|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

| -------- |

| |

| FORM N-CSR |

| -------- |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| |

| INVESTMENT COMPANY ACT FILE NUMBER 811-4325 |

| |

| FIRST INVESTORS LIFE SERIES FUNDS |

| (Exact name of registrant as specified in charter) |

| |

| 110 Wall Street |

| New York, NY 10005 |

| (Address of principal executive offices) (Zip code) |

| |

| Joseph I. Benedek |

| First Investors Management Company, Inc. |

| Raritan Plaza I |

| Edison, NJ 08837-3620 |

| 1-732-855-2712 |

| (Name and address of agent for service) |

| |

| REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE: |

| 1-212-858-8000 |

| |

| DATE OF FISCAL YEAR END: DECEMBER 31, 2009 |

| |

| DATE OF REPORTING PERIOD: DECEMBER 31, 2009 |

| |

| Item 1. | Reports to Stockholders |

| |

| The Annual Report to Stockholders follows |

This report is for the information of the shareholders of the Funds. It is the Funds’ practice to mail only one copy of their annual and semi-annual reports to all family members who reside in the same household. Additional copies of the reports will be mailed if requested by any shareholder in writing or by calling 1-800-423-4026. The Funds will ensure that separate reports are sent to any shareholder who subsequently changes his or her mailing address.

The views expressed in the portfolio manager letters reflect those views of the portfolio managers only through the end of the period covered. Any such views are subject to change at any time based upon market or other conditions and we disclaim any responsibility to update such views. These views may not be relied on as investment advice.

You may obtain a free prospectus for any of the Funds by contacting your representative, calling 1-800-423-4026, writing to us at the following address: First Investors Corporation, 110 Wall Street, New York, NY 10005, or by visiting our website at www.firstinvestors.com. You should consider the investment objectives, risks, charges and expenses of a Fund carefully before investing. The prospectus contains this and other information about the Fund, and should be read carefully before investing.

An investment in a Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although the Cash Management Fund seeks to preserve a net asset value at $1.00 per share, it is possible to lose money by investing in it, just as it is possible to lose money by investing in any of the other Funds. Past performance is no guarantee of future results.

A Statement of Additional Information (“SAI”) for any of the Funds may also be obtained, without charge, upon request by calling 1-800-423-4026, writing to us at our address or by visiting our website listed above. The SAI contains more detailed information about the Fund, including information about its Trustees.

Portfolio Manager’s Letter

BLUE CHIP FUND

Dear Investor:

This is the annual report for the First Investors Life Blue Chip Fund for the year ended December 31, 2009. During the period, the Fund’s return on a net asset value basis was 21.61%, including dividends of 36.4 cents per share.

During the first part of the review period, the markets were in a steep free fall, culminating with a multi-decade market low achieved on March 9, 2009. Only after U.S. and global regulators took extraordinary measures to supply massive financial aid and intervention, such as through the TARP program, did the markets stabilize. The markets then rallied convincingly, ending the year with a significant gain.

Despite its strong performance, the Fund underperformed the overall market, as measured by the S&P 500 Index, due to its focus on high-quality companies. During 2008 and into 2009, share prices of lower-quality companies were driven sharply lower as investors prepared for the worst-case scenario: an economic depression. Then, late in the first quarter, as fears of depression dissipated, the market rallied, and shares of lower-quality companies rebounded more sharply than shares of more stable companies, which had lost less ground when investors’ fears were peaking.

The Fund’s defensive positioning had the biggest negative impact on relative performance in the information technology and consumer discretionary sectors. While information technology was the best performing sector for the Fund, returns did not keep up with the comparable sector of the S&P 500 Index because the Fund did not own some strong performers that it believed were overvalued. Similarly, in the consumer discretionary sector, the Fund did not own momentum stocks like Amazon. com, which traded at valuations beyond those which the Fund deemed appropriate, or troubled companies like Ford Motor, which snapped back from the brink of disaster.

Overall, however, the Fund generated a substantial positive return led by technology stocks such as Microsoft and International Business Machines, which both gained more than 50%. The materials sector also generated strong returns, led by Dow Chemical as it stabilized its balance sheet and cut costs after making a large acquisition. Media companies such as Walt Disney and Time Warner helped the Fund turn in a positive performance in the consumer discretionary sector. Financial firms JPMorgan Chase and American Express were also among the best stocks in the portfolio as their business outlook improved as the year progressed. Individual positions that hurt Fund performance the most included ExxonMobil, which announced a large acquisition near the end of the year, Procter & Gamble, which suffered as consumers traded down to cheaper brands, and General Electric, whose finance arm was heavily affected by the meltdown in the real estate and credit markets.

Portfolio Manager’s Letter (continued)

BLUE CHIP FUND

Thank you for placing your trust in First Investors. We appreciate the opportunity to serve your investment needs.

Sincerely,

Matthew S. Wright

Portfolio Manager

January 29, 2010

Understanding Your Fund’s Expenses

FIRST INVESTORS LIFE SERIES FUNDS

As a mutual fund shareholder, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including advisory fees and other expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 in each Fund at the beginning of the period, July 1, 2009, and held for the entire six-month period ended December 31, 2009. The calculations assume that no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

Actual Expense Example:

These amounts help you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid during the period.

To estimate the expenses you paid on your account during this period simply divide your ending account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period”.

Hypothetical Expense Example:

These amounts provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transactional costs. Therefore, the hypothetical expense example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Fund Expenses (unaudited)

BLUE CHIP FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 3 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (7/1/09) | (12/31/09) | (7/1/09–12/31/09)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $1,203.11 | $4.61 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,021.03 | $4.23 |

| |

| * | Expenses are equal to the annualized expense ratio of .83%, multiplied by the average account |

| value over the period, multiplied by 184/365 (to reflect the one-half year period). |

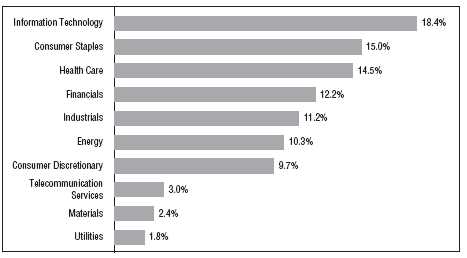

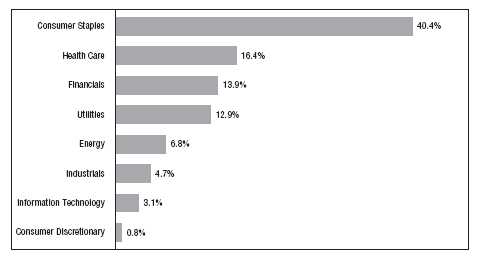

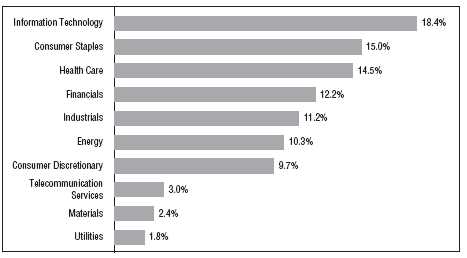

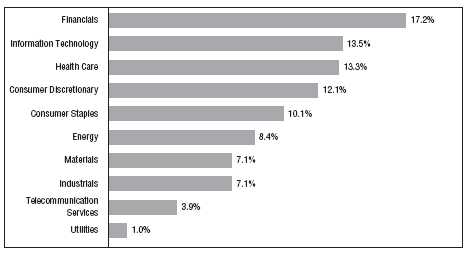

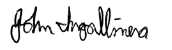

Portfolio Composition

TOP TEN SECTORS

|

| Portfolio holdings and allocations are subject to change. Percentages are as of December 31, 2009, |

| and are based on the total value of investments. |

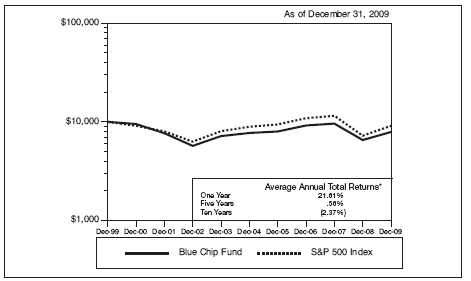

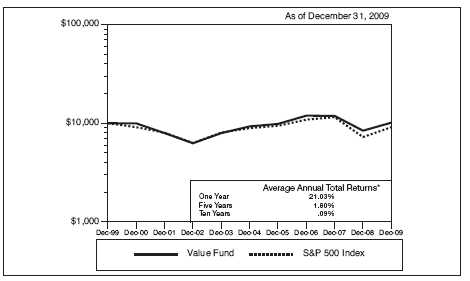

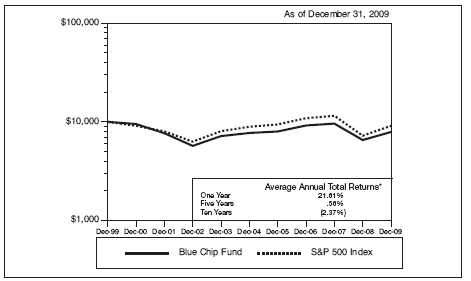

Cumulative Performance Information

BLUE CHIP FUND

Comparison of change in value of $10,000 investment in the First Investors Life Series Blue

Chip Fund and the Standard & Poor’s 500 Index.

The graph compares a $10,000 investment in the First Investors Life Series Blue Chip Fund beginning 12/31/99 with a theoretical investment in the Standard & Poor’s 500 Index (the “Index”). The Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of such stocks, which represent all major industries. It is not possible to invest directly in this Index. In addition, the Index does not reflect fees and expenses associated with the active management of a mutual fund portfolio. For purposes of the graph and the accompanying table it is assumed that all dividends and distributions were reinvested.

* The Average Annual Total Return figures are for the periods ended 12/31/09.

The returns shown do not reflect any sales charges, since the Fund sells its shares solely to variable annuity and/or variable life insurance subaccounts at net asset value. The returns do not reflect the fees and charges that an individual would pay in connection with an investment in a variable annuity or life contract or policy. Results represent past performance and do not indicate future results. The graph and the returns shown do not reflect the deduction of taxes that an investor would pay on distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Standard & Poor’s 500 Index figures are from Standard & Poor’s and all other figures are from First Investors Management Company, Inc.

