UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00852

fpa PARAMOUNT FUND, INC.

(Exact name of registrant as specified in charter)

11601 WILSHIRE BLVD., STE. 1200

LOS ANGELES, CALIFORNIA 90025

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: |

| | |

J. RICHARD ATWOOD, PRESIDENT FPA PARAMOUNT FUND, INC. 11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA 90025 | MARK D. PERLOW, ESQ. DECHERT LLP ONE BUSH STREET, STE. 1600 SAN FRANCISCO, CA 94104 |

Registrant’s telephone number, including area code: (310) 473-0225

Date of fiscal year end: September 30

Date of reporting period: September 30, 2020

Item 1: Report to Shareholders.

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, we intend to no longer mail paper copies of the Fund's shareholder reports, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the FPA Funds website (fpa.com/funds), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you prefer to receive shareholder reports and other communications electronically, you may update your mailing preferences with your financial intermediary, or enroll in e-delivery at fpa.com (for accounts held directly with the Fund).

You may elect to continue to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you may inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting us at (800) 638-3060. Your election to receive reports in paper will apply to all funds held with the FPA Funds or through your financial intermediary.

FPA PARAMOUNT FUND, INC.

LETTER TO SHAREHOLDERS

Dear Fellow Shareholders,

For the last 12 months, the Fund gained 2.69% compared to an increase of 1.38% for the MSCI All Country World NR Index (the "Index"). The returns of each of the past four quarters shows the volatility of the Fund and the Index over the period with the Fund returning 10.77% for the quarter ended 12/31/19, -22.79% for 3/31/20, 21.19% for 6/30/20 and 7.76% for 9/30/20, versus 8.95%, -21.37%, 19.22%, and 8.13%, respectively, for the Index in the same periods. While the Fund's performance over the past year exceeded the Index, we continue to believe short-term performance is not the best way to judge investment results. Against the backdrop of the COVID-19 crisis, its anticipated economic impact and government responses, the results only represent a point in time compared to the Index. Market sentiment toward an industry, or even a specific company, which often shifts significantly from one year to the next, has been even more volatile in the recent period. It typically takes several years for discounts to our estimates of intrinsic value to unwind. That is why we advocate evaluating the Fund's performance over longer periods, ideally over a market cycle.

As of September 30, we owned 48 disclosed positions. This is within the range of the number of businesses we would expect to own at any given time, and most of the Fund's assets were invested in companies domiciled in Europe, the United States and the UK. As we have previously stated, where a company is domiciled is largely irrelevant to us since many of the Fund's holdings are large companies that conduct business on a global scale. That means they often generate significant amounts of their cash flow outside their home countries, rendering traditional country classifications less useful.

Below please find the Fund's top 5 contributors and detractors for the year ending September 30, 2020.

Trailing Twelve Month Contributors and Detractors as of September 30, 20201

| Contributors | | Perf.

Cont. | | % of

Port. | | Detractors | | Perf.

Cont. | | % of

Port. | |

TTM | |

ALS | | | 2.66 | % | | | 0.8 | % | | ISS A/S | | | -1.74 | % | | | 3.5 | % | |

Microsoft | | | 2.37 | % | | | 5.0 | % | | AIB Group | | | -1.66 | % | | | 0.0 | % | |

NAVER | | | 1.86 | % | | | 2.1 | % | | Ambev | | | -1.57 | % | | | 0.9 | % | |

Activision Blizzard | | | 1.78 | % | | | 3.5 | % | | Babcock International Group | | | -1.56 | % | | | 1.6 | % | |

Tencent Holdings | | | 1.76 | % | | | 4.0 | % | | Sodexo | | | -1.22 | % | | | 0.0 | % | |

| | | 10.43 | % | | | 15.4 | % | | | | | -7.75 | % | | | 6.0 | % | |

1 Reflects the top five contributors and detractors to the Fund's performance based on contribution to return for the trailing twelve months ("TTM"). Contribution is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. A copy of the methodology used and a list of every holding's contribution to the overall Fund's performance during the TTM is available by contacting FPA Client Service at crm@fpa.com. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities listed.

Past performance is no guarantee, nor is it indicative, of future results.

1

FPA PARAMOUNT FUND, INC.

LETTER TO SHAREHOLDERS

(Continued)

Among portfolio holdings, ISS A/S was the largest detractor to performance in the fiscal year ended Sept. 30. Based in Denmark, ISS is a global leading provider of cleaning, property services, catering, security, and facility management services. While the business was recently hit by the Covid-19 pandemic, the company had produced weak operating results prior to current health crisis. Over the last 12 months, ISS issued multiple profit warnings, suffered execution problems with several large contracts, and saw cash flow seemingly curtailed by changes to a receivables factoring program. As 2020 began, the company's IT systems also received a largescale malware attack that significantly affected operations. With those issues weighing on the share price, we established a position and have further added to it as the spread of the virus put further pressure on ISS' share price.

Turning to future prospects for the business, we note that cleaning, which is about half of ISS' portfolio, is seeing increased demand as customers require deep cleaning and disinfection services as they ready their work environments for the safe return of employees. We believe customers are likely to ascribe greater value to cleaning services in general going forward. We think further expansion of outsourcing services is also likely in the current environment. While ISS' financial leverage ratios appear elevated due to both depressed current profitability and the way some obligations are classified, we believe ISS has sufficient financial strength to weather the weak environment. Finally, a new, well-regarded CEO joined the company at the beginning of September. We will closely monitor the business as he firms up his plans for the business in the months ahead. Based on its quality attributes and its discounted valuation, we remain owners of ISS.

Among portfolio holdings, ALS was the top performance contributor for the fiscal year.2 ALS, based in Australia, is a leading global provider of analytical test and inspection services for commodity, life science and industrial customers. Long-term shareholders will remember that we previously held ALS for a number of years. During the first quarter of 2020, the company's shares fell significantly due to concerns about weakening economic activity and the related impact on demand for its testing services. We saw the price decline as an attractive opportunity. We have long appreciated the company's strong reputation with clients, its technical capabilities and the benefits of scale from its global testing network of more than 350 laboratories. We believed that the company possessed ample financial strength based on the combination of expected cash flows and the company's balance sheet leverage. We have also known and respected the company's CEO since his tenure running the life sciences segment.

Since our purchase, reported results have been stronger than the market had likely expected. Global gold and copper exploration growth boosted results for the commodities division. In addition, a rebound in growth across environmental, pharmaceutical and food testing customers lifted results for the life science division. We remain interested in owning shares of ALS, so long as they continue to be valued at a discount to our intrinsic value estimate.

Fund Reorganization

In February 2020, Polar Capital Holdings plc ("Polar") announced that it had reached an agreement to acquire from First Pacific Advisors, LP, the adviser to the Fund, its World Value equity team. We established a joint venture with Polar, called Phaeacian Partners LLC, which will serve as the investment adviser to the Phaeacian Global Value Fund, a series of Datum One. The reorganization of the Fund into the Phaeacian Global Value Fund, and the appointment of Phaeacian Partners LLC as the investment adviser, was approved by Fund

2 Past performance is no guarantee, nor is it indicative, of future results.

2

FPA PARAMOUNT FUND, INC.

LETTER TO SHAREHOLDERS

(Continued)

shareholders on October 9, 2020. The reorganization was subsequently completed on October 16, 2020, and through Phaeacian Partners LLC we continue to serve as the Fund's portfolio managers. Please visit PhaeacianPartners.com for current information about the Fund.

Respectfully submitted,

| |

| |

Gregory Herr | | Pierre O. Py | |

Portfolio Manager | | Portfolio Manager | |

September 30, 2020 | | | |

3

FPA PARAMOUNT FUND, INC.

