UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-4279 |

|

Securian Funds Trust |

(Exact name of registrant as specified in charter) |

|

400 Robert Street North St. Paul, Minnesota | | 55101-2098 |

(Address of principal executive offices) | | (Zip code) |

|

David M. Dimitri, Esq.

400 Robert Street North

St. Paul, Minnesota 55101-2098 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (651) 665-3500 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2017 | |

| | | | | | | | |

ITEM 1. REPORT TO STOCKHOLDERS.

Filed herewith.

Annual Report

December 31, 2017

Offered in Minnesota Life Insurance Company and

Securian Life Insurance Company Variable Products

SFT Advantus Bond Fund

SFT Advantus Dynamic Managed Volatility Fund

SFT Advantus Government Money Market Fund

SFT Advantus Index 400 Mid-Cap Fund

SFT Advantus Index 500 Fund

SFT Advantus International Bond Fund

SFT Advantus Managed Volatility Equity Fund

SFT Advantus Mortgage Securities Fund

SFT Advantus Real Estate Securities Fund

SFT IvySM Growth Fund

SFT IvySM Small Cap Growth Fund

SFT T. Rowe Price Value Fund

SFT Wellington Core Equity Fund

(formerly SFT Pyramis® Core Equity Fund)

Financial security

for the long run ®

Securian Funds Trust

Supplement dated December 18, 2017 to the Prospectus of Securian Funds Trust dated May 1, 2017.

This Supplement describes portfolio manager changes for the SFT Advantus Bond Fund, SFT Advantus Dynamic Managed Volatility Fund, SFT Advantus Government Money Market Fund, SFT Advantus Managed Volatility Equity Fund and the SFT Advantus Mortgage Securities Fund.

The text on page 5, under the caption "SFT Advantus Bond Fund: Management," is replaced by the following:

SFT Advantus Bond Fund: Management

The Fund is advised by Advantus Capital. The following individuals serve as the Fund's primary portfolio managers:

Name and Title | | Primary Manager Since | |

Thomas B. Houghton

Vice President and Portfolio Manager,

Advantus Capital | | April 29, 2005 | |

David W. Land

Vice President and Portfolio Manager,

Advantus Capital | | April 29, 2005 | |

Daniel A. Henken

Vice President and Portfolio Manager,

Advantus Capital | | December 1, 2017 | |

The text on page 12, under the caption "SFT Advantus Dynamic Managed Volatility Fund: Management," is replaced by the following:

SFT Advantus Dynamic Managed Volatility Fund: Management

The Fund is advised by Advantus Capital. The following individuals serve as the Fund's primary portfolio managers:

Name and Title | | Primary Manager Since | |

Craig M. Stapleton

Vice President and Portfolio Manager,

Advantus Capital | | May 1, 2013 | |

Jeremy P. Gogos, Ph. D.

Portfolio Manager,

Advantus Capital | | June 1, 2017 | |

Merlin L. Erickson

Vice President and Portfolio Manager,

Advantus Capital | | December 1, 2017 | |

Please retain this supplement for future reference.

F90716 12-2017

The text on page 16, under the caption "SFT Advantus Government Money Market Fund: Management," is replaced by the following:

SFT Advantus Government Money Market Fund: Management

The Fund is advised by Advantus Capital. The following individuals serve as the Fund's primary portfolio managers:

Name and Title | | Primary Manager Since | |

Thomas B. Houghton

Vice President and Portfolio Manager,

Advantus Capital | | August 18, 2003 | |

Lena S. Harhaj

Portfolio Manager,

Advantus Capital | | April 29, 2016 | |

The text on page 37, under the caption "SFT Advantus Managed Volatility Equity Fund: Management," is replaced by the following:

SFT Advantus Managed Volatility Equity Fund: Management

The Fund is advised by Advantus Capital. The following individuals serve as the Fund's primary portfolio managers:

Name and Title | | Primary Manager Since | |

Craig M. Stapleton

Vice President and Portfolio Manager,

Advantus Capital | | November 18, 2015 | |

Jeremy P. Gogos, Ph. D.

Portfolio Manager,

Advantus Capital | | June 1, 2017 | |

Merlin L. Erickson

Vice President and Portfolio Manager,

Advantus Capital | | December 1, 2017 | |

The text on page 43, under the caption "SFT Advantus Mortgage Securities Fund: Management," is replaced by the following:

SFT Advantus Mortgage Securities Fund: Management

The Fund is advised by Advantus Capital. The following individuals serve as the Fund's primary portfolio managers:

Name and Title | | Primary Manager Since | |

David W. Land

Vice President and Portfolio Manager,

Advantus Capital | | April 5, 2004 | |

Lena S. Harhaj

Portfolio Manager,

Advantus Capital | | December 1, 2017 | |

The text relating to the SFT Advantus Bond Fund, the SFT Advantus Dynamic Managed Volatility Fund, the SFT Advantus Government Money Market Fund, the SFT Advantus Managed Volatility Equity Fund, and the SFT Advantus Mortgage Securities Fund starting on page 119, under the caption "Portfolio Managers," is replaced by the following:

| Fund | | Portfolio Manager

and Title | | Primary Portfolio

Manager Since | | Business Experience During

Past Five Years | |

SFT Advantus

Bond

| | Thomas B. Houghton

Vice President and

Portfolio Manager,

Advantus Capital | | April 29, 2005

| | Vice President and Portfolio Manager

since August 2003, Advantus Capital

| |

| | | David W. Land

Vice President and

Portfolio Manager,

Advantus Capital | | April 29, 2005

| | Vice President and Portfolio Manager

since April 2004, Advantus Capital

| |

| | | Daniel A. Henken

Vice President and

Portfolio Manager,

Advantus Capital | | December 1, 2017

| | Vice President and Portfolio Manager

since December 2017, previously

Investment Officer since

August 2010, Advantus Capital | |

SFT Advantus

Dynamic

Managed

Volatility

| | Craig M. Stapleton

Vice President and

Portfolio Manager,

Advantus Capital

| | May 1, 2013

| | Vice President and Portfolio Manager

since December 2012, previously

Portfolio Manager since June 2012,

Associate Portfolio Manager

2010-2012, and Quantitative

Research Analyst 2005-2010,

Advantus Capital | |

| | | Jeremy P. Gogos, Ph. D.

Portfolio Manager,

Advantus Capital

| | June 1, 2017

| | Portfolio Manager since

December 2017, previously Associate

Portfolio Manager since June 2017,

and Quantitative Research Analyst

2013-2017, Advantus Capital | |

| | | Merlin L. Erickson

Vice President and

Portfolio Manager,

Advantus Capital

| | December 1, 2017

| | Vice President and Portfolio Manager

since December 2017, previously

Vice President and Senior Quantitative

Analyst since November 2007,

Advantus Capital | |

SFT Advantus

Government

Money Market

| | Thomas B. Houghton

Vice President and

Portfolio Manager,

Advantus Capital | | August 18, 2003

| | Vice President and Portfolio Manager

since August 2003, Advantus Capital

| |

| | | Lena S. Harhaj

Portfolio Manager,

Advantus Capital

| | April 29, 2016

| | Portfolio Manager since

December 2017, previously Total

Return Portfolio Analyst since

April 2016, Senior Investment Analyst

2013-2016, and Associate Mortgage

Analyst 2010-2013, Advantus Capital | |

SFT Advantus

Managed

Volatility

Equity

| | Craig M. Stapleton

Vice President and

Portfolio Manager,

Advantus Capital

| | May 1, 2013

| | Vice President and Portfolio Manager

since December 2012, previously

Portfolio Manager since June 2012,

Associate Portfolio Manager

2010-2012, and Quantitative

Research Analyst 2005-2010,

Advantus Capital | |

| Fund | | Portfolio Manager

and Title | | Primary Portfolio

Manager Since | | Business Experience During

Past Five Years | |

| | | Jeremy P. Gogos, Ph. D.

Portfolio Manager,

Advantus Capital

| | June 1, 2017

| | Portfolio Manager since

December 2017, previously Associate

Portfolio Manager since June 2017,

and Quantitative Research Analyst

2013-2017, Advantus Capital | |

| | | Merlin L. Erickson

Vice President and

Portfolio Manager,

Advantus Capital

| | December 1, 2017

| | Vice President and Portfolio Manager

since December 2017, previously

Vice President and Senior Quantitative

Analyst since November 2007,

Advantus Capital | |

SFT Advantus

Mortgage

Securities

| | David W. Land

Vice President and

Portfolio Manager,

Advantus Capital | | April 5, 2004

| | Vice President and Portfolio Manager

since April 2004, Advantus Capital

| |

| | | Lena S. Harhaj

Portfolio Manager,

Advantus Capital

| | December 1, 2017

| | Portfolio Manager since

December 2017, previously Total

Return Portfolio Analyst since

April 2016, Senior Investment Analyst

2013-2016, and Associate Mortgage

Analyst 2010-2013, Advantus Capital | |

TABLE OF CONTENTS

| | | Page No. | |

Letter from the President | | | 1 | | |

Portfolio Manager Reviews | |

SFT Advantus Bond Fund | | | 2 | | |

SFT Advantus Dynamic Managed Volatility Fund | | | 6 | | |

SFT Advantus Government Money Market Fund | | | 10 | | |

SFT Advantus Index 400 Mid-Cap Fund | | | 12 | | |

SFT Advantus Index 500 Fund | | | 14 | | |

SFT Advantus International Bond Fund | | | 16 | | |

SFT Advantus Managed Volatility Equity Fund | | | 22 | | |

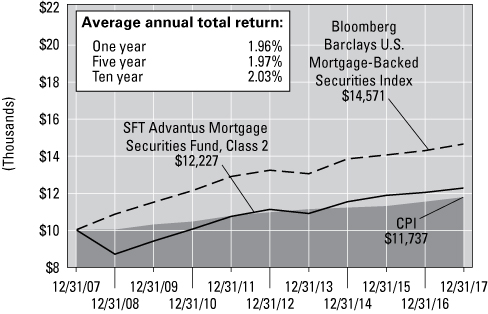

SFT Advantus Mortgage Securities Fund | | | 26 | | |

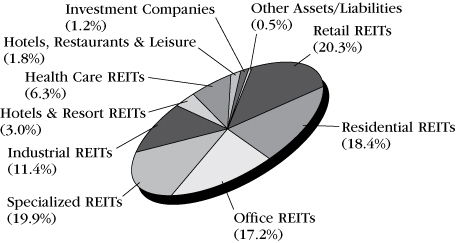

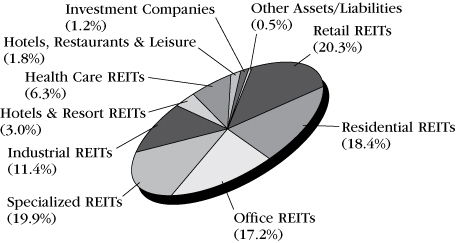

SFT Advantus Real Estate Securities Fund | | | 30 | | |

SFT IvySM Growth Fund | | | 33 | | |

SFT IvySM Small Cap Growth Fund | | | 36 | | |

SFT T. Rowe Price Value Fund | | | 39 | | |

SFT Wellington Core Equity Fund (formerly SFT Pyramis® Core Equity Fund) | | | 41 | | |

