | | | 0.05 | % | | | 0.02 | % |

1Calculated based on average shares outstanding during the periods.

2Less than $(0.01).

3Represents aggregate total return for the periods indicated, and assumes reinvestment of all distributions. Total return would have been lower had certain expenses not been waived or reimbursed during the periods. Periods less than one year are not annualized.

4Annualized.

The accompanying notes are an integral part of the financial statements.

9

Equity Series

Notes to Financial Statements

(unaudited)

Equity Series (the “Series”) is a no-load diversified series of Manning & Napier Fund, Inc. (the “Fund”). The Fund is organized in Maryland and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

The Series’ investment objective is to provide long-term growth of capital.

The Fund’s Advisor is Manning & Napier Advisors, LLC (the “Advisor”). Shares of the Series are offered to investors, clients and employees of the Advisor and its affiliates. The total authorized capital stock of the Fund consists of 15 billion shares of common stock each having a par value of $0.01. As of April 30, 2016, 10.5 billion shares have been designated in total among 40 series, of which 200 million have been designated as Equity Series Class A common stock.

| 2. | Significant Accounting Policies |

The following is a summary of significant accounting policies followed by the Series. The Series is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 - Investment Companies, which is part of accounting principles generally accepted in the United States of America (“GAAP”).

Security Valuation

Portfolio securities, including domestic equities, listed on an exchange other than the NASDAQ Stock Market are valued at the latest quoted sales price of the exchange on which the security is primarily traded. Securities not traded on valuation date or securities not listed on an exchange are valued at the latest quoted bid price provided by the Fund’s pricing service. Securities listed on the NASDAQ Stock Market are valued in accordance with the NASDAQ Official Closing Price.

Short-term investments that mature in sixty days or less may be valued at amortized cost, which approximates fair value. Investments in open-end investment companies are valued at their net asset value per share on valuation date.

Volume and level of activity in established markets for an asset or liability are evaluated to determine whether recent transactions and quoted prices are determinative of fair value. Where there have been significant decreases in volume and level of activity, further analysis and adjustment may be necessary to estimate fair value. The Series measures fair value in these instances by the use of inputs and valuation techniques which may be based upon current market prices of securities that are comparable in coupon, rating, maturity and industry and/or expectation of future cash flows. As a result of trading in relatively thin markets and/or markets that experience significant volatility, the prices used by the Series to value these securities may differ from the value that would be realized if these securities were sold, and the differences could be material.

Securities for which representative valuations or prices are not available from the Series’ pricing service may be valued at fair value as determined in good faith by the Advisor under procedures approved by and under the general supervision and responsibility of the Fund’s Board of Directors (the “Board”). Due to the inherent uncertainty of valuations of such securities, the fair value may differ significantly from the values that would have been used had a ready market for such securities existed. If trading or events occurring after the close of the principal market in which securities are traded are expected to materially affect the value of those securities, then they may be valued at their fair value, taking this trading or these events into account.

Various inputs are used in determining the value of the Series’ assets or liabilities carried at fair value. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical assets and liabilities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Level 3 includes significant unobservable inputs (including the Series’ own assumptions in determining the fair value of investments). A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input both individually and in aggregate that is significant to the fair value measurement. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

10

Equity Series

Notes to Financial Statements (continued)

(unaudited)

| 2. | Significant Accounting Policies (continued) |

Security Valuation (continued)

The following is a summary of the valuation levels used for major security types as of April 30, 2016 in valuing the Series’ assets or liabilities carried at fair value:

| | | | | | | | | | | | | | | | |

| DESCRIPTION | | TOTAL | | | LEVEL 1 | | | LEVEL 2 | | | LEVEL 3 | |

Assets: | | | | | | | | | | | | | | | | |

Equity securities: | | | | | | | | | | | | | | | | |

Consumer Discretionary | | $ | 24,782,114 | | | $ | 24,782,114 | | | $ | — | | | $ | — | |

Consumer Staples | | | 2,259,264 | | | | 2,259,264 | | | | — | | | | — | |

Energy | | | 2,082,874 | | | | 2,082,874 | | | | — | | | | — | |

Financials | | | 10,854,763 | | | | 10,854,763 | | | | — | | | | — | |

Health Care | | | 19,735,467 | | | | 19,735,467 | | | | — | | | | — | |

Industrials | | | 7,044,600 | | | | 7,044,600 | | | | — | | | | — | |

Information Technology | | | 34,802,624 | | | | 34,802,624 | | | | — | | | | — | |

Materials | | | 8,015,854 | | | | 8,015,854 | | | | — | | | | — | |

Mutual Fund | | | 3,757,862 | | | | 3,757,862 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total assets | | $ | 113,335,422 | | | $ | 113,335,422 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

There were no Level 2 or Level 3 securities held by the Series as of October 31, 2015 or April 30, 2016.

The Fund’s policy is to recognize transfers in and transfers out of the valuation levels as of the beginning of the reporting period. There were no transfers between Level 1 and Level 2 during the six months ended April 30, 2016.

Security Transactions, Investment Income and Expenses

Security transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date, except that if the ex-dividend date has passed, certain dividends from foreign securities are recorded as soon as the Series is informed of the ex-dividend date. Non-cash dividends, if any, are recorded at the fair value of the securities received. Interest income, including amortization of premium and accretion of discounts using the effective interest method, is earned from settlement date and accrued daily.

Expenses are recorded on an accrual basis. Most expenses of the Fund can be attributed to a specific series. Expenses which cannot be directly attributed are apportioned among the series in the Fund in such a manner as deemed equitable by the Fund’s Board, taking into consideration, among other things, the nature and type of expense.

The Series uses the identified cost method for determining realized gain or loss on investments for both financial statement and federal income tax reporting purposes.

Federal Taxes

The Series’ policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. The Series is not subject to federal income tax or excise tax to the extent that the Series distributes to shareholders each year its taxable income, including any net realized gains on investments, in accordance with requirements of the Internal Revenue Code. Accordingly, no provision for federal income tax or excise tax has been made in the financial statements.

