Item 1: Report to Shareholders| High Yield Fund | November 30, 2006 |

The views and opinions in this report were current as of November 30, 2006. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Fellow Shareholders

The last six months may well have been the best overall environment for high-yield bonds that we have seen in two decades. Although the tone of the market at the end of May was a little uncertain—investors were a bit confused about the direction of the economy and interest rates had been rising steadily—those concerns turned into bullish optimism that the Fed would stop raising rates. In August, the Fed did, indeed, stop its series of rate hikes, and the market began to believe that the “soft landing” scenario would be a boon for corporate bonds. High-yield bonds and risky assets in general rallied sharply. Following a small setback in June, your fund posted five consecutive months of strong advances.

PORTFOLIO PERFORMANCE AND MARKET ENVIRONMENT

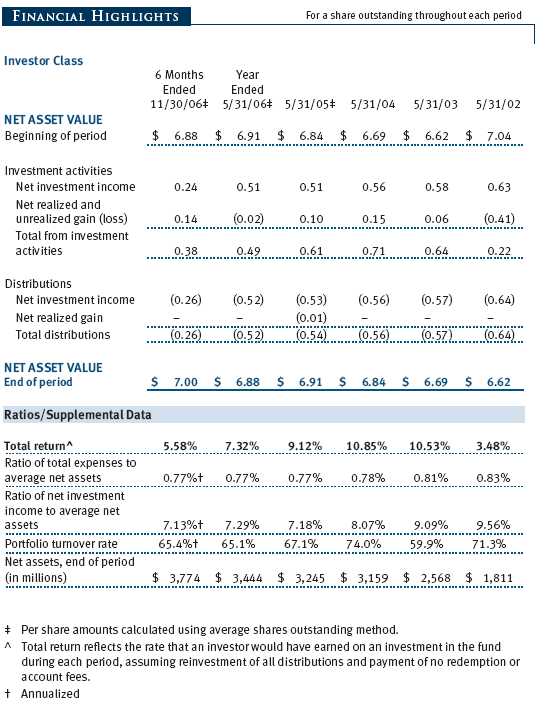

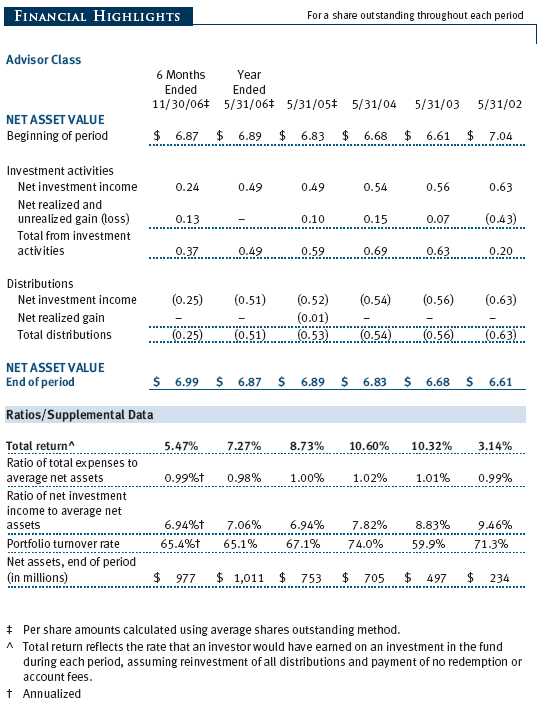

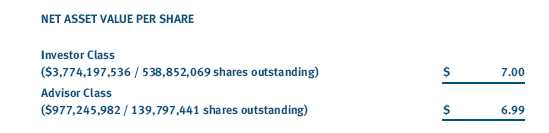

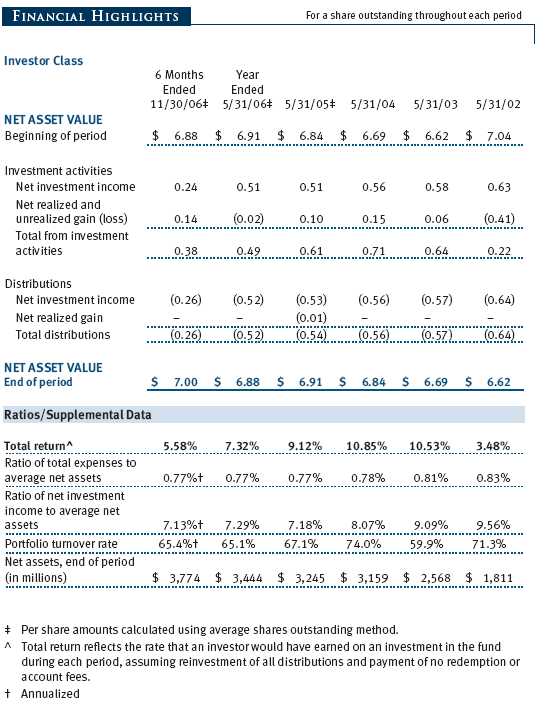

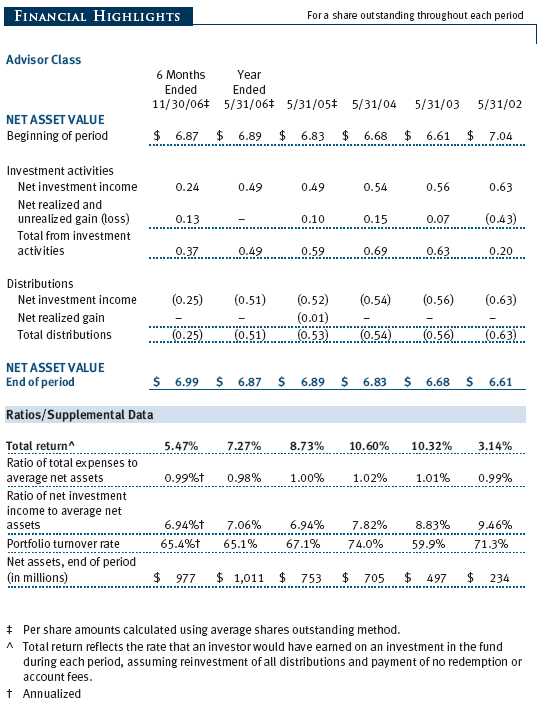

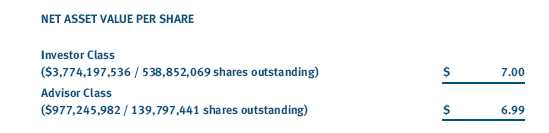

We did not expect appreciation from high-yield bonds in 2006 because of tight spreads—the narrow difference in yields between high- and low-quality bonds��and low interest rates at the start of the year. We were convinced the market was expensive and expected that all of our return this year would come from clipping coupons. However, over the past six months, not only did the fund generate $0.26 of dividend income per share, but the net asset value climbed $0.12 to $7.00, which combined for a 5.58% total return. Although the portfolio generated excellent absolute results, it trailed the Lipper peer group of high-yield funds and the Credit Suisse High Yield Index for the six-month period. Advisor Class results were similar but reflected their different fee structure.

A look at the individual holdings in the portfolio shows that over the past six months the 15 companies that were the largest detractors cost the fund 32 basis points of performance (100 basis points equal 1.00%). On the flip side, the fund’s two best-performing securities over that period generated a gain of 34 basis points, and the top 15 issues rose 123 basis points. The balance of debits and credits was substantially positive for the fund over the six-month period.

Credit Nirvana

The underlying driver of the high-yield market’s excellent performance since the end of May was the absence of companies running into credit problems. Credit spreads were historically tight, and there were few defaults (none in our portfolio). As a result, we were able to keep all of the incremental income that is paid on high-yield securities to compensate for potential defaults—a highly unusual situation in our asset class! As the market gained momentum at the end of the summer, investors became increasingly comfortable buying speculative credits, which drove up the prices of lower-rated bonds. This hurt our relative performance because we have maintained a moderately conservative posture.

As we have stated on numerous occasions, we are pleased with the fund’s strong absolute results but do not plan on taking additional—and what we view as undue—risk. We do not want to sacrifice our long-term investing tenets, which have served us well over the years, by adding significantly in the lowest-quality tiers of the market to potentially capture a little additional yield.

PORTFOLIO REVIEW

The New Issue Market Heats Up

In the May report, we said the first half of the year was relatively quiet from a new-issue standpoint. However, in the past six months we have seen a significant increase, and most have performed extraordinarily well. Several of the recent new issues are particularly enticing because of their higher coupons—many were priced to yield 9% or more. We missed out on some of this short-term appreciation because we maintained our discipline, avoiding what we viewed as riskier securities because we feared they could get us into trouble in a year or two. We have been, and continue to be, reluctant to chase every basis point of appreciation in an increasingly richly valued market.

