UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-4279 |

|

Securian Funds Trust |

(Exact name of registrant as specified in charter) |

|

400 Robert Street North St. Paul, Minnesota | | 55101-2098 |

(Address of principal executive offices) | | (Zip code) |

|

David Dimitri, Esq. 400 Robert Street North St. Paul, Minnesota 55101-2098 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (651) 665-3500 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2019 | |

| | | | | | | | |

ITEM 1. REPORT TO STOCKHOLDERS.

Filed herewith.

Offered in Minnesota Life

Insurance Company and

Securian Life Insurance

Company variable products

Semi-Annual report

June 30, 2019

SFT Core Bond Fund

SFT Dynamic Managed Volatility Fund

SFT Government Money Market Fund

SFT Index 400 Mid-Cap Fund

SFT Index 500 Fund

SFT International Bond Fund

SFT IvySM Growth Fund

SFT IvySM Small Cap Growth Fund

SFT Managed Volatility Equity Fund

SFT Real Estate Securities Fund

SFT T.Rowe Price Value Fund

SFT Wellington Core Equity Fund

TABLE OF CONTENTS

| | | Page No. | |

Fund Reviews | |

| SFT Core Bond Fund | | | 1 | | |

SFT Dynamic Managed Volatility Fund | | | 2 | | |

SFT Government Money Market Fund | | | 3 | | |

SFT lndex 400 Mid-Cap Fund | | | 4 | | |

| SFT lndex 500 Fund | | | 5 | | |

SFT lnternational Bond Fund | | | 6 | | |

SFT IvySM Growth Fund | | | 7 | | |

SFT IvySM Small Cap Growth Fund | | | 8 | | |

SFT Managed Volatility Equity Fund | | | 9 | | |

SFT Real-Estate Securities Fund | | | 10 | | |

SFT T. Rowe Price Value Fund | | | 11 | | |

SFT Wellington Core Equity Fund | | | 12 | | |

Investments In Securities | |

| SFT Core Bond Fund | | | 13 | | |

SFT Dynamic Managed Volatility Fund | | | 21 | | |

SFT Government Money Market Fund | | | 28 | | |

SFT lndex 400 Mid-Cap Fund | | | 29 | | |

| SFT lndex 500 Fund | | | 36 | | |

SFT lnternational Bond Fund | | | 43 | | |

SFT IvySM Growth Fund | | | 50 | | |

SFT IvySM Small Cap Growth Fund | | | 52 | | |

SFT Managed Volatility Equity Fund | | | 54 | | |

SFT Real-Estate Securities Fund | | | 55 | | |

SFT T. Rowe Price Value Fund | | | 56 | | |

SFT Wellington Core Equity Fund | | | 59 | | |

Financial Statements | |

Statements of Assets and Liabilities | | | 62 | | |

Statements of Operations | | | 64 | | |

Statements of Changes in Net Assets | | | 66 | | |

Financial Highlights | | | 71 | | |

Notes to Financial Statements | | | 83 | | |

Fund Expense Examples | | | 99 | | |

Proxy Voting and Quarterly Holdings Information | | | 100 | | |

Statement Regarding Basis for Approval of Advisory Contracts | | | 102 | | |

Trustees and Executive Officers | | | 105 | | |

SFT Core Bond Fund

Fund Objective

The SFT Core Bond Fund seeks as high a level of long-term total return as is consistent with prudent investment risk. Preservation of capital is a secondary objective. The SFT Core Bond Fund invests in long-term, fixed income, high quality debt instruments. The risks incurred by investing in debt instruments include, but are not limited to, reinvestment of prepaid debt obligations at lower rates of return, and the inability to reinvest at higher interest rates when debt obligations are prepaid more slowly than expected. In addition, the net asset value of the SFT Core Bond Fund may fluctuate in response to changes in interest rates and is not guaranteed.

Performance Update

The Fund's performance for the six-month period ended June 30, 2019, for each class of shares offered was as follows:

| Class 1 | | | 6.67 | percent* | |

| Class 2 | | | 6.54 | percent* | |

The Fund's benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, returned 6.11 percent for the same period.

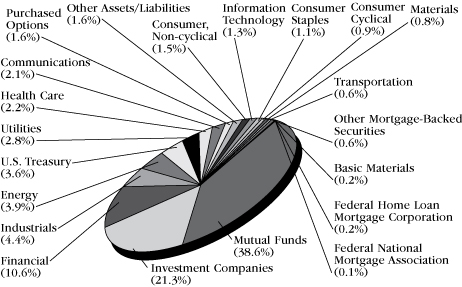

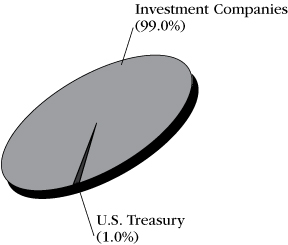

Sector Diversification (shown as a percentage of net assets)

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged benchmark composite representing average market-weighted performance of U.S. Treasury and agency securities, investment-grade corporate bonds and mortgage-backed securities with maturities greater than one year.

1

SFT Dynamic Managed Volatility Fund

Fund Objective

The SFT Dynamic Managed Volatility Fund seeks to maximize risk-adjusted total return relative to its blended benchmark index comprised of 60 percent S&P 500® Index and 40 percent Barclays U.S. Aggregate Bond Index (collectively, the Blended Benchmark Index).

The SFT Dynamic Managed Volatility Fund invests primarily in Class 1 shares of SFT Index 500 Fund for equity exposure, in a basket of fixed income securities for fixed income exposure and certain derivative instruments. The Fund is subject to risks associated with such investments as described in detail in the prospectus. The net asset value of the Fund will fluctuate and is not guaranteed. It is possible to lose money by investing in the Fund. There is no assurance that efforts to manage Fund volatility will achieve the desired results.

Performance Update

For the six-month period ended June 30, 2019, the Fund had a net return of 13.70% percent*. This return reflects the waiver, reimbursement or payment of certain of the Fund's expenses by its investment advisor.** The Blended Benchmark Index returned 13.64 percent over the same period.

Sector Diversification (shown as a percentage of net assets)

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

**Securian Asset Management, Inc. (Securian AM) and the Securian Funds Trust, on behalf of the SFT Dynamic Managed Volatility Fund (the "Fund"), have entered into an Expense Limitation Agreement, dated May 1, 2013, which limits the operating expenses of the Fund, excluding certain expenses (such as interest expense, acquired fund fees, cash overdraft fees, taxes, brokerage commissions, other expenditures which are capitalized in accordance with the generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the Fund's business), to 0.80% of the Fund's average daily net assets through April 30, 2020. The Agreement renews annually for a full year each year thereafter unless terminated by Securian AM upon at least 30 days' notice prior to the end of a contract term. The Fund is authorized to reimburse Securian AM for management fees previously waived and/or for the cost of expenses previously paid by Securian AM pursuant to this agreement, provided that such reimbursement will not cause the Fund to exceed any limits in effect at the time of such reimbursement. The Fund's ability to reimburse Securian AM in this manner only applies to fees waived or reimbursements made by Securian AM within the three fiscal years prior to the date of such reimbursement. As of June 30, 2019 Securian AM has waived $2,945,429 pursuant to the agreement. To the extent that the Fund makes such reimbursements to Securian AM, the amount of the reimbursements will be reflected in the financial statements in the Fund's shareholder reports and in Other Expenses under Fees and Expenses of the Fund.

The Blended Benchmark Index is comprised of 60 percent of the S&P 500® Index and 40 percent of the Bloomberg Barclays U.S. Aggregate Bond Index.

The S&P 500® Index is a broad, unmanaged index of 500 common stocks which are representative of the U.S. stock market overall. The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged benchmark composite representing average market-weighted performance of U.S. Treasury and agency securities, investment-grade corporate bonds and mortgage-backed securities with maturities greater than one year.

2

SFT Government Money Market Fund

Fund Objective

The SFT Government Money Market Fund seeks maximum current income to the extent consistent with liquidity and the preservation of capital. The Fund invests at least 99.5% of its total assets in cash, government securities, and/or repurchase agreements that are collateralized fully (i.e., collateralized by cash or government securities).

Investment in the SFT Government Money Market Fund is neither insured nor guaranteed by the U.S. Government, and there can be no assurance that the Fund will be able to maintain a stable net asset value of $1.00 per share. It is possible to lose money by investing in the Fund.

Performance Update

For the six-month period ended June 30, 2019, the Fund had a net return of 0.85 percent*. This return reflects the waiver, reimbursement or payment of certain of the Fund's expenses by its investment advisor and principal underwriter.** The Fund's benchmark, the Bloomberg Barclays U.S. Treasury Bill 1-3 Month Index, returned 1.25 percent for the same period.

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Investment in the SFT Government Money Market Fund is neither insured nor guaranteed by the U.S. Government or any other agency, and there can be no assurance that the Fund will be able to maintain a stable net asset value of $1.00 per share. Shares upon redemption may be worth more or less than their original cost.

Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The Bloomberg Barclays U.S.Treasury Bill 1-3 Month Index is a market value-weighted index of investment-grade fixed-rate public obligations of the U.S. Treasury with maturities of three months, excluding zero coupons.

**Effective May 1, 2012, the Board of Trustees of Securian Funds Trust approved a Restated Net Investment Income Maintenance Agreement among Securian FundsTrust (on behalf of SFT Government Money Market Fund), Securian Asset Management, Inc. (Securian AM) and Securian Financial Services, Inc. (Securian Financial). A similar agreement was previously approved by the Board of Directors of Advantus Series Fund, Inc., the Trust's predecessor, effective October 29, 2009. Under such Agreement, Securian AM agrees to waive, reimburse or pay SFT Government Money Market Fund expenses so that the Fund's daily net investment income does not fall below zero. Securian Financial may also waive its Rule 12b-1 fees. Securian AM and Securian Financial each has the option under the Agreement to recover the full amount waived, reimbursed or paid (the "Expense Waiver") on any day on which the Fund's net investment income exceeds zero. On any day, however, the Expense Waiver does not constitute an obligation of the Fund unless Securian AM or Securian Financial has expressly exercised its right to recover a specified portion of the Expense Waiver on that day, in which case such specified portion is then due and payable by the Fund. In addition, the right of Securian AM and/or Securian Financial to recover the Expense Waiver is subject to the following limitations: (1) if a repayment of the Expense Waiver by the Fund would cause the Fund's net investment income to fall below zero, such repayment is deferred until a date when repayment would not cause the Fund's net investment income to fall below zero; (2) the right to recover any portion of the Expense Waiver expires three years after the effective date of that portion of the Expense Waiver; and (3) any repayment of the Expense Waiver by the Fund cannot cause the Fund's expense ratio to exceed 1.25%. As of June 30, 2019, Securian AM and Securian Financial have collectively waived $4,631,950 pursuant to the Agreement, including expenses waived under the prior agreement with Advantus Series Fund, Inc., of which $300,636 was eligible for recovery as of such date. If Securian AM and Securian Financial exercise their rights to be paid such waived amounts, the Fund's future yield will be negatively affected for an indefinite period.The Agreement is effective through April 30, 2020, and shall continue in effect thereafter, provided such continuance is specifically approved by Securian AM, Securian Financial, and a majority of the Trust's independent Trustees.

