|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

| -------- |

| |

| FORM N-CSR |

| -------- |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| |

| INVESTMENT COMPANY ACT FILE NUMBER 811-4325 |

| |

| FIRST INVESTORS LIFE SERIES FUNDS |

| (Exact name of registrant as specified in charter) |

| |

| 110 Wall Street |

| New York, NY 10005 |

| (Address of principal executive offices) (Zip code) |

| |

| Joseph I. Benedek |

| First Investors Management Company, Inc. |

| Raritan Plaza I |

| Edison, NJ 08837-3620 |

| (Name and address of agent for service) |

| |

| REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE: |

| 1-212-858-8000 |

| |

| DATE OF FISCAL YEAR END: DECEMBER 31, 2012 |

| |

| DATE OF REPORTING PERIOD: JUNE 30, 2012 |

| |

| Item 1. | Reports to Stockholders |

| |

| | The semi-annual report to stockholders follows |

This report is for the information of the shareholders of the Funds. It is the policy of each Fund described in this report to mail only one copy of a Fund’s prospectus, annual report, semi-annual report and proxy statements to all shareholders who share the same mailing address and share the same last name and have invested in a Fund covered by the same document. You are deemed to consent to this policy unless you specifically revoke this policy and request that separate copies of such documents be mailed to you. In such case, you will begin to receive your own copies within 30 days after our receipt of the revocation. You may request that separate copies of these disclosure documents be mailed to you by writing to us at: Administrative Data Management Corp., Raritan Plaza I, Edison, NJ 08837-3620 or calling us at 1-800-423-4026.

You may obtain a free prospectus for any of the Funds by contacting your representative, calling 1-800-423-4026, writing to us at the following address: First Investors Corporation, 110 Wall Street, New York, NY 10005, or by visiting our website at www.firstinvestors.com. You should consider the investment objectives, risks, charges and expenses of a Fund carefully before investing. The prospectus contains this and other information about the Fund, and should be read carefully before investing.

An investment in a Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although the Cash Management Fund seeks to preserve a net asset value at $1.00 per share, it is possible to lose money by investing in it, just as it is possible to lose money by investing in any of the other Funds. Past performance is no guarantee of future results.

A Statement of Additional Information (“SAI”) for any of the Funds may also be obtained, without charge, upon request by calling 1-800-423-4026, writing to us at our address or by visiting our website listed above. The SAI contains more detailed information about the Funds, including information about their Trustees.

Equity & Bond Markets Overview

FIRST INVESTORS LIFE SERIES FUNDS

Dear Investor:

We are pleased to provide you with our report for the first six months of 2012 (“the review period”). During this time, investment returns were generally good, despite a number of economic and geopolitical uncertainties.

Economic Overview

The year began with indications of stronger economic growth. Jobs data from the U.S. Labor Department showed that the U.S. added an average of 245,000 positions to payrolls per month during the first three months of the year, the strongest gains since 2006, as the unemployment rate fell from 8.5% to 8.2%. In addition, housing market data suggested a bottoming in sales after a multi-year decline.

Growth slowed, however, in the second half of the review period to under 2%, as both the jobs report and manufacturing numbers were weaker than expected. According to the U.S. Bureau of Labor Statistics, nonfarm payroll employment began to disappoint, as the economy added only an average of 75,000 jobs per month, less than a third of the total from the first three months of 2012, while unemployment remained unchanged at 8.2% (though down from 9% a year ago). As hiring slowed, so did spending. Retail sales fell for two straight months in May and June, while consumer confidence tumbled in June to its lowest level since December 2011.

Beneath the weak May and June numbers emerged a deeper concern that the U.S. economic recovery was not as robust as first appeared. In May, for instance, the Commerce Department lowered its estimate of first quarter spending growth from 2.9% to 2.5%. This against the backdrop of a general global economic slowdown, as the Eurozone debt crisis intensified, adversely affecting growth and financial markets. Feeling the pressure to do something, the Federal Reserve (“the Fed”) maintained and reaffirmed its highly accommodative monetary policy by extending “Operation Twist” (where the Fed sells short-term Treasuries and purchases longer-term notes) through the end of the year.

The Stock Market

Stocks rallied for a third month in a row in January, and finished the first half of the review period near multi-year highs for U.S. markets. For the equities market in general, most sectors generated positive returns, as investors continued to embrace risk during the start of 2012. Top sectors were financials (+7.3%), technology (+5.0%) and consumer discretionary (+4.4%). Energy was the only sector posting a down return, at –3.4%. Defensive areas lagged. Among styles, growth outperformed value. Dividend-paying and higher-quality stocks underperformed overall as well.

Equity & Bond Markets Overview (continued)

FIRST INVESTORS LIFE SERIES FUNDS

In the second half of the review period, June experienced the biggest rally for stocks since 1999. Global equities rebounded from May’s losses, as there was some progress in the European sovereign debt and the Spanish banking crises. For the equities market in general most sectors were positive, as investors flocked to shares exhibiting momentum and value attributes. Factors such as earnings surprise, analyst revisions and earnings momentum were the strongest performers. Positive contributors to performance included energy (+5.6%), health care (+5.6%) and telecom (+5.4%), while the worst performing sectors were consumer discretionary (+1.8%) and technology (+2.9%). Higher dividend yield was also a positive factor. Smaller-cap stocks were also a leading performer for the month, although mid-cap stocks lagged. Among investing styles, value outperformed growth for the first time on a monthly basis in 2012. On a global scale, investors pulled back from risk, and sold off equities as renewed fears from the continuing economic problems in Europe, and weakening indicators in the U.S., pushed investors to the exits.

The Bond Market

In the first half of the review period the broad bond market gained only 0.4%, according to Bank of America Merrill Lynch, as interest rates moved higher. Most of the move up in rates occurred in March as the Fed upgraded its outlook for the economy based on better economic data. In particular, the unemployment rate fell to 8.2%, a three-year low, and consumer and business spending continued to advance. In addition, aggressive actions by the European Central Bank to bolster European banks, and the successful restructuring of Greece’s debt temporarily stabilized the European sovereign debt crisis. In turn, this decreased the safe haven appeal of U.S. Treasuries and contributed to the rise in interest rates.

In the second half of the review period, the broad bond market returned 2.2%. Fixed income returns were driven by a substantial decrease in long-term interest rates. In general, interest rates moved lower because of “flight-to-safety” flows due to the ongoing Eurozone debt crisis, slower economic growth and the Fed’s very accommodative monetary policy. Economic data, which continued to indicate a slowing global economy, was overshadowed by events in Europe. Of note, the ten-year U.S. Treasury note yield fell to 1.45% in early June, its lowest level in history. The two-year U.S. Treasury note yield, which is anchored by the Fed’s commitment to keep short-term rates very low, ended the review period at 0.30%.

Thank you for placing your trust in First Investors. As always, we appreciate the opportunity to serve your investment needs.

The Funds are only available through the purchase of variable life insurance policies and variable annuity contracts issued by First Investors Life Insurance Company. The reports do not reflect the additional expenses and charges that are applicable to variable life insurance policies and variable annuity contracts.

This Equity & Bond Markets Overview is not part of the Funds’ financial report and is submitted for the general information of the shareholders of the Funds. It is not authorized for distribution to prospective investors in the Funds, unless preceded or accompanied by an effective prospectus. The views expressed in this Overview reflect those views of the Director of Equities and Director of Fixed Income of First Investors Management Company, Inc. through the end of the period covered. Any such views are subject to change at any time based upon market or other conditions and we disclaim any responsibility to update such views. This Overview may not be relied upon as investment advice or an indication of current or future trading intent on behalf of any Fund.

There are a variety of risks associated with investing in variable life and annuity subaccounts. For all subaccounts, there is the risk that securities selected by the portfolio manager may perform differently than the overall market or may not meet the portfolio manager’s expectations. For stock subaccounts, the risks include market risk (the risk that the entire stock market will decline because of an event such as a deterioration in the economy or a rise in interest rates), as well as special risks associated with investing in certain types of stock subaccounts such as small-cap, global or international funds. For bond subaccounts, the risks include interest rate risk and credit risk. Interest rate risk is the risk that bonds will decrease in value as interest rates rise. As a general matter, bonds with longer maturities fluctuate more than bonds with shorter maturities in reaction to changes in interest rates. Credit risk is the risk that bonds will decline in value as the result of a decline in the credit rating of the bonds or the economy as a whole, or that the issuer will be unable to pay interest and/or principal when due. There are also special risks associated with investing in certain types of bond subaccounts, including liquidity risk and prepayment and extension risk. You should consult your prospectus for a precise explanation of the risks associated with your subaccounts.

Understanding Your Fund’s Expenses

FIRST INVESTORS LIFE SERIES FUNDS

As a mutual fund shareholder, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including advisory fees and other expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 in each Fund at the beginning of the period, January 1, 2012, and held for the entire six-month period ended June 30, 2012. The calculations assume that no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

Actual Expense Example:

These amounts help you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid during the period.

To estimate the expenses you paid on your account during this period simply divide your ending account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period”.

Hypothetical Expense Example:

These amounts provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transactional costs. Therefore, the hypothetical expense example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Fund Expenses (unaudited)

CASH MANAGEMENT FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | |

| | | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (1/1/12) | (6/30/12) | (1/1/12–6/30/12)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $1,000.00 | $.50 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,024.36 | $.50 |

| |

| * | Expenses are equal to the annualized expense ratio of .10%, multiplied by the average account |

| value over the period, multiplied by 182/366 (to reflect the one-half year period). Expenses paid |

| during the period are net of expenses waived and/or assumed. |

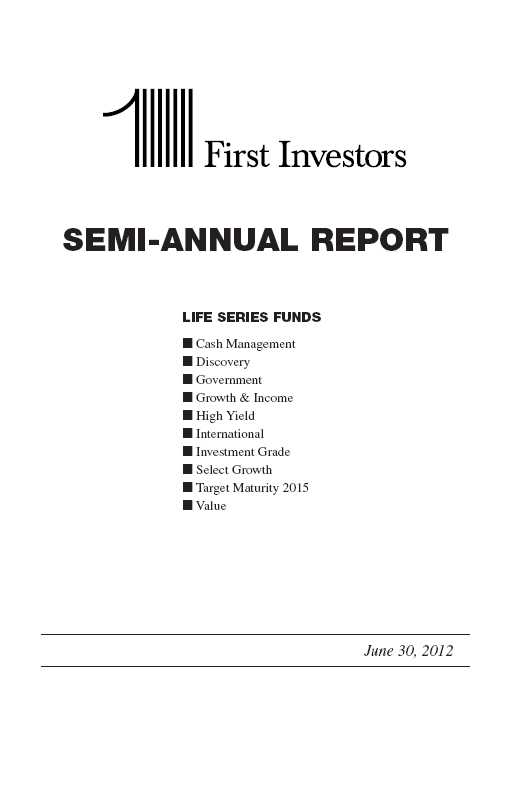

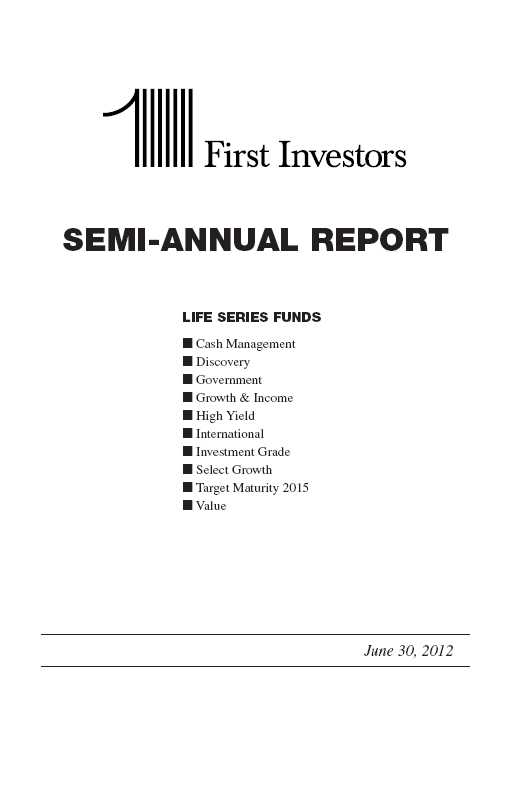

Portfolio Composition

BY SECTOR

|

| Portfolio holdings and allocations are subject to change. Percentages are as of June 30, 2012, and are |

| based on the total value of investments. |

Portfolio of Investments

CASH MANAGEMENT FUND

June 30, 2012

| | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | Interest | | |

| Amount | | Security | | | Rate | * | Value |

| | | U.S. GOVERNMENT AGENCY | | | | | |

| | | OBLIGATIONS—38.0% | | | | | |

| | | Fannie Mae: | | | | | |

| $400M | | 7/17/2012 | | | 0.07 | % | $ 399,988 |

| 500M | | 9/12/2012 | | | 0.12 | | 499,878 |

| 500M | | Federal Home Loan Bank, 9/21/2012 | | | 0.12 | | 499,863 |

| | | Freddie Mac: | | | | | |

| 600M | | 7/16/2012 | | | 0.13 | | 599,968 |

| 700M | | 8/14/2012 | | | 0.09 | | 699,923 |

| 500M | | 8/21/2012 | | | 0.14 | | 499,904 |

| 621M | | 9/17/2012 | | | 0.12 | | 620,839 |

| Total Value of U.S. Government Agency Obligations (cost $3,820,363) | | | | | 3,820,363 |

| | | CORPORATE NOTES—25.8% | | | | | |

| 500M | | Coca-Cola Co., 10/4/2012 (a) | | | 0.23 | | 499,696 |

| 400M | | Johnson & Johnson, 7/23/2012 (a) | | | 0.11 | | 399,973 |

| 350M | | McDonald’s Corp., 8/6/2012 (a) | | | 0.13 | | 349,955 |

| 450M | | PepsiCo, Inc., 8/24/2012 (a) | | | 0.12 | | 449,919 |

| 400M | | Wal-Mart Stores, Inc., 7/31/2012 (a) | | | 0.13 | | 399,957 |

| 500M | | Walt Disney Co., 7/10/2012 (a) | | | 0.11 | | 499,986 |

| Total Value of Corporate Notes (cost $2,599,486) | | | | | 2,599,486 |

| | | VARIABLE AND FLOATING RATE NOTES—22.5% | | |

| | | Federal Farm Credit Bank: | | | | | |

| 290M | | 8/8/2012 | | | 0.25 | | 290,009 |

| 300M | | 9/24/2012 | | | 0.20 | | 299,959 |

| 400M | | 3/6/2013 | | | 0.25 | | 400,041 |

| 370M | | Freddie Mac, 3/21/2013 | | | 0.20 | | 370,110 |

| 400M | | Mississippi Business Finance Corp. | | | | | |

| | | (Chevron USA, Inc.), 12/1/2030 | | | 0.18 | | 400,000 |

| | | Valdez, Alaska Marine Terminal Rev.: | | | | | |

| 200M | | Exxon Pipeline Co. Project B 12/1/2033 | | | 0.13 | | 200,000 |

| 300M | | Exxon Pipeline Co. Project C 12/1/2033 | | | 0.13 | | 300,000 |

| Total Value of Variable and Floating Rate Notes (cost $2,260,119) | | | | | 2,260,119 |

| | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | Interest | | |

| Amount | | Security | | | Rate | * | Value |

| | | SHORT-TERM U.S. GOVERNMENT | | | | | |

| | | OBLIGATIONS—11.9% | | | | | |

| | | U.S. Treasury Bills: | | | | | |

| $700M | | 8/2/2012 | | | 0.04 | % | $ 699,975 |

| 500M | | 9/6/2012 | | | 0.09 | | 499,916 |

| Total Value of Short-Term U.S. Government Obligations (cost $1,199,891) | | 1,199,891 |

| Total Value of Investments (cost $9,879,859)** | 98.2 | % | | | 9,879,859 |

| Other Assets, Less Liabilities | 1.8 | | | | 185,226 |

| Net Assets | | | 100.0 | % | | | $10,065,085 |

| |

| * | The interest rates shown are the effective rates at the time of purchase by the Fund. The interest |

| rates shown on variable and floating rate notes are adjusted periodically; the rates shown are the |

| rates in effect at June 30, 2012. |

| |

| ** | Aggregate cost for federal income tax purposes is the same. |

| |

| (a) | Security exempt from registration under Section 4(2) of Securities Act of 1933 (see Note 5). |

Portfolio of Investments (continued)

CASH MANAGEMENT FUND

June 30, 2012

Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of June 30, 2012:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| U.S. Government Agency | | | | | | | | | | | | |

| Obligations | | $ | — | | $ | 3,820,363 | | $ | — | | $ | 3,820,363 |

| Corporate Notes | | | — | | | 2,599,486 | | | — | | | 2,599,486 |

| Variable and Floating Rate Notes: | | | | | | | | | | | | |

| Municipal Bonds | | | — | | | 900,000 | | | — | | | 900,000 |

| U.S. Government Agency | | | | | | | | | | | | |

| Obligations | | | — | | | 1,360,119 | | | — | | | 1,360,119 |

| Short-Term U.S. Government | | | | | | | | | | | | |

| Obligations | | | — | | | 1,199,891 | | | — | | | 1,199,891 |

| Total Investments in Securities | | $ | — | | $ | 9,879,859 | | $ | — | | $ | 9,879,859 |

There were no transfers into or from Level 1 and Level 2 by the Fund for the period ended June 30, 2012. Transfers, if any, between Levels are recognized at the end of the reporting period.

| | |

| 8 | See notes to financial statements | |

Fund Expenses (unaudited)

DISCOVERY FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | |

| | | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (1/1/12) | (6/30/12) | (1/1/12–6/30/12)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $1,041.93 | $4.11 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,020.83 | $4.07 |

| |

| * | Expenses are equal to the annualized expense ratio of .81%, multiplied by the average account |

| value over the period, multiplied by 182/366 (to reflect the one-half year period). |

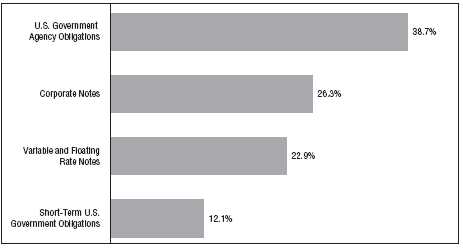

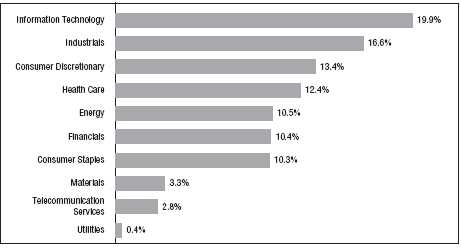

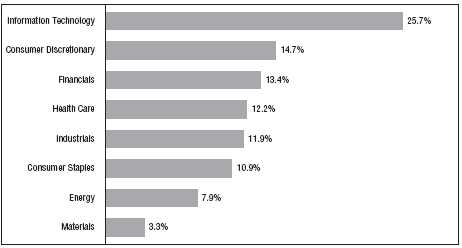

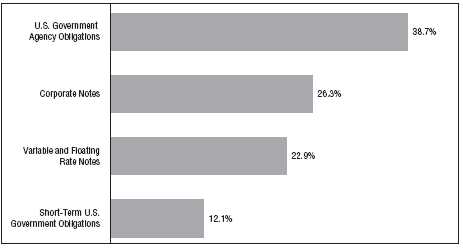

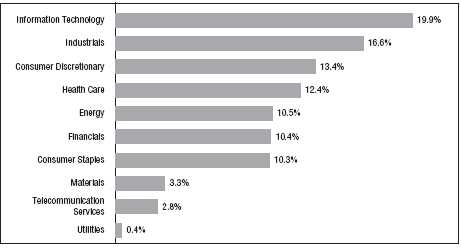

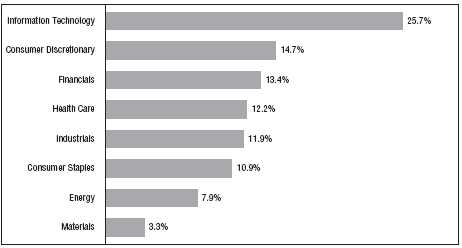

Portfolio Composition

BY SECTOR

|

| Portfolio holdings and allocations are subject to change. Percentages are as of June 30, 2012, and are |

| based on the total value of investments. |

Portfolio of Investments

DISCOVERY FUND

June 30, 2012

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Shares | | Security | | Value |

| | | COMMON STOCKS—99.6% | | |

| | | Consumer Discretionary—14.1% | | |

| 86,400 | | American Eagle Outfitters, Inc. | | $ 1,704,672 |

| 35,200 | * | Big Lots, Inc. | | 1,435,808 |

| 88,750 | * | Deckers Outdoor Corporation | | 3,905,888 |

| 120,100 | * | Express, Inc. | | 2,182,217 |

| 51,300 | | Foot Locker, Inc. | | 1,568,754 |

| 122,200 | * | Iconix Brand Group, Inc. | | 2,134,834 |

| 49,700 | | Men’s Wearhouse, Inc. | | 1,398,558 |

| 41,100 | | PVH Corporation | | 3,197,169 |

| 301,900 | | Regal Entertainment Group – Class “A” | | 4,154,144 |

| | | | | 21,682,044 |

| | | Consumer Staples—1.9% | | |

| 38,200 | | Cal-Maine Foods, Inc. | | 1,493,620 |

| 171,266 | * | Dole Food Company, Inc. | | 1,503,715 |

| | | | | 2,997,335 |

| | | Energy—8.0% | | |

| 94,300 | * | Denbury Resources, Inc. | | 1,424,873 |

| 146,687 | * | Matrix Service Company | | 1,664,897 |

| 304,000 | * | PetroQuest Energy, Inc. | | 1,520,000 |

| 23,000 | * | Plains Exploration & Production Company | | 809,140 |

| 73,000 | * | Resolute Energy Corporation | | 698,610 |

| 92,800 | | Sunoco, Inc. | | 4,408,000 |

| 41,400 | * | Whiting Petroleum Corporation | | 1,702,368 |

| | | | | 12,227,888 |

| | | Financials—22.8% | | |

| 8,052 | * | Alleghany Corporation | | 2,735,667 |

| 65,900 | | American Financial Group, Inc. | | 2,585,257 |

| 624,100 | | Anworth Mortgage Asset Corporation (REIT) | | 4,399,905 |

| 92,600 | | Aspen Insurance Holdings, Ltd. | | 2,676,140 |

| 217,100 | | Capitol Federal Financial, Inc. | | 2,579,148 |

| 94,500 | * | EZCORP, Inc. – Class “A” | | 2,216,970 |

| 275,200 | | First Niagara Financial Group, Inc. | | 2,105,280 |

| 337,000 | * | Knight Capital Group, Inc. – Class “A” | | 4,023,780 |

| 1,700 | * | Markel Corporation | | 750,890 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Shares | | Security | | Value |

| | | Financials (continued) | | |

| 501,300 | | MFA Financial, Inc. (REIT) | | $ 3,955,257 |

| 57,300 | | Mid-America Apartment Communities, Inc. (REIT) | | 3,910,152 |

| 144,600 | | Montpelier Re Holdings, Ltd. | | 3,078,534 |

| | | | | 35,016,980 |

| | | Health Care—12.5% | | |

| 96,400 | * | Endo Health Solutions, Inc. | | 2,986,472 |

| 67,100 | * | Life Technologies Corporation | | 3,018,829 |

| 102,200 | * | Magellan Health Services, Inc. | | 4,632,726 |

| 39,400 | * | MEDNAX, Inc. | | 2,700,476 |

| 173,500 | * | Myriad Genetics, Inc. | | 4,124,095 |

| 68,700 | | PerkinElmer, Inc. | | 1,772,460 |

| | | | | 19,235,058 |

| | | Industrials—5.0% | | |

| 70,600 | | Applied Industrial Technologies, Inc. | | 2,601,610 |

| 78,900 | | EMCOR Group, Inc. | | 2,194,998 |

| 32,735 | * | FTI Consulting, Inc. | | 941,131 |

| 11,800 | | Precision Castparts Corporation | | 1,940,982 |

| | | | | 7,678,721 |

| | | Information Technology—22.5% | | |

| 120,600 | * | Avnet, Inc. | | 3,721,716 |

| 177,100 | * | Compuware Corporation | | 1,645,259 |

| 138,900 | * | Comverse Technology, Inc. | | 808,398 |

| 296,775 | | Convergys Corporation | | 4,383,367 |

| 42,100 | * | Cymer, Inc. | | 2,481,795 |

| 201,500 | * | Emulex Corporation | | 1,450,800 |

| 40,500 | | IAC/InterActiveCorp | | 1,846,800 |

| 51,950 | | j2 Global, Inc. | | 1,372,519 |

| 237,900 | * | Kulicke and Soffa Industries, Inc. | | 2,122,068 |

| 17,200 | | Lender Processing Services, Inc. | | 434,816 |

| 89,100 | | Lexmark International, Inc. – Class “A” | | 2,368,278 |

| 148,200 | | Marvell Technology Group, Ltd. | | 1,671,696 |

| 92,000 | * | Microsemi Corporation | | 1,701,080 |

| 273,200 | * | QLogic Corporation | | 3,740,108 |

| 273,800 | * | TriQuint Semiconductor, Inc. | | 1,505,900 |

| 352,300 | * | Vishay Intertechnology, Inc. | | 3,322,189 |

| | | | | 34,576,789 |

Portfolio of Investments (continued)

DISCOVERY FUND

June 30, 2012

| | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Shares | | Security | | | | | Value |

| | | Materials—11.6% | | | | | |

| 50,000 | | AptarGroup, Inc. | | | | | $ 2,552,500 |

| 176,200 | * | Chemtura Corporation | | | | | 2,554,900 |

| 31,500 | * | Innospec, Inc. | | | | | 932,715 |

| 120,700 | | Olin Corporation | | | | | 2,521,423 |

| 22,600 | | Royal Gold, Inc. | | | | | 1,771,840 |

| 33,600 | | Schnitzer Steel Industries, Inc. – Class “A” | | | | | 941,472 |

| 78,500 | | Sensient Technologies Corporation | | | | | 2,883,305 |

| 6,800 | * | Tronox, Ltd. – Class “A” | | | | | 820,896 |

| 55,900 | | Westlake Chemical Corporation | | | | | 2,921,334 |

| | | | | | | | 17,900,385 |

| | | Telecommunication Services—1.2% | | | | | |

| 221,000 | * | Premiere Global Services, Inc. | | | | | 1,854,190 |

| Total Value of Common Stocks (cost $129,239,793) | 99.6 | % | | | 153,169,390 |

| Other Assets, Less Liabilities | .4 | | | | 642,474 |

| Net Assets | | | 100.0 | % | | | $153,811,864 |

| |

| * | Non-income producing |

| |

| Summary of Abbreviations: |

| REIT | Real Estate Investment Trust |

Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of June 30, 2012:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Common Stocks* | | $ | 153,169,390 | | $ | — | | $ | — | | $ | 153,169,390 |

* The Portfolio of Investments provides information on the industry categorization for common stocks.

There were no transfers into or from Level 1 and Level 2 by the Fund for the period ended June 30, 2012. Transfers, if any, between Levels are recognized at the end of the reporting period.

| | |

| See notes to financial statements | 13 |

Fund Expenses (unaudited)

GOVERNMENT FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | |

| | | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (1/1/12) | (6/30/12) | (1/1/12–6/30/12)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $1,010.69 | $3.80 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,021.08 | $3.82 |

| |

| * | Expenses are equal to the annualized expense ratio of .76%, multiplied by the average account |

| value over the period, multiplied by 182/366 (to reflect the one-half year period). Expenses paid |

| during the period are net of expenses waived. |

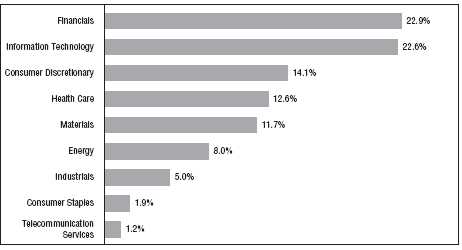

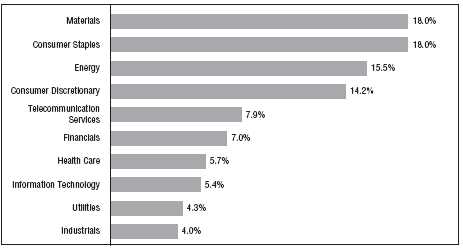

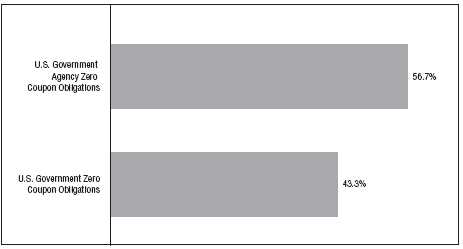

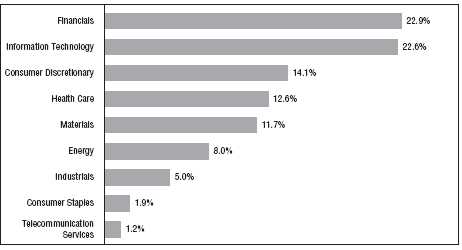

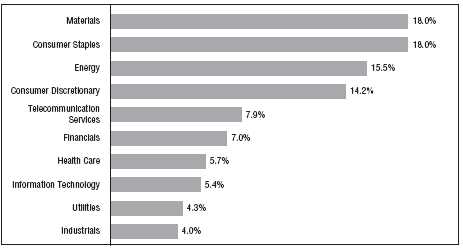

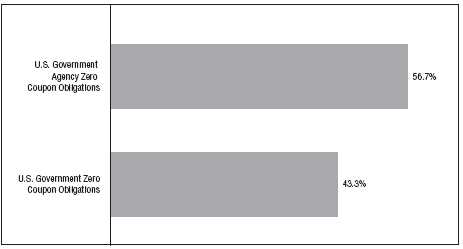

Portfolio Composition

BY SECTOR

|

| Portfolio holdings and allocations are subject to change. Percentages are as of June 30, 2012, and are |

| based on the total value of investments. |

Portfolio of Investments

GOVERNMENT FUND

June 30, 2012

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | RESIDENTIAL MORTGAGE-BACKED | | |

| | | SECURITIES—59.0% | | |

| | | Fannie Mae—5.9% | | |

| $1,271M | | 5.5%, 7/1/2034 – 10/1/2039 | | $ 1,401,270 |

| 198M | | 9%, 11/1/2026 | | 245,108 |

| 117M | | 11%, 10/1/2015 | | 130,362 |

| | | | | 1,776,740 |

| | | Freddie Mac—3.3% | | |

| 910M | | 5.5%, 11/1/2038 | | 1,001,750 |

| | | Government National Mortgage Association I | | |

| | | Program—46.2% | | |

| 3,464M | | 4%, 10/15/2040 – 11/15/2041 | | 3,795,169 |

| 3,157M | | 4.5%, 6/15/2039 – 8/15/2040 | | 3,477,357 |

| 4,365M | | 5%, 6/15/2033 – 6/15/2040 | | 4,837,907 |

| 1,338M | | 5.5%, 2/15/2033 – 11/15/2038 | | 1,498,470 |

| 250M | | 6%, 11/15/2032 – 4/15/2036 | | 284,588 |

| | | | | 13,893,491 |

| | | Government National Mortgage Association II | | |

| | | Program—3.6% | | |

| 994M | | 4%, 3/20/2042 | | 1,089,349 |

| Total Value of Residential Mortgage-Backed Securities (cost $16,935,465) | | 17,761,330 |

| | | U.S. GOVERNMENT AGENCY | | |

| | | OBLIGATIONS—29.4% | | |

| | | Fannie Mae: | | |

| 1,750M | | 1.625%, 10/26/2015 | | 1,814,136 |

| 1,750M | | 1.25%, 1/30/2017 | | 1,779,561 |

| 1,250M | | Federal Farm Credit Bank, 1.75%, 2/21/2013 | | 1,261,085 |

| 1,250M | | Federal Home Loan Bank, 5.375%, 5/18/2016 | | 1,475,164 |

| 1,250M | | Freddie Mac, 3%, 7/28/2014 | | 1,316,267 |

| 1,000M | | Tennessee Valley Authority, 4.5%, 4/1/2018 | | 1,180,882 |

| Total Value of U.S. Government Agency Obligations (cost $8,619,512) | | 8,827,095 |

| | | U.S. GOVERNMENT OBLIGATIONS—6.8% | | |

| 466M | | FDA Queens, LP, 6.99%, 6/15/2017 (a) | | 515,465 |

| 1,500M | | U.S. Treasury Note, 0.875%, 12/31/2016 | | 1,513,711 |

| Total Value of U.S. Government Obligations (cost $2,032,423) | | 2,029,176 |

Portfolio of Investments (continued)

GOVERNMENT FUND

June 30, 2012

| | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | | | |

| Amount | | Security | | | | | Value |

| | | U.S. GOVERNMENT FDIC GUARANTEED | | | | |

| | | DEBT—3.4% | | | | | |

| $1,000M | | JPMorgan Chase & Co., 2.125%, 12/26/2012 (cost $1,011,463) | | | | $ 1,009,328 |

| Total Value of Investments (cost $28,598,863) | 98.6 | % | | | 29,626,929 |

| Other Assets, Less Liabilities | 1.4 | | | | 417,708 |

| Net Assets | | | 100.0 | % | | | $30,044,637 |

|

| (a) Security exempt from registration under Rule 144A of Securities Act of 1933 (see Note 5). |

Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of June 30, 2012:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Residential Mortgage-Backed | | | | | | | | | | | | |

| Securities | | $ | — | | $ | 17,761,330 | | $ | — | | $ | 17,761,330 |

| U.S. Government Agency | | | | | | | | | | | | |

| Obligations | | | — | | | 8,827,095 | | | — | | | 8,827,095 |

| U.S. Government Obligations | | | — | | | 2,029,176 | | | — | | | 2,029,176 |

| U.S. Government FDIC | | | | | | | | | | | | |

| Guaranteed Debt | | | — | | | 1,009,328 | | | — | | | 1,009,328 |

| Total Investments in Securities | | $ | — | | $ | 29,626,929 | | $ | — | | $ | 29,626,929 |

There were no transfers into or from Level 1 and Level 2 by the Fund for the period ended June 30, 2012. Transfers, if any, between Levels are recognized at the end of the reporting period.

| | |

| 16 | See notes to financial statements | |

Fund Expenses (unaudited)

GROWTH & INCOME FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | |

| | | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (1/1/12) | (6/30/12) | (1/1/12–6/30/12)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $1,091.81 | $4.21 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,020.83 | $4.07 |

| |

| * | Expenses are equal to the annualized expense ratio of .81%, multiplied by the average account |

| value over the period, multiplied by 182/366 (to reflect the one-half year period). |

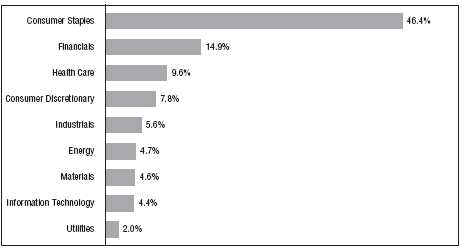

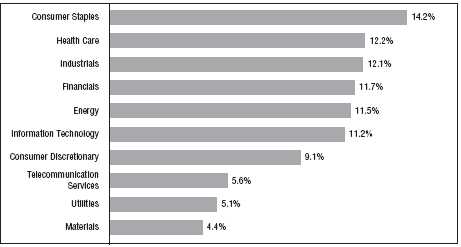

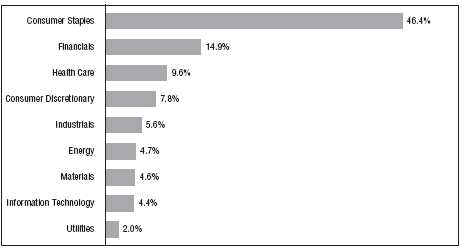

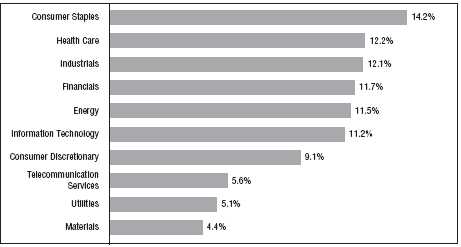

Portfolio Composition

TOP TEN SECTORS

|

| Portfolio holdings and allocations are subject to change. Percentages are as of June 30, 2012, and are |

| based on the total value of investments. |

Portfolio of Investments

GROWTH & INCOME FUND

June 30, 2012

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Shares | | Security | | Value |

| | | COMMON STOCKS—99.7% | | |

| | | Consumer Discretionary—13.3% | | |

| 98,200 | | Allison Transmission Holdings, Inc. | | $ 1,724,392 |

| 111,300 | | Best Buy Company, Inc. | | 2,332,848 |

| 39,100 | * | BorgWarner, Inc. | | 2,564,569 |

| 200 | * | CafePress, Inc. | | 2,976 |

| 144,485 | | CBS Corporation – Class “B” | | 4,736,218 |

| 17,261 | | CEC Entertainment, Inc. | | 627,783 |

| 20,064 | | Coach, Inc. | | 1,173,343 |

| 139,000 | | Dana Holding Corporation | | 1,780,590 |

| 72,600 | * | Delphi Automotive, PLC | | 1,851,300 |

| 36,800 | | GNC Acquisition Holdings, Inc. – Class “A” | | 1,442,560 |

| 57,100 | | Home Depot, Inc. | | 3,025,729 |

| 89,800 | | Limited Brands, Inc. | | 3,819,194 |

| 51,700 | | Lowe’s Companies, Inc. | | 1,470,348 |

| 33,200 | | McDonald’s Corporation | | 2,939,196 |

| 152,243 | | Newell Rubbermaid, Inc. | | 2,761,688 |

| 115,100 | | Pier 1 Imports, Inc. | | 1,891,093 |

| 41,398 | * | Steiner Leisure, Ltd. | | 1,921,281 |

| 180,870 | | Stewart Enterprises, Inc. – Class “A” | | 1,291,412 |

| 25,900 | * | TRW Automotive Holdings Corporation | | 952,084 |

| 800 | * | Tumi Holdings, Inc. | | 14,000 |

| 16,500 | | Tupperware Brands Corporation | | 903,540 |

| 20,700 | * | Vera Bradley, Inc. | | 436,356 |

| 46,900 | | Walt Disney Company | | 2,274,650 |

| 65,883 | | Wyndham Worldwide Corporation | | 3,474,669 |

| | | | | 45,411,819 |

| | | Consumer Staples—10.2% | | |

| 120,600 | | Altria Group, Inc. | | 4,166,730 |

| 98,300 | | Avon Products, Inc. | | 1,593,443 |

| 61,989 | | Coca-Cola Company | | 4,846,920 |

| 76,200 | | CVS Caremark Corporation | | 3,560,826 |

| 15,500 | | McCormick & Company, Inc. | | 940,075 |

| 44,927 | | Nu Skin Enterprises, Inc. – Class “A” | | 2,107,076 |

| 36,200 | | PepsiCo, Inc. | | 2,557,892 |

| 88,100 | | Philip Morris International, Inc. | | 7,687,606 |

| 39,713 | | Procter & Gamble Company | | 2,432,421 |

| 85,400 | | Roundy’s, Inc. | | 871,934 |

| 60,064 | | Wal-Mart Stores, Inc. | | 4,187,662 |

| | | | | 34,952,585 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Shares | | Security | | Value |

| | | Energy—10.5% | | |

| 39,400 | | Anadarko Petroleum Corporation | | $ 2,608,280 |

| 39,900 | * | C&J Energy Services, Inc. | | 738,150 |

| 41,700 | | Chevron Corporation | | 4,399,350 |

| 66,700 | | ConocoPhillips | | 3,727,196 |

| 15,700 | | Devon Energy Corporation | | 910,443 |

| 42,000 | | Ensco, PLC – Class “A” | | 1,972,740 |

| 69,611 | | ExxonMobil Corporation | | 5,956,613 |

| 13,200 | | Hess Corporation | | 573,540 |

| 102,022 | | Marathon Oil Corporation | | 2,608,703 |

| 40,911 | | Marathon Petroleum Corporation | | 1,837,722 |

| 37,950 | | National Oilwell Varco, Inc. | | 2,445,498 |

| 78,800 | * | Noble Corporation | | 2,563,364 |

| 33,350 | * | Phillips 66 | | 1,108,554 |

| 16,994 | | Sasol, Ltd. (ADR) | | 721,395 |

| 15,200 | | Schlumberger, Ltd. | | 986,632 |

| 87,107 | | Suncor Energy, Inc. | | 2,521,748 |

| | | | | 35,679,928 |

| | | Financials—10.3% | | |

| 66,806 | | American Express Company | | 3,888,777 |

| 56,500 | | Ameriprise Financial, Inc. | | 2,952,690 |

| 114,800 | | Brookline Bancorp, Inc. | | 1,015,980 |

| 14,100 | | Chubb Corporation | | 1,026,762 |

| 49,843 | | Discover Financial Services | | 1,723,571 |

| 26,600 | | Financial Select Sector SPDR Fund (ETF) | | 388,892 |

| 83,500 | | FirstMerit Corporation | | 1,379,420 |

| 37,100 | | Invesco, Ltd. | | 838,460 |

| 113,488 | | JPMorgan Chase & Company | | 4,054,926 |

| 28,800 | | M&T Bank Corporation | | 2,378,016 |

| 43,300 | | MetLife, Inc. | | 1,335,805 |

| 27,000 | | Morgan Stanley | | 393,930 |

| 128,100 | | New York Community Bancorp, Inc. | | 1,605,093 |

| 48,400 | | PNC Financial Services Group, Inc. | | 2,957,724 |

| 11,900 | * | Select Income REIT (REIT) | | 282,744 |

| 27,000 | | SPDR S&P Regional Banking (ETF) | | 739,260 |

| 103,279 | * | Sunstone Hotel Investors, Inc. (REIT) | | 1,135,036 |

| 101,588 | | U.S. Bancorp | | 3,267,070 |

| 79,600 | | Urstadt Biddle Properties – Class “A” (REIT) | | 1,573,692 |

| 69,767 | | Wells Fargo & Company | | 2,333,008 |

| | | | | 35,270,856 |

Portfolio of Investments (continued)

GROWTH & INCOME FUND

June 30, 2012

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Shares | | Security | | Value |

| | | Health Care—12.4% | | |

| 84,000 | | Abbott Laboratories | | $ 5,415,480 |

| 15,730 | | Baxter International, Inc. | | 836,050 |

| 33,700 | | Covidien, PLC | | 1,802,950 |

| 50,222 | * | Express Scripts Holding Company | | 2,803,894 |

| 58,400 | * | Gilead Sciences, Inc. | | 2,994,752 |

| 78,375 | | Johnson & Johnson | | 5,295,015 |

| 17,400 | | McKesson Corporation | | 1,631,250 |

| 87,443 | | Merck & Company, Inc. | | 3,650,745 |

| 53,600 | * | Par Pharmaceutical Companies, Inc. | | 1,937,104 |

| 246,139 | | Pfizer, Inc. | | 5,661,197 |

| 34,953 | | Sanofi (ADR) | | 1,320,524 |

| 70,543 | | Thermo Fisher Scientific, Inc. | | 3,661,887 |

| 40,500 | | UnitedHealth Group, Inc. | | 2,369,250 |

| 39,300 | * | Watson Pharmaceuticals, Inc. | | 2,907,807 |

| | | | | 42,287,905 |

| | | Industrials—16.6% | | |

| 58,294 | | 3M Company | | 5,223,142 |

| 88,800 | | Altra Holdings, Inc. | | 1,401,264 |

| 32,000 | | Armstrong World Industries, Inc. | | 1,573,120 |

| 30,800 | | Caterpillar, Inc. | | 2,615,228 |

| 34,537 | | Chicago Bridge & Iron Company NV – NY Shares | | 1,311,025 |

| 32,700 | * | Esterline Technologies Corporation | | 2,038,845 |

| 58,200 | * | Generac Holdings, Inc. | | 1,400,292 |

| 112,296 | | General Electric Company | | 2,340,249 |

| 35,235 | | Goodrich Corporation | | 4,471,321 |

| 61,040 | | Honeywell International, Inc. | | 3,408,474 |

| 52,153 | | IDEX Corporation | | 2,032,924 |

| 91,450 | | ITT Corporation | | 1,609,520 |

| 12,700 | | Lockheed Martin Corporation | | 1,105,916 |

| 48,119 | * | Mobile Mini, Inc. | | 692,914 |

| 11,518 | | Northrop Grumman Corporation | | 734,733 |

| 31,000 | | Parker Hannifin Corporation | | 2,383,280 |

| 20,400 | | Raytheon Company | | 1,154,436 |

| 44,900 | | Snap-on, Inc. | | 2,795,025 |

| 143,000 | | TAL International Group, Inc. | | 4,789,070 |

| 74,500 | | Textainer Group Holdings, Ltd. | | 2,749,050 |

| 25,700 | | Triumph Group, Inc. | | 1,446,139 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Shares | | Security | | Value |

| | | Industrials (continued) | | |

| 102,793 | | Tyco International, Ltd. | | $ 5,432,610 |

| 44,900 | | United Technologies Corporation | | 3,391,297 |

| 19,600 | | Xylem, Inc. | | 493,332 |

| | | | | 56,593,206 |

| | | Information Technology—19.9% | | |

| 12,400 | * | Apple, Inc. | | 7,241,600 |

| 7,600 | * | Arris Group, Inc. | | 105,716 |

| 51,200 | | Avago Technologies, Ltd. | | 1,838,080 |

| 27,400 | * | CACI International, Inc. – Class “A” | | 1,507,548 |

| 198,400 | | Cisco Systems, Inc. | | 3,406,528 |

| 28,500 | * | eBay, Inc. | | 1,197,285 |

| 166,700 | * | EMC Corporation | | 4,272,521 |

| 93,500 | | Hewlett-Packard Company | | 1,880,285 |

| 173,052 | | Intel Corporation | | 4,611,836 |

| 43,729 | | International Business Machines Corporation | | 8,552,518 |

| 145,900 | | Intersil Corporation – Class “A” | | 1,553,835 |

| 250,500 | | Microsoft Corporation | | 7,662,795 |

| 166,000 | * | NCR Corporation | | 3,773,180 |

| 61,700 | * | NeuStar, Inc. – Class “A” | | 2,060,780 |

| 91,500 | | Oracle Corporation | | 2,717,550 |

| 46,855 | * | Parametric Technology Corporation | | 982,081 |

| 86,488 | | QUALCOMM, Inc. | | 4,815,652 |

| 109,360 | * | Symantec Corporation | | 1,597,750 |

| 79,600 | | TE Connectivity, Ltd. | | 2,540,036 |

| 163,400 | | Western Union Company | | 2,751,656 |

| 176,400 | * | Yahoo!, Inc. | | 2,792,412 |

| | | | | 67,861,644 |

| | | Materials—3.3% | | |

| 46,700 | | Celanese Corporation – Series “A” | | 1,616,754 |

| 21,700 | | DuPont (E.I.) de Nemours & Company | | 1,097,369 |

| 72,940 | | Freeport-McMoRan Copper & Gold, Inc. | | 2,485,066 |

| 78,900 | | Kronos Worldwide, Inc. | | 1,245,831 |

| 42,700 | | LyondellBasell Industries NV – Class “A” | | 1,719,529 |

| 11,600 | | Praxair, Inc. | | 1,261,268 |

| 68,320 | | RPM International, Inc. | | 1,858,304 |

| | | | | 11,284,121 |

Portfolio of Investments (continued)

GROWTH & INCOME FUND

June 30, 2012

| | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Shares | | Security | | | | | Value |

| | | Telecommunication Services—2.8% | | | | | |

| 125,783 | | AT&T, Inc. | | | | | $ 4,485,422 |

| 113,800 | | Verizon Communications, Inc. | | | | | 5,057,272 |

| | | | | | | | 9,542,694 |

| | | Utilities—.4% | | | | | |

| 20,500 | | American Electric Power Company, Inc. | | | | | 817,950 |

| 14,426 | | Atmos Energy Corporation | | | | | 505,920 |

| | | | | | | | 1,323,870 |

| Total Value of Common Stocks (cost $259,540,970) | 99.7 | % | | | 340,208,628 |

| Other Assets, Less Liabilities | .3 | | | | 1,176,428 |

| Net Assets | | | 100.0 | % | | | $341,385,056 |

| | |

| * | Non-income producing |

| |

| Summary of Abbreviations: |

| ADR | American Depositary Receipts |

| ETF | Exchange Traded Fund |

| REIT | Real Estate Investment Trust |

Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of June 30, 2012:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Common Stocks* | | $ | 340,208,628 | | $ | — | | $ | — | | $ | 340,208,628 |

* The Portfolio of Investments provides information on the industry categorization for common stocks.

There were no transfers into or from Level 1 and Level 2 by the Fund for the period ended June 30, 2012. Transfers, if any, between Levels are recognized at the end of the reporting period.

| | |

| See notes to financial statements | 23 |

Fund Expenses (unaudited)

HIGH YIELD FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | |

| | | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (1/1/12) | (6/30/12) | (1/1/12–6/30/12)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $1,060.07 | $4.51 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,020.48 | $4.42 |

| |

| * | Expenses are equal to the annualized expense ratio of .88%, multiplied by the average account |

| value over the period, multiplied by 182/366 (to reflect the one-half year period). |

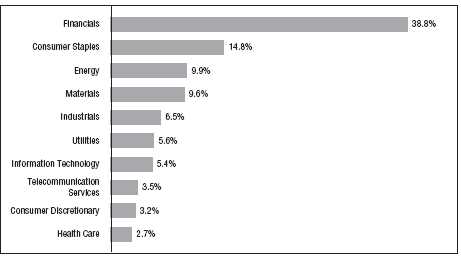

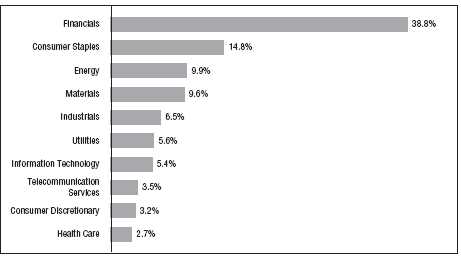

Portfolio Composition

TOP TEN SECTORS

|

| Portfolio holdings and allocations are subject to change. Percentages are as of June 30, 2012, and are |

| based on the total value of investments. |

Portfolio of Investments

HIGH YIELD FUND

June 30, 2012

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | CORPORATE BONDS—93.9% | | |

| | | Automotive—3.2% | | |

| $ 575M | | Chrysler Group, LLC/CG Co–Issuer, Inc., 8.25%, 6/15/2021 | | $ 593,687 |

| 400M | | Cooper Tire & Rubber Co., 8%, 12/15/2019 | | 430,000 |

| 300M | | Cooper-Standard Automotive, Inc., 8.5%, 5/1/2018 | | 325,125 |

| 525M | | Exide Technologies, 8.625%, 2/1/2018 | | 416,719 |

| 250M | | Ford Motor Co., 6.625%, 10/1/2028 | | 282,409 |

| 150M | | Jaguar Land Rover, PLC, 7.75%, 5/15/2018 (a) | | 155,250 |

| 300M | | Oshkosh Corp., 8.5%, 3/1/2020 | | 334,500 |

| | | | | 2,537,690 |

| | | Building Materials—2.1% | | |

| 350M | | Associated Materials, LLC, 9.125%, 11/1/2017 | | 314,125 |

| | | Building Materials Corp.: | | |

| 475M | | 6.875%, 8/15/2018 (a) | | 507,062 |

| 200M | | 7.5%, 3/15/2020 (a) | | 218,000 |

| 325M | | Griffon Corp., 7.125%, 4/1/2018 | | 331,500 |

| 300M | | Texas Industries, Inc., 9.25%, 8/15/2020 | | 301,500 |

| | | | | 1,672,187 |

| | | Capital Goods—.5% | | |

| 375M | | Belden CDT, Inc., 9.25%, 6/15/2019 | | 410,625 |

| | | Chemicals—3.3% | | |

| 400M | | Ferro Corp., 7.875%, 8/15/2018 | | 392,000 |

| 225M | | Kinove German Bondco GmbH, 9.625%, 6/15/2018 (a) | | 232,875 |

| | | LyondellBasell Industries NV: | | |

| 200M | | 5%, 4/15/2019 (a) | | 210,750 |

| 200M | | 6%, 11/15/2021 (a) | | 220,500 |

| 325M | | PolyOne Corp., 7.375%, 9/15/2020 | | 346,125 |

| 800M | | Rhodia SA, 6.875%, 9/15/2020 (a) | | 884,000 |

| | | Solutia, Inc.: | | |

| 125M | | 8.75%, 11/1/2017 | | 140,781 |

| 175M | | 7.875%, 3/15/2020 | | 205,187 |

| | | | | 2,632,218 |

Portfolio of Investments (continued)

HIGH YIELD FUND

June 30, 2012

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Consumer Non-Durables—2.1% | | |

| $ 350M | | Easton-Bell Sports, Inc., 9.75%, 12/1/2016 | | $ 384,562 |

| | | Levi Strauss & Co.: | | |

| 350M | | 7.625%, 5/15/2020 | | 373,625 |

| 350M | | 6.875%, 5/1/2022 (a) | | 360,938 |

| 150M | | Libbey Glass, Inc., 6.875%, 5/15/2020 (a) | | 154,875 |

| 325M | | Phillips Van-Heusen Corp., 7.375%, 5/15/2020 | | 361,562 |

| | | | | 1,635,562 |

| | | Energy—14.4% | | |

| | | AmeriGas Finance, LLC: | | |

| 50M | | 6.75%, 5/20/2020 | | 51,125 |

| 200M | | 7%, 5/20/2022 | | 206,500 |

| | | Basic Energy Services, Inc.: | | |

| 75M | | 7.125%, 4/15/2016 | | 74,437 |

| 150M | | 7.75%, 2/15/2019 | | 144,750 |

| 325M | | Berry Petroleum Co., 6.375%, 9/15/2022 | | 336,375 |

| 275M | | Calumet Specialty Products Partners, LP, 9.625%, 8/1/2020 (a) | | 280,500 |

| | | Chesapeake Energy Corp.: | | |

| 350M | | 7.25%, 12/15/2018 | | 358,750 |

| 25M | | 6.625%, 8/15/2020 | | 24,875 |

| 150M | | Chesapeake Midstream Partners, LP, 6.125%, 7/15/2022 | | 147,750 |

| 325M | | Concho Resources, Inc., 8.625%, 10/1/2017 | | 359,937 |

| | | Consol Energy, Inc.: | | |

| 225M | | 8%, 4/1/2017 | | 234,562 |

| 525M | | 8.25%, 4/1/2020 | | 553,875 |

| | | Copano Energy, LLC: | | |

| 75M | | 7.75%, 6/1/2018 | | 78,000 |

| 375M | | 7.125%, 4/1/2021 | | 388,125 |

| 475M | | Crosstex Energy, LP, 8.875%, 2/15/2018 | | 502,609 |

| 400M | | Denbury Resources, Inc., 8.25%, 2/15/2020 | | 440,000 |

| 375M | | El Paso Corp., 6.5%, 9/15/2020 | | 412,695 |

| 200M | | El Paso Pipeline Partners Operating Co., LLC, 5%, 10/1/2021 | | 217,385 |

| 100M | | Encore Acquisition Co., 9.5%, 5/1/2016 | | 109,750 |

| 215M | | Expro Finance Luxembourg SCA, 8.5%, 12/15/2016 (a) | | 206,938 |

| | | Ferrellgas Partners, LP: | | |

| 475M | | 9.125%, 10/1/2017 | | 498,750 |

| 190M | | 8.625%, 6/15/2020 | | 170,050 |

| 550M | | Forest Oil Corp., 7.25%, 6/15/2019 | | 507,375 |

| 450M | | Genesis Energy, LP, 7.875%, 12/15/2018 | | 463,500 |

| 575M | | Hilcorp Energy I, LP, 8%, 2/15/2020 (a) | | 622,438 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Energy (continued) | | |

| | | Inergy, LP: | | |

| $ 325M | | 7%, 10/1/2018 | | $ 336,375 |

| 92M | | 6.875%, 8/1/2021 | | 92,460 |

| 300M | | Kodiak Oil & Gas Corp., 8.125%, 12/1/2019 (a) | | 309,375 |

| | | Linn Energy, LLC: | | |

| 450M | | 6.25%, 11/1/2019 (a) | | 441,563 |

| 75M | | 8.625%, 4/15/2020 | | 81,187 |

| 325M | | Murray Energy Corp., 10.25%, 10/15/2015 (a) | | 286,813 |

| 50M | | Newfield Exploration Co., 7.125%, 5/15/2018 | | 53,187 |

| 75M | | Penn Virginia Corp., 7.25%, 4/15/2019 | | 62,250 |

| 200M | | Petrohawk Energy Corp., 10.5%, 8/1/2014 | | 221,690 |

| 150M | | Plains Exploration & Production Co., 6.125%, 6/15/2019 | | 151,500 |

| | | Quicksilver Resources, Inc.: | | |

| 125M | | 8.25%, 8/1/2015 | | 117,500 |

| 300M | | 11.75%, 1/1/2016 | | 293,625 |

| 300M | | 9.125%, 8/15/2019 | | 262,500 |

| 200M | | SandRidge Energy, Inc., 7.5%, 3/15/2021 | | 198,500 |

| 150M | | SESI, LLC, 6.375%, 5/1/2019 | | 157,875 |

| | | SM Energy Co.: | | |

| 75M | | 6.625%, 2/15/2019 | | 77,250 |

| 150M | | 6.5%, 11/15/2021 | | 153,375 |

| 150M | | 6.5%, 1/1/2023 (a) | | 151,313 |

| 225M | | Vanguard Natural Resources, LLC, 7.875%, 4/1/2020 | | 225,281 |

| 200M | | Western Refining, Inc., 11.25%, 6/15/2017 (a) | | 225,500 |

| | | | 11,290,170 |

| | | Financials—4.8% | | |

| | | Ally Financial, Inc.: | | |

| 200M | | 5.5%, 2/15/2017 | | 203,353 |

| 525M | | 6.25%, 12/1/2017 | | 554,957 |

| 500M | | 8%, 3/15/2020 | | 577,500 |

| 100M | | CNH Capital, LLC, 6.25%, 11/1/2016 (a) | | 107,500 |

| | | Ford Motor Credit Co., LLC: | | |

| 100M | | 12%, 5/15/2015 | | 125,000 |

| 100M | | 6.625%, 8/15/2017 | | 113,872 |

| 600M | | 5.875%, 8/2/2021 | | 668,695 |

Portfolio of Investments (continued)

HIGH YIELD FUND

June 30, 2012

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Financials (continued) | | |

| | | International Lease Finance Corp.: | | |

| $ 50M | | 5.875%, 5/1/2013 | | $ 51,375 |

| 50M | | 6.625%, 11/15/2013 | | 52,000 |

| 750M | | 8.625%, 9/15/2015 | | 831,562 |

| 275M | | 8.75%, 3/15/2017 | | 310,063 |

| 150M | | 8.25%, 12/15/2020 | | 172,151 |

| | | | | 3,768,028 |

| | | Food/Beverage/Tobacco—.9% | | |

| 75M | | CF Industries, Inc., 6.875%, 5/1/2018 | | 89,156 |

| 225M | | JBS USA, LLC, 7.25%, 6/1/2021 (a) | | 210,375 |

| 375M | | Pilgrim’s Pride Corp., 7.875%, 12/15/2018 | | 382,031 |

| | | | | 681,562 |

| | | Food/Drug—2.4% | | |

| 850M | | McJunkin Red Man Corp., 9.5%, 12/15/2016 | | 922,250 |

| 475M | | NBTY, Inc., 9%, 10/1/2018 | | 527,250 |

| 175M | | SUPERVALU, Inc., 7.5%, 11/15/2014 | | 178,063 |

| 200M | | Tops Holding Corp./Tops Markets, LLC, 10.125%, 10/15/2015 | | 213,500 |

| | | | | 1,841,063 |

| | | Forest Products/Containers—3.5% | | |

| 200M | | Ardagh Packaging Finance, 7.375%, 10/15/2017 (a) | | 213,500 |

| 325M | | Ball Corp., 7.375%, 9/1/2019 | | 360,750 |

| 325M | | Clearwater Paper Corp., 7.125%, 11/1/2018 | | 344,500 |

| 225M | | Exopack Holding Corp., 10%, 6/1/2018 | | 226,688 |

| 175M | | JSG Funding, PLC (Smurfit Kappa Funding, PLC), 7.75%, 4/1/2015 | | 177,625 |

| 225M | | Mead Products, LLC/ACCO Brands, 6.75%, 4/30/2020 (a) | | 238,500 |

| 400M | | Reynolds Group Escrow, LLC, 7.75%, 10/15/2016 (a) | | 423,000 |

| 200M | | Sappi Papier Holding GmbH, 8.375%, 6/15/2019 (a)(b) | | 201,000 |

| 200M | | Sealed Air Corp., 8.125%, 9/15/2019 (a) | | 224,000 |

| 300M | | Tekni-Plex, Inc., 9.75%, 6/1/2019 (a) | | 303,750 |

| | | | | 2,713,313 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Gaming/Leisure—.9% | | |

| $ 250M | | Ameristar Casinos, Inc., 7.5%, 4/15/2021 | | $ 268,750 |

| | | National CineMedia, LLC: | | |

| 200M | | 7.875%, 7/15/2021 | | 213,000 |

| 225M | | 6%, 4/15/2022 (a) | | 230,063 |

| | | | | 711,813 |

| | | Health Care—5.5% | | |

| 250M | | AMERIGROUP Corp., 7.5%, 11/15/2019 | | 270,000 |

| 600M | | Aviv Healthcare Properties, LP, 7.75%, 2/15/2019 | | 621,000 |

| 175M | | Capella Healthcare, Inc., 9.25%, 7/1/2017 | | 182,000 |

| | | Community Health Systems, Inc.: | | |

| 126M | | 8.875%, 7/15/2015 | | 129,465 |

| 250M | | 8%, 11/15/2019 | | 267,500 |

| 200M | | DaVita, Inc., 6.375%, 11/1/2018 | | 207,000 |

| | | Fresenius Medical Care US Finance II, Inc.: | | |

| 150M | | 5.625%, 7/31/2019 (a) | | 156,750 |

| 125M | | 5.875%, 1/31/2022 (a) | | 130,469 |

| 600M | | Genesis Health Ventures, Inc., 9.75%, 6/15/2005 (c)(d) | | 375 |

| | | HCA, Inc.: | | |

| 150M | | 6.375%, 1/15/2015 | | 160,125 |

| 75M | | 8%, 10/1/2018 | | 84,375 |

| 75M | | 6.5%, 2/15/2020 | | 81,469 |

| 25M | | 7.25%, 9/15/2020 | | 27,625 |

| 275M | | 7.75%, 5/15/2021 | | 296,313 |

| 325M | | 7.5%, 2/15/2022 | | 355,062 |

| | | Healthsouth Corp.: | | |

| 300M | | 7.25%, 10/1/2018 | | 321,000 |

| 125M | | 7.75%, 9/15/2022 | | 134,688 |

| 175M | | LVB Acquisition, Inc. (Biomet, Inc.), 10%, 10/15/2017 | | 187,797 |

| 225M | | Universal Hospital Services, Inc., 8.5%, 6/1/2015 | | 230,484 |

| | | Vanguard Health Holding Co. II, LLC: | | |

| 250M | | 8%, 2/1/2018 | | 256,875 |

| 200M | | 7.75%, 2/1/2019 (a) | | 203,000 |

| | | | | 4,303,372 |

| | | Information Technology—4.0% | | |

| 275M | | Audatex North America, Inc., 6.75%, 6/15/2018 (a) | | 290,812 |

| 425M | | Computer Sciences Corp., 6.5%, 3/15/2018 | | 454,750 |

| | | Equinix, Inc.: | | |

| 250M | | 8.125%, 3/1/2018 | | 278,125 |

| 175M | | 7%, 7/15/2021 | | 192,938 |

Portfolio of Investments (continued)

HIGH YIELD FUND

June 30, 2012

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Information Technology (continued) | | |

| | | Fidelity National Information Services, Inc.: | | |

| $ 175M | | 7.625%, 7/15/2017 | | $ 193,812 |

| 325M | | 7.875%, 7/15/2020 | | 367,250 |

| | | Jabil Circuit, Inc.: | | |

| 50M | | 7.75%, 7/15/2016 | | 57,250 |

| 550M | | 8.25%, 3/15/2018 | | 647,625 |

| 400M | | Lawson Software, Inc., 9.375%, 4/1/2019 (a) | | 429,000 |

| 275M | | MEMC Electronic Materials, Inc., 7.75%, 4/1/2019 | | 218,625 |

| | | | | 3,130,187 |

| | | Manufacturing—2.5% | | |

| 200M | | Amsted Industries, 8.125%, 3/15/2018 (a) | | 212,500 |

| 375M | | Bombardier, Inc., 5.75%, 3/15/2022 (a) | | 375,469 |

| 515M | | Case New Holland, Inc., 7.875%, 12/1/2017 | | 597,400 |

| 300M | | EDP Finance BV, 6%, 2/2/2018 (a) | | 261,273 |

| 275M | | Rexel SA, 6.125%, 12/15/2019 (a) | | 278,094 |

| 175M | | Terex Corp., 10.875%, 6/1/2016 | | 197,094 |

| | | | | 1,921,830 |

| | | Media-Broadcasting—4.5% | | |

| 325M | | Allbritton Communication Co., 8%, 5/15/2018 | | 341,250 |

| | | Belo Corp.: | | |

| 100M | | 7.75%, 6/1/2027 | | 98,500 |

| 575M | | 7.25%, 9/15/2027 | | 550,562 |

| 375M | | Block Communications, Inc., 7.25%, 2/1/2020 (a) | | 382,500 |

| 400M | | Cumulus Media Holdings, Inc., 7.75%, 5/1/2019 | | 379,000 |

| 350M | | Nexstar/Mission Broadcasting, Inc., 8.875%, 4/15/2017 | | 371,438 |

| 575M | | Sinclair Television Group, Inc., 9.25%, 11/1/2017 (a) | | 638,250 |

| 700M | | XM Satellite Radio, Inc., 7.625%, 11/1/2018 (a) | | 756,000 |

| | | | | 3,517,500 |

| | | Media-Cable TV—7.7% | | |

| 525M | | Cablevision Systems Corp., 8.625%, 9/15/2017 | | 588,000 |

| | | CCO Holdings, LLC: | | |

| 150M | | 7.25%, 10/30/2017 | | 164,250 |

| 225M | | 7.875%, 4/30/2018 | | 245,812 |

| 150M | | 7%, 1/15/2019 | | 162,750 |

| 175M | | 7.375%, 6/1/2020 | | 193,156 |

| 225M | | Cequel Communications Holdings I, Inc., 8.625%, 11/15/2017 (a) | | 243,562 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| |

| | | Media-Cable TV (continued) | | |

| | | Clear Channel Worldwide: | | |

| $ 350M | | 9.25%, 12/15/2017 Series “A” | | $ 382,375 |

| 300M | | 9.25%, 12/15/2017 Series “B” | | 328,500 |

| 25M | | 7.625%, 3/15/2020 Series “A” (a) | | 24,063 |

| 250M | | 7.625%, 3/15/2020 Series “B” (a) | | 245,625 |

| 50M | | CSC Holdings, LLC, 6.75%, 11/15/2021 (a) | | 53,500 |

| | | DISH DBS Corp.: | | |

| 350M | | 7.875%, 9/1/2019 | | 405,125 |

| 75M | | 6.75%, 6/1/2021 | | 81,375 |

| 100M | | 5.875%, 7/15/2022 (a) | | 101,500 |

| 225M | | Echostar DBS Corp., 7.125%, 2/1/2016 | | 248,063 |

| 225M | | Harron Communications, LP, 9.125%, 4/1/2020 (a) | | 234,000 |

| 800M | | Nara Cable Funding, Ltd., 8.875%, 12/1/2018 (a) | | 692,000 |

| 475M | | Quebecor Media, Inc., 7.75%, 3/15/2016 | | 489,250 |

| 675M | | UPC Germany GmbH, 8.125%, 12/1/2017 (a) | | 729,000 |

| 400M | | UPC Holding BV, 9.875%, 4/15/2018 (a) | | 440,000 |

| |

| | | | | 6,051,906 |

| |

| | | Media-Diversified—1.4% | | |

| 426M | | Entravision Communications Corp., 8.75%, 8/1/2017 | | 453,690 |

| 475M | | Lamar Media Corp., 7.875%, 4/15/2018 | | 524,875 |

| 125M | | NAI Entertainment Holdings, LLC, 8.25%, 12/15/2017 (a) | | 138,750 |

| |

| | | | | 1,117,315 |

| |

| | | Metals/Mining—9.4% | | |

| | | AK Steel Corp.: | | |

| 100M | | 7.625%, 5/15/2020 | | 85,000 |

| 75M | | 8.375%, 4/1/2022 | | 64,125 |

| | | ArcelorMittal: | | |

| 50M | | 4.5%, 2/25/2017 | | 49,286 |

| 450M | | 9.85%, 6/1/2019 | | 536,210 |

| 200M | | 5.5%, 3/1/2021 | | 189,623 |

| 150M | | 6.25%, 2/25/2022 | | 147,173 |

| | | Arch Coal, Inc.: | | |

| 375M | | 7.25%, 10/1/2020 | | 318,750 |

| 400M | | 7.25%, 6/15/2021 | | 337,000 |

Portfolio of Investments (continued)

HIGH YIELD FUND

June 30, 2012

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Metals/Mining (continued) | | |

| | | FMG Resources (August 2006) Property, Ltd.: | | |

| $ 50M | | 7%, 11/1/2015 (a) | | $ 51,250 |

| 175M | | 6.375%, 2/1/2016 (a) | | 178,063 |

| 125M | | 6%, 4/1/2017 (a) | | 125,938 |

| 225M | | 6.875%, 2/1/2018 (a) | | 228,094 |

| 125M | | 8.25%, 11/1/2019 (a) | | 133,125 |

| 100M | | 6.875%, 4/1/2022 (a) | | 101,000 |

| 175M | | JMC Steel Group, 8.25%, 3/15/2018 (a) | | 174,563 |

| 150M | | Kaiser Aluminum Corp., 8.25%, 6/1/2020 (a) | | 153,750 |

| 375M | | Metals USA, Inc., 11.125%, 12/1/2015 | | 391,406 |

| 225M | | Molycorp, Inc., 10%, 6/1/2020 (a) | | 223,875 |

| 700M | | Novelis, Inc., 8.375%, 12/15/2017 | | 752,500 |

| | | Peabody Energy Corp.: | | |

| 325M | | 6%, 11/15/2018 (a) | | 325,000 |

| 175M | | 6.5%, 9/15/2020 | | 178,063 |

| 475M | | 6.25%, 11/15/2021 (a) | | 472,625 |

| | | Schaeffler Finance BV: | | |

| 200M | | 7.75%, 2/15/2017 (a) | | 209,500 |

| 400M | | 8.5%, 2/15/2019 (a) | | 429,000 |

| | | United States Steel Corp.: | | |

| 125M | | 7%, 2/1/2018 | | 124,063 |

| 475M | | 7.375%, 4/1/2020 | | 460,750 |

| 175M | | 7.5%, 3/15/2022 | | 168,875 |

| | | Vulcan Materials Co.: | | |

| 175M | | 6.5%, 12/1/2016 | | 185,063 |

| 525M | | 7%, 6/15/2018 | | 561,750 |

| | | | | 7,355,420 |

| | | Real Estate Investment Trusts—1.0% | | |

| | | Developers Diversified Realty Corp.: | | |

| 100M | | 9.625%, 3/15/2016 | | 121,564 |

| 75M | | 7.875%, 9/1/2020 | | 89,818 |

| | | Omega Healthcare Investors, Inc.: | | |

| 125M | | 7.5%, 2/15/2020 | | 136,875 |

| 200M | | 6.75%, 10/15/2022 | | 214,500 |

| 200M | | Taylor Morrison Communities, Inc., 7.75%, 4/15/2020 (a) | | 209,500 |

| | | | | 772,257 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Retail-General Merchandise—4.6% | | |

| $ 119M | | CKE Restaurants, Inc., 11.375%, 7/15/2018 | | $ 136,552 |

| 300M | | J.C. Penney Corp., Inc., 7.95%, 4/1/2017 | | 301,500 |

| 350M | | Landry’s, Inc., 9.375%, 5/1/2020 (a) | | 357,438 |

| 300M | | Limited Brands, Inc., 8.5%, 6/15/2019 | | 354,000 |

| 275M | | Monitronics International, Inc., 9.125%, 4/1/2020 (a) | | 265,375 |

| 475M | | Needle Merger Sub Corp., 8.125%, 3/15/2019 (a) | | 475,000 |

| 475M | | NPC International, Inc., 10.5%, 1/15/2020 | | 528,438 |

| 200M | | QVC, Inc., 7.5%, 10/1/2019 (a) | | 222,115 |

| 200M | | Sally Holdings, LLC/Sally Capital, Inc., 6.875%, 11/15/2019 | | 218,500 |

