Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2009

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 1-13283

PENN VIRGINIA CORPORATION

(Exact name of registrant as specified in its charter)

| Virginia | 23-1184320 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

THREE RADNOR CORPORATE CENTER, SUITE 300

100 MATSONFORD ROAD

RADNOR, PA 19087

| (Address of principal executive offices) | (Zip Code) |

(610) 687-8900

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (“Exchange Act”) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by a check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer x Accelerated filer ¨ | ||

Non-accelerated filer ¨ (Do not check if a smaller reporting company) Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

As of May 7, 2009, 41,883,830 shares of common stock of the registrant were outstanding.

Table of Contents

PENN VIRGINIA CORPORATION AND SUBSIDIARIES

| Page | ||||

PART I. | Financial Information | |||

Item 1. | Financial Statements | |||

| Consolidated Statements of Income for the Three Months Ended March 31, 2009 and 2008 | 1 | |||

| Consolidated Balance Sheets as of March 31, 2009 and December 31, 2008 | 2 | |||

| Consolidated Statements of Cash Flows for the Three Months Ended March 31, 2009 and 2008 | 3 | |||

| Notes to Consolidated Financial Statements | 4 | |||

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 22 | ||

Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 51 | ||

Item 4. | Controls and Procedures | 55 | ||

PART II. | Other Information | |||

Item 6. | Exhibits | 56 | ||

Table of Contents

PART I. FINANCIAL INFORMATION

| Item 1 | Financial Statements |

PENN VIRGINIA CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME — unaudited

(in thousands, except per share data)

| Three Months Ended March 31, | ||||||||

| 2009 | 2008 | |||||||

Revenues | ||||||||

Natural gas | $ | 52,821 | $ | 80,513 | ||||

Crude oil | 6,328 | 9,215 | ||||||

Natural gas liquids (NGLs) | 3,370 | 1,868 | ||||||

Natural gas midstream | 95,206 | 125,048 | ||||||

Coal royalties | 30,630 | 23,962 | ||||||

Other | 10,805 | 8,529 | ||||||

Total revenues | 199,160 | 249,135 | ||||||

Expenses | ||||||||

Cost of midstream gas purchased | 79,398 | 99,697 | ||||||

Operating | 22,702 | 21,002 | ||||||

Exploration (see Note 13) | 21,312 | 4,680 | ||||||

Taxes other than income | 6,432 | 7,395 | ||||||

General and administrative | 18,486 | 17,659 | ||||||

Impairments | 1,196 | — | ||||||

Depreciation, depletion and amortization | 57,073 | 38,569 | ||||||

Total expenses | 206,599 | 189,002 | ||||||

Operating income (loss) | (7,439 | ) | 60,133 | |||||

Other income (expense) | ||||||||

Interest expense | (12,502 | ) | (10,747 | ) | ||||

Other | 1,573 | 2,331 | ||||||

Derivatives | 10,255 | (25,901 | ) | |||||

Income (loss) before income taxes and noncontrolling interests | (8,113 | ) | 25,816 | |||||

Income tax benefit (expense) | 4,562 | (2,594 | ) | |||||

Net income (loss) | (3,551 | ) | 23,222 | |||||

Less net income attributable to noncontrolling interests | (3,658 | ) | (20,028 | ) | ||||

Net income (loss) attributable to Penn Virginia Corporation | $ | (7,209 | ) | $ | 3,194 | |||

Earnings per share – basic and diluted (see Note 10): | ||||||||

Net income (loss) per share attributable to Penn Virginia Corporation common shareholders, basic | $ | (0.17 | ) | $ | 0.08 | |||

Net income (loss) per share attributable to Penn Virginia Corporation common shareholders, diluted | $ | (0.17 | ) | $ | 0.07 | |||

Weighted average shares outstanding, basic | 41,922 | 41,558 | ||||||

Weighted average shares outstanding, diluted | 41,922 | 41,803 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

1

Table of Contents

PENN VIRGINIA CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS — unaudited

(in thousands, except share data)

| March 31, 2009 | December 31, 2008 | |||||||

Assets | ||||||||

Current assets | ||||||||

Cash and cash equivalents | $ | 29,721 | $ | 18,338 | ||||

Accounts receivable, net of allowance for doubtful accounts | 110,443 | 149,241 | ||||||

Derivative assets | 62,727 | 67,569 | ||||||

Inventory | 17,993 | 18,468 | ||||||

Other current assets | 10,980 | 9,902 | ||||||

Total current assets | 231,864 | 263,518 | ||||||

Property and equipment | ||||||||

Oil and gas properties (successful efforts method) | 2,176,467 | 2,107,128 | ||||||

Other property and equipment | 1,092,922 | 1,076,471 | ||||||

| 3,269,389 | 3,183,599 | |||||||

Accumulated depreciation, depletion and amortization | (726,585 | ) | (671,422 | ) | ||||

Net property and equipment | 2,542,804 | 2,512,177 | ||||||

Equity investments | 80,003 | 78,443 | ||||||

Intangibles, net | 90,817 | 92,672 | ||||||

Derivative assets | 1,276 | 4,070 | ||||||

Other assets | 53,734 | 45,685 | ||||||

Total assets | $ | 3,000,498 | $ | 2,996,565 | ||||

Liabilities and Shareholders’ Equity | ||||||||

Current liabilities | ||||||||

Short-term borrowings | $ | — | $ | 7,542 | ||||

Accounts payable and accrued liabilities | 157,307 | 206,902 | ||||||

Derivative liabilities | 17,741 | 15,534 | ||||||

Deferred taxes | 15,292 | 17,598 | ||||||

Income taxes payable | — | 18 | ||||||

Total current liabilities | 190,340 | 247,594 | ||||||

Other liabilities | 45,011 | 45,887 | ||||||

Derivative liabilities | 7,550 | 8,721 | ||||||

Deferred income taxes | 255,964 | 258,037 | ||||||

Convertible Notes (see Note 7) | 201,545 | 199,896 | ||||||

Revolving Credit Facility | 390,000 | 332,000 | ||||||

Long-term debt of PVR | 595,100 | 568,100 | ||||||

Shareholders’ equity: | ||||||||

Penn Virginia Corporation Shareholders’ Equity: | ||||||||

Preferred stock of $100 par value – 100,000 shares authorized; none issued | — | — | ||||||

Common stock of $0.01 par value – 64,000,000 shares authorized; 41,883,695 and 41,870,893 shares issued and outstanding at March 31, 2009 and December 31, 2008 | 230 | 230 | ||||||

Paid-in capital | 599,984 | 599,855 | ||||||

Retained earnings | 434,087 | 443,646 | ||||||

Deferred compensation obligation | 2,012 | 2,237 | ||||||

Accumulated other comprehensive loss | (3,931 | ) | (4,182 | ) | ||||

Treasury stock – 81,257 and 95,378 shares common stock, at cost, on March 31, 2009 and December 31, 2008 | (2,459 | ) | (2,683 | ) | ||||

Total Penn Virginia Corporation shareholders’ equity | 1,029,923 | 1,039,103 | ||||||

Noncontrolling interests of subsidiaries (see Note 4) | 285,065 | 297,227 | ||||||

Total shareholders’ equity | 1,314,988 | 1,336,330 | ||||||

Total liabilities and shareholders’ equity | $ | 3,000,498 | $ | 2,996,565 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

2

Table of Contents

PENN VIRGINIA CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS — unaudited

(in thousands)

| Three Months Ended March 31, | ||||||||

| 2009 | 2008 | |||||||

Cash flows from operating activities | ||||||||

Net income (loss) | $ | (3,551 | ) | $ | 23,222 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

Depreciation, depletion and amortization | 57,073 | 38,569 | ||||||

Impairments | 1,196 | — | ||||||

Derivative contracts: | ||||||||

Total derivative losses (gains) | (9,801 | ) | 27,009 | |||||

Cash received (paid) to settle derivatives | 19,148 | (8,953 | ) | |||||

Deferred income taxes | (4,634 | ) | 2,142 | |||||

Dry hole and unproved leasehold expense | 10,504 | 3,553 | ||||||

Non-cash interest expense | 2,711 | 1,952 | ||||||

Other | 780 | (2,918 | ) | |||||

Changes in operating assets and liabilities | 29,593 | (18,424 | ) | |||||

Net cash provided by operating activities | 103,019 | 66,152 | ||||||

Cash flows from investing activities | ||||||||

Acquisitions | (3,073 | ) | (4,740 | ) | ||||

Additions to property and equipment | (136,213 | ) | (108,662 | ) | ||||

Other | 254 | 405 | ||||||

Net cash used in investing activities | (139,032 | ) | (112,997 | ) | ||||

Cash flows from financing activities | ||||||||

Dividends paid | (2,349 | ) | (2,344 | ) | ||||

Distributions paid to noncontrolling interests holders | (18,455 | ) | (13,740 | ) | ||||

