UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSRS

Investment Company Act file number: 811-04257

Deutsche DWS Variable Series I

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154-0004

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code:(212) 250-2500

Diane Kenneally

One International Place

Boston, MA 02110

(Name and Address of Agent for Service)

| Date of fiscal year end: | 12/31 |

| | |

| Date of reporting period: | 6/30/2019 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

| | |

June 30, 2019

Semiannual Report

Deutsche DWS Variable Series I

DWS Bond VIP

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, you may not be receiving paper copies of the Fund’s shareholder reports from the insurance company that offers your contract unless you specifically request paper copies from your insurance company or from your financial intermediary. Instead, the shareholder reports will be made available on a Web site, and your insurance company will notify you by mail each time a report is posted and provide you with a Web site link to access the report. Instructions for requesting paper copies will be provided by your insurance company.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from your insurance company electronically by following the instructions provided by your insurance company.

You may elect to receive all future reports in paper free of charge from your insurance company. If your insurance company informs you that future reports will be delivered via Web access, you can inform your insurance company that you wish to continue receiving paper copies of your shareholder reports by following the instructions provided by your insurance company.

Contents

This report must be preceded or accompanied by a prospectus. To obtain an additional prospectus or summary prospectus, if available, call (800)728-3337 or your financial representative. We advise you to consider the Fund’s objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

Bond investments are subject tointerest-rate, credit, liquidity and market risks to varying degrees. When interest rates rise, bond prices generally fall. Credit risk refers to the ability of an issuer to make timely payments of principal and interest. Investments inlower-quality (“junk bonds”) andnon-rated securities present greater risk of loss than investments in higher-quality securities. Investing in foreign securities, particularly those of emerging markets, presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Emerging markets tend to be more volatile and less liquid than the markets of more mature economies, and generally have less diverse and less mature economic structures and less stable political systems than those of developed countries. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. Please read the prospectus for details.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc. which offers investment products or DWS Investment Management Americas, Inc. and RREEF America L.L.C. which offer advisory services.

DWS Distributors, Inc., 222 South Riverside Plaza, Chicago, IL 60606, (800)621-1148

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

| | | | | | |

| | 2 | | | | | | Deutsche DWS Variable Series I — DWS Bond VIP |

| | |

| Performance Summary | | June 30, 2019 (Unaudited) |

Fund performance shown is historical, assumes reinvestment of all dividend and capital gain distributions, and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please contact your participating insurance company for the Fund’s most recentmonth-end performance. Performance does not reflect charges and fees (“contract charges”) associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. These charges and fees will reduce returns.

The gross expense ratio of the Fund, as stated in the fee table of the prospectus dated May 1, 2019 is 0.87% for Class A shares and may differ from the expense ratio disclosed in the Financial Highlights table in this report.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

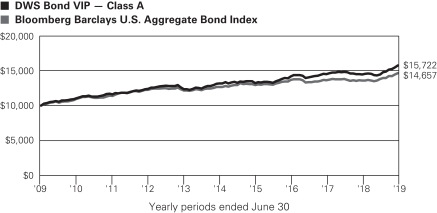

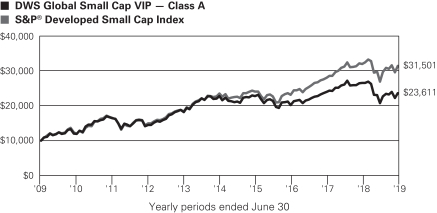

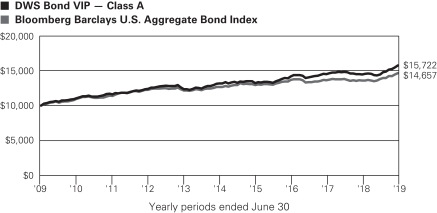

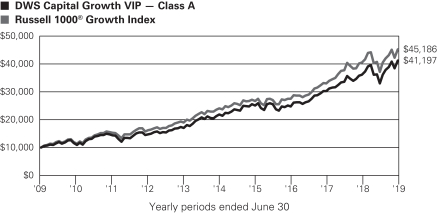

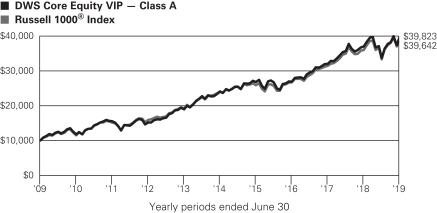

Growth of an Assumed $10,000 Investment

| | |

| | The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index representing domestic taxable investment-grade bonds, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities with an average maturity of one year or more. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index. |

| | | | | | | | | | | | |

| Comparative Results | | | | | | | | | | | | |

| | | | | | |

| DWS Bond VIP | | | | 6-Month‡ | | 1-Year | | 3-Year | | 5-Year | | 10-Year |

| Class A | | Growth of $10,000 | | $10,887 | | $10,887 | | $11,095 | | $11,930 | | $15,722 |

| | | Average annual total return | | 8.87% | | 8.87% | | 3.53% | | 3.59% | | 4.63% |

| Bloomberg Barclays U.S. Aggregate Bond Index | | Growth of $10,000 | | $10,611 | | $10,787 | | $10,710 | | $11,564 | | $14,657 |

| | Average annual total return | | 6.11% | | 7.87% | | 2.31% | | 2.95% | | 3.90% |

The growth of $10,000 is cumulative.

| ‡ | Total returns shown for periods less than one year are not annualized. |

| | | | |

Deutsche DWS Variable Series I — DWS Bond VIP | | | | | 3 |

| | | | |

| Portfolio Summary | | (Unaudited) | | |

| | | | | | | | |

| Asset Allocation (As a % of Total Net Assets) | | 6/30/19 | | | 12/31/18 | |

| Corporate Bonds | | | 53% | | | | 58% | |

| Mortgage-Backed Securities Pass-Throughs | | | 19% | | | | 20% | |

| Asset-Backed | | | 10% | | | | 9% | |

| Collateralized Mortgage Obligations | | | 9% | | | | 4% | |

Government & Agency Obligations | | | 6% | | | | 5% | |

| Commercial Mortgage-Backed Securities | | | 5% | | | | 4% | |

| Short-Term U.S. Treasury Obligations | | | 3% | | | | 3% | |

| Commercial Paper | | | — | | | | 1% | |

| Cash Equivalents, Securities Lending Collateral and other Assets and Liabilities, net | | | –5% | | | | –4% | |

| | | | 100% | | | | 100% | |

| | |

| Quality (Excludes Cash Equivalents and Securities Lending Collateral) | | 6/30/19 | | | 12/31/18 | |

| AAA | | | 33% | | | | 26% | |

| AA | | | 11% | | | | 9% | |

| A | | | 17% | | | | 19% | |

| BBB | | | 27% | | | | 33% | |

| BB | | | 10% | | | | 11% | |

| B | | | 1% | | | | 1% | |

| Not Rated | | | 1% | | | | 1% | |

| | | | 100% | | | | 100% | |

| | |

| Interest Rate Sensitivity | | 6/30/19 | | | 12/31/18 | |

| Effective Maturity | | | 8.9 years | | | | 9.6 years | |

| Effective Duration | | | 6.0 years | | | | 5.8 years | |

The quality ratings represent the higher of Moody’s Investors Service, Inc. (“Moody’s”), Fitch Ratings, Inc. (“Fitch”) or Standard & Poor’s Corporation (“S&P”) credit ratings. The ratings of Moody’s, Fitch and S&P represent their opinions as to the quality of the securities they rate. Credit quality measures a bond issuer’s ability to repay interest and principal in a timely manner. Ratings are relative and subjective and are not absolute standards of quality. Credit quality does not remove market risk and is subject to change.

Effective maturity is the weighted average of the maturity date of bonds held by the Fund taking into consideration any available maturity shortening features.

Effective duration is an approximate measure of the Fund’s sensitivity to interest rate changes taking into consideration any maturity shortening features.

Portfolio holdings and characteristics are subject to change.

For more complete details about the Fund’s investment portfolio, see page 5.

Following the Fund’s fiscal first and thirdquarter-end, a complete portfolio holdings listing is filed with the SEC on FormN-Q or Form N-PORT (available for filings after March 31, 2019). The Fund’s Form N-Q or Form N-PORT will be available on the SEC’s Web site at sec.gov. The Fund’s portfolio holdings are also posted on dws.com from time to time. Please read the Fund’s current prospectus for more information.

