Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2009

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 1-13283

PENN VIRGINIA CORPORATION

(Exact name of registrant as specified in its charter)

| Virginia | 23-1184320 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

THREE RADNOR CORPORATE CENTER, SUITE 300

100 MATSONFORD ROAD

RADNOR, PA 19087

(Address of principal executive offices) (Zip Code)

(610) 687-8900

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (“Exchange Act”) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by a check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

As of August 6, 2009, 45,384,732 shares of common stock of the registrant were outstanding.

Table of Contents

PENN VIRGINIA CORPORATION AND SUBSIDIARIES

INDEX

Table of Contents

| Item 1 | Financial Statements |

PENN VIRGINIA CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME – unaudited

(in thousands, except per share data)

| Three Months Ended June 30 | Six Months Ended June 30 | |||||||||||||||

| 2009 | 2008 | 2009 | 2008 | |||||||||||||

Revenues | ||||||||||||||||

Natural gas | $ | 39,830 | $ | 113,212 | $ | 92,651 | $ | 193,725 | ||||||||

Crude oil | 11,825 | 14,463 | 18,153 | 23,678 | ||||||||||||

Natural gas liquids (NGLs) | 4,336 | 6,538 | 7,706 | 8,406 | ||||||||||||

Natural gas midstream | 91,655 | 184,298 | 186,861 | 309,346 | ||||||||||||

Coal royalties | 29,997 | 31,641 | 60,627 | 55,603 | ||||||||||||

Other | 6,274 | 10,262 | 17,079 | 18,791 | ||||||||||||

Total revenues | 183,917 | 360,414 | 383,077 | 609,549 | ||||||||||||

Expenses | ||||||||||||||||

Cost of midstream gas purchased | 71,933 | 152,986 | 151,331 | 252,683 | ||||||||||||

Operating | 22,648 | 22,214 | 45,350 | 43,216 | ||||||||||||

Exploration (see Note 10) | 17,472 | 6,739 | 38,784 | 11,419 | ||||||||||||

Taxes other than income | 4,930 | 8,259 | 11,362 | 15,654 | ||||||||||||

General and administrative | 20,355 | 19,058 | 38,841 | 36,717 | ||||||||||||

Depreciation, depletion and amortization | 58,218 | 44,934 | 115,291 | 83,503 | ||||||||||||

Impairments | 3,279 | — | 4,475 | — | ||||||||||||

Loss on sale of assets | 1,599 | — | 1,599 | — | ||||||||||||

Total expenses | 200,434 | 254,190 | 407,033 | 443,192 | ||||||||||||

Operating income (loss) | (16,517 | ) | 106,224 | (23,956 | ) | 166,357 | ||||||||||

Other income (expense) | ||||||||||||||||

Interest expense | (15,046 | ) | (11,345 | ) | (27,548 | ) | (22,092 | ) | ||||||||

Derivatives | 752 | (103,618 | ) | 11,007 | (129,519 | ) | ||||||||||

Other | 353 | 975 | 1,926 | 3,306 | ||||||||||||

Income (loss) before income taxes and noncontrolling interests | (30,458 | ) | (7,764 | ) | (38,571 | ) | 18,052 | |||||||||

Income tax benefit | 14,620 | 7,163 | 19,182 | 4,569 | ||||||||||||

Net income (loss) | (15,838 | ) | (601 | ) | (19,389 | ) | 22,621 | |||||||||

Less net income attributable to noncontrolling interests | (6,345 | ) | (3,948 | ) | (10,003 | ) | (23,976 | ) | ||||||||

Loss attributable to Penn Virginia Corporation | $ | (22,183 | ) | $ | (4,549 | ) | $ | (29,392 | ) | $ | (1,355 | ) | ||||

Earnings per share - basic and diluted: | ||||||||||||||||

Loss per share attributable to Penn Virginia Corporation | ||||||||||||||||

Basic | $ | (0.52 | ) | $ | (0.11 | ) | $ | (0.69 | ) | $ | (0.03 | ) | ||||

Diluted | $ | (0.52 | ) | $ | (0.11 | ) | $ | (0.69 | ) | $ | (0.03 | ) | ||||

Weighted average shares outstanding, basic | 42,798 | 41,740 | 42,422 | 41,642 | ||||||||||||

Weighted average shares outstanding, diluted | 42,798 | 41,740 | 42,422 | 41,642 | ||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

1

Table of Contents

PENN VIRGINIA CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS – unaudited

(in thousands, except share data)

| June 30, 2009 | December 31, 2008 | |||||||

Assets | ||||||||

Current assets | ||||||||

Cash and cash equivalents | $ | 18,337 | $ | 18,338 | ||||

Accounts receivable, net of allowance for doubtful accounts | 105,423 | 149,241 | ||||||

Derivative assets | 42,768 | 67,569 | ||||||

Inventory | 15,136 | 18,468 | ||||||

Other current assets | 7,876 | 9,902 | ||||||

Total current assets | 189,540 | 263,518 | ||||||

Property and equipment | ||||||||

Oil and gas properties (successful efforts method) | 2,207,465 | 2,107,128 | ||||||

Other property and equipment | 1,106,237 | 1,076,471 | ||||||

| 3,313,702 | 3,183,599 | |||||||

Accumulated depreciation, depletion and amortization | (782,255 | ) | (671,422 | ) | ||||

Net property and equipment | 2,531,447 | 2,512,177 | ||||||

Equity investments | 79,512 | 78,443 | ||||||

Intangibles, net | 88,962 | 92,672 | ||||||

Derivative assets | 2,100 | 4,070 | ||||||

Other assets | 65,378 | 45,685 | ||||||

Total assets | $ | 2,956,939 | $ | 2,996,565 | ||||

Liabilities and shareholders’ equity | ||||||||

Current liabilities | ||||||||

Short-term borrowings | $ | — | $ | 7,542 | ||||

Accounts payable and accrued liabilities | 118,108 | 206,902 | ||||||

Derivative liabilities | 16,609 | 15,534 | ||||||

Deferred taxes | 8,317 | 17,598 | ||||||

Income taxes payable | — | 18 | ||||||

Total current liabilities | 143,034 | 247,594 | ||||||

Other liabilities | 45,384 | 45,887 | ||||||

Derivative liabilities | 6,074 | 8,721 | ||||||

Deferred income taxes | 254,152 | 258,037 | ||||||

Long-term debt of PVR | 597,100 | 568,100 | ||||||

Revolving credit facility | 70,000 | 332,000 | ||||||

Senior notes | 291,115 | — | ||||||

Convertible notes | 203,217 | 199,896 | ||||||

Shareholders’ equity: | ||||||||

Common stock of $0.01 par value – 64,000,000 shares authorized; 45,384,566 and 41,870,893 shares issued and outstanding at June 30, 2009 and December 31, 2008 | 265 | 230 | ||||||

Paid-in capital | 668,133 | 599,855 | ||||||

Retained earnings | 409,535 | 443,646 | ||||||

Deferred compensation obligation | 2,147 | 2,237 | ||||||

Accumulated other comprehensive loss | (4,165 | ) | (4,182 | ) | ||||

Treasury stock – 99,242 and 85,227 shares common stock, at cost, on June 30, 2009 and December 31, 2008 | (2,646 | ) | (2,683 | ) | ||||

Total Penn Virginia Corporation shareholders’ equity | 1,073,269 | 1,039,103 | ||||||

Noncontrolling interests of subsidiaries | 273,594 | 297,227 | ||||||

Total shareholders’ equity | 1,346,863 | 1,336,330 | ||||||

Total liabilities and shareholders’ equity | $ | 2,956,939 | $ | 2,996,565 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

2

Table of Contents

PENN VIRGINIA CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS – unaudited

(in thousands)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2009 | 2008 | 2009 | 2008 | |||||||||||||

Cash flows from operating activities | ||||||||||||||||

Net income (loss) | $ | (15,838 | ) | $ | (601 | ) | $ | (19,389 | ) | $ | 22,621 | |||||

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | ||||||||||||||||

Depreciation, depletion and amortization | 58,218 | 44,934 | 115,291 | 83,503 | ||||||||||||

Impairments | 3,279 | — | 4,475 | — | ||||||||||||

Commodity derivative contracts: | ||||||||||||||||

Total derivative losses (gains) | 668 | 105,135 | (9,133 | ) | 132,144 | |||||||||||

Cash settlements of derivatives | 17,281 | (18,032 | ) | 36,429 | (26,985 | ) | ||||||||||

Deferred income taxes | (14,166 | ) | (3,589 | ) | (18,800 | ) | (1,447 | ) | ||||||||

Dry hole and umproved leasehold expense | 9,379 | 5,919 | 19,883 | 9,472 | ||||||||||||

Other | 9,888 | 2,222 | 13,379 | 1,256 | ||||||||||||

Changes in operating assets and liabilities | (33,751 | ) | (17,248 | ) | (4,158 | ) | (35,672 | ) | ||||||||

Net cash provided by operating activities | 34,958 | 118,740 | 137,977 | 184,892 | ||||||||||||

Cash flows from investing activities | ||||||||||||||||

Acquisitions | (3,120 | ) | (111,367 | ) | (6,193 | ) | (116,107 | ) | ||||||||

Additions to property, plant and equipment | (56,982 | ) | (120,512 | ) | (193,195 | ) | (229,174 | ) | ||||||||

Other | 5,568 | 334 | 5,822 | 739 | ||||||||||||

Net cash used in investing activities | (54,534 | ) | (231,545 | ) | (193,566 | ) | (344,542 | ) | ||||||||

Cash flows from financing activities | ||||||||||||||||

Dividends paid | (2,370 | ) | (2,342 | ) | (4,719 | ) | (4,686 | ) | ||||||||

Distributions paid to noncontrolling interest holders | (18,455 | ) | (14,172 | ) | (36,910 | ) | (27,912 | ) | ||||||||