Repayments of bank borrowings | (7,542 | ) | — | |||||

Proceeds from Company borrowings | 58,000 | 54,000 | ||||||

Proceeds from borrowings of PVR | 27,000 | 25,000 | ||||||

Repayments of borrowings of PVR | — | (23,000 | ) | |||||

Other | (9,258 | ) | 5,282 | |||||

Net cash provided by financing activities | 47,396 | 45,198 | ||||||

Net increase (decrease) in cash and cash equivalents | 11,383 | (1,647 | ) | |||||

Cash and cash equivalents – beginning of period | 18,338 | 34,527 | ||||||

Cash and cash equivalents – end of period | $ | 29,721 | $ | 32,880 | ||||

Supplemental disclosures: | ||||||||

Cash paid during the periods for: | ||||||||

Interest (net of amounts capitalized) | $ | 10,286 | $ | 7,237 | ||||

Income taxes | $ | 2,269 | $ | 1,245 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

3

Table of Contents

PENN VIRGINIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — unaudited

March 31, 2009

1. Nature of Operations

Penn Virginia Corporation (“Penn Virginia,” the “Company,” “we,” “us” or “our”) is an independent oil and gas company primarily engaged in the development, exploration and production of natural gas and oil in various domestic onshore regions including East Texas, the Mid-Continent, Appalachia, Mississippi and the Gulf Coast. We also indirectly own partner interests in Penn Virginia Resource Partners, L.P. (“PVR”), a publicly traded limited partnership formed by us in 2001. Our ownership interests in PVR are held principally through our general partner interest and 77% limited partner interests in Penn Virginia GP Holdings, L.P. (“PVG”), a publicly traded limited partnership formed by us in 2006. As of March 31, 2009, PVG owned an approximately 37% limited partner interest in PVR and 100% of the general partner of PVR, which holds a 2% general partner interest in PVR and all of the incentive distribution rights (“IDRs”).

We are engaged in three primary business segments: (i) oil and gas, (ii) coal and natural resource management and (iii) natural gas midstream. We directly operate our oil and gas segment and PVR operates our coal and natural resource management and natural gas midstream segments. Because PVG controls the general partner of PVR, the financial results of PVR are included in PVG’s consolidated financial statements. Because we control the general partner of PVG, the financial results of PVG are included in our consolidated financial statements. However, PVG and PVR function with capital structures that are independent of each other and us, with each having publicly traded common units and PVR having its own debt instruments. PVG does not currently have any debt instruments.

2. Penn Virginia Resource Partners, L.P. and Penn Virginia GP Holdings, L.P.

PVR is principally engaged in the management of coal and natural resource properties and the gathering and processing of natural gas in the United States. PVG derives its cash flow solely from cash distributions received from PVR. PVG’s general partner is an indirect wholly owned subsidiary of ours.

PVR’s coal and natural resource management segment primarily involves the management and leasing of coal properties and the subsequent collection of royalties. PVR’s coal reserves are primarily located in Kentucky, Virginia, West Virginia, Illinois and New Mexico. PVR also earns revenues from other land management activities, such as selling standing timber, leasing fee-based coal-related infrastructure facilities to certain lessees and end-user industrial plants, collecting oil and gas royalties and from coal transportation, or wheelage, fees.

PVR’s natural gas midstream segment is engaged in providing natural gas processing, gathering and other related services. PVR owns and operates natural gas midstream assets located in Oklahoma and Texas. PVR’s natural gas midstream business derives revenues primarily from gas processing contracts with natural gas producers and from fees charged for gathering natural gas volumes and providing other related services. In addition, PVR owns a 25% member interest in Thunder Creek Gas Services, LLC (“Thunder Creek”), a joint venture that gathers and transports coalbed methane in Wyoming’s Powder River Basin. PVR also owns a natural gas marketing business, which aggregates third-party volumes and sells those volumes into intrastate pipeline systems and at market hubs accessed by various interstate pipelines.

3. Summary of Significant Accounting Policies

Our accounting policies are consistent with those described in our Annual Report on Form 10-K for the year ended December 31, 2008. Please refer to such Form 10-K for a further discussion of those policies.

Basis of Presentation

Our consolidated financial statements include the accounts of Penn Virginia and all of its subsidiaries, including PVG and PVR. Intercompany balances and transactions have been eliminated in consolidation. Our consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United

4

Table of Contents

States of America. These statements involve the use of estimates and judgments where appropriate. In the opinion of management, all adjustments, consisting of normal recurring accruals, considered necessary for a fair presentation of our consolidated financial statements have been included. Our consolidated financial statements should be read in conjunction with our consolidated financial statements and footnotes included in our Annual Report on Form 10-K for the year ended December 31, 2008. Operating results for the three months ended March 31, 2009 are not necessarily indicative of the results that may be expected for the year ending December 31, 2009.

New Accounting Standards

In April 2009, the Financial Accounting Standards Board (“FASB”) issued FSP FAS 107-1 and APB 28-1,Interim Disclosures About Fair Value of Financial Instruments (“FSP FAS 107-1 and APB 28-1”). This FSP requires disclosures about the fair value of financial instruments whenever we issue financial statements. The disclosures outlined in FSP FAS 107-1 and APB 28-1 are required for interim and annual periods ending after June 15, 2009. Early adoption is permitted for periods ending after March 15, 2009, and we have elected to adopt this FSP for the three months ended March 31, 2009. This FSP does not require disclosures for earlier periods presented for comparative purposes at initial adoption. See Note 5, “Fair Value Measurements” for the disclosure required under FSP FAS 107-1 and APB 28-1.

In April 2009, the FASB issued FSP FAS 141(R)-1,Accounting for Assets Acquired and Liabilities Assumed in a Business Combination That Arise from Contingencies (“FSP FAS 141(R)-1”). This FSP requires us to recognize assets acquired or liabilities assumed in a business combination that arise from a contingency if the acquisition-date fair value of that asset or liability can be determined during the measurement period. If the acquisition-date fair value of an asset acquired or a liability assumed in a business combination that arises from a contingency cannot be determined during the measurement period, an asset or liability shall be recognized at the acquisition at the amount that would be recognized in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 5,Accounting for Contingencies and FASB Interpretation No. 14,Reasonable Estimation of the Amount of a Loss—an interpretation of FASB Statement No. 5. Certain disclosures are also required under this FSP. FSP FAS 141(R)-1 is effective for assets or liabilities arising from contingencies in business combinations for which the acquisition date is on or after December 15, 2008. We have had no material acquisitions since our adoption of this FSP. For each acquisition that includes assets acquired or liabilities assumed arising from contingencies, we will determine the fair value of the assets or liabilities and will make the appropriate disclosures.

5

Table of Contents

4. Noncontrolling Interests

We adopted SFAS No. 160,Noncontrolling Interests in Consolidated Financial Statements, effective January 1, 2009. SFAS No. 160 requires that noncontrolling interests in PVG and PVR be classified as a separate component of shareholders’ equity. Net income attributable to the noncontrolling interests in PVG and PVR is separately presented on the consolidated statements of income, applied retrospectively for all periods presented.

The following is a reconciliation of the carrying amount of total shareholders’ equity, shareholders’ equity attributable to us and shareholders’ equity attributable to the noncontrolling interests in PVG and PVR:

| Penn Virginia Corporation Shareholders | Noncontrolling Interests | Total Shareholders’ Equity | Comprehensive Income (Loss) | |||||||||||||

| (in thousands) | ||||||||||||||||

Balance at December 31, 2008 | $ | 1,039,103 | $ | 297,227 | $ | 1,336,330 | ||||||||||

Dividends paid ($0.05625 per share) | (2,349 | ) | — | (2,349 | ) | |||||||||||

Distributions to noncontrolling interest holders | — | (18,455 | ) | (18,455 | ) | |||||||||||

Other changes to shareholders’ equity | 127 | 2,412 | 2,539 | |||||||||||||

Comprehensive Income: | ||||||||||||||||

Net income (loss) | (7,209 | ) | 3,658 | (3,551 | ) | (3,551 | ) | |||||||||

Hedging unrealized loss, net of tax of ($205) | (28 | ) | (353 | ) | (381 | ) | (381 | ) | ||||||||

Hedging reclassification adjustment, net of tax of $442 | 244 | 576 | 820 | 820 | ||||||||||||

Other, net of tax of $19 | 35 | — | 35 | 35 | ||||||||||||

Balance at March 31, 2009 | $ | 1,029,923 | $ | 285,065 | $ | 1,314,988 | $ | (3,077 | ) | |||||||

