| | |

OMB APPROVAL |

OMB Number: | | 3235-0570 |

| |

Expires: | | September 30, 2007 |

|

Estimated average burden |

hours per response: | | 19.4 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04088

Excelsior Funds, Inc.

(Exact name of registrant as specified in charter)

United States Trust Company of New York

114 West 47th Street

New York, New York 10036

(Address of principal executive offices) (Zip code)

BISYS Fund Services

3435 Stelzer Road

Columbus, Ohio 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-212-852-1000

Date of fiscal year end: March 31, 2005

Date of reporting period: March 31, 2005

| Item 1. | Reports to Stockholders. |

EQUITY FUNDS

ANNUAL REPORT

March 31, 2005

TABLE OF CONTENTS

For shareholder account information, current price and yield quotations, or to make an initial purchase or obtain a prospectus, call 1-800-446-1012, from overseas, call 617-483-7297.

Internet Address: http://www.excelsiorfunds.com

This report must be preceded or accompanied by a current prospectus.

A description of the policies and procedures that Excelsior Funds use to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-800-446-1012, or (ii) by accessing the Excelsior Funds’ internet address and (iii) on the Commission’s website at http://www.sec.gov.

Excelsior Funds file their June 30 and December 31 schedule of portfolio holdings with the Securities and Exchange Commission, on Form N-Q, within sixty days after the applicable reporting period. Excelsior Funds Form N-Q is available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

You should consider the Fund’s investment objectives, risks and expenses carefully before you invest. Information about these and other important subjects is in the Fund’s prospectus, which you should read carefully before investing.

Excelsior Funds, Inc. and Excelsior Funds Trust are distributed by BISYS Fund Services Limited Partnership.

You may write to Excelsior Funds, Inc. and Excelsior Funds Trust at the following address:

Excelsior Funds

P.O. Box 8529

Boston, MA 02266-8529

SHARES IN THE FUNDS ARE NOT DEPOSITS OR OBLIGATIONS OF, OR GUARANTEED OR ENDORSED BY, UNITED STATES TRUST COMPANY OF NEW YORK, U.S. TRUST COMPANY, N.A. THEIR PARENT OR AFFILIATES AND SHARES ARE NOT INSURED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION, THE FEDERAL RESERVE BOARD, OR ANY OTHER AGENCY. INVESTMENTS IN THE FUNDS INVOLVE INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF PRINCIPAL. FUND SHARES ARE NOT INSURED OR GUARANTEED BY THE U.S. GOVERNMENT.

LETTER TO SHAREHOLDERS

March 31, 2005

Dear Fellow Shareholder:

The fiscal year ended March 31, 2005 was marked by a continuing uptrend in broad based market indices. Financial markets spent much of 2004 waiting to see who would win the U.S. Presidential election. Stocks rose in the post-election period, posting gains from the first week of November to year end. The markets held their ground despite higher than anticipated energy prices. On December 14th, the Standard & Poor’s 500 Index closed above 1200 for the first time since August of 2001, and stocks retained most of their year-end 2004 gains during the first quarter of 2005. Also, the Federal Reserve monetary policy took hold, with its seventh increase in the Federal Funds rate to 2.75% as of the end of the first quarter of 2005.

Going forward, our overall investment theme reflects a preference for goods versus services, real versus financial assets, and “old economy” sectors and industries stocks versus the so-called “new economy”. Creating the cities and the infrastructure that are springing up in giant global emerging economies has raised overall levels of demand for commodities that are in relatively short supply, particularly after a decade or more of capital under investment in tangible producing sectors. We expect to focus on opportunities for above-market returns, and our portfolio managers will aim to capitalize on these prospects as they take shape.

As always, we value your confidence in selecting Excelsior to fulfill your investment needs. We strongly believe that Excelsior’s array of funds will help meet the full range of your financial objectives.

Sincerely,

Mary Martinez

President

1

| | DOMESTIC EQUITY MARKET REVIEW |

After a strong performance across sectors, styles, and capitalization ranges during the previous reporting period ended March 31, 2004, the domestic equity markets turned challenging and finished the current reporting period only slightly higher. For the twelve months ended March 31, 2005, the Dow Jones Industrial Average (DJIA) rose 1.4%, the NASDAQ Composite Index (COMP) ticked up 0.25%, while the Standard & Poor’s 500 Index (S&P 500) gained 4.8%.

Throughout the reporting period, good news—including positive macroeconomic trends and attractive corporate fundamentals—was overshadowed by the triple threat of rising market interest rates, surging oil prices, and ongoing violence in the Middle East. The closely fought presidential election added further uncertainty to the markets, which rallied late in 2004 following President Bush’s reelection. However, a falling dollar, repeated interest rate hikes by the Federal Reserve, and a resurgence of oil prices depressed the domestic equity markets in the first calendar quarter of 2005.

During the first fiscal quarter ended June 30, 2004, stocks found solid support behind a bulwark of positive economic news and good company fundamentals. Although a major advance was checked, stocks were able to shake off the so-called “triple threat” to continue their rally.

The second fiscal quarter proved more challenging as stocks declined after the Democratic Convention gave candidate John Kerry a lift in the polls. Prices recovered in September after President Bush took the lead in the polls following the Republican Convention and the markets began to believe he would win reelection. Oil prices exceeded $50 per barrel during the quarter and investors began to fret about declining inventories. This, in turn, fueled worries over inflation and the effect of high energy prices on domestic economic growth.

The markets received a boost in the fiscal third quarter as growth in gross domestic product (GDP) was revised upwards to 3.9% from an initial reading of 3.7%. The reelection of President Bush by a solid majority was also well received by the markets in anticipation of favorable tax developments in the future. In December, new unemployment claims fell to a one-year low, and there was hope that the pace of job creation had stepped up. Retail sales data reported in mid-December surprised on the upside, suggesting that consumers were maintaining spending in the face of increased costs for gasoline and heating oil. Even the persistently high oil prices eased, adding to the good news, while inflation remained in check.

In the final fiscal quarter ended March 31, 2005, the combined headwinds of rising oil prices (which reversed course to exceed $50 per barrel once again), rising market interest rates, and a falling dollar proved too strong for stocks to overcome. Despite these overhangs, consumer confidence remained strong and the labor market remained stable. However, two key measures of business activity in the U.S. decelerated during the quarter. The rally of late 2004 stalled in January 2005, regained momentum in February, only to stall again in March. As a result, domestic equities generally declined in the quarter.

2

INTERNATIONAL EQUITY MARKET REVIEW

After an especially strong year for International equities for the previous fiscal year ended March 31, 2004, the non-U.S. stock markets generally produced another year of solid returns during the twelve-month period ended March 31, 2005. Gains were largely driven by two factors: the continuing global economic recovery and the slumping U.S. dollar, which boosted International equity gains further in U.S. currency terms.

For the first fiscal quarter ended June 30, 2004, MSCI Europe led the way, posting a gain of 2.1% (in U.S. dollars) versus MSCI Asia, which declined 5.3% in USD. Currencies had a negative bias throughout the world but were the worst in Australia and Japan. Key macroeconomic drivers continued to be terrorism and its effects on oil prices, as well as a general bias towards interest-rate tightening globally. The Bank of England raised rates twice for a total hike of 50 basis points (one-half of one percent) while the European Central Bank (ECB) and China stood pat. European stock exchanges were generally in positive territory but Asia was a far different story, as overall weakness in non-Japan Asia resulted from a slowdown being orchestrated in China and an overwhelmingly negative sentiment towards technology that hurt Taiwan and Korea.

In the second fiscal quarter, European stocks rose slightly while Japanese stocks sold off fairly dramatically. Outside of Japan, however, Asian equities delivered a strong rebound in the quarter. The positive fallout from the declining interest rates in the U.S. was strongly felt throughout emerging markets as risk premiums declined. Indeed, the Hong Kong property market, in an environment of negative real interest rates, was up sharply. With the U.S. raising interest rates, the ECB stayed on hold at 2% while the Bank of England raised rates by 25 basis points to 4.75%.

The third fiscal quarter saw international markets once again outperforming the U.S. market, and the performance differential was quite impressive. A continuing contributor to the absolute performance of the international market was the decline of the U.S. dollar, which established new all-time lows against the euro during the fourth calendar quarter.

In general, non-U.S. stocks finished the final fiscal quarter on a positive note. Developed markets were supported by solid economic growth worldwide, while emerging markets continued to benefit from substantial improvements in the quality of management and the transparency of balance sheets. However, the previously all-too-familiar weakness of the U.S. dollar ceased to be a contributor to the absolute performance of International equities during this period as lingering concerns regarding both current account and federal budget deficits were overcome by the realization that the U.S. enjoyed one of the fastest-growing economies in the developed world.

3

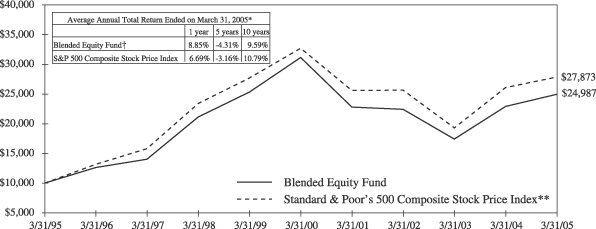

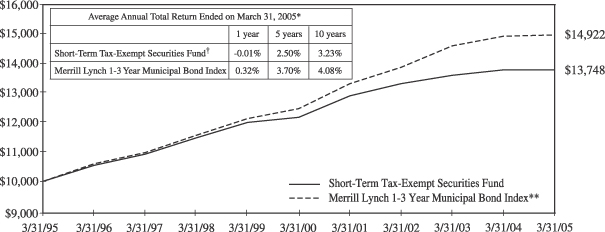

EXCELSIOR FUNDS, INC. | BLENDED EQUITY FUND |

The reporting period began on a promising note following a strong showing for the equity markets in 2003 and the first calendar quarter of 2004. Economic growth was accelerating, interest rates remained low, consumer and business confidence continued to improve, and corporate profits grew at a brisk pace. As a result, we emphasized companies in the capital markets, energy, and consumer goods sectors as well as larger and higher-quality companies. Strength in selected consumer stocks, as well as an overweight position in the energy sector, helped performance relative to the benchmark in the second fiscal quarter. Poor performance in technology and selected pharmaceutical stocks detracted from relative performance. In the third fiscal quarter, consumer-related and energy stocks continued to drive relative performance, while technology stocks (primarily large-cap and semiconductors) as well as pharmaceutical stocks detracted from relative returns. In the final fiscal quarter, a lackluster and trading range market environment, the two best performing sectors within the portfolio were utilities and energy. The latter sector (which also turned in the strongest performance in 2004) was supported by consistently high oil prices and the resultant surge in profits. The portfolio’s healthcare stocks outperformed, helped in part by its emphasis away from the large pharmaceutical companies. The financial stocks showed weakness with concerns over rising interest rates; however, the portfolio’s financial stocks performed well on a relative basis. The same was true with respect to the portfolio’s relative performance in the weak technology sector.

