UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-04323

Natixis Funds Trust I

(Exact name of Registrant as specified in charter)

| | |

| 888 Boylston Street, Suite 800 Boston, Massachusetts 02199-8197 |

| (Address of principal executive offices) (Zip code) |

Russell L. Kane, Esq.

Natixis Distribution, L.P.

888 Boylston Street, Suite 800

Boston, Massachusetts 02199-8197

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617)449-2822

Date of fiscal year end: September 30

Date of reporting period: September 30, 2019

Item 1. Reports to Stockholders.

The Registrant’s annual report transmitted to shareholders pursuant to Rule30e-1 under the Investment Company Act of 1940 is as follows:

Annual Report

September 30, 2019

Loomis Sayles Core Plus Bond Fund

Loomis Sayles Global Allocation Fund

Table of Contents

IMPORTANT NOTICE TO SHAREHOLDERS

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you wish to continue receiving paper copies of your shareholder reports after January 1, 2021, you can inform the Fund at any time by calling 1-800-225-5478. If you hold your account with a financial intermediary and you wish to continue receiving paper copies after January 1, 2021, you should call your financial intermediary directly. Paper copies are provided free of charge, and your election to receive reports in paper will apply to all funds held with the Natixis Funds complex. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You currently may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically atwww.icsdelivery.com/natixisfunds.

LOOMIS SAYLES CORE PLUS BOND FUND

| | |

| |

| Managers | | Symbols |

| |

| Peter W. Palfrey, CFA® | | Class A NEFRX |

| |

| Richard G. Raczkowski | | Class C NECRX |

| |

| Loomis, Sayles & Company, L.P. | | Class N NERNX |

| |

| | Class Y NERYX |

Investment Goal

The Fund seeks high total investment return through a combination of current income and capital appreciation.

Market Conditions

Global fixed income markets delivered healthy gains over the12-month period, reflecting the combination of slowing economic growth, persistently low inflation and the US Federal Reserve’s (Fed’s) shift toward an increasingly accommodative monetary policy. As recently as the fourth quarter of 2018, the markets generally anticipated that the Fed would continue to raise interest rates for at least another 12 months. As growth slowed in late 2018 and risk sentiment faltered, credit spread widened, equities fell, and rates plunged. By early 2019, the Fed was forced to reverse forward guidance towards an easing bias.

The Fed subsequently cut rates by a quarter point on August 1, September 19, and again early in the fourth quarter of 2019, bringing its benchmark federal funds target rate to a range of 1.50% to 1.75%. The dramatic change in the outlook for Fed policy was the leading factor in the strong, broad-based rally in bonds. These circumstances helped fuel gains for US Treasuries, with longer-term issues registering the largest advance. The yield on the benchmark10-year Treasury note, after reaching a peak of 3.23% in October 2018, fell to 1.47% in early September — near its lowest level of the past decade. (Prices and yields move in opposite directions.)

Domestic inflation remained below target, mirroring a trend that was in place across the globe. US core personal consumption expenditure inflation (which excludes food and energy) moved toward the 2% level in late 2018 before settling into a range between 1.5% and 1.7% from March onward. Low inflation was one of the key factors providing the Fed and foreign central banks with the ability to loosen policy in order to address slowing growth.

Investment grade corporates generated robust returns and finished the period as the top performing major fixed income category. In addition to benefiting from the rally in rate-sensitive assets, corporates were boosted by both positive earnings trends and healthy investor risk appetites.

Performance Results

For the 12 months ended September 30, 2019, Class Y shares of the Loomis Sayles Core Plus Bond Fund returned 8.67% at net asset value. The Fund underperformed its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, which returned 10.30%.

1 |

Explanation of Fund Performance

While on a year-to-date basis, the Fund has outperformed its benchmark, the weaker 12 month relative return reflects the Fund’s underperformance during the “risk-off” period in the fourth quarter of 2018. The Fund’s allocation to Treasury inflation-protected securities (TIPS) was the primary detractor from relative performance as inflation expectations softened over the year. Exposure to emerging markets, specifically an allocation to US dollar-denominated Argentina bonds, also weighed on performance. Non-dollar exposure, specifically Mexican peso, detracted from relative returns as the peso depreciated versus the US dollar over the twelve month period. Additionally, the Fund’s holdings within Securitized Agency also constrained performance relative to the benchmark.

The Fund’s slightly above-benchmark stance with respect to duration (and corresponding sensitivity to changes in interest rates) added to relative performance. An underweight to nominal US Treasuries also added to relative return as riskier assets outperformed. Security selection within US investment grade corporates also boosted performance, led by positions within industrials and utilities.

Outlook

We believe that the Fed will likely remain on hold for the remainder of 2019 and into 2020, depending on substantive progress of trade talks and economic indicators. The three rate cuts have already helped to ameliorate yield curve inversion, stimulate activity and ease concerns about the impending end of the credit cycle.1 We believe these cuts represent a“mid-cycle adjustment” and we do not expect a US recession to take hold over the next twelve months.

Corporate fundamentals remain consistent with a credit cycle in late expansion. Top line revenues have plateaued, margins have started to deteriorate, leverage is elevated and businesses are concerned with the economic environment, particularly given the ongoing discussions around trade. Primary cycle risks continue to include the pace of global growth, US trade policy, strong dollar, global central bank policy accommodation and the potential for further escalation of Middle East tensions.

We currently have a 7.7% market value allocation to TIPS which accounts for approximately 22% of total portfolio duration. We continue to find breakeven inflation levels (the difference between yields on nominal Treasuries and TIPS of the same maturity) on10- and30-year TIPS attractive relative to historical levels and versus our inflation and interest rate expectations. In light of what we consider an overbought nominal Treasury market, we expect TIPS to provide an attractive alternative to longer-dated US Treasuries going forward, especially as the Fed refocuses on generating and sustaining a more robust inflation outlook for the US economy.

Our portfolio duration (which reflects price sensitivity to interest rate expectations) is approximately 0.45 years longer than the benchmark on a nominal basis, but we expect the portfolio to behave about 0.45 years shorter, largely due to our TIPS and high yield exposure.

We believe our higher-than-benchmark yield, in combination with our meaningful underweight to nominal Treasuries (with TIPS as a substitute), should help reduce interest rate risk should economic fundamentals start to stabilize and then improve late this year and next in response to the Fed’s decision to further ease monetary policy.

We may opportunistically add exposure back to investment grade credit, high yield credit and emerging market debt and currencies in the coming months, as valuations permit.

| 2

LOOMIS SAYLES CORE PLUS BOND FUND

Given the late stage in the credit cycle, we are unlikely to return to the levels of overall credit exposure that we carried in recent years without a significant repricing of credit markets or a more lasting improvement in the US and global economic outlook.

During periods in which the US dollar appreciates relative to foreign currencies, funds that holdnon-US-dollar-denominated bonds may realize currency losses in connection with the maturity or sale of certain bonds. These losses impact a fund’s ordinary income distributions (to the extent that losses are not offset by realized currency gains within the fund’s fiscal year). A recognized currency loss, in accordance with federal tax rules, decreases the amount of ordinary income a fund has available to distribute, even though these bonds continue to generate coupon income.

Fund officers have analyzed the Fund’s current portfolio of investments, realized currency gains and losses, schedule of maturities, and the corresponding amounts of unrealized currency losses that may become realized during the current fiscal year. This analysis is performed regularly to determine how realized currency losses will affect periodic ordinary income distributions for the Fund. Based on the most recent quarterly analysis (as of September 30, 2019), Fund officers believe that realized currency losses will have an impact on the distributions in the 2020 fiscal year. This analysis is based on certain assumptions including, but not limited to, the level of foreign currency exchange rates, security prices, interest rates, the Fund advisers’ ability to manage realized currency losses, and the net asset level of the Fund. Changes to these assumptions could materially impact the analysis and the amounts of future Fund distributions. Fund officers will continue to monitor these amounts on a regular basis and take the necessary actions required to manage the Fund’s distributions to address realized currency losses while seeking to avoid a return of capital distribution.

| 1 | A credit cycle is a cyclical pattern that follows credit availability and corporate health. |

