UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-04253

MFS SERIES TRUST XV

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617)954-5000

Date of fiscal year end: October 31

Date of reporting period: April 30, 2020

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Semiannual Report

April 30, 2020

MFS® Commodity Strategy Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the complete reports will be made available on the fund’s Web site (funds.mfs.com), and you will be notified by mail each time a report is posted and provided with a Web site link to access the report.

If you are already signed up to receive shareholder reports by email, you will not be affected by this change and you need not take any action. You may sign up to receive shareholder reports and other communications from the fund by email by contacting your financial intermediary (such as a broker-dealer or bank) or, if you hold your shares directly with the fund, by calling 1-800-225-2606 or by logging on to MFS Access at mfs.com.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. Contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the fund, you can call 1-800-225-2606 or send an email request to orderliterature@mfs.com to let the fund know that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the MFS fund complex if you invest directly.

CMS-SEM

MFS® Commodity Strategy Fund

CONTENTS

The report is prepared for the general information of shareholders.

It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED• MAY LOSE VALUE• NO BANK GUARANTEE

LETTER FROM THE EXECUTIVE CHAIR

Dear Shareholders:

Markets experienced dramatic swings in early 2020 as the coronavirus pandemic crippled the global economy for a time. Optimism over the development of vaccines

and therapeutics, along with a decline in cases in countries hit early in the outbreak, has brightened the economic and market outlook during the second quarter, though a great deal of uncertainty remains on how long the aftereffects of the lockdowns will linger.

Global central banks have taken aggressive, coordinated steps to cushion the economic and market fallout related to the virus, and governments are undertaking unprecedented levels of fiscal stimulus. As uncertainty recedes, these measures can help build a supportive environment and encourage economic recovery. In the aftermath of the crisis, there are likely to be societal changes as

households, businesses, and governments adjust to a new reality, and these alterations could change the investment landscape. For investors, occurrences such as theCOVID-19 outbreak demonstrate the importance of having a deep understanding of company fundamentals, and our global research platform has been built to do just that.

Here at MFS®, we aim to help our clients navigate the growing complexity of the markets and world economies. Our long-term investment philosophy and commitment to the responsible allocation of capital allow us to tune out the noise and uncover what we believe are the best, most durable investment opportunities in the market. Through our powerful global investment platform, we combine collective expertise, thoughtful risk management, and long-term discipline to create sustainable value for investors.

Respectfully,

Robert J. Manning

Executive Chair

MFS Investment Management

June 16, 2020

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

PORTFOLIO COMPOSITION

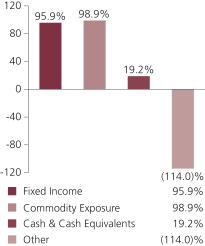

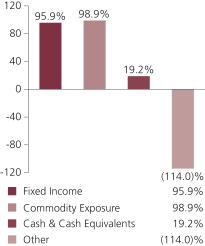

Portfolio structure (c)(i)

| | | | |

| Fixed income sectors (i) | | | | |

| Investment Grade Corporates | | | 37.0% | |

| U.S. Treasury Securities | | | 28.9% | |

| Collateralized Debt Obligations | | | 8.9% | |

| Asset-Backed Securities | | | 7.0% | |

| Commercial Mortgage-Backed Securities | | | 5.9% | |

| High Yield Corporates | | | 2.1% | |

| Emerging Markets Bonds | | | 1.7% | |

| Mortgage-Backed Securities | | | 1.4% | |

| Residential Mortgage-Backed Securities | | | 1.3% | |

| Municipal Bonds | | | 1.2% | |

| Non-U.S. Government Bonds | | | 0.5% | |

| U.S. Government Agencies (o) | | | 0.0% | |

| | | | |

Composition including fixed income credit quality (a)(i) | |

| AAA | | | 9.1% | |

| AA | | | 9.9% | |

| A | | | 15.7% | |

| BBB | | | 24.8% | |

| BB | | | 2.1% | |

| U.S. Government | | | 14.6% | |

| Federal Agencies | | | 1.4% | |

| Not Rated | | | 18.3% | |

| Non-Fixed Income | | | 98.9% | |

| Cash & Cash Equivalents | | | 19.2% | |

| Other | | | (114.0)% | |

2

Portfolio Composition – continued

| | | | |

| Commodity exposure (c)(i) | | | | |

| Gold | | | 19.4% | |

| Natural Gas | | | 9.0% | |

| Copper (COMEX) | | | 6.6% | |

| Soybeans | | | 5.8% | |

| Corn | | | 5.5% | |

| Silver | | | 5.0% | |

| Soybean Meal | | | 4.8% | |

| Wheat | | | 4.6% | |

| Live Cattle | | | 4.2% | |

| Coffee | | | 4.1% | |

| Brent Crude | | | 3.9% | |

| WTI Crude Oil | | | 3.9% | |

| Aluminum | | | 3.3% | |

| Zinc | | | 3.2% | |

| Nickel | | | 2.7% | |

| Sugar | | | 2.7% | |

| Soybean Oil | | | 2.5% | |

| Kansas Wheat | | | 1.7% | |

| Cotton | | | 1.4% | |

| Cocoa | | | 1.3% | |

| Gas Oil | | | 1.3% | |

| Unleaded Gasoline | | | 1.2% | |

| Lean Hogs | | | 1.1% | |

| Heating Oil | | | 1.0% | |

| Feeder Cattle | | | (1.3)% | |

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. U.S. Government includes securities issued by the U.S. Department of the Treasury. Federal Agencies includes rated and unrated U.S. Agency fixed-income securities, U.S. Agency mortgage-backed securities, and collateralized mortgage obligations of U.S. Agency mortgage-backed securities. Not Rated includes fixed income securities and fixed income derivatives, which have not been rated by any rating agency.Non-Fixed Income includes equity securities (including convertible bonds and equity derivatives) and/or commodity-linked derivatives. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies. |

3

Portfolio Composition – continued

| (c) | MFS expects to gain exposure to the commodities markets by investing a portion of the fund’s assets in the MFS Commodity Strategy Portfolio, a wholly-owned and controlled subsidiary organized in the Cayman Islands (“Subsidiary”). The Subsidiary gains exposure to the commodities markets by investing in commodity linked derivatives (such as commodity-linked futures, options, and/or swaps). The Subsidiary’s investments in commodity-linked derivatives are leveraged (i.e. involves investment exposure greater than the amount of the investment). For more information about commodity-linked derivatives and the risks of investing in such derivatives, please see the fund’s prospectus. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

The fund invests a portion of its assets in the MFS Commodity Strategy Portfolio, a wholly-owned subsidiary of the fund. Percentages reflect exposure to the underlying holdings of the MFS Commodity Strategy Portfolio and not to the exposure from investing directly in the MFS Commodity Strategy Portfolio itself.

Where the fund holds convertible bonds, they are treated as part of the equity portion of the portfolio.

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Other includes equivalent exposure from currency derivatives and/or any offsets to derivative positions and may be negative.

Percentages are based on net assets as of April 30, 2020.

The portfolio is actively managed and current holdings may be different.

4

EXPENSE TABLE

Fund expenses borne by the shareholders during the period, November 1, 2019 through April 30, 2020

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service(12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period November 1, 2019 through April 30, 2020.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

5

Expense Table – continued

| | | | | | | | | | | | | | | | | | |

Share

Class | | | | Annualized

Expense

Ratio | | | Beginning

Account Value

11/01/19 | | | Ending

Account Value

4/30/20 | | | Expenses

Paid During

Period (p)

11/01/19-4/30/20 | |

| A | | Actual | | | 1.09% | | | | $1,000.00 | | | | $766.92 | | | | $4.79 | |

| | Hypothetical (h) | | | 1.09% | | | | $1,000.00 | | | | $1,019.44 | | | | $5.47 | |

| B | | Actual | | | 1.84% | | | | $1,000.00 | | | | $764.27 | | | | $8.07 | |

| | Hypothetical (h) | | | 1.84% | | | | $1,000.00 | | | | $1,015.71 | | | | $9.22 | |

| C | | Actual | | | 1.84% | | | | $1,000.00 | | | | $764.14 | | | | $8.07 | |

| | Hypothetical (h) | | | 1.84% | | | | $1,000.00 | | | | $1,015.71 | | | | $9.22 | |

| I | | Actual | | | 0.84% | | | | $1,000.00 | | | | $770.10 | | | | $3.70 | |

| | Hypothetical (h) | | | 0.84% | | | | $1,000.00 | | | | $1,020.69 | | | | $4.22 | |

| R1 | | Actual | | | 1.84% | | | | $1,000.00 | | | | $764.37 | | | | $8.07 | |

| | Hypothetical (h) | | | 1.84% | | | | $1,000.00 | | | | $1,015.71 | | | | $9.22 | |

| R2 | | Actual | | | 1.34% | | | | $1,000.00 | | | | $767.22 | | | | $5.89 | |

| | Hypothetical (h) | | | 1.34% | | | | $1,000.00 | | | | $1,018.20 | | | | $6.72 | |

| R3 | | Actual | | | 1.09% | | | | $1,000.00 | | | | $767.70 | | | | $4.79 | |

| | Hypothetical (h) | | | 1.09% | | | | $1,000.00 | | | | $1,019.44 | | | | $5.47 | |

| R4 | | Actual | | | 0.84% | | | | $1,000.00 | | | | $770.09 | | | | $3.70 | |

| | Hypothetical (h) | | | 0.84% | | | | $1,000.00 | | | | $1,020.69 | | | | $4.22 | |

| R6 | | Actual | | | 0.82% | | | | $1,000.00 | | | | $768.75 | | | | $3.61 | |

| | Hypothetical (h) | | | 0.82% | | | | $1,000.00 | | | | $1,020.79 | | | | $4.12 | |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 182/366 (to reflect theone-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

6

CONSOLIDATED PORTFOLIO OF INVESTMENTS

4/30/20 (unaudited)