LETTER TO SHAREHOLDERS

(Continued)

Performance data quoted in this letter represents past performance and neither indicates nor guarantees future performance. The discussions of Fund investments represent the views of the Fund's managers at the time of this report and are subject to change without notice. References to individual securities are for informational purposes only and should not be construed as recommendations to purchase or sell individual securities. While the Fund's managers believe that the Fund's holdings are value stocks, there can be no assurance that others will consider them as such. Further, investing in value stocks presents the risk that value stocks may fall out of favor with investors and underperform growth stocks during given periods.

The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of the following 24 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. Individuals cannot invest directly in an Index.

FUND RISKS

Investments in mutual funds carry risks and investors may lose principal value. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The funds may purchase foreign securities which are subject to interest rate, currency exchange rate, economic and political risks: this may be enhanced when investing in emerging markets. Small and mid-cap stocks involve greater risks and they can fluctuate in price more than larger company stocks. Groups of stocks, such as value and growth, go in and out of favor which may cause certain funds to underperform other equity funds.

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on our current expectations, they are considered "forward-looking statements" which may or may not prove to be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

4

FPA PARAMOUNT FUND, INC.

HISTORICAL PERFORMANCE

(Unaudited)

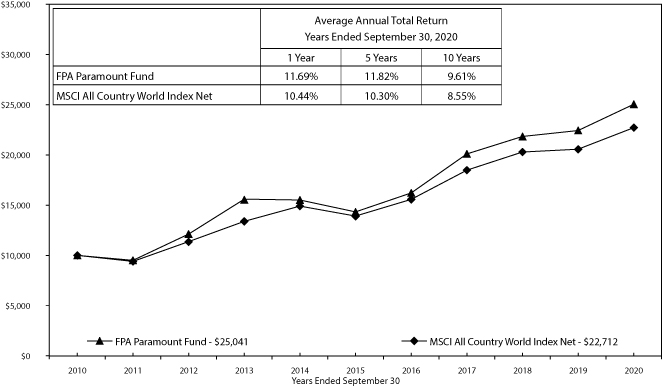

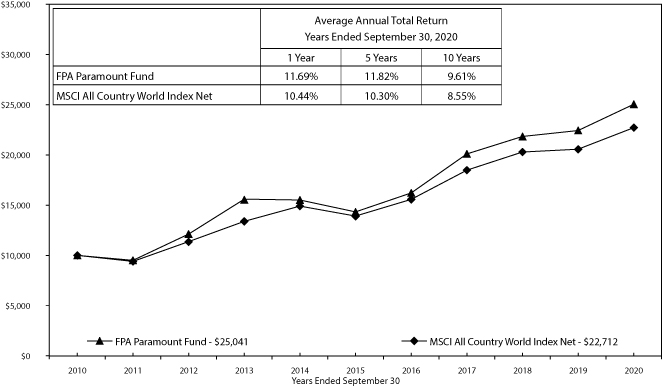

Change in Value of a $10,000 Investment in FPA Paramount Fund, Inc. vs. MSCI AWCI from October 1, 2010 to September 30, 2020

The MSCI All Country World NR Index is a float-adjusted market capitalization index that is designed to measure the combined equity market performance of developed and emerging markets. This index does not reflect any commissions or fees which would be incurred by an investor purchasing the stocks it represents. The performance of the Fund and of the Index is computed on a total return basis, which includes reinvestment of all distributions.

A new strategy for FPA Paramount Fund, Inc. was implemented beginning on September 1, 2013. The returns above include performance of the previous managers prior to that date. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown. This data represents past performance, and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment it may be worth more or less than its original cost. Current month-end performance data can be obtained by visiting the website at www.fpa.com or by calling toll-free, 1-800-982-4372. As of the most recent prospectus, the expense ratio is 1.29% (see notes to financial statements).

The Prospectus details the Fund's objective and policies, charges, and other matters of interest to prospective investors. Please read the prospectus carefully before investing. The Prospectus may be obtained by visiting the website at www.fpa.com, by email at crm@fpa.com, toll-free by calling 1-800-982-4372 or by contacting the Fund in writing.

5

FPA PARAMOUNT FUND, INC.

PORTFOLIO SUMMARY

September 30, 2020

Common Stocks | | | | | 97.9 | % | |

Application Software | | | 16.3 | % | | | | | |

Infrastructure Software | | | 8.6 | % | | | | | |

Information Technology Services | | | 6.7 | % | | | | | |

Medical Equipment | | | 6.1 | % | | | | | |

Internet Media | | | 5.5 | % | | | | | |

Industrials | | | 4.3 | % | | | | | |

Beverages | | | 4.2 | % | | | | | |

Consumer Finance | | | 4.0 | % | | | | | |

Building Maintenance Services | | | 3.5 | % | | | | | |

Health Care Supplies | | | 3.3 | % | | | | | |

Mass Merchants | | | 2.9 | % | | | | | |

Rubber & Plastic | | | 2.8 | % | | | | | |

Specialty Chemicals | | | 2.6 | % | | | | | |

Health Care Services | | | 2.4 | % | | | | | |

Advertising & Marketing | | | 2.1 | % | | | | | |

Non Wood Building Materials | | | 2.1 | % | | | | | |

Other Specialty Retail — Discretionary | | | 2.1 | % | | | | | |

Consumer Electronics | | | 2.0 | % | | | | | |

Professional Services | | | 2.0 | % | | | | | |

Reinsurance | | | 1.9 | % | | | | | |

Household Products | | | 1.7 | % | | | | | |

Commercial Services | | | 1.6 | % | | | | | |

Packaged Food | | | 1.5 | % | | | | | |

Automotive Retailers | | | 1.4 | % | | | | | |

Apparel, Footwear & Accessory Design | | | 1.3 | % | | | | | |

Semiconductor Manufacturing | | | 1.3 | % | | | | | |

Cement & Aggregates | | | 1.1 | % | | | | | |

Food & Drug Stores | | | 0.9 | % | | | | | |

Communications Equipment | | | 0.9 | % | | | | | |

Other Commercial Services | | | 0.8 | % | | | | | |

Short-term Investments | | | | | 1.4 | % | |

Other Assets And Liabilities, Net | | | | | 0.7 | % | |

Net Assets | | | | | 100.0 | % | |

6

FPA PARAMOUNT FUND, INC.

