Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04236

| JPMorgan Trust II |

(Exact name of registrant as specified in charter)

245 Park Avenue New York, NY 10167 |

(Address of principal executive offices) (Zip code)

Frank J. Nasta 245 Park Avenue New York, NY 10167 |

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: October 31

Date of reporting period: November 1, 2009 through October 31, 2010

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Table of Contents

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Table of Contents

Annual Report

J.P. Morgan International Equity Funds

October 31, 2010

JPMorgan Emerging Economies Fund

JPMorgan Emerging Markets Equity Fund

JPMorgan Global Focus Fund

JPMorgan International Equity Fund

JPMorgan International Equity Index Fund

JPMorgan International Opportunities Fund

JPMorgan International Value Fund

JPMorgan Intrepid International Fund

Table of Contents

| CEO’s Letter | 1 | |||

| Market Overview | 2 | |||

| 3 | ||||

| 6 | ||||

| 9 | ||||

| 12 | ||||

| 15 | ||||

| 18 | ||||

| 21 | ||||

| 24 | ||||

| Schedules of Portfolio Investments | 27 | |||

| Financial Statements | 68 | |||

| Financial Highlights | 86 | |||

| Notes to Financial Statements | 102 | |||

| Report of Independent Registered Public Accounting Firm | 122 | |||

| Trustees | 123 | |||

| Officers | 125 | |||

| Schedule of Shareholder Expenses | 126 | |||

| Board Approval of Investment Advisory Agreements | 129 | |||

| Tax Letter | 133 | |||

| Privacy Policy | 134 | |||

Investments in a Fund are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on conditions through the end of the reporting period and are subject to change without notice based on market and other conditions. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Funds’ prospectus for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Funds Service Center at (800) 480-4111 for a prospectus containing more complete information about a Fund including management fees and other expenses. Please read it carefully before investing.

Table of Contents

OCTOBER 31, 2010 (Unaudited)

Dear Shareholder:

If 2009 was the year that we tried to sort out the aftermath of the global financial crisis and recession, then 2010 should be viewed as the year we began to slowly emerge from the crisis and embark on the road to recovery.

|

“If 2009 was the year that we tried to sort out the aftermath of the global financial crisis and recession, then 2010 should be viewed as the year we began to slowly emerge from the crisis and embark on the road to recovery.” |

Last year, some welcome improvements in economic data appeared to indicate that a modest recovery was occurring. Investors responded warmly to these signs by displaying their appetite for risk. The equity markets rebounded sharply, and by November 18, 2009, the Standard & Poor’s 500 Index (the “S&P 500 Index”) had risen by nearly 67% from its 14-year low on March 9, 2009. By the end of December 2009, the S&P 500 Index had risen 26.5% for the year to close at 1,115, and this positive momentum carried over into early 2010.

However, investors’ upbeat mood didn’t last for long. A wave of discouraging U.S. economic data, compounded by sovereign debt issues in Europe, led to a major market correction in May 2010, followed by heightened market volatility throughout most of the summer. Beginning in the latter half of the third quarter, however, the markets responded well to a wave of much anticipated news, including a strong September labor market report, the U.S. mid-term elections, as well as the Federal Reserve’s (“the Fed”) announced launch of a second round of quantitative easing (“QE2”).

These gains, however, should be viewed as tentative, as while the recovery continues, markets remain sensitive to risks such as high unemployment, the future direction of tax policy, as well as concerns that Ireland’s fiscal issues will contribute to additional European financial stress.

We believe, however, that the current economic recovery offers some encouraging signs for investors, including positive gross domestic product growth and a strong conclusion to third quarter 2010 corporate earnings, as many companies reported some of their healthiest profit margins in years.

Investors buoyed by solid corporate earnings

During the late spring and summer months, economic uncertainty and fears of deflation drove investors to the safety of U.S. Treasuries and gold. A recent run of positive news, however, including improved economic data and better-than-expected corporate earnings, led to a surge late in the third quarter. As of the end of the 12- month period ended October 31, 2010, the Standard & Poor’s 500 Index had reached a level of 1,183, a 16.5% increase from 12 months earlier.

Although global stock indices reflected steady growth throughout most of the year, this trend has recently been interrupted

due to growing anxiety surrounding sovereign debt in Europe and inflationary concerns in China. However, as of the end of the 12-month reporting period, the MSCI EAFE Index (Europe, Australasia, and the Far East) had returned 8.8% (gross), while the MSCI EM (Emerging Markets) Index had returned 23.9% (gross) for the same reporting period.

Treasuries move higher, pushing yields to historic lows

Weak economic growth boosted the fixed income market throughout the year, as investors sought safety in U.S. Treasuries and high-quality corporate bonds. In this environment, the Barclays Capital High Yield Index returned 19.4%, while the Barclays Capital Emerging Markets Index returned 18.3% for the 12-month period ended October 31, 2010. The Barclays Capital U.S. Aggregate Bond Index returned 8.0% for the same period.

Investors continued to demonstrate their concern about the stability of the economic recovery, pushing bond prices up and yields down. At one point, these concerns, combined with near-zero official policy rates and central bank bond purchases, drove 10-year yields to their lowest levels since January 2009. As of October 31, 2010, the yields on the benchmark 10-year Treasury bond had dropped from 3.4% to 2.6%. Yields on the 30-year bond also declined, falling from 4.2% to 4.0% as of the end of the period, as did the two-year note, from 0.9% to 0.3%.

Will QE2 promote stronger economic growth

In a much anticipated action, the Fed initiated a second round of quantitative easing designed to stimulate the economy. It plans to spend an additional $600 billion to buy a wide range of both short-term and long-term U.S. Treasuries. In its statement, the Fed also indicated that it may extend the program if conditions warrant doing so, and promised to “employ its policies as needed.” Although this measure may potentially hold down both short and long-term interest rates, it does increase the risk of higher inflation and rising interest rates down the road. Additionally, the flexibility that the Fed has afforded itself in implementing the program may increase uncertainty about future monetary policy and the economy.

Certainly, if the economy continues to improve going forward, the Fed may likely resume a more balanced posture. However, due to the uncertainty of the impact of this plan, it still makes sense for investors to maintain a balanced portfolio, including a diversified approach to fixed income and other securities.

On behalf of everyone at J.P. Morgan Asset Management, I would like to wish you a very happy holiday season and a safe and healthy year. We look forward to continuing to support your investment goals in 2011 and beyond. Should you have any questions, please visit our website at www.jpmorganfunds.com, or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

George C.W. Gatch

CEO-Investment Management Americas

J.P. Morgan Asset Management

| OCTOBER 31, 2010 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | 1 | ||||||

Table of Contents

J.P. Morgan International Equity Funds

TWELVE MONTHS ENDED OCTOBER 31, 2010 (Unaudited)

Stock markets in most parts of the world continued to rally for the first five months of the reporting period, maintaining the upward momentum they enjoyed after the March 2009 market bottom. Stock prices declined in the second quarter of 2010 as risk aversion returned in April amid concerns about the threat of systemic fallout from Europe’s debt crisis. However, stocks recovered during the third quarter of 2010 and into October 2010 on strong corporate earnings, better-than-expected economic data, a return of merger and acquisition activity and accommodative policies from the U.S. Federal Reserve and the Bank of Japan. While most stock markets advanced for the twelve months ended October 31, 2010, there was clear separation among regions and countries.

