| | |

OMB APPROVAL |

OMB Number: | | 3235-0570 |

Expires: | | September 30, 2007 |

Estimated average burden |

hours per response | | 19.4 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number 811-04088 |

Excelsior Funds, Inc.

|

| (Exact name of registrant as specified in charter) |

| | |

101 Montgomery Street San Francisco, CA 94104 |

| (Address of principal executive offices) (Zip code) |

BISYS Fund Services

3435 Stelzer Road

Columbus, Ohio 43219

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: 1-415-627-7000

Date of fiscal year end: March 31, 2007

Date of reporting period: March 31, 2007

| Item 1. | Reports to Stockholders. |

EQUITY FUNDS

ANNUAL REPORT

March 31, 2007

TABLE OF CONTENTS

For shareholder account information, current price and yield quotations, or to make an initial purchase or obtain a prospectus, call (800) 446-1012, from overseas, call (617) 483-7297.

| · | | Internet Address: http://www.excelsiorfunds.com |

This report must be preceded or accompanied by a current prospectus.

You should consider the Funds’ investment objectives, risks and expenses carefully before you invest. Information about these and other important subjects is in the Funds’ prospectus, which you should read carefully before investing.

Nothing in this report represents a recommendation of a security by the investment adviser. Manager views and portfolio holdings may have changed since the report date.

Investments in equity securities are subject to sudden and unpredictable drops in value and periods of lackluster performance.

Funds which concentrate their investments in one economic sector or in a geographical region may expose an investor to greater volatility. When used as part of a broader investment portfolio, these funds may serve to reduce overall portfolio volatility. Currency fluctuations, differences in security regulation, accounting standards, and foreign taxation regulation are among the risks associated with foreign investing as well as political risk—investing in emerging markets may accentuate these risks.

Small cap stocks may be less liquid and subject to greater price volatility.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

A description of the policies and procedures that Excelsior Funds use to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling (800) 446-1012, or (ii) by accessing the Excelsior Funds’ internet address and (iii) on the Commission’s website at http://www.sec.gov.

Excelsior Funds file their June 30 and December 31 schedule of portfolio holdings with the Securities and Exchange Commission, on Form N-Q, within sixty days after the applicable reporting period. Excelsior Funds Form N-Q is available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

A schedule of each Fund’s portfolio holdings, as of the end of the prior month, is also available on the Funds’ website at www. excelsiorfunds.com. This schedule is updated monthly, typically by the 15th calendar day, after the end of each month. The Funds may terminate or modify this policy at anytime.

Excelsior Funds, Inc. and Excelsior Funds Trust are distributed by BISYS Fund Services Limited Partnership.

You may write to Excelsior Funds, Inc. and Excelsior Funds Trust at the following address:

Excelsior Funds

P.O. Box 8529

Boston, MA 02266-8529

Notice About Duplicate Mailings

The Excelsior Funds have adopted a policy that allows the Funds to send only one copy of a Fund’s prospectus and annual and semi-annual reports to certain shareholders residing at the same “household.” This reduces Fund expenses, which benefits you and other shareholders. If you do not want your mailings to be “householded,” please call (800) 542-1061 or contact your financial intermediary.

SHARES OF THE FUNDS ARE NOT DEPOSITS OR OBLIGATIONS OF, OR GUARANTEED OR ENDORSED BY, ANY BANK, AND THE SHARES ARE NOT FEDERALLY INSURED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION, BANK INSURANCE FUND, FEDERAL RESERVE BOARD, OR ANY OTHER GOVERNMENTAL AGENCY. FUND SHARES ARE NOT INSURED OR GUARANTEED BY THE U.S. GOVERNMENT. AN INVESTMENT IN A FUND IS SUBJECT TO RISK OF PRINCIPAL.

LETTER TO SHAREHOLDERS

March 31, 2007

Dear Valued Excelsior Fund Shareholder,

I am pleased to bring you the annual report for the year ended March 31, 2007 for the Excelsior Funds. The funds in this report are part of the Excelsior Fund family which has over $20 billion in assets as of the end of the reporting period and includes a wide array of asset classes and investment strategies designed to meet the individual investor’s investment needs.

By now, you have received notification that on November 20, 2006, The Charles Schwab Corporation (“Schwab”) announced an agreement to sell the U.S. Trust Corporation (“U.S. Trust”), a wholly-owned subsidiary of Schwab, to the Bank of America Corporation (“Bank of America”) (the “Sale”). The Sale involves all of U.S. Trust’s subsidiaries, including the Excelsior Funds’ investment advisers, UST Advisers, Inc. (“USTA”) and United States Trust Company National Association, on behalf of its asset management division, U.S. Trust New York Asset Management (“USTNA”). Consequently, the Excelsior Funds will need to enter into new investment advisory agreements with USTA and USTNA.

At a meeting held on January 8, 2007, the Board approved new investment advisory agreements under which, subject to approval by the Excelsior Funds’ shareholders, USTA and USTNA will continue to serve as investment advisers to the Excelsior Funds after the Sale is completed. At the same meeting, the Board directed that the new investment advisory agreements be submitted to the shareholders of each Fund for approval.

A Special Meeting of Shareholders of Excelsior Funds, Inc., Excelsior Tax-Exempt Funds, Inc and Excelsior Funds Trust and each of their funds was held on March 30, 2007. The number of votes necessary to conduct the Special Meeting and approve the new investment advisory agreements was obtained for each fund except the Value and Restructuring, Energy and Natural Resources and Treasury Money Funds. The Special Meeting for Value and Restructuring, Energy and Natural Resources and Treasury Money Funds was adjourned for the purpose of soliciting additional proxies, and we anticipate that the new investment advisory agreements will be approved by the shareholders of these funds at a subsequent Special Meeting.

The integration of U.S. Trust, Bank of America's private bank and its ultra high net worth extension will create the nation’s largest private wealth management firm with assets under management of over $260 billion and total client assets of almost $420 billion.

We at the Excelsior Funds are excited about our future within Bank of America and remain committed to helping you with your long-term investment goals. Thank you for investing with us.

Sincerely,

Evelyn Dilsaver

President

1

EXCELSIOR FUNDS | EQUITY MARKET REVIEW |

Equity Market Review

After breezing through the end of the Funds’ fourth fiscal quarter, the financial markets generally, and equities in particular—encountered severe headwinds as the Excelsior Funds began their new fiscal year in April of 2006. Emerging markets in particular fell 4.3% in the fiscal first quarter. Non-U.S. equities overall, however, managed to achieve a small gain, thanks to advances in Europe. The U.S. equity market declined during these first three months as well (the S&P 500 Index was down 1.4%, while the Russell 1000 Index declined 1.7%), amidst concerns about the Federal Reserve’s (Fed) tightening policy, inflation, and gradually mounting worries about global growth and a hard landing in the U.S. Small caps were bested by large caps (the Russell 2000 Index was down 5% in the quarter), with small cap growth stocks the weakest-performing market segment. Value outperformed growth no matter the market cap as investors became defensive. In this period, energy, utilities and integrated oils were the best-performing sectors. Technology and health care were the weakest-performing sectors in the period.

Volatility continued unabated through the first part of the summer, until August, when investor appetite for risk returned, and the equity markets rebounded strongly. The long-anticipated Fed pause and a drop in energy prices were among the reasons for the improving environment. For the fiscal second quarter, the S&P 500 Index, for instance, saw a 5.7% advance. Large caps continued their outperformance versus mid- and small-cap stocks, and value continued to best growth, although growth did appear to be gaining a better footing in the period. Among economic sectors, financial services rallied on the Fed pause, while technology, health care and utilities (telecom) sectors all were given a boost by strong M&A activity in the period. Non-U.S. equity markets, paced by Continental Europe, were mostly up in the quarter, although a slightly stronger U.S. dollar had an impact on results. Japanese and emerging markets saw a rebound as well.

The positive conditions continued into the fiscal third quarter, given the Fed’s decision not to raise rates, lower oil prices, and encouraging inflation numbers. For the quarter, the S&P 500 Index achieved a 6.7% gain. While large cap stocks were strong in the period, they did give away their leadership position to small caps. Value continued to outperform growth. On a sector basis, performance across sectors was strong overall, although energy (integrated oils) saw the largest gains; health care saw the smallest advance, given investor concerns over a Democrat-controlled Congress.

The final fiscal quarter (the first calendar quarter of 2007) saw volatility return to the markets with a large sell-off in late February, although most of the world’s equity markets managed to come in basically flat for the three-month period. International markets, led by the developed markets, advanced in the period, and in most cases outpaced the U.S. market.

Outlook

The current market environment is similar to conditions that prevailed at the end of December. At that time, the markets were dealing with excess noise on the health of the economy—related specifically to inflation and slowing growth in the U.S., and how that slowing growth would impact economies around the world. Later, in the first months of the new calendar year, equities saw a sharp correction sparked by weakness in the sub-prime mortgage sector. While leading inflation indicators remained weak, actual inflation had yet to roll over, and concerns were mounting that earnings would come in better than expected. The fear was the Fed would not be able to cut interest rates anytime soon.

2

EXCELSIOR FUNDS | EQUITY MARKET REVIEW |

Right now, the focus continues on earnings. For our part, we still expect to see some muted earnings growth in 2007 accompanied by a bit of P/E expansion as rates come down. We’re also expecting a re-acceleration of the equity market to occur toward year-end, after we work through what we expect will be a typical summer dry period. Our rationale? Inflation is not much of a concern (which should become increasingly apparent in coming months), economic growth is slowing, and we believe the Fed has ample ammunition to cut interest rates—and is likely to do so in the next several months, thereby averting a growth slowdown becoming a recession.

Equities should, as a result, continue overweight relative to fixed income, even though we believe yields will be lower by year-end. Within equities, we continue to believe non-U.S. growth and valuations are more attractive than they are in the U.S., driven in large part by continued growth in Europe and Japan. European equity markets continue to benefit from huge deal flow. Japan is making its way out of a long slump, and we’re still at the early stages of the adjustment process. Within the U.S., we plan to focus on high-quality cash-generating businesses that provide a decent yield, as well as selective growth stories.

