UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-04264

Name of Fund: BlackRock California Municipal Opportunities Fund of BlackRock California Municipal

Series Trust

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock California

Municipal Opportunities Fund of BlackRock California Municipal Series Trust, 55 East 52nd Street,

New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 05/31/2018

Date of reporting period: 05/31/2018

Item 1 – Report to Stockholders

MAY 31, 2018

| | |

ANNUAL REPORT | |  |

BlackRock California Municipal Series Trust

| Ø | | BlackRock California Municipal Opportunities Fund |

BlackRock Multi-State Municipal Series Trust

| Ø | | BlackRock New Jersey Municipal Bond Fund |

| Ø | | BlackRock Pennsylvania Municipal Bond Fund |

BlackRock Municipal Series Trust

| Ø | | BlackRock Strategic Municipal Opportunities Fund |

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

The Markets in Review

Dear Shareholder,

In the 12 months ended May 31, 2018, the strongest corporate profits in seven years drove the equity market higher, while rising interest rates constrained bond returns. Though the market’s appetite for risk remained healthy, risk taking varied by asset class, as bond investors cautiously shifted to higher-quality securities, and stock investors continued to embrace risk by investing abroad.

Strong equity performance worldwide was underpinned by the global economic expansion, driven by synchronized growth across the most influential economies. Emerging markets stocks posted the highest return, as accelerating growth in China, the second-largest economy in the world, improved the outlook for corporate profits in most developing nations.

Short-term U.S. Treasury interest rates rose the fastest, while longer-term rates slightly increased, leading to a substantial flattening of the yield curve. The annual return for the three-month U.S. Treasury bill surpassed 1.0%, but remained well below the annual headline inflation rate of 2.8%. In contrast, the ten-year U.S. Treasury — a bellwether of the bond market — posted a negative return, as rising inflation expectations drove yields higher. Although the fundamentals in credit markets remained relatively solid, investment-grade bonds declined slightly, and high-yield bonds posted modest returns.

Even though it faced rising pressure to boost interest rates in 2017, the U.S. Federal Reserve (the “Fed”) increased short-term interest rates just three times during the reporting period. The Fed also announced plans to reduce its $4.4 trillion balance sheet by $420 billion in 2018, which began the process of gradually reversing its unprecedented stimulus measures after the financial crisis. By contrast, the European Central Bank and the Bank of Japan continued to expand their balance sheets despite nascent signs of sustained economic growth.

The U.S. economy continued to gain momentum despite the Fed’s modest reduction of economic stimulus, as unemployment dipped below 4.0%, wages increased, and the number of job openings reached a record high. Strong economic performance may justify a more rapid pace of rate hikes in 2018, as the headline inflation rate and investors’ expectations for inflation have already surpassed the Fed’s target of 2.0%.

While U.S. monetary policy is seeking to restrain economic growth and inflation, fiscal policy has produced new sources of growth that could nourish the economy for the next few years. Corporate tax cuts and repatriation of capital held abroad could encourage a virtuous cycle of business spending, while lower individual tax rates coupled with the robust job market may refresh consumer spending. Proposed infrastructure spending would deliver growth from the government sector, generate demand, and improve economic activity in other sectors.

We continue to believe the primary risks to economic expansion are trade protectionism, rapidly rising interest rates, and geopolitical tension. Given the deflationary forces of technology and globalization, a substantial increase in inflation is unlikely to materialize as long as the unemployment rate remains above 3.0%. However, we are closely monitoring trade protectionism and the rise of populism in Western nations. In particular, the outcome of trade negotiations between the United States and China is likely to influence the global growth trajectory and set the tone for free trade in many other nations.

In this environment, investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | |

| Total Returns as of May 31, 2018 |

| | | 6-month | | 12-month |

U.S. large cap equities

(S&P 500® Index) | | 3.16% | | 14.38% |

U.S. small cap equities

(Russell 2000® Index) | | 6.47 | | 20.76 |

International equities

(MSCI Europe, Australasia, Far East Index) | | 0.03 | | 7.97 |

Emerging market equities

(MSCI Emerging Markets Index) | | 0.89 | | 14.03 |

3-month Treasury bills

(ICE BofAML 3-Month U.S. Treasury Bill Index) | | 0.75 | | 1.28 |

U.S. Treasury securities

(ICE BofAML 10-Year U.S. Treasury Index) | | (2.42) | | (3.40) |

U.S. investment grade bonds

(Bloomberg Barclays U.S. Aggregate Bond Index) | | (1.04) | | (0.37) |

Tax-exempt municipal bonds

(S&P Municipal Bond Index) | | 0.80 | | 1.26 |

U.S. high yield bonds

(Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | | 0.06 | | 2.35 |

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | |

| 2 | | THIS PAGEISNOT PARTOF YOUR FUND REPORT |

Table of Contents

| | |

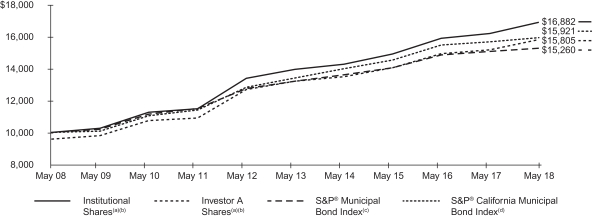

| Fund Summary as of May 31, 2018 | | BlackRock California Municipal Opportunities Fund |

Investment Objective

BlackRock California Municipal Opportunities Fund’s (the “Fund”) investment objective is to provide shareholders with income exempt from Federal and California income taxes.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended May 31, 2018, the Fund outperformed both its primary benchmark, the S&P® Municipal Bond Index, and its secondary benchmark, the S&P® California Municipal Bond Index. The following discussion of relative performance pertains to the S&P® California Municipal Bond Index.

What factors influenced performance?

California municipal issues modestly outperformed national tax-exempt bonds over the past twelve months. A stable credit profile for the state, combined with reduced issuance of new debt and steady demand from retail investors looking to shield income from the highest tax regime in the nation, contributed to strong returns for the California market.

The Fund’s position in longer-term bonds, which outpaced short-term issues, contributed to performance. Overweight positions in the transportation and utilities sectors also added value.

The Fund sought to manage interest rate risk using U.S. Treasury futures. Given that Treasury yields rose, this aspect of the Fund’s positioning had a positive impact on relative performance. Additionally, the Fund’s use of leverage provided both incremental return and income.

At a time of generally positive market performance, the portion of the portfolio invested in lower-duration bonds detracted from returns.

Describe recent portfolio activity.

The Fund aims to deliver a balance of competitive total return and tax-free income using a tactical strategy designed to take advantage of credit, yield curve and interest rate trends.

During the period, the investment adviser sought to put cash inflows to work in both the new-issue and secondary markets. The Fund stayed close to fully invested, as the investment adviser considers income accrual to be a critical component of total return. Leverage was generally constant at approximately 6% of total assets.

Describe portfolio positioning at period end.

At the end of May, the average coupon rate of the Fund’s municipal bond holdings stood at 5.1%. The Fund closed the period with an underweight duration posture (an interest-rate sensitivity lower than that of the benchmark) to help manage the risk of rising rates.

The Fund maintained a bias in favor of higher-quality California issues, as reflected in its average credit quality of AA- as of May 31, 2018. The Fund held a 3.9% allocation to non-investment grade securities at the close of the period, the majority of which was invested in the tobacco sector. The Fund’s largest sector overweight positions were in transportation and utilities, and it was underweight in state tax-backed issues. The Fund also had a 4% position in cash and a 3.2% weighting in taxable municipal bonds.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 4 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Fund Summary as of May 31, 2018 (continued) | | BlackRock California Municipal Opportunities Fund |

