UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4279

Securian Funds Trust

(Exact name of registrant as specified in charter)

400 Robert Street North

St. Paul, Minnesota 55101-2098

(Address of principal executive offices) (Zip code)

Michael P. Boyle, Esq.

400 Robert Street North

St. Paul, Minnesota 55101-2098

(Name and address of agent for service)

Registrant's telephone number, including area code:

(651) 665-3500

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

ITEM 1. REPORT TO STOCKHOLDERS.

Filed herewith.

Offered in Minnesota Life

Insurance Company and

Securian Life Insurance

Company variable products

Annual report

December 31, 2020

SFT Core Bond Fund

SFT Dynamic Managed Volatility Fund

SFT Government Money Market Fund

SFT Index 400 Mid-Cap Fund

SFT Index 500 Fund

SFT International Bond Fund

SFT IvySM Growth Fund

SFT IvySM Small Cap Growth Fund

SFT Managed Volatility Equity Fund

SFT Real Estate Securities Fund

SFT T. Rowe Price Value Fund

SFT Wellington Core Equity Fund

(This page has been left blank intentionally.)

TABLE OF CONTENTS

| | | Page No. | |

Letter from the President | | | 1 | | |

Portfolio Manager Reviews | |

| SFT Core Bond Fund | | | 2 | | |

SFT Dynamic Managed Volatility Fund | | | 6 | | |

SFT Government Money Market Fund | | | 11 | | |

SFT lndex 400 Mid-Cap Fund | | | 13 | | |

| SFT lndex 500 Fund | | | 17 | | |

SFT lnternational Bond Fund | | | 21 | | |

SFT IvySM Growth Fund | | | 26 | | |

SFT IvySM Small Cap Growth Fund | | | 30 | | |

SFT Managed Volatility Equity Fund | | | 34 | | |

SFT Real Estate Securities Fund | | | 39 | | |

SFT T. Rowe Price Value Fund | | | 43 | | |

SFT Wellington Core Equity Fund | | | 47 | | |

Report of Independent Registered Public Accounting Firm | | | 51 | | |

Investments In Securities | |

| SFT Core Bond Fund | | | 52 | | |

SFT Dynamic Managed Volatility Fund | | | 61 | | |

SFT Government Money Market Fund | | | 68 | | |

SFT lndex 400 Mid-Cap Fund | | | 69 | | |

| SFT lndex 500 Fund | | | 76 | | |

SFT lnternational Bond Fund | | | 84 | | |

SFT IvySM Growth Fund | | | 90 | | |

SFT IvySM Small Cap Growth Fund | | | 92 | | |

SFT Managed Volatility Equity Fund | | | 94 | | |

SFT Real Estate Securities Fund | | | 95 | | |

SFT T. Rowe Price Value Fund | | | 97 | | |

SFT Wellington Core Equity Fund | | | 100 | | |

Financial Statements | |

Statements of Assets and Liabilities | | | 102 | | |

Statements of Operations | | | 104 | | |

Statements of Changes in Net Assets | | | 106 | | |

Financial Highlights | | | 111 | | |

Notes to Financial Statements | | | 123 | | |

Fund Expense Examples | | | 141 | | |

Proxy Voting and Quarterly Holdings Information | | | 143 | | |

Statement Regarding Liquidity Risk Management Program | | | 144 | | |

Trustees and Executive Officers | | | 145 | | |

Letter from the President

2020 was a year most of us will not soon forget. While starting the year off on solid footing, the pandemic soon changed many aspects of our lives and led to a pronounced drop-off in employment, economic growth, and the markets overall. As the pandemic spread, many industries were forced to close or to make significant changes to their business models. This led to broad layoffs in the service sector, in particular in industries such as travel, hospitality, and leisure. The markets reacted as expected and we experienced a broad correction in the equity markets as well as in the credit sensitive fixed income markets during the first half of the year.

This market correction, however, remained short lived. As we progressed through the year, people and businesses learned to cope with the pandemic. Many changes that might have taken a decade to evolve, occurred seemingly overnight. The broad movement and acceptance of working from home, of remote education, and the use of telemedicine are just a few of the ways we adapted. This ingenuity restored many of our jobs, strengthened our economic growth, and led to a strong market recovery. Bold Federal Reserve actions to provide ample liquidity and credit support to the markets, the multi trillion-dollar stimulus packages passed by Congress, and the encouragement provided by enhanced COVID-19 testing and news of a vaccine all contributed to the recovery.

These actions culminated with exceptional market returns across most major asset classes. The S&P 500® ended the year up 18.40 percent, with the Russell 2000 up an even stronger 19.96 percent. Technology stocks were in a league of their own with the Nasdaq up over 45 percent. Fixed income returns were solid with the Bloomberg Barclays U.S. Aggregate Bond Index up 7.51 percent.

As we look forward to 2021, we are encouraged by the prospects of the roll out of vaccinations, putting much of our economic shutdown behind. We expect, however, this could be a bumpy path as many complications need to be worked through. We also anticipate that many of the recent lessons learned will lead to lasting improvements in the way many organizations work and provide services as new business models emerge. This optimism leads us to believe that our economic future remains bright and that market returns will continue to remain positive. As always, we believe the best investment tactic is to position for the long-term and seek diversification to help reduce risk of a downside surprise.

Sincerely,

David Kuplic

President, Securian Funds Trust

1

Thomas Houghton, CFA, Daniel Henken, CFA and Lena Harhaj, CFA Portfolio Managers

Fund Objective

The SFT Core Bond Fund seeks as high a level of long-term total return as is consistent with prudent investment risk. Preservation of capital is a secondary objective. The SFT Core Bond Fund invests in long-term, fixed income, high quality debt instruments. The risks incurred by investing in debt instruments include, but are not limited to, reinvestment of prepaid debt obligations at lower rates of return, and the inability to reinvest at higher interest rates when debt obligations are prepaid more slowly than expected. In addition, the net asset value of the SFT Core Bond Fund may fluctuate in response to changes in interest rates and is not guaranteed.

Performance Update

The Fund's Class 2 shares generated a total net return of 6.88 percent over the 12 months ending December 31, 2020, underperforming the Bloomberg Barclays U.S. Aggregate Bond Index which returned 7.51 percent over the same period.

What influenced the Fund's return during the past 12 months?

Investors looked through near term weakness to bid up lagging asset classes during the fourth quarter of 2020, resulting in winners all around. The final quarter provided clarity in the U.S. election, another COVID-19 relief package, and news of several effective vaccines, and all boosted confidence that 2021 would see a return to normal. For the past 12 months, almost all major asset classes ended in strongly positive territory.

Credit markets finished the year on a high note. In the fourth quarter, investment grade and high yield corporates tightened 40 basis points (bps) and 161 bps, respectively, producing excess returns of 4.11 percent and 6.69 percent, respectively. Fixed income returns were solid on the year with the Bloomberg Barclays U.S. Aggregate Bond Index up 7.51 percent.

Despite the strong positive momentum, equity markets continue to price in stubbornly high volatility. While inflation expectations have perked up, interest rates remain at historically low levels. The Federal Reserve's (Fed) intentions are clear—rates are to remain anchored near zero until inflation takes hold. The Fed remains committed to maintaining an aggressive pace of asset purchases, even as its balance sheet has grown by over $3.2 trillion since the end of February 2020.

What other market conditions or events influenced the Fund's performance during the past 12 months?

Credit's fourth quarter rally propelled high yield and investment grade corporates to record low yields, resulting in positive excess returns over comparable U.S. Treasury securities for the full year, despite starting the year with the worst quarter ever recorded for corporate bond performance.

What strategies and techniques did you employ that specifically affected Fund performance?

The decision to overweight corporates, particularly industrials and utilities, as well as agency credit risk-transfer securities resulted in a strong positive excess return in 2020. Security selection was a detractor in 2020 as we have been very cautious on adding high yield, crossover credit, or higher beta investment grade holdings to the portfolio. We have favored holdings that we feel are durable in a choppy economic recovery and exhibit more stable credit fundamentals. Recent security selection results have been encouraging as the market normalizes and liquidity has returned to off the run sectors. Consistent with our philosophy, overall duration did not exhibit

2

material differences from the Fund's benchmark in 2020 and interest rate positioning contributed very little to performance relative to the benchmark.

What will affect the Fund going forward?

While COVID-19 continues to take a real toll, the return to normal is likely to be far more robust than in previous recoveries. Unlike most recessions, the pandemic was an exogenous event. Quick regulatory approvals and an imminent vaccine rollout were game changers, lifting a cloud of uncertainty and unleashing animal spirits.

While a strong rebound is likely, in our view we're not going to return to the old normal. The pandemic accelerated trends that were already in place and focused an unflinching spotlight on imbalances and sectors with weak value propositions. Work from home appears to be here to stay, and demand for office space and business travel may take years to recover. Brick-and-mortar retail may never be the same with the ramped up online environment and delivery services. We expect that new business models will emerge, and some sectors could experience a painful transition as investment and infrastructure align in new ways, while other businesses benefit as supply chains realign.

