UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04087

Manning & Napier Fund, Inc.

(Exact name of registrant as specified in charter)

290 Woodcliff Drive, Fairport, NY 14450

(Address of principal executive offices)(Zip Code)

Michele T. Mosca 290 Woodcliff Drive, Fairport, NY 14450

(Name and address of agent for service)

Registrant’s telephone number, including area code: 585-325-6880

Date of fiscal year end: December 31

Date of reporting period: January 1, 2017 through June 30, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| ITEM 1: | REPORTS TO STOCKHOLDERS. |

Real Estate Series

Shareholder Expense Example

(unaudited)

As a shareholder of the Series, you incur ongoing costs, including management fees, shareholder service fees and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2017 to June 30, 2017).

Actual Expenses

The Actual lines of the table below provide information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the Actual line for the Class in which you have invested under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The Hypothetical lines of each Class in the table below provide information about hypothetical account values and hypothetical expenses based on the Class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. You may use this information to compare the ongoing costs of investing in a class of the Series and other funds. To do so, compare this 5% hypothetical example for the class in which you have invested with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs such as sales charges (loads), redemption fees, or exchange fees that you may incur in other mutual funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | |

| | | BEGINNING

ACCOUNT VALUE

1/1/17 | | ENDING

ACCOUNT VALUE

6/30/17 | | EXPENSES PAID

DURING PERIOD*

1/1/17-6/30/17 | | ANNUALIZED

EXPENSE RATIO |

Class S | | |

Actual | | $1,000.00 | | $1,045.60 | | $5.58 | | 1.10% |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,019.34 | | $5.51 | | 1.10% |

Class I | | | | | | | | |

Actual | | $1,000.00 | | $1,047.00 | | $4.31 | | 0.85% |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,020.58 | | $4.26 | | 0.85% |

*Expenses are equal to each Class’ annualized expense ratio (for the six-month period), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Expenses are based on the most recent fiscal half year.

1

Real Estate Series

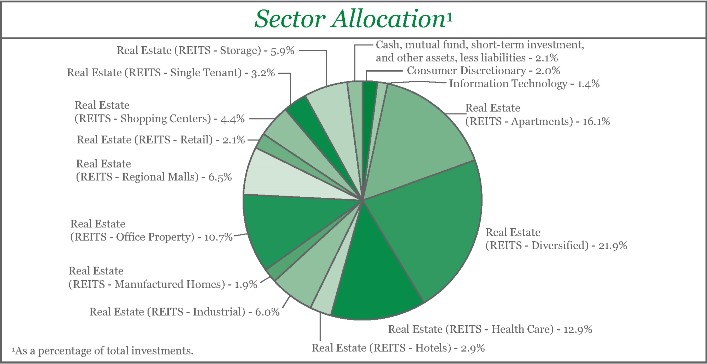

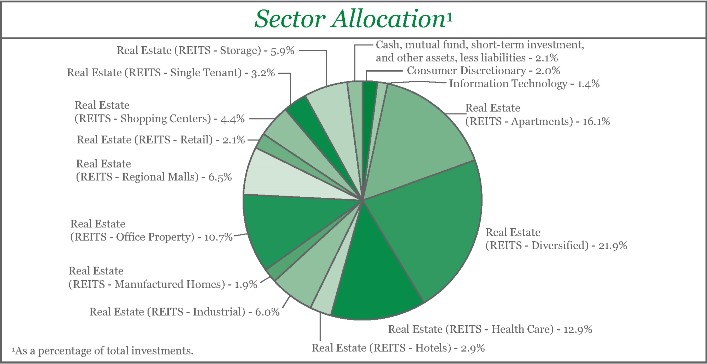

Portfolio Composition as of June 30, 2017

(unaudited)

| | | | | | | | | | |

Top Ten Stock Holdings2 | |

Equinix, Inc. | | | 4.7 | % | | Prologis, Inc. | | | 2.3 | % |

Simon Property Group, Inc. | | | 4.0 | % | | Rexford Industrial Realty, Inc. | | | 2.2 | % |

AvalonBay Communities, Inc. | | | 2.7 | % | | Ventas, Inc. | | | 2.2 | % |

Alexandria Real Estate Equities, Inc. | | | 2.6 | % | | Digital Realty Trust, Inc. | | | 2.2 | % |

Community Healthcare Trust, Inc. | | | 2.5 | % | | CoreCivic, Inc. | | | 2.2 | % |

2As a percentage of total investments. | | | | | | | | | | |

2

Real Estate Series

Investment Portfolio - June 30, 2017

(unaudited)

| | | | | | | | |

| | |

| | | SHARES | | | VALUE (NOTE 2) | |

| | |

COMMON STOCKS - 97.9% | | | | | | | | |

| | |

Consumer Discretionary - 2.0% | | | | | | | | |

Hotels, Restaurants & Leisure - 0.8% | | | | | | | | |

Accor S.A. (France)1 | | | 57,150 | | | $ | 2,680,867 | |

| | | | | | | | |

| | |

Household Durables - 1.2% | | | | | | | | |

LGI Homes, Inc.* | | | 95,290 | | | | 3,828,752 | |

| | | | | | | | |

| | |

Total Consumer Discretionary | | | | | | | 6,509,619 | |

| | | | | | | | |

Information Technology - 1.4% | | | | | | | | |

IT Services - 1.4% | | | | | | | | |

| | |

InterXion Holding N.V. - ADR (Netherlands)* | | | 97,675 | | | | 4,471,562 | |

| | | | | | | | |

Real Estate - 94.5% | | | | | | | | |

REITS - Apartments - 16.1% | | | | | | | | |

American Campus Communities, Inc. | | | 88,240 | | | | 4,173,752 | |

American Homes 4 Rent - Class A | | | 194,500 | | | | 4,389,865 | |

Apartment Investment & Management Co. - Class A | | | 147,790 | | | | 6,350,536 | |

AvalonBay Communities, Inc. | | | 44,835 | | | | 8,615,942 | |

Colony Starwood Homes | | | 123,560 | | | | 4,239,344 | |

Education Realty Trust, Inc. | | | 109,030 | | | | 4,224,912 | |

Equity Residential | | | 88,835 | | | | 5,848,008 | |

Essex Property Trust, Inc. | | | 9,980 | | | | 2,567,555 | |

Mid-America Apartment Communities, Inc. | | | 64,940 | | | | 6,843,377 | |

UDR, Inc. | | | 112,825 | | | | 4,396,790 | |

| | | | | | | | |

| | |

| | | | | | | 51,650,081 | |

| | | | | | | | |

REITS - Diversified - 21.9% | | | | | | | | |

CatchMark Timber Trust, Inc. - Class A | | | 262,070 | | | | 2,979,736 | |

Colony NorthStar, Inc. - Class A | | | 298,566 | | | | 4,206,795 | |

CoreCivic, Inc. | | | 251,485 | | | | 6,935,956 | |

Cousins Properties, Inc. | | | 360,885 | | | | 3,172,179 | |

Crown Castle International Corp | | | 40,520 | | | | 4,059,294 | |

Digital Realty Trust, Inc. | | | 62,330 | | | | 7,040,173 | |

EPR Properties | | | 42,080 | | | | 3,024,290 | |

Equinix, Inc. | | | 34,890 | | | | 14,973,392 | |

Forest City Realty Trust, Inc. - Class A | | | 209,745 | | | | 5,069,537 | |

Hibernia REIT plc (Ireland)1 | | | 1,606,740 | | | | 2,523,320 | |

Lamar Advertising Co. - Class A | | | 40,430 | | | | 2,974,435 | |

Outfront Media, Inc. | | | 228,005 | | | | 5,271,476 | |

Potlatch Corp | | | 34,520 | | | | 1,577,564 | |

Weyerhaeuser Co | | | 182,180 | | | | 6,103,029 | |

| | | | | | | | |

| | |

| | | | | | | 69,911,176 | |

| | | | | | | | |

REITS - Health Care - 12.9% | | | | | | | | |

Community Healthcare Trust, Inc. | | | 315,260 | | | | 8,067,503 | |

Global Medical REIT, Inc. | | | 400,935 | | | | 3,584,359 | |

HCP, Inc. | | | 177,270 | | | | 5,665,549 | |

The accompanying notes are an integral part of the financial statements.