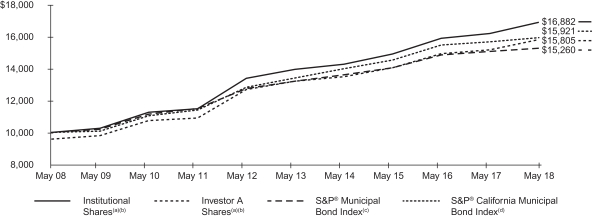

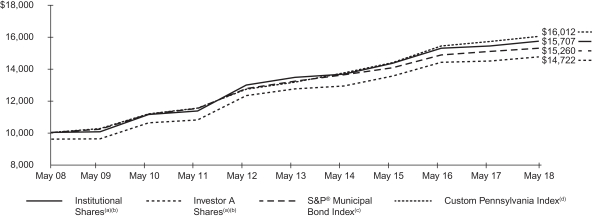

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. See “About Fund Performance” on page 14 for more information about the performance of Investor A Shares. |

| (b) | Under normal circumstances, the Fund will invest at least 80% of its assets in California municipal bonds. The Fund’s total returns prior to January 26, 2015 are the returns of the Fund when it followed different investment strategies under the name BlackRock California Municipal Bond Fund. |

| (c) | The S&P® Municipal Bond Index is composed of bonds held by managed municipal bond fund customers of Standard & Poor’s Securities Pricing, Inc. that are priced daily. Bonds in the S&P® Municipal Bond Index must have an outstanding par value of at least $2 million and a remaining maturity of not less than one month. |

| (d) | The S&P® California Municipal Bond Index includes all California bonds in the S&P® Municipal Bond Index. Effective as of January 26, 2015, the Fund’s secondary benchmark, the Custom California Index, was replaced with the S&P® California Municipal Bond Index. |

Performance Summary for the Period Ended May 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Average Annual Total Returns (a)(b) | |

| | | | | | | | | | | | | | | 1 Year | | | | | | 5 Years | | | | | | 10 Years | |

| | | Standardized 30-Day Yields | | | Unsubsidized 30-Day Yields | | | 6-Month Total Returns | | | | | | w/o sales charge | | | w/sales charge | | | | | | w/o sales charge | | | w/sales charge | | | | | | w/o sales charge | | | w/sales charge | |

Institutional | | | 2.19 | % | | | 2.14 | % | | | 2.50 | % | | | | | | | 4.37 | % | | | N/A | | | | | | | | 3.90 | % | | | N/A | | | | | | | | 5.38 | % | | | N/A | |

Investor A | | | 1.88 | | | | 1.84 | | | | 2.38 | | | | | | | | 4.19 | | | | (0.23 | )% | | | | | | | 3.67 | | | | 2.78 | % | | | | | | | 5.14 | | | | 4.68 | % |

Investor A1 | | | 2.02 | | | | 1.97 | | | | 2.45 | | | | | | | | 4.35 | | | | N/A | | | | | | | | 3.81 | | | | N/A | | | | | | | | 5.29 | | | | N/A | |

Investor C | | | 1.21 | | | | 1.16 | | | | 1.99 | | | | | | | | 3.33 | | | | 2.33 | | | | | | | | 2.89 | | | | 2.89 | | | | | | | | 4.35 | | | | 4.35 | |

Investor C1 | | | 1.63 | | | | 1.58 | | | | 2.20 | | | | | | | | 3.75 | | | | N/A | | | | | | | | 3.29 | | | | N/A | | | | | | | | 4.76 | | | | N/A | |

Class K | | | 2.24 | | | | 2.19 | | | | 2.52 | | | | | | | | 4.39 | | | | N/A | | | | | | | | 3.90 | | | | N/A | | | | | | | | 5.38 | | | | N/A | |

S&P® Municipal Bond Index | | | — | | | | — | | | | 0.80 | | | | | | | | 1.26 | | | | N/A | | | | | | | | 2.94 | | | | N/A | | | | | | | | 4.32 | | | | N/A | |

S&P® California Municipal Bond Index | | | — | | | | — | | | | 0.93 | | | | | | | | 1.64 | | | | N/A | | | | | | | | 3.52 | | | | N/A | | | | | | | | 4.76 | | | | N/A | |

| | (a) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 14 for a detailed description of share classes, including any related sales charges and fees, and how performance was calculated for certain share classes. | |

| | (b) | Under normal circumstances, the Fund will invest at least 80% of its assets in California municipal bonds. The Fund’s total returns prior to January 26, 2015 are the returns of the Fund when it followed different investment strategies under the name BlackRock California Municipal Bond Fund. | |

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

| | |

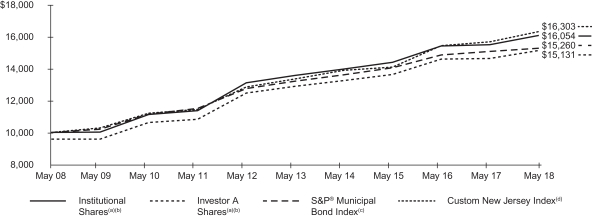

| Fund Summary as of May 31, 2018 | | BlackRock New Jersey Municipal Bond Fund |

Investment Objective

BlackRock New Jersey Municipal Bond Fund’s (the “Fund”) investment objective is to provide shareholders with income exempt from Federal income tax and New Jersey personal income taxes.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended May 31, 2018, the Fund outperformed its primary benchmark, the S&P® Municipal Bond Index, but it underperformed its secondary benchmark, the Custom New Jersey Index. The following discussion of relative performance pertains to the Custom New Jersey Index.

What factors influenced performance?

New Jersey bonds outpaced the national market due in part to investors’ positive perception of legislation that redirected roughly $1 billion annually in lottery proceeds to the state’s pension bonds. Yield spreads on New Jersey bonds compressed, contributing to the positive returns. With yields higher across the municipal curve, coupon income was also a key driver of performance. (Prices and yields move in opposite directions.)

Short-term bonds underperformed long-term issues as the Fed continued to raise interest rates, leading to a flattening of the yield curve. As a result, the Fund’s holdings in shorter-maturity bonds generally underperformed.

Although yields rose during the period, reinvestment had an adverse effect on the Fund’s income as the proceeds of higher-yielding bonds that matured or were called needed to be reinvested at lower prevailing rates.

On a sector basis, local tax-backed, health care and education issues produced the widest margin of outperformance. Conversely, the transportation, state tax-backed, school district and tobacco sectors lagged.

Bonds rated BBB and below outpaced higher-rated bonds due to the combination of limited new-issue supply and persistent investor demand for higher-yielding securities. The bonds’ higher yields also led to stronger total returns compared to lower-yielding debt.

The Fund sought to manage interest rate risk using U.S. Treasury futures. Given that Treasury yields rose, this aspect of the Fund’s positioning had the largest positive impact on relative performance.

The use of leverage contributed to results by helping the Fund generate higher income. However, higher financing costs resulting from the increase in short-term rates compressed the benefits of leverage.

Describe recent portfolio activity.

Much of the Fund’s activity revolved around replacing bonds that matured or were scheduled to mature in the near term. In addition, the Fund sought to maintain a high level of income by focusing its buying at the long end of the curve in revenue sectors that provided compelling yields for the associated risk.

Describe portfolio positioning at period end.

The Fund kept duration (interest-rate sensitivity) below that of the benchmark, and maintained a barbelled yield curve strategy with concentrations in bonds with maturities of zero to three years and 20-plus years. Much of the allocation to short-maturity bonds consisted of pre-refunded/escrowed securities whose above-average yields translated to attractive risk/reward profiles. The Fund’s largest sector overweight positions were in pre-refunded bonds and health care issues, while state tax-backed securities represented the most notable underweight.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 6 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Fund Summary as of May 31, 2018 (continued) | | BlackRock New Jersey Municipal Bond Fund |

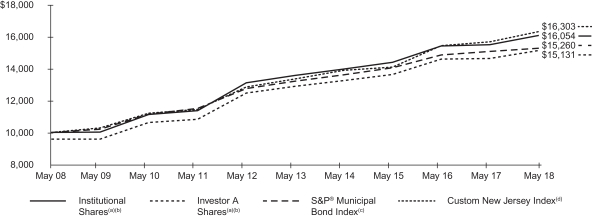

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. See “About Fund Performance” on page 14 for more information about the performance of Investor A Shares. |

| (b) | The Fund invests primarily in a portfolio of long-term investment grade New Jersey municipal bonds. |

| (c) | The S&P® Municipal Bond Index is composed of bonds held by managed municipal bond fund customers of Standard & Poor’s Securities Pricing, Inc. that are priced daily. Bonds in the S&P® Municipal Bond Index must have an outstanding par value of at least $2 million and a remaining maturity of not less than one month. |

| (d) | The Custom New Jersey Index is a customized benchmark that reflects the returns of the S&P® New Jersey Municipal Bond Index for periods prior to January 1, 2013, and the returns of only those New Jersey bonds in the S&P® New Jersey Municipal Bond Index that have maturities greater than 5 years for periods subsequent to January 1, 2013. |