Emerging Markets

Emerging market stocks were bolstered by strong gross domestic product (GDP) growth in developing countries, as the Morgan Stanley Capital International (“MSCI”) Emerging Markets Index gained 23.89% and was among the best performing stock indexes during the reporting period.

Indian stocks were supported by strong corporate earnings and robust flows from foreign investors into the Indian market. In addition, the country’s monetary policy tightening was in line with investor expectations, creating optimism among investors that the Reserve Bank of India was attempting to maintain continued economic growth as it took measures to control inflation.

Meanwhile, the greater China region lagged other emerging markets. Investors were concerned that the Chinese government would be forced to take measures to clamp down on the surging Chinese economy and ward off inflation, potentially causing a sharp pullback in economic activity (also known as a “hard landing”). However, concerns about a hard landing in China failed to materialize and the Chinese stock market performed well toward the end of the reporting period.

Developed Markets

International stocks, as measured by the MSCI EAFE (Europe, Australasia and Far East) Index, gained 8.36%, underperforming emerging markets stocks and the S&P 500 Index’s 16.52% return for the twelve months ended October 31, 2010. The relative weakness of the MSCI EAFE Index was driven primarily by lagging European stocks. While European policymakers and the International Monetary Fund responded to the region’s fiscal crisis with an aggressive emergency funding package, skepticism remained surrounding the unity of European leaders, as well as the impact that austerity measures would have on growth in the region.

| 2 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | OCTOBER 31, 2010 | ||||

Table of Contents

JPMorgan Emerging Economies Fund

TWELVE MONTHS ENDED OCTOBER 31, 2010 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Select Class Shares)* | 36.48% | |||

| Morgan Stanley Capital International (“MSCI”) Emerging Markets Index | 23.89% | |||

| Net Assets as of 10/31/2010 (In Thousands) | $7,461 | |||

INVESTMENT OBJECTIVE**

The JPMorgan Emerging Economies Fund (the “Fund”) seeks long-term capital growth.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Select Class Shares) outperformed the MSCI Emerging Markets Index (the “Benchmark”) for the twelve months ended October 31, 2010. The Fund’s stock selection was strongest in the energy and materials sectors. The Fund’s underweight in the healthcare sector and overweight in the information technology sector detracted from relative performance.

Individual contributors to relative performance included the Fund’s positions in Charoen Pokphand Foods Public Company Limited and Pacific Rubiales Energy Corp, which were both not held in the Benchmark. Shares of Charoen Pokphand Foods Public Company Limited, a Thailand-based agro-industrial and integrated food company, benefited as investor fears surrounding political upheaval in Thailand abated. Pacific Rubiales Energy Corp. is an oil exploration and production company. Shares of the company rose due to its increasing oil production.

The Fund’s underweight position in Petroleo Brasileiro S.A. also contributed to relative performance as the stock declined on concerns regarding the structure of an offering that allowed the Brazilian government to purchase shares of the company.

Individual detractors from relative performance included the Fund’s overweight positions in Chaoda Modern Agriculture Holdings Ltd., Gerdau S.A. and OTP Bank plc. Chaoda Modern Agriculture Holdings Ltd.’s stock was hurt after the agricultural produce provider issued new shares, options and convertible bonds to raise capital to expand the company’s production, diluting the value of existing shares. Shares of Gerdau S.A., a Brazil-based producer of long rolled steel, declined as the appreciating Brazil Real caused steel imports to rise, hurting the Brazilian steel industry. Shares of OTP Bank plc, a Hungarian bank, declined after the Hungarian government increased taxation on the country’s banking sector, hurting OTP Bank plc’s profitability.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers used a combination of top-down and bottom-up research, rigorously researching companies to determine their underlying value and potential for future earnings growth. The Fund held an average of 94 stocks during the reporting period. As a result of this process, the Fund’s largest overweight was in the financials sector and the Fund’s largest underweight was in the materials sector. From a country perspective, the Fund’s largest overweight was in Turkey and the Fund’s largest underweight was in India.

| OCTOBER 31, 2010 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | 3 | ||||||

Table of Contents

JPMorgan Emerging Economies Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2010 (Unaudited) (continued)

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | Samsung Electronics Co., Ltd. (South Korea) | 3.4 | % | |||||

| 2. | Itau Unibanco Holding S.A., ADR (Preferred Stock) (Brazil) | 2.4 | ||||||

| 3. | China Mobile Ltd. (Hong Kong) | 2.4 | ||||||

| 4. | CNOOC Ltd. (Hong Kong) | 2.2 | ||||||

| 5. | Hon Hai Precision Industry Co., Ltd., GDR (Taiwan) | 2.1 | ||||||

| 6. | Sberbank of Russia (Russia) | 1.9 | ||||||

| 7. | Infosys Technologies Ltd., ADR (India) | 1.9 | ||||||

| 8. | Hyundai Motor Co. (South Korea) | 1.8 | ||||||

| 9. | OGX Petroleo e Gas Participacoes S.A. (Brazil) | 1.7 | ||||||

| 10. | Honam Petrochemical Corp. (South Korea) | 1.6 | ||||||

PORTFOLIO COMPOSITION BY COUNTRY*** | ||||

| South Korea | 16.7 | % | ||

| Brazil | 15.9 | |||

| Hong Kong | 10.6 | |||

| Taiwan | 10.2 | |||

| South Africa | 8.1 | |||

| Russia | 7.7 | |||

| China | 6.4 | |||

| Turkey | 5.5 | |||

| India | 5.0 | |||

| Thailand | 4.0 | |||

| Mexico | 3.1 | |||

| Poland | 2.7 | |||

| Egypt | 1.4 | |||

| Canada | 1.1 | |||

| Others (each less than 1.0%) | 1.6 | |||

| * | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments as of October 31, 2010. The Fund’s composition is subject to change. |

| 4 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | OCTOBER 31, 2010 | ||||

Table of Contents

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2010 | ||||||||||||

| INCEPTION DATE OF CLASS | 1 YEAR | SINCE INCEPTION | ||||||||||

CLASS A SHARES | 2/28/08 | |||||||||||

Without Sales Charge | 36.12 | % | (0.43 | )% | ||||||||

With Sales Charge* | 28.97 | (2.41 | ) | |||||||||

CLASS C SHARES | 2/28/08 | |||||||||||

Without CDSC | 35.33 | (0.95 | ) | |||||||||

With CDSC** | 34.33 | (0.95 | ) | |||||||||

CLASS R5 SHARES | 2/28/08 | 36.66 | 0.00 | % | ||||||||

SELECT CLASS SHARES | 2/28/08 | 36.48 | (0.19 | ) | ||||||||

| * | Sales Charge for Class A Shares is 5.25%. |

| ** | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

LIFE OF FUND PERFORMANCE (2/28/08 TO 10/31/10)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on February 28, 2008.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Emerging Economies Fund, the MSCI Emerging Markets Index and the Lipper Emerging Markets Funds Index from February 28, 2008 to October 31, 2010. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and does not include a sales charge. The performance of the MSCI Emerging Markets Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark. The amount reinvested is the entire dividend distributed to individuals resident in the country of the company, but does not include tax credits. The performance of the Lipper Emerging Markets Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market

performance of emerging markets. The Lipper Emerging Markets Funds Index is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the U.S. and other nations. The Fund is also subject to the additional risk of non-diversified “regional” fund investing.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| OCTOBER 31, 2010 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | 5 | ||||||