The Consolidated Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - 81.1% | | | | | | |

| Aerospace - 1.6% | | | | | | |

| Boeing Co., 2.3%, 8/01/2021 | | $ | 2,524,000 | | | $ | 2,481,257 | |

| Boeing Co., 4.508%, 5/01/2023 | | | 1,375,000 | | | | 1,375,000 | |

| Boeing Co., 4.875%, 5/01/2025 | | | 2,940,000 | | | | 2,940,000 | |

| Huntington Ingalls Industries, Inc., 3.844%, 5/01/2025 (n) | | | 1,422,000 | | | | 1,495,050 | |

| Raytheon Technologies Corp., 3.65%, 8/16/2023 | | | 323,000 | | | | 349,080 | |

| | | | | | | | |

| | | | | | | $ | 8,640,387 | |

| Asset-Backed & Securitized - 23.1% | | | | | | |

| Allegro CLO Ltd.,2014-1RA, “A2”, FLR, 2.709% (LIBOR - 3mo. + 1.6%), 10/21/2028 (n) | | $ | 252,269 | | | $ | 235,092 | |

| ALM Loan Funding, CLO,2015-16A, “BR2”, FLR, 3.118% (LIBOR - 3mo. + 1.9%), 7/15/2027 (n) | | | 1,497,569 | | | | 1,386,953 | |

| AmeriCredit Automobile Receivables Trust,2020-1, “C”, 1.59%, 10/20/2025 | | | 678,000 | | | | 647,506 | |

| Arbor Realty Trust, Inc., CLO,2019-FL1, “A”, FLR, 1.964% (LIBOR - 1mo. + 1.15%), 5/15/2037 (n) | | | 2,110,500 | | | | 1,969,892 | |

| AREIT CRE Trust, 2019-CRE3, “AS” FLR, 2.094% (LIBOR - 1mo. + 1.3%), 9/14/2036 (n) | | | 613,500 | | | | 536,495 | |

| AREIT CRE Trust, 2019-CRE3, “B”, FLR, 2.344% (LIBOR - 1mo. + 1.55%), 9/14/2036 (n) | | | 303,000 | | | | 251,268 | |

| AREIT CRE Trust, 2019-CRE3, “C”, FLR, 2.694% (LIBOR - 1mo. + 1.9%), 9/14/2036 (n) | | | 250,500 | | | | 197,503 | |

| Avery Point CLO Ltd.,2014-1A, “CR”, FLR, 3.341% (LIBOR - 3mo. + 2.35%), 4/25/2026 (n) | | | 1,150,000 | | | | 1,105,094 | |

| Avis Budget Rental Car Funding LLC,2019-1A, “A”, 3.45%, 3/20/2023 (n) | | | 2,690,000 | | | | 2,611,888 | |

| Ballyrock Ltd., CLO,2018-1A, “A2”, FLR, 2.735% (LIBOR - 3mo. + 1.6%), 4/20/2031 (n) | | | 1,368,365 | | | | 1,283,145 | |

| Ballyrock Ltd., CLO,2018-1A, “B”, FLR, 3.035% (LIBOR - 3mo. + 1.9%), 4/20/2031 (n) | | | 579,877 | | | | 502,350 | |

| Bancorp Commercial Mortgage Trust, 2018-CRE3, “B”, FLR, 2.364% (LIBOR - 1mo. + 1.55%), 1/15/2033 (n) | | | 1,177,240 | | | | 1,090,534 | |

| Bancorp Commercial Mortgage Trust, 2018-CRE4, “AS”, FLR, 1.914% (LIBOR - 1mo. + 1.1%), 9/15/2035 (n) | | | 1,512,000 | | | | 1,356,059 | |

| Bancorp Commercial Mortgage Trust, 2019-CRE5, “A”, FLR, 1.814% (LIBOR - 1mo. + 1%), 3/15/2036 (n) | | | 1,578,364 | | | | 1,481,920 | |

| Bancorp Commercial Mortgage Trust, 2019-CRE5, “AS”, FLR, 2.164% (LIBOR - 1mo. + 1.35%), 3/15/2036 (n) | | | 1,181,173 | | | | 1,067,141 | |

| Bancorp Commercial Mortgage Trust, 2019-CRE5, “B”, FLR, 2.314% (LIBOR - 1mo. + 1.5%), 3/15/2036 (n) | | | 1,635,470 | | | | 1,460,049 | |

7

Consolidated Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | |

| Asset-Backed & Securitized - continued | | | | | | |

| Bancorp Commercial Mortgage Trust, 2019-CRE6, “AS”, FLR, 2.114% (LIBOR - 1mo. + 1.3%), 9/15/2036 (n) | | $ | 1,360,019 | | | $ | 1,298,443 | |

| Bancorp Commercial Mortgage Trust, 2019-CRE6, “B”, FLR, 2.364% (LIBOR - 1mo. + 1.55%), 9/15/2036 (n) | | | 1,713,302 | | | | 1,589,829 | |

| Barclays Commercial Mortgage Securities LLC,2018-C2, “XA”, 0.936%, 12/15/2051 (i)(n) | | | 19,613,808 | | | | 1,017,207 | |

| BSPRT Ltd.,2018-FL4, “A”, FLR, 2.914% (LIBOR - 1mo. + 2.1%), 9/15/2035 (n) | | | 1,813,000 | | | | 1,452,083 | |

| Business Jet Securities LLC,2018-1, “A”, 4.335%, 2/15/2033 (n) | | | 845,778 | | | | 730,522 | |

| BXMT Ltd.,2020-FL2, “B”, FLR, 2.151% (LIBOR - 1mo. + 1.4%), 2/16/2037 (n) | | | 1,492,000 | | | | 1,342,661 | |

| BXMT Ltd.,2020-FL2, “A”, FLR, 1.65% (LIBOR - 1mo. + 0.9%), 2/16/2037 (n) | | | 2,317,500 | | | | 2,183,305 | |

| Capital Automotive,2020-1A, “A4”, REIT, 3.19%, 2/15/2050 (n) | | | 568,789 | | | | 546,774 | |

| CarMax Auto Owner Trust,2020-2, “B”, 2.9%, 8/15/2025 (n) | | | 344,000 | | | | 344,000 | |

| CD Commercial Mortgage Trust,2017-CD4, “XA”, 1.459%, 5/10/2050 (i) | | | 11,939,209 | | | | 658,525 | |

| Chesapeake Funding II LLC,2017-2A, “B”, 2.81%, 5/15/2029 (n) | | | 832,000 | | | | 833,730 | |

| Chesapeake Funding II LLC,2017-2A, “C”, 3.01%, 5/15/2029 (n) | | | 372,000 | | | | 372,943 | |

| Chesapeake Funding II LLC,2017-3A, “B”, 2.57%, 8/15/2029 (n) | | | 536,000 | | | | 535,638 | |

| Chesapeake Funding II LLC,2017-4A, “B”, 2.59%, 11/15/2029 (n) | | | 578,000 | | | | 561,961 | |

| Chesapeake Funding II LLC,2017-4A, “C”, 2.76%, 11/15/2029 (n) | | | 709,000 | | | | 686,883 | |

| Commercial Mortgage Pass-Through Certificates, 2019-BN24 ,“XA”, 0.768%, 11/15/2062 (i) | | | 9,148,899 | | | | 444,519 | |

| CPS Auto Trust,2017-C, “C”, 2.86%, 6/15/2023 (n) | | | 373,886 | | | | 373,997 | |

| Cutwater CLO Ltd.,2015-1A, “AR”, FLR, 2.438% (LIBOR - 3mo. + 1.22%), 1/15/2029 (n) | | | 2,242,075 | | | | 2,180,358 | |

| Cutwater Ltd.,2014-1A, “A2R”, FLR, 2.918% (LIBOR - 3mo. + 1.7%), 7/15/2026 (n) | | | 2,250,000 | | | | 2,204,644 | |

| Dell Equipment Finance Trust,2017-2, “B”, 2.47%, 10/24/2022 (n) | | | 510,000 | | | | 510,764 | |

| Dell Equipment Finance Trust,2018-2, “B”, 3.55%, 10/22/2023 (n) | | | 1,616,000 | | | | 1,640,259 | |

| Dell Equipment Finance Trust,2020-1, “A2”, 2.26%, 6/22/2022 (n) | | | 767,000 | | | | 766,847 | |

| DLL Securitization Trust,2017-A, “A3”, 2.14%, 12/15/2021 (n) | | | 245,210 | | | | 245,132 | |

| DT Auto Owner Trust,2017-1A, “D”, 3.55%, 11/15/2022 (n) | | | 444,589 | | | | 445,176 | |

| DT Auto Owner Trust,2017-2A, “D”, 3.89%, 1/15/2023 (n) | | | 780,819 | | | | 784,495 | |

| DT Auto Owner Trust,2017-3A, “D”, 3.58%, 5/15/2023 (n) | | | 1,378,628 | | | | 1,379,640 | |

| DT Auto Owner Trust,2018-2A, “C”, 3.67%, 3/15/2024 (n) | | | 542,663 | | | | 543,245 | |

| Exantas Capital Corp. CLO Ltd., 2019-RS07, “B”, FLR, 2.45% (LIBOR - 1mo. + 1.7%), 4/15/2036 (n) | | | 1,788,500 | | | | 1,521,448 | |

| Exeter Automobile Receivables Trust,2019-3A, “C”, 2.79%, 5/15/2024 (n) | | | 2,205,000 | | | | 2,159,016 | |

| Exeter Automobile Receivables Trust,2020-1, 2.26%, 4/15/2024 (n) | | | 375,000 | | | | 369,680 | |

| Exeter Automobile Receivables Trust,2020-1A, 2.49%, 1/15/2025 (n) | | | 510,000 | | | | 490,993 | |

8

Consolidated Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | |

| Asset-Backed & Securitized - continued | | | | | | |

| Figueroa CLO Ltd.,2014-1A, “BR”, FLR, 2.719% (LIBOR - 3mo. + 1.5%), 1/15/2027 (n) | | $ | 2,050,000 | | | $ | 1,980,484 | |

| Flagship CLO,2014-8A, “BRR”, FLR, 2.576% (LIBOR - 3mo. + 1.4%), 1/16/2026 (n) | | | 1,598,837 | | | | 1,519,332 | |

| Fort CRE LLC,2018-1A, “A1”, FLR, 1.975% (LIBOR - 1mo. + 1.35%), 11/16/2035 (n) | | | 2,319,000 | | | | 2,163,683 | |

| Freedom Financial,2019-1, “A”, 3.42%, 6/18/2026 (n) | | | 209,466 | | | | 205,156 | |

| General Motors,2019-1, “B”, 2.86%, 4/15/2024 (n) | | | 1,172,000 | | | | 1,149,389 | |

| General Motors,2019-1, “C”, 3.06%, 4/15/2024 (n) | | | 902,000 | | | | 879,835 | |

| GLS Auto Receivables Trust,2020-1A, “A”, 2.17%, 2/15/2024 (n) | | | 930,216 | | | | 918,814 | |

| GM Financial Automobile Leasing Trust,2020-1, “B”, 1.84%, 12/20/2023 | | | 633,000 | | | | 619,936 | |

| GM Financial Automobile Leasing Trust,2020-1, “C”, 2.04%, 12/20/2023 | | | 464,000 | | | | 449,402 | |

| Grand Avenue CRE Ltd.,2019-FL1, “A”, FLR, 1.934% (LIBOR - 1mo. + 1.12%), 6/15/2037 (n) | | | 1,444,500 | | | | 1,386,201 | |

| Granite Point Mortgage Trust, Inc.,2018-FL1, “A” FLR, 1.573% (LIBOR - 1mo. + 0.9%), 11/21/2035 (n) | | | 740,746 | | | | 731,701 | |

| GS Mortgage Securities Trust,2017-GS6, “XA”, 1.04%, 5/10/2050 (i) | | | 10,928,939 | | | | 612,448 | |

| GS Mortgage Securities Trust,2017-GS7, “XA”, 1.274%, 8/10/2050 (i) | | | 11,377,432 | | | | 662,996 | |

| Hertz Fleet Lease Funding LP,2017-1, “A2”, 2.13%, 4/10/2031 (n) | | | 630,223 | | | | 617,647 | |

| Hertz Fleet Lease Funding LP,2018-1, “B”, 3.64%, 5/10/2032 (n) | | | 862,000 | | | | 809,325 | |

| Hertz Fleet Lease Funding LP,2018-1, “C”, 3.77%, 5/10/2032 (n) | | | 495,000 | | | | 459,117 | |

| Invitation Homes Trust, 2018-SFR1, “B”, FLR, 1.7% (LIBOR - 1mo. + 0.95%), 3/17/2037 (n) | | | 953,000 | | | | 893,423 | |