Portfolio of Investments

BLUE CHIP FUND

December 31, 2009

| | | | |

| Shares | | | Security | Value |

| |

| | | | COMMON STOCKS—98.5% | |

| | | | Consumer Discretionary—9.7% | |

| 14,800 | | | Best Buy Company, Inc. | $ 584,008 |

| 51,850 | | | Comcast Corporation – Special Class “A” | 830,119 |

| 33,000 | | | H&R Block, Inc. | 746,460 |

| 39,700 | | | Home Depot, Inc. | 1,148,521 |

| 13,200 | | * | Kohl’s Corporation | 711,876 |

| 50,000 | | | Lowe’s Companies, Inc. | 1,169,500 |

| 15,700 | | | McDonald’s Corporation | 980,308 |

| 9,000 | | | NIKE, Inc. – Class “B” | 594,630 |

| 15,300 | | | Omnicom Group, Inc. | 598,995 |

| 24,900 | | | Staples, Inc. | 612,291 |

| 14,800 | | | Target Corporation | 715,876 |

| 29,900 | | | Time Warner, Inc. | 871,286 |

| 22,400 | | * | Viacom, Inc. – Class “B” | 665,952 |

| 44,900 | | | Walt Disney Company | 1,448,025 |

| |

| | | | | 11,677,847 |

| |

| | | | Consumer Staples—15.0% | |

| 30,700 | | | Altria Group, Inc. | 602,641 |

| 20,900 | | | Avon Products, Inc. | 658,350 |

| 9,900 | | | Clorox Company | 603,900 |

| 37,300 | | | Coca-Cola Company | 2,126,100 |

| 14,700 | | | Costco Wholesale Corporation | 869,799 |

| 34,900 | | | CVS Caremark Corporation | 1,124,129 |

| 21,200 | | | Kimberly-Clark Corporation | 1,350,652 |

| 39,861 | | | Kraft Foods, Inc. – Class “A” | 1,083,422 |

| 29,800 | | | Kroger Company | 611,794 |

| 35,300 | | | PepsiCo, Inc. | 2,146,240 |

| 29,600 | | | Philip Morris International, Inc. | 1,426,424 |

| 31,935 | | | Procter & Gamble Company | 1,936,219 |

| 34,900 | | | Walgreen Company | 1,281,528 |

| 42,000 | | | Wal-Mart Stores, Inc. | 2,244,900 |

| |

| | | | | 18,066,098 |

| |

| | | | Energy—10.3% | |

| 13,000 | | | BP PLC (ADR) | 753,610 |

| 32,500 | | | Chevron Corporation | 2,502,175 |

| 25,771 | | | ConocoPhillips | 1,316,125 |

| 11,000 | | | Devon Energy Corporation | 808,500 |

| 48,100 | | | ExxonMobil Corporation | 3,279,939 |

| 21,300 | | | Halliburton Company | 640,917 |

| | | | |

| Shares | | | Security | Value |

| |

| | | | Energy (continued) | |

| 10,300 | | | Hess Corporation | $ 623,150 |

| 19,700 | | | Marathon Oil Corporation | 615,034 |

| 19,600 | | | Schlumberger, Ltd. | 1,275,764 |

| 7,424 | | * | Transocean, Ltd. | 614,707 |

| |

| | | | | 12,429,921 |

| |

| | | | Financials—12.2% | |

| 14,400 | | | ACE, Ltd. | 725,760 |

| 20,000 | | | Allstate Corporation | 600,800 |

| 29,900 | | | American Express Company | 1,211,548 |

| 15,500 | | | Ameriprise Financial, Inc. | 601,710 |

| 52,817 | | | Bank of America Corporation | 795,424 |

| 41,205 | | | Bank of New York Mellon Corporation | 1,152,504 |

| 250 | | * | Berkshire Hathaway, Inc. – Class “B” | 821,500 |

| 15,700 | | | Capital One Financial Corporation | 601,938 |

| 15,800 | | | Chubb Corporation | 777,044 |

| 42,900 | | | Financial Select Sector SPDR Fund (ETF) | 617,331 |

| 44,200 | | | Hudson City Bancorp, Inc. | 606,866 |

| 53,432 | | | JPMorgan Chase & Company | 2,226,511 |

| 27,500 | | | Marsh & McLennan Companies, Inc. | 607,200 |

| 20,000 | | | Morgan Stanley | 592,000 |

| 11,600 | | | Northern Trust Corporation | 607,840 |

| 17,700 | | | Travelers Companies, Inc. | 882,522 |

| 26,500 | | | U.S. Bancorp | 596,515 |

| 26,900 | | | Wells Fargo & Company | 726,031 |

| |

| | | | | 14,751,044 |

| |

| | | | Health Care—14.5% | |

| 37,400 | | | Abbott Laboratories | 2,019,226 |

| 21,500 | | * | Amgen, Inc. | 1,216,255 |

| 46,200 | | | Bristol-Myers Squibb Company | 1,166,550 |

| 8,200 | | | C.R. Bard, Inc. | 638,780 |

| 15,200 | | * | Gilead Sciences, Inc. | 657,856 |

| 57,200 | | | Johnson & Johnson | 3,684,252 |

| 9,700 | | | McKesson Corporation | 606,250 |

| 29,300 | | | Medtronic, Inc. | 1,288,614 |

| 27,300 | | | Merck & Company. Inc. | 997,542 |

| 23,700 | | | Novartis AG (ADR) | 1,289,991 |

| 106,257 | | | Pfizer, Inc. | 1,932,815 |

| 18,900 | | * | St. Jude Medical, Inc. | 695,142 |

Portfolio of Investments (continued)

BLUE CHIP FUND

December 31, 2009

| | | | |

| Shares | | | Security | Value |

| |

| | | | Health Care (continued) | |

| 13,200 | | | Teva Pharmaceutical Industries, Ltd. (ADR) | $ 741,576 |

| 10,200 | | * | Zimmer Holdings, Inc. | 602,922 |

| |

| | | | | 17,537,771 |

| |

| | | | Industrials—11.2% | |

| 14,900 | | | 3M Company | 1,231,783 |

| 12,500 | | | Danaher Corporation | 940,000 |

| 22,700 | | | Emerson Electric Company | 967,020 |

| 133,900 | | | General Electric Company | 2,025,907 |

| 19,800 | | | Honeywell International, Inc. | 776,160 |

| 13,500 | | | Illinois Tool Works, Inc. | 647,865 |

| 13,900 | | | ITT Corporation | 691,386 |

| 12,600 | | | Lockheed Martin Corporation | 949,410 |

| 11,100 | | | Northrop Grumman Corporation | 619,935 |

| 14,500 | | | Raytheon Company | 747,040 |

| 20,525 | | | Tyco International, Ltd. | 732,332 |

| 11,300 | | | United Parcel Service, Inc. – Class “B” | 648,281 |

| 28,800 | | | United Technologies Corporation | 1,999,008 |

| 17,400 | | | Waste Management, Inc. | 588,294 |

| |

| | | | | 13,564,421 |

| |

| | | | Information Technology—18.4% | |

| 55,500 | | * | Activision Blizzard, Inc. | 616,605 |

| 16,900 | | * | Adobe Systems, Inc. | 621,582 |

| 5,600 | | * | Apple, Inc. | 1,180,816 |

| 15,000 | | | Automatic Data Processing, Inc. | 642,300 |

| 84,800 | | * | Cisco Systems, Inc. | 2,030,112 |

| 55,500 | | * | EMC Corporation | 969,585 |

| 42,100 | | | Hewlett-Packard Company | 2,168,571 |

| 84,300 | | | Intel Corporation | 1,719,720 |

| 16,800 | | | International Business Machines Corporation | 2,199,120 |

| 156,800 | | | Microsoft Corporation | 4,780,832 |

| 46,100 | | | Nokia Corporation – Class “A” (ADR) | 592,385 |

| 55,000 | | | Oracle Corporation | 1,349,700 |

| 17,200 | | | QUALCOMM, Inc. | 795,672 |

| 34,200 | | * | Symantec Corporation | 611,838 |

| 30,600 | | | Texas Instruments, Inc. | 797,436 |

| 32,000 | | | Western Union Company | 603,200 |

| 34,200 | | * | Yahoo!, Inc. | 573,876 |

| |

| | | | | 22,253,350 |

| | | | | | |

| Shares or | | | | | | |

| Principal | | | | | | |

| Amount | | | Security | | | Value |

| |

| | | | Materials—2.4% | | | |

| 28,100 | | | Dow Chemical Company | | | $ 776,403 |

| 27,800 | | | DuPont (E.I.) de Nemours & Company | | | 936,026 |

| 12,700 | | | Newmont Mining Corporation | | | 600,837 |

| 10,300 | | | PPG Industries, Inc. | | | 602,962 |

| |

| | | | | | | 2,916,228 |

| |

| | | | Telecommunication Services—3.0% | | | |

| 64,700 | | | AT&T, Inc. | | | 1,813,541 |

| 55,800 | | | Verizon Communications, Inc. | | | 1,848,654 |

| |

| | | | | | | 3,662,195 |

| |

| | | | Utilities—1.8% | | | |

| 20,000 | | | American Electric Power, Inc. | | | 695,800 |

| 51,500 | | | Duke Energy Corporation | | | 886,315 |

| 11,500 | | | FPL Group, Inc. | | | 607,430 |

| |

| | | | | | | 2,189,545 |

| |

| Total Value of Common Stocks (cost $91,762,255) | | | 119,048,420 |

| |

| | | | SHORT-TERM INVESTMENTS—1.5% | | |

| | | | Money Market Fund | | | |

| $1,785 | M | | First Investors Cash Reserve Fund, .24% (cost $1,785,000)** | | 1,785,000 |

| |

| Total Value of Investments (cost $93,547,255) | 100.0 | % | 120,833,420 |

| Other Assets, Less Liabilities | — | | 29,060 |

| |

| Net Assets | | | | 100.0 | % | $120,862,480 |

| |

| * | Non-income producing |

| ** | Affiliated unregistered money market fund available only to First Investors funds and certain |

| accounts managed by First Investors Management Company, Inc. Rate shown is the 7-day yield |

| at December 31, 2009 (see Note 3). |

| | |

| Summary of Abbreviations: |

| ADR | American Depositary Receipts |

| ETF | Exchange Traded Fund |

Portfolio of Investments (continued)

BLUE CHIP FUND

December 31, 2009

Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| Level 1 — quoted prices in active markets for identical securities |

| |

| Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| |

| Level 3 — significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments) |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of December 31, 2009:

| | | | | | | | | | | | |

| | | | | | | Level 2 | | | | | | |

| | | | | | | Other | | | Level 3 | | | |

| | | | Level 1 | | | Significant | | | Significant | | | |

| | | | Quoted | | | Observable | | | Unobservable | | | |

| | | | Prices | | | Inputs | | | Inputs | | | Total |

| Common Stocks | | $ | 119,048,420 | | $ | — | | $ | — | | $ | 119,048,420 |

| Money Market Fund | | | 1,785,000 | | | — | | | — | | | 1,785,000 |

| Total Investments | | | | | | | | | | | | |

| in Securities* | | $ | 120,833,420 | | $ | — | | $ | — | | $ | 120,833,420 |

|

| * The Portfolio of Investments provides information on the industry categorization for the portfolio. |

| | |

| 10 | See notes to financial statements | |

Portfolio Manager’s Letter

CASH MANAGEMENT FUND

Dear Investor:

This is the annual report for the First Investors Life Cash Management Fund for the year ended December 31, 2009. During the period, the Fund’s return on a net asset value basis was 0.17%, including dividends of 0.2 cents per share. The Fund maintained a $1.00 net asset value per share throughout the year.

