|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

| -------- |

| |

| FORM N-CSR |

| -------- |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| |

| INVESTMENT COMPANY ACT FILE NUMBER 811-4325 |

FIRST INVESTORS LIFE SERIES FUNDS

(Exact name of registrant as specified in charter)

40 Wall Street

New York, NY 10005

(Address of principal executive offices) (Zip code)

Joseph I. Benedek

Foresters Investment Management Company, Inc.

Raritan Plaza I

Edison, NJ 08837-3620

(Name and address of agent for service)

REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE:

1-212-858-8000

DATE OF FISCAL YEAR END: DECEMBER 31

DATE OF REPORTING PERIOD: DECEMBER 31, 2018

Item 1. Reports to Stockholders

The annual report to stockholders follows

This report is for the information of the shareholders of the Funds. It is the policy of each Fund described in this report to mail only one copy of a Fund’s prospectus, annual report, semi-annual report and proxy statements to all shareholders who share the same mailing address and share the same last name and have invested in a Fund covered by the same document. You are deemed to consent to this policy unless you specifically revoke this policy and request that separate copies of such documents be mailed to you. In such case, you will begin to receive your own copies within 30 days after our receipt of the revocation. You may request that separate copies of these disclosure documents be mailed to you by writing to us at: Foresters Investor Services, Inc., Raritan Plaza I, Edison, NJ 08837-3620 or calling us at 1-800-423-4026.

The views expressed in the portfolio manager letters reflect those views of the portfolio managers only through the end or the period covered. Any such views are subject to change at any time based upon market or other conditions and we disclaim any responsibility to update such views. These views may not be relied on as investment advice.

You may obtain a free prospectus for any of the Funds by contacting your representative, calling 1-800-423-4026, writing to us at the following address: Foresters Financial Services, Inc., 40 Wall Street, New York, NY 10005, or by visiting our website atwww.foresters.com. You should consider the investment objectives, risks, charges and expenses of a Fund carefully before investing. The prospectus contains this and other information about the Fund, and should be read carefully before investing.

An investment in a Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although the Government Cash Management Fund seeks to preserve a net asset value at $1.00 per share, it is possible to lose money by investing in it, just as it is possible to lose money by investing in any of the other Funds. Past performance is no guarantee of future results. There is no guarantee that a Fund’s investment objective will be achieved.

A Statement of Additional Information (“SAI”) for any of the Funds may also be obtained, without charge, upon request by calling 1-800-423-4026, writing to us at our address or by visiting our website listed above. The SAI contains more detailed information about the Funds, including information about their Trustees.

Foresters Financial™ and Foresters™ are the trade names and trademarks of The Independent Order of Foresters (Foresters), a fraternal benefit society, 789 Don Mills Road, Toronto, Canada M3C 1T9 and its subsidiaries.

There are a variety of risks associated with investing in variable life and annuity subaccounts. For all subaccounts, there is the risk that securities selected by the portfolio manager may perform differently than the overall market or may not meet the portfolio managers’ expectations. For stock subaccounts, the risks include market risk (the risk that the entire stock market will decline because of an event such as a deterioration in the economy or a rise in interest rates), as well as special risks associated with investing in certain types of stock subaccounts such as small-cap, global or international funds. For bond subaccounts, the risks include interest rate risk and credit risk. Interest rate risk is the risk that bonds will decrease in value as interest rates rise. As a general matter, bonds with longer maturities fluctuate more than bonds with shorter maturities in reaction to changes in interest rates. Credit risk is the risk that bonds will decline in value as the result of a decline in the credit rating of the bonds or the economy as a whole, or that the issuer will be unable to pay interest and/or principal when due. There are also special risks associated with investing in certain types of bond subaccounts, including liquidity risk and prepayment and extension risk. To the extent a subaccount uses derivatives, it will have risks associated with such use. You should consult the Funds’ prospectus for a precise explanation of the risks associated with your subaccounts.

Portfolio Managers’ Letter

COVERED CALL STRATEGY FUND

Dear Investor:

This is the annual report for the First Investors Life Series Covered Call Strategy Fund for the year ended December 31, 2018. During the year, the Fund’s return on a net asset value basis was –9.99%, including dividends of 12.6 cents per share. This return underperformed the Fund’s benchmark, the CBOE S&P 500 Buy Write Monthly Index, which returned –4.77% during the period.

The Markets

The S&P 500 declined –13.52% during the fourth quarter of 2018 and –4.39% for the full year, despite double digit earnings growth. As a result, the forward price-to-earnings ratio ended the year at 14.4, the most attractive market valuation since 2013, but below its long-term average.

Irrespective of these negative equity market returns, economic fundamentals remain solid. Consider that the two usual culprits that tend to lead to recessions are currently absent from the existing macroeconomic environment: 1) an inflationary overheating or 2) a debt financed asset price bubble. Household and corporate balance sheets are also healthy, and savings rates are relatively high, providing an additional buffer against a recession. The stock market, as measured by the S&P 500, typically doesn’t have corrections worse than 20%, unless there is an accompanying recession. The peak to trough decline in the S&P 500 was –19.78% during the second half of 2018 and, based on the economic data, the odds of a recession in the U.S. in 2019 appear relatively low.

Monetary policy and foreign trade concerns were major factors influencing the market during 2018. And the nearly 20% decline in the S&P 500 indicates that market participants may have been pricing in a policy mistake in one or both of these areas. Monetary policy is closer to neutral, but it is not yet restrictive. Plus, the Federal Reserve (Fed) appears to be ahead of the curve—meaning it won’t have to increase rates as much in the coming year as growth is already set to naturally slow in 2019 due to tougher comparisons with strong 2018 growth. Fed Chairman Jerome Powell confirmed this position and reduced market fears that the Fed would go too far by recently stating, “With muted inflation readings we’ve seen coming in, we will be patient as we watch to see how the economy evolves.” As a result, the market is pricing in no Fed rate increases during 2019. Regarding trade, NAFTA negotiations produced a positive outcome, with all three countries agreeing to a deal. China also appears intent on making a deal with the U.S., after announcing purchases of U.S. soybeans and eliminating retaliatory tariffs on U.S. autos.

Portfolio Managers’ Letter(continued)

COVERED CALL STRATEGY FUND

The Fund

During calendar year 2018, the Fund returned –9.14% (before fees) versus –4.77% for the BXM Index and –4.39% for the S&P 500 Index. The actively managed call options in the Fund outperformed the call options in the benchmark BXM Index by 123 basis points (bps) during the year, mostly due to actively rolling the call options up in strike price during stock market rallies. However, the outperformance from the call options in the Fund was more than offset by underperformance from the value-oriented stocks in the Fund, as value stocks underperformed the market by a wide margin during 2018. In fact, the S&P 500 Growth Index returned –0.01%, while the S&P 500 Value Index returned –8.97% for the year. Stock selection was positive in Financials, but negative in Consumer Discretionary and Healthcare.

While the growth versus value performance disparity was the largest driver of the Fund’s relative return during the year, covered call strategies in general underperformed the market as a whole. Covered call strategies underperformed in 2018 because the call options added less value than normal, mostly due to the roller coaster path of the market. The Fund had 78% upside capture during the S&P 500’s 7.71% third quarter return, while the BXM Index captured only 64% of the rally. When the fourth quarter began, implied volatility, as measured by the VIX Index, was far below average at 12.1%. As a result, the call options provided less downside protection than normal as the market began its descent. And on the first day of December, well into the market decline, the VIX was at only 16.4%, still below the 20-year average of 19.9%.

Outlook

Given current market valuations and record corporate earnings, stocks have many positives. The Fund, in particular, is invested in attractively valued equities with strong fundamentals and a bias toward U.S.-based earnings. Earnings per share for the stocks in the Fund is expected to grow 7.9% over the next 12 months, slower than the past 12 months, but close to its long-term average, as profit margins remain near record levels. The stocks are more attractively valued than the S&P 500, with a forward price-to-earnings ratio of 12.2 for the stocks in the Fund versus 14.4 for the S&P 500.

The implied volatility spike during the fourth quarter was on par with the spike during the first quarter of 2018, as the VIX Index reached 36.07 on Christmas Eve. We took advantage of the implied volatility spike during the fourth quarter by selling longer-term call options to “lock-in” the high implied volatility levels for longer, extending the duration of the option portfolio from 1.1 months at the beginning of the quarter to 3.8 months at quarter-end. The higher call premiums we wrote will

gradually decay over the next 3-6 months. As a result, we begin 2019 with not only attractively priced stocks, but also attractive call options.

Thank you for placing your trust in Foresters Financial. As always, we appreciate the opportunity to serve your investment needs.

Understanding Your Fund’s Expenses(unaudited)

FIRST INVESTORS LIFE SERIES FUNDS

As a mutual fund shareholder, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including advisory fees and other expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 in each Fund at the beginning of the period, July 1, 2018, and held for the entire six-month period ended December 31, 2018. The calculations assume that no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

Actual Expense Example:

These amounts help you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid during the period.

To estimate the expenses you paid on your account during this period simply divide your ending account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period”.

Hypothetical Expense Example:

These amounts provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transactional costs. Therefore, the hypothetical expense example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Fund Expenses(unaudited)

COVERED CALL STRATEGY FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (7/1/18) | (12/31/18) | (7/1/18–12/31/18)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $ 900.13 | $4.55 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,020.42 | $4.84 |

| |

| * | Expenses are equal to the annualized expense ratio of .95%, multiplied by the average account |

| value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses paid |

| during the period are net of expenses waived. |

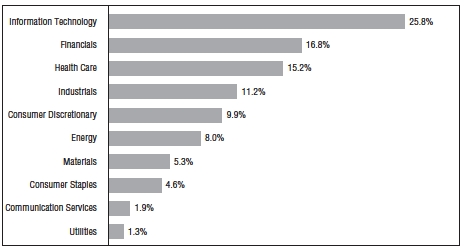

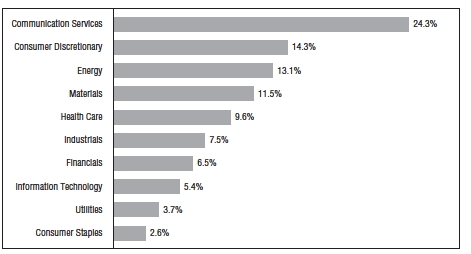

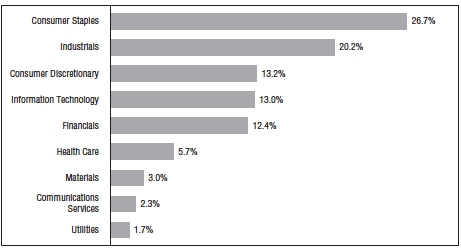

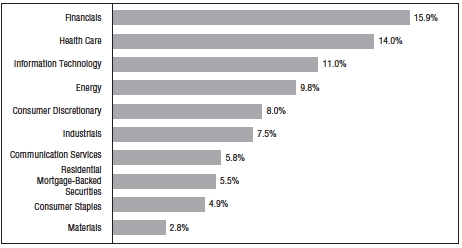

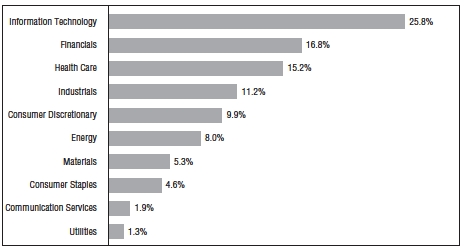

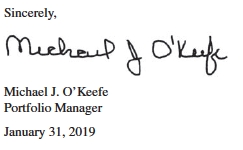

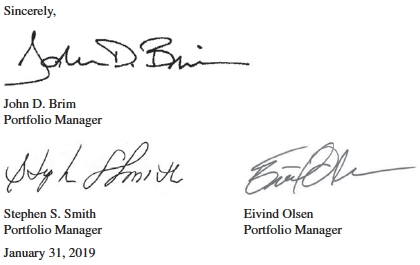

Portfolio Composition

BY SECTOR

|

| Portfolio holdings and allocations are subject to change. Percentages are as of December 31, 2018, |

