UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-04304 |

| | |

| Exact name of registrant as specified in charter: | Delaware Group® Government Fund |

| | |

| Address of principal executive offices: | 610 Market Street Philadelphia, PA 19106 |

| | |

| Name and address of agent for service: | David F. Connor, Esq. 610 Market Street Philadelphia, PA 19106 |

| | |

| Registrant’s telephone number, including area code: | (800) 523-1918 |

| | |

| Date of fiscal year end: | July 31 |

| | |

| Date of reporting period: | July 31, 2023 |

Item 1. Reports to Stockholders

Annual report

Fixed income mutual fund

Delaware Strategic Income Fund

July 31, 2023

Carefully consider the Fund's investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund's prospectus and its summary prospectus, which may be obtained by visiting delawarefunds.com/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit delawarefunds.com/edelivery.

Experience Delaware Funds by Macquarie®

Macquarie Asset Management (MAM) is a global asset manager that aims to deliver positive impact for everyone. MAM Public Investments traces its roots to 1929 and partners with institutional and individual clients to deliver specialist active investment capabilities across global equities, fixed income, and multi-asset solutions using a conviction-based, long-term approach to investing. In the US, retail investors recognize our Delaware Funds by Macquarie family of funds as one of the oldest mutual fund families.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Funds or obtain a prospectus for Delaware Strategic Income Fund at delawarefunds.com/literature.

Manage your account online

| • | Check your account balance and transactions |

| • | View statements and tax forms |

| • | Make purchases and redemptions |

Visit delawarefunds.com/account-access.

Macquarie Asset Management (MAM) is the asset management division of Macquarie Group. MAM is a full-service asset manager offering a diverse range of products across public and private markets including fixed income, equities, multi-asset solutions, private credit, infrastructure, renewables, natural assets, real estate, and asset finance. The Public Investments business is a part of MAM and includes the following investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Investment Management Europe S.A.

The Fund is distributed by Delaware Distributors, L.P. (DDLP), an affiliate of MIMBT and Macquarie Group Limited.

Other than Macquarie Bank Limited ABN 46 008 583 542 ("Macquarie Bank"), any Macquarie Group entity noted in this document is not an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these other Macquarie Group entities do not represent deposits or other liabilities of Macquarie Bank. Macquarie Bank does not guarantee or otherwise provide assurance in respect of the obligations of these other Macquarie Group entities. In addition, if this document relates to an investment, (a) the investor is subject to investment risk including possible delays in repayment and loss of income and principal invested and (b) none of Macquarie Bank or any other Macquarie Group entity guarantees any particular rate of return on or the performance of the investment, nor do they guarantee repayment of capital in respect of the investment.

The Fund is governed by US laws and regulations.

This annual report is for the information of Delaware Strategic Income Fund shareholders, but it may be used with prospective investors when preceded or accompanied by the Delaware Fund fact sheet for the most recently completed calendar quarter. These documents are available at delawarefunds.com/literature.

Unless otherwise noted, views expressed herein are current as of July 31,2023, and subject to change for events occurring after such date.

The Fund is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor.

All third-party marks cited are the property of their respective owners.

© 2023 Macquarie Management Holdings, Inc.

Portfolio management review

| Delaware Strategic Income Fund | July 31, 2023 (Unaudited) |

| Performance preview (for the year ended July 31, 2023) | | |

| Delaware Strategic Income Fund (Institutional Class shares) | 1-year return | +4.26% |

| Delaware Strategic Income Fund (Class A shares) | 1-year return | +4.00% |

| Bloomberg US Aggregate Index (benchmark) | 1-year return | -3.37% |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Strategic Income Fund, please see the table on page 5. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. The performance of both Institutional Class shares and Class A shares reflects the reinvestment of all distributions.

Please see page 8 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investment objective

The Fund seeks high current income and, secondarily, long-term total return.

Market review

The fiscal year ended July 31, 2023, experienced several critical geopolitical, monetary policy, financial, and economic events. The year started with US inflation well above the Federal Reserve's target, as residual stimulus from the pandemic continued to support consumer spending despite corporations' pricing power.

The idea that inflation would be transitory was tested during the year, as the Fed continued to raise short-term rates, reaching the highest level in 22 years. The debate shifted from inflation to recession as the months passed and concerns mounted that the Fed would tighten monetary policy too much. Early in the fiscal year, economists predicted that the steep climb in short-term rates would lead to economic contraction. This appeared to be supported by the yield curve inversion, in which the US Treasury 10-year to 3-month yield spread slipped into negative territory in fall 2022.

| Allocations to high yield, emerging markets debt, non-agency mortgage-backed securities (MBS), and bank loans, as well as favorable yield-curve management, drove performance for the fiscal year. An underweight to investment grade corporates and an overweight to commercial mortgage-backed securities (CMBS) detracted from performance. |

Portfolio management review

Delaware Strategic Income Fund

However, at fiscal year end, inflation as measured by the US Consumer Price Index (CPI) had dropped to 3.2% from a high of 9.1% a year earlier. Investors noted the improvement and began to use terms like “immaculate disinflation” or “no landing,” implying that the Fed had successfully transitioned inflation from near-double-digit annual increases to a level that would indicate the tightening cycle was nearing completion without tipping the economy into a recession.

In March, Silicon Valley Bank, a little-known regional bank with an idiosyncratic depositor base and long history of high-quality lending, succumbed to depositor panic and was taken into receivership by the Federal Deposit Insurance Corporation (FDIC). The event spooked depositors and markets, opening the door to the possibility of a run on banks. At record speed, the Fed put into place a lending facility for US banks to borrow against Treasury and agency mortgage-backed securities (MBS) at par, effectively insuring deposits. Additionally, in Europe, the Swiss regulator engineered an arrangement between UBS and Credit Suisse to prevent a confidence crisis at Credit Suisse from becoming a systemic issue.

Despite the temporary market disruption, central banks remained focused on fighting inflation. Markets seemed willing to accept that the worst had been averted, as interest rate volatility retreated from the highs observed during March and credit markets again began to outperform high-quality assets such as Treasurys. Higher yields were viewed as an opportunity for many fixed income investors and may have provided important technical support at a time when most central banks in the developed world were raising short-term rates. Indeed, despite the Silicon Valley Bank default and broader banking sector concerns, credit premiums have yet to match the highs seen during other stress periods. Looking forward, we think the silver lining for fixed income investors may be in the higher yields that can potentially offer an income buffer to further price volatility.

Within the Fund

For the fiscal year ended July 31, 2023, Delaware Strategic Income Fund posted a positive return and outperformed its benchmark, the Bloomberg US Aggregate Index. The Fund's Institutional Class shares gained 4.26%. The Fund's Class A shares advanced 4.00% at net asset value and declined 0.71% at maximum offer price. These figures reflect all distributions reinvested. For the same period, the Fund's benchmark fell 3.37%. For complete, annualized performance of Delaware Strategic Income Fund, please see the table on page 5.

Allocations to high yield corporates, emerging markets debt, non-agency MBS, and bank loans, as well as favorable yield-curve management, drove outperformance for the fiscal year. An underweight to investment grade corporates and an overweight to commercial mortgage-backed securities (CMBS) detracted from performance.

The Fund's position in cruise ship operator Carnival Corp. senior unsecured bonds performed well, aided by favorable booking activity following the COVID-19 slowdown and the return to free-cash-flow generation. Additional exposure to the cruise line industry, including Royal Caribbean Cruises Ltd., was also beneficial. Exposure to subordinated levels of the capital structure of SVB Financial Group, which filed for bankruptcy in March, offset some of this performance. The Fund's exposure to pharmaceutical company Bausch Health Companies Inc. and wireless provider

Altice France SA weighed on performance. These securities remain in the portfolio.

A meaningful allocation to Brazilian and Mexican emerging market corporates proved beneficial. Alsea SAB de CV, an operator of various restaurant segments in Latin America, as well as bank operator Banco Mercantil del Norte SA contributed to performance and remain in the Fund's portfolio. Exposure to CIFI Holdings Group Co. Ltd., a real estate development company in China, somewhat offset this as the bond performed poorly. We sold the position during the fiscal year.

Structured credit plays an important role in the Fund throughout the market cycle, and this fiscal year was no exception. The Fund carried an overweight to non-agency MBS, asset-backed securities (ABS), and CMBS. Exposure to credit risk transfer (CRT) notes, which structure mortgage credit risk into securities, thereby shifting risk from government sponsored entities to private capital, contributed to performance. The allocation to CMBS and security selection within ABS slightly detracted from performance. A meaningful underweight to agency mortgage-backed securities aided performance as the sector underperformed.

The Fund had lower interest rate sensitivity than the benchmark for the entire fiscal year. This benefited overall performance when rates moved meaningfully higher. As overall rates advanced, we increased the Fund's duration but remained shorter than the benchmark, in adherence with the Fund's investment style.

During the fiscal year, we reduced the Fund's exposure to credit markets on concerns about rising market volatility and relatively low risk premiums, given the uncertain economic backdrop. We decreased the Fund's exposure to high yield corporates and bank loans by about 3 percentage points each and lowered the emerging markets allocation by approximately 10 percentage points over the 12-month period. We used the proceeds from the sales primarily to increase the higher-quality, more liquid portion of the Fund by investing in US Treasurys.