Effective November 1, 2017, Securian AM and Securian Funds Trust, on behalf of the SFT Government Money Market Fund, entered into an Expense Limitation Agreement which limits the operating expenses of the Fund, excluding certain expenses, (such as interest expense, acquired fund fees, cash overdraft fees, taxes, brokerage commissions, other expenditures which are capitalized in accordance with GAAP, and other extraordinary expenses not incurred in the ordinary course of the Funds' business), to 0.70% of the Fund's Average daily net assets through April 30, 2020.

The Agreement renews annually for a full year each year thereafter unless terminated by Securian AM upon at least 30 days' notice prior to the end of the contract term.The Fund is authorized to reimburse Securian AM for management fees previously waived and/or for the cost of expenses previously paid by Securian AM pursuant to this agreement, provided that such reimbursement will not cause any Fund to exceed any limits in effect at the time of such reimbursement.

The Fund's ability to reimburse Securian AM in this manner only applies to fees waived or reimbursements made by Securian AM within the three fiscal years prior to the date of such reimbursement. To the extent that the Fund makes such reimbursements to Securian AM, the amount of the reimbursements will be reflected in the financial statements in the Funds' shareholder reports and in Other Expenses under Fees and Expenses of the Fund in the prospectus.

As of June 30, 2019, Securian AM has waived $251,547 pursuant to the agreement, all of which was eligible for recovery as of such date. To the extent that the Fund makes such reimbursements to Securian AM, the amount of the reimbursements will be reflected in the financial statements in the Fund's shareholder reports and in Other Expenses under Fees and Expenses to the Fund.

3

SFT Index 400 Mid-Cap Fund

Fund Objective

The SFT Index 400 Mid-Cap Fund seeks to provide investment results generally corresponding to the aggregate price and dividend performance of publicly traded common stocks that comprise the Standard & Poor's MidCap 400® Index (S&P 400). It is designed to provide an economical and convenient means of maintaining a diversified portfolio in this equity security area as part of an over-all investment strategy. The risks incurred by investing in the SFT Index 400 Mid-Cap Fund include, but are not limited to, the risk that the Fund may not be able to replicate the performance of the S&P 400, and the risk of declines in the market for mid-cap stocks or in the equity markets generally.

Performance Update

The Fund's performance for the six-month period ended June 30, 2019, for each class of shares offered was as follows:

| Class 1 | | | 17.77 | percent* | |

| Class 2 | | | 17.63 | percent* | |

The Fund's benchmark, the Standard and Poor's MidCap 400® Index, returned 17.97 percent for the same period.

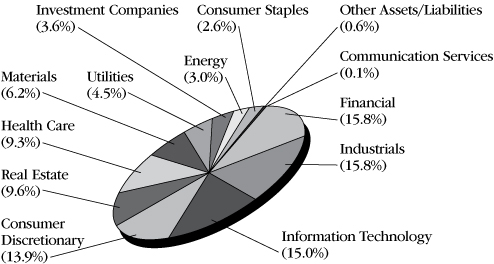

Sector Diversification (shown as a percentage of net assets)

"Standard & Poor's®", "S&P®", "Standard & Poor's MidCap 400" and "S&P MidCap 400" are trademarks of the S&P Global, Inc. and have been licensed for use by the Securian Funds Trust—Index 400 Mid-Cap Fund. The Fund is not sponsored, endorsed, sold or promoted by Standard & Poor's and Standard & Poor's makes no representation regarding the advisability of investing in the Fund.

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

S&P MidCap 400® Index consists of 400 domestic stocks chosen for market size (median market capitalization of about $4.1 billion), liquidity and industry group representation. It is a market-weighted index (stock price times shares outstanding), with each stock affecting the index in proportion to its market value.

4

SFT Index 500 Fund

Fund Objective

The SFT Index 500 Fund seeks investment results that correspond generally to the price and yield performance of the common stocks included in the Standard and Poor's 500® Index (S&P 500). It is designed to provide an economical and convenient means of maintaining a broad position in the equity market as part of an overall investment strategy. The risks incurred by investing in the SFT Index 500 Fund include, but are not limited to, the risk that the Fund may not be able to replicate the performance of the S&P 500, and the risk of declines in the equity markets generally.

Performance Update

The Fund's performance for the six-month period ended June 30, 2019, for each class of shares offered was as follows:

| Class 1 | | | 18.39 | percent* | |

| Class 2 | | | 18.24 | percent* | |

The Fund's benchmark, the Standard & Poor's 500® Index, returned 18.54 percent for the same period.

Sector Diversification (shown as a percentage of net assets)

"Standard & Poor's®", "S&P®", "Standard & Poor's 500" and "S&P 500" are trademarks of the S&P Global, Inc. and have been licensed for use by Securian Funds Trust—Index 500 Fund. The Fund is not sponsored, endorsed, sold or promoted by Standard & Poor's and Standard & Poor's makes no representation regarding the advisability of investing in the Fund.

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The S&P 500® Index is a broad, unmanaged index of 500 common stocks which are representative of the U.S. stock market overall.

5

SFT International Bond Fund

Fund Objective

The SFT International Bond Fund seeks to maximize current income consistent with protection of principal. The Fund pursues its objective by investing primarily in debt securities issued by issuers located anywhere in the world. While Securian Asset Management, Inc. (Securian AM) acts as the investment adviser for the Fund, Franklin Advisers, Inc. provides investment advice to the SFT International Bond Fund under a sub-advisory agreement. Investment risks associated with international investing in addition to other risks include currency fluctuations, political and economic instability, and differences in accounting standards when investing in foreign markets.

Performance Update

The Fund's performance for the six-month period ended June 30, 2019, for each class of shares offered was as follows:

| Class 1 | | | 3.36 | percent* | |

| Class 2 | | | 3.23 | percent* | |

The Fund's benchmark, the FTSE World Government Bond Index, returned

5.38 percent for the same period.

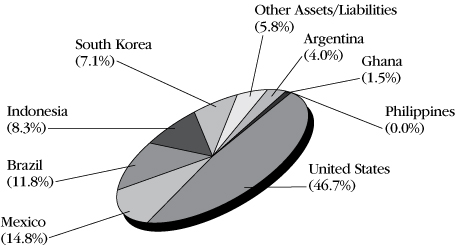

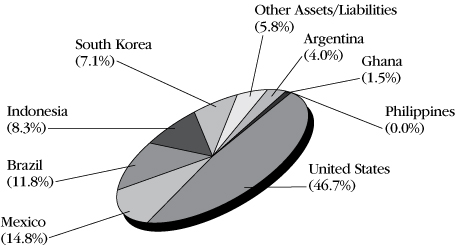

Country Diversification (shown as a percentage of net assets)

Currency Diversification (shown as a percentage of net assets)

African | | | 1.53 | % | |

Ghana Cedi | | | 1.53 | % | |

Americas | | | 124.08 | % | |

United States Dollar | | | 93.26 | % | |

Mexican Peso | | | 14.79 | % | |

Brazilian Real | | | 12.21 | % | |

Argentine Peso | | | 3.82 | % | |

Canadian Dollar | | | 0.00 | % | |

Asia Pacific | | | 14.05 | % | |

Japanese Yen | | | 20.28 | % | |

Indonesian Rupiah | | | 8.45 | % | |

Republic of Korea Won | | | 0.45 | % | |

Philippine Peso | | | 0.03 | % | |

Australian Dollar (AUD)* | | | -15.16 | % | |

Europe | | | -39.66 | % | |

Euro* | | | -39.66 | % | |

*A negative figure reflects net "short" exposure, designed to benefit if the value of the associated currency decreases. Conversely, the Fund's value would potentially decline if the value of the associated currency increases.

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The FTSE World Government Bond Index is a market capitalization weighted index consisting of the government bond markets from over twenty countries. Country eligibility is determined based upon market capitalization and investability criteria. The index includes all fixed-rate bonds with a remaining maturity of one year or longer and with amounts outstanding of at least the equivalent of U.S. $25 million. Government securities typically exclude floating or variable rate bonds, U.S./Canadian savings bonds and private placements. Each bond must have a minimum rating of BBB-/Baa3 by S&P or Moody's.

6

SFT IvySM Growth Fund

Fund Objective

The SFT IvySM Growth Fund seeks to provide growth of capital. The Fund pursues its objective by investing primarily in a diversified portfolio of common stocks issued by large capitalization companies. While Securian Asset Management, Inc. acts as the investment adviser for the Fund, Ivy Investment Management Company (IICO) provides investment advice to the Fund under a sub-advisory agreement. The risks incurred by investing in the Fund include, but are not limited to, the risk of declines in the market for large cap stocks or in the equity markets generally.

Performance Update

For the six-month period ended June 30, 2019, the Fund had a net return of 23.88 percent*. The Fund's benchmark, the Russell 1000 Growth Index, returned 21.49 percent for the same period.

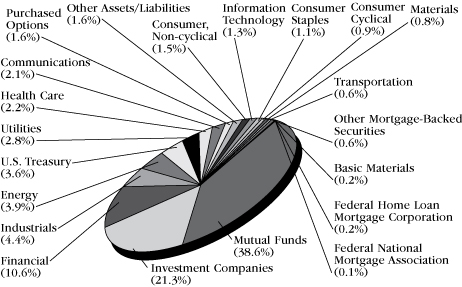

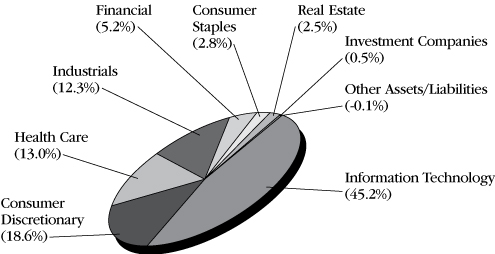

Sector Diversification (shown as a percentage of net assets)

'Ivy' is the registered service mark of Ivy Funds Distributor, Inc., an affiliate of the Ivy Investment Management Company, the Fund's sub-adviser.