Performance Summary for the Period Ended May 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Average Annual Total Returns (a) | |

| | | | | | | | | | | | | | | 1 Year | | | | | | 5 Years | | | | | | 10 Years | |

| | | Standardized 30-Day Yields | | | Unsubsidized 30-Day Yields | | | 6-Month Total Returns | | | | | | w/o sales charge | | | w/sales charge | | | | | | w/o sales charge | | | w/sales charge | | | | | | w/o sales charge | | | w/sales charge | |

Institutional | | | 2.76 | % | | | 2.51 | % | | | 1.21 | % | | | | | | | 3.69 | % | | | N/A | | | | | | | | 3.42 | % | | | N/A | | | | | | | | 4.85 | % | | | N/A | |

Service | | | 2.51 | | | | 2.27 | | | | 1.08 | | | | | | | | 3.43 | | | | N/A | | | | | | | | 3.26 | | | | N/A | | | | | | | | 4.68 | | | | N/A | |

Investor A | | | 2.39 | | | | 2.21 | | | | 1.09 | | | | | | | | 3.43 | | | | (0.97 | )% | | | | | | | 3.26 | | | | 2.36 | % | | | | | | | 4.68 | | | | 4.23 | % |

Investor A1 | | | 2.55 | | | | 2.37 | | | | 1.16 | | | | | | | | 3.49 | | | | N/A | | | | | | | | 3.40 | | | | N/A | | | | | | | | 4.83 | | | | N/A | |

Investor C | | | 1.77 | | | | 1.57 | | | | 0.71 | | | | | | | | 2.65 | | | | 1.65 | | | | | | | | 2.49 | | | | 2.49 | | | | | | | | 3.89 | | | | 3.89 | |

Investor C1 | | | 2.21 | | | | 2.02 | | | | 0.93 | | | | | | | | 3.08 | | | | N/A | | | | | | | | 2.88 | | | | N/A | | | | | | | | 4.31 | | | | N/A | |

Class K | | | 2.82 | | | | 2.63 | | | | 1.14 | | | | | | | | 3.61 | | | | N/A | | | | | | | | 3.40 | | | | N/A | | | | | | | | 4.84 | | | | N/A | |

S&P® Municipal Bond Index | | | — | | | | — | | | | 0.80 | | | | | | | | 1.26 | | | | N/A | | | | | | | | 2.94 | | | | N/A | | | | | | | | 4.32 | | | | N/A | |

Custom New Jersey Index | | | — | | | | — | | | | 1.03 | | | | | | | | 4.04 | | | | N/A | | | | | | | | 4.10 | | | | N/A | | | | | | | | 5.01 | | | | N/A | |

| | (a) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 14 for a detailed description of share classes, including any related sales charges and fees, and how performance was calculated for certain share classes. | |

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

| | |

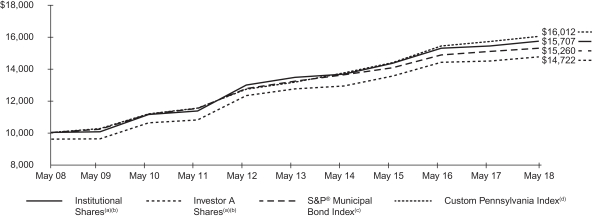

| Fund Summary as of May 31, 2018 | | BlackRock Pennsylvania Municipal Bond Fund |

Investment Objective

BlackRock Pennsylvania Municipal Bond Fund’s (the “Fund”) investment objective is to provide shareholders with income exempt from Federal income tax and Pennsylvania personal income taxes.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended May 31, 2018, the Fund outperformed its primary benchmark, the S&P® Municipal Bond Index, with the exception of Class C Shares, which underperformed its primary benchmark. For the same period, the Fund underperformed its secondary benchmark, the Custom Pennsylvania Index, with the exception of Institutional and Class K Shares, which performed in line with the secondary benchmark. The following discussion of relative performance pertains to the Custom Pennsylvania Index.

What factors influenced performance?

S&P Global Inc. (“S&P”) downgraded the Commonwealth of Pennsylvania to A+ from AA- and revised the outlook to stable. S&P cited the Commonwealth’s chronic structural imbalance and history of late budget adoption, as well as its belief that these practices will continue. Still, Pennsylvania’s municipal market posted a small gain and modestly outperformed the national market in the 12-month period. With yields higher across the municipal curve, coupon income was the main driver of positive returns. (Prices and yields move in opposite directions.)

Short-term bonds underperformed long-term issues as the Fed continued to raise interest rates, leading to a flattening of the yield curve. As a result, the Fund’s holdings in shorter-maturity bonds generally underperformed.

Although yields rose during the period, reinvestment had an adverse effect on the Fund’s income as the proceeds of higher-yielding bonds that matured or were called needed to be reinvested at lower prevailing rates.

On a sector basis, health care, corporate and housing issues produced the widest margin of outperformance. Conversely, the transportation, state tax-backed and utilities sectors lagged.

Bonds rated BBB and below outpaced higher-rated bonds due to the combination of limited new-issue supply and persistent investor demand for higher-yielding securities. The bonds’ higher yields also led to stronger total returns compared to lower-yielding debt.

The Fund sought to manage interest rate risk using U.S. Treasury futures. Given that Treasury yields rose, this aspect of the Fund’s positioning had the largest positive impact on relative performance.

The use of leverage contributed to results by helping the Fund generate higher income. However, higher financing costs resulting from the increase in short-term rates compressed the benefits of leverage.

Describe recent portfolio activity.

Much of the Fund’s activity revolved around replacing bonds that matured or were scheduled to mature in the near-term. In addition, the Fund sought to maintain a high level of income by focusing its buying at the long end of the curve in revenue sectors that provided compelling yields for the associated risk.

Describe portfolio positioning at period end.

The Fund kept duration (interest-rate sensitivity) below that of the benchmark, and maintained a barbelled yield curve strategy with concentrations in bonds with maturities of zero to three years and 20-plus years. Much of the allocation to short-maturity bonds consisted of pre-refunded/escrowed securities whose above-average yields translated to favorable risk/reward profiles. The health care and education sectors continued to have large weightings in the portfolio due to their attractive yield spreads and the large volume of issuance in these revenue sectors in Pennsylvania. The Fund maintained an underweight in state tax-backed bonds due to Pennsylvania’s weak fundamental trends.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 8 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Fund Summary as of May 31, 2018 (continued) | | BlackRock Pennsylvania Municipal Bond Fund |

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. See “About Fund Performance” on page 14 for more information about the performance of Investor A Shares. |

| (b) | The Fund invests primarily in a portfolio of long-term investment grade Pennsylvania municipal bonds. |

| (c) | The S&P® Municipal Bond Index is composed of bonds held by managed municipal bond fund customers of Standard & Poor’s Securities Pricing, Inc. that are priced daily. Bonds in the S&P® Municipal Bond Index must have an outstanding par value of at least $2 million and a remaining maturity of not less than one month. |

| (d) | The Custom Pennsylvania Index is customized benchmark that reflects the returns of the S&P® Pennsylvania Municipal Bond Index for periods prior to January 1, 2013, and the returns of only those Pennsylvania bonds in the S&P® Pennsylvania Municipal Bond Index that have maturities greater than 5 years for periods subsequent to January 1, 2013. |

Performance Summary for the Period Ended May 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Average Annual Total Returns (a) | |

| | | | | | | | | | | | | | | 1 Year | | | | | | 5 Years | | | | | | 10 Years | |

| | | Standardized 30-Day Yields | | | Unsubsidized 30-Day Yields | | | 6-Month Total Returns | | | | | | w/o sales charge | | | w/sales charge | | | | | | w/o sales charge | | | w/sales charge | | | | | | w/o sales charge | | | w/sales charge | |

Institutional | | | 2.42 | % | | | 2.21 | % | | | 1.01 | % | | | | | | | 2.02 | % | | | N/A | | | | | | | | 3.16 | % | | | N/A | | | | | | | | 4.62 | % | | | N/A | |

Service | | | 2.17 | | | | 1.98 | | | | 0.80 | | | | | | | | 1.76 | | | | N/A | | | | | | | | 2.97 | | | | N/A | | | | | | | | 4.41 | | | | N/A | |

Investor A | | | 2.08 | | | | 1.90 | | | | 0.80 | | | | | | | | 1.76 | | | | (2.56 | )% | | | | | | | 2.96 | | | | 2.07 | % | | | | | | | 4.40 | | | | 3.94 | % |