3

Real Estate Series

Investment Portfolio - June 30, 2017

(unaudited)

| | | | | | | | |

| | |

| | | SHARES | | | VALUE (NOTE 2) | |

| | |

COMMON STOCKS (continued) | | | | | | | | |

| | |

Real Estate (continued) | | | | | | | | |

REITS - Health Care (continued) | | | | | | | | |

Healthcare Trust of America, Inc. - Class A | | | 123,150 | | | $ | 3,831,196 | |

Physicians Realty Trust | | | 328,345 | | | | 6,612,868 | |

Ventas, Inc. | | | 102,495 | | | | 7,121,353 | |

Welltower, Inc. | | | 86,600 | | | | 6,482,011 | |

| | | | | | | | |

| | |

| | | | | | | 41,364,839 | |

| | | | | | | | |

REITS - Hotels - 2.9% | | | | | | | | |

Chesapeake Lodging Trust | | | 170,870 | | | | 4,181,189 | |

Host Hotels & Resorts, Inc. | | | 155,790 | | | | 2,846,283 | |

LaSalle Hotel Properties | | | 73,940 | | | | 2,203,412 | |

| | | | | | | | |

| | |

| | | | | | | 9,230,884 | |

| | | | | | | | |

REITS - Industrial - 6.0% | | | | | | | | |

Prologis, Inc. | | | 124,350 | | | | 7,291,884 | |

Rexford Industrial Realty, Inc. | | | 259,600 | | | | 7,123,424 | |

Terreno Realty Corp. | | | 143,235 | | | | 4,821,290 | |

| | | | | | | | |

| | |

| | | | | | | 19,236,598 | |

| | | | | | | | |

REITS - Manufactured Homes - 1.9% | | | | | | | | |

Equity LifeStyle Properties, Inc. | | | 35,530 | | | | 3,067,660 | |

Sun Communities, Inc. | | | 34,465 | | | | 3,022,236 | |

| | | | | | | | |

| | |

| | | | | | | 6,089,896 | |

| | | | | | | | |

REITS - Office Property - 10.7% | | | | | | | | |

Alexandria Real Estate Equities, Inc. | | | 69,510 | | | | 8,373,870 | |

Axiare Patrimonio SOCIMI S.A. (Spain)1 | | | 120,490 | | | | 2,058,764 | |

Boston Properties, Inc. | | | 33,030 | | | | 4,063,351 | |

Brandywine Realty Trust | | | 292,070 | | | | 5,119,987 | |

Columbia Property Trust, Inc. | | | 111,530 | | | | 2,496,041 | |

Douglas Emmett, Inc. | | | 107,980 | | | | 4,125,916 | |

Equity Commonwealth* | | | 153,335 | | | | 4,845,386 | |

VEREIT, Inc. | | | 383,400 | | | | 3,120,876 | |

| | | | | | | | |

| | |

| | | | | | | 34,204,191 | |

| | | | | | | | |

REITS - Regional Malls - 6.5% | | | | | | | | |

General Growth Properties, Inc. | | | 218,950 | | | | 5,158,462 | |

The Macerich Co. | | | 48,470 | | | | 2,814,168 | |

Simon Property Group, Inc. | | | 78,470 | | | | 12,693,307 | |

| | | | | | | | |

| | |

| | | | | | | 20,665,937 | |

| | | | | | | | |

REITS - Retail - 2.1% | | | | | | | | |

Acadia Realty Trust | | | 71,230 | | | | 1,980,194 | |

Cedar Realty Trust, Inc. | | | 527,220 | | | | 2,557,017 | |

Klepierre (France)1 | | | 55,285 | | | | 2,265,903 | |

| | | | | | | | |

| | |

| | | | | | | 6,803,114 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

4

Real Estate Series

Investment Portfolio - June 30, 2017

(unaudited)

| | | | | | | | |

| | | SHARES | | | VALUE (NOTE 2) | |

| | |

COMMON STOCKS (continued) | | | | | | | | |

| | |

Real Estate (continued) | | | | | | | | |

REITS - Shopping Centers - 4.4% | | | | | | | | |

Brixmor Property Group, Inc. | | | 105,450 | | | $ | 1,885,446 | |

DDR Corp. | | | 182,070 | | | | 1,651,375 | |

Regency Centers Corp. | | | 54,682 | | | | 3,425,280 | |

Retail Opportunity Investments Corp. | | | 111,610 | | | | 2,141,796 | |

Urban Edge Properties | | | 209,775 | | | | 4,977,961 | |

| | | | | | | | |

| | |

| | | | | | | 14,081,858 | |

| | | | | | | | |

REITS - Single Tenant - 3.2% | | | | | | | | |

Agree Realty Corp. | | | 78,980 | | | | 3,622,813 | |

National Retail Properties, Inc. | | | 81,020 | | | | 3,167,882 | |

STORE Capital Corp. | | | 151,235 | | | | 3,395,225 | |

| | | | | | | | |

| | |

| | | | | | | 10,185,920 | |

| | | | | | | | |

REITS - Storage - 5.9% | | | | | | | | |

CubeSmart | | | 246,450 | | | | 5,924,658 | |

Extra Space Storage, Inc. | | | 29,720 | | | | 2,318,160 | |

Life Storage, Inc. | | | 61,331 | | | | 4,544,627 | |

National Storage Affiliates Trust | | | 102,575 | | | | 2,370,509 | |

Public Storage | | | 18,300 | | | | 3,816,099 | |

| | | | | | | | |

| | |

| | | | | | | 18,974,053 | |

| | | | | | | | |

| | |

Total Real Estate | | | | | | | 302,398,547 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS | | | | | | | | |

(Identified Cost $270,158,763) | | | | | | | 313,379,728 | |

| | | | | | | | |

| | |

MUTUAL FUND - 0.5% | | | | | | | | |

Vanguard REIT ETF | | | | | | | | |

(Identified Cost $1,513,829) | | | 18,425 | | | | 1,533,513 | |

| | | | | | | | |

| | |

SHORT-TERM INVESTMENT - 1.2% | | | | | | | | |

| | |

Dreyfus Government Cash Management2, 0.91% | | | | | | | | |

(Identified Cost $3,834,613) | | | 3,834,613 | | | | 3,834,613 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS - 99.6% | | | | | | | | |

(Identified Cost $275,507,205) | | | | | | | 318,747,854 | |

OTHER ASSETS, LESS LIABILITIES - 0.4% | | | | | | | 1,135,463 | |

| | | | | | | | |

NET ASSETS - 100% | | | | | | $ | 319,883,317 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

5

Real Estate Series

Investment Portfolio - June 30, 2017

(unaudited)

|

ADR - American Depositary Receipt ETF - Exchange-Traded Fund REITS - Real Estate Investment Trusts *Non-income producing security. 1A factor from a third party vendor was applied to determine the security’s fair value following the close of local trading. 2Rate shown is the current yield as of June 30, 2017. |

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of MSCI Inc. (MSCI) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (S&P), and is licensed for use by Manning & Napier when referencing GICS sectors. Neither MSCI, S&P, nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification, nor shall any such party have any liability therefrom.

The accompanying notes are an integral part of the financial statements.

6

Real Estate Series

Statement of Assets and Liabilities

June 30, 2017 (unaudited)

| | | | |

ASSETS: | | | | |

| |

Investments, at value (identified cost $275,507,205) (Note 2) | | $ | 318,747,854 | |

Receivable for securities sold | | | 3,227,003 | |

Dividends receivable | | | 1,128,345 | |

Receivable for fund shares sold | | | 514,458 | |

Foreign tax reclaims receivable | | | 883 | |

Prepaid expenses | | | 32,019 | |

| | | | |

| |

TOTAL ASSETS | | | 323,650,562 | |

| | | | |

| |

LIABILITIES: | | | | |

| |

Accrued management fees (Note 3) | | | 198,048 | |

Accrued shareholder services fees (Class S)(Note 3) | | | 58,688 | |

Accrued fund accounting and administration fees (Note 3) | | | 12,321 | |

Accrued Directors’ fees (Note 3) | | | 275 | |

Accrued Chief Compliance Officer service fees (Note 3) | | | 274 | |

Payable for securities purchased | | | 3,236,141 | |

Payable for fund shares repurchased | | | 212,296 | |

Other payables and accrued expenses | | | 49,202 | |

| | | | |

| |

TOTAL LIABILITIES | | | 3,767,245 | |

| | | | |

| |

TOTAL NET ASSETS | | $ | 319,883,317 | |

| | | | |

| |

NET ASSETS CONSIST OF: | | | | |

| |

Capital stock | | $ | 236,834 | |

Additional paid-in-capital | | | 269,102,166 | |

Undistributed net investment income | | | 4,097,399 | |

Accumulated net realized gain on investments, foreign currency and translation of other assets and liabilities | | | 3,206,249 | |

Net unrealized appreciation on investments, foreign currency and translation of other assets and liabilities | | | 43,240,669 | |

| | | | |

| |

TOTAL NET ASSETS | | $ | 319,883,317 | |

| | | | |

| |

NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - Class S ($283,203,775/ 18,701,391 shares) | | $ | 15.14 | |

| | | | |

| |

NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - Class I ($36,679,542/ 4,982,034 shares) | | $ | 7.36 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

7

Real Estate Series

Statement of Operations

For the Six Months Ended June 30, 2017 (unaudited)

| | | | |

INVESTMENT INCOME: | | | | |

| |

Dividends (net of foreign taxes withheld, $57,576) | | $ | 5,893,074 | |

| | | | |

| |

EXPENSES: | | | | |

| |

Management fees (Note 3) | | | 1,162,650 | |

Shareholder services fees (Class S)(Note 3) | | | 349,522 | |

Fund accounting and administration fees (Note 3) | | | 35,528 | |

Transfer agent fees (Note 3) | | | 30,536 | |

Directors’ fees (Note 3) | | | 10,153 | |

Chief Compliance Officer service fees (Note 3) | | | 1,933 | |

Custodian fees | | | 9,307 | |

Miscellaneous | | | 62,223 | |

| | | | |

| |

Total Expenses | | | 1,661,852 | |

| | | | |

| |

NET INVESTMENT INCOME | | | 4,231,222 | |

| | | | |

| |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | | | | |

| |

Net realized gain (loss) on- | | | | |

Investments | | | 3,013,475 | |

Foreign currency and translation of other assets and liabilities | | | 4,952 | |

| | | | |

| |

| | | 3,018,427 | |

| | | | |

| |

Net change in unrealized appreciation (depreciation) on- | | | | |

Investments | | | 6,769,738 | |

Foreign currency and translation of other assets and liabilities | | | (167 | ) |

| | | | |

| |

| | | 6,769,571 | |

| | | | |

| |

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY | | | 9,787,998 | |

| | | | |

| |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 14,019,220 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

