UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-00852 |

|

FPA PARAMOUNT FUND, INC. |

(Exact name of registrant as specified in charter) |

|

11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA | | 90025 |

(Address of principal executive offices) | | (Zip code) |

|

(Name and Address of Agent for Service) J. RICHARD ATWOOD, PRESIDENT FPA PARAMOUNT FUND, INC. 11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA 90025 | Copy to: MARK D. PERLOW, ESQ. DECHERT LLP ONE BUSH STREET, STE. 1600 SAN FRANCISCO, CA 94104 |

|

Registrant’s telephone number, including area code: | (310) 473-0225 | |

|

Date of fiscal year end: | September 30 | |

|

Date of reporting period: | September 30, 2019 | |

| | | | | | | | | |

Item 1: Report to Shareholders.

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, we intend to no longer mail paper copies of the Fund's shareholder reports, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the FPA Funds website (fpa.com/funds), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you prefer to receive shareholder reports and other communications electronically, you may update your mailing preferences with your financial intermediary, or enroll in e-delivery at fpa.com (for accounts held directly with the Fund).

You may elect to continue to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you may inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting us at (800) 638-3060. Your election to receive reports in paper will apply to all funds held with the FPA Funds or through your financial intermediary.

FPA PARAMOUNT FUND, INC.

LETTER TO SHAREHOLDERS

Dear Fellow Shareholders,

Fiscal 2019

For the last 12 months, the Fund gained 2.69% compared to an increase of 1.38% for the MSCI All Country World ("ACWI") NR Index (the "Index").

Among portfolio holdings, AIB Group ("AIB") was the largest detractor to performance in the fiscal year ended September 30.1

Based in Ireland, AIB is one of the country's leading financial services groups. AIB is well-positioned in Ireland because of its established network of physical branches and strong digital banking platform. The company leads a market that has consolidated in recent years. While there are five major banks in Ireland, AIB and Bank of Ireland together control roughly 70% of the market. From a balance sheet standpoint, AIB stands out in a highly leveraged industry. It is the best-capitalized bank in Europe, with a leverage ratio of below 7x, and about three times the average capital of its peers. Unfortunately, central banks' negative interest rate policies create substantial long-term challenges for financial institutions. Recently, the ECB moved to further cut rates, which were already in negative territory, and to continue its bond buying program. We believe the long-anticipated cuts caused European bank stock prices, including AIB's, to decline significantly in recent months.2

Among portfolio holdings, Ströer was the top performance contributor for the fiscal year.3 Ströer, based in Germany, is a leading provider of out-of-home advertising solutions with around 300,000 sites across the country. The group also operates a large portfolio of German-language websites, and recently created a leading provider of direct marketing services through several acquisitions.

Third Quarter 2019

During the third quarter of 2019, the Fund gained 0.28% (in U.S. currency) compared to a decrease of 0.03% for the Index. Since the start of 2019, the Fund gained 16.75% (in U.S. currency) compared to an increase of 16.20% for the Index.

While the third quarter results were slightly stronger than the Index, we continue to believe short-term performance is not the best way to judge results. As value investors, we seek to buy businesses at a discount. Stock prices can, and often do, decline after purchases. We also know that market sentiment toward an industry, or even a specific company, often shifts significantly from one year to the next. It typically takes several years for discounts to our estimates of intrinsic value to unwind. That is why we advocate evaluating the Fund's performance over longer periods, ideally over a market cycle.

1 Reflects the top detractor to the Fund's performance based on contribution to return for the fiscal year. Contribution is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented.

2 Source: AIB Group plc 2019 Half-Yearly Financial Report.

3 Reflects the top contributor to the Fund's performance based on contribution to return for the fiscal year. Contribution is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented.

Past performance is no guarantee, nor is it indicative, of future results.

1

FPA PARAMOUNT FUND, INC.

LETTER TO SHAREHOLDERS

(Continued)

Key Performers4

The biggest performance detractor in the third quarter was AIB Group. AIB's share price weakness in the quarter largely reflected the issues previously noted.

GrandVision NV was the top performance contributor for the quarter. Based in the Netherlands, GrandVision operates optical stores across more than 40 countries. Its sizable store base makes it one of the largest customers of another portfolio holding, EssilorLuxottica. During the quarter, the two companies announced that EssilorLuxottica would buy GrandVision.

Portfolio Activity5

We made several new purchases in the third quarter, including Compagnie Financiere Richemont SA ("Richemont"), Naver Corp, and ASML Holding NV. Based in Switzerland, Richemont is a luxury goods company with leading jewelry and watch brands, including Cartier, Van Cleef & Arpels, Vacheron Constantin, Piaget, and Montblanc. Although Richemont has not been held by the Fund in recent quarters, we believe it is a high-quality business and we have owned it previously. Recent price declines allowed us to re-establish a position in the company with what we believe to be an attractive margin of safety. Naver, based in South Korea, operates the country's leading internet portal and holds a majority stake in Line, Japan's leading mobile messaging service. ASML, based in the Netherlands, is a leading manufacturer of lithography systems used in the production of semiconductors.

We also sold our investments in several companies, including Danone, Magazine Luiza, and Hypera. Based in France, Danone is a leading global producer of dairy products, beverages and infant and medical nutrition products. Based in Brazil, Hypera is one of the country's leading pharmaceutical companies. Magazine Luiza is also based in Brazil. Both companies were among the Brazilian purchases we made in 2018 as market sentiment was depressed due to a severe, multi-year economic contraction, political instability and fears about currency devaluation. Following government elections, the market outlook for Brazil improved and both companies operated their businesses well. We sold Danone, Hypera and Magazine Luiza because each company's share price had reached our estimate of its intrinsic value.

Portfolio Profile

We owned 41 disclosed positions as of September 30. This is within the range of the number of businesses we would expect to own at any given time.

4 Reflects the top contributor and top detractor to the Fund's performance based on contribution to return for the quarter. Contribution is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. Please see end of this Commentary for top five contributors and top five detractors for the quarter.

5 The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities listed.

2

FPA PARAMOUNT FUND, INC.

LETTER TO SHAREHOLDERS

(Continued)

Most of the Fund's positions are in large-cap companies (with a weighted average capitalization of approximately $117 billion). However, we do not consider a company's size to be a relevant criterion from an investment perspective. Reflecting a median capitalization of approximately $28 billion, we are invested across a wide range of market capitalization sizes, including several businesses that are considered mega-caps.6

At quarter end, most of the Fund's assets were invested in companies domiciled in Europe (about 62%). The United States represented about 23% of the portfolio, with Asia-Pacific about 8% of the portfolio, and the balance in other regions and cash. Where a company is domiciled is largely irrelevant to us, however, since many of our holdings are large companies that conduct business on a global scale. That means they often generate significant amounts of their cash flow outside their home countries, rendering traditional country classifications less useful.

We thank you, as always, for your confidence, and look forward to continuing to serve your interests as shareholders of the FPA Paramount Fund.

Respectfully submitted,

| |

| |

Gregory Herr | | Pierre O. Py | |

Portfolio Manager | | Portfolio Manager | |

September 30, 2019 | | | |

6 Large-cap refers to companies with a market capitalization value of more than $10 billion. Mega-cap refers to the biggest companies in the investment universe, as measured by market capitalization. While there is no exact definition of the term, mega-cap generally refers to companies with a market cap exceeding $100 billion.

Past performance is no guarantee, nor is it indicative, of future results.

3

FPA PARAMOUNT FUND, INC.

LETTER TO SHAREHOLDERS

(Continued)

Important Disclosures

You should consider the Fund's investment objectives, risks, and charges and expenses carefully before you invest. The Prospectus details the Fund's objective and policies and other matters of interest to the prospective investor. Please read this Prospectus carefully before investing. The Prospectus may be obtained by visiting the website at www.fpa.com, by calling toll-free, 1-800-982-4372, or by contacting the Fund in writing.

Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. This data represents past performance and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment it may be worth more or less than its original cost. The Fund's expense ratio as of its most recent prospectus is 1.29%. Current month-end performance data, which may be lower or higher than the performance quoted, may be obtained at www.fpa.com or by calling toll-free, 1-800-982-4372.

The views expressed herein and any forward-looking statements are as of the date of this publication and are those of the portfolio management team. Future events or results may vary significantly from those expressed and are subject to change at any time in response to changing circumstances and industry developments. This information and data has been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data.

Portfolio composition will change due to ongoing management of the Fund. References to individual securities are for informational purposes only and should not be construed as recommendations by the Fund, the portfolio managers, the Adviser, or the Distributor. It should not be assumed that future investments will be profitable or will equal the performance of the security examples discussed. The portfolio holdings as of the most recent quarter-end may be obtained at www.fpa.com.

Investments in mutual funds carry risks and investors may lose principal value. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The Fund may purchase foreign securities, including American Depository Receipts (ADRs) and other depository receipts, which are subject to interest rate, currency exchange rate, economic and political risks. Foreign investments, especially those of companies in emerging markets, can be riskier, less liquid, harder to value, and more volatile than investments in the United States. Adverse political and economic developments or changes in the value of foreign currency can make it more difficult for the Fund to value the securities. Differences in tax and accounting standards, difficulties in obtaining information about foreign companies, restrictions on receiving investment proceeds from a foreign country, confiscatory foreign tax laws, and potential difficulties in enforcing contractual obligations, can all add to the risk and volatility of foreign investments.

Small and mid-cap stocks involve greater risks and they can fluctuate in price more than larger company stocks. Groups of stocks, such as value and growth, go in and out of favor which may cause certain funds to underperform other equity funds.

The Fund is non-diversified and may hold fewer securities than a diversified fund because it is permitted to invest a greater percentage of its assets in a smaller number of securities. Holding fewer securities increases the risk that the value of the Fund could go down because of the poor performance of a single investment.

Value style investing presents the risk that the holdings or securities may never reach their full market value because the market fails to recognize what the portfolio management team considers the true business

4

FPA PARAMOUNT FUND, INC.

LETTER TO SHAREHOLDERS

(Continued)

value or because the portfolio management team has misjudged those values. In addition, value style investing may fall out of favor and underperform growth or other styles of investing during given periods.

The Fund transitioned to its current investment strategy on September 1, 2013. Performance prior to that date reflects performance of the prior portfolio management team and investment strategy and is not indicative of performance for any subsequent periods.

Index Definitions

Comparison to any index is for illustrative purposes only and should not be relied upon as a fully accurate measure of comparison. The Fund will be less diversified than the indices noted herein, and may hold non-index securities or securities that are not comparable to those contained in an index. Indices will hold positions that are not within the Fund's investment strategy. Indices are unmanaged and do not reflect any commissions or fees which would be incurred by an investor purchasing the underlying securities. An investor cannot invest directly in an index.

The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 44 country indices comprising 23 developed and 21 emerging market country indices

Other Definitions

Margin of safety — buying with a "margin of safety" is when a security is purchased at a discount to the portfolio manager's estimate of its intrinsic value. Buying a security with a margin of safety is designed to protect against permanent capital loss in the case of an unexpected event or analytical mistake. A purchase made with a margin of safety does not guarantee the security will not decline in price.

Takeout price — The estimated value of a company if it were to be taken private or acquired.

5

FPA PARAMOUNT FUND, INC.

HISTORICAL PERFORMANCE

(Unaudited)

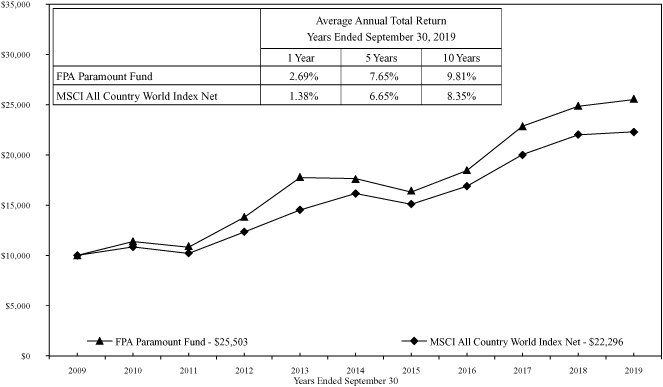

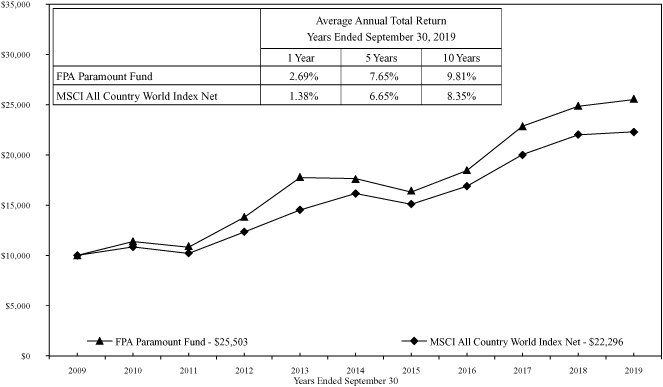

Change in Value of a $10,000 Investment in FPA Paramount Fund, Inc. vs. MSCI AWCI from October 1, 2009 to September 30, 2019

The MSCI All Country World NR Index is a float-adjusted market capitalization index that is designed to measure the combined equity market performance of developed and emerging markets. This index does not reflect any commissions or fees which would be incurred by an investor purchasing the stocks it represents. The performance of the Fund and of the Index is computed on a total return basis, which includes reinvestment of all distributions.

A new strategy for FPA Paramount Fund, Inc. was implemented beginning on September 1, 2013. The returns above include performance of the previous managers prior to that date. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown. This data represents past performance, and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment it may be worth more or less than its original cost. Current month-end performance data can be obtained by visiting the website at www.fpa.com or by calling toll-free, 1-800-982-4372. As of the most recent prospectus, the expense ratio is 1.29% (see notes to financial statements).

The Prospectus details the Fund's objective and policies, charges, and other matters of interest to prospective investors. Please read the prospectus carefully before investing. The Prospectus may be obtained by visiting the website at www.fpa.com, by email at crm@fpa.com, toll-free by calling 1-800-982-4372 or by contacting the Fund in writing.

6

FPA PARAMOUNT FUND, INC.

PORTFOLIO SUMMARY

September 30, 2019

Common Stocks | | | | | 96.5 | % | |

Application Software | | | 8.6 | % | | | | | |

Internet Media | | | 6.1 | % | | | | | |

Infrastructure Software | | | 5.9 | % | | | | | |

Airlines | | | 5.2 | % | | | | | |

Beverages | | | 5.0 | % | | | | | |

Other Common Stocks | | | 4.3 | % | | | | | |

Professional Services | | | 3.9 | % | | | | | |

Other Specialty Retail — Discretionary | | | 3.6 | % | | | | | |

Household Products | | | 3.3 | % | | | | | |

Specialty Apparel Stores | | | 3.1 | % | | | | | |

Information Technology Services | | | 2.9 | % | | | | | |

Health Care Supplies | | | 2.9 | % | | | | | |

Commercial Services & Supplies | | | 2.9 | % | | | | | |

Non Wood Building Materials | | | 2.7 | % | | | | | |

Mass Merchants | | | 2.7 | % | | | | | |

Semiconductor Manufacturing | | | 2.7 | % | | | | | |

Internet Based Services | | | 2.6 | % | | | | | |

Apparel, Footwear & Accessory Design | | | 2.4 | % | | | | | |

Food Services | | | 2.3 | % | | | | | |

Investment Companies | | | 2.3 | % | | | | | |

Health Care Services | | | 2.3 | % | | | | | |

Other Commercial Services | | | 2.2 | % | | | | | |

Advertising & Marketing | | | 2.2 | % | | | | | |

Flow Control Equipment | | | 2.2 | % | | | | | |

Machinery | | | 2.2 | % | | | | | |

Banks | | | 2.2 | % | | | | | |

Building Maintenance Services | | | 2.1 | % | | | | | |

Automotive Retailers | | | 1.9 | % | | | | | |

Communications Equipment | | | 1.6 | % | | | | | |

Packaged Food | | | 0.9 | % | | | | | |

Reinsurance | | | 0.9 | % | | | | | |

Basic & Diversified Chemicals | | | 0.4 | % | | | | | |

Short-term Investments | | | | | 5.1 | % | |

Other Assets And Liabilities, Net | | | | | (1.6 | )% | |

Net Assets | | | | | 100.0 | % | |

7

FPA PARAMOUNT FUND, INC.