| Invitation Homes Trust, 2018-SFR2, “A”, FLR, 1.601% (LIBOR - 1mo. + 0.85%), 12/17/2036 (n) | | | 1,604,384 | | | | 1,551,128 | |

| Invitation Homes Trust, 2018-SFR2, “A”, FLR, 1.714% (LIBOR - 1mo. + 0.9%), 6/17/2037 (n) | | | 3,169,677 | | | | 3,061,567 | |

| JPMorgan Chase Commercial Mortgage Securities Corp., 1.213%, 9/15/2050 (i) | | | 12,935,837 | | | | 684,880 | |

| KKR Real Estate Financial Trust, Inc.,2018-FL1, “C”, FLR, 2.751% (LIBOR - 1mo. + 2%), 6/15/2036 (n) | | | 1,177,500 | | | | 1,012,994 | |

| LoanCore Ltd., 2018-CRE1, “AS”, FLR, 2.314% (LIBOR - 1mo. + 1.5%), 5/15/2028 (n) | | | 1,731,000 | | | | 1,594,635 | |

| LoanCore Ltd., 2018-CRE1, “C”, FLR, 3.364% (LIBOR - 1mo. + 2.55%), 5/15/2028 (n) | | | 577,000 | | | | 487,166 | |

| LoanCore Ltd., 2019-CRE3, “A”, FLR, 1.864% (LIBOR - 1mo. + 1.05%), 4/15/2034 (n) | | | 1,286,000 | | | | 1,199,491 | |

| LoanCore Ltd., 2019-CRE3, “AS”, FLR, 2.184% (LIBOR - 1mo. + 1.37%), 4/15/2034 (n) | | | 2,108,000 | | | | 1,890,211 | |

9

Consolidated Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | |

| Asset-Backed & Securitized - continued | | | | | | |

| Loomis, Sayles & Co., CLO, “A2”, FLR, 2.618% (LIBOR - 3mo. + 1.4%), 4/15/2028 (n) | | $ | 2,652,449 | | | $ | 2,493,469 | |

| Loomis, Sayles & Co., CLO,2015-2A, “A1R”, FLR, 2.118% (LIBOR -3mo. + 0.9%), 4/15/2028 (n) | | | 1,274,850 | | | | 1,217,482 | |

| Madison Park Funding Ltd.,2014-13A, “BR2”, FLR, 2.635% (LIBOR -3mo. + 1.5%), 4/19/2030 (n) | | | 2,174,539 | | | | 2,066,680 | |

| Magnetite CLO Ltd.,2015-16A, “BR”, FLR, 2.335% (LIBOR - 3mo. + 1.2%), 1/18/2028 (n) | | | 2,590,000 | | | | 2,450,269 | |

| Man GLG U.S. CLO Ltd.,2018-2A, “BR”, FLR, 3.668% (LIBOR - 3mo. + 2.45%), 10/15/2028 | | | 2,019,578 | | | | 1,814,023 | |

| MF1 CLO Ltd.,2019-FL2, “A”, FLR, 1.617% (LIBOR - 1mo. + 1.13%), 12/25/2034 (n) | | | 1,316,000 | | | | 1,201,591 | |

| MF1 CLO Ltd.,2019-FL2, “AS”, FLR, 1.917% (LIBOR - 1mo. + 1.43%), 12/25/2034 (n) | | | 1,316,000 | | | | 1,191,889 | |

| Morgan Stanley Bank of America Merrill Lynch Trust, 2.655%, 2/15/2046 | | | 1,340,429 | | | | 1,346,350 | |

| Morgan Stanley Bank of America Merrill Lynch Trust,2017-C33, “XA”, 1.573%, 5/15/2050 (i) | | | 11,748,609 | | | | 702,066 | |

| Morgan Stanley Capital I Trust,2017-H1, “XA”, 1.588%, 6/15/2050 (i) | | | 4,632,563 | | | | 301,196 | |

| Morgan Stanley Capital I Trust,2018-H4, “XA”, 1.032%, 12/15/2051 (i) | | | 16,396,814 | | | | 933,881 | |

| Mountain Hawk CLO Ltd.,2013-2A, “BR”, FLR, 2.735% (LIBOR -3mo. + 1.6%), 7/20/2024 (n) | | | 842,378 | | | | 831,886 | |

| Mountain Hawk CLO Ltd.,2014-3A, “BR”, FLR, 2.935% (LIBOR -3mo. + 1.8%), 4/18/2025 (n) | | | 2,325,000 | | | | 2,256,696 | |

| Nationstar HECM Loan Trust,2018-2A, “M1”, 3.551%, 7/25/2028 (n) | | | 1,072,000 | | | | 1,066,574 | |

| Nationstar HECM Loan Trust,2018-3, “A”, 3.554%, 11/25/2028 (n) | | | 454,186 | | | | 454,827 | |

| Nationstar HECM Loan Trust,2019-1A, “A”, 2.651%, 6/25/2029 (n) | | | 453,391 | | | | 451,770 | |

| Navistar Financial Dealer Note Master Owner Trust,2018-1, “B”, FLR, 1.287% (LIBOR - 1mo. + 0.8%), 9/25/2023 (n) | | | 302,000 | | | | 294,658 | |

| Navistar Financial Dealer Note Master Owner Trust,2018-1, “C”, FLR, 1.537% (LIBOR - 1mo. + 1.05%), 9/25/2023 (n) | | | 340,000 | | | | 331,536 | |

| Navistar Financial Dealer Note Master Owner Trust,2019-1, “C”, FLR, 1.437% (LIBOR - 1mo. + 0.95%), 5/25/2024 (n) | | | 397,000 | | | | 387,870 | |

| Neuberger Berman CLO Ltd.,2015-20A, “BR”, 2.468%, 1/15/2028 (n) | | | 2,729,000 | | | | 2,596,302 | |

| Neuberger Berman CLO Ltd.,2016-21A, “CR”, FLR, 2.735% (LIBOR - 3mo. + 1.6%), 4/20/2027 (n) | | | 1,515,565 | | | | 1,405,849 | |

| NextGear Floorplan Master Owner Trust,2017-2A, “B”, 3.02%, 10/17/2022 (n) | | | 766,000 | | | | 760,692 | |

10

Consolidated Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | |

| Asset-Backed & Securitized - continued | | | | | | |

| NextGear Floorplan Master Owner Trust,2019-2A, “A2”, 2.07%, 10/15/2024 (n) | | $ | 1,026,000 | | | $ | 989,629 | |

| OCP CLO Ltd.,2015-10A, “A2R”, FLR, 2.291% (LIBOR - 3mo. + 1.3%), 10/26/2027 (n) | | | 2,211,957 | | | | 2,101,892 | |

| OneMain Financial Issuance Trust,2020-1A, “A”, 3.84%, 5/14/2032 (n) | | | 1,759,649 | | | | 1,759,649 | |

| Oscar U.S. Funding Trust,2017-1A, “A3”, 2.82%, 6/10/2021 (n) | | | 1,610 | | | | 1,620 | |

| Oscar U.S. Funding Trust,2018-2A, “A3”, 3.39%, 9/12/2022 (n) | | | 820,000 | | | | 832,114 | |

| PFS Financing Corp.,2019-B, “A”, FLR, 1.364% (LIBOR - 1mo. + 0.55%), 9/15/2023 (n) | | | 1,972,000 | | | | 1,910,719 | |

| Santander Drive Auto Receivables Trust,2017-2, “C”, 2.79%, 8/15/2022 | | | 193,179 | | | | 193,206 | |

| Santander Drive Auto Receivables Trust,2018-1, “B”, 2.63%, 7/15/2022 | | | 10,122 | | | | 10,125 | |

| Santander Retail Auto Lease Trust,2017-A, “B”, 2.68%, 1/20/2022 (n) | | | 866,000 | | | | 867,250 | |

| Securitized Term Auto Receivable Trust, 2019-CRTA, “B”, 2.453%, 3/25/2026 (n) | | | 355,833 | | | | 356,473 | |

| Securitized Term Auto Receivable Trust, 2019-CRTA, “C”, 2.849%, 3/25/2026 (n) | | | 456,812 | | | | 457,632 | |

| Shackelton CLO Ltd.,2013-4RA, “B”, FLR, 3.211% (LIBOR - 3mo. + 1.9%), 4/13/2031 (n) | | | 722,762 | | | | 623,705 | |

| Shelter Growth CRE,2019-FL2, “A”, FLR, 1.914% (LIBOR - 1mo. + 1.1%), 5/15/2036 (n) | | | 2,681,446 | | | | 2,479,970 | |

| SPS Servicer Advance Receivables Trust, 2.24%, 10/15/2051 (n) | | | 1,180,000 | | | | 1,164,470 | |

| SPS Servicer Advance Receivables Trust, 2.34%, 10/15/2051 (n) | | | 214,000 | | | | 211,160 | |

| SPS Servicer Advance Receivables Trust, 2.39%, 10/15/2051 (n) | | | 256,000 | | | | 252,606 | |

| Starwood Waypoint Homes Trust,2017-1, “B”, FLR, 1.984% (LIBOR - 1mo. + 1.17%), 1/17/2035 (n) | | | 1,514,489 | | | | 1,461,179 | |

| Thacher Park CLO Ltd.,2014-1A, “CR”, FLR, 3.335% (LIBOR - 3mo. + 2.2%), 10/20/2026 (n) | | | 1,143,000 | | | | 1,088,760 | |

| TICP CLO Ltd.,2018-3R, “B”, FLR, 2.485% (LIBOR - 3mo. + 1.35%), 4/20/2028 (n) | | | 681,356 | | | | 642,460 | |

| TICP CLO Ltd.,2018-3R, “C”, FLR, 2.935% (LIBOR - 3mo. + 1.8%), 4/20/2028 (n) | | | 1,195,706 | | | | 1,108,912 | |

| TPG Real Estate Finance,2018-FL2, “AS”, FLR, 2.201% (LIBOR -1mo. + 1.45%), 11/15/2037 (n) | | | 1,914,000 | | | | 1,762,112 | |

| UBS Commercial Mortgage Trust,2017-C1, “XA”, 1.158%, 11/15/2050 (i) | | | 7,893,824 | | | | 402,019 | |

| UBS Commercial Mortgage Trust,2018-C14, “XA”, 1.176%, 12/15/2051 (i) | | | 8,020,609 | | | | 521,668 | |

| Verizon Owner Trust,2017-3A, “B”, 2.38%, 4/20/2022 (n) | | | 769,000 | | | | 771,136 | |

| Veros Auto Receivables Trust,2018-1, “A”, 3.63%, 5/15/2023 (n) | | | 111,859 | | | | 111,862 | |