PORTFOLIO OF INVESTMENTS

September 30, 2020

COMMON STOCKS | | Shares | | Fair Value | |

APPLICATION SOFTWARE — 16.3% | |

Activision Blizzard, Inc. | | | 70,550 | | | $ | 5,711,022 | | |

Dassault Systemes SE (France) | | | 23,590 | | | | 4,401,471 | | |

SAP SE (Germany) | | | 24,180 | | | | 3,765,264 | | |

Tencent Holdings Ltd. (China) | | | 94,292 | | | | 6,368,799 | | |

Ubisoft Entertainment SA (France)(a) | | | 66,318 | | | | 5,977,108 | | |

| | | $ | 26,223,664 | | |

INFRASTRUCTURE SOFTWARE — 8.6% | |

Microsoft Corp. | | | 38,119 | | | $ | 8,017,570 | | |

Obic Co. Ltd. (Japan) | | | 12,291 | | | | 2,161,528 | | |

Oracle Corp. | | | 60,980 | | | | 3,640,506 | | |

| | | $ | 13,819,604 | | |

INFORMATION TECHNOLOGY SERVICES — 6.7% | |

Accenture plc (Class A) (Ireland) | | | 19,027 | | | $ | 4,299,912 | | |

Capgemini SE (France) | | | 39,460 | | | | 5,062,535 | | |

RELX plc (Britain) | | | 66,460 | | | | 1,479,269 | | |

| | | $ | 10,841,716 | | |

MEDICAL EQUIPMENT — 6.1% | |

Alcon, Inc. (Switzerland)(a) | | | 97,025 | | | $ | 5,500,899 | | |

Koninklijke Philips NV (Netherlands)(a) | | | 89,791 | | | | 4,239,851 | | |

| | | $ | 9,740,750 | | |

INTERNET MEDIA — 5.5% | |

Alphabet, Inc. (Class C)(a) | | | 3,770 | | | $ | 5,540,392 | | |

NAVER Corp. (South Korea) | | | 13,342 | | | | 3,390,485 | | |

| | | $ | 8,930,877 | | |

INDUSTRIALS — 4.3% | |

Electrocomponents plc (Britain) | | | 585,488 | | | $ | 5,366,696 | | |

General Dynamics Corp. | | | 11,700 | | | | 1,619,631 | | |

| | | $ | 6,986,327 | | |

BEVERAGES — 4.2% | |

Ambev SA (Brazil) | | | 667,956 | | | $ | 1,491,510 | | |

Britvic plc (Britain) | | | 156,233 | | | | 1,655,500 | | |

Heineken Holding NV (Netherlands) | | | 19,664 | | | | 1,532,377 | | |

Pernod Ricard SA (France) | | | 13,229 | | | | 2,109,177 | | |

| | | $ | 6,788,564 | | |

CONSUMER FINANCE — 4.0% | |

Adyen NV (Netherlands)(a)(b) | | | 2,977 | | | $ | 5,491,026 | | |

Euronet Worldwide, Inc.(a) | | | 10,500 | | | | 956,550 | | |

| | | $ | 6,447,576 | | |

7

FPA PARAMOUNT FUND, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2020

COMMON STOCKS — Continued | | Shares | | Fair Value | |

BUILDING MAINTENANCE SERVICES — 3.5% | |

ISS A/S (Denmark)(a) | | | 424,108 | | | $ | 5,581,976 | | |

HEALTH CARE SUPPLIES — 3.3% | |

EssilorLuxottica SA (France)(a) | | | 38,886 | | | $ | 5,293,797 | | |

MASS MERCHANTS — 2.9% | |

Dollar General Corp. | | | 22,150 | | | $ | 4,643,083 | | |

RUBBER & PLASTIC — 2.8% | |

Hexpol AB (Sweden)(a) | | | 502,137 | | | $ | 4,491,672 | | |

SPECIALTY CHEMICALS — 2.6% | |

Koninklijke DSM NV (Netherlands) | | | 25,691 | | | $ | 4,229,547 | | |

HEALTH CARE SERVICES — 2.4% | |

Laboratory Corp. of America Holdings(a) | | | 20,100 | | | $ | 3,784,227 | | |

ADVERTISING & MARKETING — 2.1% | |

Stroeer SE & Co. KGaA (Germany)(a) | | | 43,886 | | | $ | 3,408,993 | | |

NON WOOD BUILDING MATERIALS — 2.1% | |

Cie de Saint-Gobain (France)(a) | | | 79,741 | | | $ | 3,340,122 | | |

OTHER SPECIALTY RETAIL — DISCRETIONARY — 2.1% | |

Fielmann AG (Germany)(a) | | | 10,478 | | | $ | 841,518 | | |

GrandVision NV (Netherlands)(a)(b) | | | 88,394 | | | | 2,467,362 | | |

| | | $ | 3,308,880 | | |

CONSUMER ELECTRONICS — 2.0% | |

Sony Corp. (Japan) | | | 42,586 | | | $ | 3,263,877 | | |

PROFESSIONAL SERVICES — 2.0% | |

Pagegroup plc (Britain)(a) | | | 364,466 | | | $ | 1,756,972 | | |

SGS SA (Switzerland) | | | 544 | | | | 1,457,832 | | |

| | | $ | 3,214,804 | | |

REINSURANCE — 1.9% | |

RenaissanceRe Holdings Ltd. (Bermuda) | | | 17,761 | | | $ | 3,014,752 | | |

8

FPA PARAMOUNT FUND, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2020

COMMON STOCKS — Continued | | Shares | | Fair Value | |

HOUSEHOLD PRODUCTS — 1.7% | |

Henkel AG & Co. KGaA (Germany) | | | 15,419 | | | $ | 1,442,110 | | |

Unilever plc (Britain) | | | 20,810 | | | | 1,283,002 | | |

| | | $ | 2,725,112 | | |

COMMERCIAL SERVICES — 1.6% | |

Babcock International Group plc (Britain) | | | 819,754 | | | $ | 2,644,103 | | |

PACKAGED FOOD — 1.5% | |

Alicorp SAA (Peru) | | | 1,094,845 | | | $ | 2,330,298 | | |

AUTOMOTIVE RETAILERS — 1.4% | |

O'Reilly Automotive, Inc.(a) | | | 4,900 | | | $ | 2,259,292 | | |

APPAREL, FOOTWEAR & ACCESSORY DESIGN — 1.3% | |

Cie Financiere Richemont SA (Switzerland) | | | 31,830 | | | $ | 2,137,157 | | |

SEMICONDUCTOR MANUFACTURING — 1.3% | |

ASML Holding NV (Netherlands) | | | 5,494 | | | $ | 2,029,334 | | |

CEMENT & AGGREGATES — 1.1% | |

CRH plc (Ireland) | | | 49,890 | | | $ | 1,809,077 | | |

FOOD & DRUG STORES — 0.9% | |

Empire Co. Ltd. (Class A) (Canada) | | | 52,286 | | | $ | 1,517,670 | | |

COMMUNICATIONS EQUIPMENT — 0.9% | |

Samsung Electronics Co. Ltd. (South Korea) | | | 29,416 | | | $ | 1,460,332 | | |

OTHER COMMERCIAL SERVICES — 0.8% | |

ALS, Ltd. (Australia) | | | 199,135 | | | $ | 1,329,446 | | |

| TOTAL COMMON STOCKS — 97.9% (Cost $127,655,660) | | $ | 157,596,629 | | |

| TOTAL INVESTMENT SECURITIES — 97.9% (Cost $127,655,660) | | $ | 157,596,629 | | |

9

FPA PARAMOUNT FUND, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2020

SHORT-TERM INVESTMENTS — 1.4% | | Principal

Amount | | Fair Value | |

State Street Bank Repurchase Agreement — 0.00% 10/1/2020

(Dated 09/30/2020, repurchase price of $2,263,000, collateralized

by $2,307,200 principal amount U.S. Treasury Notes — 0.13% 2022,

fair value $2,308,309) | | $ | 2,263,000 | | | $ | 2,263,000 | | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $2,263,000) | | $ | 2,263,000 | | |

| TOTAL INVESTMENTS — 99.3% (Cost $129,918,660) | | $ | 159,859,629 | | |

Other assets and liabilities, net — 0.7% | | | 1,159,364 | | |

NET ASSETS — 100.0% | | $ | 161,018,993 | | |

(a) Non-income producing security.

(b) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Unless otherwise indicated, these securities are not considered to be illiquid.

See accompanying Notes to Financial Statements.

10

FPA PARAMOUNT FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2020

ASSETS | |

Investment securities — at fair value (identified cost $127,655,660) | | $ | 157,596,629 | | |

Short-term investments — repurchase agreements | | | 2,263,000 | | |

Cash | | | 531 | | |

Foreign currencies at value (identified cost $135) | | | 136 | | |

Receivable for: | |

Investment securities sold | | | 1,362,713 | | |

Dividends and interest | | | 370,583 | | |

Capital Stock sold | | | 214 | | |

Prepaid expenses and other assets | | | 94 | | |

Total assets | | | 161,593,900 | | |

LIABILITIES | |

Payable for: | |

Investment securities purchased | | | 165,303 | | |

Advisory fees | | | 109,207 | | |

Capital Stock repurchased | | | 52,646 | | |

Accrued expenses and other liabilities | | | 247,751 | | |

Total liabilities | | | 574,907 | | |

NET ASSETS | | $ | 161,018,993 | | |

SUMMARY OF SHAREHOLDERS' EQUITY | |

Capital Stock — par value $0.01 per share; authorized 25,000,000 shares;

outstanding 7,338,607 shares | | $ | 73,386 | | |

Additional Paid-in Capital | | | 136,321,309 | | |

Distributable earnings | | | 24,624,298 | | |

NET ASSETS | | $ | 161,018,993 | | |

NET ASSET VALUE | |

Offering and redemption price per share | | $ | 21.94 | | |

See accompanying Notes to Financial Statements.