Investor A1 | | | 2.23 | | | | 2.10 | | | | 0.97 | | | | | | | | 2.01 | | | | N/A | | | | | | | | 3.14 | | | | N/A | | | | | | | | 4.57 | | | | N/A | |

Investor C | | | 1.44 | | | | 1.31 | | | | 0.52 | | | | | | | | 1.01 | | | | 0.03 | | | | | | | | 2.17 | | | | 2.17 | | | | | | | | 3.60 | | | | 3.60 | |

Investor C1 | | | 1.88 | | | | 1.75 | | | | 0.73 | | | | | | | | 1.42 | | | | N/A | | | | | | | | 2.59 | | | | N/A | | | | | | | | 4.03 | | | | N/A | |

Class K | | | 2.49 | | | | 2.36 | | | | 1.03 | | | | | | | | 2.03 | | | | N/A | | | | | | | | 3.17 | | | | N/A | | | | | | | | 4.62 | | | | N/A | |

S&P® Municipal Bond Index | | | — | | | | — | | | | 0.80 | | | | | | | | 1.26 | | | | N/A | | | | | | | | 2.94 | | | | N/A | | | | | | | | 4.32 | | | | N/A | |

Custom Pennsylvania Index | | | — | | | | — | | | | 1.03 | | | | | | | | 2.07 | | | | N/A | | | | | | | | 4.03 | | | | N/A | | | | | | | | 4.82 | | | | N/A | |

| | (a) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 14 for a description of share classes, including any related sales charges and fees, and how performance was calculated for certain share classes. | |

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

| | |

| Fund Summary as of May 31, 2018 | | BlackRock Strategic Municipal Opportunities Fund |

Investment Objective

BlackRock Strategic Municipal Opportunities Fund’s (the “Fund”) investment objective is to provide shareholders with a high level of income exempt from Federal income taxes.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended May 31, 2018, the Fund outperformed its primary benchmark, the S&P® Municipal Bond Index, as well as its custom blended secondary benchmark comprised of 65% S&P® Municipal Bond Investment Grade Index, 30% S&P® Municipal Bond High Yield Index and 5% Bloomberg Barclays Taxable Municipal: U.S. Aggregate Eligible Index. The following discussion of relative performance pertains to the custom blended benchmark.

What factors influenced performance?

2018 has been a challenging year for fixed income investing. Volatile interest rates, reaction to tax reform, and a changing technical landscape have resulted in negative absolute return figures for the asset class. Despite these challenges, the Fund was able to navigate the volatile market via duration management and credit flexibility to provide downside protection in addition to positive relative and absolute returns. (Duration is a measure of interest-rate sensitivity.)

Several factors contributed to the Fund’s outperformance. Positions in bonds rated AA and BBB, which outpaced the benchmark at a time of relative strength for lower-quality debt, were key positives. At the sector level, positions in utilities, transportation and state tax-backed issues aided results. Investments in bonds with maturities of 20 years and above contributed to performance.

The Fund sought to manage interest rate risk using U.S. Treasury futures. Given that Treasury yields rose, this aspect of the Fund’s positioning had a positive impact on relative performance. Additionally, the Fund’s use of leverage provided both incremental return and income.

The Fund’s underweight positions in non-rated bonds and Illinois issues were the largest detractors from performance. An underweight in the zero- to one-year part of the yield curve was an additional detractor.

Describe recent portfolio activity.

The Fund kept duration below that of the benchmark, opening the period at 4.39 years and closing at 4.65 years. The Fund held an allocation of approximately 55% to bonds with maturities of 20 years and above as of the end of May, down from 60% at the beginning of the period.

The Fund maintained a high-quality bias in the investment-grade category, where its largest allocations were to the AA and A rating tiers. About 16% of the Fund’s assets were in high yield (below investment-grade) bonds as of May 31, 2018, down from 24% at the start of the period. At the sector level, the largest increase occurred in the state tax-backed area.

Later in the period, the investment adviser positioned the portfolio with a lower risk profile on the belief that the bond market could remain volatile and that income would continue to be a significant contributor to returns.

Describe portfolio positioning at period end.

The Fund was overweight in transportation and corporate municipal issues and underweight in the school district, local tax-backed and pre-refunded/escrowed sectors. The Fund’s average credit quality remained at A.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 10 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Fund Summary as of May 31, 2018 (continued) | | BlackRock Strategic Municipal Opportunities Fund |

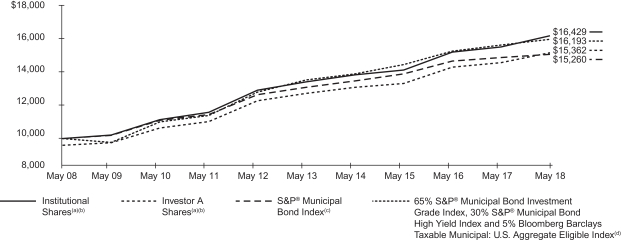

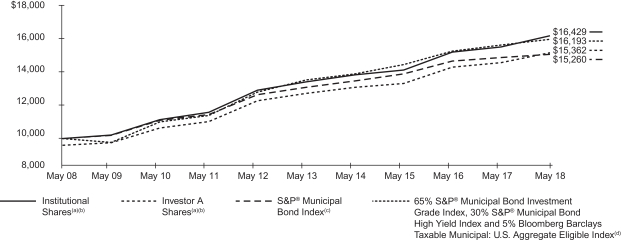

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. See “About Fund Performance” on page 14 for more information about the performance of Investor A Shares. |

| (b) | Under normal circumstances the Fund invests at least 80% of its assets in municipal bonds. The Fund’s total returns prior to January 27, 2014 are the returns of the Fund when it followed different investment strategies under the name BlackRock Intermediate Municipal Fund. |

| (c) | The S&P® Municipal Bond Index is composed of bonds held by managed municipal bond fund customers of Standard & Poor’s Securities Pricing, Inc. that are priced daily. Bonds in the S&P® Municipal Bond Index must have an outstanding par value of at least $2 million and a remaining maturity of not less than one month. |

| (d) | See “About Fund Performance” on page 14 for descriptions of the indexes. |

Performance Summary for the Period Ended May 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Average Annual Total Returns (a)(b) | |

| | | | | | | | | | | | | | | 1 Year | | | | | | 5 Years | | | | | | 10 Years | |

| | | Standardized 30-Day Yields | | | Unsubsidized 30-Day Yields | | | 6-Month Total Returns | | | | | | w/o sales charge | | | w/sales charge | | | | | | w/o sales charge | | | w/sales charge | | | | | | w/o sales charge | | | w/sales charge | |

Institutional | | | 2.84 | % | | | 2.78 | % | | | 2.60 | % | | | | | | | 4.47 | % | | | N/A | | | | | | | | 3.93 | % | | | N/A | | | | | | | | 5.09 | % | | | N/A | |

Investor A | | | 2.52 | | | | 2.47 | | | | 2.41 | | | | | | | | 4.26 | | | | (0.18 | )% | | | | | | | 3.69 | | | | 2.79 | % | | | | | | | 4.84 | | | | 4.39 | % |

Investor A1 | | | 2.73 | | | | 2.68 | | | | 2.57 | | | | | | | | 4.49 | | | | N/A | | | | | | | | 3.85 | | | | N/A | | | | | | | | 5.00 | | | | N/A | |

Investor C | | | 1.87 | | | | 1.81 | | | | 2.11 | | | | | | | | 3.54 | | | | 2.54 | | | | | | | | 2.92 | | | | 2.92 | | | | | | | | 4.06 | | | | 4.06 | |

Class K | | | 2.92 | | | | 2.86 | | | | 2.63 | | | | | | | | 4.50 | | | | N/A | | | | | | | | 3.94 | | | | N/A | | | | | | | | 5.09 | | | | N/A | |

S&P® Municipal Bond Index | | | — | | | | — | | | | 0.80 | | | | | | | | 1.26 | | | | N/A | | | | | | | | 2.94 | | | | N/A | | | | | | | | 4.32 | | | | N/A | |

S&P® Municipal Bond Investment Grade Index | | | — | | | | — | | | | 0.57 | | | | | | | | 1.08 | | | | N/A | | | | | | | | 2.82 | | | | N/A | | | | | | | | 4.21 | | | | N/A | |

S&P® Municipal Bond High Yield Index | | | — | | | | — | | | | 4.56 | | | | | | | | 4.44 | | | | N/A | | | | | | | | 4.59 | | | | N/A | | | | | | | | 6.05 | | | | N/A | |

