Item 1. Reports to Stockholders

US equity mutual fund

Delaware Select Growth Fund

October 31, 2018

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and its summary prospectus, which may be obtained by visiting delawarefunds.com/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit delawarefunds.com/edelivery.

Experience Delaware Funds® by Macquarie

Macquarie Investment Management (MIM) is a global asset manager with offices throughout the United States, Europe, Asia, and Australia. We are active managers who prioritize autonomy and accountability at the investment team level in pursuit of opportunities that matter for our clients. Delaware Funds is one of the longest-standing mutual fund families, with more than 75 years in existence.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Funds or obtain a prospectus for Delaware Select Growth Fund at delawarefunds.com/literature.

Manage your account online

| • | | Check your account balance and transactions |

| • | | View statements and tax forms |

| • | | Make purchases and redemptions |

Visit delawarefunds.com/account-access.

Macquarie Asset Management (MAM) offers a diverse range of products including securities investment management, infrastructure and real asset management, and fund and equity-based structured products. MIM is the marketing name for certain companies comprising the asset management division of Macquarie Group. This includes the following registered investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Capital Investment Management LLC.

The Fund is distributed by Delaware Distributors, L.P. (DDLP), an affiliate of MIMBT and Macquarie Group Limited.

Other than Macquarie Bank Limited (MBL), none of the entities noted are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise. The Fund is governed by US laws and regulations.

Table of contents

Unless otherwise noted, views expressed herein are current as of Oct. 31, 2018, and subject to change for events occurring after such date.

The Fund is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor.

All third-party marks cited are the property of their respective owners.

© 2018 Macquarie Management Holdings, Inc.

| | | | |

| Portfolio management review | | | | |

| Delaware Select Growth Fund | | | November 13, 2018 | |

| | | | | | | | |

Performance preview (for the year ended October 31, 2018) | | | | | | | | |

Delaware Select Growth Fund (Institutional Cass shares) | | | 1-year return | | | | +7.10% | |

Delaware Select Growth Fund (Class A shares) | | | 1-year return | | | | +6.84% | |

Russell 3000® Growth Index (benchmark) | | | 1-year return | | | | +10.20% | |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Select Growth Fund, please see the table on page 4. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

Please see page 6 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Jackson Square Partners, LLC (JSP), a US registered investment advisor, is the sub-advisor to the Fund. As sub-advisor, JSP is responsible for day-to-day management of the Fund’s assets. Delaware Management Company (DMC), a series of Macquarie Investment Management Business Trust, has ultimate responsibility for all investment advisory services.

Overall US stock performance was fair during the fiscal year ended Oct. 31, 2018, as the S&P 500® Index gained 7.35%, despite marked volatility. Gains spiked in January 2018, only to drop more than 10% during an early February selloff. Stocks slowly regained momentum throughout the summer and early fall but lost some ground once again as the United States geared up for the midterm election cycle. The result was net positive, particularly for the largest blue-chip stocks, as indicated by a 9.87% rise in the Dow Jones Industrial Average® during the fiscal period.

A robust labor market fueled US growth. The unemployment rate fell below 4% (its lowest level since 1969), consumer confidence was at an 18-year high, and the economy hit its fastest pace of growth since 2014. The fiscal year ended with retail sales in October ahead of expectations. (Source: US Bureau of Economic Analysis.)

The Federal Reserve raised rates four times throughout the fiscal year, in December 2017, then March, June, and September 2018. None of

| | |

Regardless of the economic outcome, we remain consistent in our long-term investment philosophy: We want to own what we view as strong secular-growth companies with solid business models and competitive positions that we believe can grow market share and have the potential to deliver shareholder value in a variety of market environments. | | |

1

Portfolio management review

Delaware Select Growth Fund

these moves came as a surprise to investors, despite a February transition from former Fed Chair Janet Yellen to Jerome Powell. In a September statement, the Federal Open Market Committee (FOMC) announced that the combination of strong labor-market conditions, sustained economic activity, and an inflation rate that was hovering around the target 2% objective all added up to “balanced” risks for the nation’s economic outlook.

The housing market, which had been on an upswing for nearly 10 years, began to wane during the fiscal period as rising house prices and mortgage rates combined with salary stagnation led potential homebuyers to hold off. Residential investment declined, as did existing- and new-home sales. Low inventory and a new tax law that reduces tax incentives for homeownership have the potential to solidify this slump.

An unprecedented surge in US crude oil and natural gas production during the fiscal year, made possible by shale development, led to record US exports. Oil prices had been creeping higher, but with expanding US crude inventories and a lowered estimate for global demand by the Organization of the Petroleum Exporting Countries (OPEC), prices tumbled in October 2018. (Sources: Bloomberg, U.S. Energy Information Administration.)

The US imposed taxes on imports, which included steel and aluminum, from China, Mexico, Canada, and the European Union; all four responded with retaliatory tariffs on US goods. The US, Canada, and Mexico, however, negotiated a new trade deal to replace the North American Free Trade Agreement (NAFTA), the United States-Mexico-Canada Agreement (USMCA).

The combination of a strong US dollar, rising US interest rates, and an escalating global trade war hurt overseas markets. International stocks were down 6.85% for the fiscal year, as measured by the MSCI EAFE Index (net). Emerging markets

fared worse, losing 12.52% for the same period, as measured by the MSCI Emerging Markets Index (net).

Within the Fund

For the fiscal year ended Oct. 31, 2018, Delaware Select Growth Fund Institutional Class shares returned +7.10%. The Fund’s Class A shares returned +6.84% at net asset value (NAV) and +0.69% at maximum offer price. These figures reflect all distributions reinvested. During the same period, the Fund’s benchmark, the Russell 3000 Growth Index, returned +10.20%. For complete, annualized performance of Delaware Select Growth Fund, please see the table on page 4.

Strong relative performance in the communication services and industrials sectors was unable to overcome weak relative performance in the information technology, consumer discretionary, and real estate sectors. On a stock-specific level, the following were the most significant contributors and detractors during the fiscal year:

TripAdvisor Inc., a website providing travel advice and planning features, contributed to the Fund’s performance during the fiscal year. The company’s earnings reports have been positive during the 12-month period, which management attributed to the stabilization of its click-based ad auction and lower online acquisition costs. TripAdvisor has seen accelerated growth in its nonhotel segment and has integrated third-party networks, such as delivery.com, into its website and mobile app. We believe that could drive synergies over the long term and consider TripAdvisor to be an undervalued asset due to its ability to attract 415 million interested travelers.

Bioverativ Inc., a biotech company specializing in the discovery, development, and delivery of therapies for the treatment of hemophilia, added to the Fund’s performance. Sanofi, a global pharmaceutical company based in France, agreed to buy Bioverativ for $11.6 billion, representing a 64% premium to the previous day’s closing. As a

2

leader in specialty care, Sanofi intends to leverage Bioverativ’s clinical expertise and portfolio in rare blood disorders. Overall, we were pleased with the premium offered.

LiveRamp Holdings Inc. (previously Acxiom Holdings Inc.), a global technology and enablement services company, was also a contributor to performance during the fiscal period. We recently entered into this position as we believe it is an underfollowed and undervalued name in the market. The company’s new CEO, Scott Howe, joined from Microsoft in 2011 and has brought new entrepreneurial vigor to a previously sleepy firm, in our view. Howe aggressively pursued and acquired LiveRamp, a rapidly growing, subscription-based, data onboarding and analytics company that has been nurtured as an autonomous division within Acxiom. Additionally, Acxiom recently announced the sale of its legacy AMS (or Acxiom Marketing Services) business to Interpublic Group for $2.3 billion, which will result in net $1.7 billion in cash upon closing. This was approximately half the company’s market cap at the time of the Fund’s investment. As a result, we believe new management, combined with a Software-as-a-Service (SaaS) data middleware provider embedded in a firm with large cash reserves, have the potential to position Acxiom to drive value over the long term.