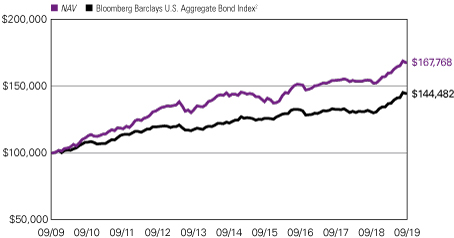

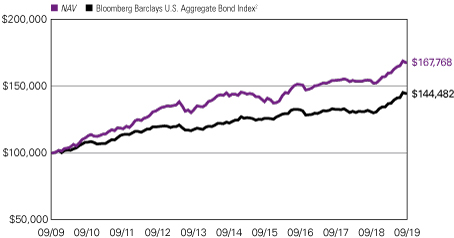

Hypothetical Growth of $100,000 Investment in Class Y Shares3

September 30, 2009 to September 30, 2019

3 |

Average Annual Total Returns — September 30, 20193

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | Life of | | | Expense Ratios4 | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | Class N | | | Gross | | | Net | |

| | | | | |

| Class Y (Inception 12/30/94) | | | | | | | | | | | | | | | | | |

| NAV | | | 8.67 | % | | | 3.31 | % | | | 5.31 | % | | | — | % | | | 0.48 | % | | | 0.48 | % |

| | | | | | | |

| Class A (Inception 11/7/73) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 8.39 | | | | 3.04 | | | | 5.04 | | | | — | | | | 0.73 | | | | 0.73 | |

| With 4.25% Maximum Sales Charge | | | 3.75 | | | | 2.14 | | | | 4.58 | | | | — | | | | | | | | | |

| | | | | |

| Class C (Inception 12/30/94) | | | | | | | | | | | | | | | | | |

| NAV | | | 7.57 | | | | 2.28 | | | | 4.25 | | | | — | | | | 1.48 | | | | 1.48 | |

| With CDSC1 | | | 6.57 | | | | 2.28 | | | | 4.25 | | | | | | | | | | | | | |

| | | | | | | |

| Class N (Inception 2/1/13) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 8.85 | | | | 3.40 | | | | — | | | | 3.39 | | | | 0.39 | | | | 0.39 | |

| | | | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | | | | | | | | | |

| Bloomberg Barclays U.S. Aggregate Bond Index2 | | | 10.30 | | | | 3.38 | | | | 3.75 | | | | 2.95 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com.Performance for other share classes will be greater or less than shown based on differences and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Class C shares performance assumes a 1% CDSC applied when you sell shares within one year of purchase. |

| 2 | The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index that covers the U.S.-dollar-denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. The index includes bonds from the Treasury, government-related, corporate, mortgage-backed securities, asset-backed securities, and collateralized mortgage-backed securities sectors. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 1/31/20. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 6 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

| 4

LOOMIS SAYLES GLOBAL ALLOCATION FUND

| | |

| |

| Managers | | Symbols |

| |

| Daniel J. Fuss, CFA®, CIC | | Class A LGMAX |

| |

| Eileen N. Riley, CFA® | | Class C LGMCX |

| |

| David W. Rolley, CFA® | | Class N LGMNX |

| |

| Lee M. Rosenbaum | | Class Y LSWWX |

| |

| Loomis, Sayles & Company, L.P. | | |

Investment Goal

The Fund seeks high total investment return through a combination of capital appreciation and current income.

Market Conditions

The first half of the period saw initial signs of decelerating global growth. The slowdown in majornon-US economies proved more persistent due to political uncertainty and weak manufacturing data. However, employment statistics continued to indicate labor market strength and rising wages, which kept consumer confidence healthy. In the second half of the period global economic data and inflation expectations weakened, particularly in major export-driven economies like Germany and South Korea. Declining business investment and slowing trade flows are signals that theUS-China trade conflict is hindering global growth.

Global equity markets started the period with double-digit declines. Markets moved sharply upward in the first quarter of 2019 then leveled off over the second and third quarters. Overall global equity market returns were muted for the12-month period. The utilities, real estate, and consumer staples sectors posted the highest returns, as investors moved into perceived less risky areas of the market. The energy, materials, health care, and industrials sectors posted declines.

The US Federal Reserve (Fed) Open Market Committee raised its target rate in December by 25 basis points; market pricing reflected an expectation that the Fed may have tightened policy rates enough for the foreseeable future. In January, a more dovish tone from the Fed coupled with strong US jobs numbers sparked a relief rally and reduced fears of a global recession. Central bank easing has been a global theme in 2019 and some, such as the European Central Bank (ECB) and Bank of Japan (BOJ), are pressing further into negative territory. The ECB has also indicated that it will restart quantitative easing in November 2019.

The US dollar, despite the Fed cutting the policy rate by 50 basis points in fiscal year 2019, has strengthened against most currency peers during the period. Investors remain uneasy about prospects in Europe given the uncertain Brexit situation, political instability in Italy and rising fears of a recession in Germany. The low prospective returns on government bonds in Europe and Japan have pushed investors to seek the higher available yields in the US.

5 |

Performance Results

For the 12 months ended September 30, 2019, Class Y shares of the Loomis Sayles Global Allocation Fund returned 7.95% at net asset value. The Fund outperformed its primary benchmark, the MSCI All Country World Index (Net), which returned 1.38%. The Fund outperformed its secondary blended benchmark, 60% MSCI All Country World Index (Net)/40% Bloomberg Barclays Global Aggregate Index, which returned 4.19%.

Explanation of Performance

The global equity, US fixed income, and non-US fixed income components of the Fund posted returns higher than the all equity primary benchmark. Performance against the secondary blended index was due to the Fund’s equity component. The US and non-US fixed income components of the Fund detracted marginally from relative return.

In equities, the largest three contributors were Danaher, Nestle, and Roper Technologies. Shares of Danaher, a technology-focused health care company, outperformed as the company announced its plan to acquire the Biopharma business of General Electric (GE) for $21 billion. Danaher’s three-decade-long track record of acquiring growth companies and improving operations via the application of its Danaher Business Systems provides investors with a clear path towards realizing value. In the case of GE Biopharma, Danaher was able to acquire a market leader in attractive end markets — bioprocessing and biopharma production — that Danaher already understood from its acquisition of Pall in 2015. We believe the Biopharma acquisition will enhance Danaher’s intrinsic value growth. We continue to view Danaher as one of the more attractive values within our scenario-based framework.

Shares of Nestle, the world’s largest food and beverage company, outperformed over the12-month period, as the stock was supported by strong organic growth, successful restructuring, and returning capital to shareholders. We continue to view Nestle as a high-quality company with multiple levers for intrinsic value growth; shares remain attractive based on our discounted cash flow methodology.

Shares of Roper Technologies, a manufacturer and distributor of industrial equipment and software, rose steadily over the period as the company continues to execute on its business strategy. The company rates highly across our quality criteria; its management team successfully executes an acquisitive business model, focused on purchasing cash-generative, asset-light companies in niche industries. By specifically focusing on consumables, replacement, and subscription-based products, the company generates an attractive recurring revenue stream (currently greater than 50% of total revenue) which we forecast to grow over time. We expect intrinsic value growth to be driven by top line growth, margin expansion, and capital allocation as management continues to redeploy organic free cash flow into acquisitions and return cash to shareholders.

In fixed income, the corporate credit allocation was a positive source of returns during the period. Particularly helpful to performance were overweight allocations to the consumer cyclical, communications, banking, and finance company sectors. The likelihood of further global central bank easing and the attractiveness of corporate yields versus a plethora of negative and low yielding government bonds benefited the asset class. Allocations to high

| 6

LOOMIS SAYLES GLOBAL ALLOCATION FUND

yield corporate credit also contributed to positive performance. US high yield holdings contributed to results as they generally outpaced higher grade names. The expectation of further Fed rate cuts, a relatively strong consumer, and still-positive corporate earnings growth benefited the high yield market.

In equities, the largest three detractors were UnitedHealth Group, Amazon, and EOG Resources.

UnitedHealth Group, the largest managed care operator in the US, was the largest individual detractor for the period. Uncertainty around the Democratic Party’s potential health care platform as we approach the 2020 presidential election has weighed on shares, along with the broader managed care sector. We continue to view UnitedHealth Group shares favorably as it evolves from a health insurance pure play into an integrated service provider.

Shares of Amazon lagged over the period as the company absorbed the cost of offering one day shipping to customers. We believe this offering will enhance Amazon’s long-term competitive advantage versus other retailers. News flow around anti-trust investigations also weighed on Amazon shares; however, we think it’s unlikely that Amazon will be subject to anti-trust regulation at this juncture given its market share, which is currently in themid-single digits. We continue to view Amazon as a high-quality company and shares remain attractive based on our discounted cash flow methodology.

EOG Resources, an upstream oil and gas company, detracted from performance as shares declined in sympathy with the overall energy sector. We sold out of our position in EOG in August as intensive production challenged our investment thesis. We viewed the risk/reward opportunities in other holdings and in new ideas as more favorable.

In fixed income, allocations to select positions in the supermarket category did not keep pace with other corporate sectors. Supermarkets underperformed the broader corporate market. In addition, individual bond choices in the energy sector, in particular among select US independent and oil field services companies, failed to keep pace. Global oil demand has been very weak given slowing demand growth in major growth regions such as India and China as well as stagnant demand in the US. The Fund’s stance with respect to duration (and corresponding sensitivity to interest rates) and yield curve positioning along the US dollar-pay yield curve detracted from relative performance. Our underweight to the euro-pay markets also impeded performance as yields moved deeper into negative territory throughout the period. We were underweight the negative yielding Euro and JPY bond markets, as the Fund invested in higher yielding markets in the US. We utilized currency forwards in both currencies to maintain a more representative currency allocation in the account, which resulted in losses due to the FX hedging costs of selling USDs and mainly driven by the purchase of JPY. Exposure to the Colombian peso, Chilean peso, and Brazilian real also detracted as these currencies depreciated over the period.

