UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04244

SOUND SHORE FUND, INC.

(Exact name of registrant as specified in charter)

3435 Stelzer Road

Columbus, OH 43219

(Address of principal executive offices) (Zip Code)

T. Gibbs Kane, Jr., President

8 Sound Shore Drive

Greenwich, Connecticut 06830

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 551-1980

Date of fiscal year end: December 31

Date of reporting period: December 31, 2012

Item 1. Reports to Stockholders.

3435 STELZER ROAD, COLUMBUS, OH 43219 1-800-551-1980

December 31, 2012

Dear Shareholder:

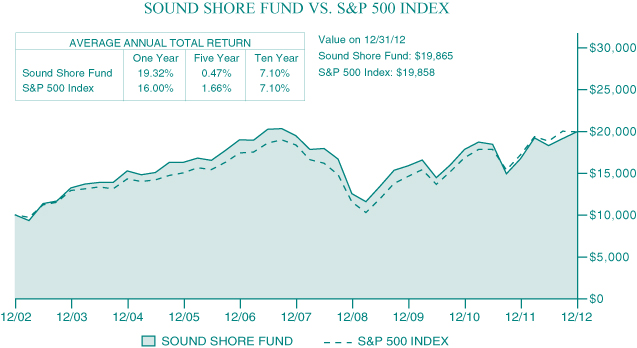

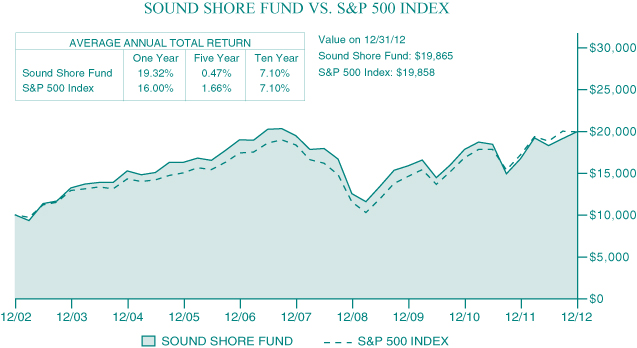

The Sound Shore Fund ended December 31, 2012 with a net asset value of $34.91 per share, after a year-end income distribution of $0.139623. The fourth quarter total return of 4.22% exceeded that of the Standard & Poor’s 500 Index (“S&P 500”) which declined -0.38% and the Dow Jones Industrial Average (“Dow Jones”) which fell -1.74%. For the year, the Fund gained 19.32% and compared well with the S&P 500 and the Dow Jones, which had positive returns of 16.00% and 10.24%, respectively.

We are required by the SEC to say that: Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. The Fund’s 1, 5, 10, and 15-year average annual total returns for the period ended December 31, 2012 were 19.32%, 0.47%, 7.10%, and 5.04%, respectively. As stated in the current prospectus, the Fund’s annual operating expense ratio is 0.94%. For the most recent month-end performance, please visit the Fund’s website at www.soundshorefund.com.

Last year saw continued sluggish economic activity for many sectors of the world economy. In the US, S&P 500 revenue and EPS are expected to have increased only marginally from 2011. Fiscal deficits stretched across the globe, unrest continued in the Middle East, and political drama dominated various country headlines. Many thought the US cliff would be an appropriate place for its politicians to visit. Stock markets are said to abhor last year’s type of uncertainty, which, if true, makes the double-digit returns of many world stock markets puzzling. To many, the S&P 500 Index’s strong 13.4% price gain may be surprising enough, but few would have guessed it would be trumped by Germany, France, and Japan, not to mention Ireland and Greece (as measured by their respective Dow Jones indices in local currencies). The offsets to the troubling economic and political backdrop, in our opinion, were the lack of competition from fixed income investments (stock yields exceeded the 10 year Treasury for the first time in over 50 years) and the promises from various central banks to keep flooding the market until private demand for funds recovers, implying interest rates might remain low for the foreseeable future. Additionally, US corporations continued to manage their labor costs well and, while earnings were flat year-to-year, returns on equity remain high by historical standards at 16%. Capital expenditures were held in check, thereby freeing up cash to be returned to shareholders in the form of increased dividends and/or share repurchases.

Our “value” investment process at Sound Shore is somewhat analogous to the market’s performance last year in that we don’t dwell on current headlines and don’t try to predict the unpredictable. Instead, we use the market’s uncertainty towards an out-of-favor stock as an opportunity to investigate whether that company is likely to soon see improving fundamentals through internal management decisions if not

1

economic tailwinds. If we are correct, then the stock should see improving earnings versus expectations and a recovering P/E valuation towards “normal.”

In 2012, your portfolio had 10 previously unpopular stocks that returned more than 30%: Bank of America, Charles Schwab, Citigroup, Comcast, Invesco, Lowes, Sanofi, Sunoco, Time Warner, and Thermo Fisher. In particular, diversified financials Bank of America and Citigroup performed well as both companies benefited from efforts to focus on core franchises, reduce costs, and improve capital ratios.

Equally important as the financials, however, were several companies that benefitted from their management’s more optimal balancing of growth and shareholder returns. Cable service provider Comcast, a long held position, provides a great case study. We started our position in Comcast in 2007 when the company was on the threshold of significant free cash improvement derived from lower capital spending. Over the past five plus years, Comcast has been successful in the telecommunications marketplace, enhanced its portfolio through the acquisition of NBC Universal, initiated a competitive dividend, including an increase of 44% in 2012, and retired over 10% of its shares. Comcast has outperformed the market by approximately 40% and yet its shares still boast a 6.9% free cash flow yield.

Oil service provider Weatherford was the year’s biggest detractor, the result of a temporarily higher 2012 book tax rate and sluggish North American energy markets. Similarly, oil and gas producer Devon declined due to wider than normal price discounts in the US and Canada. Low end valuations for both stocks (Weatherford at 11.9 times forward P/E, Devon at $1.40 per reserve unit) leave room for significant upside as the companies execute as we believe they can.

The new year features its usual share of uncertainty and countervailing trends. Based on P/E the S&P 500 is not quite the bargain it was a year ago, but at 13.2 times is still below its long-term average of 16.0. Additionally, barring reentry into recessionary conditions, equity yields and cash generation seems sufficient to provide support for stocks as competition to fixed income investments.

Sound Shore’s research process includes an average of 700 private management meetings per year and our starting point of researching previously underperforming but sound companies puts us, we believe, in a good position to uncover favorable risk/reward investment opportunities despite the headlines.