DENTSPLY SIRONA Inc., a dental-equipment maker and dental-consumables producer, detracted from the Fund’s performance during the fiscal period. Investors have been concerned about declining revenues in the US amid continued headwinds related to foreign-exchange rates. Concern for the timing of a return to growth after recent investments and capital expenditures has weighed on the stock as well. Since we think these issues represent fundamental change to the thesis, we exited the position in the Fund.

Symantec Corp., a global leader in security and information management solutions, also detracted

from the Fund’s performance. Concerns raised by a former employee in conjunction with the U.S. Securities and Exchange Commission (SEC) triggered an internal investigation by the company’s Audit Committee. With little transparency provided to the public markets, we think this issue represents a fundamental change at the thesis level. As a result, we decided to exit the position and redeploy the capital elsewhere in the Fund’s portfolio.

Applied Materials Inc., the global leader in providing equipment, services, and software to enable the manufacture of advanced semiconductors and flat panel displays, also weighed on the Fund’s performance during the fiscal year. Despite earnings that were broadly in line with guidance, continued industry-wide memory and capital expenditure pushouts into 2019 seemed to provoke caution among investors, who have seen estimates come down across the sector. Nonetheless, we continue to believe we are witnessing a small cyclical downturn in an otherwise strong, secular growth story. We remain confident that Applied Materials is undervalued by the market, is competitively placed in a consolidated sector with high barriers to entry, and has growth drivers, namely increasing capital intensity at an industry level, that have the potential to position the company well for the long term.

Note that the Fund utilized foreign currency exchange contracts to facilitate the purchase and sale of equities traded on international exchanges. The effect of these contracts on performance was immaterial.

Regardless of the economic outcome, we remain consistent in our long-term investment philosophy: We want to own what we view as strong secular-growth companies with solid business models and competitive positions that we believe can grow market share and have the potential to deliver shareholder value in a variety of market environments.

3

| | | | |

| Performance summary | | | | |

| Delaware Select Growth Fund | | | October 31, 2018 | |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| | | | | | | | | | | | | | | | |

Fund and benchmark performance1,2 | | | Average annual total returns through October 31, 2018 | |

| | | | 1 year | | | | 5 years | | | | 10 years | | | | Lifetime | |

Class A (Est. May 16, 1994) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +6.84% | | | | +7.42% | | | | +14.78% | | | | +10.07% | |

Including sales charge | | | +0.69% | | | | +6.15% | | | | +14.10% | | | | +9.80% | |

Class C (Est. May 20, 1994) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +6.02% | | | | +6.61% | | | | +13.92% | | | | +9.24% | |

Including sales charge | | | +5.04% | | | | +6.61% | | | | +13.92% | | | | +9.24% | |

Class R (Est. June 2, 2003) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +6.55% | | | | +7.14% | | | | +14.49% | | | | +8.82% | |

Including sales charge | | | +6.55% | | | | +7.14% | | | | +14.49% | | | | +8.82% | |

Institutional Class (Est. Aug. 28, 1997) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +7.10% | | | | +7.69% | | | | +15.07% | | | | +8.15% | |

Including sales charge | | | +7.10% | | | | +7.69% | | | | +15.07% | | | | +8.15% | |

Russell 3000 Growth Index | | | +10.20% | | | | +13.06% | | | | +15.33% | | | | +7.04%* | |

*The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

1Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 5. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

Class A shares are sold with a maximum front-end sales charge of 5.75%, and have an annual distribution and service fee of 0.25% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual distribution and service fee of 0.50% of average daily net assets.

4

Investments in small and/or medium-sized companies typically exhibit greater risk and higher volatility than larger, more established companies.

International investments entail risks not ordinarily associated with US investments including fluctuation in currency values, differences in

accounting principles, or economic or political instability in other nations.

Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

2 The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale and dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations) from exceeding 1.00% of the Fund’s average daily net assets during the period from Nov. 1, 2017 to Oct. 31, 2018.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| | | | | | | | |

| Fund expense ratios | | Class A | | Class C | | Class R | | Institutional Class |

Total annual operating expenses | | 1.28% | | 2.03% | | 1.53% | | 1.03% |

(without fee waivers) | | | | | | | | |

Net expenses | | 1.25% | | 2.00% | | 1.50% | | 1.00% |

(including fee waivers, if any) | | | | | | | | |

Type of waiver | | Contractual | | Contractual | | Contractual | | Contractual |

*The aggregate contractual waiver period covering this report is from Feb. 28, 2017 through Feb. 28, 2019.

5

Performance summary

Delaware Select Growth Fund

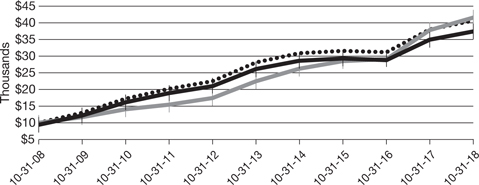

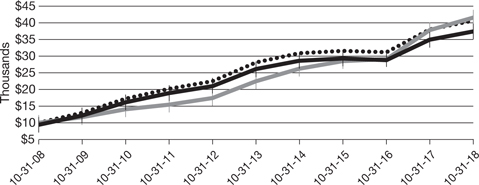

Performance of a $10,000 investment1

Average annual total returns from Oct. 31, 2008 through Oct. 31, 2018

| | | | | | | | | | | | |

| For the period beginning Oct. 31, 2008 through Oct. 31, 2018 | | | Starting value | | | | Ending value | |

| | Russell 3000 Growth Index | | | $10,000 | | | | $41,644 | |

| | Delaware Select Growth Fund — Institutional Class shares | | | $10,000 | | | | $40,701 | |

| | Delaware Select Growth Fund — Class A shares | | | $9,425 | | | | $37,394 | |

1 The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on Oct. 31, 2008, and includes the effect of a 5.75% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 5. Please note additional details on pages 4 through 7.

The graph also assumes $10,000 invested in the Russell 3000 Growth Index as of Oct. 31, 2008. The Russell 3000 Growth Index measures the performance of the broad growth segment of the US equity universe. It includes those Russell 3000

companies with higher price-to-book ratios and higher forecasted growth values.

The S&P 500 Index, mentioned on page 1, measures the performance of 500 mostly large-cap stocks weighted by market value, and is often used to represent performance of the US stock market.

The Dow Jones Industrial Average, mentioned on page 1, is an often-quoted market indicator that comprises 30 widely held US blue-chip stocks.

The MSCI EAFE (Europe, Australasia, Far East) Index, mentioned on page 2, is a free float-adjusted market capitalization weighted index designed to measure equity market performance of developed markets, excluding the United States and Canada. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate.

6

The MSCI Emerging Markets Index, mentioned on page 2, is a free float-adjusted market capitalization index designed to measure equity market performance across emerging market countries worldwide. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate.

Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks, and

copyrights related to the Russell Indexes. Russell® is a trademark of the Frank Russell Company.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| | | | | | |

| | | Nasdaq symbols | | CUSIPs | | |

Class A | | DVEAX | | 928931104 | | |

Class C | | DVECX | | 928931203 | | |

Class R | | DFSRX | | 928931740 | | |

Institutional Class | | VAGGX | | 928931757 | | |

7

| | | | |

| Disclosure of Fund expenses | | | | |

| For the six-month period from May 1, 2018 to October 31, 2018 (Unaudited) | | | | |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from May 1, 2018 to Oct. 31, 2018.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Fund’s expenses shown in the table reflect fee waivers in effect. The Fund’s expenses shown in the table assume reinvestment of all dividends and distributions.