Bloomberg Barclays Taxable Municipal: U.S. Aggregate Eligible Index | | | — | | | | — | | | | (0.92 | ) | | | | | | | 4.28 | | | | N/A | | | | | | | | 4.92 | | | | N/A | | | | | | | | 6.78 | | | | N/A | |

65% S&P® Municipal Bond Investment Grade Index, 30% S&P® Municipal Bond High Yield Index and 5% Bloomberg Barclays Taxable Municipal: U.S. Aggregate Eligible Index | | | — | | | | — | | | | 1.68 | | | | | | | | 2.24 | | | | N/A | | | | | | | | 3.47 | | | | N/A | | | | | | | | 4.94 | | | | N/A | |

| | (a) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 14 for a description of share classes, including any related sales charges and fees, and how performance was calculated for certain share classes. | |

| | (b) | Under normal circumstances, the Fund invests at least 80% of its assets in municipal bonds. The Fund’s total returns prior to January 27, 2014 are the returns of the Fund when it followed different investment strategies under the name BlackRock Intermediate Municipal Fund. | |

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Portfolio Information as of May 31, 2018

BlackRock California Municipal Opportunities Fund

SECTOR ALLOCATION (a)

| | | | |

| Sector | | Percent of

Total Investments (b) | |

County/City/Special District/School District | | | 29 | % |

Utilities | | | 22 | |

Transportation | | | 21 | |

Health | | | 8 | |

State | | | 8 | |

Education | | | 6 | |

Tobacco | | | 3 | |

Commercial Services & Supplies | | | 2 | |

Health Care Providers & Services | | | 1 | |

CREDIT QUALITY ALLOCATION (c)

| | | | |

| Credit Rating | | Percent of

Total Investments (b) | |

AAA/Aaa | | | 14 | % |

AA/Aa | | | 57 | |

A | | | 11 | |

BBB/Baa | | | 1 | |

BB/Ba | | | 1 | |

B/B | | | 3 | |

N/R(d) | | | 13 | |

CALL/MATURITY SCHEDULE (e)

| | | | |

| | | Percent of

Total Investments (b) | |

Calendar Year Ended December 31, | | | | |

2018 | | | 8 | % |

2019 | | | 8 | |

2020 | | | 3 | |

2021 | | | 7 | |

2022 | | | 5 | |

BlackRock New Jersey Municipal Bond Fund

SECTOR ALLOCATION (a)

| | | | |

| Sector | | Percent of

Total Investments (b) | |

Transportation | | | 28 | % |

Health | | | 20 | |

Education | | | 17 | |

County/City/Special District/School District | | | 14 | |

State | | | 9 | |

Corporate | | | 3 | |

Utilities | | | 3 | |

Housing | | | 3 | |

Tobacco | | | 3 | |

CREDIT QUALITY ALLOCATION (c)

| | | | |

| Credit Rating | | Percent of

Total Investments (b) | |

AAA/Aaa | | | 2 | % |

AA/Aa | | | 32 | |

A | | | 28 | |

BBB/Baa | | | 29 | |

BB/Ba | | | 6 | |

N/R(d) | | | 3 | |

CALL/MATURITY SCHEDULE (e)

| | | | |

| | | Percent of

Total Investments (b) | |

Calendar Year Ended December 31, | | | | |

2018 | | | 8 | % |

2019 | | | 6 | |

2020 | | | 5 | |

2021 | | | 14 | |

2022 | | | 6 | |

| | (a) | For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. | |

| | (b) | Excludes short-term securities. | |

| | (c) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Inc. (“S&P”) or Moody’s Investors Service (“Moody’s”) if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. | |

| | (d) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of May 31, 2018, the market value of unrated securities deemed by the investment adviser to be investment grade represented less than 1% of the Fund’s long-term investments. | |

| | (e) | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. | |

| | |

| 12 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

Portfolio Information as of May 31, 2018 (continued)

BlackRock Pennsylvania Municipal Bond Fund

SECTOR ALLOCATION (a)

| | | | |

| Sector | | Percent of

Total Investments (b) | |

Health | | | 23 | % |

Education | | | 23 | |

County/City/Special District/School District | | | 14 | |

Transportation | | | 12 | |

State | | | 10 | |

Housing | | | 7 | |

Utilities | | | 6 | |

Corporate | | | 5 | |

CREDIT QUALITY ALLOCATION (c)

| | | | |

| Credit Rating | | Percent of

Total Investments (b) | |

AAA/Aaa | | | 1 | % |

AA/Aa | | | 43 | |

A | | | 31 | |

BBB/Baa | | | 8 | |

BB/Ba | | | 2 | |

B/B | | | 1 | |

N/R(d) | | | 14 | |

CALL/MATURITY SCHEDULE (e)

| | | | |

| | | Percent of

Total Investments (b) | |

Calendar Year Ended December 31, | | | | |

2018 | | | 7 | % |

2019 | | | 12 | |

2020 | | | 16 | |

2021 | | | 14 | |

2022 | | | 4 | |

BlackRock Strategic Municipal Opportunities Fund

SECTOR ALLOCATION (a)

| | | | |

| Sector | | Percent of

Total Investments (b) | |

Transportation | | | 25 | % |

State | | | 16 | |

Utilities | | | 13 | |

Health | | | 12 | |

County/City/Special District/School District | | | 11 | |

Education | | | 9 | |

Corporate | | | 6 | |

Tobacco | | | 5 | |

Housing | | | 3 | |

CREDIT QUALITY ALLOCATION (c)

| | | | |

| Credit Rating | | Percent of

Total Investments (b) | |

AAA/Aaa | | | 11 | % |

AA/Aa | | | 38 | |

A | | | 19 | |

BBB/Baa | | | 16 | |

BB/Ba | | | 5 | |

B/B | | | 6 | |

N/R(d) | | | 5 | |

CALL/MATURITY SCHEDULE (e)

| | | | |

| | | Percent of

Total Investments (b) | |

Calendar Year Ended December 31, | | | | |

2018 | | | 6 | % |

2019 | | | 1 | |

2020 | | | 2 | |

2021 | | | 5 | |

2022 | | | 7 | |

| | (a) | For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. | |

| | (b) | Excludes short-term securities. | |

| | (c) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. | |

| | (d) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of May 31, 2018, the market value of unrated securities deemed by the investment adviser to be investment grade represented less than 1% of the Fund’s long-term investments. | |

| | (e) | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. | |

About Fund Performance

Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors.

Class K Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. Class K Share performance shown prior to the January 25, 2018 inception date is that of Institutional Shares. The performance of the Funds’ Class K Shares would be substantially similar to Institutional Shares because Class K Shares and Institutional Shares invest in the same portfolio of securities and performance would only differ to the extent that Class K Shares and Institutional Shares have different expenses. The actual returns of Class K Shares would have been higher than those of the Institutional Shares because Class K Shares have lower expenses than the Institutional Shares.

Service Shares (available only in BlackRock New Jersey Municipal Bond Fund and BlackRock Pennsylvania Municipal Bond Fund) are not subject to any sales charge. These shares are subject to a service fee of 0.25% per year (but no distribution fee) and are only available to certain eligible investors.

Investor A Shares are subject to a maximum initial sales charge (front-end load) of 4.25% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are generally available through financial intermediaries.

Investor A1 Shares (for all Funds except BlackRock Strategic Municipal Opportunities Fund) are subject to a maximum initial sales charge (front-end load) of 4.00% and a service fee of 0.10% per year (but no distribution fee). Investor A1 Shares for BlackRock Strategic Municipal Opportunities Fund incur a maximum initial sales charge (front-end load) of 1.00% and a service fee of 0.10% per year (but no distribution fee). The maximum initial sales charge does not apply to current eligible shareholders of Investor A1 Shares of the Funds. Certain redemptions of these shares may be subject to a CDSC where no initial sales charge was paid at the time of purchase. However, the CDSC does not apply to redemptions by certain employer-sponsored retirement plans or to redemptions of shares acquired through reinvestment of dividends and capital gains by existing shareholders, and for California Municipal Opportunities Fund only, fee based programs previously approved by the Fund.

Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares are generally available through financial intermediaries.

Investor C1 Shares (available in all Funds except BlackRock Strategic Municipal Opportunities Fund) are subject to a 1.00% CDSC if redeemed within one year of purchase. However, the CDSC does not apply to redemptions by certain employer-sponsored retirement plans or to redemptions of shares acquired through reinvestment of dividends and capital gains by existing shareholders, and for California Municipal Opportunities Fund only, fee based programs previously approved by the Fund. In addition, these shares are subject to a distribution fee of 0.35% per year and a service fee of 0.25% per year.