Table of Contents

JPMorgan Emerging Markets Equity Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2010 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Institutional Class Shares)* | 25.64% | |||

| Morgan Stanley Capital International (“MSCI”) Emerging Markets Index | 23.89% | |||

| Net Assets as of 10/31/2010 (In Thousands) | $ | 1,744,141 | ||

INVESTMENT OBJECTIVE**

The JPMorgan Emerging Markets Equity Fund (the “Fund”) seeks to provide high total return from a portfolio of equity securities from emerging markets issuers.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Institutional Class Shares) outperformed the MSCI Emerging Markets Index (the “Benchmark”) for the twelve months ended October 31, 2010 as the Fund’s stock selection in the financials sector more than offset relative weakness from the Fund’s materials holdings. The Fund’s overweight in the consumer staples sector also contributed to relative performance. In addition, the Fund’s average cash position was relatively high as the Fund experienced significant inflows during the reporting period. This was a modest drag on relative performance as the yields available from cash were low during the reporting period.

Individual contributors to relative performance included Turkiye Garanti Bankasi A.S. and Hyundai Mobis. Shares of Turkiye Garanti Bankasi A.S., a Turkish bank, benefited from improving trends for consumer lending in Turkey. Shares of Hyundai Mobis, a Korea-based auto parts manufacturer, benefited from recovering demand for automobiles. The Fund’s relative performance was also helped by not owning Gazprom OAO, as the Russian energy company was a weak performer in the Benchmark.

Individual detractors from relative performance included Orascom Telecom Holding SAE, Esprit Holdings Ltd. and Petroleo Brasileiro S.A. (“Petrobras”). Shares of Orascom Telecom Holding SAE, an Egyptian-based mobile phone operator, declined amid the overhang of the company’s dispute with the Algerian government. The Algerian government imposed restrictions on the company’s Algerian-based Djezzy unit, hurting the company’s profitability. Shares of Esprit Holdings Ltd., a Hong Kong-based retailer that is not held in the Benchmark, were hurt by the company’s weak earnings results announced in early September 2010, as growth in its Chinese operations was not enough to offset weakness in Europe. Shares of Petrobras declined during the reporting period on concerns regarding the structure of an offering that allowed the Brazilian government to purchase shares of the company.

HOW WAS THE FUND POSITIONED?

The Fund employed an active strategy in which portfolio construction was focused on the highest-conviction ideas found at the stock level, holding an average of 68 stocks during the reporting period. The Fund’s portfolio managers used bottom-up fundamental research to determine the Fund’s security weightings against the Benchmark, rigorously researching companies to determine their underlying value and potential for future earnings growth. As a result of this process, the Fund’s largest overweight was in the consumer staples sector and the Fund’s largest underweight was in the industrials sector. From a country perspective, the Fund’s largest overweight was in India and the Fund’s largest underweight was in Taiwan.

| 6 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | OCTOBER 31, 2010 | ||||

Table of Contents

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | Housing Development Finance Corp., Ltd. (India) | 4.5 | % | |||||

| 2. | Vale S.A., ADR (Preferred Stock) (Brazil) | 4.1 | ||||||

| 3. | China Merchants Bank Co., Ltd., Class H (China) | 3.3 | ||||||

| 4. | Petroleo Brasileiro S.A., ADR (Preferred Stock) (Brazil) | 3.2 | ||||||

| 5. | Turkiye Garanti Bankasi A.S. (Turkey) | 3.2 | ||||||

| 6. | Samsung Electronics Co., Ltd. (South Korea) | 2.5 | ||||||

| 7. | Ping An Insurance Group Co. of China Ltd., Class H (China) | 2.4 | ||||||

| 8. | Sberbank of Russia (Russia) | 2.4 | ||||||

| 9. | Li & Fung Ltd. (Hong Kong) | 2.2 | ||||||

| 10. | Taiwan Semiconductor Manufacturing Co., Ltd., ADR (Taiwan) | 2.2 | ||||||

PORTFOLIO COMPOSITION BY COUNTRY*** | ||||

| Brazil | 15.3 | % | ||

| China | 13.9 | |||

| India | 12.5 | |||

| Hong Kong | 10.1 | |||

| South Korea | 9.0 | |||

| South Africa | 6.4 | |||

| Taiwan | 5.1 | |||

| Mexico | 4.4 | |||

| Russia | 4.0 | |||

| Indonesia | 3.5 | |||

| Turkey | 3.2 | |||

| Luxembourg | 2.1 | |||

| Chile | 1.3 | |||

| Egypt | 1.2 | |||

| United States | 1.1 | |||

| Hungary | 1.1 | |||

| Others (each less than 1.0%) | 0.3 | |||

| Short-Term Investment | 5.5 | |||

| * | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments as of October 31, 2010. The Fund’s composition is subject to change. |

| OCTOBER 31, 2010 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | 7 | ||||||

Table of Contents

JPMorgan Emerging Markets Equity Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2010 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2010 | ||||||||||||||||

| INCEPTION DATE OF CLASS | 1 YEAR | 5 YEAR | 10 YEAR | |||||||||||||

CLASS A SHARES | 9/28/01 | |||||||||||||||

Without Sales Charge | 25.12 | % | 14.57 | % | 14.07 | % | ||||||||||

With Sales Charge* | 18.56 | 13.34 | 13.45 | |||||||||||||

CLASS B SHARES | 9/28/01 | |||||||||||||||

Without CDSC | 24.49 | 14.03 | 13.65 | |||||||||||||

With CDSC** | 19.49 | 13.79 | 13.65 | |||||||||||||

CLASS C SHARES | 2/28/06 | |||||||||||||||

Without CDSC | 24.49 | 14.01 | 13.58 | |||||||||||||

With CDSC*** | 23.49 | 14.01 | 13.58 | |||||||||||||

INSTITUTIONAL CLASS SHARES | 11/15/93 | 25.64 | 15.06 | 14.61 | ||||||||||||

SELECT CLASS SHARES | 9/10/01 | 25.48 | 14.86 | 14.33 | ||||||||||||

| * | Sales Charge for Class A Shares is 5.25%. |

| ** | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

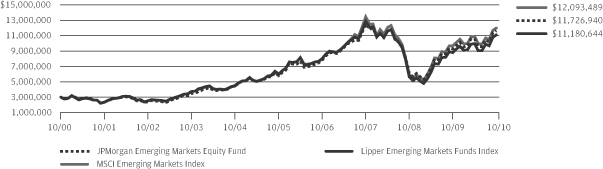

TEN YEAR PERFORMANCE (10/31/00 TO 10/31/10)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Prior to September 7, 2001, the Fund operated in a master feeder structure. The returns for the Institutional Class Shares prior to September 7, 2001 reflect the performance of the institutional feeder of the Emerging Markets Equity Portfolio, whose historical expenses were substantially similar to those of the Institutional Class Shares. The returns for the Select Class Shares before they were launched on September 10, 2001 reflect the performance of the retail feeder. The historical expenses of the retail feeder are substantially similar to those of the Select Class Shares.