Key risks and opportunities

We think investors face complex considerations going forward, from the remaining stress on smaller regional banks to pressure in commercial real estate markets, the possibility of lingering inflation, and the risk of recession. However, we suggest the landscape may be simplified to something more straightforward: Although many believe the Fed has successfully brought down inflation without pushing real growth into negative territory, our base case remains that the economy may experience a shallow recession. As we transition away from near-double-digit inflation to slowing growth, we believe there are relatively simple implications to be considered.

First, with yields returning to where they were before quantitative easing (QE) monetary policy took hold, bonds seem to be acting like bonds again, featuring historically compelling yields and a return to their inverse correlation with equities.

Second, history suggests it may be better to be early than late at turning points in tightening cycles, as yield curve inversions and rising recession risks mean the outlook for longer-term interest rates is quite bright, in our view.

Lastly, transitions don't usually go smoothly. In our opinion, volatility is likely to remain high; credit spreads, while more attractive than before the tightening cycle, may need to increase further as recession risks take center

Portfolio management review

Delaware Strategic Income Fund

stage; and market movements may happen rapidly.

We think this is a compelling time for agile active management and bottom-up (bond by bond) security selection as dispersion (the gap between the best- and worst-performing assets) increases. We believe value has emerged in certain areas of the market, such as agency MBS. Meanwhile the high-income feature of credit and emerging markets debt, coupled with volatility, may create opportunities down the road. Bonds are bonds again, in our view, and we believe exposure to the asset class is as attractive as we've seen in decades. We believe agility and security selection will remain key to navigating the uncertainty.

During the fiscal year, the Fund used a variety of derivatives, including futures to manage interest rate risk, swaps and swaptions to adjust the Fund's overall exposure to certain markets, and currency forwards to increase or decrease exposure to foreign currencies. The use of derivatives detracted modestly from the Fund's performance for the fiscal year.

Performance summary

| Delaware Strategic Income Fund | July 31, 2023 (Unaudited) |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | Average annual total returns through July 31, 2023 |

| | 1 year | 5 year | 10 year |

| Class A (Est. August 16, 1985) | | | |

| Excluding sales charge | +4.00% | +2.38% | +2.43% |

| Including sales charge | -0.71% | +1.43% | +1.96% |

| Class C (Est. November 29, 1995) | | | |

| Excluding sales charge | +3.08% | +1.56% | +1.64% |

| Including sales charge | +2.09% | +1.56% | +1.64% |

| Class R (Est. June 2, 2003) | | | |

| Excluding sales charge | +3.74% | +2.10% | +2.15% |

| Including sales charge | +3.74% | +2.10% | +2.15% |

| Institutional Class (Est. June 1, 1992) | | | |

| Excluding sales charge | +4.26% | +2.61% | +2.67% |

| Including sales charge | +4.26% | +2.61% | +2.67% |

| Bloomberg US Aggregate Index | -3.37% | +0.75% | +1.50% |

1Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed in the “Fund expense ratios” table on page 7. Performance would have been lower had expense limitations not been in effect.

Class A shares are sold with a maximum front-end sales charge of 4.50%, and have an annual distribution and service (12b-1) fee of 0.25% of average daily net assets. The Board has adopted a formula for calculating 12b-1 plan fees for the Fund's Class A shares. The Fund's Class A shares are currently subject to a blended 12b-1 fee equal to the sum of: (i) 0.10% of average daily net assets representing shares acquired prior to June 1, 1992, and (ii) 0.25% of average daily net assets representing shares acquired on or after June 1, 1992. All Class A shares currently bear 12b-1 fees at the blended rate, which is currently 0.25% of average daily net assets, based on the formula described previously. This method of calculating Class A 12b-1 fees may be discontinued at the sole discretion of the Board. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge (CDSC) of 1.00% if

Performance summary

Delaware Strategic Income Fund

redeemed during the first 12 months. They are also subject to an annual 12b-1 fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that CDSCs did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual 12b-1 fee of 0.50% of average daily net assets.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no 12b-1 fee.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer's ability to make interest and principal payments on its debt. This includes prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult to obtain precise valuations of the high yield securities.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivatives transaction depends upon the counterparties' ability to fulfill their contractual obligations.

If and when the Fund invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Fund will be subject to special risks, including counterparty risk.

The Fund may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

International investments entail risks including fluctuation in currency values, differences in accounting principles, or economic or political instability. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility, lower trading volume, and higher risk of market closures. In many emerging markets, there is substantially less publicly available information and the available information may be incomplete or misleading. Legal claims are generally more difficult to pursue.

IBOR risk is the risk that changes related to the use of the London interbank offered rate (LIBOR) or similar rates (such as EONIA) could have adverse impacts on financial instruments that reference these rates. The potential abandonment of these rates and transition to alternative rates could affect the value and liquidity of instruments that reference them and could affect investment strategy performance.

This document may mention bond ratings published by nationally recognized statistical rating organizations (NRSROs) Standard & Poor's, Moody's Investors Service, and Fitch, Inc. For securities rated by an NRSRO other than S&P, the rating is converted to the equivalent S&P credit rating. Bonds rated AAA

are rated as having the highest quality and are generally considered to have the lowest degree of investment risk. Bonds rated AA are considered to be of high quality, but with a slightly higher degree of risk than bonds rated AAA. Bonds rated A are considered to have many favorable investment qualities, though they are somewhat more susceptible to adverse economic conditions. Bonds rated BBB are believed to be of medium-grade quality and generally riskier over the long term. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment decisions in a timely manner and could negatively impact the Fund's ability to achieve its investment objective and the value of the Fund's investments.

2The Fund's expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. The expense ratios below may differ from the expense ratios in the “Financial highlights” since they are based on different time periods and the expense ratios in the prospectus include acquired fund fees and expenses, if any. See Note 2 in “Notes to financial statements” for additional details. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| Fund expense ratios | Class A | Class C | Class R | Institutional Class |

| Total annual operating expenses (without fee waivers) | 1.24% | 1.99% | 1.49% | 0.99% |

| Net expenses (including fee waivers, if any) | 0.84% | 1.59% | 1.09% | 0.59% |

| Type of waiver | Contractual | Contractual | Contractual | Contractual |

Performance summary

Delaware Strategic Income Fund

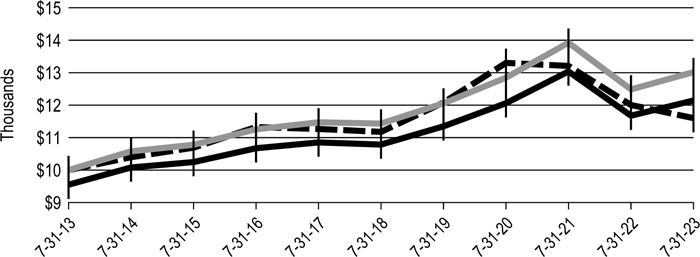

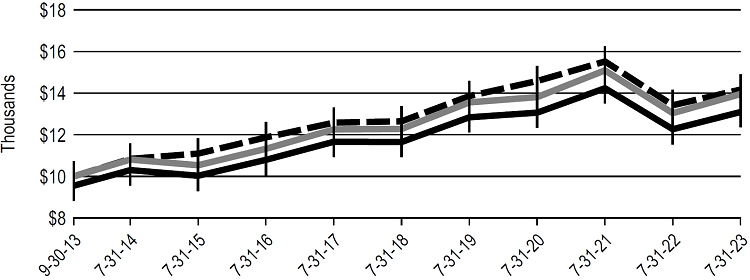

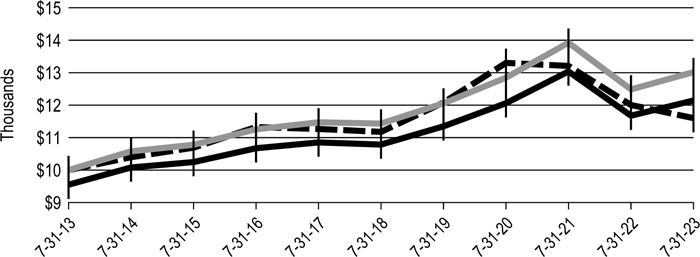

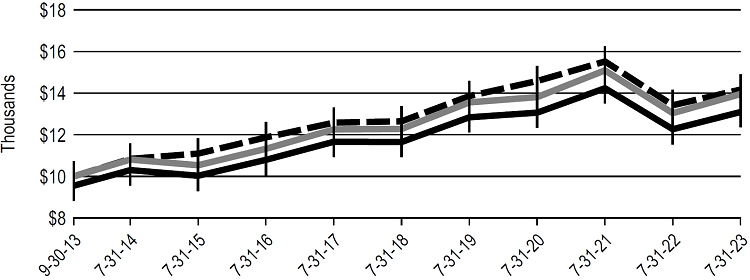

Performance of a $10,000 investment1

For the period July 31, 2013 through July 31, 2023

| | | Starting value | Ending value |

| Delaware Strategic Income Fund – Institutional Class shares | $10,000 | $13,017 |

| Delaware Strategic Income Fund – Class A shares | $9,550 | $12,143 |

| Bloomberg US Aggregate Index | $10,000 | $11,601 |

1The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on July 31, 2013, and includes the effect of a 4.50% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 7. Please note additional details on pages 5 through 9.

