| 1

Annual Report

Municipal Bond Market Overview

For the 12 months ended February 29, 2012, the municipal bond market posted healthy gains as measured by the +12.42% return of the Barclays Capital (BC) Municipal Bond Index, which tracks investment-grade securities.1 Over the reporting period municipal bonds generally outperformed Treasuries, which returned +9.60% according to the BC U.S. Treasury Index, which tracks various U.S. Treasury securities.1

During the reporting period, domestic and global events affected the municipal bond market. Domestically, the Federal Reserve Board’s (Fed’s) commitment to maintain an accommodative monetary policy stance with historically low interest rates supported the municipal market. The market was further supported by an extended period of low supply, thus reducing the availability of bonds to meet investor demand. In Europe, several countries struggled with financial challenges that resulted in a flight to quality benefiting the U.S. Treasury market, as well as the municipal bond market.

From a credit perspective, on August 2, 2011, the U.S. raised its debt ceiling and avoided defaulting on its debt obligations. Independent credit rating agency Standard & Poor’s (S&P) lowered the country’s long-term Treasury bond rating to AA+ from AAA, citing political risks and a rising debt burden.2 All municipal bonds backed by the U.S. government or government-sponsored enterprises (GSEs) were also downgraded along with the country’s rating and those of GSEs. S&P’s downgrade of U.S. Treasury securities led to the review of more than 11,000 municipal credits supported by federal programs and agency escrows. Primarily, prerefunded municipal bonds and housing bonds tied to federal subsidy programs were affected by the downgrade, although they generally still carried high-grade ratings. Furthermore, on July 19, 2011, independent credit rating agency Moody’s Investors Service placed five Aaa-rated states on its watch list for potential rating cuts partly based on their dependency on federal funding. After the debt ceiling was raised, Moody’s reconfirmed the Aaa rating to states and public finance issuers previously identified as directly or indirectly linked to the U.S. government.2 The same credits are currently assigned a negative outlook based on the identification of certain shared characteristics.

1. Source: © 2012 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

2. These do not indicate ratings of the Funds.

4 | Annual Report

Congress enacted the Budget Control Act of 2011 with the potential to reduce the federal deficit by approximately $2 trillion by 2021. While the plan of action is unknown, one can expect reduced federal funding, which would impact state and local programs dependent on federal subsidies. State and local officials may need to reevaluate current budget forecasts and the potential effects. Despite facing fiscal restraints and broad budget cuts to achieve balance, many states continued to show mild growth in revenues, and the actual default rate for municipal bonds was very low.

At period-end, we maintained our positive view of the municipal bond market. We believe municipal bonds continue to be an attractive asset class among fixed income securities, and we intend to follow our solid discipline of investing to maximize income while seeking value in the municipal bond market.

The foregoing information reflects our analysis and opinions as of February 29, 2012, the end of the reporting period. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

Annual Report | 5

Investment Strategy and

Manager’s Discussion

Investment Strategy

We use a consistent, disciplined strategy in an effort to maximize tax-exempt income for our shareholders by seeking to maintain exposure to higher coupon securities while balancing risk and return within each Fund’s range of allowable investments. We generally employ a buy-and-hold approach and invest in securities we believe should provide the most relative value in the market. As we invest during different interest rate environments, each Fund’s portfolio remains diversified with a broad range of securities. This broad diversification may help mitigate interest rate risk. We do not use leverage or exotic derivatives, nor do we use hedging techniques that could add volatility and contribute to under-performance in adverse markets. We generally stay fully invested to help maximize income distribution.

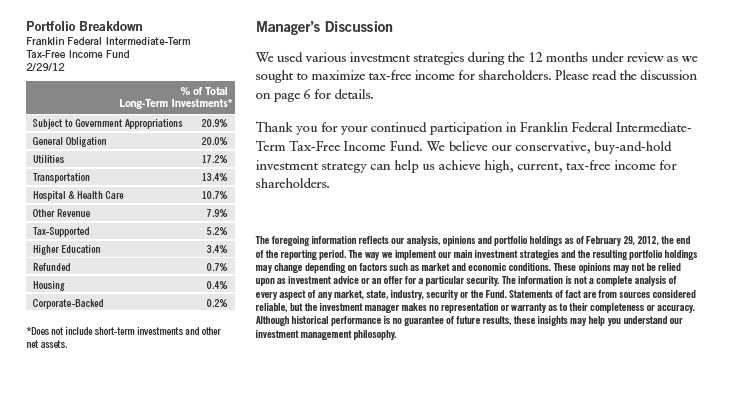

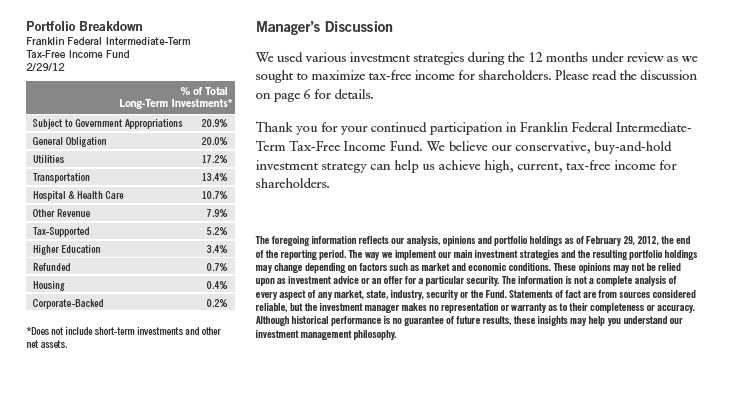

Manager’s Discussion

Based on the combination of our value-oriented philosophy of investing primarily for income and a positive-sloping municipal yield curve, we favored the use of longer term bonds. Consistent with our strategy, we sought to purchase bonds from 15 to 30 years in maturity with good call features for the long-term funds, 10 to 15 years for the intermediate-term fund, and five years or less for the limited-term fund. We believe our conservative, buy-and-hold investment strategy can help us achieve high, current, tax-free income for shareholders.

We invite you to read your Fund report for more detailed performance and portfolio information. Thank you for your participation in Franklin Tax-Free Trust. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of February 29, 2012, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, state, industry, security or fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

6 | Annual Report

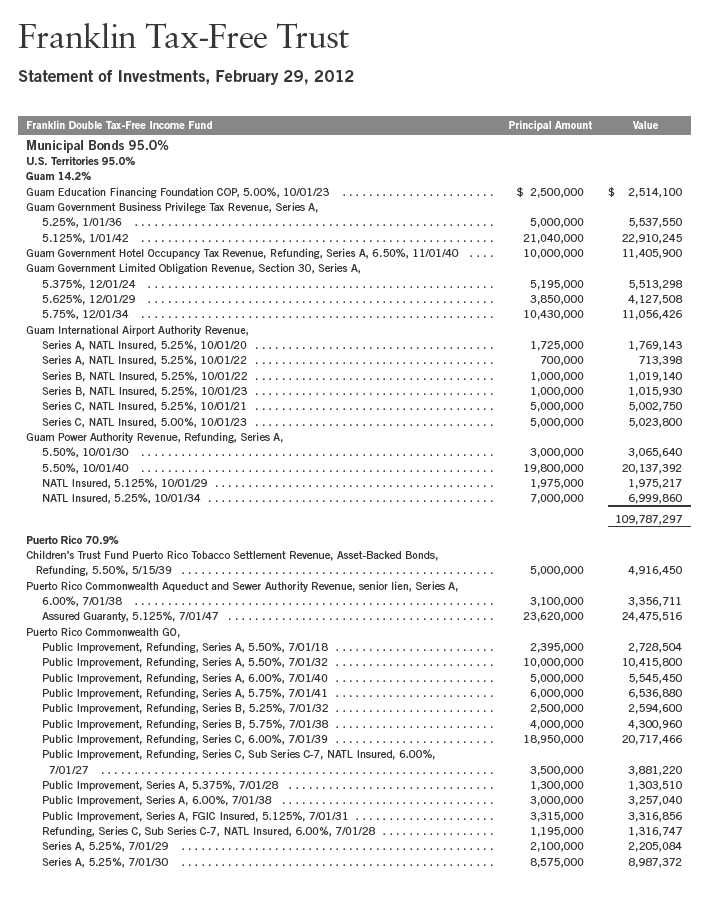

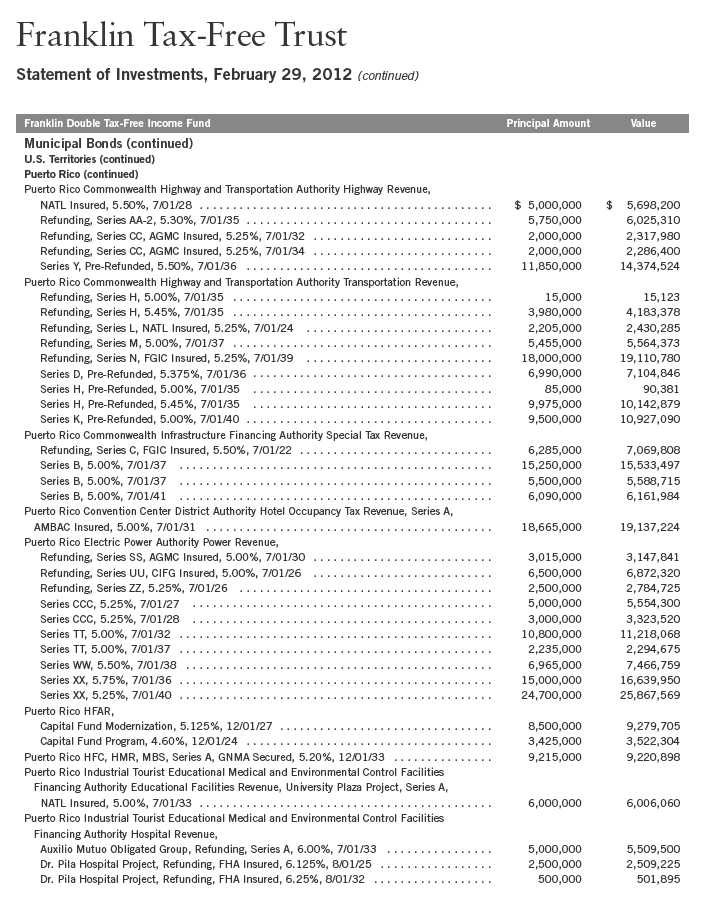

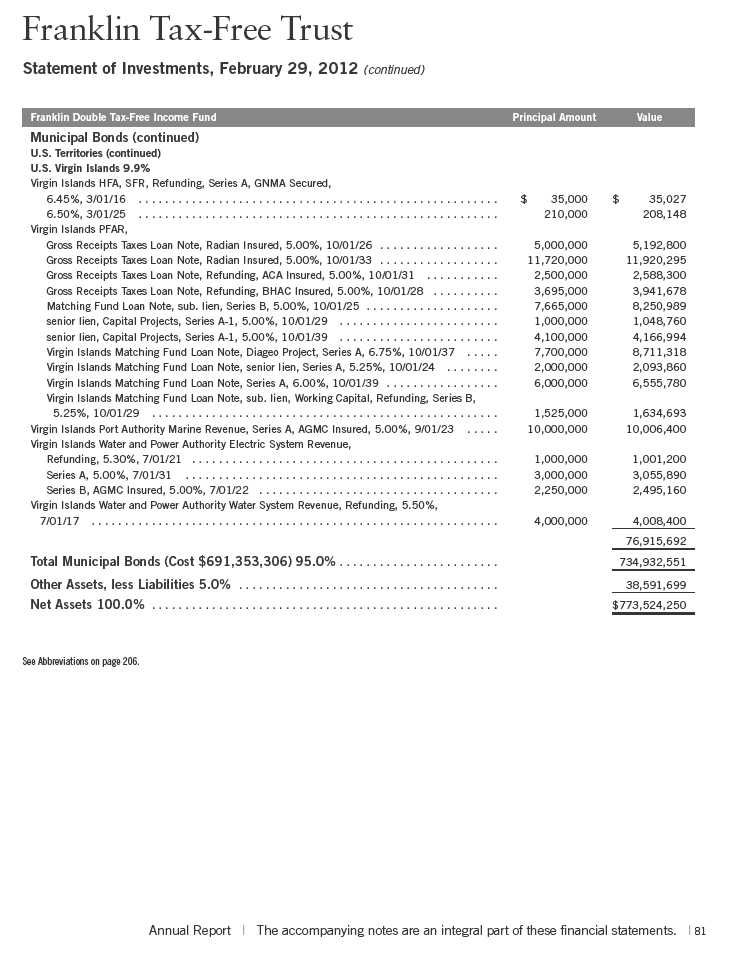

Franklin Double Tax-Free Income Fund

Your Fund’s Goal and Main Investments: Franklin Double Tax-Free Income Fund seeks to provide as high a level of income exempt from federal and state personal income taxes as is consistent with prudent investment management and preservation of capital by investing at least 80% of its net assets in securities that pay interest free from such taxes.1 The Fund focuses on municipal securities issued by U.S. territories such as Puerto Rico, Guam and the U.S. Virgin Islands, and currently invests primarily in Puerto Rican municipal securities.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Performance Overview

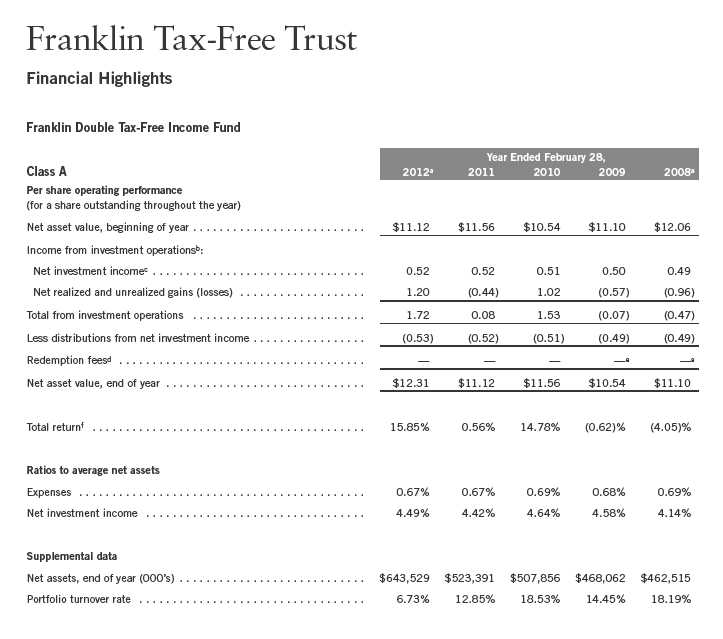

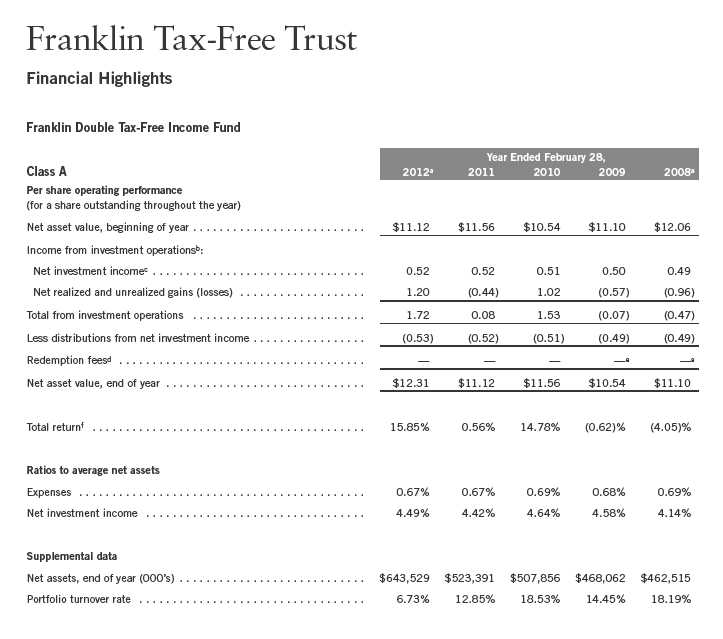

The Fund’s Class A share price, as measured by net asset value, increased from $11.12 on February 28, 2011, to $12.31 on February 29, 2012. The Fund’s

1. For investors subject to alternative minimum tax, a small portion of Fund dividends may be taxable. Distributions of capital gains are generally taxable. To avoid imposition of 28% backup withholding on all Fund distributions and redemption proceeds, U.S. investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

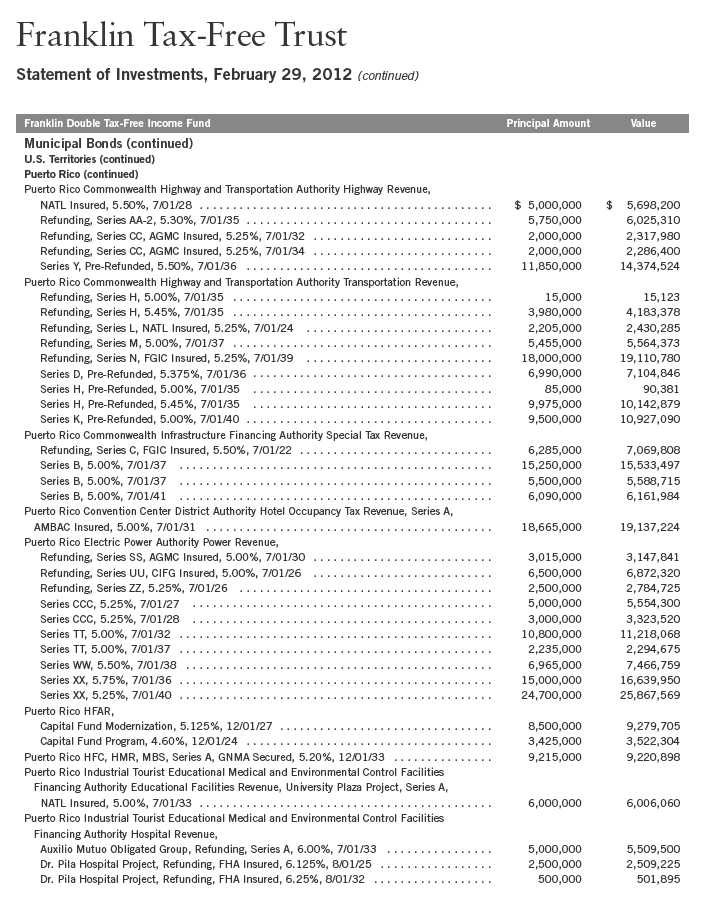

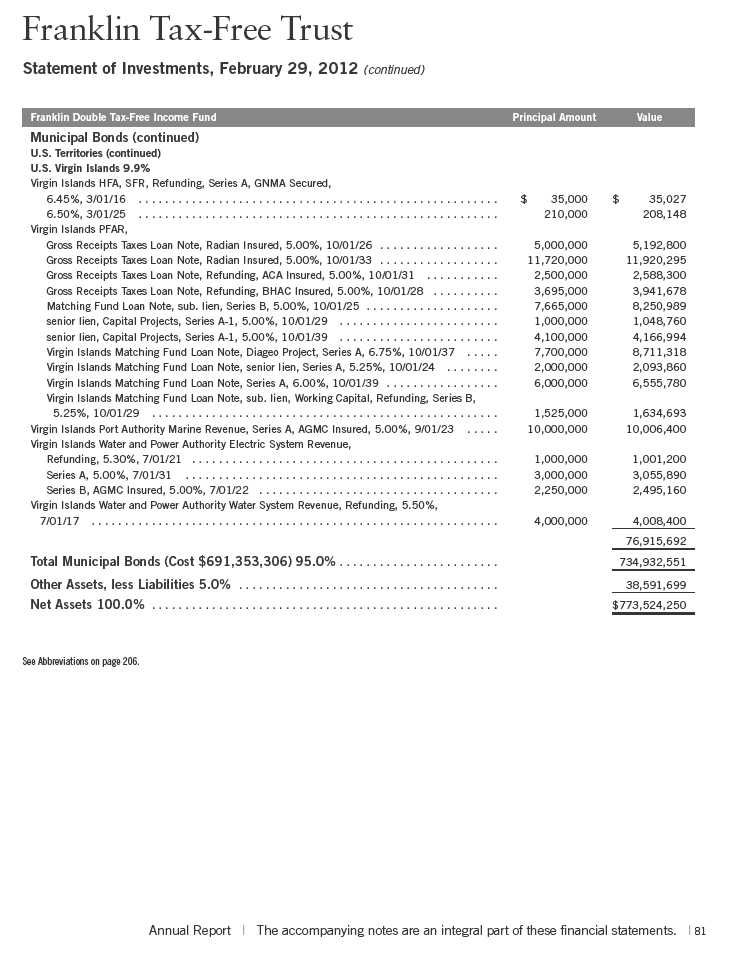

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 78.

Annual Report | 7

| | |

| Portfolio Breakdown | | |

| Franklin Double Tax-Free Income Fund | |

| 2/29/12 | | |

| % of Total | |

| Long-Term Investments* | |

| Utilities | 21.7 | % |

| General Obligation | 19.2 | % |

| Tax-Supported | 18.5 | % |

| Transportation | 11.2 | % |

| Other Revenue | 7.7 | % |

| Subject to Government Appropriations | 7.4 | % |

| Refunded | 7.2 | % |

| Housing | 3.0 | % |

| Higher Education | 2.9 | % |

| Hospital & Health Care | 1.2 | % |

| |

| *Does not include short-term investments and other | |

| net assets. | | |

Class A shares paid dividends totaling 53.26 cents per share for the same period.2 The Performance Summary beginning on page 10 shows that at the end of this reporting period the Fund’s Class A shares’ distribution rate was 4.05%, based on an annualization of the current 4.34 cent per share dividend and the maximum offering price of $12.86 on February 29, 2012. An investor in the 2012 maximum federal income tax bracket of 35.00% would need to earn a distribution rate of 6.23% from a taxable investment to match the Fund’s Class A tax-free distribution rate. For the Fund’s Class C and Advisor shares’ performance, please see the Performance Summary.