Short-term interest rates remained at historically low levels as the Federal Reserve maintained its benchmark federal funds rate at a range of 0 – 0.25% throughout the year. With rates at record lows for such an extended period, the Fund’s yield fell steadily through the year and, like many money market funds, was at 0% by year-end.

Conditions in the money markets were characterized by low yields, tight spreads and a flat yield curve. Consequently, there were few places to realize incremental return in 2009. Even floating rate notes, which were a positive contributor to the portfolio through the first half of the year, were of no solace as resets declined sharply when LIBOR levels reverted to pre-crisis relationships. The LIBOR—London Interbank Offered Rate—is the world’s most widely used benchmark for short-term interest rates.

The Fund’s yield was buffered during the first half of the period by its longer-than-average weighted maturity. In addition, with LIBOR levels elevated, floating rate securities were a major positive for the portfolio, especially during the first half of the year. The Fund also used short maturity corporate and municipal bonds to supplement performance.

The Fund continued to invest conservatively through the period, and attempted to mitigate credit risk by generally limiting corporate security investments to shorter maturities and smaller position sizes while maintaining a significant portion of its assets in U.S. government and agency securities. The Fund did not invest in asset-backed commercial paper or second-tier securities during the review period and it avoided negative credit events as well.

The Fund’s performance was aided by financial support provided by its Investment Adviser. By the end of the review period, First Investors Management Company, Inc. (“FIMCO”) was not only waiving its management fees, but also assuming certain other expenses otherwise payable by the Fund in order to avoid a negative yield to the Fund’s shareholders. FIMCO expects this situation to continue, and as a result, the yield to shareholders should be at or near zero for the foreseeable future.

Although money market funds in general are relatively conservative vehicles, there can be no assurance that the Fund will be able to maintain a stable net asset value of $1.00 per share. Money market mutual funds are neither insured nor guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

Portfolio Manager’s Letter (continued)

CASH MANAGEMENT FUND

Thank you for placing your trust in First Investors. We appreciate the opportunity to serve your investment needs.

Sincerely,

Michael J. O’Keefe

Portfolio Manager

January 29, 2010

Fund Expenses (unaudited)

CASH MANAGEMENT FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 3 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (7/1/09) | (12/31/09) | (7/1/09–12/31/09)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $1,000.18 | $2.52 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,022.69 | $2.55 |

| |

| * | Expenses are equal to the annualized expense ratio of .50%, multiplied by the average account |

| value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses paid |

| during the period are net of expenses waived. |

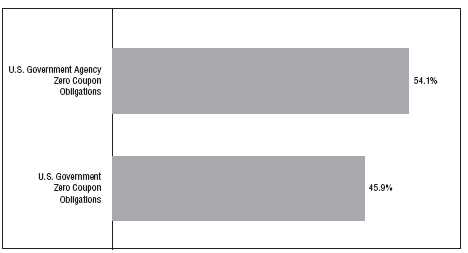

Portfolio Composition

BY SECTOR

|

| Portfolio holdings and allocations are subject to change. Percentages are as of December 31, 2009, |

| and are based on the total value of investments. |

Portfolio of Investments

CASH MANAGEMENT FUND

December 31, 2009

| | | | | | | | | |

| Principal | | | | | | | Interest | | |

| Amount | | | Security | | | | Rate | * | Value |

| |

| | | | CORPORATE NOTES—42.8% | | | | | | |

| $ 400 | M | | Abbott Laboratories, 3/8/10 (a) | | | | 0.11 | % | $ 399,919 |

| 250 | M | | BP Capital Markets PLC, 3/15/10 | | | | 1.55 | | 251,656 |

| 500 | M | | Coca-Cola Co., 1/20/10 (a) | | | | 0.14 | | 499,963 |

| 450 | M | | Dell, Inc., 2/9/10 (a) | | | | 0.13 | | 449,937 |

| 200 | M | | General Electric Capital Corp., 1/19/10 | | | | 1.30 | | 200,588 |

| 350 | M | | John Deere, Ltd., 1/13/10 (a) | | | | 0.13 | | 349,985 |

| 500 | M | | Johnson & Johnson, 3/26/10 (a) | | | | 0.12 | | 499,860 |

| 300 | M | | Medtronic, Inc., 2/3/10 (a) | | | | 0.14 | | 299,961 |

| 525 | M | | Northwest Natural Gas Co., 2/5/10 (a) | | | | 0.27 | | 524,862 |

| 500 | M | | Paccar Financial Corp., 2/16/10 | | | | 0.19 | | 499,879 |

| 500 | M | | Philip Morris International, Inc., 1/11/10 (a) | | | | 0.17 | | 499,976 |

| 190 | M | | United Technologies Corp., 5/1/10 | | | | 0.63 | | 192,349 |

| |

| Total Value of Corporate Notes (cost $4,668,935) | | | | | | 4,668,935 |

| |

| | | | FLOATING RATE NOTES—25.9% | | | | | | |

| 100 | M | | BP Capital Markets PLC, 3/17/10 | | | | 0.18 | | 100,076 |

| 400 | M | | Federal Farm Credit Bank, 4/9/10 | | | | 0.59 | | 400,009 |

| 200 | M | | Freddie Mac, 1/8/10 | | | | 0.57 | | 200,002 |

| 320 | M | | GlaxoSmithKline Capital, Inc., 5/13/10 | | | | 0.90 | | 320,912 |

| 400 | M | | Mississippi Business Finance Corp. | | | | | | |

| | | | (Chevron USA, Inc.), 12/1/30 | | | | 0.18 | | 400,000 |

| 310 | M | | Procter & Gamble Co., 3/9/10 | | | | 0.44 | | 310,154 |

| 300 | M | | Roche Holdings, Inc., 2/25/10 (b) | | | | 1.26 | | 300,514 |

| 300 | M | | Toyota Motor Credit Corp., 2/26/10 | | | | 0.29 | | 299,921 |

| 500 | M | | Valdez, Alaska Marine Terminal Rev. | | | | | | |

| | | | (Exxon Pipeline Co.), 12/1/33 | | | | 0.18 | | 500,000 |

| |

| Total Value of Floating Rate Notes (cost $2,831,588) | | | | | | 2,831,588 |

| |

| | | | U.S. GOVERNMENT AGENCY | | | | | | |

| | | | OBLIGATIONS—23.6% | | | | | | |

| | | | Fannie Mae: | | | | | | |

| 170 | M | | 4/28/10 | | | | 0.76 | | 171,831 |

| 600 | M | | 5/5/10 | | | | 0.15 | | 599,690 |

| | | | Federal Home Loan Bank: | | | | | | |

| 250 | M | | 1/6/10 | | | | 0.93 | | 250,087 |

| 500 | M | | 1/13/10 | | | | 0.08 | | 499,987 |

| 300 | M | | 7/29/10 | | | | 0.06 | | 300,000 |

| | | | | | | | | |

| Principal | | | | | | | Interest | | |

| Amount | | | Security | | | | Rate | * | Value |

| |

| | | | U.S. GOVERNMENT AGENCY | | | | | | |

| | | | OBLIGATIONS (continued) | | | | | | |

| | | | Freddie Mac: | | | | | | |

| $ 250 | M | | 1/28/10 | | | | 0.11 | | $ 249,980 |

| 500 | M | | 2/16/10 | | | | 0.07 | | 499,955 |

| |

| Total Value of U.S. Government Agency Obligations (cost $2,571,530) | | | | | 2,571,530 |

| |

| | | | BANKERS’ ACCEPTANCES—4.2% | | | | | | |

| | | | JPMorgan Chase Bank: | | | | | | |

| 235 | M | | 1/21/10 | | | | 0.23 | | 234,970 |

| 220 | M | | 2/3/10 | | | | 0.23 | | 219,954 |

| |

| Total Value of Bankers’ Acceptances (cost $454,924) | | | | | | 454,924 |

| |

| | | | MUNICIPAL BONDS—2.4% | | | | | | |

| 260 | M | | New Jersey State Highway Authority, 1/1/10 | | | | | | |

| | | | (cost $260,000) | | | | 2.56 | | 260,000 |

| |

| Total Value of Investments (cost $10,786,977)** | 98.9 | % | | | | 10,786,977 |

| Other Assets, Less Liabilities | 1.1 | | | | | 124,153 |

| |

| Net Assets | | | | 100.0 | % | | | | $10,911,130 |

| |

| * | The interest rates shown are the effective rates at the time of purchase by the Fund. The interest |

| rates shown on floating rate notes are adjusted periodically; the rates shown are the rates in effect |

| at December 31, 2009. |

| ** | Aggregate cost for federal income tax purposes is the same. |

| (a) | Security exempt from registration under Section 4(2) of the Securities Act of 1933 (see Note 5). |

| (b) | Security exempt from registration under Rule 144A of Securities Act of 1933 (see Note 5). |

Portfolio of Investments (continued)