11

Consolidated Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | |

| Asset-Backed & Securitized - continued | | | | | | |

| Veros Auto Receivables Trust,2020-1, “A”, 1.67%, 9/15/2023 (n) | | $ | 1,270,350 | | | $ | 1,259,171 | |

| West CLO Ltd.,2013-1A, “A2BR”, 3.393%, 11/07/2025 (n) | | | 273,483 | | | | 273,484 | |

| Wind River CLO Ltd.,2012-1A, “BR2”, FLR, 2.668% (LIBOR - 3mo. + 1.45%), 1/15/2026 (n) | | | 2,079,666 | | | | 2,038,607 | |

| | | | | | | | |

| | | | | | | $ | 127,149,713 | |

| Automotive - 3.8% | | | | | | |

| BMW U.S. Capital LLC, 3.1%, 4/12/2021 (n) | | $ | 1,639,000 | | | $ | 1,646,633 | |

| Ford Motor Credit Co. LLC, 5.085%, 1/07/2021 | | | 984,000 | | | | 961,860 | |

| Ford Motor Credit Co. LLC, 5.75%, 2/01/2021 | | | 1,151,000 | | | | 1,122,225 | |

| Ford Motor Credit Co. LLC, 3.087%, 1/09/2023 | | | 1,222,000 | | | | 1,099,418 | |

| Ford Motor Credit Co. LLC, 4.063%, 11/01/2024 | | | 1,665,000 | | | | 1,448,550 | |

| Harley-Davidson Financial Services, 4.05%, 2/04/2022 (n) | | | 1,251,000 | | | | 1,253,466 | |

| Harley-Davidson Financial Services, FLR, 2.52% (LIBOR - 3mo. + 0.94%), 3/02/2021 (n) | | | 1,473,000 | | | | 1,448,061 | |

| Hyundai Capital America, 3.75%, 7/08/2021 (n) | | | 1,082,000 | | | | 1,085,830 | |

| Hyundai Capital America, 2.85%, 11/01/2022 (n) | | | 1,427,000 | | | | 1,392,367 | |

| Hyundai Capital America, 2.375%, 2/10/2023 (n) | | | 723,000 | | | | 695,690 | |

| Hyundai Capital America, 5.75%, 4/06/2023 (n) | | | 1,526,000 | | | | 1,614,677 | |

| Toyota Motor Credit Corp., 2.9%, 3/30/2023 | | | 1,560,000 | | | | 1,635,178 | |

| Toyota Motor Credit Corp., 3%, 4/01/2025 | | | 2,080,000 | | | | 2,217,447 | |

| Volkswagen Group of America Co., 3.875%, 11/13/2020 (n) | | | 1,177,000 | | | | 1,178,912 | |

| Volkswagen Group of America Co., 4%, 11/12/2021 (n) | | | 977,000 | | | | 992,366 | |

| Volkswagen Group of America Co., 2.85%, 9/26/2024 (n) | | | 1,078,000 | | | | 1,058,384 | |

| | | | | | | | |

| | | | | | | $ | 20,851,064 | |

| Broadcasting - 0.5% | | | | | | |

| Fox Corp., 3.666%, 1/25/2022 | | $ | 648,000 | | | $ | 671,536 | |

| Fox Corp., 3.05%, 4/07/2025 | | | 776,000 | | | | 823,547 | |

| Interpublic Group of Companies, Inc., 3.5%, 10/01/2020 | | | 1,512,000 | | | | 1,521,722 | |

| | | | | | | | |

| | | | | | | $ | 3,016,805 | |

| Brokerage & Asset Managers - 1.0% | | | | | | |

| E*TRADE Financial Corp., 2.95%, 8/24/2022 | | $ | 3,674,000 | | | $ | 3,751,092 | |

| Intercontinental Exchange, Inc., 2.75%, 12/01/2020 | | | 696,000 | | | | 702,090 | |

| National Securities Clearing Corp., 1.2%, 4/23/2023 (n) | | | 600,000 | | | | 600,274 | |

| National Securities Clearing Corp., 1.5%, 4/23/2025 (n) | | | 250,000 | | | | 251,285 | |

| | | | | | | | |

| | | | | | | $ | 5,304,741 | |

| Business Services - 0.0% | | | | | | |

| NXP Semiconductors N.V., 2.7%, 5/01/2025 (n) | | $ | 151,000 | | | $ | 152,675 | |

12

Consolidated Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | |

| Cable TV - 0.5% | | | | | | |

| Comcast Corp., 3.1%, 4/01/2025 | | $ | 350,000 | | | $ | 377,603 | |

| SES S.A., 3.6%, 4/04/2023 (n) | | | 2,416,000 | | | | 2,374,281 | |

| | | | | | | | |

| | | | | | | $ | 2,751,884 | |

| Chemicals - 0.5% | | | | | | |

| DuPont de Nemours, Inc., 2.169%, 5/01/2023 | | $ | 2,665,000 | | | $ | 2,682,779 | |

| | |

| Computer Software - 0.9% | | | | | | |

| Dell International LLC/EMC Corp., 5.85%, 7/15/2025 (n) | | $ | 471,000 | | | $ | 512,322 | |

| Dell Investments LLC/EMC Corp., 4.42%, 6/15/2021 | | | 3,130,000 | | | | 3,180,829 | |

| Dell Investments LLC/EMC Corp., 4%, 7/15/2024 (n) | | | 1,285,000 | | | | 1,304,573 | |

| | | | | | | | |

| | | | | | | $ | 4,997,724 | |

| Computer Software - Systems - 0.2% | | | | | | |

| Apple, Inc., 1.7%, 9/11/2022 | | $ | 1,188,000 | | | $ | 1,218,808 | |

| | |

| Conglomerates - 0.8% | | | | | | |

| Roper Technologies, Inc., 2.8%, 12/15/2021 | | $ | 1,383,000 | | | $ | 1,410,798 | |

| Westinghouse Air Brake Technologies Corp., 4.4%, 3/15/2024 | | | 2,317,000 | | | | 2,326,294 | |

| Westinghouse Air Brake Technologies Corp., FLR, 2.04% (LIBOR - 3mo. + 1.05%), 9/15/2021 | | | 754,000 | | | | 727,468 | |

| | | | | | | | |

| | | | | | | $ | 4,464,560 | |

| Consumer Products - 0.4% | | | | | | |

| Reckitt Benckiser Treasury Services PLC, 2.375%, 6/24/2022 (n) | | $ | 2,213,000 | | | $ | 2,253,207 | |

| | |

| Consumer Services - 0.6% | | | | | | |

| Alibaba Group Holding Ltd., 2.8%, 6/06/2023 | | $ | 1,506,000 | | | $ | 1,556,643 | |

| Booking Holdings, Inc., 4.1%, 4/13/2025 | | | 244,000 | | | | 259,167 | |

| QVC, Inc., 5.125%, 7/02/2022 | | | 1,468,000 | | | | 1,442,310 | |

| | | | | | | | |

| | | | | | | $ | 3,258,120 | |

| Electronics - 0.6% | | | | | | |

| Broadcom Corp./Broadcom Cayman Finance Ltd., 3.625%, 1/15/2024 | | $ | 1,117,000 | | | $ | 1,166,227 | |

| Broadcom, Inc., 4.7%, 4/15/2025 (n) | | | 690,000 | | | | 760,829 | |

| Microchip Technology, Inc., 3.922%, 6/01/2021 | | | 1,208,000 | | | | 1,227,562 | |

| | | | | | | | |

| | | | | | | $ | 3,154,618 | |

| Emerging Market Quasi-Sovereign - 0.5% | | | | | | |

| Bharat Petroleum Corp. Ltd., 4.625%, 10/25/2022 | | $ | 1,716,000 | | | $ | 1,707,763 | |

| Indian Oil Corp. Ltd., 5.75%, 8/01/2023 | | | 858,000 | | | | 877,279 | |

| | | | | | | | |

| | | | | | | $ | 2,585,042 | |

13

Consolidated Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | |

| Energy - Integrated - 1.4% | | | | | | |

| Cenovus Energy, Inc., 3%, 8/15/2022 | | $ | 1,474,000 | | | $ | 1,300,918 | |

| Cenovus Energy, Inc., 3.8%, 9/15/2023 | | | 689,000 | | | | 574,878 | |

| Eni S.p.A., 4%, 9/12/2023 (n) | | | 1,723,000 | | | | 1,755,915 | |

| Exxon Mobil Corp., 1.571%, 4/15/2023 | | | 983,000 | | | | 995,565 | |

| Exxon Mobil Corp., 2.992%, 3/19/2025 | | | 2,700,000 | | | | 2,883,413 | |

| | | | | | | | |

| | | | | | | $ | 7,510,689 | |

| Entertainment - 0.1% | | | | | | |

| Royal Caribbean Cruises Ltd., 2.65%, 11/28/2020 | | $ | 836,000 | | | $ | 760,589 | |

| | |

| Financial Institutions - 1.2% | | | | | | |

| AerCap Ireland Capital DAC, 4.45%, 12/16/2021 | | $ | 1,723,000 | | | $ | 1,606,594 | |

| AerCap Ireland Capital DAC, 4.875%, 1/16/2024 | | | 1,964,000 | | | | 1,822,967 | |

| Avolon Holdings Funding Ltd., 3.625%, 5/01/2022 (n) | | | 1,634,000 | | | | 1,495,828 | |

| Avolon Holdings Funding Ltd., 3.95%, 7/01/2024 (n) | | | 1,131,000 | | | | 973,134 | |

| Century Housing Corp., 3.995%, 11/01/2021 | | | 691,000 | | | | 722,203 | |

| | | | | | | | |

| | | | | | | $ | 6,620,726 | |

| Food & Beverages - 1.1% | | | | | | |

| Conagra Brands, Inc., 3.8%, 10/22/2021 | | $ | 905,000 | | | $ | 933,399 | |

Conagra Brands, Inc., FLR, 1.847% (LIBOR - 3mo. +

0.75%), 10/22/2020 | | | 317,000 | | | | 316,579 | |

| Constellation Brands, Inc., 4.25%, 5/01/2023 | | | 1,510,000 | | | | 1,618,416 | |

Constellation Brands, Inc., FLR, 2.391% (LIBOR - 3mo. +

0.7%), 11/15/2021 | | | 739,000 | | | | 727,197 | |

| Diageo Capital PLC, 3%, 5/18/2020 | | | 967,000 | | | | 967,917 | |

| Diageo Capital PLC, 1.375%, 9/29/2025 | | | 836,000 | | | | 835,626 | |

| Pernod Ricard S.A., 5.75%, 4/07/2021 (n) | | | 480,000 | | | | 497,758 | |

| | | | | | | | |

| | | | | | | $ | 5,896,892 | |

| Gaming & Lodging - 0.9% | | | | | | |

| GLP Capital LP/GLP Financing II, Inc., 5.375%, 11/01/2023 | | $ | 1,259,000 | | | $ | 1,221,230 | |

| Las Vegas Sands Corp., 3.2%, 8/08/2024 | | | 1,420,000 | | | | 1,380,095 | |

| Marriott International, Inc., 2.3%, 1/15/2022 | | | 2,151,000 | | | | 2,083,455 | |

| Marriott International, Inc., 3.75%, 10/01/2025 | | | 509,000 | | | | 480,635 | |

| | | | | | | | |

| | | | | | | $ | 5,165,415 | |

| Industrial - 0.1% | | | | | | |

| Howard University, Washington D.C., 2.638%, 10/01/2021 | | $ | 96,000 | | | $ | 96,713 | |

| Howard University, Washington D.C., 2.738%, 10/01/2022 | | | 101,000 | | | | 102,126 | |

| Howard University, Washington D.C., 2.801%, 10/01/2023 | | | 111,000 | | | | 113,361 | |

| Howard University, Washington D.C., 2.416%, 10/01/2024 | | | 123,000 | | | | 125,427 | |

