UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-4279 |

|

Securian Funds Trust |

(Exact name of registrant as specified in charter) |

|

400 Robert Street North St. Paul, Minnesota | | 55101-2098 |

(Address of principal executive offices) | | (Zip code) |

|

Eric J. Bentley, Esq. 400 Robert Street North St. Paul, Minnesota 55101-2098 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (651) 665-3500 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2016 | |

| | | | | | | | |

ITEM 1. REPORT TO STOCKHOLDERS.

Filed herewith.

Semi-Annual Report

June 30, 2016

Offered in Minnesota Life Insurance Company and

Securian Life Insurance Company Variable Products

SFT Advantus Bond Fund

SFT Advantus Dynamic Managed Volatility Fund

(formerly SFT Advantus Managed Volatility Fund)

SFT Advantus Government Money Market Fund

(formerly SFT Advantus Money Market Fund)

SFT Advantus Index 400 Mid-Cap Fund

SFT Advantus Index 500 Fund

SFT Advantus International Bond Fund

SFT Advantus Managed Volatility Equity Fund

SFT Advantus Mortgage Securities Fund

SFT Advantus Real Estate Securities Fund

SFT IvySM Growth Fund

SFT IvySM Small Cap Growth Fund

SFT Pyramis® Core Equity Fund

SFT T. Rowe Price Value Fund

Financial security

for the long run ®

Securian Funds Trust

Supplement dated August 1, 2016 to the Prospectus of Securian Funds Trust dated April 29, 2016.

Effective August 1, 2016, Philip J. Sanders will no longer serve as a manager of the SFT IvySM Growth Fund. At that time, Bradley M. Klapmeyer, Vice President of WRIMCO, will become a co-manager of the Fund.

The text on page 49, under the caption "SFT IvySM Growth Fund: Management," is replaced by the following:

SFT IvySM Growth Fund: Management

The Fund is advised by Advantus Capital Management, Inc. (Advantus Capital) and sub-advised by Waddell & Reed Investment Management Company (WRIMCO). 'Ivy' is the service mark of Ivy Distributor, Inc., an affiliate of WRIMCO. The following individuals serve as the Fund's primary portfolio managers:

Name and Title | | Primary Manager Since | |

Daniel P. Becker,

Senior Vice President, WRIMCO | | May 1, 2014 | |

Bradley M. Klapmeyer

Vice President, WRIMCO | | August 1, 2016 | |

The text relating to SFT IvySM Growth Fund on page 115, under the caption "Portfolio Managers," is replaced by the following:

Portfolio Managers

Fund | | Portfolio Manager

and Title | | Primary Portfolio

Manager Since | | Business Experience During

Past Five Years | |

SFT IvySM

Growth

Fund

| | Daniel P. Becker

Senior Vice President,

WRIMCO

| | May 1, 2014

| | Portfolio Manager, Ivy Funds VIP Growth

(formerly W& R Target Funds Growth Portfolio)

since January 1997. Portfolio Manager,

Waddell & Reed Investment Advisors Vanguard

Fund since July 1997; Portfolio Manager, Ivy

Large Cap Growth Fund since June 2000;

Co-portfolio manager of the large cap growth

product suite since July 2006, comprising

institutional accounts, Waddell & Reed

Advisors Vanguard Fund, Ivy Large Cap Growth

Fund and Ivy Funds VIP Growth. | |

| | | Bradley M. Klapmeyer

Vice President,

WRIMCO

| | August 1, 2016

| | Investment Analyst with WRIMCO beginning

in 2007; joined the Large Cap Growth team as

Assistant Portfolio Manager in 2011; Portfolio

Manager of Waddell & Reed Advisors

Tax-Managed Equity Fund and Ivy

Tax-Managed Equity Fund since 2014. | |

Please retain this supplement for future reference.

F86854 08-2016

Securian Funds Trust

Supplement dated August 15, 2016 to the Prospectus of Securian Funds Trust dated April 29, 2016.

The table and expense example on pages 31 and 32, under the caption "SFT Advantus Managed Volatility Equity Fund: Fees and Expenses," are replaced by the following:

Shareholder Fees

(fees paid directly from your investment) | |

Not Applicable | | | | | |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment) | |

Management Fees | | | 0.65 | % | |

Distribution (12b-1) Fees | | | 0.25 | % | |

Other Expenses(1) | | | 1.38 | % | |

Acquired Fund Fees and Expenses(2) | | | 0.18 | % | |

| Total Annual Fund Operating Expenses | | | 2.46 | % | |

| Fee Waiver and/or Expense Reimbursement(3) | | | 1.48 | % | |

Total Annual Fund Operating Expenses After

Fee Waiver and/or Expense Reimbursement | | | 0.98 | % | |

(1) Estimated expenses for the Fund's first fiscal year.

(2) Because Acquired Fund Fees and Expenses are not included in the Fund's Financial Highlights, the Fund's total annual fund operating expenses do not correlate to the ratios of expenses to average net assets shown in the Financial Highlights table.

(3) Advantus Capital Management, Inc. ("Advantus Capital"), the Fund's investment adviser, has contractually agreed, through April 30, 2017, to waive its "management fees" or absorb "other expenses" such that the Fund's total annual operating expenses after such fee waiver and/or expense absorption, excluding "acquired fund fees and expenses," will not exceed 0.80% of the average net assets of the Fund. This fee waiver and/or expense absorption renews annually for a full year unless terminated by Advantus Capital upon at least 30 days' notice prior to the end of the contract term.

Expense Example. This example is intended to help you compare the costs of investing in the Fund with the cost of investing in other funds.

The example assumes an investment of $10,000 in the Fund for the time periods indicated and then redemption of all shares at the end of those periods. The example also assumes that the investment has a 5% return each year and the Fund's operating expenses remain the same. The example further assumes that the fee waiver and/or expense reimbursement described above is in effect for only one year. The example does not reflect the other fees and expenses related to a variable life insurance policy, variable annuity contract or qualified plan that invests in the Fund. If these other fees and expenses were included, the expenses shown in the example below would be higher. Although actual costs may be higher or lower, based on these assumptions, costs would be:

Please retain this supplement for future reference.

F87802 08-2016

TABLE OF CONTENTS

| | | Page No. | |

Fund Reviews | |

SFT Advantus Bond Fund | | | 1 | | |

SFT Advantus Dynamic Managed Volatility Fund (formerly SFT Advantus Managed Volatility Fund) | | | 2 | | |

SFT Advantus Government Money Market Fund (formerly SFT Advantus Money Market Fund) | | | 3 | | |

SFT Advantus Index 400 Mid-Cap Fund | | | 4 | | |

SFT Advantus Index 500 Fund | | | 5 | | |

SFT Advantus International Bond Fund | | | 6 | | |

SFT Advantus Managed Volatility Equity Fund | | | 7 | | |

SFT Advantus Mortgage Securities Fund | | | 8 | | |

SFT Advantus Real Estate Securities Fund | | | 9 | | |

SFT IvySM Growth Fund | | | 10 | | |

SFT IvySM Small Cap Growth Fund | | | 11 | | |

SFT Pyramis® Core Equity Fund | | | 12 | | |

SFT T. Rowe Price Value Fund | | | 13 | | |

Investments In Securities | |

SFT Advantus Bond Fund | | | 14 | | |

SFT Advantus Dynamic Managed Volatility Fund (formerly SFT Advantus Managed Volatility Fund) | | | 20 | | |

SFT Advantus Government Money Market Fund (formerly SFT Advantus Money Market Fund) | | | 25 | | |

SFT Advantus Index 400 Mid-Cap Fund | | | 26 | | |

SFT Advantus Index 500 Fund | | | 32 | | |

SFT Advantus International Bond Fund | | | 39 | | |

SFT Advantus Managed Volatility Equity Fund | | | 49 | | |

SFT Advantus Mortgage Securities Fund | | | 50 | | |

SFT Advantus Real Estate Securities Fund | | | 54 | | |

SFT IvySM Growth Fund | | | 55 | | |

SFT IvySM Small Cap Growth Fund | | | 57 | | |

SFT Pyramis® Core Equity Fund | | | 59 | | |

SFT T. Rowe Price Value Fund | | | 61 | | |

Financial Statements | |

Statements of Assets and Liabilities | | | 64 | | |

Statements of Operations | | | 66 | | |

Statements of Changes in Net Assets | | | 68 | | |

Financial Highlights | | | 73 | | |

Notes to Financial Statements | | | 86 | | |

Fund Expense Examples | | | 101 | | |

Proxy Voting and Quarterly Holdings Information | | | 102 | | |

Statement Regarding Basis for Approval of Advisory Contracts | | | 104 | | |

Trustees and Executive Officers | | | 107 | | |

SFT Advantus Bond Fund

Fund Objective

The SFT Advantus Bond Fund seeks as high a level of long-term total return as is consistent with prudent investment risk. Preservation of capital is a secondary objective. The SFT Advantus Bond Fund invests in long-term, fixed income, high quality debt instruments. The risks incurred by investing in debt instruments include, but are not limited to, reinvestment of prepaid debt obligations at lower rates of return, and the inability to reinvest at higher interest rates when debt obligations are prepaid more slowly than expected. In addition, the net asset value of the SFT Advantus Bond Fund may fluctuate in response to changes in interest rates and is not guaranteed.

Performance Update

The Fund's performance for the six-month period ended June 30, 2016, for each class of shares offered was as follows:

Class 1 | | | 5.47 percent* | | |

Class 2 | | | 5.34 percent* | | |

The Fund's benchmark, the Barclays U.S. Aggregate Bond Index, returned 5.31 percent for the same period.

Sector Diversification (shown as a percentage of net assets)

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The Barclays U.S. Aggregate Bond Index is an unmanaged benchmark composite representing average market-weighted performance of U.S. Treasury and agency securities, investment-grade corporate bonds and mortgage-backed securities with maturities greater than one year.