Although markets seem fully priced and even overvalued by normal standards, we believe the stage is set for good economic growth in the coming year. We expect the current slowdown to be short-lived, and ample liquidity remains a strong support. Despite the recent rise in rates and inflation expectations, we do not believe interest rates are set to rise dramatically from current levels. The world's developed economies are awash in savings and have plenty of labor slack, and their respective central banks are determined to keep rising rates from choking off nascent economic growth.

3

Ten Largest Holdings^

| Security description | | Market

value | | % of net

assets | |

U.S. Treasury Bond 1.250%, 05/15/50 | | $ | 10,119,676 | | | | 2.0 | % | |

U.S. Treasury Note 0.250%, 05/31/25 | | | 7,667,296 | | | | 1.5 | % | |

U.S. Treasury Bond 5.375%, 02/15/31 | | | 7,353,212 | | | | 1.5 | % | |

Invitation Homes 2018-SFR4 Trust, 1.553%, 01/17/38 | | | 5,049,998 | | | | 1.0 | % | |

U.S. Treasury Note 0.625%, 11/30/27 | | | 5,049,211 | | | | 1.0 | % | |

U.S. Treasury Note 0.500%, 05/31/27 | | | 5,002,352 | | | | 1.0 | % | |

Bank of America Corp., 3.974%, 02/07/30 | | | 4,758,442 | | | | 1.0 | % | |

Eagle RE 2020-1 Ltd., 1.598%, 01/25/30 | | | 4,664,641 | | | | 0.9 | % | |

Wells Fargo & Co 2.393%, 06/02/28 | | | 4,391,566 | | | | 0.9 | % | |

Federal Home Loan Mortgage Corporation 3.598%, 10/25/29 | | | 4,131,146 | | | | 0.8 | % | |

| | | $ | 58,187,540 | | | | 11.6 | % | |

^Excludes short-term investments.

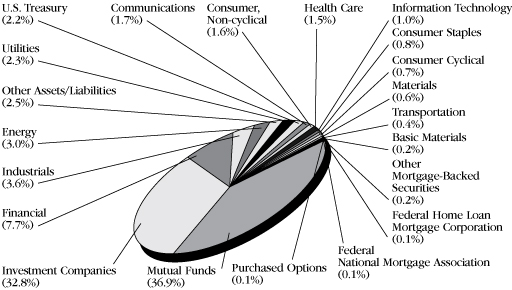

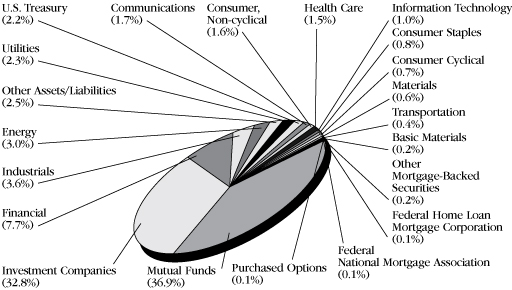

Sector Diversification (shown as a percentage of net assets)

Asset Quality (shown as a percentage of investments) (Unaudited)

Ratings are obtained from Standard & Poor's, Moody's and Fitch. If only one rating is available for a security, that rating is used. A weighted average is used for holdings where more than one of the agencies have assigned a rating. Securian Asset Management provides ratings for securities that are not assigned a rating by the agencies.

4

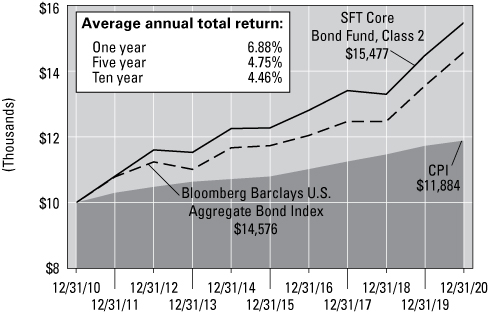

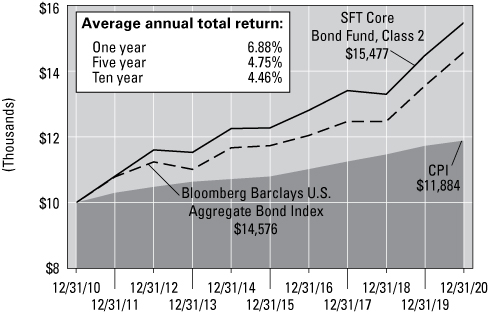

Comparison of Change in Investment Value*

A Hypothetical $10,000 Investment in SFT Core Bond Fund,

Bloomberg Barclays U.S. Aggregate Bond Index and Consumer Price Index (CPI)

On the chart above you can see how the SFT Core Bond Fund's Class 2 shares total return compared to the Bloomberg Barclays U.S. Aggregate Bond Index and the Consumer Price Index. The three lines represent the total return of a hypothetical $10,000 investment made on December 31, 2010 through December 31, 2020, assuming reinvestment of distributions, if any.

* The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged benchmark composite representing average market-weighted performance of U.S. Treasury and agency securities, investment-grade corporate bonds and mortgage-backed securities with maturities greater than one year.

5

SFT Dynamic Managed Volatility Fund

Craig M. Stapleton, CFA, FRM, Jeremy Gogos, Ph.D., CFA and Merlin Erickson Portfolio Managers

Fund Objective

The SFT Dynamic Managed Volatility Fund seeks to maximize risk-adjusted total return relative to its blended benchmark index comprised of 60 percent S&P 500® Index and 40 percent Barclays U.S. Aggregate Bond Index (collectively, the Blended Benchmark Index). The SFT Dynamic Managed Volatility Fund invests primarily in Class 1 shares of the SFT Index 500 Fund for equity exposure, in a basket of fixed income securities for fixed income exposure and certain derivative instruments. The Fund is subject to risks associated with such investments as described in detail in the Fund's prospectus. The net asset value of the Fund will fluctuate and is not guaranteed. It is possible to lose money by investing in the Fund. There is no assurance that efforts to manage Fund volatility will achieve the desired results.

Performance Update

The Fund generated a total net return of 10.67 percent, with a volatility of 12.11 percent, over the 12 months ending December 31, 2020. The Blended Benchmark Index, which is comprised of the S&P 500® Index, weighted 60 percent, and the Bloomberg Barclays U.S. Aggregate Index, weighted 40 percent, returned 14.73 percent with a volatility of 20.21 percent, over the same period.

What influenced the Fund's return during the past 12 months?

Equity volatility is what guides the asset allocation of this strategy. When equity volatility is low, the equity exposure of this strategy will be high. Conversely, when equity volatility is high, the equity exposure of this strategy will be low. Clearly, in 2020, the COVID-19 virus was the predominant driver of market volatility.

The S&P 500® realized 34.43 percent volatility for 2020, the sixth highest calendar-year volatility in the index's 93-year history. 2008 is the only year in the modern era more volatile (40.97 percent realized volatility). All other higher years occurred in the 1920s and 1930s. Realized one-month volatility began 2020 quite low, entering the year at 6.90 percent. As such, the Fund's equity exposure was at 80.28 percent. In early February, as the market began to appreciate how truly disruptive COVID-19 could be, volatility began to escalate. From 02/03/2020 through 03/16/2020, the Fund was steadily de-risked from 80.04 percent to 19.38 percent equity exposure. This reduction in equity exposure was concurrent with one-month volatility increasing from 11.80 percent to 79.66 percent over the same time period. This volatility peaked on 03/27/2020, at 97.12 percent, but stayed above 40 percent through the end of April. Indeed, the Fund did not begin adding back equity exposure in earnest until mid-May, and volatility did not drop enough for the Fund to get to "neutral" weight—i.e. 60 percent exposure—until early August. September and October also saw brief periods of volatility rising to the mid 20 percent range, and as a result the Fund was underweight equity for most of Q3 and Q4. One-month volatility closed out 2020 at 8.3 percent, and the Fund finished 2020 with 56.62 percent linear S&P exposure, approximately 15.00 percent exposure in long S&P 500® call options, and approximately 1.30 percent exposure in long Chicago Board of Options Exchange (CBOE) Volatility Index (VIX) puts.

All told, the Fund's average equity exposure for 2020 was 46.32 percent, which contributed 8.10 percent to the overall Fund return on a net basis. The benchmark equity component contributed 11.56 percent to the Blended Benchmark Index return. The Fund's fixed income and cash assets averaged 53.68 percent weight for the year, and contributed 2.57 percent to the overall Fund return on a net basis. The benchmark fixed income component delivered 3.17 percent to the Blended Benchmark Index return.

6

What other market conditions or events influenced the Fund's performance during the past 12 months?

Following are just some of the financial extremes witnessed in 2020:

• March 2020 saw a realized volatility of 93.42 percent, the most volatile month ever in the S&P 500® history.

• The CBOE VIX set a new closing record of 82.7 on 03/16/2020.