The graph also assumes $10,000 invested in the Bloomberg US Aggregate Index as of July 31, 2013. The Bloomberg US Aggregate Index is a broad-based benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market.

The US Consumer Price Index (CPI), mentioned on pages 1-2, is a measure of inflation that is calculated by the US Department of Labor, representing changes in prices of all goods and services purchased for consumption by urban households.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Performance of other Fund classes will vary due to different charges and expenses.

| | Nasdaq symbols | CUSIPs |

| Class A | DEGGX | 246094205 |

| Class C | DUGCX | 246094700 |

| Class R | DUGRX | 246094809 |

| Institutional Class | DUGIX | 246094502 |

Disclosure of Fund expenses

For the six-month period from February 1, 2023 to July 31, 2023 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from February 1, 2023 to July 31, 2023.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Fund's expenses shown in the table reflect fee waivers in effect and assume reinvestment of all dividends and distributions.

Delaware Strategic Income Fund

Expense analysis of an investment of $1,000

| | | Beginning

Account Value

2/1/23 | | Ending

Account Value

7/31/23 | | Annualized

Expense Ratio | | Expenses

Paid During Period

2/1/23 to 7/31/23* |

| Actual Fund return† | | | | | | | | | | | | | | |

| Class A | | $ | 1,000.00 | | | $ | 1,012.40 | | | 0.84% | | $ | 4.19 | |

| Class C | | | 1,000.00 | | | | 1,007.30 | | | 1.59% | | | 7.91 | |

| Class R | | | 1,000.00 | | | | 1,009.90 | | | 1.09% | | | 5.43 | |

| Institutional Class | | | 1,000.00 | | | | 1,013.70 | | | 0.59% | | | 2.95 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | |

| Class A | | $ | 1,000.00 | | | $ | 1,020.63 | | | 0.84% | | $ | 4.21 | |

| Class C | | | 1,000.00 | | | | 1,016.91 | | | 1.59% | | | 7.95 | |

| Class R | | | 1,000.00 | | | | 1,019.39 | | | 1.09% | | | 5.46 | |

| Institutional Class | | | 1,000.00 | | | | 1,021.87 | | | 0.59% | | | 2.96 | |

*“Expenses Paid During Period” are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

†Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns.

In addition to the Fund's expenses reflected above, the Fund also indirectly bears its portion of the fees and expenses of any investment companies (Underlying Funds), in which it invests. The table above does not reflect the expenses of any Underlying Funds.

Security type / sector allocations

| Delaware Strategic Income Fund | As of July 31, 2023 (Unaudited) |

Sector designations may be different from the sector designations presented in other Fund materials. The sector designations may represent the investment manager's internal sector classifications, which may result in the sector designations for one fund being different from another fund's sector designations.

| Security type / sector | Percentage of net assets |

| Agency Collateralized Mortgage Obligations | 7.52% | |

| Agency Commercial Mortgage-Backed Securities | 1.82% | |

| Agency Mortgage-Backed Securities | 4.84% | |

| Convertible Bonds | 1.92% | |

| Corporate Bonds | 38.96% | |

| Banking | 3.59% | |

| Basic Industry | 2.72% | |

| Brokerage | 0.72% | |

| Capital Goods | 3.59% | |

| Communications | 6.47% | |

| Consumer Cyclical | 3.49% | |

| Consumer Non-Cyclical | 3.37% | |

| Electric | 1.44% | |

| Energy | 5.05% | |

| Finance Companies | 1.09% | |

| Government Agency | 2.22% | |

| Insurance | 0.26% | |

| Natural Gas | 0.51% | |

| Technology | 1.47% | |

| Transportation | 2.41% | |

| Utilities | 0.56% | |

| Municipal Bonds | 0.93% | |

| Non-Agency Asset-Backed Securities | 5.60% | |

| Non-Agency Collateralized Mortgage Obligations | 5.59% | |

| Non-Agency Commercial Mortgage-Backed Securities | 3.17% | |

| Loan Agreements | 2.93% | |

| Sovereign Bonds | 3.77% | |

| US Treasury Obligations | 19.50% | |

| Common Stock | 0.76% | |

| Short-Term Investments | 1.71% | |

| Total Value of Securities | 99.02% | |

| Receivables and Other Assets Net of Liabilities | 0.98% | |

| Total Net Assets | 100.00% | |

Schedule of investments

| Delaware Strategic Income Fund | July 31, 2023 |

| | | Principal

amount° | | | Value (US $) | |

| Agency Collateralized Mortgage Obligations — 7.52% | | | | | | |

| Freddie Mac Structured Agency Credit Risk REMIC Trust | | | | | | | | |

| Series 2020-HQA2 M2 144A 8.283% (SOFR + 3.21%) 3/25/50 #, • | | | 1,097,554 | | | $ | 1,124,871 | |

| Series 2021-DNA1 M2 144A 6.869% (SOFR + 1.80%) 1/25/51 #, • | | | 1,103,840 | | | | 1,105,712 | |

| Series 2021-DNA3 M2 144A 7.169% (SOFR+ 2.10%) 10/25/33 #, • | | | 1,350,000 | | | | 1,339,457 | |

| Series 2021-HQA1 M2 144A 7.319% (SOFR + 2.25%) 8/25/33 #, • | | | 1,891,441 | | | | 1,884,799 | |

| Series 2021-HQA2 M2 144A 7.119% (SOFR + 2.05%) 12/25/33 #, • | | | 2,000,000 | | | | 1,967,540 | |

| Total Agency Collateralized Mortgage Obligations (cost $7,436,770) | | | | | | | 7,422,379 | |

| | | | | | | | | |

| Agency Commercial Mortgage-Backed Securities — 1.82% | | | | | | | | |

| FREMF Mortgage Trust | | | | | | | | |

| Series 2017-K66 B 144A 4.038% 7/25/27 #, • | | | 325,000 | | | | 303,869 | |

| Series 2017-K71 B 144A 3.752% 11/25/50 #, • | | | 325,000 | | | | 298,774 | |

| Series 2018-K72 B 144A 3.994% 12/25/50 #, • | | | 325,000 | | | | 302,610 | |

| Series 2018-K86 C 144A 4.294% 11/25/51 #, • | | | 970,000 | | | | 893,647 | |

| Total Agency Commercial Mortgage-Backed Securities (cost $2,140,546) | | | | | | | 1,798,900 | |

| | | | | | | | | |

| Agency Mortgage-Backed Securities — 4.84% | | | | | | | | |

| Fannie Mae S.F. 30 yr | | | | | | | | |

| 4.50% 2/1/53 | | | 787,948 | | | | 754,333 | |

| 5.00% 9/1/52 | | | 879,657 | | | | 859,246 | |

| 5.50% 10/1/52 | | | 835,590 | | | | 832,578 | |

| 5.50% 7/1/53 | | | 755,916 | | | | 750,695 | |

| 6.00% 12/1/52 | | | 407,114 | | | | 410,327 | |

| Freddie Mac S.F. 15 yr | | | | | | | | |

| 5.00% 6/1/38 | | | 430,198 | | | | 427,152 | |

| Freddie Mac S.F. 20 yr | | | | | | | | |

| 5.50% 6/1/43 | | | 442,304 | | | | 441,977 | |

| Freddie Mac S.F. 30 yr | | | | | | | | |

| 5.00% 6/1/53 | | | 304,637 | | | | 298,391 | |

| Total Agency Mortgage-Backed Securities (cost $4,797,718) | | | | | | | 4,774,699 | |

Schedule of investments

Delaware Strategic Income Fund

| | | Principal

amount° | | | Value (US $) | |

| Convertible Bonds — 1.92% | | | | | | | | |

| Helix Energy Solutions Group 6.75% exercise price $6.97, maturity date 2/15/26 | | | 290,000 | | | $ | 446,310 | |

| Kaman 3.25% exercise price $65.26, maturity date 5/1/24 | | | 1,124,000 | | | | 1,085,784 | |

| Spirit Airlines 1.00% exercise price $42.10, maturity date 5/15/26 | | | 404,000 | | | | 357,615 | |