CASH MANAGEMENT FUND

December 31, 2009

Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| Level 1 — quoted prices in active markets for identical securities |

| |

| Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| |

| Level 3 — significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments) |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of December 31, 2009:

| | | | | | | | | | | | |

| | | | | | | Level 2 | | | | | | |

| | | | | | | Other | | | Level 3 | | | |

| | | | Level 1 | | | Significant | | | Significant | | | |

| | | | Quoted | | | Observable | | | Unobservable | | | |

| | | | Prices | | | Inputs | | | Inputs | | | Total |

| Corporate Notes | | $ | — | | $ | 4,668,935 | | $ | — | | $ | 4,668,935 |

| U.S. Government Agency | | | | | | | | | | | | |

| Obligations | | | — | | | 2,571,530 | | | — | | | 2,571,530 |

| Floating Rate Notes: | | | | | | | | | | | | |

| Corporate Notes | | | — | | | 1,331,577 | | | — | | | 1,331,577 |

| Municipal Bonds | | | — | | | 900,000 | | | — | | | 900,000 |

| U.S. Government Agency | | | — | | | 600,011 | | | — | | | 600,011 |

| Obligations | | | | | | | | | | | | |

| Bankers’ Acceptances | | | — | | | 454,924 | | | — | | | 454,924 |

| |

| Municipal Bonds | | | — | | | 260,000 | | | — | | | 260,000 |

| Total Investments in | | | | | | | | | | | | |

| Securities | | $ | — | | $ | 10,786,977 | | $ | — | | $ | 10,786,977 |

| | |

| 16 | See notes to financial statements | |

Portfolio Managers’ Letter

DISCOVERY FUND

Dear Investor:

This is the annual report for the First Investors Life Discovery Fund for the year ended December 31, 2009. During the period, the Fund’s return on a net asset value basis was 30.77%, including dividends of 26.6 cents per share.

In 2008, the stock market experienced its worst panic since the 1970s, as the banking system seemed close to collapse. Fortunately, the Federal Reserve and U.S. Treasury were able to restore confidence in the system by the early spring of 2009, and the stock market has rallied strongly since mid-March. We approached these markets in a conservative fashion, and over the course of the year outperformed our benchmark, the Russell 2000 Index. Our best performing sector was the financials sector, which did well because of our decision to eschew bank stocks. Information technology was our largest detractor, both because we were underweight this top-performing sector, and because our technology picks did not keep up with some of the more speculative names in the sector.

During the sell-off in the late winter and early spring of 2009, the Fund was able to pick up several high quality names that made significant contributions to Fund returns, including Jefferies Group, Micros Systems, and Mednax. Jefferies Group, a mid-tier brokerage house, wisely raised excess capital in early 2008. Because of its strong balance sheet, the firm did not have to accept TARP funds from the government, and managed to recruit top talent away from former powerhouses that had to go hat-in-hand to the government to maintain solvency. Micros Systems, a software company with a solid balance sheet, was another top contributor to Fund performance. Through the strength of its franchise and flexibility of its business model, Micros managed to generate record operating margins, despite tough economic headwinds. During the sell-off, we also invested in Mednax, a company that manages neonatal units and anesthesiology practices for hospitals. The market had been concerned about neonatal unit volumes and reimbursement rates, allowing us to purchase shares in this top quality health care company for only nine times trailing earnings. Subsequent to our purchase, Mednax reported double-digit earnings growth, and continued high operating margins and cash flow generation.

On a macroeconomic level, we are still somewhat concerned about the high level of unemployment in the U.S., although we have seen some positive data on the economy recently. Our conversations with company managements indicate to us that a bottom to the downturn may have been reached. The timing of a recovery is harder to predict. However, we are long-term value investors, not market timers, and we remain focused on finding good companies at attractive valuations.

Portfolio Managers’ Letter (continued)

DISCOVERY FUND

Thank you for placing your trust in First Investors. We appreciate the opportunity to serve your investment needs.

Sincerely,

Jason Ronovech

Portfolio Manager

Jonathan S. Vyorst

Portfolio Manager

January 29, 2010

Fund Expenses (unaudited)

DISCOVERY FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 3 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (7/1/09) | (12/31/09) | (7/1/09–12/31/09)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $1,203.46 | $4.61 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,021.03 | $4.23 |

| |

| * | Expenses are equal to the annualized expense ratio of .83%, multiplied by the average account |

| value over the period, multiplied by 184/365 (to reflect the one-half year period). |

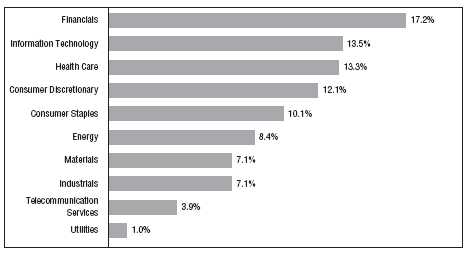

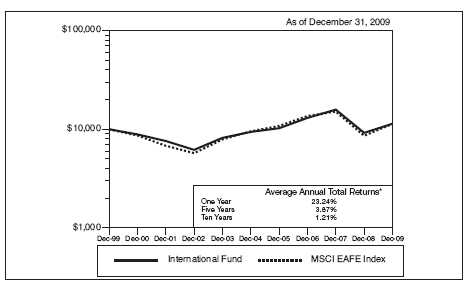

Portfolio Composition

TOP TEN SECTORS

Portfolio holdings and allocations are subject to change. Percentages are as of December 31, 2009,

and are based on the total value of investments.

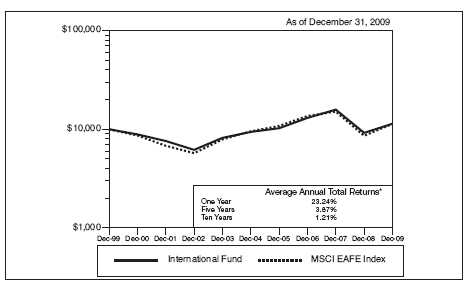

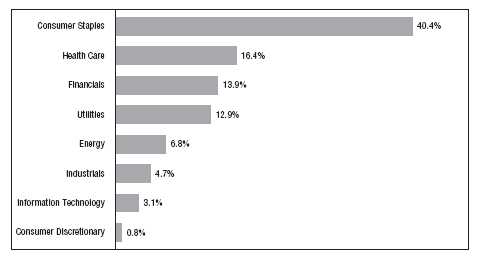

Cumulative Performance Information

DISCOVERY FUND

Comparison of change in value of $10,000 investment in the First Investors Life Series Discovery

Fund and the Russell 2000 Index.

The graph compares a $10,000 investment in the First Investors Life Series Discovery Fund beginning 12/31/99 with a theoretical investment in the Russell 2000 Index (the “Index”). The Index is an unmanaged Index that measures the performance of the small-cap segment of the U.S. equity universe. The Index is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. The Index includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. It is not possible to invest directly in this Index. In addition, the Index does not reflect fees and expenses associated with the active management of a mutual fund portfolio. For purposes of the graph and the accompanying table, it is assumed that all dividend and distributions were reinvested.

* The Average Annual Total Return figures are for the periods ended 12/31/09.

The returns shown do not reflect any sales charges, since the Fund sells its shares solely to variable annuity and/or variable life insurance subaccounts at net asset value. The returns do not reflect the fees and charges that an individual would pay in connection with an investment in a variable annuity or life contract or policy. Results represent past performance and do not indicate future results. The graph and the returns shown do not reflect the deduction of taxes that an investor would pay on distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Russell 2000 Index figures are from Frank Russell and Company and all other figures are from First Investors Management Company, Inc.

Portfolio of Investments

DISCOVERY FUND

December 31, 2009

| | | | |

| Shares | | | Security | Value |

| |

| | | | COMMON STOCKS—92.5% | |

| | | | Consumer Discretionary—11.9% | |

| 119,800 | | | American Eagle Outfitters, Inc. | $ 2,034,204 |

| 38,600 | | * | Big Lots, Inc. | 1,118,628 |

| 75,200 | | * | Career Education Corporation | 1,752,912 |

| 157,000 | | | Foot Locker, Inc. | 1,748,980 |

| 67,700 | | * | GameStop Corporation – Class “A” | 1,485,338 |

| 58,700 | | | Hasbro, Inc. | 1,881,922 |

| 102,800 | | * | Pacific Sunwear of California, Inc. | 409,144 |

| 48,700 | | | Phillips Van-Heusen Corporation | 1,981,116 |

| 187,800 | | | Regal Entertainment Group – Class “A” | 2,711,832 |

| |

| | | | | 15,124,076 |

| |

| | | | Consumer Staples—10.0% | |

| 38,600 | | * | American Italian Pasta Company – Class “A” | 1,342,894 |

| 32,975 | | | Church & Dwight Company, Inc. | 1,993,339 |

| 65,400 | | | Corn Products International, Inc. | 1,911,642 |

| 149,100 | | | Dole Food Company, Inc. | 1,850,331 |

| 68,100 | | | Flowers Foods, Inc. | 1,618,056 |

| 80,400 | | * | Fresh Del Monte Produce, Inc. | 1,776,840 |

| 34,700 | | | J. M. Smucker Company | 2,142,725 |

| |

| | | | | 12,635,827 |

| |

| | | | Energy—8.3% | |

| 113,100 | | | EXCO Resources, Inc. | 2,401,113 |

| 129,100 | | * | Matrix Service Company | 1,374,915 |

| 54,700 | | * | Plains Exploration & Production Company | 1,513,002 |

| 172,300 | | * | Resolute Energy Corporation | 1,984,896 |

| 53,500 | | | St. Mary Land & Exploration Company | 1,831,840 |

| 20,300 | | * | Whiting Petroleum Corporation | 1,450,841 |

| |

| | | | | 10,556,607 |

| |

| | | | Financials—17.0% | |

| 7,795 | | * | Alleghany Corporation | 2,151,420 |

| 51,200 | | | American Financial Group, Inc. | 1,277,440 |

| 240,900 | | | Anworth Mortgage Asset Corporation (REIT) | 1,686,300 |

| 23,200 | | | Everest Re Group, Ltd. | 1,987,776 |

| 116,200 | | * | EZCORP, Inc. – Class “A” | 1,999,802 |

| 54,100 | | | Harleysville Group, Inc. | 1,719,839 |

| 119,800 | | * | Hilltop Holdings, Inc. | 1,394,472 |

| 91,700 | | * | Jefferies Group, Inc. | 2,176,041 |

Portfolio of Investments (continued)