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost.

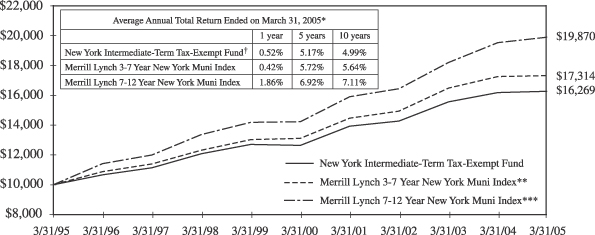

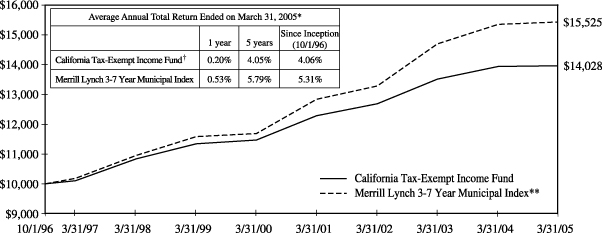

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Standard & Poor’s Corporation—Reflects the reinvestment of income dividends and, where applicable, capital gain distributions. The Standard & Poor’s 500 Composite Stock Price Index is a widely accepted unmanaged index of U.S. stock market performance. |

| † | | Currently certain fees are waived. Had certain fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

4

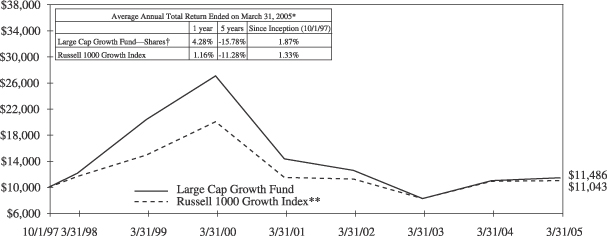

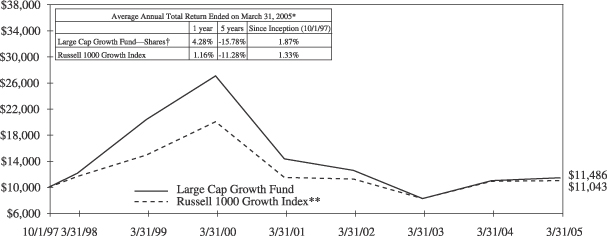

EXCELSIOR FUNDS, INC. | LARGE CAP GROWTH FUND |

Throughout the reporting period, investors focused more on interest-rate-sensitive and low-multiple stocks than would be typical at this stage of the business cycle. We had expected a shift toward companies with sustainable growth stories, and the diversity of the portfolio’s best performers during the reporting period reflected that expectation, with selected consumer goods, telecommunications, and healthcare companies leading the way. In the first fiscal quarter, top performers included a leading pet-supply retailer and the largest futures exchange in the U.S. Also driving performance was a holding from the healthcare sector. On the negative side, an adult education provider and major investment banker hampered returns. Most major equity indices were down in the second fiscal quarter as investors sought shelter in large-cap value stocks. The Russell 1000 Value Index gained 1.5% and stood out as the only large-cap domestic equity benchmark in the black. The S&P 500 and NASDAQ Composite Indices declined 2% and 7%, respectively. Normally, growth stocks would have outperformed value stocks at this stage of the business cycle. However, equity investors took their cues from the bond market and preferred to hold on to interest-rate-sensitive and low-multiple stocks until clear signs of a sustained rebound emerged. In the third fiscal quarter, the bulk of our positive outperformance was generated by holdings in the healthcare, financials, and consumer discretionary stocks, while lack of exposure to the energy, utility, and materials sectors modestly hindered returns. In the reporting period’s final quarter, the Fund underperformed both the market in general and its benchmark. Above-market returns were generated in health care, financial and telecom services, while underperformance was caused primarily by Internet, healthcare and consumer discretionary stocks.

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index since 10/1/97 (inception date). The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Frank Russell Company—The Russell 1000 Growth Index is an unmanaged index composed of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000 Index is composed of the 1000 largest companies in The Russell 3000 Index which is composed of 3,000 of the largest U.S. companies by market capitalization. The Index includes dividends reinvested. |

| † | | Currently certain fees are waived. Had certain fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

5

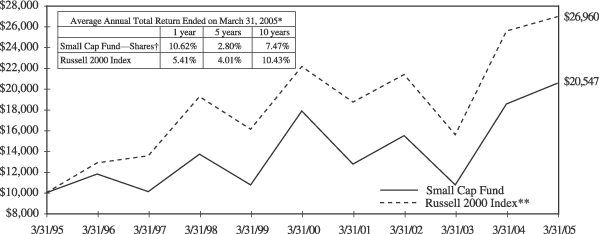

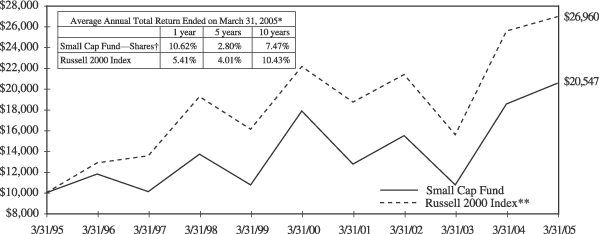

EXCELSIOR FUNDS, INC. | SMALL CAP FUND |

Compared to its benchmark, the Fund’s holdings during the period generally comprised larger-capitalization stocks with a significantly higher median return on equity and lower debt. It is our belief that higher growth, generated with less debt and greater profitability, and acquired at a lower price, is the hallmark of good value. Throughout the reporting period, an otherwise attractive environment for small-cap stocks—including positive macroeconomic trends and solid-to-strong corporate fundamentals—was overshadowed by the triple threat of rising market interest rates, surging oil prices, and ongoing violence in the Middle East. Despite these headwinds, the small-cap asset class powered ahead in calendar year 2004, completing five years of outperformance compared to its larger-cap brethren. The Fund’s outperformance in the first fiscal quarter was driven by holdings in healthcare, technology, and industrial stocks, which outperformed relative to the benchmark. In the second fiscal quarter, the energy, industrials, and technology sectors aided relative returns by overweight holdings and healthcare stocks detracted from relative returns. The reporting period ended on a challenging note as small-cap stocks generally suffered steeper declines than their larger-cap peers. Companies with pricing power, such as energy and materials (especially steel) outperformed those without pricing power, particularly technology. An underweight in financials, which were pressured by rising interest rates, proved beneficial to relative returns.

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. There is greater volatility associated with an investment in the Small Cap Market.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Frank Russell Company—The Russell 2000 Index is an unmanaged index and is composed of the 2,000 smallest companies in the Russell 3000 Index. The Russell 3000 Index is composed of 3,000 of the largest U.S. companies by market capitalization. The index includes dividends reinvested. |

| † | | Currently certain fees are waived. Had certain fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

6

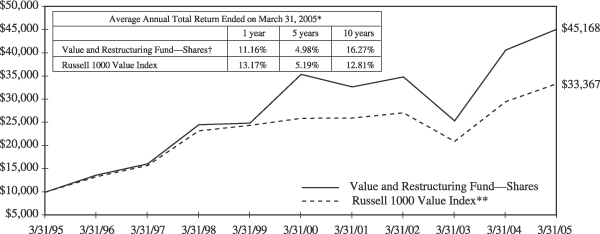

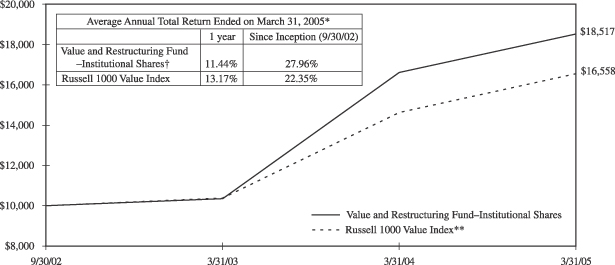

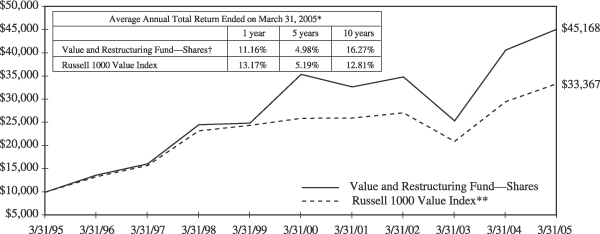

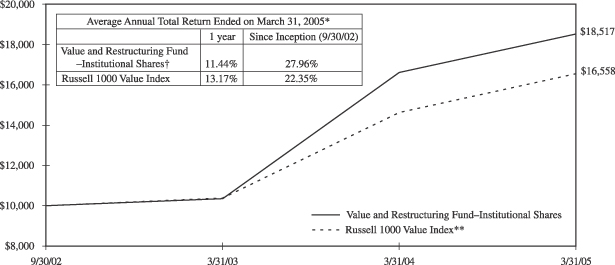

EXCELSIOR FUNDS, INC. | VALUE AND RESTRUCTURING FUND |

Throughout the reporting period, holdings in the energy sector benefited Fund performance as energy prices—particularly oil, but also natural gas—rose significantly. Positions in cyclical stocks also boosted returns. In the first fiscal quarter, underweight exposure to technology, pharmaceutical, and healthcare stocks aided relative returns, as did overweight positions in energy and industrials. Meanwhile, holdings in financial firms detracted from performance. In the second fiscal quarter, energy and cyclical stocks performed solidly, while our underweight positions in technology and healthcare once again benefited relative performance as neither sector fared particularly well. During the third fiscal quarter, an important trend emerged: an increasing number of, as well as higher, dividend payouts. Flush with cash, corporate managers began using dividends to enhance shareholder value. This allowed the Fund’s yield to remain steady and rewarding, despite a gain in asset value throughout the period. Dividends are an important component of total return, and the trend towards higher payouts is, we believe, an important feature of the market environment going forward. Once again, energy and natural resource-related stocks powered Fund returns. In the final fiscal quarter of the reporting period, the equity markets essentially went sideways, with energy holdings (particularly overseas-based companies), as well as an underweight exposure to technology and healthcare once again boosting relative performance.

