Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04236

JPMorgan Trust II

(Exact name of registrant as specified in charter)

270 Park Avenue

New York, NY 10017

(Address of principal executive offices) (Zip code)

Frank J. Nasta

270 Park Avenue

New York, NY 10017

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: June 30

Date of reporting period: July 1, 2010 through June 30, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Table of Contents

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Table of Contents

Annual Report

J.P. Morgan Small Cap Funds

June 30, 2011

JPMorgan Dynamic Small Cap Growth Fund

JPMorgan Small Cap Core Fund

JPMorgan Small Cap Equity Fund

JPMorgan Small Cap Growth Fund

JPMorgan Small Cap Value Fund

JPMorgan U.S. Small Company Fund

Table of Contents

Investments in a Fund are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee for future performance. The general market views expressed in this report are opinions based on conditions through the end of the reporting period and are subject to change without notice based on market and other conditions. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Funds’ prospectus for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Funds Service Center at (800)-480-4111 for a prospectus containing more complete information about a Fund including management fees and other expenses. Please read it carefully before investing.

Table of Contents

AUGUST 8, 2011 (Unaudited)

Dear Shareholder:

Last summer, investors’ optimism about the markets was tempered by a wave of both discouraging U.S. economic data and sovereign debt issues in Europe, which led to a market correction.

|

“Earlier this year, we reminded investors about the likelihood of setbacks on the road out of the economic doldrums. Meanwhile, the tragic earthquake in Japan and political unrest in the Middle East are examples of how sensitive the markets and economy can be to geopolitical shocks and other global crises. “ |

As we enter the second half of 2011, concerns about softening U.S. economic data persist. While we are encouraged that corporate earnings and profits have continued to grow consistently, spending levels in many areas of the economy remain critically low, which has resulted in tight inventories and pent-up consumer demand. Meanwhile, investors still lack confidence in the ability of the European governments to combat the region’s debt crisis. Concerns about the credit downgrade of U.S.-issued debt exacerbated this negative sentiment among investors and helped trigger the recent downturn, as August 8, 2011 saw each of the three major U.S. stock indices experience their worst one-day performance since December 1, 2008. The current slowdown in growth should not be viewed as a surprise. Earlier this year, we reminded investors about the likelihood of setbacks on the road out of the economic doldrums. Meanwhile, the tragic earthquake in Japan and political unrest in the Middle East are examples of how sensitive the markets and economy can be to geopolitical shocks and other global crises.

Monetary stimulus and corporate profits move stocks higher

Despite periods of volatility, monetary and fiscal stimulus and strong corporate profits lifted stocks higher over the past year. As of the end of the 12-month reporting period ended June 30, 2011, the S&P 500 Index was at a level of 1,321, an increase of 30.7% from 12 months earlier.

Small cap growth stocks led all style categories for the 12-month reporting period, with the Russell 2000 Growth Index returning 43.5%. For the same period, the Russell Midcap Growth Index returned 43.3%, compared to 35.0% for the Russell 1000 Growth Index. In the value category, the Russell

Midcap Value Index returned 34.3%, outperforming both the Russell 2000 Value Index, which returned 31.4%, and the Russell 1000 Value index, which returned 28.9%.

Most U.S. Treasury yields rise amid softer economic data

In the U.S. bond markets, yields were generally volatile, but longer-term Treasury yields generally rose, while shorter-term yields declined as economic expectations weakened. The yield on the 10-year U.S. Treasury bond rose from 3.0% to 3.2% as of the end of the 12-month reporting period ended June 30, 2011, while yields on the 30-year U.S. Treasury bond increased from 3.9% to 4.4%. Yields on the 2-year U.S. Treasury bond dropped from 0.6% to 0.5% as of the end of the same period.

Is the economic soft patch temporary?

As we enter the second half of 2011, the markets have clearly entered a period of uncertainty. Stocks have been volatile in response to weaker economic growth, as well as concerns over the European sovereign debt crisis, the credit downgrade of U.S.-issued debt, policy tightening in China, and the conclusion of the second round of quantitative easing (QE2) in the U.S. Given these events, it’s not surprising that investors remain largely risk averse, and less than confident about prospects for future growth.

Despite the slowdown and uncertain political environment, however, we do believe that some aspects of our markets and economy—including strong corporate balance sheets and valuations—present potential opportunities for investors. As always, we advise investors to be mindful of continued volatility and other unexpected risks by maintaining a diversified and balanced approach to investing.

On behalf of everyone at J.P. Morgan Asset Management, thank you for your continued support. We look forward to managing your investment needs for years to come. Should you have any questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

George C.W. Gatch

CEO, Investment Management Americas

J.P. Morgan Asset Management

| JUNE 30, 2011 | J.P. MORGAN SMALL CAP FUNDS | 1 | ||||||

Table of Contents

MARKET OVERVIEW

TWELVE MONTHS ENDED JUNE 30, 2011 (Unaudited)

Stocks in most of the world’s capital markets rallied during the twelve months ended June 30, 2011. In the United States, investor sentiment was supported by strong corporate earnings, returning merger and acquisition activity and accommodative policies from the U.S. Federal Reserve. Investors were also encouraged by the U.S. government’s two-year extension of the Bush era tax cuts, emergency unemployment benefits and a payroll tax cut. Concerns about economic contagion from Europe’s debt crisis, political unrest in the Middle East and the tragic earthquake and subsequent tsunami in Japan lowered investor confidence toward the end of the reporting period but stocks still finished with gains.

U.S. stocks, as measured by the S&P 500 Index, returned 30.69% for the twelve months ended June 30, 2011. The Russell 2000 Index, which is comprised of U.S. small-cap stocks, returned 37.41% for the twelve months ended June 30, 2011, while the Russell 2000 Growth Index and the Russell 2000 Value Index returned 43.50% and 31.35%, respectively.

| 2 | J.P. MORGAN SMALL CAP FUNDS | JUNE 30, 2011 | ||||

Table of Contents

JPMorgan Dynamic Small Cap Growth Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2011 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Class A Shares, without a sales charge)* | 46.48% | |||

| Russell 2000 Growth Index | 43.50% | |||

| Net Assets as of 6/30/2011 (In Thousands) | $ | 376,374 | ||

INVESTMENT OBJECTIVE**

The JPMorgan Dynamic Small Cap Growth Fund (the “Fund”) seeks capital growth over the long term.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Class A Shares, without a sales charge) outperformed the Russell 2000 Growth Index (the “Benchmark”) for the twelve months ended June 30, 2011. The Fund’s stock selection in the technology, producer durables and health care sectors contributed to relative performance, while the Fund’s stock selection in the energy, materials and processing and consumer discretionary sectors detracted from relative performance.

Individual contributors to relative performance included the Fund’s positions in NetSuite, Inc., Fortinet, Inc. and BroadSoft, Inc. Shares of NetSuite, Inc., a software and programming company, benefited from investor enthusiasm surrounding the company’s participation in the growing cloud computing industry (cloud computing is a type of computing where shared servers provide resources, software, and data to computers and other devices on demand). Network security provider Fortinet, Inc. posted better-than-expected quarterly results, helped by increased demand for its unified threat management software. Shares of BroadSoft, Inc., a global provider of Internet protocol-based communications services, rose after the company reported strong first-quarter earnings due to higher demand for its communications applications.

Individual detractors from relative performance included the Fund’s positions in OfficeMax, Inc., Petroleum Development Corp. and MedAssets, Inc. Shares of office supplies retailer OfficeMax, Inc. declined after the company reported disappointing quarterly profits, as corporate customers spent less on office supplies and fewer shoppers visited its stores. Shares of Petroleum Development Corp. declined as many investors were disappointed by the lack of production from the company’s oil well in the Niobrara shale oil formation (a shale rock formation located in Northeast Colorado, Northwest Kansas, Southwest Nebraska and Southeast Wyoming). Shares of MedAssets, Inc., which provides technology-enabled products and services to hospitals, declined after the company reported a fourth-quarter loss compared to a profit in the same period a year ago.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers utilized a bottom-up approach to stock selection, rigorously researching individual companies in an effort to construct portfolios of stocks that have strong fundamentals. The Fund’s portfolio managers preferred to invest in high quality companies with durable franchises that, in their view, possessed the ability to generate strong future earnings growth.

As a result of this bottom-up stock selection process, the Fund’s largest underweight versus the Benchmark was in the materials and processing sector and the Fund’s largest overweight versus the Benchmark was in the technology sector.