Outlook

Global economic data may continue to indicate weakness near term. However, we expect the manufacturing-driven slowdown to reverse course later in the fourth quarter without a recession. Elsewhere, the ECB and BOJ have indicated signs of continued easing until

7 |

growth and inflation approach mandated targets. Global growth consensus forecasts have stabilized across developed and emerging market economies. Absolute levels of real GDP still look decent for this year and next.

The outlook for corporate earnings and global growth remain critical factors helping to drive equity market performance. Downside risks include any uncontrolled trade escalation between the US and China and a slower-than-anticipated uptick in economic activity. Both could have a negative impact on earnings and equity markets. US trade policy remains a source of uncertainty for corporate decision-makers and investors. Clarity on trade negotiations with China and some sort of deal, even if small, would introduce potential upside for global equity markets.

Short-term volatility often provides us with entry points to build long-term positions in high-quality companies and opportunities to trim or sell positions at what we consider attractive levels. Rather than try to predict macro events, we focus on companies with sustainable business models and attractive valuations. The Fund continues to be positioned with a majority equity allocation and a tilt towardnon-US within fixed income as we are finding opportunities within these asset classes.

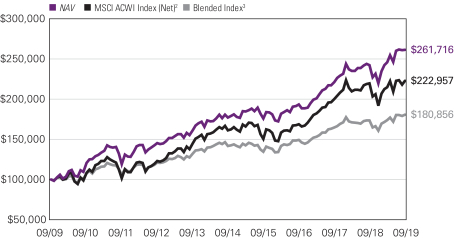

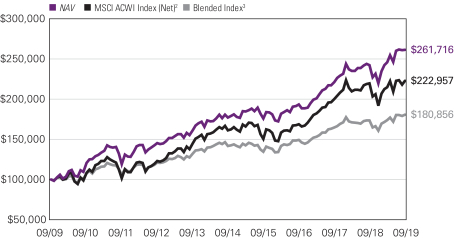

Hypothetical Growth of $100,000 Investment in Class Y Shares4

September 30, 2009 through September 30, 2019

See notes to chart on page 10.

| 8

LOOMIS SAYLES GLOBAL ALLOCATION FUND

Top Ten Holdings as of September 30, 2019

| | | | | | |

| Security Name | | % of

Assets | |

| 1 | | Danaher Corp. | | | 3.35 | % |

| 2 | | Roper Technologies, Inc. | | | 3.20 | |

| 3 | | Northrop Grumman Corp. | | | 3.12 | |

| 4 | | Sherwin-Williams Co. (The) | | | 2.67 | |

| 5 | | Nestle S.A., (Registered) | | | 2.50 | |

| 6 | | Alibaba Group Holding Ltd., Sponsored ADR | | | 2.43 | |

| 7 | | Marriott International, Inc., Class A | | | 2.41 | |

| 8 | | Amazon.com, Inc. | | | 2.38 | |

| 9 | | UnitedHealth Group, Inc. | | | 2.32 | |

| 10 | | AIA Group Ltd. | | | 2.11 | |

The portfolio is actively managed and holdings are subject to change. There is no guarantee the Fund continues to invest in the securities referenced. The holdings listed exclude any temporary cash investments.

9 |

Average Annual Total Returns — September 30, 20194

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | Life of | | | Expense Ratios5 | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | Class N | | | Gross | | | Net | |

| | | | | |

| Class Y (Inception 5/1/96) | | | | | | | | | | | | | | | | | |

| NAV | | | 7.95 | % | | | 8.10 | % | | | 10.10 | % | | | — | % | | | 0.91 | % | | | 0.91 | % |

| | | | | | | |

| Class A (Inception 2/1/06) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 7.66 | | | | 7.84 | | | | 9.82 | | | | — | | | | 1.16 | | | | 1.16 | |

| With 5.75% Maximum Sales Charge | | | 1.46 | | | | 6.56 | | | | 9.17 | | | | — | | | | | | | | | |

| | | | | |

| Class C (Inception 2/1/06) | | | | | | | | | | | | | | | | | |

| NAV | | | 6.85 | | | | 7.04 | | | | 9.00 | | | | — | | | | 1.91 | | | | 1.91 | |

| With CDSC1 | | | 5.85 | | | | 7.04 | | | | 9.00 | | | | — | | | | | | | | | |

| | | | | | | |

| Class N (Inception 2/1/17) | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV | | | 8.04 | | | | — | | | | — | | | | 11.63 | | | | 0.83 | | | | 0.83 | |

| | | | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | | | | | | | | | |

| MSCI All Country World Index (Net)2 | | | 1.38 | | | | 6.65 | | | | 8.35 | | | | 9.37 | | | | | | | | | |

| Blended Index3 | | | 4.19 | | | | 4.94 | | | | 6.10 | | | | 7.52 | | | | | | | | | |

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. The table(s) do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| 1 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | The MSCI All Country World Index (Net) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. |

| 3 | The Blended Index is an unmanaged, blended index composed of the following weights: 60% MSCI All Country World Index (Net) and 40% Bloomberg Barclays Global Aggregate Bond Index. The Bloomberg Barclays Global Aggregate Bond Index provides a broad-based measure of the global investment-grade fixed income markets. The three major components of this index are the U.S. Aggregate, the Pan-European Aggregate, and the Asian-Pacific Aggregate Indices. The index also includes Eurodollar and Euro-Yen corporate bonds, Canadian government, agency and corporate securities, and USD investment grade 144A securities. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 5 | Expense ratios are as shown in the Fund’s prospectus in effect as of the date of this report. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report under Ratios to Average Net Assets. Net expenses reflect contractual expense limitations set to expire on 1/31/20. When a Fund’s expenses are below the limitation, gross and net expense ratios will be the same. See Note 6 of the Notes to Financial Statements for more information about the Fund’s expense limitations. |

| 10

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the Funds are actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

All investing involves risk, including the risk of loss. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

ADDITIONAL INDEX INFORMATION

This document may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with Natixis Investment Managers or any of its related or affiliated companies (collectively “Natixis Affiliates”) and does not sponsor, endorse or participate in the provision of any Natixis Affiliates services, funds or other financial products.

The index information contained herein is derived from third parties and is provided on an “as is” basis. The user of this information assumes the entire risk of use of this information. Each of the third party entities involved in compiling, computing or creating index information disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to such information.

PROXY VOTING INFORMATION

A description of the Natixis Funds’ proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on the Fund’s website at im.natixis.com; and on the Securities and Exchange Commission’s (“SEC’s”) website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities the most recent 12-month period ended June 30 is available from the Fund’s website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

The Natixis Funds file complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at www.sec.gov.

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

11 |

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different costs: transaction costs, including sales charges (loads) on purchases and contingent deferred sales charges on redemptions; and ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the Fund’s prospectuses. The following examples are intended to help you understand the ongoing costs of investing in the Fund and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table of each class of Fund shares shows the actual account values and actual fund expenses you would have paid on a $1,000 investment in the Fund from April 1, 2019 through September 30, 2019. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.6) and multiply the result by the number in the Expenses Paid During Period column as shown below for your class.

The second line in the table of each class of Fund shares provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the Fund to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs, such as sales charges. Therefore, the second line in the table of the fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| | | | | | | | | | | | |

| LOOMIS SAYLES CORE PLUS BOND FUND | | BEGINNING

ACCOUNT VALUE

4/1/2019 | | | ENDING

ACCOUNT VALUE

9/30/2019 | | | EXPENSES PAID

DURING PERIOD*

4/1/2019 – 9/30/2019 | |

| Class A | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,048.00 | | | | $3.70 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,021.46 | | | | $3.65 | |

| Class C | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,044.10 | | | | $7.53 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,017.70 | | | | $7.44 | |

| Class N | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,050.20 | | | | $2.00 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,023.11 | | | | $1.98 | |

| Class Y | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,049.70 | | | | $2.41 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,022.71 | | | | $2.38 | |

| * | Expenses are equal to the Fund’s annualized expense ratio: 0.72%, 1.47%, 0.39% and 0.47% for Class A, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). |

| 12

| | | | | | | | | | | | |

LOOMIS SAYLES GLOBAL ALLOCATION

FUND | | BEGINNING

ACCOUNT VALUE

4/1/2019 | | | ENDING

ACCOUNT VALUE

9/30/2019 | | | EXPENSES PAID

DURING PERIOD*

4/1/2019 – 9/30/2019 | |

| Class A | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,063.10 | | | | $5.95 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.30 | | | | $5.82 | |

| Class C | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,059.20 | | | | $9.81 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,015.54 | | | | $9.60 | |

| Class N | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,065.00 | | | | $4.24 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.96 | | | | $4.15 | |

| Class Y | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,064.10 | | | | $4.66 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.56 | | | | $4.56 | |

| * | Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 1.15%, 1.90%, 0.82% and 0.90% for Class A, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). |

13 |

BOARD APPROVAL OF THE EXISTING ADVISORY AGREEMENTS

The Board of Trustees of the Trusts (the “Board”), including the Independent Trustees, considers matters bearing on each Fund’s advisory agreement (collectively, the “Agreements”) at most of its meetings throughout the year. Each year, usually in the spring, the Contract Review Committee of the Board meets to review the Agreements to determine whether to recommend that the full Board approve the continuation of the Agreements, typically for an additionalone-year period. After the Contract Review Committee has made its recommendation, the full Board, including the Independent Trustees, determines whether to approve the continuation of the Agreements.

