UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-4103

Seligman High Income Fund Series

(Exact name of Registrant as specified in charter)

100 Park Avenue

New York, New York 10017

(Address of principal executive offices) (Zip code)

Lawrence P. Vogel

100 Park Avenue

New York, New York 10017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 850-1864

Date of fiscal year end: 12/31

Date of reporting period: 12/31/06

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Seligman

High-Yield Fund

Annual Report

December 31, 2006

Seeking a High Level of Current Income and the Potential for Capital Appreciation by Investing in a Diversified Portfolio of High-Yield Securities

J. & W. SELIGMAN & CO.

INCORPORATED

ESTABLISHED 1864

100 Park Avenue, New York, NY 10017

Experience

Seligman has been in business for more than 140 years, at times playing a central role in the financial development of the country and its markets. Over that time, the firm has managed clients’ wealth through dramatic market changes and has remained a consistent, reliable presence on Wall Street. Today, Seligman is drawing on its long history and long-term perspective as we focus on the future and on developing investment solutions that help clients arrive at their goals.

Insight

Asset management is driven by insight — into the direction of the economy, how companies will perform, how markets will behave, and how investors will respond. Portfolio managers at the firm have been in the investment business, on average, for more than 20 years. Over that time, they have refined their ability to assess a company’s prospects, management, and products, while also weighing the impact of economic and market cycles, new trends, and developing technologies.

Solutions

Seligman’s commitment to the development of innovative investment products — including the nation’s first growth mutual fund, pioneering single-state municipal funds, and one of the country’s premier technology funds — defines our past and informs our future. Our ongoing research into the nature of investment risk — begun in the early 1990s — has resulted in the Seligman Time Horizon Matrix® asset allocation strategy that redefines the relationship between risk and reward over time. The strategy offers investors a variety of investment solutions for goals ranging from college savings to retirement planning. Whether you select Seligman for one investment product, or as a comprehensive asset manager, we believe we can help you reach your goals.

Table of Contents

To The Shareholders

We are pleased to present your annual shareholder report for Seligman High-Yield Fund. The report contains an interview with your portfolio managers, investment results, a portfolio of investments, and the Fund’s financial statements.

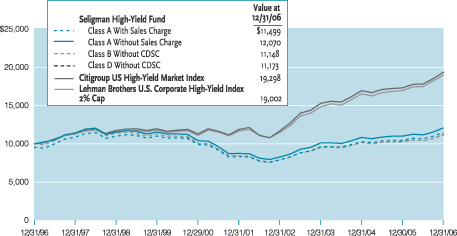

For the year ended December 31, 2006, Seligman High-Yield Fund delivered a total return of 9.7% based on the net asset value of Class A shares. For the same period, the Lipper High Current Yield Funds Average returned 10.1%, the Citigroup US High-Yield Market Index returned 11.8%, and the Lehman Brothers U.S. Corporate High-Yield Index 2% Cap returned 10.8%.

Thank you for your continued support of Seligman High-Yield Fund. We look forward to providing you with the investment experience, insight, and solutions you need to help you seek your financial goals for many years to come.

By order of the Board of Trustees,

| | |

| |  |

William C. Morris Chairman | | Brian T. Zino President |

February 26, 2007

| | | | |

| | |

Manager J. & W. Seligman & Co. Incorporated 100 Park Avenue New York, NY 10017 General Distributor Seligman Advisors, Inc. 100 Park Avenue New York, NY 10017 General Counsel Sullivan & Cromwell LLP | | Shareholder Service Agent Seligman Data Corp. 100 Park Avenue New York, NY 10017 Mail Inquiries To: P.O. Box 9759 Providence, RI 02940-9759 Independent Registered Public Accounting Firm Deloitte & ToucheLLP | | Important Telephone Numbers (800) 221-2450 Shareholder Services (800) 445-1777 Retirement Plan Services (212) 682-7600 Outside the United States (800) 622-4597 24-Hour Automated Telephone Access Service |

1

Interview With Your Portfolio Managers

J. Eric Misenheimer, Paul A. Langlois, and Henry P. Rose

| Q. | How did Seligman High-Yield Fund perform for the year ended December 31, 2006? |

| A. | For the year ended December 31, 2006, Seligman High-Yield Fund delivered a total return of 9.7% based on the net asset value of Class A shares. For the same period, the Lipper High Current Yield Funds Average returned 10.1%, the Citigroup US High-Yield Market Index returned 11.8%, and the Lehman Brothers U.S. Corporate High-Yield Index 2% Cap returned 10.8%. |

| Q. | What market conditions and events materially affected the Fund’s performance during 2006? |

| A. | The Federal Reserve Board continued its campaign of monetary tightening through the first half of 2006, with the fed funds rate increasing from 4.25% at the start of the year to 5.25% by the end of June. The 10-year US Treasury Bond yield rose and the fixed-income market responded to rising shorter-term rates as yields rose almost uniformly across the curve through the first half of the year. The lower quality, distressed end of the high-yield market outperformed as investors sought higher yields in a tight spread environment while the more interest-rate sensitive high-quality segment suffered as Treasury rates moved higher. Strong investor appetite led to a supply/demand imbalance, forcing investors into the secondary market and keeping spreads to Treasuries tight. Investors lost their appetite for risk in late May–June and riskier issues sold-off as skittishness over economic growth and inflation cooled the market. As underlying rates rose, the Treasury-sensitive, higher-quality portion of the market suffered. |

In a sign to investors that it was comfortable with the level of inflation and economic growth, the Fed halted its two-year tightening campaign at the August meeting of the Federal Open Market Committee. Relief from inflation worries, falling energy prices, and the Fed pause led to a rally in Treasuries. High-yield bonds benefited from a renewed appetite for risk and a quest for maximum yield in a low interest rate environment, outperforming investment-grade and government bonds by a wide margin. A rally in CCC-rated issues drove the high-yield market’s fourth quarter gains. Spreads to treasuries for lowest-grade high-yield debt tightened considerably as high-yield spreads to Treasuries approached near record tight levels.

| Q. | What investment strategies and techniques materially affected the Fund’s performance during the period? |

| A. | The three largest contributing areas to the Fund’s performance on both an absolute and relative basis for the year were Airlines, Autos, and Cable. It was a year characterized by risk and investors searching for yield, and we witnessed a tremendous spread rally in |

A TEAM APPROACH

Seligman High-Yield Fund is managed by the Seligman High-Yield Team, headed by J. Eric Misenheimer. Mr. Misenheimer is assisted by a group of seasoned professionals who are responsible for research and trading consistent with the Fund’s investment objective. Team members include Frances Cao, Michael Hunt (trader), Paul Langlois, and Henry Rose.

2

Interview With Your Portfolio Managers

J. Eric Misenheimer, Paul A. Langlois, and Henry P. Rose

these three industries. The largest spread rally occurred in the riskier CCC-rated sector, which included Airlines and Cable. Within Airlines, the Fund owned both the unsecured debt as well as the equity of Continental Airlines and American Airlines. This strategic play was rewarded as industry fundamentals improved with decreasing oil prices and increasing load factors. Cable benefited from investor appetite for lower quality, asset-rich businesses and leveraged buy-out speculation.

Similar to the prior year, Autos continues to be a significant variable to performance. Anticipating a continued rally in Autos, we began increasing our positions in GM and GMAC during the May-June sell-off. We were rewarded as an improved outlook for GM and increased confidence in a successful conclusion to GMAC’s sale to Cerberus drove the industry’s performance in the second half of the year.

Healthcare Facilities, the bottom performing industry in the benchmark for the year, made the largest negative contribution to the Fund’s performance, due primarily to the leveraged buy-out of HCA. The hospital company was taken private in a deal that layered new senior debt onto HCA’s outstanding debt, which pressured its existing bonds lower.

2006 was a year in which we made many tactical maneuvers. In addition to our strategic increase in the portfolio’s Auto weighting, we judiciously scaled back our energy exposure in anticipation of easing prices. We extended the portfolio’s risk profile in the difficult May-June cycle. Believing that the correction would be short-lived, we increased duration and added credit risk. Performance benefited as investors’ appetite for risk returned following the sell-off and the lower-quality names in the portfolio outperformed higher-quality issues.

The views and opinions expressed are those of the Portfolio Manager(s), are provided for general information only, and do not constitute specific tax, legal, or investment advice to, or recommendations for, any person. There can be no guarantee as to the accuracy of market forecasts. Opinions, estimates, and forecasts may be changed without notice.

3

Performance Overview

This section of the report is intended to help you understand the performance of Seligman High-Yield Fund and to provide a summary of the Fund’s portfolio characteristics.

Performance data quoted in this report represents past performance and does not guarantee or indicate future investment results. The rates of return will vary and the principal value of an investment will fluctuate. Shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Total returns of the Fund as of the most recent month-end will be available at www.seligman.com1 by the seventh business day following that month-end. Calculations assume reinvestment of distributions, if any. Performance data quoted does not reflect the deduction of taxes that an investor may pay on distributions or the redemption of shares.

Returns for Class A shares are calculated with and without the effect of the initial 4.75% maximum sales charge. Returns for Class B shares are calculated with and without the effect of the maximum 5% contingent deferred sales charge (“CDSC”), charged on redemptions made within one year of purchase, declining to 1% in the sixth year and 0% thereafter. The ten-year return for Class B shares reflects automatic conversion to Class A shares approximately eight years after date of purchase. Returns for Class C shares are calculated with and without the effect of the initial 1% maximum sales charge and the 1% CDSC that is charged on redemptions made within 18 months of purchase. Returns for Class D and Class R shares are calculated with and without the effect of the 1% CDSC, charged on redemptions made within one year of purchase. Class I shares have no sales charges, and returns are calculated accordingly.