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | HEICO Corp. | 1.8 | % | |||||

| 2. | Old Dominion Freight Line, Inc. | 1.6 | ||||||

| 3. | Healthspring, Inc. | 1.4 | ||||||

| 4. | Taleo Corp., Class A | 1.4 | ||||||

| 5. | EnerSys | 1.3 | ||||||

| 6. | Middleby Corp. | 1.3 | ||||||

| 7. | Avis Budget Group, Inc. | 1.3 | ||||||

| 8. | Omnicell, Inc. | 1.3 | ||||||

| 9. | Insulet Corp. | 1.3 | ||||||

| 10. | Wabtec Corp. | 1.2 | ||||||

PORTFOLIO COMPOSITION BY SECTOR*** | ||||

| Information Technology | 23.2 | % | ||

| Industrials | 22.0 | |||

| Health Care | 20.4 | |||

| Consumer Discretionary | 16.5 | |||

| Financials | 6.6 | |||

| Energy | 6.2 | |||

| Short-Term Investments | 2.3 | |||

| Materials | 1.5 | |||

| Others (each less than 1.0%) | 1.3 | |||

| * | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments (excluding Investments of Cash Collateral for Securities on Loan) as of June 30, 2011. The Fund’s composition is subject to change. |

| JUNE 30, 2011 | J.P. MORGAN SMALL CAP FUNDS | 3 | ||||||

Table of Contents

JPMorgan Dynamic Small Cap Growth Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2011 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2011 | ||||||||||||||||

| INCEPTION DATE OF CLASS | 1 YEAR | 5 YEAR | 10 YEAR | |||||||||||||

CLASS A SHARES | 5/19/97 | |||||||||||||||

Without Sales Charge | 46.48 | % | 4.85 | % | 4.74 | % | ||||||||||

With Sales Charge* | 38.83 | 3.73 | 4.18 | |||||||||||||

CLASS B SHARES | 5/19/97 | |||||||||||||||

Without CDSC | 45.67 | 4.24 | 4.24 | |||||||||||||

With CDSC** | 40.67 | 3.90 | 4.24 | |||||||||||||

CLASS C SHARES | 1/7/98 | |||||||||||||||

Without CDSC | 45.59 | 4.23 | 4.11 | |||||||||||||

With CDSC*** | 44.59 | 4.23 | 4.11 | |||||||||||||

SELECT CLASS SHARES | 4/5/99 | 46.91 | 5.25 | 5.15 | ||||||||||||

| * | Sales Charge for Class A Shares is 5.25%. |

| ** | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

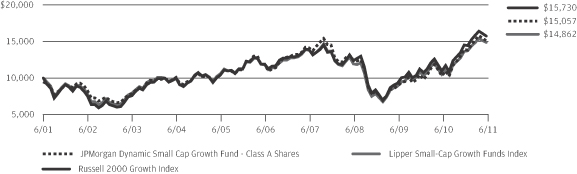

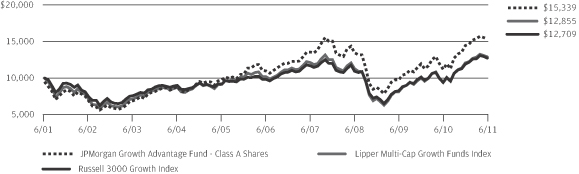

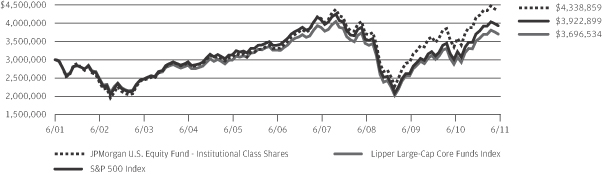

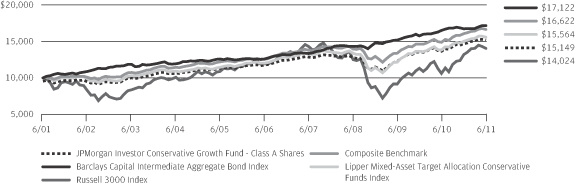

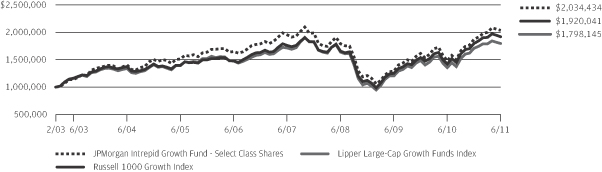

TEN YEAR PERFORMANCE (6/30/01 TO 6/30/11)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Dynamic Small Cap Growth Fund, the Russell 2000 Growth Index and the Lipper Small-Cap Growth Funds Index from June 30, 2001 to June 30, 2011. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and includes a sales charge. The performance of the Russell 2000 Growth Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The performance of the Lipper Small-Cap Growth Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The Russell 2000 Growth Index is an unmanaged index which measures the performance of those Russell 2000 companies with higher

price-to-book ratios and higher forecasted growth values. The Lipper Small-Cap Growth Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Class A Shares have a $1,000 minimum initial investment and carry a 5.25% sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Because Class B Shares automatically convert to Class A Shares after eight years, the 10 year average annual total return shown above for Class B reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| 4 | J.P. MORGAN SMALL CAP FUNDS | JUNE 30, 2011 | ||||

Table of Contents

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2011 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Select Class Shares)* | 38.37% | |||

| Russell 2000 Index | 37.41% | |||

| Net Assets as of 6/30/2011 (In Thousands) | $ | 549,530 | ||

INVESTMENT OBJECTIVE**

The JPMorgan Small Cap Core Fund seeks capital growth over the long term.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The JPMorgan Small Cap Core Fund (Select Class Shares) outperformed the Russell 2000 Index (the “Benchmark”) for the twelve months ended June 30, 2011. The Fund’s stock selection in the consumer cyclical and finance sectors contributed to relative performance, while the Fund’s stock selection in the health services and systems and systems hardware sectors detracted from relative performance.

Individual contributors to relative performance included the Fund’s positions in Tempur-Pedic International, Inc., a mattress manufacturer, and Cash America International, Inc., a financial services provider. Shares of Tempur-Pedic International, Inc. increased after the company reported strong first-quarter results, boosted by better-than-expected mattress sales. Shares of Cash America International, Inc. increased after the company announced better-than-expected first-quarter earnings due to strong loan demand.

Individual detractors from relative performance included the Fund’s positions in THQ, Inc. and Gentiva Health Services, Inc. Shares of THQ, Inc., a developer and publisher of video games, declined on investors’ concerns about the quality of its recent games as well as disappointing sell through (the percentage of video games shipped that are actually sold to consumers). Shares of Gentiva Health Services, Inc., a provider of home health services, declined on investors’ concerns about regulatory changes and potential cuts to home health services as part of federal deficit reduction discussions.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers took limited sector bets and constructed the Fund so that stock selection would be the primary driver of its relative performance versus the Benchmark. The Fund’s portfolio managers employed a bottom-up approach to stock selection, using quantitative screening and

proprietary analysis to construct a portfolio of, in their view, attractively priced stocks with strong fundamentals.

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | GT Solar International, Inc. | 1.0 | % | |||||

| 2. | Cash America International, Inc. | 1.0 | ||||||

| 3. | Portland General Electric Co. | 0.9 | ||||||

| 4. | Dillard’s, Inc., Class A | 0.8 | ||||||

| 5. | Kulicke & Soffa Industries, Inc. | 0.8 | ||||||

| 6. | Tempur-Pedic International, Inc. | 0.8 | ||||||

| 7. | JDA Software Group, Inc. | 0.8 | ||||||

| 8. | World Acceptance Corp. | 0.8 | ||||||

| 9. | Healthspring, Inc. | 0.8 | ||||||

| 10. | Triumph Group, Inc. | 0.7 | ||||||

PORTFOLIO COMPOSITION BY SECTOR*** | ||||

| Financials | 17.1 | % | ||

| Information Technology | 13.7 | |||

| Consumer Discretionary | 12.7 | |||

| Industrials | 11.7 | |||

| Health Care | 10.2 | |||

| Energy | 5.1 | |||

| Materials | 4.9 | |||

| Utilities | 2.9 | |||

| Consumer Staples | 2.1 | |||

| Telecommunication Services | 1.5 | |||

| U.S. Treasury Obligation | 0.4 | |||

| Short-Term Investment | 17.7 | |||

| * | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments (excluding Investments of Cash Collateral for Securities on Loan) as of June 30, 2011. The Fund’s composition is subject to change. |

| JUNE 30, 2011 | J.P. MORGAN SMALL CAP FUNDS | 5 | ||||||

Table of Contents

JPMorgan Small Cap Core Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2011 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2011 | ||||||||||||||||||||

| INCEPTION DATE OF CLASS | 1 YEAR | 3 YEAR | 5 YEAR | SINCE INCEPTION | ||||||||||||||||

Select Class Shares | 1/1/97 | 38.37 | % | 7.43 | % | 3.30 | % | 9.78 | % | |||||||||||