11

FPA PARAMOUNT FUND, INC.

STATEMENT OF OPERATIONS

For the Year Ended September 30, 2020

INVESTMENT INCOME | |

Dividends (net of foreign taxes withheld of $265,165) | | $ | 3,640,270 | | |

Interest | | | 75 | | |

Total investment income | | | 3,640,345 | | |

EXPENSES | |

Advisory fees | | | 1,578,643 | | |

Legal fees | | | 131,322 | | |

Director fees and expenses | | | 106,516 | | |

Custodian fees | | | 98,759 | | |

Transfer agent fees and expenses | | | 64,598 | | |

Reports to shareholders | | | 63,071 | | |

Filing fees | | | 44,103 | | |

Audit and tax services fees | | | 42,523 | | |

Other professional fees | | | 9,191 | | |

Administrative services fees | | | 8,293 | | |

Other | | | 61,837 | | |

Total expenses | | | 2,208,856 | | |

Reimbursement from Adviser | | | (171,160 | ) | |

Net expenses | | | 2,037,696 | | |

Net investment income | | | 1,602,649 | | |

NET REALIZED AND UNREALIZED APPRECIATION (DEPRECIATION) | |

Net realized gain (loss) on: | |

Investments | | | (5,498,805 | ) | |

Investments in foreign currency transactions | | | (44,500 | ) | |

Net change in unrealized appreciation (depreciation) of: | |

Investments | | | 20,708,156 | | |

Translation of foreign currency denominated amounts | | | 32,538 | | |

Net realized and unrealized gain | | | 15,197,389 | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 16,800,038 | | |

See accompanying Notes to Financial Statements.

12

FPA PARAMOUNT FUND, INC.

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended

September 30, 2020 | | Year Ended

September 30, 2019 | |

INCREASE (DECREASE) IN NET ASSETS | |

Operations: | |

Net investment income | | $ | 1,602,649 | | | $ | 988,879 | | |

Net realized gain (loss) | | | (5,543,305 | ) | | | 12,086,004 | | |

Net change in unrealized appreciation (depreciation) | | | 20,740,694 | | | | (10,209,156 | ) | |

Net increase in net assets resulting from operations | | | 16,800,038 | | | | 2,865,727 | | |

Distributions to shareholders | | | (12,376,261 | ) | | | (16,820,381 | ) | |

Capital Stock transactions: | |

Proceeds from Capital Stock sold | | | 4,141,699 | | | | 3,406,733 | | |

Proceeds from shares issued to shareholders upon reinvestment of

dividends and distributions | | | 7,251,266 | | | | 9,866,566 | | |

Cost of Capital Stock repurchased | | | (18,792,708 | ) | | | (15,617,027 | ) | |

Net decrease from Capital Stock transactions | | | (7,399,743 | ) | | | (2,343,728 | ) | |

Total change in net assets | | | (2,975,966 | ) | | | (16,298,382 | ) | |

NET ASSETS | |

Beginning of Year | | | 163,994,959 | | | | 180,293,341 | | |

End of Year | | $ | 161,018,993 | | | $ | 163,994,959 | | |

CHANGE IN CAPITAL STOCK OUTSTANDING | |

Shares of Capital Stock sold | | | 212,429 | | | | 175,222 | | |

Shares issued to shareholders upon reinvestment of

dividends and distributions | | | 336,798 | | | | 543,911 | | |

Shares of Capital Stock repurchased | | | (975,786 | ) | | | (772,908 | ) | |

Change in Capital Stock outstanding | | | (426,559 | ) | | | (53,775 | ) | |

See accompanying Notes to Financial Statements.

13

FPA PARAMOUNT FUND, INC.

FINANCIAL HIGHLIGHTS

Selected Data for Each Share of Capital Stock Outstanding Throughout Each Year

| | | Year Ended September 30 | |

| | | 2020 | | 2019 | | 2018 | | 2017 | | 2016 | |

Per share operating performance: | |

Net asset value at beginning of year | | $ | 21.12 | | | $ | 23.06 | | | $ | 21.30 | | | $ | 17.36 | | | $ | 15.42 | | |

Income from investment operations: | |

Net investment income* | | | 0.21 | | | | 0.13 | | | | 0.12 | | | | 0.08 | | | | 0.18 | | |

Net realized and unrealized gain

on investment securities | | | 2.23 | | | | 0.13 | | | | 1.72 | | | | 4.04 | | | | 1.84 | | |

Total from investment operations | | | 2.44 | | | | 0.26 | | | | 1.84 | | | | 4.12 | | | | 2.02 | | |

Less distributions: | |

Dividends from net investment income | | | (0.12 | ) | | | (0.12 | ) | | | (0.08 | ) | | | (0.18 | ) | | | (0.08 | ) | |

Distributions from net realized

capital gains | | | (1.50 | ) | | | (2.08 | ) | | | — | | | | — | | | | — | | |

Total distributions | | | (1.62 | ) | | | (2.20 | ) | | | (0.08 | ) | | | (0.18 | ) | | | (0.08 | ) | |

Redemption fees | | | — | | | | — | | | | — | | | | — | ** | | | — | ** | |

Net asset value at end of year | | $ | 21.94 | | | $ | 21.12 | | | $ | 23.06 | | | $ | 21.30 | | | $ | 17.36 | | |

Total investment return*** | | | 11.69 | % | | | 2.69 | % | | | 8.65 | % | | | 23.92 | % | | | 13.19 | % | |

Ratios/supplemental data: | |

Net assets, end of year (in $000's) | | $ | 161,019 | | | $ | 163,995 | | | $ | 180,293 | | | $ | 174,131 | | | $ | 149,050 | | |

Ratio of expenses to average net assets: | |

Before reimbursement from Adviser | | | 1.40 | % | | | 1.36 | % | | | 1.35 | % | | | 1.44 | % | | | 1.43 | % | |

After reimbursement from Adviser | | | 1.29 | % | | | 1.29 | % | | | 1.29 | % | | | 1.29 | % | | | 1.29 | % | |

Ratio of net investment income to average

net assets: | |

Before reimbursement from Adviser | | | 0.91 | % | | | 0.54 | % | | | 0.46 | % | | | 0.27 | % | | | 0.99 | % | |

After reimbursement from Adviser | | | 1.02 | % | | | 0.61 | % | | | 0.52 | % | | | 0.41 | % | | | 1.13 | % | |

Portfolio turnover rate | | | 96 | % | | | 62 | % | | | 79 | % | | | 72 | % | | | 52 | % | |

* Per share amount is based on average shares outstanding.

** Rounds to less than $0.01 per share.

*** Return is based on net asset value per share, adjusted for reinvestment of distributions, and does not reflect deduction of the sales charge.

See accompanying Notes to Financial Statements.

14

FPA PARAMOUNT FUND, INC.

NOTES TO FINANCIAL STATEMENTS

September 30, 2020

NOTE 1 — Significant Accounting Policies

FPA Paramount Fund, Inc. (the "Fund") is registered under the Investment Company Act of 1940, as a non-diversified, open-end management investment company. The Fund's primary investment objective is high total investment return, including capital appreciation and income. The Fund qualifies as an investment company pursuant to Financial Accounting Standards Codification (ASC) No. 946, Financial Services — Investment Companies. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

A. Security Valuation

The Fund's investments are reported at fair value as defined by accounting principles generally accepted in the United States of America, ("U.S. GAAP"). The Fund generally determines its net asset value as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open. Further discussion of valuation methods, inputs and classifications can be found under Disclosure of Fair Value Measurements.

B. Securities Transactions and Related Investment Income

Securities transactions are accounted for on the date the securities are purchased or sold. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income and expenses are recorded on an accrual basis. The books and records of the Fund are maintained in U.S. dollars as follows: (1) the foreign currency fair value of investment securities, and other assets and liabilities stated in foreign currencies, are translated using the daily spot rate; and (2) purchases, sales, income and expenses are translated at the rate of exchange prevailing on the respective dates of such transactions. The resultant exchange gains and losses are included in net realized or net unrealized gain (loss) in the statement of operations.