| and are based on the total value of investments. |

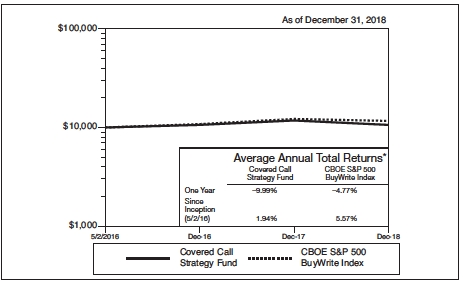

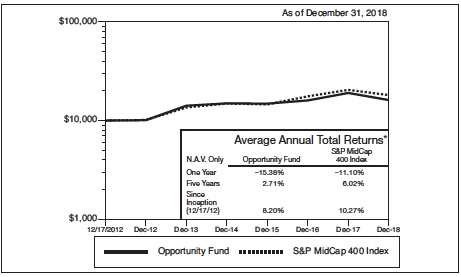

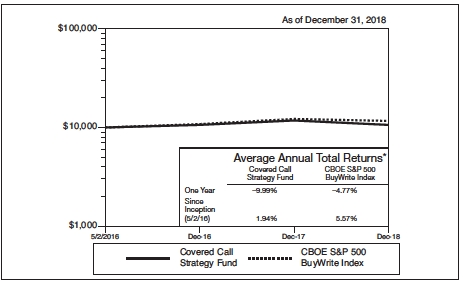

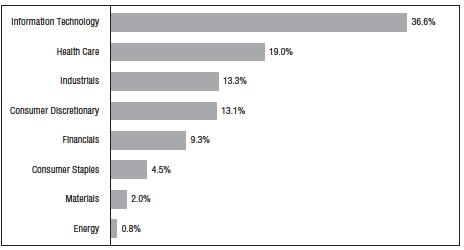

Cumulative Performance Information(unaudited)

COVERED CALL STRATEGY FUND

Comparison of change in value of $10,000 investment in the First Investors Life Series Covered Call Strategy Fund and CBOE Standard & Poors 500 BuyWrite Index.

The graph compares a $10,000 investment in the First Investors Life Series Covered Call Strategy Fund beginning 5/2/16 (commencement of operations) with theoretical investment in CBOE Standard & Poor’s 500 BuyWrite Index (the “Index”). The Index is a benchmark index designed to track the performance of a hypothetical buy-write strategy on the S&P 500 Index. The index is a passive total return index based on (1) buying an S&P 500 stock index portfolio, and (2) “writing” (or selling) the near-term S&P 500 Index (“SPX”) “covered” call option, generally on the third Friday of each month. The SPX call written will have about one month remaining to expiration, with an exercise price just above the prevailing index level (i.e., slightly out of the money). The SPX call is held until expiration and cash settled, at which time a new one-month, near-the-money call is written. It is not possible to invest directly in this Index. In addition, the Index does not reflect fees and expenses associated with the active management of a mutual fund portfolio. For purposes of the graph and the accompanying table it is assumed that all dividends and distributions were reinvested.

* Average Annual Total Return figures are for the periods ended 12/31/18.

The returns shown do not reflect any sales charges, since the Fund sells its shares solely to variable annuity and/or variable life insurance subaccounts at net asset value. The returns do not reflect the fees and charges that an individual would pay in connection with an investment in a variable annuity or life contract or policy.Results represent past performance and do not indicate future results. The graph and the returns shown do not reflect the deduction of taxes that an investor would pay on distributions or the redemption of fund shares.Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. BofA Merrill Lynch U.S. Corporate, Government & Mortgage Index figures are from Bank of America Merrill Lynch & Co. and Standard & Poor’s 500 Index figures are from Standard & Poor’s and all other figures are from Foresters Investment Management Company, Inc.

Portfolio of Investments(continued)

COVERED CALL STRATEGY FUND

December 31, 2018

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Shares | | Security | | Value |

| | | COMMON STOCKS—100.4% | | |

| | | Communication Services—1.9% | | |

| 11,600 | | AT&T, Inc. | | $ 331,064 |

| | | Consumer Discretionary—10.0% | | |

| 5,100 | | Best Buy Co., Inc. | | 270,096 |

| 2,800 | | Carnival Corp. | | 138,040 |

| 3,000 | | Home Depot, Inc. | | 515,460 |

| 4,700 | | Ross Stores, Inc. | | 391,040 |

| 3,900 | | Whirlpool Corp. | | 416,793 |

| | | | | 1,731,429 |

| | | Consumer Staples—4.6% | | |

| 3,200 | | Costco Wholesale Corp. | | 651,872 |

| 2,300 | | Philip Morris International, Inc. | | 153,548 |

| | | | | 805,420 |

| | | Energy—8.0% | | |

| 6,400 | | Chevron Corp. | | 696,256 |

| 13,200 | | Halliburton Co. | | 350,856 |

| 5,500 | | Occidental Petroleum Corp. | | 337,590 |

| | | | | 1,384,702 |

| | | Financials—16.9% | | |

| 4,400 | | Allstate Corp. | | 363,572 |

| 4,500 | | American Express Co. | | 428,940 |

| 16,100 | | Bank of America Corp. | | 396,704 |

| 7,500 | | BB&T, Inc. | | 324,900 |

| 1,200 | | BlackRock, Inc. | | 471,384 |

| 7,500 | | JPMorgan Chase & Co. | | 732,150 |

| 5,400 | | Morgan Stanley | | 214,110 |

| | | | | 2,931,760 |

| | | Health Care—15.2% | | |

| 2,400 | | Allergan, PLC | | 320,784 |

| 4,400 | * | Celgene Corp. | | 281,996 |

| 5,100 | | CVS Health Corp. | | 334,152 |

| 9,800 | | Medtronic, PLC | | 891,408 |

| 5,500 | | Merck & Co., Inc. | | 420,255 |

| 2,500 | | Stryker Corp. | | 391,875 |

| | | | | 2,640,470 |

Portfolio of Investments(continued)

COVERED CALL STRATEGY FUND

December 31, 2018

| | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Shares | | Security | | | | | Value |

| | | Industrials—11.3% | | | | | |

| 5,000 | | Honeywell International, Inc. | | | | | $ 660,600 |

| 1,500 | | Lockheed Martin Corp. | | | | | 392,760 |

| 2,500 | | Parker Hannifin Corp. | | | | | 372,850 |

| 2,100 | | Raytheon Co. | | | | | 322,035 |

| 1,500 | | Union Pacific Corp. | | | | | 207,345 |

| | | | | | | | 1,955,590 |

| | | Information Technology—25.9% | | | | | |

| 5,100 | | Apple, Inc. | | | | | 804,474 |

| 2,100 | | Broadcom, Inc. | | | | | 533,988 |

| 15,700 | | Cisco Systems, Inc. | | | | | 680,281 |

| 12,400 | | Intel Corp. | | | | | 581,932 |

| 2,600 | | International Business Machines Corp. | | | | | 295,542 |

| 3,000 | | Mastercard, Inc. – Class “A” | | | | | 565,950 |

| 8,300 | | Microsoft Corp. | | | | | 843,031 |

| 2,100 | | Texas Instruments, Inc. | | | | | 198,450 |

| | | | | | | | 4,503,648 |

| | | Materials—5.3% | | | | | |

| 10,700 | | DowDuPont, Inc. | | | | | 572,236 |

| 6,800 | | Nucor Corp. | | | | | 352,308 |

| | | | | | | | 924,544 |

| | | Utilities—1.3% | | | | | |

| 1,300 | | NextEra Energy, Inc. | | | | | 225,966 |

| Total Value of Common Stocks(cost $18,130,076) | 100.4 | % | | 17,434,593 |

| Excess of Liabilites Over Other Assets | (.4 | ) | | | (75,342) |

| Net Assets | | | 100.0 | % | | $17,359,251 |

| | | | | |

| | Expiration | Exercise | | |

| CALL OPTIONS WRITTEN—(2.4)% | Date | Price | Contracts | Value |

| Allergan, PLC | 5/17/19 | $155.00 | (24) | $ (7,800) |

| Allstate Corp. | 7/19/19 | 85.00 | (44) | (19,360) |

| American Express Co. | 1/18/19 | 110.00 | (39) | (195) |

| American Express Co. | 4/18/19 | 100.00 | (6) | (1,962) |

| Apple, Inc | 6/21/19 | 180.00 | (51) | (28,713) |

| AT&T, Inc. | 1/18/19 | 32.00 | (101) | (303) |

| AT&T, Inc. | 7/19/19 | 31.00 | (15) | (1,155) |

| Bank of America Corp. | 5/17/19 | 27.00 | (161) | (12,719) |

| BB&T, Inc. | 3/15/19 | 47.00 | (75) | (4,725) |

| Best Buy Co., Inc. | 6/21/19 | 55.00 | (51) | (24,480) |

| BlackRock, Inc | 1/18/19 | 520.00 | (1) | (5) |

| BlackRock, Inc | 4/18/19 | 440.00 | (11) | (8,470) |

| Broadcom, Inc. | 1/18/19 | 250.00 | (21) | (23,415) |

| Carnival Corp. | 4/18/19 | 52.50 | (28) | (4,620) |

| Celgene Corp. | 4/18/19 | 70.00 | (44) | (14,036) |

| Chevron Corp | 1/18/19 | 130.00 | (25) | (25) |

| Chevron Corp | 6/21/19 | 125.00 | (31) | (5,704) |

| Chevron Corp | 1/17/20 | 120.00 | (8) | (4,824) |

| Cisco Systems, Inc. | 1/18/19 | 49.00 | (136) | (272) |

| Cisco Systems, Inc. | 6/21/19 | 46.00 | (21) | (4,788) |

| Costco Wholesale Corp. | 6/21/19 | 220.00 | (28) | (20,720) |

| Costco Wholesale Corp. | 1/17/20 | 230.00 | (4) | (3,800) |

| CVS Health Corp. | 2/15/19 | 80.00 | (44) | (396) |

| CVS Health Corp. | 1/17/20 | 75.00 | (7) | (2,779) |

| DowDuPont, Inc | 6/21/19 | 57.50 | (107) | (27,927) |

| Halliburton Co. | 2/15/19 | 35.00 | (25) | (150) |

| Halliburton Co. | 6/21/19 | 30.00 | (107) | (15,301) |

| Home Depot, Inc. | 2/15/19 | 200.00 | (26) | (546) |

| Home Depot, Inc. | 6/21/19 | 190.00 | (4) | (2,000) |

| Honeywell International, Inc. | 1/18/19 | 155.00 | (43) | (86) |

| Honeywell International, Inc. | 3/15/19 | 140.00 | (7) | (1,715) |

| Intel Corp. | 1/18/19 | 49.00 | (108) | (5,076) |

| Intel Corp. | 7/19/19 | 50.00 | (16) | (4,512) |

| International Business Machines Corp. | 1/18/19 | 130.00 | (23) | (92) |

| International Business Machines Corp. | 1/17/20 | 130.00 | (3) | (1,290) |

| JPMorgan Chase & Co | 6/21/19 | 100.00 | (18) | (9,666) |

| JPMorgan Chase & Co | 1/17/20 | 105.00 | (57) | (34,200) |

| Lockheed Martin Corp. | 1/17/20 | 290.00 | (15) | (22,650) |

| Mastercard, Inc. - Class “A” | 1/18/19 | 220.00 | (26) | (234) |

| Mastercard, Inc. - Class “A” | 6/21/19 | 210.00 | (4) | (3,100) |

Portfolio of Investments(continued)

