UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-04323

Natixis Funds Trust I

(Exact name of Registrant as specified in charter)

888 Boylston Street, Suite 800, Boston, Massachusetts 02199-8197

(Address of principal executive offices) (Zip code)

Russell L. Kane, Esq.

Natixis Distribution, L.P.

888 Boylston Street, Suite 800

Boston, Massachusetts 02199-8197

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617)449-2822

Date of fiscal year end: December 31

Date of reporting period: December 31, 2019

Item 1. Reports to Stockholders.

The Registrant’s annual report transmitted to shareholders pursuant to Rule30e-1 under the Investment Company Act of 1940 is as follows:

Annual Report

December 31, 2019

Loomis Sayles High Income Fund

Loomis Sayles Investment Grade Bond Fund

Loomis Sayles Multi-Asset Income Fund

Table of Contents

IMPORTANT NOTICE TO SHAREHOLDERS

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you wish to continue receiving paper copies of your shareholder reports after January 1, 2021, you can inform the Fund at any time by calling 1-800-225-5478. If you hold your account with a financial intermediary and you wish to continue receiving paper copies after January 1, 2021, you should call your financial intermediary directly. Paper copies are provided free of charge, and your election to receive reports in paper will apply to all funds held with the Natixis Funds complex. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You currently may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically at www.icsdelivery.com/natixisfunds.

LOOMIS SAYLES HIGH INCOME FUND

| | |

| |

| Managers | | Symbols |

| |

| Matthew J. Eagan, CFA® | | Class A NEFHX |

| |

| Brian P. Kennedy | | Class C NEHCX |

| |

| Elaine M. Stokes | | Class N LSHNX |

| |

| Todd P. Vandam, CFA® | | Class Y NEHYX |

| |

| Loomis, Sayles & Company, L.P. | | |

Investment Goal

The Fund seeks high current income plus the opportunity for capital appreciation to produce a high total return.

Market Conditions

The fixed income markets produced robust returns in 2019, reflecting global central banks’ shift to more accommodative policies. A backdrop of moderate economic growth and low inflation provided the US Federal Reserve (the “Fed”) with the latitude to lower interest rates by a quarter point on three occasions in the span from July to October. While the Fed subsequently made it clear that it was unlikely to enact any further cuts in the near future barring a meaningful slowdown in growth, investors remained confident that it would keep rates steady throughout 2020. A number of other world central banks followed the Fed’s move toward easier policy, highlighted by the European Central Bank’s pledge to restart its stimulative quantitative easing program.

US Treasuries performed well in this environment, with falling yields (and rising prices) for bonds of all maturities. The yield on the bellwether 10-year note fell from 2.69% to 1.92% in 2019, while the two-year issue moved from 2.48% to 1.58%. As a result, the yield curve steepened compared to its level of December 31, 2018. The Treasury market reached its peak in late August, at which point yields began to tick higher as investors factored in improving economic data and the apparently low likelihood of further cuts in the coming year.

High-grade corporate bonds performed very well and finished the year as one of the best performing areas of the bond market. In addition to benefiting from the decline in Treasury yields, the asset class was helped by continued spread compression and elevated demand for high quality investments.

Lower-quality corporate debt also rallied in 2019 as the search for yield continued. The category was boosted by broad strength across higher-risk assets, an accommodative Fed and a benign economic outlook for 2020.

Domestic inflation remained tame, mirroring a trend that was in place across the globe. After flirting with the 2% level in late 2018, US core personal consumption expenditure inflation (which excludes food and energy) settled into a range between 1.5% and 1.7% from February onward. Low inflation was one of the key factors providing the Fed and foreign central banks with the ability to loosen policy in order to address slowing growth.

1 |

Performance Results

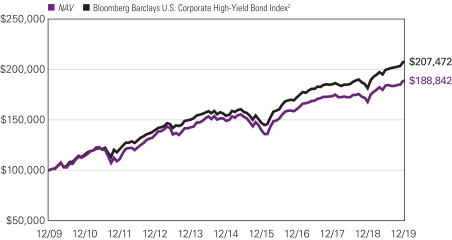

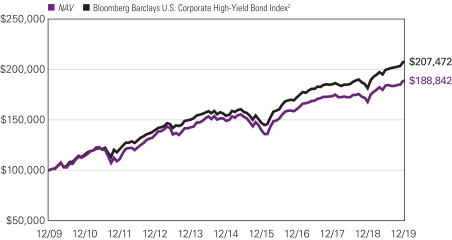

For the 12 months ended December 31, 2019, Class Y shares of the Loomis Sayles High Income Fund returned 12.52% at net asset value. The Fund underperformed its benchmark, the Bloomberg Barclays U.S. Corporate High-Yield Bond Index, which returned 14.32%.

Explanation of Fund Performance

Security selection was the primary source of underperformance for the year. Within convertibles, selected energy holdings weighed on returns. Allocations to securitized issues and defensive reserve-like positions were also detractors as they underperformed higher-yielding securities during the period.

The Fund’s longer-than-benchmark positioning with respect to duration (and corresponding interest rate sensitivity) aided relative performance as yields declined over the period. Emerging market credit exposure positively contributed to performance as well, led by basic industry, consumer non-cyclical and government-related names. Finally, security selection within investment grade credit positively impacted performance during the year, most notably holdings of electric, banking and technology issues.

Outlook

We continue to believe we are late in the credit cycle1 rather than at the end of it. Probabilities of a shift to a downturn in the cycle declined over the fourth quarter as the Fed provided additional rate cuts, a phase one deal with China became increasingly likely and odds of a no-deal Brexit declined. We do not see the US economy sliding into recession in 2020. These developments fueled further support for corporate bonds and risk assets, driving valuations up and delivering a strong year for fixed income assets in 2019.

Our macro outlook remains benign and the market backdrop has largely remained supportive. We believe that Fed rate cuts and relatively good news on trade and Brexit will allow the United States to emerge from a third “mini cycle” slow down within this long running late cycle phase without a recession. We expect global manufacturing to continue to improve into 2020 as uncertainty regarding global trade declines. We anticipate that slow, but positive, global growth will continue and that this will help support mid-single digit corporate profit growth and allow for reasonably strong corporate credit metrics in 2020.

We expect the US Fed to remain on hold for most, if not all, of 2020. Inflation remains well contained. Overall yield levels in the United States should remain within current established ranges, although there could be some modest upward pressure on yields should the global macro environment firm more quickly on better-than-expected news on the trade front. From a duration perspective, we remain modestly short relative to the broad market. Nonetheless, global developed market yields will likely remain low and relatively high US yields should be a supportive technical factor for US bonds.

The double-barreled market rally of lower yields and tighter spreads has pushed valuations on corporate bonds higher. High yield and investment grade corporate bond risk premiums declined over the course of 2019. While we believe that the global demand for yield and a continued late cycle environment can support spreads at current levels, we expect returns to be

| 2

LOOMIS SAYLES HIGH INCOME FUND

based more on carry in 2020. We believe corporate credit quality will continue to marginally decline but not enough to cause a dramatic move wider in spreads or a large uptick in corporate defaults. That said, we retain a cautious and “up in quality” bias. By historic standards we have less exposure to high yield bonds than usual, while retaining relatively high liquidity which can be deployed should opportunities develop within the sector.

We continue to strive for positive issue selection through our credit research efforts. Our portfolios are dominated by credits we believe are attractively priced relative to the credit quality we assign them. Communications and cable and media issues account for the bulk of this exposure, along with select areas within consumer cyclical. We believe that opportunities for positive carry in emerging market corporate bonds could expand should global growth strengthen. While we have pulled back some of our energy exposure, we believe sentiment regarding the sector has become too negative relative to the actual fundamentals. Accordingly, we believe there is upside potential for some of our best picks in this sector.

We also remain comfortable with the securitized sector, which largely lagged the bigger moves in other fixed income sectors in 2019. We still like the defensive nature of the sector based on good carry for higher quality.

Overall, we believe that the large rally seen in 2019 presents a challenge to fixed income return potential in 2020. However, some of those same market drivers could provide support as we enter a new year. These include global demand for yield, reduced uncertainty on global trade and Brexit, and positive global growth. The late cycle environment is likely to continue. We remain focused on maintaining favorable carry/yield, seeking to identify attractively priced bonds and retaining the liquidity and flexibility to adapt should the benign market conditions deteriorate.

| 1 | A credit cycle is a cyclical pattern that follows credit availability and corporate health. |

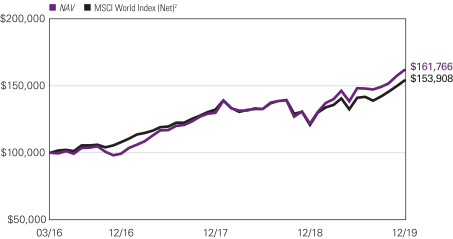

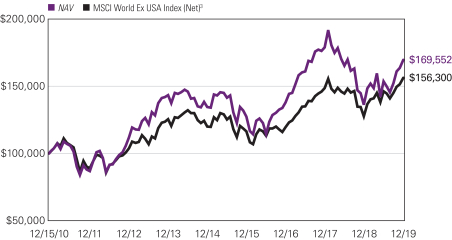

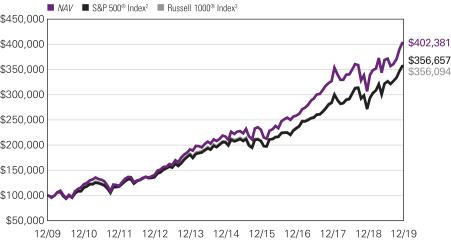

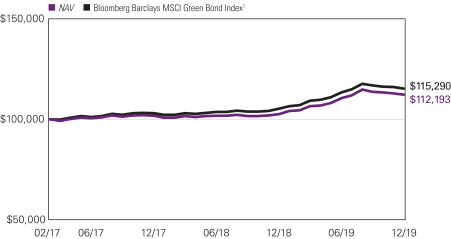

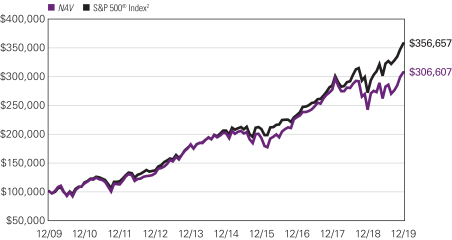

Hypothetical Growth of $100,000 Investment in Class Y Shares3

December 31, 2009 through December 31, 2019

3 |

Average Annual Total Returns — December 31, 20193

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Expense Ratios4 | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | Life of