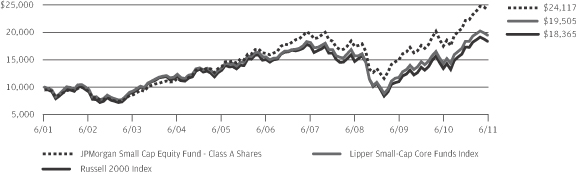

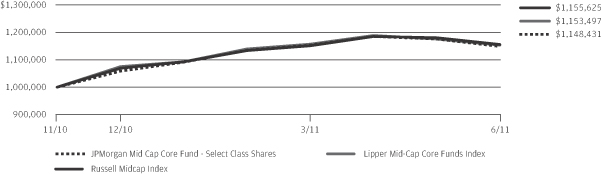

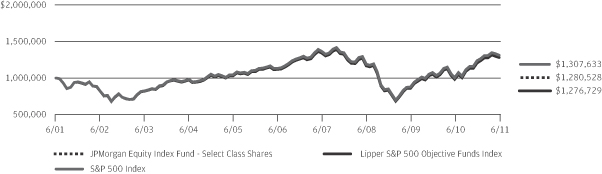

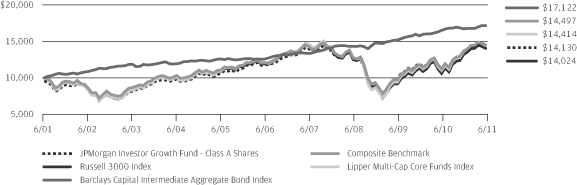

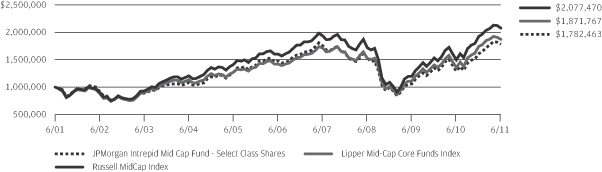

TEN YEAR PERFORMANCE (6/30/01 - 6/30/11)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Small Cap Core Fund, the Russell 2000 Index and the Lipper Small-Cap Core Funds Index from June 30, 2001 to June 30, 2011. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and does not include a sales charge. The performance of the Russell 2000 Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The performance of the Lipper Small-Cap Core Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the

Fund. The Russell 2000 Index is an unmanaged index which measures the performance of the 2000 smallest stocks (on the basis of capitalization) in the Russell 3000 Index. The Lipper Small-Cap Core Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| 6 | J.P. MORGAN SMALL CAP FUNDS | JUNE 30, 2011 | ||||

Table of Contents

JPMorgan Small Cap Equity Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2011 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Class A Shares, without a sales charge)* | 37.77% | |||

| Russell 2000 Index | 37.41% | |||

| Net Assets as of 6/30/2011 (In Thousands) | $ | 2,524,593 | ||

INVESTMENT OBJECTIVE**

The JPMorgan Small Cap Equity Fund (the “Fund”) seeks capital growth over the long term.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Class A Shares, without a sales charge) outperformed the Russell 2000 Index (the “Benchmark”) for the twelve months ended June 30, 2011. The Fund’s stock selection in the consumer discretionary and producer durables sectors contributed to relative performance, while the Fund’s stock selection and underweight in the energy sector and stock selection in the materials and processing sector detracted from relative performance.

Individual contributors included the Fund’s position in Coventry Health Care, Inc., NetSuite, Inc. and Penn National Gaming, Inc. Shares of Coventry Health Care, Inc. increased after the company reported better-than-expected first-quarter earnings. Shares of NetSuite, Inc., a software and programming company, benefited from investor enthusiasm surrounding the company’s participation in the growing cloud computing industry (cloud computing is a type of computing where shared servers provide resources, software, and data to computers and other devices on demand). Casino and gaming company Penn National Gaming, Inc. reported strong revenue, benefiting from a series of accretive acquisitions.

Among individual detractors, shares of PharMerica Corp., an institutional pharmacy services company, declined on uncertainty surrounding federal health care reform. The Fund’s underweight positions in technology companies Riverbed Technology, Inc. and TIBCO Software, Inc. also detracted from relative performance, as both of these stocks were strong performers in the Benchmark during the reporting period. Shares of Riverbed Technology, Inc. increased after the company increased its expectations for first-quarter earnings. Shares of TIBCO Software, Inc. benefited from the company’s strong sales and profit growth.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers employed a bottom-up approach to stock selection, constructing portfolios based on company fundamentals and proprietary analysis. The Fund’s portfolio managers looked for companies that, in their view,

had leading competitive advantages, predictable and durable business models, and sustainable free cash flow generation with management teams committed to increasing intrinsic value.

As a result of this process, the Fund’s largest overweight versus the Benchmark during the reporting period was in the materials and processing sector, while the Fund’s largest underweight versus the Benchmark was in the technology sector.

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | Silgan Holdings, Inc. | 2.6 | % | |||||

| 2. | Coventry Health Care, Inc. | 2.6 | ||||||

| 3. | Jarden Corp. | 2.5 | ||||||

| 4. | ProAssurance Corp. | 2.4 | ||||||

| 5. | Waste Connections, Inc. | 2.2 | ||||||

| 6. | Penn National Gaming, Inc. | 2.1 | ||||||

| 7. | TransDigm Group, Inc. | 2.1 | ||||||

| 8. | Papa John’s International, Inc. | 1.9 | ||||||

| 9. | Aptargroup, Inc. | 1.9 | ||||||

| 10. | Patterson-UTI Energy, Inc. | 1.8 | ||||||

PORTFOLIO COMPOSITION BY SECTOR*** | ||||

| Consumer Discretionary | 21.0 | % | ||

| Financials | 20.8 | |||

| Industrials | 15.1 | |||

| Information Technology | 10.8 | |||

| Health Care | 10.7 | |||

| Materials | 9.0 | |||

| Energy | 5.8 | |||

| Utilities | 2.6 | |||

| Consumer Staples | 1.1 | |||

| Telecommunication Services | 0.9 | |||

| Short-Term Investment | 2.2 | |||

| * | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments (excluding Investments of Cash Collateral for Securities on Loan) as of June 30, 2011. The Fund’s composition is subject to change. |

| JUNE 30, 2011 | J.P. MORGAN SMALL CAP FUNDS | 7 | ||||||

Table of Contents

JPMorgan Small Cap Equity Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2011 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2011 | ||||||||||||||||

| INCEPTION DATE OF CLASS | 1 YEAR | 5 YEAR | 10 YEAR | |||||||||||||

CLASS A SHARES | 12/20/94 | |||||||||||||||

Without Sales Charge | 37.77 | % | 8.36 | % | 9.79 | % | ||||||||||

With Sales Charge* | 30.52 | 7.19 | 9.20 | |||||||||||||

CLASS B SHARES | 3/28/95 | |||||||||||||||

Without CDSC | 37.10 | 7.81 | 9.26 | |||||||||||||

With CDSC** | 32.10 | 7.52 | 9.26 | |||||||||||||

CLASS C SHARES | 2/19/05 | |||||||||||||||

Without CDSC | 37.13 | 7.82 | 9.14 | |||||||||||||

With CDSC*** | 36.13 | 7.82 | 9.14 | |||||||||||||

CLASS R2 SHARES | 11/3/08 | 37.41 | 8.21 | 9.72 | ||||||||||||

CLASS R5 SHARES | 5/15/06 | 38.46 | 8.90 | 10.35 | ||||||||||||

SELECT CLASS SHARES | 5/7/96 | 38.16 | 8.68 | 10.24 | ||||||||||||

| * | Sales Charge for Class A Shares is 5.25%. |

| ** | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

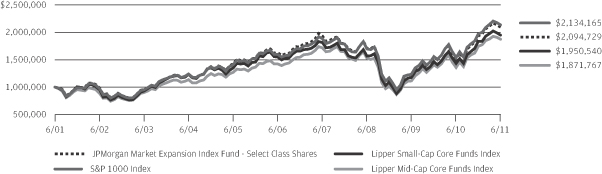

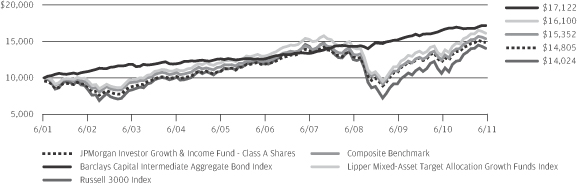

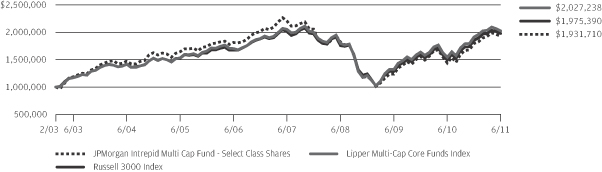

TEN YEAR PERFORMANCE (6/30/01 TO 6/30/11)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class C Shares prior to their inception date are based on the performance of the Class B Shares, whose expenses are substantially similar to those of Class C Shares. Returns for Class R5 Shares prior to their inception date are based on the performance of the Select Class Shares. The actual returns of Class R5 Shares would have been different than those shown because Class R5 Shares have different expenses than Select Class Shares. Returns for Class R2 Shares prior to their inception date are based on the performance of Class A Shares. The actual returns of Class R2 Shares would have been lower than those shown because Class R2 Shares have higher expenses than Class A Shares.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Small Cap Equity Fund, the Russell 2000 Index and the Lipper Small-Cap Core Funds Index from June 30, 2001 to June 30, 2011. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and includes a sales charge. The performance of the Russell 2000 Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The