1

SFT Advantus Dynamic Managed Volatility Fund

(formerly SFT Advantus Managed Volatility Fund)

Fund Objective

The SFT Advantus Dynamic Managed Volatility Fund seeks to maximize risk adjusted total return relative to its blended benchmark index comprised of 60 percent S&P 500 Index and 40 percent Barclays U.S. Aggregate Bond Index (collectively, the Blended Benchmark Index). The Fund's prior blended benchmark index was comprised of 60 percent S&P 500 Index and 40 percent Barclays U.S. Corporate Index.

The SFT Advantus Dynamic Managed Volatility Fund invests primarily in Class 1 shares of SFT Advantus Index 500 Fund for equity exposure, in a basket of fixed income securities for fixed income exposure and certain derivative instruments. The Fund is subject to risks associated with such investments as described in detail in the prospectus. The net asset value of the Fund will fluctuate and is not guaranteed. It is possible to lose money by investing in the Fund. There is no assurance that efforts to manage Fund volatility will achieve the desired results.

Performance Update

For the six month period ended June 30, 2016, the Fund had a net return of 4.05 percent*. This return reflects the waiver, reimbursement or payment of certain of the Fund's expenses by its investment advisor.** The current Blended Benchmark Index returned 4.52 percent over the same period. The Fund's prior blended benchmark index returned 5.43 percent over the same period.

Sector Diversification (shown as a percentage of net assets)

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

**Advantus Capital Management Inc. (Advantus Capital) and the Securian Funds Trust, on behalf of the SFT Advantus Dynamic Managed Volatility Fund (the "Fund"), have entered into an Expense Limitation Agreement, dated May 1, 2013, which limits the operating expenses of the Fund, excluding certain expenses (such as interest expense, acquired fund fees, cash overdraft fees, taxes, brokerage commissions, other expenditures which are capitalized in accordance with the generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the Fund's business), to 0.80% of the Fund's average daily net assets through April 30, 2017. The Agreement renews annually for a full year each year thereafter unless terminated by Advantus Capital upon at least 30 days' notice prior to the end of a contract term. The Fund is authorized to reimburse Advantus Capital for management fees previously waived and/or for the cost of expenses previously paid by Advantus Capital pursuant to this agreement, provided that such reimbursement will not cause the Fund to exceed any limits in effect at the time of such reimbursement. The Fund's ability to reimburse Advantus Capital in this manner only applies to fees waived or reimbursements made by Advantus Capital within the three fiscal years prior to the date of such reimbursement. As of June 30, 2016 Advantus Capital has waived $1,070,170 pursuant to the agreement, of which $1,047,142 was eligible for recovery as of such date. To the extent that the Fund makes such reimbursements to Advantus Capital, the amount of the reimbursements will be reflected in the financial statements in the Fund's shareholder reports and in Other Expenses under Fees and Expenses of the Fund.

The Blended Benchmark Index is comprised of 60 percent of the S&P 500 Index and 40 percent of the Barclays U.S. Aggregate Bond Index.

The S&P 500 Index is a broad, unmanaged index of 500 common stocks which are representative of the U.S. stock market overall. The Barclays U.S. Aggregate Bond Index is an unmanaged benchmark composite representing average market-weighted performance of U.S. Treasury and agency securities, investment-grade corporate bonds and mortgage-backed securities with maturities greater than one year.

2

SFT Advantus Government Money Market Fund

(formerly SFT Advantus Money Market Fund)

Fund Objective

The SFT Advantus Government Money Market Fund seeks maximum current income to the extent consistent with liquidity and the preservation of capital. The Fund invests at least 99.5% of its total assets in cash, government securities, and/or repurchase agreements that are collateralized fully (i.e., collateralized by cash or government securities).

Investment in the SFT Advantus Government Money Market Fund is neither insured nor guaranteed by the U.S. Government, and there can be no assurance that the Fund will be able to maintain a stable net asset value of $1.00 per share. It is possible to lose money by investing in the Fund.

Performance Update

For the six month period ended June 30, 2016, the Fund had a net return of 0.00 percent*. This return reflects the waiver, reimbursement or payment of certain of the Fund's expenses by its investment advisor and principal underwriter.† The Fund's benchmark, the U.S. Treasury bill, returned 0.16 percent for the same period.

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Investment in the SFT Advantus Government Money Market Fund is neither insured nor guaranteed by the U.S. Government or any other agency, and there can be no assurance that the Fund will be able to maintain a stable net asset value of $1.00 per share. Shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

† Effective May 1, 2012, the Board of Trustees of Securian Funds Trust approved a Restated Net Investment Income Maintenance Agreement among Securian Funds Trust (on behalf of SFT Advantus Government Money Market Fund), Advantus Capital and Securian Financial Services, Inc. (Securian Financial). A similar agreement was previously approved by the Board of Directors of Advantus Series Fund, Inc., the Trust's predecessor, effective October 29, 2009. Under such Agreement, Advantus Capital agrees to waive, reimburse or pay SFT Advantus Government Money Market Fund expenses so that the Fund's daily net investment income does not fall below zero. Securian Financial may also waive its Rule 12b-1 fees. Advantus Capital and Securian Financial each has the option under the Agreement to recover the full amount waived, reimbursed or paid (the "Expense Waiver") on any day on which the Fund's net investment income exceeds zero. On any day, however, the Expense Waiver does not constitute an obligation of the Fund unless Advantus Capital or Securian Financial has expressly exercised its right to recover a specified portion of the Expense Waiver on that day, in which case such specified portion is then due and payable by the Fund. In addition, the right of Advantus Capital and/or Securian Financial to recover the Expense Waiver is subject to the following limitations: (1) if a repayment of the Expense Waiver by the Fund would cause the Fund's net investment income to fall below zero, such repayment is deferred until a date when repayment would not cause the Fund's net investment income to fall below zero; (2) the right to recover any portion of the Expense Waiver expires three years after the effective date of that portion of the Expense Waiver; and (3) any repayment of the Expense Waiver by the Fund cannot cause the Fund's expense ratio to exceed 1.25%. As of June 30, 2016, Advantus Capital and Securian Financial have collectively waived $4,331,315 pursuant to the Agreement, including expenses waived under the prior agreement with Advantus Series Fund, Inc., of which $1,856,196 was eligible for recovery as of such date. If Advantus Capital and Securian Financial exercise their rights to be paid such waived amounts, the Fund's future yield will be negatively affected for an indefinite period. The Agreement shall continue in effect following April 30, 2017, provided such continuance is specifically approved by Advantus Capital, Securian Financial, and a majority of the Trust's independent Trustees.

The Barclays U.S. Three Month Treasury Bellwether Index is a market value-weighted index of investment-grade fixed-rate public obligations of the U.S. Treasury with maturities of three months, excluding zero coupons.

3

SFT Advantus Index 400 Mid-Cap Fund

Fund Objective

The SFT Advantus Index 400 Mid-Cap Fund seeks to provide investment results generally corresponding to the aggregate price and dividend performance of publicly traded common stocks that comprise the Standard & Poor's MidCap 400 Index (S&P 400). It is designed to provide an economical and convenient means of maintaining a diversified portfolio in this equity security area as part of an over-all investment strategy. The risks incurred by investing in the SFT Advantus Index 400 Mid-Cap Fund include, but are not limited to, the risk that the Fund may not be able to replicate the performance of the S&P 400, and the risk of declines in the market for mid-cap stocks or in the equity markets generally.

Performance Update

The Fund's performance for the six-month period ended June 30, 2016, for each class of shares offered was as follows:

Class 1 | | | 7.79 percent* | | |

Class 2 | | | 7.66 percent* | | |

The Fund's benchmark, the Standard and Poor's MidCap 400 Index, returned 7.93 percent for the same period.

Sector Diversification (shown as a percentage of net assets)

"Standard & Poor's®", "S&P®", "Standard & Poor's MidCap 400" and "S&P MidCap 400" are trademarks of the McGraw-Hill Companies, Inc. and have been licensed for use by the Securian Funds Trust—Advantus Index 400 Mid-Cap Fund. The Fund is not sponsored, endorsed, sold or promoted by Standard & Poor's and Standard & Poor's makes no representation regarding the advisability of investing in the Fund.

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

S&P MidCap 400 Index consists of 400 domestic stocks chosen for market size (median market capitalization of about $3.4 billion), liquidity and industry group representation. It is a market-weighted index (stock price times shares outstanding), with each stock affecting the index in proportion to its market value.

4

SFT Advantus Index 500 Fund

Fund Objective

The SFT Advantus Index 500 Fund seeks investment results that correspond generally to the price and yield performance of the common stocks included in the Standard and Poor's 500 Index (S&P 500). It is designed to provide an economical and convenient means of maintaining a broad position in the equity market as part of an overall investment strategy. The risks incurred by investing in the SFT Advantus Index 500 Fund include, but are not limited to, the risk that the Fund may not be able to replicate the performance of the S&P 500, and the risk of declines in the equity markets generally.

Performance Update

The Fund's performance for the six-month period ended June 30, 2016, for each class of shares offered was as follows:

Class 1 | | | 3.72 percent* | | |

Class 2 | | | 3.60 percent* | | |

The Fund's benchmark, the Standard & Poor's 500 Index, returned 3.84 percent for the same period.

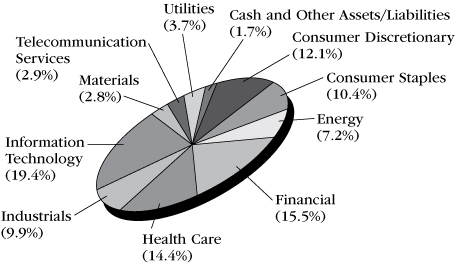

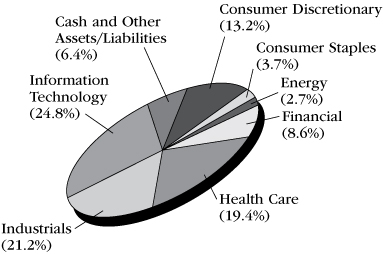

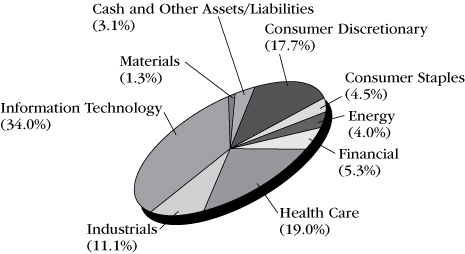

Sector Diversification (shown as a percentage of net assets)

"Standard & Poor's®", "S&P®", "Standard & Poor's 500" and "S&P 500" are trademarks of the McGraw-Hill Companies, Inc. and have been licensed for use by Securian Funds Trust—Advantus Index 500 Fund. The Fund is not sponsored, endorsed, sold or promoted by Standard & Poor's and Standard & Poor's makes no representation regarding the advisability of investing in the Fund.