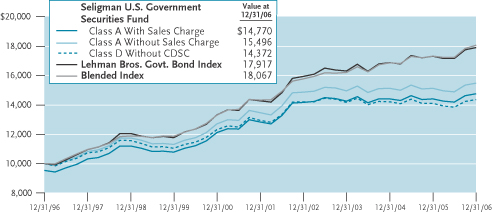

The chart on page 5 compares a $10,000 hypothetical investment made in Class A shares, with and without the initial 4.75% maximum sales charge; Class B shares, without the 5% CDSC and converted to Class A shares; and Class D shares, without the 1% CDSC, with $10,000 investments made in the Citigroup US High-Yield Market Index and the Lehman Brothers U.S. Corporate High-Yield Index 2% Cap for the 10-year period ended December 31, 2006. The performance of Class C, Class I and Class R shares, which commenced on later dates, and of Class A, Class B and Class D shares for other periods, with and without applicable sales charges and CDSCs, is not shown in this chart but is included in the total returns table. The performance of Class C, Class I, and Class R shares will differ from the performance shown for Class A, Class B and Class D shares, based on the differences in sales charges and fees paid by shareholders. The Citigroup US High-Yield Market Index and the Lehman Brothers U.S. Corporate High-Yield Index 2% Cap exclude the effect of taxes, fees and sales charges.

An investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

1 | The website reference is an inactive textual reference and information contained in or otherwise accessible through the website does not form a part of this report or the Fund’s prospectuses or statement of additional information. |

4

Performance Overview

Investment Results

Total Returns

For Periods Ended December 31, 2006

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual | |

| | | Six

Months* | | | One

Year | | | Five

Years | | | Ten

Years | | | Class C Since

Inception 5/27/99 | | | Class I Since

Inception 11/30/01 | | | Class R Since

Inception 4/30/03 | |

| Class A | | | | | | | | | | | | | | | | | | | | | |

| With Sales Charge | | 2.72 | % | | 4.38 | % | | 5.59 | % | | 1.41 | % | | n/a | | | n/a | | | n/a | |

| Without Sales Charge | | 7.78 | | | 9.74 | | | 6.60 | | | 1.90 | | | n/a | | | n/a | | | n/a | |

| Class B | | | | | | | | | | | | | | | | | | | | | |

| With CDSC† | | 2.06 | | | 3.62 | | | 5.45 | | | n/a | | | n/a | | | n/a | | | n/a | |

| Without CDSC | | 7.06 | | | 8.62 | | | 5.74 | | | 1.09 | ††† | | n/a | | | n/a | | | n/a | |

| Class C | | | | | | | | | | | | | | | | | | | | | |

| With Sales Charge and CDSC†† | | 5.40 | | | 6.63 | | | 5.57 | | | n/a | | | (0.49 | )% | | n/a | | | n/a | |

| Without Sales Charge and CDSC | | 7.37 | | | 8.60 | | | 5.79 | | | n/a | | | (0.36 | ) | | n/a | | | n/a | |

| Class D | | | | | | | | | | | | | | | | | | | | | |

| With 1% CDSC | | 6.37 | | | 7.60 | | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | |

| Without CDSC | | 7.37 | | | 8.60 | | | 5.79 | | | 1.12 | | | n/a | | | n/a | | | n/a | |

| Class I | | 8.02 | | | 10.23 | | | 7.03 | | | n/a | | | n/a | | | 6.68 | % | | n/a | |

| Class R | | | | | | | | | | | | | | | | | | | | | |

| With 1% CDSC | | 6.65 | | | 8.48 | | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | |

| Without CDSC | | 7.65 | | | 9.48 | | | n/a | | | n/a | | | n/a | | | n/a | | | 7.72 | % |

| Benchmarks** | | | | | | | | | | | | | | | |

| Citigroup US High-Yield Market Index | | 8.72 | | | 11.83 | | | 10.22 | | | 6.80 | | | 6.27 | # | | 9.90 | | | 10.25 | |

Lehman Brothers U.S. Corporate High Yield Index 2% Cap | | 8.02 | | | 10.76 | | | 10.20 | | | 6.63 | | | 6.51 | ## | | 9.94 | | | 10.26 | |

| Lipper High Current Yield Funds Average | | 7.42 | | | 10.08 | | | 8.83 | | | 5.32 | | | 5.13 | | | 8.63 | | | 9.49 | |

See footnotes on page 6.

5

Performance Overview

Investment Results

| | | | | | | | | | | | | | | | | | |

| Net Asset Value Per Share | | | | Dividend Per Share and Yield Information |

| | | 12/31/06 | | 6/30/06 | | 12/31/05 | | | | For Periods Ended December 31, 2006 |

| | | | | | | | | | | Dividendsø | | | | SEC 30-Day Yieldsøø |

| Class A | | $ | 3.39 | | $ | 3.25 | | $ | 3.31 | | | | $ | 0.2301 | | | | 5.36% |

| Class B | | | 3.39 | | | 3.26 | | | 3.32 | | | | | 0.2066 | | | | 4.69 |

| Class C | | | 3.40 | | | 3.26 | | | 3.33 | | | | | 0.2066 | | | | 4.80 |

| Class D | | | 3.40 | | | 3.26 | | | 3.33 | | | | | 0.2066 | | | | 4.85 |

| Class I | | | 3.39 | | | 3.25 | | | 3.31 | | | | | 0.2456 | | | | 6.11 |

| Class R | | | 3.39 | | | 3.25 | | | 3.31 | | | | | 0.2230 | | | | 5.49 |

| * | | Returns for periods of less than one year are not annualized. |

| ** | | The Citigroup US High-Yield Market Index (“Citigroup Index”), the Lehman Brothers U.S. Corporate High-Yield Index 2% Cap (“Lehman Index”) and the Lipper High Current Yield Funds Average (“Lipper Average”) are unmanaged benchmarks that assume reinvestment of all distributions and exclude the effect of taxes and sales charges, and the Citigroup Index also excludes the effect of fees. The Lipper Average is an average of funds that aim at high (relative) current yield from fixed income securities, have no quality or maturity restrictions, and tend to invest in lower-grade debt instruments. The Citigroup Index and the Lehman Index each cover the US corporate bond market of high-yield bonds denominated in US dollars, and are included for comparison with Fund performance. The Citigroup Index is not limited in the amount of exposure to a single issuer. Unlike the Citigroup Index, the Lehman Index is constrained from having greater than 2% of the securities of a single issuer. Although the Fund may hold greater than 2% of the securities of a single issuer, the Fund has no current intention of owning greater than 5% of the securities of a single issuer. Investors cannot invest directly in an average or an index. |

| ø | | Represents per share amount paid or declared for the year ended December 31, 2006. |

| øø | | Current yield, representing the annualized yield for the 30-day period ended December 31, 2006, has been computed in accordance with SEC regulations and will vary. |

| † | | The CDSC is 5% if you sell your shares within one year of purchase and 2% for the five-year period. |

| †† | | The CDSC is 1% if you sell your shares within 18 months of purchase. |

| ††† | | Ten-year return of Class B shares reflects automatic conversion to Class A shares approximately eight years after their date of purchase. |

6

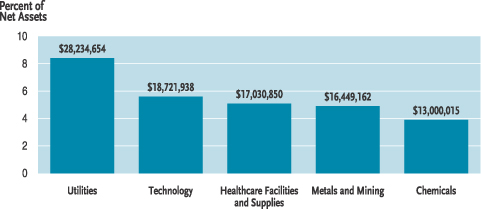

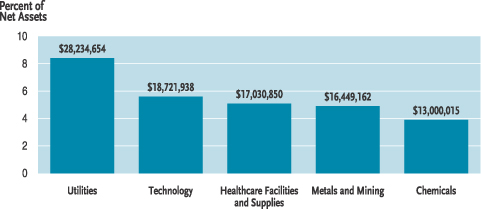

Portfolio Overview

Largest Industries

December 31, 2006

Largest Portfolio Changes

During Past Six Months

| | | | |

| | |

| Largest Purchases | | | | Largest Sales |

| General Motors Acceptance 8%, 11/1/2031 | | | | US Steel 10.75%, 8/1/2008** |

| General Motors 8.375%, 7/15/2033 | | | | Neenah Foundry 11%, 9/30/2010** |

| Williams Companies 6.375%, 10/1/2010* | | | | MGM Mirage 8.5%, 9/15/2010** |

| Georgia-Pacific 8.875%, 5/15/2031 | | | | Universal Hospital Services 10.125%, 11/1/2011** |

| West 11%, 10/15/2016* | | | | Intrawest 7.5%, 10/15/2013** |

| Continental Airlines 8.75%, 12/1/2011* | | | | Earle M. Jorgensen 9.75%, 6/1/2012** |

| FMG Finance 10%, 9/1/2013* | | | | Houghton Mifflin 9.875%, 2/1/2013** |

| Idearc 8%, 11/15/2016* | | | | Insight Midwest/Insight Capital 10.5%, 11/1/2010** |

| Jefferson Smurfit 8.25%, 10/1/2012 | | | | Crown Cork & Seal 7.375%, 12/15/2026** |

| Ford Motor 7.45%, 7/16/2031* | | | | BWAY 10%, 10/15/2010** |

Largest portfolio changes from the previous period to the current period are based on cost of purchases and proceeds from sales of securities, listed in descending order.

| * | Position added during the period. |

| ** | Position eliminated during the period. |

7

Portfolio Overview

Top Ten Companies†

December 31, 2006

| | | | | | |

| | | |

| Security | | Value | | Percent

of Net

Assets | |

| General Motors Acceptance | | $ | 9,383,918 | | 2.9 | % |

| El Paso | | | 7,866,983 | | 2.4 | |

| AES | | | 7,564,753 | | 2.3 | |

| General Motors | | | 6,882,000 | | 2.1 | |

| Charter Communications Holdings | | | 6,506,031 | | 2.0 | |

| Qwest | | | 6,452,803 | | 1.9 | |

| Edison Mission Energy | | | 5,746,000 | | 1.7 | |

| Dynegy Holdings | | | 5,558,000 | | 1.7 | |

| Echostar DBS | | | 4,871,750 | | 1.5 | |

| Xerox | | | 4,644,062 | | 1.4 | |

The amounts shown for the top ten companies represent the aggregate value of the Fund’s investments in securities issued by the companies or their affiliates.