In connection with these meetings, the Trustees receive materials that the Funds’ investment adviser and Loomis Sayles Core Plus Bond Fund’s advisory administrator (the “Advisers”) believes to be reasonably necessary for the Trustees to evaluate the Agreements. These materials generally include, among other items, (i) information on the investment performance of the Funds and the performance of peer groups of funds and the Funds’ performance benchmarks, (ii) information on the Funds’ advisory fees and other expenses, including information comparing the Funds’ advisory fees to the fees charged to institutional accounts with similar strategies managed by the Advisers, if any, and to those of peer groups of funds and information about any applicable expense caps and/or fee “breakpoints,” (iii) sales and redemption data in respect of the Funds, (iv) information about the profitability of the Agreements to the Advisers and (v) information obtained through the completion by the Advisers of a questionnaire distributed on behalf of the Trustees. The Board, including the Independent Trustees, also considers other matters such as (i) each Fund’s investment objective and strategies and the size, education and experience of the Advisers’ investment staffs and their use of technology, external research and trading cost measurement tools, (ii) arrangements in respect of the distribution of the Funds’ shares and the related costs, (iii) the allocation of the Funds’ brokerage, if any, including, to the extent applicable, the use of “soft” commission dollars to pay for research and other similar services, (iv) the Advisers’ policies and procedures relating to, among other things, compliance, trading and best execution, proxy voting and valuation, (v) information about amounts invested by the Funds’ portfolio managers in the Funds or in similar accounts that they manage and (vi) the general economic outlook with particular emphasis on the mutual fund industry. Throughout the process, the Trustees are afforded the opportunity to ask questions of and request additional materials from the Advisers.

In addition to the materials requested by the Trustees in connection with their annual consideration of the continuation of the Agreements, the Trustees receive materials in advance of each regular quarterly meeting of the Board that provide detailed information about the Funds’ investment performance and the fees charged to the Funds for advisory and other services. This information generally includes, among other things, an internal performance rating for each Fund based on agreed-upon criteria, graphs showing each Fund’s performance and expense differentials against each Fund’s peer group/category, performance ratings provided by a third-party, total return information for various periods, and third-party performance rankings for various periods comparing a Fund against similarly categorized funds. The portfolio management team for each Fund or other

| 14

representatives of the Advisers make periodic presentations to the Contract Review Committee and/or the full Board, and Funds identified as presenting possible performance concerns may be subject to more frequent Board or Committee presentations and reviews. In addition, each quarter the Trustees are provided with detailed statistical information about each Fund’s portfolio. The Trustees also receive periodic updates between meetings.

The Board most recently approved the continuation of the Agreements for aone-year period at its meeting held in June 2019. In considering whether to approve the continuation of the Agreements, the Board, including the Independent Trustees, did not identify any single factor as determinative. Individual Trustees may have evaluated the information presented differently from one another, giving different weights to various factors. Matters considered by the Trustees, including the Independent Trustees, in connection with their approval of the Agreements included, but were not limited to, the factors listed below.

The nature, extent and quality of the services provided to the Funds under the Agreements. The Trustees considered the nature, extent and quality of the services provided by the Advisers and their affiliates to the Funds and the resources dedicated to the Funds by the Advisers and their affiliates.

The Trustees considered not only the advisory services provided by the Advisers to the Funds, but also the monitoring and oversight services provided by Natixis Advisors, L.P. (“Natixis Advisors”). They also considered the administrative and shareholder services provided by Natixis Advisors and its affiliates to the Funds.

For each Fund, the Trustees also considered the benefits to shareholders of investing in a mutual fund that is part of a family of funds that offers shareholders the right to exchange shares of one type of fund for shares of another type of fund, and provides a variety of fund and shareholder services.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the nature, extent and quality of services provided supported the renewal of the Agreements.

Investment performance of the Funds and the Advisers. As noted above, the Trustees received information about the performance of the Funds over various time periods, including information that compared the performance of the Funds to the performance of peer groups and categories of funds and the Funds’ respective performance benchmarks. In addition, the Trustees reviewed data prepared by an independent third party that analyzed the performance of the Funds using a variety of performance metrics, including metrics that measured the performance of the Funds on a risk adjusted basis.

The Board noted that, through December 31, 2018, each Fund’sone-, three- and five-year performance stated as percentile rankings within categories selected by the independent third-party data provider was as follows (where the best performance would be in the first percentile of its category):

| | | | | | | | | | | | |

| | | One-Year | | | Three-Year | | | Five-Year | |

Loomis Sayles Core Plus Bond Fund | | | 68 | % | | | 3 | % | | | 27 | % |

Loomis Sayles Global Allocation Fund | | | 8 | % | | | 4 | % | | | 3 | % |

15 |

In the case of a Fund that had performance that lagged that of a relevant category median as determined by the independent third party for certain (although not necessarily all) periods, the Board concluded that other factors relevant to performance supported renewal of the Agreements. These factors included: (1) that the underperformance was attributable, to a significant extent, to investment decisions (such as security selection or sector allocation) by the Advisers that were reasonable and consistent with the Fund’s investment objective and policies; (2) that the Fund’s long-term performance was strong; and (3) that the Fund had recently been assigned to a different category by the independent third-party data provider, which is expected to result in more relevant performance comparisons.

The Trustees also considered the Advisers’ performance and reputation generally, the performance of the fund family generally, and the historical responsiveness of the Advisers to Trustee concerns about performance and the willingness of the Advisers to take steps intended to improve performance.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the performance of the Funds and the Advisers and/or other relevant factors supported the renewal of the Agreements.

The costs of the services to be provided and profits to be realized by the Advisers and their affiliates from their respective relationships with the Funds. The Trustees considered the fees charged to the Funds for advisory and administrative services as well as the total expense levels of the Funds. This information included comparisons (provided both by management and by an independent third party) of the Funds’ advisory fees and total expense levels to those of their peer groups and information about the advisory fees charged by the Advisers to comparable accounts (such as institutional separate accounts), as well as information about differences in such fees and the reasons for any such differences. In considering the fees charged to comparable accounts, the Trustees considered, among other things, management’s representations about the differences between managing mutual funds as compared to other types of accounts, including the additional resources required to effectively manage mutual fund assets and the greater regulatory costs associated with the management of such assets. In evaluating each Fund’s advisory fee, the Trustees also took into account the demands, complexity and quality of the investment management of such Fund, as well as the need for the Advisers to offer competitive compensation and the potential need to expend additional resources to the extent the Fund grows in size. The Trustees considered that over the past several years, management had made recommendations regarding reductions in advisory fee rates, implementation of advisory fee breakpoints and the institution of advisory fee waivers and expense caps for various funds in the fund family. They noted that the Funds have expense caps in place, and that the current expenses were below their caps. The Trustees also noted that the total advisory fee rate for each Fund was at or below the median of its peer group of funds.

The Trustees also considered the compensation directly or indirectly received by the Advisers and their affiliates from their relationships with the Funds. The Trustees reviewed information provided by management as to the profitability of the Advisers’ and their affiliates’ relationships with the Funds, and information about the allocation of expenses used to calculate profitability. They also reviewed information provided by management about the effect of distribution costs and changes in asset levels on Adviser profitability,

| 16

including information regarding resources spent on distribution activities. When reviewing profitability, the Trustees also considered information about court cases in which adviser compensation or profitability were issues, the performance of the Funds, the expense levels of the Funds, whether the Advisers had implemented breakpoints and/or expense caps with respect to such Funds and the overall profit margin of Natixis Investment Managers compared to that of certain other investment managers for which such data was available.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding the Agreements, that the advisory fee charged to each of the Funds was fair and reasonable, and that the costs of these services generally and the related profitability of the Advisers and their affiliates in respect of their relationships with the Funds supported the renewal of the Agreements.