| Howard University, Washington D.C., 2.516%, 10/01/2025 | | | 152,000 | | | | 151,941 | |

| | | | | | | | |

| | | | | | | $ | 589,568 | |

14

Consolidated Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | |

| Insurance - Health - 0.3% | | | | | | |

| UnitedHealth Group, Inc., 1.95%, 10/15/2020 | | $ | 1,571,000 | | | $ | 1,571,036 | |

| | |

| Insurance - Property & Casualty - 0.5% | | | | | | |

| Aon PLC, 2.2%, 11/15/2022 | | $ | 1,193,000 | | | $ | 1,215,167 | |

| Marsh & McLennan Cos., Inc., 2.75%, 1/30/2022 | | | 1,383,000 | | | | 1,425,284 | |

| | | | | | | | |

| | | | | | | $ | 2,640,451 | |

| International Market Quasi-Sovereign - 0.5% | | | | | | |

| Dexia Credit Local S.A. (Kingdom of Belgium), 1.875%, 9/15/2021 (n) | | $ | 2,010,000 | | | $ | 2,044,343 | |

| Kommunalbanken A.S. (Kingdom of Norway), 1.375%, 10/26/2020 (n) | | | 720,000 | | | | 723,233 | |

| | | | | | | | |

| | | | | | | $ | 2,767,576 | |

| Internet - 0.4% | | | | | | |

| Baidu, Inc., 3.875%, 9/29/2023 | | $ | 2,225,000 | | | $ | 2,319,118 | |

| | |

| Machinery & Tools - 0.6% | | | | | | |

| CNH Industrial Capital LLC, 4.2%, 1/15/2024 | | $ | 1,931,000 | | | $ | 2,015,141 | |

| CNH Industrial N.V., 4.5%, 8/15/2023 | | | 1,073,000 | | | | 1,098,634 | |

| Deere & Co., 2.75%, 4/15/2025 | | | 437,000 | | | | 465,250 | |

| | | | | | | | |

| | | | | | | $ | 3,579,025 | |

| Major Banks - 7.9% | | | | | | |

| ABN AMRO Bank N.V., 2.65%, 1/19/2021 (n) | | $ | 3,685,000 | | | $ | 3,718,460 | |

| Bank of Montreal, 2.05%, 11/01/2022 | | | 1,694,000 | | | | 1,724,184 | |

| Barclays PLC, 4.61%, 2/15/2023 | | | 4,665,000 | | | | 4,847,094 | |

| Barclays PLC, 2.85%, 5/07/2026 | | | 759,000 | | | | 759,000 | |

Credit Agricole, “A”, FLR, 2.741% (LIBOR - 3mo. +

1.43%), 1/10/2022 (n) | | | 750,000 | | | | 747,718 | |

| Credit Suisse Group AG, 3.574%, 1/09/2023 (n) | | | 2,060,000 | | | | 2,108,359 | |

| DNB Bank A.S.A., 2.125%, 10/02/2020 (n) | | | 1,684,000 | | | | 1,691,945 | |

| HSBC Holdings PLC, 3.262% to 3/13/2022, FLR (LIBOR - 3mo. + 1.055%) to 3/13/2023 | | | 2,383,000 | | | | 2,443,543 | |

| HSBC Holdings PLC, 3.033% to 11/22/2022, FLR (LIBOR - 3mo. + 0.923%) to 11/22/2023 | | | 957,000 | | | | 984,980 | |

| JPMorgan Chase & Co., 3.207% to 4/01/2022, FLR (LIBOR - 3mo. + 0.695%) to 4/01/2023 | | | 2,839,000 | | | | 2,928,707 | |

| JPMorgan Chase & Co., 3.375%, 5/01/2023 | | | 1,196,000 | | | | 1,252,382 | |

| KeyBank N.A., 3.3%, 2/01/2022 | | | 772,000 | | | | 796,530 | |

| Mitsubishi UFJ Financial Group, Inc., 2.95%, 3/01/2021 | | | 261,000 | | | | 265,048 | |

| Mitsubishi UFJ Financial Group, Inc., 2.623%, 7/18/2022 | | | 2,006,000 | | | | 2,046,620 | |

| NatWest Markets PLC, 3.625%, 9/29/2022 (n) | | | 925,000 | | | | 954,645 | |

| Royal Bank of Scotland Group PLC, 4.269% to 3/22/2024, FLR (LIBOR - 3mo. + 1.762%) to 3/22/2025 | | | 1,282,000 | | | | 1,357,669 | |

15

Consolidated Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | |

| Major Banks - continued | | | | | | |

| Skandinaviska Enskilda Banken AB, 2.45%, 5/27/2020 (n) | | $ | 2,200,000 | | | $ | 2,201,276 | |

State Street Corp., 2.825% to 3/30/2022, FLR (SOFR +

2.69%) to 3/30/2023 (n) | | | 483,000 | | | | 496,376 | |

State Street Corp., 2.901% to 3/30/2025, FLR (SOFR +

2.7%) to 3/30/2026 (n) | | | 250,000 | | | | 265,524 | |

| UBS Group Funding (Switzerland) AG, 3.491%, 5/23/2023 (n) | | | 5,533,000 | | | | 5,694,116 | |

| UBS Group Funding Ltd., 3%, 4/15/2021 (n) | | | 600,000 | | | | 606,417 | |

| UniCredito Italiano S.p.A., 6.572%, 1/14/2022 (n) | | | 1,297,000 | | | | 1,337,752 | |

| UniCredito Italiano S.p.A., 3.75%, 4/12/2022 (n) | | | 1,116,000 | | | | 1,127,265 | |

| Wells Fargo & Co., 2.164% to 2/11/2025, FLR (LIBOR - 3mo. + 0.75%) to 2/11/2026 | | | 2,912,000 | | | | 2,926,072 | |

| | | | | | | | |

| | | | | | | $ | 43,281,682 | |

| Medical & Health Technology & Services - 1.1% | | | | | | |

| Becton, Dickinson and Co., 2.404%, 6/05/2020 | | $ | 718,000 | | | $ | 717,879 | |

| Becton, Dickinson and Co., 2.894%, 6/06/2022 | | | 856,000 | | | | 877,706 | |

| Cigna Corp., FLR, 1.493% (LIBOR - 3mo. + 0.65%), 9/17/2021 | | | 1,496,000 | | | | 1,470,763 | |

| HCA, Inc., 5%, 3/15/2024 | | | 2,522,000 | | | | 2,735,796 | |

| | | | | | | | |

| | | | | | | $ | 5,802,144 | |

| Medical Equipment - 0.1% | | | | | | |

| Zimmer Biomet Holdings, Inc., FLR, 1.802% (LIBOR - 3mo. + 0.75%), 3/19/2021 | | $ | 356,000 | | | $ | 352,155 | |

| | |

| Metals & Mining - 1.3% | | | | | | |

| Anglo American Capital PLC, 3.625%, 9/11/2024 (n) | | $ | 809,000 | | | $ | 809,840 | |

| Anglo American Capital PLC, 5.375%, 4/01/2025 (n) | | | 1,000,000 | | | | 1,075,869 | |

| Glencore Finance (Canada) Ltd., 4.95%, 11/15/2021 (n) | | | 729,000 | | | | 749,259 | |

| Glencore Funding LLC, 3%, 10/27/2022 (n) | | | 610,000 | | | | 605,211 | |

| Glencore Funding LLC, 4.125%, 3/12/2024 (n) | | | 1,280,000 | | | | 1,313,038 | |

| Steel Dynamics, Inc., 4.125%, 9/15/2025 | | | 2,725,000 | | | | 2,724,807 | |

| | | | | | | | |

| | | | | | | $ | 7,278,024 | |

| Midstream - 1.6% | | | | | | |

| El Paso LLC, 6.5%, 9/15/2020 | | $ | 1,691,000 | | | $ | 1,710,476 | |

| Energy Transfer Operating Co., 2.9%, 5/15/2025 | | | 788,000 | | | | 733,485 | |

| MPLX LP, 3.5%, 12/01/2022 (n) | | | 2,416,000 | | | | 2,386,169 | |

| MPLX LP, 3.375%, 3/15/2023 | | | 471,000 | | | | 462,661 | |

| MPLX LP, FLR, 1.899% (LIBOR - 3mo. + 0.9%), 9/09/2021 | | | 920,000 | | | | 865,529 | |

| Western Midstream Operating LP, 3.1%, 2/01/2025 | | | 1,209,000 | | | | 1,103,213 | |

| Western Midstream Operating LP, FLR, 2.161% (LIBOR - 3mo. + 0.85%), 1/13/2023 | | | 1,727,000 | | | | 1,407,689 | |

| | | | | | | | |

| | | | | | | $ | 8,669,222 | |

16

Consolidated Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | |

| Mortgage-Backed - 1.4% | | | | | | |

| Fannie Mae, 4.5%, 4/01/2024 - 5/01/2025 | | $ | 193,935 | | | $ | 205,686 | |

| Fannie Mae, 3%, 12/01/2031 | | | 498,570 | | | | 530,735 | |

| Fannie Mae, 2%, 5/25/2044 | | | 1,308,426 | | | | 1,340,546 | |

| Freddie Mac, 1.015%, 4/25/2024 (i) | | | 126,542 | | | | 3,404 | |

| Freddie Mac, 4%, 7/01/2025 | | | 160,296 | | | | 169,393 | |

| Freddie Mac, 3%, 4/15/2033 - 6/15/2045 | | | 4,199,246 | | | | 4,511,231 | |

| Freddie Mac, 2%, 7/15/2042 | | | 839,318 | | | | 858,346 | |

| | | | | | | | |

| | | | | | | $ | 7,619,341 | |

| Municipals - 1.2% | | | | | | |

| Illinois Sales Tax Securitization Corp., Second Lien, “B”, 2.128%, 1/01/2023 | | $ | 430,000 | | | $ | 417,921 | |

| Illinois Sales Tax Securitization Corp., Second Lien, “B”, 2.225%, 1/01/2024 | | | 1,030,000 | | | | 987,533 | |

| New Jersey Economic Development Authority State Pension Funding Rev., Capital Appreciation, “B”, 0%, 2/15/2023 | | | 3,058,000 | | | | 2,927,423 | |

| New Jersey Transportation Trust Fund Authority, Transportation System, “B”, 2.384%, 6/15/2022 | | | 460,000 | | | | 465,718 | |

| New Jersey Transportation Trust Fund Authority, Transportation System, “B”, 2.551%, 6/15/2023 | | | 475,000 | | | | 483,232 | |

| New Jersey Transportation Trust Fund Authority, Transportation System, “B”, 2.631%, 6/15/2024 | | | 450,000 | | | | 459,567 | |

| Texas Transportation Commission, Central Texas Turnpike System First Tier Refunding Rev., Taxable, “B”, 1.98%, 8/15/2042 | | | 695,000 | | | | 687,529 | |

| | | | | | | | |

| | | | | | | $ | 6,428,923 | |

| Oil Services - 0.0% | | | | | | |

| Halliburton Co., 3.8%, 11/15/2025 | | $ | 152,000 | | | $ | 146,801 | |

| | |

| Oils - 0.5% | | | | | | |

| Marathon Petroleum Corp., 4.75%, 12/15/2023 | | $ | 1,684,000 | | | $ | 1,697,950 | |