| Total Convertible Bonds (cost $1,728,092) | | | | | | | 1,889,709 | |

| | | | | | | | | |

| Corporate Bonds — 38.96% | | | | | | | | |

| Banking — 3.59% | | | | | | | | |

| Access Bank 144A 6.125% 9/21/26 # | | | 600,000 | | | | 525,030 | |

| Banco Mercantil del Norte 144A 8.375% | | | | | | | | |

| 10/14/30 #, m, ψ | | | 500,000 | | | | 490,530 | |

| Bank of New York Mellon 4.70% 9/20/25 m, ψ | | | 47,000 | | | | 46,003 | |

| Deutsche Bank | | | | | | | | |

| 5.625% 5/19/31 m | EUR | | 200,000 | | | | 214,998 | |

| 6.72% 1/18/29 m | | | 150,000 | | | | 152,861 | |

| 7.146% 7/13/27 m | | | 150,000 | | | | 153,061 | |

| Huntington National Bank 4.552% 5/17/28 m | | | 775,000 | | | | 736,599 | |

| KeyBank 4.15% 8/8/25 | | | 770,000 | | | | 737,184 | |

| Popular 7.25% 3/13/28 | | | 255,000 | | | | 257,808 | |

| SVB Financial Group | | | | | | | | |

| 4.00% 5/15/26 m, ‡, ψ | | | 385,000 | | | | 26,089 | |

| 4.57% 4/29/33 m, ‡ | | | 71,000 | | | | 47,690 | |

| Truist Financial 4.95% 9/1/25 m, ψ | | | 165,000 | | | | 156,040 | |

| | | | | | | | 3,543,893 | |

| Basic Industry — 2.72% | | | | | | | | |

| CSN Resources 144A 5.875% 4/8/32 # | | | 535,000 | | | | 446,496 | |

| Domtar 144A 6.75% 10/1/28 # | | | 509,000 | | | | 445,070 | |

| First Quantum Minerals 144A 6.875% 10/15/27 # | | | 1,000,000 | | | | 984,510 | |

| Sasol Financing USA | | | | | | | | |

| 6.50% 9/27/28 | | | 440,000 | | | | 407,624 | |

| 144A 8.75% 5/3/29 # | | | 400,000 | | | | 400,449 | |

| | | | | | | | 2,684,149 | |

| Brokerage — 0.72% | | | | | | | | |

| Jefferies Financial Group 6.50% 1/20/43 NFP | | | 245,000 | | | | 244,057 | |

| 144A 6.875% 8/15/28 # | | | 270,000 | | | | 239,296 | |

| 144A 7.50% 10/1/30 # | | | 235,000 | | | | 228,796 | |

| | | | | | | | 712,149 | |

| | | Principal

amount° | | | Value (US $) | |

| Corporate Bonds (continued) | | | | | | | | |

| Capital Goods — 3.59% | | | | | | | | |

| Ardagh Metal Packaging Finance USA 2.00% 9/1/28 | EUR | | 300,000 | | | $ | 278,007 | |

| Cemex 144A 9.125% 3/14/28 #, m, ψ | | | 370,000 | | | | 385,279 | |

| Embraer Netherlands Finance | | | | | | | | |

| 5.40% 2/1/27 | | | 490,000 | | | | 480,852 | |

| 144A 7.00% 7/28/30 # | | | 495,000 | | | | 500,742 | |

| Mauser Packaging Solutions Holding 144A 7.875% 8/15/26 # | | | 460,000 | | | | 459,205 | |

| SAN Miguel Industrias 144A 3.50% 8/2/28 # | | | 640,000 | | | | 547,420 | |

| Standard Industries | | | | | | | | |

| 144A 3.375% 1/15/31 # | | | 159,000 | | | | 128,544 | |

| 144A 4.375% 7/15/30 # | | | 313,000 | | | | 272,053 | |

| Turkiye Sise ve Cam Fabrikalari 144A 6.95% 3/14/26 # | | | 500,000 | | | | 490,880 | |

| | | | | | | | 3,542,982 | |

| Communications — 6.47% | | | | | | | | |

| Altice France 144A 5.50% 10/15/29 # | | | 865,000 | | | | 614,982 | |

| Cellnex Finance 144A 3.875% 7/7/41 # | | | 200,000 | | | | 144,806 | |

| CMG Media 144A 8.875% 12/15/27 # | | | 415,000 | | | | 324,405 | |

| Consolidated Communications | | | | | | | | |

| 144A 5.00% 10/1/28 # | | | 340,000 | | | | 251,865 | |

| 144A 6.50% 10/1/28 # | | | 540,000 | | | | 425,250 | |

| CSC Holdings 144A 5.375% 2/1/28 # | | | 835,000 | | | | 698,255 | |

| Cumulus Media New Holdings 144A 6.75% 7/1/26 # | | | 500,000 | | | | 375,687 | |

| Directv Financing 144A 5.875% 8/15/27 # | | | 530,000 | | | | 478,921 | |

| Discovery Communications 4.00% 9/15/55 | | | 10,000 | | | | 6,635 | |

| DISH DBS 144A 5.75% 12/1/28 # | | | 315,000 | | | | 242,989 | |

| Frontier Communications Holdings 144A 5.875% 10/15/27 # | | | 500,000 | | | | 458,439 | |

| Gray Escrow II 144A 5.375% 11/15/31 # | | | 350,000 | | | | 244,584 | |

| IHS Holding 144A 5.625% 11/29/26 # | | | 400,000 | | | | 350,708 | |

| Prosus 144A 4.193% 1/19/32 # | | | 580,000 | | | | 491,170 | |

| Time Warner Cable 7.30% 7/1/38 | | | 350,000 | | | | 357,110 | |

| Turkcell Iletisim Hizmetleri 144A 5.80% 4/11/28 # | | | 555,000 | | | | 505,534 | |

| Vmed O2 UK Financing I 144A 4.25% 1/31/31 # | | | 400,000 | | | | 331,587 | |

| Warnermedia Holdings 5.141% 3/15/52 | | | 95,000 | | | | 77,271 | |

| | | | | | | | 6,380,198 | |

| Consumer Cyclical — 3.49% | | | | | | | | |

| Alsea 144A 7.75% 12/14/26 # | | | 600,000 | | | | 604,316 | |

| Arcos Dorados 144A 6.125% 5/27/29 # | | | 370,000 | | | | 358,391 | |

| Bath & Body Works 6.875% 11/1/35 | | | 460,000 | | | | 427,332 | |

Schedule of investments

Delaware Strategic Income Fund

| | | Principal

amount° | | | Value (US $) | |

| Corporate Bonds (continued) | | | | | | |

| Consumer Cyclical (continued) | | | | | | | | |

| Carnival | | | | | | | | |

| 144A 5.75% 3/1/27 # | | | 355,000 | | | $ | 328,698 | |

| 144A 7.625% 3/1/26 # | | | 653,000 | | | | 644,782 | |

| Ford Motor Credit 6.95% 6/10/26 | | | 215,000 | | | | 216,913 | |

| PetSmart 144A 7.75% 2/15/29 # | | | 250,000 | | | | 244,090 | |

| Royal Caribbean Cruises 144A 5.50% 4/1/28 # | | | 135,000 | | | | 127,361 | |

| Staples 144A 7.50% 4/15/26 # | | | 510,000 | | | | 421,979 | |

| VICI Properties 4.95% 2/15/30 | | | 75,000 | | | | 71,029 | |

| | | | | | | | 3,444,891 | |

| Consumer Non-Cyclical — 3.37% | | | | | | | | |

| Bausch Health | | | | | | | | |

| 144A 5.50% 11/1/25 # | | | 120,000 | | | | 108,162 | |

| 144A 11.00% 9/30/28 # | | | 173,000 | | | | 127,977 | |

| Central American Bottling 144A 5.25% 4/27/29 # | | | 585,000 | | | | 540,201 | |

| DaVita | | | | | | | | |

| 144A 3.75% 2/15/31 # | | | 250,000 | | | | 200,182 | |

| 144A 4.625% 6/1/30 # | | | 335,000 | | | | 286,158 | |

| InRetail Consumer 144A 3.25% 3/22/28 # | | | 625,000 | | | | 542,197 | |

| JBS USA LUX 144A 3.00% 2/2/29 # | | | 25,000 | | | | 21,455 | |

| MHP Lux 144A 6.25% 9/19/29 # | | | 505,000 | | | | 267,650 | |

| Organon & Co. 144A 5.125% 4/30/31 # | | | 500,000 | | | | 424,309 | |

| Pilgrim's Pride 144A 5.875% 9/30/27 # | | | 121,000 | | | | 119,790 | |

| Tenet Healthcare | | | | | | | | |

| 6.125% 10/1/28 | | | 145,000 | | | | 138,256 | |

| 6.875% 11/15/31 | | | 370,000 | | | | 370,890 | |

| Teva Pharmaceutical Finance Netherlands III 5.125% 5/9/29 | | | 200,000 | | | | 183,434 | |

| | | | | | | | 3,330,661 | |

| Electric — 1.44% | | | | | | | | |

| Calpine | | | | | | | | |

| 144A 5.00% 2/1/31 # | | | 145,000 | | | | 122,182 | |

| 144A 5.125% 3/15/28 # | | | 279,000 | | | | 253,317 | |

| Duke Energy 4.875% 9/16/24 m, ψ | | | 80,000 | | | | 77,968 | |

| NRG Energy 144A 4.45% 6/15/29 # | | | 285,000 | | | | 253,704 | |

| Pacific Gas and Electric 3.30% 8/1/40 | | | 367,000 | | | | 252,764 | |

| Vistra 144A 7.00% 12/15/26 #, m, ψ | | | 520,000 | | | | 463,268 | |

| | | | | | | | 1,423,203 | |

| | | Principal

amount° | | | Value (US $) | |

| Corporate Bonds (continued) | | | | | | | | |

| Energy — 5.05% | | | | | | | | |

| CNX Midstream Partners 144A 4.75% 4/15/30 # | | | 500,000 | | | $ | 433,830 | |