Thank you for your continued investment alongside us in the Fund.

Sincerely,

SOUND SHORE FUND

Harry Burn, III

John P. DeGulis

T. Gibbs Kane, Jr.

Co-Portfolio Managers

2

Fund returns assume the reinvestment of all dividend and capital gain distributions. The Standard & Poor’s 500 Index is an unmanaged index representing the average performance of 500 widely held, publicly traded, large capitalization stocks. The Dow Jones Industrial Average consists of 30 stocks that are considered to be major factors in their industries and that are widely held by individuals and institutional investors. It is not possible to invest directly in an Index or Average.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on returns. Because of ongoing market volatility, Fund performance may be subject to substantial short-term changes.

This letter may contain discussions about certain investments both held and not held in the portfolio. As required by the Financial Industry Regulatory Authority (FINRA), we must remind you that current and future portfolio holdings are subject to risk. Percent of net assets as of 12/31/12: Bank of America Corp.: 2.85%; Charles Schwab Corp.: 2.59%; Citigroup, Inc.: 2.84%; Comcast Corp. “A”: 2.46%; Devon Energy Corp.: 2.49%; Invesco LTD: 2.58%; Lowes Companies, Inc.: 2.15%; NBC Universal: 0.00%; Sanofi ADR: 2.82%; Sunoco Inc.: 0.00%; Time Warner, Inc.: 2.25%; Thermo Fisher Scientific, Inc.: 2.41%; and Weatherford International, LTD: 1.90%.

An investment in the Fund is subject to risk, including the possible loss of principal amount invested. Mid Cap Risk: Securities of medium sized companies may be more volatile and more difficult to liquidate during market downturns than securities of large, more widely traded companies. Foreign Securities Risk: The Fund may invest in foreign securities primarily in the form of American Depositary Receipts. Investing in the securities of foreign issuers also involves certain special risks, which are not typically associated with investing in U.S. dollar-denominated securities or quoted securities of U.S. issuers including increased risks of adverse issuer, political, regulatory, market or economic developments. Investments in foreign securities also may be affected favorably or unfavorably by changes in currency rates and in exchange control regulations.

The views in this letter were those of the Fund managers as of 12/31/12 and may not necessarily reflect their views on the date this letter is first published or anytime thereafter. These views (i) are intended to assist shareholders in understanding the Fund’s present investment methodology and (ii) do not constitute investment advice. This letter must be preceded or accompanied by a current Fund prospectus. Distributed by Foreside Fund Services, LLC.

3

The following chart reflects a ten-year comparison in the change in value of a hypothetical $10,000 investment in the Fund, including reinvested dividends and distributions, compared with a broad-based securities market index. The Standard and Poor’s 500 Index (the “S&P 500”) is a market-weighted index composed of 500 large capitalization companies and reflects the reinvestment of dividends. The Fund is professionally managed, while the S&P 500 is unmanaged and is not available for investment. The S&P 500 excludes the effect of any expenses, which have been deducted from the Fund’s return. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Furthermore, in the years 2003 through 2005, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. Past performance cannot predict nor guarantee future results. Investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Results of an investment made today may differ substantially from the Fund’s historical performance. Current performance may be lower or higher than the performance data quoted.

The above information is not covered by the Report of the Independent Registered Public Accounting Firm.

4

SOUND SHORE FUND, INC.

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2012

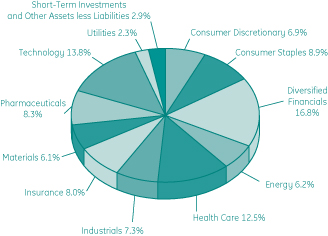

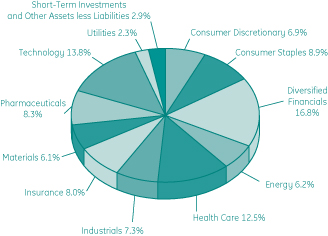

Sector/Industry Weightings (as of December 31, 2012)

as a percentage of Net Assets (Unaudited)

| | | | | | | | |

| | | Share

Amount

| | | Market

Value

| |

Common Stocks (97.1%) | |

Consumer Discretionary (6.9%) | |

Comcast Corp., Class A | | | 982,100 | | | $ | 36,710,898 | |

Lowe’s Companies, Inc. | | | 901,200 | | | | 32,010,624 | |

Time Warner, Inc. | | | 701,800 | | | | 33,567,094 | |

| | | | | | |

|

|

|

| | | | | | | | 102,288,616 | |

| | | | | | |

|

|

|

Consumer Staples (8.9%) | | | | | | | | |

Bunge, Ltd. | | | 538,700 | | | | 39,158,103 | |

CVS Caremark Corp. | | | 777,600 | | | | 37,596,960 | |

Procter & Gamble Co. | | | 491,500 | | | | 33,367,935 | |

Sysco Corp. | | | 709,800 | | | | 22,472,268 | |

| | | | | | |

|

|

|

| | | | | | | | 132,595,266 | |

| | | | | | |

|

|

|

Diversified Financials (16.8%) | | | | | | | | |

Bank of America Corp. | | | 3,670,600 | | | | 42,578,960 | |

Capital One Financial Corp. | | | 739,900 | | | | 42,862,407 | |

See Notes to Financial Statements.

5

SOUND SHORE FUND, INC.

SCHEDULE OF INVESTMENTS (Continued)