Returns for Class A and Class B Shares prior to their inception date are based on the performance of the Select Class Shares. The actual returns for Class A and Class B Shares would have been lower than shown because Class A and Class B Shares have higher expenses than Select Class Shares.

Returns for Class C Shares prior to their inception date are based on the performance of Class B Shares. The actual returns of Class C Shares would have been similar to those shown because Class C Shares have expenses similar to those of Class B Shares.

The graph illustrates comparative performance for $3,000,000 invested in Institutional Class Shares of the JPMorgan Emerging Markets Equity Fund, the MSCI Emerging Markets Index and the Lipper Emerging Markets Funds Index from October 31, 2000 to October 31, 2010. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and does not include a sales charge. The performance of the MSCI Emerging Markets Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the maximum possible dividend reinvestment of the securities included in the benchmark. The amount reinvested is the entire dividend

distributed to individuals resident in the country of the company, but does not include tax credits. The performance of the Lipper Emerging Markets Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of emerging markets. The Lipper Emerging Markets Funds Index is an index based on the total returns of the funds in the indicated category, as defined by Lipper, Inc. Investors cannot invest directly in an index.

Institutional Class Shares have a $3,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

Because Class B shares automatically convert to Class A shares after 8 years, the 10 Year average annual total return shown above for Class B reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| 8 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | OCTOBER 31, 2010 | ||||

Table of Contents

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2010 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Select Class Shares)* | 22.57% | |||

| Morgan Stanley Capital International (“MSCI”) World Index | 13.32% | |||

| Net Assets as of 10/31/2010 (In Thousands) | $3,143 | |||

INVESTMENT OBJECTIVE**

The JPMorgan Global Focus Fund (the “Fund”) seeks to provide long term capital growth by investing in a portfolio of equity securities in developed and emerging markets.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Select Class Shares) outperformed the MSCI World Index (the “Benchmark”) for the twelve months ended October 31, 2010. The Fund’s stock selection in the autos and energy sectors contributed to relative performance while the Fund’s holdings in the healthcare and retail sectors detracted from relative performance.

Individual contributors to relative performance included the Fund’s overweight positions in German-based Lanxess AG and France-based Rhodia S.A., specialty chemical providers not held in the Benchmark. Both companies’ earnings received a boost from their managements’ disciplined cost-cutting measures and recovering demand in their end markets.

Another contributor to relative performance was the Fund’s overweight position in InterOil Corp., an integrated energy company operating in Papua New Guinea that was not held in the Benchmark. The stock rose as the company’s projects started to come on-line and generate revenues.

On the negative side, the Fund’s overweight positions in Greece-based Sidenor Steel Products Manufacturing Co. S.A. and EFG Eurobank Ergasias S.A. hurt relative performance. These stocks declined with other Greek stocks as the country’s debt crisis escalated.

Another individual detractor was the Fund’s overweight position in Austrian biotech company Intercell AG. Intercell AG’s management warned that the company may post a loss for 2010, due in part, to ongoing research and development costs.

HOW THE FUND WAS MANAGED

The Fund’s portfolio managers employed a bottom-up fundamental approach to stock selection, rigorously researching companies to determine their underlying value and potential for future growth. The Fund’s portfolio managers looked for stocks that possessed an attractive valuation signal (as measured by the Fund’s portfolio managers’ proprietary dividend discount model), high significant profit growth potential and a timely catalyst that would enable the stock to realize its inherent value. The Fund was largely unconstrained with regards to sector, regional and market-cap distribution.

In addition, the Fund employed currency forwards to bring the Fund’s currency exposure closer in line with the U.S. dollar denominated Benchmark.

| OCTOBER 31, 2010 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | 9 | ||||||

Table of Contents

JPMorgan Global Focus Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2010 (Unaudited) (continued)

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | Lanxess AG (Germany) | 4.3 | % | |||||

| 2. | Rhodia S.A. (France) | 3.4 | ||||||

| 3. | Telefonica S.A. (Spain) | 2.5 | ||||||

| 4. | Intercontinental Hotels Group plc (United Kingdom) | 2.2 | ||||||

| 5. | InterOil Corp. (Australia) | 2.2 | ||||||

| 6. | McDonald’s Corp. (United States) | 2.1 | ||||||

| 7. | Telekomunikasi Indonesia Tbk PT (Indonesia) | 1.9 | ||||||

| 8. | Nokian Renkaat OYJ (Finland) | 1.8 | ||||||

| 9. | Koninklijke KPN N.V. (Netherlands) | 1.8 | ||||||

| 10. | Kubota Corp. (Japan) | 1.8 | ||||||

PORTFOLIO COMPOSITION BY COUNTRY*** | ||||

| United States | 22.4 | % | ||

| United Kingdom | 14.1 | |||

| Japan | 10.4 | |||

| Germany | 7.4 | |||

| France | 6.5 | |||

| Hong Kong | 4.5 | |||

| Netherlands | 4.0 | |||

| Australia | 3.2 | |||

| Indonesia | 2.8 | |||

| Spain | 2.5 | |||

| Austria | 2.2 | |||

| Norway | 2.2 | |||

| China | 2.0 | |||

| Denmark | 2.0 | |||

| Finland | 1.8 | |||

| Canada | 1.7 | |||

| Switzerland | 1.5 | |||

| Italy | 1.3 | |||

| Brazil | 1.3 | |||

| Taiwan | 1.2 | |||

| Ireland | 1.1 | |||

| South Africa | 1.0 | |||

| Belgium | 1.0 | |||

| Others (each less than 1.0%) | 1.9 | |||

| * | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments as of October 31, 2010. The Fund’s composition is subject to change. |

| 10 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | OCTOBER 31, 2010 | ||||

Table of Contents

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2010 | ||||||||||||||||

| INCEPTION DATE OF CLASS | 1 YEAR | 3 YEAR | SINCE INCEPTION | |||||||||||||

CLASS A SHARES | 3/30/07 | |||||||||||||||

Without Sales Charge | 22.26 | % | (3.69 | )% | (0.38 | )% | ||||||||||

With Sales Charge* | 15.86 | (5.41 | ) | (1.87 | ) | |||||||||||

CLASS C SHARES | 3/30/07 | |||||||||||||||

Without CDSC | 21.59 | (4.19 | ) | (0.89 | ) | |||||||||||

With CDSC** | 20.59 | (4.19 | ) | (0.89 | ) | |||||||||||

CLASS R5 SHARES | 3/30/07 | 22.75 | (3.27 | ) | 0.06 | |||||||||||

SELECT CLASS SHARES | 3/30/07 | 22.57 | (3.45 | ) | (0.13 | ) | ||||||||||

| * | Sales Charge for Class A Shares is 5.25%. |

| ** | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

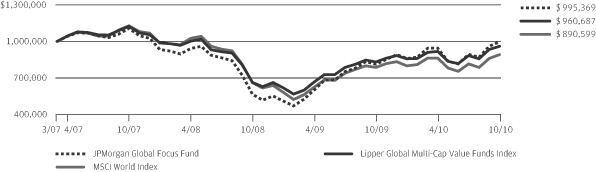

LIFE OF FUND PERFORMANCE (3/30/07 TO 10/31/10)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