Balance at December 31, 2007 | $ | 835,793 | $ | 174,420 | $ | 1,010,213 | ||||||||||

Dividends paid ($0.05625 per share) | (2,344 | ) | — | (2,344 | ) | |||||||||||

Distributions to noncontrolling interest holders | — | (13,740 | ) | (13,740 | ) | |||||||||||

Other changes to shareholders’ equity | 3,510 | 1,703 | 5,213 | |||||||||||||

Comprehensive Income: | ||||||||||||||||

Net income | 3,194 | 20,028 | 23,222 | 23,222 | ||||||||||||

Hedging unrealized loss, net of tax of ($2,343) | (1,060 | ) | (3,291 | ) | (4,351 | ) | (4,351 | ) | ||||||||

Hedging reclassification adjustment, net of tax of $303 | 24 | 538 | 562 | 562 | ||||||||||||

Other, net of tax of $22 | 41 | — | 41 | 41 | ||||||||||||

Balance at March 31, 2008 | $ | 839,158 | $ | 179,658 | $ | 1,018,816 | $ | 19,474 | ||||||||

5. Fair Value Measurements

We adopted SFAS No. 157,Fair Value Measurements, effective January 1, 2008, for financial assets and liabilities measured on a recurring basis. FASB Staff Position FAS 157-2,Effective Date of FASB Statement No. 157 (“FSP FAS 157-2”), delayed the application of SFAS No. 157 for nonfinancial assets and liabilities to fiscal years and interim periods beginning after November 15, 2008. Prior to the adoption of FSP FAS 157-2, we only applied fair value measurements to our financial assets and liabilities. Effective January 1, 2009, SFAS No. 157 now applies to both financial and nonfinancial assets and liabilities that are measured and reported on a fair value basis.

Our financial instruments consist of cash and cash equivalents, receivables, accounts payable, derivative instruments and long-term debt. At March 31, 2009, the carrying values of all of these financial instruments, except the convertible senior subordinated notes (“Convertible Notes”) portion of our long-term debt, approximated fair value. The fair value of the Convertible Notes portion of our long-term debt at March 31, 2009 was $137.4 million, which was derived from quoted market prices.

6

Table of Contents

SFAS No. 157 defines fair value, establishes a framework for measuring fair value and requires enhanced disclosures about fair value measurements. SFAS No. 157 requires fair value measurements to be classified and disclosed in one of the following three categories:

| • | Level 1: Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities. Level 1 inputs generally provide the most reliable evidence of fair value. |

| • | Level 2: Quoted prices in markets that are not active or inputs, which are observable, either directly or indirectly, for substantially the full term of the asset or liability. |

| • | Level 3: Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (i.e., supported by little or no market activity). |

The following table summarizes the valuation of certain assets and liabilities by the above SFAS No. 157 categories as of March 31, 2009 (in thousands):

| Fair Value Measurement at March 31, 2009, Using | |||||||||||||||

| Description | Fair Value Measurements, March 31, 2009 | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | |||||||||||

Marketable securities – noncurrent asset | $ | 4,559 | $ | 4,559 | $ | — | $ | — | |||||||

Deferred compensation – noncurrent liability | (4,769 | ) | (4,769 | ) | — | — | |||||||||

Oil and gas properties – current | 4,394 | — | 4,394 | ||||||||||||

Interest rate swap liability – current | (8,947 | ) | — | (8,947 | ) | — | |||||||||

Interest rate swap liability – noncurrent | (7,550 | ) | — | (7,550 | ) | — | |||||||||

Commodity derivative assets – current | 62,727 | — | 62,727 | — | |||||||||||

Commodity derivative assets – noncurrent | 1,276 | — | 1,276 | — | |||||||||||

Commodity derivative liability – current | 8,794 | — | 8,794 | — | |||||||||||

Total | $ | 60,484 | $ | (210 | ) | $ | 56,300 | $ | 4,394 | ||||||

See Note 6 – “Derivative Instruments,” for the effects of derivative instruments on our consolidated financial statements.

We use the following methods and assumptions to estimate the fair values in the above table:

| • | Marketable securities: Our marketable securities consist of various publicly traded equities. The fair values are based on quoted market prices, which are Level 1 inputs. |

| • | Deferred compensation: The fair values for deferred compensation are based on quoted market prices of the underlying securities, which are Level 1 inputs. |

| • | Oil and gas segment properties: In accordance with the provisions of SFAS No. 144,Accounting for the Impairment or Disposal of Long-Lived Assets, oil and gas properties of $5.6 million were written down to their fair value of $4.4 million, resulting in impairment. See Note 9, “Impairments and Unproved Leasehold Expense” for a further description of the impairment charge. The fair value of the oil and gas properties is estimated to be the present value of future net cash flows from the underlying reserves, using a forward strip commodity price discounted at a rate commensurate with the risk and remaining life of the asset. This is a Level 3 input. |

| • | Commodity derivative instruments: Both our oil and gas commodity derivatives and PVR’s natural gas midstream segment commodity derivatives utilize collar derivative contracts, commodity price swaps and three-way collar derivative contracts. PVR also utilizes a combination of collar derivative contracts and commodity price swaps to hedge against the variability in its frac spread. We determine the fair values of our oil and gas derivative agreements based on discounted cash flows derived from third-party quoted forward prices for NYMEX Henry Hub gas and West Texas Intermediate crude oil forward prices as of March 31, 2009. PVR determines the fair values of its commodity derivative |

7

Table of Contents

agreements based on discounted cash flows based on quoted forward prices for the respective commodities, and use discount rates adjusted for the credit risk of the counterparties if the derivative is in an asset position and our own credit risk for derivatives in a liability position. We generally use the income approach, using valuation techniques that convert future cash flows to a single discounted value. Each of these is a Level 2 input. See Note 6 – “Derivative Instruments.” |

| • | Interest rate swaps: We have entered into interest rate swaps (the “Interest Rate Swaps”) to establish fixed rates on a portion of the outstanding borrowings under our revolving credit facility (the “Revolver”). PVR has entered into interest rate swaps (the “PVR Interest Rate Swaps”) to establish fixed rates on a portion of the outstanding borrowings under PVR’s revolving credit facility (the “PVR Revolver”). We use an income approach using valuation techniques that connect future cash flows to a single discounted value. We estimate the fair value of the swaps based on published interest rate yield curves as of the date of the estimate, and use discount rates adjusted for the credit risk of the counterparties if the derivative is in an asset position and our own credit risk for derivatives in a liability position. Each of these is a Level 2 input. See Note 6 – “Derivative Instruments.” |

6. Derivative Instruments

For commodity derivative instruments, we recognize changes in fair values in earnings currently, rather than deferring such amounts in accumulated other comprehensive income (“AOCI”) within shareholders’ equity.

Oil and Gas Segment Commodity Derivatives

We utilize costless collars, price swaps and three-way collar derivative contracts to hedge against the variability in cash flows associated with forecasted sales of our future oil and gas production. While the use of derivative instruments limits the risk of adverse price movements, such use may also limit future revenues or cost savings from favorable price movements.

The counterparty to a costless collar contract is required to make a payment to us if the settlement price for any settlement period is below the floor price for such contract. We are required to make a payment to the counterparty if the settlement price for any settlement period is above the ceiling price for such contract. Neither party is required to make a payment to the other party if the settlement price for any settlement period is equal to or greater than the floor price and equal to or less than the ceiling price for such contract. The counterparty to a swap contract is required to make a payment to us if the settlement price for any settlement period is less than the swap price for such contract, and we are required to make a payment to the counterparty if the settlement price for any settlement period is greater than the swap price for such contract.

A three-way collar contract consists of a collar contract plus a put option contract sold by us with a price below the floor price of the collar. The counterparty to a collar contract is required to make a payment to us if the settlement price for any settlement period is below the floor price for such contract. We are required to make a payment to the counterparty if the settlement price for any settlement period is above the ceiling price for such contract. Neither party is required to make a payment to the other party if the settlement price for any settlement period is equal to or greater than the floor price and equal to or less than the ceiling price for such contract. The additional put option sold by us requires us to make a payment to the counterparty if the settlement price for any settlement period is below the put option price. By combining the collar contract with the additional put option, we are entitled to a net payment equal to the difference between the floor price of the collar contract and the additional put option price if the settlement price is equal to or less than the additional put option price. If the settlement price is greater than the additional put option price, the result is the same as it would have been with a collar contract only. If market prices are below the additional put option, we would be entitled to receive the market price plus the difference between the additional put option and the floor.