Repayments of bank borrowings | — | — | (7,542 | ) | — | |||||||||||

Net proceeds from (repayments of) PVR borrowings | 2,000 | (32,600 | ) | 29,000 | (30,600 | ) | ||||||||||

Net proceeds from (repayments of) Company borrowings | (320,000 | ) | 29,000 | (262,000 | ) | 83,000 | ||||||||||

Net proceeds from issuance of senior notes | 291,009 | — | 291,009 | — | ||||||||||||

Net proceeds from issuance of PVR partners’ capital | — | 138,015 | — | 138,015 | ||||||||||||

Net proceeds from issuance of equity | 64,835 | — | 64,835 | — | ||||||||||||

Other | (8,827 | ) | 5,504 | (18,085 | ) | 10,786 | ||||||||||

Net cash provided by financing activities | 8,192 | 123,405 | 55,588 | 168,603 | ||||||||||||

Net increase (decrease) in cash and cash equivalents | (11,384 | ) | 10,600 | (1 | ) | 8,953 | ||||||||||

Cash and cash equivalents – beginning of period | 29,721 | 32,880 | 18,338 | 34,527 | ||||||||||||

Cash and cash equivalents – end of period | $ | 18,337 | $ | 43,480 | $ | 18,337 | $ | 43,480 | ||||||||

Supplemental disclosure: | ||||||||||||||||

Cash paid during the periods for: | ||||||||||||||||

Interest | $ | 14,968 | $ | 10,654 | $ | 25,254 | $ | 17,891 | ||||||||

Income taxes | $ | 684 | $ | 934 | $ | 2,953 | $ | 2,179 | ||||||||

The accompanying notes are an integral part of these consolidated financial statements.

3

Table of Contents

PENN VIRGINIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – unaudited

June 30, 2009

1. Organization

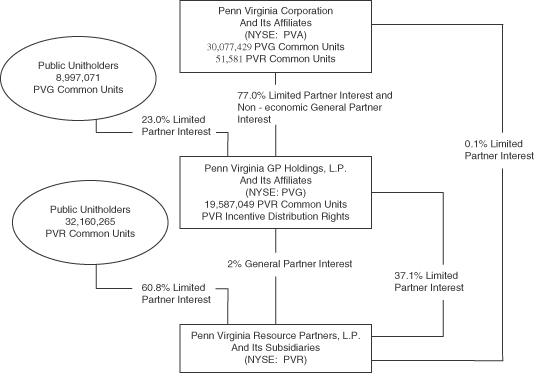

Penn Virginia Corporation (“Penn Virginia,” the “Company,” “we,” “us” or “our”) is an independent oil and gas company primarily engaged in the development, exploration and production of natural gas and oil in various domestic onshore regions including East Texas, the Mid-Continent, Appalachia, Mississippi and the Gulf Coast. We also indirectly own partner interests in Penn Virginia Resource Partners, L.P. (“PVR”), a publicly traded limited partnership formed by us in 2001. Our ownership interests in PVR are held principally through our general partner interest and 77% limited partner interest in Penn Virginia GP Holdings, L.P. (“PVG”), a publicly traded limited partnership formed by us in 2006. As of June 30, 2009 PVG owned an approximately 37% limited partner interest in PVR and 100% of the general partner of PVR, which holds a 2% general partner interest in PVR and all of the incentive distribution rights.

We are engaged in three primary business segments: (i) oil and gas, (ii) coal and natural resource management and (iii) natural gas midstream. We directly operate our oil and gas segment and PVR operates our coal and natural resource management and natural gas midstream segments.

2. Basis of Presentation

Our consolidated financial statements include the accounts of Penn Virginia and all of its subsidiaries, including PVG and PVR. Intercompany balances and transactions have been eliminated in consolidation. Our consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. These statements involve the use of estimates and judgments where appropriate. In the opinion of management, all adjustments, consisting of normal recurring accruals, considered necessary for a fair presentation of our consolidated financial statements have been included. Our consolidated financial statements should be read in conjunction with our consolidated financial statements and footnotes included in our Annual Report on Form 10-K for the year ended December 31, 2008. Operating results for the three and six months ended June 30, 2009 are not necessarily indicative of the results that may be expected for the year ending December 31, 2009. In preparing the accompanying consolidated financial statements, we have evaluated subsequent events through August 7, 2009.

3. Noncontrolling interests

We adopted Statement of Financial Accounting Standard (“SFAS”) No. 160,Noncontrolling Interests in Consolidated Financial Statements, effective January 1, 2009. SFAS No. 160 requires that the noncontrolling interests in PVG and PVR be classified as a separate component of shareholders’ equity. Net income attributable to the noncontrolling interests in PVG and PVR is separately presented on our consolidated statements of income. Our consolidated financial statements have been retroactively adjusted to reflect this adoption.

4

Table of Contents

The following is a reconciliation of the carrying amount of total shareholders’ equity, shareholders’ equity attributable to us and shareholders’ equity attributable to the noncontrolling interests in PVG and PVR:

| Penn Virginia Corporation Shareholders | Noncontrolling Interests | Total Shareholders’ Equity | Comprehensive Income (Loss) | |||||||||||||

Balance at December 31, 2008 | $ | 1,039,103 | $ | 297,227 | $ | 1,336,330 | ||||||||||

Dividends paid ($0.05625 per share) | (4,719 | ) | — | (4,719 | ) | |||||||||||

Distributions to noncontrolling interest holders | — | (36,910 | ) | (36,910 | ) | |||||||||||

Common Stock offering | 64,835 | — | 64,835 | |||||||||||||

Other changes to shareholders’ equity | 3,425 | 2,412 | 5,837 | |||||||||||||

Comprehensive Income: | ||||||||||||||||

Net income (loss) | (29,392 | ) | 10,003 | (19,389 | ) | $ | (19,389 | ) | ||||||||

Hedging unrealized loss, net of tax | 257 | (353 | ) | (96 | ) | (96 | ) | |||||||||

Hedging reclassification adjustment, net of tax | (240 | ) | 1,215 | 975 | 975 | |||||||||||

Balance at June 30, 2009 | $ | 1,073,269 | $ | 273,594 | $ | 1,346,863 | $ | (18,510 | ) | |||||||

Balance at December 31, 2007 | $ | 835,793 | $ | 174,420 | $ | 1,010,213 | ||||||||||

Dividends paid ($0.05625 per share) | (4,686 | ) | — | (4,686 | ) | |||||||||||

Distributions to noncontrolling interest holders | — | (27,912 | ) | (27,912 | ) | |||||||||||

Issuance of PVR units | — | 138,015 | 138,015 | |||||||||||||

Recognition of SAB 51 gain | 39,659 | (39,659 | ) | — | ||||||||||||

Other changes to shareholders’ equity | 11,619 | 1,712 | 13,331 | |||||||||||||

Comprehensive Income: | ||||||||||||||||

Net income (loss) | (1,355 | ) | 23,976 | 22,621 | $ | 22,621 | ||||||||||

Hedging unrealized loss, net of tax | (262 | ) | (376 | ) | (638 | ) | (638 | ) | ||||||||

Hedging reclassification adjustment, net of tax | 186 | 1,985 | 2,171 | 2,171 | ||||||||||||

Balance at June 30, 2008 | $ | 880,954 | $ | 272,161 | $ | 1,153,115 | $ | 24,154 | ||||||||

4. Fair Value Measurements

Effective January 1, 2009, SFAS No. 157,Fair Value Measurements,applies to both our financial and nonfinancial assets and liabilities that are measured and reported on a fair value basis. Our financial instruments that are subject to fair value disclosures consist of cash and cash equivalents, accounts receivable, accounts payable, derivative instruments and long-term debt. We have followed consistent methods and assumptions to estimate the fair values as more fully described in our Annual Report on Form 10-K for the year ended December 31, 2008.

At June 30, 2009, the carrying values of all of these financial instruments, except our convertible senior subordinated notes due 2012 (“Convertible Notes”) portion of our long-term debt, approximated fair value. The fair value of the Convertible Notes portion of our long-term debt at June 30, 2009 was $192.6 million, which was derived from quoted market prices.

5

Table of Contents

The following table summarizes the valuation of certain assets and liabilities by category as of June 30, 2009 (in thousands):

Description | Fair Value Measurements, June 30, 2009 | Fair Value Measurement at June 30, 2009, Using | |||||||||||||

| Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | |||||||||||||

Publicly traded equities | $ | 4,687 | $ | 4,687 | $ | — | $ | — | |||||||

Deferred compensation liabilities - noncurrent | (5,176 | ) | (5,176 | ) | — | — | |||||||||

Interest rate swap assets - noncurrent | 900 | — | 900 | — | |||||||||||

Interest rate swap liabilities - current | (8,709 | ) | — | (8,709 | ) | — | |||||||||

Interest rate swap liabilities - noncurrent | (4,774 | ) | — | (4,774 | ) | — | |||||||||

Commodity derivative assets - current | 42,768 | — | 42,768 | — | |||||||||||

Commodity derivative assets - noncurrent | 1,200 | — | 1,200 | — | |||||||||||

Commodity derivative liabilities - current | (7,900 | ) | — | (7,900 | ) | — | |||||||||

Commodity derivative liabilities - noncurrent | (1,300 | ) | — | (1,300 | ) | — | |||||||||

Total | $ | 21,696 | $ | (489 | ) | $ | 22,185 | $ | — | ||||||

See Note 5 – “Derivative Instruments,” for the effects of derivative instruments on our consolidated financial statements.

5. Derivative Instruments

For commodity derivative instruments, we recognize variances in fair values in earnings currently, rather than deferring such amounts in accumulated other comprehensive income (“AOCI”) within shareholders’ equity.

Commodity Derivatives

Oil and Gas

We determine the fair values of our oil and gas derivative agreements based on discounted cash flows derived from third-party quoted forward prices for NYMEX Henry Hub gas and West Texas Intermediate crude oil forward prices as of June 30, 2009. We compute discounted cash flows using discount rates adjusted for the credit risk of our counterparties for derivatives in an asset position and our own credit risk if the derivative is in a liability position, in accordance with SFAS No. 157.