DECEMBER 31, 2012

| | | | | | | | |

| | | Share

Amount

| | | Market

Value

| |

Diversified Financials (Continued) | | | | | | | | |

Citigroup, Inc. | | | 1,069,300 | | | $ | 42,301,508 | |

Invesco, Ltd. | | | 1,473,200 | | | | 38,435,788 | |

State Street Corp. | | | 971,800 | | | | 45,684,318 | |

The Charles Schwab Corp. | | | 2,692,600 | | | | 38,665,736 | |

| | | | | | |

|

|

|

| | | | | | | | 250,528,717 | |

| | | | | | |

|

|

|

Energy (6.2%) | | | | | | | | |

BP PLC ADR | | | 662,800 | | | | 27,598,992 | |

Devon Energy Corp. | | | 712,500 | | | | 37,078,500 | |

Weatherford International, Ltd. † | | | 2,532,200 | | | | 28,335,318 | |

| | | | | | |

|

|

|

| | | | | | | | 93,012,810 | |

| | | | | | |

|

|

|

Health Care (12.5%) | | | | | | | | |

Cardinal Health, Inc. | | | 906,100 | | | | 37,313,198 | |

Life Technologies Corp. † | | | 816,900 | | | | 40,093,452 | |

Thermo Fisher Scientific, Inc. | | | 563,500 | | | | 35,940,030 | |

UnitedHealth Group, Inc. | | | 742,300 | | | | 40,262,352 | |

WellPoint, Inc. | | | 539,300 | | | | 32,854,156 | |

| | | | | | |

|

|

|

| | | | | | | | 186,463,188 | |

| | | | | | |

|

|

|

Industrials (7.3%) | | | | | | | | |

General Electric Co. | | | 1,888,100 | | | | 39,631,219 | |

Republic Services, Inc. | | | 1,168,600 | | | | 34,275,038 | |

Southwest Airlines Co. | | | 3,379,000 | | | | 34,600,960 | |

| | | | | | |

|

|

|

| | | | | | | | 108,507,217 | |

| | | | | | |

|

|

|

Insurance (8.0%) | | | | | | | | |

American International Group, Inc. † | | | 1,247,500 | | | | 44,036,750 | |

Aon PLC | | | 685,900 | | | | 38,136,040 | |

Marsh & McLennan Cos., Inc. | | | 1,084,900 | | | | 37,396,503 | |

| | | | | | |

|

|

|

| | | | | | | | 119,569,293 | |

| | | | | | |

|

|

|

See Notes to Financial Statements.

6

SOUND SHORE FUND, INC.

SCHEDULE OF INVESTMENTS (Continued)

DECEMBER 31, 2012

| | | | | | | | |

| | | Share

Amount

| | | Market

Value

| |

Materials (6.1%) | | | | | | | | |

E.I. du Pont de Nemours & Co. | | | 869,200 | | | $ | 39,087,924 | |

Newmont Mining Corp. | | | 483,900 | | | | 22,472,316 | |

Owens-Illinois, Inc. † | | | 1,422,700 | | | | 30,260,829 | |

| | | | | | |

|

|

|

| | | | | | | | 91,821,069 | |

| | | | | | |

|

|

|

Pharmaceuticals (8.3%) | | | | | | | | |

Novartis AG ADR | | | 630,900 | | | | 39,935,970 | |

Pfizer, Inc. | | | 1,653,800 | | | | 41,477,304 | |

Sanofi SA ADR | | | 886,800 | | | | 42,016,584 | |

| | | | | | |

|

|

|

| | | | | | | | 123,429,858 | |

| | | | | | |

|

|

|

Technology (13.8%) | | | | | | | | |

Analog Devices, Inc. | | | 263,600 | | | | 11,087,016 | |

Applied Materials, Inc. | | | 2,393,400 | | | | 27,380,496 | |

Flextronics International, Ltd. † | | | 6,075,800 | | | | 37,730,718 | |

Google, Inc., Class A † | | | 60,300 | | | | 42,775,011 | |

Microsoft Corp. | | | 1,560,800 | | | | 41,720,184 | |

Texas Instruments, Inc. | | | 1,441,300 | | | | 44,593,822 | |

| | | | | | |

|

|

|

| | | | | | | | 205,287,247 | |

| | | | | | |

|

|

|

Utilities (2.3%) | | | | | | | | |

AES Corp. | | | 3,255,700 | | | | 34,835,990 | |

| | | | | | |

|

|

|

Total Common Stocks (cost $1,209,896,860) | | | $ | 1,448,339,271 | |

| | | | | | |

|

|

|

Short-Term Investments (2.7%) | | | | | | | | |

Money Market Fund (2.7%) | | | | | | | | |

Western Asset Institutional U.S. Treasury Fund, 0.02% (a) | | | 40,435,902 | | | $ | 40,435,902 | |

| | | | | | |

|

|

|

Total Money Markets (cost $40,435,902) | | | | | | $ | 40,435,902 | |

| | | | | | |

|

|

|

Total Investments (99.8%) (cost $1,250,332,762) * | | | | | | $ | 1,488,775,173 | |

Other Assets less Liabilities (0.2%) | | | | | | | 2,649,903 | |

| | | | | | |

|

|

|

Net Assets (100.0%) | | | | | | $ | 1,491,425,076 | |

| | | | | | |

|

|

|

See Notes to Financial Statements.

7

SOUND SHORE FUND, INC.

SCHEDULE OF INVESTMENTS (Concluded)

DECEMBER 31, 2012

| † | Non-income producing security |

| (a) | Rate disclosed is as of December 31, 2012. |

ADR — American Depositary Receipt

PLC — Public Limited Company

| * | Cost for federal income tax purposes is $1,253,720,927 and net unrealized appreciation consists of: |

| | | | |

Gross Unrealized Appreciation | | $ | 254,966,469 | |

Gross Unrealized Depreciation | | | (19,912,223 | ) |

| | | | | |

Net Unrealized Appreciation | | $ | 235,054,246 | |

| | | | | |

See Notes to Financial Statements.

8

SOUND SHORE FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

DECEMBER 31, 2012

| | | | |

| ASSETS | | | | |

Investments, at value (Cost $1,250,332,762) | | $ | 1,488,775,173 | |

Receivables: | | | | |

Investments sold | | | 22,456,880 | |

Capital shares sold | | | 1,223,056 | |

Dividends | | | 1,422,202 | |

Prepaid expenses | | | 62,680 | |

| | |

|

|

|

Total Assets | | | 1,513,939,991 | |

| | |

|

|

|

| |

| LIABILITIES | | | | |

Payables: | | | | |

Investments purchased | | | 13,714,366 | |

Capital shares redeemed | | | 7,453,568 | |

Accrued liabilities: | | | | |

Advisory fees | | | 957,709 | |

Administrator fees | | | 38,630 | |

Transfer agent fees and expenses | | | 147,843 | |

Custodian fees | | | 3,988 | |

Compliance and Treasurer Services fees | | | 16,072 | |

Directors’ fees and expenses | | | 2,704 | |

Professional fees | | | 96,346 | |

Other | | | 83,689 | |

| | |

|

|

|

Total Liabilities | | | 22,514,915 | |

| | |

|

|

|

Net Assets | | $ | 1,491,425,076 | |

| | |

|

|

|

| |

| COMPONENTS OF NET ASSETS | | | | |

Par Value (200,000,000 $0.001 par value shares authorized) | | $ | 42,719 | |

Paid-in capital | | | 1,417,546,148 | |

Accumulated undistributed net investment income | | | 39,677 | |

Accumulated net realized loss on investments | | | (164,645,879 | ) |

Net unrealized appreciation on investments | | | 238,442,411 | |

| | |

|

|

|

Net Assets | | $ | 1,491,425,076 | |

| | |

|

|

|

| |

| NET ASSET VALUE | | | | |

Net Assets | | $ | 1,491,425,076 | |

Shares Outstanding | | | 42,718,897 | |

| | |

|

|

|

Net Asset Value (offering price & redemption price per share) | | $ | 34.91 | |

| | |

|

|

|

See Notes to Financial Statements.