The Double-Edged Sword of the Private Equity World

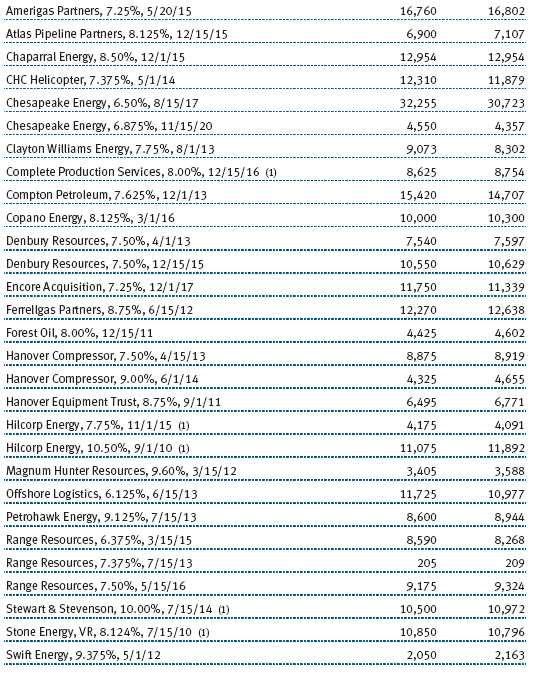

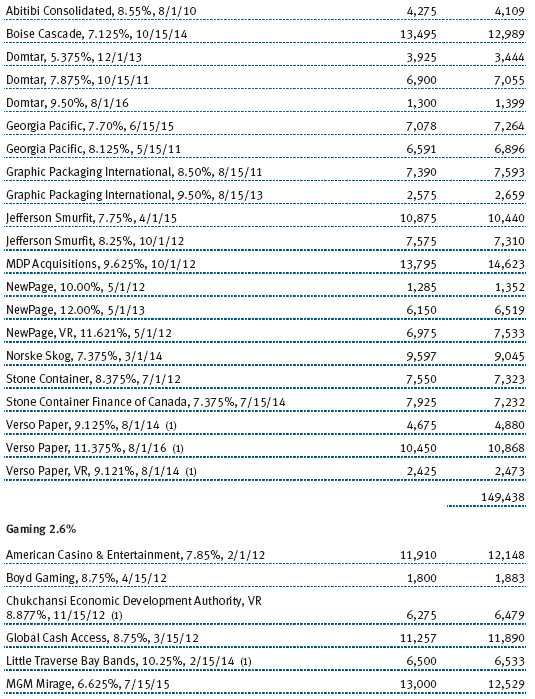

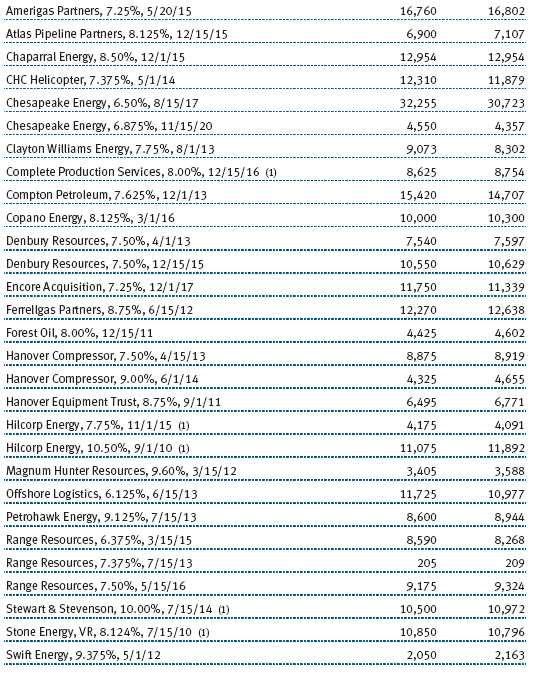

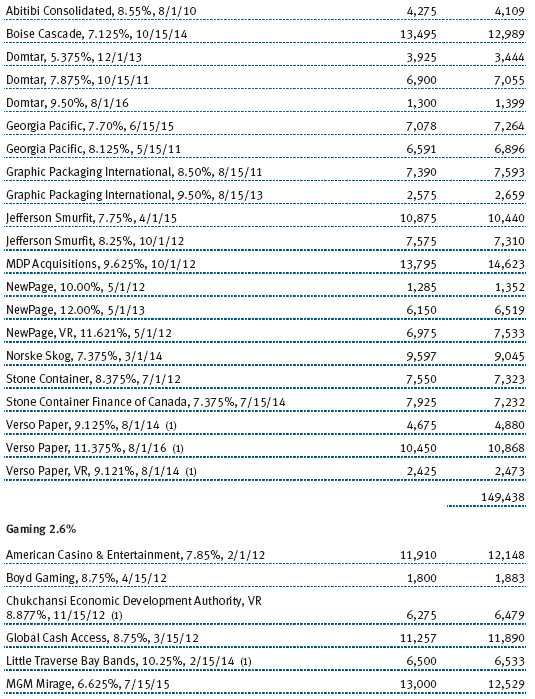

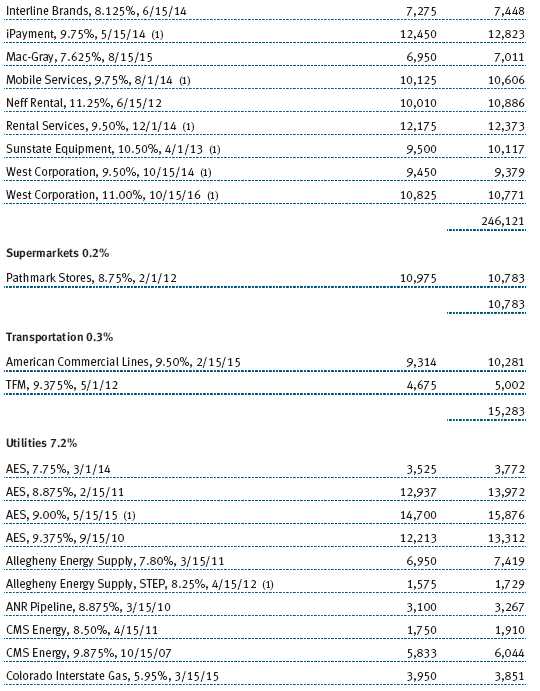

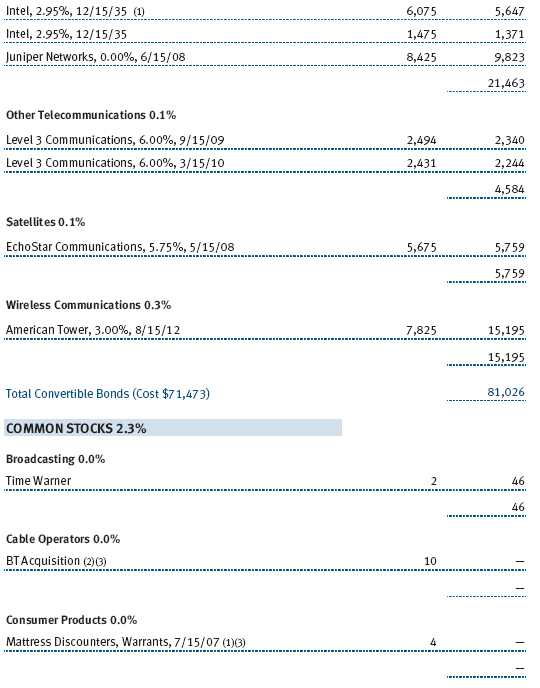

HCA, a leading hospital management company and a high-yield market bellwether, surprised investors in July when its management announced that it was taking the company private through a large consortium headed by Kohlberg Kravis Roberts & Company (KKR). Most viewed the BB rated company as a conservative investment because it had a dominant market position in the for-profit hospital management business and was aggressively buying back its own stock. However, when the news broke, HCA’s bonds immediately headed lower because investors expected another large issue of new debt. We trimmed our loss by unloading about half of our 1% position, but some of our HCA bonds declined 20%. (Please refer to the portfolio of investments for a complete listing of holdings and the amount each represents of the portfolio.)