We determine the fair values of our oil and gas derivative agreements based on discounted cash flows derived from third-party forward quoted prices for NYMEX Henry Hub gas and West Texas Intermediate crude oil forward prices as of March 31, 2009. The discounted cash flows utilize discount rates adjusted for the credit risk of our counterparties for derivatives in an asset position and our own credit risk derivatives in a liability position, in

8

Table of Contents

accordance with SFAS No. 157. The following table sets forth our commodity derivative positions as of March 31, 2009:

| Weighted Average Price | Estimated Fair Value (in thousands) | ||||||||||||||

| Average Volume Per Day | Additional Put Option | Floor | Ceiling | ||||||||||||

| (in MMBtus) | (per MMBtu) | ||||||||||||||

Natural Gas Costless Collars | |||||||||||||||

Second Quarter 2009 | 15,000 | $ | 4.25 | $ | 5.70 | 791 | |||||||||

Third Quarter 2009 | 15,000 | $ | 4.25 | $ | 5.70 | 633 | |||||||||

Fourth Quarter 2009 | 15,000 | $ | 4.25 | $ | 5.70 | (89 | ) | ||||||||

First Quarter 2010 | 35,000 | $ | 4.96 | $ | 7.41 | (101 | ) | ||||||||

Second Quarter 2010 | 30,000 | $ | 5.33 | $ | 8.02 | 1,077 | |||||||||

Third Quarter 2010 | 30,000 | $ | 5.33 | $ | 8.02 | 653 | |||||||||

Fourth Quarter 2010 | 30,000 | $ | 5.42 | $ | 8.67 | 276 | |||||||||

First Quarter 2011 | 30,000 | $ | 5.42 | $ | 8.67 | (730 | ) | ||||||||

| (in MMBtus) | (per MMBtu) | ||||||||||||||

Natural Gas Three-way Collars | |||||||||||||||

Second Quarter 2009 | 40,000 | $ | 6.38 | $ | 8.75 | $ | 10.79 | 8,577 | |||||||

Third Quarter 2009 | 40,000 | $ | 6.38 | $ | 8.75 | $ | 10.79 | 8,234 | |||||||

Fourth Quarter 2009 | 30,000 | $ | 6.83 | $ | 9.50 | $ | 13.60 | 6,358 | |||||||

First Quarter 2010 | 30,000 | $ | 6.83 | $ | 9.50 | $ | 13.60 | 5,527 | |||||||

| (in MMBtus) | (per MMBtu) | ||||||||||||||

Natural Gas Swaps | |||||||||||||||

Second Quarter 2009 | 40,000 | $ | 4.91 | 4,095 | |||||||||||

Third Quarter 2009 | 40,000 | $ | 4.91 | 2,735 | |||||||||||

Fourth Quarter 2009 | 40,000 | $ | 4.91 | (105 | ) | ||||||||||

| (Bbl) | (Bbl) | ||||||||||||||

Crude Oil Three-way Collars | |||||||||||||||

Second Quarter 2009 | 500 | $ | 80.00 | $ | 110.00 | $ | 179.00 | 1,372 | |||||||

Third Quarter 2009 | 500 | $ | 80.00 | $ | 110.00 | $ | 179.00 | 1,326 | |||||||

Fourth Quarter 2009 | 500 | $ | 80.00 | $ | 110.00 | $ | 179.00 | 1,261 | |||||||

Settlements to be paid in subsequent period | 421 | ||||||||||||||

Oil and gas segment commodity derivatives – net asset | $ | 42,311 | |||||||||||||

At March 31, 2009, we reported a net derivative asset related to the oil and gas commodity derivatives of $42.3 million. See theFinancial Statement Impact of Derivatives section below for the impact of the oil and gas commodity derivatives on our consolidated financial statements.

PVR Natural Gas Midstream Segment Commodity Derivatives

PVR utilizes three-way collar derivative contracts to hedge against the variability in cash flows associated with anticipated natural gas midstream revenues and cost of midstream gas purchased. PVR also utilizes a combination of collar derivative contracts and swap contracts to hedge against the variability in its frac spread. PVR’s frac spread is the spread between the purchase price for the natural gas PVR purchases from producers and the sale price for natural gas liquids (“NGLs”) that PVR sells after processing. PVR hedges against the variability in its frac spread by entering into costless collar and swap derivative contracts to sell NGLs forward at a predetermined commodity price and to purchase an equivalent volume of natural gas forward on an MMBtu basis. While the use of derivative instruments limits the risk of adverse price movements, such use may also limit future revenues or cost savings from favorable price movements.

9

Table of Contents

PVR determines the fair values of its derivative agreements based on discounted cash flows based on forward quoted prices for the respective commodities as of March 31, 2009, using discount rates adjusted for the credit risk of the counterparties if the derivative is in an asset position and PVR’s own credit risk for derivatives in a liability position. The following table sets forth PVR’s positions as of March 31, 2009 for commodities related to natural gas midstream revenues and cost of midstream gas purchased:

| Weighted Average Price Collars | ||||||||||||||

| Average Volume Per Day | Additional Put Option | Put | Call | Fair Value (in thousands) | ||||||||||

| (in barrels) | (per barrel) | |||||||||||||

Crude Oil Three-way Collar | ||||||||||||||

Second Quarter 2009 through Fourth Quarter 2009 | 1,000 | $ | 70.00 | $ | 90.00 | $ | 119.25 | $ | 4,939 | |||||

| (in MMBtu) | (per MMBtu) | |||||||||||||

Frac Spread Collar | ||||||||||||||

Second Quarter 2009 through Fourth Quarter 2009 | 6,000 | $ | 9.09 | $ | 13.94 | 5,594 | ||||||||

Settlements to be received in subsequent period | 2,366 | |||||||||||||

Natural gas midstream segment commodity derivatives – net asset | $ | 12,899 | ||||||||||||

At March 31, 2009, PVR reported a net derivative asset related to the natural gas midstream segment of $12.9 million. See theFinancial Statement Impact of Derivativessection below for the impact of the PVR natural gas midstream commodity derivatives on our consolidated financial statements.

Interest Rate Swaps

We have entered into the Interest Rate Swaps to establish fixed rates on a portion of the outstanding borrowings under the Revolver until December 2010. The notional amounts of the Interest Rate Swaps total $50.0 million, or approximately 13% of our total long-term debt outstanding under the Revolver at March 31, 2009. We will pay a weighted average fixed rate of 5.34% on the notional amount, and the counterparties will pay a variable rate equal to the three-month London Interbank Offered Rate (“LIBOR”). Settlements on the Interest Rate Swaps are recorded as interest expense. We reported a (i) net derivative liability of $3.4 million at March 31, 2009 and (ii) loss in AOCI of $2.2 million, net of the related income tax benefit of $1.2 million, at March 31, 2009 related to the Interest Rate Swaps. In connection with periodic settlements, we recognized $0.3 million in net hedging losses, net of the related income tax benefit of $0.1 million, on the Interest Rate Swaps in interest expense in the three months ended March 31, 2009. See theFinancial Statement Impact of Derivativessection below for the impact of the Interest Rate Swaps on our consolidated financial statements.

During the first quarter of 2009, we discontinued hedge accounting for all of the Interest Rate Swaps. Accordingly, subsequent fair value gains and losses for the Interest Rate Swaps are recognized in earnings currently. At March 31, 2009, a $2.2 million loss remained in AOCI related to these discontinued Interest Rate Swaps hedges. The $2.2 million loss will be recognized in earnings through the end of 2011 as the originally forecasted transactions occur.

PVR Interest Rate Swaps

PVR has entered into the PVR Interest Rate Swaps to establish fixed rates on a portion of the outstanding borrowings under the PVR Revolver. The following table sets forth the PVR Interest Rate Swap positions at March 31, 2009:

| Dates | Notional Amounts | Weighted-Average Fixed Rate | |||

| (in millions) | |||||

Until March 2010 | $ | 310.0 | 3.54% | ||

March 2010 – December 2011 | $ | 250.0 | 3.37% | ||

December 2011– December 2012 | $ | 100.0 | 2.09% | ||

10

Table of Contents

The notional amount of $310.0 million represents approximately 52% of PVR’s total long-term debt outstanding at March 31, 2009. The weighted-average fixed rate is paid by PVR based on the notional amount, with the counterparties paying a variable rate equal to the three-month LIBOR. The PVR Interest Rate Swaps extend one year past the maturity of the PVR Revolver. The PVR Interest Rate Swaps have been entered into with seven financial institution counterparties, with no counterparty having more than 24% of the open positions.

During the first quarter of 2009, PVR discontinued hedge accounting for all of the PVR Interest Rate Swaps. Accordingly, subsequent fair value gains and losses for the PVR Interest Rate Swaps are recognized in earnings currently. At March 31, 2009, a $3.9 million loss remained in AOCI related to these discontinued PVR Interest Rate Swap hedges. The $3.9 million loss will be recognized in earnings through the end of 2011 as the originally forecasted transactions occur.