| CNX Resources 144A 6.00% 1/15/29 # | | | 700,000 | | | | 655,356 | |

| Crestwood Midstream Partners 144A 6.00% 2/1/29 # | | | 442,000 | | | | 416,992 | |

| Energean Israel Finance 144A 8.50% 9/30/33 # | | | 550,000 | | | | 551,375 | |

| Energy Transfer 6.50% 11/15/26 m, ψ | | | 485,000 | | | | 440,529 | |

| Genesis Energy 7.75% 2/1/28 | | | 505,000 | | | | 491,587 | |

| Geopark 144A 5.50% 1/17/27 # | | | 620,000 | | | | 533,362 | |

| Guara Norte 144A 5.198% 6/15/34 # | | | 548,241 | | | | 489,716 | |

| PDC Energy 5.75% 5/15/26 | | | 445,000 | | | | 447,937 | |

| Tullow Oil 144A 10.25% 5/15/26 # | | | 640,000 | | | | 521,088 | |

| | | | | | | | 4,981,772 | |

| Finance Companies — 1.09% | | | | | | | | |

| AerCap Ireland Capital DAC | | | | | | | | |

| 2.45% 10/29/26 | | | 150,000 | | | | 135,003 | |

| 3.30% 1/30/32 | | | 150,000 | | | | 123,136 | |

| 3.40% 10/29/33 | | | 150,000 | | | | 120,066 | |

| Castlelake Aviation Finance DAC 144A 5.00% 4/15/27 # | | | 620,000 | | | | 572,583 | |

| RKPF Overseas 2020 5.125% 7/26/26 | | | 300,000 | | | | 122,242 | |

| | | | | | | | 1,073,030 | |

| Government Agency — 2.22% | | | | | | | | |

| Ecopetrol 6.875% 4/29/30 | | | 595,000 | | | | 561,113 | |

| Georgian Railway JSC 4.00% 6/17/28 | | | 355,000 | | | | 309,524 | |

| Oryx Funding 144A 5.80% 2/3/31 # | | | 485,000 | | | | 476,480 | |

| Petroleos Mexicanos 5.95% 1/28/31 | | | 1,135,000 | | | | 843,707 | |

| | | | | | | | 2,190,824 | |

| Insurance — 0.26% | | | | | | | | |

| Brighthouse Financial 4.70% 6/22/47 | | | 112,000 | | | | 86,382 | |

| MetLife 3.85% 9/15/25 m, ψ | | | 185,000 | | | | 173,329 | |

| | | | | | | | 259,711 | |

| Natural Gas — 0.51% | | | | | | | | |

| Medco Laurel Tree 144A 6.95% 11/12/28 # | | | 545,000 | | | | 500,706 | |

| | | | | | | | 500,706 | |

| Technology — 1.47% | | | | | | | | |

| Broadcom 144A 3.469% 4/15/34 # | | | 320,000 | | | | 262,670 | |

| CommScope Technologies 144A 6.00% 6/15/25 # | | | 100,000 | | | | 90,811 | |

| Entegris Escrow 144A 4.75% 4/15/29 # | | | 90,000 | | | | 84,042 | |

Schedule of investments

Delaware Strategic Income Fund

| | | Principal

amount° | | | Value (US $) | |

| Corporate Bonds (continued) | | | | | | | | |

| Technology (continued) | | | | | | | | |

| Iron Mountain | | | | | | | | |

| 144A 5.25% 7/15/30 # | | | 71,000 | | | $ | 64,248 | |

| 144A 5.625% 7/15/32 # | | | 600,000 | | | | 541,097 | |

| Iron Mountain Information Management Services 144A 5.00% 7/15/32 # | | | 230,000 | | | | 199,250 | |

| NCR | | | | | | | | |

| 144A 5.00% 10/1/28 # | | | 105,000 | | | | 95,076 | |

| 144A 5.125% 4/15/29 # | | | 127,000 | | | | 113,684 | |

| | | | | | | | 1,450,878 | |

| Transportation — 2.41% | | | | | | | | |

| Abertis Infraestructuras Finance 3.248% 11/24/25 m, ψ | | EUR | 100,000 | | | | 100,871 | |

| Acu Petroleo Luxembourg 144A 7.50% 7/13/35 # | | | 505,534 | | | | 452,669 | |

| Azul Secured Finance 144A 11.93% 8/28/28 # | | | 435,000 | | | | 438,263 | |

| Grupo Aeromexico 144A 8.50% 3/17/27 # | | | 500,000 | | | | 453,347 | |

| International Consolidated Airlines Group 3.75% 3/25/29 | | EUR | 200,000 | | | | 195,158 | |

| Mileage Plus Holdings 144A 6.50% 6/20/27 # | | | 320,000 | | | | 320,270 | |

| United Airlines 144A 4.625% 4/15/29 # | | | 457,000 | | | | 413,933 | |

| | | | | | | | 2,374,511 | |

| Utilities — 0.56% | | | | | | | | |

| Clean Renewable Power Mauritius 144A 4.25% 3/25/27 # | | | 623,100 | | | | 554,762 | |

| | | | | | | | 554,762 | |

| Total Corporate Bonds (cost $42,133,472) | | | | | | | 38,448,320 | |

| | | | | | | | | |

| Municipal Bonds — 0.93% | | | | | | | | |

| Commonwealth of Puerto Rico (Restructured) | | | | | | | | |

| Series A 2.993% 7/1/24^ | | | 6,064 | | | | 5,825 | |

| Series A-1 4.00% 7/1/35 | | | 27,144 | | | | 25,143 | |

| GDB Debt Recovery Authority of Puerto Rico (Taxable) | | | | | | | | |

| 7.50% 8/20/40 | | | 1,077,403 | | | | 886,164 | |

| Total Municipal Bonds (cost $992,454) | | | | | | | 917,132 | |

| | | | | | | | | |

| Non-Agency Asset-Backed Securities — 5.60% | | | | | | | | |

| Citicorp Residential Mortgage Trust Series 2006-3 A5 4.704% 11/25/36 f | | | 69,294 | | | | 67,841 | |

| DataBank Issuer Series 2021-1A A2 144A 2.06% 2/27/51 # | | | 1,000,000 | | | | 875,610 | |

| | | Principal

amount° | | | Value (US $) | |

| Non-Agency Asset-Backed Securities (continued) | | | | | | | | |

| Diamond Infrastructure Funding Series 2021-1A A 144A 1.76% 4/15/49 # | | | 750,000 | | | $ | 645,838 | |

| Domino's Pizza Master Issuer Series 2021-1A A2I 144A 2.662% 4/25/51 # | | | 439,875 | | | | 371,797 | |

| Hardee's Funding Series 2020-1A A2 144A 3.981% 12/20/50 # | | | 2,145,000 | | | | 1,812,585 | |

| Taco Bell Funding Series 2018-1A A2II 144A 4.94% 11/25/48 # | | | 955,000 | | | | 896,980 | |

| Wendy's Funding Series 2018-1A A2II 144A 3.884% 3/15/48 # | | | 945,000 | | | | 856,340 | |

| Total Non-Agency Asset-Backed Securities (cost $6,049,425) | | | | | | | 5,526,991 | |

| | | | | | | | | |

| Non-Agency Collateralized Mortgage Obligations — 5.59% | | | | | | | | |

| JPMorgan Mortgage Trust Series 2021-13 B1 144A 3.142% 4/25/52 #, • | | | 577,693 | | | | 452,658 | |

| Sequoia Mortgage Trust | | | | | | | | |

| Series 2014-1 B3 144A 3.981% 4/25/44 #, • | | | 675,449 | | | | 611,353 | |

| Series 2017-5 B2 144A 3.779% 8/25/47 #, • | | | 1,651,944 | | | | 1,499,510 | |

| Series 2017-6 B2 144A 3.726% 9/25/47 #, • | | | 1,670,539 | | | | 1,492,674 | |

| Series 2017-7 B2 144A 3.726% 10/25/47 #, • | | | 1,663,174 | | | | 1,459,263 | |

| Total Non-Agency Collateralized Mortgage Obligations (cost $6,469,519) | | | | | | | 5,515,458 | |

| | | | | | | | | |

| Non-Agency Commercial Mortgage-Backed Securities — 3.17% | | | | | | | | |

| BANK Series 2022-BNK39 B 3.239% 2/15/55 • | | | 600,000 | | | | 444,989 | |

| Benchmark Mortgage Trust | | | | | | | | |

| Series 2020-B21 C 3.345% 12/17/53 • | | | 500,000 | | | | 345,024 | |

| Series 2020-B22 A5 1.973% 1/15/54 | | | 1,500,000 | | | | 1,183,777 | |

| DBJPM Mortgage Trust Series 2020-C9 B 2.567% 8/15/53 | | | 500,000 | | | | 366,080 | |

| Goldman Sachs Mortgage Securities Trust | | | | | | | | |

| Series 2017-GS6 B 3.869% 5/10/50 | | | 500,000 | | | | 425,969 | |

| GS Mortgage Securities Trust Series 2018-GS9 B 4.321% 3/10/51 • | | | 280,000 | | | | 245,117 | |

| JPMorgan Chase Commercial Mortgage Securities | | | | | | | | |

| Trust Series 2013-LC11 B 3.499% 4/15/46 | | | 130,000 | | | | 113,750 | |

| Total Non-Agency Commercial Mortgage-Backed Securities (cost $3,760,822) | | | | | | | 3,124,706 | |