KKR’s plan was to retire all of the company’s common stock with the $14 billion of bank term loans and the proceeds from the $6 billion debt offering. After analyzing the terms of the new issue, we decided that we should go ahead and buy into the deal, which was one of the largest high-yield bond issues ever. That has turned out to be a good decision as the new bonds have traded up significantly, allowing us to recoup a sizable chunk of our earlier losses. Since their issuance in November, the new HCA 9.25% coupon bonds have appreciated about 6%.

We believe this may be the blueprint for the high-yield market environment over the next few years. We will have to seriously analyze all the leveraged buyout (LBO) proposals to distinguish what we think are good long-term deals from potential time bombs. It is somewhat reminiscent of the late 1980s, when there was a wave of privatizations, and the LBO sponsors were actively at work targeting public companies and doing aggressive deals. It was very profitable for a while, but when the economy began to slow down in 1989 and 1990, the high-yield market went through a shakeout.

In addition to HCA, we also bought into the new issues of Freescale Semiconductor, which was formerly a division of Motorola, and NXP Semiconductor, a spin-off from Europe’s largest consumer-electronics manufacturer, Philips Electronics. Although they are in the historically volatile semiconductor industry, both are well-run companies, have strong management teams, and good competitive market positions. Our Freescale position is well diversified, with a little more than half of our holdings in term-loan bank debt. Should we become less positive about the risk in these big LBOs, we will focus on owning higher-quality debt, such as bank loans.

While we have seen abundant new-issue activity in recent months—such as in the retail sector—we have sidestepped many deals because of our long-term focus. We believe that there will be some blowups, and our goal, as always, is to avoid the land mines. Although we want to own more high-quality companies that will be defensive investments in an economic downturn, holding them exposes us to the risk they will be buyout targets. The deals are getting bigger because the private equity firms are working together, rather than competing against one another, a trend that seems likely to continue for several years.

The Automotives Sector Drives the High-Yield Market

We increased our allocation in automotives to 7% during the reporting period from 5% six months ago. We continued to gain confidence in the resolution of the General Motors spin-off of General Motors Acceptance Corp. (GMAC) to Cerberus, which now owns a controlling interest. Our overall ownership in GM went up significantly in the past six months and was among our strongest contributors since May. We also logged excellent gains from the 0.5% position in GM convertible preferred stock that we discussed in our last shareholder letter. (We also own a 0.5% position in a GM bond.)

We added to the GMAC position in the third and fourth quarters and we have reclassified GMAC as a financial services company in our holdings breakdown. At the end of the reporting period, our GMAC position totaled 2.6% of the fund. Most of the position was in the 8% bond maturing in 2031, which turned out to be a home run for the portfolio as it posted significant appreciation in addition to a nice coupon. We think this is a good defensive holding and expect the company will regain its investment-grade rating over time. Ford Motor Credit was also a top contributor over the past six months.

Show Me the Cash Flow

Over the past year, we have focused on companies that are generating significant amounts of free cash flow, even if their revenues are not growing rapidly. The application of that cash, such as paying down debt, can often have a positive effect on credit fundamentals. If the company is returning cash to shareholders through dividends or stock repurchases, we will sometimes buy equity exposure in the form of convertible or preferred stock or, to a lesser extent, common stock.

An example is our large position in NRG Energy, which announced that it would execute a stock repurchase program in September. Initially, the news was bad for its bonds because it implied that the period of improving credit quality was over, and the free cash would be directed to stockholders in the future. But the good news was that we already had a large position in the convertible preferred stock, which powered higher on the news.

We’ve increased our position in landline telephone companies. Specifically, we have seized several opportunities in local exchange carriers (LECs), which are traditional local and long-distance phone companies. Windstream, a spin-off from Alltel, is a BB rated company with a solid balance sheet. The 8.625% bond issue has appreciated about 10% since we purchased it. Citizens Communications is also losing market share to the wireless and cable companies, but like Windstream it has a great balance sheet and is generating a large amount of free cash flow. To supplement our positions in Citizens and Windstream bonds, we’ve added a small slice of common stock. Idearc, the yellow pages division of Verizon, is another significant free cash flow generator that has performed well. This big company uses debt appropriately, offers a competitive yield, and has a B+ rating. We think the theme of owning companies that generate strong free cash flows will be fruitful over the long term.

Among our disappointments during the past six months were several defensive energy and utilities holdings that generated only moderately positive returns. Both sectors have already enjoyed strong multiyear run-ups, and we think that there is not a lot of upside potential left in either of these areas. We trimmed some of the holdings as we found better return potential in other sectors.

OUTLOOK

We intend to continue buying and holding the securities of what our analysts view as the best-quality companies in our market, such as American Tower, Rogers Communications, and NRG Energy. These are solid businesses that we have known for a long time. We would rather own a convertible or the common stock in a good high-yield company than a CCC rated bond in a marginal, speculative situation. Over the long term, this has proven to be a profitable approach for our shareholders.

Owning convertibles and preferred and common stocks has been a good way to diversify our riskier assets, and term loans have been a good way to diversify our higher-quality BB type assets. Our additions to equity-linked securities, which total about 5% of the fund, have outperformed the high-yield market, and we hope to gain some incremental advantage because our bond holdings remain more conservative than the peer group averages. Nevertheless, we think the credit quality is solid for the vast majority of our companies.

We remain optimistic about the prospects for the high-yield market for the coming three to six months, but are unwilling to take on any significant additional risk. The economy is showing signs of slowing, and we are concerned about the housing market downturn and its impact on consumer spending. As we have said in previous shareholder letters, we expect the portfolio to generate more modest absolute returns in the future than we have enjoyed in the recent past.

