UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO _______ TO ______

Commission File Number: 000-13580

SUFFOLK BANCORP

(Exact name of registrant as specified in its charter)

New York | | 11-2708279 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

4 West Second Street, P.O. Box 9000, Riverhead, NY | | 11901 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (631) 208-2400

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

Common Stock, par value $2.50 per share | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | Accelerated filer x | Non-accelerated filer ¨ | Smaller reporting company ¨ |

Indicate by check mark whether the Registrant is a shell company. YES ¨ NO x

The aggregate market value of the common equity held by non-affiliates of the Registrant as of the last business day of the Registrant’s most recently completed second fiscal quarter was $184 million.

As of February 20, 2014, there were 11,573,014 shares of Registrant’s Common Stock outstanding.

Annual Report on Form 10-K

For the Year Ended December 31, 2013

Table of Contents

| | Page |

| | |

| | 3 |

| | |

| PART I | |

| | |

| Item 1. | | 3 |

| | |

| Item 1A. | | 7 |

| | |

| Item 1B. | | 10 |

| | |

| Item 2. | | 11 |

| | |

| Item 3. | | 11 |

| | |

| Item 4. | | 11 |

| | |

| PART II | |

| | |

| Item 5. | | 11 |

| | |

| Item 6. | | 13 |

| | |

| Item 7. | | 14 |

| | |

| Item 7A. | | 29 |

| | |

| Item 8. | | 32 |

| | |

| Item 9. | | 71 |

| | |

| Item 9A. | | 71 |

| | |

| PART III | |

| | |

| Item 10. | | 74 |

| | |

| Item 11. | | 74 |

| | |

| Item 12. | | 74 |

| | |

| Item 13. | | 74 |

| | |

| Item 14. | | 74 |

| | |

| PART IV | |

| | |

| Item 15. | | 75 |

| | |

| | 76 |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement to be used in connection with the Annual Meeting of Stockholders and which is expected to be filed with the Securities and Exchange Commission (“SEC”) within 120 days from December 31, 2013 are incorporated by reference into Part III.

PART I

Suffolk Bancorp (the “Company”) was incorporated in 1985 as a bank holding company. The Company currently owns all of the outstanding capital stock of the Suffolk County National Bank of Riverhead (the “Bank”). The Bank was organized under the national banking laws of the United States in 1890. The Bank is a member of the Federal Reserve System and its deposits are insured by the Federal Deposit Insurance Corporation (“FDIC”) to the extent provided by law. In 1994, the Company acquired all the outstanding capital stock of Hamptons Bancshares, Inc. and merged it into a subsidiary. The income of the Company is primarily derived through the operations of the Bank and its subsidiaries, consisting of the real estate investment trust (“REIT”) Suffolk Greenway, Inc., an insurance agency and two corporations used to acquire foreclosed real estate. The insurance agency and the two corporations used to acquire foreclosed real estate are immaterial to the Company’s operations. The Company had 350 full-time equivalent employees as of December 31, 2013.

The Bank is a full-service bank serving the needs of its local residents through 25 branches, exclusive of four branches scheduled to be closed in the first quarter of 2014, in Nassau and Suffolk Counties, New York and loan production offices in Garden City and Melville, New York. The Bank offers a full line of domestic commercial and retail banking services and wealth management services. The Bank’s primary lending area includes all of Suffolk County and the adjacent markets of Nassau County and New York City. The Bank makes commercial real estate floating and fixed rate loans, commercial and industrial loans to manufacturers, wholesalers, distributors, developers/contractors and retailers and agricultural loans. The Bank also makes loans secured by residential mortgages, and both fixed and floating rate second mortgage loans with a variety of plans for repayment. Real estate construction loans are also offered.

At December 31, 2013, the Company, on a consolidated basis, had total assets of approximately $1.7 billion, total deposits of approximately $1.5 billion and stockholders’ equity of approximately $167 million.

Unless the context otherwise requires, references herein to the Company include the Company and the Bank on a consolidated basis.

Business Segment Reporting

The Bank is a community bank, which offers a wide array of products and services to its customers. Pursuant to its banking strategy, emphasis is placed on building relationships with its customers, as opposed to building specific lines of business. As a result, the Company is not organized around discernible lines of business and prefers to work as an integrated unit to customize solutions for its customers, with business line emphasis and product offerings changing over time as needs and demands change.

Available Information

The Company files Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements on Schedule 14A, and any amendments to those reports, with the United States Securities and Exchange Commission (“SEC”). The public may read and copy any of these materials at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330 (1-800-732-0330). The SEC also maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers, including the Company, that file electronically with the SEC. The Company also makes these reports available free of charge through its Internet website (http://www.suffolkbancorp.com) as soon as practicably possible after the Company files these reports electronically with the SEC. Information on the Company’s website is not incorporated by reference into this Form 10-K.

Supervision and Regulation

References in this section to applicable statutes and regulations are brief summaries only and do not purport to be complete. It is suggested that the reader review such statutes and regulations in their entirety for a full understanding.

As a consequence of the extensive regulation of commercial banking activities in the United States, the business of the Company and the Bank is particularly susceptible to federal and state legislation that may affect the cost of doing business, modifying permissible activities or enhancing the competitive position of other financial institutions.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) signed into law in 2011 makes extensive changes to the laws regulating financial services firms. The Dodd-Frank Act also requires significant rulemaking and mandates multiple studies which could result in additional legislative or regulatory action. Under the Dodd-Frank Act federal banking regulatory agencies are required to draft and implement enhanced supervision, examination and capital standards for depository institutions and their holding companies. The enhanced requirements include, among other things, changes to capital, leverage and liquidity standards and numerous other requirements. The Dodd-Frank Act authorizes various new assessments and fees, expands supervision and oversight authority over non-bank subsidiaries, increases the standards for certain covered transactions with affiliates and requires the establishment of minimum leverage and risk-based capital requirements for insured depository institutions. The Dodd-Frank Act also established a new federal Consumer Financial Protection Bureau with broad authority and permits states to adopt stricter consumer protection laws and enforce consumer protection rules issued by the Consumer Financial Protection Bureau. Due to the passage of the Dodd-Frank Act, the standard deposit insurance amount is $250 thousand per depositor per insured bank for each account ownership category. In addition, the FDIC assessment is now based on the Bank’s total average assets less tier 1 capital, instead of deposits, and is computed at lower rates.

Bank Holding Company Regulation

The Company is a bank holding company registered under the Bank Holding Company Act (“BHC Act”) and is subject to supervision and regulation by the Federal Reserve Board. Federal laws subject bank holding companies to particular restrictions on the types of activities in which they may engage and to a range of supervisory requirements and activities, including regulatory enforcement actions, for violation of laws and policies.

Activities Closely Related to Banking

The BHC Act prohibits a bank holding company, with certain limited exceptions, from acquiring direct or indirect ownership or control of any voting shares of any company that is not a bank or from engaging in any activities other than those of banking, managing or controlling banks and certain other subsidiaries or furnishing services to or performing services for its subsidiaries. Bank holding companies also may engage in or acquire interests in companies that engage in a limited set of activities that are closely related to banking or managing or controlling banks. If a bank holding company has become a financial holding company (an “FHC”), it may engage in a broader set of activities, including insurance underwriting and broker-dealer services as well as activities that are jointly determined by the Federal Reserve Board and the Treasury Department to be financial in nature or incidental to such financial activity. FHCs may also engage in activities that are determined by the Federal Reserve to be complementary to financial activities. The Company has not elected to be an FHC at this time but may make such an election at any time so long as the statutory criteria are satisfied. In order to become an FHC, the bank holding company and all subsidiary depository institutions must be well managed and well capitalized. Additionally, all subsidiary depository institutions must have received at least a “satisfactory” rating on its most recent Community Reinvestment Act (“CRA”) examination. At December 31, 2013, the Bank’s CRA rating was “outstanding.”

