Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04236

| JPMorgan Trust II |

(Exact name of registrant as specified in charter)

270 Park Avenue New York, NY 10017 |

(Address of principal executive offices) (Zip code)

Frank J. Nasta 270 Park Avenue New York, NY 10017 |

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: Last day of February

Date of reporting period: March 1, 2010 through February 28, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Table of Contents

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Table of Contents

Annual Report

J.P. Morgan Municipal Bond Funds

February 28, 2011

JPMorgan Arizona Municipal Bond Fund

JPMorgan Michigan Municipal Bond Fund

JPMorgan Municipal Income Fund

JPMorgan Ohio Municipal Bond Fund

JPMorgan Short-Intermediate Municipal Bond Fund

JPMorgan Tax Free Bond Fund

Table of Contents

CONTENTS

| CEO’s Letter | 1 | |||

| A Message From Gary J. Madich | 2 | |||

| Market Overview | 3 | |||

Fund Commentaries: | ||||

| 4 | ||||

| 6 | ||||

| 8 | ||||

| 10 | ||||

| 12 | ||||

| 14 | ||||

| Schedules of Portfolio Investments | 16 | |||

| Financial Statements | 62 | |||

| Financial Highlights | 74 | |||

| Notes to Financial Statements | 86 | |||

| Report of Independent Registered Public Accounting Firm | 103 | |||

| Trustees | 104 | |||

| Officers | 106 | |||

| Schedule of Shareholder Expenses | 107 | |||

| Tax Letter | 110 | |||

Privacy Notice | 111 | |||

Investments in a Fund are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on conditions through the end of the reporting period and are subject to change without notice based on market and other conditions. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Funds’ prospectus for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Funds Service Center at (800) 480-4111 for a prospectus containing more complete information about a Fund including management fees and other expenses. Please read it carefully before investing.

Table of Contents

March 21, 2011

Dear Shareholder:

For many investors, the old adage “What’s old is new again,” may be the best way to describe the current economic recovery. While we are encouraged by recent economic growth, we continue to be reminded of how sensitive the markets and our economy can be to geopolitical risks and other global crises.

In the U.S., economic momentum and growth appear to be accelerating, helped by pent-up consumer demand, improved balance sheets, and an extension of the Bush-era tax cuts. Additionally, this recovery has seen a sharp rebound in corporate profits. Investors responded enthusiastically to these developments, sending stock markets on an impressive rally, and leading to double-digit gains in 2010.

|

“While we are encouraged by recent economic growth, we continue to be reminded of how sensitive the markets and our economy can be to geopolitical risks and other global crises.” |

On the other hand, heightened tensions in the Middle East and renewed concerns about European debt resulted in an increase in market volatility, while the devastating earthquake and tsunami in Japan and the uncertain aftermath is likely to have lingering macroeconomic and market implications.

While positive tailwinds may continue to fuel economic growth, we remain concerned about the scope and potential impact of political unrest and other crises on global markets and economies.

U.S. Treasuries experience broad gains

Investors have continued to focus their investments on fixed income securities, particularly mortgage, investment grade corporate and high yield areas of the market. However, the heightened publicity surrounding the fiscal woes of state and local governments, and the expiration of the Build America Bond Program led many investors away from municipal bonds, which contributed to an increase in market volatility.

The Barclays Capital High Yield Index returned 17.5%, while the Barclays Capital U.S. Aggregate Bond Index returned 4.9%, and the Barclays Capital Emerging Markets Index returned 11.3% for the 12-month period ended February 28, 2011. The Barclays Capital Municipal Index returned 1.7% for the same period.

A late year U.S. stock market rally did little to reverse broad gains experienced by U.S. Treasuries in 2010. Stock market volatility, rising oil prices, and concerns about unrest in the

Middle East generally led to higher prices and lower yields for U.S. Treasuries and other safe haven investments. As of the end of the 12-month period ended February 28, 2011, the yield on the 10-year U.S. Treasury bond declined from 3.6% to 3.4%. Yields on the 30-year U.S. Treasury bond dropped slightly, from 4.6% to 4.5%, while yields on the 2-year U.S. Treasury bond dipped from 0.8% to 0.7% as of the end of the annual reporting period.

Improved economic outlook fuels equity rally

Stocks were supported by improved economic expectations and job growth, as well as the combination of the Federal Reserve’s launch of quantitative easing (QE2) and Congress’ extension of the Bush-era tax cuts. As of the 12-month reporting period ended February 28, 2011, the S&P 500 Index had reached a level of 1,327, an increase of 22.6% from 12 months prior.

Recently, however, risky assets have become more volatile as investors grew concerned about how the disaster in Japan, rising oil prices, and Middle East turmoil will impact the global recovery.

Rely on diversification to prepare for geopolitical risks

While the global economic recovery has demonstrated resiliency, the world is witnessing ongoing turmoil in the Middle East and uncertainty surrounding the fallout from the tragedy in Japan. Additionally, we continue to experience concerns about European sovereign debt.

This environment reminds us of the importance of preparing portfolios for shocks that could not only potentially derail the economic recovery, but also our investment goals. As “uncertainty” is often the only certainty, it makes sense for investors to prepare by maintaining a diversified approach to investing within the context of a balanced portfolio.

On behalf of everyone at J.P. Morgan Asset Management, thank you for your continued confidence. We look forward to managing your investment needs for years to come. Should you have any questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

George C.W. Gatch

CEO-Investment Management Americas

J.P. Morgan Asset Management

| FEBRUARY 28, 2011 | J.P. MORGAN MUNICIPAL BOND FUNDS | 1 | ||||||

Table of Contents

A MESSAGE FROM GARY J. MADICH, CFA

Global Chief Investment Officer for J.P. Morgan Asset Management’s Global Fixed Income Group

APRIL 4, 2011 (Unaudited)

Flows into bond funds remain strong, although decreased from the very high levels of the past two years. Investors still seem to be drawn to the perception of bonds’ relative safety versus other investments and continue to allocate assets to fixed income securities given the uncertainty prevalent in today’s marketplace. While we believe that bonds play an essential role in any well-diversified portfolio, we would like to take this opportunity to remind you about the risks associated with bond funds and the importance of diversification.**

Bond prices generally decrease as interest rates rise and increase as interest rates fall. Currently, interest rates are at very low levels and most fixed income portfolios would be negatively impacted in an environment where interest rates may increase, as the fixed income securities held in the portfolios would likely decrease in value. This is a broad risk that applies to most portfolios of bonds across the spectrum of the fixed income market. Bond portfolios comprised mostly of municipal bonds share this risk and also carry other risks specific to the nature of their asset class.

The ability of states and municipalities to repay their debt could be hindered by unfavorable local economic or political events. This risk has garnered recent attention as many states have seen their growing budget deficit challenges become the topic of newspaper headlines, leading many investors to pull assets out of municipal bond funds.

Acknowledging the challenges that are facing many states and municipalities, our municipal and tax free funds have main-

tained their bias towards bonds with high credit quality and sectors that have historically demonstrated lower volatility. However, it is important to note that, given their inherent geographic concentration, state-specific municipal bond funds may experience a disproportionately negative impact as a result of unfavorable economic or political developments in the state or region where the funds are primarily invested.

While we certainly believe that municipal bond funds are a valuable tool for many investors, the risks associated with these funds serve as a stark reminder about the importance of a well-diversified portfolio. As an investor, the best way to guard against any type of risk is to proactively build a well-diversified portfolio, a portfolio that is able to withstand and benefit from a variety of future outcomes.

On behalf of the Funds’ fixed income portfolio management team,

Gary J. Madich, CFA

| ** | Diversification does not guarantee investment returns and does not eliminate the risk of loss. |

| 2 | J.P. MORGAN MUNICIPAL BOND FUNDS | FEBRUARY 28, 2011 | ||||

Table of Contents

J.P. Morgan Municipal Bond Funds

MARKET OVERVIEW

TWELVE MONTHS ENDED FEBRUARY 28, 2011

For the first six months of the reporting period, the municipal bond market enjoyed a positive supply and demand environment and accommodative policies from the U.S. Federal Reserve, which contributed to historically low interest rates and helped support prices for the majority of municipal bond securities. However, the positive supply and demand environment began to reverse itself at the beginning of September 2010, leading municipal fixed income securities to register five consecutive months of negative returns.