3

EXCELSIOR FUNDS, INC. | BLENDED EQUITY FUND |

Performance Summary

For the fiscal year ended March 31, 2007, the Excelsior Blended Equity Fund slightly underperformed the S&P 500 Index. To be more specific, the actively managed portion of the Fund outperformed, while the quantitative overlay portion brought the overall portfolio closer to the S&P 500 Index.

Performance Attribution

The strongest performers for the trailing year were spread across sectors. Utility company TXU Corporation was the top performer, followed by Exxon Mobil, pharmaceutical companies Novo Nordisk and Abbott Laboratories, and the auction house Sotheby’s. Underperformers were focused in the consumer sector, including Furniture Brands, Timberland, and Eastman Kodak, as well as land-owner and developer St. Joe, and technology company National Instruments.

The utilities sector was the best-performing sector from a relative standpoint, followed by the health care and industrials sectors, while stock selection in consumer discretionary and no weight in telecommunications services hurt Fund performance.

Portfolio Activity

In the past 12 months, the active portion of the Fund has included a move away from direct exposure to the U.S. consumer and into revenues generated in currencies other than the U.S. dollar. This has been motivated by a concern that the U.S. economy is entering a cyclical slowdown that will translate into a challenging business environment for companies earning revenues in already-weak U.S. dollars. In addition, we continued to build on several themes: the growing impact of biotechnology, as represented by investments including Monsanto, Roche, NovoNordisk and Senomyx; the changing nature and pricing of energy (ExxonMobil, Suncor, AES, El Paso, BorgWarner); and global expansion (Expeditors International, GE, NYSE Group). From an overall investment standpoint, we continue to seek out companies with excellent corporate culture and management or those stocks that are simply cheap.

In keeping with these themes, additions to the active portion of the fund included stocks with a global reach, such as the Singapore Exchange, NYSE Group and Expeditors International of Washington; beneficiaries of the changing nature of energy use, including International Rectifier and Borg Warner; and a biotech, Senomyx. Eliminations included companies undergoing significant changes during a time likely to make a successful restructuring difficult, including Eastman Kodak, Analog Devices and Furniture Brands.

Selected Additions:

| • | The Singapore Exchange (SGX.SI) is a global capital markets exchange focused on a combination of domestic and foreign stocks and derivative products. The Exchange is an exceptionally well-managed business that is well positioned globally and functions within a regulatory environment closely aligned to business goals. It is led by an innovative and driven management and is growing rapidly in a wide variety of products. The Exchange sits at the fulcrum of several trends in global capital markets. |

4

EXCELSIOR FUNDS, INC. | BLENDED EQUITY FUND |

| • | Microchip’s corporate culture separates it from its competition and has helped lead the company back from the edge of bankruptcy and into a high-margin, high-efficiency market leader. Microchip’s powerful corporate culture is central to our investment thesis. A good example of this culture is the sales force incentive—people are paid not on commission, but on company-wide metrics. This has led to a more collegial and satisfying relationship with customers, who are in turn measurably more loyal. This kind of company-driven and customer-focused thinking is critical to market gains and to margin growth, in our view. |

| • | RHJ International is the publicly traded investment vehicle of Ripplewood. Among Ripplewood’s best-known transactions are the acquisitions of Japan Telecom, the largest leveraged buyout in Japan, and The Long-Term Credit Bank of Japan, since renamed Shinsei Bank. |

| • | Expeditors International of Washington is a high-quality company in the rapidly growing global freight forwarding and logistics industry. The industry is highly fragmented with no logistics provider having greater than low-single-digit market share. As freight forwarding grows globally and Expeditors takes some share, the company has the opportunity to grow at a rapid pace. Expeditors fits in our portfolio of companies that treat their employees well. Each company office is its own profit center, and there is no limit to how much a manager can earn if successful. The corporate culture has led to low turnover, a distinct advantage in an industry where repeat business is almost entirely relationship-driven. |

Selected Eliminations:

| • | Analog Devices (ADI) was eliminated based on a combination of fundamental and valuation concerns. Specifically, ADI’s power management segment has been underperforming and losing share to more effective competitors; the DSP unit has also been losing share and will likely continue to do so. |

| • | Furniture Brands was eliminated to realize losses and raise funds for new investments. The company has been unable to weather the difficult environment in residential furniture in spite of a three-year long restructuring effort. |

| • | At Eastman Kodak, the speed with which traditional revenues were drying up accelerated and new revenue generation showed signs of coming on slower than projected. |

| • | At the time of elimination from the Fund, AutoZone had not lived up to its potential market-share gains in the commercial space and had been giving up share in its strongest markets. In addition, hoped-for margin growth hadn’t materialized. |

Outlook

The active investment team of the Excelsior Blended Equity Fund continues to seek investment opportunities within—but not limited to—the three themes outlined above that fit in our dual strategy of investing in companies with excellent corporate cultures or those that are simply cheap. This strategy is combined with a quantitative risk overlay which has been developed to dampen Fund volatility relative to the S&P 500 Index.

Richard Bayles

Managing Director and Senior Portfolio Manager

5

EXCELSIOR FUNDS, INC. | BLENDED EQUITY FUND |

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | | |

| | |

Expense Ratio (As of 7/31/06) | | Shares | |

Gross Expense Ratio | | 1.21 | % |

Net Expense Ratio | | 1.10 | % |

The expense information in the table reflects contractual fee waivers currently in effect. This information is included in the most current prospectus available to current and prospective shareholders of the Fund. The Adviser has contractually agreed to waive fees or reimburse expenses in order to keep total operating expenses from exceeding 1.10%. The waiver agreement may not be terminated before July 31, 2007. In addition, this agreement will renew automatically for an additional 12 month term unless the Adviser terminates the agreement by providing written notice to the Fund prior to the expiration of the current term.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Standard & Poor’s Corporation—Reflects the reinvestment of income dividends and, where applicable, capital gain distributions. The Standard & Poor’s 500 Composite Stock Price Index is a widely accepted unmanaged index of U.S. stock market performance. |

| † | | Currently certain fees are waived. Had certain fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. Returns do not reflect the 2% fee imposed on shares redeemed 30 days or less after their date of purchase. |

6

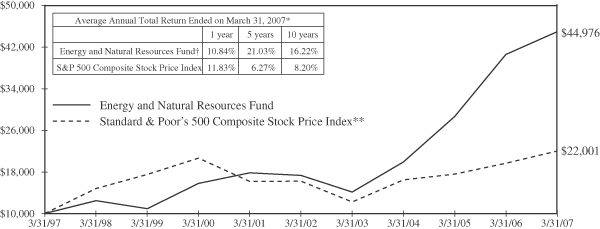

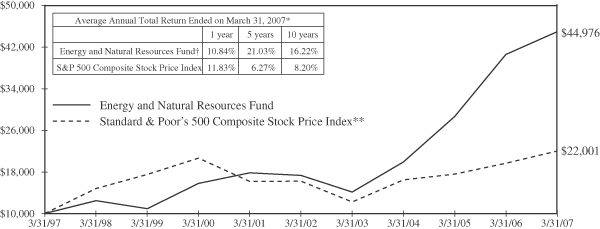

EXCELSIOR FUNDS, INC. | ENERGY AND NATURAL RESOURCES FUND |

Performance Summary

For the fiscal year ended March 31, 2007, the Excelsior Energy and Natural Resources Fund successfully navigated a highly volatile commodity price environment, modestly underperforming the S&P 500 Index.

Performance Attribution

End-point to end-point, crude oil prices were essentially flat at approximately $66.00 per barrel. On an interim basis, however, crude soared to $77.00 per barrel in August 2006—in the midst of the Iran nuclear stalemate—and subsequently plummeted to a low of nearly $50.00 per barrel in January 2007 in reaction to rising inventory levels and an unusually warm January across the Northern Hemisphere.

Following a five-year run-up in crude oil prices from $20.00 per barrel in 2001 to $77.00 per barrel in August 2006, the market is now struggling to determine a mid-cycle or ‘normalized’ price band which, we believe, could prove to be $50.00 to $70.00 per barrel, or an average of $60.00 per barrel in 2007.

Given the aforementioned price volatility, outperformance was concentrated in small-capitalization names with strong unit volume growth; i.e., HudBay Minerals a beneficiary of soaring zinc prices; Arena Resources, an emerging oil producer, and Kodiak Oil & Gas, an early cycle natural gas producer. Two large-capitalization names also contributed, notably Phelps Dodge—which was acquired by Freeport McMoran Copper and Gold—and ExxonMobil—which showed strong production volume growth and benefited from its defensive characteristics in a volatile energy tape.

Portfolio Activity

As we enter the second calendar quarter of 2007, we maintain a barbell strategy with a blend of large capitalization and small capitalization stocks. We initiated positions in two refiners, Valero Energy and Sunoco, which are benefiting from strong motor gasoline demand and restructuring. We also initiated positions in Deere & Company, a derivative on the explosive demand for ethanol and a beneficiary of rising corn prices; Energy Conversion Devices, a play on both batteries for hybrid engines and the manufacture of solar film; and participated in the initial public offering of Claymont Steel, a producer of customized steel plate, a critical ingredient for infrastructure development such as bridge repair and ethanol tank railroad car components.

Overall, we reduced positions in the major oils in January, concerned with the prospect of several quarters of flat to down earnings—given difficult comparisons with last year, when crude averaged $70.00 during the June and September quarters of 2006. The proceeds sourced an increase in our natural resource component in an effort to dampen volatility due to oil and gas prices.

Outlook

We will continue to take advantage of underlying commodity price volatility to buy select names on price dips and remain constructive on the energy and natural resource sector. Producers are challenged to replace production and reserves in a strong demand environment led by the ongoing industrialization and urbanization of China and emerging economies of Brazil and India.

The greatest threat to the end of the energy cycle is escalating crude oil prices, which could eventually choke off demand and induce a global recession. We believe that OPEC is well aware of this risk and has sufficient spare capacity to (1) contain a potential spike in oil prices and (2) ratchet down production to defend a $50.00 floor and manage a mid-cycle price believed to be in the $60.00 per

7

EXCELSIOR FUNDS, INC. | ENERGY AND NATURAL RESOURCES FUND |

barrel area. While cautious on North American natural gas prices near term due to high storage levels upon the exit of winter, we would look to add to gas–levered names on potential breaks in the natural gas price toward $6.00 per MCF (1,000 cubic feet), the lower end of our forecasted $6.00 to $8.00 per MCF range.