The Fund commenced operations on March 30, 2007.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Global Focus Fund, the MSCI World Index and the Lipper Global Multi-Cap Value Funds Index from March 30, 2007 to October 31, 2010. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and does not include a sales charge. The performance of the MSCI World Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark. The dividend is reinvested after deduction of withholding tax, applying the maximum rate to non-resident institutional investors who do not benefit from double taxation treaties. The performance of the Lipper Global Multi-Cap Value Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The Lipper Global Multi-Cap Value

Funds is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

From the inception of the Fund through April 30, 2010, the Fund did not experience any shareholder purchase and sale activity. If such shareholder activity had occurred, the Fund’s performance may have been impacted.

Select Class Shares have a $1,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| OCTOBER 31, 2010 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | 11 | ||||||

Table of Contents

JPMorgan International Equity Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2010 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Select Class Shares)* | 10.72% | |||

| Morgan Stanley Capital International (“MSCI”) EAFE Index | 8.36% | |||

| Net Assets as of 10/31/2010 (In Thousands) | $ | 642,362 | ||

INVESTMENT OBJECTIVE**

The JPMorgan International Equity Fund (the “Fund”) seeks total return from long-term capital growth and income. Total return consists of capital growth and current income.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Select Class Shares) outperformed the MSCI EAFE Index (the “Benchmark”) for the twelve months ended October 31, 2010 as positive stock selection in the consumer discretionary sector more than offset negative stock selection in the energy sector.

Individual contributors to relative performance included Symrise AG and Burberry Group plc. Burberry Group plc, a luxury retail company, and Symrise AG, a Germany-based manufacturer of fragrances used in perfumes, both benefited from recovering demand, particularly among higher-end consumers. Other individual contributors included Volkswagen AG, as the success of the car manufacturer’s Audi brand, its strong presence in China and recovering global demand for autos fueled its strong earnings growth for the first nine months of the year, overshadowing concerns about the company’s pending merger with Porsche.

Individual detractors from relative performance included Lafarge S.A., Piraeus Bank S.A. and Esprit Holdings Ltd. Lafarge S.A., a France-based building materials company, was hurt by continued weakness in European construction activity. Piraeus Bank S.A. is a Greece-based financial and banking services group. The stock declined amid concerns about Greece’s debt crisis. Esprit Holdings Ltd., a Hong Kong-based fashion retailer that derived most of its earnings from Europe, was hurt as the fiscal crisis in Europe dampened regional demand and undermined the value of European currencies.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers continued to focus on stock selection to build a diversified portfolio of international equities. The Fund’s portfolio managers employed rigorous, bottom-up fundamental research in an effort to identify quality companies that were well-managed, had solid financial positions, possessed sustainable earnings that were growing faster than that of their peers yet whose stocks were trading below or at par with the market.

| 12 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | OCTOBER 31, 2010 | ||||

Table of Contents

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | Vodafone Group plc (United Kingdom) | 2.5 | % | |||||

| 2. | Royal Dutch Shell plc, Class A (Netherlands) | 2.5 | ||||||

| 3. | Total S.A. (France) | 2.3 | ||||||

| 4. | BHP Billiton Ltd. (Australia) | 2.3 | ||||||

| 5. | Nestle S.A. (Switzerland) | 2.1 | ||||||

| 6. | HSBC Holdings plc (United Kingdom) | 2.1 | ||||||

| 7. | Honda Motor Co., Ltd. (Japan) | 1.9 | ||||||

| 8. | BG Group plc (United Kingdom) | 1.8 | ||||||

| 9. | Telefonica S.A. (Spain) | 1.8 | ||||||

| 10. | Novartis AG (Switzerland) | 1.8 | ||||||

PORTFOLIO COMPOSITION BY COUNTRY*** | ||||

| United Kingdom | 23.2 | % | ||

| Japan | 16.3 | |||

| France | 14.0 | |||

| Switzerland | 10.9 | |||

| Germany | 8.0 | |||

| Netherlands | 5.4 | |||

| Spain | 3.6 | |||

| Hong Kong | 3.3 | |||

| Australia | 3.2 | |||

| China | 1.7 | |||

| Brazil | 1.6 | |||

| Ireland | 1.5 | |||

| Italy | 1.5 | |||

| Belgium | 1.0 | |||

| Others (each less than 1.0%) | 3.9 | |||

| Short-Term Investment | 0.9 | |||

| * | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments (excluding Investments of Cash Collateral for Securities on Loan) as of October 31, 2010. The Fund’s composition is subject to change. |

| OCTOBER 31, 2010 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | 13 | ||||||

Table of Contents

JPMorgan International Equity Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2010 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2010 | ||||||||||||||||

| INCEPTION DATE OF CLASS | 1 YEAR | 5 YEAR | 10 YEAR | |||||||||||||

CLASS A SHARES | 2/28/02 | |||||||||||||||

Without Sales Charge | 10.33 | % | 3.45 | % | 3.39 | % | ||||||||||

With Sales Charge* | 4.57 | 2.34 | 2.84 | |||||||||||||

CLASS B SHARES | 2/28/02 | |||||||||||||||

Without CDSC | 9.82 | 2.87 | 2.94 | |||||||||||||

With CDSC** | 4.82 | 2.51 | 2.94 | |||||||||||||

CLASS C SHARES | 1/31/03 | |||||||||||||||

Without CDSC | 9.69 | 2.87 | 2.90 | |||||||||||||

With CDSC*** | 8.69 | 2.87 | 2.90 | |||||||||||||

CLASS R2 SHARES | 11/3/08 | 10.07 | 3.33 | 3.33 | ||||||||||||

CLASS R5 SHARES | 5/15/06 | 10.86 | 3.88 | 3.75 | ||||||||||||

SELECT CLASS SHARES | 1/1/97 | 10.72 | 3.72 | 3.67 | ||||||||||||

| * | Sales Charge for Class A Shares is 5.25%. |

| ** | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

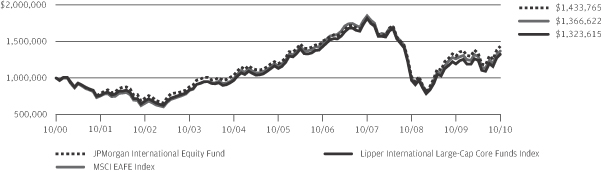

TEN YEAR PERFORMANCE (10/31/00 TO 10/31/10)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class A, Class B and Class R5 Shares prior to their inception dates are based on the performance of the Select Class Shares. The actual returns for Class A and Class B Shares would have been lower than shown because Class A and Class B Shares have higher expenses than Select Class Shares. The actual returns of Class R5 Shares would have been different because Class R5 Shares have different expenses than Select Class Shares.