Management evaluates its tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. At April 30, 2016, the Series has recorded no liability for net unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken in future tax returns.

11

Equity Series

Notes to Financial Statements (continued)

(unaudited)

| 2. | Significant Accounting Policies (continued) |

Federal Taxes (continued)

The Series files income tax returns in the U.S. federal jurisdiction, various states and foreign jurisdictions, as required. No income tax returns are currently under investigation. The statute of limitations on the Series’ tax returns remains open for the years ended October 31, 2012 through October 31, 2015. The Series is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Foreign Taxes

Based on the Series’ understanding of the tax rules and rates related to income, gains and currency purchase/repatriation transactions for foreign jurisdictions in which it invests, the Series will provide for foreign taxes, and where appropriate, deferred foreign tax.

Distributions of Income and Gains

Distributions to shareholders of net investment income and net realized gains are made annually. An additional distribution may be necessary to avoid taxation of the Series. Distributions are recorded on the ex-dividend date.

Indemnifications

The Fund’s organizational documents provide former and current directors and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Other

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

| 3. | Transactions with Affiliates |

The Fund has an Investment Advisory Agreement (the “Agreement”) with the Advisor, for which the Series pays a fee, computed daily and payable monthly, at an annual rate of 1.00% of the Series’ average daily net assets.

Under the Agreement, personnel of the Advisor provide the Series with advice and assistance in the choice of investments and the execution of securities transactions, and otherwise maintain the Series’ organization. The Advisor also provides the Fund with necessary office space and fund administration and support services. The salaries of all officers of the Fund (except a percentage of the Fund’s Chief Compliance Officer’s salary, which is paid by the Fund), and of all Directors who are “affiliated persons” of the Fund, or of the Advisor, and all personnel of the Fund, or of the Advisor, performing services relating to research, statistical and investment activities, are paid by the Advisor. Each “non-affiliated” Director receives an annual stipend, which is allocated among all the active series of the Fund. In addition, these Directors also receive a fee per Board meeting attended plus a fee for each committee meeting attended and are reimbursed for travel and other out-of-pocket expenses incurred by them in connection with attending such meetings. The Fund also has an Audit Committee Chair, who receives an additional annual stipend for this role.

The Advisor has contractually agreed, until at least February 28, 2017, to waive its management fee and, if necessary, pay other operating expenses of the Series in order to maintain total direct annual fund operating expenses for the Series at no more than 1.05% of average daily net assets each year. Accordingly, the Advisor waived fees of $250,153 for the six months ended April 30, 2016, which is included as a reduction of expenses on the Statement of Operations. The Advisor is not eligible to recoup any expenses that have been waived or reimbursed in prior years.

Manning & Napier Investor Services, Inc., a registered broker-dealer affiliate of the Advisor, acts as distributor for the Fund’s shares. The services of Manning & Napier Investor Services, Inc. are provided at no additional cost to the Series.

12

Equity Series

Notes to Financial Statements (continued)

(unaudited)

| 3. | Transactions with Affiliates (continued) |

Pursuant to a master services agreement dated November 1, 2014, the Fund pays the Advisor an annual fee related to fund accounting and administration of 0.0085% on the first $25 billion of average daily net assets (excluding Target Series and Strategic Income Series); 0.0075% on the next $15 billion of average daily net assets (excluding Target Series and Strategic Income Series); and 0.0065% of the average daily net assets in excess of $40 billion (excluding Target Series and Strategic Income Series); plus a base fee of $30,400 per series. Transfer agent fees are charged to the Fund on a per account basis. Additionally, certain transaction and out-of-pocket expenses, including charges for reporting relating to the Fund’s compliance program, are charged. The Advisor has agreements with BNY Mellon Investment Servicing (U.S.) Inc. (“BNY”) under which BNY serves as sub-accountant services agent and sub-transfer agent.

Expenses not directly attributable to a series are allocated based on each series’ relative net assets or number of accounts, depending on the expense.

| 4. | Purchases and Sales of Securities |

For the six months ended April 30, 2016, purchases and sales of securities, other than U.S. Government securities and short-term securities, were $39,739,625 and $410,446,285, respectively. There were no purchases or sales of U.S. Government securities.

| 5. | Capital Stock Transactions |

Transactions in shares of Equity Series were:

| | | | | | | | | | | | | | | | |

| | | FOR THE SIX MONTHS ENDED 4/30/16 | | | FOR THE YEAR ENDED 10/31/15 | |

| | | SHARES | | | AMOUNT | | | SHARES | | | AMOUNT | |

Sold | | | 933,574 | | | $ | 11,678,036 | | | | 7,560,319 | | | $ | 132,732,396 | |

Reinvested | | | 4,999,943 | | | | 55,867,602 | | | | 12,219,383 | | | | 198,472,048 | |

Repurchased | | | (26,524,446 | ) | | | (391,943,515 | ) | | | (50,651,323 | ) | | | (921,577,237 | ) |

| | | | | | | | | | | | | | | | |

Total | | | (20,590,929 | ) | | $ | (324,397,877 | ) | | | (30,871,621 | ) | | $ | (590,372,793 | ) |

| | | | | | | | | | | | | | | | |

At April 30, 2016, the retirement plan of the Advisor and its affiliates owned 505,774 shares of the Series (5.3% of shares outstanding) valued at $5,983,306.

The Series may trade in instruments including written and purchased options, forward foreign currency exchange contracts and futures contracts and other derivatives in the normal course of investing activities to assist in managing exposure to various market risks. The Series may be subject to various elements of risk, which may involve, to a varying degree, elements of risk in excess of the amounts recognized for financial statement purposes. These risks include: the risk that changes in the value of a derivative may not correlate perfectly with the underlying asset, rate or index; counterparty credit risk related to over the counter derivative counterparties’ failure to perform under contract terms; liquidity risk related to the lack of a liquid market for these contracts allowing the fund to close out its position(s); and documentation risk relating to disagreement over contract terms. No such investments were held by the Series as of April 30, 2016.

Investing in securities of foreign companies and foreign governments involves special risks and considerations not typically associated with investing in securities of domestic companies and the U.S. Government. These risks include revaluation of currencies and future adverse political and economic developments. Moreover, securities of foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of comparable domestic companies and the U.S. Government.

