UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04163

| T. Rowe Price Tax-Free High Yield Fund, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: February 28

Date of reporting period: August 31, 2016

Item 1. Report to Shareholders

| Tax-Free High Yield Fund | August 31, 2016 |

The views and opinions in this report were current as of August 31, 2016. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our Email Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

Tax-free municipal bonds performed well in the six-month period ended August 31, 2016, with the Barclays Municipal Bond Index returning 3.14%. With solid fundamentals and relatively attractive yields, munis generated strong demand as global growth expectations slowed, interest rates on many high-quality government bonds in developed markets were near or below 0%, and market volatility escalated after Britain’s late-June vote to leave the European Union. Longer-maturity municipal bonds outperformed shorter-maturity issues, as longer-term rates fell to record lows. Lower-quality securities outperformed higher-quality bonds as investors continued to search for yield.

ECONOMY AND INTEREST RATES

U.S. economic growth has been sluggish thus far in 2016, with gross domestic product (GDP) increasing at an annual rate of only 1.1% in the second quarter, according to the most recent estimate, and 0.8% in the first quarter. We believe economic growth will improve in the second half of the year. While productivity growth is subpar, the labor market has been strong—and resilient in the face of unfavorable economic developments overseas—but the pace of employment growth has moderated in recent months. The national unemployment rate was 4.9% in August, near an eight-year low.

Broad measures of inflation have remained very low due to continued low prices of oil and other commodities—which is a plus for consumers and many businesses—but core inflation, which excludes food and energy costs, has been firming. The Fed raised short-term rates last December, but due to the slowdown in global economic activity and elevated risks, the central bank has kept rates unchanged thus far in 2016. However, we believe that another Fed rate hike is possible by the end of the year if the labor market recovery persists and measures of domestic demand strengthen.

The Treasury yield curve flattened over the last six months, as shorter-term yields were little changed but longer-term yields declined. Shorter-term municipal bond yields modestly increased, while 10- and 30-year muni yields fell to a greater degree than their Treasury counterparts with similar maturities. As a result, high-quality 30-year muni yields are now lower than the 30-year U.S. government bond yield.

Nonetheless, municipals still offer relative value for many fixed income investors on an after-tax basis. As of August 31, 2016, the 2.12% yield offered by a 30-year tax-free general obligation (GO) bond rated AAA was 95% of the 2.23% pretax yield offered by a 30-year Treasury bond. Including the 3.8% net investment income tax that took effect in 2013 as part of the Affordable Care Act, the top marginal federal tax rate currently stands at 43.4%. An investor in this tax bracket would need to invest in a taxable bond yielding about 3.75% to receive the same after-tax income as that generated by the municipal bond. (To calculate a municipal bond’s taxable-equivalent yield, divide the yield by the quantity of 1.00 minus your federal tax bracket expressed as a decimal—in this case, 1.00 – 0.434, or 0.566.)

MUNICIPAL MARKET NEWS

August was an unusually busy month for municipal bond issuance, according to The Bond Buyer, lifting total year-to-date issuance to $290 billion. Issuance had declined through April relative to the same period last year, but the pace of deals has picked up since that time, coinciding with the sizable decline in muni yields. Strong demand, as evidenced by the 48 consecutive weeks of inflows into municipal bond funds, effectively offset the added net supply in the last few months.

Generally, fundamentals for municipal issuers remain solid, and most issuers in the $3.7 trillion municipal bond market have been fiscally responsible. State and local governments in general have been cautious about adding to indebtedness since the 2008 financial crisis, and a strengthening economy has helped tax revenues rebound. Over 60% of the market, as measured by the Barclays Municipal Bond Index, is AAA or AA rated.

Although the market is overwhelmingly high quality, many states and municipalities are grappling with underfunded pensions and other post-employment benefit (OPEB) obligations. New reporting rules from the Governmental Accounting Standards Board are bringing greater transparency to state and local governments’ pension funding gaps, long-term risks that investors often overlooked in the past. We believe the market will increasingly price in higher pension risks over time, as the magnitude of unfunded liabilities becomes more conspicuous.

The financial condition of the Commonwealth of Puerto Rico continued to worsen over the last six months, but on June 30, President Barack Obama signed the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA) into law to help the island return to fiscal solvency. The legislation authorized a federal fiscal oversight board to help the struggling U.S. territory improve its finances and restructure its debt. However, the new law didn’t pass in time to prevent further defaults as Puerto Rico’s liquidity situation deteriorated. The commonwealth defaulted on about $400 million of debt in May and later defaulted on nearly $800 million in GO debt service due July 1. There was little impact to the broader municipal market, as news of the default was tempered by the legislative action and some level of payment default was widely expected. T. Rowe Price’s municipal team has long maintained that Puerto Rico’s debt burden is unsustainable and would eventually need to be restructured.

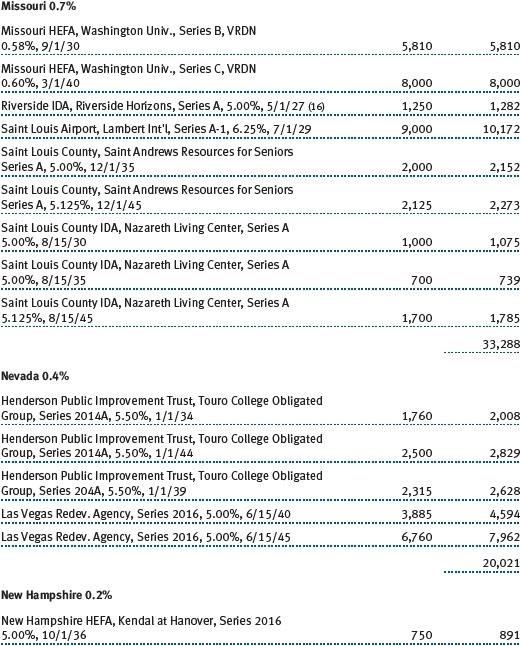

In terms of sector performance, revenue bonds outperformed state and local GOs during the last six months. We continue to favor bonds backed by a dedicated revenue stream over GOs, as we consider revenue bonds to be largely insulated from the pension funding concerns facing state and local governments. Across our municipal platform, we have an overweight to the higher-yielding health care and transportation revenue-backed sectors. Among revenue bonds, hospital and leasing were the best-performing segments, while resource recovery bonds lagged the broader market but still posted positive results. High yield tobacco bonds significantly outperformed the broad muni market for the period.

PORTFOLIO STRATEGY

TAX-EXEMPT MONEY FUND

The fund returned 0.01% during the six months ended August 31, 2016, compared with 0.03% for the Lipper Tax-Exempt Money Market Funds Index.

The municipal money markets were slow to react to the December 2015 Fed rate hike, holding on to yields in the low-single-digit basis points for the first few months of 2016. But more recently, overnight and seven-day yields have moved higher, reaching 0.58% and 0.62%, respectively, at the end of the reporting period—increases of over 50 basis points since the beginning of the year. Longer-maturity yields of up to one year moved higher in sympathy with changes in the short-maturity segment of the yield curve, with one-year yields rising to 0.60% on August 31. With seven-day yields higher than one-year rates, the money market yield curve was inverted. The yields on money market municipal debt at the end of the reporting period were the highest since 2009.

Fund consolidation and asset movement in the money market industry resulting from the Securities and Exchange Commission’s (SEC) Rule 2a-7 money market reform were the primary drivers moving yields later in the reporting period. As we have discussed in previous shareholder letters, the SEC rule changes, which will become fully effective in October, will differentiate between types of money funds (prime versus government funds, for example) as well as classes of shareholders (individual versus institutional investors). Assets are shifting across all money market asset classes as a result of the new SEC regulations. For example, according to iMoneyNet, national retail funds lost 42.3% of their assets from December 29, 2015, through August 30, 2016, while national institutional funds lost 45.1%. Meanwhile, retail government money market funds saw inflows of over $150 billion during the same time period, while government institutional funds gained $373.6 billion. The data from iMoneyNet showed that tax-exempt money market assets under management (AUM) industrywide were $152.9 billion as of August 30, down over $107 billion, or 41.2%, from December 29, 2015. We significantly reduced the fund’s weighted average maturity and weighted average life early in the reporting period in anticipation of the major shifts preceding the implementation of the new SEC regulations.