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The Russell 1000 Growth Index is an unmanaged index that measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. The index measures the performance of the 1,000 largest companies in the Russel 3000 Index, which measures the performance of the 3,000 largest U.S. companies based on total market capitalization.

7

SFT IvySM Small Cap Growth Fund

Fund Objective

The SFT IvySM Small Cap Growth Fund seeks to provide growth of capital. The Fund pursues its objective by investing primarily in a diversified portfolio of common stocks issued by small capitalization companies. While Securian Asset Management, Inc. acts as the investment adviser for the Fund, Ivy Investment Management Company (IICO) provides investment advice to the Fund under a sub-advisory agreement. The risks incurred by investing in the Fund include, but are not limited to, the risk of declines in the market for small cap stocks or in the equity markets generally.

Performance Update

For the six-month period ended June 30, 2019, the Fund had a net return of 24.24 percent*. The Fund's benchmark, the Russell 2000 Growth Index, returned 20.36 percent for the same period.

Sector Diversification (shown as a percentage of net assets)

'Ivy' is the registered service mark of Ivy Funds Distributor, Inc., an affiliate of the Ivy Investment Management Company, the Fund's sub-adviser.

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The Russell 2000 Growth Index is an unmanaged index of those Russell 2000 Index growth companies with higher price-to-book ratios and higher forecasted growth values. The index is broad-based, comprised of 2,000 of the smallest U.S.-domiciled company common stocks based on total market capitalization.

8

SFT Managed Volatility Equity Fund

Fund Objective

The SFT Managed Volatility Equity Fund seeks to maximize risk-adjusted total return relative to its blended benchmark index comprised of 60 percent S&P 500® Low Volatility Index, 20% S&P 500® BMI International Developed Low Volatility Index and 20% Bloomberg Barclays U.S. 3-Month Treasury Bellwether Index (collectively, the Blended Benchmark Index).

The SFT Managed Volatility Equity Fund invests at least 80% of its assets in equity securities. Equity securities include those that are equity based, such as ETFs that invest primarily in U.S. and foreign equity securities. The Fund is subject to risks associated with such investments as described in detail in the prospectus. The net asset value of the Fund will fluctuate and is not guaranteed. It is possible to lose money by investing in the Fund. There is no assurance that efforts to manage Fund volatility will achieve the desired results.

Performance Update

For the six-month period ended June 30, 2019, the Fund had a net return of 10.77 percent*. This return reflects the waiver, reimbursement or payment of certain of the Fund's expenses by its investment advisor.** The Blended Benchmark Index, returned 14.94 percent for the same period.

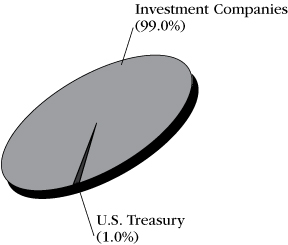

Sector Diversification (shown as a percentage of net assets)

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

**Securian Asset Management, Inc. (Securian AM) and the Securian Funds Trust, on behalf of the SFT Managed Volatility Equity Fund (the "Fund"), have entered into an Expense Limitation Agreement, dated November 18, 2015, which limits the operating expenses of the Fund, excluding certain expenses (such as interest expense, acquired fund fees, cash overdraft fees, taxes, brokerage commissions, other expenditures which are capitalized in accordance with the generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the Fund's business), to 0.80% of the Fund's average daily net assets through April 30, 2020. The Agreement renews annually for a full year each year thereafter unless terminated by Securian AM upon at least 30 days' notice prior to the end of a contract term. The Fund is authorized to reimburse Securian AM for management fees previously waived and/or for the cost of expenses previously paid by Securian AM pursuant to this agreement, provided that such reimbursement will not cause the Fund to exceed any limits in effect at the time of such reimbursement. The Fund's ability to reimburse Securian AM in this manner only applies to fees waived or reimbursements made by Securian AM within the three fiscal years prior to the date of such reimbursement. As of June 30, 2019, Securian AM has waived $1,511,954 pursuant to the agreement. To the extent that the Fund makes such reimbursements to Securian AM, the amount of the reimbursements will be reflected in the financial statements in the Fund's shareholder reports and in Other Expenses under Fees and Expenses of the Fund. The Blended Benchmark Index is comprised of 60 percent of the S&P 500® Low Volatility Index, 20% S&P 500® BMI International Developed Low Volatility Index and 20% Bloomberg Barclays U.S. 3-Month Treasury Bellwether Index. The S&P 500® Low Volatility Index measures performance of the 100 least volatile stocks in the S&P 500®. The S&P 500® BMI International Developed Low Volatility Index measures the performance of the 200 least volatile stocks in the S&P Developed Market large/midcap universe. Constituents are weighted relative to the inverse of their corresponding volatility, with the least volatile stocks receiving the highest weights. The Bloomberg Barclays U.S. 3-Month Treasury Bellwether Index tracks the market for the on-the-run 3 month Treasury bill issued by the U.S. government.

9

SFT Real Estate Securities Fund

Fund Objective

The SFT Real Estate Securities Fund seeks above-average income and long-term growth of capital. The Fund intends to pursue its objective by investing primarily in equity securities of companies in the real estate industry. Investment risks associated with investing in the SFT Real Estate Securities Fund, in addition to other risks, include rental income fluctuations, depreciation, property tax value changes, and differences in real estate market value.

Performance Update

The Fund's performance for the six-month period ended June 30, 2019, for each class of shares offered was as follows:

| Class 1 | | | 15.95 | percent* | |

| Class 2 | | | 15.81 | percent* | |

The Fund's benchmark, the FTSE NAREIT Equity REITs Index, returned 17.78 percent for the same period.

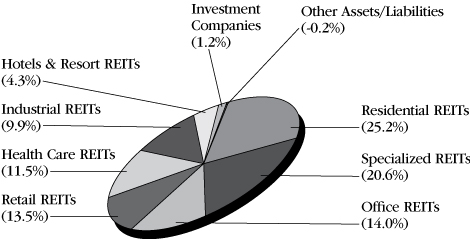

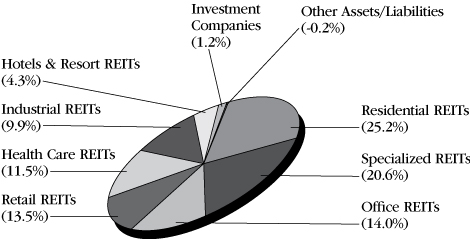

Sector Diversification (shown as a percentage of net assets)

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

FTSE NAREIT Equity REITs Index is a broad-based index consisting of real estate investment trusts.

10

SFT T. Rowe Price Value Fund

Fund Objective

The SFT T. Rowe Price Value Fund seeks to provide long-term capital appreciation by investing in common stocks believed to be undervalued. Income is a secondary objective. The Fund pursues its objective by taking a value approach to investment selection. Holdings consist primarily of large cap stocks, but may also include stocks of mid-cap and small-cap companies. While Securian Asset Management, Inc. acts as the investment adviser for the Fund, T. Rowe Price Associates, Inc. (T. Rowe Price) provides investment advice to the Fund under a sub-advisory agreement. The Fund's value approach to investing carries the risk that the market will not recognize a security's intrinsic value for a long time or that a stock judged to be undervalued may actually be appropriately priced at a low level.

Performance Update

For the six-month period ended June 30, 2019, the Fund had a net return of 17.53 percent*. The Fund's benchmark, the Russell 1000 Value Index, returned 16.24 percent for the same period.

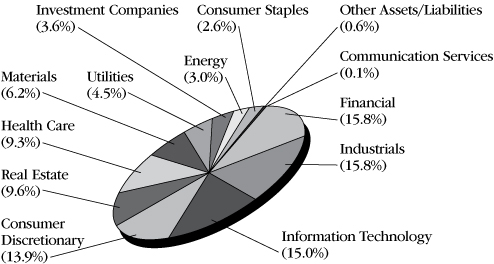

Sector Diversification (shown as a percentage of net assets)

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

Russell 1000 Value Index measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

11

SFT Wellington Core Equity Fund

Fund Objective

The SFT Wellington Core Equity Fund seeks long-term capital appreciation. The Fund pursues its objective by investing primarily in a diversified portfolio of common stocks. Securian Asset Management, Inc. acts as the investment adviser for the Fund, Wellington Management Company LLP (Wellington Management) provides investment advice to the Fund under a sub-advisory agreement. Risks associated with investing in the Fund include, but are not limited to, issuer-specific market volatility and risk of declines in the equity markets generally.

Performance Update

The Fund's performance for the six-month period ended June 30, 2019, for each class of shares offered was as follows:

| Class 1 | | | 19.86 | percent* | |

| Class 2 | | | 19.72 | percent* | |

The Fund's benchmark, the Standard & Poor's 500® Index, returned 18.54 percent for the same period.

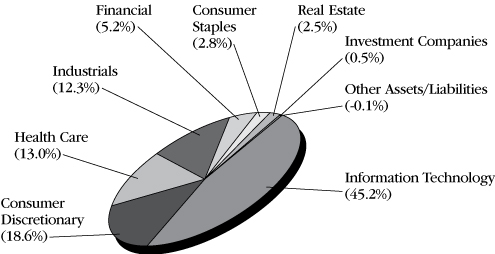

Sector Diversification (shown as a percentage of net assets)

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The S&P 500® Index is a broad, unmanaged index of 500 common stocks which are representative of the U.S. stock market overall.