9

SOUND SHORE FUND, INC.

STATEMENT OF OPERATIONS

FOR THE YEAR ENDED DECEMBER 31, 2012

| | | | |

| INVESTMENT INCOME | | | | |

Income: | | | | |

Dividends (net of foreign withholding taxes of $848,758) | | $ | 28,645,552 | |

| | |

|

|

|

Total Income | | | 28,645,552 | |

| | |

|

|

|

Expenses: | | | | |

Advisory fees (Note 3) | | | 11,709,036 | |

Administrator fees | | | 507,789 | |

Transfer agent fees and expenses | | | 1,663,476 | |

Custodian fees | | | 152,916 | |

Compliance and Treasurer Services fees (Note 3) | | | 148,577 | |

Directors’ fees and expenses (Note 3) | | | 75,954 | |

Professional fees | | | 230,766 | |

Insurance fees | | | 79,769 | |

Registration fees | | | 49,433 | |

Printing fees | | | 124,671 | |

Miscellaneous | | | 3,307 | |

| | |

|

|

|

Total Expenses | | | 14,745,694 | |

| | |

|

|

|

Net Investment Income | | | 13,899,858 | |

| | |

|

|

|

| |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | |

Net realized gain on investments sold | | | 68,625,035 | |

Net change in unrealized appreciation/(depreciation) on investments | | | 197,889,722 | |

| | |

|

|

|

Net realized and unrealized gain on investments | | | 266,514,757 | |

| | |

|

|

|

Net increase in net assets from operations | | $ | 280,414,615 | |

| | |

|

|

|

See Notes to Financial Statements.

10

SOUND SHORE FUND, INC.

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | For the

Year Ended

December 31,

2012

| | | For the

Year Ended

December 31,

2011

| |

Operations: | | | | | | | | |

Net investment income | | $ | 13,899,858 | | | $ | 12,712,207 | |

Net realized gain on investments sold | | | 68,625,035 | | | | 133,631,618 | |

Net change in unrealized appreciation/(depreciation) on investments | | | 197,889,722 | | | | (264,726,637 | ) |

| | |

|

|

| |

|

|

|

Increase (decrease) in net assets from operations | | | 280,414,615 | | | | (118,382,812 | ) |

| | |

|

|

| |

|

|

|

Dividends to shareholders from net investment income | | | (13,720,813 | ) | | | (12,901,175 | ) |

Return of Capital | | | — | | | | (5,861,925 | ) |

| | |

|

|

| |

|

|

|

Total distributions to shareholders | | | (13,720,813 | ) | | | (18,763,100 | ) |

| | |

|

|

| |

|

|

|

Capital share transactions (Note 6) | | | (364,091,527 | ) | | | (201,894,126 | ) |

| | |

|

|

| |

|

|

|

Total decrease | | | (97,397,725 | ) | | | (339,040,038 | ) |

Net assets: | | | | | | | | |

Beginning of the year | | | 1,588,822,801 | | | | 1,927,862,839 | |

| | |

|

|

| |

|

|

|

End of the year (Including accumulated undistributed net investment income of $39,677 and $0, respectively) | | $ | 1,491,425,076 | | | $ | 1,588,822,801 | |

| | |

|

|

| |

|

|

|

See Notes to Financial Statements.

11

SOUND SHORE FUND, INC.

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2012

1. Organization

Sound Shore Fund, Inc. (the “Fund”) was incorporated under the laws of the State of Maryland on February 19, 1985 and is registered as a diversified, open-end management investment company under the Investment Company Act of 1940 (the “Act”). The investment objective of the Fund is growth of capital.

2. Significant Accounting Policies

These financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent liabilities, if any, at the date of the financial statements, and the reported amounts of increase and decrease in net assets from operations during the fiscal period. Actual results could differ from those estimates.

The following represent significant accounting policies of the Fund:

a. Security Valuation

Exchange traded securities, including those traded on the National Association of Securities Dealers’ Automated Quotation system (“NASDAQ”), are valued at the last quoted sale price as provided by independent pricing services as of the close of trading on the system or exchange on which they are primarily traded, on each Fund business day. In the absence of a sale, such securities are valued at the mean of the last bid and asked prices. Non-exchange traded securities for which over-the-counter market quotations are readily available are generally valued at the mean between the current bid and asked prices provided by independent pricing services. Fixed-income securities may be valued at prices supplied by the Fund’s pricing agent based on broker or dealer supplied valuations or matrix pricing, a method of valuing securities by reference to the value of other securities with similar characteristics, such as rating, interest rate and maturity. Investments in other open-end regulated investment companies are valued at net asset value (“NAV”). Short-term instruments with remaining maturities of 60 days or less may be valued at amortized cost.

The Fund values securities at fair value pursuant to procedures adopted by the Board of Directors if market quotations are not readily available (including a short and temporary lapse in the provision of a price by the regular pricing source) or, if in the judgment of the Adviser, the prices or values available do not represent the fair value of the instrument. Factors which may cause the Adviser to make such a judgment include, but are not limited to, the following: (i) only a bid price or an asked price is available, (ii) the spread between the bid price and the asked price is substantial, (iii) the frequency of sales, (iv) the thinness of the market, (v) the size of reported trades, and (vi) actions of the securities markets, such as the suspension or limitation of trading. Fair valuation is based on subjective factors and, as a result, the fair value price of an asset may differ from the asset’s market price and may not be the price at which the asset may be sold. Fair valuation could result in a NAV different from one determined by using market quotations.

12

SOUND SHORE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2012

Valuation inputs used to determine the value of the Fund’s investments are summarized in the three broad levels listed below:

| | • | | Level 1 - quoted prices in active markets for identical assets |

| | • | | Level 2 - other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3 - significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Pursuant to the valuation procedures noted previously, equity securities (including exchange traded securities and other open-end regulated investment companies) are generally categorized as Level 1 securities in the fair value hierarchy. Fixed-income securities and short-term instruments are generally categorized as Level 2 securities in the fair value hierarchy. Investments for which there are no quotations, or for which quotations do not appear reliable, are valued at fair value as determined in good faith by the Pricing Committee under the direction of the Board. These valuations are typically categorized as Level 2 or Level 3 in the fair value hierarchy.