Returns for Class R2 Shares prior to their inception date are based on the performance of Class A Shares. The actual returns of R2 Shares would have been lower than shown because R2 Shares have higher expenses than Class A Shares.

Returns for Class C Shares prior to their inception date are based on the performance of Class B Shares. The actual returns of Class C Shares would have been similar to those shown because Class C Shares have expenses similar to those of Class B Shares.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan International Equity Fund, the MSCI EAFE Index and the Lipper International Large-Cap Core Funds Index from October 31, 2000 to October 31, 2010. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and does not include a sales charge. The performance of the MSCI EAFE Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark. The dividend is reinvested after deduction of withholding tax, applying the maximum rate to non-resident institutional investors who do not benefit from double taxation treaties. The performance of the Lipper International Large-Cap Core Funds Index

includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The MSCI EAFE Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The Lipper International Large-Cap Core Funds Index is based on the total returns of the funds in the indicated category, as defined by Lipper, Inc. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

Because Class B Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class B reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| 14 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | OCTOBER 31, 2010 | ||||

Table of Contents

JPMorgan International Equity Index Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2010 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Select Class Shares)* | 8.42% | |||

| Morgan Stanley Capital International (“MSCI”) EAFE GDP Index | 5.66% | |||

| Net Assets as of 10/31/2010 (In Thousands) | $ | 665,617 | ||

INVESTMENT OBJECTIVE**

The JPMorgan International Equity Index Fund (the “Fund”) seeks to provide investment results that correspond to the aggregate price and dividend performance of the securities in the MSCI EAFE Gross Domestic Product (GDP) (the “Benchmark”).

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Select Class Shares) outperformed the Benchmark for the twelve months ended October 31, 2010. The Fund’s strategy is not a full replication approach. The Fund seeks to achieve a correlation of 0.90 with the Benchmark. Perfect correlation would be 1.00. The tracking error (a measure of how closely a portfolio follows the index to which it is benchmarked) of this strategy can be attributed to not owning all the names in the Benchmark and the Fund’s exposure to emerging markets stocks, which are not held in the Benchmark. The Fund’s exposure to emerging market stocks, which performed strongly during the reporting period, caused the Fund to outperform the Benchmark during the reporting period.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers constructed the Fund as a fundamental index strategy, with country weightings based on

gross domestic product (“GDP”) rather than traditional market capitalization. Each country was weighted by GDP, because the Fund’s portfolio managers believed that this measure served as a better indication of each country’s potential earning power than traditional market capitalization.

The Fund was well diversified throughout the reporting period, with approximately 1,000 developed country stocks and 150 emerging country stocks. On average, the Fund had the following weights within the major regions during the reporting period: Europe and Middle East ex-U.K., 55.4%; Japan, 18.0%; the United Kingdom, 9.4%; and Pacific ex-Japan, 6.4%.

The Fund’s emerging markets exposure had an average weighting of 8.6% during the reporting period. The Fund’s emerging markets exposure was constructed so that countries were about equally weighted, with periodic rebalancing to return to this weighting.

During the reporting period, the Fund’s portfolio managers used a combination of exchange-traded funds and futures to help manage cash flows. The Fund continued to closely track the Benchmark, consistent with its investment strategy, and attempted to provide broad passive international exposure for U.S. investors.

| OCTOBER 31, 2010 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | 15 | ||||||

Table of Contents

JPMorgan International Equity Index Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2010 (Unaudited) (continued)

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | iShares MSCI EAFE Index Fund | 1.8 | % | |||||

| 2. | Telefonica S.A. (Spain) | 1.7 | ||||||

| 3. | Banco Santander S.A. (Spain) | 1.6 | ||||||

| 4. | ENI S.p.A. (Italy) | 1.5 | ||||||

| 5. | Siemens AG (Germany) | 1.5 | ||||||

| 6. | Total S.A. (France) | 1.1 | ||||||

| 7. | BASF SE (Germany) | 1.1 | ||||||

| 8. | Enel S.p.A. (Italy) | 1.0 | ||||||

| 9. | Bayer AG (Germany) | 1.0 | ||||||

| 10. | Daimler AG (Germany) | 0.9 | ||||||

PORTFOLIO COMPOSITION BY COUNTRY*** | ||||

| Japan | 17.5 | % | ||

| Germany | 13.6 | |||

| France | 10.4 | |||

| Italy | 8.1 | |||

| United Kingdom | 7.5 | |||

| Spain | 6.3 | |||

| Australia | 4.0 | |||

| Netherlands | 3.9 | |||

| Switzerland | 2.1 | |||

| United States | 2.0 | |||

| Belgium | 1.9 | |||

| Sweden | 1.7 | |||

| Austria | 1.6 | |||

| Norway | 1.4 | |||

| Denmark | 1.2 | |||

| Greece | 1.0 | |||

| Hong Kong | 1.0 | |||

| Others (each less than 1.0%) | 14.8 | |||

| * | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments (excluding Investments of Cash Collateral for Securities on Loan) as of October 31, 2010. The Fund’s composition is subject to change. |

| 16 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | OCTOBER 31, 2010 | ||||

Table of Contents

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2010 | ||||||||||||||||

| INCEPTION DATE OF CLASS | 1 YEAR | 5 YEAR | 10 YEAR | |||||||||||||

CLASS A SHARES | 4/23/93 | |||||||||||||||

Without Sales Charge | 8.09 | % | 3.56 | % | 3.29 | % | ||||||||||

With Sales Charge* | 2.42 | 2.46 | 2.73 | |||||||||||||

CLASS B SHARES | 1/14/94 | |||||||||||||||

Without CDSC | 7.32 | 2.82 | 2.71 | |||||||||||||

With CDSC** | 2.32 | 2.46 | 2.71 | |||||||||||||

CLASS C SHARES | 11/4/97 | |||||||||||||||

Without CDSC | 7.40 | 2.84 | 2.56 | |||||||||||||

With CDSC*** | 6.40 | 2.84 | 2.56 | |||||||||||||

CLASS R2 SHARES | 11/3/08 | 7.88 | 3.30 | 3.04 | ||||||||||||

SELECT CLASS SHARES | 10/28/92 | 8.42 | 3.83 | 3.57 | ||||||||||||

| * | Sales Charge for Class A Shares is 5.25%. |

| ** | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

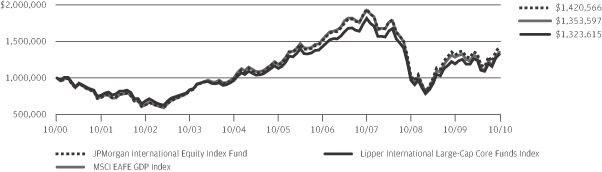

TEN YEAR PERFORMANCE (10/31/00 TO 10/31/10)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R2 Shares prior to their inception date are based on the performance of the Select Class Shares. Class R2 Shares performance has been adjusted to reflect the difference in expenses between classes.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan International Equity Index Fund, the MSCI EAFE GDP Index, Lipper International Large-Cap Core Funds Index and the Lipper International Multi-Cap Core Funds Index from October 31, 2000 to October 31, 2010. Effective October 7, 2009, the Fund’s Lipper category was changed to the Lipper International Large-Cap Core Funds Index. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and does not include a sales charge. The performance of the MSCI EAFE GDP Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark. The dividend is reinvested after deduction of withholding tax, applying the maximum rate to non-resident institutional investors who do not benefit from double taxation treaties. The performance of the Lipper International Large-Cap Core Funds Index and Lipper International Multi-Cap Core Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the