Supply of municipal fixed income securities increased in early September 2010 and placed pressure on the market. This development was followed by an increase in U.S. Treasury interest rates and a wave of negative headlines related to the challenging fiscal conditions that many state and local municipalities were facing. In response, many investors began to withdraw assets allocated to municipal securities, ending 22 consecutive months of positive municipal bond fund inflows. The deteriorating supply and demand environment was amplified by the realization that the Build America Bond (BABs) would not likely be extended by Congress. BABS are taxable municipal bonds, in which the federal government rebates back 35% of the interest cost to the issuing entity.

Higher quality municipal securities underperformed during the first six months of the reporting period and then outperformed over the second half of the reporting period, as market conditions deteriorated. Bonds with maturities in the 6-12 year range were the strongest performers during the reporting period.

| FEBRUARY 28, 2011 | J.P. MORGAN MUNICIPAL BOND FUNDS | 3 | ||||||

Table of Contents

JPMorgan Arizona Municipal Bond Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2011 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Select Class Shares)* | 1.46% | |||

| Barclays Capital Competitive Intermediate Municipal (1–17 Year) Maturities Index | 2.32% | |||

| Net Assets as of 2/28/2011 (In Thousands) | $ | 123,708 | ||

| Duration as of 2/28/2011 | 5.5 Years | |||

INVESTMENT OBJECTIVE**

The JPMorgan Arizona Municipal Bond Fund (the “Fund”) seeks current income exempt from federal income tax and Arizona personal income tax, consistent with the preservation of principal.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

For the twelve months ended February 28, 2011, the Fund’s relative performance versus the Barclays Capital Competitive Intermediate Municipal (1-17 Year) Maturities Index (the “Benchmark”) was hurt by the Fund’s overweight of pre-refunded bonds (bonds that are secured with U.S. government securities), as this was the worst performing sector during the reporting period. In addition, the Fund was overweight revenue bonds and underweight state-issued general obligation bonds (Arizona’s constitution does not permit it to issue state general obligation bonds), which detracted from the Fund’s relative performance as revenue bonds underperformed state-issued general obligation bonds during the reporting period.

The Fund’s investments in the education sector contributed to the Fund’s absolute performance and relative performance versus the Benchmark. Meanwhile, the best performing part of the yield curve, which shows the relationship between yields and maturity dates for a set of similar bonds at a given point in time, was the 6-12 year range. The Fund was overweight the 6-8 year segment of the yield curve and this contributed to its absolute and relative performance, while the Fund’s investments on the 8-12 year segment of the yield curve were among the strongest contributors to the Fund’s absolute return.

The Fund had slightly shorter duration than the Benchmark, which hurt its relative performance during the first half of the reporting period when interest rates declined and contributed to its relative performance during the second half of the reporting period when interest rates increased. Duration is used to measure the price sensitivity of a bond or a portfolio of bonds

to relative changes in interest rates. Generally, bonds with shorter duration will experience a smaller increase/decrease in price as interest rates go down/up versus bonds with longer duration.

HOW WAS THE FUND POSITIONED?

From a credit quality perspective, the Fund had an overweight position versus the Benchmark in AAA-rated and A-rated securities, and an underweight in AA-rated securities and BBB-rated securities. Given the volatility in the municipal bond market, the Fund used investments in money market funds to maintain liquidity and manage Fund flows.

CREDIT QUALITY ALLOCATIONS*** | ||||

| AAA | 38.7 | % | ||

| AA | 39.5 | |||

| A | 14.8 | |||

| BAA | 7.0 | |||

J.P. Morgan Investment Management (“JPMIM”) receives credit quality ratings on underlying securities of the portfolio from the three major ratings agencies — S&P, Moody’s and Fitch. When calculating the credit quality breakdown, JPMIM selects the middle rating of the agencies when all three agencies rate a security. JPMIM will use the lower of the two ratings if only two agencies rate a security and JPMIM will use one rating if that is all that is provided. Securities that are not rated by all three agencies are reflected as such.

| * | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments as of February 28, 2011. The Fund’s composition is subject to change. |

| 4 | J.P. MORGAN MUNICIPAL BOND FUNDS | FEBRUARY 28, 2011 | ||||

Table of Contents

AVERAGE ANNUAL TOTAL RETURNS AS OF FEBRUARY 28, 2011 | ||||||||||||||||

| INCEPTION DATE OF CLASS | 1 YEAR | 5 YEAR | 10 YEAR | |||||||||||||

CLASS A SHARES | 1/20/97 | |||||||||||||||

Without Sales Charge | 1.23 | % | 3.65 | % | 3.81 | % | ||||||||||

With Sales Charge* | (2.55 | ) | 2.87 | 3.41 | ||||||||||||

CLASS B SHARES | 1/20/97 | |||||||||||||||

Without CDSC | 0.58 | 3.01 | 3.28 | |||||||||||||

With CDSC** | (4.42 | ) | 2.65 | 3.28 | ||||||||||||

CLASS C SHARES | 2/19/05 | |||||||||||||||

Without CDSC | 0.60 | 3.00 | 3.15 | |||||||||||||

With CDSC*** | (0.40 | ) | 3.00 | 3.15 | ||||||||||||

SELECT CLASS SHARES | 1/20/97 | 1.46 | 3.90 | 4.08 | ||||||||||||

| * | Sales Charge for Class A Shares is 3.75%. |

| ** | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

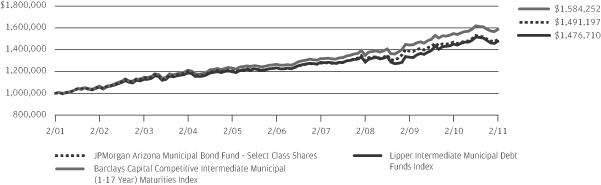

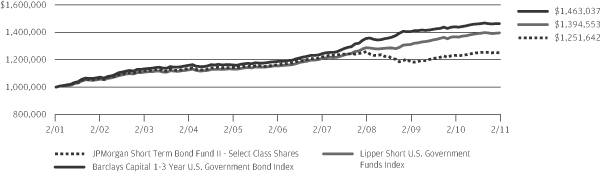

TEN YEAR PERFORMANCE (2/28/01 TO 2/28/11)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

Returns for Class C Shares prior to their inception are based on the performance of Class B Shares.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Arizona Municipal Bond Fund, the Barclays Capital Competitive Intermediate Municipal (1–17 Year) Maturities Index and the Lipper Intermediate Municipal Debt Funds Index from February 28, 2001 to February 28, 2011. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and does not include a sales charge. The performance of the Barclays Capital Competitive Intermediate Municipal (1–17 Year) Maturities Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The performance of the Lipper Intermediate Municipal Debt Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The Barclays Capital Competitive Intermediate Municipal (1–17 Year) Maturities Index represents the performance of municipal bonds with matur-

ities from 1 to 17 years. The Lipper Intermediate Municipal Debt Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Capital gains distributions are subject to federal income tax, a portion of the Fund’s income distributions may be subject to the Alternative Minimum Tax and some investors may be subject to certain state and local taxes.