6

Table of Contents

The following table sets forth our commodity derivative positions as of June 30, 2009:

| Average Volume Per Day | Weighted Average Price | Estimated Fair Value at June 30, 2009 | ||||||||||||

| Additional Put Option | Floor | Ceiling | ||||||||||||

| (in thousands) | ||||||||||||||

Natural Gas Costless Collars | (MMBtu) | ($ | per MMBtu | ) | ||||||||||

Third Quarter 2009 | 15,000 | 4.25 | 5.70 | $ | 658 | |||||||||

Fourth Quarter 2009 | 15,000 | 4.25 | 5.70 | (5 | ) | |||||||||

First Quarter 2010 | 35,000 | 4.96 | 7.41 | (116 | ) | |||||||||

Second Quarter 2010 | 30,000 | 5.33 | 8.02 | 878 | ||||||||||

Third Quarter 2010 | 30,000 | 5.33 | 8.02 | 459 | ||||||||||

Fourth Quarter 2010 | 50,000 | 5.65 | 8.77 | 479 | ||||||||||

First Quarter 2011 | 50,000 | 5.65 | 8.77 | (860 | ) | |||||||||

Second Quarter 2011 | 10,000 | 6.00 | 8.00 | 144 | ||||||||||

Third Quarter 2011 | 10,000 | 6.00 | 8.00 | 5 | ||||||||||

Natural Gas Three-way Collars | (MMBtu) | ($ | per MMBtu | ) | ||||||||||

Third Quarter 2009 | 40,000 | 6.38 | 8.75 | 10.79 | 8,652 | |||||||||

Fourth Quarter 2009 | 30,000 | 6.83 | 9.50 | 13.60 | 6,711 | |||||||||

First Quarter 2010 | 30,000 | 6.83 | 9.50 | 13.60 | 5,910 | |||||||||

Natural Gas Swaps | (MMBtu) | ($ | per MMBtu | ) | ||||||||||

Third Quarter 2009 | 40,000 | 4.91 | 3,609 | |||||||||||

Fourth Quarter 2009 | 40,000 | 4.91 | 148 | |||||||||||

First Quarter 2010 | 15,000 | 6.19 | 464 | |||||||||||

Second Quarter 2010 | 30,000 | 6.17 | 1,066 | |||||||||||

Third Quarter 2010 | 30,000 | 6.17 | 331 | |||||||||||

Crude Oil Three-way Collars | (barrels) | ($ | per barrel | ) | ||||||||||

Third Quarter 2009 | 500 | 80.00 | 110.00 | 179.00 | 1,317 | |||||||||

Fourth Quarter 2009 | 500 | 80.00 | 110.00 | 179.00 | 1,186 | |||||||||

Crude Oil Swaps | (barrels) | ($ | per barrel | ) | ||||||||||

Third Quarter 2009 | 500 | 59.25 | (540 | ) | ||||||||||

Fourth Quarter 2009 | 500 | 59.25 | (621 | ) | ||||||||||

Crude Oil Costless Collars | (barrels) | ($ | per barrel | ) | ||||||||||

First Quarter 2010 | 500 | 60.00 | 74.75 | (206 | ) | |||||||||

Second Quarter 2010 | 500 | 60.00 | 74.75 | (249 | ) | |||||||||

Third Quarter 2010 | 500 | 60.00 | 74.75 | (292 | ) | |||||||||

Fourth Quarter 2010 | 500 | 60.00 | 74.75 | (331 | ) | |||||||||

Settlements to be received in subsequent period | 293 | |||||||||||||

Oil and gas segment commodity derivatives - net asset | $ | 29,090 | ||||||||||||

See theFinancial Statement Impact of Derivatives section below for the impact of the oil and gas commodity derivatives on our consolidated financial statements.

7

Table of Contents

PVR Natural Gas Midstream Segment

PVR determines the fair values of its derivative agreements based on discounted cash flows based on quoted forward prices for the respective commodities as of June 30, 2009, using discount rates adjusted for the credit risk of the counterparties if the derivative is in an asset position and PVR’s own credit risk if the derivative is in a liability position. The following table sets forth PVR’s positions as of June 30, 2009 for commodities related to natural gas midstream revenues and cost of midstream gas purchased:

| Weighted Average Price Collars | |||||||||||||||

| Average Volume Per Day | Additional Put Option | Put | Call | Fair Value (in thousands) | |||||||||||

Crude Oil Three-Way Collar | (in barrels | ) | (per gallon) | ||||||||||||

Third Quarter 2009 through Fourth Quarter 2009 | 1,000 | $ | 70.00 | $ | 90.00 | $ | 119.25 | $ | 2,634 | ||||||

Frac Spread Collar | (in MMBtu | ) | (per MMBtu) | ||||||||||||

Third Quarter 2009 through Fourth Quarter 2009 | 6,000 | $ | 9.09 | $ | 13.94 | 1,235 | |||||||||

Crude Oil Collar | (in barrels | ) | (per gallon) | ||||||||||||

First Quarter 2010 through Fourth Quarter 2010 | 750 | $ | 70.00 | $ | 81.25 | 28 | |||||||||

Settlements to be received in subsequent period | 1,781 | ||||||||||||||

Natural gas midstream segment commodity derivatives - net asset | $ | 5,678 | |||||||||||||

At June 30, 2009, PVR reported a derivative asset related to the PVR natural gas midstream segment of $5.7 million. See theFinancial Statement Impact of Derivativessection below for the impact of the PVR natural gas midstream commodity derivatives on our consolidated financial statements.

Interest Rate Swaps

We entered into interest rate swaps (the “Interest Rate Swaps”) with notional amounts of $50.0 million to establish fixed rates on a portion of the outstanding borrowings under our revolving credit facility (the “Revolver”) through December 2010. During the first quarter of 2009, we discontinued cash flow hedge accounting for all of the Interest Rate Swaps. Accordingly, subsequent fair value gains and losses for the Interest Rate Swaps are recognized in the derivative line item of the income statement. At June 30, 2009, a $1.9 million loss, net of income taxes, remained in AOCI related to the discontinued Interest Rate Swap hedges. The $1.9 million loss will be recognized in interest expense through the end of 2010 as the originally forecasted transactions settle.

We reported a (i) net derivative liability of $3.1 million at June 30, 2009 and (ii) loss in AOCI of $1.9 million, net of the income taxes, at June 30, 2009 related to the Interest Rate Swaps. See theFinancial Statement Impact of Derivativessection below for the impact of the Interest Rate Swaps on our consolidated financial statements.

PVR Interest Rate Swaps

PVR has entered into interest rate swaps (the “PVR Interest Rate Swaps”) to establish fixed rates on a portion of the outstanding borrowings under its revolving credit facility (the “PVR Revolver”). The following table sets forth PVR’s Interest Rate Swap positions at June 30, 2009:

Dates | Notional Amounts | Weighted-Average Fixed Rate | ||||

| (in millions) | ||||||

Until March 2010 | $ | 310.0 | 3.54 | % | ||

March 2010 - December 2011 | $ | 250.0 | 3.37 | % | ||

December 2011 - December 2012 | $ | 100.0 | 2.09 | % | ||

During the first quarter of 2009, PVR discontinued cash flow hedge accounting for all of the PVR Interest Rate Swaps. Accordingly, subsequent fair value gains and losses for the PVR Interest Rate Swaps are recognized in the derivative line item of our

8

Table of Contents

consolidated statements of income. At June 30, 2009, a $2.5 million loss remained in AOCI related to these discontinued PVR Interest Rate Swap hedges. The $2.5 million loss will be recognized in interest expense through the end of 2011 as the originally forecasted transactions settle.

PVR reported a (i) net derivative liability of $9.5 million at June 30, 2009 and (ii) loss in AOCI of $2.5 million at June 30, 2009 related to the PVR Interest Rate Swaps. See theFinancial Statement Impact of Derivativessection below for the impact of the PVR Interest Rate Swaps on our consolidated financial statements.

Financial Statement Impact of Derivatives

The following table summarizes the effects of our consolidated derivative activities, as well as the location of the gains and losses, on our consolidated statements of income for the three and six months ended June 30, 2009 and 2008 (in thousands):

Location of gain (loss) on derivatives recognized in income | Three Months Ended June 30, 2009 | Three Months Ended June 30, 2008 | ||||||||

Derivatives de-designated as hedging instruments under SFAS No. 133: | ||||||||||

Interest rate contracts (1) | Interest expense | $ | (1,420 | ) | $ | (955 | ) | |||

Decrease in net income resulting from derivatives de-designated as hedging instruments under SFAS No. 133 | $ | (1,420 | ) | $ | (955 | ) | ||||

Derivatives not designated as hedging instruments under SFAS No. 133: | ||||||||||

Interest rate contracts | Derivatives | $ | 1,633 | $ | — | |||||

Commodity contracts (1) | Natural gas midstream revenues | — | (1,997 | ) | ||||||

Commodity contracts (1) | Cost of midstream gas purchased | — | 480 | |||||||

Commodity contracts | Derivatives | (881 | ) | (103,618 | ) | |||||

Increase (decrease) in net income resulting from derivatives not designated as hedging instruments under SFAS No. 133 | $ | 752 | $ | (105,135 | ) | |||||

Total decrease in net income resulting from derivatives | $ | (668 | ) | $ | (106,090 | ) | ||||

Realized and unrealized derivative impact: | ||||||||||

Cash received (paid) for commodity and interest rate contract settlements | Derivatives | $ | 17,281 | $ | (18,032 | ) | ||||

Cash paid for interest rate contract settlements | Interest expense | — | (955 | ) | ||||||

Unrealized derivative gain (2) | (17,949 | ) | (87,103 | ) | ||||||

Total decrease in net income resulting from derivatives | $ | (668 | ) | $ | (106,090 | ) | ||||