Report of Independent Registered Public Accounting Firm | | | 45 | | |

Investments In Securities | |

SFT Advantus Bond Fund | | | 46 | | |

SFT Advantus Dynamic Managed Volatility Fund | | | 53 | | |

SFT Advantus Government Money Market Fund | | | 59 | | |

SFT Advantus Index 400 Mid-Cap Fund | | | 60 | | |

SFT Advantus Index 500 Fund | | | 66 | | |

SFT Advantus International Bond Fund | | | 73 | | |

SFT Advantus Managed Volatility Equity Fund | | | 80 | | |

SFT Advantus Mortgage Securities Fund | | | 81 | | |

SFT Advantus Real Estate Securities Fund | | | 86 | | |

SFT IvySM Growth Fund | | | 87 | | |

SFT IvySM Small Cap Growth Fund | | | 89 | | |

SFT T. Rowe Price Value Fund | | | 91 | | |

SFT Wellington Core Equity Fund (formerly SFT Pyramis® Core Equity Fund) | | | 94 | | |

Financial Statements | |

Statements of Assets and Liabilities | | | 96 | | |

Statements of Operations | | | 98 | | |

Statements of Changes in Net Assets | | | 100 | | |

Financial Highlights | | | 105 | | |

Notes to Financial Statements | | | 118 | | |

Fund Expense Examples | | | 136 | | |

Proxy Voting and Quarterly Holdings Information | | | 137 | | |

Trustees and Executive Officers | | | 142 | | |

Letter from the President

From a market perspective, 2017 was a very good year. Soaring equity values and stable credit markets led to strong returns for investors. The Goldilocks scenario of moderate growth and low inflation was the perfect setting for the market. Add to this the pro-business policies of the Trump administration, and it became difficult to find a market sector that wasn't aligned for success. The U.S. Federal Reserve (Fed) also played a part, raising short-term rates at a measured pace, so as to keep the economy humming along, yet removing the threat of an economic contraction.

As we look forward into 2018, we continue to see many of the same forces at work. The Fed has indicated that they will raise short-term rates two or three times, attempting to maintain job growth without overstimulating. President Trump signed tax legislation that is expected to foster growth, yet keep the national deficit in check. With the tax cut, businesses seem inclined to use some of the savings to bolster their capital spending and to provide workers a moderate pay increase. All of this suggests that 2018 will also be a good year for investors.

While all looks good, many risks remain. Finding and maintaining the right level of economic growth is very difficult and the risk that the Fed becomes too cautious and allows growth to accelerate too rapidly is real. Accelerating wage growth could become a factor leading to higher inflation and rising long-term rates. On the equity side, the recent euphoria could dip as the bounce from the tax cut and business expansion gets fully reflected in prices. If earnings growth experiences a pull-back, equity prices would likely move down.

As we balance the currently favorable economic forces against the risk of a pull-back, we remain optimistic but cautious. We concede that the current environment could shift and market conditions become more volatile as the year unfolds. That said, we believe the underlying economic fundamentals will remain in place, leading to a prosperous year. As always, we believe the best tactic is to position for the long-term and use investment diversification to reduce your risk.

Sincerely,

David Kuplic

President, Securian Funds Trust

1

David Land, CFA, Thomas Houghton, CFA

and Daniel Henken, CFA Portfolio Managers

The SFT Advantus Bond Fund seeks as high a level of long-term total return as is consistent with prudent investment risk. Preservation of capital is a secondary objective. The SFT Advantus Bond Fund invests in long-term, fixed income, high quality debt instruments. The risks incurred by investing in debt instruments include, but are not limited to, reinvestment of prepaid debt obligations at lower rates of return, and the inability to reinvest at higher interest rates when debt obligations are prepaid more slowly than expected. In addition, the net asset value of the SFT Advantus Bond Fund may fluctuate in response to changes in interest rates and is not guaranteed.

SFT Advantus Bond Fund

How did the Fund perform during the period?

The Fund's Class 2 shares generated a net return of 4.69 percent over the 12 months ending December 31, 2017, outperforming the Bloomberg Barclays U.S. Aggregate Bond Index, which returned 3.54 percent over the same period.

What influenced the Fund's return during the past 12 months?

Throughout 2017, the markets were focused on the Trump administration and its policies. The economy did well, with average GDP for the year around 2.3 percent, and above long-term growth average of over 3 percent in the second through fourth quarters. Investor and business optimism were strong, and the markets reacted positively to the passage of the tax reform measure.

The U.S. Federal Reserve (Fed) increased its Fed funds rate three times in 2017. This pushed yields in the short end up as well, but longer term yields moved little on the lack of breakout inflation or growth. The difference in yields between the two and ten-year U.S. Treasury has narrowed to just over 50 basis points, down from its traditional 100-point spread.

Stocks moved steadily higher and spreads steadily tighter for most of the year. Spreads on investment grade corporate bonds reached their tightest levels in ten years at the end of 2017. With spreads at or near post-crisis tights, investors appear to remain comfortable buying corporate bonds and other forms of spread product.

What other market conditions or events influenced the Fund's return during the past 12 months?

Tax reform was a focus for Washington and Wall Street during the fourth quarter. By repeatedly reaching new all-time highs, the markets celebrated the December passage of the most significant tax changes in 30 years. Under the new tax regime, undoubtedly some sectors of the economy will fare better than others. We expect the tax law's limits on deducting interest expenses will help investment grade corporate bonds and may hurt lower quality (high yield) issues. Companies will need to rely less on debt, which could help strengthen balance sheets.

Low interest rates abroad are drawing foreign investors into the bond market. Foreign buyers are seeking income opportunities in U.S. corporate bonds as well as U.S. equities. The U.S. corporate bond market is three times the size of Europe's. Foreign buyers, who had focused on U.S. Treasuries, may be seeking to invest in utility company stocks—attracted by their potential stability.

What strategies and techniques did you employ that specifically affected Fund performance?

We maintained an overweight exposure to corporate bonds and the securitized sector throughout the year. Tightening corporate and securitized spreads benefitted the Fund's performance. We finished the year with about five percent more corporate exposure than the start of 2017.

Throughout the year, we kept our interest rate position roughly neutral-to-short relative to the Fund's index. We kept the duration of the Fund slightly short of its benchmark.

What industries or sectors did you emphasize during the past 12 months and what is your outlook going forward?

During the year we reduced the Fund's exposure to the industrial sector. Spreads in this sector tightened the most of any sector in the benchmark and we find less value in

2

industrials. In the financial sector, we believe the banking sector remains attractive overall and we increased the Fund's overweight exposure during the year. We added to the Fund's positions in the utility sector, which remains the Fund's largest overweight sector relative to its benchmark. The Fund remains overweight in pipelines. We continue to like the stable cash flow profile of the business, but sold several positions that reached their valuation targets. The Fund remains overweight in the corporate bond sector relative to its benchmark, but with spreads at post-crisis tights, it has become more difficult to find attractive relative value.

We actively managed positons in the securitized sector and the Fund remains overweight in asset-backed securities, commercial mortgage-backed securities (CMBS) and non-Agency MBS. We added to the Fund's positions in non-Agency MBS during the fourth quarter. The underwriting in this sector has remained disciplined since the housing crisis and we feel the U.S. housing cycle has longer to run relative to the corporate credit cycle. We also added to the Fund's positions in CMBS as new AAA-rated tranches were issued during the quarter and represented attractive value to us.

Going forward, we expect slow and steady growth, low inflation and a lack of market volatility. Tax reform should keep the expansion going, but it could also increase inflation and spur accelerated economic growth, which could prompt the Fed to respond. Treasury markets already appear to reflect potential inflation risk, as well as prospects for greater growth, following the passage of the tax bill.

Central Bank policies here and in Europe have the potential to upset the apple cart. Janet Yellen wraps up her term as Fed chair, with Jerome Powell ready to take over in February. We believe Powell will likely follow a path similar to Yellen's, although he may be slightly more aggressive about raising interest rates. Four vacancies on the Fed's board of governors await filling. The new occupants could affect future Fed policy as much as the change at the top. The December Fed meeting minutes projected three rate raises in 2018. For now, interest rate futures pricing indicates the market expects the Fed to raise rates only twice in 2018. If concerns grow that the Fed will raise rates at a quicker pace than currently anticipated, it could put a dent in the markets.

The European Central Bank (ECB) is also tilting more hawkish. It announced a slowdown in monthly bond purchases in October, and rising inflation and increased growth forecasts make it unlikely that the ECB will continue its quantitative easing program past its currently planned end in September 2018. Rates could finally start to rise in Europe and could start to drive up rates here. The equity markets clearly anticipate another year of market gains.

The bond market's outlook, as reflected in the yields of two and ten-year U.S. Treasuries, is more pessimistic. We believe U.S. Treasury yields didn't increase in 2017 due to concerns about low economic growth, low volatility and lack of inflation. We expect the yield curve will continue to flatten unless the economy grows more than anticipated.