Portfolio Management Team

Thomas M. Farina, CFA, Managing Director

Gregory M. Staples, CFA, Managing Director

Kelly L. Beam, CFA, Director

Portfolio Managers

| | | | | | |

| | 4 | | | | | | Deutsche DWS Variable Series I — DWS Bond VIP |

| | |

| Investment Portfolio | | as of June 30, 2019 (Unaudited) |

| | | | | | | | |

| | | Principal

Amount ($)(a) | | | Value ($) | |

| Corporate Bonds 53.3% | |

| Communication Services 7.2% | |

| | |

Amazon.com, Inc., 4.25%, 8/22/2057 | | | 135,000 | | | | 155,639 | |

| | |

AT&T, Inc.,3-monthUSD-LIBOR + 1.180%, 3.616%*, 6/12/2024 | | | 207,000 | | | | 209,603 | |

| | |

CCO Holdings LLC, 144A,: 5.375%, 6/1/2029 | | | 85,000 | | | | 87,762 | |

| | |

Charter Communications Operating LLC: | | | | | | | | |

| | |

3.75%, 2/15/2028 | | | 110,000 | | | | 110,780 | |

| | |

5.375%, 5/1/2047 | | | 70,000 | | | | 73,863 | |

| | |

5.75%, 4/1/2048 | | | 35,000 | | | | 38,711 | |

| | |

Comcast Corp.: | | | | | | | | |

| | |

3.55%, 5/1/2028 | | | 140,000 | | | | 147,408 | |

| | |

4.15%, 10/15/2028 | | | 80,000 | | | | 88,172 | |

| | |

4.6%, 10/15/2038 | | | 100,000 | | | | 114,505 | |

| | |

4.95%, 10/15/2058 | | | 70,000 | | | | 85,445 | |

| | |

Empresa Nacional de Telecomunicaciones SA, REG S, 4.75%, 8/1/2026 | | | 250,000 | | | | 264,003 | |

| | |

GrubHub Holdings, Inc., 144A, 5.5%, 7/1/2027 | | | 55,000 | | | | 56,450 | |

| | |

Netflix, Inc.: | | | | | | | | |

| | |

144A, 5.375%, 11/15/2029 | | | 105,000 | | | | 111,530 | |

| | |

5.5%, 2/15/2022 | | | 225,000 | | | | 236,531 | |

| | |

5.875%, 11/15/2028 | | | 235,000 | | | | 260,173 | |

| | |

Nexstar Escrow, Inc., 144A, 5.625%, 7/15/2027 (b) | | | 20,000 | | | | 20,475 | |

| | |

Sirius XM Radio, Inc., 144A, 4.625%, 7/15/2024 (b) | | | 100,000 | | | | 102,328 | |

| | |

Sprint Communications, Inc., 6.0%, 11/15/2022 | | | 250,000 | | | | 260,625 | |

| | |

Symantec Corp., 3.95%, 6/15/2022 | | | 225,000 | | | | 227,865 | |

| | |

Tencent Holdings Ltd., 144A, 3.975%, 4/11/2029 | | | 250,000 | | | | 261,229 | |

| | |

VeriSign, Inc.: | | | | | | | | |

| | |

4.625%, 5/1/2023 | | | 250,000 | | | | 254,075 | |

| | |

5.25%, 4/1/2025 | | | 250,000 | | | | 266,875 | |

| | |

Verizon Communications, Inc., 5.5%, 3/16/2047 | | | 60,000 | | | | 75,334 | |

| | |

Vodafone Group PLC,

5.25%, 5/30/2048 | | | 60,000 | | | | 66,233 | |

| | | | | | | | |

| | | | | | | 3,575,614 | |

|

| Consumer Discretionary 5.2% | |

| | |

Ford Motor Credit Co. LLC, 5.584%, 3/18/2024 | | | 206,000 | | | | 221,116 | |

| | |

General Motors Co., 5.95%, 4/1/2049 | | | 70,000 | | | | 73,339 | |

| | |

General Motors Financial Co., Inc.: | | | | | | | | |

| | |

3.15%, 6/30/2022 | | | 265,000 | | | | 266,619 | |

| | |

4.35%, 4/9/2025 | | | 84,000 | | | | 86,653 | |

| | |

Hilton Domestic Operating Co., Inc.: | | | | | | | | |

| | |

4.25%, 9/1/2024 | | | 130,000 | | | | 131,950 | |

| | |

144A, 4.875%, 1/15/2030 | | | 63,000 | | | | 64,890 | |

| | |

Hilton Worldwide Finance LLC, 4.875%, 4/1/2027 | | | 220,000 | | | | 227,359 | |

| | |

Home Depot, Inc., 4.5%, 12/6/2048 | | | 50,000 | | | | 59,026 | |

| | |

IAA, Inc., 144A, 5.5%, 6/15/2027 | | | 45,000 | | | | 46,800 | |

| | | | | | | | |

| | | Principal

Amount ($)(a) | | | Value ($) | |

| | |

Lowe’s Companies, Inc., 4.55%, 4/5/2049 | | | 45,000 | | | | 48,311 | |

| | |

MGM Resorts International, 5.5%, 4/15/2027 | | | 300,000 | | | | 314,625 | |

| | |

Nordstrom, Inc., 5.0%, 1/15/2044 | | | 135,000 | | | | 125,938 | |

| | |

Sabre GLBL, Inc., 144A, 5.375%, 4/15/2023 | | | 130,000 | | | | 132,925 | |

| | |

Sands China Ltd., 4.6%, 8/8/2023 | | | 200,000 | | | | 210,208 | |

| | |

Starbucks Corp., 4.5%, 11/15/2048 | | | 100,000 | | | | 109,795 | |

| | |

VOC Escrow Ltd., 144A, 5.0%, 2/15/2028 | | | 95,000 | | | | 96,306 | |

| | |

Volkswagen Group of America Finance LLC, 144A, 4.25%, 11/13/2023 | | | 200,000 | | | | 210,538 | |

| | |

Walmart, Inc., 3.4%, 6/26/2023 | | | 175,000 | | | | 183,930 | |

| | | | | | | | |

| | | | | | | 2,610,328 | |

|

| Consumer Staples 2.8% | |

| | |

Altria Group, Inc.: | | | | | | | | |

| | |

4.8%, 2/14/2029 | | | 70,000 | | | | 75,305 | |

| | |

5.95%, 2/14/2049 | | | 160,000 | | | | 182,623 | |

| | |

Anheuser-Busch Companies LLC, 4.9%, 2/1/2046 | | | 140,000 | | | | 155,880 | |

| | |

Anheuser-Busch InBev Worldwide, Inc.: | | | | | | | | |

| | |

4.75%, 4/15/2058 | | | 60,000 | | | | 63,453 | |

| | |

5.45%, 1/23/2039 | | | 90,000 | | | | 107,106 | |

| | |

5.55%, 1/23/2049 | | | 55,000 | | | | 67,403 | |

| | |

BAT Capital Corp., 3.557%, 8/15/2027 | | | 125,000 | | | | 124,342 | |

| | |

Constellation Brands, Inc., 5.25%, 11/15/2048 | | | 30,000 | | | | 34,752 | |

| | |

Keurig Dr Pepper, Inc.: | | | | | | | | |

| | |

4.057%, 5/25/2023 | | | 90,000 | | | | 94,489 | |

| | |

4.597%, 5/25/2028 | | | 70,000 | | | | 76,636 | |

| | |

5.085%, 5/25/2048 | | | 100,000 | | | | 111,343 | |

| | |

Kraft Heinz Foods Co., 4.625%, 1/30/2029 | | | 90,000 | | | | 96,840 | |

| | |

Nestle Holdings, Inc., 144A, 4.0%, 9/24/2048 | | | 150,000 | | | | 166,321 | |

| | |

Post Holdings, Inc., 144A, 5.5%, 12/15/2029 (b) | | | 45,000 | | | | 45,113 | |

| | | | | | | | |

| | | | | | | 1,401,606 | |

|

| Energy 6.8% | |

| | |

Antero Midstream Partners LP: | | | | | | | | |

| | |

144A, 5.75%, 3/1/2027 | | | 225,000 | | | | 225,000 | |

| | |

144A, 5.75%, 1/15/2028 | | | 150,000 | | | | 148,500 | |

| | |

Apache Corp., 4.375%, 10/15/2028 | | | 145,000 | | | | 151,527 | |

| | |

Boardwalk Pipelines LP, 4.95%, 12/15/2024 | | | 55,000 | | | | 58,657 | |

| | |

Canadian Natural Resources Ltd., 3.85%, 6/1/2027 | | | 125,000 | | | | 129,777 | |

| | |

Cheniere Energy Partners LP, 144A, 5.625%, 10/1/2026 | | | 370,000 | | | | 390,350 | |

| | |

Continental Resources, Inc., 4.9%, 6/1/2044 | | | 90,000 | | | | 94,415 | |

| | |

DCP Midstream Operating LP, 5.375%, 7/15/2025 | | | 105,000 | | | | 110,644 | |

| | |

Devon Energy Corp., 5.0%, 6/15/2045 | | | 100,000 | | | | 114,725 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

Deutsche DWS Variable Series I — DWS Bond VIP | | | | | 5 |

| | | | | | | | |

| | | Principal

Amount ($)(a) | | | Value ($) | |

| | |

Empresa Nacional del Petroleo, 144A, 5.25%, 11/6/2029 | | | 200,000 | | | | 226,588 | |

| | |

Energy Transfer Operating LP: | | | | | | | | |

| | |

4.25%, 3/15/2023 | | | 350,000 | | | | 365,371 | |

| | |

6.25%, 4/15/2049 | | | 60,000 | | | | 71,091 | |

| | |

Enterprise Products Operating LP, 4.2%, 1/31/2050 (b) | | | 221,000 | | | | 220,540 | |

| | |

EQM Midstream Partners LP, 4.75%, 7/15/2023 | | | 92,000 | | | | 95,667 | |

| | |

EQT Corp., 3.9%, 10/1/2027 | | | 105,000 | | | | 99,690 | |

| | |

Hess Corp., 5.8%, 4/1/2047 | | | 110,000 | | | | 122,135 | |

| | |

Kinder Morgan, Inc., 5.2%, 3/1/2048 | | | 60,000 | | | | 67,778 | |

| | |

MPLX LP, 5.5%, 2/15/2049 | | | 140,000 | | | | 159,008 | |

| | |

Noble Energy, Inc., 4.95%, 8/15/2047 | | | 100,000 | | | | 106,120 | |

| | |

Parkland Fuel Corp., 5.875%, 7/15/2027 (b) | | | 150,000 | | | | 150,000 | |

| | |

Range Resources Corp., 5.0%, 3/15/2023 | | | 100,000 | | | | 94,250 | |

| | |

Sunoco Logistics Partners Operations LP, 5.4%, 10/1/2047 | | | 60,000 | | | | 63,726 | |