Manager’s Discussion

We used various investment strategies during the 12 months under review as we sought to maximize tax-free income for shareholders. Please read the discussion on page 6 for details. Franklin Double Tax-Free Income Fund is the

2. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

8 | Annual Report

first mutual fund to offer both state and federal income tax exemptions in all 50 states. We do this by focusing on investments in U.S. territories such as Puerto Rico, the U.S. Virgin Islands and Guam. This can be particularly appealing to residents of states such as Illinois, Iowa and Wisconsin, where income from their own municipal securities may be fully taxable.

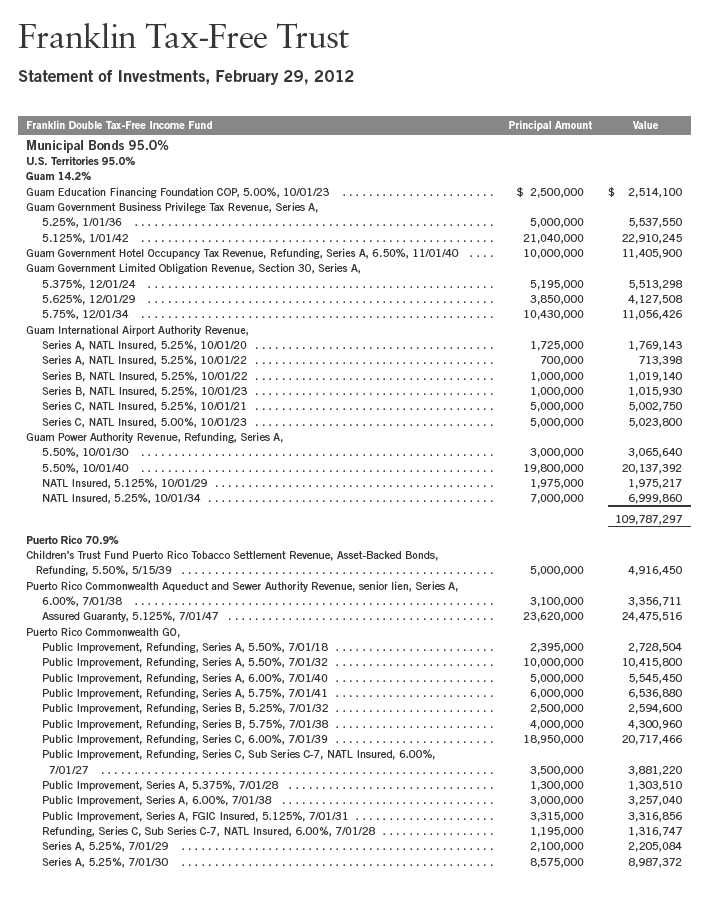

The Fund was well diversified with 120 different positions across 10 different sectors as of February 29, 2012. Issuers represented in the portfolio included Puerto Rico (74.6% of the Fund’s total long-term investments), Guam (14.9%) and the U.S. Virgin Islands (10.5%).

Many municipal bond funds purchase U.S. territory paper, mainly Puerto Rico’s, as an alternative for their specialty state funds when the supply within a particular state is running low. This strong demand for territory paper can help to keep bond values high relative to other states. Puerto Rico’s municipal bond market is widely traded because of its dual tax-exemption advantages.

Thank you for your continued participation in Franklin Double Tax-Free Income Fund. We believe our conservative, buy-and-hold investment strategy can help us achieve high, current, tax-free income for shareholders.

The foregoing information reflects our analysis, opinions and portfolio holdings as of February 29, 2012, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, state, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Annual Report | 9

Performance Summary as of 2/29/12

Franklin Double Tax-Free Income Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | | | |

| Price and Distribution Information | | | | | | |

| Class A (Symbol: FPRTX) | | | | Change | | 2/29/12 | | 2/28/11 |

| Net Asset Value (NAV) | | | +$ | 1.19 | $ | 12.31 | $ | 11.12 |

| Distributions (3/1/11–2/29/12) | | | | | | | | |

| Dividend Income | $ | 0.5326 | | | | | | |

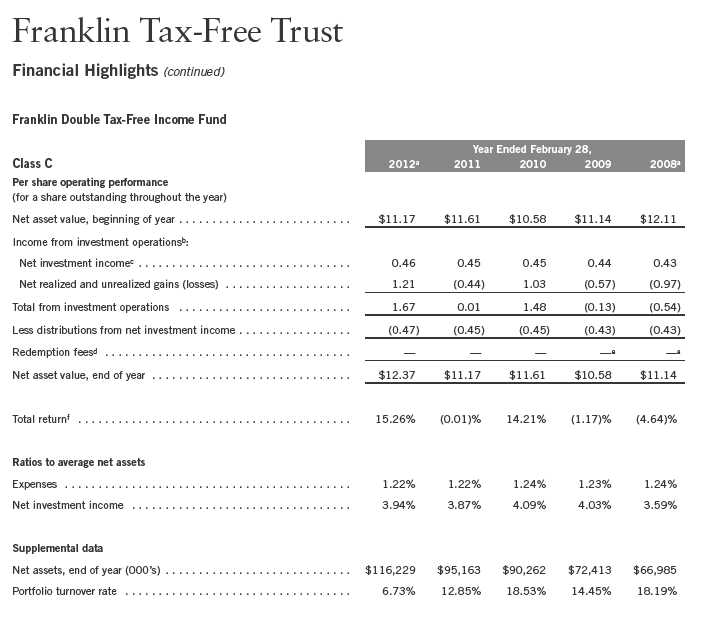

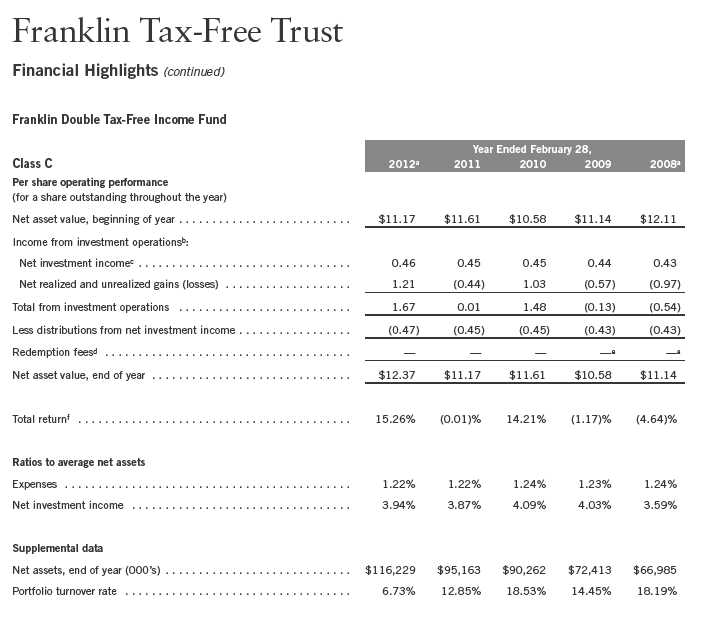

| Class C (Symbol: FPRIX) | | | | Change | | 2/29/12 | | 2/28/11 |

| Net Asset Value (NAV) | | | +$ | 1.20 | $ | 12.37 | $ | 11.17 |

| Distributions (3/1/11–2/29/12) | | | | | | | | |

| Dividend Income | $ | 0.4700 | | | | | | |

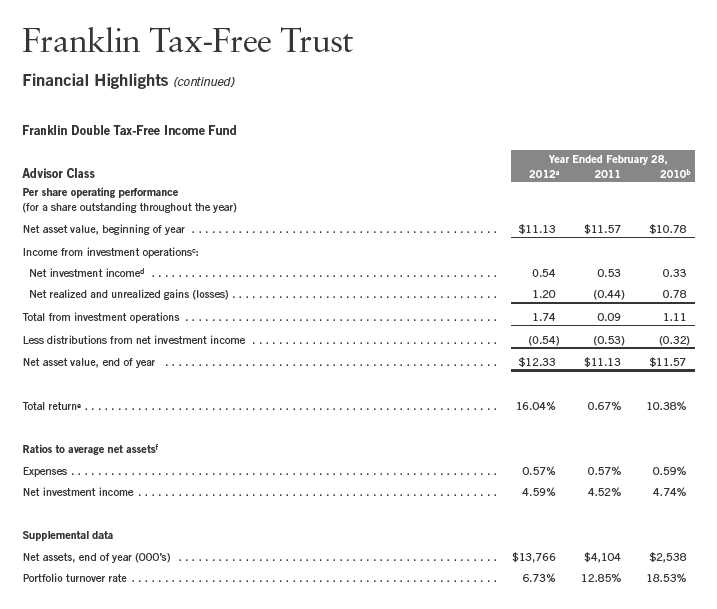

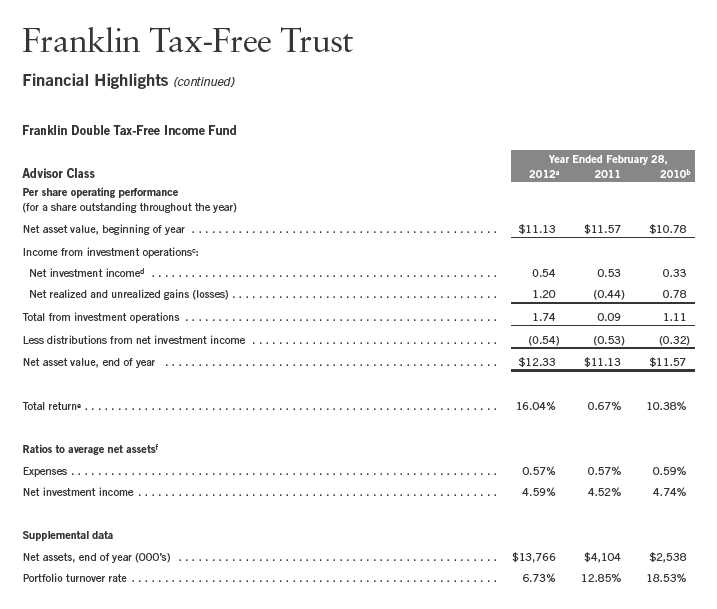

| Advisor Class (Symbol: FDBZX) | | | | Change | | 2/29/12 | | 2/28/11 |

| Net Asset Value (NAV) | | | +$ | 1.20 | $ | 12.33 | $ | 11.13 |

| Distributions (3/1/11–2/29/12) | | | | | | | | |

| Dividend Income | $ | 0.5435 | | | | | | |

10 | Annual Report

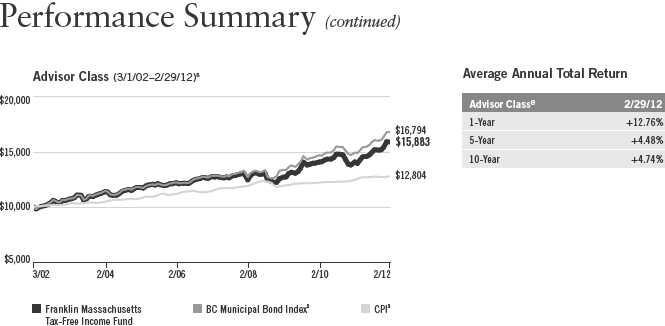

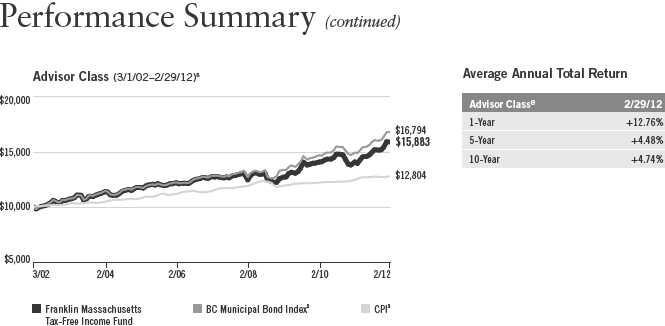

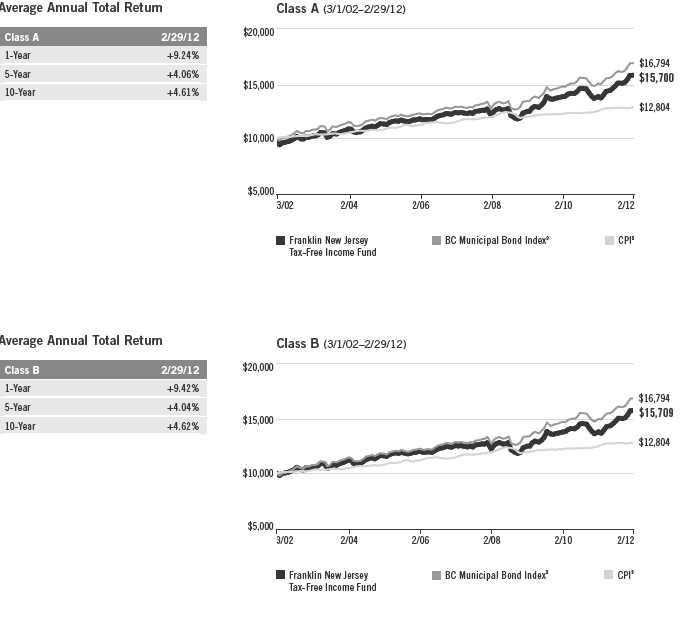

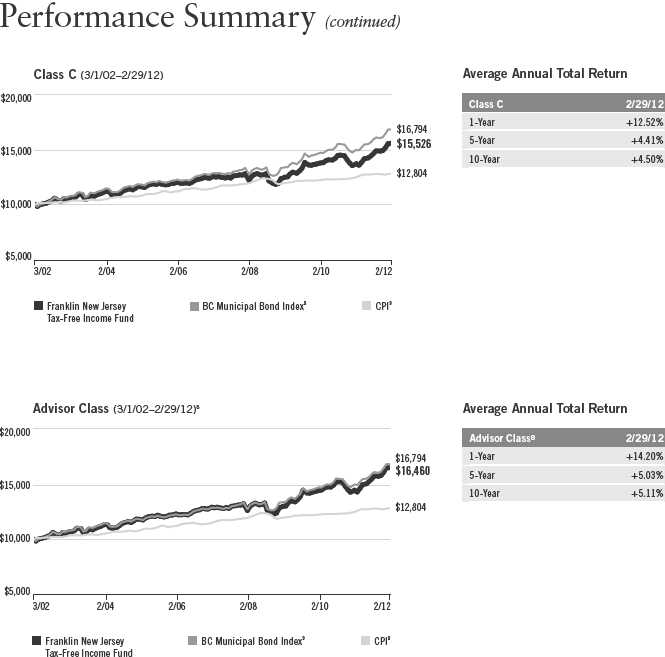

Performance Summary (continued)

Performance

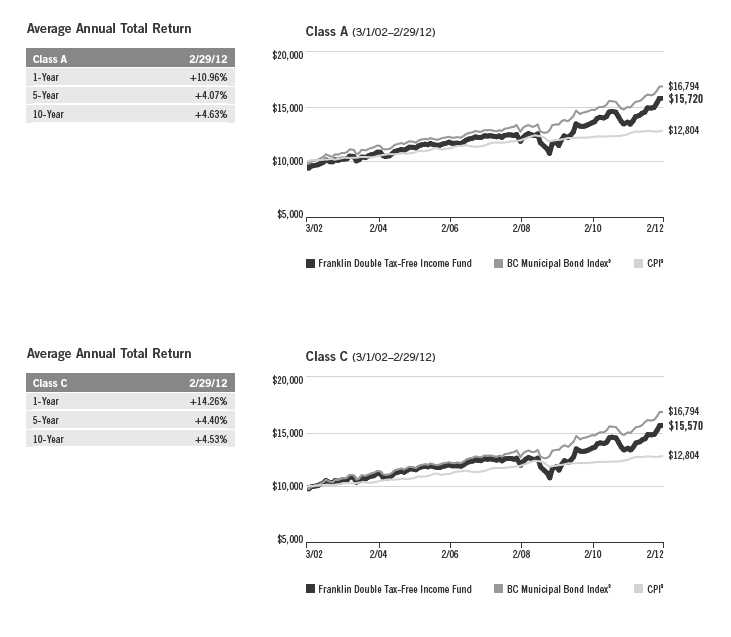

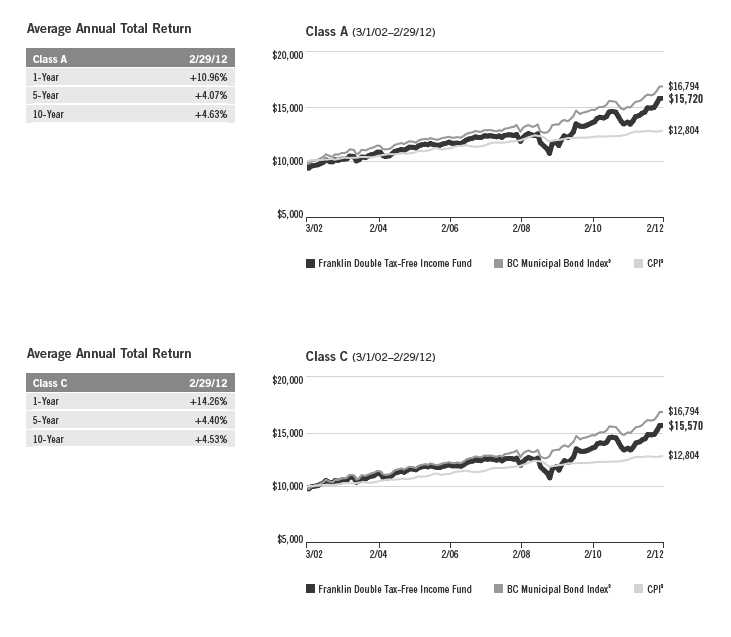

Cumulative total return excludes sales charges. Average annual total returns include maximum sales charges. Class A: 4.25% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Advisor Class: no sales charges.

| | | | | | | | | | | |

| Class A | | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | + | 15.85 | % | + | 27.51 | % | + | 64.20 | % |

| Average Annual Total Return2 | | | + | 10.96 | % | + | 4.07 | % | + | 4.63 | % |

| Avg. Ann. Total Return (3/31/12)3 | | | + | 11.74 | % | + | 3.97 | % | + | 4.74 | % |

| Distribution Rate4 | 4.05 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 6.23 | % | | | | | | | | | |

| 30-Day Standardized Yield6 | 3.24 | % | | | | | | | | | |

| Taxable Equivalent Yield5 | 4.98 | % | | | | | | | | | |

| Total Annual Operating Expenses7 | 0.67 | % | | | | | | | | | |

| Class C | | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | + | 15.26 | % | + | 24.04 | % | + | 55.70 | % |

| Average Annual Total Return2 | | | + | 14.26 | % | + | 4.40 | % | + | 4.53 | % |

| Avg. Ann. Total Return (3/31/12)3 | | | + | 14.96 | % | + | 4.30 | % | + | 4.62 | % |

| Distribution Rate4 | 3.66 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 5.63 | % | | | | | | | | | |

| 30-Day Standardized Yield6 | 2.84 | % | | | | | | | | | |

| Taxable Equivalent Yield5 | 4.37 | % | | | | | | | | | |

| Total Annual Operating Expenses7 | 1.22 | % | | | | | | | | | |

| Advisor Class8 | | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | + | 16.04 | % | + | 28.03 | % | + | 64.87 | % |

| Average Annual Total Return2 | | | + | 16.04 | % | + | 5.07 | % | + | 5.13 | % |

| Avg. Ann. Total Return (3/31/12)3 | | | + | 16.75 | % | + | 4.94 | % | + | 5.23 | % |

| Distribution Rate4 | 4.33 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 6.66 | % | | | | | | | | | |

| 30-Day Standardized Yield6 | 3.49 | % | | | | | | | | | |

| Taxable Equivalent Yield5 | 5.37 | % | | | | | | | | | |

| Total Annual Operating Expenses7 | 0.57 | % | | | | | | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Annual Report | 11

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any current, applicable, maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

12 | Annual Report

Endnotes

All investments involve risks, including possible loss of principal. Because municipal bonds are sensitive to interest rate movements, the Fund’s yield and share price will fluctuate with market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. Since the Fund may concentrate its investments in a single U.S. territory, it may be subject to greater risk of adverse economic and regulatory changes in that territory than a geographically diversified fund. The Fund is classified as a nondiversified Fund because it may invest a greater portion of its assets in the municipal securities of one issuer than a diversified fund. The Fund’s prospectus also includes a description of the main investment risks.

Class C: Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated.

3. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

4. Distribution rate is based on an annualization of the respective class’s current monthly dividend and the maximum offering price (NAV for Classes C and Advisor) per share on 2/29/12.

5. Taxable equivalent distribution rate and yield assume the 2012 maximum federal income tax rate of 35.00%.

6. The 30-day standardized yield for the month ended 2/29/12 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

7. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

8. Effective 7/15/09, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 7/15/09, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 7/15/09, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 7/15/09 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +28.93% and +10.17%.

9. Source: © 2012 Morningstar. The BC Municipal Bond Index is a market value-weighted index engineered for the long-term tax-exempt bond market. To be included in the index, bonds must be fixed rate, have at least one year to final maturity and be rated investment grade (Baa3/BBB- or higher) by at least two of the following agencies: Moody’s, Standard & Poor’s and Fitch. The Consumer Price Index (CPI), calculated by the U.S. Bureau of Labor Statistics, is a commonly used measure of the inflation rate.

Annual Report | 13

Your Fund’s Expenses

Franklin Double Tax-Free Income Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1 | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

14 | Annual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Class A | | Value 9/1/11 | | Value 2/29/12 | | Period* 9/1/11–2/29/12 |

| Actual | $ | 1,000 | $ | 1,086.70 | $ | 3.48 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.53 | $ | 3.37 |

| Class C | | | | | | |

| Actual | $ | 1,000 | $ | 1,084.20 | $ | 6.37 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.75 | $ | 6.17 |

| Advisor Class | | | | | | |

| Actual | $ | 1,000 | $ | 1,087.10 | $ | 2.96 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.03 | $ | 2.87 |

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.67%; C: 1.23%; and Advisor: 0.57%), multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period.