After several years of strong free cash flow, company balance sheets are vastly improved. Value-enhancing levers include dividend increases, share repurchase and merger activity.

Michael E. Hoover

Managing Director and Portfolio Manager

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. Concentration in one economic sector may subject an investor to greater volatility.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | | |

Expense Ratio (As of 7/31/06) | | Shares | |

Gross Expense Ratio | | 1.13 | % |

This information is included in the most current prospectus available to current and prospective shareholders of the Fund. The Adviser has contractually agreed to waive fees or reimburse expenses in order to keep total operating expenses from exceeding 1.25%. The waiver agreement may not be terminated before July 31, 2007. In addition, this agreement will renew automatically for an additional 12 month term unless the Adviser terminates the agreement by providing written notice to the Fund prior to the expiration of the current term.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Standard & Poor’s Corporation—Reflects the reinvestment of income dividends and, where applicable, capital gain distributions. The Standard & Poor’s 500 Composite Stock Price Index is a widely accepted unmanaged index of U.S. stock market performance. |

| † | | Certain fees may be waived. Had certain fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. One year returns presented in the table differs from the return presented in the Financial Highlights. Returns do not reflect the 2% fee imposed on shares redeemed 30 days or less after their date of purchase. |

8

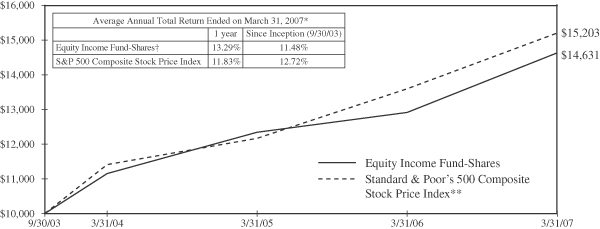

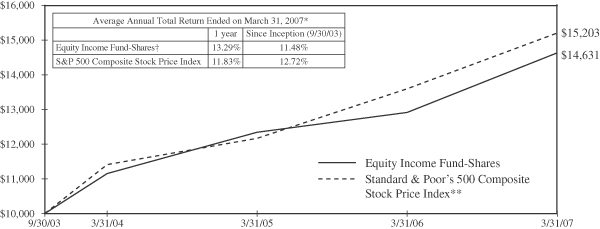

EXCELSIOR FUNDS TRUST | EQUITY INCOME FUND |

Performance Summary

The Excelsior Equity Income Fund outperformed the S&P 500 Index over the last twelve months. This outcome is a result of our efforts to grow our income stream by purchasing stocks at attractive initial yields and by owning companies with progressive dividend policies. The Fund concentrates on investing in stocks that offer above-average dividend yields or have the potential to grow their dividends at above-average rates.

Performance Attribution

The strongest contributors to performance were RPM International, Chevron and AT&T. RPM, one of our largest holdings and best performers, has industrial operations that are growing nicely and legacy asbestos costs that are moderating. Chevron’s total returns are directly related to their outstanding earnings growth amidst a strong energy price environment. Telecom stocks underperformed in 2005 despite improving industry fundamentals, so AT&T’s recent strong performance is a culmination of investor recognition of improving fundamentals while the stock was trading at low valuations. In addition, AT&T’s acquisitions (purchasing the historic AT&T and Bellsouth in the last 18 months) are being viewed more favorably today in light of improving industry fundamentals.

Our worst contributors to performance were Home Depot, Halliburton and WP Stewart. We continue to hold Home Depot and Halliburton and like their respective outlooks. We fortunately sold W.P. Stewart in the summer of 2006 at higher prices than today’s. We lost confidence in W.P. Stewart’s turnaround, despite efforts to fix their asset accumulation problems. As part of our sell discipline, if a company is not making fundamental progress versus our expectations over a 2 year time frame, we will exit the stock.

We believe Halliburton remains attractive because its Energy Services Group has excellent growth opportunities. Global demand for energy services should be strong for several years, resulting in strong volume and significant pricing power for Halliburton and its peers. Halliburton has a particularly strong business serving North America’s gas production needs, but this opportunity is overshadowed by short-term concerns of a North American natural gas overhang. The value of the Energy Services Group within Halliburton has been obscured by the lumpy and controversial business of Kellogg, Brown and Root (KBR). The separation of KBR from Halliburton should help highlight the value of the Energy Services Group.

Portfolio Activity

During the last year, we initiated four new significant positions: Home Depot, SuperValu, Penn West Energy and Xilinx.

Home Depot operates in a favorable retail category. Lowe’s and Home Depot have less formidable competitors in their segment compared to any other big box category; this dynamic is supported by excellent growth and profit margins for both companies. Furthermore, the housing stock has expanded greatly over the last 10 years, which bodes well for future home improvement spending.

All in all, sales should grow at least 5-10% over the next several years and earnings per share (EPS) should grow approximately 10% plus. The company sells for 12x earnings and produces considerable free cash flow. We believe their acquisitions and their large repurchases of stock are high quality investments. Their dividend payout ratio is 35% and it is likely to modestly increase over time. The stock’s current yield is 2.4%; the company increased its dividend by 125% over the last year.

9

EXCELSIOR FUNDS TRUST | EQUITY INCOME FUND |

SuperValu, a grocery retailer, is engaged in a transforming deal by teaming up with Cerberus and CVS to purchase the assets of Albertsons. SuperValu acquired the best stores within the Albertsons network, with Cerberus and CVS purchasing the balance of the supermarket and stand-alone pharmacy locations. As a result, SuperValu’s base increased by 1,200 stores; its revenue should increase from $19 billion to $45 billion. Importantly, about 75% of its revenue will be from regions where it is either #1 or #2 in market share.

Penn West Energy Trust is a Canadian income trust with significant gas and oil production potential. It has three long-term projects worthy of note: 1) it has begun to farm out some of its 4.3 million acres of undeveloped land. Farming out is a minimally capital intensive method to monetize its large strategic land position; 2) the Seal Oil Sands Project has the potential to greatly enhance the company’s level of heavy oil production. (Initially, primary methods of production are being employed in the Seal project, resulting in less capital intensity. Ultimately, tertiary methods will be needed to greatly enhance production.) 3) it has begun to employ carbon dioxide recovery techniques to its largest conventional oil field, Pembina. Carbon flooding has been very successful in the U.S.

The semiconductor sector represents a growing source of dividend growth as more of these companies recognize the importance of returning excess capital to shareholders in an efficient manner. We like Xilinx because it has a growth business that requires modest capital in order to grow. As a result, it has accumulated a large cash balance ($4.00 per share). Xilinx initiated a dividend 3 years ago in recognition of its strong cash flow and large cash balance, and it has since grown it rapidly. Today, the payout ratio is approximately 45% and yield is 1.8%. The yield could be considered higher if the extra cash were disbursed through a special dividend immediately.

Outlook

The outlook for a dividend-focused approach is positive. Dividend-paying stocks have led the market higher over the last few years, a trend that looks sustainable for the foreseeable future. Since the tax law changes in 2003, the number of companies paying dividends has increased, the average rate of dividend increase has accelerated, and the stocks that pay dividends have outperformed as a group.

Despite these positive developments, the average payout ratio for S&P 500 companies remains historically low because recent earnings growth has been very strong. We believe many companies can “afford” to increase their payout ratio without negatively impacting their growth prospects.

We remain enthusiastic about the earnings growth opportunities for the companies in the Fund and we think that their current valuations are reasonable. In fact, many of our companies have experienced valuation compression over the last two years as earnings growth has outpaced share price appreciation. The fundamental drivers of growth are intact, capital market liquidity is great, investor sentiment is healthy, and valuations are attractive. We remain bullish on the prospects for our companies.

Thomas W. Vail

Managing Director and

Senior Portfolio Manager

Brian V. DiRubbio

Senior Vice President and

Senior Portfolio Manager

10

EXCELSIOR FUNDS TRUST | EQUITY INCOME FUND |

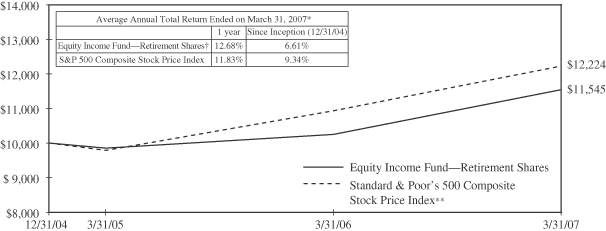

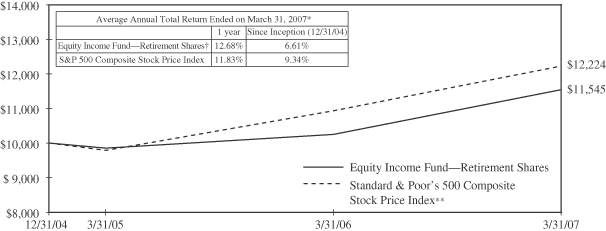

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index since 9/30/03 (inception date). The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | | |

| | |

Expense Ratio (As of 7/31/06) | | Shares | |

Gross Expense Ratio | | 1.22 | % |

Net Expense Ratio | | 1.10 | % |

The expense information in the table reflects contractual fee waivers currently in effect. This information is included in the most current prospectus available to current and prospective shareholders of the Fund. The Adviser has contractually agreed to waive fees or reimburse expenses in order to keep total operating expenses from exceeding 1.10%. The waiver agreement may not be terminated before July 31, 2007. In addition, this agreement will renew automatically for an additional 12 month term unless the Adviser terminates the agreement by providing written notice to the Fund prior to the expiration of the current term.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Standard & Poor’s Corporation—Reflects the reinvestment of income dividends and, where applicable, capital gain distributions. The Standard & Poor’s 500 Composite Stock Price Index is a widely accepted unmanaged index of U.S. stock market performance. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. Returns do not reflect the 2% fee imposed on shares redeemed 30 days or less after their date of purchase. |