Geopolitical issues could shake things up in 2018—the North Korea situation, rivalry between Saudi Arabia and Iran, the political landscape in Japan, and the Russia investigation here in the United States all have the potential to upset the economic apple cart. Market volatility has been low for some time. We can't dismiss that an unforeseen "black swan" event could bring volatility back, but our forecast indicates good things for the economy and markets in 2018.

3

Ten Largest Holdings^

| Security description | | Market

value | | % of bond

portfolio | |

U.S. Treasury Note 2.000%, 10/31/22 | | $ | 17,535,903 | | | | 4.6 | % | |

U.S. Treasury Bond 2.750%, 08/15/47 | | | 6,823,519 | | | | 1.8 | % | |

U.S. Treasury Bond 5.375%, 02/15/31 | | | 6,796,356 | | | | 1.8 | % | |

U.S. Treasury Note 2.250%, 10/31/24 | | | 5,549,303 | | | | 1.5 | % | |

Federal National Mortgage Association

3.000%, 01/01/33 | | | 4,461,270 | | | | 1.2 | % | |

PPL Capital Funding, Inc.

Series A 4.358%, 03/30/67 | | | 4,443,750 | | | | 1.2 | % | |

BNSF Funding Trust I 6.613%, 12/15/55 | | | 4,362,213 | | | | 1.1 | % | |

UBS Commercial Mortgage Trust

Series 2017-C1, Class AS 3.724%, 06/15/50 | | | 4,057,921 | | | | 1.1 | % | |

The Chubb Corp. 3.609%, 04/15/37 | | | 3,970,000 | | | | 1.0 | % | |

U.S. Treasury Note 2.000%, 11/30/22 | | | 3,963,594 | | | | 1.0 | % | |

| | $ | 61,963,829 | | | | 16.3 | % | |

^Excludes short-term investments.

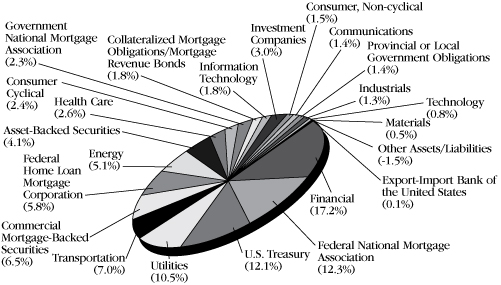

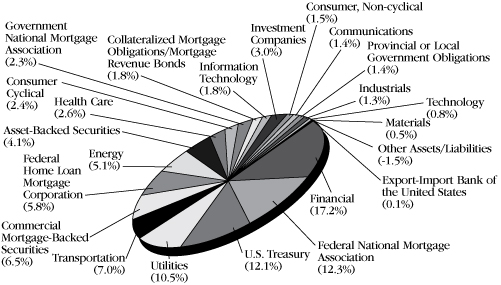

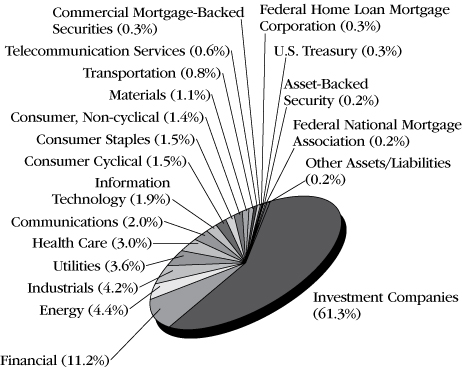

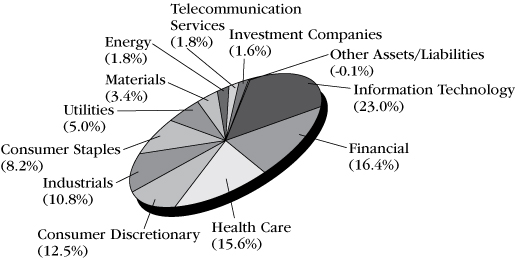

Sector Diversification (shown as a percentage of net assets)

Asset Quality (shown as a percentage of investments)

(Unaudited)

4

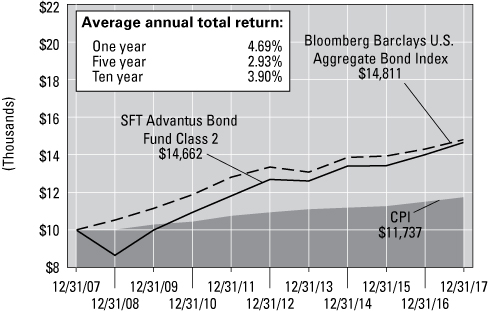

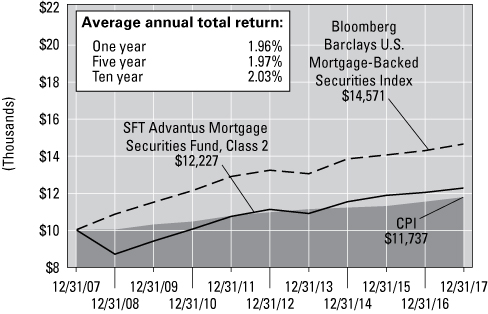

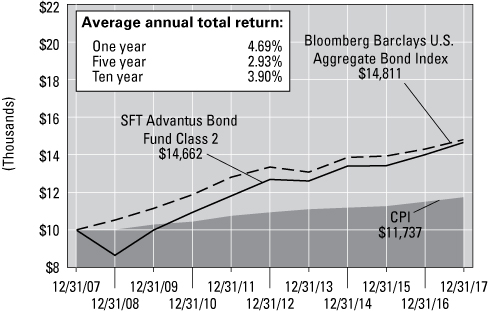

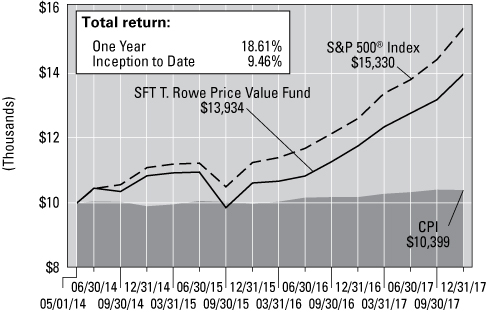

Comparison of Change in Investment Value*

A Hypothetical $10,000 Investment in SFT Advantus Bond Fund,

Bloomberg Barclays U.S. Aggregate Bond Index, and Consumer Price Index

On the chart above you can see how the SFT Advantus Bond Fund's Class 2 shares total return compared to the Bloomberg Barclays U.S. Aggregate Bond Index and the Consumer Price Index. The three lines represent the total return of a hypothetical $10,000 investment made on December 31, 2007 through December 31, 2017, assuming reinvestment of distributions, if any.

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged benchmark composite representing average market-weighted performance of U.S. Treasury and agency securities, investment-grade corporate bonds and mortgage-backed securities with maturities greater than one year.

5

Craig M. Stapleton, CFA, FRM, Jeremy Gogos, Ph.D., CFA and

Merlin Erickson Portfolio Managers

The SFT Advantus Dynamic Managed Volatility Fund seeks to maximize risk-adjusted total return relative to its blended benchmark index comprised of 60 percent S&P 500 Index and 40 percent Bloomberg Barclays U.S. Aggregate Bond Index (collectively, the Blended Benchmark Index).

The SFT Advantus Dynamic Managed Volatility Fund invests primarily in Class 1 shares of SFT Advantus Index 500 Fund, an affiliated fund of the Securian Funds Trust, for equity exposure, in a basket of fixed income securities for fixed income exposure and certain derivative instruments. The Fund is subject to risks associated with such investments as described in detail in the prospectus. The net asset value of the Fund will fluctuate and is not guaranteed. It is possible to lose money by investing in the Fund. There is no assurance that efforts to manage Fund volatility will achieve the desired results.

SFT Advantus Dynamic Managed Volatility Fund

How did the Fund perform during the period?

The Fund's Class 2 shares generated a total net return of 17.94 percent over the 12 months ending December 31, 2017. The blended benchmark index, which is comprised of the S&P 500® Index, weighted 60 percent, and the Bloomberg Barclays U.S. Aggregate Bond Index, weighted 40 percent, returned 14.21 percent with a volatility of 3.79 percent over the same period.

What influenced the Fund's return during the past 12 months?

The Dynamic overlay strategy has essentially two sides: the Fund should carry more equity exposure in low volatility periods and less equity exposure in high volatility periods. Given that the S&P 500® Index realized volatility for 2017 was 6.69 percent, the second lowest of the 89 calendar years in the index's history, the Fund averaged a 79 percent equity allocation. This equity overweight, combined with very strong equity returns, was by far the largest driver of Fund performance this year.

What other market conditions or events influenced the Fund's return during the past 12 months?

There were numerous events this past year that could have rattled financial markets: North Korean missile tests, the U.S. Federal Reserve (Fed) hiking rates while other central banks are still in quantitative easing mode, hurricanes, and of course the lack of policy progress out of Washington until the very end of the year. The market shrugged off all these potential obstacles and marched steadily upward through all of 2017. The S&P 500® Index did not have a down month, and its largest one-day loss was only -1.8 percent. It returned 21.8 percent for the year. Therefore, from an equity perspective, the solid return combined with extremely low volatility made for a nearly ideal year.

On the fixed income side, the 10-year U.S. Treasury yield made a round trip over the course of 2017. It started the year at 2.44, ended the year at 2.40, and had a maximum and minimum of 2.63 and 2.04, respectively. Corporate spreads ended the year modestly lower than they started it. Thus, as previously mentioned, the equity portion of the Fund drove the Fund's return this year.

What strategies and techniques did you employ that specifically affected Fund performance?

Throughout the year, the Fund tactically purchased long positions in call options on the Chicago Board Options Exchange (CBOE) Volatility Index (VIX) futures, and long S&P 500® put spreads, as additional hedges for managing the risk of the Fund. We believe that these options provide a great tool for managing risk, and were attractively priced relative to historical valuations. These hedges reduced the volatility of the Fund's returns while helping to protect the Fund against quick market sell-offs.

