UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04323

Natixis Funds Trust I

(Exact name of Registrant as specified in charter)

399 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Coleen Downs Dinneen, Esq.

NGAM Distribution, L.P.

399 Boylston Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2810

Date of fiscal year end: December 31

Date of reporting period: December 31, 2015

| Item 1. | Reports to Stockholders. |

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

ANNUAL REPORT

December 31, 2015

CGM Advisor Targeted Equity Fund

Natixis Oakmark Fund

Natixis Oakmark International Fund

Vaughan Nelson Small Cap Value Fund

Vaughan Nelson Value Opportunity Fund

TABLE OF CONTENTS

Portfolio Review page 1

Portfolio of Investments page 22

Financial Statements page 41

Notes to Financial Statements page 70

CGM ADVISOR TARGETED EQUITY FUND

| | |

| Manager | | Symbols |

| G. Kenneth Heebner, CFA® | | Class A NEFGX |

| Capital Growth Management Limited Partnership | | Class B NEBGX |

| | Class C NEGCX |

| | Class Y NEGYX |

Objective

The Fund seeks long-term growth of capital through investments in equity securities of companies whose earnings are expected to grow at a faster rate than that of the overall U.S. economy.

Market Conditions

In 2015, the U.S. stock market delivered its worst return since 2008, ending the year basically flat and in sharp contrast to 2014’s double-digit gains. Throughout the period, worries about an economic slowdown in China, a weaker global economy, and the timing of interest rate increases by the Federal Reserve Board plagued the market. Another factor contributing to the market’s very modest return was plunging oil prices. While the consumer may benefit from lower energy prices, the collapse in oil prices is generally unwelcome news for large energy and industrial companies, whose stocks can significantly impact the market.

Overall uncertainty led to a wild ride in the stock market which reached new highs earlier in the year, but fell sharply in August as concerns over China’s slowdown mounted. The stock market recouped most of its lost ground late in the period, but investors had little to cheer about as the year came to a close.

Performance Results

For the 12 months ended December 31, 2015, Class A shares of CGM Advisor Targeted Equity Fund returned -3.30% at net asset value. The Fund underperformed its benchmark, the S&P 500® Index, which returned 1.38%.

Explanation of Fund Performance

The Fund remained fully invested throughout 2015 in anticipation of strong U.S. economic growth, fueled by rising consumer spending. During the period, the U.S. consumer benefited from escalating housing prices as well as a significant reduction in personal debt, an ongoing trend since 2009.

Globally, the economic outlook was more uncertain. The Chinese economy in particular experienced a significant slowdown in 2015, which negatively impacted developing countries dependent on commodity exports. The major drop in oil prices worldwide further hobbled a number of developing economies. Ultimately, we believe that the impact of an optimistic outlook for domestic consumer spending is more crucial to U.S. economic growth than the limited impact of reduced exports to China and other developing nations.

1 |

Declining oil and gas prices were a boon to the U.S. consumer, sharply reducing transportation and home heating costs during the year, which translated into greater disposable income. These factors, coupled with rising employment and consumer confidence, stimulated consumer spending, the most critical factor in the economic growth equation.

During the period, the portfolio was focused on industries that would benefit from a stronger economy and rising interest rates, which typically accompany an economic upturn. The Fund’s largest concentrations were in homebuilders, financial stocks, and other economically sensitive industries. This group of stocks, however, lagged the market somewhat due to investor fears about the global economy.

Individual detractors to fund performance included apparel and footwear giant PVH Corp. (formerly Phillips-Van Heusen) which owns Calvin Klein, Tommy Hilfiger, Van Heusen, and other well-known brands. The stock suffered as a strong U.S. dollar negatively impacted revenues outside of the United States. Another apparel and footwear retailer, VF Corp., which owns Timberland, The North Face, Nautica and Vans as well as other internationally recognized labels, also struggled in the face of a stronger dollar and declining overseas revenues. We sold both stocks on the expectations of continued strength in the U.S. dollar.

Leading financial services firm Morgan Stanley also proved disappointing. Shares of the stock have been impaired by a weakness in commodity prices and bond prices, as well as the perception that the firm’s opportunities to benefit from rising interest rates are limited by market sentiment. We continue to hold this issue.

Among the stocks that delivered positive returns during the year was The Walt Disney Company (Disney). The company enjoyed continued success as a producer of top-grossing films, including the year-end blockbuster Star Wars. Shares of Disney also climbed in anticipation of the spring 2016 opening of its newest vacation destination, Shanghai Disney Resort. We sold the issue because of concerns about the negative impact of possible disruptions in the cable TV industry, which is critical to Disney’s business.

The Fund also realized a gain in financial services giant Visa which benefitted from increased processed transaction volume on its credit cards, along with a growth in gift cards and prepaid debit cards. Concerns over stock valuation, however, caused us to sell the stock. Meanwhile, D.R. Horton, a top homebuilder, also contributed positively to fund performance. Despite a sluggish homebuilding market, the firm enjoyed healthy earnings as it introduced new economy and luxury product lines which have proven highly successful. We continue to hold the stock. Home Depot was also a strong performer for the Fund. The Company benefitted from rising home improvement expenditures.

Outlook

On December 23, 2015, the Board of Trustees approved the liquidation of the CGM Advisor Targeted Equity Fund. Sale of the Fund’s assets and corresponding liquidating distributions to shareholders were completed on February 17, 2016.

| 2

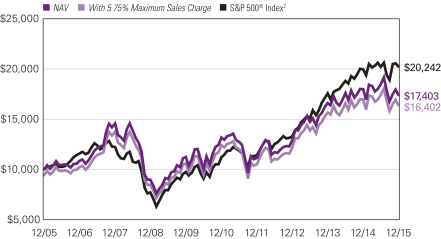

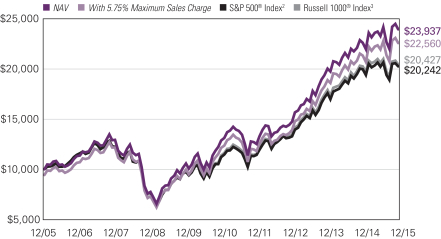

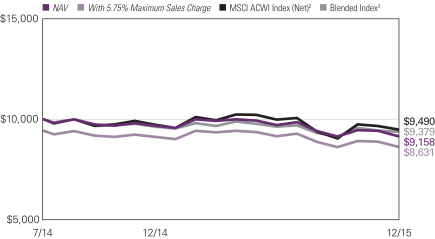

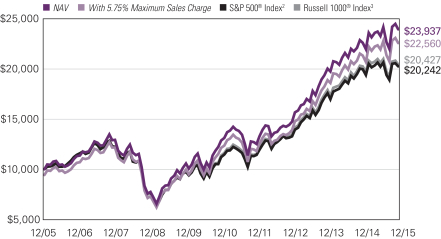

CGM ADVISOR TARGETED EQUITY FUND

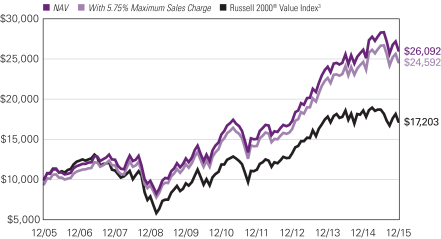

Growth of $10,000 investment in Class A Shares

December 31, 2005 through December 31, 2015

Average Annual Total Returns — December 31, 2015

| | | | | | | | | | | | |

| | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| Class A (Inception 11/27/68) | | | | | | | | | | | | |

| NAV | | | -3.30 | % | | | 5.71 | % | | | 5.70 | % |

| With 5.75% Maximum Sales Charge | | | -8.83 | | | | 4.46 | | | | 5.07 | |

| Class B (Inception 2/28/97) | | | | | | | | | | | | |

| NAV | | | -4.10 | | | | 4.90 | | | | 4.91 | |

| With CDSC1 | | | -8.74 | | | | 4.62 | | | | 4.91 | |

| Class C (Inception 9/1/98) | | | | | | | | | | | | |

| NAV | | | -4.02 | | | | 4.91 | | | | 4.91 | |

| With CDSC1 | | | -4.95 | | | | 4.91 | | | | 4.91 | |

| Class Y (Inception 6/30/99) | | | | | | | | | | | | |

| NAV | | | -3.01 | | | | 5.97 | | | | 5.98 | |

| Comparative Performance | | | | | | | | | | | | |

| S&P 500® Index2 | | | 1.38 | | | | 12.57 | | | | 7.31 | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. The table(s) does not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses. It is not possible to invest directly in an index.

| 1 | Performance for Class B shares assumes a maximum 5.00% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C share performance assumes a 1.00% CDSC applied when you sell shares within one year of purchase. |

| 2 | S&P 500® Index is a widely recognized measure of U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. |

3 |

NATIXIS OAKMARK FUND

| | |

| Managers | | Symbols |

| William C. Nygren, CFA® | | Class A NEFOX |

| Kevin G. Grant, CFA® | | Class B NEGBX |

| M. Colin Hudson, CFA® | | Class C NECOX |

| Michael J. Mangan, CFA® | | Class Y NEOYX |

| Harris Associates L.P. | | |

Objective

The Fund seeks long-term capital appreciation.