| | |

TransCanada PipeLines Ltd, 5.1%, 3/15/2049 | | | 95,000 | | | | 110,078 | |

| | | | | | | | |

| | | | | | | 3,375,637 | |

|

| Financials 11.0% | |

| | |

Air Lease Corp., 4.625%, 10/1/2028 | | | 160,000 | | | | 171,478 | |

| | |

Aircastle Ltd.: | | | | | | | | |

| | |

4.4%, 9/25/2023 | | | 109,000 | | | | 113,205 | |

| | |

5.5%, 2/15/2022 | | | 175,000 | | | | 185,494 | |

| | |

ANZ New Zealand Int’l Ltd., 144A, 3.4%, 3/19/2024 | | | 200,000 | | | | 207,518 | |

| | |

ASB Bank Ltd., 144A, 3.75%, 6/14/2023 | | | 200,000 | | | | 208,372 | |

| | |

Banco de Credito e Inversiones SA, 144A, 3.5%, 10/12/2027 | | | 225,000 | | | | 226,971 | |

| | |

Banco Santander Maxico SA, 2.706%, 6/27/2024 | | | 200,000 | | | | 200,380 | |

| | |

Bank of America Corp.: | | | | | | | | |

| | |

3.824%, 1/20/2028 | | | 364,000 | | | | 385,312 | |

| | |

3.974%, 2/7/2030 | | | 160,000 | | | | 171,504 | |

| | |

Bank of New Zealand, 144A, 3.5%, 2/20/2024 | | | 250,000 | | | | 258,922 | |

| | |

BPCE SA, 144A, 4.625%, 9/12/2028 | | | 250,000 | | | | 275,735 | |

| | |

Citigroup, Inc.: | | | | | | | | |

| | |

3.2%, 10/21/2026 | | | 170,000 | | | | 173,373 | |

| | |

3.98%, 3/20/2030 | | | 160,000 | | | | 170,892 | |

| | |

Credit Suisse Group AG, 144A, 4.282%, 1/9/2028 | | | 250,000 | | | | 263,921 | |

| | |

Fairfax Financial Holdings Ltd., 4.85%, 4/17/2028 | | | 96,000 | | | | 101,219 | |

| | |

JPMorgan Chase & Co., 3.782%, 2/1/2028 | | | 230,000 | | | | 243,825 | |

| | |

Morgan Stanley: | | | | | | | | |

| | |

3.591%, 7/22/2028 | | | 100,000 | | | | 104,125 | |

| | |

4.431%, 1/23/2030 | | | 250,000 | | | | 276,565 | |

| | |

Prudential Financial, Inc., 4.35%, 2/25/2050 | | | 100,000 | | | | 112,112 | |

| | |

Santander Holdings U.S.A., Inc., 3.7%, 3/28/2022 | | | 270,000 | | | | 276,550 | |

| | |

State Street Corp., 4.141%, 12/3/2029 | | | 130,000 | | | | 143,892 | |

| | |

Swiss Re Treasury U.S. Corp., 144A, 4.25%, 12/6/2042 | | | 70,000 | | | | 75,898 | |

| | | | | | | | |

| | | Principal

Amount ($)(a) | | | Value ($) | |

| | |

Synchrony Financial, 4.375%, 3/19/2024 | | | 40,000 | | | | 41,886 | |

| | |

The Allstate Corp., 3.85%, 8/10/2049 | | | 30,000 | | | | 31,378 | |

| | |

The Goldman Sachs Group, Inc.: | | | | | | | | |

| | |

3.75%, 2/25/2026 | | | 200,000 | | | | 208,763 | |

| | |

3.814%, 4/23/2029 | | | 155,000 | | | | 162,001 | |

| | |

4.223%, 5/1/2029 | | | 170,000 | | | | 182,326 | |

| | |

Wells Fargo & Co.: | | | | | | | | |

| | |

3.196%, 6/17/2027 | | | 90,000 | | | | 91,719 | |

| | |

4.15%, 1/24/2029 | | | 150,000 | | | | 163,408 | |

| | |

Woori Bank, 144A, 4.5%, Perpetual (c) | | | 250,000 | | | | 250,171 | |

| | | | | | | | |

| | | | | | | 5,478,915 | |

|

| Health Care 3.8% | |

| | |

AbbVie, Inc., 4.45%, 5/14/2046 | | | 70,000 | | | | 68,746 | |

| | |

Allergan Funding SCS, 4.75%, 3/15/2045 | | | 70,000 | | | | 71,903 | |

| | |

Boston Scientific Corp., 4.0%, 3/1/2029 | | | 75,000 | | | | 81,134 | |

| | |

Bristol-Myers Squibb Co., 144A, 4.25%, 10/26/2049 | | | 175,000 | | | | 193,445 | |

| | |

CVS Health Corp.: | | | | | | | | |

| | |

4.78%, 3/25/2038 | | | 129,000 | | | | 134,569 | |

| | |

5.05%, 3/25/2048 | | | 145,000 | | | | 154,442 | |

| | |

Eli Lilly & Co.: | | | | | | | | |

| | |

3.95%, 3/15/2049 | | | 80,000 | | | | 86,603 | |

| | |

4.15%, 3/15/2059 | | | 90,000 | | | | 98,792 | |

| | |

HCA, Inc.: | | | | | | | | |

| | |

4.125%, 6/15/2029 | | | 110,000 | | | | 113,078 | |

| | |

5.25%, 6/15/2026 | | | 130,000 | | | | 143,937 | |

| | |

5.375%, 9/1/2026 | | | 115,000 | | | | 123,913 | |

| | |

7.5%, 2/15/2022 | | | 225,000 | | | | 248,062 | |

| | |

Merck & Co., Inc., 4.0%, 3/7/2049 | | | 80,000 | | | | 88,927 | |

| | |

Pfizer, Inc., 4.2%, 9/15/2048 | | | 90,000 | | | | 101,406 | |

| | |

Stryker Corp.: | | | | | | | | |

| | |

3.375%, 11/1/2025 | | | 80,000 | | | | 84,068 | |

| | |

4.625%, 3/15/2046 | | | 40,000 | | | | 45,468 | |

| | |

UnitedHealth Group, Inc., 4.45%, 12/15/2048 | | | 60,000 | | | | 69,092 | |

| | | | | | | | |

| | | | | | | 1,907,585 | |

|

| Industrials 2.9% | |

| | |

Avolon Holdings Funding Ltd., 144A, 5.125%, 10/1/2023 | | | 167,000 | | | | 176,769 | |

| | |

Clean Harbors, Inc., 144A, 4.875%, 7/15/2027 (b) | | | 45,000 | | | | 45,736 | |

| | |

CSX Corp.: | | | | | | | | |

| | |

4.25%, 11/1/2066 | | | 130,000 | | | | 134,004 | |

| | |

4.5%, 3/15/2049 | | | 41,000 | | | | 45,822 | |

| | |

Delta Air Lines, Inc., 4.375%, 4/19/2028 | | | 154,000 | | | | 156,986 | |

| | |

FedEx Corp., 4.05%, 2/15/2048 | | | 125,000 | | | | 120,174 | |

|

General Electric Co.: | |

| | |

4.125%, 10/9/2042 | | | 45,000 | | | | 41,447 | |

| | |

4.5%, 11/3/2044 | | | 40,000 | | | | 38,809 | |

| | |

Ingersoll-Rand Luxembourg Finance SA, 3.8%, 3/21/2029 | | | 120,000 | | | | 126,027 | |

| | |

Norfolk Southern Corp., 4.1%, 5/15/2049 | | | 40,000 | | | | 42,646 | |

| | |

Parker-Hannifin Corp., 3.25%, 6/14/2029 | | | 40,000 | | | | 41,488 | |

| | |

Prime Security Services Borrower LLC, 144A, 5.25%, 4/15/2024 | | | 195,000 | | | | 198,412 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | 6 | | | | | | Deutsche DWS Variable Series I — DWS Bond VIP |

| | | | | | | | |

| | | Principal

Amount ($)(a) | | | Value ($) | |

| | |

Union Pacific Corp., 4.5%, 9/10/2048 | | | 125,000 | | | | 142,229 | |

| | |

United Technologies Corp., 4.625%, 11/16/2048 | | | 100,000 | | | | 116,615 | |

| | | | | | | | |

| | | | | | | 1,427,164 | |

|

| Information Technology 4.4% | |

|

Apple, Inc.: | |

| | |

3.45%, 2/9/2045 | | | 60,000 | | | | 59,788 | |

| | |

3.75%, 9/12/2047 | | | 100,000 | | | | 104,791 | |

|

Broadcom, Inc.: | |

| | |

144A, 3.125%, 4/15/2021 | | | 105,000 | | | | 105,680 | |

| | |

144A, 3.625%, 10/15/2024 | | | 200,000 | | | | 200,994 | |

| | |

144A, 4.75%, 4/15/2029 | | | 65,000 | | | | 66,741 | |

|

Dell International LLC: | |

| | |

144A, 4.9%, 10/1/2026 | | | 198,000 | | | | 206,584 | |

| | |

144A, 5.3%, 10/1/2029 | | | 60,000 | | | | 63,228 | |

| | |

144A, 5.875%, 6/15/2021 | | | 240,000 | | | | 243,984 | |

| | |

Fair Isaac Corp., 144A, 5.25%, 5/15/2026 | | | 95,000 | | | | 99,750 | |

|

Fiserv, Inc.: | |

| | |

3.5%, 7/1/2029 | | | 140,000 | | | | 143,904 | |

| | |

4.4%, 7/1/2049 | | | 40,000 | | | | 42,083 | |

| | |

International Business Machines Corp., 3.5%, 5/15/2029 | | | 100,000 | | | | 104,658 | |