Select Class Shares have a $1,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Because Class B shares automatically convert to Class A shares after 8 years, the 10 Year average annual total return shown above for Class B reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| FEBRUARY 28, 2011 | J.P. MORGAN MUNICIPAL BOND FUNDS | 5 | ||||||

Table of Contents

JPMorgan Michigan Municipal Bond Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2011 (Unaudited)

| REPORTING PERIOD RETURN: | ||

| Fund (Select Class Shares)* | 1.59% | |

| Barclays Capital Competitive Intermediate Municipal (1–17 Year) Maturities Index | 2.32% | |

| Net Assets as of 2/28/2011 (In Thousands) | $117,330 | |

| Duration as of 2/28/2011 | 5.2 Years | |

INVESTMENT OBJECTIVE**

The JPMorgan Michigan Municipal Bond Fund (the “Fund”) seeks current income exempt from federal income tax and Michigan personal income tax, consistent with the preservation of principal.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

For the twelve months ended February 28, 2011, the Fund’s relative performance versus the Barclays Capital Competitive Intermediate Municipal (1-17 Year) Maturities Index (the “Benchmark”) was hurt by the Fund’s underweight of state-issued general obligation bonds, which performed well for the Benchmark during the reporting period. The Fund’s investments in pre-refunded bonds (bonds that are secured with U.S. government securities) outperformed those held in the Benchmark and contributed to the Fund’s relative performance, as well as its absolute return.

The Fund had slightly shorter duration than the Benchmark, which hurt its relative performance during the first half of the reporting period when interest rates declined and contributed to its relative performance during the second half of the reporting period when interest rates increased. Duration is used to measure the price sensitivity of a bond or a portfolio of bonds to relative changes in interest rates. Generally, bonds with shorter duration will experience a smaller increase/decrease in price as interest rates go down/up versus bonds with longer duration.

The Fund’s investments in the education sector contributed to the Fund’s absolute performance and relative performance versus the Benchmark, while the Fund’s overweight of the hospital sector contributed to the Fund’s relative performance. Meanwhile, the best performing part of the yield curve, which shows the relationship between yields and maturity dates for a set of similar bonds at a given point in time, was the 6-12 year

range. The Fund was overweight the 6-12 year segment of the yield curve and this contributed to its absolute and relative performance.

HOW WAS THE FUND POSITIONED?

From a credit quality perspective, the Fund had an overweight position versus the Benchmark in AA-rated securities, an underweight in BBB-rated securities, and an underweight in AAA-rated issues. Given the volatility in the municipal bond market, the Fund used investments in money market funds to maintain liquidity and manage Fund flows.

CREDIT QUALITY ALLOCATIONS*** | ||||

| AAA | 21.0 | % | ||

| AA | 48.0 | |||

| A | 23.6 | |||

| BAA | 7.4 | |||

J.P. Morgan Investment Management (“JPMIM”) receives credit quality ratings on underlying securities of the portfolio from the three major ratings agencies — S&P, Moody’s and Fitch. When calculating the credit quality breakdown, JPMIM selects the middle rating of the agencies when all three agencies rate a security. JPMIM will use the lower of the two ratings if only two agencies rate a security and JPMIM will use one rating if that is all that is provided. Securities that are not rated by all three agencies are reflected as such.

| * | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments as of February 28, 2011. The Fund’s composition is subject to change. |

| 6 | J.P. MORGAN MUNICIPAL BOND FUNDS | FEBRUARY 28, 2011 | ||||

Table of Contents

AVERAGE ANNUAL TOTAL RETURNS AS OF FEBRUARY 28, 2011 | ||||||||||||||||

| INCEPTION DATE OF CLASS | 1 YEAR | 5 YEAR | 10 YEAR | |||||||||||||

CLASS A SHARES | 2/1/93 | |||||||||||||||

Without Sales Charge | 1.26 | % | 3.41 | % | 3.76 | % | ||||||||||

With Sales Charge* | (2.54 | ) | 2.61 | 3.36 | ||||||||||||

CLASS B SHARES | 9/23/96 | |||||||||||||||

Without CDSC | 0.70 | 2.79 | 3.25 | |||||||||||||

With CDSC** | (4.30 | ) | 2.43 | 3.25 | ||||||||||||

CLASS C SHARES | 2/19/05 | |||||||||||||||

Without CDSC | 0.71 | 2.79 | 3.12 | |||||||||||||

With CDSC*** | (0.29 | ) | 2.79 | 3.12 | ||||||||||||

SELECT CLASS SHARES | 2/1/93 | 1.59 | 3.67 | 4.03 | ||||||||||||

| * | Sales Charge for Class A Shares is 3.75%. |

| ** | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

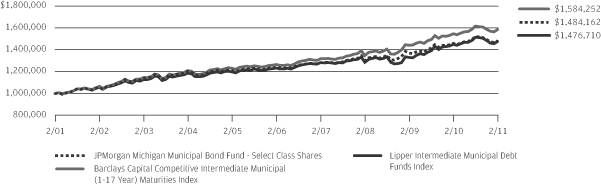

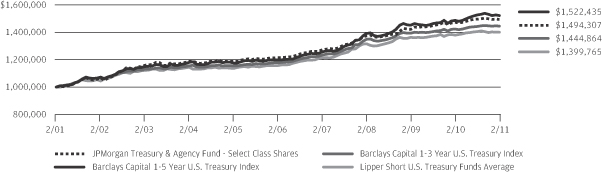

TEN YEAR PERFORMANCE (2/28/01 TO 2/28/11)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

Returns for Class C Shares prior to their inception are based on the performance of Class B Shares.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Michigan Municipal Bond Fund, the Barclays Capital Competitive Intermediate Municipal (1–17 Year) Maturities Index and the Lipper Intermediate Municipal Debt Funds Index from February 28, 2001 to February 28, 2011. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and does not include a sales charge. The performance of the Barclays Capital Competitive Intermediate Municipal (1–17 Year) Maturities Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The performance of the Lipper Intermediate Municipal Debt Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The Barclays Capital Competitive Intermediate Municipal (1–17 Year) Maturities Index represents the performance of municipal bonds with matur-

ities from 1 to 17 years. The Lipper Intermediate Municipal Debt Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Capital gains distributions are subject to federal income tax, a portion of the Fund’s income distributions may be subject to the Alternative Minimum Tax and some investors may be subject to certain state and local taxes.

Select Class Shares have a $1,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Because Class B shares automatically convert to Class A shares after 8 years, the 10 Year average annual total return shown above for Class B reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| FEBRUARY 28, 2011 | J.P. MORGAN MUNICIPAL BOND FUNDS | 7 | ||||||

Table of Contents

JPMorgan Municipal Income Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2011 (Unaudited)

| REPORTING PERIOD RETURN: | ||

| Fund (Select Class Shares)* | 1.94% | |

| Barclays Capital Competitive Intermediate Municipal (1–17 Year) Maturities Index | 2.32% | |

| Net Assets as of 2/28/2011 (In Thousands) | $1,089,494 | |

| Duration as of 2/28/2011 | 5.3 Years | |

INVESTMENT OBJECTIVE**

The JPMorgan Municipal Income Fund (the “Fund”) seeks current income exempt from federal income taxes.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s relative performance versus the Barclays Capital Competitive Intermediate Municipal (1-17 Year) Maturities Index (the “Benchmark”) was hurt by its underweight of the intermediate (6-12 years) segment of the yield curve (the yield curve shows the relationship between yields and maturity dates for a set of similar bonds). While the Fund’s 6-12 year securities were strong contributors to the Fund’s absolute return, the Fund’s underweight versus the Benchmark detracted from relative performance as this was the best performing segment of the yield curve. The Fund was also underweight state-issued general obligation bonds, which detracted from relative performance as this sector was a strong performer for the Benchmark.

The Fund’s preference for higher yielding sectors and defensive positioning cushioned its absolute performance during the municipal market’s downturn in the second half of the reporting period and contributed to the Fund’s relative performance. Specifically, the Fund’s investments in the housing sector, where the Fund had its largest overweight, were strong contributors to the Fund’s absolute performance and relative performance versus the Benchmark. The Fund’s underweight to the pre-refunded (bonds that are secured with U.S. government securities) sector, which was one of the worst performing sectors in the Benchmark, also contributed to the Fund’s absolute and relative performance.

HOW WAS THE FUND POSITIONED?

The Fund continued to emphasize yield sectors, particularly the housing sector, and was underweight lower-yielding bonds,

such as pre-refunded bonds. The Fund was also overweight versus the Benchmark in the hospital and education sectors. The Fund’s duration (duration is used to measure the price sensitivity of a bond or a portfolio of bonds to relative changes in interest rates) was shorter than the Benchmark during the reporting period. Given the volatility in the municipal bond market, the Fund used investments in money market funds to maintain liquidity and manage Fund flows.