performance of the Lipper Small-Cap Core Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The Russell 2000 Index is an unmanaged index which measures the performance of the 2000 smallest stocks (on the basis of capitalization) in the Russell 3000 Index. The Lipper Small-Cap Core Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Class A Shares have a $1,000 minimum initial investment and carry a 5.25% sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Because Class B Shares automatically convert to Class A Shares after eight years, the 10 year average annual total return shown above for Class B reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| 8 | J.P. MORGAN SMALL CAP FUNDS | JUNE 30, 2011 | ||||

Table of Contents

JPMorgan Small Cap Growth Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2011 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Class A Shares, without a sales charge)* | 46.98% | |||

| Russell 2000 Growth Index | 43.50% | |||

| Net Assets as of 6/30/2011 (In Thousands) | $ | 745,480 | ||

INVESTMENT OBJECTIVE**

The JPMorgan Small Cap Growth Fund (the “Fund”) seeks long-term capital growth primarily by investing in a portfolio of equity securities of small-capitalization and emerging growth companies.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Class A Shares, without a sales charge) outperformed the Russell 2000 Growth Index (the “Benchmark”) for the twelve months ended June 30, 2011. The Fund’s stock selection in the technology, producer durables and health care sectors contributed to relative performance, while the Fund’s stock selection in the energy, materials and processing and consumer discretionary sectors detracted from relative performance.

Individual contributors to relative performance included the Fund’s positions in NetSuite, Inc., Fortinet, Inc. and BroadSoft, Inc. NetSuite, Inc., a software and programming company, benefited from investor enthusiasm surrounding the company’s participation in the growing cloud computing industry (cloud computing is a type of computing where shared servers provide resources, software, and data to computers and other devices on demand). Network security provider Fortinet, Inc. posted better-than-expected quarterly results, helped by increased demand for its unified threat management software. Shares of BroadSoft, Inc., a global provider of Internet protocol-based communications services, rose after the company reported strong third-quarter earnings and increased its earnings outlook due to higher demand for its communications applications.

Individual detractors from relative performance included the Fund’s positions in OfficeMax, Inc., Petroleum Development Corp. and MedAssets, Inc. Shares of office supplies retailer OfficeMax, Inc. declined after the company reported disappointing quarterly profits, as corporate customers spent less on office supplies and fewer shoppers visited its stores. Shares of Petroleum Development Corp. declined as many investors were disappointed by the lack of production from the company’s oil well in the Niobrara shale oil formation (a shale rock formation located in Northeast Colorado, Northwest Kansas, Southwest Nebraska and Southeast Wyoming). Shares of MedAssets, Inc., which provides technology-enabled products and services to hospitals, declined after the company reported a fourth-quarter loss compared to a profit in the same period a year ago.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers utilized a bottom-up approach to stock selection, rigorously researching individual companies in an effort to construct portfolios of stocks that have strong fundamentals. The Fund’s portfolio managers preferred to invest in high quality companies with durable franchises that, in their view, possessed the ability to generate strong future earnings growth.

As a result of this bottom-up stock selection process, the Fund’s largest underweight versus the Benchmark was in the materials and processing sector and the Fund’s largest overweight versus the Benchmark was in the technology sector.

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | HEICO Corp. | 1.8 | % | |||||

| 2. | Old Dominion Freight Line, Inc. | 1.6 | ||||||

| 3. | Healthspring, Inc. | 1.4 | ||||||

| 4. | Taleo Corp., Class A | 1.4 | ||||||

| 5. | EnerSys | 1.3 | ||||||

| 6. | Middleby Corp. | 1.3 | ||||||

| 7. | Avis Budget Group, Inc. | 1.3 | ||||||

| 8. | Omnicell, Inc. | 1.3 | ||||||

| 9. | Insulet Corp. | 1.3 | ||||||

| 10. | Wabtec Corp. | 1.3 | ||||||

PORTFOLIO COMPOSITION BY SECTOR*** | ||||

| Information Technology | 23.5 | % | ||

| Industrials | 22.2 | |||

| Health Care | 20.6 | |||

| Consumer Discretionary | 16.7 | |||

| Financials | 6.6 | |||

| Energy | 6.3 | |||

| Materials | 1.5 | |||

| Others (each less than 1.0%) | 1.4 | |||

| Short-Term Investments | 1.2 | |||

| * | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments (excluding Investments of Cash Collateral for Securities on Loan) as of June 30, 2011. The Fund’s composition is subject to change. |

| JUNE 30, 2011 | J.P. MORGAN SMALL CAP FUNDS | 9 | ||||||

Table of Contents

JPMorgan Small Cap Growth Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2011 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2011 | ||||||||||||||||

| INCEPTION DATE OF CLASS | 1 YEAR | 5 YEAR | 10 YEAR | |||||||||||||

CLASS A SHARES | 7/1/91 | |||||||||||||||

Without Sales Charge | 46.98 | % | 6.74 | % | 6.99 | % | ||||||||||

With Sales Charge* | 39.24 | 5.59 | 6.41 | |||||||||||||

CLASS B SHARES | 9/12/94 | |||||||||||||||

Without CDSC | 46.14 | 6.08 | 6.39 | |||||||||||||

With CDSC** | 41.14 | 5.76 | 6.39 | |||||||||||||

CLASS C SHARES | 11/4/97 | |||||||||||||||

Without CDSC | 46.16 | 6.12 | 6.30 | |||||||||||||

With CDSC*** | 45.16 | 6.12 | 6.30 | |||||||||||||

CLASS R2 SHARES | 11/3/08 | 46.55 | 6.47 | 6.24 | ||||||||||||

CLASS R6 SHARES | 11/30/10 | 47.54 | 7.16 | 7.35 | ||||||||||||

INSTITUTIONAL CLASS SHARES | 2/19/05 | 47.42 | 7.14 | 7.34 | ||||||||||||

SELECT CLASS SHARES | 3/26/96 | 47.28 | 6.98 | 7.25 | ||||||||||||

| * | Sales Charge for Class A Shares is 5.25%. |

| ** | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

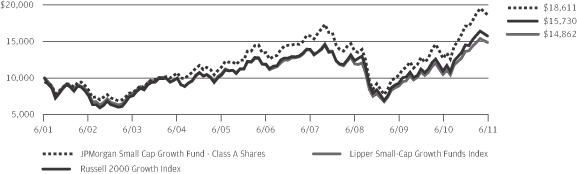

TEN YEAR PERFORMANCE (6/30/01 TO 6/30/11)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Institutional Class Shares and Class R6 Shares prior to their inception date are based on the performance of Select Class Shares. The actual returns for Institutional Class Shares and Class R6 Shares would have been different than those shown because Institutional Class Shares have different expenses than Select Class Shares. Returns for Class R2 Shares prior to their inception date are based on the performance of Class A Shares. All prior class performance for Class R2 Shares has been adjusted to reflect the differences in expenses between classes.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Small Cap Growth Fund, the Russell 2000 Growth Index and the Lipper Small-Cap Growth Funds Index from June 30, 2001 to June 30, 2011. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and includes a sales charge. The performance of the Russell 2000 Growth Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The performance of the Lipper Small-Cap Growth Funds Index

includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The Russell 2000 Growth Index is an unmanaged index which measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. The Lipper Small-Cap Growth Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper Inc. Investors cannot invest directly in an index.