12

SFT Core Bond Fund

Investments in Securities

(Percentages of each investment category relate to total net assets)

| | | Principal | | Value(a) | |

Long-Term Debt Securities (99.0%) | |

Government Obligations (32.2%) | |

Other Government Obligations (1.6%) | |

Provincial or Local Government

Obligations (1.6%) | |

Douglas County Public

Utility District No. 1,

5.450%, 09/01/40 | | $ | 1,185,000 | | | $ | 1,491,477 | | |

Municipal Electric

Authority of Georgia,

6.655%, 04/01/57 | | | 1,188,000 | | | | 1,552,407 | | |

Ohio State Water

Development Authority,

4.817%, 12/01/30 | | | 250,000 | | | | 291,880 | | |

Port Authority of

New York & New Jersey | |

4.458%, 10/01/62 | | | 1,150,000 | | | | 1,376,078 | | |

4.926%, 10/01/51 | | | 2,055,000 | | | | 2,588,355 | | |

Texas A&M University,

4.000%, 05/15/31 | | | 325,000 | | | | 346,518 | | |

| | | | | | 7,646,715 | | |

U.S. Government Agencies and

Obligations (30.6%) | |

Federal Home Loan Mortgage Corporation

(FHLMC) (5.8%) | |

2.500%, 03/01/28 | | | 491,394 | | | | 496,057 | | |

2.500%, 04/01/28 | | | 168,646 | | | | 170,246 | | |

3.000%, 08/01/42 | | | 527,469 | | | | 538,188 | | |

3.000%, 12/01/42 | | | 204,545 | | | | 208,702 | | |

3.000%, 01/01/43 | | | 266,451 | | | | 272,032 | | |

3.000%, 02/01/43 | | | 644,953 | | | | 659,656 | | |

3.000%, 04/01/43 | | | 1,069,947 | | | | 1,091,651 | | |

3.000%, 10/25/46 | | | 322,541 | | | | 323,070 | | |

3.081%, 01/25/23

(1-Month USD LIBOR +

0.650%) (b) | | | 89,212 | | | | 89,267 | | |

3.354%, 10/25/29 (1-Month

USD LIBOR + 0.950%) (b) | | | 450,000 | | | | 421,237 | | |

3.500%, 10/01/25 | | | 210,212 | | | | 219,062 | | |

3.500%, 05/01/32 | | | 233,973 | | | | 242,826 | | |

3.500%, 03/01/42 | | | 888,423 | | | | 922,551 | | |

3.500%, 08/01/42 | | | 677,581 | | | | 703,913 | | |

3.500%, 05/25/45 | | | 1,245,668 | | | | 1,264,509 | | |

4.000%, 02/01/20 | | | 36,877 | | | | 38,296 | | |

4.000%, 09/01/40 | | | 816,486 | | | | 862,446 | | |

4.000%, 11/01/40 | | | 1,490,780 | | | | 1,578,769 | | |

4.000%, 02/01/41 | | | 338,443 | | | | 357,307 | | |

4.000%, 03/01/41 | | | 327,491 | | | | 348,018 | | |

4.500%, 04/01/23 | | | 23,477 | | | | 24,537 | | |

4.500%, 09/01/40 | | | 201,613 | | | | 216,682 | | |

4.500%, 01/01/41 | | | 608,595 | | | | 654,084 | | |

4.500%, 02/01/41 | | | 365,563 | | | | 392,888 | | |

4.500%, 03/01/41 | | | 683,782 | | | | 734,892 | | |

4.500%, 04/01/41 | | | 534,778 | | | | 576,633 | | |

5.000%, 03/01/23 | | | 16,720 | | | | 17,682 | | |

5.000%, 05/01/29 | | | 30,468 | | | | 32,220 | | |

5.000%, 04/01/35 | | | 130,245 | | | | 137,750 | | |

5.000%, 08/01/35 | | | 61,254 | | | | 67,032 | | |

5.000%, 11/01/35 | | | 123,436 | | | | 134,946 | | |

5.000%, 11/01/39 | | | 646,961 | | | | 712,357 | | |

| | | Principal | | Value(a) | |

5.000%, 04/01/40 | | $ | 266,986 | | | $ | 290,343 | | |

5.000%, 08/01/40 | | | 155,395 | | | | 168,990 | | |

5.500%, 06/01/20 | | | 8,674 | | | | 8,690 | | |

5.500%, 10/01/20 | | | 41,664 | | | | 41,933 | | |

5.500%, 11/01/23 | | | 112,859 | | | | 120,348 | | |

5.500%, 05/01/34 | | | 669,476 | | | | 747,055 | | |

5.500%, 10/01/34 | | | 189,444 | | | | 209,777 | | |

5.500%, 07/01/35 | | | 267,688 | | | | 297,196 | | |

5.500%, 10/01/35 | | | 260,313 | | | | 288,998 | | |

5.500%, 12/01/38 | | | 136,254 | | | | 150,070 | | |

5.854%, 10/25/29 (1-Month

USD LIBOR + 3.450%) (b) | | | 4,000,000 | | | | 4,277,060 | | |

6.000%, 09/01/22 | | | 27,458 | | | | 28,576 | | |

6.000%, 11/01/33 | | | 350,132 | | | | 398,629 | | |

6.250%, 12/15/23 | | | 35,667 | | | | 37,695 | | |

6.500%, 09/01/32 | | | 41,281 | | | | 47,743 | | |

6.500%, 11/01/32 | | | 31,777 | | | | 36,715 | | |

6.500%, 06/01/36 | | | 192,987 | | | | 227,198 | | |

6.954%, 10/25/24 (1-Month

USD LIBOR + 4.550%) (b) | | | 170,310 | | | | 183,276 | | |

7.000%, 12/01/37 | | | 39,750 | | | | 45,286 | | |

7.204%, 05/25/28 (1-Month

USD LIBOR + 4.800%) (b) | | | 1,700,000 | | | | 1,848,494 | | |

7.954%, 07/25/28 (1-Month

USD LIBOR + 5.550%) (b) | | | 3,000,000 | | | | 3,398,357 | | |

| | | | | | 27,361,935 | | |

Federal National Mortgage Association

(FNMA) (11.8%) | |

2.500%, 03/01/27 | | | 278,172 | | | | 280,652 | | |

2.500%, 11/01/27 | | | 477,745 | | | | 482,161 | | |

2.500%, 03/01/28 | | | 308,517 | | | | 311,265 | | |

2.500%, 07/01/28 | | | 415,610 | | | | 419,320 | | |

3.000%, 06/01/22 | | | 99,412 | | | | 101,402 | | |

3.000%, 09/01/22 | | | 64,172 | | | | 65,456 | | |

3.000%, 11/01/27 | | | 204,735 | | | | 209,533 | | |

3.000%, 06/01/28 | | | 170,695 | | | | 174,948 | | |

3.000%, 07/18/34 (c) | | | 2,400,000 | | | | 2,447,179 | | |

3.000%, 09/01/42 | | | 147,351 | | | | 150,254 | | |

3.000%, 01/01/46 | | | 489,303 | | | | 495,919 | | |

3.000%, 07/15/49 (c) | | | 6,570,000 | | | | 6,626,076 | | |

3.500%, 11/01/25 | | | 236,774 | | | | 246,629 | | |

3.500%, 01/01/26 | | | 282,045 | | | | 293,815 | | |

3.500%, 12/01/32 | | | 195,369 | | | | 202,636 | | |

3.500%, 11/01/40 | | | 577,321 | | | | 600,268 | | |

3.500%, 01/01/41 | | | 648,038 | | | | 671,474 | | |

3.500%, 02/01/41 | | | 916,465 | | | | 948,738 | | |

3.500%, 04/01/41 | | | 356,961 | | | | 370,381 | | |

3.500%, 11/01/41 | | | 2,355,028 | | | | 2,445,768 | | |

3.500%, 12/01/41 | | | 600,234 | | | | 623,176 | | |

3.500%, 05/01/42 | | | 232,804 | | | | 241,699 | | |

3.500%, 01/01/43 | | | 567,409 | | | | 589,052 | | |

3.500%, 02/01/43 | | | 491,498 | | | | 514,671 | | |

3.500%, 05/01/43 | | | 1,850,833 | | | | 1,929,711 | | |

3.500%, 07/15/49 (c) | | | 9,705,000 | | | | 9,922,225 | | |

4.000%, 06/25/23 | | | 74,395 | | | | 74,872 | | |

4.000%, 12/01/40 | | | 129,288 | | | | 136,336 | | |

4.000%, 04/01/41 | | | 1,272,261 | | | | 1,343,780 | | |

4.000%, 09/01/41 | | | 536,218 | | | | 566,844 | | |

4.000%, 11/01/41 | | | 259,086 | | | | 273,247 | | |

4.000%, 06/01/42 | | | 696,815 | | | | 734,839 | | |

4.000%, 09/01/43 | | | 427,902 | | | | 449,090 | | |

See accompanying notes to financial statements.