CREDIT QUALITY ALLOCATIONS*** | ||||

| AAA | 29.0 | % | ||

| AA | 48.7 | |||

| A | 13.1 | |||

| BAA | 7.8 | |||

| BA & NR | 1.4 | |||

J.P. Morgan Investment Management (“JPMIM”) receives credit quality ratings on underlying securities of the portfolio from the three major ratings agencies — S&P, Moody’s and Fitch. When calculating the credit quality breakdown, JPMIM selects the middle rating of the agencies when all three agencies rate a security. JPMIM will use the lower of the two ratings if only two agencies rate a security and JPMIM will use one rating if that is all that is provided. Securities that are not rated by all three agencies are reflected as such.

| * | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments as of February 28, 2011. The Fund’s composition is subject to change. |

| 8 | J.P. MORGAN MUNICIPAL BOND FUNDS | FEBRUARY 28, 2011 | ||||

Table of Contents

AVERAGE ANNUAL TOTAL RETURNS AS OF FEBRUARY 28, 2011 | ||||||||||||||||

| INCEPTION DATE OF CLASS | 1 YEAR | 5 YEAR | 10 YEAR | |||||||||||||

CLASS A SHARES | 2/23/93 | |||||||||||||||

Without Sales Charge | 1.67 | % | 3.56 | % | 3.74 | % | ||||||||||

With Sales Charge* | (2.14 | ) | 2.78 | 3.35 | ||||||||||||

CLASS B SHARES | 1/14/94 | |||||||||||||||

Without CDSC | 1.12 | 2.98 | 3.24 | |||||||||||||

With CDSC** | (3.88 | ) | 2.62 | 3.24 | ||||||||||||

CLASS C SHARES | 11/4/97 | |||||||||||||||

Without CDSC | 1.04 | 2.98 | 3.11 | |||||||||||||

With CDSC*** | 0.04 | 2.98 | 3.11 | |||||||||||||

SELECT CLASS SHARES | 2/9/93 | 1.94 | 3.82 | 4.01 | ||||||||||||

| * | Sales Charge for Class A Shares is 3.75%. |

| ** | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

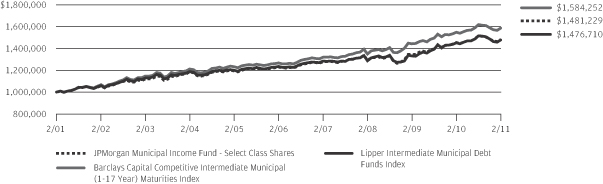

TEN YEAR PERFORMANCE (2/28/01 TO 2/28/11)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Municipal Income Fund, the Barclays Capital Competitive Intermediate Municipal (1–17 Year) Maturities Index and the Lipper Intermediate Municipal Debt Funds Index from February 28, 2001 to February 28, 2011. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and does not include a sales charge. The performance of the Barclays Capital Competitive Intermediate Municipal (1–17 Year) Maturities Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The performance of the Lipper Intermediate Municipal Debt Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The Barclays Capital Competitive Intermediate Municipal (1–17 Year) Maturities Index represents the performance of municipal bonds with maturities from 1 to 17 years. The Lipper Intermediate Municipal Debt Funds Index is

an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Capital gains distributions are subject to federal income tax, a portion of the Fund’s income distributions may be subject to the Alternative Minimum Tax and some investors may be subject to certain state and local taxes.

Select Class Shares have a $1,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Because Class B shares automatically convert to Class A shares after 8 years, the 10 Year average annual total return shown above for Class B reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| FEBRUARY 28, 2011 | J.P. MORGAN MUNICIPAL BOND FUNDS | 9 | ||||||

Table of Contents

JPMorgan Ohio Municipal Bond Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2011 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Select Class Shares)* | 1.49% | |||

| Barclays Capital Competitive Intermediate Municipal (1–17 Year) Maturities Index | 2.32% | |||

| Net Assets as of 2/28/2011 (In Thousands) | $ | 259,046 | ||

| Duration as of 2/28/2011 | 5.6 Years | |||

INVESTMENT OBJECTIVE**

The JPMorgan Ohio Municipal Bond Fund (the “Fund”) seeks current income exempt from federal income tax and Ohio personal income tax, consistent with the preservation of principal.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

On an absolute basis and relative to the Barclays Capital Competitive Intermediate Municipal (1-17 Year) Maturities Index (the “Benchmark”), the Fund’s placement along the yield curve (the yield curve shows the relationship between yields and maturity dates for a set of similar bonds), primarily on the 6-12 year segment, was a key driver of performance during the reporting period.

Positive economic and market trends in the municipal bond space defined the first half of the reporting period. These trends, however, reversed themselves in the beginning of September 2010 and the municipal bond market registered five consecutive months of negative returns. Interest rates followed a straight-line downward path for the first half of the reporting period, which was then offset by a period of rising rates that persisted for most of the remaining reporting period. This interest rate environment produced better returns for the intermediate (6-12 years) segment of the yield curve versus the shorter and longer parts of the curve.

The Fund’s holdings among housing and insured bonds contributed to its absolute performance and relative performance versus the Benchmark. The outperformance in these sectors was driven by the concentration of holdings in the better performing intermediate (6-12 years) part of the yield curve.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers preferred to invest in issuances from highly rated, large state and local municipalities. Given the volatility in the municipal bond market, the Fund used investments in money market funds to maintain liquidity and manage Fund flows. The Fund began the reporting period with slightly longer duration than the Benchmark and finished the reporting period with slightly shorter duration than the Benchmark.

CREDIT QUALITY ALLOCATIONS*** | ||||

| AAA | 20.9 | % | ||

| AA | 58.2 | |||

| A | 15.1 | |||

| BAA | 5.2 | |||

| BA & NR | 0.6 | |||

J.P. Morgan Investment Management (“JPMIM”) receives credit quality ratings on underlying securities of the portfolio from the three major ratings agencies — S&P, Moody’s and Fitch. When calculating the credit quality breakdown, JPMIM selects the middle rating of the agencies when all three agencies rate a security. JPMIM will use the lower of the two ratings if only two agencies rate a security and JPMIM will use one rating if that is all that is provided. Securities that are not rated by all three agencies are reflected as such.

| * | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments as of February 28, 2011. The Fund’s composition is subject to change. |

| 10 | J.P. MORGAN MUNICIPAL BOND FUNDS | FEBRUARY 28, 2011 | ||||

Table of Contents

AVERAGE ANNUAL TOTAL RETURNS AS OF FEBRUARY 28, 2011 | ||||||||||||||||

| INCEPTION DATE OF CLASS | 1 YEAR | 5 YEAR | 10 YEAR | |||||||||||||

CLASS A SHARES | 2/18/92 | |||||||||||||||

Without Sales Charge | 1.33 | % | 3.75 | % | 3.86 | % | ||||||||||

With Sales Charge* | (2.44 | ) | 2.96 | 3.47 | ||||||||||||

CLASS B SHARES | 1/14/94 | |||||||||||||||

Without CDSC | 0.69 | 3.10 | 3.33 | |||||||||||||

With CDSC** | (4.31 | ) | 2.74 | 3.33 | ||||||||||||

CLASS C SHARES | 2/19/05 | |||||||||||||||

Without CDSC | 0.62 | 3.11 | 3.21 | |||||||||||||

With CDSC*** | (0.38 | ) | 3.11 | 3.21 | ||||||||||||

SELECT CLASS SHARES | 7/2/91 | 1.49 | 3.99 | 4.11 | ||||||||||||

| * | Sales Charge for Class A Shares is 3.75%. |

| ** | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

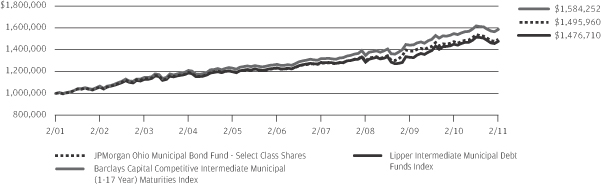

TEN YEAR PERFORMANCE (2/28/01 TO 2/28/11)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class C Shares prior to its inception are based on the performance of Class B Shares.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Ohio Municipal Bond Fund, the Barclays Capital Competitive Intermediate Municipal (1–17 Year) Maturities Index and the Lipper Intermediate Municipal Debt Funds Index from February 28, 2001 to February 28, 2011. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and does not include a sales charge. The performance of the Barclays Capital Competitive Intermediate Municipal (1–17 Year) Maturities Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The performance of the Lipper Intermediate Municipal Debt Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The Barclays Capital Competitive Intermediate Municipal (1–17 Year) Maturities Index represents the performance of municipal bonds with matur-

ities from 1 to 17 years. The Lipper Intermediate Municipal Debt Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Capital gains distributions are subject to federal income tax, a portion of the Fund’s income distributions may be subject to the Alternative Minimum Tax and some investors may be subject to certain state and local taxes.