Thank you for investing with T. Rowe Price.

Respectfully submitted,

Mark J. Vaselkiv

Chairman of the fund’s Investment Advisory Committee

December 15, 2006

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISKS OF BOND INVESTING

Bonds are subject to interest rate risk, the decline in bond prices that usually accompanies a rise in interest rates, and credit risk, the chance that any fund holding could have its credit rating downgraded, or that a bond issuer will default (fail to make timely payments of interest or principal), potentially reducing the fund’s income level and share price. High-yield corporate bonds could have greater price declines than funds that invest primarily in high-quality bonds. Companies issuing high-yield bonds are not as strong financially as those with higher credit ratings, so the bonds are usually considered speculative investments.

GLOSSARY

Average maturity: The weighted average of the stated maturity dates of the portfolio’s securities. In general, the longer the average maturity, the greater the fund’s sensitivity to interest rate changes. A shorter average maturity usually means less interest rate sensitivity and therefore a less volatile portfolio.

Credit Suisse High Yield Index: Tracks the performance of domestic noninvestment-grade corporate bonds.

Duration: A measure of a bond or bond fund’s sensitivity to changes in interest rates. For example, a fund with a four-year duration would fall about 4% in response to a one-percentage-point rise in interest rates, and vice versa.

Federal funds rate: The interest rate charged on overnight loans of reserves by one financial institution to another in the United States. The Federal Reserve sets a target federal funds rate to affect the direction of interest rates.

Lehman Brothers U.S. Aggregate Index: An unmanaged index that tracks domestic investment-grade bonds, including corporate, government, and mortgage-backed securities.

Lipper averages: Consist of all mutual funds in a particular category as tracked by Lipper Inc.

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

| AVERAGE ANNUAL COMPOUND TOTAL RETURN |

This table shows how the fund would have performed each year if its actual (or cumulative) returns for the periods shown had been earned at a constant rate.

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs such as redemption fees or sales loads and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Please note that the fund has two share classes: The original share class (“investor class”) charges no distribution and service (12b-1) fee. Advisor Class shares are offered only through unaffiliated brokers and other financial intermediaries and charge a 0.25% 12b-1 fee. Each share class is presented separately in the table.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual small-account maintenance fee of $10, generally for accounts with less than $2,000 ($500 for UGMA/UTMA). The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $25,000 or more, accounts employing automatic investing, and IRAs and other retirement plan accounts that utilize a prototype plan sponsored by T. Rowe Price (although a separate custodial or administrative fee may apply to such accounts). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