| | |

IQVIA, Inc., 144A, 5.0%, 5/15/2027 | | | 215,000 | | | | 221,987 | |

|

NXP BV: | |

| | |

144A, 3.875%, 9/1/2022 | | | 200,000 | | | | 205,648 | |

| | |

144A, 3.875%, 6/18/2026 | | | 140,000 | | | | 143,885 | |

| | |

144A, 4.3%, 6/18/2029 | | | 100,000 | | | | 103,088 | |

| | |

Oracle Corp., 4.0%, 11/15/2047 | | | 55,000 | | | | 59,105 | |

| | | | | | | | |

| | | | | | | 2,175,898 | |

|

| Materials 2.0% | |

| | |

AngloGold Ashanti Holdings PLC, 5.125%, 8/1/2022 | | | 110,000 | | | | 115,015 | |

| | |

DuPont de Nemours, Inc., 5.419%, 11/15/2048 | | | 125,000 | | | | 151,889 | |

| | |

Freeport-McMoRan, Inc., 4.55%, 11/14/2024 | | | 200,000 | | | | 204,450 | |

| | |

SASOL Financing U.S.A. LLC, 5.875%, 3/27/2024 | | | 200,000 | | | | 216,729 | |

| | |

Suzano Austria GmbH, 144A, 5.75%, 7/14/2026 | | | 200,000 | | | | 218,500 | |

| | |

Yamana Gold, Inc., 4.95%, 7/15/2024 | | | 110,000 | | | | 115,928 | |

| | | | | | | | |

| | | | | | | 1,022,511 | |

|

| Real Estate 2.7% | |

| | |

American Tower Corp., 3.8%, 8/15/2029 | | | 300,000 | | | | 309,240 | |

|

Crown Castle International Corp.: | |

| | |

(REIT), 3.8%, 2/15/2028 | | | 50,000 | | | | 51,927 | |

| | |

(REIT), 5.25%, 1/15/2023 | | | 135,000 | | | | 146,795 | |

| | |

Hospitality Properties Trust, (REIT), 5.25%, 2/15/2026 | | | 155,000 | | | | 159,203 | |

| | |

Host Hotels & Resorts LP, (REIT), 3.875%, 4/1/2024 | | | 135,000 | | | | 138,859 | |

|

Office Properties Income Trust: | |

| | |

(REIT), 4.15%, 2/1/2022 | | | 80,000 | | | | 81,175 | |

| | |

(REIT), 4.25%, 5/15/2024 | | | 80,000 | | | | 79,728 | |

| | |

Omega Healthcare Investors, Inc., (REIT), 5.25%, 1/15/2026 | | | 50,000 | | | | 54,137 | |

| | | | | | | | |

| | | Principal

Amount ($)(a) | | | Value ($) | |

|

SBA Communications Corp.: | |

| | |

(REIT), 4.0%, 10/1/2022 | | | 190,000 | | | | 192,613 | |

| | |

(REIT), 4.875%, 9/1/2024 | | | 125,000 | | | | 128,750 | |

| | | | | | | | |

| | | | | | | 1,342,427 | |

|

| Utilities 4.5% | |

| | |

Abu Dhabi National Energy Co. PJSC, 144A, 4.375%, 4/23/2025 | | | 210,000 | | | | 222,337 | |

| | |

EDP Finance BV, 144A, 3.625%, 7/15/2024 | | | 200,000 | | | | 205,561 | |

| | |

Enel Finance International NV, 144A, 4.25%, 9/14/2023 | | | 300,000 | | | | 315,039 | |

| | |

Israel Electric Corp., Ltd., Series 6, 144A, REG S, 5.0%, 11/12/2024 | | | 300,000 | | | | 324,660 | |

|

NextEra Energy Capital Holdings, Inc.: | |

| | |

3.25%, 4/1/2026 | | | 36,000 | | | | 37,008 | |

| | |

3.5%, 4/1/2029 | | | 58,000 | | | | 60,327 | |

| | |

NextEra Energy Operating Partners LP, 144A, 4.25%, 7/15/2024 | | | 250,000 | | | | 251,567 | |

| | |

NRG Energy, Inc., 144A, 5.25%, 6/15/2029 | | | 123,000 | | | | 131,302 | |

| | |

Perusahaan Listrik Negara PT, 144A, 2.875%, 10/25/2025 | | | EUR 222,000 | | | | 271,401 | |

| | |

Sempra Energy, 4.0%, 2/1/2048 | | | 55,000 | | | | 53,885 | |

| | |

Southern California Edison Co., Series B, 3.65%, 3/1/2028 | | | 250,000 | | | | 255,963 | |

| | |

Southern Power Co., Series F, 4.95%, 12/15/2046 | | | 87,000 | | | | 93,328 | |

| | |

Vistra Operations Co. LLC, 144A, 5.0%, 7/31/2027 | | | 50,000 | | | | 51,813 | |

| | | | | | | | |

| | | | | | | | 2,274,191 | |

Total Corporate Bonds (Cost $25,363,592) | | | | 26,591,876 | |

|

| Mortgage-Backed SecuritiesPass-Throughs 18.5% | |

|

Federal Home Loan Mortgage Corp.: | |

| | |

5.5%, with various maturities from 10/1/2023 until 5/1/2041 | | | 503,368 | | | | 543,571 | |

| | |

6.5%, 3/1/2026 | | | 45,793 | | | | 49,100 | |

| | |

4.0%, 8/1/2039 | | | 331,161 | | | | 349,395 | |

|

Federal National Mortgage Association: | |

| | |

5.0%, 10/1/2033 | | | 26,661 | | | | 28,968 | |

| | |

5.5%, with various maturities from 12/1/2032 until 8/1/2037 | | | 506,165 | | | | 561,158 | |

| | |

6.0%, with various maturities from 4/1/2024 until 3/1/2025 | | | 113,346 | | | | 124,073 | |

| | |

6.5%, with various maturities from 11/1/2024 until 1/1/2036 | | | 52,411 | | | | 58,133 | |

| | |

12-monthUSD-LIBOR + 1.750%, 4.5%*, 9/1/2038 | | | 26,494 | | | | 27,732 | |

| | |

4.0%, with various maturities from 4/1/2047 until 7/1/2049 (b) | | | 4,848,849 | | | | 5,056,234 | |

| | |

3.5%, with various maturities from 12/1/2045 until 1/1/2047 | | | 2,354,786 | | | | 2,440,784 | |

Total Mortgage-Backed SecuritiesPass-Throughs(Cost $9,105,470) | | | | 9,239,148 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

Deutsche DWS Variable Series I — DWS Bond VIP | | | | | 7 |

| | | | | | | | |

| | | Principal

Amount ($)(a) | | | Value ($) | |

| Asset-Backed 10.0% | |

| Automobile Receivables 4.8% | |

| | |

AmeriCredit Automobile Receivables Trust, “C”,Series 2019-2, 2.74%, 4/18/2025 | | | 660,000 | | | | 662,776 | |

| | |

Avis Budget Rental Car Funding AESOP LLC, “C”,Series 2015-1A, 144A, 3.96%, 7/20/2021 | | | 500,000 | | | | 501,922 | |

|

Hertz Vehicle Financing II LP: | |

| | |

“A”, Series2017-1A, 144A, 2.96%, 10/25/2021 | | | 750,000 | | | | 753,783 | |

| | |

“A”, Series2018-1A, 144A, 3.29%, 2/25/2024 | | | 500,000 | | | | 508,706 | |

| | | | | | | 2,427,187 | |

|

| Credit Card Receivables 2.0% | |

World Financial Network Credit Card Master Trust, “M”,Series 2016-A, 2.33%, 4/15/2025 | | | 1,000,000 | | | | 996,960 | |

|

| Miscellaneous 3.2% | |

| | |

GMF Floorplan Owner Revolving Trust, “C”,Series 2019-1, 144A, 3.06%, 4/15/2024 | | | 230,000 | | | | 233,031 | |

| | |

Goldentree Loan Opportunities X Ltd., “AJR”, Series2015-10A, 144A,3-monthUSD-LIBOR + 1.450%, 4.042%*, 7/20/2031 | | | 433,333 | | | | 427,950 | |

| | |

Hilton Grand Vacations Trust, “B”,Series 2014-AA, 144A, 2.07%, 11/25/2026 | | | 67,345 | | | | 66,832 | |

| | |

MVW Owner Trust, “A”,Series 2019-1A, 144A, 2.89%, 11/20/2036 | | | 450,000 | | | | 455,929 | |

| | |

Venture XXVIII CLO Ltd., “A2”,Series 2017-28A, 144A,3-monthUSD-LIBOR + 1.110%, 3.702%*, 7/20/2030 | | | 400,000 | | | | 398,077 | |

| | | | | | | | |

| | | | | | | | 1,581,819 | |

Total Asset-Backed (Cost $4,981,901) | | | | 5,005,966 | |

|

| Commercial Mortgage-Backed Securities 5.3% | |

| | |

Bank, “B”, Series 2018-BN13, 4.689%*, 8/15/2061 | | | 500,000 | | | | 548,888 | |

| | |

BXP Trust, “B”,Series 2017-CQHP, 144A,1-monthUSD-LIBOR + 1.100%, 3.494%*, 11/15/2034 | | | 280,000 | | | | 278,950 | |

| | |

FHLMC Multifamily Structured Pass-Through Certificates: | | | | | | | | |

| | |

“X1”, Series K043, Interest Only, 0.668%*, 12/25/2024 | | | 4,898,922 | | | | 127,786 | |

| | |

“X1”, Series K054, Interest Only, 1.314%*, 1/25/2026 | | | 1,823,321 | | | | 120,291 | |

| | |

GS Mortgage Securities Corp. II, “B”, Series 2018-GS10, 4.521%*, 7/10/2051 | | | 500,000 | | | | 548,406 | |

| | |

GS Mortgage Securities Corp.: “A4”, Series 2019-GC40, 3.16%, 7/10/2052 (b) (d) | | | 500,000 | | | | 514,978 | |

| | | | | | | | |

| | | Principal

Amount ($)(a) | | | Value ($) | |

| | |

Morgan Stanley Capital Barclays Bank Trust, “C”,Series 2016-MART, 144A, 2.817%, 9/13/2031 | | | 500,000 | | | | 499,443 | |