There can be no assurance that the securities presented have remained or will remain in the Fund’s portfolio. Information regarding the Fund’s portfolio holdings should not be construed as a recommendation to buy or sell any security or as an indication that any security is suitable for a particular investor.

| | | | | | | | | |

| Ratings§ | | | | | | | Duration* | | 4.3 years |

| December 31, 2006 | | | | | | | December 31, 2006 |

| | | | |

| | | Moody’s | | | | | | | |

| Baa | | 1.6 | % | | | | | | |

| Ba | | 26.9 | | | | | | | |

| B | | 54.2 | | | | | | | |

| Caa | | 16.3 | | | | | | | |

| Nonrated | | 1.0 | | | | | | | |

| † | Excludes short-term holdings. |

| § | Credit ratings are those issued by Moody’s Investors Services, Inc. Percentages are based on the market values of long-term corporate bond holdings. |

| * | Duration is the average amount of time that it takes to receive the interest and principal of a bond or portfolio of bonds. The duration formula is based on a formula that calculates the weighted average of the cash flows (interest and principal payments) of the bond, discounted to present time. |

8

Understanding and Comparing Your Fund’s Expenses

As a shareholder of the Fund, you incur ongoing expenses, such as management fees, distribution and/or service (12b-1) fees (as applicable), and other Fund expenses. The information below is intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to compare them with the ongoing expenses of investing in other mutual funds. Please note that the expenses shown in the table are meant to highlight your ongoing expenses only and do not reflect any transactional costs, such as sales charges (also known as loads) on certain purchases or redemptions. Therefore, the table is useful in comparing ongoing expenses only, and will not help you to determine the relative total expenses of owning different funds. In addition, if transactional costs were included, your total expenses would have been higher.

The table is based on an investment of $1,000 invested at the beginning of July 1, 2006 and held for the entire six-month period ended December 31, 2006.

Actual Expenses

The table below provides information about actual expenses and actual account values. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value at the beginning of the period by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” for the Fund’s share class that you own to estimate the expenses that you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The table below also provides information about hypothetical expenses and hypothetical account values based on the actual expense ratio of each class and an assumed rate of return of 5% per year before expenses, which is not the actual return of any class of the Fund. The hypothetical expenses and account values may not be used to estimate the ending account value or the actual expenses you paid for the period. You may use this information to compare the ongoing expenses of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

| | | | | | | | | | | | | | | | | |

| | | | | | | Actual | | Hypothetical |

| | | Beginning

Account

Value

7/1/06 | | Annualized

Expense

Ratio* | | Ending

Account

Value

12/31/06 | | Expenses Paid

During Period**

7/1/06 to 12/31/06 | | Ending

Account

Value

12/31/06 | | Expenses Paid

During Period**

7/1/06 to 12/31/06 |

| Class A | | $ | 1,000.00 | | 1.36% | | $ | 1,077.80 | | $ | 7.11 | | $ | 1,018.36 | | $ | 6.90 |

| Class B | | | 1,000.00 | | 2.11 | | | 1,070.60 | | | 11.01 | | | 1,014.57 | | | 10.71 |

| Class C | | | 1,000.00 | | 2.11 | | | 1,073.70 | | | 11.01 | | | 1,014.58 | | | 10.70 |

| Class D | | | 1,000.00 | | 2.11 | | | 1,073.70 | | | 11.01 | | | 1,014.59 | | | 10.69 |

| Class I | | | 1,000.00 | | 0.72 | | | 1,080.20 | | | 3.80 | | | 1,021.56 | | | 3.69 |

| Class R | | | 1,000.00 | | 1.61 | | | 1,076.50 | | | 8.40 | | | 1,017.11 | | | 8.16 |

| * | | Expenses of Class B, Class C, Class D, Class I and Class R shares differ from the expenses of Class A shares due to the differences in 12b-1 fees and other class-specific expenses paid by each share class. See the Fund’s prospectuses for a description of each share class and its fees, expenses and sales charges. |

| ** | | Expenses are equal to the annualized expense ratio based on actual expenses for the period July 1, 2006 to December 31, 2006, multiplied by the average account value over the period, multiplied by 184/365 (number of days in the period). |

9

Portfolio of Investments

December 31, 2006

| | | | | | |

| | | Principal

Amount | | Value |

| Corporate Bonds 85.0% | | | | | | |

| | |

| Aerospace 2.4% | | | | | | |

| DRS Technologies: | | | | | | |

6.625%, 2/1/2016 | | $ | 1,450,000 | | $ | 1,468,125 |

7.625%, 2/1/2018 | | | 475,000 | | | 491,625 |

| K&F Acquisition 7.75%, 11/15/2014 | | | 1,550,000 | | | 1,604,250 |

| L3 Communications 5.875%, 1/15/2015 | | | 1,940,000 | | | 1,881,800 |

| Sequa 9%, 8/1/2009 | | | 2,250,000 | | | 2,418,750 |

| | | | | | | 7,864,550 |

| | |

| Airlines 1.3% | | | | | | |

| AMR 9%, 8/1/2012 | | | 2,000,000 | | | 2,117,500 |

| Continental Airlines 8.75%, 12/1/2011 | | | 2,000,000 | �� | | 2,025,000 |

| | | | | | | 4,142,500 |

| | |

| Automobiles 3.1% | | | | | | |

| Ford Motor 7.45%, 7/16/2031 | | | 2,000,000 | | | 1,580,000 |

| Ford Motor Credit 8.625%, 11/1/2010 | | | 925,000 | | | 952,922 |

| General Motors 8.375%, 7/15/2033 | | | 7,400,000 | | | 6,882,000 |

| Lear 8.75%, 12/1/2016* | | | 500,000 | | | 485,625 |

| Westinghouse Air Brake Technologies 6.875%, 7/31/2013 | | | 500,000 | | | 500,000 |

| | | | | | | 10,400,547 |

| | |

| Broadband 0.3% | | | | | | |

| Level 3 Communications 9.25%, 11/1/2014* | | | 1,000,000 | | | 1,025,000 |

| | |

| Building Products 0.6% | | | | | | |

| Ply Gem Industries 9%, 2/15/2012 | | | 1,000,000 | | | 855,000 |

| Texas Industries 7.25%, 7/15/2013 | | | 1,050,000 | | | 1,071,000 |

| | | | | | | 1,926,000 |

| | |

| Cable 2.9% | | | | | | |

| Charter Communications Holdings I 11%, 10/1/2015 | | | 1,900,000 | | | 1,959,375 |

| Charter Communications Holdings II 10.25%, 9/15/2010 | | | 4,325,000 | | | 4,546,656 |

| CSC Holdings 6.75%, 4/15/2012 | | | 1,000,000 | | | 980,000 |

| Liberty Media 8.5%, 7/15/2029 | | | 1,000,000 | | | 1,010,456 |

| Mediacom Broadband 8.5%, 10/15/2015* | | | 1,000,000 | | | 1,017,500 |

| | | | | | | 9,513,987 |

| | |

| Capital Goods 1.9% | | | | | | |

| Norcross Safety Products 9.875%, 8/15/2011 | | | 3,100,000 | | | 3,317,000 |

| Park Ohio Industries 8.375%, 11/15/2014 | | | 3,300,000 | | | 3,093,750 |

| | | | | | | 6,410,750 |

See footnotes on page 19.

10

Portfolio of Investments

December 31, 2006

| | | | | | |

| | | Principal

Amount | | Value |

| Chemicals 3.9% | | | | | | |

| Huntsman International: | | | | | | |

7.875%, 11/15/2014* | | $ | 1,000,000 | | $ | 1,012,500 |

7.375%, 1/1/2015* | | | 925,000 | | | 922,688 |

| Ineos Group Holdings 8.5%, 2/15/2016* | | | 500,000 | | | 480,000 |

| KI Holdings 0% (9.875%†), 11/15/2014 | | | 2,700,000 | | | 2,173,500 |

| Lyondell Chemical: | | | | | | |

8%, 9/15/2014 | | | 1,000,000 | | | 1,042,500 |

8.25%, 9/15/2016 | | | 800,000 | | | 844,000 |

| Momentive Performance 11.5%, 12/1/2016* | | | 1,000,000 | | | 985,000 |

| Mosaic 7.625%, 12/1/2016* | | | 950,000 | | | 989,187 |

| Nova Chemicals 8.502%, 11/15/2013# | | | 1,000,000 | | | 1,005,000 |

| Terra Capital 11.50%, 6/1/2010 | | | 3,283,000 | | | 3,545,640 |

| | | | | | | 13,000,015 |

| | |

| Consumer Products 2.0% | | | | | | |

| ACCO Brands 7.625%, 8/15/2015 | | | 2,400,000 | | | 2,370,000 |

| American Achievement Group 12.75%, 10/1/2012 | | | 1,038,604 | | | 1,111,306 |

| Jostens 0% (10.25%†), 12/1/2013 | | | 3,525,000 | | | 3,128,437 |

| | | | | | | 6,609,743 |

| | |

| Containers 2.3% | | | | | | |

| AEP Industries 7.875%, 3/15/2013 | | | 1,375,000 | | | 1,395,625 |

| Ball 6.625%, 3/15/2018 | | | 1,450,000 | | | 1,446,375 |

| Berry Plastics: | | | | | | |

8.875%, 9/15/2014* | | | 800,000 | | | 816,000 |

9.235%, 9/15/2014*# | | | 500,000 | | | 508,750 |

| Crown Cork & Seal 8%, 4/15/2023 | | | 975,000 | | | 955,500 |

| Owens-Brockway Glass Container 8.25%, 5/15/2013 | | | 1,900,000 | | | 1,973,625 |

| Silgan Holdings 6.75%, 11/15/2013 | | | 500,000 | | | 492,500 |

| | | | | | | 7,588,375 |

| | |

| Diversified Telecommunication 3.3% | | | | | | |

| Citizens Communications: | | | | | | |

9.25%, 5/15/2011 | | | 1,185,000 | | | 1,316,831 |

9%, 8/15/2031 | | | 1,000,000 | | | 1,090,000 |

| Nordic 8.875%, 5/1/2016* | | | 1,500,000 | | | 1,612,500 |

| Qwest: | | | | | | |

7.5%, 10/1/2014 | | | 2,450,000 | | | 2,609,250 |

6.875%, 9/15/2033 | | | 500,000 | | | 480,000 |

| Qwest Capital Funding: | | | | | | |

7.25%, 2/15/2011 | | | 1,000,000 | | | 1,026,250 |

7.75%, 2/15/2031 | | | 1,000,000 | | | 986,258 |

| Qwest Communications International 8.874%, 2/15/2009# | | | 1,000,000 | | | 1,017,500 |

| Syniverse Technologies 7.75%, 8/15/2013 | | | 950,000 | | | 952,375 |

| | | | | | | 11,090,964 |

See footnotes on page 19.