13

SFT Core Bond Fund

Investments in Securities – continued

| | | Principal | | Value(a) | |

4.000%, 07/15/49 (c) | | $ | 1,745,000 | | | $ | 1,803,519 | | |

4.500%, 04/01/21 | | | 1,376 | | | | 1,406 | | |

4.500%, 04/01/25 | | | 41,744 | | | | 43,814 | | |

4.500%, 05/25/34 | | | 537,000 | | | | 618,345 | | |

4.500%, 05/01/35 | | | 260,622 | | | | 279,647 | | |

4.500%, 07/01/35 | | | 482,409 | | | | 513,237 | | |

4.500%, 09/01/37 | | | 175,748 | | | | 188,203 | | |

4.500%, 06/01/39 | | | 184,357 | | | | 197,904 | | |

4.500%, 04/01/41 | | | 1,491,986 | | | | 1,616,316 | | |

4.500%, 07/01/41 | | | 1,366,996 | | | | 1,468,237 | | |

4.500%, 07/01/47 | | | 452,909 | | | | 482,321 | | |

5.000%, 10/01/20 | | | 13,275 | | | | 13,583 | | |

5.000%, 06/25/23 | | | 69,857 | | | | 72,464 | | |

5.000%, 07/01/23 | | | 51,171 | | | | 54,085 | | |

5.000%, 11/01/33 | | | 199,928 | | | | 217,082 | | |

5.000%, 03/01/34 | | | 179,337 | | | | 193,131 | | |

5.000%, 05/01/34 | | | 45,707 | | | | 49,588 | | |

5.000%, 12/01/34 | | | 215,199 | | | | 234,312 | | |

5.000%, 07/01/35 | | | 189,811 | | | | 207,038 | | |

5.000%, 08/01/35 | | | 61,915 | | | | 67,611 | | |

5.000%, 03/01/38 | | | 95,188 | | | | 103,263 | | |

5.000%, 04/01/38 | | | 132,253 | | | | 145,427 | | |

5.000%, 06/01/39 | | | 114,200 | | | | 123,980 | | |

5.000%, 12/01/39 | | | 457,321 | | | | 504,574 | | |

5.000%, 06/01/40 | | | 68,747 | | | | 74,708 | | |

5.000%, 04/01/41 | | | 402,210 | | | | 442,011 | | |

5.500%, 08/01/23 | | | 31,149 | | | | 33,198 | | |

5.500%, 02/01/24 | | | 47,618 | | | | 50,751 | | |

5.500%, 04/01/33 | | | 591,551 | | | | 652,737 | | |

5.500%, 05/01/33 | | | 11,850 | | | | 13,157 | | |

5.500%, 12/01/33 | | | 74,354 | | | | 82,588 | | |

5.500%, 01/01/34 | | | 143,402 | | | | 159,281 | | |

5.500%, 02/01/34 | | | 143,045 | | | | 157,796 | | |

5.500%, 03/01/34 | | | 222,700 | | | | 246,651 | | |

5.500%, 04/01/34 | | | 148,665 | | | | 164,806 | | |

5.500%, 05/01/34 | | | 5,022 | | | | 5,353 | | |

5.500%, 09/01/34 | | | 200,920 | | | | 219,284 | | |

5.500%, 10/01/34 | | | 58,858 | | | | 65,377 | | |

5.500%, 01/01/35 | | | 98,146 | | | | 108,870 | | |

5.500%, 02/01/35 | | | 242,629 | | | | 264,592 | | |

5.500%, 04/01/35 | | | 248,113 | | | | 275,092 | | |

5.500%, 06/01/35 | | | 41,792 | | | | 44,974 | | |

5.500%, 08/01/35 | | | 151,351 | | | | 167,755 | | |

5.500%, 10/01/35 | | | 333,809 | | | | 373,918 | | |

5.500%, 11/01/35 | | | 75,919 | | | | 84,534 | | |

5.500%, 09/01/36 | | | 131,229 | | | | 145,766 | | |

5.500%, 12/01/39 | | | 88,519 | | | | 97,481 | | |

6.000%, 08/01/23 | | | 38,920 | | | | 40,392 | | |

6.000%, 09/01/32 | | | 14,798 | | | | 16,802 | | |

6.000%, 10/01/32 | | | 449,681 | | | | 510,799 | | |

6.000%, 11/01/32 | | | 383,683 | | | | 435,955 | | |

6.000%, 03/01/33 | | | 426,684 | | | | 483,943 | | |

6.000%, 04/01/33 | | | 24,192 | | | | 26,481 | | |

6.000%, 12/01/33 | | | 127,118 | | | | 144,000 | | |

6.000%, 08/01/34 | | | 38,986 | | | | 43,030 | | |

6.000%, 09/01/34 | | | 24,975 | | | | 27,979 | | |

6.000%, 11/01/34 | | | 13,101 | | | | 14,448 | | |

6.000%, 12/01/34 | | | 108,194 | | | | 122,677 | | |

6.000%, 11/01/36 | | | 12,682 | | | | 14,360 | | |

6.000%, 01/01/37 | | | 131,558 | | | | 148,945 | | |

6.000%, 08/01/37 | | | 79,192 | | | | 89,566 | | |

6.000%, 12/01/37 | | | 6,255 | | | | 6,847 | | |

6.000%, 10/01/38 | | | 167,463 | | | | 192,505 | | |

| | | Principal | | Value(a) | |

6.054%, 09/25/29 (1-Month

USD LIBOR + 3.650%) (b) | | $ | 250,000 | | | $ | 265,999 | | |

6.500%, 11/01/23 | | | 29,361 | | | | 30,846 | | |

6.500%, 12/01/31 | | | 65,641 | | | | 76,360 | | |

6.500%, 02/01/32 | | | 201,093 | | | | 233,039 | | |

6.500%, 04/01/32 | | | 146,131 | | | | 169,323 | | |

6.500%, 05/01/32 | | | 36,668 | | | | 40,672 | | |

6.500%, 07/01/32 | | | 288,685 | | | | 333,365 | | |

6.500%, 08/01/32 | | | 111,204 | | | | 128,338 | | |

6.500%, 09/01/32 | | | 74,038 | | | | 85,510 | | |

6.500%, 10/01/32 | | | 112,258 | | | | 129,145 | | |

6.500%, 09/01/34 | | | 10,318 | | | | 11,497 | | |

6.500%, 11/01/34 | | | 6,038 | | | | 6,950 | | |

6.500%, 03/01/35 | | | 82,407 | | | | 95,749 | | |

6.500%, 02/01/36 | | | 14,646 | | | | 16,245 | | |

6.500%, 09/01/37 | | | 79,447 | | | | 90,125 | | |

6.500%, 11/01/37 | | | 52,532 | | | | 60,315 | | |

6.804%, 01/25/24 (1-Month

USD LIBOR + 4.400%) (b) | | | 100,000 | | | | 109,308 | | |

6.854%, 01/25/29 (1-Month

USD LIBOR + 4.450%) (b) | | | 2,485,533 | | | | 2,646,769 | | |

7.000%, 07/01/31 | | | 57,256 | | | | 67,050 | | |

7.000%, 09/01/31 | | | 190,428 | | | | 218,579 | | |

7.000%, 11/01/31 | | | 194,826 | | | | 221,968 | | |

7.000%, 02/01/32 | | | 95,231 | | | | 110,195 | | |

7.000%, 03/01/32 | | | 17,205 | | | | 20,252 | | |

7.000%, 07/01/32 | | | 74,967 | | | | 85,412 | | |

7.000%, 10/01/37 | | | 15,652 | | | | 16,433 | | |

7.500%, 07/25/22 | | | 22,108 | | | | 22,805 | | |

7.500%, 04/01/31 | | | 89,052 | | | | 99,670 | | |

7.500%, 05/01/31 | | | 20,912 | | | | 23,436 | | |

| | | | | | 55,807,267 | | |

Government National Mortgage Association

(GNMA) (3.0%) | |

0.018%, 06/17/45 (b) (d) | | | 367,314 | | | | 202 | | |

0.643%, 07/16/40 (b) (d) | | | 24,335 | | | | 1 | | |

1.000%, 12/20/42 | | | 123,176 | | | | 119,839 | | |

3.000%, 03/15/45 | | | 1,368,737 | | | | 1,398,110 | | |

3.000%, 04/15/45 | | | 2,530,263 | | | | 2,584,561 | | |

3.000%, 05/15/45 | | | 122,282 | | | | 124,906 | | |

3.250%, 04/20/33 | | | 160,274 | | | | 165,666 | | |

3.250%, 03/20/35 | | | 1,094,953 | | | | 1,131,641 | | |

3.250%, 11/20/35 | | | 599,423 | | | | 618,724 | | |

3.250%, 01/20/36 | | | 1,013,780 | | | | 1,046,425 | | |

3.500%, 11/15/40 | | | 77,123 | | | | 80,137 | | |

3.500%, 04/20/46 | | | 954,969 | | | | 986,326 | | |

3.750%, 03/20/46 | | | 915,504 | | | | 947,703 | | |

4.000%, 07/20/31 | | | 359,617 | | | | 375,825 | | |

4.000%, 04/20/39 | | | 238,455 | | | | 249,232 | | |

4.000%, 12/20/40 | | | 759,258 | | | | 811,681 | | |

4.000%, 01/15/41 | | | 48,869 | | | | 51,915 | | |

4.000%, 02/15/41 | | | 356,652 | | | | 381,276 | | |

4.000%, 10/15/41 | | | 256,790 | | | | 272,810 | | |

4.000%, 12/20/44 | | | 134,928 | | | | 142,280 | | |

4.500%, 06/15/40 | | | 247,788 | | | | 268,008 | | |

5.000%, 05/15/33 | | | 76,033 | | | | 82,513 | | |

5.000%, 12/15/39 | | | 93,187 | | | | 102,528 | | |

5.000%, 01/15/40 | | | 1,017,445 | | | | 1,105,360 | | |

5.000%, 07/15/40 | | | 238,163 | | | | 251,280 | | |

5.500%, 07/15/38 | | | 233,546 | | | | 258,078 | | |

5.500%, 10/15/38 | | | 349,995 | | | | 386,762 | | |

8.500%, 10/15/22 | | | 7,882 | | | | 7,903 | | |

| | | | | | 13,951,692 | | |

See accompanying notes to financial statements.