Market Conditions

After almost a full year of speculation, the Federal Reserve (the “Fed”) finally lifted short-term interest rates in the fourth quarter. Investors appeared pleased by the news, concluding that the Fed’s decision points to a strengthening economy. Indeed, critical economic measures, such as employment and housing, have improved. New job creation in recent months met or exceeded economists’ forecasts, and the unemployment rate dropped throughout 2015 and reached the lowest level in more than seven years. Likewise, new housing permits rose more than industry projections, and single-family housing starts increased 10.5% in November to the highest level in nearly eight years.

Total consumer spending has similarly been on the rise, according to data compiled by the Bureau of Economic Analysis, and marked an all-time high in the third quarter of this year. However, consumer-friendly conditions, such as mild inflation and very low energy prices, have become concerning to the market. Investors worry that the long duration of these factors may lead to slowing economic growth and deflation. Falling energy prices in particular have severely impacted energy producers and related companies, resulting in reduced capital investment spending and depressed stock valuations across the sector. This scenario has also brought about some volatility in the broader market, as negative investor sentiment periodically pressured other equity prices in tandem with energy shares.

Performance Results

For the 12 months ended December 31, 2015, Class A shares of the Natixis Oakmark Fund returned -4.41% at net asset value. The Fund underperformed its benchmark, the S&P 500® Index, which returned 1.38%.

Explanation of Fund Performance

As value investors with an emphasis on individual stock selection, our sector weights are a byproduct of our bottom-up process. On an absolute-return basis, shares in the health care sector gained the most value, while holdings in the energy sector posted the lowest return for calendar 2015.

Chesapeake Energy and Glencore were the largest detractors to fund performance for the calendar year. Chesapeake Energy was no exception to the depressed energy stock prices that were seen across the sector this year, especially in oil. However, we still believe that this oil and natural gas company’s business is sound. The company plans to reduce its amount of capital leverage and improve liquidity by selling select assets, including $200-$300 million of non-core assets. In the meantime, Chesapeake’s third-quarter earnings release was not as bad as investors feared, as its earnings per share ($-0.05 vs. $-0.13) result was far ahead of

| 4

NATIXIS OAKMARK FUND

market expectations. Importantly, capital spending fell 47% from the previous quarter and about 60% year-over-year, which was better than forecasts, and management indicated further significant spending reductions through 2016. We are pleased that Chesapeake’s management team is focused on cutting costs and optimizing operational efficiencies, and we think these measures will strengthen Chesapeake Energy’s performance going forward.

Glencore’s share price came under pressure mainly in the latter half of the year, as commodity and energy prices declined significantly. We consider Glencore’s leadership team to be highly effective with a strong commitment to protecting and elevating shareholder value. In December, Glencore hosted a conference call to provide a review of the business and the progress made strengthening the balance sheet. Some key updates included management’s guidance for $2.3 billion of free cash flow and earnings (excluding depreciation and amortization) of roughly $7.7 billion in 2016 at current “spot” prices, which is ahead of market expectations. Management believes that strong unit cost and capital expenditure reductions along with stability in the marketing business will make these targets achievable. In addition, the company plans to reduce debt by another $3 billion, bringing total projected cost cuts to $13 billion. Of that amount, nearly $9 billion in savings has already been achieved or otherwise earmarked.

The leading contributors to fund performance for the year were Amazon and Alphabet (formerly Google). As of the end of October, Amazon had returned over 100% since the beginning of the fiscal year. A third-quarter earnings report released in October showed earnings per share ($0.17 vs. -$0.13) and revenue ($25.36 billion vs. $24.88 billion) figures that beat consensus outlook, which helped to make this name a top contributor based on excess return. We subsequently sold out of our position in the first week of November as it reached our estimation of its intrinsic value.

Google delivered a positive second-quarter earnings report in July, highlighted by an earnings per share result ($6.99 vs. $6.70) that handily beat market expectations. Aggregate paid clicks were up 18% and paid clicks on Google websites were up 30%. Additionally, Google announced the creation of a new public holding company, Alphabet, as well as a new corporate structure in August. The company’s share price also reacted positively to third-quarter results that showed earnings and revenues both increased more than market expectations. Importantly, Alphabet also reported accelerating constant currency revenue growth of 21%. In our view, this growth was high quality with gains across all important segments. The fastest growth was in Google Sites (Search, YouTube, Gmail, etc.), which is the most profitable revenue. It was also important that mobile search revenue experienced substantial growth, as this eases concerns that the shift to mobile computing will harm Alphabet’s profitability. We continue to believe that the company enjoys a very strong tailwind as advertising continues to move online.

Outlook

While economic growth in the U.S. persists at a moderate pace overall, going forward, the market faces new concerns, including possible actions the Fed may take regarding future interest rate increases and growing turmoil abroad which may continue to sway market behavior. Slowing growth in China remains at the forefront, as its government works to boost domestic consumption, and currency disparities still adversely affect businesses around the world. Lastly, in addition to causing real world destruction, the unpredictable timing and intensity of terrorists’ activities may also threaten market stability. Even in light of these considerations, we focus on making rational investment decisions for the benefit of our clients. As patient value investors, we choose to stay the course and remain committed to our investment philosophy and methodology.

5 |

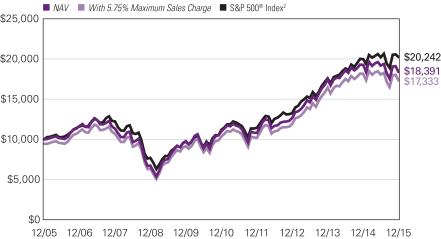

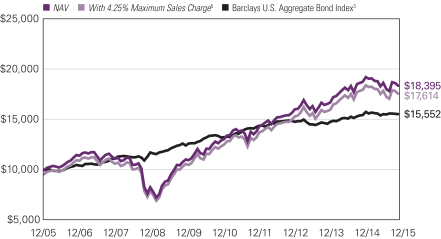

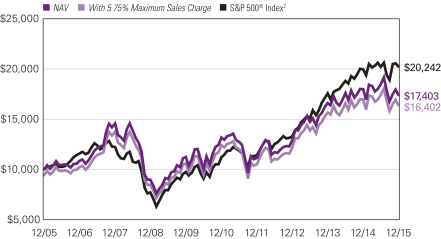

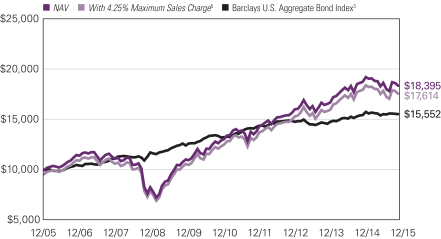

Growth of $10,000 Investment in Class A Shares3

December 31, 2005 through December 31, 2015

Average Annual Total Returns — December 31, 20153

| | | | | | | | | | | | |

| | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| Class A (Inception 5/6/31) | | | | | | | | | | | | |

| NAV | | | -4.41 | % | | | 10.88 | % | | | 6.28 | % |

| With 5.75% Maximum Sales Charge | | | -9.92 | | | | 9.58 | | | | 5.65 | |

| Class B (Inception 9/13/93) | | | | | | | | | | | | |

| NAV | | | -5.11 | | | | 10.04 | | | | 5.48 | |

| With CDSC1 | | | -9.68 | | | | 9.77 | | | | 5.48 | |

| Class C (Inception 5/1/95) | | | | | | | | | | | | |

| NAV | | | -5.07 | | | | 10.07 | | | | 5.49 | |

| With CDSC1 | | | -5.99 | | | | 10.07 | | | | 5.49 | |

| Class Y (Inception 11/18/98) | | | | | | | | | | | | |

| NAV | | | -4.18 | | | | 11.15 | | | | 6.60 | |

| Comparative Performance | | | | | | | | | | | | |

| S&P 500® Index2 | | | 1.38 | | | | 12.57 | | | | 7.31 | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. The table(s) does not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses. It is not possible to invest directly in an index.

| 1 | Performance for Class B shares assumes a maximum 5.00% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C share performance assumes a 1.00% CDSC applied when you sell shares within one year of purchase. |

| 2 | S&P 500® Index is a widely recognized measure of U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 6

NATIXIS OAKMARK INTERNATIONAL FUND

| | |

| Managers | | Symbols |

| David G. Herro, CFA® | | Class A NOIAX |

| Robert A. Taylor, CFA® | | Class C NOICX |

| Harris Associates L.P. | | |

Objective

The Fund seeks long-term capital appreciation.