11

Portfolio of Investments

December 31, 2006

| | | | | | |

| | | Principal

Amount | | Value |

| Electric 3.1% | | | | | | |

Aquila 14.875%, 7/1/2012 | | $ | 1,800,000 | | $ | 2,358,000 |

CMS Energy 7.5%, 1/15/2009 | | | 2,700,000 | | | 2,797,875 |

MSW Energy Holdings 8.5%, 9/1/2010 | | | 2,475,000 | | | 2,586,375 |

Sierra Pacific Resources 8.625%, 3/15/2014 | | | 609,000 | | | 656,903 |

| TXU 5.55%, 11/15/2014 | | | 2,000,000 | | | 1,908,682 |

| | | | | | | 10,307,835 |

| | |

| Energy 3.5% | | | | | | |

Atlas Pipeline Partners 8.125%, 12/15/2015 | | | 950,000 | | | 980,875 |

Complete Production Services 8%, 12/15/2016* | | | 500,000 | | | 515,000 |

El Paso: | | | | | | |

7.875%, 6/15/2012 | | | 4,000,000 | | | 4,310,000 |

6.95%, 6/1/2028 | | | 3,150,000 | | | 3,150,000 |

Opti Canada 8.25%, 12/15/2014* | | | 250,000 | | | 258,125 |

| Williams Companies 6.375%, 10/1/2010* | | | 2,500,000 | | | 2,528,125 |

| | | | | | | 11,742,125 |

| | |

| Environmental 0.9% | | | | | | |

Allied Waste North America 8.5%, 12/1/2008 | | | 2,400,000 | | | 2,535,000 |

| Browning-Ferris Industries 7.4%, 9/15/2035 | | | 500,000 | | | 470,000 |

| | | | | | | 3,005,000 |

| | |

| Finance 3.7% | | | | | | |

E*TRADE Financial 7.375%, 9/15/2013 | | | 1,425,000 | | | 1,489,125 |

General Motors Acceptance 8%, 11/1/2031 | | | 8,150,000 | | | 9,383,918 |

SGS International 12%, 12/15/2013 | | | 950,000 | | | 992,750 |

| Ventas Realty 6.75%, 6/1/2010 | | | 500,000 | | | 517,500 |

| | | | | | | 12,383,293 |

| | |

| Food Products 1.7% | | | | | | |

Dean Foods 7%, 6/1/2016 | | | 1,000,000 | | | 1,015,000 |

Del Monte 6.75%, 2/15/2015 | | | 675,000 | | | 671,625 |

Reddy Ice Holdings 0% (10.5%†), 11/1/2012 | | | 3,800,000 | | | 3,439,000 |

| Smithfield Foods 7%, 8/1/2011 | | | 500,000 | | | 507,500 |

| | | | | | | 5,633,125 |

| | |

| Food and Staples Retailing 0.8% | | | | | | |

Delhaize America 8.125%, 4/15/2011 | | | 1,940,000 | | | 2,102,487 |

| Stater Brothers Holdings 8.125%, 6/15/2012 | | | 500,000 | | | 510,000 |

| | | | | | | 2,612,487 |

See footnotes on page 19.

12

Portfolio of Investments

December 31, 2006

| | | | | | |

| | | Principal

Amount | | Value |

| Gaming 1.9% | | | | | | |

Inn Of The Mountain Gods 12%, 11/15/2010 | | $ | 1,175,000 | | $ | 1,274,875 |

Mandalay Resort Group 9.375%, 2/15/2010 | | | 2,750,000 | | | 2,956,250 |

San Pasqual Casino 8%, 9/15/2013* | | | 950,000 | | | 980,875 |

| Station Casinos 6.875%, 3/1/2016 | | | 1,350,000 | | | 1,218,375 |

| | | | | | | 6,430,375 |

| | |

| Healthcare Facilities and Supplies 5.1% | | | | | | |

Coventry Health Care 8.125%, 2/15/2012 | | | 3,850,000 | | | 4,013,625 |

DaVita 7.25%, 3/15/2015 | | | 1,500,000 | | | 1,537,500 |

Fresenius Medical Care Capital Trust 7.875%, 6/15/2011 | | | 1,940,000 | | | 2,041,850 |

HCA: | | | | | | |

9.125%, 11/15/2014* | | | 500,000 | | | 535,625 |

6.5%, 2/15/2016 | | | 1,900,000 | | | 1,610,250 |

9.25%, 11/15/2016* | | | 500,000 | | | 536,875 |

7.5%, 11/6/2033 | | | 1,900,000 | | | 1,558,000 |

HealthSouth: | | | | | | |

11.354%, 6/15/2014*# | | | 1,000,000 | | | 1,070,000 |

10.75%, 6/15/2016* | | | 2,000,000 | | | 2,162,500 |

| Omega Healthcare Investors 7%, 1/15/2016 | | | 1,950,000 | | | 1,964,625 |

| | | | | | | 17,030,850 |

| | |

| Home Builders 0.9% | | | | | | |

K. Hovnanian Enterprises 6.5%, 1/15/2014 | | | 500,000 | | | 487,500 |

KB Home: | | | | | | |

7.75%, 2/1/2010 | | | 500,000 | | | 511,250 |

6.25%, 6/15/2015 | | | 500,000 | | | 469,571 |

Standard Pacific 9.25%, 4/15/2012 | | | 500,000 | | | 513,750 |

| WCI Communities 9.125%, 5/1/2012 | | | 1,000,000 | | | 957,500 |

| | | | | | | 2,939,571 |

| | |

| Household Products 0.6% | | | | | | |

| Central Garden and Pet 9.125%, 2/1/2013 | | | 1,825,000 | | | 1,907,125 |

| | |

| Leisure 1.5% | | | | | | |

AMC Entertainment 9.875%, 2/1/2012 | | | 475,000 | | | 501,125 |

HRP Myrtle Beach Operations 10.12%, 4/1/2012*# | | | 1,000,000 | | | 1,005,000 |

Town Sports International 9.625%, 4/15/2011 | | | 2,293,000 | | | 2,433,446 |

| Universal City Florida Holding 10.121%, 5/1/2010# | | | 1,000,000 | | | 1,037,500 |

| | | | | | | 4,977,071 |

| | |

| Lodging 2.1% | | | | | | |

Felcor Lodging 8.5%, 6/1/2011# | | | 2,625,000 | | | 2,808,750 |

Hilton Hotels 7.625%, 12/1/2012 | | | 1,940,000 | | | 2,066,100 |

| Host Marriott 6.75%, 6/1/2016 | | | 1,925,000 | | | 1,937,031 |

| | | | | | | 6,811,881 |

See footnotes on page 19.

13

Portfolio of Investments

December 31, 2006

| | | | | | |

| | | Principal

Amount | | Value |

| | |

| Metals and Mining 4.4% | | | | | | |

Aleris International 10%, 12/15/2016* | | $ | 1,000,000 | | $ | 1,007,500 |

FMG Finance 10%, 9/1/2013* | | | 2,000,000 | | | 2,065,000 |

Gerdau Ameristeel 10.375%, 7/15/2011 | | | 1,750,000 | | | 1,885,625 |

Massey Energy 6.875%, 12/15/2013 | | | 500,000 | | | 472,500 |

Novelis 7.25%, 2/15/2015* | | | 2,200,000 | | | 2,139,500 |

Peabody Energy 6.875%, 3/15/2013 | | | 500,000 | | | 515,000 |

PNA Group 10.75%, 9/1/2016* | | | 1,000,000 | | | 1,038,750 |

Ryerson Tull 8.25%, 12/15/2011 | | | 2,000,000 | | | 1,995,000 |

| UCAR Finance 10.25%, 2/15/2012 | | | 3,475,000 | | | 3,679,156 |

| | | | | | | 14,798,031 |

| | |

| Multiline Retail 0.2% | | | | | | |

| Stripes Acquisition 10.625%, 12/15/2013* | | | 670,000 | | | 730,300 |

| | |

| Oil, Gas and Consumable Fuels 1.2% | | | | | | |

Chesapeake Energy: | | | | | | |

7.625%, 7/15/2013 | | | 2,000,000 | | | 2,117,500 |

6.5%, 8/15/2017 | | | 925,000 | | | 908,813 |

| Petrohawk Energy 9.125%, 7/15/2013 | | | 1,000,000 | | | 1,055,000 |

| | | | | | | 4,081,313 |

| | |

| Paper and Forest Products 3.3% | | | | | | |

Abitibi-Consolidated: | | | | | | |

8.86%, 6/15/2011# | | | 2,000,000 | | | 1,910,000 |

8.375%, 4/1/2015 | | | 500,000 | | | 435,000 |

Bowater 6.5%, 6/15/2013 | | | 1,250,000 | | | 1,146,875 |

Domtar 7.875%,10/15/2011 | | | 950,000 | | | 990,375 |

Georgia-Pacific 8.875%, 5/15/2031 | | | 3,000,000 | | | 3,187,500 |

Jefferson Smurfit 8.25%, 10/1/2012 | | | 2,400,000 | | | 2,352,000 |

| Verso Paper Holdings 11.375%, 8/1/2016* | | | 1,000,000 | | | 1,055,000 |

| | | | | | | 11,076,750 |

| | |

| Publishing 2.4% | | | | | | |

Dex Media 0% (9%†), 11/15/2013 | | | 3,225,000 | | | 2,894,438 |

Idearc 8%, 11/15/2016* | | | 2,000,000 | | | 2,040,000 |

| R.H. Donnelley 8.875%, 1/15/2016 | | | 2,975,000 | | | 3,138,625 |

| | | | | | | 8,073,063 |

| | |

| Satellite 2.1% | | | | | | |

Echostar DBS: | | | | | | |

7%, 10/1/2013 | | | 2,000,000 | | | 2,007,500 |

7.125%, 2/1/2016 | | | 2,850,000 | | | 2,864,250 |

Sirius Satellite Radio 9.625%, 8/1/2013 | | | 1,500,000 | | | 1,483,125 |

| XM Satellite Radio 9.871%, 5/1/2013# | | | 800,000 | | | 782,000 |

| | | | | | | 7,136,875 |

See footnotes on page 19.