8

Real Estate Series

Statements of Changes in Net Assets

| | | | | | | | |

| | | FOR THE SIX

MONTHS ENDED

6/30/17

(UNAUDITED) | | | FOR THE

YEAR ENDED

12/31/16 | |

INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | |

| | |

OPERATIONS: | | | | | | | | |

| | |

Net investment income | | $ | 4,231,222 | | | $ | 4,252,596 | |

Net realized gain (loss) on investments and foreign currency | | | 3,018,427 | | | | 9,476,993 | |

Net change in unrealized appreciation (depreciation) on investments and foreign currency | | | 6,769,571 | | | | 6,292,220 | |

| | | | | | | | |

| | |

Net increase from operations | | | 14,019,220 | | | | 20,021,809 | |

| | | | | | | | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS (Note 9): | | | | | | | | |

| | |

From net investment income (Class S) | | | — | | | | (5,064,182 | ) |

From net investment income (Class I) | | | — | | | | (1,083,326 | ) |

From net realized gain on investments (Class S) | | | — | | | | (9,237,683 | ) |

From net realized gain on investments (Class I) | | | — | | | | (1,741,246 | ) |

| | | | | | | | |

| | |

Total distributions to shareholders | | | — | | | | (17,126,437 | ) |

| | | | | | | | |

| | |

CAPITAL STOCK ISSUED AND REPURCHASED: | | | | | | | | |

| | |

Net increase from capital share transactions (Note 5) | | | 1,242,778 | | | | 34,261,209 | |

| | | | | | | | |

| | |

Net increase in net assets | | | 15,261,998 | | | | 37,156,581 | |

| | |

NET ASSETS: | | | | | | | | |

| | |

Beginning of period | | | 304,621,319 | | | | 267,464,738 | |

| | | | | | | | |

| | |

End of period (including undistributed net investment income of $4,097,399 and distributions in excess of net investment income of $133,823, respectively) | | $ | 319,883,317 | | | $ | 304,621,319 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

9

Real Estate Series

Financial Highlights - Class S*

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | FOR THE SIX

MONTHS ENDED | | | FOR THE YEARS ENDED | |

| | | 6/30/17

(UNAUDITED) | | | 12/31/16 | | | 12/31/15 | | | 12/31/14 | | | 12/31/13 | | | 12/31/12 | |

Per share data (for a share outstanding throughout each period): | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value - Beginning of period | | | $14.48 | | | | $14.15 | | | | $15.46 | | | | $13.32 | | | | $14.57 | | | | $12.65 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income1 | | | 0.20 | | | | 0.22 | | | | 0.24 | | | | 0.44 | 2 | | | 0.24 | | | | 0.21 | |

Net realized and unrealized gain on investments | | | 0.46 | | | | 0.88 | | | | 0.34 | | | | 3.24 | | | | 0.10 | | | | 2.54 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.66 | | | | 1.10 | | | | 0.58 | | | | 3.68 | | | | 0.34 | | | | 2.75 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | (0.27 | ) | | | (0.24 | ) | | | (0.44 | ) | | | (0.21 | ) | | | (0.29 | ) |

From net realized gain on investments | | | — | | | | (0.50 | ) | | | (1.65 | ) | | | (1.10 | ) | | | (1.38 | ) | | | (0.54 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total distributions to shareholders | | | — | | | | (0.77 | ) | | | (1.89 | ) | | | (1.54 | ) | | | (1.59 | ) | | | (0.83 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value - End of period | | | $15.14 | | | | $14.48 | | | | $14.15 | | | | $15.46 | | | | $13.32 | | | | $14.57 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets - End of period

(000’s omitted) | | | $283,204 | | | | $278,322 | | | | $217,216 | | | | $231,188 | | | | $168,167 | | | | $170,898 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return3 | | | 4.56% | | | | 7.91% | | | | 4.14% | | | | 28.14% | | | | 2.67% | | | | 21.93% | |

Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.10% | 4 | | | 1.09% | | | | 1.09% | | | | 1.11% | | | | 1.12% | | | | 1.10% | |

Net investment income | | | 2.69% | 4 | | | 1.47% | | | | 1.54% | | | | 2.89% | 2 | | | 1.57% | | | | 1.49% | |

Portfolio turnover | | | 19% | | | | 46% | | | | 57% | | | | 44% | | | | 40% | | | | 14% | |

| |

| *Effective August 1, 2012, the shares of the Series have been designated as Class S. | | | | | |

1Calculated based on average shares outstanding during the periods.

2Reflects a special dividend paid out during the period by two of the Series’ holdings. Had the Series not received the special dividends, the net investment income per share would have been $0.22 and the net investment income ratio would have been 1.49%.

3Represents aggregate total return for the periods indicated, and assumes reinvestment of all distributions. Total return would have been lower had certain expenses not been waived or reimbursed during certain periods. Periods less than one year are not annualized.

4Annualized.

The accompanying notes are an integral part of the financial statements.

10

Real Estate Series

Financial Highlights - Class I

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | FOR THE SIX

MONTHS ENDED | | | FOR THE YEARS ENDED | | | FOR THE PERIOD 8/1/121 TO

12/31/12 | |

| | | 6/30/17

(UNAUDITED) | | | 12/31/16 | | | 12/31/15 | | | 12/31/14 | | | 12/31/13 | | |

Per share data (for a share outstanding throughout each period): | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value - Beginning of period | | | $7.03 | | | | $7.26 | | | | $8.86 | | | | $8.18 | | | | $9.55 | | | | $10.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income2 | | | 0.11 | | | | 0.11 | | | | 0.16 | | | | 0.29 | 3 | | | 0.19 | | | | 0.08 | |

Net realized and unrealized gain on investments | | | 0.22 | | | | 0.47 | | | | 0.17 | | | | 1.97 | | | | 0.04 | | | | 0.32 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.33 | | | | 0.58 | | | | 0.33 | | | | 2.26 | | | | 0.23 | | | | 0.40 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | (0.31 | ) | | | (0.28 | ) | | | (0.48 | ) | | | (0.22 | ) | | | (0.31 | ) |

From net realized gain on investments | | | — | | | | (0.50 | ) | | | (1.65 | ) | | | (1.10 | ) | | | (1.38 | ) | | | (0.54 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | — | | | | (0.81 | ) | | | (1.93 | ) | | | (1.58 | ) | | | (1.60 | ) | | | (0.85 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value - End of period | | | $7.36 | | | | $7.03 | | | | $7.26 | | | | $8.86 | | | | $8.18 | | | | $9.55 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net assets - End of period (000’s omitted) | | | $36,680 | | | | $26,300 | | | | $50,249 | | | | $50,513 | | | | $37,310 | | | | $26,396 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total return4 | | | 4.70% | | | | 8.17% | | | | 4.43% | | | | 28.44% | | | | 2.94% | | | | 4.16% | |

Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 0.85% | 5 | | | 0.84% | | | | 0.84% | | | | 0.86% | | | | 0.87% | | | | 0.87% | 5 |

Net investment income | | | 3.06% | 5 | | | 1.50% | | | | 1.81% | | | | 3.14% | 3 | | | 1.88% | | | | 1.95% | 5 |

Portfolio turnover | | | 19% | | | | 46% | | | | 57% | | | | 44% | | | | 40% | | | | 14% | |

1Commencement of operations.

2Calculated based on average shares outstanding during the periods.

3Reflects a special dividend paid out during the period by two of the Series’ holdings. Had the Series not received the special dividends, the net investment income per share would have been $0.16 and the net investment income ratio would have been 1.74%.

4Represents aggregate total return for the periods indicated, and assumes reinvestment of all distributions. Total return would have been lower had certain expenses not been waived or reimbursed during certain periods. Periods less than one year are not annualized.

5Annualized.

The accompanying notes are an integral part of the financial statements.

11

Real Estate Series

Notes to Financial Statements

(unaudited)

Real Estate Series (the “Series”) is a no-load diversified series of Manning & Napier Fund, Inc. (the “Fund”). The Fund is organized in Maryland and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

The Series’ investment objective is to provide high current income and long-term capital appreciation by investing principally in companies in the real estate industry.

The Fund’s advisor is Manning & Napier Advisors, LLC (the “Advisor”). Shares of the Series are offered to investors, clients and employees of the Advisor and its affiliates. The Series is authorized to issue two classes of shares (Class S and Class I). Each class of shares is substantially the same, except that Class S shares bear shareholder services fees. The total authorized capital stock of the Fund consists of 15 billion shares of common stock each having a par value of $0.01. As of June 30, 2017, 10.6 billion shares have been designated in total among 39 series, of which 100 million have been designated as Real Estate Series Class S common stock and 100 million have been designated as Real Estate Series Class I common stock.

| 2. | Significant Accounting Policies |

The following is a summary of significant accounting policies followed by the Series. The Series is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 - Investment Companies, which is part of accounting principles generally accepted in the United States of America (“GAAP”).

Security Valuation

Portfolio securities, including domestic equities, foreign equities, warrants and options, listed on an exchange other than the NASDAQ Stock Market are valued at the latest quoted sales price of the exchange on which the security is primarily traded. Securities not traded on valuation date or securities not listed on an exchange are valued at the latest quoted bid price provided by the Fund’s pricing service. Securities listed on the NASDAQ Stock Market are valued in accordance with the NASDAQ Official Closing Price.

Short-term investments that mature in sixty days or less may be valued at amortized cost, which approximates fair value. Investments in open-end investment companies are valued at their net asset value per share on valuation date.