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The S&P 500 Index is a broad, unmanaged index of 500 common stocks which are representative of the U.S. stock market overall.

5

SFT Advantus International Bond Fund

Fund Objective

The SFT Advantus International Bond Fund seeks to maximize current income consistent with protection of principal. The Fund pursues its objective by investing primarily in debt securities issued by issuers located anywhere in the world. While Advantus Capital Management, Inc. acts as the investment adviser for the Fund, Franklin Advisers, Inc. provides investment advice to the SFT Advantus International Bond Fund under a sub-advisory agreement. Investment risks associated with international investing in addition to other risks include currency fluctuations, political and economic instability, and differences in accounting standards when investing in foreign markets.

Performance Update

The Fund's performance for the six-month period ended June 30, 2016, for each class of shares offered was as follows:

Class 1 | | | (1.42) percent* | | |

Class 2 | | | (1.54) percent* | | |

The Fund's benchmark, the Citigroup World Government Bond Index, returned 10.74 percent for the same period.

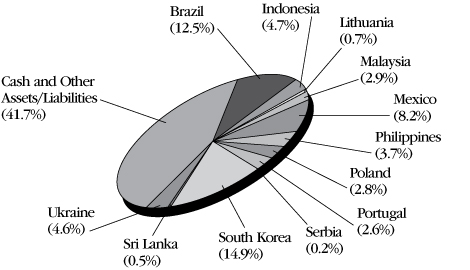

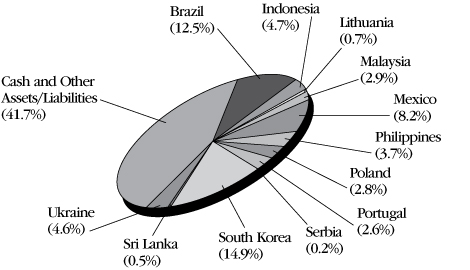

Country Diversification (shown as a percentage of net assets)

Currency Diversification (shown as a percentage of net assets)

Americas | | | 145.56 | % | |

United States Dollar (USD) | | | 106.58 | % | |

Mexican Peso (MXN) | | | 21.04 | % | |

Brazilian Real (BRL) | | | 12.81 | % | |

Chilean Peso (CLP) | | | 5.13 | % | |

Asia Pacific | | | -7.65 | % | |

Republic of Korea Won (KRW) | | | 0.10 | % | |

Malaysian Ringgit (MYR) | | | 14.36 | % | |

Indonesian Rupiah (IDR) | | | 8.18 | % | |

Indian Rupee (INR) | | | 5.47 | % | |

Philippine Peso (PHP) | | | 4.77 | % | |

Sri Lankan Rupee (LKR) | | | 0.59 | % | |

Australian Dollar (AUD)* | | | -8.82 | % | |

Japanese Yen (JPY)* | | | -32.30 | % | |

Europe* | | | -37.89 | % | |

Polish Zloty (PLN) | | | 2.90 | % | |

Euro (EUR)* | | | -40.79 | % | |

*A negative figure reflects net "short" exposure, designed to benefit if the value of the associated currency decreases. Conversely, the Fund's value would potentially decline if the value of the associated currency increases.

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The Citigroup World Government Bond Index is a market capitalization weighted index consisting of the government bond markets from over twenty countries. Country eligibility is determined based upon market capitalization and investability criteria. The index includes all fixed-rate bonds with a remaining maturity of one year or longer and with amounts outstanding of at least the equivalent of U.S. $25 million. Government securities typically exclude floating or variable rate bonds, U.S./Canadian savings bonds and private placements. Each bond must have a minimum rating of BBB-/Baa3 by S&P or Moody's.

6

SFT Advantus Managed Volatility Equity Fund

Fund Objective

The SFT Advantus Managed Volatility Equity Fund seeks to maximize risk-adjusted total return relative to its blended benchmark index, comprised of 60% S&P 500® Low Volatility Index, 20% S&P BMI International Developed Low Volatility Index and 20% Barclays U.S. 3 Month Treasury Bellwether Index (collectively, the Blended Benchmark Index).

Performance Update

For the six-month period ended June 30, 2016, the Fund had a net return of 5.22 percent*. This return reflects the waiver, reimbursement or payment of certain of the Fund's expenses by its investment advisor.** The Blended Benchmark Index returned 8.44 percent over the same period.

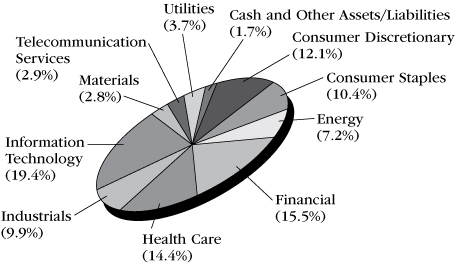

Sector Diversification (shown as a percentage of net assets)

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

**Advantus Capital Management Inc. (Advantus Capital) and the Securian Funds Trust, on behalf of the SFT Advantus Managed Volatility Equity Fund (the "Fund"), have entered into an Expense Limitation Agreement, dated November 18, 2015, which limits the operating expenses of the Fund, excluding certain expenses (such as interest expense, acquired fund fees, cash overdraft fees, taxes, brokerage commissions, other expenditures which are capitalized in accordance with the generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the Fund's business), to 0.80% of the Fund's average daily net assets through November 17, 2016. The Agreement renews annually for a full year each year thereafter unless terminated by Advantus Capital upon at least 30 days' notice prior to the end of a contract term. The Fund is authorized to reimburse Advantus Capital for management fees previously waived and/or for the cost of expenses previously paid by Advantus Capital pursuant to this agreement, provided that such reimbursement will not cause the Fund to exceed any limits in effect at the time of such reimbursement. The Fund's ability to reimburse Advantus Capital in this manner only applies to fees waived or reimbursements made by Advantus Capital within the three fiscal years prior to the date of such reimbursement. As of June 30, 2016, Advantus Capital has waived $171,087 pursuant to the agreement. To the extent that the Fund makes such reimbursements to Advantus Capital, the amount of the reimbursements will be reflected in the financial statements in the Fund's shareholder reports and in Other Expenses under Fees and Expenses of the Fund. The Blended Benchmark Index is comprised of 60 percent of the S&P 500 Low Volatility Index, 20% S&P BMI International Developed Low Volatility Index and 20% Barclays U.S. 3 Month Treasury Bellwether Index. The S&P 500 Low Volatility Index measures performance of the 100 least volatile stocks in the S&P 500. The S&P BMI International Developed Low Volatility Index measures the performance of the 200 least volatile stocks in the S&P Developed Market large/midcap universe. Constituents are weighted relative to the inverse of their corresponding volatility, with the least volatile stocks receiving the highest weights. The Barclays U.S. 3 Month Treasury Bellwethers Index tracks the market for the on-the-run 3 month Treasury bill issued by the U.S. government.

7

SFT Advantus Mortgage Securities Fund

Fund Objective

The SFT Advantus Mortgage Securities Fund seeks a high level of current income consistent with prudent investment risk. The SFT Advantus Mortgage Securities Fund will invest primarily in mortgage-related securities. The risks incurred by investing in mortgage-related securities include, but are not limited to, reinvestment of prepaid loans at low rates of return, and the inability to reinvest at higher interest rates when mortgages are prepaid more slowly than expected. In addition, the net asset value of the SFT Advantus Mortgage Securities Fund may fluctuate in response to changes in interest rates and is not guaranteed.

Performance Update

The Fund's performance for the six-month period ended June 30, 2016, for each class of shares offered was as follows:

Class 1 | | | 3.10 percent* | | |

Class 2 | | | 2.97 percent* | | |

The Fund's benchmark, the Barclays U.S. Mortgage-Backed Securities Index, returned 3.10 percent for the same period.

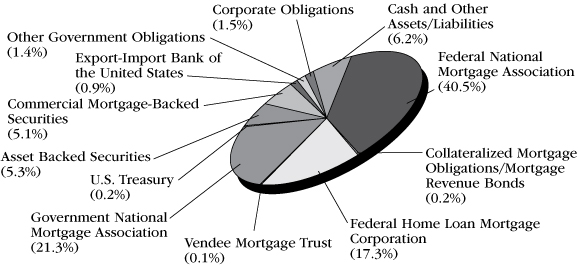

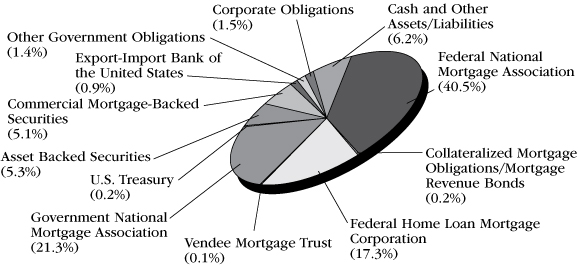

Sector Diversification (shown as a percentage of net assets)

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The Barclays U.S. Mortgage-Backed Securities Index is an unmanaged benchmark composite which includes all fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal Home Loan Mortgage Corporation (FHLMC) and Federal National Mortgage Association (FNMA).

8

SFT Advantus Real Estate Securities Fund

Fund Objective

The SFT Advantus Real Estate Securities Fund seeks above-average income and long-term growth of capital. The Fund intends to pursue its objective by investing primarily in equity securities of companies in the real estate industry. Investment risks associated with investing in the SFT Advantus Real Estate Securities Fund, in addition to other risks, include rental income fluctuations, depreciation, property tax value changes, and differences in real estate market value.