Annual Report | 15

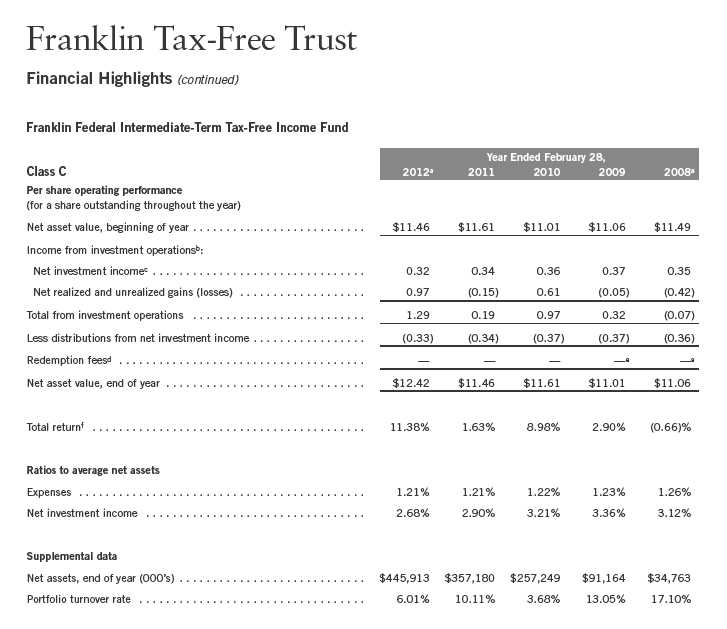

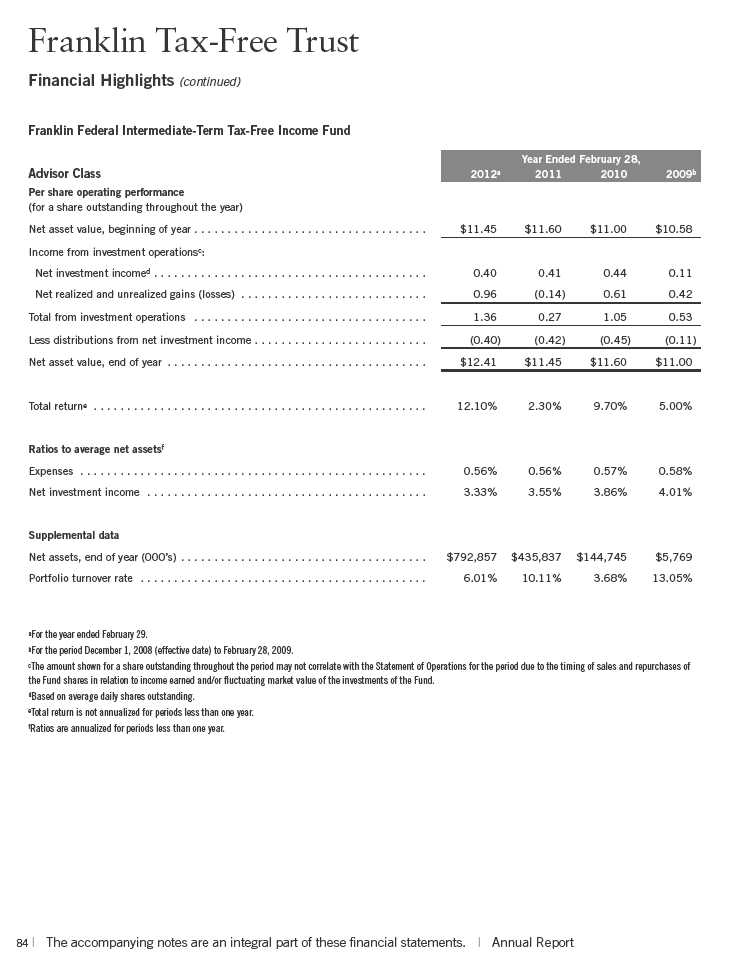

Franklin Federal Intermediate-Term Tax-Free Income Fund

Your Fund’s Goal and Main Investments: Franklin Federal Intermediate-Term Tax-Free Income Fund seeks to provide as high a level of income exempt from federal income taxes as is consistent with prudent investment management and preservation of capital by investing at least 80% of its total assets in securities that pay interest free from such taxes.1 The Fund maintains a dollar-weighted average portfolio maturity (the time in which the debt must be repaid) of three to 10 years.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

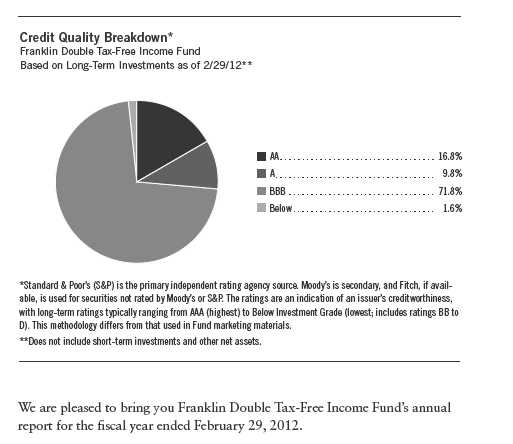

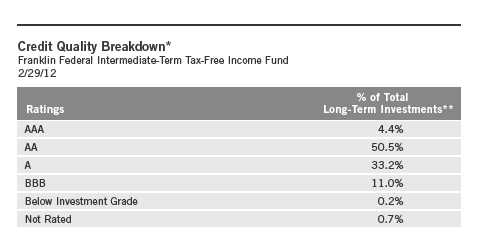

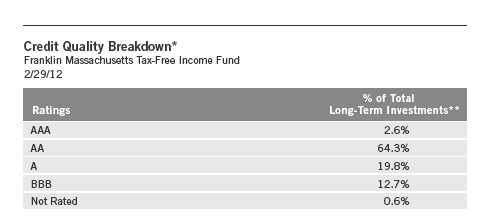

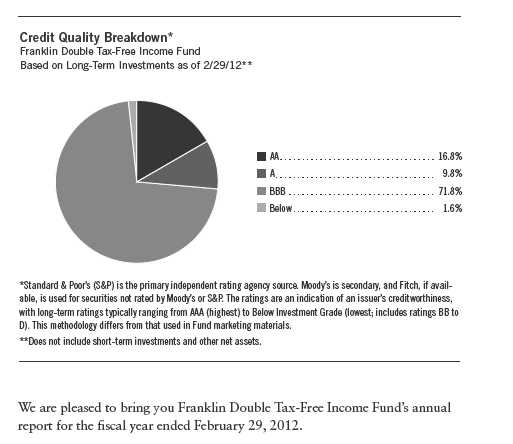

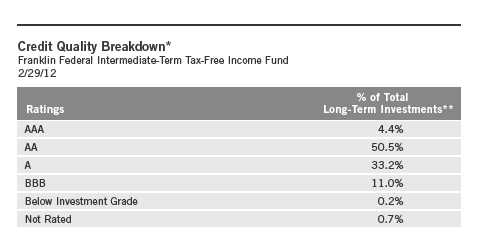

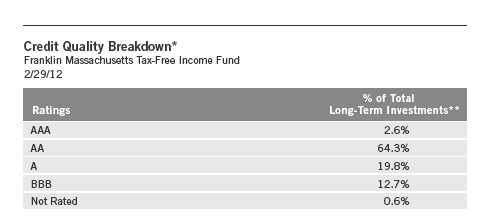

*Standard & Poor’s (S&P) is the primary independent rating agency source. Moody’s is secondary, and Fitch, if available, is used for securities not rated by Moody’s or S&P. The ratings are an indication of an issuer’s creditworthiness, with long-term ratings typically ranging from AAA (highest) to Below Investment Grade (lowest; includes ratings BB to D). This methodology differs from that used in Fund marketing materials.

**Does not include short-term investments and other net assets.

We are pleased to bring you Franklin Federal Intermediate-Term Tax-Free Income Fund’s annual report for the fiscal year ended February 29, 2012.

Performance Overview

The Fund’s Class A share price, as measured by net asset value, increased from $11.43 on February 28, 2011, to $12.39 on February 29, 2012. The Fund’s

1. Dividends are generally subject to state and local taxes, if any. For investors subject to alternative minimum tax, a small portion of Fund dividends may be taxable. Distributions of capital gains are generally taxable. To avoid imposition of 28% backup withholding on all Fund distributions and redemption proceeds, U.S. investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

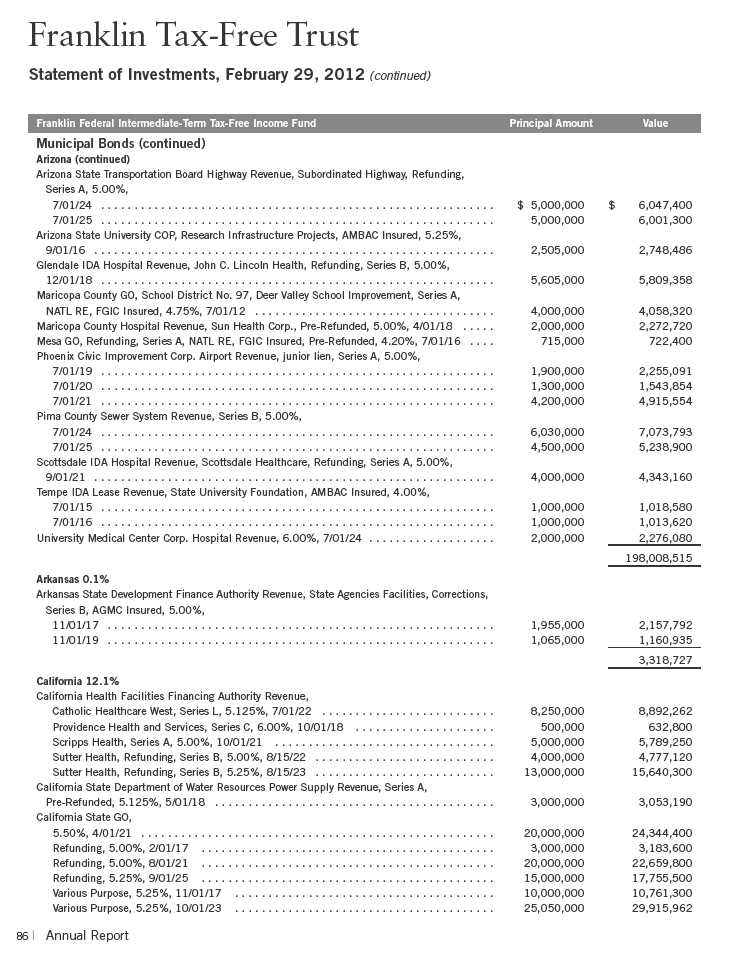

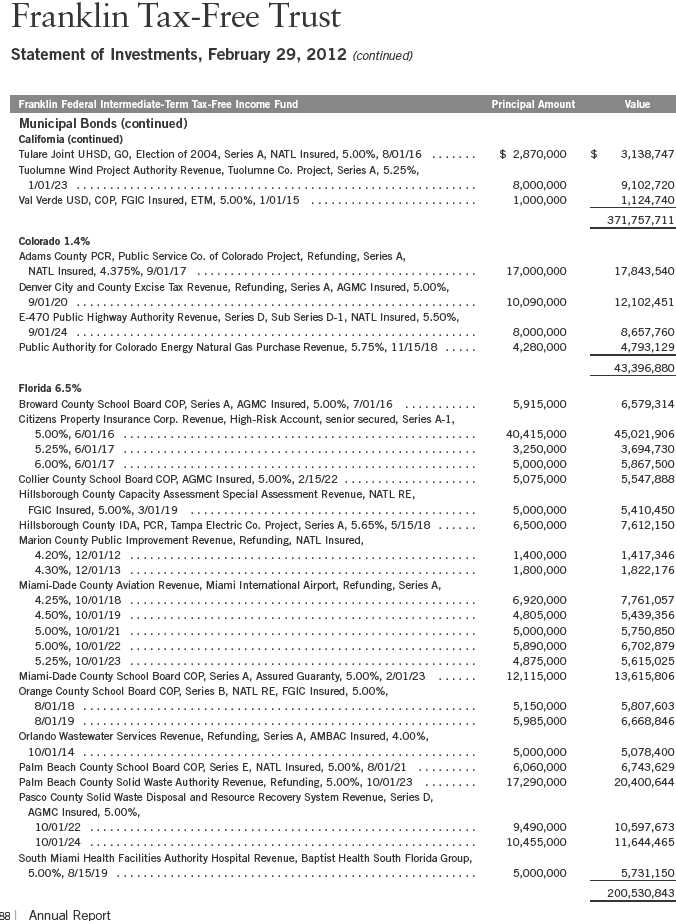

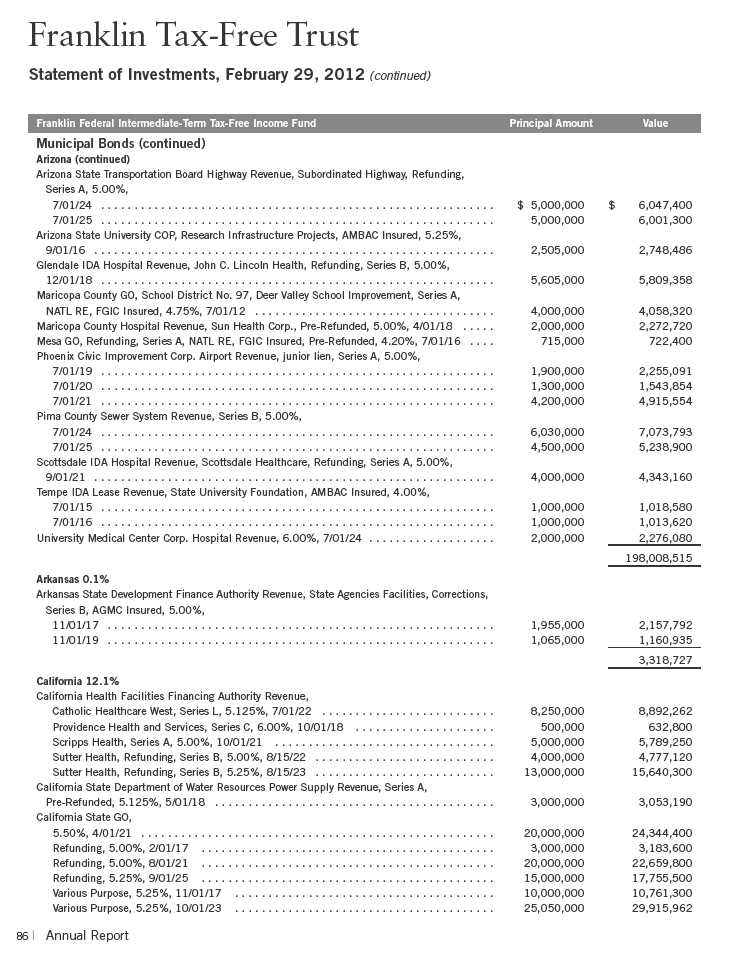

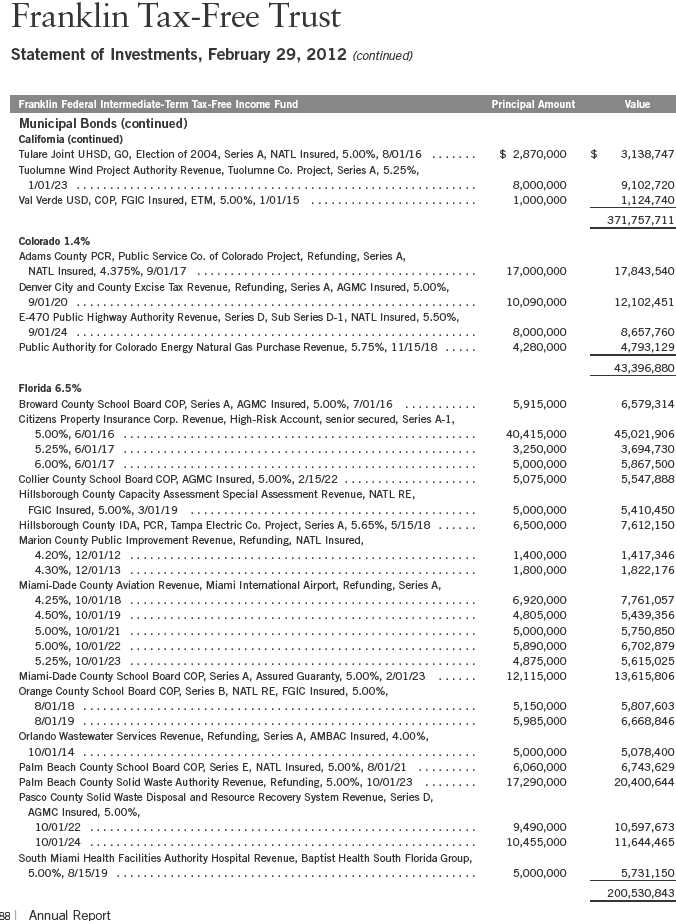

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 85.

16 | Annual Report

| | | |

| Dividend Distributions* | | | |

| Franklin Federal Intermediate-Term Tax-Free Income Fund | | |

| | | Dividend per Share |

| Month | Class A | Class C | Advisor Class |

| March 2011 | 3.23 cents | 2.72 cents | 3.32 cents |

| April 2011 | 3.23 cents | 2.72 cents | 3.32 cents |

| May 2011 | 3.23 cents | 2.72 cents | 3.32 cents |

| June 2011 | 3.38 cents | 2.87 cents | 3.47 cents |

| July 2011 | 3.38 cents | 2.87 cents | 3.47 cents |

| August 2011 | 3.38 cents | 2.87 cents | 3.47 cents |

| September 2011 | 3.28 cents | 2.73 cents | 3.38 cents |

| October 2011 | 3.28 cents | 2.73 cents | 3.38 cents |

| November 2011 | 3.28 cents | 2.73 cents | 3.38 cents |

| December 2011** | 4.13 cents | 3.38 cents | 4.27 cents |

| January 2012 | 2.13 cents | 1.74 cents | 2.19 cents |

| February 2012 | 3.13 cents | 2.56 cents | 3.23 cents |

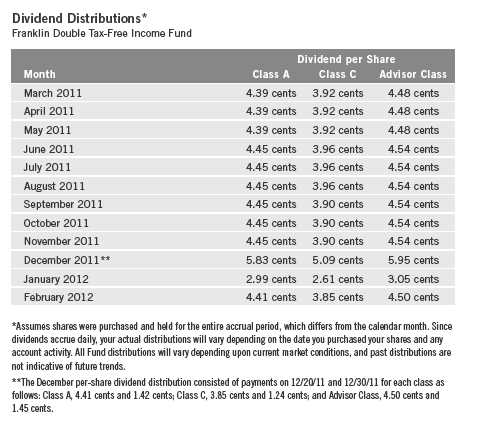

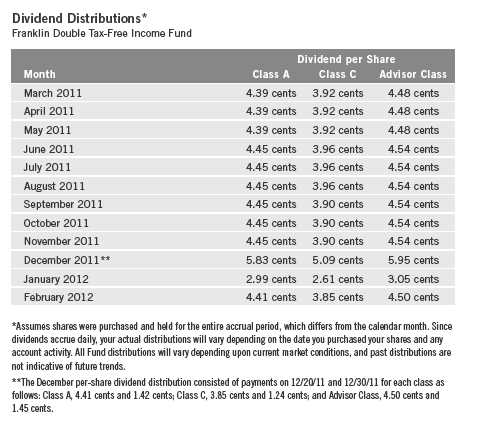

*Assumes shares were purchased and held for the entire accrual period, which differs from the calendar month. Since dividends accrue daily, your actual distributions will vary depending on the date you purchased your shares and any account activity. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

**The December per-share dividend distribution consisted of payments on 12/20/11 and 12/30/11 for each class as follows: Class A, 3.13 cents and 1.00 cent; Class C, 2.56 cents and 0.82 cents; and Advisor Class, 3.23 cents and 1.04 cents.

Class A shares paid dividends totaling 39.10 cents per share for the same period.2 The Performance Summary beginning on page 19 shows that at the end of this reporting period the Fund’s Class A shares’ distribution rate was 2.82%, based on an annualization of the current 2.98 cent per share dividend and the maximum offering price of $12.68 on February 29, 2012. An investor in the 2012 maximum federal income tax bracket of 35.00% would need to earn a distribution rate of 4.34% from a taxable investment to match the Fund’s Class A tax-free distribution rate. For the Fund’s Class C and Advisor shares’ performance, please see the Performance Summary. The reduction in dividend distributions from the start to the end of the period under review reflected generally declining interest rates. Additionally, investor demand was strong for municipal bonds in an environment of limited tax-exempt supply. These factors resulted in reduced income for the portfolio and caused dividends to decline overall.

2. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

Annual Report | 17

18 | Annual Report

Performance Summary as of 2/29/12

Franklin Federal Intermediate-Term Tax-Free Income Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | | | |

| Price and Distribution Information | | | | | | |

| Class A (Symbol: FKITX) | | | | Change | | 2/29/12 | | 2/28/11 |

| Net Asset Value (NAV) | | | +$ | 0.96 | $ | 12.39 | $ | 11.43 |

| Distributions (3/1/11–2/29/12) | | | | | | | | |

| Dividend Income | $ | 0.3910 | | | | | | |

| Class C (Symbol: FCITX) | | | | Change | | 2/29/12 | | 2/28/11 |

| Net Asset Value (NAV) | | | +$ | 0.96 | $ | 12.42 | $ | 11.46 |

| Distributions (3/1/11–2/29/12) | | | | | | | | |

| Dividend Income | $ | 0.3263 | | | | | | |

| Advisor Class (Symbol: FITZX) | | | | Change | | 2/29/12 | | 2/28/11 |

| Net Asset Value (NAV) | | | +$ | 0.96 | $ | 12.41 | $ | 11.45 |

| Distributions (3/1/11–2/29/12) | | | | | | | | |

| Dividend Income | $ | 0.4025 | | | | | | |

Annual Report | 19

Performance Summary (continued)

Performance

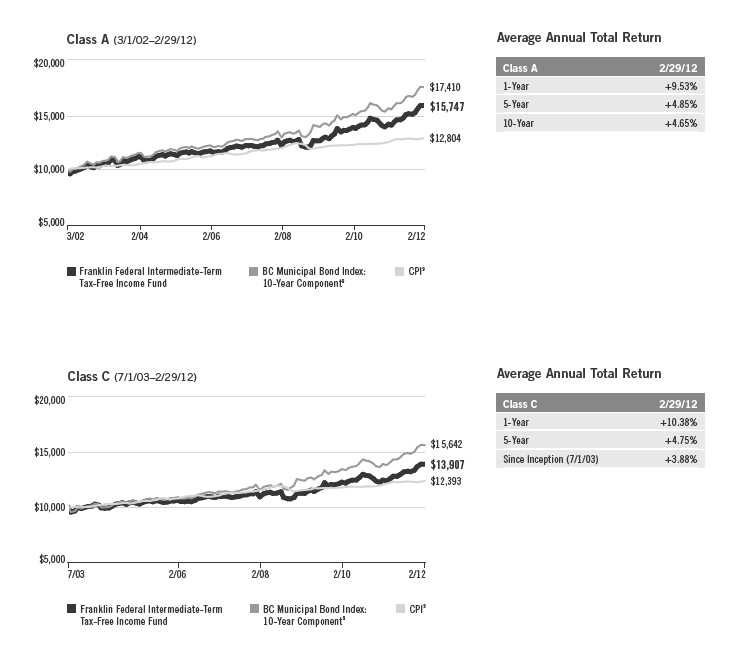

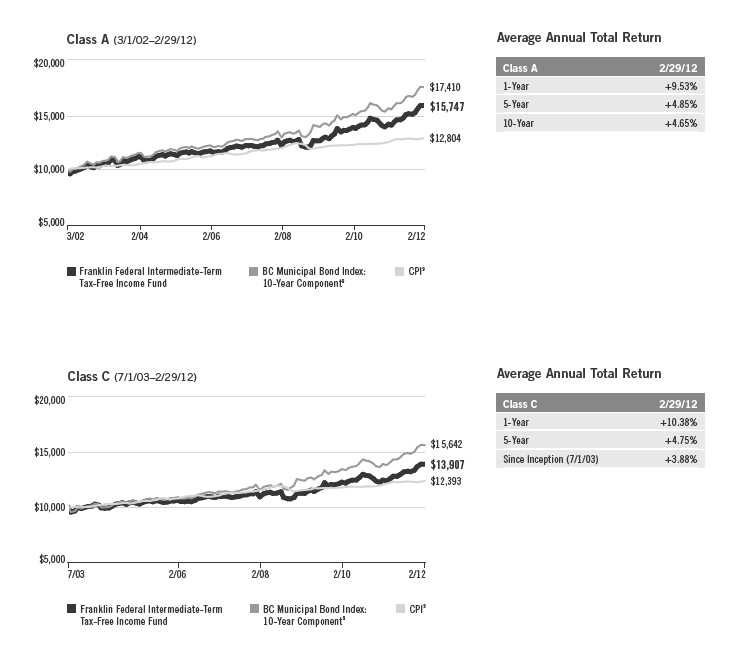

Cumulative total return excludes sales charges. Average annual total returns include maximum sales charges. Class A: 2.25% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Advisor Class: no sales charges.

| | | | | | | | | | | |

| Class A | | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | + | 12.02 | % | + | 29.60 | % | + | 61.15 | % |

| Average Annual Total Return2 | | | + | 9.53 | % | + | 4.85 | % | + | 4.65 | % |

| Avg. Ann. Total Return (3/31/12)3 | | | + | 9.16 | % | + | 4.68 | % | + | 4.73 | % |

| Distribution Rate4 | 2.82 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 4.34 | % | | | | | | | | | |

| 30-Day Standardized Yield6 | 1.64 | % | | | | | | | | | |

| Taxable Equivalent Yield5 | 2.52 | % | | | | | | | | | |

| Total Annual Operating Expenses7 | 0.66 | % | | | | | | | | | |

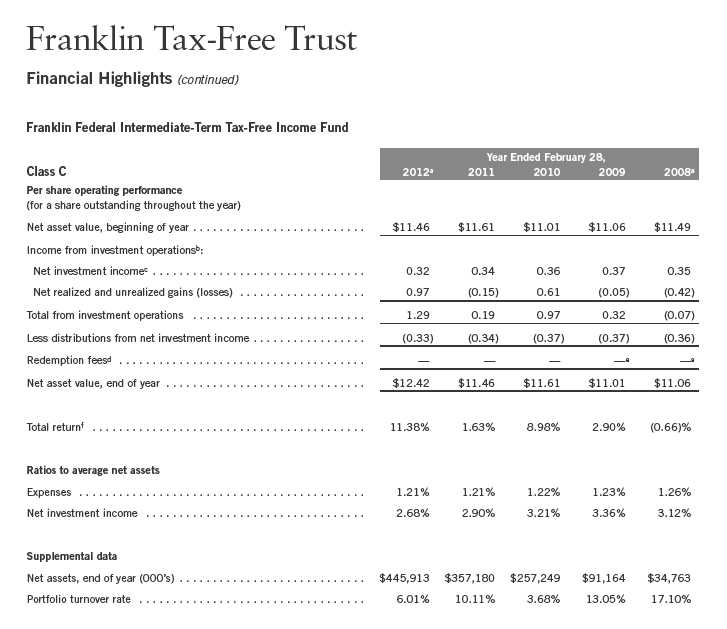

| Class C | | | | 1-Year | | | 5-Year | | | Inception (7/1/03) | |

| Cumulative Total Return1 | | | + | 11.38 | % | + | 26.10 | % | + | 39.07 | % |

| Average Annual Total Return2 | | | + | 10.38 | % | + | 4.75 | % | + | 3.88 | % |

| Avg. Ann. Total Return (3/31/12)3 | | | + | 10.04 | % | + | 4.60 | % | + | 3.72 | % |

| Distribution Rate4 | 2.31 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 3.55 | % | | | | | | | | | |

| 30-Day Standardized Yield6 | 1.14 | % | | | | | | | | | |

| Taxable Equivalent Yield5 | 1.75 | % | | | | | | | | | |

| Total Annual Operating Expenses7 | 1.21 | % | | | | | | | | | |

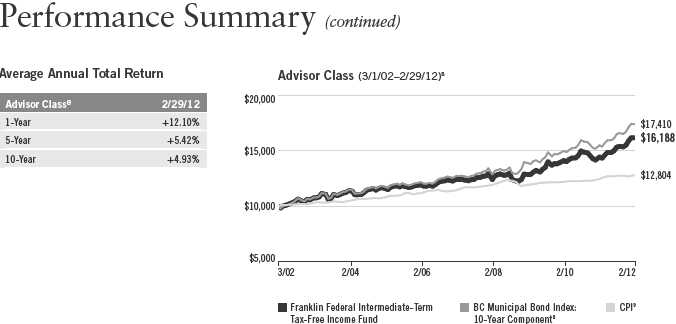

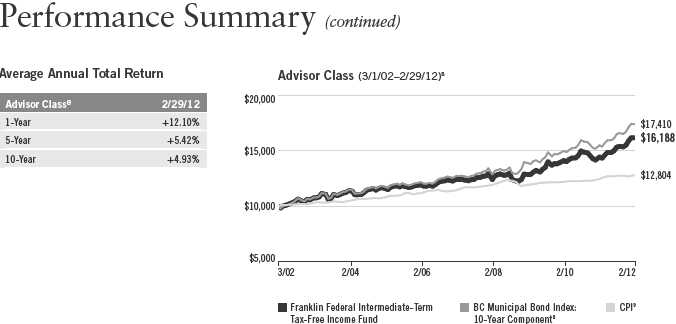

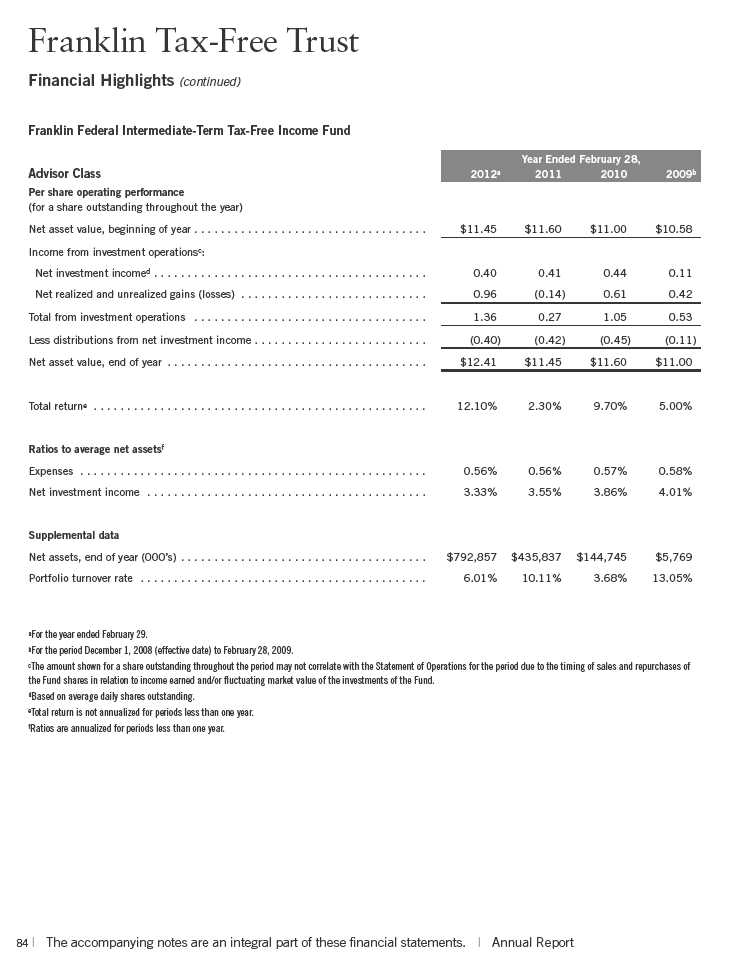

| Advisor Class8 | | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | + | 12.10 | % | + | 30.18 | % | + | 61.88 | % |

| Average Annual Total Return2 | | | + | 12.10 | % | + | 5.42 | % | + | 4.93 | % |

| Avg. Ann. Total Return (3/31/12)3 | | | + | 11.76 | % | + | 5.25 | % | + | 5.01 | % |

| Distribution Rate4 | 2.99 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 4.60 | % | | | | | | | | | |

| 30-Day Standardized Yield6 | 1.78 | % | | | | | | | | | |

| Taxable Equivalent Yield5 | 2.74 | % | | | | | | | | | |

| Total Annual Operating Expenses7 | 0.56 | % | | | | | | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

20 | Annual Report

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any current, applicable, maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

Annual Report | 21

Endnotes

All investments involve risks, including possible loss of principal. Because municipal bonds are sensitive to interest rate movements, the Fund’s yield and share price will fluctuate with market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class C: | Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

| |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated.

3. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

4. Distribution rate is based on an annualization of the respective class’s current monthly dividend and the maximum offering price (NAV for Classes C and Advisor) per share on 2/29/12.

5. Taxable equivalent distribution rate and yield assume the 2012 maximum federal income tax rate of 35.00%.

6. The 30-day standardized yield for the month ended 2/29/12 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

7. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

8. Effective 12/1/08, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 12/1/08, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 12/1/08, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 12/1/08 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +32.10% and +8.96%.

9. Source: © 2012 Morningstar. The BC Municipal Bond Index: 10-Year Component is the 10-year (8-12) component of the Municipal Bond Index, which is a market value-weighted index engineered for the long-term tax-exempt bond market. To be included in the index, bonds must be fixed rate, have at least one year to final maturity and be rated investment grade (Baa3/BBB- or higher) by at least two of the following agencies: Moody’s, Standard & Poor’s and Fitch. The Consumer Price Index (CPI), calculated by the U.S. Bureau of Labor Statistics, is a commonly used measure of the inflation rate.

22 | Annual Report

Your Fund’s Expenses

Franklin Federal Intermediate-Term Tax-Free Income Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Annual Report | 23

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Class A | | Value 9/1/11 | | Value 2/29/12 | | Period* 9/1/11–2/29/12 |

| Actual | $ | 1,000 | $ | 1,055.00 | $ | 3.37 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.58 | $ | 3.32 |

| Class C | | | | | | |

| Actual | $ | 1,000 | $ | 1,052.00 | $ | 6.17 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.85 | $ | 6.07 |

| Advisor Class | | | | | | |

| Actual | $ | 1,000 | $ | 1,055.40 | $ | 2.86 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.08 | $ | 2.82 |

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.66%; C: 1.21%; and Advisor: 0.56%), multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period.

24 | Annual Report

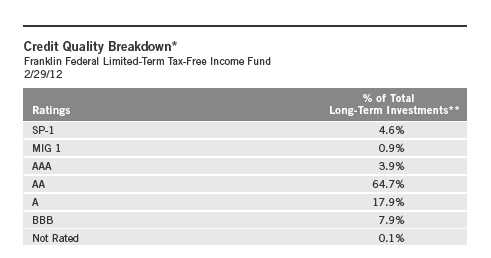

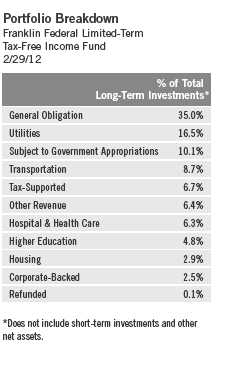

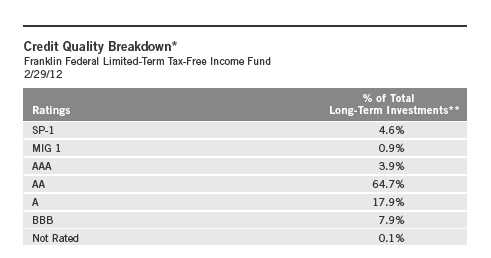

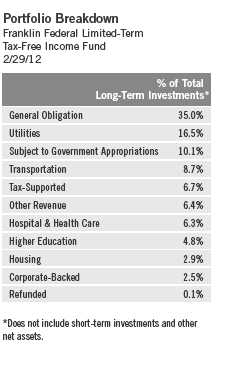

Franklin Federal Limited-Term Tax-Free Income Fund

Your Fund’s Goal and Main Investments: Franklin Federal Limited-Term Tax-Free Income Fund seeks to provide as high a level of income exempt from federal income taxes as is consistent with prudent investment management and preservation of capital by investing at least 80% of its total assets in securities that pay interest free from such taxes.1 The Fund maintains a dollar-weighted average portfolio maturity (the time in which the debt must be repaid) of five years or less.

*Standard & Poor’s (S&P) is the primary independent rating agency source. Moody’s is secondary, and Fitch, if available, is used for securities not rated by Moody’s or S&P. The ratings are an indication of an issuer’s creditworthiness, with short-term ratings typically ranging from SP-1 and MIG 1 (highest) to SP-3 and SG (lowest) and long-term ratings typically ranging from AAA (highest) to Below Investment Grade (lowest; includes ratings BB to D). This methodology differs from that used in Fund marketing materials.

**Does not include short-term investments and other net assets.

We are pleased to bring you Franklin Federal Limited-Term Tax-Free Income Fund’s annual report for the fiscal year ended February 29, 2012.

1. Dividends are generally subject to state and local taxes, if any. For investors subject to alternative minimum tax, a small portion of Fund dividends may be taxable. Distributions of capital gains are generally taxable. To avoid imposition of 28% backup withholding on all Fund distributions and redemption proceeds, U.S. investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

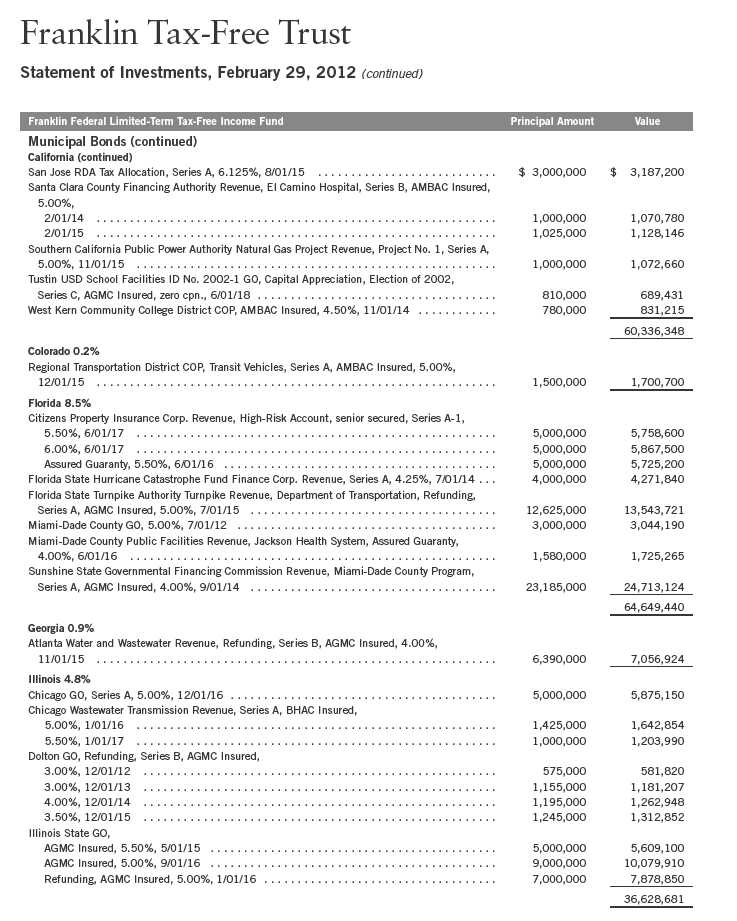

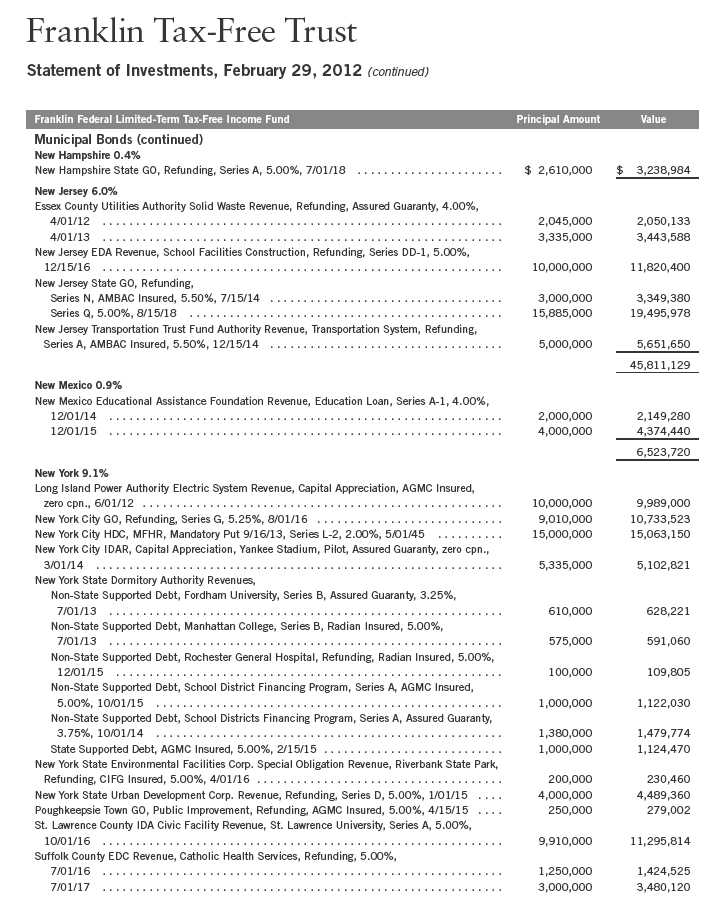

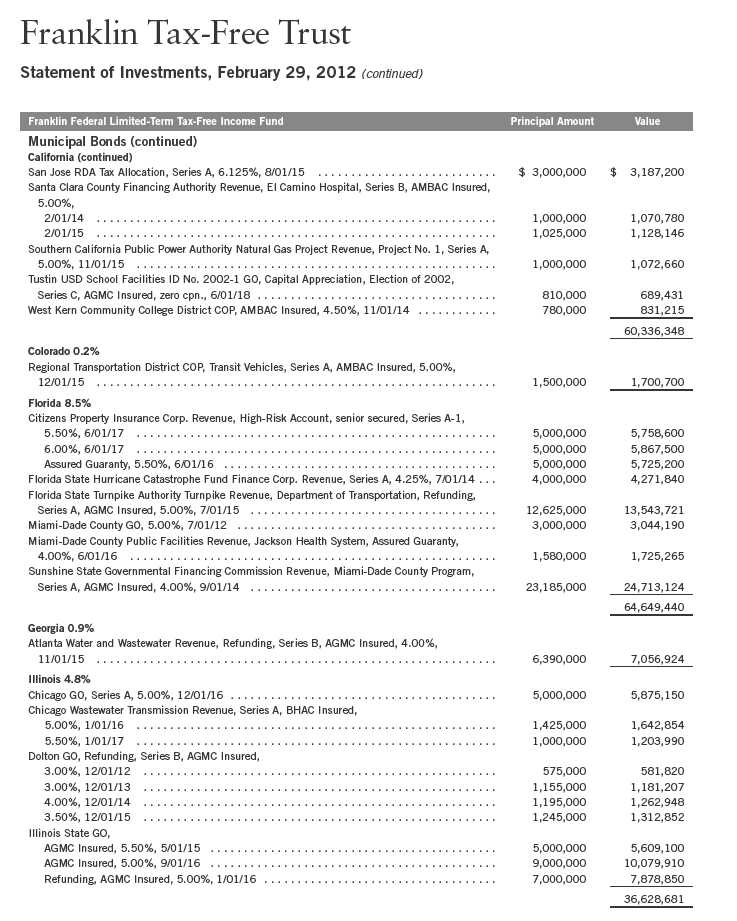

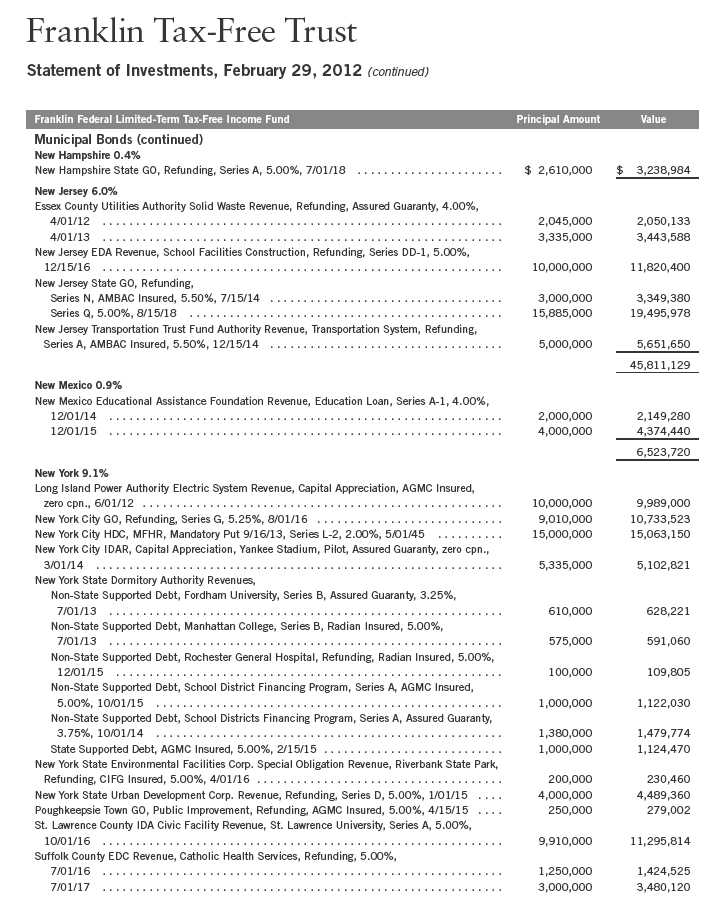

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 102.