Economies of Scale. The Trustees considered the existence of any economies of scale in the provision of services by the Advisers and whether those economies are shared with the Funds through breakpoints in their investment advisory fees or other means, such as expense caps. The Trustees also considered management’s explanation of the factors that are taken into account with respect to the implementation of breakpoints in investment advisory fees or expense caps. With respect to economies of scale, the Trustees noted that each of the Funds had breakpoints in its advisory fee and that each of the Funds was subject to an expense cap. In considering these issues, the Trustees also took note of the costs of the services provided (both on an absolute and on a relative basis) and the profitability to the Advisers and their affiliates of their relationships with the Funds, as discussed above. The Trustees also considered that the Funds have benefitted from the substantial reinvestment each Adviser has made into its business.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding the Agreements, that the extent to which economies of scale were shared with the Funds supported the renewal of the Agreements.

The Trustees also considered other factors, which included but were not limited to the following:

| · | | The effect of recent market and economic events on the performance, asset levels and expense ratios of each Fund. |

| · | | Whether each Fund has operated in accordance with its investment objective and the Fund’s record of compliance with its investment restrictions, and the compliance programs of the Funds and the Advisers. They also considered the compliance-related resources the Advisers and their affiliates were providing to the Funds. |

| · | | So-called “fallout benefits” to the Advisers, such as the engagement of affiliates of the Advisers to provide distribution and administrative services to the Funds, and the benefits of research made available to the Advisers by reason of brokerage commissions (if any) generated by the Funds’ securities transactions. The Trustees also considered the benefits to the parent company of Natixis Advisors from the retention of the Advisers. The Trustees considered the possible conflicts of interest associated with these fallout and other benefits, and the reporting, disclosure and other processes in place to disclose and monitor such possible conflicts of interest. |

17 |

| · | | The Trustees’ review and discussion of the Funds’ advisory arrangements in prior years, and management’s record of responding to Trustee concerns raised during the year and in prior years. |

Based on their evaluation of all factors that they deemed to be material, including those factors described above, and assisted by the advice of independent counsel, the Trustees, including the Independent Trustees, concluded that the existing Agreements should be continued through June 30, 2020.

| 18

Portfolio of Investments – as of September 30, 2019

Loomis Sayles Core Plus Bond Fund

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | Bonds and Notes — 93.2% of Net Assets | |

| | Non-Convertible Bonds — 93.0% | |

| | | | ABS Car Loan — 0.9% | |

| $ | 2,654,201 | | | AmeriCredit Automobile Receivables Trust, Series2015-4, Class C, 2.880%, 7/08/2021 | | $ | 2,656,991 | |

| | 109,099 | | | AmeriCredit Automobile Receivables Trust, Series2017-1, Class A3, 1.870%, 8/18/2021 | | | 109,047 | |

| | 2,000,000 | | | Avis Budget Rental Car Funding AESOP LLC, Series2015-1A, Class A, 2.500%, 7/20/2021, 144A | | | 2,001,520 | |

| | 11,955,000 | | | Avis Budget Rental Car Funding AESOP LLC, Series2016-1A, Class A, 2.990%, 6/20/2022, 144A | | | 12,084,438 | |

| | 15,005,000 | | | Avis Budget Rental Car Funding AESOP LLC, Series2016-2A, Class A, 2.720%, 11/20/2022, 144A | | | 15,128,860 | |

| | 10,350,000 | | | Avis Budget Rental Car Funding AESOP LLC, Series2017-1A, Class A, 3.070%, 9/20/2023, 144A | | | 10,566,336 | |

| | 4,985,000 | | | Avis Budget Rental Car Funding AESOP LLC, Series2019-1, Class A, 3.450%, 3/20/2023, 144A | | | 5,120,301 | |

| | 515,075 | | | CPS Auto Receivables Trust, Series2015-C, Class C, 3.420%, 8/16/2021, 144A | | | 515,286 | |

| | 1,026,408 | | | Credit Acceptance Auto Loan Trust, Series2017-1A, Class A, 2.560%, 10/15/2025, 144A | | | 1,026,814 | |

| | 7,435,000 | | | Credit Acceptance Auto Loan Trust, Series2017-3A, Class B, 3.210%, 8/17/2026, 144A | | | 7,522,871 | |

| | 880,537 | | | Drive Auto Receivables Trust, Series2017-AA, Class C, 2.980%, 1/18/2022, 144A | | | 881,421 | |

| | 5,755,000 | | | Santander Drive Auto Receivables Trust, Series2018-2, Class B, 3.030%, 9/15/2022 | | | 5,767,776 | |

| | 4,140,000 | | | Santander Drive Auto Receivables Trust, Series2018-2, Class C, 3.350%, 7/17/2023 | | | 4,183,022 | |

| | 2,475,000 | | | Santander Drive Auto Receivables Trust, Series2019-3, Class A3, 2.160%, 11/15/2022 | | | 2,475,423 | |

| | | | | | | | |

| | | | | | | 70,040,106 | |

| | | | | | | | |

| | | | ABS Credit Card — 0.3% | |

| | 11,115,000 | | | World Financial Network Credit Card Master Trust, Series2016-A, Class A, 2.030%, 4/15/2025 | | | 11,097,318 | |

| | 12,265,000 | | | World Financial Network Credit Card Master Trust, Series2016-C, Class A, 1.720%, 8/15/2023 | | | 12,262,531 | |

| | | | | | | | |

| | | | | | | 23,359,849 | |

| | | | | | | | |

| | | | ABS Home Equity — 1.8% | |

| | 3,122,786 | | | Bayview Opportunity Master Fund IVa Trust, Series 2016-SPL1, Class A, 4.000%, 4/28/2055, 144A | | | 3,190,072 | |

| | 1,749,461 | | | Bayview Opportunity Master Fund IVa Trust, Series2017-RT1, Class A1, 3.000%, 3/28/2057, 144A(a) | | | 1,766,775 | |

| | 9,261,109 | | | Bayview Opportunity Master Fund IVa Trust, Series2017-RT5, Class A, 3.500%, 5/28/2069, 144A(a) | | | 9,425,778 | |

| | 5,043,583 | | | Bayview Opportunity Master Fund IVa Trust, Series 2017-SPL1, Class A, 4.000%, 10/28/2064, 144A(a) | | | 5,189,709 | |

See accompanying notes to financial statements.

19 |

Portfolio of Investments – as of September 30, 2019

Loomis Sayles Core Plus Bond Fund – (continued)

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | ABS Home Equity — continued | |

| $ | 2,078,072 | | | Bayview Opportunity Master Fund IVb Trust, Series 2017-SPL2, Class A, 4.000%, 6/28/2054, 144A(a) | | $ | 2,136,223 | |

| | 2,313,465 | | | Bayview Opportunity Master Fund IVb Trust, Series 2017-SPL3, Class A, 4.000%, 11/28/2053, 144A(a) | | | 2,378,511 | |

| | 3,215,092 | | | Colony American Finance Ltd., Series2015-1, Class A, 2.896%, 10/15/2047, 144A | | | 3,210,314 | |

| | 41,750 | | | Countrywide Asset-Backed Certificates, Series2004-S1, Class A3, 5.115%, 2/25/2035(a)(b)(c) | | | 41,289 | |

| | 25,419,601 | | | Invitation Homes Trust, Series 2018-SFR2, Class A,1-month LIBOR + 0.900%, 2.928%, 6/17/2037, 144A(d) | | | 25,419,563 | |

| | 8,960,000 | | | Lanark Master Issuer PLC, Series2019-1A, Class 1A1,3-month LIBOR + 0.770%, 2.902%, 12/22/2069, 144A(d) | | | 8,979,730 | |

| | 2,476,283 | | | Mill City Mortgage Loan Trust, Series2016-1, Class A1, 2.500%, 4/25/2057, 144A(a) | | | 2,480,073 | |

| | 9,434,291 | | | Onslow Bay Financial LLC, Series 2018-EXP1, Class 1A3, 4.000%, 4/25/2048, 144A(a) | | | 9,587,348 | |

| | 2,684,063 | | | Sequoia Mortgage Trust, Series2017-CH1, Class A1, 4.000%, 8/25/2047, 144A(a) | | | 2,751,408 | |

| | 2,654,845 | | | Sequoia Mortgage Trust, Series2017-CH2, Class A10, 4.000%, 12/25/2047, 144A(a) | | | 2,682,869 | |

| | 5,867,629 | | | Sequoia Mortgage Trust, Series2018-CH1, Class A1, 4.000%, 2/25/2048, 144A(a) | | | 6,004,124 | |

| | 13,065,857 | | | Sequoia Mortgage Trust, Series2018-CH3, Class A2, 4.000%, 8/25/2048, 144A(a) | | | 13,281,946 | |

| | 1,454,000 | | | Towd Point Mortgage Trust, Series2015-1, Class A5, 3.997%, 10/25/2053, 144A(a) | | | 1,511,605 | |