Investor A1 and Investor C1 Shares are only available for dividend and capital gain reinvestment by existing shareholders, and for purchase by certain employer-sponsored retirement plans and, for California Municipal Opportunities Fund only, fee based programs previously approved by the Fund.

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in the performance tables on the previous pages assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend date/payable date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), each Fund’s investment adviser, has contractually agreed to waive and/or reimburse a portion of each Fund’s expenses. Without such waiver and/or reimbursement, each Fund’s performance would have been lower. The Manager is under no obligation to continue waiving and/or reimbursing its fees after the applicable termination date of such agreement. See Note 6 of the Notes to Financial Statements for additional information on waivers and/or reimbursements. The standardized 30-day yield includes the effects of any waivers and/or reimbursements. The unsubsidized 30-day yield excludes the effects of any waivers and/or reimbursements.

Bloomberg Barclays Taxable Municipal: U.S. Aggregate Eligible Index — represents securities that are taxable, dollar-denominated, and issued by a U.S. state or territory, and have at least one year to final maturity regardless of call features, have at least $250 million par amount outstanding, and are rated investment-grade (at least BBB- by S&P or Fitch Ratings (“Fitch”) and/or Baa3 by Moody’s) by at least two of the following ratings agencies: S&P, Moody’s and Fitch.

S&P® Municipal Bond High Yield Index — a market-value-weighted index that consists of bonds in the S&P Municipal Bond Index that are nonrated or that are rated BB+ by S&P and/or Ba1 by Moody’s or lower; bonds that are prerefunded or escrowed to maturity are not included in this index.

S&P® Municipal Bond Investment Grade Index — a market-value-weighted index that consists of bonds in the S&P Municipal Bond Index that are rated at least BBB- by S&P and/or Baa3 by Moody’s.

| | |

| 14 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

Shareholders of these Funds may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses, and other Fund expenses. The expense examples shown below (which are based on a hypothetical investment of $1,000 invested on December 1, 2017 and held through May 31, 2018) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

Expense Examples

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical (c) | |

| | | | | | | | | Including

Interest

Expense

and Fees | | | Excluding

Interest

Expense

and Fees | | | | | | | | | Including

Interest

Expense

and Fees | | | Excluding

Interest

Expense

and Fees | |

BlackRock California Municipal

Opportunities Fund | | Beginning Account Value

(12/01/17) | | | Ending Account Value

(05/31/18) | | | Expenses

Paid During

the Period (a) | | | Expenses

Paid During

the Period (b) | | | | | | Beginning Account Value

(12/01/17) | | | Ending Account Value

(05/31/18) | | | Expenses

Paid During

the Period (a) | | | Ending Account Value

(05/31/18) | | | Expenses

Paid During

the Period (b) | |

Institutional | | $ | 1,000.00 | | | $ | 1,025.00 | | | $ | 2.83 | | | $ | 2.22 | | | | | | | $ | 1,000.00 | | | $ | 1,022.09 | | | $ | 2.82 | | | $ | 1,022.74 | | | $ | 2.22 | |

Investor A | | | 1,000.00 | | | | 1,023.80 | | | | 4.09 | | | | 3.43 | | | | | | | | 1,000.00 | | | | 1,020.89 | | | | 4.08 | | | | 1,021.54 | | | | 3.43 | |

Investor A1 | | | 1,000.00 | | | | 1,024.50 | | | | 3.38 | | | | 2.73 | | | | | | | | 1,000.00 | | | | 1,021.74 | | | | 3.38 | | | | 1,022.24 | | | | 2.72 | |

Investor C | | | 1,000.00 | | | | 1,019.90 | | | | 7.91 | | | | 7.25 | | | | | | | | 1,000.00 | | | | 1,017.20 | | | | 7.90 | | | | 1,017.75 | | | | 7.24 | |

Investor C1 | | | 1,000.00 | | | | 1,022.00 | | | | 5.85 | | | | 5.19 | | | | | | | | 1,000.00 | | | | 1,019.25 | | | | 5.84 | | | | 1,019.80 | | | | 5.19 | |

Class K | | | 1,000.00 | | | | 1,025.20 | | | | 1.71 | | | | 1.36 | | | | | | | | 1,000.00 | | | | 1,022.04 | | | | 1.71 | | | | 1,022.99 | | | | 1.36 | |

| | (a) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.56% for Institutional Class, 0.81% for Investor A Class, 0.67% for Investor A1 Class, 1.57% for Investor C Class, 1.16% for Investor C1 Class and 0.49% for Class K), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown), except Class K which is multiplied by 126/365 (to reflect the period since inception date of January 25, 2018). | |

| | (b) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.44% for Institutional Class, 0.68% for Investor A Class, 0.54% for Investor A1 Class, 1.44% for Investor C Class, 1.03% for Investor C1 Class and 0.39% for Class K), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one half year period shown), except Class K which is multiplied by 126/365 (to reflect the period since inception date of January 25, 2018). | |

| | (c) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical (c) | |

| | | | | | | | | Including

Interest

Expense

and Fees | | | Excluding

Interest

Expense

and Fees | | | | | | | | | Including

Interest

Expense

and Fees | | | Excluding

Interest

Expense

and Fees | |

BlackRock New Jersey Municipal Bond Fund | | Beginning

Account Value

(12/01/17) | | | Ending

Account Value

(05/31/18) | | | Expenses

Paid During

the Period (a) | | | Expenses

Paid During

the Period (b) | | | | | | Beginning Account Value

(12/01/17) | | | Ending

Account Value

(05/31/18) | | | Expenses

Paid During

the Period (a) | | | Ending

Account Value

(05/31/18) | | | Expenses

Paid During

the Period (b) | |

Institutional | | $ | 1,000.00 | | | $ | 1,012.10 | | | $ | 3.21 | | | $ | 2.66 | | | | | | | $ | 1,000.00 | | | $ | 1,021.69 | | | $ | 3.23 | | | $ | 1,022.29 | | | $ | 2.67 | |

Service | | | 1,000.00 | | | | 1,010.80 | | | | 4.46 | | | | 3.91 | | | | | | | | 1,000.00 | | | | 1,020.49 | | | | 4.48 | | | | 1,021.04 | | | | 3.93 | |

Investor A | | | 1,000.00 | | | | 1,010.90 | | | | 4.46 | | | | 3.91 | | | | | | | | 1,000.00 | | | | 1,020.49 | | | | 4.48 | | | | 1,021.04 | | | | 3.93 | |

Investor A1 | | | 1,000.00 | | | | 1,011.60 | | | | 3.71 | | | | 3.16 | | | | | | | | 1,000.00 | | | | 1,021.24 | | | | 3.73 | | | | 1,021.79 | | | | 3.18 | |

Investor C | | | 1,000.00 | | | | 1,007.10 | | | | 8.21 | | | | 7.66 | | | | | | | | 1,000.00 | | | | 1,016.75 | | | | 8.25 | | | | 1,017.30 | | | | 7.70 | |

Investor C1 | | | 1,000.00 | | | | 1,009.30 | | | | 6.06 | | | | 5.46 | | | | | | | | 1,000.00 | | | | 1,018.90 | | | | 6.09 | | | | 1,019.50 | | | | 5.49 | |

Class K | | | 1,000.00 | | | | 1,011.40 | | | | 1.98 | | | | 1.15 | | | | | | | | 1,000.00 | | | | 1,021.59 | | | | 1.99 | | | | 1,022.59 | | | | 1.15 | |

| | (a) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.64% for Institutional Class, 0.89% for Service Class, 0.89% for Investor A Class, 0.74% for Investor A1 Class, 1.64% for Investor C Class, 1.21% for Investor C1 Class and 0.57% for Class K), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown), except Class K which is multiplied by 126/365 (to reflect the period since inception date of January 25, 2018). | |

| | (b) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.53% for Institutional Class, 0.78% for Service Class, 0.78% for Investor A Class, 0.63% for Investor A1 Class, 1.53% for Investor C Class, 1.09% for Investor C1 Class and 0.33% for Class K), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown), except Class K which is multiplied by 126/365 (to reflect the period since inception date of January 25, 2018). | |

| | (c) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

| | | | |

| DISCLOSURE OF EXPENSES | | | 15 | |

| | |

| Disclosure of Expenses (continued) | | |

Expense Examples (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical (c) | |

| | | | | | | | | Including

Interest

Expense

and Fees | | | Excluding

Interest

Expense

and Fees | | | | | | | | | Including

Interest

Expense

and Fees | | | Excluding

Interest

Expense

and Fees | |

BlackRock Pennsylvania Municipal Bond Fund | | Beginning

Account Value

(12/01/17) | | | Ending

Account Value

(05/31/18) | | | Expenses

Paid During

the Period (a) | | | Expenses

Paid During

the Period (b) | | | | | | Beginning

Account Value

(12/01/17) | | | Ending

Account Value

(05/31/18) | | | Expenses

Paid During

the Period (a) | | | Ending

Account Value

(05/31/18) | | | Expenses

Paid During

the Period (b) | |

Institutional | | $ | 1,000.00 | | | $ | 1,010.10 | | | $ | 4.01 | | | $ | 2.71 | | | | | | | $ | 1,000.00 | | | $ | 1,020.84 | | | $ | 4.03 | | | $ | 1,022.24 | | | $ | 2.72 | |