| Phillips 66, FLR, 2.246% (LIBOR - 3mo. + 0.6%), 2/26/2021 | | | 839,000 | | | | 822,442 | |

| Valero Energy Corp., 2.85%, 4/15/2025 | | | 173,000 | | | | 171,599 | |

| | | | | | | | |

| | | | | | | $ | 2,691,991 | |

| Other Banks & Diversified Financials - 2.8% | | | | | | |

| American Express Co., 3.7%, 11/05/2021 | | $ | 1,307,000 | | | $ | 1,348,949 | |

| Banque Federative du Credit Mutuel S.A., 2.2%, 7/20/2020 (n) | | | 1,854,000 | | | | 1,859,523 | |

| BBVA USA, 3.5%, 6/11/2021 | | | 1,498,000 | | | | 1,510,622 | |

| BBVA USA, 2.875%, 6/29/2022 | | | 2,542,000 | | | | 2,554,881 | |

| BBVA USA Bancshares, Inc., 2.5%, 8/27/2024 | | | 1,122,000 | | | | 1,098,104 | |

| Discover Bank, 3.1%, 6/04/2020 | | | 1,190,000 | | | | 1,190,207 | |

| Groupe BPCE S.A., 4%, 9/12/2023 (n) | | | 1,193,000 | | | | 1,254,025 | |

17

Consolidated Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | |

| Other Banks & Diversified Financials - continued | | | | | | |

Groupe BPCE S.A., FLR, 2.024% (LIBOR - 3mo. +

1.24%), 9/12/2023 (n) | | $ | 1,193,000 | | | $ | 1,164,117 | |

| National Bank of Canada, 2.15%, 10/07/2022 (n) | | | 1,305,000 | | | | 1,322,418 | |

| SunTrust Banks, Inc., 2.8%, 5/17/2022 | | | 1,884,000 | | | | 1,942,978 | |

| UBS AG, 1.75%, 4/21/2022 (n) | | | 395,000 | | | | 396,668 | |

| | | | | | | | |

| | | | | | | $ | 15,642,492 | |

| Personal Computers & Peripherals - 0.0% | | | | | | |

| Equifax, Inc., 2.6%, 12/15/2025 | | $ | 223,000 | | | $ | 225,854 | |

| | |

| Pharmaceuticals - 1.2% | | | | | | |

| AbbVie, Inc., 2.15%, 11/19/2021 (n) | | $ | 1,193,000 | | | $ | 1,208,324 | |

| Allergan Funding SCS, 3.45%, 3/15/2022 | | | 2,322,000 | | | | 2,379,833 | |

| Bristol-Myers Squibb Co., 2.875%, 8/15/2020 (n) | | | 1,625,000 | | | | 1,633,449 | |

| Bristol-Myers Squibb Co., 2.75%, 2/15/2023 (n) | | | 1,103,000 | | | | 1,159,378 | |

Bristol-Myers Squibb Co., FLR, 2.072% (LIBOR - 3mo. +

0.38%), 5/16/2022 (n) | | | 421,000 | | | | 418,834 | |

| | | | | | | | |

| | | | | | | $ | 6,799,818 | |

| Printing & Publishing - 0.2% | | | | | | |

| Moody’s Corp., 3.25%, 6/07/2021 | | $ | 1,266,000 | | | $ | 1,290,809 | |

| | |

| Restaurants - 0.1% | | | | | | |

| McDonald’s Corp., 3.3%, 7/01/2025 | | $ | 375,000 | | | $ | 408,567 | |

| | |

| Retailers - 0.1% | | | | | | |

| Alimentation Couche-Tard, Inc., 2.7%, 7/26/2022 (n) | | $ | 308,000 | | | $ | 309,718 | |

| Macy’s Retail Holdings, Inc., 3.875%, 1/15/2022 | | | 324,000 | | | | 272,565 | |

| | | | | | | | |

| | | | | | | $ | 582,283 | |

| Specialty Stores - 0.2% | | | | | | |

| TJX Cos., Inc., 3.5%, 4/15/2025 | | $ | 1,080,000 | | | $ | 1,164,733 | |

| | |

| Telecommunications - Wireless - 1.4% | | | | | | |

| American Tower Corp., REIT, 2.8%, 6/01/2020 | | $ | 517,000 | | | $ | 517,006 | |

| American Tower Corp., REIT, 2.25%, 1/15/2022 | | | 2,250,000 | | | | 2,281,442 | |

| Crown Castle International Corp., 3.4%, 2/15/2021 | | | 550,000 | | | | 555,077 | |

| Crown Castle International Corp., 3.15%, 7/15/2023 | | | 680,000 | | | | 712,317 | |

| SBA Tower Trust, 2.877%, 7/09/2021 (n) | | | 660,000 | | | | 662,968 | |

| T-Mobile USA, Inc., 3.5%, 4/15/2025 (n) | | | 2,676,000 | | | | 2,829,656 | |

| | | | | | | | |

| | | | | | | $ | 7,558,466 | |

18

Consolidated Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | |

| Tobacco - 0.4% | | | | | | |

| B.A.T Capital Corp., 2.764%, 8/15/2022 | | $ | 708,000 | | | $ | 717,344 | |

| Imperial Tobacco Finance PLC, 3.75%, 7/21/2022 (n) | | | 755,000 | | | | 764,972 | |

| Philip Morris International, Inc., 1.125%, 5/01/2023 | | | 805,000 | | | | 803,617 | |

| | | | | | | | |

| | | | | | | $ | 2,285,933 | |

| Transportation - Services - 1.1% | | | | | | |

| Adani Ports & Special Economic Zone Ltd., 3.95%, 1/19/2022 | | $ | 2,605,000 | | | $ | 2,532,216 | |

| ERAC USA Finance LLC, 2.7%, 11/01/2023 (n) | | | 787,000 | | | | 775,681 | |

| ERAC USA Finance LLC, 3.85%, 11/15/2024 (n) | | | 341,000 | | | | 351,045 | |

| ERAC USA Finance LLC, 3.8%, 11/01/2025 (n) | | | 457,000 | | | | 466,912 | |

| TTX Co., 2.6%, 6/15/2020 (n) | | | 2,145,000 | | | | 2,144,580 | |

| | | | | | �� | | |

| | | | | | | $ | 6,270,434 | |

| U.S. Government Agencies and Equivalents - 0.0% | | | | | | |

| Small Business Administration, 2.25%, 7/01/2021 | | $ | 59,397 | | | $ | 60,051 | |

| | |

| U.S. Treasury Obligations - 14.5% | | | | | | |

| U.S. Treasury Notes, 1.5%, 5/31/2020 (s) | | $ | 15,000,000 | | | $ | 15,017,204 | |

| U.S. Treasury Notes, 1.625%, 7/31/2020 (s) | | | 18,000,000 | | | | 18,068,589 | |

| U.S. Treasury Notes, 2.625%, 12/15/2021 (f) | | | 27,750,000 | | | | 28,842,656 | |

| U.S. Treasury Notes, 1.875%, 4/30/2022 (f) | | | 2,871,000 | | | | 2,966,102 | |

| U.S. Treasury Notes, 2.375%, 1/31/2023 | | | 14,124,000 | | | | 14,951,017 | |

| | | | | | | | |

| | | | | | | $ | 79,845,568 | |

| Utilities - Electric Power - 1.9% | | | | | | |

| Dominion Energy, Inc., 2.579%, 7/01/2020 | | $ | 1,136,000 | | | $ | 1,136,348 | |

| Emera U.S. Finance LP, 2.7%, 6/15/2021 | | | 468,000 | | | | 470,661 | |

| Enel Finance International N.V., 2.875%, 5/25/2022 (n) | | | 2,820,000 | | | | 2,836,169 | |

| Florida Power & Light Co., 2.85%, 4/01/2025 | | | 307,000 | | | | 332,656 | |

Florida Power & Light Co., FLR, 2.137% (LIBOR - 3mo. +

0.4%), 5/06/2022 | | | 1,398,000 | | | | 1,385,572 | |

| NextEra Energy Capital Holdings, Inc., 2.403%, 9/01/2021 | | | 2,062,000 | | | | 2,096,167 | |

| NextEra Energy, Inc., 2.9%, 4/01/2022 | | | 1,411,000 | | | | 1,457,625 | |

| WEC Energy Group, Inc., 3.1%, 3/08/2022 | | | 826,000 | | | | 851,701 | |

| | | | | | | | |

| | | | | | | $ | 10,566,899 | |

| Total Bonds (Identified Cost, $451,077,313) | | | | | | $ | 446,875,402 | |

| | |

| Investment Companies (h) - 7.3% | | | | | | |

| Money Market Funds - 7.3% | | | | | | |

MFS Institutional Money Market Portfolio, 0.41% (v)

(Identified Cost, $40,068,836) | | | 40,063,941 | | | $ | 40,067,947 | |

19

Consolidated Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Short-Term Obligations (s)(y) - 10.6% | | | | | | |

Federal Home Loan Bank, 0%, due 5/01/2020

(Identified Cost, $58,603,000) | | $ | 58,603,000 | | | $ | 58,603,000 | |

| | |

| Other Assets, Less Liabilities - 1.0% | | | | | 5,545,482 | |

| Net Assets - 100.0% | | | | | | $ | 551,091,831 | |

| (f) | All or a portion of the security has been segregated as collateral for open futures contracts, cleared swap agreements, and uncleared swap agreements. |

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund’s investments in affiliated issuers and in unaffiliated issuers were $40,067,947 and $505,478,402, respectively. |

| (i) | Interest only security for which the fund receives interest on notional principal (Par amount). Par amount shown is the notional principal and does not reflect the cost of the security. |

| (n) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of these securities was $195,153,736, representing 35.4% of net assets. |

| (s) | All or a portion of security is held by a wholly-owned subsidiary. See Note 2 of the Notes to Consolidated Financial Statements for details of the wholly-owned subsidiary. |

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualizedseven-day yield of the fund at period end. |

| (y) | The rate shown represents an annualized yield at time of purchase. |

The following abbreviations are used in this report and are defined:

| BCOMALTR | | Bloomberg Aluminum Subindex Total Return, this index is composed of futures contracts on aluminum. |

| BCOMCLTR | | Bloomberg WTI Crude Oil Subindex Total Return, this index is composed of composed of futures contracts on WTI crude oil. It reflects the return on fully collateralized futures positions. It is quoted in USD. |

| BCOMCOT | | Bloomberg Brent Crude Subindex Total Return, this index is composed of futures contracts on brent crude. |

| BCOMF3T | | Bloomberg Commodity Index 3 Month Forward Total Return, this index is composed of longer-dated futures contracts on 19 physical commodities. |

| BCOMFCT | | Bloomberg Feeder Cattle Subindex Total Return, this index is comprised of futures contracts on feeder cattle. It is quoted in USD. |

| BCOMGCTR | | Bloomberg Gold Subindex Total Return, this index is composed of futures contracts on gold. |

| BCOMKCTR | | Bloomberg Coffee Subindex Total Return, this index is composed of futures contracts on coffee. It reflects the return on fully collateralized futures positions. It is quoted in USD. |

| BCOMLCTR | | Bloomberg Live Cattle Subindex Total Return, this index is composed of futures contracts on live cattle. |

| BCOMLHTR | | Bloomberg Lean Hogs Subindex Total Return, this index is composed of futures contracts on lean hogs. It reflects the return of underlying commodity futures price movements only. It is quoted in USD. |

| BCOMSITR | | Bloomberg Silver Subindex Total Return, this index is composed of futures contracts on silver. |