Schedule of investments

Delaware Strategic Income Fund

| | | Principal

amount° | | | Value (US $) | |

| Loan Agreements — 2.93% | | | | | | | | |

| Applied Systems 2nd Lien 11.992% (SOFR03M + 6.75%) 9/17/27 • | | | 451,630 | | | $ | 454,264 | |

| AssuredPartners 8.933% (SOFR01M + 3.61%) 2/12/27 • | | | 447,144 | | | | 445,002 | |

| Connect US Finco 8.819% (SOFR01M + 3.50%) 12/11/26 • | | | 275,738 | | | | 275,508 | |

| Frontier Communications Tranche B 9.183% (SOFR01M + 3.86%) 5/1/28 • | | | 684,250 | | | | 650,037 | |

| Hamilton Projects Acquiror 9.933% (SOFR01M + 4.61%) 6/17/27 • | | | 657,731 | | | | 652,716 | |

| Ultimate Software Group 1st Lien 9.219% (SOFR03M + 3.75%) 5/4/26 • | | | 418,865 | | | | 418,484 | |

| Total Loan Agreements (cost $2,892,909) | | | | | | | 2,896,011 | |

| | | | | | | | | |

| Sovereign Bonds — 3.77%∆ | | | | | | | | |

| Brazil — 0.43% | | | | | | | | |

| Brazilian Government International Bond 4.75% 1/14/50 | | | 550,000 | | | | 423,017 | |

| | | | | | | | 423,017 | |

| Dominican Republic — 0.37% | | | | | | | | |

| Dominican Republic International Bond 144A 4.50% 1/30/30 # | | | 414,000 | | | | 367,983 | |

| | | | | | | | 367,983 | |

| Honduras — 0.80% | | | | | | | | |

| Honduras Government International Bond 144A 5.625% 6/24/30 # | | | 959,000 | | | | 791,175 | |

| | | | | | | | 791,175 | |

| Ivory Coast — 0.72% | | | | | | | | |

| Ivory Coast Government International Bond 144A 6.125% 6/15/33 # | | | 784,000 | | | | 707,061 | |

| | | | | | | | 707,061 | |

| Senegal — 0.58% | | | | | | | | |

| Senegal Government International Bond 144A 6.75% 3/13/48 # | | | 764,000 | | | | 575,037 | |

| | | | | | | | 575,037 | |

| | | Principal

amount° | | | Value (US $) | |

| Sovereign Bonds∆ (continued) | | | | | | | | |

| Uzbekistan — 0.87% | | | | | | | | |

| Republic of Uzbekistan International Bond 144A 4.75% 2/20/24 # | | | 862,000 | | | $ | 855,606 | |

| | | | | | | | 855,606 | |

| Total Sovereign Bonds (cost $4,392,426) | | | | | | | 3,719,879 | |

| | | | | | | | | |

| US Treasury Obligations — 19.50% | | | | | | | | |

| US Treasury Bonds | | | | | | | | |

| 3.625% 2/15/53 | | | 1,595,000 | | | | 1,488,085 | |

| 3.875% 2/15/43 | | | 1,770,000 | | | | 1,691,456 | |

| US Treasury Floating Rate Notes 5.418% (USBMMY3M + 0.17%) 4/30/25 • | | | 1,390,000 | | | | 1,391,602 | |

| US Treasury Notes | | | | | | | | |

| 3.375% 5/15/33 | | | 6,245,000 | | | | 5,957,633 | |

| 3.50% 1/31/30 | | | 3,100,000 | | | | 2,992,893 | |

| 3.75% 6/30/30 | | | 675,000 | | | | 661,816 | |

| 4.00% 6/30/28 | | | 615,000 | | | | 610,099 | |

| 4.125% 11/15/32 | | | 480,000 | | | | 485,625 | |

| 4.50% 11/30/24 | | | 1,370,000 | | | | 1,356,407 | |

| 4.75% 6/30/25 | | | 2,620,000 | | | | 2,605,672 | |

| Total US Treasury Obligations (cost $19,522,739) | | | | | | | 19,241,288 | |

| | | | | | | | | |

| | | | Number of | | | | | |

| | | | shares | | | | | |

| Common Stock — 0.76% | | | | | | | | |

| Transportation — 0.76% | | | | | | | | |

| Grupo Aeromexico =, † | | | 49,917 | | | | 745,252 | |

| Total Common Stock (cost $815,893) | | | | | | | 745,252 | |

| | | | | | | | | |

| Short-Term Investments — 1.71% | | | | | | | | |

| Money Market Mutual Funds — 1.71% | | | | | | | | |

| BlackRock Liquidity FedFund – Institutional Shares (seven-day effective yield 5.15%) | | | 422,454 | | | | 422,454 | |

| Fidelity Investments Money Market Government Portfolio – Class I (seven-day effective yield 5.16%) | | | 422,454 | | | | 422,454 | |

| Goldman Sachs Financial Square Government Fund – Institutional Shares (seven-day effective yield 5.29%) | | | 422,454 | | | | 422,454 | |

Schedule of investments

Delaware Strategic Income Fund

| | | Number of | | | | |

| | | shares | | | Value (US $) | |

| Short-Term Investments (continued) | | | | | | | | |

| Money Market Mutual Funds (continued) | | | | | | | | |

| Morgan Stanley Institutional Liquidity Funds Government Portfolio – Institutional Class (seven-day effective yield 5.19%) | | | 422,453 | | | $ | 422,453 | |

| Total Short-Term Investments (cost $1,689,815) | | | | | | | 1,689,815 | |

Total Value of Securities—99.02% (cost $104,822,600) | | | | | | $ | 97,710,539 | |

| ° | Principal amount shown is stated in USD unless noted that the security is denominated in another currency. |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At July 31, 2023, the aggregate value of Rule 144A securities was $51,672,010, which represents 52.36% of the Fund's net assets. See Note 12 in “Notes to financial statements.” |

| • | Variable rate investment. Rates reset periodically. Rate shown reflects the rate in effect at July 31, 2023. For securities based on a published reference rate and spread, the reference rate and spread are indicated in their descriptions. The reference rate descriptions (i.e. SOFR01M, SOFR03M, etc.) used in this report are identical for different securities, but the underlying reference rates may differ due to the timing of the reset period. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions, or for mortgage-backed securities, are impacted by the individual mortgages which are paying off over time. These securities do not indicate a reference rate and spread in their descriptions. |

| m | Fixed to variable rate investment. The rate shown reflects the fixed rate in effect at July 31, 2023. Rate will reset at a future date. |

| Y | Perpetual security. Maturity date represents next call date. |

| ‡ | Non-income producing security. Security is currently in default. |

| ^ | Zero-coupon security. The rate shown is the effective yield at the time of purchase. |

| f | Step coupon bond. Stated rate in effect at July 31, 2023 through maturity date. |

| ∆ | Securities have been classified by country of risk. |

| = | The value of this security was determined using significant unobservable inputs and is reported as a Level 3 security in the disclosure table located in Note 3 in “Notes to financial statements.” |

| † | Non-income producing security. |

The following foreign currency exchange contracts and futures contracts were outstanding at July 31, 2023:1

Foreign Currency Exchange Contracts

| Counterparty | | Currency to

Receive (Deliver) | | | In Exchange For | | | Settlement

Date | | Unrealized

Appreciation | | | Unrealized

Depreciation | |

| CITI | | EUR | 86,999 | | | USD | (95,791 | ) | | 8/25/23 | | $ | — | | | $ | (6 | ) |

| JPMCB | | EUR | (817,247 | ) | | USD | 899,026 | | | 8/25/23 | | | — | | | | (747 | ) |

| Total Foreign Currency Exchange Contracts | | $ | — | | | $ | (753 | ) |

Futures Contracts

Exchange-Traded

| Contracts to Buy (Sell) | | Notional

Amount | | | Notional

Cost

(Proceeds) | | | Expiration

Date | | Value/

Unrealized

Appreciation | | | Value/

Unrealized

Depreciation | | | Variation

Margin

Due from

(Due to)

Brokers | |

| (2) | | Euro-BOBL | | $ | (231,780 | ) | | $ | (234,656 | ) | | 9/7/23 | | $ | 2,876 | | | $ | — | | | $ | (140 | ) |

| 109 | | US Treasury 5 yr Notes | | | 11,643,414 | | | | 11,794,624 | | | 9/29/23 | | | — | | | | (151,210 | ) | | | 6,062 | |

| 25 | | US Treasury 10 yr Notes | | | 2,785,156 | | | | 2,827,250 | | | 9/20/23 | | | — | | | | (42,094 | ) | | | 1,562 | |

| 10 | | US Treasury 10 yr Ultra Notes | | | 1,169,844 | | | | 1,185,010 | | | 9/20/23 | | | — | | | | (15,166 | ) | | | 938 | |

| Total Futures Contracts | | | | | | $ | 15,572,228 | | | | | $ | 2,876 | | | $ | (208,470 | ) | | $ | 8,422 | |

The use of foreign currency exchange contracts and futures contracts involves elements of market risk and risks in excess of the amounts disclosed in the financial statements. The foreign currency exchange contracts and notional amounts presented above represent the Fund's total exposure in such contracts, whereas only the net unrealized appreciation (depreciation) and variation margin are reflected in the Fund's net assets.

| 1 | See Note 9 in “Notes to financial statements.” |

Schedule of investments

Delaware Strategic Income Fund

Summary of abbreviations:

BOBL – Bundesobligationen

CITI – Citigroup

DAC – Designated Activity Company

FREMF – Freddie Mac Multifamily

GS – Goldman Sachs

JPMCB – JPMorgan Chase Bank

JSC – Joint Stock Company

REMIC – Real Estate Mortgage Investment Conduit

S.F. – Single Family

SOFR – Secured Overnight Financing Rate

SOFR01M – Secured Overnight Financing Rate 1 Month

SOFR03M – Secured Overnight Financing Rate 3 Month

USBMMY3M – US Treasury 3 Month Bill Money Market Yield

yr – Year

Summary of currencies:

EUR – European Monetary Unit

USD – US Dollar

See accompanying notes, which are an integral part of the financial statements.