COVERED CALL STRATEGY FUND

December 31, 2018

| | | | | |

| | Expiration | Exercise | | |

| CALL OPTIONS WRITTEN(continued) | Date | Price | Contracts | Value |

| Medtronic, PLC | 2/15/19 | $ 92.50 | (13) | $ (3,068) |

| Medtronic, PLC | 6/21/19 | 97.50 | (85) | (26,307) |

| Merck & Co., Inc. | 2/15/19 | 80.00 | (55) | (4,950) |

| Microsoft Corp | 1/18/19 | 115.00 | (40) | (320) |

| Microsoft Corp | 2/15/19 | 115.00 | (43) | (3,784) |

| Morgan Stanley | 2/15/19 | 49.00 | (47) | (282) |

| Morgan Stanley | 2/15/19 | 44.00 | (7) | (350) |

| NextEra Energy, Inc. | 1/18/19 | 185.00 | (11) | (308) |

| NextEra Energy, Inc. | 6/21/19 | 180.00 | (2) | (1,220) |

| Nucor Corp | 4/18/19 | 65.00 | (68) | (2,108) |

| Occidental Petroleum Corp. | 2/15/19 | 77.50 | (48) | (288) |

| Occidental Petroleum Corp. | 2/15/19 | 67.50 | (7) | (532) |

| Parker Hannifin Corp. | 2/15/19 | 180.00 | (22) | (1,265) |

| Parker Hannifin Corp. | 5/17/19 | 170.00 | (3) | (1,275) |

| Philip Morris International, Inc. | 6/21/19 | 75.00 | (23) | (3,772) |

| Raytheon Co | 1/17/20 | 185.00 | (18) | (9,180) |

| Raytheon Co | 1/17/20 | 180.00 | (3) | (1,845) |

| Ross Stores, Inc. | 5/17/19 | 95.00 | (47) | (7,873) |

| Stryker Corp | 3/15/19 | 170.00 | (25) | (5,800) |

| Texas Instruments, Inc. | 4/18/19 | 105.00 | (21) | (5,103) |

| Union Pacific Corp | 2/15/19 | 150.00 | (15) | (2,640) |

| Whirlpool Corp. | 3/15/19 | 130.00 | (39) | (3,549) |

| Total Value of Call Options Written(premium received $500,520) | | $ (409,630) |

The Fund’s assets and liabilities are classified into the following three levels based on the inputs used to value the assets and liabilities:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, U.S. Government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of December 31, 2018:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Assets | | | | | | | | | | | | |

| Common Stocks* | | $ | 17,434,593 | | $ | — | | $ | — | | $ | 17,434,593 |

| Liabilities | | | | | | | | | | | | |

| Call Options Written | | $ | (409,630) | | $ | — | | $ | — | | $ | (409,630) |

| |

| * | The Portfolio of Investments provides information on the industry categorization for common stocks. |

| |

| There were no transfers into or from Level 1 and Level 2 by the Fund for the year ended December 31, |

| 2018. Transfers, if any, between Levels are recognized at the end of the reporting period. |

| | |

| See notes to financial statements | 11 |

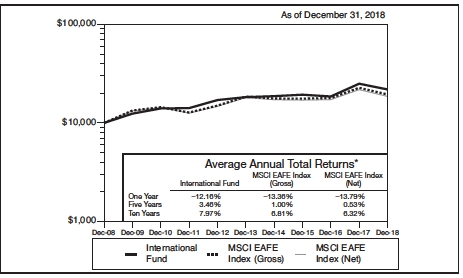

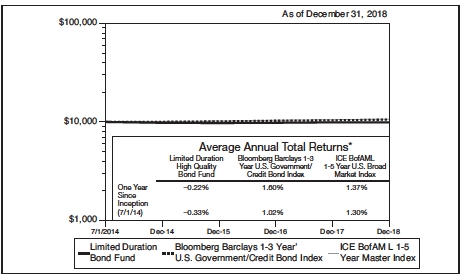

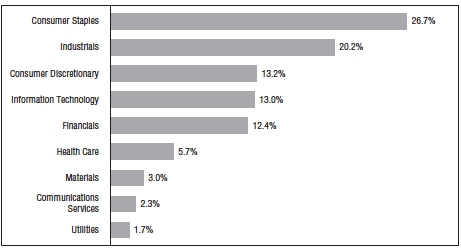

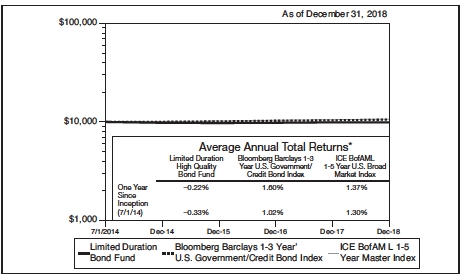

Portfolio Manager’s Letter

EQUITY INCOME FUND

Dear Investor:

This is the annual report for the First Investors Life Series Equity Income Fund for the year ended December 31, 2018. During the year, the Fund’s return on a net asset value basis was –8.42%, including dividends of 42.7 cents per share and capital gains of 69.4 cents per share. This return underperformed the Fund’s benchmark, the Russell 1000 Value Index, which returned –8.27% during the period.

Economic Overview

Despite escalating trade tensions, especially between the U.S. and China, the U.S. enjoyed strong economic conditions throughout most of 2018. Record corporate earnings, strong GDP growth, tax cuts to start the year, low unemployment, and healthy consumer confidence and spending buoyed the economy. However, the economic climate and forward corporate guidance began to taper off near the end of the year. Globally, the world experienced tensions within emerging markets, such as debt issues in Turkey, trade tensions with China, and continued uncertainty in Europe with Brexit concerns.

The U.S. economy started the year with a continuation of 2017’s “Goldilocks” environment, posting annualized growth rates of 4.2% and 3.4% for the second and third quarters, respectively. Unemployment, at 3.7% in November, remained at a record 50-year low, boosting consumer confidence but tightening the domestic labor supply. Consumer confidence persisted at elevated levels throughout 2018, although some deterioration occurred towards year-end. Despite witnessing multi-year highs in retail sales and personal spending, the backdrop changed late in the third quarter as global economic growth started to slow and economic indicators began to fall off. Consumer confidence dropped to a two-year low in December, while the ISM manufacturing index fell to 54.1, the most severe decline since October 2008 and below even the most pessimistic of industry estimations at 55.0. It is worth noting, however, that any level above 50 is still considered expansionary.

The Federal Reserve (the Fed) stayed its course in 2018, raising interest rates four times and bringing the central bank’s benchmark interest rate to a range of 2.25% to 2.5%. This brings the total number of hikes since the Fed began tightening in December 2015 to nine. While the Fed has maintained a fairly hawkish stance throughout 2018, its tone turned more dovish toward the end of the year.

As the year progressed, central bank tightening began to put immense strains on both domestic as well as global markets, with the days of “easy money” a thing of the past and liquidity drying up. A modern barometer that is sometimes used to gauge if a recession may be looming, the 2-year versus 10-year U.S. Treasury spread, continued

to flatten throughout 2018, reaching a low of 11 basis points (bps), last seen prior to the 2008 recession. While inversion is typically seen as a precursor to a recession, it has historically taken an average of 20 months between when the yield curve first inverts and the start of an actual recession.

Global economic growth diverged from the U.S. In Europe, measured by the Euro-zone aggregate, economic growth averaged 2% throughout the year. Other developed economies, such as Japan, experienced equally lackluster GDP growth, averaging less than 1% in 2018. This divergence comes at a time when many countries still enjoyed loose central bank policy, contrary to the tightening in the U.S.

Emerging markets, excluding China, experienced a turbulent year, starting off 2018 on a positive note, quickly followed by a sharp sell-off, then a mild recovery toward year-end. This was triggered by many idiosyncratic risks, such as the Turkish debt crisis, which then spread into other emerging markets. On the other hand, China maintained its growth rate, while facing many threats to its economy, albeit growth did appear to weaken as the year came to a close. The Chinese economy expanded at an average pace of 6.7% quarter-over-quarter during 2018, nearly 1.5% faster than the emerging markets aggregate. Trade concerns with the U.S. continued to persist; however, hopes of a resolution appeared to emerge near year-end.

The Equity Market

After returning 10.6% for the first nine months of the year, U.S. stocks suffered a meaningful reversal during the fourth quarter of 2018, driven by concerns over fiscal tightening, the ongoing U.S.-China trade dispute and slowing global growth. The S&P 500 Index returned –13.5% during the final quarter of the year, with a decline of –9.0% in December alone. This drove the S&P’s 2018 return to –4.4%, its first negative total-return year since 2008. The forward earnings multiple for the S&P contracted from 18x in January to 15x at year’s end.

Within the S&P 500, Healthcare (6%), Utilities (4%) and Consumer Discretionary (0.8%) were the only GICS sectors to post positive total returns during the year. The worst-performing sectors were Energy (–18%), Materials (–13%) and Financials (–13%), which all saw declines in the fourth quarter. The Technology sector also posted a steep –17% return during the quarter, effectively offsetting its positive 20% return posted through September.

On the style front, growth outperformed value during the first three quarters of the year, but growth stocks drove the sell-off witnessed during the final quarter of 2018. The S&P 500 Growth Index returned –0.01% for the year compared to the S&P 500 Value Index’s –8.95% return. Although small-cap stocks meaningfully

Portfolio Manager’s Letter(continued)

EQUITY INCOME FUND

outperformed large caps and mid-caps through August, sharp declines during the final four months of the year rendered small caps the worst performer for 2018. For the year, the Russell 1000 (–4.8%) outperformed the Russell Mid-Cap (–9.1%) and the Russell 2000 (–11.0%).

The Fund

Compared to its benchmark, the Fund’s slight underperformance for the year was driven by the Materials, Energy and Communication Services sectors. In contrast, the Fund outperformed its benchmark in the Healthcare, Consumer Discretionary and Financials sectors. Within the Materials sector, shares of Westrock, FMC Corp and DowDupont were negatively impacted by fears of a slowdown in global growth, primarily led by a slowdown in the Chinese economy. Westrock provides packaging solutions for companies, but a recent decline in shipments has resulted in the stock’s underperformance. There has also been a slowdown in Brazil, the company’s second largest market. FMC and DowDupont are global leaders in crop protection and agricultural chemicals, but with recent uncertainty around tariffs imposed by the current U.S. administration and the impacts of a potential global slowdown on their business, investors sold down shares. In the Energy sector, Encana and Suncor, two Canadian oil producers, suffered significant declines when oil corrected from the highs it set earlier in the year. Encana’s stock price was negatively impacted when it made a bid for a competitor. Longer term, we think this is a good deal for Encana because it enhances shareholder value, but it will take some time for the market to get comfortable with the purchase. There was no negative company specific issue with Suncor; the stock simply sold off with the price of oil. In the Communication sector, Comcast sold off after it made a bid to buy Sky Plc and got into a bidding war. Some feel Comcast overpaid for the assets, but the added diversification should ultimately prove a positive move for the company over the longer term.