Location of gain (loss) on derivatives recognized in income | Six Months Ended June 30, 2009 | Six Months Ended June 30, 2008 | ||||||||

Derivatives de-designated as hedging instruments under SFAS No. 133: | ||||||||||

Interest rate contracts (1) | Interest expense | $ | (2,683 | ) | $ | (712 | ) | |||

Decrease in net income resulting from derivatives de-designated as hedging instruments under SFAS No. 133 | $ | (2,683 | ) | $ | (712 | ) | ||||

Derivatives not designated as hedging instruments under SFAS No. 133: | ||||||||||

Interest rate contracts | Derivatives | $ | 519 | $ | — | |||||

Commodity contracts (1) | Natural gas midstream revenues | — | (4,248 | ) | ||||||

Commodity contracts (1) | Cost of midstream gas purchased | — | 1,623 | |||||||

Commodity contracts | Derivatives | 10,488 | (129,519 | ) | ||||||

Increase (decrease) in net income resulting from derivatives not designated as hedging instruments under SFAS No. 133 | $ | 11,007 | $ | (132,144 | ) | |||||

Total increase (decrease) in net income resulting from derivatives | $ | 8,324 | $ | (132,856 | ) | |||||

Realized and unrealized derivative impact: | ||||||||||

Cash received (paid) for commodity and interest rate contract settlements | Derivatives | $ | 36,429 | $ | (26,985 | ) | ||||

Cash paid for interest rate contract settlements | Interest expense | (808 | ) | (712 | ) | |||||

Unrealized derivative gain (2) | (27,297 | ) | (105,159 | ) | ||||||

Total increase (decrease) in net income resulting from derivatives | $ | 8,324 | $ | (132,856 | ) | |||||

9

Table of Contents

| (1) | This activity represents amounts reclassified out of AOCI and into earnings due to the discontinuance of hedge accounting. At June 30, 2009, a $4.4 million loss remained in AOCI, which consisted of $1.9 million of Interest Rate Swaps and $2.5 million of PVR Interest Rate Swaps. |

| (2) | This activity represents unrealized gains in the natural gas midstream, cost of midstream gas purchased, interest expense and derivatives lines on our consolidated statements of income. |

The following table summarizes the fair value of our derivative instruments, as well as the locations of these instruments, on our consolidated balance sheets as of June 30, 2009 and December 31, 2008 (in thousands):

Balance Sheet Location | Fair values at June 30, 2009 | Fair values at December 31, 2008 | ||||||||||||

| Derivative Assets | Derivative Liabilities | Derivative Assets | Derivative Liabilities | |||||||||||

Derivatives de-designated as hedging instruments under SFAS No. 133: | ||||||||||||||

Interest rate contracts | Derivative liabilities - current | $ | — | $ | — | $ | — | $ | 3,177 | |||||

Interest rate contracts | Derivative liabilities - noncurrent | — | — | — | 3,648 | |||||||||

Total derivatives de-designated as hedging instruments | $ | — | $ | — | $ | — | $ | 6,825 | ||||||

Derivatives not designated as hedging instruments under SFAS No. 133: | ||||||||||||||

Interest rate contracts | Derivative assets/liabilities - current | $ | — | $ | 8,709 | $ | — | $ | 4,663 | |||||

Interest rate contracts | Derivative assets/liabilities - noncurrent | 900 | 4,774 | — | 5,073 | |||||||||

Commodity contracts | Derivative assets/liabilities - current | 42,768 | 7,900 | 67,569 | 7,694 | |||||||||

Commodity contracts | Derivative assets/liabilities - noncurrent | 1,200 | 1,300 | 4,070 | — | |||||||||

Total derivatives not designated as hedging instruments | $ | 44,868 | $ | 22,683 | $ | 71,639 | $ | 17,430 | ||||||

Total estimated fair value of derivative instruments | $ | 44,868 | $ | 22,683 | $ | 71,639 | $ | 24,255 | ||||||

See Note 4 – “Fair Value Measurements,” for a description of how the above financial instruments are valued in accordance with SFAS No. 157.

The following table summarizes our consolidated interest expense for the three and six months ended June 30, 2009, including the effect of the Interest Rate Swaps and the PVR Interest Rate Swaps:

| Three Months Ended | Six Months Ended | |||||||

Source | June 30, 2009 | |||||||

| (in thousands) | ||||||||

Interest on borrowings | $ | 14,318 | $ | 25,998 | ||||

Capitalized interest | (690 | ) | (1,131 | ) | ||||

Interest rate swaps | 1,418 | 2,681 | ||||||

Total interest expense | $ | 15,046 | $ | 27,548 | ||||

At June 30, 2009, we reported a commodity derivative asset related to our oil and gas segment of $29.1 million. At June 30, 2009, PVR reported a commodity derivative asset related to the PVR natural gas midstream segment of $5.7 million that is with three counterparties, which are investment grade financial institutions, and is substantially concentrated with one of those counterparties. These concentrations may impact our overall credit risk, either positively or negatively, in that these counterparties may be similarly affected by changes in economic or other conditions. Neither we nor PVR paid or received collateral with respect to our or PVR’s derivative positions. The maximum amount of loss due to credit risk if counterparties to our or PVR’s derivative asset positions fail to perform according to the terms of the contracts would be equal to the fair value of the contracts as of June 30, 2009. No significant uncertainties related to the collectability of amounts owed to us or PVR exist with regard to these counterparties.

The above hedging activity represents cash flow hedges. As of June 30, 2009 neither we nor PVR actively traded derivative instruments or had any fair value hedges. In addition neither we nor PVR owned derivative instruments containing credit risk contingencies as of June 30, 2009.

10

Table of Contents

6. Common Stock Offering

On May 22, 2009, we completed the sale of 3.5 million shares of our common stock in a registered public offering. The net sales proceeds of $64.8 million were used to repay borrowings under our Revolver.

7. Long-Term Debt

In June 2009, the Company sold $300.0 million of unsecured senior notes due on June 15, 2016 (the “Senior Notes”) with an annual interest rate of 10.375% which is payable June 15 and December 15 of each year. The Senior Notes were sold at 97% of par, equating to an effective yield to maturity of approximately 11%. The net proceeds from the sale of the Senior Notes of approximately $281.6 million, after deducting a discount of $9.0 million and fees and expenses of approximately $9.4 million which is amortizable through June 15, 2016, were used to repay borrowings under our Revolver. We have a call option on the Senior Notes, which we may redeem some or all of the notes at any time on or after June 15, 2013 at the redemption prices set forth in the debt agreement and prior to such date at a “make-whole” redemption price. We may also redeem up to 35% of the notes prior to June 15, 2012 with cash proceeds received from certain equity offerings. If we sell certain assets and do not reinvest the proceeds or repay senior indebtedness or if we experience specific kinds of changes of control, we must offer to repurchase the notes. The Senior Notes are senior to our existing and future subordinated indebtedness, including the Convertible Notes and are effectively subordinated to all of our secured indebtedness including our Revolver to the extent of the collateral securing that indebtedness. The obligations under the Senior Notes are fully and unconditionally guaranteed by our oil and gas subsidiaries, which are also guarantors under our Revolver.

During the second quarter of 2009, the borrowing base of the Revolver was revised from $450.0 million to $367.0 million due to the issuance of our Senior Notes. The financial covenants under the Revolver require us to comply with certain specified financial ratios. The Revolver contains various other covenants that limit our ability to incur additional indebtedness, grant liens, make certain loans, acquisitions and investments, make any material change to the nature of our business or enter into a merger or sale of our assets, including the sale or transfer of interests in our subsidiaries. As of June 30, 2009, the weighted average interest rate on the Revolver was approximately 2.3%, and we were in compliance with all of our covenants under the Revolver.

In March 2009, PVR increased the size of the PVR Revolver from $700.0 million to $800.0 million. The PVR Revolver is secured with substantially all of PVR’s assets and will mature in December 2011. Interest is payable at a base rate plus an applicable margin of up to 1.25% if PVR selects the base rate borrowing option under the PVR Revolver or at a rate derived from the London Interbank Offered Rate (“LIBOR”) plus an applicable margin ranging from 1.75% to 2.75% if PVR selects the LIBOR-based borrowing option. As of June 30, 2009, the weighted average interest rate on borrowing outstanding under the PVR Revolver was approximately 2.5%, and PVR was in compliance with all of the covenants under the PVR Revolver.

The following table summarizes our and PVR’s long-term debt as of June 30, 2009 and December 31, 2008:

| June 30, 2009 | December 31, 2008 | ||||||

| (in thousands) | |||||||

Short-term borrowings | $ | — | $ | 7,542 | |||

Revolving credit facility | 70,000 | 332,000 | |||||

Senior notes, net of discount(1) | 291,115 | — | |||||

Convertible notes, net of discount | 203,217 | 199,896 | |||||

Total recourse debt of the Company | 564,332 | 539,438 | |||||

Long-term debt of PVR | 597,100 | 568,100 | |||||

Total consolidated debt | 1,161,432 | 1,107,538 | |||||

Less: Short-term borrowings | — | (7,542 | ) | ||||

Total consolidated long-term debt | $ | 1,161,432 | $ | 1,099,996 | |||

| (1) | Includes discount of $9.0 million, which is amortizable through June 15, 2016. |

11

Table of Contents

8. Guarantors Subsidiaries

In June 2009, the Company issued our Senior Notes, which are fully and unconditionally and joint and severally guaranteed by our oil and gas subsidiaries (collectively, the “Guarantor Subsidiaries”). The primary non-guarantor subsidiaries are PVG and PVR (collectively, the “Non-guarantor Subsidiaries”). As such, the Company is subject to the requirements regarding financial statements of guarantors and issuers of registered guaranteed securities, according to Rule 3-10 of Regulation S-X of the Securities and Exchange Commission.

The tables below present the condensed consolidating financial position, results of operations and cash flows of the Company, the Guarantor Subsidiaries and Non-guarantor Subsidiaries.