Class A Shares have a $1,000 minimum initial investment and carry a 5.25% sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Because Class B Shares automatically convert to Class A Shares after eight years, the 10 year average annual total return shown above for Class B reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| 10 | J.P. MORGAN SMALL CAP FUNDS | JUNE 30, 2011 | ||||

Table of Contents

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2011 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Select Class Shares)* | 31.86% | |||

| Russell 2000 Value Index | 31.35% | |||

| Net Assets as of 6/30/2011 (In Thousands) | $ | 572,377 | ||

INVESTMENT OBJECTIVE**

The JPMorgan Small Cap Value Fund (the “Fund”) seeks long-term capital growth primarily by investing in equity securities of small-capitalization companies.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Select Class Shares) outperformed the Russell 2000 Value Index (the “Benchmark”) for the twelve months ended June 30, 2011. The Fund’s stock selection in the retail and software and services sectors contributed to relative performance, while the Fund’s stock selection in the insurance and basic materials sectors detracted from relative performance.

Individual contributors to relative performance included the Fund’s positions in Dillard’s, Inc., a U.S. department store chain, and TIBCO Software, Inc., a software and programming company. Shares of Dillard’s, Inc. benefited after the company reported strong same-store sales (a statistic used by retailers that compares sales of a company’s stores that have been open for a year or more) and reported better-than-expected earnings per share due to improving gross margins. Investors also reacted favorably to its announced stock repurchase plan. Shares of TIBCO Software, Inc. benefited from the company’s strong sales and profit growth.

Individual detractors from relative performance included the Fund’s positions in Horizon Lines, Inc. and Spartech Corp. Shares of Horizon Lines, Inc. declined after the shipping company announced that it may be forced to seek bankruptcy protection. Subsequently, the Fund exited its position in Horizon Lines, Inc. during the reporting period. Shares of Spartech Corp., a producer of engineered plastic and rubber products, declined as rising prices for raw materials hurt the company’s profits. In addition, the company fired and replaced its chief executive officer for the third time in five years.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers took limited sector bets and constructed the Fund so that stock selection would be the primary driver of its relative performance versus the Benchmark. The Fund’s portfolio managers used a quantitative

ranking methodology to identify stocks in each sector that, in their view, were trading at attractively valued levels. Through bottom-up fundamental research, they sought companies that exhibited high earnings quality and had management teams that made effective capital deployment decisions.

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | Magellan Health Services, Inc. | 1.3 | % | |||||

| 2. | Capstead Mortgage Corp. | 1.1 | ||||||

| 3. | Anworth Mortgage Asset Corp. | 1.1 | ||||||

| 4. | CBL & Associates Properties, Inc. | 1.0 | ||||||

| 5. | Dillard’s, Inc., Class A | 1.0 | ||||||

| 6. | Nicor, Inc. | 1.0 | ||||||

| 7. | World Acceptance Corp. | 1.0 | ||||||

| 8. | Coherent, Inc. | 1.0 | ||||||

| 9. | Worthington Industries, Inc. | 1.0 | ||||||

| 10. | Comtech Telecommunications Corp. | 0.9 | ||||||

PORTFOLIO COMPOSITION BY SECTOR*** | ||||

| Financials | 32.2 | % | ||

| Industrials | 14.0 | |||

| Consumer Discretionary | 12.8 | |||

| Information Technology | 11.5 | |||

| Utilities | 6.6 | |||

| Health Care | 6.2 | |||

| Materials | 5.0 | |||

| Energy | 4.7 | |||

| Consumer Staples | 3.5 | |||

| Others (each less than 1.0%) | 1.0 | |||

| Short-Term Investments | 2.5 | |||

| * | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments (excluding Investments of Cash Collateral for Securities on Loan) as of June 30, 2011. The Fund’s composition is subject to change. |

| JUNE 30, 2011 | J.P. MORGAN SMALL CAP FUNDS | 11 | ||||||

Table of Contents

JPMorgan Small Cap Value Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2011 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2011 | ||||||||||||||||

| INCEPTION DATE OF CLASS | 1 YEAR | 5 YEAR | 10 YEAR | |||||||||||||

CLASS A SHARES | 1/27/95 | |||||||||||||||

Without Sales Charge | 31.56 | % | 3.13 | % | 7.97 | % | ||||||||||

With Sales Charge* | 24.61 | 2.03 | 7.39 | |||||||||||||

CLASS B SHARES | 1/27/95 | |||||||||||||||

Without CDSC | 30.75 | 2.49 | 7.39 | |||||||||||||

With CDSC** | 25.75 | 2.13 | 7.39 | |||||||||||||

CLASS C SHARES | 3/22/99 | |||||||||||||||

Without CDSC | 30.72 | 2.50 | 7.26 | |||||||||||||

With CDSC*** | 29.72 | 2.50 | 7.26 | |||||||||||||

CLASS R2 SHARES | 11/3/08 | 31.22 | 2.88 | 7.68 | ||||||||||||

CLASS R5 SHARES | 5/15/06 | 31.95 | 3.49 | 8.29 | ||||||||||||

CLASS R6 SHARES | 2/22/05 | 32.06 | 3.53 | 8.33 | ||||||||||||

SELECT CLASS SHARES | 1/27/95 | 31.86 | 3.39 | 8.23 | ||||||||||||

| * | Sales Charge for Class A Shares is 5.25%. |

| ** | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

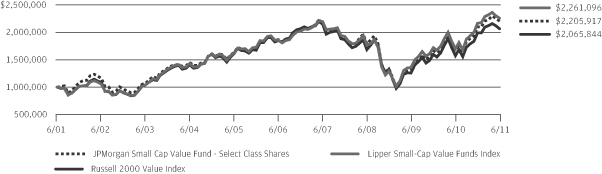

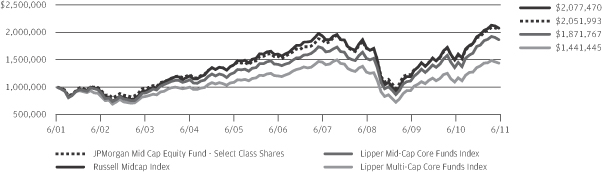

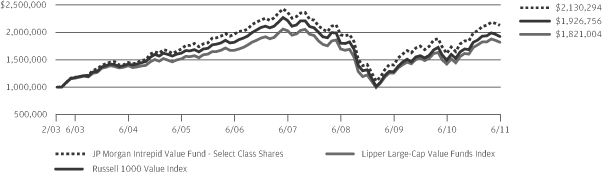

TEN YEAR PERFORMANCE (6/30/01 TO 6/30/11)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R2, Class R5 and Class R6 Shares prior to their inception dates are based on the performance of the Select Class Shares, the original class offered. All prior class performance for Class R2 Shares has been adjusted to reflect the differences in expenses between classes. The actual returns of Class R5 Shares and Class R6 Shares would have been different than those shown because Class R5 Shares and Class R6 Shares have different expenses than Select Class Shares.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Small Cap Value Fund, the Russell 2000 Value Index and the Lipper Small-Cap Value Funds Index from June 30, 2001 to June 30, 2011. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and does not include a sales charge. The performance of the Russell 2000 Value Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The performance of the Lipper Small-Cap

Value Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The Russell 2000 Value Index is an unmanaged index which measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. The Lipper Small-Cap Value Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Because Class B Shares automatically convert to Class A Shares after eight years, the 10 year average annual total return shown above for Class B reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| 12 | J.P. MORGAN SMALL CAP FUNDS | JUNE 30, 2011 | ||||

Table of Contents

JPMorgan U.S. Small Company Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2011 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Institutional Class Shares)* | 37.58% | |||

| Russell 2000 Index | 37.41% | |||

| Net Assets as of 6/30/2011 (In Thousands) | $ | 69,151 | ||

INVESTMENT OBJECTIVE**

The JPMorgan U.S. Small Company Fund (the “Fund”) seeks to provide high total return from a portfolio of small company stocks.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Institutional Class Shares) outperformed the Russell 2000 Index (the “Benchmark”) for the twelve months ended June 30, 2011. The Fund’s stock selection in the retail and industrial cyclical sectors contributed to relative performance, while the Fund’s stock selection in the basic materials and systems hardware sectors detracted from relative performance.

Individual contributors to relative performance included the Fund’s positions in Dillard’s, Inc., a U.S. department store chain, and Sauer-Danfoss Inc., a mechanical components manufacturer. Shares of Dillard’s, Inc. benefited after the company reported strong same-store sales (a statistic used by retailers that compares sales of a company’s stores that have been open for a year or more) and reported better-than-expected earnings per share due to improving gross margins. Investors also reacted favorably to its announced stock repurchase plan. Shares of Sauer-Danfoss Inc. increased after the company announced that it expected an increase in its fiscal 2011 sales.