8

| | | | |

| Delaware Select Growth Fund | | | | |

| Expense analysis of an investment of $1,000 | | | | |

| | | | | | | | | | | | | | | | |

| | Beginning

Account Value

5/1/18 | | | Ending

Account Value

10/31/18 | | | Annualized

Expense Ratio | | | Expenses

Paid During Period

5/1/18 to 10/31/18* | |

Actual Fund return† | | | | | | | | | | | | | | | | |

Class A | | | $1,000.00 | | | | $1,041.90 | | | | 1.23% | | | | $6.33 | |

Class C | | | 1,000.00 | | | | 1,037.90 | | | | 1.98% | | | | 10.17 | |

Class R | | | 1,000.00 | | | | 1,040.50 | | | | 1.48% | | | | 7.61 | |

Institutional Class | | | 1,000.00 | | | | 1,043.30 | | | | 0.98% | | | | 5.05 | |

Hypothetical 5% return (5% return before expenses) | | | | | |

Class A | | | $1,000.00 | | | | $1,019.00 | | | | 1.23% | | | | $6.26 | |

Class C | | | 1,000.00 | | | | 1,015.22 | | | | 1.98% | | | | 10.06 | |

Class R | | | 1,000.00 | | | | 1,017.74 | | | | 1.48% | | | | 7.53 | |

Institutional Class | | | 1,000.00 | | | | 1,020.27 | | | | 0.98% | | | | 4.99 | |

*“Expenses Paid During Period” are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

†Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns.

9

| | |

Security type / sector allocation and top 10 equity holdings | | |

| Delaware Select Growth Fund | | As of October 31, 2017 (Unaudited) |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications.

| | |

| Security type / sector | | Percentage of net assets |

Common Stocks² | | 97.56% |

Consumer Discretionary | | 21.07% |

Energy | | 1.48% |

Financials | | 9.89% |

Healthcare | | 13.75% |

Industrials | | 8.22% |

Real Estate | | 3.14% |

Technology | | 40.01% |

Short-Term Investments | | 2.67% |

Total Value of Securities | | 100.23% |

Liabilities Net of Receivables and Other Assets | | (0.23%) |

Total Net Assets | | 100.00% |

| ² | Narrow industries are utilized for compliance purposes for diversification whereas broad sectors are used for financial reporting. |

To monitor compliance with the Fund’s concentration guidelines as described in the Fund’s prospectus and statement of additional information, the Technology sector (as disclosed herein for financial reporting purposes) is subdivided into a variety of “industries” (in accordance with the requirements of the Investment Company Act of 1940, as amended). The Technology sector consisted of commercial services, computers, diversified financial services, Internet, semiconductors, software, and telecommunications. As of Oct. 31, 2018 such amounts, as a percentage of total net assets, were 2.45%, 1.20%, 3.38%, 4.74%, 3.62%, 23.37%, and 1.25%, respectively. The percentage in any such single industry will comply with the Fund’s concentration policy even if the percentage in the Technology sector for financial reporting purposes may exceed 25%.