| | 6,771,874 | | | Towd Point Mortgage Trust, Series2015-2, Class 1A12, 2.750%, 11/25/2060, 144A(a) | | | 6,779,684 | |

| | 5,018,000 | | | Towd Point Mortgage Trust, Series2015-4, Class M2, 3.750%, 4/25/2055, 144A(a) | | | 5,184,413 | |

| | 5,858,195 | | | Towd Point Mortgage Trust, Series2016-2, Class A1A, 2.750%, 8/25/2055, 144A(a) | | | 5,881,331 | |

| | 6,017,000 | | | Towd Point Mortgage Trust, Series2016-2, Class M2, 3.000%, 8/25/2055, 144A(a) | | | 6,025,167 | |

| | 12,758,018 | | | Towd Point Mortgage Trust, Series2018-3, Class A1, 3.750%, 5/25/2058, 144A(a) | | | 13,228,193 | |

| | | | | | | | |

| | | | | | | 137,136,125 | |

| | | | | | | | |

| | | | ABS Other — 0.1% | |

| | 4,538,904 | | | OneMain Financial Issuance Trust, Series2016-1A, Class A, 3.660%, 2/20/2029, 144A | | | 4,554,604 | |

| | 4,476,400 | | | TAL Advantage V LLC, Series2014-3A, Class A, 3.270%, 11/21/2039, 144A | | | 4,487,120 | |

| | | | | | | | |

| | | | | | | 9,041,724 | |

| | | | | | | | |

| | | | ABS Student Loan — 0.0% | |

| | 620,918 | | | SoFi Professional Loan Program LLC, Series2014-B, Class A2, 2.550%, 8/27/2029, 144A | | | 621,041 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 20

Portfolio of Investments – as of September 30, 2019

Loomis Sayles Core Plus Bond Fund – (continued)

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | ABS Whole Business — 0.5% | |

| $ | 19,149,225 | | | Coinstar Funding LLC, Series2017-1A, Class A2, 5.216%, 4/25/2047, 144A | | $ | 19,721,674 | |

| | 14,335,200 | | | Planet Fitness Master Issuer LLC, Series2018-1A, Class A2I, 4.262%, 9/05/2048, 144A | | | 14,655,878 | |

| | | | | | | | |

| | | | | | | 34,377,552 | |

| | | | | | | | |

| | | | Aerospace & Defense — 0.2% | |

| | 921,000 | | | Bombardier, Inc., 5.750%, 3/15/2022, 144A | | | 935,966 | |

| | 14,932,000 | | | Embraer Netherlands Finance BV, 5.050%, 6/15/2025 | | | 16,332,025 | |

| | | | | | | | |

| | | | | | | 17,267,991 | |

| | | | | | | | |

| | | | Agency Commercial Mortgage-Backed Securities — 2.9% | |

| | 15,165,000 | | | Federal National Mortgage Association, Series2015-M15, Class A2, 2.923%, 10/25/2025(a) | | | 15,802,998 | |

| | 6,750,000 | | | Federal National Mortgage Association, Series2015-M17, Class A2, 3.035%, 11/25/2025(a) | | | 7,049,736 | |

| | 10,975,000 | | | Federal National Mortgage Association, Series2016-M4, Class A2, 2.576%, 3/25/2026 | | | 11,235,243 | |

| | 20,355,000 | | | Federal National Mortgage Association, Series2017-M14, Class A2, 2.972%, 11/25/2027(a) | | | 21,324,932 | |

| | 1,660,000 | | | Federal National Mortgage Association, Series2017-M15, Class A2, 3.058%, 9/25/2027(a) | | | 1,757,458 | |

| | 7,591,000 | | | Federal National Mortgage Association, Series2017-M3, Class A2, 2.566%, 12/25/2026(a) | | | 7,740,459 | |

| | 6,538,096 | | | Federal National Mortgage Association, Series2017-M7, Class A2, 2.961%, 2/25/2027(a) | | | 6,861,898 | |

| | 11,860,279 | | | Federal National Mortgage Association, Series2018-M1, Class A2, 3.085%, 12/25/2027(a) | | | 12,587,491 | |

| | 2,460,000 | | | Federal National Mortgage Association, Series2018-M10, Class A2, 3.497%, 7/25/2028(a) | | | 2,674,254 | |

| | 6,965,000 | | | Federal National Mortgage Association, Series2018-M7, Class A2, 3.150%, 3/25/2028(a) | | | 7,388,937 | |

| | 4,665,000 | | | Federal National Mortgage Association, Series2018-M8, Class A2, 3.436%, 6/25/2028(a) | | | 5,052,325 | |

| | 7,350,000 | | | FHLMC Multifamily Structured Pass Through Certificates, Series K725, Class A2, 3.002%, 1/25/2024 | | | 7,626,356 | |

| | 2,770,000 | | | FHLMC Multifamily Structured Pass Through Certificates, Series K058, Class A2, 2.653%, 8/25/2026 | | | 2,876,576 | |

| | 6,195,000 | | | FHLMC Multifamily Structured Pass Through Certificates, Series K061, Class A2, 3.347%, 11/25/2026(a) | | | 6,707,706 | |

| | 6,995,000 | | | FHLMC Multifamily Structured Pass Through Certificates, Series K062, Class A2, 3.413%, 12/25/2026 | | | 7,607,237 | |

| | 5,105,490 | | | FHLMC Multifamily Structured Pass Through Certificates, Series K063, Class A2, 3.430%, 1/25/2027(a) | | | 5,553,636 | |

| | 915,000 | | | FHLMC Multifamily Structured Pass Through Certificates, Series K069, Class A2, 3.187%, 9/25/2027(a) | | | 983,729 | |

| | 1,310,000 | | | FHLMC Multifamily Structured Pass Through Certificates, Series K071, Class A2, 3.286%, 11/25/2027 | | | 1,417,447 | |

| | 8,045,000 | | | FHLMC Multifamily Structured Pass Through Certificates, Series K072, Class A2, 3.444%, 12/25/2027 | | | 8,802,413 | |

See accompanying notes to financial statements.

21 |

Portfolio of Investments – as of September 30, 2019

Loomis Sayles Core Plus Bond Fund – (continued)

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | Agency Commercial Mortgage-Backed Securities — continued | |

| $ | 2,550,000 | | | FHLMC Multifamily Structured Pass Through Certificates, Series K073, Class A2, 3.350%, 1/25/2028 | | $ | 2,775,702 | |

| | 21,680,000 | | | FHLMC Multifamily Structured Pass Through Certificates, Series K081, Class A2, 3.900%, 8/25/2028(a) | | | 24,540,097 | |

| | 7,205,000 | | | FHLMC Multifamily Structured Pass Through Certificates, Series K082, Class A2, 3.920%, 9/25/2028(a) | | | 8,176,853 | |

| | 10,465,000 | | | FHLMC Multifamily Structured Pass Through Certificates, Series K084, Class A2, 3.780%, 10/25/2028(a) | | | 11,752,675 | |

| | 11,410,000 | | | FHLMC Multifamily Structured Pass Through Certificates, Series K727, Class A2, 2.946%, 7/25/2024 | | | 11,815,449 | |

| | 2,151,433 | | | FNMA, 2.880%, 12/01/2027 | | | 2,263,970 | |

| | 6,485,000 | | | FNMA, 2.900%, 12/01/2027 | | | 6,824,238 | |

| | 5,035,000 | | | FNMA, 2.950%, 11/01/2027 | | | 5,337,997 | |

| | 1,826,000 | | | FNMA, 3.015%, 7/01/2028 | | | 1,941,284 | |

| | | | | | | | |

| | | | | | | 216,479,096 | |

| | | | | | | | |

| | | | Airlines — 0.0% | |

| | 2,294,395 | | | Continental Airlines Pass Through Certificates, Series2012-2, Class A, 4.000%, 4/29/2026 | | | 2,418,338 | |

| | 505,079 | | | Continental Airlines Pass Through Trust, Series2010-1, Class A, 4.750%, 7/12/2022 | | | 518,611 | |

| | | | | | | | |

| | | | | | | 2,936,949 | |

| | | | | | | | |

| | | | Automotive — 1.6% | |

| | 12,010,000 | | | Ford Motor Credit Co. LLC, 3.336%, 3/18/2021 | | | 12,066,096 | |

| | 27,688,000 | | | Ford Motor Credit Co. LLC, 5.750%, 2/01/2021 | | | 28,624,266 | |

| | 16,412,000 | | | Ford Motor Credit Co. LLC, 5.875%, 8/02/2021 | | | 17,190,749 | |

| | 18,701,000 | | | General Motors Co., 5.000%, 4/01/2035 | | | 18,770,984 | |

| | 22,752,000 | | | Hyundai Capital America, 3.000%, 10/30/2020, 144A | | | 22,859,972 | |

| | 10,350,000 | | | Toyota Motor Corp., 2.358%, 7/02/2024 | | | 10,457,727 | |

| | 8,370,000 | | | Volkswagen Group of America Finance LLC, 3.200%, 9/26/2026, 144A | | | 8,435,187 | |