Annual Report | 25

Dividend Distributions*

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

| | |

| Franklin Federal Limited-Term Tax-Free Income Fund | | |

| | Dividend per Share |

| Month | Class A | Advisor Class |

| March 2011 | 1.62 cents | 1.70 cents |

| April 2011 | 1.62 cents | 1.70 cents |

| May 2011 | 1.62 cents | 1.70 cents |

| June 2011 | 1.62 cents | 1.74 cents |

| July 2011 | 1.62 cents | 1.74 cents |

| August 2011 | 1.62 cents | 1.74 cents |

| September 2011 | 1.62 cents | 1.77 cents |

| October 2011 | 1.62 cents | 1.77 cents |

| November 2011 | 1.62 cents | 1.77 cents |

| December 2011** | 2.14 cents | 2.31 cents |

| January 2012 | 1.10 cents | 1.19 cents |

| February 2012 | 1.62 cents | 1.75 cents |

*Assumes shares were purchased and held for the entire accrual period, which differs from the calendar month. Since dividends accrue daily, your actual distributions will vary depending on the date you purchased your shares and any account activity. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

**The December per-share dividend distribution consisted of payments on 12/20/11 and 12/30/11 for each class as follows: Class A, 1.62 cents and 0.52 cents; and Advisor Class, 1.75 cents and 0.56 cents.

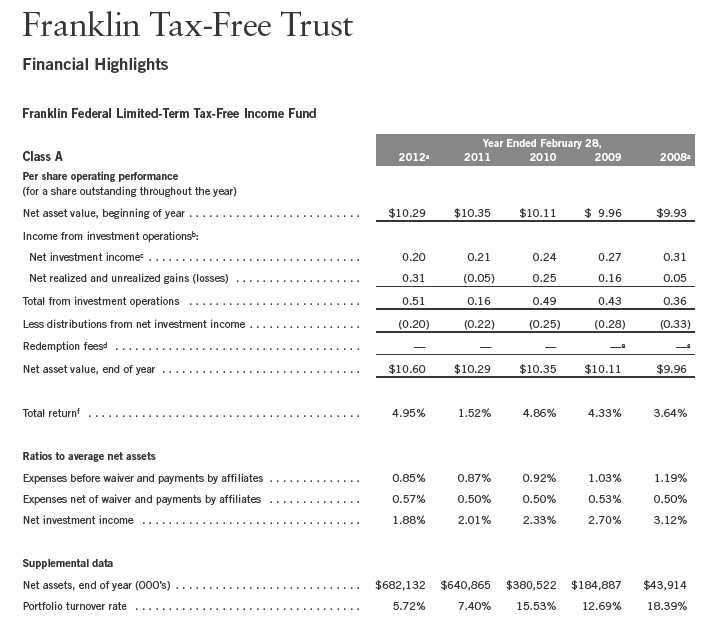

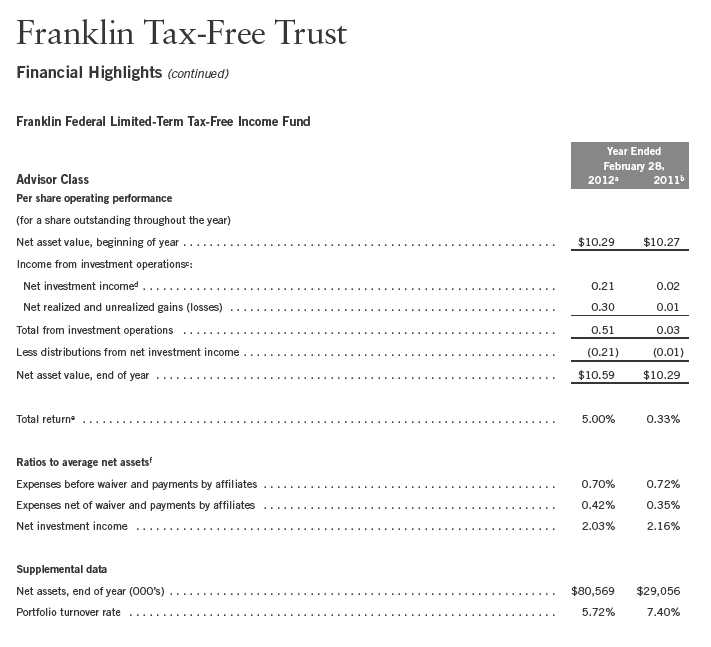

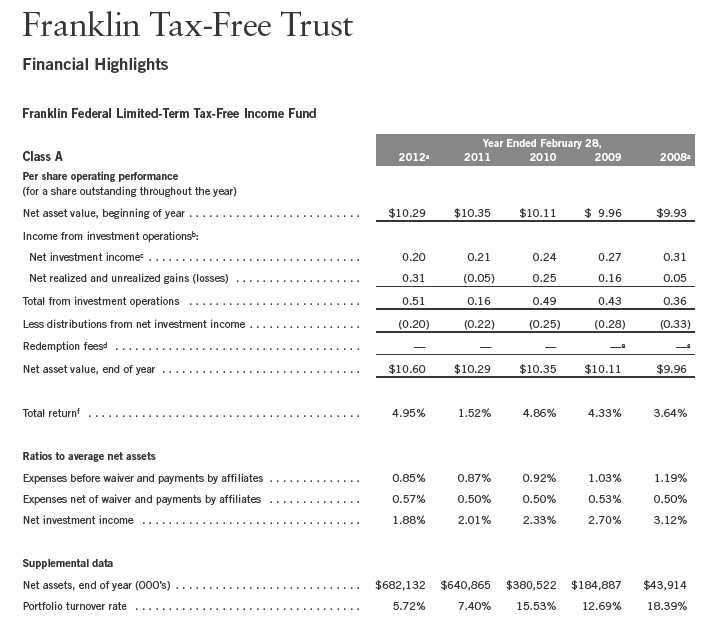

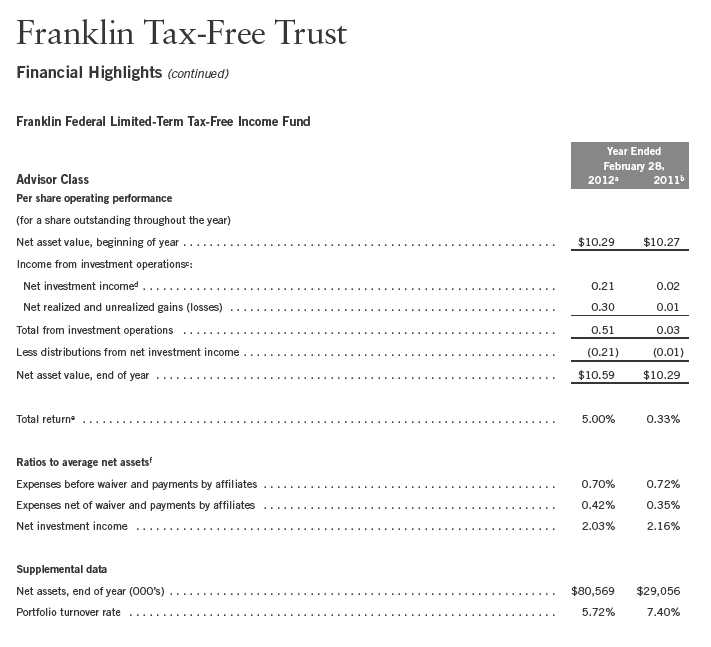

Performance Overview

The Fund’s Class A share price, as measured by net asset value, increased from $10.29 on February 28, 2011, to $10.60 on February 29, 2012. The Fund’s Class A shares paid dividends totaling 19.51 cents per share for the same period.2 The Performance Summary beginning on page 28 shows that at the end of this reporting period the Fund’s Class A shares’ distribution rate was 1.79%, based on an annualization of the current 1.62 cent per share dividend and the maximum offering price of $10.84 on February 29, 2012. An investor in the 2012 maximum federal income tax bracket of 35.00% would need to earn a distribution rate of 2.75% from a taxable investment to match the Fund’s Class A tax-free distribution rate. For the Fund’s Advisor shares’ performance, please see the Performance Summary.

2. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

26 | Annual Report

Manager’s Discussion

We used various investment strategies during the 12 months under review as we sought to maximize tax-free income for shareholders. Please read the discussion on page 6 for details.

Consistent with our investment strategy, we invested in bonds we believed could provide the most relative value from an income perspective. Seeking a dollar-weighted average portfolio maturity of five years or less, we concentrated in the one- to five-year range in an effort to insulate investors against bond market volatility. As a result of our strategy, we believe the Fund was positioned to capture changes in short-term interest rates, preserve capital and produce tax-free income.

Thank you for your continued participation in Franklin Federal Limited-Term Tax-Free Income Fund. We believe our conservative, buy-and-hold investment strategy can help us achieve high, current, tax-free income for shareholders.

The foregoing information reflects our analysis, opinions and portfolio holdings as of February 29, 2012, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, state, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Annual Report | 27

Performance Summary as of 2/29/12

Franklin Federal Limited-Term Tax-Free Income Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | | | |

| Price and Distribution Information | | | | | | |

| Class A (Symbol: FFTFX) | | | | Change | | 2/29/12 | | 2/28/11 |

| Net Asset Value (NAV) | | | +$ | 0.31 | $ | 10.60 | $ | 10.29 |

| Distributions (3/1/11–2/29/12) | | | | | | | | |

| Dividend Income | $ | 0.1951 | | | | | | |

| Advisor Class (Symbol: FTFZX) | | | | Change | | 2/29/12 | | 2/28/11 |

| Net Asset Value (NAV) | | | +$ | 0.30 | $ | 10.59 | $ | 10.29 |

| Distributions (3/1/11–2/29/12) | | | | | | | | |

| Dividend Income | $ | 0.2097 | | | | | | |

28 | Annual Report

Performance Summary (continued)

Performance1

Cumulative total return excludes sales charges. Average annual total returns include maximum sales charges. Class A: 2.25% maximum initial sales charge; Advisor Class: no sales charges.

| | | | | | | | | | | |

| Class A | | | | 1-Year | | | 5-Year | | | Inception (9/2/03) | |

| Cumulative Total Return2 | | | + | 4.95 | % | + | 20.80 | % | + | 28.57 | % |

| Average Annual Total Return3 | | | + | 2.56 | % | + | 3.38 | % | + | 2.73 | % |

| Avg. Ann. Total Return (3/31/12)4 | | | + | 2.06 | % | + | 3.25 | % | + | 2.66 | % |

| Distribution Rate5 | 1.79 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate6 | 2.75 | % | | | | | | | | | |

| 30-Day Standardized Yield7 | 0.79 | % | | | | | | | | | |

| Taxable Equivalent Yield6 | 1.22 | % | | | | | | | | | |

| Total Annual Operating Expenses8 | | | | | | | | | | | |

| Without Waiver | 0.87 | % | | | | | | | | | |

| With Waiver | 0.60 | % | | | | | | | | | |

| Advisor Class9 | | | | 1-Year | | | 5-Year | | | Inception (9/2/03) | |

| Cumulative Total Return2 | | | + | 5.00 | % | + | 20.86 | % | + | 28.64 | % |

| Average Annual Total Return3 | | | + | 5.00 | % | + | 3.86 | % | + | 3.01 | % |

| Avg. Ann. Total Return (3/31/12)4 | | | + | 4.49 | % | + | 3.74 | % | + | 2.94 | % |

| Distribution Rate5 | 1.98 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate6 | 3.05 | % | | | | | | | | | |

| 30-Day Standardized Yield7 | 0.96 | % | | | | | | | | | |

| Taxable Equivalent Yield6 | 1.48 | % | | | | | | | | | |

| Total Annual Operating Expenses8 | | | | | | | | | | | |

| Without Waiver | 0.72 | % | | | | | | | | | |

| With Waiver | 0.45 | % | | | | | | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

The investment manager and administrator have contractually agreed to waive or assume certain expenses so that common expenses (excluding Rule 12b-1 fees and acquired fund fees and expenses) for each class of the Fund do not exceed 0.45% (other than certain nonroutine expenses) until 6/30/12.

Annual Report | 29

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any current maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

30 | Annual Report

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Because municipal bonds are sensitive to interest rate movements, the Fund’s yield and share price will fluctuate with market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class A: Advisor Class: | Prior to 2/1/06, these shares were offered without an initial sales charge; thus actual total returns would have differed. Shares are available to certain eligible investors as described in the prospectus. |

1. If the manager and administrator had not waived fees, the Fund’s distribution rate and total return would have been lower, and yield for the period would have been 0.54% for Class A and 0.70% for Advisor Class.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Distribution rate is based on an annualization of the respective class’s current monthly dividend and the maximum offering price (NAV for Advisor Class) per share on 2/29/12.

6. Taxable equivalent distribution rate and yield assume the 2012 maximum federal income tax rate of 35.00%.

7. The 30-day standardized yield for the month ended 2/29/12 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

8. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

9. Effective 2/1/11, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 2/1/11, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 2/1/11, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 2/1/11 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +5.34% and +4.96%.

10. Source: © 2012 Morningstar. The BC Municipal Bond Index: 5-Year Component is the 5-year (4-6) component of the Municipal Bond Index, which is a market value-weighted index engineered for the long-term tax-exempt bond market. To be included in the index, bonds must be fixed rate, have at least one year to final maturity and be rated investment grade (Baa3/BBB- or higher) by at least two of the following agencies: Moody’s, Standard & Poor’s and Fitch. The Consumer Price Index (CPI), calculated by the U.S. Bureau of Labor Statistics, is a commonly used measure of the inflation rate.

Annual Report | 31

Your Fund’s Expenses

Franklin Federal Limited-Term Tax-Free Income Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

32 | Annual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Class A | | Value 9/1/11 | | Value 2/29/12 | | Period* 9/1/11–2/29/12 |

| Actual | $ | 1,000 | $ | 1,015.00 | $ | 3.01 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.88 | $ | 3.02 |

| Advisor Class | | | | | | |

| Actual | $ | 1,000 | $ | 1,015.80 | $ | 2.26 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.63 | $ | 2.26 |

*Expenses are calculated using the most recent six-month annualized expense ratio, net of expense waivers, annualized for each class (A: 0.60%; and Advisor: 0.45%), multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period.