Select Class Shares have a $1,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Because Class B shares automatically convert to Class A shares after 8 years, the 10 Year average annual total return shown above for Class B reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| FEBRUARY 28, 2011 | J.P. MORGAN MUNICIPAL BOND FUNDS | 11 | ||||||

Table of Contents

JPMorgan Short-Intermediate Municipal Bond Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2011 (Unaudited)

| REPORTING PERIOD RETURN: | ||

| Fund (Select Class Shares)* | 0.59% | |

| Barclays Capital 1–5 Year Municipal Blend Index | 1.61% | |

| Net Assets as of 2/28/2011 (In Thousands) | $1,187,661 | |

| Duration as of 2/28/2011 | 2.6 Years | |

INVESTMENT OBJECTIVE**

The JPMorgan Short-Intermediate Municipal Bond Fund (“the Fund”) seeks as high a level of current income exempt from federal income tax as is consistent with relative stability of principal.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

On an absolute basis and relative to the Barclays Capital 1-5 Year Municipal Blend Index (the “Benchmark”), the Fund’s placement along the yield curve (the yield curve shows the relationship between yields and maturity dates for a set of similar bonds), specifically on the 6-12 year segment, and its bias for high quality issuances were the key drivers of performance during the reporting period.

Positive economic and market trends in the municipal bond space defined the first half of the reporting period. These trends, however, reversed themselves in the beginning of September 2010 and the municipal bond market registered five consecutive months of negative returns. Interest rates followed a straight-line downward path for the first half of the reporting period, which was then offset by a period of rising rates that persisted for most of the remaining reporting period. This interest rate environment produced better returns for the intermediate (6-12 years) segment of the yield curve versus the shorter and longer parts of the curve.

Meanwhile, the Fund invested a small percentage of its assets in securities with maturities of 6-10 years, which performed strongly during the reporting period. These investments contributed to relative performance as the Benchmark did not hold securities on this segment of the yield curve.

The Fund invested primarily in high-quality general obligation bonds, pre-refunded bonds (bonds that are secured with U.S. government securities) and essential-service revenue bonds. While this quality bias hurt the Fund early in the reporting period, the Fund’s higher quality holdings cushioned the Fund when the municipal market deteriorated in the second half of the reporting period and boosted the Fund’s relative performance versus the Benchmark.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund continued to employ a bottom-up, security-selection-based investment approach. The Fund’s portfolio managers sought to take advantage of opportunities stemming from increased volatility, supply pressures and headline credit risk, while maintaining its bias toward higher quality issuances. From a state perspective, the Fund was underweight versus the Benchmark in California, New Jersey and New York. The Fund was overweight versus the Benchmark in Virginia. Given the volatility in the municipal bond market, the Fund used investments in money market funds to maintain liquidity and manage Fund flows.

CREDIT QUALITY ALLOCATIONS*** | ||||

| AAA | 42.7 | % | ||

| AA | 46.5 | |||

| A | 8.3 | |||

| BAA | 2.3 | |||

| BA & NR | 0.2 | |||

J.P. Morgan Investment Management (“JPMIM”) receives credit quality ratings on underlying securities of the portfolio from the three major ratings agencies — S&P, Moody’s and Fitch. When calculating the credit quality breakdown, JPMIM selects the middle rating of the agencies when all three agencies rate a security. JPMIM will use the lower of the two ratings if only two agencies rate a security and JPMIM will use one rating if that is all that is provided. Securities that are not rated by all three agencies are reflected as such.

| * | The return shown is based on net asset value calculated for share-holder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments as of February 28, 2011. The Fund’s composition is subject to change. |

| 12 | J.P. MORGAN MUNICIPAL BOND FUNDS | FEBRUARY 28, 2011 | ||||

Table of Contents

AVERAGE ANNUAL TOTAL RETURNS AS OF FEBRUARY 28, 2011 | ||||||||||||||||

| INCEPTION DATE OF CLASS | 1 YEAR | 5 YEAR | 10 YEAR | |||||||||||||

CLASS A SHARES | 5/4/98 | |||||||||||||||

Without Sales Charge | 0.32 | % | 2.89 | % | 2.88 | % | ||||||||||

With Sales Charge | (1.91 | ) | 2.43 | 2.65 | ||||||||||||

CLASS B SHARES | 5/4/98 | |||||||||||||||

Without CDSC | (0.18 | ) | 2.38 | 2.57 | ||||||||||||

With CDSC | (3.18 | ) | 2.38 | 2.57 | ||||||||||||

CLASS C SHARES | 11/1/01 | (0.07 | ) | 2.39 | 2.37 | |||||||||||

INSTITUTIONAL CLASS SHARES | 6/19/09 | 0.84 | 3.25 | 3.18 | ||||||||||||

SELECT CLASS SHARES | 5/4/98 | 0.59 | 3.15 | 3.13 | ||||||||||||

| * | Sales Charge for Class A Shares is 2.25%. |

| ** | Assumes 3% CDSC (contingent deferred sales charge) for the one year period, 0% CDSC for the five year period and thereafter. |

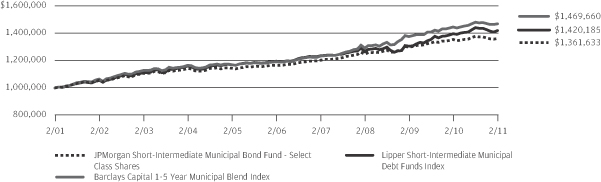

TEN YEAR PERFORMANCE (2/28/01 TO 2/28/11)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

Returns for Class C and Institutional Class Shares prior to their inception are based on the performance of Select Class Shares. Returns for Class C Shares have been adjusted to reflect the differences in expenses and sales charges between classes. The actual returns of Institutional Class Shares would have been different than shown because Institutional Class Shares have different expenses than Select Class Shares.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Short-Intermediate Municipal Bond Fund, the Barclays Capital 1–5 Year Municipal Blend Index and the Lipper Short-Intermediate Municipal Debt Funds Index from February 28, 2001 to February 28, 2011. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and does not include a sales charge. The performance of the Barclays Capital 1–5 Year Municipal Blend Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The performance of the Lipper Short-Intermediate Municipal Debt Funds Index includes expenses associated with a mutual fund, such as investment management fees. These

expenses are not identical to the expenses charged by the Fund. The Barclays Capital 1–5 Year Municipal Blend Index is an unmanaged index of investment grade tax-exempt municipal bonds with maturities of 1–5.999 years. The Lipper Short-Intermediate Municipal Debt Funds Index represents the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Capital gains distributions are subject to federal income tax, a portion of the Fund’s income distributions may be subject to the Alternative Minimum Tax and some investors may be subject to certain state and local taxes.