Volume and level of activity in established markets for an asset or liability are evaluated to determine whether recent transactions and quoted prices are determinative of fair value. Where there have been significant decreases in volume and level of activity, further analysis and adjustment may be necessary to estimate fair value. The Series measures fair value in these instances by the use of inputs and valuation techniques which may be based upon current market prices of securities that are comparable in coupon, rating, maturity and industry and/or expectation of future cash flows. As a result of trading in relatively thin markets and/or markets that experience significant volatility, the prices used by the Series to value these securities may differ from the value that would be realized if these securities were sold, and the differences could be material.

Securities for which representative valuations or prices are not available from the Series’ pricing service may be valued at fair value as determined in good faith by the Advisor under procedures approved by and under the general supervision and responsibility of the Fund’s Board of Directors (the “Board”). Due to the inherent uncertainty of valuations of such securities, the fair value may differ significantly from the values that would have been used had a ready market for such securities existed. If trading or events occurring after the close of the principal market in which securities are traded are expected to materially affect the value of those securities, then they may be valued at their fair value, taking this trading or these events into account. In accordance with the procedures approved by the Board, the values of certain securities trading outside the U.S. were adjusted following the close of local trading using a factor from a third party vendor. The third party vendor uses statistical analyses and quantitative models, which consider among other things subsequent movement and changes in the prices of indices, securities and exchange rates in other markets, to determine the factors which are used to adjust local market prices. The value of securities used for net asset value calculation under these procedures may differ from published prices for the same securities. It is the Fund’s policy to classify each foreign equity security where a factor from a third party vendor is provided as a Level 2 security.

12

Real Estate Series

Notes to Financial Statements (continued)

(unaudited)

| 2. | Significant Accounting Policies (continued) |

Security Valuation (continued)

Various inputs are used in determining the value of the Series’ assets or liabilities carried at fair value. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical assets and liabilities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Level 3 includes significant unobservable inputs (including the Series’ own assumptions in determining the fair value of investments). A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input both individually and in aggregate that is significant to the fair value measurement. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the valuation levels used for major security types as of June 30, 2017 in valuing the Series’ assets or liabilities carried at fair value:

��

| | | | | | | | | | | | | | | | |

| DESCRIPTION | | TOTAL | | | LEVEL 1 | | | LEVEL 2 | | | LEVEL 3 | |

Assets: | | | | | | | | | | | | | | | | |

Equity securities: | | | | | | | | | | | | | | | | |

Consumer Discretionary | | $ | 6,509,619 | | | $ | 3,828,752 | | | $ | 2,680,867 | | | $ | — | |

Information Technology | | | 4,471,562 | | | | 4,471,562 | | | | — | | | | — | |

Real Estate | | | 302,398,547 | | | | 295,550,560 | | | | 6,847,987 | | | | — | |

Mutual fund | | | 5,368,126 | | | | 5,368,126 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total assets | | $ | 318,747,854 | | | $ | 309,219,000 | | | $ | 9,528,854 | | | $ | — | |

| | | | | | | | | | | | | | | | |

Please see the Investment Portfolio for foreign securities where a factor from a third party vendor was applied to determine the securities’ fair value following the close of local trading. Such securities are included in Level 2 in the table above.

The Fund’s policy is to recognize transfers in and transfers out of the valuation levels as of the beginning of the reporting period. There were no transfers between fair value levels during the six months ended June 30, 2017.

New Accounting Guidance

In October 2016, the Securities and Exchange Commission (SEC) issued a new rule, Investment Company Reporting Modernization, which, among other provisions, amends Regulation S-X to require standardized, enhanced disclosures, particularly related to derivatives, in investment company financial statements. The compliance date for implementing the new or amended rules is August 1, 2017; adoption will have no effect on the Fund’s net assets or results of operations.

Security Transactions, Investment Income and Expenses

Security transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date, except that if the ex-dividend date has passed, certain dividends from foreign securities are recorded as soon as the Series is informed of the ex-dividend date. Non-cash dividends, if any, are recorded at the fair value of the securities received. Interest income, including amortization of premium and accretion of discounts using the effective interest method, is earned from settlement date and accrued daily.

Expenses are recorded on an accrual basis. Most expenses of the Fund can be attributed to a specific series. Expenses which cannot be directly attributed are apportioned among the series in the Fund in such a manner as deemed equitable by the Fund’s Board, taking into consideration, among other things, the nature and type of expense. Income, expenses (other than shareholder services fees), and realized and unrealized gains and losses are prorated among the classes based on the relative net assets of each class. Class specific expenses are directly charged to that class.

13

Real Estate Series

Notes to Financial Statements (continued)

(unaudited)

| 2. | Significant Accounting Policies (continued) |

Security Transactions, Investment Income and Expenses (continued)

The Fund records distributions received in excess of income from underlying investments as a reduction of cost of investments and/or realized gain. Such amounts are based on estimates if actual amounts are not available and actual amounts of income, realized gain and return of capital may differ from the estimated amounts. The Fund adjusts the estimated amounts of components of distributions (and consequently its net investment income) as necessary once the issuers provide information about the actual composition of the distributions.

The Series uses the identified cost method for determining realized gain or loss on investments for both financial statement and federal income tax reporting purposes.

Foreign Currency Translation

The books and records of the Series are maintained in U.S. dollars. Foreign currencies, investments and other assets and liabilities are translated into U.S. dollars at the current exchange rates. Purchases and sales of investment securities and income and expenses are translated on the respective dates of such transactions. The Series does not isolate realized and unrealized gains and losses attributable to changes in the exchange rates from gains and losses that arise from changes in the market value of investments. Such fluctuations are included with net realized and unrealized gain or loss on investments. Net realized foreign currency gains and losses represent foreign currency gains and losses between trade date and settlement date on securities transactions, gains and losses on disposition of foreign currencies and the difference between the amount of income and foreign withholding taxes recorded on the books of the Series and the amounts actually received or paid.

Federal Taxes

The Series’ policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. The Series is not subject to federal income tax or excise tax to the extent that the Series distributes to shareholders each year its taxable income, including any net realized gains on investments, in accordance with requirements of the Internal Revenue Code. Accordingly, no provision for federal income tax or excise tax has been made in the financial statements.

Management evaluates its tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. At June 30, 2017, the Series has recorded no liability for net unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken in future tax returns.

The Series files income tax returns in the U.S. federal jurisdiction, various states and foreign jurisdictions, as required. No income tax returns are currently under investigation. The statute of limitations on the Series’ tax returns remains open for the years ended December 31, 2013 through December 31, 2016. The Series is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Foreign Taxes

Based on the Series’ understanding of the tax rules and rates related to income, gains and currency purchase/repatriation transactions for foreign jurisdictions in which it invests, the Series will provide for foreign taxes, and where appropriate, deferred foreign tax.

Distributions of Income and Gains

Distributions to shareholders of net investment income and net realized gains are made annually. An additional distribution may be necessary to avoid taxation of the Series. Distributions are recorded on the ex-dividend date.

Indemnifications

The Fund’s organizational documents provide former and current directors and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

14

Real Estate Series

Notes to Financial Statements (continued)

(unaudited)

| 2. | Significant Accounting Policies (continued) |

Other

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

| 3. | Transactions with Affiliates |

The Fund has an Investment Advisory Agreement (the “Agreement”) with the Advisor, for which the Series pays a fee, computed daily and payable monthly, at an annual rate of 0.75% of the Series’ average daily net assets.

Under the Agreement, personnel of the Advisor provide the Series with advice and assistance in the choice of investments and the execution of securities transactions, and otherwise maintain the Series’ organization. The Advisor also provides the Fund with necessary office space and fund administration and support services. The salaries of all officers of the Fund (except a percentage of the Fund’s Chief Compliance Officer’s salary, which is paid by the Fund), and of all Directors who are “affiliated persons” of the Fund, or of the Advisor, and all personnel of the Fund, or of the Advisor, performing services relating to research, statistical and investment activities, are paid by the Advisor. Each “non-affiliated” Director receives an annual stipend, which is allocated among all the active series of the Fund. In addition, these Directors also receive a fee per Board meeting attended plus a fee for each committee meeting attended and are reimbursed for travel and other out-of-pocket expenses incurred by them in connection with attending such meetings. The Fund also has an Audit Committee Chair and Governance & Nominating Committee Chair, who each receive an additional annual stipend for each role.

The Class S shares of the Series are subject to a shareholder services fee in accordance with a shareholder services plan adopted by the Board. The shareholder services fee is intended to compensate financial intermediaries, including affiliates of the Fund, in connection with the provision of direct client service, personal services, maintenance of shareholder accounts and reporting services. For these services, Class S of the Series pays a fee, computed daily and payable monthly, at an annual rate of 0.25% of the average daily net assets of Class S. The Fund has a Shareholder Services Agreement with the Advisor, for which the Advisor receives the shareholder services fee as stated above.

The Advisor has contractually agreed, until at least April 30, 2018, to waive its management fee and, if necessary, pay other operating expenses of the Series in order to maintain total direct annual fund operating expenses for the Series, exclusive of each share class’ shareholder services fee, at no more than 0.95% of average daily net assets. The Advisor did not waive any fees for the six months ended June 30, 2017. The Advisor is not eligible to recoup any expenses that have been waived or reimbursed in prior years.

Manning & Napier Investor Services, Inc., a registered broker-dealer affiliate of the Advisor, acts as distributor for the Fund’s shares. The services of Manning & Napier Investor Services, Inc. are provided at no additional cost to the Series.