What industries or sectors did you emphasize during the past 12 months, and what is your outlook going forward?

The Fund's equity exposure is pure S&P 500®. On the fixed income side, the only notable overweight was to Financials.

Over the next several months, we expect continued low equity volatility and further price appreciation in the stock market. The Republican-controlled government in Washington passed, just before the end of the year, a tax reform bill that drastically reduced the U.S. corporate tax rate. In general, this lower tax rate will increase the

6

earnings of most companies and, by extension, we anticipate equity investors enthusiastically using said earnings growth as justification for pouring more money into the market.

It is worth noting that the Fed began to taper its balance sheet in October, starting at $10B per month. Each quarter, that amount will increase by $10B, until it reaches $50B per month. Despite this slight increase in the supply of U.S. Treasury and agency/mortgage-backed securities, the U.S. 2-year to 10-year spread actually decreased over the final quarter of 2017, from 85 basis points to 52 basis points. This move was largely due to the upward move of the 2- year rate. The stagnant 10-year rate suggests the domestic bond market is still not pricing in a material pickup in inflation, nor excessive economic growth. With the European Central Bank (ECB) and Bank of Japan (BOJ) continuing quantitative easing, we do not believe the Fed balance sheet unwind will materially increase mid-term and longer interest rates, domestically or internationally.

Ultimately, our view can be distilled down to a conflict between short-term and long-term economic effects. In the short term, the recent action from Washington—tax reform and numerous deregulation efforts across federal agencies—should continue to be supportive of equity valuations. The same can be said for the ongoing monetary policies from the ECB and the BOJ, which are set to continue until at least September 2018.

If any of the central bank plans change unexpectedly, we anticipate some reaction, most likely negative, in the equity market. Further, as we transition to considering longer time frames, we are much less optimistic. Global debt to GDP is still very close to the peak of Q3 2016, and as one considers the prospects of accelerating global growth, central bank policy normalization, or both, it is difficult to imagine how that debt is serviced in an environment of rising rates. In particular, corporations in America and abroad are saddled with a huge debt burden after years of issuance to take advantage of artificially low interest rates. It is unclear whether there will be enough earnings growth and inflation to make this debt load manageable as interest rates rise. In the face of this, it is difficult to imagine positive equity scenarios beyond a few years.

In a tactical sense, we will continue to use our volatility metrics to inform the equity allocations of the Fund. We will aim to de-risk from our current equity overweight when we believe volatility will be high, and to tactically carry equity hedges to mitigate tail risk until then.

7

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

Advantus Capital Management Inc. (Advantus Capital) and the Securian Funds Trust, on behalf of the SFT Advantus Dynamic Managed Volatility Fund (the "Fund"), have entered into an Expense Limitation Agreement, dated May 1, 2013, which limits the operating expenses of the Fund, excluding certain expenses (such as interest expense, acquired fund fees, cash overdraft fees, taxes, brokerage commissions, other expenditures which are capitalized in accordance with the generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the Fund's business), to 0.80% of the Fund's average daily net assets through April 30, 2019. The Agreement renews annually for a full year each year thereafter unless terminated by Advantus Capital upon at least 30 days' notice prior to the end of a

Ten Largest Holdings^

| Security description | | Market

value | | % of

Long-Term

portfolio | |

SPDR S&P 500 ETF Trust | | $ | 9,652,326 | | | | 3.1 | % | |

iShares iBoxx $ Investment Grade

Corporate Bond ETF | | | 5,409,420 | | | | 1.7 | % | |

Vanguard S&P 500 ETF | | | 4,948,726 | | | | 1.6 | % | |

Southern Natural Gas Co. LLC,

4.800%, 03/15/47 | | | 1,649,532 | | | | 0.5 | % | |

Ford Motor Co., 5.291%, 12/08/46 | | | 1,632,313 | | | | 0.5 | % | |

Avnet, Inc., 3.750%, 12/01/21 | | | 1,521,576 | | | | 0.5 | % | |

Comcast Corp., 6.400%, 05/15/38 | | | 1,350,383 | | | | 0.4 | % | |

Mead Johnson Nutrition Co., 5.900%, 11/01/39 | | | 1,268,713 | | | | 0.4 | % | |

Tyson Foods, Inc., 5.150%, 08/15/44 | | | 1,170,265 | | | | 0.4 | % | |

Apple, Inc., 4.375%, 05/13/45 | | | 1,126,568 | | | | 0.4 | % | |

| | $ | 29,729,822 | | | | 9.5 | % | |

^Does not include short-term investments or investments in Class 1 shares of the SFT Advantus Index 500 Fund, an affiliated Fund in Securian Funds Trust, which provides the Fund with its primary equity exposure.

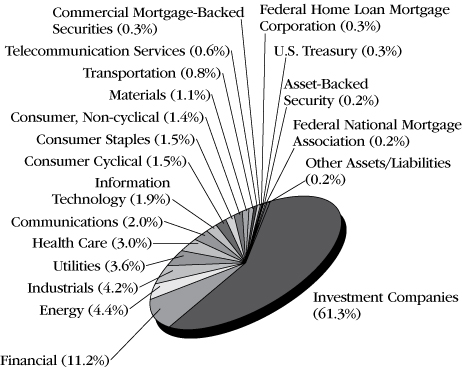

Sector Diversification (shown as a percentage of net assets)

8

Asset Quality (shown as a percentage of investments)

(Unaudited)

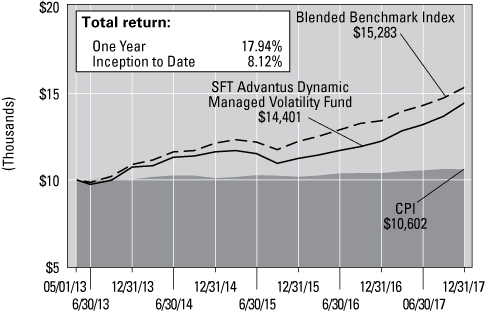

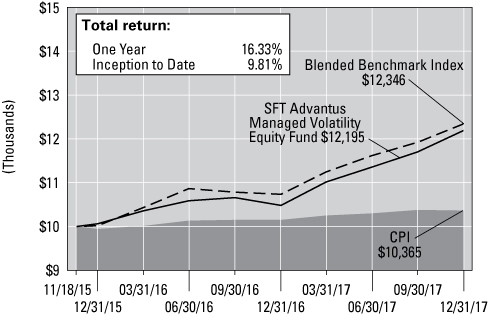

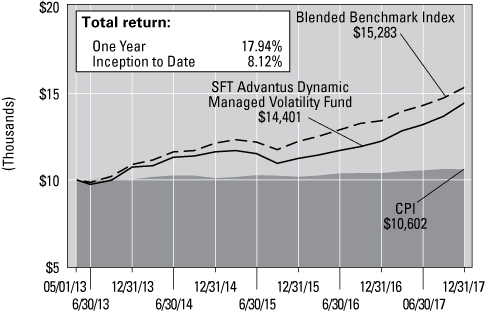

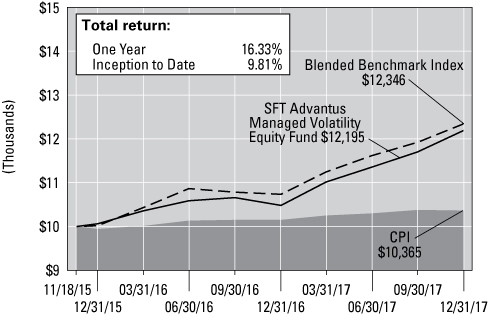

Comparison of Change in Investment Value*

A Hypothetical $10,000 Investment in SFT Advantus Dynamic Managed Volatility Fund,

the Blended Benchmark Index, and Consumer Price Index

On the chart above you can see how the SFT Advantus Dynamic Managed Volatility Fund's shares total return compared to its Blended Benchmark, comprised of 60 percent of the S&P 500 Index and 40 percent of the Bloomberg Barclays U.S. Aggregate Bond Index, and the Consumer Price Index. The three lines represent the total return of a hypothetical $10,000 investment made on May 1, 2013 through December 31, 2017, assuming reinvestment of distributions, if any.

contract term. The Fund is authorized to reimburse Advantus Capital for management fees previously waived and/or for the cost of expenses previously paid by Advantus Capital pursuant to this agreement, provided that such reimbursement will not cause the Fund to exceed any limits in effect at the time of such reimbursement. The Fund's ability to reimburse Advantus Capital in this manner only applies to fees waived or reimbursements made by Advantus Capital within the three fiscal years prior to the date of such reimbursement. As of December 31, 2017, Advantus Capital has waived $1,906,287 pursuant to the agreement. To the extent that the Fund makes such reimbursements to Advantus Capital, the amount of the reimbursements will be reflected in the financial statements in the Fund's shareholder reports and in Other Expenses under Fees and Expenses of the Fund.

The Blended Benchmark Index is comprised of 60 percent of the S&P 500 Index and 40 percent of the Bloomberg Barclays U.S. Aggregate Bond Index.

The S&P 500 Index is a broad, unmanaged index of 500 common stocks which are representative of the U.S. stock market overall. The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged benchmark composite representing the average market-weighted performance of U.S. Treasury and agency securities, investment grade corporate bonds and mortgage-backed securities with maturities greater than one year.

9

Thomas Houghton, CFA and Lena Harhaj, CFA Portfolio Managers

The SFT Advantus Government Money Market Fund seeks maximum current income to the extent consistent with liquidity and the preservation of capital.

It invests at least 99.5 percent of its total assets in cash, government securities, and /or repurchase agreements that are collateralized fully.

Investment in the SFT Advantus Government Money Market Fund is neither insured nor guaranteed by the U.S. Government, and there can be no assurance that the Fund will be able to maintain a stable net asset value of $1.00 per share. It is possible to lose money by investing in the Fund.

SFT Advantus Government Money Market Fund

How did the Fund perform during the period?