14

Portfolio of Investments

December 31, 2006

| | | | | | |

| | | Principal

Amount | | Value |

| | |

| Services 3.5% | | | | | | |

Ashtead 9%, 8/15/2016* | | $ | 1,000,000 | | $ | 1,075,000 |

Hertz 8.875%, 1/1/2014* | | | 1,900,000 | | | 1,999,750 |

Mobile Mini 9.50%, 7/1/2013 | | | 812,000 | | | 870,870 |

Rental Service 9.5%, 12/1/2014* | | | 1,000,000 | | | 1,037,500 |

Service Corporation 7%, 6/15/2017 | | | 3,450,000 | | | 3,510,375 |

West 11%, 10/15/2016* | | | 2,000,000 | | | 2,030,000 |

| Williams Scotsman 8.5%, 10/1/2015 | | | 950,000 | | | 996,312 |

| | | | | | | 11,519,807 |

| | |

| Stores 1.2% | | | | | | |

Asbury Automotive Group 9%, 6/15/2012 | | | 1,775,000 | | | 1,863,750 |

Michaels Stores 11.375%, 11/1/2016* | | | 1,000,000 | | | 1,047,500 |

| Neiman Marcus 9%, 10/15/2015 | | | 950,000 | | | 1,041,438 |

| | | | | | | 3,952,688 |

| | |

| Technology 5.6% | | | | | | |

Freescale Semiconductor: | | | | | | |

8.875%, 12/15/2014* | | | 1,450,000 | | | 1,451,812 |

10.125%, 12/15/2016* | | | 950,000 | | | 955,938 |

IKON Office Solutions 7.75%, 9/15/2015 | | | 2,850,000 | | | 2,999,625 |

Nortel Networks: | | | | | | |

9.624%, 7/15/2011*# | | | 1,000,000 | | | 1,058,750 |

10.75%, 7/15/2016* | | | 1,000,000 | | | 1,098,750 |

Serena Software 10.375%, 3/15/2016 | | | 950,000 | | | 1,012,938 |

STATS ChipPac 7.5%, 7/19/2010 | | | 2,700,000 | | | 2,733,750 |

SunGard Data Systems 9.125%, 8/15/2013 | | | 1,500,000 | | | 1,582,500 |

Viasystems 10.5%, 1/15/2011 | | | 1,175,000 | | | 1,183,813 |

Xerox: | | | | | | |

9.75%, 1/15/2009 | | | 2,625,000 | | | 2,848,125 |

6.4%, 3/15/2016 | | | 1,750,000 | | | 1,795,937 |

| | | | | | | 18,721,938 |

| | |

| Textile, Apparel and Shoes 0.6% | | | | | | |

| Quiksilver 6.875%, 4/15/2015 | | | 2,125,000 | | | 2,098,437 |

| | |

| Tobacco 0.6% | | | | | | |

| Reynolds American 7.625%, 6/1/2016 | | | 2,000,000 | | | 2,129,068 |

See footnotes on page 19.

15

Portfolio of Investments

December 31, 2006

| | | | | | | |

| | | Principal

Amount or

Shares | | | Value |

| | |

| Utilities 7.8% | | | | | | | |

AES 9.375%, 9/15/2010 | | $ | 6,400,000 | | | $ | 6,984,000 |

Allegheny Energy Supply 7.8%, 3/15/2011 | | | 2,000,000 | | | | 2,155,000 |

Dynegy Holdings: | | | | | | | |

8.375%, 5/1/2016 | | | 3,325,000 | | | | 3,507,875 |

8.75%, 2/15/2012 | | | 1,925,000 | | | | 2,050,125 |

Edison Mission Energy 7.73%, 6/15/2009 | | | 5,525,000 | | | | 5,746,000 |

NRG Energy 7.375%, 2/1/2016 | | | 1,900,000 | | | | 1,914,250 |

| Reliant Energy 9.5%, 7/15/2013 | | | 3,525,000 | | | | 3,798,188 |

| | | | | | | | 26,155,438 |

| | |

| Wireless Telecommunication Services 2.3% | | | | | | | |

Dobson Communications 9.624%, 10/15/2012# | | | 1,000,000 | | | | 1,025,000 |

MetroPCS Wireless 9.25%, 11/1/2014* | | | 1,000,000 | | | | 1,050,000 |

Rogers Wireless 7.25%, 12/15/2012 | | | 1,940,000 | | | | 2,066,100 |

| Rural Cellular 9.75%, 1/15/2010 | | | 3,325,000 | | | | 3,433,063 |

| | | | | | | | 7,574,163 |

| | |

| Total Corporate Bonds (Cost $275,237,749) | | | | | | | 283,401,040 |

| Common Stocks 9.1% | | | | | | | |

| | |

| Aerospace 0.4% | | | | | | | |

BE Aerospace** | | | 35,950 | shs. | | | 923,196 |

| Hexcel** | | | 25,420 | | | | 442,562 |

| | | | | | | | 1,365,758 |

| | |

| Airlines 0.5% | | | | | | | |

AMR** | | | 27,150 | | | | 820,744 |

| Continental Airlines** | | | 20,000 | | | | 825,000 |

| | | | | | | | 1,645,744 |

| | |

| Automobiles 0.3% | | | | | | | |

Honda Motor (ADR) | | | 12,365 | | | | 488,912 |

| Toyota Motor (ADR) | | | 3,260 | | | | 437,851 |

| | | | | | | | 926,763 |

| | |

| Communications Equipment 0.2% | | | | | | | |

| Corning** | | | 32,190 | | | | 602,275 |

| | |

| Computers and Peripherals 0.5% | | | | | | | |

Apple Computer** | | | 8,550 | | | | 725,382 |

| Seagate Technology** | | | 33,005 | | | | 874,633 |

| | | | | | | | 1,600,015 |

See footnotes on page 19.

16

Portfolio of Investments

December 31, 2006

| | | | | |

| | | Shares | | Value |

| | |

| Containers and Packaging 0.6% | | | | | |

Ball | | 11,400 | | $ | 497,040 |

Crown Holdings** | | 24,285 | | | 508,042 |

Owens-Illinois** | | 17,800 | | | 328,410 |

Silgan Holdings | | 11,700 | | | 513,864 |

| Smurfit-Stone Container** | | 28,100 | | | 296,736 |

| | | | | | 2,144,092 |

| | |

| Diversified Telecommunication 0.2% | | | | | |

Citizens Communications | | 25,530 | | | 366,866 |

| Qwest Communications** | | 39,850 | | | 333,545 |

| | | | | | 700,411 |

| | |

| Electronic Equipment and Instruments 0.0% | | | | | |

| Flextronics International** | | 11,700 | | | 134,316 |

| | |

| Energy 0.2% | | | | | |

El Paso | | 26,635 | | | 406,983 |

| Hanover Compressor** | | 13,485 | | | 254,732 |

| | | | | | 661,715 |

| | |

| Finance 0.3% | | | | | |

| E*TRADE Financial** | | 44,010 | | | 986,704 |

| | |

| Food Products 0.2% | | | | | |

| Pilgrim’s Pride | | 22,750 | | | 669,532 |

| | |

| Health Care Providers and Services 0.2% | | | | | |

DaVita** | | 7,000 | | | 398,160 |

| Genesis Healthcare** | | 7,000 | | | 330,610 |

| | | | | | 728,770 |

| | |

| Hotels, Restaurants and Leisure 0.5% | | | | | |

Boyd Gaming | | 11,704 | | | 530,308 |

Domino’s Pizza | | 24,500 | | | 686,000 |

Isle of Capri Casinos** | | 9,710 | | | 258,092 |

| Pinnacle Entertainment** | | 6,025 | | | 199,669 |

| | | | | | 1,674,069 |

| | |

| Household Durables 0.2% | | | | | |

D.R. Horton | | 6,400 | | | 169,536 |

Lennar | | 3,200 | | | 167,872 |

Standard Pacific | | 6,300 | | | 168,777 |

| Toll Brothers** | | 6,800 | | | 219,164 |

| | | | | | 725,349 |

See footnotes on page 19.

17

Portfolio of Investments

December 31, 2006

| | | | | |

| | | Shares | | Value |

| | |

| Index Derivatives 2.2% | | | | | |

iShares Russell 2000 Index Fund | | 46,985 | | $ | 3,667,179 |

| SPDR Trust (Series 1) | | 26,225 | | | 3,715,820 |

| | | | | | 7,382,999 |

| | |

| Machinery 0.0% | | | �� | | |

| Actuant (Class A) | | 2,519 | | | 120,030 |

| | |

| Metals and Mining 0.5% | | | | | |

Alcan | | 10,702 | | | 521,615 |

Century Aluminum** | | 6,700 | | | 299,155 |

Companhia Vale do Rio Doce “CVRD” (ADR) | | 12,120 | | | 360,449 |

Freeport-McMoRan Copper & Gold (Class B) | | 7,372 | | | 410,842 |

| Reliance Steel and Aluminum | | 1,500 | | | 59,070 |

| | | | | | 1,651,131 |

| | |

| Oil, Gas and Consumable Fuels 0.6% | | | | | |

Chesapeake Energy | | 20,375 | | | 591,894 |

Overseas Shipholding Group | | 5,280 | | | 297,264 |

Peabody Energy | | 9,300 | | | 375,813 |

Valero Energy | | 7,300 | | | 373,468 |

| Williams Companies | | 14,000 | | | 365,680 |

| | | | | | 2,004,119 |

| | |

| Paper and Forest Products 0.1% | | | | | |

| Domtar** | | 36,190 | | | 305,444 |

| | |

| Road and Rail 0.2% | | | | | |

| Burlington Northern Santa Fe | | 9,310 | | | 687,171 |

| | |

| Semiconductors and Semiconductor Equipment 0.1% | | | | | |

| Applied Materials | | 9,500 | | | 175,275 |

| | |

| Services 0.2% | | | | | |

Corrections Corporation of America** | | 6,142 | | | 277,803 |

| Mobile Mini** | | 12,750 | | | 343,485 |

| | | | | | 621,288 |

| | |

| Tobacco 0.1% | | | | | |

| Reynolds American | | 6,430 | | | 420,972 |

| | |

| Trading Companies and Distributors 0.1% | | | | | |

| Williams Scotsman International** | | 17,875 | | | 350,708 |

See footnotes on page 19.