Pursuant to a master services agreement effective through February 28, 2017, the Fund paid the Advisor an annual fee related to fund accounting and administration of 0.0085% on the first $25 billion of average daily net assets (excluding Target Series and Strategic Income Series); and 0.0075% on the next $15 billion of average daily net assets (excluding Target Series and Strategic Income Series); and 0.0065% of average daily net assets in excess of $40 billion (excluding Target Series and Strategic Income Series); plus a base fee of $30,400 per series. Transfer agent fees were charged to the Fund on a per account basis. Additionally, certain transaction and out-of-pocket expenses, including charges for reporting relating to the Fund’s compliance program, were charged. The Advisor had agreements with BNY Mellon Investment Servicing (U.S.) Inc. (“BNY”) under which BNY served as sub-accountant services agent and sub-transfer agent. Effective March 1, 2017, BNY became the named transfer agent for the Fund. Pursuant to a master services agreement dated March 1, 2017, the Fund continues to pay

15

Real Estate Series

Notes to Financial Statements (continued)

(unaudited)

| 3. | Transactions with Affiliates (continued) |

the Advisor the annual fee related to fund accounting and administration of 0.0085% on the first $25 billion of average daily net assets (excluding Target Series and Strategic Income Series); and 0.0075% on the next $15 billion of average daily net assets (excluding Target Series and Strategic Income Series); and 0.0065% of average daily net assets in excess of $40 billion (excluding Target Series and Strategic Income Series); plus the base fee of $30,400 per series. Additionally, certain transaction and out-of-pocket expenses, including charges for reporting relating to the Fund’s compliance program, are charged. The agreement between the Advisor and BNY under which BNY serves as sub-accountant services agent continues to be in effect.

Expenses not directly attributable to a Series are allocated based on each Series’ relative net assets or number of accounts, depending on the expense.

| 4. | Purchases and Sales of Securities |

For the six months ended June 30, 2017, purchases and sales of securities, other than U.S. Government securities and short-term securities, were $62,445,993 and $59,372,806, respectively. There were no purchases or sales of U.S. Government securities.

| 5. | Capital Stock Transactions |

Transactions in shares of Class S and I shares of Real Estate Series were:

| | | | | | | | | | | | | | | | |

| CLASS S | | FOR THE SIX MONTHS ENDED 6/30/17 | | | FOR THE YEAR ENDED 12/31/2016 | |

| | | SHARES | | | AMOUNT | | | SHARES | | | AMOUNT | |

Sold | | | 1,851,319 | | | $ | 27,498,640 | | | | 7,223,311 | | | $ | 111,145,344 | |

Reinvested | | | — | | | | — | | | | 978,068 | | | | 13,965,650 | |

Repurchased | | | (2,373,783 | ) | | | (35,274,241 | ) | | | (4,332,234 | ) | | | (64,163,584 | ) |

| | | | | | | | | | | | | | | | |

Total | | | (522,464 | ) | | $ | (7,775,601 | ) | | | 3,869,145 | | | $ | 60,947,410 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| CLASS I | | FOR THE SIX MONTHS ENDED 6/30/17 | | | FOR THE YEAR ENDED 12/31/2016 | |

| | | SHARES | | | AMOUNT | | | SHARES | | | AMOUNT | |

Sold | | | 1,913,735 | | | $ | 13,923,495 | | | | 2,348,412 | | | $ | 17,645,161 | |

Reinvested | | | — | | | | — | | | | 332,761 | | | | 2,327,762 | |

Repurchased | | | (672,483 | ) | | | (4,905,116 | ) | | | (5,864,133 | ) | | | (46,659,124 | ) |

| | | | | | | | | | | | | | | | |

Total | | | 1,241,252 | | | $ | 9,018,379 | | | | (3,182,960 | ) | | $ | (26,686,201 | ) |

| | | | | | | | | | | | | | | | |

Approximately 68% of the shares outstanding are fiduciary accounts where the Advisor has sole investment discretion.

The Series may trade in instruments including written and purchased options, forward foreign currency exchange contracts and futures contracts and other derivatives in the normal course of investing activities to assist in managing exposure to various market risks. The Series may be subject to various elements of risk, which may involve, to a varying degree, elements of risk in excess of the amounts recognized for financial statement purposes. These risks include: the risk that changes in the value of a derivative may not correlate perfectly with the underlying asset, rate or index; counterparty credit risk related to over the counter derivative counterparties’ failure to perform under contract terms; liquidity risk related to the lack of a liquid market for these contracts allowing the fund to close out its position(s); and documentation risk relating to disagreement over contract terms. No such investments were held by the Series as of June 30, 2017.

16

Real Estate Series

Notes to Financial Statements (continued)

(unaudited)

Investing in securities of foreign companies and foreign governments involves special risks and considerations not typically associated with investing in securities of domestic companies and the U.S. Government. These risks include revaluation of currencies and future adverse political and economic developments. Moreover, securities of foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of comparable domestic companies and the U.S. Government.

The Series may focus its investments in certain real estate related industries; hence, the Series may subject itself to a greater degree of risk than a series that is more diversified.

| 9. | Federal Income Tax Information |

The amount and characterization of certain income and capital gains to be distributed are determined in accordance with federal income tax regulations, which may differ from GAAP. The Series may periodically make reclassifications among its capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations without impacting the Series’ net asset value. Any such reclassifications are not reflected in the financial highlights.

The final determination of the tax character of current year distributions will be made at the conclusion of the fiscal year. The tax character of distributions paid for the year ended December 31, 2016 were as follows:

| | | | | | | | | | | | |

Ordinary income | | $ | 4,979,900 | | | | | | | | | |

Long-term capital gains | | $ | 12,146,537 | | | | | | | | | |

At June 30, 2017, the identified cost for federal income tax purposes, the resulting gross unrealized appreciation and depreciation, and the net unrealized appreciation were as follows:

| | | | | | | | |

Cost for federal income tax purposes | | $ | 275,893,386 | | | | | |

Unrealized appreciation | | | 50,788,029 | | | | | |

Unrealized depreciation | | | (7,933,561 | ) | | | | |

| | | | | | | | |

Net unrealized appreciation | | $ | 42,854,468 | | | | | |

| | | | | | | | |

17

Real Estate Series

Literature Requests

(unaudited)

Proxy Voting Policies and Procedures

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available, without charge, upon request:

| | | | | | |

By phone | | 1-800-466-3863 | | | | |

On the Securities and Exchange | | | | | | |

Commission’s (SEC) web site | | http://www.sec.gov | | | | |

Proxy Voting Record

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available, without charge, upon request:

| | | | | | |

By phone | | 1-800-466-3863 | | | | |

On the SEC’s web site | | http://www.sec.gov | | | | |

Quarterly Portfolio Holdings

The Series’ complete schedule of portfolio holdings for the 1st and 3rd quarters of each fiscal year are provided on Form N-Q, and are available, without charge, upon request:

| | | | | | |

By phone | | 1-800-466-3863 | | | | |

On the SEC’s web site | | http://www.sec.gov | | | | |

The Series’ Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Prospectus and Statement of Additional Information (SAI)

For more information about any of the Manning & Napier Fund, Inc. Series, you may obtain a prospectus and SAI at www.manning-napier.com or by calling (800) 466-3863. Before investing, carefully consider the objectives, risks, charges and expenses of the investment and read the prospectus carefully as it contains this and other information about the investment company. In addition, this information can be found on the SEC’s web site, http://www.sec.gov.

Additional information available at www.manning-napier.com

1. Fund Holdings - Month-End

2. Fund Holdings - Quarter-End

3. Shareholder Report - Annual

4. Shareholder Report - Semi-Annual

The Fund also offers electronic notification or “e-delivery” when certain documents are available on-line to be downloaded or reviewed. Direct shareholders can elect to receive electronic notification when shareholder reports, prospectus updates, and/or statements are available. If you do not currently have on-line access to your account, you can establish access by going to www.manning-napier.com, click on “Login” in the top corner of the page, and follow the prompts to self-enroll. Once enrolled, you can set your electronic notification preferences by clicking on the Account Options tab located within the green toolbar and then select E-Delivery Option. Should you have any questions on either how to establish on-line access or how to update your account settings, please contact Investor Services at 1-800-466-3863.

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

MNRES-6/17-SAR

International Series

Shareholder Expense Example

(unaudited)

As a shareholder of the Series, you incur ongoing costs, including management fees, shareholder service fees and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested in each class at the beginning of the period and held for the entire period (January 1, 2017 to June 30, 2017).

Actual Expenses

The Actual lines of the table below provide information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the Actual line for the Class in which you have invested under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The Hypothetical lines of each Class in the table below provide information about hypothetical account values and hypothetical expenses based on the Class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. You may use this information to compare the ongoing costs of investing in a class of the Series and other funds. To do so, compare this 5% hypothetical example for the class in which you have invested with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads), redemption fees, or exchange fees that you may incur in other mutual funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | |

| | | BEGINNING

ACCOUNT VALUE 1/1/17 | | ENDING

ACCOUNT

VALUE 6/30/17 | | EXPENSES PAID

DURING PERIOD*

1/1/17-6/30/17 | | ANNUALIZED

EXPENSE RATIO |

Class S | | | | | | | | |

Actual | | $1,000.00 | | $1,133.60 | | $5.82 | | 1.10% |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,019.34 | | $5.51 | | 1.10% |

Class I | | | | | | | | |

Actual | | $1,000.00 | | $1,134.60 | | $4.50 | | 0.85% |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,020.58 | | $4.26 | | 0.85% |

*Expenses are equal to each Class’ annualized expense ratio (for the six-month period), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Expenses are based on the most recent fiscal half year. The Class’ total return would have been lower had certain expenses not been waived during the period.