Over the last few months, industry outflows reversed the trend of tax-exempt money fund assets exceeding supply that had persisted since 2009. The imbalance between supply and demand had kept yields depressed. Total tax-exempt money market assets ended 2015 at $260.2 billion, easily exceeding variable rate demand note (VRDN) supply of $177.5 billion. In 2016, tax-exempt AUM have seen a significant drop, but VRDN supply has remained fairly stable. We expect more consolidation in the money market industry as October 14—the deadline for compliance with the new SEC regulations—approaches.

Credit quality plays a large role in the management of the fund, and the portfolio’s overall credit quality remains quite strong. As a policy, we favor only the most highly rated issuers in sectors such as hospitals and education as well as some select GO issuers. Some prominent positions in the portfolio include Trinity Healthcare, the University of Texas, and the District of Columbia. (Please refer to the fund’s portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

We believe that the Fed’s path toward rate normalization will be long and slow. As always, we remain committed to managing a high-quality, diversified portfolio focused on liquidity and stability of principal, which we deem of utmost importance to our valued shareholders.

We are not making any changes to the fund’s investment program as a result of the new SEC rules. However, the SEC regulations dictate that the fund must adopt the ability—effective October 14, 2016—to implement liquidity fees or temporarily suspend redemptions (also known as “gates”) in times of severe redemption pressure on the fund. Also, because the fund will be available only to individual investors under the new rules, we closed the fund to new institutional accounts on July 1, 2016.

TAX-FREE SHORT-INTERMEDIATE FUND

The fund returned 0.83% during the six-month reporting period versus 1.10% for the Lipper Short-Intermediate Municipal Debt Funds Average, which measures the performance of competing funds. (Performance is also shown in the table for the Advisor Class, which has a different fee structure.) The fund’s shorter maturity profile and focus on bonds with higher credit quality relative to the peer group weighed on returns as longer-maturity, lower-quality municipals performed best. The fund’s net asset value per share was $5.68 at the end of August, up from $5.67 six months earlier. Dividends per share contributed $0.04 to the fund’s total return during the six-month period.

The fund’s duration shortened modestly to 2.8 years after peaking for the reporting period at 3.0 years. We actively reduced duration in August to lower the fund’s interest rate risk as yields were low and credit spreads were tight. As for yield curve positioning, most of our new purchases were designed to reduce the portfolio’s underweight to bonds maturing in three to seven years. We executed this positioning shift to take advantage of the higher yields offered in that segment of the curve.

While our preference for revenue bonds over GOs remains intact as a result of our concerns about the considerable unfunded pension and OPEB liabilities that many state and local government issuers face, it has become challenging to find opportunities in revenue debt over the past couple of years in the short- to intermediate-term municipal market. As a result, we were also overweight GOs from high-quality states that do not have large near-term pension funding problems, including Washington, Florida, and North Carolina. We also initiated a small position in Pennsylvania GO bonds in the new issue market as we felt we were being compensated for the associated pension risk. We were encouraged that Pennsylvania passed its budget on time this year and exhibited an improvement in pension funding practices. The portfolio’s underweight to the prerefunded debt sector contributed to relative performance over the last six months as the high-quality but lower-yielding sector underperformed both GOs and revenue bonds.

Within the revenue sector, health care and transportation remained the fund’s largest allocations and overweights relative to the index. The two sectors together account for almost 30% of the fund’s net assets. We continue to like the fundamental credit quality of both health care and transportation revenue bonds. However, credit spreads in these sectors have moved to very narrow levels. While we do not anticipate reducing our exposure to health care or transportation, we have not been finding much value given their tight spread levels. Security selection within the health care sector, which is an area where our credit research team has been finding investment opportunities that offer incremental risk-adjusted yield, contributed to the fund’s relative performance.

With general muni valuations appearing elevated in August, we increased the portfolio’s allocation to cash by selling some longer-maturity holdings with small capital gains as well as some shorter-maturity bonds. We made this shift toward a more conservative positioning because we anticipated that the SEC’s money fund reforms, which are set to go into effect in October, would put unusual pressure on short-term obligations that could also negatively impact short- to intermediate-term municipal debt. Another factor contributing to our increasingly defensive positioning near the end of the reporting period was our expectation for a higher level of new supply to reach the municipal market in the fall, potentially further weighing on bond prices.

TAX-FREE INCOME FUND

The fund returned 3.29% during the six-month period ended August 31, 2016, versus 3.49% for the Lipper peer group average, which measures the performance of competing funds. (Performance for the Advisor Class was somewhat lower, reflecting its different fee structure.) The fund’s shorter maturity profile and focus on bonds with higher credit quality weighed on returns as longer-maturity, lower-quality municipals performed best. The fund’s net asset value per share was $10.57 at the end of August, up from $10.42 six months earlier. Dividends per share contributed $0.19 to the fund’s total return during the six-month period.

The fund’s duration lengthened modestly to 4.5 years from 4.3 years over the past six months and ended the period shorter than the duration of the Barclays Municipal Bond Index. Our duration was also short relative to the Lipper peer group. This positioning modestly detracted from relative returns as the yield curve flattened over the period, with longer-maturity bonds outperforming short-term securities. As for yield curve positioning, our relative overweight in bonds with maturities of 15 years and longer made a positive contribution to performance. We continue to believe the long-maturity end of the yield curve represents the best relative value, and our purchases over the period were concentrated in securities with maturities of 20 years and longer. This extended the fund’s weighted average maturity to 16.3 years from 15.9 years six months ago.

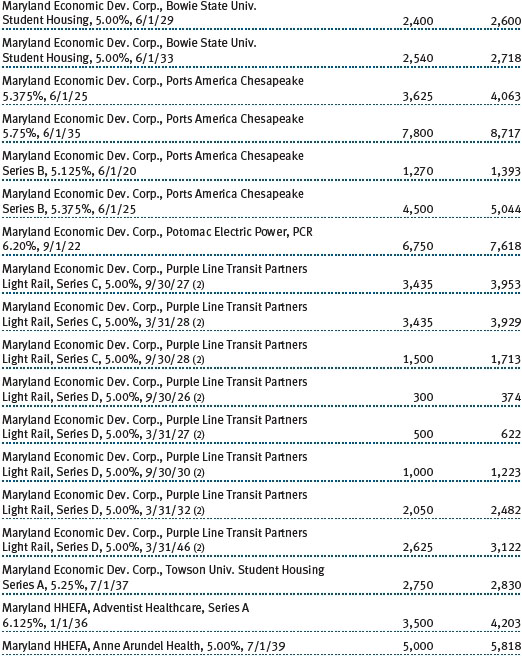

Our preference for revenue bonds over GOs remained intact as a result of our longer-term concern that many municipalities will face fiscal challenges related to unfunded pension and OPEB liabilities. Within the revenue sector, health care and transportation, which typically offer above-average yields, remained our largest allocations and together made up 47% of the fund’s net assets. The portfolio’s allocation to health care increased by about three percentage points over the period, with purchases including revenue bonds from the Health and Educational Facilities Board of the Metropolitan Government of Nashville and Davidson County, Tennessee (Vanderbilt University Medical Center); South Broward, Florida (Memorial Healthcare System); and Tampa, Florida (BayCare Health System). Within the transportation sector, we purchased bonds issued by the Alameda Corridor Transportation Authority, California, as well as the Illinois State Toll Highway Authority. The level of sales in the fund was rather muted during the period as we sought to stay fully invested and keep cash at minimal levels. (Please refer to the fund’s portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

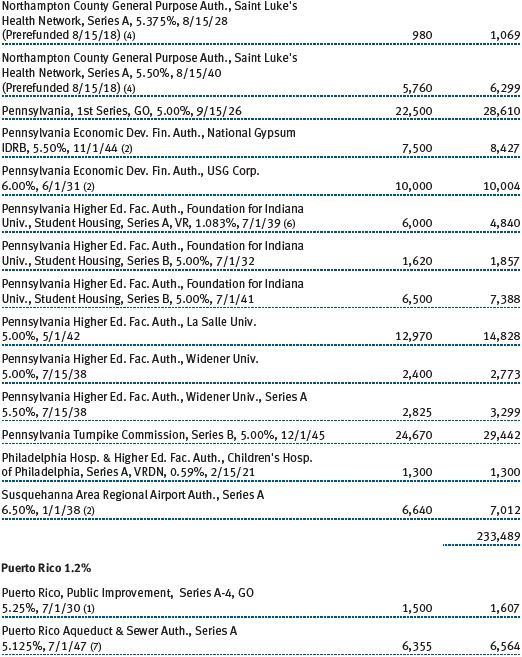

While our bias toward revenue bonds over GOs is still an overarching theme, we recently initiated a small position in Pennsylvania GO bonds in the new issue market as we felt we were being compensated for the associated pension risk. We were encouraged that Pennsylvania passed its budget on time this year and exhibited an improvement in pension funding practices.