PORTFOLIO OF INVESTMENTS

September 30, 2019

COMMON STOCKS | | Shares | | Fair Value | |

APPLICATION SOFTWARE — 8.6% | |

Activision Blizzard, Inc. | | | 93,890 | | | $ | 4,968,659 | | |

Tencent Holdings Ltd. (China) | | | 110,062 | | | | 4,603,661 | | |

Ubisoft Entertainment SA (France)(a) | | | 63,527 | | | | 4,579,699 | | |

| | | $ | 14,152,019 | | |

INTERNET MEDIA — 6.1% | |

Alphabet, Inc. (Class C)(a) | | | 4,400 | | | $ | 5,363,600 | | |

Naver Corp. (South Korea) | | | 34,803 | | | | 4,564,942 | | |

| | | $ | 9,928,542 | | |

INFRASTRUCTURE SOFTWARE — 5.9% | |

Microsoft Corp. | | | 44,000 | | | $ | 6,117,320 | | |

Oracle Corporation | | | 66,000 | | | | 3,631,980 | | |

| | | $ | 9,749,300 | | |

AIRLINES — 5.2% | |

Ryanair Holdings plc (Ireland)(a) | | | 735,955 | | | $ | 8,466,740 | | |

BEVERAGES — 5.0% | |

Ambev SA (Brazil)(a) | | | 883,976 | | | $ | 4,095,485 | | |

Heineken Holding NV (Netherlands) | | | 41,264 | | | | 4,105,343 | | |

| | | $ | 8,200,828 | | |

PROFESSIONAL SERVICES — 3.9% | |

Pagegroup plc (Britain) | | | 830,421 | | | $ | 4,476,549 | | |

Randstad NV (Netherlands) | | | 40,216 | | | | 1,974,446 | | |

| | | $ | 6,450,995 | | |

OTHER SPECIALTY RETAIL — DISCRETIONARY — 3.6% | |

GrandVision NV (Netherlands)(b) | | | 194,238 | | | $ | 5,816,685 | | |

HOUSEHOLD PRODUCTS — 3.3% | |

Henkel AG & Co. KGaA (Germany) | | | 39,200 | | | $ | 3,588,597 | | |

L'Oreal SA (France) | | | 6,732 | | | | 1,882,731 | | |

| | | $ | 5,471,328 | | |

SPECIALTY APPAREL STORES — 3.1% | |

Industria de Diseno Textil SA (Spain) | | | 162,410 | | | $ | 5,026,194 | | |

INFORMATION TECHNOLOGY SERVICES — 2.9% | |

Capgemini SE (France) | | | 40,880 | | | $ | 4,813,668 | | |

8

FPA PARAMOUNT FUND, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2019

COMMON STOCKS — Continued | | Shares | | Fair Value | |

HEALTH CARE SUPPLIES — 2.9% | |

EssilorLuxottica SA (France) | | | 32,716 | | | $ | 4,716,968 | | |

COMMERCIAL SERVICES & SUPPLIES — 2.9% | |

Babcock International Group plc (Britain) | | | 682,294 | | | $ | 4,679,395 | | |

NON WOOD BUILDING MATERIALS — 2.7% | |

Cie de Saint-Gobain (France) | | | 113,750 | | | $ | 4,458,169 | | |

MASS MERCHANTS — 2.7% | |

Dollar General Corporation | | | 28,000 | | | $ | 4,450,320 | | |

SEMICONDUCTOR MANUFACTURING — 2.7% | |

ASML Holding NV (Netherlands) | | | 17,923 | | | $ | 4,445,145 | | |

INTERNET BASED SERVICES — 2.6% | |

Booking Holdings, Inc.(a) | | | 2,200 | | | $ | 4,317,742 | | |

APPAREL, FOOTWEAR & ACCESSORY DESIGN — 2.4% | |

Cie Financiere Richemont SA (Switzerland) | | | 53,740 | | | $ | 3,938,371 | | |

FOOD SERVICES — 2.3% | |

Sodexo SA (France) | | | 34,000 | | | $ | 3,817,006 | | |

INVESTMENT COMPANIES — 2.3% | |

Melrose Industries plc (Britain) | | | 1,527,877 | | | $ | 3,785,288 | | |

HEALTH CARE SERVICES — 2.3% | |

Laboratory Corp. of America Holdings(a) | | | 22,000 | | | $ | 3,696,000 | | |

OTHER COMMERCIAL SERVICES — 2.2% | |

ALS, Ltd. (Australia) | | | 679,619 | | | $ | 3,678,635 | | |

ADVERTISING & MARKETING — 2.2% | |

Stroeer SE & Co. KGaA (Germany) | | | 47,136 | | | $ | 3,588,912 | | |

9

FPA PARAMOUNT FUND, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2019

COMMON STOCKS — Continued | | Shares | | Fair Value | |

FLOW CONTROL EQUIPMENT — 2.2% | |

Sulzer AG (Switzerland) | | | 36,371 | | | $ | 3,579,961 | | |

MACHINERY — 2.2% | |

Cargotec Oyj (B Shares) (Finland) | | | 110,997 | | | $ | 3,570,862 | | |

BANKS — 2.2% | |

AIB Group plc (Ireland) | | | 1,202,464 | | | $ | 3,567,071 | | |

BUILDING MAINTENANCE SERVICES — 2.1% | |

ISS A/S (Denmark) | | | 138,834 | | | $ | 3,432,438 | | |

AUTOMOTIVE RETAILERS — 1.9% | |

O'Reilly Automotive, Inc.(a) | | | 8,000 | | | $ | 3,188,080 | | |

COMMUNICATIONS EQUIPMENT — 1.6% | |

Cisco Systems, Inc. | | | 37,000 | | | $ | 1,828,170 | | |

Samsung Electronics Co. Ltd. (South Korea) | | | 20,216 | | | | 827,724 | | |

| | | $ | 2,655,894 | | |

PACKAGED FOOD — 0.9% | |

Nestle SA (Switzerland) | | | 13,900 | | | $ | 1,507,517 | | |

REINSURANCE — 0.9% | |

RenaissanceRe Holdings Ltd. (Bermuda) | | | 7,490 | | | $ | 1,448,940 | | |

BASIC & DIVERSIFIED CHEMICALS — 0.4% | |

Air Liquide SA (France) | | | 4,870 | | | $ | 693,099 | | |

OTHER COMMON STOCKS — 4.3%(a)(c) | | $ | 7,004,486 | | |

| TOTAL COMMON STOCKS — 96.5% (Cost $149,063,785) | | $ | 158,296,598 | | |

| TOTAL INVESTMENT SECURITIES — 96.5% (Cost $149,063,785) | | $ | 158,296,598 | | |

10

FPA PARAMOUNT FUND, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2019

SHORT-TERM INVESTMENTS — 5.1% | | Principal

Amount | | Fair Value | |

State Street Bank Repurchase Agreement — 0.25% 10/1/2019

(Dated 09/30/2019, repurchase price of $8,293,058, collateralized

by $8,380,000 principal amount U.S. Treasury Notes — 1.75% 2022,

fair value $8,460,683) | | $ | 8,293,000 | | | $ | 8,293,000 | | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $8,293,000) | | $ | 8,293,000 | | |

| TOTAL INVESTMENTS — 101.6% (Cost $157,356,785) | | $ | 166,589,598 | | |

Other Assets and Liabilities, net — (1.6)% | | | (2,594,639 | ) | |

NET ASSETS — 100.0% | | $ | 163,994,959 | | |

(a) Non-income producing security.