The following table summarizes the Fund’s investments categorized in the fair value hierarchy as of December 31, 2012:

| | | | | | | | | | | | | | | | |

Security Type

| | Level 1

| | | Level 2

| | | Level 3

| | | Total

Investments

in Securities

| |

Common Stocks | | $ | 1,448,339,271 | | | $ | — | | | $ | — | | | $ | 1,448,339,271 | |

Short-Term Investments | | $ | 40,435,902 | | | | — | | | | — | | | $ | 40,435,902 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Investments | | $ | 1,488,775,173 | | | $ | — | | | $ | — | | | $ | 1,488,775,173 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

At December 31, 2012, all equity securities and open-end mutual funds were included in Level 1 in the table above. Please refer to the Schedule of Investments to view equity securities categorized by industry type.

The Fund’s policy is to disclose transfers between Levels based on valuations at the end of the reporting period. There were no transfers between Levels for the year ended December 31, 2012, based on the valuation input Levels on December 31, 2011.

b. Security Transactions and Investment Income

Dividend income is recorded on the ex-dividend date. Interest income is recorded on an accrual basis. Foreign dividend income is recorded on the ex-dividend date or as soon as practicable after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. Income and capital gains on some foreign securities may be subject to foreign withholding tax, which is accrued as applicable. Security transactions

13

SOUND SHORE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2012

are recorded on a trade date basis. Realized gain and loss on investments sold are recorded on the basis of identified cost.

c. Dividends to Shareholders

Dividends and distributions payable to shareholders are recorded by the fund on the ex-dividend date. Dividends from net investment income, if any, are declared and paid semiannually. Capital gains, if any, are distributed to shareholders at least annually. The Fund determines its net investment income and capital gains distributions in accordance with income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and gains on various investment securities held by the Fund, timing differences and differing characterizations of distributions made by the Fund.

d. Federal Taxes

The Fund intends to qualify each year as a regulated investment company and to distribute substantially all of its taxable income. In addition, by distributing in each calendar year substantially all of its net investment income, capital gain and certain other amounts, if any, the Fund will not be subject to federal taxation. Therefore, no federal income or excise tax provision is required.

For all open tax years and all major taxing jurisdictions, management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Open tax years are those that are open for examination by taxing authorities (i.e., generally, the last three tax year ends 2009-2011, and the interim tax period since then). Further, management of the Fund is also not aware of any uncertain tax positions that would require the Fund to record a tax liability and, therefore, there is no impact to the Fund’s financial statements.

3. Investment Advisory and Other Services

Investment Adviser

The Fund’s investment adviser is Sound Shore Management, Inc. (the “Adviser”). Pursuant to an investment advisory agreement, the Adviser receives an advisory fee, accrued daily and paid monthly at an annual rate of 0.75% of the Fund’s average daily net assets.

Other Services

Citi Fund Services Ohio, Inc. (“Citi”) provides certain administration, portfolio accounting and transfer agency services to the Fund.

The Fund also has agreements with various financial intermediaries and “mutual fund supermarkets” under which customers of these intermediaries may purchase and hold Fund shares. These intermediaries effectively provide sub-transfer agent services that the Fund transfer agent would have otherwise had to provide. In recognition of this, the transfer agent, the Fund and the Fund’s Adviser have entered into an agreement whereby the transfer agent agrees to

14

SOUND SHORE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2012

pay financial intermediaries a portion of the amount denoted on the Statement of Operations as “Transfer agent fees and expenses” that it receives from the Fund and the Adviser agrees to pay the excess, if any, charged by a financial intermediary.

Foreside Fund Services, LLC is the Fund’s distributor (the “Distributor”). The Distributor is neither affiliated with the Adviser, Citi nor its affiliated companies. The Distributor receives no compensation from the Fund for its distribution services.

Pursuant to a Compliance Services Agreement with the Fund, Foreside Compliance Services, LLC (“FCS”), an affiliate of the Distributor, provides a Chief Compliance Officer and Anti-Money Laundering Officer to the Fund as well as some additional compliance support functions. Under a Treasurer Services Agreement with the Fund, Foreside Management Services, LLC (“FMS”), an affiliate of the Distributor, provides a Treasurer to the Fund. Neither the Distributor, FCS, FMS, nor their employees that serve as officers of the Fund, have any role in determining the investment policies of or securities to be purchased or sold by the Fund.

The Fund pays each director who is not an “interested person” of the Fund, as defined in Section 2(a)(19) of the Act (“Independent Director”), quarterly fees of $1,250, plus $5,000 per quarterly in-person meeting, $2,000 per quarterly meeting attended telephonically and $1,000 per special meeting attended in person or telephonically.

Certain Officers and Directors of the Fund are officers, directors, or employees of the aforementioned companies.

4. Purchases and Sales of Securities

The cost of securities purchased and the proceeds from sales of securities (excluding short-term investments) for the year ended December 31, 2012 aggregated $857,374,313 and $1,226,791,846, respectively.

5. Federal Income Tax and Investment Transactions

Distributions during the fiscal years ended as noted were characterized for tax purposes as follows:

| | | | | | | | |

| | | December 31,

2012

| | | December 31,

2011

| |

Ordinary Income | | $ | 13,720,813 | | | $ | 12,901,175 | |

Long-Term Capital Gains | | | — | | | | — | |

| | |

|

|

| |

|

|

|

Total Taxable Distributions | | | 13,720,813 | | | | 12,901,175 | |

Return of Capital | | | — | | | | 5,861,925 | |

| | |

|

|

| |

|

|

|

Total Distributions Paid | | $ | 13,720,813 | | | $ | 18,763,100 | |

| | |

|

|

| |

|

|

|

15

SOUND SHORE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2012

Components of capital on a federal income tax basis at 12/31/2012, were as follows:

| | | | |

Par Value + Paid-in capital | | $ | 1,417,588,867 | |

Undistributed Ordinary Income | | | 39,677 | |

Capital Loss Carryforwards | | | (161,257,714 | ) |

Net Unrealized Appreciation | | | 235,054,246 | |

| | |

|

|

|

| | | $ | 1,491,425,076 | |

On the Statement of Assets and Liabilities, as a result of permanent book to tax differences arising from the character of distributions received from certain of the Fund’s portfolio holdings, the following amounts have been reclassified for the year ended December 31, 2012.

| | | | |

Accumulated undistributed net investment income | | $ | (139,368 | ) |

Accumulated net realized loss on investments | | | 139,368 | |

At December 31, 2012, the Fund, for federal income tax purposes, had capital loss carryforwards which expire (pre-effective capital loss carryforwards) as set forth in the table below. These amounts may be applied against future net realized gains until the earlier of their utilization or expiration.