DISCOVERY FUND

December 31, 2009

| | | | |

| Shares | | | Security | Value |

| |

| | | | Financials (continued) | |

| 3,400 | | * | Markel Corporation | $ 1,156,000 |

| 228,700 | | | MFA Financial, Inc. (REIT) | 1,680,945 |

| 4,683 | | | National Western Life Insurance Company – Class “A” | 813,062 |

| 37,100 | | * | Piper Jaffray Companies, Inc. | 1,877,631 |

| 113,200 | | | Walter Investment Management Corporation (REIT) | 1,622,156 |

| |

| | | | | 21,542,884 |

| |

| | | | Health Care—13.1% | |

| 75,200 | | * | AMERIGROUP Corporation | 2,027,392 |

| 113,100 | | * | Endo Pharmaceuticals Holdings, Inc. | 2,319,681 |

| 38,900 | | * | Life Technologies Corporation | 2,031,747 |

| 51,300 | | * | Lincare Holdings, Inc. | 1,904,256 |

| 67,000 | | * | Magellan Health Services, Inc. | 2,728,910 |

| 30,100 | | * | MEDNAX, Inc. | 1,809,612 |

| 108,000 | | | PerkinElmer, Inc. | 2,223,720 |

| 55,700 | | | STERIS Corporation | 1,557,929 |

| |

| | | | | 16,603,247 |

| |

| | | | Industrials—7.0% | |

| 20,700 | | * | Alliant Techsystems, Inc. | 1,827,189 |

| 36,100 | | | Curtiss-Wright Corporation | 1,130,652 |

| 60,100 | | * | DXP Enterprises, Inc. | 785,507 |

| 78,800 | | * | EMCOR Group, Inc. | 2,119,720 |

| 17,500 | | | Precision Castparts Corporation | 1,931,125 |

| 43,500 | | | Robbins & Myers, Inc. | 1,023,120 |

| |

| | | | | 8,817,313 |

| |

| | | | Information Technology—13.3% | |

| 333,700 | | * | Compuware Corporation | 2,412,651 |

| 172,700 | | * | Convergys Corporation | 1,856,525 |

| 207,300 | | | EarthLink, Inc. | 1,722,663 |

| 68,800 | | | Fair Isaac Corporation | 1,466,128 |

| 52,200 | | * | MICROS Systems, Inc. | 1,619,766 |

| 106,500 | | * | QLogic Corporation | 2,009,655 |

| 48,500 | | * | Sybase, Inc. | 2,104,900 |

| 176,100 | | * | Verigy, Ltd. | 2,266,407 |

| 172,700 | | * | Vishay Intertechnology, Inc. | 1,442,045 |

| |

| | | | | 16,900,740 |

| | | | | | |

| Shares or | | | | | | |

| Principal | | | | | | |

| Amount | | | Security | | | Value |

| |

| | | | Materials—7.0% | | | |

| 31,900 | | | AptarGroup, Inc. | | | $ 1,140,106 |

| 23,200 | | | Compass Minerals International, Inc. | | | 1,558,808 |

| 130,200 | | | Innospec, Inc. | | | 1,313,718 |

| 86,000 | | | Olin Corporation | | | 1,506,720 |

| 50,900 | | | Sensient Technologies Corporation | | | 1,338,670 |

| 34,200 | | | Silgan Holdings, Inc. | | | 1,979,496 |

| |

| | | | | | | 8,837,518 |

| |

| | | | Telecommunication Services—3.9% | | | |

| 152,900 | | * | Iridium Communications, Inc. | | | 1,227,787 |

| 262,200 | | * | Premiere Global Services, Inc. | | | 2,163,150 |

| 49,275 | | | Telephone & Data Systems, Inc. – Special Shares | | 1,488,105 |

| |

| | | | | | | 4,879,042 |

| |

| | | | Utilities—1.0% | | | |

| 77,100 | | | CMS Energy Corporation | | | 1,207,386 |

| |

| Total Value of Common Stocks (cost $99,796,577) | | | 117,104,640 |

| |

| | | | SHORT-TERM INVESTMENTS—6.2% | | |

| | | | Money Market Fund | | | |

| $ 7,920 | M | | First Investors Cash Reserve Fund, .24% (cost $7,920,000)** | | 7,920,000 |

| |

| Total Value of Investments (cost $107,716,577) | 98.7 | % | 125,024,640 |

| Other Assets, Less Liabilities | 1.3 | | 1,608,355 |

| |

| Net Assets | | | | 100.0 | % | $126,632,995 |

| |

| * | Non-income producing |

| ** | Affiliated unregistered money market fund available only to First Investors funds and certain |

| accounts managed by First Investors Management Company, Inc. Rate shown is the 7-day yield at |

| December 31, 2009 (see Note 3). |

| |

| Summary of Abbreviations: |

| REIT Real Estate Investment Trust |

Portfolio of Investments (continued)

DISCOVERY FUND

December 31, 2009

Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| Level 1 — quoted prices in active markets for identical securities |

| |

| Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| |

| Level 3 — significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments) |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of December 31, 2009:

| | | | | | | | | | | | |

| | | | | | | Level 2 | | | | | | |

| | | | | | | Other | | | Level 3 | | | |

| | | | Level 1 | | | Significant | | | Significant | | | |

| | | | Quoted | | | Observable | | | Unobservable | | | |

| | | | Prices | | | Inputs | | | Inputs | | | Total |

| Common Stocks | | $ | 117,104,640 | | $ | — | | $ | — | | $ | 117,104,640 |

| Money Market Fund | | | 7,920,000 | | | — | | | — | | | 7,920,000 |

| Total Investments | | | | | | | | | | | | |

| in Securities* | | $ | 125,024,640 | | $ | — | | $ | — | | $ | 125,024,640 |

* The Portfolio of Investments provides information on the industry categorization for the portfolio.

| | |

| 24 | See notes to financial statements | |

Portfolio Manager’s Letter

GOVERNMENT FUND

Dear Investor:

This is the annual report for the First Investors Life Government Fund for the year ended December 31, 2009. During the period, the Fund’s return on a net asset value basis was 4.28%, including dividends of 43.4 cents per share.

The Fund invests in securities and debt issued or guaranteed by the U.S. government and its agencies. These include mortgage-backed bonds guaranteed by the Government National Mortgage Association (Ginnie Mae), the Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (Freddie Mac); debt issued by these and other agencies; and U.S. Treasury securities. The investments held by the Fund all have the highest possible credit rating (AAA). The Fund does not invest in subprime mortgage-backed debt.

The review period began with considerable uncertainty in the financial markets and with the economy in its longest and deepest downturn since the Great Depression. As the year progressed, the extraordinary actions taken by the U.S. government and the Federal Reserve (the “Fed”) helped to stabilize the markets and the economy. In particular, the Fed provided support to the bond market by purchasing over $1.5 trillion of mortgage-backed, agency, and U.S. Treasury securities, while keeping the benchmark federal funds rate at a historic low range of 0 – 0.25%.

By year-end, the financial markets had stabilized and the economy had exited the recession. With a return to a more normal environment, Treasury securities lost their safe haven status and longer-term yields moved sharply higher from historically low levels. Consequently, the Treasury market was the worst performing sector of the bond market in 2009, falling 3.7% according to BofA Merrill Lynch. The U.S. agency market fared slightly better due to the Fed’s support, returning .9%. The biggest beneficiary, though, of the Fed’s purchase program was the mortgage-backed market, where the Fed bought over $1 trillion of securities during the year. As a result, the mortgage-backed market returned 5.8%.

The Fund substantially outperformed the Citigroup Government/Mortgage Index. In particular, the Fund benefited from its asset allocation. It had approximately 80% of its assets invested in mortgage-backed securities with the balance in U.S. agency notes and a small amount in cash equivalents for most of the review period. The Fund had negligible exposure to the Treasury market. Security selection also contributed to the Fund’s performance, as the Fund was underweight lower coupon mortgage-backed bonds, which had the weakest returns among mortgage-backed securities.

Portfolio Manager’s Letter (continued)

GOVERNMENT FUND

Thank you for placing your trust in First Investors. We appreciate the opportunity to serve your investment needs.

Sincerely,

Clark D. Wagner

Portfolio Manager and

Director of Fixed Income, First Investors Management Company, Inc.

January 29, 2010

Fund Expenses (unaudited)

GOVERNMENT FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 3 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (7/1/09) | (12/31/09) | (7/1/09–12/31/09)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $1,023.88 | $4.08 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,021.18 | $4.08 |

| |

| * | Expenses are equal to the annualized expense ratio of .80%, multiplied by the average account |

| value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses paid |

| during the period are net of expenses waived. |

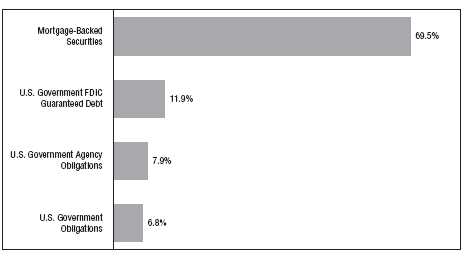

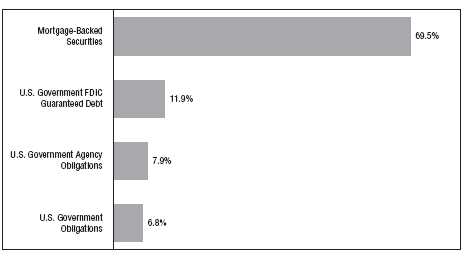

Portfolio Composition

BY SECTOR

Portfolio holdings and allocations are subject to change. Percentages are as of December 31, 2009,

and are based on the total value of investments.

Cumulative Performance Information

GOVERNMENT FUND

Comparison of change in value of $10,000 investment in the First Investors Life Series Government Fund, the Bank of America (“BofA”) Merrill Lynch GNMA Master Index and the Citigroup Government/Mortgage Index†.