1

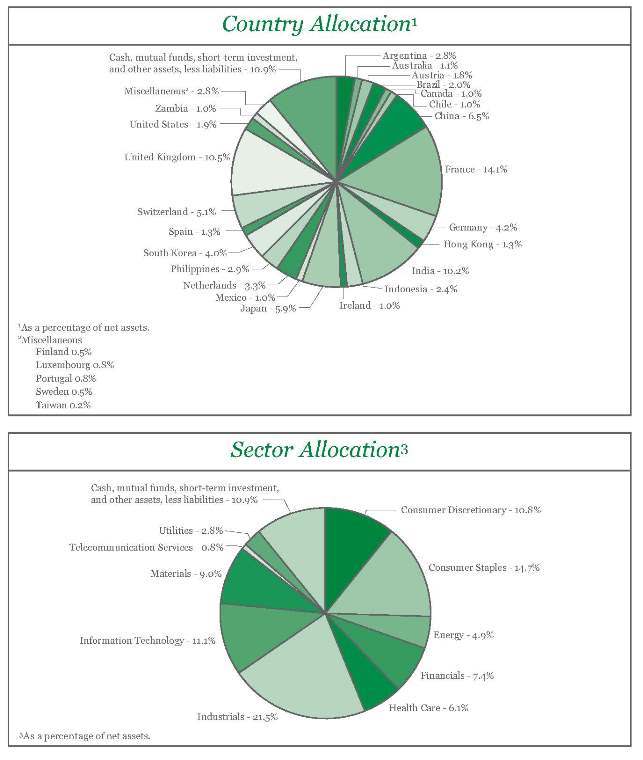

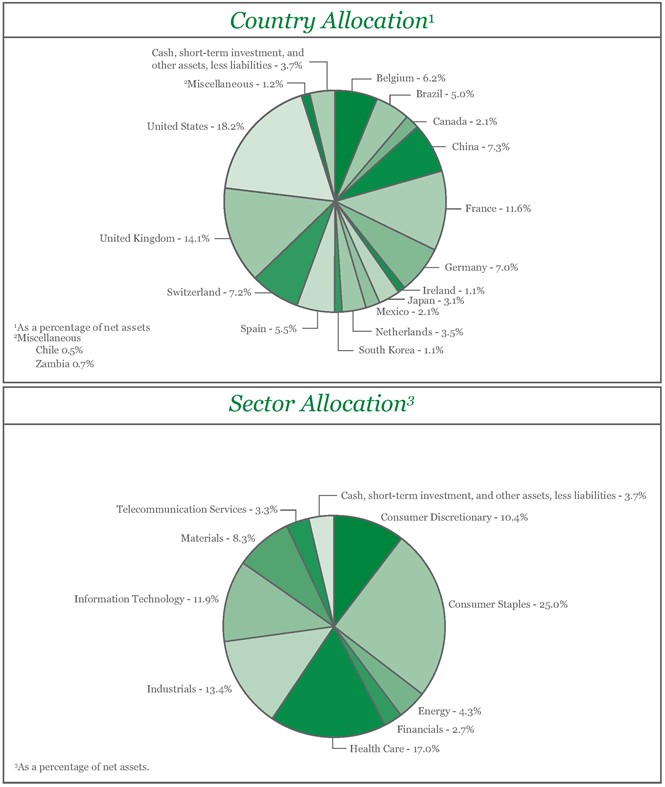

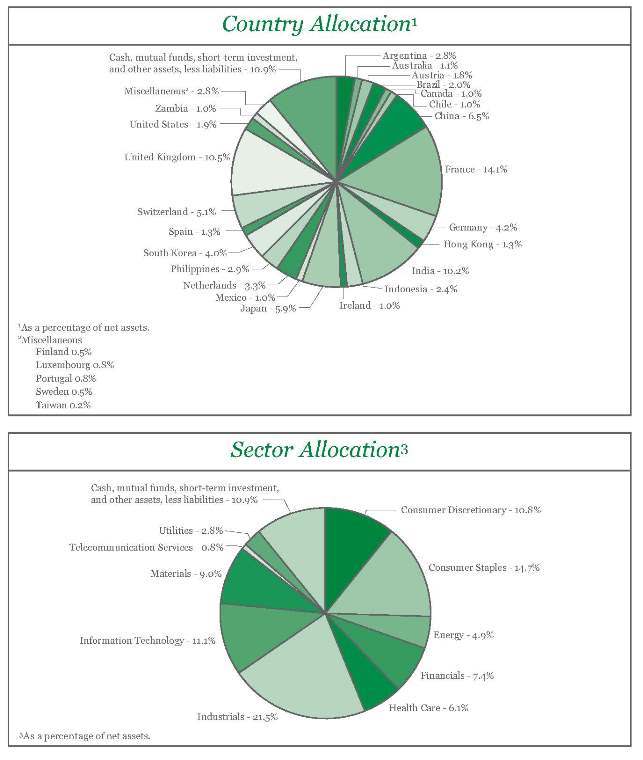

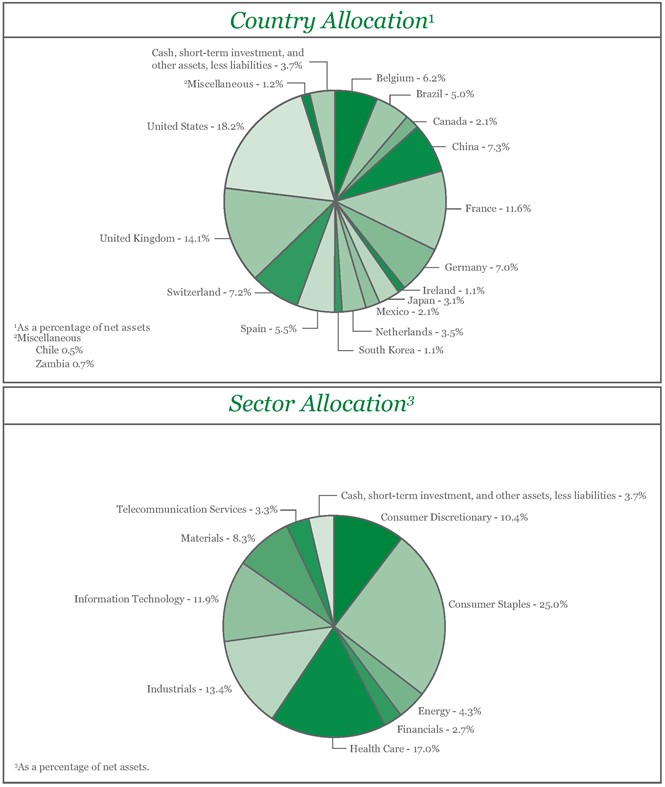

International Series

Portfolio Composition as of June 30, 2017

(unaudited)

2

International Series

Investment Portfolio - June 30, 2017

(unaudited)

| | | | | | | | |

| | |

| | | SHARES | | | VALUE (NOTE 2) | |

| | |

COMMON STOCKS - 89.1% | | | | | | | | |

| | |

Consumer Discretionary - 10.8% | | | | | | | | |

Automobiles - 0.8% | | | | | | | | |

Maruti Suzuki India Ltd. (India)1 | | | 39,480 | | | $ | 4,405,121 | |

| | | | | | | | |

Diversified Consumer Services - 1.0% | | | | | | | | |

Fu Shou Yuan International Group Ltd. (China)1 | | | 8,765,000 | | | | 5,287,368 | |

| | | | | | | | |

Hotels, Restaurants & Leisure - 1.1% | | | | | | | | |

Elior Group (France)1,2 | | | 106,980 | | | | 3,109,347 | |

Jollibee Foods Corp. (Philippines)1 | | | 626,060 | | | | 2,529,570 | |

| | | | | | | | |

| | | | | | | 5,638,917 | |

| | | | | | | | |

Household Durables - 0.4% | | | | | | | | |

Kaufman & Broad S.A. (France)1 | | | 51,068 | | | | 2,276,006 | |

| | | | | | | | |

Internet & Direct Marketing Retail - 1.0% | | | | | | | | |

Ctrip.com International Ltd. - ADR (China)* | | | 50,555 | | | | 2,722,892 | |

SRP Groupe S.A. (France)*1,2 | | | 97,455 | | | | 2,593,487 | |

| | | | | | | | |

| | | | | | | 5,316,379 | |

| | | | | | | | |

Leisure Products - 1.6% | | | | | | | | |

Shimano, Inc. (Japan)1 | | | 55,600 | | | | 8,828,089 | |

| | | | | | | | |

Media - 2.7% | | | | | | | | |

Dish TV India Ltd. (India)*1 | | | 2,658,510 | | | | 3,291,694 | |

Informa plc (United Kingdom)1 | | | 317,315 | | | | 2,767,757 | |

JCDecaux S.A. (France)1 | | | 75,060 | | | | 2,460,965 | |

Surya Citra Media Tbk PT (Indonesia)1 | | | 10,587,400 | | | | 2,057,568 | |

Zee Entertainment Enterprises Ltd. (India)1 | | | 479,875 | | | | 3,642,299 | |

| | | | | | | | |

| | | | | | | 14,220,283 | |

| | | | | | | | |

Multiline Retail - 0.5% | | | | | | | | |

Matahari Department Store Tbk PT (Indonesia)1 | | | 2,436,000 | | | | 2,590,617 | |

| | | | | | | | |

Textiles, Apparel & Luxury Goods - 1.7% | | | | | | | | |

ANTA Sports Products Ltd. (China)1 | | | 1,961,000 | | | | 6,478,435 | |

Burberry Group plc (United Kingdom)1 | | | 126,215 | | | | 2,731,144 | |

| | | | | | | | |

| | | | | | | 9,209,579 | |

| | | | | | | | |

| | |

Total Consumer Discretionary | | | | | | | 57,772,359 | |

| | | | | | | | |

| | |

Consumer Staples - 14.7% | | | | | | | | |

Beverages - 3.8% | | | | | | | | |

Ambev S.A. - ADR (Brazil) | | | 723,610 | | | | 3,972,619 | |

Diageo plc (United Kingdom)1 | | | 363,055 | | | | 10,728,974 | |

Treasury Wine Estates Ltd. (Australia)1 | | | 558,469 | | | | 5,647,195 | |

| | | | | | | | |

| | | | | | | 20,348,788 | |

| | | | | | | | |

Food & Staples Retailing - 2.9% | | | | | | | | |

Dairy Farm International Holdings Ltd. (Hong Kong)1 | | | 865,800 | | | | 6,822,504 | |

Puregold Price Club, Inc. (Philippines)1 | | | 3,152,820 | | | | 2,783,554 | |

The accompanying notes are an integral part of the financial statements.