C. Use of Estimates

The preparation of the financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported. Actual results could differ from those estimates.

D. Recent Accounting Pronouncements

In August 2018, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2018-13, Fair Value Measurement (Topic 820) — Disclosure Framework — Changes to the Disclosure Requirements for Fair Value Measurement. The amendments eliminate certain disclosure requirements for fair value measurements for all entities, requires public entities to disclose certain new information and modifies some disclosure requirements. The new guidance is effective for all entities for fiscal years beginning after December 15, 2019 and for interim periods within those fiscal years. An entity is permitted to early adopt either the entire standard or only the provisions that eliminate or modify requirements. The Adviser is currently evaluating the impact of this new guidance on the Fund's financial statements.

NOTE 2 — Risk Considerations

Investing in the Fund may involve certain risks including, but not limited to, those described below.

Market Risk: Because the values of the Fund's investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund or the Fund could underperform other investments.

15

FPA PARAMOUNT FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Continued)

Common Stocks and other Securities: The prices of common stocks and other securities held by the Fund may decline in response to certain events taking place around the world, including; those directly involving companies whose securities are owned by the Fund; conditions affecting the general economy; overall market changes; local, regional or global political, social or economic instability; and currency, interest rate and commodity price fluctuations. Since the Fund invests in foreign securities, it will be subject to risks not typically associated with domestic securities. Foreign investments, especially those of companies in emerging markets, can be riskier less liquid, harder to value, and more volatile than investments in the United States. Adverse political and economic developments or changes in the value of foreign currency can make it more difficult for the Fund to value the securities. Differences in tax and accounting standards, difficulties in obtaining information about foreign companies, restrictions on receiving investment proceeds from a foreign country, confiscatory foreign tax laws, and potential difficulties in enforcing contractual obligations, can all add to the risk and volatility of foreign investments. The financial problems in global economies over the past several years, including the European sovereign debt crisis, may continue to cause high volatility in global financial markets.

Risks Associated with Non-Diversification: The Fund is non-diversified, which generally means that it may invest a greater percentage of its total assets in the securities of fewer issuers than a "diversified" fund. This increases the risk that a change in the value of any one investment held by the Fund could affect the overall value of the Fund more than it would affect that of a diversified fund holding a greater number of investments. Accordingly, the Fund's value will likely be more volatile than the value of a more diversified fund.

Repurchase Agreements: Repurchase agreements permit the Fund to maintain liquidity and earn income over periods of time as short as overnight. Repurchase agreements held by the Fund are fully collateralized by U.S. Government securities, or securities issued by U.S. Government agencies, or securities that are within the three highest credit categories assigned by established rating agencies (Aaa, Aa, or A by Moody's or AAA, AA or A by Standard & Poor's) or, if not rated by Moody's or Standard & Poor's, are of equivalent investment quality as determined by the Adviser. Such collateral is in the possession of the Fund's custodian. The collateral is evaluated daily to ensure its fair value equals or exceeds the current fair value of the repurchase agreements including accrued interest. In the event of default on the obligation to repurchase, the Fund has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation.

The Fund may enter into repurchase agreements, under the terms of a Master Repurchase Agreement ("MRA"). The MRA permits the Fund, under certain circumstances including an event of default (such as bankruptcy or insolvency), to offset payables and/or receivables under the MRA with collateral held and/or posted to the counterparty and create one single net payment due to or from the Fund. However, bankruptcy or insolvency laws of a particular jurisdiction may impose restrictions on or prohibitions against such a right of offset in the event of a MRA counterparty's bankruptcy or insolvency. Pursuant to the terms of the MRA, the Fund receives securities as collateral with a fair value in excess of the repurchase price to be received by the Fund upon the maturity of the repurchase transaction. Upon a bankruptcy or insolvency of the MRA counterparty, the Fund recognizes a liability with respect to such excess collateral to reflect the Fund's obligation under bankruptcy law to return the excess to the counterparty. Repurchase agreements outstanding at the end of the period are listed in the Fund's Portfolio of Investments.

Many countries have experienced outbreaks of infectious illnesses in recent decades, including swine flu, avian influenza, SARS and, more recently, COVID-19. The global outbreak of COVID-19 in early 2020 has resulted in various disruptions, including travel and border restrictions, quarantines, supply chain disruptions, lower consumer demand and general market uncertainty. The effects of COVID-19 have and may continue to

16

FPA PARAMOUNT FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Continued)

adversely affect the global economy, financial markets and the economies of certain nations and individual issuers, any of which may negatively impact the Fund and its holdings. Similar consequences could arise as a result of the spread of other infectious diseases.

NOTE 3 — Purchases and Sales of Investment Securities

Cost of purchases of investment securities (excluding short-term investments) aggregated $149,526,578 for the year ended September 30, 2020. The proceeds and cost of securities sold resulting in net realized loss of $5,498,805 aggregated $165,402,310 and $170,901,115, respectively, for the year ended September 30, 2020. Realized gains or losses are based on the specific identification method.

NOTE 4 — Federal Income Tax

No provision for federal income tax is required because the Fund has elected to be taxed as a "regulated investment company" under the Internal Revenue Code (the "Code") and intends to maintain this qualification and to distribute each year to its shareholders, in accordance with the minimum distribution requirements of the Code, its taxable net investment income and taxable net realized gains on investments.

Distributions paid to shareholders are based on net investment income and net realized gains determined on a tax reporting basis, which may differ from financial reporting. For federal income tax purposes, the Fund had the following components of distributable earnings at September 30, 2020:

Unrealized Appreciation | | $ | 28,257,602 | | |

Undistributed Ordinary Income | | | 1,406,461 | | |

Capital Loss Carryover | | | (5,039,765 | ) | |

The tax status of distributions paid during the fiscal years ended September 30, 2020 and 2019 were as follows:

| | | 2020 | | 2019 | |

Dividends from ordinary income | | $ | 5,234,973 | | | $ | 9,709,947 | | |

Distributions from long-term capital gains | | $ | 7,141,288 | | | $ | 7,110,434 | | |

The Fund utilizes the provisions of federal income tax laws that provide for the carryforward of capital losses for prior years, offsetting such losses against any future realized capital gains. Under the Regulated Investment Company Act of 2010 (the "Act"), net capital losses recognized for fiscal years beginning after December 22, 2010 may be carried forward indefinitely, and their character is retained as short-term and/or long-term losses.

As of September 30, 2020, the fund had $5,039,765 of long-term capital losses available to offset possible future capital gains.

The cost of investment securities held at September 30, 2020, was $129,354,534 for federal income tax purposes. Gross unrealized appreciation and depreciation for all investments (excluding short-term investments) at September 30, 2020, for federal income tax purposes was $35,915,014 and $7,672,918, respectively resulting in net unrealized appreciation of $28,242,096. As of and during the year ended September 30, 2020, the Fund did not have any liability for unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. The statute of limitations remains open for the last 3 years, once a return is filed. No examinations are in progress at this time.

17

FPA PARAMOUNT FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Continued)

NOTE 5 — Advisory Fees and Other Affiliated Transactions

Pursuant to an Investment Advisory Agreement (the "Agreement") approved by shareholders on November 15, 2013 advisory fees were paid by the Fund to First Pacific Advisors, LP (the "Adviser"). Under the terms of this Agreement, the Fund pays the Adviser a monthly fee calculated at the annual rate of 1.00% of the Fund's average daily net assets. The Adviser has contractually agreed to reimburse expenses in excess of 1.29% of the average net assets of the Fund (excluding brokerage fees and commissions, interest, taxes, shareholder service fees, fees and expenses of other funds in which the Fund invests, and extraordinary expenses) through January 31, 2021.