The graph compares a $10,000 investment in the First Investors Life Series Government Fund beginning 12/31/99 with theoretical investments in the BofA Merrill Lynch GNMA Master Index and the Citigroup Government/Mortgage Index (the “Indices”). The BofA Merrill Lynch GNMA Master Index is a market capitalization-weighted index, including generic-coupon GNMA mortgages, with at least $150 million principal amounts outstanding. Every issue included in the Index is trader-priced and the Index follows consistent and realistic availability limits, including only those securities with sufficient amounts outstanding. The Citigroup Government/Mortgage Index is an unmanaged index that is a combination of the Citigroup Government Index and the Citigroup Mortgage Index. The Government Index tracks the performance of the U.S. Treasury and U.S. Government-sponsored indices within the Citigroup U.S. Broad Investment Grade Bond Index. The Mortgage Index tracks t he performance of the mortgage component of the Citigroup U.S. Broad Investment Grade Bond Index, which is comprised of 30- and 15-year GNMA, FNMA and FHLMC pass-throughs and FNMA and FHLMC balloon mortgages. It is not possible to invest directly in these Indices. In addition, the Indices do not reflect fees and expenses associated with the active management of a mutual fund portfolio. For purposes of the graph and the accompanying table, it is assumed that all dividends and distributions were reinvested.

* The Average Annual Total Return figures are for the periods ended 12/31/09. During the periods shown, some of the expenses of the Fund were waived or assumed. If such expenses had been paid by the Fund, the Average Annual Total Returns for One Year, Five Years and Ten Years would have been 4.12%, 4.65% and 5.63%, respectively.

The returns shown do not reflect any sales charge, since the Fund sells its shares solely to variable annuity and/or variable life insurance subaccounts at net asset value. The returns do not reflect the fees and charges that an individual would pay in connection with an investment in a variable annuity or life contract or policy. Results represent past performance and do not indicate future results. The graph and the returns shown do not reflect the deduction of taxes that an investor would pay on distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. BofA Merrill Lynch GNMA Master Index figures are from Bank of America Merrill Lynch & Co., Citigroup Government/Mortgage Index figures are from Citigroup and a ll other figures are from First Investors Management Company, Inc.

† We have added a comparison to the Citigroup Government/Mortgage Index this year since it more closely reflects the performance of the securities in which the Fund invests. After this year we will not show a comparison to the BofA Merrill Lynch GNMA Master Index.

Portfolio of Investments

GOVERNMENT FUND

December 31, 2009

| | | | |

| Principal | | | | |

| Amount | | | Security | Value |

| |

| | | | MORTGAGE-BACKED SECURITIES—68.5% | |

| | | | Fannie Mae—18.1% | |

| $ 1,578 | M | | 5%, 1/1/2035 – 4/1/2039 | $ 1,622,280 |

| 2,004 | M | | 5.5%, 6/1/2033 – 7/1/2034 | 2,106,489 |

| 333 | M | | 6%, 6/1/2039 | 353,498 |

| 342 | M | | 9%, 6/1/2015 – 11/1/2026 | 388,302 |

| 200 | M | | 11%, 10/1/2015 | 226,808 |

| |

| | | | | 4,697,377 |

| |

| | | | Freddie Mac—10.0% | |

| 2,436 | M | | 6%, 8/1/2032 – 12/1/2038 | 2,595,266 |

| |

| | | | Government National Mortgage Association I | |

| | | | Program—40.4% | |

| 2,985 | M | | 5%, 3/15/2033 – 4/15/2039 | 3,086,918 |

| 5,561 | M | | 5.5%, 2/15/2033 – 4/15/2039 | 5,846,035 |

| 782 | M | | 6%, 11/15/2032 – 4/15/2036 | 835,576 |

| 690 | M | | 6.5%, 7/15/2032 – 8/15/2036 | 746,740 |

| |

| | | | | 10,515,269 |

| |

| Total Value of Mortgage-Backed Securities (cost $17,274,821) | 17,807,912 |

| |

| | | | U.S. GOVERNMENT FDIC | |

| | | | GUARANTEED DEBT—11.7% | |

| 1,000 | M | | Bank of America Corp., 3.125%, 2012 | 1,036,807 |

| 1,000 | M | | Citigroup Funding, Inc., 1.875%, 2012 | 998,113 |

| 1,000 | M | | JPMorgan Chase & Co., 2.125%, 2012 | 1,005,130 |

| |

| Total Value of U.S. Government FDIC Guaranteed Debt (cost $3,048,262) | 3,040,050 |

| |

| | | | U.S. GOVERNMENT AGENCY | |

| | | | OBLIGATIONS—7.8% | |

| 1,000 | M | | Federal Farm Credit Bank, 4.25%, 2016 | 1,008,404 |

| 1,000 | M | | Tennessee Valley Authority, 4.5%, 2018 | 1,019,391 |

| |

| Total Value of U.S. Government Agency Obligations (cost $2,028,156) | 2,027,795 |

| |

| | | | U.S. GOVERNMENT OBLIGATIONS—6.7% | |

| 670 | M | | FDA Queens LP, 6.99%, 2017 (a) | 754,401 |

| 1,000 | M | | U.S. Treasury Notes, 3.625%, 2019 | 983,438 |

| |

| Total Value of U.S. Government Obligations (cost $1,777,253) | 1,737,839 |

Portfolio of Investments (continued)

GOVERNMENT FUND

December 31, 2009

| | | | | | |

| Principal | | | | | | |

| Amount | | | Security | | | Value |

| | | | SHORT-TERM U.S. GOVERNMENT AGENCY | | |

| | | | OBLIGATIONS—3.8% | | | |

| $ 1,000 | M | | Federal Home Loan Bank, 0.005%, 2/24/10 (cost $999,993) | | $ 999,993 |

| Total Value of Investments (cost $25,128,485) | 98.5 | % | 25,613,589 |

| Other Assets, Less Liabilities | 1.5 | | 394,901 |

| |

| Net Assets | | | | 100.0 | % | $26,008,490 |

| | |

| (a) | Security exempt from registration under Rule 144A of Securities Act of 1933 (see Note 5). |

| |

| Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below: |

| | |

| | Level 1 — quoted prices in active markets for identical securities |

| | |

| | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | |

| | Level 3 — significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments) |

| | |

| The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. |

| |

| The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of December 31, 2009: |

| | | | | | | | | | | | |

| | | | | | | Level 2 | | | | | | |

| | | | | | | Other | | | Level 3 | | | |

| | | | Level 1 | | | Significant | | | Significant | | | |

| | | | Quoted | | | Observable | | Unobservable | | | |

| | | | Prices | | | Inputs | | | Inputs | | | Total |

| Mortgage-Backed | | | | | | | | | | | | |

| Certificates | | $ | — | | $ | 17,807,912 | | $ | — | | $ | 17,807,912 |

| U.S. Government Agency | | | | | | | | | | | | |

| Obligations | | | — | | | 2,027,795 | | | — | | | 2,027,795 |

| U.S. Government FDIC | | | | | | | | | | | | |

| Guaranteed Debt | | | — | | | 3,040,050 | | | — | | | 3,040,050 |

| U.S. Government | | | | | | | | | | | | |

| Obligations | | | — | | | 1,737,839 | | | — | | | 1,737,839 |

| Short-Term U.S. Government | | | | | | | | | | | | |

| Agency Obligations | | | — | | | 999,993 | | | — | | | 999,993 |

| Total Investments | | | | | | | | | | | | |

| in Securities | | $ | — | | $ | 25,613,589 | | $ | — | | $ | 25,613,589 |

| | |

| 30 | See notes to financial statements | |

Portfolio Manager’s Letter

GROWTH & INCOME FUND

Dear Investor:

This is the annual report for the First Investors Life Growth & Income Fund for the year ended December 31, 2009. During the period, the Fund’s return on a net asset value basis was 28.05%, including dividends of 39.9 cents per share.

During the first part of the review period, the markets were in a steep free fall, culminating with a multi-decade market low reached on March 9, 2009. Only after U.S. and global regulators took extraordinary measures to supply massive financial aid and intervention, such as through the TARP program, did the markets stabilize. The markets then rallied convincingly, ending the year with a significant gain.

With this as a backdrop, the Fund assumed a relatively conservative position, choosing to underweight or avoid volatile and uncertain areas of the market. This strategy benefited the Fund during the market decline, but caused the Fund to lag during the recovery phase that began in March 2009. For the period overall, the Fund slightly outperformed the S&P 500 Index. Following the strategy from 2008, the Fund remained underweight the financials sector for the entire year, as we were concerned that uncertainty over continuing loan losses, inadequate capital structures and ongoing governmental involvement would impair valuations for equity holders for some time to come. The Fund likewise reduced its holdings in the volatile energy sector, as global recession has dampened usage, and energy pricing still seems to hold a speculative bias that is not reflective of true underlying supply and demand.

The Fund’s weightings in consumer staples and health care increased throughout the year, as these sectors demonstrated solid earnings and were generally immune from the economic chaos. Overall stock selection within consumer staples and weightings within both consumer staples and health care benefited the Fund’s relative performance. Additionally, stock selection aided investments within the materials, energy and industrials sectors. The Fund’s underweighting in the energy and utilities sectors also helped performance. On the negative side, the Fund’s performance was hurt by its investments in the technology, telecommunications and financials sectors.

Notable individual performers within consumer staples included shares of small-cap direct seller of nutritional and personal products NuSkin Enterprises, which rose 158%. Additionally, shares of Chattem rose 30% on news of its being acquired by French drug maker Sanofi-Aventis. In addition, shares of large-cap pharmacy and drugstore operator Walgreen’s, and tobacco giants Altria and Philip Morris International provided solid returns. Within health care, Wyeth was a top contributor after agreeing to merge with competitor Pfizer. Biotech firm Genentech was also a top performer after it agreed to a merger offer from rival Novartis. The overall top performer was Temple Inland, a maker of paper and corrugated packaging, which

Portfolio Manager’s Letter (continued)

GROWTH & INCOME FUND

benefited from cost controls and a cyclical upturn in its businesses. The stock rose 340% during 2009.

The Fund maintained a diverse market capitalization allocation during the period, ending with 60% large cap, 14% mid cap and 26% small cap, according to Lipper’s market capitalization ranges. The small-cap component outperformed similar-size companies within the S&P 500 Index, the large-cap segment performed in line with those in the Index, while the mid-cap segment delivered results slightly below similar-size companies in the S&P 500 Index during the review period.