10

Holdings are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

| | |

| Top 10 equity holdings | | Percentage of net assets |

LiveRamp Holdings | | 7.48% |

Microsoft | | 7.40% |

New York Times Class A | | 5.78% |

Biogen | | 4.21% |

FedEx | | 3.24% |

Liberty TripAdvisor Holdings Class A | | 3.11% |

IQVIA Holdings | | 3.09% |

TripAdvisor | | 3.07% |

KKR & Co. Class A | | 2.88% |

Take-Two Interactive Software | | 2.86% |

11

| | | | |

| Schedule of investments | | | | |

| Delaware Select Growth Fund | | | October 31, 2018 | |

| | | | | | | | |

| | Number of shares | | | Value (US $) | |

Common Stock – 97.56%² | | | | | | | | |

Consumer Discretionary – 21.07% | | | | | | | | |

Dollar General | | | 68,918 | | | $ | 7,676,087 | |

Dollar Tree † | | | 7,983 | | | | 672,967 | |

Dunkin’ Brands Group | | | 24,479 | | | | 1,776,196 | |

eBay † | | | 22,151 | | | | 643,044 | |

Hasbro | | | 92,968 | | | | 8,526,095 | |

Liberty Global Class A † | | | 93,659 | | | | 2,400,480 | |

Liberty Global Class C † | | | 174,209 | | | | 4,362,193 | |

Liberty Media-Liberty Formula One Class C † | | | 8,062 | | | | 266,691 | |

Liberty TripAdvisor Holdings Class A † | | | 667,228 | | | | 9,621,428 | |

Lowe’s | | | 8,839 | | | | 841,650 | |

New York Times Class A | | | 677,391 | | | | 17,883,122 | |

TripAdvisor † | | | 182,166 | | | | 9,498,135 | |

Wyndham Hotels & Resorts | | | 10,456 | | | | 515,376 | |

ZOZO | | | 19,342 | | | | 464,093 | |

| | | | | | | | |

| | | | | | | 65,147,557 | |

| | | | | | | | |

Energy – 1.48% | | | | | | | | |

Centennial Resource Development Class A † | | | 157,813 | | | | 3,023,697 | |

Kinder Morgan | | | 90,316 | | | | 1,537,178 | |

| | | | | | | | |

| | | | | | | 4,560,875 | |

| | | | | | | | |

Financials – 9.89% | | | | | | | | |

Affiliated Managers Group | | | 4,073 | | | | 462,937 | |

Charles Schwab | | | 175,890 | | | | 8,133,154 | |

CME Group | | | 37,652 | | | | 6,899,352 | |

Intercontinental Exchange | | | 55,740 | | | | 4,294,210 | |

KKR & Co. Class A | | | 376,192 | | | | 8,896,941 | |

LendingTree † | | | 9,399 | | | | 1,895,684 | |

| | | | | | | | |

| | | | | | | 30,582,278 | |

| | | | | | | | |

Healthcare – 13.75% | | | | | | | | |

ABIOMED † | | | 1,585 | | | | 540,802 | |

AMAG Pharmaceuticals † | | | 95,903 | | | | 2,061,915 | |

Biogen † | | | 42,815 | | | | 13,027,320 | |

Cambrex † | | | 6,652 | | | | 354,485 | |

Evolent Health Class A † | | | 40,035 | | | | 888,777 | |

Haemonetics † | | | 20,676 | | | | 2,160,022 | |

Illumina † | | | 14,897 | | | | 4,635,202 | |

IQVIA Holdings † | | | 77,714 | | | | 9,553,382 | |

Portola Pharmaceuticals † | | | 99,937 | | | | 1,967,760 | |

UnitedHealth Group | | | 27,938 | | | | 7,301,596 | |

| | | | | | | | |

| | | | | | | 42,491,261 | |

| | | | | | | | |

12

| | | | | | | | |

| | Number of shares | | | Value (US $) | |

Common Stock² (continued) | | | | | | | | |

Industrials – 8.22% | | | | | | | | |

Boeing | | | 21,475 | | | $ | 7,620,619 | |

Expeditors International of Washington | | | 40,010 | | | | 2,687,872 | |

Experian | | | 32,324 | | | | 743,426 | |

FedEx | | | 45,470 | | | | 10,018,860 | |

IHS Markit † | | | 44,499 | | | | 2,337,532 | |

Safran | | | 15,606 | | | | 2,016,729 | |

| | | | | | | | |

| | | | | | | 25,425,038 | |

| | | | | | | | |

Real Estate – 3.14% | | | | | | | | |

Crown Castle International | | | 23,817 | | | | 2,589,861 | |

Equinix | | | 1,665 | | | | 630,602 | |

Equity Commonwealth † | | | 79,988 | | | | 2,382,043 | |

Outfront Media | | | 43,398 | | | | 769,013 | |

Redfin † | | | 215,451 | | | | 3,328,718 | |

| | | | | | | | |

| | | | | | | 9,700,237 | |

| | | | | | | | |

Technology – 40.01% | | | | | | | | |

Alibaba Group Holding ADR † | | | 10,875 | | | | 1,547,295 | |

Alphabet Class A † | | | 2,171 | | | | 2,367,649 | |

Alphabet Class C † | | | 3,781 | | | | 4,071,267 | |

Amadeus IT Group | | | 4,781 | | | | 384,988 | |

Applied Materials | | | 219,259 | | | | 7,209,236 | |

Arista Networks † | | | 16,773 | | | | 3,863,661 | |

ASML Holding | | | 3,380 | | | | 582,185 | |

Autodesk † | | | 53,376 | | | | 6,898,848 | |

Baidu ADR † | | | 5,343 | | | | 1,015,491 | |

Cars.com† | | | 29,378 | | | | 767,060 | |

Coupa Software † | | | 11,256 | | | | 729,726 | |

Electronic Arts † | | | 55,715 | | | | 5,068,951 | |

IPG Photonics † | | | 7,730 | | | | 1,032,341 | |

j2 Global | | | 52,717 | | | | 3,839,906 | |

LiveRamp Holdings † | | | 506,107 | | | | 23,118,967 | |

Logitech International | | | 25,448 | | | | 942,194 | |

Mastercard Class A | | | 25,494 | | | | 5,039,399 | |

MercadoLibre | | | 1,417 | | | | 459,817 | |

Microsoft | | | 214,139 | | | | 22,872,187 | |

Paycom Software † | | | 2,210 | | | | 276,692 | |

PayPal Holdings † | | | 89,902 | | | | 7,568,849 | |

Samsung Electronics | | | 13,050 | | | | 488,537 | |

Samsung Electronics GDR | | | 2,027 | | | | 1,891,191 | |

Scout24 144A # | | | 31,498 | | | | 1,305,384 | |

ServiceNow † | | | 1,259 | | | | 227,929 | |

Take-Two Interactive Software † | | | 68,505 | | | | 8,828,239 | |

Tencent Holdings | | | 17,082 | | | | 585,217 | |

13

Schedule of investments

Delaware Select Growth Fund

| | | | | | | | |

| | Number of shares | | | Value (US $) | |

Common Stock² (continued) | | | | | | | | |

Technology (continued) | | | | | | | | |

Varonis Systems † | | | 45,458 | | | $ | 2,776,120 | |

Visa Class A | | | 39,280 | | | | 5,414,748 | |

Wix.com † | | | 11,505 | | | | 1,120,012 | |

Yelp † | | | 32,800 | | | | 1,404,496 | |

| | | | | | | | |

| | | | | | | 123,698,582 | |

| | | | | | | | |

Total Common Stock (cost $272,190,991) | | | | | | | 301,605,828 | |

| | | | | | | | |

| | |

| | Principal amount° | | | | |

Short-Term Investments – 2.67% | | | | | | | | |

Discount Note – 0.40%≠ | | | | | | | | |

Federal Home Loan Bank 2.00% 11/1/18 | | | 1,249,851 | | | | 1,249,851 | |

| | | | | | | | |

| | | | | | 1,249,851 | |

| | | | | | | | |

Repurchase Agreements – 2.27% | | | | | | | | |

Bank of America Merrill Lynch

2.12%, dated 10/31/18, to be repurchased on 11/1/18, repurchase price $961,481 (collateralized by US government obligations 0.00% 5/15/19 –8/15/31; market value $980,653) | | | 961,424 | | | | 961,424 | |

Bank of Montreal

2.10%, dated 10/31/18, to be repurchased on 11/1/18, repurchase price $2,644,071 (collateralized by US government obligations 0.00%–3.75% 11/1/18–2/15/47; market value $2,696,796) | | | 2,643,917 | | | | 2,643,917 | |

BNP Paribas

2.17%, dated 10/31/18, to be repurchased on 11/1/18, repurchase price $3,395,089 (collateralized by US government obligations 0.00%–8.00% 2/28/19–8/15/46; market value $3,462,783) | | | 3,394,885 | | | | 3,394,885 | |

| | | | | | | | |

| | | | | | 7,000,226 | |

| | | | | | | | |

Total Short-Term Investments (cost $8,250,077) | | | | | | | 8,250,077 | |

| | | | | | | | |

| | |

Total Value of Securities – 100.23%

(cost $280,441,068) | | | | | | $ | 309,855,905 | |

| | | | | | | | |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At Oct. 31, 2018, the aggregate value of Rule 144A securities was $1,305,384, which represents 0.42% of the Fund’s net assets. See Note 11 in “Notes to financial statements.” |

| ² | Narrow industries are utilized for compliance purposes for diversification whereas broad sectors are used for financial reporting. |

| ≠ | The rate shown is the effective yield at the time of purchase. |

| ° | Principal amount shown is stated in USD unless noted that the security is denominated in another currency. |

14

| † | Non-income producing security. |

| The | following foreign currency exchange contracts were outstanding at Oct. 31, 2018:1 |

Foreign Currency Exchange Contracts

| | | | | | | | | | | | |

Counterparty | | Contracts to Receive (Deliver) | | In Exchange For | | Settlement

Date | | | Unrealized

Depreciation | |

BNYM | | EUR 1,704,817 | | USD (1,935,168) | | | 11/1/18 | | | $ | (4,058 | ) |

The use of foreign currency exchange contracts involves elements of market risk and risks in excess of the amounts disclosed in the financial statements. The foreign currency exchange contracts presented above represent the Fund’s total exposure in such contracts, whereas only the net unrealized appreciation (depreciation) is reflected in the Fund’s net assets.

1See Note 8 in “Notes to financial statements.”

Summary of abbreviations:

ADR – American Depositary Receipt

BNYM – BNY Mellon

EUR – European Monetary Unit

GDR – Global Depositary Receipt

USD – US Dollar

See accompanying notes, which are an integral part of the financial statements.

15

| | | | |

| Statement of assets and liabilities | | | | |

| Delaware Select Growth Fund | | | October 31, 2018 | |

| | | | |

Assets: | | | | |

Investments, at value1 | | $ | 309,855,905 | |

Foreign currencies, at value2 | | | 506,050 | |

Cash | | | 1,237 | |

Receivable for securities sold | | | 1,791,186 | |

Foreign tax reclaims receivable | | | 159,731 | |

Dividends and interest receivable | | | 93,590 | |

Receivable for fund shares sold | | | 21,506 | |

| | | | |

Total assets | | | 312,429,205 | |

| | | | |

Liabilities: | | | | |

Payable for securities purchased | | | 2,305,712 | |

Payable for fund shares redeemed | | | 539,921 | |

Investment management fees payable to affiliates | | | 205,322 | |

Other accrued expenses | | | 147,526 | |

Distribution fees payable to affiliates | | | 66,546 | |

Unrealized depreciation on foreign currency exchange contracts | | | 4,058 | |

Dividend disbursing and transfer agent fees and expenses payable to affiliates | | | 2,653 | |

Accounting and administration expenses payable to affiliates | | | 1,353 | |

Trustees’ fees and expenses payable | | | 788 | |

Legal fees payable to affiliates | | | 498 | |

Reports and statements to shareholders expenses payable to affiliates | | | 245 | |

| | | | |

Total liabilities | | | 3,274,622 | |

| | | | |

Total Net Assets | | $ | 309,154,583 | |

| | | | |

| |

Net Assets Consist of: | | | | |

Paid-in capital | | $ | 207,479,783 | |

Total distributable earnings (loss) | | | 101,674,800 | |

| | | | |

Total Net Assets | | $ | 309,154,583 | |

| | | | |

16

| | | | |

Net Asset Value | | | | |

Class A: | | | | |

Net assets | | $ | 241,008,556 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 6,064,348 | |

Net asset value per share | | $ | 39.74 | |

Sales charge | | | 5.75 | % |

Offering price per share, equal to net asset value per share / (1 – sales charge) | | $ | 42.16 | |

| |

Class C: | | | | |

Net assets | | $ | 13,759,000 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 492,821 | |

Net asset value per share | | $ | 27.92 | |

| |

Class R: | | | | |

Net assets | | $ | 4,100,076 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 109,938 | |

Net asset value per share | | $ | 37.29 | |

| |

Institutional Class: | | | | |

Net assets | | $ | 50,286,951 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 1,160,322 | |

Net asset value per share | | $ | 43.34 | |

| |

| | | | |

1 Investments, at cost | | $ | 280,441,068 | |

2 Foreign currencies, at cost | | | 517,869 | |

See accompanying notes, which are an integral part of the financial statements.