18

Portfolio of Investments

December 31, 2006

| | | | | | | |

| | | Shares or

Principal

Amount | | | Value |

| Utilities 0.6% | | | | | | | |

| AES** | | | 26,350 | shs. | | $ | 580,753 |

| Allegheny Energy** | | | 8,175 | | | | 375,314 |

| Reliant Energy** | | | 26,000 | | | | 369,460 |

| Sierra Pacific Resources** | | | 24,000 | | | | 403,920 |

| TECO Energy | | | 20,300 | | | | 349,769 |

| | | | | | | | 2,079,216 |

| | |

| Wireless Telecommunication Services 0.1% | | | | | | | |

| Dobson Communications** | | | 8,490 | | | | 73,948 |

| Rural Cellular (Class A)** | | | 8,395 | | | | 110,310 |

| | | | | | | | 184,258 |

| | |

| Total Common Stocks (Cost $29,078,154) | | | | | | | 30,548,124 |

| | |

| Short-Term Investments 3.2% | | | | | | | |

| | |

| Equity-Linked Note 0.3% | | | | | | | |

| Morgan Stanley 8.08%, 5/1/2007*†† | | $ | 999,994 | | | | 1,044,014 |

| | |

| Time Deposit 2.9% | | | | | | | |

| BNP Paribas, Grand Cayman, 5.15%, 1/3/2007 | | | 9,646,000 | | | | 9,646,000 |

| | |

| Total Short-Term Investments (Cost $10,645,994) | | | | | | | 10,690,014 |

| | |

| Total Investments (Cost $314,961,897) 97.3% | | | | | | | 324,639,178 |

| | |

| Other Assets Less Liabilities 2.7% | | | | | | | 8,907,460 |

| | |

| Net Assets 100.0% | | | | | | $ | 333,546,638 |

| * | | The security may be offered and sold only to “qualified institutional buyers” under Rule 144A of the Securities Act of 1933. |

| ** | | Non-income producing security. |

| # | | Floating rate security, the interest rate is reset periodically. The interest rate disclosed reflects the rate in effect at December 31, 2006. |

| † | | Deferred-interest debentures accrue no interest for a stipulated number of years, after which they pay the indicated coupon rate. |

| †† | | This note is exchangeable at maturity for the value of the common stock of Yahoo! (Internet Software and Services). |

| | | The maturity value of the stock is limited to 120% of the stock’s price at the date of purchase of the note. |

ADR – American Depositary Receipts.

See Notes to Financial Statements.

19

Statement of Assets and Liabilities

December 31, 2006

| | | | |

| Assets: | | | | |

| Investments, at value: | | | | |

Corporate bonds (cost $275,237,749) | | $ | 283,401,040 | |

Common stocks (cost $29,078,154) | | | 30,548,124 | |

Short-term holdings (cost $10,645,994) | | | 10,690,014 | |

| Total investments (cost $314,961,897) | | | 324,639,178 | |

| Cash (includes restricted cash of $4,000) | | | 4,534,528 | |

Dividends and interest receivable | | | 5,925,331 | |

| Receivable for shares of Beneficial Interest sold | | | 3,490,302 | |

| Receivable for securities sold | | | 3,331,949 | |

| Expenses prepaid to shareholder service agent | | | 35,002 | |

| Other | | | 18,864 | |

| Total Assets: | | | 341,975,154 | |

| |

| Liabilities: | | | | |

| Payable for shares of Beneficial Interest repurchased | | | 6,400,629 | |

| Payable for securities purchased | | | 826,449 | |

| Dividends payable | | | 750,670 | |

| Management fee payable | | | 187,311 | |

| Distribution and service (12b-1) fees payable | | | 165,873 | |

| Accrued expenses and other | | | 97,584 | |

| Total Liabilities | | | 8,428,516 | |

| Net Assets | | $ | 333,546,638 | |

| |

| Composition of Net Assets: | | | | |

Shares of Beneficial Interest, at par (unlimited shares authorized;

$0.001 par value; 98,366,802 shares outstanding): | | | | |

Class A | | $ | 54,041 | |

Class B | | | 16,709 | |

Class C | | | 7,868 | |

Class D | | | 17,285 | |

Class I | | | 2,031 | |

Class R | | | 433 | |

| Additional paid-in capital | | | 1,772,813,460 | |

Dividends in excess of net investment income (Note 6) | | | (204,231 | ) |

| Accumulated net realized loss (Note 6) | | | (1,448,838,239 | ) |

| Net unrealized appreciation of investments | | | 9,677,281 | |

| Net Assets | | $ | 333,546,638 | |

| |

| Net Asset Value Per Share: | | | | |

| Class A ($183,042,185 ÷ 54,040,616) | | | $3.39 | |

| Class B ($56,664,038 ÷ 16,708,464) | | | $3.39 | |

| Class C ($26,741,820 ÷ 7,867,939) | | | $3.40 | |

| Class D ($58,751,908 ÷ 17,285,410) | | | $3.40 | |

| Class I ($6,879,061 ÷ 2,031,362) | | | $3.39 | |

| Class R ($1,467,626 ÷ 433,011) | | | $3.39 | |

See Notes to Financial Statements.

20

Statement of Operations

For the Year Ended December 31, 2006

| | | |

| Investment Income: | | | |

| Interest | | $ | 27,894,338 |

| Dividends | | | 332,908 |

| Other income | | | 1,054,823 |

| Total Investment Income | | | 29,282,069 |

| |

| Expenses: | | | |

| Management fee | | | 2,443,687 |

| Distribution and service (12b-1) fees | | | 2,302,977 |

| Shareholder account services | | | 1,239,384 |

| Registration | | | 116,915 |

| Custody and related services | | | 106,924 |

| Auditing and legal fees | | | 84,552 |

| Shareholder reports and communications | | | 61,281 |

| Trustees’ fees and expenses | | | 14,129 |

| Miscellaneous | | | 37,648 |

| Total Expenses | | | 6,407,497 |

| Net Investment Income | | | 22,874,572 |

| |

| Net Realized And Unrealized Gain on Investments: | | | |

| Net realized gain on investments | | | 5,367,908 |

| Net change in unrealized appreciation of investments | | | 3,831,562 |

| Net Gain on Investments | | | 9,199,470 |

| Increase in Net Assets from Operations | | $ | 32,074,042 |

See Notes to Financial Statements.

21

Statements of Changes In Net Assets

| | | | | | | | |

| | | Year Ended December 31, | |

| | | 2006 | | | 2005 | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 22,874,572 | | | $ | 33,464,369 | |

| Net realized gain on investments | | | 5,367,908 | | | | 9,647,552 | |

| Net change in unrealized appreciation of investments | | | 3,831,562 | | | | (37,514,981 | ) |

| Increase in Net Assets from Operations | | | 32,074,042 | | | | 5,596,940 | |

| | |

| Distributions To Shareholders: | | | | | | | | |

| Dividends from net investment income: | | | | | | | | |

Class A | | | (11,689,382 | ) | | | (14,248,891 | ) |

Class B | | | (5,115,297 | ) | | | (10,757,724 | ) |

Class C | | | (1,770,851 | ) | | | (2,534,363 | ) |

Class D | | | (3,700,331 | ) | | | (5,379,057 | ) |

Class I | | | (531,659 | ) | | | (497,488 | ) |

Class R | | | (67,052 | ) | | | (46,846 | ) |

| Total | | | (22,874,572 | ) | | | (33,464,369 | ) |

| Dividends in excess of net investment income: | | | | | | | | |

Class A | | | (1,006,930 | ) | | | (779,599 | ) |

Class B | | | (440,635 | ) | | | (588,587 | ) |

Class C | | | (152,543 | ) | | | (138,662 | ) |

Class D | | | (318,748 | ) | | | (294,304 | ) |

Class I | | | (45,797 | ) | | | (27,219 | ) |

Class R | | | (5,776 | ) | | | (2,563 | ) |

| Total | | | (1,970,429 | ) | | | (1,830,934 | ) |

| Decrease in Net Assets from Distributions | | | (24,845,001 | ) | | | (35,295,303 | ) |

| | |

| Transactions in Shares of Beneficial Interest: | | | | | | | | |

| Net proceeds from sales of shares | | | 19,127,082 | | | | 25,576,955 | |

| Investment of dividends | | | 13,270,708 | | | | 18,426,740 | |

| Exchanged from associated funds | | | 9,205,665 | | | | 22,483,216 | |

| Total | | | 41,603,455 | | | | 66,486,911 | |

| Cost of shares repurchased | | | (123,031,462 | ) | | | (184,941,660 | ) |

| Exchanged into associated funds | | | (13,397,308 | ) | | | (37,117,937 | ) |

| Total | | | (136,428,770 | ) | | | (222,059,597 | ) |

| Decrease in Net Assets from Transactions in Shares of Beneficial Interest | | | (94,825,315 | ) | | | (155,572,686 | ) |

| Decrease in Net Assets | | | (87,596,274 | ) | | | (185,271,049 | ) |

| | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 421,142,912 | | | | 606,413,961 | |

End of Year (including undistributed (dividends in excess of) net investment income of $(223,827) and $84,989, respectively) | | $ | 333,546,638 | | | $ | 421,142,912 | |

See Notes to Financial Statements.