Annual Report | 33

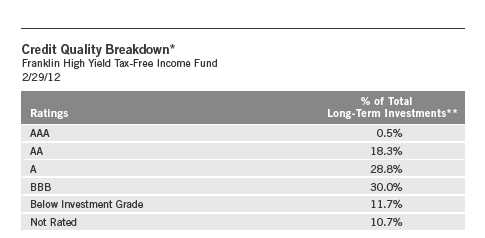

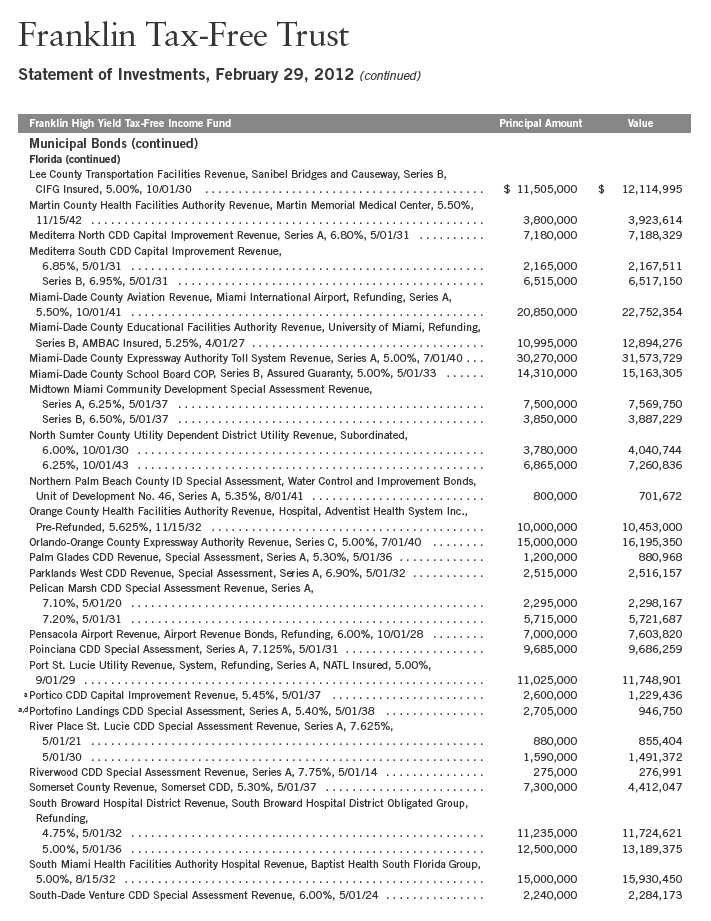

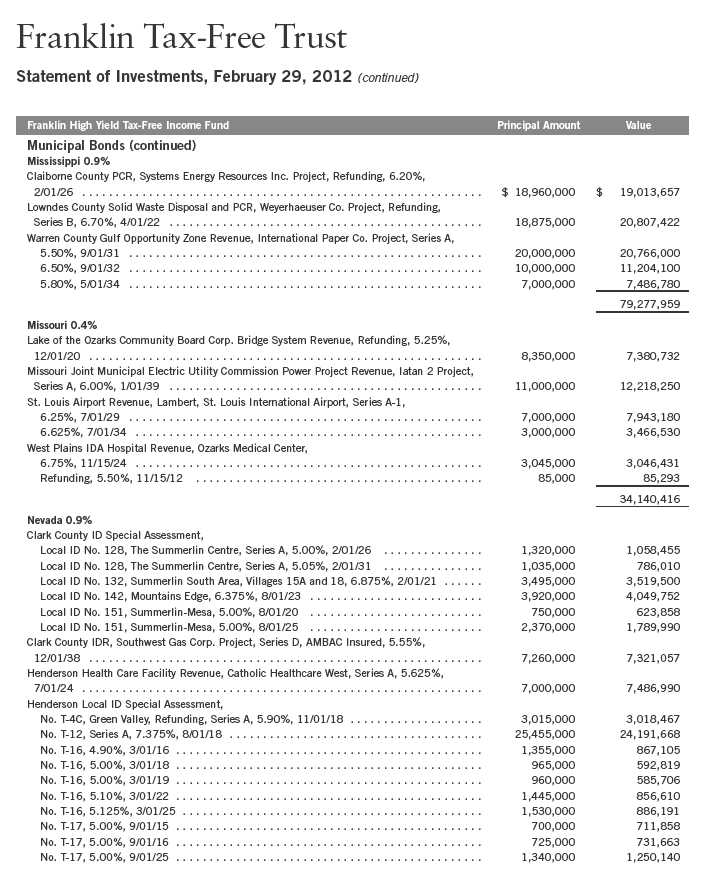

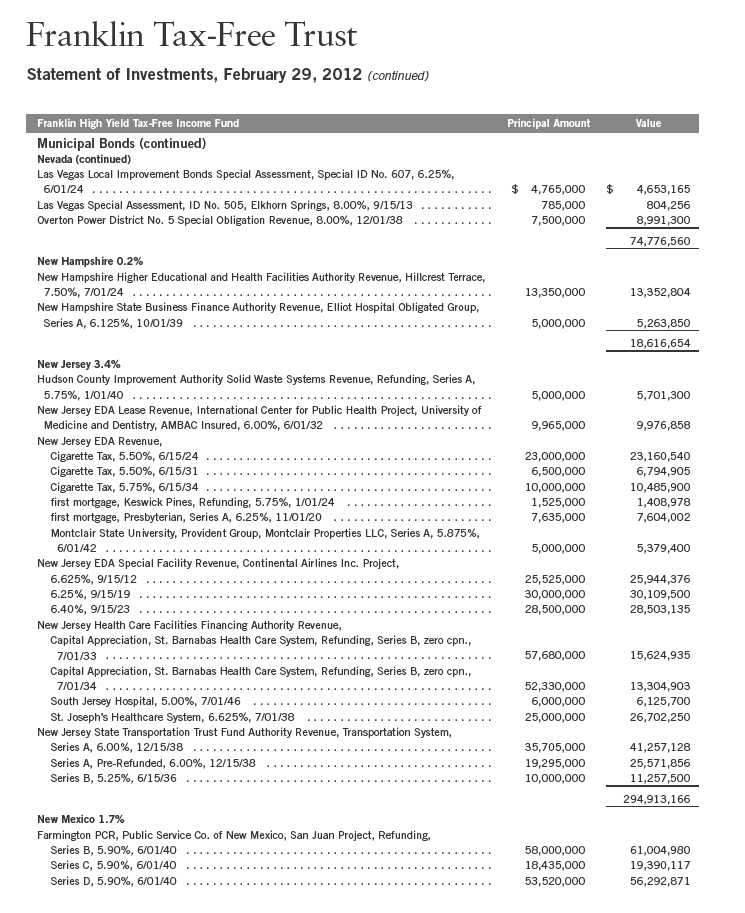

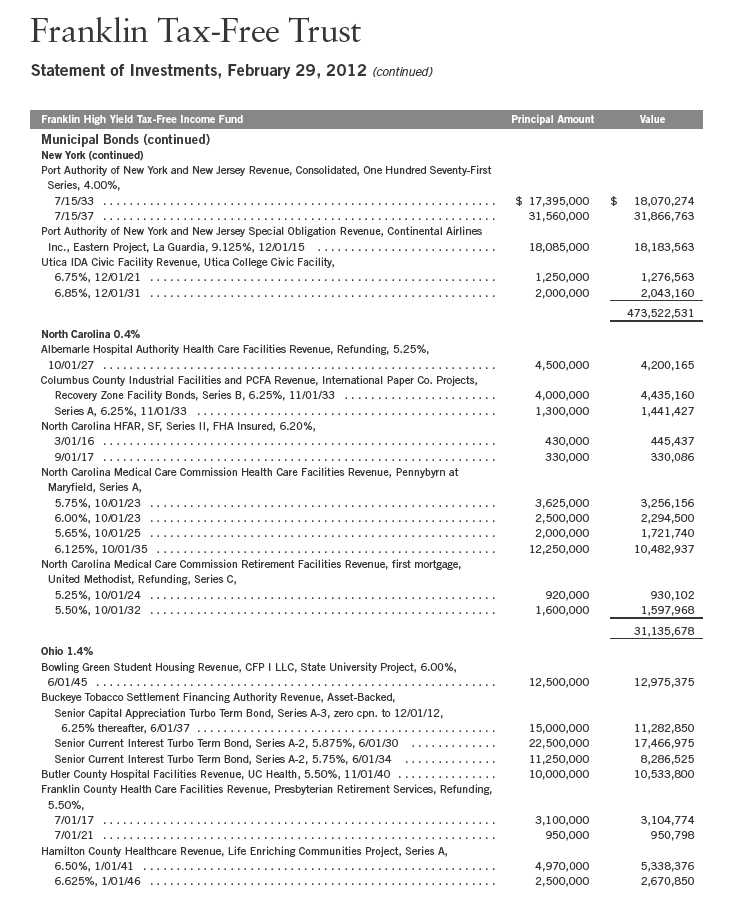

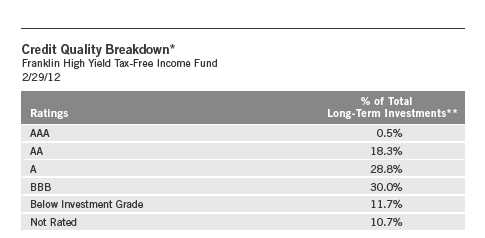

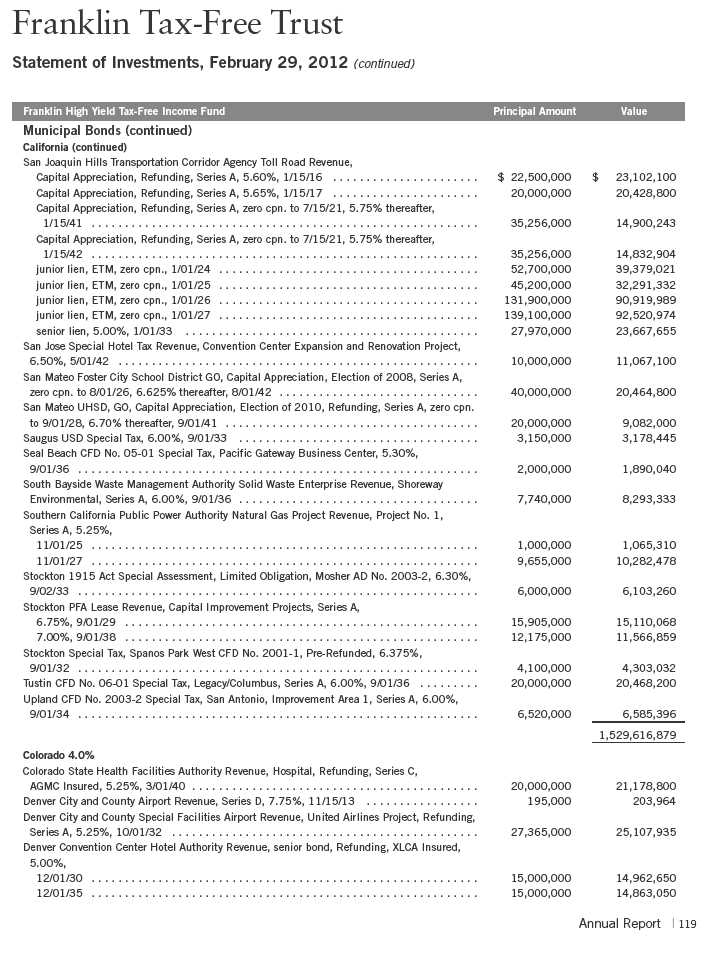

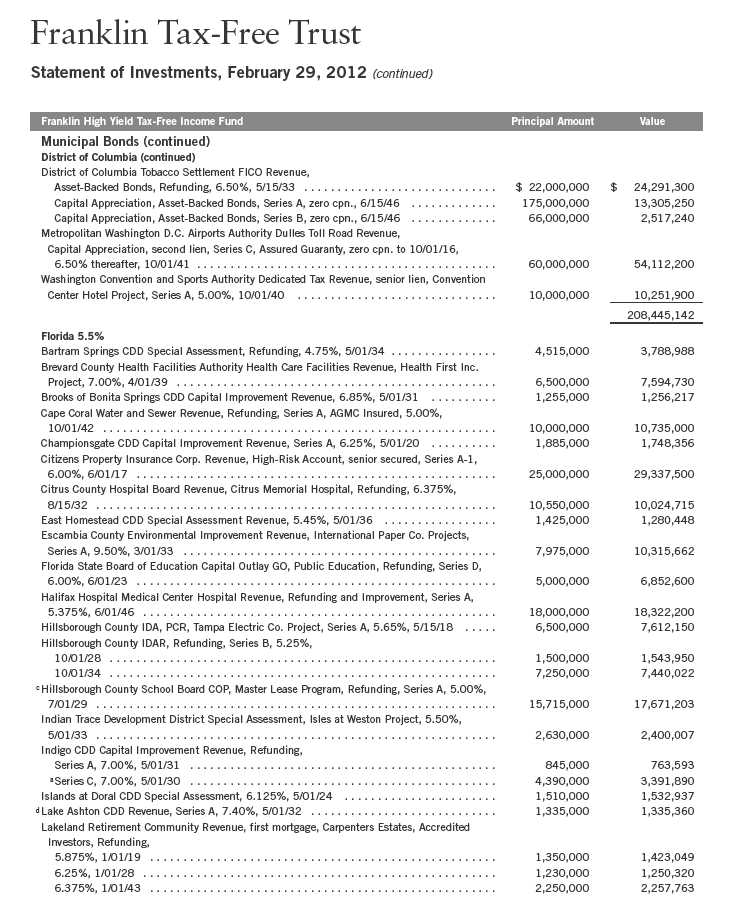

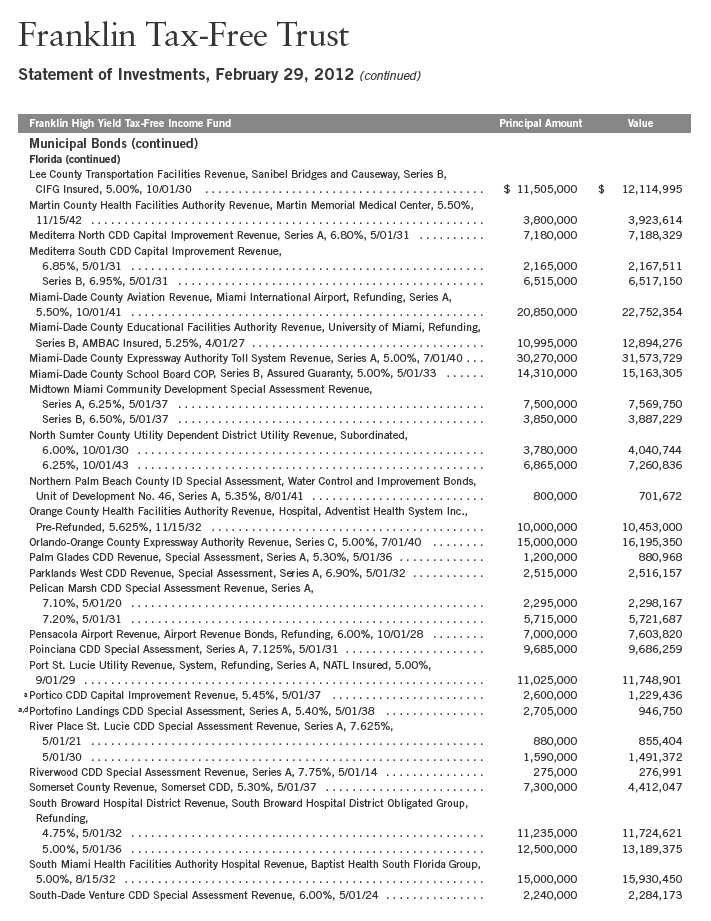

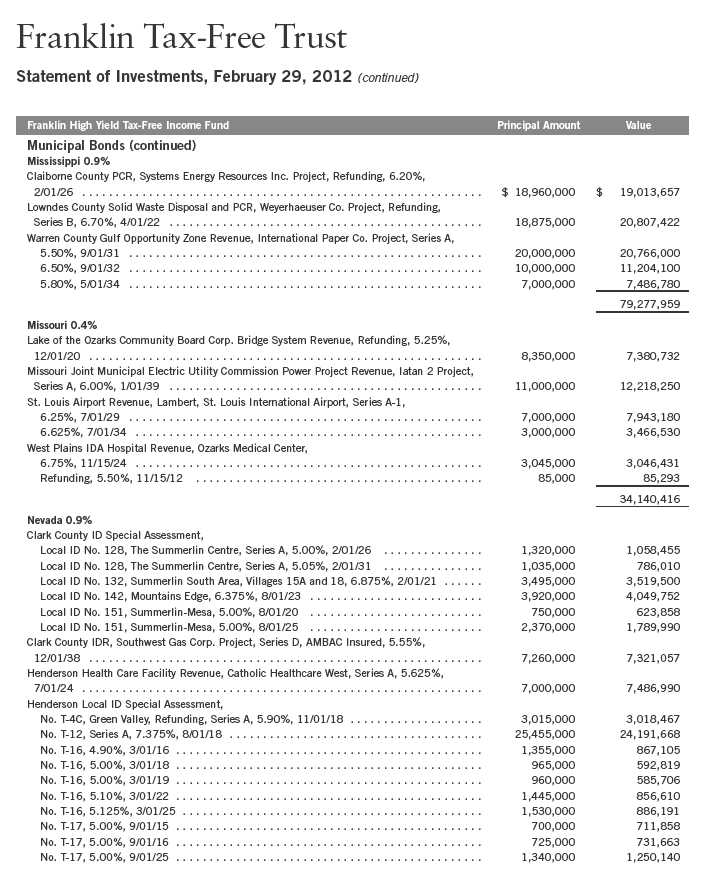

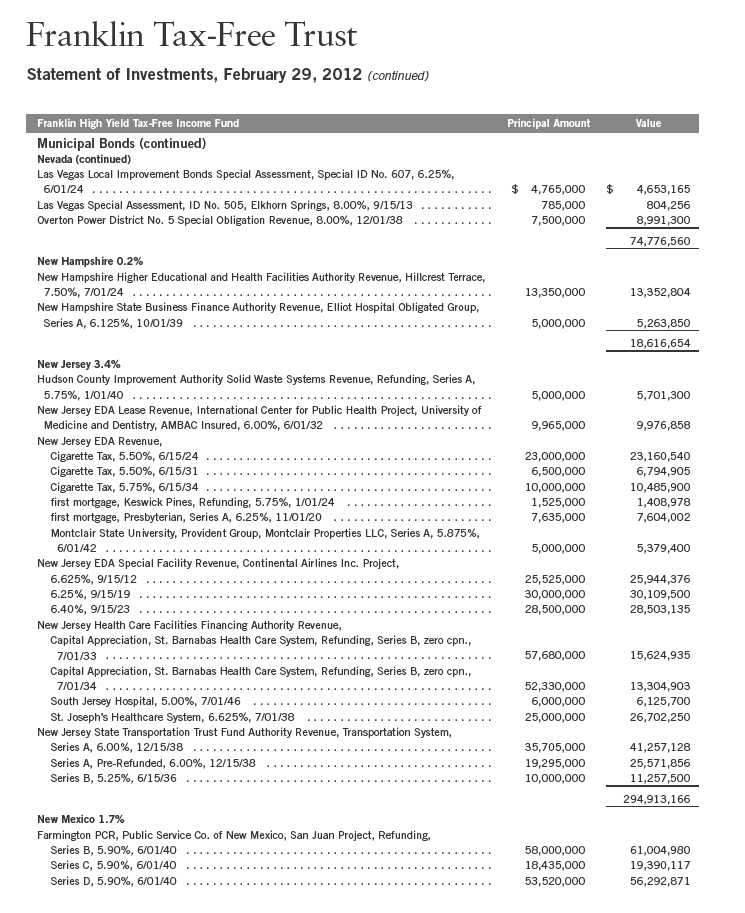

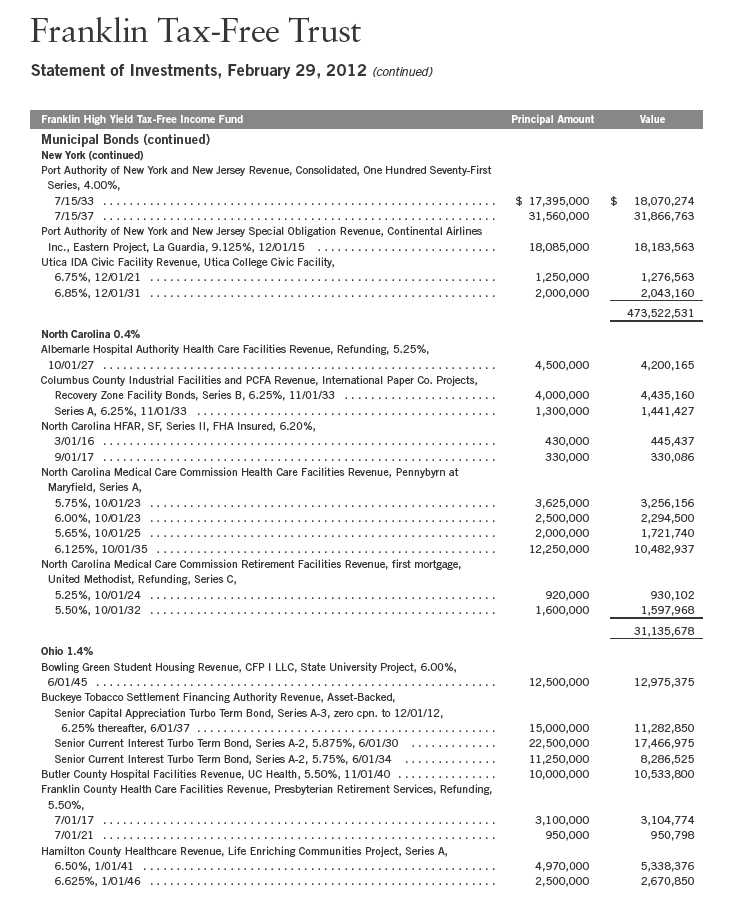

Franklin High Yield Tax-Free Income Fund

Your Fund’s Goals and Main Investments: Franklin High Yield Tax-Free Income Fund seeks to provide a high current yield exempt from federal income taxes by investing at least 80% of its net assets in securities that pay interest free from such taxes.1 Its secondary goal is capital appreciation to the extent possible and consistent with the Fund’s principal investment goal.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

*Standard & Poor’s (S&P) is the primary independent rating agency source. Moody’s is secondary, and Fitch, if available, is used for securities not rated by Moody’s or S&P. The ratings are an indication of an issuer’s creditworthiness, with long-term ratings typically ranging from AAA (highest) to Below Investment Grade (lowest; includes ratings BB to D). This methodology differs from that used in Fund marketing materials.

**Does not include short-term investments and other net assets.

We are pleased to bring you Franklin High Yield Tax-Free Income Fund’s annual report for the fiscal year ended February 29, 2012.

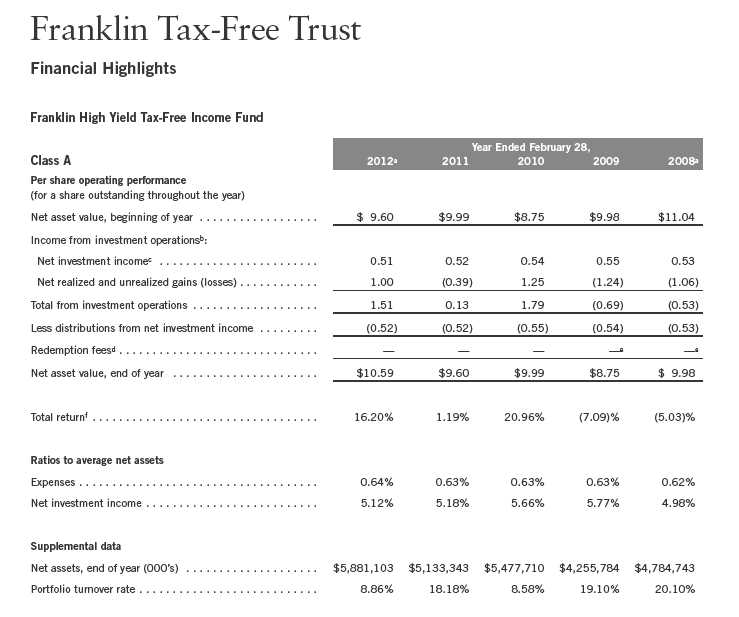

Performance Overview

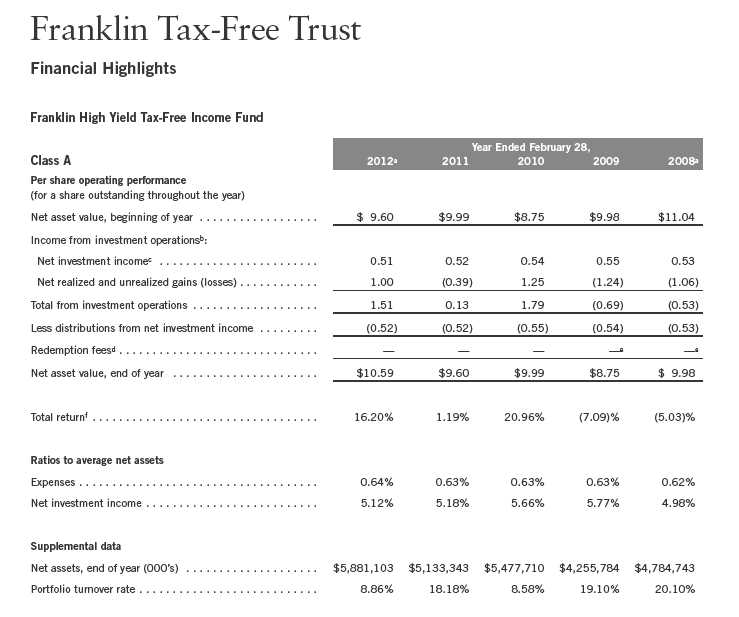

The Fund’s Class A share price, as measured by net asset value, increased from $9.60 on February 28, 2011, to $10.59 on February 29, 2012. The Fund’s Class A shares paid dividends totaling 52.43 cents per share for the

1. Dividends are generally subject to state and local taxes, if any. For investors subject to alternative minimum tax, a small portion of Fund dividends may be taxable. Distributions of capital gains are generally taxable. To avoid imposition of 28% backup withholding on all Fund distributions and redemption proceeds, U.S. investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