PVR reported a (i) net derivative liability of $13.1 million at March 31, 2009 and (ii) loss in AOCI of $3.9 million at March 31, 2009 related to the PVR Interest Rate Swaps. In connection with periodic settlements, PVR recognized $0.8 million of net hedging losses in interest expense in the three months ended March 31, 2009. See theFinancial Statement Impact of Derivativessection below for the impact of the PVR Interest Rate Swaps on our consolidated financial statements.

Financial Statement Impact of Derivatives

In the three months ended March 31, 2009, we reclassified a total of $0.8 million, net of income tax expense of $0.5 million, out of AOCI and into earnings. We also recorded unrealized hedging losses of $0.4 million, net of income tax benefit of $0.2 million, in AOCI in the three months ended March 31, 2009 related to the Interest Rate Swaps and the PVR Interest Rate Swaps. See Note 4, “Noncontrolling Interests,” for a detailed schedule of our AOCI.

The following table summarizes the effects of our consolidated derivative activities, as well as the location of the gains and losses, on our consolidated statements of income for the three months ended March 31, 2009 and 2008 (in thousands):

Location of gain (loss) on | Three Months Ended March 31, | |||||||||

| Derivatives de-designated as hedging instruments under SFAS No. 133: | 2009 | 2008 | ||||||||

Interest rate contracts (1) | Interest expense | $ | (1,263 | ) | $ | 243 | ||||

Increase (decrease) in net income resulting from derivatives | $ | (1,263 | ) | $ | 243 | |||||

Derivatives not designated as hedging instruments under SFAS No. 133: | ||||||||||

Interest rate contracts | Derivatives | $ | (1,114 | ) | $ | — | ||||

Commodity contracts (1) | Natural gas midstream revenues | — | (2,251 | ) | ||||||

Commodity contracts (1) | Cost of midstream gas purchased | — | 1,143 | |||||||

Commodity contracts | Derivatives | 11,369 | (25,901 | ) | ||||||

Increase (decrease) in net income resulting from derivatives not designated as hedging instruments under SFAS No. 133 | $ | 10,255 | $ | (27,009 | ) | |||||

Total increase (decrease) in net income resulting from derivatives | $ | 8,992 | $ | (26,766 | ) | |||||

Realized and unrealized derivative impact: | ||||||||||

Cash received (paid) for commodity and interest rate contract settlements | Derivatives | $ | 19,148 | $ | (8,953 | ) | ||||

Cash paid for interest rate contract settlements | Interest expense | (808 | ) | 243 | ||||||

Unrealized derivative gain | (2) | (9,348 | ) | (18,056 | ) | |||||

Total increase (decrease) in net income resulting from derivatives | $ | 8,992 | $ | (26,766 | ) | |||||

11

Table of Contents

| (1) | This represents amounts reclassified out of AOCI and into earnings. At March 31, 2009, a $3.9 million loss remained in AOCI related to the PVR Interest Rate Swaps on which PVR discontinued hedge accounting. |

| (2) | This activity represents unrealized gains in the natural gas midstream, cost of midstream gas purchased, interest expense and derivatives lines on our consolidated statements of income. |

The following table summarizes the fair value of our derivative instruments, as well as the locations of these instruments on our consolidated balance sheets as of March 31, 2009 and December 31, 2008 (in thousands):

| Balance Sheet Location | Fair values at March 31, 2009 | Fair values at December 31, 2008 | ||||||||||||

| Derivative Assets | Derivative Liabilities | Derivative Assets | Derivative Liabilities | |||||||||||

Derivatives de-designated as hedging instruments under SFAS No. 133: | ||||||||||||||

Interest rate contracts | Derivative liabilities - current | $ | — | $ | — | $ | — | $ | 3,177 | |||||

Interest rate contracts | Derivative liabilities - noncurrent | — | — | — | 3,648 | |||||||||

Total derivatives de-designated as hedging instruments under SFAS No. 133 | $ | — | $ | — | $ | — | $ | 6,825 | ||||||

Derivatives not designated as hedging instruments under SFAS No. 133: | ||||||||||||||

Interest rate contracts | Derivative liabilities - current | $ | — | $ | 8,947 | $ | — | $ | 4,663 | |||||

Interest rate contracts | Derivative liabilities - noncurrent | — | 7,550 | — | 5,073 | |||||||||

Commodity contracts | Derivative assets/liabilities - current | 62,727 | 8,794 | 67,569 | 7,694 | |||||||||

Commodity contracts | Derivative assets/liabilities - noncurrent | 1,276 | — | 4,070 | — | |||||||||

Total derivatives not designated as hedging instruments under SFAS No. 133 | $ | 64,003 | $ | 25,291 | $ | 71,639 | $ | 17,430 | ||||||

Total estimated fair value of derivative instruments | $ | 64,003 | $ | 25,291 | $ | 71,639 | $ | 24,255 | ||||||

See Note 5, “Fair Value Measurements” for a description of how the above financial instruments are valued in accordance with SFAS No. 157.

The following table summarizes the effect of the Interest Rate Swaps and the PVR Interest Rate Swaps on our total interest expense for the three months ended March 31, 2009 and 2008 (in thousands):

| Three Months Ended March 31, | ||||||||

Source | 2009 | 2008 | ||||||

Interest on borrowings | $ | (11,680 | ) | $ | (12,292 | ) | ||

Capitalized interest (1) | 441 | 1,302 | ||||||

Interest rate swaps | (1,263 | ) | 243 | |||||

Total interest expense | $ | (12,502 | ) | $ | (10,747 | ) | ||

| (1) | Capitalized interest was primarily related to the oil and gas segment’s development of unproved properties. |

The effects of derivative gains (losses), cash settlements of our oil and gas commodity derivatives, cash settlements of PVR’s natural gas midstream commodity derivatives and cash settlements of the PVR Interest Rate Swaps are reported as adjustments to reconcile net income to net cash provided by operating activities on our consolidated statements of cash flows. These items are recorded in the “Total derivative losses (gains)” and “Cash settlements of derivatives” lines on our consolidated statements of cash flows.

At March 31, 2009, PVR reported a net commodity derivative asset related to the natural gas midstream segment of $12.9 million that is with two counterparties, which are financial institutions, and is substantially concentrated with one of those counterparties. We reported a net commodity derivative asset related to our oil and gas segment of $42.3 million, 80% of which was concentrated with three counterparties. These concentrations may

12

Table of Contents

impact our overall credit risk, either positively or negatively, in that these counterparties may be similarly affected by changes in economic or other conditions. Neither we nor PVR paid nor received collateral with respect to our derivative positions. The maximum amount of loss due to credit risk if counterparties to our or PVR’s derivative asset positions fail to perform according to the terms of the contracts would be equal to the fair value of the contracts as of March 31, 2009 and March 31, 2008. No significant uncertainties related to the collectability of amounts owed to us or PVR exists with regard to these counterparties.

The above hedging activity represents cash flow hedges. As of March 31, 2009 neither PVR nor we actively traded derivative instruments or has any fair value hedges. In addition, as of March 31, 2009, neither PVR nor we owned derivative instruments containing credit risk contingencies.

7. Convertible Notes and Adoption of FSP APB 14-1

We adopted FASB Staff Position APB 14-1,Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion (Including Partial Cash Settlement) (“FSP APB 14-1”) effective January 1, 2009. We are accounting for the adoption of this standard as a change in accounting principle in accordance with FSP APB 14-1 and SFAS 154,Accounting Changes and Error Corrections. FSP APB 14-1 has therefore been applied retrospectively to all periods presented.

Because our Convertible Notes can be settled wholly or partly in cash upon conversion into our common stock, FSP APB 14-1 requires us to separately account for the liability and equity components in a manner that reflects our nonconvertible debt borrowing rate when measuring interest cost of the Convertible Notes. The value assigned to the liability component was the estimated value of a similar debt issuance without the conversion feature as of the issuance date in November 2007. Transaction costs associated with issuing the instrument were allocated to the liability and equity components in proportion to the allocation of the original proceeds and were accounted for as debt issuance costs and equity issuance costs. In addition, recognizing our Convertible Notes as two separate components resulted in a tax basis difference associated with the liability component that represents a temporary difference for purposes of applying SFAS No. 109,Accounting for Income Taxes. Because the liability component was valued exclusive of the conversion feature, the Convertible Notes were recorded at a discount reflecting the below-market coupon interest rate. This discount is accreted to par value over the expected life of the debt through additional interest expense.