13

Equity Series

Notes to Financial Statements (continued)

(unaudited)

| 8. | Federal Income Tax Information |

The amount and characterization of certain income and capital gains to be distributed are determined in accordance with federal income tax regulations, which may differ from GAAP. The Series may periodically make reclassifications among its capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations, without impacting the Series’ net asset value. Any such reclassifications are not reflected in the financial highlights.

The final determination of the tax character of current year distributions will be made at the conclusion of the fiscal year. The tax character of distributions paid for the year ended October 31, 2015, were as follows:

| | | | |

Ordinary income | | $ | 49,123,867 | |

Long-term capital gains | | | 154,104,204 | |

At April 30, 2016, the identified cost of investments for federal income tax purposes, the resulting gross unrealized appreciation and depreciation, and the net unrealized appreciation were as follows:

| | | | |

Cost for federal income tax purposes | | $ | 113,158,801 | |

Unrealized appreciation | | | 6,683,542 | |

Unrealized depreciation | | | (6,506,921 | ) |

| | | | |

Net unrealized appreciation | | $ | 176,621 | |

| | | | |

14

Equity Series

Renewal of Investment Advisory Agreement

(unaudited)

At the Manning & Napier Fund, Inc. (the “Fund”) Board of Directors’ (the “Board”) meeting, held on November 17, 2015, the Investment Advisory Agreement (the “Agreement”) between the Fund and Manning & Napier Advisors, LLC (the “Advisor”) was considered by the Board for renewal. In connection with the decision whether to renew the Agreement, a variety of material was prepared for and considered by the Board.

Representatives of the Advisor attended the meeting and presented additional oral and written information to the Board to assist the Board in its considerations. The discussion immediately below outlines the materials and information presented to the Board in connection with the Board’s 2015 Annual consideration of the Agreement and the conclusions made by the Directors when determining to continue the Agreement.

| | • | | The Board considered the services provided by the Advisor under the Agreement including, among others: deciding what securities to purchase and sell for each Series; arranging for the purchase and sale of such securities by placing orders with broker-dealers; administering the affairs of the Fund (including the books and records of the Fund not maintained by third party service providers such as the custodian or sub-transfer agent); arranging for the insurance coverage for the Fund; and supervising the preparation of tax returns, SEC filings (including registration statements) and reports to shareholders for the Fund. The Board also considered the nature and quality of such services provided under the Agreement in light of the Advisor’s services provided to the Fund for 29 years. The Board discussed the quality of these services with representatives from the Advisor and concluded that the Advisor was performing its services to the Fund required under the Agreement in a reasonable manner. |

| | • | | The Board considered the performance of each Series since its inception, as well as performance over multiple time periods. Performance for one or more of the following time periods was considered as applicable to the Series’ inception date: inception, three year, five year, ten year, and current market cycle. A market cycle includes periods of both rising and falling markets. Returns for established benchmark indices for each Series were provided. In addition, the Board considered a number of other factors relevant to performance at the meeting (and considers on a quarterly basis) including: a peer group performance analysis consisting of Morningstar universes of mutual funds with similar investment objectives, investment performance of core products, product offerings, performance on an aggregate basis vs. performance over reasonable time periods and the Advisor’s investment process. The Directors acknowledged the challenging performance and discussed the investment process of the Advisor. The Directors confirmed that qualitative factors such as the Advisor’s investment process, including recent enhancements, were an important subset to be considered as part of their consideration of performance. The Board discussed the performance with representatives from the Advisor and concluded that the investment performance of each of the Fund’s Series was reasonable based on the Series’ actual performance and comparative performance, especially for those series with performance over the current market cycle. |

| | • | | The Board considered the costs of the Advisor’s services and the profits of the Advisor as they relate to the Advisor’s services to the Fund under the Agreement. In reviewing the Advisor’s costs and profits, the Board discussed the Advisor’s revenues generated from the Fund (on both an actual and adjusted basis) and its expenses associated with providing the services under the Agreement. In addition, the Board reviewed the Advisor’s expenses associated with Fund activities outside of the Agreement (such as expense reimbursements pursuant to expense caps and payments made by the Advisor to third party platforms on which shares of the Fund are available for purchase). It was noted by representatives of the Advisor that 22 of the 36 active Series of the Fund are currently experiencing expenses above the capped expense ratios, and thus the Advisor is incurring those expenses over the cap. After discussing the above costs and profits, the Board concluded that the Advisor’s profitability relating to its services provided under the Agreement was reasonable. |

| | • | | The Board considered the fees and expenses of the various Series of the Fund. The Advisor presented the advisory fees and total expenses for each Series, including the advisory fee adjusted for any expense waivers or reimbursements (either contractual or voluntary) paid by the Advisor. The advisory fees and expense ratios of each Series were compared to an average (on both a mean and median basis) of similar funds as disclosed on the Morningstar database. Representatives of the Advisor discussed with the Board the levels of its advisory fee for each Series of the Fund and as compared to the median and mean advisory fees for similar funds as listed on Morningstar. Expense ratios for every Series, except the Tax Managed Series, Equity Income Class S, High Yield Bond Class S, Pro-Blend Series Classes C and R, and Target Series’ Classes R and K, are lower than, or substantially similar to the Morningstar mean and median reported total expense ratio. |