22

Notes to Financial Statements

| 1. | Multiple Classes of Shares — Seligman High-Yield Fund (the “Fund”) is a series of Seligman High Income Fund Series (the “Series”). The Fund offers the following six classes of shares: |

Class A shares are sold with an initial sales charge of up to 4.75% and a continuing service fee of up to 0.25% on an annual basis. Class A shares purchased in an amount of $1,000,000 or more are sold without an initial sales charge but are subject to a contingent deferred sales charge (“CDSC”) of 1% on redemptions within 18 months of purchase. Eligible employee benefit plans that have at least $500,000 invested in the Seligman Group of mutual funds or 50 eligible employees may purchase Class A shares at net asset value, but in the event of a plan termination, will be subject to a CDSC of 1% on redemption of shares purchased within 18 months prior to plan termination.

Class B shares are sold without an initial sales charge but are subject to a distribution fee of 0.75% and a service fee of up to 0.25% on an annual basis, and a CDSC, if applicable, of 5% on redemptions in the first year of purchase, declining to 1% in the sixth year and 0% thereafter. Class B shares will automatically convert to Class A shares approximately eight years after their date of purchase. If Class B shares of the Fund are exchanged for Class B shares of another Seligman mutual fund, the holding period of the shares exchanged will be added to the holding period of the shares acquired, both for determining the applicable CDSC and the conversion of Class B shares to Class A shares.

Class C shares are sold primarily with an initial sales charge of up to 1%, and a CDSC, if applicable, of 1% imposed on redemptions made within 18 months of purchase. Shares purchased through certain financial intermediaries may be bought without an initial sales charge and with a 1% CDSC on redemptions made within 12 months of purchase. All Class C shares are subject to a distribution fee of up to 0.75% and a service fee of up to 0.25% on an annual basis.

Class D shares are sold without an initial sales charge but are subject to a distribution fee of up to 0.75% and a service fee of up to 0.25% on an annual basis, and a CDSC, if applicable, of 1% imposed on redemptions made within one year of purchase.

Class I shares are offered to certain institutional clients and other investors, as described in the Fund’s Class I shares prospectus. Class I shares are sold without any sales charges and are not subject to distribution or service fees.

Class R shares are offered to certain employee benefit plans and are not available to all investors. They are sold without an initial sales charge, but are subject to a distribution fee of up to 0.25% and a service fee of up to 0.25% on an annual basis, and a CDSC, if applicable, of 1% on redemptions made within one year of a plan’s initial purchase of Class R shares.

All classes of shares represent interests in the same portfolio of investments, have the same rights and are generally identical in all respects except that each class bears its own class-specific expenses, and has exclusive voting rights with respect to any matter on which a separate vote of any class is required.

| 2. | Significant Accounting Policies — The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America which require management to make certain estimates and assumptions at the date of the financial statements. Actual results may differ from these estimates. The following summarizes the significant accounting policies of the Fund: |

| | a. | Security Valuation — Securities traded on an exchange are valued at the last sales price on the primary exchange or market on which they are traded. Fixed income securities not listed on an exchange or security market are valued by independent pricing services based on bid prices, which consider such factors as coupons, maturities, credit ratings, liquidity, specific terms and features, and the US Treasury yield curve, or are valued by J. & W. Seligman & Co. Incorporated (the “Manager”) based on quotations provided by primary market makers in such securities. Equity securities not listed on an exchange or security market, or equity securities for which there is no last sales price, are valued at the mean of the most recent bid and asked prices or valued by the Manager based on quotations provided by primary market makers in such securities. Securities for which market quotations are not readily available (or are |

23

Notes to Financial Statements

| | otherwise no longer valid or reliable) are valued at fair value determined in accordance with procedures approved by the Trustees. This can occur in the event of, among other things, natural disasters, acts of terrorism, market disruptions, intra-day trading halts, and extreme market volatility in the US markets. The determination of fair value involves subjective judgments. As a result, using fair value to price a security may result in a price materially different from the prices used by other mutual funds to determine net asset value or the price that may be realized upon the actual sale of the security. Short-term holdings that mature in more than 60 days are valued at current market quotations. Short-term holdings maturing in 60 days or less are valued at amortized cost. |

| | b. | Federal Taxes — There is no provision for federal income tax. The Fund has elected to be taxed as a regulated investment company and intends to distribute substantially all taxable net income and net gain realized. |

| | c. | Security Transactions and Related Investment Income — Investment transactions are recorded on trade dates. Identified cost of investments sold is used for both financial reporting and federal income tax purposes. Dividends receivable are recorded on ex-dividend dates. Interest income is recorded on an accrual basis. The Fund amortizes discount and premium on portfolio securities for financial reporting purposes. |

| | d. | Repurchase Agreements — The Fund may enter into repurchase agreements. Generally, securities received as collateral subject to repurchase agreements are deposited with the Fund’s custodian and, pursuant to the terms of the repurchase agreement, must have an aggregate market value greater than or equal to the repurchase price, plus accrued interest, at all times. On a daily basis, the market value of securities held as collateral for repurchase agreements is monitored to ensure the existence of the proper level of collateral. |

| | e. | Multiple Class Allocations — All income, expenses (other than class-specific expenses), and realized and unrealized gains or losses are allocated daily to each class of shares based upon the relative value of shares of each class. Class-specific expenses, which include distribution and service (12b-1) fees and any other items that are specifically attributable to a particular class, are charged directly to such class. For the year ended December 31, 2006, distribution and service (12b-1) fees, shareholder account services and registration expenses were class-specific expenses. |

| | f. | Distributions to Shareholders — Dividends are declared daily and paid monthly. Other distributions paid by the Fund are recorded on ex-dividend dates. |

| | g. | Restricted Cash — Restricted cash represents deposits that are being held by banks as collateral for letters of credit issued in connection with the Fund’s insurance policies. |

| | h. | Equity-Linked Notes — The Fund may purchase notes created by a counterparty, typically an investment bank. The notes bear interest at a fixed or floating rate. At maturity, the notes must be exchanged for an amount based on the value of one or more equity securities (“Index Stocks”) of third party issuers. The exchange value may be limited to an amount less than the actual value of the Index Stocks at the maturity date. Any difference between the exchange amount and the original cost of the notes will be a gain or loss. |

| 3. | Management Fee, Distribution Services, and Other Transactions — The Manager manages the affairs of the Fund and provides the necessary personnel and facilities. Compensation of all officers of the Fund, all trustees of the Series who are employees of the Manager, and all personnel of the Fund and the Manager is paid by the Manager. The Manager receives a fee, calculated daily and payable monthly, equal to 0.65% per annum of the first $1 billion of the Fund’s average daily net assets and 0.55% per annum of the Fund’s average daily net assets in excess of $1 billion. The management fee reflected in the Statement of Operations represents 0.65% per annum of the Fund’s average daily net assets. |

For the year ended December 31, 2006, Seligman Advisors, Inc. (the “Distributor”), agent for the distribution of the Fund’s shares and an affiliate of the Manager, received commissions and concessions of $9,144 from sales of Class A and Class C shares. Commissions of $47,729 and $5,819 were also paid to dealers for sales of Class A and Class C shares, respectively.

24

Notes to Financial Statements

The Fund has an Administration, Shareholder Services and Distribution Plan (the “Plan”) with respect to distribution of its shares. Under the Plan, with respect to Class A shares, service organizations can enter into agreements with the Distributor and receive a continuing fee of up to 0.25% on an annual basis, payable monthly, of the average daily net assets of the Class A shares attributable to the particular service organizations for providing personal services and/or the maintenance of shareholder accounts. The Distributor charges such fees to the Fund pursuant to the Plan. For the year ended December 31, 2006, fees incurred under the Plan aggregated $456,192 or 0.25% per annum of the average daily net assets of Class A shares.

Under the Plan, with respect to Class B shares, Class C shares, Class D shares, and Class R shares, service organizations can enter into agreements with the Distributor and receive a continuing fee for providing personal services and/or the maintenance of shareholder accounts of up to 0.25% on an annual basis of the average daily net assets of the Class B, Class C, Class D, and Class R shares for which the organizations are responsible; and, for Class C, Class D, and Class R shares, fees for providing other distribution assistance of up to 0.75% (0.25%, in the case of Class R shares) on an annual basis of such average daily net assets. Such fees are paid monthly by the Fund to the Distributor pursuant to the Plan.

For the year ended December 31, 2006, fees incurred under the Plan, equivalent to 1% per annum of the average daily net assets of Class B, Class C, and Class D shares, and 0.50% per annum of average daily net assets of Class R shares, amounted to $887,935, $308,973, $644,414, and $5,463, respectively.

The Distributor and Seligman Services, Inc., also an affiliate of the Manager, are eligible to receive distribution and service (12b-1) fees pursuant to the Plan. For the year ended December 31, 2006, the Distributor and Seligman Services, Inc. received distribution and service (12b-1) fees of $20,471.

The Distributor is entitled to retain any CDSC imposed on certain redemptions of Class A , Class C, Class D and Class R shares. For the year ended December 31, 2006, such charges amounted to $8,806. The Distributor has sold its rights to third parties to collect any CDSC imposed on redemptions of Class B shares.

For the year ended December 31, 2006, Seligman Data Corp., which is owned by certain associated investment companies, charged the Fund at cost $1,239,384 for shareholder account services in accordance with a methodology approved by the Fund’s trustees. Class I shares receive more limited shareholder services than the Fund’s other classes of shares (the “Retail Classes”). Seligman Data Corp. does not allocate to Class I the costs of any of its departments that do not provide services to the Class I shareholders.

Costs of Seligman Data Corp. directly attributable to the Retail Classes of the Fund were charged to those classes in proportion to their respective net asset values. Costs directly attributable to Class I shares were charged to Class I. The remaining charges were allocated to the Retail Classes and Class I by Seligman Data Corp. pursuant to a formula based on their net assets, shareholder transaction volumes and number of shareholder accounts.

The Series and certain other associated investment companies (together, the “Guarantors”) have severally but not jointly guaranteed the performance and observance of all the terms and conditions of two leases entered into by Seligman Data Corp., including the payment of rent by Seligman Data Corp. (the “Guaranties”). The leases and the related Guaranties expire in September 2008 and January 2009. The obligation of the Series to pay any amount due under the Guaranties is limited to a specified percentage of the full amount, which generally is based on the Series’ percentage of the expenses billed by Seligman Data Corp. to all Guarantors in the most recent calendar quarter. As of December 31, 2006, the Series’ potential obligation under the Guaranties is $112,300. As of December 31, 2006, no event has occurred which would result in the Series becoming liable to make any payment under the Guaranties. The Fund would bear a portion of any payments made by the Series under the Guaranties. A portion of the rent paid by Seligman Data Corp. is charged to the Fund as part of Seligman Data Corp.’s shareholder account services cost.