Select Class Shares have a $1,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Because Class B shares automatically convert to Class A shares after 6 years, the 10 Year average annual total return shown above for Class B reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| FEBRUARY 28, 2011 | J.P. MORGAN MUNICIPAL BOND FUNDS | 13 | ||||||

Table of Contents

JPMorgan Tax Free Bond Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2011 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Class A Shares, without a sales charge)* | 0.78% | |||

| Barclays Capital Municipal Bond Index | 1.72% | |||

| Net Assets as of 2/28/2011 (In Thousands) | $ | 504,169 | ||

| Duration as of 2/28/2011 | 6.9 Years | |||

INVESTMENT OBJECTIVE**

The JPMorgan Tax Free Bond Fund (the “Fund”) seeks as high a level of current income exempt from federal income tax as is consistent with relative stability of principal.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

In the municipal bond market, positive trends marked the first half of the reporting period. However, this positive environment ended in August 2010 and was followed by six consecutive months of negative trends for municipal fixed income securities.

The Fund invested primarily in high-quality general obligation bonds, pre-refunded bonds (bonds that are secured with U.S. government securities) and essential-service revenue bonds. While this quality bias hurt the Fund early in the reporting period, the Fund’s higher quality holdings cushioned the Fund when the municipal market deteriorated in the second half of the reporting period and boosted the Fund’s relative performance versus the Benchmark.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund continued to employ a bottom-up, security-selection-based investment approach and sought to take advantage of opportunities stemming from increased volatility, supply pressures and headline credit risk. The Fund maintained its quality bias, as the Fund’s portfolio managers preferred higher-quality issuances. For liquidity and to enhance the Fund’s overall credit quality, the Fund maintained

its overweight versus the Benchmark in pre-refunded bonds. Given the volatility in the municipal bond market, the Fund used investments in money market funds to maintain liquidity and manage Fund flows.

CREDIT QUALITY ALLOCATIONS*** | ||||

| AAA | 18.6 | % | ||

| AA | 49.7 | |||

| A | 20.6 | |||

| BAA | 11.1 | |||

J.P. Morgan Investment Management (“JPMIM”) receives credit quality ratings on underlying securities of the portfolio from the three major ratings agencies — S&P, Moody’s and Fitch. When calculating the credit quality breakdown, JPMIM selects the middle rating of the agencies when all three agencies rate a security. JPMIM will use the lower of the two ratings if only two agencies rate a security and JPMIM will use one rating if that is all that is provided. Securities that are not rated by all three agencies are reflected as such.

| * | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon total investments as of February 28, 2011. The Fund’s composition is subject to change. |

| 14 | J.P. MORGAN MUNICIPAL BOND FUNDS | FEBRUARY 28, 2011 | ||||

Table of Contents

AVERAGE ANNUAL TOTAL RETURNS AS OF FEBRUARY 28, 2011 | ||||||||||||||||

| INCEPTION DATE OF CLASS | 1 YEAR | 5 YEAR | 10 YEAR | |||||||||||||

CLASS A SHARES | 3/1/88 | |||||||||||||||

Without Sales Charge | 0.78 | % | 3.20 | % | 3.96 | % | ||||||||||

With Sales Charge* | (3.03 | ) | 2.41 | 3.56 | ||||||||||||

CLASS B SHARES | 4/4/95 | |||||||||||||||

Without CDSC | 0.07 | 2.48 | 3.40 | |||||||||||||

With CDSC** | (4.93 | ) | 2.12 | 3.40 | ||||||||||||

CLASS C SHARES | 7/1/08 | |||||||||||||||

Without CDSC | 0.08 | 2.50 | 2.93 | |||||||||||||

With CDSC*** | (0.92 | ) | 2.50 | 2.93 | ||||||||||||

SELECT CLASS SHARES | 2/1/95 | 1.02 | 3.38 | 4.16 | ||||||||||||

| * | Sales Charge for Class A Shares is 3.75%. |

| ** | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

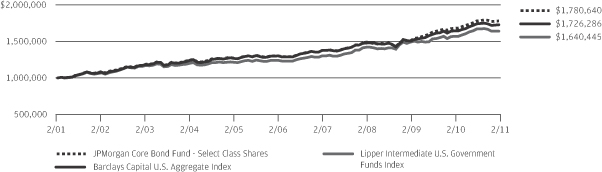

TEN YEAR PERFORMANCE (2/28/01 TO 2/28/11)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

Returns for Class C Shares prior to their inception date are based on the performance of Class B Shares.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Tax Free Bond Fund, the Barclays Capital Municipal Bond Index and the Lipper General Municipal Debt Funds Index from February 28, 2001 to February 28, 2011. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and includes a sales charge. The performance of the Barclays Capital Municipal Bond Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The performance of the Lipper General Municipal Debt Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The Barclays Capital Municipal Bond Index is a total return performance benchmark for the long-term, investment-grade tax-exempt bond market. The Lipper General Municipal Debt

Funds Index represents the total returns of the 30 largest mutual funds in the indicated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Capital gains distributions are subject to federal income tax, a portion of the Fund’s income distributions may be subject to the Alternative Minimum Tax and some investors may be subject to certain state and local taxes.

Class A Shares have a $1,000 minimum initial investment and carry a 3.75% sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Because Class B shares automatically convert to Class A shares after 8 years, the 10 Year average annual total return shown above for Class B reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| FEBRUARY 28, 2011 | J.P. MORGAN MUNICIPAL BOND FUNDS | 15 | ||||||

Table of Contents

JPMorgan Arizona Municipal Bond Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2011

(Amounts in thousands)

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION (t) | VALUE($) | ||||||

| Municipal Bonds — 98.9% |

| ||||||

Arizona — 92.0% |

| |||||||

Certificate of Participation/Lease — 10.9% |

| |||||||

Arizona School Facilities Board, | ||||||||

| 1,000 | COP, 5.250%, 09/01/23 | 1,016 | ||||||

| 1,500 | Series A, COP, NATL-RE, 5.000%, 09/01/12 | 1,573 | ||||||

Arizona State University, Board of Regents, | ||||||||

| 2,000 | COP, NATL-RE, 5.000%, 07/01/17 | 2,166 | ||||||

| 1,000 | COP, NATL-RE, 5.000%, 07/01/18 | 1,077 | ||||||

| 1,065 | Pima County, Justice Building Project, Series A, COP, AMBAC, 5.000%, 07/01/16 | 1,149 | ||||||

| 1,570 | Scottsdale Municipal Property Corp., Rev., COP, 5.000%, 07/01/26 | 1,743 | ||||||

| 2,000 | State of Arizona, Department of Administration, Series A, COP, AGM, 5.250%, 10/01/23 | 2,083 | ||||||

University of Arizona, | ||||||||

| 1,365 | Series A, COP, AMBAC, 5.000%, 06/01/19 | 1,446 | ||||||

| 1,000 | Series B, COP, AMBAC, 5.000%, 06/01/21 | 1,040 | ||||||

| 145 | University of Arizona, Unrefunded Balance, Series A, COP, AMBAC, 5.500%, 06/01/17 | 152 | ||||||

| 13,445 | ||||||||

Education — 7.1% |

| |||||||

| 2,700 | Arizona School Facilities Board, State School Trust, Rev., AMBAC, 5.000%, 07/01/18 | 2,901 | ||||||

| 2,000 | Arizona State University, Rev., AGM, 5.250%, 07/01/15 | 2,125 | ||||||

| 1,520 | City of Glendale IDA, Midwestern University, Rev., 5.000%, 05/15/14 | 1,637 | ||||||

| 1,905 | Navajo County, Unified School District No. 20-Whiteriver, Project of 2005, Series A, Rev., NATL-RE, 5.000%, 07/01/18 | 2,129 | ||||||

| 8,792 | ||||||||

General Obligation — 14.2% |

| |||||||

| 1,090 | City of Mesa, GO, NATL-RE, FGIC, 5.375%, 07/01/14 | 1,216 | ||||||

| 1,000 | City of Scottsdale, Projects of 2000 & 2004, GO, 5.000%, 07/01/16 | 1,160 | ||||||

| 1,345 | City of Scottsdale, Unrefunded Balance, GO, 5.250%, 07/01/18 | 1,371 | ||||||

| 1,500 | City of Tucson, GO, NATL-RE, 5.000%, 07/01/18 | 1,689 | ||||||

| 1,000 | Maricopa County, High School District No. 210-Phoenix, GO, AGM, 5.250%, 07/01/19 | 1,146 | ||||||

| 1,265 | Maricopa County, School District No. 38-Madison Elementary, Project of 2004, Series A, GO, NATL-RE, 5.000%, 07/01/19 | 1,362 | ||||||