Class N | | | Gross | | | Net | |

| | | | | | | |

| Class Y (Inception 2/29/08) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 12.52 | % | | | 4.84 | % | | | 6.56 | % | | | — | % | | | 1.02 | % | | | 0.75 | % |

| | | | | | | |

| Class A (Inception 2/22/84) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 11.94 | | | | 4.51 | | | | 6.25 | | | | — | | | | 1.27 | | | | 1.00 | |

| With 4.25% Maximum Sales Charge | | | 7.11 | | | | 3.61 | | | | 5.79 | | | | — | | | | | | | | | |

| | | | | | | |

| Class C (Inception 3/2/98) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 11.32 | | | | 3.76 | | | | 5.46 | | | | — | | | | 2.02 | | | | 1.75 | |

| With CDSC1 | | | 10.32 | | | | 3.76 | | | | 5.46 | | | | — | | | | | | | | | |

| | | | | | | |

| Class N (Inception 11/30/16) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 12.28 | | | | — | | | | — | | | | 5.86 | | | | 0.89 | | | | 0.70 | |

| | | | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | | | | | | | | | |

| Bloomberg Barclays U.S.Corporate High-Yield Bond Index2 | | | 14.32 | | | | 6.13 | | | | 7.57 | | | | 6.80 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Class C shares performance assumes a 1% CDSC applied when you sell shares within one year of purchase. |

| 2 | The Bloomberg Barclays U.S. Corporate High-Yield Bond Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below, excluding emerging market debt. The Bloomberg Barclays U.S. Corporate High-Yield Bond Index was created in 1986, with history backfilled to July 1, 1983, and rolls up into the Bloomberg Barclays U.S. Universal and Global High-Yield Indices. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 4/30/21. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 6 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

| 4

LOOMIS SAYLES INVESTMENT GRADE BOND FUND

| | | | |

| | |

| Managers | | Symbols | | |

| | |

| Matthew J. Eagan, CFA® | | Class A | | LIGRX |

| | |

| Brian P. Kennedy | | Class C | | LGBCX |

| | |

| Elaine M. Stokes | | Class N | | LGBNX |

| | |

| Loomis, Sayles & Company, L.P. | | Class Y | | LSIIX |

| | |

| | Admin Class | | LIGAX |

Investment Goal

The Fund seeks high total investment return through a combination of current income and capital appreciation.

Market Conditions

The fixed income markets produced robust returns in 2019, reflecting global central banks’ shift to more accommodative policies. A backdrop of moderate economic growth and low inflation provided the US Federal Reserve (the “Fed”) with the latitude to lower interest rates by a quarter point on three occasions in the span from July to October. While the Fed subsequently made it clear that it was unlikely to enact any further cuts in the near future barring a meaningful slowdown in growth, investors remained confident that it would keep rates steady throughout 2020. A number of other world central banks followed the Fed’s move toward easier policy, highlighted by the European Central Bank’s pledge to restart its stimulative quantitative easing program.

US Treasuries performed well in this environment, with falling yields (and rising prices) for bonds of all maturities. The yield on the bellwether 10-year note fell from 2.69% to 1.92% in 2019, while the two-year issue moved from 2.48% to 1.58%. As a result, the yield curve steepened compared to its level of December 31, 2018. The Treasury market reached its peak in late August, at which point yields began to tick higher as investors factored in improving economic data and the apparently low likelihood of further cuts in the coming year.

High-grade corporate bonds performed very well and finished the year as one of the best performing areas of the bond market. In addition to benefiting from the decline in Treasury yields, the asset class was helped by continued spread compression and elevated demand for high quality investments.

Lower-quality corporate debt also rallied in 2019 as the search for yield continued. The category was boosted by broad strength across higher-risk assets, an accommodative Fed and a benign economic outlook for 2020.

Domestic inflation remained tame, mirroring a trend that was in place across the globe. After flirting with the 2% level in late 2018, US core personal consumption expenditure inflation (which excludes food and energy) settled into a range between 1.5% and 1.7% from February onward. Low inflation was one of the key factors providing the Fed and foreign central banks with the ability to loosen policy in order to address slowing growth.

5 |

Performance Results

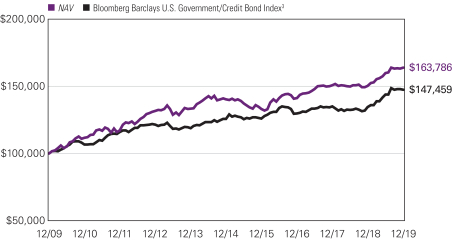

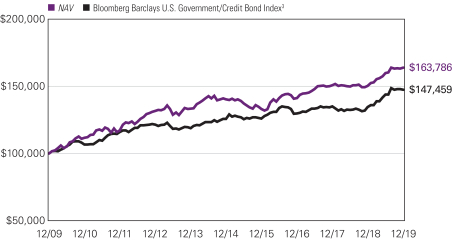

For the 12 months ended December 31, 2019, Class Y shares of the Loomis Sayles Investment Grade Bond Fund returned 9.04% at net asset value. The Fund underperformed its benchmark, the Bloomberg Barclays U.S. Government/Credit Bond Index, which returned 9.71%.

Explanation of Fund Performance

The Fund’s overall shorter-than-benchmark positioning with respect to duration weighed on return as interest rates declined over the period. Exposure to securitized issues had the largest negative impact on relative performance as the sector lagged both corporate credit and Treasuries. Additionally, holdings of defensive reserve-like positions detracted as these underperformed higher-yielding issues during the period.

A significant underweight to US Treasuries bolstered relative performance. An allocation to high yield corporate credit positively impacted performance during the year, aided by consumer non-cyclical, energy and banking names. Emerging market credit exposure also generated positive relative return, with metals & mining and government-related issues as top performers.

Outlook

We continue to believe we are late in the credit cycle1 rather than at the end of it. Probabilities of a shift to a downturn in the cycle declined over the fourth quarter as the Fed provided additional rate cuts, a phase one deal with China became increasingly likely and odds of a no-deal Brexit declined. We do not see the US economy sliding into recession in 2020. These developments fueled further support for corporate bonds and risk assets, driving valuations up and delivering a strong year for fixed income assets in 2019.

Our macro outlook remains benign and the market backdrop has largely remained supportive. We believe that Fed rate cuts and relatively good news on trade and Brexit will allow the US to emerge from a third “mini cycle” slow down within this long running late cycle phase without a recession. We expect global manufacturing to continue to improve into 2020 as uncertainty regarding global trade declines. We anticipate that slow, but positive, global growth will continue and that this will help support mid-single digit corporate profit growth and allow for reasonably strong corporate credit metrics in 2020.

We expect the Fed to remain on hold for most, if not all, of 2020. Inflation remains well contained. Overall yield levels in the United States should remain within current established ranges, although there could be some modest upward pressure on yields should the global macro environment firm more quickly on better-than-expected news on the trade front. From a duration perspective, we remain modestly short relative to the broad market. Nonetheless, global developed market yields will likely remain low and relatively high US yields should be a supportive technical factor for US bonds.

The double-barreled market rally of lower yields and tighter spreads has pushed valuations on corporate bonds higher. High yield and investment grade corporate bond risk premiums declined over the course of 2019. While we believe that the global demand for yield and a continued late cycle environment can support spreads at current levels, we expect returns to be

| 6

LOOMIS SAYLES INVESTMENT GRADE BOND FUND

based more on carry in 2020. We believe corporate credit quality will continue to marginally decline but not enough to cause a dramatic move wider in spreads or a large uptick in corporate defaults. That said, we retain a cautious and “up in quality” bias. By historic standards we have less exposure to high yield bonds than usual, while retaining relatively high liquidity which can be deployed should opportunities develop within the sector.

We continue to strive for positive issue selection through our credit research efforts. Our portfolios are dominated by credits we believe are attractively priced relative to the credit quality we assign them. Communications and cable and media issues account for the bulk of this exposure, along with select areas within consumer cyclical. We believe that opportunities for positive carry in emerging market corporate bonds could expand should global growth strengthen. While we have pulled back some of our energy exposure, we believe sentiment regarding the sector has become too negative relative to the actual fundamentals. Accordingly, we believe there is upside potential for some of our best picks in this sector.

We also remain comfortable with the securitized sector, which largely lagged the bigger moves in other fixed income sectors in 2019. We still like the defensive nature of the sector based on good carry for higher quality.