(b) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Unless otherwise indicated, these securities are not considered to be illiquid.

(c) As permitted by U.S. Securities and Exchange Commission regulations, "Other" Common Stocks include holdings in their first year of acquisition that have not previously been publicly disclosed.

See accompanying Notes to Financial Statements.

11

FPA PARAMOUNT FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2019

ASSETS | |

Investment securities — at fair value (identified cost $149,063,785) | | $ | 158,296,598 | | |

Short-term investments — repurchase agreements | | | 8,293,000 | | |

Cash | | | 157 | | |

Foreign currencies at value (identified cost $115) | | | 117 | | |

Receivable for: | |

Investment securities sold | | | 577,899 | | |

Dividends and interest | | | 734,431 | | |

Capital Stock sold | | | 7,696 | | |

Prepaid expenses and other assets | | | 676 | | |

Total assets | | | 167,910,574 | | |

LIABILITIES | |

Payable for: | |

Investment securities purchased | | | 3,466,720 | | |

Advisory fees | | | 155,351 | | |

Capital Stock repurchased | | | 125,498 | | |

Accrued expenses and other liabilities | | | 168,046 | | |

Total liabilities | | | 3,915,615 | | |

NET ASSETS | | $ | 163,994,959 | | |

SUMMARY OF SHAREHOLDERS' EQUITY | |

Capital Stock — par value $0.01 per share; authorized 25,000,000 shares;

outstanding 7,765,166 shares | | $ | 77,652 | | |

Additional Paid-in Capital | | | 143,716,786 | | |

Distributable earnings | | | 20,200,521 | | |

NET ASSETS | | $ | 163,994,959 | | |

NET ASSET VALUE | |

Offering and redemption price per share | | $ | 21.12 | | |

See accompanying Notes to Financial Statements.

12

FPA PARAMOUNT FUND, INC.

STATEMENT OF OPERATIONS

For the Year Ended September 30, 2019

INVESTMENT INCOME | |

Dividends (net of foreign taxes withheld of $607,206) | | $ | 3,077,593 | | |

Interest | | | 5,249 | | |

Total investment income | | | 3,082,842 | | |

EXPENSES | |

Advisory fees | | | 1,621,867 | | |

Director fees and expenses | | | 115,789 | | |

Custodian fees | | | 84,746 | | |

Legal fees | | | 83,194 | | |

Reports to shareholders | | | 72,829 | | |

Transfer agent fees and expenses | | | 72,149 | | |

Audit and tax services fees | | | 37,943 | | |

Filing fees | | | 37,816 | | |

Administrative services fees | | | 8,538 | | |

Other professional fees | | | 7,727 | | |

Other | | | 62,126 | | |

Total expenses | | | 2,204,724 | | |

Reimbursement from Adviser | | | (110,761 | ) | |

Net expenses | | | 2,093,963 | | |

Net investment income | | | 988,879 | | |

NET REALIZED AND UNREALIZED APPRECIATION (DEPRECIATION) | |

Net realized gain (loss) on: | |

Investments | | | 12,148,282 | | |

Foreign currency transactions | | | (62,278 | ) | |

Net change in unrealized appreciation (depreciation) of: | |

Investments | | | (10,193,706 | ) | |

Translation of foreign currency denominated amounts | | | (15,450 | ) | |

Net realized and unrealized gain | | | 1,876,848 | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 2,865,727 | | |

See accompanying Notes to Financial Statements.

13

FPA PARAMOUNT FUND, INC.

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended

September 30, 2019 | | Year Ended

September 30, 2018 | |

INCREASE (DECREASE) IN NET ASSETS | |

Operations: | |

Net investment income | | $ | 988,879 | | | $ | 934,410 | | |

Net realized gain | | | 12,086,004 | | | | 18,643,452 | | |

Net change in unrealized appreciation (depreciation) | | | (10,209,156 | ) | | | (4,797,077 | ) | |

Net increase in net assets resulting from operations | | | 2,865,727 | | | | 14,780,785 | | |

Distributions to shareholders | | | (16,820,381 | ) | | | (629,503 | ) | |

Capital Stock transactions: | |

Proceeds from Capital Stock sold | | | 3,406,733 | | | | 8,814,817 | | |

Proceeds from shares issued to shareholders upon reinvestment of

dividends and distributions | | | 9,866,566 | | | | 380,337 | | |

Cost of Capital Stock repurchased | | | (15,617,027 | ) | | | (17,183,644 | ) | |

Net decrease from Capital Stock transactions | | | (2,343,728 | ) | | | (7,988,490 | ) | |

Total change in net assets | | | (16,298,382 | ) | | | 6,162,792 | | |

NET ASSETS | |

Beginning of Year | | | 180,293,341 | | | | 174,130,549 | | |

End of Year | | $ | 163,994,959 | | | $ | 180,293,341 | | |

CHANGE IN CAPITAL STOCK OUTSTANDING | |

Shares of Capital Stock sold | | | 175,222 | | | | 392,202 | | |

Shares issued to shareholders upon reinvestment of

dividends and distributions | | | 543,911 | | | | 17,271 | | |

Shares of Capital Stock repurchased | | | (772,908 | ) | | | (764,402 | ) | |

Change in Capital Stock outstanding | | | (53,775 | ) | | | (354,929 | ) | |

See accompanying Notes to Financial Statements.

14

FPA PARAMOUNT FUND, INC.

FINANCIAL HIGHLIGHTS

Selected Data for Each Share of Capital Stock Outstanding Throughout Each Year

| | | Year Ended September 30, | |

| | | 2019 | | 2018 | | 2017 | | 2016 | | 2015 | |

Per share operating performance: | |

Net asset value at beginning of year | | $ | 23.06 | | | $ | 21.30 | | | $ | 17.36 | | | $ | 15.42 | | | $ | 17.47 | | |

Income from investment operations: | |

Net investment income* | | | 0.13 | | | | 0.12 | | | | 0.08 | | | | 0.18 | | | | 0.08 | | |

Net realized and unrealized gain (loss)

on investment securities | | | 0.13 | | | | 1.72 | | | | 4.04 | | | | 1.84 | | | | (1.35 | ) | |

Total from investment operations | | | 0.26 | | | | 1.84 | | | | 4.12 | | | | 2.02 | | | | (1.27 | ) | |

Less distributions: | |

Dividends from net investment income | | | (0.12 | ) | | | (0.08 | ) | | | (0.18 | ) | | | (0.08 | ) | | | (0.25 | ) | |

Distributions from net realized

capital gains | | | (2.08 | ) | | | — | | | | — | | | | — | | | | (0.53 | ) | |

Total distributions | | | (2.20 | ) | | | (0.08 | ) | | | (0.18 | ) | | | (0.08 | ) | | | (0.78 | ) | |

Redemption fees | | | — | | | | — | | | | — | ** | | | — | ** | | | — | ** | |

Net asset value at end of year | | $ | 21.12 | | | $ | 23.06 | | | $ | 21.30 | | | $ | 17.36 | | | $ | 15.42 | | |

Total investment return*** | | | 2.69 | % | | | 8.65 | % | | | 23.92 | % | | | 13.19 | % | | | (7.63 | )% | |

Ratios/supplemental data: | |

Net assets, end of year (in $000's) | | $ | 163,995 | | | $ | 180,293 | | | $ | 174,131 | | | $ | 149,050 | | | $ | 153,633 | | |

Ratio of expenses to average net assets: | |

Before reimbursement from Adviser | | | 1.36 | % | | | 1.35 | % | | | 1.44 | % | | | 1.43 | % | | | 1.32 | % | |

After reimbursement from Adviser | | | 1.29 | % | | | 1.29 | % | | | 1.29 | % | | | 1.29 | % | | | 1.30 | % | |

Ratio of net investment income to average

net assets: | |

Before reimbursement from Adviser | | | 0.54 | % | | | 0.46 | % | | | 0.27 | % | | | 0.99 | % | | | 0.46 | % | |

After reimbursement from Adviser | | | 0.61 | % | | | 0.52 | % | | | 0.41 | % | | | 1.13 | % | | | 0.48 | % | |

Portfolio turnover rate | | | 62 | % | | | 79 | % | | | 72 | % | | | 52 | % | | | 38 | % | |

* Per share amount is based on average shares outstanding.