| | | | | | | | |

| | | | | | | 118,404,981 | |

| | | | | | | | |

| | | | Banking — 8.4% | |

| | 17,853,000 | | | Ally Financial, Inc., 3.750%, 11/18/2019 | | | 17,869,068 | |

| | 21,085,000 | | | American Express Co., 2.500%, 7/30/2024 | | | 21,248,033 | |

| | 16,016,000 | | | Banco Santander Chile, 3.875%, 9/20/2022, 144A | | | 16,633,082 | |

| | 31,480,000 | | | Bangkok Bank PCL, 4.050%, 3/19/2024, 144A | | | 33,537,263 | |

| | 10,172,000 | | | Bank of America Corp., (fixed rate to 12/20/2022, variable rate thereafter), 3.004%, 12/20/2023 | | | 10,388,334 | |

| | 45,265,000 | | | Bank of America Corp., (fixed rate to 4/23/2026, variable rate thereafter), MTN, 3.559%, 4/23/2027 | | | 47,745,499 | |

| | 5,715,000 | | | Bank of America Corp., GMTN, 2.625%, 4/19/2021 | | | 5,766,043 | |

| | 10,850,000 | | | Bank of Montreal, Series D, 3.100%, 4/13/2021 | | | 11,036,081 | |

| | 45,518,000 | | | Barclays PLC, 2.875%, 6/08/2020 | | | 45,688,237 | |

| | 7,058,000 | | | Barclays PLC, 3.200%, 8/10/2021 | | | 7,120,110 | |

| | 14,545,000 | | | Capital One NA, 2.150%, 9/06/2022 | | | 14,530,753 | |

| | 5,780,000 | | | Citigroup, Inc., 2.650%, 10/26/2020 | | | 5,815,391 | |

See accompanying notes to financial statements.

| 22

Portfolio of Investments – as of September 30, 2019

Loomis Sayles Core Plus Bond Fund – (continued)

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | Banking — continued | |

| $ | 30,055,000 | | | Citigroup, Inc., 4.050%, 7/30/2022 | | $ | 31,476,021 | |

| | 11,955,000 | | | Goldman Sachs Bank USA, SOFR + 0.600%, 2.575%, 5/24/2021(d) | | | 11,974,556 | |

| | 5,780,000 | | | Goldman Sachs Group, Inc. (The), 2.600%, 4/23/2020 | | | 5,790,734 | |

| | 12,701,000 | | | Goldman Sachs Group, Inc. (The), 3.625%, 1/22/2023 | | | 13,208,738 | |

| | 14,867,000 | | | Goldman Sachs Group, Inc. (The), 5.750%, 1/24/2022 | | | 16,017,577 | |

| | 13,448,000 | | | Goldman Sachs Group, Inc. (The), 6.750%, 10/01/2037 | | | 18,153,241 | |

| | 19,915,000 | | | Huntington Bancshares, Inc., 2.625%, 8/06/2024 | | | 20,108,120 | |

| | 3,205,000 | | | JPMorgan Chase & Co., 2.550%, 3/01/2021 | | | 3,222,990 | |

| | 10,919,000 | | | JPMorgan Chase & Co., 3.200%, 1/25/2023 | | | 11,276,472 | |

| | 1,785,000 | | | JPMorgan Chase & Co., 4.250%, 10/15/2020 | | | 1,826,488 | |

| | 10,223,000 | | | JPMorgan Chase & Co., 4.350%, 8/15/2021 | | | 10,634,563 | |

| | 23,597,000 | | | JPMorgan Chase & Co., 4.500%, 1/24/2022 | | | 24,893,311 | |

| | 33,445,000 | | | JPMorgan Chase & Co., (fixed rate to 10/15/2029, variable rate thereafter), 2.739%, 10/15/2030 | | | 33,210,078 | |

| | 3,235,000 | | | Lloyds Banking Group PLC, 3.000%, 1/11/2022 | | | 3,268,164 | |

| | 3,955,000 | | | Lloyds Banking Group PLC, 3.100%, 7/06/2021 | | | 4,008,210 | |

| | 23,780,000 | | | Lloyds Banking Group PLC, 4.344%, 1/09/2048 | | | 24,366,052 | |

| | 7,690,000 | | | Morgan Stanley, 2.800%, 6/16/2020 | | | 7,728,849 | |

| | 19,598,000 | | | Morgan Stanley, 5.750%, 1/25/2021 | | | 20,506,859 | |

| | 3,381,000 | | | Morgan Stanley, GMTN, 3.700%, 10/23/2024 | | | 3,580,042 | |

| | 12,550,000 | | | Morgan Stanley, GMTN, 5.500%, 7/28/2021 | | | 13,317,096 | |

| | 21,770,000 | | | Morgan Stanley, Series F, 3.875%, 4/29/2024 | | | 23,159,573 | |

| | 16,700,000 | | | Nationwide Building Society, (fixed rate to 4/26/2022, variable rate thereafter), 3.622%, 4/26/2023, 144A | | | 17,024,717 | |

| | 9,123,000 | | | Santander UK Group Holdings PLC, 5.625%, 9/15/2045, 144A | | | 10,505,781 | |

| | 18,300,000 | | | Sumitomo Mitsui Financial Group, Inc., 2.696%, 7/16/2024 | | | 18,504,172 | |

| | 14,405,000 | | | Sumitomo Mitsui Financial Group, Inc., 3.040%, 7/16/2029 | | | 14,734,591 | |

| | 25,285,000 | | | Toronto Dominion Bank (The), 2.650%, 6/12/2024 | | | 25,761,640 | |

| | | | | | | | |

| | | | | | | 625,636,529 | |

| | | | | | | | |

| | | | Building Materials — 0.1% | |

| | 8,563,000 | | | Owens Corning, 4.200%, 12/01/2024 | | | 9,013,883 | |

| | | | | | | | |

| | | | Cable Satellite — 0.2% | |

| | 924,000 | | | Time Warner Cable LLC, 5.500%, 9/01/2041 | | | 994,965 | |

| | 2,648,000 | | | Time Warner Cable LLC, 5.875%, 11/15/2040 | | | 2,961,480 | |

| | 8,447,000 | | | Time Warner Cable LLC, 6.550%, 5/01/2037 | | | 10,140,711 | |

| | 2,013,000 | | | Time Warner Cable LLC, 6.750%, 6/15/2039 | | | 2,460,760 | |

| | | | | | | | |

| | | | | | | 16,557,916 | |

| | | | | | | | |

| | | | Chemicals — 1.4% | |

| | 26,749,000 | | | Braskem America Finance Co., 7.125%, 7/22/2041, 144A | | | 31,764,438 | |

| | 3,680,000 | | | Koppers, Inc., 6.000%, 2/15/2025, 144A | | | 3,682,318 | |

| | 3,566,000 | | | Methanex Corp., 3.250%, 12/15/2019 | | | 3,573,018 | |

| | 14,107,000 | | | Methanex Corp., 5.250%, 3/01/2022 | | | 14,660,254 | |

| | 17,715,000 | | | Methanex Corp., 5.250%, 12/15/2029 | | | 17,786,565 | |

| | 10,242,000 | | | Orbia Advance Corp. SAB de CV, 5.875%, 9/17/2044, 144A | | | 10,843,718 | |

| | 11,165,000 | | | Orbia Advance Corp. SAB de CV, 6.750%, 9/19/2042, 144A | | | 13,063,162 | |

| | 4,402,000 | | | RPM International, Inc., 3.450%, 11/15/2022 | | | 4,518,814 | |

See accompanying notes to financial statements.