For the year ended September 30, 2020, the Fund paid aggregate fees and expenses of $106,516 to all Directors who are not affiliated persons of the Adviser. Certain officers of the Fund are also officers of the Adviser.

On October 9, 2020, stockholders approved the reorganization of the Fund into the Phaeacian Global Value Fund, a series of the Datum One Trust. The Fund will continue to be managed by Pierre O. Py and Gregory A. Herr. Phaeacian Partners LLC will be the new adviser.

NOTE 6 — Disclosure of Fair Value Measurements

The Fund uses the following methods and inputs to establish the fair value of its assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued each day at the official closing price of, or the last reported sale price on, the exchange or market on which such securities principally are traded, as of the close of business on that day. If there have been no sales that day, equity securities are generally valued at the last available bid price. Securities that are unlisted and fixed-income and convertible securities listed on a national securities exchange for which the over-the-counter ("OTC") market more accurately reflects the securities' value in the judgment of the Fund's officers, are valued at the most recent bid price. Events occurring after the close of trading on non-U.S. exchanges may result in adjustments to the valuation of foreign securities to reflect their fair value as of the close of regular trading on the NYSE. The Fund may utilize an independent fair valuation service in adjusting the valuations of foreign securities. Short-term corporate notes with maturities of 60 days or less at the time of purchase are valued at amortized cost.

Securities for which representative market quotations are not readily available or are considered unreliable by the Adviser are valued as determined in good faith under procedures adopted by the authority of the Fund's Board of Directors. Various inputs may be reviewed in order to make a good faith determination of a security's value. These inputs include, but are not limited to, the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations of investments that would have been used had greater market activity occurred.

The Fund classifies its assets based on three valuation methodologies. Level 1 values are based on quoted market prices in active markets for identical assets. Level 2 values are based on significant observable market inputs, such as quoted prices for similar assets and quoted prices in inactive markets or other market observable inputs as noted above including spreads, cash flows, financial performance, prepayments, defaults, collateral, credit enhancements, and interest rate volatility. Level 3 values are based on significant unobservable inputs that

18

FPA PARAMOUNT FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Continued)

reflect the Fund's determination of assumptions that market participants might reasonably use in valuing the assets. The valuation levels are not necessarily an indication of the risk associated with investing in those securities. The following table presents the valuation levels of the Fund's investments as of September 30, 2020:

Investments | | Level 1 | | Level 2 | | Level 3 | | Total | |

Common Stocks | |

Application Software | | $ | 5,711,022 | | | $ | 20,512,642 | | | | — | | | $ | 26,223,664 | | |

Infrastructure Software | | | 11,658,075 | | | | 2,161,529 | | | | — | | | | 13,819,604 | | |

Information Technology Services | | | 4,299,912 | | | | 6,541,804 | | | | — | | | | 10,841,716 | | |

Medical Equipment | | | — | | | | 9,740,750 | | | | — | | | | 9,740,750 | | |

Internet Media | | | 5,540,392 | | | | 3,390,485 | | | | — | | | | 8,930,877 | | |

Industrials | | | 1,619,631 | | | | 5,366,696 | | | | — | | | | 6,986,327 | | |

Beverages | | | 1,491,510 | | | | 5,297,054 | | | | — | | | | 6,788,564 | | |

Consumer Finance | | | 956,550 | | | | 5,491,026 | | | | — | | | | 6,447,576 | | |

Building Maintenance Services | | | — | | | | 5,581,976 | | | | — | | | | 5,581,976 | | |

Health Care Supplies | | | — | | | | 5,293,797 | | | | — | | | | 5,293,797 | | |

Mass Merchants | | | 4,643,083 | | | | — | | | | — | | | | 4,643,083 | | |

Rubber & Plastic | | | — | | | | 4,491,672 | | | | — | | | | 4,491,672 | | |

Specialty Chemicals | | | — | | | | 4,229,547 | | | | — | | | | 4,229,547 | | |

Health Care Services | | | 3,784,227 | | | | — | | | | — | | | | 3,784,227 | | |

Advertising & Marketing | | | — | | | | 3,408,993 | | | | — | | | | 3,408,993 | | |

Non Wood Building Materials | | | — | | | | 3,340,122 | | | | — | | | | 3,340,122 | | |

Other Specialty Retail — Discretionary | | | 841,518 | | | | 2,467,362 | | | | — | | | | 3,308,880 | | |

Consumer Electronics | | | — | | | | 3,263,877 | | | | — | | | | 3,263,877 | | |

Professional Services | | | — | | | | 3,214,804 | | | | — | | | | 3,214,804 | | |

Reinsurance | | | 3,014,752 | | | | — | | | | — | | | | 3,014,752 | | |

Household Products | | | — | | | | 2,725,112 | | | | — | | | | 2,725,112 | | |

Commercial Services | | | — | | | | 2,644,103 | | | | — | | | | 2,644,103 | | |

Packaged Food | | | 2,330,298 | | | | — | | | | — | | | | 2,330,298 | | |

Automotive Retailers | | | 2,259,292 | | | | — | | | | — | | | | 2,259,292 | | |

Apparel, Footwear & Accessory Design | | | — | | | | 2,137,157 | | | | — | | | | 2,137,157 | | |

Semiconductor Manufacturing | | | — | | | | 2,029,334 | | | | — | | | | 2,029,334 | | |

Cement & Aggregates | | | — | | | | 1,809,077 | | | | — | | | | 1,809,077 | | |

Food & Drug Stores | | | 1,517,670 | | | | — | | | | — | | | | 1,517,670 | | |

Communications Equipment | | | — | | | | 1,460,332 | | | | — | | | | 1,460,332 | | |

Other Commercial Services | | | — | | | | 1,329,446 | | | | — | | | | 1,329,446 | | |

19

FPA PARAMOUNT FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Continued)

Investments | | Level 1 | | Level 2 | | Level 3 | | Total | |

Short-Term Investment | | | — | | | $ | 2,263,000 | | | | — | | | $ | 2,263,000 | | |

| | | $ | 49,667,932 | | | $ | 110,191,697 | | | | — | | | $ | 159,859,629 | | |

Transfers of investments between different levels of the fair value hierarchy are recorded at fair value as of the end of the reporting period. There were no transfers between Levels 1, 2 or 3 during year ended September 30, 2020.

NOTE 7 — Line of Credit

The Fund, along with FPA International Value Fund (another mutual fund managed by the Adviser) has collectively entered into an agreement that enables them to participate in a $50 million unsecured line of credit with State Street Bank and Trust. Borrowings will be made solely to temporarily finance the repurchase of Capital Stock. Interest is charged to each Fund based on its borrowings at a rate per annum equal to the Overnight LIBOR Rate plus 1.25%. In addition, the Fund and FPA International Value Fund pay a combined commitment fee of 0.25% per annum on any unused portion of the line of credit.

NOTE 8 — Collateral Requirements

FASB Accounting Standards Update No. 2011-11, Disclosures about Offsetting Assets and Liabilities, requires disclosures to make financial statements that are prepared under U.S. GAAP more comparable to those prepared under International Financial Reporting Standards. Under this guidance the Fund discloses both gross and net information about instruments and transactions eligible for offset such as instruments and transactions subject to an agreement similar to a master netting arrangement. In addition, the Fund discloses collateral received and posted in connection with master netting agreements or similar arrangements. Under this guidance the Fund discloses both gross and net information about instruments and transactions eligible for offset such as instruments and transactions subject to an agreement similar to a master netting arrangement. In addition, the Fund discloses collateral received and posted in connection with master netting agreements or similar arrangements.