** Rounds to less than $0.01 per share.

*** Return is based on net asset value per share, adjusted for reinvestment of distributions, and does not reflect deduction of the sales charge.

See accompanying Notes to Financial Statements.

15

FPA PARAMOUNT FUND, INC.

NOTES TO FINANCIAL STATEMENTS

September 30, 2019

NOTE 1 — Significant Accounting Policies

FPA Paramount Fund, Inc. (the "Fund") is registered under the Investment Company Act of 1940, as a non-diversified, open-end management investment company. The Fund's primary investment objective is high total investment return, including capital appreciation and income. The Fund qualifies as an investment company pursuant to Financial Accounting Standards Codification (ASC) No. 946, Financial Services — Investment Companies. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

A. Security Valuation

The Fund's investments are reported at fair value as defined by accounting principles generally accepted in the United States of America, ("U.S. GAAP"). The Fund generally determines its net asset value as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open. Further discussion of valuation methods, inputs and classifications can be found under Disclosure of Fair Value Measurements.

B. Securities Transactions and Related Investment Income

Securities transactions are accounted for on the date the securities are purchased or sold. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income and expenses are recorded on an accrual basis. The books and records of the Fund are maintained in U.S. dollars as follows: (1) the foreign currency fair value of investment securities, and other assets and liabilities stated in foreign currencies, are translated using the daily spot rate; and (2) purchases, sales, income and expenses are translated at the rate of exchange prevailing on the respective dates of such transactions. The resultant exchange gains and losses are included in net realized or net unrealized gain (loss) in the statement of operations.

C. Use of Estimates

The preparation of the financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported. Actual results could differ from those estimates.

D. Recent Accounting Pronouncements

In August 2018, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2018-13, Fair Value Measurement (Topic 820) — Disclosure Framework — Changes to the Disclosure Requirements for Fair Value Measurement. The amendments eliminate certain disclosure requirements for fair value measurements for all entities, requires public entities to disclose certain new information and modifies some disclosure requirements. The new guidance is effective for all entities for fiscal years beginning after December 15, 2019 and for interim periods within those fiscal years. An entity is permitted to early adopt either the entire standard or only the provisions that eliminate or modify requirements. The Adviser is currently evaluating the impact of this new guidance on the Fund's financial statements.

NOTE 2 — Risk Considerations

Investing in the Fund may involve certain risks including, but not limited to, those described below.

Market Risk: Because the values of the Fund's investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund or the Fund could underperform other investments.

16

FPA PARAMOUNT FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Continued)

Common Stocks and other Securities: The prices of common stocks and other securities held by the Fund may decline in response to certain events taking place around the world, including; those directly involving companies whose securities are owned by the Fund; conditions affecting the general economy; overall market changes; local, regional or global political, social or economic instability; and currency, interest rate and commodity price fluctuations. Since the Fund invests in foreign securities, it will be subject to risks not typically associated with domestic securities. Foreign investments, especially those of companies in emerging markets, can be riskier less liquid, harder to value, and more volatile than investments in the United States. Adverse political and economic developments or changes in the value of foreign currency can make it more difficult for the Fund to value the securities. Differences in tax and accounting standards, difficulties in obtaining information about foreign companies, restrictions on receiving investment proceeds from a foreign country, confiscatory foreign tax laws, and potential difficulties in enforcing contractual obligations, can all add to the risk and volatility of foreign investments. The financial problems in global economies over the past several years, including the European sovereign debt crisis, may continue to cause high volatility in global financial markets.

Risks Associated with Non-Diversification: The Fund is non-diversified, which generally means that it may invest a greater percentage of its total assets in the securities of fewer issuers than a "diversified" fund. This increases the risk that a change in the value of any one investment held by the Fund could affect the overall value of the Fund more than it would affect that of a diversified fund holding a greater number of investments. Accordingly, the Fund's value will likely be more volatile than the value of a more diversified fund.

Repurchase Agreements: Repurchase agreements permit the Fund to maintain liquidity and earn income over periods of time as short as overnight. Repurchase agreements held by the Fund are fully collateralized by U.S. Government securities, or securities issued by U.S. Government agencies, or securities that are within the three highest credit categories assigned by established rating agencies (Aaa, Aa, or A by Moody's or AAA, AA or A by Standard & Poor's) or, if not rated by Moody's or Standard & Poor's, are of equivalent investment quality as determined by the Adviser. Such collateral is in the possession of the Fund's custodian. The collateral is evaluated daily to ensure its fair value equals or exceeds the current fair value of the repurchase agreements including accrued interest. In the event of default on the obligation to repurchase, the Fund has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation.

The Fund may enter into repurchase agreements, under the terms of a Master Repurchase Agreement ("MRA"). The MRA permits the Fund, under certain circumstances including an event of default (such as bankruptcy or insolvency), to offset payables and/or receivables under the MRA with collateral held and/or posted to the counterparty and create one single net payment due to or from the Fund. However, bankruptcy or insolvency laws of a particular jurisdiction may impose restrictions on or prohibitions against such a right of offset in the event of a MRA counterparty's bankruptcy or insolvency. Pursuant to the terms of the MRA, the Fund receives securities as collateral with a fair value in excess of the repurchase price to be received by the Fund upon the maturity of the repurchase transaction. Upon a bankruptcy or insolvency of the MRA counterparty, the Fund recognizes a liability with respect to such excess collateral to reflect the Fund's obligation under bankruptcy law to return the excess to the counterparty. Repurchase agreements outstanding at the end of the period are listed in the Fund's Portfolio of Investments.

NOTE 3 — Purchases and Sales of Investment Securities

Cost of purchases of investment securities (excluding short-term investments) aggregated $99,694,297 for the year ended September 30, 2019. The proceeds and cost of securities sold resulting in net realized loss of

17

FPA PARAMOUNT FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Continued)

$12,148,282 aggregated $119,726,035 and $131,874,317, respectively, for the year ended September 30, 2019. Realized gains or losses are based on the specific identification method.

NOTE 4 — Federal Income Tax

No provision for federal income tax is required because the Fund has elected to be taxed as a "regulated investment company" under the Internal Revenue Code (the "Code") and intends to maintain this qualification and to distribute each year to its shareholders, in accordance with the minimum distribution requirements of the Code, its taxable net investment income and taxable net realized gains on investments.

Distributions paid to shareholders are based on net investment income and net realized gains determined on a tax reporting basis, which may differ from financial reporting. For federal income tax purposes, the Fund had the following components of distributable earnings at September 30, 2019:

Undistributed Ordinary Income | | $ | 5,083,285 | | |

Undistributed Capital Gains | | | 7,141,288 | | |

The tax status of distributions paid during the fiscal years ended September 30, 2019 and 2018 were as follows:

| | | 2019 | | 2018 | |

Dividends from ordinary income and short-term capital gains | | $ | 9,709,947 | | | $ | 629,503 | | |

| Dividends from long-term capital gains | | | 7,110,434 | | | | — | | |

The Fund utilizes the provisions of federal income tax laws that provide for the carryforward of capital losses for prior years, offsetting such losses against any future realized capital gains. Under the Regulated Investment Company Act of 2010 (the "Act"), net capital losses recognized for fiscal years beginning after December 22, 2010 may be carried forward indefinitely, and their character is retained as short-term and/or long-term losses. Previously, net capital losses were carried forward for eight years and treated as short-term losses. As a transition rule, the Act requires that post-enactment net capital losses be used before pre-enactment net capital losses.