expenses charged by the Fund. The MSCI EAFE GDP Index is a country weighted

index that is designed to measure the size of developed market economies, excluding the U.S. & Canada. The Lipper International Large-Cap Core Funds Index and Lipper International Multi-Cap Core Funds Index are indexes based on the total returns of the funds in the indicated category as defined by Lipper, Inc. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside of the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

Because Class B Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class B reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| OCTOBER 31, 2010 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | 17 | ||||||

Table of Contents

JPMorgan International Opportunities Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2010 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Institutional Class Shares)* | 12.12% | |||

| Morgan Stanley Capital International (“MSCI”) EAFE Index | 8.36% | |||

| Net Assets as of 10/31/2010 (In Thousands) | $ | 318,726 | ||

INVESTMENT OBJECTIVE**

The JPMorgan International Opportunities Fund (the “Fund”) seeks to provide high total return from a portfolio of equity securities of foreign companies in developed and, to a lesser extent, emerging markets.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Institutional Class Shares) outperformed the MSCI EAFE Index (the “Benchmark”) for the twelve months ended October 31, 2010 as positive stock selection in the energy and utilities sectors more than compensated for the Fund’s negative stock selection and underweight positions in the outperforming retail and basic industries sectors.

Individual contributors to relative performance included the Fund’s overweight position in German-based Lanxess AG, a specialty chemical provider not held in the Benchmark. The company’s earnings received a boost from its management’s disciplined cost-cutting measures, recovering demand in the developed world, a growing presence in emerging markets and rising demand for synthetic rubber. Other individual contributors included the Fund’s overweight position in Volkswagen AG, as the success of the car manufacturer’s Audi brand, its strong presence in China and recovering global demand for autos fueled its strong earnings growth for the first nine months of the year, overshadowing concerns about the company’s pending merger with Porsche. In addition, the Fund bought shares of integrated energy company BP plc after the company’s oil spill in the Gulf of Mexico had taken its toll on the stock. The Fund benefited as the stock rebounded off its lows.

Individual detractors from relative performance included the Fund’s overweight positions in Lafarge S.A. and China Resources Land Ltd. Lafarge S.A., a France-based building materials company, was hurt by continued weakness in European construction activity. China Resources Land Ltd. is a real estate development company. Property stocks in the greater China region declined broadly on investor concerns about the Chinese government’s efforts to cool its surging property market, such as raising the installment requirement for second-home purchases and raising the mortgage rates applied to these purchases.

Another individual detractor was the Fund’s overweight position in Austrian biotech company Intercell AG. Management warned that the company may post a loss for 2010, due in part, to ongoing research and development costs.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers employed a bottom-up fundamental approach to stock selection, rigorously researching companies to determine their underlying value and potential for future earnings growth. They used a proprietary dividend discount model and worked closely with analysts to identify the most attractive stocks in each sector.

In addition, the Fund employed futures and currency forwards to help manage cash flows and bring the Fund’s currency exposure closer in line with the U.S. dollar denominated Benchmark.

| 18 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | OCTOBER 31, 2010 | ||||

Table of Contents

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | Royal Dutch Shell plc, Class A (Netherlands) | 3.2 | % | |||||

| 2. | Vodafone Group plc (United Kingdom) | 2.2 | ||||||

| 3. | Telefonica S.A. (Spain) | 2.2 | ||||||

| 4. | Siemens AG (Germany) | 1.9 | ||||||

| 5. | Nissan Motor Co., Ltd. (Japan) | 1.7 | ||||||

| 6. | HSBC Holdings plc (United Kingdom) | 1.7 | ||||||

| 7. | Sanofi-Aventis S.A. (France) | 1.7 | ||||||

| 8. | Mitsubishi Electric Corp. (Japan) | 1.7 | ||||||

| 9. | Unilever N.V. CVA (Netherlands) | 1.6 | ||||||

| 10. | GlaxoSmithKline plc (United Kingdom) | 1.6 | ||||||

PORTFOLIO COMPOSITION BY COUNTRY*** | ||||

| United Kingdom | 22.7 | % | ||

| Japan | 17.6 | |||

| France | 10.9 | |||

| Netherlands | 9.1 | |||

| Germany | 7.8 | |||

| Hong Kong | 4.8 | |||

| Spain | 3.1 | |||

| Switzerland | 2.4 | |||

| Australia | 2.2 | |||

| Taiwan | 2.0 | |||

| Ireland | 1.7 | |||

| Canada | 1.6 | |||

| Luxembourg | 1.4 | |||

| China | 1.3 | |||

| Italy | 1.2 | |||

| Norway | 1.0 | |||

| Austria | 1.0 | |||

| Indonesia | 1.0 | |||

| Others (each less than 1.0%) | 4.6 | |||

| Short-Term Investment | 2.6 | |||

| * | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments (excluding Investments of Cash Collateral for Securities on Loan) as of October 31, 2010. The Fund’s composition is subject to change. |

| OCTOBER 31, 2010 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | 19 | ||||||

Table of Contents

JPMorgan International Opportunities Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2010 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2010 | ||||||||||||||||

| INCEPTION DATE OF CLASS | 1 YEAR | 5 YEAR | 10 YEAR | |||||||||||||

CLASS A SHARES | 9/10/01 | |||||||||||||||

Without Sales Charge | 11.67 | % | 4.33 | % | 2.48 | % | ||||||||||

With Sales Charge* | 5.81 | 3.22 | 1.94 | |||||||||||||

CLASS B SHARES | 9/10/01 | |||||||||||||||

Without CDSC | 11.01 | 3.79 | 2.08 | |||||||||||||

With CDSC** | 6.01 | 3.44 | 2.08 | |||||||||||||

CLASS C SHARES | 7/31/07 | |||||||||||||||

Without CDSC | 11.05 | 3.79 | 2.02 | |||||||||||||

With CDSC*** | 10.05 | 3.79 | 2.02 | |||||||||||||

INSTITUTIONAL CLASS SHARES | 2/26/97 | 12.12 | 4.81 | 3.19 | ||||||||||||

SELECT CLASS SHARES | 9/10/01 | 11.93 | 4.59 | 2.90 | ||||||||||||

| * | Sales Charge for Class A Shares is 5.25%. |

| ** | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

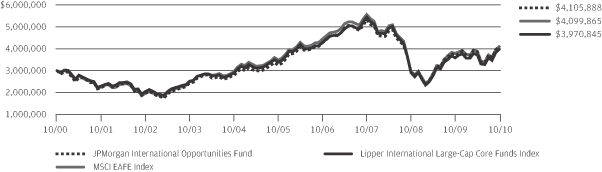

TEN YEAR PERFORMANCE (10/31/00 TO 10/31/10)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Prior to September 7, 2001 operated in a master feeder structure. The returns for the Institutional Class Shares prior to September 7, 2001 reflect the performance of the institutional feeder of the International Opportunities Portfolio, whose historical expenses were substantially similar to those of the Institutional Class Shares. The returns for the Select Class Shares before they were launched on September 10, 2001 reflect the performance of the retail feeder. The historical expenses of the retail feeder are substantially similar to those of the Select Class Shares.