Safe and Sound Banking Practices

Bank holding companies are not permitted to engage in unsafe and unsound banking practices. The Federal Reserve Board may order a bank holding company to terminate an activity or control of a nonbank subsidiary if such activity or control constitutes a significant risk to the financial safety, soundness or stability of a subsidiary bank and is inconsistent with sound banking principles. Regulation Y also requires a holding company to give the Federal Reserve Board prior notice of any redemption or repurchase of its own equity securities if the consideration to be paid, together with the consideration paid for any repurchases or redemptions in the preceding year, is equal to 10% or more of the company’s consolidated net worth.

The Federal Reserve Board has broad authority to prohibit activities of bank holding companies and their non-banking subsidiaries which represent unsafe and unsound banking practices or which constitute violations of laws or regulations. Notably, the Financial Institutions Reform, Recovery and Enforcement Act of 1989 (“FIRREA”) provides that the Federal Reserve Board can assess civil money penalties for such practices or violations which can be as high as $1 million per day. FIRREA contains expansive provisions regarding the scope of individuals and entities against which such penalties may be assessed.

Annual Reporting and Examinations

The Company is required to file an annual report with the Federal Reserve Board and such additional information as the Federal Reserve Board may require pursuant to the BHC Act. The Federal Reserve Board may examine a bank holding company or any of its subsidiaries and charge the company for the cost of such an examination. The Company is also subject to reporting and disclosure requirements under state and federal securities laws.

New Rules on Regulatory Capital

New regulatory capital rules, released in July 2013, implement higher minimum capital requirements for bank holding companies and banks. The new rules include a new common equity tier 1 capital requirement and establish criteria that instruments must meet in order to be considered common equity tier 1 capital, additional tier 1 capital or tier 2 capital. These enhancements are expected to both improve the quality and increase the quantity of capital required to be held by banking organizations, better equipping the U.S. banking system to deal with adverse economic conditions. The revised capital rules require banks and bank holding companies to maintain a minimum common equity tier 1 capital ratio of 4.5%, a tier 1 capital ratio of 6%, a total capital ratio of 8% and a leverage ratio of 4%. Bank holding companies are also required to hold a capital conservation buffer of common equity tier 1 capital of 2.5% to avoid limitations on capital distributions and executive compensation payments. The revised capital rules also require banks to maintain a common equity tier 1 capital ratio of 6.5%, a tier 1 capital ratio of 8%, a total capital ratio of 10% and a leverage ratio of 5% to be deemed “well capitalized” for purposes of certain rules and prompt corrective action requirements.

The new rules attempt to improve the quality of capital by implementing changes to the definition of capital. Among the most important changes are stricter eligibility criteria for regulatory capital instruments that would disallow the inclusion of instruments, such as trust preferred securities, in tier 1 capital going forward and new constraints on the inclusion of minority interests, mortgage-servicing assets, deferred tax assets and certain investments in the capital of unconsolidated financial institutions. In addition, the new rules require that most regulatory capital deductions be made from common equity tier 1 capital.

Under the new rules, in order to avoid limitations on capital distributions, including dividend payments and certain discretionary bonus payments to executive officers, a banking organization must hold a capital conservation buffer composed of common equity tier 1 capital above its minimum risk-based capital requirements. This buffer will help to ensure that banking organizations conserve capital when it is most needed, allowing them to better weather periods of economic stress. The buffer is measured relative to risk-weighted assets.

Community banks, such as the Bank, will begin transitioning to the new rules on January 1, 2015. The new minimum capital requirements are effective on January 1, 2015, whereas the capital conservation buffer and the deductions from common equity tier 1 capital phase in over time. Phase-in of the capital conservation buffer requirements will begin on January 1, 2016. Although these new capital ratios do not become effective until 2015 and 2016, the banking regulators will expect bank holding companies and banks to meet these requirements well ahead of that date.

The Federal Reserve Board may also set higher capital requirements for holding companies whose circumstances warrant it. For example, holding companies experiencing internal growth or making acquisitions are expected to maintain strong capital positions substantially above the minimum supervisory levels, without significant reliance on intangible assets. At this time, the bank regulatory agencies are more inclined to impose higher capital requirements in order to meet well-capitalized standards and future regulatory change could impose higher capital standards as a routine matter. The Company’s regulatory capital ratios and those of the Bank are in excess of the levels established for “well-capitalized” institutions.

Imposition of Liability for Undercapitalized Subsidiaries

The Federal Deposit Insurance Corporation Improvement Act of 1991 (“FDICIA”) required each federal banking agency to revise its risk-based capital standards to ensure that those standards take adequate account of interest rate risk, concentration of credit risk and the risks of nontraditional activities, as well as reflect the actual performance and expected risk of loss on multifamily mortgages. In accordance with the law, each federal banking agency has specified, by regulation, the levels at which an insured institution would be considered well capitalized, adequately capitalized, undercapitalized, significantly undercapitalized and critically undercapitalized. As of December 31, 2013, the Bank exceeded the capital levels required in order to be deemed well capitalized.

By statute and regulation a bank holding company must serve as a source of financial and managerial strength to each bank that it controls and, under appropriate circumstances, may be required to commit resources to support each such controlled bank. This support may be required at times when the bank holding company may not have the resources to provide the support.

Under the prompt corrective action provisions of FDICIA, if a controlled bank is undercapitalized, then the regulators could require the bank holding company to guarantee the bank’s capital restoration plan. In addition, if the Federal Reserve Board believes that a bank holding company’s activities, assets or affiliates represent a significant risk to the financial safety, soundness or stability of a controlled bank, then the Federal Reserve Board could require the bank holding company to terminate the activities, liquidate the assets or divest the affiliates. The regulators may require these and other actions in support of controlled banks even if such actions are not in the best interests of the bank holding company or its stockholders.

The appropriate federal banking agency may also require a holding company to provide financial assistance to a bank with impaired capital. Under this requirement, in the future the Company could be required to provide financial assistance to Bank should it experience financial distress. Based on our ownership of a national bank subsidiary, the Office of the Comptroller of the Currency (“OCC”) could assess us if the capital of the Bank were to become impaired. If we failed to pay the assessment within three months, the OCC could order the sale of our stock in the Bank to cover the deficiency.

Additionally, FDICIA requires bank regulators to take prompt corrective action to resolve problems associated with insured depository institutions. In the event an institution becomes undercapitalized, it must submit a capital restoration plan. If an institution becomes significantly undercapitalized or critically undercapitalized, additional and significant limitations are placed on the institution. The capital restoration plan of an undercapitalized institution will not be accepted by the regulators unless each company having control of the undercapitalized institution guarantees the subsidiary’s compliance with the capital restoration plan until it becomes adequately capitalized. The Company has control of the Bank for the purpose of this statute.

Acquisitions by Bank Holding Companies

The BHC Act requires every bank holding company to obtain the prior approval of the Federal Reserve Board before it may acquire all or substantially all of the assets of any bank or ownership or control of any voting shares of any bank if after such acquisition it would own or control, directly or indirectly, more than 5% of the voting shares of such bank. In approving bank acquisitions by bank holding companies, the Federal Reserve Board is required to consider the financial and managerial resources and future prospects of the bank holding company and banks concerned, the convenience and needs of the communities to be served and the effect on competition. The Attorney General of the United States may, within 30 days after approval of an acquisition by the Federal Reserve Board, bring an action challenging such acquisition under the federal antitrust laws, in which case the effectiveness of such approval is stayed pending a final ruling by the courts. Under certain circumstances, the 30-day period may be shortened to 15 days.