Capital loss carry forwards subject to expiration:

| | | | |

Expires tax year ending

| | Capital loss carry

forwards

| |

2017 | | $ | 161,257,714 | |

During the year ended December 31, 2012, the Fund utilized $62,860,561 of pre-effective capital loss carryforwards.

Under the Regulated Investment Company Modernization Act of 2010, capital losses incurred by the Fund after December 31, 2010 will not be subject to expiration (post-effective capital loss carryforwards). In addition, post-effective capital loss carryforwards must be utilized prior to the utilization of pre-effective capital loss carryforwards. At December 31, 2012, the Fund had $0 of post-effective capital loss carryforwards.

6. Capital Stock

As of December 31, 2012, 200,000,000 shares of $.001 par value stock were authorized and capital paid in amounted to $1,417,546,148. Transactions in capital stock were as follows:

| | | | | | | | | | | | | | | | |

| | | For the

Year Ended

December 31, 2012

| | | For the

Year Ended

December 31, 2011

| |

| | | Shares

| | | Amount

| | | Shares

| | | Amount

| |

Sale of shares | | | 4,925,360 | | | $ | 162,580,220 | | | | 8,394,594 | | | $ | 265,779,132 | |

Reinvestment of dividends | | | 404,789 | | | | 13,223,339 | | | | 591,692 | | | | 18,094,876 | |

Redemption of shares | | | (16,413,576 | ) | | | (539,895,086 | ) | | | (15,779,452 | ) | | | (485,768,134 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net decrease from capital transactions | | | (11,083,427 | ) | | $ | (364,091,527 | ) | | | (6,793,166 | ) | | $ | (201,894,126 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

16

SOUND SHORE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Concluded)

DECEMBER 31, 2012

Of the 42,718,897 shares outstanding as of December 31, 2012, the Employees’ Profit Sharing Plan of the Adviser owned 611,049 shares.

7. Other Information

On December 31, 2012, two entities, Charles Schwab & Co. Inc. and National Financial Services LLC, held of record in omnibus accounts approximately 62% of the outstanding shares of the Fund on behalf of numerous investors.

8. Subsequent Events

Subsequent events occurring after the date of this report have been evaluated for potential impact to this report through the date the report was issued.

17

SOUND SHORE FUND, INC.

FINANCIAL HIGHLIGHTS

These financial highlights reflect selected data for a share outstanding throughout each period.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31,

| |

| | 2012

| | | 2011

| | | 2010

| | | 2009

| | | 2008

| |

Net Asset Value, Beginning of Year | | $ | 29.53 | | | $ | 31.82 | | | $ | 28.58 | | | $ | 22.76 | | | $ | 35.68 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net investment income(a) | | | 0.29 | | | | 0.22 | | | | 0.19 | | | | 0.22 | | | | 0.25 | |

Net realized and unrealized gain (loss) on investments | | | 5.39 | | | | (2.18 | ) | | | 3.25 | | | | 5.82 | | | | (12.91 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from Investment Operations | | | 5.68 | | | | (1.96 | ) | | | 3.44 | | | | 6.04 | | | | (12.66 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Distributions from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.30 | ) | | | (0.23 | ) | | | (0.20 | ) | | | (0.22 | ) | | | (0.26 | ) |

Return of capital | | | — | | | | (0.10 | ) | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Distributions | | | (0.30 | ) | | | (0.33 | ) | | | (0.20 | ) | | | (0.22 | ) | | | (0.26 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Asset Value, End of Year | | $ | 34.91 | | | $ | 29.53 | | | $ | 31.82 | | | $ | 28.58 | | | $ | 22.76 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Return | | | 19.32 | % | | | (6.18 | )% | | | 12.13 | % | | | 26.64 | % | | | (35.60 | )% |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net Assets at End of Year (in thousands) | | $ | 1,491,425 | | | $ | 1,588,823 | | | $ | 1,927,863 | | | $ | 2,116,522 | | | $ | 1,624,674 | |

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 0.94 | % | | | 0.94 | % | | | 0.94 | % | | | 0.94 | % | | | 0.92 | % |

Net Investment Income | | | 0.89 | % | | | 0.69 | % | | | 0.66 | % | | | 0.89 | % | | | 0.80 | % |

Portfolio Turnover Rate | | | 56 | % | | | 61 | % | | | 64 | % | | | 97 | % | | | 111 | % |

| (a) | Calculated using the average shares outstanding for the period. |

18

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors of

Sound Shore Fund, Inc.:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Sound Shore Fund, Inc. (the “Fund”) as of December 31, 2012, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2012, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above, present fairly, in all material respects, the financial position of Sound Shore Fund, Inc. as of December 31, 2012, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

New York, New York

February 27, 2013

19

SOUND SHORE FUND, INC.

DECEMBER 31, 2012 (Unaudited)

Shareholder Expense Example

As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The following example is based on $1,000 invested at the beginning of the period and held for the entire period from July 1, 2012 through December 31, 2012.

Actual Expenses - The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes - The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | |

| | | Beginning

Account Value

July 1, 2012

| | | Ending

Account Value

December 31, 2012

| | | Expenses Paid

During Period*

| |

Actual Return | | $ | 1,000.00 | | | $ | 1,091.20 | | | $ | 4.94 | |

Hypothetical Return | | $ | 1,000.00 | | | $ | 1,020.41 | | | $ | 4.77 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.94%, multiplied by the average account value over the period, multiplied by 184/366 to reflect the most recent one half-year period. |

20

SOUND SHORE FUND, INC.