Service | | | 1,000.00 | | | | 1,008.00 | | | | 5.26 | | | | 3.95 | | | | | | | | 1,000.00 | | | | 1,019.60 | | | | 5.29 | | | | 1,020.99 | | | | 3.98 | |

Investor A | | | 1,000.00 | | | | 1,008.00 | | | | 5.36 | | | | 3.95 | | | | | | | | 1,000.00 | | | | 1,020.00 | | | | 5.39 | | | | 1,020.99 | | | | 3.98 | |

Investor A1 | | | 1,000.00 | | | | 1,009.70 | | | | 4.56 | | | | 3.21 | | | | | | | | 1,000.00 | | | | 1,020.49 | | | | 4.58 | | | | 1,021.74 | | | | 3.23 | |

Investor C | | | 1,000.00 | | | | 1,005.20 | | | | 9.00 | | | | 7.70 | | | | | | | | 1,000.00 | | | | 1,016.01 | | | | 9.05 | | | | 1,017.25 | | | | 7.75 | |

Investor C1 | | | 1,000.00 | | | | 1,007.30 | | | | 6.86 | | | | 5.55 | | | | | | | | 1,000.00 | | | | 1,018.10 | | | | 6.89 | | | | 1,019.40 | | | | 5.59 | |

Class K | | | 1,000.00 | | | | 1,010.30 | | | | 2.50 | | | | 1.70 | | | | | | | | 1,000.00 | | | | 1,020.19 | | | | 2.51 | | | | 1,022.49 | | | | 1.71 | |

| | (a) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.80% for Institutional Class, 1.05% for Service Class, 1.07% for Investor A Class, 0.91% for Investor A1 Class, 1.80% for Investor C Class, 1.37% for Investor C1 Class and 0.72% for Class K), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown), except Class K which is multiplied by 126/365 (to reflect the period since inception date of January 25, 2018). | |

| | (b) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.54% for Institutional Class, 0.79% for Service Class, 0.79% for Investor A Class, 0.64% for Investor A1 Class, 1.54% for Investor C Class, 1.11% for Investor C1 Class and 0.49% for Class K), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown), except Class K which is multiplied by 126/365 (to reflect the period since inception date of January 25, 2018). | |

| | (c) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical (c) | |

| | | | | | | | | Including

Interest

Expense

and Fees | | | Excluding

Interest

Expense

and Fees | | | | | | | | | Including

Interest

Expense

and Fees | | | Excluding

Interest

Expense

and Fees | |

BlackRock Strategic Municipal Opportunities Fund | | Beginning

Account Value

(12/01/17) | | | Ending

Account Value

(05/31/18) | | | Expenses

Paid During

the Period (a) | | | Expenses

Paid During

the Period (b) | | | | | | Beginning

Account Value

(12/01/17) | | | Ending

Account Value

(05/31/18) | | | Expenses

Paid During

the Period (a) | | | Ending

Account Value

(05/31/18) | | | Expenses

Paid During

the Period (b) | |

Institutional | | $ | 1,000.00 | | | $ | 1,026.00 | | | $ | 3.89 | | | $ | 2.88 | | | | | | | $ | 1,000.00 | | | $ | 1,021.04 | | | $ | 3.88 | | | $ | 1,022.09 | | | $ | 2.87 | |

Investor A | | | 1,000.00 | | | | 1,024.10 | | | | 4.95 | | | | 3.94 | | | | | | | | 1,000.00 | | | | 1,020.09 | | | | 4.94 | | | | 1,021.04 | | | | 3.93 | |

Investor A1 | | | 1,000.00 | | | | 1,025.70 | | | | 4.29 | | | | 3.23 | | | | | | | | 1,000.00 | | | | 1,020.89 | | | | 4.28 | | | | 1,021.74 | | | | 3.23 | |

Investor C | | | 1,000.00 | | | | 1,021.10 | | | | 8.87 | | | | 7.81 | | | | | | | | 1,000.00 | | | | 1,016.36 | | | | 8.85 | | | | 1,017.20 | | | | 7.80 | |

Class K | | | 1,000.00 | | | | 1,026.30 | | | | 2.38 | | | | 1.75 | | | | | | | | 1,000.00 | | | | 1,020.79 | | | | 2.38 | | | | 1,022.44 | | | | 1.75 | |

| | (a) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.77% for Institutional Class, 0.98% for Investor A Class, 0.85% for Investor A1 Class, 1.76% for Investor C Class and 0.68% for Class K), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown), except Class K which is multiplied by 126/365 (to reflect the period since inception date of January 25, 2018). | |

| | (b) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.57% for Institutional Class, 0.78% for Investor A Class, 0.64% for Investor A1 Class, 1.55% for Investor C Class and 0.50% for Class K), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown), except Class K which is multiplied by 126/365 (to reflect the period since inception date of January 25, 2018). | |

| | (c) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

| | |

| 16 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

The Benefits and Risks of Leveraging

The Funds may utilize leverage to seek to enhance returns and net asset value (“NAV”). However, these objectives cannot be achieved in all interest rate environments.

Each Fund may leverage its assets through the use of proceeds received in tender option bond (“TOB”) transactions, as described in the Notes to Financial Statements. In a TOB Trust transaction, the Funds transfer municipal bonds or other municipal securities into a special purpose entity (a “TOB Trust”). TOB investments generally provide the Funds with economic benefits in periods of declining short-term interest rates, but expose the Funds to risks during periods of rising short-term interest rates. Additionally, fluctuations in the market value of municipal bonds deposited into a TOB Trust may adversely affect the Funds’ NAV per share.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned by each Fund on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of each Fund (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, the Funds’ shareholders benefit from the incremental net income.

The interest earned on securities purchased with the proceeds from leverage is distributed to the Funds’ shareholders, and the value of these portfolio holdings is reflected in the Funds’ per share NAV. However, in order to benefit shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other ongoing costs of leverage exceed a Fund’s return on assets purchased with leverage proceeds, income to shareholders is lower than if the Funds had not used leverage.

Furthermore, the value of each Fund’s portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can also influence the value of portfolio investments. As a result, changes in interest rates can influence each Fund’s NAV positively or negatively in addition to the impact on each Fund’s performance from leverage. Changes in the direction of interest rates are difficult to predict accurately, and there is no assurance that a Fund’s leveraging strategy will be successful.

The use of leverage also generally causes greater changes in each Fund’s NAV and dividend rates than comparable portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the NAV of a Fund’s shares than if the Fund were not leveraged. In addition, each Fund may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of the leverage instruments, which may cause the Fund to incur losses. The use of leverage may limit a Fund’s ability to invest in certain types of securities or use certain types of hedging strategies. Each Fund incurs expenses in connection with the use of leverage, all of which are borne by each Fund’s shareholders and may reduce income.