3

International Series

Investment Portfolio - June 30, 2017

(unaudited)

| | | | | | | | |

| | |

| | | SHARES | | | VALUE (NOTE 2) | |

| | |

COMMON STOCKS (continued) | | | | | | | | |

| | |

Consumer Staples (continued) | | | | | | | | |

Food & Staples Retailing (continued) | | | | | | | | |

Raia Drogasil S.A. (Brazil) | | | 131,180 | | | $ | 2,791,569 | |

Robinsons Retail Holdings, Inc. (Philippines)1 | | | 1,655,825 | | | | 2,852,015 | |

| | | | | | | | |

| | |

| | | | | | | 15,249,642 | |

| | | | | | | | |

Food Products - 3.2% | | | | | | | | |

Kerry Group plc - Class A (Ireland)1 | | | 48,125 | | | | 4,144,618 | |

Nestle S.A. (Switzerland)1 | | | 90,115 | | | | 7,859,621 | |

Universal Robina Corp. (Philippines)1 | | | 1,527,355 | | | | 4,933,723 | |

| | | | | | | | |

| | |

| | | | | | | 16,937,962 | |

| | | | | | | | |

Household Products - 2.2% | | | | | | | | |

Hindustan Unilever Ltd. (India)1 | | | 180,385 | | | | 3,011,866 | |

Reckitt Benckiser Group plc (United Kingdom)1 | | | 57,240 | | | | 5,802,627 | |

Unilever Indonesia Tbk PT (Indonesia)1 | | | 786,200 | | | | 2,878,751 | |

| | | | | | | | |

| | |

| | | | | | | 11,693,244 | |

| | | | | | | | |

Personal Products - 1.7% | | | | | | | | |

Emami Ltd. (India)1 | | | 238,905 | | | | 3,975,584 | |

Unilever plc - ADR (United Kingdom) | | | 98,680 | | | | 5,340,562 | |

| | | | | | | | |

| | |

| | | | | | | 9,316,146 | |

| | | | | | | | |

Tobacco - 0.9% | | | | | | | | |

ITC Ltd. (India)1 | | | 909,440 | | | | 4,549,417 | |

| | | | | | | | |

| | |

Total Consumer Staples | | | | | | | 78,095,199 | |

| | | | | | | | |

| | |

Energy - 4.9% | | | | | | | | |

Energy Equipment & Services - 2.7% | | | | | | | | |

Nabors Industries Ltd. (United States) | | | 466,800 | | | | 3,799,752 | |

Schlumberger Ltd. (United States) | | | 96,755 | | | | 6,370,349 | |

Tenaris S.A. - ADR (Luxembourg) | | | 130,385 | | | | 4,060,189 | |

| | | | | | | | |

| | |

| | | | | | | 14,230,290 | |

| | | | | | | | |

Oil, Gas & Consumable Fuels - 2.2% | | | | | | | | |

Galp Energia SGPS S.A. (Portugal)1 | | | 266,055 | | | | 4,031,743 | |

Royal Dutch Shell plc - Class B - ADR (Netherlands) | | | 71,600 | | | | 3,897,188 | |

YPF S.A. - ADR (Argentina) | | | 169,995 | | | | 3,722,890 | |

| | | | | | | | |

| | |

| | | | | | | 11,651,821 | |

| | | | | | | | |

| | |

Total Energy | | | | | | | 25,882,111 | |

| | | | | | | | |

| | |

Financials - 7.4% | | | | | | | | |

Banks - 6.1% | | | | | | | | |

Axis Bank Ltd. (India)1 | | | 330,915 | | | | 2,646,262 | |

Banco Macro S.A. - ADR (Argentina) | | | 29,830 | | | | 2,750,028 | |

BNP Paribas S.A. (France)1 | | | 55,735 | | | | 4,012,523 | |

Credit Agricole S.A. (France)1 | | | 264,515 | | | | 4,260,911 | |

The accompanying notes are an integral part of the financial statements.

4

International Series

Investment Portfolio - June 30, 2017

(unaudited)

| | | | | | | | |

| | |

| | | SHARES | | | VALUE (NOTE 2) | |

| | |

COMMON STOCKS (continued) | | | | | | | | |

| | |

Financials (continued) | | | | | | | | |

Banks (continued) | | | | | | | | |

Grupo Financiero Galicia S.A. - ADR (Argentina) | | | 65,790 | | | $ | 2,805,286 | |

ICICI Bank Ltd. (India)1 | | | 666,127 | | | | 2,998,666 | |

IndusInd Bank Ltd. (India)1 | | | 116,715 | | | | 2,668,451 | |

Kotak Mahindra Bank Ltd. (India)1 | | | 186,985 | | | | 2,763,022 | |

Natixis S.A. (France)1 | | | 565,310 | | | | 3,794,771 | |

Societe Generale S.A. (France)1 | | | 71,910 | | | | 3,877,805 | |

| | | | | | | | |

| | |

| | | | | | | 32,577,725 | |

| | | | | | | | |

Capital Markets - 1.3% | | | | | | | | |

Amundi S.A. (France)1,2 | | | 38,425 | | | | 2,784,151 | |

Euronext N.V. (Netherlands)1,2 | | | 77,750 | | | | 4,037,948 | |

| | | | | | | | |

| | |

| | | | | | | 6,822,099 | |

| | | | | | | | |

| | |

Total Financials | | | | | | | 39,399,824 | |

| | | | | | | | |

| | |

Health Care - 6.1% | | | | | | | | |

Biotechnology - 0.8% | | | | | | | | |

China Biologic Products, Inc. (China)* | | | 36,825 | | | | 4,164,908 | |

| | | | | | | | |

Health Care Equipment & Supplies - 1.7% | | | | | | | | |

Essilor International S.A. (France)1 | | | 40,440 | | | | 5,144,494 | |

Osstem Implant Co. Ltd. (South Korea)*1 | | | 84,725 | | | | 3,881,698 | |

| | | | | | | | |

| | |

| | | | | | | 9,026,192 | |

| | | | | | | | |

Health Care Providers & Services - 2.5% | | | | | | | | |

Fleury S.A. (Brazil) | | | 464,860 | | | | 3,756,317 | |

Fresenius Medical Care AG & Co. KGaA - ADR (Germany) | | | 117,870 | | | | 5,696,657 | |

Orpea (France)1 | | | 35,425 | | | | 3,949,461 | |

| | | | | | | | |

| | |

| | | | | | | 13,402,435 | |

| | | | | | | | |

Life Sciences Tools & Services - 0.8% | | | | | | | | |

Tecan Group AG (Switzerland)1 | | | 23,090 | | | | 4,348,000 | |

| | | | | | | | |

Pharmaceuticals - 0.3% | | | | | | | | |

Kalbe Farma Tbk PT (Indonesia)1 | | | 11,000,000 | | | | 1,339,076 | |

| | | | | | | | |

| | |

Total Health Care | | | | | | | 32,280,611 | |

| | | | | | | | |

| | |

Industrials - 21.5% | | | | | | | | |

Aerospace & Defense - 3.2% | | | | | | | | |

Korea Aerospace Industries Ltd. (South Korea)1 | | | 143,094 | | | | 7,128,749 | |

LIG Nex1 Co. Ltd. (South Korea)1 | | | 73,940 | | | | 4,783,444 | |

QinetiQ Group plc (United Kingdom)1 | | | 703,810 | | | | 2,479,390 | |

Thales S.A. (France)1 | | | 25,940 | | | | 2,791,781 | |

| | | | | | | | |

| | |

| | | | | | | 17,183,364 | |

| | | | | | | | |

Airlines - 0.2% | | | | | | | | |

Ryanair Holdings plc - ADR (Ireland)* | | | 12,419 | | | | 1,336,409 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

5

International Series

Investment Portfolio - June 30, 2017

(unaudited)

| | | | | | | | |

| | |

| | | SHARES | | | VALUE (NOTE 2) | |

| | |

COMMON STOCKS (continued) | | | | | | | | |

| | |

Industrials (continued) | | | | | | | | |

Building Products - 1.5% | | | | | | | | |

Cie de Saint-Gobain (France)1 | | | 96,045 | | | $ | 5,129,299 | |

Geberit AG (Switzerland)1 | | | 5,690 | | | | 2,657,004 | |

| | | | | | | | |

| | |

| | | | | | | 7,786,303 | |

| | | | | | | | |

Commercial Services & Supplies - 2.1% | | | | | | | | |

China Everbright International Ltd. (China)1 | | | 1,941,000 | | | | 2,420,831 | |