Overall, we believe that the large rally seen in 2019 presents a challenge to fixed income return potential in 2020. However, some of those same market drivers could provide support as we enter a new year. These include global demand for yield, reduced uncertainty on global trade and Brexit, and positive global growth. The late cycle environment is likely to continue. We remain focused on maintaining favorable carry/yield, seeking to identify attractively priced bonds and retaining the liquidity and flexibility to adapt should the benign market conditions deteriorate.

| 1 | A credit cycle is a cyclical pattern that follows credit availability and corporate health. |

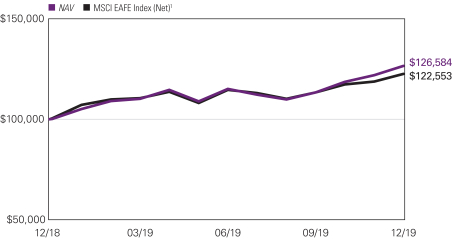

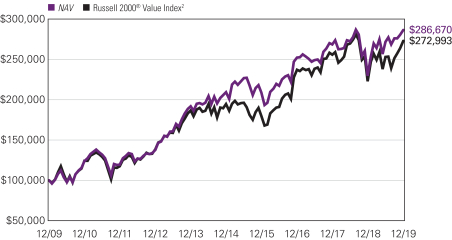

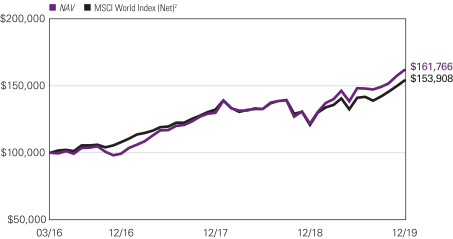

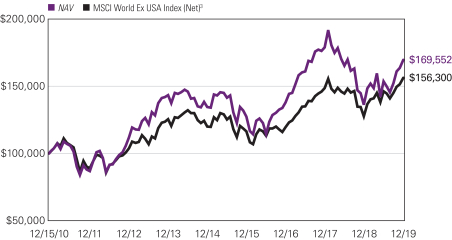

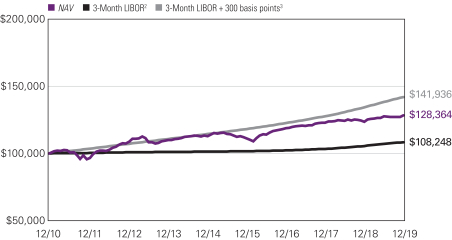

Hypothetical Growth of $100,000 Investment in Class Y Shares4

December 31, 2009 through December 31, 2019

7 |

Average Annual Total Returns — December 31, 20194

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Expense Ratios5 | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | Life of

Class N | | | Gross | | | Net | |

| | | | | | | |

| Class Y (Inception 12/31/96) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 9.04 | % | | | 3.16 | % | | | 5.06 | % | | | — | % | | | 0.57 | % | | | 0.51 | % |

| | | | | | | |

| Class A (Inception 12/31/96) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 8.78 | | | | 2.90 | | | | 4.79 | | | | — | | | | 0.82 | | | | 0.76 | |

| With 4.25% Maximum Sales Charge | | | 4.14 | | | | 2.01 | | | | 4.33 | | | | — | | | | | | | | | |

| | | | | | | |

| Class C (Inception 9/12/03) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 7.94 | | | | 2.12 | | | | 4.01 | | | | — | | | | 1.57 | | | | 1.51 | |

| With CDSC2 | | | 6.94 | | | | 2.12 | | | | 4.01 | | | | — | | | | | | | | | |

| | | | | | | |

| Class N (Inception 2/1/13) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 9.11 | | | | 3.25 | | | | — | | | | 3.20 | | | | 0.48 | | | | 0.46 | |

| | | | | | | |

| Admin Class (Inception 2/1/10)1 | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 8.43 | | | | 2.67 | | | | 4.54 | | | | — | | | | 1.07 | | | | 1.01 | |

| | | | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | | | | | | | | | |

| Bloomberg Barclays U.S. Government/Credit Bond Index3 | | | 9.71 | | | | 3.23 | | | | 3.96 | | | | 2.97 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Prior to the inception of Admin Class shares (2/1/10), performance is that of Class A shares, restated to reflect the higher net expenses of Admin Class shares. |

| 2 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 3 | The Bloomberg Barclays U.S. Government/Credit Bond Index is the non-securitized component of the U.S. Aggregate Index and was the first macro index launched by Barclays Capital. The U.S. Government/Credit Bond Index includes investment grade, US dollar denominated, fixed rate Treasuries (i.e., public obligations of the U.S. Treasury that have remaining maturities of more than one year), government-related issues (i.e., agency, sovereign, supranational, and local authority debt), and corporate securities. The U.S. Government/Credit Index was launched on January 1, 1979, with index history backfilled to 1973, and is a subset of the Bloomberg Barclays U.S. Aggregate Index. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 5 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 4/30/21. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 6 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

| 8

LOOMIS SAYLES MULTI-ASSET INCOME FUND

| | | | |

| | |

| Managers | | Symbols | | |

| | |

| Thomas Fahey | | Class A | | IIDPX |

| | |

| Kevin Kearns | | Class C | | CIDPX |

| | |

| Maura Murphy, CFA® | | Class N | | LMINX |

| | |

| Loomis, Sayles & Company, L.P. | | Class Y | | YIDPX |

Investment Goal

The Fund seeks current income with a secondary objective of capital appreciation.

Market Conditions

Subdued inflation has allowed central banks to maintain largely accommodative policies, which have supported risk assets. The US Federal Reserve’s (the “Fed”) indication that it will pause has given way to the expectation of yields to be tightly range bound.

Despite persistently soft data, some signs have been seen to indicate that the manufacturing slowdown may be bottoming out. Easy monetary policy has largely been used to counteract anemic global growth encumbered by the manufacturing slowdown.

Risk assets have been supported by the macro risk landscape softening in several regards since the end of the previous year. Central banks have shown a willingness to continue economic stimulus through monetary policy. The likelihood of a no deal Brexit appears to have diminished with negotiations spanning multiple Brexit deadlines. Trade negotiations between China and the US seem to have taken on a less tenuous tone; suggesting a lower probability of escalation and higher probability of a “phase one” agreement being reached.

Performance Results

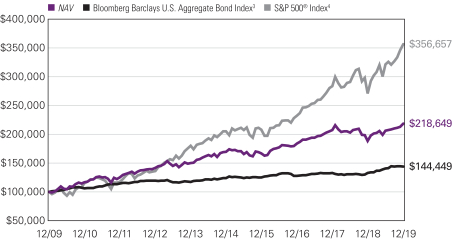

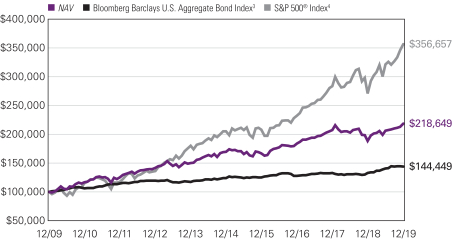

For the 12 months ended December 31, 2019, Class Y shares of the Loomis Sayles Multi-Asset Income Fund returned 15.80% at net asset value. The Fund outperformed its primary benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, which returned 8.72%.

Explanation of Fund Performance

Our allocation to US dividend-paying equities provided the largest positive contribution to performance for the year. During the period, markets remained focused on the direction of the US/China trade negotiations, the state of the Chinese economy and central bank policy in response to anemic growth and soft manufacturing data. Equity markets were assisted by a Fed that remained largely supportive throughout the year.

Our allocation to preferred stock benefited from a strong equity market and accommodative central bank policy throughout the period. In addition, the Fund’s focus on financial issues within preferreds added to the performance.

Exposure to emerging market fixed income assets aided performance despite a strong dollar. The perceived softening of Chinese trade-related macro risks buoyed the asset class. There remains a concern that a protracted trade conflict between the United States and

9 |

China could exacerbate the global growth slowdown and increase pressure on export-driven economies. The focus within emerging markets remains on China regarding both its trade relations with the US and its pace of growth. Within the portfolio, the most significant contributions came from our Brazilian, Qatari and South African exposures.

An allocation to bank loan assets was the largest detractor during the year. The accommodative tack taken by the Fed throughout the year created headwinds for floating rate instruments. Within the portfolio, energy issues had the largest negative impact on performance.

Outlook

While near-term downside risks remain present, we expect to exit the manufacturing slowdown without an economy-wide recession. This view hinges on the idea that the Fed will remain supportive and continue accommodative monetary policy. We project the Fed to remain on hold for the next twelve months. Chair Powell has indicated that a rate cut is unlikely in the near term, barring any significant, unexpected increase in inflation acceleration.

We maintain our cautious outlook on risk sentiment. While the Fed appears likely to continue to maintain an accommodative monetary policy, China’s economic recovery is faltering and risk related to the United States/China trade war remains despite an increased likelihood of a phase one agreement. Markets will remain focused on Chinese stimulus as a potential catalyst for global growth. So far, however, Chinese policy makers have been reluctant to utilize all options available, instead favoring an incremental approach that emphasizes leverage stabilization.

Despite some volatility, the US dollar has essentially traded within a range. We expect a continuation of this theme, which should be supportive for risk assets in general. While there was some dollar weakening during October, we haven’t seen much of a breakout in either direction since. The perception of softening risks related to United States/China trade has caused the dollar’s recent bid as a safe-haven to largely evaporate. Volatility shocks and weakening risk appetite are factors that could prove constructive for the dollar.

The fund closed as of February 3, 2020, and as it closed, primary consideration was given to clients and their interests. There was no unusual market action that affected our trading of the portfolio during liquidation. All fund assets were subsequently redeemed or distributed to fund shareholders.