Performance Update

The Fund's performance for the six-month period ended June 30, 2016, for each class of shares offered was as follows:

Class 1 | | | 11.10 percent* | | |

Class 2 | | | 10.96 percent* | | |

The Fund's benchmark, the Wilshire US Real Estate Securities Index, returned 11.60 percent for the same period.

Sector Diversification (shown as a percentage of net assets)

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The Wilshire US Real Estate Securities Index is a market capitalization-weighted index of equity securities whose primary business is equity ownership of commercial real estate (REITs).

9

SFT IvySM Growth Fund

Fund Objective

The SFT IvySM Growth Fund seeks to provide growth of capital. The Fund pursues its objective by investing primarily in a diversified portfolio of common stocks issued by large capitalization companies. While Advantus Capital Management, Inc. acts as the investment adviser for the Fund, Waddell & Reed Investment Management Company (WRIMCO) provides investment advice to the Fund under a sub-advisory agreement. The risks incurred by investing in the Fund include, but are not limited to, the risk of declines in the market for large cap stocks or in the equity markets generally.

Performance Update

For the six month period ended June 30, 2016, the Fund had a net return of (4.10) percent*. The Fund's benchmark, the Russell 1000 Growth Index, returned 1.36 percent for the same period.

Sector Diversification (shown as a percentage of net assets)

'Ivy' is the registered service mark of Ivy Funds Distributor, Inc., an affiliate of the Waddell & Reed Investment Management Company, the Fund's sub-adviser.

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The Russell 1000 Growth Index is an unmanaged index that measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. The index measures the performance of the 1,000 largest companies in the Russel 3000 Index, which measures the performance of the 3,000 largest U.S. companies based on total market capitalization.

10

SFT IvySM Small Cap Growth Fund

Fund Objective

The SFT IvySM Small Cap Growth Fund seeks to provide growth of capital. The Fund pursues its objective by investing primarily in a diversified portfolio of common stocks issued by small capitalization companies. While Advantus Capital Management, Inc. acts as the investment adviser for the Fund, Waddell & Reed Investment Management Company (WRIMCO) provides investment advice to the Fund under a sub-advisory agreement. The risks incurred by investing in the Fund include, but are not limited to, the risk of declines in the market for small cap stocks or in the equity markets generally.

Performance Update

For the six month period ended June 30, 2016, the Fund had a net return of 10.24 percent*. The Fund's benchmark, the Russell 2000 Growth Index, returned 6.30 percent for the same period.

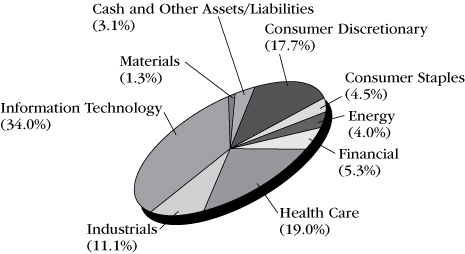

Sector Diversification (shown as a percentage of net assets)

'Ivy' is the registered service mark of Ivy Funds Distributor, Inc., an affiliate of the Waddell & Reed Investment Management Company, the Fund's sub-adviser.

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The Russell 2000 Growth Index is an unmanaged index of those Russell 2000 Index growth companies with higher price-to-book ratios and higher forecasted growth values. The index is broad-based, comprised of 2,000 of the smallest U.S.-domiciled company common stocks based on total market capitalization.

11

SFT Pyramis® Core Equity Fund

Fund Objective

The SFT Pyramis® Core Equity Fund seeks long-term capital appreciation. The Fund pursues its objective by investing primarily in a diversified portfolio of common stocks. While Advantus Capital Management, Inc. acts as the investment adviser for the Fund, Pyramis Global Advisors, LLC (Pyramis) provides investment advice to the Fund under a sub-advisory agreement. Risks associated with investing in the Fund include, but are not limited to, issuer-specific market volatility and risk of declines in the equity markets generally.

Performance Update

The Fund's performance for the six month period ended June 30, 2016, for each class of shares offered was as follows:

Class 1 | | | (0.68) percent* | | |

Class 2 | | | (0.81) percent* | | |

The Fund's benchmark, the Standard & Poor's 500 Index, returned 3.84 percent for the same period.

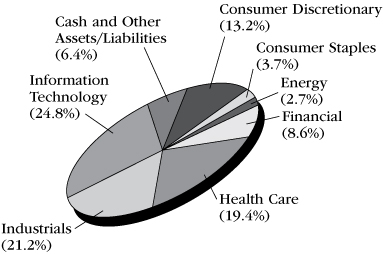

Sector Diversification (shown as a percentage of net assets)

'Pyramis' is a registered trademark of FMR LLC. Used with permission.

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The S&P 500 Index is a broad, unmanaged index of 500 common stocks which are representative of the U.S. stock market overall.

12

SFT T. Rowe Price Value Fund

Fund Objective

The SFT T. Rowe Price Value Fund seeks to provide long-term capital appreciation by investing in common stocks believed to be undervalued. Income is a secondary objective. The Fund pursues its objective by taking a value approach to investment selection. Holdings consist primarily of large cap stocks, but may also include stocks of mid-cap and small-cap companies. While Advantus Capital Management, Inc. acts as the investment adviser for the Fund, T. Rowe Price Associates, Inc. (T. Rowe Price) provides investment advice to the Fund under a sub-advisory agreement. The Fund's value approach to investing carries the risk that the market will not recognize a security's intrinsic value for a long time or that a stock judged to be undervalued may actually be appropriately priced at a low level.

Performance Update

For the period ended June 30, 2016, the Fund had a net return of 1.99 percent*. The Fund's benchmark, the Standard & Poor's 500 Index, returned 3.84 percent for the same period.

Sector Diversification (shown as a percentage of net assets)

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The S&P 500 Index is a broad, unmanaged index of 500 common stocks which are representative of the U.S. stock market overall.

13

SFT Advantus Bond Fund

Investments in Securities

(Percentages of each investment category relate to total net assets)