Interstate Acquisitions

Under the Riegle-Neal Interstate Banking and Branching Efficiency Act (“Riegle-Neal Act”), a bank holding company may acquire banks in states other than its home state, subject to any state requirement that the bank has been organized and operating for a minimum period of time, not to exceed five years, and the requirement that the bank holding company not control, prior to or following the proposed acquisition, more than 10% of the total amount of deposits of insured depository institutions nationwide or, unless the acquisition is the bank holding company’s initial entry into the state, more than 30% of such deposits in the state (or such lesser or greater amount set by the state). The Riegle-Neal Act also authorizes banks to merge across state lines, thereby creating interstate branches. The Dodd-Frank Act permits a national or state bank, with the approval of its regulator, to open a branch in any state if the law of the state in which the branch is located would permit the establishment of the branch if the bank were a bank chartered in that state. National banks may provide trust services in any state to the same extent as a trust company chartered by that state.

Bank Regulation

The Bank is a national bank, which is subject to regulation and supervision primarily by the OCC and secondarily by the Federal Reserve Board and the FDIC. The Bank is subject to requirements and restrictions under federal law, including requirements to maintain reserves against deposits, restrictions on the types and amounts of loans that may be granted and the interest that may be charged thereon and limitations on the types of investments that may be made and the types of services that may be offered. Various consumer laws and regulations also affect the operations of the Bank.

The OCC regularly examines the Bank and records of the Bank. The FDIC may also periodically examine and evaluate insured banks.

Standards for Safety and Soundness

As part of FDICIA’s efforts to promote the safety and soundness of depository institutions and their holding companies, appropriate federal banking regulators are required to have in place regulations specifying operational and management standards (addressing internal controls, loan documentation, credit underwriting and interest rate risk), asset quality and earnings. As discussed above, the Federal Reserve Board, the OCC, and the FDIC have extensive authority to police unsafe or unsound practices and violations of applicable laws and regulations by depository institutions and their holding companies. For example, the FDIC may terminate the deposit insurance of any institution that it determines has engaged in an unsafe or unsound practice. The agencies can also assess civil money penalties of up to $1 million per day, issue cease-and-desist or removal orders, seek injunctions and publicly disclose such actions.

Restrictions on Transactions with Affiliates

Section 23A of the Federal Reserve Act imposes quantitative and qualitative limits on transactions between a bank and any affiliate and requires certain levels of collateral for such loans. It also limits the amount of advances to third parties which are collateralized by the securities or obligations of the Company. Section 23B requires that certain transactions between the Bank and its affiliates must be on terms substantially the same, or at least as favorable, as those prevailing at the time for comparable transactions with or involving other nonaffiliated companies. In the absence of such comparable transactions, any transaction between the Bank and its affiliates must be on terms and under circumstances, including credit standards, which in good faith would be offered to or would apply to nonaffiliated companies.

Governmental Monetary Policies and Economic Conditions

The principal sources of funds essential to the business of banks and bank holding companies are deposits, stockholders’ equity and borrowed funds. The availability of these various sources of funds and other potential sources, such as preferred stock or commercial paper, and the extent to which they are utilized depends on many factors, the most important of which are the Federal Reserve Board’s monetary policies and the relative costs of different types of funds. An important function of the Federal Reserve Board is to regulate the national supply of bank credit in order to combat recession and curb inflationary pressure. Among the instruments of monetary policy used by the Federal Reserve Board to implement these objectives are open market operations in United States government securities, changes in the discount rate on bank borrowings and changes in reserve requirements against bank deposits. The monetary policies of the Federal Reserve Board have had a significant effect on the operating results of commercial banks in the past and are expected to continue to do so in the future. In view of the recent changes in regulations affecting commercial banks and other actions and proposed actions by the federal government and its monetary and fiscal authorities, no prediction can be made as to future changes in interest rates, availability of credit, deposit balances or the overall performance of banks generally or the Company and the Bank in particular.

The Company’s results may be adversely affected if it suffers higher than expected losses on its loans or is required to increase its allowance for loan losses.

The Company assumes credit risk from the possibility that it will suffer losses because borrowers, guarantors, and related parties fail to perform under the terms of their loans. Management tries to minimize and monitor this risk by adopting and implementing what management believes are effective underwriting and credit policies and procedures, including how the Company establishes and reviews the allowance for loan losses. The allowance for loan losses is determined by continuous analysis of the loan portfolio and the analytical process is regularly reviewed and adjustments may be made based on the assessments of internal and external influences on credit quality. Those policies and procedures may still not prevent unexpected losses that could adversely affect our results. Weak economic conditions could adversely impact the ability of borrowers to repay outstanding loans or the value of collateral securing those loans. In addition, deterioration in economic conditions affecting borrowers, new information regarding existing loans, identification of additional problem loans, changes in regulation and regulatory interpretation and other factors, both within and outside of our control, may require an increase in the allowance for loan losses. (See also Part II, Item 7, Loans and Allowance for Loan Losses and Part II, Item 8, Notes 1 and 4 to our Consolidated Financial Statements contained in this Form 10-K for further discussion related to our loan portfolio and our process for determining the appropriate level of the allowance for loan losses.)

The Company operates in a highly regulated environment and its operations and income may be affected adversely by changes in laws and regulations governing its operations.

The Company is subject to extensive regulation and supervision by the Federal Reserve Board, the OCC and the FDIC. Such regulators govern the activities in which the Company may engage. These regulatory authorities have extensive discretion in connection with their supervisory and enforcement activities, including the ability to impose restrictions on a bank’s operations, reclassify assets, determine the adequacy of a bank’s allowance for loan losses and determine the level of deposit insurance premiums assessed. Any change in such regulation and oversight, whether in the form of regulatory policy, new regulations or legislation or additional deposit insurance premiums could have a material adverse impact on the Company’s operations. Any new laws, rules and regulations could make compliance more difficult or expensive or otherwise adversely affect the Company’s business, financial condition or growth prospects. Such changes could subject the Company to additional costs, limit the types of financial services and products the Company may offer and/or increase the ability of non-banks to offer competing financial services and products, among other things.

Recent financial reforms and related regulations may affect our results of operations, financial condition or liquidity.

The Dodd-Frank Act could result in additional legislative or regulatory action. For a description of the Dodd-Frank Act see Part I, Item 1. Business, Supervision and Regulation contained in this Form 10-K. At this time, it is difficult to predict the extent to which the Dodd-Frank Act or the resulting regulations will impact the Company’s business. However, compliance with these new laws and regulations will likely result in additional costs and these additional costs may adversely impact our results of operations, financial condition or liquidity.

As a bank holding company that conducts substantially all of its operations through its banking subsidiary, our ability to pay dividends to stockholders depends upon the results of operations of the Bank and its ability to pay dividends to the Company. Dividends paid by the Bank are subject to limits imposed by law and regulation.

Substantially all of the Company’s activities are conducted through the Bank, and the Company receives substantially all of its funds through dividends from the Bank. The Company’s ability to pay dividends to stockholders depends on the Bank’s ability to pay dividends to the Company. Various laws and regulations limit the amount of dividends that the Bank may pay to the Company. If the Bank is unable to pay dividends to the Company, the Company will not be able to pay dividends to its stockholders.