Returns for Class A and Class B Shares prior to their inception date are based on the performance of the Institutional Class Shares. The actual returns for Class A and Class B Shares would have been lower than shown because Class A and Class B Shares have higher expenses than Institutional Class Shares.

Returns for Class C Shares prior to their inception date are based on the performance of Class B Shares. The actual returns of Class C Shares would have been similar to those shown because Class C Shares have expenses similar to those of Class B Shares.

The graph illustrates comparative performance for $3,000,000 invested in Institutional Class Shares of the JPMorgan International Opportunities Fund, the MSCI EAFE Index and the Lipper International Large-Cap Core Funds Index from October 31, 2000 to October 31, 2010. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and does not include a sales charge. The performance of the MSCI EAFE Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark. The dividend is reinvested after deduction of withholding tax, applying

the maximum rate to non-resident institutional investors who do not benefit from double taxation treaties. The performance of the Lipper International Large-Cap Core Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The MSCI EAFE Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The Lipper International Large-Cap Core Funds Index is based on the total returns of the funds in the indicated category, as defined by Lipper, Inc. Investors cannot invest directly in an index.

Institutional Class Shares have a $3,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

Because Class B shares automatically convert to Class A shares after 8 years, the 10 Year average annual total return shown above for Class B reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| 20 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | OCTOBER 31, 2010 | ||||

Table of Contents

JPMorgan International Value Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2010 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Institutional Class Shares)* | 11.79% | |||

| Morgan Stanley Capital International (“MSCI”) EAFE Value Index | 4.63% | |||

| Net Assets as of 10/31/2010 (In Thousands) | $ | 1,534,634 | ||

INVESTMENT OBJECTIVE**

The JPMorgan International Value Fund (the “Fund”) seeks to provide high total return from a portfolio of foreign company equity securities.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Institutional Class Shares) outperformed the MSCI EAFE Value Index (the “Benchmark”) for the twelve months ended October 31, 2010 as positive stock selection in the autos, energy and utilities sectors more than offset negative stock selection in the consumer nondurable sector and the Fund’s underweight positions in the outperforming retail and property sectors.

Individual contributors to relative performance included the Fund’s overweight positions in German-based Lanxess AG and France-based Rhodia S.A., specialty chemical providers not held in the Benchmark. Both companies’ earnings received a boost from their managements’ disciplined cost-cutting measures and recovering demand in their end markets.

Another contributor to relative performance was the Fund’s overweight position in Cairn Energy plc., an independent oil and gas exploration and production company not held in the Benchmark. The stock rose as the company ramped up

production following the completion of its pipeline project. In addition, Vedanta Resources plc announced plans to buy a controlling stake in Cairn Energy plc.’s Indian operations.

Individual detractors included the Fund’s overweight position in Lafarge S.A., a France-based building materials company that was hurt by continued weakness in European construction activity. Not owning chemical company BASF SE detracted from the Fund’s relative performance as the stock was a strong performer in the Benchmark. The Fund’s overweight position in Koninklijke Philips Electronics N.V., a provider of consumer electronics, lighting and medical equipment, also detracted from relative performance as its revenues and earnings failed to exceed the market’s estimates.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers employed a bottom-up fundamental approach to stock selection, rigorously researching companies to determine their underlying value and potential for future earnings growth. They used a proprietary dividend discount model and worked closely with analysts to identify the most attractive value stocks in each sector.

In addition, the Fund employed futures and currency forwards to help manage cash flows and bring the Fund’s currency exposure closer in line with the U.S. dollar denominated Benchmark.

| OCTOBER 31, 2010 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | 21 | ||||||

Table of Contents

JPMorgan International Value Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2010 (Unaudited) (continued)

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | Royal Dutch Shell plc, Class A (Netherlands) | 4.3 | % | |||||

| 2. | HSBC Holdings plc (United Kingdom) | 3.2 | ||||||

| 3. | Vodafone Group plc (United Kingdom) | 3.0 | ||||||

| 4. | Telefonica S.A. (Spain) | 2.8 | ||||||

| 5. | GDF Suez (France) | 2.7 | ||||||

| 6. | Sanofi-Aventis S.A. (France) | 2.5 | ||||||

| 7. | BP plc (United Kingdom) | 2.2 | ||||||

| 8. | Bayer AG (Germany) | 1.9 | ||||||

| 9. | BNP Paribas (France) | 1.8 | ||||||

| 10. | Allianz SE (Germany) | 1.8 | ||||||

PORTFOLIO COMPOSITION BY COUNTRY*** | ||||

| United Kingdom | 20.9 | % | ||

| Japan | 16.9 | |||

| France | 13.5 | |||

| Germany | 10.0 | |||

| Netherlands | 9.6 | |||

| Spain | 4.1 | |||

| Hong Kong | 2.8 | |||

| Switzerland | 2.4 | |||

| Norway | 2.4 | |||

| Australia | 1.3 | |||

| Finland | 1.2 | |||

| Canada | 1.2 | |||

| Portugal | 1.2 | |||

| Belgium | 1.2 | |||

| Italy | 1.0 | |||

| China | 1.0 | |||

| Others (each less than 1.0%) | 6.7 | |||

| Short-Term Investment | 2.6 | |||

| * | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments (excluding Investments of Cash Collateral for Securities on Loan) as of October 31, 2010. The Fund’s composition is subject to change. |

| 22 | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | OCTOBER 31, 2010 | ||||

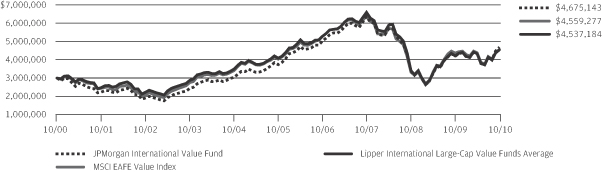

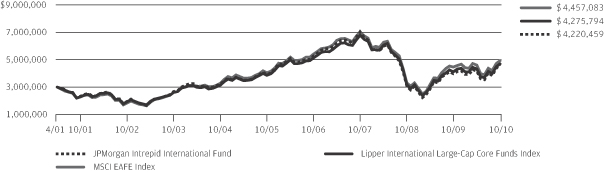

Table of Contents