Persistently low rates have enabled issuers to refinance older, high-cost debt at more favorable terms, creating a larger allocation to prerefunded bonds in the portfolio. The fund’s exposure to this high-quality sector moved significantly higher over the last year and now represents an overweight position. This provides the fund with a modest addition of liquidity in addition to cash. We believe this is appropriate within the recent volatile rate environment, and it leaves us well positioned to take advantage of the possibility of rising interest rates. However, the returns of prerefunded bonds lagged the broad municipal market during the period because of their high quality and low duration, detracting from the portfolio’s relative performance.

The fund’s credit quality profile was largely unchanged during the reporting period. We maintained an overweight to A and BBB rated debt as we believe this is an area where our credit research team can find investment opportunities that offer incremental risk-adjusted yield. We kept modest exposure to below investment-grade and unrated bonds. The portfolio’s allocation to AA rated debt increased by two percentage points in the past six months, mainly as a result of new health care debt purchases, previously noted, that offered greater value than lower-quality alternatives.

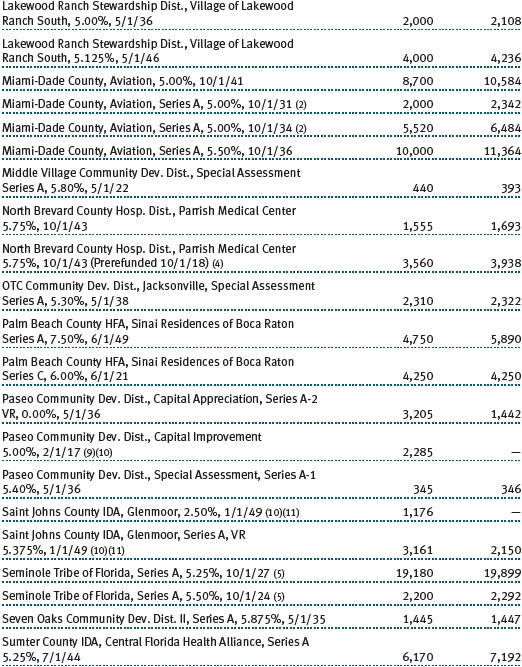

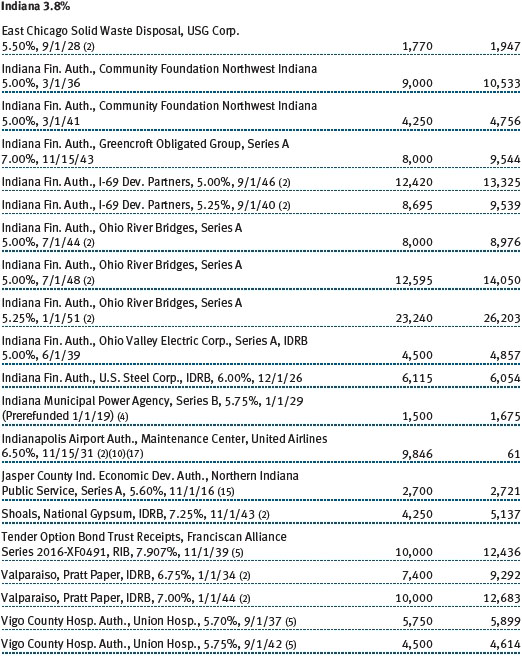

TAX-FREE HIGH YIELD FUND

The Tax-Free High Yield Fund posted a return of 5.18% for the six-month period ended August 31, 2016, versus 5.35% for our Lipper peer group. (The result for the Advisor Class, which has a different fee structure, is also shown in the table.) The fund’s net asset value per share was $12.41 at the end of August, up from $12.02 six months earlier, and dividends per share contributed $0.23 to the fund’s total return during the six-month period.

Our conservative positioning in tobacco securitization bonds detracted from relative performance over the last six months as the sector sharply outperformed. Cigarette shipments have recently declined at a much slower rate after years of precipitous drops due to “sin” taxes and successful cessation initiatives. These shipments are a key driver of payments to states under the Master Settlement Agreement struck with tobacco companies in the late 1990s. We remain skeptical about the long-term prospects for tobacco bonds and maintained about half the average exposure of funds in our Lipper peer group.

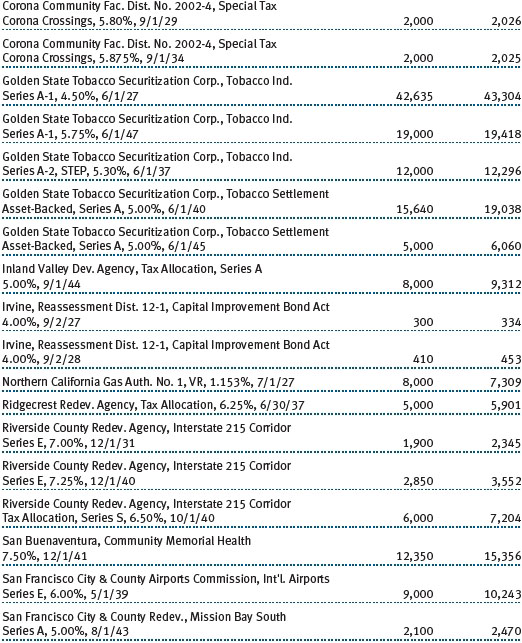

We increased the fund’s exposure to transportation revenue bonds over the period and maintained overweight positions in airports and toll roads versus many of our peers. We like the essential service status of these large infrastructure projects and the limited competition that they enjoy. Returns for transportation revenue bonds outpaced the returns of the general muni market for the reporting period. In airports, we added bonds issued by Dallas Fort Worth (DFW), Chicago Midway, and LaGuardia (New York). In toll roads, we initiated new positions in Pennsylvania Turnpike senior lien bonds, Illinois Toll Authority debt, and State Highway 288 (Texas) bonds. (Please refer to the fund’s portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

In keeping with our preference for essential service revenue bonds, we added exposure to bonds issued for large water and sewer projects. We increased our holdings in debt issued by Chicago Water Authority, which has solid credit quality and pays a yield premium as a result of the fiscal challenges facing the city. We also initiated a position in bonds from PRASA, the water authority for Puerto Rico. These bonds trade at distressed prices but provide a senior lien on water system revenues. Unlike most borrowers in the commonwealth, the water authority remains solvent and is current on its debt payments. However, we remain pessimistic about the prospects for most other Puerto Rico borrowers.

The fund had significant exposure to bonds in the health care industry issued by hospitals and continuing care retirement communities (CCRCs). The credit quality of not-for-profit hospitals has been on a positive trajectory for several years, driven by improving reimbursement trends, solid fiscal stewardship, and bolstered balance sheets. Bonds issued by Loma Linda University Medical Center (California) and Care New England (Rhode Island) performed well during the six-month period. We continue to favor investment opportunities in well-conceived CCRC projects as well because the demographics of an aging population provide steady support for this industry.