14

SFT Core Bond Fund

Investments in Securities – continued

| | | Principal | | Value(a) | |

U.S. Treasury (10.0%) | |

U.S. Treasury Bond | |

3.000%, 02/15/49 | | $ | 18,725,000 | | | $ | 20,565,316 | | |

5.375%, 02/15/31 (e) | | | 5,115,000 | | | | 6,869,485 | | |

U.S. Treasury Note | |

1.250%, 02/29/20 | | | 1,250,000 | | | | 1,243,457 | | |

1.375%, 04/30/20 | | | 1,000,000 | | | | 994,727 | | |

1.375%, 05/31/20 | | | 550,000 | | | | 546,820 | | |

2.000%, 05/31/24 | | | 3,425,000 | | | | 3,465,271 | | |

2.125%, 05/31/26 | | | 3,600,000 | | | | 3,660,187 | | |

2.250%, 03/31/26 | | | 2,000,000 | | | | 2,049,375 | | |

2.250%, 02/15/27 (e) | | | 150,000 | | | | 153,715 | | |

2.625%, 12/31/25 | | | 1,400,000 | | | | 1,466,227 | | |

2.750%, 08/31/25 | | | 3,000,000 | | | | 3,159,609 | | |

2.750%, 02/15/28 | | | 200,000 | | | | 212,656 | | |

3.000%, 09/30/25 | | | 2,680,000 | | | | 2,863,203 | | |

| | | | | | 47,250,048 | | |

Vendee Mortgage Trust (0.0%) | |

Vendee Mortgage Trust,

7.793%, 02/15/25 | | | 29,224 | | | | 31,738 | | |

Total government obligations

(cost: $146,675,108) | | | | | 152,049,395 | | |

Asset-Backed Securities (13.3%) | |

Bank of The West Auto Trust,

3.210%, 04/15/25 (f) | | | 2,293,000 | | | | 2,299,145 | | |

Bear Stearns Asset Backed

Securities Trust,

3.379%, 02/25/34

(1-Month USD LIBOR +

0.975%) (b) | | | 361,951 | | | | 367,160 | | |

CarMax Auto Owner Trust | |

2.160%, 08/16/21 | | | 1,300,000 | | | | 1,297,401 | | |

2.950%, 11/15/23 | | | 1,950,000 | | | | 1,965,665 | | |

Chase Funding Trust

2.964%, 02/25/33

(1-Month USD LIBOR +

0.560%) (b) | | | 155,233 | | | | 151,652 | | |

3.044%, 08/25/32

(1-Month USD LIBOR +

0.640%) (b) | | | 120,225 | | | | 118,636 | | |

Chesapeake Funding II LLC

3.260%, 11/15/29 (f) | | | 375,000 | | | | 376,887 | | |

3.380%, 08/15/29 (f) | | | 275,000 | | | | 277,768 | | |

3.570%, 04/15/30 (f) | | | 1,200,000 | | | | 1,225,036 | | |

3.710%, 05/15/29 (f) | | | 100,000 | | | | 101,413 | | |

Commonbond Student

Loan Trust | |

2.550%, 05/25/41 (f) | | | 499,059 | | | | 498,839 | | |

5.280%, 05/25/41 (f) | | | 68,439 | | | | 72,052 | | |

Commonbond Student

Loan Trust 2018-A-GS

2.904%, 02/25/44

(1-Month USD LIBOR +

0.500%) (b) (f) | | | 1,013,120 | | | | 999,578 | | |

3.210%, 02/25/44 (f) | | | 2,214,614 | | | | 2,258,409 | | |

DT Auto Owner Trust 2015-3,

4.530%, 10/17/22 (f) | | | 284,944 | | | | 286,100 | | |

Earnest Student Loan

Program LLC | |

2.650%, 01/25/41 (f) | | | 232,886 | | | | 232,537 | | |

2.720%, 01/25/41 (f) | | | 428,154 | | | | 429,632 | | |

3.020%, 05/25/34 (f) | | | 570,442 | | | | 570,839 | | |

| | | Principal | | Value(a) | |

Entergy Gulf States

Reconstruction

Funding 1 LLC,

5.930%, 06/29/22 | | $ | 286,870 | | | $ | 295,753 | | |

Exeter Automobile

Receivables Trust 2015-3,

6.550%, 10/17/22 (f) | | | 2,000,000 | | | | 2,060,209 | | |

Exeter Automobile

Receivables Trust 2016-2,

8.250%, 04/17/23 (f) | | | 1,800,000 | | | | 1,919,585 | | |

FAN Engine

Securitization Ltd.,

3.000%, 10/15/19 (f) (g) (h) | | | 49,507 | | | | 49,478 | | |

FirstEnergy Ohio PIRB

Special Purpose Trust,

1.726%, 01/15/22 | | | 49,978 | | | | 49,892 | | |

Foursight Capital

Automobile Receivables

Trust

2.340%, 01/15/21 (f) | | | 13,128 | | | | 13,119 | | |

3.710%, 01/18/22 (f) | | | 1,485,000 | | | | 1,496,301 | | |

5.280%, 08/15/24 (f) | | | 3,850,000 | | | | 3,983,673 | | |

GM Financial Consumer

Automobile Receivables

Trust,

2.770%, 07/17/23 | | | 800,000 | | | | 806,192 | | |

Home Partners of

America 2018-1 Trust,

3.294%, 07/17/37

(1-Month USD LIBOR +

0.900%) (b) (f) | | | 2,096,141 | | | | 2,085,726 | | |

Invitation Homes

2018-SFR1 Trust

3.644%, 03/17/37

(1-Month USD LIBOR +

1.250%) (b) (f) | | | 3,500,000 | | | | 3,481,494 | | |

3.844%, 03/17/37

(1-Month USD LIBOR +

1.450%) (b) (f) | | | 1,000,000 | | | | 994,743 | | |

Invitation Homes

2018-SFR3 Trust

3.394%, 07/17/37

(1-Month USD LIBOR +

1.000%) (b) (f) | | | 2,099,598 | | | | 2,093,687 | | |

4.044%, 07/17/37

(1-Month USD LIBOR +

1.650%) (b) (f) | | | 1,500,000 | | | | 1,497,516 | | |

Invitation Homes

2018-SFR4 Trust,

3.794%, 01/17/38

(1-Month USD LIBOR +

1.400%) (b) (f) | | | 4,300,000 | | | | 4,310,431 | | |

Invitation Homes Trust,

3.674%, 06/17/37

(1-Month USD LIBOR +

1.280%) (b) (f) | | | 1,500,000 | | | | 1,499,997 | | |

Morgan Stanley Dean

Witter Capital I, Inc.,

2.964%, 08/25/32

(1-Month USD LIBOR +

0.560%) (b) | | | 178,343 | | | | 172,647 | | |

Progress Residential

2018-SFR1 Trust,

3.684%, 03/17/35 (f) | | | 500,000 | | | | 508,474 | | |

See accompanying notes to financial statements.

15

SFT Core Bond Fund

Investments in Securities – continued

| | | Principal | | Value(a) | |

Progress Residential

2019-SFR2 Trust,

3.446%, 05/17/36 (f) | | $ | 2,500,000 | | | $ | 2,552,584 | | |

Progress Residential Trust,

3.565%, 08/17/34 (f) | | | 1,525,000 | | | | 1,545,575 | | |

Saxon Asset Securities

Trust,

2.944%, 03/25/35

(1-Month USD LIBOR +

0.540%) (b) | | | 270,238 | | | | 256,023 | | |

Sofi Professional Loan

Program 2017-F LLC,

2.840%, 01/25/41 (f) | | | 1,500,000 | | | | 1,515,970 | | |

Sofi Professional Loan

Program 2018-A LLC,

2.950%, 02/25/42 (f) | | | 1,200,000 | | | | 1,219,582 | | |

Towd Point Mortgage Trust

3.000%, 06/25/58 (b) (f) | | | 3,972,223 | | | | 4,032,219 | | |

3.750%, 04/25/55 (b) (f) | | | 1,455,000 | | | | 1,505,629 | | |

4.558%, 11/25/57 (b) (f) | | | 3,154,000 | | | | 3,319,073 | | |

Volvo Financial

Equipment LLC

Series 2018-1,

3.060%, 12/15/25 (f) | | | 1,300,000 | | | | 1,310,126 | | |

Westlake Automobile

Receivables Trust 2017-1,

5.050%, 08/15/24 (f) | | | 725,000 | | | | 738,065 | | |

Westlake Automobile

Receivables Trust 2017-2,

4.630%, 07/15/24 (f) | | | 850,000 | | | | 870,085 | | |

Westlake Automobile

Receivables Trust 2018-1,

2.920%, 05/15/23 (f) | | | 3,000,000 | | | | 3,008,992 | | |

Wheels SPV 2 LLC,

1.870%, 05/20/25 (f) | | | 293,992 | | | | 293,386 | | |

Total asset-backed securities

(cost: $62,488,376) | | | | | 63,014,975 | | |

Other Mortgage-Backed Securities (12.8%) | |

Collateralized Mortgage Obligations/Mortgage

Revenue Bonds (6.2%) | |

Agate Bay Mortgage Trust,

3.815%, 01/25/45 (b) (f) | | | 247,663 | | | | 253,131 | | |

Bear Stearns Mortgage

Securities, Inc.,

8.000%, 11/25/29 | | | 84,749 | | | | 58,721 | | |

Bellemeade Re 2018-1, Ltd.,

4.004%, 04/25/28

(1-Month USD LIBOR +

1.600%) (b) (f) (h) | | | 2,250,000 | | | | 2,258,126 | | |

Bellemeade Re 2018-3, Ltd.,

4.254%, 10/25/27

(1-Month USD LIBOR +

1.850%) (b) (f) (h) | | | 3,800,000 | | | | 3,805,692 | | |

Citigroup Mortgage

Loan Trust, Inc.,

3.000%, 09/25/64 (b) (f) | | | 430,844 | | | | 436,756 | | |

COLT 2018-3 Mortgage

Loan Trust,

3.692%, 10/26/48 (b) (f) | | | 1,734,781 | | | | 1,758,767 | | |

COLT 2019-2 Mortgage

Loan Trust,

3.337%, 05/25/49 (b) (f) | | | 3,753,403 | | | | 3,812,952 | | |

| | | Principal | | Value(a) | |

CSMC Trust,

3.500%, 06/25/47 (b) (f) | | $ | 2,550,000 | | | $ | 2,541,641 | | |

GS Mortgage-Backed

Securities Trust,

3.118%, 07/25/44 (b) (f) | | | 2,759,236 | | | | 2,690,610 | | |

JP Morgan Mortgage Trust

3.371%, 10/25/46 (b) (f) | | | 312,125 | | | | 304,288 | | |

3.405%, 06/25/29 (b) (f) | | | 244,067 | | | | 248,072 | | |

3.648%, 05/25/43 (b) (f) | | | 353,332 | | | | 355,014 | | |

4.625%, 11/25/33 (b) | | | 125,811 | | | | 125,154 | | |

Mellon Residential

Funding Corp.,

6.750%, 06/25/28 | | | 5,690 | | | | 5,809 | | |

Prudential Home Mortgage

Securities

7.672%, 09/28/24 (b) (f) | | | 521 | | | | 488 | | |

7.900%, 04/28/22 (f) | | | 2,083 | | | | 2,049 | | |

PSMC Trust,

3.500%, 02/25/48 (b) (f) | | | 3,904,918 | | | | 3,964,617 | | |

Radnor RE 2019-1, Ltd.,

4.354%, 02/25/29

(1-Month USD LIBOR +

1.950%) (b) (f) (h) | | | 1,138,000 | | | | 1,145,956 | | |

Seasoned Credit Risk

Transfer Trust

4.000%, 07/25/56 (b) | | | 2,602,000 | | | | 2,552,034 | | |

4.000%, 08/25/56 (b) (f) | | | 1,200,000 | | | | 1,204,020 | | |

Sequoia Mortgage Trust

3.191%, 11/25/30 (b) (f) | | | 651,208 | | | | 654,120 | | |

3.712%, 07/25/45 (b) (f) | | �� | 450,089 | | | | 459,180 | | |

3.876%, 01/25/45 (b) (f) | | | 373,771 | | | | 383,823 | | |

Structured Asset Mortgage

Investments, Inc., | |

0.818%, 05/02/30 (b) | | | 6,219 | | | | 717 | | |

0.818%, 05/02/30 (b) | | | 4,035 | | | | 463 | | |

| | | | | | 29,022,200 | | |

Commercial Mortgage-Backed Securities (6.6%) | |

Banc of America

Re-Remic Trust,

4.325%, 08/15/46 (b) (f) | | | 1,350,000 | | | | 1,503,276 | | |

BB-UBS Trust,

4.160%, 11/05/36 (b) (f) | | | 1,000,000 | | | | 1,028,910 | | |

CFCRE Commercial

Mortgage Trust,

3.839%, 12/10/54 | | | 500,000 | | | | 536,954 | | |

Citigroup Commercial

Mortgage Trust 2018-TBR,

3.224%, 12/15/36

(1-Month USD LIBOR +

0.830%) (b) (f) | | | 4,000,000 | | | | 3,997,453 | | |

CSMC Trust,

3.304%, 09/15/37 (f) | | | 400,000 | | | | 407,726 | | |

Hometown Commercial

Mortgage,

6.057%, 06/11/39 (f) | | | 28,292 | | | | 23,971 | | |

Irvine Core Office Trust,

2.068%, 05/15/48 (f) | | | 212,726 | | | | 212,407 | | |

JPMCC Commercial

Mortgage Securities Trust,

3.723%, 03/15/50 | | | 1,000,000 | | | | 1,069,833 | | |

See accompanying notes to financial statements.