| 10

LOOMIS SAYLES MULTI-ASSET INCOME FUND

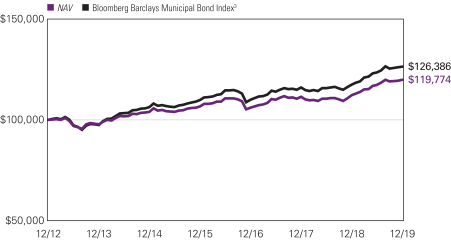

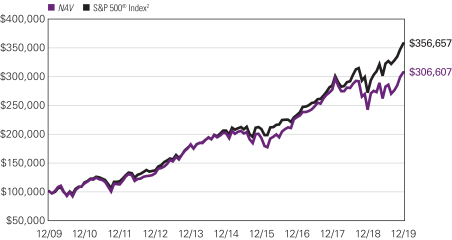

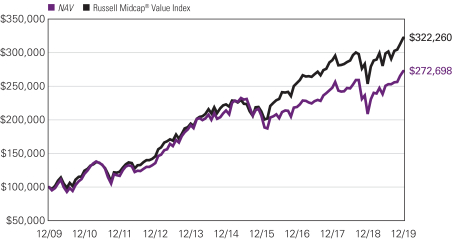

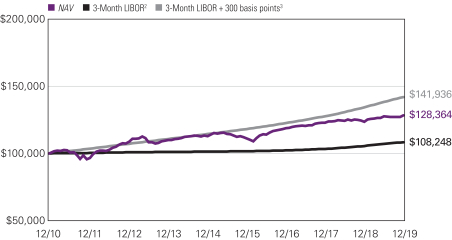

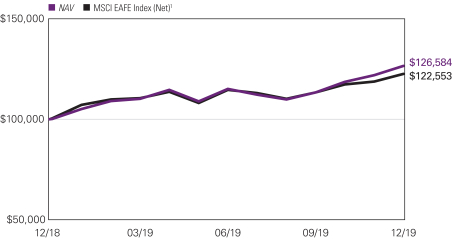

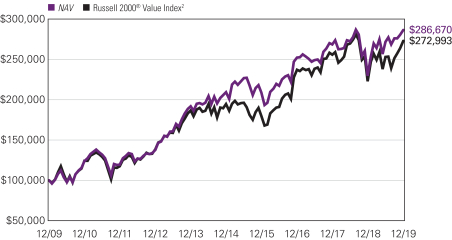

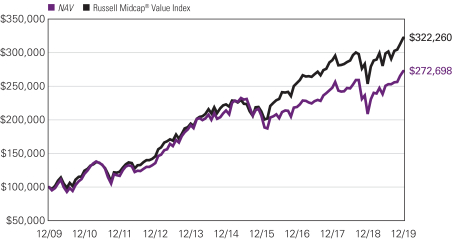

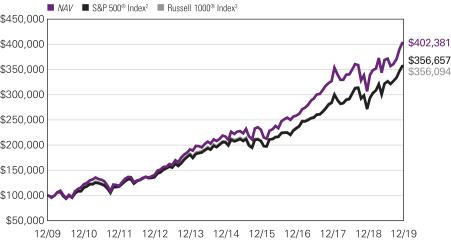

Hypothetical Growth of $100,000 Investment in Class Y Shares1,5,6

December 31, 2009 through December 31, 2019

Top Ten Holdings as of December 31, 2019

| | | | | | |

| | | Security Name | | % of

Assets | |

| 1 | | Alerian MLP ETF | | | 5.06 | % |

| 2 | | Gol LuxCo S.A., 1st Lien Term Loan, 6.500%, 8/31/2020 | | | 2.41 | |

| 3 | | Standard Chartered PLC, (fixed rate to 4/02/2023, variable rate thereafter), 7.750% | | | 2.30 | |

| 4 | | Apple, Inc. | | | 1.98 | |

| 5 | | HSBC Holdings PLC, (fixed rate to 3/23/2023, variable rate thereafter), 6.250% | | | 1.92 | |

| 6 | | Royal Bank of Scotland Group PLC, (fixed rate to 8/10/2025, variable rate thereafter), 8.000% | | | 1.87 | |

| 7 | | Banco BTG Pactual SA, (fixed rate to 2/15/2024, variable rate thereafter), 7.750%, 2/15/2029 | | | 1.86 | |

| 8 | | Credit Agricole S.A., (fixed rate to 1/23/2024, variable rate thereafter), 7.875% | | | 1.85 | |

| 9 | | Microsoft Corp. | | | 1.76 | |

| 10 | | Banco Bilbao Vizcaya Argentaria S.A., (fixed rate to 11/16/2027, variable rate thereafter), 6.125% | | | 1.43 | |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

11 |

Average Annual Total Returns — December 31, 20195,6

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | Life of

| | | Expense Ratios7 | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | Class N | | | Gross | | | Net | |

| | | | | | | |

| Class Y (Inception 12/3/12)1 | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 15.80 | % | | | 5.18 | % | | | 8.13 | % | | | — | % | | | 0.89 | % | | | 0.75 | % |

| | | | | | | |

| Class A (Inception 11/17/05) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 15.39 | | | | 4.92 | | | | 7.98 | | | | — | | | | 1.14 | | | | 1.00 | |

| With 4.25% Maximum Sales Charge | | | 10.51 | | | | 4.00 | | | | 7.52 | | | | — | | | | | | | | | |

| | | | | | | |

| Class C (Inception 11/17/05) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 14.59 | | | | 4.14 | | | | 7.18 | | | | — | | | | 1.89 | | | | 1.75 | |

| With CDSC2 | | | 13.59 | | | | 4.14 | | | | 7.18 | | | | — | | | | | | | | | |

| | | | | | | |

| Class N (Inception 8/31/15) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 15.86 | | | | — | | | | — | | | | 6.98 | | | | 1.38 | | | | 0.70 | |

| | | | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | | | | | | | | | |

| Bloomberg Barclays U.S. Aggregate Bond Index3 | | | 8.72 | | | | 3.05 | | | | 3.75 | | | | 3.40 | | | | | | | | | |

| S&P 500® Index4 | | | 31.49 | | | | 11.70 | | | | 13.56 | | | | 14.32 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Prior to the inception of Class Y shares (12/3/2012), performance is that of Class A shares and reflects the higher net expenses of that share class. |

| 2 | Class C share performance assumes a 1.00% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 3 | The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index that covers the U.S.-dollar denominated, investment grade, fixed-rate, taxable bond market of SEC-registered securities. The index includes bonds from the Treasury, government-related, corporate, mortgage-backed securities, asset-backed securities, and collateralized mortgage-backed securities sectors. |

| 4 | S&P 500® Index is a widely recognized measure of U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. |

| 5 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 6 | Prior to the stock market close August 31, 2015, the Fund had multiple subadvisers. The performance results shown above for the periods prior to the stock market close August 31, 2015 reflect results achieved by those subadvisers using different investment strategies. |

| 7 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 4/30/20. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 6 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

| 12

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the Fund is actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

All investing involves risk, including the risk of loss. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

ADDITIONAL INDEX INFORMATION

This document may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with Natixis Investment Managers or any of its related or affiliated companies (collectively “Natixis Affiliates”) and does not sponsor, endorse or participate in the provision of any Natixis Affiliates services, funds or other financial products.

The index information contained herein is derived from third parties and is provided on an “as is” basis. The user of this information assumes the entire risk of use of this information. Each of the third party entities involved in compiling, computing or creating index information disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to such information.

PROXY VOTING INFORMATION

A description of the Natixis Funds’ proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on the Natixis Funds’ website at im.natixis.com; and on the Securities and Exchange Commission’s (“SEC’s”) website at www.sec.gov. Information regarding how the funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available from the Natixis Funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

Natixis Funds file complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Funds’ Forms N-PORT reports are available on the SEC’s website at www.sec.gov.

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

13 |

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different costs: transaction costs, including sales charges (loads) on purchases and contingent deferred sales charges on redemptions, and ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the Funds’ prospectuses. The following examples are intended to help you understand the ongoing costs of investing in the Funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table of each class of Fund shares shows the actual account values and actual Fund expenses you would have paid on a $1,000 investment in the Fund from July 1, 2019 through December 31, 2019. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.6) and multiply the result by the number in the Expenses Paid During Period column as shown below for your class.

The second line in the table of each class of Fund shares provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the Fund to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs, such as sales charges. Therefore, the second line in the table of each fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| 14

| | | | | | | | | | | | |

| LOOMIS SAYLES HIGH INCOME FUND | | BEGINNING

ACCOUNT VALUE

7/1/2019 | | | ENDING

ACCOUNT VALUE

12/31/2019 | | | EXPENSES PAID

DURING PERIOD*

7/1/2019 – 12/31/2019 | |

| Class A | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,022.20 | | | | $5.10 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.16 | | | | $5.09 | |

| Class C | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,020.50 | | | | $8.91 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,016.38 | | | | $8.89 | |

| Class N | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,023.80 | | �� | | $3.57 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,021.68 | | | | $3.57 | |

| Class Y | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,026.00 | | | | $3.83 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,021.43 | | | | $3.82 | |

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.00%, 1.75%, 0.70% and 0.75% for Class A, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

| | | | | | | | | | | | |

LOOMIS SAYLES INVESTMENT GRADE

BOND FUND | | BEGINNING

ACCOUNT VALUE

7/1/2019 | | | ENDING

ACCOUNT VALUE

12/31/2019 | | | EXPENSES PAID

DURING PERIOD*

7/1/2019 – 12/31/2019 | |

| Class A | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,024.40 | | | | $3.88 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,021.37 | | | | $3.87 | |

| Class C | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,020.60 | | | | $7.69 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,017.59 | | | | $7.68 | |

| Class N | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,026.00 | | | | $2.35 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,022.89 | | | | $2.35 | |

| Class Y | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,025.70 | | | | $2.60 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,022.64 | | | | $2.60 | |

| Admin Class | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,023.20 | | | | $5.15 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.11 | | | | $5.14 | |

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 0.76%, 1.51%, 0.46%, 0.51% and 1.01% for Class A, C, N, Y and Admin Class, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

15 |

| | | | | | | | | | | | |

LOOMIS SAYLES MULTI-ASSET INCOME

FUND | | BEGINNING

ACCOUNT VALUE

7/1/2019 | | | ENDING

ACCOUNT VALUE

12/31/2019 | | | EXPENSES PAID

DURING PERIOD*

7/1/2019 – 12/31/2019 | |

| Class A | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,055.70 | | | | $4.92 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.42 | | | | $4.84 | |

| Class C | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,052.60 | | | | $8.80 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,016.64 | | | | $8.64 | |

| Class N | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,057.70 | | | | $3.37 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,021.93 | | | | $3.31 | |

| Class Y | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,057.50 | | | | $3.63 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,021.68 | | | | $3.57 | |