Individual detractors from relative performance included the Fund’s positions in Spartech Corp., a producer of engineered plastic and rubber products, and New York-based bank Suffolk Bancorp. Shares of Spartech Corp. declined as rising prices for raw materials hurt the company’s profits. In addition, the company fired and replaced its chief executive officer for the third time in five years. Shares of Suffolk Bancorp declined due to weak credit results.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers took limited sector bets and constructed the Fund so that stock selection would be the primary driver of its relative performance versus the Benchmark. The Fund’s portfolio managers used a quantitative ranking methodology to identify stocks in each sector that, in their view, were trading at attractively valued levels. Through

bottom-up fundamental research, they sought companies that exhibited high earnings quality and had management teams that made effective capital deployment decisions.

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | Greatbatch, Inc. | 1.2 | % | |||||

| 2. | Affymetrix, Inc. | 1.2 | ||||||

| 3. | Nordson Corp. | 1.2 | ||||||

| 4. | Sauer-Danfoss, Inc. | 1.2 | ||||||

| 5. | Finish Line, Inc. (The), Class A | 1.1 | ||||||

| 6. | Dillard’s, Inc., Class A | 1.1 | ||||||

| 7. | Manhattan Associates, Inc. | 1.1 | ||||||

| 8. | Minerals Technologies, Inc. | 1.1 | ||||||

| 9. | JAKKS Pacific, Inc. | 1.0 | ||||||

| 10. | Knoll, Inc. | 1.0 | ||||||

PORTFOLIO COMPOSITION BY SECTOR*** | ||||

Financials | 19.2 | % | ||

Information Technology | 16.3 | |||

Consumer Discretionary | 14.7 | |||

Industrials | 14.1 | |||

Health Care | 13.3 | |||

Energy | 6.5 | |||

Materials | 4.8 | |||

Utilities | 3.2 | |||

Consumer Staples | 3.1 | |||

Telecommunication Services | 1.6 | |||

U.S. Treasury Obligation | 0.3 | |||

Short-Term Investment | 2.9 | |||

| * | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments (excluding Investments of Cash Collateral for Securities on Loan) as of June 30, 2011. The Fund’s composition is subject to change. |

| JUNE 30, 2011 | J.P. MORGAN SMALL CAP FUNDS | 13 | ||||||

Table of Contents

JPMorgan U.S. Small Company Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2011 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2011 | ||||||||||||||||

| INCEPTION DATE OF CLASS | 1 YEAR | 5 YEAR | 10 YEAR | |||||||||||||

CLASS A SHARES | 11/1/07 | |||||||||||||||

Without Sales Charge | 36.78 | % | 3.91 | % | 4.73 | % | ||||||||||

With Sales Charge* | 29.63 | 2.79 | 4.16 | |||||||||||||

CLASS C SHARES | 11/1/07 | |||||||||||||||

Without CDSC | 36.19 | 3.55 | 4.54 | |||||||||||||

With CDSC** | 35.19 | 3.55 | 4.54 | |||||||||||||

INSTITUTIONAL CLASS SHARES | 11/4/93 | 37.58 | 4.33 | 5.02 | ||||||||||||

SELECT CLASS SHARES | 9/10/01 | 37.27 | 4.14 | 4.84 | ||||||||||||

| * | Sales Charge for Class A Shares is 5.25%. |

| ** | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

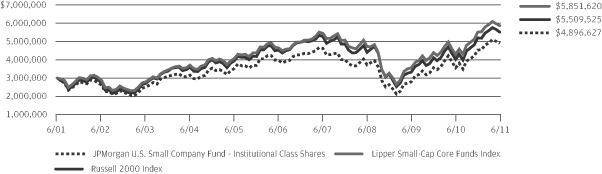

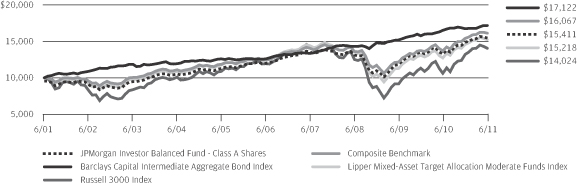

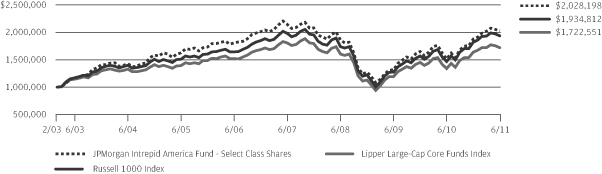

TEN YEAR PERFORMANCE (6/30/01 TO 6/30/11)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on November 4, 1993 and prior to September 7, 2001, operated in a master feeder structure. Returns for the Institutional Class Shares prior to September 7, 2001 are calculated using the historical expenses of an institutional feeder, whose expenses are substantially similar to the expenses of the Institutional Class Shares.

Returns for the Select Class Shares prior to their inception date are calculated using the historical expenses of a retail feeder, that was merged out of existence and whose expenses are substantially similar to the expenses of the Select Class Shares, from June 30, 1999 to September 10, 2001.

Returns for Class A and Class C Shares prior to their inception dates are based on the performance of the Select Class Shares. The actual returns for Class A and Class C Shares would have been lower than those shown because Class A and Class C Shares have higher expenses than Select Class Shares.

The graph illustrates comparative performance for $3,000,000 invested in Institutional Class Shares of the JPMorgan U.S. Small Company Fund, the Russell 2000 Index and the Lipper Small-Cap Core Funds Index from June 30, 2001 to June 30, 2011. The performance of the Fund assumes reinvestment of all

dividends and capital gains, if any, and does not include a sales charge. The performance of the Russell 2000 Index does not reflect the deduction of expenses associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The performance of the Lipper Small-Cap Core Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The Russell 2000 Index is an unmanaged index which measures the performance of the 2000 smallest stocks (on the basis of capitalization) in the Russell 3000 Index. The Lipper Small-Cap Core Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Institutional Class Shares have a $3,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| 14 | J.P. MORGAN SMALL CAP FUNDS | JUNE 30, 2011 | ||||

Table of Contents

JPMorgan Dynamic Small Cap Growth Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2011

(Amounts in thousands)