Thank you for placing your trust in First Investors. We appreciate the opportunity to serve your investment needs.

Sincerely,

Edwin D. Miska

Portfolio Manager and

Director of Equities, First Investors Management Company, Inc.

January 29, 2010

Fund Expenses (unaudited)

GROWTH & INCOME FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 3 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (7/1/09) | (12/31/09) | (7/1/09–12/31/09)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $1,216.85 | $4.64 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,021.03 | $4.23 |

| |

| * | Expenses are equal to the annualized expense ratio of .83%, multiplied by the average account |

| value over the period, multiplied by 184/365 (to reflect the one-half year period). |

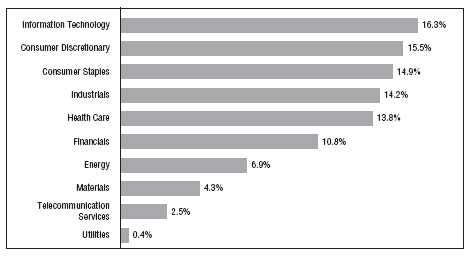

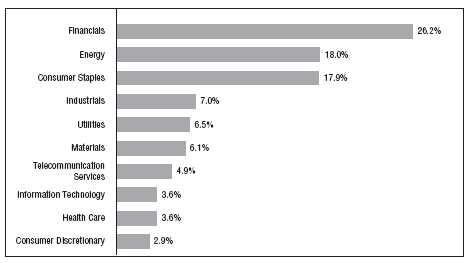

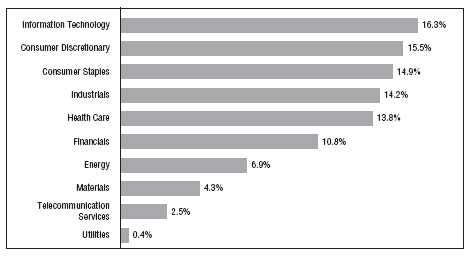

Portfolio Composition

TOP TEN SECTORS

|

| Portfolio holdings and allocations are subject to change. Percentages are as of December 31, 2009, |

| and are based on the total value of investments. |

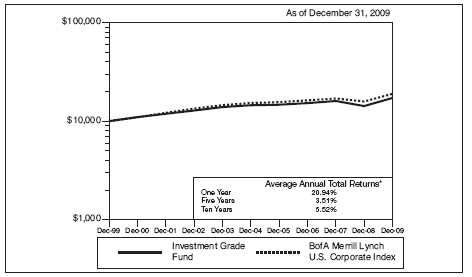

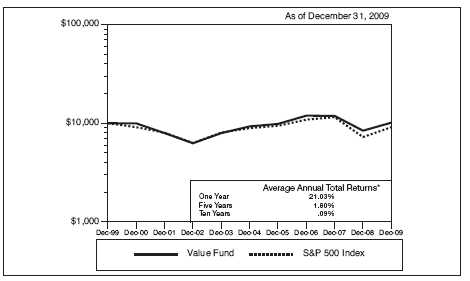

Cumulative Performance Information

GROWTH & INCOME FUND

Comparison of change in value of $10,000 investment in the First Investors Life Series

Growth & Income Fund and the Standard & Poor’s 500 Index.

The graph compares a $10,000 investment in the First Investors Life Series Growth & Income Fund beginning 12/31/99 with a theoretical investment in the Standard & Poor’s 500 Index (the “Index”). The Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of such stocks, which represent all major industries. It is not possible to invest directly in this Index. In addition, the Index does not reflect fees and expenses associated with the active management of a mutual fund portfolio. For purposes of the graph and the accompanying table it is assumed that all dividends and distributions were reinvested.

* The Average Annual Total Return figures are for the periods ended 12/31/09.

The returns shown do not reflect any sales charges, since the Fund sells its shares solely to variable annuity and/or variable life insurance subaccounts at net asset value. The returns do not reflect the fees and charges that an individual would pay in connection with an investment in a variable annuity or life contract or policy. Results represent past performance and do not indicate future results. The graph and the returns shown do not reflect the deduction of taxes that an investor would pay on distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Standard & Poor’s 500 Index figures are from Standard & Poor’s and all other figures are from First Investors Management Company, Inc.

Portfolio of Investments

GROWTH & INCOME FUND

December 31, 2009

| | | | |

| Shares | | | Security | Value |

| |

| | | | COMMON STOCKS—99.4% | |

| | | | Consumer Discretionary—15.5% | |

| 40,200 | | * | Big Lots, Inc. | $ 1,164,996 |

| 32,400 | | | BorgWarner, Inc. | 1,076,328 |

| 29,469 | | | Brown Shoe Company, Inc. | 290,859 |

| 7,300 | | | Burger King Holdings, Inc. | 137,386 |

| 57,485 | | | CBS Corporation – Class “B” | 807,664 |

| 48,661 | | * | CEC Entertainment, Inc. | 1,553,259 |

| 42,364 | | | Coach, Inc. | 1,547,557 |

| 37,600 | | * | Corinthian Colleges, Inc. | 517,752 |

| 53,700 | | * | GameStop Corporation – Class “A” | 1,178,178 |

| 20,070 | | | Genuine Parts Company | 761,857 |

| 55,500 | | | H&R Block, Inc. | 1,255,410 |

| 59,500 | | | Home Depot, Inc. | 1,721,335 |

| 62,200 | | * | Jack in the Box, Inc. | 1,223,474 |

| 51,000 | | | Limited Brands, Inc. | 981,240 |

| 62,500 | | * | Lincoln Educational Services Corporation | 1,354,375 |

| 34,000 | | | McDonald’s Corporation | 2,122,960 |

| 143,800 | | * | Morgans Hotel Group Company | 651,414 |

| 106,943 | | | Newell Rubbermaid, Inc. | 1,605,214 |

| 18,400 | | | NIKE, Inc. – Class “B” | 1,215,688 |

| 14,421 | | | Polo Ralph Lauren Corporation – Class “A” | 1,167,813 |

| 121,645 | | * | Ruby Tuesday, Inc. | 875,844 |

| 200 | | * | Rue21, Inc. | 5,618 |

| 50,237 | | | Staples, Inc. | 1,235,328 |

| 30,574 | | * | Steiner Leisure, Ltd. | 1,215,622 |

| 224,370 | | | Stewart Enterprises, Inc. – Class “A” | 1,155,506 |

| 16,000 | | | Tupperware Brands Corporation | 745,120 |

| 72,083 | | | Wyndham Worldwide Corporation | 1,453,914 |

| |

| | | | | 29,021,711 |

| |

| | | | Consumer Staples—14.9% | |

| 124,000 | | | Altria Group, Inc. | 2,434,120 |

| 29,700 | | | Avon Products, Inc. | 935,550 |

| 32,700 | | * | Chattem, Inc. | 3,050,910 |

| 33,589 | | | Coca-Cola Company | 1,914,573 |

| 63,000 | | | CVS Caremark Corporation | 2,029,230 |

| 2,700 | | * | Dean Foods Company | 48,708 |

| 16,500 | | * | Dole Food Company, Inc. | 204,765 |

| 47,000 | | | McCormick & Company, Inc. | 1,698,110 |

| 102,127 | | | Nu Skin Enterprises, Inc. – Class “A” | 2,744,152 |

| 29,400 | | | PepsiCo, Inc. | 1,787,520 |

Portfolio of Investments (continued)