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 0.95%, 1.70%, 0.65% and 0.70% for Class A, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

| 16

Portfolio of Investments – as of December 31, 2019

Loomis Sayles High Income Fund

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| | Bonds and Notes — 93.6% of Net Assets | |

| | Non-Convertible Bonds — 87.8% | |

| | | | ABS Home Equity — 0.2% | |

| $ | 70,254 | | | Banc of America Alternative Loan Trust, Series2003-8, Class 1CB1, 5.500%, 10/25/2033 | | $ | 73,692 | |

| | 53,688 | | | Banc of America Funding Trust, Series2007-4, Class 5A1, 5.500%, 11/25/2034 | | | 53,667 | |

| | 159,769 | | | DSLA Mortgage Loan Trust, Series2005-AR5, Class 2A1A,1-month LIBOR + 0.330%, 2.094%, 9/19/2045(a) | | | 130,510 | |

| | | | | | | | |

| | | | | | | 257,869 | |

| | | | | | | | |

| | | | Aerospace & Defense — 2.4% | |

| | 740,000 | | | Bombardier, Inc., 6.000%, 10/15/2022, 144A | | | 739,778 | |

| | 638,000 | | | Leonardo U.S. Holdings, Inc., 6.250%, 1/15/2040, 144A | | | 700,218 | |

| | 383,000 | | | Leonardo U.S. Holdings, Inc., 7.375%, 7/15/2039, 144A | | | 475,839 | |

| | 60,000 | | | Moog, Inc., 4.250%, 12/15/2027, 144A | | | 61,056 | |

| | 365,000 | | | Signature Aviation U.S. Holdings, Inc., 4.000%, 3/01/2028, 144A | | | 359,999 | |

| | 1,155,000 | | | TransDigm, Inc., 6.250%, 3/15/2026, 144A | | | 1,250,415 | |

| | | | | | | | |

| | | | | | | 3,587,305 | |

| | | | | | | | |

| | | | Airlines — 0.5% | |

| | 535,000 | | | Latam Finance Ltd., 6.875%, 4/11/2024, 144A | | | 565,233 | |

| | 200,000 | | | Latam Finance Ltd., 7.000%, 3/01/2026, 144A | | | 216,502 | |

| | | | | | | | |

| | | | | | | 781,735 | |

| | | | | | | | |

| | | | Automotive — 1.2% | |

| | 195,000 | | | Allison Transmission, Inc., 5.000%, 10/01/2024, 144A | | | 199,631 | |

| | 510,000 | | | Allison Transmission, Inc., 5.875%, 6/01/2029, 144A | | | 558,450 | |

| | 285,000 | | | Dana Financing Luxembourg S.a.r.l., 5.750%, 4/15/2025, 144A | | | 297,825 | |

| | 255,000 | | | Delphi Technologies PLC, 5.000%, 10/01/2025, 144A | | | 235,875 | |

| | 115,000 | | | Goodyear Tire & Rubber Co. (The), 5.000%, 5/31/2026 | | | 119,600 | |

| | 420,000 | | | Midas Intermediate Holdco II LLC/Midas Intermediate Holdco II Finance, Inc., 7.875%, 10/01/2022, 144A | | | 383,250 | |

| | | | | | | | |

| | | | | | | 1,794,631 | |

| | | | | | | | |

| | | | Banking — 3.0% | |

| | 700,000 | | | Ally Financial, Inc., 3.875%, 5/21/2024 | | | 733,250 | |

| | 1,730,000 | | | Ally Financial, Inc., 4.625%, 3/30/2025 | | | 1,872,725 | |

| | 485,000 | | | Ally Financial, Inc., 5.750%, 11/20/2025 | | | 542,594 | |

| | 120,000 | | | CIT Group, Inc., 4.125%, 3/09/2021 | | | 122,263 | |

| | 425,000 | | | Deutsche Bank AG, (fixed rate to 12/01/2027, variable rate thereafter), 4.875%, 12/01/2032 | | | 400,563 | |

| | 470,000 | | | Intesa Sanpaolo SpA, 5.017%, 6/26/2024, 144A | | | 493,864 | |

| | 265,000 | | | Intesa Sanpaolo SpA, 5.710%, 1/15/2026, 144A | | | 286,848 | |

| | | | | | | | |

| | | | | | | 4,452,107 | |

| | | | | | | | |

| | | | Building Materials — 2.2% | |

| | 280,000 | | | American Builders & Contractors Supply Co., Inc., 4.000%, 1/15/2028, 144A | | | 284,200 | |

| | 230,000 | | | Cemex SAB de CV, 5.700%, 1/11/2025, 144A | | | 236,327 | |

| | 350,000 | | | Cemex SAB de CV, 7.750%, 4/16/2026, 144A | | | 380,625 | |

| | 420,000 | | | James Hardie International Finance Ltd., 4.750%, 1/15/2025, 144A | | | 435,750 | |

See accompanying notes to financial statements.

17 |

Portfolio of Investments – as of December 31, 2019

Loomis Sayles High Income Fund – (continued)

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| | | | Building Materials — continued | |

| $ | 445,000 | | | James Hardie International Finance Ltd., 5.000%, 1/15/2028, 144A | | $ | 467,250 | |

| | 360,000 | | | JELD-WEN, Inc., 4.625%, 12/15/2025, 144A | | | 370,620 | |

| | 160,000 | | | JELD-WEN, Inc., 4.875%, 12/15/2027, 144A | | | 163,600 | |

| | 110,000 | | | Summit Materials LLC/Summit Materials Finance Corp., 6.125%, 7/15/2023 | | | 111,788 | |

| | 685,000 | | | U.S. Concrete, Inc., 6.375%, 6/01/2024 | | | 714,969 | |

| | | | | | | | |

| | | | | | | 3,165,129 | |

| | | | | | | | |

| | | | Cable Satellite — 9.2% | |

| | 2,700,000 | | | CCO Holdings LLC/CCO Holdings Capital Corp., 4.750%, 3/01/2030, 144A | | | 2,748,681 | |

| | 450,000 | | | CCO Holdings LLC/CCO Holdings Capital Corp., 5.375%, 5/01/2025, 144A | | | 464,625 | |

| | 405,000 | | | CCO Holdings LLC/CCO Holdings Capital Corp., 5.375%, 6/01/2029, 144A | | | 433,350 | |

| | 865,000 | | | CCO Holdings LLC/CCO Holdings Capital Corp., 5.750%, 2/15/2026, 144A | | | 912,592 | |

| | 1,360,000 | | | CSC Holdings LLC, 5.500%, 4/15/2027, 144A | | | 1,460,436 | |

| | 390,000 | | | CSC Holdings LLC, 6.500%, 2/01/2029, 144A | | | 434,850 | |

| | 415,000 | | | DISH DBS Corp., 7.750%, 7/01/2026 | | | 439,647 | |

| | 70,000 | | | Intelsat Jackson Holdings S.A., 5.500%, 8/01/2023 | | | 60,133 | |

| | 195,000 | | | Intelsat Jackson Holdings S.A., 8.500%, 10/15/2024, 144A | | | 177,612 | |

| | 430,000 | | | Intelsat Jackson Holdings S.A., 9.750%, 7/15/2025, 144A | | | 397,750 | |

| | 355,000 | | | Sirius XM Radio, Inc., 5.000%, 8/01/2027, 144A | | | 374,525 | |

| | 1,400,000 | | | Telenet Finance Luxembourg Notes S.a.r.l., 5.500%, 3/01/2028, 144A | | | 1,498,518 | |

| | 265,000 | | | Virgin Media Finance PLC, 6.000%, 10/15/2024, 144A | | | 272,950 | |

| | 1,070,000 | | | Virgin Media Secured Finance PLC, 5.500%, 5/15/2029, 144A | | | 1,132,862 | |

| | 2,570,000 | | | Ziggo BV, 5.500%, 1/15/2027, 144A | | | 2,730,625 | |

| | | | | | | | |

| | | | | | | 13,539,156 | |

| | | | | | | | |

| | | | Chemicals — 1.3% | |

| | 1,510,000 | | | Hercules LLC, 6.500%, 6/30/2029 | | | 1,593,050 | |

| | 245,000 | | | SASOL Financing USA LLC, 5.875%, 3/27/2024 | | | 265,301 | |

| | | | | | | | |

| | | | | | | 1,858,351 | |

| | | | | | | | |

| | | | Construction Machinery — 0.8% | |

| | 615,000 | | | United Rentals North America, Inc., 4.625%, 10/15/2025 | | | 632,282 | |

| | 15,000 | | | United Rentals North America, Inc., 5.500%, 5/15/2027 | | | 16,069 | |

| | 235,000 | | | United Rentals North America, Inc., 5.875%, 9/15/2026 | | | 252,096 | |

| | 195,000 | | | United Rentals North America, Inc., 6.500%, 12/15/2026 | | | 214,317 | |

| | | | | | | | |

| | | | | | | 1,114,764 | |

| | | | | | | | |

| | | | Consumer Cyclical Services — 1.2% | |

| | 350,000 | | | ServiceMaster Co. LLC (The), 7.450%, 8/15/2027 | | | 395,500 | |

| | 180,000 | | | Staples, Inc., 7.500%, 4/15/2026, 144A | | | 186,750 | |

| | 680,000 | | | Uber Technologies, Inc., 7.500%, 11/01/2023, 144A | | | 710,600 | |

| | 345,000 | | | Uber Technologies, Inc., 7.500%, 9/15/2027, 144A | | | 353,949 | |

| | 150,000 | | | Uber Technologies, Inc., 8.000%, 11/01/2026, 144A | | | 156,375 | |

| | | | | | | | |

| | | | | | | 1,803,174 | |

| | | | | | | | |

| | | | Consumer Products — 0.2% | |

| | 115,000 | | | Mattel, Inc., 5.875%, 12/15/2027, 144A | | | 121,181 | |

| | 175,000 | | | Prestige Brands, Inc., 5.125%, 1/15/2028, 144A | | | 183,313 | |

| | | | | | | | |

| | | | | | | 304,494 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 18

Portfolio of Investments – as of December 31, 2019

Loomis Sayles High Income Fund – (continued)