The Fund returned 0.13 percent over the twelve months ending December 31, 2017, while the three-month U.S. Treasury bill returned 0.87 percent for the same period.

What influenced the Fund's return during the past 12 months?

The return on the Fund for the year was 0.90 percent before expenses, higher than the return of the three-month U.S. Treasury bill, but not enough to compensate for the fund management expenses.

What other market conditions or events influenced the Fund's performance during the past 12 months?

Since the transition to a U.S. Government Only Fund in 2016, investments consist of primarily short-term discount notes issued by the Federal Home Loan Bank, Fannie Mae and Freddie Mac as well as U.S. Treasury bills and U.S. Treasury floating rate notes.

The U.S. Federal Reserve (Fed) hiked rates three times during 2017. However, yield premiums on agency discount notes collapsed as investors looked for yield. In fact, spreads between agency discount notes with maturities greater than 90 days and the three-month U.S. Treasury bill are negative. Investors can still earn a modest spread premium on agency discount notes that mature within three months. During the year, the Fund continued to invest in U.S. Treasury floating rate notes to take advantage of rising rates.

What strategies and techniques did you employ that affected Fund performance?

The Fund's performance this year was driven by the declining excess spread of agency discount notes over U.S. Treasury Bills and by the Fund's use of U.S. Treasury floating rate notes, whose yields rose along with short-term interest rates.

What industries or sectors did you emphasize during the past 12 months, and what is your outlook going forward?

We expect slow and steady growth, low inflation and a lack of market volatility. Tax reform should keep the expansion going, but it could also increase inflation and spur accelerated economic growth, which could prompt the Fed to respond. Treasury markets already appear to reflect potential inflation risk, as well as prospects for greater growth, following the passage of the tax bill.

Central Bank policies here and in Europe have the potential to upset the apple cart. Janet Yellen wraps up her term as Fed chair, with Jerome Powell ready to take over in February. We believe Powell will likely follow a path similar to Yellen's, although he may be slightly more aggressive about raising interest rates. Four vacancies on the Fed's board of governors await filling. The new occupants could affect future Fed policy as much as the change at the top. The December Fed meeting minutes projected three rate raises in 2018. For now, interest rate futures pricing indicates the market expects the Fed to raise rates only twice in 2018. If concerns grow that the Fed will raise rates at a quicker pace than currently anticipated, it could put a dent in the markets.

10

The results are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Investment in the SFT Advantus Government Money Market Fund is neither insured nor guaranteed by the U.S. Government or any other agency, and there can be no assurance that the Fund will be able to maintain a stable net asset value of $1.00 per share. Shares upon redemption may be worth more or less than their original cost.

Performance figures of the Fund do not reflect changes pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

Effective May 1, 2012, the Board of Trustees of Securian Funds Trust approved a Restated Net Investment Income Maintenance Agreement among Securian Funds Trust (on behalf of SFT Advantus Government Money Market Fund), Advantus Capital and Securian Financial Services, Inc. (Securian Financial). A similar agreement was previously approved by the Board of Directors of Advantus Series Fund, Inc., the Trust's predecessor, effective October 29, 2009. Under such Agreement, Advantus Capital agrees to waive, reimburse or pay Money Market Fund expenses so that the Fund's daily net investment income does not fall below zero. Securian Financial may also waive its Rule 12b-1 fees. Advantus capital and Securian Financial each has the option under the Agreement to recover the full amount waived, reimbursed or paid (the "Expense Waiver") on any day on which the Fund's net investment income exceeds zero. On any day, however, the Expense Waiver does not constitute an obligation of the Fund unless Advantus Capital or Securian Financial has expressly exercised its rights to recover a specified portion of the Expense Waiver on that day, in which case such specified portion is then due and payable by the Fund. In addition, the right of Advantus and/or Securian Financial to recover the Expense Waiver is subject to the following limitations: (1) if a repayment of the Expense Waiver by the Fund would cause the Fund's net investment income to fall below zero, such repayment is deferred until a date when repayment would cause the Fund's net investment income to fall below zero; (2) the right to recover any portion of the Expense Waiver expires three years after the effective date of that portion of the Expense Waiver; and (3) any repayment of the Expense Waiver by the Fund cannot cause the Fund's expense ratio to exceed 1.25%. as of December 31, 2017, Advantus Capital and Securian Financial have collectively waived $4,631,950 pursuant to the Agreement, including expenses waived under the prior agreement with Advantus Series Fund, Inc., of which $1,176,744 was eligible for recovery as of such date. If Advantus Capital and Securian Financial exercise their rights to be paid such waived amounts, the Fund's future yield will be negatively affected for an indefinite period. The Agreement shall continue in effect following April 30, 2018, provided such continuance is specifically approved by a majority of the Trust's independent Trustees.

Effective November 1, 2017, Advantus Capital and Securian Funds Trust, on behalf of the SFT Advantus Government Money Market Fund, entered into an Expense Limitation Agreement which limits the operating expenses of the Fund, excluding certain expenses, (such as interest expense, acquired fund fees, cash overdraft fees, taxes brokerage commissions, other expenditures which are capitalized in accordance with GAAP, and other extraordinary expenses not incurred in the ordinary course of the Funds' business),to 0.70% of the Fund's Average daily net assets through April 30, 2019.

The Agreement renews annually for a full year each year thereafter unless terminated by Advantus Capital upon at least 30 days' notice prior to the end of the contract term. The Fund is authorized to reimburse Advantus Capital for management fees previously waived and/or for the cost of expenses previously paid by Advantus Capital pursuant to this agreement, provided that such reimbursement will not cause any Fund to exceed any limits in effect at the time of such reimbursement.

The Fund's ability to reimburse Advantus Capital in this manner only applies to fees waived or reimbursements made by Advantus Capital within the three fiscal years prior to the date of such reimbursement. To the extent that the Fund makes such reimbursements to Advantus Capital, the amount of the reimbursements will be reflected in the financial statements in the Funds' shareholder reports and in Other Expenses under Fees and Expenses of the Fund in the prospectus.

As of December 31, 2017, Advantus Capital has waived $26,980 pursuant to the agreement, all of which was eligible for recovery as of such date. To the extent that the Fund makes such reimbursements to Advantus Capital, the amount of the reimbursements will be reflected in the financial statements in the Fund's shareholder reports and in Other Expenses under Fees and Expenses to the Fund.

11

James Seifert Portfolio Manager

The SFT Advantus Index 400 Mid-Cap Fund seeks to provide investment results generally corresponding to the aggregate price and dividend performance of publicly traded common stocks that comprise the Standard & Poor's MidCap 400 Index (S&P 400). It is designed to provide an economical and convenient means of maintaining a diversified portfolio in this equity security area as part of an overall investment strategy. The risks incurred by investing in the SFT Advantus Index 400 Mid-Cap Fund include, but are not limited to, the risk that the Fund may not be able to replicate the performance of the S&P 400, and the risk of declines in the market for mid-cap stocks or in the equity markets generally.

SFT Advantus Index 400 Mid-Cap Fund

How did the Fund perform during the period?

The Fund's Class 2 shares generated a total net return of 15.61 percent over the 12 months ending December 31, 2017, while the S&P MidCap 400® Index returned 16.24 percent over the same period.

What influenced the Fund's return during the past 12 months?

The Securian Funds Trust Advantus Index 400 Mid-Cap Fund is passively managed. The Fund is fully invested and holds all names at published free float adjusted index weights. The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the S&P MidCap 400® Index.

Eight of the nine sectors posted positive annual returns. The capital goods sector led all sectors with a 12-month return of 31.5 percent. Technology names followed with an annual return of 27.1 percent. Decile segments consist of 50 names; in terms of size, decile 1 (consisting of the largest names and representing 27.7 percent of the weight in the index), ended the period with a return of 27.7 percent. Decile ten, (representing the 50 smallest market cap names in the index with a 4 percent weight) lagged in terms of annual decile return with a 6.1 percent gain.

What other market conditions or events influenced the Fund's performance during the past 12 months?

Tax reform was a focus for Washington and Wall Street during the last half of 2017. By repeatedly reaching new all-time highs, the markets celebrated the passage of the most significant tax changes in 30 years.

Retail, industrial and financial corporations will benefit from the corporate tax rate dropping from 35 percent to 21 percent. Financial firms will also likely benefit from regulatory relief, which should increase profitability.

What will affect the Fund going forward?

Expect slow and steady growth, low inflation and a lack of market volatility in the months ahead. Tax reform should keep the expansion going, but it could also increase inflation, which may prompt the Fed to respond if the inflation outpaces desired expectations. Geopolitical issues could disrupt this economic outlook and bring back volatility in a big way.

12

Ten Largest Holdings^

| Security description | | Market

value | | % of stock

portfolio | |

Take-Two Interactive Software, Inc. | | $ | 1,542,080 | | | | 0.7 | % | |

| SVB Financial Group | | | 1,518,570 | | | | 0.7 | % | |

NVR, Inc. | | | 1,515,551 | | | | 0.7 | % | |

MSCI, Inc. | | | 1,403,582 | | | | 0.6 | % | |

Teleflex, Inc. | | | 1,380,453 | | | | 0.6 | % | |

Huntington Ingalls Industries, Inc. | | | 1,318,270 | | | | 0.6 | % | |

Cognex Corp. | | | 1,304,482 | | | | 0.6 | % | |

Broadridge Financial Solutions, Inc. | | | 1,300,276 | | | | 0.6 | % | |

Trimble, Inc. | | | 1,260,206 | | | | 0.6 | % | |

Steel Dynamics, Inc. | | | 1,258,749 | | | | 0.6 | % | |

| | $ | 13,802,219 | | | | 6.3 | % | |

^Excludes short-term investments.