20

Consolidated Portfolio of Investments (unaudited) – continued

| BCOMSMT | | Bloomberg Soybean Meal Subindex Total Return, this index is composed of futures contracts on soybean meal. |

| BCOMTR | | Bloomberg Commodity Index Total Return |

| BCOMWHTR | | Bloomberg Wheat Subindex Total Return, this index is composed of futures contracts on wheat. It reflects the return on fully collateralized futures positions. It is quoted in USD. |

| CLO | | Collateralized Loan Obligation |

| FLR | | Floating Rate. Interest rate resets periodically based on the parenthetically disclosed reference rate plus a spread (if any). Theperiod-end rate reported may not be the current rate. All reference rates are USD unless otherwise noted. |

| LIBOR | | London Interbank Offered Rate |

| MLCILPRT | | Merrill Lynch International Bloomberg Commodity Index Total Return |

| REIT | | Real Estate Investment Trust |

| SOFR | | Secured Overnight Financing Rate |

| SPGCCCTR | | S&P GSCI Cocoa Index Total Return |

Derivative Contracts at 4/30/20

Futures Contracts

| | | | | | | | | | | | | | | | | | | | | | |

| Description | | Long/

Short | | | Currency | | | Contracts | | Notional

Amount | | | Expiration

Date | | | Value/

Unrealized

Appreciation

(Depreciation) | |

| Interest Rate Futures | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Treasury Note 2 yr | | | Long | | | | USD | | | 90 | | | $19,838,672 | | | | June - 2020 | | | | $289,002 | |

| | | | | | | | | | | | | | | | | | | | | | |

21

Consolidated Portfolio of Investments (unaudited) – continued

Cleared Swap Agreements

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Maturity

Date | | Notional

Amount | | Counterparty | | Cash Flows to

Receive/

Frequency | | Cash Flows to

Pay/Frequency | | Unrealized

Appreciation

(Depreciation) | | | Net

Unamortized

Upfront

Payments

(Receipts) | | | Value | |

| Asset Derivatives | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Interest Rate Swaps | | | | | | | | | | | | | | | | |

| 7/15/21 | | USD | | | 35,500,000 | | | | | centrally cleared | | 1.88% (fixed rate) / Semi-annually | | LIBOR - 3mo. (floating rate) / Quarterly | | | $808,960 | | | | $— | | | | $808,960 | |

| 9/19/21 | | USD | | | 22,400,000 | | | | | centrally cleared | | 1.57% (fixed rate) / Semi-annually | | LIBOR - 1mo. (floating rate) / Monthly | | | 448,570 | | | | — | | | | 448,570 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | $1,257,530 | | | | $— | | | | $1,257,530 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Uncleared Swap Agreements | | | | | | | | | | | | | | | | |

Maturity

Date | | Notional Amount | | Counterparty | | Cash Flows to

Receive (Monthly) | | Cash Flows to

Pay (Monthly) | | Unrealized

Appreciation

(Depreciation) | | | Net

Unamortized

Upfront

Payments

(Receipts) | | | Value | |

| Asset Derivatives | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Total Return Swaps | | | | | | | | | | | | | | | | |

| 8/11/20 | | USD | | | 3,991,016 (Short) | | | | | Morgan Stanley | | 3 month T-Bill + 0.02% | | BCOMALTR (floating rate) | | | $354 | | | | $— | | | | $354 | |

| 10/30/20 | | USD | | | 3,934,140 (Short) | | | | | Morgan Stanley | | 3 month T-Bill + 0.15% | | BCOMLHTR (floating rate) | | | 776 | | | | — | | | | 776 | |

| 2/09/21 | | USD | | | 7,048,937 (Short) | | | | | Morgan Stanley | | 3 month T-Bill + 0.05% | | BCOMFCT (floating rate) | | | 820 | | | | — | | | | 820 | |

| 5/21/21 | | USD | | | 18,000,000 (Long) | | | | | Goldman Sachs International | | BCOMF3T (floating rate) | | 3 month T-Bill + 0.13% | | | 15,036 | | | | — | | | | 15,036 | |

| 5/21/21 | | USD | | | 10,000,000 (Long) | | | | | JPMorgan Chase Bank N.A. | | BCOMTR (floating rate) | | 3 month T-Bill + 0.09% | | | 35,515 | | | | — | | | | 35,515 | |

| 5/21/21 | | USD | | | 20,000,000 (Long) | | | | | Citibank N.A. | | BCOMF3T (floating rate) | | 3 month T-Bill + 0.13% | | | 16,707 | | | | — | | | | 16,707 | |

| 5/21/21 | | USD | | | 20,000,000 (Long) | | | | | JPMorgan Chase Bank N.A. | | BCOMF3T (floating rate) | | 3 monthT-Bill + 0.10% | | | 16,838 | | | | — | | | | 16,838 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | $86,046 | | | | $— | | | | $86,046 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

22

Consolidated Portfolio of Investments (unaudited) – continued

Uncleared Swap Agreements - continued

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Maturity

Date | | Notional Amount | | Counterparty | | Cash Flows to

Receive (Monthly) | | Cash Flows to

Pay (Monthly) | | Unrealized

Appreciation

(Depreciation) | | | Net

Unamortized

Upfront

Payments

(Receipts) | | | Value | |

| Liability Derivatives | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Total Return Swaps | | | | | | | | | | | | | | | | |

| 6/04/20 | | USD | | | 7,686,143 (Long) | | | | | JPMorgan Chase Bank N.A. | | BCOMTR (floating rate) | | 3 month T-Bill + 0.09% | | | $(1,115 | ) | | | $— | | | | $(1,115 | ) |

| 6/04/20 | | USD | | | 58,605,330 (Long) | | | | | Merrill Lynch International | | MLCILPRT (a) (floating rate) | | 3 monthT-Bill + 0.13% | | | (13,789 | ) | | | — | | | | (13,789 | ) |

| 8/04/20 | | USD | | | 1,377,241 (Long) | | | | | Goldman Sachs International | | BCOMCLTR (floating rate) | | 3 monthT-Bill + 0.08% | | | (245 | ) | | | — | | | | (245 | ) |

| 8/11/20 | | USD | | | 73,781,155 (Long) | | | | | Merrill Lynch International | | MLCILPRT (a) (floating rate) | | 3 monthT-Bill + 0.13% | | | (13,061 | ) | | | — | | | | (13,061 | ) |

| 8/18/20 | | USD | | | 8,336,444 (Long) | | | | | Morgan Stanley | | BCOMGCTR (floating rate) | | 3 monthT-Bill + 0.07% | | | (999 | ) | | | — | | | | (999 | ) |

| 8/25/20 | | USD | | | 9,313,891 (Long) | | | | | JPMorgan Chase Bank N.A. | | BCOMTR (floating rate) | | 3 monthT-Bill + 0.09% | | | (1,351 | ) | | | — | | | | (1,351 | ) |

| 9/30/20 | | USD | | | 19,789,771 (Long) | | | | | Merrill Lynch International | | BCOMF3T (floating rate) | | 3 monthT-Bill + 0.07% | | | (2,509 | ) | | | — | | | | (2,509 | ) |

| 9/30/20 | | USD | | | 28,588,729 (Long) | | | | | Merrill Lynch International | | MLCILPRT (a) (floating rate) | | 3 monthT-Bill + 0.13% | | | (5,060 | ) | | | — | | | | (5,060 | ) |

| 9/30/20 | | USD | | | 40,021,751 (Long) | | | | | Goldman Sachs International | | BCOMTR (floating rate) | | 3 monthT-Bill + 0.09% | | | (5,804 | ) | | | — | | | | (5,804 | ) |

| 9/30/20 | | USD | | | 40,021,751 (Long) | | | | | JPMorgan Chase Bank N.A. | | BCOMTR (floating rate) | | 3 monthT-Bill + 0.09% | | | (5,804 | ) | | | — | | | | (5,804 | ) |

| 9/30/20 | | USD | | | 12,006,525 (Long) | | | | | Citibank N.A. | | BCOMTR (floating rate) | | 3 monthT-Bill + 0.11% | | | (1,941 | ) | | | — | | | | (1,941 | ) |

| 10/30/20 | | USD | | | 8,026,651 (Long) | | | | | JPMorgan Chase Bank N.A. | | SPGCCCTR (floating rate) | | 3 monthT-Bill + 0.09% | | | (1,075 | ) | | | — | | | | (1,075 | ) |

| 1/20/21 | | USD | | | 1,315,994 (Long) | | | | | Citibank N.A. | | BCOMCLTR (floating rate) | | 3 monthT-Bill + 0.08% | | | (234 | ) | | | — | | | | (234 | ) |

| 1/20/21 | | USD | | | 5,831,179 (Long) | | | | | Morgan Stanley | | BCOMLCTR (floating rate) | | 3 monthT-Bill + 0.13% | | | (1,101 | ) | | | — | | | | (1,101 | ) |

| 1/21/21 | | USD | | | 3,959,226 (Long) | | | | | JPMorgan Chase Bank N.A. | | BCOMCOT (floating rate) | | 3 monthT-Bill + 0.08% | | | (601 | ) | | | — | | | | (601 | ) |

| 1/22/21 | | USD | | | 16,795,950 (Long) | | | | | JPMorgan Chase Bank N.A. | | BCOMF3T (floating rate) | | 3 monthT-Bill + 0.10% | | | (2,540 | ) | | | — | | | | (2,540 | ) |

| 2/09/21 | | USD | | | 15,151,882 (Long) | | | | | Goldman Sachs International | | BCOMF3T (floating rate) | | 3 monthT-Bill + 0.13% | | | (2,665 | ) | | | — | | | | (2,665 | ) |

| 2/09/21 | | USD | | | 15,151,882 (Long) | | | | | JPMorgan Chase Bank N.A. | | BCOMF3T (floating rate) | | 3 monthT-Bill + 0.10% | | | (2,293 | ) | | | — | | | | (2,293 | ) |

| 2/26/21 | | USD | | | 7,369,956 (Long) | | | | | Morgan Stanley | | BCOMWHTR (floating rate) | | 3 monthT-Bill + 0.12% | | | (1,344 | ) | | | — | | | | (1,344 | ) |

| 3/31/21 | | USD | | | 5,938,411 (Long) | | | | | JPMorgan Chase Bank N.A. | | BCOMF3T (floating rate) | | 3 monthT-Bill + 0.10% | | | (898 | ) | | | — | | | | (898 | ) |

| 3/31/21 | | USD | | | 12,414,742 (Long) | | | | | Goldman Sachs International | | BCOMTR (floating rate) | | 3 monthT-Bill + 0.09% | | | (1,800 | ) | | | — | | | | (1,800 | ) |

| 3/31/21 | | USD | | | 8,147,136 (Long) | | | | | Goldman Sachs International | | BCOMSITR (floating rate) | | 3 monthT-Bill + 0.07% | | | (988 | ) | | | — | | | | (988 | ) |

| 3/31/21 | | USD | | | 6,333,558 (Long) | | | | | Goldman Sachs International | | BCOMGCTR (floating rate) | | 3 monthT-Bill + 0.07% | | | (759 | ) | | | — | | | | (759 | ) |

| 3/31/21 | | USD | | | 12,197,551 (Long) | | | | | Merrill Lynch International | | MLCILPRT (a) (floating rate) | | 3 monthT-Bill + 0.20% | | | (2,863 | ) | | | — | | | | (2,863 | ) |

| 4/30/21 | | USD | | | 50,943,126 (Long) | | | | | Goldman Sachs International | | BCOMF3T (floating rate) | | 3 monthT-Bill + 0.10% | | | (7,709 | ) | | | — | | | | (7,709 | ) |

| 4/30/21 | | USD | | | 6,236,532 (Long) | | | | | Merrill Lynch International | | BCOMSMT (floating rate) | | 3 monthT-Bill + 0.20% | | | (1,695 | ) | | | — | | | | (1,695 | ) |

| 5/14/21 | | USD | | | 7,929,300 (Long) | | | | | JPMorgan Chase Bank N.A. | | BCOMKCTR (floating rate) | | 3 monthT-Bill + 0.12% | | | (1,672 | ) | | | — | | | | (1,672 | ) |

| 5/14/21 | | USD | | | 8,693,332 (Long) | | | | | JPMorgan Chase Bank N.A. | | BCOMTR (floating rate) | | 3 monthT-Bill + 0.09% | | | (1,422 | ) | | | — | | | | (1,422 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | $(83,337 | ) | | | $— | | | | $(83,337 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