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Frank Russell Company—The Russell 1000 Value Index is an unmanaged index composed of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. The Russell 1000 Index is composed of the 1000 largest companies in The Russell 3000 Index which is composed of 3,000 of the largest U.S. companies by market capitalization. The Index includes dividends reinvested. |

| † | | Currently certain fees are waived. Had certain fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

7

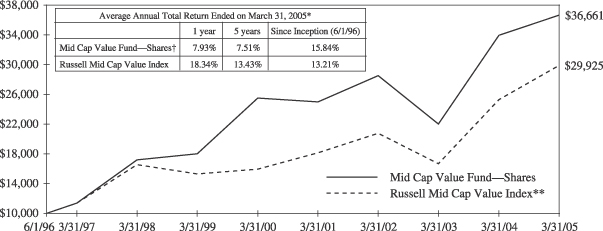

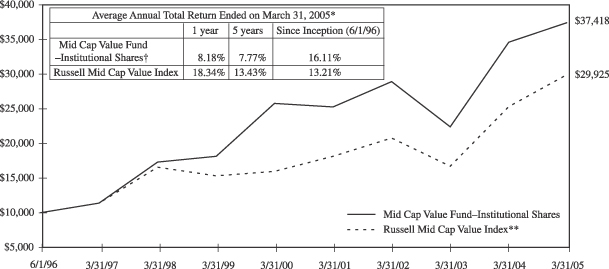

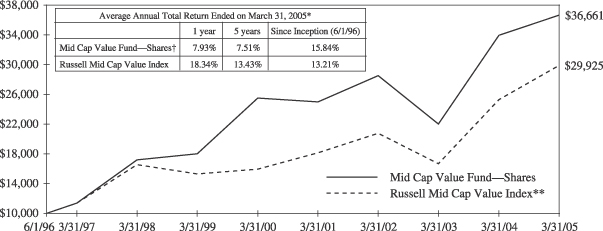

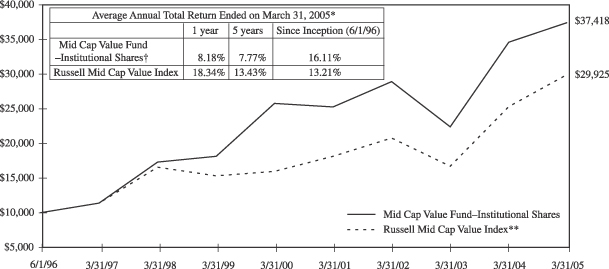

EXCELSIOR FUNDS TRUST | MID CAP VALUE FUND |

Throughout the reporting period, an attractive environment for mid-cap stocks—including positive macroeconomic trends and solid-to-strong corporate fundamentals—was overshadowed by the triple threat of rising market interest rates, surging oil prices, and ongoing violence in the Middle East. In the first fiscal quarter, appreciation in equities essentially paused while volatility increased. The Fund’s top-performing stocks included two energy-related firms, while holdings in the technology and home-building sectors lagged. In the second fiscal quarter, the Fund maintained its bias toward companies positioned to benefit from continued economic expansion, a posture we believed remained appropriate. The third fiscal quarter was strong for stocks and the Fund participated in the rally, led by holdings in consumer products and land development companies. Late in the reporting period, the emerging “triple threat” depressed investor sentiment toward the domestic equity markets and ushered in a challenging period for stocks in general, with the majority of equity market indices losing ground. Specific to the portfolio, the Fund’s exposure to healthcare, technology, and energy stocks (particularly power producers) hampered relative returns. Despite the less-than-stellar environment, the Fund maintained its longer-range view of investment opportunities and made new investments in sectors believed to be overlooked during the recent rise in commodity prices and that generally lagged in the quarter, including technology stocks and select financials.

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index since 6/1/96 (inception date). The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Frank Russell Company—The Russell Mid Cap Value Index measures the performance of medium-sized value-oriented securities. |

| † | | Currently certain fees are waived. Had certain fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

8

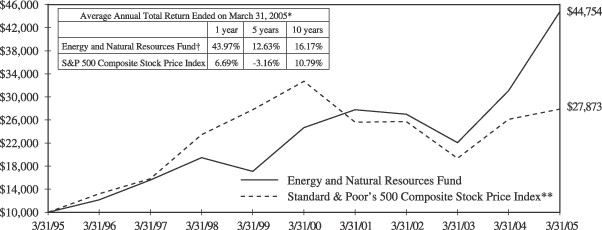

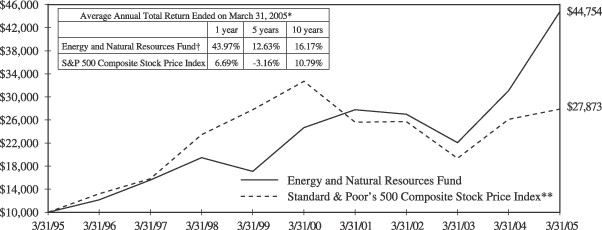

EXCELSIOR FUNDS, INC. | ENERGY AND NATURAL RESOURCES FUND |

The dramatic rise in oil and natural gas prices may have hindered non-energy stocks, but certainly supported gains in the energy sector. Tight supplies resulting from production problems in Iraq, Indonesia and Venezuela, coupled with rising demand—driven by a synchronized global recovery and China’s accelerating growth—combined to propel energy prices to or near record highs. Crude oil prices above $25 a barrel typically generate significant free cash flow for producers, resulting in value-enhancing dividend increases, debt reduction, share repurchase and merger activity. Prices remained above this key threshold for the entire duration of this reporting period. As a result, many of our holdings saw significant gains in share prices. In the first fiscal quarter, the Fund benefited from two holdings experiencing takeovers. Higher pricing began to accrue to service providers, so we raised our weighting in the oilfield service sector from 18% to 25%. This weighting began to pay off in the third fiscal quarter as capacity utilization for oilfield services began to reach a tipping point and higher service pricing accrued to the sector. In the final fiscal quarter, the Fund’s top performers were a mid-capitalization refiner, which benefited from rising refining margins; a major domestic oil producer that became a takeover target, a small capitalization independent oil producer, and a mid-capitalization independent gas producer. Laggards included a seismic company, which experienced a tepid launch of its new seismic product, and an engineering and construction firm forced to restate its financials.

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. Concentration in one economic sector may subject an investor to greater volatility.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Standard & Poor’s Corporation—Reflects the reinvestment of income dividends and, where applicable, capital gain distributions. The Standard & Poor’s 500 Composite Stock Price Index is a widely accepted unmanaged index of U.S. stock market performance. |

| † | | Currently certain fees are waived. Had certain fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

9

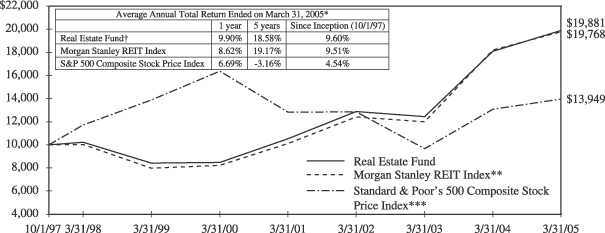

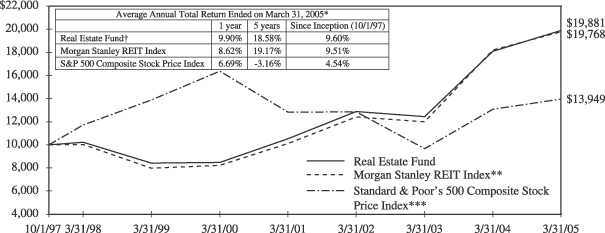

EXCELSIOR FUNDS, INC. | REAL ESTATE FUND |

During the reporting period, interest-rate hikes by the Federal Reserve were largely overshadowed by the brisk pace of growth in the U.S. economy. As the 12-month period began, the group as a whole declined as interest rates began to rise and cash flows into real estate mutual funds turned modestly negative. The best performers in the first fiscal quarter were multifamily stocks, while the mall and healthcare categories were the poorest performers. Following a significant sell-off in the first quarter of the reporting period, however, REITs recovered strongly in the period’s second quarter, with the Morgan Stanley REIT Index climbing 8.4%. The retail sector performed particularly well during this time, while the manufactured housing group lagged. For the second fiscal quarter, the retail sector continued to perform well while the manufactured housing group lagged. The third fiscal quarter saw a recovery from the dramatic sell-off in the first fiscal quarter, as investors began to adapt to an environment of rising interest rates and inflows into REIT securities continued. Investors were also attracted by the announcement of sizable acquisitions in the retail and multifamily subsectors. In the reporting period’s final quarter, returns on REIT securities reversed course once again as repeated interest rates hikes and mounting inflationary pressures weighed on investor sentiment. The office subsector was the top performer in this quarter, while industrial REITs were the worst performer, declining on average by more than 10%. Smaller companies generally outperformed large-cap companies. During the quarter, we reduced our positions in small-cap REITs and geographically in Florida, while adding to a position in the storage sector, where fundamentals appear attractive.

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. Concentration in one economic sector may subject an investor to greater volatility.