Certain officers and trustees of the Series are officers or directors of the Manager, the Distributor, Seligman Services, Inc., and/or Seligman Data Corp.

The Series has a compensation arrangement under which trustees who receive fees may elect to defer receiving such fees. Trustees may elect to have their deferred fees accrue interest or earn a return based on

25

Notes to Financial Statements

the performance of the Fund or other funds in the Seligman Group of Investment Companies. Deferred fees and related accrued earnings are not deductible by the Fund for federal income tax purposes until such amounts are paid. The accumulated balance at December 31, 2005 of $24,507 was paid to the participating trustee in January 2006. As of December 31, 2006, no trustees were participating in the deferred compensation arrangement.

| 4. | Committed Line of Credit — The Fund is a participant in a joint $400 million committed line of credit that is shared by substantially all open-end funds in the Seligman Group of Investment Companies. The trustees have currently limited the Fund’s borrowings to 10% of its net assets. Borrowings pursuant to the credit facility are subject to interest at a rate equal to the overnight federal funds rate plus 0.50%. The Fund incurs a commitment fee of 0.10% per annum on its share of the unused portion of the credit facility. The credit facility may be drawn upon only for temporary purposes and is subject to certain other customary restrictions. The credit facility commitment expires in June 2007, but is renewable annually with the consent of the participating banks. For the year ended December 31, 2006, the Fund did not borrow from the credit facility. |

| 5. | Purchases and Sales of Securities — Purchases and sales of portfolio securities, excluding short-term investments, for the year ended December 31, 2006, amounted to $422,516,488 and $497,864,556, respectively. |

| 6. | Federal Tax Information — Certain components of income, expense and realized capital gain and loss are recognized at different times or have a different character for federal income tax purposes and for financial reporting purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value per share of the Fund. As a result of the differences described above, the treatment for financial reporting purposes of distributions made during the year from net investment income or net realized gains may differ from their treatment for federal income tax purposes. Further, the cost of investments also can differ for federal income tax purposes. |

At December 31, 2006, the cost of investments for federal income tax purposes was $315,759,769. The tax basis cost was greater than the cost for financial reporting purposes due to the tax deferral of losses on wash sales in the amount of $94,168 and the amortization of premium for financial reporting purposes of $703,704.

At December 31, 2006, the tax basis components of accumulated losses were as follows:

| | |

| Gross unrealized appreciation of portfolio securities | | $10,657,237 |

| Gross unrealized depreciation of portfolio securities | | (1,777,828) |

| Net unrealized appreciation of portfolio securities | | 8,879,409 |

| Undistributed ordinary income | | 479,878 |

| Capital loss carryforwards | | (1,448,746,474) |

| Total accumulated losses | | $(1,439,387,187) |

At December 31, 2006, the Fund had net capital loss carryforwards for federal income tax purposes of $1,448,746,474, which are available for offset against future taxable net capital gains, with $78,635,967 expiring in 2007, $255,659,981 expiring in 2008, $668,622,539 expiring in 2009, $444,283,739 expiring in 2010, and $1,544,248 expiring in 2012. The amount was determined after adjustments for certain differences between financial reporting and tax purposes, such as wash sale losses. Accordingly, no capital gain distributions are expected to be paid to shareholders until net capital gains have been realized in excess of the available capital loss carryforwards. There can be no assurance that the Fund will be able to utilize all of these capital loss carryforwards before they expire.

From November 1, 2005 through December 31, 2005, the Fund incurred $3,104,451 of net realized capital losses. These losses were deferred for federal income tax purposes and deemed as incurred in the fiscal year ended December 31, 2006. During the year ended December 31, 2006, the Fund utilized $413,676 of prior years’ capital loss carryforwards.

26

Notes to Financial Statements

For the years ended December 31, 2006 and 2005, all of the distributions to shareholders were from ordinary income.

| 7. | Transactions in Shares of Beneficial Interest — The Fund has authorized unlimited shares of $0.001 par value Shares of Beneficial Interest. Transactions in Shares of Beneficial Interest were as follows: |

| | | | | | | | |

| | | Year Ended December 31, |

| | | 2006 | | 2005 |

| Class A | | Shares | | Amount | | Shares | | Amount |

| Net proceeds from sales of shares | | 2,908,239 | | $9,662,478 | | 5,153,980 | | $17,463,985 |

| Investment of dividends | | 1,960,526 | | 6,488,284 | | 2,287,576 | | 7,765,791 |

| Exchanged from associated funds | | 1,285,834 | | 4,238,336 | | 4,420,651 | | 14,857,283 |

| Converted from Class B* | | 11,062,126 | | 36,659,286 | | 11,037,080 | | 37,511,622 |

| Total | | 17,216,725 | | 57,048,384 | | 22,899,287 | | 77,598,681 |

| Cost of shares repurchased | | (16,984,499) | | (56,221,784) | | (22,939,945) | | (77,879,047) |

| Exchanged into associated funds | | (2,422,750) | | (7,992,346) | | (7,239,469) | | (24,670,382) |

| Total | | (19,407,249) | | (64,214,130) | | (30,179,414) | | (102,549,429) |

| Decrease | | (2,190,524) | | $(7,165,746) | | (7,280,127) | | $(24,950,748) |

| Class B | | Shares | | Amount | | Shares | | Amount |

| Net proceeds from sales of shares | | 269,156 | | $891,124 | | 376,852 | | $1,285,893 |

| Investment of dividends | | 750,904 | | 2,487,189 | | 1,520,848 | | 5,180,643 |

| Exchanged from associated funds | | 586,193 | | 1,929,107 | | 1,167,107 | | 3,997,570 |

| Total | | 1,606,253 | | 5,307,420 | | 3,064,807 | | 10,464,106 |

| Cost of shares repurchased | | (9,757,814) | | (32,399,540) | | (17,840,995) | | (60,865,088) |

| Exchanged into associated funds | | (878,870) | | (2,927,765) | | (2,351,869) | | (8,045,185) |

| Converted to Class A* | | (11,026,267) | | (36,600,603) | | (11,000,238) | | (37,450,772) |

| Total | | (21,662,951) | | (71,927,908) | | (31,193,102) | | (106,361,045) |

| Decrease | | (20,056,698) | | $(66,620,488) | | (28,128,295) | | $ (95,896,939) |

| Class C | | Shares | | Amount | | Shares | | Amount |

| Net proceeds from sales of shares | | 649,658 | | $2,157,609 | | 594,687 | | $2,039,878 |

| Investment of dividends | | 320,982 | | 1,065,596 | | 433,332 | | 1,477,242 |

| Exchanged from associated funds | | 193,389 | | 637,996 | | 612,817 | | 2,072,364 |

| Total | | 1,164,029 | | 3,861,201 | | 1,640,836 | | 5,589,484 |

| Cost of shares repurchased | | (3,157,046) | | (10,519,029) | | (4,403,553) | | (14,998,995) |

| Exchanged into associated funds | | (313,103) | | (1,040,730) | | (694,254) | | (2,356,021) |

| Total | | (3,470,149) | | (11,559,759) | | (5,097,807) | | (17,355,016) |

| Decrease | | (2,306,120) | | $(7,698,558) | | (3,456,971) | | $(11,765,532) |

See footnote on page 28.

27

Notes to Financial Statements

| | | | | | | | | | |

| | | Year Ended December 31, |

| | | 2006 | | 2005 |

| Class D | | Shares | | Amount | | Shares | | Amount |

| Net proceeds from sales of shares | | 1,166,374 | | $ | 3,874,379 | | 854,043 | | $ | 2,918,070 |

| Investment of dividends | | 781,158 | | | 2,593,432 | | 1,007,293 | | | 3,432,128 |

| Exchanged from associated funds | | 726,552 | | | 2,398,442 | | 450,756 | | | 1,555,980 |

| Total | | 2,674,084 | | | 8,866,253 | | 2,312,092 | | | 7,906,178 |

| Cost of shares repurchased | | (6,294,756) | | | (20,937,851) | | (8,797,255) | | | (30,007,302) |

| Exchanged into associated funds | | (432,391) | | | (1,434,587) | | (604,234) | | | (2,046,254) |

| Total | | (6,727,147) | | | (22,372,438) | | (9,401,489) | | | (32,053,556) |

| Decrease | | (4,053,063) | | $ | (13,506,185) | | (7,089,397) | | $ | (24,147,378) |

| Class I | | Shares | | Amount | | Shares | | Amount |

| Net proceeds from sales of shares | | 485,525 | | $ | 1,611,054 | | 378,823 | | $ | 1,280,944 |

| Investment of dividends | | 170,905 | | | 565,105 | | 153,917 | | | 521,617 |

| Total | | 656,430 | | | 2,176,159 | | 532,740 | | | 1,802,561 |

| Cost of shares repurchased | | (827,485) | | | (2,758,631) | | (182,310) | | | (622,301) |

| Increase (decrease) | | (171,055) | | $ | (582,472) | | 350,430 | | $ | 1,180,260 |

| Class R | | Shares | | Amount | | Shares | | Amount |

| Net proceeds from sales of shares | | 262,814 | | $ | 871,755 | | 155,523 | | $ | 527,335 |

| Investment of dividends | | 21,468 | | | 71,102 | | 14,545 | | | 49,319 |

| Exchanged from associated funds | | 534 | | | 1,784 | | 5 | | | 19 |

Total | | 284,816 | | | 944,641 | | — | | | — |

| Cost of shares repurchased | | (59,083) | | | (194,627) | | (167,444) | | | (568,927) |

| Exchanged into associated funds | | (571) | | | (1,880) | | (27) | | | (95) |

| Total | | (59,654) | | | (196,507) | | (167,471) | | | (569,022) |

| Increase | | 225,162 | | $ | 748,134 | | 2,602 | | $ | 7,651 |