Elis S.A. (France)1 | | | 122,855 | | | | 2,814,801 | |

SPIE S.A. (France)1 | | | 193,685 | | | | 5,817,890 | |

| | | | | | | | |

| | |

| | | | | | | 11,053,522 | |

| | | | | | | | |

Construction & Engineering - 3.5% | | | | | | | | |

Eiffage S.A. (France)1 | | | 63,170 | | | | 5,738,439 | |

Larsen & Toubro Ltd. (India)1 | | | 292,955 | | | | 7,643,742 | |

Vinci S.A. (France)1 | | | 62,950 | | | | 5,369,740 | |

| | | | | | | | |

| | |

| | | | | | | 18,751,921 | |

| | | | | | | | |

Industrial Conglomerates - 1.9% | | | | | | | | |

Siemens AG (Germany)1 | | | 73,430 | | | | 10,100,608 | |

| | | | | | | | |

| | |

Machinery - 3.7% | | | | | | | | |

Airtac International Group (Taiwan)1 | | | 98,000 | | | | 1,158,264 | |

ANDRITZ AG (Austria)1 | | | 88,945 | | | | 5,366,318 | |

FANUC Corp. (Japan)1 | | | 20,740 | | | | 4,014,139 | |

Jungheinrich AG (Germany)1 | | | 72,420 | | | | 2,653,716 | |

Metso OYJ (Finland)1 | | | 73,185 | | | | 2,539,370 | |

The Weir Group plc (United Kingdom)1 | | | 170,525 | | | | 3,848,741 | |

| | | | | | | | |

| | |

| | | | | | | 19,580,548 | |

| | | | | | | | |

| | |

Professional Services - 4.7% | | | | | | | | |

Applus Services S.A. (Spain)1 | | | 564,650 | | | | 7,123,826 | |

Intertek Group plc (United Kingdom)1 | | | 100,110 | | | | 5,499,597 | |

Randstad Holding N.V. (Netherlands)1 | | | 68,870 | | | | 4,015,206 | |

RELX plc (United Kingdom)1 | | | 130,085 | | | | 2,812,062 | |

SGS S.A. (Switzerland)1 | | | 2,330 | | | | 5,649,519 | |

| | | | | | | | |

| | |

| | | | | | | 25,100,210 | |

| | | | | | | | |

| | |

Trading Companies & Distributors - 0.7% | | | | | | | | |

Ashtead Group plc (United Kingdom)1 | | | 187,240 | | | | 3,874,507 | |

| | | | | | | | |

| | |

Total Industrials | | | | | | | 114,767,392 | |

| | | | | | | | |

| | |

Information Technology - 11.1% | | | | | | | | |

| | |

Electronic Equipment, Instruments & Components - 5.0% | | | | | | | | |

Halma plc (United Kingdom)1 | | | 179,885 | | | | 2,577,829 | |

Hexagon A.B. (Sweden)1 | | | 62,100 | | | | 2,950,350 | |

Hitachi Ltd. (Japan)1 | | | 1,168,660 | | | | 7,205,598 | |

Hollysys Automation Technologies Ltd. (China) | | | 161,940 | | | | 2,689,823 | |

The accompanying notes are an integral part of the financial statements.

6

International Series

Investment Portfolio - June 30, 2017

(unaudited)

| | | | | | | | |

| | |

| | | SHARES | | | VALUE (NOTE 2) | |

| | |

COMMON STOCKS (continued) | | | | | | | | |

| | |

Information Technology (continued) | | | | | | | | |

Electronic Equipment, Instruments & Components (continued) | | | | | | | | |

Keyence Corp. (Japan)1 | | | 25,618 | | | $ | 11,277,757 | |

| | | | | | | | |

| | |

| | | | | | | 26,701,357 | |

| | | | | | | | |

Internet Software & Services - 1.7% | | | | | | | | |

Alibaba Group Holding Ltd. - ADR (China)* | | | 32,750 | | | | 4,614,475 | |

Tencent Holdings Ltd. - Class H (China)1 | | | 122,200 | | | | 4,383,920 | |

| | | | | | | | |

| | |

| | | | | | | 8,998,395 | |

| | | | | | | | |

IT Services - 1.2% | | | | | | | | |

Altran Technologies S.A. (France)1 | | | 229,605 | | | | 3,740,465 | |

Sopra Steria Group (France)1 | | | 17,490 | | | | 2,791,141 | |

| | | | | | | | |

| | |

| | | | | | | 6,531,606 | |

| | | | | | | | |

Software - 2.2% | | | | | | | | |

Dassault Systemes S.E. (France)1 | | | 30,025 | | | | 2,692,974 | |

Gemalto N.V. (Netherlands)1 | | | 93,595 | | | | 5,613,560 | |

Sophos Group plc (United Kingdom)1,2 | | | 592,295 | | | | 3,421,938 | |

| | | | | | | | |

| | |

| | | | | | | 11,728,472 | |

| | | | | | | | |

Technology Hardware, Storage & Peripherals - 1.0% | | | | | | | | |

Samsung Electronics Co. Ltd. (South Korea)1 | | | 2,610 | | | | 5,436,165 | |

| | | | | | | | |

| | |

Total Information Technology | | | | | | | 59,395,995 | |

| | | | | | | | |

| | |

Materials - 9.0% | | | | | | | | |

| | |

Chemicals - 4.2% | | | | | | | | |

Asian Paints Ltd. (India)1 | | | 150,520 | | | | 2,565,365 | |

Croda International plc (United Kingdom)1 | | | 79,940 | | | | 4,048,382 | |

D&L Industries, Inc. (Philippines)1 | | | 10,271,300 | | | | 2,446,416 | |

Givaudan S.A. (Switzerland)1 | | | 3,440 | | | | 6,893,070 | |

Pidilite Industries Ltd. (India)1 | | | 214,040 | | | | 2,668,836 | |

Symrise AG (Germany)1 | | | 56,560 | | | | 4,012,957 | |

| | | | | | | | |

| | |

| | | | | | | 22,635,026 | |

| | | | | | | | |

Construction Materials - 0.8% | | | | | | | | |

Wienerberger AG (Austria)1 | | | 176,730 | | | | 4,020,472 | |

| | | | | | | | |

| | |

Metals & Mining - 4.0% | | | | | | | | |

Antofagasta plc (Chile)1 | | | 522,585 | | | | 5,452,147 | |

First Quantum Minerals Ltd. (Zambia) | | | 600,205 | | | | 5,077,305 | |

Grupo Mexico, S.A.B. de C.V. - Series B (Mexico) | | | 1,949,010 | | | | 5,475,860 | |

Lundin Mining Corp. (Canada) | | | 936,885 | | | | 5,324,524 | |

| | | | | | | | |

| | |

| | | | | | | 21,329,836 | |

| | | | | | | | |

Total Materials | | | | | | | 47,985,334 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

7

International Series

Investment Portfolio - June 30, 2017

(unaudited)

| | | | | | | | |

| | |

| | | SHARES | | | VALUE (NOTE 2) | |

| | |

COMMON STOCKS (continued) | | | | | | | | |

| | |

Telecommunication Services - 0.8% | | | | | | | | |

Diversified Telecommunication Services - 0.8% | | | | | | | | |

Telekomunikasi Indonesia Persero Tbk PT (Indonesia)1 | | | 12,002,900 | | | $ | 4,076,083 | |

| | | | | | | | |

| | |

Utilities - 2.8% | | | | | | | | |

Electric Utilities - 2.4% | | | | | | | | |

Pampa Energia S.A. - ADR (Argentina)* | | | 95,910 | | | | 5,644,304 | |

Power Grid Corp. of India Ltd. (India)1 | | | 2,298,945 | | | | 7,485,802 | |

| | | | | | | | |

| | |

| | | | | | | 13,130,106 | |

| | | | | | | | |

Water Utilities - 0.4% | | | | | | | | |

CT Environmental Group Ltd. (China)1 | | | 11,250,000 | | | | 1,958,791 | |

| | | | | | | | |

| | |

Total Utilities | | | | | | | 15,088,897 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS | | | | | | | | |

(Identified Cost $426,918,821) | | | | | | | 474,743,805 | |

| | | | | | | | |

| | |

MUTUAL FUNDS - 7.5% | | | | | | | | |

Global X MSCI Argentina ETF (United States) | | | 90,770 | | | | 2,658,653 | |

Global X MSCI Greece ETF (United States) | | | 437,915 | | | | 4,427,321 | |

iShares MSCI Europe Financials ETF (United States) | | | 244,115 | | | | 5,355,883 | |

iShares MSCI Eurozone ETF (United States) | | | 398,385 | | | | 16,064,875 | |

iShares MSCI South Korea Capped ETF (United States) | | | 168,063 | | | | 11,396,352 | |

| | | | | | | | |

| | |

TOTAL MUTUAL FUNDS | | | | | | | | |

(Identified Cost $38,049,560) | | | | | | | 39,903,084 | |

| | | | | | | | |

| | |

SHORT-TERM INVESTMENT - 3.0% | | | | | | | | |

Dreyfus Government Cash Management3, 0.91%, (Identified Cost $16,204,241) | | | 16,204,241 | | | | 16,204,241 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS - 99.6% | | | | | | | | |

(Identified Cost $481,172,622) | | | | | | | 530,851,130 | |

| | |

OTHER ASSETS, LESS LIABILITIES - 0.4% | | | | | | | 1,874,412 | |

| | | | | | | | |

| | |

NET ASSETS - 100% | | | | | | $ | 532,725,542 | |

| | | | | | | | |

ADR - American Depositary Receipt

ETF - Exchange-Traded Fund

*Non-income producing security.

1A factor from a third party vendor was applied to determine the security’s fair value following the close of local trading.