| | | Principal | | Value(a) | |

Long-Term Debt Securities (98.5%) | |

Government Obligations (46.0%) | |

Other Government Obligations (2.0%) | |

Provincial or Local Government

Obligations (2.0%) | |

County of Sarasota FL,

7.016%, 10/01/40 | | $ | 515,000 | | | $ | 609,925 | | |

Douglas County Public

Utility District No. 1,

5.450%, 09/01/40 | | | 1,185,000 | | | | 1,497,331 | | |

Port Authority of

New York & New Jersey, | |

4.458%, 10/01/62 | | | 1,150,000 | | | | 1,311,667 | | |

4.926%, 10/01/51 | | | 3,055,000 | | | | 3,885,868 | | |

| | | | | | 7,304,791 | | |

U.S. Government Agencies and

Obligations (44.0%) | |

Export-Import Bank of the

United States (1.1%) | |

Helios Leasing I LLC,

2.018%, 05/29/24 | | | 679,028 | | | | 690,758 | | |

Tagua Leasing LLC, | |

1.732%, 09/18/24 | | | 710,943 | | | | 714,618 | | |

1.900%, 07/12/24 | | | 611,946 | | | | 619,651 | | |

Ulani MSN 37894,

2.184%, 12/20/24 | | | 1,603,913 | | | | 1,642,263 | | |

Union 13 Leasing LLC,

1.870%, 06/28/24 | | | 540,094 | | | | 546,120 | | |

| | | | | | 4,213,410 | | |

Federal Home Loan Mortgage Corporation

(FHLMC) (8.1%) | |

2.103%, 08/25/24 (b) | | | 293,851 | | | | 294,522 | | |

2.500%, 03/01/28 | | | 666,433 | | | | 692,202 | | |

2.653%, 09/25/24 (b) | | | 2,000,000 | | | | 2,000,786 | | |

3.000%, 08/01/42 | | | 655,688 | | | | 687,008 | | |

3.000%, 04/01/43 | | | 1,172,645 | | | | 1,227,869 | | |

3.000%, 07/01/45 | | | 948,909 | | | | 984,650 | | |

3.500%, 10/01/25 | | | 320,599 | | | | 343,359 | | |

3.500%, 08/01/42 | | | 698,427 | | | | 746,341 | | |

3.500%, 05/25/45 | | | 1,499,899 | | | | 1,548,674 | | |

3.500%, 03/01/46 | | | 1,955,548 | | | | 2,065,865 | | |

4.000%, 02/01/20 | | | 575,519 | | | | 595,714 | | |

4.000%, 09/01/40 | | | 630,324 | | | | 687,969 | | |

4.000%, 10/01/40 | | | 664,565 | | | | 717,514 | | |

4.000%, 11/01/40 | | | 2,388,851 | | | | 2,617,455 | | |

4.000%, 02/01/41 | | | 530,505 | | | | 577,774 | | |

4.000%, 08/01/41 | | | 712,516 | | | | 772,350 | | |

4.000%, 07/01/42 | | | 640,843 | | | | 688,677 | | |

4.500%, 01/01/41 | | | 830,140 | | | | 908,457 | | |

4.500%, 02/01/41 | | | 672,662 | | | | 740,063 | | |

4.500%, 03/01/41 | | | 819,662 | | | | 899,205 | | |

4.500%, 04/01/41 | | | 926,619 | | | | 1,031,283 | | |

5.000%, 04/01/35 | | | 144,613 | | | | 159,600 | | |

5.000%, 08/01/35 | | | 60,198 | | | | 66,886 | | |

5.000%, 11/01/35 | | | 153,666 | | | | 170,130 | | |

5.000%, 11/01/39 | | | 518,604 | | | | 580,427 | | |

5.000%, 03/01/40 | | | 2,766,569 | | | | 3,118,536 | | |

5.000%, 04/01/40 | | | 469,983 | | | | 522,934 | | |

5.000%, 08/01/40 | | | 286,273 | | | | 317,443 | | |

| | | Principal | | Value(a) | |

5.500%, 12/01/17 | | $ | 20,397 | | | $ | 20,771 | | |

5.500%, 06/01/20 | | | 60,823 | | | | 63,915 | | |

5.500%, 10/01/20 | | | 124,231 | | | | 132,364 | | |

5.500%, 11/01/23 | | | 141,946 | | | | 158,028 | | |

5.500%, 05/01/34 | | | 968,960 | | | | 1,115,134 | | |

5.500%, 10/01/34 | | | 395,944 | | | | 451,098 | | |

5.500%, 07/01/35 | | | 450,637 | | | | 508,432 | | |

5.500%, 10/01/35 | | | 465,876 | | | | 531,245 | | |

5.500%, 12/01/38 | | | 331,865 | | | | 375,758 | | |

6.000%, 11/01/33 | | | 367,476 | | | | 424,055 | | |

6.500%, 09/01/32 | | | 72,266 | | | | 85,927 | | |

6.500%, 06/01/36 | | | 379,355 | | | | 453,871 | | |

7.000%, 12/01/37 | | | 123,439 | | | | 136,480 | | |

| | | | | | 30,220,771 | | |

Federal National Mortgage Association

(FNMA) (16.3%) | |

1.403%, 05/25/24 (b) | | | 402,676 | | | | 400,827 | | |

2.500%, 11/01/27 | | | 628,188 | | | | 647,909 | | |

2.500%, 07/01/28 | | | 762,387 | | | | 798,054 | | |

2.500%, 07/01/31 (c) | | | 340,000 | | | | 351,760 | | |

3.000%, 06/01/22 | | | 354,257 | | | | 371,828 | | |

3.000%, 11/01/27 | | | 129,919 | | | | 136,417 | | |

3.000%, 07/01/31 (c) | | | 2,380,000 | | | | 2,495,095 | | |

3.000%, 03/01/42 | | | 638,503 | | | | 663,759 | | |

3.000%, 04/01/43 | | | 764,165 | | | | 794,662 | | |

3.000%, 05/01/43 | | | 1,543,049 | | | | 1,604,691 | | |

3.000%, 06/01/43 | | | 380,410 | | | | 395,642 | | |

3.000%, 09/01/43 | | | 1,301,750 | | | | 1,353,671 | | |

3.000%, 07/01/46 (c) | | | 2,000,000 | | | | 2,075,546 | | |

3.500%, 11/01/25 | | | 421,764 | | | | 449,847 | | |

3.500%, 01/01/26 | | | 414,612 | | | | 442,149 | | |

3.500%, 11/01/40 | | | 557,059 | | | | 596,570 | | |

3.500%, 01/01/41 | | | 518,301 | | | | 554,189 | | |

3.500%, 02/01/41 | | | 333,253 | | | | 358,474 | | |

3.500%, 04/01/41 | | | 573,345 | | | | 613,125 | | |

3.500%, 11/01/41 | | | 3,073,994 | | | | 3,288,616 | | |

3.500%, 01/01/42 | | | 2,960,666 | | | | 3,135,851 | | |

3.500%, 04/01/42 | | | 3,106,467 | | | | 3,290,369 | | |

3.500%, 08/01/42 | | | 2,130,341 | | | | 2,277,473 | | |

3.500%, 01/01/43 | | | 490,554 | | | | 519,476 | | |

3.500%, 03/01/43 | | | 1,758,954 | | | | 1,883,483 | | |

3.500%, 05/01/43 | | | 1,518,065 | | | | 1,623,985 | | |

3.500%, 05/01/45 | | | 1,482,922 | | | | 1,566,221 | | |

3.500%, 10/01/45 | | | 941,225 | | | | 993,504 | | |

3.500%, 07/01/46 (c) | | | 1,000,000 | | | | 1,055,156 | | |

4.000%, 04/01/41 | | | 1,718,487 | | | | 1,879,657 | | |

4.000%, 08/01/41 | | | 587,407 | | | | 631,374 | | |

4.000%, 09/01/41 | | | 940,547 | | | | 1,025,917 | | |

4.000%, 04/01/44 | | | 3,676,695 | | | | 3,941,493 | | |

4.000%, 08/01/44 | | | 531,108 | | | | 570,163 | | |

4.000%, 07/01/46 (c) | | | 600,000 | | | | 643,295 | | |

4.500%, 05/01/35 | | | 173,757 | | | | 189,537 | | |

4.500%, 07/01/35 | | | 641,044 | | | | 702,326 | | |

4.500%, 06/01/39 | | | 361,265 | | | | 399,801 | | |

4.500%, 04/01/41 | | | 2,298,890 | | | | 2,550,854 | | |

4.500%, 07/01/41 | | | 2,211,000 | | | | 2,424,328 | | |

5.000%, 05/01/18 | | | 11,231 | | | | 11,550 | | |

5.000%, 06/01/18 | | | 24,129 | | | | 24,810 | | |

5.000%, 07/01/18 | | | 57,234 | | | | 58,879 | | |

5.000%, 07/01/23 | | | 136,894 | | | | 151,889 | | |

5.000%, 11/01/33 | | | 75,758 | | | | 84,580 | | |

See accompanying notes to financial statements.