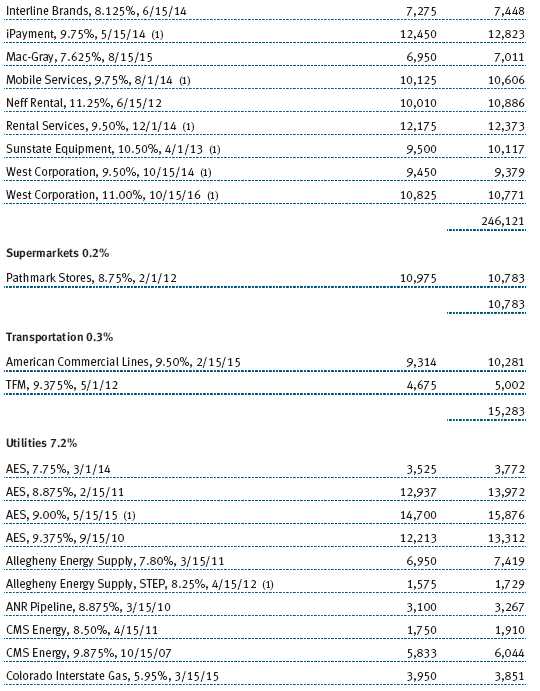

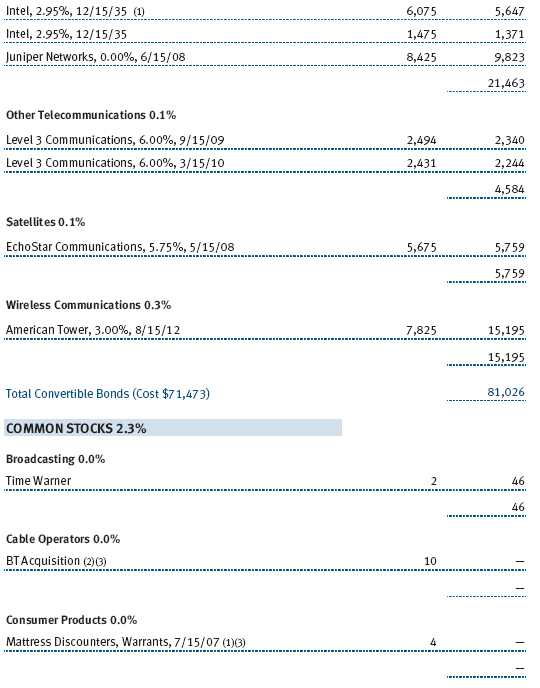

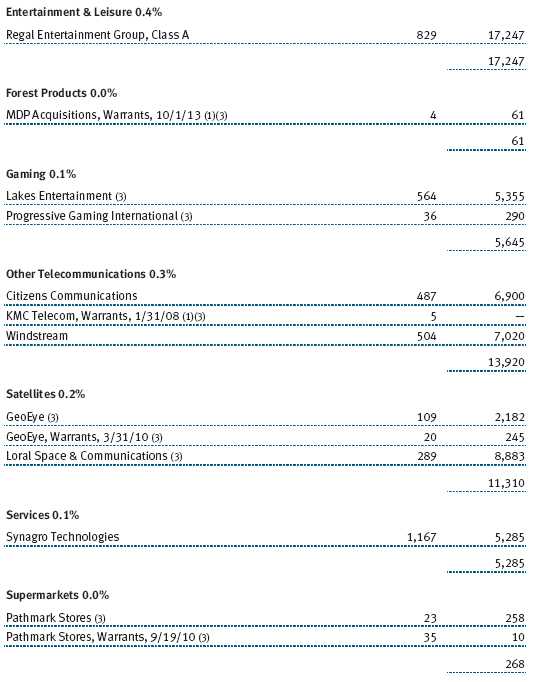

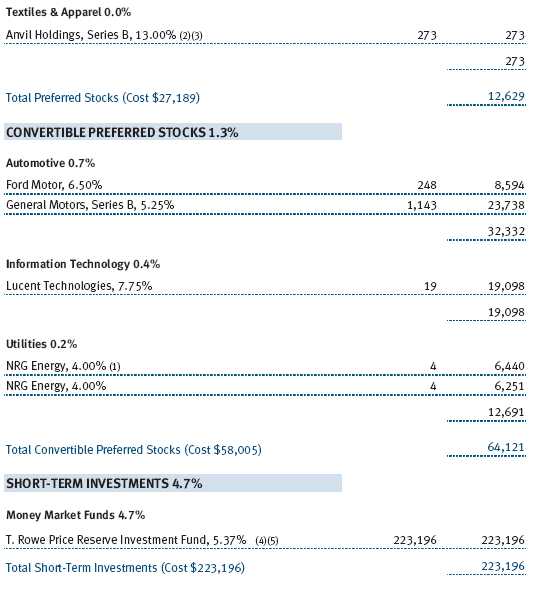

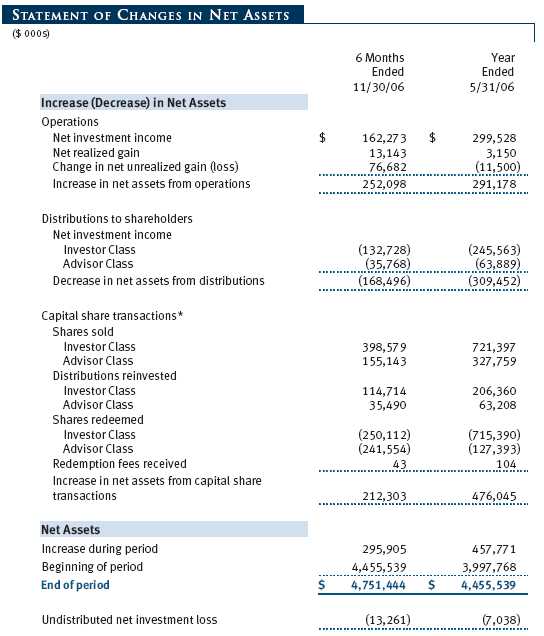

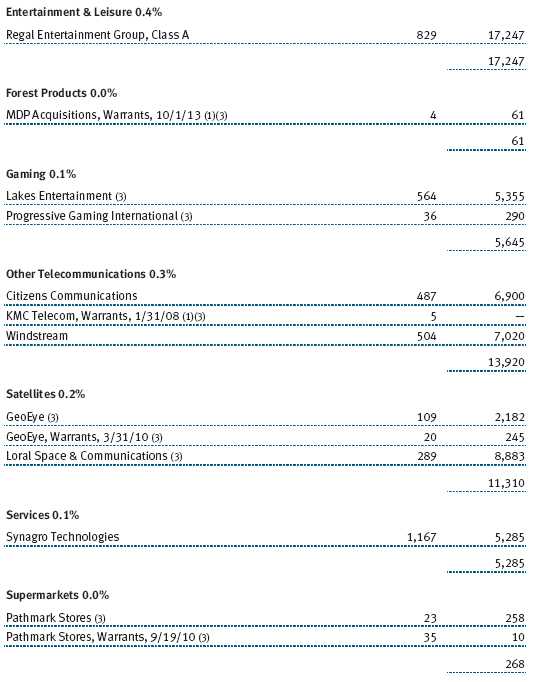

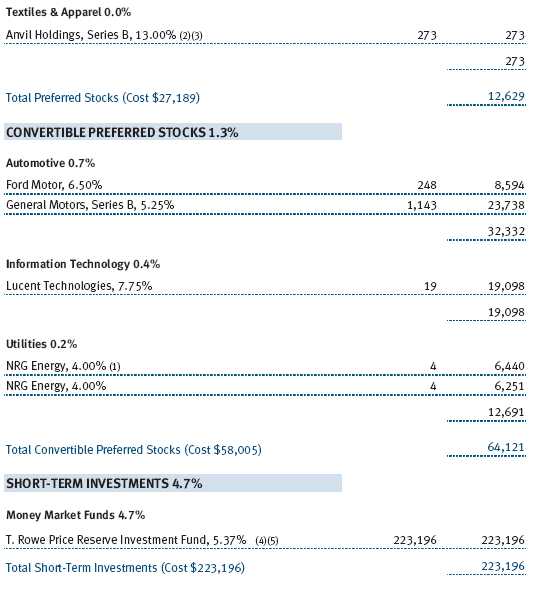

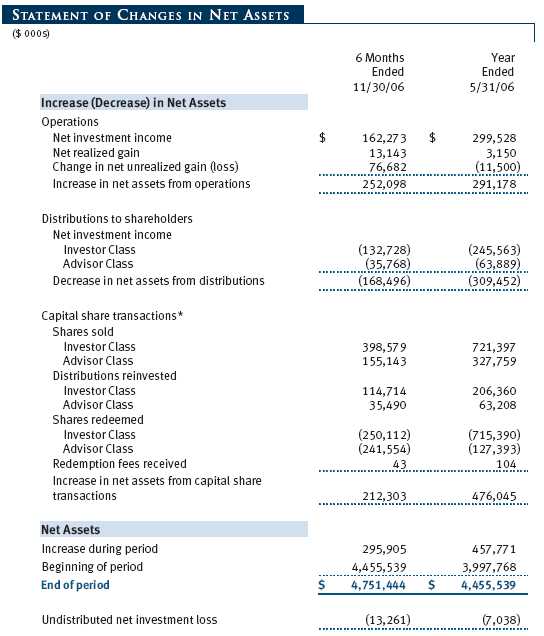

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

| NOTES TO FINANCIAL STATEMENTS |

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

T. Rowe Price High Yield Fund, Inc. (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund seeks high current income and, secondarily, capital appreciation. The fund has two classes of shares: the High Yield Fund original share class, referred to in this report as the Investor Class, offered since December 31, 1984, and High Yield Fund—Advisor Class (Advisor Class), offered since March 31, 2000. Advisor Class shares are sold only through unaffiliated brokers and other unaffiliated financial intermediaries that are compensated by the class for distribution, shareholder servicing, and/or certain administrative services under a Board-approved Rule 12b-1 plan. Each class has exclusive voting rights on matters related solely to that class, separate voting rights on matters that relate to both classes, and, in all other respects, the same rights and obligations as the other class.

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, which require the use of estimates made by fund management. Fund management believes that estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the fund ultimately realizes upon sale of the securities.

Valuation The fund values its investments and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business. Debt securities are generally traded in the over-the-counter market. Securities with original maturities of one year or more are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service, which considers yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Securities with original maturities of less than one year are stated at fair value, which is determined by using a matrix system that establishes a value for each security based on bid-side money market yields.

Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made, except for OTC Bulletin Board securities, which are valued at the mean of the latest bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the latest bid and asked prices for domestic securities and the last quoted sale price for international securities.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation. Swap agreements are valued at prices furnished by dealers who make markets in such securities.