11

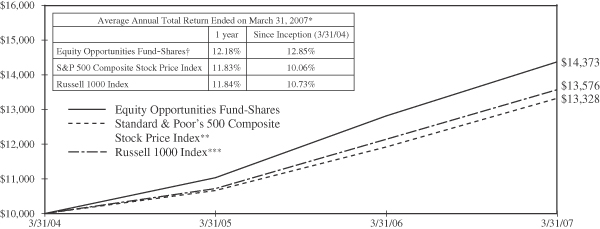

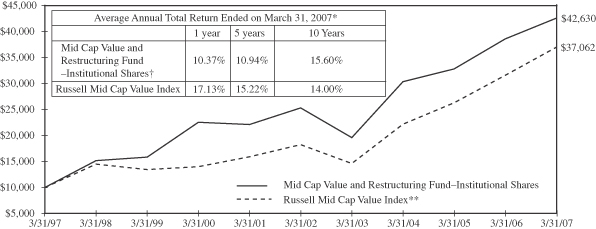

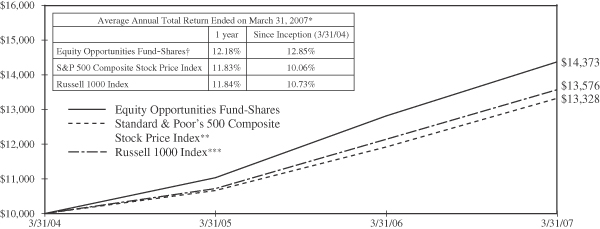

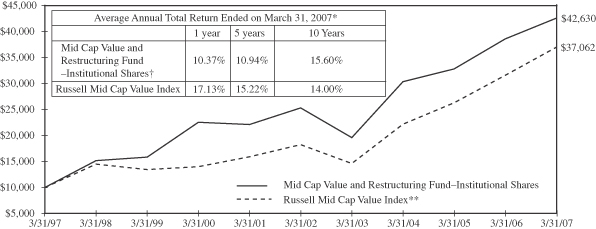

EXCELSIOR FUNDS TRUST | EQUITY OPPORTUNITIES FUND |

Performance Summary

For the year ended March 31, 2007, the Excelsior Equity Opportunities Fund outperformed the S&P 500 Index. The relative outperformance can largely be attributed to individual stock picking in the industrials and health care sectors, and our sector overweight in materials and utilities. Offsetting this outperformance were individual stocks in the information technology and consumer discretionary sectors.

Performance Attribution

The strongest performers in the fiscal year were concentrated in the industrials and materials sector, led by Quanta, Bombardier, Vulcan, Monsanto, Rolls-Royce and Nucor. Sotheby’s and pharmaceutical company Novo Nordisk were strong performers as were financial firms New York Stock Exchange and American Capital Strategies, and utilities CenterPoint Energy and AES. Underperformers came from the consumer and technology sectors, including technology companies 3Com, Analog Devices and National Instruments; Furniture Brands, Timberland, and Eastman Kodak in the consumer space; and land-owner and developer St. Joe.

Portfolio Activity

Over the past 12 months, the Fund has included a move away from direct exposure to the U.S. consumer and into revenues generated in currencies other than the U.S. dollar. This has been motivated by a concern that the U.S. economy is entering a cyclical slowdown that will translate into a challenging business environment for companies earning revenues in already-weak U.S. dollars. In addition, we continued to build on several themes: the growing impact of biotechnology (as represented by investments including Monsanto, Roche, NovoNordisk and Senomyx); the changing nature and pricing of energy (ExxonMobil, Suncor, AES, El Paso, BorgWarner), and global expansion (Expeditors International, GE, NYSE Group). From an overall investment standpoint, we continue to seek out companies with excellent corporate culture and management or those stocks that are simply cheap.

In keeping with these themes, our additions included stocks with global reach, such as Olam International, the Singapore Exchange, NYSE Group and Expeditors International of Washington; beneficiaries of the changing nature of energy use, including International Rectifier and Borg Warner; and a biotech, Senomyx. Eliminations included companies undergoing significant changes during a time likely to make a successful restructuring difficult, including Eastman Kodak, Analog Devices and Furniture Brands.

Selected Additions:

| • | Olam International (OLAM.SI) is a global supply chain manager of agricultural products and food ingredients. The company directly sources goods from over 40 countries and supplies 3,800 customers in 55 countries. Olam’s business model is unique in that it is integrated from the farm gate to the factory—without owning the underlying production process. Olam has projected earnings CAGR at 25%, giving confidence that there is significant growth ahead as the company expands into new commodities, new geographies and into an acquisitive growth phase. |

| • | The Singapore Exchange (SGX.SI) is a global capital markets exchange focused on a combination of domestic and foreign stocks and derivative products. The Exchange is an exceptionally well-managed business that is well positioned globally and functions within a regulatory environment closely aligned to business goals. It is led by an innovative and driven management and is growing rapidly in a wide variety of products. The Exchange sits at the fulcrum of several trends in global capital markets. |

12

EXCELSIOR FUNDS TRUST | EQUITY OPPORTUNITIES FUND |

| • | Microchip’s corporate culture separates it from its competition and has helped lead the company back from the edge of bankruptcy and into a high-margin, high-efficiency market leader. Microchip’s powerful corporate culture is central to our investment thesis. A good example of this culture is the sales force incentive—people are paid not on commission, but on company-wide metrics. This has led to a more collegial and satisfying relationship with customers, who are in turn measurably more loyal. This kind of company-driven and customer-focused thinking is critical to market gains and to margin growth, in our view. |

| • | RHJ International is the publicly traded investment vehicle of Ripplewood. Among Ripplewood’s best-known transactions are the acquisitions of Japan Telecom, the largest leveraged buyout in Japan, and The Long-Term Credit Bank of Japan, since renamed Shinsei Bank. |

| • | Expeditors International of Washington is a high-quality company in the rapidly growing global freight forwarding and logistics industry. The industry is highly fragmented with no logistics provider having greater than low-single-digit market share. As freight forwarding grows globally and Expeditors takes some share, the company has the opportunity to grow at a rapid pace. Expeditors fits in our portfolio of companies that treat their employees well. Each company office is its own profit center, and there is no limit to how much a manager can earn if successful. The corporate culture has led to low turnover, a distinct advantage in an industry where repeat business is almost entirely relationship-driven. |

Selected Eliminations:

| • | Analog Devices (ADI) was eliminated based on a combination of fundamental and valuation concerns. Specifically, ADI’s power management segment has been underperforming and losing share to more effective competitors; the Digital Signal Processors unit has also been losing share and will likely continue to do so. |

| • | Furniture Brands was eliminated to realize losses and raise funds for new investments. The company has been unable to weather the difficult environment in residential furniture in spite of a three-year long restructuring effort. |

| • | At Eastman Kodak, the speed with which traditional revenues were drying up accelerated and new revenue generation showed signs of coming on slower than projected. |

| • | At the time of elimination from the Fund, AutoZone had not lived up to its potential market-share gains in the commercial space and had been giving up share in its strongest markets. In addition, hoped-for margin growth hadn’t materialized. |

Outlook

The Equity Opportunities team continues to seek investment opportunities within—but not limited to—the three themes outlined above that fit in our dual strategy of investing in companies with excellent corporate cultures or those that are simply cheap.

Richard Bayles

Managing Director and

Senior Portfolio Manager

Fatima Dickey

Managing Director and

Portfolio Manager

13

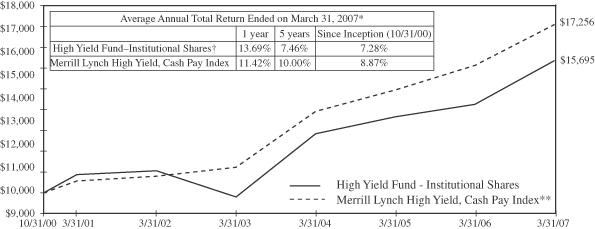

EXCELSIOR FUNDS TRUST | EQUITY OPPORTUNITIES FUND |

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost.

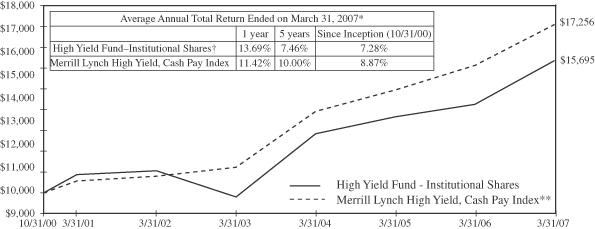

The above illustration compares a $10,000 investment made in the Fund and a broad-based index since 3/31/04 (inception date). The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | | |

| | |

Expense Ratio

(As of 7/31/06) | | Shares | |

Gross Expense Ratio | | 1.31 | % |

Net Expense Ratio | | 1.05 | % |

The expense information in the table reflects contractual fee waivers currently in effect. This information is included in the most current prospectus available to current and prospective shareholders of the Fund. The Adviser has contractually agreed to waive fees or reimburse expenses in order to keep total operating expenses from exceeding 1.05%. The waiver agreement may not be terminated before July 31, 2007. In addition, this agreement will renew automatically for an additional 12 month term unless the Adviser terminates the agreement by providing written notice to the Fund prior to the expiration of the current term.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Standard & Poor’s Corporation—Reflects the reinvestment of income dividends and, where applicable, capital gain distributions. The Standard & Poor’s 500 Composite Stock Price Index is a widely accepted unmanaged index of U.S. stock market performance. |

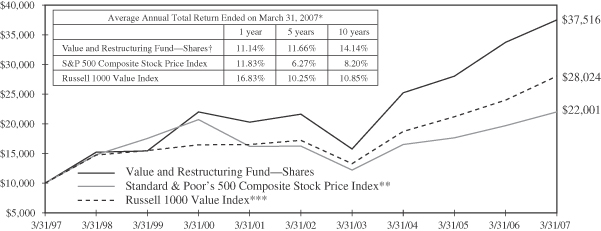

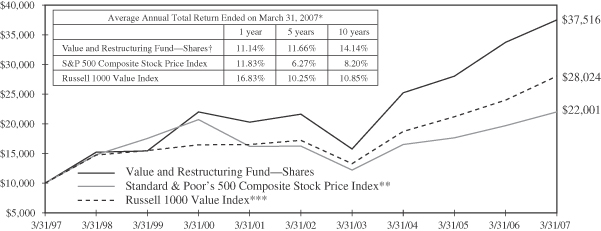

| *** | | Source: Frank Russell Company—The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index. The Index includes dividends reinvested. |

| † | | Currently certain fees are waived. Had such fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. Returns do not reflect the 2% fee imposed on shares redeemed 30 days or less after their date of purchase. |