16

SFT Core Bond Fund

Investments in Securities – continued

| | | Principal | | Value(a) | |

JPMorgan Chase

Commercial Mortgage

Securities Corp.,

2.078%, 12/05/27 (b) (d) (f) | | $ | 3,246,988 | | | $ | 26,782 | | |

Morgan Stanley Bank of

America Merrill Lynch

Trust,

3.720%, 12/15/49 | | | 225,000 | | | | 240,798 | | |

Morgan Stanley Capital I

Trust,

3.451%, 08/05/34 (f) | | | 700,000 | | | | 716,928 | | |

One Market Plaza Trust,

3.614%, 02/10/32 (f) | | | 2,500,000 | | | | 2,609,464 | | |

UBS Commercial

Mortgage Trust

3.580%, 12/15/50 | | | 3,500,000 | | | | 3,709,199 | | |

3.724%, 06/15/50 | | | 5,500,000 | | | | 5,741,081 | | |

4.061%, 12/15/50 (b) | | | 1,505,000 | | | | 1,607,938 | | |

Vornado DP LLC,

4.004%, 09/13/28 (f) | | | 1,475,000 | | | | 1,496,678 | | |

Wells Fargo Commercial

Mortgage Trust

2.814%, 08/15/49 | | | 2,705,000 | | | | 2,701,878 | | |

3.184%, 04/15/50 | | | 1,544,000 | | | | 1,598,034 | | |

3.637%, 06/15/48 | | | 1,905,000 | | | | 2,019,103 | | |

| | | | | | 31,248,413 | | |

Total other mortgage-backed securities

(cost: $59,635,837) | | | | | 60,270,613 | | |

Corporate Obligations (40.7%) | |

Communications (2.2%) | |

Media (0.9%) | |

NBCUniversal Media LLC,

4.375%, 04/01/21 | | | 4,000,000 | | | | 4,148,063 | | |

Telecommunication (1.3%) | |

AT&T, Inc., 5.250%, 03/01/37 | | | 2,300,000 | | | | 2,581,294 | | |

Crown Castle Towers LLC,

3.222%, 05/15/42 (f) | | | 2,375,000 | | | | 2,401,251 | | |

Verizon

Communications, Inc.,

3.618%, 05/15/25

(3-Month USD LIBOR +

1.100%) (b) | | | 1,500,000 | | | | 1,519,275 | | |

| | | | | | 6,501,820 | | |

Consumer Cyclical (2.7%) | |

Airlines (0.2%) | |

US Airways 2013-1 Class B

Pass Through Trust,

5.375%, 05/15/23 | | | 1,103,312 | | | | 1,149,048 | | |

Auto/Truck Parts & Equipment — Original (2.5%) | |

Ford Motor Credit Co. LLC

2.459%, 03/27/20 | | | 1,325,000 | | | | 1,321,090 | | |

5.750%, 02/01/21 | | | 2,190,000 | | | | 2,279,743 | | |

5.875%, 08/02/21 | | | 1,045,000 | | | | 1,101,910 | | |

General Motors

Financial Co., Inc.

3.442%, 04/09/21

(3-Month USD LIBOR +

0.850%) (b) | | | 1,650,000 | | | | 1,649,247 | | |

4.200%, 11/06/21 | | | 3,250,000 | | | | 3,346,481 | | |

| | | Principal | | Value(a) | |

Lear Corp., 5.250%, 01/15/25 | | $ | 1,915,000 | | | $ | 1,984,058 | | |

| | | | | | 11,682,529 | | |

Consumer, Non-cyclical (3.0%) | |

Agricultural Products (0.6%) | |

Altria Group, Inc.,

5.800%, 02/14/39 | | | 955,000 | | | | 1,073,073 | | |

5.950%, 02/14/49 | | | 1,875,000 | | | | 2,140,118 | | |

| | | | | | 3,213,191 | | |

Beverages (0.3%) | |

Bacardi, Ltd.,

5.300%, 05/15/48 (f) (h) | | | 1,325,000 | | | | 1,394,544 | | |

Drugstore Chains (1.0%) | |

CVS Pass-Through Trust

5.298%, 01/11/27 (f) | | | 1,038,737 | | | | 1,104,977 | | |

5.880%, 01/10/28 | | | 359,170 | | | | 397,177 | | |

6.036%, 12/10/28 | | | 2,154,815 | | | | 2,412,833 | | |

6.943%, 01/10/30 | | | 544,607 | | | | 640,837 | | |

| | | | | | 4,555,824 | | |

Health Care Products (0.8%) | |

Boston Scientific Corp.,

4.700%, 03/01/49 | | | 3,125,000 | | | | 3,586,459 | | |

Pharmaceuticals (0.3%) | |

McKesson Corp.,

3.650%, 11/30/20 | | | 1,275,000 | | | | 1,300,894 | | |

Energy (4.4%) | |

Oil, Gas & Consumable Fuels (0.6%) | |

Marathon Petroleum Corp.,

5.850%, 12/15/45 | | | 2,270,000 | | | | 2,504,119 | | |

Pipelines (3.8%) | |

Andeavor Logistics

LP/Tesoro Logistics

Finance Corp.,

5.250%, 01/15/25 | | | 2,450,000 | | | | 2,592,417 | | |

Boardwalk Pipelines L.P.,

4.800%, 05/03/29 | | | 2,375,000 | | | | 2,478,772 | | |

Cheniere Energy

Partners L.P.,

5.250%, 10/01/25 | | | 2,000,000 | | | | 2,067,500 | | |

El Paso Natural Gas Co. LLC,

8.375%, 06/15/32 | | | 675,000 | | | | 906,978 | | |

Enterprise Products

Operating LLC,

5.298%, 06/01/67

(3-Month USD LIBOR +

2.778%) (b) | | | 2,180,000 | | | | 2,005,600 | | |

EQM Midstream

Partners L.P.,

6.500%, 07/15/48 | | | 975,000 | | | | 1,024,082 | | |

MPLX L.P.,

5.500%, 02/15/49 | | | 1,700,000 | | | | 1,930,813 | | |

Sunoco Logistics Partners

Operations L.P.,

6.850%, 02/15/40 | | | 2,150,000 | | | | 2,547,996 | | |

Tennessee Gas

Pipeline Co. LLC,

8.375%, 06/15/32 | | | 1,850,000 | | | | 2,505,554 | | |

| | | | | | 18,059,712 | | |

See accompanying notes to financial statements.

17

SFT Core Bond Fund

Investments in Securities – continued

| | | Principal | | Value(a) | |

Financial (13.2%) | |

Banks (9.1%) | |

Bank of America Corp.,

3.974%, 02/07/30 (b) | | $ | 4,040,000 | | | $ | 4,330,484 | | |

Barclays PLC,

4.209%, 01/10/23

(3-Month USD LIBOR +

1.625%) (b) (h) | | | 3,300,000 | | | | 3,306,963 | | |

Citibank NA,

3.123%, 05/20/22

(3-Month USD LIBOR +

0.600%) (b) | | | 3,650,000 | | | | 3,654,568 | | |

Citigroup, Inc.,

4.400%, 06/10/25 | | | 1,500,000 | | | | 1,600,868 | | |

Citizens Bank NA/

Providence,

3.280%, 03/29/23

(3-Month USD LIBOR +

0.950%) (b) | | | 3,150,000 | | | | 3,165,315 | | |

Compass Bank

3.500%, 06/11/21 | | | 850,000 | | | | 866,250 | | |

3.875%, 04/10/25 | | | 2,500,000 | | | | 2,590,009 | | |

Discover Bank

3.450%, 07/27/26 | | | 1,900,000 | | | | 1,932,990 | | |

4.650%, 09/13/28 | | | 2,300,000 | | | | 2,515,405 | | |

8.700%, 11/18/19 | | | 322,000 | | | | 329,138 | | |

HSBC Holdings PLC,

3.262%, 03/13/23

(3-Month USD LIBOR +

1.055%) (b) (h) | | | 1,875,000 | | | | 1,909,844 | | |

JPMorgan Chase & Co.