The above illustration compares a $10,000 investment made in the Fund and broad-based indices since 10/1/97 (inception date). The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The indices do not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Morgan Stanley & Co., Incorporated—Reflects the reinvestment of income dividends and, where applicable, capital gain distributions. The Morgan Stanley REIT Index is an unmanaged capitalization-weighted index composed of the largest and most actively traded REITs designed to provide a broad measure of real estate equity performance. |

| *** | | Source: Standard & Poor’s Corporation—Reflects the reinvestment of income dividends and, where applicable, capital gain distributions. The Standard & Poor’s 500 Composite Stock Price Index is a widely accepted unmanaged index of U.S. stock market performance. |

| † | | Currently certain fees are waived. Had certain fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

10

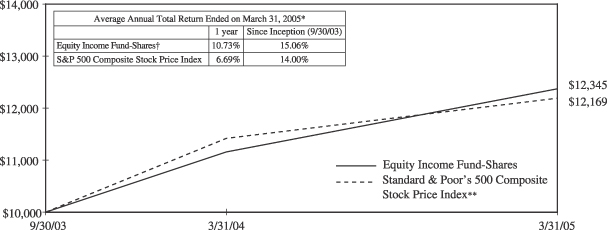

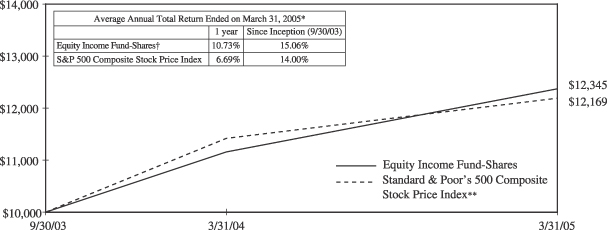

EXCELSIOR FUNDS TRUST | EQUITY INCOME FUND |

In the first fiscal quarter, the largest share of the Fund’s return was generated by selected holdings, including in a global maker of metal components for furniture; a major supermarket chain; a manufacturer of automotive components; and the leading provider of computer software. Two energy-related firms detracted from performance. During the second fiscal quarter, we initiated positions in two telecommunications companies that pay solid dividend yields. We continued to see key factors supporting the Fund’s investment strategy, including a historically low dividend payout ratio (implying room for future dividend growth), increasingly healthy corporate balance sheets, a shortage of quality reinvestment opportunities for corporations, and favorable changes in tax law treatment of dividends. The third quarter saw a trend toward a number of portfolio holdings raising their annual dividends by significant amounts, generally by double-digit figures. At quarter’s end, the portfolio’s current dividend yield was approximately 2.9%, compared to approximately 1.8% for the S&P 500 Index. In the reporting period’s final quarter, the portfolio benefited from merger activities in department stores and telecommunications, when two of our holdings were acquired. Other significant contributors in the quarter were in energy, specifically among the oil majors. We also did well in the food sector. The worst performing stocks in the portfolio during the quarter were in telecom, and data services. However, we are maintaining our investment in the specific companies where our analysis still suggests positive investment potential.

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index since 9/30/03 (inception date). The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Standard & Poor’s Corporation—Reflects the reinvestment of income dividends and, where applicable, capital gain distributions. The Standard & Poor’s 500 Composite Stock Price Index is a widely accepted unmanaged index of U.S. stock market performance. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

11

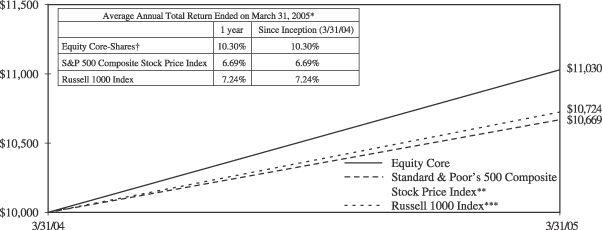

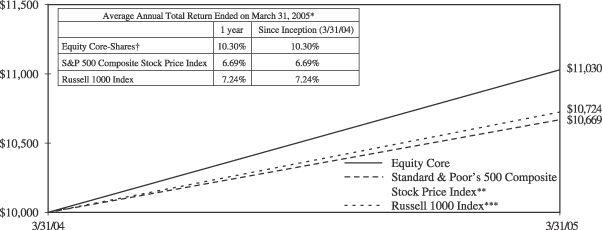

EXCELSIOR FUNDS TRUST | EQUITY CORE FUND |

At the end of the first fiscal quarter, the portfolio emphasized the consumer discretionary, materials, and utilities sectors and underweighted information technology, financial and telecommunications stocks. The underweight of financial stocks resulted from concerns about rising interest rates. In terms of performance, holdings in department stores, pharmaceuticals, and energy were positive while an auto parts retailer, a cable provider, and an Internet networking and storage firm suffered the largest absolute declines. During the second fiscal quarter, the Fund prospered by owning a number of restructuring companies, including a large maker of digital imaging equipment and film, as well as three energy-related companies. On the other hand, holdings in auto parts retailers and networking and storage solutions firms hampered performance. The Fund advanced in the third fiscal quarter as investors became convinced of the viability and strength of the U.S. economic recovery, and the presidential election was resolved in favor of the Bush administration. The same restructuring companies that helped power returns in the previous quarter continued to perform well, and our pro-growth holdings structure allowed us to capitalize on the market’s forceful gains in the quarter. The Fund also continued to benefit from our holding of Florida’s single biggest land company, which beat earnings guidance in the third calendar quarter and reaffirmed guidance for 2004. On the negative side, we suffered from the big-pharmaceutical backlash triggered by drug recalls. In the reporting period’s final fiscal quarter, a lackluster and trading range market environment, the two best performing sectors within the portfolio were utilities and energy. The latter sector (which also turned in the strongest performance in 2004) was supported by consistently high oil prices and the resultant surge in profits. The consumer stocks in the portfolio held up well in a generally weak group. The portfolio’s healthcare stocks outperformed, helped in part by its emphasis away from the large pharmaceutical companies. The financial stocks showed weakness with concerns over rising interest rates; however, the portfolio’s financial stocks performed well on a relative basis, helped by our underweighting of commercial banks. Our underweighting in technology also aided performance.

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index since 3/31/04 (inception date). The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Standard & Poor’s Corporation—Reflects the reinvestment of income dividends and, where applicable, capital gain distributions. The Standard & Poor’s 500 Composite Stock Price Index is a widely accepted unmanaged index of U.S. stock market performance. |

| *** | | Source: Frank Russell Company—The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index. The Index includes dividends reinvested. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

12

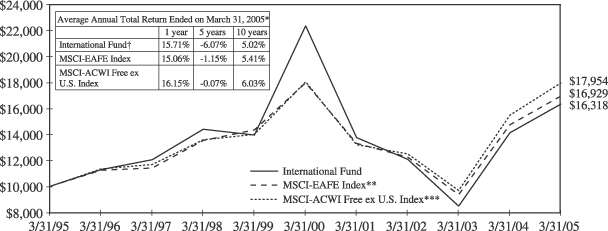

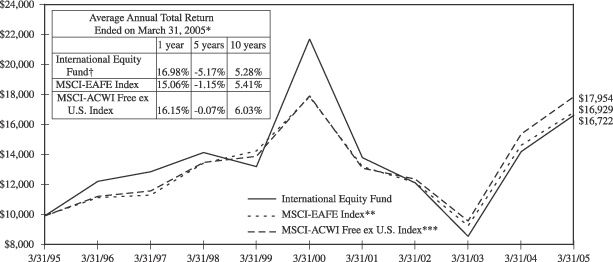

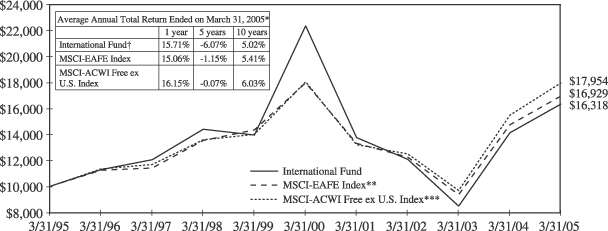

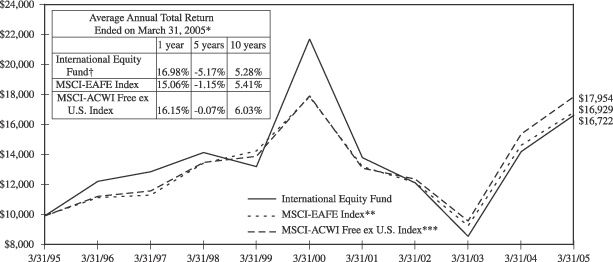

EXCELSIOR FUNDS, INC. | INTERNATIONAL FUND |

During the first fiscal quarter, we maintained weightings in Japan roughly in-line with the benchmark, while underweighting the United Kingdom on a negative outlook for the financial sector and overweighting the Asian emerging markets due to accelerating growth. Holdings in consumer staples, healthcare, and energy boosted relative returns while information technology, telecommunications, and materials stocks were a drag on performance. In the second fiscal quarter, we reduced exposure to technology and, within the energy sector, diversified out of exploration and production into oil service companies we believe held greater appreciation potential. The third fiscal quarter saw the Fund outperform its benchmark due to successful stock selection across sectors. During the quarter, we initiated new positions in the Taiwanese technology and European media sectors. In the reporting period’s final quarter, the Fund continued to benefit from successful stock selection, especially in the energy, materials, and industrials sectors, and an overweight position in Emerging Markets stocks. By country, Norway, Denmark, and Canada were performance leaders while holdings in Ireland, Hong Kong, and New Zealand were laggards. By period’s end, we had eliminated selected positions in Asia, moving away from consumer sectors, while adding positions in robotics and pharmaceuticals. In Europe, we added in consumer sectors and autos.

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. International investing is subject to special risks such as currency fluctuations and differences in accounting and taxation standards.