DECEMBER 31, 2012

Federal Tax Status of Dividends Declared during the Fiscal Year (Unaudited)

Income Dividends - For federal income tax purposes, dividends from short-term capital gains are classified as ordinary income. All net investment income dividends were ordinary income. The Fund paid income dividends of $13,720,813 for the tax year ended December 31, 2012, of which $0 were short-term capital gain dividends. The Fund designated 100% of its income dividend distributed as qualifying for the corporate dividends-received deductions (DRD) and 100% for the qualified dividend rate (QDI) as defined in Section 1(h)(11) of the Internal Revenue Code. The Fund also designates 0% of its income dividends as qualified interest income (QII) and 0% as qualified short-term capital gain dividends exempt from U.S. tax for foreign shareholders (QSD).

Proxy Voting Information

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to securities held in the Fund’s portfolio is available, without charge and upon request, by calling (800) 551-1980 or by visiting the Fund’s web site at http://www.soundshorefund.com. This information is also available on the SEC’s web site at http://www.sec.gov under the name of the Sound Shore Fund.

The Fund’s proxy voting record for the most recent 12-month period ended June 30 is available, without charge and upon request, by calling (800) 551-1980 or by visiting the Fund’s web site at http://www.soundshorefund.com. This information is available on the SEC’s web site at http://www.sec.gov under the name of the Sound Shore Fund.

Availability of Quarterly Portfolio Schedule

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. This information is available on the SEC’s web site at http://www.sec.gov under the name of the Sound Shore Fund. It may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

21

SOUND SHORE FUND, INC.

DECEMBER 31, 2012

Directors and Officers of the Fund

The following is relevant information regarding Directors and Officers of the Fund:

| | | | | | | | |

Name, Address and Age

| | Position(s) With the Fund

| | Length of Time

Served(1)

| | Principal Occupation(s) During the Past Five Years

| | Other

Directorships

Held by Director

|

|

Independent Directors |

Harry W. Clark c/o Sound Shore Fund, Inc. 3435 Stelzer Road Columbus, OH 43219 Age: 63 | | Director; Audit Committee (member); Nominating Committee (member); Valuation Committee (member) | | January 23, 2006 to present | | Managing Partner, Stanwich Group LLC (public policy consulting firm) since January 2001; Senior Counselor, Brunswick Group LLC (international financial communications consulting firm) since January 2005; Senior Director, Albright Stonebridge Group (international political risk consultancy) since May, 2012. | | Member, Executive Committee of the Board of Directors, Center for International Private Enterprise since 2008; Director, U.S. Chamber of Commerce Foundation since 2005. |

| | | | |

H. Williamson Ghriskey, Jr. c/o Sound Shore Fund, Inc. 3435 Stelzer Road Columbus, OH 43219 Age: 68 | | Director; Audit Committee (member); Nominating Committee (member); Valuation Committee (member) | | January 23, 2006 to present | | Senior Managing Director/Portfolio Management, First Republic Investment Management (investment counseling firm) since September 1978. | | Past President of Investment Advisor Association 1990 - 1992 |

| | | | |

David Blair Kelso c/o Sound Shore Fund, Inc. 3435 Stelzer Road Columbus, OH 43219 Age: 60 | | Lead Independent Director; Audit Committee (Chair); Nominating Committee (Chair); Valuation Committee (member); Audit Committee Financial Expert | | January 23, 2006 to present | | Managing Partner, Kelso Advisory Services (consulting firm) since October 2003; Trustee, Connecticut College, since October 2007; Director, Round Hill Development Corp. (resort development firm) since 2006; Director, Aspen Holdings, Inc. (insurance firm) 2005 - April 2011; Executive Vice President, Strategy & Finance, Aetna, Inc. (insurance firm) September 2001 - September 2003; Chief Financial Officer, Executive Vice President, and Managing Director, Chubb, Inc. (insurance firm) August 1996 - August 2001. | | Director, EXL Service Holdings, Inc. (since July 2006); Director, Assurant, Inc. (since March 2007) |

| | | | |

John J. McCloy, II c/o Sound Shore Fund, Inc. 3435 Stelzer Road Columbus, OH 43219 Age: 75 | | Director | | April 1985 to February 1, 2012 | | Chairman, Apelles - III (military housing); Director, American Council on Germany (non-profit entity) until April 2011; Chairman, Gravitas Technologies, Inc. (information technology firm); entrepreneur, J.J. McCloy II, Inc.; Chairman, SpringerRun, Inc. (marketing firm) until 2010. | | |

22

SOUND SHORE FUND, INC.

DECEMBER 31, 2012

Directors and Officers of the Fund

| | | | | | | | |

Name, Address and Age

| | Position(s) With the Fund

| | Length of Time

Served(1)

| | Principal Occupation(s) During the Past Five Years

| | Other

Directorships

Held by Director

|

| | | | |

Interested Directors(2) | | | | | | | | |

Harry Burn, III, M.B.A. 8 Sound Shore Drive Greenwich, Connecticut 06830 Age: 68 | | Chairman and Director; Valuation Committee (member) | | April 1985 to present (Chairman September 1992 to present) | | Chairman and Director, Sound Shore Management, Inc. since 1978; Chartered Financial Analyst. | | |

| | | | |

T. Gibbs Kane, Jr. 8 Sound Shore Drive Greenwich, Connecticut 06830 Age: 65 | | President and Director, Valuation Committee (member) | | April 1985 to present | | President and Director, Sound Shore Management, Inc. since 1977; Chartered Financial Analyst. | | |

| | | | |

Officers | | | | | | | | |

Lowell E. Haims 8 Sound Shore Drive Greenwich, Connecticut 06830 Age: 45 | | Secretary, Valuation Committee (Chair) | | October 2010 to present | | Chief Administrative Officer, Sound Shore Management, Inc. since October 2005; Chief Compliance Officer, Sound Shore Management, Inc. since June 2007; Chartered Financial Analyst. | | |

| | | | |

Charles S. Todd Three Canal Plaza, Suite 100 Portland, Maine 04101 Age: 41 | | Treasurer | | June 2009 to present | | Foreside Management Services, LLC, Business Head, Sarbanes - Oxley Services, 2012 - Present; Director, 2008-2012; Vice President/Assistant Vice President within the Fund Administration Department of J.P. Morgan Investor Services Co. (June 2000 - December 2008). | | |

| | | | |

Julie Walsh 10 High Street, Suite 302A Boston, Massachusetts 02110 Age: 41 | | Chief Compliance Officer | | May 2011 to present | | Managing Director, Foreside Compliance Services, LLC (May 2010 to present). Compliance Marketing Consultant, Grantham, Mayo, & Van Otterloo & Co LLC (May 2008 - May 2010). Chief Compliance Officer, Grantham, Mayo, & Van Otterloo LLC (April 1995 - May 2008) | | |

| (1) | Term of Service is until his/her successor is elected or qualified or until his/her earlier resignation or removal. |

| (2) | Harry Burn, III and T. Gibbs Kane, Jr. are “interested persons” of the Fund as defined in Section 2(a)(19) of the 1940 Act by virtue of their position as shareholders, senior officers, and Directors of the Adviser. Each is a portfolio manager of the Fund. |

The Fund’s Statement of Additional Information (“SAI”) contains additional information about the Fund’s Directors. The SAI is available for free, by contacting the Fund at (800) 551-1980.