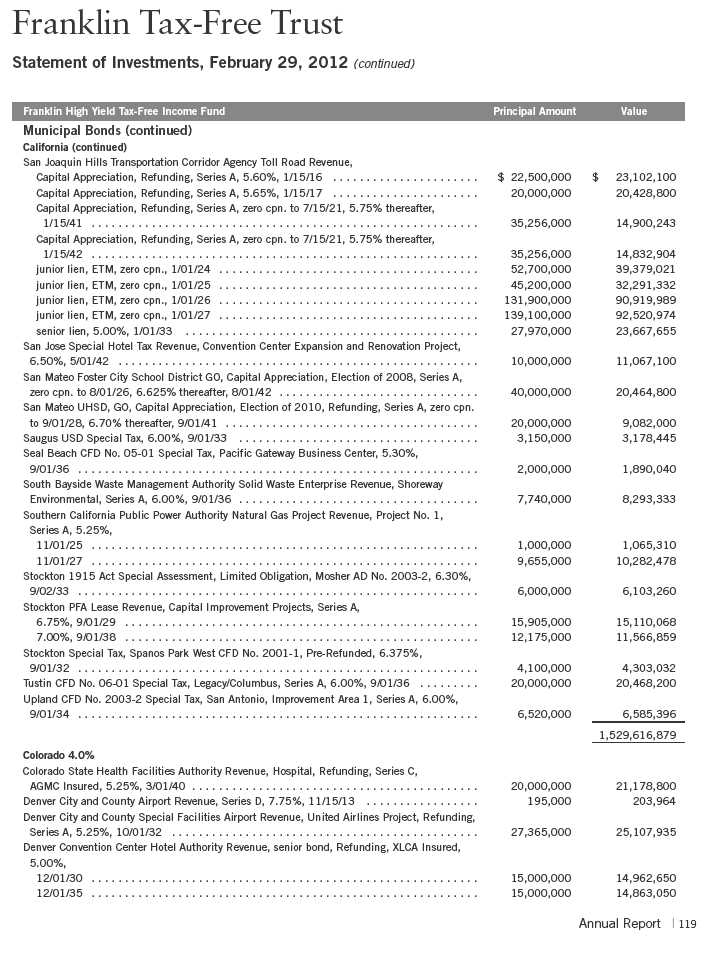

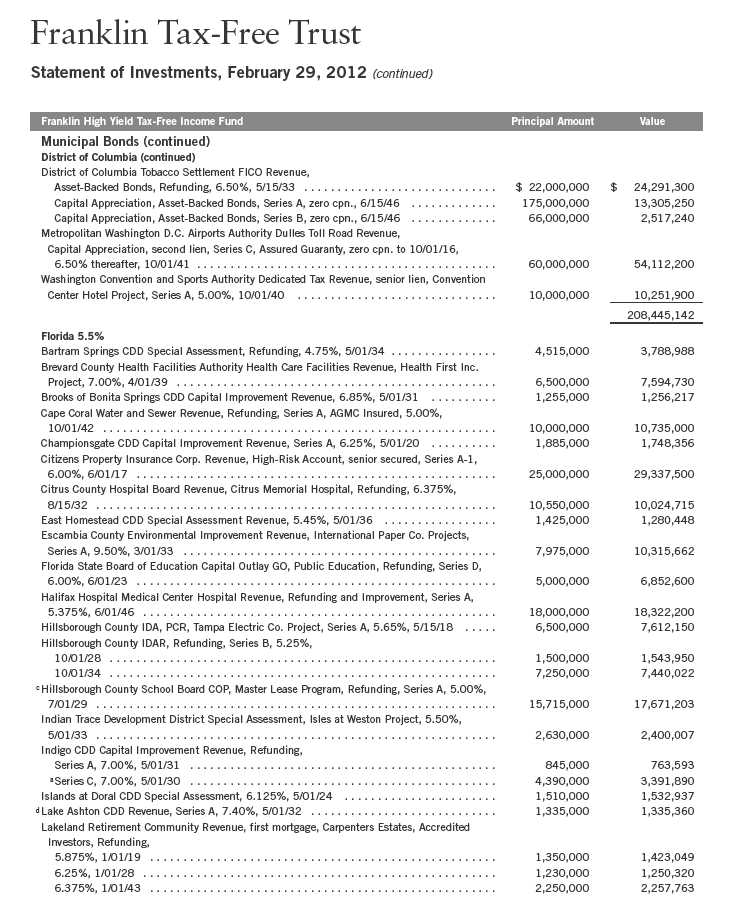

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 115.

34 | Annual Report

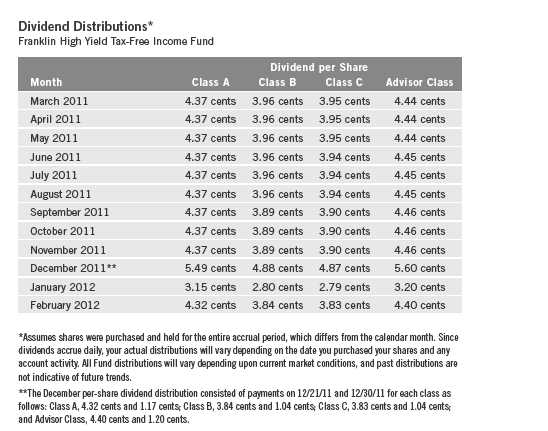

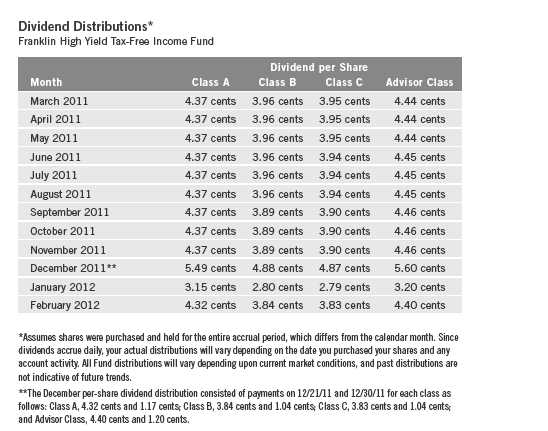

same period.2 The Performance Summary beginning on page 37 shows that at the end of this reporting period the Fund’s Class A shares’ distribution rate was 4.39%, based on an annualization of the current 4.05 cent per share dividend and the maximum offering price of $11.06 on February 29, 2012. An investor in the 2012 maximum federal income tax bracket of 35.00% would need to earn a distribution rate of 6.75% from a taxable investment to match the Fund’s Class A tax-free distribution rate. For the Fund’s Class B, C and Advisor shares’ performance, please see the Performance Summary. The reduction in dividend distributions from the start to the end of the period under review reflected generally declining interest rates. Additionally, investor demand was strong for municipal bonds in an environment of limited tax-exempt supply. These factors resulted in reduced income for the portfolio and caused dividends to decline overall.

2. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

Annual Report | 35

Portfolio Breakdown

Franklin High Yield Tax-Free Income Fund 2/29/12

|

| % of Total |

| Long-Term Investments* |

| | |

| Utilities | 19.0 | % |

| Transportation | 18.0 | % |

| Hospital & Health Care | 17.2 | % |

| Tax-Supported | 10.6 | % |

| General Obligation | 9.0 | % |

| Corporate-Backed | 6.3 | % |

| Subject to Government Appropriations | 5.6 | % |

| Other Revenue | 5.6 | % |

| Refunded | 5.3 | % |

| Higher Education | 2.3 | % |

| Housing | 1.1 | % |

*Does not include short-term investments and other net assets.

Manager’s Discussion

We used various investment strategies during the 12 months under review as we sought to maximize tax-free income for shareholders. Please read the discussion on page 6 for details.

During the reporting period, the Fund continued to generate high, current, tax-free income for its shareholders. Consistent with our strategy, the Fund did not use leverage or credit derivatives to boost short-term returns, and we were careful to not overexpose the portfolio to any one credit sector.

Thank you for your continued participation in Franklin High Yield Tax-Free Income Fund. We believe our conservative, buy-and-hold investment strategy can help us achieve high, current, tax-free income for shareholders.

The foregoing information reflects our analysis, opinions and portfolio holdings as of February 29, 2012, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, state, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

36 | Annual Report

Performance Summary as of 2/29/12

Franklin High Yield Tax-Free Income Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | | | |

| Price and Distribution Information | | | | | | |

| Class A (Symbol: FRHIX) | | | | Change | | 2/29/12 | | 2/28/11 |

| Net Asset Value (NAV) | | | +$ | 0.99 | $ | 10.59 | $ | 9.60 |

| Distributions (3/1/11–2/29/12) | | | | | | | | |

| Dividend Income | $ | 0.5243 | | | | | | |

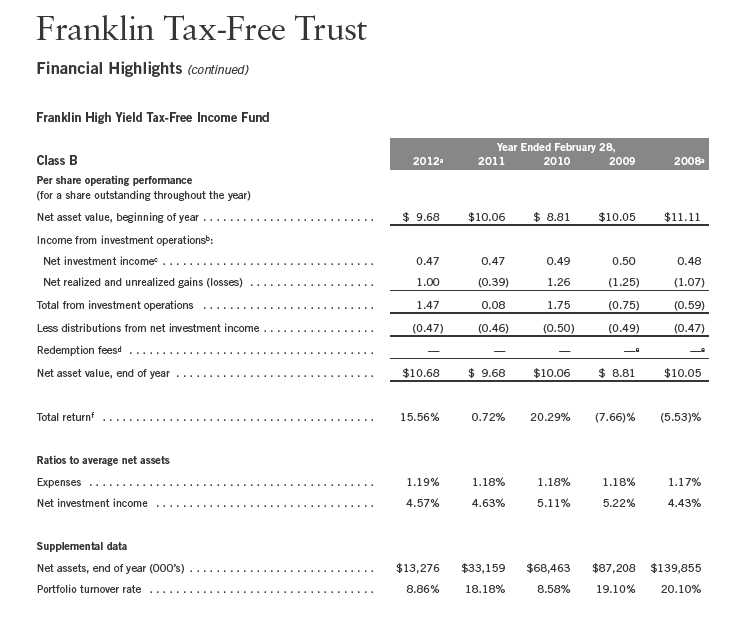

| Class B (Symbol: FYIBX) | | | | Change | | 2/29/12 | | 2/28/11 |

| Net Asset Value (NAV) | | | +$ | 1.00 | $ | 10.68 | $ | 9.68 |

| Distributions (3/1/11–2/29/12) | | | | | | | | |

| Dividend Income | $ | 0.4705 | | | | | | |

| Class C (Symbol: FHYIX) | | | | Change | | 2/29/12 | | 2/28/11 |

| Net Asset Value (NAV) | | | +$ | 1.02 | $ | 10.75 | $ | 9.73 |

| Distributions (3/1/11–2/29/12) | | | | | | | | |

| Dividend Income | $ | 0.4696 | | | | | | |

| Advisor Class (Symbol: FHYVX) | | | | Change | | 2/29/12 | | 2/28/11 |

| Net Asset Value (NAV) | | | +$ | 1.00 | $ | 10.63 | $ | 9.63 |

| Distributions (3/1/11–2/29/12) | | | | | | | | |

| Dividend Income | $ | 0.5340 | | | | | | |

Annual Report | 37

Performance Summary (continued)

Performance

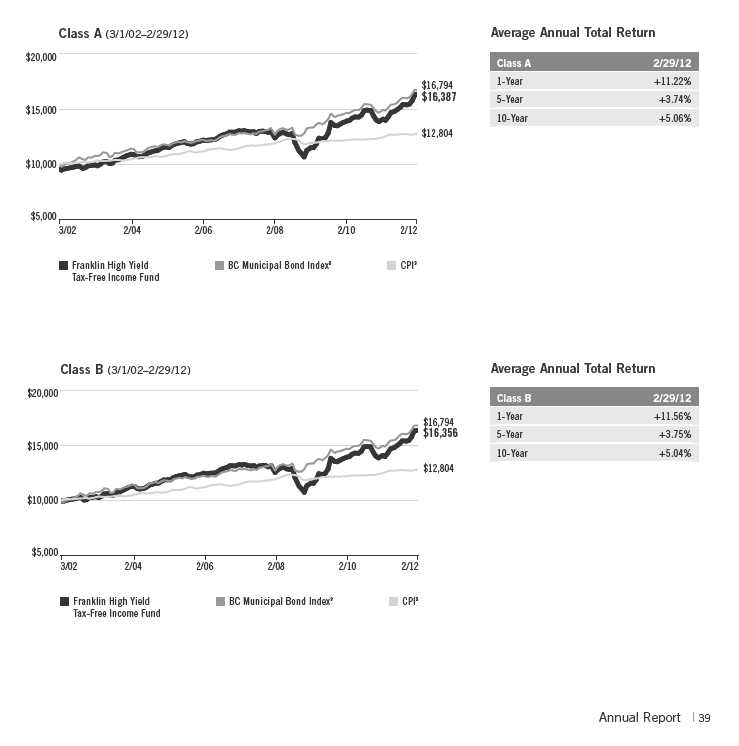

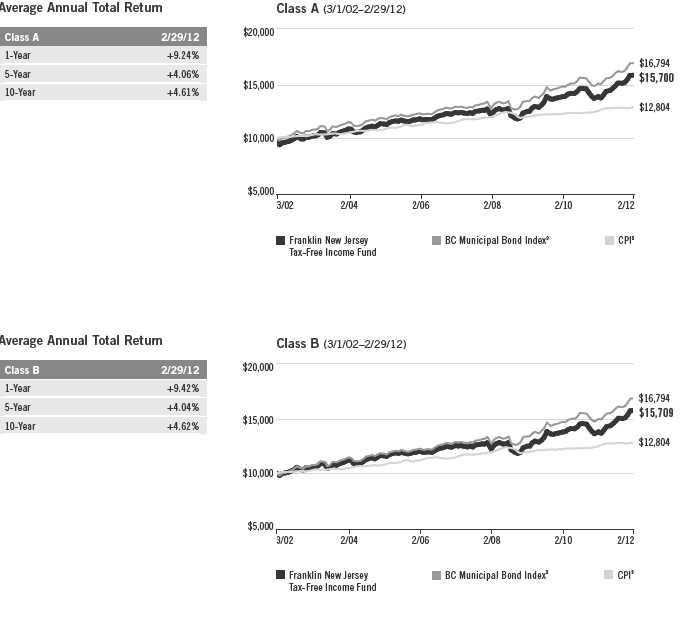

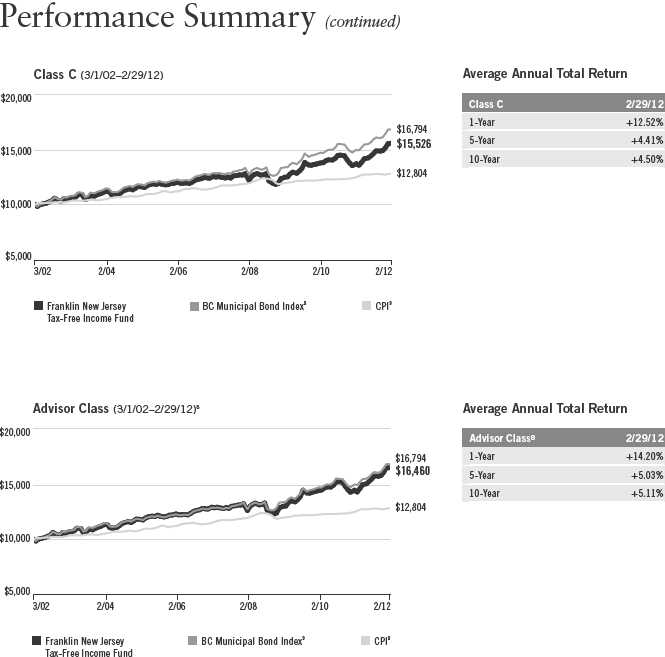

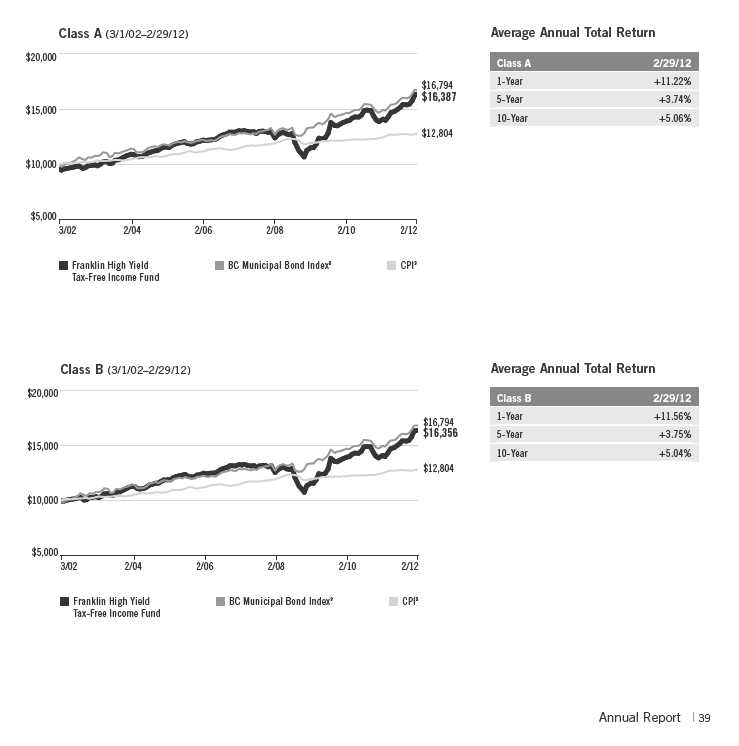

Cumulative total return excludes sales charges. Average annual total returns include maximum sales charges. Class A: 4.25% maximum initial sales charge; Class B: contingent deferred sales charge (CDSC) declining from 4% to 1% over six years, and eliminated thereafter; Class C: 1% CDSC in first year only; Advisor Class: no sales charges.

| | | | | | | | | | | |

| Class A | | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | + | 16.20 | % | + | 25.49 | % | + | 71.15 | % |

| Average Annual Total Return2 | | | + | 11.22 | % | + | 3.74 | % | + | 5.06 | % |

| Avg. Ann. Total Return (3/31/12)3 | | | + | 11.90 | % | + | 3.78 | % | + | 5.15 | % |

| Distribution Rate4 | 4.39 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 6.75 | % | | | | | | | | | |

| 30-Day Standardized Yield6 | 3.70 | % | | | | | | | | | |

| Taxable Equivalent Yield5 | 5.69 | % | | | | | | | | | |

| Total Annual Operating Expenses7 | 0.63 | % | | | | | | | | | |

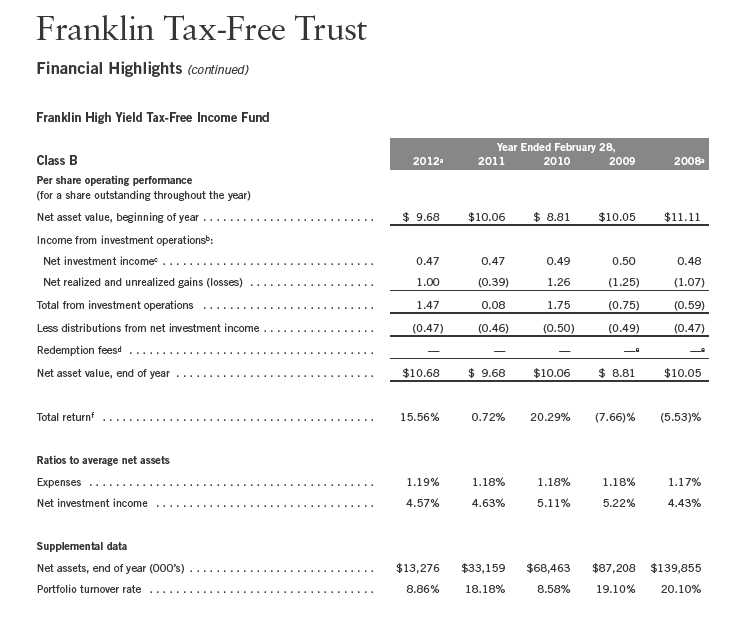

| Class B | | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | + | 15.56 | % | + | 22.13 | % | + | 63.56 | % |

| Average Annual Total Return2 | | | + | 11.56 | % | + | 3.75 | % | + | 5.04 | % |

| Avg. Ann. Total Return (3/31/12)3 | | | + | 12.33 | % | + | 3.79 | % | + | 5.14 | % |

| Distribution Rate4 | 3.98 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 6.12 | % | | | | | | | | | |

| 30-Day Standardized Yield6 | 3.31 | % | | | | | | | | | |

| Taxable Equivalent Yield5 | 5.09 | % | | | | | | | | | |

| Total Annual Operating Expenses7 | 1.18 | % | | | | | | | | | |

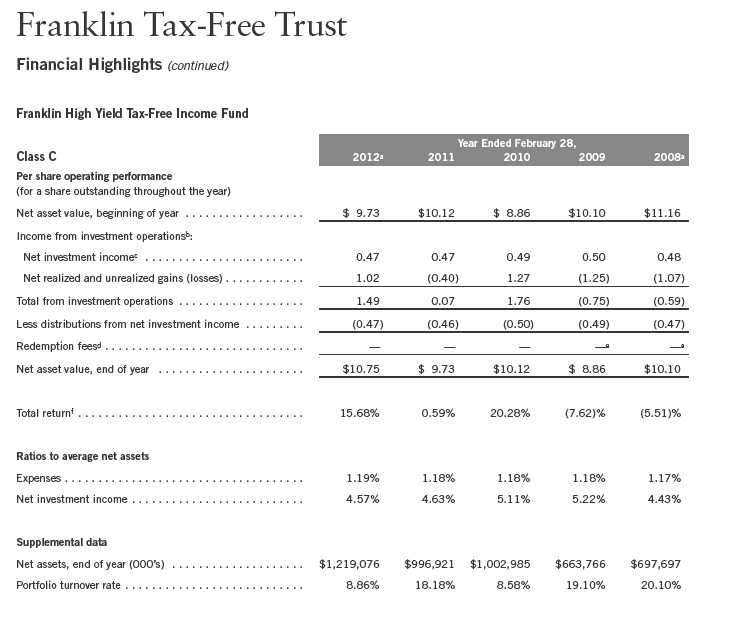

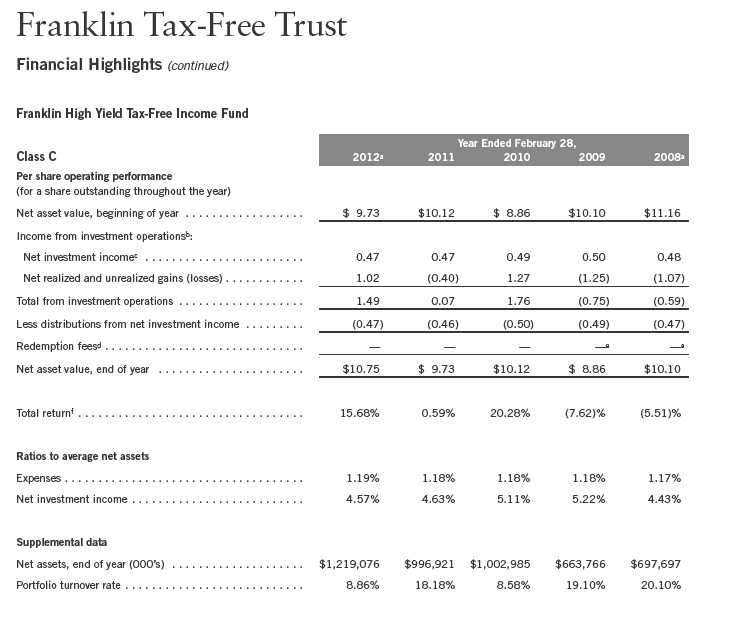

| Class C | | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | + | 15.68 | % | + | 22.17 | % | + | 62.07 | % |