23 |

Portfolio of Investments – as of September 30, 2019

Loomis Sayles Core Plus Bond Fund – (continued)

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | Chemicals — continued | |

| $ | 3,558,000 | | | RPM International, Inc., 6.125%, 10/15/2019 | | $ | 3,562,566 | |

| | | | | | | | |

| | | | | | | 103,454,853 | |

| | | | | | | | |

| | | | Collateralized Mortgage Obligations — 1.1% | |

| | 22,649,444 | | | Federal Home Loan Mortgage Corp., Series 277, Class 30, 3.000%, 9/15/2042 | | | 23,163,620 | |

| | 2,672,415 | | | Federal Home Loan Mortgage Corp., Series 353, Class 300, 3.000%, 12/15/2046 | | | 2,754,050 | |

| | 5,000,000 | | | Federal Home Loan Mortgage Corp., Series 3654, Class DC, 5.000%, 4/15/2030 | | | 5,636,088 | |

| | 508,419 | | | Government National Mortgage Association, Series2010-H20, Class AF,1-month LIBOR + 0.330%, 2.559%, 10/20/2060(d) | | | 506,477 | |

| | 416,946 | | | Government National Mortgage Association, Series2010-H24, Class FA,1-month LIBOR + 0.350%, 2.579%, 10/20/2060(d) | | | 415,454 | |

| | 340,084 | | | Government National Mortgage Association, Series2011-H06, Class FA,1-month LIBOR + 0.450%, 2.679%, 2/20/2061(d) | | | 339,814 | |

| | 3,712,414 | | | Government National Mortgage Association, Series2012-H12, Class FA,1-month LIBOR + 0.550%, 2.779%, 4/20/2062(d) | | | 3,717,707 | |

| | 473,450 | | | Government National Mortgage Association, Series2012-H18, Class NA,1-month LIBOR + 0.520%, 2.749%, 8/20/2062(d) | | | 473,647 | |

| | 3,858,337 | | | Government National Mortgage Association, Series2012-H27, Class FA,1-month LIBOR + 0.400%, 2.629%, 10/20/2062(d) | | | 3,851,047 | |

| | 1,231,485 | | | Government National Mortgage Association, Series2013-H01, Class FA, 1.650%, 1/20/2063 | | | 1,225,422 | |

| | 2,014,006 | | | Government National Mortgage Association, Series2013-H03, Class HA, 1.750%, 12/20/2062 | | | 2,004,984 | |

| | 2,922,468 | | | Government National Mortgage Association, Series2013-H04, Class BA, 1.650%, 2/20/2063 | | | 2,908,107 | |

| | 7,682,448 | | | Government National Mortgage Association, Series2013-H07, Class DA, 2.500%, 3/20/2063 | | | 7,680,171 | |

| | 11,798,963 | | | Government National Mortgage Association, Series2013-H10, Class PA, 2.500%, 4/20/2063 | | | 11,780,263 | |

| | 12,590,023 | | | Government National Mortgage Association, Series2015-H10, Class JA, 2.250%, 4/20/2065 | | | 12,429,811 | |

| | 6,351,944 | | | Government National Mortgage Association, Series2015-H13, Class FG,1-month LIBOR + 0.400%, 2.629%, 4/20/2065(d) | | | 6,340,238 | |

| | 237,504 | | | Government National Mortgage Association, Series2015-H13, Class FL,1-month LIBOR + 0.280%, 2.509%, 5/20/2063(d) | | | 237,228 | |

| | | | | | | | |

| | | | | | | 85,464,128 | |

| | | | | | | | |

| | | | Construction Machinery — 0.2% | |

| | 8,705,000 | | | CNH Industrial Capital LLC, 4.375%, 4/05/2022 | | | 9,039,446 | |

| | 4,790,000 | | | John Deere Capital Corp., MTN, 2.600%, 3/07/2024 | | | 4,887,647 | |

| | | | | | | | |

| | | | | | | 13,927,093 | |

| | | | | | | | |

| | | | Consumer Cyclical Services — 0.4% | |

| | 25,600,000 | | | Amazon.com, Inc., 4.250%, 8/22/2057 | | | 31,822,977 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 24

Portfolio of Investments – as of September 30, 2019

Loomis Sayles Core Plus Bond Fund – (continued)

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | Consumer Products — 0.2% | |

| $ | 11,675,000 | | | Whirlpool Corp., 4.750%, 2/26/2029 | | $ | 13,013,105 | |

| | 3,495,000 | | | Whirlpool Corp., MTN, 4.850%, 6/15/2021 | | | 3,627,693 | |

| | | | | | | | |

| | | | | | | 16,640,798 | |

| | | | | | | | |

| | | | Diversified Manufacturing — 0.1% | |

| | 1,158,000 | | | Crane Co., 6.550%, 11/15/2036 | | | 1,457,345 | |

| | 2,770,000 | | | General Electric Co., 5.300%, 2/11/2021 | | | 2,861,982 | |

| | | | | | | | |

| | | | | | | 4,319,327 | |

| | | | | | | | |

| | | | Electric — 1.3% | |

| | 26,437,125 | | | Cometa Energia S.A. de CV, 6.375%, 4/24/2035, 144A | | | 28,122,492 | |

| | 3,315,000 | | | Enel Americas S.A., 4.000%, 10/25/2026 | | | 3,462,517 | |

| | 3,364,000 | | | Enel Generacion Chile S.A., 4.250%, 4/15/2024 | | | 3,557,544 | |

| | 17,805,000 | | | Florida Power & Light Co., 3.150%, 10/01/2049 | | | 18,117,095 | |

| | 17,247,000 | | | National Rural Utilities Cooperative Finance Corp., (fixed rate to 4/30/2023, variable rate thereafter), 4.750%, 4/30/2043 | | | 17,567,277 | |

| | 5,930,000 | | | PPL Electric Utilities Corp., 3.000%, 10/01/2049 | | | 5,737,611 | |

| | 8,413,000 | | | Transelec S.A., 4.250%, 1/14/2025, 144A | | | 8,917,864 | |

| | 4,380,000 | | | Transelec S.A., 4.625%, 7/26/2023, 144A | | | 4,653,794 | |

| | 3,050,000 | | | Virginia Electric & Power Co., 2.875%, 7/15/2029 | | | 3,123,867 | |

| | | | | | | | |

| | | | | | | 93,260,061 | |

| | | | | | | | |

| | | | Finance Companies — 0.5% | |

| | 1,534,000 | | | AerCap Ireland Capital DAC/AerCap Global Aviation Trust, 3.300%, 1/23/2023 | | | 1,564,331 | |

| | 18,035,000 | | | Air Lease Corp., GMTN, 3.750%, 6/01/2026 | | | 18,735,250 | |

| | 3,910,000 | | | International Lease Finance Corp., 5.875%, 8/15/2022 | | | 4,283,838 | |

| | 14,547,000 | | | Navient LLC, MTN, 8.000%, 3/25/2020 | | | 14,819,756 | |

| | | | | | | | |

| | | | | | | 39,403,175 | |

| | | | | | | | |

| | | | Financial Other — 0.1% | |

| | 7,243,251 | | | Cielo USA, Inc., 3.750%, 11/16/2022, 144A | | | 7,246,148 | |

| | | | | | | | |

| | | | Food & Beverage — 0.4% | |

| | 7,380,000 | | | Bacardi Ltd., 5.150%, 5/15/2038, 144A | | | 8,099,097 | |

| | 16,885,000 | | | Bacardi Ltd., 5.300%, 5/15/2048, 144A | | | 19,344,095 | |

| | 3,490,000 | | | Gruma SAB de CV, 4.875%, 12/01/2024, 144A | | | 3,777,960 | |

| | 1,230,000 | | | Sigma Alimentos S.A. de CV, 6.875%, 12/16/2019, 144A | | | 1,239,803 | |

| | | | | | | | |

| | | | | | | 32,460,955 | |

| | | | | | | | |

| | | | Government Owned – No Guarantee — 2.6% | |

| | 7,757,000 | | | CNPC General Capital Ltd., 3.950%, 4/19/2022, 144A | | | 8,029,038 | |

| | 17,981,000 | | | Dolphin Energy Ltd. LLC, 5.500%, 12/15/2021, 144A | | | 19,081,977 | |

| | 11,005,000 | | | Mexico City Airport Trust, 5.500%, 7/31/2047, 144A | | | 10,915,859 | |

| | 18,213,000 | | | OCP S.A., 5.625%, 4/25/2024, 144A | | | 19,858,617 | |

| | 7,355,000 | | | Ooredoo International Finance Ltd., 3.250%, 2/21/2023, 144A | | | 7,490,664 | |

| | 10,955,000 | | | Ooredoo International Finance Ltd., 3.875%, 1/31/2028, 144A | | | 11,749,237 | |

| | 11,250,000 | | | Saudi Arabian Oil Co., 4.375%, 4/16/2049, 144A | | | 12,288,832 | |

| | 18,945,000 | | | Syngenta Finance NV, 3.698%, 4/24/2020, 144A | | | 19,007,952 | |

| | 24,223,000 | | | Tennessee Valley Authority, 4.250%, 9/15/2065 | | | 33,472,745 | |

See accompanying notes to financial statements.

25 |

Portfolio of Investments – as of September 30, 2019

Loomis Sayles Core Plus Bond Fund – (continued)

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | Government Owned – No Guarantee — continued | |

| $ | 6,160,000 | | | Tennessee Valley Authority, 4.625%, 9/15/2060 | | $ | 8,956,090 | |

| | 6,401,000 | | | Tennessee Valley Authority, 4.875%, 1/15/2048 | | | 9,117,270 | |

| | 10,957,000 | | | Tennessee Valley Authority, 5.250%, 9/15/2039 | | | 15,509,272 | |

| | 5,215,000 | | | Tennessee Valley Authority, 5.880%, 4/01/2036 | | | 7,564,405 | |

| | 10,930,000 | | | Transportadora de Gas Internacional S.A. E.S.P., 5.550%, 11/01/2028, 144A | | | 12,596,934 | |