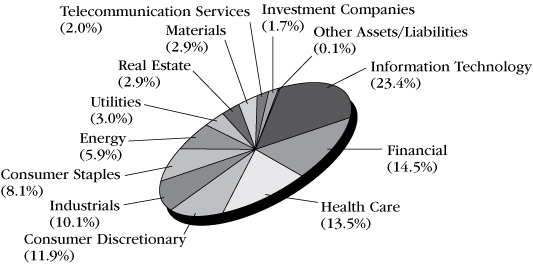

Sector Diversification (shown as a percentage of net assets)

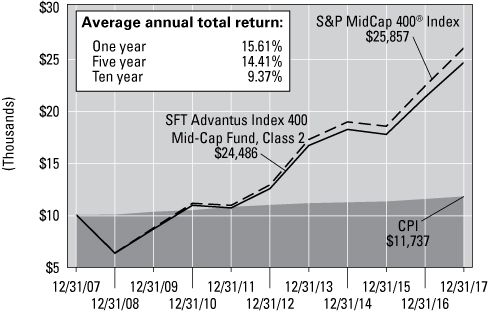

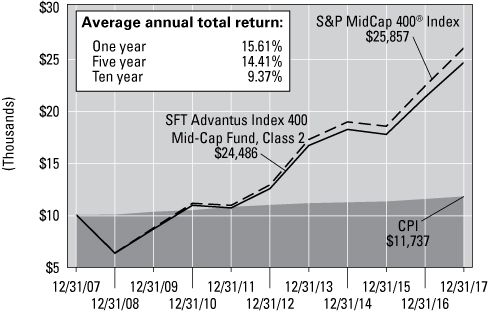

Comparison of Change in Investment Value*

A Hypothetical $10,000 Investment in SFT Advantus Index 400 Mid-Cap Fund,

S&P MidCap 400® Index, and Consumer Price Index

On the chart above you can see how the SFT Advantus Index 400 Mid-Cap Fund's Class 2 shares total return compared to the S&P MidCap 400 Index and the Consumer Price Index. The three lines represent the total return of a hypothetical $10,000 investment made on December 31, 2007 through December 31, 2017, assuming reinvestment of distributions, if any.

"Standard & Poor's®", "S&P®", "Standard & Poor's MidCap 400" and "S&P MidCap 400" are trademarks of the S&P Global, Inc. and have been licensed for use by the Securian Funds Trust—SFT Advantus Index 400 Mid-Cap Fund. The Fund is not sponsored, endorsed, sold or promoted by Standard & Poor's and Standard & Poor's makes no representation regarding the advisability of investing in the Fund.

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

S&P MidCap 400 Index consists of 400 domestic stocks chosen for market size (median market capitalization of about $4.1 billion), liquidity and industry group representation. It is a market-weighted index (stock price times shares outstanding), with each stock affecting the index in proportion to its market value.

13

James Seifert Portfolio Manager

The SFT Advantus Index 500 Fund seeks investment results that correspond generally to the price and yield performance of the common stocks included in the Standard and Poor's Corporation 500 Composite Stock Index (S&P 500). It is designed to provide an economical and convenient means of maintaining a broad position in the equity market as part of an overall investment strategy. The risks incurred by investing in the SFT Advantus Index 500 Fund include, but are not limited to, the risk that the Fund may not be able to replicate the performance of the S&P 500, and the risk of declines in the equity markets generally.

SFT Advantus Index 500 Fund

How did the Fund perform during the period?

The Fund's Class 2 shares generated a total net return of 21.23 percent over the 12 months ending December 31, 2017, while the S&P 500® Index returned 21.83 percent over the same period.

What influenced the Fund's return during the past 12 months?

The Securian Funds Trust Advantus Index 500 Fund is passively managed. The Fund is fully invested and holds all names at published float adjusted index weights. The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the S&P 500® Index.

Eight of the nine sectors invested in posted positive annual returns. The technology sector led all sectors with a 12-month return of 37.0 percent. Material and services names followed with an annual return of 29.4 percent. The energy sector was the only sector that ended the year with a negative return of -1.5 percent. Decile segments consist of 50 names; in terms of size, decile 1, (consisting of the mega-cap names and representing 48.1 percent of the weight in the index), ended the period with a return of 22.1 percent. Decile ten (representing the 50 smallest market cap names in the index with a 1.4 percent weight) lagged in terms of annual decile return with a 6.6 percent gain. All other deciles ended the year with positive double-digit returns.

What other market conditions or events influenced the Fund's performance during the past 12 months?

Tax reform was a focus for Washington and Wall Street during the last half of 2017. By repeatedly reaching new all-time highs, the markets celebrated the passage of the most significant tax changes in 30 years.

Retail, industrial and financial corporations will benefit from the corporate tax rate dropping from 35 percent to 21 percent. Financial firms will also likely benefit from regulatory relief, which should increase profitability.

What will affect the Fund going forward?

Expect slow and steady growth, low inflation and a lack of market volatility in the months ahead. Tax reform should keep the expansion going, but it could also increase inflation, which may prompt the U.S. Federal Reserve to respond if the inflation outpaces desired expectations. Geopolitical issues could disrupt this economic outlook and bring higher volatility back to the market in 2018.

14

Ten Largest Holdings^

| Security description | | Market

value | | % of stock

portfolio | |

Apple, Inc. | | $ | 32,786,959 | | | | 3.8 | % | |

Microsoft Corp. | | | 24,901,378 | | | | 2.9 | % | |

Amazon.com, Inc. | | | 17,684,725 | | | | 2.1 | % | |

Facebook, Inc.—Class A | | | 15,879,635 | | | | 1.8 | % | |

Berkshire Hathaway, Inc.—Class B | | | 14,394,142 | | | | 1.7 | % | |

Johnson & Johnson | | | 14,164,115 | | | | 1.6 | % | |

JPMorgan Chase & Co. | | | 14,001,547 | | | | 1.6 | % | |

Exxon Mobil Corp. | | | 13,373,367 | | | | 1.6 | % | |

Alphabet, Inc.—Class C | | | 11,924,774 | | | | 1.4 | % | |

Alphabet, Inc.—Class A | | | 11,850,750 | | | | 1.4 | % | |

| | $ | 170,961,392 | | | | 19.9 | % | |

^Excludes short-term investments.

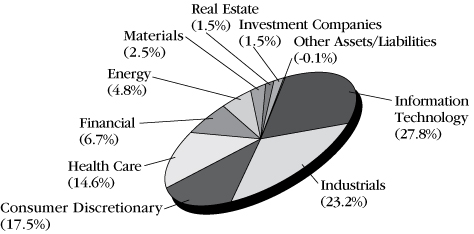

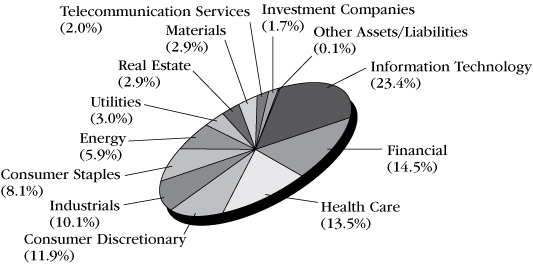

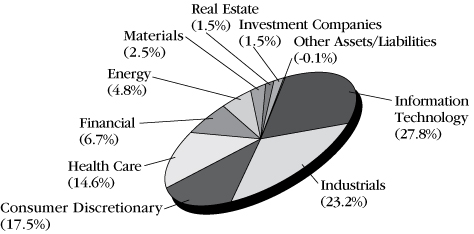

Sector Diversification (shown as a percentage of net assets)

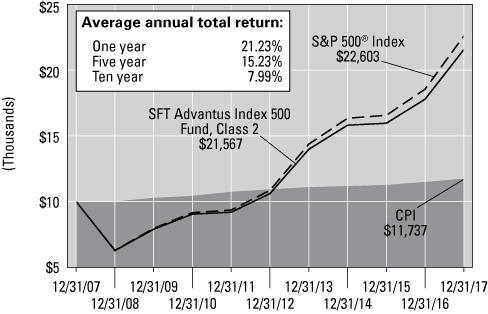

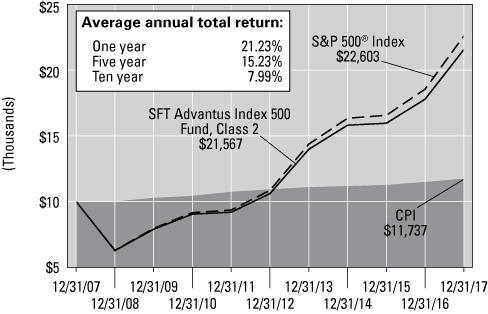

Comparison of Change in Investment Value*

A Hypothetical $10,000 Investment in SFT Advantus Index 500 Fund,

S&P 500® Index, and Consumer Price Index

On the chart above you can see how the SFT Advantus Index 500 Fund's Class 2 shares total return compared to the S&P 500 Index (as adjusted for dividend reinvestment) and the Consumer Price Index. The three lines represent the total return of a hypothetical $10,000 investment made on December 31, 2007 through December 31, 2017, assuming reinvestment of distributions, if any.

"Standard & Poor's®", "S&P®", "Standard & Poor's 500" and "S&P 500" are trademarks of the S&P Global, Inc. and have been licensed for use by Securian Funds Trust—SFT Advantus Index 500 Fund. The Fund is not sponsored, endorsed, sold or promoted by Standard & Poor's and Standard & Poor's makes no representation regarding the advisability of investing in the Fund.

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The S&P 500 Index is a broad, unmanaged index of 500 common stocks which are representative of the U.S. stock market overall.

15

Michael Hasenstab, Ph.D. and Christine Zhu Portfolio Managers Franklin Advisers, Inc.

The SFT Advantus International Bond Fund seeks to maximize current income consistent with protection of principal. The Fund pursues its objective by investing primarily in debt securities issued by issuers located anywhere in the world. While Advantus Capital Management, Inc. acts as the investment adviser for the Fund, Franklin Advisers, Inc. provides investment advice to the SFT Advantus International Bond Fund under a sub-advisory agreement. Investment risks associated with international investing in addition to other risks include currency fluctuations, political and economic instability, and differences in accounting standards when investing in foreign markets.

SFT Advantus International Bond Fund

How did the Fund perform during the period?