• The 33.92 percent drawdown from 02/20/2020 through 03/23/2020 was the ninth-largest S&P loss ever in 23 business days, and all other such periods that surpassed it were in 1929 and 1931.

• Similarly, over the next 103 days, the S&P 500® rallied 51.50 percent, surpassing its pre-COVID-19 high. The speed of this rally is also unmatched in the last 87 years; only periods from 1932 and 1933 saw a larger S&P 500® price appreciation in the same number of business days.

• The highest single-week Initial Jobless Claims (IJC) number during the Great Financial Crisis (GFC) was 665,000; during the week of 03/20/2020, the IJC number jumped from 282,000 to 3,307,000, and experienced forty-one continuous weeks of prints above the GFC peak.

• The US 10-year Treasury rate set a new record low of 0.51 percent on 08/04/2020.

• Second quarter of 2020 saw the largest quarter-over-quarter US Gross Domestic Product (GDP) contraction in history -31.40 percent.

In addition to these "top-level" anomalies, there were other very troubling developments underneath:

• The well-known concentration of S&P 500® market cap in tech names was not helped by Tesla joining the index. As of year end, 24.86 percent of the S&P 500® market cap was concentrated in Apple, Amazon, Facebook, Alphabet (Google), Microsoft, Tesla, and Netflix. Also of note, Tesla saw a 743 percent return for 2020.

• The best-performing S&P 500® sector in 2020 was Information Technology. The worst-performing sector was Energy. The performance gap between the two was the largest on record, going back to 2002. COVID-19 created an environment where industries that benefit from "work from home" (delivery retail, tech, etc.) were handed outlandish returns, and most other real-economy sectors were punished.

• The Growth and Value sub-indexes of the S&P 500® tell a similar story. The outperformance of Growth over Value in 2020 is the largest on record back to 1994. The next largest Growth-Value gap was in 1998, leading up to the DotCom bubble.

• The current projection for S&P 500® earnings growth year-over-year for the fourth quarter 2020 is 8.8 percent; yet the S&P 500® closed 2020 at a new all-time high.

We continue to view the equity markets as generally overvalued, and the absurd performance of the top equity sectors and names as liquidity fueled mania. To that end, consider the peak-to-trough performance of both the Fund and the Fund's benchmark through the COVID-19 panic. The Fund achieved its goal of mitigating severe drawdowns. However, with the Federal Reserve unexpectedly cutting its target policy rate to 0.0 percent (03/13/2020) and pledging to inject trillions of short-term liquidity into the financial system, and the roughly $2 trillion CARES Act passing on 03/27/2020, any asset allocation that involved being underweight equity was a losing proposition. This underweight was the driver of the Fund's underperformance in 2020.

What strategies and techniques did you employ that specifically affected Fund performance?

Throughout the year, the Fund held a core long position in cash equity that tracks the S&P 500®. In addition, the Fund had long and short positions in S&P 500® futures, long and short S&P 500® call options, long and short S&P 500® put options, long and short CBOE VIX call options, and long and short VIX put options. These derivative positions were held either as expressions of the target equity allocation of the Fund given prevailing volatility, or as supplemental hedges for managing the Fund's risk.

7

What will affect the Fund going forward?

We expect worse-than-average returns, and higher volatility, for domestic risk markets on a go-forward basis. Equity indexes continue to make new highs, while most fundamental valuation metrics suggest the equity market is quite overvalued, and S&P 500® earnings have declined year-over-year for 7 of the last 8 quarters. Both investment grade and high yield corporate credit yields are near their historic lows, while domestic corporate debt outstanding hit another new record in 2020. Multiple indications of inflation expectations have steadily risen since early 2020.

In short, up to this point, the monetary and fiscal tsunami unleashed upon the markets has been the primary driver of the returns seen since the COVID-19 market nadir. In our view, it seems plausible that the market has finally reached the point where central bank liquidity can no longer be injected without stoking fears of inflation. Further, every major central bank is now at their logical policy limit: short-term rates pinned at zero, and aggressive asset purchases to support markets.

Some market observers find justification for bullish sentiment in the COVID-19 vaccine release, and the promise of societal dynamics returning to normal. But in response, we pose the following simple logical question: if the market was impervious to the sectors worst affected by COVID-19 struggling mightily for the better part of a year, should the market see material gains as a result of those sectors returning to normal operation?

Given the present situation of extremely accommodative monetary policy, and probable further fiscal stimulus from the newly-elected Democratic federal government, we view the risk of a major equity selloff as reduced. But again, we are hard-pressed to see the case for material risk asset gains in 2021. And, perhaps more importantly, given the current central bank positioning, the—in our view—absolutely irresponsible federal debt and deficit, and the already staggering level of federal stimulus, we see the entire market as extremely vulnerable to an exogenous shock.

In a tactical sense, we will continue to use our volatility metrics to inform the equity allocations of the Fund. We will increase equity exposure if we believe volatility will decrease, decrease equity exposure if we believe volatility will increase, and in the event that we are overweight equity, we will carry some form of tail risk hedge for the foreseeable future.

8

Ten Largest Holdings^

| Security description | | Market

value | | % of net

assets | |

U.S. Treasury Note, 2.625%, 12/15/21 | | $ | 15,356,836 | | | | 2.3 | % | |

SPDR S&P 500 ETF Trust | | | 13,523,240 | | | | 2.0 | % | |

Vanguard S&P 500 ETF | | | 6,933,946 | | | | 1.0 | % | |

iShares iBoxx $ Investment Grade Corporate Bond ETF | | | 6,146,785 | | | | 0.9 | % | |

Regions Financial Corp., 3.800%, 08/14/23 | | | 2,169,609 | | | | 0.3 | % | |

Raytheon Technologies Corp. 4.125%, 11/16/28 | | | 1,788,245 | | | | 0.3 | % | |

Pine Street Trust I, 4.572%, 02/15/29 | | | 1,778,290 | | | | 0.3 | % | |

Welltower, Inc., 4.125%, 03/15/29 | | | 1,749,862 | | | | 0.3 | % | |

Southern Natural Gas Co. LLC, 4.800%, 03/15/47 | | | 1,744,424 | | | | 0.3 | % | |

Bank 2019-BNK18, 3.584%, 05/15/62 | | | 1,736,682 | | | | 0.3 | % | |

| | | $ | 52,927,919 | | | | 8.0 | % | |

^Does not include short-term investments or investments in Class 1 shares of the SFT Index 500 Fund, an affiliated Fund in Securian Funds Trust, which provides the SFT Dynamic Managed Volatility Fund with its primary equity exposure.

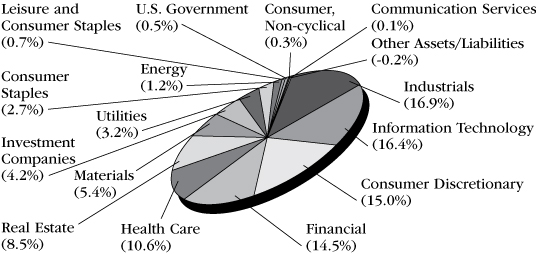

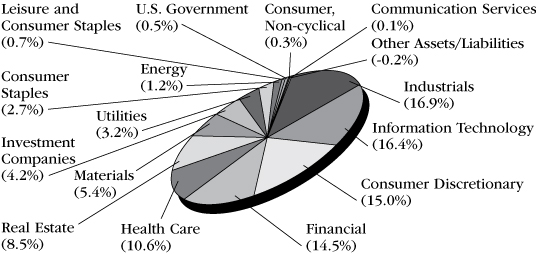

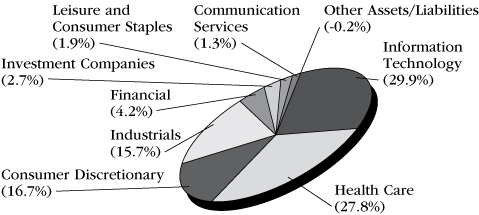

Sector Diversification (shown as a percentage of net assets)

Asset Quality (shown as a percentage of fixed income investments) (Unaudited)

Ratings are obtained from Standard & Poor's, Moody's and Fitch. If only one rating is available for a security, that rating is used. A weighted average is used for holdings where more than one of the agencies have assigned a rating. Securian Asset Management provides ratings for securities that are not assigned a rating by the agencies.