Market Conditions

The year 2015 included terrorist attacks in France and the U.S., two elections in Greece, continued slowdown in the BRIC economies with slower growth in China causing the most concern, ongoing political crisis in Brazil, the rise of ISIS, concerns about too-low inflation and stalled growth in Japan, and depressed energy and commodity prices. Considering that share prices often reflect the mood of investors in the short term, the persistent bad news was perhaps another reason for the lack of buoyancy in global equity markets.

We still believe, however, there are reasons for optimism, including the eurozone which is slowly coming out of its funk led by some limited reforms (especially in the periphery countries), a stabilized situation in Greece, a weaker euro, and an easier monetary policy. Even in Latin America, reformers have won elections in Argentina and Venezuela. In Japan, the Abe administration is raising the minimum wage by 3% annually and easing regulations to encourage corporate investment. Furthermore, the unemployment rate in the U.S. dropped throughout 2015 and reached the lowest level in more than seven years, total consumer spending marked an all-time high in the third quarter, and the Federal Reserve finally lifted short-term interest rates in the fourth quarter. All things considered, the International Monetary Fund still expects the world to grow at a 3% rate. While this leaves room for improvement, it is still a level that allows for acceptable corporate profitability.

Performance Results

For the 12 months ended December 31, 2015, Class A shares of Natixis Oakmark International Fund returned -5.35% at net asset value. The Fund trailed its benchmark, the MSCI World ex USA Index (Net), which returned -3.04%.

Explanation of Fund Performance

Geographically, we ended the quarter with 65% of our holdings in Europe, 21% in Japan and 3% in Australia. The remaining positions are in the United States, South Korea, China, Hong Kong, Indonesia, Mexico and Israel. As value investors with an emphasis on individual stock selection, our country and sector weights are a byproduct of our bottom-up process.

On an absolute-return basis, shares in the health care sector produced the best collective return. Holdings in the materials sector declined the most during the year.

The largest detractors from return were Glencore and Prada. Glencore’s share price came under pressure mainly in the latter half of the year, as commodity and energy prices declined significantly. We consider Glencore’s leadership team to be highly effective and focused on elevating shareholder value. In December, Glencore hosted a conference call to provide a review of the business and the progress made strengthening the balance sheet. Some key updates included management’s guidance for $2.3 billion of free cash flow and earnings (excluding depreciation and amortization) of roughly $7.7 billion in 2016 at current “spot” prices, which is ahead of market expectations. Management believes that strong unit cost and capital expenditure reductions along with stability in the marketing business will make these

7 |

targets achievable. In addition, the company plans to reduce debt by another $3 billion, bringing total projected cost cuts to $13 billion. Of that amount, nearly $9 billion in savings has already been achieved or otherwise earmarked. Keeping in mind that members of the company’s management team are large stakeholders (having purchased 22% of the recent $2.5 billion equity offering), we think management’s actions remain aligned with all of Glencore’s shareholders as they navigate through these trying times.

Prada, the Italian fashion and luxury goods brand, was also a top detractor for the quarter. The company reported fiscal third-quarter results that disappointed investors, as revenue and earnings figures fell short of analysts’ expectations. Sales in China, particularly of leather goods, continued to decline, and the company has struggled to find the right product offering to generate top-line growth. Management believes that Chinese customers are transitioning from just wanting global products found in the West to wanting bespoke products and plans to tailor clothing by geographic region, which should appeal to Chinese consumers. Prada’s lean and efficient distribution network will enable the company to move new product offerings from the design stage to the retail floor quickly — approximately four to five weeks’ time. We think that while Prada may face some short-term obstacles, its long-term outlook is promising and it is trading at a meaningful discount to its intrinsic value.

The top contributors to the yearly return were Intesa Sanpaolo and Baidu. Intesa Sanpaolo, an Italian retail and commercial bank, was the top contributor to performance over the past 12 months. Intesa’s share price has rebounded as fears over Italy’s banking system and government have subsided. During the period of concern a few years ago, the share price of Intesa plummeted and it was a major detractor from performance. Nevertheless we maintained and added to our position, and our shareholders have benefited from the turnaround. This example illustrates why we often increase our holdings in quality companies whose stock prices suffer as a result of short-term fears. Investors reacted positively this year to Intesa’s impressive revenue growth numbers in spite of challenging headwinds: Italian GDP has been static and banking penetration remains low, while the household savings rate remains high. Management has announced additional returns of capital to shareholders in 2015 via an increased dividend, resulting in a payout ratio in excess of 70%.

Baidu, China’s largest Internet search engine that commands over 70% market share, saw shares react positively to the company’s nine-month earnings release in October and to the company’s plans to merge their majority-controlled travel business Qunar with Ctrip. This important deal will combine the top two online travel sites in China and should lead to significantly lower subsidies and higher profitability. Additionally, the shareholder-focused management team announced a new $2 billion share repurchase program during the fourth quarter. Finally, we believe that management’s significant investments in new businesses, such as online-to-offline services (e.g. food delivery, ride sharing, etc.), are masking the strength of the core search business, which continues to grow at a healthy rate and generates significant profits. For these reasons, we believe Baidu’s current valuation neither reflects the fair value of the company’s search business nor gives any credit for its many non-search businesses; therefore, the stock price underestimates Baidu’s true value.

We continue to believe some currencies are overvalued versus the U.S. dollar. We maintained our defensive currency hedges and ended the year with approximately 23% of the Swiss franc and 10% of the Australian dollar hedged.

Outlook

Although macro and geopolitical events dominated the news in 2015, we believe it is a mistake to focus on these factors when making investment decisions. We find that these events rarely impact long-term business value in a meaningful way. In fact, these events should be used to exploit short-term mispricing, as they enable investors to buy into businesses at low entry prices. We recognize that our job is to measure and determine intrinsic value, to buy when stock prices are low and to sell when stock prices are high. It is our belief that by focusing on this, rather than the exogenous events mentioned above, we will earn acceptable rates of return over time for those who entrust their funds with us.

| 8

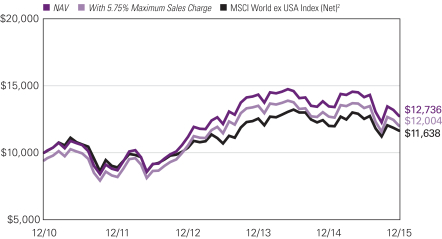

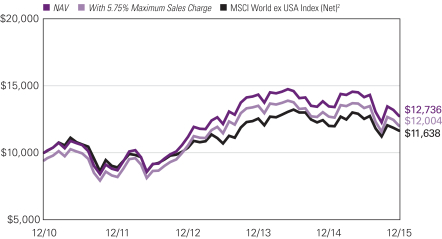

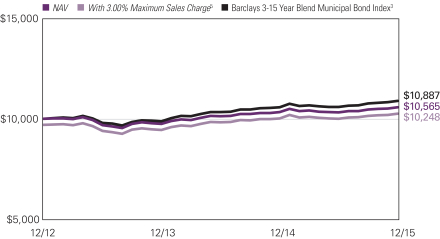

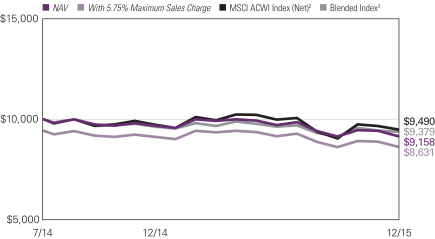

NATIXIS OAKMARK INTERNATIONAL FUND

Growth of $10,000 Investment in Class A Shares

December 15, 2010 (inception) through December 31, 20153

Average Annual Total Returns — December 31, 2015

| | | | | | | | | | | | |

| | | | |

| | | 1 Year | | | 5 Years | | | Life of Fund | |

| | | | |

| Class A (Inception 12/15/10) | | | | | | | | | | | | |

| NAV | | | -5.35 | % | | | 4.63 | % | | | 4.92 | % |

| With 5.75% Maximum Sales Charge | | | -10.80 | | | | 3.39 | | | | 3.69 | |

| | | | |

| Class C (Inception 12/15/10) | | | | | | | | | | | | |

| NAV | | | -6.08 | | | | 3.88 | | | | 4.15 | |

| With CDSC1 | | | -7.00 | | | | 3.88 | | | | 4.15 | |

| | | | |

| Comparative Performance | | | | | | | | | | | | |

| MSCI World ex USA Index (Net)2 | | | -3.04 | | | | 2.79 | | | | 3.05 | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. The table(s) does not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses. It is not possible to invest directly in an index.