| SHARES | SECURITY DESCRIPTION | VALUE($) | ||||||

| Common Stocks — 97.6% |

| ||||||

Consumer Discretionary — 16.5% | ||||||||

Auto Components — 1.0% |

| |||||||

| 61 | Gentex Corp. | 1,853 | ||||||

| 43 | Tenneco, Inc. (a) | 1,890 | ||||||

|

| |||||||

| 3,743 | ||||||||

|

| |||||||

Automobiles — 0.4% |

| |||||||

| 58 | Tesla Motors, Inc. (a) (c) | 1,693 | ||||||

|

| |||||||

Diversified Consumer Services — 2.3% |

| |||||||

| 105 | American Public Education, Inc. (a) (c) | 4,652 | ||||||

| 44 | Sotheby’s | 1,911 | ||||||

| 15 | Strayer Education, Inc. (c) | 1,908 | ||||||

|

| |||||||

| 8,471 | ||||||||

|

| |||||||

Hotels, Restaurants & Leisure — 6.1% |

| |||||||

| 57 | BJ’s Restaurants, Inc. (a) | 2,966 | ||||||

| 306 | Boyd Gaming Corp. (a) (c) | 2,666 | ||||||

| 156 | Bravo Brio Restaurant Group, Inc. (a) | 3,823 | ||||||

| 108 | Gaylord Entertainment Co. (a) | 3,237 | ||||||

| 115 | Life Time Fitness, Inc. (a) | 4,588 | ||||||

| 428 | Morgans Hotel Group Co. (a) | 3,074 | ||||||

| 55 | Vail Resorts, Inc. (c) | 2,550 | ||||||

|

| |||||||

| 22,904 | ||||||||

|

| |||||||

Internet & Catalog Retail — 0.5% |

| |||||||

| 52 | HomeAway, Inc. (a) | 2,013 | ||||||

|

| |||||||

Media — 2.3% |

| |||||||

| 35 | Morningstar, Inc. | 2,115 | ||||||

| 227 | National CineMedia, Inc. | 3,841 | ||||||

| 218 | Regal Entertainment Group, Class A | 2,694 | ||||||

|

| |||||||

| 8,650 | ||||||||

|

| |||||||

Specialty Retail — 0.5% |

| |||||||

| 74 | Lumber Liquidators Holdings, Inc. (a) (c) | 1,882 | ||||||

|

| |||||||

Textiles, Apparel & Luxury Goods — 3.4% | ||||||||

| 53 | Deckers Outdoor Corp. (a) | 4,694 | ||||||

| 131 | Oxford Industries, Inc. | 4,422 | ||||||

| 92 | Vera Bradley, Inc. (a) | 3,520 | ||||||

|

| |||||||

| 12,636 | ||||||||

|

| |||||||

Total Consumer Discretionary | 61,992 | |||||||

|

| |||||||

Consumer Staples — 0.7% | ||||||||

Food & Staples Retailing — 0.7% |

| |||||||

| 67 | Fresh Market, Inc. (The) (a) | 2,572 | ||||||

|

| |||||||

Energy — 6.2% |

| |||||||

Energy Equipment & Services — 3.7% | ||||||||

| 25 | CARBO Ceramics, Inc. (c) | 4,005 | ||||||

| 61 | Dril-Quip, Inc. (a) | 4,125 | ||||||

| SHARES | SECURITY DESCRIPTION | VALUE($) | ||||||

Energy Equipment & Services — Continued | ||||||||

| 177 | Global Geophysical Services, Inc. (a) | 3,142 | ||||||

| 69 | Superior Energy Services, Inc. (a) | 2,578 | ||||||

|

| |||||||

| 13,850 | ||||||||

|

| |||||||

Oil, Gas & Consumable Fuels — 2.5% |

| |||||||

| 106 | Forest Oil Corp. (a) | 2,820 | ||||||

| 150 | Lone Pine Resources, Inc., (Canada) (a) | 1,596 | ||||||

| 297 | Magnum Hunter Resources Corp. (a) | 2,006 | ||||||

| 103 | Petroleum Development Corp. (a) | 3,091 | ||||||

|

| |||||||

| 9,513 | ||||||||

|

| |||||||

Total Energy | 23,363 | |||||||

|

| |||||||

Financials — 6.6% | ||||||||

Capital Markets — 4.4% |

| |||||||

| 33 | Affiliated Managers Group, Inc. (a) | 3,389 | ||||||

| 70 | Cohen & Steers, Inc. | 2,312 | ||||||

| 137 | Financial Engines, Inc. (a) | 3,554 | ||||||

| 40 | Greenhill & Co., Inc. | 2,160 | ||||||

| 306 | PennantPark Investment Corp. | 3,426 | ||||||

| 44 | Stifel Financial Corp. (a) | 1,589 | ||||||

|

| |||||||

| 16,430 | ||||||||

|

| |||||||

Commercial Banks — 1.0% |

| |||||||

| 39 | City National Corp. | 2,127 | ||||||

| 29 | Signature Bank (a) | 1,684 | ||||||

|

| |||||||

| 3,811 | ||||||||

|

| |||||||

Diversified Financial Services — 0.3% |

| |||||||

| 26 | MSCI, Inc., Class A (a) | 967 | ||||||

|

| |||||||

Real Estate Investment Trusts (REITs) — 0.9% |

| |||||||

| 33 | BRE Properties, Inc. | 1,621 | ||||||

| 57 | Douglas Emmett, Inc. | 1,132 | ||||||

| 11 | Home Properties, Inc. | 663 | ||||||

|

| |||||||

| 3,416 | ||||||||

|

| |||||||

Total Financials | 24,624 | |||||||

|

| |||||||

Health Care — 20.3% | ||||||||

Biotechnology — 4.7% |

| |||||||

| 64 | Acorda Therapeutics, Inc. (a) (m) | 2,069 | ||||||

| 229 | Ariad Pharmaceuticals, Inc. (a) | 2,591 | ||||||

| 100 | AVEO Pharmaceuticals, Inc. (a) | 2,053 | ||||||

| 99 | Cubist Pharmaceuticals, Inc. (a) | 3,557 | ||||||

| 322 | Halozyme Therapeutics, Inc. (a) | 2,228 | ||||||

| 282 | Idenix Pharmaceuticals, Inc. (a) | 1,409 | ||||||

| 68 | Onyx Pharmaceuticals, Inc. (a) | 2,413 | ||||||

| 13 | Pharmasset, Inc. (a) | 1,511 | ||||||

|

| |||||||

| 17,831 | ||||||||

|

| |||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2011 | J.P. MORGAN SMALL CAP FUNDS | 15 | ||||||

Table of Contents

JPMorgan Dynamic Small Cap Growth Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2011 (continued)

(Amounts in thousands)