14

SFT Advantus Bond Fund

Investments in Securities – continued

| | | Principal | | Value(a) | |

5.000%, 05/01/34 | | $ | 22,746 | | | $ | 25,309 | | |

5.000%, 12/01/34 | | | 348,210 | | | | 388,692 | | |

5.000%, 04/01/35 | | | 86,469 | | | | 96,354 | | |

5.000%, 08/01/35 | | | 105,104 | | | | 116,952 | | |

5.000%, 04/01/38 | | | 297,090 | | | | 336,812 | | |

5.000%, 12/01/39 | | | 401,109 | | | | 455,353 | | |

5.000%, 04/01/41 | | | 494,877 | | | | 562,202 | | |

5.500%, 09/01/17 | | | 5,956 | | | | 6,046 | | |

5.500%, 02/01/18 | | | 27,342 | | | | 28,109 | | |

5.500%, 03/01/18 | | | 48,973 | | | | 50,316 | | |

5.500%, 04/01/33 | | | 515,879 | | | | 592,290 | | |

5.500%, 12/01/33 | | | 138,863 | | | | 159,870 | | |

5.500%, 01/01/34 | | | 197,097 | | | | 223,683 | | |

5.500%, 02/01/34 | | | 197,850 | | | | 225,757 | | |

5.500%, 03/01/34 | | | 403,638 | | | | 464,609 | | |

5.500%, 04/01/34 | | | 192,636 | | | | 216,577 | | |

5.500%, 09/01/34 | | | 81,264 | | | | 93,133 | | |

5.500%, 02/01/35 | | | 274,792 | | | | 313,616 | | |

5.500%, 04/01/35 | | | 423,390 | | | | 480,186 | | |

5.500%, 06/01/35 | | | 66,515 | | | | 75,220 | | |

5.500%, 08/01/35 | | | 193,663 | | | | 219,375 | | |

5.500%, 10/01/35 | | | 509,010 | | | | 587,264 | | |

5.500%, 11/01/35 | | | 137,115 | | | | 155,712 | | |

5.500%, 12/01/35 | | | 107,785 | | | | 122,407 | | |

5.500%, 12/01/39 | | | 177,141 | | | | 201,945 | | |

6.000%, 09/01/17 | | | 31,664 | | | | 32,204 | | |

6.000%, 08/01/23 | | | 110,761 | | | | 123,439 | | |

6.000%, 10/01/32 | | | 386,831 | | | | 452,297 | | |

6.000%, 11/01/32 | | | 284,564 | | | | 333,752 | | |

6.000%, 03/01/33 | | | 437,124 | | | | 513,622 | | |

6.000%, 04/01/33 | | | 25,504 | | | | 29,127 | | |

6.000%, 12/01/33 | | | 149,703 | | | | 173,770 | | |

6.000%, 01/01/36 | | | 101,282 | | | | 117,453 | | |

6.000%, 08/01/37 | | | 65,609 | | | | 75,389 | | |

6.000%, 09/01/37 | | | 158,724 | | | | 183,568 | | |

6.000%, 10/01/38 | | | 285,255 | | | | 333,832 | | |

6.000%, 12/01/38 | | | 174,349 | | | | 200,467 | | |

6.000%, 06/01/40 | | | 73,892 | | | | 84,566 | | |

6.500%, 12/01/31 | | | 105,112 | | | | 125,724 | | |

6.500%, 02/01/32 | | | 36,591 | | | | 43,147 | | |

6.500%, 04/01/32 | | | 162,016 | | | | 195,332 | | |

6.500%, 05/01/32 | | | 48,556 | | | | 55,877 | | |

6.500%, 07/01/32 | | | 133,781 | | | | 160,583 | | |

6.500%, 08/01/32 | | | 204,261 | | | | 246,701 | | |

6.500%, 09/01/32 | | | 125,531 | | | | 149,389 | | |

6.500%, 10/01/32 | | | 189,251 | | | | 228,556 | | |

6.500%, 11/01/37 | | | 115,836 | | | | 133,302 | | |

7.000%, 07/01/31 | | | 101,383 | | | | 121,260 | | |

7.000%, 09/01/31 | | | 202,579 | | | | 247,640 | | |

7.000%, 11/01/31 | | | 282,358 | | | | 332,035 | | |

7.000%, 02/01/32 | | | 44,865 | | | | 52,208 | | |

7.000%, 03/01/32 | | | 30,393 | | | | 37,317 | | |

7.000%, 07/01/32 | | | 83,930 | | | | 98,153 | | |

7.500%, 04/01/31 | | | 147,684 | | | | 168,733 | | |

7.500%, 05/01/31 | | | 30,544 | | | | 35,337 | | |

| | | | | | 61,311,371 | | |

Government National Mortgage Association

(GNMA) (3.5%) | |

0.009%, 06/17/45 (b) (d) | | | 502,807 | | | | — | | |

3.000%, 03/15/45 | | | 1,432,480 | | | | 1,497,733 | | |

3.000%, 03/20/45 | | | 1,376,164 | | | | 1,440,734 | | |

3.000%, 04/15/45 | | | 1,881,294 | | | | 1,966,992 | | |

| | | Principal | | Value(a) | |

3.000%, 07/01/46 (c) | | $ | 1,000,000 | | | $ | 1,045,566 | | |

3.250%, 11/20/35 | | | 420,358 | | | | 445,678 | | |

3.500%, 10/20/43 | | | 1,001,544 | | | | 1,067,110 | | |

3.500%, 02/20/45 | | | 730,090 | | | | 775,287 | | |

3.500%, 03/20/45 | | | 812,025 | | | | 862,351 | | |

3.500%, 04/20/46 | | | 1,495,494 | | | | 1,589,133 | | |

3.750%, 03/20/46 | | | 835,622 | | | | 891,281 | | |

5.000%, 12/15/39 | | | 39,651 | | | | 45,168 | | |

5.000%, 01/15/40 | | | 666,181 | | | | 745,159 | | |

5.500%, 07/15/38 | | | 313,678 | | | | 356,575 | | |

5.500%, 10/15/38 | | | 396,777 | | | | 461,602 | | |

8.500%, 10/15/22 | | | 13,538 | | | | 13,708 | | |

| | | | | | 13,204,077 | | |

U.S. Treasury (15.0%) | |

U.S. Treasury Bond | |

2.500%, 02/15/46 | | | 16,330,000 | | | | 17,004,249 | | |

5.375%, 02/15/31 (e) | | | 5,115,000 | | | | 7,586,384 | | |

U.S. Treasury Note | |

0.875%, 10/15/18 | | | 10,000 | | | | 10,053 | | |

0.875%, 05/15/19 | | | 370,000 | | | | 371,778 | | |

1.000%, 06/30/21 | | | 14,165,000 | | | | 14,235,273 | | |

1.250%, 06/30/23 | | | 8,865,000 | | | | 8,910,708 | | |

1.625%, 05/15/26 | | | 8,270,000 | | | | 8,371,117 | | |

| | | | | | 56,489,562 | | |

Total government obligations

(cost: $163,738,275) | | | | | 172,743,982 | | |

Asset-Backed Securities (4.9%) | |

Asset-Backed Securities (4.9%) | |

Appalachian Consumer

Rate Relief Funding LLC,

3.772%, 08/01/31 | | | 780,000 | | | | 865,575 | | |

CarMax Auto Owner Trust,

2.160%, 08/16/21 | | | 1,300,000 | | | | 1,306,851 | | |

Conseco Financial Corp.,

6.400%, 10/15/18 | | | 14,739 | | | | 14,739 | | |

CountryPlace Manufactured

Housing Contract Trust,

5.200%, 12/15/35 (b) (f) | | | 1,755,000 | | | | 1,826,590 | | |

Countrywide Asset-Backed

Certificates,

5.934%, 05/25/37 (b) | | | 1,544,659 | | | | 1,465,956 | | |

Earnest Student Loan

Program LLC,

3.020%, 05/25/34 (f) | | | 1,875,000 | | | | 1,877,247 | | |

FAN Engine

Securitization, Ltd.,

3.000%,

10/15/19 (f) (g) (h) (i) | | | 449,578 | | | | 451,914 | | |

Foursight Capital

Automobile Receivables

Trust,

3.710%, 01/18/22 (f) | | | 1,200,000 | | | | 1,186,078 | | |

GMAC Mortgage Corp.

Loan Trust,

5.952%, 08/25/37 (b) | | | 3,095,000 | | | | 2,921,998 | | |

Longtrain Leasing III LLC,

2015-1A Class A1,

2.980%, 01/15/45 (f) (g) | | | 1,327,813 | | | | 1,284,988 | | |

Origen Manufactured

Housing Contract Trust,

5.860%, 06/15/36 (b) | | | 297,146 | | | | 313,071 | | |

See accompanying notes to financial statements.

15

SFT Advantus Bond Fund

Investments in Securities – continued

| | | Principal | | Value(a) | |

TAL Advantage V LLC,

3.510%, 02/22/39 (f) | | $ | 425,500 | | | $ | 415,115 | | |

TCF Auto Receivables

Owner Trust,

2.060%, 04/15/20 (f) | | | 1,830,000 | | | | 1,846,201 | | |

Trip Rail Master

Funding LLC,

2.863%, 04/15/44 (f) | | | 799,798 | | | | 792,320 | | |

World Omni Automobile

Lease Securitization Trust,

1.940%, 12/15/20 | | | 1,880,000 | | | | 1,884,232 | | |

Total asset-backed securities

(cost: $18,557,869) | | | | | 18,452,875 | | |

Other Mortgage-Backed Securities (5.3%) | |

Collateralized Mortgage Obligations/Mortgage

Revenue Bonds (0.4%) | |

Credit-Based Asset

Servicing and

Securitization LLC,

5.340%, 10/25/36 (f) (j) | | | 1,108,274 | | | | 1,150,792 | | |

JPMorgan Mortgage Trust,

2.705%, 11/25/33 (b) | | | 343,543 | | | | 308,631 | | |

Mellon Residential

Funding Corp.,

6.750%, 06/25/28 | | | 7,602 | | | | 7,658 | | |

| | | | | | 1,467,081 | | |

Commercial Mortgage-Backed Securities (4.9%) | |

7 WTC Depositor LLC Trust,

4.082%, 03/13/31 (f) | | | 604,703 | | | | 611,889 | | |

American Tower Trust I,

1.551%, 03/15/43 (f) | | | 1,420,000 | | | | 1,423,007 | | |

Aventura Mall Trust

2013-AVM,

3.867%, 12/05/32 (b) (f) | | | 1,000,000 | | | | 1,063,273 | | |

Banc of America Re-Remic

Trust,

4.325%, 08/15/46 (b) (f) | | | 1,350,000 | | | | 1,503,557 | | |

Citigroup Commercial

Mortgage Trust,

3.008%, 01/12/30 (b) (f) | | | 725,000 | | | | 722,691 | | |

Hometown Commercial

Mortgage, | |

5.506%, 11/11/38 (f) (g) | | | 353,835 | | | | 327,411 | | |

6.057%, 06/11/39 (f) (g) | | | 389,424 | | | | 296,075 | | |

JPMorgan Chase

Commercial Mortgage

Securities Corp., | |

2.157%, 12/05/27 (b) (d) (f) (g) | | | 10,405,795 | | | | 614,500 | | |

5.633%, 12/05/27 (f) | | | 2,165,000 | | | | 2,404,506 | | |

Merrill Lynch Mortgage

Investors, Inc.,

6.250%, 12/10/29 (b) | | | 297,563 | | | | 297,448 | | |

Morgan Stanley Capital I

Trust, | |

3.201%, 08/05/34 (f) | | | 860,000 | | | | 901,526 | | |

3.451%, 08/05/34 (f) | | | 550,000 | | | | 572,976 | | |

Multi Security Asset Trust,

5.880%, 11/28/35 (b) (f) (g) | | | 1,540,000 | | | | 1,456,738 | | |

| | | Principal | | Value(a) | |

Timberstar Trust,

6.208%, 10/15/36 (f) | | $ | 2,515,000 | | | $ | 2,518,951 | | |

Vornado DP LLC,

4.004%, 09/13/28 (f) | | | 1,475,000 | | | | 1,578,499 | | |

Wells Fargo Commercial

Mortgage Trust,

3.148%, 05/15/48 | | | 1,560,000 | | | | 1,643,822 | | |

WF-RBS Commercial

Mortgage Trust,

3.667%, 11/15/44 | | | 345,000 | | | | 374,234 | | |

| | | | | | 18,311,103 | | |

Total other mortgage-backed securities

(cost: $19,542,949) | | | | | 19,778,184 | | |

Corporate Obligations (42.3%) | |

Communications (2.4%) | |

Telecommunication (1.7%) | |

AT&T, Inc. | |

4.125%, 02/17/26 | | | 2,700,000 | | | | 2,900,432 | | |

5.550%, 08/15/41 | | | 900,000 | | | | 1,008,330 | | |

Crown Castle Towers LLC, | |

3.222%, 05/15/42 (f) | | | 1,950,000 | | | | 2,026,781 | | |

6.113%, 01/15/40 (f) | | | 440,000 | | | | 489,438 | | |

| | | | | | 6,424,981 | | |

Telephone Services (0.7%) | |

SBA Tower Trust,

2.240%, 04/15/43 (f) | | | 2,440,000 | | | | 2,446,676 | | |

Consumer Cyclical (1.3%) | |

Auto/Truck Parts & Equipment-Original (1.3%) | |

General Motors

Financial Co., Inc. | |

2.400%, 05/09/19 | | | 1,675,000 | | | | 1,679,667 | | |

4.375%, 09/25/21 | | | 590,000 | | | | 622,597 | | |

5.250%, 03/01/26 | | | 2,500,000 | | | | 2,717,712 | | |

| | | | | | 5,019,976 | | |

Consumer, Non-cyclical (1.0%) | |

Drugstore Chains (1.0%) | |

CVS Pass-Through Trust, | |

5.880%, 01/10/28 | | | 447,910 | | | | 504,861 | | |

6.036%, 12/10/28 | | | 2,358,550 | | | | 2,676,410 | | |

6.943%, 01/10/30 | | | 381,995 | | | | 459,233 | | |

| | | | | | 3,640,504 | | |

Energy (5.1%) | |

Oil, Gas & Consumable Fuels (0.3%) | |

Tesoro Corp.,

4.250%, 10/01/17 | | | 1,135,000 | | | | 1,160,537 | | |

Pipelines (4.8%) | |

Boardwalk Pipelines L.P., | |

3.375%, 02/01/23 | | | 1,040,000 | | | | 953,495 | | |

5.200%, 06/01/18 | | | 400,000 | | | | 407,467 | | |

5.750%, 09/15/19 | | | 2,629,000 | | | | 2,752,944 | | |

5.950%, 06/01/26 | | | 900,000 | | | | 945,375 | | |

Buckeye Partners L.P.,

5.600%, 10/15/44 | | | 3,000,000 | | | | 2,847,186 | | |

Enterprise Products

Operating LLC,

7.034%, 01/15/68 (b) | | | 1,835,000 | | | | 1,934,079 | | |

See accompanying notes to financial statements.