Changes in interest rates could adversely affect the Company’s results of operations and financial condition.

The Company’s ability to generate net income depends primarily upon our net interest income. Net interest income is income that remains after deducting from total income generated by earning assets the interest expense attributable to the acquisition of the funds required to support earning assets. Income from earning assets includes income from loans, investment securities and short-term investments. The amount of interest income is dependent on many factors including the volume of earning assets, the general level of interest rates, the dynamics of the change in interest rates and the levels of non-performing loans. The cost of funds varies with the amount of funds necessary to support earning assets, the rates paid to attract and hold deposits, rates paid on borrowed funds and the levels of non-interest-bearing demand deposits and equity capital.

Different types of assets and liabilities may react differently, at different times, to changes in market interest rates. Management expects that the Company will periodically experience gaps in the interest-rate sensitivities of its assets and liabilities. That means either our interest-bearing liabilities will be more sensitive to changes in market interest rates than our interest earning assets or vice versa. When interest-bearing liabilities mature or reprice more quickly than interest-earning assets, an increase in market rates of interest could reduce our net interest income. Likewise, when interest-earning assets mature or reprice more quickly than interest-bearing liabilities, falling interest rates could reduce net interest income. Management is unable to predict changes in market interest rates which are affected by many factors beyond our control including inflation, recession, unemployment, money supply and other governmental monetary and fiscal policies, domestic and international events and changes in the United States and other financial markets. Net interest income is not only affected by the level and direction of interest rates, but also by the shape of the yield curve, relationships between interest sensitive instruments and key driver rates, as well as balance sheet growth, client loan and deposit preferences and the timing of changes in these variables.

Management attempts to manage risk from changes in market interest rates, in part, by controlling the mix of interest rate-sensitive assets and interest rate-sensitive liabilities. Management reviews the Company's interest rate risk position and modifies its strategies based on projections to minimize the impact of future interest rate changes. However, interest rate risk management techniques are not exact. A rapid increase or decrease in interest rates could adversely affect our results of operations and financial condition.

Potential impairment in the carrying value of our goodwill could negatively impact our earnings and capital.

At December 31, 2013, the Company had goodwill totaling $814 thousand. Goodwill is reviewed for impairment at least annually or more frequently if events or changes in circumstances indicate that the carrying value may not be recoverable. Given the current economic environment, we could be required to evaluate the recoverability of goodwill prior to our normal annual assessment if we experience disruption in our business and/or sustained market capitalization declines. These types of events and the resulting analyses could result in goodwill impairment charges in the future. These non-cash impairment charges could adversely affect our results of operations or financial condition in future periods.

The Company is subject to risks associated with taxation.

The amount of income taxes the Company is required to pay on its earnings is based on federal and state legislation and regulations. The Company provides for current and deferred taxes in its financial statements, based on its results of operations, business activity, legal structure, interpretation of tax statutes, assessment of risk of adjustment upon audit and application of financial accounting standards. The Company may take tax return filing positions for which the final determination of tax is uncertain. The Company’s net income and earnings per share may be reduced if a federal, state or local authority assesses additional taxes that have not been provided for in the consolidated financial statements. There can be no assurance that the Company will achieve its anticipated effective tax rate either due to a change in tax law, a change in regulatory or judicial guidance or an audit assessment that denies previously recognized tax benefits. Tax provisions of New York State Article 32 allow banking corporations to exclude from income 60% of the dividends it has received from subsidiaries such as a REIT. On various occasions over the course of a number of years, including most recently in 2014, the tax commissioner of New York State has proposed the elimination of this provision, raising the question for New York State banking corporations as to whether this exclusion would remain in effect. Going forward, the Company may not realize the benefits of the exclusion from income of 60% of the dividends received from the REIT, resulting in a higher effective state income tax rate.

The Company’s financial condition and results of operations are dependent on the economy, as well as competition from other banks. Changing economic conditions could adversely impact the Company’s earnings and increase the credit risk of the Company’s loan portfolio.

The Company’s primary market area includes all of Suffolk County, New York and the adjacent markets of Nassau County and New York City. Adverse economic conditions in that market area could reduce the Company’s rate of growth, affect customers’ ability to repay loans and result in higher levels of loan delinquencies, problem assets and foreclosures and a decline in the values of the collateral securing the Company’s loans, any of which could have a material adverse effect on the Company’s business, financial condition and results of operations. General economic conditions, including inflation, unemployment and money supply fluctuations, also may adversely affect the Company’s business, financial condition and results of operations. In addition, competition in the banking industry is intense and the Company’s profitability depends upon its continued ability to successfully compete in its market.

The Company is subject to significant operational risks.

Operational risk is the risk of loss from operations, including fraud by employees or outside persons, employees’ execution of incorrect or unauthorized transactions and breaches of internal control systems. Operational risk also encompasses technology, compliance and legal risk, which is the risk of loss from violations of, or noncompliance with, laws, rules, regulations, prescribed practices or ethical standards, as well as the risk of our noncompliance with contractual and other obligations. The Company is also exposed to operational risk through its outsourcing arrangements and the effect that changes in circumstances or capabilities of its outsourcing vendors can have on the Company’s ability to continue to perform operational functions necessary to its business. Although the Company seeks to mitigate operational risk through a system of internal controls which it reviews and updates, no system of controls, however well designed and maintained, is infallible. Control weaknesses or failures or other operational risks could result in charges, increased operational costs, harm to the Company’s reputation or foregone business opportunities.

A failure in or breach of the Company’s security systems or infrastructure, or those of our third-party service providers, could result in financial losses or in the disclosure or misuse of confidential or proprietary information, including client information.

As a financial institution, the Company may be the target of fraudulent activity that may result in financial losses to the Company and its clients, privacy breaches against its clients or damage to its reputation. Such fraudulent activity may take many forms, including check fraud, electronic fraud, wire fraud, phishing, unauthorized intrusion into or use of the Company’s systems and other dishonest acts. The Company provides its customers the ability to bank remotely, including online over the Internet. The secure transmission of confidential information is a critical element of remote banking. The Company’s network could be vulnerable to unauthorized access, computer viruses, phishing schemes, spam attacks, human error, natural disasters, power loss and other security breaches. The Company may be required to spend significant capital and other resources to protect against the threat of security breaches and computer viruses, or to alleviate problems caused by security breaches or viruses. Given the volume of Internet transactions, certain errors may be repeated or compounded before they can be discovered and rectified. To the extent that the Company’s activities or the activities of its customers involve the storage and transmission of confidential information, security breaches and viruses could expose the Company to claims, litigation and other possible liabilities. Any inability to prevent security breaches or computer viruses could also cause existing customers to lose confidence in the Company’s systems and could adversely affect its reputation, results of operations and ability to attract and maintain customers and businesses. In addition, a security breach could also subject the Company to additional regulatory scrutiny, expose it to civil litigation and possible financial liability and cause reputational damage. The Company’s risk and exposure to these matters remains heightened because of the evolving nature and complexity of the threats from organized cybercriminals and hackers, and the Company’s plans to continue to provide electronic banking services to its customers.

Liquidity risk could impair the Company’s ability to fund operations and jeopardize its financial condition.

Liquidity is essential to the Company’s business. An inability to raise funds through deposits, borrowings, the sale of loans or securities and other sources could have a substantial negative effect on the Company’s liquidity. The Company’s access to funding sources in amounts adequate to finance its activities or on terms that are acceptable to it could be impaired by factors that affect the Company specifically or the banking industry or economy in general. Factors that could detrimentally impact the Company’s access to liquidity sources include a decrease in the level of its business activity as a result of a downturn in the markets in which its loans are concentrated or adverse regulatory action against the Company. The Company’s ability to borrow could also be impaired by factors that are not specific to it, such as a disruption in the financial markets.