9

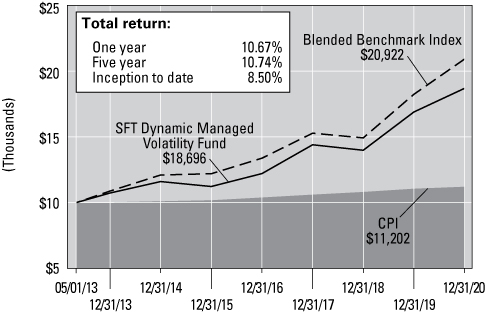

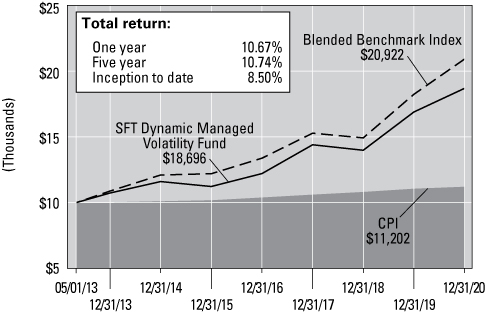

Comparison of Change in Investment Value*

A Hypothetical $10,000 Investment in SFT Dynamic Managed Volatility Fund,

the Blended Benchmark Index and Consumer Price Index (CPI)

On the chart above you can see how the SFT Dynamic Managed Volatility Fund's shares total return compared to its Blended Benchmark Index, comprised of 60 percent of the S&P 500 Index and 40 percent of the Bloomberg Barclays U.S. Aggregate Bond Index, and the Consumer Price Index. The three lines represent the total return of a hypothetical $10,000 investment made on May 1, 2013 through December 31, 2020, assuming reinvestment of distributions, if any.

* The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

Securian Asset Management, Inc. (Securian AM) and the Securian Funds Trust, on behalf of the SFT Dynamic Managed Volatility Fund (the "Fund"), have entered into an Expense Limitation Agreement, dated May 1, 2013, which limits the operating expenses of the Fund, excluding certain expenses (such as interest expense, acquired fund fees, cash overdraft fees, taxes, brokerage commissions, other expenditures which are capitalized in accordance with the generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the Fund's business), to 0.80% of the Fund's average daily net assets through April 30, 2021. The Agreement renews annually for a full year each year thereafter unless terminated by Securian AM upon at least 30 days' notice prior to the end of a contract term. The Fund is authorized to reimburse Securian AM for management fees previously waived and/or for the cost of expenses previously paid by Securian AM pursuant to this agreement, provided that such reimbursement will not cause the Fund to exceed any limits in effect at the time of such reimbursement. The Fund's ability to reimburse Securian AM in this manner only applies to fees waived or reimbursements made by Securian AM within the three fiscal years prior to the date of such reimbursement. To the extent that the Fund makes such reimbursements to Securian AM, the amount of the reimbursements will be reflected in the financial statements in the Fund's shareholder reports and in Other Expenses under Fees and Expenses of the Fund.

The Blended Benchmark Index is comprised of 60 percent of the S&P 500® Index and 40 percent of the Bloomberg Barclays U.S. Aggregate Bond Index.

The S&P 500® Index is a broad, unmanaged index of 500 common stocks which are representative of the U.S. stock market overall. The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged benchmark composite representing the average market-weighted performance of U.S. Treasury and agency securities, investment grade corporate bonds and mortgage-backed securities with maturities greater than one year.

10

SFT Government Money Market Fund

Thomas Houghton, CFA and Lena Harhaj, CFA Portfolio Managers

Fund Objective

The SFT Government Money Market Fund seeks maximum current income to the extent consistent with liquidity and the preservation of capital. The Fund invests at least 99.5 percent of its total assets in cash, government securities, and/or repurchase agreements that are collateralized fully (i.e., collateralized by cash or government securities). Investment in the SFT Government Money Market Fund is neither insured nor guaranteed by the U.S. Government, and there can be no assurance that the Fund will be able to maintain a stable net asset value of $1.00 per share. It is possible to lose money by investing in the Fund.

Performance Update

The Fund generated a total net return of 0.21 percent over the 12 months ending December 31, 2020, underperforming the three-month Treasury Bill which returned 0.67 percent over the same period.

What influenced the Fund's return during the past 12 months?

The U.S. Treasury yield curve followed the decline in the Federal Funds Rate at the beginning of the year. Rates in the front end of the curve finished the year down 140-150 basis points.

What strategies and techniques did you employ that specifically affected Fund performance?

The Fund continues to pick up incremental yield versus U.S. Treasury Bills by purchasing short dated Agency Discount Notes.

What will affect the Fund going forward?

While COVID-19 continues to take a real toll, the return to normal is likely to be far more robust than in previous recoveries. Unlike most recessions, the pandemic was an exogenous event. Quick regulatory approvals and an imminent vaccine rollout were game changers, lifting a cloud of uncertainty and unleashing animal spirits.

Although markets seem fully priced and even overvalued by normal standards, we believe the stage is set for good economic growth in the coming year. We expect the current slowdown to be short-lived, and ample liquidity remains a strong support. Despite the recent rise in rates and inflation expectations, we do not believe interest rates are set to rise dramatically from current levels. The world's developed economies are awash in savings and have plenty of labor slack, and their respective central banks are determined to keep rising rates from choking off nascent economic growth.

11

The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Investment in the SFT Government Money Market Fund is neither insured nor guaranteed by the U.S. Government or any other agency, and there can be no assurance that the Fund will be able to maintain a stable net asset value of $1.00 per share. Shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The Bloomberg Barclays U.S. Treasury Bill 1-3 Month Index is a market value-weighted index of investment-grade fixed-rate public obligations of the U.S. Treasury with maturities of three months, excluding zero coupons.

Effective May 1, 2012, the Board of Trustees of Securian Funds Trust approved a Restated Net Investment Income Maintenance Agreement among Securian Funds Trust (on behalf of SFT Government Money Market Fund), Securian Asset Management, Inc. (Securian AM) and Securian Financial Services, Inc. (Securian Financial). A similar agreement was previously approved by the Board of Directors of Advantus Series Fund, Inc., the Trust's predecessor, effective October 29, 2009. Under such Agreement, Securian AM agrees to waive, reimburse or pay SFT Government Money Market Fund expenses so that the Fund's daily net investment income does not fall below zero. Securian Financial may also waive its Rule 12b-1 fees. Securian AM and Securian Financial each has the option under the Agreement to recover the full amount waived, reimbursed or paid (the "Expense Waiver") on any day on which the Fund's net investment income exceeds zero. On any day, however, the Expense Waiver does not constitute an obligation of the Fund unless Securian AM or Securian Financial has expressly exercised its right to recover a specified portion of the Expense Waiver on that day, in which case such specified portion is then due and payable by the Fund. In addition, the right of Securian AM and/or Securian Financial to recover the Expense Waiver is subject to the following limitations: (1) if a repayment of the Expense Waiver by the Fund would cause the Fund's net investment income to fall below zero, such repayment is deferred until a date when repayment would not cause the Fund's net investment income to fall below zero; (2) the right to recover any portion of the Expense Waiver expires three years after the effective date of that portion of the Expense Waiver; and (3) any repayment of the Expense Waiver by the Fund cannot cause the Fund's expense ratio to exceed 1.25%. If Securian AM and Securian Financial exercise their rights to be paid such waived amounts, the Fund's future yield will be negatively affected for an indefinite period. The Agreement is effective through April 30, 2021, and shall continue in effect thereafter, provided such continuance is specifically approved by Securian AM, Securian Financial, and a majority of the Trust's independent Trustees.

Effective November 1, 2017, Securian AM and Securian Funds Trust, on behalf of the SFT Government Money Market Fund, entered into an Expense Limitation Agreement which limits the operating expenses of the Fund, excluding certain expenses, (such as interest expense, acquired fund fees, cash overdraft fees, taxes, brokerage commissions, other expenditures which are capitalized in accordance with GAAP, and other extraordinary expenses not incurred in the ordinary course of the Funds' business), to 0.70% of the Fund's Average daily net assets through April 30, 2021.

The Agreement renews annually for a full year each year thereafter unless terminated by Securian AM upon at least 30 days' notice prior to the end of the contract term. The Fund is authorized to reimburse Securian AM for management fees previously waived and/or for the cost of expenses previously paid by Securian AM pursuant to this agreement, provided that such reimbursement will not cause any Fund to exceed any limits in effect at the time of such reimbursement.

The Fund's ability to reimburse Securian AM in this manner only applies to fees waived or reimbursements made by Securian AM within the three fiscal years prior to the date of such reimbursement. To the extent that the Fund makes such reimbursements to Securian AM, the amount of the reimbursements will be reflected in the financial statements in the Funds' shareholder reports and in Other Expenses under Fees and Expenses of the Fund in the prospectus.

12

SFT Index 400 Mid-Cap Fund

James Seifert

Portfolio Manager

Fund Objective

The SFT Index 400 Mid-Cap Fund seeks to provide investment results generally corresponding to the aggregate price and dividend performance of publicly traded common stocks that comprise the Standard & Poor's MidCap 400® Index (S&P MidCap 400®). It is designed to provide an economical and convenient means of maintaining a diversified portfolio in this equity security area as part of an overall investment strategy. The risks incurred by investing in the SFT Index 400 Mid-Cap Fund include, but are not limited to, the risk that the Fund may not be able to replicate the performance of the S&P MidCap 400®, and the risk of declines in the market for mid-cap stocks or in the equity markets generally.

Performance Update

The Fund's Class 2 shares generated a total net return of 13.06 percent over the 12 months ending December 31, 2020; the S&P MidCap 400® Index returned 13.66 percent over the same period.