Total Commercial Mortgage-Backed Securities (Cost $2,548,534) | | | | 2,638,742 | |

|

| Collateralized Mortgage Obligations 9.2% | |

| | |

Countrywide Home Loan, “A2”,Series 2006-1, 6.0%, 3/25/2036 | | | 148,581 | | | | 121,993 | |

| | |

CSFB Mortgage-BackedPass-Through Certificates, “10A3”, Series2005-10, 6.0%, 11/25/2035 | | | 75,355 | | | | 39,002 | |

|

Federal Home Loan Mortgage Corp.: | |

| | |

“PI”, Series 4485, Interest Only, 3.5%, 6/15/2045 | | | 1,512,570 | | | | 223,872 | |

| | |

“PI”, Series 3940, Interest Only, 4.0%, 2/15/2041 | | | 229,574 | | | | 27,603 | |

| | |

“C31”, Series 303, Interest Only, 4.5%, 12/15/2042 | | | 1,075,437 | | | | 202,438 | |

|

Federal National Mortgage Association: | |

| | |

“ZL”, Series2017-55, 3.0%, 10/25/2046 | | | 530,879 | | | | 516,585 | |

| | |

“CL”, Series 7436, 3.0%, 12/15/2047 | | | 1,000,000 | | | | 1,017,713 | |

| | |

“PA”, Series 4885, 3.0%, 4/15/2048 | | | 994,547 | | | | 1,012,568 | |

|

Government National Mortgage Association: | |

| | |

“PL”, Series2013-19, 2.5%, 2/20/2043 | | | 684,500 | | | | 685,086 | |

| | |

“PI”, Series2015-40, Interest Only, 4.0%, 4/20/2044 | | | 219,486 | | | | 20,257 | |

| | |

“PI”, Series2014-108, Interest Only, 4.5%, 12/20/2039 | | | 176,773 | | | | 24,857 | |

| | |

“IV”, Series2009-69, Interest Only, 5.5%, 8/20/2039 | | | 102,256 | | | | 17,144 | |

| | |

“IN”, Series2009-69, Interest Only, 5.5%, 8/20/2039 | | | 52,588 | | | | 8,844 | |

| | |

“IJ”, Series2009-75, Interest Only, 6.0%, 8/16/2039 | | | 39,267 | | | | 6,378 | |

|

MASTR Alternative Loans Trust: | |

| | |

“5A1”, Series2005-1, 5.5%, 1/25/2020 | | | 2,669 | | | | 2,733 | |

| | |

“8A1”, Series2004-3, 7.0%, 4/25/2034 | | | 3,371 | | | | 3,737 | |

|

New Residential Mortgage Loan: | |

| | |

“A1”, Series 2019-NQM2, 144A, 3.6%, 4/25/2049 | | | 215,177 | | | | 218,283 | |

| | |

“A1”, Series 2019-NQM3, 144A, 2.802%, 7/25/2049 | | | 250,000 | | | | 250,442 | |

| | |

Verus Securitization Trust, “A1”, Series 2019-INV1, 144A, 3.402%, 12/25/2059 | | | 217,608 | | | | 220,000 | |

Total Collateralized Mortgage Obligations (Cost $4,646,458) | | | | 4,619,535 | |

|

| Government & Agency Obligations 6.0% | |

| Other Government Related (e) 0.6% | |

Novatek OAO, 144A, 6.604%, 2/3/2021 | | | 300,000 | | | | 315,457 | |

|

| Sovereign Bonds 1.5% | |

| | |

Perusahaan Penerbit SBSN Indonesia III, 144A, 4.45%, 2/20/2029 | | | 200,000 | | | | 214,250 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | 8 | | | | | | Deutsche DWS Variable Series I — DWS Bond VIP |

| | | | | | | | |

| | | Principal

Amount ($)(a) | | | Value ($) | |

| | |

Republic of Kazakhstan, 144A, 1.55%, 11/9/2023 | | | EUR 290,000 | | | | 346,125 | |

| | |

Republic of South Africa, 4.875%, 4/14/2026 | | | 200,000 | | | | 206,820 | |

| | | | | | | | |

| | | | | | | 767,195 | |

|

| U.S. Treasury Obligations 3.9% | |

| | |

U.S. Treasury Bond, 3.0%, 2/15/2049 | | | 648,000 | | | | 711,686 | |

|

U.S. Treasury Notes: | |

| | |

2.25%, 4/30/2024 | | | 787,000 | | | | 804,861 | |

| | |

2.375%, 5/15/2029 | | | 409,400 | | | | 423,074 | |

| | | | | | | | |

| | | | | | | | 1,939,621 | |

Total Government & Agency Obligations(Cost $2,910,399) | | | | 3,022,273 | |

|

| Short-Term U.S. Treasury Obligations 2.6% | |

|

U.S. Treasury Bills: | |

| | |

2.372%**, 8/15/2019 (f) | | | 804,000 | | | | 801,897 | |

| | |

2.548%**, 10/10/2019 | | | 500,000 | | | | 497,061 | |

Total Short-Term U.S. Treasury Obligations

(Cost $1,298,042) | | | | 1,298,958 | |

| | | | | | | | |

| | | Shares | | | Value ($) | |

| Cash Equivalents 2.0% | |

DWS Central Cash Management Government Fund, 2.40% (g)

(Cost $1,008,610) | | | 1,008,610 | | | | 1,008,610 | |

| | |

| | | % of Net

Assets | | | Value ($) | |

Total Investment Portfolio

(Cost $51,863,006) | | | 106.9 | | | | 53,425,108 | |

| Other Assets and Liabilities, Net | | | (6.9 | ) | | | (3,462,407 | ) |

| Net Assets | | | 100.0 | | | | 49,962,701 | |

A summary of the Fund’s transactions with affiliated investments during the period ended June 30, 2019 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Value ($) at

12/31/2018 | | Purchases

Cost ($) | | | Sales

Proceeds ($) | | | Net

Realized

Gain/

(Loss) ($) | | | Net Change in

Unrealized

Appreciation

(Depreciation) ($) | | | Income ($) | | | Capital Gain

Distributions ($) | | | Number

of Shares

at

6/30/2019 | | | Value ($)

at

6/30/2019 | |

Securities Lending Collateral 0.0% | |

DWS Government & Agency Securities Portfolio “DWS Government Cash Institutional Shares”, 2.28% (g) (h) | |

| 111,600 | | | — | | | | 111,600 | (i) | | | — | | | | — | | | | 1,811 | | | | — | | | | — | | | | — | |

Cash Equivalents 2.0% | |

DWS Central Cash Management Government Fund, 2.40% (g) | |

| 1,975,521 | | | 16,433,188 | | | | 17,400,099 | | | | — | | | | — | | | | 24,313 | | | | — | | | | 1,008,610 | | | | 1,008,610 | |

| 2,087,121 | | | 16,433,188 | | | | 17,511,699 | | | | — | | | | — | | | | 26,124 | | | | — | | | | 1,008,610 | | | | 1,008,610 | |

| * | Variable or floating rate security. These securities are shown at their current rate as of June 30, 2019. For securities based on a published reference rate and spread, the reference rate and spread are indicated within the description above. Certain variable rate securities are not based on a published reference rate and spread but adjust periodically based on current market conditions, prepayment of underlying positions and/or other variables. |

| ** | Annualized yield at time of purchase; not a coupon rate. |

| (a) | Principal amount stated in U.S. dollars unless otherwise noted. |

| (b) | When-issued, delayed delivery or forward commitment securities included. |

| (c) | Perpetual, callable security with no stated maturity date. |

| (d) | Investment was valued using significant unobservable inputs. |

| (e) | Government-backed debt issued by financial companies or government sponsored enterprises. |

| (f) | At June 30, 2019, this security has been pledged, in whole or in part, to cover initial margin requirements for open futures contracts. |

| (g) | Affiliated fund managed by DWS Investment Management Americas, Inc. The rate shown is the annualizedseven-day yield at period end. |

| (h) | Represents cash collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates. |

| (i) | Represents the net increase (purchase cost) or decrease (sales proceeds) in the amount invested in cash collateral for the period ended June 30, 2019. |

144A: Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

CLO: Collateralized Loan Obligation

Interest Only: Interest Only (IO) bonds represent the “interest only” portion of payments on a pool of underlying mortgages or mortgage-backed securities. IO securities are subject to prepayment risk of the pool of underlying mortgages.