Other investments, including restricted securities, and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors.

Most foreign markets close before the close of trading on the NYSE. If the fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of some or all of its portfolio securities, which in turn will affect the fund’s share price, the fund will adjust the previous closing prices to reflect the fair value of the securities as of the close of the NYSE, as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors. A fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. In deciding whether to make fair value adjustments, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. The fund uses outside pricing services to provide it with closing market prices and information used for adjusting those prices. The fund cannot predict when and how often it will use closing prices and when it will adjust those prices to reflect fair value. As a means of evaluating its fair value process, the fund routinely compares closing market prices, the next day’s opening prices in the same markets, and adjusted prices.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

Class Accounting The Advisor Class pays distribution, shareholder servicing, and/or certain administrative expenses in the form of Rule 12b-1 fees, in an amount not exceeding 0.25% of the class’s average daily net assets. Shareholder servicing, prospectus, and shareholder report expenses incurred by each class are charged directly to the class to which they relate. Expenses common to both classes and investment income are allocated to the classes based upon the relative daily net assets of each class’s settled shares; realized and unrealized gains and losses are allocated based upon the relative daily net assets of each class’s outstanding shares.

Credits The fund earns credits on temporarily uninvested cash balances at the custodian that reduce the fund’s custody charges. Custody expense in the accompanying financial statements is presented before reduction for credits, which are reflected as expenses paid indirectly.

Redemption Fees A 1% fee is assessed on redemptions of Investor Class and Advisor Class fund shares held less than 90 days to deter short-term trading and to protect the interests of long-term shareholders. Redemption fees are withheld from proceeds that shareholders receive from the sale or exchange of fund shares. The fees are paid to the fund, and are recorded as an increase to paid-in capital. The fees may cause the redemption price per share to differ from the net asset value per share.