3.540%, 05/01/28

(3-Month USD LIBOR +

1.380%) (b) | | | 1,500,000 | | | | 1,561,349 | | |

5.639%, 10/01/19

(3-Month USD LIBOR +

3.320%) (b) | | | 1,700,000 | | | | 1,694,560 | | |

6.053%, 07/30/19

(3-Month USD LIBOR +

3.470%) (b) | | | 1,076,000 | | | | 1,075,419 | | |

Morgan Stanley

3.125%, 07/27/26 | | | 800,000 | | | | 815,212 | | |

5.500%, 07/28/21 | | | 740,000 | | | | 786,223 | | |

Regions Financial Corp.,

3.800%, 08/14/23 | | | 1,675,000 | | | | 1,752,451 | | |

SunTrust Bank,

3.115%, 05/17/22

(3-Month USD LIBOR +

0.590%) (b) | | | 2,850,000 | | | | 2,854,434 | | |

Synovus Financial Corp.,

3.125%, 11/01/22 | | | 2,580,000 | | | | 2,591,584 | | |

The Goldman Sachs

Group, Inc.,

3.363%, 10/31/22 (b) | | | 1,050,000 | | | | 1,050,618 | | |

US Bancorp,

5.300%, 04/15/27

(3-Month USD LIBOR +

2.914%) (b) | | | 800,000 | | | | 830,000 | | |

Wells Fargo & Co.,

3.000%, 10/23/26 | | | 1,100,000 | | | | 1,111,376 | | |

Zions Bancorp NA,

3.500%, 08/27/21 | | | 650,000 | | | | 663,412 | | |

| | | | | | 42,988,472 | | |

| | | Principal | | Value(a) | |

Diversified Financial Services (1.0%) | |

Block Financial LLC,

4.125%, 10/01/20 | | $ | 2,050,000 | | | $ | 2,084,652 | | |

DY7 Leasing LLC,

2.578%, 12/10/25 | | | 135,417 | | | | 137,462 | | |

Export Leasing 2009 LLC,

1.859%, 08/28/21 | | | 58,783 | | | | 58,607 | | |

Helios Leasing I LLC

1.825%, 05/16/25 | | | 79,162 | | | | 78,450 | | |

2.018%, 05/29/24 | | | 115,939 | | | | 115,519 | | |

The Charles Schwab Corp.,

4.625%, 03/01/22

(3-Month USD LIBOR +

3.315%) (b) | | | 2,200,000 | | | | 2,209,262 | | |

Union 16 Leasing LLC,

1.863%, 01/22/25 | | | 126,332 | | | | 125,521 | | |

| | | | | | 4,809,473 | | |

Insurance (2.1%) | |

AXA Equitable Holdings, Inc.,

5.000%, 04/20/48 | | | 2,270,000 | | | | 2,342,302 | | |

Reinsurance Group of

America, Inc.,

3.900%, 05/15/29 | | | 1,300,000 | | | | 1,349,456 | | |

Teachers Insurance &

Annuity Association of

America,

4.270%, 05/15/47 (f) | | | 2,500,000 | | | | 2,706,952 | | |

Unum Group

4.000%, 06/15/29 | | | 1,050,000 | | | | 1,077,838 | | |

5.750%, 08/15/42 | | | 1,975,000 | | | | 2,281,123 | | |

| | | | | | 9,757,671 | | |

Real Estate Investment Trust — Health Care (0.5%) | |

Ventas Realty L.P.,

3.100%, 01/15/23 | | | 2,500,000 | | | | 2,543,973 | | |

Real Estate Investment Trust — Office Property (0.4%) | |

SL Green Operating

Partnership L.P.,

3.505%, 08/16/21

(3-Month USD LIBOR +

0.980%) (b) | | | 2,000,000 | | | | 2,000,724 | | |

Real Estate Investment Trust — Residential (0.1%) | |

UDR, Inc.,

4.000%, 10/01/25 | | | 400,000 | | | | 425,210 | | |

Health Care (1.1%) | |

Health Care Providers & Services (0.7%) | |

NYU Langone Hospitals,

4.428%, 07/01/42 | | | 1,480,000 | | | | 1,668,174 | | |

Sinai Health System,

3.034%, 01/20/36 | | | 1,375,000 | | | | 1,421,958 | | |

| | | | | | 3,090,132 | | |

Medical Products/Supplies (0.4%) | |

Bio-Rad Laboratories, Inc.,

4.875%, 12/15/20 | | | 1,985,000 | | | | 2,047,161 | | |

Industrials (1.2%) | |

Electrical Equipment (0.3%) | |

Keysight Technologies, Inc.,

3.300%, 10/30/19 | | | 1,500,000 | | | | 1,501,666 | | |

See accompanying notes to financial statements.

18

SFT Core Bond Fund

Investments in Securities – continued

| | | Principal | | Value(a) | |

Machinery (0.4%) | |

Wabtec Corp.,

3.710%, 09/15/21

(3-Month USD LIBOR +

1.300%) (b) | | $ | 1,925,000 | | | $ | 1,919,489 | | |

Transportation (0.5%) | |

AP Moller – Maersk AS,

4.500%, 06/20/29 (f) (h) | | | 2,075,000 | | | | 2,104,857 | | |

Technology (1.2%) | |

Computers (1.2%) | |

Dell International LLC /

EMC Corp.,

5.300%, 10/01/29 (f) | | | 1,475,000 | | | | 1,554,355 | | |

5.450%, 06/15/23 (f) | | | 1,790,000 | | | | 1,929,247 | | |

International Business

Machines Corp.,

2.800%, 05/13/21 | | | 2,280,000 | | | | 2,307,452 | | |

| | | | | | 5,791,054 | | |

Transportation (4.3%) | |

Airlines (4.3%) | |

Air Canada 2015-1 Class C

Pass Through Trust,

5.000%, 03/15/20 (f) (h) | | | 2,600,000 | | | | 2,625,740 | | |

Air Canada 2017-1 Class A

Pass Through Trust,

3.550%, 07/15/31 (f) (h) | | | 2,119,320 | | | | 2,128,700 | | |

America West Airlines

2000-1 Pass Through Trust,

8.057%, 01/02/22 | | | 509,366 | | | | 535,313 | | |

American Airlines 2013-1

Class B Pass Through Trust,

5.625%, 07/15/22 (f) | | | 1,236,314 | | | | 1,266,851 | | |

American Airlines 2013-2

Class B Pass Through Trust,

5.600%, 01/15/22 (f) | | | 976,880 | | | | 994,367 | | |

American Airlines 2015-1

Class B Pass Through Trust,

3.700%, 11/01/24 | | | 1,374,387 | | | | 1,381,533 | | |

American Airlines 2016-1

Class B Pass Through Trust,

5.250%, 07/15/25 | | | 1,115,148 | | | | 1,175,588 | | |

British Airways 2013-1

Class B Pass Through Trust,

5.625%, 12/20/21 (f) | | | 153,314 | | | | 155,874 | | |

Continental Airlines 2009-2

Class A Pass Through Trust,

7.250%, 05/10/21 | | | 1,135,531 | | | | 1,151,882 | | |

Continental Airlines 2012-1

Class B Pass Through Trust,

6.250%, 10/11/21 | | | 587,825 | | | | 599,464 | | |

Delta Air Lines 2012-1

Class A Pass Through Trust,

4.750%, 11/07/21 | | | 314,403 | | | | 319,685 | | |

Delta Air Lines 2015-1

Class B Pass Through Trust,

4.250%, 01/30/25 | | | 1,411,196 | | | | 1,494,993 | | |

Hawaiian Airlines 2013-1

Class B Pass Through

Certificates,

4.950%, 07/15/23 | | | 1,979,723 | | | | 2,020,110 | | |

| | | Principal | | Value(a) | |

United Airlines 2014-1

Class B Pass

Through Trust,

4.750%, 10/11/23 | | $ | 444,248 | | | $ | 457,620 | | |

United Airlines 2014-2

Class B Pass Through Trust,

4.625%, 03/03/24 | | | 1,849,476 | | | | 1,903,296 | | |

US Airways 2012-2

Class B Pass Through Trust,

6.750%, 12/03/22 | | | 1,249,343 | | | | 1,325,558 | | |

Virgin Australia 2013-1A

Pass Through Trust,

5.000%, 04/23/25 (f) (h) | | | 452,975 | | | | 466,292 | | |

Virgin Australia 2013-1B

Pass Through Trust,

6.000%, 04/23/22 (f) (h) | | | 222,461 | | | | 225,976 | | |

| | | | | | 20,228,842 | | |

Utilities (7.4%) | |

Electric Companies (0.4%) | |

Indianapolis Power &

Light Co.,

4.700%, 09/01/45 (f) | | | 1,900,000 | | | | 2,142,483 | | |

Electric Utilities (6.2%) | |

Cleco Corporate

Holdings LLC,

3.743%, 05/01/26 (i) | | | 1,125,000 | | | | 1,136,000 | | |

Entergy Mississippi LLC,

3.250%, 12/01/27 | | | 1,100,000 | | | | 1,114,511 | | |

Entergy Texas, Inc.,

3.450%, 12/01/27 | | | 1,885,000 | | | | 1,914,311 | | |

Eversource Energy,

3.800%, 12/01/23 | | | 2,400,000 | | | | 2,532,345 | | |

FirstEnergy

Transmission LLC,

5.450%, 07/15/44 (f) | | | 2,000,000 | | | | 2,376,252 | | |

IPALCO Enterprises, Inc.

3.450%, 07/15/20 | | | 1,400,000 | | | | 1,408,454 | | |

3.700%, 09/01/24 | | | 1,175,000 | | | | 1,216,309 | | |

Metropolitan Edison Co.,

4.300%, 01/15/29 (f) | | | 1,500,000 | | | | 1,635,258 | | |

MidAmerican Energy Co.,

4.250%, 07/15/49 | | | 1,750,000 | | | | 1,992,214 | | |

Mississippi Power Co.,

2.961%, 03/27/20

(3-Month USD LIBOR +

0.650%) (b) | | | 700,000 | | | | 700,172 | | |

Pennsylvania Electric Co.,

3.600%, 06/01/29 (f) | | | 975,000 | | | | 1,007,164 | | |

PPL Capital Funding, Inc.,

4.995%, 03/30/67

(3-Month USD LIBOR +

2.665%) (b) | | | 4,500,000 | | | | 4,107,334 | | |

Public Service Enterprise

Group, Inc.,

2.875%, 06/15/24 | | | 2,400,000 | | | | 2,430,921 | | |

Southern Power Co.,

4.950%, 12/15/46 | | | 2,450,000 | | | | 2,628,189 | | |

Vistra Operations Co. LLC

3.550%, 07/15/24 (f) | | | 1,175,000 | | | | 1,181,912 | | |

4.300%, 07/15/29 (f) | | | 1,650,000 | | | | 1,672,704 | | |

| | | | | | 29,054,050 | | |

See accompanying notes to financial statements.

19

SFT Core Bond Fund

Investments in Securities – continued

| | | Principal | | Value(a) | |

Gas Utilities (0.8%) | |

Southern Co. Gas

Capital Corp.

3.875%, 11/15/25 | | $ | 2,605,000 | | | $ | 2,739,203 | | |

4.400%, 05/30/47 | | | 775,000 | | | | 819,782 | | |

| | | | | | 3,558,985 | | |

Total corporate obligations

(cost: $186,103,508) | | | | | 192,060,445 | | |

Total long-term debt securities

(cost: $454,902,829) | | | | | 467,395,428 | | |

| | | Shares | | Value(a) | |

Short-Term Securities (4.9%) | |

Investment Companies (4.9%) | |

State Street Institutional

U.S. Government Money

Market Fund, current rate

2.310% (j) | | | 23,109,686 | | | $ | 23,109,686 | | |

Total short-term securities

(cost: $23,109,686) | | | | | 23,109,686 | | |

Total investments in securities

(cost: $478,012,515) (k) | | | | | 490,505,114 | | |

Liabilities in excess of cash

and other assets (-3.9%) | | | | | (18,476,867 | ) | |

Total net assets (100.0%) | | | | $ | 472,028,247 | | |

Investments in Securities Legend

(a) Securities are valued by procedures described in Note 2 of the Notes to Financial Statements.

(b) Variable rate security.

(c) Security is issued on a when-issued or forward commitment basis. As of June 30, 2019 the total cost of investments issued on a when-issued or forward commitment basis was $20,760,384.

(d) Interest-only security that entitles holders to receive only interest on the underlying mortgages. The principal amount of the underlying pool represents the notional amount on which current interest is calculated. The yield to maturity of an interest-only security is sensitive to the rate of principal payments on the underlying mortgage assets. The rate disclosed represents the market yield based upon the current cost basis and estimated timing and amount of future cash flows.

(e) Fully or partially pledged as initial margin deposits on open futures contracts.