LIBOR: London Interbank Offered Rate

PJSC: Public Joint Stock Company

REG S: Securities sold under Regulation S may not be offered, sold or delivered within the United States or to, or for the account or benefit of, U.S. persons, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933.

REIT: Real Estate Investment Trust

SBSN: Surat Berharga Syariah Negara (Islamic Based Government Securities)

The accompanying notes are an integral part of the financial statements.

| | | | |

Deutsche DWS Variable Series I — DWS Bond VIP | | | | | 9 |

Included in the portfolio are investments in mortgage or asset-backed securities which are interests in separate pools of mortgages or assets. Effective maturities of these investments may be shorter than stated maturities due to prepayments. Some separate investments in the Federal Home Loan Mortgage Corp. and Federal National Mortgage Association issues which have similar coupon rates have been aggregated for presentation purposes in this investment portfolio.

At June 30, 2019 open futures contracts purchased were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Futures | | Currency | | | Expiration

Date | | | Contracts | | | Notional

Amount ($) | | | Notional

Value ($) | | | Unrealized

Appreciation ($) | |

| 10 Year U.S. Treasury Note | | | USD | | | | 9/19/2019 | | | | 12 | | | | 1,511,843 | | | | 1,535,625 | | | | 23,782 | |

| U.S. Treasury Long Bond | | | USD | | | | 9/19/2019 | | | | 3 | | | | 456,874 | | | | 466,781 | | | | 9,907 | |

| Ultra 10 Year U.S. Treasury Note | | | USD | | | | 9/19/2019 | | | | 52 | | | | 7,081,901 | | | | 7,182,500 | | | | 100,599 | |

| Total unrealized appreciation | | | | 134,288 | |

At June 30, 2019, open futures contracts sold were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Futures | | Currency | | | Expiration

Date | | | Contracts | | | Notional

Amount ($) | | | Notional

Value ($) | | | Unrealized

(Depreciation) ($) | |

| 5 Year U.S. Treasury Note | | | USD | | | | 9/30/2019 | | | | 7 | | | | 818,436 | | | | 827,094 | | | | (8,658 | ) |

| Ultra Long U.S. Treasury Bond | | | USD | | | | 9/19/2019 | | | | 17 | | | | 2,953,463 | | | | 3,018,351 | | | | (64,888 | ) |

| Total unrealized depreciation | | | | (73,546 | ) |

At June 30, 2019, the Fund had the following open forward foreign currency contracts:

| | | | | | | | | | | | | | | | | | | | |

| Contracts to Deliver | | | In Exchange For | | | Settlement

Date | | | Unrealized

Appreciation ($) | | | Counterparty |

| EUR | | | 840,000 | | | JPY | | | 103,462,380 | | | | 8/7/2019 | | | | 4,267 | | | Australia and New Zealand Banking Group Ltd. |

| USD | | | 955,385 | | | CAD | | | 1,280,000 | | | | 8/7/2019 | | | | 22,874 | | | State Street Bank and Trust |

| EUR | | | 542,424 | | | USD | | | 622,669 | | | | 9/26/2019 | | | | 1,634 | | | JPMorgan Chase Securities, Inc. |

| Total unrealized appreciation | | | | | | | | 28,775 | | | |

| | | | | | | | | | | | | | | | | | | | |

| Contracts to Deliver | | | In Exchange For | | | Settlement

Date | | | Unrealized

Depreciation ($) | | | Counterparty |

| EUR | | | 860,000 | | | JPY | | | 104,895,146 | | | | 8/7/2019 | | | | (5,218) | | | Credit Agricole CIB |

| CAD | | | 1,280,000 | | | USD | | | 952,035 | | | | 8/7/2019 | | | | (26,224) | | | Bank of America |

| AUD | | | 1,360,000 | | | USD | | | 949,276 | | | | 8/8/2019 | | | | (6,776) | | | State Street Bank and Trust |

| AUD | | | 1,385,000 | | | USD | | | 960,968 | | | | 8/8/2019 | | | | (12,659) | | | National Australia Bank Ltd. |

| Total unrealized depreciation | | | | | | | | (50,877) | | | |

Currency Abbreviations

For information on the Fund’s policy and additional disclosures regarding future contracts and forward foreign currency contracts, please refer to the Derivatives section of Note B in the accompanying Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | 10 | | | | | | Deutsche DWS Variable Series I — DWS Bond VIP |

Fair Value Measurements

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

The following is a summary of the inputs used as of June 30, 2019 in valuing the Fund’s investments. For information on the Fund’s policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Fixed Income Investments (j) | | | | | | | | | | | | | | | | |

Corporate Bonds | | $ | — | | | $ | 26,591,876 | | | $ | — | | | $ | 26,591,876 | |

Mortgage-Backed Securities Pass-Throughs | | | — | | | | 9,239,148 | | | | — | | | | 9,239,148 | |

Asset-Backed | | | — | | | | 5,005,966 | | | | — | | | | 5,005,966 | |

Commercial Mortgage-Backed Securities | | | — | | | | 2,123,764 | | | | 514,978 | | | | 2,638,742 | |

Collateralized Mortgage Obligations | | | — | | | | 4,619,535 | | | | — | | | | 4,619,535 | |

Government & Agency Obligations | | | — | | | | 3,022,273 | | | | — | | | | 3,022,273 | |

Short-Term U.S. Treasury Obligations | | | — | | | | 1,298,958 | | | | — | | | | 1,298,958 | |

| Short-Term Investments (j) | | | 1,008,610 | | | | — | | | | — | | | | 1,008,610 | |

| Derivatives (k) | | | | | | | | | | | | | | | | |

Futures Contracts | | | 134,288 | | | | — | | | | — | | | | 134,288 | |

Forward Foreign Currency Contracts | | | — | | | | 28,775 | | | | — | | | | 28,775 | |

| Total | | $ | 1,142,898 | | | $ | 51,930,295 | | | $ | 514,978 | | | $ | 53,588,171 | |

| | | | |

| Liabilities | | | | | | | | | | | | |

| Derivatives (k) | | | | | | | | | | | | | | | | |

Futures Contracts | | $ | (73,546 | ) | | $ | — | | | $ | — | | | $ | (73,546 | ) |

Forward Foreign Currency Contracts | | | — | | | | (50,877 | ) | | | — | | | | (50,877 | ) |

| Total | | $ | (73,546 | ) | | $ | (50,877 | ) | | $ | — | | | $ | (124,423 | ) |

| (j) | See Investment Portfolio for additional detailed categorizations. |

| (k) | Derivatives include unrealized appreciation (depreciation) on open futures contracts and forward foreign currency contracts. |

The accompanying notes are an integral part of the financial statements.

| | | | |

Deutsche DWS Variable Series I — DWS Bond VIP | | | | | 11 |

Statement of Assets and Liabilities

| | | | |

| as of June 30, 2019 (Unaudited) | | | | |

| |

| Assets | | | | |

| Investments innon-affiliated securities, at value (cost $50,854,396) | | $ | 52,416,498 | |

| Investment in DWS Central Cash Management Government Fund (cost $1,008,610) | | | 1,008,610 | |

| Cash | | | 4,878 | |

| Foreign currency, at value (cost $508,051) | | | 505,767 | |

| Receivable for investments sold | | | 353,216 | |

| Receivable for Fund shares sold | | | 3,581 | |

| Interest receivable | | | 381,209 | |

| Receivable for variation margin on futures contracts | | | 4,812 | |

| Unrealized appreciation on forward foreign currency contracts | | | 28,775 | |

| Foreign taxes recoverable | | | 975 | |

| Other assets | | | 582 | |

| Total assets | | | 54,708,903 | |

| |

| Liabilities | | | | |

| Payable for investments purchased | | | 765,630 | |

Payable for investments purchased —

when-issued/delayed delivery securities | | | 3,828,654 | |

| Payable for Fund shares redeemed | | | 12,279 | |

| Unrealized depreciation on forward foreign currency contracts | | | 50,877 | |

| Accrued management fee | | | 11,516 | |

| Accrued Trustees’ fees | | | 196 | |

| Other accrued expenses and payables | | | 77,050 | |

| Total liabilities | | | 4,746,202 | |

| Net assets, at value | | $ | 49,962,701 | |

| |

| Net Assets Consist of | | | | |

| Distributable earnings (loss) | | | (252,269 | ) |

| Paid-in capital | | | 50,214,970 | |

| Net assets, at value | | $ | 49,962,701 | |

Net Asset Value | | | | |

| |

| Net asset value,offering and redemption price per share ($49,962,701 ÷ 8,941,839 outstanding shares of beneficial interest, $.01 par value, unlimited number of shares authorized) | | $ | 5.59 | |