The above illustration compares a $10,000 investment made in the Fund and broad-based indices over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The indices do not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Morgan Stanley & Co., Incorporated—Morgan Stanley Capital International EAFE (Europe, Australia, Asia, Far East) Index is a widely accepted, unmanaged index composed of a sample of companies from 21 countries representing the developed stock markets outside North America. |

| *** | | Source: Morgan Stanley & Co., Incorporated—Morgan Stanley Capital International All Country World Index Free ex U.S. is a widely accepted, unmanaged index of global stock market performance comprising 47 countries with developed and emerging markets excluding the United States. |

| † | | Currently certain fees are waived. Had such fees not been waived returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. Returns do not reflect the 2% fee imposed on shares redeemed 30 days or less after their date of purchase. |

13

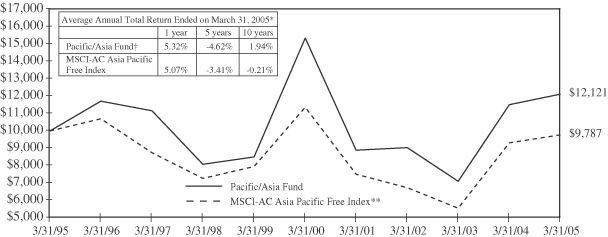

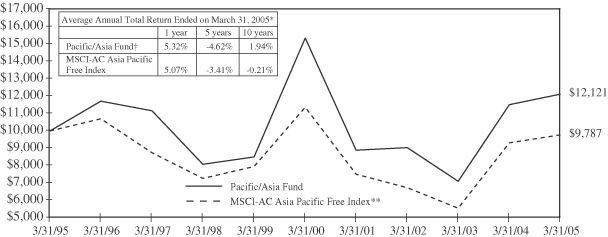

EXCELSIOR FUNDS, INC. | PACIFIC/ASIA FUND |

During the quarter preceding the reporting period, we increased exposure to Japan and that strategy paid off in the first fiscal quarter. We also remained overweight in a number of key markets including India, Hong Kong, China, and Korea. Negatively influencing returns were holdings in healthcare, consumer discretionary, materials, financials, and telecommunications. In the second quarter, we bought back shares in a Chinese power company as the share price had fallen enough to become attractive and the outlook for power generation in China is strong. In addition, we increased exposure to Australia, especially in the media sector. Performance in the third fiscal quarter was led by a resurgence in India, Indonesia, and South Korea, whose equity markets were all up nearly or more than 20%. Outperformers were quite geographically diverse and reflected successful bottom-up stock selection, while limited exposure to Australian stocks hampered returns. Meanwhile, we raised exposure to larger-capitalization Japanese equities as they became more attractively valued on a global basis. The reporting period’s final quarter saw lackluster performance in absolute terms but strong performance relative to the Fund’s benchmark, driven by overweight exposure to equities in Thailand, Indonesia, and Korea. By period’s end, we had increased emphasis on technology and pharmaceuticals as well as firms poised to benefit from rising textile quotas.

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. International investing is subject to special risks such as currency fluctuations and differences in accounting and taxation standards.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Morgan Stanley & Co., Incorporated—The Morgan Stanley Capital International All Country Asia Pacific Free Index is a widely-accepted, unmanaged index composed of a sample of companies representative of the market structure of 10 developed and emerging market countries: China Free, Hong Kong, Japan, Indonesia, Korea, Malaysia, Philippines, Singapore, Taiwan and Thailand. The Index aims to capture 85% of the free float adjusted market capitalization in each industry group, in each country, for those securities not subject to foreign ownership restrictions. The Index includes dividends reinvested. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. Returns do not reflect the 2% fee imposed on shares redeemed 30 days or less after their date of purchase. |

14

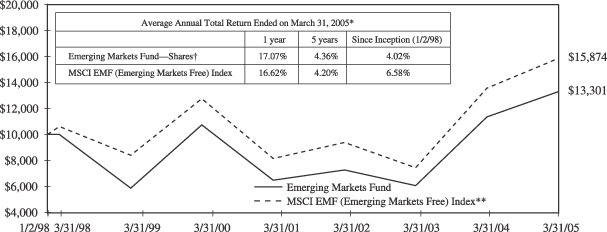

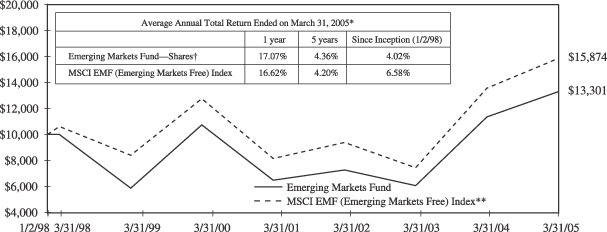

EXCELSIOR FUNDS, INC. | EMERGING MARKETS FUND |

After five quarters of positive dollar returns, emerging markets equities stumbled in the period’s first fiscal quarter on fears of a “hard landing” in China, the Russian government’s multibillion-dollar tax levy against Yukos Oil, and political uncertainty in India. Overweight exposure to telecommunications stocks helped relative performance during the period. We reduced exposure to the banking sector by selling Taiwanese banks, whose outlook dimmed on a potential economic slowdown in China. In the second fiscal quarter, emerging markets continued to stumble, only to come on strong in September as fears of economic weakness in China eased. The portfolio benefited by overweight exposure to Mexican equities, and telecommunications remained the Fund’s largest overweight. The fiscal third quarter saw strong performance by emerging markets stocks. Banks were a solid contributor to absolute returns, with South African, Brazilian and Indian institutions leading the way. In the reporting period’s final quarter, the Fund underperformed its benchmark due largely to underweight exposure to cyclical sectors such as industrials, metals, and technology. Disappointing performance by holdings in China, most notably food and Internet-related stocks, also hampered relative returns. At period’s end we remained optimistic about appreciation opportunities in emerging markets equities.

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. International investing is subject to special risks such as currency fluctuations and differences in accounting and taxation standards.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index since 1/2/98 (inception date). For comparative purposes, the value of the index on 12/31/97 is used as the beginning value on 1/2/98. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Morgan Stanley & Co., Incorporated—Morgan Stanley Capital International EMF (Emerging Markets Free) Index is a widely-accepted, unmanaged index composed of a sample of companies representative of the market structure of 26 global emerging market countries. The Index includes dividends reinvested. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. Returns do not reflect the 2% fee imposed on shares redeemed 30 days or less after their date of purchase. |

15

Excelsior Funds, Inc.