14

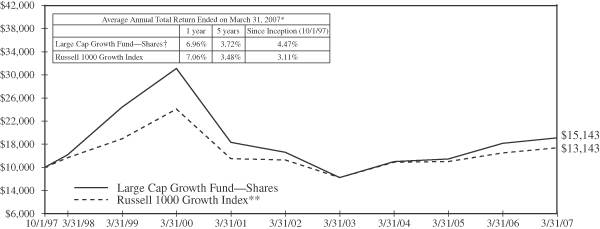

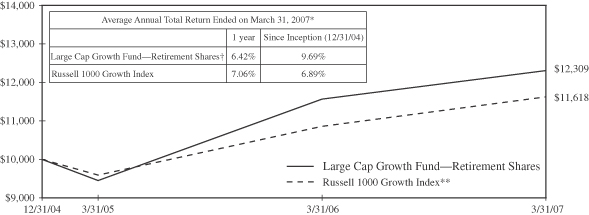

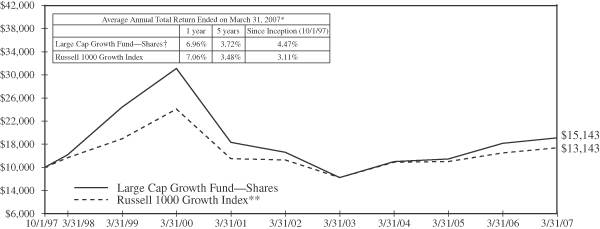

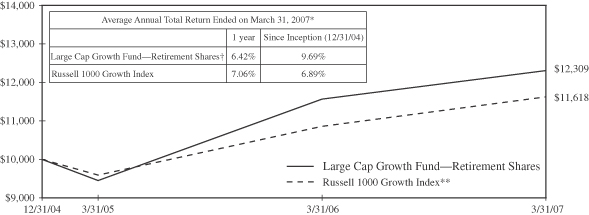

EXCELSIOR FUNDS, INC. | LARGE CAP GROWTH FUND |

Performance Summary

The Excelsior Large Cap Growth Fund over the year ended March 31, 2007 posted solid results, in line with the Russell 1000 Growth Index. That said, it was a difficult year for growth investors. First, earnings growth for the overall market, originally expected to be mid-single digits a year ago, turned out to be in the mid-teens, which was consistent with the price gain of the broad-market S&P 500 Index and double the long-term average rate of EPS growth. In this type of earnings environment, investors were unwilling to pay a premium for high growth companies. Additionally, technology, which represented one of our largest weights, was beaten down by stock options investigations and concerns about the sustainability of growth. Fortunately, the market has gone a long way towards sorting out the good from the bad regarding stock options.

Performance Attribution

Our stock picking helped overcome the above-mentioned drags and deliver positive absolute and benchmark-relative returns. From a sector perspective, we generated positive returns versus the Russell 1000 Growth Index in technology, health care and telecom stocks. Conversely, our picks in the industrial, financial and consumer discretionary sectors hurt. Also, the lack of exposure to materials, utilities and consumer staples was a modest drag. On an individual stock basis, our top five positive contributors in the past year were Research in Motion, Apple Inc., Coach, America Movil and Akamai Technologies. On the flip side, Amgen, Corporate Executive Board, Broadcom, Sallie Mae and eBay were the most significant negative contributors.

Portfolio Activity

We made several company changes to the Excelsior Large Cap Growth Fund in the past year, with eight new additions and ten deletions. We eliminated positions in Carnival Cruise, Dell, Patterson Companies, PetSmart, Wellpoint, Medtronic, SAP, Caremark, Teva Pharmaceuticals and Yahoo. We initiated positions in Akamai, Allergan, Corning, Best Buy, Corporate Executive Board, Intuitive Surgical, Adobe Systems and Las Vegas Sands. We expect these additions to generate EPS growth of 25%, on average, over the next 12 to 18 months, thereby providing attractive total return opportunities. Here are some brief business descriptions of these new additions.

Akamai (AKAM) is the leading provider of content and application delivery services that speed up how content is distributed over the internet, thus enabling organizations to expand and optimize their online content, applications, and business processes better without the required IT investment that would otherwise be necessary to support this growth.

Allergan (AGN) is a global specialty pharmaceutical and medical device company targeting the ophthalmology, neuroscience, medical dermatology and medical aesthetics markets. AGN’s future growth should come from its three core franchises—Ophthalmology, Neurology (Botox) and Aesthetics.

Corning (GLW) is a global technology company with operations in four business segments: Display Technologies, Telecommunications, Environmental Technologies and Life Sciences. GLW stands to benefit from several trends: increased LCD TV penetration, demand for notebook displays and flat-screen monitors, increased fiber deployments, and emissions control regulations.

15

EXCELSIOR FUNDS, INC. | LARGE CAP GROWTH FUND |

Best Buy (BBY) is a leading retailer of consumer electronics, home office, entertainment software, appliances and related services. The company is in the sweet spot of two product cycles, digital TVs and video games, which should continue to drive demand for its products. In addition, the expansion of its Geek Squad and Best Buy for Business platforms is expected to drive incremental growth opportunities.

Corporate Executive Board (EXBD) provides “best practices” research, decision support tools and executive education focusing on corporate strategy, operations and general management issues. The company’s membership-based model permits its clients to learn about the best practices of leading corporations at a fraction of the cost of a customized analysis.

Intuitive Surgical (ISRG) is the market leader in robotic-assisted minimally invasive surgery. The company’s da Vinci surgical system is used primarily in urologic, gynecologic, cardiothoracic and general surgery procedures. Clinically, the benefits and patient outcomes from robotic-assisted minimally invasive surgery are superior to conventional endoscopic surgery.

Adobe Systems (ADBE) is a leading developer of software for creative professionals and consumer hobbyists. Through its broad portfolio of software offerings, ADBE is well positioned to take advantage of several secular trends including the transition to Web 2.0 and rich internet applications, the shift to online advertising, and the increase in digital media consumption.

Las Vegas Sands (LVS) currently operates The Venetian Resort Hotel Casino and Sands Expo and Convention Center in Las Vegas, as well as the Sands Macao. LVS has an aggressive development pipeline being driven by the booming growth of the middle class in China, easing travel restrictions, and a healthy appetite for gaming and leisure consumption. Within a five-hour flight of nearly half of the world’s population, and offering the only legal gaming market in China, the Macao market has quickly become the most significant growth opportunity for gaming operators.

Outlook

Our outlook for growth investing remains positive. While there is no shortage of things to be concerned about, including geo-political angst, energy market volatility, the bursting of a housing bubble and the potential for an economic recession, we see reasons to be optimistic. Economic growth is moderating, but we believe a recession is unlikely. Diplomats are hard at work, sub-prime problems are currently contained, unemployment is low, inflation is low, and corporate profitability is still close to all-time highs. Equities appear attractive from a valuation perspective relative to bonds and real estate; growth stocks in particular look historically cheap relative to value stocks and the market in general. Corporate balance sheets are in good shape and returns on equity in the aggregate are close to all-time highs. After 18 consecutive quarters of double-digit EPS growth from S&P 500 companies, we are now transitioning to a mid-single-digit growth world for 2007. As with the mid-80s and mid-90s mid-cycle slowdowns, this transition may lead investors to pay a premium once again for companies capable of sustaining premium earnings growth like those found in the Excelsior Large Cap Growth Fund.

Thomas M. Gavin, CFA

President and CIO of the Growth Equity Group

16

EXCELSIOR FUNDS, INC. | LARGE CAP GROWTH FUND |

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index since 10/1/97 (inception date). The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | | |

| | |

Expense Ratio (As of 7/31/06) | | Shares | |

Gross Expense Ratio | | 1.23 | % |

Net Expense Ratio | | 1.20 | % |

The expense information in the table reflects contractual fee waivers currently in effect. This information is included in the most current prospectus available to current and prospective shareholders of the Fund. The Adviser has contractually agreed to waive fees or reimburse expenses in order to keep total operating expenses from exceeding 1.20%. The waiver agreement may not be terminated before July 31, 2007. In addition, this agreement will renew automatically for an additional 12 month term unless the Adviser terminates the agreement by providing written notice to the Fund prior to the expiration of the current term.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Frank Russell Company—The Russell 1000 Growth Index is an unmanaged index composed of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000 Index is composed of the 1000 largest companies in The Russell 3000 Index which is composed of 3,000 of the largest U.S. companies by market capitalization. The Index includes dividends reinvested. |

| † | | Currently certain fees are waived. Had certain fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. Returns do not reflect the 2% fee imposed on shares redeemed 30 days or less after their date of purchase. |