The following table reflects the effects of adopting FSP APB 14-1 on our consolidated statements of income for the three months ended March 31, 2009 and 2008 (in thousands):

13

Table of Contents

Effects of FSP APB 14-1 Adoption on the Consolidated Statement of Income | ||||||||||||

Three Months Ended March 31, 2009 | ||||||||||||

| Consolidated Statement of Income | As computed under prior accounting principle | As adjusted | Effects of change | |||||||||

Interest expense – (1) | $ | (10,666 | ) | $ | (12,502 | ) | $ | (1,836 | ) | |||

Income tax benefit – (2) | 3,851 | 4,562 | 711 | |||||||||

Net income (loss) | (2,426 | ) | (3,551 | ) | (1,125 | ) | ||||||

Net loss attributable to Penn Virginia Corporation | (6,084 | ) | (7,209 | ) | (1,125 | ) | ||||||

Earnings per share – basic and diluted: | ||||||||||||

Net income (loss) per share attributable to Penn Virginia Corporation common shareholders, basic | $ | (0.15 | ) | $ | (0.17 | ) | $ | (0.02 | ) | |||

Net income (loss) per share attributable to Penn Virginia Corporation common shareholders, diluted | $ | (0.14 | ) | $ | (0.17 | ) | $ | (0.03 | ) | |||

Three Months Ended March 31, 2008 | ||||||||||||

Consolidated Statement of Income | As originally reported | As adjusted | Effects of change | |||||||||

Interest expense – (3) | $ | (9,552 | ) | $ | (10,747 | ) | $ | (1,195 | ) | |||

Income tax expense – (2) | (3,057 | ) | (2,594 | ) | 463 | |||||||

Net income | 23,954 | 23,222 | (732 | ) | ||||||||

Net income (loss) attributable to Penn Virginia Corporation | 3,926 | 3,194 | (732 | ) | ||||||||

Earnings per share – basic and diluted: | ||||||||||||

Net income per share attributable to Penn Virginia Corporation common shareholders, basic | $ | 0.09 | $ | 0.08 | $ | (0.02 | ) | |||||

Net income per share attributable to Penn Virginia Corporation common shareholders, diluted | $ | 0.09 | $ | 0.07 | $ | (0.02 | ) | |||||

| (1) | The additional interest expense incurred in the three months ended March 31, 2009 as a result of adopting FSP APB 14-1 is due to the debt discount that was created, which increased the amount of interest expense recognized for the period. This increase is partially offset by the amortization of debt issuance costs, which resulted from the separation of the debt and equity components of the Convertible Notes. |

| (2) | The adjustment to income tax benefit (expense) is based on our effective tax rates. |

| (3) | The impact on interest expense as presented for the three months ended March 31, 2008 is due to the additional interest expense that would have been incurred from the debt discount had FSP APB 14-1 been in place when the Convertible Notes were issued. This increase is partially offset by changes in capitalized interest and the amortization of debt issuance costs, which resulted from the separation of the debt and equity components of the Convertible Notes. |

The following table reflects the effects of adopting FSP APB 14-1 on our consolidated balance sheets at March 31, 2009 and December 31, 2008 (in thousands):

14

Table of Contents

Effects of FSP APB 14-1 Adoption on the Consolidated Balance Sheets | ||||||||||

Three Months Ended March 31, 2009 | ||||||||||

Consolidated Balance Sheet | As computed under prior accounting principle | As adjusted | Effect of change | |||||||

Oil and gas properties (successful efforts method) – (1) | $ | 2,175,214 | $ | 2,176,467 | $ | 1,253 | ||||

Other assets – (2) | 54,660 | 53,734 | (926 | ) | ||||||

Deferred income taxes – (3) | 243,716 | 255,964 | 12,248 | |||||||

Convertible Notes – (4) | 230,000 | 201,545 | (28,455 | ) | ||||||

Paid-in capital – (5) | 578,768 | 599,984 | 21,216 | |||||||

Retained earnings – (6) | 439,019 | 434,087 | (4,932 | ) | ||||||

December 31, 2008 | ||||||||||

Consolidated Balance Sheet | As originally reported | As adjusted | Effects of change | |||||||

Oil and gas properties (successful efforts method) – (1) | $ | 2,106,126 | $ | 2,107,128 | $ | 1,002 | ||||

Other assets – (2) | 46,674 | 45,685 | (989 | ) | ||||||

Deferred income taxes – (3) | 245,789 | 258,037 | 12,248 | |||||||

Convertible Notes – (4) | 230,000 | 199,896 | (30,104 | ) | ||||||

Paid-in capital – (5) | 578,639 | 599,855 | 21,216 | |||||||

Retained earnings – (6) | 446,993 | 443,646 | (3,347 | ) | ||||||

| (1) | The impact on oil and gas properties is due to capitalized interest. |

| (2) | The adjustment to other assets reflects a decrease in debt issuance costs as a portion of such costs with allocated to equity upon issuance of Convertible Notes. |

| (3) | The impact on deferred income taxes is due to the change in the tax basis of the liability component. |

| (4) | The impact on the Convertible Notes balance is due to the unamortized debt discount attributable to the equity component to the Convertible Note. |

| (5) | The impact on the paid-in capital balance is due to the equity component and related issueance costs as well as the change in deferred income taxes. |

| (6) | The impact on retained earnings is due to the additional interest expense, net of tax, that would have been incurred had FSP APB 14-1 been in place when the Convertible Notes were issued. |

The following table reflects the effects of adopting FSP APB 14-1 on our consolidated statements of cash flows at March 31, 2009 and December 31, 2008 (in thousands):

15

Table of Contents

Effects of FSP APB 14-1 Adoption on the Consolidated Statements of Cash Flows | ||||||||||||

Three Months Ended March 31, 2009 | ||||||||||||

Consolidated Statement of Cash Flows | As computed under prior accounting principle | As adjusted | Effects of change | |||||||||

Cash flows from operating activities | ||||||||||||

Net income | $ | (2,426 | ) | $ | (3,551 | ) | $ | (1,125 | ) | |||

Deferred income taxes | (3,923 | ) | (4,634 | ) | (711 | ) | ||||||

Non-cash interest expense | 875 | 2,711 | 1,836 | |||||||||

Total impact on the statement of cash flows | $ | (5,474 | ) | $ | (5,474 | ) | $ | — | ||||

Three Months Ended March 31, 2008 | ||||||||||||

Consolidated Statement of Cash Flows | As originally reported | As adjusted | Effects of change | |||||||||

Cash flows from operating activities | ||||||||||||

Net income | $ | 23,954 | $ | 23,222 | $ | (732 | ) | |||||

Deferred income taxes | 2,605 | 2,142 | (463 | ) | ||||||||

Non-cash interest expense | 757 | 1,952 | 1,195 | |||||||||

Total impact on the statement of cash flows | $ | 27,316 | $ | 27,316 | $ | — | ||||||

The following table reflects the carrying amounts of the liability and equity components of the Convertible Notes:

| March 31, 2009 | December 31, 2008 | |||||||

Principal | $ | 230,000 | $ | 230,000 | ||||

Unamortized discount | (28,455 | ) | (30,104 | ) | ||||

Net carrying amount of liability component | $ | 201,545 | $ | 199,896 | ||||

Carrying amount of equity component | $ | 36,850 | $ | 36,850 | ||||

The net carrying amount of the liability component is reported as long-term debt of the Company in the consolidated balance sheets. The carrying amount of the equity component is reported in paid-in capital in the consolidated balance sheets. The discount amortization is recorded in interest expense in the consolidated statements of income.

As of March 31, 2009, the remaining period over which the discount will be amortized is approximately four years. The effective interest rate on the liability component for the three months ended March 31, 2009 and 2008 was 8.50%. For the three months ended March 31, 2009, we recognized $2.6 million of interest expense related to the contractual coupon rate on the Convertible Notes and $1.6 million of interest expense related to the amortization of the discount. For the three months ended March 31, 2008, we recognized $2.5 million of interest expense related to the contractual coupon rate on the Convertible Notes and $1.5 million of interest expense related to the amortization of the discount.

The Convertible Notes are convertible into cash up to the principal amount thereof and shares of our common stock, if any, in respect of the excess conversion value, based on an initial conversion rate of 17.3160 shares of common stock per $1,000 principal amount of the Convertible Notes (which is equal to an initial conversion price of approximately $57.75 per share of common stock), subject to adjustment, and, if not converted or repurchased earlier, will mature on November 15, 2012.

In connection with the issuance of the Convertible Notes, we entered into convertible note hedge transactions (the “Note Hedges) with respect to shares of our common stock with affiliates of certain of the underwriters of the Convertible Notes (collectively, the “Option Counterparties”). The Note Hedges cover, subject to anti-dilution adjustments, the net shares of our common stock that would be deliverable to converting noteholders in the event of a conversion of the Convertible Notes. In December 2007, we paid an aggregate amount of $18.6 million of the net proceeds from the sale of the Convertible Notes for the cost of the Note Hedges (after such cost was offset by the proceeds of the Warrants described below).