GROWTH & INCOME FUND

December 31, 2009

| | | | |

| Shares | | | Security | Value |

| |

| | | | Consumer Staples (continued) | |

| 65,300 | | | Philip Morris International, Inc. | $ 3,146,807 |

| 26,713 | | | Procter & Gamble Company | 1,619,609 |

| 52,407 | | | Safeway, Inc. | 1,115,745 |

| 3,291 | | | Tootsie Roll Industries, Inc. | 90,108 |

| 74,500 | | | Walgreen Company | 2,735,640 |

| 43,564 | | | Wal-Mart Stores, Inc. | 2,328,496 |

| |

| | | | | 27,884,043 |

| |

| | | | Energy—6.9% | |

| 110,569 | | * | Cal Dive International, Inc. | 835,902 |

| 26,018 | | | ConocoPhillips | 1,328,739 |

| 29,029 | | | ExxonMobil Corporation | 1,979,488 |

| 22,522 | | | Marathon Oil Corporation | 703,137 |

| 53,500 | | | Noble Corporation | 2,177,450 |

| 23,194 | | | Sasol, Ltd. (ADR) | 926,368 |

| 13,000 | | | Schlumberger, Ltd. | 846,170 |

| 72,107 | | | Suncor Energy, Inc. | 2,546,098 |

| 32,600 | | | XTO Energy, Inc. | 1,516,878 |

| |

| | | | | 12,860,230 |

| |

| | | | Financials—10.8% | |

| 15,006 | | | American Express Company | 608,043 |

| 41,000 | | | Ameriprise Financial, Inc. | 1,591,620 |

| 31,766 | | | Astoria Financial Corporation | 394,851 |

| 19,428 | | | Bank of America Corporation | 292,586 |

| 59,900 | | | Brookline Bancorp, Inc. | 593,609 |

| 19,905 | | | Capital One Financial Corporation | 763,158 |

| 18,937 | | | Citigroup, Inc. | 62,681 |

| 29,143 | | | Discover Financial Services | 428,694 |

| 170,000 | | | Financial Select Sector SPDR Fund (ETF) | 2,446,300 |

| 53,037 | | | First Mercury Financial Corporation | 727,137 |

| 14,121 | | | Hartford Financial Services Group, Inc. | 328,455 |

| 74,500 | | | Hudson City Bancorp, Inc. | 1,022,885 |

| 52,656 | | | JPMorgan Chase & Company | 2,194,176 |

| 26,968 | | | KeyCorp | 149,672 |

| 48,113 | | | Morgan Stanley | 1,424,145 |

| 122,300 | | | New York Community Bancorp, Inc. | 1,774,573 |

| 89,800 | | | NewAlliance Bancshares, Inc. | 1,078,498 |

| 60,000 | | | SPDR KBW Regional Banking (ETF) | 1,335,000 |

| 109,779 | | * | Sunstone Hotel Investors, Inc. (REIT) | 974,838 |

| 29,688 | | | U.S. Bancorp | 668,277 |

| | | | |

| Shares | | | Security | Value |

| |

| | | | Financials (continued) | |

| 26,400 | | | Urstadt Biddle Properties – Class “A” (REIT) | $ 403,128 |

| 18,046 | | | Webster Financial Corporation | 214,206 |

| 26,367 | | | Wells Fargo & Company | 711,645 |

| |

| | | | | 20,188,177 |

| |

| | | | Health Care—13.8% | |

| 45,700 | | | Abbott Laboratories | 2,467,343 |

| 14,946 | | * | Amgen, Inc. | 845,495 |

| 16,730 | | | Baxter International, Inc. | 981,716 |

| 30,000 | | | Becton, Dickinson & Company | 2,365,800 |

| 19,300 | | * | Cephalon, Inc. | 1,204,513 |

| 20,800 | | * | Genzyme Corporation | 1,019,408 |

| 36,400 | | * | Gilead Sciences, Inc. | 1,575,392 |

| 51,375 | | | Johnson & Johnson | 3,309,064 |

| 21,121 | | * | Laboratory Corporation of America Holdings | 1,580,696 |

| 38,832 | | | Medtronic, Inc. | 1,707,831 |

| 29,043 | | | Merck & Company. Inc. | 1,061,231 |

| 42,200 | | | Perrigo Company | 1,681,248 |

| 123,282 | | | Pfizer, Inc. | 2,242,500 |

| 46,700 | | * | PSS World Medical, Inc. | 1,054,019 |

| 32,453 | | | Sanofi-Aventis (ADR) | 1,274,429 |

| 18,500 | | * | St. Jude Medical, Inc. | 680,430 |

| 17,443 | | * | Thermo Fisher Scientific, Inc. | 831,857 |

| |

| | | | | 25,882,972 |

| |

| | | | Industrials—14.1% | |

| 23,294 | | | 3M Company | 1,925,715 |

| 38,200 | | * | AAR Corporation | 877,836 |

| 24,559 | | | Alexander & Baldwin, Inc. | 840,655 |

| 38,095 | | * | Altra Holdings, Inc. | 470,473 |

| 52,300 | | * | Armstrong World Industries, Inc. | 2,036,039 |

| 18,400 | | | Baldor Electric Company | 516,856 |

| 28,843 | | * | BE Aerospace, Inc. | 677,811 |

| 10,000 | | | Burlington Northern Santa Fe Corporation | 986,200 |

| 54,537 | | | Chicago Bridge & Iron Company NV – NY Shares | 1,102,738 |

| 45,500 | | * | DynCorp International, Inc. – Class “A” | 652,925 |

| 34,000 | | * | Esterline Technologies Corporation | 1,386,180 |

| 67,196 | | | General Electric Company | 1,016,676 |

| 14,700 | | | Harsco Corporation | 473,781 |

| 38,640 | | | Honeywell International, Inc. | 1,514,688 |

| 36,553 | | | IDEX Corporation | 1,138,626 |

Portfolio of Investments (continued)

GROWTH & INCOME FUND

December 31, 2009

| | | | |

| Shares | | | Security | Value |

| |

| | | | Industrials (continued) | |

| 16,400 | | | Lockheed Martin Corporation | $ 1,235,740 |

| 29,500 | | * | Mistras Group, Inc. | 444,270 |

| 63,919 | | * | Mobile Mini, Inc. | 900,619 |

| 17,618 | | | Northrop Grumman Corporation | 983,965 |

| 36,762 | | * | PGT, Inc. | 77,200 |

| 27,900 | | | Raytheon Company | 1,437,408 |

| 23,150 | | | Republic Services, Inc. | 655,377 |

| 89,200 | | | TAL International Group, Inc. | 1,180,116 |

| 53,900 | | | Textainer Group Holdings, Ltd. | 910,910 |

| 29,168 | | | Tyco International, Ltd. | 1,040,714 |

| 29,400 | | | United Technologies Corporation | 2,040,654 |

| |

| | | | | 26,524,172 |

| |

| | | | Information Technology—16.2% | |

| 131,700 | | * | Brocade Communications Systems, Inc. | 1,004,871 |

| 21,400 | | * | CACI International, Inc. – Class “A” | 1,045,390 |

| 58,600 | | * | Cisco Systems, Inc. | 1,402,884 |

| 106,690 | | * | EMC Corporation | 1,863,874 |

| 22,000 | | | Harris Corporation | 1,046,100 |

| 44,340 | | | Hewlett-Packard Company | 2,283,953 |

| 55,352 | | | Intel Corporation | 1,129,181 |

| 31,529 | | | International Business Machines Corporation | 4,127,146 |

| 131,300 | | | Microsoft Corporation | 4,003,337 |

| 88,100 | | | National Semiconductor Corporation | 1,353,216 |

| 49,425 | | * | NCI, Inc. – Class “A” | 1,366,601 |

| 94,117 | | | Nokia Corporation – Class “A” (ADR) | 1,209,403 |

| 72,355 | | * | Parametric Technology Corporation | 1,182,281 |

| 48,088 | | | QUALCOMM, Inc. | 2,224,551 |

| 72,650 | | * | SRA International, Inc. – Class “A” | 1,387,615 |

| 123,460 | | * | Symantec Corporation | 2,208,699 |

| 60,200 | | | Western Union Company | 1,134,770 |

| 18,185 | | | Xilinx, Inc. | 455,716 |

| |

| | | | | 30,429,588 |

| |

| | | | Materials—4.3% | |

| 51,200 | | | Bemis Company, Inc. | 1,518,080 |

| 36,800 | | | Celanese Corporation – Series “A” | 1,181,280 |

| 23,370 | | * | Freeport-McMoRan Copper & Gold, Inc. | 1,876,377 |

| 7,300 | | | Olin Corporation | 127,896 |

| | | | | | |

| Shares or | | | | | | |

| Principal | | | | | | |

| Amount | | | Security | | | Value |

| |

| | | | Materials (continued) | | | |

| 12,200 | | | Praxair, Inc. | | | $ 979,782 |

| 68,320 | | | RPM International, Inc. | | | 1,388,946 |

| 49,464 | | | Temple-Inland, Inc. | | | 1,044,185 |

| |

| | | | | | | 8,116,546 |

| |

| | | | Telecommunication Services—2.5% | | | |

| 71,083 | | | AT&T, Inc. | | | 1,992,457 |

| 82,200 | | | Verizon Communications, Inc. | | | 2,723,286 |

| |

| | | | | | | 4,715,743 |

| |

| | | | Utilities—.4% | | | |

| 24,126 | | | Atmos Energy Corporation | | | 709,304 |

| |

| Total Value of Common Stocks (cost $188,442,374) | | | 186,332,486 |

| |

| | | | SHORT-TERM INVESTMENTS—.4% | | | |

| | | | Money Market Fund | | | |

| $775 | M | | First Investors Cash Reserve Fund, .24% (cost $775,000)** | | 775,000 |

| |

| Total Value of Investments (cost $189,217,374) | 99.8 | % | 187,107,486 |

| Other Assets, Less Liabilities | .2 | | 292,631 |

| |

| Net Assets | | | | 100.0 | % | $187,400,117 |

| |

| * | Non-income producing |

| ** | Affiliated unregistered money market fund available only to First Investors funds and certain |

| accounts managed by First Investors Management Company, Inc. Rate shown is the 7-day yield at |

| December 31, 2009 (see Note 3). |

| | |

| Summary of Abbreviations: |

| ADR | American Depositary Receipts |

| ETF | Exchange Traded Fund |

| REIT | Real Estate Investment Trust |

Portfolio of Investments (continued)

GROWTH & INCOME FUND

December 31, 2009

Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| Level 1 — quoted prices in active markets for identical securities |

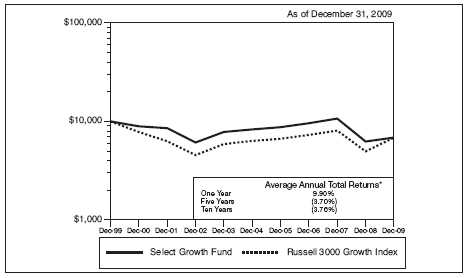

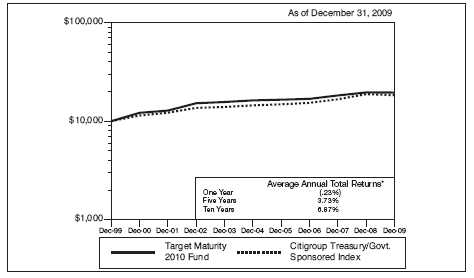

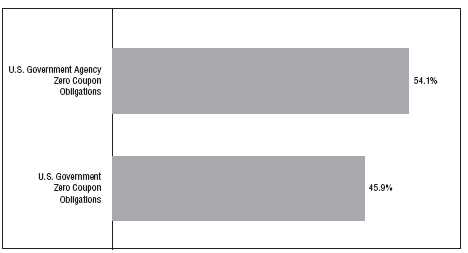

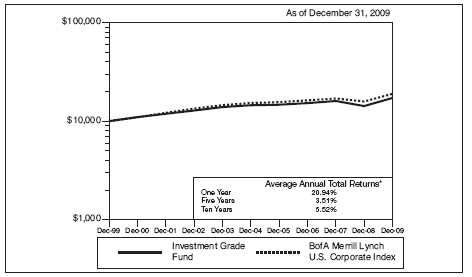

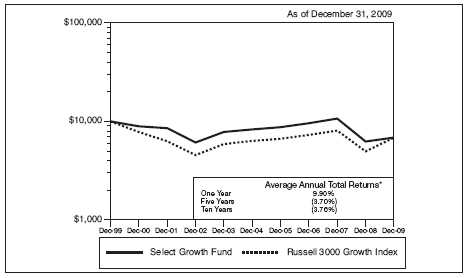

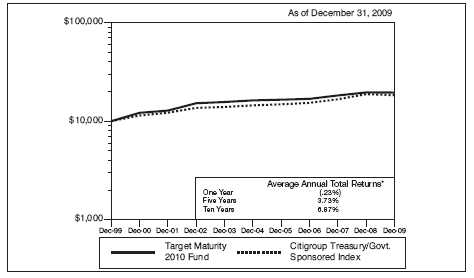

| |