Balance Sheets

| June 30, 2009 | ||||||||||||||||

| Penn Virginia Corporation | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Eliminations | Consolidated | ||||||||||||

| (in thousands) | ||||||||||||||||

Assets | ||||||||||||||||

Cash and cash equivalents | $ | 1,319 | $ | — | $ | 17,018 | $ | — | $ | 18,337 | ||||||

Accounts receivable | 22 | 42,966 | 62,435 | — | 105,423 | |||||||||||

Inventory | — | 12,899 | 2,237 | — | 15,136 | |||||||||||

Other current assets | 27,321 | 785 | 15,779 | 6,759 | 50,644 | |||||||||||

Total current assets | 28,662 | 56,650 | 97,469 | 6,759 | 189,540 | |||||||||||

Property and equipment, net | 7,861 | 1,659,079 | 893,059 | (28,552 | ) | 2,531,447 | ||||||||||

Investments in affiliates (equity method) | 1,628,055 | 254,497 | — | (1,882,552 | ) | — | ||||||||||

Other assets | 29,146 | 47 | 233,374 | (26,615 | ) | 235,952 | ||||||||||

Total assets | $ | 1,693,724 | $ | 1,970,273 | $ | 1,223,902 | $ | (1,930,960 | ) | $ | 2,956,939 | |||||

Liabilities and shareholders’ equity | ||||||||||||||||

Accounts payable and accrued liabilities | $ | 6,435 | $ | 54,124 | $ | 54,562 | $ | — | $ | 115,121 | ||||||

Other current liabilities | 5,878 | 11 | 15,265 | 6,759 | 27,913 | |||||||||||

Total current liabilities | 12,313 | 54,135 | 69,827 | 6,759 | 143,034 | |||||||||||

Deferred income taxes | — | 280,971 | — | (26,819 | ) | 254,152 | ||||||||||

Long-term debt of PVR | — | — | 597,100 | — | 597,100 | |||||||||||

Long-term debt of the Company | 564,332 | — | — | — | 564,332 | |||||||||||

Other long-term liabilities | 15,462 | 7,112 | 28,884 | — | 51,458 | |||||||||||

Penn Virginia Corporation's equity | 1,101,617 | 1,628,055 | 254,497 | (1,910,900 | ) | 1,073,269 | ||||||||||

Noncontrolling interests in subsidiaries | — | — | 273,594 | — | 273,594 | |||||||||||

Total liabilities and shareholders’ equity | $ | 1,693,724 | $ | 1,970,273 | $ | 1,223,902 | $ | (1,930,960 | ) | $ | 2,956,939 | |||||

Balance Sheets

| December 31, 2008 | ||||||||||||||||

| Penn Virginia Corporation | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Eliminations | Consolidated | ||||||||||||

| (in thousands) | ||||||||||||||||

Assets | ||||||||||||||||

Cash and cash equivalents | $ | — | $ | — | $ | 18,338 | $ | — | $ | 18,338 | ||||||

Accounts receivable | — | 75,962 | 73,279 | — | 149,241 | |||||||||||

Inventory | — | 16,595 | 1,873 | — | 18,468 | |||||||||||

Other current assets | 37,455 | 7,241 | 32,823 | (48 | ) | 77,471 | ||||||||||

Total current assets | 37,455 | 99,798 | 126,313 | (48 | ) | 263,518 | ||||||||||

Property and equipment, net | 8,255 | 1,637,832 | 895,247 | (29,157 | ) | 2,512,177 | ||||||||||

Investments in affiliates (equity method) | 1,574,758 | 268,314 | — | (1,843,072 | ) | — | ||||||||||

Other assets | 32,857 | 49 | 237,065 | (49,101 | ) | 220,870 | ||||||||||

Total assets | $ | 1,653,325 | $ | 2,005,993 | $ | 1,258,625 | $ | (1,921,378 | ) | $ | 2,996,565 | |||||

Liabilities and shareholders’ equity | ||||||||||||||||

Current maturities of long-term debt | $ | 7,542 | $ | — | $ | — | $ | — | $ | 7,542 | ||||||

Accounts payable and accrued liabilities | 8,294 | 129,190 | 69,418 | — | 206,902 | |||||||||||

Other current liabilities | 15,032 | — | 18,166 | (48 | ) | 33,150 | ||||||||||

Total current liabilities | 30,868 | 129,190 | 87,584 | (48 | ) | 247,594 | ||||||||||

Deferred income taxes | 11,868 | 295,270 | — | (49,101 | ) | 258,037 | ||||||||||

Long-term debt of PVR | — | — | 568,100 | — | 568,100 | |||||||||||

Long-term debt of the Company | 531,896 | — | — | — | 531,896 | |||||||||||

Other long-term liabilities | 10,433 | 6,775 | 37,400 | — | 54,608 | |||||||||||

Penn Virginia Corporation's equity | 1,068,260 | 1,574,758 | 268,314 | (1,872,229 | ) | 1,039,103 | ||||||||||

Noncontrolling interests in subsidiaries | — | — | 297,227 | — | 297,227 | |||||||||||

Total liabilities and shareholders’ equity | $ | 1,653,325 | $ | 2,005,993 | $ | 1,258,625 | $ | (1,921,378 | ) | $ | 2,996,565 | |||||

12

Table of Contents

Income Statements

| Three Months Ended June 30, 2009 | ||||||||||||||||||||

| Penn Virginia Corporation | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Eliminations | Consolidated | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Revenues | $ | — | $ | 55,780 | $ | 149,544 | $ | (21,407 | ) | $ | 183,917 | |||||||||

Cost of midstream gas purchased | — | — | 92,154 | (20,221 | ) | 71,933 | ||||||||||||||

Operating | — | 14,748 | 9,084 | (1,184 | ) | 22,648 | ||||||||||||||

Exploration | — | 17,472 | — | — | 17,472 | |||||||||||||||

Taxes other than income | 206 | 3,744 | 980 | — | 4,930 | |||||||||||||||

General and administrative | 5,803 | 5,713 | 8,839 | — | 20,355 | |||||||||||||||

Depreciation, depletion and amortization | 978 | 39,917 | 17,622 | (299 | ) | 58,218 | ||||||||||||||

Impairments | — | 3,279 | — | — | 3,279 | |||||||||||||||

Loss on sale of assets | — | 1,599 | — | — | 1,599 | |||||||||||||||

Operating expenses | 6,987 | 86,472 | 128,679 | (21,704 | ) | 200,434 | ||||||||||||||

Operating income (loss) | (6,987 | ) | (30,692 | ) | 20,865 | 297 | (16,517 | ) | ||||||||||||

Equity in earnings of subsidiaries | (14,503 | ) | 3,670 | — | 10,833 | — | ||||||||||||||

Interest expense and other | (8,703 | ) | 887 | (6,878 | ) | 1 | (14,693 | ) | ||||||||||||

Derivatives | 2,787 | — | (2,035 | ) | — | 752 | ||||||||||||||

Income (loss) before income taxes and noncontrolling interests | (27,406 | ) | (26,135 | ) | 11,952 | 11,131 | (30,458 | ) | ||||||||||||

Income tax benefit (expense) | 4,925 | 11,632 | (1,937 | ) | — | 14,620 | ||||||||||||||

Net income (loss) | (22,481 | ) | (14,503 | ) | 10,015 | 11,131 | (15,838 | ) | ||||||||||||

Less net income attributable to noncontrolling interests | — | — | (6,345 | ) | — | (6,345 | ) | |||||||||||||

Net income (loss) attributable to Penn Virginia Corporation | $ | (22,481 | ) | $ | (14,503 | ) | $ | 3,670 | $ | 11,131 | $ | (22,183 | ) | |||||||

Income Statements

| Three Months Ended June 30, 2008 | ||||||||||||||||||||

| Penn Virginia Corporation | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Eliminations | Consolidated | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Revenues | $ | 1 | $ | 134,368 | $ | 276,940 | $ | (50,895 | ) | $ | 360,414 | |||||||||

Cost of midstream gas purchased | — | — | 202,819 | (49,833 | ) | 152,986 | ||||||||||||||

Operating | — | 14,095 | 9,181 | (1,062 | ) | 22,214 | ||||||||||||||

Exploration | — | 6,739 | — | — | 6,739 | |||||||||||||||

Taxes other than income | 212 | 7,085 | 962 | — | 8,259 | |||||||||||||||

General and administrative | 6,587 | 5,163 | 7,308 | — | 19,058 | |||||||||||||||

Depreciation, depletion and amortization | 830 | 31,568 | 12,924 | (388 | ) | 44,934 | ||||||||||||||

Impairments | — | — | — | — | — | |||||||||||||||

Operating expenses | 7,629 | 64,650 | 233,194 | (51,283 | ) | 254,190 | ||||||||||||||

Operating income (loss) | (7,628 | ) | 69,718 | 43,746 | 388 | 106,224 | ||||||||||||||

Equity in earnings of subsidiaries | 48,699 | 5,523 | — | (54,222 | ) | — | ||||||||||||||

Interest expense and other | (6,560 | ) | 1,062 | (4,872 | ) | — | (10,370 | ) | ||||||||||||

Derivatives | (73,676 | ) | — | (29,942 | ) | — | (103,618 | ) | ||||||||||||

Income (loss) before income taxes and noncontrolling interests | (39,165 | ) | 76,303 | 8,932 | (53,834 | ) | (7,764 | ) | ||||||||||||

Income tax benefit (expense) | 34,228 | (27,604 | ) | 539 | — | 7,163 | ||||||||||||||

Net income (loss) | (4,937 | ) | 48,699 | 9,471 | (53,834 | ) | (601 | ) | ||||||||||||

Less net income attributable to noncontrolling interests | — | — | (3,948 | ) | — | (3,948 | ) | |||||||||||||