23

Consolidated Portfolio of Investments (unaudited) – continued

At April 30, 2020, the fund had cash collateral of $30,215,590 to cover any collateral or margin obligations for certain derivative contracts. Restricted cash and/or deposits with brokers in the Statement of Assets and Liabilities are comprised of cash collateral.

| (a) | The Merrill Lynch MLCILPRT Commodity Index, the components of which are not publicly available, seeks to provide exposure to a diversified group of commodities. Through its investment in the swap, the fund has indirect exposure to the following positions that compose the MLCILPRT: |

| | | | | | | | | | | | | | | | | | |

Referenced Commodity

Futures Contracts | | % of

Notional | | | Notional

Amount:

$58,605,330* | | | Notional

Amount:

$73,781,155* | | Notional

Amount:

$28,588,729* | | | Notional

Amount:

$12,197,551* | |

| Long Futures Contracts | | | | | | | | | | | | | | | | | | |

| Aluminum July 2020 | | | 4.5% | | | | $2,637,240 | | | $3,320,152 | | | $1,286,492 | | | | $548,890 | |

| Brent July 2020 | | | 0.9% | | | | 527,446 | | | 664,030 | | | 257,299 | | | | 109,778 | |

| Brent September 2020 | | | 2.8% | | | | 1,640,949 | | | 2,065,874 | | | 800,484 | | | | 341,531 | |

| Coffee July 2020 | | | 3.0% | | | | 1,758,160 | | | 2,213,435 | | | 857,662 | | | | 365,927 | |

| Copper Comex July 2020 | | | 7.3% | | | | 4,278,189 | | | 5,386,024 | | | 2,086,977 | | | | 890,421 | |

| Corn July 2020 | | | 6.1% | | | | 3,574,925 | | | 4,500,650 | | | 1,743,912 | | | | 744,051 | |

| Cotton July 2020 | | | 1.5% | | | | 879,080 | | | 1,106,717 | | | 428,831 | | | | 182,963 | |

| Gasoil July 2020 | | | 1.4% | | | | 820,475 | | | 1,032,936 | | | 400,242 | | | | 170,766 | |

| Gasoline RBOB July 2020 | | | 1.4% | | | | 820,475 | | | 1,032,936 | | | 400,242 | | | | 170,766 | |

| Gold June 2020 | | | 4.9% | | | | 2,871,661 | | | 3,615,277 | | | 1,400,848 | | | | 597,680 | |

| Gold August 2020 | | | 13.5% | | | | 7,911,720 | | | 9,960,456 | | | 3,859,478 | | | | 1,646,669 | |

| Heating Oil July 2020 | | | 1.2% | | | | 703,264 | | | 885,374 | | | 343,065 | | | | 146,371 | |

| Kansas Wheat July 2020 | | | 1.9% | | | | 1,113,501 | | | 1,401,842 | | | 543,186 | | | | 231,753 | |

| Lean Hogs June 2020 | | | 0.5% | | | | 293,027 | | | 368,906 | | | 142,944 | | | | 60,988 | |

| Lean Hogs July 2020 | | | 1.4% | | | | 820,475 | | | 1,032,936 | | | 400,242 | | | | 170,766 | |

| Live Cattle June 2020 | | | 0.9% | | | | 527,448 | | | 664,030 | | | 257,299 | | | | 109,778 | |

| Live Cattle August 2020 | | | 2.7% | | | | 1,582,344 | | | 1,992,091 | | | 771,896 | | | | 329,334 | |

| Natural Gas July 2020 | | | 10.0% | | | | 5,860,533 | | | 7,378,116 | | | 2,858,873 | | | | 1,219,755 | |

| Nickel July 2020 | | | 3.0% | | | | 1,758,160 | | | 2,213,435 | | | 857,662 | | | | 365,927 | |

| Silver July 2020 | | | 3.9% | | | | 2,285,608 | | | 2,877,465 | | | 1,114,960 | | | | 475,704 | |

| Soybean Meal July 2020 | | | 4.0% | | | | 2,344,213 | | | 2,951,246 | | | 1,143,549 | | | | 487,902 | |

| Soybean Oil June 2020 | | | 2.8% | | | | 1,640,949 | | | 2,065,872 | | | 800,484 | | | | 341,531 | |

| Soybeans July 2020 | | | 6.4% | | | | 3,750,741 | | | 4,721,994 | | | 1,829,679 | | | | 780,643 | |

| Sugar July 2020 | | | 2.9% | | | | 1,699,555 | | | 2,139,653 | | | 829,073 | | | | 353,729 | |

| Wheat July 2020 | | | 3.6% | | | | 2,109,792 | | | 2,656,122 | | | 1,029,194 | | | | 439,112 | |

| WTI July 2020 | | | 0.9% | | | | 527,448 | | | 664,030 | | | 257,299 | | | | 109,778 | |

| WTI September 2020 | | | 3.1% | | | | 1,816,765 | | | 2,287,216 | | | 886,251 | | | | 378,124 | |

| Zinc July 2020 | | | 3.5% | | | | 2,051,187 | | | 2,582,340 | | | 1,000,606 | | | | 426,914 | |

| | | 100.0% | | | | $58,605,330 | | | $73,781,155 | | | $28,588,729 | | | | $12,197,551 | |

| * | The notional amount is indicative of the quantity and proportionate value of each commodity futures contract. |

See Notes to Consolidated Financial Statements

24

Financial Statements

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES

At 4/30/20 (unaudited)

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| | | | |

| Assets | | | | |

Investments in unaffiliated issuers, at value (identified cost, $509,680,313) | | | $505,478,402 | |

Investments in affiliated issuers, at value (identified cost, $40,068,836) | | | 40,067,947 | |

Restricted cash for | | | | |

Uncleared swaps | | | 30,215,590 | |

Receivables for | | | | |

Due from uncleared swap brokers | | | 2,606,878 | |

Net daily variation margin on open futures contracts | | | 2,094 | |

Fund shares sold | | | 1,748,697 | |

Interest | | | 2,566,568 | |

Uncleared swaps, at value | | | 86,046 | |

Other assets | | | 1,629 | |

Total assets | | | $582,773,851 | |

| |

| Liabilities | | | | |

Payable to custodian | | | $14,002,506 | |

Payables for | | | | |

Distributions | | | 66 | |

Due to uncleared swap brokers | | | 6,672,112 | |

Net daily variation margin on open cleared swap agreements | | | 15,456 | |

Investments purchased | | | 10,763,792 | |

Uncleared swaps, at value | | | 83,337 | |

Payable to affiliates | | | | |

Investment adviser | | | 21,852 | |

Administrative services fee | | | 482 | |

Shareholder servicing costs | | | 366 | |

Distribution and service fees | | | 30 | |

Payable for independent Trustees’ compensation | | | 1,187 | |

Accrued expenses and other liabilities | | | 120,834 | |

Total liabilities | | | $31,682,020 | |

Net assets | | | $551,091,831 | |

| |

| Net assets consist of | | | | |

Paid-in capital | | | $805,191,301 | |

Total distributable earnings (loss) | | | (254,099,470 | ) |

Net assets | | | $551,091,831 | |

Shares of beneficial interest outstanding | | | 137,173,897 | |

25

Consolidated Statement of Assets and Liabilities (unaudited) – continued

| | | | | | | | | | | | |

| | | |

| | | Net assets | | | Shares

outstanding | | | Net asset value

per share (a) | |

Class A | | | $600,360 | | | | 149,550 | | | | $4.01 | |

Class B | | | 36,385 | | | | 9,089 | | | | 4.00 | |

Class C | | | 313,364 | | | | 78,490 | | | | 3.99 | |

Class I | | | 74,201 | | | | 18,450 | | | | 4.02 | |

Class R1 | | | 36,385 | | | | 9,089 | | | | 4.00 | |

Class R2 | | | 36,697 | | | | 9,153 | | | | 4.01 | |

Class R3 | | | 36,855 | | | | 9,185 | | | | 4.01 | |

Class R4 | | | 37,010 | | | | 9,217 | | | | 4.02 | |

Class R6 | | | 549,920,574 | | | | 136,881,674 | | | | 4.02 | |

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Class A, for which the maximum offering price per share was $4.25 [100 / 94.25 x $4.01]. Redemption price per share was equal to the net asset value per share for Classes I, R1, R2, R3, R4, and R6. |

See Notes to Consolidated Financial Statements

26

Financial Statements

CONSOLIDATED STATEMENT OF OPERATIONS

Six months ended 4/30/20 (unaudited)

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| | | | |

| Net investment income (loss) | | | | |

Income | | | | |

Interest | | | $6,811,350 | |

Dividends from affiliated issuers | | | 332,390 | |

Other | | | 3,209 | |

Foreign taxes withheld | | | 1,496 | |

Total investment income | | | $7,148,445 | |

Expenses | | | | |

Management fee | | | $2,273,240 | |

Distribution and service fees | | | 1,818 | |

Shareholder servicing costs | | | 547 | |

Administrative services fee | | | 45,241 | |

Independent Trustees’ compensation | | | 7,745 | |

Custodian fee | | | 25,651 | |

Shareholder communications | | | 4,139 | |

Audit and tax fees | | | 47,783 | |

Legal fees | | | 6,320 | |

Miscellaneous | | | 108,914 | |

Total expenses | | | $2,521,398 | |

Reduction of expenses by investment adviser | | | (31,706 | ) |

Net expenses | | | $2,489,692 | |

Net investment income (loss) | | | $4,658,753 | |

| |

| Realized and unrealized gain (loss) | | | | |

Realized gain (loss) (identified cost basis) | | | | |

Unaffiliated issuers | | | $1,142,203 | |

Affiliated issuers | | | 4,950 | |

Futures contracts | | | 32,918 | |

Swap agreements | | | (155,331,788 | ) |

Net realized gain (loss) | | | $(154,151,717 | ) |