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| | | | Electric — 3.2% | |

| $ | 125,000 | | | AES Corp. (The), 5.125%, 9/01/2027 | | $ | 133,438 | |

| | 479,000 | | | AES Corp. (The), 5.500%, 4/15/2025 | | | 495,262 | |

| | 150,000 | | | AES Corp. (The), 6.000%, 5/15/2026 | | | 159,750 | |

| | 1,105,000 | | | Calpine Corp., 5.125%, 3/15/2028, 144A | | | 1,127,874 | |

| | 1,502,000 | | | Enel SpA, (fixed rate to 9/24/2023, variable rate thereafter), 8.750%, 9/24/2073, 144A | | | 1,762,972 | |

| | 1,055,000 | | | Vistra Operations Co. LLC, 3.700%, 1/30/2027, 144A | | | 1,048,319 | |

| | | | | | | | |

| | | | | | | 4,727,615 | |

| | | | | | | | |

| | | | Finance Companies — 3.2% | |

| | 820,000 | | | Navient Corp., 6.500%, 6/15/2022 | | | 888,675 | |

| | 315,000 | | | Provident Funding Associates LP/PFG Finance Corp., 6.375%, 6/15/2025, 144A | | | 308,700 | |

| | 1,305,000 | | | Quicken Loans, Inc., 5.250%, 1/15/2028, 144A | | | 1,350,675 | |

| | 710,000 | | | Quicken Loans, Inc., 5.750%, 5/01/2025, 144A | | | 733,962 | |

| | 185,000 | | | Springleaf Finance Corp., 6.875%, 3/15/2025 | | | 210,438 | |

| | 700,000 | | | Springleaf Finance Corp., 7.125%, 3/15/2026 | | | 809,340 | |

| | 405,000 | | | Unifin Financiera SAB de CV, 7.250%, 9/27/2023, 144A | | | 421,795 | |

| | | | | | | | |

| | | | | | | 4,723,585 | |

| | | | | | | | |

| | | | Financial Other — 1.5% | |

| | 745,000 | | | Icahn Enterprises LP/Icahn Enterprises Finance Corp., 4.750%, 9/15/2024, 144A | | | 765,487 | |

| | 635,000 | | | Icahn Enterprises LP/Icahn Enterprises Finance Corp., 5.250%, 5/15/2027, 144A | | | 649,370 | |

| | 465,000 | | | Nationstar Mortgage Holdings, Inc., 8.125%, 7/15/2023, 144A | | | 492,212 | |

| | 330,000 | | | Nationstar Mortgage Holdings, Inc., 9.125%, 7/15/2026, 144A | | | 365,475 | |

| | | | | | | | |

| | | | | | | 2,272,544 | |

| | | | | | | | |

| | | | Food & Beverage — 2.2% | |

| | 245,000 | | | BRF S.A., 4.875%, 1/24/2030, 144A | | | 252,659 | |

| | 330,000 | | | JBS USA LUX S.A./JBS USA Finance, Inc., 5.750%, 6/15/2025, 144A | | | 341,550 | |

| | 285,000 | | | JBS USA LUX S.A./JBS USA Food Co./JBS USA Finance, Inc., 5.500%, 1/15/2030, 144A | | | 306,118 | |

| | 385,000 | | | Marfrig Holdings Europe BV, Class B, 8.000%, 6/08/2023, 144A | | | 401,081 | |

| | 250,000 | | | NBM U.S Holdings, Inc., 7.000%, 5/14/2026, 144A | | | 270,753 | |

| | 225,000 | | | Performance Food Group, Inc., 5.500%, 10/15/2027, 144A | | | 240,469 | |

| | 280,000 | | | Pilgrim’s Pride Corp., 5.750%, 3/15/2025, 144A | | | 289,416 | |

| | 540,000 | | | Pilgrim’s Pride Corp., 5.875%, 9/30/2027, 144A | | | 583,875 | |

| | 550,000 | | | Post Holdings, Inc., 5.750%, 3/01/2027, 144A | | | 589,875 | |

| | | | | | | | |

| | | | | | | 3,275,796 | |

| | | | | | | | |

| | | | Gaming — 1.8% | |

| | 375,000 | | | Boyd Gaming Corp., 4.750%, 12/01/2027, 144A | | | 389,531 | |

| | 175,000 | | | Boyd Gaming Corp., 6.375%, 4/01/2026 | | | 188,289 | |

| | 200,000 | | | Melco Resorts Finance Ltd., 5.375%, 12/04/2029, 144A | | | 205,187 | |

| | 210,000 | | | MGM Growth Properties Operating Partnership LP/MGP FinanceCo-Issuer, Inc., 4.500%, 1/15/2028 | | | 218,925 | |

| | 345,000 | | | MGM Growth Properties Operating Partnership LP/MGP FinanceCo-Issuer, Inc., 5.750%, 2/01/2027, 144A | | | 384,675 | |

| | 380,000 | | | MGM Resorts International, 7.750%, 3/15/2022 | | | 425,125 | |

| | 155,000 | | | Scientific Games International, Inc., 7.000%, 5/15/2028, 144A | | | 166,238 | |

See accompanying notes to financial statements.

19 |

Portfolio of Investments – as of December 31, 2019

Loomis Sayles High Income Fund – (continued)

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| | | | Gaming — continued | |

| $ | 160,000 | | | Scientific Games International, Inc., 7.250%, 11/15/2029, 144A | | $ | 173,600 | |

| | 250,000 | | | Wynn Macau Ltd., 5.125%, 12/15/2029, 144A | | | 255,127 | |

| | 215,000 | | | Wynn Resorts Finance LLC/Wynn Resorts Capital Corp., 5.125%, 10/01/2029, 144A | | | 230,588 | |

| | | | | | | | |

| | | | | | | 2,637,285 | |

| | | | | | | | |

| | | | Government Owned – No Guarantee — 1.0% | |

| | 550,000 | | | Petrobras Global Finance BV, 5.750%, 2/01/2029 | | | 620,400 | |

| | 225,000 | | | Petrobras Global Finance BV, 6.900%, 3/19/2049 | | | 263,925 | |

| | 710,000 | | | YPF S.A., 6.950%, 7/21/2027, 144A | | | 631,900 | |

| | | | | | | | |

| | | | | | | 1,516,225 | |

| | | | | | | | |

| | | | Health Insurance — 0.8% | |

| | 630,000 | | | Centene Corp., 4.250%, 12/15/2027, 144A | | | 648,112 | |

| | 290,000 | | | Centene Corp., 4.625%, 12/15/2029, 144A | | | 304,892 | |

| | 210,000 | | | Centene Corp., 4.750%, 1/15/2025, 144A | | | 218,133 | |

| | | | | | | | |

| | | | | | | 1,171,137 | |

| | | | | | | | |

| | | | Healthcare — 6.0% | |

| | 590,000 | | | CHS/Community Health Systems, Inc., 6.250%, 3/31/2023 | | | 598,850 | |

| | 160,000 | | | CHS/Community Health Systems, Inc., 8.000%, 3/15/2026, 144A | | | 164,800 | |

| | 350,000 | | | Encompass Health Corp., 4.500%, 2/01/2028 | | | 362,688 | |

| | 365,000 | | | Encompass Health Corp., 4.750%, 2/01/2030 | | | 378,688 | |

| | 170,000 | | | HCA, Inc., 7.050%, 12/01/2027 | | | 201,450 | |

| | 655,000 | | | HCA, Inc., 7.500%, 12/15/2023 | | | 741,787 | |

| | 145,000 | | | HCA, Inc., 7.500%, 11/06/2033 | | | 182,700 | |

| | 590,000 | | | HCA, Inc., 7.690%, 6/15/2025 | | | 710,950 | |

| | 480,000 | | | HCA, Inc., 8.360%, 4/15/2024 | | | 583,200 | |

| | 820,000 | | | HCA, Inc., MTN, 7.580%, 9/15/2025 | | | 979,900 | |

| | 515,000 | | | HCA, Inc., MTN, 7.750%, 7/15/2036 | | | 612,850 | |

| | 95,000 | | | Hill Rom Holdings, Inc., 4.375%, 9/15/2027, 144A | | | 97,731 | |

| | 275,000 | | | Hologic, Inc., 4.375%, 10/15/2025, 144A | | | 283,938 | |

| | 140,000 | | | Hologic, Inc., 4.625%, 2/01/2028, 144A | | | 148,400 | |

| | 200,000 | | | IQVIA, Inc., 5.000%, 10/15/2026, 144A | | | 211,000 | |

| | 715,000 | | | MPH Acquisition Holdings LLC, 7.125%, 6/01/2024, 144A | | | 691,762 | |

| | 850,000 | | | Polaris Intermediate Corp., 9.250% PIK or 8.500% Cash, 12/01/2022, 144A(b) | | | 791,562 | |

| | 725,000 | | | Tenet Healthcare Corp., 4.625%, 7/15/2024 | | | 742,219 | |

| | 390,000 | | | Tenet Healthcare Corp., 5.125%, 5/01/2025 | | | 401,700 | |

| | | | | | | | |

| | | | | | | 8,886,175 | |

| | | | | | | | |

| | | | Home Construction — 1.7% | |

| | 1,200,000 | | | Corporacion GEO SAB de CV, 8.875%, 2/27/2022, 144A(e)(f)(h) | | | — | |

| | 230,000 | | | KB Home, 4.800%, 11/15/2029 | | | 235,175 | |

| | 800,000 | | | Lennar Corp., 4.750%, 5/30/2025 | | | 860,000 | |

| | 1,130,000 | | | PulteGroup, Inc., 5.500%, 3/01/2026 | | | 1,262,775 | |

| | 185,000 | | | Taylor Morrison Communities, Inc., 5.750%, 1/15/2028, 144A | | | 201,650 | |

| | | | | | | | |

| | | | | | | 2,559,600 | |

| | | | | | | | |

| | | | Independent Energy — 4.8% | |

| | 460,000 | | | Aker BP ASA, 5.875%, 3/31/2025, 144A | | | 488,750 | |

| | 685,000 | | | Baytex Energy Corp., 5.625%, 6/01/2024, 144A | | | 623,350 | |

See accompanying notes to financial statements.

| 20

Portfolio of Investments – as of December 31, 2019

Loomis Sayles High Income Fund – (continued)