Healthcare was the best performing sector for the Fund, and it substantially outperformed its benchmark. The Fund was overweight Healthcare and it was the best performing sector in the market for the year, especially in the fourth quarter when the overall market sold off. Merck is one of the Fund’s top positions, and it benefited from its tremendous stock appreciation this year. The company’s key oncology drug, Keytruda, outperformed expectations and picked up additional indications for treatments of different types of cancers. Pfizer, also a top holding for the Fund, had another strong year, especially in the fourth quarter, again when investors were looking to invest in less economically sensitive companies during the market sell-off. The Fund also profited from its investment in UnitedHealth Group, as the company benefited from improvement in both its government and non-government health plans. In Consumer Discretionary, the Fund was underweight the sector versus the Index due

to our decision to underweight retailers in what we perceived to be a rough environment for consumers. We did benefit modestly in the Fund’s position in Home Depot, which has reported strong numbers despite the headline slowdown in new home sales for the year. In Financials, the Fund benefited from our holding in Alliance Bernstein, the investment management company, which offers a healthy 9% dividend yield, is reducing overhead costs and is improving its investment performance.

Thank you for placing your trust in Foresters Financial. As always, we appreciate the opportunity to serve your investment needs.

Fund Expenses(unaudited)

EQUITY INCOME FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (7/1/18) | (12/31/18) | (7/1/18–12/31/18)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $ 915.83 | $3.91 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,021.13 | $4.13 |

| |

| * | Expenses are equal to the annualized expense ratio of .81%, multiplied by the average account |

| value over the period, multiplied by 184/365 (to reflect the one-half year period). |

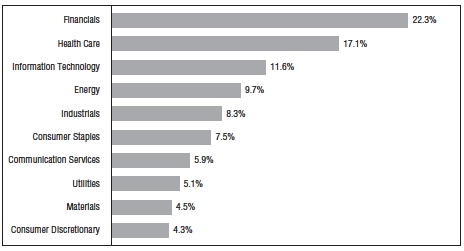

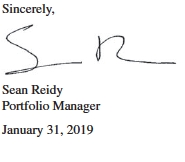

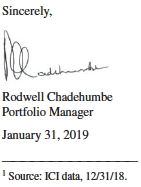

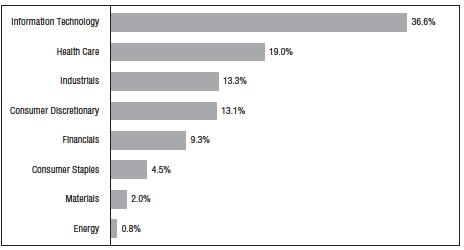

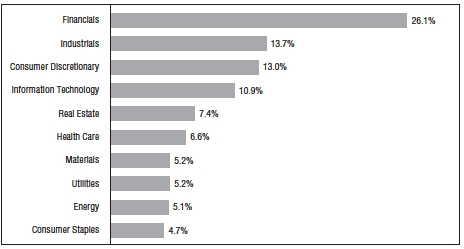

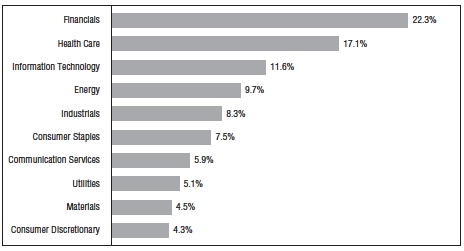

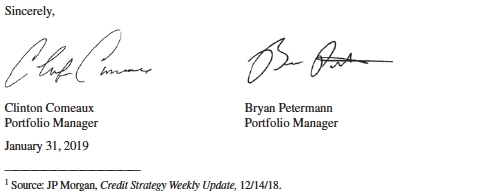

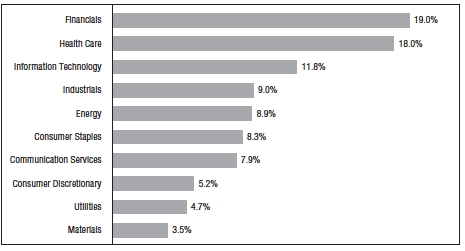

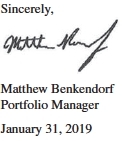

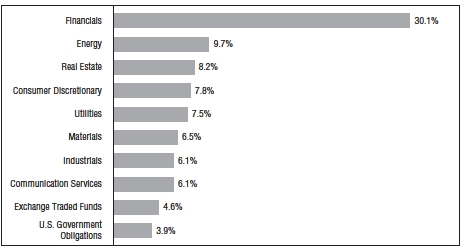

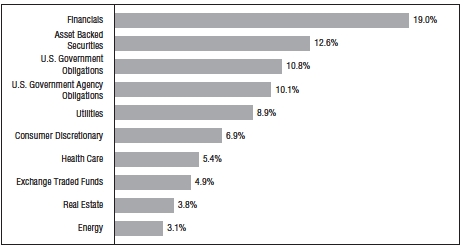

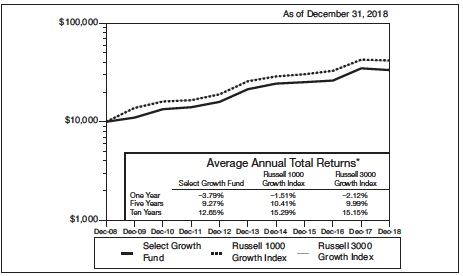

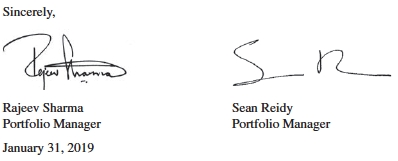

Portfolio Composition

TOP TEN SECTORS

|

| Portfolio holdings and allocations are subject to change. Percentages are as of December 31, 2018, |

| and are based on the total value of investments. |

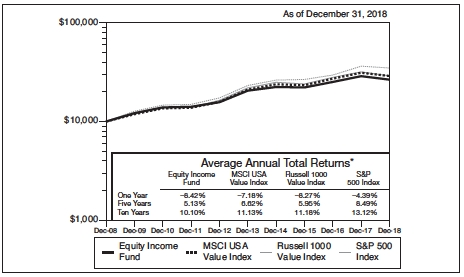

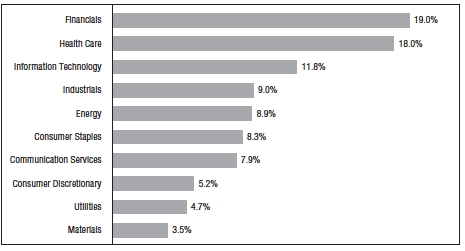

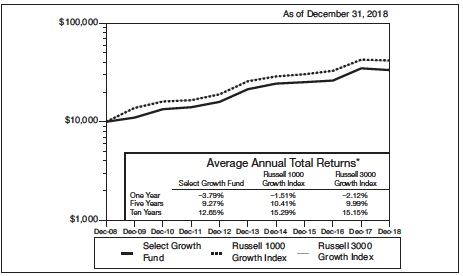

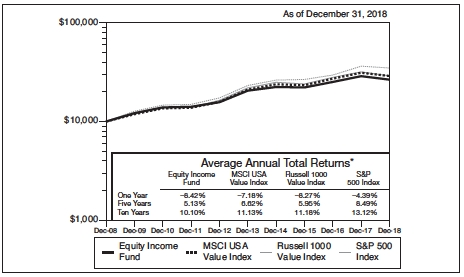

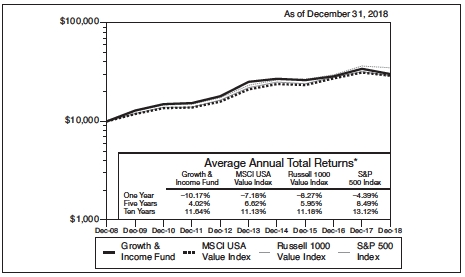

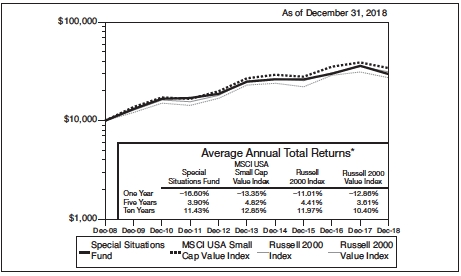

Cumulative Performance Information(unaudited)

EQUITY INCOME FUND

Comparison of change in value of $10,000 investment in the First Investors Life Series Equity Income Fund the MSCI USA Value Index**, the Standard & Poor’s 500 Index and the Russell 1000 Value Index.

The graph compares a $10,000 investment in the First Investors Life Series Equity Income Fund beginning 12/31/08 with theoretical investments in the MSCI USA Value Index, the Standard & Poor’s 500 Index and the Russell 1000 Value Index (the “Indices”). The MSCI USA Value Index captures large and mid-cap securities exhibiting overall value characteristics. The value investment style characteristics for index construction are defined using book value to price, 12-month forward earnings to price and dividend yield. The Standard & Poor’s 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of such stocks, which represent all major industries. The Russell 1000 Value Index is an unmanaged index that measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values. It is not possible to invest directly in these Indices. In addition, the Indices do not reflect fees and expenses associated with the active management of a mutual fund portfolio. For purposes of the graph and the accompanying table it is assumed that all dividends and distributions were reinvested.

* The Average Annual Total Return figures are for the periods ended 12/31/18.

The returns shown do not reflect any sales charges, since the Fund sells its shares solely to variable annuity and/or variable life insurance subaccounts at net asset value. The returns do not reflect the fees and charges that an individual would pay in connection with an investment in a variable annuity or life contract or policy.Results represent past performance and do not indicate future results. The graph and the returns shown do not reflect the deduction of taxes that an investor would pay on distributions or the redemption of fund shares.Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Index figures are MSCI, Standard & Poor’s and FTSE Russell. All other figures are from Foresters Investment Management Company, Inc.

** The Fund changed its primary broad based securities index to the MSCI USA Value Index as of January 31, 2019. The Fund had previously changed its primary broad-based securities index to the Russell 1000 Value Index on May 1, 2018. In each case, the Fund elected to use the new index because it more closely reflected the Fund’s investment strategies. After this year we will not show comparisons to the Standard & Poor’s 500 Index and the Russell 1000 Value Index.