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

General Obligation — Continued | ||||||||

| 1,020 | Maricopa County, Unified School District No. 11-Peoria, Unrefunded Balance, School Improvement, GO, NATL-RE, FGIC, 4.750%, 07/01/14 | 1,030 | ||||||

| 1,000 | Maricopa County, Unified School District No. 69-Paradise Valley, Certificates of Ownership, Series A, GO, NATL-RE, FGIC, 5.250%, 07/01/14 | 1,107 | ||||||

| 1,560 | Pima County, Unified School District No. 12-Sunnyside, GO, AGM, 5.000%, 07/01/14 | 1,724 | ||||||

| 3,000 | Town of Gilbert, GO, NATL-RE, 5.000%, 07/01/16 | 3,419 | ||||||

| 2,100 | Town of Gilbert, Projects of 2006 & 2007, GO, 5.000%, 07/01/18 | 2,404 | ||||||

| 17,628 | ||||||||

Hospital — 5.3% |

| |||||||

Arizona Health Facilities Authority, Banner Health, | ||||||||

| 1,185 | Series A, Rev., 5.000%, 01/01/12 | 1,222 | ||||||

| 1,225 | Series A, Rev., 5.000%, 01/01/14 | 1,301 | ||||||

| 1,200 | City of Scottsdale IDA, Healthcare, Series A, Rev., 5.000%, 09/01/22 | 1,226 | ||||||

| 1,000 | City of Show Low IDA, Navapache Regional Medical Center, Series A, Rev., ACA, 5.500%, 12/01/17 | 1,001 | ||||||

| 1,000 | Scottsdale IDA, Healthcare, Series A, Rev., 5.000%, 09/01/15 | 1,078 | ||||||

| 695 | Yavapai County IDA, Yavapai Regional Medical Center, Series A, Rev., AGM, 5.125%, 12/01/13 | 697 | ||||||

| 6,525 | ||||||||

Housing — 0.0% (g) |

| |||||||

| 5 | Pima County IDA, Single Family Mortgage, Series A, Rev., 6.400%, 08/01/11 | 5 | ||||||

Other Revenue — 7.1% |

| |||||||

| 2,500 | Arizona Power Authority, Crossover, Series A, Rev., SO, 5.250%, 10/01/17 | 2,868 | ||||||

| 2,500 | Arizona Water Infrastructure Finance Authority, Series A, Rev., 5.000%, 10/01/17 | 2,889 | ||||||

| 1,000 | Greater Arizona Development Authority, Series A, Rev., NATL-RE, 5.000%, 08/01/22 | 1,017 | ||||||

| 2,000 | Phoenix Civic Improvement Corp., Junior Lien, Series A, Rev., 5.000%, 07/01/27 | 1,993 | ||||||

| 8,767 | ||||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| 16 | J.P. MORGAN MUNICIPAL BOND FUNDS | FEBRUARY 28, 2011 | ||||

Table of Contents

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

| Municipal Bonds — Continued |

| ||||||

Prerefunded — 8.5% |

| |||||||

| 1,000 | Arizona School Facilities Board, Series A, COP, NATL-RE, 5.250%, 03/01/13 (p) | 1,089 | ||||||

| 1,000 | City of Phoenix, GO, 5.000%, 07/01/14 (p) | 1,133 | ||||||

| 6,450 | Maricopa County IDA, Capital Appreciation, Series 1983 A, Rev., Zero Coupon, 12/31/14 (p) | 6,003 | ||||||

| 2,000 | Scottsdale Municipal Property Corp., Rev., 5.000%, 07/01/16 (p) | 2,335 | ||||||

| 10,560 | ||||||||

Special Tax — 10.7% |

| |||||||

| 2,500 | City of Phoenix, Street & Highway, Capital Appreciation, Junior Lien, Series A, Rev., NATL-RE, FGIC, Zero Coupon, 07/01/12 | 2,450 | ||||||

| 1,125 | City of Tempe, Excise Tax, Rev., 5.000%, 07/01/16 | 1,270 | ||||||

| 3,000 | Phoenix Civic Improvement Corp., Sub Lien, Series B, Rev., NATL-RE, 5.000%, 07/01/15 | 3,315 | ||||||

Scottsdale Municipal Property Corp., | ||||||||

| 2,500 | Rev., 5.000%, 07/01/14 | 2,787 | ||||||

| 3,000 | Rev., 5.000%, 07/01/17 | 3,441 | ||||||

| 13,263 | ||||||||

Transportation — 9.1% |

| |||||||

Arizona Transportation Board, | ||||||||

| 2,000 | Series A, Rev., 5.000%, 07/01/24 | 2,125 | ||||||

| 2,000 | Series A, Rev., 5.250%, 07/01/17 | 2,145 | ||||||

| 3,000 | Series B, Rev., 5.250%, 07/01/18 | 3,147 | ||||||

| 1,000 | City of Mesa, Street & Highway, Rev., AGM, 5.000%, 07/01/12 | 1,054 | ||||||

| 1,000 | Tucson Airport Authority, Inc., Rev., AGM, 5.000%, 06/01/12 | 1,052 | ||||||

| 1,670 | Tucson Airport Authority, Inc., Sub Lien, Rev., AMT, NATL-RE, 5.000%, 12/01/18 | 1,705 | ||||||

| 11,228 | ||||||||

Utility — 7.2% |

| |||||||

| 3,000 | City of Mesa, Utility Systems, Rev., NATL-RE, FGIC, 5.000%, 07/01/20 | 3,337 | ||||||

Salt River Project Agricultural Improvement & Power District, | ||||||||

| 1,550 | Series A, Rev., 5.000%, 01/01/21 | 1,716 | ||||||

| 3,600 | Series A, Rev., 5.000%, 01/01/23 | 3,880 | ||||||

| 8,933 | ||||||||

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Water & Sewer — 11.9% |

| |||||||

Arizona Water Infrastructure Finance Authority, Water Quality, | ||||||||

| 1,915 | Series A, Rev., 5.000%, 10/01/23 | 2,096 | ||||||

| 2,025 | Series A, Rev., 5.000%, 10/01/24 | 2,176 | ||||||

| 2,020 | Series A, Rev., 5.000%, 10/01/29 | 2,109 | ||||||

City of Scottsdale, Water & Sewer, | ||||||||

| 1,430 | Rev., 5.250%, 07/01/21 | 1,713 | ||||||

| 1,875 | Rev., 5.250%, 07/01/23 | 2,228 | ||||||

| 2,000 | Phoenix Civic Improvement Corp., Junior Lien, Series A, Rev., 5.000%, 07/01/25 | 2,119 | ||||||

| 2,000 | Phoenix Civic Improvement Corp., Wastewater Systems, Senior Lien, Rev., 5.500%, 07/01/20 | 2,291 | ||||||

| 14,732 | ||||||||

Total Arizona | 113,878 | |||||||

Illinois — 0.8% |

| |||||||

Other Revenue — 0.8% |

| |||||||

| 1,000 | Railsplitter Tobacco Settlement Authority, Rev., 5.000%, 06/01/16 | 1,041 | ||||||

Pennsylvania — 0.9% |

| |||||||

Hospital — 0.9% |

| |||||||

| 1,000 | Allegheny County Hospital Development Authority, University of Pittsburgh Medical Center, Series A, Rev., 5.000%, 09/01/14 | 1,103 | ||||||

South Carolina — 0.9% |

| |||||||

Utility — 0.9% |

| |||||||

| 1,000 | South Carolina State Public Service Authority, Santee Cooper, Series A, Rev., 5.375%, 01/01/28 | 1,066 | ||||||