The Company may elect or be compelled to seek additional capital in the future, but that capital may not be available when it is needed.

The Company is required by federal regulatory authorities to maintain adequate levels of capital to support its operations. At some point, the Company may need to raise additional capital. If the Company raises additional capital, it may seek to do so through the issuance of, among other things, its common stock. The issuance of additional shares of common stock or convertible securities to new stockholders would be dilutive to the Company’s current stockholders.

The Company’s ability to raise additional capital, if needed, will depend on conditions in the capital markets, economic conditions and a number of other factors, many of which are outside the Company’s control, and on the Company’s financial performance. Accordingly, the Company cannot be assured of its ability to raise additional capital if needed or to raise capital on terms acceptable to the Company. If the Company cannot raise additional capital when needed, its ability to further expand its operations could be materially impaired and its financial condition and liquidity could be materially and adversely affected.

The Company is subject to risks associated with litigation.

The Company is subject to litigation risks as a result of a number of factors and from various sources. Substantial legal liability against the Company could have a material adverse effect or cause significant reputational harm to the Company. For a description of the litigation risks that the Company faces, see Part I, Item 3. Legal Proceedings contained in this Form 10-K.

The price of the Company’s common stock may fluctuate significantly, making it difficult to resell shares of the Company’s common stock at times and prices that stockholders may find attractive.

The Company cannot predict how its common stock will trade in the future. The market value of the Company’s common stock will likely continue to fluctuate in response to a number of factors including the following, many of which are beyond the Company’s control, as well as the other risk factors described herein:

| • | actual or anticipated quarterly fluctuations in the Company’s operating and financial results; |

| • | developments related to investigations, proceedings or litigation involving the Company; |

| • | changes in financial estimates and recommendations by financial analysts; |

| • | dispositions, acquisitions and financings; |

| • | actions of the Company’s current stockholders, including sales of common stock by existing stockholders and the Company’s directors and executive officers; |

| • | fluctuations in the stock price and operating results of the Company’s competitors; |

| • | regulatory developments; and |

| • | developments related to the financial services industry. |

The market value of the Company’s common stock may also be affected by conditions affecting the financial markets in general, including price and trading fluctuations. These conditions may result in volatility in the market prices of stocks generally and, in turn, the Company’s common stock and sales of substantial amounts of the Company’s common stock in the market, in each case that could be unrelated or disproportionate to changes in the Company’s operating performance. These broad market fluctuations may adversely affect the market value of the Company’s common stock.

There may be future sales of additional common stock or other dilution of the Company’s stockholders’ equity, which may adversely affect the market price of the Company’s common stock.

The Company is not restricted from issuing additional common stock, including securities that are convertible into or exchangeable for, or that represent the right to receive, common stock or any substantially similar securities. The market value of the Company’s common stock could decline as a result of sales by the Company of a large number of shares of common stock or similar securities in the market or the perception that such sales could occur.

Anti-takeover provisions could negatively impact the Company’s stockholders.

Provisions in the Company’s charter and bylaws, the corporate law of the State of New York and federal laws and regulations could delay, defer or prevent a third party from acquiring the Company, despite the possible benefit to its stockholders, or otherwise adversely affect the market price of the Company’s common stock. These provisions include the election of directors to staggered terms of three years, advance notice requirements for nominations for election to the Company’s Board of Directors and for proposing matters that stockholders may act on at stockholder meetings and the requirement that directors fill vacancies on the Company’s Board of Directors. In addition, the BHC Act, as amended, and the Change in Bank Control Act of 1978, as amended, together with federal regulations, require that, depending on the particular circumstances, either regulatory approval must be obtained or notice must be furnished to the appropriate regulatory agencies and not disapproved prior to any person or entity acquiring control of a national bank, such as the Bank. These provisions may prevent a merger or acquisition that may be attractive to stockholders and could limit the price investors would be willing to pay in the future for the Company’s common stock. These provisions could also discourage proxy contests and make it more difficult for holders of the Company’s common stock to elect directors other than the candidates nominated by the Company’s Board of Directors.

The Company’s loan portfolio has a high concentration of commercial real estate loans (exclusive of multifamily loans) and its business may be adversely affected by credit risk associated with commercial real estate and a decline in property values.

At December 31, 2013, $469 million, or 44% of the Company’s total gross loan portfolio, was comprised of commercial real estate (exclusive of multifamily loans). This type of lending is generally sensitive to regional and local economic conditions that significantly impact the ability of borrowers to meet their loan payment obligations, making loss levels difficult to predict. Although real estate prices have shown signs of improvement, a decline in real estate values may reduce the value of the real estate collateral securing these types of loans and increase the risk that the Company would incur losses if borrowers default on their loans.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS None. |

The following table sets forth certain information relating to properties owned or used in the Company’s banking activities at December 31, 2013:

| Location | Primary Use | Owned or Leased |

| 4 West Second Street, Riverhead, NY | Corporate Headquarters | Owned |

| 400 Merrick Road, Amityville, NY | Branch Office | Leased |

| 3880 Veterans Memorial Highway, Bohemia, NY | Branch Office | Owned |

| 502 Main Street, Center Moriches, NY | Branch Office | Leased |

| 31525 Main Road, Cutchogue, NY | Branch Office | Leased |

| 21 East Industry Court, Deer Park, NY | Branch Office | Leased |

| 351 Pantigo Road, East Hampton, NY | Branch Office | Owned |

| 99 Newtown Lane, East Hampton, NY | Branch Office | Leased |

| 168 West Montauk Highway, Hampton Bays, NY | Branch Office | Owned |

| 110 Marcus Boulevard, Hauppauge, NY | Branch Office | Leased |

| 460 County Road 111, Manorville, NY (1) | Branch Office | Leased |

| 10900 Main Road, Mattituck, NY (1) | Branch Office | Owned |

| 2801 Route 112, Medford, NY | Branch Office | Leased |

| 159 Route 25A, Miller Place, NY | Branch Office | Leased |

| 541 West Lake Drive, Montauk, NY (1) | Branch Office | Leased |

| 746 Montauk Highway, Montauk, NY | Branch Office | Owned |

| 135 West Broadway, Port Jefferson, NY | Branch Office | Owned |

| 1500-10 Route 112, Port Jefferson Station, NY (1) | Branch Office | Leased |

| 228 East Main Street, Port Jefferson, NY | Branch Office | Leased |

| 1201 Ostrander Avenue, Riverhead, NY | Branch Office | Owned |

| 6 West Second Street, Riverhead, NY | Branch Office | Owned |

| 17 Main Street, Sag Harbor, NY | Branch Office | Owned |

| 161 North Main Street, Sayville, NY | Branch Office | Leased |

| 9926 Route 25A, Shoreham, NY | Branch Office | Leased |

| 222 Middle Country Road, Smithtown, NY | Branch Office | Leased |

| 295 North Sea Road, Southampton, NY | Branch Office | Owned |

| 2065 Wading River-Manor Road, Wading River, NY | Branch Office | Owned |

| 955 Little East Neck Road, West Babylon, NY | Branch Office | Leased |

| 144 Sunset Avenue, Westhampton Beach, NY | Branch Office | Owned |

| 1055 Franklin Avenue, Garden City, NY | Loan Production and Branch Office | Leased |

| 290 Broad Hollow Road, Melville, NY | Loan Production Office | Leased |

| 206 Griffing Avenue, Riverhead, NY | Administrative Office | Owned |

| (1) | Scheduled to be closed in the first quarter of 2014. |

See the information set forth in Note 17. Legal Proceedings in the Notes to Consolidated Financial Statements under Part II, Item 8, which information is incorporated by reference in response to this item.