17

| | | | |

| Statement of operations | | | | |

| Delaware Select Growth Fund | | | Year ended October 31, 2018 | |

| | | | |

Investment Income: | | | | |

Dividends | | $ | 2,973,131 | |

Interest | | | 64,633 | |

Foreign tax withheld | | | (36,379 | ) |

| | | | |

| | | 3,001,385 | |

| | | | |

Expenses: | | | | |

Management fees | | | 2,742,944 | |

Distribution expenses — Class A | | | 609,551 | |

Distribution expenses — Class C | | | 331,658 | |

Distribution expenses — Class R | | | 22,606 | |

Dividend disbursing and transfer agent fees and expenses | | | 505,523 | |

Accounting and administration expenses | | | 97,418 | |

Reports and statements to shareholders expenses | | | 69,316 | |

Registration fees | | | 65,779 | |

Audit and tax fees | | | 36,329 | |

Legal fees | | | 31,276 | |

Trustees’ fees and expenses | | | 17,272 | |

Custodian fees | | | 15,911 | |

Other | | | 25,189 | |

| | | | |

| | | 4,570,772 | |

Less expenses paid indirectly | | | (1,655 | ) |

| | | | |

Total operating expenses | | | 4,569,117 | |

| | | | |

Net Investment Loss | | | (1,567,732 | ) |

| | | | |

| |

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized gain (loss) on: | | | | |

Investments | | | 77,905,806 | |

Foreign currencies | | | (4,524 | ) |

Foreign currency exchange contracts | | | (5,182 | ) |

| | | | |

Net realized gain | | | 77,896,100 | |

| | | | |

Net change in unrealized appreciation (depreciation) of: | | | | |

Investments | | | (47,700,050 | ) |

Foreign currencies | | | (9,279 | ) |

Foreign currency exchange contracts | | | (4,058 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) | | | (47,713,387 | ) |

| | | | |

Net Realized and Unrealized Gain | | | 30,182,713 | |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 28,614,981 | |

| | | | |

See accompanying notes, which are an integral part of the financial statements.

18

This page intentionally left blank.

| | | | |

| Statements of changes in net assets | | | | |

| Delaware Select Growth Fund | | | | |

| | | | | | | | |

| | | Year ended | |

| | | 10/31/18 | | | 10/31/17 | |

Increase (Decrease) in Net Assets from Operations: | | | | | | | | |

Net investment loss | | $ | (1,567,732 | ) | | $ | (1,729,908 | ) |

Net realized gain | | | 77,896,100 | | | | 26,638,046 | |

Net change in unrealized appreciation (depreciation) | | | (47,713,387 | ) | | | 57,756,983 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 28,614,981 | | | | 82,665,121 | |

| | | | | | | | |

| | |

Dividends and Distributions to Shareholders from: | | | | | | | | |

Distributable earnings*: | | | | | | | | |

Class A | | | (13,284,528 | ) | | | (33,563,358 | ) |

Class C | | | (3,396,155 | ) | | | (10,351,305 | ) |

Class R | | | (291,213 | ) | | | (1,391,001 | ) |

Institutional Class | | | (5,317,098 | ) | | | (20,784,384 | ) |

| | | | | | | | |

| | | (22,288,994 | ) | | | (66,090,048 | ) |

| | | | | | | | |

| | |

Capital Share Transactions: | | | | | | | | |

Proceeds from shares sold: | | | | | | | | |

Class A | | | 31,571,991 | | | | 10,376,973 | |

Class C | | | 478,378 | | | | 518,709 | |

Class R | | | 621,092 | | | | 1,299,257 | |

Institutional Class | | | 10,198,960 | | | | 25,672,077 | |

| | |

Net asset value of shares based upon reinvestment of dividends and distributions: | | | | | | | | |

Class A | | | 13,034,709 | | | | 32,864,589 | |

Class C | | | 3,354,158 | | | | 10,034,042 | |

Class R | | | 288,244 | | | | 1,390,989 | |

Institutional Class | | | 5,243,724 | | | | 20,470,366 | |

| | | | | | | | |

| | | 64,791,256 | | | | 102,627,002 | |

| | | | | | | | |

20

| | | | | | | | |

| | | Year ended | |

| | | 10/31/18 | | | 10/31/17 | |

Capital Share Transactions (continued): | | | | | | | | |

Cost of shares redeemed: | | | | | | | | |

Class A | | $ | (42,282,478 | ) | | $ | (70,786,700 | ) |

Class C | | | (35,721,542 | ) | | | (25,425,897 | ) |

Class R | | | (1,737,760 | ) | | | (9,284,945 | ) |

Institutional Class | | | (72,842,025 | ) | | | (118,440,922 | ) |

| | | | | | | | |

| | | (152,583,805 | ) | | | (223,938,464 | ) |

| | | | | | | | |

| | |

Decrease in net assets derived from capital share transactions | | | (87,792,549 | ) | | | (121,311,462 | ) |

| | | | | | | | |

Net Decrease in Net Assets | | | (81,466,562 | ) | | | (104,736,389 | ) |

Net Assets: | | | | | | | | |

Beginning of year | | $ | 390,621,145 | | | $ | 495,357,534 | |

| | | | | | | | |

End of year1 | | $ | 309,154,583 | | | $ | 390,621,145 | |

| | | | | | | | |

| 1 | Net Assets – There was no undistributed net investment income for the year ended 10/31/17. The Securities and Exchange Commission eliminated the requirement to disclose undistributed (distributions in excess of) net investment income in 2018. |

| * | For the year ended Oct. 31, 2018, the Fund has adopted amendments to Regulation S-X (see Note 13 in “Notes to financial statements”). For the year ended Oct. 31, 2017, the dividends and distributions to shareholders were as follows: |

| | | | | | | | |

| | | Class A | | Class C | | Class R | | Institutional

Class |

Distributions from net realized gains | | $(33,563,358) | | $(10,351,305) | | $(1,391,001) | | $(20,784,384) |

See accompanying notes, which are an integral part of the financial statements.