The following table presents the Fund's repurchase agreements by counterparty net of amounts available for offset under an ISDA Master agreement or similar agreements and net of the related collateral received or pledged by the Fund as of September 30, 2020, are as follows:

| | | | | Gross Amounts Not Offset in the

Statement of Assets and Liabilities | | | |

Counterparty | | Gross Assets

(Liabilities)

in the Statement of

Assets and Liabilities | | Collateral

(Received)

Pledged | | Assets (Liabilities)

Available for Offset | | Net Amount

of Assets

(Liabilities)* | |

State Street Bank and

Trust Company: | |

Repurchase Agreements | | $ | 2,263,000 | | | $ | (2,263,000 | )** | | | — | | | | — | | |

* Represents the net amount receivable from the counterparty in the event of default.

** Collateral with a value of $2,308,309 has been received in connection with a master repurchase agreement. Excess of collateral received from the individual master repurchase agreement is not shown for financial reporting purposes.

20

FPA PARAMOUNT FUND, INC.

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

TO THE SHAREHOLDERS AND

BOARD OF DIRECTORS OF FPA PARAMOUNT FUND, INC.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of FPA Paramount Fund, Inc. (the "Fund"), including the portfolio of investments, as of September 30, 2020, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the three years in the period then ended and the related notes (collectively referred to as the "financial statements"). The financial highlights for the years ended September 30, 2016 and September 30, 2017 were audited by another independent registered public accounting firm whose report, dated November 20, 2017, expressed an unqualified opinion on those financial highlights. In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund at September 30, 2020, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and its financial highlights for each of the three years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of the Fund's internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2020, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more investment companies in the FPA family of funds since 2018.

Los Angeles, CA

November 24, 2020

21

FPA PARAMOUNT FUND, INC.

SHAREHOLDER EXPENSE EXAMPLE

September 30, 2020 (Unaudited)

Fund Expenses

Mutual fund shareholders generally incur two types of costs: (1) transaction costs, and (2) ongoing costs, including advisory and administrative fees; shareholder service fees; and other Fund expenses. The Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the year and held for the entire year.

Actual Expenses

The information in the table under the heading "Actual Performance" provides information about actual account values and actual expenses. You may use the information in this column, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first column in the row entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading "Hypothetical Performance (5% return before expenses)" provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to

compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the information under the heading "Hypothetical Performance (5% return before expenses)" is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. Even though the Fund does not charge transaction fees, if you purchase shares through a broker, the broker may charge you a fee. You should evaluate other mutual funds' transaction fees and any applicable broker fees to assess the total cost of ownership for comparison purposes.

| | | Actual

Performance | | Hypothetical

Performance

(5% return

before

expenses) | |

Beginning Account Value

March 31, 2020 | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending Account Value

September 30, 2020 | | $ | 1,306.00 | | | $ | 1,018.55 | | |

Expenses Paid During

Period* | | $ | 7.43 | | | $ | 6.51 | | |

* Expenses are equal to the Fund's annualized expense ratio of 1.29%, multiplied by the average account value over the period and prorated for the six-months ended September 30, 2020 (183/366 days).

22

FPA PARAMOUNT FUND, INC.

APPROVAL OF INVESTMENT ADVISORY AGREEMENT

(Unaudited)

Approval of the Advisory Agreement. At a meeting of the Board of Directors held on August 10, 2020, the Directors approved the continuation of the advisory agreement between the Fund and the Adviser (the "Advisory Agreement") for an additional one-year period through September 30, 2021, on the recommendation of the Independent Directors, who met in executive session on August 10, 2020 prior to the Board meeting to review and discuss the proposed continuation of the Advisory Agreement. The Board had also met on July 13, 2020, with the Independent Directors meeting separately prior to the Meeting in executive session with the management of the Adviser and then separately with independent counsel to evaluate the renewal of the Advisory Agreement. Prior to their July 13 meeting, the Independent Directors, through their independent counsel, had requested and received extensive materials prepared in connection with the review of the Advisory Agreements. The materials provided a broad range of information regarding the Fund, including a description of, among other matters, the terms of the Advisory Agreement; the services provided by the Adviser; the experience of the relevant investment personnel; the Fund's performance in absolute terms and as compared to the performance of peers and appropriate benchmark(s); the fees and expenses of the Fund in absolute terms and as compared to peers; and the profitability of the Adviser from serving as adviser to the Fund. Following their review at the July 13 meeting, the Independent Directors requested (through their independent counsel) and received supplemental information and responses to a number of questions relating to the materials provided by the Adviser.

In addition to the executive sessions, the Boards, acting directly or through their committees, met regularly throughout the year and received information on a variety of topics that were relevant to its annual consideration of the renewal of each Advisory Agreement including, among other matters, Fund investment performance, compliance, risk management, liquidity, valuation, trade execution, service provider oversight and other matters relating to Fund operations. The Independent Directors also had met with management of the Adviser (including key investment personnel) at their quarterly meetings as well as with management at other times between the quarterly meetings throughout the year. The materials specifically provided in connection with the annual review of the Advisory Agreements supplement the information received throughout the year.

At their regular Board meetings and executive sessions, the Independent Directors were also advised by independent legal counsel. In addition to the materials provided by the Adviser, the Independent Directors received a legal memorandum from independent counsel that outlined, among other matters: the duties of the Independent Directors and relevant requirements under the 1940 Act; the general principles under state law relevant to considering the approval of advisory contracts; an adviser's fiduciary duty with respect to advisory agreements and compensation; the standards used by courts in determining whether investment advisers and investment company boards of trustees have fulfilled their duties; and factors to be considered by the Independent Directors when voting on advisory agreements. During both executive sessions, independent legal counsel reviewed with Independent Directors these duties, standards and factors summarized in the legal memorandum described above. The following paragraphs summarize the material information and factors considered by the Board and the Independent Directors, as well as the Directors' conclusions relative to such factors.

Nature, Extent and Quality of Services. The Board and the Independent Directors considered information provided by the Adviser in response to their requests, as well as information provided throughout the year regarding: the Adviser and its staffing in connection with the Fund, including the Fund's portfolio managers and the senior analysts on their team; the scope of services supervised and provided by the Adviser; and the absence of any significant service problems reported to the Board. The Board and the Independent Directors noted the experience, length of service and the outstanding reputation of the Fund's portfolio managers, Gregory A. Herr and Pierre O. Py, who have each served as portfolio manager of the Fund since 2011. The Board and the

23

FPA PARAMOUNT FUND, INC.

APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Continued)

(Unaudited)

Independent Directors concluded that the nature, extent and quality of services provided by the Adviser, including if the proposed strategy and team were implemented, would benefit the Fund and its shareholders.

Investment Performance. The Board and the Independent Directors reviewed the overall investment performance of the Fund. The Directors also received information from an independent consultant, Broadridge, regarding the Fund's performance relative to a peer group of global multi-cap core funds and global multi-cap growth funds selected by Broadridge (the "Peer Group"). The Board and the Independent Directors discussed the Fund's relative investment performance when compared to the Peer Group. The Board and the Independent Directors noted the Fund underperformed its Peer Group median for the one- and three-year periods ended March 31, 2020,t outperformed its Peer Group median for the five-year period ended March 31, 2020, and equaled its Peer Group median for the 10-year period ended March 31, 2020. In addition, the Fund outperformed the Fund's benchmark, MSCI all Country World Index for the one-, three-, five-, and ten-year periods ending March 31, 2020. The Board and the Independent Directors concluded that the Adviser's continued management of the Fund should benefit the Fund and its shareholders.

Advisory Fees and Fund Expenses; Comparison with Peer Group and Institutional Fees. The Board and the Independent Directors considered information provided by the Adviser regarding the Fund's advisory fees and total expense levels, noting that the Adviser is waiving a portion of the Fund's advisory fee in order to maintain a maximum limit of the Fund's expense ratio. The Board and the Independent Directors reviewed comparative information regarding fees and expenses for the Peer Group. The Board and the Independent Directors noted that the Fund's advisory fees and overall net expense ratio were above the average of those for the Peer Group. They noted that FPA believed that the fees are competitive with the fees of similar global funds and recognized the increased complexity of managing a global fund. In addition, the Directors noted that the fee rate charged to the Fund is the same as the fee rate proposed to be charged by the Adviser on the institutional accounts managed in a similar style by the portfolio managers, although they recognized FPA did not currently have any such accounts. The Board and the Independent Directors noted that the advisory fee is consistent with advisory fees charged by FPA to another Fund investing in non-U.S. securities, and they noted that FPA had initially proposed this consistency to create a proper alignment of internal incentives for the portfolio management team. The Board and the Independent Directors concluded that the continued payment of advisory fees and expenses by the Fund to the Adviser was fair and reasonable and should continue to benefit the Fund and its shareholders.