| ITEM 4. | MINE SAFETY DISCLOSURES Not applicable. |

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

At December 31, 2013, the approximate number of common equity stockholders was as follows:

Title of Class: Common Stock

Number of Record Holders: 1,266

The Company’s common stock is traded on the NASDAQ Global Select Market under the symbol SUBK. Following are quarterly high and low closing prices of the Company’s common stock for the years ended December 31, 2013 and 2012 and the quarterly dividends paid during those periods.

| 2013 | | High Close | | | Low Close | | | Dividends | | 2012 | | High Close | | | Low Close | | | Dividends | |

| 1st Quarter | | $ | 14.42 | | | $ | 13.15 | | | $ | - | | 1st Quarter | | $ | 13.82 | | | $ | 11.51 | | | $ | - | |

| 2nd Quarter | | | 17.04 | | | | 13.96 | | | | - | | 2nd Quarter | | | 13.72 | | | | 11.26 | | | | - | |

| 3rd Quarter | | | 19.05 | | | | 16.69 | | | | - | | 3rd Quarter | | | 16.80 | | | | 11.53 | | | | - | |

| 4th Quarter | | | 20.80 | | | | 17.18 | | | | - | | 4th Quarter | | | 15.86 | | | | 12.47 | | | | - | |

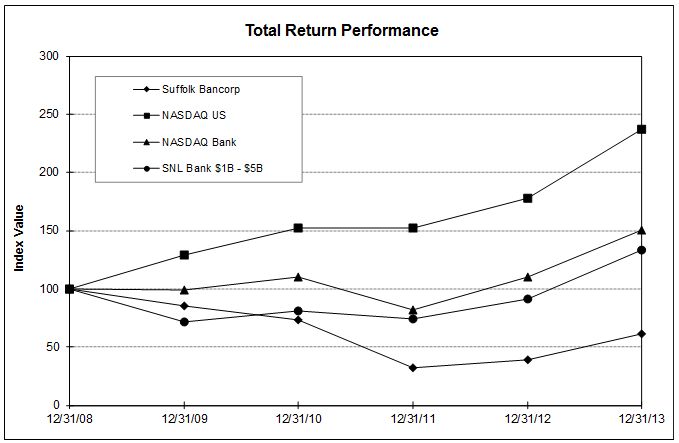

The following Performance Graph compares the yearly percentage change in the Company’s cumulative total stockholder return on its common stock with the cumulative total return of the NASDAQ US Index, the cumulative total return of the NASDAQ Bank index and the cumulative total return of the SNL Bank $1B - $5B index. We believe the newly selected SNL Bank $1B - $5B index, comprised of banks with assets from $1 billion to $5 billion, more accurately represents our asset size peer group than does the NASDAQ Bank index.

| | Period Ending | |

| Index | | 12/31/08 | | | 12/31/09 | | | 12/31/10 | | | 12/31/11 | | | 12/31/12 | | | 12/31/13 | |

| Suffolk Bancorp | | | 100.00 | | | | 85.52 | | | | 73.17 | | | | 31.99 | | | | 38.84 | | | | 61.66 | |

| NASDAQ US | | | 100.00 | | | | 129.26 | | | | 151.94 | | | | 152.42 | | | | 177.46 | | | | 236.88 | |

| NASDAQ Bank | | | 100.00 | | | | 98.65 | | | | 109.85 | | | | 81.92 | | | | 110.37 | | | | 150.79 | |

| SNL Bank $1B - $5B | | | 100.00 | | | | 71.68 | | | | 81.25 | | | | 74.10 | | | | 91.37 | | | | 132.87 | |

Sources: Performance Graph prepared by SNL Financial LC, Charlottesville, VA, NASDAQ Bank and NASDAQ US total return data provided by CRSP.

For information about the Company’s equity compensation plans, please see Part III, Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters contained in this Form 10-K.

| ITEM 6. | SELECTED FINANCIAL DATA |

The Company’s selected financial data for the last five years follows.

FIVE-YEAR SUMMARY (dollars in thousands, except per share data)

| As of or for the year ended December 31, | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| OPERATING RESULTS: | | | | | | | | | | | | | | | |

| Interest income | | $ | 59,678 | | | $ | 60,447 | | | $ | 75,433 | | | $ | 86,276 | | | $ | 87,008 | |

| Interest expense | | | 2,930 | | | | 3,719 | | | | 5,925 | | | | 9,714 | | | | 12,672 | |

| Net interest income | | | 56,748 | | | | 56,728 | | | | 69,508 | | | | 76,562 | | | | 74,336 | |

| Provision for loan losses | | | 1,250 | | | | 8,500 | | | | 24,888 | | | | 32,086 | | | | 4,275 | |

| Net interest income after provision | | | 55,498 | | | | 48,228 | | | | 44,620 | | | | 44,476 | | | | 70,061 | |

| Non-interest income | | | 19,507 | | | | 10,881 | | | | 10,121 | | | | 11,253 | | | | 11,118 | |

| Operating expenses | | | 58,565 | | | | 61,571 | | | | 59,042 | | | | 50,778 | | | | 48,801 | |

| Income (loss) before income taxes | | | 16,440 | | | | (2,462 | ) | | | (4,301 | ) | | | 4,951 | | | | 32,378 | |

| Provision (benefit) for income taxes | | | 3,722 | | | | (714 | ) | | | (4,223 | ) | | | (1,305 | ) | | | 9,830 | |

| Net income (loss) | | $ | 12,718 | | | $ | (1,748 | ) | | $ | (78 | ) | | $ | 6,256 | | | $ | 22,548 | |

| FINANCIAL CONDITION: | | | | | | | | | | | | | | | | | | | | |

| Investment securities | | | 412,446 | | | | 410,388 | | | | 308,519 | | | | 406,606 | | | | 446,343 | |

| Loans | | | 1,068,848 | | | | 780,780 | | | | 969,654 | | | | 1,112,279 | | | | 1,160,379 | |

| Total assets | | | 1,699,816 | | | | 1,622,464 | | | | 1,484,227 | | | | 1,606,867 | | | | 1,694,496 | |

| Total deposits | | | 1,510,061 | | | | 1,431,114 | | | | 1,311,872 | | | | 1,402,753 | | | | 1,385,278 | |

| Borrowings | | | - | | | | - | | | | - | | | | 40,000 | | | | 150,800 | |

| Stockholders' equity | | | 167,198 | | | | 163,985 | | | | 136,560 | | | | 136,820 | | | | 137,171 | |

| SELECTED FINANCIAL RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Performance: | | | | | | | | | | | | | | | | | | | | |

| Return on average stockholders' equity | | | 7.78 | % | | | (1.22 | )% | | | (0.06 | )% | | | 4.42 | % | | | 18.30 | % |

| Return on average assets | | | 0.76 | | | | (0.11 | ) | | | - | | | | 0.37 | | | | 1.36 | |

| Net interest margin (taxable-equivalent) | | | 3.91 | | | | 4.19 | | | | 4.97 | | | | 5.05 | | | | 4.99 | |

| Efficiency ratio | | | 73.64 | | | | 86.22 | | | | 71.83 | | | | 57.82 | | | | 57.11 | |