16

SFT Advantus Bond Fund

Investments in Securities – continued

| | | Principal | | Value(a) | |

NuStar Logistics L.P.,

8.150%, 04/15/18 | | $ | 2,986,000 | | | $ | 3,165,160 | | |

Sunoco Logistics Partners

Operations L.P.,

6.850%, 02/15/40 | | | 2,150,000 | | | | 2,278,546 | | |

Tennessee Gas Pipeline

Co. LLC,

8.375%, 06/15/32 | | | 2,500,000 | | | | 2,833,603 | | |

| | | | | | 18,117,855 | | |

Financial (13.0%) | |

Banks (6.7%) | |

Bank of America Corp., | |

4.000%, 01/22/25 | | | 1,650,000 | | | | 1,681,863 | | |

5.875%, 01/05/21 | | | 765,000 | | | | 877,585 | | |

3.950%, 04/21/25 | | | 780,000 | | | | 794,309 | | |

Capital One Financial Corp.,

5.550%, 06/01/20 (b) | | | 2,915,000 | | | | 2,878,562 | | |

Citigroup, Inc.,

4.400%, 06/10/25 | | | 1,500,000 | | | | 1,568,414 | | |

Citizens Bank NA,

2.300%, 12/03/18 | | | 1,250,000 | | | | 1,266,358 | | |

Compass Bank,

3.875%, 04/10/25 | | | 2,500,000 | | | | 2,399,065 | | |

Deutsche Bank AG,

3.375%, 05/12/21 (h) | | | 2,750,000 | | | | 2,759,465 | | |

Discover Bank,

3.100%, 06/04/20 | | | 2,250,000 | | | | 2,298,598 | | |

Discover Bank,

8.700%, 11/18/19 | | | 322,000 | | | | 379,159 | | |

Huntington Bancshares, Inc.,

3.150%, 03/14/21 | | | 3,000,000 | | | | 3,107,754 | | |

JPMorgan Chase & Co.,

5.000%, 07/01/19 (b) | | | 1,700,000 | | | | 1,625,625 | | |

Morgan Stanley, | |

5.450%, 07/15/19 (b) | | | 1,870,000 | | | | 1,795,200 | | |

5.500%, 07/28/21 | | | 740,000 | | | | 844,988 | | |

SunTrust Bank,

3.300%, 05/15/26 | | | 1,050,000 | | | | 1,058,546 | | |

| | | | | | 25,335,491 | | |

Diversified Financial Services (1.0%) | |

Block Financial LLC,

4.125%, 10/01/20 | | | 2,050,000 | | | | 2,111,642 | | |

Nasdaq, Inc.,

3.850%, 06/30/26 | | | 1,615,000 | | | | 1,640,869 | | |

| | | | | | 3,752,511 | | |

Insurance (3.2%) | |

Aon PLC,

3.875%, 12/15/25 (h) | | | 1,525,000 | | | | 1,608,474 | | |

Liberty Mutual Group, Inc.,

6.500%, 05/01/42 (f) | | | 1,805,000 | | | | 2,186,088 | | |

Peachtree Corners

Funding Trust,

3.976%, 02/15/25 (f) | | | 1,825,000 | | | | 1,829,728 | | |

TIAA Asset Management

Finance Co. LLC, | |

2.950%, 11/01/19 (f) | | | 1,345,000 | | | | 1,377,896 | | |

4.125%, 11/01/24 (f) | | | 1,150,000 | | | | 1,208,069 | | |

| | | Principal | | Value(a) | |

Trinity Acquisition PLC,

3.500%, 09/15/21 (h) | | $ | 1,400,000 | | | $ | 1,451,226 | | |

Unum Group,

5.750%, 08/15/42 | | | 1,975,000 | | | | 2,180,657 | | |

| | | | | | 11,842,138 | | |

Real Estate Investment Trust — Health Care (0.8%) | |

Ventas Realty L.P./ Ventas

Capital Corp.,

2.700%, 04/01/20 | | | 2,800,000 | | | | 2,857,593 | | |

Real Estate Investment Trust — Single Tenant (1.1%) | |

Select Income REIT,

2.850%, 02/01/18 | | | 4,080,000 | | | | 4,111,959 | | |

Real Estate Investment Trust — Hotels (0.2%) | |

Hospitality Properties Trust,

4.650%, 03/15/24 | | | 920,000 | | | | 936,807 | | |

Health Care (4.2%) | |

Health Care Providers & Services (2.2%) | |

Aetna, Inc., | |

2.800%, 06/15/23 | | | 425,000 | | | | 434,139 | | |

4.375%, 06/15/46 | | | 1,425,000 | | | | 1,479,860 | | |

Express Scripts Holding Co., | |

3.000%, 07/15/23 | | | 1,700,000 | | | | 1,701,904 | | |

4.800%, 07/15/46 | | | 1,475,000 | | | | 1,473,032 | | |

NYU Hospitals Center,

4.428%, 07/01/42 | | | 1,480,000 | | | | 1,618,083 | | |

Sinai Health System,

3.034%, 01/20/36 | | | 1,545,000 | | | | 1,617,519 | | |

| | | | | | 8,324,537 | | |

Medical Products/Supplies (0.8%) | |

Bio-Rad Laboratories, Inc.,

4.875%, 12/15/20 | | | 2,700,000 | | | | 2,987,339 | | |

Pharmaceuticals (1.2%) | |

AbbVie, Inc.,

2.850%, 05/14/23 | | | 1,500,000 | | | | 1,520,385 | | |

Mylan NV, | |

3.150%, 06/15/21 (f) (g) (h) | | | 2,050,000 | | | | 2,079,414 | | |

5.250%, 06/15/46 (f) (g) (h) | | | 950,000 | | | | 989,607 | | |

| | | | | | 4,589,406 | | |

Industrials (1.8%) | |

Aerospace & Defense (0.6%) | |

Newell Brands, Inc.,

5.000%, 11/15/23 (f) | | | 2,000,000 | | | | 2,100,048 | | |

Electrical Equipment (0.4%) | |

Keysight Technologies, Inc.,

3.300%, 10/30/19 | | | 1,500,000 | | | | 1,523,241 | | |

Machinery (0.5%) | |

Pentair Finance S.A.,

3.625%, 09/15/20 (h) | | | 1,925,000 | | | | 1,973,373 | | |

Tools-Hand Held (0.3%) | |

Stanley Black & Decker, Inc.,

5.750%, 12/15/53 (b) | | | 1,000,000 | | | | 1,047,500 | | |

See accompanying notes to financial statements.