17

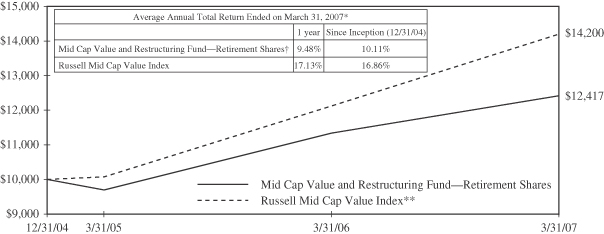

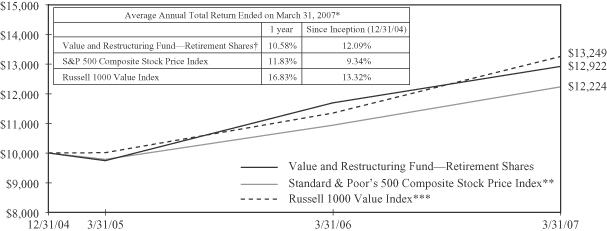

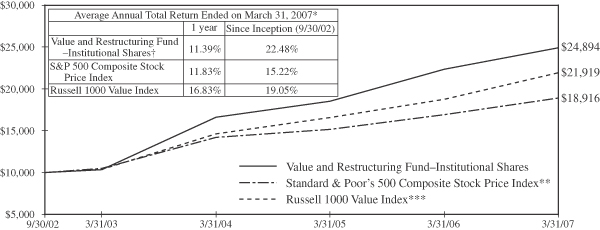

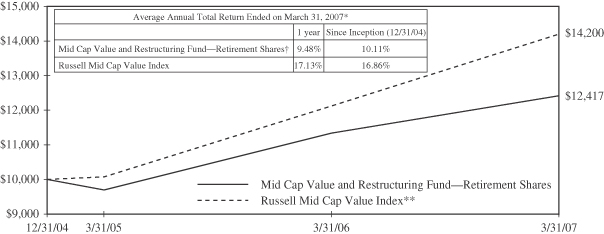

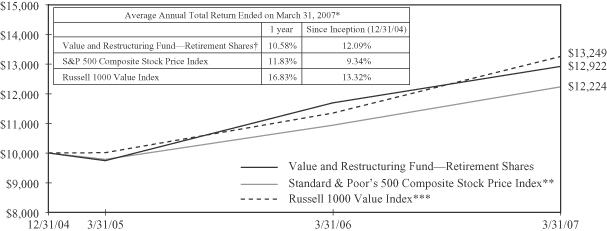

EXCELSIOR FUNDS TRUST MID CAP VALUE AND RESTRUCTURING FUND | |

Performance Summary

A renewed awareness of risk and volatility stands as the hallmark of the past year. While second quarter activity was driven almost wholly by a reaction to new “management” at the Federal Reserve Bank, the third quarter was marked by defensiveness as investors worried whether interest rates were enough to contain inflation, or too much so as to cause recession. This was followed by a clear break in favor of higher stock prices at the end of 2006, only to be followed by a volatile first quarter of 2007 as credit risk emerged in the sub-prime lending sector.

The common assumption that risk has been underpriced, while stated broadly, applies mostly to segments of the fixed income market. The equity market has experienced the opposite, with risk largely overpriced. This has brought on the current wave of leveraged buyouts, debt-financed corporate mergers and debt-financed special dividends—exactly what should happen. We expect it to continue until debt and equity markets reflect a similar view of the future, an event at least as likely to come by way of higher stock prices as by lower bond prices.

To be sure, segments of the equity market, notably stocks of companies heavily involved in high-risk lending, experienced sharp declines and a few bankruptcies. This is normal and necessary in a well-functioning market where businesses, taking on undue risk and betting incorrectly, lose. Left to its own devices, the still inexpensive, broader equity market is likely to rise to levels consistent with the favorable long-term conditions of low inflation and high profitability.

Winners, losers and new additions combined to push the Fund ahead nicely for the past twelve months, roughly in line with broad market measures though behind the Russell Mid-Cap Value Index, which bested nearly all categories with over a 17% return. Divergence from the benchmark is common given the Fund’s relative concentration and emphasis on companies undergoing change, though we prefer it more when the Fund diverges positively from the benchmark as opposed to lagging. Nonetheless, the Fund’s annual performance relative to the index is not surprising considering the pervasive emphasis on near-term risk, which we are willing to bear, in the most recent quarter.

Performance Attribution

The Fund benefited from heightened deal making and debt-financed dividends. The acquisition of Symbol Technologies by Motorola closed in the past quarter. Dean Foods and Health Management Associates raised substantial cash from debt offerings and paid special dividends to shareholders, with the stocks reacting favorably to the distributions. A number of other holdings seem primed to take similar action or be acquired outright.

The strongest performer in the Fund for the year was Mastercard, purchased on its attractively priced initial public offering in the summer, which rose 177%. Other strong performers for the past twelve months were Kennametal, Tempur-Pedic, Sherwin Williams, First Marblehead and Echostar. Kennametal fits well with our strategy of investing in good businesses in the midst of substantial transitions and with attractively valued stocks. Kennametal’s management is moving the company from a largely commodity-focused manufacturing and distribution business toward a higher-margin, faster-growing, advanced materials business. Continued progress and a well-received tuck-in acquisition propelled the stock, which is up nicely since being added to the portfolio six months ago.

18

EXCELSIOR FUNDS TRUST | MID CAP VALUE AND RESTRUCTURING FUND |

Conversely, International Coal and Centex weighed on portfolio results. International Coal Group disappointed after numerous setbacks on both mining and operational fronts delayed fundamental improvement. The stock was sold from the portfolio. The Fund’s small remaining investment in homebuilder Centex was down as further malaise set in to the housing market.

Portfolio Activity

Oshkosh Truck, a company we have long admired, was added to the portfolio following its acquisition of JLG Industries, another company we nearly purchased many times. Management of Oshkosh has a long history of levering the company’s balance sheet in order to make sizeable acquisitions. With strong cash flow, the company has always improved its debt position following acquisitions and integrated new companies well. We expect similar results this time and believe there are plentiful opportunities for the combined company to grow revenues and increase margins. The stock’s decline in advance of the merger precipitated our purchase.

E*Trade, Leucadia National and Progressive were all added to the portfolio in the last three months. E*Trade is undergoing a rapid transition from a broker-focused earnings model to a fuller financial services franchise, while producing strong margin improvement and growth in the process. The Fund has owned both Progressive and Leucadia in the past, with good results. We re-purchased Progressive near its lowest price to book in 10 years and at a roughly 10% earnings yield. Progressive generates very high returns on equity and excellent underwriting margins; and while near-term results may be pressured, long-term returns may have potential to be excellent.

Funding for the new purchases came from sales of Sovereign Bancorp, Zale Corp, Blockbuster, Callaway Golf and Doral Financial. Sovereign stock rallied nicely under pressure from activist shareholders. Stock of Zale rose as consumers proved more resilient than many had expected. Neither stock represented particularly strong value any longer when compared to alternatives. The sale of Zale also reduced the portfolio’s retail exposure a bit.

Outlook

The Fund continues to display the attractive valuation and fundamental characteristics that mark our way of investing. The median stock in the portfolio sells at 14× expected earnings, 10× cash flow and 2.4× book value, all discounts to market benchmarks despite attractive earnings growth forecasts and high levels of profitability. There is plenty of evidence suggesting choppy waters ahead. If a liquidity crunch in credit markets occurs, it will take a heavy toll on equity markets in the short term—but that is far from a foregone conclusion. Over an extended horizon, we expect the trend in stock prices to be up. The Fund is invested as such and so represents very good value in our estimation.

Tim Evnin

Managing Director and Senior Portfolio Manager

John McDermott, CFA

Managing Director and Senior Portfolio Manager

19

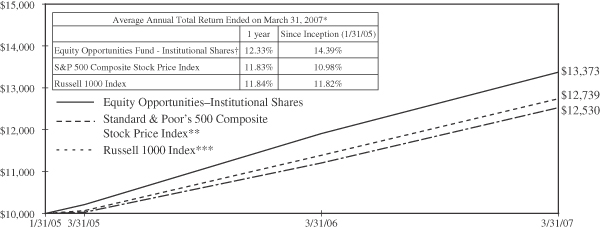

EXCELSIOR FUNDS TRUST | MID CAP VALUE AND RESTRUCTURING FUND |

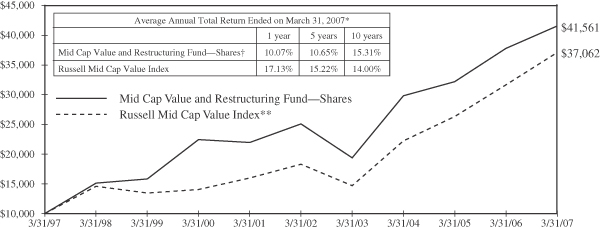

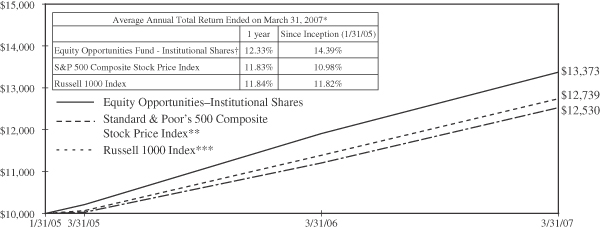

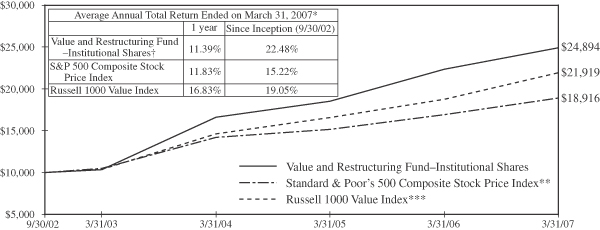

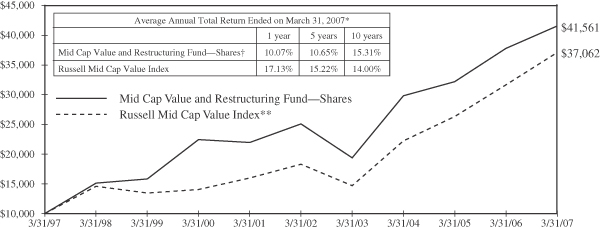

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | | |

| | |

Expense Ratio (As of 7/31/06) | | Shares | |

Gross Expense Ratio | | 1.13 | % |

This information is included in the most current prospectus available to current and prospective shareholders of the Fund. The Adviser has contractually agreed to waive fees or reimburse expenses in order to keep total operating expenses from exceeding 1.14%. The waiver agreement may not be terminated before July 31, 2007. In addition, this agreement will renew automatically for an additional 12 month term unless the Adviser terminates the agreement by providing written notice to the Fund prior to the expiration of the current term.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Frank Russell Company—The Russell Mid Cap Value Index measures the performance of medium-sized value-oriented securities. |

| † | | Certain fees may be waived. Had certain fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. Returns do not reflect the 2% fee imposed on shares redeemed 30 days or less after their date of purchase. |

20

EXCELSIOR FUNDS, INC. | REAL ESTATE FUND |

Performance Summary

For the twelve months ending in March 2007, the REIT universe performed well, with the Morgan Stanley REIT Index providing a total return of over 22%. This result outpaced most major market indices. Thematically the year was characterized by strong fundamentals resulting from good economic growth, as well as continued investor appetite for real estate. Throughout the past year, the group continued to attract capital—both the public markets, where real estate-dedicated funds experienced positive flows; and private capital, which has been put to work in buyouts of public real estate companies. Acquisitions of public companies for cash from private buyers led to a recycling of the capital back into the segment by real estate-dedicated investors. The one area of general economic weakness, housing, has not had a marked impact on the broader real estate market to date. In the various sectors there has been little new supply built, as commercial developers have been remarkably disciplined. As a result of these positive fundamentals, we continued to observe dividend growth at many REITs this past year. Of the National Association of REITs (NAREIT) universe of 142 REITs, 79 increased their dividend rates paid over the past 12 months.