Portfolio of Investments

EQUITY INCOME FUND

December 31, 2018

| | | | |

| | | | | |

| | | | |

| | | | |

| | | | |

| Shares | | Security | | Value |

| | | COMMON STOCKS—95.6% | | |

| | | Communication Services—5.7% | | |

| 56,034 | | AT&T, Inc. | | $ 1,599,210 |

| 48,700 | | Comcast Corp. – Special Shares “A” | | 1,658,235 |

| 44,200 | | Verizon Communications, Inc. | | 2,484,924 |

| 6,900 | | Walt Disney Co. | | 756,585 |

| | | | | 6,498,954 |

| | | Consumer Discretionary—4.1% | | |

| 10,800 | | Acushnet Holdings Corp. | | 227,556 |

| 29,800 | | American Eagle Outfitters, Inc. | | 576,034 |

| 11,350 | | DSW, Inc. – Class “A” | | 280,345 |

| 13,100 | | Lowe’s Cos., Inc. | | 1,209,916 |

| 6,300 | | McDonald’s Corp. | | 1,118,691 |

| 6,650 | | Oxford Industries, Inc. | | 472,416 |

| 7,950 | | Penske Automotive Group, Inc. | | 320,544 |

| 15,700 | | Tapestry, Inc. | | 529,875 |

| | | | | 4,735,377 |

| | | Consumer Staples—7.3% | | |

| 18,050 | | Altria Group, Inc. | | 891,489 |

| 18,600 | | Coca-Cola Co. | | 880,710 |

| 7,400 | | Kimberly-Clark Corp. | | 843,156 |

| 10,116 | | Kraft Heinz Co. | | 435,393 |

| 13,400 | | PepsiCo, Inc. | | 1,480,432 |

| 11,400 | | Philip Morris International, Inc. | | 761,064 |

| 15,000 | | Procter & Gamble Co. | | 1,378,800 |

| 17,200 | | Wal-Mart, Inc. | | 1,602,180 |

| | | | | 8,273,224 |

| | | Energy—9.5% | | |

| 13,000 | | Anadarko Petroleum Corp. | | 569,920 |

| 37,051 | | BP, PLC (ADR) | | 1,404,974 |

| 22,100 | | Chevron Corp. | | 2,404,259 |

| 14,950 | | ConocoPhillips | | 932,132 |

| 89,850 | | EnCana Corp. | | 519,333 |

| 5,800 | | EOG Resources, Inc. | | 505,818 |

| 15,200 | | ExxonMobil Corp. | | 1,036,488 |

| 14,764 | | Marathon Petroleum Corp. | | 871,224 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Shares | | Security | | Value |

| | | Energy(continued) | | |

| 11,150 | | Occidental Petroleum Corp. | | $ 684,387 |

| 9,250 | | Royal Dutch Shell, PLC – Class “A” (ADR) | | 538,998 |

| 14,650 | | Schlumberger, Ltd. | | 528,572 |

| 28,800 | | Suncor Energy, Inc. | | 805,536 |

| | | | | 10,801,641 |

| | | Financials—20.6% | | |

| 35,950 | * | AllianceBernstein Holding, LP (MLP) | | 982,154 |

| 12,550 | | American Express Co. | | 1,196,266 |

| 73,650 | | Bank of America Corp. | | 1,814,736 |

| 26,200 | | Bank of New York Mellon Corp. | | 1,233,234 |

| 2,900 | * | Berkshire Hathaway, Inc. – Class “B” | | 592,122 |

| 1,650 | | BlackRock, Inc. | | 648,153 |

| 14,467 | | Chubb, Ltd. | | 1,868,847 |

| 14,100 | | Citigroup, Inc. | | 734,046 |

| 10,600 | | Comerica, Inc. | | 728,114 |

| 7,500 | | Discover Financial Services | | 442,350 |

| 23,600 | | Fidelity National Financial, Inc. | | 741,984 |

| 4,550 | | Goldman Sachs Group, Inc. | | 760,077 |

| 21,355 | | Hamilton Lane, Inc. – Class “A” | | 790,135 |

| 22,400 | | iShares S&P U.S. Preferred Stock Index Fund (ETF) | | 766,752 |

| 26,500 | | JPMorgan Chase & Co. | | 2,586,930 |

| 16,800 | | MetLife, Inc. | | 689,808 |

| 31,900 | | Old National Bancorp of Indiana | | 491,260 |

| 6,900 | | PNC Financial Services Group, Inc. | | 806,679 |

| 15,600 | | Popular, Inc. | | 736,632 |

| 64,950 | | Regions Financial Corp. | | 869,031 |

| 41,000 | | Sterling Bancorp | | 676,910 |

| 7,200 | | Travelers Cos., Inc. | | 862,200 |

| 52,200 | | Wells Fargo & Co. | | 2,405,376 |

| | | | | 23,423,796 |

| | | Health Care—16.6% | | |

| 18,100 | | Abbott Laboratories | | 1,309,173 |

| 3,200 | | Anthem, Inc. | | 840,416 |

| 18,850 | | Bristol-Myers Squibb Co. | | 979,823 |

| 16,805 | | CVS Health Corp. | | 1,101,064 |

| 7,950 | | Eli Lilly & Co. | | 919,974 |

| 17,050 | | GlaxoSmithKline, PLC (ADR) | | 651,480 |

| 18,350 | | Johnson & Johnson | | 2,368,068 |

| 17,800 | | Koninklijke Philips NV (ADR) | | 624,958 |

Portfolio of Investments(continued)

EQUITY INCOME FUND

December 31, 2018

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Shares | | Security | | Value |

| | | Health Care(continued) | | |

| 18,362 | | Medtronic, PLC | | $ 1,670,208 |

| 39,770 | | Merck & Co., Inc. | | 3,038,826 |

| 63,385 | | Pfizer, Inc. | | 2,766,755 |

| 8,913 | | Phibro Animal Health Corp. – Class “A” | | 286,642 |

| 25,600 | | Smith & Nephew, PLC (ADR) | | 956,928 |

| 5,700 | | UnitedHealth Group, Inc. | | 1,419,984 |

| | | | | 18,934,299 |

| | | Industrials—8.1% | | |

| 2,300 | | 3M Co. | | 438,242 |

| 12,900 | | Eaton Corp., PLC | | 885,714 |

| 4,400 | | General Dynamics Corp. | | 691,724 |

| 7,400 | | Honeywell International, Inc. | | 977,688 |

| 10,300 | | Ingersoll-Rand, PLC | | 939,669 |

| 6,250 | | ITT, Inc. | | 301,687 |

| 9,150 | | Kansas City Southern, Inc. | | 873,368 |

| 4,180 | | Lockheed Martin Corp. | | 1,094,491 |

| 14,500 | | Triton International, Ltd. | | 450,515 |

| 11,100 | | United Parcel Service, Inc. – Class “B” | | 1,082,583 |

| 13,800 | | United Technologies Corp. | | 1,469,424 |

| | | | | 9,205,105 |

| | | Information Technology—11.3% | | |

| 8,340 | | Apple, Inc. | | 1,315,552 |

| 51,200 | | Cisco Systems, Inc. | | 2,218,496 |

| 65,650 | | HP Enterprise Co. | | 867,236 |

| 32,300 | | HP, Inc. | | 660,858 |

| 39,400 | | Intel Corp. | | 1,849,042 |

| 6,300 | | LogMeIn, Inc. | | 513,891 |

| 14,400 | | Maxim Integrated Products, Inc. | | 732,240 |

| 25,350 | | Microsoft Corp. | | 2,574,800 |

| 25,700 | | QUALCOMM, Inc. | | 1,462,587 |

| 6,900 | | Texas Instruments, Inc. | | 652,050 |

| | | | | 12,846,752 |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Shares | | Security | Value |

| | | Materials—4.3% | |

| 27,331 | | DowDuPont, Inc. | $ 1,461,662 |

| 7,400 | | Eastman Chemical Co. | 541,014 |

| 14,300 | | FMC Corp. | 1,057,628 |

| 4,800 | | Linde, PLC | 748,992 |

| 6,950 | | LyondellBasell Industries NV – Class “A” | 577,962 |

| 15,140 | | WestRock Co. | 571,686 |

| | | | 4,958,944 |

| | | Real Estate—3.1% | |

| 27,450 | | Americold Realty Trust (REIT) | 701,073 |

| 23,234 | | Brookfield Property Partners (MLP) (REIT) | 374,532 |

| 16,800 | | Douglas Emmett, Inc. (REIT) | 573,384 |

| 5,900 | | Federal Realty Investment Trust (REIT) | 696,436 |

| 41,500 | | Tanger Factory Outlet Centers, Inc. (REIT) | 839,130 |

| 15,693 | | Urstadt Biddle Properties, Inc. (REIT) | 301,620 |

| | | | 3,486,175 |

| | | Utilities—5.0% | |

| 8,250 | | American Electric Power Co., Inc. | 616,605 |

| 23,000 | | CenterPoint Energy, Inc. | 649,290 |

| 10,350 | | Dominion Energy, Inc. | 739,611 |

| 7,100 | | Duke Energy Corp. | 612,730 |

| 19,300 | | Exelon Corp. | 870,430 |

| 5,500 | | NextEra Energy, Inc. | 956,010 |

| 15,400 | | PPL Corp. | 436,282 |

| 10,700 | | Vectren Corp. | 770,186 |

| | | | 5,651,144 |

| Total Value of Common Stocks(cost $89,493,092) | 108,815,411 |

| | | PREFERRED STOCKS—1.8% | |

| | | Financials—1.2% | |

| 200 | | Citizens Financial Group, Inc., Series A, 5.5%, 2049 | 198,000 |

| 21,200 | | JPMorgan Chase & Co., Series Y, 6.125%, 2020 | 537,420 |

| 24,000 | | U.S. Bancorp, Series K, 5.5%, 2023 | 592,560 |

| | | | 1,327,980 |

Portfolio of Investments(continued)

EQUITY INCOME FUND

December 31, 2018

| | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Shares | | Security | | | | | Value |

| | | Real Estate—.6% | | | | | |

| 11,400 | | Digital Realty Trust, Inc. (REIT), Series G, 5.875%, 2049 | | | | $ 267,672 |

| | | Urstadt Biddle Properties, Inc. (REIT): | | | | | |

| 11,000 | | Series G, 6.75%, 2049 | | | | | 270,600 |

| 8,300 | | Series H, 6.25%, 2022 | | | | | 194,635 |

| | | | | | | | 732,907 |

| Total Value of Preferred Stocks(cost $2,095,099) | | | | | 2,060,887 |

| Total Value of Investments(cost $91,588,191) | 97.4 | % | | | 110,876,298 |

| Other Assets, Less Liabilities | 2.6 | | | | 3,008,429 |

| Net Assets | | | 100.0 | % | | $113,884,727 |

| | |

| * | Non-income producing |

| |

| Summary of Abbreviations: |

| ADR | American Depositary Receipts |

| ETF | Exchange Traded Fund |

| MLP | Master Limited Partnership |

| REIT | Real Estate Investment Trust |

The Fund’s assets and liabilities are classified into the following three levels based on the inputs used to value the assets and liabilities:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, U.S. Government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of December 31, 2018:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Common Stocks | | $ | 108,815,411 | | $ | — | | $ | — | | $ | 108,815,411 |

| Preferred Stocks | | | 2,060,887 | | | — | | | — | | | 2,060,887 |

| Total Investments in Securities* | | $ | 110,876,298 | | $ | — | | $ | — | | $ | 110,876,298 |

| |

| * | The Portfolio of Investments provides information on the industry categorization for common stocks |

| and preferred stocks. |

| |

| There were no transfers into or from Level 1 and Level 2 by the Fund for the year ended December 31, |

| 2018. Transfers, if any, between Levels are recognized at the end of the reporting period. |

| | |

| See notes to financial statements | 23 |

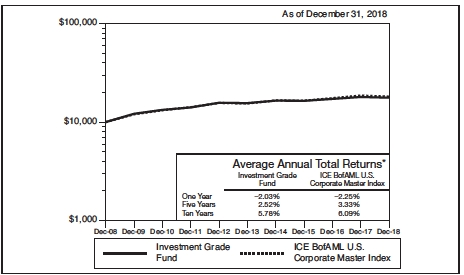

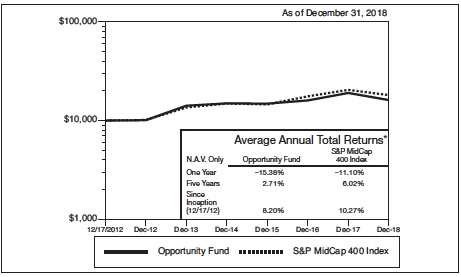

Portfolio Managers’ Letter

FUND FOR INCOME

Dear Investor:

This is the annual report for the First Investors Life Series Fund For Income for the year ended December 31, 2018. During the year, the Fund’s return on a net asset value basis was –2.58%, including dividends of 33.1 cents per share. This return underperformed the Fund’s benchmark, the ICE BofA Merrill Lynch BB-B U.S. Cash Pay High Yield Constrained Index, which returned –2.04% during the period.