Portfolio of Investments — March 31, 2005

Blended Equity Fund

| | | | | |

| | | | | |

Shares

| | | | Value

|

| COMMON STOCKS — 99.19% | | |

| | | CONSUMER DISCRETIONARY — 14.09% |

| 29,200 | | Autozone, Inc.(a) | | $ | 2,502,440 |

| 179,243 | | Coach, Inc.(a) | | | 10,150,530 |

| 166,480 | | Eastman Kodak Co. | | | 5,418,924 |

| 98,800 | | eBay(a) | | | 3,681,288 |

| 305,810 | | Fossil, Inc.(a) | | | 7,928,124 |

| 284,002 | | John Wiley & Sons, Class A | | | 10,011,071 |

| 73,325 | | Mohawk Industries, Inc.(a) | | | 6,181,298 |

| 30,900 | | Omnicom Group | | | 2,735,268 |

| 19,451 | | Sears Holding Corp.(a) | | | 2,590,290 |

| 176,400 | | Target Corp. | | | 8,823,528 |

| 81,515 | | Timberland Co., Class A(a) | | | 5,781,859 |

| | | | |

|

|

| | | | | | 65,804,620 |

| | | | |

|

|

| | | CONSUMER STAPLES — 6.84% |

| 88,200 | | Altria Group, Inc. | | | 5,767,398 |

| 51,200 | | Kellogg Co. | | | 2,215,424 |

| 204,836 | | Sysco Corp. | | | 7,333,129 |

| 156,100 | | Wal-Mart Stores, Inc. | | | 7,822,171 |

| 81,800 | | Walgreen Co. | | | 3,633,556 |

| 78,437 | | Wm. Wrigley Jr. Co. | | | 5,143,114 |

| | | | |

|

|

| | | | | | 31,914,792 |

| | | | |

|

|

| | | ENERGY — 9.31% |

| 129,044 | | Apache Corp. | | | 7,901,364 |

| 37,100 | | ChevronTexaco Corp. | | | 2,163,301 |

| 314,564 | | Exxon Mobil Corp. | | | 18,748,014 |

| 103,929 | | Nabors Industries Ltd.(a) | | | 6,146,361 |

| 37,200 | | Royal Dutch Petroleum Co.(NY Shares) | | | 2,233,488 |

| 155,608 | | Suncor Energy, Inc. | | | 6,256,998 |

| | | | |

|

|

| | | | | | 43,449,526 |

| | | | |

|

|

| | | FINANCIAL — 20.52% |

| 169,864 | | Allstate Corp. | | | 9,182,848 |

| 92,600 | | American Express Co. | | | 4,756,862 |

| 160,591 | | American International Group, Inc. | | | 8,898,347 |

| 168,520 | | Bank of America Corp. | | | 7,431,732 |

| 200,762 | | Citigroup, Inc. | | | 9,022,244 |

| 95,666 | | Goldman Sachs Group, Inc. | | | 10,522,304 |

| 23,350 | | HSBC Holdings plc ADR | | | 1,853,990 |

| 76,000 | | JP Morgan Chase & Co. | | | 2,629,600 |

| 29,700 | | MBIA, Inc. | | | 1,552,716 |

| 49,088 | | Mellon Financial Corp. | | | 1,400,972 |

| 55,600 | | Merrill Lynch & Co., Inc. | | | 3,146,960 |

| | | | | |

| | | | | |

| | | | | |

Shares

| | | | Value

|

| COMMON STOCKS — (continued) | | |

| | | FINANCIAL — (continued) |

| 105,457 | | RenaissanceRe Holdings Ltd. | | $ | 4,924,842 |

| 213,100 | | State Street Corp. | | | 9,316,732 |

| 160,618 | | U.S. BanCorp. | | | 4,629,011 |

| 177,300 | | Washington Mutual, Inc. | | | 7,003,350 |

| 160,460 | | Wells Fargo & Co. | | | 9,595,508 |

| | | | |

|

|

| | | | | | 95,868,018 |

| | | | |

|

|

| | | HEALTH CARE — 12.65% |

| 180,800 | | Abbott Laboratories | | | 8,428,896 |

| 55,245 | | Barr Laboratories, Inc.(a) | | | 2,697,613 |

| 22,100 | | Genzyme Corp. — General Division(a) | | | 1,265,004 |

| 35,900 | | HCA, Inc. | | | 1,923,163 |

| 18,100 | | Hospira, Inc.(a) | | | 584,087 |

| 235,270 | | Johnson & Johnson | | | 15,800,733 |

| 98,044 | | Medtronic, Inc. | | | 4,995,342 |

| 105,297 | | Novo-Nordisk A/S ADR | | | 5,877,679 |

| 301,300 | | Pfizer, Inc. | | | 7,915,151 |

| 97,100 | | Schering Plough Corp. | | | 1,762,365 |

| 62,246 | | Wellpoint Health Networks(a) | | | 7,802,536 |

| | | | |

|

|

| | | | | | 59,052,569 |

| | | | |

|

|

| | | INDUSTRIALS — 11.55% |

| 170,070 | | Danaher Corp. | | | 9,083,439 |

| 52,100 | | Dover Corp. | | | 1,968,859 |

| 631,184 | | General Electric Co. | | | 22,760,495 |

| 79,400 | | Herman Miller, Inc. | | | 2,391,528 |

| 137,100 | | Illinois Tool Works, Inc. | | | 12,274,563 |

| 75,000 | | Tyco International Ltd. | | | 2,535,000 |

| 101,500 | | Waste Management, Inc. | | | 2,928,275 |

| | | | |

|

|

| | | | | | 53,942,159 |

| | | | |

|

|

| | | INFORMATION TECHNOLOGY — 12.98% |

| 231,925 | | Accenture Ltd., Class A(a) | | | 5,600,989 |

| 152,352 | | Analog Devices, Inc. | | | 5,506,001 |

| 432,065 | | Cisco Systems, Inc.(a) | | | 7,729,643 |

| 40 | | Computer Associates International, Inc. | | | 1,084 |

| 70,600 | | Dell, Inc.(a) | | | 2,712,452 |

| 149,070 | | Intel Corp. | | | 3,462,896 |

| 87,349 | | International Business Machines Corp. | | | 7,981,952 |

| 10,200 | | Maxim Integrated Products, Inc. | | | 416,874 |

| 316,700 | | Microsoft Corp. | | | 7,654,639 |

| 210,799 | | Molex, Inc., Class A | | | 4,974,856 |

See Notes to Financial Statements.

16

Excelsior Funds, Inc.

Portfolio of Investments — March 31, 2005

Blended Equity Fund — (continued)

| | | | | |

| | | | | |

| | | | | |

Shares

| | | | Value

|

| COMMON STOCKS — (continued) | | |

| | | INFORMATION TECHNOLOGY — (continued) |

| 207,563 | | National Instruments Corp. | | $ | 5,614,579 |

| 141,200 | | NCR Corp.(a) | | | 4,764,088 |

| 103,888 | | SAP AG ADR | | | 4,163,831 |

| | | | |

|

|

| | | | | | 60,583,884 |

| | | | |

|

|

| | | RAW/INTERMEDIATE MATERIALS — 4.03% |

| 26,500 | | Air Products & Chemicals, Inc. | | | 1,677,185 |

| 295,633 | | Aracruz Cellulose S.A. ADR | | | 10,583,662 |

| 55,918 | | E.I. Du Pont de Nemours & Co. | | | 2,865,238 |

| 25,600 | | International Paper Co. | | | 941,824 |

| 48,215 | | Vulcan Materials Company | | | 2,740,058 |

| | | | |

|

|

| | | | | | 18,807,967 |

| | | | |

|

|

| | | REAL ESTATE — 2.52% |

| 175,018 | | St. Joe Co. | | | 11,778,711 |

| | | | |

|

|

| | | UTILITIES — 4.70% |

| 384,715 | | AES Corp.(a) | | | 6,301,632 |

| 482,621 | | Centerpoint Energy, Inc. | | | 5,805,931 |

| 123,500 | | TXU Corp. | | | 9,834,304 |

| | | | |

|

|

| | | | | | 21,941,867 |

| | | | |

|

|

| | | TOTAL COMMON STOCKS

(Cost $267,407,781) | | | 463,144,113 |

| | | | |

|

|

| | | | | |

| | | | | |

| | | | | |

Principal

Amount

| | | | Value

|

| REPURCHASE AGREEMENT — 0.59% | | |

| $2,737,000 | | JP Morgan Chase Securities, Inc., 2.30%, dated 3/31/05, to be repurchased 4/01/05,

repurchase price $2,737,175 (collateralized by Federal National Mortgage Association MTN, par value $2,734,000, 4.63%, maturing 10/15/14; total market value $2,795,314) | | $ | 2,737,000 |

| | | | |

|

|

| | | TOTAL REPURCHASE AGREEMENT

(Cost $2,737,000) | | | 2,737,000 |

| | | | |

|

|

| | | | | | |

| | | | | | |

| | | | | | |

TOTAL INVESTMENTS

(Cost $270,144,781)(b) | | 99.78 | % | | $ | 465,881,113 |

OTHER ASSETS IN EXCESS OF LIABILITIES | | 0.22 | | | | 1,022,029 |

| | |

|

| |

|

|

NET ASSETS | | 100.00 | % | | $ | 466,903,142 |

| | |

|

| |

|

|

| (a) | Non-income producing security. |

| (b) | Unrealized appreciation (depreciation) of securities: |

| | | | |

Unrealized

Appreciation

| | Unrealized

(Depreciation)

| | Net Unrealized

Appreciation/

(Depreciation)

|

| $197,668,910 | | $(1,932,578) | | $195,736,332 |

ADR—American Depository Receipt

Ltd.—Limited

MTN—Medium Term Note

plc—public limited company

See Notes to Financial Statements.

17

Excelsior Funds, Inc.

Portfolio of Investments — March 31, 2005

Blended Equity Fund — (continued)

The summary of the Fund’s investments as of March 31, 2005 is as follows: (Unaudited)

| | | | | | |

Sector Diversification

| | % of

Net

Assets

| | | Market Value

|

Financial | | 20.52 | % | | $ | 95,868,018 |

Consumer Discretionary | | 14.09 | | | | 65,804,620 |

Information Technology | | 12.98 | | | | 60,583,884 |

Health Care | | 12.65 | | | | 59,052,569 |

Industrials | | 11.55 | | | | 53,942,159 |

Energy | | 9.31 | | | | 43,449,526 |

Consumer Staples | | 6.84 | | | | 31,914,792 |

Utilities | | 4.70 | | | | 21,941,867 |

Raw/Intermediate Materials | | 4.03 | | | | 18,807,967 |

Real Estate | | 2.52 | | | | 11,778,711 |

Repurchase Agreements | | 0.59 | | | | 2,737,000 |

| | |

|

| |

|

|

Total Investment | | 99.78 | % | | $ | 465,881,113 |

Other Assets and Liabilities (Net) | | 0.22 | | | | 1,022,029 |

| | |

|

| |

|

|

Net Assets | | 100.00 | % | | $ | 466,903,142 |

| | |

|

| |

|

|

See Notes to Financial Statements.

18

Excelsior Funds, Inc.

Portfolio of Investments — March 31, 2005

Large Cap Growth Fund

| | | | | |

| | | | | |

Shares

| | | | Value

|

| COMMON STOCKS — 96.14% | | |

| | | CONSUMER DISCRETIONARY — 21.53% |

| 161,500 | | Carnival Corp., Class A | | $ | 8,367,315 |

| 110,600 | | eBay(a) | | | 4,120,956 |

| 60,900 | | Kohls Corp.(a) | | | 3,144,267 |

| 96,300 | | Lowes Companies, Inc. | | | 5,497,767 |

| 492,900 | | News Corp., Class A | | | 8,339,868 |

| 162,500 | | Petsmart, Inc. | | | 4,671,875 |

| 87,600 | | Starbucks Corp.(a) | | | 4,525,416 |

| 237,100 | | Univision Communications, Inc.(a) | | | 6,565,299 |

| | | | |

|

|

| | | | | | 45,232,763 |

| | | | |

|

|

| | | FINANCIAL — 7.90% |

| 32,300 | | Chicago Mercantile Exchange | | | 6,267,169 |

| 42,700 | | Lehman Brothers Holding, Inc. | | | 4,020,632 |

| 126,526 | | SLM Corp. | | | 6,306,056 |

| | | | |

|

|

| | | | | | 16,593,857 |

| | | | |

|

|

| | | HEALTH CARE — 29.16% |

| 97,900 | | Alcon, Inc. | | | 8,741,491 |

| 78,400 | | Amgen, Inc.(a) | | | 4,563,664 |

| 124,400 | | Boston Scientific Corp.(a) | | | 3,643,676 |

| 204,700 | | Caremark Rx, Inc.(a) | | | 8,142,966 |

| 73,600 | | Eli Lilly & Co. | | | 3,834,560 |

| 257,100 | | Gilead Sciences, Inc.(a) | | | 9,204,180 |

| 75,700 | | Medtronic, Inc. | | | 3,856,915 |

| 88,900 | | Patterson Cos., Inc.(a) | | | 4,440,555 |

| 222,800 | | Teva Pharmaceutical | | | 6,906,800 |

| 101,700 | | Zimmer Holdings, Inc.(a) | | | 7,913,277 |

| | | | |

|

|

| | | | | | 61,248,084 |

| | | | |

|

|

| | | INDUSTRIALS — 5.50% |

| 57,900 | | Apollo Group, Inc., Class A(a) | | | 4,288,074 |

| 104,900 | | Career Education Corp.(a) | | | 3,593,874 |

| 68,600 | | Expeditors International of Washington, Inc. | | | 3,673,530 |

| | | | |

|

|

| | | | | | 11,555,478 |

| | | | |

|

|

| | | INFORMATION TECHNOLOGY — 28.01% |

| 183,700 | | Apple Computer, Inc.(a) | | | 7,654,779 |

| 169,800 | | Broadcom Corp., Class A(a) | | | 5,080,416 |

| 163,200 | | Dell, Inc.(a) | | | 6,270,144 |

| 118,300 | | Electronic Arts, Inc.(a) | | | 6,125,574 |

| 71,400 | | Infosys Technologies, Ltd. ADR | | | 5,264,322 |

| 231,984 | | Qualcomm, Inc. | | | 8,502,213 |

| 92,918 | | Research In Motion, Ltd.(a) | | | 7,100,794 |

| | | | | |

| | | | | |

Shares

| | | | Value

|

| COMMON STOCKS — (continued) | | |

| | | INFORMATION TECHNOLOGY — (continued) |

| 201,800 | | SAP AG ADR | | $ | 8,088,144 |

| 126,000 | | Symantec Corp.(a) | | | 2,687,580 |

| 89,300 | | Veritas Software Corp.(a) | | | 2,073,546 |

| | | | |

|

|

| | | | | | 58,847,512 |

| | | | |

|

|

| | | TELECOMMUNICATION — 4.04% |

| 164,300 | | America Movil S.A. de C.V., Series L ADR | | | 8,477,880 |

| | | | |

|

|

| | | Total COMMON STOCKS

(Cost $175,170,826) | | | 201,955,574 |

| | | | |

|

|

| | |

Principal

Amount

| | | | |

| REPURCHASE AGREEMENT — 8.25% | | |

| $17,324,000 | | JP Morgan Chase Securities, Inc., 2.30%, dated 03/31/05, to be repurchased on 04/01/05, repurchase price $17,325,107 (collateralized by Federal National Mortgage Association MTN, par value $17,302,000, 4.63%, maturing on 10/15/14; total market value $17,692,963) | | | 17,324,000 |

| | | | |

|

|

| | | TOTAL REPURCHASE AGREEMENT

(Cost $17,324,000) | | | 17,324,000 |

| | | | |

|

|

| | | | | | | |

| | | | | | | |

TOTAL INVESTMENTS

(Cost $192,494,826)(b) | | 104.39 | % | | $ | 219,279,574 | |

LIABILITIES IN EXCESS OF

OTHER ASSETS | | (4.39 | ) | | | (9,218,684 | ) |

| | |

|

| |

|

|

|

NET ASSETS | | 100.00 | % | | $ | 210,060,890 | |

| | |

|

| |

|

|

|

| (a) | Non-income producing security |

| (b) | Unrealized appreciation (depreciation) of securities: |

| | | | |

Unrealized

Appreciation

| | Unrealized

(Depreciation)

| | Net Unrealized

Appreciation/

(Depreciation)

|

| $34,414,355 | | $(7,629,607) | | $26,784,748 |

ADR—American Depository Receipt

Ltd.—Limited

MTN—Medium Term Note

See Notes to Financial Statements.

19

Excelsior Funds, Inc.

Portfolio of Investments — March 31, 2005

Large Cap Growth Fund — (continued)

The summary of the Fund’s investments as of March 31, 2005 is as follows: (Unaudited)

| | | | | | | |

Sector Diversification

| | % of

Net

Assets

| | | Market Value

| |

Health Care | | 29.16 | % | | $ | 61,248,084 | |

Information Technology | | 28.01 | | | | 58,847,512 | |

Consumer Discretionary | | 21.53 | | | | 45,232,763 | |

Repurchase Agreements | | 8.25 | | | | 17,324,000 | |

Financial | | 7.90 | | | | 16,593,857 | |

Industrials | | 5.50 | | | | 11,555,478 | |

Telecommunication | | 4.04 | | | | 8,477,880 | |

| | |

|

| |

|

|

|

Total Investment | | 104.39 | % | | $ | 219,279,574 | |

Other Assets and Liabilities (Net) | | (4.39 | ) | | | (9,218,684 | ) |

| | |

|

| |

|

|

|

Net Assets | | 100.00 | % | | $ | 210,060,890 | |

| | |

|

| |

|

|

|

See Notes to Financial Statements.

20

Excelsior Funds, Inc.

Portfolio of Investments — March 31, 2005

Small Cap Fund

| | | | | |

| | | | | |

Shares

| | | | Value

|

| COMMON STOCKS — 99.57% | | |

| | | CONSUMER DISCRETIONARY — 16.50% |

| 440,000 | | BJ’s Wholesale Club, Inc.(a) | | $ | 13,666,400 |

| 800,000 | | Corinthian Colleges, Inc.(a) | | | 12,576,000 |

| 1,000,000 | | Oakley, Inc. | | | 12,820,000 |

| 200,000 | | Panera Bread Co., Class A(a) | | | 11,306,000 |

| 1,000,000 | | Sotheby’s Holdings, Inc., Class A(a) | | | 16,960,000 |

| 250,000 | | Thor Industries, Inc. | | | 7,477,500 |

| 120,000 | | Urban Outfitters, Inc.(a) | | | 5,756,400 |

| | | | |

|

|

| | | | | | 80,562,300 |

| | | | |

|

|

| | | CONSUMER STAPLES — 1.68% |

| 300,000 | | American Italian Pasta Co. | | | 8,220,000 |

| | | | |

|

|

| | | ENERGY — 5.63% |

| 330,000 | | Cal Dive International, Inc.(a) | | | 14,949,000 |

| 240,000 | | Helmerich & Payne, Inc. | | | 9,525,600 |

| 80,000 | | Oceaneering International, Inc.(a) | | | 3,000,000 |

| | | | |

|

|

| | | | | | 27,474,600 |

| | | | |

|

|

| | | FINANCIAL — 13.79% |

| 320,000 | | Jefferies Group, Inc. | | | 12,057,600 |

| 1,500,000 | | Knight Trading Group, Inc.(a) | | | 14,460,000 |

| 1,600,000 | | LaBranche & Co., Inc.(a) | | | 14,880,000 |

| 65,000 | | Park National Corp. | | | 7,312,500 |

| 240,000 | | Philadelphia Consolidated Holdings Corp.(a) | | | 18,607,200 |

| | | | |

|

|

| | | | | | 67,317,300 |

| | | | |

|

|

| | | HEALTH CARE — 9.90% |

| 300,000 | | Arrow International, Inc. | | | 10,305,000 |

| 430,000 | | Kensey Nash Corp.(a) | | | 11,644,400 |

| 370,000 | | LifePoint Hospitals, Inc.(a) | | | 16,220,800 |

| 1,500,000 | | Orthovita, Inc.(a) | | | 5,100,000 |

| 224,930 | | Zoll Medical Group(a) | | | 5,067,673 |

| | | | |

|

|

| | | | | | 48,337,873 |

| | | | |

|

|

| | | INDUSTRIALS — 10.08% |

| 1,800,000 | | Quanta Services, Inc.(a) | | | 13,734,000 |

| 400,000 | | Simpson Manufacturing Co., Inc. | | | 12,360,000 |

| 450,000 | | Thomas & Betts Corp.(a) | | | 14,535,000 |

| 220,000 | | Triumph Group, Inc.(a) | | | 8,566,800 |

| | | | |

|

|

| | | | | | 49,195,800 |

| | | | |

|

|

| | | | | |

| | | | | |

Shares

| | | | Value

|

| COMMON STOCKS — (continued) | | |

| | | INFORMATION TECHNOLOGY — 21.82% |

| 170,000 | | Anteon International Corp.(a) | | $ | 6,618,100 |

| 250,000 | | Cabot Microelectronics Corp.(a) | | | 7,845,000 |

| 340,000 | | CACI International, Inc., Class A(a) | | | 18,778,200 |

| 480,000 | | Dendrite International, Inc.(a) | | | 6,739,200 |

| 600,000 | | Forrester Research, Inc.(a) | | | 8,448,000 |

| 1,000,000 | | Keane, Inc.(a) | | | 13,030,000 |

| 240,000 | | Manhattan Associates, Inc.(a) | | | 4,888,800 |

| 300,000 | | MAXIMUS, Inc. | | | 10,047,000 |

| 120,000 | | Palmone, Inc.(a) | | | 3,045,600 |

| 280,000 | | Quanex Corp. | | | 14,929,600 |

| 770,000 | | RSA Security, Inc.(a) | | | 12,204,500 |

| | | | |

|

|

| | | | | | 106,574,000 |

| | | | |

|

|

| | | RAW/INTERMEDIATE MATERIALS — 8.71% |

| 400,000 | | Cambrex Corp. | | | 8,520,000 |

| 360,000 | | Oregon Steel Mills, Inc.(a) | | | 8,280,000 |

| 260,000 | | Steel Dynamics, Inc. | | | 8,957,000 |

| 380,000 | | Stillwater Mining Co.(a) | | | 3,743,000 |

| 800,000 | | USEC, Inc. | | | 13,024,000 |

| | | | |

|

|

| | | | | | 42,524,000 |

| | | | |

|

|

| | | TECHNOLOGY — 6.17% |

| 660,000 | | CommScope, Inc.(a) | | | 9,873,600 |

| 1,000,000 | | Kulicke & Soffa Industries, Inc.(a) | | | 6,290,000 |

| 240,000 | | Power Integrations(a) | | | 5,013,600 |

| 600,000 | | Technitrol, Inc.(a) | | | 8,952,000 |

| | | | |

|

|

| | | | | | 30,129,200 |

| | | | |

|

|

| | | TRANSPORTATION — 3.79% |

| 960,000 | | Kansas City Southern(a) | | | 18,489,600 |

| | | | |

|

|

| | | UTILITIES — 1.50% |

| 300,000 | | Aqua America, Inc. | | | 7,308,000 |

| | | | |

|

|

| | | TOTAL COMMON STOCKS

(Cost $391,639,078) | | | 486,132,673 |

| | | | |

|

|

See Notes to Financial Statements.

21

Excelsior Funds, Inc.

Portfolio of Investments — March 31, 2005

Small Cap Fund — (continued)

| | | | | |

| | | | | |

Principal

Amount

| | | | Value

|

| REPURCHASE AGREEMENT — 0.69% | | |

| $3,353,000 | | JP Morgan Chase Securities, Inc., 2.30%, dated 03/31/05, to be repurchased on 04/01/05, repurchase price $3,353,214 (collateralized by Federal National Mortgage Association MTN, par value $3,349,000, 4.63%, maturing on 10/15/14; total market value $3,424,407) | | $ | 3,353,000 |

| | | | |

|

|

| | | TOTAL REPURCHASE AGREEMENT

(Cost $3,353,000) | | | 3,353,000 |

| | | | |

|

|

| | | | | | | |

| | | | | | | |

TOTAL INVESTMENTS

(Cost $394,992,078)(b) | | 100.26 | % | | $ | 489,485,673 | |

LIABILITIES IN EXCESS OF OTHER ASSETS | | (0.26 | ) | | | (1,263,151 | ) |

| | |

|

| |

|

|

|

NET ASSETS | | 100.00 | % | | $ | 488,222,522 | |

| | |

|

| |

|

|

|

| (a) | Non-income producing security |

| (b) | Unrealized appreciation (depreciation) of securities: |

| | | | |

Unrealized

Appreciation

| | Unrealized

(Depreciation)

| | Net Unrealized

Appreciation/

(Depreciation)

|

| $113,033,494 | | $(18,539,899) | | $94,493,595 |

MTN—Medium Term Note

The summary of the Fund’s investments as of March 31, 2005 is as follows: (Unaudited)

| | | | | | | |

Sector Diversification

| | % of

Net

Assets

| | | Market Value

| |

Information Technology | | 21.82 | % | | $ | 106,574,000 | |

Consumer Discretionary | | 16.50 | | | | 80,562,300 | |

Financial | | 13.79 | | | | 67,317,300 | |

Industrials | | 10.08 | | | | 49,195,800 | |

Health Care | | 9.90 | | | | 48,337,873 | |

Raw/Intermediate Materials | | 8.71 | | | | 42,524,000 | |

Technology | | 6.17 | | | | 30,129,200 | |

Energy | | 5.63 | | | | 27,474,600 | |

Transportation | | 3.79 | | | | 18,489,600 | |

Consumer Staples | | 1.68 | | | | 8,220,000 | |

Utilities | | 1.50 | | | | 7,308,000 | |

Repurchase Agreements | | 0.69 | | | | 3,353,000 | |

| | |

|

| |

|

|

|

Total Investment | | 100.26 | % | | $ | 489,485,673 | |

Other Assets and Liabilities (Net) | | (0.26 | ) | | | (1,263,151 | ) |

| | |

|

| |

|

|

|

Net Assets | | 100.00 | % | | $ | 488,222,522 | |

| | |

|

| |

|

|

|

See Notes to Financial Statements.

22

Excelsior Funds, Inc.

Portfolio of Investments — March 31, 2005

Value and Restructuring Fund

| | | | | |

| | | | | |

Shares

| | | | Value

|

| COMMON STOCKS — 95.06% | | |

| | | CONSUMER DISCRETIONARY — 20.83% |

| 1,750,000 | | Avon Products, Inc. | | $ | 75,145,000 |

| 1,800,000 | | Black & Decker Corp. | | | 142,182,000 |

| 2,450,000 | | Centex Corp. | | | 140,311,500 |

| 1,011,388 | | Harman International | | | 89,467,382 |

| 3,650,000 | | Interpublic Group of Companies, Inc.(a) | | | 44,822,000 |

| 1,700,000 | | Journal Communications, Inc., Class A | | | 28,135,000 |

| 3,700,000 | | Liberty Media Corp., Class A(a) | | | 38,369,000 |

| 2,000,000 | | Loews Corp. — Carolina Group | | | 66,200,000 |

| 2,250,000 | | Newell Rubbermaid, Inc. | | | 49,365,000 |

| 2,100,000 | | TJX Cos., Inc. | | | 51,723,000 |

| 5,600,000 | | XM Satellite Radio Holdings, Inc., Class A(a) | | | 176,400,001 |

| 2,075,000 | | Zale Corp.(a) | | | 61,669,000 |

| | | | |

|

|

| | | | | | 963,788,883 |

| | | | |

|

|

| | | CONSUMER STAPLES — 4.32% |

| 1,850,000 | | ConAgra Foods, Inc. | | | 49,987,000 |

| 2,425,000 | | Dean Foods Co.(a) | | | 83,177,500 |

| 1,575,000 | | Kraft Foods, Inc., Class A | | | 52,053,750 |

| 1,500,000 | | Vintage Wine Trust, Inc.(a)(b) | | | 15,000,000 |

| | | | |

|

|

| | | | | | 200,218,250 |

| | | | |

|

|

| | | ENERGY — 12.97% |

| 200,000 | | Alpha Natural Resources, Inc.(a) | | | 5,734,000 |

| 2,100,000 | | Burlington Resources, Inc.(c) | | | 105,147,000 |

| 625,000 | | ConocoPhillips | | | 67,400,000 |

| 2,050,000 | | Consol Energy, Inc. | | | 96,391,000 |

| 2,225,000 | | Devon Energy Corp.(c) | | | 106,243,750 |

| 1,200,000 | | Mariner Energy, Inc.(a)(b) | | | 16,800,000 |

| 950,000 | | Noble Energy, Inc. | | | 64,619,000 |

| 1,650,000 | | Petrobras ADR | | | 72,897,000 |

| 1,650,000 | | Todco, Class A(a) | | | 42,636,000 |

| 1,100,000 | | W&T Offshore, Inc.(a) | | | 22,836,000 |

| | | | |

|

|

| | | | | | 600,703,750 |

| | | | |

|

|

| | | FINANCIAL — 16.84% |

| 1,450,000 | | Ace Ltd. | | | 59,841,500 |

| 2,486,200 | | Amvescap plc ADR | | | 31,525,016 |

| 1,650,000 | | Apollo Investment Corp.(d) | | | 27,687,000 |

| | | | | |

| | | | | |

Shares

| | | | Value

|

| COMMON STOCKS — (continued) | | |

| | | FINANCIAL — (continued) |

| 725,000 | | CIT Group, Inc. | | $ | 27,550,000 |

| 1,625,000 | | Citigroup, Inc. | | | 73,027,500 |

| 1,000,000 | | Freddie Mac | | | 63,200,000 |

| 1,825,000 | | JP Morgan Chase & Co. | | | 63,145,000 |

| 675,000 | | Lehman Brothers Holding, Inc. | | | 63,558,000 |

| 700,000 | | Loews Corp. | | | 51,478,000 |

| 2,400,000 | | MCG Capital Corp. | | | 36,924,000 |

| 1,300,000 | | Metlife, Inc. | | | 50,830,000 |

| 1,500,000 | | MoneyGram International, Inc. | | | 28,335,000 |

| 1,325,000 | | Morgan Stanley | | | 75,856,250 |

| 800,000 | | PNC Financial Services Group, Inc. | | | 41,184,000 |

| 2,100,000 | | Primus Guaranty Ltd.(a) | | | 27,363,000 |

| 650,000 | | Washington Mutual, Inc. | | | 25,675,000 |

| 450,000 | | XL Capital Ltd., Class A | | | 32,566,500 |

| | | | |

|

|

| | | | | | 779,745,766 |

| | | | |

|

|

| | | HEALTH CARE — 3.85% |

| 860,000 | | AmerisourceBergen Corp. | | | 49,269,400 |

| 525,000 | | Baxter International, Inc. | | | 17,839,500 |

| 900,000 | | Bristol-Myers Squibb Co. | | | 22,914,000 |

| 1,175,000 | | HCA, Inc. | | | 62,944,750 |

| 600,000 | | Wyeth | | | 25,308,000 |

| | | | |

|

|

| | | | | | 178,275,650 |

| | | | |

|

|

| | | INDUSTRIALS — 12.89% |

| 1,850,000 | | AGCO Corp.(a) | | | 33,762,500 |

| 700,000 | | Arlington Tankers | | | 16,450,000 |

| 2,875,000 | | Cendant Corp. | | | 59,052,500 |

| 1,350,000 | | Deluxe Corp. | | | 53,811,000 |

| 120,200 | | Dolby Laboratories, Inc., Class A(a) | | | 2,824,700 |

| 1,775,000 | | Empresa Brasileira de Aeronautica S.A. ADR | | | 55,557,500 |

| 1,150,000 | | Gol Linhas Aereas Inteligentes S.A. ADR(a) | | | 28,899,500 |

| 1,425,000 | | Overnite Corp. | | | 45,585,750 |

| 1,100,000 | | Ryder Systems, Inc. | | | 45,870,000 |

| 1,650,000 | | Tyco International Ltd. | | | 55,770,000 |

| 1,100,000 | | Union Pacific Corp. | | | 76,670,000 |

| 3,300,000 | | United Rentals, Inc.(a) | | | 66,693,000 |

| 550,000 | | United Technologies Corp. | | | 55,913,000 |

| | | | |

|

|

| | | | | | 596,859,450 |

| | | | |

|

|

See Notes to Financial Statements.

23

Excelsior Funds, Inc.

Portfolio of Investments — March 31, 2005

Value and Restructuring Fund — (continued)

| | | | | |

| | | | | |

Shares

| | | | Value

|

| COMMON STOCKS — (continued) | | |

| | | INFORMATION TECHNOLOGY — 5.61% |

| 1,970 | | Computer Associates International, Inc. | | $ | 53,387 |

| 3,400,000 | | Harris Corp. | | | 111,010,000 |

| 2,575,000 | | Nokia Oyj ADR | | | 39,732,250 |

| 1,300,000 | | Plantronics, Inc. | | | 49,504,000 |

| 1,200,000 | | Texas Instruments, Inc.(c) | | | 30,588,000 |

| 2,325,000 | | Vishay Intertechnology, Inc.(a) | | | 28,899,750 |

| | | | |

|

|

| | | | | | 259,787,387 |

| | | | |

|

|

| | | RAW/INTERMEDIATE MATERIALS — 7.00% |

| 550,000 | | Cambrex Corp. | | | 11,715,000 |

| 2,450,000 | | Celanese Corp., Class A(a) | | | 44,075,500 |

| 400,000 | | Eagle Materials, Inc., Class B | | | 31,520,000 |

| 1,300,000 | | Foundation Coal Holdings, Inc. | | | 30,563,000 |

| 1,775,000 | | Georgia-Pacific Corp. | | | 62,994,750 |

| 1,200,000 | | Lafarge Corp. | | | 70,140,000 |

| 1,025,000 | | PPG Industries, Inc. | | | 73,308,000 |

| | | | |

|

|

| | | | | | 324,316,250 |

| | | | |

|

|

| | | REAL ESTATE — 4.19% |

| 1,150,000 | | Capital Lease Funding, Inc. | | | 12,707,500 |

| 1,920,000 | | Diamondrock Hospitality Co.(a)(b) | | | 20,448,000 |

| 1,875,000 | | Fieldstone Investment Corp.(b) | | | 27,225,000 |