16

Table of Contents

We also entered into separate warrant transactions (the “Warrants”), whereby we sold to the Option Counterparties warrants to acquire, subject to anti-dilution adjustments, approximately 3,982,680 shares of our common stock at an exercise price of $74.25 per share. In December 2007, we received proceeds of $18.2 million resulting from this sale. If the warrants are exercised, we would deliver shares of our common stock equal to the difference between the then market price and the strike price of the Warrants.

If the market value per share of our common stock at the time of conversion of the Convertible Notes is above the strike price of the Note Hedges, the Note Hedges entitle us to receive from the Option Counterparties net shares of our common stock (and cash for any fractional share cash amount) based on the excess of the then current market price of our common stock over the strike price of the Note Hedges. Additionally, if the market price of our common stock at the time of exercise of the Warrants exceeds the strike price of the Warrants, we will owe the Option Counterparties net shares of our common stock (and cash for any fractional share cash amount), not offset by the Note Hedges, in an amount based on the excess of the then current market price of our common stock over the strike price of the Warrants.

8. Long-Term Debt

In March 2009, our bank group completed a semi-annual re-determination of the borrowing base under the Revolver. As a result, the borrowing base has been revised to $450.0 million, which is approximately 6% less than its previous level of $479.0 million.

In March 2009, PVR increased the size of the PVR Revolver from $700.0 million to $800.0 million. The PVR Revolver is secured with substantially all of PVR’s assets. The December 2011 maturity date for the PVR Revolver did not change. Interest is payable at a base rate plus an applicable margin of up to 1.25% if PVR selects the base rate borrowing option under the PVR Revolver or at a rate derived from LIBOR, plus an applicable margin ranging from 1.75% to 2.75% if PVR selects the LIBOR-based borrowing option. As of March 31, 2009 the interest rate on the PVR Revolver was at the bank’s base rate of 3.75%. Effective April 1, 2009, the interest rate on the PVR Revolver was a LIBOR-based rate of 2.87%.

9. Impairments and Unproved Leasehold Expense

We review long-lived assets to be held and used whenever events or circumstances indicate that the carrying value of those assets may not be recoverable. We recognize an impairment loss when the carrying amount of an asset exceeds the sum of the undiscounted estimated future cash flows. In this circumstance, we recognize an impairment loss equal to the difference between the carrying value and the fair value of the asset. Fair value is estimated to be the present value of future net cash flows from the asset, discounted using a rate commensurate with the risk and remaining life of the asset.

For the three months ended March 31, 2009, we recorded impairment charges related to our oil and gas segment properties of $1.2 million. These charges were primarily related to market declines in the spot and future oil and gas prices.

Costs related to unproved properties are capitalized and periodically evaluated (at least quarterly) as to recoverability based on changes brought about by economic factors and potential shifts in business strategy employed by management. We continue to experience an increase in lease expirations and unproved leasehold expense caused by current economic conditions which have impacted our future drilling plans thereby increasing the amount of expected lease expirations. Effective January 1, 2009, we changed our accounting process to amortize additional insignificant unproved properties over the average estimated life of the leases versus amortizing some leases and assessing other leases on an occurrence basis. As a result of amortizing additional leases, we recorded additional unproved leasehold expense, which is included in exploration expense on the consolidated statements of income, of $6.3 million in the three months ended March 31, 2009. The impact of this change on net income for the three months ended March 31, 2009 was a decrease of $3.9 million, net of income taxes. The impact of this change decreased basic and diluted earnings per share for the three months ended March 31, 2009 by $0.09.

17

Table of Contents

10. Earnings per Share

The following is a reconciliation of the numerators and denominators used in the calculation of basic and diluted earnings per share for the three months ended March 31, 2009 and 2008:

| Three Months Ended March 31, | ||||||||

| 2009 | 2008 | |||||||

| (in thousands, except per share data) | ||||||||

Net income (loss) attributable to Penn Virginia Corporation common shareholders | $ | (7,209 | ) | $ | 3,194 | |||

Less: Portion of subsidiary net income allocated to undistributed share-based compensation awards (net of tax) | (13 | ) | (103 | ) | ||||

| $ | (7,222 | ) | $ | 3,091 | ||||

Weighted average shares, basic | 41,922 | 41,558 | ||||||

Effect of dilutive securities: | ||||||||

Stock options(1) | — | 245 | ||||||

Weighted average shares, diluted | 41,922 | 41,803 | ||||||

Net income (loss) per share attributable to Penn Virginia Corporation common shareholders, basic | $ | (0.17 | ) | $ | 0.08 | |||

Net income (loss) per share attributable to Penn Virginia Corporation common shareholders, diluted | $ | (0.17 | ) | $ | 0.07 | |||

| ||||||||

| (1) | For the three months ended March 31, 2009, 0.2 million, potentially dilutive securities, including stock options and phantom stock had the effect of being anti-dilutive and were excluded from the calculation of diluted earnings per share. |

11. Share-Based Compensation

Stock Compensation Plans

We recognized compensation expense related to the granting of common stock and deferred common stock units and the vesting of stock options and restricted and phantom stock granted under our stock compensation plans. For the three months ended March 31, 2009 and 2008, we recognized a total of $2.6 million and $1.2 million of compensation expense related to our stock compensation plans. The total income tax benefit recognized in our consolidated statements of income for our stock compensation plans was $1.0 million and $0.4 million for the three months ended March 31, 2009 and 2008. Compensation expense is recorded on the general and administrative expense line on the consolidated statements of income.

Stock Options. In February 2009, we granted 1,147,472 stock options with a weighted average exercise price of $15.06 and a weighted average grant date fair value of $5.57 per option. The options granted vest over a three-year period, with one-third vesting in each year. We recognize compensation expense on a straight-line basis over the vesting period.

Phantom Units. In February 2009, we granted 104,449 phantom units of our stock to non-employee directors with a weighted average grant date fair value of $15.06 per share. The phantom units granted vest over a three-year period, with one-third vesting in each year. We recognize compensation expense on a straight-line basis over the vesting period.

18

Table of Contents

Deferred Common Stock Units. In February 2009, we granted 7,966 deferred common stock units to non-employee directors with a weighted average grant date fair value of $19.76 per share. The deferred common stock units granted vest immediately. We recognized compensation expense in the period these units were granted.

PVR Long-Term Incentive Plan

PVR recognized a total of $1.4 million and $0.7 million of compensation expense related to the granting of common units and deferred common units and the vesting of restricted units granted under the long-term incentive plan for the three months ended March 31, 2009 and 2008. During the three months ended March 31, 2009, PVR’s general partner granted 354,792 phantom units with a weighted average grant date fair value of $11.59 per unit to employees of Penn Virginia and its affiliates. During the same period, 98,322 restricted units with a weighted average grant date fair value of $27.44 per unit vested. The phantom units granted in 2009 vest over a three-year period, with one-third vesting in each year. PVR recognizes compensation expense on a straight-line basis over the vesting period. These expenses are recorded on the general and administrative expense line on our consolidated statements of income.

12. Commitments and Contingencies

Drilling Rig Commitments and Standby Charges

In the first quarter of 2009, our oil and gas segment opted to defer drilling of many wells due to unfavorable economic conditions. As a result, we amended certain drilling rig contracts to delay commencement of drilling until January 2010. In the first quarter of 2009, we incurred a liability of approximately $9.9 million for lump sum delay fees, minimum daily standby fees and demobilization fees expected to be paid during the standby period. These fees and costs are recorded in accounts payable and accrued liabilities on the consolidated balance sheets and as exploration expense on the consolidated statements of income. We will continue to evaluate economic conditions through the remainder of 2009 to determine whether or not to defer additional drilling. This could result in additional exploration expenses of up to approximately $14.8 million for 2009.

Legal

We are involved, from time to time, in various legal proceedings arising in the ordinary course of business. While the ultimate results of these proceedings cannot be predicted with certainty, our management believes that these claims will not have a material effect on our financial position or results of operations.

Environmental Compliance

Extensive federal, state and local laws govern oil and natural gas operations, regulate the discharge of materials into the environment or otherwise relate to the protection of the environment. Numerous governmental departments issue rules and regulations to implement and enforce such laws that are often difficult and costly to comply with and which carry substantial administrative, civil and even criminal penalties for failure to comply. Some laws, rules and regulations relating to protection of the environment may, in certain circumstances, impose “strict liability” for environmental contamination, rendering a person liable for environmental and natural resource damages and cleanup costs without regard to negligence or fault on the part of such person. Other laws, rules and regulations may restrict the rate of oil and natural gas production below the rate that would otherwise exist or even prohibit exploration or production activities in sensitive areas. In addition, state laws often require some form of remedial action to prevent pollution from former operations, such as closure of inactive pits and plugging of abandoned wells. The regulatory burden on the oil and natural gas industry increases its cost of doing business and consequently affects its profitability. These laws, rules and regulations affect our operations, as well as the oil and gas exploration and production industry in general. We believe that we are in substantial compliance with current applicable environmental laws, rules and regulations and that continued compliance with existing requirements will not have a material adverse impact on us. Nevertheless, changes in existing environmental laws or the adoption of new environmental laws have the potential to adversely affect our operations.