21

| | | | |

| Financial highlights | | | | |

| Delaware Select Growth Fund Class A | | | | |

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

Net asset value, beginning of period |

|

Income (loss) from investment operations: |

Net investment income (loss)1 |

Net realized and unrealized gain (loss) |

|

Total from investment operations |

|

Less dividends and distributions from: |

Net investment income |

Net realized gain |

|

Total dividends and distributions |

|

Net asset value, end of period |

|

|

Total return2 |

|

Ratios and supplemental data: |

Net assets, end of period (000 omitted) |

Ratio of expenses to average net assets |

Ratio of expenses to average net assets prior to fees waived |

Ratio of net investment income (loss) to average net assets |

Ratio of net investment income (loss) to average net assets prior to fees waived |

Portfolio turnover |

| 1 | The average shares outstanding method has been applied for per share information. |

| 2 | Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return during some of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

22

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended | |

| | | 10/31/18 | | | 10/31/17 | | | 10/31/16 | | | 10/31/15 | | | 10/31/14 | |

| | $ | 39.46 | | | $ | 37.68 | | | $ | 47.82 | | | $ | 52.44 | | | $ | 49.60 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | (0.17 | ) | | | (0.14 | ) | | | (0.11 | ) | | | 0.05 | | | | (0.06 | ) |

| | | 2.69 | | | | 7.13 | | | | (0.31 | ) | | | 1.20 | | | | 4.68 | |

| | | | | | | | | | | | | | | | | | | | |

| | | 2.52 | | | | 6.99 | | | | (0.42 | ) | | | 1.25 | | | | 4.62 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | — | | | | — | | | | — | | | | (0.09 | ) | | | — | |

| | | (2.24 | ) | | | (5.21 | ) | | | (9.72 | ) | | | (5.78 | ) | | | (1.78 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | (2.24 | ) | | | (5.21 | ) | | | (9.72 | ) | | | (5.87 | ) | | | (1.78 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | $ | 39.74 | | | $ | 39.46 | | | $ | 37.68 | | | $ | 47.82 | | | $ | 52.44 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | 6.84% | | | | 21.43% | | | | (1.63% | ) | | | 2.31% | | | | 9.53% | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | $ | 241,009 | | | $ | 237,363 | | | $ | 253,027 | | | $ | 348,846 | | | $ | 402,000 | |

| | | 1.24% | | | | 1.25% | | | | 1.26% | | | | 1.25% | | | | 1.25% | |

| | | 1.24% | | | | 1.28% | | | | 1.28% | | | | 1.25% | | | | 1.25% | |

| | | (0.42% | ) | | | (0.39% | ) | | | (0.30% | ) | | | 0.09% | | | | (0.12% | ) |

| | | (0.42% | ) | | | (0.42% | ) | | | (0.32% | ) | | | 0.09% | | | | (0.12% | ) |

| | | | 51% | | | | 35% | | | | 33% | | | | 46% | | | | 41% | |

23

| | | | |

| Financial highlights | | | | |

| Delaware Select Growth Fund Class C | | | | |

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

Net asset value, beginning of period |

|

Income (loss) from investment operations: |

Net investment loss1 |

Net realized and unrealized gain (loss) |

|

Total from investment operations |

|

Less dividends and distributions from: |

Net realized gain |

|

Total dividends and distributions |

|

|

Net asset value, end of period |

|

|

Total return2 |

|

Ratios and supplemental data: |

Net assets, end of period (000 omitted) |

Ratio of expenses to average net assets |

Ratio of expenses to average net assets prior to fees waived |

Ratio of net investment loss to average net assets |

Ratio of net investment loss to average net assets prior to fees waived |

Portfolio turnover |

| 1 | The average shares outstanding method has been applied for per share information. |

| 2 | Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return during some of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

24

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended | |

| | | 10/31/18 | | | 10/31/17 | | | 10/31/16 | | | 10/31/15 | | | 10/31/14 | |

| | $ | 28.60 | | | $ | 28.91 | | | $ | 39.13 | | | $ | 44.16 | | | $ | 42.34 | |

| | | | | |

| | | (0.33 | ) | | | (0.30 | ) | | | (0.31 | ) | | | (0.27 | ) | | | (0.37 | ) |

| | | 1.89 | | | | 5.20 | | | | (0.19 | ) | | | 1.02 | | | | 3.97 | |

| | | | | | | | | | | | | | | | | | | | |

| | | 1.56 | | | | 4.90 | | | | (0.50 | ) | | | 0.75 | | | | 3.60 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | (2.24 | ) | | | (5.21 | ) | | | (9.72 | ) | | | (5.78 | ) | | | (1.78 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | (2.24 | ) | | | (5.21 | ) | | | (9.72 | ) | | | (5.78 | ) | | | (1.78 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | $ | 27.92 | | | $ | 28.60 | | | $ | 28.91 | | | $ | 39.13 | | | $ | 44.16 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | 6.02% | | | | 20.57% | | | | (2.36% | ) | | | 1.52% | | | | 8.71% | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | $ | 13,759 | | | $ | 44,775 | | | $ | 60,815 | | | $ | 87,833 | | | $ | 101,991 | |

| | | 1.99% | | | | 2.00% | | | | 2.01% | | | | 2.00% | | | | 2.00% | |

| | | 1.99% | | | | 2.03% | | | | 2.03% | | | | 2.00% | | | | 2.00% | |

| | | (1.17% | ) | | | (1.14% | ) | | | (1.05% | ) | | | (0.66% | ) | | | (0.87% | ) |

| | | (1.17% | ) | | | (1.17% | ) | | | (1.07% | ) | | | (0.66% | ) | | | (0.87% | ) |

| | | | 51% | | | | 35% | | | | 33% | | | | 46% | | | | 41% | |

25

| | | | |

| Financial highlights | | | | |

| Delaware Select Growth Fund Class R | | | | |

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

Net asset value, beginning of period |

|

Income (loss) from investment operations: |

Net investment loss1 |

Net realized and unrealized gain (loss) |

|

Total from investment operations |

|

Less dividends and distributions from: |

Net realized gain |

|

Total dividends and distributions |

|

|

Net asset value, end of period |

|

|

Total return2 |

|

Ratios and supplemental data: |

Net assets, end of period (000 omitted) |

Ratio of expenses to average net assets |

Ratio of expenses to average net assets prior to fees waived |

Ratio of net investment loss to average net assets |

Ratio of net investment loss to average net assets prior to fees waived |

Portfolio turnover |

| 1 | The average shares outstanding method has been applied for per share information. |

| 2 | Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total investment return during some of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

26

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended | |

| | | 10/31/18 | | | 10/31/17 | | | 10/31/16 | | | 10/31/15 | | | 10/31/14 | |

| | $ | 37.26 | | | $ | 35.94 | | | $ | 46.15 | | | $ | 50.83 | | | $ | 48.25 | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | (0.25 | ) | | | (0.22 | ) | | | (0.20 | ) | | | (0.08 | ) | | | (0.18 | ) |

| | | 2.52 | | | | 6.75 | | | | (0.29 | ) | | | 1.18 | | | | 4.54 | |

| | | | | | | | | | | | | | | | | | | | |

| | | 2.27 | | | | 6.53 | | | | (0.49 | ) | | | 1.10 | | | | 4.36 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | (2.24 | ) | | | (5.21 | ) | | | (9.72 | ) | | | (5.78 | ) | | | (1.78 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | (2.24 | ) | | | (5.21 | ) | | | (9.72 | ) | | | (5.78 | ) | | | (1.78 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | $ | 37.29 | | | $ | 37.26 | | | $ | 35.94 | | | $ | 46.15 | | | $ | 50.83 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | 6.55% | | | | 21.16% | | | | (1.87% | ) | | | 2.02% | | | | 9.26% | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | $ | 4,100 | | | $ | 4,913 | | | $ | 11,487 | | | $ | 18,766 | | | $ | 20,022 | |

| | | 1.49% | | | | 1.50% | | | | 1.51% | | | | 1.50% | | | | 1.50% | |

| | | 1.49% | | | | 1.53% | | | | 1.53% | | | | 1.50% | | | | 1.50% | |

| | | (0.67% | ) | | | (0.64% | ) | | | (0.55% | ) | | | (0.16% | ) | | | (0.37% | ) |

| | | (0.67% | ) | | | (0.67% | ) | | | (0.57% | ) | | | (0.16% | ) | | | (0.37% | ) |

| | | | 51% | | | | 35% | | | | 33% | | | | 46% | | | | 41% | |

27

| | | | |

| Financial highlights | | | | |

| Delaware Select Growth Fund Institutional Class | | | | |

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

Net asset value, beginning of period |

|

Income (loss) from investment operations: |

Net investment income (loss)1 |

Net realized and unrealized gain (loss) |

|

Total from investment operations |

|

Less dividends and distributions from: |

Net investment income |

Net realized gain |

|

Total dividends and distributions |

|

|

Net asset value, end of period |

|

|

Total return2 |

|

Ratios and supplemental data: |

Net assets, end of period (000 omitted) |

Ratio of expenses to average net assets |

Ratio of expenses to average net assets prior to fees waived |

Ratio of net investment income (loss) to average net assets |

Ratio of net investment income (loss) to average net assets prior to fees waived |