15

Equity Series

Renewal of Investment Advisory Agreement

(unaudited)

| | The higher than mean and median total expense ratios for Classes C and R reflect higher distribution, marketing and shareholder service fees payable to broker-dealers through a 100bp 12b-1 fee for Class C and a 50bp 12b-1 fee for Class R. Based on their review of the information provided, the Board concluded that the fees and expenses of each Series of the Fund were reasonable on a comparative basis. |

| | • | | The Board also considered the other benefits the Advisor derives from its relationship with the Fund. Such other benefits include certain research services provided by soft dollars. The Board reviewed the broker-dealers who provided research to the Advisor and the products and services paid for, in whole or in part, using soft dollar commissions. Given the level of soft dollar transactions involving the Fund, the Board concluded that these additional benefits to the Advisor were reasonable. |

| | • | | In addition to the factors described above, the Board considered the Advisor’s personnel, investment strategies, policies and procedures relating to compliance with personal securities transactions, reputation, expertise and resources in domestic and foreign financial markets. The Board concluded that these factors support the conclusion that the Advisor performs its services in a reasonable manner. |

| | • | | The Board then considered economies of scale and concluded that the current fee schedule to the advisory agreement remained reasonable given the multiple uses of the Fund (for the Advisor’s discretionary investment account clients in addition to direct investors), the current profitability of the Advisor’s services to the Fund under the Agreement, the number of newly established series of the Fund and the overall size of the Fund complex. |

Based on the Board’s deliberations and their evaluation of the information described above, the Board, including a majority of Directors that are not “interested persons” as defined in the Investment Company Act of 1940, concluded that the compensation under the Agreement was fair and reasonable in light of the services and expenses and such other matters as the Directors considered to be relevant in the exercise of their reasonable judgment. Accordingly, the Board approved the renewal of the Agreement. In the course of their deliberations, the Directors did not identify any particular information that was all important or controlling.

16

{This page intentionally left blank}

17

Equity Series

Literature Requests

(unaudited)

Proxy Voting Policies and Procedures

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available, without charge, upon request:

| | | | |

| By phone | | 1-800-466-3863 | | |

| On the Securities and Exchange | | | | |

| Commission’s (SEC) web site | | http://www.sec.gov | | |

Proxy Voting Record

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available, without charge, upon request:

| | | | |

| By phone | | 1-800-466-3863 | | |

| On the SEC’s web site | | http://www.sec.gov | | |

Quarterly Portfolio Holdings

The Series’ complete schedule of portfolio holdings for the 1st and 3rd quarters of each fiscal year are provided on Form N-Q, and are available, without charge, upon request:

| | | | |

| By phone | | 1-800-466-3863 | | |

| On the SEC’s web site | | http://www.sec.gov | | |

The Series’ Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Prospectus and Statement of Additional Information (SAI)

For more information about any of the Manning & Napier Fund, Inc. Series, you may obtain a prospectus and SAI at www.manning-napier.com or by calling (800) 466-3863. Before investing, carefully consider the objectives, risks, charges and expenses of the investment and read the prospectus carefully as it contains this and other information about the investment company. In addition, this information can be found on the SEC’s web site, http://www.sec.gov.

Additional information available at www.manning-napier.com

1. Fund Holdings - Month-End

2. Fund Holdings - Quarter-End

3. Shareholder Report - Annual

4. Shareholder Report - Semi-Annual

The Fund also offers electronic notification or “e-delivery” when certain documents are available on-line to be downloaded or reviewed. Direct shareholders can elect to receive electronic notification when shareholder reports, prospectus updates, and/or statements are available. If you do not currently have on-line access to your account, you can establish access by going to www.manning-napier.com, click on “Login” in the top corner of the page, and follow the prompts to self-enroll. Once enrolled, you can set your electronic notification preferences by clicking on the Account Options tab located within the green toolbar and then select E-Delivery Option. Should you have any questions on either how to establish on-line access or how to update your account settings, please contact Investor Services at 1-800-466-3863.

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

MNEQY-04/16-SAR

Tax Managed Series

Shareholder Expense Example

(unaudited)

As a shareholder of the Series, you incur ongoing costs, including management fees, shareholder service fees and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2015 to April 30, 2016).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Series’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads), redemptions fees, or exchange fees that you may incur in other mutual funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | |

| | | BEGINNING

ACCOUNT VALUE

11/1/15 | | ENDING

ACCOUNT VALUE

4/30/16 | | EXPENSES PAID

DURING PERIOD*

11/1/15-4/30/16 |

Actual | | $1,000.00 | | $1,012.60 | | $6.00 |

Hypothetical | | | | | | |

(5% return before expenses) | | $1,000.00 | | $1,018.90 | | $6.02 |

*Expenses are equal to the Series’ annualized expense ratio (for the six-month period) of 1.20%, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). The Series’ total return would have been lower had certain expenses not been waived during the period.