Performance Attribution

Among the major property sectors, regional mall REITs had the best performance during the year; this performance was weighted toward year end. For the early part of this period, the regional malls lagged. The office companies also performed well during this period, with the best performance coming in the December quarter, at the height of the acquisition activity. Of the major sectors, the apartment REITs had the worst performance during the year ending March 2007; this sector actually outperformed in the beginning of the period, but underperformed more recently. Of the smaller sub-sectors of REITs, the health care companies had a very good year, whereas the manufactured housing companies fared poorly.

During the year, the fund underperformed the Morgan Stanley REIT benchmark. Although it is a small sector, our positioning in health care detracted most from performance over the past 12 months. We were underweight the sector and did not have exposure to some of the stronger performers. Also affecting our performance were some of the non-REITs; St. Joe, the land company based in the panhandle of Florida, was our worst performer this year.

Our best sector for the year was the office sector, where security selection improved results. The best total return came from Equity Office, a company that was purchased in the first quarter of 2007. Other strong performers in the office sector were S. L. Green and a smaller company, Digital Realty.

Portfolio Activity

During the year, several of our holdings—Equity Office, Trizec and Pan Pacific Realty—were purchased for cash. We sold three other companies: Brandywine Realty, Healthcare Realty Trust and Republic Properties. In each case we were disappointed in the results; in the case of Healthcare Realty, we felt there were better opportunities among other health care-related REITs.

During the year, our purchases included three newly public companies, Douglas Emmett, Digital Realty and Kite Realty. Douglas Emmett is an office company based in Southern California; Digital provides technology-related real estate; Kite is a small cap company focused on retail development and ownership.

21

EXCELSIOR FUNDS, INC. | REAL ESTATE FUND |

We also purchased Ventas and Health Care REIT to complement our health care exposure. And lastly, we initiated a position in Taubman to provide greater exposure in regional malls.

Outlook

Economic activity and job creation are important for the underlying fundamentals of all real estate. Throughout this real estate cycle, there has been relatively less new supply in the office markets, driving a positive leasing environment across that important sector. In the apartment business, economic activity and a cooling housing market made for strong fundamentals. However, the conversion of apartment units to condominiums is no longer taking place, creating a headwind for some of the apartment companies.

To date, the acquisition appetite remains healthy, particularly from private buyers, providing a bonus to real estate valuations. We will carefully watch the credit markets in the coming months. The concerns about risk in the single-family mortgage business could move beyond that business into other real estate-related businesses but have not done so thus far.

Joan Ellis, CFA

Managing Director and

Senior Portfolio Manager

22

EXCELSIOR FUNDS, INC. REAL ESTATE FUND | |

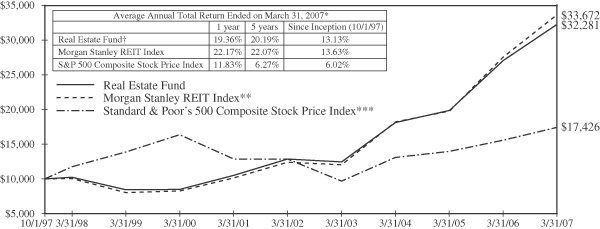

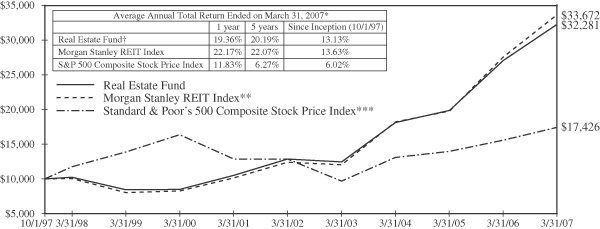

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. Concentration in one economic sector may subject an investor to greater volatility.

The above illustration compares a $10,000 investment made in the Fund and broad-based indices since 10/1/97 (inception date). The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The indices do not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | | |

| | |

Expense Ratio (As of 7/31/06) | | Shares | |

Gross Expense Ratio | | 1.52 | % |

Net Expense Ratio | | 1.25 | % |

The expense information in the table reflects contractual fee waivers currently in effect. This information is included in the most current prospectus available to current and prospective shareholders of the Fund. The Adviser has contractually agreed to waive fees or reimburse expenses in order to keep total operating expenses from exceeding 1.25%. The waiver agreement may not be terminated before July 31, 2007. In addition, this agreement will renew automatically for an additional 12 month term unless the Adviser terminates the agreement by providing written notice to the Fund prior to the expiration of the current term.

| * | | Total return represents the change during the period in a hypothetical account with dividends reinvested. |

| ** | | Source: Morgan Stanley & Co., Incorporated—Reflects the reinvestment of income dividends and, where applicable, capital gain distributions. The Morgan Stanley REIT Index is an unmanaged capitalization-weighted index composed of the largest and most actively traded REITs designed to provide a broad measure of real estate equity performance. |

| *** | | Source: Standard & Poor’s Corporation—Reflects the reinvestment of income dividends and, where applicable, capital gain distributions. The Standard & Poor’s 500 Composite Stock Price Index is a widely accepted unmanaged index of U.S. stock market performance. |

| † | | Currently certain fees are waived. Had certain fees not been waived, returns would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. Returns do not reflect the 2% fee imposed on shares redeemed 30 days or less after their date of purchase. |

23

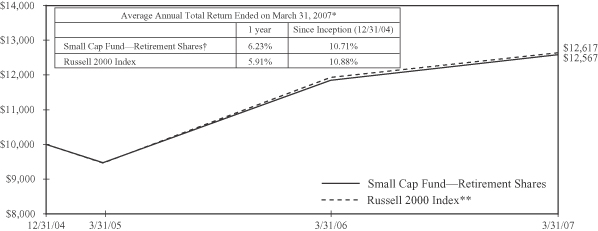

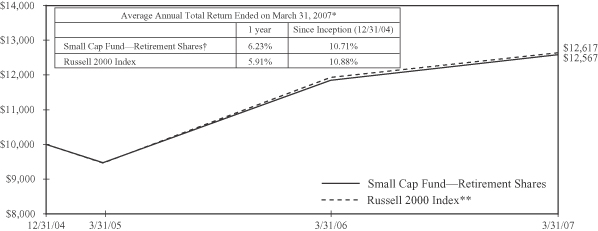

EXCELSIOR FUNDS, INC. | SMALL CAP FUND |

Performance Summary

For the Excelsior Small Cap Fund, results for the fiscal year ended March 31, 2007, came in well ahead of the Russell 2000 Index.

The year can best be characterized as highly volatile, given the summer’s 10% correction and February 27, 2007 sell-off that seemed to hit most equity asset classes in the same way, with declines of 3%-4%. The Fund’s investment program, however, always centers on stock selection rather than market calls; as a result, we had a handful of significant contributors that overpowered a relatively few laggards.

The enduring run in the small-cap asset class is now in its ninth year of outperformance relative to large stocks, as identified by the S&P 500 Index. For those attempting to time a switch from “small” to “large” to achieve relative performance, it has been a tough call. Obviously, the longer the run lasts, the more likely it is to turn at some point, but our valuation work and studies of other small cap cycles continue to be inconclusive in divining a locus in this cycle. Meanwhile, the combined effects of excess liquidity, driven by hedge funds and private equity partnerships, and the powerful trends of mergers, acquisitions and management-led buyouts should contribute to the drive of small companies in 2007 or at a minimum put a floor under the asset class. For our part, we just do what we do and try to be astute about it. Compared with many of our peers, the Excelsior Small Cap Fund holds relatively few positions, at 38. If and when a turn occurs, larger portfolios will reflect merely a call on the assets class. Our limited, stock-focused, approach should clearly differentiate our effort, for better or worse.

This is an interesting time. In the corporate real estate market, we witnessed a battle between Blackstone Group and Vornado Properties to overpay for the REIT, Equity Office Properties. When the smoke cleared, the new owner had paid an historically low “cap” rate and an historically high dollar price—this after a six-year period of outperformance by the entire sector. Today’s valuations do not leave much room for the little calamities that visit from time to time—lenders tightening standards (post the sub-prime mortgage sector collapse), higher long-term interest rates as the yield curve returns to its normal shape, a tenant going broke, etc. Elsewhere a private equity firm, Fortress Group, had its initial public offering; on the basis of a price-to-earnings metric, breathless new investors priced it at twice the valuation of Goldman Sachs, an excellent company with a hundred-year history that does many of the same things Fortress does and many other things as well. Another interesting headline was seen in the Wall Street Journal on April 2, 2007: “Eager Investors Lift Margin Debt To New Heights”. We are not bearish, but we are alert to extremes in the system that could produce some unhappy results.

Performance Attribution

Viewing the account-specific analysis, we will first look at annual attribution. While most economic sectors within the portfolio were positive, our most significant overweighted commitments to the consumer discretionary, industrials, and information technology sectors collaborated to provide returns in excess of the index’s return. Our largest underweighted sectors were consumer staples, health care, finance, and materials. Between these major over/under weighted sectors, we deployed capital fairly efficiently in the fiscal year as the decision to overweight one sector at the expense of another was additive.

24

EXCELSIOR FUNDS, INC. | SMALL CAP FUND |

Stock-by-stock contribution was diverse by sector or theme; however, technology had the most representatives with CommScope (coaxial cable), Varian Semiconductor (up 90% in the fiscal year), FLIR (infrared cameras), Manhattan Associates (warehouse/inventory management software), Forrester Research (independent market and technology application), and Innovative Solutions (flat panel avionics displays; up approximately 75% in the fiscal year). Other significant contributors rounding out the top ten were long-term holdings Sotheby’s (the auction house), Kansas City Southern Railway, Quanta Services (electric and cable transmission), and Philadelphia Consolidated Insurance (niche property and casualty insurance).