Statement of Operations

| | | | |

| for the six months ended June 30, 2019 (Unaudited) | |

| |

| Investment Income | | | | |

| Income: | | | | |

| Interest (net of foreign taxes withheld of $37) | | $ | 893,743 | |

| Income distributions — DWS Central Cash Management Government Fund | | | 24,313 | |

| Securities lending income, net of borrower rebates | | | 1,811 | |

| Total income | | | 919,867 | |

| Expenses: | | | | |

| Management fee | | | 91,170 | |

| Administration fee | | | 23,377 | |

| Services to shareholders | | | 450 | |

| Custodian fee | | | 7,160 | |

| Professional fees | | | 46,178 | |

| Reports to shareholders | | | 13,722 | |

| Trustees’ fees and expenses | | | 2,274 | |

| Pricing service fee | | | 11,782 | |

| Other | | | 3,043 | |

| Total expenses before expense reductions | | | 199,156 | |

| Expense reductions | | | (44,868 | ) |

| Total expenses after expense reductions | | | 154,288 | |

| Net investment income | | | 765,579 | |

| |

| Realized and Unrealized Gain (Loss) | | | | |

Net realized gain (loss) from: Investments | | | 453,836 | |

| Swap contracts | | | (29,075 | ) |

| Futures | | | 43,248 | |

| Forward foreign currency contracts | | | 46,196 | |

| Foreign currency | | | (14,465 | ) |

| | | | 499,740 | |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 2,643,496 | |

| Swap contracts | | | 24,142 | |

| Futures | | | 72,133 | |

| Forward foreign currency contracts | | | (40,013 | ) |

| Foreign currency | | | 11,387 | |

| | | | 2,711,145 | |

| Net gain (loss) | | | 3,210,885 | |

| Net increase (decrease) in net assets resulting from operations | | $ | 3,976,464 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | 12 | | | | | | Deutsche DWS Variable Series I — DWS Bond VIP |

Statements of Changes in Net Assets

| | | | | | | | |

| | | Six Months

Ended June 30, 2019

(Unaudited) | | | Year Ended

December 31, 2018 | |

| Increase (Decrease) in Net Assets |

| Operations: | |

| Net investment income | | $ | 765,579 | | | $ | 1,528,195 | |

| Net realized gain (loss) | | | 499,740 | | | | (1,343,833 | ) |

| Change in net unrealized appreciation (depreciation) | | | 2,711,145 | | | | (1,524,541 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 3,976,464 | | | | (1,340,179 | ) |

| Distributions to shareholders: | |

Class A | | | (1,466,158 | ) | | | (2,159,140 | ) |

| Fund share transactions: | | | | | | | | |

Class A | | | | | | | | |

| Proceeds from shares sold | | | 3,679,308 | | | | 2,190,642 | |

| Reinvestment of distributions | | | 1,466,158 | | | | 2,159,140 | |

| Payments for shares redeemed | | | (3,488,938 | ) | | | (6,549,537 | ) |

| Net increase (decrease) in net assets from Class A share transactions | | | 1,656,528 | | | | (2,199,755 | ) |

| Increase (decrease) in net assets | | | 4,166,834 | | | | (5,699,074 | ) |

| Net assets at beginning of period | | | 45,795,867 | | | | 51,494,941 | |

| | |

| Net assets at end of period | | $ | 49,962,701 | | | $ | 45,795,867 | |

| | |

| Other Information: | | | | | | | | |

Class A | | | | | | | | |

| Shares outstanding at beginning of period | | | 8,635,826 | | | | 9,030,036 | |

| Shares sold | | | 673,989 | | | | 405,229 | |

| Shares issued to shareholders in reinvestment of distributions | | | 271,511 | | | | 407,385 | |

| Shares redeemed | | | (639,487 | ) | | | (1,206,824 | ) |

| Net increase (decrease) in Class A shares | | | 306,013 | | | | (394,210 | ) |

| | |

| Shares outstanding at end of period | | | 8,941,839 | | | | 8,635,826 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

Deutsche DWS Variable Series I — DWS Bond VIP | | | | | 13 |

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months

Ended 6/30/19 | | | Years Ended December 31, | |

| Class A | | (Unaudited) | | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| | | | | | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 5.30 | | | $ | 5.70 | | | $ | 5.52 | | | $ | 5.49 | | | $ | 5.67 | | | $ | 5.51 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomea | | | .09 | | | | .17 | | | | .17 | | | | .15 | | | | .14 | | | | .17 | |

Net realized and unrealized gain (loss) | | | .37 | | | | (.32 | ) | | | .15 | | | | .17 | | | | (.15 | ) | | | .19 | |

Total from investment operations | | | .46 | | | | (.15 | ) | | | .32 | | | | .32 | | | | (.01 | ) | | | .36 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (.17 | ) | | | (.25 | ) | | | (.14 | ) | | | (.29 | ) | | | (.17 | ) | | | (.20 | ) |

| Net asset value, end of period | | $ | 5.59 | | | $ | 5.30 | | | $ | 5.70 | | | $ | 5.52 | | | $ | 5.49 | | | $ | 5.67 | |

| Total Return (%)b | | | 8.87 | ** | | | (2.65 | ) | | | 5.83 | | | | 5.93 | | | | (.29 | ) | | | 6.63 | |

| | | | | | |

| Ratios to Average Net Assets and Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period ($ millions) | | | 50 | | | | 46 | | | | 51 | | | | 77 | | | | 80 | | | | 101 | |

| Ratio of expenses before expense reductions (%)c | | | .85 | * | | | .87 | | | | .74 | | | | .78 | | | | .69 | | | | .69 | |

| Ratio of expenses after expense reductions (%)c | | | .66 | * | | | .69 | | | | .65 | | | | .64 | | | | .64 | | | | .61 | |

| Ratio of net investment income (%) | | | 3.27 | * | | | 3.19 | | | | 2.99 | | | | 2.68 | | | | 2.54 | | | | 2.99 | |

| Portfolio turnover rate (%) | | | 282 | ** | | | 260 | | | | 205 | | | | 236 | | | | 197 | | | | 273 | |

| a | Based on average shares outstanding during the period. |

| b | Total return would have been lower had certain expenses not been reduced. |

| c | Expense ratio does not reflect charges and fees associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | 14 | | | | | | Deutsche DWS Variable Series I — DWS Bond VIP |

| | |

| Notes to Financial Statements | | (Unaudited) |

A. Organization and Significant Accounting Policies

Deutsche DWS Variable Series I (the “Trust“) is registered under the Investment Company Act of 1940, as amended (the “1940 Act“), as anopen-end, registered management investment company organized as a Massachusetts business trust. The Trust consists of five diversified funds: DWS Bond VIP, DWS Capital Growth VIP, DWS Core Equity VIP, DWS CROCI® International VIP and DWS Global Small Cap VIP (individually or collectively hereinafter referred to as a “Fund“ or the “Funds“). These financial statements report on DWS Bond VIP. The Trust is intended to be the underlying investment vehicle for variable annuity contracts and variable life insurance policies to be offered by the separate accounts of certain life insurance companies (“Participating Insurance Companies“).

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) which require the use of management estimates. Actual results could differ from those estimates. The Fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of U.S. GAAP. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

Debt securities are valued at prices supplied by independent pricing services approved by the Trustees of the Series. Such services may use various pricing techniques which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, prepayment speeds and other data, as well as broker quotes. If the pricing services are unable to provide valuations, debt securities are valued at the average of the most recent reliable bid quotations or evaluated prices, as applicable, obtained frombroker-dealers. These securities are generally categorized as Level 2.

Investments inopen-end investment companies are valued at their net asset value each business day and are categorized as Level 1.

Futures contracts are generally valued at the settlement prices established each day on the exchange on which they are traded and are categorized as Level 1.

Swap contracts are valued daily based upon prices supplied by a Board approved pricing vendor, if available, and otherwise are valued at the price provided by thebroker-dealer. Swap contracts are generally categorized as Level 2.

Forward currency contracts are valued at the prevailing forward exchange rate of the underlying currencies and are categorized as Level 2.

Securities and other assets for which market quotations are not readily available or for which the above valuation procedures are deemed not to reflect fair value are valued in a manner that is intended to reflect their fair value as determined in accordance with procedures approved by the Trustees and are generally categorized as Level 3. In accordance with the Fund’s valuation procedures, factors considered in determining value may include, but are not limited to, the type of the security; the size of the holding; the initial cost of the security; the existence of any contractual restrictions on the security’s disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices frombroker-dealers and/or pricing services; information obtained from the issuer, analysts, and/or the appropriate stock exchange (forexchange-traded securities); an analysis of the company’s or issuer’s financial statements; an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold; and with respect to debt securities, the maturity, coupon, creditworthiness, currency denomination and the movement of the market in which the security is normally traded. The value determined under these procedures may differ from published values for the same securities.

| | | | |

Deutsche DWS Variable Series I — DWS Bond VIP | | | | | 15 |

Disclosure about the classification of fair value measurements is included in a table following the Fund’s Investment Portfolio.

Securities Lending. Deutsche Bank AG, as lending agent, lends securities of the Fund to certain financial institutions under the terms of its securities lending agreement. During the term of the loans, the Fund continues to receive interest and dividends generated by the securities and to participate in any changes in their market value. The Fund requires the borrowers of the securities to maintain collateral with the Fund consisting of either cash or liquid, unencumbered assets having a value at least equal to the value of the securities loaned. When the collateral falls below specified amounts, the lending agent will use its best effort to obtain additional collateral on the next business day to meet required amounts under the securities lending agreement. As of period end, any securities on loan were collateralized by cash. During the six months ended June 30, 2019, the Fund invested the cash collateral into a joint trading account in DWS Government & Agency Securities Portfolio, an affiliated money market fund managed by DWS Investment Management Americas, Inc. DWS Investment Management Americas, Inc. receives a management/administration fee (0.11% annualized effective rate as of June 30, 2019) on the cash collateral invested in DWS Government & Agency Securities Portfolio. The Fund receives compensation for lending its securities either in the form of fees or by earning interest on invested cash collateral net of borrower rebates and fees paid to a lending agent. Either the Fund or the borrower may terminate the loan at any time and the borrower, after notice, is required to return borrowed securities within a standard time period. There may be risks of delay and costs in recovery of securities or even loss of rights in the collateral should the borrower of the securities fail financially. If the Fund is not able to recover securities lent, the Fund may sell the collateral and purchase a replacement investment in the market, incurring the risk that the value of the replacement security is greater than the value of the collateral. The Fund is also subject to all investment risks associated with the reinvestment of any cash collateral received, including, but not limited to, interest rate, credit and liquidity risk associated with such investments.