Net income (loss) attributable to Penn Virginia Corporation | $ | (4,937 | ) | $ | 48,699 | $ | 5,523 | $ | (53,834 | ) | $ | (4,549 | ) | |||||||

13

Table of Contents

Income Statements

| Six Months Ended June 30, 2009 | ||||||||||||||||||||

| Penn Virginia Corporation | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Eliminations | Consolidated | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Revenues | $ | — | $ | 120,344 | $ | 306,311 | $ | (43,578 | ) | $ | 383,077 | |||||||||

Cost of midstream gas purchased | — | — | 192,774 | (41,443 | ) | 151,331 | ||||||||||||||

Operating | — | 29,511 | 17,974 | (2,135 | ) | 45,350 | ||||||||||||||

Exploration | — | 38,784 | — | — | 38,784 | |||||||||||||||

Taxes other than income | 589 | 8,570 | 2,203 | — | 11,362 | |||||||||||||||

General and administrative | 11,025 | 10,837 | 16,979 | — | 38,841 | |||||||||||||||

Depreciation, depletion and amortization | 1,849 | 79,916 | 34,131 | (605 | ) | 115,291 | ||||||||||||||

Impairments | — | 4,475 | — | — | 4,475 | |||||||||||||||

Loss on sale of assets | — | 1,599 | — | — | 1,599 | |||||||||||||||

Operating expenses | 13,463 | 173,692 | 264,061 | (44,183 | ) | 407,033 | ||||||||||||||

Operating income | (13,463 | ) | (53,348 | ) | 42,250 | 605 | (23,956 | ) | ||||||||||||

Equity in earnings of subsidiaries | (24,778 | ) | 7,328 | — | 17,450 | — | ||||||||||||||

Interest expense and other | (15,204 | ) | 887 | (11,305 | ) | — | (25,622 | ) | ||||||||||||

Derivatives | 20,202 | — | (9,195 | ) | — | 11,007 | ||||||||||||||

Income (loss) before income taxes and noncontrolling interests | (33,243 | ) | (45,133 | ) | 21,750 | 18,055 | (38,571 | ) | ||||||||||||

Income tax benefit (expense) | 3,246 | 20,355 | (4,419 | ) | — | 19,182 | ||||||||||||||

Net income (loss) | (29,997 | ) | (24,778 | ) | 17,331 | 18,055 | (19,389 | ) | ||||||||||||

Less net income attributable to noncontrolling interests | — | — | (10,003 | ) | — | (10,003 | ) | |||||||||||||

Net income (loss) attributable to Penn Virginia Corporation | $ | (29,997 | ) | $ | (24,778 | ) | $ | 7,328 | $ | 18,055 | $ | (29,392 | ) | |||||||

Income Statements

| Six Months Ended June 30, 2008 | ||||||||||||||||||||

| Penn Virginia Corporation | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Eliminations | Consolidated | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Revenues | $ | 3 | $ | 226,666 | $ | 433,775 | $ | (50,895 | ) | $ | 609,549 | |||||||||

Cost of midstream gas purchased | — | — | 302,516 | (49,833 | ) | 252,683 | ||||||||||||||

Operating | — | 28,304 | 15,974 | (1,062 | ) | 43,216 | ||||||||||||||

Exploration | — | 11,419 | — | — | 11,419 | |||||||||||||||

Taxes other than income | 676 | 12,943 | 2,035 | — | 15,654 | |||||||||||||||

General and administrative | 12,521 | 9,748 | 14,448 | — | 36,717 | |||||||||||||||

Depreciation, depletion and amortization | 1,649 | 58,184 | 24,430 | (760 | ) | 83,503 | ||||||||||||||

Impairments | — | — | — | — | — | |||||||||||||||

Operating expenses | 14,846 | 120,598 | 359,403 | (51,655 | ) | 443,192 | ||||||||||||||

Operating income | (14,843 | ) | 106,068 | 74,372 | 760 | 166,357 | ||||||||||||||

Equity in earnings of subsidiaries | 79,168 | 14,164 | — | (93,332 | ) | — | ||||||||||||||

Interest expense and other | (11,005 | ) | 1,062 | (8,843 | ) | — | (18,786 | ) | ||||||||||||

Derivatives | (107,353 | ) | — | (22,166 | ) | — | (129,519 | ) | ||||||||||||

Income (loss) before income taxes and noncontrolling interests | (54,033 | ) | 121,294 | 43,363 | (92,572 | ) | 18,052 | |||||||||||||

Income tax benefit (expense) | 51,918 | (42,126 | ) | (5,223 | ) | — | 4,569 | |||||||||||||

Net income (loss) | (2,115 | ) | 79,168 | 38,140 | (92,572 | ) | 22,621 | |||||||||||||

Less net income attributable to noncontrolling interests | — | — | (23,976 | ) | — | (23,976 | ) | |||||||||||||

Net income (loss) attributable to Penn Virginia Corporation | $ | (2,115 | ) | $ | 79,168 | $ | 14,164 | $ | (92,572 | ) | $ | (1,355 | ) | |||||||

14

Table of Contents

Statements of Cash Flows

| Three Months Ended June 30, 2009 | ||||||||||||||||||||

| Penn Virginia Corporation | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Eliminations | Consolidated | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Net cash provided by (used in) operating activities | $ | 5,587 | $ | (9,396 | ) | $ | 38,767 | $ | — | $ | 34,958 | |||||||||

Cash flows provided by (used in) investing activities: | ||||||||||||||||||||

Investment in (distributions from) affiliates | (35,844 | ) | 11,531 | — | 24,313 | — | ||||||||||||||

Additions to property and equipment | (1,048 | ) | (39,240 | ) | (15,814 | ) | — | (56,102 | ) | |||||||||||

Proceeds from the sale of assets and other | — | 1,261 | 307 | — | 1,568 | |||||||||||||||

Cash flows provided by (used in) investing activities | (36,892 | ) | (26,448 | ) | (15,507 | ) | 24,313 | (54,534 | ) | |||||||||||

Cash flows provided by (used in) financing activities: | ||||||||||||||||||||

Distributions paid to noncontrolling interest holders | — | — | (18,455 | ) | — | (18,455 | ) | |||||||||||||

Net proceeds from (repayments of) borrowings | (320,000 | ) | — | 2,000 | — | (318,000 | ) | |||||||||||||

Net proceeds from issuance of senior notes | 291,009 | — | — | — | 291,009 | |||||||||||||||

Net proceeds from issuance of equity | 64,835 | — | — | — | 64,835 | |||||||||||||||

Capital contributions from (distributions to) affiliates | — | 35,844 | (11,531 | ) | (24,313 | ) | — | |||||||||||||

Other | (11,197 | ) | — | — | — | (11,197 | ) | |||||||||||||

Cash flows provided by (used in) financing activities | 24,647 | 35,844 | (27,986 | ) | (24,313 | ) | 8,192 | |||||||||||||

Net decrease in cash and cash equivalents | (6,658 | ) | — | (4,726 | ) | — | (11,384 | ) | ||||||||||||

Cash and Cash equivalents - beginning of period | 7,977 | — | 21,744 | — | 29,721 | |||||||||||||||

Cash and Cash equivalents - end of period | $ | 1,319 | $ | — | $ | 17,018 | $ | — | $ | 18,337 | ||||||||||

Statements of Cash Flows

| Three Months Ended June 30, 2008 | ||||||||||||||||||||

| Penn Virginia Corporation | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Eliminations | Consolidated | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Net cash provided by operating activities | $ | 20 | $ | 74,166 | $ | 44,554 | $ | — | $ | 118,740 | ||||||||||

Cash flows provided by (used in) investing activities: | ||||||||||||||||||||

Investment in (distributions from) affiliates | (29,000 | ) | 11,047 | — | 17,953 | — | ||||||||||||||

Additions to property and equipment | (256 | ) | (114,213 | ) | (117,410 | ) | — | (231,879 | ) | |||||||||||

Proceeds from the sale of assets and other | — | — | 334 | — | 334 | |||||||||||||||

Cash flows provided by (used in) investing activities | (29,256 | ) | (103,166 | ) | (117,076 | ) | 17,953 | (231,545 | ) | |||||||||||

Cash flows provided by (used in) financing activities: | ||||||||||||||||||||

Distributions paid to noncontrolling interest holders | — | — | (14,172 | ) | — | (14,172 | ) | |||||||||||||

Net proceeds from (repayments of) borrowings | 29,000 | — | (32,600 | ) | — | (3,600 | ) | |||||||||||||

Net proceeds from equity issuance | 138,015 | — | 138,015 | |||||||||||||||||

Capital contributions from (distributions to) affiliates | — | 29,000 | (11,047 | ) | (17,953 | ) | — | |||||||||||||

Other | 3,782 | — | (620 | ) | — | 3,162 | ||||||||||||||

Cash flows provided by (used in) financing activities | 32,782 | 29,000 | 79,576 | (17,953 | ) | 123,405 | ||||||||||||||

Net increase in cash and cash equivalents | 3,546 | — | 7,054 | — | 10,600 | |||||||||||||||

Cash and Cash equivalents - beginning of period | 13,919 | — | 18,961 | — | 32,880 | |||||||||||||||

Cash and Cash equivalents - end of period | $ | 17,465 | $ | — | $ | 26,015 | $ | — | $ | 43,480 | ||||||||||

15

Table of Contents

Statements of Cash Flows

| Six Months Ended June 30, 2009 | ||||||||||||||||||||

| Penn Virginia Corporation | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Eliminations | Consolidated | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Net cash provided by operating activities | $ | 16,319 | $ | 49,198 | $ | 72,460 | $ | — | $ | 137,977 | ||||||||||

Cash flows provided by (used in) investing activities: | ||||||||||||||||||||

Investment in (distributions from) affiliates | (86,302 | ) | 23,064 | — | 63,238 | — | ||||||||||||||

Additions to property and equipment | (1,454 | ) | (159,814 | ) | (34,120 | ) | — | (195,388 | ) | |||||||||||