What influenced the Fund's return during the past 12 months?

The SFT Index 400 Mid-Cap Fund is passively managed. The Fund is fully invested and holds all names at published free float adjusted index weights. The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the S&P MidCap 400®.

Six of the nine sectors posted positive annual returns. The consumer non-durables sector led all sectors with a 12 month return of 36.3 percent. Technology names followed with an annual return of 32.6 percent. Energy, utility and finance sectors detracted from performance with returns of -37.1 percent, -9.7 percent and -5.9 percent, respectively. In terms of size, decile 1, (decile segments consist of 40 names) consisting of the largest of the mid-cap index and representing 20.6 percent of the weight in the index, ended the period with a return of 18.7 percent. Decile ten, representing the 40 smallest market cap names, ended the year with a return of 48.1 percent.

What other market conditions or events influenced the Fund's performance during the past 12 months?

Lower political uncertainty, another COVID-19 relief package, and news of a number of effective vaccines boosted confidence that 2021 would see a return to normal. Investors looked through near term weakness to bid up lagging asset classes, resulting in winners all around in the fourth quarter. For the full year, almost all major asset classes ended the year strongly. COVID-19 continues to weigh on real estate performance, and commodities also lagged, posting negative returns for the year. Despite the strong positive momentum, equity markets continue to price in stubbornly high volatility. While inflation expectations have perked up, rates remain at historically low levels with even the 30-year bond yielding only 1.65 percent at the end of the year.

Despite what is still the worst economic contraction in decades with consensus growth in real GDP of -3.5 percent for the year, it could have been far worse. When signs that the economy was stalling emerged in fourth quarter, Congress stepped up once again. While it remains the worst of times for more than 10 million workers who are still unemployed, aggregate personal income is higher than a year ago, a far different result than in previous shocks.

Fiscal transfers and a lack of spending opportunities not only provided needed aid but increased the savings rate. Substantial pent up demand is the backdrop for a vaccine-driven return to normal next year. Investors are not the only people looking through to a normalizing economy. Manufacturing, both in the U.S. and globally, returned to expansion territory at the end of the second quarter in 2020.

13

What will affect the Fund going forward?

While a strong rebound is likely, in our view we're not going to return to the old normal. The pandemic accelerated trends that were already in place and focused an unflinching spotlight on imbalances and sectors with weak value propositions. Work from home appears to be here to stay, and demand for office space and business travel may take years to recover. Bricks and mortar retail will never be the same. Financial services companies need to compete in a low return world, at least for now. Higher education will have to demonstrate a better value proposition for on-campus learning. The cat's out of the bag as more patients opt for telemedicine over in-person visits.

We believe new business models will emerge, and some sectors could experience a painful transition as investment and infrastructure align in new ways, while other businesses benefit as supply chains realign. Even well-performing companies will feel pressure to leverage technology to increase efficiency and scale. These changes are likely to continue to provide investment opportunities.

The pandemic bared the reality of unequal impacts with low wage, service workers suffering the most. At the same time, the "haves" have more flexibility than ever before. Low tax states with a strong quality of life are drawing attractive businesses, which sets the stage for tension between needed rebalancing and tax policy. Populism and political division are most likely here to stay.

On the bright side, the economy has been surprisingly resilient, and strong growth will likely ease the transition. While markets seem fully priced and even overvalued by normal standards, the stage is set for good economic growth in the coming year. We expect the current slowdown to be short-lived, and ample liquidity remains a strong support. However, with markets fully valued and rates at rock bottom, we believe now is a good time maintain investment discipline.

14

Ten Largest Holdings^

| Security description | | Market

value | | % of net

Assets | |

Enphase Energy, Inc. | | $ | 2,101,253 | | | | 1.0 | % | |

Trimble, Inc. | | | 1,583,451 | | | | 0.8 | % | |

SolarEdge Technologies, Inc. | | | 1,553,157 | | | | 0.8 | % | |

Caesars Entertainment, Inc. | | | 1,466,313 | | | | 0.7 | % | |

Monolithic Power Systems, Inc. | | | 1,464,920 | | | | 0.7 | % | |

Fair Isaac Corp. | | | 1,439,600 | | | | 0.7 | % | |

Generac Holdings, Inc. | | | 1,354,681 | | | | 0.7 | % | |

Cognex Corp. | | | 1,329,038 | | | | 0.7 | % | |

Ceridian HCM Holding, Inc. | | | 1,313,778 | | | | 0.6 | % | |

Masimo Corp. | | | 1,288,492 | | | | 0.6 | % | |

| | | $ | 14,894,683 | | | | 7.3 | % | |

^Excludes short-term investments.

Sector Diversification (shown as a percentage of net assets)

15

Comparison of Change in Investment Value*

A Hypothetical $10,000 Investment in SFT Index 400 Mid-Cap Fund,

S&P MidCap 400® Index and Consumer Price Index (CPI)

On the chart above you can see how the SFT Index 400 Mid-Cap Fund's Class 2 shares total return compared to the S&P MidCap 400® Index and the Consumer Price Index. The three lines represent the total return of a hypothetical $10,000 investment made on December 31, 2010 through December 31, 2020, assuming reinvestment of distributions, if any.

* The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The S&P MidCap 400® provides investors with a benchmark for mid-sized companies. The index, which is distinct from the large-cap S&P 500®, is designed to measure the performance of 400 mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment.

"Standard & Poor's®", "S&P®", "Standard & Poor's MidCap 400®" and "S&P MidCap 400®" are trademarks of the S&P Global, Inc. and have been licensed for use by the Securian Funds Trust—SFT Index 400 Mid-Cap Fund. The Fund is not sponsored, endorsed, sold or promoted by Standard & Poor's and Standard & Poor's makes no representation regarding the advisability of investing in the Fund.

16

James Seifert

Portfolio Manager

Fund Objective

The SFT Index 500 Fund seeks investment results that correspond generally to the price and yield performance of the common stocks included in the Standard and Poor's 500® Index (S&P 500). It is designed to provide an economical and convenient means of maintaining a broad position in the equity market as part of an overall investment strategy. The risks incurred by investing in the SFT Index 500 Fund include, but are not limited to, the risk that the Fund may not be able to replicate the performance of the S&P 500®, and the risk of declines in the equity markets generally.

Performance Update

The Fund's Class 2 shares generated a total net return of 17.91 percent over the 12 months ending December 31, 2020; the S&P 500® Index returned 18.40 percent over the same period.

What influenced the Fund's return during the past 12 months?

The SFT Index 500 Fund is passively managed. The Fund is fully invested and holds all names at published float adjusted index weights. The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the S&P 500®.

Seven of the nine sectors posted positive annual returns. The technology sector led all sectors with a 12 month return of 38 percent. Materials and services names followed with an annual return of 26.8 percent. Energy and Utilities sectors detracted from performance with returns of -33.4 percent and -1.9 percent, respectively. In terms of size, decile 1, (decile segments consist of 50 names) consisting of the mega-cap names and representing 51.4 percent of the weight in the index, ended the period with a return of 23.7 percent. All other decile groups ended the year with positive returns.

What other market conditions or events influenced the Fund's performance during the past 12 months?

Lower political uncertainty, another COVID-19 relief package, and news of a number of effective vaccines boosted confidence that 2021 would see a return to normal. Investors looked through near term weakness to bid up lagging asset classes, resulting in winners all around in the fourth quarter. For the full year, almost all major asset classes ended the year strongly. COVID-19 continues to weigh on real estate performance, and commodities also lagged, posting negative returns for the year. Despite the strong positive momentum, equity markets continue to price in stubbornly high volatility. While inflation expectations have perked up, rates remain at historically low levels with even the 30-year bond yielding only 1.65 percent at the end of the year.

Despite what is still the worst economic contraction in decades with consensus growth in real GDP of -3.5 percent for the year, it could have been far worse. When signs that the economy was stalling emerged in fourth quarter, Congress stepped up once again. While it remains the worst of times for more than 10 million workers who are still unemployed, aggregate personal income is higher than a year ago, a far different result than in previous shocks.

Fiscal transfers and a lack of spending opportunities not only provided needed aid but increased the savings rate. Substantial pent up demand is the backdrop for a vaccine-driven return to normal next year. Investors are not the only people looking through to a normalizing economy. Manufacturing, both in the U.S. and globally, returned to expansion territory at the end of the second quarter in 2020.

17

What will affect the Fund going forward?

While a strong rebound is likely, in our view we're not going to return to the old normal. The pandemic accelerated trends that were already in place and focused an unflinching spotlight on imbalances and sectors with weak value propositions. Work from home appears to be here to stay, and demand for office space and business travel may take years to recover. Bricks and mortar retail will never be the same. Financial services companies need to compete in a low return world, at least for now. Higher education will have to demonstrate a better value proposition for on-campus learning. The cat's out of the bag as more patients opt for telemedicine over in-person visits.