1

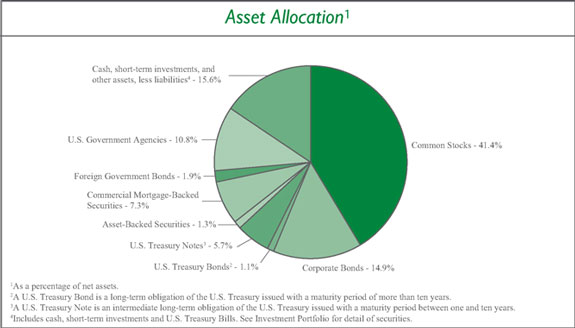

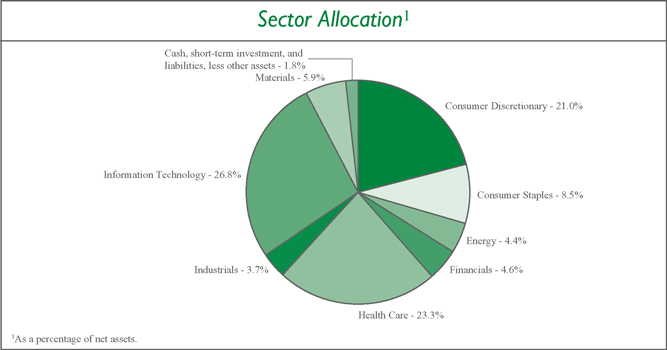

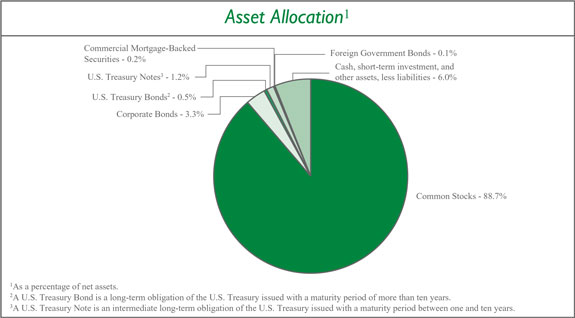

Tax Managed Series

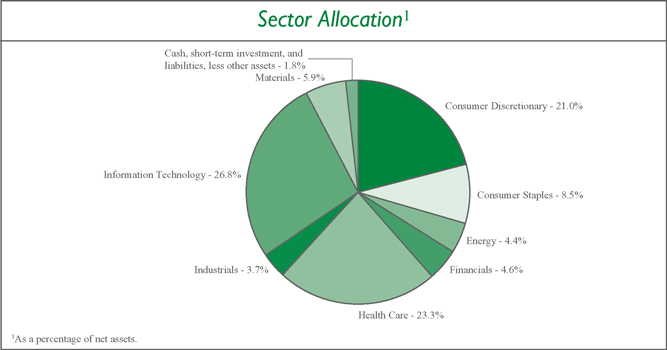

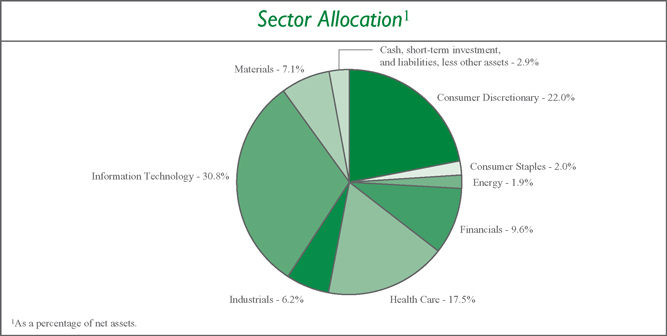

Portfolio Composition as of April 30, 2016

(unaudited)

2

Tax Managed Series

Investment Portfolio - April 30, 2016

(unaudited)

| | | | | | | | |

| | | SHARES | | | VALUE

(NOTE 2) | |

| | |

COMMON STOCKS - 98.2% | | | | | | | | |

| | |

Consumer Discretionary - 21.0% | | | | | | | | |

Diversified Consumer Services - 1.4% | | | | | | | | |

Houghton Mifflin Harcourt Co.* | | | 11,430 | | | $ | 234,429 | |

| | | | | | | | |

Hotels, Restaurants & Leisure - 1.9% | | | | | | | | |

Yum! Brands, Inc. | | | 4,100 | | | | 326,196 | |

| | | | | | | | |

Internet & Catalog Retail - 5.4% | | | | | | | | |

Amazon.com, Inc.* | | | 360 | | | | 237,452 | |

The Priceline Group, Inc.* | | | 340 | | | | 456,844 | |

TripAdvisor, Inc.* | | | 3,180 | | | | 205,396 | |

| | | | | | | | |

| | |

| | | | | | | 899,692 | |

| | | | | | | | |

Media - 10.6% | | | | | | | | |

AMC Networks, Inc. - Class A* | | | 3,760 | | | | 245,265 | |

Liberty Global plc - Class A - ADR (United Kingdom)* | | | 2,850 | | | | 107,530 | |

Sinclair Broadcast Group, Inc. - Class A | | | 3,370 | | | | 108,076 | |

TEGNA, Inc. | | | 2,300 | | | | 53,728 | |

Time Warner, Inc. | | | 5,880 | | | | 441,823 | |

Tribune Media Co. - Class A | | | 9,990 | | | | 385,114 | |

Twenty-First Century Fox, Inc. - Class A | | | 13,690 | | | | 414,260 | |

| | | | | | | | |

| | |

| | | | | | | 1,755,796 | |

| | | | | | | | |

Textiles, Apparel & Luxury Goods - 1.7% | | | | | | | | |

lululemon athletica, Inc.* | | | 4,220 | | | | 276,621 | |

| | | | | | | | |

| | |

Total Consumer Discretionary | | | | | | | 3,492,734 | |

| | | | | | | | |

| | |

Consumer Staples - 8.5% | | | | | | | | |

Beverages - 5.0% | | | | | | | | |

Anheuser-Busch InBev S.A./N.V. (Belgium)1 | | | 2,510 | | | | 311,377 | |

The Coca-Cola Co. | | | 5,210 | | | | 233,408 | |

Diageo plc (United Kingdom)1 | | | 10,300 | | | | 278,473 | |

| | | | | | | | |

| | |

| | | | | | | 823,258 | |

| | | | | | | | |

Food Products - 1.1% | | | | | | | | |

Nestle S.A. (Switzerland)1 | | | 2,550 | | | | 190,330 | |

| | | | | | | | |

Personal Products - 2.4% | | | | | | | | |

Beiersdorf AG (Germany)1 | | | 2,090 | | | | 187,673 | |

Unilever plc - ADR (United Kingdom) | | | 4,650 | | | | 208,599 | |

| | | | | | | | |

| | |

| | | | | | | 396,272 | |

| | | | | | | | |

| | |

Total Consumer Staples | | | | | | | 1,409,860 | |

| | | | | | | | |

Energy - 4.4% | | | | | | | | |

Energy Equipment & Services - 2.1% | | | | | | | | |

Schlumberger Ltd. | | | 4,260 | | | | 342,248 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