As of September 30, 2019, there were no post enactment accumulated losses or pre-enactment losses.

The cost of investment securities held at September 30, 2019, was $150,303,619 for federal income tax purposes. Gross unrealized appreciation and depreciation for all investments (excluding short-term investments) at September 30, 2019, for federal income tax purposes was $21,615,381 and $13,622,402, respectively resulting in net unrealized appreciation of $7,992,979. As of and during the year ended September 30, 2019, the Fund did not have any liability for unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. The statute of limitations remains open for the last 3 years, once a return is filed. No examinations are in progress at this time.

NOTE 5 — Advisory Fees and Other Affiliated Transactions

Pursuant to an Investment Advisory Agreement (the "Agreement") approved by shareholders on November 15, 2013 advisory fees were paid by the Fund to First Pacific Advisors, LP (the "Adviser"). Under the terms of this

18

FPA PARAMOUNT FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Continued)

Agreement, the Fund pays the Adviser a monthly fee calculated at the annual rate of 1% of the Fund's average daily net assets. The Adviser has contractually agreed to reimburse expenses in excess of 1.29% of the average net assets of the Fund (excluding brokerage fees and commissions, interest, taxes, shareholder service fees, fees and expenses of other funds in which the Fund invests, and extraordinary expenses) through January 31, 2020.

For the year ended September 30, 2019, the Fund paid aggregate fees and expenses of $115,789 to all Directors who are not affiliated persons of the Adviser. Certain officers of the Fund are also officers of the Adviser.

NOTE 6 — Disclosure of Fair Value Measurements

The Fund uses the following methods and inputs to establish the fair value of its assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued each day at the official closing price of, or the last reported sale price on, the exchange or market on which such securities principally are traded, as of the close of business on that day. If there have been no sales that day, equity securities are generally valued at the last available bid price. Securities that are unlisted and fixed-income and convertible securities listed on a national securities exchange for which the over-the-counter ("OTC") market more accurately reflects the securities' value in the judgment of the Fund's officers, are valued at the most recent bid price. Events occurring after the close of trading on non-U.S. exchanges may result in adjustments to the valuation of foreign securities to reflect their fair value as of the close of regular trading on the NYSE. The Fund may utilize an independent fair valuation service in adjusting the valuations of foreign securities. Short-term corporate notes with maturities of 60 days or less at the time of purchase are valued at amortized cost.

Securities for which representative market quotations are not readily available or are considered unreliable by the Adviser are valued as determined in good faith under procedures adopted by the authority of the Fund's Board of Directors. Various inputs may be reviewed in order to make a good faith determination of a security's value. These inputs include, but are not limited to, the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations of investments that would have been used had greater market activity occurred.

The Fund classifies its assets based on three valuation methodologies. Level 1 values are based on quoted market prices in active markets for identical assets. Level 2 values are based on significant observable market inputs, such as quoted prices for similar assets and quoted prices in inactive markets or other market observable inputs as noted above including spreads, cash flows, financial performance, prepayments, defaults, collateral, credit enhancements, and interest rate volatility. Level 3 values are based on significant unobservable inputs that reflect the Fund's determination of assumptions that market participants might reasonably use in valuing the

19

FPA PARAMOUNT FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Continued)

assets. The valuation levels are not necessarily an indication of the risk associated with investing in those securities. The following table presents the valuation levels of the Fund's investments as of September 30, 2019:

Investments | | Level 1 | | Level 2 | | Level 3 | | Total | |

Common Stocks | |

Application Software | | $ | 4,968,659 | | | $ | 9,183,360 | | | | — | | | $ | 14,152,019 | | |

Internet Media | | | 5,363,600 | | | | 4,564,942 | | | | — | | | | 9,928,542 | | |

Infrastructure Software | | | 9,749,300 | | | | — | | | | — | | | | 9,749,300 | | |

Airlines | | | 8,466,740 | | | | — | | | | — | | | | 8,466,740 | | |

Beverages | | | 4,095,485 | | | | 4,105,343 | | | | — | | | | 8,200,828 | | |

Professional Services | | | — | | | | 6,450,995 | | | | — | | | | 6,450,995 | | |

Other Specialty Retail — Discretionary | | | — | | | | 5,816,685 | | | | — | | | | 5,816,685 | | |

Household Products | | | — | | | | 5,471,328 | | | | — | | | | 5,471,328 | | |

Specialty Apparel Stores | | | — | | | | 5,026,194 | | | | — | | | | 5,026,194 | | |

Information Technology Services | | | — | | | | 4,813,668 | | | | — | | | | 4,813,668 | | |

Health Care Supplies | | | — | | | | 4,716,968 | | | | — | | | | 4,716,968 | | |

Commercial Services & Supplies | | | — | | | | 4,679,395 | | | | �� | | | | 4,679,395 | | |

Non Wood Building Materials | | | — | | | | 4,458,169 | | | | — | | | | 4,458,169 | | |

Mass Merchants | | | 4,450,320 | | | | — | | | | — | | | | 4,450,320 | | |

Semiconductor Manufacturing | | | — | | | | 4,445,145 | | | | — | | | | 4,445,145 | | |

Internet Based Services | | | 4,317,742 | | | | — | | | | — | | | | 4,317,742 | | |

Apparel, Footwear & Accessory Design | | | — | | | | 3,938,371 | | | | — | | | | 3,938,371 | | |

Food Services | | | 3,817,006 | | | | — | | | | — | | | | 3,817,006 | | |

Investment Companies | | | — | | | | 3,785,288 | | | | — | | | | 3,785,288 | | |

Health Care Services | | | 3,696,000 | | | | — | | | | — | | | | 3,696,000 | | |

Other Commercial Services | | | — | | | | 3,678,635 | | | | — | | | | 3,678,635 | | |

Advertising & Marketing | | | — | | | | 3,588,912 | | | | — | | | | 3,588,912 | | |

Flow Control Equipment | | | — | | | | 3,579,961 | | | | — | | | | 3,579,961 | | |

Machinery | | | — | | | | 3,570,862 | | | | — | | | | 3,570,862 | | |

Banks | | | — | | | | 3,567,071 | | | | — | | | | 3,567,071 | | |

Building Maintenance Services | | | — | | | | 3,432,438 | | | | — | | | | 3,432,438 | | |

Automotive Retailers | | | 3,188,080 | | | | — | | | | — | | | | 3,188,080 | | |

Communications Equipment | | | 1,828,170 | | | | 827,724 | | | | — | | | | 2,655,894 | | |

Packaged Food | | | — | | | | 1,507,517 | | | | — | | | | 1,507,517 | | |

Reinsurance | | | 1,448,940 | | | | — | | | | — | | | | 1,448,940 | | |

Basic & Diversified Chemicals | | | — | | | | 693,099 | | | | — | | | | 693,099 | | |

Other Common Stocks | | | — | | | | 7,004,486 | | | | — | | | | 7,004,486 | | |

Short-Term Investment | | | — | | | | 8,293,000 | | | | — | | | | 8,293,000 | | |

| | | $ | 55,390,042 | | | $ | 111,199,556 | | | | — | | | $ | 166,589,598 | | |

20

FPA PARAMOUNT FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Continued)

Transfers of investments between different levels of the fair value hierarchy are recorded at fair value as of the end of the reporting period. There were transfers of $52,894,345 out of Level 1 into Level 2 during the year ended September 30, 2019. The transfers between Level 1 and Level 2 of the fair value hierarchy during the year ended September 30, 2019, were due to changes in valuation of international equity securities from the exchange closing price to the fair value price.