Statement of assets and liabilities

| Delaware Strategic Income Fund | July 31, 2023 |

| Assets: | | | |

| Investments, at value* | | $ | 97,710,539 | |

| Cash | | | 37,072 | |

| Cash collateral due from broker | | | 248,911 | |

| Dividends and interest receivable | | | 978,115 | |

| Receivable for securities sold | | | 503,333 | |

| Receivable for fund shares sold | | | 42,052 | |

| Prepaid expenses | | | 19,294 | |

| Variation margin due from broker on futures contracts | | | 8,422 | |

| Other assets | | | 806 | |

| Total Assets | | | 99,548,544 | |

| Liabilities: | | | | |

| Due to custodian | | | 132 | |

| Payable for securities purchased | | | 492,312 | |

| Other accrued expenses | | | 152,047 | |

| Payable for fund shares redeemed | | | 147,881 | |

| Investment management fees payable to affiliates | | | 34,014 | |

| Administration expenses payable to affiliates | | | 16,868 | |

| Distribution fees payable to affiliates | | | 15,816 | |

| Distribution payable | | | 10,482 | |

| Unrealized depreciation on foreign currency exchange contracts | | | 753 | |

| Total Liabilities | | | 870,305 | |

| Total Net Assets | | $ | 98,678,239 | |

| | | | | |

| Net Assets Consist of: | | | | |

| Paid-in capital | | $ | 122,650,820 | |

| Total distributable earnings (loss) | | | (23,972,581 | ) |

| Total Net Assets | | $ | 98,678,239 | |

Statement of assets and liabilities

Delaware Strategic Income Fund

| Net Asset Value | | | | |

| | | | | |

| Class A: | | | | |

| Net assets | | $ | 71,421,813 | |

| Shares of beneficial interest outstanding, unlimited authorization, no par | | | 9,776,751 | |

| Net asset value per share | | $ | 7.31 | |

| Sales charge | | | 4.50 | % |

| Offering price per share, equal to net asset value per share / (1 - sales charge) | | $ | 7.65 | |

| | | | | |

| Class C: | | | | |

| Net assets | | $ | 819,184 | |

| Shares of beneficial interest outstanding, unlimited authorization, no par | | | 112,149 | |

| Net asset value per share | | $ | 7.30 | |

| | | | | |

| Class R: | | | | |

| Net assets | | $ | 174,493 | |

| Shares of beneficial interest outstanding, unlimited authorization, no par | | | 23,832 | |

| Net asset value per share | | $ | 7.32 | |

| | | | | |

| Institutional Class: | | | | |

| Net assets | | $ | 26,262,749 | |

| Shares of beneficial interest outstanding, unlimited authorization, no par | | | 3,593,449 | |

| Net asset value per share | | $ | 7.31 | |

| | | | | |

| *Investments, at cost | | $ | 104,822,600 | |

See accompanying notes, which are an integral part of the financial statements.

Statement of operations

| Delaware Strategic Income Fund | Year ended July 31, 2023 |

| Investment Income: | | | |

| Interest | | $ | 5,356,607 | |

| Dividends | | | 80,999 | |

| Foreign tax withheld | | | (1,059 | ) |

| | | | 5,436,547 | |

| Expenses: | | | | |

| Management fees | | | 525,805 | |

| Distribution expenses — Class A | | | 183,223 | |

| Distribution expenses — Class C | | | 9,473 | |

| Distribution expenses — Class R | | | 787 | |

| Dividend disbursing and transfer agent fees and expenses | | | 87,917 | |

| Registration fees | | | 66,134 | |

| Accounting and administration expenses | | | 55,410 | |

| Audit and tax fees | | | 49,410 | |

| Reports and statements to shareholders expenses | | | 34,766 | |

| Legal fees | | | 29,554 | |

| Custodian fees | | | 14,510 | |

| Trustees' fees and expenses | | | 4,402 | |

| Other | | | 40,707 | |

| | | | 1,102,098 | |

| Less expenses waived | | | (344,460 | ) |

| Less expenses paid indirectly | | | (111 | ) |

| Total operating expenses | | | 757,527 | |

| Net Investment Income (Loss) | | | 4,679,020 | |

Statement of operations

Delaware Strategic Income Fund

| Net Realized and Unrealized Gain (Loss): | | | |

| Net realized gain (loss) on: | | | |

| Investments | | $ | (4,682,858 | ) |

| Foreign currencies | | | (394,368 | ) |

| Foreign currency exchange contracts | | | 1,082 | |

| Futures contracts | | | 304,444 | |

| Options purchased | | | (103,571 | ) |

| Options written | | | 66,345 | |

| Swap contracts | | | 21,603 | |

| Net realized gain (loss) | | | (4,787,323 | ) |

| | | | | |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 4,347,356 | |

| Foreign currencies | | | 8,219 | |

| Foreign currency exchange contracts | | | (104,926 | ) |

| Futures contracts | | | (139,748 | ) |

| Options purchased | | | 61,380 | |

| Options written | | | (22,862 | ) |

| Net change in unrealized appreciation (depreciation) | | | 4,149,419 | |

| Net Realized and Unrealized Gain (Loss) | | | (637,904 | ) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 4,041,116 | |

See accompanying notes, which are an integral part of the financial statements.

Statements of changes in net assets

Delaware Strategic Income Fund

| | | Year ended | |

| | | 7/31/23 | | | 7/31/22 | |

| Increase (Decrease) in Net Assets from Operations: | | | | | | | | |

| Net investment income (loss) | | $ | 4,679,020 | | | $ | 3,727,159 | |

| Net realized gain (loss) | | | (4,787,323 | ) | | | (1,274,500 | ) |

| Net change in unrealized appreciation (depreciation) | | | 4,149,419 | | | | (14,864,832 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 4,041,116 | | | | (12,412,173 | ) |

| | | | | | | | | |

| Dividends and Distributions to Shareholders from: | | | | | | | | |

| Distributable earnings: | | | | | | | | |

| Class A | | | (3,565,873 | ) | | | (3,262,736 | ) |

| Class C | | | (38,935 | ) | | | (39,080 | ) |

| Class R | | | (7,287 | ) | | | (5,847 | ) |

| Institutional Class | | | (1,089,875 | ) | | | (703,462 | ) |

| | | | (4,701,970 | ) | | | (4,011,125 | ) |

| Capital Share Transactions: | | | | | | | | |

| Proceeds from shares sold: | | | | | | | | |

| Class A | | | 5,531,741 | | | | 3,940,143 | |

| Class C | | | 201,893 | | | | 370,161 | |

| Class R | | | 40,545 | | | | 13,966 | |

| Institutional Class | | | 42,692,222 | | | | 11,002,091 | |

| | | | | | | | | |

| Net assets from merger:1 | | | | | | | | |

| Class A | | | — | | | | 73,890,835 | |

| Institutional Class | | | — | | | | 294,650 | |

| | | | | | | | | |

| Net asset value of shares issued upon reinvestment of dividends and distributions: | | | | | | | | |

| Class A | | | 3,464,773 | | | | 3,270,373 | |

| Class C | | | 38,911 | | | | 38,749 | |

| Class R | | | 7,284 | | | | 5,839 | �� |

| Institutional Class | | | 1,089,171 | | | | 703,742 | |

| | | | 53,066,540 | | | | 93,530,549 | |

Statements of changes in net assets

Delaware Strategic Income Fund

| | | Year ended | |

| | | 7/31/23 | | | 7/31/22 | |

| Capital Share Transactions (continued): | | | | | | | | |

| Cost of shares redeemed: | | | | | | | | |

| Class A | | $ | (16,051,864 | ) | | $ | (19,911,369 | ) |

| Class C | | | (520,915 | ) | | | (567,428 | ) |

| Class R | | | (20,141 | ) | | | (19,219 | ) |

| Institutional Class | | | (32,791,372 | ) | | | (10,522,231 | ) |

| | | | (49,384,292 | ) | | | (31,020,247 | ) |

| Increase in net assets derived from capital share transactions | | | 3,682,248 | | | | 62,510,302 | |

| Net Increase in Net Assets | | | 3,021,394 | | | | 46,087,004 | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 95,656,845 | | | | 49,569,841 | |

| End of year | | $ | 98,678,239 | | | $ | 95,656,845 | |

| 1 | See Note 7 in “Notes to financial statements.” |

See accompanying notes, which are an integral part of the financial statements.