| Average stockholders' equity to average assets | | | 9.83 | | | | 9.30 | | | | 8.55 | | | | 8.32 | | | | 7.41 | |

| Dividend payout ratio | | | - | | | | - | | | | - | | | | 124.62 | | | | 37.44 | |

| Asset quality: | | | | | | | | | | | | | | | | | | | | |

| Non-performing loans to total loans (1) | | | 1.42 | | | | 2.10 | | | | 8.33 | | | | 2.61 | | | | 1.66 | |

| Non-performing assets to total assets | | | 0.89 | | | | 1.17 | | | | 5.56 | | | | 2.16 | | | | 1.73 | |

| Allowance for loan losses to non-performing loans (1) | | | 113.70 | | | | 108.19 | | | | 49.48 | | | | 98.03 | | | | 63.91 | |

| Allowance for loan losses to total loans (1) | | | 1.62 | | | | 2.28 | | | | 4.12 | | | | 2.56 | | | | 1.06 | |

| Net charge-offs to average loans | | | 0.20 | | | | 3.57 | | | | 1.31 | | | | 1.42 | | | | 0.09 | |

| CAPITAL RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Tier 1 leverage ratio | | | 9.81 | % | | | 9.79 | % | | | 8.85 | % | | | 8.26 | % | | | 8.21 | % |

| Total risk-based capital ratio | | | 15.02 | | | | 18.15 | | | | 14.26 | | | | 12.62 | | | | 11.73 | |

| Tangible common equity ratio | | | 9.68 | | | | 9.96 | | | | 9.05 | | | | 8.38 | | | | 7.97 | |

| COMMON SHARE DATA: | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) per share - fully diluted | | $ | 1.10 | | | $ | (0.17 | ) | | $ | (0.01 | ) | | $ | 0.65 | | | $ | 2.35 | |

| Cash dividends per share | | | - | | | | - | | | | - | | | | 0.81 | | | | 0.88 | |

| Book value per share | | | 14.45 | | | | 14.18 | | | | 14.04 | | | | 14.12 | | | | 14.27 | |

| Tangible book value per share | | | 14.19 | | | | 13.95 | | | | 13.79 | | | | 13.87 | | | | 14.03 | |

| Average common shares outstanding | | | 11,570,731 | | | | 10,248,751 | | | | 9,720,827 | | | | 9,658,534 | | | | 9,602,802 | |

| OTHER INFORMATION: | | | | | | | | | | | | | | | | | | | | |

| Number of full-time-equivalent employees | | | 350 | | | | 373 | | | | 368 | | | | 370 | | | | 368 | |

| Number of branch offices (2) | | | 25 | | | | 30 | | | | 30 | | | | 30 | | | | 29 | |

| Number of ATMs (2) | | | 25 | | | | 30 | | | | 30 | | | | 30 | | | | 29 | |

| (1) | Excluding loans held-for-sale. |

| (2) | 2013 amounts exclusive of four branches scheduled to be closed in the first quarter of 2014. |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Safe Harbor Statement Pursuant to the Private Securities Litigation Reform Act of 1995

Certain statements contained in this discussion are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These can include remarks about the Company, the banking industry, the economy in general, expectations of the business environment in which the Company operates, projections of future performance, and potential future credit experience. These remarks are based upon current management expectations, and may, therefore, involve risks and uncertainties that cannot be predicted or quantified and are beyond the Company’s control and are subject to a variety of uncertainties that could cause future results to vary materially from the Company’s historical performance, or from current expectations. These remarks may be identified by such forward-looking statements as “should,” “expect,” “believe,” “view,” “opportunity,” “allow,” “continues,” “reflects,” “typically,” “usually,” “anticipate,” or similar statements or variations of such terms. Factors that could affect the Company include particularly, but are not limited to: increased capital requirements mandated by the Company’s regulators; the Company’s ability to raise capital; competitive factors, including price competition; changes in interest rates; increases or decreases in retail and commercial economic activity in the Company’s market area; variations in the ability and propensity of consumers and businesses to borrow, repay, or deposit money, or to use other banking and financial services; results of regulatory examinations or changes in law, regulations or regulatory practices; the Company’s ability to attract and retain key management and staff; any failure by the Company to maintain effective internal control over financial reporting; larger-than-expected losses from the sale of assets; the potential that net charge-offs are higher than expected or for further increases in our provision for loan losses; and a failure by the Company to meet the deadlines under SEC rules for filing its periodic reports (or any permitted extension thereof). Further, it could take the Company longer than anticipated to implement its strategic plans to increase revenue and manage non-interest expense, or it may not be possible to implement those plans at all. Finally, new and unanticipated legislation, regulation, or accounting standards may require the Company to change its practices in ways that materially change the results of operations. We have no obligation to update any forward-looking statements to reflect events or circumstances after the date of this document. For more information, see the risk factors described in this Annual Report on Form 10-K and other filings with the Securities and Exchange Commission.

Non-GAAP Disclosure

This discussion includes a non-GAAP financial measure of the Company’s tangible common equity (“TCE”) ratio. A non-GAAP financial measure is a numerical measure of historical or future financial performance, financial position or cash flows that excludes or includes amounts that are required to be disclosed in the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). The Company believes that this non-GAAP financial measure provides both management and investors a more complete understanding of the underlying operational results and trends and the Company’s marketplace performance. The presentation of this additional information is not meant to be considered in isolation or as a substitute for the numbers prepared in accordance with U.S. GAAP and may not be comparable to similarly titled measures used by other financial institutions.

Executive Summary

The Company is a one-bank holding company incorporated in 1985. The Company operates as the parent for its wholly owned subsidiary, the Bank, a national bank founded in 1890. The income of the Company is primarily derived through the operations of the Bank and the REIT.

The Bank is a full-service bank serving the needs of its local residents through 25 branches, exclusive of four branches scheduled to be closed in the first quarter of 2014, in Nassau and Suffolk Counties, New York and loan production offices in Garden City and Melville, New York. The Bank offers a full line of domestic commercial and retail banking services and wealth management services. The Bank’s primary lending area includes all of Suffolk County and the adjacent markets of Nassau County and New York City. The Bank makes commercial real estate floating and fixed rate loans, commercial and industrial loans to manufacturers, wholesalers, distributors, developers/contractors and retailers and agricultural loans. The Bank also makes loans secured by residential mortgages, and both fixed and floating rate second mortgage loans with a variety of plans for repayment. Real estate construction loans are also offered.

In order to expand the Company geographically into western Suffolk and Nassau Counties and to diversify the lending business of the Company, loan production offices were opened in Garden City and Melville in 2013 and 2012, respectively. As part of our strategy to move westward, the loan production office in Garden City serves the major business markets in central and western Long Island. Seasoned banking professionals have joined the Company to augment both interest and fee income through the origination of commercial and industrial loans, the generation of high quality multifamily and jumbo mortgages to be retained in the portfolio and conforming mortgages for sale in secondary markets. The Bank finances most of its activities with deposits, including demand, saving, N.O.W. and money market deposits, as well as time deposits. It may also rely on other sources of funds, including inter-bank overnight loans. The Company’s chief competition includes local banks within its market area, as well as New York City money center banks and regional banks.