NOTE 7 — Line of Credit

The Fund, along with FPA International Value Fund (another mutual fund managed by the Adviser) has collectively entered into an agreement that enables them to participate in a $50 million unsecured line of credit with State Street Bank and Trust. Borrowings will be made solely to temporarily finance the repurchase of Capital Stock. Interest is charged to each Fund based on its borrowings at a rate per annum equal to the Overnight LIBOR Rate plus 1.25%. In addition, the Fund and FPA International Value Fund pay a combined commitment fee of 0.25% per annum on any unused portion of the line of credit.

NOTE 8 — Collateral Requirements

FASB Accounting Standards Update No. 2011-11, Disclosures about Offsetting Assets and Liabilities, requires disclosures to make financial statements that are prepared under U.S. GAAP more comparable to those prepared under International Financial Reporting Standards. Under this guidance the Fund discloses both gross and net information about instruments and transactions eligible for offset such as instruments and transactions subject to an agreement similar to a master netting arrangement. In addition, the Fund discloses collateral received and posted in connection with master netting agreements or similar arrangements.

The following table presents the Fund's repurchase agreements by counterparty net of amounts available for offset under an ISDA Master agreement or similar agreements and net of the related collateral received or pledged by the Fund as of September 30, 2019, are as follows:

| | | | | Gross Amounts Not Offset in the

Statement of Assets and Liabilities | | | |

Counterparty | | Gross Assets

(Liabilities)

in the Statement of

Assets and Liabilities | | Collateral

(Received) | | Assets (Liabilities)

Available for Offset | | Net Amount

of Assets

(Liabilities)* | |

State Street Bank and

Trust Company: | |

Repurchases Agreement | | $ | 8,293,000 | | | $ | (8,293,000 | )** | | | — | | | | — | | |

* Represents the net amount receivable from the counterparty in the event of default.

** Collateral with a value of $8,460,683 has been received in connection with a master repurchase agreement. Excess of collateral received from the individual master repurchase agreement is not shown for financial reporting purposes.

21

FPA PARAMOUNT FUND, INC.

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

TO THE SHAREHOLDERS AND

BOARD OF DIRECTORS OF FPA PARAMOUNT FUND, INC.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of FPA Paramount Fund, Inc. (the "Fund"), including the portfolio of investments, as of September 30, 2019, the related statement of operations for the year then ended, and the statement of changes in net assets and the financial highlights for each of the two years in the period then ended and the related notes (collectively referred to as the "financial statements"). The financial highlights for the years ended September 30, 2015, September 30, 2016, and September 30, 2017 were audited by another independent registered public accounting firm whose report, dated November 20, 2017, expressed an unqualified opinion on those financial highlights. In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund at September 30, 2019, the results of its operations for the year then ended, and the changes in its net assets and its financial highlights for each of the two years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of the Fund's internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2019, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of the Fund since 2018.

Los Angeles, CA

November 20, 2019

22

FPA PARAMOUNT FUND, INC.

SHAREHOLDER EXPENSE EXAMPLE

September 30, 2019 (Unaudited)

Fund Expenses

Mutual fund shareholders generally incur two types of costs: (1) transaction costs, and (2) ongoing costs, including advisory and administrative fees; shareholder service fees; and other Fund expenses. The Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the year and held for the entire year.

Actual Expenses

The information in the table under the heading "Actual Performance" provides information about actual account values and actual expenses. You may use the information in this column, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first column in the row entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading "Hypothetical Performance (5% return before expenses)" provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund

and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the information under the heading "Hypothetical Performance (5% return before expenses)" is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. Even though the Fund does not charge transaction fees, if you purchase shares through a broker, the broker may charge you a fee. You should evaluate other mutual funds' transaction fees and any applicable broker fees to assess the total cost of ownership for comparison purposes.

| | | Actual

Performance | | Hypothetical

Performance

(5% return

before

expenses) | |

Beginning Account Value

March 31, 2019 | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending Account Value

September 30, 2019 | | $ | 1,053.90 | | | $ | 1,018.60 | | |

Expenses Paid During

Period* | | $ | 6.64 | | | $ | 6.53 | | |

* Expenses are equal to the Fund's annualized expense ratio of 1.29%, multiplied by the average account value over the period and prorated for the six-months ended September 30, 2019 (183/365 days).

23

FPA PARAMOUNT FUND, INC.

APPROVAL OF INVESTMENT ADVISORY AGREEMENT

(Unaudited)

Approval of the Advisory Agreement. At a meeting of the Board of Directors held on August 12, 2019, the Directors approved the continuation of the advisory agreement between the Fund and the Adviser (the "Advisory Agreement") for an additional one-year period through September 30, 2020, on the recommendation of the Independent Directors, who met in executive session on August 12, 2019 prior to the Board meeting to review and discuss the proposed continuation of the Advisory Agreement. The Board had also met on July 8, 2019, with the Independent Directors meeting separately prior to the Meeting in executive session with the management of the Adviser and then separately with independent counsel to evaluate the renewal of the Advisory Agreement. Prior to their July 8 meeting, the Independent Directors, through their independent counsel, had requested and received extensive materials prepared in connection with the review of the Advisory Agreements. The materials provided a broad range of information regarding the Fund, including a description of, among other matters, the terms of the Advisory Agreement; the services provided by the Adviser; the experience of the relevant investment personnel; the Fund's performance in absolute terms and as compared to the performance of peers and appropriate benchmark(s); the fees and expenses of the Fund in absolute terms and as compared to peers; and the profitability of the Adviser from serving as adviser to the Fund. Following their review at the July 8 meeting, the Independent Directors requested (through their independent counsel) and received supplemental information and responses to a number of questions relating to the materials provided by the Adviser.

In addition, the Board met regularly throughout the year and received information on a variety of topics that were relevant to its annual consideration of the renewal of the Advisory Agreement including, among other matters, Fund investment performance, compliance, risk management, liquidity, valuation, trade execution and other matters relating to Fund operations. The Independent Directors also had met with management of the Adviser (including key investment personnel) at their quarterly meetings as well as with management at other times between the quarterly meetings throughout the year. The materials specifically provided in connection with the annual review of the Advisory Agreement supplement the information received throughout the year.

At their regular Board meetings and executive sessions, the Independent Directors were also assisted by independent legal counsel. In addition to the materials provided by the Adviser, the Independent Directors received a legal memorandum from independent counsel that outlined, among other matters: the duties of the Independent Directors and relevant requirements under the 1940 Act; the general principles under state law relevant to considering the approval of advisory contracts; an adviser's fiduciary duty with respect to advisory agreements and compensation; the standards used by courts in determining whether investment advisers and investment company boards of trustees have fulfilled their duties; and factors to be considered by the Independent Directors when voting on advisory agreements. During executive session, independent legal counsel reviewed with the Independent Directors these duties, standards and factors summarized in the legal memorandum described above. The following paragraphs summarize the material information and factors considered by the Board and the Independent Directors, as well as the Directors' conclusions relative to such factors.

Nature, Extent and Quality of Services. The Board and the Independent Directors considered information provided by the Adviser in response to their requests, as well as information provided throughout the year regarding: the Adviser and its staffing in connection with the Fund, including the Fund's portfolio managers and the senior analysts on their team; the scope of services supervised and provided by the Adviser; and the absence of any significant service problems reported to the Board. The Board and the Independent Directors noted the experience, length of service and the outstanding reputation of the Fund's portfolio managers, Gregory A. Herr and Pierre O. Py, who have each served as portfolio manager of the Fund since 2011. The Board and the

24

FPA PARAMOUNT FUND, INC.

APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Continued)

(Unaudited)

Independent Directors concluded that the nature, extent and quality of services provided by the Adviser, including if the proposed strategy and team were implemented, would benefit the Fund and its shareholders.