3

Tax Managed Series

Investment Portfolio - April 30, 2016

(unaudited)

| | | | | | | | |

| | | SHARES | | | VALUE (NOTE 2) | |

| | |

COMMON STOCKS (continued) | | | | | | | | |

| | |

Energy (continued) | | | | | | | | |

Oil, Gas & Consumable Fuels - 2.3% | | | | | | | | |

Range Resources Corp. | | | 8,750 | | | $ | 385,962 | |

| | | | | | | | |

| | |

Total Energy | | | | | | | 728,210 | |

| | | | | | | | |

Financials - 4.6% | | | | | | | | |

Consumer Finance - 2.0% | | | | | | | | |

SLM Corp.* | | | 27,870 | | | | 188,680 | |

Synchrony Financial* | | | 4,960 | | | | 151,627 | |

| | | | | | | | |

| | |

| | | | | | | 340,307 | |

| | | | | | | | |

Real Estate Investment Trusts (REITS) - 1.9% | | | | | | | | |

Weyerhaeuser Co | | | 9,880 | | | | 317,346 | |

| | | | | | | | |

Real Estate Management & Development - 0.7% | | | | | | | | |

Realogy Holdings Corp.* | | | 3,030 | | | | 108,292 | |

| | | | | | | | |

| | |

Total Financials | | | | | | | 765,945 | |

| | | | | | | | |

Health Care - 23.3% | | | | | | | | |

Health Care Equipment & Supplies - 7.0% | | | | | | | | |

The Cooper Companies, Inc. | | | 2,030 | | | | 310,752 | |

Intuitive Surgical, Inc.* | | | 790 | | | | 494,824 | |

Medtronic plc | | | 4,490 | | | | 355,384 | |

| | | | | | | | |

| | |

| | | | | | | 1,160,960 | |

| | | | | | | | |

Health Care Providers & Services - 5.7% | | | | | | | | |

DaVita HealthCare Partners, Inc.* | | | 4,730 | | | | 349,547 | |

Express Scripts Holding Co.* | | | 5,090 | | | | 375,286 | |

Fresenius Medical Care AG & Co. KGaA (Germany)1 | | | 2,500 | | | | 217,594 | |

| | | | | | | | |

| | |

| | | | | | | 942,427 | |

| | | | | | | | |

Health Care Technology - 2.6% | | | | | | | | |

Cerner Corp.* | | | 7,570 | | | | 424,980 | |

| | | | | | | | |

Life Sciences Tools & Services - 3.1% | | | | | | | | |

QIAGEN N.V.* | | | 9,240 | | | | 207,530 | |

Thermo Fisher Scientific, Inc. | | | 2,130 | | | | 307,252 | |

| | | | | | | | |

| | |

| | | | | | | 514,782 | |

| | | | | | | | |

Pharmaceuticals - 4.9% | | | | | | | | |

Johnson & Johnson | | | 3,320 | | | | 372,106 | |

Novartis AG - ADR (Switzerland) | | | 2,320 | | | | 176,250 | |

Perrigo Co. plc | | | 2,780 | | | | 268,743 | |

| | | | | | | | |

| | |

| | | | | | | 817,099 | |

| | | | | | | | |

| | |

Total Health Care | | | | | | | 3,860,248 | |

| | | | | | | | |

Industrials - 3.7% | | | | | | | | |

Building Products - 1.7% | | | | | | | | |

Masco Corp. | | | 9,280 | | | | 284,989 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

4

Tax Managed Series

Investment Portfolio - April 30, 2016

(unaudited)

| | | | | | | | |

| | | SHARES | | | VALUE

(NOTE 2) | |

| | |

COMMON STOCKS (continued) | | | | | | | | |

| | |

Industrials (continued) | | | | | | | | |

Industrial Conglomerates - 2.0% | | | | | | | | |

Danaher Corp. | | | 3,430 | | | $ | 331,853 | |

| | | | | | | | |

| | |

Total Industrials | | | | | | | 616,842 | |

| | | | | | | | |

Information Technology - 26.8% | | | | | | | | |

Electronic Equipment, Instruments & Components - 3.2% | | | | | | | | |

FLIR Systems, Inc. | | | 10,870 | | | | 328,383 | |

VeriFone Systems, Inc.* | | | 7,080 | | | | 201,497 | |

| | | | | | | | |

| | |

| | | | | | | 529,880 | |

| | | | | | | | |

Internet Software & Services - 7.3% | | | | | | | | |

Alphabet, Inc. - Class A* | | | 260 | | | | 184,049 | |

Alphabet, Inc. - Class C* | | | 290 | | | | 200,973 | |

Facebook, Inc. - Class A* | | | 5,400 | | | | 634,932 | |

Tencent Holdings Ltd. - Class H (China)1 | | | 9,200 | | | | 187,205 | |

| | | | | | | | |

| | |

| | | | | | | 1,207,159 | |

| | | | | | | | |

IT Services - 7.1% | | | | | | | | |

Amdocs Ltd. - ADR | | | 3,150 | | | | 178,101 | |

MasterCard, Inc. - Class A | | | 4,650 | | | | 451,004 | |

PayPal Holdings, Inc.* | | | 8,280 | | | | 324,410 | |

Visa, Inc. - Class A | | | 3,020 | | | | 233,265 | |

| | | | | | | | |

| | |

| | | | | | | 1,186,780 | |

| | | | | | | | |

Semiconductors & Semiconductor Equipment - 2.5% | | | | | | | | |

QUALCOMM, Inc. | | | 8,060 | | | | 407,191 | |

| | | | | | | | |

Software - 4.4% | | | | | | | | |

Aspen Technology, Inc.* | | | 3,770 | | | | 143,373 | |

Electronic Arts, Inc.* | | | 3,660 | | | | 226,371 | |

ServiceNow, Inc.* | | | 5,150 | | | | 368,122 | |

| | | | | | | | |

| | |

| | | | | | | 737,866 | |

| | | | | | | | |

Technology Hardware, Storage & Peripherals - 2.3% | | | | | | | | |

Apple, Inc. | | | 3,990 | | | | 374,023 | |

| | | | | | | | |

| | |

Total Information Technology | | | | | | | 4,442,899 | |

| | | | | | | | |

Materials - 5.9% | | | | | | | | |

Chemicals - 4.0% | | | | | | | | |

Ashland, Inc. | | | 1,910 | | | | 213,156 | |

Monsanto Co. | | | 4,810 | | | | 450,601 | |

| | | | | | | | |

| | |

| | | | | | | 663,757 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

5

Tax Managed Series

Investment Portfolio - April 30, 2016

(unaudited)

| | | | | | | | |

| | | | | | VALUE | |

| | | SHARES | | | (NOTE 2) | |

| | |

COMMON STOCKS (continued) | | | | | | | | |

| | |

Materials (continued) | | | | | | | | |

Metals & Mining - 1.9% | | | | | | | | |

Alcoa, Inc. | | | 27,710 | | | $ | 309,521 | |

| | | | | | | | |

| | |

Total Materials | | | | | | | 973,278 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS | | | | | | | | |

(Identified Cost $13,721,415) | | | | | | | 16,290,016 | |

| | | | | | | | |

| | |

SHORT-TERM INVESTMENT - 2.0% | | | | | | | | |

Dreyfus Cash Management, Inc. - Institutional Shares2, 0.29% | | | | | | | | |

(Identified Cost $335,999) | | | 335,999 | | | | 335,999 | |

| | | | | | | | |

TOTAL INVESTMENTS - 100.2% | | | | | | | | |

(Identified Cost $14,057,414) | | | | | | | 16,626,015 | |

LIABILITIES, LESS OTHER ASSETS - (0.2%) | | | | | | | (35,401 | ) |

| | | | | | | | |

NET ASSETS - 100% | | | | | | $ | 16,590,614 | |

| | | | | | | | |

ADR - American Depositary Receipt

*Non-income producing security.

1A factor from a third party vendor was applied to determine the security’s fair value following the close of local trading.

2Rate shown is the current yield as of April 30, 2016.

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of MSCI Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P), and is licensed for use by Manning & Napier when referencing GICS sectors. Neither MSCI, S&P, nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification, nor shall any such party have any liability therefrom.

The accompanying notes are an integral part of the financial statements.

6

Tax Managed Series

Statement of Assets and Liabilities

April 30, 2016 (unaudited)

| | | | |

| |

ASSETS: | | | | |

| |

Investments, at value (identified cost $14,057,414) (Note 2) | | $ | 16,626,015 | |

Foreign tax reclaims receivable | | | 16,357 | |

Dividends receivable | | | 9,544 | |

Prepaid expenses | | | 8,845 | |

| | | | |

| |

TOTAL ASSETS | | | 16,660,761 | |

| | | | |

| |

LIABILITIES: | | | | |

| |

Accrued management fees (Note 3) | | | 7,025 | |

Accrued fund accounting and administration fees (Note 3) | | | 6,125 | |

Accrued transfer agent fees (Note 3) | | | 2,142 | |

Accrued Chief Compliance Officer service fees (Note 3) | | | 381 | |

Payable for securities purchased | | | 20,855 | |

Audit fees payable | | | 16,404 | |

Accrued printing and postage fees | | | 10,330 | |

Other payables and accrued expenses | | | 6,885 | |

| | | | |

| |

TOTAL LIABILITIES | | | 70,147 | |

| | | | |

| |

TOTAL NET ASSETS | | $ | 16,590,614 | |

| | | | |

| |

NET ASSETS CONSIST OF: | | | | |

| |

Capital stock | | $ | 7,267 | |

Additional paid-in-capital | | | 12,891,893 | |

Undistributed net investment loss | | | (21,947 | ) |

Accumulated net realized gain (loss) on investments, foreign currency and translation of other assets and liabilities | | | 1,145,825 | |

Net unrealized appreciation (depreciation) on investments, foreign currency and translation of other assets and liabilities | | | 2,567,576 | |

| | | | |

| |

TOTAL NET ASSETS | | $ | 16,590,614 | |

| | | | |

NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - Class A | | | | |

($16,590,614/726,681 shares) | | $ | 22.83 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

7

Tax Managed Series

Statement of Operations

For the Six Months Ended April 30, 2016 (unaudited)

| | | | |

INVESTMENT INCOME: | | | | |

| |

Dividends (net of foreign taxes withheld, $3,711) | | $ | 82,958 | |

| | | | |

| |

EXPENSES: | | | | |

| |

Management fees (Note 3) | | | 87,343 | |

Fund accounting and administration fees (Note 3) | | | 16,957 | |

Transfer agent fees (Note 3) | | | 3,369 | |

Chief Compliance Officer service fees (Note 3) | | | 1,258 | |

Directors’ fees (Note 3) | | | 462 | |

Audit fees | | | 13,745 | |

Printing and postage fees | | | 8,403 | |

Registration and filing fees | | | 7,822 | |

Custodian fees | | | 2,266 | |

Miscellaneous | | | 2,442 | |

| | | | |

| |

Total Expenses | | | 144,067 | |

Less reduction of expenses (Note 3) | | | (39,255 | ) |

| | | | |

| |

Net Expenses | | | 104,812 | |

| | | | |

| |

NET INVESTMENT LOSS | | | (21,854 | ) |

| | | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | | | | |

| |

Net realized gain (loss) on- | | | | |

Investments | | | 1,146,226 | |

Foreign currency and translation of other assets and liabilities | | | (385 | ) |

| | | | |

| |

| | | 1,145,841 | |

| | | | |

Net change in unrealized appreciation (depreciation) on- | | | | |

Investments | | | (993,977 | ) |

Foreign currency and translation of other assets and liabilities | | | 856 | |

| | | | |

| |

| | | (993,121 | ) |

| | | | |

| |

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY | | | 152,720 | |

| | | | |

| |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 130,866 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

8

Tax Managed Series

Statements of Changes in Net Assets

| | | | | | | | |

| | | FOR THE SIX

MONTHS ENDED

4/30/16

(UNAUDITED) | | | FOR THE YEAR ENDED

10/31/15 | |

INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | |

| | |

OPERATIONS: | | | | | | | | |

Net investment income (loss) | | $ | (21,854 | ) | | $ | 35,073 | |

Net realized gain on investments and foreign currency | | | 1,145,841 | | | | 2,702,559 | |