Financial highlights

Delaware Strategic Income Fund Class A

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Return of capital |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return3 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets4 |

| Ratio of expenses to average net assets prior to fees waived4 |

| Ratio of net investment income to average net assets |

| Ratio of net investment income to average net assets prior to fees waived |

| Portfolio turnover |

| 1 | Calculated using average shares outstanding. |

| 2 | Amount is less than $0.005 per share. |

| 3 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total return during the period reflects waivers by the manager and/or distributor. Performance would have been lower had the waivers not been in effect. |

| 4 | Expense ratios do not include expenses of any investment companies in which the Fund invests. |

| 5 | Net expense ratio includes extraordinary expenses. |

See accompanying notes, which are an integral part of the financial statements.

| Year ended | |

| 7/31/23 | | | 7/31/22 | | | 7/31/21 | | | 7/31/20 | | | 7/31/19 | |

| $ | 7.38 | | | $ | 8.57 | | | $ | 8.24 | | | $ | 8.07 | | | $ | 8.01 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | 0.35 | | | | 0.29 | | | | 0.30 | | | | 0.29 | | | | 0.32 | |

| | (0.07 | ) | | | (1.17 | ) | | | 0.35 | | | | 0.20 | | | | 0.08 | |

| | 0.28 | | | | (0.88 | ) | | | 0.65 | | | | 0.49 | | | | 0.40 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | (0.35 | ) | | | (0.31 | ) | | | (0.32 | ) | | | (0.32 | ) | | | (0.27 | ) |

| | — | | | | — | | | | — | 2 | | | — | 2 | | | (0.07 | ) |

| | (0.35 | ) | | | (0.31 | ) | | | (0.32 | ) | | | (0.32 | ) | | | (0.34 | ) |

| | | | | | | | | | | | | | | | | | | |

| $ | 7.31 | | | $ | 7.38 | | | $ | 8.57 | | | $ | 8.24 | | | $ | 8.07 | |

| | | | | | | | | | | | | | | | | | | |

| | 4.00 | % | | | (10.45 | )% | | | 8.02 | % | | | 6.27 | % | | | 5.20 | % |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| $ | 71,422 | | | $ | 79,273 | | | $ | 31,690 | | | $ | 29,793 | | | $ | 31,032 | |

| | 0.84 | % | | | 0.90 | %5 | | | 0.84 | % | | | 0.84 | % | | | 0.84 | % |

| | 1.20 | % | | | 1.24 | % | | | 1.53 | % | | | 1.52 | % | | | 1.50 | % |

| | 4.85 | % | | | 3.62 | % | | | 3.54 | % | | | 3.66 | % | | | 4.09 | % |

| | 4.49 | % | | | 3.28 | % | | | 2.85 | % | | | 2.98 | % | | | 3.43 | % |

| | 99 | % | | | 65 | % | | | 89 | % | | | 130 | % | | | 106 | % |

Financial highlights

Delaware Strategic Income Fund Class C

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Return of capital |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return3 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets4 |

| Ratio of expenses to average net assets prior to fees waived4 |

| Ratio of net investment income to average net assets |

| Ratio of net investment income to average net assets prior to fees waived |

| Portfolio turnover |

| 1 | Calculated using average shares outstanding. |

| 2 | Amount is less than $0.005 per share. |

| 3 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total return during the period reflects waivers by the manager and/or distributor. Performance would have been lower had the waivers not been in effect. |

| 4 | Expense ratios do not include expenses of any investment companies in which the Fund invests. |

| 5 | Net expense ratio includes extraordinary expenses. |

See accompanying notes, which are an integral part of the financial statements.

| Year ended | |

| 7/31/23 | | | 7/31/22 | | | 7/31/21 | | | 7/31/20 | | | 7/31/19 | |

| $ | 7.38 | | | $ | 8.58 | | | $ | 8.25 | | | $ | 8.08 | | | $ | 8.02 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | 0.30 | | | | 0.23 | | | | 0.24 | | | | 0.23 | | | | 0.26 | |

| | (0.08 | ) | | | (1.18 | ) | | | 0.35 | | | | 0.20 | | | | 0.08 | |

| | 0.22 | | | | (0.95 | ) | | | 0.59 | | | | 0.43 | | | | 0.34 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | (0.30 | ) | | | (0.25 | ) | | | (0.26 | ) | | | (0.26 | ) | | | (0.21 | ) |

| | — | | | | — | | | | — | 2 | | | — | 2 | | | (0.07 | ) |

| | (0.30 | ) | | | (0.25 | ) | | | (0.26 | ) | | | (0.26 | ) | | | (0.28 | ) |

| | | | | | | | | | | | | | | | | | | |

| $ | 7.30 | | | $ | 7.38 | | | $ | 8.58 | | | $ | 8.25 | | | $ | 8.08 | |

| | | | | | | | | | | | | | | | | | | |

| | 3.08 | % | | | (11.22 | )% | | | 7.21 | % | | | 5.47 | % | | | 4.42 | % |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| $ | 819 | | | $ | 1,110 | | | $ | 1,451 | | | $ | 1,846 | | | $ | 2,793 | |

| | 1.59 | % | | | 1.65 | %5 | | | 1.59 | % | | | 1.59 | % | | | 1.59 | % |

| | 1.95 | % | | | 1.99 | % | | | 2.28 | % | | | 2.27 | % | | | 2.25 | % |

| | 4.10 | % | | | 2.87 | % | | | 2.79 | % | | | 2.91 | % | | | 3.34 | % |

| | 3.74 | % | | | 2.53 | % | | | 2.10 | % | | | 2.23 | % | | | 2.68 | % |

| | 99 | % | | | 65 | % | | | 89 | % | | | 130 | % | | | 106 | % |

Financial highlights

Delaware Strategic Income Fund Class R

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Return of capital |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return3 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets4 |

| Ratio of expenses to average net assets prior to fees waived4 |

| Ratio of net investment income to average net assets |

| Ratio of net investment income to average net assets prior to fees waived |

| Portfolio turnover |

| 1 | Calculated using average shares outstanding. |

| 2 | Amount is less than $0.005 per share. |

| 3 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total return during the period reflects waivers by the manager and/or distributor. Performance would have been lower had the waivers not been in effect. |

| 4 | Expense ratios do not include expenses of any investment companies in which the Fund invests. |

| 5 | Net expense ratio includes extraordinary expenses. |

See accompanying notes, which are an integral part of the financial statements.

| Year ended | |

| 7/31/23 | | | 7/31/22 | | | 7/31/21 | | | 7/31/20 | | | 7/31/19 | |

| $ | 7.39 | | | $ | 8.60 | | | $ | 8.27 | | | $ | 8.10 | | | $ | 8.03 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | 0.33 | | | | 0.27 | | | | 0.28 | | | | 0.27 | | | | 0.30 | |

| | (0.06 | ) | | | (1.19 | ) | | | 0.35 | | | | 0.20 | | | | 0.09 | |

| | 0.27 | | | | (0.92 | ) | | | 0.63 | | | | 0.47 | | | | 0.39 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | (0.34 | ) | | | (0.29 | ) | | | (0.30 | ) | | | (0.30 | ) | | | (0.25 | ) |

| | — | | | | — | | | | — | 2 | | | — | 2 | | | (0.07 | ) |

| | (0.34 | ) | | | (0.29 | ) | | | (0.30 | ) | | | (0.30 | ) | | | (0.32 | ) |

| | | | | | | | | | | | | | | | | | | |

| $ | 7.32 | | | $ | 7.39 | | | $ | 8.60 | | | $ | 8.27 | | | $ | 8.10 | |

| | | | | | | | | | | | | | | | | | | |

| | 3.74 | % | | | (10.86 | )% | | | 7.74 | % | | | 5.99 | % | | | 5.07 | % |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| $ | 174 | | | $ | 148 | | | $ | 171 | | | $ | 431 | | | $ | 738 | |

| | 1.09 | % | | | 1.15 | %5 | | | 1.09 | % | | | 1.09 | % | | | 1.09 | % |

| | 1.45 | % | | | 1.49 | % | | | 1.78 | % | | | 1.77 | % | | | 1.75 | % |

| | 4.60 | % | | | 3.37 | % | | | 3.29 | % | | | 3.41 | % | | | 3.84 | % |

| | 4.24 | % | | | 3.03 | % | | | 2.60 | % | | | 2.73 | % | | | 3.18 | % |

| | 99 | % | | | 65 | % | | | 89 | % | | | 130 | % | | | 106 | % |

Financial highlights

Delaware Strategic Income Fund Institutional Class

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Return of capital |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return3 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets4 |

| Ratio of expenses to average net assets prior to fees waived4 |

| Ratio of net investment income to average net assets |

| Ratio of net investment income to average net assets prior to fees waived |

| Portfolio turnover |

| 1 | Calculated using average shares outstanding. |

| 2 | Amount is less than $0.005 per share. |