Investment Performance. The Board and the Independent Directors reviewed the overall investment performance of the Fund. The Directors also received information from an independent consultant, Broadridge, regarding the Fund's performance relative to a peer group of global multi-cap core funds and global multi-cap growth funds selected by Broadridge (the "Peer Group"). The Board and the Independent Directors discussed the Fund's relative investment performance when compared to the Peer Group. The Board and the Independent Directors noted the Fund underperformed its Peer Group median for the one-, three-, five- and 10-year periods ending March 31, 2019. In addition, the Fund underperformed the Fund's benchmark, MSCI all Country World Index for the one- and five-year periods ending March 31, 2019 but outperformed the Index for the three- and ten-year periods ending March 31, 2019. The Board and the Independent Directors concluded that the Adviser's continued management of the Fund should benefit the Fund and its shareholders.

Advisory Fees and Fund Expenses; Comparison with Peer Group and Institutional Fees. The Board and the Independent Directors considered information provided by the Adviser regarding the Fund's advisory fees and total expense levels, noting that the Adviser is waiving a portion of the Fund's advisory fee in order to maintain a maximum limit of the Fund's expense ratio. The Board and the Independent Directors reviewed comparative information regarding fees and expenses for the Peer Group. The Board and the Independent Directors noted that the Fund's advisory fees and overall expense ratio were above the average of those for the Peer Group. They noted that FPA believed that the fees are competitive with the fees of similar global funds and recognized the increased complexity of managing a global fund. In addition, the Directors noted that the fee rate charged to the Fund is the same as the fee rate proposed to be charged by the Adviser on the institutional accounts managed in a similar style by the portfolio managers, although they recognized FPA did not currently have any such accounts. The Board and the Independent Directors noted that the advisory fee is consistent with advisory fees charged by FPA to another Fund investing in non-U.S. securities, and they noted that FPA had initially proposed this consistency to create a proper alignment of internal incentives for the portfolio management team. The Board and the Independent Directors concluded that the continued payment of advisory fees and expenses by the Fund to the Adviser was fair and reasonable and should continue to benefit the Fund and its shareholders.

Adviser Profitability and Costs. The Board and the Independent Directors considered information provided by the Adviser regarding the Adviser's costs in providing services to the Fund, the profitability of the Adviser and the benefits to the Adviser from its relationship to the Fund. They reviewed and considered the Adviser's representations regarding its assumptions and methods of allocating certain costs, such as personnel costs, which constitute the Adviser's largest operating cost, overhead and trading costs with respect to the provision of investment advisory services. The Independent Directors discussed with the Adviser the general process through which individuals' compensation is determined and then reviewed by the management committee of the Adviser, as well as the Adviser's methods for determining that its compensation levels are set at appropriate levels to attract and retain the personnel necessary to provide high quality professional investment advice. In evaluating the Adviser's profitability, they considered a portion of the compensation of the Adviser's principals that could be deemed a form of profit, and they excluded certain distribution and marketing-related expenses. The Board and the Independent Directors recognized that the Adviser is entitled under the law to earn a reasonable level of profits for the services that it provides to the Fund. The Board and the Independent Directors concluded that the

25

FPA PARAMOUNT FUND, INC.

APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Continued)

(Unaudited)

Adviser's level of profitability from its relationship with the Fund did not indicate that the Adviser's compensation was unreasonable or excessive.

Economies of Scale and Sharing of Economies of Scale. The Board and the Independent Directors considered whether there have been economies of scale with respect to the management of the Fund, whether the Fund has appropriately benefited from any economies of scale, and whether the proposed fee rate is reasonable in relation to the Fund's asset levels and any economies of scale that may exist. The Board and the Independent Directors considered the Adviser's representation that its internal costs of providing investment management services to the Fund have significantly increased in recent years as a result of a number of factors, including the Adviser's substantial investment in additional professional resources and staffing. The Board and the Independent Directors considered information regarding the Adviser's representation that such increased costs have also included a significant investment in: (1) the portfolio management team, analyst, traders and other investment personnel who assist with the management of the Fund; (2) new compliance, operations, and administrative personnel; (3) information technology, portfolio accounting and trading systems; and (4) office space, each of which enhances the quality of services provided to the Fund. They considered the Adviser's representation that it would invest in additional investment analysts supporting the investment team and strategy when appropriate. The Board and the Independent Directors also considered that the Adviser had agreed to forgo the reimbursement for providing certain financial services that it had previously received from the Fund. The Board and the Independent Directors also considered the Adviser's willingness to close funds to new investors when it believed that a fund may have limited capacity to grow or that it otherwise would benefit fund shareholders.

The Board and the Independent Directors recognized that the advisory fee rate schedule for the Fund does not have breakpoints. They considered that many mutual funds have breakpoints in the advisory fee structure as a means by which to share in the benefits of potential economies of scale as a fund's assets grow. They also considered that not all funds have breakpoints in their fee structures and that breakpoints are not the exclusive means of sharing potential economies of scale. The Board and the Independent Directors considered the Adviser's statement that it believes that breakpoints are not appropriate for the Fund given the ongoing investments the Adviser is making in its business and its proposed investments for the benefit of the Fund, uncertainties regarding the direction of the economy, rising inflation, increasing costs for personnel and systems, and growth or contraction in the Fund's assets, all of which could negatively impact the profitability of the Adviser. The Board and the Independent Directors also noted that the Adviser has contractually agreed to reimburse the Fund for Total Annual Fund Operating Expenses in excess of 1.29% of the average daily net assets of the Fund (excluding brokerage fees and commissions, interest, taxes, shareholder service fees, fees and expenses of other funds in which the Fund invests, and extraordinary expenses) through January 31, 2020. The Board and the Independent Trustees concluded that the Fund is benefitting from the ongoing investments made by the Adviser in its team of personnel serving the Fund and in the Adviser's service infrastructure, and that in light of these investments, the addition of breakpoints to the Fund's advisory fee structure was not warranted at current asset levels.

Ancillary Benefits. The Board and the Independent Directors considered other actual and potential benefits to the Adviser from managing the Fund, including the acquisition and use of research services with commissions generated by the Fund, in concluding that the contractual advisory and other fees are fair and reasonable for the Fund. They noted that the Adviser does not have any affiliates that benefit from the Adviser's relationship to the Fund.

26

FPA PARAMOUNT FUND, INC.

APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Continued)

(Unaudited)

Conclusions. The Board and the Independent Directors determined that the Fund continues to benefit from the services of the Adviser's portfolio management team. In addition, the Board and the Independent Directors agreed that the Fund continues to receive high quality services from the Adviser. The Board and the Independent Directors concluded that the current advisory fee rate is reasonable and fair to the Fund and its shareholders in light of the nature and quality of the services currently provided by the Adviser and the Adviser's profitability and costs. The Board and the Independent Directors also noted their intention to continue monitoring the factors relevant to the Adviser's compensation, such as changes in the Fund's asset levels, changes in portfolio management personnel and the cost and quality of the services provided by the Adviser to the Fund. On the basis of the foregoing, and without assigning particular weight to any single factor, none of which was dispositive, the Board and the Independent Directors concluded that it would be in the best interests of the Fund to continue to be advised and managed by the Adviser and determined to approve the continuation of the current Advisory Agreement for another one-year period through September 30, 2020.

27

FPA PARAMOUNT FUND, INC.

PRIVACY POLICY

The FPA Funds consider customer privacy to be an essential part of their investor relationships and are committed to maintaining the confidentiality, integrity and security of their current, prospective and former investors' non-public personal information. The FPA Funds have developed policies that are designed to protect this confidentiality, while permitting investor needs to be served.

Obtaining Personal Information. While providing investors with products and services, the FPA Funds, and certain service providers, such as the FPA Fund's Transfer Agents and/or Administrators, may obtain non-public personal information about investors, which may come from sources such as (i) account applications, subscription agreements and other forms, (ii) written, electronic or verbal correspondence, (iii) investor transactions, (iv) an investor's brokerage or financial advisory firm, financial advisor or consultant, and/or (v) from information captured on applicable websites. The non-public personal information that may be collected from investors may include the investor's name, address, tax identification number, birth date, investment selection, beneficiary information, and possibly the investor's personal bank account information and/or email address if the investor has provided that information, as well as the investor's transaction and account history with the FPA Funds.