| Average Annual Total Return2 | | | + | 14.68 | % | + | 4.09 | % | + | 4.95 | % |

| Avg. Ann. Total Return (3/31/12)3 | | | + | 15.32 | % | + | 4.13 | % | + | 5.03 | % |

| Distribution Rate4 | 3.95 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 6.08 | % | | | | | | | | | |

| 30-Day Standardized Yield6 | 3.32 | % | | | | | | | | | |

| Taxable Equivalent Yield5 | 5.11 | % | | | | | | | | | |

| Total Annual Operating Expenses7 | 1.18 | % | | | | | | | | | |

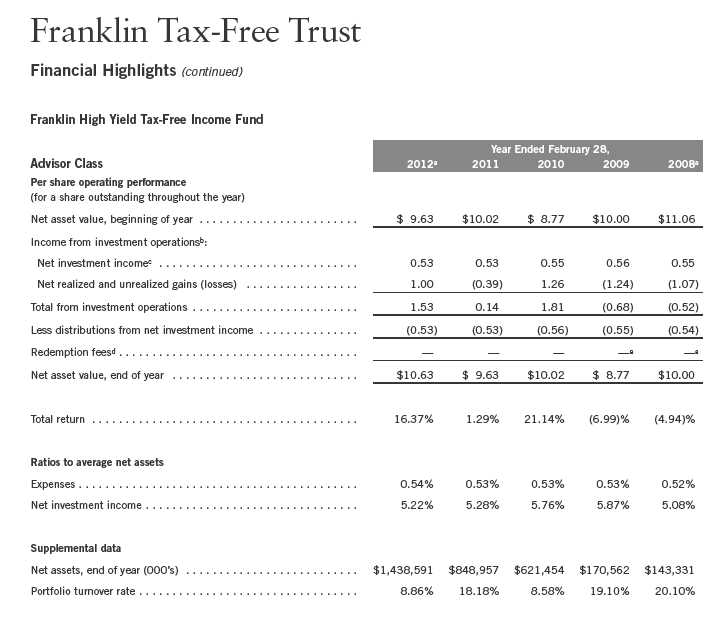

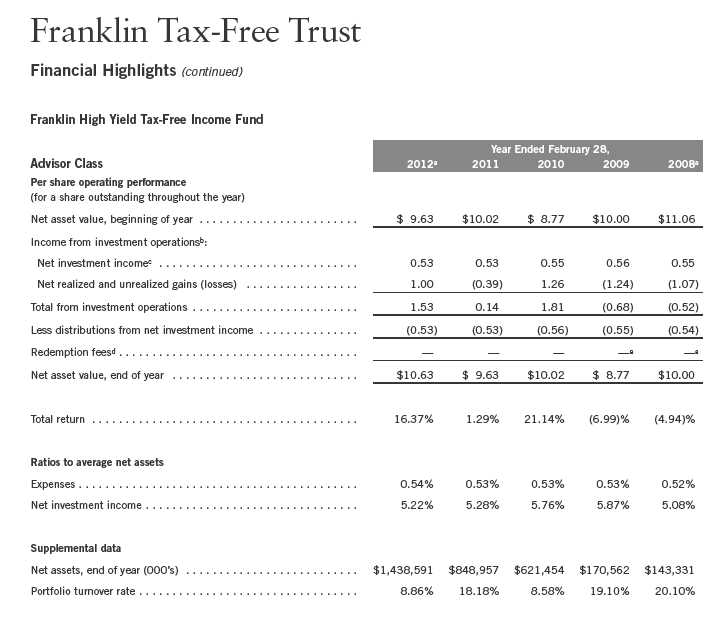

| Advisor Class8 | | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | + | 16.37 | % | + | 26.25 | % | + | 72.29 | % |

| Average Annual Total Return2 | | | + | 16.37 | % | + | 4.77 | % | + | 5.59 | % |

| Avg. Ann. Total Return (3/31/12)3 | | | + | 17.02 | % | + | 4.82 | % | + | 5.67 | % |

| Distribution Rate4 | 4.67 | % | | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 7.18 | % | | | | | | | | | |

| 30-Day Standardized Yield6 | 3.98 | % | | | | | | | | | |

| Taxable Equivalent Yield5 | 6.12 | % | | | | | | | | | |

| Total Annual Operating Expenses7 | 0.53 | % | | | | | | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

38 | Annual Report

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any current, applicable, maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

40 | Annual Report

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Because municipal bonds are sensitive to interest rate movements, the Fund’s yield and share price will fluctuate with market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. In general, an investor is paid a higher yield to assume a greater degree of credit risk. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class B: Class C: | These shares have higher annual fees and expenses than Class A shares. Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated.

3. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

4. Distribution rate is based on an annualization of the respective class’s current monthly dividend and the maximum offering price (NAV for Classes B, C and Advisor) per share on 2/29/12.

5. Taxable equivalent distribution rate and yield assume the 2012 maximum federal income tax rate of 35.00%.

6. The 30-day standardized yield for the month ended 2/29/12 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

7. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

8. Effective 1/3/06, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 1/3/06, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 1/3/06, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 1/3/06 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +37.01% and +5.25%.

9. Source: © 2012 Morningstar. The BC Municipal Bond Index is a market value-weighted index engineered for the long-term tax-exempt bond market. To be included in the index, bonds must be fixed rate, have at least one year to final maturity and be rated investment grade (Baa3/BBB- or higher) by at least two of the following agencies: Moody’s, Standard & Poor’s and Fitch. The Consumer Price Index (CPI), calculated by the U.S. Bureau of Labor Statistics, is a commonly used measure of the inflation rate.

Annual Report | 41

Your Fund’s Expenses

Franklin High Yield Tax-Free Income Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1 | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

42 | Annual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Class A | | Value 9/1/11 | | Value 2/29/12 | | Period* 9/1/11–2/29/12 |

| Actual | $ | 1,000 | $ | 1,080.50 | $ | 3.36 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.63 | $ | 3.27 |

| Class B | | | | | | |

| Actual | $ | 1,000 | $ | 1,077.90 | $ | 6.20 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.90 | $ | 6.02 |

| Class C | | | | | | |

| Actual | $ | 1,000 | $ | 1,077.30 | $ | 6.20 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.90 | $ | 6.02 |

| Advisor Class | | | | | | |

| Actual | $ | 1,000 | $ | 1,081.80 | $ | 2.85 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.13 | $ | 2.77 |

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.65%; B: 1.20%; C: 1.20%; and Advisor: 0.55%), multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period.

Annual Report | 43

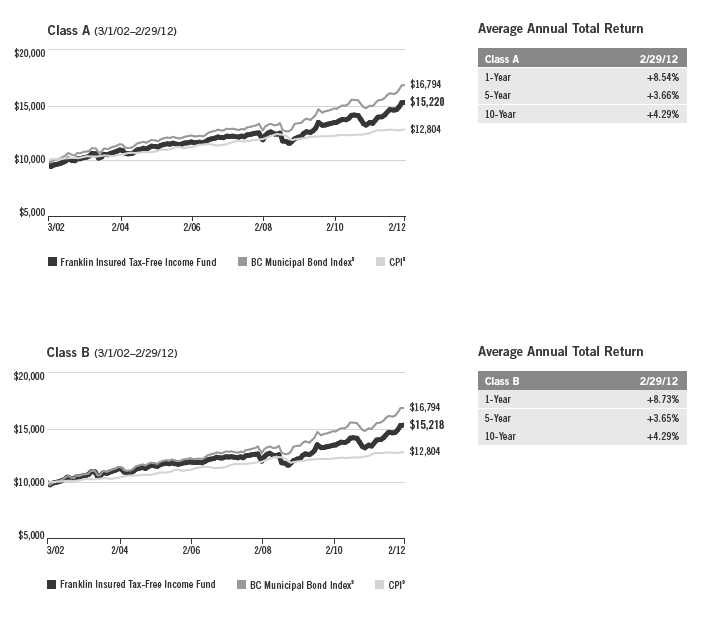

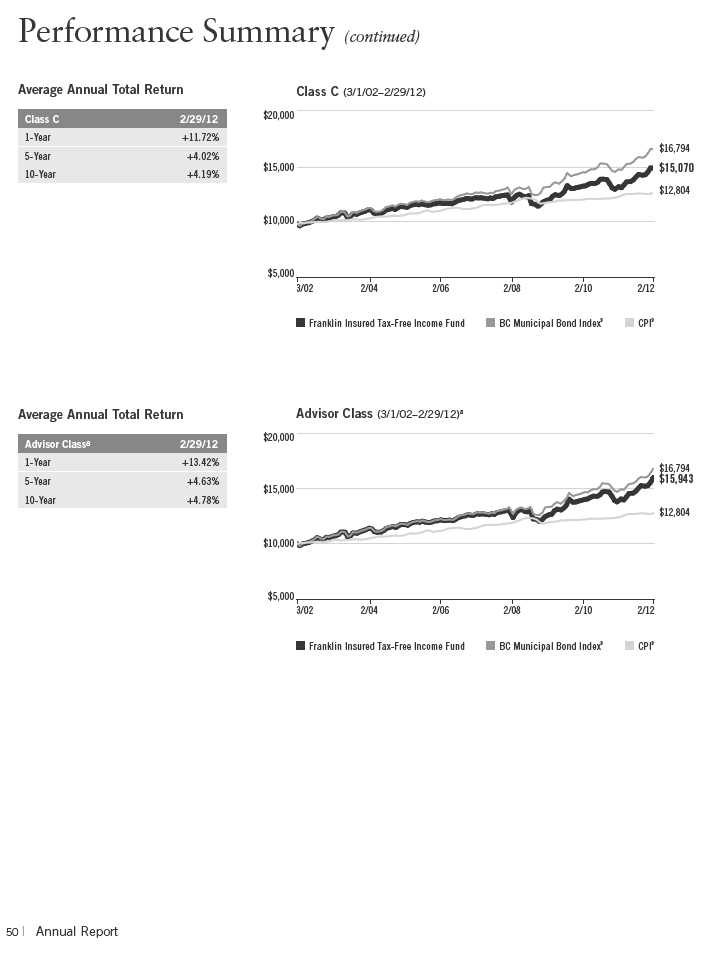

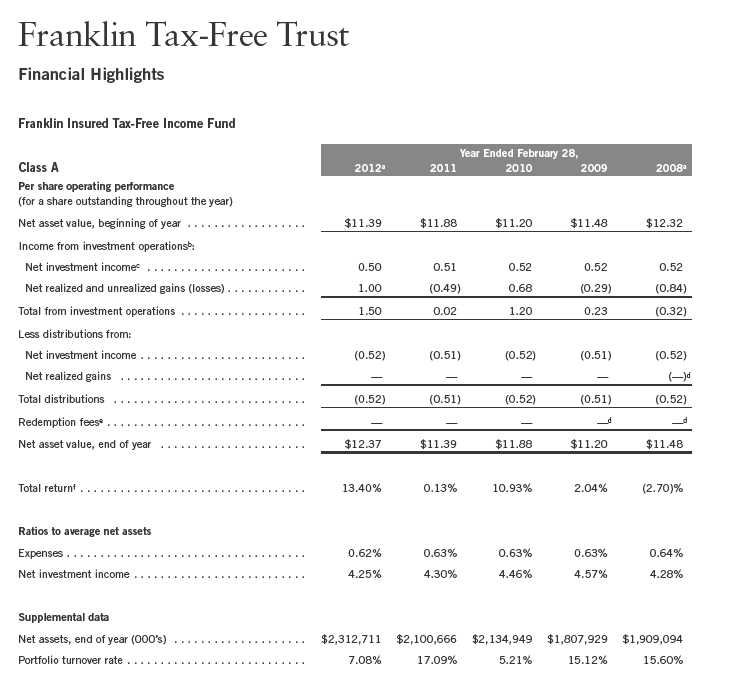

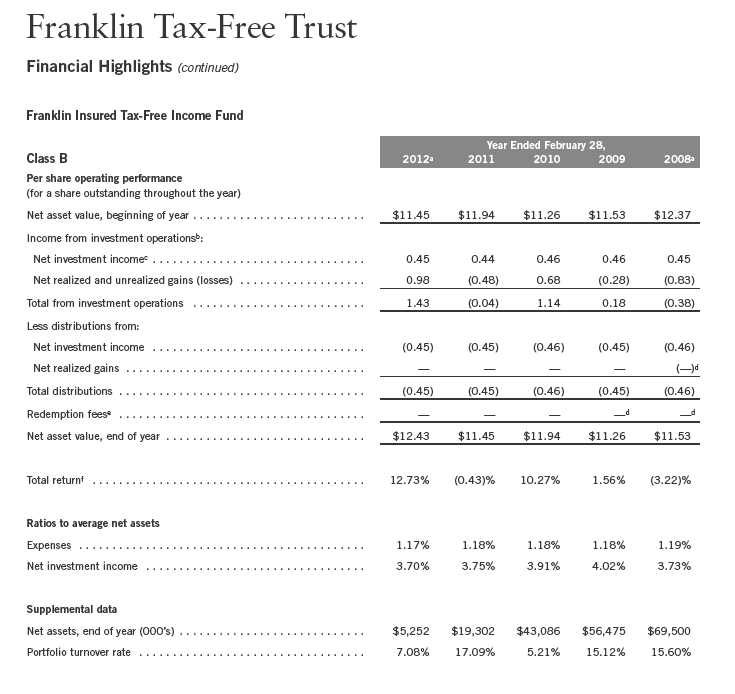

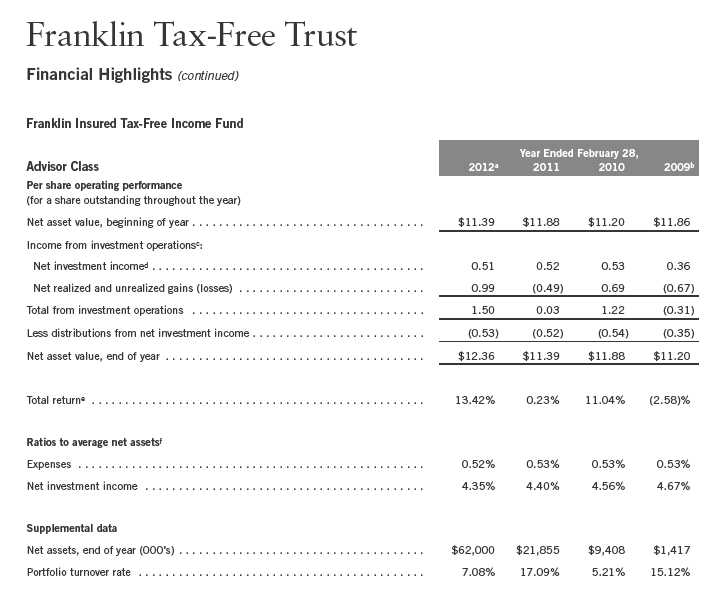

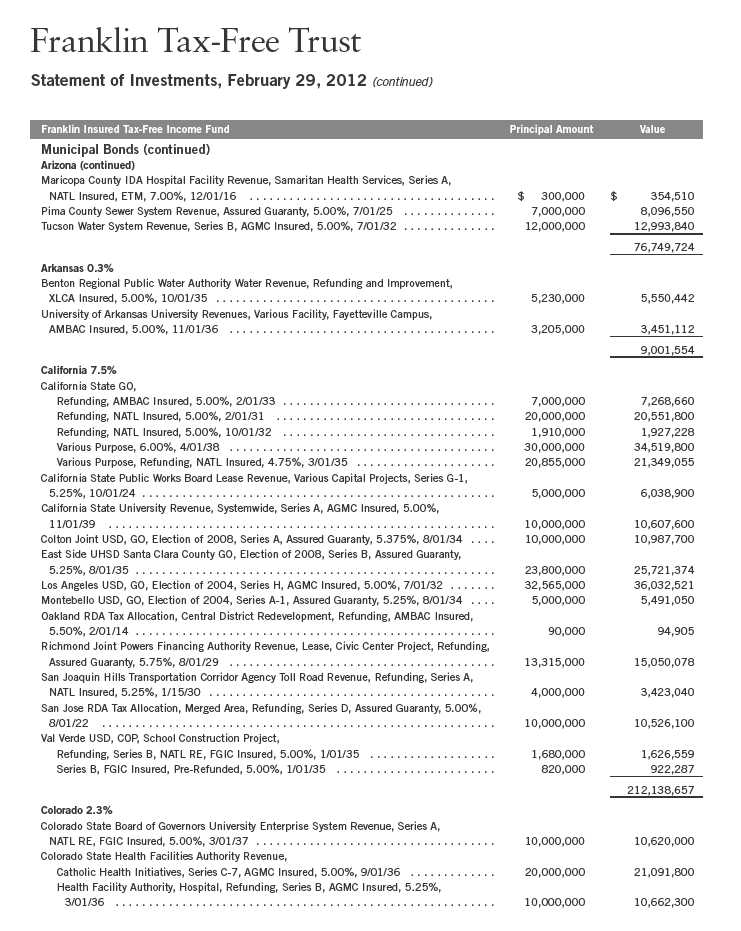

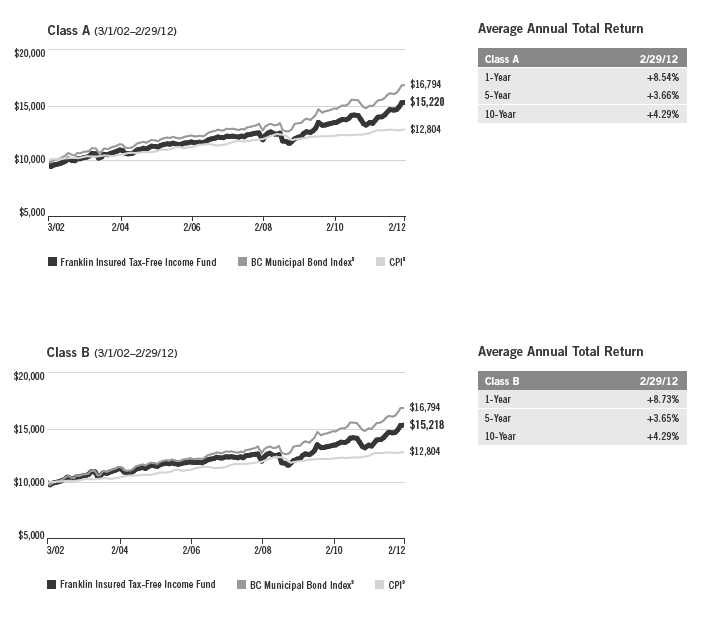

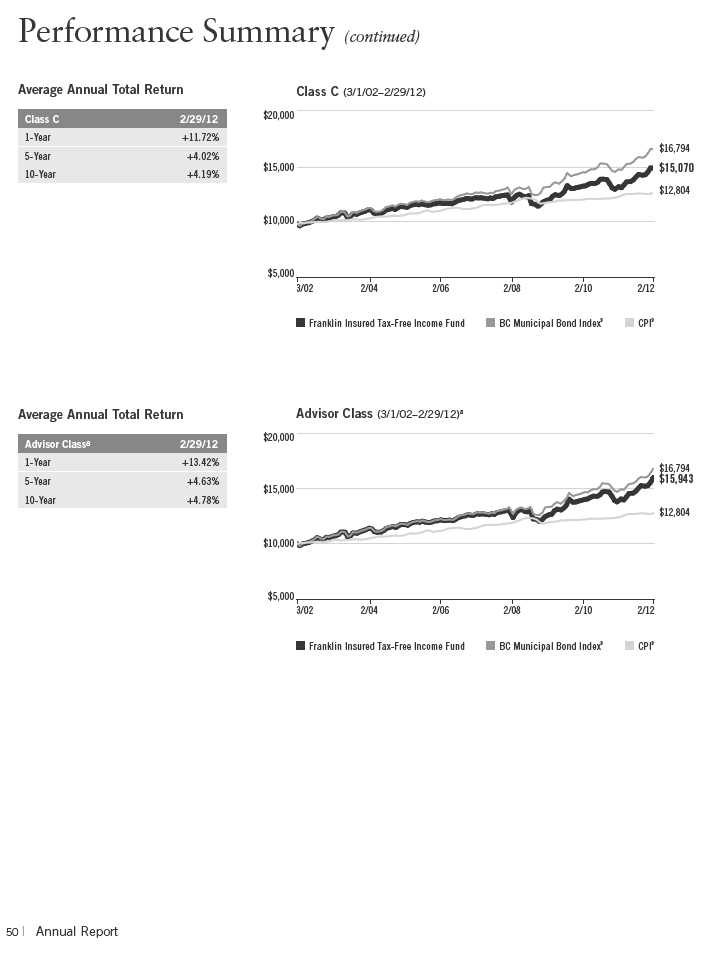

Franklin Insured Tax-Free Income Fund