| SHARES | SECURITY DESCRIPTION | VALUE($) | ||||||

| Common Stocks — Continued | |||||||

Health Care Equipment & Supplies — 6.6% |

| |||||||

| 354 | DynaVox, Inc., Class A (a) | 2,692 | ||||||

| 440 | Imris, Inc., (Canada) (a) | 3,003 | ||||||

| 218 | Insulet Corp. (a) (c) | 4,827 | ||||||

| 92 | Masimo Corp. | 2,744 | ||||||

| 157 | MELA Sciences, Inc. (a) (c) | 367 | ||||||

| 54 | Merit Medical Systems, Inc. (a) | 963 | ||||||

| 318 | Syneron Medical Ltd., (Israel) (a) | 3,854 | ||||||

| 84 | Thoratec Corp. (a) | 2,740 | ||||||

| 140 | Tornier B.V., (Netherlands) (a) | 3,761 | ||||||

|

| |||||||

| 24,951 | ||||||||

|

| |||||||

Health Care Providers & Services — 3.7% |

| |||||||

| 218 | Emeritus Corp. (a) (c) | 4,622 | ||||||

| 130 | Health Net, Inc. (a) | 4,186 | ||||||

| 113 | Healthspring, Inc. (a) | 5,207 | ||||||

|

| |||||||

| 14,015 | ||||||||

|

| |||||||

Health Care Technology — 1.3% |

| |||||||

| 310 | Omnicell, Inc. (a) | 4,838 | ||||||

|

| |||||||

Life Sciences Tools & Services — 1.6% |

| |||||||

| 196 | Bruker Corp. (a) | 3,992 | ||||||

| 113 | Fluidigm Corp. (a) | 1,889 | ||||||

|

| |||||||

| 5,881 | ||||||||

|

| |||||||

Pharmaceuticals — 2.4% |

| |||||||

| 111 | Aegerion Pharmaceuticals, Inc. (a) | 1,750 | ||||||

| 83 | Impax Laboratories, Inc. (a) | 1,817 | ||||||

| 198 | Nektar Therapeutics (a) | 1,441 | ||||||

| 96 | Sagent Pharmaceuticals, Inc. (a) | 2,579 | ||||||

| 77 | ViroPharma, Inc. (a) | 1,432 | ||||||

|

| |||||||

| 9,019 | ||||||||

|

| |||||||

Total Health Care | 76,535 | |||||||

|

| |||||||

Industrials — 21.9% | ||||||||

Aerospace & Defense — 2.7% |

| |||||||

| 136 | DigitalGlobe, Inc. (a) | 3,450 | ||||||

| 126 | HEICO Corp. (c) | 6,870 | ||||||

|

| |||||||

| 10,320 | ||||||||

|

| |||||||

Building Products — 1.9% |

| |||||||

| 23 | Lennox International, Inc. | 969 | ||||||

| 110 | Simpson Manufacturing Co., Inc. (c) | 3,278 | ||||||

| 124 | Trex Co., Inc. (a) | 3,042 | ||||||

|

| |||||||

| 7,289 | ||||||||

|

| |||||||

Commercial Services & Supplies — 0.3% |

| |||||||

| 49 | GEO Group, Inc. (The) (a) | 1,125 | ||||||

|

| |||||||

| SHARES | SECURITY DESCRIPTION | VALUE($) | ||||||

Electrical Equipment — 4.6% |

| |||||||

| 82 | Acuity Brands, Inc. (m) | 4,581 | ||||||

| 143 | EnerSys (a) | 4,924 | ||||||

| 177 | Generac Holdings, Inc. (a) | 3,425 | ||||||

| 102 | General Cable Corp. (a) | 4,357 | ||||||

|

| |||||||

| 17,287 | ||||||||

|

| |||||||

Industrial Conglomerates — 1.0% |

| |||||||

| 76 | Carlisle Cos., Inc. | 3,724 | ||||||

|

| |||||||

Machinery — 3.8% |

| |||||||

| 62 | Graco, Inc. | 3,160 | ||||||

| 52 | Middleby Corp. (a) | 4,861 | ||||||

| 67 | Titan International, Inc. | 1,616 | ||||||

| 71 | Wabtec Corp. | 4,695 | ||||||

|

| |||||||

| 14,332 | ||||||||

|

| |||||||

Professional Services — 1.4% |

| |||||||

| 74 | Corporate Executive Board Co. (The) | 3,247 | ||||||

| 115 | Mistras Group, Inc. (a) | 1,863 | ||||||

|

| |||||||

| 5,110 | ||||||||

|

| |||||||

Road & Rail — 4.6% |

| |||||||

| 284 | Avis Budget Group, Inc. (a) | 4,856 | ||||||

| 147 | Marten Transport Ltd. | 3,180 | ||||||

| 158 | Old Dominion Freight Line, Inc. (a) | 5,903 | ||||||

| 168 | Zipcar, Inc. (a) (c) | 3,427 | ||||||

|

| |||||||

| 17,366 | ||||||||

|

| |||||||

Trading Companies & Distributors — 1.6% |

| |||||||

| 213 | Rush Enterprises, Inc., Class A (a) | 4,054 | ||||||

| 29 | Watsco, Inc. | 1,938 | ||||||

|

| |||||||

| 5,992 | ||||||||

|

| |||||||

Total Industrials | 82,545 | |||||||

|

| |||||||

Information Technology — 23.2% | ||||||||

Communications Equipment — 1.9% |

| |||||||

| 102 | Aruba Networks, Inc. (a) | 3,011 | ||||||

| 76 | Ixia (a) | 969 | ||||||

| 80 | Riverbed Technology, Inc. (a) | 3,157 | ||||||

|

| |||||||

| 7,137 | ||||||||

|

| |||||||

Computers & Peripherals — 0.6% |

| |||||||

| 80 | Fusion-io, Inc. (a) (c) | 2,414 | ||||||

|

| |||||||

Internet Software & Services — 4.5% |

| |||||||

| 98 | Cornerstone OnDemand, Inc. (a) | 1,734 | ||||||

| 167 | DealerTrack Holdings, Inc. (a) | 3,840 | ||||||

| 199 | Envestnet, Inc. (a) | 2,958 | ||||||

| 143 | IntraLinks Holdings, Inc. (a) | 2,476 | ||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| 16 | J.P. MORGAN SMALL CAP FUNDS | JUNE 30, 2011 | ||||

Table of Contents

| SHARES | SECURITY DESCRIPTION | VALUE($) | ||||||

| Common Stocks — Continued | |||||||

Internet Software & Services — Continued | ||||||||

| 80 | LogMeIn, Inc. (a) | 3,093 | ||||||

| 68 | Rackspace Hosting, Inc. (a) | 2,903 | ||||||

|

| |||||||

| 17,004 | ||||||||

|

| |||||||

Semiconductors & Semiconductor Equipment — 4.6% |

| |||||||

| 79 | Cavium, Inc. (a) | 3,435 | ||||||

| 64 | Cymer, Inc. (a) | 3,180 | ||||||

| 59 | Hittite Microwave Corp. (a) | 3,672 | ||||||

| 155 | Inphi Corp. (a) | 2,694 | ||||||

| 103 | Mellanox Technologies Ltd., (Israel) (a) | 3,085 | ||||||

| 114 | TriQuint Semiconductor, Inc. (a) | 1,165 | ||||||

|

| |||||||

| 17,231 | ||||||||

|

| |||||||

Software — 11.6% |

| |||||||

| 94 | Blackboard, Inc. (a) (c) | 4,076 | ||||||

| 53 | BroadSoft, Inc. (a) | 2,024 | ||||||

| 57 | Concur Technologies, Inc. (a) (c) | 2,849 | ||||||

| 94 | Fortinet, Inc. (a) | 2,572 | ||||||

| 109 | NetSuite, Inc. (a) (c) | 4,281 | ||||||

| 142 | Nuance Communications, Inc. (a) | 3,056 | ||||||

| 164 | RealD, Inc. (a) (c) | 3,846 | ||||||

| 130 | RealPage, Inc. (a) | 3,437 | ||||||

| 169 | SolarWinds, Inc. (a) | 4,415 | ||||||

| 143 | Sourcefire, Inc. (a) | 4,246 | ||||||

| 139 | Taleo Corp., Class A (a) | 5,162 | ||||||

| 124 | TIBCO Software, Inc. (a) | 3,609 | ||||||

|

| |||||||

| 43,573 | ||||||||

|

| |||||||

Total Information Technology | 87,359 | |||||||

|

| |||||||

Materials — 1.5% | ||||||||

Chemicals — 0.8% |

| |||||||

| 92 | Innospec, Inc. (a) | 3,099 | ||||||

|

| |||||||

Metals & Mining — 0.7% |

| |||||||

| 171 | Commercial Metals Co. | 2,452 | ||||||

|

| |||||||

Total Materials | 5,551 | |||||||

|

| |||||||

Telecommunication Services — 0.7% | ||||||||

Diversified Telecommunication Services — 0.7% |

| |||||||

| 303 | Boingo Wireless, Inc. (a) | 2,750 | ||||||

|

| |||||||

Total Common Stocks | 367,291 | |||||||

|

| |||||||

| Short-Term Investment — 2.3% |

| ||||||

Investment Company — 2.3% |

| |||||||

| 8,471 | JPMorgan Prime Money Market Fund, | 8,471 | ||||||

|

| |||||||

| SHARES | SECURITY DESCRIPTION | VALUE($) | ||||||

| Investments of Cash Collateral for Securities on Loan — 6.3% |

| ||||||

Investment Company — 6.3% |

| |||||||

| 23,887 | JPMorgan Prime Money Market Fund, | 23,887 | ||||||

|

| |||||||

Total Investments — 106.2% | 399,649 | |||||||

Liabilities in Excess of | (23,275 | ) | ||||||

|

| |||||||

NET ASSETS — 100.0% | $ | 376,374 | ||||||

|

| |||||||

Percentages indicated are based on net assets.

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2011 | J.P. MORGAN SMALL CAP FUNDS | 17 | ||||||

Table of Contents

JPMorgan Small Cap Core Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2011

(Amounts in thousands)

| SHARES | SECURITY DESCRIPTION | VALUE($) | ||||||

| Common Stocks — 81.1% |

| ||||||

Consumer Discretionary — 12.6% | ||||||||

Auto Components — 0.5% |

| |||||||

| 11 | American Axle & Manufacturing Holdings, Inc. (a) | 124 | ||||||

| 75 | Cooper Tire & Rubber Co. | 1,488 | ||||||

| 65 | Standard Motor Products, Inc. | 984 | ||||||

|

| |||||||

| 2,596 | ||||||||

|

| |||||||

Diversified Consumer Services — 0.5% |

| |||||||

| 92 | Bridgepoint Education, Inc. (a) (c) | 2,287 | ||||||

| 7 | Lincoln Educational Services Corp. | 117 | ||||||

| 11 | Mac-Gray Corp. | 176 | ||||||

|

| |||||||

| 2,580 | ||||||||

|

| |||||||

Hotels, Restaurants & Leisure — 2.0% |

| |||||||

| 131 | Ameristar Casinos, Inc. | 3,096 | ||||||

| 13 | Cracker Barrel Old Country Store, Inc. | 626 | ||||||

| 57 | DineEquity, Inc. (a) | 2,985 | ||||||

| 101 | Domino’s Pizza, Inc. (a) | 2,557 | ||||||

| 81 | Ruby Tuesday, Inc. (a) | 876 | ||||||

| 127 | Ruth’s Hospitality Group, Inc. (a) | 714 | ||||||

|

| |||||||

| 10,854 | ||||||||

|

| |||||||

Household Durables — 2.1% |

| |||||||

| 78 | American Greetings Corp., Class A | 1,863 | ||||||

| 1 | CSS Industries, Inc. | 11 | ||||||

| 115 | Helen of Troy Ltd., (Bermuda) (a) | 3,981 | ||||||

| 16 | Jarden Corp. | 549 | ||||||

| 17 | Libbey, Inc. (a) | 274 | ||||||

| 39 | Lifetime Brands, Inc. | 454 | ||||||

| 65 | Tempur-Pedic International, Inc. (a) | 4,435 | ||||||

|

| |||||||

| 11,567 | ||||||||

|

| |||||||

Leisure Equipment & Products — 0.3% |

| |||||||

| 65 | JAKKS Pacific, Inc. (a) | 1,195 | ||||||

| 12 | Sturm Ruger & Co., Inc. | 261 | ||||||

|

| |||||||

| 1,456 | ||||||||

|

| |||||||

Media — 0.8% |

| |||||||

| 79 | Entercom Communications Corp., Class A (a) | 687 | ||||||

| 124 | Journal Communications, Inc., Class A (a) | 640 | ||||||

| 14 | Knology, Inc. (a) | 203 | ||||||

| 24 | LIN TV Corp., Class A (a) | 118 | ||||||

| 26 | McClatchy Co. (The), Class A (a) (c) | 73 | ||||||

| 20 | Pandora Media, Inc. (a) (c) | 384 | ||||||

| 213 | Sinclair Broadcast Group, Inc., Class A | 2,337 | ||||||

|

| |||||||

| 4,442 | ||||||||

|

| |||||||