Portfolio turnover |

| 1 | The average shares outstanding method has been applied for per share information. |

| 2 | Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total investment return during some of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

28

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended | |

| | | 10/31/18 | | | 10/31/17 | | | 10/31/16 | | | 10/31/15 | | | 10/31/14 | |

| | $ | 42.73 | | | $ | 40.27 | | | $ | 50.35 | | | $ | 54.92 | | | $ | 51.73 | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | (0.07 | ) | | | (0.05 | ) | | | (0.02 | ) | | | 0.18 | | | | 0.07 | |

| | | 2.92 | | | | 7.72 | | | | (0.34 | ) | | | 1.25 | | | | 4.90 | |

| | | | | | | | | | | | | | | | | | | | |

| | | 2.85 | | | | 7.67 | | | | (0.36 | ) | | | 1.43 | | | | 4.97 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | — | | | | — | | | | — | | | | (0.22 | ) | | | — | |

| | | (2.24 | ) | | | (5.21 | ) | | | (9.72 | ) | | | (5.78 | ) | | | (1.78 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | (2.24 | ) | | | (5.21 | ) | | | (9.72 | ) | | | (6.00 | ) | | | (1.78 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | $ | 43.34 | | | $ | 42.73 | | | $ | 40.27 | | | $ | 50.35 | | | $ | 54.92 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | 7.10% | | | | 21.76% | | | | (1.37% | ) | | | 2.54% | | | | 9.80% | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | $ | 50,287 | | | $ | 103,570 | | | $ | 170,029 | | | $ | 422,581 | | | $ | 496,967 | |

| | | 0.99% | | | | 1.00% | | | | 1.01% | | | | 1.00% | | | | 1.00% | |

| | | 0.99% | | | | 1.03% | | | | 1.03% | | | | 1.00% | | | | 1.00% | |

| | | (0.17% | ) | | | (0.14% | ) | | | (0.05% | ) | | | 0.34% | | | | 0.13% | |

| | | (0.17% | ) | | | (0.17% | ) | | | (0.07% | ) | | | 0.34% | | | | 0.13% | |

| | | | 51% | | | | 35% | | | | 33% | | | | 46% | | | | 41% | |

29

| | | | |

| Notes to financial statements | | | | |

| Delaware Select Growth Fund | | | October 31, 2018 | |

Voyageur Mutual Funds III (Trust) is organized as a Delaware statutory trust and offers one series: Delaware Select Growth Fund (Fund). The Fund is an open-end investment company. The Fund is considered diversified under the Investment Company Act of 1940, as amended (1940 Act), and offers Class A, Class C, Class R, and Institutional Class shares. Class A shares are sold with a maximum front-end sales charge of 5.75%. Class A share purchases of $1,000,000 or more will incur a contingent deferred sales charge (CDSC) instead of a front-end sales charge of 1.00% if redeemed during the first year, and 0.50% during the second year, provided that Delaware Distributors, L.P. (DDLP) paid a financial advisor a commission on the purchase of those shares. Class C shares are sold with a CDSC of 1.00%, which will be incurred if redeemed during the first 12 months. Class R and Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors.

The investment objective of the Fund is to seek long-term capital appreciation.

1. Significant Accounting Policies

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services –Investment Companies. The following accounting policies are in accordance with US generally accepted accounting principles (US GAAP) and are consistently followed by the Fund.

Security Valuation – Equity securities, except those traded on the Nasdaq Stock Market LLC (Nasdaq), are valued at the last quoted sales price as of the time of the regular close of the New York Stock Exchange on the valuation date. Equity securities traded on the Nasdaq are valued in accordance with the Nasdaq Official Closing Price, which may not be the last sales price. If, on a particular day, an equity security does not trade, the mean between the bid and ask prices will be used, which approximates fair value. Equity securities listed on a foreign exchange are normally valued at the last quoted sales price on the valuation date. US government and agency securities are valued at the mean between the bid and ask prices, which approximates fair value. Foreign currency exchange contracts and foreign cross currency exchange contracts are valued at the mean between the bid and ask prices, which approximates fair value. Interpolated values are derived when the settlement date of the contract is an interim date for which quotations are not available. Generally, other securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith under the direction of the Trust’s Board of Trustees (Board). In determining whether market quotations are readily available or fair valuation will be used, various factors will be taken into consideration, such as market closures or suspension of trading in a security. The Fund may use fair value pricing more frequently for securities traded primarily in non-US markets because, among other things, most foreign markets close well before the Fund values its securities, generally as of 4:00pm Eastern time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, government actions or pronouncements, aftermarket trading, or news events may have occurred in the interim. Whenever such a significant event occurs, the Fund may value foreign securities using fair value prices based on third-party vendor modeling tools (international fair value pricing). Restricted securities are valued at fair value using methods approved by the Board.

Federal and Foreign Income Taxes – No provision for federal income taxes has been made as the Fund intends to continue to qualify for federal income tax purposes as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and make the

30

requisite distributions to shareholders. The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the “more-likely-than-not” threshold are recorded as a tax benefit or expense in the current year. Management has analyzed the Fund’s tax positions taken or expected to be taken on the Fund’s federal income tax returns through the year ended Oct. 31, 2018 and for all open tax years (years ended Oct. 31, 2015–Oct. 31, 2017), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. If applicable, the Fund recognizes interest accrued on unrecognized tax benefits in interest expense and penalties in other expenses on the “Statement of operations.” During the year ended Oct. 31, 2018, the Fund did not incur any interest or tax penalties. In regard to foreign taxes only, the Fund has open tax years in certain foreign countries in which it invests in that may date back to the inception of the Fund.

Class Accounting – Investment income, common expenses, and realized and unrealized gain (loss) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Distribution expenses relating to a specific class are charged directly to that class.

Repurchase Agreements – The Fund may purchase certain US government securities subject to the counterparty’s agreement to repurchase them at an agreed upon date and price. The counterparty will be required on a daily basis to maintain the value of the collateral subject to the agreement at not less than the repurchase price (including accrued interest). The agreements are conditioned upon the collateral being deposited under the Federal Reserve book-entry system with the Fund’s custodian or a third-party sub-custodian. In the event of default or bankruptcy by the other party to the agreement, retention of the collateral may be subject to legal proceedings. All open repurchase agreements as of the date of this report were entered into on Oct. 31, 2018, and matured on the next business day.

Foreign Currency Transactions – Transactions denominated in foreign currencies are recorded at the prevailing exchange rates on the valuation date in accordance with the Fund’s prospectus. The value of all assets and liabilities denominated in foreign currencies is translated daily into US dollars at the exchange rate of such currencies against the US dollar. Transaction gains or losses resulting from changes in exchange rates during the reporting period or upon settlement of the foreign currency transaction are reported in operations for the current period. The Fund generally does not bifurcate that portion of realized gains and losses on investments which is due to changes in foreign exchange rates from that which is due to changes in market prices. These gains and losses are included on the “Statement of operations” under “Net realized gain (loss) on investments.” The Fund reports certain foreign currency related transactions as components of realized gains (losses) for financial reporting purposes, whereas such components are treated as ordinary income (loss) for federal income tax purposes.