Overview of Results of Operations and Financial Condition for the Year Ended December 31, 2013

At December 31, 2013, the Company, on a consolidated basis, had total assets of $1.7 billion, total deposits of $1.5 billion and stockholders’ equity of $167 million. The Company recorded net income of $12.7 million, or $1.10 per diluted common share, in 2013, compared with a net loss of $1.7 million, or ($0.17) per diluted common share, in 2012. The increase in 2013 net income primarily reflects an $8.6 million improvement in non-interest income, a $7.2 million decrease in the provision for loan losses and a $3.0 million reduction in total operating expenses in 2013 versus 2012. Somewhat offsetting these positive factors was a $4.4 million increase in income tax expense in 2013.

The $8.6 million increase in non-interest income resulted from improvements in several categories, including a $755 thousand increase in income from bank owned life insurance, a $7.8 million gain on the sale of Visa, Inc.’s (“Visa”) Class B shares in 2013 and a $620 thousand increase in the net gain on the sale of securities available for sale. The gain on the sale of the Visa shares and the increase in the net gain on the sale of securities available for sale should not be considered indicative of future results.

Total operating expenses declined by $3.0 million or 4.9% to $58.6 million in 2013 from $61.6 million in 2012, primarily due to reductions in employee compensation and benefits ($2.8 million), other operating expenses ($3.4 million), accounting and audit fees ($553 thousand) and consulting and professional services ($463 thousand). Partially offsetting these improvements was an increase in occupancy expense ($687 thousand), which includes $507 thousand in accelerated depreciation related to two branches closed in 2013 and four branches scheduled to be closed in the first quarter of 2014. Additional one-time branch closing costs of $2.1 million and $231 thousand were recorded in branch consolidation costs and equipment expense, respectively, in 2013.

Net interest income was flat in 2013 versus 2012 as growth in average loans outstanding of $46 million and investment securities were offset by a 28 basis point narrowing of the Company’s net interest margin to 3.91% in 2013 from 4.19% a year ago. Generally, the Company’s net interest margin is impacted not only by the average balance and mix of the Company’s interest-earning assets and interest-bearing liabilities, but also by the level of market interest rates. These rates are significantly influenced by the actions of the Federal Open Market Committee of the Board of Governors of the Federal Reserve System (“FOMC”) policy makers. The Company’s average cost of funds declined by seven basis points to 0.20% in 2013 versus 0.27% a year ago.

The Company recorded income tax expense of $3.7 million in 2013 resulting in an effective tax rate of 22.6% versus an income tax benefit of $714 thousand in 2012.

The Company’s return on average assets and return on average common stockholders’ equity were 0.76% and 7.78%, respectively, for 2013 versus (0.11%) and (1.22%), respectively, for 2012.

The Company experienced an overall increase in the total loan portfolio of $288 million, from $781 million at December 31, 2012 to $1.1 billion at December 31, 2013, a 36.9% year-over-year growth rate. The geographic and product diversification strategies implemented in our lending businesses are working well. Each of our lending businesses, commercial, multifamily and residential, are contributing to this momentum. The Company is increasing market share by preserving our eastern Suffolk lending franchise while simultaneously expanding west.

As part of the Bank’s desire to diversify its portfolio on both a product and geographic basis, an initiative aimed at the development of a multifamily mortgage portfolio has given the Bank more exposure to a favorable geographic area that had previously been a minimal segment of the portfolio. This effort is primarily concentrated in the five boroughs of New York City and targets rent-controlled or rent-stabilized buildings. It has been well-established that the incidence of loss in multifamily loan transactions is lower than almost all other loan categories as their performance over time has shown limited defaults, even during the worst period of the recent recession. The property value for these buildings is directly attributable to the cash flow from rents and the rate of return investors need on their invested capital. Rental rates are a function of demand for apartments and the vacancy rates in New York City (where the majority of the Bank’s assets are located) are currently at historical lows. Average rental rates for an apartment in Manhattan are above $3,000/month for the first time ever. New apartments are coming to market but are being absorbed rapidly.

The Bank has dedicated credit analysts/underwriters and a portfolio manager for the multifamily product line that have extensive experience in this type of lending. The portfolio of multifamily loans continues to perform satisfactorily with no delinquencies reported and risk ratings solidly in the pass range. At December 31, 2013, the Company’s multifamily loans totaled $185 million, and represented 17.3% of the Company’s total loans, compared to only $9 million or 1.2% at December 31, 2012.

The Company’s core deposit franchise continues to be among the best in the region. Core deposits, consisting of demand, N.O.W., saving and money market deposits, totaled $1.3 billion at December 31, 2013, representing 85% of total deposits at that date. Demand deposits totaled $629 million at December 31, 2013 and represented 42% of total deposits at that date. The deposit product mix continues to be a primary strength of the Company and resulted in an average cost of funds of 20 basis points in 2013.

On the expense side, management continues to work diligently to balance the increased investments needed to grow the lending businesses with offsetting operating expense reductions in other areas, and believe we will see continued improvement as we move forward. Several of the major projects previously announced on the expense reduction side are performing better than expected. During 2013 we announced the phased-in closing of six branches in Suffolk County that, once fully implemented, will reduce annual operating expenses by an estimated $2.4 million. Further, the assumptions used in deciding to close these branches relating to deposit runoff and expense savings are proving to be conservative.

Overview of Asset Quality for the Year Ended December 31, 2013

Credit performance strengthened in 2013 as important credit metrics showed improvement. This improvement is largely attributable to the successful conclusion of several negotiated workout transactions, the upgrading of several large relationships to accrual status based on sustained improvement in financial performance and the successful completion of an $8 million sale of both non-accrual and classified loans during the fourth quarter of 2013.

Non-accrual loans, excluding loans categorized as held-for-sale, totaled $15 million or 1.42% of total loans outstanding at December 31, 2013 versus $16 million or 2.10% of loans outstanding at December 31, 2012. At December 31, 2013, approximately 71% of the Company’s non-accrual loans were current with respect to principal and interest payments. The allowance for loan losses as a percentage of total non-accrual loans amounted to 114% at December 31, 2013 versus 108% at December 31, 2012. Total accruing loans delinquent 30 days or more amounted to $3 million or 0.33% of loans outstanding at December 31, 2013 versus $14 million or 1.81% of loans outstanding at December 31, 2012.

Total criticized and classified loans were $43 million at December 31, 2013 versus $99 million at December 31, 2012. Criticized loans are those loans that require some degree of heightened monitoring but are not classified. Classified loans were $37 million at December 31, 2013 as compared to $54 million at December 31, 2012. The allowance for loan losses as a percentage of total classified loans was 47% and 33%, respectively, at the same dates.

At December 31, 2013, the Company had $16 million in troubled debt restructurings (“TDRs”), primarily consisting of commercial and industrial loans, commercial real estate loans and residential mortgages totaling $6 million, $6 million and $4 million, respectively. The Company had TDRs amounting to $17 million at December 31, 2012.

At December 31, 2013, the Company’s allowance for loan losses amounted to $17 million or 1.62% of period-end loans outstanding. The allowance as a percentage of loans outstanding was 2.28% at December 31, 2012.

Net loan charge-offs of $1.8 million, inclusive of a charge-off of $1.5 million incurred in connection with the fourth quarter 2013 loan sale mentioned above, were recorded in 2013 versus $30.7 million in 2012. As a percentage of average total loans outstanding, these net amounts represented 0.20% for 2013 and 3.57% for 2012.

The Company held no OREO at December 31, 2013. The Company held OREO amounting to $1.6 million at December 31, 2012.

The Company’s investment portfolio does not contain any mortgage obligations with underlying collateral that could be classified as sub-prime.

Critical Accounting Policies, Judgments and Estimates

The Company’s accounting and reporting policies conform to U.S. GAAP and general practices within the banking industry. The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and the accompanying notes. Actual results could differ from those estimates.