17

SFT Advantus Bond Fund

Investments in Securities – continued

| | | Principal | | Value(a) | |

Information Technology (0.3%) | |

Electronic Equipment, Instruments &

Components (0.3%) | |

FLIR Systems, Inc.,

3.125%, 06/15/21 | | $ | 1,075,000 | | | $ | 1,103,771 | | |

Technology (1.8%) | |

Computers (0.8%) | |

Diamond 1 Finance Corp./

Diamond 2 Finance Corp., | |

5.450%, 06/15/23 (f) | | | 1,790,000 | | | | 1,857,255 | | |

8.350%, 07/15/46 (f) | | | 980,000 | | | | 1,053,607 | | |

| | | | | | 2,910,862 | | |

Semiconductor Equipment (0.5%) | |

Lam Research Corp.,

3.450%, 06/15/23 | | | 2,075,000 | | | | 2,143,021 | | |

Software (0.2%) | |

Fidelity National

Information Services, Inc.,

2.850%, 10/15/18 | | | 700,000 | | | | 718,401 | | |

Software & Services (0.3%) | |

HP Enterprise Co.,

2.850%, 10/05/18 (f) | | | 1,175,000 | | | | 1,203,271 | | |

Transportation (5.9%) | |

Airlines (4.8%) | |

Air Canada 2015-1 Class C

Pass Through Trust,

5.000%, 03/15/20 (f) (h) | | | 2,000,000 | | | | 1,925,000 | | |

America West Airlines 2000-1

Pass Through Trust,

8.057%, 01/02/22 | | | 672,633 | | | | 753,349 | | |

American Airlines 2013-1

Class B Pass Through Trust,

5.625%, 01/15/21 (f) | | | 1,562,355 | | | | 1,609,226 | | |

American Airlines 2013-2

Class B Pass Through Trust,

5.600%, 01/15/22 (f) (g) | | | 1,461,195 | | | | 1,505,031 | | |

American Airlines 2015-1

Class B Pass Through Trust,

3.700%, 11/01/24 | | | 953,675 | | | | 934,601 | | |

British Airways PLC,

5.625%, 12/20/21 (f) (h) | | | 613,255 | | | | 638,552 | | |

Continental Airlines 2009-2

Class A Pass Through Trust,

7.250%, 05/10/21 | | | 1,384,752 | | | | 1,582,079 | | |

Delta Air Lines 2012-1

Class A Pass Through Trust,

4.750%, 11/07/21 | | | 600,416 | | | | 636,441 | | |

Delta Air Lines 2012-1

Class B Pass Through Trust,

6.875%, 05/07/19 (f) | | | 1,498,277 | | | | 1,618,139 | | |

Delta Air Lines 2015-1

Class B Pass Through Trust,

4.250%, 01/30/25 | | | 677,985 | | | | 691,545 | | |

United Airlines 2014-1

Class B Pass Through Trust,

4.750%, 10/11/23 | | | 634,499 | | | | 640,051 | | |

United Airlines 2014-2

Class B Pass Through Trust,

4.625%, 03/03/24 | | | 2,615,103 | | | | 2,621,641 | | |

| | | Principal | | Value(a) | |

United Airlines, Inc.,

10.400%, 05/01/18 | | $ | 354,797 | | | $ | 364,554 | | |

US Airways 2010-1 Class A

Pass Through Trust,

6.250%, 10/22/24 | | | 1,229,128 | | | | 1,379,696 | | |

US Airways 2012-2 Class A

Pass Through Trust,

4.625%, 12/03/26 | | | 222,954 | | | | 237,470 | | |

Virgin Australia 2013-1B Trust,

6.000%, 04/23/22 (f) (h) | | | 747,535 | | | | 760,617 | | |

| | | | | | 17,897,992 | | |

Transport — Rail (1.1%) | |

BNSF Funding Trust I,

6.613%, 12/15/55 (b) | | | 3,785,000 | | | | 4,258,125 | | |

Utilities (5.5%) | |

Electric Companies (1.0%) | |

Dominion Gas

Holdings LLC,

2.500%, 12/15/19 | | | 1,470,000 | | | | 1,503,555 | | |

Indianapolis Power &

Light Co.,

4.700%, 09/01/45 (f) | | | 1,900,000 | | | | 2,140,656 | | |

| | | | | | 3,644,211 | | |

Electric Utilities (3.7%) | |

Cleco Corporate

Holdings LLC, | |

3.743%, 05/01/26 (f) | | | 1,125,000 | | | | 1,156,188 | | |

4.973%, 05/01/46 (f) | | | 2,000,000 | | | | 2,100,534 | | |

Dominion Resources, Inc., | |

2.962%, 07/01/19 (j) | | | 750,000 | | | | 763,526 | | |

5.750%, 10/01/54 (b) | | | 1,800,000 | | | | 1,791,000 | | |

El Paso Electric Co.,

5.000%, 12/01/44 | | | 1,165,000 | | | | 1,336,177 | | |

Entergy Corp.,

4.000%, 07/15/22 | | | 1,200,000 | | | | 1,287,702 | | |

Exelon Corp.,

5.100%, 06/15/45 | | | 1,275,000 | | | | 1,465,160 | | |

Exelon Generation Co. LLC,

2.950%, 01/15/20 | | | 2,475,000 | | | | 2,545,941 | | |

IPALCO Enterprises, Inc.,

3.450%, 07/15/20 | | | 1,400,000 | | | | 1,421,000 | | |

| | | | | | 13,867,228 | | |

Gas Utilities (0.8%) | |

AGL Capital Corp.,

3.875%, 11/15/25 | | | 1,650,000 | | | | 1,772,314 | | |

Brooklyn Union Gas Co.,

4.504%, 03/10/46 (f) | | | 1,300,000 | | | | 1,471,100 | | |

| | | | | | 3,243,414 | | |

Total corporate obligations

(cost: $154,618,245) | | | | | 159,182,768 | | |

Total long-term debt securities

(cost: $356,457,338) | | | | | 370,157,809 | | |

See accompanying notes to financial statements.

18

SFT Advantus Bond Fund

Investments in Securities – continued

| | | Shares | | Value(a) | |

Short-Term Securities (4.7%) | |

Investment Companies (4.7%) | |

State Street Institutional

U.S. Government

Money Market Fund,

current rate 0.250%(k) | | | 17,832,089 | | | $ | 17,832,089 | | |

Total short-term securities

(cost: $17,832,089) | | | | | 17,832,089 | | |

Total investments in securities

(cost: $374,289,427) (l) | | | | | 387,989,898 | | |

Liabilities in excess of cash

and other assets (-3.2%) | | | | | (12,191,150 | ) | |

Total net assets (100.0%) | | | | $ | 375,798,748 | | |

Investments in Securities Legend

(a) Securities are valued by procedures described in Note 2 of the Notes to Financial Statements.

(b) Variable rate security.

(c) Security is issued on a when-issued or forward commitment basis. As of June 30, 2016 the total cost of investments issued on a when-issued or forward commitment basis was $7,618,051.

(d) Interest-only security that entitles holders to receive only interest on the underlying mortgages. The principal amount of the underlying pool represents the notional amount on which current interest is calculated. The yield to maturity of an interest-only security is sensitive to the rate of principal payments on the underlying mortgage assets. The rate disclosed represents the market yield based upon the current cost basis and estimated timing and amount of future cash flows.

(e) Fully or partially pledged as initial margin deposits on open futures contracts.

Holdings of Open Futures Contracts

On June 30, 2016, securities with an aggregate market value of $444,949 have been pledged to cover margin requirements for the following open futures contracts:

Type | | Expiration | | Number of

Contracts | | Position

Type | | Unrealized

Appreciation/

(Depreciation) | |

5 Year U.S.

Treasury

Note | | September 2016 | | | 49 | | | Long | | $ | 108,191 | | |

2 Year U.S.

Treasury

Note | | September 2016 | | | 3 | | | Long | | | 4,632 | | |

10 Year U.S.

Treasury

Note | | September 2016 | | | 145 | | | Short | | | (511,342 | ) | |

U.S. Long

Bond | | September 2016 | | | 10 | | | Short | | | (96,750 | ) | |

| | | | | | 207 | | | | | $ | (495,269 | ) | |

(f) Security sold within terms of a private placement memorandum exempt from registration under Section 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program. This security has been determined to be liquid unless otherwise indicated.

(g) Illiquid security. (See Note 3.)

(h) Foreign security: The Fund held 3.9% of net assets in foreign securities at June 30, 2016.

(i) These securities are being fair-valued according to procedures approved by the Board of Trustees.

(j) Step rate security.

(k) All or a portion of the security segregated to cover when-issued purchase commitments outstanding or extended settlement trades as of June 30, 2016.

(l) At June 30, 2016 the cost of securities for federal income tax purposes was $375,353,796. The aggregate unrealized appreciation and depreciation of investments in securities based on this cost were:

Gross unrealized appreciation | | $ | 14,778,285 | | |

Gross unrealized depreciation | | | (2,142,183 | ) | |

Net unrealized appreciation | | $ | 12,636,102 | | |

See accompanying notes to financial statements.

19

SFT Advantus Dynamic Managed Volatility Fund

(formerly SFT Advantus Managed Volatility Fund)

Investments in Securities

(Percentages of each investment category relate to total net assets)

| | | Principal | | Value(a) | |

Long-Term Debt Securities (40.1%) | |

Government Obligations (1.6%) | |

U.S. Government Agencies and Obligations (1.6%) | |

Federal Home Loan Mortgage

Corporation (FHLMC) (0.6%) | |

3.000%, 09/01/43 | | $ | 201,684 | | | $ | 209,574 | | |

3.500%, 10/01/44 | | | 381,669 | | | | 402,524 | | |

3.500%, 11/01/44 | | | 384,892 | | | | 405,922 | | |

3.500%, 12/01/44 | | | 400,929 | | | | 422,836 | | |

| | | | | | 1,440,856 | | |

Federal National Mortgage

Association (FNMA) (0.6%) | |

3.000%, 04/01/43 | | | 305,236 | | | | 317,455 | | |

3.000%, 05/01/43 | | | 143,673 | | | | 149,425 | | |

3.000%, 06/01/43 | | | 384,161 | | | | 399,521 | | |

3.500%, 08/01/42 | | | 171,802 | | | | 183,667 | | |

3.500%, 02/01/43 | | | 184,447 | | | | 197,926 | | |

| | | | | | 1,247,994 | | |

U.S. Treasury (0.4%) | |

U.S. Treasury Note, | |

0.625%, 04/30/18 (b) | | | 1,000,000 | | | | 1,000,664 | | |

Total government obligations

(cost: $3,569,988) | | | | | 3,689,514 | | |

Asset-Backed Security (0.4%) | |

Longtrain Leasing III LLC

2015-1A Class A2, | |

4.060%, 01/15/45 (c) (d) | | | 1,000,000 | | | | 940,821 | | |

Total asset-backed securities

(cost: $999,570) | | | | | 940,821 | | |

Other Mortgage-Backed Securities (0.4%) | |

Commercial Mortgage-Backed Securities (0.4%) | |

CSMC Mortgage Trust, | |

4.276%, 11/15/37 (d) (e) | | | 1,000,000 | | | | 1,030,384 | | |

Total other mortgage-backed securities

(cost: $1,008,907) | | | | | 1,030,384 | | |

Corporate Obligations (37.7%) | |

Basic Materials (0.1%) | |

Mining (0.1%) | |

BHP Billiton Finance USA, Ltd.,

2.875%, 02/24/22 (f) | | | 250,000 | | | | 259,538 | | |

Communications (2.0%) | |

Cable/Satellite TV (0.4%) | |

Comcast Corp., | |

4.200%, 08/15/34 | | | 500,000 | | | | 550,529 | | |

4.650%, 07/15/42 | | | 250,000 | | | | 286,879 | | |

| | | | | | 837,408 | | |

Media (1.0%) | |

CBS Corp., | |

3.500%, 01/15/25 | | | 750,000 | | | | 771,140 | | |

4.000%, 01/15/26 | | | 250,000 | | | | 266,842 | | |

Time Warner, Inc., | |

4.850%, 07/15/45 | | | 1,000,000 | | | | 1,087,269 | | |

| | | Principal | | Value(a) | |

Viacom, Inc.,

5.625%, 09/15/19 | | $ | 250,000 | | | $ | 275,581 | | |

| | | | | | 2,400,832 | | |

Telecommunication (0.5%) | |

Crown Castle Towers LLC,

3.663%, 05/15/25 (d) | | | 1,000,000 | | | | 1,034,070 | | |

Wireless Telecommunication Services (0.1%) | |

Rogers Communications, Inc.,

4.100%, 10/01/23 (f) | | | 250,000 | | | | 277,756 | | |

Consumer Cyclical (1.4%) | |

Home Furnishings (0.5%) | |

Harman International

Industries, Inc.,

4.150%, 05/15/25 | | | 1,000,000 | | | | 1,042,871 | | |

Retail (0.9%) | |

AutoZone, Inc.,

3.250%, 04/15/25 | | | 1,000,000 | | | | 1,036,648 | | |

Target Corp.,

3.500%, 07/01/24 | | | 750,000 | | | | 831,046 | | |

Wal-Mart Stores, Inc.,

1.950%, 12/15/18 | | | 250,000 | | | | 256,816 | | |

| | | | | | 2,124,510 | | |

Consumer Staples (0.6%) | |

Beverages (0.2%) | |