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| | | | Independent Energy — continued | |

| $ | 1,025,000 | | | Bruin E&P Partners LLC, 8.875%, 8/01/2023, 144A | | $ | 667,336 | |

| | 90,000 | | | California Resources Corp., 5.500%, 9/15/2021(c)(d) | | | 42,300 | |

| | 41,000 | | | California Resources Corp., 6.000%, 11/15/2024(c)(d) | | | 12,300 | |

| | 950,000 | | | California Resources Corp., 8.000%, 12/15/2022, 144A(c)(d) | | | 424,717 | |

| | 425,000 | | | Centennial Resource Production LLC, 6.875%, 4/01/2027, 144A | | | 442,000 | |

| | 195,000 | | | Denbury Resources, Inc., 7.750%, 2/15/2024, 144A | | | 172,575 | |

| | 375,000 | | | Gulfport Energy Corp., 6.000%, 10/15/2024 | | | 266,250 | |

| | 595,000 | | | Gulfport Energy Corp., 6.375%, 5/15/2025 | | | 377,825 | |

| | 365,000 | | | Gulfport Energy Corp., 6.375%, 1/15/2026 | | | 226,300 | |

| | 690,000 | | | Montage Resources Corp., 8.875%, 7/15/2023 | | | 636,525 | |

| | 302,000 | | | Oasis Petroleum, Inc., 6.875%, 3/15/2022 | | | 290,675 | |

| | 685,000 | | | Seven Generations Energy Ltd., 5.375%, 9/30/2025, 144A | | | 688,425 | |

| | 175,000 | | | Seven Generations Energy Ltd., 6.875%, 6/30/2023, 144A | | | 180,031 | |

| | 320,000 | | | SM Energy Co., 5.000%, 1/15/2024 | | | 304,800 | |

| | 425,000 | | | Vine Oil & Gas LP/Vine Oil & Gas Finance Corp., 9.750%, 4/15/2023, 144A | | | 212,500 | |

| | 50,000 | | | Viper Energy Partners LP, 5.375%, 11/01/2027, 144A | | | 52,000 | |

| | 405,000 | | | Whiting Petroleum Corp., 5.750%, 3/15/2021 | | | 383,130 | |

| | 50,000 | | | Whiting Petroleum Corp., 6.250%, 4/01/2023 | | | 42,085 | |

| | 805,000 | | | Whiting Petroleum Corp., 6.625%, 1/15/2026 | | | 548,591 | |

| | | | | | | | |

| | | | | | | 7,082,465 | |

| | | | | | | | |

| | | | Industrial Other — 0.1% | |

| | 130,000 | | | Installed Building Products, Inc., 5.750%, 2/01/2028, 144A | | | 138,938 | |

| | | | | | | | |

| | | | Integrated Energy — 0.1% | |

| | 200,000 | | | Geopark Ltd., 6.500%, 9/21/2024, 144A | | | 208,404 | |

| | | | | | | | |

| | | | Leisure — 0.4% | |

| | 330,000 | | | Live Nation Entertainment, Inc., 4.750%, 10/15/2027, 144A | | | 341,550 | |

| | 300,000 | | | Speedway Motorsports LLC/Speedway Funding II, Inc., 4.875%, 11/01/2027, 144A | | | 304,125 | |

| | | | | | | | |

| | | | | | | 645,675 | |

| | | | | | | | |

| | | | Life Insurance — 0.3% | |

| | 340,000 | | | CNO Financial Group, Inc., 5.250%, 5/30/2025 | | | 376,550 | |

| | | | | | | | |

| | | | Local Authorities — 0.2% | |

| | 325,000 | | | Provincia de Buenos Aires, 6.500%, 2/15/2023, 144A | | | 134,875 | |

| | 270,000 | | | Provincia de Buenos Aires, 7.875%, 6/15/2027, 144A | | | 114,750 | |

| | | | | | | | |

| | | | | | | 249,625 | |

| | | | | | | | |

| | | | Lodging — 1.2% | |

| | 150,000 | | | Hilton Domestic Operating Co., Inc., 4.250%, 9/01/2024 | | | 152,813 | |

| | 755,000 | | | Hilton Worldwide Finance LLC/Hilton Worldwide Finance Corp., 4.625%, 4/01/2025 | | | 775,762 | |

| | 565,000 | | | Marriott Ownership Resorts, Inc., 4.750%, 1/15/2028, 144A | | | 578,419 | |

| | 60,000 | | | Marriott Ownership Resorts, Inc./ILG LLC, 6.500%, 9/15/2026 | | | 65,325 | |

| | 255,000 | | | Wyndham Destinations, Inc., 4.625%, 3/01/2030, 144A | | | 255,637 | |

| | | | | | | | |

| | | | | | | 1,827,956 | |

| | | | | | | | |

See accompanying notes to financial statements.

21 |

Portfolio of Investments – as of December 31, 2019

Loomis Sayles High Income Fund – (continued)

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| | | | Media Entertainment — 3.5% | |

| $ | 735,000 | | | AMC Networks, Inc., 4.750%, 8/01/2025 | | $ | 737,756 | |

| | 720,000 | | | Diamond Sports Group LLC/Diamond Sports Finance Co., 5.375%, 8/15/2026, 144A | | | 728,317 | |

| | 120,000 | | | Gray Television, Inc., 5.125%, 10/15/2024, 144A | | | 124,500 | |

| | 275,000 | | | iHeartCommunications, Inc., 4.750%, 1/15/2028, 144A | | | 281,875 | |

| | 99,931 | | | iHeartCommunications, Inc., 6.375%, 5/01/2026 | | | 108,425 | |

| | 346,125 | | | iHeartCommunications, Inc., 8.375%, 5/01/2027 | | | 382,468 | |

| | 395,000 | | | Meredith Corp., 6.875%, 2/01/2026 | | | 410,682 | |

| | 740,000 | | | Netflix, Inc., 4.875%, 4/15/2028 | | | 768,638 | |

| | 390,000 | | | Netflix, Inc., 5.375%, 11/15/2029, 144A | | | 415,342 | |

| | 105,000 | | | Nexstar Broadcasting, Inc., 5.625%, 7/15/2027, 144A | | | 110,649 | |

| | 805,000 | | | Nielsen Finance LLC/Nielsen Finance Co., 5.000%, 4/15/2022, 144A | | | 808,019 | |

| | 120,000 | | | Outfront Media Capital LLC/Outfront Media Capital Corp., 4.625%, 3/15/2030, 144A | | | 122,100 | |

| | 170,000 | | | Terrier Media Buyer, Inc., 8.875%, 12/15/2027, 144A | | | 179,775 | |

| | | | | | | | |

| | | | | | | 5,178,546 | |

| | | | | | | | |

| | | | Metals & Mining — 2.7% | |

| | 60,000 | | | Allegheny Technologies, Inc., 5.875%, 12/01/2027 | | | 63,000 | |

| | 190,000 | | | Commercial Metals Co., 4.875%, 5/15/2023 | | | 197,600 | |

| | 665,000 | | | First Quantum Minerals Ltd., 6.500%, 3/01/2024, 144A | | | 666,663 | |

| | 835,000 | | | First Quantum Minerals Ltd., 6.875%, 3/01/2026, 144A | | | 845,437 | |

| | 200,000 | | | First Quantum Minerals Ltd., 7.250%, 4/01/2023, 144A | | | 207,056 | |

| | 210,000 | | | First Quantum Minerals Ltd., 7.500%, 4/01/2025, 144A | | | 214,725 | |

| | 840,000 | | | FMG Resources (August 2006) Pty Ltd., 4.750%, 5/15/2022, 144A | | | 867,300 | |

| | 370,000 | | | FMG Resources (August 2006) Pty Ltd., 5.125%, 5/15/2024, 144A | | | 393,125 | |

| | 435,000 | | | Mineral Resources Ltd., 8.125%, 5/01/2027, 144A | | | 477,413 | |

| | | | | | | | |

| | | | | | | 3,932,319 | |

| | | | | | | | |

| | | | Midstream — 3.7% | |

| | 385,000 | | | EnLink Midstream Partners LP, 5.050%, 4/01/2045 | | | 304,150 | |

| | 205,000 | | | EnLink Midstream Partners LP, 5.450%, 6/01/2047 | | | 165,537 | |

| | 435,000 | | | EnLink Midstream Partners LP, 5.600%, 4/01/2044 | | | 352,350 | |

| | 1,265,000 | | | Hess Midstream Operations LP, 5.625%, 2/15/2026, 144A | | | 1,321,723 | |

| | 145,000 | | | NGL Energy Partners LP/NGL Energy Finance Corp., 6.125%, 3/01/2025 | | | 136,663 | |

| | 350,000 | | | NGL Energy Partners LP/NGL Energy Finance Corp., 7.500%, 11/01/2023 | | | 350,000 | |

| | 165,000 | | | NGPL PipeCo LLC, 4.375%, 8/15/2022, 144A | | | 171,391 | |

| | 700,000 | | | NGPL PipeCo LLC, 4.875%, 8/15/2027, 144A | | | 744,056 | |

| | 935,000 | | | Summit Midstream Holdings LLC/Summit Midstream Finance Corp., 5.500%, 8/15/2022 | | | 832,150 | |

| | 95,000 | | | Targa Resources Partners LP/Targa Resources Partners Finance Corp., 4.250%, 11/15/2023 | | | 95,950 | |

| | 640,000 | | | Targa Resources Partners LP/Targa Resources Partners Finance Corp., 5.250%, 5/01/2023 | | | 646,400 | |

| | 255,000 | | | Targa Resources Partners LP/Targa Resources Partners Finance Corp., 5.500%, 3/01/2030, 144A | | | 262,012 | |

| | | | | | | | |

| | | | | | | 5,382,382 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 22

Portfolio of Investments – as of December 31, 2019

Loomis Sayles High Income Fund – (continued)