The Fund's Class 2 shares generated a net return of 1.12 percent over the 12 months ending December 31, 2017, underperforming the Citigroup World Government Bond Index, which returned 7.49 percent over the same period.

What influenced the Fund's return during the past 12 months?

The Fund underperformed its benchmark index in 2017 primarily due to currency positions. Interest-rate strategies contributed to relative results, while sovereign credit exposures had a largely neutral effect. Among currencies, the Fund's underweighted positions in the euro, the Japanese yen and the Australian dollar detracted from relative performance. However, overweighted currency positions in Latin America (the Mexican peso and Brazilian real) and Asia ex Japan (Indian rupee) contributed to relative results. The Fund maintained a defensive approach regarding interest rates in developed markets, while holding duration exposures in select emerging markets. Select overweighted duration exposures in Asia ex Japan (Indonesia) and Latin America (Brazil) contributed to relative performance, while underweighted duration exposure in the United States detracted.

What other market conditions or events influenced the Fund's return during the last 12 months?

The U.S. Federal Reserve (Fed) raised the federal funds target rate three times during 2017. U.S. Treasury (UST) yields initially rose significantly in the weeks leading up to its March 15 meeting, with the 10-year UST note reaching its highest yield of the reporting period on the day before the meeting, at 2.63 percent. The Fed hiked the federal funds target rate 25 basis points to a range of 0.75 percent to 1.00 percent, as largely expected by markets. However, yields declined during the second half of the month on U.S. policy uncertainties and less hawkish-sounding language than anticipated in the Fed's forward guidance. The Fed raised its policy rate 25 basis points (to a range of 1.00 percent to 1.25 percent) at its June 14 meeting and appeared more committed to tightening policy than it has been in recent years, specifically stating its intentions to begin unwinding its balance sheet later in the year, while remaining on course for three rate hikes in 2017 and highlighting the need to strengthen financial market stability. However, it was not until the last week of June that markets began to react to the renewed determination from the Fed—only after similar comments on potential policy direction were made by the heads of the European Central Bank (ECB), Bank of England and Bank of Canada.

During the second half of 2017, the Fed raised the federal funds target rate another 25 bps in December to a range of 1.25 percent to 1.50 percent. The Fed also began unwinding its nearly U.S. $4.5 trillion balance sheet in October, allowing around U.S. $6 billion in USTs and U.S. $4 billion in mortgage-backed securities (MBS) to begin rolling off each month as they matured. That volume was scheduled to increase in January 2018 to U.S. $12 billion in USTs and U.S. $8 billion in MBS per month. President Donald Trump nominated Jerome Powell to be the next Fed chair, scheduled to replace Janet Yellen in February 2018. Markets have appeared to view Powell as a mainstream continuation of the Yellen/Bernanke Fed, though Powell brings more private sector experience and more support for deregulation. The 10-year UST note finished the year at 2.41 percent. Overall, we continue to expect UST yields to rise with growing inflation pressures in an environment of economic resilience and exceptionally strong U.S. labor markets.

16

In Europe, UK Prime Minister Theresa May formally triggered Article 50 to begin the Brexit process on March 29 in a written letter to Donald Tusk, president of the European Council, largely spurring a protracted decline in the yield on 10-year British Gilts. In April, the ECB reduced its pace of monthly quantitative easing (QE) purchases to €60 billion from its previous €80 billion a month pace, but kept policy rates unchanged. In early May, Emmanuel Macron won the French presidential election over Marine Le Pen, resulting in strengthening European market sentiment, appreciation of the euro and a rise in European bond yields.

Europe largely remained in a state of optimism during the much of the year, driven by the cyclical upswing in eurozone growth as well as the political refortifying after French President Emmanuel Macron's victory in May. However, Angela Merkel's win in the German election in September came with new uncertainties around forming a coalition with the Free Democrats (FDP) and the Greens, and dissolving the grand coalition between her center-right Christian Democratic Union (CDU) party and the Social Democrat (SPD). In Europe, yields moderately increased while the euro strengthened against the U.S. dollar during the year. We expect widening rate differentials between rising yields in the U.S. and the low to negative yields in the eurozone to depreciate the euro against the U.S. dollar. The ECB is scheduled to reduce the pace of its bond-buying program in January 2018 to €30 billion per month, down from the December pace of €60 billion per month. ECB President Mario Draghi has continued to indicate that rates are not likely to be hiked until QE ends, implying that rates would likely remain unchanged in 2018. Overall, we expect accommodative effects to continue in Europe for the upcoming year. Additionally, we continue to see ongoing risks to the political cohesion across Europe as populist movements continue to influence the political discourse. In Germany, Angela Merkel's efforts to form a coalition government remain unfulfilled at the end of 2017, complicating the political mandates in Europe. The euro continues to be vulnerable to unresolved structural and political risks across Europe, in our view.

In Japan, Prime Minister Shinzo Abe's political mandate remained strong after his political coalition maintained its supermajority in October elections. We expect Abenomics programs to continue as planned with Abe's ongoing political strength. The Bank of Japan (BOJ) continued with its QE program throughout 2017 as short-term yields in Japan remained negative. Rising UST yields should produce a more effective environment for the BOJ to actively deploy additional monetary accommodation that weakens the yen, as it continues to target a 0.0 percent yield on the 10-year Japanese government bond. We expect the Japanese yen to weaken on widening rate differentials with the U.S.

Across emerging markets, yields declined in specific areas of Latin America and Asia, notably Indonesia and Brazil during the year, but rose in other countries, such as India and Mexico. Global currencies broadly strengthened against a weakened U.S. dollar during 2017, with some notable exceptions such as the depreciations of the Argentine peso and Ghanaian cedi. Overall, we continue to see a number of local-currency markets that we believe remain undervalued, particularly in India, Indonesia, Mexico and Colombia. We also see attractive risk-adjusted yields in places like Brazil and Argentina. On the whole, we expect select currencies to appreciate over the medium term, particularly in countries with economic resilience and relatively higher, maintainable rate differentials.

17

What strategies and techniques did you employ that affected the Fund's performance?

On the whole, we have continued to position our strategies for rising rates by maintaining low portfolio duration and aiming at a negative correlation with UST returns. We have also continued to actively seek select duration exposures in emerging markets that can offer positive real yields without taking undue interest-rate risk, favoring countries that have solid underlying fundamentals and prudent fiscal and monetary policies. When investing globally, investment opportunities may take time to materialize, which may require weathering short-term volatility as the longer-term investing theses develop.

We remained positioned in a number of emerging markets, with notable local-currency duration exposures in Brazil, Argentina, Colombia, Indonesia and India, and notable currency exposure to the Mexican peso. We adjusted specific positions during 2017, notably increasing our local-currency exposures in India in April and exiting much of our local-currency exposures in Malaysia. We continued to hold net-negative positions in the euro and Japanese yen based on our expectations for widening rate differentials with the U.S. as the Fed tightens policy while the ECB and BOJ continue with monetary accommodation. The short positions in the euro and yen represent directional views on the currencies, as well as hedges against broad strengthening of the U.S. dollar. The short euro position is also a hedge against euro-skeptic political risks and unresolved structural risks in Europe. We also continued to hold net-negative positioning in the Australian dollar based on the Reserve Bank of Australia's continued leanings towards accommodative rates, and as a partial hedge against potential economic risks in China as well as broad-based beta risk across emerging markets.

What sectors did you emphasize during the fiscal year, and what is your outlook for the next 12 months?

We anticipate a rise in UST yields and a reversal of U.S. dollar weakness as the Fed moves towards tightening policy while U.S. inflation pressures begin to pick up. We expect the Fed's balance sheet unwinding to put additional upward pressure on yields. Several major buyers of USTs have pulled back from the UST market in recent years, including foreign governments and central banks in Asia, notably the People's Bank of China. Major oil producing countries have also pulled back, becoming net borrowers instead of net lenders as they were when oil prices were above U.S. $100 per barrel. The Fed will now be added to that list of diminishing demand, as it unwinds its UST positions at a pace of U.S. $6 billion per month, raising that pace by U.S. $6 billion every three months until reaching a pace of U.S. $30 billion per month. That transfers much of the proportional demand for USTs to price-sensitive domestic investors, which we expect to add to the upward pressure on yields.

Markets have appeared to place a lot of focus on the speed and extent of rate hikes, in our view, but not placed enough attention on the balance sheet unwinding—an unprecedented event for the UST and MBS markets. Investors who are holding longer duration exposures are taking on a lot of asymmetric risk, in our opinion, particularly in an environment of economic resilience and growing inflation pressures.

Outside of the developed markets, we continue to see a subset of countries with domestically strong economies that have demonstrated their resilience to global shocks, including potential increases in trade costs. We are focused on specific emerging markets that are less externally vulnerable and more domestically driven, and that have responsible, credible central banks that consistently respond with appropriate monetary policies. Certainly, 20 years ago it may have been difficult for many of these countries to weather a protectionist trade shock, a commodity price shock and an exchange rate

18

shock all at the same time, but today several countries have greatly reduced those external vulnerabilities.

In 2017, we saw notable strength across a number of local-currency emerging markets. Some positive tailwinds developed from foreign investment returning to several undervalued markets. A lot of foreign capital had left in prior years—when it came back the valuations in those asset categories tended to come back quickly as well. Nonetheless, we are still in the initial phases of emerging market resurgence, and there is still a lot of room to strengthen given how far valuations dropped in prior years, particularly during the selloffs in 2016.

In the major developed economies, we anticipate continued monetary accommodation and low rates in Japan and the eurozone while rates rise in the U.S.—those increasing rate differentials should depreciate the yen and euro against the U.S. dollar, in our view. Despite the eurozone being in a cyclical upswing, we continue to have a negative view on the euro not only because of ongoing monetary accommodation, but also because of persistent populist risks.

Overall, we continue to maintain low portfolio duration while aiming at a negative correlation with UST returns. We also continue to hold select local currency duration exposures in countries that we believe have healthy fundamentals and significantly higher yields than those available in developed markets. Looking ahead, we anticipate rising inflation pressures in the U.S. to drive UST yields higher. We also expect depreciations of the euro and Japanese yen against the U.S. dollar and currency appreciation across a select subset of emerging markets.