In-Kind Redemptions In accordance with guidelines described in the fund’s prospectus, the fund may distribute portfolio securities rather than cash as payment for a redemption of fund shares (in-kind redemption). For financial reporting purposes, the fund recognizes a gain on in-kind redemptions to the extent the value of the distributed securities on the date of redemption exceeds the cost of those securities. Gains and losses realized on in-kind redemptions are not recognized for tax purposes and are reclassified from undistributed realized gain (loss) to paid-in capital. During the six months ended November 30, 2006, the fund realized $2,581,000 of net gain on $93,719,000 of in-kind redemptions.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Net periodic receipts or payments required by swaps are accrued daily and recorded as realized gain or loss in the accompanying financial statements.

Fluctuations in the fair value of swaps are reflected in change in net unrealized gain or loss and are reclassified to realized gain or loss upon termination prior to maturity. Paydown gains and losses are recorded as an adjustment to interest income. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared by each class on a daily basis and paid monthly. Capital gain distributions, if any, are declared and paid by the fund, typically on an annual basis.

New Accounting Pronouncements In June 2006, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation No. 48 (“FIN 48”), Accounting for Uncertainty in Income Taxes, a clarification of FASB Statement No. 109, Accounting for Income Taxes. FIN 48 establishes financial reporting rules regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. Management is evaluating the anticipated impact on the fund from FIN 48, which is effective for the fund’s fiscal year beginning June 1, 2007.

In September 2006, the Financial Accounting Standards Board (“FASB”) released the Statement of Financial Accounting Standard No. 157 (“FAS 157”), Fair Value Measurements. FAS 157 clarifies the definition of fair value and establishes the framework for measuring fair value, as well as proper disclosure of this methodology in the financial statements. It will be effective for the fund’s fiscal year beginning June 1, 2008. Management is evaluating the effects of FAS 157; however, it is not expected to have a material impact on the fund’s net assets or results of operations.