| 1 | Performance for Class C shares assumes a 1.00% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | MSCI World ex USA Index (Net) is an unmanaged index that is designed to measure the equity market performance of developed markets, excluding the United States. The index calculates reinvested dividends net of withholding taxes using Luxembourg tax rates. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

9 |

VAUGHAN NELSON SMALL CAP VALUE FUND

| | |

| Managers | | Symbols |

| Dennis G. Alff, CFA® | | Class A NEFJX |

| Chad D. Fargason | | Class B NEJBX |

| Chris D. Wallis, CFA® | | Class C NEJCX |

| Scott J. Weber, CFA® | | Class Y NEJYX |

| Vaughan Nelson Investment Management, L.P. |

Effective July 31, 2009, the fund was closed to new investors.

Objective

The Fund seeks capital appreciation.

Market Conditions

During the past twelve months, deteriorating market breadth resulted in increased equity market volatility. The current market volatility will likely continue as capital markets adjust to the shifts in central bank policy that are occurring globally. Specifically, the ongoing shift in U.S. monetary policy creates deflationary pressures as the dollar strengthens relative to those currencies whose monetary authorities are accelerating simulative policies. In typical business cycles, shifts in monetary policy that reduce liquidity occur when the economy is accelerating, profit margins are increasing, and inflation expectations are rising. Unfortunately, none of these conditions are currently present in the U.S., which is why we believe this market cycle will be materially different from market cycles experienced prior to the 2008 financial crisis.

Equity markets are digesting falling earnings growth estimates, declining profit margins, and rising credit costs. The recent volatility in the market is consistent with our view that, with valuations stretched, near term earnings estimates declining, and corporate borrowing rates likely beyond their cyclical lows, the market will present attractive investment opportunities.

Performance Results

For the 12 months ended December 31, 2015, Class A shares of Vaughan Nelson Small Cap Value Fund returned -0.29% at net asset value. The Fund outperformed its benchmark, the Russell 2000® Value Index, which returned -7.47%.

Explanation of Fund Performance

Stock selection drove the majority of the portfolio’s relative outperformance over the past year while modest multiple contraction limited absolute returns. The best-performing stocks in the portfolio were mostly service-oriented businesses with the ability to grow their revenues and earnings despite the slowing economic recovery. These high-quality, well-managed businesses, many of which benefit from long-term secular tailwinds, are a natural fit with our returns-focused philosophy and were uncovered through our company-specific stock selection process. The portfolio continued to be materially underweight in REITs and utilities for most of the year, but our weighting to utilities increased in the fourth quarter as market volatility provided an opportunity to own high quality regulated assets. Healthcare, technology, and financial stocks were the biggest contributors to our performance, while consumer discretionary stocks and more cyclically exposed industrials were the largest performance detractors.

| 10

VAUGHAN NELSON SMALL CAP VALUE FUND

Stock selection drove performance in the health care sector with PRA Health Sciences, Amsurg, and Integra LifeSciences making the most significant contributions to performance. PRA Health Sciences benefited from the secular outsourcing of clinical trials by bio-pharmaceutical companies particularly by smaller and emerging companies searching for new molecular entities. Management continues to drive operating margins higher with internal efficiency programs and the company continues to seek new areas of business and engage more directly with its customers. We have trimmed our position on valuation concerns but still retain a positive view. Amsurg continues to benefit from the integration of its strategic acquisition of Sheridan Healthcare while also benefitting from the trend of patients moving to lower-cost outpatient settings in its core ambulatory surgery center business. Integra LifeSciences continues to optimize its portfolio of assets, spinning off SeaSpine during the year for example, and focusing on its core competencies. While the company has a number of new product launches coming in 2016-2017, management has continued to rationalize its cost footprint and sees margins moving higher over time.

The technology sector was also driven by stock selection, with Broadridge and IGATE as the greatest contributors to performance. Broadridge continued to drive higher levels of recurring revenue and grew backlog while introducing new products and ways to interact with customers. The company came off a year in which they made four acquisitions to bolster product capabilities in both the Investor Communications and Global Technology & Operation segments. Integrating these acquisitions will help drive new client growth, shed unnecessary costs, and help the company expand its market-leading positions. IGATE is an information technology outsourcing company that continued its multi-year investment in domain expertise and pruned unprofitable customers from its client list. Secular trends remain favorable in the business as evidenced by the acquisition by CapGemini in mid-2015.

Performance in the financials sector was driven by allocation and stock selection, as the portfolio was overweight insurance, underweight REITs, and exposed to stocks that performed well during the year. The largest contributors to performance were HCC Insurance and Webster Financial. HCC Insurance was acquired by Tokyo Marine at a healthy price-to-book multiple as HCC demonstrated great underwriting expertise in niche lines of specialty business that are not as price sensitive as the licensed market. The company had compounded its book value in the high single digits over the past five years while paying a healthy dividend, and consistently repurchased shares rather than allocating capital to inferior business lines with subpar returns. Webster Financial showed strong organic loan growth and synergies from the JP Morgan HSA business it acquired early in 2015. Management continues to look for ways to drive the efficiency ratio lower while expanding its loan footprint.

The consumer discretionary sector detracted from performance as traditional retail companies were faced with changing customer tastes and preferences while struggling to adapt to omni-channel supply chain and selling strategies. What is good for consumers — ubiquitous product distribution with constant markdowns — is bad for retailers if there is no compelling brand value proposition or reason to visit stores. Men’s Wearhouse was hurt by changing customer patterns at its Joseph A. Bank stores as the core customer failed to shop after a change in the assortment and marketing message. We sold most of our position in Men’s Wearhouse and exited other consumer retail names such as Fossil, Bloomin’ Brands, Wolverine Worldwide, and GNC Holdings during the second half of the year as it became evident consumers were spending their discretionary monies elsewhere.

11 |

The industrial sector also detracted from performance as the decline in commodity prices had negative direct and indirect effects on our names. Rexnord’s Process and Motion Control business suffered from a lack of new orders, and replacement and maintenance orders were materially reduced or pushed out. The Esterline Technologies management team executed poorly on their cost cutting rationalization plans while the aerospace and defense end market started to slow.

Other notable performers during the year include ServiceMaster Holdings and Renaissance Reinsurance. ServiceMaster continued to layer on additional services to its core residential and commercial insect and pest control offerings to drive incremental revenues. The company’s home warranty business continues to benefit from a rebounding housing market and it was able to successfully pass through price increases. ServiceMaster is also in the later stages of realizing shared services synergies to drive overhead costs lower. Renaissance Reinsurance continues to find synergies with the Platinum Underwriters acquisition and diversify its reinsurance operations. The company continues to be a front-runner in consolidating the reinsurance space and keeping overhead costs well contained in a soft pricing market.

The largest increases in sector and industry weightings were in utilities and IT services. We took advantage of the late summer sell-off to add regulated utility names with visible rate base reinvestment opportunities over the next 3-5 years. The increase in IT services weighting was driven by federal government IT contractor names. With government budgets set to increase in the near future and the need for heightened cyber security and intelligence, names like CACI International, Booz Allen Hamilton and Engility Holdings are poised to benefit.

The largest decreases in sector weightings were in consumer discretionary and healthcare. As discussed earlier, the reduction in consumer discretionary holdings was due to the stresses on consumers wallets and the team subsequently trimmed Men’s Wearhouse and sold Fossil, Bloomin’ Brands, Wolverine Worldwide, and GNC Holdings. In healthcare, our reduction in sector weighting was due mostly to profit taking as well as valuation concerns.

Outlook

Given current valuations in the equity market, sluggish growth, and the Federal Reserve moving off its zero interest rate policy, the equity markets are likely to be volatile and could experience a further correction. We would welcome any correction as an opportunity to make attractive investments.