Derivative Financial Instruments

The Funds may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. The Funds’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Funds’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| | | | |

| THE BENEFITSAND RISKSOF LEVERAGING / DERIVATIVE FINANCIAL INSTRUMENTS | | | 17 | |

| | |

Schedule of Investments May 31, 2018 | | BlackRock California Municipal Opportunities Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

Corporate Bonds — 2.7% | |

|

| Banks — 0.2% | |

Capital One Financial Corp., 3.80%, 01/31/28 | | $ | 3,411 | | | $ | 3,252,827 | |

| | | | | | | | |

| Commercial Services & Supplies — 1.6% | |

The Board of Trustees of The Leland Stanford Junior University, 4.75%, 05/01/19 | | | 20,590 | | | | 20,992,632 | |

Pepperdine University, 3.95%, 12/01/57 | | | 9,385 | | | | 9,378,269 | |

University of Southern California, 3.03%, 10/01/39 | | | 4,500 | | | | 4,073,909 | |

| | | | | | | | |

| | | | | | | 34,444,810 | |

| Consumer Finance — 0.2% | |

American Express Co., 3.40%, 02/27/23 | | | 4,750 | | | | 4,725,589 | |

| | | | | | | | |

| Health Care Providers & Services — 0.6% | |

Kaiser Foundation Hospitals: | | | | | | | | |

3.50%, 04/01/22 | | | 4,880 | | | | 4,933,641 | |

4.15%, 05/01/47 | | | 3,650 | | | | 3,721,441 | |

Sutter Health, 3.70%, 08/15/28 | | | 2,854 | | | | 2,829,964 | |

| | | | | | | | |

| | | | | | | 11,485,046 | |

| Pharmaceuticals — 0.1% | |

CVS Health Corp., 5.05%, 03/25/48 | | | 1,975 | | | | 2,025,529 | |

| | | | | | | | |

Total Corporate Bonds — 2.7%

(Cost — $56,108,742) | | | | 55,933,801 | |

| | | | | | | | |

|

Municipal Bonds — 78.9% | |

|

| California — 78.5% | |

| County/City/Special District/School District — 27.1% | |

Alameda Unified School District-Alameda County, GO, Election of 2014: | | | | | | | | |

Series A, 5.00%, 08/01/39 | | | 1,410 | | | | 1,609,896 | |

Series B, 5.00%, 08/01/42 | | | 6,780 | | | | 7,911,785 | |

Antelope Valley Community College District, GO, Refunding, Election of 2016, Series A, 5.25%, 08/01/42 | | | 26,710 | | | | 31,664,438 | |

Buena Park School District, GO, Election of 2014, 5.00%, 08/01/47 | | | 6,125 | | | | 7,152,775 | |

Butte-Glenn Community College District, GO, Election of 2016, Series A, 5.25%, 08/01/46 | | | 12,360 | | | | 14,724,839 | |

California Infrastructure & Economic Development Bank, RB: | | | | | | | | |

Build America Bonds, 6.49%, 05/15/49 | | | 2,125 | | | | 2,835,706 | |

Goodwill Industry San Joaquin, 5.85%, 09/01/37 | | | 2,910 | | | | 2,831,168 | |

California Municipal Finance Authority, RB, Orange County Civic Center Infrastructure Improvement Program Phase I, Series A, 5.00%, 06/01/42 | | | 11,110 | | | | 12,954,593 | |

Central School District, GO, Refunding, Crossover, 5.00%, 08/01/47 | | | 3,500 | | | | 3,997,665 | |

Central Union High School District-Imperial County, GO, Election of 2016, 5.25%, 08/01/46 | | | 4,240 | | | | 5,037,035 | |

Chaffey Joint Union High School District, GO, Election of 2012, Series C, 5.25%, 08/01/47 | | | 725 | | | | 857,037 | |

City & County of San Francisco California, COP, Series C, AMT, 5.25%, 03/01/33 | | | 140 | | | | 155,784 | |

City & County of San Francisco California Redevelopment Agency, Tax Allocation Bonds, Series D: | | | | | | | | |

Mission Bay South Redevelopment Project, 0.00%, 08/01/23(a)(b) | | | 1,000 | | | | 792,490 | |

Mission Bay South Redevelopment Project, 0.00%, 08/01/31(a)(b) | | | 3,000 | | | | 1,578,510 | |

3.13%, 08/01/28 | | | 1,150 | | | | 1,109,313 | |

3.25%, 08/01/29 | | | 1,000 | | | | 967,150 | |

3.38%, 08/01/30 | | | 1,250 | | | | 1,210,763 | |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

| County/City/Special District/School District (continued) | |

City of Los Angeles California, COP, Senior, Sonnenblick Del Rio West Los Angeles (AMBAC), 6.20%, 11/01/31 | | $ | 4,000 | | | $ | 4,013,960 | |

City of Los Angeles California, Series A, 5.00%, 06/28/18 | | | 86,000 | | | | 86,236,500 | |

City of Martinez California, GO, Election of 2008, Series A, 5.88%, 08/01/19(c) | | | 6,035 | | | | 6,339,104 | |

City of Monrovia, Refunding RB, Taxable, 3.89%, 05/01/33 | | | 4,300 | | | | 4,257,043 | |

City of San Jose California Hotel Tax, RB, Convention Center Expansion & Renovation Project, 6.50%, 05/01/42 | | | 2,395 | | | | 2,690,016 | |

County of Orange California Water District, COP, Refunding, 5.25%, 08/15/19(c) | | | 12,200 | | | | 12,744,974 | |

County of Riverside California Public Financing Authority, RB, Capital Facilities Project, 5.25%, 11/01/45 | | | 11,200 | | | | 12,926,928 | |

County of San Joaquin California Transportation Authority, Refunding RB, Limited Tax, Measure K, Series A(c): | | | | | | | | |

5.50%, 03/01/21 | | | 10,550 | | | | 11,616,183 | |

6.00%, 03/01/21 | | | 2,895 | | | | 3,226,159 | |

County of Santa Clara California, GO, Election of 2008, Series B, 4.00%, 08/01/41 | | | 5,185 | | | | 5,351,231 | |

El Monte City School District, GO, Los Angeles Country, California Series B, 5.50%, 08/01/46 | | | 4,265 | | | | 5,151,395 | |

Evergreen School District, GO, Election of 2014, 5.00%, 08/01/46 | | | 3,300 | | | | 3,905,847 | |

Foothill-De Anza Community College District, GO, Refunding, 4.00%, 08/01/40 | | | 7,900 | | | | 8,373,684 | |

Fresno Unified School District, GO, Election of 2016, Series A, 5.00%, 08/01/41 | | | 7,250 | | | | 8,297,770 | |

Glendale Community College District, GO, Election of 2016, Series A, 5.25%, 08/01/41 | | | 5,900 | | | | 7,092,095 | |

Hacienda La Puente Unified School District, GO, Election 2016, Series A, 5.25%, 08/01/42 | | | 5,000 | | | | 5,961,100 | |

Los Angeles Community College District California, GO: | | | | | | | | |

Build America Bonds, 6.60%, 08/01/42 | | | 2,500 | | | | 3,499,500 | |

Refunding Election of 2008, Series A, 6.00%, 08/01/19(c) | | | 16,250 | | | | 17,092,075 | |

Los Angeles Unified School District, GO, Election of 2008: | | | | | | | | |

Series A, 5.00%, 07/01/40 | | | 10,000 | | | | 11,472,100 | |

Series B-1, 5.00%, 07/01/38 | | | 15,000 | | | | 17,851,650 | |

Series B-1, 5.25%, 07/01/42 | | | 26,825 | | | | 32,210,923 | |

Lucia Mar Unified School District, GO, Election of 2016, Series B, 5.00%, 08/01/42 | | | 1,800 | | | | 2,128,500 | |

Metropolitan Water District of Southern California, Refunding RB, Series A, 5.00%, 10/01/29 | | | 11,985 | | | | 13,321,088 | |

Millbrae School District, GO, Series B-2, 6.00%, 07/01/21(c) | | | 2,585 | | | | 2,914,949 | |

Mountain View-Whisman School District, GO, Election of 2012, Series A, 4.00%, 09/01/42 | | | 12,000 | | | | 12,708,000 | |

Ohlone Community College District, GO, Series C, 4.00%, 08/01/41 | | | 10,715 | | | | 11,286,431 | |

Palmdale Elementary School District, GO: | | | | | | | | |

Election of 2012, Series B, 5.25%, 08/01/42 | | | 2,050 | | | | 2,449,525 | |

Election of 2016, Series A, 5.25%, 08/01/42 | | | 7,695 | | | | 9,194,679 | |

Palomar Community College District, GO, Election of 2006, Series D, 5.25%, 08/01/45 | | | 1,000 | | | | 1,195,780 | |

Peralta Community College District, GO, Election of 2006, Series D, 4.00%, 08/01/39 | | | 7,090 | | | | 7,463,997 | |

Pittsburg Unified School District, GO, Refunding, 4.00%, 08/01/40 | | | 4,925 | | | | 5,173,269 | |