As of June 30, 2019, the Fund had no securities on loan.

Foreign Currency Translations. The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of the transactions.

Net realized and unrealized gains and losses on foreign currency transactions represent net gains and losses between trade and settlement dates on securities transactions, the acquisition and disposition of foreign currencies, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. The portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.

When-Issued/Delayed Delivery Securities. The Fund may purchase or sell securities with delivery or payment to occur at a later date beyond the normal settlement period. At the time the Fund enters into a commitment to purchase or sell a security, the transaction is recorded and the value of the transaction is reflected in the net asset value. The price of such security and the date when the security will be delivered and paid for are fixed at the time the transaction is negotiated. The value of the security may vary with market fluctuations. At the time the Fund enters into a purchase transaction it is required to segregate cash or other liquid assets at least equal to the amount of the commitment. Additionally, the Fund may be required to post securities and/or cash collateral in accordance with the terms of the commitment.

Certain risks may arise upon entering intowhen-issued or delayed delivery transactions from the potential inability of counterparties to meet the terms of their contracts or if the issuer does not issue the securities due to political, economic, or other factors. Additionally, losses may arise due to changes in the value of the underlying securities.

Taxes. The Fund is treated as a separate taxpayer as provided for in the Internal Revenue Code, as amended. It is the Fund’s policy to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies, and to distribute all of its taxable income to the separate accounts of the Participating Insurance Companies which hold its shares.

Additionally, the Fund may be subject to taxes imposed by the governments of countries in which it invests and are generally based on income and/or capital gains earned or repatriated. Estimated tax liabilities on certain foreign securities are recorded on an accrual basis and are reflected as components of interest income or net change in unrealized gain/loss on investments. Tax liabilities realized as a result of security sales are reflected as a component of net realized gain/loss on investments.

| | | | | | |

| | 16 | | | | | | Deutsche DWS Variable Series I — DWS Bond VIP |

At December 31, 2018, the Fund had a net tax basis capital loss carryforward of approximately $3,092,000 which may be applied against realized net taxable capital gains indefinitely, including short-term losses ($887,000) and long-term losses ($2,205,000).

At June 30, 2019, the aggregate cost of investments for federal income tax purposes was $51,863,332. The net unrealized depreciation for all investments based on tax cost was $1,561,776. This consisted of aggregate gross unrealized appreciation for all investments in which there was an excess of value over tax cost of $1,773,576 and aggregate gross unrealized depreciation for all investments in which there was an excess of tax cost over value of $211,800.

The Fund has reviewed the tax positions for the open tax years as of December 31, 2018 and has determined that no provision for income tax and/or uncertain tax provisions is required in the Fund’s financial statements. The Fund’s federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. Distributions from net investment income of the Fund, if any, are declared and distributed to shareholders annually. Net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed, and, therefore, will be distributed to shareholders at least annually. The Fund may also make additional distributions for tax purposes if necessary.

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to investments in foreign denominated investments, investments in forward foreign currency exchange contracts, futures contracts, swap contracts and certain securities sold at a loss. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the net asset value of the Fund.

The tax character of current year distributions will be determined at the end of the current fiscal year.

Expenses. Expenses of the Trust arising in connection with a specific Fund are allocated to that Fund. Other Trust expenses which cannot be directly attributed to a Fund are apportioned among the Funds in the Trust based upon the relative net assets or other appropriate measures.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience, the Fund expects the risk of loss to be remote.

Other. Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is recorded on the accrual basis net of foreign withholding taxes. Realized gains and losses from investment transactions are recorded on an identified cost basis. Proceeds from litigation payments, if any, are included in net realized gain (loss) from investments. All discounts and premiums are accreted/amortized for both tax and financial reporting purposes.

B. Derivative Instruments

Futures Contracts. A futures contract is an agreement between a buyer or seller and an established futures exchange or its clearinghouse in which the buyer or seller agrees to take or make a delivery of a specific amount of a financial instrument at a specified price on a specific date (settlement date). For the six months ended June 30, 2019, the Fund invested in interest rate futures to gain exposure to different parts of the yield curve while managing the overall duration. The Fund also entered into interest rate futures contracts fornon-hedging purposes to seek to enhance potential gains.

Upon entering into a futures contract, the Fund is required to deposit with a financial intermediary cash or securities (“initial margin”) in an amount equal to a certain percentage of the face value indicated in the futures contract. Subsequent payments (“variation margin”) are made or received by the Fund dependent upon the daily fluctuations in the value and are recorded for financial reporting purposes as unrealized gains or losses by the Fund. Gains or losses are realized when the contract expires or is closed. Since all futures contracts are exchange traded, counterparty risk is minimized as the exchange’s clearinghouse acts as the counterparty, and guarantees the futures against default.

| | | | |

Deutsche DWS Variable Series I — DWS Bond VIP | | | | | 17 |

Certain risks may arise upon entering into futures contracts, including the risk that an illiquid market will limit the Fund’s ability to close out a futures contract prior to the settlement date and the risk that the futures contract is not well correlated with the security, index or currency to which it relates. Risk of loss may exceed amounts disclosed in the Statement of Assets and Liabilities.

A summary of the open futures contracts as of June 30, 2019, is included in a table following the Fund’s Investment Portfolio. For the six months ended June 30, 2019, the investment in futures contracts purchased had a total notional value generally indicative of a range from approximately $5,318,000 to $9,051,000, and the investment in futures contracts sold had a total notional value generally indicative of a range from approximately $3,234,000 to $3,829,000.

Swaps.A swap is a contract between two parties to exchange future cash flows at periodic intervals based on the notional amount of the swap. A bilateral swap is a transaction between the fund and a counterparty where cash flows are exchanged between the two parties. A centrally cleared swap is a transaction executed between the fund and a counterparty, then cleared by a clearing member through a central clearinghouse. The central clearinghouse serves as the counterparty, with whom the fund exchanges cash flows.

The value of a swap is adjusted daily, and the change in value, if any, is recorded as unrealized appreciation or depreciation in the Statement of Assets and Liabilities. Gains or losses are realized when the swap expires or is closed. Certain risks may arise when entering into swap transactions including counterparty default; liquidity; or unfavorable changes in interest rates or the value of the underlying reference security, commodity or index. In connection with bilateral swaps, securities and/or cash may be identified as collateral in accordance with the terms of the swap agreement to provide assets of value and recourse in the event of default. The maximum counterparty credit risk is the net present value of the cash flows to be received from or paid to the counterparty over the term of the swap, to the extent that this amount is beneficial to the Fund, in addition to any related collateral posted to the counterparty by the Fund. This risk may be partially reduced by a master netting arrangement between the Fund and the counterparty. Upon entering into a centrally cleared swap, the Fund is required to deposit with a financial intermediary cash or securities (“initial margin”) in an amount equal to a certain percentage of the notional amount of the swap. Subsequent payments (“variation margin”) are made or received by the Fund dependent upon the daily fluctuations in the value of the swap. In a cleared swap transaction, counterparty risk is minimized as the central clearinghouse acts as the counterparty.

An upfront payment, if any, made by the Fund is recorded as an asset in the Statement of Assets and Liabilities. An upfront payment, if any, received by the Fund is recorded as a liability in the Statement of Assets and Liabilities. Payments received or made at the end of the measurement period are recorded as realized gain or loss in the Statement of Operations.

Credit default swaps are agreements between a buyer and a seller of protection against predefined credit events for the reference entity. The Fund may enter into credit default swaps to gain exposure to an underlying issuer’s credit quality characteristics without directly investing in that issuer or to hedge against the risk of a credit event on debt securities. As a seller of a credit default swap, the Fund is required to pay the par (or other agreed-upon) value of the referenced entity to the counterparty with the occurrence of a credit event by a third party, such as a U.S. or foreign corporate issuer, on the reference entity, which would likely result in a loss to the Fund. In return, the Fund receives from the counterparty a periodic stream of payments over the term of the swap provided that no credit event has occurred. If no credit event occurs, the Fund keeps the stream of payments with no payment obligations. The Fund may also buy credit default swaps, in which case the Fund functions as the counterparty referenced above. This involves the risk that the swap may expire worthless. It also involves counterparty risk that the seller may fail to satisfy its payment obligations to the Fund with the occurrence of a credit event. When the Fund sells a credit default swap, it will cover its commitment. This may be achieved by, among other methods, maintaining cash or liquid assets equal to the aggregate notional value of the reference entities for all outstanding credit default swaps sold by the Fund. For the six months ended June 30, 2019, the Fund entered into credit default swap agreements to gain exposure to the underlying issuer’s credit quality characteristics, or to hedge the risk of default or other specified credit events on portfolio assets.

Under the terms of a credit default swap, the Fund receives or makes periodic payments based on a specified interest rate on a fixed notional amount. These payments are recorded as a realized gain or loss in the Statement of Operations. Payments received or made as a result of a credit event or termination of the swap are recognized, net of a proportional amount of the upfront payment, as realized gains or losses in the Statement of Operations.

There were no open credit default swap contracts as of June 30, 2019. For the period ended June 30, 2019 , the investment in credit default swap contracts purchased had a total notional amount generally indicative of a range from $0 to approximately $9,900,000.

| | | | | | |

| | 18 | | | | | | Deutsche DWS Variable Series I — DWS Bond VIP |