23

Investment Adviser

Sound Shore Management, Inc.

Greenwich, Connecticut

Administrator

Citi Fund Services Ohio, Inc.

Columbus, Ohio

Distributor

Foreside Fund Services, LLC

Portland, Maine

www.foreside.com

Transfer and

Distribution Paying Agent

Citi Fund Services Ohio, Inc.

Columbus, Ohio

Custodian

Citibank, N.A.

New York, New York

Fund Counsel

Dechert LLP

New York, New York

Counsel to the Independent Directors

Wilmer Cutler Pickering Hale

and Dorr, LLP

New York, New York

Independent Registered

Public Accounting Firm

Deloitte & Touche LLP

New York, New York

107-AR-1212

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus, which includes information regarding the Fund’s objectives and policies, experience of its management, and other information.

SOUND SHORE FUND, INC.

3435 Stelzer Road

Columbus, OH 43219

http://www.soundshorefund.com

(800) 551-1980

Annual Report

DECEMBER 31, 2012

Item 2. Code of Ethics.

Sound Shore Fund, Inc. maintains a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its President and Treasurer. A copy of the code of ethics is filed as an exhibit to this Form N-CSR. During the period covered by the Report, there were no amendments to the code of ethics as filed nor were any waivers from its provisions granted.

Item 3. Audit Committee Financial Expert.

The Board of Directors has determined that David Blair Kelso, who meets the definition of an independent director as specified by Item 3, is an “audit committee financial expert” as that term is defined by applicable regulator guideline.

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees – The aggregate fees billed for each of the last two fiscal years (the “Reporting Periods”) for professional services rendered by the Registrant’s principal accountant for the audit of the Registrant’s annual financial statements, or services that are normally provided by the principal accountant in connection with the statutory and regulatory filings or engagements for the Reporting Periods, were $43,300 in 2012 and $42,120 in 2011. |

| | |

| (b) | | Audit-Related Fees – The aggregate fees billed in the Reporting Periods for assurance and related services rendered by the principal accountant that were reasonably related to the performance of the audit of the Registrant’s financial statements and are not reported under paragraph (a) of this item 4 were $0 in 2012 and $0 in 2011. |

| |

| (c) | | Tax Fees – The aggregate fees billed in the Reporting Periods for professional services rendered by the principal accountant to the Registrant for tax compliance, tax advice and tax planning (“Tax Fees”) were $4,600 in 2012 and $4,475 in 2011. These services consisted of review or preparation of U.S. federal, state, local and excise tax returns. |

| |

| (d) | | All Other Fees – There were no other fees billed in the Reporting Periods for products and services provided by the principal accountant to the Registrant, other than the services reported in paragraphs (a) through (c) of this Item. |

| |

| (e)(1) | | Pre-Approval Requirements for Audit and Non-Audit Services. The Audit Committee reviews and approves in advance all audit and “permissible non-audit services” to be provided to Sound Shore Management, Inc. (“Sound Shore Management”), the Fund’s investment adviser, by the Fund’s independent auditor if the engagement relates to the operations and financial reporting of the Fund. The Audit Committee considers whether fees paid by Sound Shore Management for audit and permissible non-audit services are consistent with the independent auditor’s independence. Pre-approval of any permissible non-audit services provided to the Fund is not required so long as: (i) the aggregate amount of all such permissible non-audit services provided to the Fund constitutes not more than 5% of the total amount of revenues paid by the Fund to its auditor during the fiscal year in which the permissible non-audit services are provided; (ii) the permissible non-audit services were not recognized by the Fund at the time of engagement to be non-audit services; and (iii) such services are promptly brought to the attention of the Audit Committee and approved prior to the completion of the audit by the Audit Committee or its authorized delegate(s). Pre-approval of permissible non-audit services rendered to Sound Shore Management is not required if provided. The Audit Committee may delegate to one or more of its members authority to pre-approve permissible non-audit services to be provided to the Fund. Any pre-approval determination of a delegate will be presented to the full Audit Committee at its next meeting. |

| |

| (e)(2) | | No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2- 01 of Regulation S-X. |

| |

| (f) | | Not applicable as less than 50%. |

| |

| (g) | | The aggregate fees billed in the Reporting Periods for Non-Audit Services by the principal accountant to the Registrant and Sound Shore Management were $13,250 in 2012 and $12,500 in 2011. |

| |

| (h) | | The Registrant’s Audit Committee considers the provision of any non-audit services rendered to the investment adviser, to the extent applicable, in evaluating the independence of the Registrant’s principal accountant. Any services provided by the principal accountant to the Registrant or to Sound Shore Management requiring pre-approval were pre-approved. |

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments.

| (a) | Included as part of the report to stockholders under Item 1. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) were effective as of a date within 90 days of the filing date of this report (the “Evaluation Date”) based on their evaluation of the registrant’s disclosure controls and procedures as of the Evaluation Date.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) A copy of the Code of Ethics (Exhibit filed herewith).

(a)(2) Certifications pursuant to Rule 30a-2(a) of the Investment Company Act of 1940 as amended, and Section 302 of the Sarbanes-Oxley Act of 2002 (Exhibit filed herewith).

(a)(3) Not applicable.

(b) Certifications pursuant to Rule 30a-2(b) of the Investment Company Act of 1940, as amended, and Section 906 of the Sarbanes-Oxley Act of 2002 (Exhibit filed herewith).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

|

| Registrant Sound Shore Fund, Inc. |

|

| By (Signature and Title) /s/ T. Gibbs Kane, Jr. |

| T. Gibbs Kane, Jr., President |

|

| Date March 7, 2013 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | |

| By (Signature and Title) /s/ T. Gibbs Kane, Jr. |

| T. Gibbs Kane, Jr., President |

Date March 7, 2013

| | |

| By (Signature and Title) /s/ Charles S. Todd |

| Charles S. Todd, Treasurer |

Date March 7, 2013