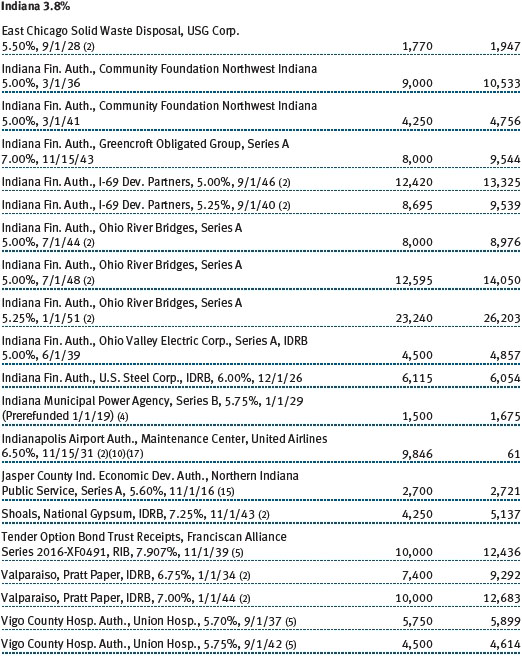

We maintained considerable exposure to industrial development and pollution control revenue bonds backed by corporations. Prices for bonds backed by several of these borrowers improved sharply over the six-month period as credit concerns in the energy sector abated. Our holdings in U.S Steel-backed debt and in National Gypsum bonds rallied sharply in the spring as prospects for those companies improved significantly.

As noted, T. Rowe Price has long favored revenue bonds over GOs, and we expect continued downgrades for borrowers with significant pension and OPEB issues. We believe the market is in the early stages of repricing these risks in the GO market and that investment opportunities will arise for “fallen angel” states and localities (issuers downgraded to noninvestment-grade status). We will follow these trends carefully over the next several years.

Medium- and lower-quality tax-exempt bonds performed very well over the last six months as interest rates declined and credit spreads narrowed to fairly tight levels. While valuations feel stretched versus historical norms, the incremental yields available for taxable investors in this market appear attractive versus many other fixed income asset classes, driving demand. We remain constructive on the fundamental credit prospects for most segments of the municipal market, and we will continue to rely on our fundamental research-driven investment process to uncover the best risk-adjusted opportunities in this market.

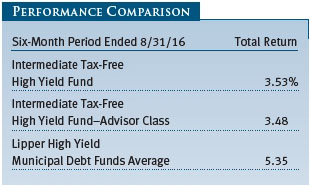

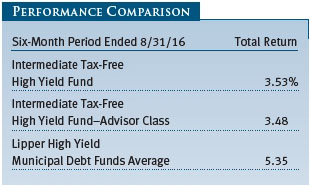

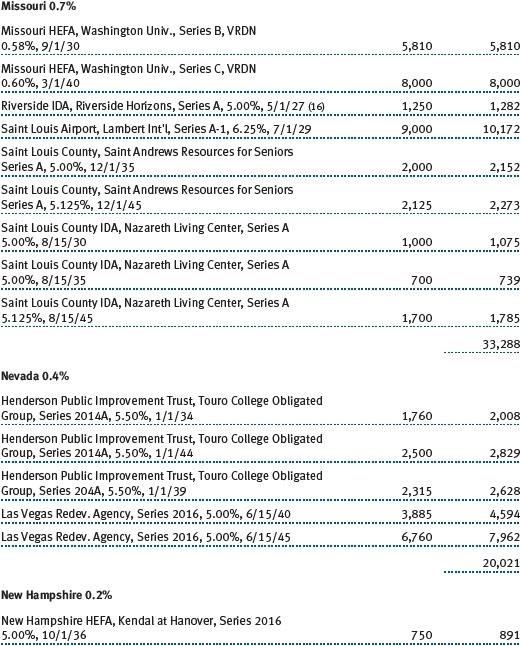

INTERMEDIATE TAX-FREE HIGH YIELD FUND

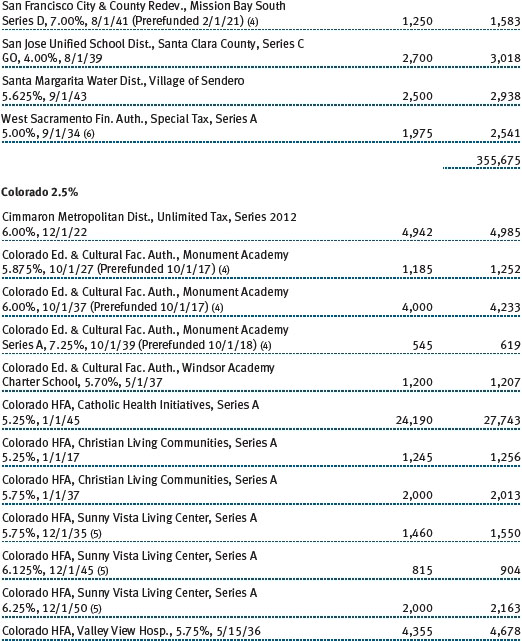

The Intermediate Tax-Free High Yield Fund generated a return of 3.53% for the six-month period ended August 31, 2016, versus 5.35% for our Lipper peer group average. (The result for the Advisor Class, which has a different fee structure, is also shown in the table.) The fund’s net asset value per share was $10.58 at the end of August, up from $10.35 six months earlier, and dividends per share contributed $0.13 to the fund’s total return during the six-month period.

The fund’s duration is significantly shorter than the average duration of its Lipper peers as a result of our intermediate-term mandate. The fund’s Lipper peer group encompasses all tax-free high yield funds regardless of targeted duration or maturity. This weighed on the relative results of our intermediate-term portfolio as interest rates decreased over the period. We expect this outcome to reverse during periods of rising interest rates, when the limited term structure of our portfolio would buoy returns versus riskier competitors.

Our conservative positioning in tobacco securitization bonds also detracted from relative performance as the sector sharply outperformed. Cigarette shipments have recently declined at a much slower rate after years of precipitous drops due to sin taxes and successful cessation initiatives. These shipments are a key driver of payments to states under the Master Settlement Agreement struck with tobacco companies in the late 1990s. We remain skeptical about the long-term prospects for tobacco bonds and maintained about half the average exposure of funds in our Lipper peer group.

We increased the portfolio’s exposure to industrial development and pollution control revenue bonds backed by corporations, which performed well during the reporting period. Our holdings in bonds issued for U.S. Steel recovered sharply as the company recapitalized in the taxable bond market and prospects for the steel industry improved through the summer months. Our Westlake Chemical and Celanese bonds also generated solid returns. Prepaid gas bonds, whose payments are backed by large U.S. banks, outperformed for the period, while bonds issued by First Energy Solutions fell in concert with the company’s credit rating downgrades. (Please refer to the fund’s portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

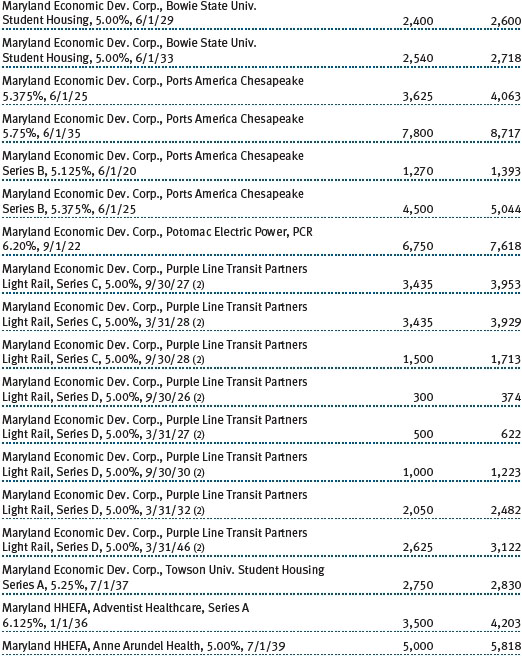

The portfolio’s allocation to health care revenue bonds fell by about five percentage points during the period as several of our holdings matured or were refinanced by the issuer. However, we retained significant holdings in bonds issued by hospitals and retirement communities, which together accounted for roughly 30% of the portfolio’s net assets. The credit quality of not-for-profit hospitals has been on a positive trajectory for several years, driven by improving reimbursement trends, solid fiscal stewardship, and bolstered balance sheets. Bonds issued by Adventist Health (Maryland) and Memorial Health System (Ohio) performed well for the period. We continue to favor investment opportunities in well-conceived CCRC projects as well because the demographics of an aging population provide steady support for this industry.