Adviser Profitability and Costs. The Board and the Independent Directors considered information provided by the Adviser regarding the Adviser's costs in providing services to the Fund, the profitability of the Adviser and the benefits to the Adviser from its relationship to the Fund. They reviewed and considered the Adviser's representations regarding its assumptions and methods of allocating certain costs, such as personnel costs, which constitute the Adviser's largest operating cost, overhead and trading costs with respect to the provision of investment advisory services. The Independent Directors discussed with the Adviser the general process through which individuals' compensation is determined and then reviewed by the management committee of the Adviser, as well as the Adviser's methods for determining that its compensation levels are set at appropriate levels to attract and retain the personnel necessary to provide high quality professional investment advice. In evaluating the Adviser's profitability, they considered a portion of the compensation of the Adviser's principals that could be deemed a form of profit, and they excluded certain distribution and marketing-related expenses. The Board and the Independent Directors recognized that the Adviser is entitled under the law to earn a reasonable level of profits for the services that it provides to the Fund. The Board and the Independent Directors concluded that the

24

FPA PARAMOUNT FUND, INC.

APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Continued)

(Unaudited)

Adviser's level of profitability from its relationship with the Fund did not indicate that the Adviser's compensation was unreasonable or excessive.

Economies of Scale and Sharing of Economies of Scale. The Board and the Independent Directors considered whether there have been economies of scale with respect to the management of the Fund, whether the Fund has appropriately benefited from any economies of scale, and whether the proposed fee rate is reasonable in relation to the Fund's asset levels and any economies of scale that may exist. The Board and the Independent Directors considered the Adviser's representation that its internal costs of providing investment management services to the Fund have significantly increased in recent years as a result of a number of factors, including the Adviser's substantial investment in additional professional resources and staffing. The Board and the Independent Directors considered information regarding the Adviser's representation that such increased costs have also included a significant investment in: (1) the portfolio management team, analyst, traders and other investment personnel who assist with the management of the Fund; (2) new compliance, operations, and administrative personnel; (3) information technology, portfolio accounting and trading systems; and (4) office space, each of which enhances the quality of services provided to the Fund. They considered the Adviser's representation that it would invest in additional investment analysts supporting the investment team and strategy when appropriate. The Board and the Independent Directors also considered that the Adviser had agreed to forgo the reimbursement for providing certain financial services that it had previously received from the Fund. The Board and the Independent Directors also considered the Adviser's willingness to close funds to new investors when it believed that a fund may have limited capacity to grow or that it otherwise would benefit fund shareholders. The Board noted that the Fund does not charge sales loads.

The Board and the Independent Directors recognized that the advisory fee rate schedule for the Fund does not have breakpoints. They considered that many mutual funds have breakpoints in the advisory fee structure as a means by which to share in the benefits of potential economies of scale as a fund's assets grow. They also considered that not all funds have breakpoints in their fee structures and that breakpoints are not the exclusive means of sharing potential economies of scale. The Board and the Independent Directors considered the Adviser's statement that it believes that breakpoints are not appropriate for the Fund given the ongoing investments the Adviser is making in its business and its proposed investments for the benefit of the Fund, uncertainties regarding the direction of the economy, rising inflation, increasing costs for personnel and systems, and growth or contraction in the Fund's assets, all of which could negatively impact the profitability of the Adviser. The Board and the Independent Directors also noted that the Adviser has contractually agreed to reimburse the Fund for Total Annual Fund Operating Expenses in excess of 1.29% of the average daily net assets of the Fund (excluding brokerage fees and commissions, interest, taxes, shareholder service fees, fees and expenses of other funds in which the Fund invests, and extraordinary expenses) through January 31, 2021. The Board and the Independent Trustees concluded that the Fund is benefitting from the ongoing investments made by the Adviser in its team of personnel serving the Fund and in the Adviser's service infrastructure, and that in light of these investments, the addition of breakpoints to the Fund's advisory fee structure was not warranted at current asset levels.

Ancillary Benefits. The Board and the Independent Directors considered other actual and potential benefits to the Adviser from managing the Fund, including the acquisition and use of research services with commissions generated by the Fund, in concluding that the contractual advisory and other fees are fair and reasonable for the Fund. They noted that the Adviser does not have any affiliates that benefit from the Adviser's relationship to the Fund.

25

FPA PARAMOUNT FUND, INC.

APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Continued)

(Unaudited)

Conclusions. The Board and the Independent Directors determined that the Fund continues to benefit from the services of the Adviser's portfolio management team. In addition, the Board and the Independent Directors agreed that the Fund continues to receive high quality services from the Adviser. The Board and the Independent Directors concluded that the current advisory fee rate is reasonable and fair to the Fund and its shareholders in light of the nature and quality of the services currently provided by the Adviser and the Adviser's profitability and costs. The Board and the Independent Directors also noted their intention to continue monitoring the factors relevant to the Adviser's compensation, such as changes in the Fund's asset levels, changes in portfolio management personnel and the cost and quality of the services provided by the Adviser to the Fund. On the basis of the foregoing, and without assigning particular weight to any single factor, none of which was dispositive, the Board and the Independent Directors concluded that it would be in the best interests of the Fund to continue to be advised and managed by the Adviser and determined to approve the continuation of the current Advisory Agreement for another one-year period through September 30, 2021.

26

FPA PARAMOUNT FUND, INC.

PRIVACY POLICY

The following is the privacy notice of the mutual funds managed by First Pacific Advisors, LP ("FPA", and the mutual funds, the "FPA Funds" ). A complete list of funds is provided below.

The FPA Funds take privacy seriously and consider privacy to be a fundamental aspect of its relationships with its former, prospective and current investors. The FPA Funds are committed to maintaining the confidentiality, integrity and security of its former, current, and prospective investors' non-public personal information and other personal information. This privacy policy describes our privacy practices surrounding the collection and sharing of non-public personal information and other personal information of current, former and prospective investors and visitors to websites maintained by the FPA Funds.

Obtaining Personal Data. While providing investors and/or prospective investors (collectively, "investors") with products and services, the FPA Funds, and certain service providers, such as the FPA Fund's Transfer Agents and/or Administrators, may obtain personal data about such investors, which may come directly from the investor or their intermediaries from sources such as: (i) account applications, subscription agreements and other forms, (ii) written, electronic or verbal correspondence, (iii) investor transactions, (iv) an investor's brokerage or financial advisory firm, financial advisor or consultant, and/or (v) from information captured on applicable websites, including information you may voluntarily provide when you subscribe to receive FPA's quarterly updates or request us to mail you information about the FPA Funds. In addition, the FPA Funds may collect additional personal data from different sources, such as affiliates or their service providers; public websites or other publicly available sources such as government records; or from credit reporting agencies, sanctions screening databases, or from sources designed to detect and prevent fraud.

The personal data collected about an investor may include: (i) identifiers and similar information such as the investor's name, address, tax identification number, birth date, driver's license number, and potentially email address and phone number (if provided); (ii) certain information protected under other federal or state law, like an investor's signature or bank account information; (iii) characteristics of protected classifications under federal or state law, like gender or marital status; (iv) commercial information like an investment selection, beneficiary information, or transaction and account history with the FPA Funds; (v) internet or other electronic network activity like interactions with the FPA website; (vi) professional or employment-related information like an investor's occupation and job title; and (vii) inferences drawn from the other categories to build a profile on an investor to, for example, gauge an investor's potential interest in investing in new funds or products.