PVR’s operations and those of its lessees are subject to environmental laws and regulations adopted by various governmental authorities in the jurisdictions in which these operations are conducted. The terms of PVR’s coal

19

Table of Contents

property leases impose liability on the relevant lessees for all environmental and reclamation liabilities arising under those laws and regulations. The lessees are bonded and have indemnified PVR against any and all future environmental liabilities. PVR regularly visits its coal properties to monitor lessee compliance with environmental laws and regulations and to review mining activities. PVR’s management believes that its operations and those of its lessees comply with existing laws and regulations and does not expect any material impact on its financial condition or results of operations.

As of March 31, 2009 and December 31, 2008, PVR’s environmental liabilities were $1.1 million and $1.2 million, which represents PVR’s best estimate of the liabilities as of those dates related to its coal and natural resource management and natural gas midstream businesses. PVR has reclamation bonding requirements with respect to certain unleased and inactive properties. Given the uncertainty of when a reclamation area will meet regulatory standards, a change in this estimate could occur in the future.

Mine Health and Safety Laws

There are numerous mine health and safety laws and regulations applicable to the coal mining industry. However, since PVR does not operate any mines and does not employ any coal miners, PVR is not subject to such laws and regulations. Accordingly, we have not accrued any related liabilities.

13. Segment Information

Segment information has been prepared in accordance with SFAS No. 131,Disclosure about Segments of an Enterprise and Related Information. Under SFAS No. 131, operating segments are defined as components of an enterprise about which separate financial information is available and is evaluated regularly by the chief operating decision maker, or decision-making group, in assessing performance. Our decision-making group consists of our Chief Executive Officer and other senior officers. This group routinely reviews and makes operating and resource allocation decisions among our oil and gas operations and PVR’s coal and natural resource management operations and PVR’s natural gas midstream operations. Accordingly, our reportable segments are as follows:

| • | Oil and Gas—crude oil and natural gas exploration, development and production. |

| • | PVR Coal and Natural Resource Management—management and leasing of coal properties and subsequent collection of royalties; other land management activities such as selling standing timber; leasing of fee-based coal-related infrastructure facilities to certain lessees and end-user industrial plants; collection of oil and gas royalties; and coal transportation, or wheelage fees. |

| • | PVR Natural Gas Midstream—natural gas processing, gathering and other related services. |

Other items primarily represent corporate functions and elimination of intercompany sales.

The following table presents a summary of certain financial information relating to our segments as of and for the three months ended March 31, 2009 and 2008 (in thousands):

20

Table of Contents

| Revenues | Intersegment revenues (1) | |||||||||||||||

| Three Months Ended March 31, | Three Months Ended March 31, | |||||||||||||||

| 2009 | 2008 | 2009 | 2008 | |||||||||||||

Oil and gas | $ | 64,565 | $ | 92,772 | $ | (346 | ) | $ | (473 | ) | ||||||

Coal and natural resource | 38,252 | 30,492 | 198 | (198 | ) | |||||||||||

Natural gas midstream | 118,507 | 126,047 | 22,520 | 473 | ||||||||||||

Other | (22,164 | ) | (176 | ) | (22,372 | ) | 198 | |||||||||

Consolidated totals | $ | 199,160 | $ | 249,135 | $ | — | $ | — | ||||||||

| Operating income | DD&A expense | |||||||||||||||

| Three Months Ended March 31, | Three Months Ended March 31, | |||||||||||||||

| 2009 | 2008 | 2009 | 2008 | |||||||||||||

Oil and gas | $ | (22,655 | ) | $ | 36,352 | $ | 39,999 | $ | 26,616 | |||||||

Coal and natural resource | 24,974 | 17,582 | 7,394 | 6,413 | ||||||||||||

Natural gas midstream | (3,047 | ) | 13,652 | 9,109 | 5,087 | |||||||||||

Other | (6,711 | ) | (7,453 | ) | 571 | 453 | ||||||||||

Consolidated totals | $ | (7,439 | ) | $ | 60,133 | $ | 57,073 | $ | 38,569 | |||||||

Interest expense | (12,502 | ) | (10,747 | ) | ||||||||||||

Other | 1,573 | 2,331 | ||||||||||||||

Derivatives | 10,255 | (25,901 | ) | |||||||||||||

Income tax expense | 4,562 | (2,594 | ) | |||||||||||||

Net income attributable to noncontrolling interest | (3,658 | ) | (20,028 | ) | ||||||||||||

Net income attributable to Penn Virginia Corporation | $ | (7,209 | ) | $ | 3,194 | |||||||||||

| Additions to property and equipment | ||||||||||||||||

| Three Months Ended March 31, | Total assets at | |||||||||||||||

| 2009 | 2008 | March 31, 2009 | December 31, 2008 | |||||||||||||

Oil and gas | $ | 120,574 | $ | 95,189 | $ | 1,737,860 | $ | 1,728,375 | ||||||||

Coal and natural resource | 1,300 | 48 | 609,372 | 600,418 | ||||||||||||

Natural gas midstream | 17,006 | 17,622 | 597,347 | 618,402 | ||||||||||||

Other | 406 | 543 | 55,919 | 49,370 | ||||||||||||

Consolidated totals | $ | 139,286 | $ | 113,402 | $ | 3,000,498 | $ | 2,996,565 | ||||||||

| (1) | Intersegment revenues represent gas gathering and processing transactions between the PVR natural gas midstream segment and the oil and gas segment. Intersegment revenues also represent agent fees paid by the oil and gas segment to the PVR natural gas midstream segment for marketing certain natural gas production and rail car rental fees paid by a corporate affiliate to the PVR coal and natural resource management segment. |

21

Table of Contents

| Item 2 | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion and analysis of the financial condition and results of operations of Penn Virginia Corporation and its subsidiaries (“Penn Virginia,” “we,” “us” or “our”) should be read in conjunction with our consolidated financial statements and the accompanying notes in Item 1, “Financial Statements.”

Overview of Business

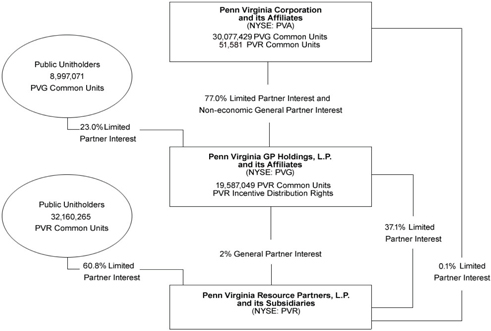

We are an independent oil and gas company primarily engaged in the development, exploration and production of natural gas and oil in various domestic onshore regions including East Texas, the Mid-Continent, Appalachia, Mississippi and the Gulf Coast. We also indirectly own partner interests in PVR, which is engaged in the coal and natural resource management and natural gas midstream businesses. Our ownership interests in Penn Virginia Resource Partners, L.P., or PVR, are held principally through our general partner interest and our 77% limited partner interest in Penn Virginia GP Holdings, L.P., or PVG. As of March 31, 2009, PVG owned an approximately 37% limited partner interest in PVR and 100% of the general partner of PVR, which holds a 2% general partner interest in PVR and all of the incentive distribution rights, or IDRs.

Because PVG controls the general partner of PVR, the financial results of PVR are included in PVG’s consolidated financial statements. Because we control the general partner of PVG, the financial results of PVG are included in our consolidated financial statements. However, PVG and PVR function with capital structures that are independent of each other and us, with each having publicly traded common units and PVR having its own debt instruments. PVG does not currently have any debt instruments.

While we report consolidated financial results of PVR’s coal and natural resource management and natural gas midstream businesses, the only cash we received from those businesses is in the form of cash distributions we received from PVG and PVR in respect of our partner interests in each of them.

The following diagram depicts our ownership of PVG and PVR as of March 31, 2009:

We are engaged in three primary business segments: (i) oil and gas, (ii) coal and natural resource management and (iii) natural gas midstream. We operate our oil and gas segment and PVR operates the coal and natural resource management and natural gas midstream segments. Our consolidated operating loss was $7.4 million in the three

22

Table of Contents

months ended March 31, 2009, compared to consolidated operating income of $60.1 million in the same period of 2008, with contributions by segment as follows: