Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-4338

EAGLE CAPITAL APPRECIATION FUND

(Formerly: Heritage Capital Appreciation Trust)

(Exact name of Registrant as Specified in Charter)

880 Carillon Parkway

St. Petersburg, FL 33716

(Address of Principal Executive Office) (Zip Code)

Registrant’s Telephone Number, including Area Code: (727) 567-8143

STEPHEN G. HILL, PRESIDENT

880 Carillon Parkway

St. Petersburg, FL 33716

(Name and Address of Agent for Service)

Copy to:

FRANCINE J. ROSENBERGER, ESQ.

K&L Gates LLP

1601 K Street, NW

Washington, D.C. 20006

Date of fiscal year end: October 31

Date of reporting period: April 30, 2009

Table of Contents

Item 1. Reports to Shareholders

Table of Contents

EAGLE MUTUAL FUNDS

Semiannual Report

and Investment Performance Review

for the six-month period ended April 30, 2009

Eagle Capital Appreciation Fund

Eagle Growth & Income Fund

Eagle International Equity Fund

Eagle Large Cap Core Fund

Eagle Mid Cap Growth Fund

Eagle Mid Cap Stock Fund

Eagle Small Cap Core Value Fund

Eagle Small Cap Growth Fund

Table of Contents

Performance Summary and Commentary |

Investment Portfolios |

Table of Contents

Dear Fellow Shareholders:

I am pleased to present the semiannual report and investment performance review of the Eagle mutual funds for the six-month period ended April 30, 2009 (“reporting period”).

During the reporting period, investor confidence was challenged by worsening economic conditions, continued stress in the financial system, and a dramatic rise in unemployment. The current recession has already run 18 months, making it the longest recession in the post-World War II era. The United States government has taken unprecedented actions to restore order to the credit markets and exercise control over private corporations (namely banks and auto makers) receiving federal assistance. Governments throughout the world have taken similar actions, including the United Kingdom’s government taking ownership of some of that country’s largest banks.

Market volatility was the main theme during the reporting period. The S&P 500 Index, an unmanaged index of 500 U.S. stocks, gives a broad look at how stock prices have performed, declined 8.53% during the reporting period, but the ending point does not tell the whole story. As the reporting period began, the markets continued their declines from the end of the last fiscal year. There was a rally in December, only to be followed by steep declines in January through early March as bad economic news was the order of the day. From early March through the end of the reporting period, the S&P 500 Index sharply rallied, gaining 29% during that period. As I write this letter, the markets have been able to hold most of the gains recorded during the rally and we are hopeful that this rally reflects early signs of stabilization in the financial markets and the economy as a whole.

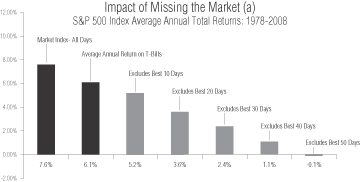

By many measures, the recent dramatic market volatility is unprecedented. We understand your concerns. We can not predict when this recession will end or when the stock market will recover. We do believe that a consistent and disciplined investing strategy is more important than ever. Investors who wait to see that a stock market rally has begun often miss a significant portion of the market’s gains. The following chart shows the impact of missing just a few of the best days in the S&P 500 Index over the past 30 years (1978-2008).

(a) All investing involves risk and you may incur a profit or a loss. Past performance is not a guarantee of future results. Source: The Hartford, Ibbotson Associates, Inc. The S&P 500 Index is not available for direct investment. The returns assume the reinvestment of all dividends and do not reflect the impact of any commissions, fees or taxes that would apply to an actual investment.

In the commentaries that follow, each fund’s portfolio managers discuss the specific performance in their funds. While there can be no way to accurately predict short-term market movements, our portfolio managers hope to take advantage of investment opportunities that may arise during the current market.

Contact us at 800.421.4184 or eagleasset.com or your financial advisor for a prospectus, which contains important information about the Eagle Family of Funds. Our website also has timely information about the Funds, including performance and portfolio holdings. We are grateful for your continued support and confidence in the Eagle Family of Funds.

Sincerely,

Stephen G. Hill

President

June 18, 2009

| 2 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Capital Appreciation Fund | (formerly known as the Heritage Capital Appreciation Trust) | |

Meet the managers | Steven M. Barry and David G. Shell, CFA are Chief Investment Officers and Senior Portfolio Managers at Goldman Sachs Asset Management L.P. and have been responsible for the day-to-day management of the Eagle Capital Appreciation Fund (the “Fund”) since 2002. Mr. Shell has been affiliated with the Fund since 1987 and has 22 years of investment experience; Mr. Barry joined the team in 1999 and has 23 years of investment experience.

Investment highlights | The Fund invests primarily in common stocks. The Fund’s portfolio management team believes that wealth is created through the long-term ownership of a growing business. They take a “bottom-up” approach to investing based on in-depth, fundamental research. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The portfolio managers use an intensive research process and each company is analyzed as if they were going to own and operate that company indefinitely. Key characteristics of the companies in which the Fund currently seeks to invest may include: dominant market share, established brand name, pricing power, recurring revenue stream, free cash flow, high returns on invested capital, predictable growth, sustainable growth, long product life cycle, enduring competitive advantage, favorable demographic trends and excellent management.

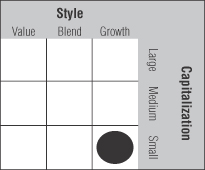

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

© Copyright 2009 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Performance summary | The Fund’s class A shares returned 3.34% (excluding front-end sales charges) during the six-month period ended April 30, 2009, outperforming its benchmark index, the Russell 1000® Growth Index, which returned -1.52%. The Russell 1000® Growth Index measures performance of

those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values and is representative of U.S. securities exhibiting growth characteristics. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

On May 14, 2009, the portfolio managers gave the following discussion of the Fund’s performance.

Performance discussion | On an absolute basis, the Fund’s holdings in the consumer discretionary and producer goods and services sectors contributed to positive performance while holdings in the media and consumer staples sectors weighed on results.

Positive stock selection in the utilities and energy sectors contributed to the Fund performance relative to the Russell 1000® Growth Index. On the downside, an underweight position and negative stock selection in the technology sector detracted from relative performance.

In several instances, on both a stock and sector level, the Fund is meaningfully different from its benchmark index, thus creating the potential for its performance to be materially higher or lower than the index. The Fund’s sector weightings are a direct result of our bottom-up, research intensive approach to investing. For example, when compared to the Russell 1000® Growth Index, the Fund’s portfolio is underweight in cyclicals, as most of these businesses do not typically meet our investment criteria since their revenues predominately depend on the increasing price of an underlying commodity. While our growth strategy is based on a purely bottom-up approach to investing, we do pay attention to the weights in the Russell 1000® Growth Index so we are aware of any weighting differences that may exist.

Top performers | Crown Castle International Corporation contributed to performance as the company reported fourth quarter earnings that beat expectations and provided a positive outlook. The Fund continues to hold the stock as we have conviction in the wireless tower business and Crown Castle has dominant market share in an industry with high barriers to

| 3 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Capital Appreciation Fund (cont’d) | ||

entry and generates significant free cash flow, enabling the company to self-finance its growth.

Marriott contributed to performance during the period. While the company reported a decline in first quarter revenue, it was also able to control expenses and continue with its expansion strategy by adding 30,000 new rooms to its inventory. We continue to hold the stock as we believe Marriott stands to benefit from this cyclical downturn in the hotel industry. In our view, the more challenging operating environment will lead to a tightening of supply in the lodging industry as recent difficulties in the credit markets have made borrowing more expensive, reducing the number of new hotels being constructed. We believe that these factors will constrain lodging supply, creating a potentially strong pricing environment for existing hotels in the future.

Apple Inc. contributed to performance as the company reported strong results behind sales of its iPod and iPhone products. In our view, Apple is positioned to increase sales as it expands its presence internationally and continues to grow its unique product portfolio. We continue to hold the stock in the Fund’s portfolio.

Coach Inc., a luxury goods producer, benefitted from increased traffic in its factory stores, which was driven by price cuts. In addition, the company showed improved inventories which gave the market confidence that the company could sustain its very high margins over time. The company has stated that its strategy in the current economic slowdown is to focus on converting traffic into sales, regardless of the type of sale, with the hope of leading to repeat customers and higher transaction volumes. The Fund continues to hold the stock in its portfolio.

QUALCOMM, Inc., a chip-maker for digital wireless communications products and services, was up during the period as the company reported solid revenue for its second fiscal quarter. While operating results were strong, the company reported a loss due to a $748 million litigation charge associated with its patent lawsuit settlement with Broadcom Corporation. The stock remains a Fund position as the company increased its full-year revenue outlook on strong demand for its cell phone chips.

Under performers | Activision Blizzard, Inc. detracted from performance as consumer spending declined during the holiday season. Video game stocks were particularly singled out given their reliance on holiday sales, which can be as much as half of a year’s revenue and all of a year’s earnings. We continue to have conviction in Activision Blizzard as its World of Warcraft subscription game provides recurring revenue, which gives the company a consistent base from which to take well-researched risks on new franchises and extensions to existing franchises.

Thermo Fisher Scientific, Inc. manufactures and distributes scientific instruments and laboratory supplies. The company’s stock detracted from the Fund’s performance as shares sold-off on concerns regarding industrial headwinds. In our view, the stock’s sell-off was unrelated to company fundamentals so we took advantage of the stock’s weakness and increased the Fund’s holdings.

Entravision Communications, a Spanish-language media company, detracted from performance during the period as economic headwinds and the company’s outstanding debt concerned investors. The Fund exited its position in the stock.

Baxter International Inc. makes a wide variety of medical products, including drugs and vaccines, dialysis equipment, and IV supplies. Baxter’s stock price fell despite reporting strong first quarter earnings. The company reported substantial revenue growth across most core segments, though results were negatively impacted by foreign exchange rate movements. During the reporting period we have added to the Fund’s position as we believe Baxter’s diversified portfolio of innovative products provide significant high-growth opportunities.

Merck & Company’s share price traded down after reporting first quarter results that fell short of analysts’ expectations. Sales for the first quarter declined compared to the same period last year as a challenging economic environment and adverse currency exchange rates negatively impacted results. Sales of Merck’s cervical cancer vaccine, Gardasil, disappointed. While we continue to believe Gardasil to be an important long-term growth driver for the company, we decided to exit the position in order to fund higher conviction ideas.

| 4 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Growth & Income Fund | (formerly known as the Heritage Growth and Income Trust) | |

Meet the managers | William V. Fries, CFA, Managing Director, and Cliff Remily, CFA, of Thornburg Investment Management, Inc. are Co-Portfolio Managers of the Eagle Growth & Income Fund (the “Fund”). Mr. Fries has more than 33 years of investment experience and has been Co-Portfolio Manager since 2001. Mr. Remily was named Co-Portfolio Manager in January 2009 and has over 9 years of industry experience.

Investment highlights | The Fund invests primarily in domestic equity securities (primarily common stocks). The Fund’s portfolio managers look for promising investments that can be purchased at a discount to their estimate of each investment’s intrinsic value. They seek investments that deliver a competitive total return over multiple time horizons. Holdings are classified in three categories: basic value, consistent earners and emerging franchises as a means of structuring diversification. Dividends and dividend growth are a consideration in stock selection and may include stocks outside the traditional dividend paying areas.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s class A shares returned -0.97% (excluding front-end sales charges) during the six-month period ended April 30, 2009, outperforming the Fund’s benchmark index, which returned -8.53% during the same period. The Fund’s benchmark index, the Standard & Poor’s 500 Composite Stock Index (“S&P 500 Index”), is an unmanaged index of 500 U.S. stocks and gives a broad look at how stock prices have performed. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current

performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

On May 13, 2009, the portfolio managers gave the following discussion of the Fund’s performance.

Performance discussion | It was encouraging to see a number of positive outcomes for individual stocks within the portfolio following a difficult calendar 2008. Recognition of improving company-specific fundamentals, some relief in credit spreads and more access to the debt markets, as well as further clarity around government sponsorship of the financial system all played a role. Interestingly, the Fund’s fixed income exposure holdings were among the better contributors to performance during the period. Our goal in these fixed income investments is to achieve total return from the bond’s price appreciation as well as the interest income earned over our holding period. While the upside is generally limited to a return to par on these bonds, yield to maturities are attractive, and downside is often less than with many of the equity investment opportunities. In some cases we have “moved up the capital structure,” trimming or selling the Fund’s equity stake in a company as we have added fixed income exposure. In other cases we have added to the Fund’s overall investment with a particular issuer. We increased the Fund’s fixed income exposure this year as opportunities appeared in the markets for convertible and hybrid debt. In the convertible debt market we found issues where the value of the equity conversion feature appeared to be ignored, despite our belief that significant potential value exists. In the hybrid debt market, which is typically characterized by long durations and floating rates, we invested in securities that in our view would outperform as the financial crisis passed and credit spreads contracted.

On an absolute basis, positive contributors to performance were the Fund’s holdings in the information technology, consumer discretionary and financials sectors. In technology, we anticipate that, during the economic downturn, secular growth in demand will continue for paid activity search on the internet, smart phones with advanced features, and software applications that improve efficiency at the corporate level.

In the financial sector, we adopted a two-pronged strategy, holding both quality companies as well as companies that appeared to be undercapitalized. We felt that quality franchises had the potential to hold or possibly improve their market share. Further, we saw opportunities to establish positions in

| 5 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Growth & Income Fund (cont’d) | ||

companies perceived to be weaker as the market was pricing these companies as if they would not survive the downturn.

The Fund’s exposure to the energy and consumer staples sectors detracted from absolute returns. The Fund’s exposure to the energy sector underperformed as it experienced pressure from dramatically lower oil and gas prices.

The foreign stock component of the Fund’s portfolio (approximately 29% as of April 30, 2009) slightly outperformed U.S. equities, with particular strength coming from the Fund’s holdings in countries such as Australia, Brazil, China, Greece and Spain. The Fund’s holdings in Canada, France, Hong Kong, Switzerland and the United Kingdom detracted from absolute returns. Among the Fund’s foreign holdings, emerging market exposure at the end of the period was 5.3% of the Fund’s portfolio (inclusive of Hong Kong given the Fund’s holding in the local stock market exchange which is importantly linked to Chinese companies for its future success).

Stock selection in the financials, healthcare and consumer staples sectors helped contribute to the Fund’s outperformance of the benchmark. Stock selection in both the energy and telecommunication services sectors detracted from the Fund’s performance relative to the benchmark. The Fund’s overweight positions in the financials and telecommunication services sector, as well as its underweight positions in industrials, healthcare, and utilities sectors were all positive factors in the outperformance of the benchmark. When compared to the benchmark index, the Fund was underweight in the information technology sector which negatively impacted relative returns.

Cash and cash equivalents are, and always have been, the byproduct of our investment process as we weigh each potential investment’s risks and returns. Due to an abnormally volatile market, particularly at the beginning of the reporting period, we felt that it was prudent to be more cautious in evaluating security selection when deploying capital; therefore, we held higher than normal cash balances, which helped relative performance.

Top performers | U.S. Bancorp is one of the strongest large banks in the U.S. Although we sold out of the position in the Fund last fiscal year, we purchased the stock again before the market rally as we believed that its size and profitability would enable it to weather the financial crisis without additional significant equity dilution. The Fund continues to hold the stock as we expect U.S. Bancorp to emerge from the downturn larger and stronger and believe the current valuation does not reflect this potential.

OPAP, SA, which operates and manages numerical lottery and sports betting games, has had a relatively stable cash flow profile, despite a slowdown in the Greek economy. Although revenues from its Stilhma game have moderated, its Kino game has held up well and new regulations surrounding online betting have been postponed indefinitely due to the financial crisis. We continue to see the 7% dividend as attractive for shareholders and continue to hold the stock in the Fund’s portfolio.

Communication services provider Level 3 Communications, Inc. successfully refinanced some of its short-term debt during its fourth quarter and reported operating cash flow growth of 7% while providing guidance pointing to lower capital expenditures for 2009. For these reasons, the stock remains a Fund holding.

Baidu, Inc., the leader in Chinese language internet search, experienced better than expected revenue growth in the fourth quarter and solid internet traffic numbers during the first quarter. The Fund continues to hold the stock.

The Charles Schwab Corporation was purchased during the market rally in March. It was attracting healthy flows from new customers and saw growth in its DARTs (daily average revenue trades transactions). It was our belief that their retail banking franchise was underappreciated.

Under performers | Swiss Reinsurance Company reinsures life, health, property, motor and liability insurance. The stock was sold from the Fund due to balance sheet impairments that have accelerated in the near-term resulting in the need for more capital infusions. In addition, management changes indicate business model stress in this economic environment.

ConocoPhillips has suffered from a litany of items—lower oil and gas prices, Russian market risk (through its stake in LUKOIL) and poor refining and marketing margins—all of which have led to a temporary suspension of their share buyback program. For these reasons, the Fund reduced its position in the stock.

The decline in oil prices negatively affected the stock price of Canadian Oil Sands Trust and Diamond Offshore Drilling. The Fund no longer holds Canadian Oil Sands Trust and the Fund’s position in Diamond Offshore Drilling has been significantly reduced.

KKR Financial Holdings is a leading diversified specialty finance company that is now trading below its stated book value due to investor concerns about possible future loan losses and possible equity dilution if they are forced to issue new shares to offset realized losses. The Fund no longer holds the stock.

| 6 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle International Equity Fund | (formerly known as the International Equity Fund) | |

Meet the managers | Richard C. Pell is Chief Executive Officer at Artio Global Investors Inc. and Chief Investment Officer at its subsidiary, Artio Global Management LLC (“Artio Global”). Rudolph-Riad Younes, CFA, is Head of International Equities at Artio Global. Messrs. Pell and Younes have managed the Eagle International Equity Fund (the “Fund”) since 2002.

Investment highlights | The Fund invests primarily in foreign equity securities. The Fund’s portfolio managers seek investment opportunities within the developed and emerging markets. In the developed markets, a “bottom-up” approach is adopted. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. In the emerging markets, a “top-down” assessment consisting of currency/interest rate risks, political environments/leadership assessment, growth rates, structural reforms and risk (liquidity) is applied. A top-down method of analysis emphasizes the significance of economy and market cycles. In Japan, given the highly segmented nature of this market comprised of both strong global competitors and protected domestic industries, a hybrid approach encompassing both bottom-up and top-down analyses is conducted.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s class A shares returned -7.98% (excluding front-end sales charges) during the six-month period ended April 30, 2009, underperforming the Fund’s benchmark index, which returned 1.03% during the same period. The Fund’s benchmark index, the Morgan Stanley Capital International® All Country World Index ex-US (“MSCI® ACWI ex- US”), is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

On May 13, 2009, the portfolio managers gave the following discussion of the Fund’s performance.

Performance discussion | For most of the reporting period, markets continued to exhibit tremendous volatility amid what has been one of the most difficult investment environments. However, March and April provided much needed relief as the degree of negativity on the news front began to abate. Amid this volatile environment, we have tried our best to steer the Fund’s holdings from areas we foresaw as the most prone to danger and sought refuge in regions, sectors and companies that we believed would be least affected.

From a sector perspective, materials had the largest positive impact on absolute and relative performance. Over the period, the Fund’s allocation to the materials sector was increased as the strategy began to move toward cyclical sectors such as materials amid signs of more encouraging economic data and attractive valuations. Top Fund performers in this sector included Xstrata PLC, Rio Tinto PLC, BHP Billiton PLC (United Kingdom), Rio Tinto Ltd., BHP Billiton Ltd. (Australia) and CRH PLC (Ireland). However, the positive effect on performance from investments in the material sector was outweighed by underperforming positions within the financials, energy and consumer staples sectors.

The Fund’s underperformance to its benchmark index was largely due to the Fund’s lack of positioning within emerging markets as well as Continental Europe. During March and April, investors began to move dramatically toward “risky assets” which included emerging markets as well as more troubled sectors such as financials within developed markets. During this period, due to its more defensive stance, the Fund did not fully participate in this market recovery. Additionally, the position held in cash equivalents hurt results.

Within emerging markets, the Fund’s underweight position in Asia and Brazil negatively impacted relative returns as performance in these markets outperformed the benchmark index. Within emerging Europe, OTP Bank, Hungary’s largest lender, underperformed, as did Bank Polska Kasa Opieki (Poland) and Komercni Banka (Czech Republic). Although the

| 7 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle International Equity Fund (cont’d) | ||

Fund’s allocation to Poland, Hungary and the Czech Republic is much lower than in previous periods, the Fund’s overweight position versus the benchmark index hurt performance as companies in this region, especially those in the finance sector, felt the impact of the global credit crunch.

In Continental Europe, the Fund’s underweight position compared to its benchmark index in financials had a negative impact as the sector began to rally in early March as sentiment began to shift. Also, stock selection within energy and consumer staples detracted from performance.

The Fund benefited from its continued underweight investment in the United Kingdom (“UK”), particularly within the banking

sector. UK financials underperformed the rest of Europe over the period and the Fund’s large avoidance of the sector supported relative results.

Detracting from absolute returns was the Fund’s investment in Lyxor ETF DJ Stoxx 600 Banks. This index position, initially established to gain broad-based financial exposure, was ultimately sold and individual positions were purchased within the sector. Another ETF which detracted from results was the iShares MSCI Korea Index Fund. Given our interest in emerging Asia, we initially purchased this ETF for broad exposure. However, individual positions were ultimately purchased and the ETF was sold.

| 8 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Large Cap Core Fund | (formerly known as the Core Equity Fund) | |

Meet the managers | Richard Skeppstrom, John “Jay” Jordan, CFA, Craig Dauer, CFA, and Robert Marshall at Eagle Asset Management, Inc. (“Eagle”) have been Co-Portfolio Managers of the Eagle Large Cap Core Fund (the “Fund”) since inception. Mr. Skeppstrom is a Managing Director at Eagle and has 18 years of investment experience. Mr. Jordan, Mr. Dauer and Mr. Marshall have 18, 15 and 22 years of investment experience, respectively.

Investment highlights | The Fund invests primarily in common stocks. When identifying investments for the Fund, the portfolio managers use a “bottom-up” research process that is combined with a proprietary relative-valuation discipline. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. In general, the portfolio managers seek to select securities, that, at the time of purchase, have above-average expected returns and at least one of the following characteristics: projected earnings growth rate at or above the benchmark index, above-average earnings quality and stability, or a price-to-earnings ratio comparable to the benchmark index.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s class A shares returned -4.12% (excluding front-end sales charges) during the six-month period ended April 30, 2009, outperforming the Fund’s benchmark index, which returned -8.53% during the same period. The Fund’s benchmark index, the Standard & Poor’s 500 Composite Stock Index (“S&P 500 Index”), is an unmanaged index of 500 U.S. stocks and gives a broad look at how stock prices have performed. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and

principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

On May 13, 2009, the portfolio managers gave the following discussion of the Fund’s performance.

Performance discussion | The Fund experienced strong absolute returns in the telecommunication services, consumer discretionary, consumer staples, and technology sectors. Relative to the benchmark index, the Fund outperformed in the consumer discretionary, financials, telecommunication services, consumer staples and information technology sectors. In the consumer discretionary sector, the Fund benefited from its overweight position and stock selection. In the financials and telecommunication services sectors, outperformance arose from positive stock selection. In the consumer staples sector, the Fund’s underweight position and positive stock selection led to outperformance relative to the benchmark.

Detractors from absolute returns during the period included positions in the healthcare, financials, industrials, and energy sectors. Relative to the benchmark index, the Fund underperformed in the healthcare, materials, and energy sectors. In the healthcare sector, underperformance was due to stock selection. Underperformance in the materials sector was due to a lack of Fund exposure to this strong-performing sector. The slight underperformance in energy was mostly from stock selection.

Top performers | Sprint Nextel Corporation rebounded during the period as liquidity fears were quelled while subscriber loss trends stabilized. The Fund added to its position in Sprint in November as liquidity fears, which we believed were inaccurate, drove the stock price to a meaningful discount to the underlying asset value of the business.

The Fund added a position in retailer Macy’s Inc. in February, when we thought concerns about a near-term bankruptcy were overblown. The stock price later rose as the market determined that no bankruptcy was imminent, and as the decline in consumer spending moderated in the spring. The Fund continues to hold the stock, as we see a potential rise in the share price when the economy improves.

Shares in investment bank Morgan Stanley rebounded in the period as the panic of October 2008 subsided. The stock was extremely undervalued by all measures, especially given its relatively limited exposure to the worst of the toxic assets.

| 9 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Large Cap Core Fund (cont’d) | ||

Subsequent to the end of the reporting period, the Fund sold the position for a healthy gain.

Specialty retailer Staples, Inc. demonstrated remarkable resilience in the face of the recent market swoon. The company remains very well positioned in the global office supplies space, and continues to gain market share at the expense of its financially stressed rivals. The company enjoys robust free cash generation, despite the global slowdown, and has successfully refinanced a large portion of its debt over the past several months. The Fund continues to hold the security.

While Wells Fargo & Company’s stock price collapsed with the rest of the banks early in the reporting period, it rebounded well from its lows. The Fund increased its position at the market bottom in early March.

Under performers | JPMorgan Chase got caught up in the banking sector collapse. Although the company outperformed its peers, the financial sector was the worst performing sector in the benchmark index.

Genzyme Corporation, a biotechnology firm, underperformed due to regulatory delays in the United States regarding the approval of Lumizyme, a new drug which has already been approved in Europe. The stock also suffered from concerns about how Genzyme presents its non-GAAP earnings, though we believe these were largely addressed at the company’s

early May analyst meeting. The Fund reduced its position in December, based on relative valuation.

Shares of drug maker Pfizer Inc. underperformed as investors felt that its planned acquisition of Wyeth confirmed the belief that Pfizer is growth-challenged. Concurrent with the acquisition announcement, Pfizer lowered its standalone 2009 earnings guidance, and reduced its dividend in half. Although pharmaceutical mergers driven by cost-cutting have not benefitted shareholders in the past, this one does strengthen our opinion that Pfizer can maintain a solid earnings per share through Lipitor’s loss of exclusivity in the U.S. in 2011. The Fund maintains its position in the company as we continue to see Pfizer shares as attractive based on this outlook.

General Electric underperformed due to the combination of credit fears at its General Electric Capital Corporation unit and lower earnings in its industrial businesses due to a global economic slowdown. The Fund continues to hold the stock.

Bank of America’s stock price suffered as its acquisition of Merrill Lynch significantly impaired its capital. This acquisition further compounded the impact of the banking industry collapse. The Fund sold the stock in April following the company’s disconcerting first quarter report and the risk of forced conversion of government-owned preferred shares which would be massively dilutive and highly disruptive.

| 10 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Mid Cap Growth Fund | (formerly known as the Diversified Growth Fund) | |

Meet the managers | Bert L. Boksen, CFA, a Managing Director and Senior Vice President at Eagle Asset Management, Inc. (“Eagle”), is the Portfolio Manager of the Eagle Mid Cap Growth Fund (the “Fund”). Mr. Boksen has 32 years of investment experience. Christopher Sassouni, DMD, with 20 years of investment experience and Eric Mintz, CFA, with 14 years of investment experience, have been Assistant Portfolio Managers since 2006 and 2008, respectively.

Investment highlights | The Fund invests primarily in stocks of mid-capitalization companies. The Fund’s portfolio managers seek to capture the significant long-term capital appreciation potential of mid-cap, rapidly growing companies. The portfolio managers use a “bottom-up” investment approach through a proprietary research strategy that emphasizes the selection of mid-cap growth stocks that are reasonably priced. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The Fund’s portfolio managers believe that conducting extensive research on mid cap companies may enable the Fund to capitalize on market inefficiencies and thus outperform the market.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s class A shares returned -0.38% (excluding front-end sales charges) during the six-month period ended April 30, 2009, underperforming the Fund’s benchmark index, which returned 2.71% during the same period. The Fund’s benchmark index, the Russell Midcap® Growth Index, measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

On May 11, 2009, the portfolio managers gave the following discussion of the Fund’s performance.

Performance discussion | Over the six-month reporting period, the Fund underperformed its benchmark index. The Fund’s positions lagged the benchmark index in the information technology, industrials, materials, and healthcare sectors. In information technology, industrials and materials, the Fund’s holdings in more defensive, non-cyclical investments lagged the benchmark index during the strong rally starting in March. In healthcare, the Fund’s biotechnology investment disappointed. The Fund outperformed in the energy and consumer discretionary sectors due to strong stock selection.

On an absolute basis, the Fund’s return was pulled down by the investments in the materials, industrials and healthcare sectors. Absolute returns were driven higher by stocks in the consumer discretionary and energy sectors.

Under performers | Biotechnology company, Celgene Corporation, traded down during the reporting period after it pre-announced lower than expected revenue. The sudden slowdown in sales was unexpected since the company produces a life saving therapy for a difficult to treat form of cancer. The Fund continues to hold the stock as we believe sales of the company’s lead drug will rebound as consumers cannot postpone treatment for extended periods of time.

Chemical producer, Huntsman Corporation, declined after the company settled its lawsuit against Hexion Specialty Chemicals Inc. for a lower amount than expected and started to show signs of suffering from the broad economic slowdown. The Fund continues to hold the stock because we believe the company now has enough cash to weather the economic storm and may be a strong performer in a recovery.

CF Industries is a fertilizer producer whose stock sold off sharply with other agricultural names due to fears about the global growth slowdown during the fourth quarter of 2008. The Fund’s position in the stock was sold.

We sold Cliffs Natural Resources, a producer of iron ore, from the Fund’s portfolio. The company reported better-than-

| 11 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Mid Cap Growth Fund (cont’d) | ||

expected fourth quarter earnings but concerns about weak growth expectations due to an increased cost outlook for 2009 pressured the stock price.

Corrections Corporation of America owns, operates and manages prisons and other correctional facilities. Despite strong fourth quarter 2008 earnings, the company offered muted revenue guidance for 2009. The Fund’s position in the stock was sold.

Top performers | Penn National Gaming, Inc. owns and operates casinos and horse racing facilities. The Fund purchased the stock after a substantial decline caused by the termination of the company’s proposed acquisition by a group of affiliates (Fortress Investment and Centerbridge Partners). Since then the company has reported inline or solid earnings and we believe the company is positioned for growth given its strong balance sheet and extensive, funded development pipeline. For these reasons, the Fund continues to hold the stock.

Netflix, Inc., an online DVD rental service, appreciated significantly after it beat earnings and revenue expectations and issued strong guidance. The Fund continues to hold the stock

as we believe Netflix is poised to continue to increase market share because consumers seem to favor renting over ownership in an environment of evolving formats (DVD vs. BluRay).

Denbury Resources, an exploration-and-production company, benefited from organic reserve growth despite the challenging commodity-price environment. The Fund continues to hold the stock because the company has developed a significant competitive advantage in producing oil from mature fields which we believe will lead to a higher stock price.

Freeport-McMoRan Copper & Gold appreciated due to the more positive outlook for copper prices. The Fund continues to hold the stock because we expect continued strength as the company has carefully managed costs, is poised for growth once the economic cycle improves and has a strong balance sheet that we believe can weather changing commodity prices.

Luxury goods producer, Coach Inc., traded up during the reporting period after exceeding revenue and earnings expectations. We continue to hold the stock in the Fund due to its appealing relative valuation, strong balance sheet, and cost cutting initiatives that we believe should lead to improved margins.

| 12 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Mid Cap Stock Fund | (formerly known as the Mid Cap Stock Fund) | |

Meet the managers | Todd L. McCallister, Ph.D., CFA, is a Managing Director and Senior Vice President at Eagle Asset Management, Inc. (“Eagle”) and Co-Portfolio Manager of the Eagle Mid Cap Stock Fund (the “Fund”). Mr. McCallister has 22 years of investment experience and has managed the Fund since its inception. Stacey Serafini Thomas, CFA, is a Vice President at Eagle and served as Assistant Portfolio Manager to the Fund from 2000 to 2005, before being named Co-Portfolio Manager. Ms. Thomas has more than 12 years of investment experience.

Investment highlights | The Fund invests primarily in stocks of mid-capitalization companies. The portfolio managers of the Fund employ a “bottom-up” stock-selection process to identify growing, mid-cap companies that are reasonably priced. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The portfolio managers seek to gain a comprehensive understanding of a company’s management, business plan, financials, real rate of growth and competitive threats and advantages.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s class A shares returned -3.11% (excluding front-end sales charges) during the six-month period ended April 30, 2009, underperforming the Fund’s benchmark index, which returned -0.19% during the same period. The Fund’s benchmark index, the Standard & Poor’s MidCap 400 Index (“S&P MidCap 400”), is an unmanaged index that measures the performance of the mid-sized company segment of the U.S. market. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may

have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

On May 11, 2009, the portfolio managers gave the following discussion of the Fund’s performance.

Performance discussion | In terms of absolute returns, during the reporting period, investments in the information technology and consumer discretionary sectors led the way due to positive stock selection in the information technology services and hotel/leisure industries. Holdings in the healthcare and telecommunication services sectors detracted from the Fund’s performance as the Fund’s overweight positions in healthcare providers and wireless services were negative as a group. Even though Fund positions in the consumer discretionary sector contributed positively to absolute returns, investments in this sector were the largest detractors to relative performance compared to the benchmark index. This was primarily due to underweight positions, relative to the benchmark index, in the specialty retail and diversified consumer services industries which performed very well during a market rally in March and April. Stock selection in the industrials sector also hurt relative performance mainly due to four holdings in the commercial services and supplies industry. The Fund’s underweight position versus the benchmark index in the financials and utilities sectors were the largest contributors to relative performance during the reporting period.

Under performers | Pactiv Corporation’s stock price suffered during the reporting period due to concerns regarding sales and the potential underfunding of the company’s pension plan. While the company’s packaging business is in good shape for 2009 given declining raw material input costs, we believe that the stock’s return this year will likely be more correlated with the direction of the overall stock market. Therefore, the Fund continues to hold the stock.

Service Corporation International Inc. is the largest single provider of funeral, cremation and cemetery services in the United States. Its stock price traded lower throughout 2008 despite the relative stability of its business model. We sold the position out of the Fund because we believe pre-death purchases of cemetery plots and coffins will be significantly weaker; further, potential investment write-downs may necessitate a capital infusion.

Unum Group, a provider of disability and group life insurance for corporations, traded down and was sold out of the Fund’s portfolio after an article was published questioning the

| 13 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Mid Cap Stock Fund (cont’d) | ||

company’s reliance on employment levels at its corporate customers in light of the deteriorating job market. Furthermore, at the time of its fourth quarter earnings release, the CFO stepped down.

NCR Corporation helps companies interact with their customers in different ways. Their main focuses are ATMs, point-of-sales systems, and self-service kiosks. The Fund sold the stock after weakness in the retail sector and unfavorable currency translation as the company continues to wrestle with a difficult economic environment, which is reducing demand for its products and services.

Owens-Illinois, Inc. is the world’s largest maker of glass containers and one of the largest overall packaging manufacturers. The company’s stock sold off after concerns of inflation and poor sales in Europe. We believe inflationary concerns actually may put the company at a competitive advantage over lower-margin, U.S. market-oriented glass companies. Owens-Illinois trades at what we consider to be very attractive multiples and we continue to believe in its potential for strong earnings, free-cash-flow generation and margin expansion. The Fund continues to hold the stock.

Top performers | Celanese Corporation is a chemicals producer that has a market leading position in most of the products that it sells. It is the world’s largest producer of acetyls, including acetic acid, vinyl acetate monomer and polyacetyls. The company has a high free-cash-flow yield and was trading at what we felt was a very cheap valuation before the Fund purchased it. The company had problems with inventory destocking at the end of last year which seem to be over and their end markets also are showing signs of improving. The Fund continues to hold this stock.

Penn National Gaming, Inc. has done very well beating the most recent earnings estimates during a tough environment for gaming stocks. Investors became very weary of discretionary stocks like gaming, yet they soon realized that regional casinos with strong balance sheets should trade at a premium to the group. The Fund continues to hold this stock.

Adobe Systems is a very strong software franchise that the Fund purchased recently after the stock price declined to the point that the company became a mid-cap firm again. This is a good example of a stock that has fallen into our market capitalization range, yet there are no apparent fundamental problems with the business. After purchase, Adobe became our top performer in the information technology sector. The Fund continues to hold Adobe Systems.

CME Group, the world’s largest derivatives exchange, rallied throughout the end of the reporting period as the volume of contracts has continued to trend up from the beginning of the year. Although volumes are still lower than last year, the increasing trend was encouraging. In addition, Clearport, the company’s clearing system for over-the-counter energy swaps is growing at a tremendous pace (over 40 % compared to last year) as counterparties are trying to mitigate bilateral risk. The Fund sold the stock after a nice increase.

DIRECTV Group has benefitted as consumers have been hurt by the economy and have chosen to spend more nights in and fewer nights going out. Therefore, the company has seen an increase in subscriber growth and had a lower churn of subscribers compared to competitors. Their football and baseball viewing packages have been a major boon for them. The Fund continues to hold this position.

| 14 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Small Cap Core Value Fund | ||

Meet the managers | David M. Adams, CFA, Lead Portfolio Manager, and John “Jack” McPherson, CFA, Co-Portfolio Manager, are Managing directors at Eagle Boston Investment Management, Inc. (“EBIM”) and have been responsible for the day-to-day management of the Eagle Small Cap Core Value Fund (the “Fund”) since its inception. Both Mr. Adams and Mr. McPherson have 19 years of investment experience.

Investment highlights | The Fund invests primarily in equity securities of small-capitalization companies. Using a value approach to investing, the Fund’s portfolio managers seek to capture capital growth by selecting securities that the portfolio managers believe are selling at a discount relative to their underlying value and then hold them until their market value reflects their intrinsic value. To assess value, a “bottom-up” method of analysis is utilized. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. Other factors that the portfolio managers may look for when selecting investments include: management with demonstrated ability and commitment to the company, above-average potential for earnings and revenue growth, low debt levels relative to total capitalization and strong industry fundamentals.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s class A shares returned -4.90% (excluding front-end sales charges) from November 3, 2008 (commencement of operations) to April 30, 2009, outperforming the Fund’s benchmark index, which returned -8.40% during the same period. The Fund’s benchmark index, the Russell 2000® Index, is an unmanaged index comprised of the 2,000 smallest companies in the Russell 3000® Index. The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization. Please keep in mind that an index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the active management of an actual portfolio.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

On May 13, 2009, the portfolio managers gave the following discussion of the Fund’s performance.

Performance discussion | On an absolute basis, sectors that helped performance for the Fund included materials, information technology, consumer discretionary, and energy. The Fund benefitted from its precious metals exposure in materials, the best industry for the period. Software industry holdings helped the information technology sector’s outperformance, as license revenue was stronger than expected for most companies. The Fund’s exposure to consumer durables and consumer service industries helped provide outperformance within consumer discretionary sector. The Fund had solid returns in the oil service industry of the energy sector.

Sectors that detracted from on Fund performance included: telecommunication services, a sector hurt mostly by stock selection; healthcare, particularly in the pharmaceutical industry; and consumer staples, primarily holdings in the household and personal products industries which were hurt by a strong U.S. dollar, effectively slowing international sales and earnings growth.

From the Fund’s commencement of operations on November 3, 2008 to April 30, 2009, the Fund outperformed its benchmark index. Sectors that provided positive relative performance included financials, energy, materials, industrials, and information technology. The Fund benefitted from an underweight position in the underperforming financials sector as well as some strong stock selections within the bank and insurance industries. In spite of an overweight position in the energy sector, the Fund outperformed with strong stock selection, particularly in the oil service industry. Strong stock selection in the materials sector, particularly in precious metals, compensated for the Fund’s underweight position and contributed to relative outperformance. The Fund’s underweight position in the industrials sector lead to outperformance as the sector underperformed the benchmark. The Fund’s overweight position and strong stock selection in the software industry lead to outperformance in the information technology sector.

The Fund had negative relative performance in the consumer discretionary and telecommunication services sectors, both of which were negatively affected by stock selection.

| 15 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Small Cap Core Value Fund (cont’d) | ||

Top performers | URS Corporation is an engineering, construction and technical services firm serving many industries and government entities. They have had a significant number of new contracts, coupled with the widespread belief that the company would benefit through design work in conjunction with the Obama administration’s stimulus package focus on infrastructure. The Fund continues to hold the stock.

IAMGOLD Corporation is in the precious metal, primarily gold, exploration and production business worldwide. They have benefited from the rise in gold prices, as well as some key acquisitions that should help grow their gold production over the next few years. The Fund continues to hold a position in the company’s stock.

Oceaneering International, Inc., an oilfield equipment and services company, appreciated as a relatively strong fundamental outlook offset negative investor sentiment toward energy stocks. We believe the company’s position in the deep offshore market, where contracts tend to be longer term in nature, and less commodity price sensitive in the near term, is particularly positive for the stock. The Fund continues to hold its position in the stock.

Stage Stores, Inc. operates specialty department stores in 38 states, focusing mainly on small, under-served markets. The stock was oversold when compared to their long-term prospects, and subsequently appreciated significantly with the stabilization of same store sale trends and consumer spending in their markets. The Fund continues to hold the stock.

Euronet Worldwide, Inc. is a company that provides electronic payment services internationally. The company executed their business plan well, despite difficult economic and foreign exchange issues. Continued solid cash flow and debt repayment helped the stock price. The Fund continues to hold its position in the stock.

Under performers | On Assignment, Inc., a professional staffing firm, suffered from a slowdown across several lines of business

during the period, following a record month in October 2008. The Fund continues to hold the stock as management has demonstrated the ability to cut costs in order to remain profitable in their industry’s downturn.

Psychiatric Solutions, Inc. is a provider of inpatient behavioral health care services. After reporting its earnings for the fourth quarter of 2008, the company guided 2009 earnings estimates down slightly, and investors sold the stock heavily. The Fund added to its position, firmly believing the reaction was not commensurate with the company’s valuation and fundamentals.

1-800-Flowers.com Inc. operates as a gift retailer, primarily in the floral business and through the internet. Like many consumer companies, 1-800-Flowers revenues have slowed dramatically, but the Fund continues to hold the position as management’s ability to cut costs should allow them to remain profitable through the trough of their business.

Apollo Investment Corporation is a business development fund specializing in middle market company investments. As the credit crisis widened, many of Apollo’s investments were marked down. The position of Apollo in the Fund was trimmed during this period, but not sold outright.

Cubist Pharmaceuticals, Inc. is a biopharmaceutical company with the drug Cubicin as its primary source of revenue, which is growing over 25% on a 2009 revenue estimate. Shares have come under pressure due to a patent infringement case Cubist has filed against Teva Pharmaceutical Industries Ltd. We believe the fears surrounding the patent case are overdone and continue to maintain the stock in the Fund.

Other factors | The Fund commenced operations on November 3, 2008, starting with no assets. Subscriptions in the Fund spiked in March, when the Fund’s size grew from approximately $5 million to over $40 million. Given the extreme intra-day volatility during many of the high inflow days, security purchase costs were affected in both positive and negative ways, depending on the market direction of the day.

| 16 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Small Cap Growth Fund | (formerly known as the Small Cap Stock Fund) | |

Meet the managers | Bert L. Boksen, CFA, a Managing Director and Senior Vice President at Eagle Asset Management, Inc. (“Eagle”), has been responsible for the management of the Eagle Small Cap Growth Fund (the “Fund”) since 1995. Mr. Boksen has 32 years of investment experience. Eric Mintz, CFA, has 14 years of investment experience and has been Assistant Portfolio Manager since 2008.

Investment highlights | The Fund invests primarily in stocks of small-capitalization companies. Using a “bottom-up” approach, the Fund’s portfolio managers seek to capture the significant long-term capital appreciation potential of small, rapidly growing companies. A bottom-up method of analysis emphasizes the outlook at the company and industry level versus reliance on the general economy and/or market trends. The portfolio managers also look for small-cap growth companies that are reasonably priced. Since small-cap companies often have narrower markets than large-cap companies, the portfolio managers believe that conducting extensive proprietary research on small-cap growth companies may enable the Fund to capitalize on market inefficiencies and thus outperform the market.

This Morningstar Style Box™ shows the Fund’s investment style and size of companies held in the Fund.

Performance summary | The Fund’s class A shares returned -6.22% (excluding front-end sales charges) during the six-month period ended April 30, 2009. The Fund underperformed its primary benchmark index, the Russell 2000® Growth Index, which returned -3.77% and outperformed its secondary benchmark index, the Russell 2000® Index, which returned -8.40% during the reporting period. Effective November 1, 2008, the Fund replaced its benchmark index, the Russell 2000® Index, with the Russell 2000® Growth Index. When evaluating long term performance, the Fund’s portfolio managers believe the Russell 2000® Growth Index better reflects the investment style of the Fund. The Russell 2000® Growth Index is an unmanaged index comprised of Russell

2000® companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000® Index is an unmanaged index comprised of the 2,000 smallest companies in the Russell 3000® Index. The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization.

Performance data represented is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month-end, please visit our website at eagleasset.com.

On May 11, 2009, the portfolio managers gave the following discussion of the Fund’s performance.

Performance discussion | On an absolute basis, the Fund’s negative return was primarily due to holdings in the healthcare sector (the highest weighted sector in the Fund and index) followed by investments in the financials sector. Positive contributors to absolute returns were investments in information technology (the second highest weighted sector) followed by the Fund’s holdings in the consumer discretionary sector.

Stock selection in the financials and healthcare sectors were the primary contributors to the Fund’s underperformance relative to its benchmark index. One of the Fund’s positions in the commercial banks industry pulled down returns in the financials sector. In the healthcare sector, the Fund’s clinical research organization investment dragged returns down. Relative to its benchmark index, the Fund outperformed in the industrials and energy sectors. In both sectors, the Fund’s positioning relative to the benchmark magnified strong stock selection.

The portfolio turnover rate for this reporting period was 93% compared to 51% for the fiscal year ended October 31, 2008. A major factor in the turnover increase is the repositioning that occurred during the early portion of the reporting period, due to the Fund taking over the half of the portfolio that was previously managed by Eagle Boston Investment Management, Inc.

Under performers | ICON PLC is a contract-research organization that declined along with its competitors due to concerns that a tight market for biotech funding would decrease the group’s earnings. The Fund continues to hold the stock because we believe ICON is a leader in the contract research space and that the vast majority of its clients are well-capitalized.

| 17 |

Table of Contents

| Performance Summary and Commentary | ||

| Eagle Small Cap Growth Fund (cont’d) | ||

Lufkin Industries, Inc., a producer of oil pump-jack units, suffered during the fourth quarter of 2008 due to the continued decline in oil prices which could negatively impact demand for the company’s products. The Fund continues to hold the stock as the company has a large backlog, is the supplier of choice in the Bakken Shale region and also has exposure to wind energy, which we believe will become a key source of energy in the future.

SVB Financial Group is a niche bank that disclosed information about a $69M troubled loan with a venture capital fund-of-funds client. Given the weakening economic conditions and a more difficult environment for fundraising, the Fund sold the stock.

OYO Geospace Corporation is a provider of seismic equipment for oil companies. OYO Geospace had been a big winner in previous reporting periods and the Fund trimmed some of its position at much higher prices; however, the stock price declined during the reporting period due to delays in receiving anticipated contracts. The Fund continues to hold the stock as we believe that, after the delays, the company’s new seismic products will be well-received.

Waste Connections, Inc., a provider of solid waste disposal services, declined during the reporting period due to lower than expected volumes throughout the industry. The Fund continues to hold the stock as we believe that the company may benefit from the Allied Waste Industries Inc./Republic Services Inc. merger.

Top performers | Macrovision Solutions Corporation, a provider of solutions that enable digital-product protection, exceeded earnings and revenue expectations during the reporting period.

We remain optimistic about the company as we believe strong trends in the company’s core business plus new product opportunities make Macrovision uniquely positioned for growth despite the economic downturn.

Casual diner, BJ’s Restaurants, Inc., has proven resilient in a difficult macro environment and remains a Fund holding. The company has had strong performance relative to other restaurant chains despite high exposure to states heavily impacted by housing issues. This should bode well for performance once those housing markets stabilize. We believe that easier year over year comparisons and increasing sales combined with moderating costs will continue to drive the stock.

FTI Consulting, Inc. is a leader in bankruptcy consulting services. The company has benefited from the bankruptcy cycle resulting in better than expected earnings. The Fund continues to hold the stock as we believe bankruptcy filings in this economic cycle have yet to peak.

Quality Systems, Inc. markets information-processing systems to medical and dental group practices. The stock remains in the Fund as the company has exceeded revenue and profit expectations and is poised to benefit from President Obama’s plans for investment in healthcare information technology systems.

Shares in Netflix, Inc., an online DVD rental service, appreciated significantly after the company beat earnings and revenue expectations and issued strong guidance. The Fund continues to hold the stock as we believe Netflix is poised to continue to increase market share because consumers seem to favor renting over ownership in an environment of evolving formats (DVD vs. BluRay).

| 18 |

Table of Contents

Investment Portfolios

| UNAUDITED | 04.30.2009 |

| Common stocks—98.3% (a) | Shares | Value | ||||

| Telecommunications—17.2% | ||||||

| American Tower Corporation, Class A* | 741,450 | $23,548,452 | ||||

| Crown Castle International Corporation* | 1,263,828 | 30,989,063 | ||||

| QUALCOMM Inc. | 380,540 | 16,104,452 | ||||

| Total common stocks (cost $415,024,950) | 403,783,709 | |||||

| Repurchase agreement—1.1% (a) | ||||||

| Repurchase agreement with Fixed Income Clearing Corporation dated April 30, 2009 @ 0.06% to be repurchased at $4,514,008 on May 1, 2009, collateralized by $4,675,000 United States Treasury Notes, 1.875% due February 28, 2014 (market value $4,663,233 including interest) (cost $4,514,000) | 4,514,000 | |||||

| Total investment portfolio (cost $419,538,950) 99.4% (a) | 408,297,709 | |||||

| Other assets and liabilities, net, 0.6% (a) | 2,655,560 | |||||

| Net assets, 100.0% | $410,953,269 | |||||

| * Non-income producing security. | ||||||

| (a) Percentages indicated are based on net assets. | ||||||

| ADR—American depository receipt. | ||||||

| Sector allocation | ||

| Sector | Percent of net assets | |

| Consumer, non-cyclical | 26% | |

| Communications | 24% | |

| Technology | 17% | |

| Consumer, cyclical | 10% | |

| Energy | 9% | |

| Financial | 9% | |

| Industrial | 3% | |

| Cash/Other | 2% | |

| The accompanying notes are an integral part of the financial statements. | 19 |

Table of Contents

Investment Portfolios

| UNAUDITED | 04.30.2009 |

| EAGLE GROWTH & INCOME FUND (cont’d) | ||||||

| Common stocks—78.9% (a) | Shares | Value | ||||

| Computers—4.8% | ||||||

| Apple Inc.* | 15,810 | $1,989,372 | ||||

| Dell Inc.* | 212,800 | 2,472,736 | ||||

| Electric—1.7% | ||||||

| Entergy Corporation | 24,900 | 1,612,773 | ||||

| Financial services—2.1% | ||||||

| The Charles Schwab Corporation | 108,700 | 2,008,776 | ||||

| Food—2.8% | ||||||

| Kraft Foods Inc., Class A | 36,528 | 854,755 | ||||

| Sysco Corporation | 76,000 | 1,773,080 | ||||

| Healthcare products—1.0% | ||||||

| Varian Medical Systems Inc.* | 27,588 | 920,612 | ||||

| Insurance—3.5% | ||||||

| Cincinnati Financial Corporation | 16,241 | 388,972 | ||||

| Hartford Financial Services Group, Inc. | 103,500 | 1,187,145 | ||||

| The Allstate Corporation | 74,520 | 1,738,552 | ||||

| Oil & gas—1.9% | ||||||

| ConocoPhillips | 31,800 | 1,303,800 | ||||

| Diamond Offshore Drilling, Inc. | 6,600 | 477,906 | ||||

| Pharmaceuticals—2.9% | ||||||

| Eli Lilly & Company | 81,975 | 2,698,617 | ||||

| REIT—1.8% | ||||||

| Chimera Investment Corporation | 484,000 | 1,708,520 | ||||

| Retail—3.2% | ||||||

| McDonald’s Corporation | 55,700 | 2,968,253 | ||||

| Software—3.1% | ||||||

| Microsoft Corporation | 141,100 | 2,858,686 | ||||

| Telecommunications—1.3% | ||||||

| AT&T Inc. | 47,200 | 1,209,264 | ||||

| Television, cable & radio—1.9% | ||||||

| Comcast Corporation, Class A | 122,100 | 1,792,428 | ||||

| Total domestic (cost $55,824,959) | 46,358,307 | |||||

| Foreign—29.3% (b) | ||||||

| Computers—1.4% | ||||||

| Research In Motion Ltd.* | 18,100 | 1,257,950 | ||||

| Entertainment—3.0% | ||||||

| OPAP SA | 91,545 | 2,839,130 | ||||

| Financial services—2.9% | ||||||

| Bolsas y Mercados Espanoles | 38,300 | 1,067,692 | ||||

| Hong Kong Exchanges and Clearing Ltd. | 133,000 | 1,529,416 | ||||

| Redecard SA* | 12,300 | 154,807 | ||||

| Insurance—3.5% | ||||||

| ACE Ltd. | 62,445 | 2,892,452 | ||||

| AXA SA | 22,000 | 366,596 | ||||

| Internet—1.7% | ||||||

| Baidu Inc., Sponsored ADR* | 6,800 | 1,583,720 | ||||

| Oil & gas—2.4% | ||||||

| ENI SpA | 63,000 | 1,365,326 | ||||

| Total SA | 18,000 | 900,146 | ||||

| Telecommunications—14.4% | ||||||

| Amdocs Ltd.* | 109,000 | 2,281,370 | ||||

| China Mobile Ltd. | 189,000 | 1,628,280 | ||||

| France Telecom SA | 17,466 | 387,568 | ||||

| Nokia Oyj | 121,400 | 1,730,254 | ||||

| Telefonica SA | 165,500 | 3,142,471 | ||||

| Telstra Corporation Ltd. | 1,116,400 | 2,701,773 | ||||

| Common stocks—78.9% (a) | Shares | Value | ||||

| Vodafone Group PLC | 887,535 | $1,630,242 | ||||

| Total foreign (cost $29,649,037) | 27,459,193 | |||||

| Total common stocks (cost $85,473,996) | 73,817,500 | |||||

| Preferred stocks—1.6% (a) | ||||||

| Banks—1.4% | ||||||

| Bank of America Corporation, 3.0%, Series H | 60,000 | 495,000 | ||||

| Fifth Third Bancorp, 8.50%, Series G (convertible) | 14,200 | 822,038 | ||||

| Financial services—0.2% | ||||||

| CIT Group Inc., 8.75%, Series C (convertible) | 9,400 | 150,494 | ||||

| Total preferred stocks (cost $2,428,343) | 1,467,532 | |||||

| Corporate bonds—10.4% (a) | Principal amount | Value | ||||

| Agriculture—1.3% | ||||||

| Altria Group Inc., 9.70%, 11/10/18 | $1,000,000 | 1,168,541 | ||||

| Banks—1.1% | ||||||

| Fifth Third Capital Trust IV, 6.50% to 04/15/17, floating rate to 04/15/67 | 1,059,000 | 381,240 | ||||

| USB Capital IX, 6.189% to 04/15/11, floating rate to 04/15/42 | 1,121,000 | 622,155 | ||||

| Electric—1.3% | ||||||

| Atlantic City Electric Company, 7.75%, 11/15/18 | 250,000 | 275,216 | ||||

| Entergy Gulf States, 6.0%, 05/01/18 | 1,000,000 | 919,721 | ||||

| Financial services—4.8% | ||||||

| CIT Group Inc., 5.0%, 02/13/14 | 130,600 | 73,140 | ||||

| CIT Group Inc., 5.0%, 02/01/15 | 191,800 | 105,492 | ||||

| CIT Group Inc., 5.40%, 01/30/16 | 377,700 | 198,636 | ||||

| CIT Group Inc., 5.85%, 09/15/16 | 105,200 | 56,412 | ||||

| CIT Group Inc., 6.10% to 3/15/17, floating rate to 03/15/67 | 254,000 | 59,629 | ||||

| General Electric Capital Corporation, 6.375% to 11/15/17, floating rate to 11/15/67 | 1,571,000 | 901,743 | ||||

| Glen Meadow Pass Through Trust, 144A, 6.505% to 02/15/17, floating rate to 02/12/67 | 1,359,000 | 469,722 | ||||

| Goldman Sachs Capital II, 5.793% to 06/01/12, floating rate to 06/01/43 | 1,861,000 | 920,436 | ||||

| Goldman Sachs Capital III, FRN, 2.03%, 09/01/43 | 552,000 | 237,360 | ||||

| JPMorgan Chase Capital XXI, FRN, 2.12%, 01/15/87 | 559,000 | 237,938 | ||||

| JPMorgan Chase Capital XXIII, FRN, 2.24%, 05/15/77 | 1,564,000 | 661,439 | ||||

| Swiss Reinsurance Capital I LP, 144A, 6.854% to 05/25/16, floating rate to 12/29/49 | 1,550,000 | 612,250 | ||||

| Insurance—1.5% | ||||||

| Hartford Financial Services Group Inc., 8.125% to 06/15/18, floating rate to 06/15/68 | 1,840,000 | 745,200 | ||||

| MetLife Capital Trust X, 144A, 9.25% to 04/08/38, floating rate to 04/08/68 | 1,000,000 | 640,000 | ||||

| Retail—0.4% | ||||||

| Rite Aid Corporation, 10.375%, 07/15/16 | 417,000 | 358,620 | ||||

| Rite Aid Corporation, 7.50%, 03/01/17 | 48,000 | 35,640 | ||||

| Total corporate bonds (cost $8,838,036) | 9,680,530 | |||||

| Convertible bonds—7.3% (a) | ||||||

| Airlines—0.3% | ||||||

| JetBlue Airways Corporation, 3.75%, 03/15/35 | 262,000 | 235,800 | ||||

| Commercial services—1.0% | ||||||