Proceeds from the sale of assets and other | — | 1,250 | 572 | — | 1,822 | |||||||||||||||

Cash flows provided by (used in) investing activities | (87,756 | ) | (135,500 | ) | (33,548 | ) | 63,238 | (193,566 | ) | |||||||||||

Cash flows provided by (used in) financing activities: | ||||||||||||||||||||

Distributions paid to noncontrolling interest holders | — | — | (36,910 | ) | — | (36,910 | ) | |||||||||||||

Net proceeds from (repayments of) borrowings | (269,542 | ) | — | 29,000 | — | (240,542 | ) | |||||||||||||

Net proceeds from issuance of senior notes | 291,009 | — | — | — | 291,009 | |||||||||||||||

Net proceeds from issuance of equity | 64,835 | — | — | — | 64,835 | |||||||||||||||

Capital contributions from (distributions to) affiliates | — | 86,302 | (23,064 | ) | (63,238 | ) | — | |||||||||||||

Other | (13,546 | ) | — | (9,258 | ) | — | (22,804 | ) | ||||||||||||

Cash flows provided by (used in) financing activities | 72,756 | 86,302 | (40,232 | ) | (63,238 | ) | 55,588 | |||||||||||||

Net increase (decrease) in cash and cash equivalents | 1,319 | — | (1,320 | ) | — | (1 | ) | |||||||||||||

Cash and Cash equivalents - beginning of period | — | — | 18,338 | — | 18,338 | |||||||||||||||

Cash and Cash equivalents - end of period | $ | 1,319 | $ | — | $ | 17,018 | $ | — | $ | 18,337 | ||||||||||

Statements of Cash Flows

| Six Months Ended June 30, 2008 | ||||||||||||||||||||

| Penn Virginia Corporation | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Eliminations | Consolidated | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Net cash provided by operating activities | $ | 7,509 | $ | 104,859 | $ | 72,524 | $ | — | $ | 184,892 | ||||||||||

Cash flows provided by (used in) investing activities: | ||||||||||||||||||||

Investment in (distributions from) affiliates | (83,000 | ) | 21,479 | — | 61,521 | — | ||||||||||||||

Additions to property and equipment | (799 | ) | (209,402 | ) | (135,080 | ) | — | (345,281 | ) | |||||||||||

Proceeds from the sale of assets and other | — | 64 | 675 | — | 739 | |||||||||||||||

Cash flows provided by (used in) investing activities | (83,799 | ) | (187,859 | ) | (134,405 | ) | 61,521 | (344,542 | ) | |||||||||||

Cash flows provided by (used in) financing activities: | ||||||||||||||||||||

Distributions paid to noncontrolling interest holders | — | — | (27,912 | ) | — | (27,912 | ) | |||||||||||||

Net proceeds from (repayments of) borrowings | 83,000 | — | (30,600 | ) | — | 52,400 | ||||||||||||||

Net proceeds from equity issuance | — | — | 138,015 | — | 138,015 | |||||||||||||||

Capital contributions from (distributions to) affiliates | — | 83,000 | (21,479 | ) | (61,521 | ) | — | |||||||||||||

Other | 6,720 | — | (620 | ) | — | 6,100 | ||||||||||||||

Cash flows provided by (used in) financing activities | 89,720 | 83,000 | 57,404 | (61,521 | ) | 168,603 | ||||||||||||||

Net increase (decrease) in cash and cash equivalents | 13,430 | — | (4,477 | ) | — | 8,953 | ||||||||||||||

Cash and Cash equivalents - beginning of period | 4,035 | — | 30,492 | — | 34,527 | |||||||||||||||

Cash and Cash equivalents - end of period | $ | 17,465 | $ | — | $ | 26,015 | $ | — | $ | 43,480 | ||||||||||

9. Convertible Notes and Adoption of FSP APB 14-1

We adopted Financial Accounting Standards Board (“FASB”) Staff Position APB 14-1,Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion (Including Partial Cash Settlement), (“FSP APB 14-1”) effective January 1, 2009. We accounted for the adoption of this standard as a change in accounting principle in accordance with FSP APB 14-1 and SFAS No. 154,Accounting Changes and Error Corrections. FSP APB 14-1 has therefore been applied retroactively to all periods presented. Substantially all of the decrease is attributable to the adoption of FSP APB 14-1.

16

Table of Contents

As our Convertible Notes can be settled wholly or partly in cash upon conversion into our common stock, FSP APB 14-1 requires us to account separately for the liability and equity components in a manner that reflects our nonconvertible debt borrowing rate when measuring interest cost of the Convertible Notes. The value assigned to the liability component was the estimated value of a similar debt issuance without the conversion feature as of the issuance date in November 2007. Transaction costs associated with issuing the instrument were allocated to the liability and equity components in proportion to the allocation of the original proceeds and were accounted for as debt issuance costs and equity issuance costs. In addition, recognizing our Convertible Notes as two separate components resulted in a tax basis difference associated with the liability component that represents a temporary difference for purposes of applying SFAS No. 109,Accounting for Income Taxes. Since the liability component was valued exclusive of the conversion feature, the Convertible Notes were recorded at a discount reflecting the below-market coupon interest rate. This discount is accreted through additional interest expense to par value over the remaining expected life of the debt of approximately four years.

The following tables reflect the effects of adopting FSP APB 14-1 on our consolidated statements of income for the three and six months ended June 30, 2008 (in thousands):

| Three Months Ended June 30, 2008 | ||||||||||||

Consolidated Statement of Income | As originally reported | As adjusted | Effects of change | |||||||||

Interest expense - (1) | $ | (10,110 | ) | $ | (11,345 | ) | $ | (1,235 | ) | |||

Income tax expense - (2) | (6,684 | ) | (7,163 | ) | (479 | ) | ||||||

Net income (loss) - (3) | 155 | (601 | ) | (756 | ) | |||||||

Net loss attributable to Penn Virginia Corporation | (3,793 | ) | (4,549 | ) | (756 | ) | ||||||

Loss per share attributable to Penn Virginia Corporation: | ||||||||||||

Basic | $ | (0.09 | ) | $ | (0.11 | ) | $ | (0.02 | ) | |||

Diluted | $ | (0.09 | ) | $ | (0.11 | ) | $ | (0.02 | ) | |||

| Six Months Ended June 30, 2008 | ||||||||||||

Consolidated Statement of Income | As originally reported | As adjusted | Effects of change | |||||||||

Interest expense - (1) | $ | (19,662 | ) | $ | (22,092 | ) | $ | (2,430 | ) | |||

Income tax expense - (2) | (3,627 | ) | (4,569 | ) | (942 | ) | ||||||

Net income - (3) | 24,109 | 22,621 | (1,488 | ) | ||||||||

Net income (loss) attributable to Penn Virginia Corporation | 133 | (1,355 | ) | (1,488 | ) | |||||||

Loss per share attributable to Penn Virginia Corporation: | ||||||||||||

Basic | $ | — | $ | (0.03 | ) | $ | (0.03 | ) | ||||

Diluted | $ | — | $ | (0.03 | ) | $ | (0.03 | ) | ||||

| (1) | Amounts represent the additional interest expense that would have been incurred from the debt discount had FSP APB 14-1 been in place when the Convertible Notes were issued. This increase is partially offset by variances in capitalized interest and the amortization of debt issuance costs, which resulted from the separation of the debt and equity components of the Convertible Notes. |

| (2) | The adjustment to income tax expense is based on our effective tax rates. |

| (3) | Net income includes noncontrolling interests. |

17

Table of Contents

The following tables reflect the effects of adopting FSP APB 14-1 on our consolidated balance sheet at December 31, 2008 (in thousands):

| December 31, 2008 | ||||||||||

Consolidated Balance Sheet | As originally reported | As adjusted | Effects of change | |||||||

Oil and gas properties (1) | $ | 2,106,126 | $ | 2,107,128 | $ | 1,002 | ||||

Other assets (2) | 46,674 | 45,685 | (989 | ) | ||||||

Deferred income taxes (3) | 245,789 | 258,037 | 12,248 | |||||||

Convertible notes (4) | 230,000 | 199,896 | (30,104 | ) | ||||||

Paid-in capital (5) | 578,639 | 599,855 | 21,216 | |||||||

Retained earnings (6) | 446,993 | 443,646 | (3,347 | ) | ||||||

| (1) | The impact on oil and gas properties is due to capitalized interest. |

| (2) | The adjustment to other assets reflects a decrease in debt issuance costs. |

| (3) | The impact on deferred income taxes is due to the change in the tax basis of the liability component. |

| (4) | The impact on the Convertible Notes balance is due to the unamortized discount balance. |

| (5) | The impact on the paid-in capital balance is due to the equity component and related issue costs as well as the change in deferred income taxes. |

| (6) | The impact on retained earnings is due to the additional interest expense, net of tax, that would have been incurred had FSP APB 14-1 been in place when the Convertible Notes were issued. |

The following tables reflect the effects of adopting FSP APB 14-1 on our consolidated statements of cash flows for the three and six months ended June 30, 2008 (in thousands):

| Three Months Ended June 30, 2008 | ||||||||||||

Consolidated Statement of Cash Flows | As originally reported | As adjusted | Effects of change | |||||||||

Cash flows from operating activities | ||||||||||||

Net income (loss) | $ | 155 | $ | (601 | ) | $ | (756 | ) | ||||

Deferred income taxes | (3,110 | ) | (3,589 | ) | (479 | ) | ||||||

Other | 987 | 2,222 | 1,235 | |||||||||

Total impact on the statement of cash flows | $ | (1,968 | ) | $ | (1,968 | ) | $ | — | ||||

| Six Months Ended June 30, 2008 | ||||||||||||

Consolidated Statement of Cash Flows | As originally reported | As adjusted | Effects of change | |||||||||

Cash flows from operating activities | ||||||||||||

Net income | $ | 24,109 | $ | 22,621 | $ | (1,488 | ) | |||||

Deferred income taxes | (505 | ) | (1,447 | ) | (942 | ) | ||||||

Other | (1,174 | ) | 1,256 | 2,430 | ||||||||

Total impact on the statement of cash flows | $ | 22,430 | $ | 22,430 | $ | — | ||||||

The net carrying amount of the liability component is reported as long-term debt of the Company in our consolidated balance sheets. The carrying amount of the equity component is reported in paid-in capital in our consolidated balance sheets. The discount amortization is recorded in interest expense in our consolidated statements of income.