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| | | | Non-Agency Commercial Mortgage-Backed Securities — 1.4% | |

| $ | 100,000 | | | CG-CCRE Commercial Mortgage Trust, Series2014-FL2, Class COL1,1-month LIBOR + 3.500%, 5.240%, 11/15/2031, 144A(a)(c)(d) | | $ | 99,782 | |

| | 225,000 | | | CG-CCRE Commercial Mortgage Trust, Series2014-FL2, Class COL2,1-month LIBOR + 4.500%, 6.240%, 11/15/2031, 144A(a)(c)(d) | | | 224,270 | |

| | 1,020,000 | | | Credit Suisse Mortgage Trust, Series2014-USA, Class E, 4.373%, 9/15/2037, 144A | | | 959,114 | |

| | 380,000 | | | Starwood Retail Property Trust, Series 2014-STAR, Class D,1-month LIBOR + 3.500%, 5.240%, 11/15/2027, 144A(a)(c)(d) | | | 322,911 | |

| | 420,000 | | | Starwood Retail Property Trust, Series 2014-STAR, Class E,1-month LIBOR + 4.400%, 6.140%, 11/15/2027, 144A(a)(c)(e)(f) | | | 325,435 | |

| | 125,000 | | | WFRBS Commercial Mortgage Trust, Series2012-C7, Class E, 4.813%, 6/15/2045, 144A(g) | | | 107,207 | |

| | | | | | | | |

| | | | | | | 2,038,719 | |

| | | | | | | | |

| | | | Oil Field Services — 1.8% | |

| | 935,000 | | | McDermott Technology Americas, Inc./McDermott Technology U.S., Inc., 10.625%, 5/01/2024, 144A(c)(d)(h) | | | 79,475 | |

| | 160,000 | | | Noble Holding International Ltd., 5.250%, 3/15/2042 | | | 57,970 | |

| | 1,145,000 | | | Shelf Drilling Holdings Ltd., 8.250%, 2/15/2025, 144A | | | 1,090,612 | |

| | 360,450 | | | Transocean Guardian Ltd., 5.875%, 1/15/2024, 144A | | | 368,560 | |

| | 22,250 | | | Transocean Pontus Ltd., 6.125%, 8/01/2025, 144A | | | 22,806 | |

| | 196,000 | | | Transocean Proteus Ltd., 6.250%, 12/01/2024, 144A | | | 201,880 | |

| | 695,000 | | | Transocean Sentry Ltd., 5.375%, 5/15/2023, 144A | | | 707,162 | |

| | 175,000 | | | Transocean, Inc., 7.500%, 1/15/2026, 144A | �� | | 172,813 | |

| | | | | | | | |

| | | | | | | 2,701,278 | |

| | | | | | | | |

| | | | Packaging — 0.3% | |

| | 370,000 | | | ARD Finance S.A., 7.250% PIK or 6.500% Cash, 6/30/2027, 144A(b) | | | 382,562 | |

| | | | | | | | |

| | | | Pharmaceuticals — 3.9% | |

| | 400,000 | | | Bausch Health Cos., Inc., 5.000%, 1/30/2028, 144A | | | 410,556 | |

| | 395,000 | | | Bausch Health Cos., Inc., 5.250%, 1/30/2030, 144A | | | 409,615 | |

| | 53,000 | | | Bausch Health Cos., Inc., 5.500%, 3/01/2023, 144A | | | 53,265 | |

| | 36,000 | | | Bausch Health Cos., Inc., 5.875%, 5/15/2023, 144A | | | 36,315 | |

| | 220,000 | | | Bausch Health Cos., Inc., 6.125%, 4/15/2025, 144A | | | 227,311 | |

| | 170,000 | | | Bausch Health Cos., Inc., 9.000%, 12/15/2025, 144A | | | 193,324 | |

| | 280,000 | | | Catalent Pharma Solutions, Inc., 4.875%, 1/15/2026, 144A | | | 289,800 | |

| | 600,000 | | | Endo Dac/Endo Finance LLC/Endo Finco, Inc., 6.000%, 2/01/2025, 144A | | | 404,628 | |

| | 445,000 | | | Mylan NV, 5.250%, 6/15/2046 | | | 500,519 | |

| | 75,000 | | | Mylan, Inc., 5.200%, 4/15/2048 | | | 83,973 | |

| | 150,000 | | | Mylan, Inc., 5.400%, 11/29/2043 | | | 166,238 | |

| | 1,065,000 | | | Teva Pharmaceutical Finance Netherlands III BV, 2.800%, 7/21/2023 | | | 986,020 | |

| | 65,000 | | | Teva Pharmaceutical Finance Netherlands III BV, 3.150%, 10/01/2026 | | | 54,112 | |

| | 2,155,000 | | | Teva Pharmaceutical Finance Netherlands III BV, 4.100%, 10/01/2046 | | | 1,551,600 | |

| | 405,000 | | | Teva Pharmaceutical Finance Netherlands III BV, 7.125%, 1/31/2025, 144A | | | 416,016 | |

| | | | | | | | |

| | | | | | | 5,783,292 | |

| | | | | | | | |

| | | | Property & Casualty Insurance — 0.6% | |

| | 45,000 | | | AmWINS Group, Inc., 7.750%, 7/01/2026, 144A | | | 49,731 | |

| | 780,000 | | | Ardonagh Midco 3 PLC, 8.625%, 7/15/2023, 144A | | | 774,150 | |

| | | | | | | | |

| | | | | | | 823,881 | |

| | | | | | | | |

See accompanying notes to financial statements.

23 |

Portfolio of Investments – as of December 31, 2019

Loomis Sayles High Income Fund – (continued)

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| | | | Refining — 0.8% | |

| $ | 405,000 | | | Parkland Fuel Corp., 5.875%, 7/15/2027, 144A | | $ | 435,521 | |

| | 635,000 | | | Parkland Fuel Corp., 6.000%, 4/01/2026, 144A | | | 670,750 | |

| | | | | | | | |

| | | | | | | 1,106,271 | |

| | | | | | | | |

| | | | REITs – Diversified — 0.3% | |

| | 395,000 | | | iStar, Inc., 5.250%, 9/15/2022 | | | 405,369 | |

| | | | | | | | |

| | | | REITs – Hotels — 0.7% | |

| | 350,000 | | | Service Properties Trust, 4.750%, 10/01/2026 | | | 359,056 | |

| | 715,000 | | | Service Properties Trust, 4.350%, 10/01/2024 | | | 734,794 | |

| | | | | | | | |

| | | | | | | 1,093,850 | |

| | | | | | | | |

| | | | REITs – Mortgage — 0.7% | |

| | 720,000 | | | Ladder Capital Finance Holdings LLLP/Ladder Capital Finance Corp., 5.250%, 10/01/2025, 144A | | | 747,000 | |

| | 255,000 | | | Ladder Capital Finance Holdings LLLP/Ladder Capital Finance Corp., 5.875%, 8/01/2021, 144A | | | 258,506 | |

| | | | | | | | |

| | | | | | | 1,005,506 | |

| | | | | | | | |

| | | | REITs – Regional Malls — 0.5% | |

| | 695,000 | | | Brookfield Property REIT, Inc./BPR Cumulus LLC/BPR Nimbus LLC/GGSI Sellco LL, 5.750%, 5/15/2026, 144A | | | 733,225 | |

| | | | | | | | |

| | | | Restaurants — 1.0% | |

| | 400,000 | | | 1011778 B.C. ULC/New Red Finance, Inc., 4.375%, 1/15/2028, 144A | | | 401,000 | |

| | 890,000 | | | 1011778 B.C. ULC/New Red Finance, Inc., 5.000%, 10/15/2025, 144A | | | 918,925 | |

| | 110,000 | | | Yum Brands, Inc., 4.750%, 1/15/2030, 144A | | | 115,225 | |

| | | | | | | | |

| | | | | | | 1,435,150 | |

| | | | | | | | |

| | | | Retailers — 2.2% | |

| | 830,000 | | | Asbury Automotive Group, Inc., 6.000%, 12/15/2024 | | | 856,975 | |

| | 820,000 | | | Group 1 Automotive, Inc., 5.000%, 6/01/2022 | | | 831,275 | |

| | 480,000 | | | Hanesbrands, Inc., 4.875%, 5/15/2026, 144A | | | 508,200 | |

| | 505,000 | | | J.C. Penney Corp., Inc., 5.875%, 7/01/2023, 144A | | | 433,038 | |

| | 105,000 | | | Murphy Oil USA, Inc., 4.750%, 9/15/2029 | | | 110,887 | |

| | 385,000 | | | PetSmart, Inc., 7.125%, 3/15/2023, 144A | | | 377,300 | |

| | 125,000 | | | William Carter Co. (The), 5.625%, 3/15/2027, 144A | | | 134,375 | |

| | | | | | | | |

| | | | | | | 3,252,050 | |

| | | | | | | | |

| | | | Technology — 5.4% | |

| | 335,000 | | | Camelot Finance S.A., 4.500%, 11/01/2026, 144A | | | 344,213 | |

| | 120,000 | | | CDK Global, Inc., 5.250%, 5/15/2029, 144A | | | 128,700 | |

| | 595,000 | | | CDW LLC/CDM Finance Corp., 4.250%, 4/01/2028 | | | 624,006 | |

| | 825,000 | | | CommScope Technologies LLC, 5.000%, 3/15/2027, 144A | | | 775,500 | |

| | 100,000 | | | CommScope Technologies LLC, 6.000%, 6/15/2025, 144A | | | 100,113 | |

| | 1,455,000 | | | CommScope, Inc., 5.500%, 3/01/2024, 144A | | | 1,516,837 | |

| | 620,000 | | | Dun & Bradstreet Corp. (The), 6.875%, 8/15/2026, 144A | | | 684,325 | |

| | 690,000 | | | Iron Mountain, Inc., 4.875%, 9/15/2029, 144A | | | 700,902 | |

| | 140,000 | | | MSCI, Inc., 4.000%, 11/15/2029, 144A | | | 141,925 | |

| | 865,000 | | | Nokia Oyj, 4.375%, 6/12/2027 | | | 901,762 | |

| | 190,000 | | | Open Text Corp., 5.875%, 6/01/2026, 144A | | | 203,300 | |

See accompanying notes to financial statements.

| 24

Portfolio of Investments – as of December 31, 2019

Loomis Sayles High Income Fund – (continued)

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| | | | Technology — continued | |

| $ | 275,000 | | | Sabre GLBL, Inc., 5.250%, 11/15/2023, 144A | | $ | 282,219 | |

| | 590,000 | | | SS&C Technologies, Inc., 5.500%, 9/30/2027, 144A | | | 629,825 | |

| | 900,000 | | | Western Digital Corp., 4.750%, 2/15/2026 | | | 938,250 | |

| | | | | | | | |

| | | | | | | 7,971,877 | |

| | | | | | | | |

| | | | Transportation Services — 0.2% | |

| | 275,000 | | | APL Ltd., 8.000%, 1/15/2024(c)(d) | | | 244,778 | |

| | | | | | | | |

| | | | Treasuries — 0.5% | |

| | 715,000 | | | U.S. Treasury Note, 2.125%, 5/31/2021 | | | 720,167 | |

| | | | | | | | |

| | | | Wireless — 4.2% | |