We believe new business models will emerge, and some sectors could experience a painful transition as investment and infrastructure align in new ways, while other businesses benefit as supply chains realign. Even well-performing companies will feel pressure to leverage technology to increase efficiency and scale. These changes are likely to continue to provide investment opportunities.

The pandemic bared the reality of unequal impacts with low wage, service workers suffering the most. At the same time, the "haves" have more flexibility than ever before. Low tax states with a strong quality of life are drawing attractive businesses, which sets the stage for tension between needed rebalancing and tax policy. Populism and political division are most likely here to stay.

On the bright side, the economy has been surprisingly resilient, and strong growth will likely ease the transition. While markets seem fully priced and even overvalued by normal standards, the stage is set for good economic growth in the coming year. We expect the current slowdown to be short-lived, and ample liquidity remains a strong support. However, with markets fully valued and rates at rock bottom, we believe now is a good time maintain investment discipline.

18

Ten Largest Holdings^

| Security description | | Market

value | | % of total

net assets | |

Apple, Inc. | | $ | 65,947,461 | | | | 6.6 | % | |

Microsoft Corp. | | | 52,295,168 | | | | 5.2 | % | |

Amazon.com, Inc. | | | 43,199,920 | | | | 4.3 | % | |

Facebook, Inc.—Class A | | | 20,421,168 | | | | 2.0 | % | |

Tesla, Inc. | | | 16,641,816 | | | | 1.7 | % | |

Alphabet, Inc.—Class A | | | 16,387,184 | | | | 1.6 | % | |

Alphabet, Inc.—Class C | | | 15,815,973 | | | | 1.6 | % | |

Berkshire Hathaway, Inc.—Class B | | | 14,033,004 | | | | 1.4 | % | |

Johnson & Johnson | | | 12,884,229 | | | | 1.3 | % | |

JPMorgan Chase & Co. | | | 12,045,474 | | | | 1.2 | % | |

| | | $ | 269,671,397 | | | | 26.9 | % | |

^Excludes short-term investments.

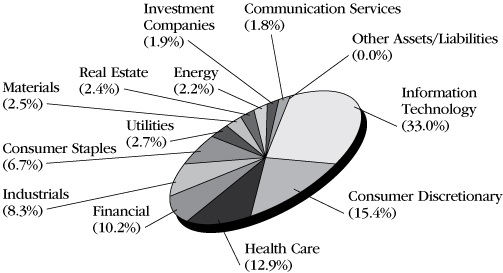

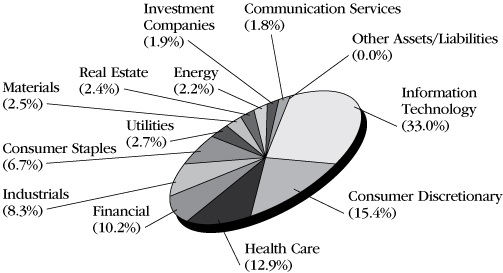

Sector Diversification (shown as a percentage of net assets)

19

Comparison of Change in Investment Value*

A Hypothetical $10,000 Investment in SFT Index 500 Fund,

S&P 500® Index and Consumer Price Index (CPI)

On the chart above you can see how the SFT Index 500 Fund's Class 2 shares total return compared to the S&P 500® Index (as adjusted for dividend reinvestment) and the Consumer Price Index. The three lines represent the total return of a hypothetical $10,000 investment made on December 31, 2010 through December 31, 2020, assuming reinvestment of distributions, if any.

* The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower. The S&P 500® Index is a broad, unmanaged index of 500 common stocks which are representative of the U.S. stock market overall.

"Standard & Poor's®", "S&P®", "Standard & Poor's 500" and "S&P 500" are trademarks of the S&P Global, Inc. and have been licensed for use by Securian Funds Trust—SFT Index 500 Fund. The Fund is not sponsored, endorsed, sold or promoted by Standard & Poor's and Standard & Poor's makes no representation regarding the advisability of investing in the Fund.

20

SFT International Bond Fund

Michael Hasenstab, Ph.D. and Christine Zhu

Portfolio Managers Franklin Advisers, Inc.

Fund Objective

The SFT International Bond Fund seeks to maximize current income consistent with protection of principal. The Fund pursues its objective by investing primarily in debt securities issued by issuers located anywhere in the world. While Securian Asset Management, Inc. acts as the investment adviser for the Fund, Franklin Advisers, Inc. provides investment advice to the SFT International Bond Fund under a sub-advisory agreement. Investment risks associated with international investing in addition to other risks include currency fluctuations, political and economic instability, and differences in accounting standards when investing in foreign markets.

Performance Update

The Fund generated a total net return of -6.36 percent over the 12 months ended December 31, 2020, underperforming the FTSE World Government Bond Index, which returned 10.11 percent over the same period.

What influenced the Fund's return during the past 12 months?

In calendar year 2020, the Fund's relative underperformance was primarily due to currency positions, followed by interest-rate strategies. Sovereign credit exposures had a largely neutral effect on relative results.

In currency markets, the US dollar (USD) initially strengthened in March on tremendous demand for US dollars during the financial market shocks, but then entered a broad-based weakening pattern in mid-May that largely persisted through the end December. The Fund's underweighted positions in the euro, the Australian dollar and the Mexican peso detracted from relative performance. We continued to hold long exposure in the USD against a net-negative position in the euro, as we expect the euro to weaken against the USD on negative rates in the eurozone and comparatively greater headwinds to growth and reflation efforts across Europe. We also held a net-negative position in the Australian dollar to hedge emerging market beta risks during much of the period, but reduced the position in December, as part of our tactical rotation into areas of risk and value in Asia.

Overweighted currency positions in Latin America (the Brazilian real and Argentine peso) and Asia ex Japan (the Indonesian rupiah) also detracted from relative results. However, overweighted positions in northern European currencies (the Swedish krona and Norwegian krone) contributed to relative performance, as did the Fund's overweighted positions in the Japanese yen.

Developed market sovereign bond yields fluctuated during the summer months, rising on reflation expectations but dropping in September as broad risk aversion returned to global financial markets. Sovereign bond yields also declined in several countries on ongoing monetary accommodation during the year, notably including much of Latin America and Asia, particularly Brazil, Mexico, Indonesia and India. The Fund maintained a defensive approach regarding interest rates in developed markets, while holding duration exposures in select emerging markets. Underweighted duration exposure in the U.S. detracted from relative results, as did select underweighted duration exposures in Europe. However, select overweighted duration exposures in Latin America (Argentina and Mexico) contributed to relative performance. We continue to emphasize select local-currency bonds outside of the major developed markets, in countries that we view as having resilient fundamentals and attractive risk-adjusted yields.

What other market conditions or events influenced the Fund's performance during the past 12 months?

The 2020 calendar year started optimistically, as a phase one trade deal between the U.S. and China appeared to bolster market sentiment, driving risk asset valuations higher in several markets across the globe.

21

In Europe, the European Central Bank (ECB) kept monetary policy unchanged through the end of the year, with the main refinancing operations rate remaining at 0.0 percent, and the main deposit facility rate remaining at -0.5 percent.

In Japan, Yoshihide Suga was confirmed as the new prime minister on September 16, following Shinzo Abe's resignation on August 28. Abe had been prime minister since December 2012. The Bank of Japan (BOJ) made no changes to its rates policy in 2020. Overnight interest rates remained at -0.1 percent and the yield target on the 10-year Japanese government bond remained at 0.0 percent throughout the period. Despite the BOJ's efforts to drive inflation higher during the Abenomics era, deflationary pressures returned, with core inflation (National Consumer Price Index (CPI) ex fresh food) dropping to -0.4 percent year-over-year in August and falling further to -0.9 percent in November. The BOJ announced in December that it had launched a comprehensive review of its monetary framework, scheduled to arrive in March 2021.

Nearly every country in the world declared some form of fiscal response to the economic crisis in 2020, with most countries pursuing programs that went beyond the measures they deployed during the global financial crisis. During the 12-month period Brazil cut rates by 250 basis points (bps) to 2.00 percent, Colombia cut rates by 250 bps to 1.75 percent, Mexico cut rates by 300 bps to 4.25 percent, Indonesia cut rates by 125 bps to 3.75 percent and India cut rates by 115 bps to 4.00 percent.

In markets, the yield on the 10-year US Treasury (UST) note finished the period 100 bps lower, at 0.92 percent, ranging from a pre-pandemic high of 1.92 percent on January 1 to an all-time low of 0.51 percent on August 4. The UST yield curve notably steepened from early August through the end of December, with the spread between the three-month UST bill and the 10-year UST note rising from 40 bps to 83 bps on mounting debt issuance and rising reflation expectations.

In Europe, the yield on the 10-year German Bund finished the year 38 bps lower at -0.57 percent, ranging from a pre-pandemic high of -0.19 percent on January 13 to an all-time low of -0.86 percent on March 9, during peak financial market shocks. Expanding monetary accommodation, political challenges to disbursing fiscal stimulus measures and persistent deflationary pressures kept yields suppressed across much of core Europe through the end of the year. Sovereign bond yields also declined in several countries on ongoing monetary accommodation during the year, notably including much of Latin America and Asia, particularly Brazil, Mexico, Indonesia and India.