18

Table of Contents

The following table reflects the carrying amounts of the liability and equity components of the Convertible Notes (in thousands):

| June 30, 2009 | December 31, 2008 | |||||||

Principal | $ | 230,000 | $ | 230,000 | ||||

Unamortized discount | (26,783 | ) | (30,104 | ) | ||||

Net carrying amount of liability component | $ | 203,217 | $ | 199,896 | ||||

Carrying amount of equity component | $ | 36,850 | $ | 36,850 | ||||

The discount will be amortized through the end of 2012. The effective interest rate on the liability component for the three and six months ended June 30, 2009 and 2008 was 8.5%. For the three and six months ended June 30, 2009, we recognized $2.6 million and $5.2 million of interest expense related to the contractual coupon rate on the Convertible Notes, and $1.7 million and $3.3 million of interest expense related to the amortization of the discount.

The Convertible Notes are convertible into cash up to the principal amount thereof and shares of our common stock, if any, in respect of the excess conversion value, based on an initial conversion rate of 17.316 shares of common stock per $1,000 principal amount of the Convertible Notes (which is equal to an initial conversion price of approximately $57.75 per share of common stock), subject to adjustment, and, if not converted or repurchased earlier, will mature on November 15, 2012.

10. Impairments and Other

We review long-lived assets to be held and used whenever events or circumstances indicate that the carrying value of those assets may not be recoverable. We recognize an impairment loss when the carrying amount of an asset exceeds the sum of the undiscounted estimated future cash flows related to that asset.

For the six months ended June 30, 2009, we recorded impairment charges related to our oil and gas segment properties and tubular inventories of $4.5 million. Of this $4.5 million, $1.2 million related to market declines in the spot and future oil and gas prices and $3.3 million related to our tubular inventory valuation.

Since the end of 2008, economic situations have impacted our future drilling plans thereby increasing the amount of expected lease expirations and unproved leasehold expenses. We continue to periodically evaluate capitalized costs related to unproved properties as to recoverability based on changes brought about by economic factors and potential shifts in our business strategy. Effective January 1, 2009, we changed our accounting process to amortize additional insignificant unproved properties over the average estimated life of the leases rather than amortizing some leases and assessing other leases on an occurrence basis. We recorded additional unproved leasehold amortization in exploration expense on our consolidated statements of income of $12.6 million in the six months ended June 30, 2009. The impact to net income for the six months ended June 30, 2009 was a decrease of $7.7 million, net of income taxes.

11. Earnings per Share

We adopted FASB Staff Position No. Emerging Issues Task Force (“EITF”) 03-6-1 “Determining Whether Instruments Granted in Share-Based Payment Transactions are Participating Securities” (“EITF 03-6-1”) on January 1, 2009. Under EITF 03-6-1, unvested share-based payment awards that contain non-forfeitable rights to dividends or dividend equivalents are participating securities and, therefore, are included in computing earnings per share pursuant to the two-class method. Under the two-class method, earnings per share are determined for each class of common stock and participating securities according to dividends or dividend equivalents and their respective participation rights in undistributed earnings. We determined that our unvested restricted shares of common stock and phantom stock awards contain non-forfeitable rights to dividends and, therefore, are participating securities as defined in EITF 03-6-1. We applied EITF 03-6-1 retroactively to all periods presented as required. See Note 9 – “Convertible Notes and Adoption of FSP APB 14-1.”

19

Table of Contents

The following tables set forth the effect of the retroactive application of EITF 03-6-1 and FSP APB 14-1 as of January 1, 2009 for the three and six months ended June 30, 2009 and 2008:

| Three Months Ended June 30, (in thousands, except per share data) | ||||||||||||||||

| 2009 | 2008 | |||||||||||||||

| As originally reported | As Adjusted (1) | Effects of changes | ||||||||||||||

Loss attributable to common shareholders | $ | (22,183 | ) | $ | (3,793 | ) | $ | (4,549 | ) | $ | (756 | ) | ||||

Portion of subsidiary net income allocated to undistributed share-based compensation awards (net of tax) | (21 | ) | (18 | ) | (18 | ) | — | |||||||||

| $ | (22,204 | ) | (3,811 | ) | $ | (4,567 | ) | $ | (756 | ) | ||||||

Weighted average shares, basic | 42,798 | 41,740 | 41,740 | — | ||||||||||||

Effect of dilutive securities(2) | — | — | — | — | ||||||||||||

Weighted average shares, diluted | 42,798 | 41,740 | 41,740 | — | ||||||||||||

Loss per common share, basic | $ | (0.52 | ) | $ | (0.09 | ) | $ | (0.11 | ) | $ | (0.02 | ) | ||||

Loss per common share, diluted | $ | (0.52 | ) | $ | (0.09 | ) | $ | (0.11 | ) | $ | (0.02 | ) | ||||

| (1) | Represents the impact of the adoption of FSP APB 14-1 and EITF 03-6-1 as of January 1, 2009. |

| (2) | For the three months ended June 30, 2009 and 2008, 0.1 million and 0.4 million potentially dilutive securities, including the Convertible Notes, stock options, restricted stock and phantom stock had the effect of being anti-dilutive and were excluded from the calculation of diluted earnings per share. |

| Six Months Ended June 30, (in thousands, except per share data) | ||||||||||||||||

| 2009 | 2008 | |||||||||||||||

| As originally reported | As Adjusted (1) | Effects of changes | ||||||||||||||

Net income (loss) attributable to Penn Virginia Corporation common shareholders | $ | (29,392 | ) | $ | 133 | $ | (1,355 | ) | $ | (1,488 | ) | |||||

Portion of subsidiary net income allocated to undistributed share-based compensation awards (net of tax) | (34 | ) | (121 | ) | (121 | ) | — | |||||||||

| $ | (29,426 | ) | $ | 12 | $ | (1,476 | ) | $ | (1,488 | ) | ||||||

Weighted average shares, basic | 42,422 | 41,642 | 41,642 | — | ||||||||||||

Effect of dilutive securities (2) | — | 274 | — | (274 | ) | |||||||||||

Weighted average shares, diluted | 42,422 | 41,916 | 41,642 | (274 | ) | |||||||||||

Loss per common share, basic | $ | (0.69 | ) | $ | 0.00 | $ | (0.03 | ) | $ | (0.03 | ) | |||||

Loss per common share, diluted | $ | (0.69 | ) | $ | 0.00 | $ | (0.03 | ) | $ | (0.03 | ) | |||||

| (1) | Represents the impact of the adoption of FSP APB 14-1 and EITF 03-6-1 as of January 1, 2009. |

| (2) | For the six months ended June 30, 2009 and 2008, 0.1 million and 0.3 million potentially dilutive securities, including the Convertible Notes, stock options, restricted stock and phantom stock had the effect of being anti-dilutive and were excluded from the calculation of diluted earnings per share. |

20

Table of Contents

12. Share-Based Compensation

Stock Compensation Plans

We recognized compensation expense related to the granting of common stock and deferred common stock units, the vesting of stock options and restricted stock and phantom stock granted under our stock compensation plans. For the three and six months ended June 30, 2009, we recognized a total of $3.7 million and $7.7 million of compensation expense related to our stock compensation plans. Compensation expense is recorded in the general and administrative expense line on our consolidated statements of income, on a straight-line basis over the respective vesting periods.

Stock Options. In February 2009, we granted 1,147,472 stock options with a weighted average exercise price of $15.06 and a weighted average grant date fair value of $5.57 per option. The options vest over a three-year period, with one-third vesting in each year.

Phantom Stock. In February 2009, we granted 104,449 shares of phantom stock to our employees with a weighted average grant date fair value of $15.06 per share. The phantom stock vests over a three-year period, with one-third vesting in each year. Phantom stock entitles the grantee to receive the common stock upon vesting of the phantom stock, or in the discretion of the Compensation and Benefits Committee of the board of directors, the cash equivalent of the value of the common stock.

Deferred Common Stock Units. In February 2009, we granted 7,966 deferred common stock units to non-employee directors with a weighted average grant date fair value of $19.76 per share. The deferred common stock units vest immediately.

PVR Long-Term Incentive Plan

PVR recognized a total of $1.3 million and $0.7 million of compensation expense related to the granting of common units and deferred common units and the vesting of restricted units and phantom units granted under its long-term incentive plan for the three months ended June 30, 2009 and 2008 and $2.7 million and $1.5 million for the six months ended June 30, 2009 and 2008. During the six months ended June 30, 2009, PVR’s general partner granted 354,792 phantom units with a weighted average grant date fair value of $11.59 per unit to employees of Penn Virginia and its affiliates. The phantom units granted in 2009 vest over a three-year period, with one-third vesting in each year. PVR recognizes compensation expense on a straight-line basis over the vesting period.

13. Commitments and Contingencies

Drilling Rig Commitments and Standby Charges

In the first quarter of 2009, our oil and gas segment reduced its drilling program due to unfavorable economic conditions. In conjunction with the drilling program reduction, we amended certain drilling rig contracts to delay commencement of drilling until January 2010. For the six months ended June 30, 2009, we recognized charges of $16.6 million for cancellation fees, minimum daily standby fees and demobilization fees. These fees and costs were recorded as exploration expense on our consolidated statements of income. We will continue to evaluate economic conditions through the remainder of 2009 to determine whether or not to defer additional drilling, which could result in additional exploration expenses of up to approximately $7.2 million for the remainder of 2009.

Legal