We increased the fund’s exposure to transportation revenue bonds over the period and maintained overweight positions in airports and toll roads versus many of our peers. We like the essential service status of these large infrastructure projects and the limited competition that they enjoy. Returns for transportation revenue bonds outpaced the returns of the general muni market for the reporting period. Our holdings of debt issued by Chicago O’Hare and Cleveland Airport performed well. In keeping with our preference for essential service revenue bonds, we maintained significant exposure to bonds issued for large water and sewer projects. We increased our holdings in debt issued by Chicago Water Authority, which has solid credit quality and pays a yield premium as a result of the fiscal challenges facing the city.

Intermediate-term, medium- and lower-quality, tax-exempt bonds performed very well over the last six months as interest rates declined and credit spreads narrowed to fairly tight levels. We believe that intermediate-term high yield bonds look increasingly attractive versus longer-maturity debt, which rallied significantly during the reporting period, while also providing less sensitivity to the negative price effects of interest rate increases. We remain constructive on the fundamental credit prospects for most segments of the municipal market, and we will continue to rely on our fundamental research-driven investment process to uncover the best risk-adjusted opportunities in this market.

OUTLOOK

We believe that the municipal bond market remains a high-quality market that offers good opportunities for long-term investors seeking tax-free income. Fundamentals are sound overall, and technical support should persist as global economic uncertainties further increase demand for the relatively high-quality and somewhat insulated municipal bond asset class. Amid increased volatility, we expect the Fed to approach the next rate hike with an added degree of caution, and we believe that we could remain in a low-rate environment for some time. If signs of economic recovery prompt the Fed to continue raising short-term interest rates, muni bond yields are likely to rise along with Treasury yields—although probably not to the same extent. While higher yields typically pressure bond prices, we expect any potential Fed rate increases to be gradual and modest. Moreover, munis should be less susceptible to rising rates than Treasuries given their attractive tax-equivalent yields and the steady demand for tax-exempt income.

While we believe that many states deserve high credit ratings and will be able to continue servicing their debts, we have longer-term concerns about significant funding shortfalls for pensions and OPEB obligations in some jurisdictions. These funding gaps stem from investment losses during the financial crisis, insufficient plan contributions over time, and unrealistic return assumptions. Although few large plans are at risk of insolvency in the near term, the magnitude of unfunded liabilities is becoming more conspicuous in a few states.

Ultimately, we believe T. Rowe Price’s independent credit research is our greatest strength and will remain an asset for our investors as we navigate the current market environment. As always, we focus on finding attractively valued bonds issued by municipalities with good long-term fundamentals—an investment strategy that we believe will continue to serve our investors well.

Thank you for investing with T. Rowe Price.

Respectfully submitted,

Joseph K. Lynagh

Chairman of the Investment Advisory Committee

Tax-Exempt Money Fund

Charles B. Hill

Chairman of the Investment Advisory Committee

Tax-Free Short-Intermediate Fund

Konstantine B. Mallas

Chairman of the Investment Advisory Committee

Tax-Free Income Fund

James M. Murphy

Chairman of the Investment Advisory Committee

Tax-Free High Yield Fund and Intermediate Tax-Free High Yield Fund

September 21, 2016

The committee chairmen have day-to-day responsibility for managing the portfolios and work with committee members in developing and executing the funds’ investment programs.

RISKS OF INVESTING IN A RETAIL MONEY MARKET FUND

You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. Beginning October 14, 2016, the Fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the Fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time.

RISKS OF FIXED INCOME INVESTING

Bonds are subject to interest rate risk (the decline in bond prices that usually accompanies a rise in interest rates) and credit risk (the chance that any fund holding could have its credit rating downgraded or that a bond issuer will default by failing to make timely payments of interest or principal), potentially reducing the fund’s income level and share price. High yield bonds could have greater price declines than funds that invest primarily in high-quality bonds. Municipalities issuing high yield bonds are not as strong financially as those with higher credit ratings, so the bonds are usually considered speculative investments. Some income may be subject to state and local taxes and the federal alternative minimum tax.

GLOSSARY

Barclays Municipal Bond Index: An unmanaged index that tracks municipal debt instruments.

Barclays 1–5 Year Blend (1–6 Year Maturity) Index: A subindex of the Barclays Municipal Bond Index. It is a rules-based, market value-weighted index of short-term bonds engineered for the tax-exempt bond market.

Barclays 65% High-Grade/35% High-Yield Index: An index that tracks Barclays indexes of both investment-grade and below investment-grade municipal debt instruments.

Basis point: One one-hundredth of one percentage point, or 0.01%.

Credit spread: The additional yield that investors demand to hold a bond with credit risk compared with a Treasury security with a comparable maturity date.

Duration: A measure of a bond fund’s sensitivity to changes in interest rates. For example, a fund with a duration of five years would fall about 5% in price in response to a one-percentage-point rise in interest rates, and vice versa.

Escrowed-to-maturity bond: A bond that has the funds necessary for repayment at maturity, or a call date, set aside in a separate or “escrow” account.

Federal funds rate: The interest rate charged on overnight loans of reserves by one financial institution to another in the United States. The Federal Reserve sets a target federal funds rate to affect the direction of interest rates.

General obligation (GO) debt: A government’s strongest pledge that obligates its full faith and credit, including, if necessary, its ability to raise taxes.

Gross domestic product (GDP): The total market value of all goods and services produced in a country in a given year.

Investment grade: High-quality bonds as measured by one of the major credit rating agencies. For example, Standard & Poor’s designates the bonds in its top four categories (AAA to BBB) as investment grade.

Lipper averages: The averages of available mutual fund performance returns for specified time periods in categories defined by Lipper.

Lipper indexes: Fund benchmarks that consist of a small number (10 to 30) of the largest mutual funds in a particular category as tracked by Lipper Inc.

Other post-employment benefits liability (OPEB): Benefits paid to an employee after retirement, such as premiums for life and health insurance.

Prerefunded bond: A bond that originally may have been issued as a general obligation or revenue bond but that is now secured by an escrow fund consisting entirely of direct U.S. government obligations that are sufficient for paying the bondholders.

SEC yield (7-day simple): A method of calculating a money fund’s yield by annualizing the fund’s net investment income for the last seven days of each period divided by the fund’s net asset value at the end of the period. Yield will vary and is not guaranteed.

SEC yield (30-day): A method of calculating a fund’s yield that assumes all portfolio securities are held until maturity. Yield will vary and is not guaranteed.

Variable rate demand note (VRDN): Generally, a debt security that requires the issuer to redeem at the holder’s discretion on a specified date or dates prior to maturity. Upon redemption, the issuer pays par to the holder who loses future coupon payments that might otherwise be due. The VRDN might be especially attractive at times of rising rates, to protect against interest rate risk by redeeming at par value and reinvesting proceeds in a new bond.

Weighted average life: A measure of a fund’s credit quality risk. In general, the longer the average life, the greater the fund’s credit quality risk. The average life is the dollar-weighted average maturity of a portfolio’s individual securities without taking into account interest rate readjustment dates. Money funds must maintain a weighted average life of less than 120 days.

Weighted average maturity: A measure of a fund’s interest rate sensitivity. In general, the longer the average maturity, the greater the fund’s sensitivity to interest rate changes. The weighted average maturity may take into account the interest rate readjustment dates for certain securities. Money funds must maintain a weighted average maturity of less than 60 days.

Yield curve: A graphic depiction of the relationship between yields and maturity dates for a set of similar securities such as Treasuries or municipal securities. Securities with longer maturities usually a have higher yield. If short-term securities offer a higher yield, then the curve is said to be “inverted.” If short- and long-term bonds are offering equivalent yields, then the curve is said to be “flat.”