Net change in unrealized appreciation (depreciation) on investments and foreign currency | | | (993,121 | ) | | | (3,184,140 | ) |

| | | | | | | | |

Net increase (decrease) from operations | | | 130,866 | | | | (446,508 | ) |

| | | | | | | | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS (Note 8): | | | | | | | | |

| | |

From net investment income | | | (22,080 | ) | | | (35,591 | ) |

From net realized gain on investments | | | (2,657,130 | ) | | | (5,685,380 | ) |

| | | | | | | | |

| | |

Total distributions to shareholders | | | (2,679,210 | ) | | | (5,720,971 | ) |

| | | | | | | | |

| | |

CAPITAL STOCK ISSUED AND REPURCHASED: | | | | | | | | |

| | |

Net decrease from capital share transactions (Note 5) | | | (3,092,221 | ) | | | (5,783,374 | ) |

| | | | | | | | |

| | |

Net decrease in net assets | | | (5,640,565 | ) | | | (11,950,853 | ) |

| | |

NET ASSETS: | | | | | | | | |

| | |

Beginning of period | | | 22,231,179 | | | | 34,182,032 | |

| | | | | | | | |

| | |

End of period (including undistributed net investment loss of $21,947 and undistributed net investment income of $21,987, respectively) | | $ | 16,590,614 | | | $ | 22,231,179 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

9

Tax Managed Series

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | FOR THE SIX

MONTHS ENDED

4/30/16 | | | FOR THE YEARS ENDED | |

| | | (UNAUDITED) | | | 10/31/15 | | | 10/31/14 | | | 10/31/13 | | | 10/31/12 | | | 10/31/11 | |

Per share data (for a share outstanding throughout each period): | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value - Beginning of period | | $ | 26.41 | | | $ | 33.05 | | | $ | 33.95 | | | $ | 27.69 | | | $ | 24.96 | | | $ | 25.01 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)1 | | | (0.03 | ) | | | 0.04 | | | | 0.04 | | | | 0.04 | | | | 0.03 | | | | 0.08 | |

Net realized and unrealized gain (loss) on investments | | | 0.23 | | | | (0.70 | ) | | | 3.73 | | | | 7.52 | | | | 2.77 | | | | (0.06 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total from investment operations | | | 0.20 | | | | (0.66 | ) | | | 3.77 | | | | 7.56 | | | | 2.80 | | | | 0.02 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.03 | ) | | | (0.04 | ) | | | (0.01 | ) | | | (0.06 | ) | | | (0.07 | ) | | | (0.07 | ) |

From net realized gain on investments | | | (3.75 | ) | | | (5.94 | ) | | | (4.66 | ) | | | (1.24 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total distributions to shareholders | | | (3.78 | ) | | | (5.98 | ) | | | (4.67 | ) | | | (1.30 | ) | | | (0.07 | ) | | | (0.07 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value - End of period | | $ | 22.83 | | | $ | 26.41 | | | $ | 33.05 | | | $ | 33.95 | | | $ | 27.69 | | | $ | 24.96 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets - End of period (000’s omitted) | | $ | 16,591 | | | $ | 22,231 | | | $ | 34,182 | | | $ | 33,669 | | | $ | 29,776 | | | $ | 47,663 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total return2 | | | 1.26 | % | | | (1.67 | %) | | | 12.82 | % | | | 28.41 | % | | | 11.28 | % | | | 0.08 | % |

Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses* | | | 1.20 | %3 | | | 1.20 | % | | | 1.20 | % | | | 1.20 | % | | | 1.20 | % | | | 1.20 | % |

Net investment income (loss) | | | (0.25 | %)3 | | | 0.13 | % | | | 0.11 | % | | | 0.13 | % | | | 0.12 | % | | | 0.29 | % |

Portfolio turnover | | | 26 | % | | | 60 | % | | | 47 | % | | | 56 | % | | | 47 | % | | | 57 | % |

|

| *The investment advisor did not impose all or a portion of its management and/or other fees, and in some periods may have paid a portion of the Series’ expenses. If these expenses had been incurred by the Series, the expense ratio (to average net assets) would have increased by the following amounts: | |

| | | | | | |

| | | 0.45 | %3 | | | 0.23 | % | | | 0.13 | % | | | 0.15 | % | | | 0.10 | % | | | 0.04 | % |

1Calculated based on average shares outstanding during the periods.

2Represents aggregate total return for the periods indicated, and assumes reinvestment of all distributions. Periods less than one year are not annualized.

3Annualized.

The accompanying notes are an integral part of the financial statements.

10

Tax Managed Series

Notes to Financial Statements

(unaudited)

Tax Managed Series (the “Series”) is a no-load diversified series of Manning & Napier Fund, Inc. (the “Fund”). The Fund is organized in Maryland and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

The Series’ investment objective is to maximize long-term growth while attempting to minimize the impact of taxes on the total return earned by shareholders.

The Fund’s Advisor is Manning & Napier Advisors, LLC (the “Advisor”). Shares of the Series are offered to investors, clients and employees of the Advisor and its affiliates. The total authorized capital stock of the Fund consists of 15 billion shares of common stock each having a par value of $0.01. As of April 30, 2016, 10.5 billion shares have been designated in total among 40 series, of which 87.5 million have been designated as Tax Managed Series Class A common stock.

| 2. | Significant Accounting Policies |

The following is a summary of significant accounting policies followed by the Series. The Series is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 - Investment Companies, which is part of accounting principles generally accepted in the United States of America (“GAAP”).

Security Valuation

Portfolio securities, including domestic equities, foreign equities, warrants and options, listed on an exchange other than the NASDAQ Stock Market are valued at the latest quoted sales price of the exchange on which the security is primarily traded. Securities not traded on valuation date or securities not listed on an exchange are valued at the latest quoted bid price provided by the Fund’s pricing service. Securities listed on the NASDAQ Stock Market are valued in accordance with the NASDAQ Official Closing Price.

Short-term investments that mature in sixty days or less may be valued at amortized cost, which approximates fair value. Investments in open-end investment companies are valued at their net asset value per share on valuation date.

Volume and level of activity in established markets for an asset or liability are evaluated to determine whether recent transactions and quoted prices are determinative of fair value. Where there have been significant decreases in volume and level of activity, further analysis and adjustment may be necessary to estimate fair value. The Series measures fair value in these instances by the use of inputs and valuation techniques which may be based upon current market prices of securities that are comparable in coupon, rating, maturity and industry and/or expectation of future cash flows. As a result of trading in relatively thin markets and/or markets that experience significant volatility, the prices used by the Series to value these securities may differ from the value that would be realized if these securities were sold, and the differences could be material.