We expect market volatility to remain elevated during the short term as levered investors unwind trading positions that were preconditioned on higher levels of liquidity and lower levels of volatility. The near term direction of U.S. equity markets will be dictated by the tug-of-war between an improving labor market, which will pressure corporate margins, and the potential reacceleration of top-line growth as wages rise and the employment base expands. Preconditions for rising equity markets are stability in credit markets combined with abating deflationary forces from overseas markets or a shift to more accommodative U.S. fiscal and monetary policies.

We continue to seek investments in companies that have better pricing power, lower earnings variability, higher profitability, and stronger balance sheets than the broader investment universe. We still do not favor any single industry or sector, and continue to look for companies with the characteristics noted above that trade at attractive valuations.

| 12

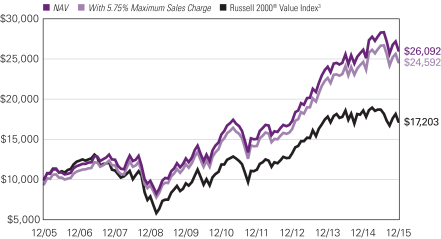

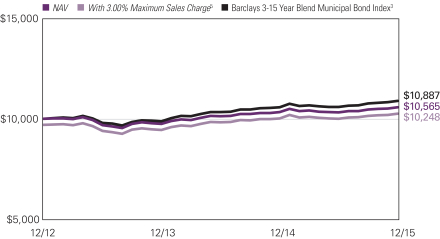

VAUGHAN NELSON SMALL CAP VALUE FUND

Growth of $10,000 Investment in Class A Shares4

December 31, 2005 through December 31, 2015

Average Annual Total Returns — December 31, 20154

| | | | | | | | | | | | |

| | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| Class A (Inception 12/31/96) | | | | | | | | | | | | |

| NAV | | | -0.29 | % | | | 10.77 | % | | | 10.07 | % |

| With 5.75% Maximum Sales Charge | | | -6.02 | | | | 9.47 | | | | 9.42 | |

| Class B (Inception 12/31/96) | | | | | | | | | | | | |

| NAV | | | -1.04 | | | | 9.93 | | | | 9.24 | |

| With CDSC1 | | | -5.07 | | | | 9.76 | | | | 9.24 | |

| Class C (Inception 12/31/96) | | | | | | | | | | | | |

| NAV | | | -1.02 | | | | 9.94 | | | | 9.24 | |

| With CDSC1 | | | -1.83 | | | | 9.94 | | | | 9.24 | |

| Class Y (Inception 8/31/06)2 | | | | | | | | | | | | |

| NAV | | | -0.05 | | | | 11.04 | | | | 10.34 | |

| Comparative Performance | | | | | | | | | | | | |

| Russell 2000® Value Index3 | | | -7.47 | | | | 7.67 | | | | 5.57 | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. The table(s) does not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses. It is not possible to invest directly in an index.

| 1 | Performance for Class B shares assumes a maximum 5.00% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C share performance assumes a 1.00% CDSC applied when you sell shares within one year of purchase. |

| 2 | Prior to the inception of Class Y shares (8/31/06), performance is that of Class A shares and reflects the higher net expenses of that share class. |

| 3 | Russell 2000® Value Index is an unmanaged index that measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

13 |

VAUGHAN NELSON VALUE OPPORTUNITY FUND

| | |

| Managers | | Symbols |

| Dennis G. Alff, CFA® | | Class A VNVAX |

| Chad D. Fargason | | Class C VNVCX |

| Chris D. Wallis, CFA® | | Class N VNVNX |

| Scott J. Weber, CFA® | | Class Y VNVYX |

| Vaughan Nelson Investment Management, L.P. |

Objective

The Fund seeks long-term capital appreciation.

Market Conditions

During the past twelve months, deteriorating market breadth resulted in increased equity market volatility. The current market volatility will likely continue as capital markets adjust to the shifts in central bank policy that are occurring globally. Specifically, the ongoing shift in U.S. monetary policy creates deflationary pressures as the dollar strengthens relative to those currencies whose monetary authorities are accelerating simulative policies. In typical business cycles, shifts in monetary policy that reduce liquidity occur when the economy is accelerating, profit margins are increasing, and inflation expectations are rising. Unfortunately, none of these conditions are currently present in the U.S., which is why we believe this market cycle will be materially different from market cycles experienced prior to the 2008 financial crisis.

Equity markets are digesting falling earnings growth estimates, declining profit margins, and rising credit costs. The recent volatility in the market is consistent with our view that, with valuations stretched, near term earnings estimates declining, and corporate borrowing rates likely beyond their cyclical lows, the market will present attractive investment opportunities.

Performance Results

For the twelve months ended December 31, 2015, Class A shares of Vaughan Nelson Value Opportunity Fund returned -3.66% at net asset value. The Fund held up better than its benchmark, the Russell Midcap® Value Index, which returned -4.78%.

Explanation of Fund Performance

The portfolio declined primarily due to weakness in cyclical stocks within the consumer discretionary, materials, industrials, and energy sectors. On a relative basis, sector allocation was the primary driver of the Fund’s outperformance as compared to the benchmark, but stock selection contributed, too. The majority of the Fund’s relative outperformance for the year stems from the decision to overweight technology and underweight energy. The best performing stocks in the portfolio were mostly service-oriented businesses with the ability to grow their revenues and earnings despite the slowing economic recovery. These high-quality, well-managed businesses, many of which benefit from long-term secular tailwinds, are a natural fit with our returns-focused philosophy and were uncovered through our company-specific stock selection process. The portfolio remains significantly underweight in REITs and utilities based on valuation. We are confident that the portfolio’s individual companies have competitive positions or secular opportunities that will allow them to outperform the market over time. Technology, financials, and consumer staples were the biggest contributors to absolute performance, while consumer discretionary, healthcare, industrials, materials, and energy detracted from performance.

| 14

VAUGHAN NELSON VALUE OPPORTUNITY FUND

Stock selection primarily drove the strong returns and relative performance in the technology sector. However, the portfolio also benefitted from being materially overweight in IT services companies. Notable standouts for the year include IT services companies Global Payments, Total System Services, and Fiserv. These companies provide electronic payment processing services and solutions for financial institutions and merchants, and as such, they produce predictable, recurring revenue streams that are growing with credit and debit card usage, and as financial institutions automate operations. The market rewarded these companies in 2015 for their visible and consistent business models. Avago, an analog semiconductor company, was also a strong performer for the portfolio and continued to benefit from global growth in mobile devices and connected products, and from new design wins and content gains on mobile platforms.

The financials sector was a positive contributor to the portfolio on an absolute basis but lagged the benchmark on a relative basis primarily due to being underweight in REITs and insurance stocks during the year. The largest contributors to performance were SEI Investments and Nasdaq. SEI Investments provides investment processing, investment management, and investment operations solutions that help financial institutions and financial advisors manage client accounts. SEI benefits from a recurring business model with high incremental margins, which are characteristics the market favored in 2015. Nasdaq, a global securities exchange and listing provider, benefitted from better volumes and more volatility in 2015. Further, Nasdaq’s business model is also recurring in nature and management has been shareholder friendly by aggressively repurchasing shares and by increasing its dividend.

Energy detracted from absolute performance but as noted earlier the portfolio was materially underweight as compared to the benchmark. Therefore, on a relative basis, the portfolio’s underweight to the energy sector contributed significantly to relative performance for the year. The portfolio remains materially underweight in the sector, but we have indirect exposure to energy primarily through our materials and industrials holdings.

The consumer discretionary sector detracted from performance as traditional retail companies were faced with changing customer tastes and preferences while struggling to adapt to omni-channel supply chain and selling strategies. What is good for consumers — ubiquitous product distribution with constant markdowns — is bad for retailers if there is no compelling brand value proposition or reason to visit stores. Men’s Wearhouse was hurt by changing customer patterns at its Joseph A. Banks stores as the core customer failed to shop after a change in the assortment and marketing message. PVH Corporation, whose apparel portfolio includes Calvin Klein, Tommy Hilfiger, and Izod also performed poorly. Cabela’s, a hunting, camping and fishing outfitter, also experienced weak store traffic and apparel sales and we sold the stock.

The healthcare sector detracted from performance primarily due to stock selection within healthcare providers and services. Community Health Systems, an acute care hospital provider, declined sharply in the third and fourth quarters of 2015 due to renewed discussion around the outlook for the Affordable Care Act (ACA). The ACA has been favorable for Community given its exposure to states with a relatively higher percentage of uninsured population and given that Community has the most exposure to the states with the possibility of Medicaid expansion. Finally, Community is one of the more levered names in the hospital group, which made it an easy candidate for investors to sell. Amsurg, an ambulatory surgery center provider, offset some of the poor performance within the hospital group. The company continues to benefit from the integration of its strategic acquisition of Sheridan Healthcare while also benefitting from the trend of patients moving to lower-cost outpatient settings like its core ambulatory surgery center business.