The Markets

What a difference a quarter makes—and that difference is not always positive. Through the first three quarters of the year, pointing to lofty U.S. large capitalization stock market returns alone might have made investors draw the conclusion that 2019 was a “risk-on” year for the markets. However, even through September, returns demonstrated a subtler—and growing—pervasiveness of interest rate risk underlying the economy. At that time, opening our lens beyond big U.S. stocks made it clear that investors preferred investments in the U.S. where credit fundamentals appeared stronger than in other markets. Within the U.S., however, there were cautions around rising U.S. Treasury rates that impact not only U.S. government bonds, but also Treasury-sensitive paper, typically longer in duration and higher in rating than the U.S. high yield bond senior floating rate loans which, together, comprise this portfolio. Broadly, through the third quarter, 2018 proved more challenging for global investment grade fixed income than the year before, and, within the U.S. itself, U.S. high yield gained modestly, but U.S. Treasurys and more interest-rate-sensitive investment grade paper declined as the stock market surged.

This turned, however, in the fourth quarter as risk assets experienced significant declines initially on Federal Reserve (Fed) tightening, but—by the end of the period—on weaker U.S. economic data which softened hawkish rate language from the Fed and caused markets to sharply reduce their view on rate increases for 2019. The constant, underlying source of market unease permeating the quarter, however, was political, with investors questioning the outcome of the U.S. elections and their impact on trade wars with China and on Congressional budgets. Even global political disarray, including failure of the UK government to hold a Brexit vote, ongoing budget wrangling between Italy and the European Central Bank, the election of populist leaders in Latin America, and rioting in Paris over increased fuel taxes, impacted domestic U.S. markets.

In this environment, high yield declined, with more equity-like portions of the market—those rated CCC and below—declining the most (and with actual equity markets declining by a multiple of the declines seen in high yield). Senior floating rate loans, which comprise a small allocation of less than 10% in the portfolio, managed to stay resilient for October and November as investors continued to worry about future rate increases, but capitulated to the general swoon in lower-rated credit in December. Higher-rated fixed income performed as one might have expected with Treasurys attracting assets (and rallying in price) in a flight to quality and outperforming all other segments of the bond market.

While the Fed had clearly telegraphed that it would raise rates at the December meeting, an equity market downdraft in early December and public remarks from President Trump pressing the Fed not to raise rates gave some investors the (false) impression the Fed might pause. While the Fed did raise rates in December, markets (as per Bloomberg data) are now forecasting a 0% probability that the Fed raises in March.

Investors appear to be focused now on weaker economic data with some questioning whether an economic slowdown will turn into a recession. While it is difficult to forecast a recession, valuations have certainly become more attractive as investors question economic strength. Whether valuations become even more attractive, stabilize, or tighten depends largely on whether the markets see some resolutions to political issues, Fed direction, and the strength of the economy.

The Fund

In this challenging environment, the Fund declined along with the BB/B market in the fourth quarter, but it preserved small outperformance of the market through the end of the year (gross of fees). As disappointing as any negative result is, the portfolio preserved capital better than the broad high yield market and better than many high yield portfolios which were more heavily invested in CCC rated paper, which sharply sold off in the fourth quarter. While this Fund takes small amounts of CCC exposure in specific lower-rated selections when we think they are mis-rated and offer specific value, we had kept even that small exposure to below 5% of holdings over the second half of the year on tight market valuations. Similarly, we reduced the Fund’s exposure to loans, which had performed well for the portfolio, in time for the loan market’s December sell-off. The reason was we thought that falling bond prices might offer a more compelling opportunity for reinvestment, given that corporate fundamentals continue to be supportive of most companies paying their debts in 2019 without a problem—even if they will not grow suitably fast to entice the equity investor.

On a sector basis, there were few places to hide over the year, with heavy industries and cyclicals, including Energy, Steel, Building Materials, Metals and Mining, and Chemicals notably underperforming the market, as might be anticipated. More defensive sectors, such as Healthcare and Utilities, outperformed. Over the year, the portfolio lost some ground against the index from an industry allocation perspective, but more than made up for that with strong credit selection. Within the portfolio itself, both of these trends were on display, for example, in the Metals and Mining sector which suffered from our overweighting of the benchmark, but which provided outperformance of the benchmark through strong credit selection. Our results were the opposite in the Banking sector, where our underweight posture—but not individual credit selection—was rewarded more than the index, leading to overall underperformance. From a duration perspective (where duration measures sensitivity to changes in the interest rate environment), the portfolio was rewarded by its overweighting of the shortest duration (and therefore least interest

Portfolio Managers’ Letter(continued)

FUND FOR INCOME

rate-sensitive) positions (including loans), and delivered relatively strong credit selection across the 1-5 year duration cohort.

The world is at an interesting place with multiple outcomes available. Unfortunately, many of these outcomes are difficult for financial analysts to model, thereby leading us toward a bias to sell the rallies and buy on the dips.

Outlook

Here is a trivia question to start the New Year. In how many years since 1994 was the U.S. high yield market down, absent a default wave? Answer: none, until now. 2018 was an anomaly in that the U.S. high yield market posted a negative return, but the default rate remained exceptionally low at 1.75% for high yield and 1.66% for loans (both par weighted and including distressed exchanges).1

We believe 2018’s challenges were driven by global central bank tightening, geopolitical uncertainty and concerns about economic growth. So, what about 2019? Historically, negative years in high yield have been followed by positive years; however, in those years, spreads were wider than current spread levels. Valuations are at their most attractive in years, but is this a screaming buy? We believe that if some of the political uncertainty is lifted (easing of trade tensions, soft Brexit), markets could snap back very quickly, given significant levels of cash sitting on the sidelines and limited dealer inventories. The snapback will be quick and likely dramatic, and the most attractive gains will be made in the inflection. Risks remain, though. We are late cycle and spreads could certainly widen from here. Managers focused on credit analysis should do well for investors looking to opportunistically take advantage of more attractive valuations even in a period of more mixed economic data. We will look to take advantage of the recent repricing, but we expect the portfolios to move up in credit quality by the end of 2019.

Thank you for placing your trust in Foresters Financial. As always, we appreciate the opportunity to serve your investment needs.

Fund Expenses(unaudited)

FUND FOR INCOME

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (7/1/18) | (12/31/18) | (7/1/18–12/31/18)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $ 974.18 | $4.58 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,020.57 | $4.69 |

| |

| * | Expenses are equal to the annualized expense ratio of .92%, multiplied by the average account |

| value over the period, multiplied by 184/365 (to reflect the one-half year period). |

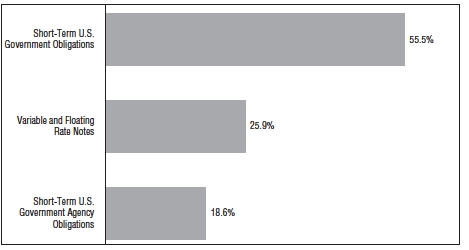

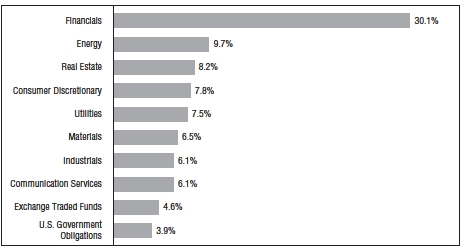

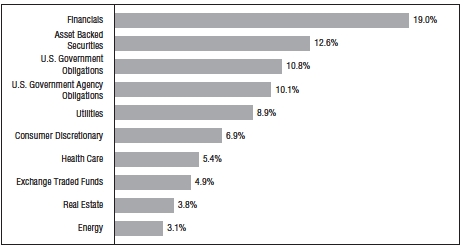

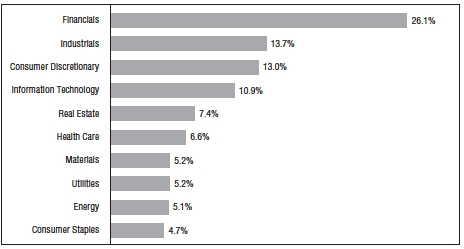

Portfolio Composition

TOP TEN SECTORS

|

| Portfolio holdings and allocations are subject to change. Percentages are as of December 31, 2018, |

| and are based on the total value of investments. |

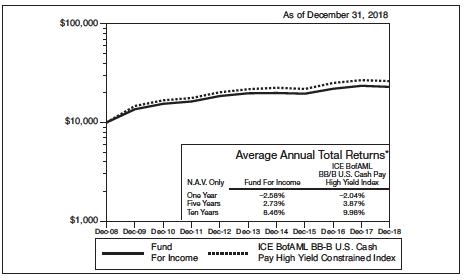

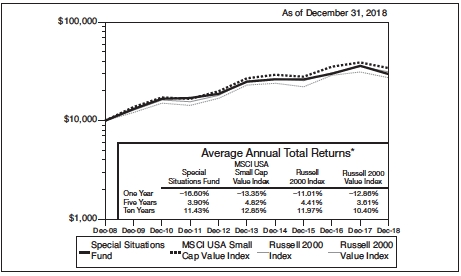

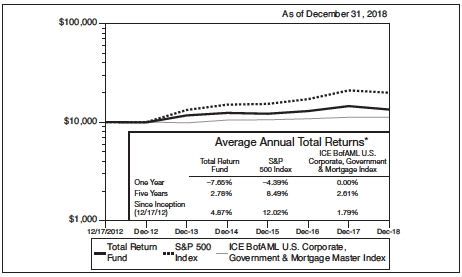

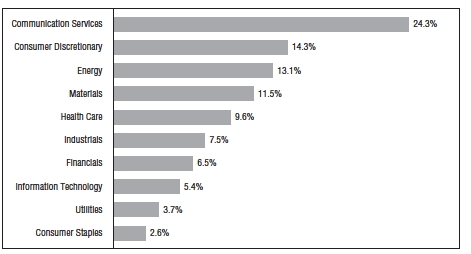

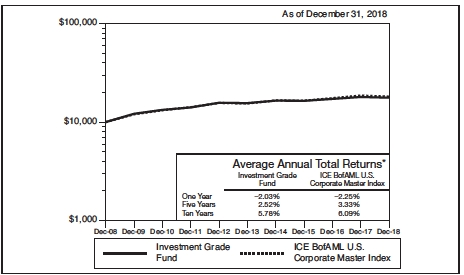

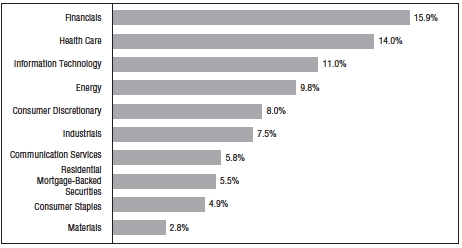

Cumulative Performance Information(unaudited)

FUND FOR INCOME

Comparison of change in value of $10,000 investment in the First Investors Life Series Fund For Income and the ICE Bank of America Merrill Lynch (“ICE BofAML”) BB-B U.S. Cash Pay High Yield Constrained Index.

The graph compares a $10,000 investment in the First Investors Life Series Fund For Income beginning 12/31/08 with a theoretical investment in the ICE BofAML BB-B U.S. Cash Pay High Yield Constrained Index (the “Index”). The Index contains all securities in the ICE BofAML U.S. Cash Pay High Yield Index rated BB1 through B3, based on an average of Moody’s, S&P and Fitch, but caps issuer exposure at 2%. It is not possible to invest directly in this Index. In addition, the Index does not reflect fees and expenses associated with the active management of a mutual fund portfolio. For purposes of the graph and the accompanying table it is assumed that all dividends and distributions were reinvested.

* The Average Annual Total Return figures are for the periods ended 12/31/18.

The returns shown do not reflect any sales charges, since the Fund sells its shares solely to variable annuity and/or variable life insurance subaccounts at net asset value. The returns do not reflect the fees and charges that an individual would pay in connection with an investment in a variable annuity or life contract or policy.Results represent past performance and do not indicate future results. The graph and the returns shown do not reflect the deduction of taxes that an investor would pay on distributions or the redemption of fund shares.Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. The issuers of the high yield bonds in which the Fund primarily invests pay higher interest rates because they have a greater likelihood of financial difficulty, which could result in their inability to repay the bonds fully when due. Prices of high yield bonds are also subject to greater fluctuations. Index figures from Intercontinental Exchange and all other figures are from Foresters Investment Management Company, Inc.

Portfolio of Investments

FUND FOR INCOME

December 31, 2018

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | CORPORATE BONDS—89.3% | | |

| | | Aerospace/Defense—1.5% | | |

| | | Bombardier, Inc.: | | |

| $ 375M | | 8.75%, 12/1/2021 (a) | | $ 387,656 |

| 275M | | 7.5%, 12/1/2024 (a) | | 259,875 |

| | | Meccanica Holdings USA, Inc.: | | |

| 275M | | 7.375%, 7/15/2039 (a) | | 290,125 |

| 100M | | 6.25%, 1/15/2040 (a) | | 93,500 |

| 500M | | TransDigm, Inc., 5.5%, 10/15/2020 | | 496,875 |

| | | | | 1,528,031 |

| | | Automotive—2.7% | | |

| 425M | | Adient Global Holdings, Ltd., 4.875%, 8/15/2026 (a) | | 327,250 |

| 475M | | American Axle & Manufacturing, Inc., 6.25%, 4/1/2025 | | 434,031 |

| 125M | | Asbury Automotive Group, Inc., 6%, 12/15/2024 | | 120,312 |

| 225M | | Avis Budget Group, Inc., 6.375%, 4/1/2024 (a) | | 216,000 |

| 175M | | Cooper Standard Automotive, Inc., 5.625%, 11/15/2026 (a) | | 154,875 |

| 150M | | Dana Financing Luxembourg Sarl, 6.5%, 6/1/2026 (a) | | 144,562 |

| | | Dana Holding Corp.: | | |

| 100M | | 6%, 9/15/2023 | | 99,875 |

| 250M | | 5.5%, 12/15/2024 | | 233,750 |

| | | Hertz Corp.: | | |

| 250M | | 5.875%, 10/15/2020 | | 243,438 |

| 250M | | 7.625%, 6/1/2022 (a) | | 236,250 |

| 225M | | J.B. Poindexter & Co., 7.125%, 4/15/2026 (a) | | 211,500 |

| 100M | | LKQ Corp., 4.75%, 5/15/2023 | | 94,500 |

| 275M | | Tenneco, Inc., 5%, 7/15/2026 | | 212,919 |

| | | | | 2,729,262 |

| | | Building Materials—1.2% | | |

| 325M | | Building Materials Corp., 5.375%, 11/15/2024 (a) | | 306,312 |

| 500M | | Griffon Corp., 5.25%, 3/1/2022 | | 454,375 |

| 250M | | New Enterprise Stone & Lime Co., 6.25%, 3/15/2026 (a) | | 228,125 |

| 200M | | Standard Industries, Inc., 5.5%, 2/15/2023 (a) | | 196,500 |

| | | | | 1,185,312 |

| | | Chemicals—2.6% | | |

| 350M | | Avantor, Inc., 9%, 10/1/2025 (a) | | 350,875 |

| 275M | | Blue Cube Spinco, Inc., 10%, 10/15/2025 | | 312,125 |

| 225M | | Chemours Co., 6.625%, 5/15/2023 | | 228,094 |

| 150M | | CVR Partners, LP, 9.25%, 6/15/2023 (a) | | 156,562 |

| 225M | | PQ Corp., 6.75%, 11/15/2022 (a) | | 232,875 |

Portfolio of Investments(continued)

FUND FOR INCOME

December 31, 2018

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Chemicals(continued) | | |

| $ 625M | | Rain CII Carbon, LLC, 7.25%, 4/1/2025 (a) | | $ 568,750 |

| 200M | | Rayonier AM Products, Inc., 5.5%, 6/1/2024 (a) | | 177,000 |

| 300M | | Tronox, Inc., 6.5%, 4/15/2026 (a) | | 250,125 |

| 375M | | Univar USA, Inc., 6.75%, 7/15/2023 (a) | | 371,719 |

| | | | | 2,648,125 |

| | | Consumer Non-Durables—1.8% | | |

| 275M | | Eagle Intermediate Global Holding, 7.5%, 5/1/2025 (a) | | 258,294 |

| 125M | | Energizer Gamma Acquisition, 6.375%, 7/15/2026 (a) | | 115,000 |

| 250M | | Energizer Holdings, Inc., 5.5%, 6/15/2025 (a) | | 226,250 |

| 350M | | First Quality Finance Co., 4.625%, 5/15/2021 (a) | | 340,375 |

| 250M | | KGA Escrow, LLC, 7.5%, 8/15/2023 (a) | | 247,188 |

| | | Reynolds Group Holdings, Inc.: | | |

| 509M | | 5.75%, 10/15/2020 | | 508,146 |

| 125M | | 5.125%, 7/15/2023 (a) | | 119,219 |

| | | | | 1,814,472 |

| | | Energy—11.8% | | |

| 250M | | Andeavor Logistics, LP, 6.875%, 12/29/2049 | | 222,969 |

| 125M | | Antero Resources Corp., 5.375%, 11/1/2021 | | 121,094 |

| 250M | | Apergy Corp., 6.375%, 5/1/2026 | | 243,750 |

| 525M | | Baytex Energy Corp., 5.125%, 6/1/2021 (a) | | 505,312 |

| 225M | | Berry Petroleum Co., 7%, 2/15/2026 (a) | | 203,625 |

| | | Blue Racer Midstream, LLC: | | |

| 200M | | 6.125%, 11/15/2022 (a) | | 194,000 |

| 250M | | 6.625%, 7/15/2026 (a) | | 233,750 |

| 400M | | California Resources Corp., 8%, 12/15/2022 (a) | | 272,000 |

| 225M | | Callon Petroleum Co., 6.375%, 7/1/2026 | | 210,375 |

| | | Carrizo Oil & Gas, Inc.: | | |

| 50M | | 6.25%, 4/15/2023 | | 46,500 |

| 75M | | 8.25%, 7/15/2025 | | 73,875 |

| | | Chesapeake Energy Corp.: | | |

| 150M | | 4.875%, 4/15/2022 | | 131,625 |

| 400M | | 7%, 10/1/2024 | | 348,000 |

| | | Consolidated Energy Finance SA: | | |

| 375M | | 6.53819%, 6/15/2022 (a)† | | 374,232 |

| 150M | | 6.5%, 5/15/2026 (a) | | 144,375 |

| 250M | | Covey Park Energy, LLC, 7.5%, 5/15/2025 (a) | | 216,250 |

| | | Crestwood Midstream Partners, LP: | | |

| 250M | | 6.25%, 4/1/2023 | | 241,875 |

| 450M | | 5.75%, 4/1/2025 | | 419,625 |

| 250M | | CrownRock, LP, 5.625%, 10/15/2025 (a) | | 225,937 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Energy(continued) | | |

| $ 225M | | CSI Compressco, LP, 7.5%, 4/1/2025 (a) | | $ 210,375 |

| 275M | | Delek Logistics Partners, LP, 6.75%, 5/15/2025 | | 268,125 |

| 100M | | Denbury Resources, Inc., 9%, 5/15/2021 (a) | | 93,500 |

| | | Diamondback Energy, Inc.: | | |

| 275M | | 4.75%, 11/1/2024 (a) | | 266,750 |

| 75M | | 4.75%, 11/1/2024 | | 72,750 |

| 375M | | EnLink Midstream Partners, LP, 4.85%, 7/15/2026 | | 338,681 |

| 400M | | Exterran Partners, LP, 6%, 10/1/2022 | | 378,000 |

| 100M | | Forum Energy Technologies, Inc., 6.25%, 10/1/2021 | | 88,500 |

| | | Genesis Energy, LP: | | |

| 200M | | 6.75%, 8/1/2022 | | 196,000 |

| 100M | | 5.625%, 6/15/2024 | | 86,250 |

| 300M | | Global Partners, LP, 6.25%, 7/15/2022 | | 285,000 |

| | | Gulfport Energy Corp.: | | |

| 200M | | 6.625%, 5/1/2023 | | 190,000 |

| 175M | | 6.375%, 5/15/2025 | | 155,531 |

| 250M | | Laredo Petroleum, Inc., 6.25%, 3/15/2023 | | 225,625 |

| 250M | | Matador Resources Co., 5.875%, 9/15/2026 | | 230,625 |

| 325M | | McDermott Escrow 1, Inc., 10.625%, 5/1/2024 (a) | | 275,438 |

| | | Murphy Oil Corp.: | | |

| 50M | | 4.45%, 12/1/2022 | | 47,201 |

| 175M | | 5.75%, 8/15/2025 | | 163,903 |

| 100M | | 5.875%, 12/1/2042 | | 76,588 |

| 275M | | Nabors Industries, Inc., 5.75%, 2/1/2025 | | 208,882 |

| 150M | | Northern Oil and Gas, Inc., 8.5%, 5/15/2023 (c)(d) | | 145,125 |

| | | Oasis Petroleum, Inc.: | | |

| 250M | | 6.875%, 1/15/2023 | | 231,563 |

| 175M | | 6.25%, 5/1/2026 (a) | | 147,438 |

| 250M | | Parkland Fuel Corp., 6%, 4/1/2026 (a) | | 235,625 |

| | | Parsley Energy, LLC: | | |

| 125M | | 5.25%, 8/15/2025 (a) | | 113,750 |

| 50M | | 5.625%, 10/15/2027 (a) | | 45,687 |

| | | Precision Drilling Corp.: | | |

| 103M | | 6.5%, 12/15/2021 | | 96,127 |

| 150M | | 7.125%, 1/15/2026 (a) | | 129,750 |

| 200M | | QEP Resources, Inc., 6.875%, 3/1/2021 | | 202,500 |

| | | SM Energy Co.: | | |

| 350M | | 5%, 1/15/2024 | | 306,250 |

| 50M | | 6.625%, 1/15/2027 | | 44,500 |

| 100M | | Southwestern Energy Co., 7.5%, 4/1/2026 | | 95,000 |

| 100M | | Suburban Propane Partners, LP, 5.875%, 3/1/2027 | | 89,000 |

Portfolio of Investments(continued)

FUND FOR INCOME

December 31, 2018

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Energy(continued) | | |

| | | Sunoco, LP: | | |

| $ 300M | | 4.875%, 1/15/2023 | | $ 293,250 |

| 175M | | 5.875%, 3/15/2028 | | 164,129 |

| 100M | | Transocean Guardian, Ltd., 5.875%, 1/15/2024 (a) | | 96,250 |

| 150M | | Transocean Pontus, Ltd., 6.125%, 8/1/2025 (a) | | 145,500 |

| | | Transocean, Inc.: | | |

| 150M | | 3.8%, 10/15/2022 | | 132,750 |

| 225M | | 7.25%, 11/1/2025 (a) | | 197,438 |

| 75M | | Unit Corp., 6.625%, 5/15/2021 | | 68,625 |

| | | Whiting Petroleum Corp.: | | |

| 250M | | 6.25%, 4/1/2023 | | 228,750 |

| 175M | | 6.625%, 1/15/2026 | | 150,938 |

| | | WPX Energy, Inc.: | | |

| 94M | | 6%, 1/15/2022 | | 91,885 |

| 50M | | 5.75%, 6/1/2026 | | 45,500 |

| | | | | 11,784,223 |

| | | Financials—5.7% | | |

| 350M | | Ally Financial, Inc., 8%, 11/1/2031 | | 390,250 |

| 250M | | Arch Merger Sub, Inc., 8.5%, 9/15/2025 (a) | | 226,800 |

| 225M | | Credit Suisse Group AG, 7.5%, 12/11/2023 (a) | | 229,387 |

| 275M | | CSTN Merger Sub, Inc., 6.75%, 8/15/2024 (a) | | 242,687 |

| | | DAE Funding, LLC: | | |

| 125M | | 5.75%, 11/15/2023 (a) | | 124,062 |

| 550M | | 5%, 8/1/2024 (a) | | 533,500 |

| | | Icahn Enterprises, LP: | | |

| 200M | | 6.25%, 2/1/2022 | | 198,000 |

| 275M | | 6.75%, 2/1/2024 | | 273,281 |

| 200M | | Intesa Sanpaolo SpA, 5.017%, 6/26/2024 (a) | | 181,588 |

| | | Ladder Capital Finance Holdings, LLLP: | | |

| 200M | | 5.25%, 3/15/2022 (a) | | 195,000 |

| 400M | | 5.25%, 10/1/2025 (a) | | 358,000 |

| 375M | | LPL Holdings, Inc., 5.75%, 9/15/2025 (a) | | 352,500 |

| 575M | | Navient Corp., 5.875%, 3/25/2021 | | 552,719 |

| | | Park Aerospace Holdings: | | |

| 81M | | 4.5%, 3/15/2023 (a) | | 75,938 |

| 525M | | 5.5%, 2/15/2024 (a) | | 507,938 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Financials(continued) | | |

| | | Springleaf Finance Corp.: | | |

| $ 175M | | 7.75%, 10/1/2021 | | $ 176,313 |

| 250M | | 5.625%, 3/15/2023 | | 231,250 |

| 250M | | 6.875%, 3/15/2025 | | 224,375 |

| 300M | | 7.125%, 3/15/2026 | | 268,313 |

| 200M | | UniCredit SpA, 5.861%, 6/19/2032 (a) | | 176,220 |

| 225M | | Wand Merger Corp., 8.125%, 7/15/2023 (a) | | 219,938 |

| | | | | 5,738,059 |

| | | Food/Beverage/Tobacco—1.7% | | |

| 50M | | HLF Financing Sarl, LLC, 7.25%, 8/15/2026 (a) | | 49,313 |

| 300M | | JBS USA LUX SA, 6.75%, 2/15/2028 (a) | | 293,625 |

| 275M | | Pilgrim’s Pride Corp., 5.875%, 9/30/2027 (a) | | 250,250 |

| | | Post Holdings, Inc.: | | |

| 250M | | 5.5%, 3/1/2025 (a) | | 240,890 |

| 400M | | 5.75%, 3/1/2027 (a) | | 377,000 |

| 550M | | Sigma Holdco BV, 7.875%, 5/15/2026 (a) | | 478,500 |

| | | | | 1,689,578 |

| | | Forest Products/Containers—2.6% | | |

| | | Ardagh Holdings USA, Inc.: | | |

| 200M | | 4.625%, 5/15/2023 (a) | | 191,500 |

| 875M | | 7.25%, 5/15/2024 (a) | | 876,094 |

| 250M | | Berry Global, Inc., 5.5%, 5/15/2022 | | 249,687 |

| 250M | | BWAY Holding Co., 5.5%, 4/15/2024 (a) | | 235,937 |

| | | Mercer International, Inc.: | | |

| 50M | | 7.75%, 12/1/2022 | | 51,625 |

| 175M | | 6.5%, 2/1/2024 | | 171,938 |

| 225M | | 7.375%, 1/15/2025 (a) | | 225,000 |

| 75M | | 5.5%, 1/15/2026 | | 67,500 |

| 250M | | Schweitzer-Mauduit International, Inc., 6.875%, 10/1/2026 (a) | | 235,625 |

| 325M | | Sealed Air Corp., 6.875%, 7/15/2033 (a) | | 325,813 |

| | | | | 2,630,719 |

| | | Gaming/Leisure—4.2% | | |

| | | Boyd Gaming Corp.: | | |

| 375M | | 6.875%, 5/15/2023 | | 380,156 |

| 200M | | 6%, 8/15/2026 | | 187,750 |

| 200M | | Cedar Fair, LP, 5.375%, 6/1/2024 | | 196,500 |

| 200M | | Golden Nugget, Inc., 8.75%, 10/1/2025 (a) | | 192,500 |

| 475M | | IRB Holding Corp., 6.75%, 2/15/2026 (a) | | 416,813 |

Portfolio of Investments(continued)

FUND FOR INCOME

December 31, 2018

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Gaming/Leisure(continued) | | |

| $ 400M | | Jack Ohio Finance, LLC, 6.75%, 11/15/2021 (a) | | $ 405,000 |

| 50M | | Lions Gate Entertainment Corp., 5.875%, 11/1/2024 (a) | | 49,625 |

| 200M | | MGM Resorts International, 6%, 3/15/2023 | | 201,500 |

| 250M | | National CineMedia, LLC, 6%, 4/15/2022 | | 251,563 |

| 525M | | Scientific Games International, Inc., 5%, 10/15/2025 (a) | | 469,875 |

| 175M | | Silversea Cruise Finance, Ltd., 7.25%, 2/1/2025 (a) | | 185,885 |

| 125M | | Six Flags Entertainment Corp., 4.875%, 7/31/2024 (a) | | 118,125 |

| 175M | | Stars Group Holdings BV, 7%, 7/15/2026 (a) | | 170,625 |

| | | Viking Cruises, Ltd.: | | |

| 600M | | 6.25%, 5/15/2025 (a) | | 594,000 |

| 175M | | 5.875%, 9/15/2027 (a) | | 163,625 |

| 250M | | Wynn Las Vegas, LLC, 5.5%, 3/1/2025 (a) | | 233,750 |

| | | | | 4,217,292 |

| | | Health Care—8.7% | | |

| 125M | | AMN Healthcare, Inc, 5.125%, 10/1/2024 (a) | | 120,000 |

| | | Bausch Health Cos., Inc.: | | |

| 50M | | 6.5%, 3/15/2022 (a) | | 50,375 |

| 200M | | 5.5%, 3/1/2023 (a) | | 183,750 |

| 450M | | 7%, 3/15/2024 (a) | | 455,625 |

| 325M | | 6.125%, 4/15/2025 (a) | | 284,375 |

| 325M | | 9%, 12/15/2025 (a) | | 324,594 |

| 200M | | 8.5%, 1/31/2027 (a) | | 194,500 |

| 375M | | Centene Corp., 6.125%, 2/15/2024 | | 384,844 |

| | | CHS/Community Health Systems, Inc.: | | |

| 100M | | 5.125%, 8/1/2021 | | 93,250 |

| 375M | | 6.25%, 3/31/2023 | | 342,206 |

| 250M | | Cimpress NV, 7%, 6/15/2026 (a) | | 241,250 |

| 825M | | DaVita, Inc., 5.125%, 7/15/2024 | | 775,500 |

| | | Endo Finance, LLC: | | |

| 175M | | 7.25%, 1/15/2022 (a) | | 152,250 |

| 225M | | 6%, 7/15/2023 (a) | | 172,687 |

| | | HCA, Inc.: | | |

| 250M | | 6.25%, 2/15/2021 | | 256,250 |

| 475M | | 5.875%, 5/1/2023 | | 482,125 |

| 225M | | 5.375%, 2/1/2025 | | 219,937 |

| 350M | | 5.875%, 2/15/2026 | | 349,125 |

| 150M | | 5.25%, 6/15/2026 | | 149,250 |

| 125M | | 5.5%, 6/15/2047 | | 118,750 |

| | | HealthSouth Corp.: | | |

| 175M | | 5.125%, 3/15/2023 | | 172,375 |

| 200M | | 5.75%, 11/1/2024 | | 198,750 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Health Care(continued) | | |

| | | Mallinckrodt Finance SB: | | |

| $ 100M | | 4.875%, 4/15/2020 (a) | | $ 97,000 |

| 275M | | 5.75%, 8/1/2022 (a) | | 237,875 |

| 225M | | 5.5%, 4/15/2025 (a) | | 156,375 |

| 300M | | MEDNAX, Inc., 6.25%, 1/15/2027 (a) | | 290,250 |

| | | Molina Healthcare, Inc.: | | |

| 400M | | 5.375%, 11/15/2022 | | 387,500 |

| 250M | | 4.875%, 6/15/2025 (a) | | 229,063 |

| 125M | | MPH Operating Partnership, LP, 7.125%, 6/1/2024 (a) | | 116,875 |

| 250M | | Polaris Intermediate Corp., 8.5%, 12/1/2022 (a) | | 228,967 |

| 216M | | RegionalCare Hospital Partners Holdings, Inc., 8.25%, 5/1/2023 (a) | | 218,970 |

| 450M | | Syneos Health, Inc., 7.5%, 10/1/2024 (a) | | 470,250 |

| 100M | | Tenet Healthcare Corp., 5.125%, 5/1/2025 | | 93,500 |

| 464M | | Universal Hospital Services, Inc., 7.625%, 8/15/2020 | | 461,100 |

| | | | | 8,709,493 |

| | | Home-Building—.2% | | |

| 250M | | William Lyon Homes, Inc., 6%, 9/1/2023 | | 226,250 |