| 175M | | Toys R Us Property Co. II, Inc., 8.5%, 12/1/2017 | | 183,094 |

| 350M | | Wendy’s/Arby’s Restaurants, LLC., 10%, 7/15/2016 | | 377,566 |

| 225M | | YCC Holdings, LLC/Yankee Finance, Inc., 10.25%, 2/15/2016 | | 230,063 |

| | | | | 3,649,641 |

| | | Services—2.4% | | |

| 275M | | CoreLogic, Inc., 7.25%, 6/1/2021 (a) | | 283,250 |

| 200M | | Covanta Holding Corp., 6.375%, 10/1/2022 | | 212,399 |

| | | Iron Mountain, Inc.: | | |

| 225M | | 7.75%, 10/1/2019 | | 244,125 |

| 300M | | 8.375%, 8/15/2021 | | 327,000 |

| 400M | | PHH Corp., 9.25%, 3/1/2016 | | 427,000 |

| 375M | | Reliance Intermediate Holdings, LP, 9.5%, 12/15/2019 (a) | | 414,375 |

| | | | | 1,908,149 |

| | | Telecommunications—6.5% | | |

| 75M | | CenturyLink, Inc., 5.8%, 3/15/2022 | | 74,800 |

| | | Citizens Communications Co.: | | |

| 750M | | 7.125%, 3/15/2019 | | 761,250 |

| 200M | | 9%, 8/15/2031 | | 192,000 |

| 350M | | GCI, Inc., 8.625%, 11/15/2019 | | 368,375 |

| 750M | | Inmarsat Finance, PLC, 7.375%, 12/1/2017 (a) | | 804,375 |

| | | Intelsat Jackson Holdings SA: | | |

| 625M | | 7.25%, 10/15/2020 (a) | | 659,375 |

| 50M | | 7.5%, 4/1/2021 | | 53,125 |

| 100M | | PAETEC Holding Corp., 9.875%, 12/1/2018 | | 112,250 |

| 150M | | Qwest Communications International, Inc., 7.125%, 4/1/2018 | | 158,813 |

| 50M | | Qwest Corp., 6.5%, 6/1/2017 | | 56,235 |

| | | Sprint Capital Corp.: | | |

| 300M | | 6.9%, 5/1/2019 | | 283,500 |

| 475M | | 6.875%, 11/15/2028 | | 384,750 |

Portfolio of Investments (continued)

HIGH YIELD FUND

June 30, 2012

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | �� |

| Amount | | Security | | Value |

| | | Telecommunications (continued) | | |

| $ 225M | | Telesat Canada/Telesat, LLC, 6%, 5/15/2017 (a) | | $ 230,063 |

| 83M | | Virgin Media Finance, PLC, 9.5%, 8/15/2016 | | 92,960 |

| | | Wind Acquisition Finance SA: | | |

| 200M | | 11.75%, 7/15/2017 (a) | | 162,500 |

| 200M | | 7.25%, 2/15/2018 (a) | | 176,000 |

| | | Windstream Corp.: | | |

| 225M | | 7.875%, 11/1/2017 | | 246,375 |

| 300M | | 7.75%, 10/15/2020 | | 319,500 |

| | | | | 5,136,246 |

| | | Transportation—1.2% | | |

| 350M | | CHC Helicopter SA, 9.25%, 10/15/2020 | | 343,875 |

| | | Navios Maritime Holdings: | | |

| 250M | | 8.875%, 11/1/2017 | | 253,125 |

| 375M | | 8.125%, 2/15/2019 | | 322,500 |

| | | | | 919,500 |

| | | Utilities—4.1% | | |

| | | AES Corp.: | | |

| 125M | | 9.75%, 4/15/2016 | | 148,750 |

| 100M | | 8%, 10/15/2017 | | 114,250 |

| 100M | | 7.375%, 7/1/2021 (a) | | 111,750 |

| 500M | | Atlantic Power Corp., 9%, 11/15/2018 (a) | | 513,750 |

| 350M | | Calpine Construction Finance Co., LP, 8%, 6/1/2016 (a) | | 379,750 |

| 75M | | Calpine Corp., 7.5%, 2/15/2021 (a) | | 81,375 |

| 75M | | DPL, Inc., 7.25%, 10/15/2021 (a) | | 83,625 |

| 189M | | Indiantown Cogeneration Utilities, LP, 9.77%, 12/15/2020 | | 197,589 |

| 400M | | Intergen NV, 9%, 6/30/2017 (a) | | 394,000 |

| | | NRG Energy, Inc.: | | |

| 625M | | 7.375%, 1/15/2017 | | 651,563 |

| 275M | | 7.625%, 5/15/2019 | | 279,813 |

| 298M | | NSG Holdings, LLC, 7.75%, 12/15/2025 (a) | | 299,490 |

| | | | | 3,255,705 |

| | | Wireless Communications—1.0% | | |

| 275M | | MetroPCS Wireless, Inc., 7.875%, 9/1/2018 | | 286,688 |

| 200M | | Nextel Communications, Inc., 5.95%, 3/15/2014 | | 201,250 |

| | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | | | |

| Amount | | | | | | | |

| or Shares | | Security | | | | | Value |

| | | Wireless Communications (continued) | | | | | |

| | | Sprint Nextel Corp.: | | | | | |

| $ 150M | | 6%, 12/1/2016 | | | | | $ 144,375 |

| 75M | | 9.125%, 3/1/2017 (a) | | | | | 78,938 |

| 75M | | ViaSat, Inc., 6.875%, 6/15/2020 (a) | | | | | 76,125 |

| | | | | | | | 787,376 |

| Total Value of Corporate Bonds (cost $72,074,907) | | | | | 73,720,635 |

| | | LOAN PARTICIPATIONS—2.1% | | | | | |

| | | Chemicals—.7% | | | | | |

| 299M | | PL Propylene, LLC, 7%, 3/23/2017 (e) | | | | | 302,805 |

| 299M | | PolyOne Corp., 5%, 12/20/2017 (e) | | | | | 300,278 |

| | | | | | | | 603,083 |

| | | Energy—.5% | | | | | |

| 375M | | Chesapeake Energy Corp., 8.5%, 12/2/2017 (b)(e) | | | | 372,382 |

| | | Forest Products/Containers—.4% | | | | | |

| 299M | | Sealed Air Corp., 4.75%, 10/3/2018 (e) | | | | | 302,198 |

| | | Metals/Mining—.5% | | | | | |

| 375M | | Arch Coal, Inc., 5.75%, 5/16/2018 (e) | | | | | 369,416 |

| Total Value of Loan Participations (cost $1,632,861) | | | | | 1,647,079 |

| | | COMMON STOCKS—.0% | | | | | |

| | | Telecommunications | | | | | |

| 3 | * | Viatel Holding (Bermuda), Ltd. (d) | | | | | — |

| 5,970 | * | World Access, Inc. | | | | | 2 |

| Total Value of Common Stocks (cost $97,360) | | | | | 2 |

| Total Value of Investments (cost $73,805,128) | 96.0 | % | | | 75,367,716 |

| Other Assets, Less Liabilities | 4.0 | | | | 3,162,091 |

| Net Assets | | | 100.0 | % | | | $78,529,807 |

Portfolio of Investments (continued)

HIGH YIELD FUND

June 30, 2012

| |

| * | Non-income producing |

| |

| (a) | Security exempt from registration under Rule 144A of the Securities Act of 1933 (see Note 5). |

| |

| (b) | A portion or all of the security purchased on a when-issued or delayed delivery basis (see |

| Note 1G). |

| |

| (c) | In default as to principal and/or interest payment |

| |

| (d) | Securities valued at fair value (see Note 1A). |

| |

| (e) | Interest rates are determined and reset periodically. The interest rates above are the rates in effect |

| at June 30, 2012. |

Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of June 30, 2012:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Corporate Bonds | | $ | — | | $ | 73,720,260 | | $ | 375 | | $ | 73,720,635 |

| Loan Participations | | | — | | | 1,647,079 | | | — | | | 1,647,079 |

| Common Stocks | | | 2 | | | — | | | — | | | 2 |

| Total Investments in Securities* | | $ | 2 | | $ | 75,367,339 | | $ | 375 | | $ | 75,367,716 |

* The Portfolio of Investments provides information on the industry categorization.

There were no transfers into or from Level 1 and Level 2 by the Fund for the period ended June 30, 2012. Transfers, if any, between Levels are recognized at the end of the reporting period.

The following is a reconciliation of Fund investments valued using Level 3 inputs for the period:

| | | | | | | | | |

| | | | Investments in | | | Investments in | | | |

| | | Corporate Bonds | | Common Stocks | | | Total |

| Balance, December 31, 2011 | | $ | 375 | | $ | — | | $ | 375 |

| Purchases | | | — | | | — | | | — |

| Sales | | | | | | | | | |

| Change in unrealized | | | | | | | | | |

| appreciation (depreciation) | | | — | | | — | | | — |

| Realized gain (loss) | | | — | | | — | | | — |

| Transfer into Level 3 | | | — | | | — | | | — |

| Transfer out of Level 3 | | | — | | | — | | | — |

| Balance, June 30, 2012 | | $ | 375 | | $ | — | | $ | 375 |

The following is a summary of Level 3 inputs by industry:

| | | |

| Health Care | | | $375 |

| Telecommunications | | | — |

| | | | $375 |

The following table presents additional information about valuation methodologies and inputs used for investments that are measured at fair value and categorized within Level 3 as of June 30, 2012.

| | | | | | | | | | |

| | | | | | | | | | | Impact to |

| | Fair Value | | Valuation | | Unobservable | | | | Valuation from and |

| | June 30, 2012 | | Methodologies | | Input(s)(1) | | Range | | Increase in Input(2) |

| Common | | | | Market | | Market | | 100% | | Increase |

| Stock | $ | — | | Comparables | | Comparables/ | | | | |

| | | | | | | Bankruptcy | | | | |

| Fixed | | | | Market | | Market | | 100% | | Increase |

| Income | $ | 375 | | Comparables | | Comparables/ | | | | |

| | | | | | | Bankruptcy | | | | |

| |

| (1) | In determining certain of these inputs, management evaluates a variety of factors including economic |

| conditions, industry and market developments, market valuations of comparable companies and |

| company specific developments including exit strategies and realization opportunities. Management |

| has determined that market participants would take these inputs into account when valuing |

| the investments. |

| |

| (2) | This column represents the directional change in the fair value of the Level 3 investments |