15 |

The materials and industrials sectors also detracted from performance as the sharp decline in commodity prices directly and indirectly impacted portfolio holdings such as specialty alloy and aluminum manufacturers, Carpenter Technology and Constellium. One industrial, ServiceMaster, the operator of Terminix and American Home Shield, was one of the portfolio’s best performers in 2015. ServiceMaster continued to layer on additional services to its core residential and commercial insect and pest control offerings to drive incremental revenues. The company’s home warranty business continues to benefit from a rebounding housing market and it was able to successfully pass through price increases. ServiceMaster is also in the later stages of realizing shared services synergies to drive overhead costs lower.

Other notable performers during the year were Sabre in the technology sector; Jarden in consumer discretionary; Alere in healthcare; and Avery Dennison in the materials sector. The greatest increases in weightings by sector were in technology, materials, and financials. The largest reductions in weightings by sector were in consumer staples, energy, and industrials. The portfolio is underweight in consumer staples, energy, financials, and utilities. These underweights are offset by overweights in technology, consumer discretionary, industrials, healthcare, and materials. The underweight to financials is primarily driven by our decision to avoid REITs since valuations look expensive.

Outlook

Given current valuations in the equity market, sluggish growth, and the Federal Reserve moving off its zero interest rate policy, the equity markets are likely to be volatile and could experience a further correction. We would welcome any correction as an opportunity to make attractive investments.

We expect market volatility to remain elevated during the short term as levered investors unwind trading positions that were preconditioned on higher levels of liquidity and lower levels of volatility. The near term direction of U.S. equity markets will be dictated by the tug-of-war between an improving labor market, which will pressure corporate margins, and the potential reacceleration of top-line growth as wages rise and the employment base expands. Preconditions for rising equity markets are stability in credit markets combined with abating deflationary forces from overseas markets or a shift to more accommodative U.S. fiscal and monetary policies.

We continue to seek investments in companies that have better pricing power, lower earnings variability, higher profitability, and stronger balance sheets than the broader investment universe. We still do not favor any single industry or sector, and continue to look for companies with the characteristics noted above that trade at attractive valuations.

| 16

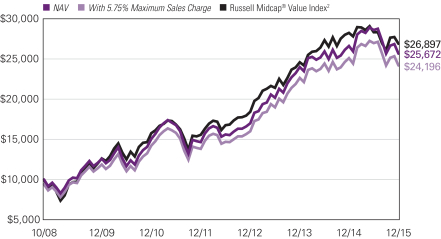

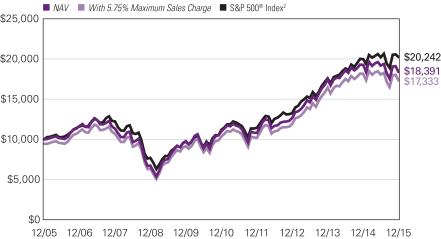

VAUGHAN NELSON VALUE OPPORTUNITY FUND

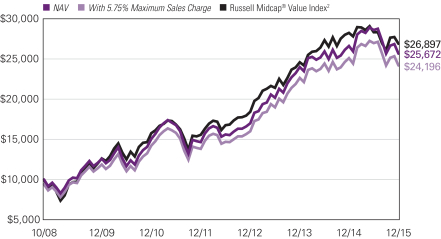

Growth of $10,000 Investment in Class A Shares3

October 31, 2008 (inception) through December 31, 2015

Average Annual Total Returns — December 31, 20153

| | | | | | | | | | | | | | | | |

| | | | | |

| | | 1 Year | | | 5 Years | | | Life of

Class A,C,Y | | | Life of

Class N | |

| Class A (Inception 10/31/08) | | | | | | | | | | | | |

| NAV | | | -3.66 | % | | | 11.22 | % | | | 14.06 | % | | | — | % |

| With 5.75% Maximum Sales Charge | | | -9.20 | | | | 9.91 | | | | 13.12 | | | | — | |

| Class C (Inception 10/31/08) | | | | | | | | | | | | | | | | |

| NAV | | | -4.39 | | | | 10.39 | | | | 13.21 | | | | — | |

| With CDSC1 | | | -5.32 | | | | 10.39 | | | | 13.21 | | | | — | |

| Class N (Inception 5/1/13) | | | | | | | | | | | | | | | | |

| NAV | | | -3.35 | | | | — | | | | — | | | | 11.61 | |

| Class Y (Inception 10/31/08) | | | | | | | | | | | | | | | | |

| NAV | | | -3.47 | | | | 11.48 | | | | 14.34 | | | | — | |

| Comparative Performance | | | | | | | | | | | | | | | | |

| Russell Midcap® Value Index2 | | | -4.78 | | | | 11.25 | | | | 14.82 | | | | 9.66 | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. The table(s) does not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses. It is not possible to invest directly in an index.

| 1 | Performance for Class C shares assumes a 1.00% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | Russell Midcap® Value Index is an unmanaged index that measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap® Index companies with lower price-to-book ratios and lower forecasted growth values. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

17 |

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the Fund is actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

ADDITIONAL INDEX INFORMATION

This document may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with Natixis Global Asset Management or any of its related or affiliated companies (collectively “NGAM”) and does not sponsor, endorse or participate in the provision of any NGAM services, funds or other financial products.

The index information contained herein is derived from third parties and is provided on an “as is” basis. The user of this information assumes the entire risk of use of this information. Each of the third party entities involved in compiling, computing or creating index information disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to such information.

PROXY VOTING INFORMATION

A description of the Natixis Funds’ proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on Natixis Funds’ website at ngam.natixis.com; and on the Securities and Exchange Commission’s (SEC) website at www.sec.gov. Information regarding how Natixis Funds voted proxies relating to portfolio securities during the 12-months ended June 30, 2015 is available from Natixis Funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

Natixis Funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public

Reference Room may be obtained by calling 800-SEC-0330.

| 18

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different costs: transaction costs, including sales charges (loads) on purchases and contingent deferred sales charges on redemptions, and ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the Funds’ prospectus. The following examples are intended to help you understand the ongoing costs of investing in the Funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table of each class of Fund shares shows the actual account values and actual Fund expenses you would have paid on a $1,000 investment in the Fund from July 1, 2015 through December 31, 2015. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.60) and multiply the result by the number in the Expenses Paid During Period column as shown for your class.

The second line in the table for each class of fund shares provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs, such as sales charges. Therefore, the second line in the table of each fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| | | | | | | | | | | | |

| CGM ADVISOR TARGETED EQUITY FUND | | BEGINNING

ACCOUNT VALUE

7/1/2015 | | | ENDING

ACCOUNT VALUE

12/31/2015 | | | EXPENSES PAID

DURING PERIOD*

7/1/2015 – 12/31/2015 | |

| Class A | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $942.60 | | | | $5.58 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.46 | | | | $5.80 | |

| Class B | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $938.60 | | | | $9.19 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,015.73 | | | | $9.55 | |

| Class C | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $939.20 | | | | $9.24 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,015.68 | | | | $9.60 | |

| Class Y | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $943.90 | | | | $4.36 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.72 | | | | $4.53 | |

| * | Expenses are equal to the Fund’s annualized expense ratio: 1.14%, 1.88%, 1.89% and 0.89% for Class A, B, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