In currency markets, the USD initially strengthened in March on tremendous demand for US dollars during the financial market shocks, but then entered a broad-based weakening pattern in mid-May that largely persisted through the end December. Many developed market and emerging market currencies alike strengthened against the USD over the final seven months of the year. In credit markets, spreads widened substantially during peak financial market volatility in February and March, but progressively tightened from April through December, with several sovereign and corporate sectors finishing the year at pre-pandemic levels.

What strategies and techniques did you employ that specifically affected Fund performance?

We continued to maintain low portfolio duration. We are significantly underweight developed market duration, preferring to hold short- to intermediate-term USTs, while holding no exposure to the long end of the curve. We hold no duration exposure in the eurozone. Instead, we continue to emphasize select local-currency bonds outside of the major developed markets, in countries that we view as having resilient fundamentals and attractive risk-adjusted yields.

In December, we shifted the emphasis of our currency allocations from a safe-haven stance toward medium-term valuation opportunities against the euro and USD. We see fundamental value in specific currencies of economies with current account surpluses, notably in northern Europe, Japan and other areas of Asia. We are also holding various unhedged local-currency positions, notably in South Korea, Indonesia, India and Ghana. We have notable long exposures in the Norwegian krone and Swedish krona against the euro, and in the Japanese yen and Chinese yuan against the USD. We continued to hold long exposure in the USD against a net-negative position in the euro, as we expect the euro to weaken against the USD on negative rates in the eurozone and comparatively greater headwinds to growth and reflation efforts across Europe. We reduced our net-negative position in the Australian dollar in December, as part of our tactical rotation into areas of risk and value in Asia.

22

We continued to broadly avoid credit sectors, which remain overvalued and vulnerable to ongoing economic damage, in our view. Nonetheless, we continue to monitor credit conditions and have become increasingly constructive in various areas of the global fixed income markets, notably in areas of Asia, as we expect vaccine distributions to improve economic activity in the second half of 2021.

What will affect the Fund going forward?

We are optimistic for the potential effectiveness of vaccine distributions in 2021, which we expect to incrementally support a rebound in economic activity midway through the year. We anticipate being constructive in a number of regions as the world transitions towards a post-COVID-19 era, with a particular focus on areas of Asia that have addressed the health crisis and economic crisis more effectively. However, it remains crucial to be highly selective as there is wide variance in how countries have contained COVID-19, handled fiscal and monetary policy, and supported their economies.

Additionally, optimism for a potential curtailment of the pandemic in the second half of the year should be counterbalanced with caution over acute near-term risks, in our view. The pandemic continues to destroy areas of economic activity as cases surge to record levels in areas of Europe, the US and Latin America, resulting in substantial risks for a number of financial assets. COVID-19 cases appear likely to reach a zenith during the winter months before vaccine distributions may cause the pandemic to ebb in the late spring and summer of 2021. Broad disinflationary effects are likely to persist until economies can return to full mobility. There will also be wide variation in distribution efficiency in countries, with several emerging markets lagging the deployments of vaccines in advanced economies, creating staggered timelines for economic recoveries and specific investment opportunities.

From a macro standpoint, fiscal and monetary policies continue to have a substantial impact on financial market valuations. Central banks are now seen as the policymaker of first and last resort during a crisis, with extreme monetary policy becoming the norm in developed economies. Emerging markets typically have less ability to pursue ultra-accommodative policies given the amplified risks to price stability and their exchange rates. Stronger institutions in developed countries allow for more extreme measures, though not without consequence; massive fiscal deficits and persistently low rates to minimize debt financing should lead to currency depreciation, notably in the euro area and the US.

We believe environmental, social and governance (ESG) factors will play a major role in rebuilding the post-COVID-19 world. Social cohesion and good governance have the power to accelerate a country's post-crisis recovery, or the lack thereof can stymie it. Tragically we have seen the consequences of weak ESG factors in specific emerging markets during the pandemic. Countries that were less prepared for a health crisis due to weaker health care systems and less developed infrastructure, and/or less prepared for an economic crisis due to fiscal imbalances, high levels of debt and external dependencies, have suffered greater damage. By contrast, countries that were in stronger fundamental shape before the crisis, with stronger institutions, lower levels of debt and more diversified economies, have generally fared better.

Widening income inequality in many countries also remains a critical issue that threatens to undermine economic stability and intensify social discord. Damaged economies and elevated unemployment from the pandemic have only worsened several pre-existing structural problems. Countries that effectively address these challenges in the years ahead can strengthen the underpinnings of their economies, while those that neglect these factors risk further instability. We expect ESG to be a defining characteristic for global fixed income markets in years ahead. Countries that are projected to improve on ESG factors often present the strongest investment opportunities.

23

Ten Largest Holdings^

| Security description | | Market

value | | % of bond

portfolio | |

U.S. Treasury Note 2.125%, 05/15/25 | | $ | 5,342,520 | | | | 5.9 | % | |

U.S. Treasury Note 1.500%, 11/30/24 | | | 4,456,690 | | | | 4.9 | % | |

U.S. Treasury Note 2.000%, 02/15/25 | | | 4,432,549 | | | | 4.9 | % | |

Korea Treasury Bond 4.250%, 06/10/21 | | | 4,279,686 | | | | 4.7 | % | |

Korea Treasury Bond 1.375%, 12/10/29 | | | 4,207,892 | | | | 4.6 | % | |

U.S. Treasury Note 1.750%, 12/31/24 | | | 3,696,023 | | | | 4.1 | % | |

Korea Treasury Bond 3.375%, 09/10/23 | | | 2,668,196 | | | | 2.9 | % | |

U.S. Treasury Note 2.875%, 05/31/25 | | | 2,659,249 | | | | 2.9 | % | |

Mexican Bonos 6.500%, 06/09/22 | | | 2,559,553 | | | | 2.8 | % | |

Korea Treasury Bond 3.000%, 09/10/24 | | | 2,371,397 | | | | 2.6 | % | |

| | | $ | 36,673,755 | | | | 40.3 | % | |

^Excludes short-term investments.

Country Diversification (shown as a percentage of net assets)

Currency Diversification (shown as a percentage of net assets)

African | | | 1.57 | % | |

Ghana Cedi | | | 1.57 | % | |

Americas | | | 37.65 | % | |

United States Dollar | | | 34.97 | % | |

Argentine Peso | | | 1.85 | % | |

Mexican Peso | | | 0.79 | % | |

Brazilian Real | | | 0.04 | % | |

Asia Pacific | | | 71.87 | % | |

Japanese Yen | | | 49.98 | % | |

Republic of Korea Won | | | 17.95 | % | |

Indian Rupee | | | 5.02 | % | |

Indonesian Rupiah | | | 4.74 | % | |

Chinese Yuan Renminbi | | | 4.47 | % | |

Australian Dollar (AUD)* | | | -10.29 | % | |

Europe | | | -11.09 | % | |

Norwegian Krone | | | 11.44 | % | |

Swedish krona | | | 7.81 | % | |

Euro* | | | -30.34 | % | |

*A negative figure reflects net "short" exposure, designed to benefit if the value of the associated currency decreases. Conversely, the Fund's value would potentially decline if the value of the associated currency increases.

24

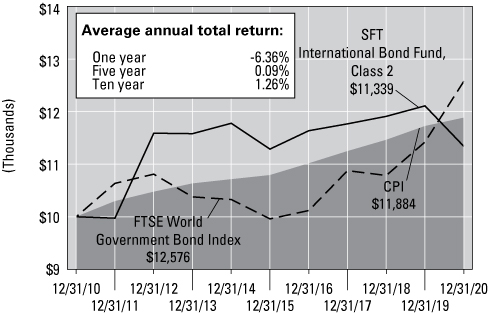

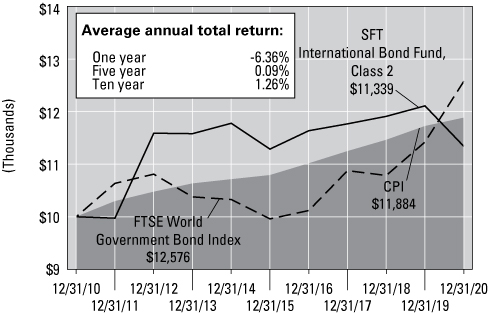

Comparison of Change in Investment Value*

A Hypothetical $10,000 Investment in SFT International Bond Fund,

FTSE World Government Bond Index and Consumer Price Index (CPI)

On the chart above you can see how the SFT International Bond Fund's Class 2 shares total return compared to the FTSE World Government Bond Index, and the Consumer Price Index. The three lines represent the total return of a hypothetical $10,000 investment made on December 31, 2010 through December 31, 2020, assuming reinvestment of distributions, if any.