Use of Estimates – The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the fair value of investments, the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and the differences could be material.

31

Notes to financial statements

Delaware Select Growth Fund

1. Significant Accounting Policies (continued)

Other – Expenses directly attributable to the Fund are charged directly to the Fund. Other expenses common to various funds within the Delaware Funds® by Macquarie (Delaware Funds) are generally allocated among such funds on the basis of average net assets. Management fees and certain other expenses are paid monthly. Security transactions are recorded on the date the securities are purchased or sold (trade date) for financial reporting purposes. Costs used in calculating realized gains and losses on the sale of investment securities are those of the specific securities sold. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Discounts and premiums on debt securities are accreted or amortized to interest income, respectively, over the lives of the respective securities using the effective interest method. Taxable non-cash dividends are recorded as dividend income. Distributions received from investments in real estate investment trusts (REITs) are recorded as dividend income on the ex-dividend date, subject to reclassification upon notice of the character of such distributions by the issuer. Foreign dividends are also recorded on the ex-dividend date or as soon after the ex-dividend date that the Fund is aware of such dividends, net of all tax withholdings, a portion of which may be reclaimable. Withholding taxes and reclaims on foreign dividends have been recorded in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. The Fund declares and pays dividends from net investment income and distributions from net realized gain on investments, if any, annually. The Fund may distribute more frequently, if necessary for tax purposes. Dividends and distributions, if any, are recorded on the ex-dividend date.

The Fund receives earnings credits from its custodian when positive cash balances are maintained, which may be used to offset custody fees. The expense paid under this arrangement is on the “Statement of operations” under “Custodian fees” with the corresponding expense offset included under “Less expenses paid indirectly.” For the year ended Oct. 31, 2018, the Fund earned $495 under this arrangement.

The Fund receives earnings credits from its transfer agent when positive cash balances are maintained, which may be used to offset transfer agent fees. If the amount earned is greater than $1, the expense paid under this arrangement is included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses” with the corresponding expense offset included under “Less expenses paid indirectly.” For the year ended Oct. 31, 2018, the Fund earned $1,160 under this arrangement.

2. Investment Management, Administration Agreements, and Other Transactions with Affiliates

In accordance with the terms of its investment management agreement, the Fund pays Delaware Management Company (DMC), a series of Macquarie Investment Management Business Trust and the investment manager, an annual fee which is calculated daily and paid monthly at the rate of 0.75% on the first $500 million of average daily net assets of the Fund, 0.70% on the next $500 million, 0.65% on the next $1.5 billion, and 0.60% on average daily net assets in excess of $2.5 billion.

DMC has contractually agreed to waive that portion if any, of its management fee and/or pay/reimburse the Fund to the extent necessary to ensure that total annual fund operating expenses (excluding any distribution and service (12b-1) fees, acquired funds fees and expenses, taxes, interest, short sale dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or

32

costs, including, but not limited to those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations) do not exceed 1.00% of the Fund’s average daily net assets from Nov. 1, 2017 through Oct. 31, 2018.* For purposes of these waivers and reimbursements, nonroutine expenses may also include such additional costs and expenses as may be agreed upon from time to time by the Board and DMC. These expense waivers and reimbursements apply to expenses paid directly to the Fund and may only be terminated by agreement of DMC and the Fund. The waivers and reimbursements are accrued daily and received monthly.

Jackson Square Partners, LLC (JSP), a related party of DMC, furnishes investment sub-advisory services to the Fund. For these services, DMC, not the Fund, pays JSP fees based on the aggregate average daily net assets of the Fund at the following annual rate: 0.450% of the first $500 million; 0.420% of the next $500 million; 0.390% of the next $1.5 billion; and 0.360% of aggregate average daily net assets in excess of $2.5 billion.

Delaware Investments Fund Services Company (DIFSC), an affiliate of DMC, provides fund accounting and financial administration oversight services to the Fund. For these services, DIFSC’s fees are calculated daily and paid monthly based on the aggregate daily net assets of all funds within the Delaware Funds at the following annual rate: 0.00475% of the first $35 billion; 0.0040% of the next $10 billion; and 0.0025% of aggregate average daily net assets in excess of $45 billion (Total Fee). Each Fund in the Delaware Funds pays a minimum of $4,000, which, in aggregate, is subtracted from the Total Fee. Each fund then pays its portion of the remainder of the Total Fee on a relative net asset value (NAV) basis. For the year ended Oct. 31, 2018, the Fund was charged $17,799 for these services. This amount is included on the “Statement of operations” under “Accounting and administration expenses.”

DIFSC is also the transfer agent and dividend disbursing agent of the Fund. For these services, DIFSC’s fees were calculated daily and paid monthly based on the aggregate daily net assets of the retail funds within the Delaware Funds from Nov. 1, 2017 through June 30, 2018 at the following annual rate: 0.025% of the first $20 billion; 0.020% of the next $5 billion; 0.015% of the next $5 billion; and 0.013% of average daily net assets in excess of $30 billion. Effective July 1, 2018, the Fund as well as the other Delaware Funds entered into an amendment to the DIFSC agreement. Under the amendment to the DIFSC agreement, DIFSC’s fees are calculated daily and paid monthly based on the aggregate daily net assets of the retail funds within the Delaware Funds at the following annual rate: 0.014% of the first $20 billion; 0.011% of the next $5 billion; 0.007% of the next $5 billion; 0.005% of the next $20 billion; and 0.0025% of average daily net assets in excess of $50 billion. The fees payable to DIFSC under the transfer agent agreement described above are allocated among all retail funds in the Delaware Funds on a relative NAV basis. This amount is included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses.” For the year ended Oct. 31, 2018, the Fund was charged $60,302 for these services. Pursuant to a sub-transfer agency agreement between DIFSC and BNY Mellon Investment Servicing (US) Inc. (BNYMIS), BNYMIS provides certain sub-transfer agency services to the Fund. Sub-transfer agency fees are paid by the Fund and are also included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses.”

Pursuant to a distribution agreement and distribution plan, the Fund pays DDLP, the distributor and an affiliate of DMC, an annual 12b-1 fee of 0.25% of the average daily net assets of the Class A shares,

33

Notes to financial statements

Delaware Select Growth Fund

2. Investment Management, Administration Agreements, and Other Transactions with Affiliates (continued)

1.00% of the average daily net assets of the Class C shares, and 0.50% of the average daily net assets of the Class R shares. These fees are calculated daily and paid monthly. Institutional Class shares pay no 12b-1 fees.

As provided in the investment management agreement, the Fund bears a portion of the cost of certain resources shared with DMC, including the cost of internal personnel of DMC and/or its affiliates that provide legal, tax, and regulatory reporting services to the Fund. For the year ended Oct. 31, 2018, the Fund was charged $10,201 for internal legal, tax, and regulatory reporting services provided by DMC and/or its affiliates’ employees. This amount is included on the “Statement of operations” under “Legal fees.”

For the year ended Oct. 31, 2018, DDLP earned $6,351 for commissions on sales of the Fund’s Class A shares. For the year ended Oct. 31, 2018, DDLP received gross CDSC commissions of $21 and $695 on redemptions of the Fund’s Class A and Class C shares, respectively, and these commissions were entirely used to offset upfront commissions previously paid by DDLP to broker/dealers on sales of those shares.

Trustees’ fees include expenses accrued by the Fund for each Trustee’s retainer and meeting fees. Certain officers of DMC, DIFSC, and DDLP are officers and/or Trustees of the Trust. These officers and Trustees are paid no compensation by the Fund.

*The aggregate contractual waiver period covering this report is from Feb. 28, 2017 through Feb. 28, 2019.

3. Investments