19

Ten Largest Holdings^

| Security description | | Market

value | | % of bond

portfolio | |

Mexican Bonos 5.000%, 12/11/19 | | $ | 4,907,317 | | | | 8.8 | % | |

Indonesia Treasury Bond 7.000%, 05/15/27 | | | 3,795,278 | | | | 6.8 | % | |

Mexican Bonos 4.750%, 06/14/18 | | | 2,855,253 | | | | 5.1 | % | |

Korea Treasury Bond 3.375%, 09/10/23 | | | 2,675,488 | | | | 4.8 | % | |

Korea Treasury Bond 1.500%, 06/10/19 | | | 2,495,011 | | | | 4.5 | % | |

Korea Treasury Bond 3.000%, 09/10/24 | | | 2,337,296 | | | | 4.2 | % | |

Mexican Bonos 8.000%, 06/11/20 | | | 2,314,990 | | | | 4.2 | % | |

Korea Treasury Bond 2.000%, 09/10/22 | | | 2,180,738 | | | | 3.9 | % | |

Indonesia Treasury Bond 8.375%, 09/15/26 | | | 2,131,053 | | | | 3.8 | % | |

Argentine Bonos del Tesoro 15.500%, 10/17/26 | | | 2,071,223 | | | | 3.7 | % | |

| | $ | 27,763,647 | | | | 49.8 | % | |

^Excludes short-term investments.

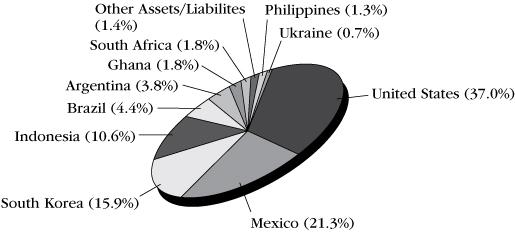

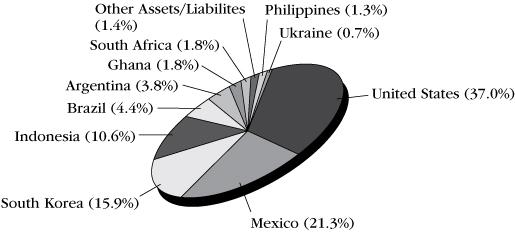

Country Diversification (shown as a percentage of net assets)

Currency Diversification (shown as a percentage of net assets)

African | | | 3.72 | % | |

South African Rand (ZAR) | | | 1.88 | % | |

Ghana Cedi (GHS) | | | 1.84 | % | |

Americas | | | 154.52 | % | |

United States Dollar (USD) | | | 115.77 | % | |

Mexican Peso (MXN) | | | 21.07 | % | |

Brazilian Real (BRL) | | | 13.38 | % | |

Argentine Peso (ARS) | | | 4.30 | % | |

Asia Pacific* | | | -17.81 | % | |

Indonesian Rupiah (IDR) | | | 10.78 | % | |

Indian Rupee (INR) | | | 10.19 | % | |

Philippine Peso (PHP) | | | 1.34 | % | |

Republic of Korea Won (KRW)* | | | -0.14 | % | |

Australian Dollar (AUD)* | | | -9.40 | % | |

Japanese Yen (JPY)* | | | -30.58 | % | |

Europe* | | | -40.45 | % | |

Euro (EUR)* | | | -40.45 | % | |

*A negative figure reflects net "short" exposure, designed to benefit if the value of the associated currency decreases. Conversely, the Fund's value would potentially decline if the value of the associated currency increases.

20

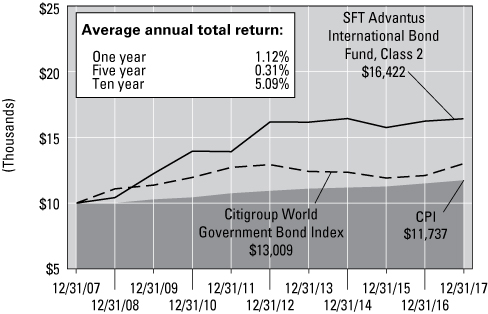

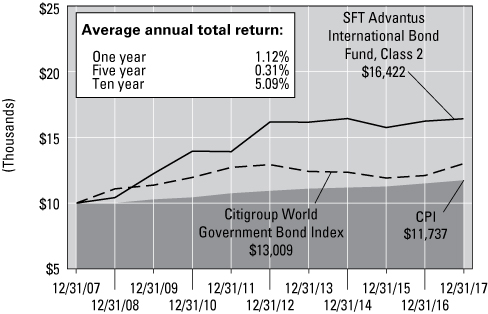

Comparison of Change in Investment Value*

A Hypothetical $10,000 Investment in SFT Advantus International Bond Fund,

Citigroup World Government Bond Index, and Consumer Price Index

On the chart above you can see how the SFT Advantus International Bond Fund's Class 2 shares total return compared to the Citigroup World Government Bond Index, and the Consumer Price Index. The three lines represent the total return of a hypothetical $10,000 investment made on December 31, 2007 through December 31, 2017, assuming reinvestment of distributions, if any.

*The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The Citigroup World Government Bond Index is a market capitalization weighted index consisting of the government bond markets from over twenty countries. Country eligibility is determined based upon market capitalization and investability criteria. The index includes all fixed-rate bonds with a remaining maturity of one year or longer and with amounts outstanding of at least the equivalent of U.S. $25 million. Government securities typically exclude floating or variable rate bonds, U.S./Canadian savings bonds and private placements. Each bond must have a minimum rating of BBB-/Baa3 by S&P or Moody's.

21

Craig M. Stapleton, CFA, FRM, Jeremy Gogos, Ph.D., CFA and Merlin Erickson Portfolio Managers

The SFT Advantus Managed Volatility Equity Fund seeks to maximize risk-adjusted total return relative to its blended benchmark index comprised of 60 percent S&P 500® Low Volatility Index, 20% S&P 500® BMI International Developed Low Volatility Index and 20% Bloomberg Barclays U.S. 3 Month Treasury Bellwether Index (collectively, the Blended Benchmark Index).

The SFT Advantus Managed Volatility Equity Fund invests at least 80% of its assets in equity securities. Equity securities include those that are equity-based, such as ETFs that invest primarily in U.S. and foreign equity securities. The Fund is subject to risks associated with such investments as described in detail in the prospectus. The net asset value of the Fund will fluctuate and is not guaranteed. It is possible to lose money by investing in the Fund. There is no assurance that efforts to manage Fund volatility will achieve the desired results.

SFT Advantus Managed Volatility Equity Fund

How did the Fund perform during the period?

The Fund generated a total net return of 16.33 percent, with a volatility of 4.81 percent, for the 12 months ending December 31, 2017. The blended benchmark index, which is comprised of the S&P 500® Low Volatility Index, weighted 60 percent, the S&P 500® BMI International Developed Low Volatility Index, weighted 20 percent, and the Bloomberg Barclays U.S. 3-Month Treasury Bellwether Index, weighted 20 percent, returned 14.99 percent, with a volatility of 4.02 percent, over the same period.

What influenced the Fund's return during the past 12 months?

The Managed Volatility Equity overlay strategy has essentially two sides: the Fund should carry more equity exposure in low volatility periods, and less equity exposure in high volatility periods. Given that the S&P 500® Index realized volatility for 2017 was 6.69 percent, the second-lowest of the 89 calendar years in the index's history, the Fund averaged a 92.6 percent equity allocation. This equity overweight contributed approximately 1.4 percent of additional portfolio return.

What other market conditions or events influenced the Fund's performance during the past 12 months?

There were numerous events this past year that could have rattled financial markets: North Korean missile tests, the U.S. Federal Reserve (Fed) hiking rates while other central banks are still in quantitative easing mode, hurricanes, and of course the lack of policy progress out of Washington until the very end of the year. The market shrugged off all these potential obstacles and marched steadily upward through all of 2017. The S&P 500® Index did not have a down month, and its largest one-day loss was only -1.8 percent. It returned 21.8 percent for the year. So, from an equity perspective, the solid return combined with extremely low volatility made for a nearly ideal year.

The Fund's international holdings outperformed the benchmark's international component on an absolute basis, with the former returning 23.7 percent, and the latter 22.8 percent. This better performance was driven largely by the Fund's higher exposures to Japan and Switzerland, the equity markets of which returned 21.3 percent and 17.9 percent, respectively, in USD terms.

What strategies and techniques did you employ that affected Fund performance?

Throughout the year, the Fund tactically purchased long positions in call options on the Chicago Board Options Exchange (CBOE) Volatility Index (VIX) futures, and long S&P 500® put spreads, as additional hedges for managing the risk of the Fund. We believe that these options provide a great tool for managing risk, and were attractively priced relative to historical valuations. These hedges reduced the volatility of the Fund's returns while helping to protect the Fund against quick market sell-offs.

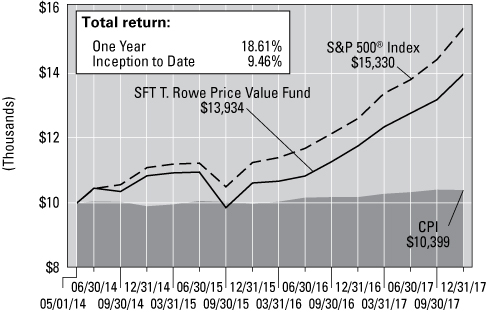

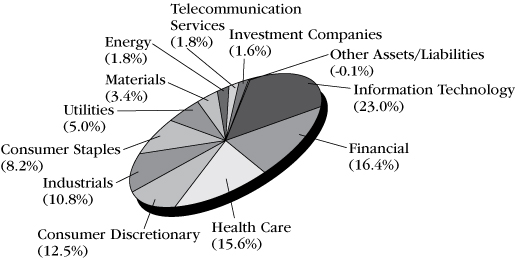

What industries or sectors did you emphasize during the past 12 months, and what is your outlook going forward?