Texas — 4.3% |

| |||||||

General Obligation — 1.6% |

| |||||||

| 1,700 | Eagle Mountain & Saginaw Independent School District, School Building, GO, PSF-GTD, 5.000%, 08/15/20 | 1,903 | ||||||

Transportation — 2.7% |

| |||||||

| 3,000 | Texas State Transportation Commission, First Tier, Series A, Rev., 5.250%, 04/01/14 | 3,364 | ||||||

Total Texas | 5,267 | |||||||

Total Municipal Bonds | 122,355 | |||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| FEBRUARY 28, 2011 | J.P. MORGAN MUNICIPAL BOND FUNDS | 17 | ||||||

Table of Contents

JPMorgan Arizona Municipal Bond Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2011 (continued)

(Amounts in thousands)

| SHARES | SECURITY DESCRIPTION | VALUE($) | ||||||

| Short-Term Investment — 0.6% |

| ||||||

Investment Company — 0.6% | ||||||||

| 710 | JPMorgan Tax Free Money Market Fund, Institutional Class Shares, | 710 | ||||||

Total Investments — 99.5% | 123,065 | |||||||

Other Assets in Excess of | 643 | |||||||

NET ASSETS — 100.0% | $ | 123,708 | ||||||

Percentages indicated are based on net assets.

SEE NOTES TO FINANCIAL STATEMENTS.

| 18 | J.P. MORGAN MUNICIPAL BOND FUNDS | FEBRUARY 28, 2011 | ||||

Table of Contents

JPMorgan Michigan Municipal Bond Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2011

(Amounts in thousands)

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION (t) | VALUE($) | ||||||

| Municipal Bonds — 97.6% |

| ||||||

Arizona — 2.7% |

| |||||||

Other Revenue — 1.8% |

| |||||||

| 2,000 | Phoenix Civic Improvement Corp., Junior Lien, Series A, Rev., 5.000%, 07/01/23 | 2,042 | ||||||

Utility — 0.9% |

| |||||||

| 1,000 | Salt River Project Agricultural Improvement & Power District, Series A, Rev., 5.000%, 01/01/23 | 1,078 | ||||||

Total Arizona | 3,120 | |||||||

California — 0.9% |

| |||||||

Water & Sewer — 0.9% |

| |||||||

| 1,000 | San Diego Public Facilities Financing Authority, Series B, Rev., 5.500%, 05/15/23 | 1,094 | ||||||

Michigan — 89.1% |

| |||||||

Certificate of Participation/Lease — 4.0% |

| |||||||

| 1,800 | City of Detroit, Wayne County Stadium Authority, Rev., COP, NATL-RE, FGIC, 5.500%, 02/01/17 | 1,803 | ||||||

| 1,250 | Michigan State Building Authority, Facilities Program, Series I, Rev., COP, AGM, 5.250%, 10/15/15 | 1,350 | ||||||

| 1,500 | Michigan Strategic Fund, House of Representatives Facilities, Series A, Rev., COP, AGC, 5.250%, 10/15/20 | 1,579 | ||||||

| 4,732 | ||||||||

Education — 3.2% |

| |||||||

| 1,000 | Michigan Higher Education Student Loan Authority, Series XVII-A, Rev., AMBAC, 5.750%, 06/01/13 | 966 | ||||||

| 1,670 | Oakland University, Rev., AMBAC, 5.250%, 05/15/19 | 1,795 | ||||||

| 1,000 | Western Michigan University, Rev., NATL-RE, 5.000%, 11/15/19 | 1,047 | ||||||

| 3,808 | ||||||||

General Obligation — 29.4% |

| |||||||

| 1,675 | Charles Stewart Mott Community College, Community College Facilities, GO, NATL-RE, 5.000%, 05/01/20 | 1,779 | ||||||

| 1,000 | City of Dearborn School District, GO, NATL-RE, FGIC, Q-SBLF, 5.000%, 05/01/18 | 1,095 | ||||||

City of Jackson, Capital Appreciation, Downtown Development, | ||||||||

| 1,710 | GO, AGM, Zero Coupon, 06/01/17 | 1,277 | ||||||

| 2,060 | GO, AGM, Zero Coupon, 06/01/18 | 1,430 | ||||||

| 2,075 | East Grand Rapids Public School District, GO, AGM, Q-SBLF, 5.000%, 05/01/18 | 2,236 | ||||||

| 1,000 | Ecorse Public School District, GO, AGM, Q-SBLF, 5.250%, 05/01/20 | 1,081 | ||||||

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

General Obligation — Continued |

| |||||||

| 1,000 | Grand Blanc Community Schools, School Building & Site, GO, AGM, Q-SBLF, 5.000%, 05/01/15 | 1,081 | ||||||

| 2,660 | Hartland Consolidated School District, GO, Q-SBLF, 5.375%, 05/01/16 | 2,673 | ||||||

| 1,515 | Healthsource Saginaw, Inc., GO, NATL-RE, 5.000%, 05/01/20 | 1,594 | ||||||

| 1,600 | Howell Public Schools, School Building & Site, GO, Q-SBLF, 5.000%, 05/01/15 | 1,698 | ||||||

| 1,620 | Jackson Public Schools, School Building & Site, GO, AGM, Q-SBLF, 5.000%, 05/01/18 | 1,746 | ||||||

| 1,250 | Lansing Community College, Building & Site, GO, NATL-RE, 5.000%, 05/01/19 | 1,330 | ||||||

Lowell Area Schools, Capital Appreciation, | ||||||||

| 5,000 | GO, NATL-RE, FGIC, Q-SBLF, Zero Coupon, 05/01/14 | 4,613 | ||||||

| 1,425 | GO, NATL-RE, FGIC, Q-SBLF, Zero Coupon, 05/01/16 | 1,197 | ||||||

| 1,210 | Newaygo Public Schools, GO, NATL-RE, Q-SBLF, 5.000%, 05/01/22 | 1,270 | ||||||

| 1,910 | Pinckney Community Schools, GO, AGM, Q-SBLF, 5.000%, 05/01/19 | 2,037 | ||||||

| 1,935 | South Lyon Community Schools, Series II, GO, NATL-RE, FGIC, Q-SBLF, 5.000%, 05/01/21 | 2,011 | ||||||

| 1,500 | South Redford School District, School Building & Site, GO, NATL-RE, Q-SBLF, 5.000%, 05/01/21 | 1,559 | ||||||

| 1,450 | Southfield Library Building Authority, GO, NATL-RE, 5.000%, 05/01/19 | 1,581 | ||||||

| 1,175 | Wayne County, Downriver Sewer Disposal, Series B, GO, NATL-RE, 5.125%, 11/01/18 | 1,182 | ||||||

| 34,470 | ||||||||

Hospital — 6.6% |

| |||||||

| 1,000 | Michigan State Hospital Finance Authority, Ascension Health, Senior Care Group, Rev., 5.000%, 11/15/16 | 1,107 | ||||||

Michigan State Hospital Finance Authority, Oakwood Obligation Group, | ||||||||

| 2,000 | Series A, Rev., 5.000%, 07/15/14 | 2,111 | ||||||

| 1,030 | Series A, Rev., 5.000%, 07/15/17 | 1,070 | ||||||

| 960 | Michigan State Hospital Finance Authority, Port Huron Hospital Obligation, Rev., AGM, 5.375%, 07/01/12 | 963 | ||||||

Michigan State Hospital Finance Authority, Sparrow Obligation Group, | ||||||||

| 1,000 | Rev., 5.000%, 11/15/19 | 1,015 | ||||||

| 1,500 | Rev., NATL-RE, 5.000%, 11/15/19 | 1,539 | ||||||

| 7,805 | ||||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| FEBRUARY 28, 2011 | J.P. MORGAN MUNICIPAL BOND FUNDS | 19 | ||||||

Table of Contents

JPMorgan Michigan Municipal Bond Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2011 (continued)

(Amounts in thousands)

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

| Municipal Bonds — Continued |

| ||||||

Housing — 2.1% |

| |||||||

Michigan State Housing Development Authority, Weston, Limited Obligation, | ||||||||