The specific detractors were difficult to pin down by sector. NYSE market maker firm LaBranche and CACI Corp were the most notable detractors. In technology, Keane (information technology), Cabot Microdevices (semiconductor polishing), and Power Integrated Devices (energy saving microchips) all had a negative impact on annual returns. Others included Simpson Manufacturing (building related), and Thor Industries (RVs).

Portfolio Activity

For the year, the Fund saw little major activity. We sold outright our long-term position in Park National Corp. While Park has produced outstanding operating results, it operates in no-to-declining growth markets in Ohio. The combination of low revenue growth and an inverted curve has made earnings growth a challenge. Also eliminated was another longtime holding, CACI Corp. This provider of information technology services, primarily to the U.S. government, has seen project funding dry up as the Iraq War has subsumed available resources. Earnings growth has gone from flat to down. Elsewhere, EGL Logistics is the object of a management/private equity buyout, and Keane is in the process of being acquired by Caritor.

Outlook

We have never been inclined to make directional market projections, but rather seek individual investments that we believe represent low risk and above-average potential reward—as identified by a set of financial statistics, strong beliefs, fundamental principles, and judgment. This approach has served our investors well. On that count, we seek to continue to find many new and exciting companies that should contribute to performance in the quarters and years ahead.

Douglas H. Pyle

Managing Director and

Senior Portfolio Manager

25

EXCELSIOR FUNDS, INC. SMALL CAP FUND | |

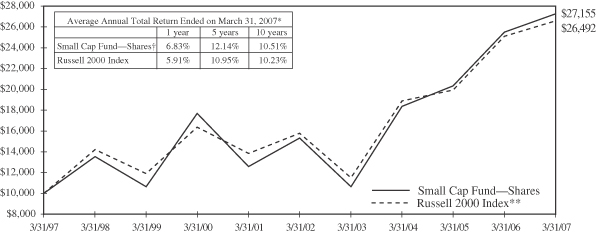

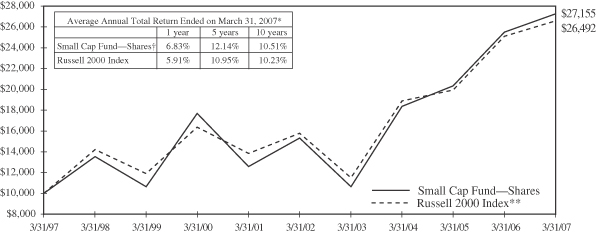

Past performance is not predictive of future performance. Investment returns and principal values will vary and shares may be worth more or less at redemption than their original cost. There is greater volatility associated with an investment in the Small Cap Market.

The above illustration compares a $10,000 investment made in the Fund and a broad-based index over the past ten fiscal years. The chart assumes all dividends and capital gain distributions are reinvested. The Fund’s performance takes into account fees and expenses. The index does not take into account charges, fees and other expenses. Further information relating to Fund performance is contained in the Financial Highlights section of the Prospectus and elsewhere in this report.

| | | |

| | |

Expense Ratio (As of 7/31/06) | | Shares | |

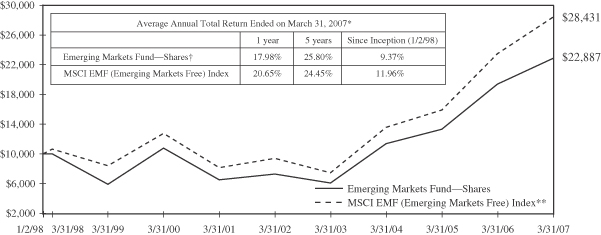

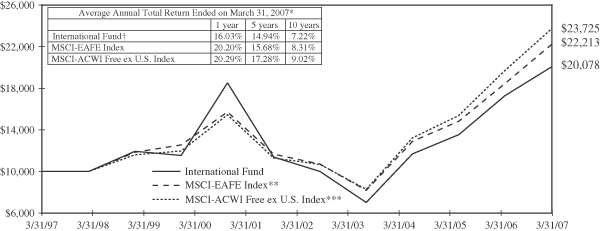

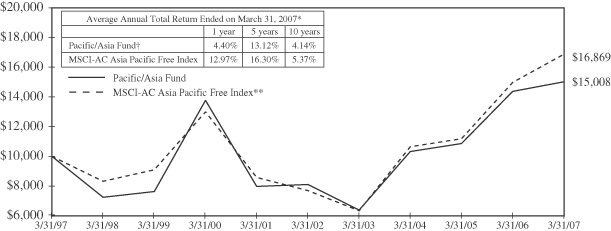

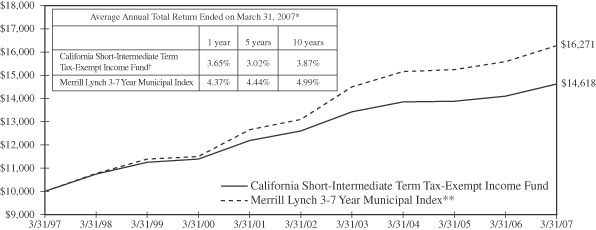

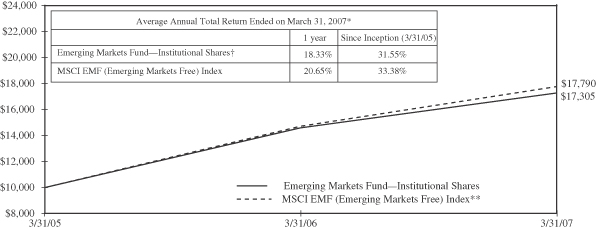

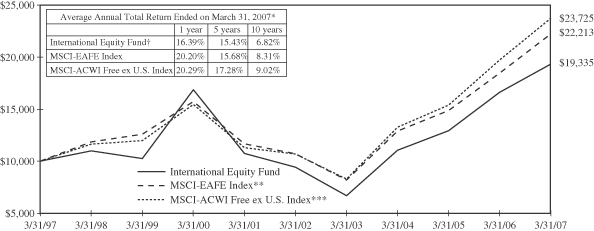

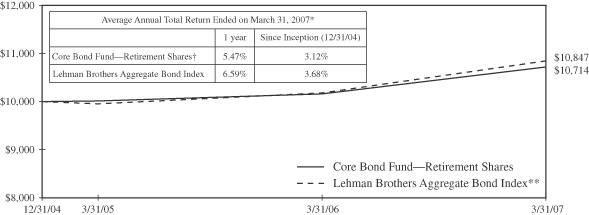

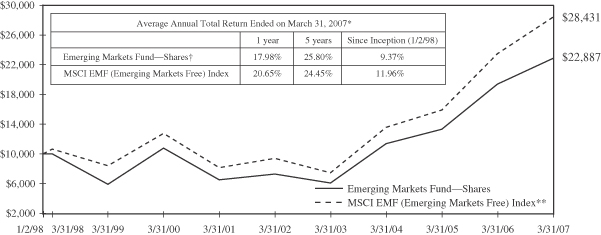

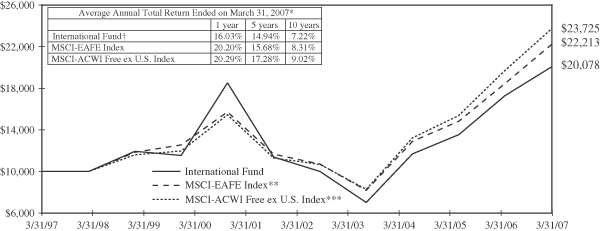

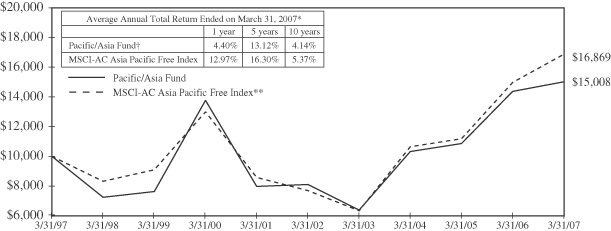

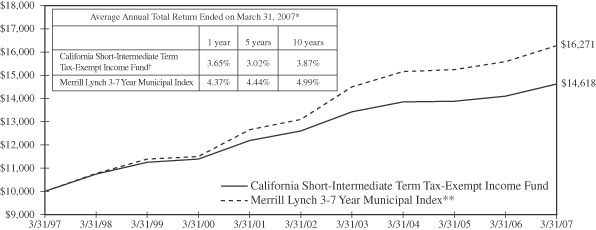

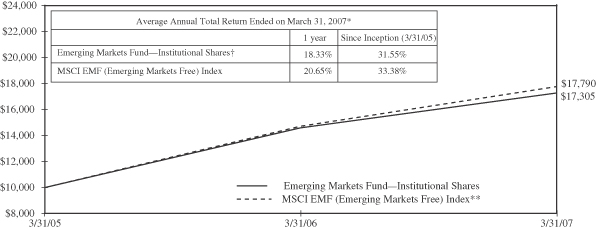

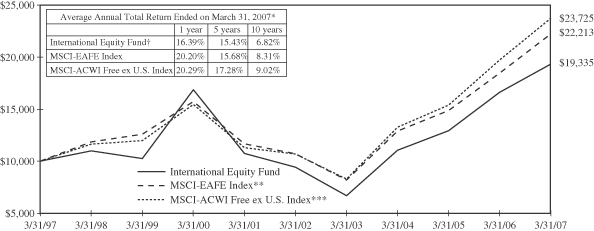

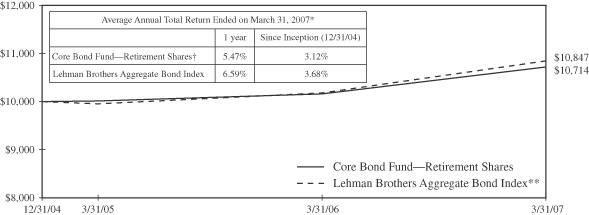

Gross Expense Ratio | | 1.21 | % |