19 |

| | | | | | | | | | | | |

| NATIXIS OAKMARK FUND | | BEGINNING

ACCOUNT VALUE

7/1/2015 | | | ENDING

ACCOUNT VALUE

12/31/2015 | | | EXPENSES PAID

DURING PERIOD*

7/1/2015 – 12/31/2015 | |

| Class A | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $960.20 | | | | $5.68 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.41 | | | | $5.85 | |

| Class B | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $956.20 | | | | $9.27 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,015.73 | | | | $9.55 | |

| Class C | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $956.60 | | | | $9.37 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,015.63 | | | | $9.65 | |

| Class Y | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $961.40 | | | | $4.45 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.67 | | | | $4.58 | |

| * | Expenses are equal to the Fund’s annualized expense ratio: 1.15%, 1.88%, 1.90% and 0.90% for Class A, B, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

| | | | | | | | | | | | |

| NATIXIS OAKMARK INTERNATIONAL FUND | | BEGINNING

ACCOUNT VALUE

7/1/2015 | | | ENDING

ACCOUNT VALUE

12/31/2015 | | | EXPENSES PAID

DURING PERIOD*

7/1/2015 – 12/31/2015 | |

| Class A | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $900.60 | | | | $6.32 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,018.55 | | | | $6.72 | |

| Class C | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $897.10 | | | | $9.90 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,014.77 | | | | $10.51 | |

| * | Expenses are equal to the Fund’s annualized expense ratio: 1.32% and 2.07% for Class A and C, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

| 20

| | | | | | | | | | | | |

| VAUGHAN NELSON SMALL CAP VALUE FUND | | BEGINNING

ACCOUNT VALUE

7/1/2015 | | | ENDING

ACCOUNT VALUE

12/31/2015 | | | EXPENSES PAID

DURING PERIOD*

7/1/2015 – 12/31/2015 | |

| Class A | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $921.90 | | | | $6.49 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,018.45 | | | | $6.82 | |

| Class B | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $917.70 | | | | $10.01 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,014.77 | | | | $10.51 | |

| Class C | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $918.40 | | | | $10.11 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,014.67 | | | | $10.61 | |

| Class Y | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $922.80 | | | | $5.28 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.71 | | | | $5.55 | |

| * | Expenses are equal to the Fund’s annualized expense ratio: 1.34%, 2.07%, 2.09% and 1.09% for Class A, B, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

| | | | | | | | | | | | |

| VAUGHAN NELSON VALUE OPPORTUNITY FUND | | BEGINNING

ACCOUNT VALUE

7/1/2015 | | | ENDING

ACCOUNT VALUE

12/31/2015 | | | EXPENSES PAID

DURING PERIOD*

7/1/2015 – 12/31/2015 | |

| Class A | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $896.40 | | | | $5.88 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.00 | | | | $6.26 | |

| Class C | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $892.90 | | | | $9.49 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,015.17 | | | | $10.11 | |

| Class N | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $897.90 | | | | $4.26 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.72 | | | | $4.53 | |

| Class Y | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $897.30 | | | | $4.69 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.27 | | | | $4.99 | |

| * | Expenses are equal to the Fund’s annualized expense ratio: 1.23%, 1.99%, 0.89% and 0.98% for Class A, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

21 |

Portfolio of Investments – as of December 31, 2015

CGM Advisor Targeted Equity Fund

| | | | | | | | |

| Shares | | | Description | |

Value (†) | |

| | Common Stocks — 88.8% of Net Assets | |

| | | | Automobiles — 8.0% | | | | |

| | 1,110,000 | | | Ford Motor Co. | | $ | 15,639,900 | |

| | 580,000 | | | General Motors Co. | | | 19,725,800 | |

| | | | | | | | |

| | | | | | | 35,365,700 | |

| | | | | | | | |

| | | | Banks — 15.6% | | | | |

| | 1,370,000 | | | Bank of America Corp. | | | 23,057,100 | |

| | 420,000 | | | Citigroup, Inc. | | | 21,735,000 | |

| | 360,000 | | | JPMorgan Chase & Co. | | | 23,770,800 | |

| | | | | | | | |

| | | | | | | 68,562,900 | |

| | | | | | | | |

| | | | Capital Markets — 14.1% | | | | |

| | 58,000 | | | BlackRock, Inc. | | | 19,750,160 | |

| | 610,000 | | | Charles Schwab Corp. (The) | | | 20,087,300 | |

| | 690,000 | | | Morgan Stanley | | | 21,948,900 | |

| | | | | | | | |

| | | | | | | 61,786,360 | |

| | | | | | | | |

| | | | Hotels, Restaurants & Leisure — 5.5% | | | | |

| | 240,000 | | | Royal Caribbean Cruises Ltd. | | | 24,290,400 | |

| | | | | | | | |

| | | | Household Durables — 27.6% | | | | |

| | 1,420,000 | | | DR Horton, Inc. | | | 45,482,600 | |

| | 770,000 | | | Lennar Corp., Class A | | | 37,660,700 | |

| | 860,000 | | | Toll Brothers, Inc.(b) | | | 28,638,000 | |

| | 65,000 | | | Whirlpool Corp. | | | 9,546,550 | |

| | | | | | | | |

| | | | | | | 121,327,850 | |

| | | | | | | | |

| | | | Insurance — 0.7% | | | | |

| | 65,000 | | | MetLife, Inc. | | | 3,133,650 | |

| | | | | | | | |

| | | | Internet Software & Services — 5.5% | | | | |

| | 32,000 | | | Alphabet, Inc., Class C(b) | | | 24,284,160 | |

| | | | | | | | |

| | | | Multiline Retail — 3.3% | | | | |

| | 200,000 | | | Dollar General Corp. | | | 14,374,000 | |

| | | | | | | | |

| | | | Specialty Retail — 8.5% | | | | |

| | 150,000 | | | Home Depot, Inc. (The) | | | 19,837,500 | |

| | 230,000 | | | Lowe’s Cos., Inc. | | | 17,489,200 | |

| | | | | | | | |

| | | | | | | 37,326,700 | |

| | | | | | | | |

| | | | Total Common Stocks

(Identified Cost $340,249,058) | | | 390,451,720 | |

| | | | | | | | |

| | | | | | | | |

See accompanying notes to financial statements.

| 22

Portfolio of Investments – as of December 31, 2015

CGM Advisor Targeted Equity Fund – (continued)

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| | Short-Term Investments — 5.1% | |

| $ | 22,390,000 | | | Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 12/31/2015 at 0.030% to be repurchased at $22,390,075 on 1/04/2016 collateralized by $22,095,000 Federal Home Loan Mortgage Corp., 4.125% due 10/11/2033 valued at $22,840,706 including accrued interest (Note 2 of Notes to Financial Statements) (Identified Cost $22,390,000) | | $ | 22,390,000 | |

| | | | | | | | |

| | | | | | | | |

| | | | Total Investments — 93.9%

(Identified Cost $362,639,058)(a) | | | 412,841,720 | |

| | | | Other assets less liabilities — 6.1% | | | 26,967,300 | |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 439,809,020 | |

| | | | | | | | |

| | | | | | | | |

| | (†) | | | See Note 2 of Notes to Financial Statements. | | | | |

| | (a) | | | Federal Tax Information: | | | | |

| | | | At December 31, 2015, the net unrealized appreciation on investments based on a cost of $363,429,779 for federal income tax purposes was as follows: | |

| | | | Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | | $ | 53,600,673 | |

| | | | Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | | | (4,188,732 | ) |

| | | | | | | | |

| | | | Net unrealized appreciation | | $ | 49,411,941 | |

| | | | | | | | |

| | | | | | | | |

| | (b) | | | Non-income producing security. | | | | |

Industry Summary at December 31, 2015

| | | | |

Household Durables | | | 27.6 | % |

Banks | | | 15.6 | |

Capital Markets | | | 14.1 | |

Specialty Retail | | | 8.5 | |

Automobiles | | | 8.0 | |

Hotels, Restaurants & Leisure | | | 5.5 | |

Internet Software & Services | | | 5.5 | |

Multiline Retail | | | 3.3 | |

Insurance | | | 0.7 | |

Short-Term Investments | | | 5.1 | |

| | | | |

Total Investments | | | 93.9 | |

Other assets less liabilities | | | 6.1 | |

| | | | |

Net Assets | | | 100.0 | % |

| | | | |

See accompanying notes to financial statements.