NOTE 2 - INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Noninvestment-Grade Debt Securities At November 30, 2006, approximately 87% of the fund’s net assets were invested in noninvestment-grade debt securities, commonly referred to as “high-yield” or “junk” bonds. A real or perceived economic downturn or higher interest rates could adversely affect the liquidity or value, or both, of such securities because such events could lessen the ability of issuers to make principal and interest payments.

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Although certain of these securities may be readily sold, for example, under Rule 144A, others may be illiquid, their sale may involve substantial delays and additional costs, and prompt sale at an acceptable price may be difficult.

Swaps During the six months ended November 30, 2006, the fund was a party to credit default swaps under which it buys or sells credit protection against a defined-issuer credit event. Upon a defined-issuer credit event, the fund is required to either deliver the notional amount of the contract in cash and take delivery of the relevant credit or deliver cash approximately equal to the notional amount of the contract less market value of the relevant credit at the time of the credit event. Risks arise from the possible inability of counterparties to meet the terms of their agreements and from changes in creditworthiness of the relevant underlying issuer.

Other Purchases and sales of portfolio securities, other than short-term and U.S. government securities, aggregated $1,681,316,000 and $1,426,696,000, respectively, for the six months ended November 30, 2006.

NOTE 3 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Federal income tax regulations differ from generally accepted accounting principles; therefore, distributions determined in accordance with tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character. Financial records are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of November 30, 2006.

For tax purposes, the fund has elected to treat net capital losses realized between November 1 and May 31 of each year as occurring on the first day of the following tax year; consequently, $26,514,000 of realized losses recognized for financial reporting purposes in the year ended May 31, 2006, were recognized for tax purposes on June 1, 2006. Further, the fund intends to retain realized gains to the extent of available capital loss carryforwards. As of May 31, 2006, the fund had $300,055,000 of unused capital loss carryforwards, of which $53,723,000 expire in fiscal 2009, $138,022,000 expire in fiscal 2010, and $108,310,000 expire in fiscal 2011.

At November 30, 2006, the cost of investments for federal income tax purposes was $4,692,514,000. Net unrealized gain aggregated $53,496,000 at period-end, of which $158,268,000 related to appreciated investments and $104,772,000 related to depreciated investments.

NOTE 4 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (the manager or Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. The investment management agreement between the fund and the manager provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.30% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.29% for assets in excess of $160 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At November 30, 2006, the effective annual group fee rate was 0.31%.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates computes the daily share prices and provides certain other administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. T. Rowe Price Retirement Plan Services, Inc., provides subaccounting and recordkeeping services for certain retirement accounts invested in the Investor Class. For the six months ended November 30, 2006, expenses incurred pursuant to these service agreements were $67,000 for Price Associates, $534,000 for T. Rowe Price Services, Inc., and $121,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

The fund is also one of several mutual funds sponsored by Price Associates (underlying Price funds) in which the T. Rowe Price Spectrum Funds (Spectrum Funds) and T. Rowe Price Retirement Funds (Retirement Funds) may invest. Neither the Spectrum Funds nor the Retirement Funds invest in the underlying Price funds for the purpose of exercising management or control. Pursuant to separate special servicing agreements, expenses associated with the operation of the Spectrum and Retirement Funds are borne by each underlying Price fund to the extent of estimated savings to it and in proportion to the average daily value of its shares owned by the Spectrum and Retirement Funds, respectively. Expenses allocated under these agreements are reflected as shareholder servicing expenses in the accompanying financial statements. For the six months ended November 30, 2006, the fund was allocated $649,000 of Spectrum Funds’ expenses and $980,000 of Retirement Funds&r squo; expenses. Of these amounts, $1,282,000 related to services provided by Price. The amount payable at period-end pursuant to this agreement is reflected as Due to Affiliates in the accompanying financial statements. At November 30, 2006, approximately 22% of the outstanding shares of the Investor Class were held by the Spectrum Funds and 25% were held by the Retirement Funds.

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the T. Rowe Price Reserve Funds), open-end management investment companies managed by Price Associates and affiliates of the fund. The T. Rowe Price Reserve Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/or its affiliates, and are not available for direct purchase by members of the public. The T. Rowe Price Reserve Funds pay no investment management fees. During the six months ended November 30, 2006, dividend income from the T. Rowe Price Reserve Funds totaled $4,400,000, and the value of shares of the T. Rowe Price Reserve Funds held at November 30, 2006, and May 31, 2006, was $223,196,000 and $141,423,000, respectively.

| INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s Web site, www.sec.gov. The description of our proxy voting policies and procedures is also available on our Web site, www.troweprice.com. To access it, click on the words “Company Info” at the top of our homepage for individual investors. Then, in the window that appears, click on the “Proxy Voting Policy” navigation button in the top left corner.

Each fund’s most recent annual proxy voting record is available on our Web site and through the SEC’s Web site. To access it through our Web site, follow the directions above, then click on the words “Proxy Voting Record” at the bottom of the Proxy Voting Policy page.

| HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s Web site (www.sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments.

Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

| | |

SIGNATURES |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the |

| undersigned, thereunto duly authorized. |

| |

| T. Rowe Price High Yield Fund, Inc. |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | January 16, 2007 |

| |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, this report has been signed below by the following persons on behalf of |

| the registrant and in the capacities and on the dates indicated. |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | January 16, 2007 |

| |

| |

| |

| By | /s/ Joseph A. Carrier |

| | Joseph A. Carrier |

| | Principal Financial Officer |

| |

| Date | January 16, 2007 |