Performance and Expenses

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

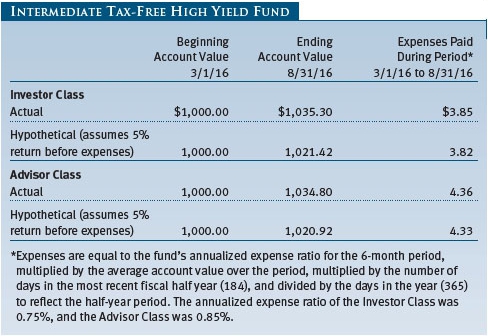

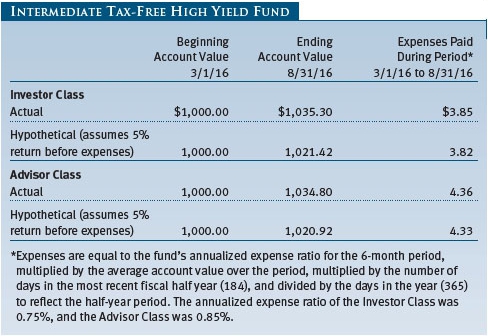

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and actual expenses. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Please note that the Tax-Free Short-Intermediate Fund, Tax-Free Income Fund, Tax-Free High Yield Fund, and Intermediate Tax-Free High Yield Fund have two share classes: The original share class (Investor Class) charges no distribution and service (12b-1) fee, and the Advisor Class shares are offered only through unaffiliated brokers and other financial intermediaries and charge a 0.25% 12b-1 fee. Each share class is presented separately in the table.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual account service fee of $20, generally for accounts with less than $10,000. The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $50,000 or more; accounts electing to receive electronic delivery of account statements, transaction confirmations, prospectuses, and shareholder reports; or accounts of an investor who is a T. Rowe Price Preferred Services, Personal Services, or Enhanced Personal Services client (enrollment in these programs generally requires T. Rowe Price assets of at least $100,000). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

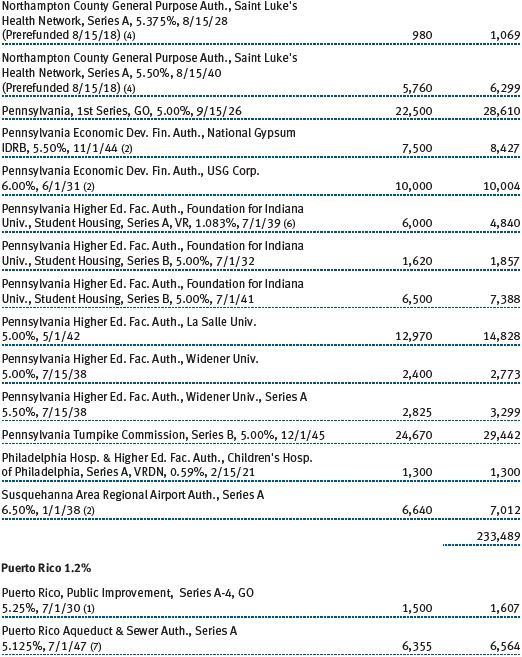

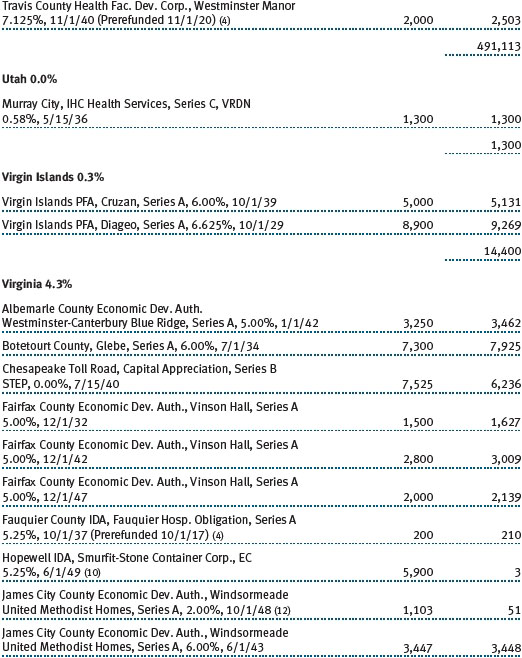

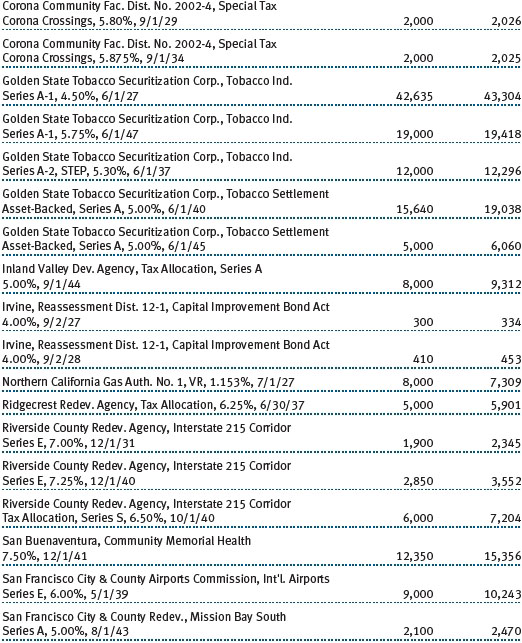

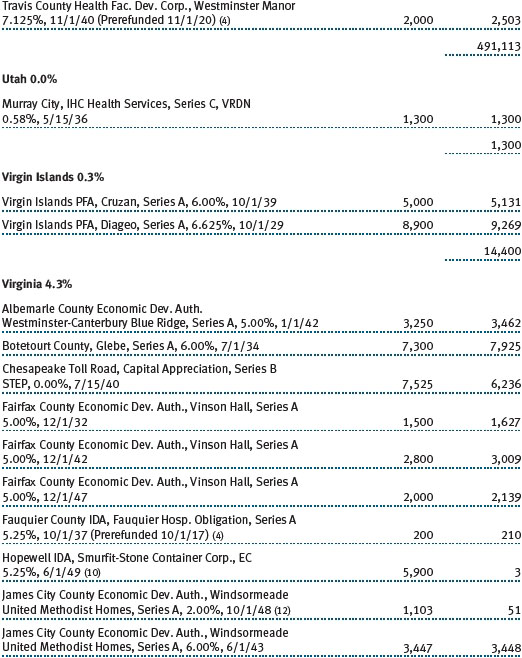

Unaudited

The accompanying notes are an integral part of these financial statements.

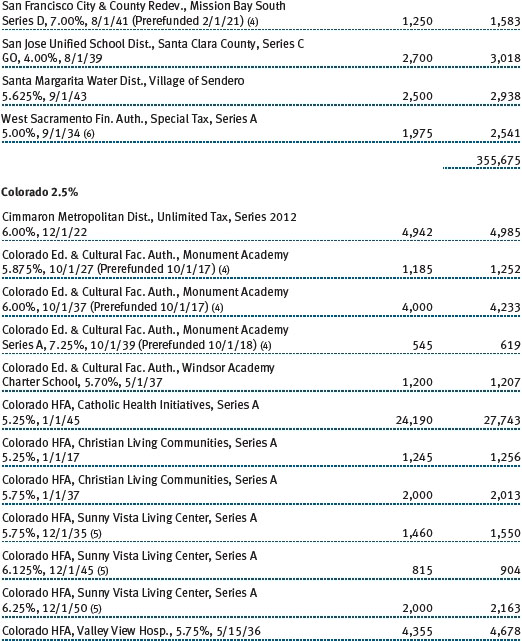

Unaudited

The accompanying notes are an integral part of these financial statements.