23 |

Portfolio of Investments – as of December 31, 2015

Natixis Oakmark Fund

| | | | | | | | |

| Shares | | | Description | | Value (†) | |

| | Common Stocks — 99.9% of Net Assets | |

| | | | Air Freight & Logistics — 2.0% | | | | |

| | 36,050 | | | FedEx Corp. | | $ | 5,371,089 | |

| | | | | | | | |

| | | | Automobiles — 3.9% | | | | |

| | 258,100 | | | Fiat Chrysler Automobiles NV(b) | | | 3,610,819 | |

| | 128,400 | | | General Motors Co. | | | 4,366,884 | |

| | 50,900 | | | Harley-Davidson, Inc. | | | 2,310,351 | |

| | | | | | | | |

| | | | | | | 10,288,054 | |

| | | | | | | | |

| | | | Banks — 11.0% | | | | |

| | 581,100 | | | Bank of America Corp. | | | 9,779,913 | |

| | 147,900 | | | Citigroup, Inc. | | | 7,653,825 | |

| | 110,100 | | | JPMorgan Chase & Co. | | | 7,269,903 | |

| | 87,000 | | | Wells Fargo & Co. | | | 4,729,320 | |

| | | | | | | | |

| | | | | | | 29,432,961 | |

| | | | | | | | |

| | | | Beverages — 1.5% | | | | |

| | 36,400 | | | Diageo PLC, Sponsored ADR | | | 3,970,148 | |

| | | | | | | | |

| | | | Capital Markets — 7.9% | | | | |

| | 104,600 | | | Bank of New York Mellon Corp. (The) | | | 4,311,612 | |

| | 88,000 | | | Franklin Resources, Inc. | | | 3,240,160 | |

| | 28,460 | | | Goldman Sachs Group, Inc. (The) | | | 5,129,346 | |

| | 84,500 | | | State Street Corp. | | | 5,607,420 | |

| | 38,000 | | | T. Rowe Price Group, Inc. | | | 2,716,620 | |

| | | | | | | | |

| | | | | | | 21,005,158 | |

| | | | | | | | |

| | | | Chemicals — 2.4% | | | | |

| | 64,600 | | | Monsanto Co. | | | 6,364,392 | |

| | | | | | | | |

| | | | Communications Equipment — 1.5% | | | | |

| | 77,900 | | | QUALCOMM, Inc. | | | 3,893,832 | |

| | | | | | | | |

| | | | Consumer Finance — 5.1% | | | | |

| | 175,600 | | | Ally Financial, Inc.(b) | | | 3,273,184 | |

| | 78,100 | | | American Express Co. | | | 5,431,855 | |

| | 67,300 | | | Capital One Financial Corp. | | | 4,857,714 | |

| | | | | | | | |

| | | | | | | 13,562,753 | |

| | | | | | | | |

| | | | Electronic Equipment, Instruments & Components — 2.0% | | | | |

| | 82,700 | | | TE Connectivity Ltd. | | | 5,343,247 | |

| | | | | | | | |

| | | | Energy Equipment & Services — 2.1% | | | | |

| | 111,600 | | | Halliburton Co. | | | 3,798,864 | |

| | 58,400 | | | National Oilwell Varco, Inc. | | | 1,955,816 | |

| | | | | | | | |

| | | | | | | 5,754,680 | |

| | | | | | | | |

| | | | Food Products — 3.0% | | | | |

| | 66,300 | | | General Mills, Inc. | | | 3,822,858 | |

| | 58,200 | | | Nestle S.A., Sponsored ADR | | | 4,331,244 | |

| | | | | | | | |

| | | | | | | 8,154,102 | |

| | | | | | | | |

| | | | Health Care Equipment & Supplies — 2.0% | | | | |

| | 68,300 | | | Medtronic PLC | | | 5,253,636 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 24

Portfolio of Investments – as of December 31, 2015

Natixis Oakmark Fund – (continued)

| | | | | | | | |

| Shares | | | Description | | Value (†) | |

| | | | Health Care Providers & Services — 1.9% | | | | |

| | 42,200 | | | UnitedHealth Group, Inc. | | $ | 4,964,408 | |

| | | | | | | | |

| | | | Household Durables — 1.8% | | | | |

| | 32,750 | | | Whirlpool Corp. | | | 4,809,993 | |

| | | | | | | | |

| | | | Industrial Conglomerates — 3.0% | | | | |

| | 254,400 | | | General Electric Co. | | | 7,924,560 | |

| | | | | | | | |

| | | | Insurance — 7.9% | | | | |

| | 93,100 | | | Aflac, Inc. | | | 5,576,690 | |

| | 119,500 | | | American International Group, Inc. | | | 7,405,415 | |

| | 50,350 | | | Aon PLC | | | 4,642,773 | |

| | 76,100 | | | Principal Financial Group, Inc. | | | 3,422,978 | |

| | | | | | | | |

| | | | | | | 21,047,856 | |

| | | | | | | | |

| | | | Internet & Catalog Retail — 2.0% | | | | |

| | 193,600 | | | Liberty Interactive Corp./QVC Group, Class A(b) | | | 5,289,152 | |

| | | | | | | | |

| | | | Internet Software & Services — 3.4% | | | | |

| | 11,540 | | | Alphabet, Inc., Class A(b) | | | 8,978,235 | |

| | | | | | | | |

| | | | IT Services — 7.4% | | | | |

| | 70,900 | | | Automatic Data Processing, Inc. | | | 6,006,648 | |

| | 72,800 | | | MasterCard, Inc., Class A | | | 7,087,808 | |

| | 86,720 | | | Visa, Inc., Class A | | | 6,725,136 | |

| | | | | | | | |

| | | | | | | 19,819,592 | |

| | | | | | | | |

| | | | Machinery — 4.9% | | | | |

| | 70,700 | | | Caterpillar, Inc. | | | 4,804,772 | |

| | 48,800 | | | Cummins, Inc. | | | 4,294,888 | |

| | 40,500 | | | Parker Hannifin Corp. | | | 3,927,690 | |

| | | | | | | | |

| | | | | | | 13,027,350 | |

| | | | | | | | |

| | | | Media — 2.7% | | | | |

| | 49,100 | | | Comcast Corp., Class A | | | 2,770,713 | |

| | 323,800 | | | News Corp., Class A | | | 4,325,968 | |

| | | | | | | | |

| | | | | | | 7,096,681 | |

| | | | | | | | |

| | | | Oil, Gas & Consumable Fuels — 4.0% | | | | |

| | 78,400 | | | Anadarko Petroleum Corp. | | | 3,808,672 | |

| | 135,900 | | | Apache Corp. | | | 6,043,473 | |

| | 197,000 | | | Chesapeake Energy Corp. | | | 886,500 | |

| | | | | | | | |

| | | | | | | 10,738,645 | |

| | | | | | | | |

| | | | Personal Products — 1.5% | | | | |

| | 91,300 | | | Unilever PLC, Sponsored ADR | | | 3,936,856 | |

| | | | | | | | |

| | | | Pharmaceuticals — 1.5% | | | | |

| | 93,100 | | | Sanofi, Sponsored ADR | | | 3,970,715 | |

| | | | | | | | |

| | | | Road & Rail — 1.4% | | | | |

| | 48,100 | | | Union Pacific Corp. | | | 3,761,420 | |

| | | | | | | | |

| | | | Semiconductors & Semiconductor Equipment — 5.6% | | | | |

| | 144,200 | | | Applied Materials, Inc. | | | 2,692,214 | |

| | 189,700 | | | Intel Corp. | | | 6,535,165 | |

| | 103,500 | | | Texas Instruments, Inc. | | | 5,672,835 | |

| | | | | | | | |

| | | | | | | 14,900,214 | |

| | | | | | | | |

See accompanying notes to financial statements.

25 |

Portfolio of Investments – as of December 31, 2015

Natixis Oakmark Fund – (continued)

| | | | | | | | |

| Shares | | | Description | | Value (†) | |

| | | | Software — 4.4% | | | | |

| | 109,000 | | | Microsoft Corp. | | $ | 6,047,320 | |

| | 154,500 | | | Oracle Corp. | | | 5,643,885 | |

| | | | | | | | |

| | | | | | | 11,691,205 | |

| | | | | | | | |

| | | | Technology Hardware, Storage & Peripherals — 2.1% | | | | |

| | 53,950 | | | Apple, Inc. | | | 5,678,777 | |

| | | | | | | | |

| | | | Total Common Stocks

(Identified Cost $253,862,002) | | | 266,029,711 | |

| | | | | | | | |

| | | | | | | | |

Principal

Amount | | | | | | |

| | Short-Term Investments — 1.4% | |

| $ | 3,795,407 | | | Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 12/31/2015 at 0.030% to be repurchased at $3,795,420 on 1/04/2016 collateralized by $3,910,000 U.S.Treasury Note, 1.750% due 2/28/2022 valued at $3,875,788 including accrued interest (Note 2 of Notes to Financial Statements) (Identified Cost $3,795,407) | | | 3,795,407 | |

| | | | | | | | |

| | | | | | | | |

| | | | Total Investments — 101.3%

(Identified Cost $257,657,409)(a) | | | 269,825,118 | |

| | | | Other assets less liabilities — (1.3)% | | | (3,556,837 | ) |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 266,268,281 | |

| | | | | | | | |

| | | | | | | | |

| | (†) | | | See Note 2 of Notes to Financial Statements. | | | | |

| | (a) | | | Federal Tax Information: | | | | |

| | | | At December 31, 2015, the net unrealized appreciation on investments based on a cost of $258,325,583 for federal income tax purposes was as follows: | |

| | | | Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | | $ | 33,430,341 | |

| | | | Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | | | (21,930,806 | ) |

| | | | | | | | |