* The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The FTSE World Government Bond Index is a market capitalization weighted index consisting of the government bond markets from over twenty countries. Country eligibility is determined based upon market capitalization and investability criteria. The index includes all fixed-rate bonds with a remaining maturity of one year or longer and with amounts outstanding of at least the equivalent of U.S. $25 million. Government securities typically exclude floating or variable rate bonds, U.S./Canadian savings bonds and private placements. Each bond must have a minimum rating of BBB-/Baa3 by S&P or Moody's.

25

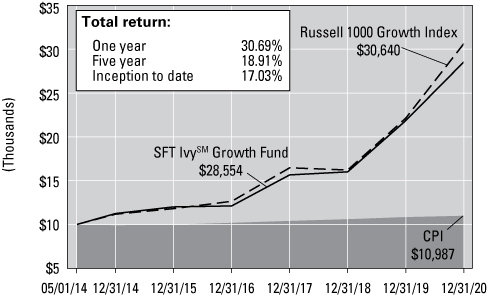

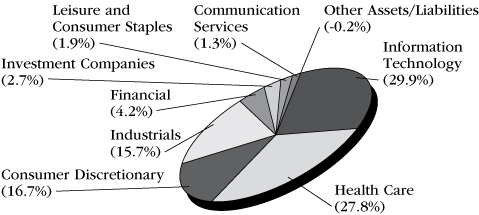

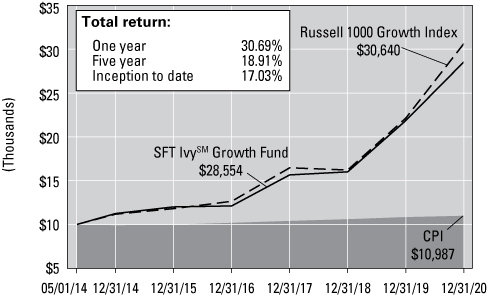

Bradley M. Klapmeyer, CFA Portfolio Manager Ivy

Investment Management Company

Fund Objective

The SFT IvySM Growth Fund seeks to provide growth of capital. The Fund pursues its objective by investing primarily in a diversified portfolio of common stocks issued by large capitalization companies. While Securian Asset Management, Inc. acts as the investment adviser for the Fund, Ivy Investment Management Company (IICO) provides investment advice to the Fund under a sub-advisory agreement. The risks incurred by investing in the Fund include, but are not limited to, the risk of declines in the market for large cap stocks or in the equity markets generally.

Performance Update

The Fund generated a total net return of 30.69 percent over the 12 months ending December 31, 2020, underperforming the Russell 1000 Growth Index which returned 38.49 percent for the same period.

What influenced the Fund's return during the past 12 months?

During the measurement period, the Fund posted a strong absolute gain, but underperformed relative to its benchmark. Stock selection within the consumer discretionary, information technology and communication services sectors was the main reason for relative underperformance.

Market returns were strongly influenced by the "tails"—on one end were hyper growers that lack proven business models throughout cycles and on the other end were cyclical value stocks that are highly dependent on accelerating economic growth prospects. This created a unique challenge for the Fund's desire to maintain a strong quality bias as many of the outperforming areas lacked the strong business model characteristics we typically require. Given that we believe quality is more durable than growth, we were forced to sacrifice on some relative growth attributes in favor of quality, and although that resulted in underperformance in 2020, we think maintaining a focus on quality growth will be rewarded through the cycle.

What other market conditions or events influenced the Fund's performance during the past 12 months?

2020 initially started, pre-pandemic, with hopes that easing credit conditions and monetary policy would ultimately lead to accelerating growth later in 2020. Oddly enough, 2020 ended with that same narrative but for 2021 with hope that another round of, again unprecedented, monetary and fiscal policy will kick-start a new, but stronger post pandemic economic cycle.

Maintaining exposure to the large-cap growth style over the past decade has been a rewarding proposition with an annual total return for the Russell 1000 Growth Index since 2010 slightly more than 17 percent. While those average annual gains are remarkable, it hasn't been a smooth ride as the past decade has been marked by its fair share of turbulence as global economies emerged from the depths of the global financial crisis. While this decade long run for growth style investing was capped with another year of strong gains, 2020 made sure it was a hard-earned return.

What strategies and techniques did you employ that specifically affected Fund performance?

Performance in consumer discretionary was the leading source of negative sector attribution. The Fund was overweight the sector but challenging stock selection more than offset this positive allocation. The most significant detractor was underweight exposure to Tesla, which posted a significant gain for the period. We maintained no exposure as we believe Telsa's valuation is embedding unrealistic long-term business economics and earnings. An

26

overweight position in two other stocks, V.F. Corp. and Booking Holdings Inc., also detracted from performance. Finally, a notable overweight position in Tractor Supply Co. was a source of positive attribution. Strength in Tractor Supply, a position initially introduced in the portfolio in January 2020, outperformed as it remained operational during COVID-19 because its products were deemed essential to consumers.

Information technology was another detractor, driven by an overweight position in Motorola Solutions, which underperformed as a result of concerns related to demand within its first responder communications business unit. Apple, Inc. was another detractor as the Fund's underweight position proved incorrect given the company's impressive returns during the period. Positive attribution wasn't absent during the period as several overweight positions, including NVIDIA Corp., PayPal Holdings, Adobe and Microsoft, provided a partial offset to challenged performance within the sector.

Within the communication services sector, the Fund continued to experience a headwind from the pervasive theme of rewarding relatively unproven business models, which stands in contrast to the Fund's well-tenured process and philosophy. Underweight positions in Netflix, Pinterest and Roku were sources of detraction, while an overweight in Electronic Arts, despite gaining double digits in the period, added to the relative underperformance within the sector. Positive attribution was present as the Fund continued to avoid traditional media companies that significantly underperformed the sector.

Industrials was a source of positive attribution driven by the Fund's stock selection within the sector. Underweight positions in aerospace and defense stalwarts such as Boeing and Lockheed Martin were bright spots. A continued overweight in CoStar Group, as in recent years, again proved to be a source of positive attribution. The Fund experienced a headwind to performance with overweight positions in several long-term holdings such as Stanley Black & Decker, Caterpillar, Northrop Grumman and J.B. Hunt Transport Services.

Lastly, Fund exposure to the real estate and materials sectors, while relatively small, provided positive sources of attribution through both positive allocation and stock selection.

What will affect the Fund going forward?

Supported by low interest rates, flowing fiscal stimulus and improving global growth prospects, the markets will likely enter 2021 with a sustained desire to swing for the fences. As such, it is possible to see continued strength in the near-term from hyper-growth dream stocks and lower quality, deeply cyclical value names.

We see these tail trades, or "barbell strategies," as temporary. Neither has deep roots attached to quality businesses. We believe as the year progresses the persistence and intensity of outperformance from these tails will cede momentum to more durable investment strategies. We are hopeful that macro and stylist influences on the market will diminish leaving a market better tuned for stock picking, not macro or factor guessing.

The catalyst driving our view of a more rational market environment is simply related to the "rubber meeting the road." Market valuation expansion has been a significant portion of growth style returns over the past two years, which embeds a high level of expectations around accelerating growth or sustaining high levels of rapid growth. We believe that parts of the market—work from home, pandemic beneficiaries and hyper-growth stocks—have built in expectations of years of forward good news based on current low interest rates, contained inflation, upsized fiscal stimulus and stronger near-term economic prospects. We think these high expectations of sustained growth along with a broadening economic recovery and upward movement in rates, poses a real risk to the growth tail of the market.

Our empirically proven investment philosophy is based on the fleeting nature of growth sustainability and that growth, if ultimately durable, needs to be attached to a quality business. As such, we have always started our stock selection process with good business model selection and believe quality is paramount to controlling downside risk and driving strong multi-year returns. Although the current environment may be recklessly rewarding only those companies with the highest near-term growth or strongest pandemic revisions, we stand firm in our assessment that quality is more durable than growth. We believe starting with quality while avoiding the temptation to chase growth for growth's sake (at any cost) will reap significant and more predictable benefits over a multi-year horizon.

27

Ten Largest Holdings^

| Security description | | Market

value | | % of net

assets | |

Microsoft Corp. | | $ | 60,341,656 | | | | 10.0 | % | |

Apple, Inc. | | | 53,483,093 | | | | 8.8 | % | |

Amazon.com, Inc. | | | 41,265,303 | | | | 6.8 | % | |

Alphabet, Inc.—Class A | | | 27,197,468 | | | | 4.5 | % | |

Visa, Inc.—Class A | | | 26,988,439 | | | | 4.5 | % | |

Facebook, Inc.—Class A | | | 22,041,280 | | | | 3.6 | % | |

PayPal Holdings, Inc. | | | 19,013,995 | | | | 3.1 | % | |

Adobe, Inc. | | | 18,808,513 | | | | 3.1 | % | |

Motorola Solutions, Inc. | | | 18,400,492 | | | | 3.0 | % | |