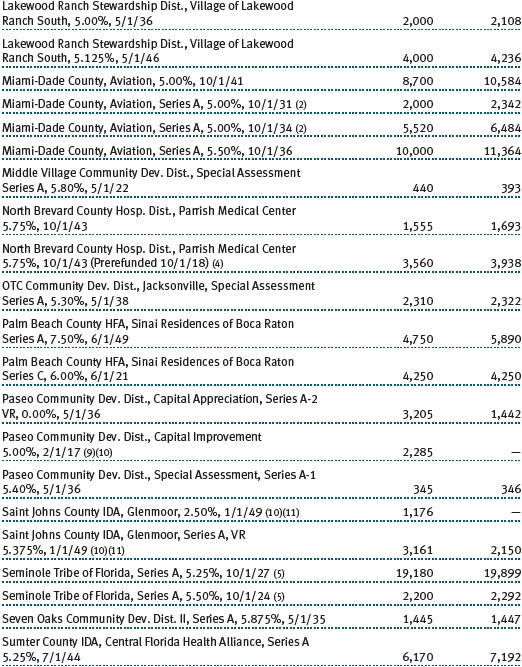

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

| Notes to Financial Statements |

T. Rowe Price Tax-Free High Yield Fund, Inc. (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund seeks to provide a high level of income exempt from federal income taxes by investing primarily in long-term low- to upper-medium-grade municipal securities. The fund has two classes of shares: the T. Rowe Price Tax-Free High Yield Fund original share class, referred to in this report as the Investor Class, incepted on March 1, 1985, and the T. Rowe Price Tax-Free High Yield Fund–Advisor Class (Advisor Class), incepted on August 8, 2012. Advisor Class shares are sold only through unaffiliated brokers and other unaffiliated financial intermediaries that are compensated by the class for distribution, shareholder servicing, and/or certain administrative services under a Board-approved Rule 12b-1 plan; the Investor Class does not pay Rule 12b-1 fees. Each class has exclusive voting rights on matters related solely to that class; separate voting rights on matters that relate to both classes; and, in all other respects, the same rights and obligations as the other class.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including, but not limited to, ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Income distributions are declared by each class daily and paid monthly. Distributions to shareholders are recorded on the ex-dividend date. Capital gain distributions, if any, are generally declared and paid by the fund annually.

Class Accounting Shareholder servicing, prospectus, and shareholder report expenses incurred by each class are charged directly to the class to which they relate. Expenses common to both classes and investment income are allocated to the classes based upon the relative daily net assets of each class’s settled shares; realized and unrealized gains and losses are allocated based upon the relative daily net assets of each class’s outstanding shares. The Advisor Class pays Rule 12b-1 fees, in an amount not exceeding 0.25% of the class’s average daily net assets.

Redemption Fees A 2% fee is assessed on redemptions of fund shares held for 90 days or less to deter short-term trading and to protect the interests of long-term shareholders. Redemption fees are withheld from proceeds that shareholders receive from the sale or exchange of fund shares. The fees are paid to the fund and are recorded as an increase to paid-in capital. The fees may cause the redemption price per share to differ from the net asset value per share.

NOTE 2 - VALUATION

The fund’s financial instruments are valued and each class’s net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day the NYSE is open for business.

Fair Value The fund’s financial instruments are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The T. Rowe Price Valuation Committee (the Valuation Committee) has been established by the fund’s Board of Directors (the Board) to ensure that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight by the Board, the Valuation Committee develops and oversees pricing-related policies and procedures and approves all fair value determinations. Specifically, the Valuation Committee establishes procedures to value securities; determines pricing techniques, sources, and persons eligible to effect fair value pricing actions; oversees the selection, services, and performance of pricing vendors; oversees valuation-related business continuity practices; and provides guidance on internal controls and valuation-related matters. The Valuation Committee reports to the Board and has representation from legal, portfolio management and trading, operations, risk management, and the fund’s treasurer.

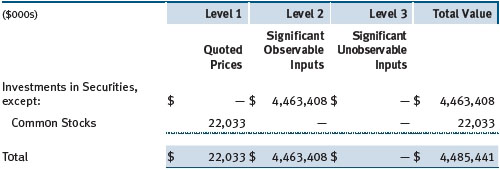

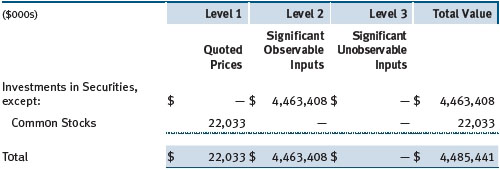

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

Valuation Techniques Debt securities generally are traded in the over-the-counter (OTC) market. Securities with remaining maturities of one year or more at the time of acquisition are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service, which considers the yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Securities with remaining maturities of less than one year at the time of acquisition generally use amortized cost in local currency to approximate fair value. However, if amortized cost is deemed not to reflect fair value or the fund holds a significant amount of such securities with remaining maturities of more than 60 days, the securities are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service. Generally, debt securities are categorized in Level 2 of the fair value hierarchy; however, to the extent the valuations include significant unobservable inputs, the securities would be categorized in Level 3.

Equity securities listed or regularly traded on a securities exchange or in the OTC market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made. OTC Bulletin Board securities are valued at the mean of the closing bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the closing bid and asked prices. Actively traded equity securities listed on a domestic exchange generally are categorized in Level 1 of the fair value hierarchy. OTC Bulletin Board securities, certain preferred securities, and equity securities traded in inactive markets generally are categorized in Level 2 of the fair value hierarchy.

Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value.

Thinly traded financial instruments and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the Valuation Committee. The objective of any fair value pricing determination is to arrive at a price that could reasonably be expected from a current sale. Financial instruments fair valued by the Valuation Committee are primarily private placements, restricted securities, warrants, rights, and other securities that are not publicly traded.

Subject to oversight by the Board, the Valuation Committee regularly makes good faith judgments to establish and adjust the fair valuations of certain securities as events occur and circumstances warrant. For instance, in determining the fair value of troubled or thinly traded debt instruments, the Valuation Committee considers a variety of factors, which may include, but are not limited to, the issuer’s business prospects, its financial standing and performance, recent investment transactions in the issuer, strategic events affecting the company, market liquidity for the issuer, and general economic conditions and events. In consultation with the investment and pricing teams, the Valuation Committee will determine an appropriate valuation technique based on available information, which may include both observable and unobservable inputs. The Valuation Committee typically will afford greatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions between market participants, transaction information can be reliably obtained, and prices are deemed representative of fair value. However, the Valuation Committee may also consider other valuation methods such as a discount or premium from market value of a similar, freely traded security of the same issuer; discounted cash flows; yield to maturity; or some combination. Fair value determinations are reviewed on a regular basis and updated as information becomes available, including actual purchase and sale transactions of the issue. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions, and fair value prices determined by the Valuation Committee could differ from those of other market participants. Depending on the relative significance of unobservable inputs, including the valuation technique(s) used, fair valued securities may be categorized in Level 2 or 3 of the fair value hierarchy.

Valuation Inputs The following table summarizes the fund’s financial instruments, based on the inputs used to determine their fair values on August 31, 2016:

There were no material transfers between Levels 1 and 2 during the six months ended August 31, 2016.

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Noninvestment-Grade Debt At August 31, 2016, approximately 39% of the fund’s net assets were invested, either directly or through its investment in T. Rowe Price institutional funds, in noninvestment-grade debt, including “high yield” or “junk” bonds or leveraged loans. The noninvestment-grade debt market may experience sudden and sharp price swings due to a variety of factors, including changes in economic forecasts, stock market activity, large sustained sales by major investors, a high-profile default, or a change in market sentiment. These events may decrease the ability of issuers to make principal and interest payments and adversely affect the liquidity or value, or both, of such securities.

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable price may be difficult and may involve substantial delays and additional costs.

Residual-Interest Bonds The fund may invest in residual-interest bonds (RIBs) purchased from third-party special purpose trusts, which securitize an underlying bond into RIBs and short-term floating rate bonds. RIBs generally are entitled to the cash flows of the underlying bond that remain after payment of amounts due to the floating rate bondholders and trust-related fees; they also generally have the right to acquire the underlying bond from the trust. RIBs can only be traded in accordance with Rule 144A of the Securities Act of 1933 and cannot be offered for public resale. Risks arise from changes in interest rates and the value of the underlying bond, and the sale of the RIBs may involve delay or additional costs.

When-Issued Securities The fund may enter into when-issued purchase or sale commitments, pursuant to which it agrees to purchase or sell, respectively, an authorized but not yet issued security for a fixed unit price, with payment and delivery not due until issuance of the security on a scheduled future date. When-issued securities may be new securities or securities issued through a corporate action, such as a reorganization or restructuring. Until settlement, the fund maintains liquid assets sufficient to settle its commitment to purchase a when-issued security or, in the case of a sale commitment, the fund maintains an entitlement to the security to be sold. Amounts realized on when-issued transactions are included in realized gain/loss on securities in the accompanying financial statements.

Other Purchases and sales of portfolio securities other than short-term securities aggregated $908,473,000 and $98,628,000, respectively, for the six months ended August 31, 2016.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of the date of this report.

The fund intends to retain realized gains to the extent of available capital loss carryforwards. Because the fund is required to use capital loss carryforwards that do not expire before those with expiration dates, all or a portion of its capital loss carryforwards subject to expiration could ultimately go unused. As of February 29, 2016, the fund had $36,710,000 of available capital loss carryforwards, which expire as follows: $6,657,000 in fiscal 2017, $12,492,000 in fiscal 2018, and $3,652,000 in fiscal 2019; $13,909,000 have no expiration.

At August 31, 2016, the cost of investments for federal income tax purposes was $4,158,420,000. Net unrealized gain aggregated $327,021,000 at period-end, of which $379,758,000 related to appreciated investments and $52,737,000 related to depreciated investments.

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management agreement between the fund and Price Associates provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.30% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.270% for assets in excess of $500 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At August 31, 2016, the effective annual group fee rate was 0.29%.

The Advisor Class was also subject to a contractual expense limitation through June 30, 2015. During the limitation period, Price Associates is required to waive its management fee or pay any expenses, excluding interest, taxes, brokerage commissions, and extraordinary expenses, that would otherwise cause the class’s ratio of annualized total expenses to average net assets (expense ratio) to exceed its expense limitation of 1.05%. The class is required to repay Price Associates for expenses previously waived/paid to the extent the class’s net assets grow or expenses decline sufficiently to allow repayment without causing the class’s expense ratio to exceed its expense limitation. However, no repayment will be made more than three years after the date of a payment or waiver.

In addition, the fund has entered into service agreements with Price Associates and a wholly owned subsidiary of Price Associates (collectively, Price). Price Associates provides certain accounting and administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend-disbursing agent. For the six months ended August 31, 2016, expenses incurred pursuant to these service agreements were $23,000 for Price Associates and $284,000 for T. Rowe Price Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

The fund may participate in securities purchase and sale transactions with other funds or accounts advised by Price Associates (cross trades), in accordance with procedures adopted by the fund’s Board and Securities and Exchange Commission rules, which require, among other things, that such purchase and sale cross trades be effected at the independent current market price of the security. Purchases and sales cross trades aggregated $48,985,000 and $12,000,000, respectively, with net realized gain of $0 for the six months ended August 31, 2016.

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our corporate website. To access it, please visit the following Web page:

https://www3.troweprice.com/usis/corporate/en/utility/policies.html

Scroll down to the section near the bottom of the page that says, “Proxy Voting Policies.” Click on the Proxy Voting Policies link in the shaded box.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through T. Rowe Price, visit the website location shown above, and scroll down to the section near the bottom of the page that says, “Proxy Voting Records.” Click on the Proxy Voting Records link in the shaded box.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 100 F St. N.E., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| Approval of Investment Management Agreement |

On March 11, 2016, the fund’s Board of Directors (Board), including a majority of the fund’s independent directors, approved the continuation of the investment management agreement (Advisory Contract) between the fund and its investment advisor, T. Rowe Price Associates, Inc. (Advisor). In connection with its deliberations, the Board requested, and the Advisor provided, such information as the Board (with advice from independent legal counsel) deemed reasonably necessary. The Board considered a variety of factors in connection with its review of the Advisory Contract, also taking into account information provided by the Advisor during the course of the year, as discussed below:

Services Provided by the Advisor

The Board considered the nature, quality, and extent of the services provided to the fund by the Advisor. These services included, but were not limited to, directing the fund’s investments in accordance with its investment program and the overall management of the fund’s portfolio, as well as a variety of related activities such as financial, investment operations, and administrative services; compliance; maintaining the fund’s records and registrations; and shareholder communications. The Board also reviewed the background and experience of the Advisor’s senior management team and investment personnel involved in the management of the fund, as well as the Advisor’s compliance record. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Advisor.

Investment Performance of the Fund

The Board reviewed the fund’s three-month, one-year, and year-by-year returns, as well as the fund’s average annualized total returns over the 3-, 5-, and 10-year periods, and compared these returns with a wide variety of comparable performance measures and market data, including those supplied by Lipper and Morningstar, which are independent providers of mutual fund data.

On the basis of this evaluation and the Board’s ongoing review of investment results, and factoring in the relative market conditions during certain of the performance periods, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Advisor under the Advisory Contract and other benefits that the Advisor (and its affiliates) may have realized from its relationship with the fund, including any research received under “soft dollar” agreements and commission-sharing arrangements with broker-dealers. The Board considered that the Advisor may receive some benefit from soft-dollar arrangements pursuant to which research is received from broker-dealers that execute the applicable fund’s portfolio transactions. The Board received information on the estimated costs incurred and profits realized by the Advisor from managing T. Rowe Price mutual funds. The Board also reviewed estimates of the profits realized from managing the fund in particular, and the Board concluded that the Advisor’s profits were reasonable in light of the services provided to the fund.

The Board also considered whether the fund benefits under the fee levels set forth in the Advisory Contract from any economies of scale realized by the Advisor. Under the Advisory Contract, the fund pays a fee to the Advisor for investment management services composed of two components—a group fee rate based on the combined average net assets of most of the T. Rowe Price mutual funds (including the fund) that declines at certain asset levels and an individual fund fee rate based on the fund’s average daily net assets—and the fund pays its own expenses of operations. The Board concluded that the advisory fee structure for the fund continued to provide for a reasonable sharing of benefits from any economies of scale with the fund’s investors.

Fees

The Board was provided with information regarding industry trends in management fees and expenses, and the Board reviewed the fund’s management fee rate, operating expenses, and total expense ratio for the Investor Class and Advisor Class in comparison with fees and expenses of other comparable funds based on information and data supplied by Lipper. The information provided to the Board indicated that the fund’s management fee rate was above the median for certain groups of comparable funds and at or below the median for other groups of comparable funds. The information also indicated that the total expense ratio for both classes was at or below the median for comparable funds.

The Board also reviewed the fee schedules for institutional accounts (including subadvised mutual funds) and private accounts with similar mandates that are advised or subadvised by the Advisor and its affiliates. Management provided the Board with information about the Advisor’s responsibilities and services provided to subadvisory and other institutional account clients, including information about how the requirements and economics of the institutional business differ from those of the Advisor’s proprietary mutual fund business. The Board considered information showing that the Advisor’s proprietary mutual fund business is generally more complex from a business and compliance perspective than its institutional account business and considered various other relevant factors, including the broader scope of operations and oversight, more extensive shareholder communication infrastructure, greater asset flows, heightened business risks, and differences in applicable laws and regulations associated with the Advisor’s proprietary mutual fund business. In assessing the reasonableness of the fund’s management fee rate, the Board considered the differences in the nature of the services required for the Advisor to manage its proprietary mutual fund business versus managing a discrete pool of assets as a subadvisor to another institution’s mutual fund or for another institutional account and the degree to which the Advisor performs significant additional services and assumes greater risk in managing the fund and other T. Rowe Price mutual funds than it does for institutional account clients.

On the basis of the information provided and the factors considered, the Board concluded that the fees paid by the fund under the Advisory Contract are reasonable.

Approval of the Advisory Contract

As noted, the Board approved the continuation of the Advisory Contract. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund and its shareholders for the Board to approve the continuation of the Advisory Contract (including the fees to be charged for services thereunder). The independent directors were advised throughout the process by independent legal counsel.

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Tax-Free High Yield Fund, Inc.

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| | |

| Date October 17, 2016 | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| | |

| Date October 17, 2016 | | |

| | |

| | |

| By | /s/ Catherine D. Mathews |

| | Catherine D. Mathews |

| | Principal Financial Officer |

| | |

| Date October 17, 2016 | | |